Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

33 results about "Electronic switching system" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

In telecommunications, an electronic switching system (ESS) is a telephone switch that uses digital electronics and computerized control to interconnect telephone circuits for the purpose of establishing telephone calls.

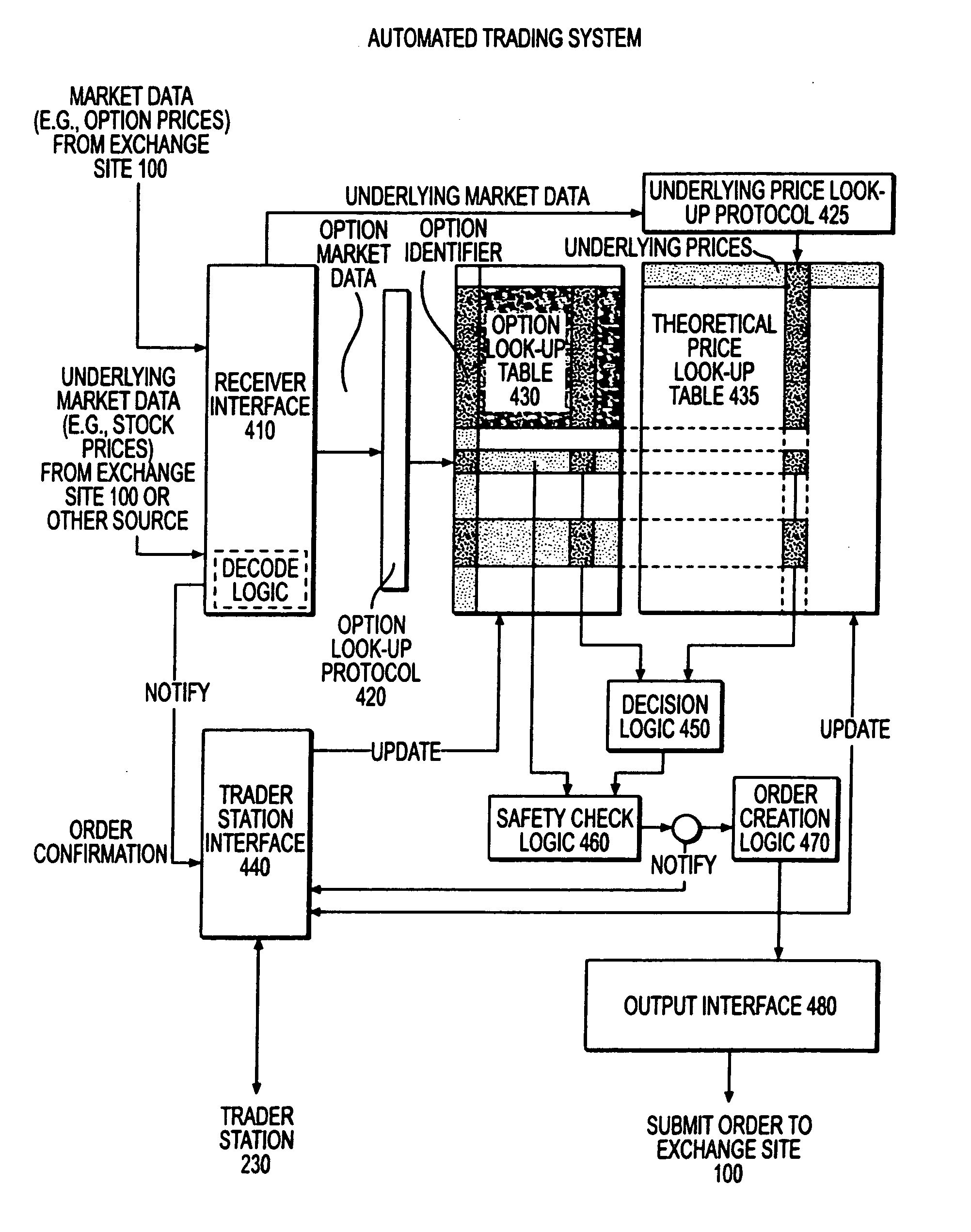

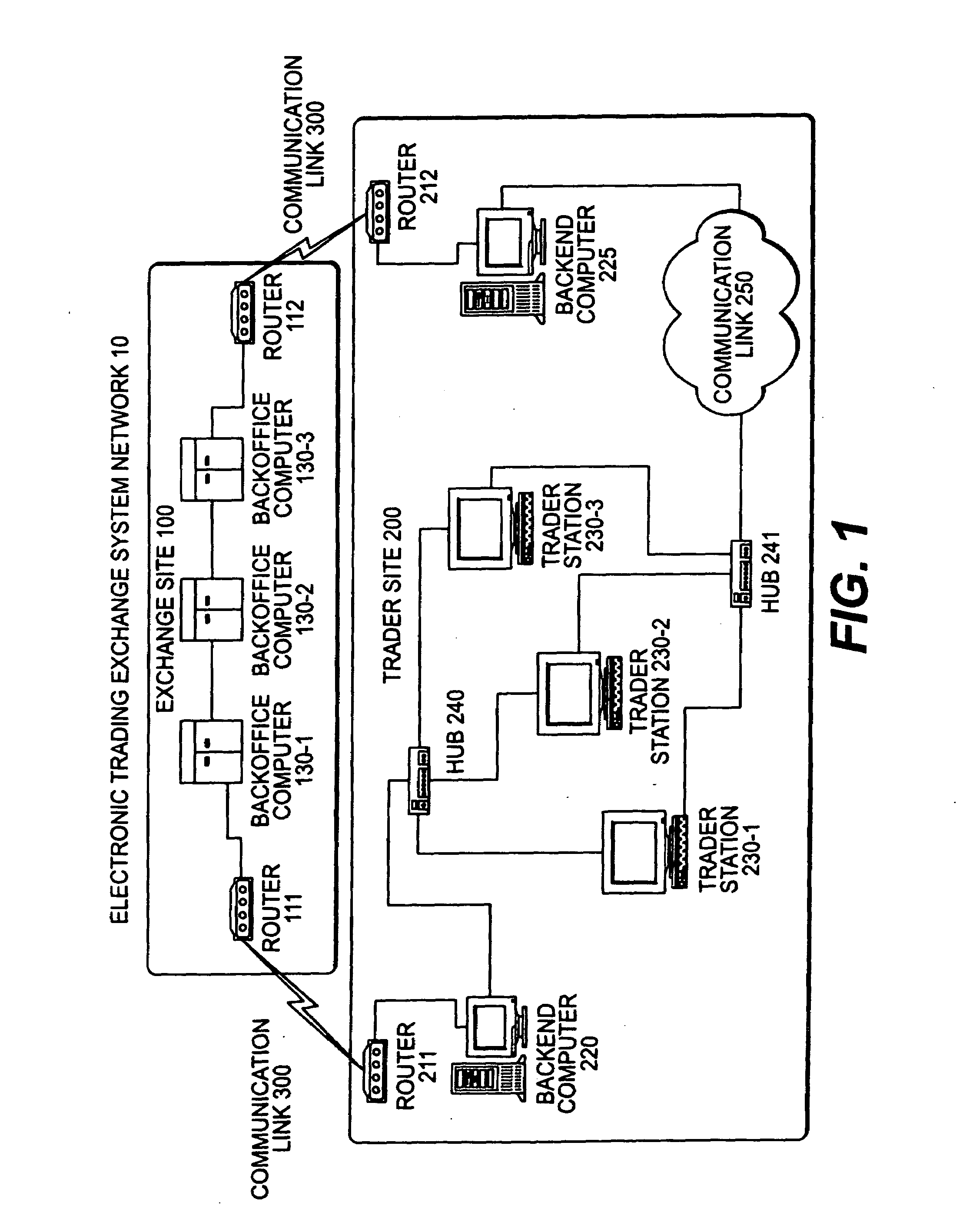

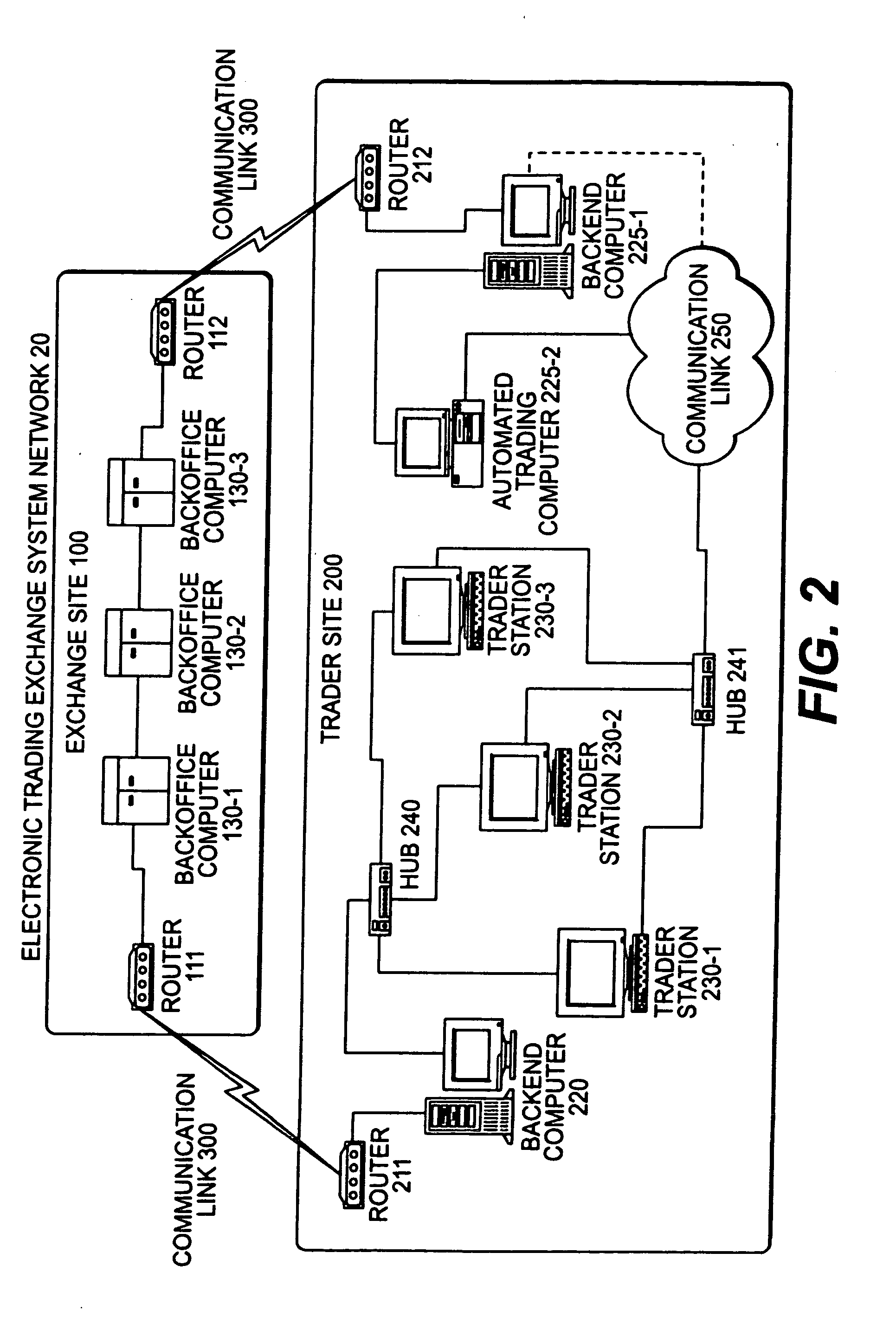

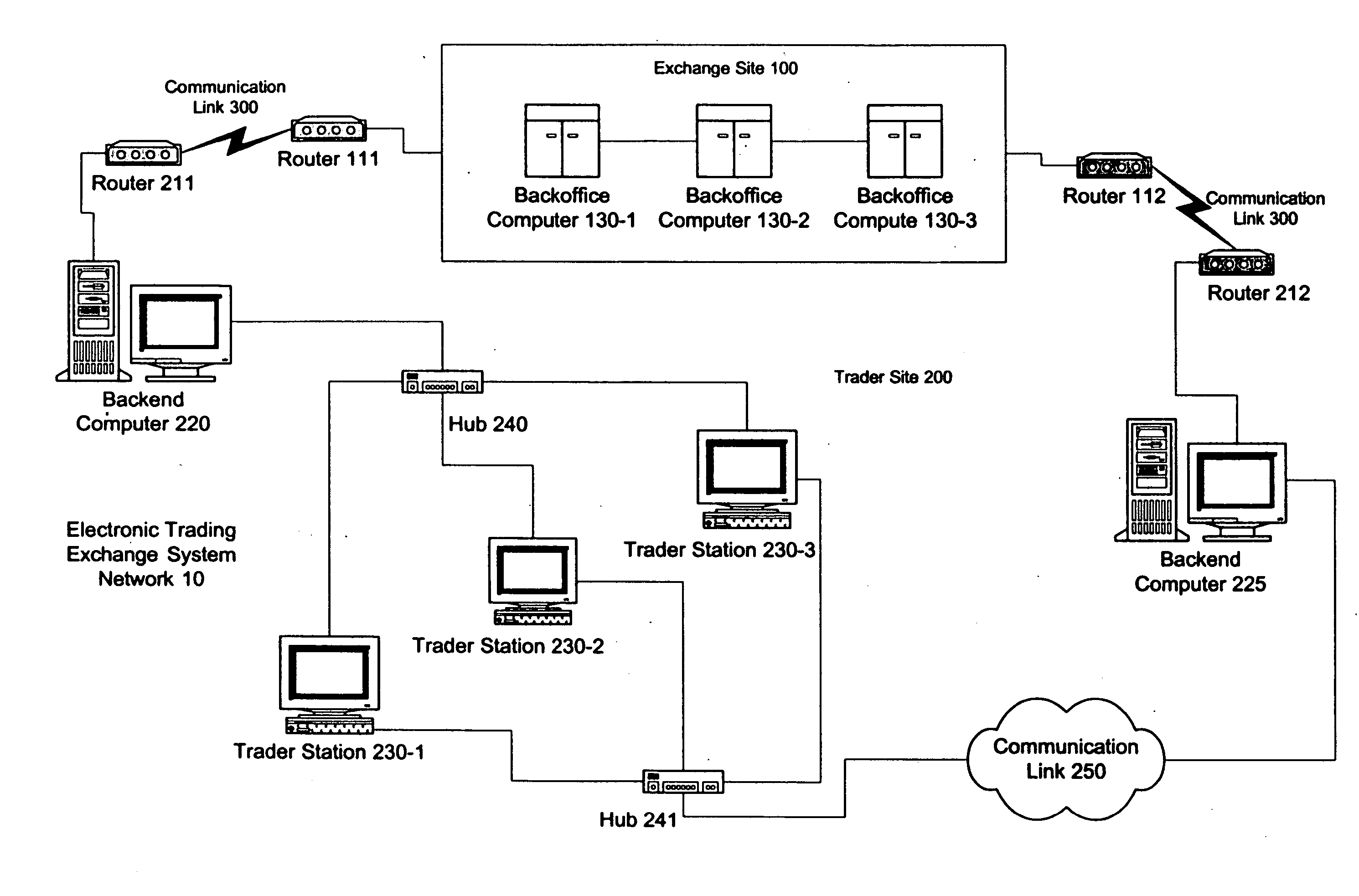

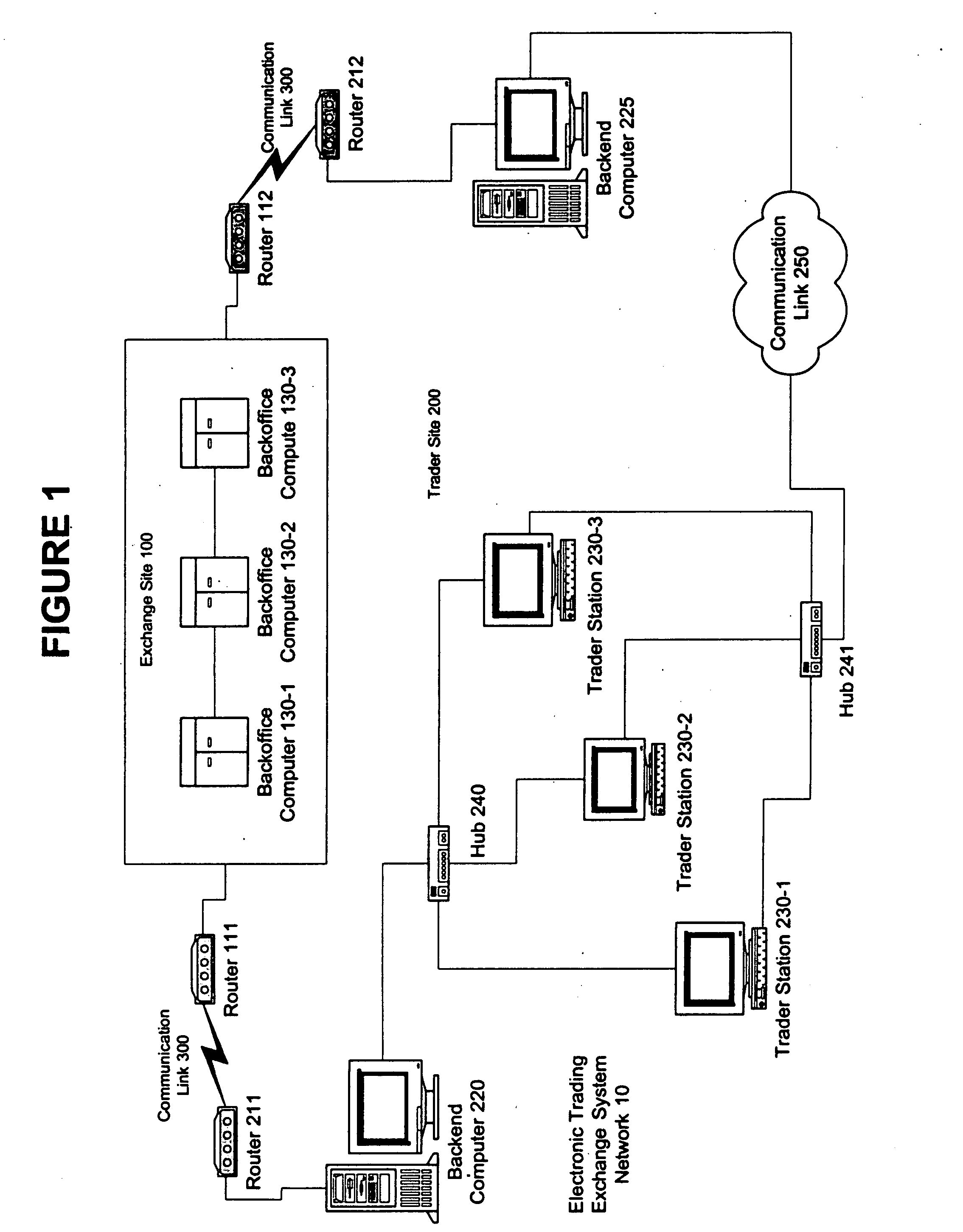

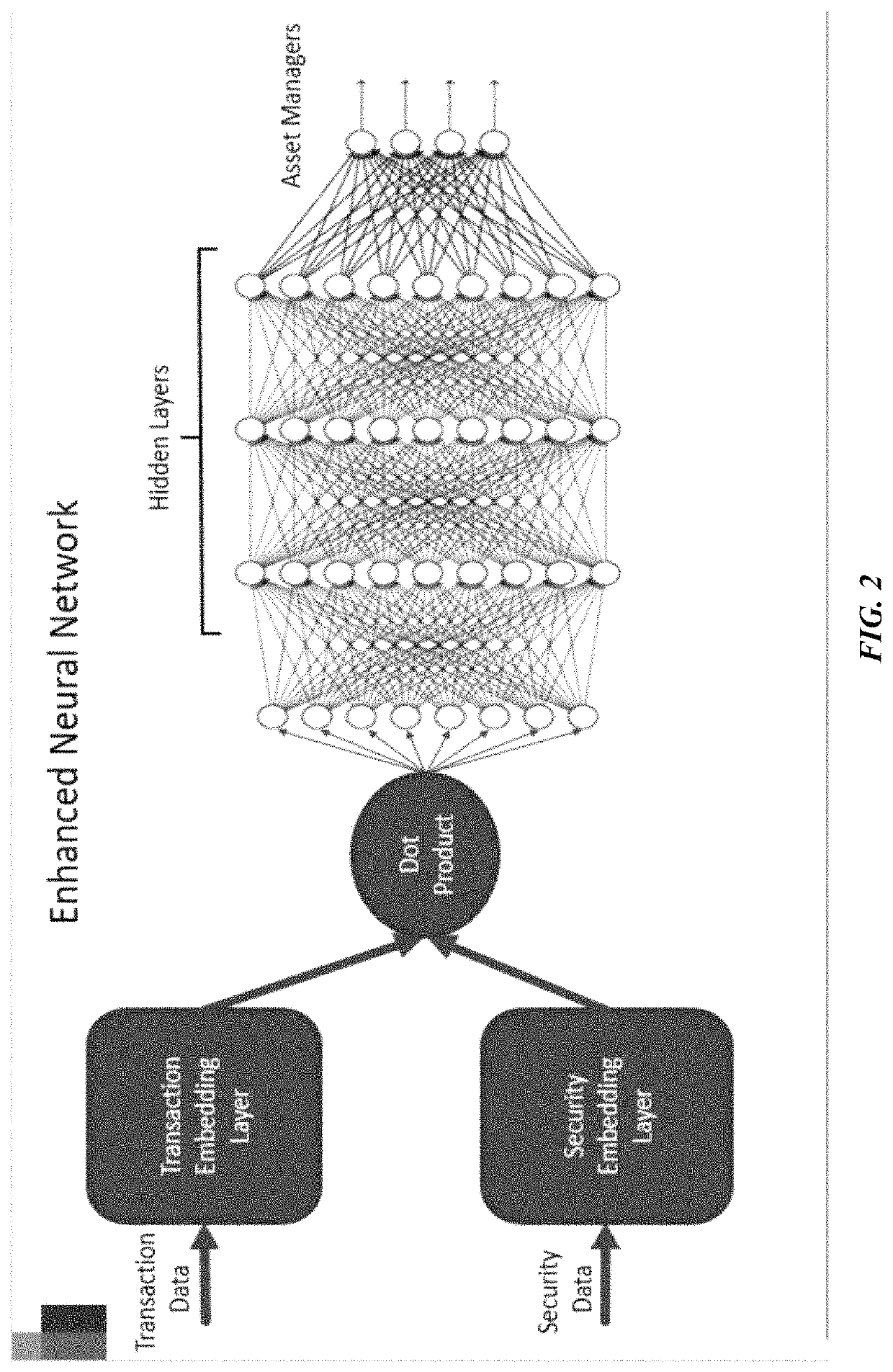

Automated trading system in an electronic trading exchange

InactiveUS7251629B1Quick responseGuaranteed accuracyComplete banking machinesFinanceData miningElectronic trading

An electronic exchange system network includes a trader site having an automated trading system capable of submitting orders to an exchange site. The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. The theoretical buy and sell prices are derived from, among other things, the current market price of the security underlying the option. A look-up table stores a range of theoretical buy and sell prices for a given range of current market price of the underlying security. Accordingly, as the price of the underlying security changes, a new theoretical price may be indexed in the look-up table, thereby avoiding calculations that would otherwise slow automated trading decisions. Other techniques may be used in addition or in the alternative to speed automatic decision-making. In addition, a system of checks may be conducted to ensure accurate and safe automated trading. The automated trading system may be capable of automatically submitting orders in connection with the underlying security in order to hedge part of the delta risk associated with the automated option trades.

Owner:DCFB

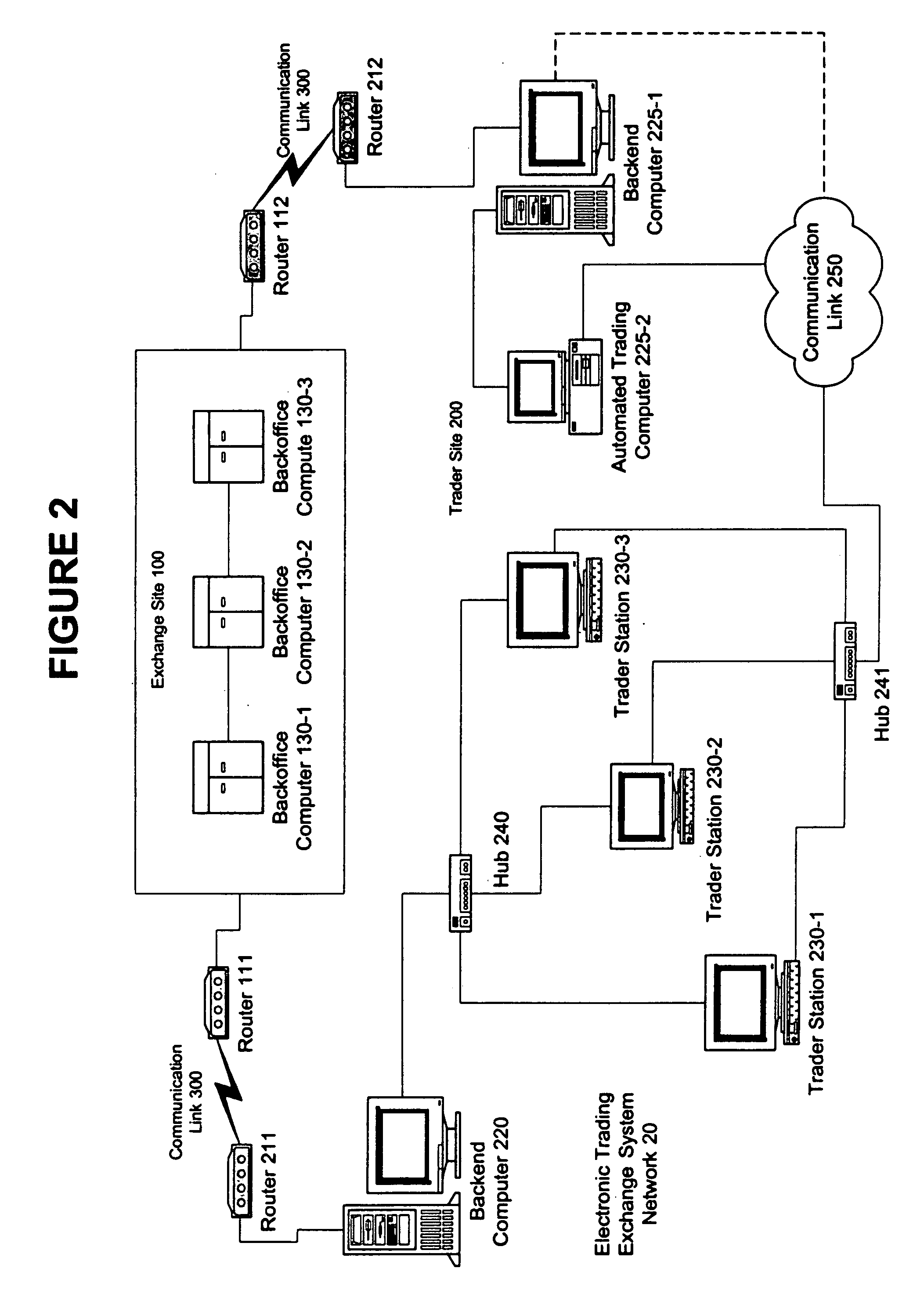

Automated trading system in an electronic trading exchange

An electronic exchange system network includes a trader site having an automated trading system capable of submitting orders and / or quotes to an exchange site. The automated trading system determines whether an order or quote should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. The theoretical buy and sell prices are derived from, among other things, the current market price of the security underlying the option. The theoretical buy and sell prices are calculated when underlying factors that contribute to the theoretical prices change. Computation times of the theoretical prices may be reduced by using precalculated values and / or using interpolation and extrapolation. Other techniques may be used in addition or in the alternative to speed automatic decision-making. In addition, a system of checks may be conducted to ensure accurate and safe automated trading. The automated trading system may be capable of automatically submitting orders in connection with the underlying security in order to hedge part of the delta risk associated with the automated option trades.

Owner:DCFB

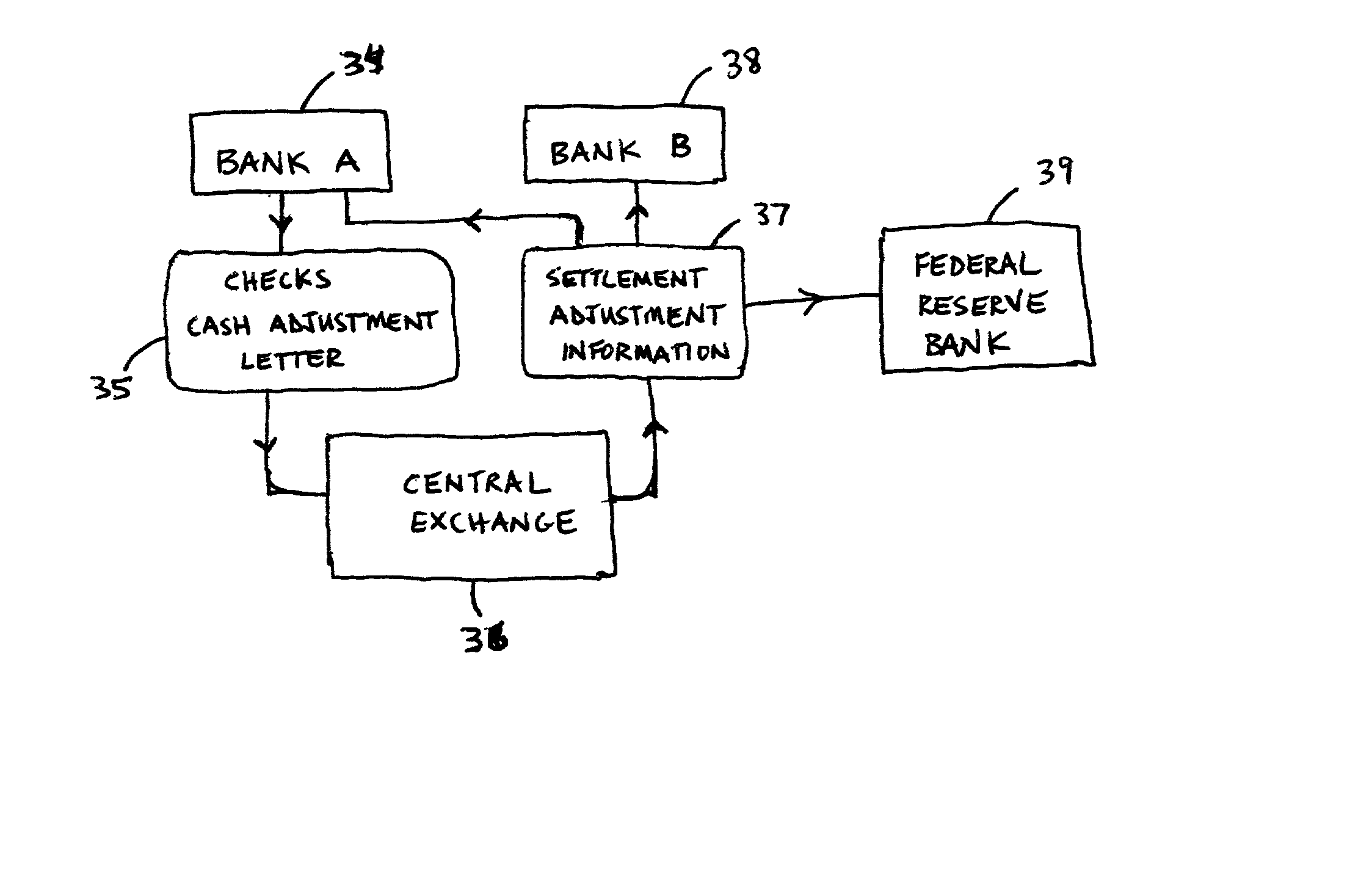

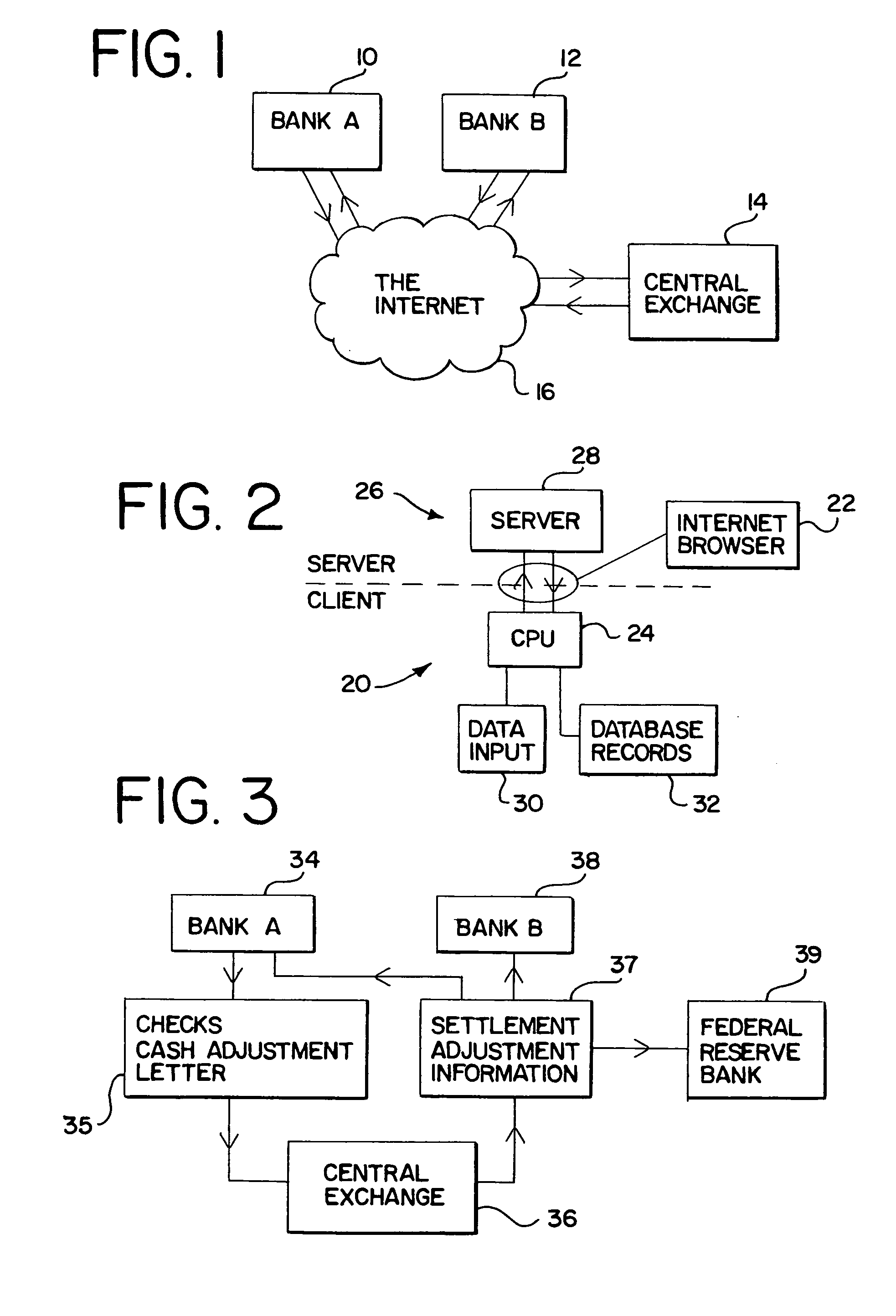

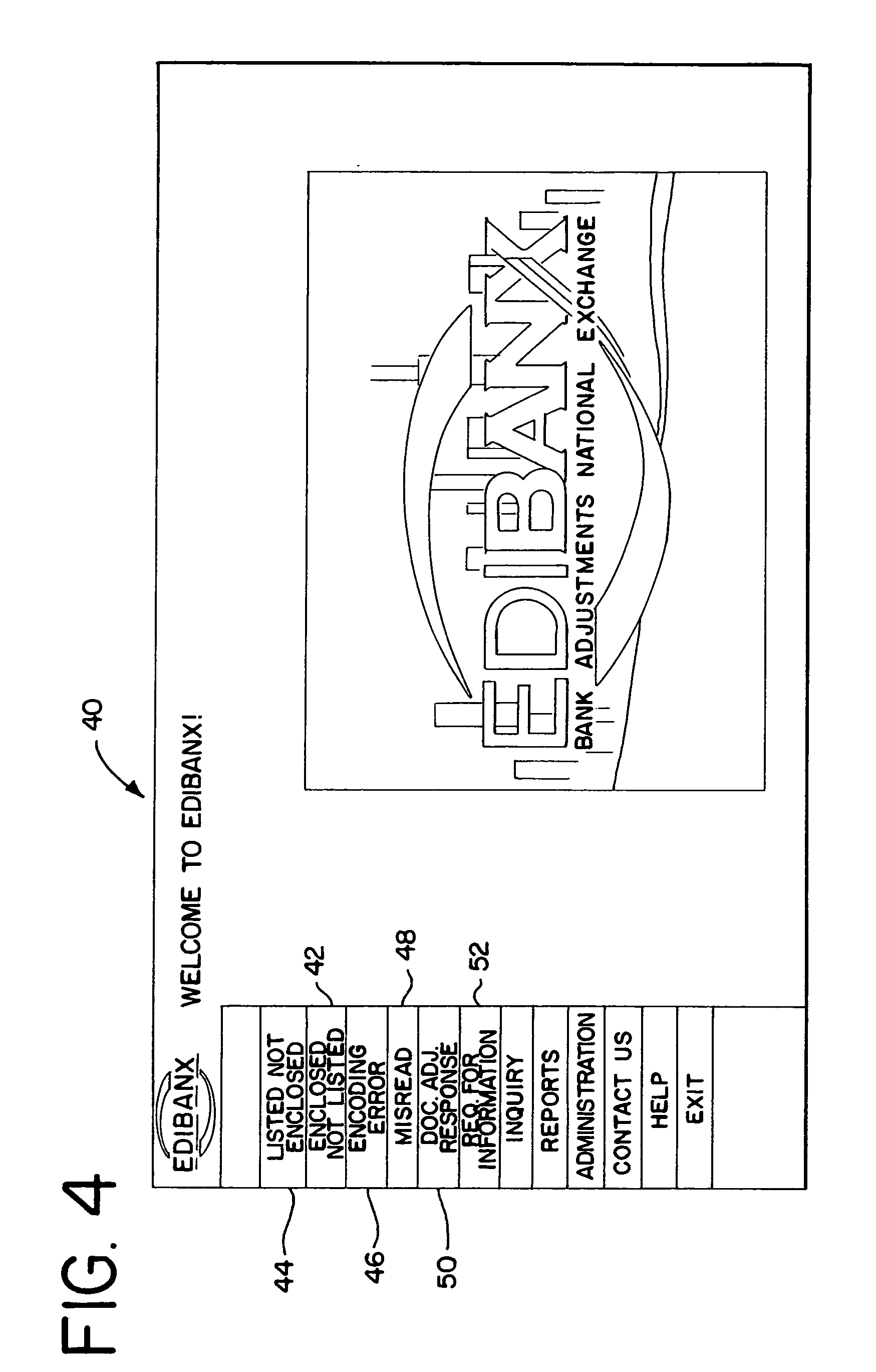

Electronic exchange and settlement system for cash letter adjustments for financial institutions

An electronic exchange system is provided for input and processing of cash letter adjustments between financial institutions and their customers. The system includes a central processor or centralized exchange mechanism and established rules and procedures for operation of the exchange and centralized hardware and software that is accessible through internet or intranet connections. Data for cash letter adjustments are entered to the system by means of standardized electronic formats which may be created from a desktop application or through an electronic interface to the user's mainframe case management system. At a predetermined time, the processor completes the settlement of each of the adjustment transactions and sends the settlement requirements to each of the participating banks or financial institutions. The system also creates a net settlement file in conformity with the "Enhanced Net Settlement" requirements of the Federal Reserve Bank to provide a net settlement of those adjustments through a participant's reserve account at the host Federal Reserve Bank or through a correspondent settling on the participant's behalf at the Federal Reserve Bank. The system also provides an electronic medium for the exchange of informational requests and responses to those requests. The system provides a database of all participants with detailed contact information for each participating financial institution.

Owner:THE CLEARING HOUSE PAYMENTS

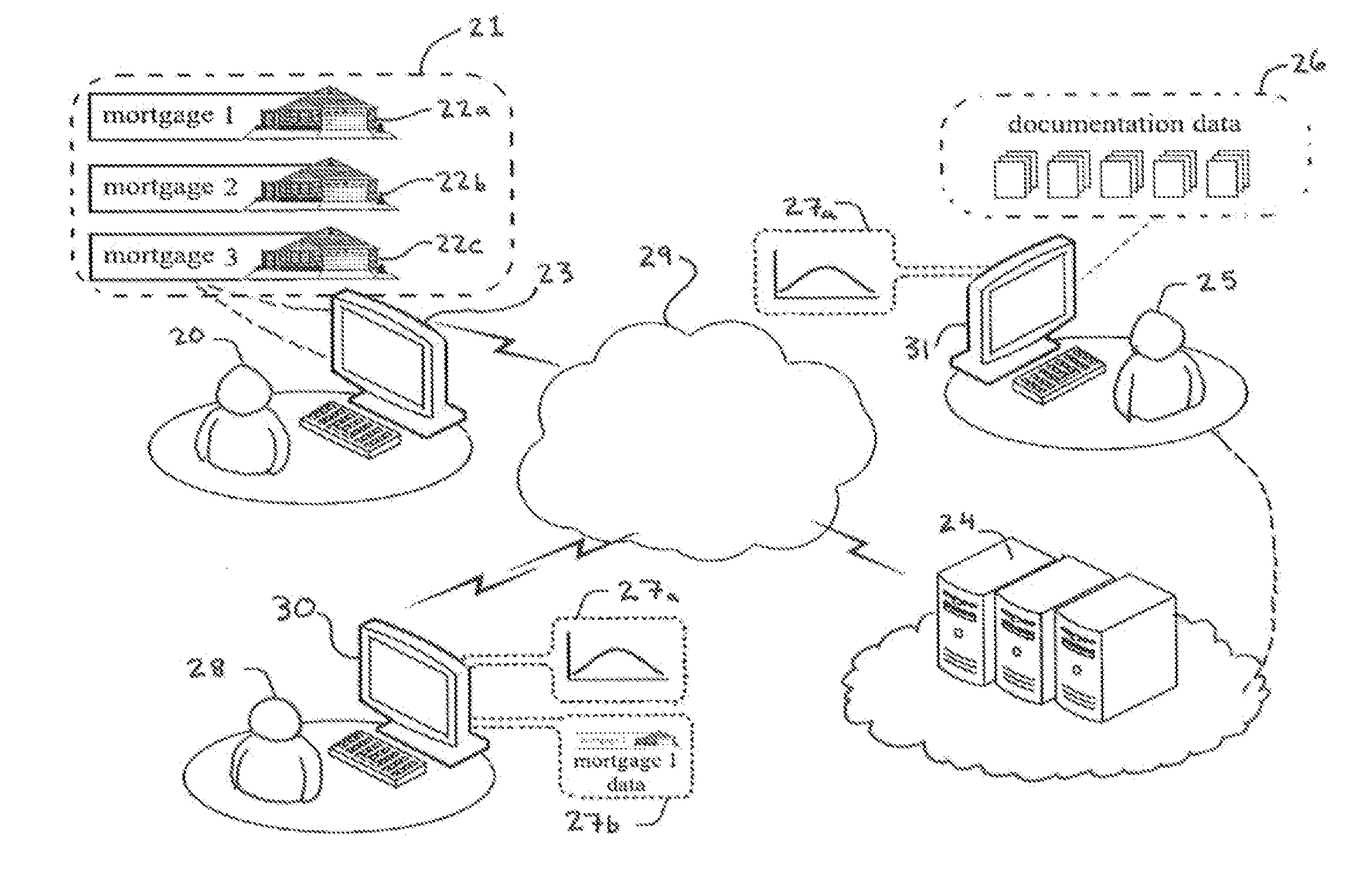

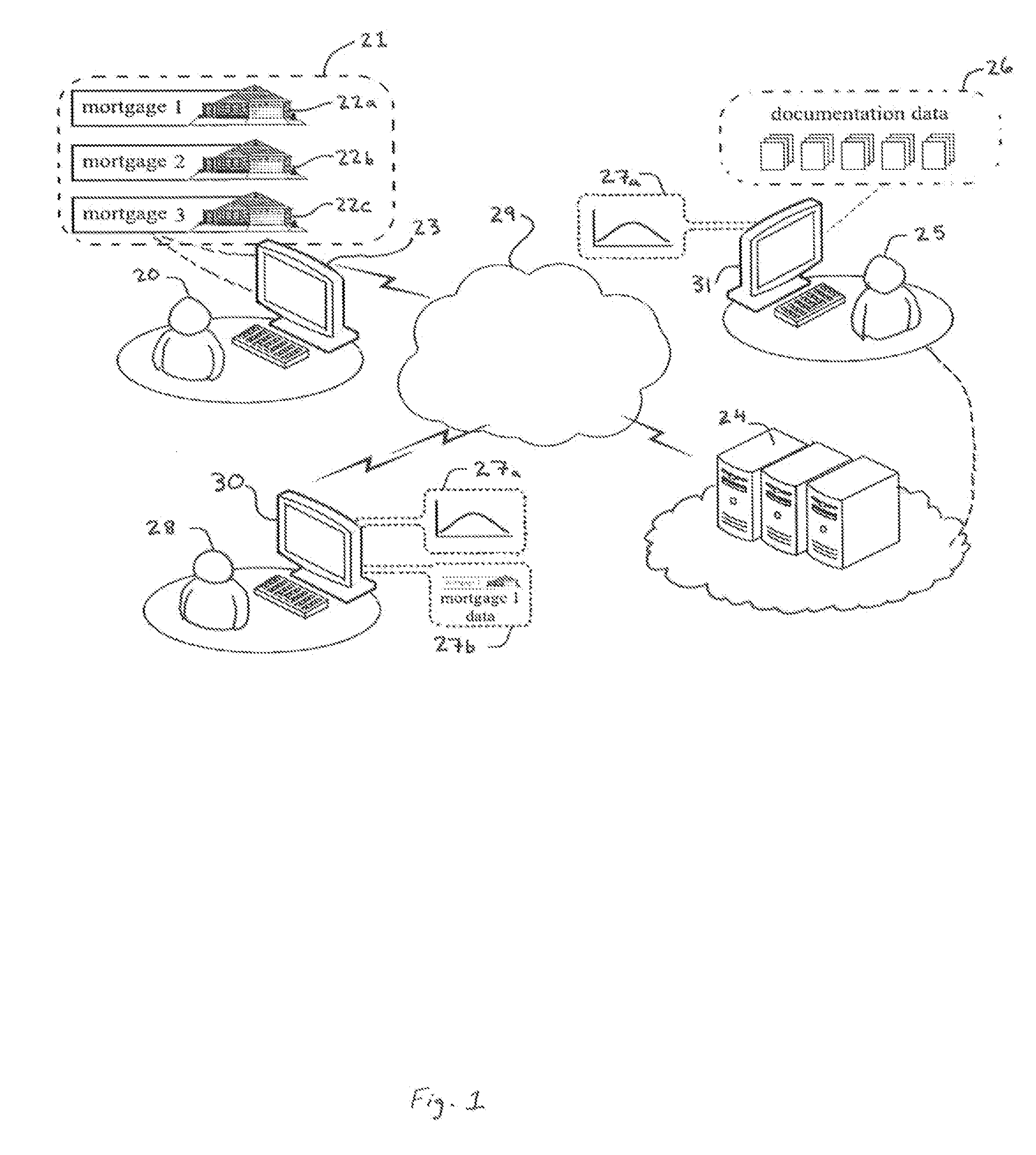

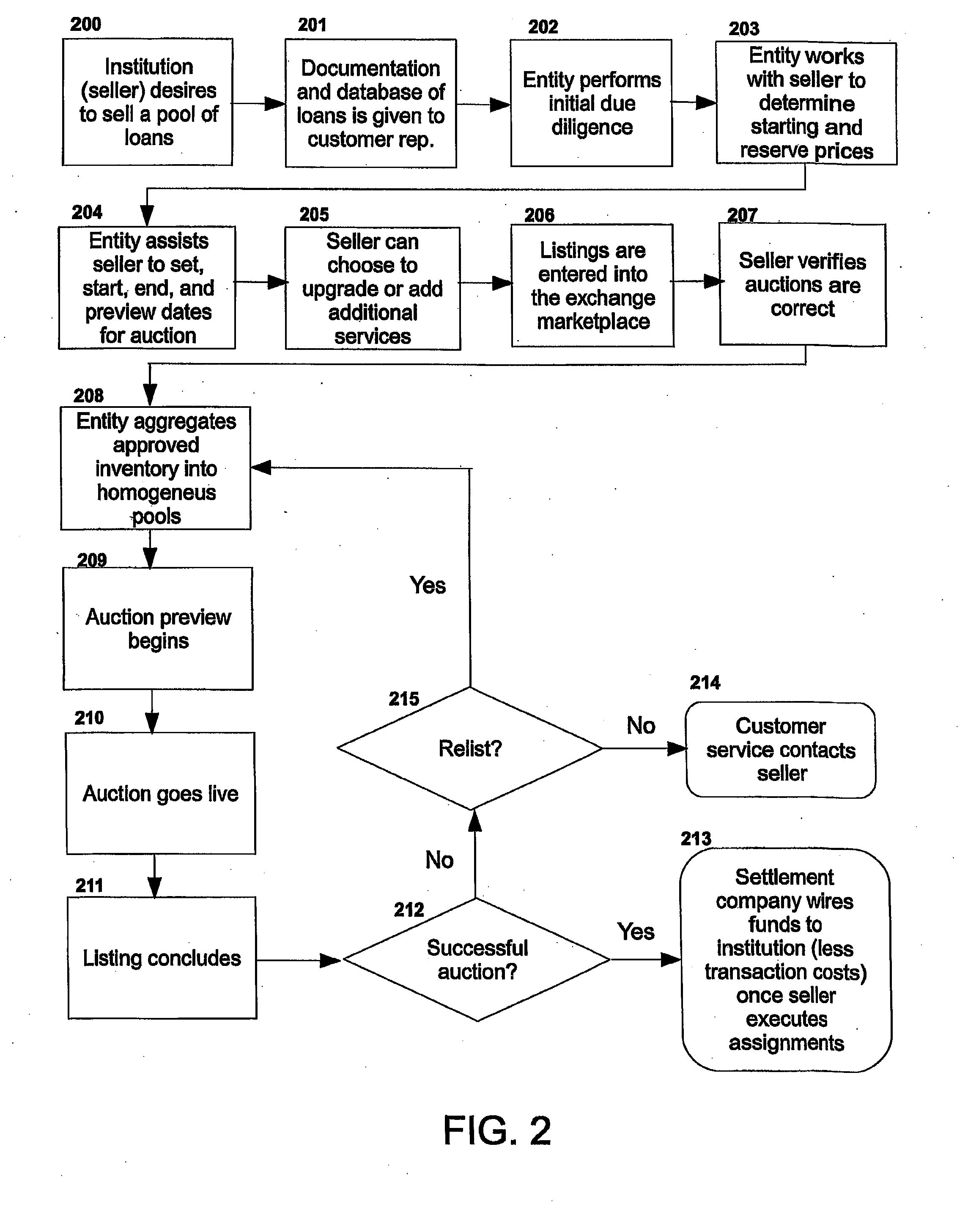

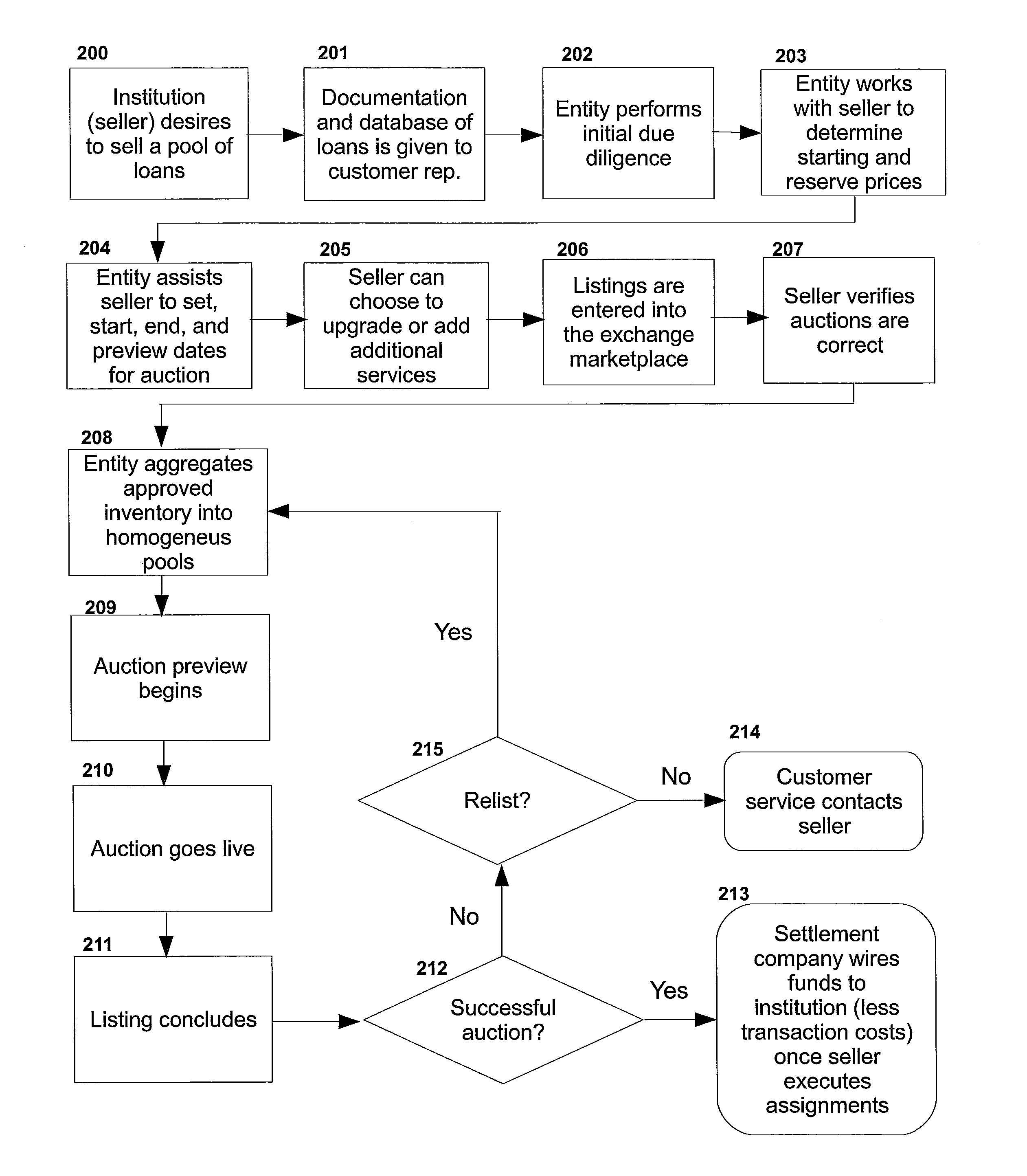

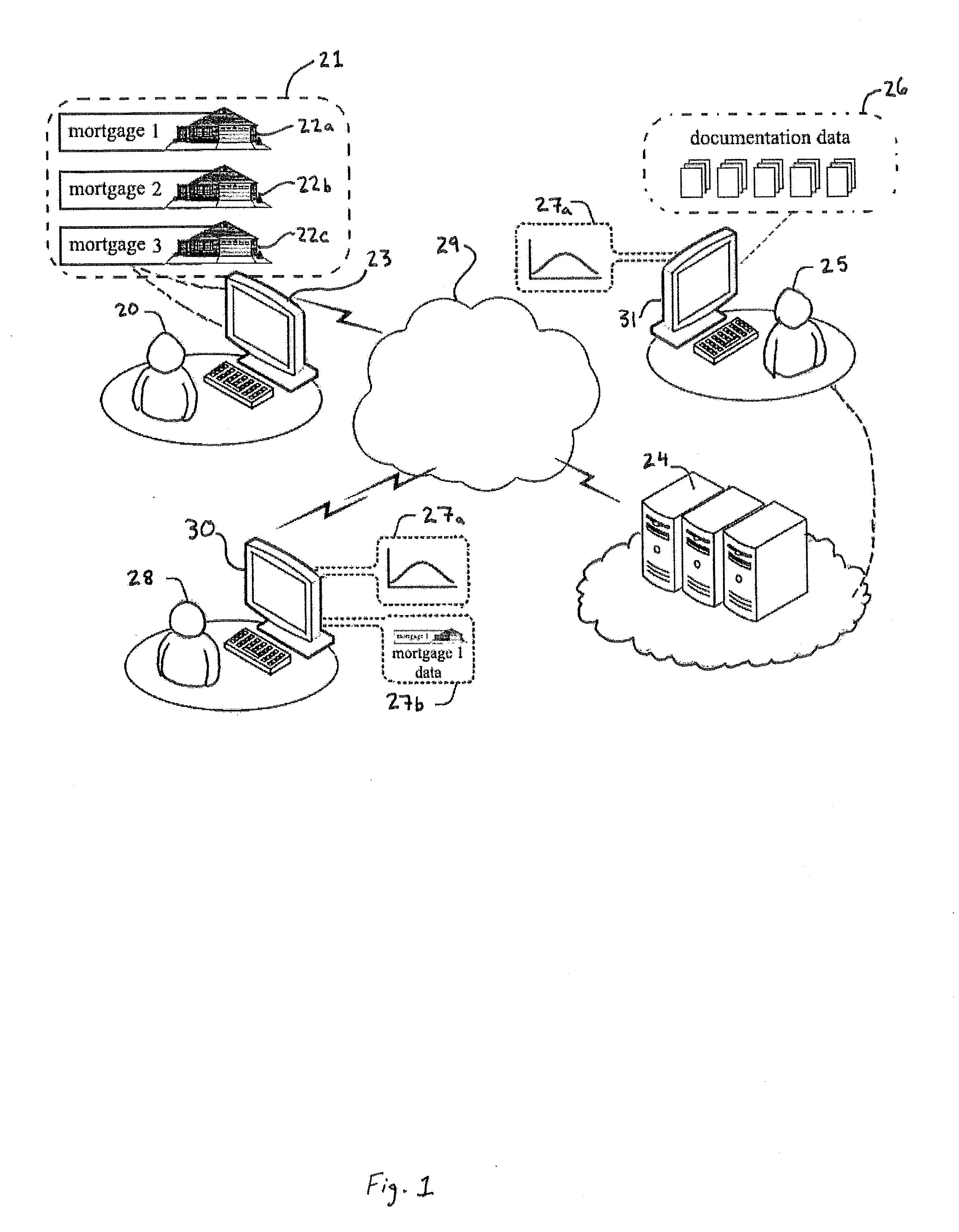

System and Method of Electronic Exchange for Residential Mortgages

A method and system for providing anonymous credit qualification and price negotiation, comprising: receiving, at a server computer, at least one application for at least one borrower, the at least one application comprising qualification data relating to the at least one borrower, supplementing the at least one application with third-party data relating to the at least one borrower, creating, for each of the at least one borrower, a complete borrower profile comprising information relating to each of the at least one borrower, and creating, for each of the at least one borrower, a universal borrower profile, wherein the Universal Borrower Profile comprises anonymous information selected from the complete borrower profile associated with each of the at least one borrower.

Owner:LTVTRADE

System and Method of Electronic Exchange for Residential Mortgages

A method and exchange system for trading individual, whole loans and providing anonymous credit qualification and price negotiation in an open forum. The system includes a server computer configured to receive data representing an estimated tradable range for the at least one whole loan, wherein the estimated tradable range is calculated from the documentation data; transmit, to the at least one seller, the data representing an estimated tradable range; make available to remote bidders, through the at least one network, listing data comprising data relating to the at least one whole loan; receive, from at least one remote bidder, at least one bid for at least one whole loan; and determine, for each of the at least one whole loan, a winning bidder based on the at least one bid received from the at least one remote bidder.

Owner:DICARLO DEAN

Electronic exchange and settlement system for cash letter adjustments for financial institutions

Owner:THE CLEARING HOUSE PAYMENTS

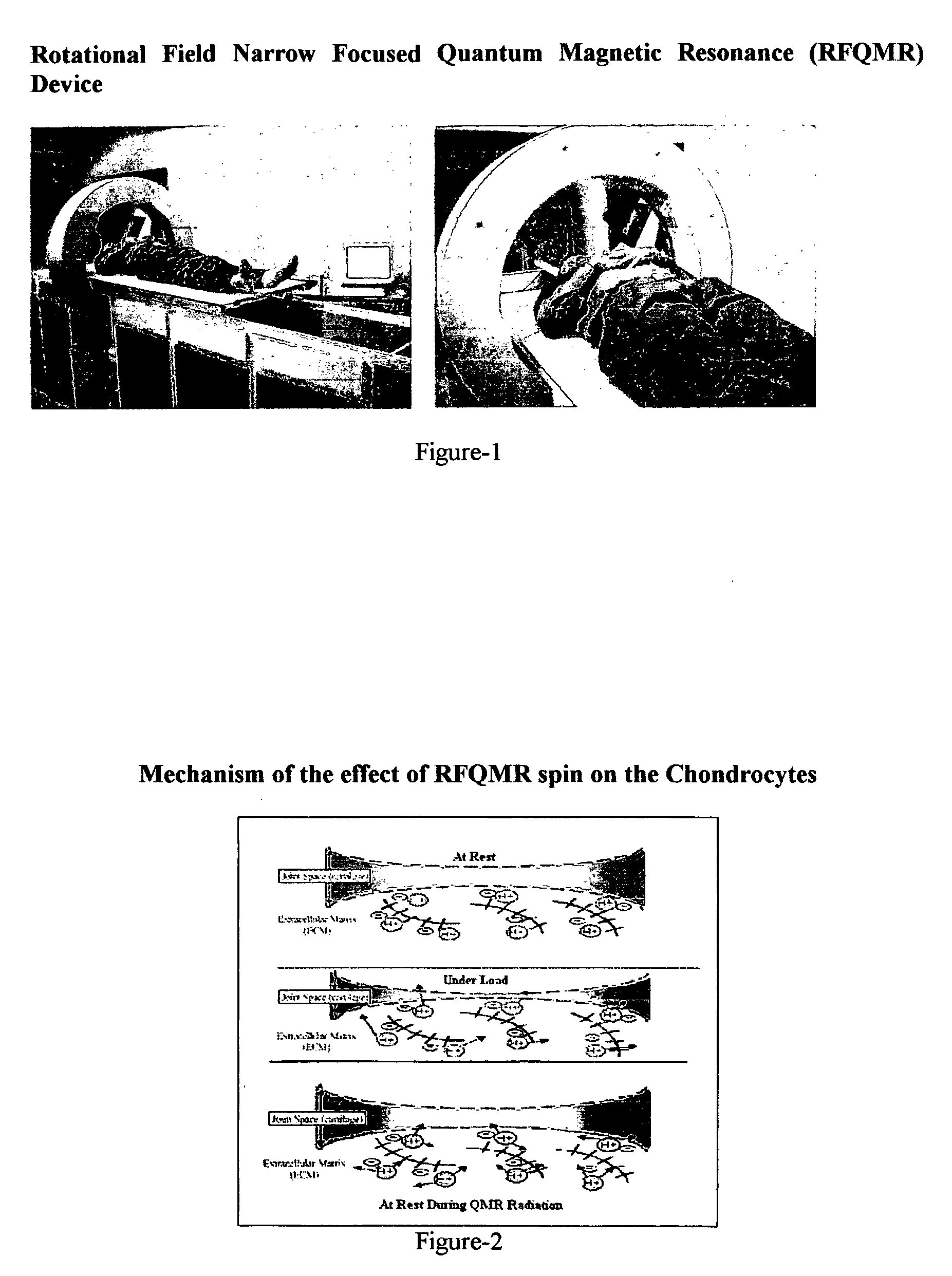

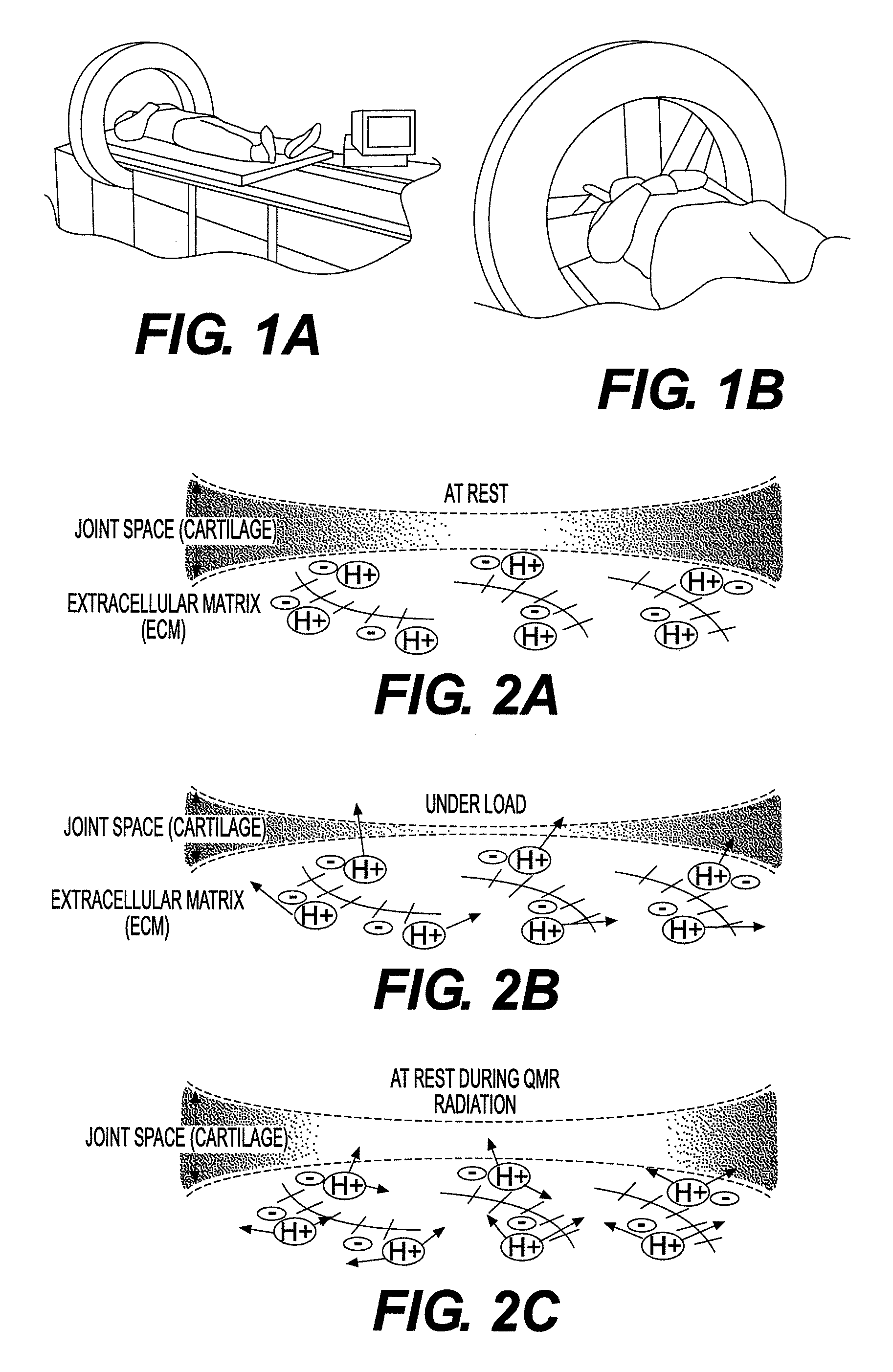

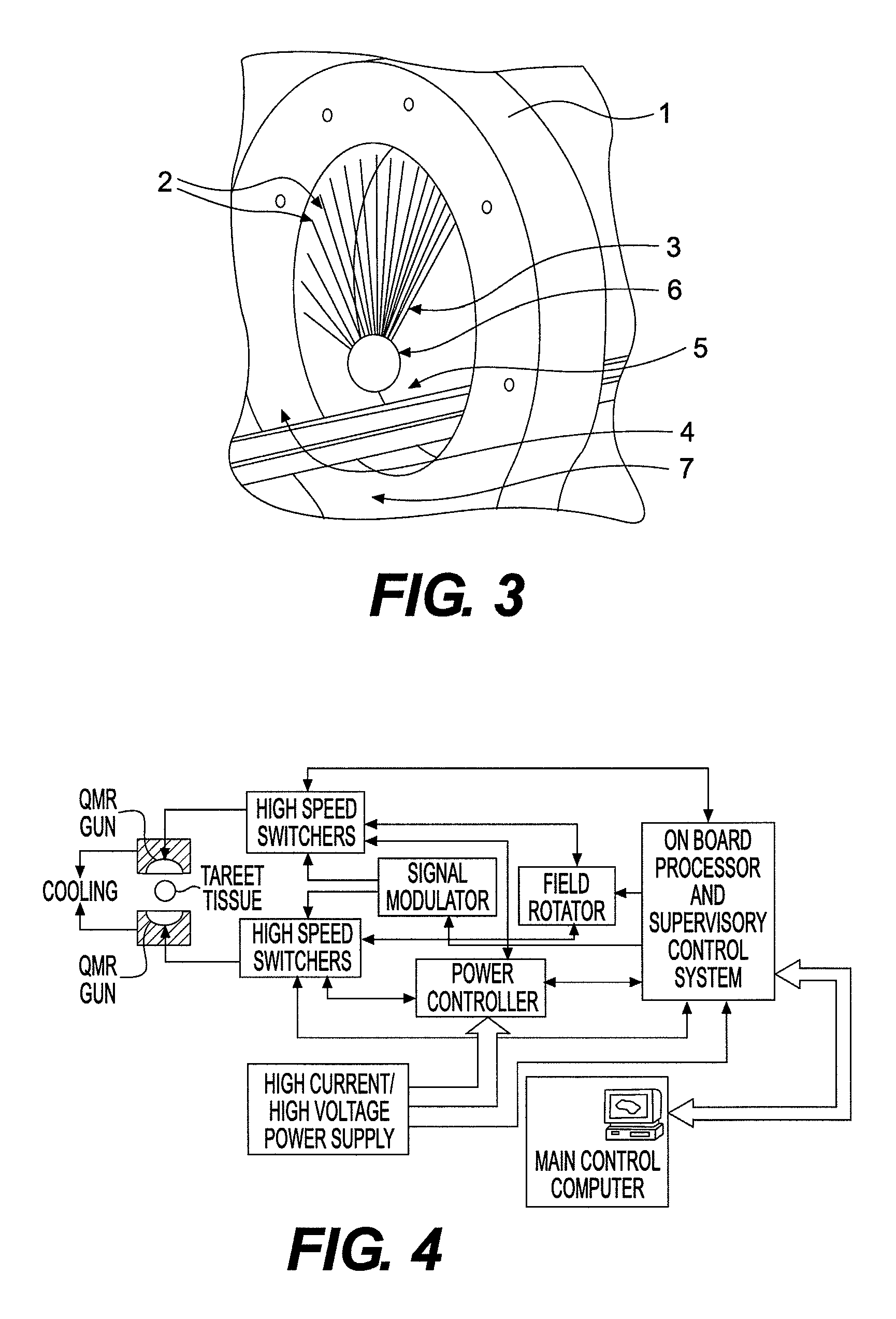

Method for tissue regeneration or degeneration in human and an apparatus therefore

ActiveUS20070208249A1Relieving disabilityRelieve painElectrotherapyMagnetotherapy using coils/electromagnetsMedicineResonance

Disclosed herein is an apparatus for tissue regeneration or degeneration in human by applying rotational field narrow focused quantum magnetic resonance on the required area. The apparatus consists of a plurality of guns for delivery the quantum magnetic resonance, a traveling platform for carrying the person under treatment, an electronic switsching system for controlling the guns, said electronic switching system being controlled by a main computer through an on board microprocessor and means for cooling and dispersing the heat generated during the operation.

Owner:KUMAR BV

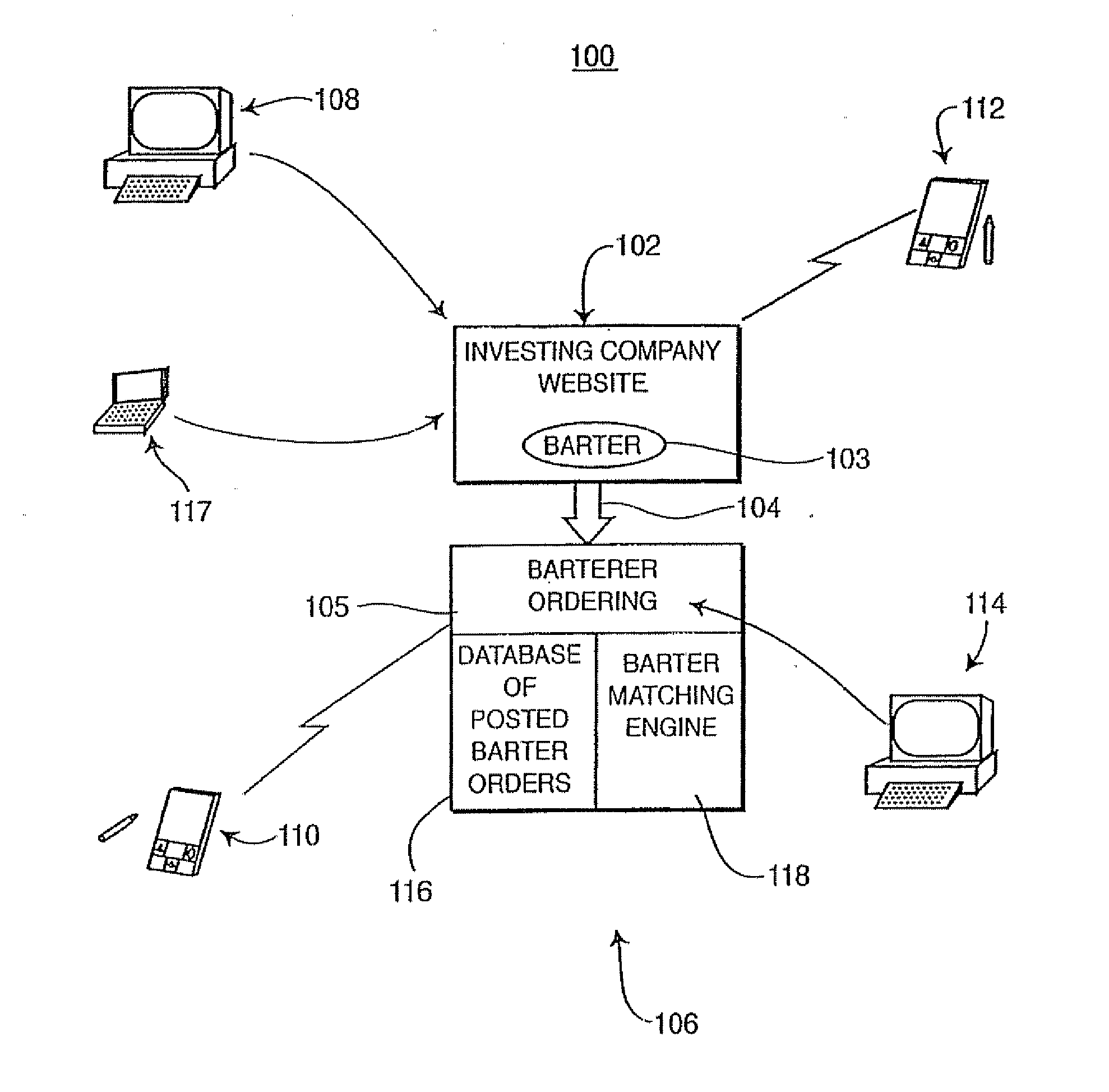

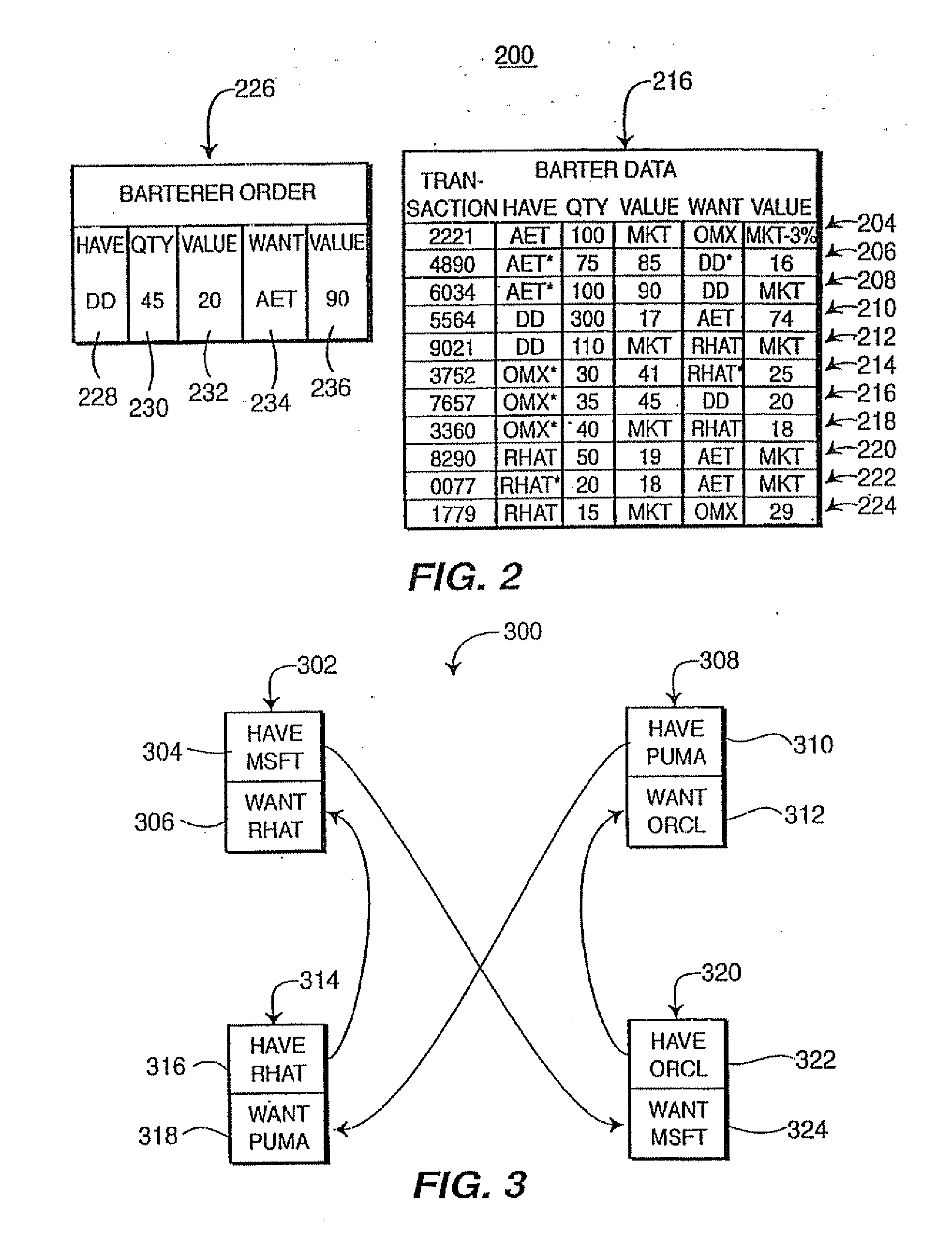

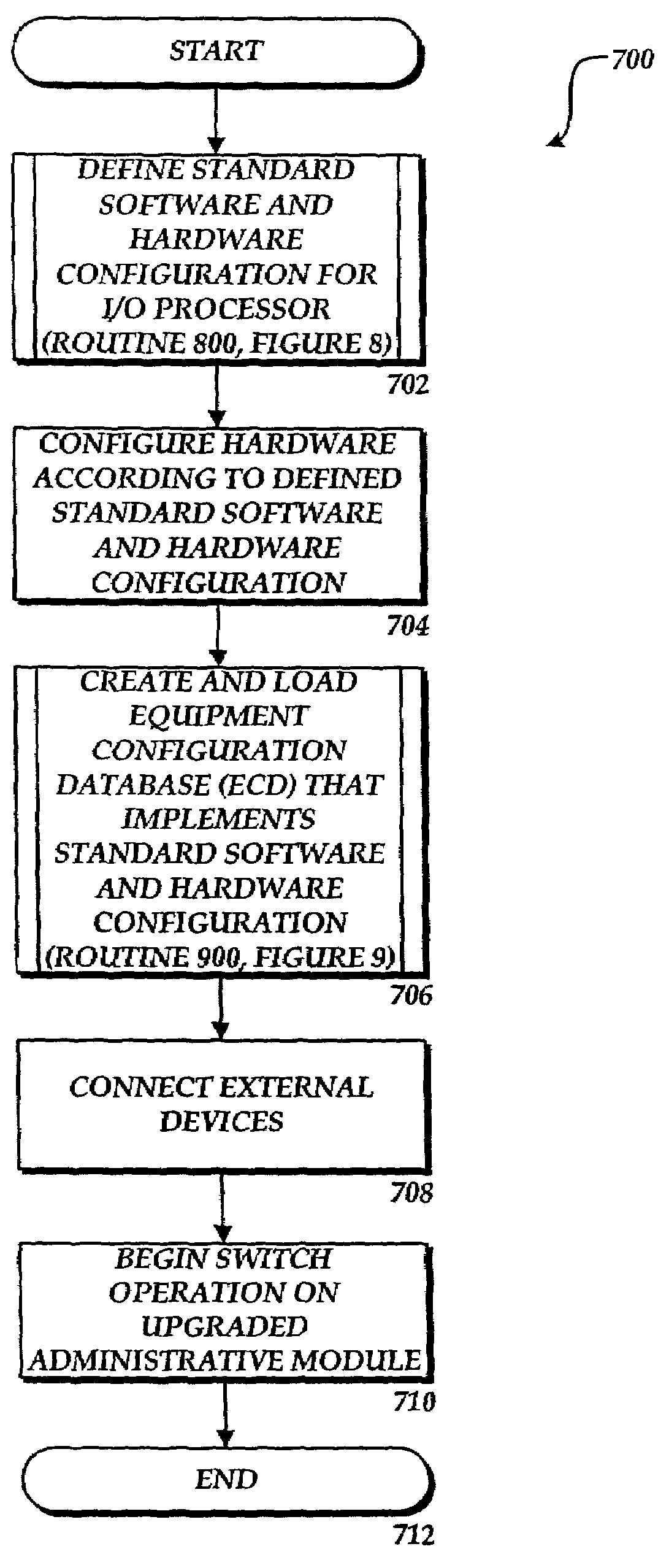

Electronic Bartering System with Facilitating Tools

A method for responding to order flow is disclosed. The method comprises establishing for a market maker a rule for automatically generating a contra order in response to an order. The rule comprises at least one condition comprising at least one characteristic describing the order. The at least one condition allowing matching based on a security in the order is in a security list specified by the market maker. The method further comprises receiving from a trader the order; matching on the computer the order to the at least one condition of the rule; automatically generating the contra order in response to the order, if the rule is satisfied; and providing the contra order for acceptance.

Owner:BARTER SECURITIES

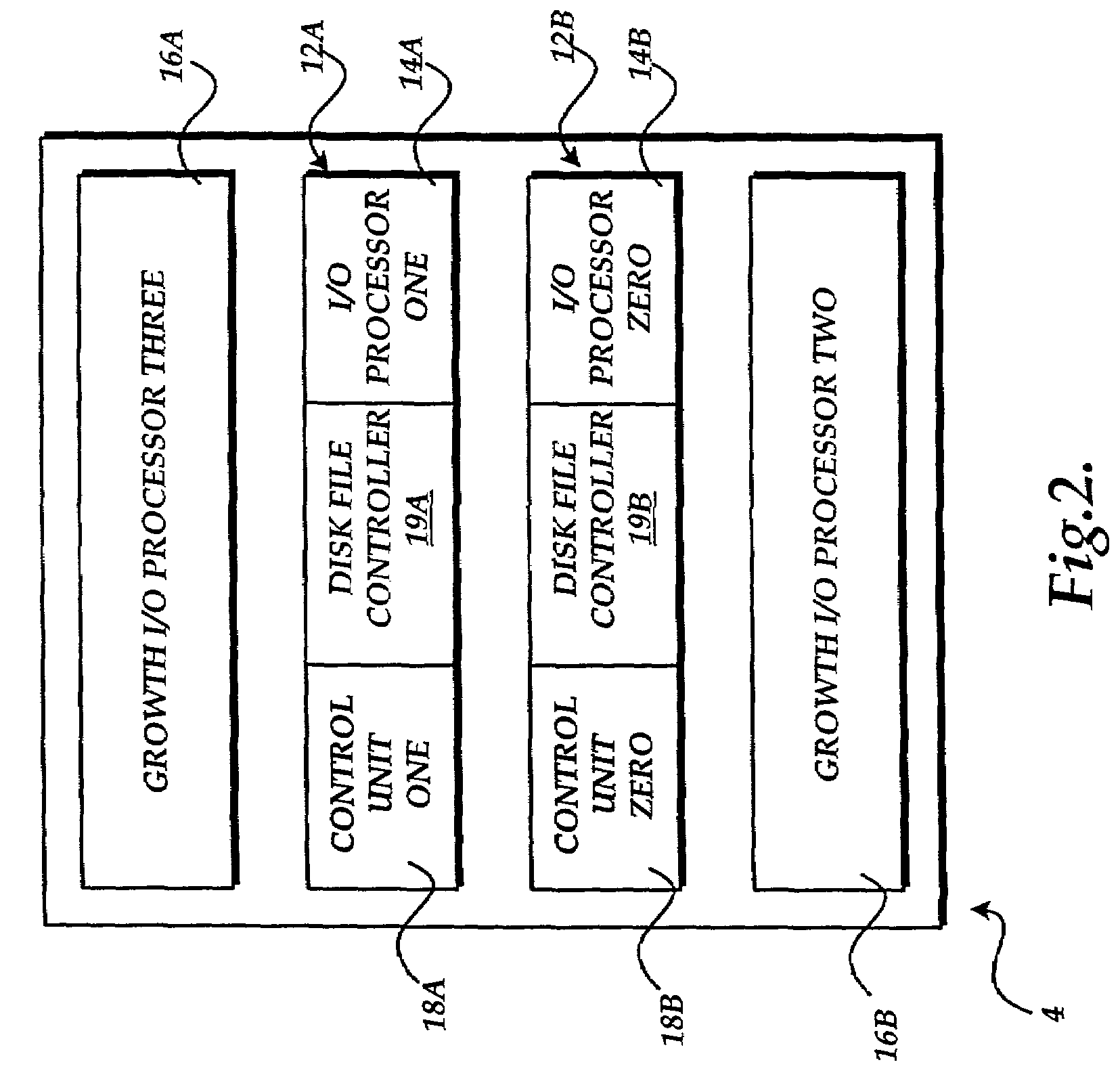

Method for configuring an upgraded administrative module computer in an electronic switching system

InactiveUS7177920B1Reduce the amount requiredReduce the possibilityMultiplex system selection arrangementsDigital computer detailsComputer-on-moduleData storing

A method for configuring an upgraded administrative module computer is provided. A standard hardware and software configuration for the upgraded administrative module computer is defined. An equipment configuration database is created that may be utilized by the upgraded administrative module computer to configure itself in accordance with the standard hardware and software configuration. The equipment configuration database is transmitted to a downlevel administrative module computer. Data stored on the downlevel computer system is migrated to an upgraded administrative module computer. The equipment configuration database is utilized to configure the upgraded administrative module computer according to the standard hardware and software configuration.

Owner:BELLSOUTH INTPROP COR

Customizable data transaction systems

PendingUS20200258153A1FinanceEncryption apparatus with shift registers/memoriesMarket placeEngineering

Owner:NASDAQ TECHNOLOGY AB

Device for final inspection

ActiveUS20070205789A1Extended service lifeImprove measurement reliabilityFault location by increasing destruction at faultIndividual semiconductor device testingElectronic switchProcedural approach

A device is provided for subjecting a plurality of singulated semiconductor components to functional verification, which includes contact pins that are integrated in a test socket and establish a mechanical and electrical contact between the test socket and the integrated semiconductor circuits, a holding fixture (DUT board) connected to the test socket for transmitting electrical signals to and from a program-controlled electronic switching system, and lines and control devices for operating at least one pneumatic transport and holding device for picking up, orienting and positioning the singulated semiconductor components, an inert gas is provided as the medium for operating the pneumatic devices.

Owner:ATMEL CORP

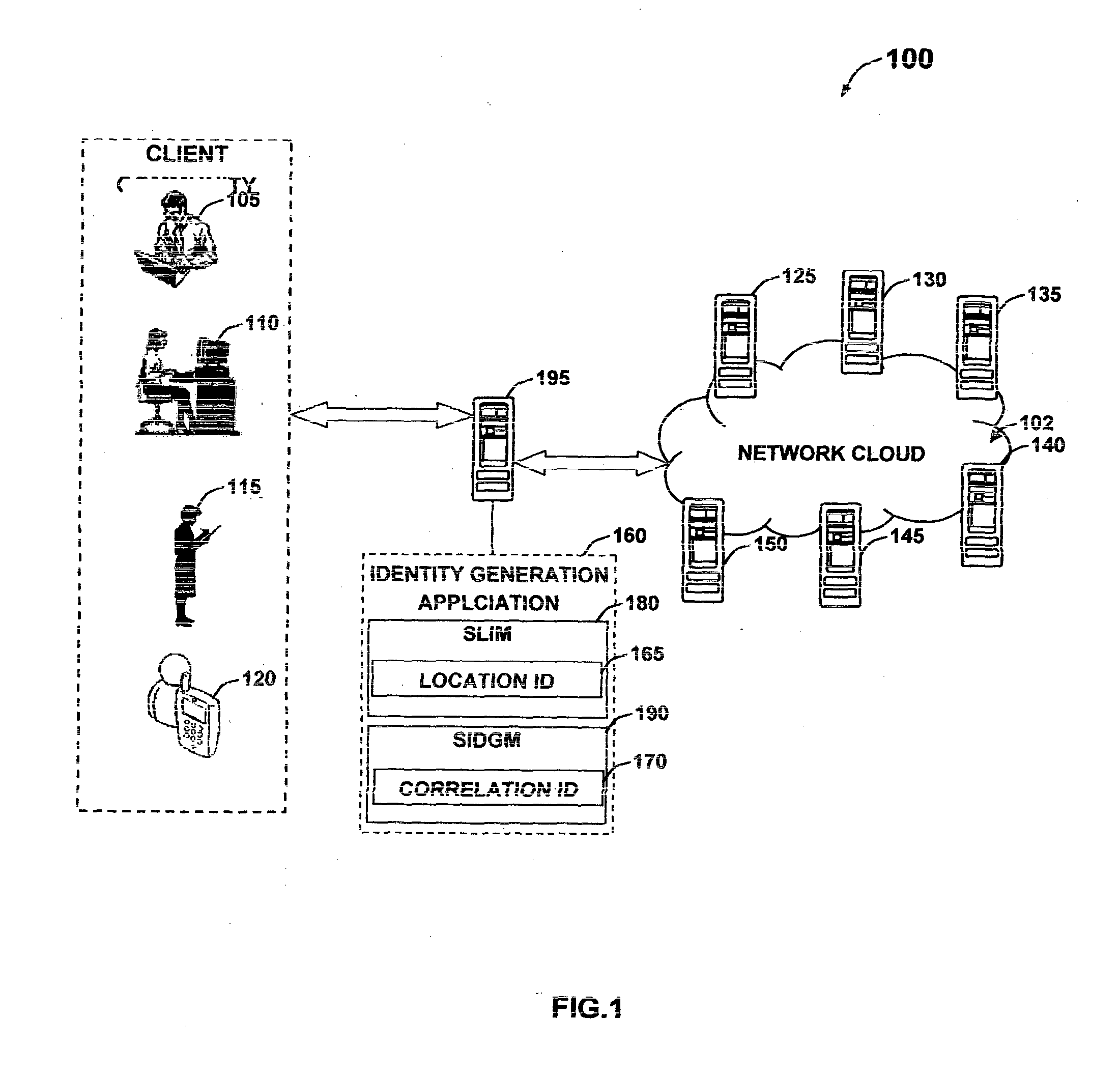

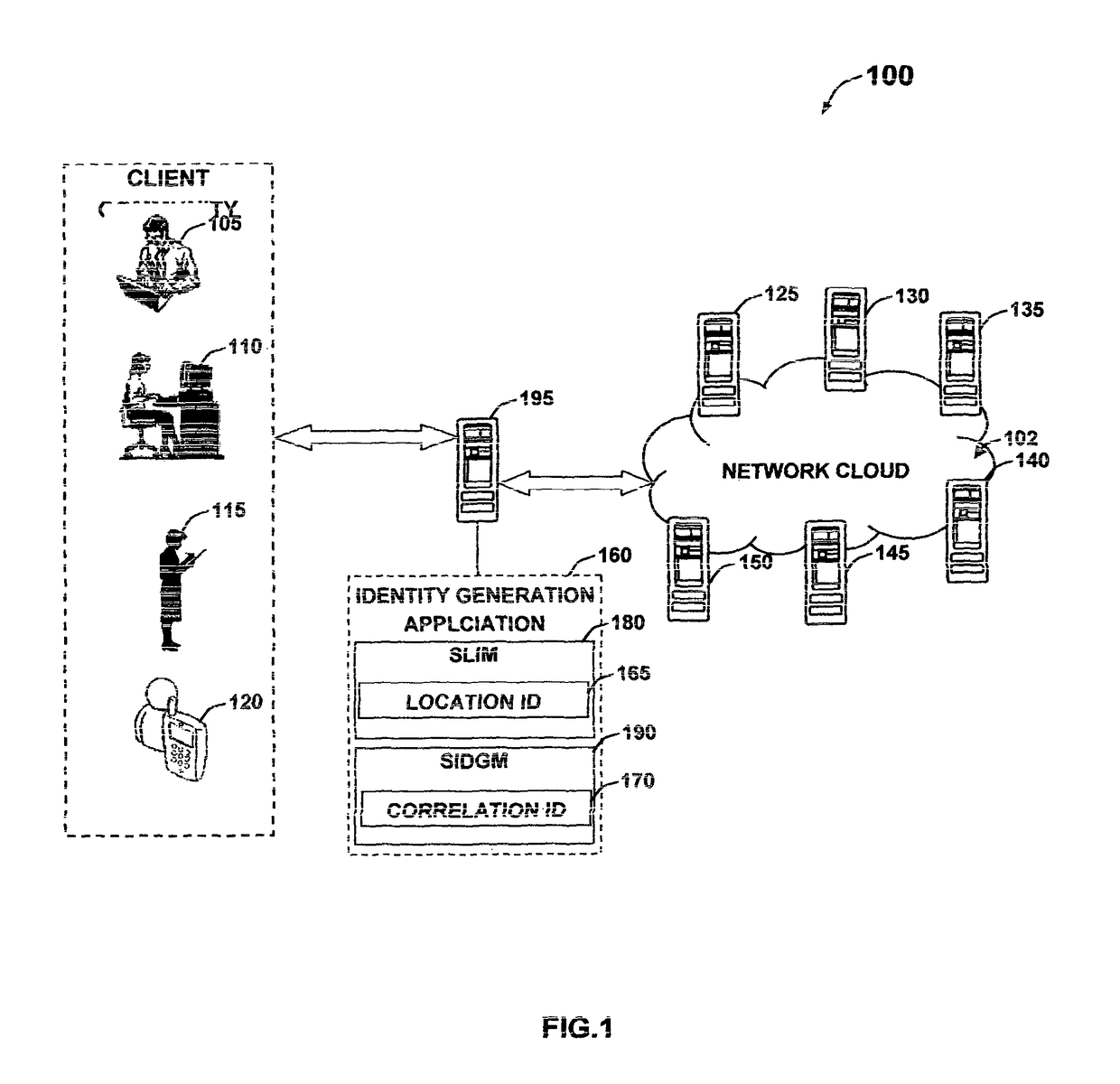

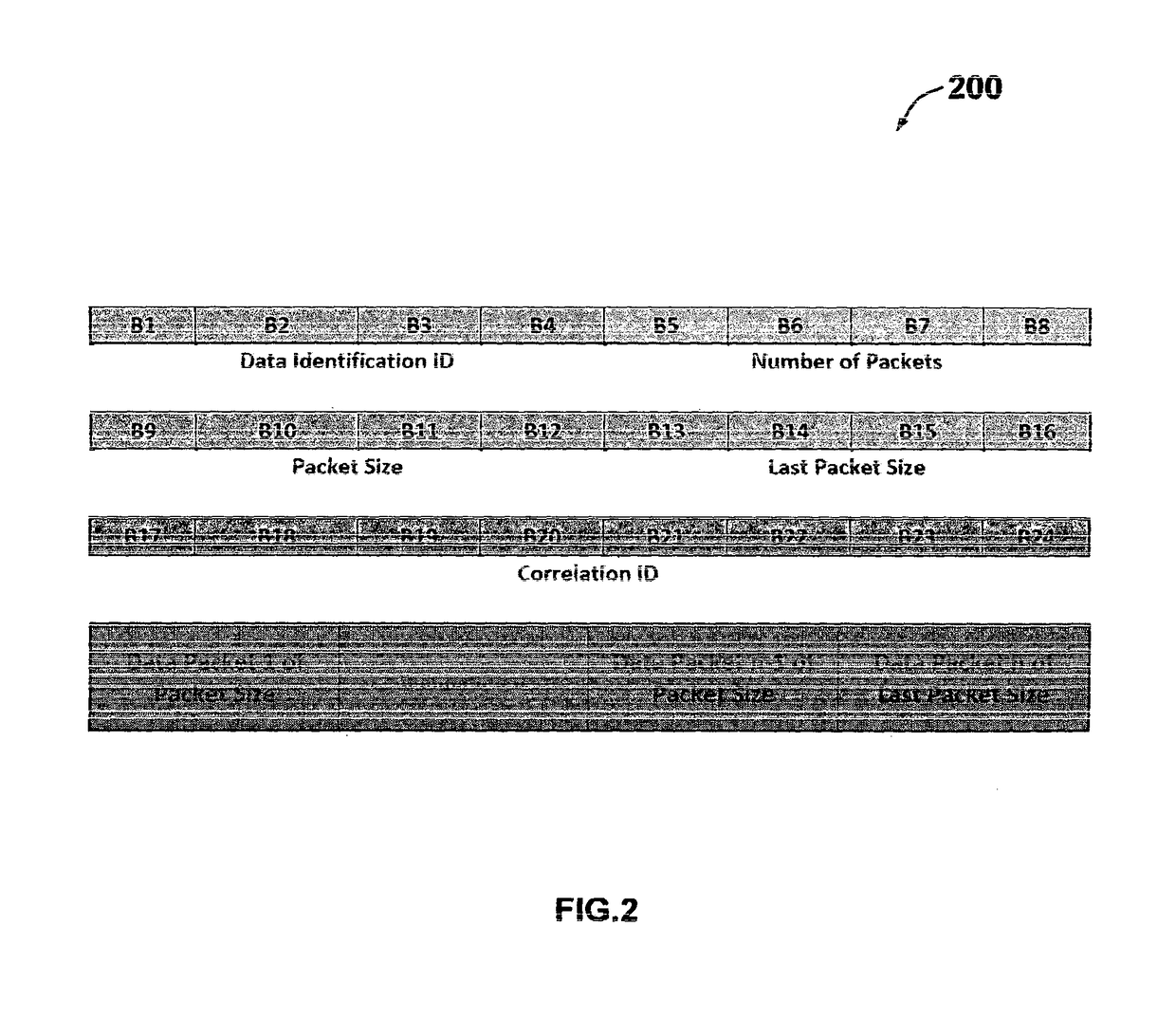

Electronic Switching System For Generating Correlation Identity

ActiveUS20160014211A1Generate efficientlyEfficiently authenticatingComputer security arrangementsMultiple digital computer combinationsClient-sideService location

An electronic switching system for generating correlation identify (ID) with respect to a client in order to thereby establish, integrate and communicate to a server (lean server or nano server) within a cloud environment (e.g. Inswit™ Cloud). A service location identification module for identifying and generating a service location identity with respect to a remote client. A source ID generating module for generating a correlation ID / source ID based on the service location identify in order to serialize the payload and establish a connection with the server. The electronic switching system proposed herein operates external to the cloud environment by effectively generating the correlation identity with respect to a client device accessing the server in a cloud environment. The system also switches, integrates and executes client communications to an appropriate server in the cloud environment using the correlation ID.

Owner:TWIXOR PTE LTD

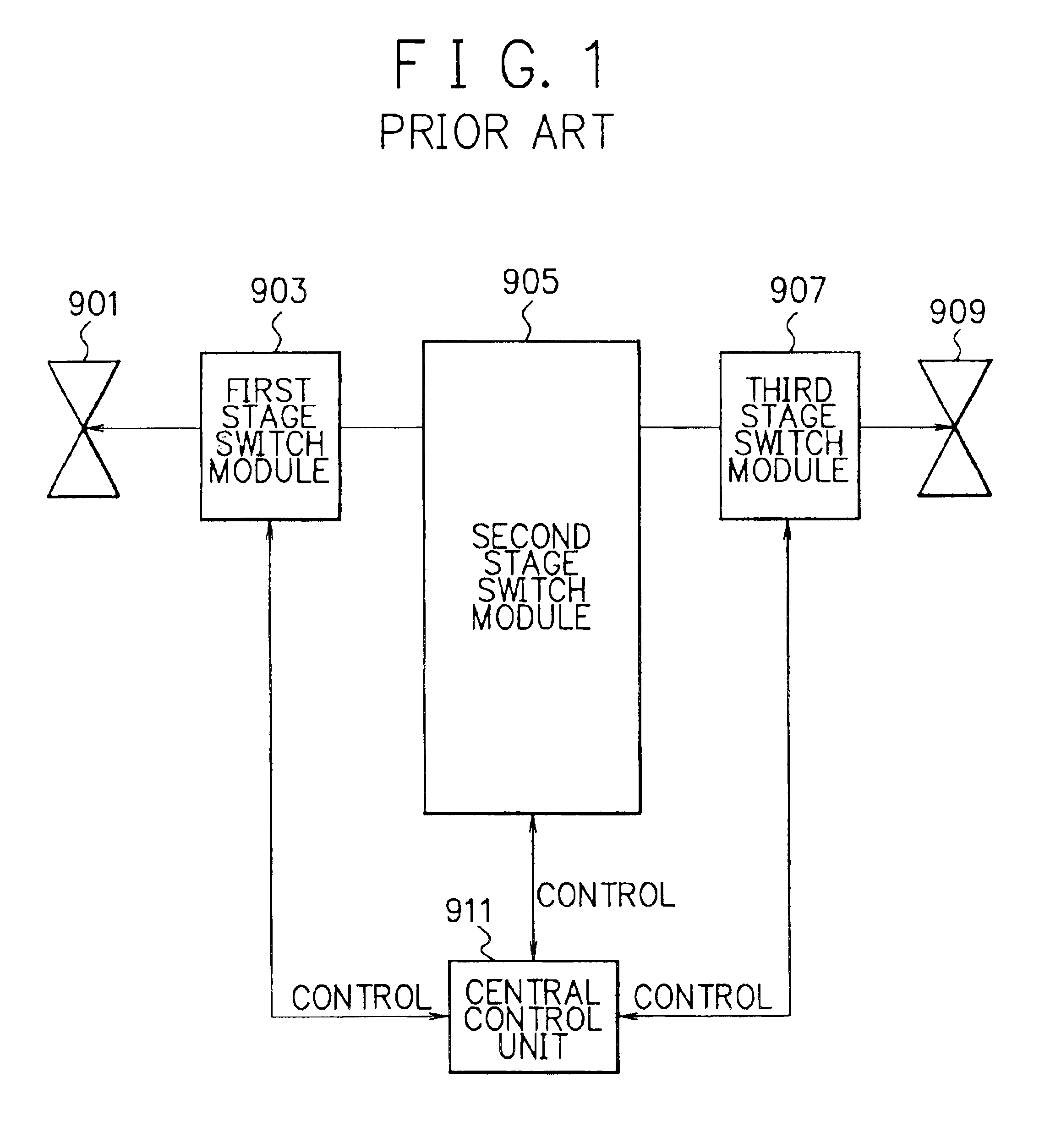

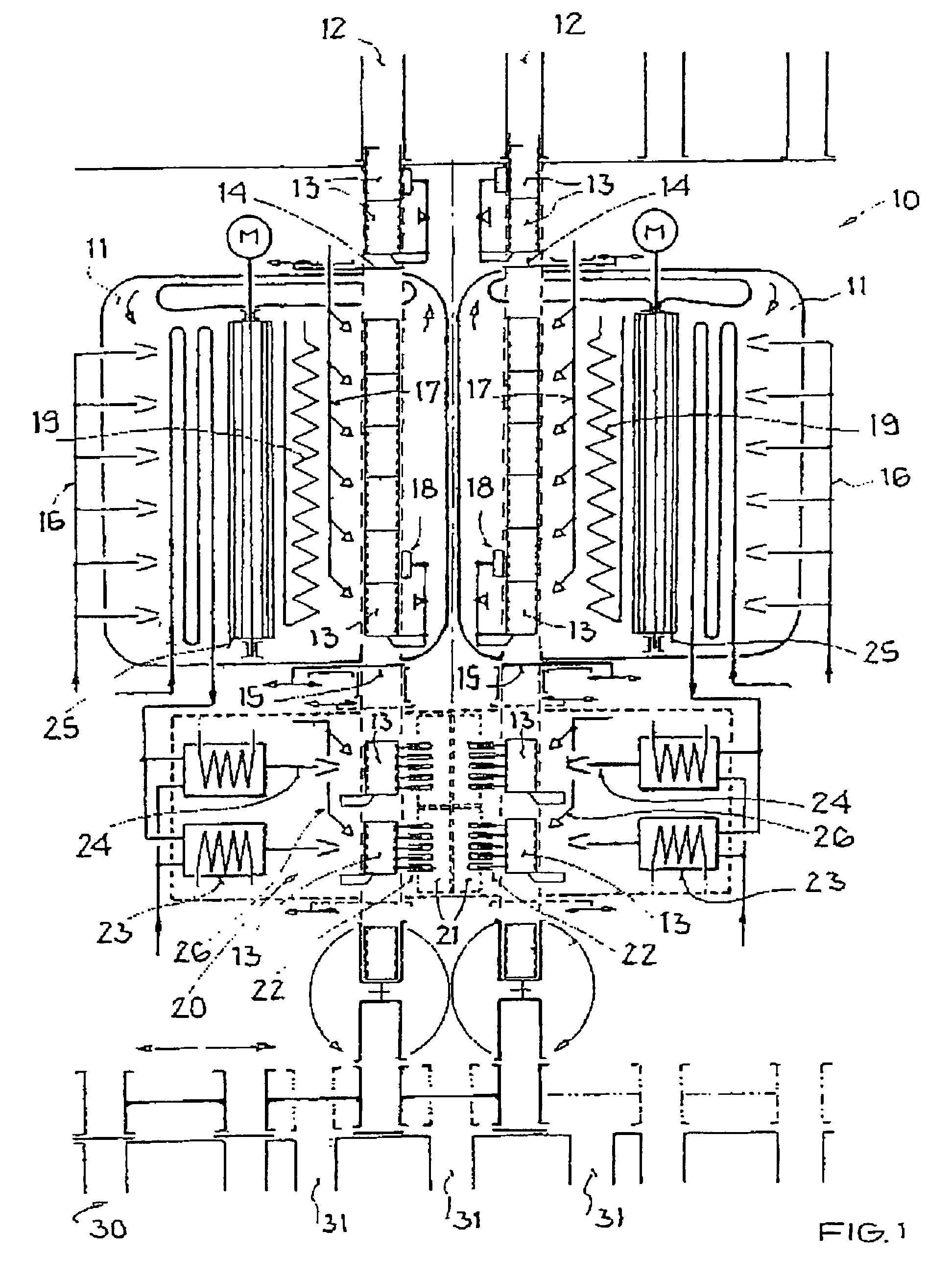

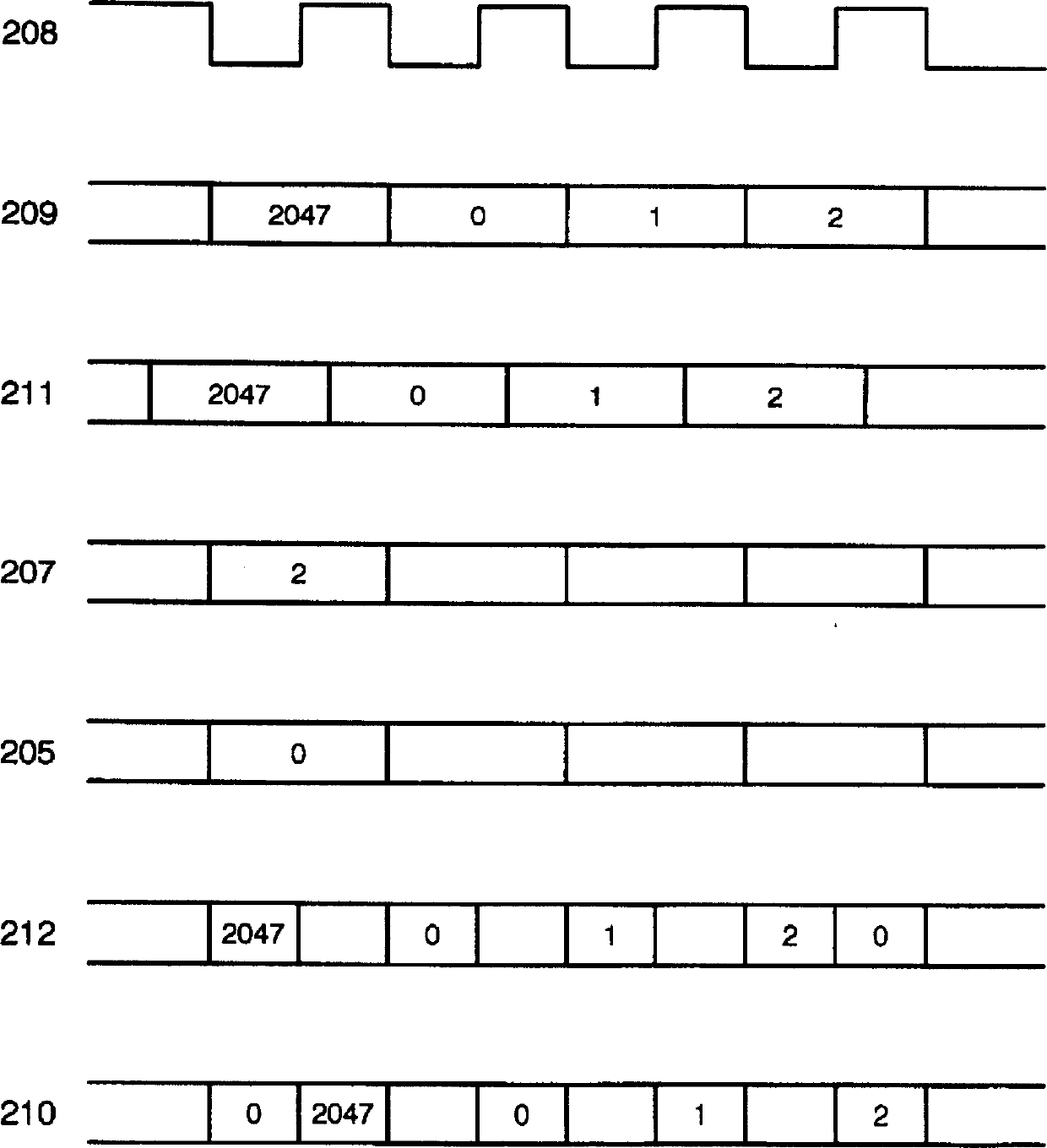

System and method for high-capacity electronic switching

InactiveUS6850517B1Interconnection arrangementsError preventionTelecommunications linkSwitching signal

A high-capacity electronic switching system includes two or more first stage switch modules to each of which one or more subscriber terminals (telephone sets, fax machines, personal computers, etc.) are connected and each of which executes signal switching for signals from / to the subscriber terminals, and a second stage switch module for switching signals between the first stage switch modules. In the high-capacity electronic switching system, each of the first stage switch modules is connected to another one of the first stage switch modules via a special-purpose link for setting a communication link between the first stage switch modules when necessary. For example, the setting of the communication link via the special-purpose link is executed when an abnormal condition of the second stage switch module occurred and normal communication link setting between two first stage switch modules via the second stage switch module is impossible. By this, even when failure occurred to the second stage switch module and communication between two first stage switch modules is impossible, a communication link can be set between the first stage switch modules via the special-purpose link, and thereby communication between the first stage switch modules is realized.

Owner:NEC INFRONTIA CORP

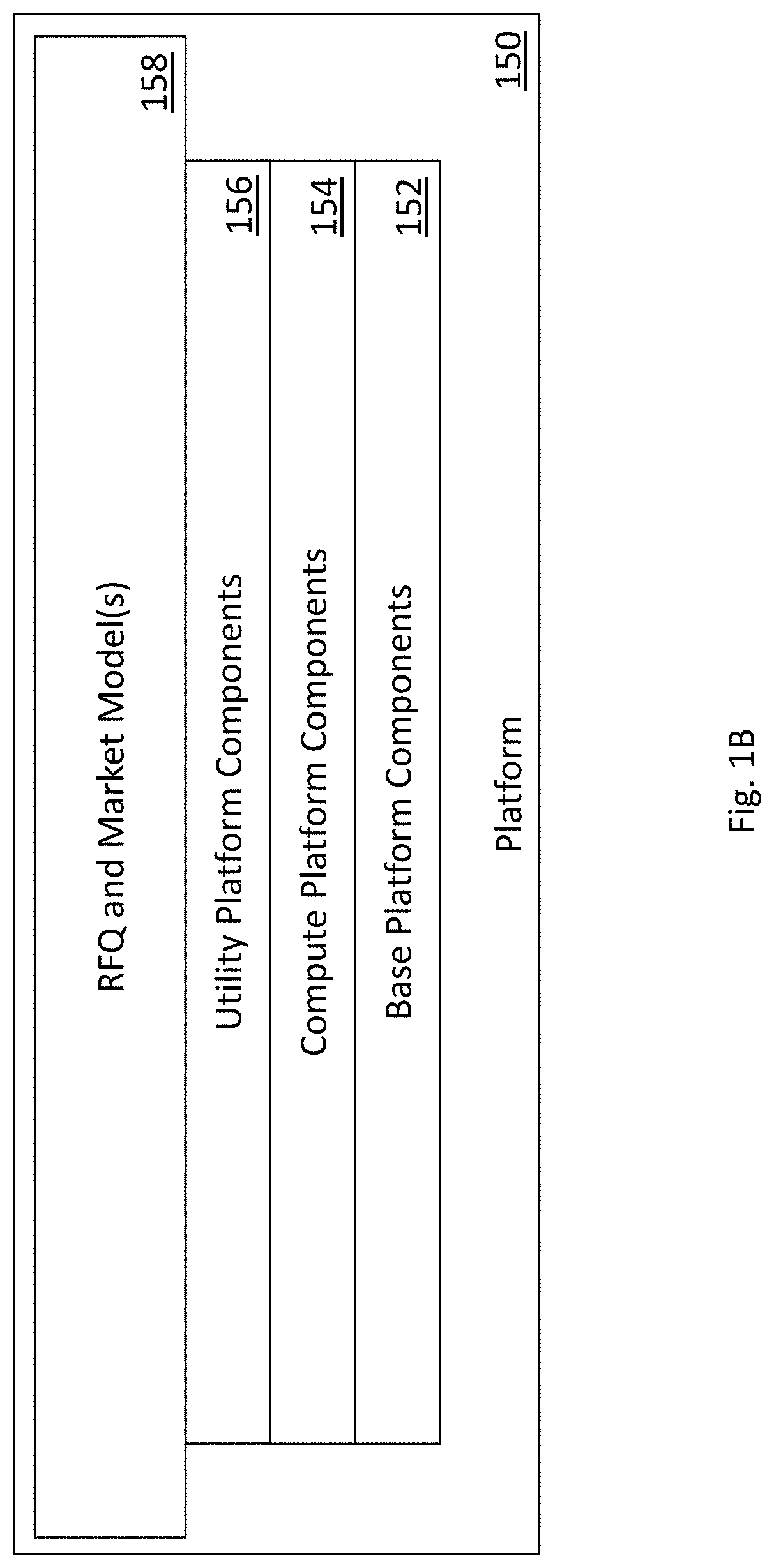

Computer platforms designed for improved electronic execution of electronic transactions and methods of use thereof

In order to facilitate secure and confidential electronic exchanges, systems and methods include establishing an electronic communication session based on participation levels controlled by a stack software object such that each invitee computing device associated with each invitee is prevented from accessing activities in the electronic communication session unless the invitee satisfies first predetermined parameters based on a locked stack participation level; an initiating computing device associated with the initiating user is enabled to access the electronic communication setting at a reserve level while each invitee computing device is prevented from accessing the activities in the electronic communication session unless the invitee satisfies second predetermined parameters based on an unlocked stack participation level; and the initiating computing device and each invitee computing device are enabled to access the activities in the electronic communication session based on an open stack participation level.

Owner:BROADRIDGE FIXED INCOME LIQUIDITY SOLUTIONS LLC

Device for final inspection

ActiveUS7589545B2Extended service lifeImprove measurement reliabilityFault location by increasing destruction at faultIndividual semiconductor device testingElectronic switchEngineering

A device is provided for subjecting a plurality of singulated semiconductor components to functional verification, which includes contact pins that are integrated in a test socket and establish a mechanical and electrical contact between the test socket and the integrated semiconductor circuits, a holding fixture (DUT board) connected to the test socket for transmitting electrical signals to and from a program-controlled electronic switching system, and lines and control devices for operating at least one pneumatic transport and holding device for picking up, orienting and positioning the singulated semiconductor components, an inert gas is provided as the medium for operating the pneumatic devices.

Owner:ATMEL CORP

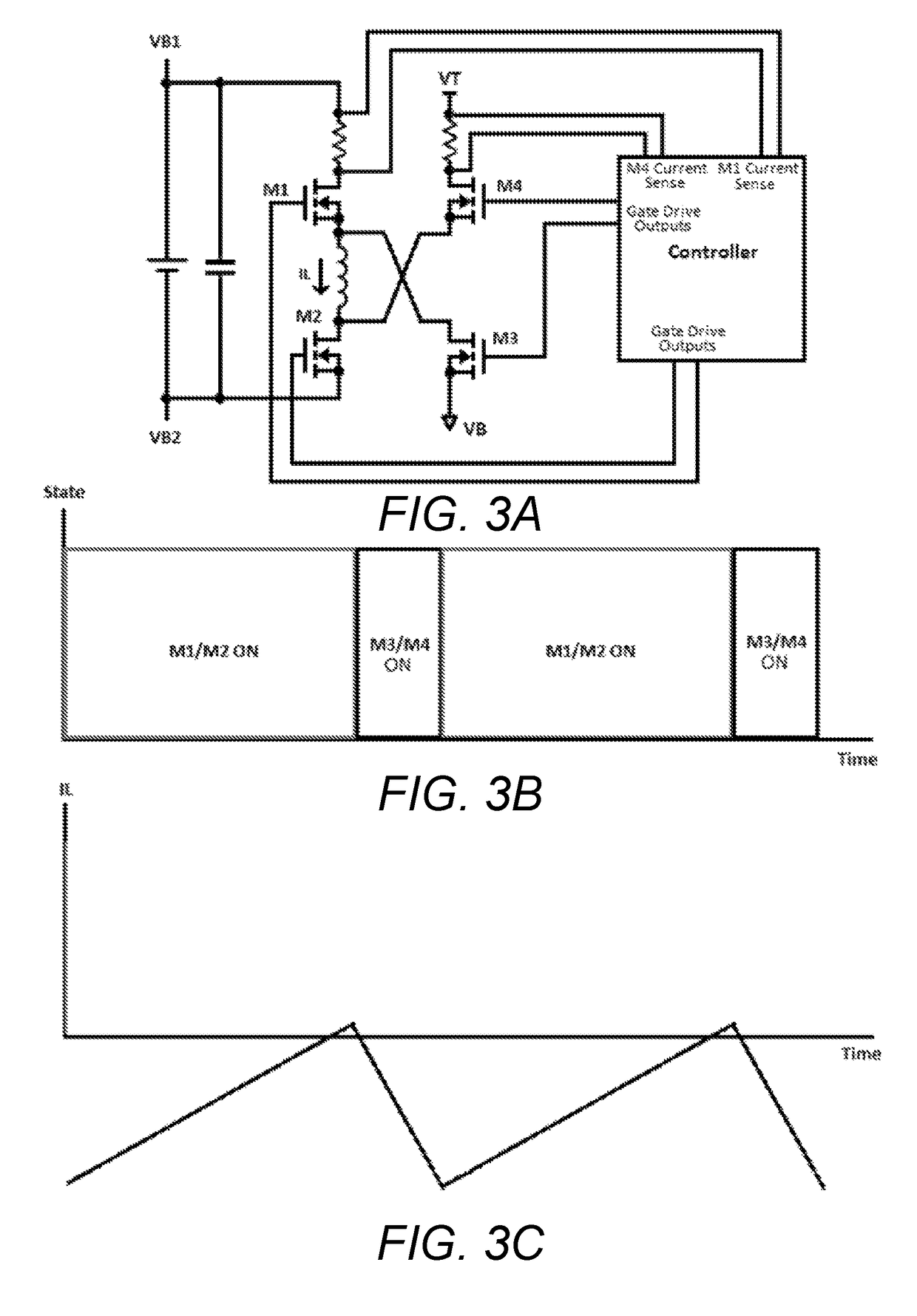

Energy storage device stack balancing using switched inductor background

ActiveUS10177580B2Charge equalisation circuitCells structural combinationControl electronicsElectronic switch

Owner:ANALOG DEVICES INT UNLTD

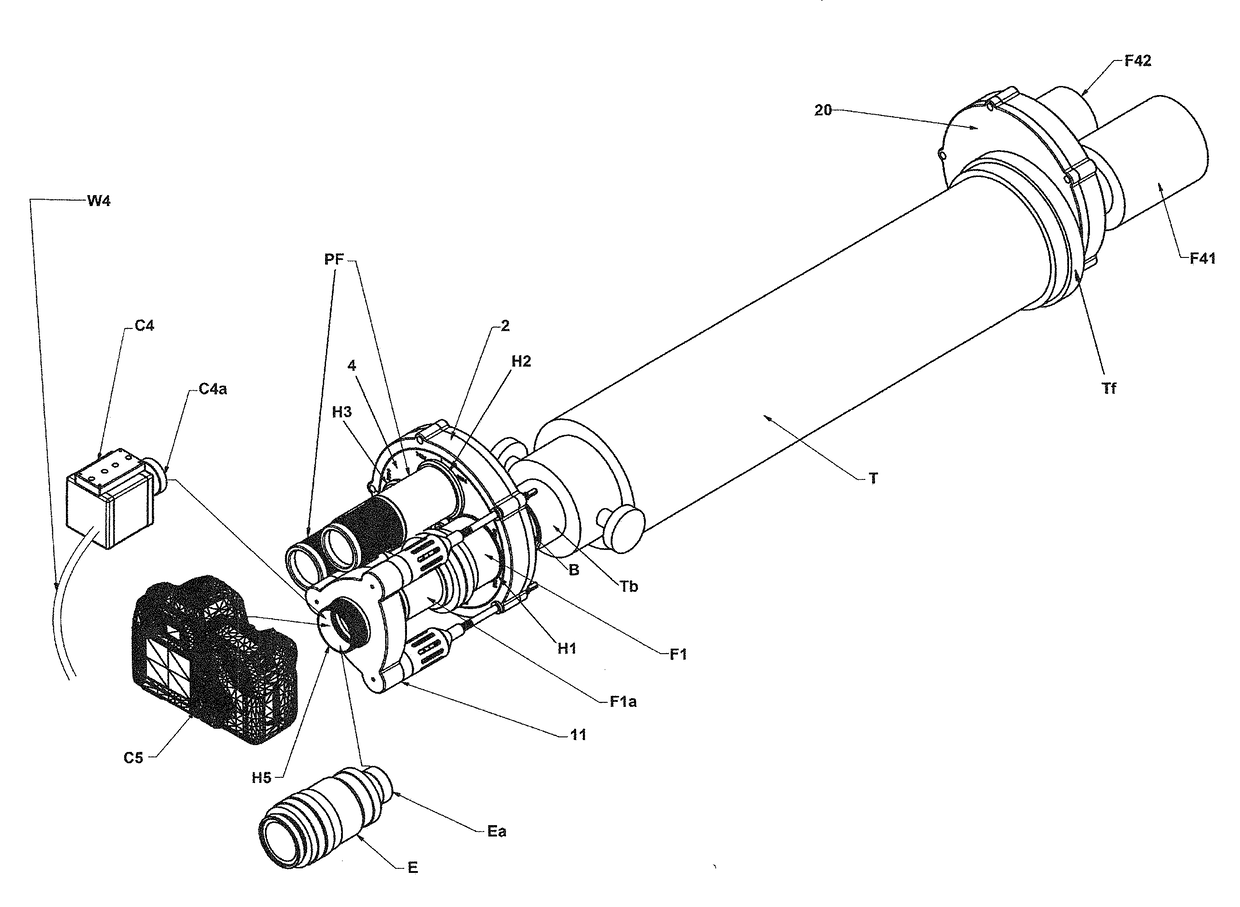

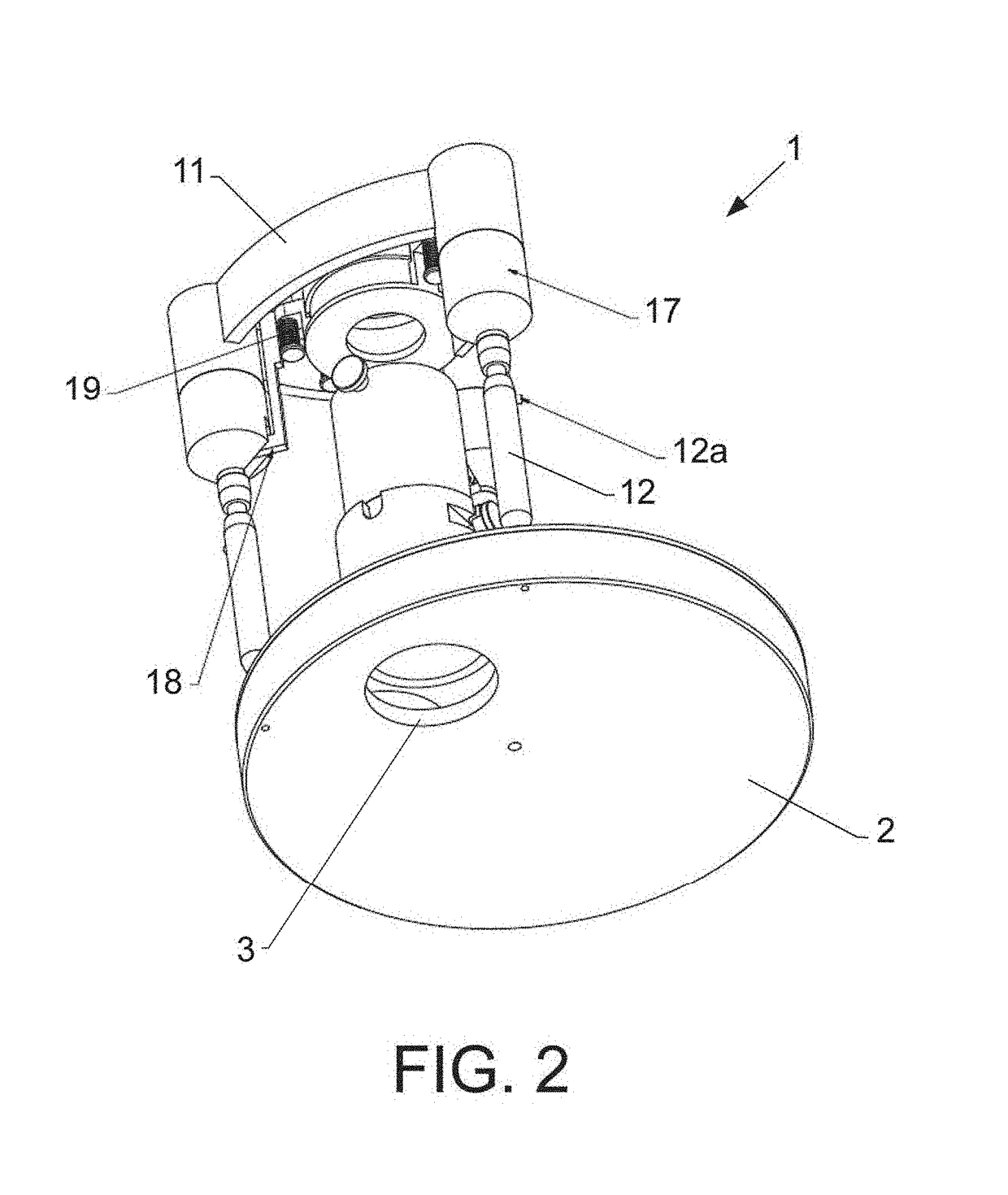

Universal electronic exchanger system for eyepieces, especially for telescopes

Universal electronic exchange system, especially for coupling to telescopes or similar, which includes an automated rotary device provided with a revolver-type rotary plate provided with a plurality of tubular members with holders for respective optical devices, an electric motor connected to the revolver-type rotary plate for transmission of a rotary movement thereto, an electronic unit for tubular-member selection, wherein the electronic unit is made and arranged to receive a selection signal indicative of a tubular member to be used, wherein the selection signal is used for controlling rotation and stopping of the revolver-type rotary plate, process a speed, angular path of rotation and stopping position of the tubular member to be used, and send a command signal to the electric motor of the revolver-type rotary plate for positioning and aligning the tubular member to be used with the optical axis.

Owner:MARTINEZ MORALES ALVARO +1

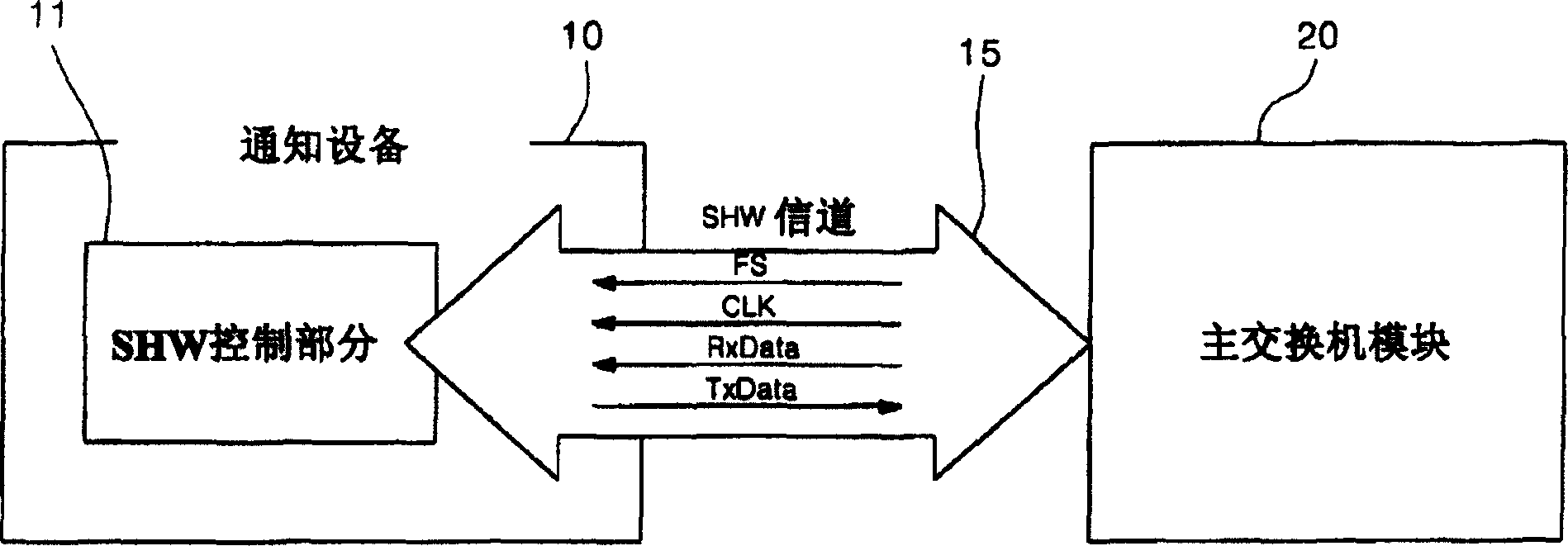

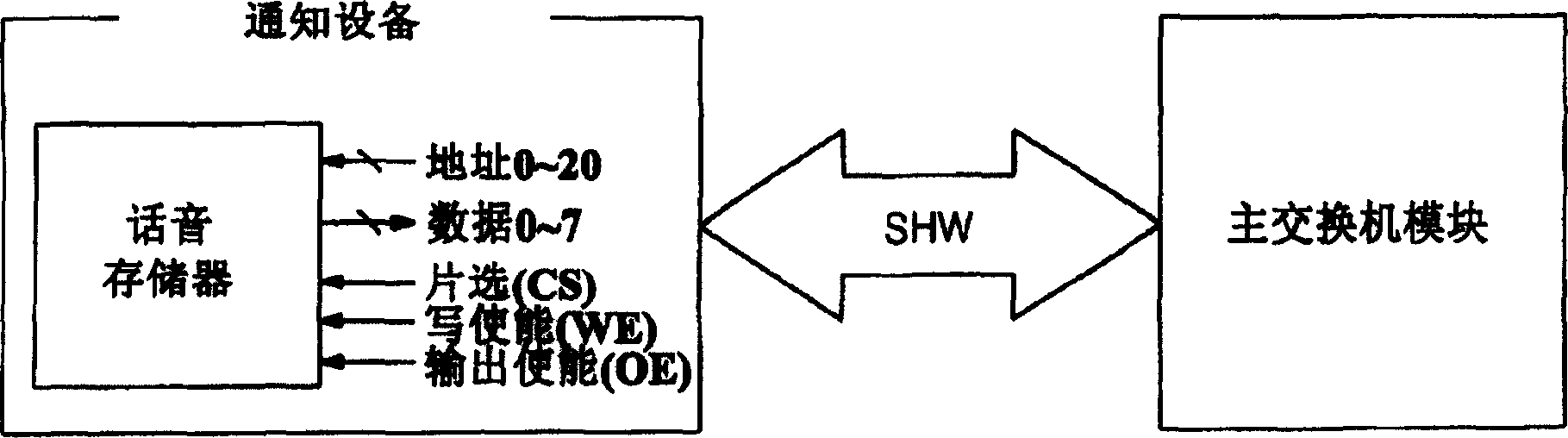

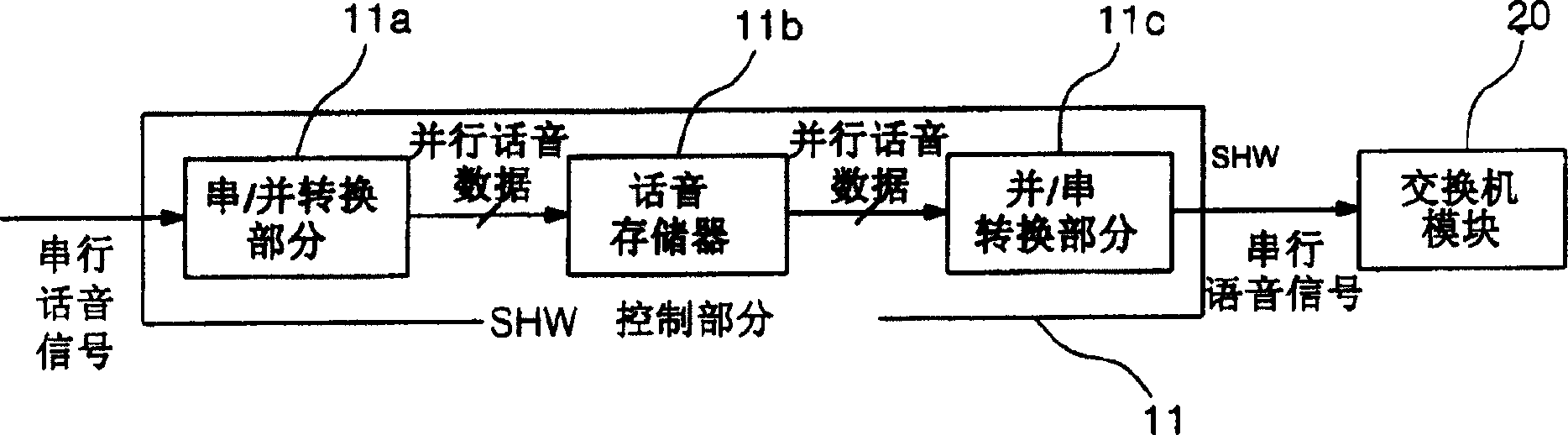

Notice device with virtual recorder

Disclosed is a notification device in an electronic switching system, the notification device comprising a virtual recorder in the electronic switching system, by utilizing a virtual channel to be able to record / monitor the voice for notification without occupying a specific channel, thereby improving the The way to occupy the channel. The notification device according to the present invention includes: a first switch branch line (SHW) control part for controlling notification; a second SHW control part for controlling the notification; an SHW channel for transmitting the first SHW control part and the second SHW control part control signals for the SHW control section; and a switch module connected to the SHW channel for performing notification.

Owner:ERICSSON-LG

Electronic exchanger, electron exchange system and control method of electronic exchanger system

InactiveCN101937411AGuaranteed continuityImprove space efficiencySubscriber stations connection selecting arrangementsNetworks interconnectionElectron exchangeEngineering

The present invention discloses an electronic exchanger allowing mutual connection of parallel connection computer and parallel connection electronic joints, an electron exchange system and a control method of an electronic exchanger system. The electron exchange system includes a computer group of parallel connection computers; an electronic joint group of the parallel connection electronic joints; an electronic exchanger for implementing dynamic connection between the computer group and the electronic joint group.

Owner:ELECTRONICS & TELECOMM RES INST

Quick locating method and system for single-party call

InactiveCN101193330ARapid positioningPrecise positioningSelection arrangementsHuman–machine interfaceUser input

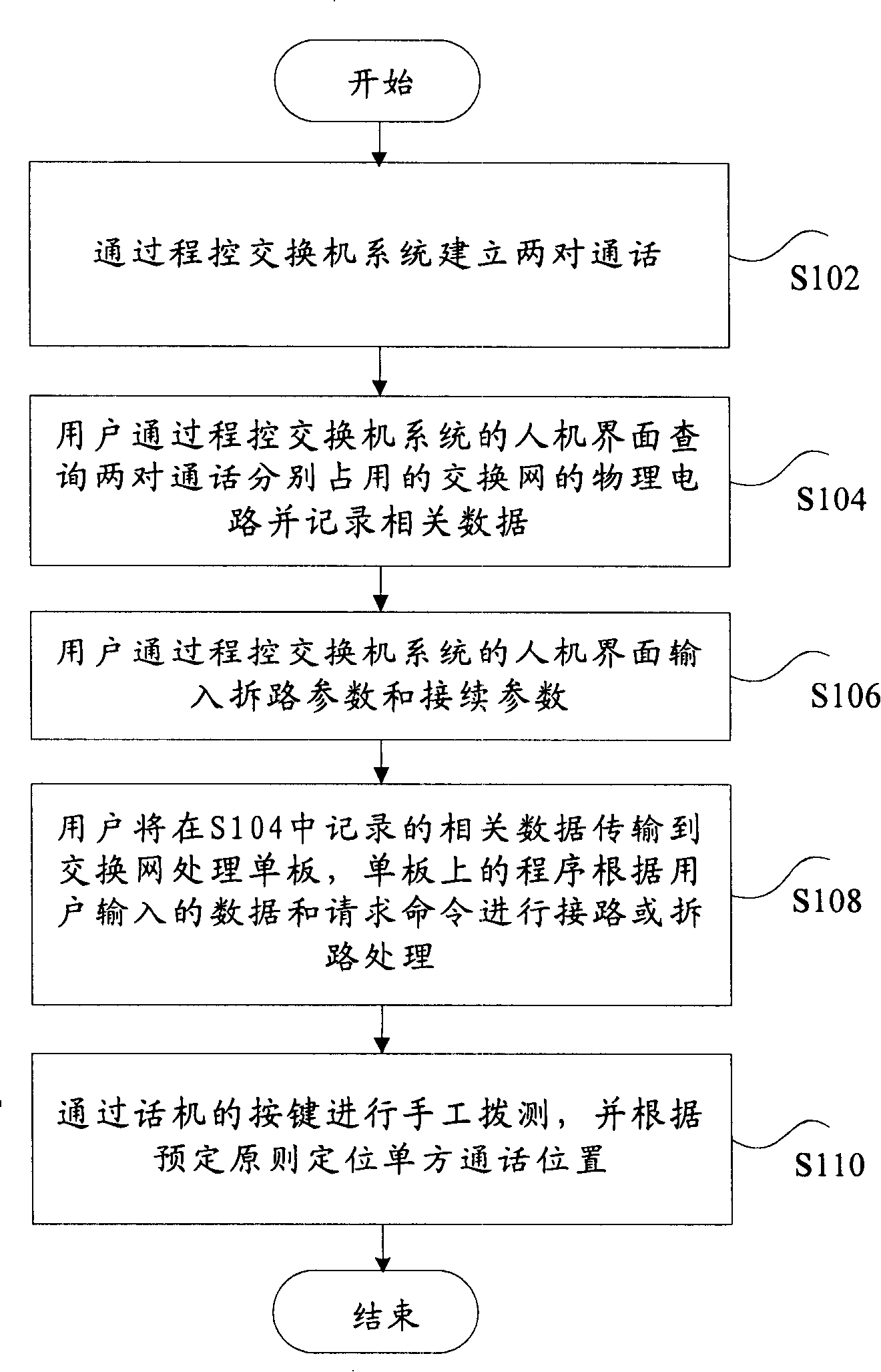

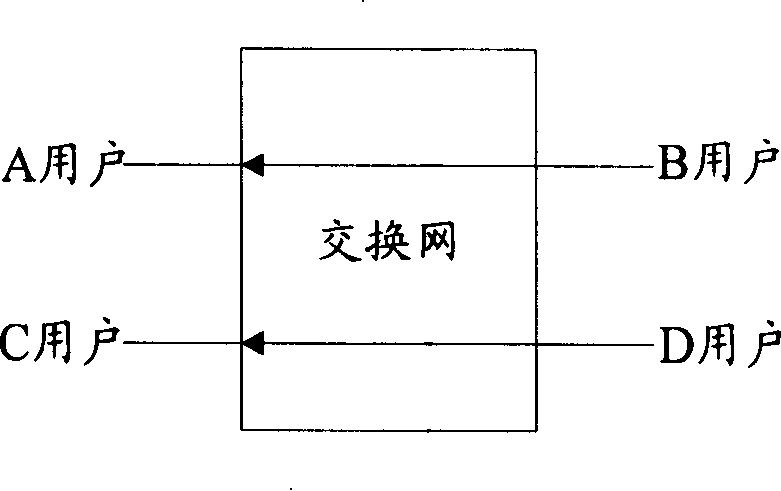

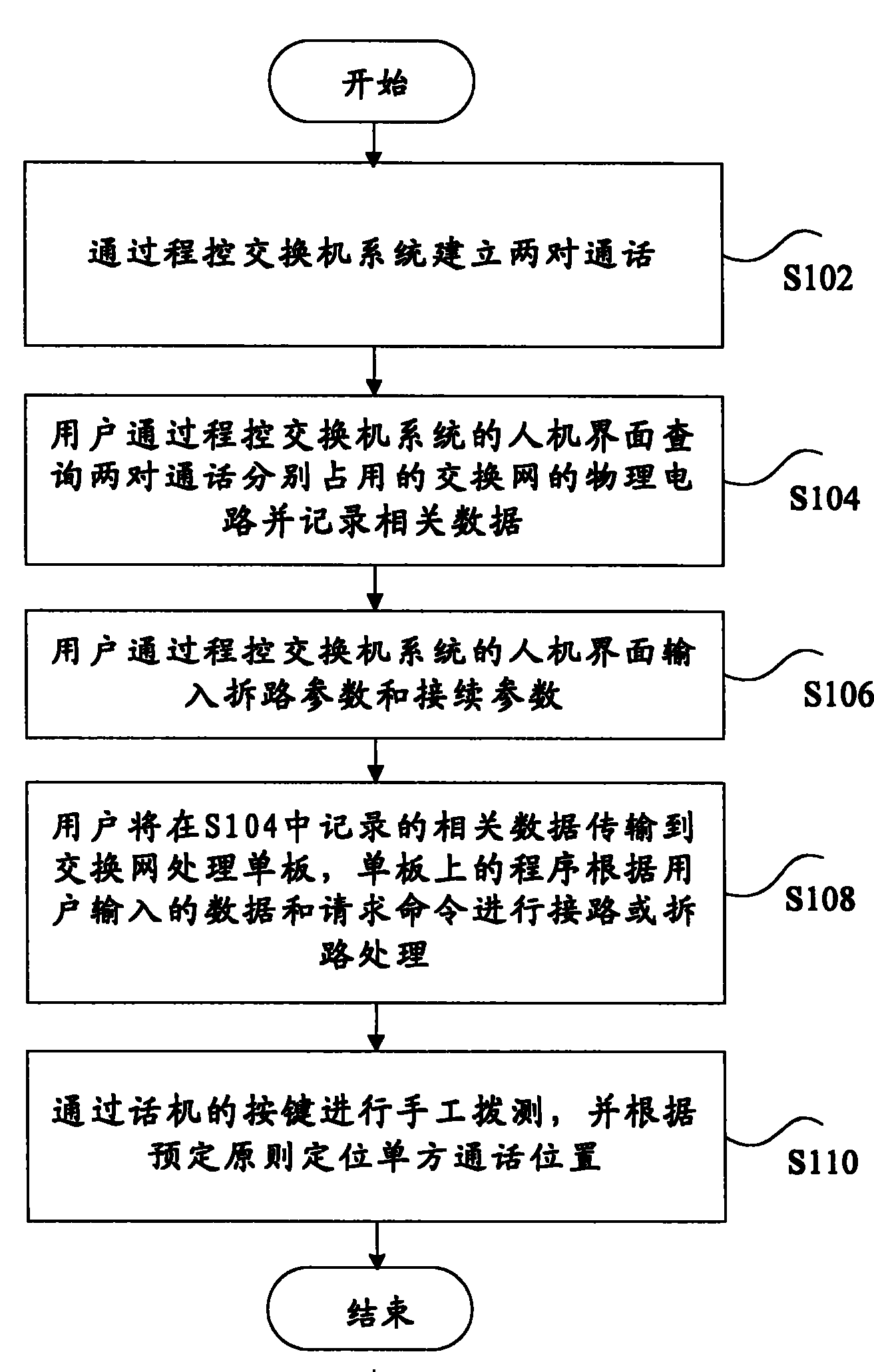

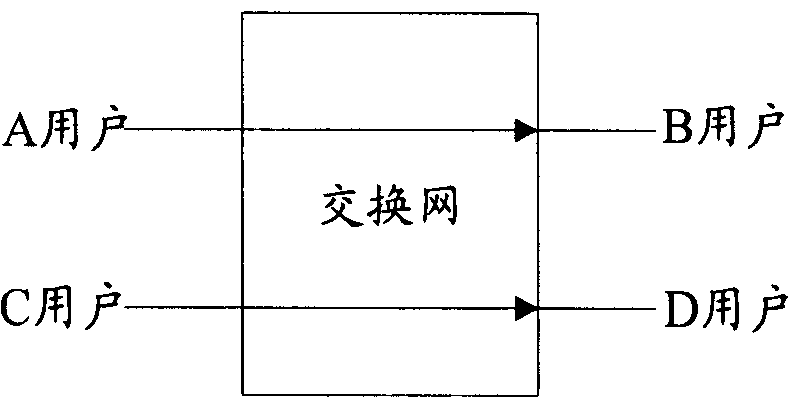

The invention discloses a method for rapidly positioning the single way call (100), which comprises the following steps: the first step S101, two pairs of calls are established through an electronic switching system; the second step S102, a user inquires the physical circuits of the switching network respectively occupied by two pairs of calls and records the related data through the man-machine interface of the electronic switching system; the third step S103, the user inputs the disconnection parameters and connection parameters through the man-machine interface of the electronic switching system; the fourth step S104, the user inputs the related data recorded in the second step S102 to the processing veneer of the switching network and the program on the veneer carries out the connection or disconnection processing according to the data and request command input by the user; the fifth step S105, the manual-dial test is carried out through the keypads of the telephone and the position of the single way call is positioned according to the predetermined principle.

Owner:ZTE CORP

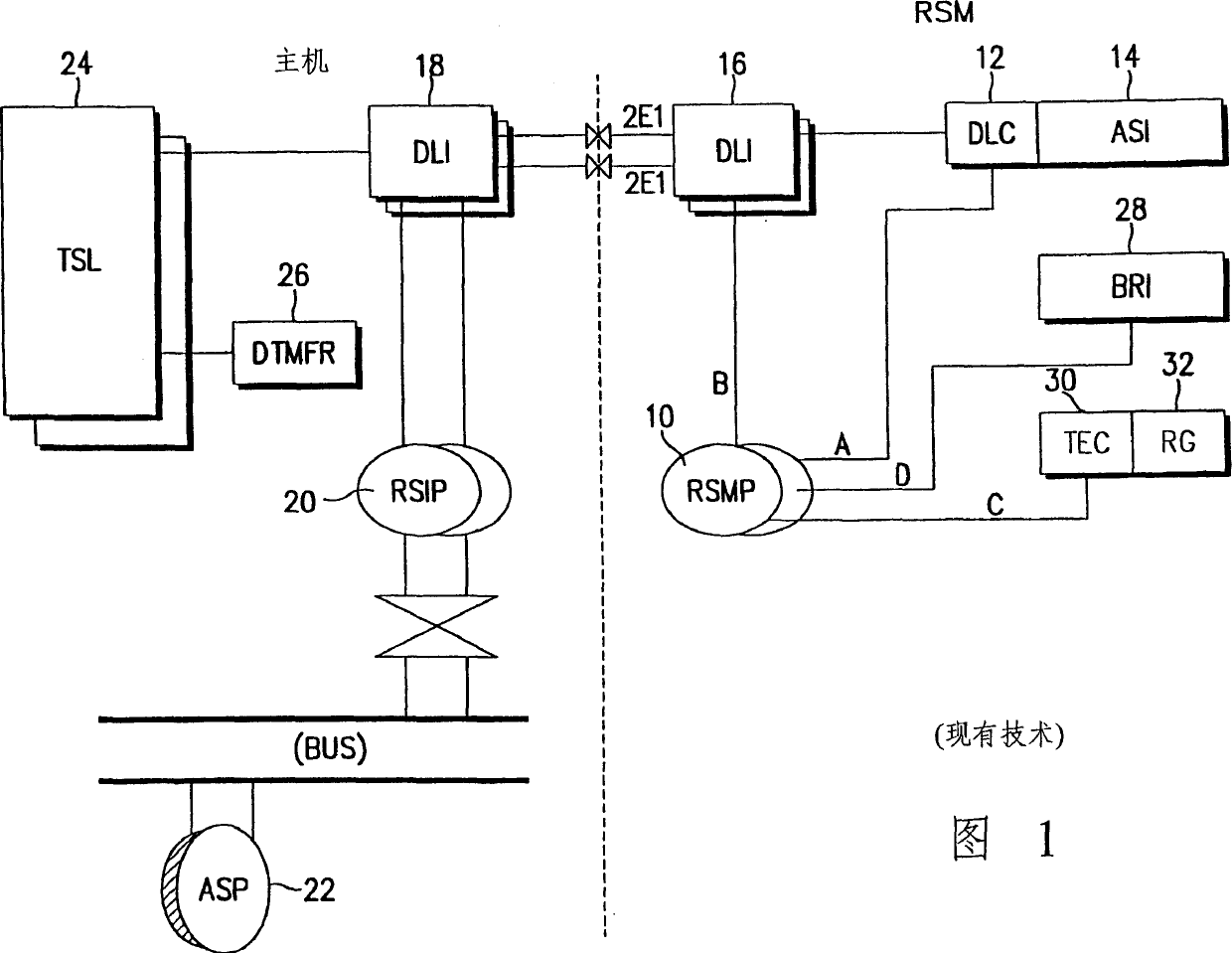

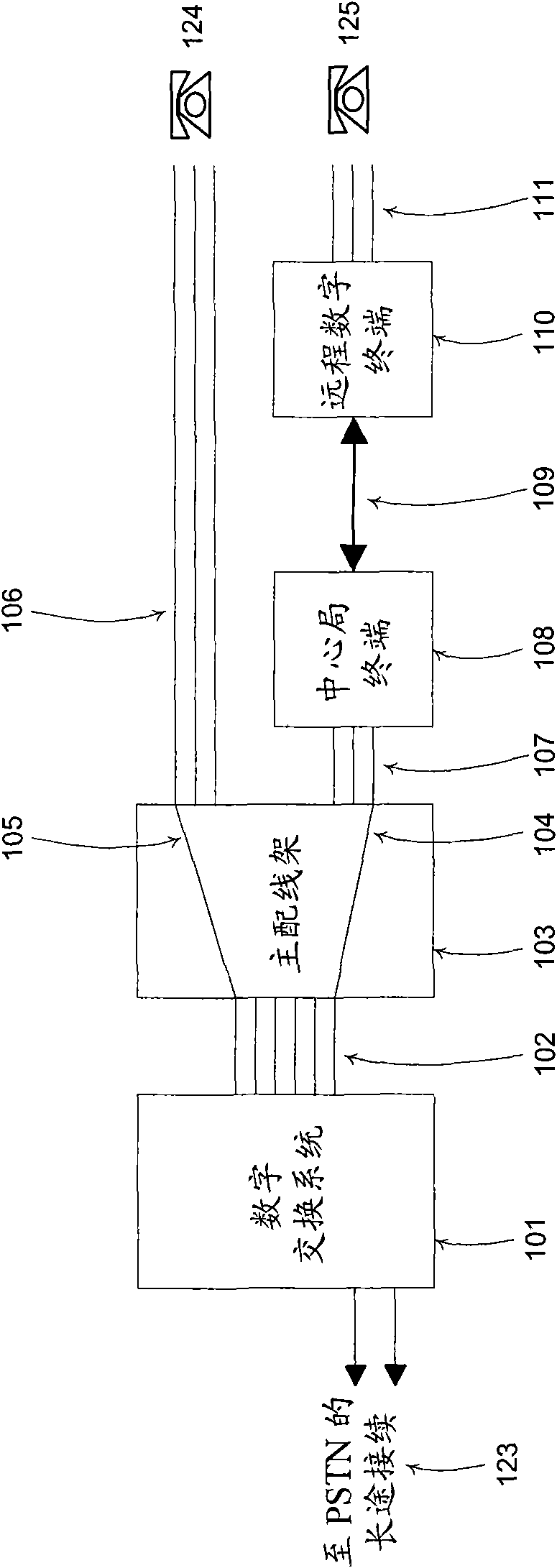

Call processing device and method in remote subscriber module of full electronic switching system

InactiveCN1105461CSupervisory/monitoring/testing arrangementsData switching networksCommunications systemElectronic switching system

Proposed gear to process calls in remote subscriber's module of electron commutation system is related to communication systems in which remote subscriber's module is connected to main switching center by means of connecting communication line. Gear to process calls includes interface with subscriber's line which has functions of reception of phone number and function of tone signals and can process calls between in-house subscribers of remote subscriber's module even if connecting communication line between main switching center and remote subscriber's module is out of order and processor of remote subscriber's module to receive and analyze phone number, to send required tone signals, to transmit and receive special digital information that functions as processor of access commutation of main switching center if connecting communication line between main switching center and remote subscriber's module is out of order.

Owner:SAMSUNG ELECTRONICS CO LTD

Electronic switching system for bus window

InactiveCN103317996AEliminate potential safety hazardsPrevent leakageWindowsWindscreensElectronic switchControl switch

The invention discloses an electronic switching system for a bus window. The electronic switching system comprises first window glass, second window glass, an electronic window latch mechanism, a window control switch and an independent power supply. The first window glass is fixedly arranged, the second window glass can move along a guide rail on the lower portion of the window, a sealing rubber strip is arranged at the edge of the first window glass adjacent to the second window glass, and a notch is formed in the lower edge of the second window glass. The electronic window latch mechanism is arranged on the lower portion of the window, positioned below the second window glass and provided with a movable pin, a power supply, a wireless receiving end and a movable pin controller, and the shape of the movable pin is matched with that of the notch. Besides, the window control switch is arranged in a cab and comprises a wireless transmitting end and a control switch.

Owner:KAIPING ZHONGLV IND

Quick locating method and system for single-party call

InactiveCN101193330BRapid positioningPrecise positioningSelection arrangementsHuman–machine interfaceUser input

The invention discloses a method for rapidly positioning the single way call (100), which comprises the following steps: the first step S101, two pairs of calls are established through an electronic switching system; the second step S102, a user inquires the physical circuits of the switching network respectively occupied by two pairs of calls and records the related data through the man-machine interface of the electronic switching system; the third step S103, the user inputs the disconnection parameters and connection parameters through the man-machine interface of the electronic switching system; the fourth step S104, the user inputs the related data recorded in the second step S102 to the processing veneer of the switching network and the program on the veneer carries out the connection or disconnection processing according to the data and request command input by the user; the fifth step S105, the manual-dial test is carried out through the keypads of the telephone and the position of the single way call is positioned according to the predetermined principle.

Owner:ZTE CORP

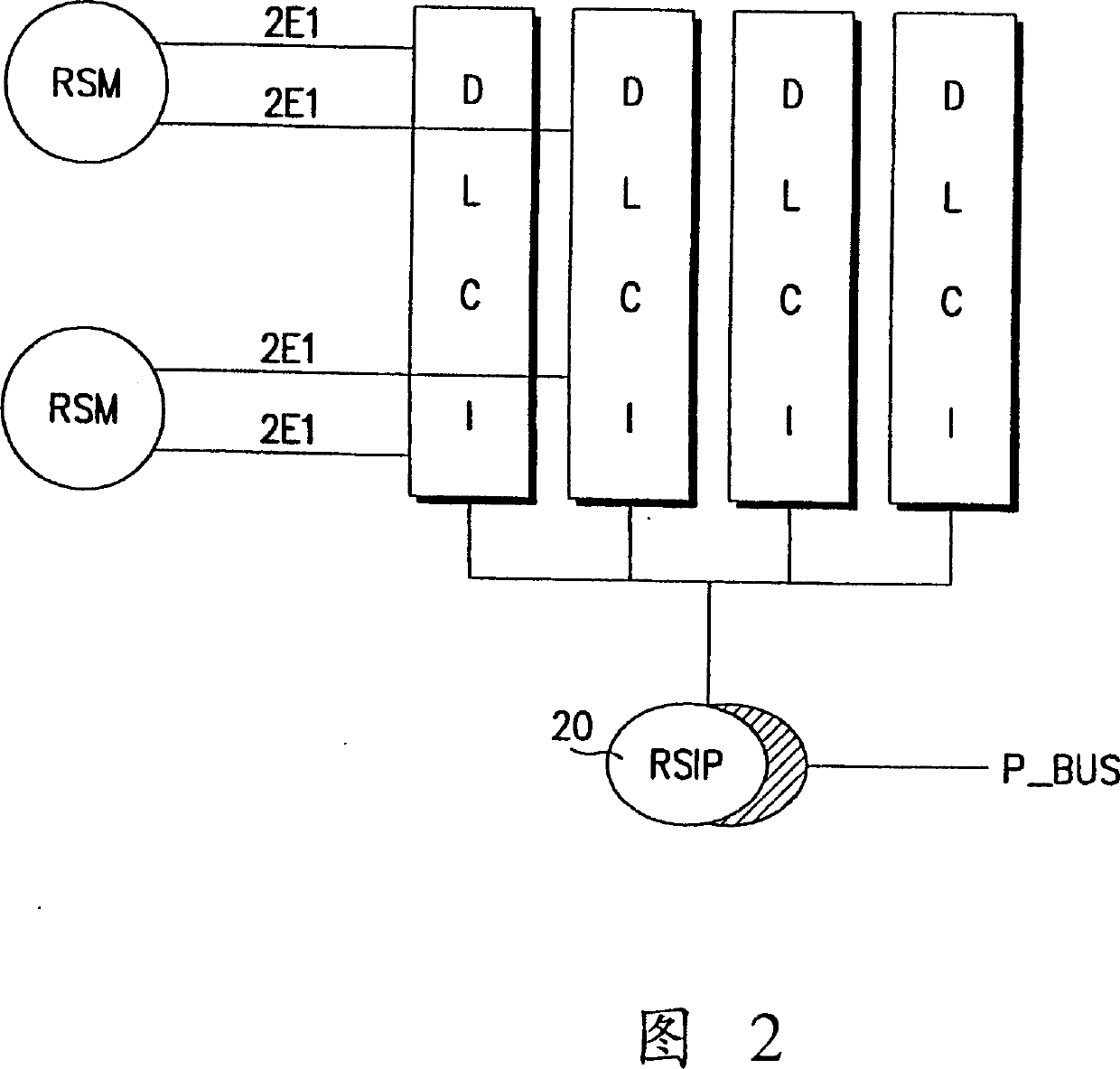

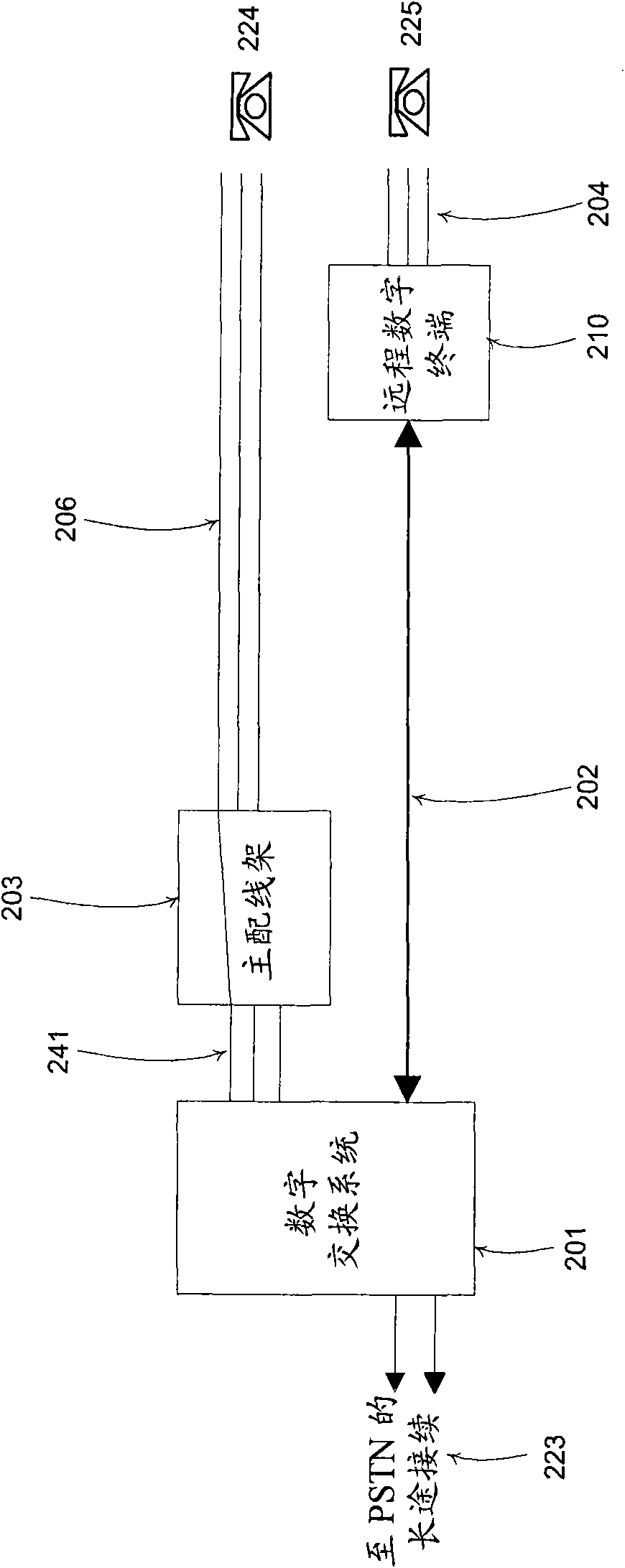

Method for processing a large amount of intra-calls in a remote control system of a full electronic telephone

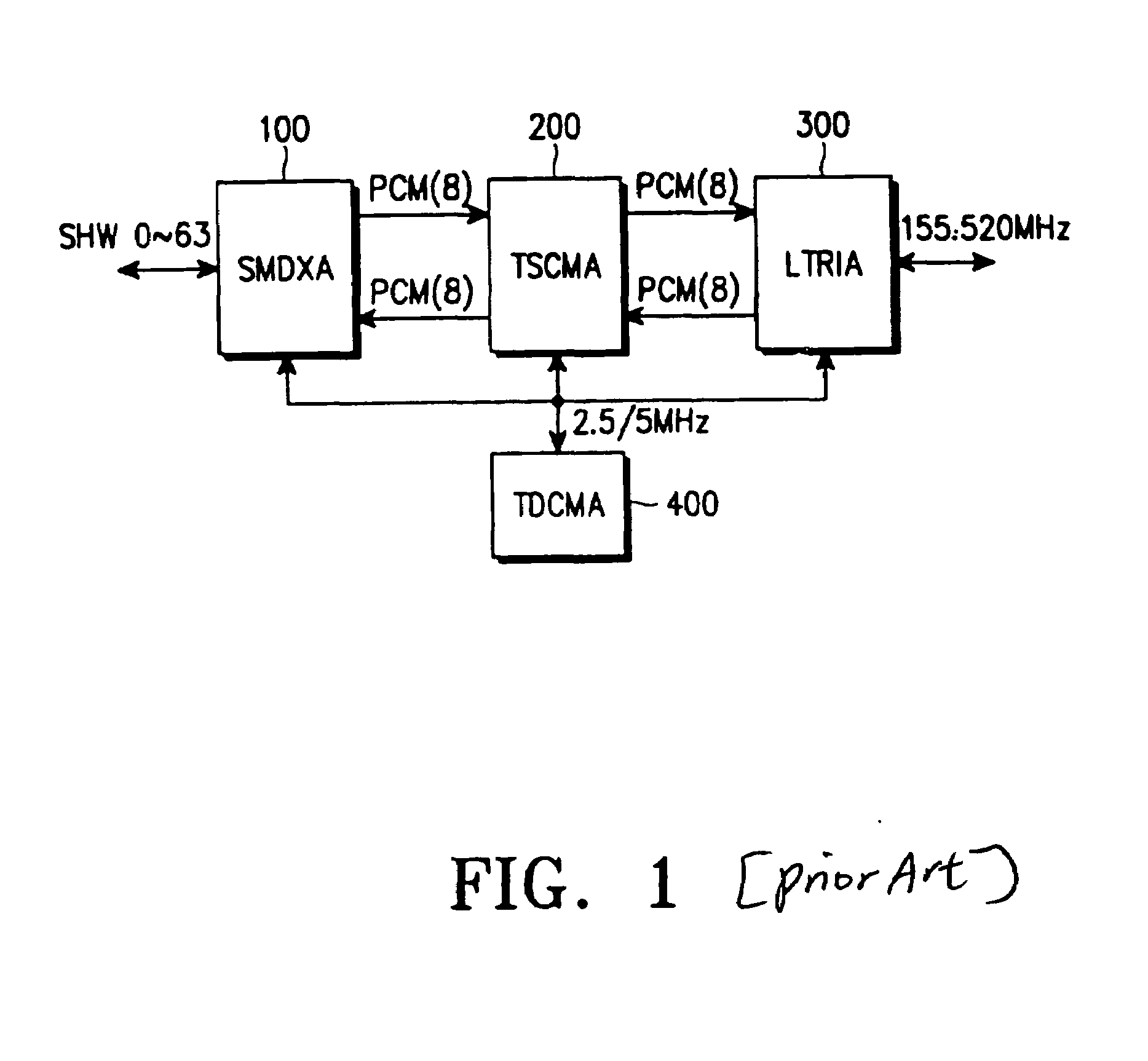

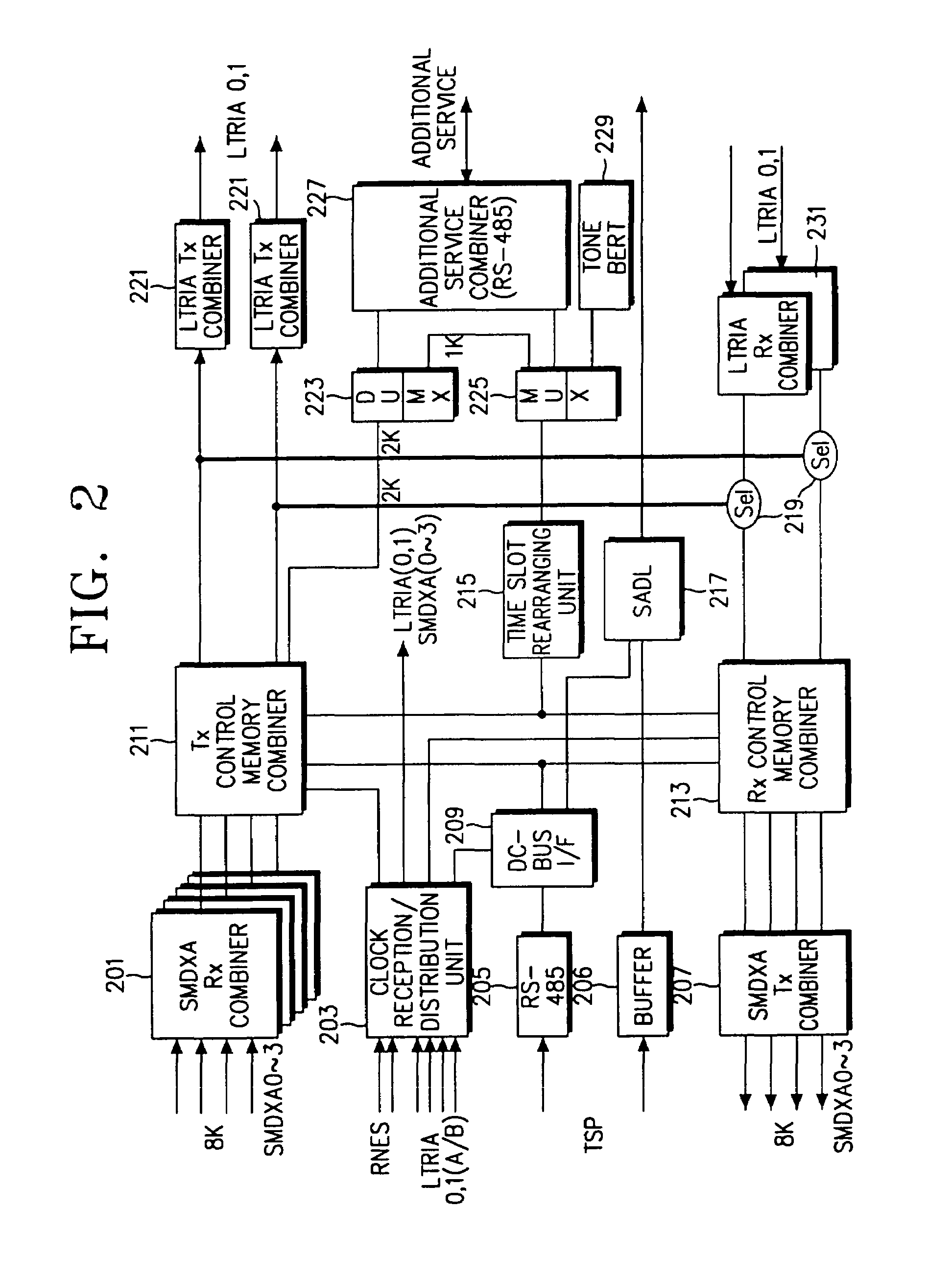

InactiveUS7002954B1Large capacityMultiplex system selection arrangementsCircuit switching systemsRemote controlControl memory

A method for processing a great amount of intra-calls in the remote control system of a full electronic exchange system, whose time switch block is provided with a voice memory device and a control memory device to switch the PCM data to the intra-direction, and with a call pass controller to transfer to the host system or loop to the intra-direction the PCM data, comprises the steps of writing call direction data for designating the intra-call direction into the data region of the control memory device to switch the PCM data sequentially stored in the voice memory device to the intra-direction, and looping the entire channels to the intra-direction to switch the PCM data from the time switch block to the intra-direction if the call direction data designates the intra-call direction according to the treatment of the great amount of the intra-calls.

Owner:SAMSUNG ELECTRONICS CO LTD

Electronic switching system for generating correlation identity

ActiveUS10084863B2Efficiently authenticatingDigital data protectionWireless commuication servicesComputer moduleService location

An electronic switching system for generating correlation identify (ID) with respect to a client in order to thereby establish, integrate and communicate to a server (lean server or nano server) within a cloud environment (e.g. Inswit™ Cloud). A service location identification module for identifying and generating a service location identity with respect to a remote client. A source ID generating module for generating a correlation ID / source ID based on the service location identify in order to serialize the payload and establish a connection with the server. The electronic switching system proposed herein operates external to the cloud environment by effectively generating the correlation identity with respect to a client device accessing the server in a cloud environment. The system also switches, integrates and executes client communications to an appropriate server in the cloud environment using the correlation ID.

Owner:TWIXOR PTE LTD

Time division multiplex high-speed switch control system and control method in electronic switching system

InactiveCN1126422CThe structure does not need to be cumbersomeTime-division multiplexing selectionHandoff controlMulti processor

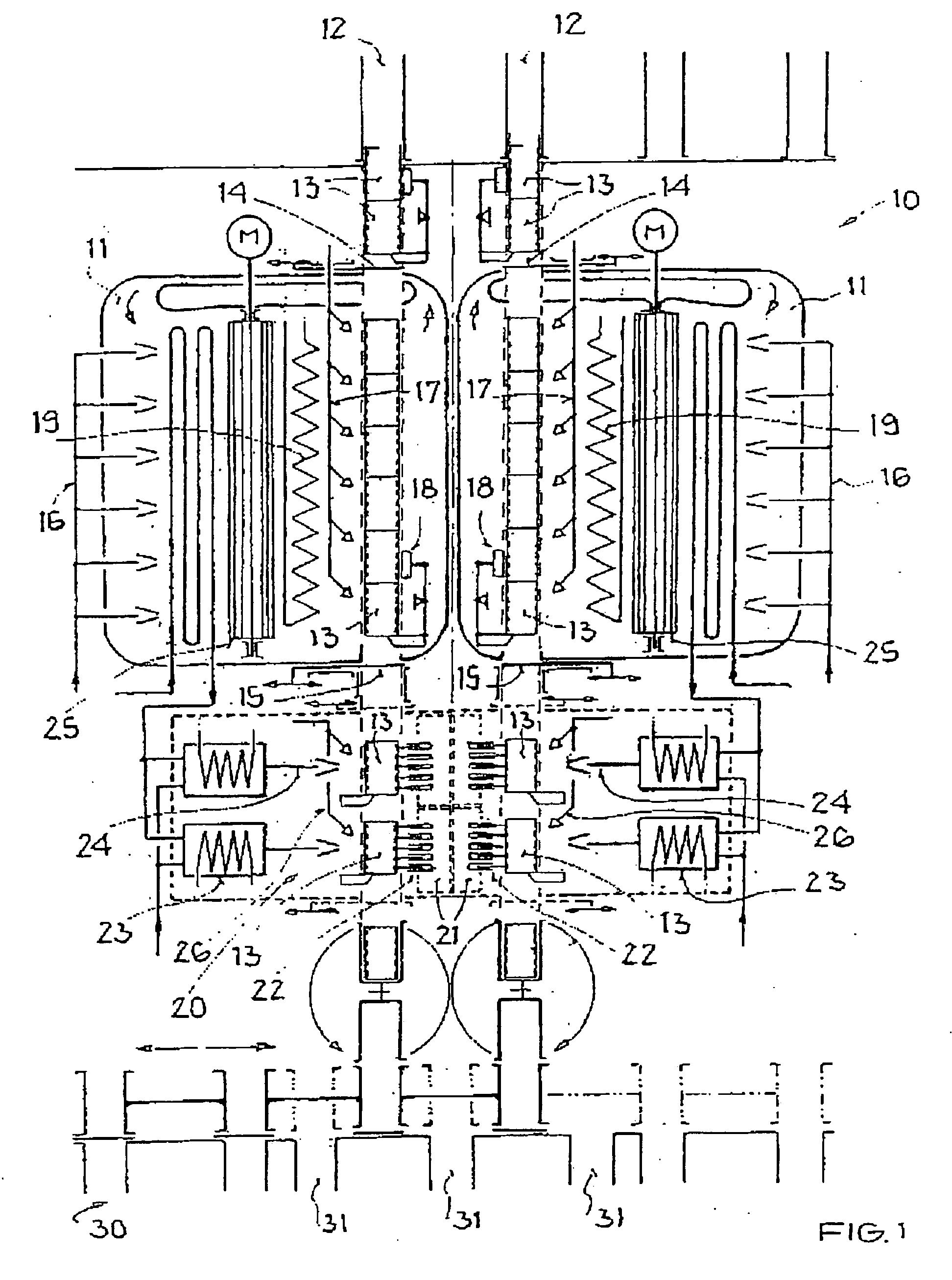

A high-speed channel switching control system that uses T-S-T three-stage switching to control high-speed switching of time-division multiplex communication in a multi-processor type electronic exchange system, including multiple groups of first switches (11-1n) using the time-division switching method, using high-speed channel The second switch (21-2n) of switching method, the 3rd switch (31-3n) of time-division switching method and the processor (41-4n) that are used to control each switch, use two processors ( 41-4n) jointly obtain the idle time slot information on the interconnection switch and determine the time slot used in the connection, so as to control the connection of the required switch.

Owner:NEC PLATFORMS LTD

Computer platforms designed for improved electronic execution of electronic transactions and methods of use thereof

In order to facilitate secure and confidential electronic exchanges, systems and methods include establishing an electronic communication session based on participation levels controlled by a stack software object such that each invitee computing device associated with each invitee is prevented from accessing activities in the electronic communication session unless the invitee satisfies first predetermined parameters based on a locked stack participation level; an initiating computing device associated with the initiating user is enabled to access the electronic communication setting at a reserve level while each invitee computing device is prevented from accessing the activities in the electronic communication session unless the invitee satisfies second predetermined parameters based on an unlocked stack participation level; and the initiating computing device and each invitee computing device are enabled to access the activities in the electronic communication session based on an open stack participation level.

Owner:BROADRIDGE FIXED INCOME LIQUIDITY SOLUTIONS LLC

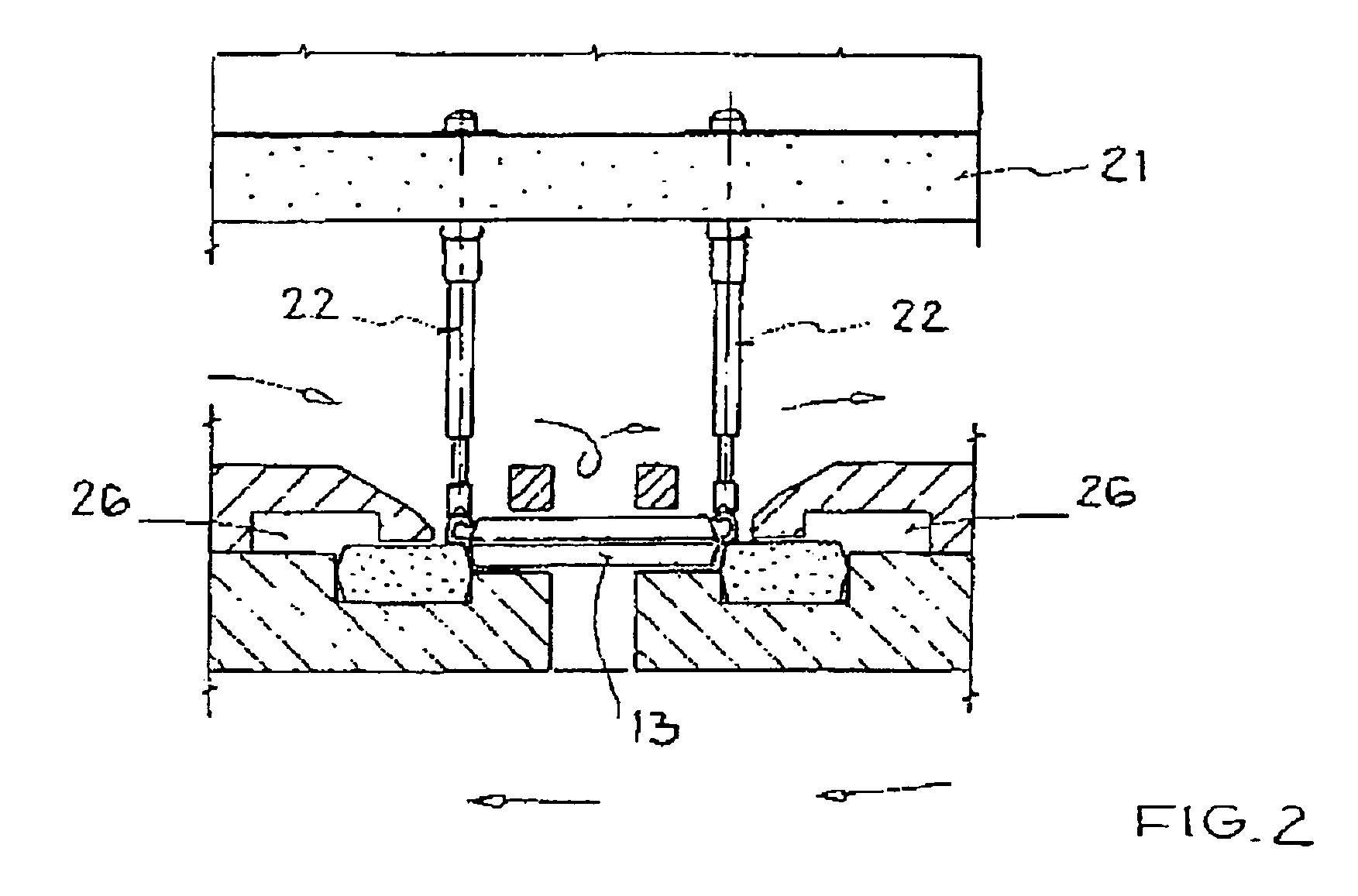

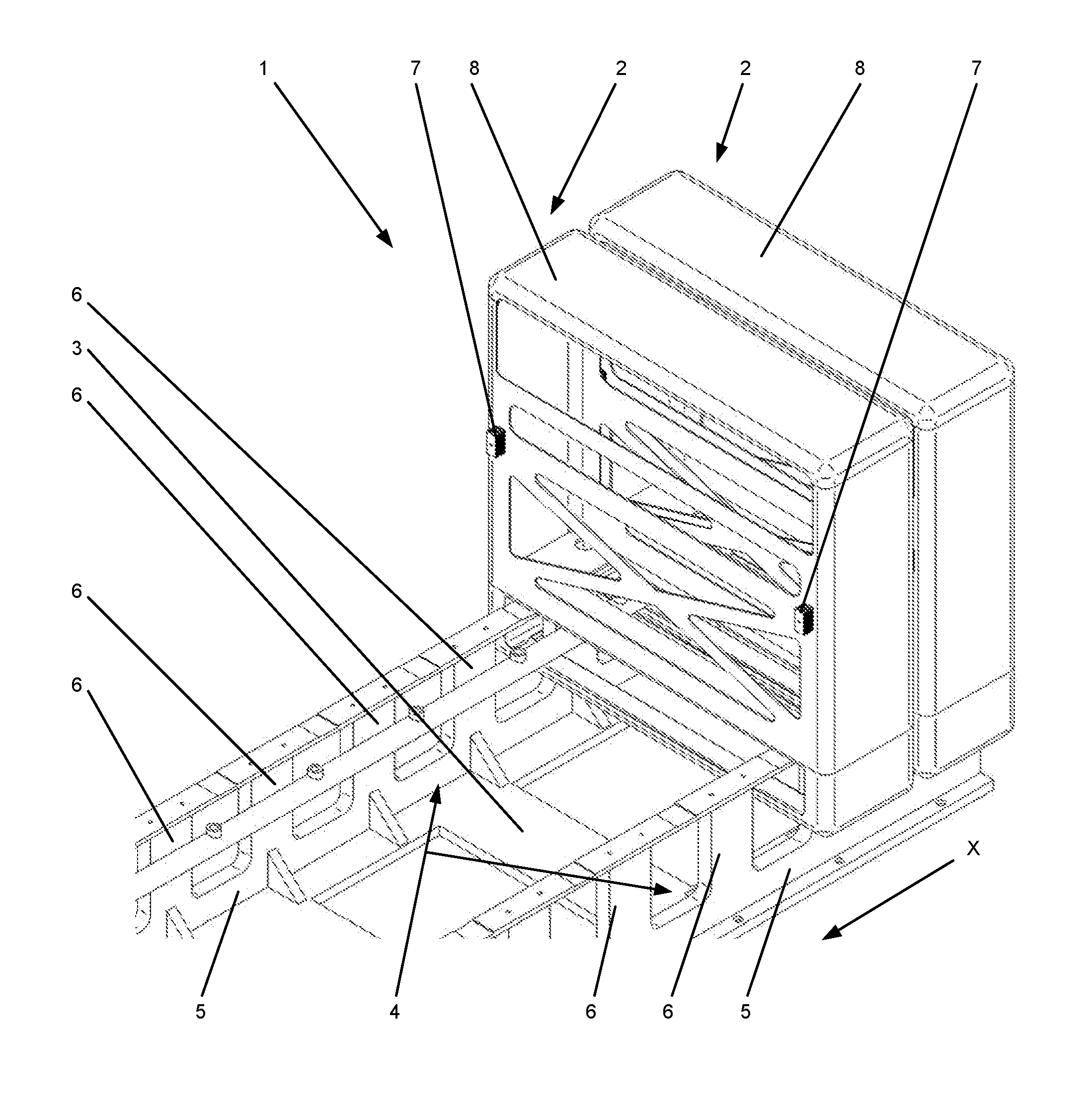

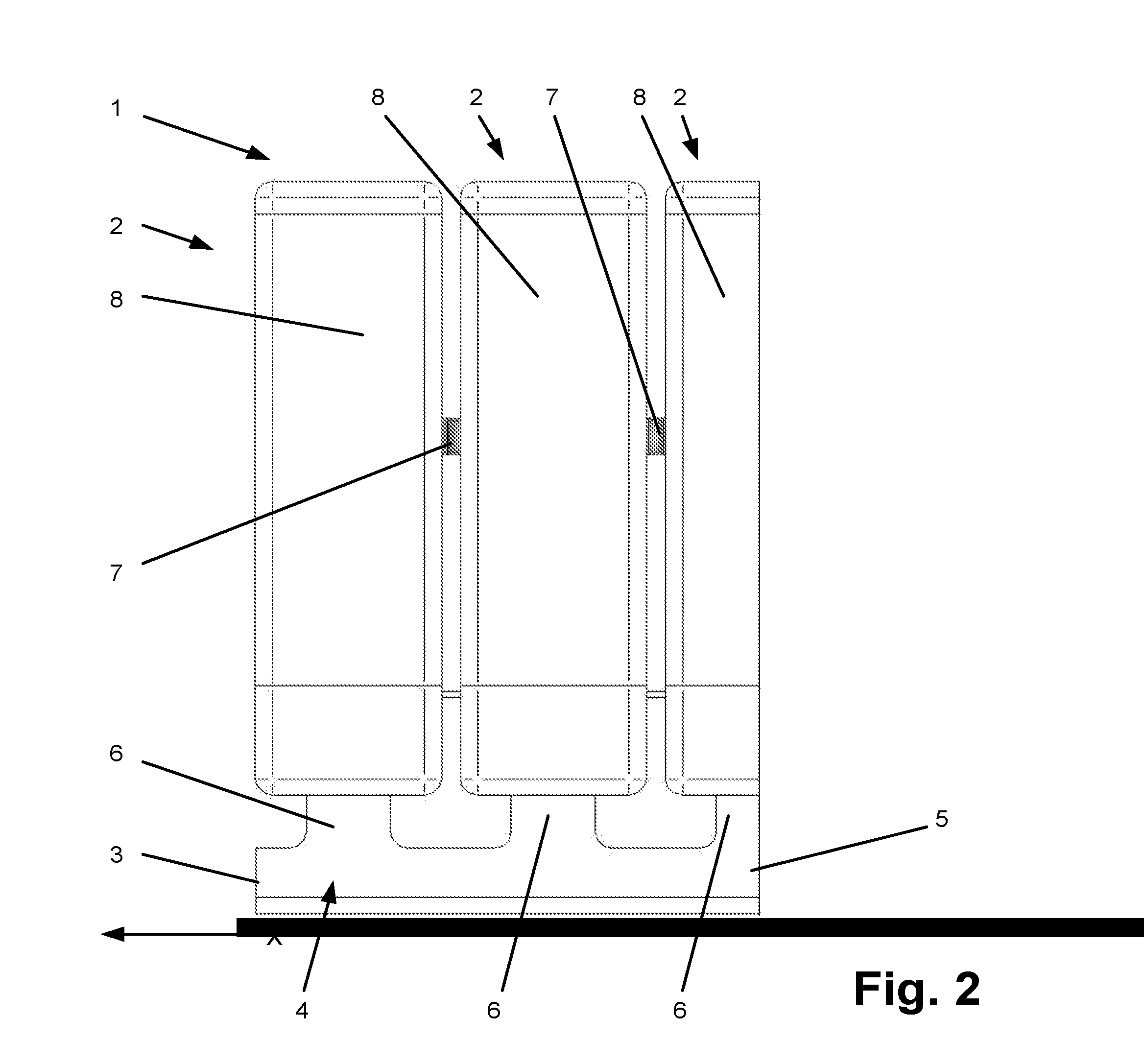

Power electronic switching system

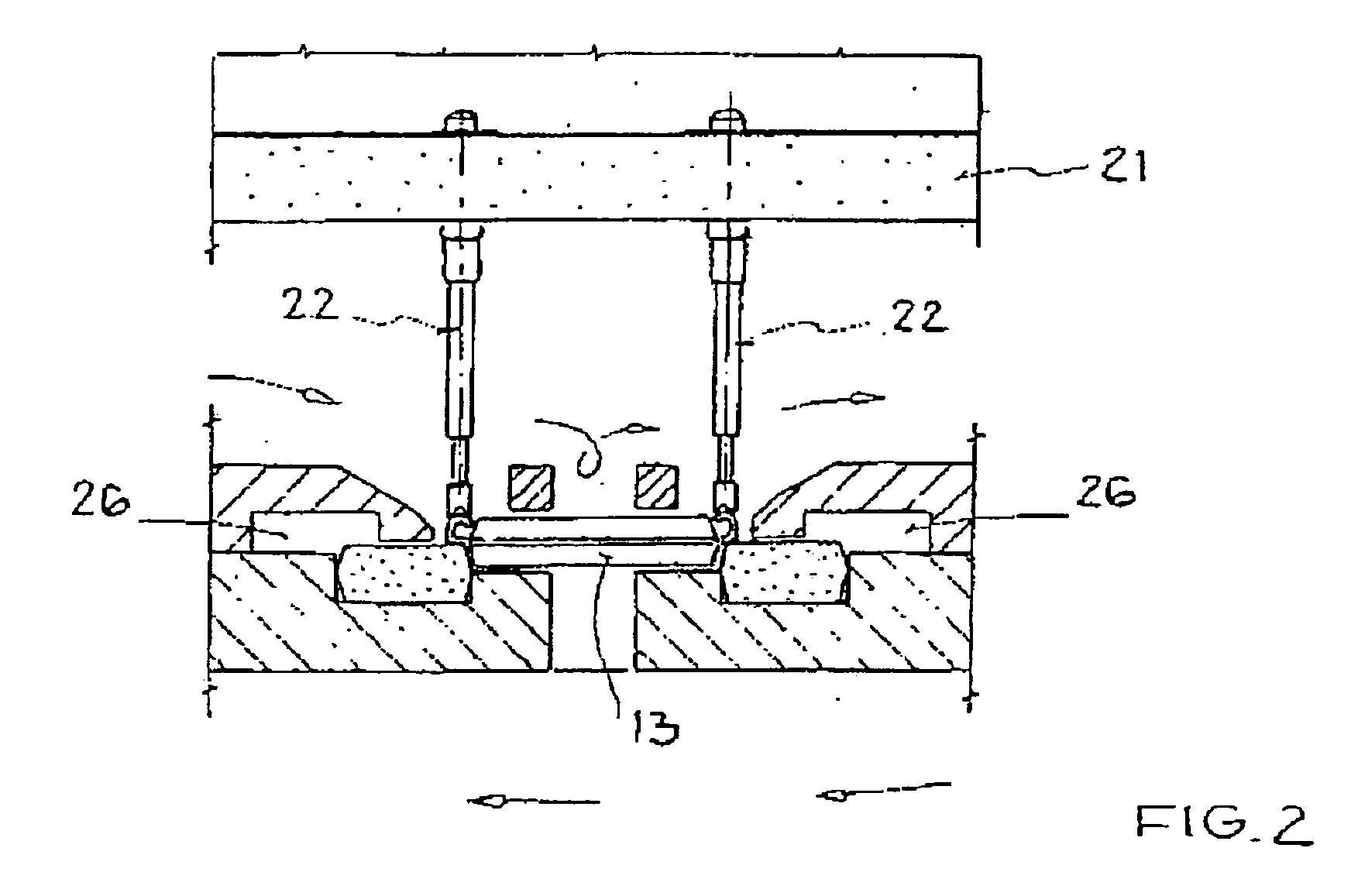

ActiveUS9526189B2Printed circuit board receptaclesClamping/extracting meansElectric powerElectric field

An exemplary power-electronic switching system has a plurality of switching units, wherein each switching unit includes a housing and at least one switching module which is arranged within the housing. A mounting unit has a holding apparatus, on which the housings of the switching units are arranged. The holding apparatus includes an insulation material for electrically insulating the holding apparatus from the housings of the switching units and the housings of the switching units from one another. The insulation material allows the housings of the switching units of the switching system to have different voltage potentials from one another and additionally can be realized in a simple and space-saving manner and easily be assembled. In addition, the housing of each switching unit includes a material for at least partially shielding an electric and magnetic field.

Owner:ABB (SCHWEIZ) AG

Method for tissue regeneration or degeneration in human and an apparatus therefore

ActiveUS9162076B2Increase ratingsMagnetotherapy using coils/electromagnetsDiagnostic recording/measuringResonanceElectronic switch

Disclosed herein is an apparatus for tissue regeneration or degeneration in human by applying rotational field narrow focused quantum magnetic resonance on the required area. The apparatus consists of a plurality of guns for delivery the quantum magnetic resonance, a traveling platform for carrying the person under treatment, an electronic switching system for controlling the guns, said electronic switching system being controlled by a main computer through an on board microprocessor and means for cooling and dispersing the heat generated during the operation.

Owner:KUMAR BV

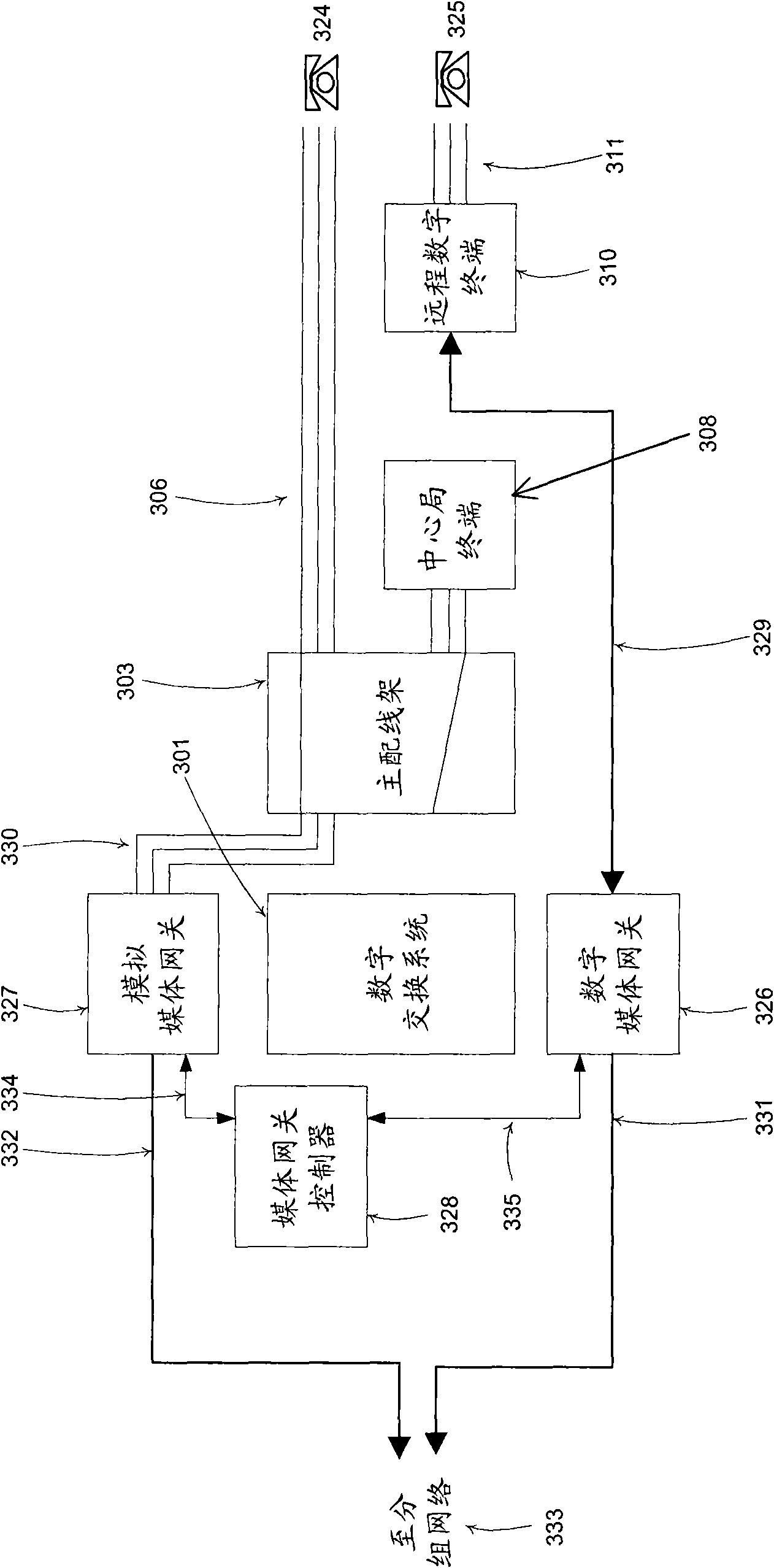

Telephone switching systems

InactiveCN101753726BFor quick replacementAdapt to migrationSupervisory/monitoring/testing arrangementsNetwork/exchange typesTelecommunications networkTelephone exchange

The invention relates to the generation of configuration data for use in the migration of telephone switching systems. Configuration data for use in the migration of subscribers from a first telephone switching system over to a second telephone switching system in a telecommunications network is generated by monitoring signalling information on telephone channels associated with subscribers for telephone calls conducted via the first telephone switching system. The monitored signalling information is then analysed in relation to call data produced by the first telephone switching system for the calls to identify relationships between the monitored signalling information and call data for calls conducted by subscribers. Configuration data based on the identified relationships is then stored and used to configure the second telephone switching system with mappings between the associated telephone channels and the telephone dialling numbers for subscribers.

Owner:METASWITCH NETWORKS LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com