Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

277 results about "CreditCard" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

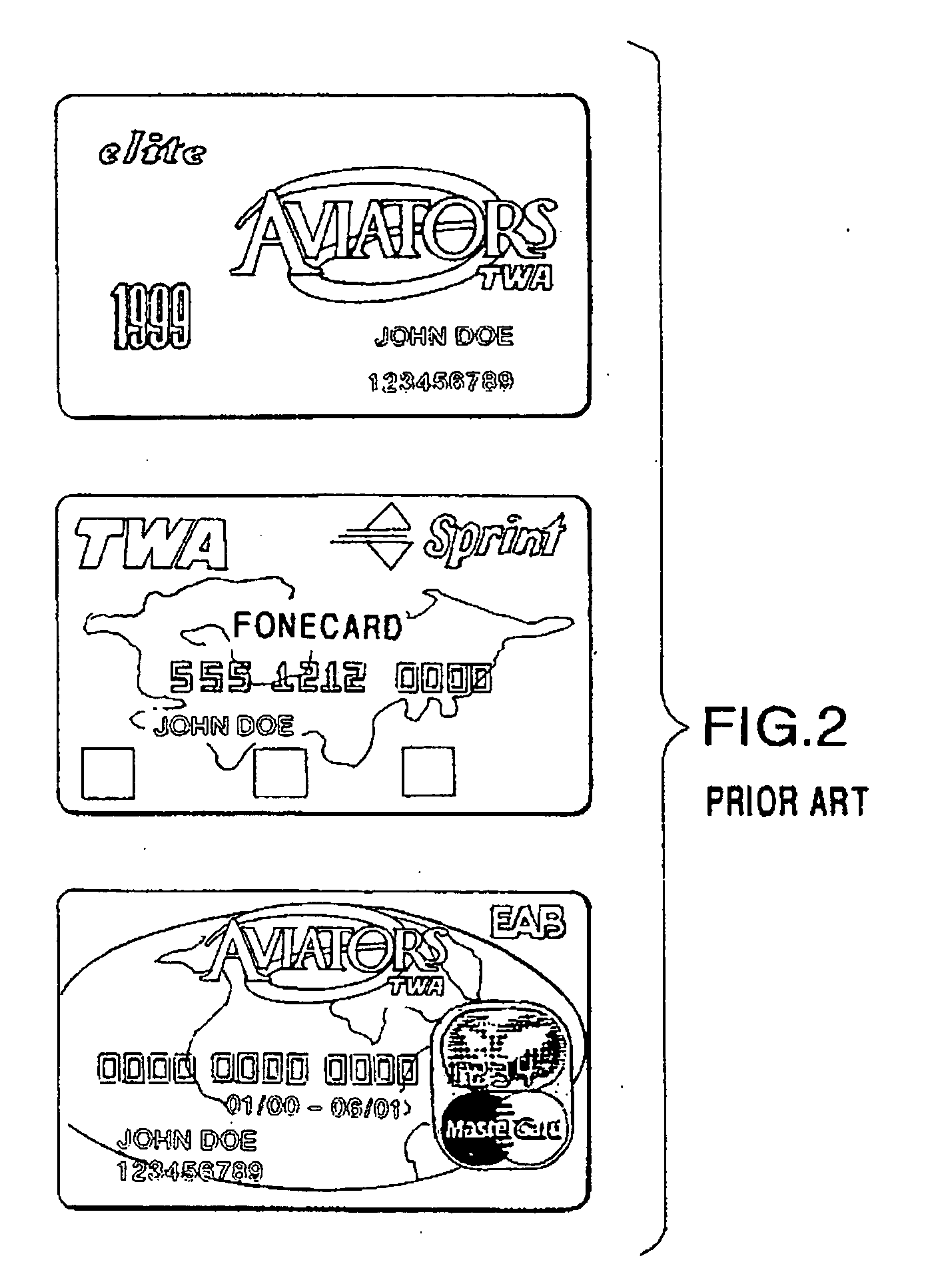

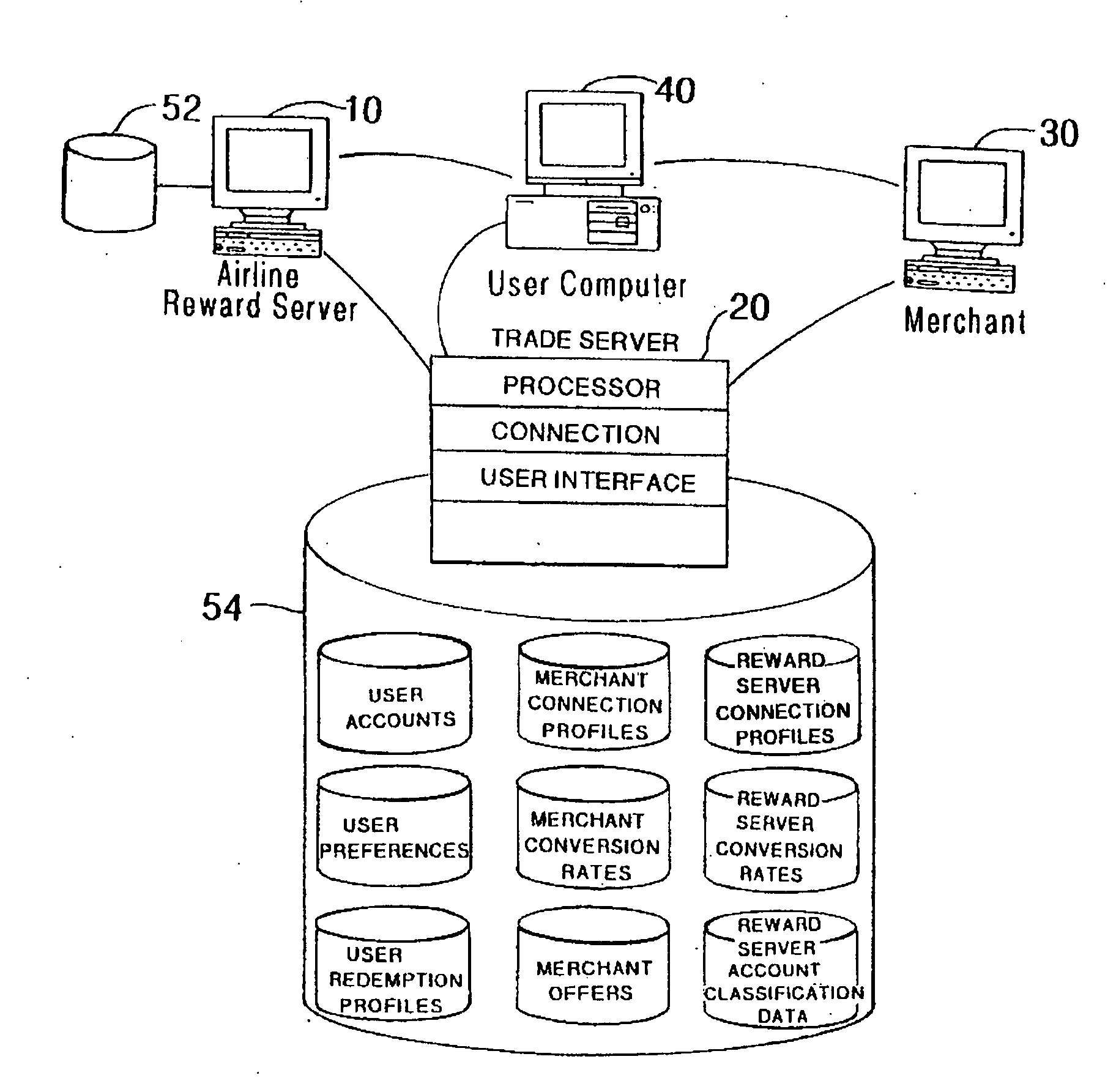

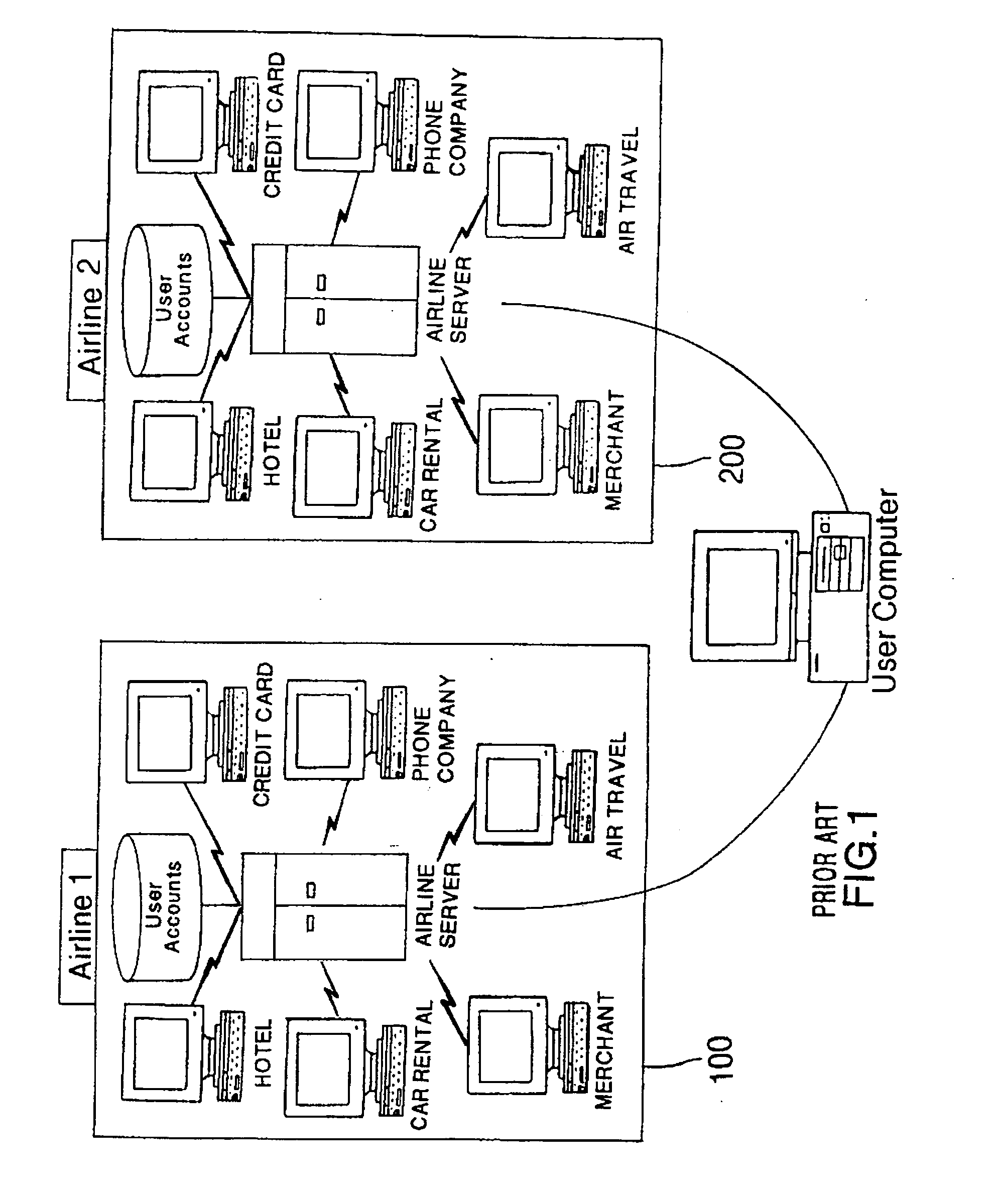

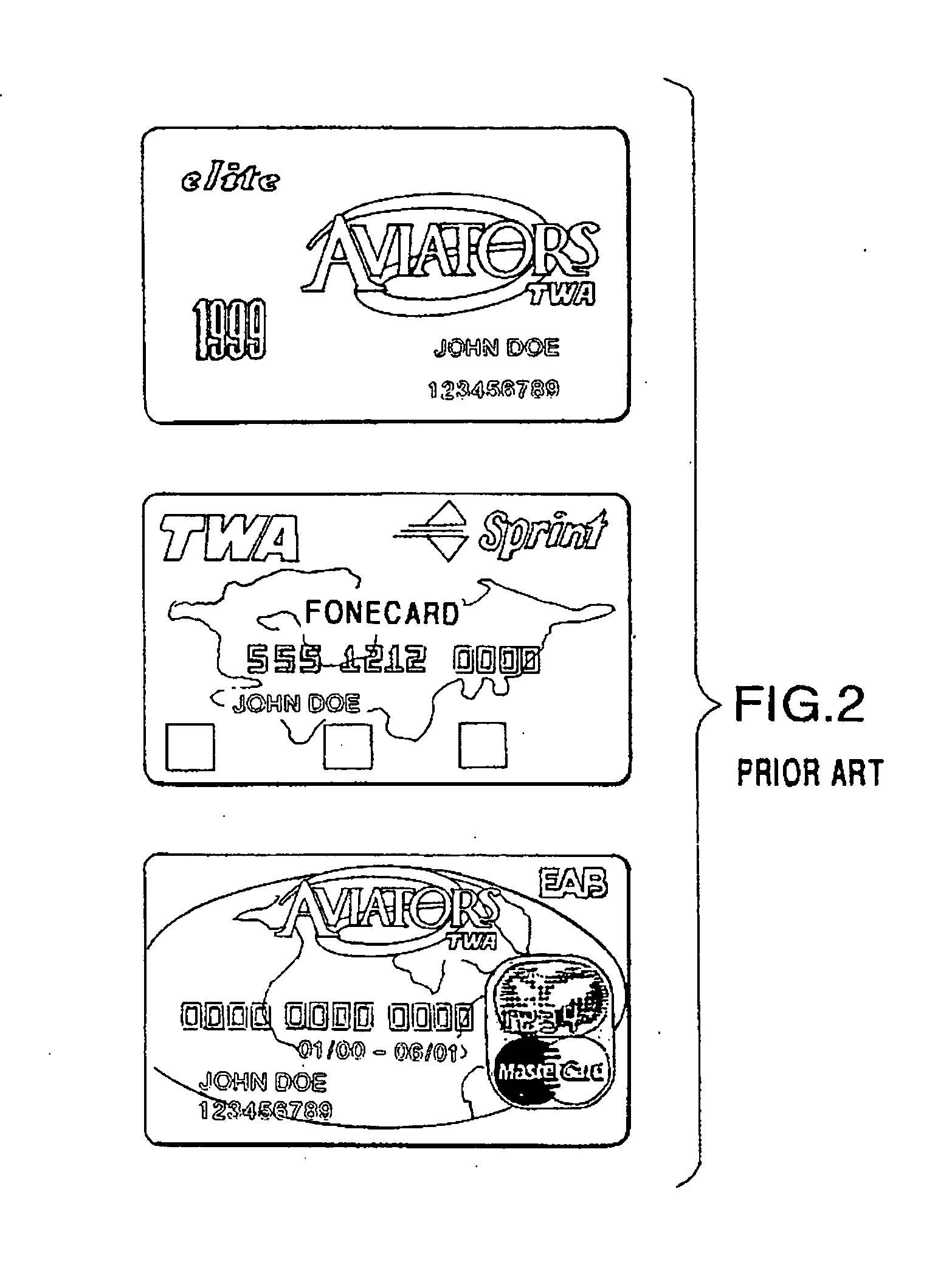

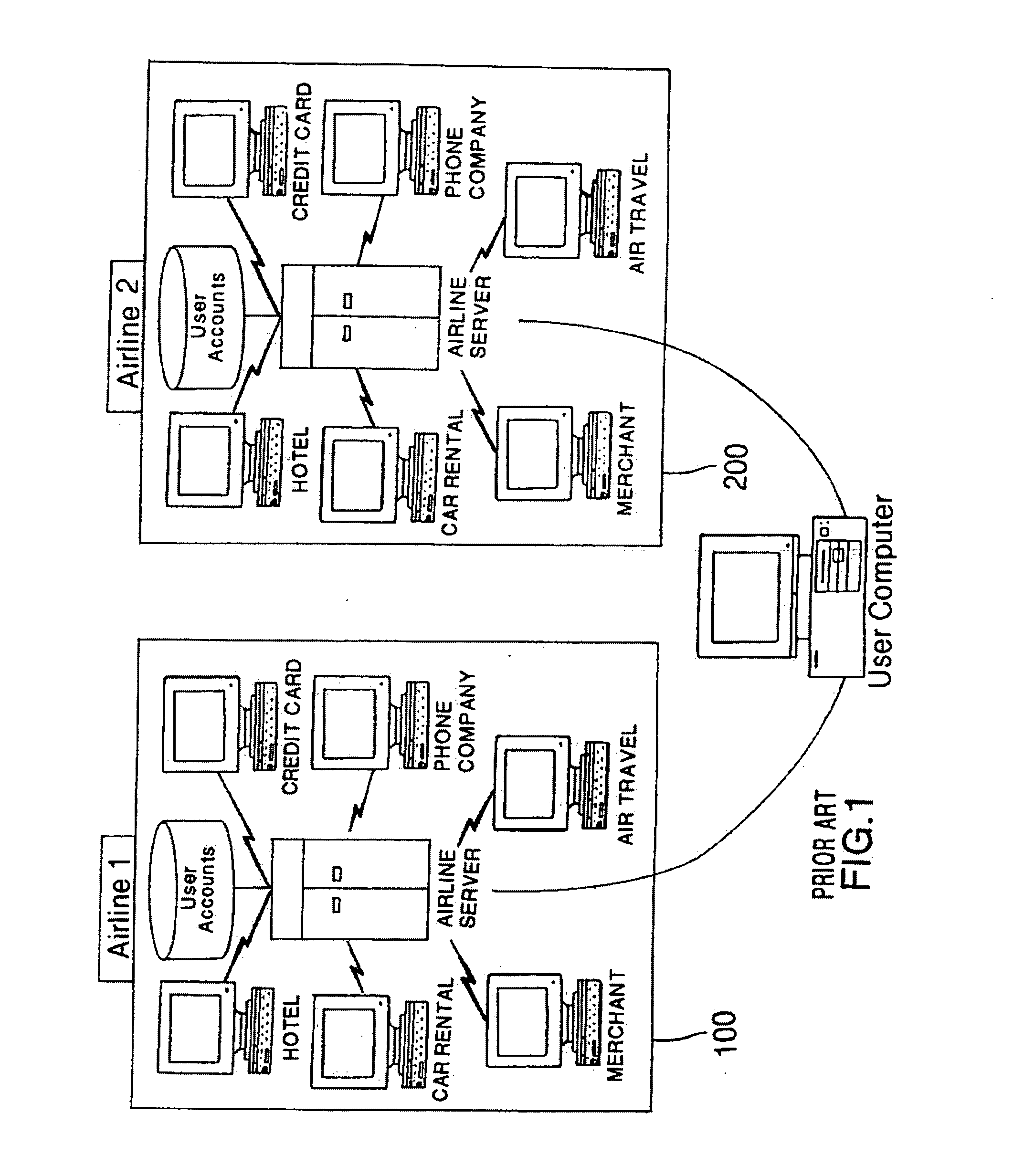

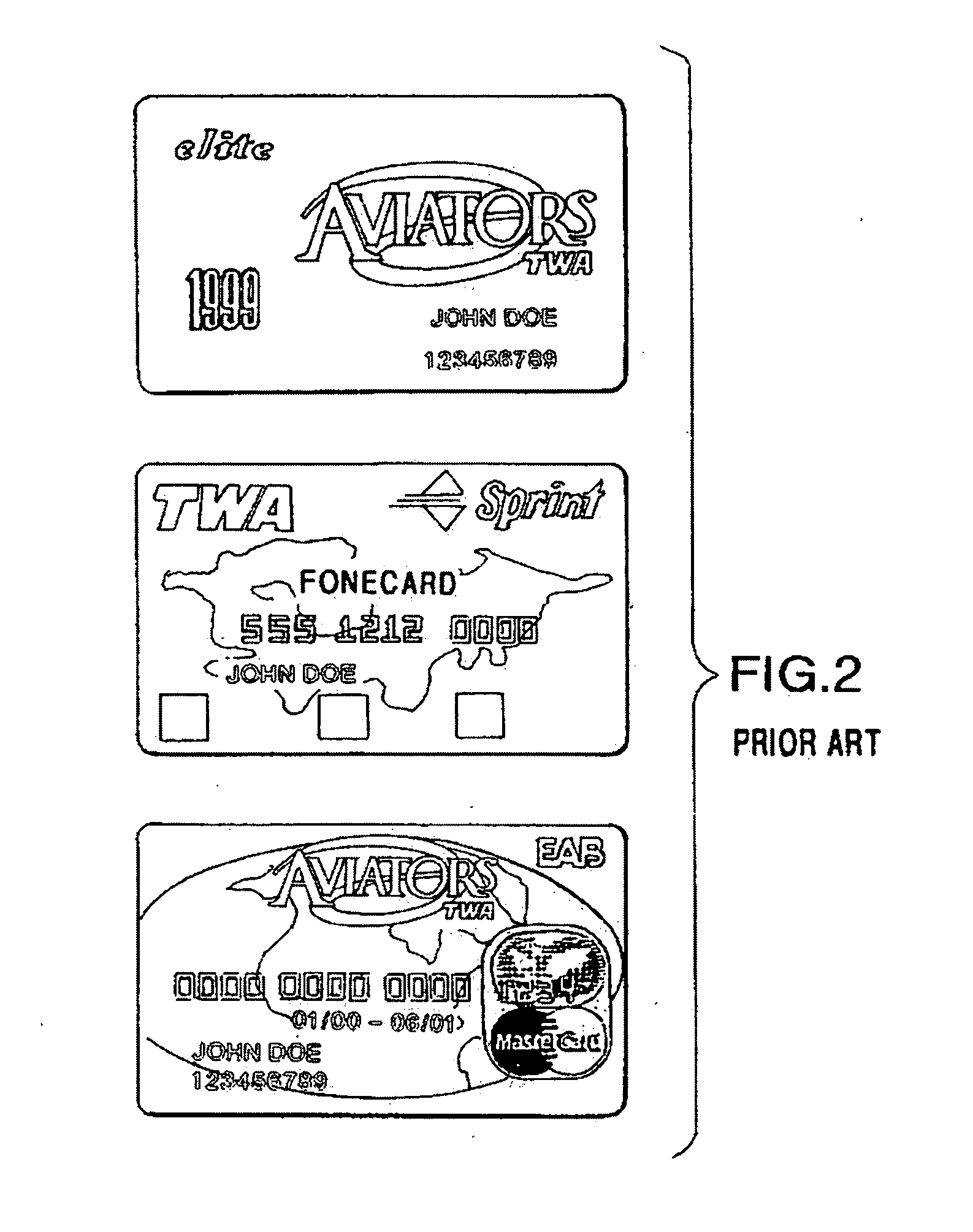

Method and system for using multi-function cards for storing, managing and aggregating reward points

InactiveUS20050021400A1Decreasing (if not eliminating) reliance on a central server systemDiscounts/incentivesFinanceCredit cardMultimedia

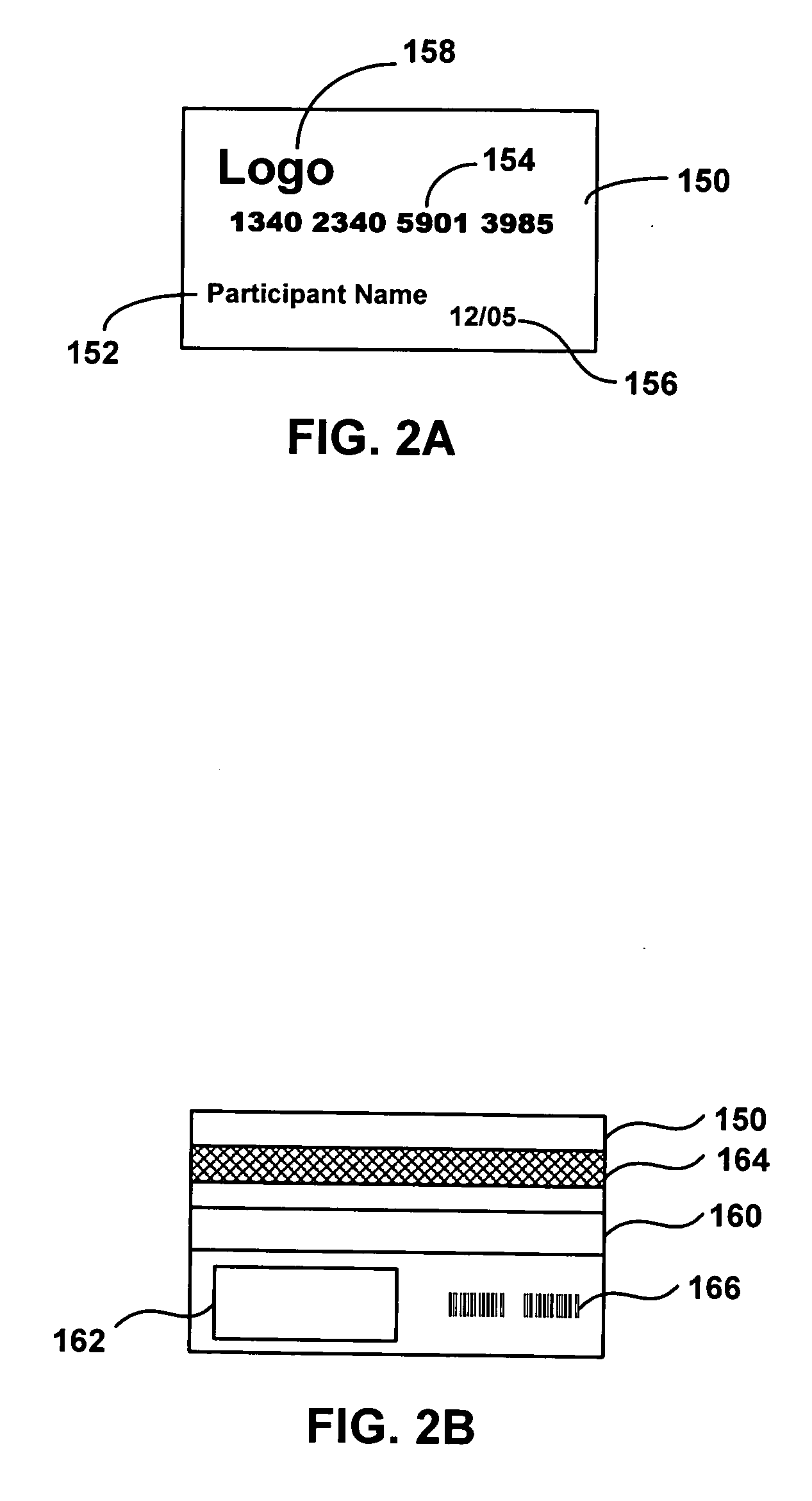

A system and method for operating a reward points accumulation and redemption program wherein a user earns reward points from a plurality of independent reward points issuing entities, with each tracking the user's earned reward points in a user reward point account stored on a multi-function card (such as a frequent flyer account or a credit card loyalty account). The multi-function card is adapted to aggregate some or all of the user's earned reward points from the reward accounts and credit the aggregated points into a single reward exchange account on the multi-function card. The user may then select an item for purchase with the accumulated reward points from the multi-function card. The item is provided to the user in exchange for a subset or all of the reward points from the multi-function card.

Owner:SIGNATURE SYST

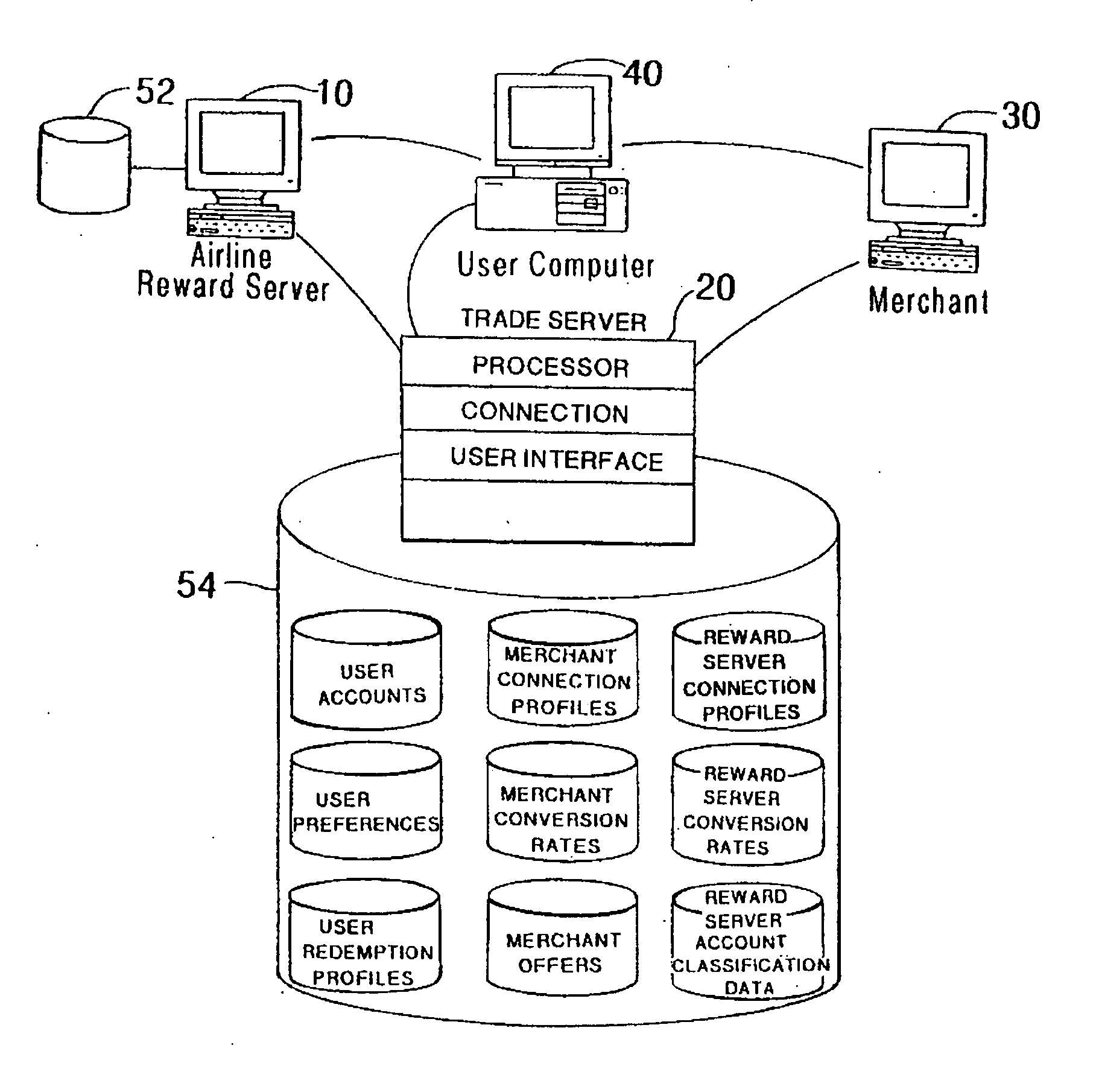

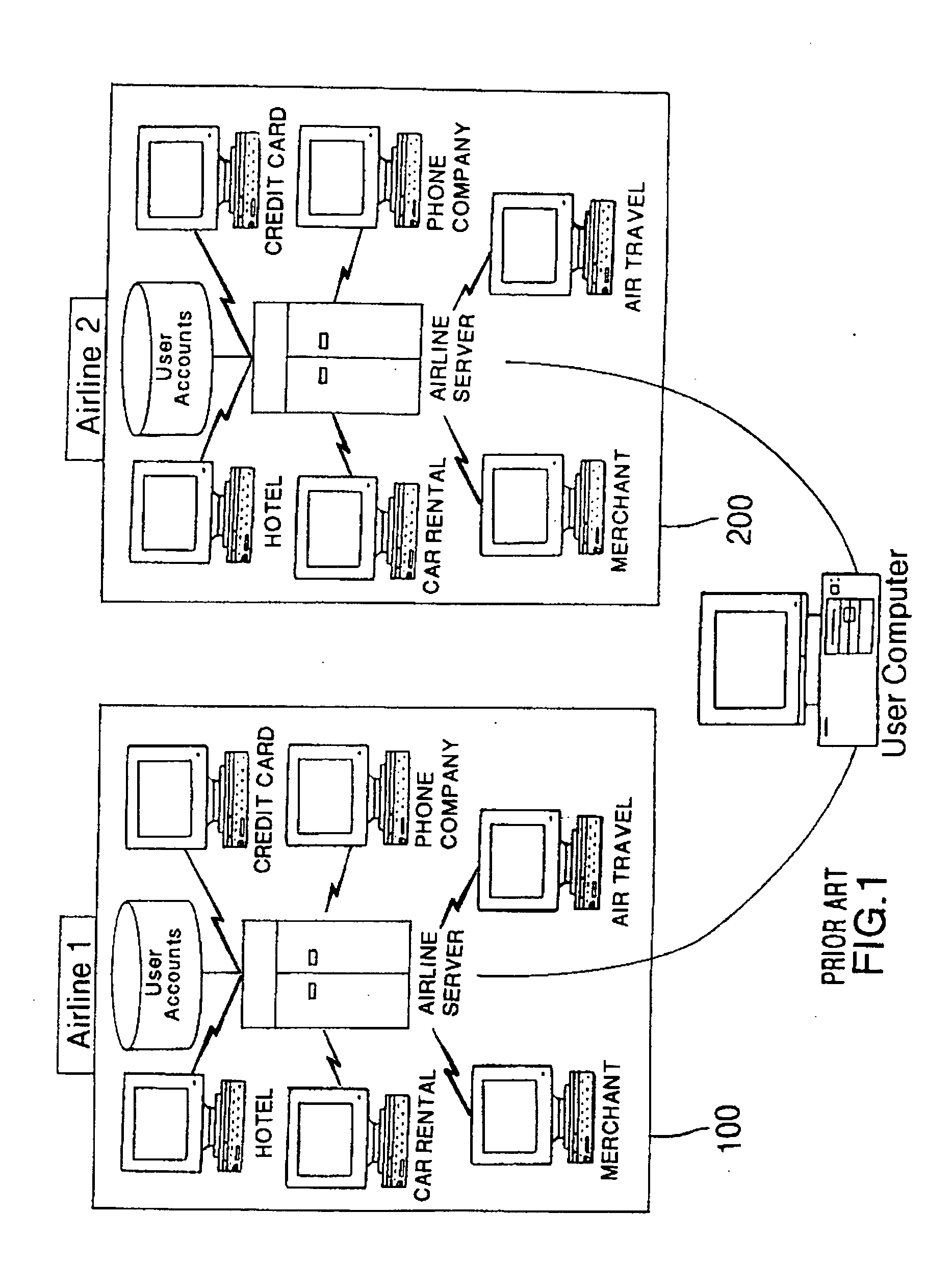

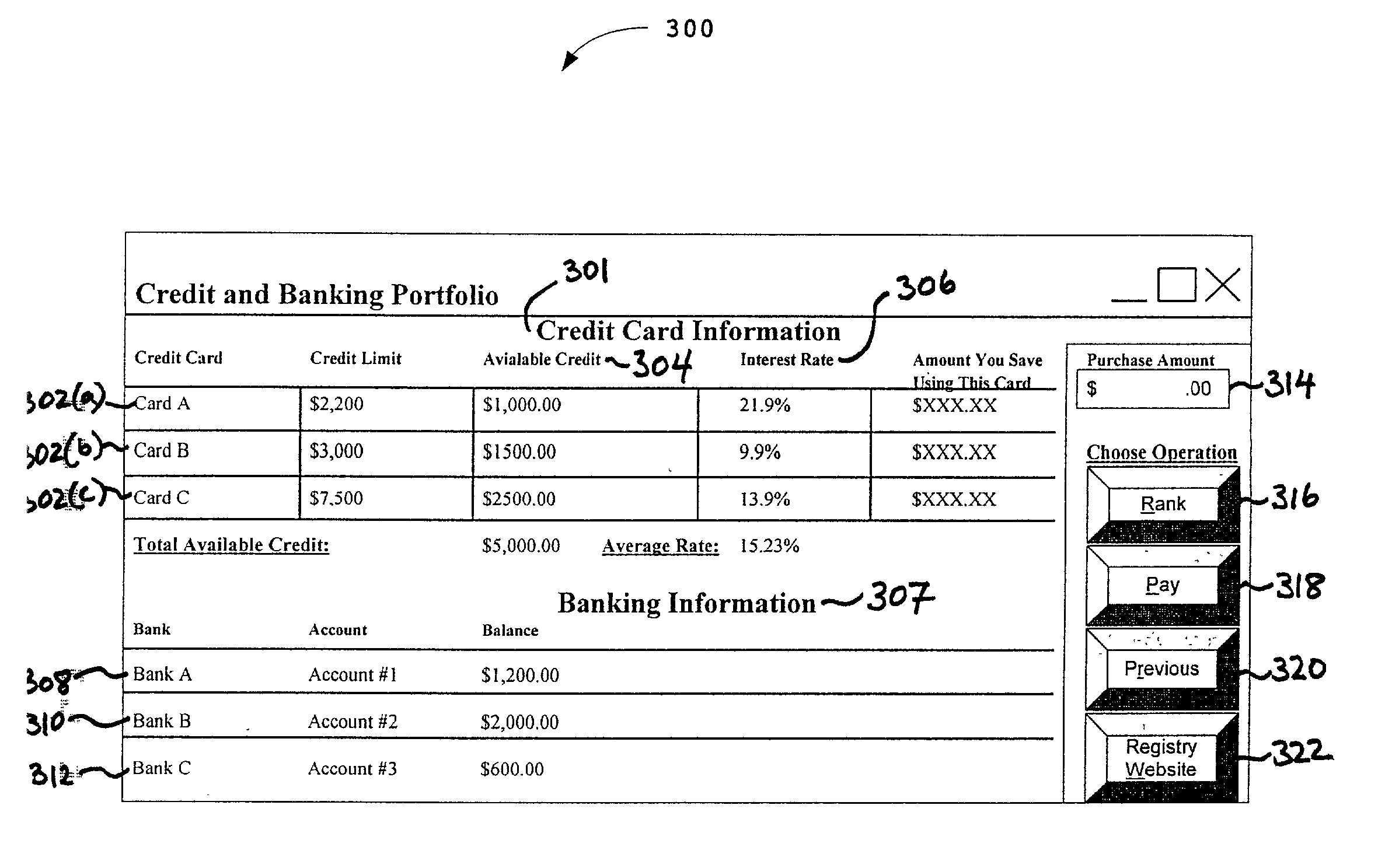

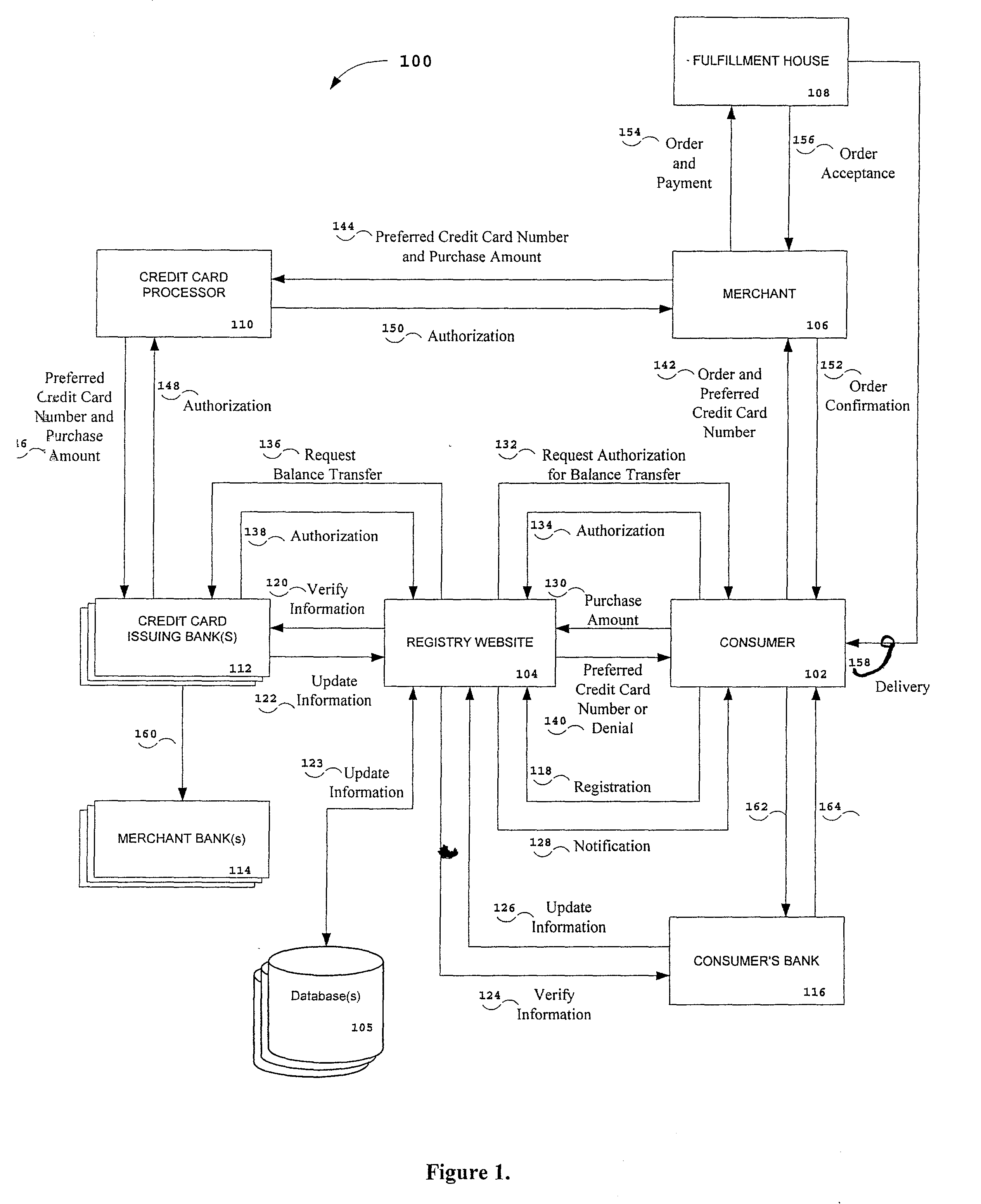

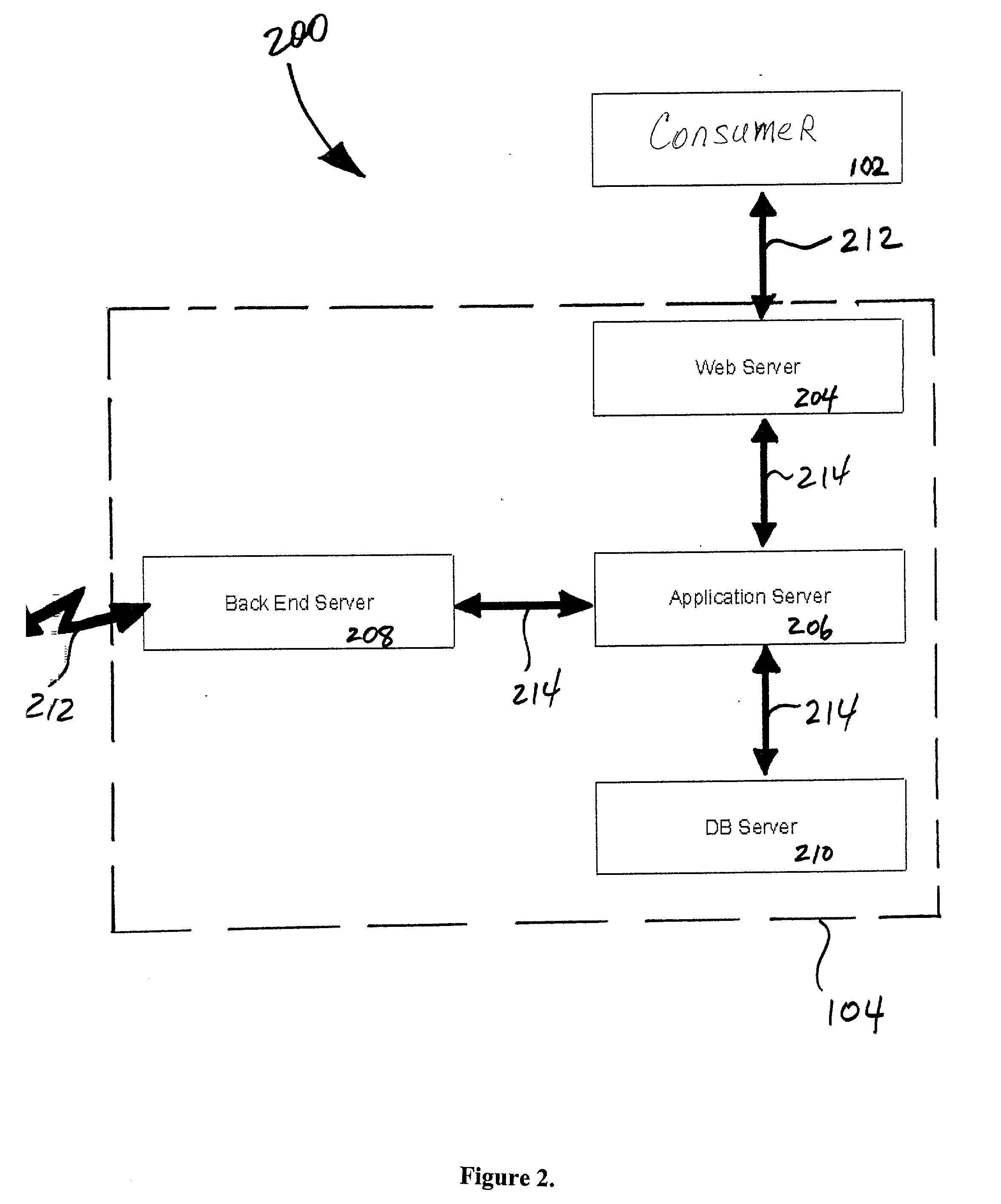

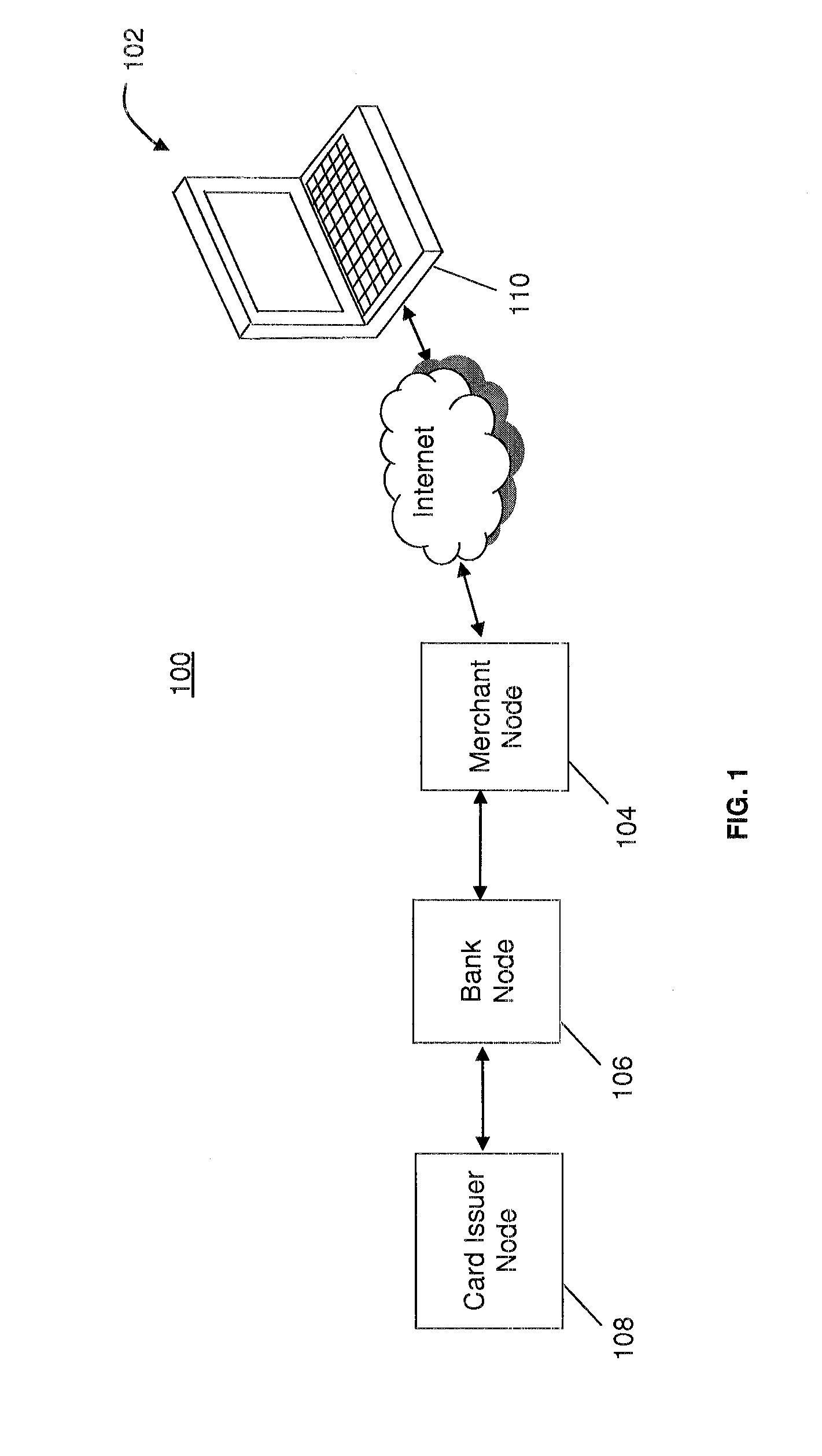

Method and system for maximizing credit card purchasing power and minimizing interest costs over the internet

InactiveUS20020069122A1Low interest rateConvenient transactionFinancePayment architectureEngineeringE-commerce

According the present invention, there is provided a method and system for facilitating an electronic commerce (e-commerce) transaction by a consumer, the method comprising: acquiring a purchase amount for an e-commerce transaction between a consumer and an Internet shopping portal; querying each of a plurality of consumer accounts for associated financial information; evaluating said associated financial information obtained for each of the plurality of consumer accounts; and facilitating a selection of one or more accounts based on the evaluation step to enable the consumer to complete the e-commerce transaction.

Owner:YUN INSUN +6

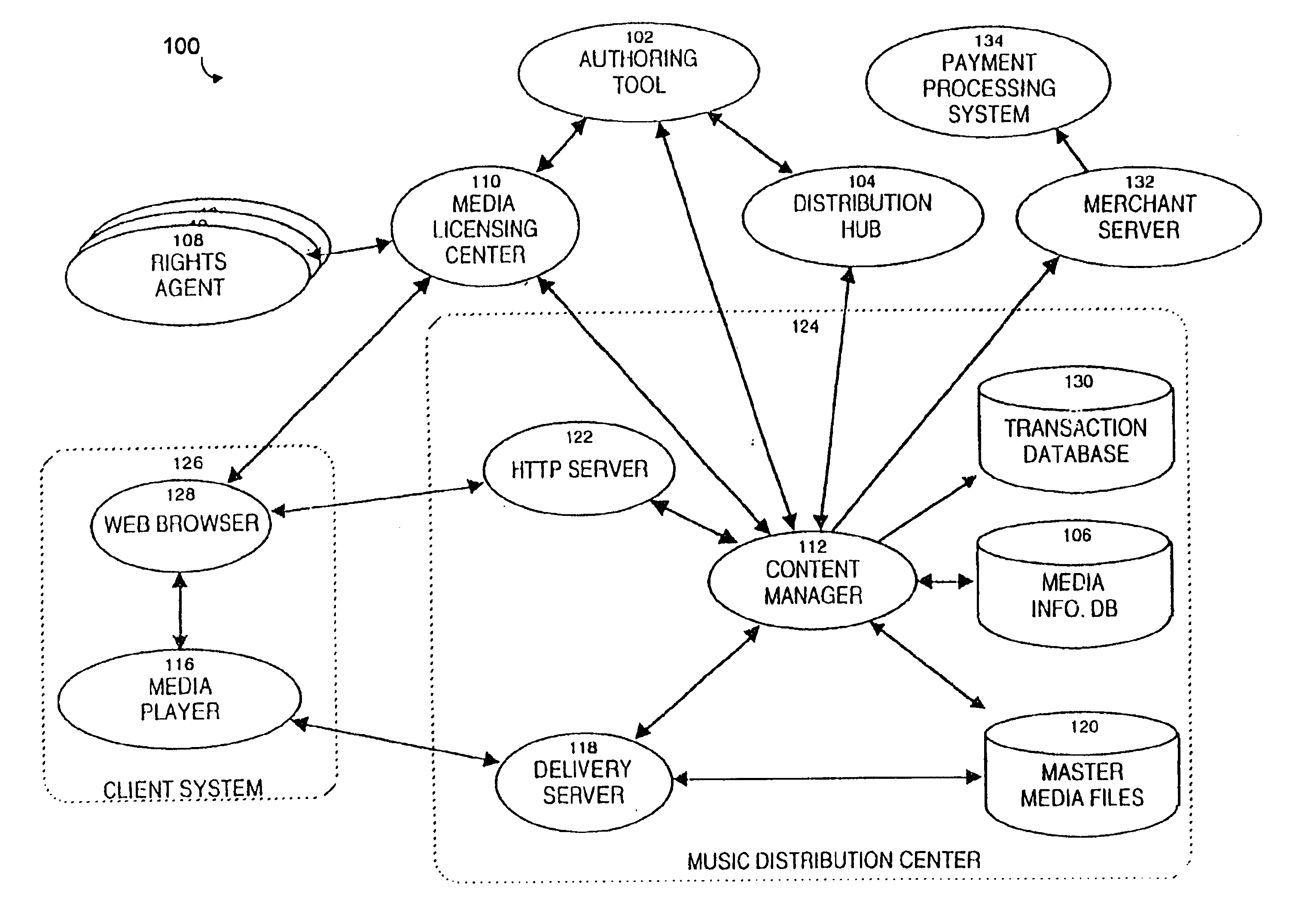

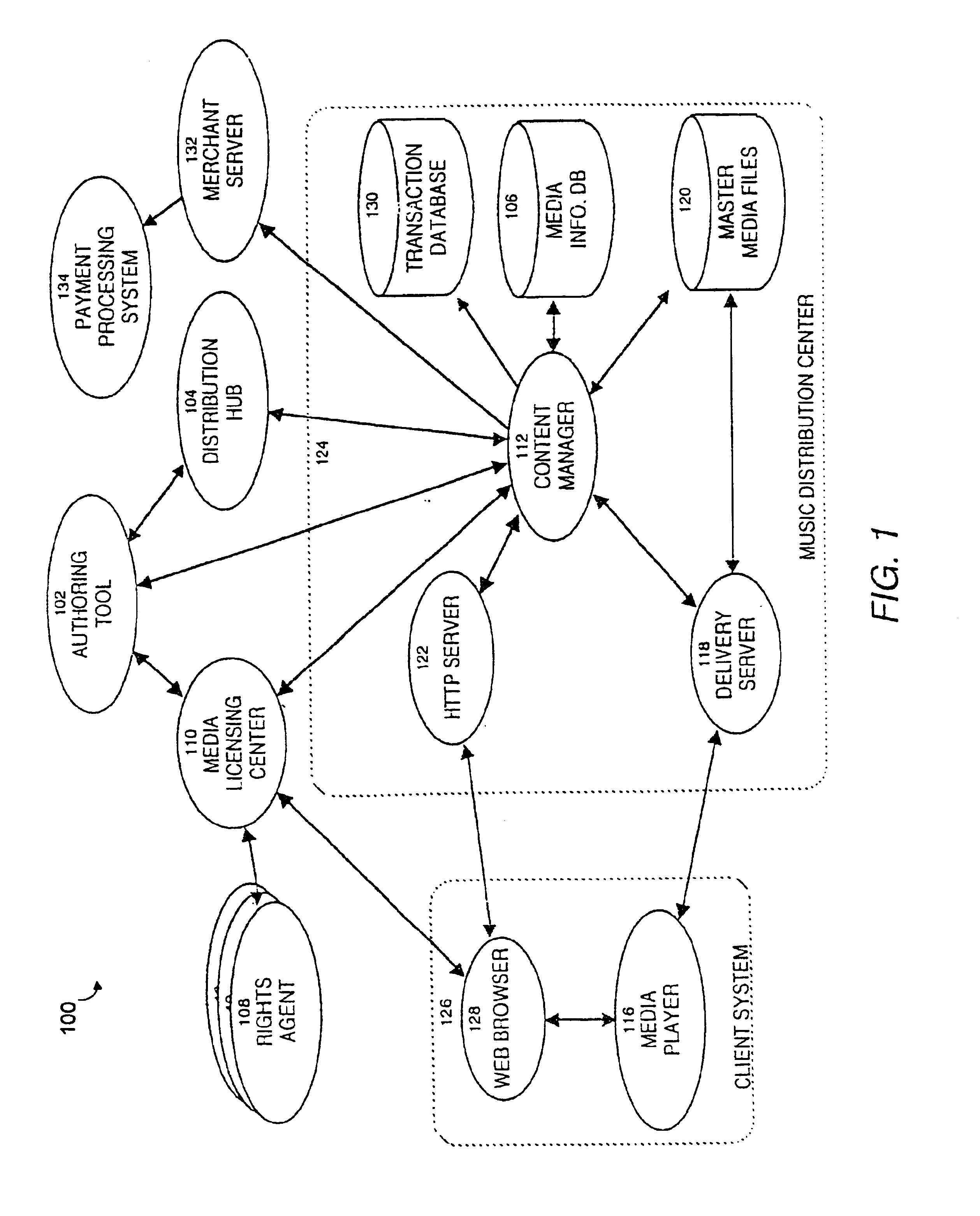

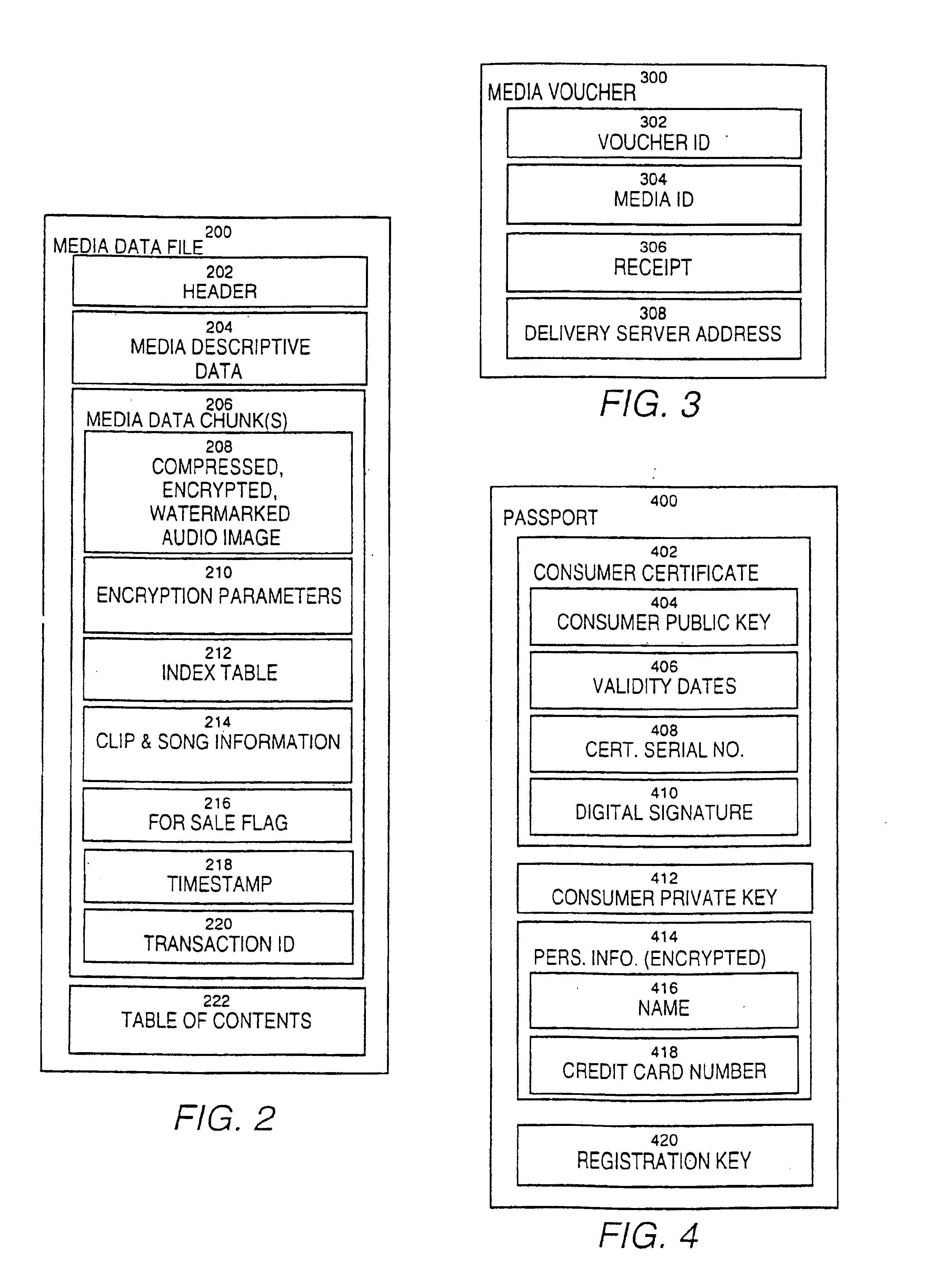

Secure online music distribution system

InactiveUS6868403B1Ease of useFlexibilityReservationsPayment architectureCredit cardClient server systems

A computer implemented online music distribution system provides for the secure delivery of audio data and related media, including text and images, over a public communications network. The online music distribution system provides security through multiple layers of encryption, and the cryptographic binding of purchased audio data to each specific purchaser. The online music distribution system also provides for previewing of audio data prior to purchase. In one embodiment, the online music distribution system is a client-server system including a content manager, a delivery server, and an HTTP server, communicating with a client system including a Web browser and a media player. The content manager provides for management of media and audio content, and processing of purchase requests. The delivery server provides delivery of the purchased media data. The Web browser and HTTP server provide a communications interface over the public network between the content manager and media players. The media player provides for encryption of user personal information, and for decryption and playback of purchased media data. Security of purchased media data is enhanced in part by the use of a personal, digital passport in each media player. The digital passport contains identifying information that identifies the purchaser, along with confidential information, such as credit card number, and encryption data, such as the media player's public and private keys. The media player encryption data is used to encrypt purchased media data, which is decrypted in real time by the media player. The media player also displays confidential information, such as the purchaser's credit card number, during playback.

Owner:MICROSOFT TECH LICENSING LLC

Method and system for issuing, aggregating and redeeming merchant loyalty points with an acquiring bank

InactiveUS20050021401A1High cost of administrationHigh cost of setupPayment architectureMarketingCredit cardComputer science

A loyalty reward point system that utilizes the pre-existing infrastructure of network such as a credit card network. A user makes a purchase at a merchant using a token such as a credit card. As part of the purchase transaction, the user is awarded reward points from the merchant based on the purchase, which are stored in an account associated with the merchant and the user by the acquiring bank. The reward account is maintained on the acquiring bank server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant in the same marketing cluster, or may aggregate those reward points with those of other merchants into a reward point exchange account, and then redeem the aggregated reward points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

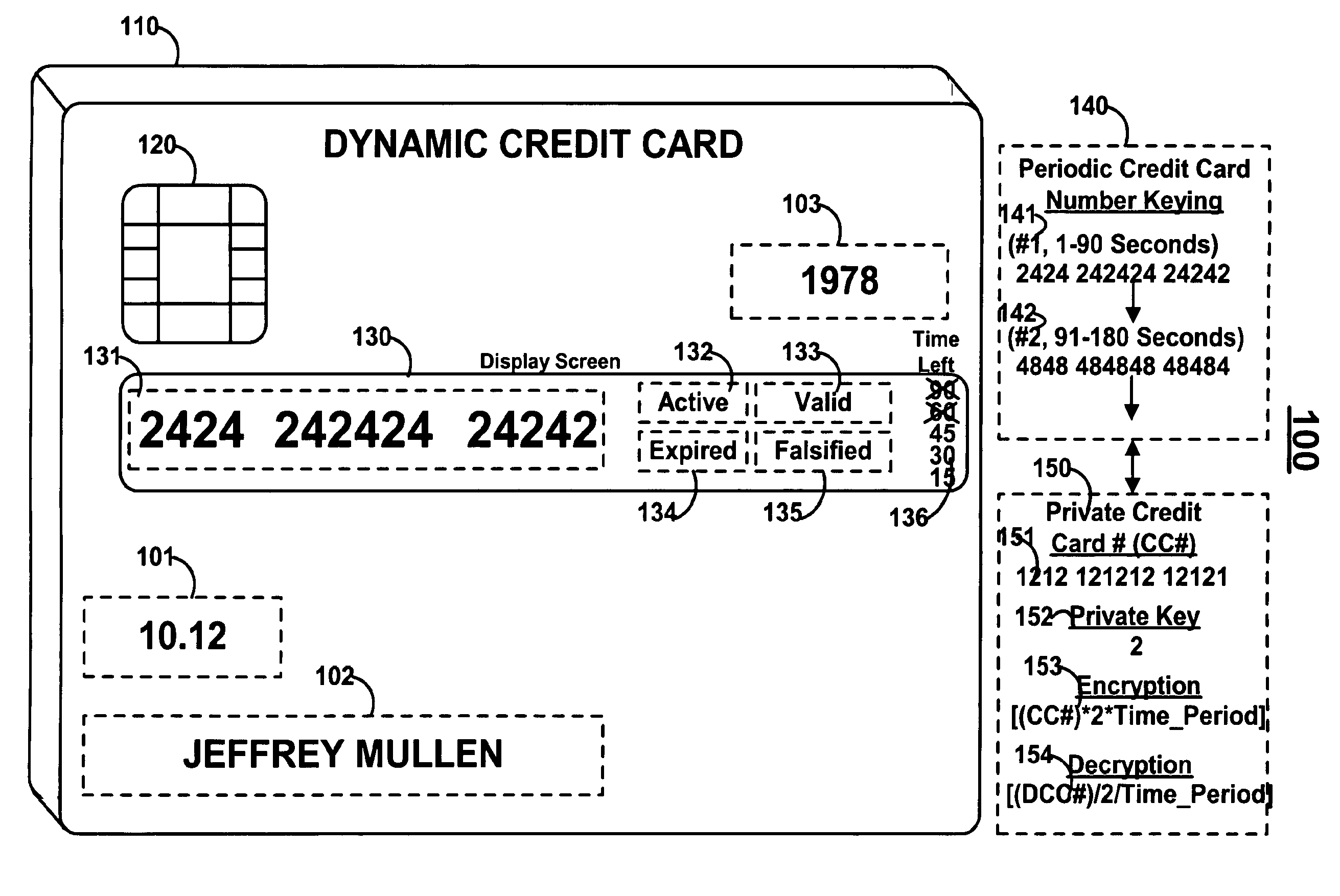

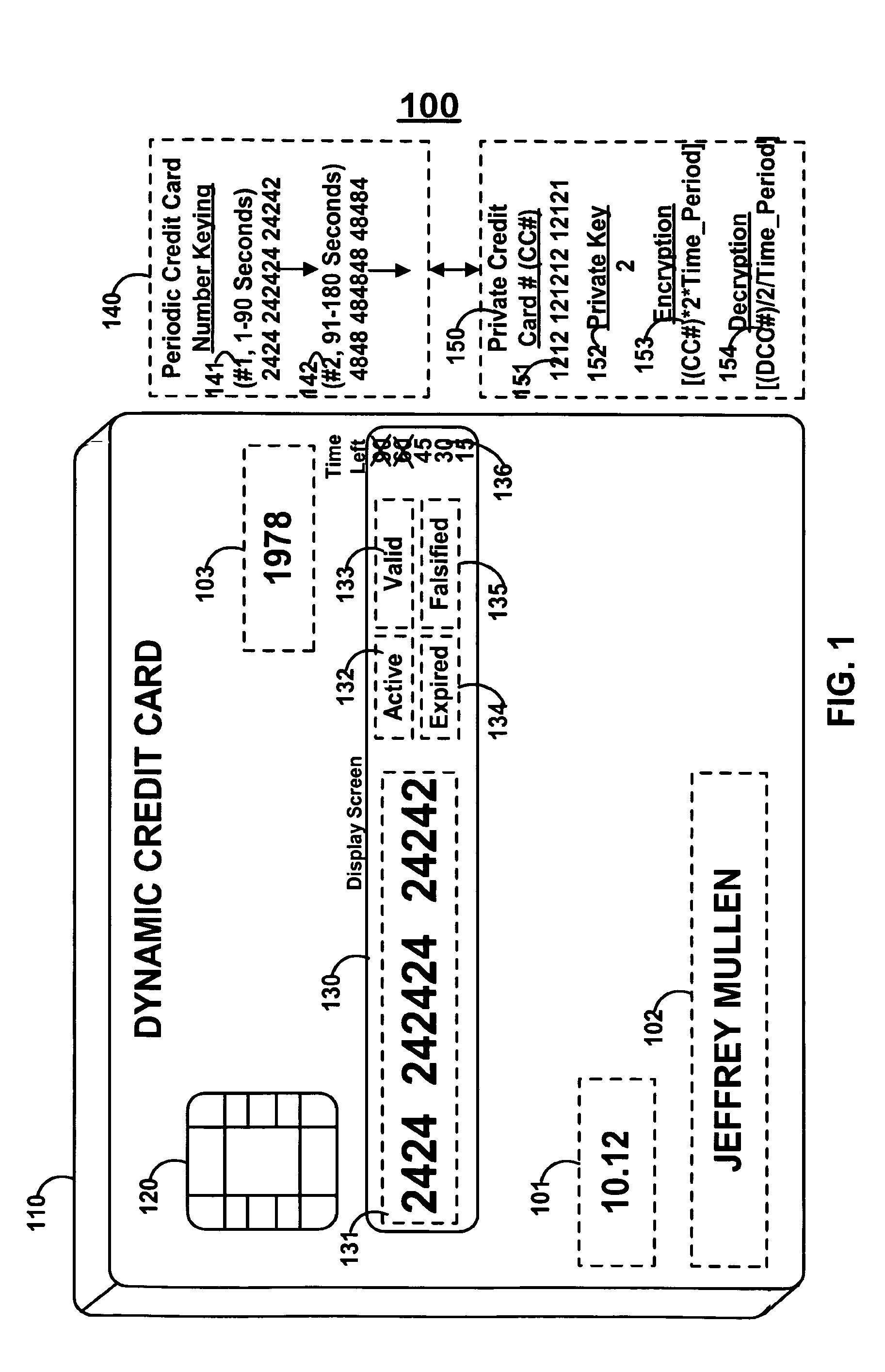

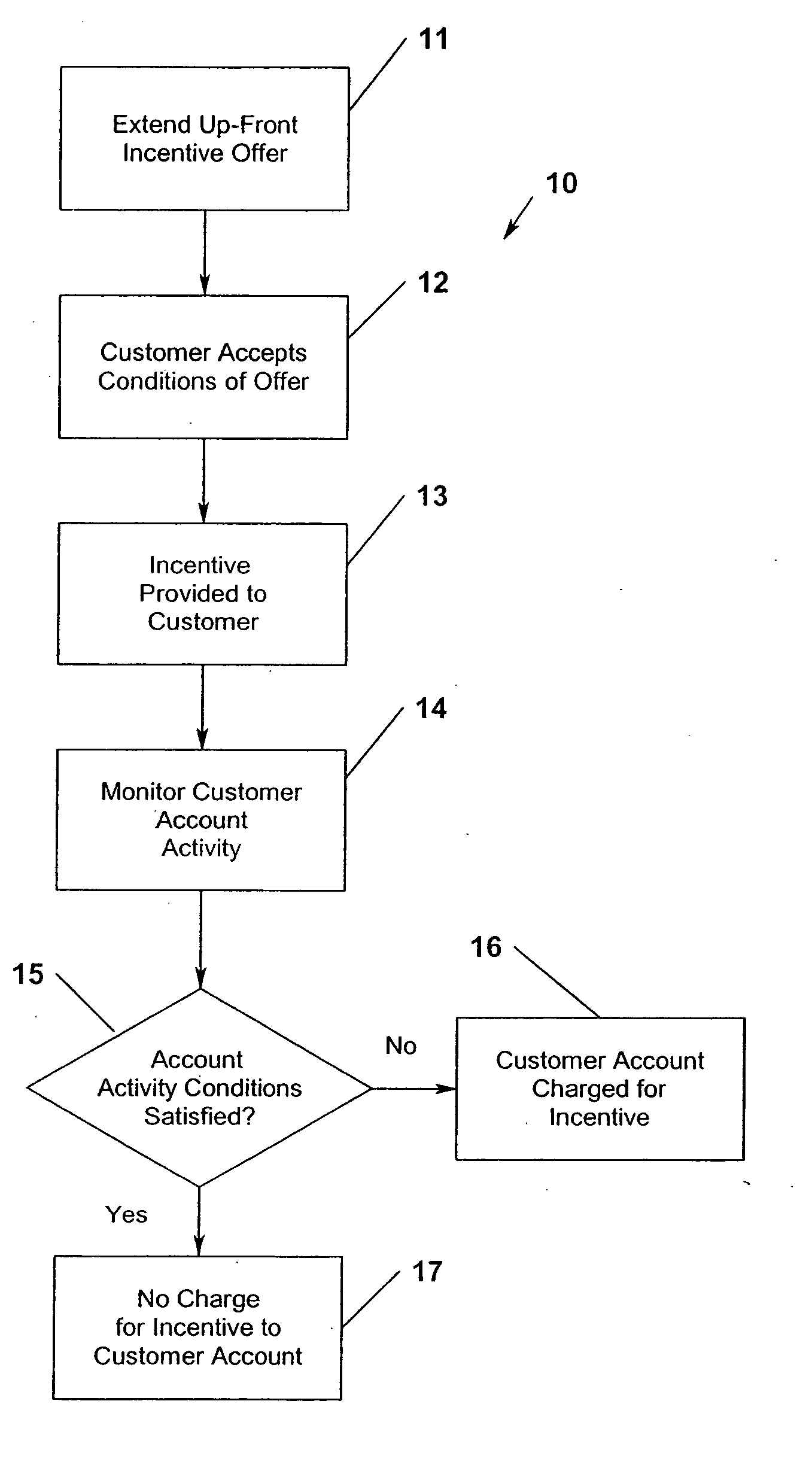

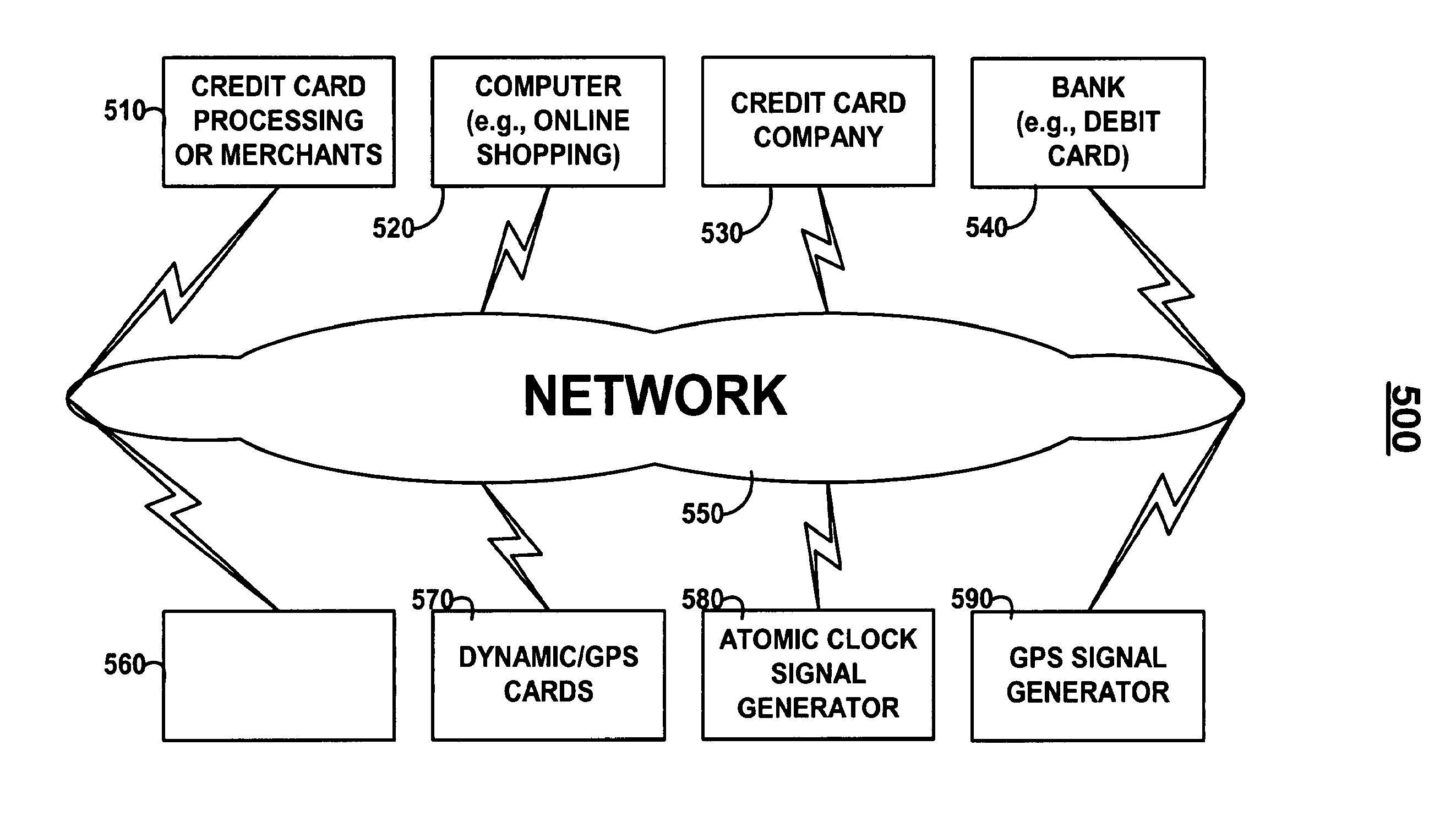

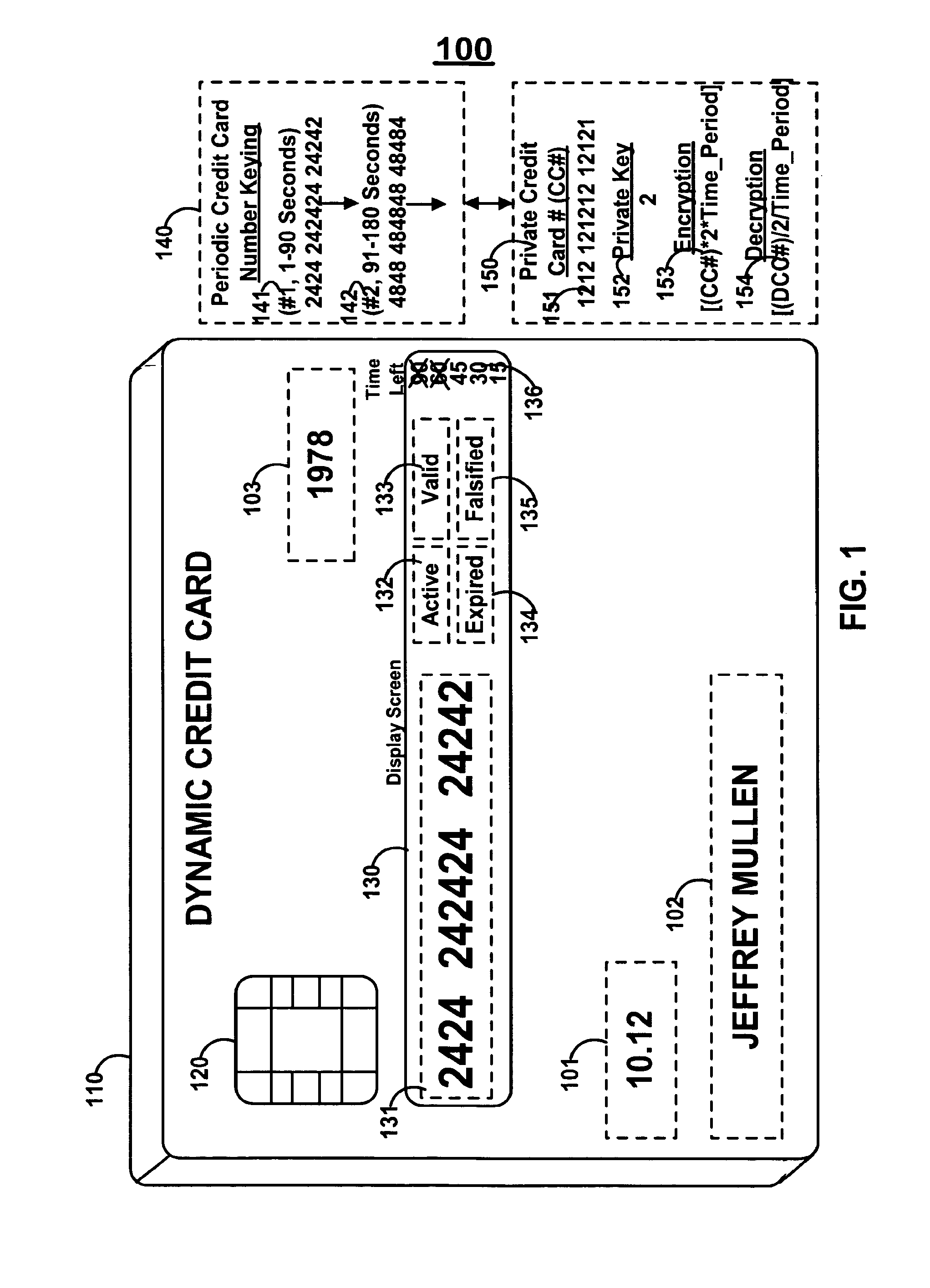

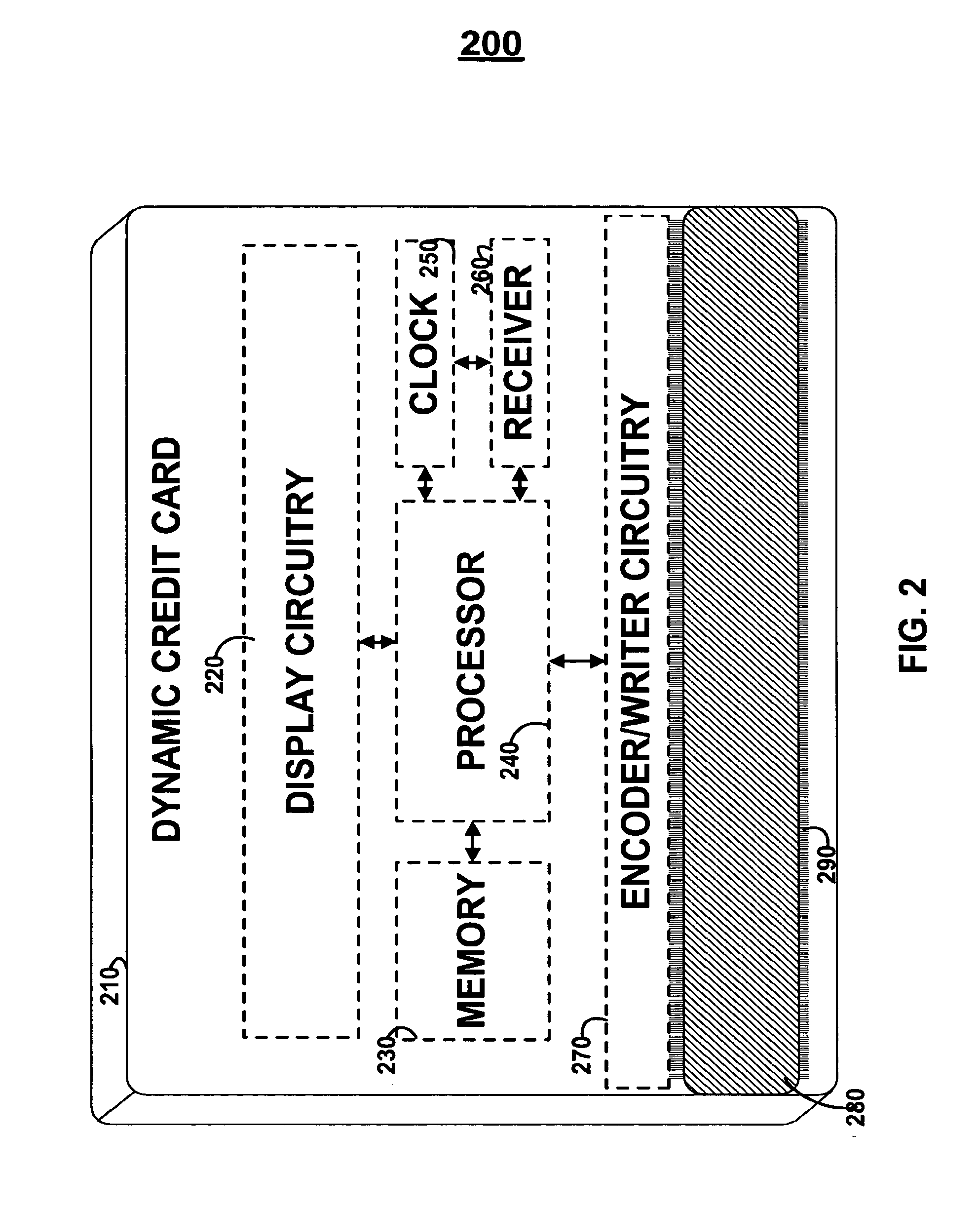

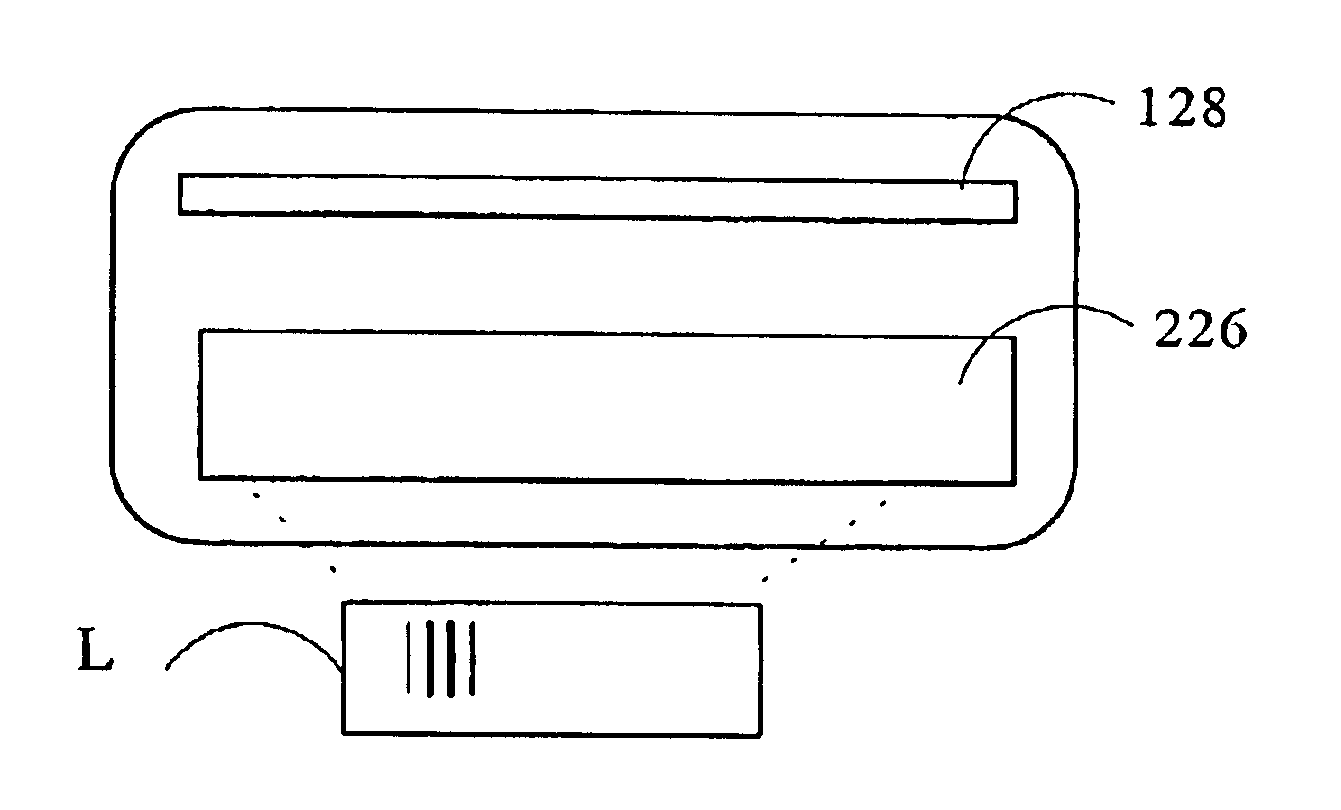

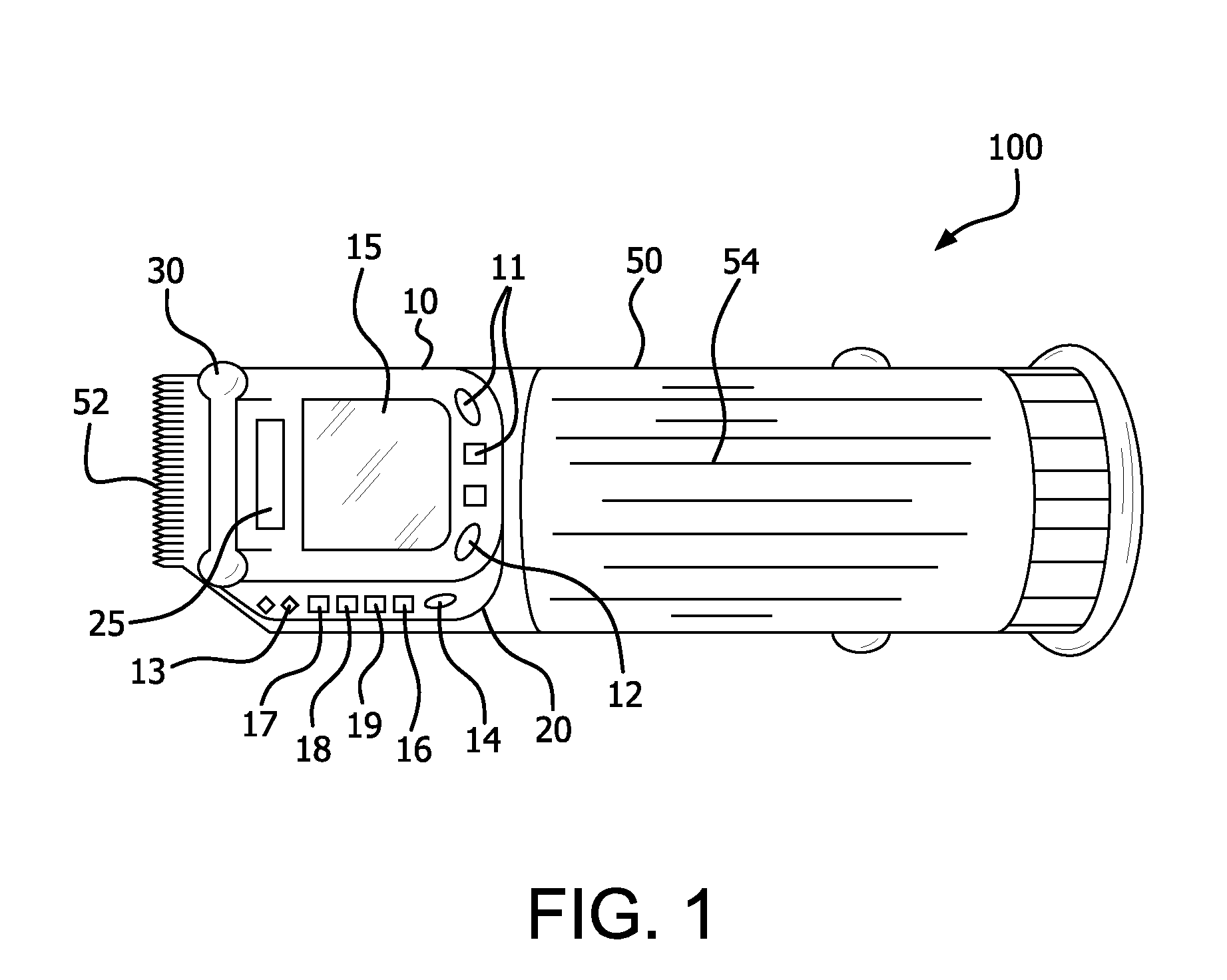

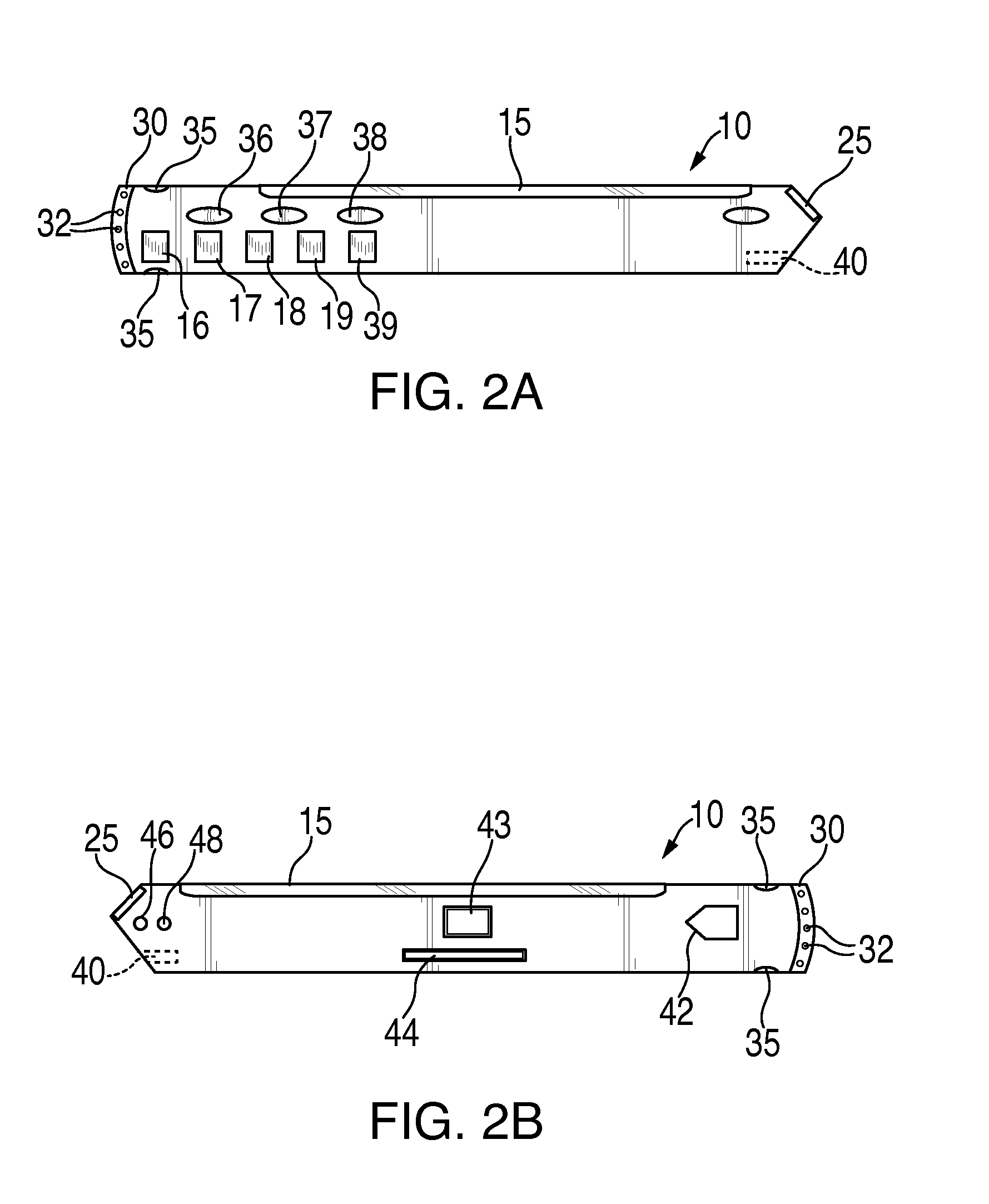

Dynamic credit card with magnetic stripe and embedded encoder and methods for using the same to provide a copy-proof credit card

A dynamic credit card is provided in which a secure credit card number (e.g., a secret / hidden credit card number) is encoded based on a timing signal (e.g., an internal counter) to provide a dynamic credit card number. This dynamic number may be displayed to a user via a display (e.g., so that online purchases can be made) or written onto a magnetic stripe such that the number may be processed by traditional credit card merchants (e.g., swiped). At a remote facility, the dynamic number may be decoded based on time (and / or a counter / key number / equation) or the facility may have the secure number and perform the same function as the dynamic credit card (e.g., encode using time data as a parameter to the encoding equation) and compare the resultant dynamic number to the dynamic number received. Thus, a dynamic credit card number may change continually or periodically (e.g., every sixty seconds) such that credit card numbers may not be copied by thieves and used at later times. A dynamic verification code may be utilized in addition to, or in lieu of, a dynamic credit card number.

Owner:DYNAMICS

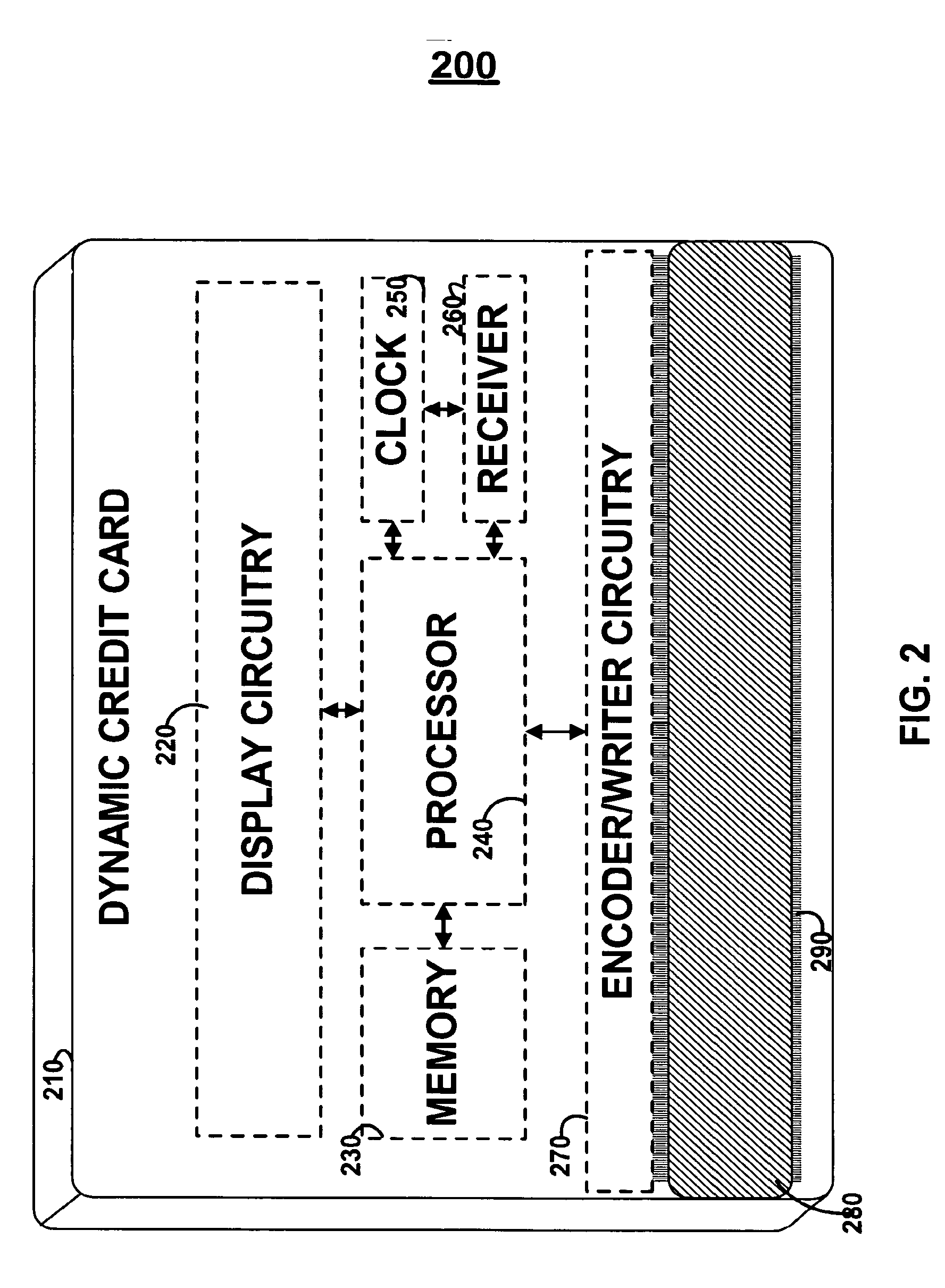

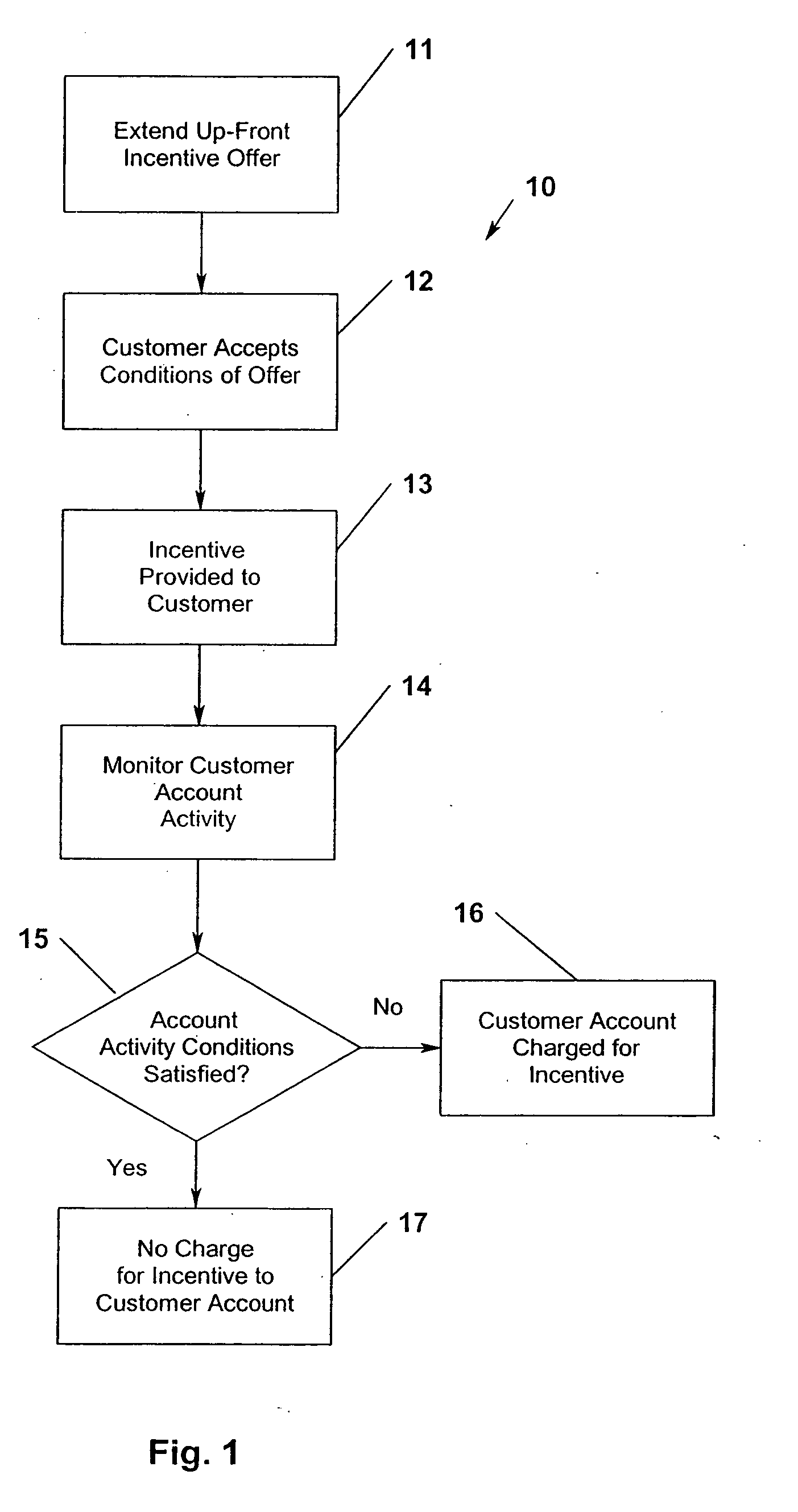

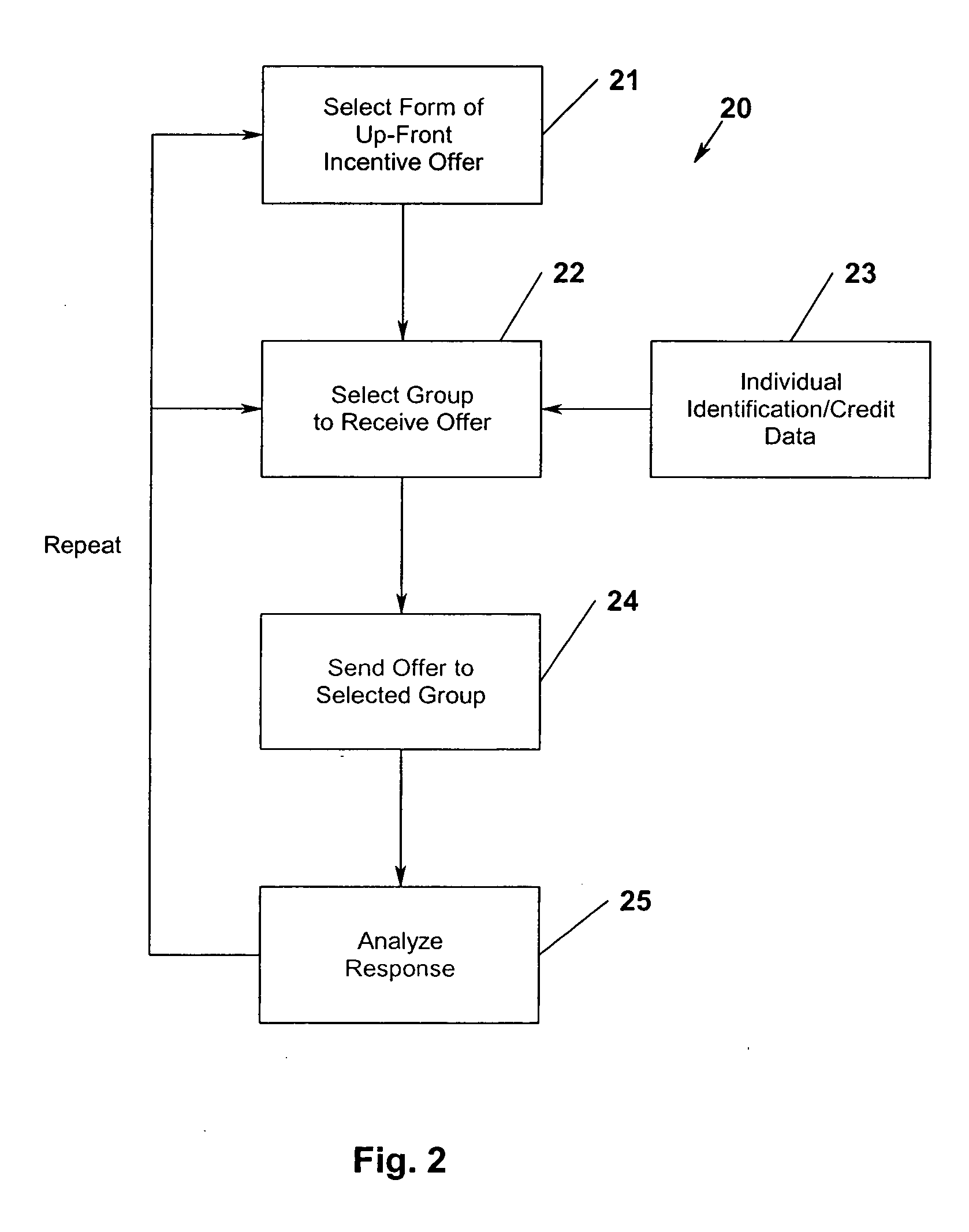

Financial account up-front incentives management system and method

InactiveUS20050021457A1Increased revenueEncourage and reward specific customer behaviorFinancePayment circuitsManagement systemDatabase

A system and method for incentivizing holders of financial accounts, e.g., credit card account holders, to engage in certain activities with those accounts. Account holders may be provided an up-front incentive based on a commitment to engage in certain account activities in the future. If the account holder fails to satisfy his commitment, at least a portion of the value of the incentive may be charged to a customer account. Rewards provided to an account holder to encourage particular account activities also may include merchandise rewards, discounts and rebates or entries into a lottery type drawing for prizes.

Owner:UNIVERSAL INTPROP HLDG

Dynamic credit card with magnetic stripe and embedded encoder and methods for using the same to provide a copy-proof credit card

A dynamic credit card is provided in which a secure credit card number (e.g., a secret / hidden credit card number) is encoded based on a timing signal (e.g., an internal counter) to provide a dynamic credit card number. This dynamic number may be displayed to a user via a display (e.g., so that online purchases can be made) or written onto a magnetic stripe such that the number may be processed by traditional credit card merchants (e.g., swiped). At a remote facility, the dynamic number may be decoded based on time (and / or a counter / key number / equation) or the facility may have the secure number and perform the same function as the dynamic credit card (e.g., encode using time data as a parameter to the encoding equation) and compare the resultant dynamic number to the dynamic number received. Thus, a dynamic credit card number may change continually or periodically (e.g., every sixty seconds) such that credit card numbers may not be copied by thieves and used at later times. A dynamic verification code may be utilized in addition to, or in lieu of, a dynamic credit card number.

Owner:MULLEN JEFFREY D

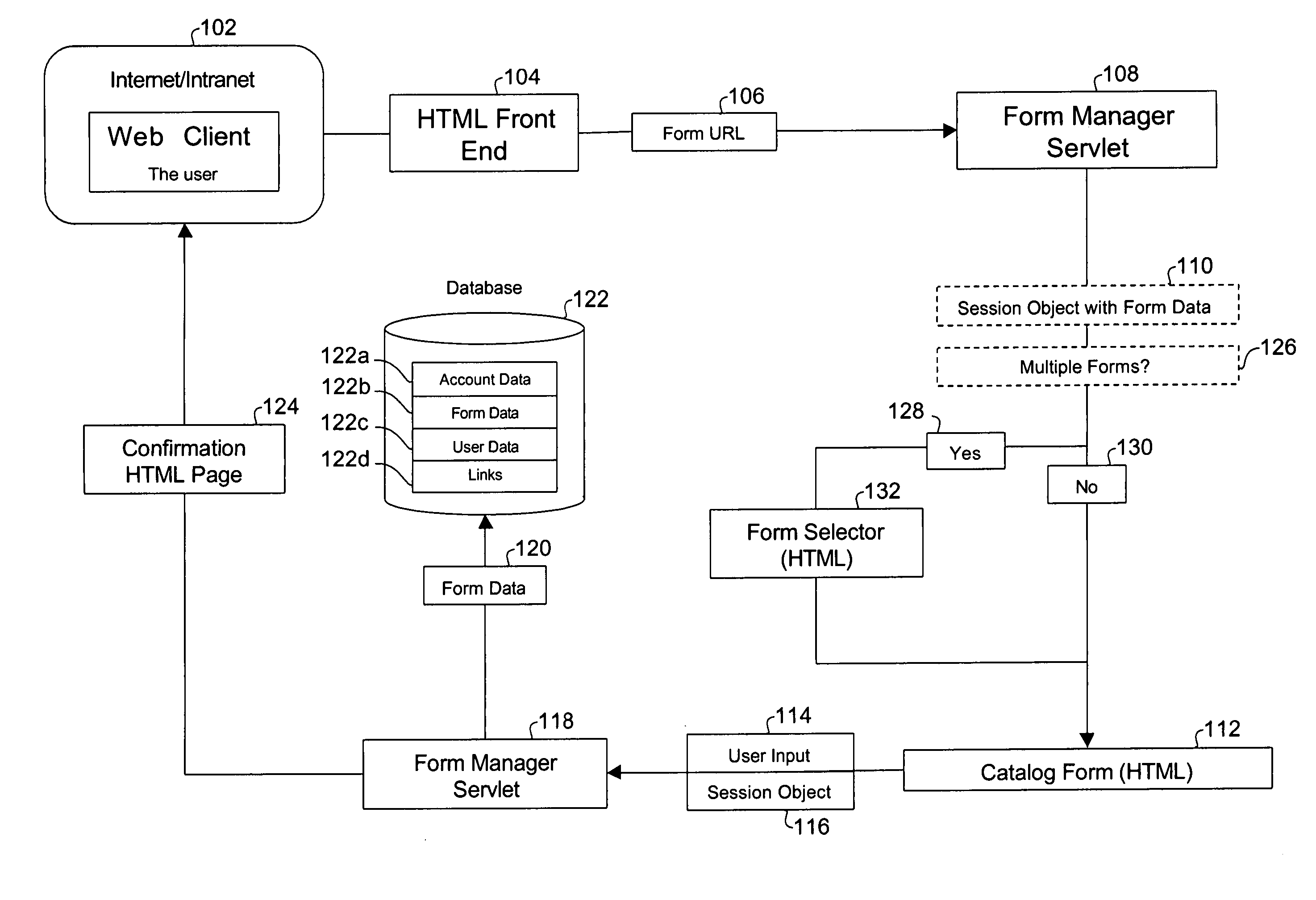

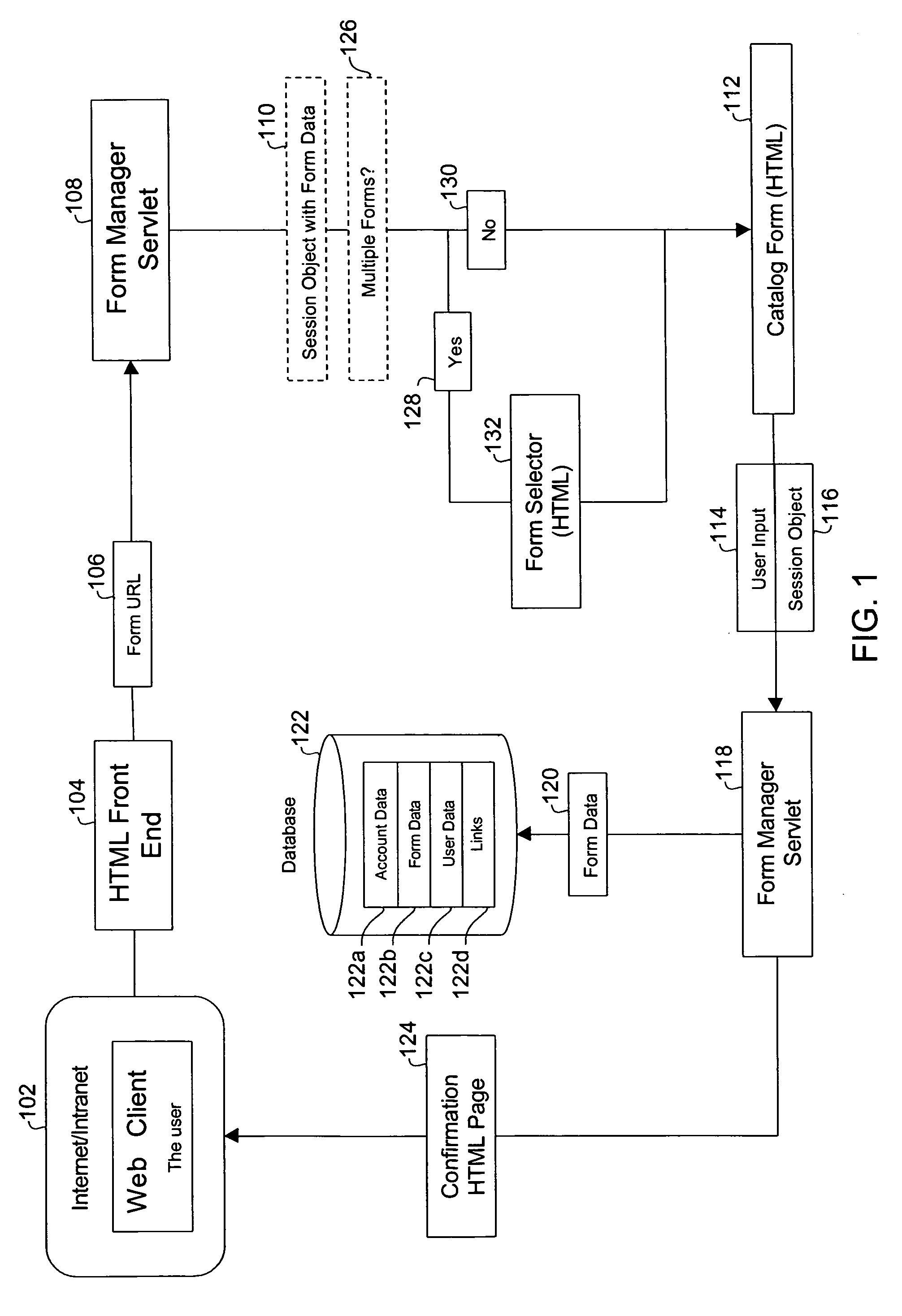

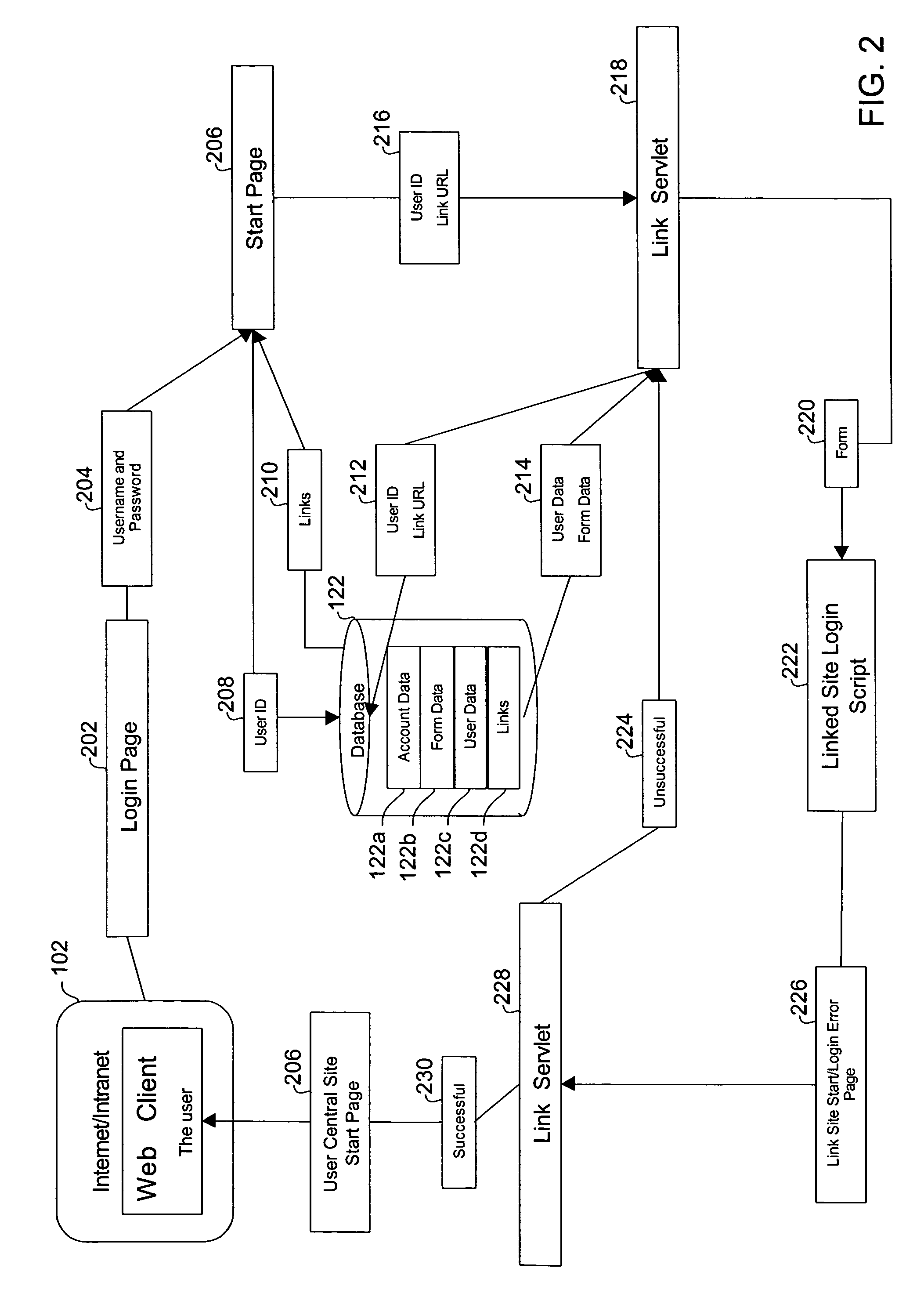

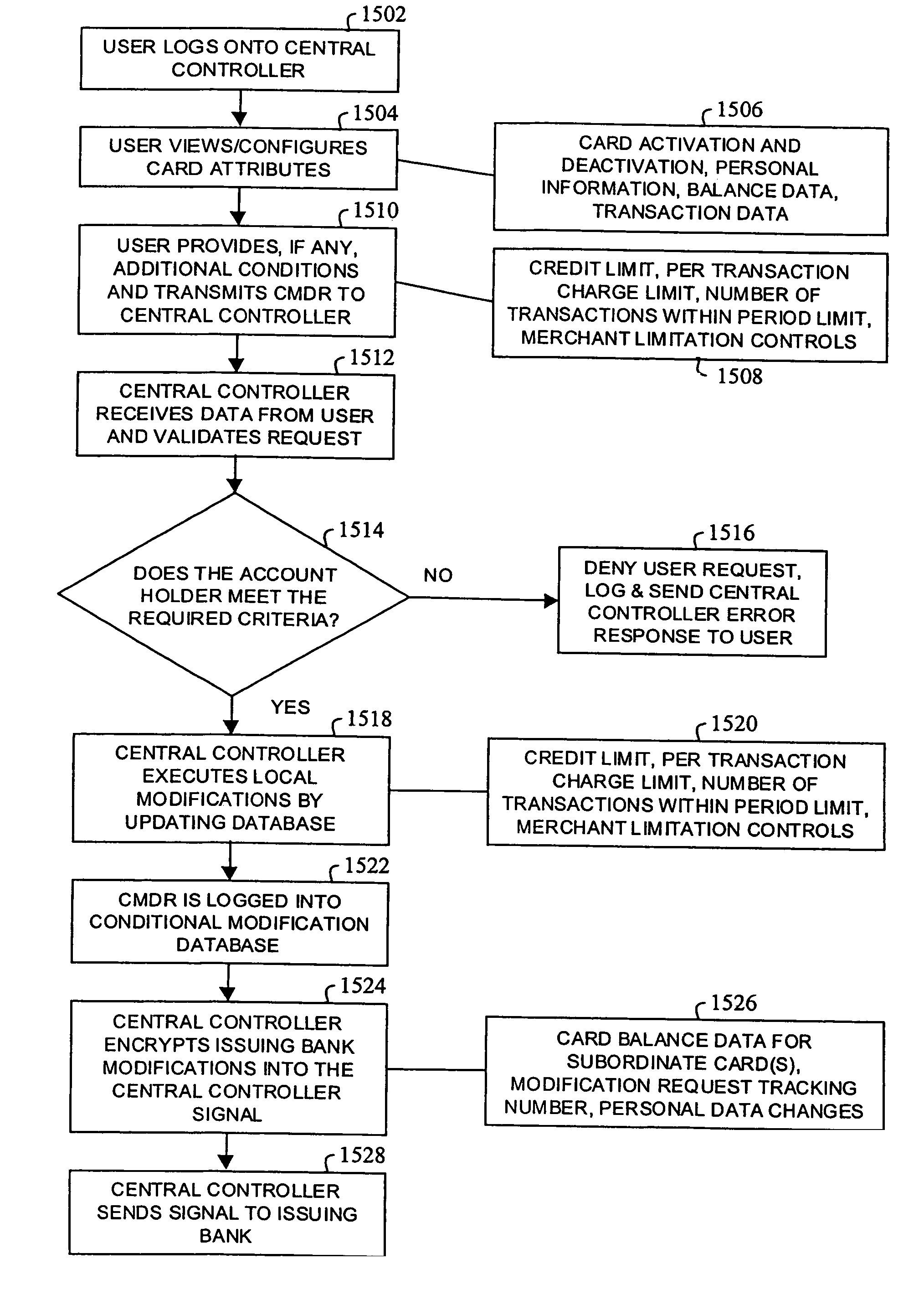

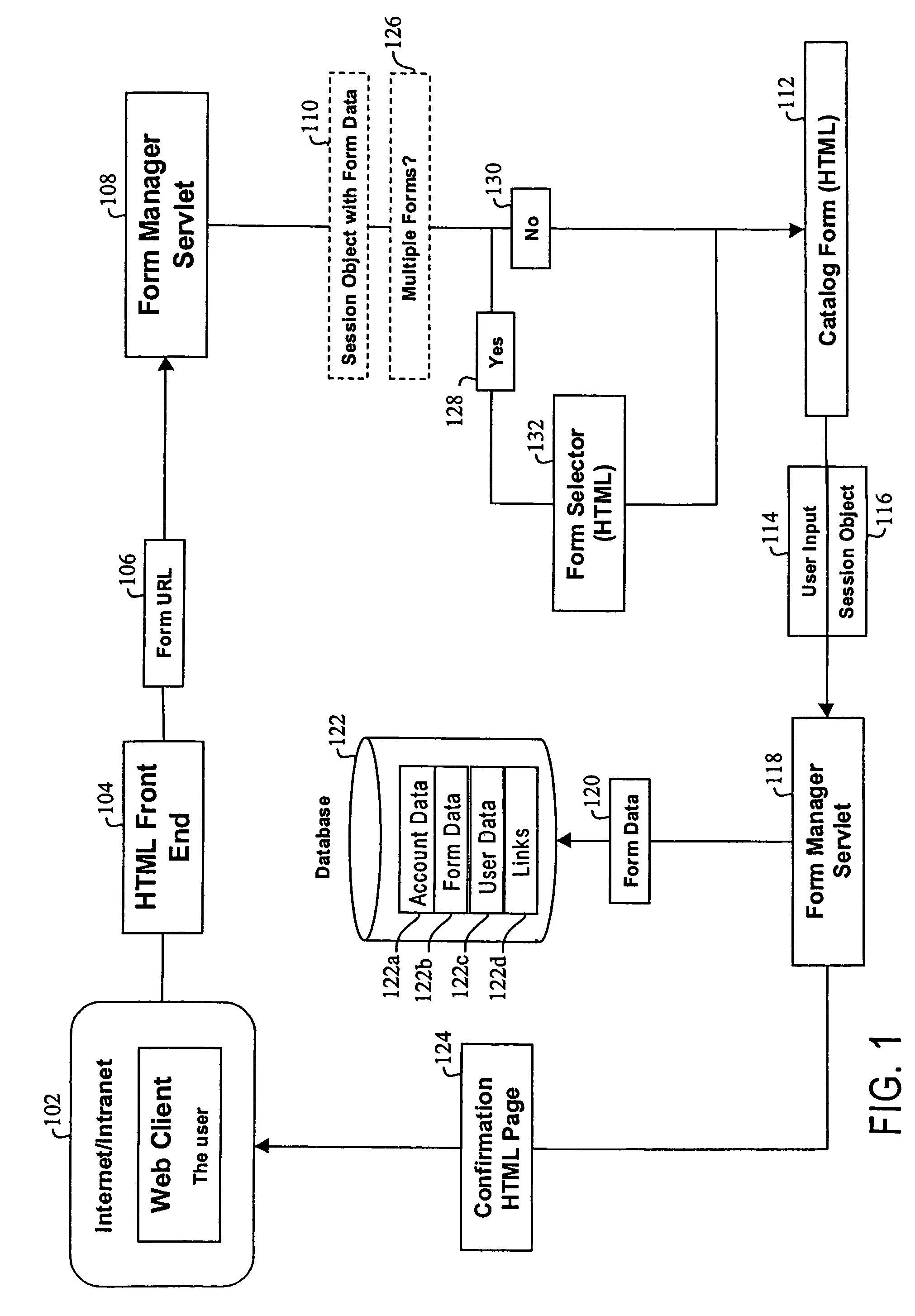

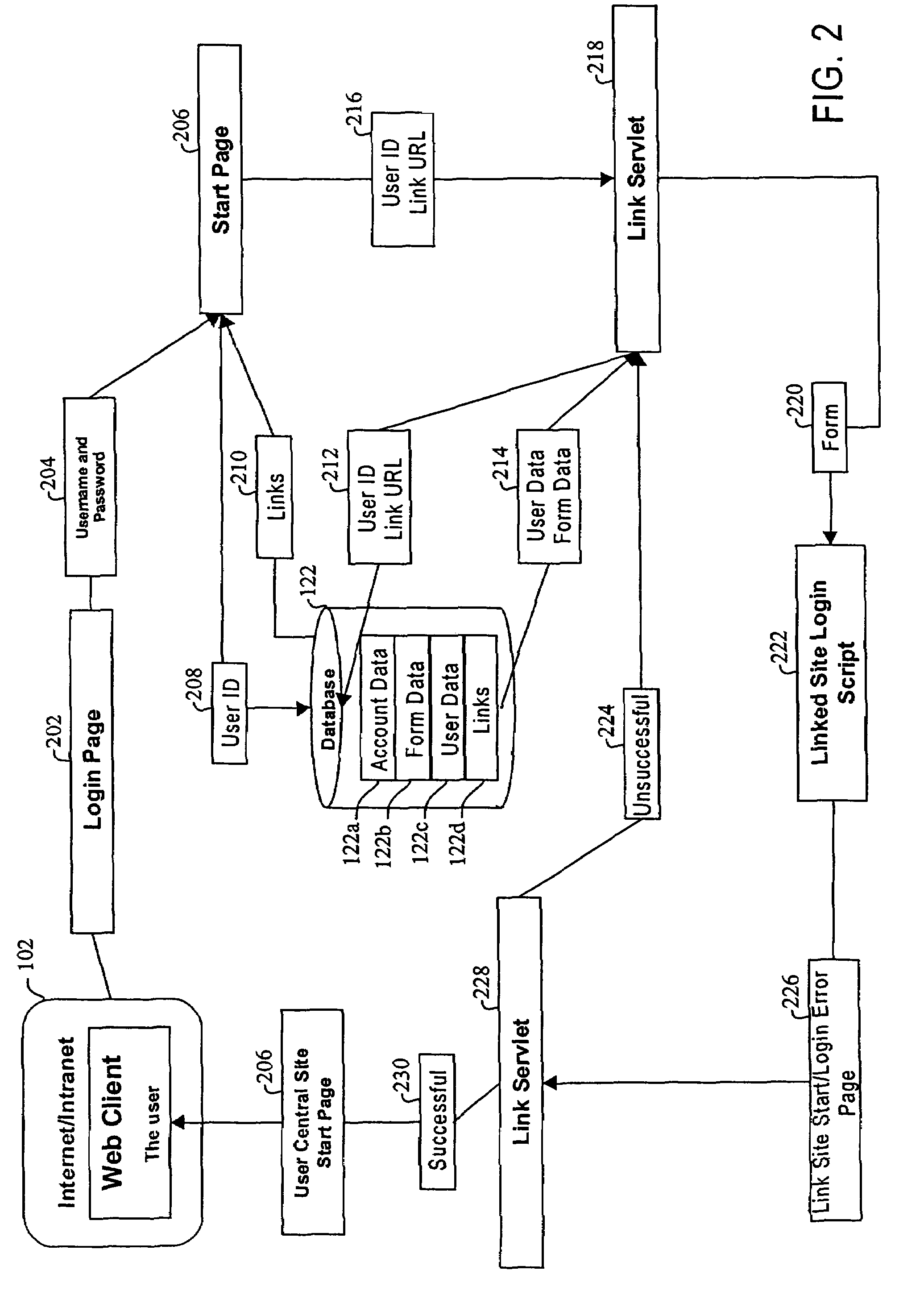

Method, system and computer readable medium for web site account and e-commerce management from a central location

InactiveUS7865414B2Minimizing activation timeMinimizing financial exposureAcutation objectsFinanceWeb sitePayment

A method, system, and computer readable medium for managing a financial transaction of a user at a merchant, including authenticating the user via a device of the user while the user is at the merchant; transmitting activation information for activating a reusable, pre-existing, unaltered and permanent credit or debit card account number of the user from the user device to a financial institution for processing financial transactions, while the user is authenticated; submitting a payment request including the account number to the financial institution from the merchant, while the account number is activated; and de-activating the account number after the payment request is processed by the financial institution. The financial institution only accepts and processes payment requests received from merchants while the account number is activated, and the financial institution declines payment requests while the account number is de-activated.

Owner:SLINGSHOT TECH LLC

Method, system and computer readable medium for web site account and e-commerce management from a central location

A method, system and computer readable medium for managing a user online financial transaction at a destination ecommerce web site using a credit or debit card account of the user, including a) transmitting an activation command to a financial institution processing financial transactions for activating the credit or debit card account of the user; b) submitting a charge request for the credit or debit card account to the financial institution via a destination e-commerce web site to which the user is logged in while the credit or debit card account is in the activated status; and c) transmitting a de-activation command to said financial institution for de-activating the credit or debit card account, wherein the financial institution only accepts and processes charge requests received from e-commerce web sites while the credit or debit card account is in the activated status and wherein the financial institution declines charge requests while said credit or debit card account is in the de-activated status, and wherein steps a) to c) are repeated at least once.

Owner:SLINGSHOT TECH LLC

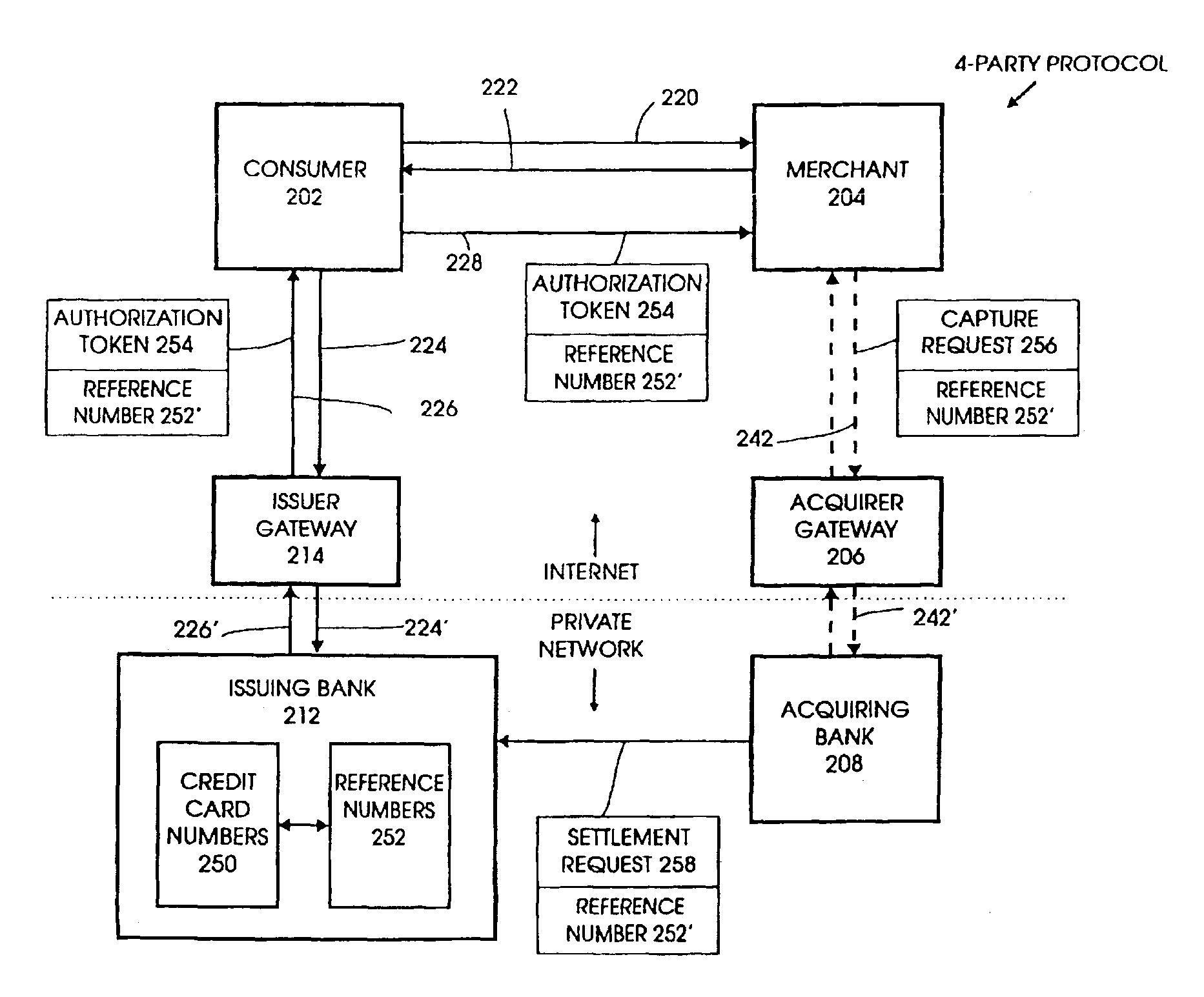

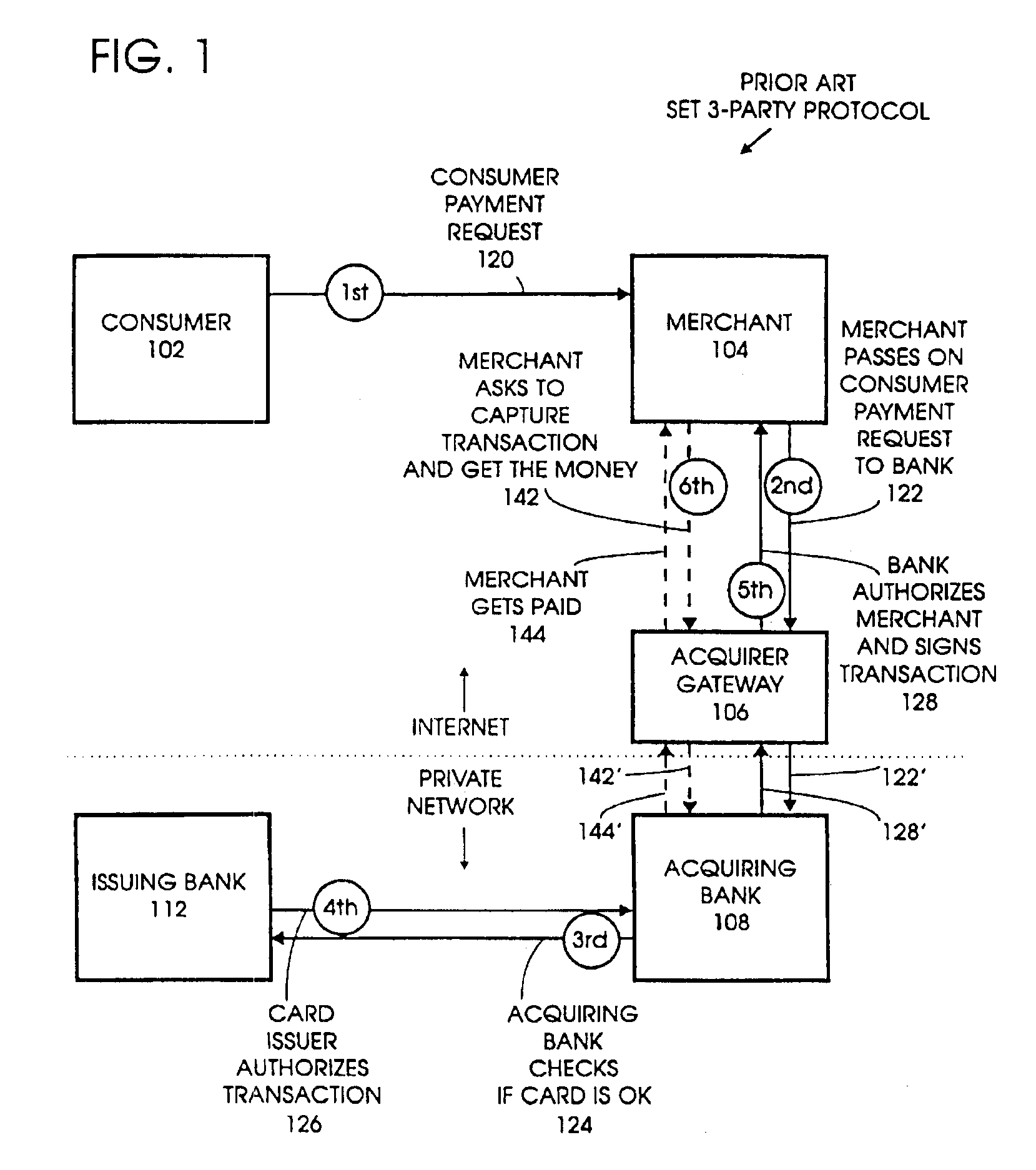

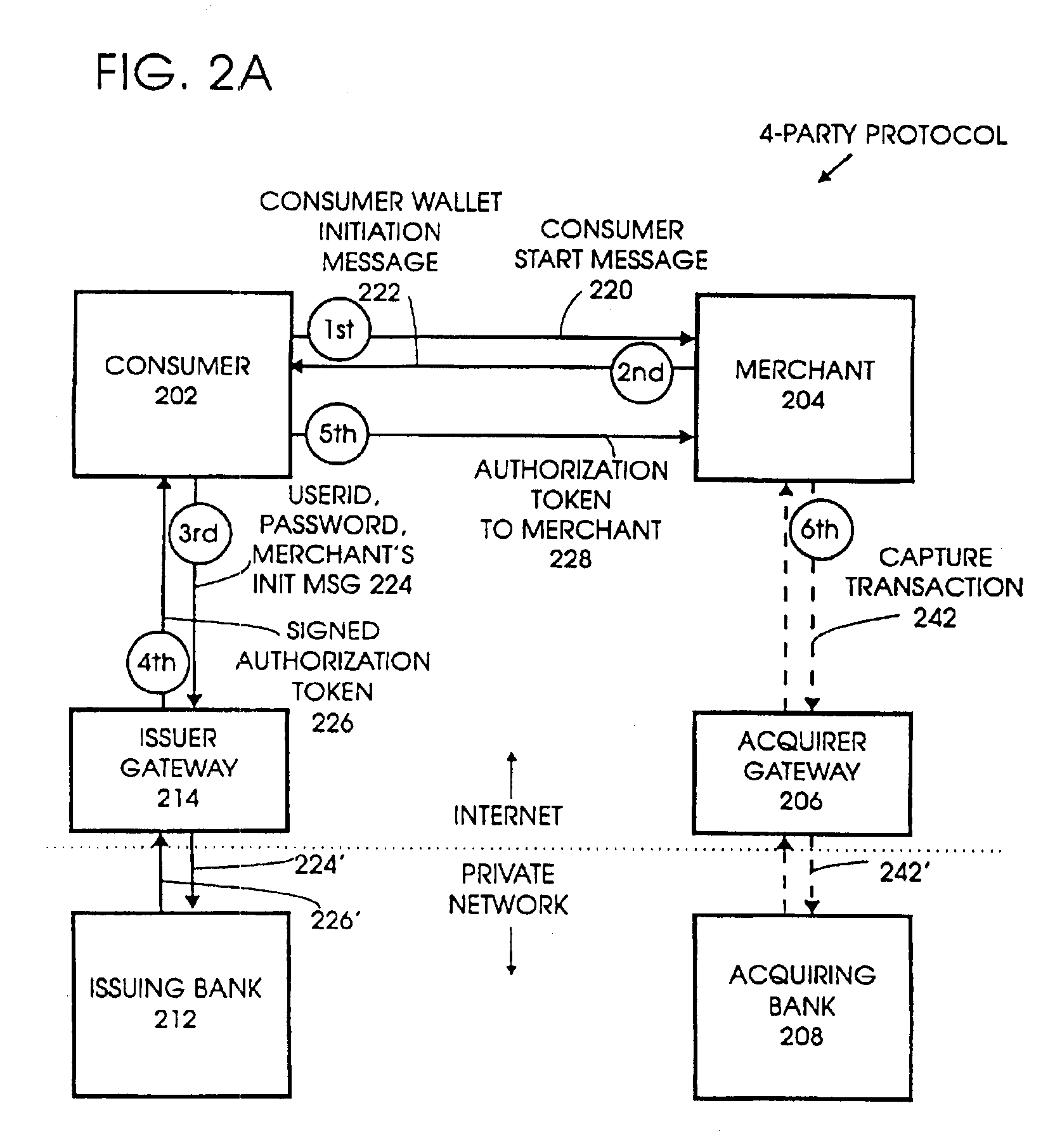

Four-party credit/debit payment protocol

InactiveUSRE40444E1Good effectReduce complexityUser identity/authority verificationSecret communicationE-commerceAuthorization

A method, system, program, and method of doing business are disclosed for electronic commerce that includes the feature of a “thin” consumer's wallet by providing issuers with an active role in each payment. This is achieved by adding an issuer gateway and moving the credit / debit card authorization function from the merchant to the issuer. This enables an issuer to independently choose alternate authentication mechanisms without changing the acquirer gateway. It also results in a significant reduction in complexity, thereby improving the ease of implementation and overall performance.

Owner:PAYPAL INC

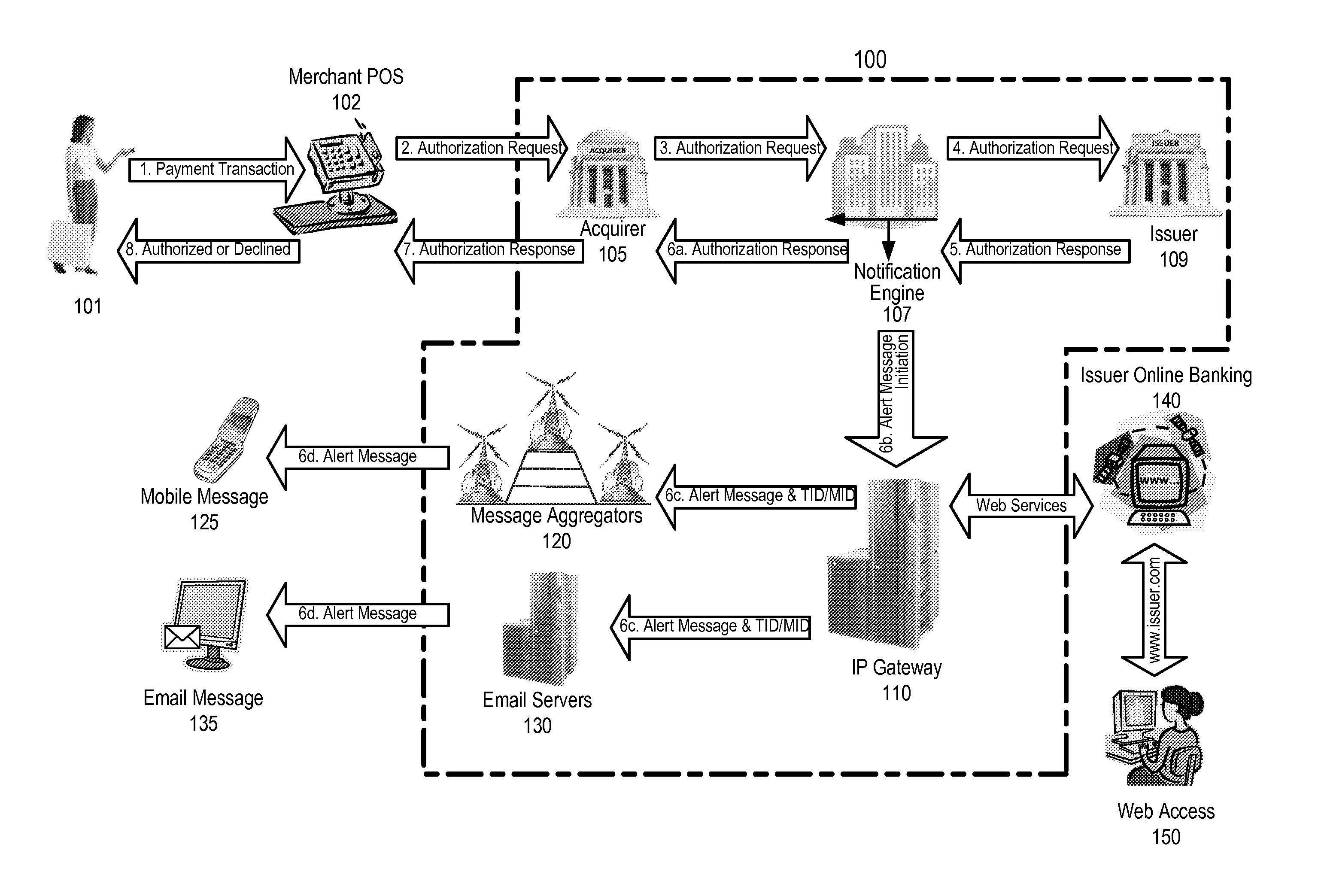

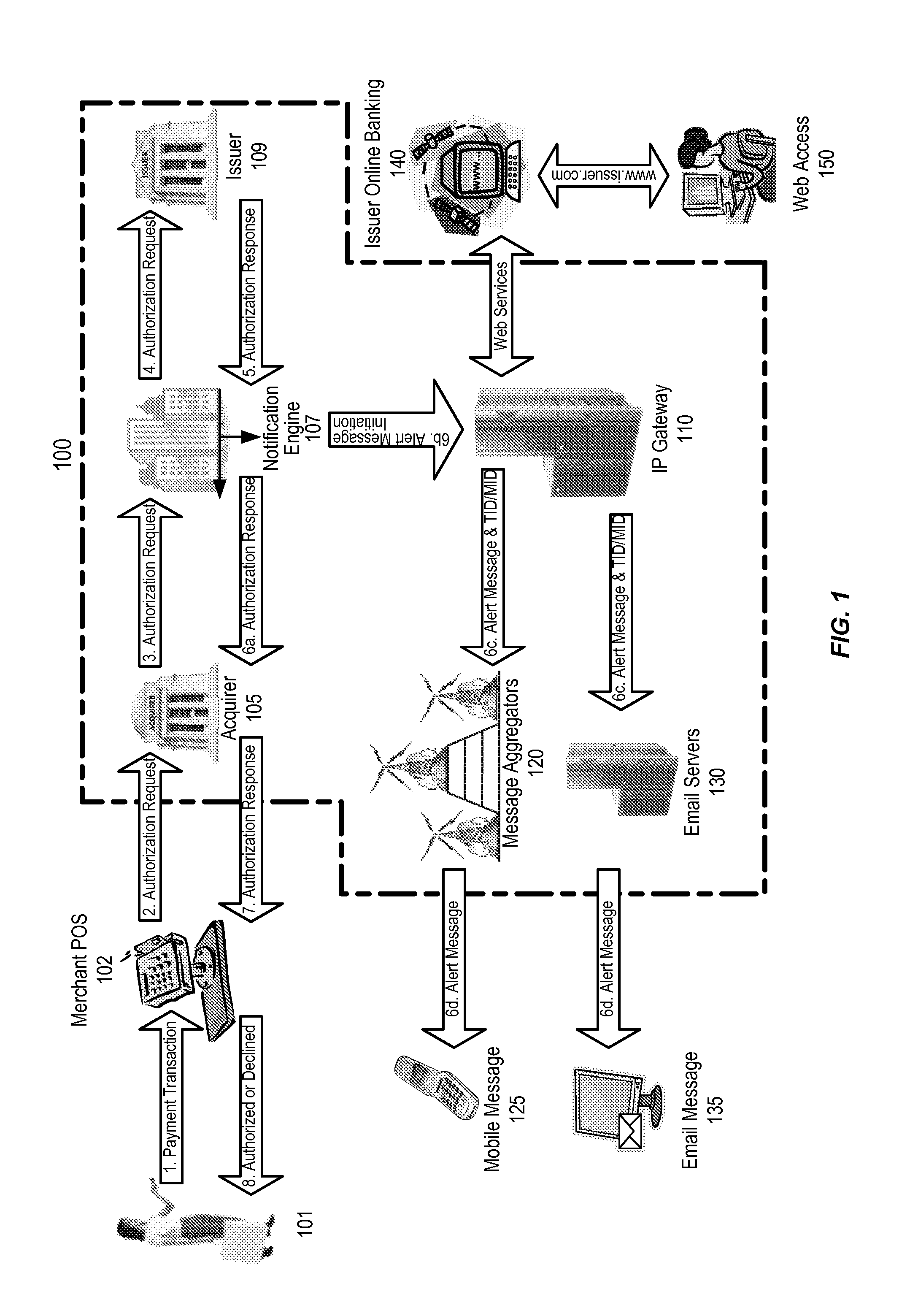

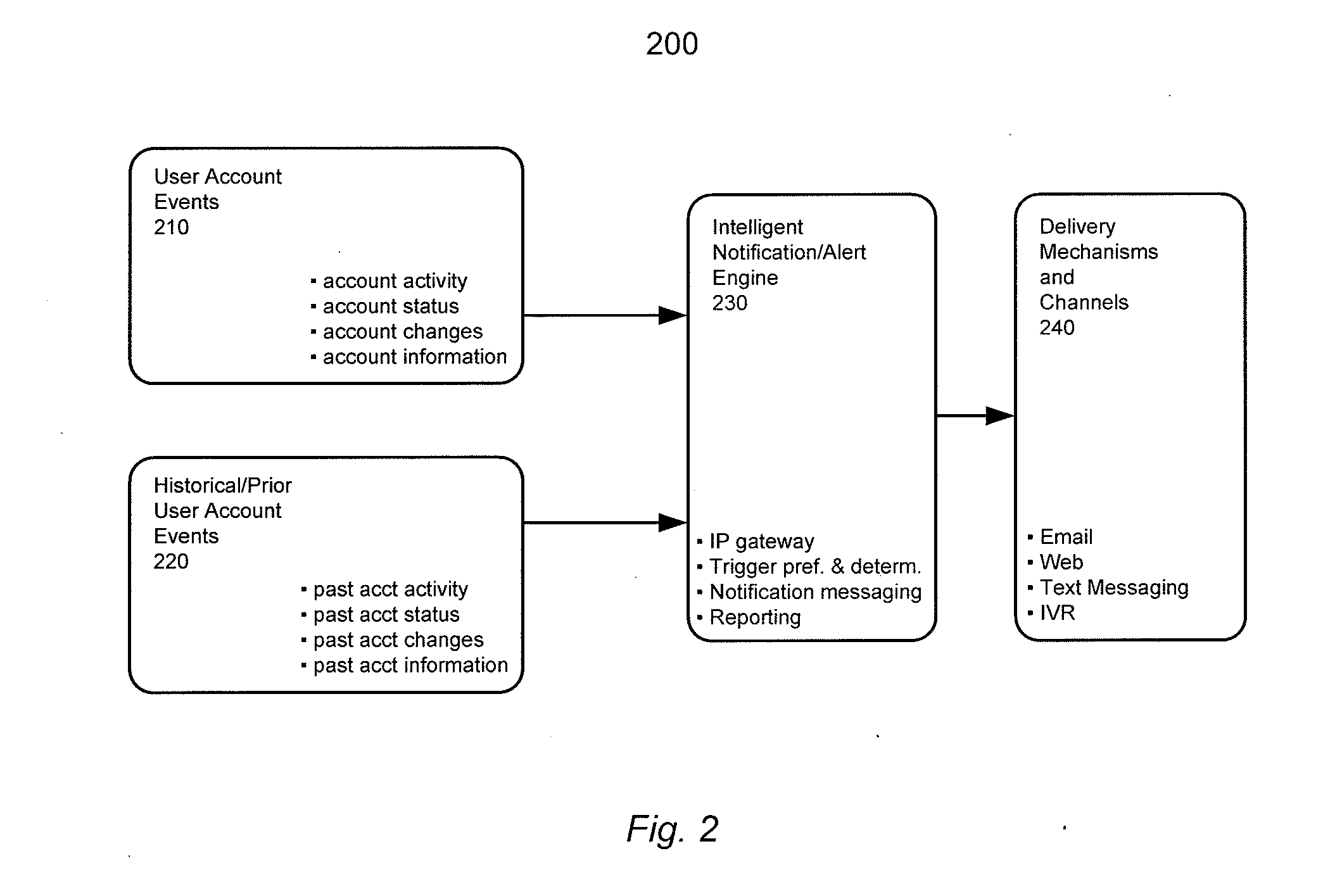

Multi alerts based system

Systems and methods for defining, observing and detecting triggering user account events that initiate a user account alert message to be sent to one or more users are disclosed. Location and merchant, transaction result, device and, usage history / trend types of user account alerts and trigger criteria can be defined or selected by users, issuers were notification alert engines. Alternatively, user account alerts and trigger criteria can be defined by analyzing previously observed user account events, such as credit card transactions, to determine user profiles and user account usage trends, i.e. credit card spending patterns, as baselines for comparing newly observed user account events. If information associated with the newly observed user account events match any of the trigger criteria or are inconsistent with the determined user profile or user account usage trends, then user account alerts can be sent to one or more users.

Owner:VISA INT SERVICE ASSOC

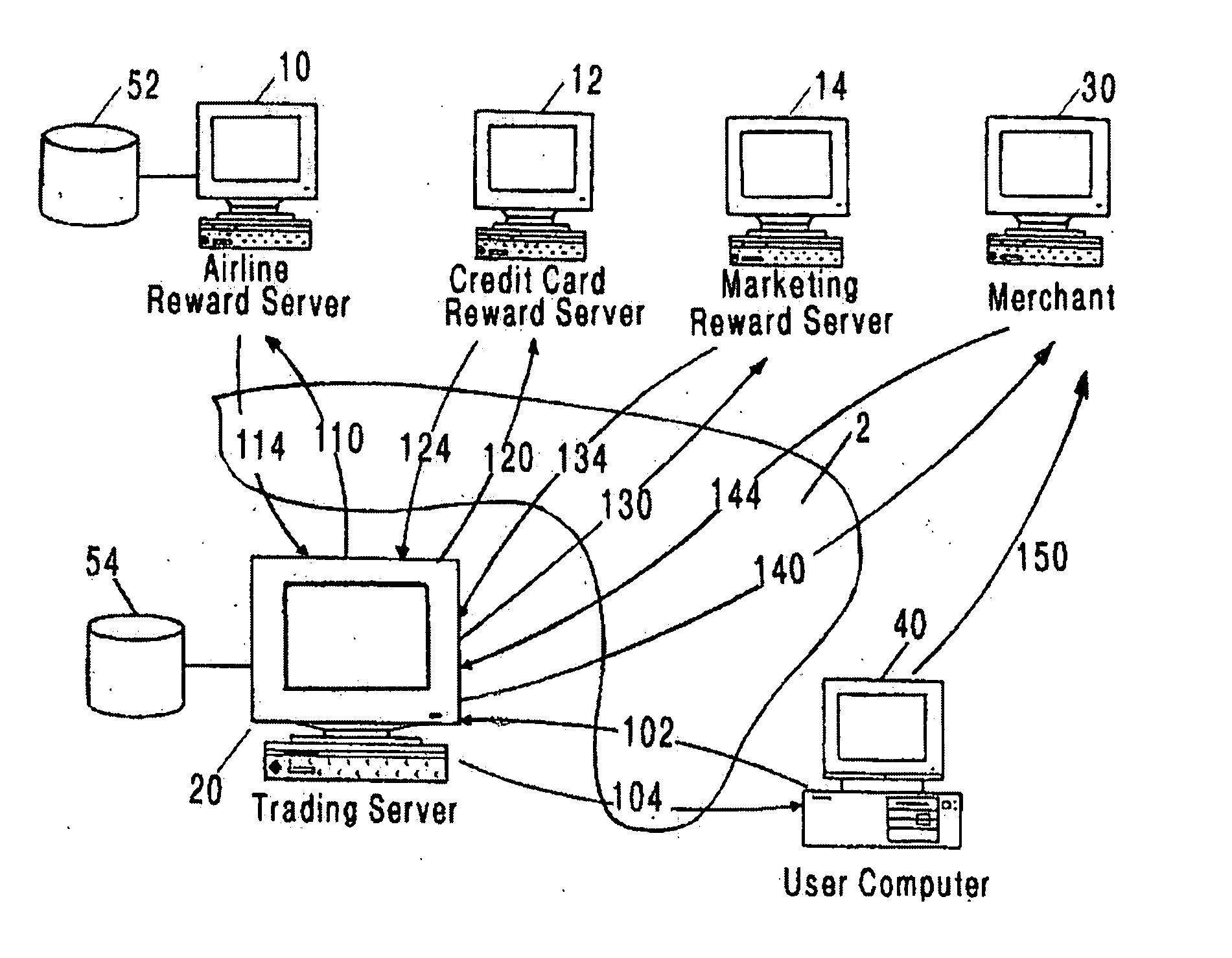

Method and system for issuing, aggregating and redeeming points based on merchant transactions

A loyalty or reward point system that utilizes the pre-existing infrastructure of a typical credit card network. In one embodiment, a user makes a purchase at a merchant of a product using a credit card. The merchant contacts the acquiring bank (which may be any type of financial institution but is referred to generically herein as a bank) with which it has contracted for credit card network services, and as known in the art, will get an approval or decline message after the acquiring bank contacts the issuing bank of the credit card used by the purchaser. Assuming that the purchase transaction is approved, the user is awarded loyalty points from the merchant based on the amount of the purchase (e.g. 100 points for a $100 purchase). A central server resides on the credit card network and tracks the transaction between the merchant, the acquiring bank, and the issuing bank. A reward account is maintained on the central server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. In an alternative embodiment, the user's reward points are logged in an account maintained by the acquiring bank on behalf of the merchant (with which it has a contractual relationship) and the user. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant on the credit card network, or may aggregate those reward points with those of other merchants into a central exchange account, and then redeem the aggregated points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

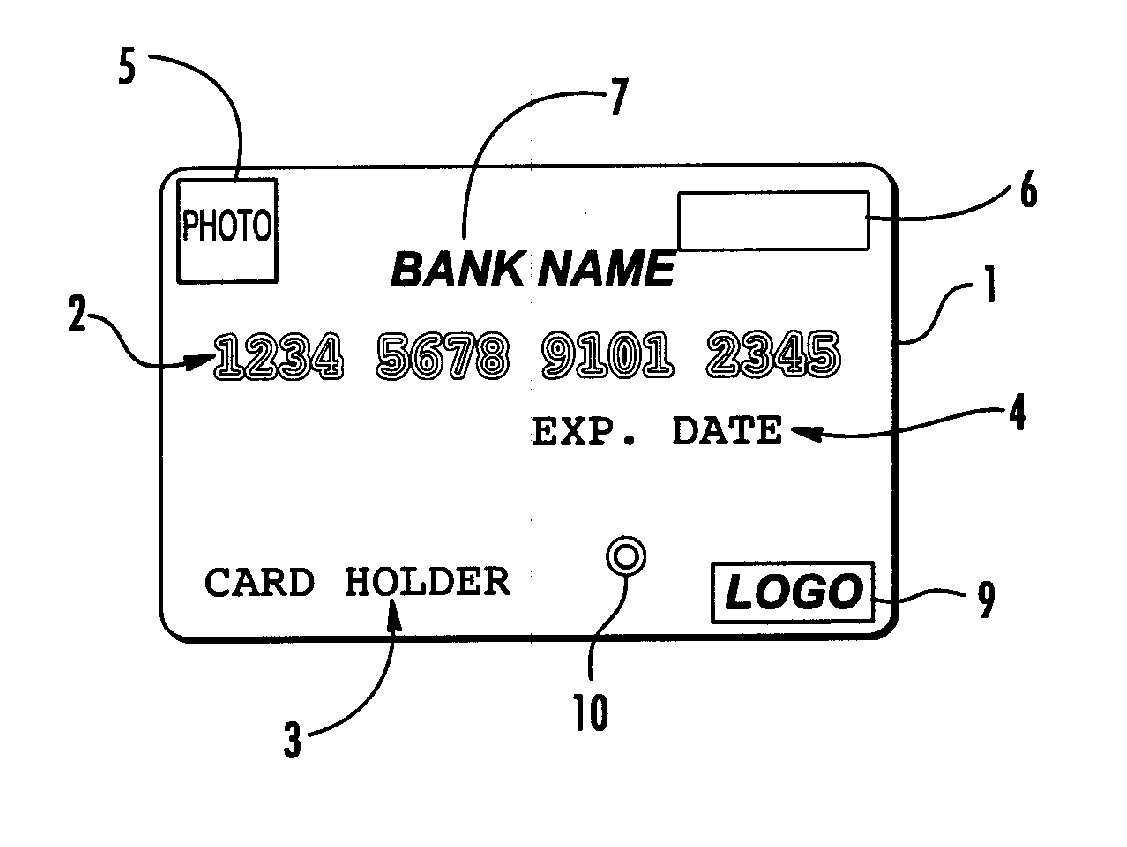

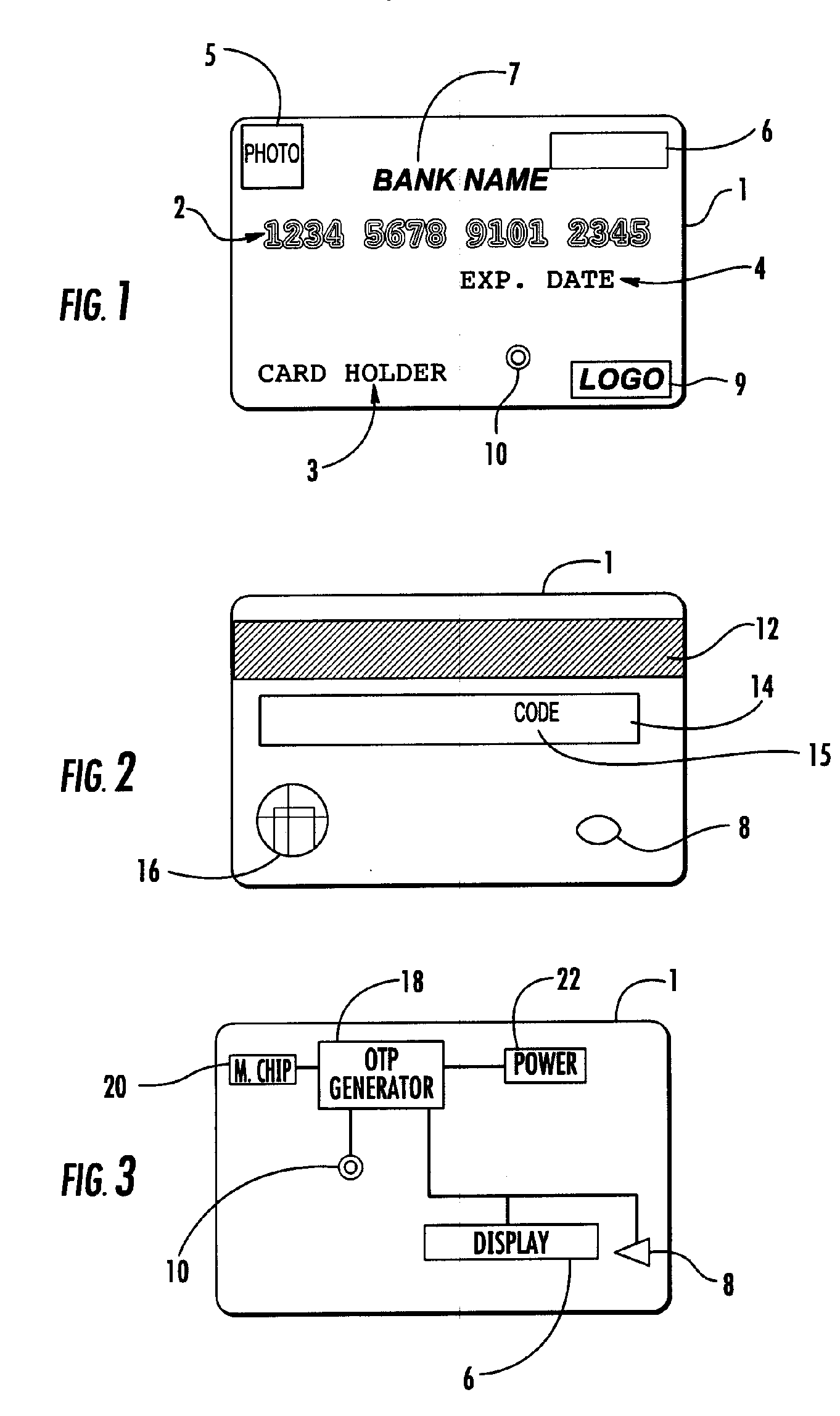

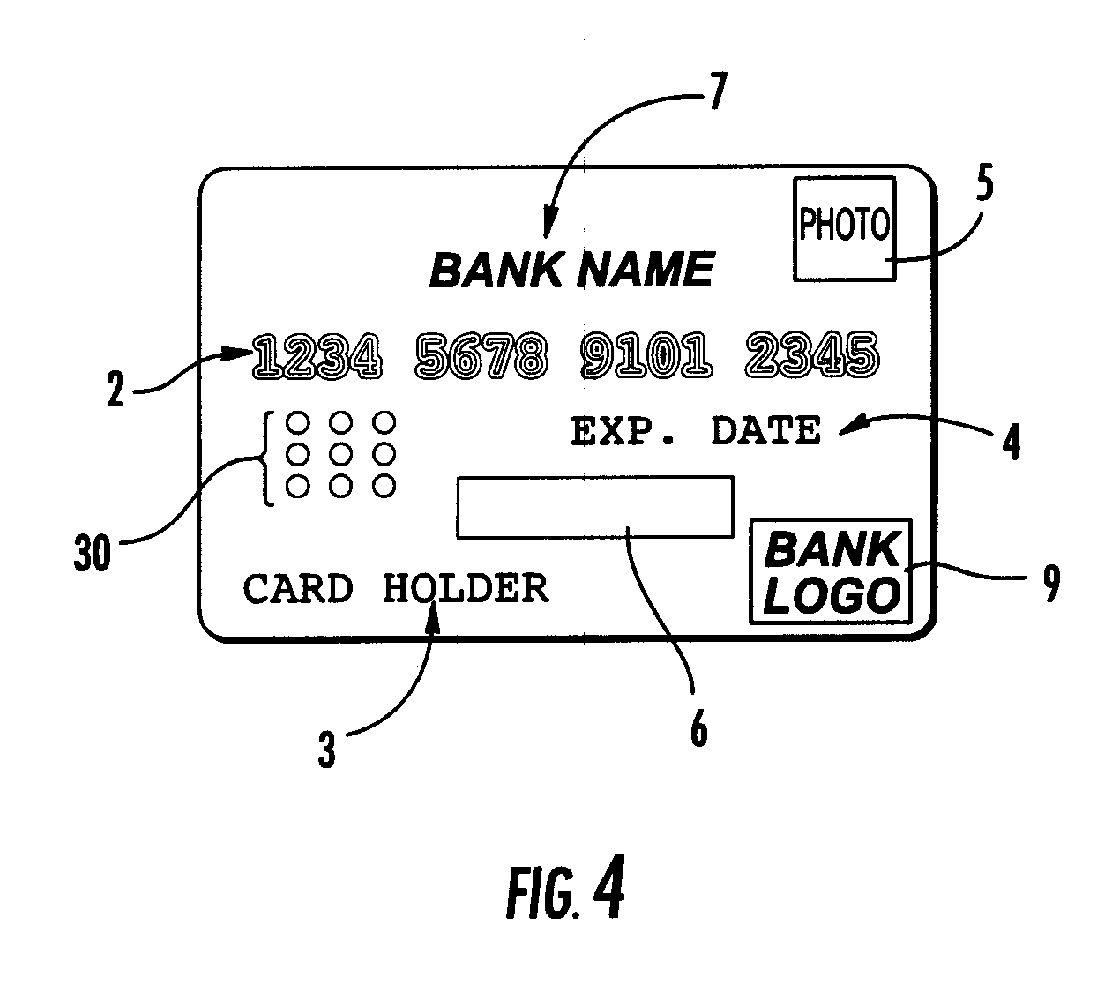

One-time password credit/debit card

ActiveUS20060242698A1Convenient to carryConvenient accessProgram control using stored programsDigital data processing detailsExpiration dateMemory chip

A one-time password (OTP) generator in combination with a conventional credit / debit card comprising a card having a magnetic bar stripe, raised imprint card numbers and name, expiration date and four digit code as are known in the art is provided. Full smart card functionality may also be provided. The card also includes a microprocessor and software, dedicated chip or a memory chip for generating the OTP. A visual and / or audio display is provided on the card to output the OTP to the user. The end user inputs the OTP to access the secured system. The credit / debit card functionality may be used apart from the OTP generator functionality.

Owner:BANK OF AMERICA CORP

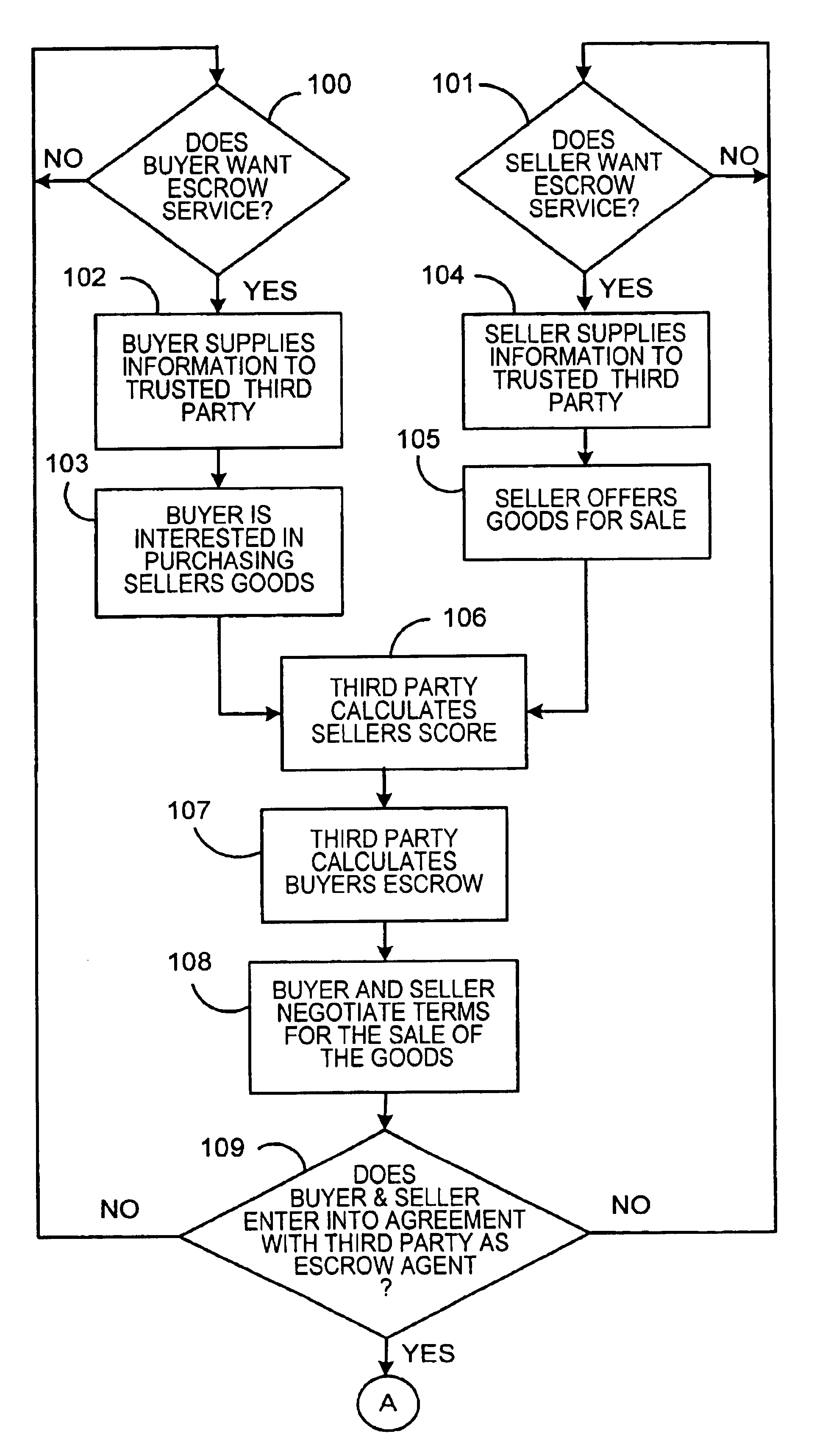

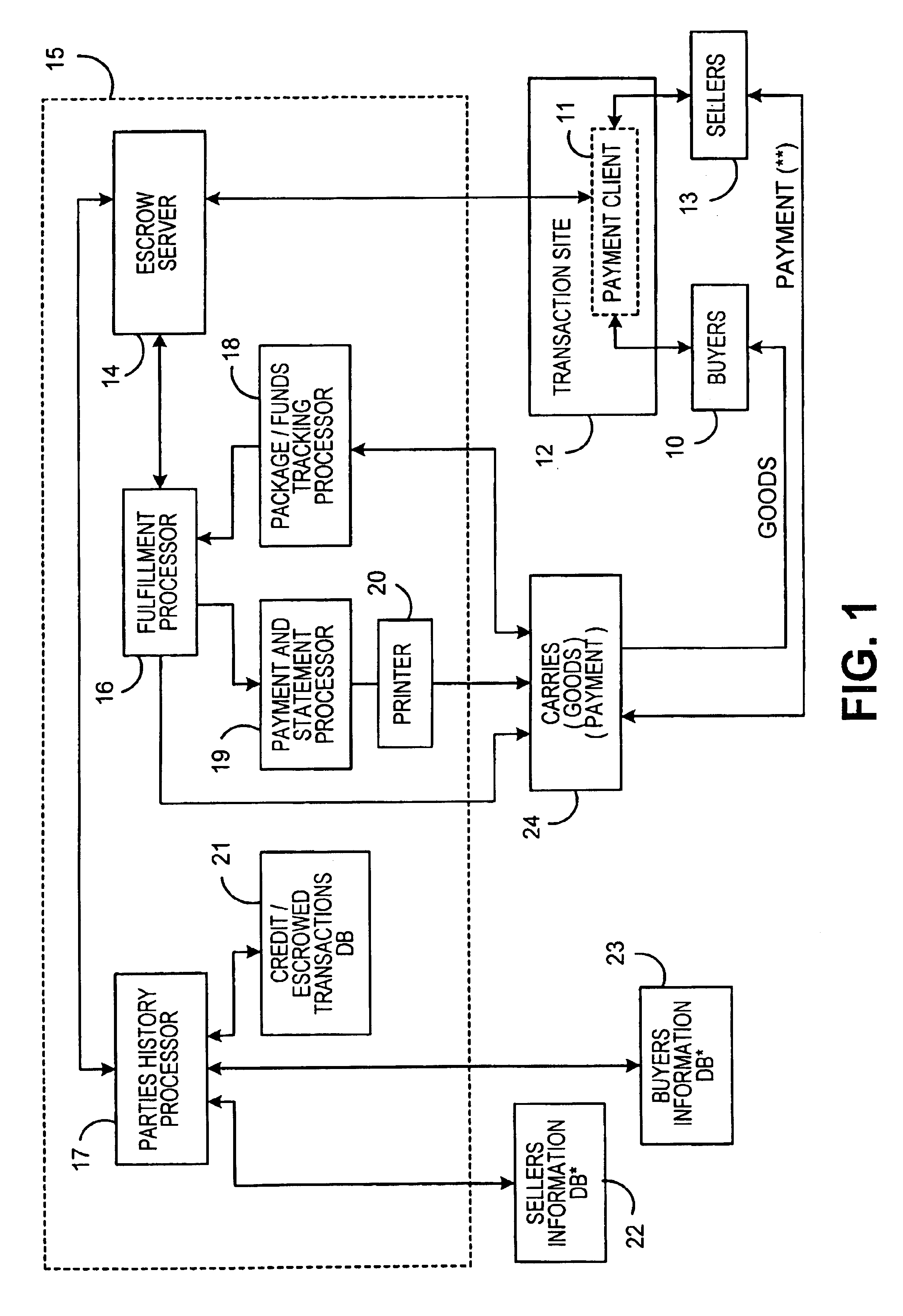

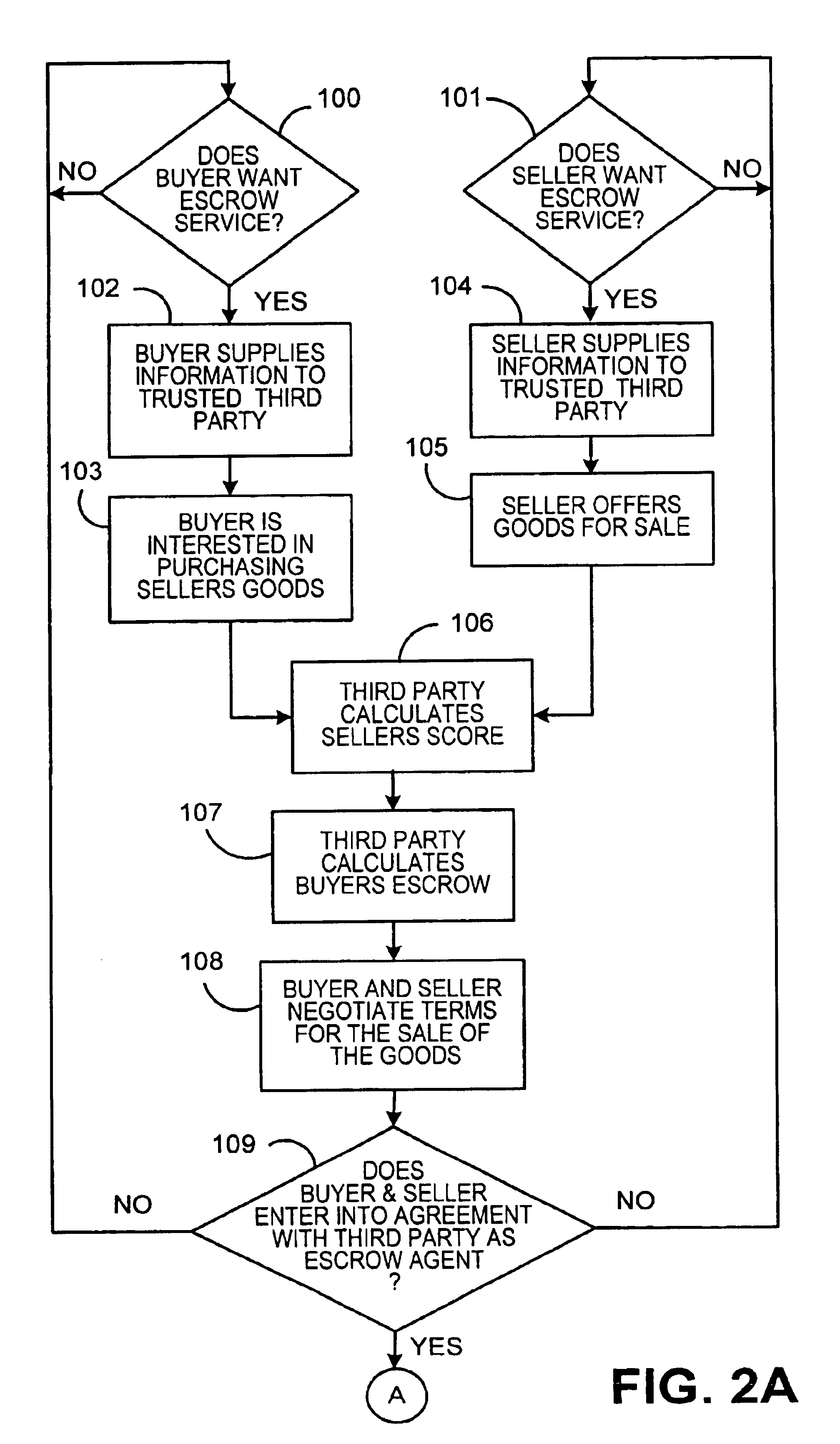

System for conducting business over the internet

An Internet-based system that allows a buyer and a seller to obtain information about each other while remaining somewhat anonymous. The system provides historic information to buyer and seller by having a trusted third party give the buyer and seller the other party's trading history information without revealing the actual identity of the parties. A buyer registers with the trusted third party by submitting an online application. The trusted third party establishes a credit score for the buyer. A seller registers with the trusted third party by submitting an online application. The trusted third party establishes a score for the seller based upon the seller's trading history, reputation and financial standing. When the buyer chooses to purchase a product from a seller over the Internet, certain parameters i.e., dollar value of transaction, type of purchase, level of current outstanding credit available, credit score, etc. are substituted into an algorithm to determine the maximum purchase amount that may be financed at what terms and how much money the buyer will have to place in escrow. The buyers escrow may be furnished to the trusted third party by credit cards, ACH, wire transfer, etc. If the trusted third party is not satisfied with the seller's score, the trusted third party may require the seller to post a bond for some or all of the seller's transactions.

Owner:PITNEY BOWES INC

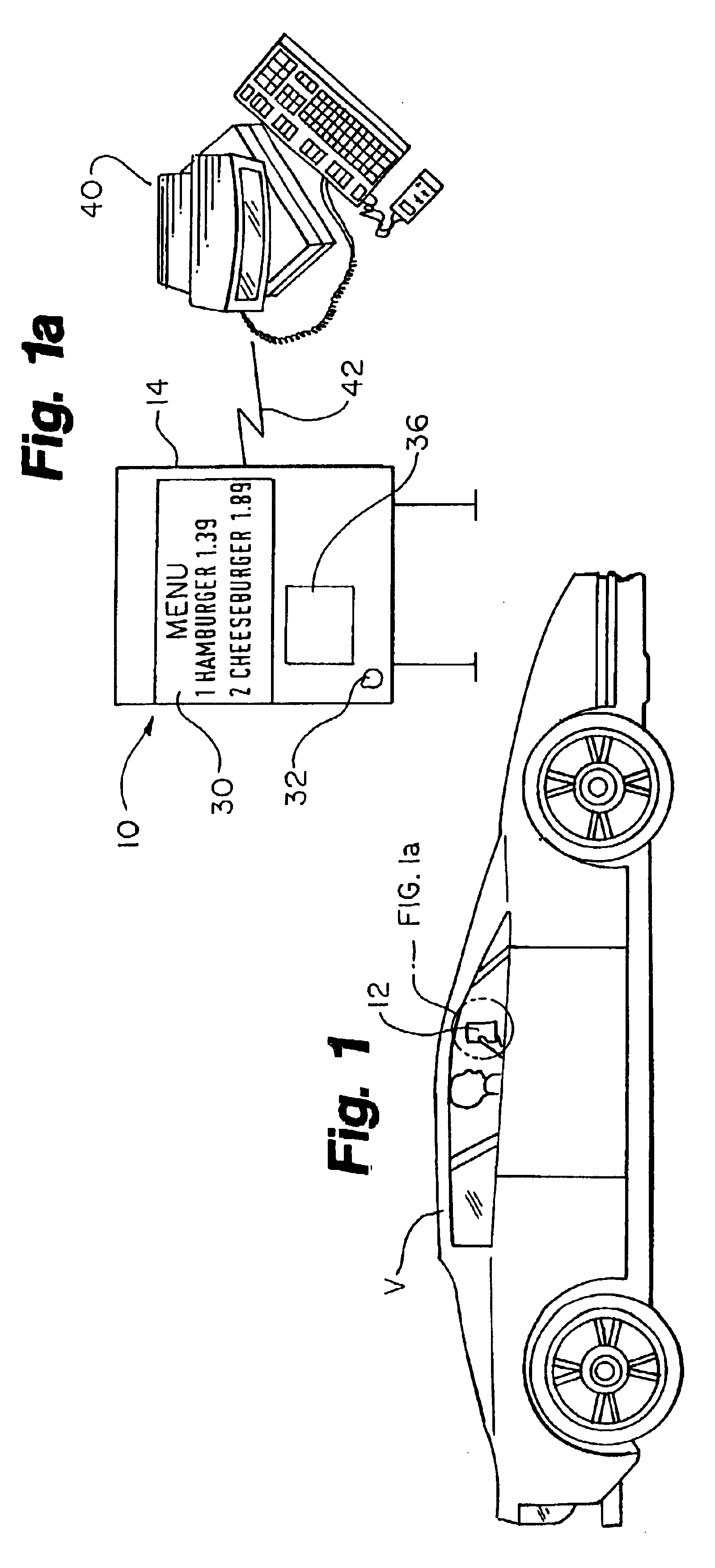

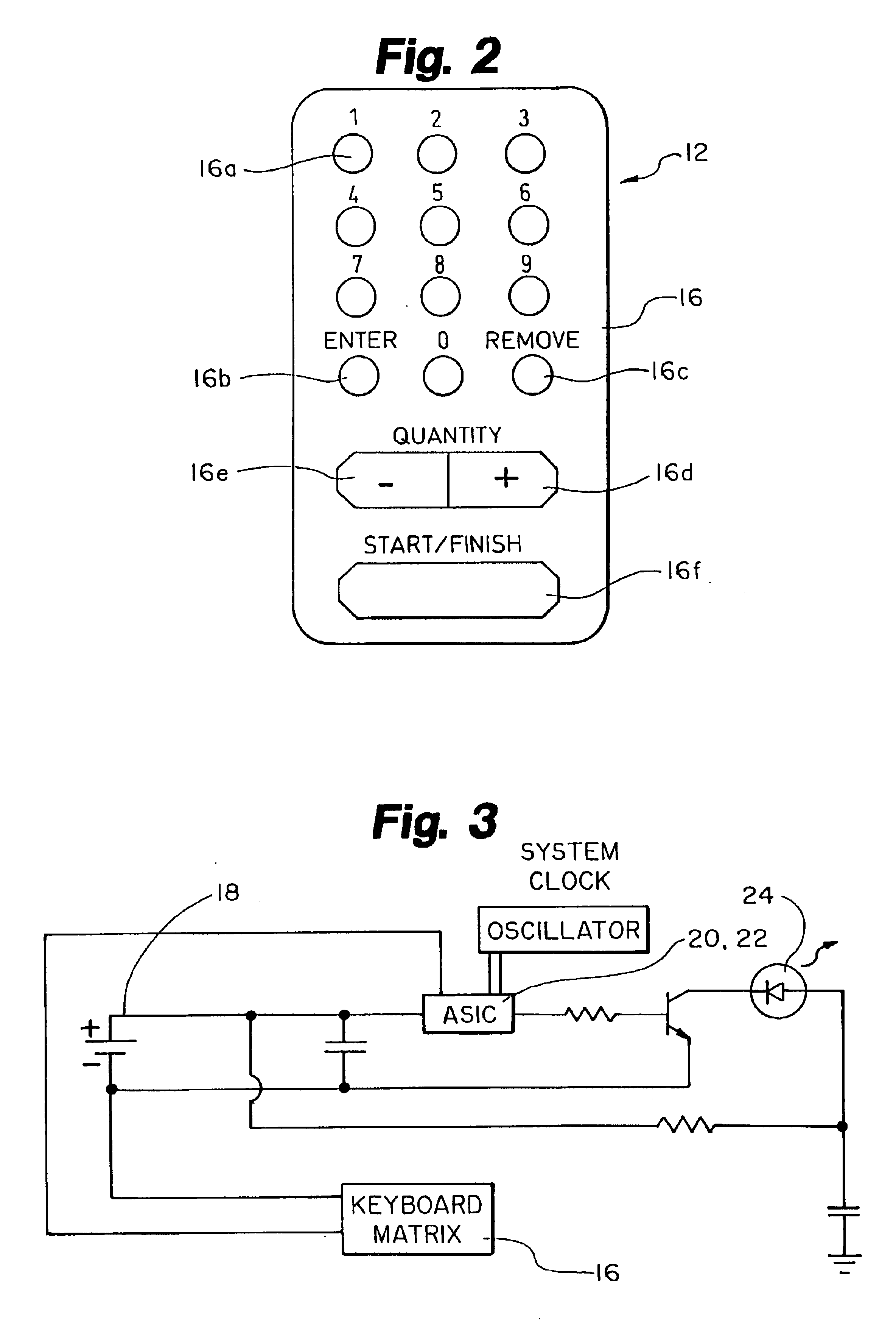

Remote ordering device

InactiveUS6880750B2Correct orderSave labor costsCredit registering devices actuationTelephonic communicationCredit cardWireless transmission

A remote ordering device for placing orders though cell phones or other data entry and wireless transmission devices and a data receiving station to receive the data, process the orders and keep track of accounts, inventory and retain other data as required. The receiving station can be in communication with other receiving stations to forward orders or data. The receiving station can provide instructions to a person or machine to fill orders at any desired location. The instructions may be printed out or displayed on a screen. A GPS, WAP or other location finding systems, may be used to identify the user's location. Bioelectronics, Caller I.D, pin numbers or other identification means can be used to verify the user for debiting accounts or credit cards. Users can remotely order tickets, meals, services, or control machines remotely and either arrange for pick up at a desired location or for delivery.

Owner:REMOTE

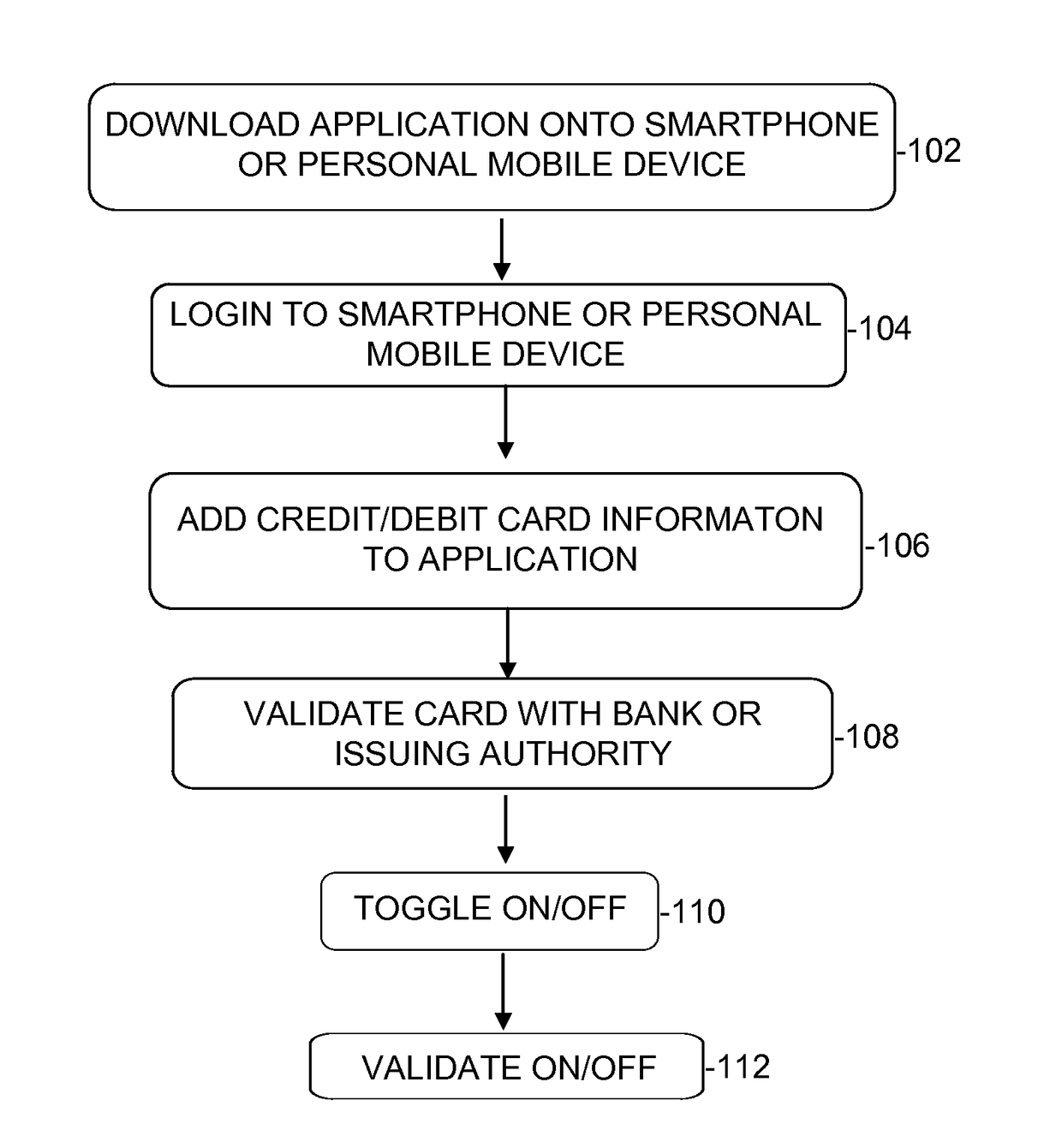

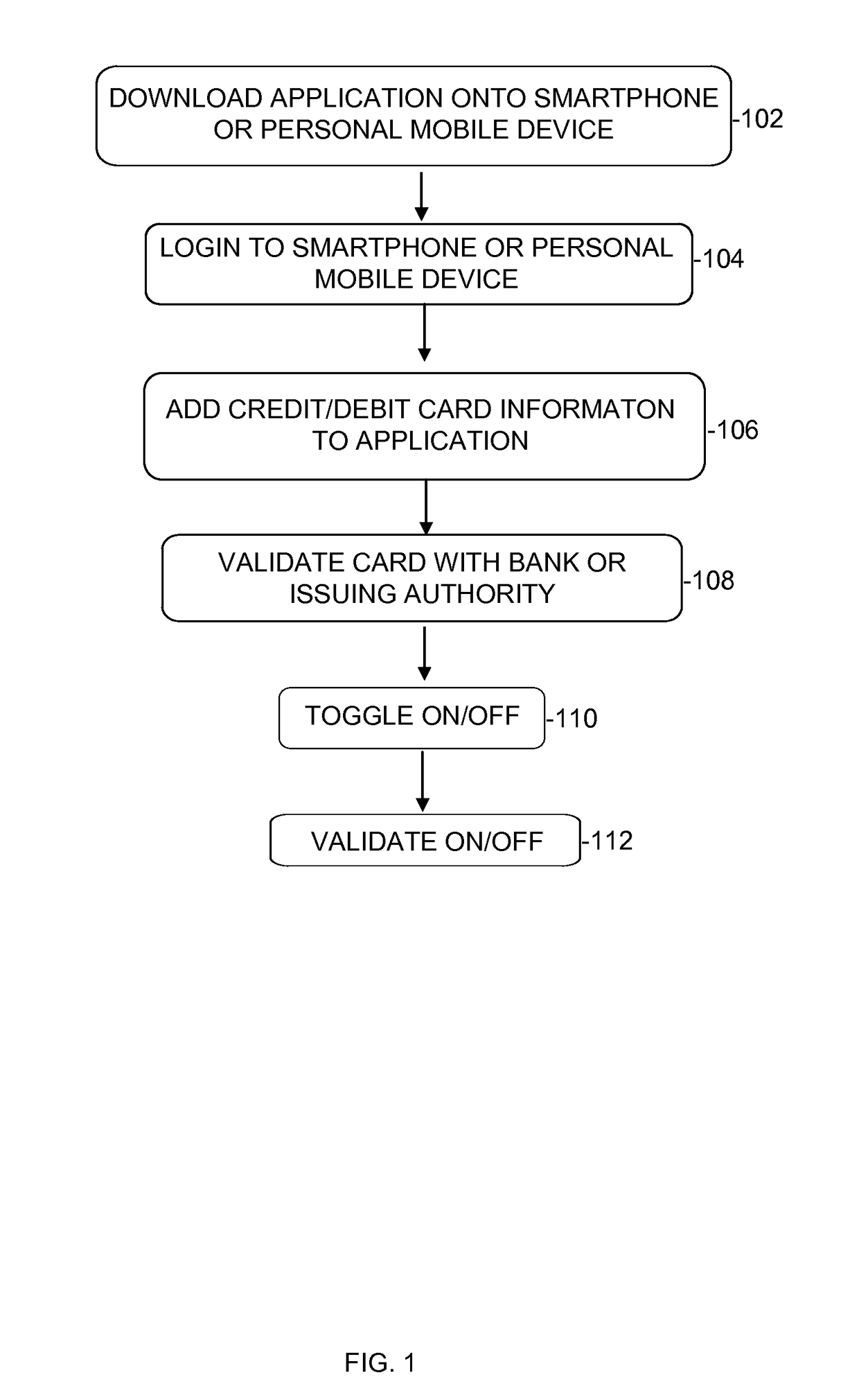

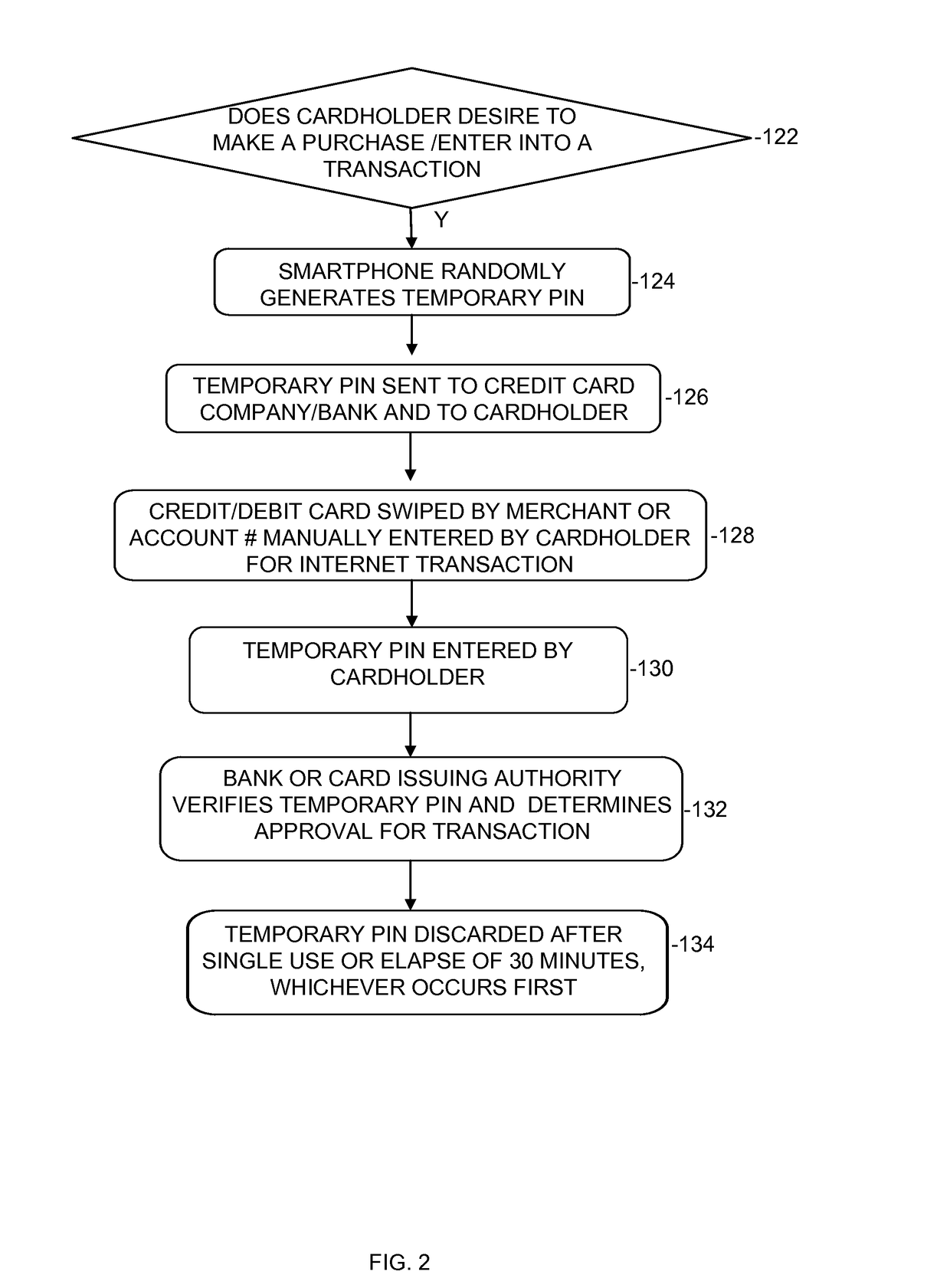

Credit card randomly generated pin

InactiveUS20170140379A1Acutation objectsProtocol authorisationComputer hardwarePersonal identification number

The present invention relates to systems and methods of randomly generating a Personal Identification Number (“PIN”) for a credit or debit card. A smart phone or other mobile device generates the PIN. The PIN number is required to be generated before a credit or debit card transaction is approved by the issuing authority.

Owner:DECK BRUCE D

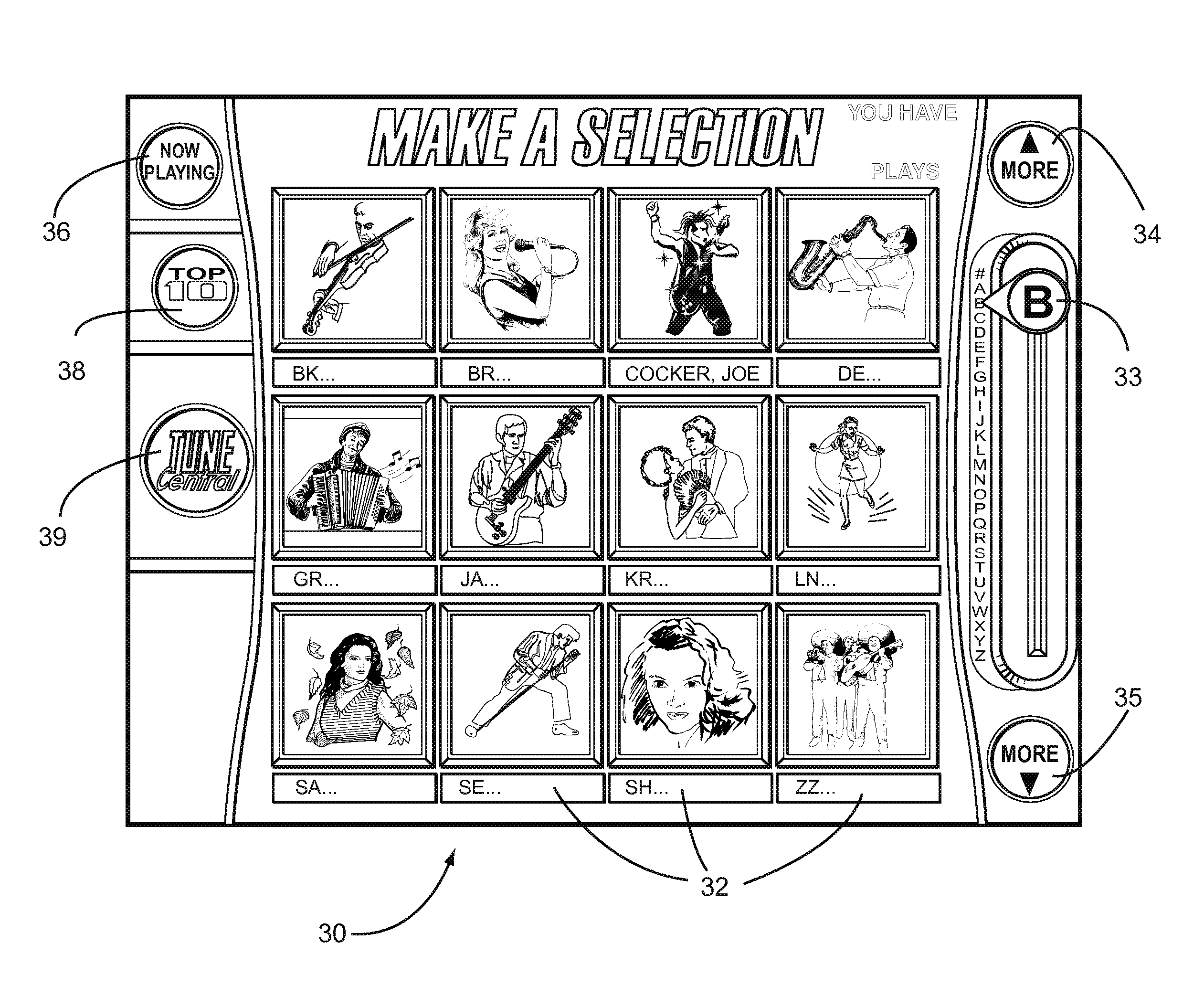

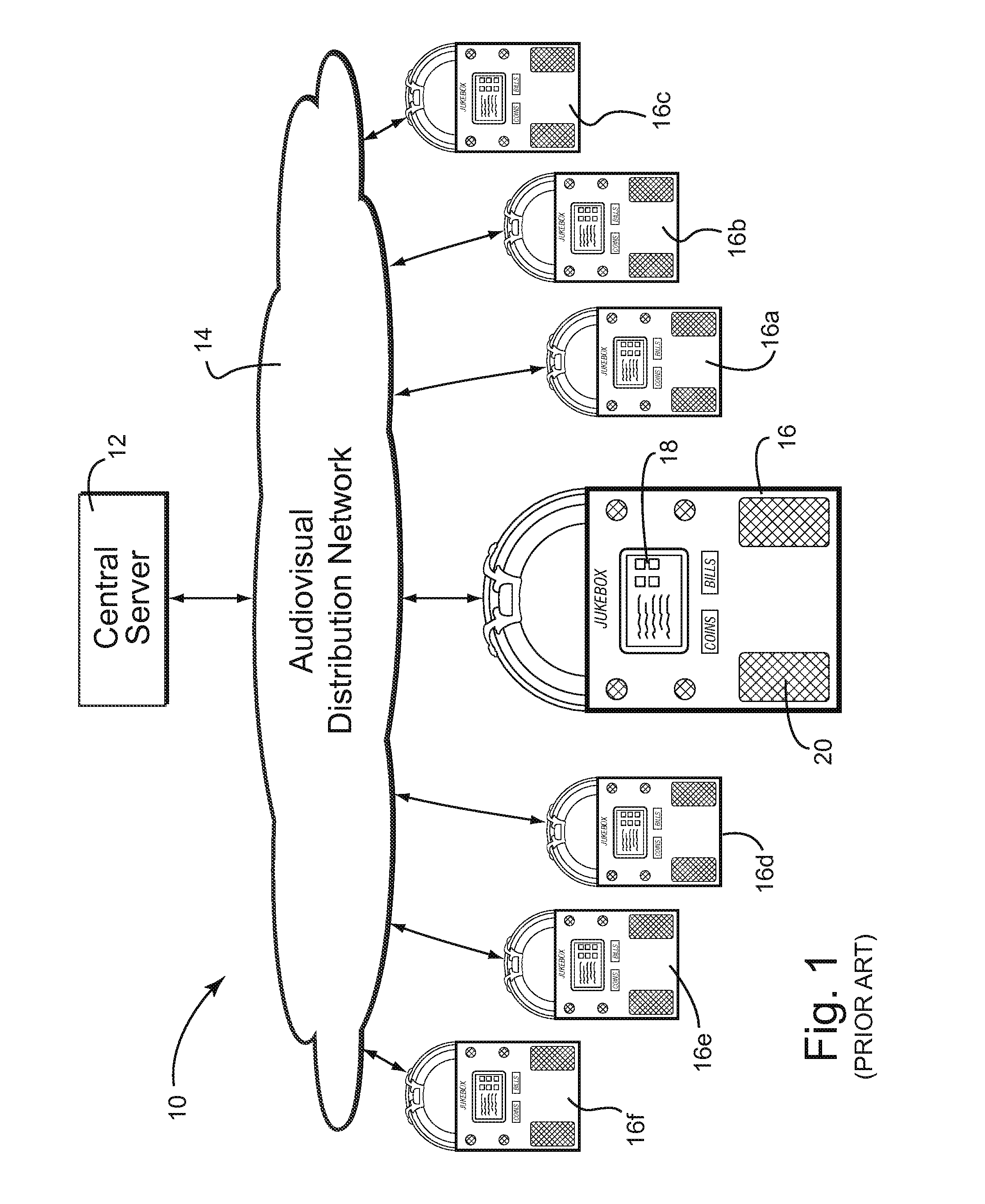

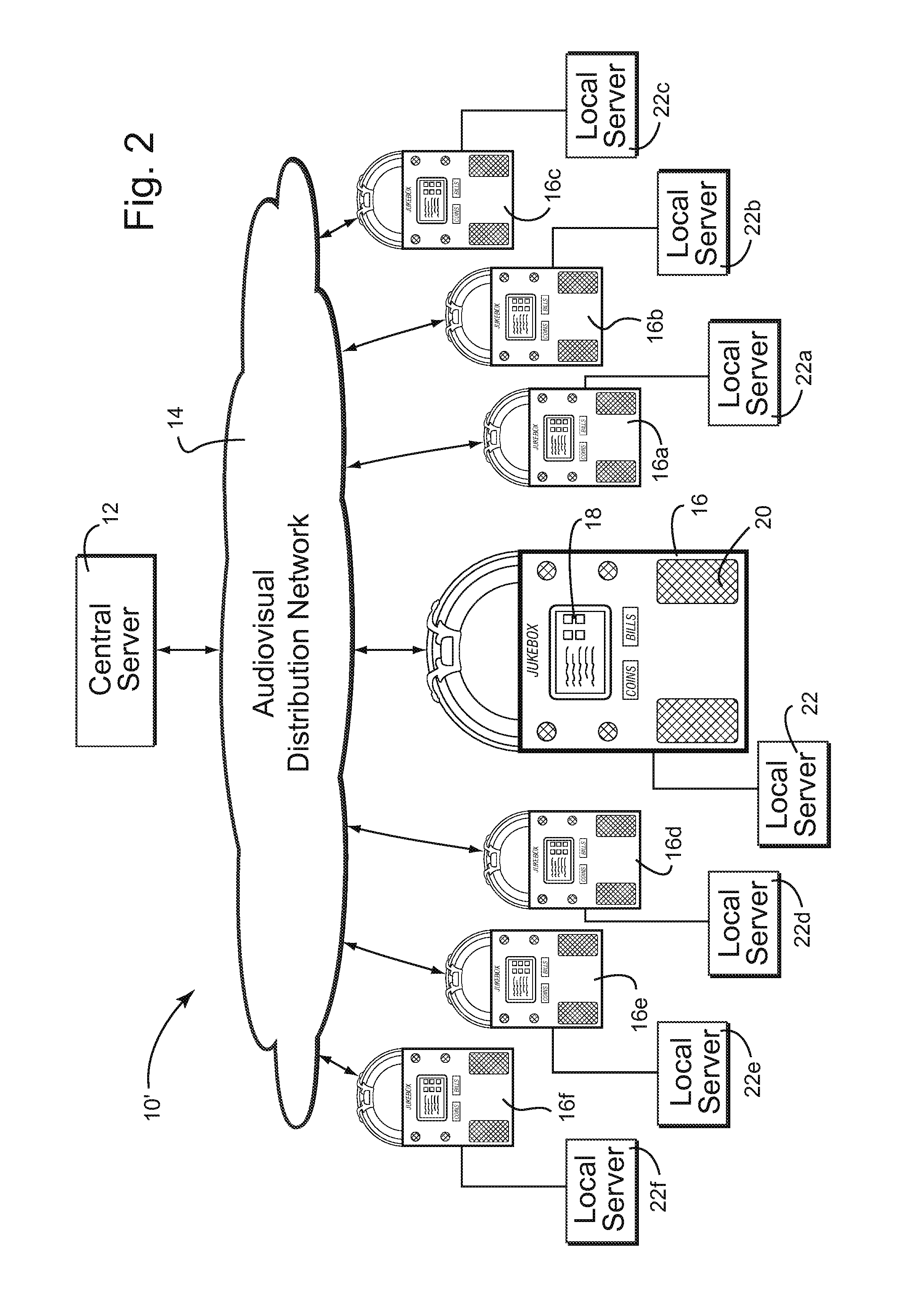

Digital downloading jukebox system with user-tailored music management, communications, and other tools

ActiveUS20120166965A1Improve convenienceDecreasing intimidationInput/output for user-computer interactionTelevision system detailsCredit cardComputer network

A digital downloading jukebox system including a mechanism for delivering custom services to a recognized user, including services for creating playlists, communicating with others, accessing other features, etc. is provided. In some exemplary embodiments, after a user is recognized, the jukebox system allows users to access a special front-end via the Internet or on an actual jukebox. Then, the user may, for example, create playlists, share songs with friends, send messages to friends, and access other value-added content. Other exemplary embodiments allow users to become certified, charging them for services without requiring constant inputting of coinage or credit card information. Such a system preferably learns about networks of friends, and enables managers to send similar messages to regular customers and / or others known to the system.

Owner:TOUCHTUNES MUSIC CO LLC

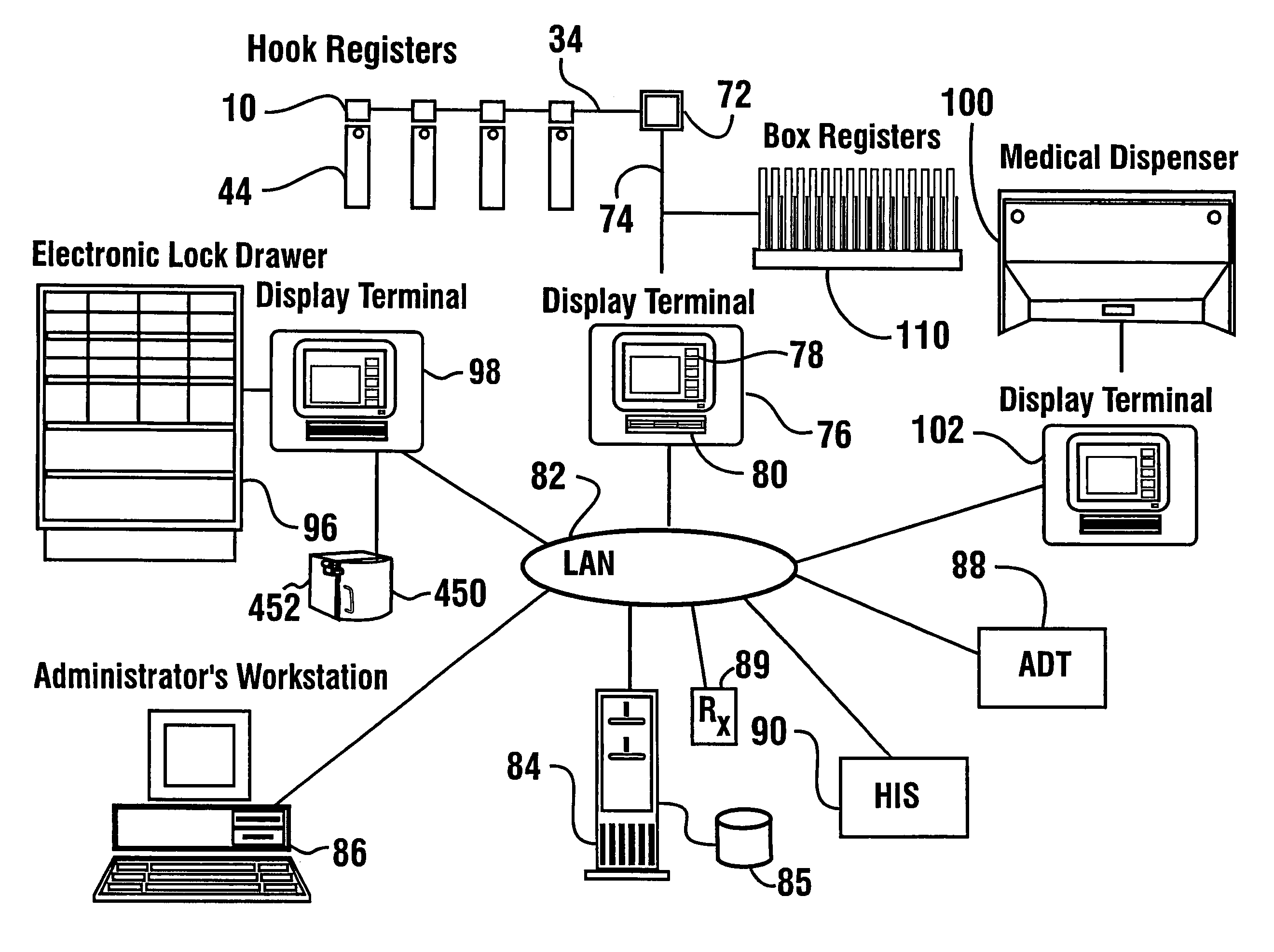

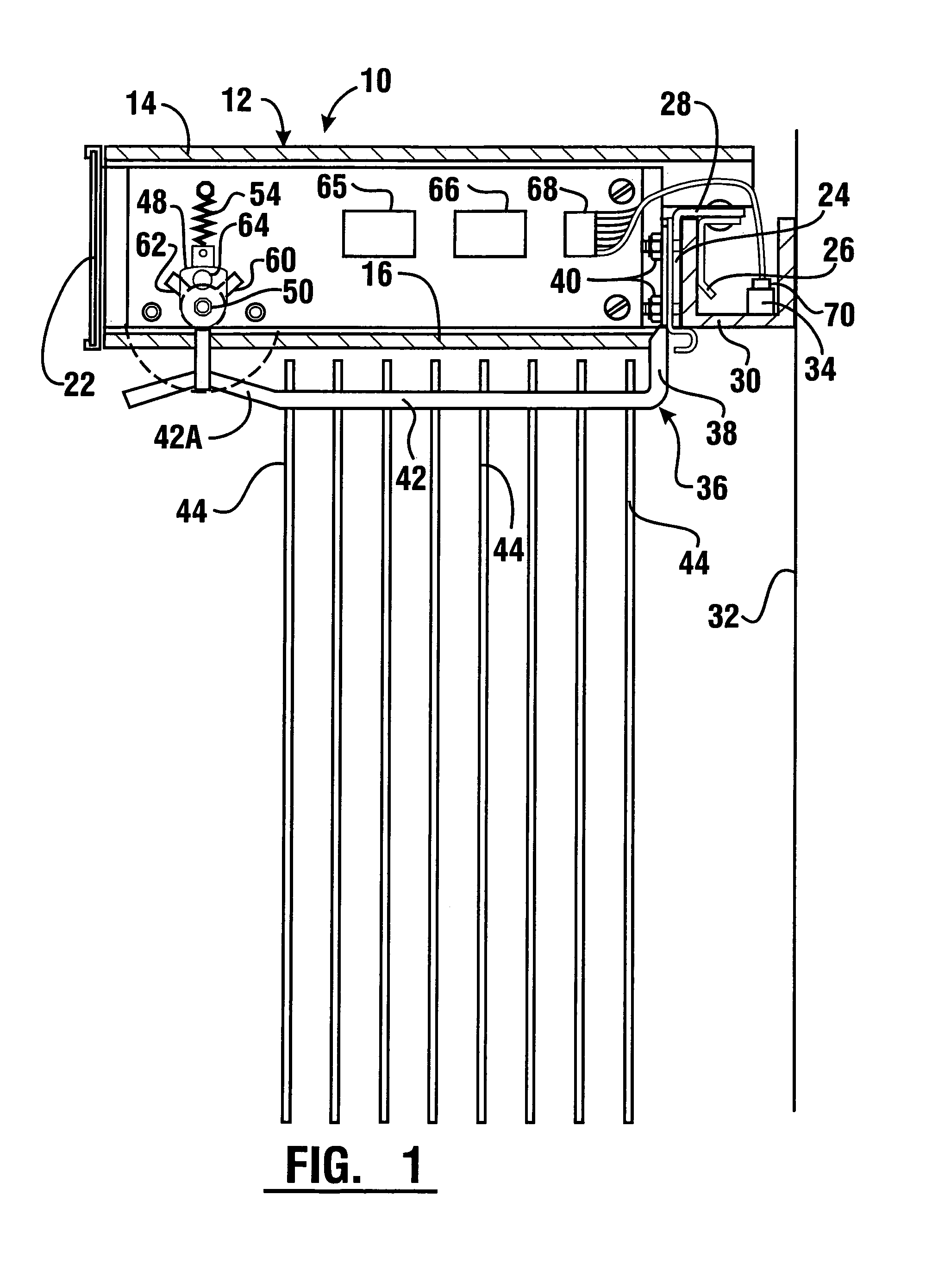

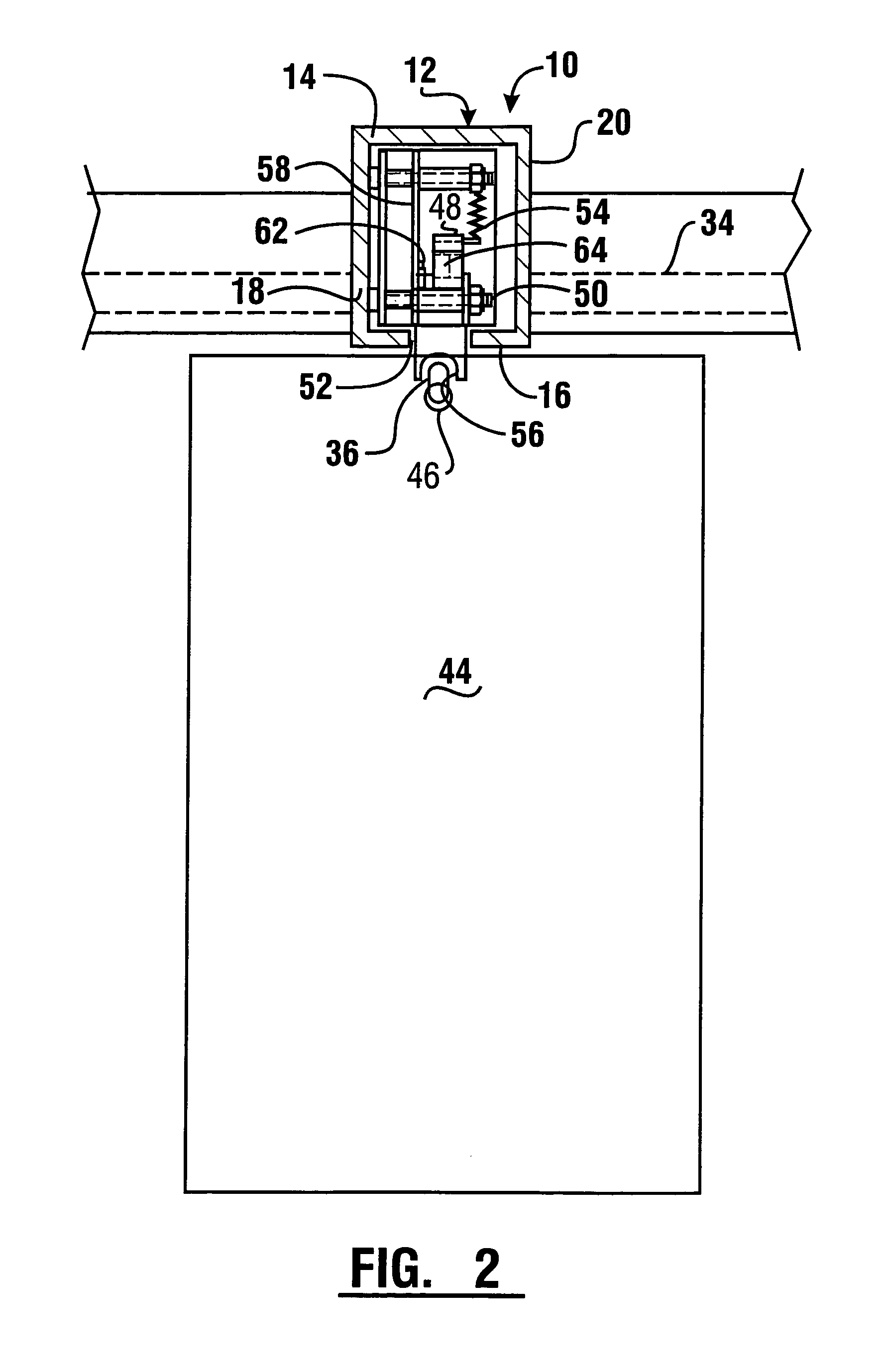

Method of tracking and despensing medical items to patients through self service delivery system

InactiveUS7467093B1Maximize accuracyInhibition transitionControlling coin-freed apparatusDrug and medicationsData memoryDispensing medications

A method of tracking and dispensing the dispense of medical items for use by patients associated with a health care institution includes storing in a data store in connection with a computer data representative of patients and medical items prescribed for the patients. Authorized users such as a nurse, are enabled to dispense prescribed items for patients through medical item dispensers. A record is included in the data store that the medical items have been dispensed. In an exemplary system (650) medical items that have been dispensed are tracked to the point of giving the item to the patients using portable terminals (662) that are carried to the bedside of the patients. The activity of giving the appropriate medical item to each respective patient is recorded in the portable terminal as medical items are given to a plurality of patients. The data stored in the portable terminal concerning the giving of medical items to patients is communicated through the system and stored in the data store to provide a record that the medical items which were dispensed for a patient were actually administered. In an alternative form of the system (700) patients are enabled to dispense medications on an outpatient basis through a self service medical item dispenser (718). In a method of operating such a system a benefit plan associated with the patient is determined from rules stored in connection with data representative of the benefit plan. Payment for dispensed medications is provided by the benefits provider associated with the patient's benefits plan and a co-payment is made by the patient from a credit or debit card account.

Owner:DIEBOLD NIXDORF

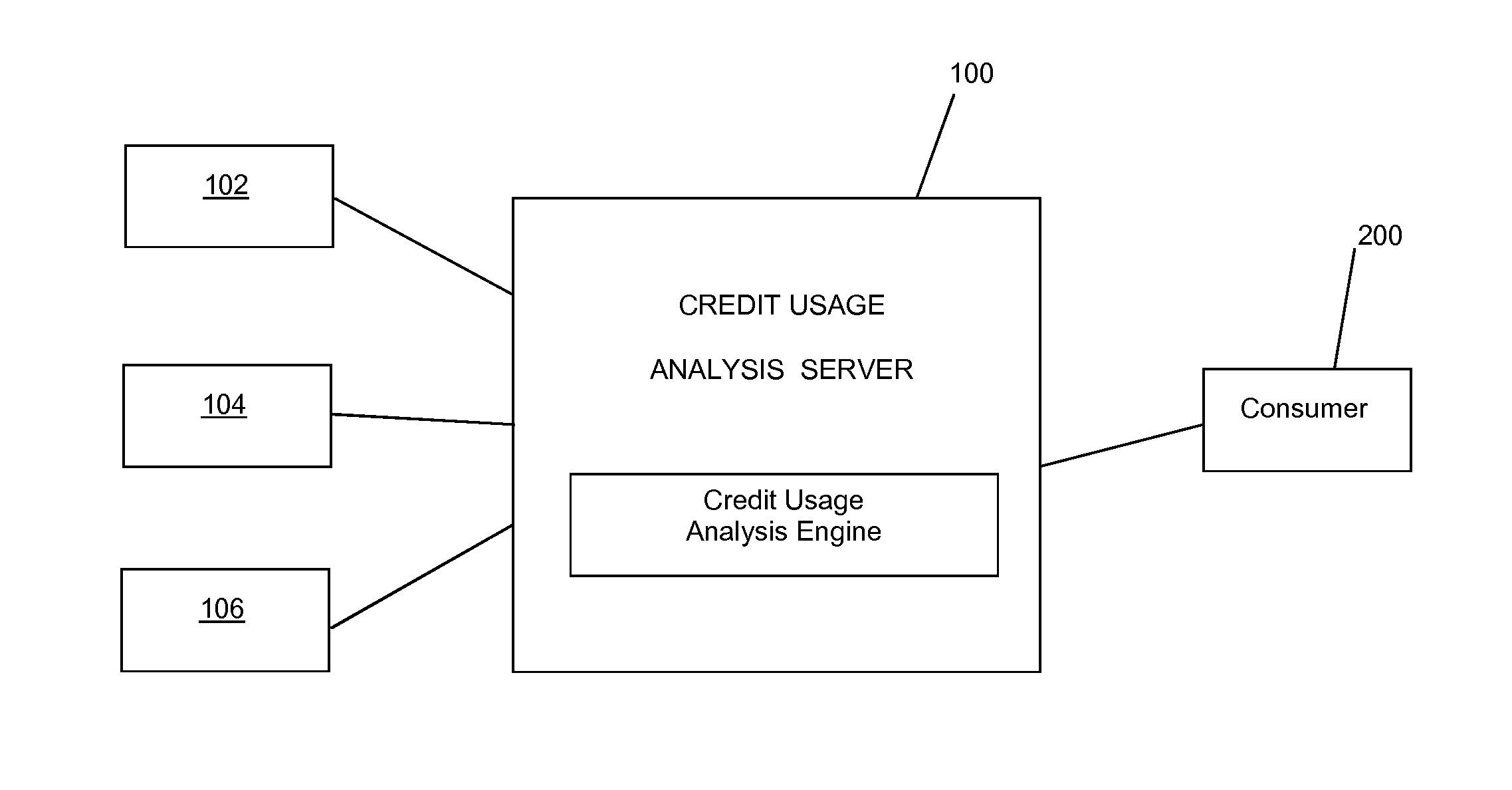

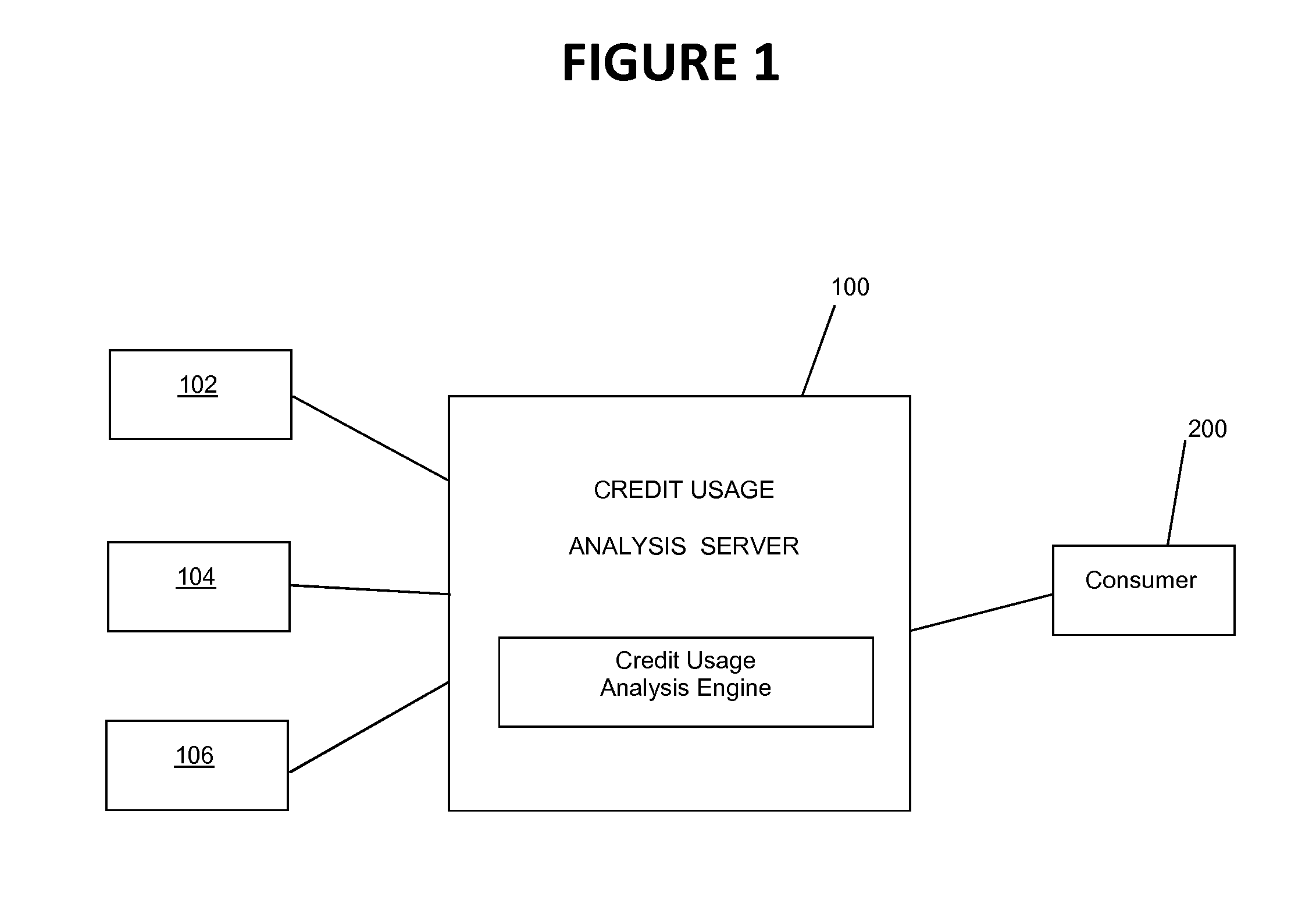

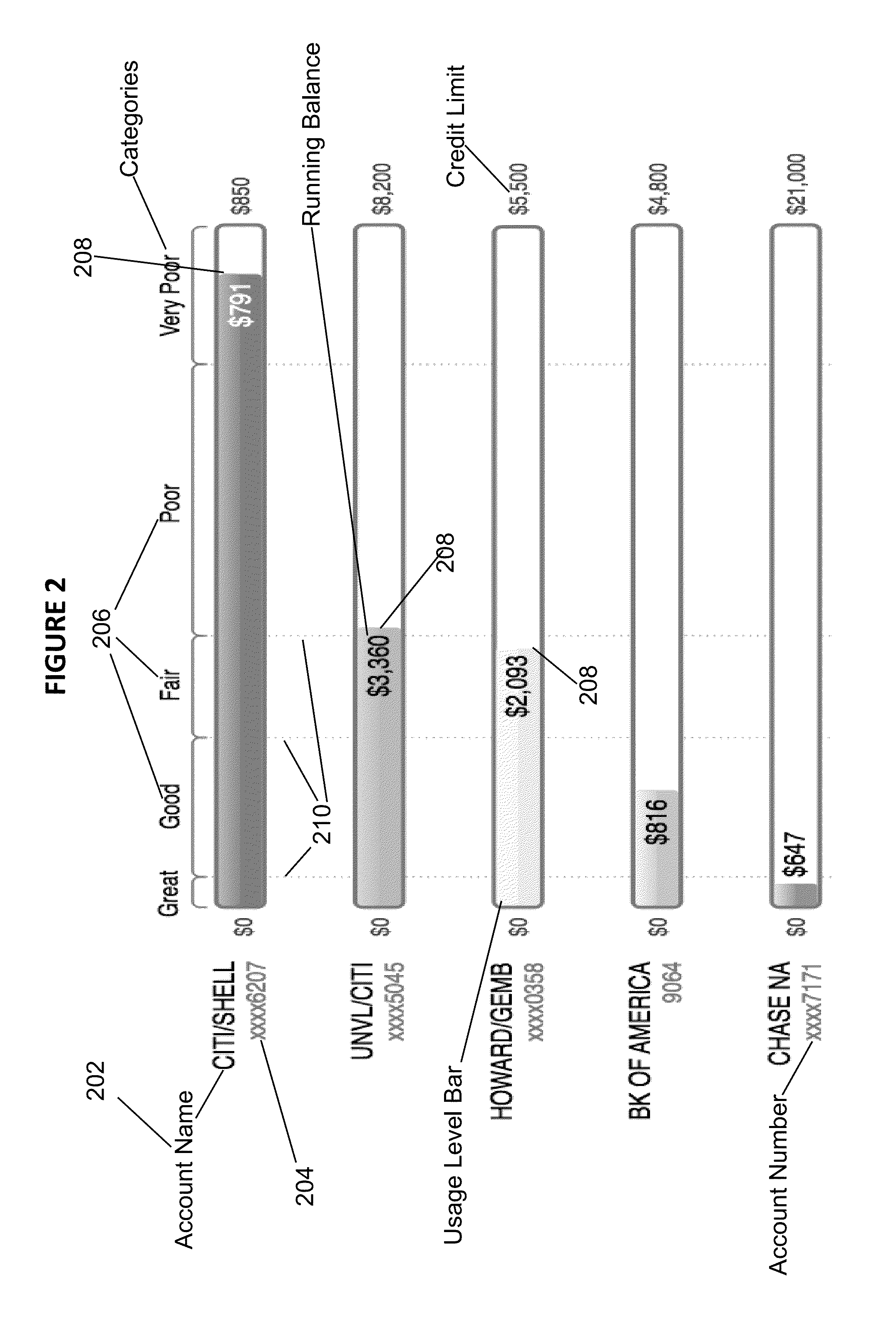

System and method for determination and reporting of credit use and impact on credit score

Disclosed is a system and method for the automated generation and display of an electronic, graphical representation of the effect of a consumer's credit card usage as a percentage of credit limit on such consumer's credit score. The presentation may show each credit card account with a graphical view of the level of usage on each of a user's card accounts and further shows in which category that usage level falls. The levels of credit usage are classified for each card account into qualitative categories. Each category is designed to communicate to the consumer the statistical association between the usage level on that account and credit scores.

Owner:CREDITXPERT

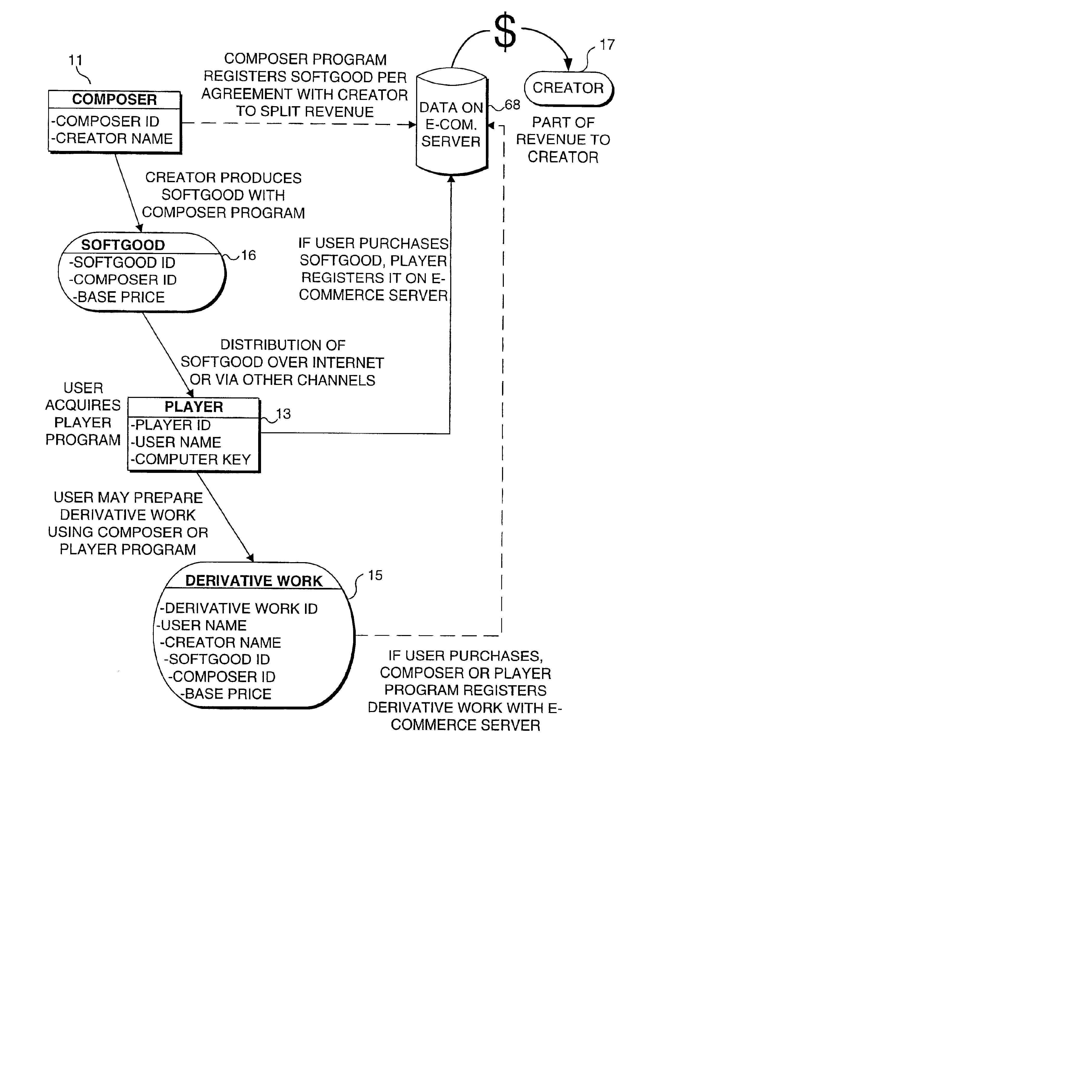

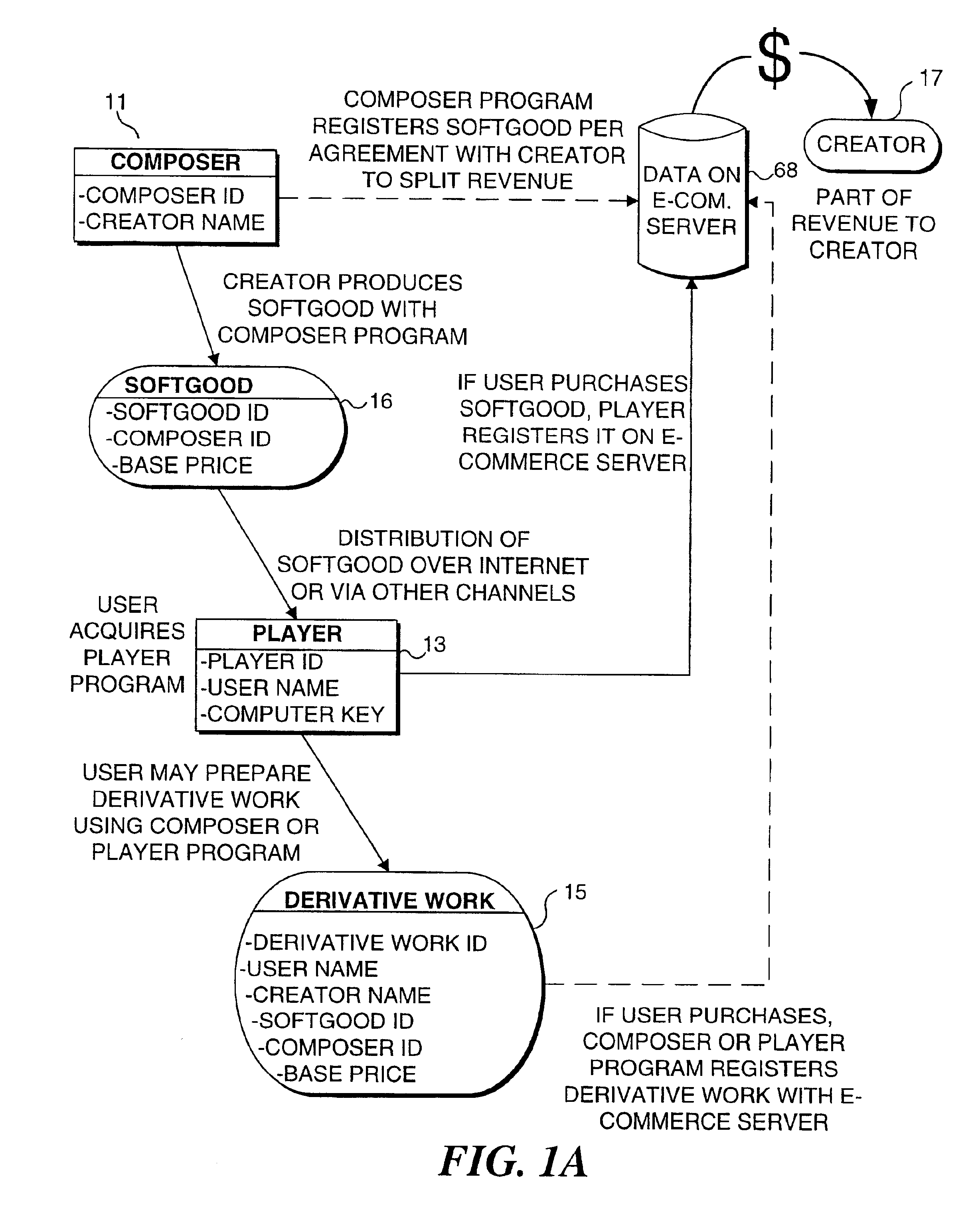

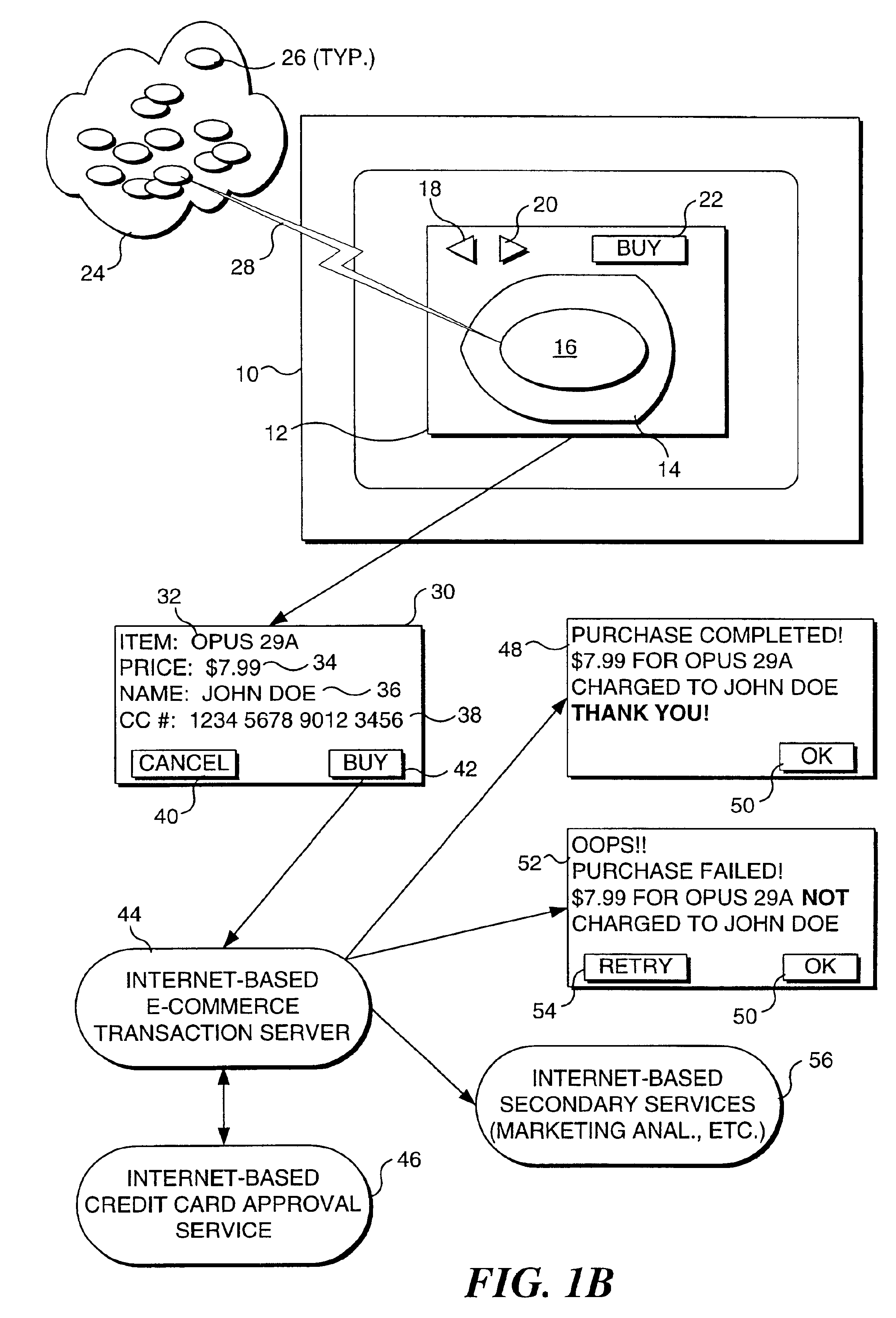

Generating revenue for the use of softgoods that are freely distributed over a network

InactiveUS6882979B1Minimizing chanceComputer security arrangementsBuying/selling/leasing transactionsCredit cardUnique identifier

An on-line electronic commerce transaction for facilitating purchase of digital products (softgoods) after enabling a user to preview the softgoods. Creators of the softgoods enter into an agreement with an e-commerce agency in which the agency agrees to handle sales of the softgoods and to return a portion of the revenue to the creators. Creators are provided with a softgood authoring tool that automates the softgood creation process. Before the softgoods are distributed, a unique identifier is included in the softgood by this authoring tool. To play a softgood, a prospective purchaser downloads or otherwise acquires a player program. The player program enables a prospective purchaser a limited preview of each softgood. If a user decides to purchase a softgood, the player program communicates with the e-commerce agency over the Internet to facilitate the purchase transaction. During this transaction, the prospective purchaser is prompted to enter a financial account number. The player program encrypts this account number and other data transmitted to the e-commerce server, unless the prospective purchaser's credit card information and other personal data are already stored in a database maintained by the e-commerce server. The validity of the credit transaction is confirmed with an appropriate approval agency, and if approved, a registration value is provided to the player program for use in registering the softgood on the user's computer. If the softgood has not been purchased and registered on the user's computer, it will not be played by the player program beyond the permitted preview.

Owner:ONADIME

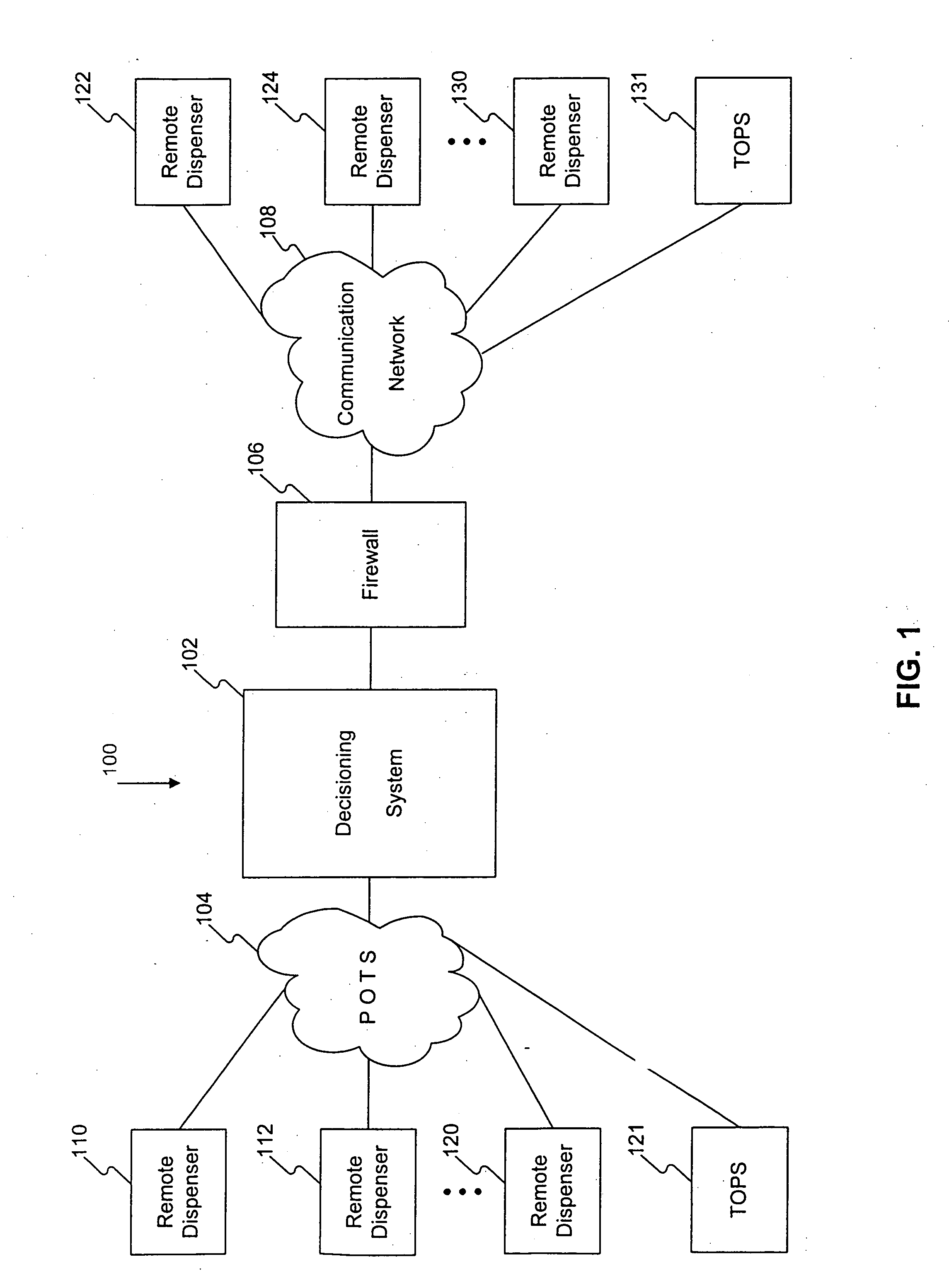

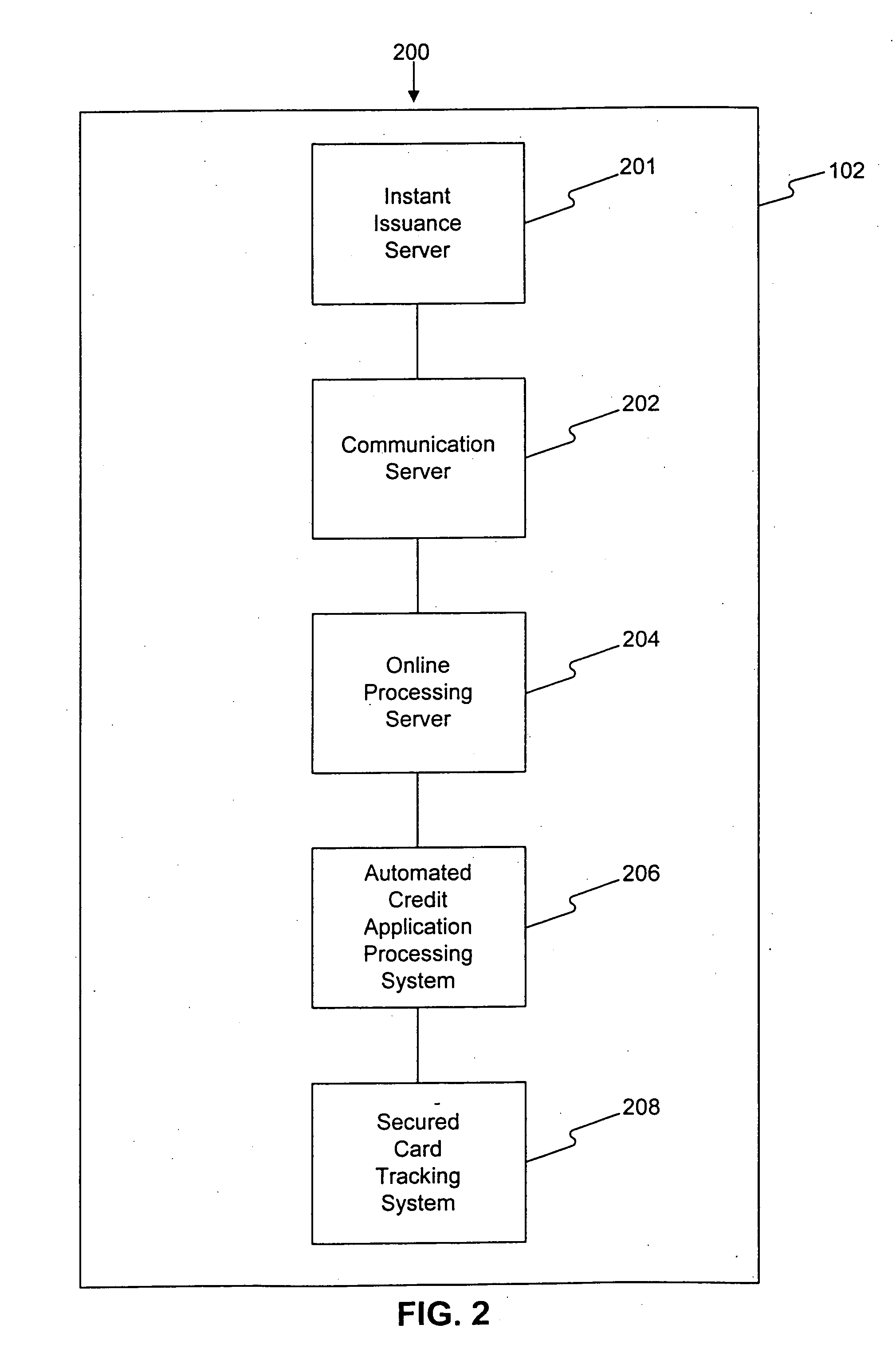

Systems, methods, and apparatus for instant issuance of a credit card

Systems, methods, and apparatus are provided for instant decisioning and remote dispensing of credit cards. In accordance with one implementation the system for instantly issuing a credit card includes means for receiving a credit card application from an applicant, means for instantly decisioning the credit card application, if declined, means for instantly notifying the applicant of that decision, and if approved, means for instantly issuing the credit card. The instant issuance credit card system can also receive a security deposit from the applicant where a determination is made that the applicant may need to remit a security deposit in order to secure the credit card. A decision to require security deposit may be based on the credit history of the applicant. A method for instantly issuing a credit card is also provided. Additionally, an apparatus for remotely dispensing a credit card is provided. The remote dispensing apparatus includes: an input device; a security deposit acceptor; a remote dispensing module, wherein the remote dispensing module communicates with a central real-time decisioning platform; a credit card dispenser; and a display.

Owner:CAPITAL ONE SERVICES

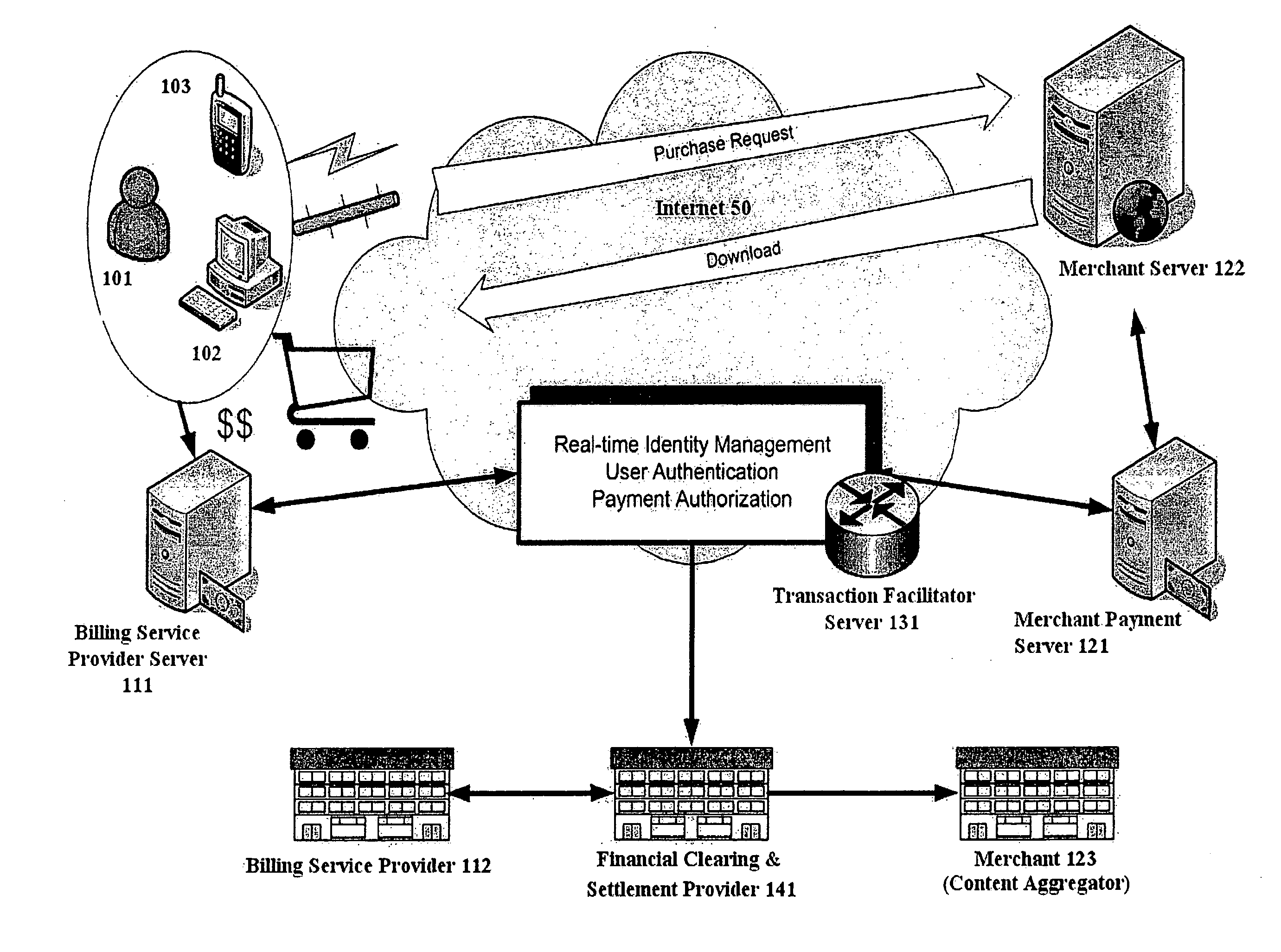

Method for universal electronic payment processing

InactiveUS20090292619A1Efficient and secureEfficient and secure methodComplete banking machinesFinanceService providerService provision

An efficient, secure method for processing an electronic transaction among a user (101), a billing service provider (112), a merchant (123) and a transaction facilitator (132) is provided using a transaction facilitator server (131) accessible via a data network (50). Billing service providers (112) include, for example, internet service providers, telephone service providers, banks, or credit card companies. Product information and a merchant identifier are received from a merchant server (122) in response to a user's purchase request. The user (101) is connected to the billing service provider server (111) in order to authorize the transaction based on the user's account information. The transaction facilitator server (131) and merchant server (122) receive an authorization response from the billing service provider server (111) indicating whether the transaction has been approved or denied. Neither the transaction facilitator server (131) nor the merchant server (122) receive the user's account information. The user (101) is redirected to the merchant server (122), completing the purchase request based on the authorization response.

Owner:EBIZ MOBILITY

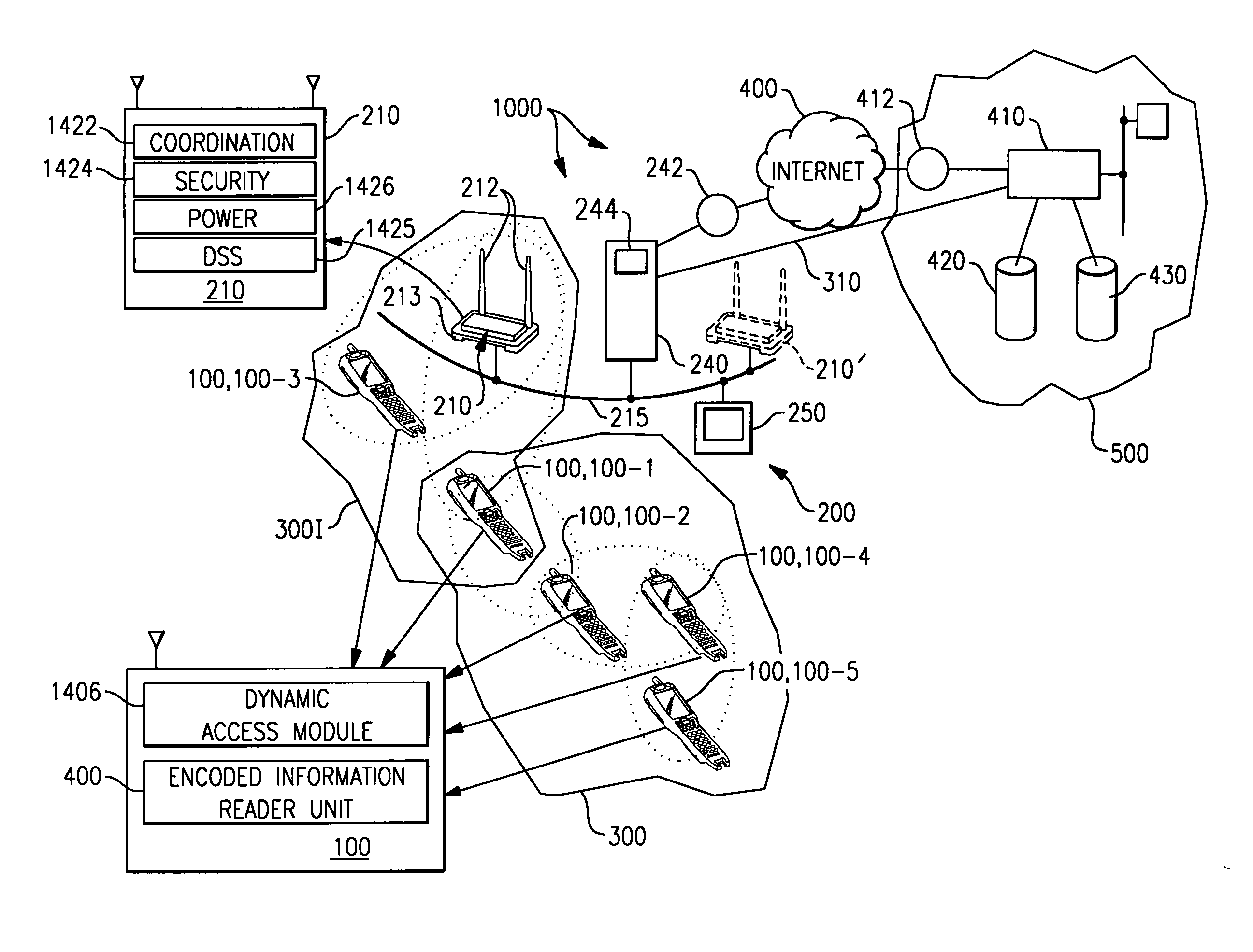

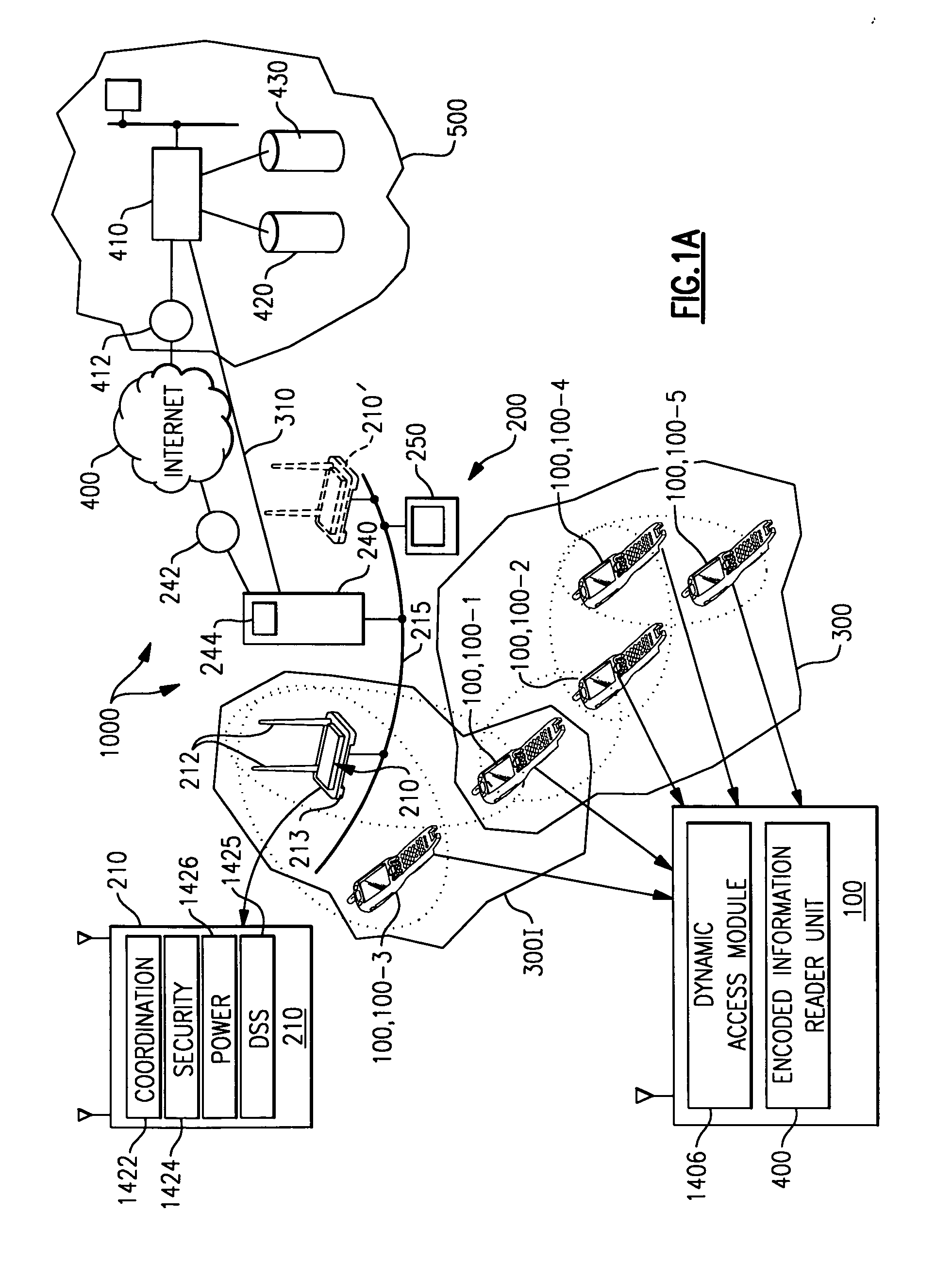

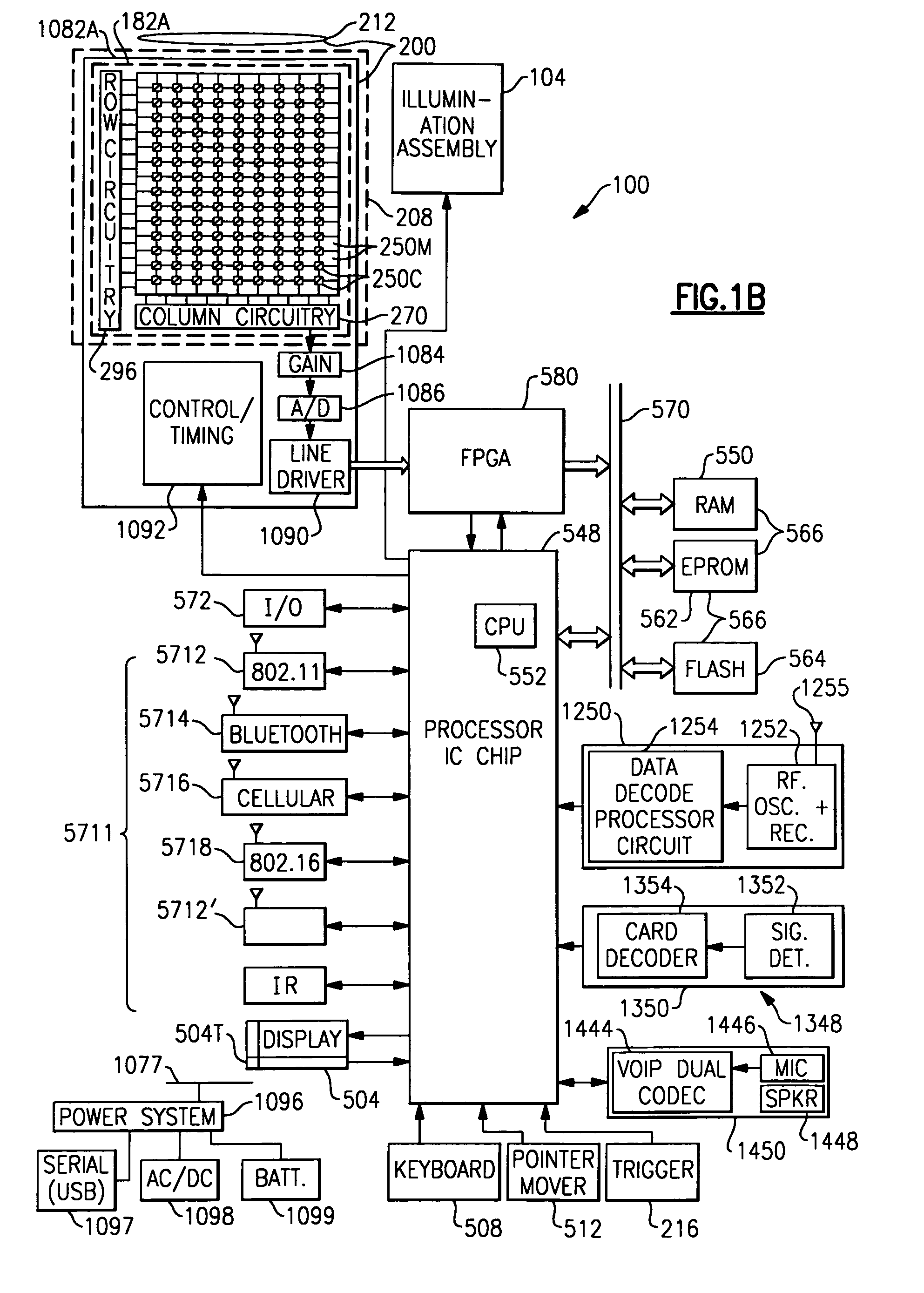

Data collection device having dynamic access to multiple wireless networks

There is described a data collection device that can incorporate an encoded information reading unit that can operate within a system including an access point that is wireline connected to a server. The encoded information reading unit can include at least one of a bar code reading unit, an RFID tag reading unit and a credit / debit card reading unit. Further incorporated in the data collection device can be dynamic access module. The dynamic access communication module enables the data collection device to participate in a self organized network that supports multi-hop data packet transmissions between data collection devices and which further enables the device to transmit data received from a peer device to the system access point.

Owner:HAND HELD PRODS

Method and system for issuing, aggregating and redeeming merchant loyalty points with an acquiring bank

A loyalty reward point system that utilizes the pre-existing infrastructure of network such as a credit card network. A user makes a purchase at a merchant using a token such as a credit card. As part of the purchase transaction, the user is awarded reward points from the merchant based on the purchase, which are stored in an account associated with the merchant and the user by the acquiring bank. The reward account is maintained on the acquiring bank server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant in the same marketing cluster, or may aggregate those reward points with those of other merchants into a reward point exchange account, and then redeem the aggregated reward points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

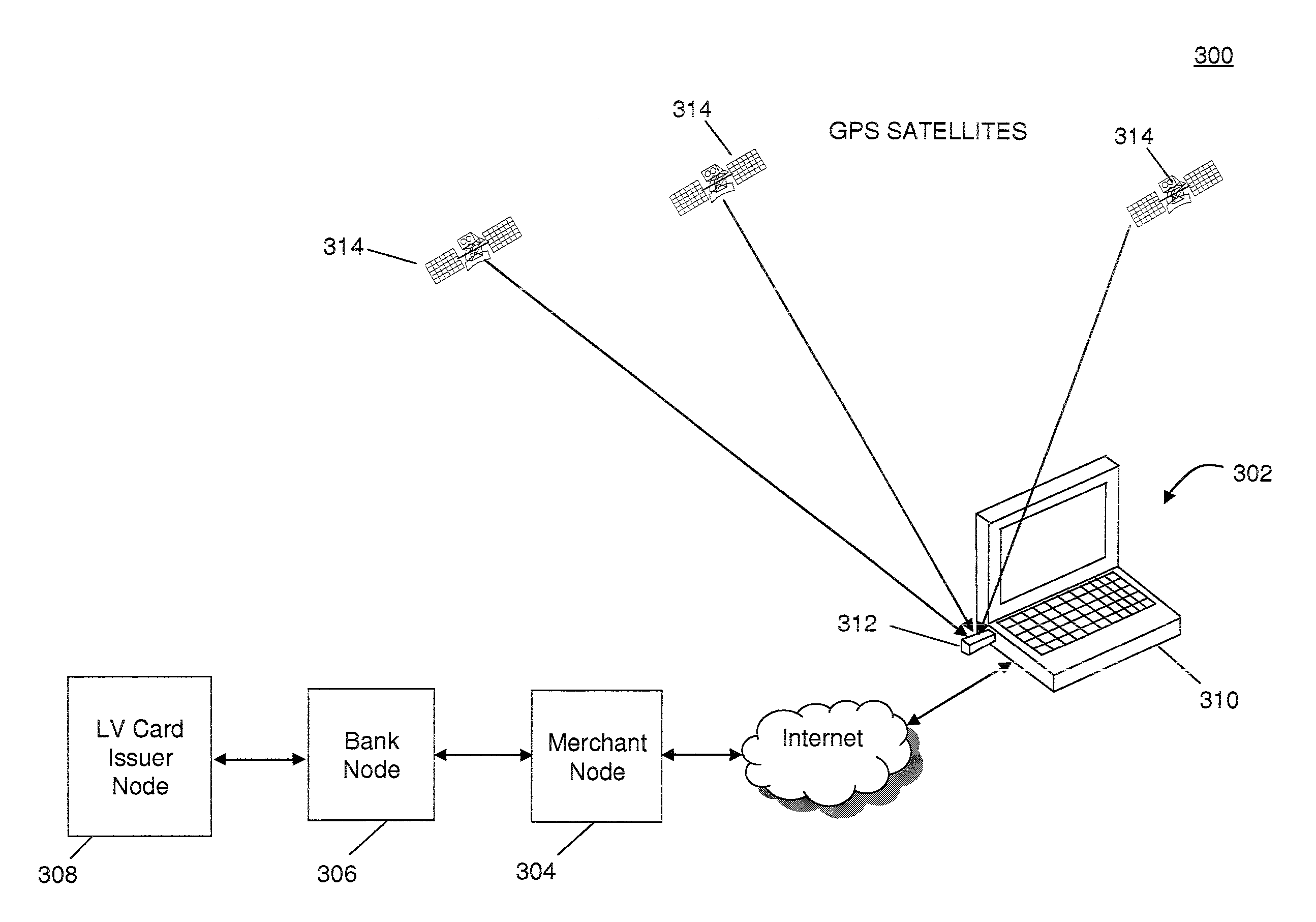

Credit and debit card transaction approval using location verification

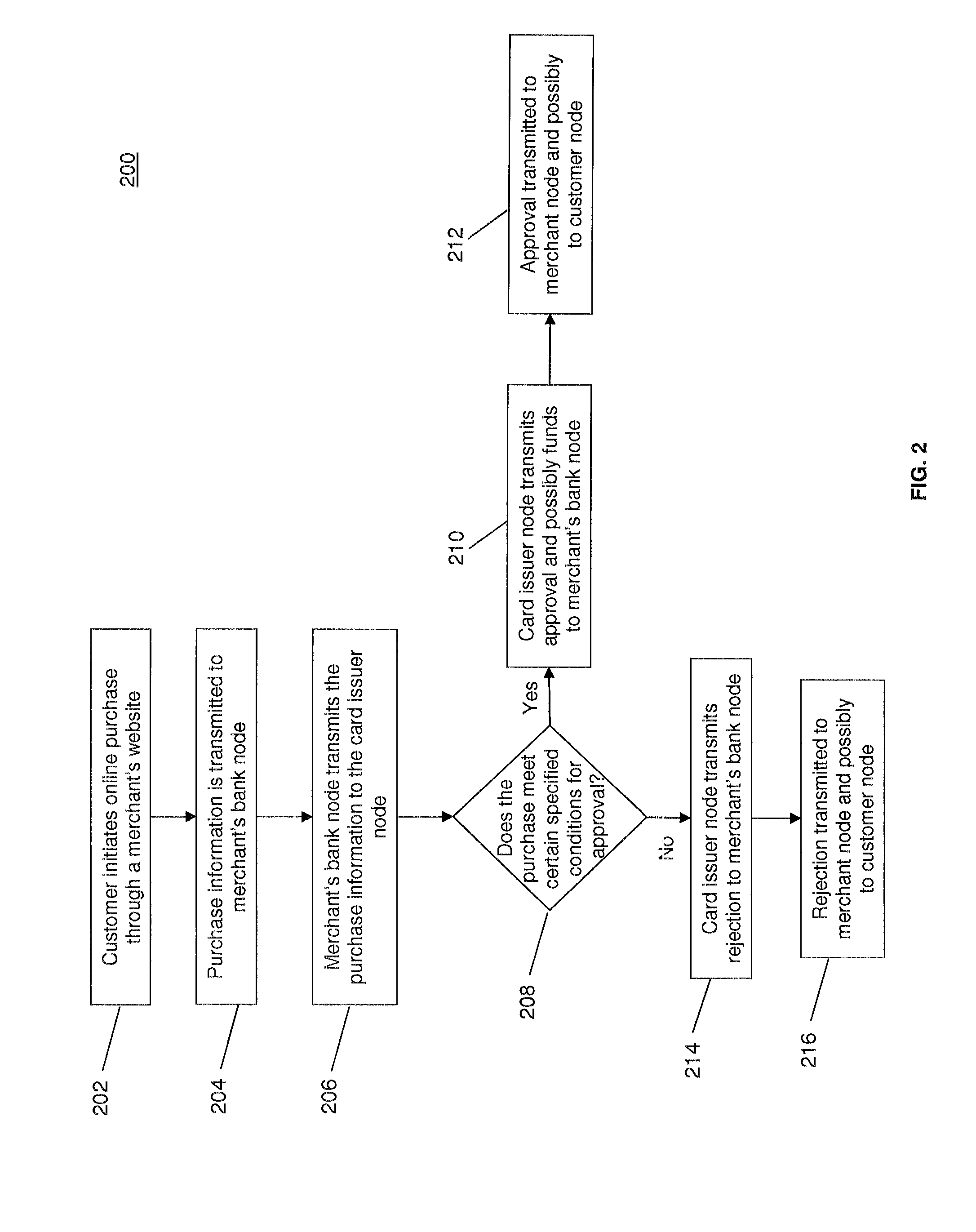

In one embodiment, an online credit or debit card transaction is processed by transmitting purchase information, including price of the purchase item and card number, to the company that issued the card. In addition, the location from which the purchase is made is calculated, e.g., using a GPS device, and the location data is transmitted to the card issuer. The card issuer determines if the purchase meets certain specified approval requirements, such as whether the card holder has sufficient funds, the card has been reported missing, or card holder's personal information is correct. Further, the card issuer compares the location data to a number of predetermined purchase locations specified by the customer. If the location data matches one of the predetermined locations and the specified approval requirements are met, then the purchase is approved.

Owner:AGERE SYST INC

Stored value account for use with virtual coupons

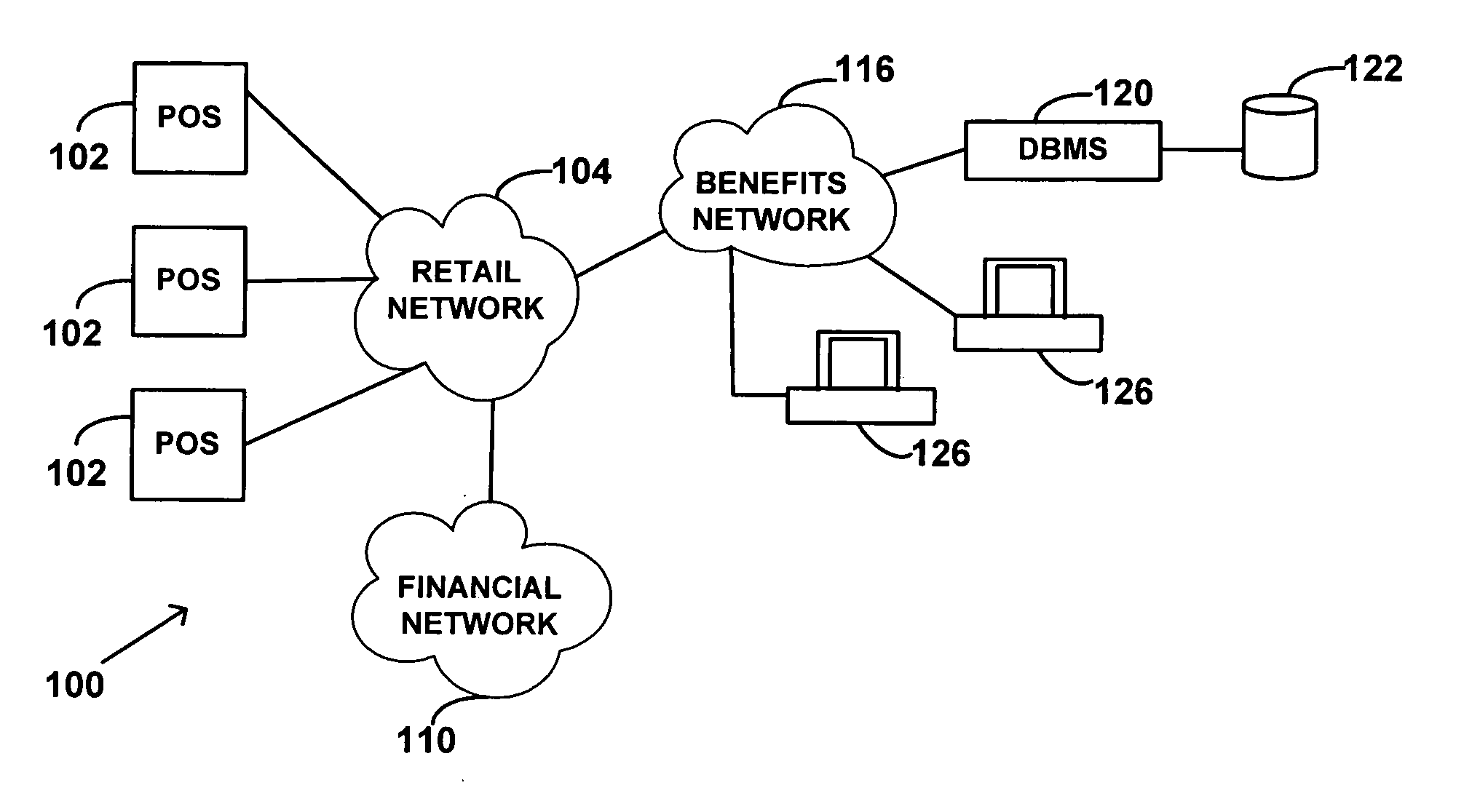

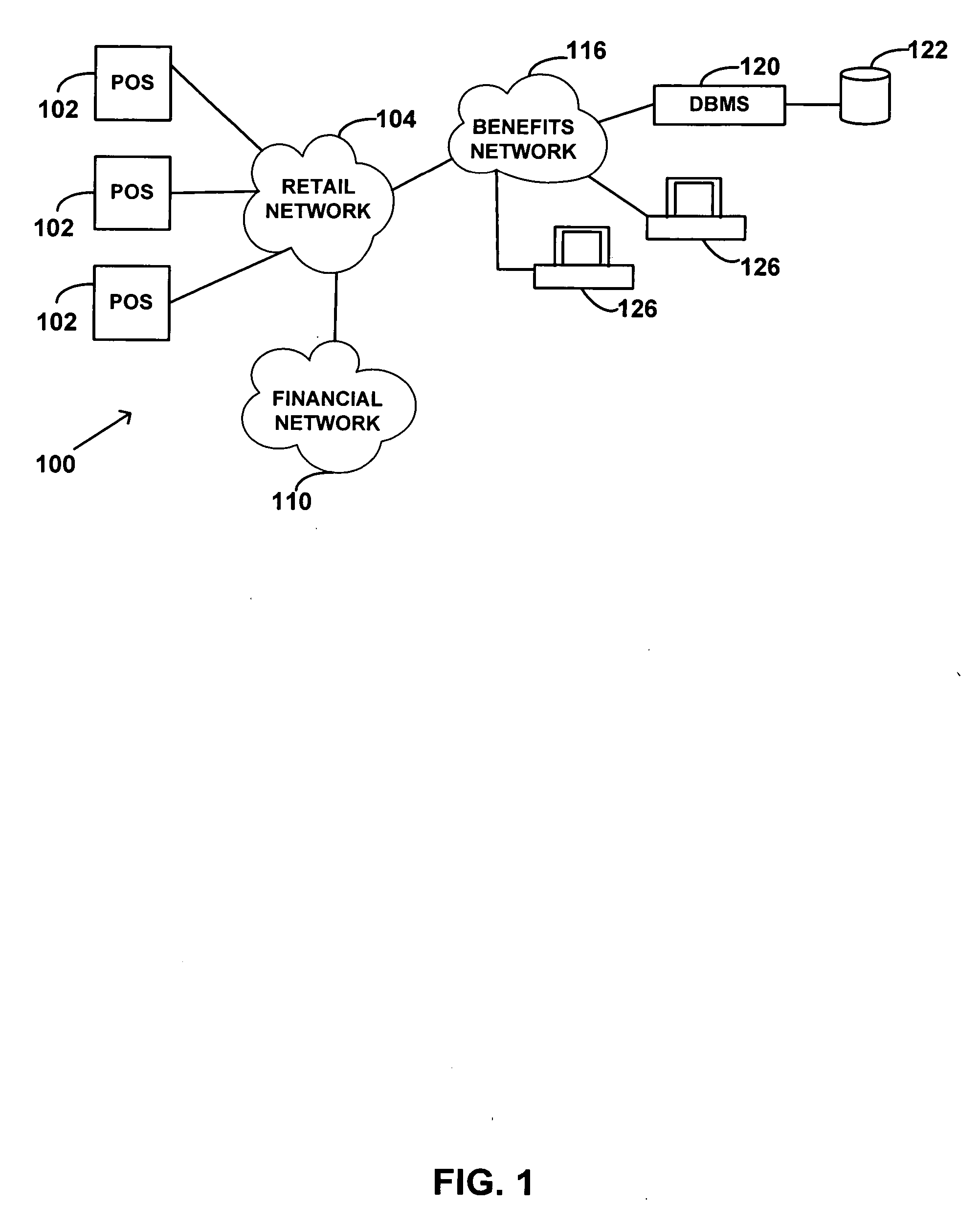

A system and method for the purchase of products, wherein a database account is credited with virtual coupons. Each virtual coupon is associated with a maximum value and a specified product. When a purchase is made, the coupon is debited from the account upon presentation of a financial card at a POS terminal, and any difference between the maximum value of the coupon and the actual purchase price is stored in the database. In one embodiment, coupons are issued through a government benefits program, such as the federally funded WIC (Women, Infants, Children) program. The financial card may also be associated with a second account, such as a credit or debit card account. The second account may be used to purchase products other than those specified by the virtual coupons.

Owner:FIRST DATA

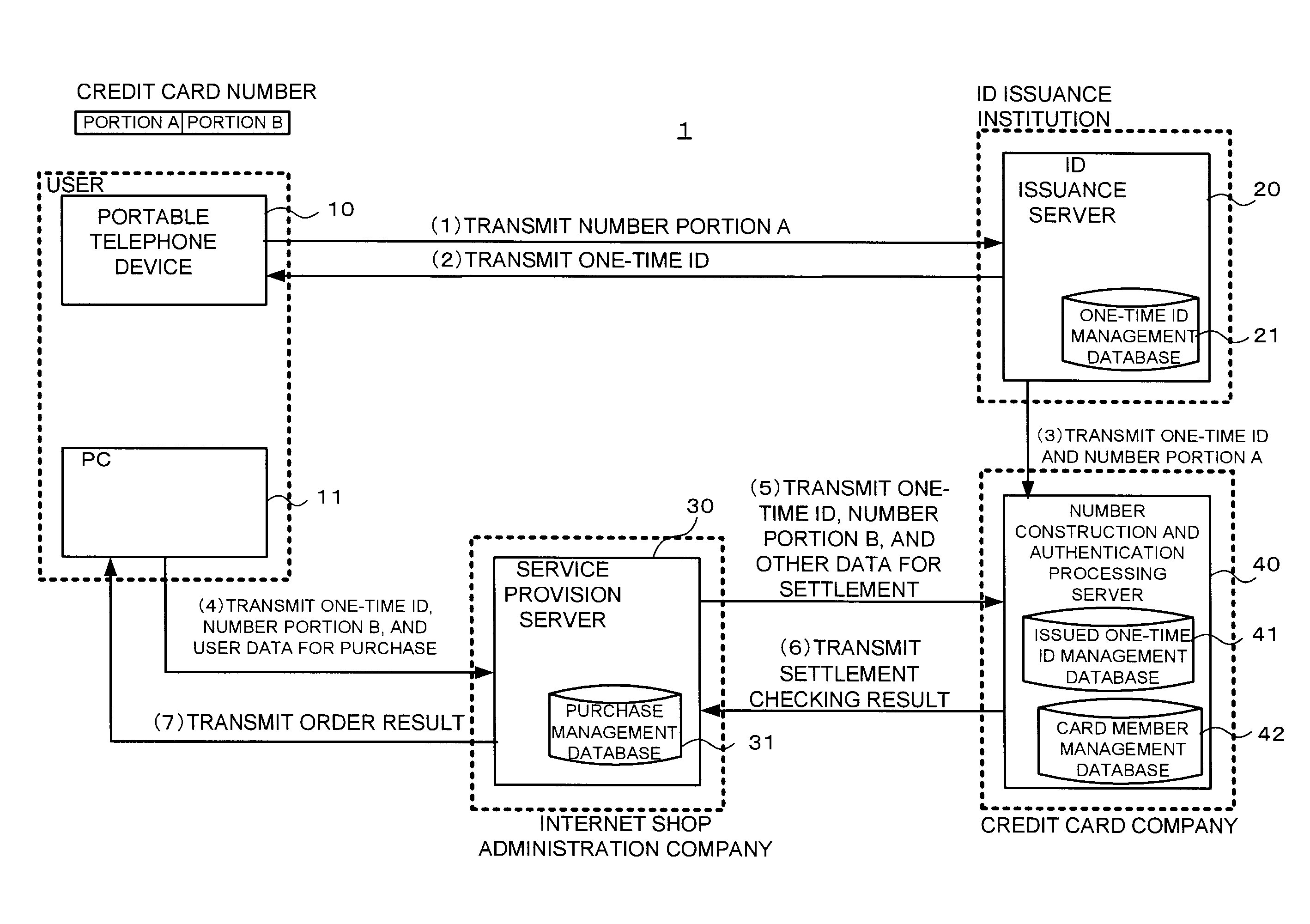

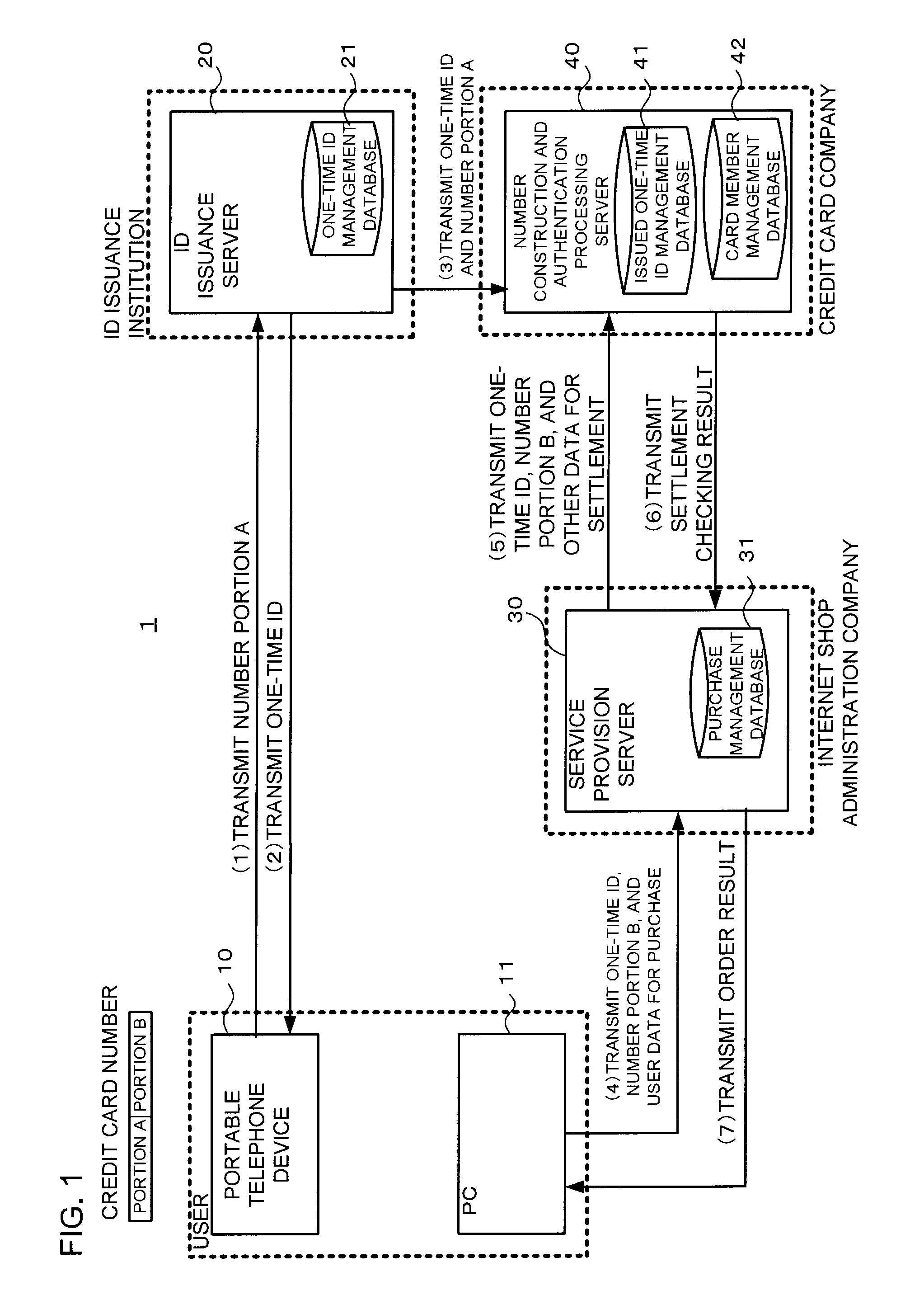

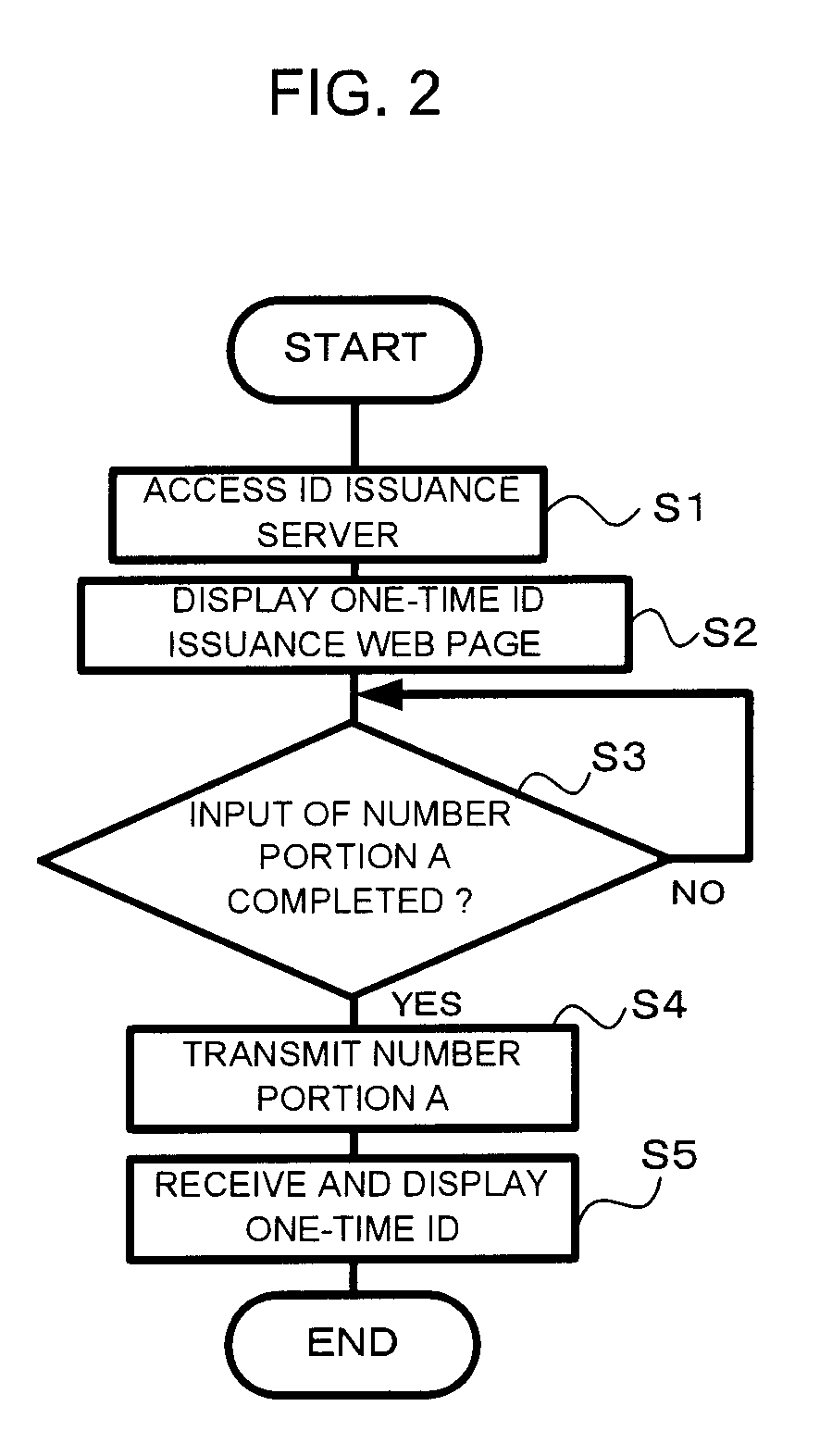

Authentication system and authentication method

InactiveUS20100017334A1Improve accuracySimple and easy mannerFinanceDigital data processing detailsEngineeringAuthentication system

In order appropriately to prevent leakage of an authentication symbol string such as a credit card number, and for it to be possible for a user to be authenticated as a legitimate user: an ID issuance server 20 receives the first eight digits of the credit card number from a portable telephone device 10 of the user and issues a one-time ID to the portable telephone device 10; a service provision server 30 receives the last eight digits of the credit card number and the one-time ID from a PC 11, and transmits the one-time ID and those last eight digits to a number construction and authentication processing server 40; and the number construction and authentication processing server 40 receives the one-time ID and the last eight digits from the service provision server 30, communicates with the ID issuance server 20 and acquires the first eight digits which correspond to the one-time ID, reconstructs the credit card number, and performs authentication with the credit card number.

Owner:SAFETY ANGLE

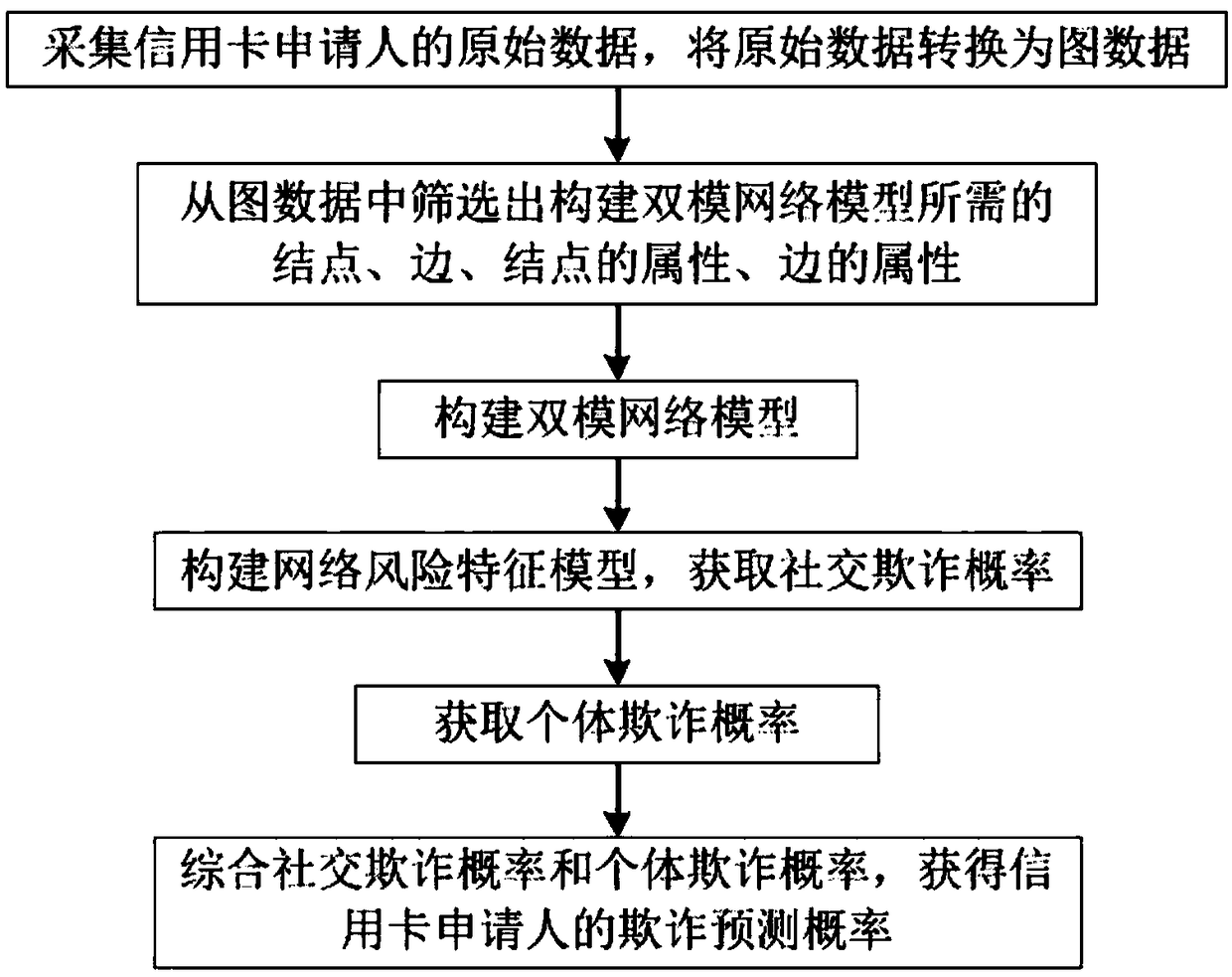

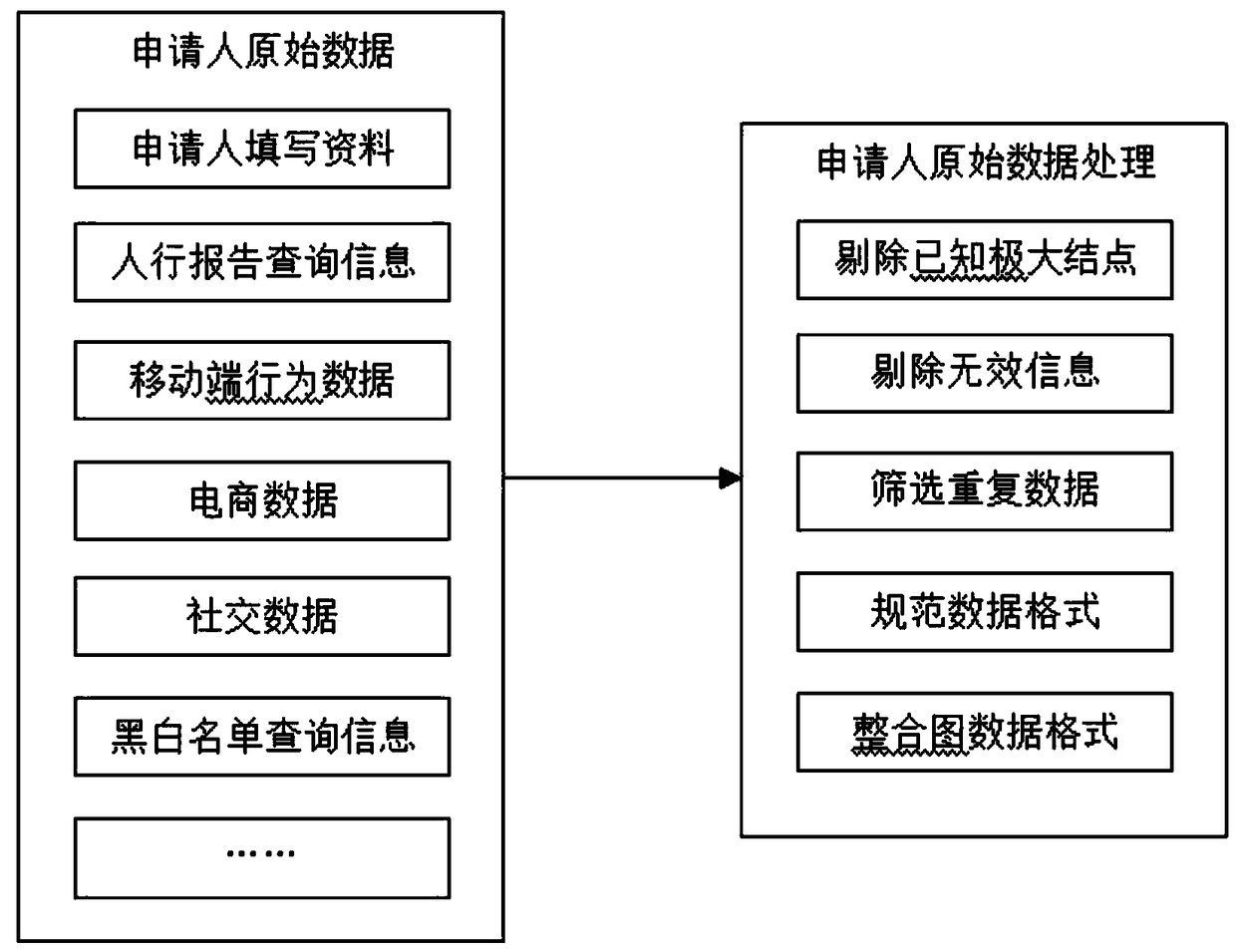

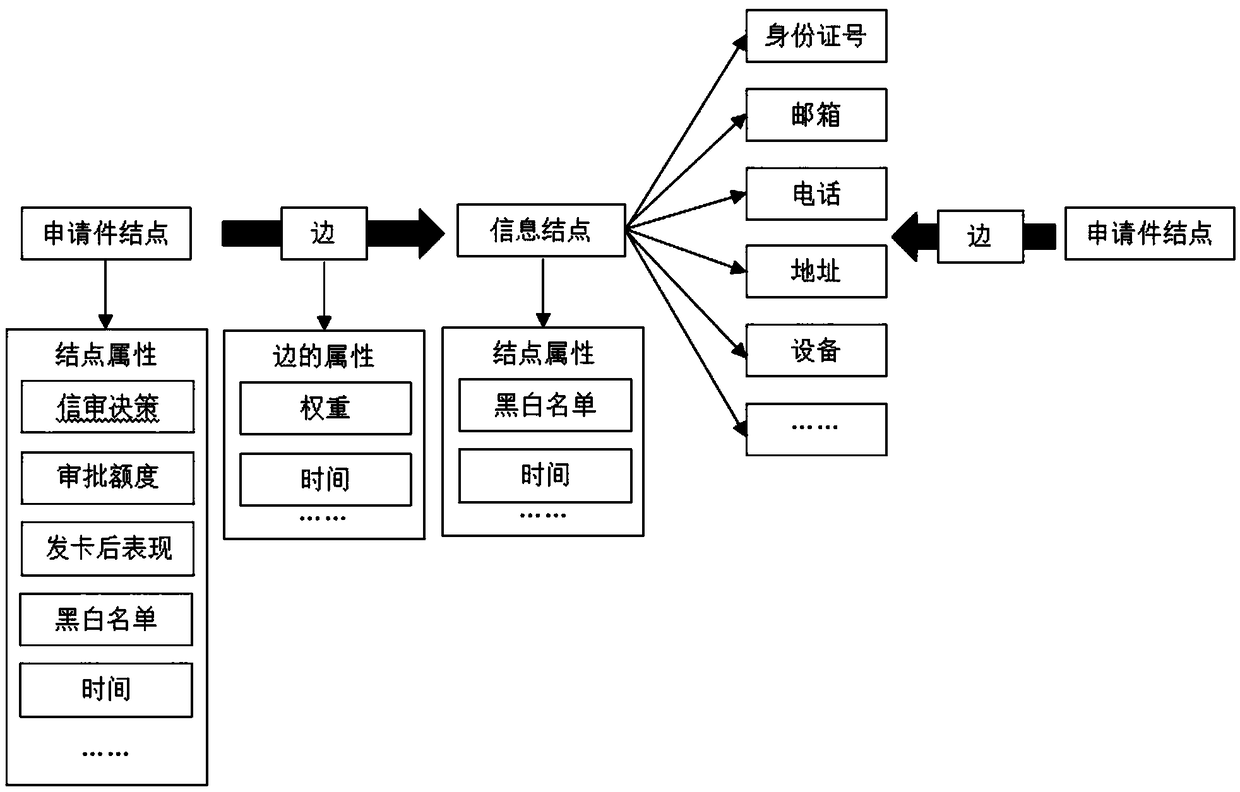

Credit card anti-fraud prediction method based on dual-mode network diagram mining algorithm

InactiveCN108492173AReal-time computingSolve the problem of risk identificationFinanceComputing modelsCredit cardRisk Control

The invention discloses a credit card anti-fraud prediction method based on a dual-mode network diagram mining algorithm. The method concretely comprises the following steps that the original data ofthe credit card applicant is acquired and the original data are converted into the diagram data; the nodes, the edges, the attributes of the nodes and the attributes of the edges required for constructing a dual-mode network model are selected out of the diagram data through screening; the dual-mode network model is constructed; a network risk characteristic model is constructed and the probability of network fraud is acquired; the probability of personal fraud is acquired; and the probability of network fraud and the probability of personal fraud are integrated so as to obtain the fraud prediction probability of the credit card applicant. The multidimensional data information related to the applicant is collected, the credit card application field data knowledge map is constructed, the dual-mode network model capable of reflecting the correlation between the clients is acquired and the influence of the individual and group risk on the applicant fraud probability can be accurately integrated so that the risk of identity forgery, group fraud and group attack can be effectively reduced, and the financial anti-fraud risk control capacity can be enhanced.

Owner:上海氪信信息技术有限公司 +1

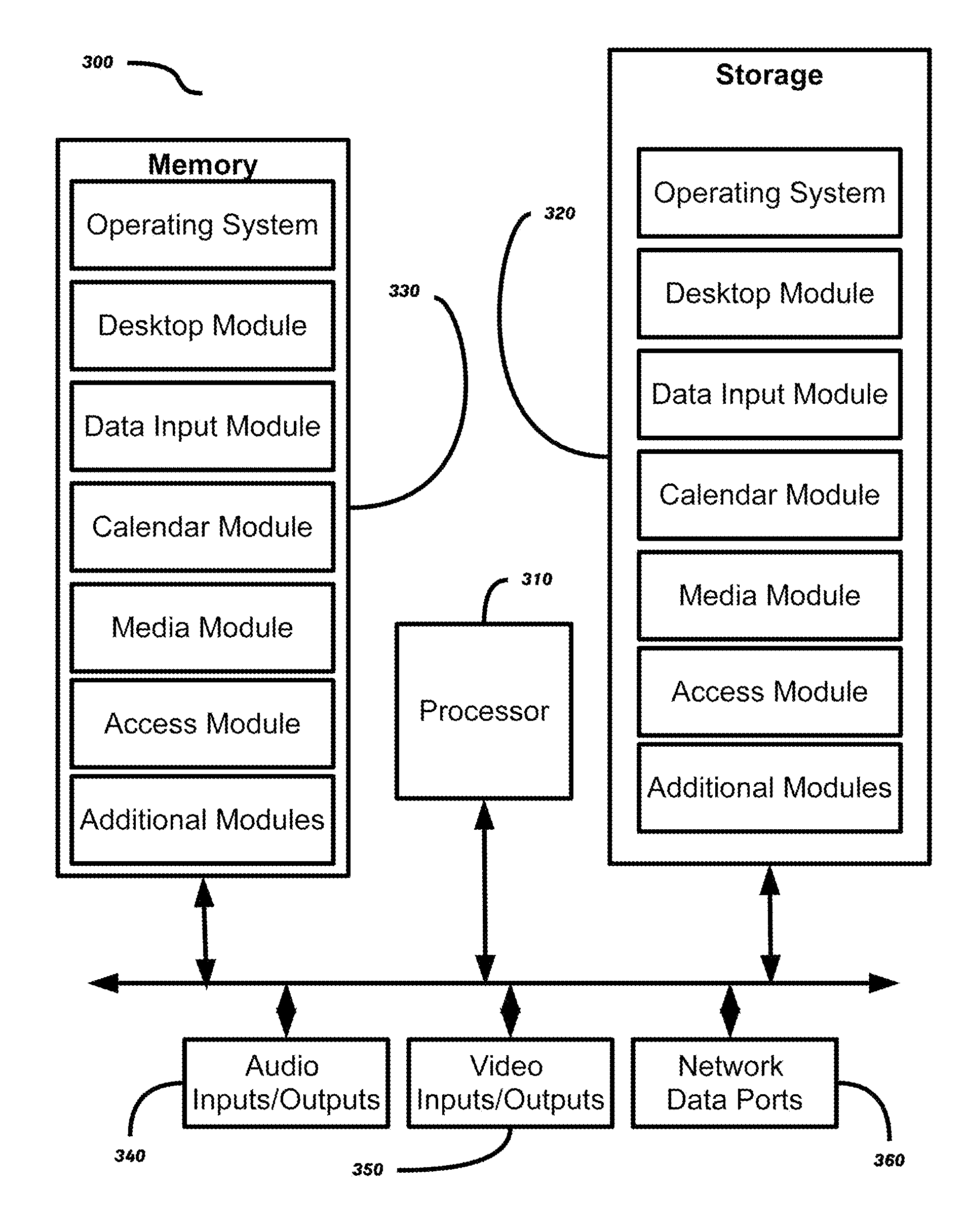

Portable Multifunctional Multimedia Device for Personal Services Industry and Mounting System and Methods of Use

InactiveUS20120019641A1Improve experienceImprove relationshipPicture framesDomestic mirrorsDisplay deviceEngineering

A novel portable multimedia device for improving client experiences in a personal services industry can be detachably mounted to a tool used by the service provider, such as a hair clipper for a barber. The device comprises a processor, data storage, memory, video display and speakers, as well as a data input module, and can accommodate a library of electronic media files. Optionally, the device can include a camera, telephone, GPS, and other functions including credit card processing and bar code reader. Also provided are methods of using the device for professional service providers, for example barbers, hairstylists, or others. Also provided is a universal mounting system for portable electronic devices that comprises a retaining member and a mounting member for mounting to a variety of mounts including handles, clips, suction cups, goosenecks, flexible joints, magnetic mounts, and key rings.

Owner:REEDER III KENNETH MARK

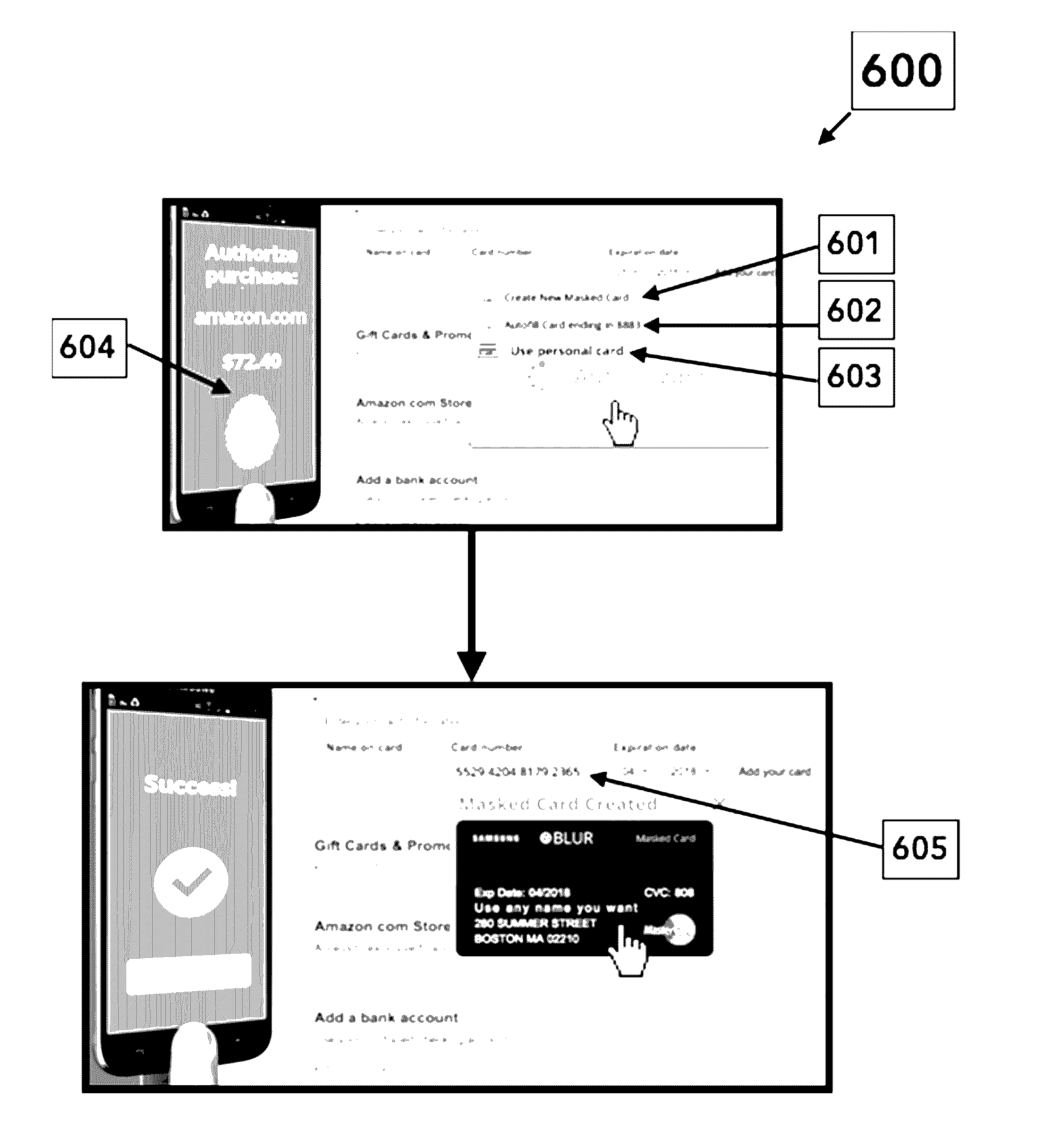

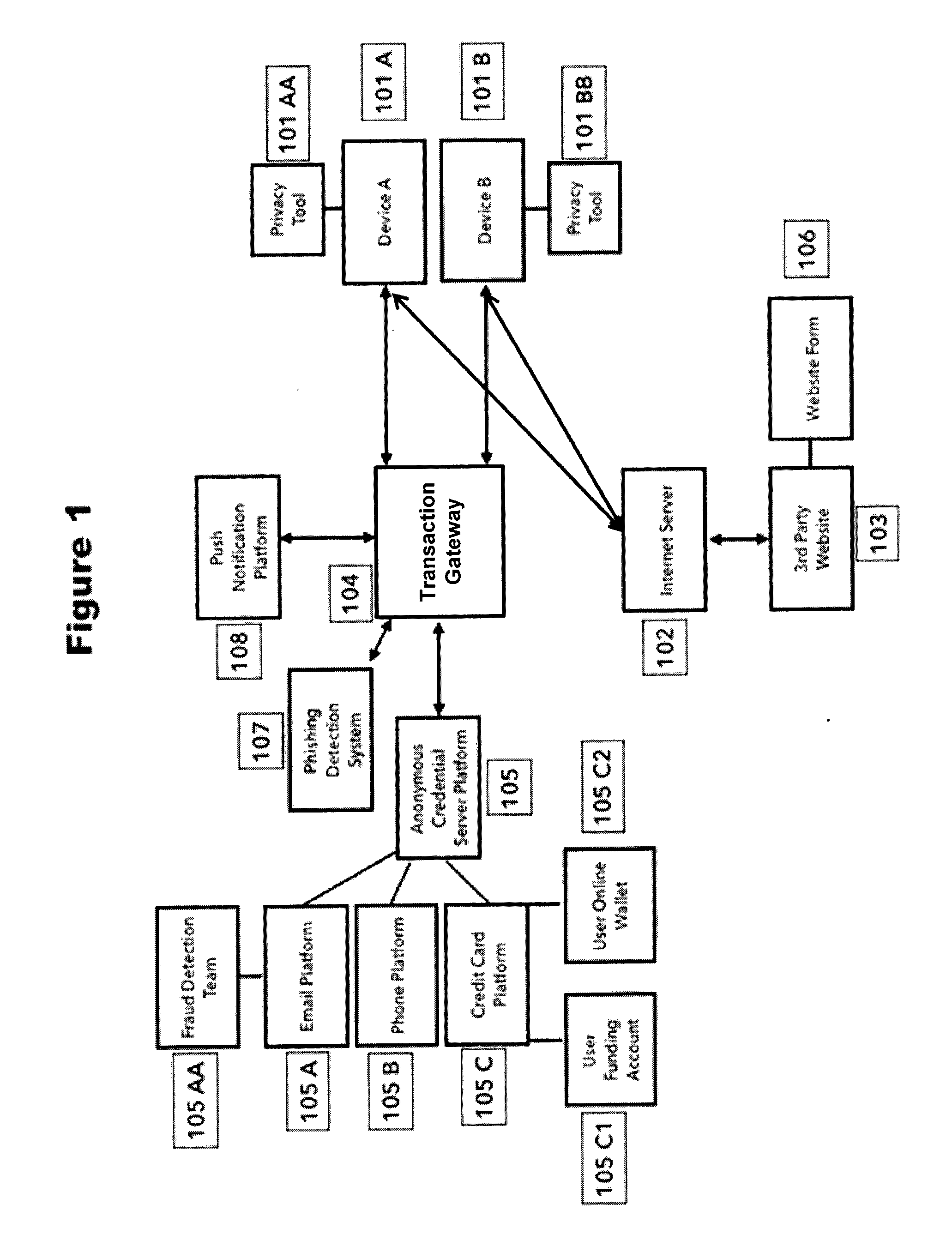

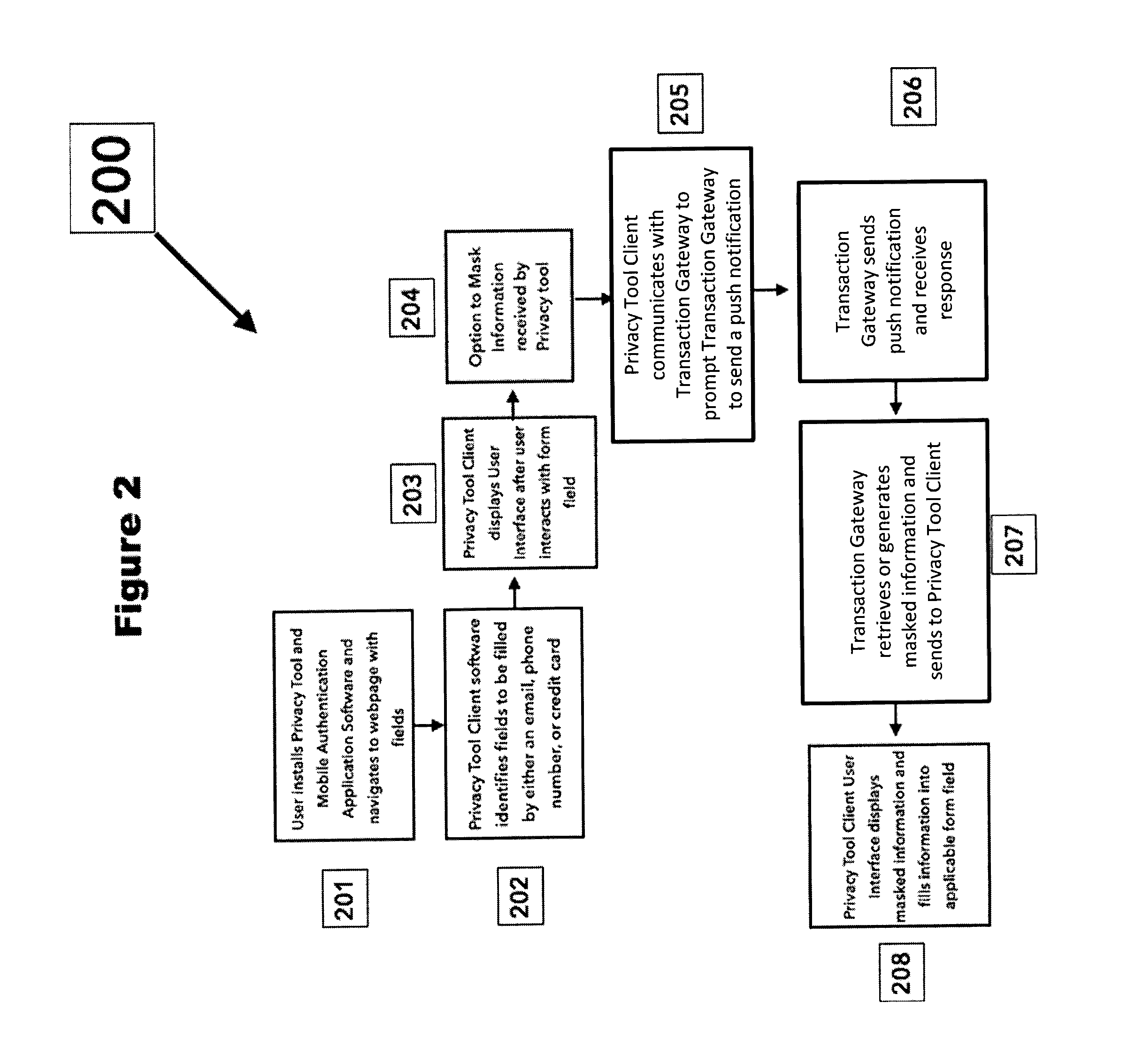

Push notification authentication platform for secured form filling

The present disclosure relates to systems and methods for notifying a user of attempts to provide masked credentials associated with the user to a third party, and for providing the user with an opportunity to approve or deny the attempt. The third party can be a website having a form field that receives the masked credential. The masked credential can include a telephone number, an email address, a mail address, a user name, a password, and funding account information (e.g., credit card or bank account numbers). Attempts to provide the masked credential using a device can be detected by an application installed on the device, and the notification can be implemented through a push notification sent to one or more devices registered with the user. Users can respond to the push notification by indicating whether the attempt to provide the masked credential is approved or denied.

Owner:IRONVEST INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com