Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

165 results about "Credit history" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A credit history is a record of a borrower's responsible repayment of debts. A credit report is a record of the borrower's credit history from a number of sources, including banks, credit card companies, collection agencies, and governments. A borrower's credit score is the result of a mathematical algorithm applied to a credit report and other sources of information to predict future delinquency.

Credit and financial information and management system

InactiveUS20050154664A1Facilitates correction of inaccuracyReduce deliveryFinanceDigital data processing detailsUser authenticationManagement system

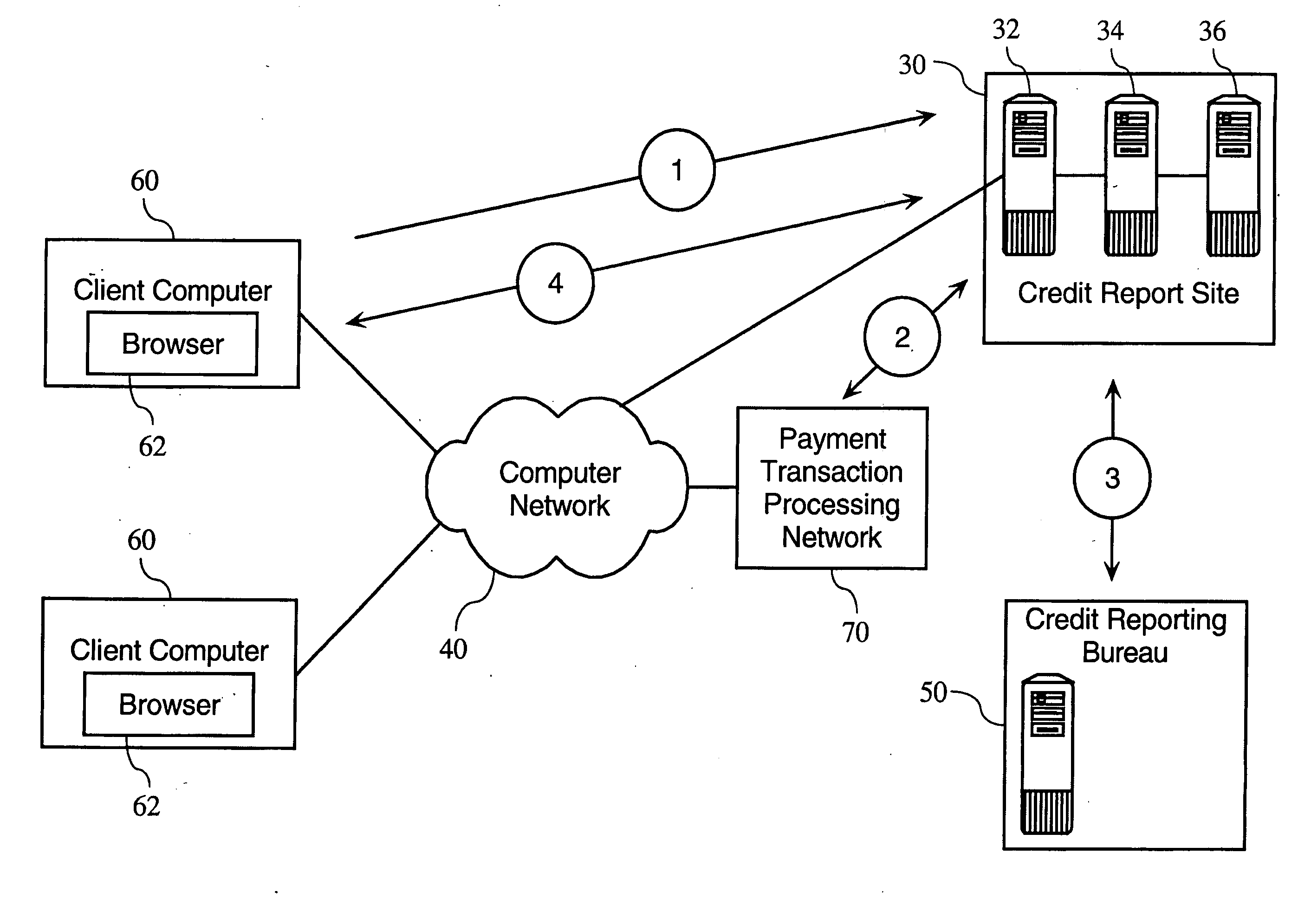

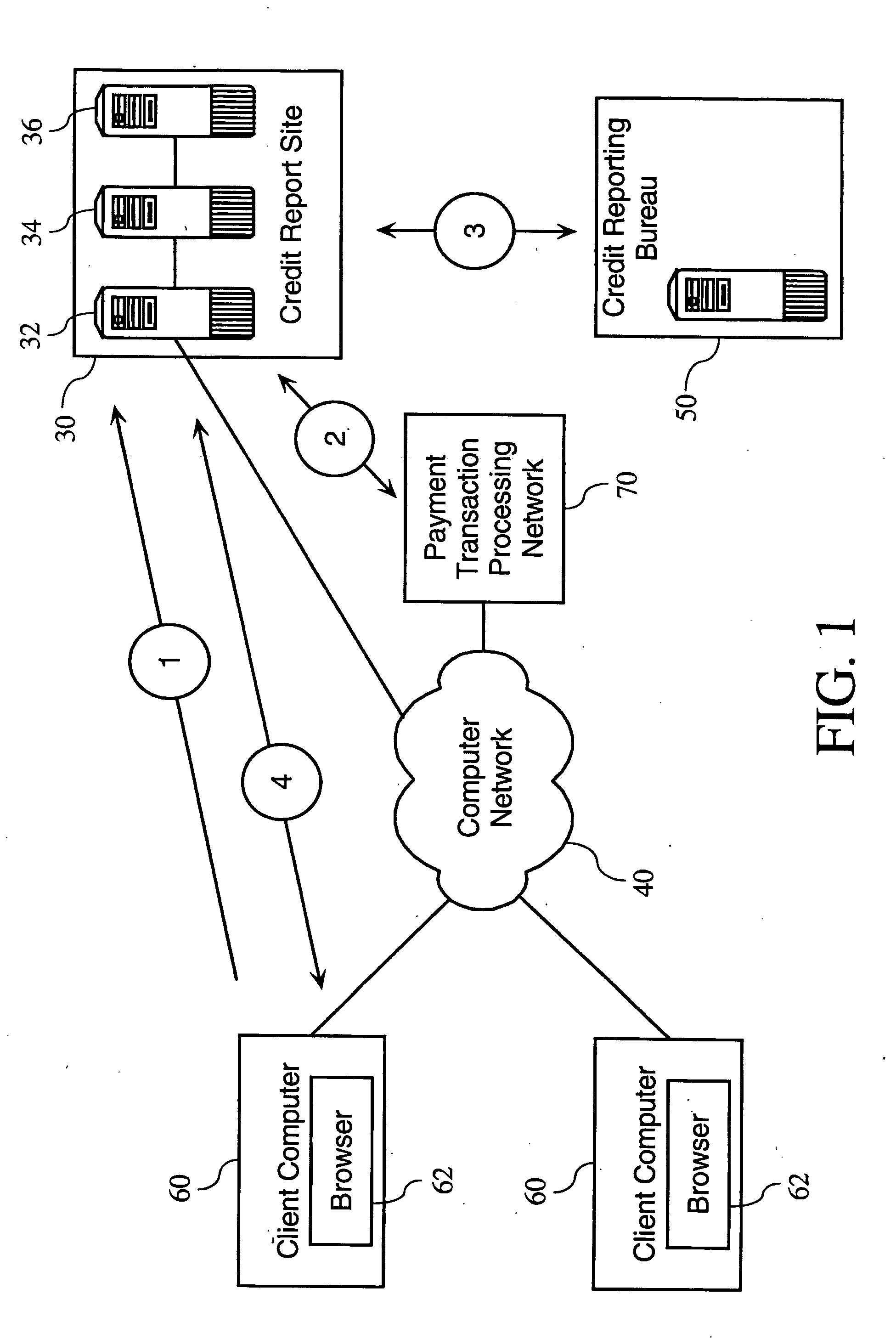

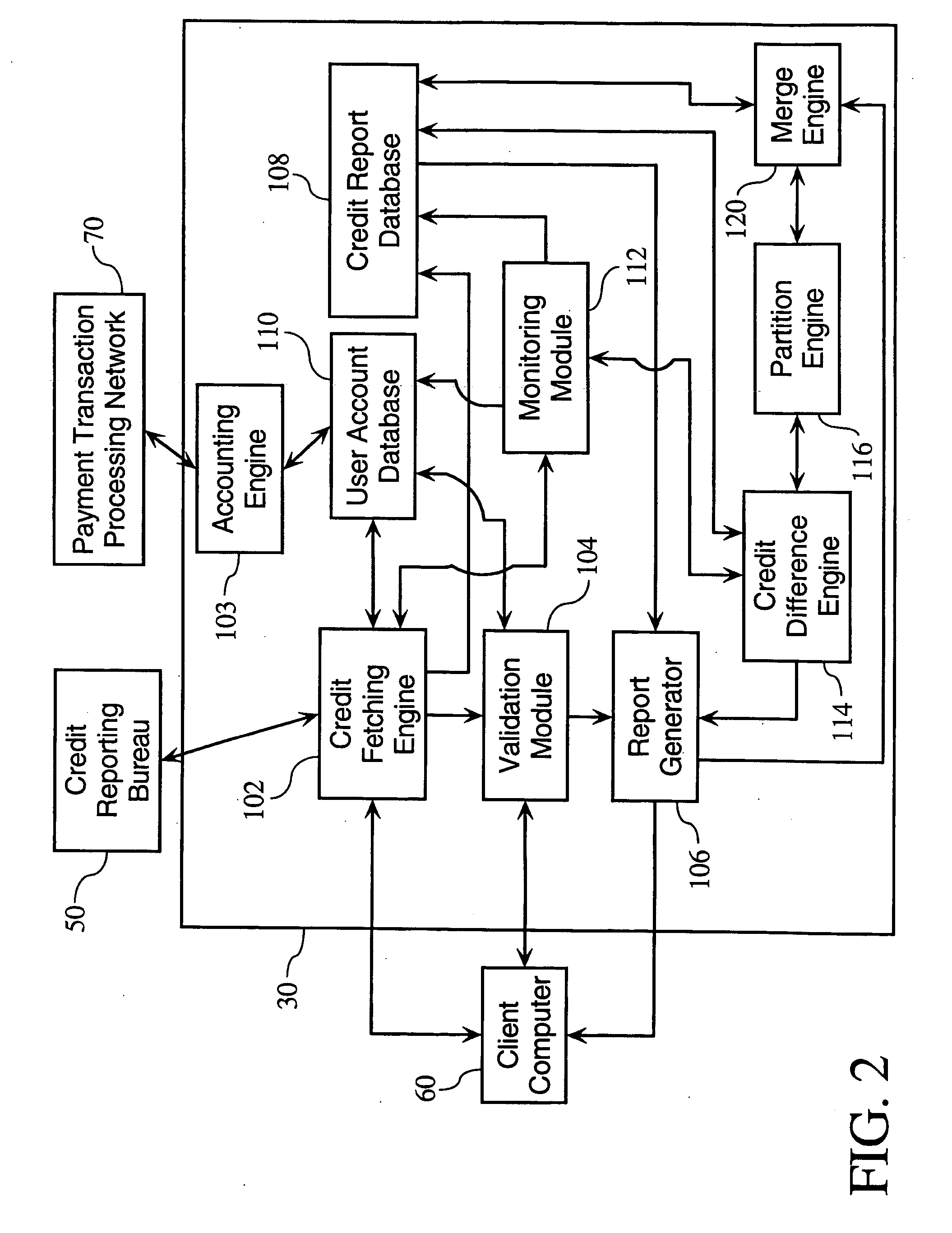

Methods and apparatuses relating to the provision of credit and financial services. In one embodiment, the present invention provides-user authentication protocols facilitating the electronic delivery of credit reports over a computer network directly to users. According to one embodiment of the invention, a credit report comprises a particular user's credit history and other financial information, and / or a credit rating. Other embodiments of the present invention allow for the provision of services related to consumer and business credit report data.

Owner:TRANSUNION INTERACTIVE

Method for providing financial and risk management

InactiveUS20020019804A1Reduce riskIncrease revenue generationFinancePayment architectureTime limitComputer science

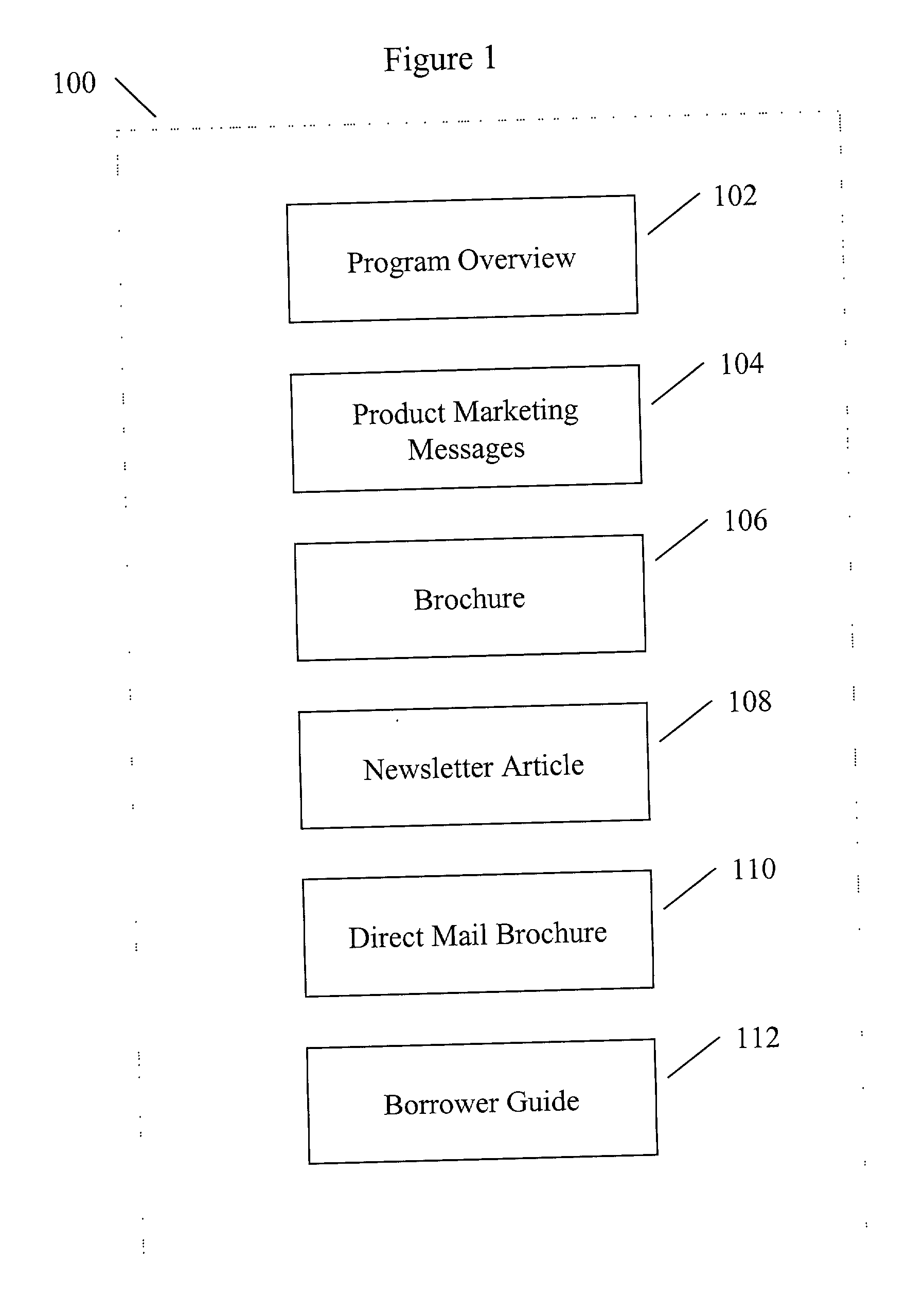

A method for marketing, assessing, underwriting, insuring and managing loans comprising marketing information and training for financial institutions, criteria for employment, credit history, and loan property type, insurance for loss limited by a predetermined amount, and tracking and servicing of a loan including collection and liquidation in the event of default. The invention further comprises status reporting, and liquidation of loans prior to expiration of the term of a loan.

Owner:WK CAPITAL ADVISORS

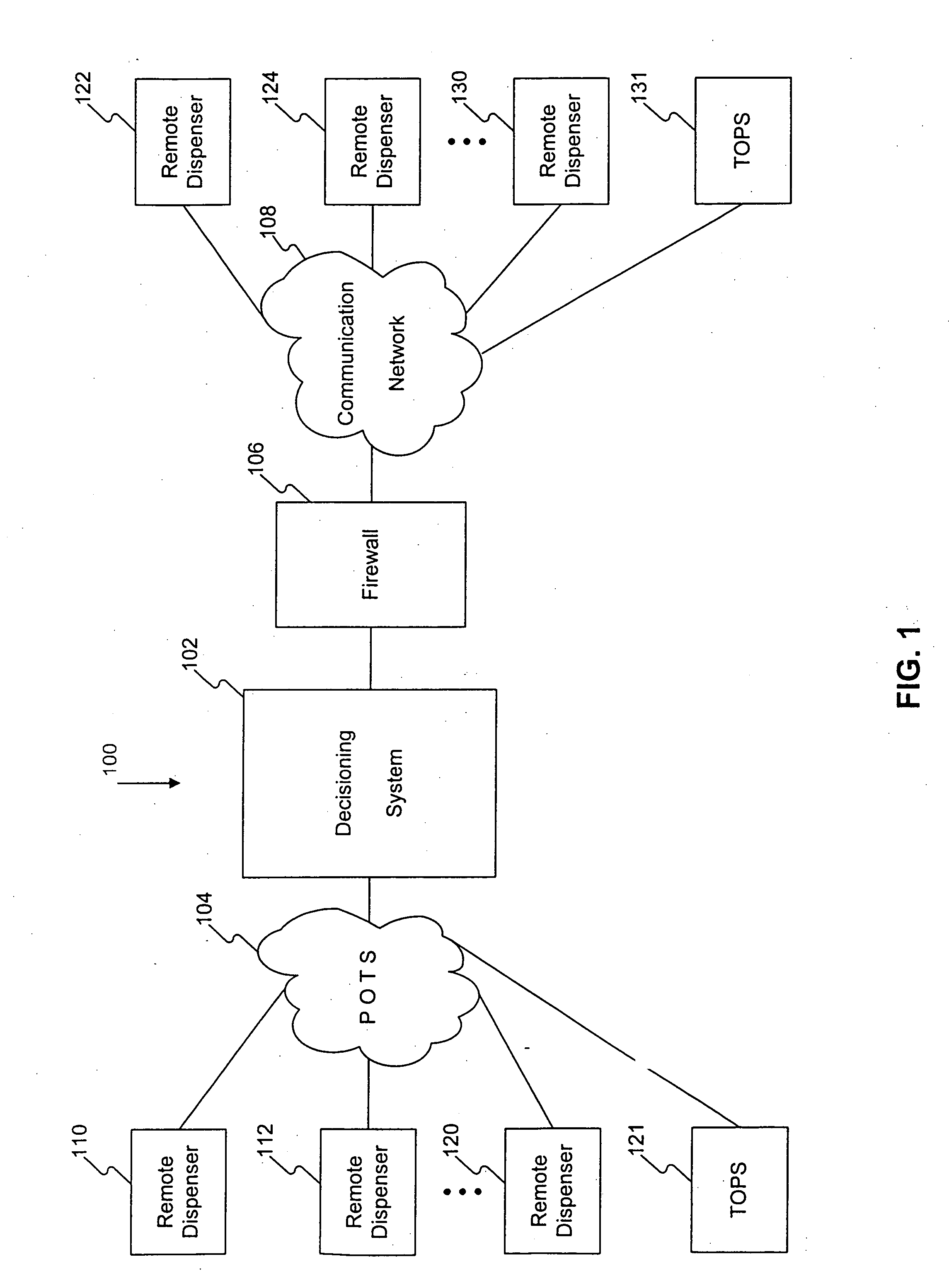

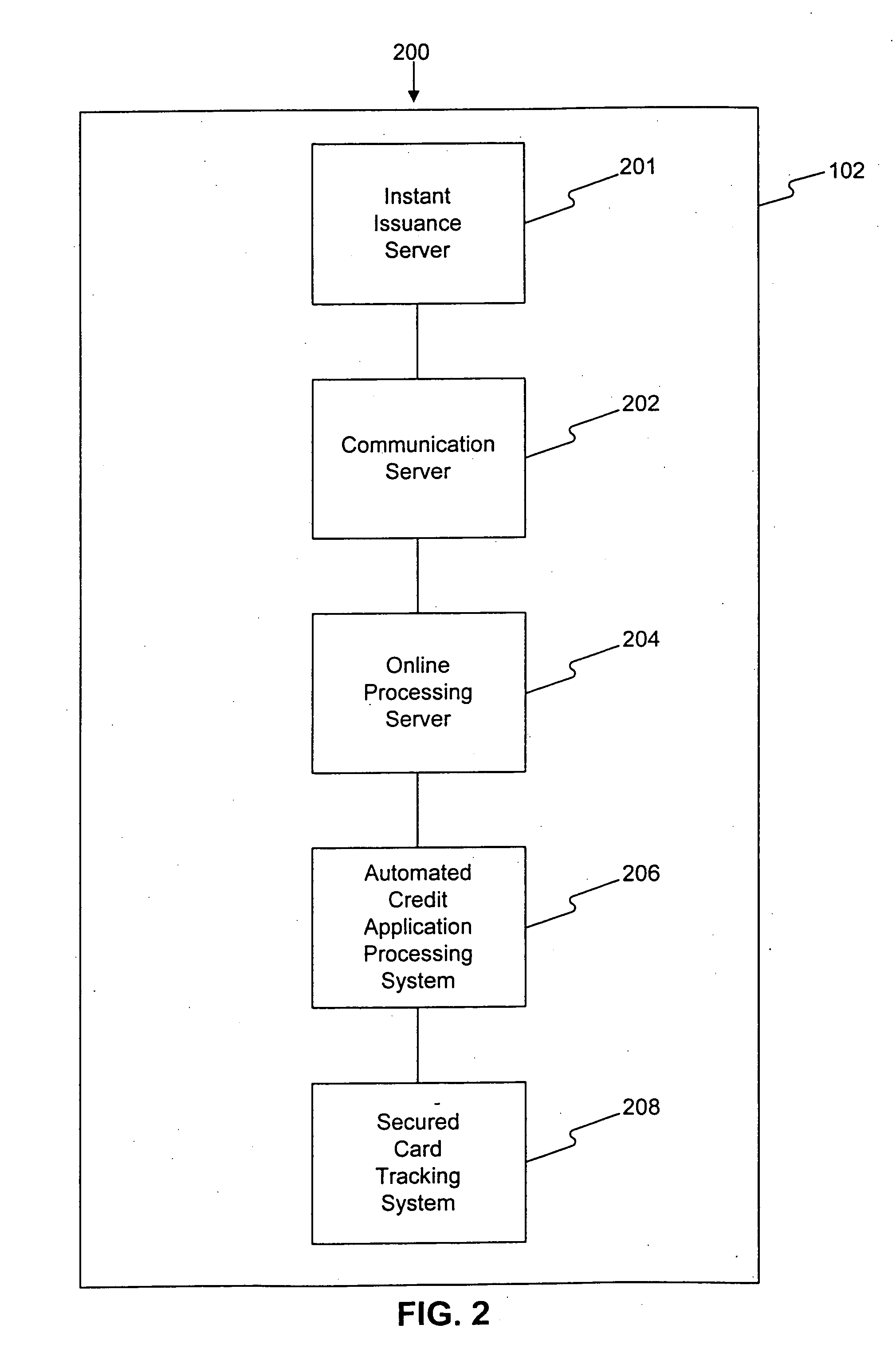

Systems, methods, and apparatus for instant issuance of a credit card

Systems, methods, and apparatus are provided for instant decisioning and remote dispensing of credit cards. In accordance with one implementation the system for instantly issuing a credit card includes means for receiving a credit card application from an applicant, means for instantly decisioning the credit card application, if declined, means for instantly notifying the applicant of that decision, and if approved, means for instantly issuing the credit card. The instant issuance credit card system can also receive a security deposit from the applicant where a determination is made that the applicant may need to remit a security deposit in order to secure the credit card. A decision to require security deposit may be based on the credit history of the applicant. A method for instantly issuing a credit card is also provided. Additionally, an apparatus for remotely dispensing a credit card is provided. The remote dispensing apparatus includes: an input device; a security deposit acceptor; a remote dispensing module, wherein the remote dispensing module communicates with a central real-time decisioning platform; a credit card dispenser; and a display.

Owner:CAPITAL ONE SERVICES

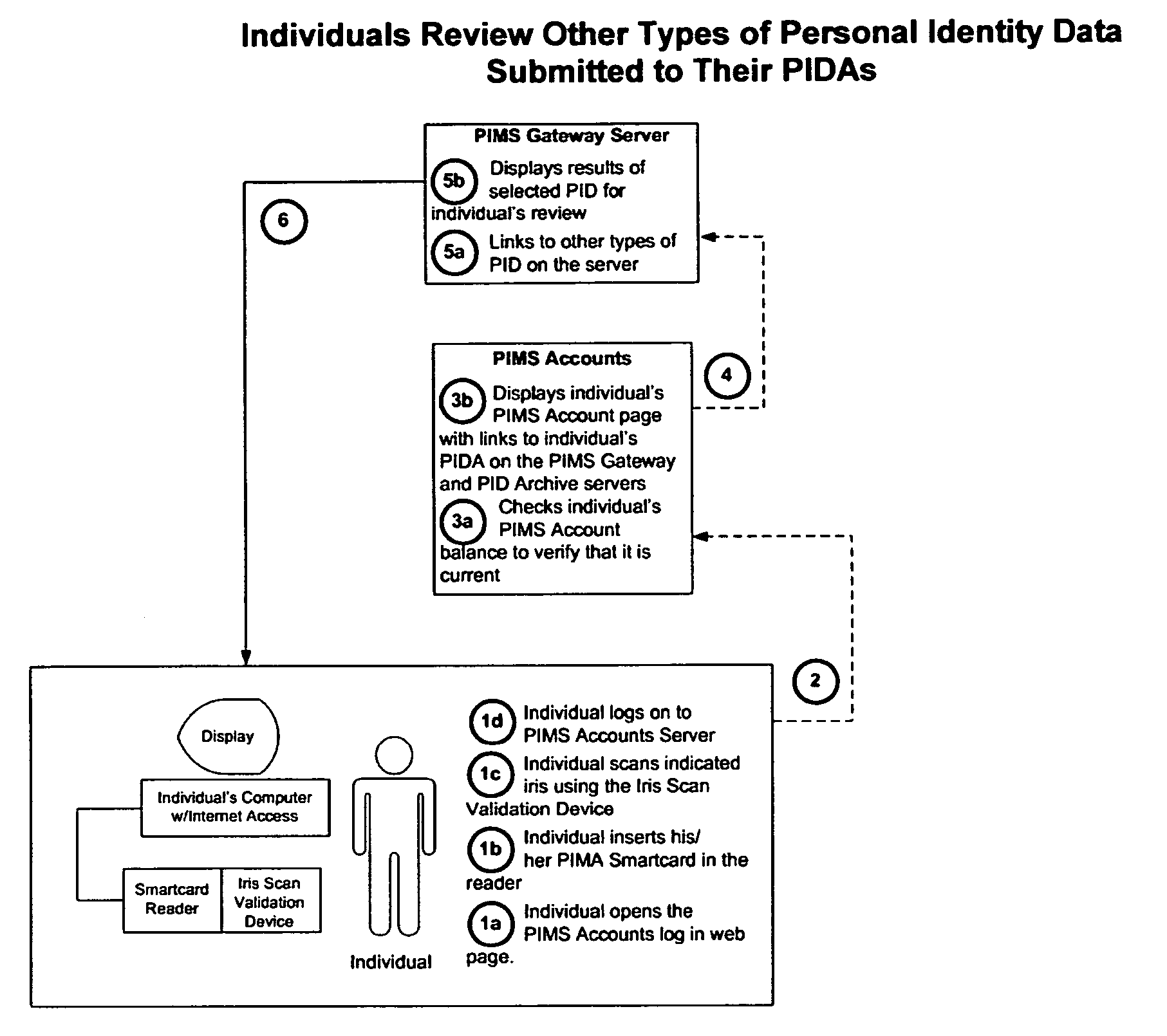

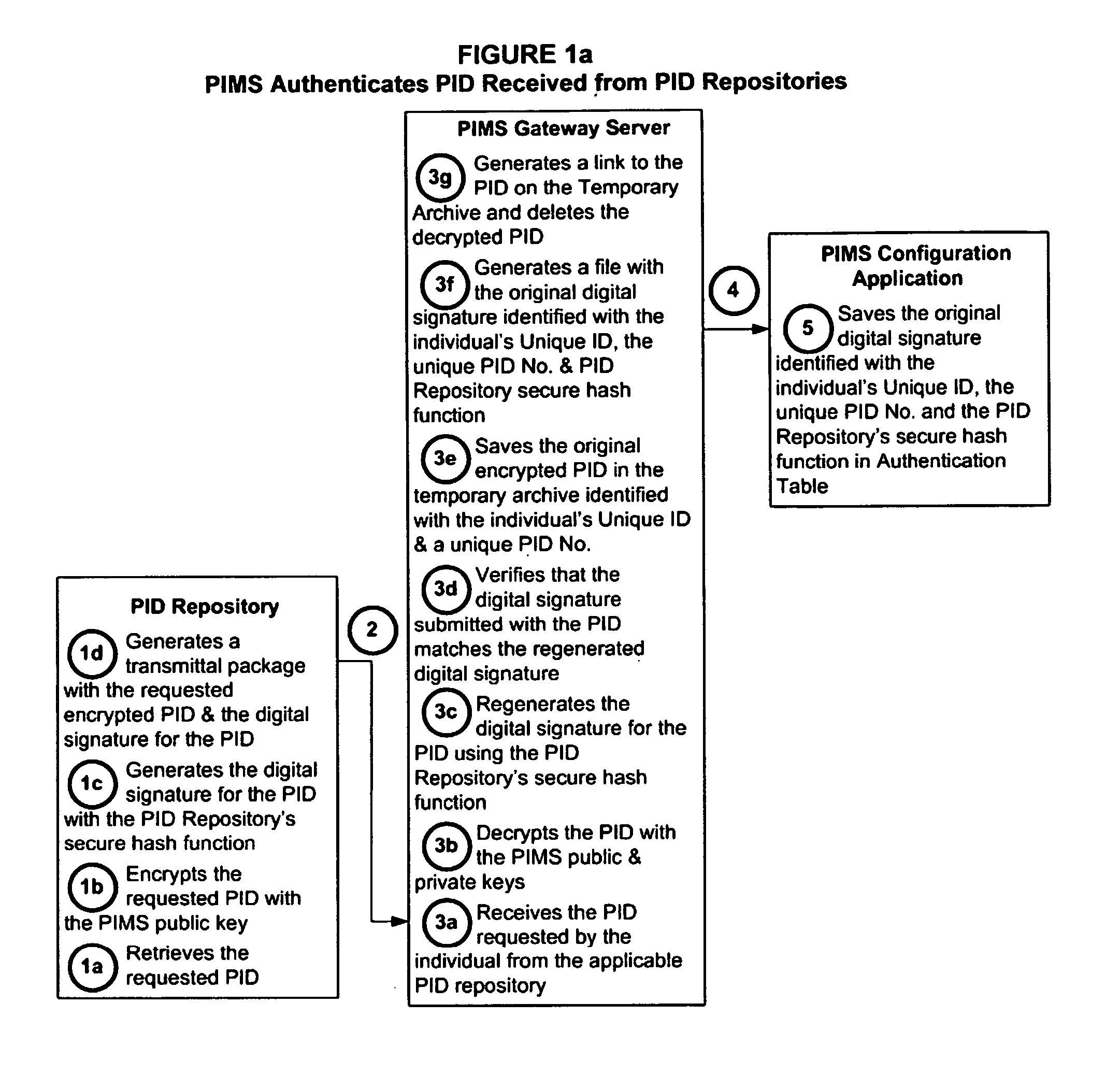

Personal identity data management

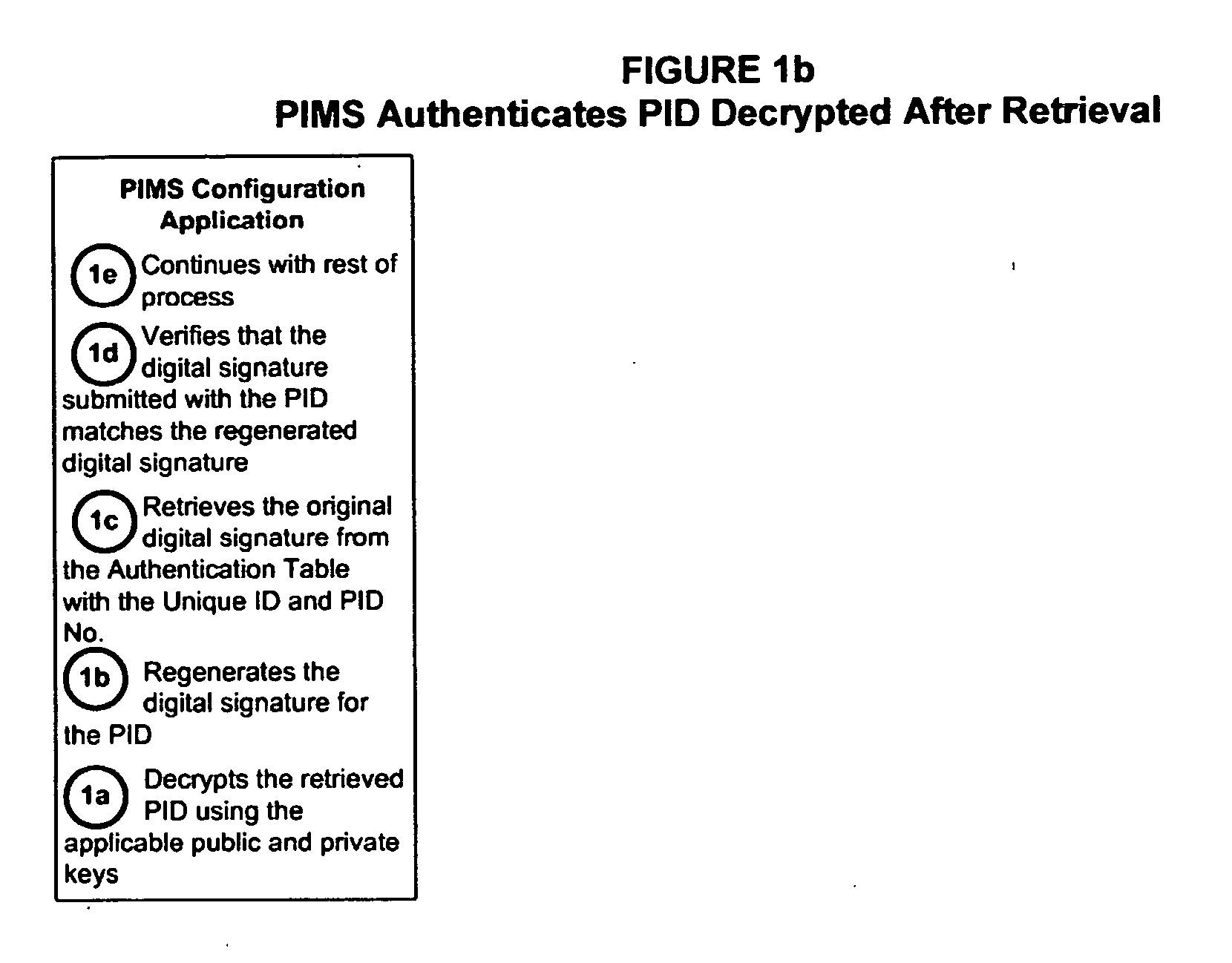

InactiveUS20060034494A1Public key for secure communicationUser identity/authority verificationSocial Security numberSmart card

Systems, methods and apparatus for personal identity data management permit individuals to manage their criminal background, credit history, employment, demographic and educational information, for example, to establish their credentials and to help protect their good names. All access to this personal identity data, including the biometrics that uniquely establish the individuals' identity, is under the personal control of the individuals, with access limited to others only with their specific authorization. The subject systems, methods and apparatus include at least two separate archives that store encrypted data about individuals that can be accessed only via the individuals' biometrics specific to the archives and unique Identification Numbers. The Identification Numbers are encrypted when they are associated with the individuals' demographic data, which includes their names, Social Security Numbers and the Unique Identifiers assigned by the system to each of the individuals. Public / private key encryption is used to encrypt the Personal Identity Data maintained in the archives and the Identification Numbers maintained in a Personal Identity Management Service configuration application server that links the rest of the system to the archives. To permit the private keys to be securely retained for use in regenerating a. Smartcard in case of loss or damage, separate segments of the private key are stored on different servers each of which requires submittal of a different biometric, which must match the biometric associated with the private key segment.

Owner:NAT BACKGROUND DATA

Systems and methods for managing accounts

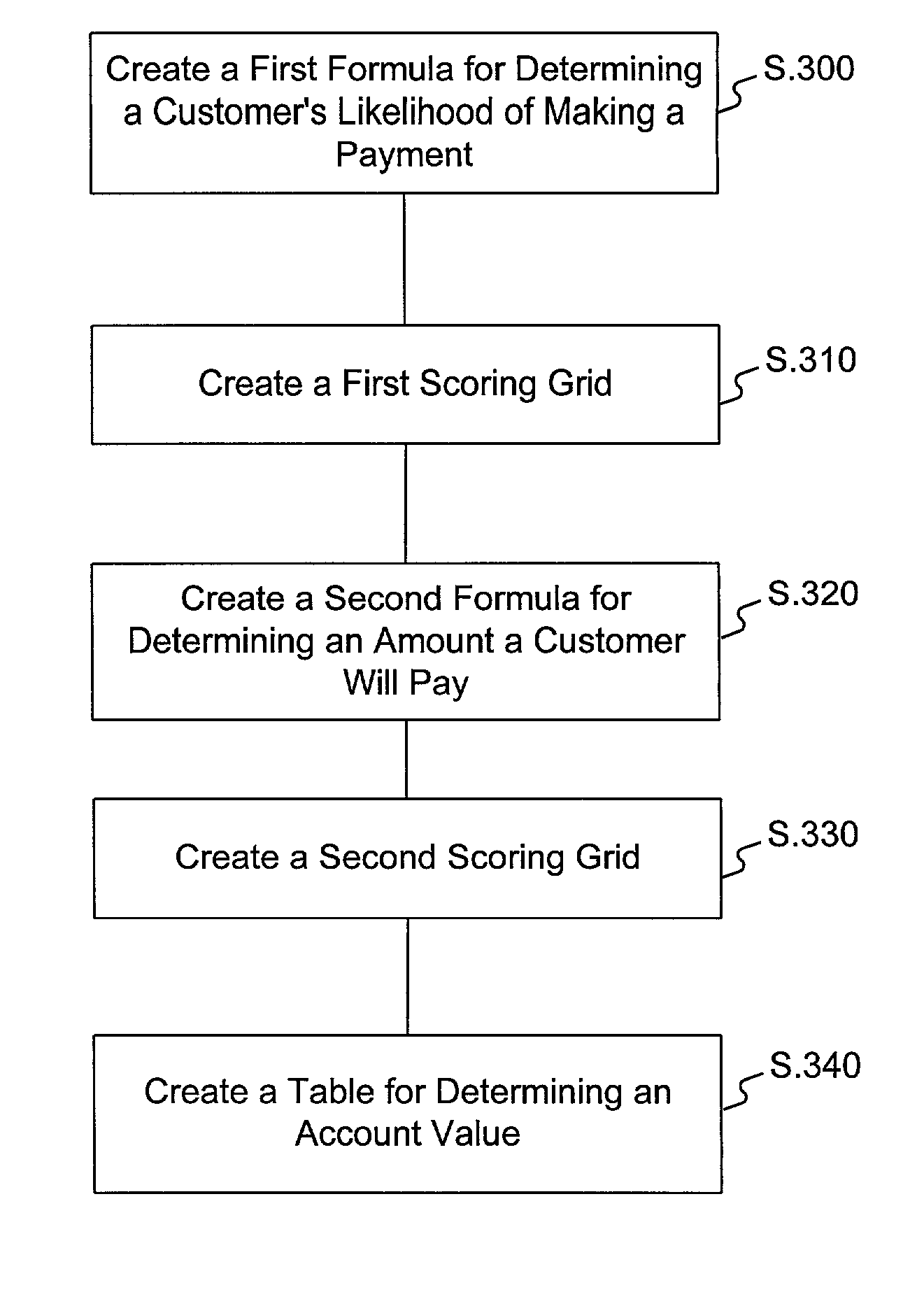

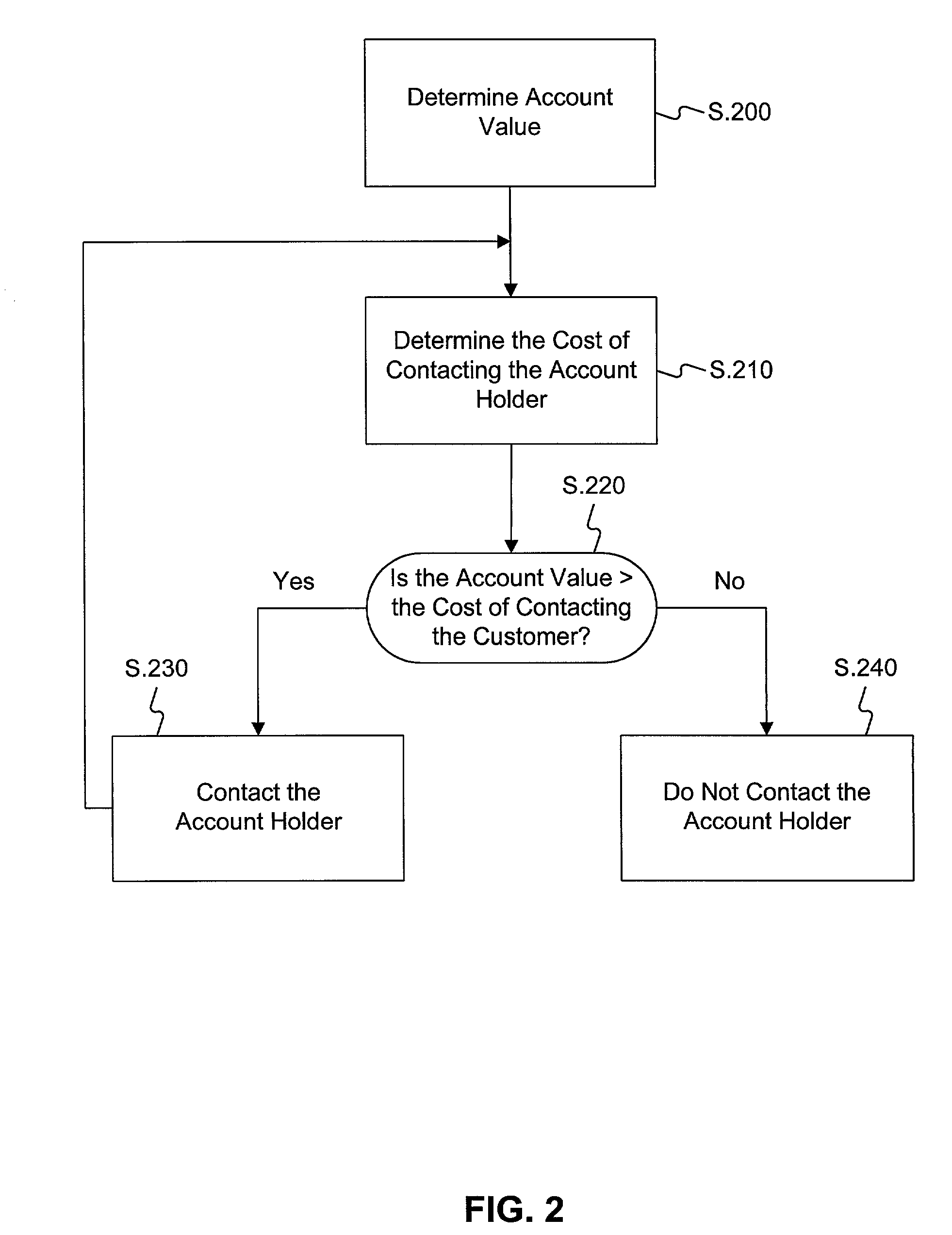

A system and method is provided for determining whether to contact a party associated with an account. The disclosed system places a value on an account, estimates a cost in contacting the account holder or customer, and attempts contact if the account value exceeds the estimated cost. The account value is an amount the customer likely would pay if he were contacted or agreed to make a purchase. It is based on the customer's financial situation and credit history. The cost in contacting a customer is determined from a probability of contacting the customer. The probability is based largely on the customer's demographic information, including the mobility of the population in his demographic area and the number of people having telephone service in that area. The system determines that a customer will be hard to contact if he lives in a highly mobile area or in an area wherein most of the population lacks telephone service. The system further determines the number of times it may attempt to contact the customer before the cost of contacting the customer exceeds the value of the account.

Owner:CAPITAL ONE FINANCIAL

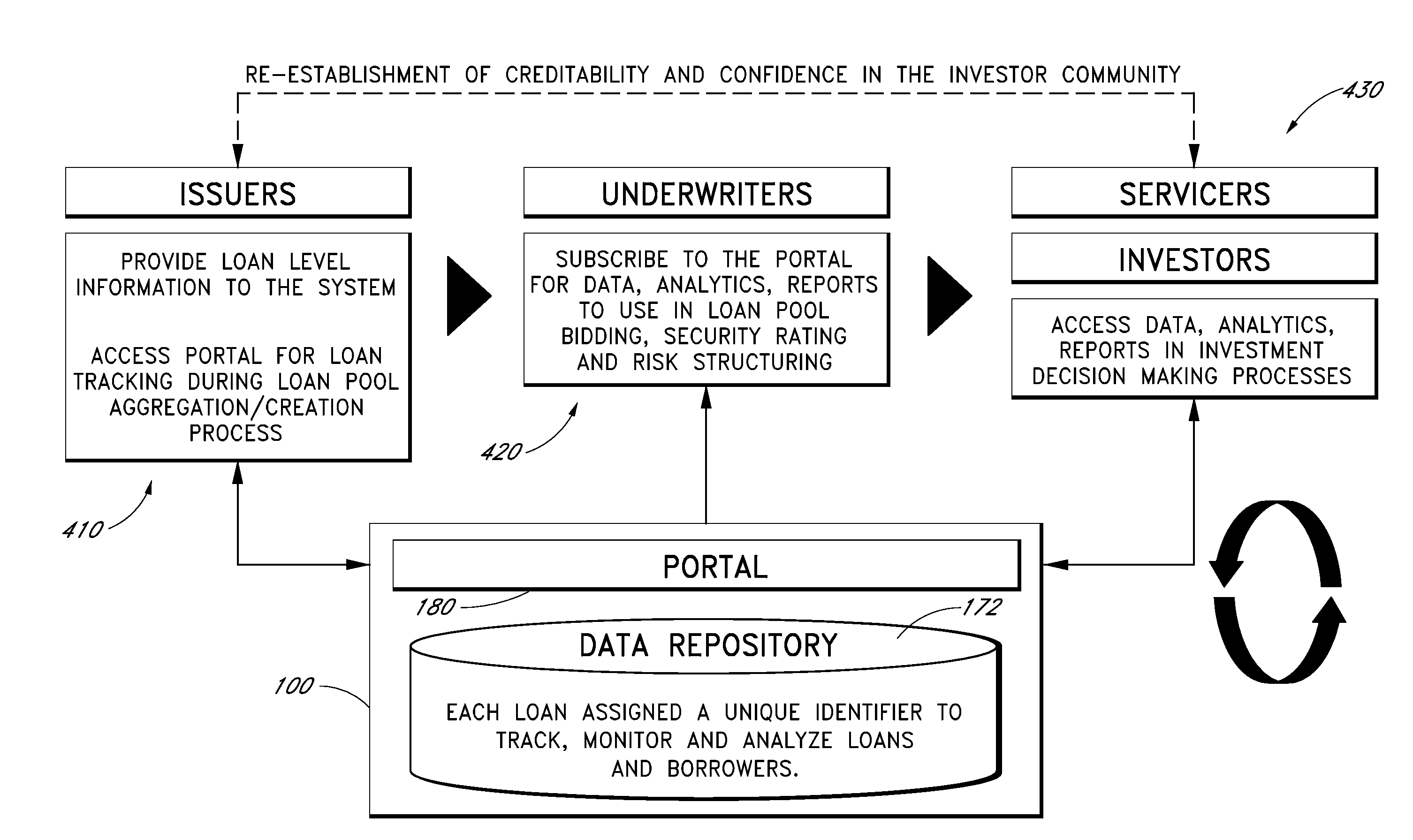

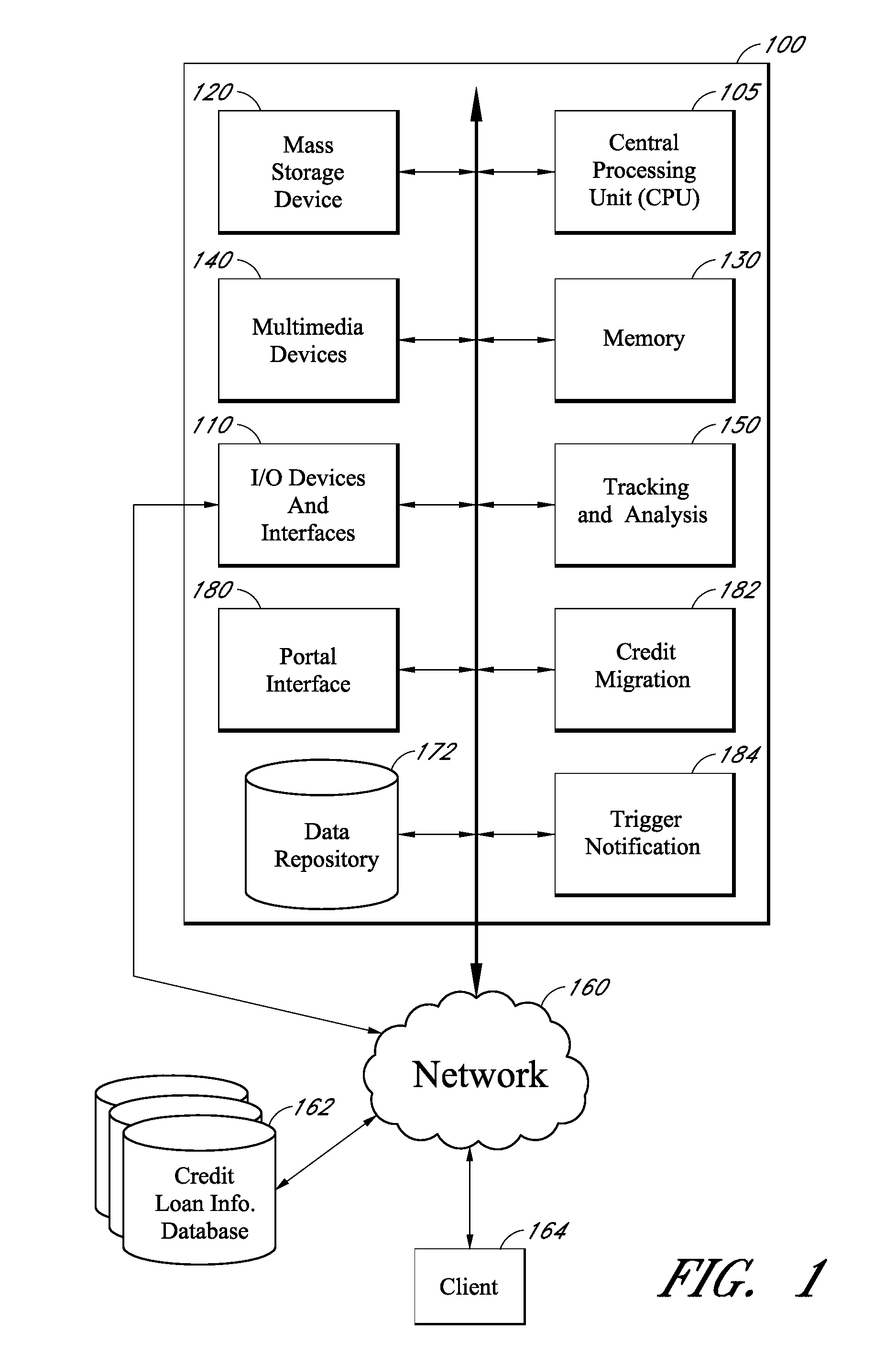

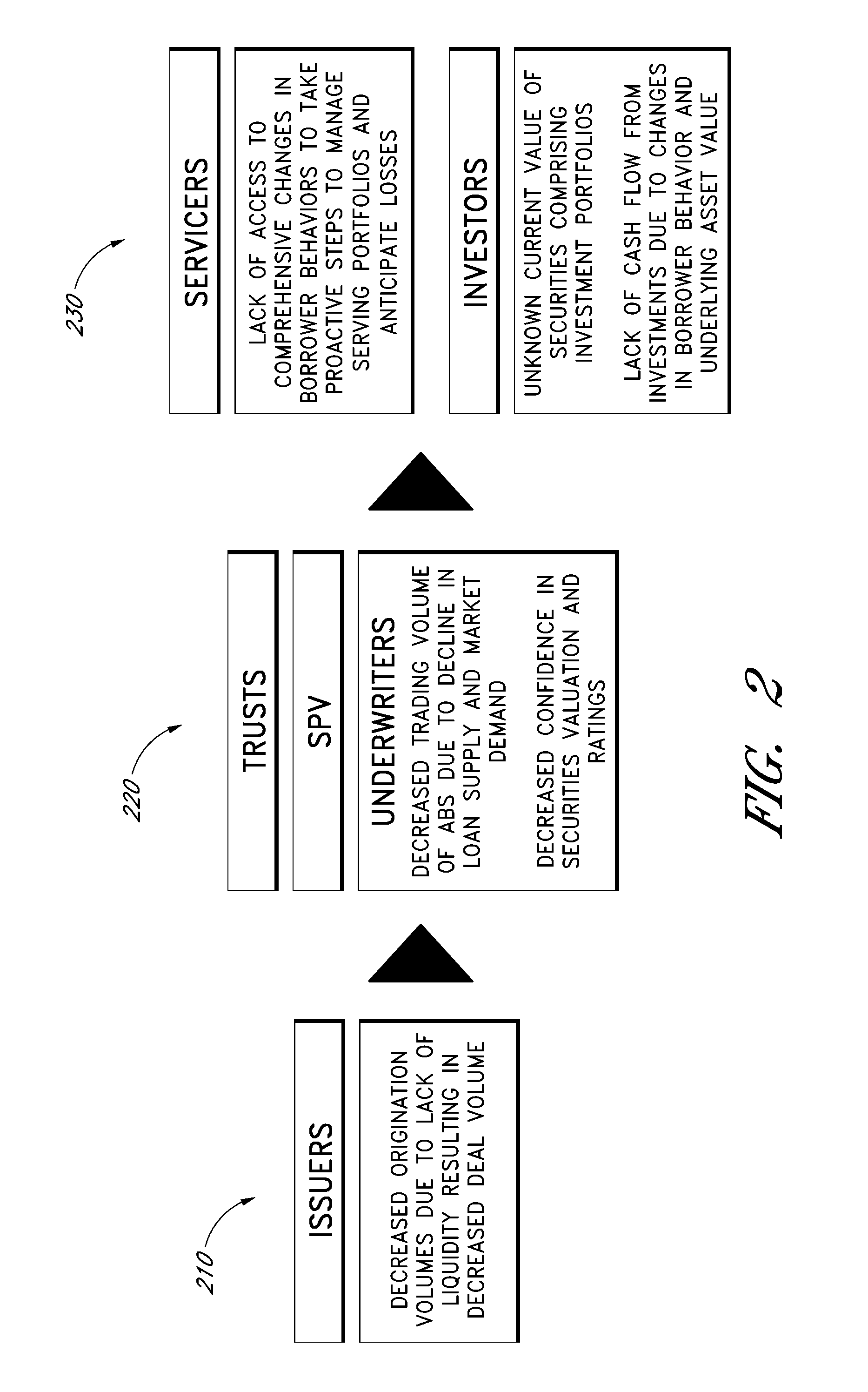

System and method for tracking and analyzing loans involved in asset-backed securities

Embodiments of the disclosure are directed to providing unique loan identifiers to track loans involved in Asset-Backed Securities (ABS) throughout the life-cycle of the individual loans, in one embodiment, a unique loan identifier, for example, a loan number, may be appended to loan data at initiation of each loan, for example, at the application stage, to and / or beyond the retirement of the loan. The unique loan identifiers may allow disparate financial data sources such as the credit histories of the borrowers to be associated with the individual loans, even as the loans are repackaged and resold as ABS in the secondary markets. Thus, market participants such as loan servicers and investors can access current and historical data associated with the loans. Other embodiments are directed to analyzing the data associated with the underlying loans and providing the analysis to the market participants including servicers, investors, and underwriters.

Owner:EXPERIAN INFORMATION SOLUTIONS

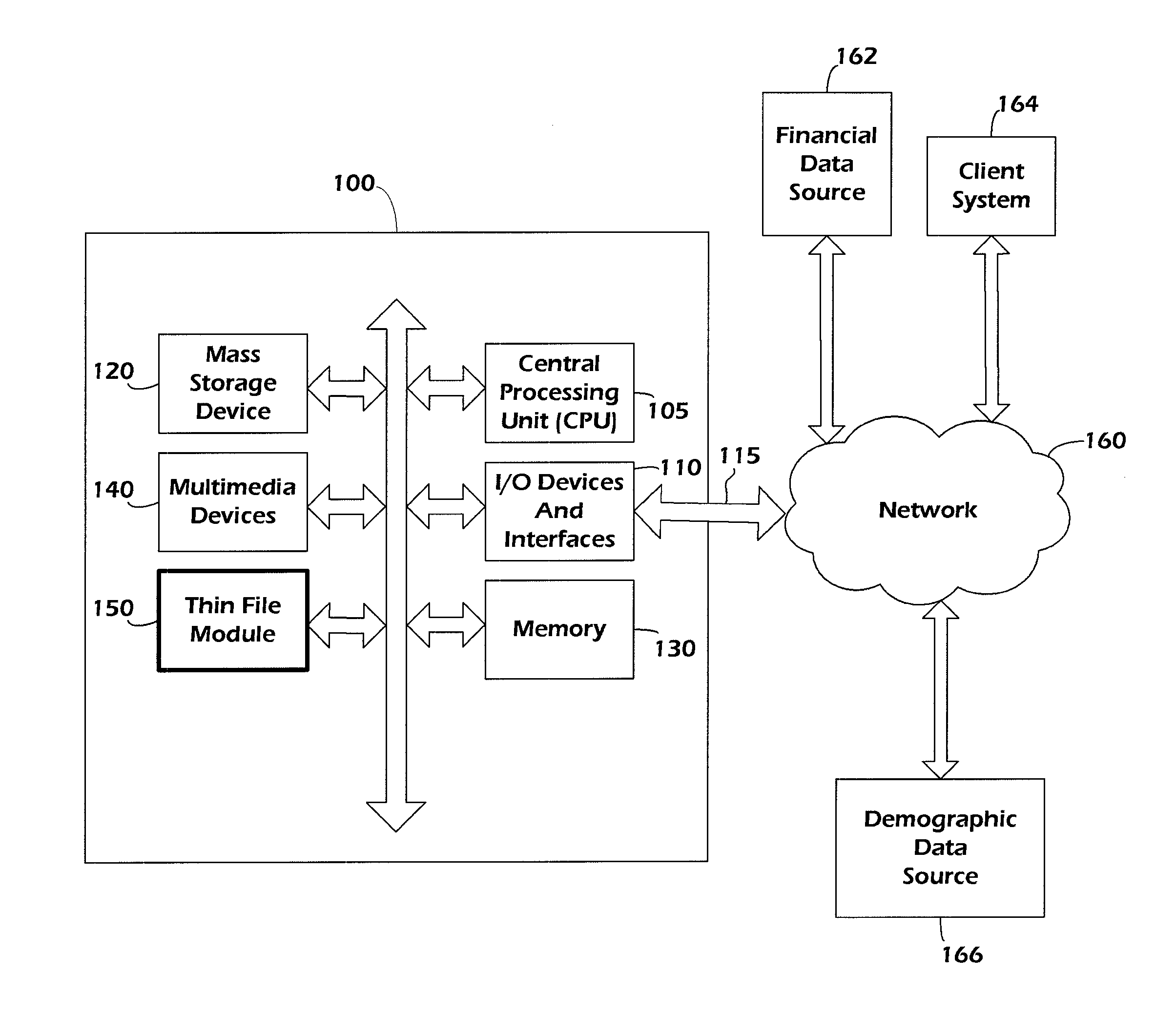

Systems and methods for determining thin-file records and determining thin-file risk levels

In some embodiments, systems and methods are disclosed for generating filters to determine whether a consumer is likely to have a scoreable credit record based on non-credit data, and to determine a potential risk level associated with an unscoreable credit record based on non-credit data. Existing scoreable and unscoreable records are compared to determine factors correlated with having an unscoreable record, and a multi-level filter is developed. Unscoreable records having at least one entry are compared to determine whether they are “good” or “bad” risks, factors correlated with either condition are determined, and a filter is developed. The filters can be applied to records comprising demographic data to determine consumers that are likely to have unscoreable records but represent good risks.

Owner:EXPERIAN MARKETING SOLUTIONS

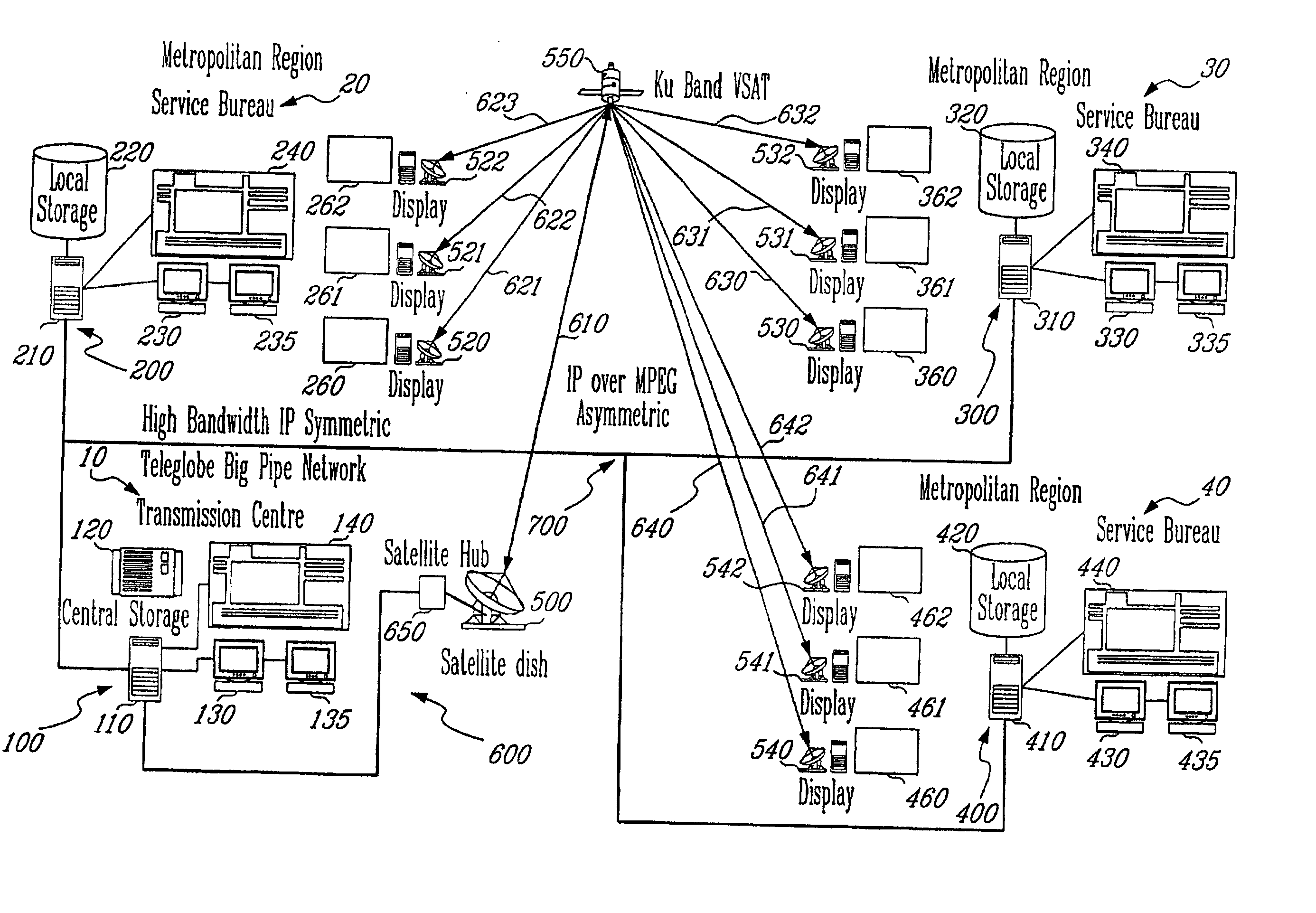

Method and apparatus for the display of selected images at selected times using an autonomous distribution system

Internet Service Providers (ISPs) or proxies owned by ISPs collect and store information regarding particular users (100) in user profiles. Profiles may include demographic information, such as age, residence, and credit history, and may include web sites the user has accessed, time spent on each web site, and Internet searches the user performed. Profile information (304) may be utilized by the proxy (102) to target advertising, provided to a web server (104) so the web server (104) may target advertising, or used to customize a user's display. Profile information (304) may also be utilized to associate a cost with certain demographic information. The ISP may evaluate profile information (304) for inserting advertisements or customizing displays. Profile information (304) may also be sold to a third party. Thus, the profile and demographic information (304) can be utilized to individually customize information displayed to a client (100).

Owner:PIXNET

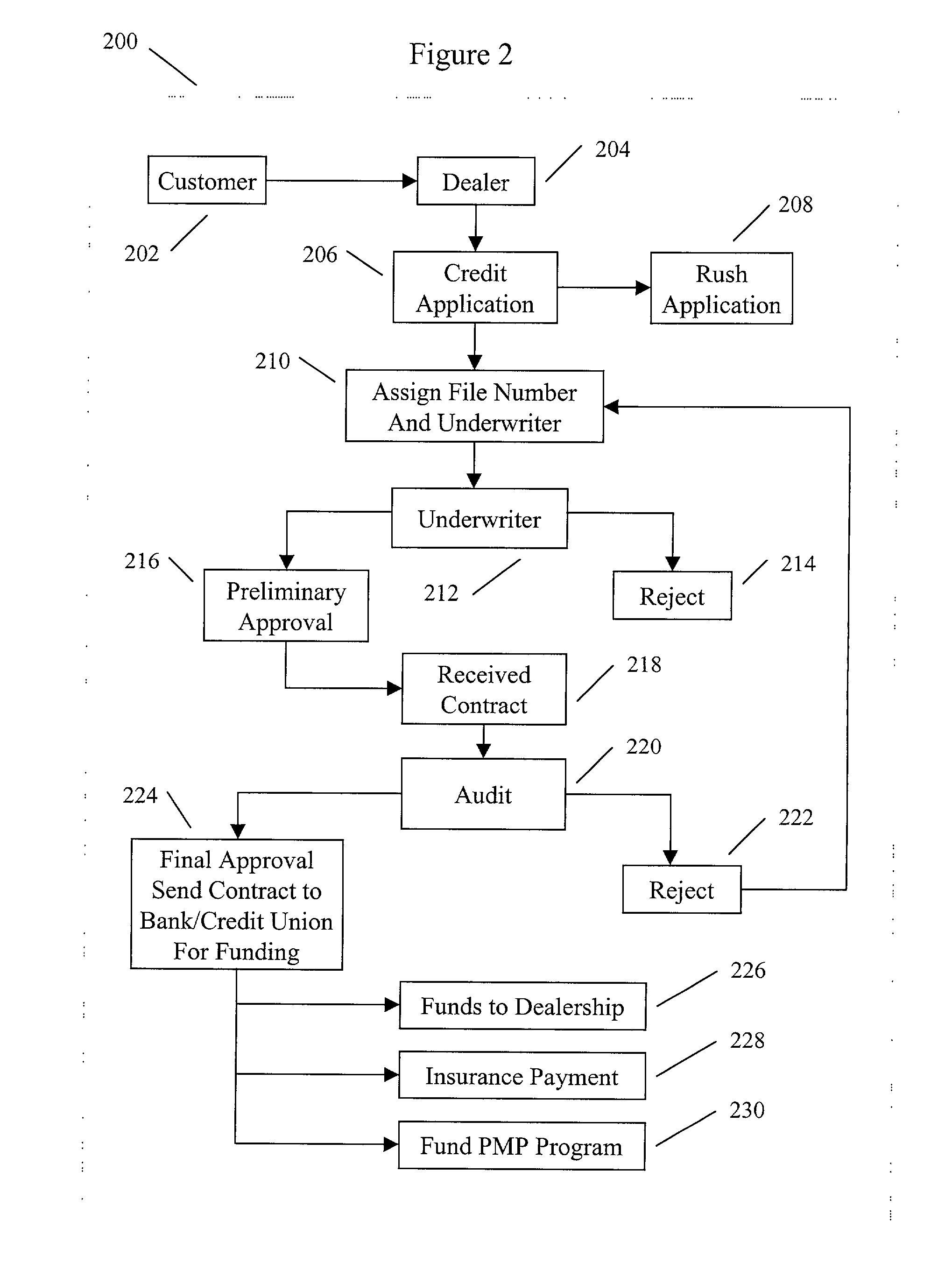

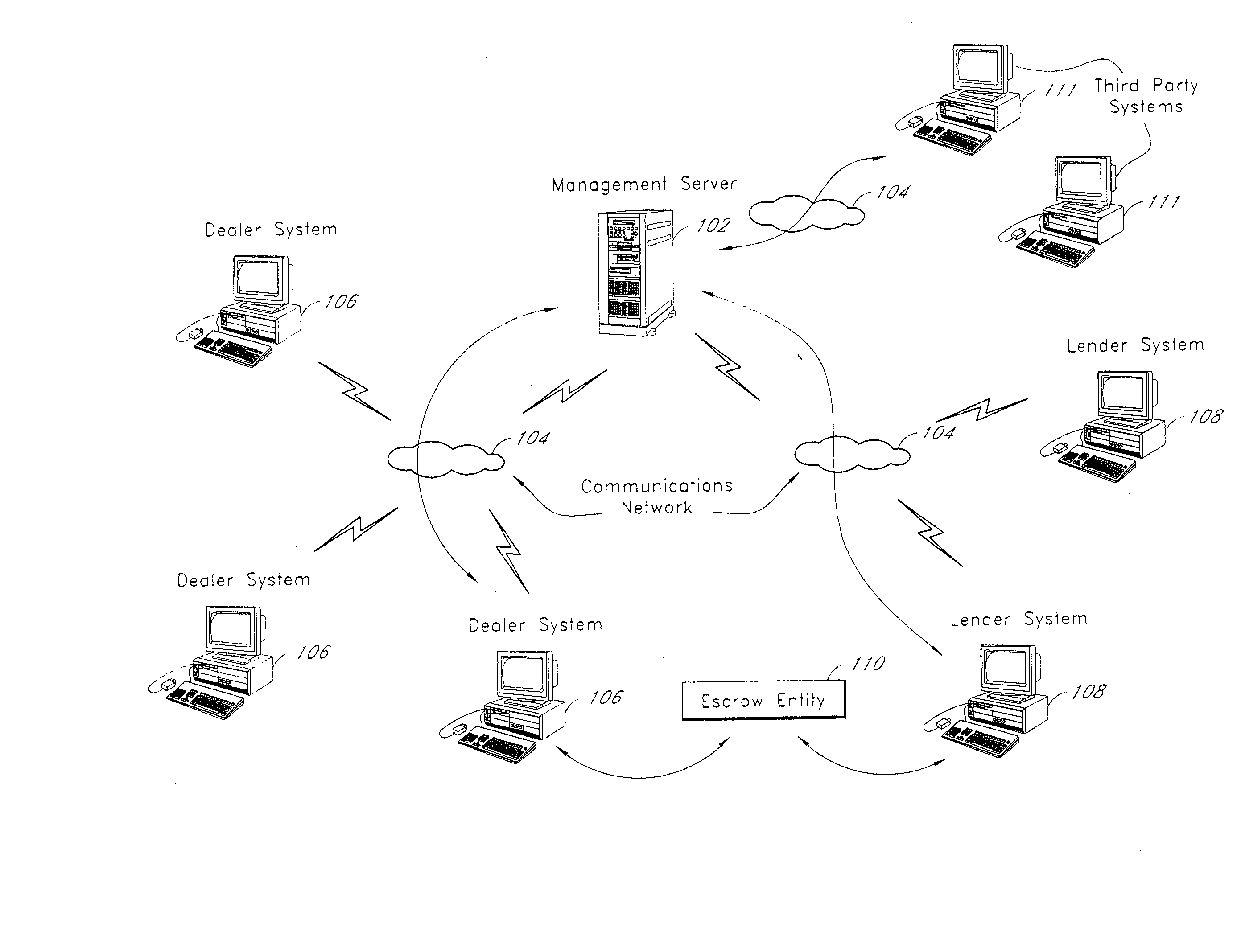

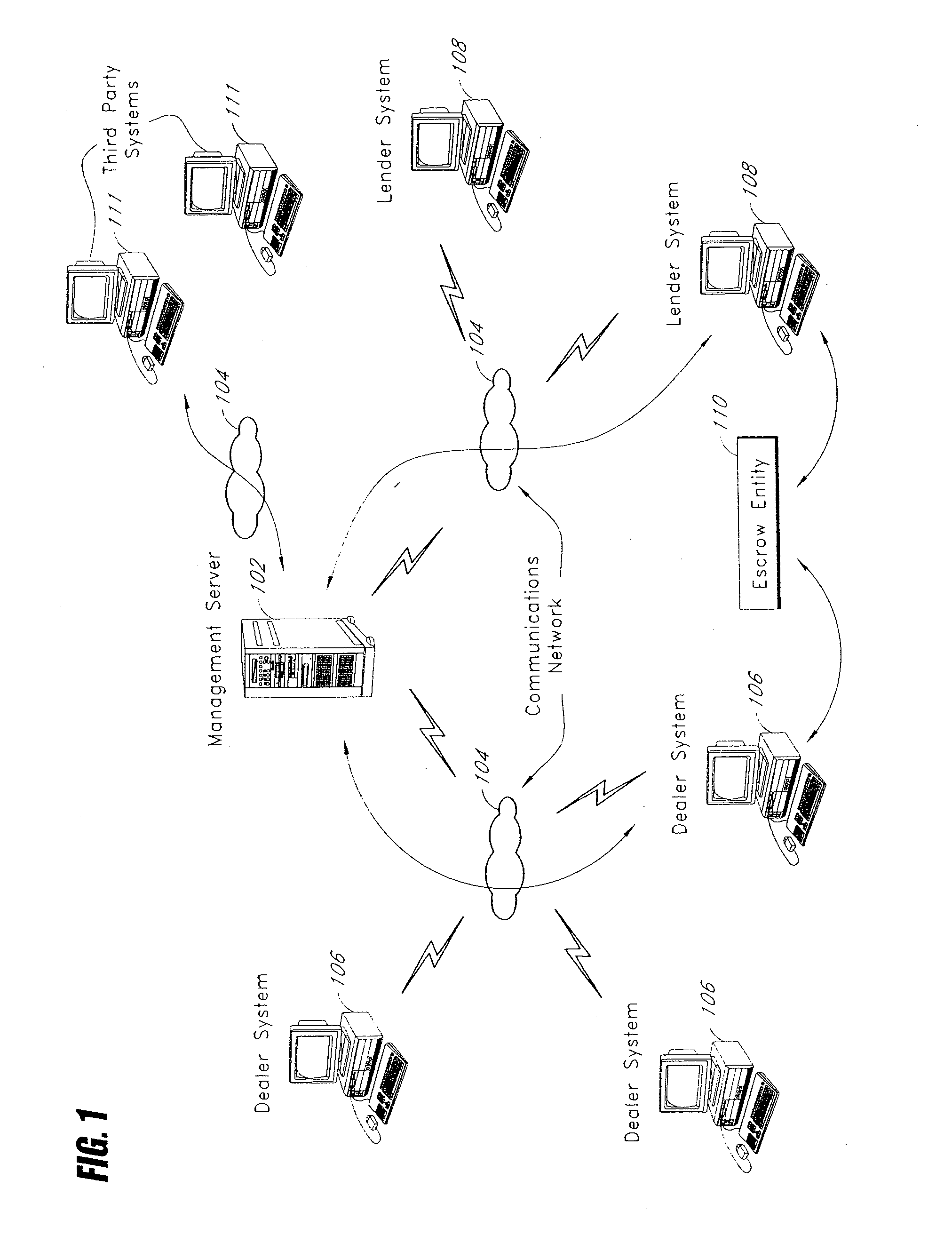

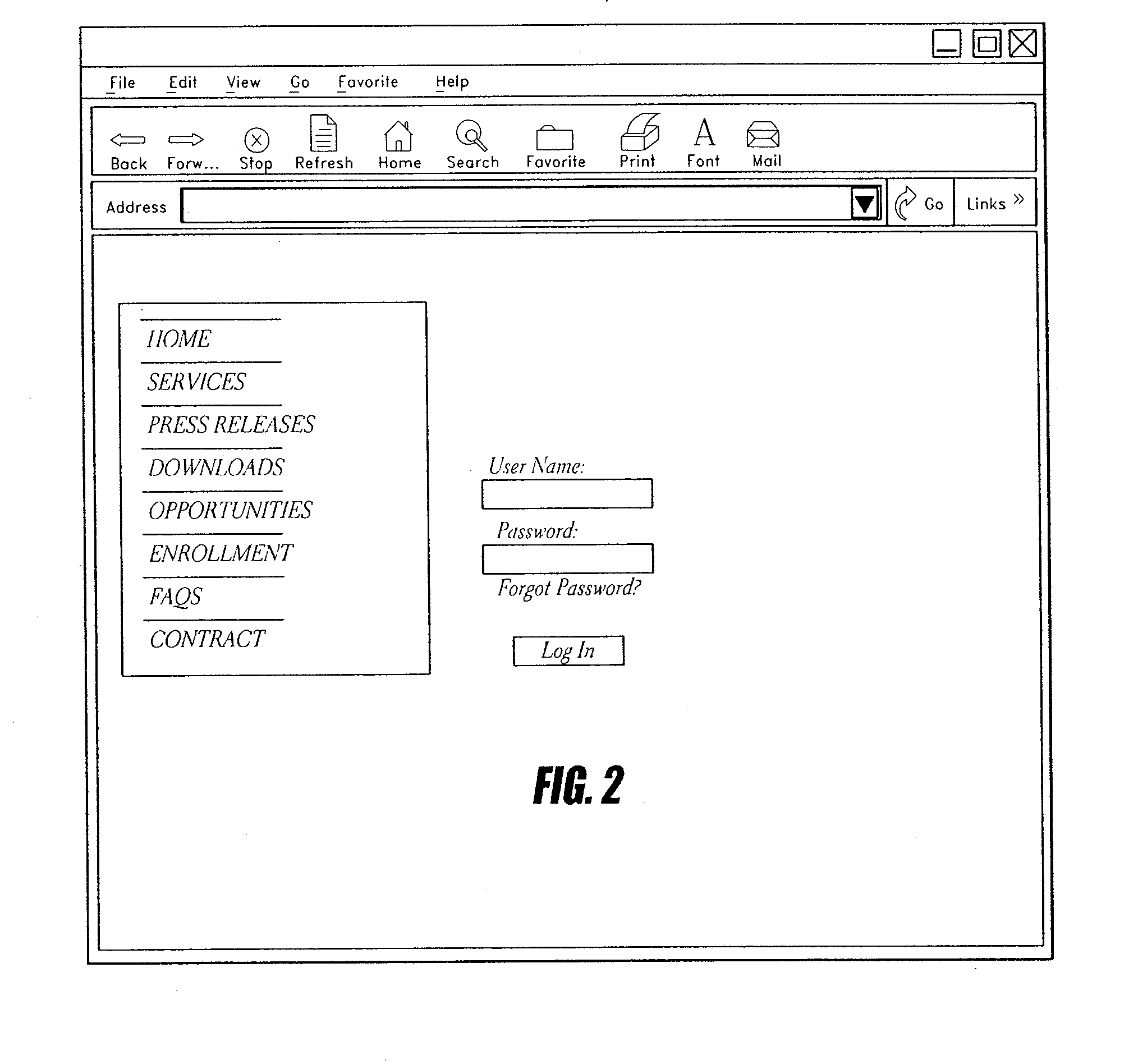

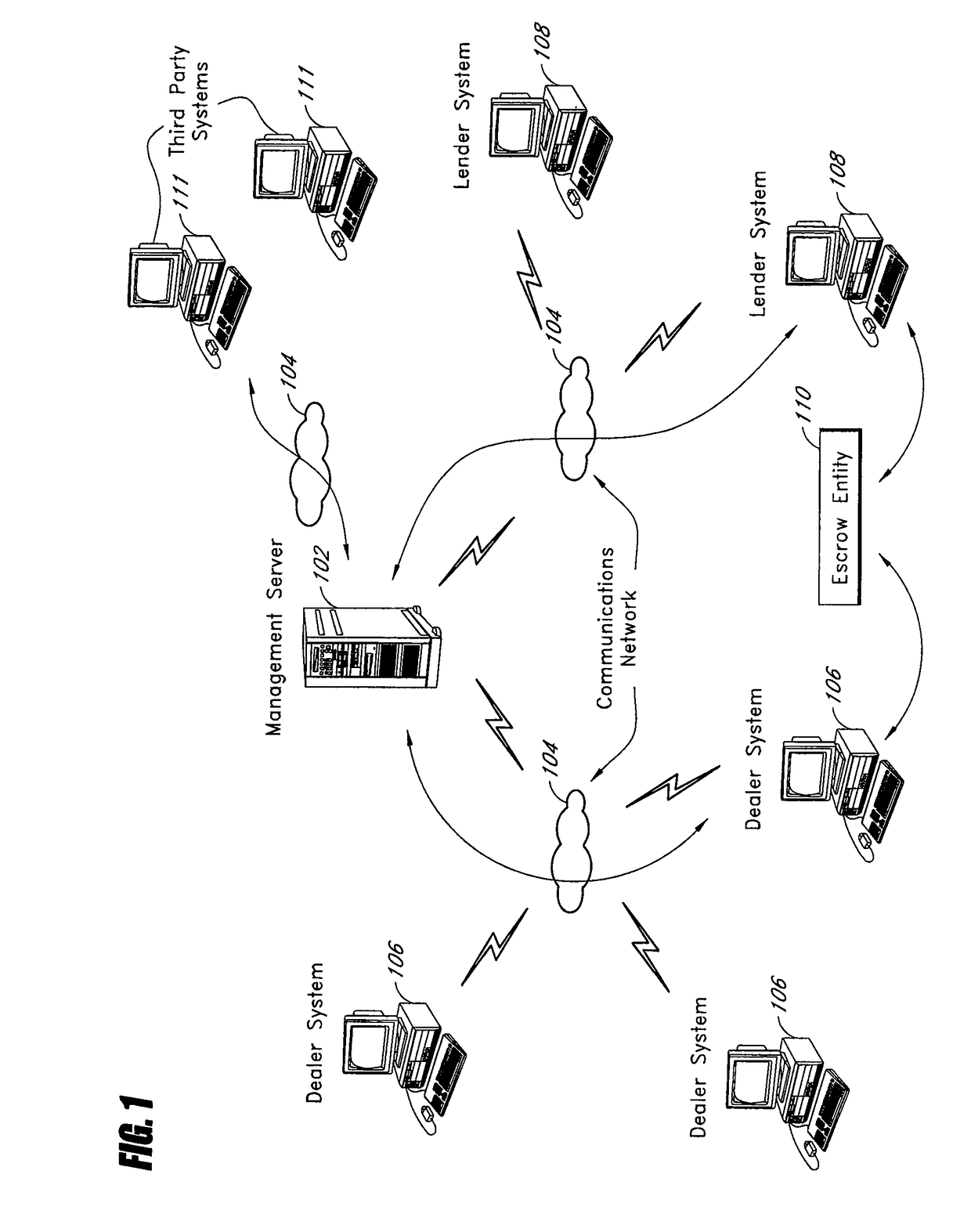

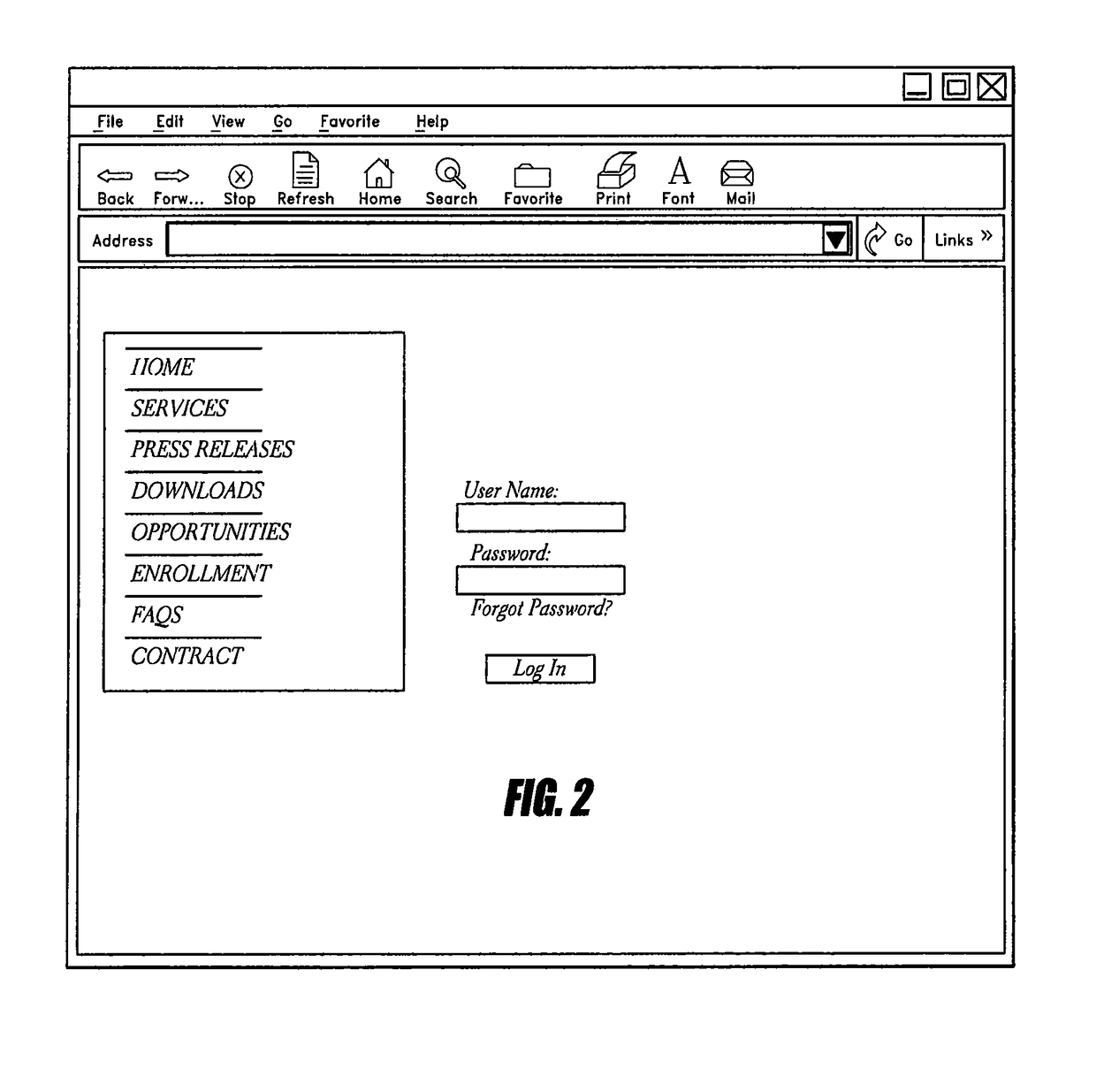

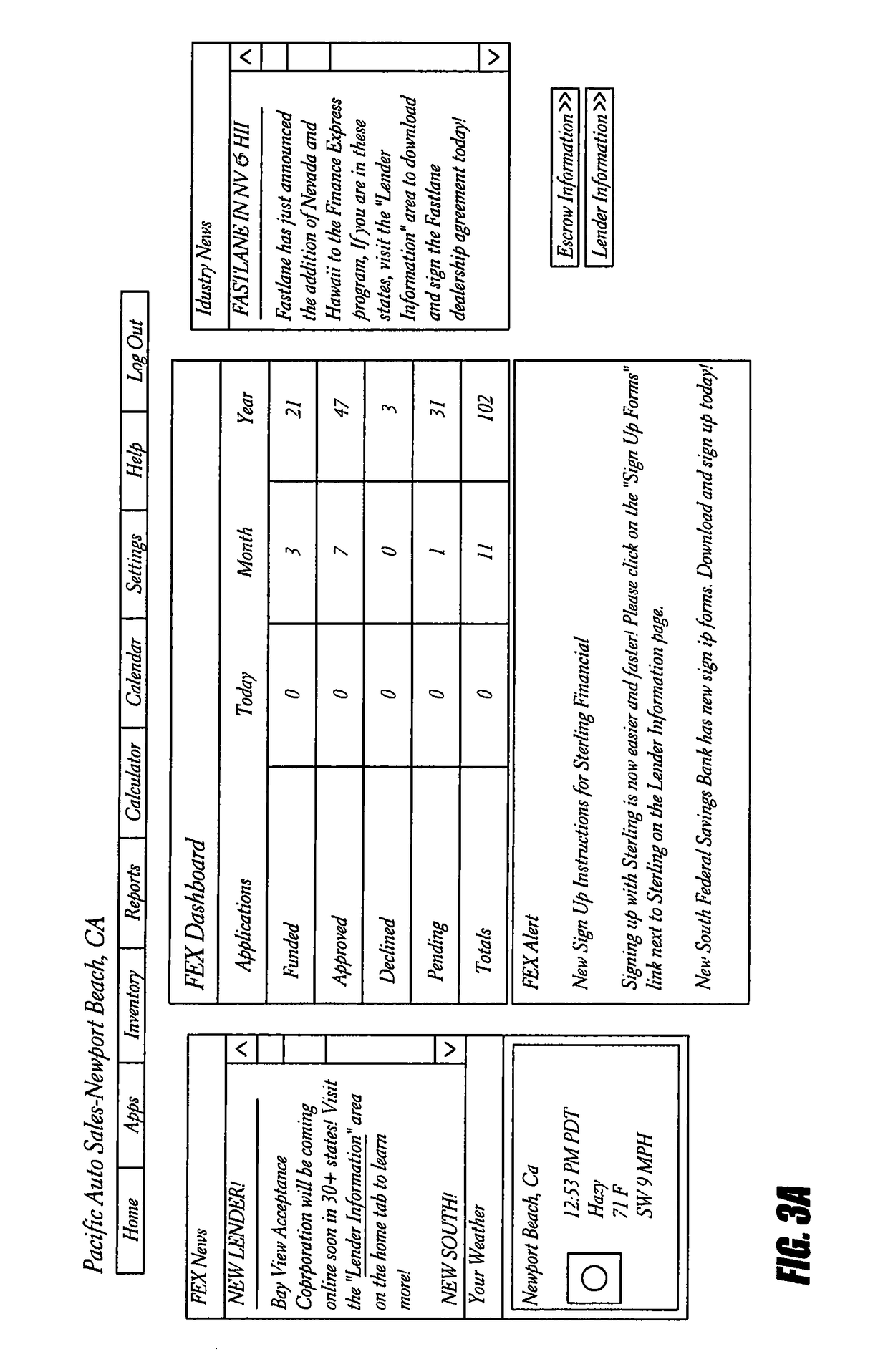

Systems and method for managing dealer information

ActiveUS20080015954A1Reduce riskSafer and easy to dealFinancePayment architectureComputer scienceCredit history

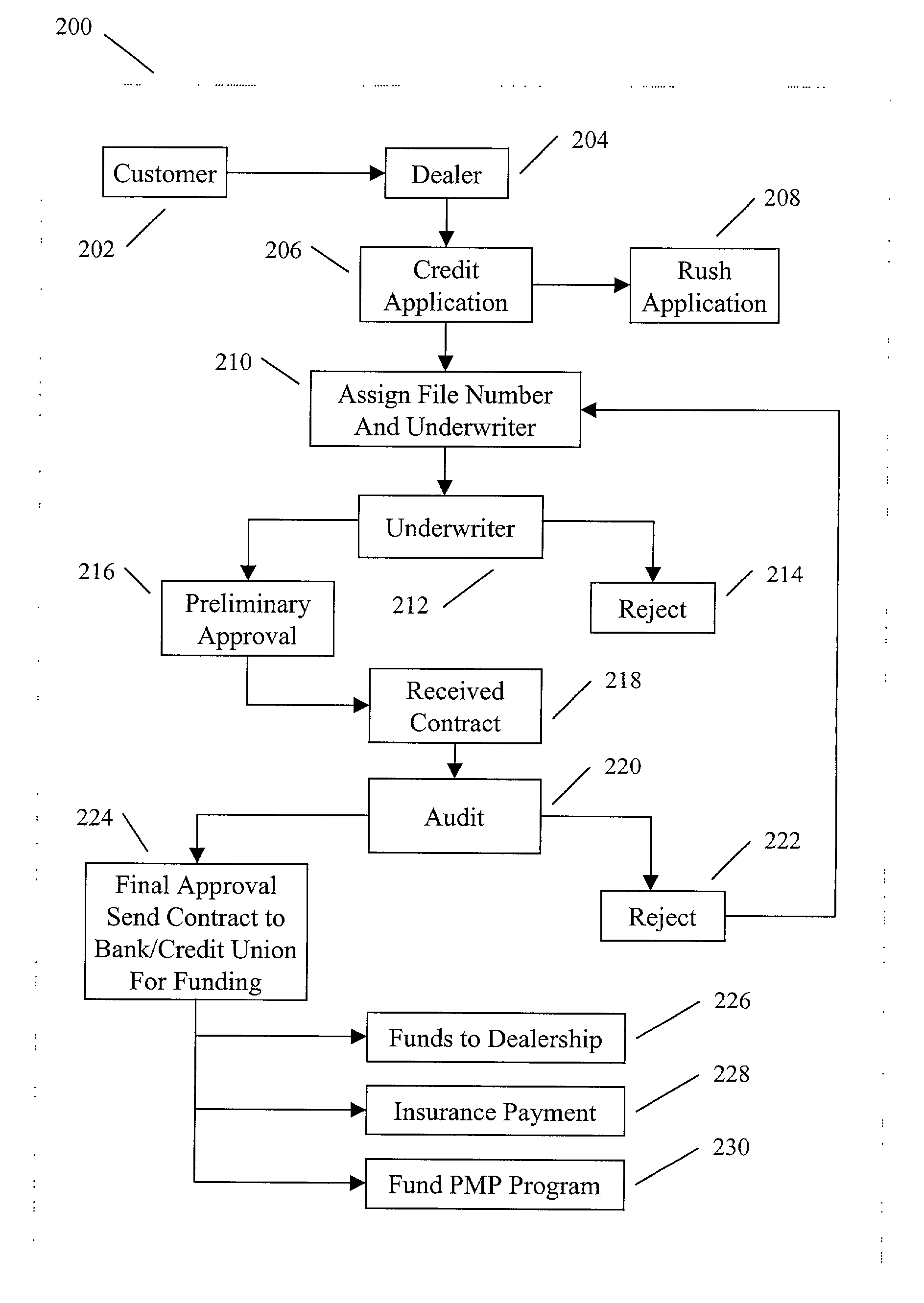

Embodiments of systems and methods are disclosed that manage transactions and communication between car dealers and lenders. In one embodiment, the system lessens risks for lenders and makes relationships with dealers safer and easier to administer. In one embodiment, a dealer may utilize the system to manage its inventory, obtain and manage credit history information about potential customers, help customers apply for credit, transact credit applications and credit approvals with various lenders, submit applications to multiple lenders, select from among the accepting lenders, and manage forms used to complete a transaction.

Owner:FINANCE EXPRESS

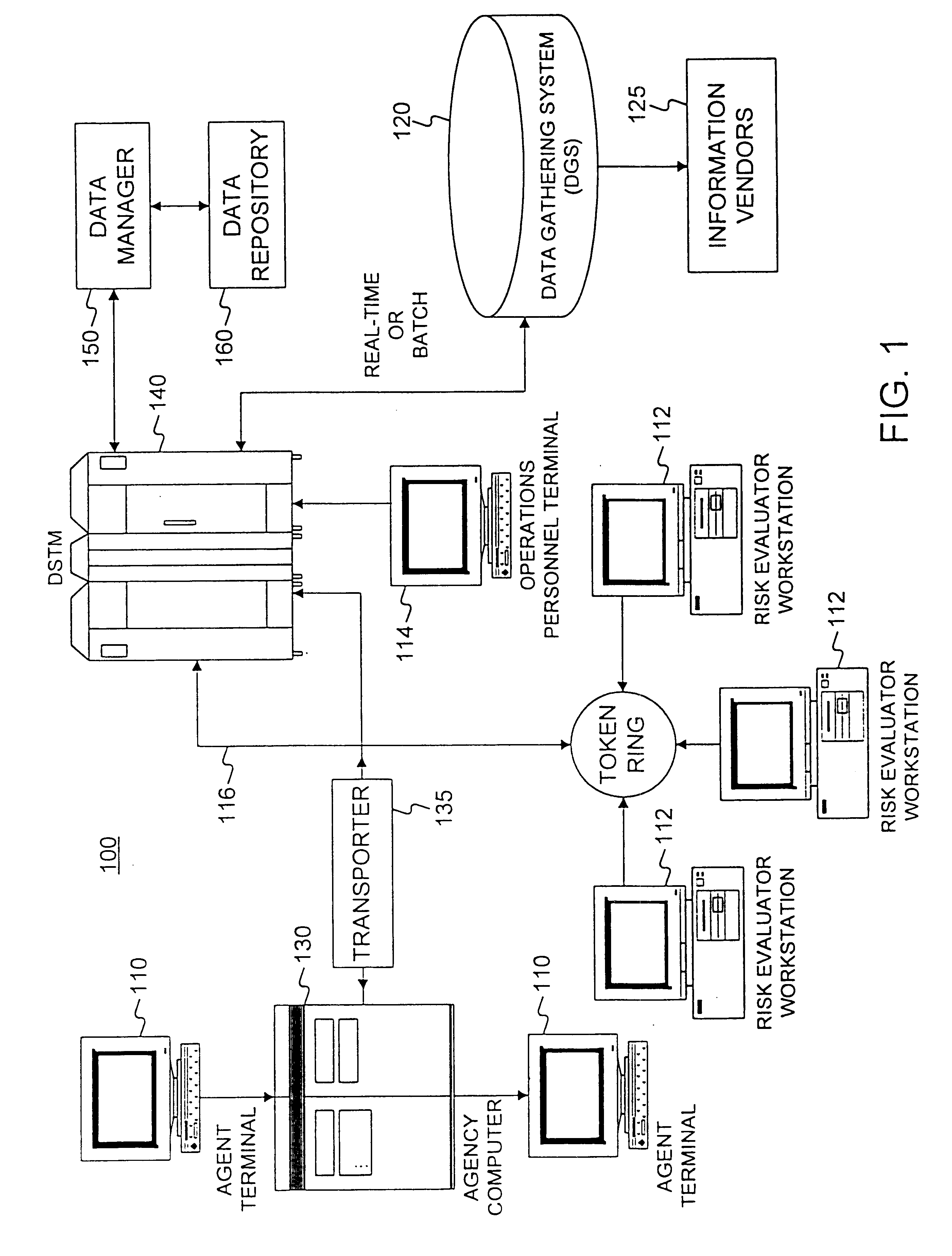

Method and apparatus for obtaining data from vendors in real time

InactiveUS6584467B1FinanceMultiple digital computer combinationsComputer networkApplication software

A system and method of controlling a computer network to obtain information needed to render risk evaluative decisions from vendors in real time. The information may be obtained for agents preparing insurance applications or for an automated application processing system. Agents or automated application processing systems require access to an external vendor to obtain information about a customer, such as car accident or credit records. The request for data must be formatted to be read by the vendor system, which sends the responding data in real time. This responding data is forwarded to the requesting party for further processing of the application.

Owner:ALLSTATE INSURANCE

System and method for tracking and analyzing loans involved in asset-backed securities

Embodiments of the disclosure are directed to providing unique loan identifiers to track loans involved in Asset-Backed Securities (ABS) throughout the life-cycle of the individual loans. In one embodiment, a unique loan identifier, for example, a loan number, may be appended to loan data at initiation of each loan, for example, at the application stage, to and / or beyond the retirement of the loan. The unique loan identifiers may allow disparate financial data sources such as the credit histories of the borrowers to be associated with the individual loans, even as the loans are repackaged and resold as ABS in the secondary markets. Thus, market participants such as loan servicers and investors can access current and historical data associated with the loans. Other embodiments are directed to analyzing the data associated with the underlying loans and providing the analysis to the market participants including servicers, investors, and underwriters.

Owner:EXPERIAN INFORMATION SOLUTIONS

Systems, methods, and apparatus for instant issuance of a credit card

Systems, methods, and apparatus are provided for instant decisioning and remote dispensing of credit cards. In accordance with one implementation the system for instantly issuing a credit card includes means for receiving a credit card application from an applicant, means for instantly decisioning the credit card application, if declined, means for instantly notifying the applicant of that decision, and if approved, means for instantly issuing the credit card. The instant issuance credit card system can also receive a security deposit from the applicant where a determination is made that the applicant may need to remit a security deposit in order to secure the credit card. A decision to require security deposit may be based on the credit history of the applicant. A method for instantly issuing a credit card is also provided. Additionally, an apparatus for remotely dispensing a credit card is provided. The remote dispensing apparatus includes: an input device; a security deposit acceptor; a remote dispensing module, wherein the remote dispensing module communicates with a central real-time decisioning platform; a credit card dispenser; and a display.

Owner:CAPITAL ONE SERVICES

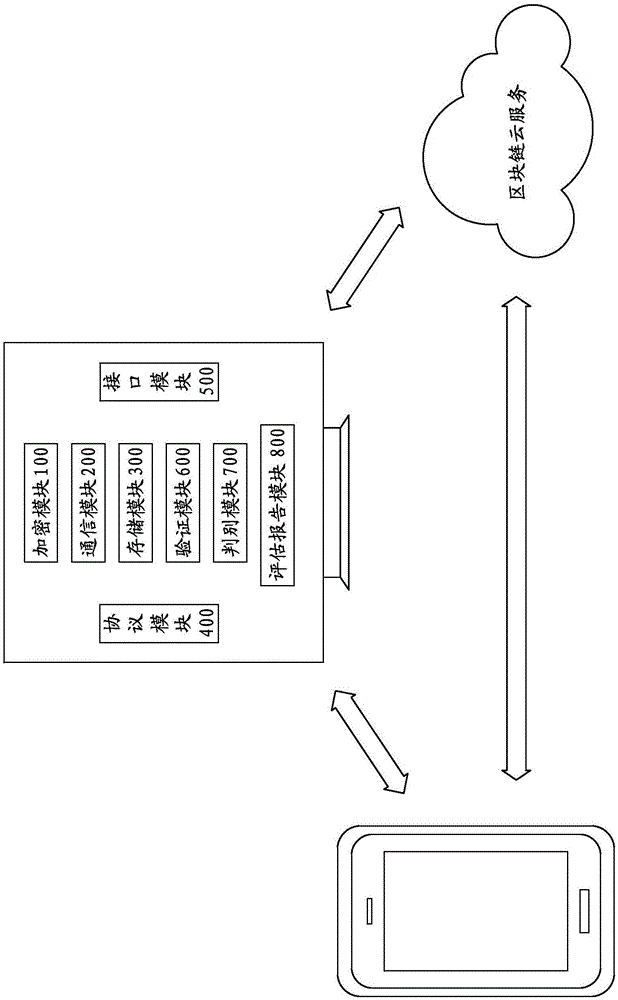

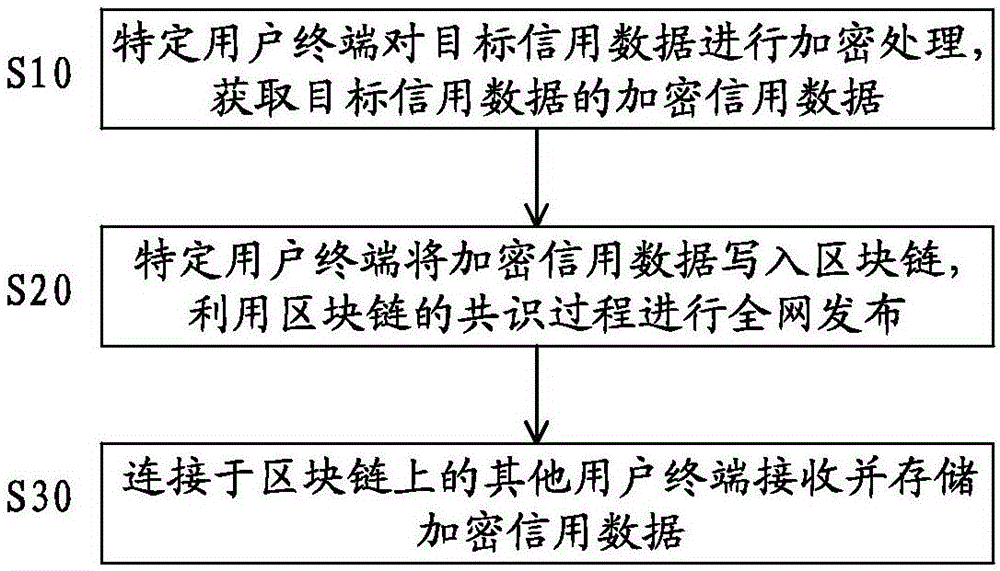

Credit recording system and method based on block chain

ActiveCN106485167AWide variety of sourcesReduce complexityDigital data protectionExtensibilityComputer terminal

The invention discloses a credit recording system and method based on a block chain. The credit recording system comprises a plurality of user terminals which are connected to the block chain and used for acquiring and verifying credit data, wherein each user terminal is installed with an encryption module for encrypting target credit data to be transmitted to form encrypted credit data, a communication module for transmitting the encrypted credit data together with the block chain, and a storage module for storing the target credit data of the user terminal and other encrypted credit data transmitted by the block chain. The credit data are wide in sources, independent, reliable and real; the cleaning and sieving complexity of the credit data are lowered greatly; and the credit recording system and method have flexible and diverse application scenes and high extensibility.

Owner:CENTRIN DATA SYST

Methods of establishing credit

A method for building credit may include providing an authorized user of a pre-paid card issued by a service provider. The service provider may charge the authorized user a fee for the pre-paid card and establish a loan loaning the authorized user an amount equal to the fee under loan terms specifying a repayment schedule. The repayment schedule may include periodic installments and a minimum amount due for each of the periodic installments, where the loan may be independent from the load applied to the pre-paid card. The authorized user repays the loan in accordance with the loan terms so as to create a credit history. The service provider may report the credit history to a credit bureau to improve a credit score of the authorized user.

Owner:EUFORA

Gambling credit card and method therefor

A system and method for a casino to grant a line of credit to a person gambling without the casino risking losing any out of pocket cash prior to the gambler paying off the line of credit. The system and has the person apply for a line of credit from a casino. The casino then reviews the credit history of the person gambling. A casino smart card is then programmed with a predetermined cash value based on the person's credit history. The casino smart card is then credited or debited based on the person's wins and loses at the casino.

Owner:ELLIS GARY E

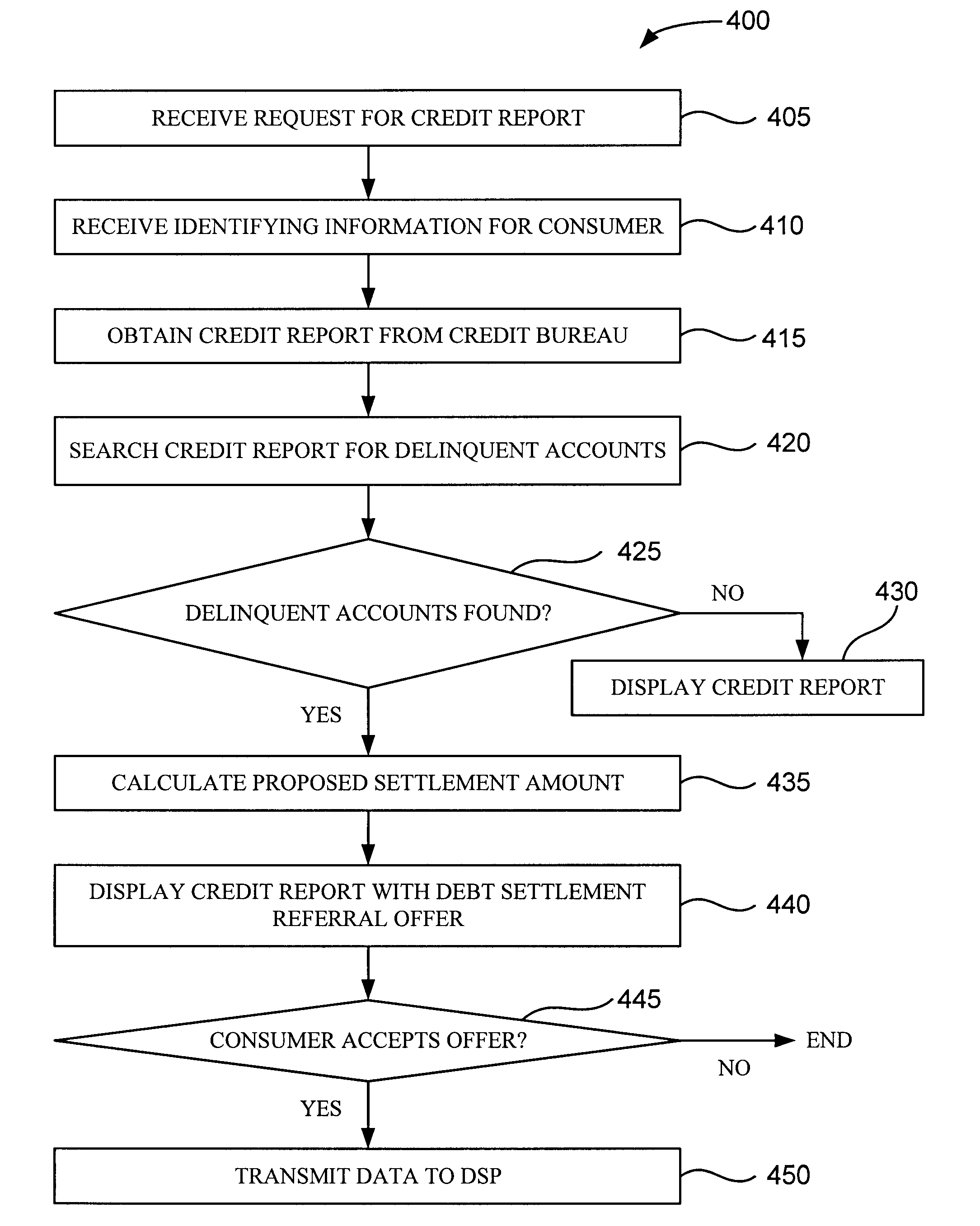

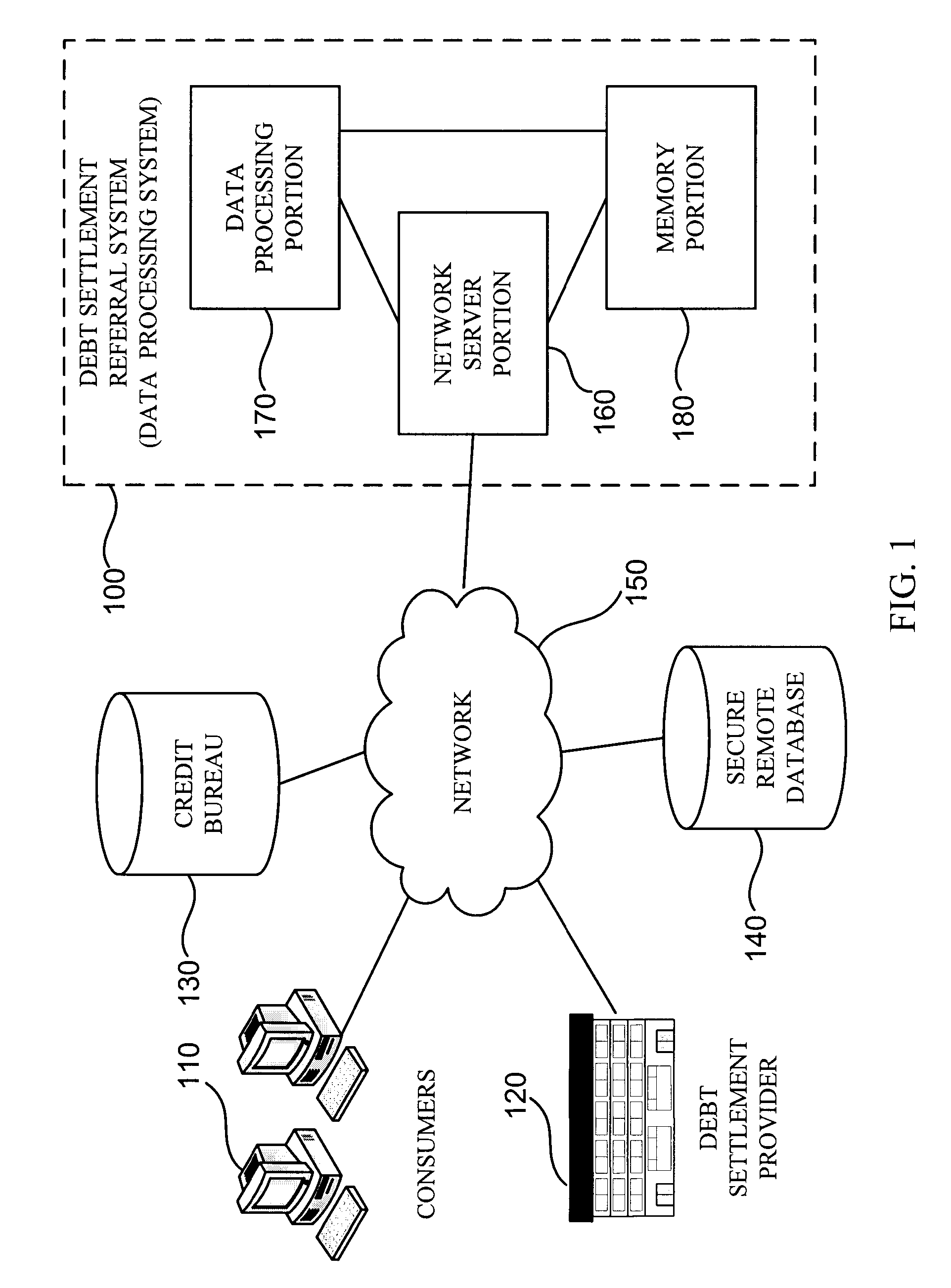

Methods and Apparatus for Directing Consumers to Debt Settlement Providers

InactiveUS20110035315A1Easy to learnEasily put in contactFinanceData processing systemData treatment

A consumer having a delinquent loan is directed to a debt settlement provider by a data processing system comprising a data processor in signal communication with a memory. Initially, the data processing system obtains a credit report for the consumer reflecting at least a portion of the consumer's credit history. The data processing system then determines the delinquent loan of the consumer directly from this credit report. Finally, the data processing system transmits information about the consumer and the delinquent loan to the debt settlement provider.

Owner:SETTLEMYACCOUNT

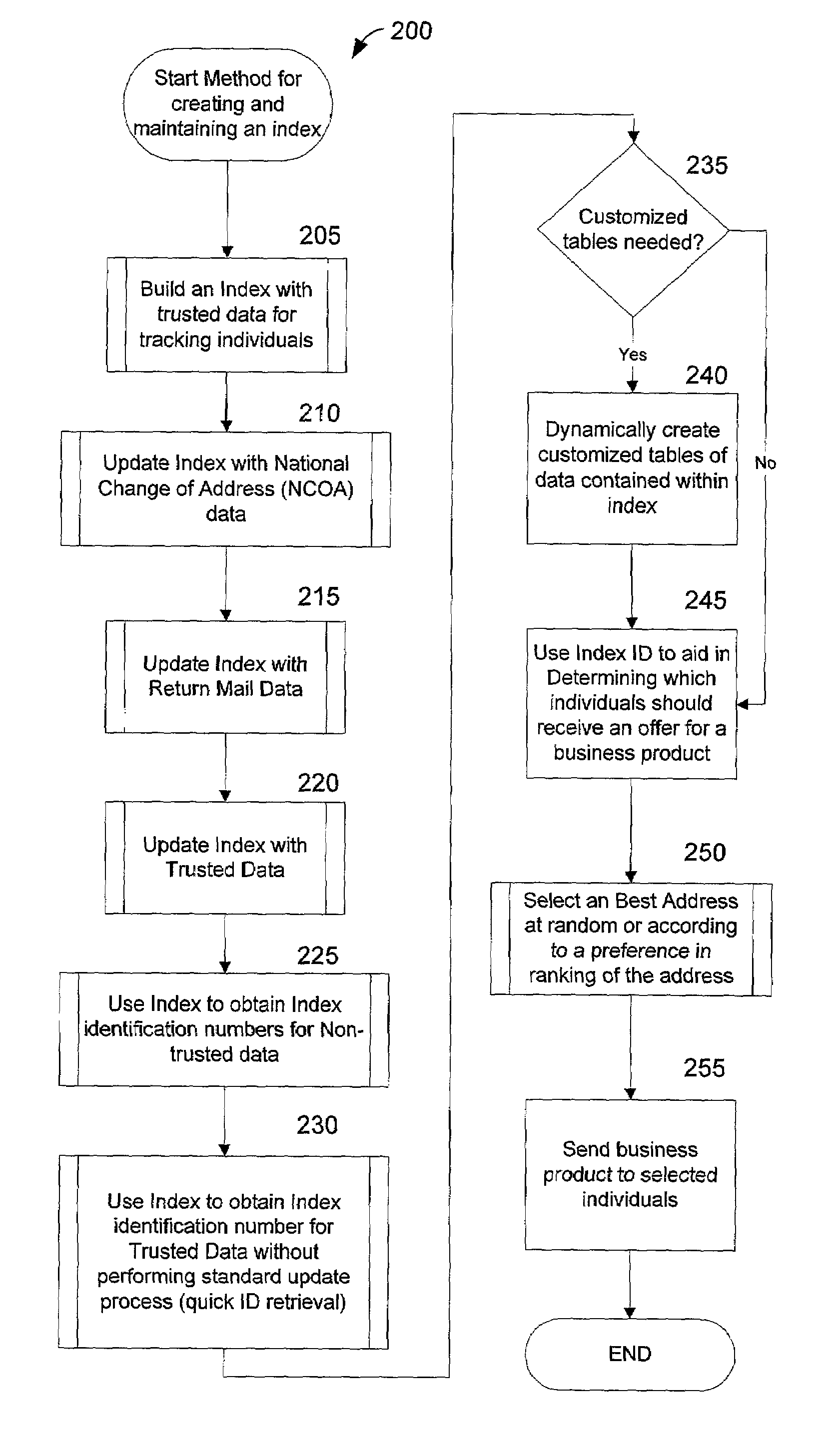

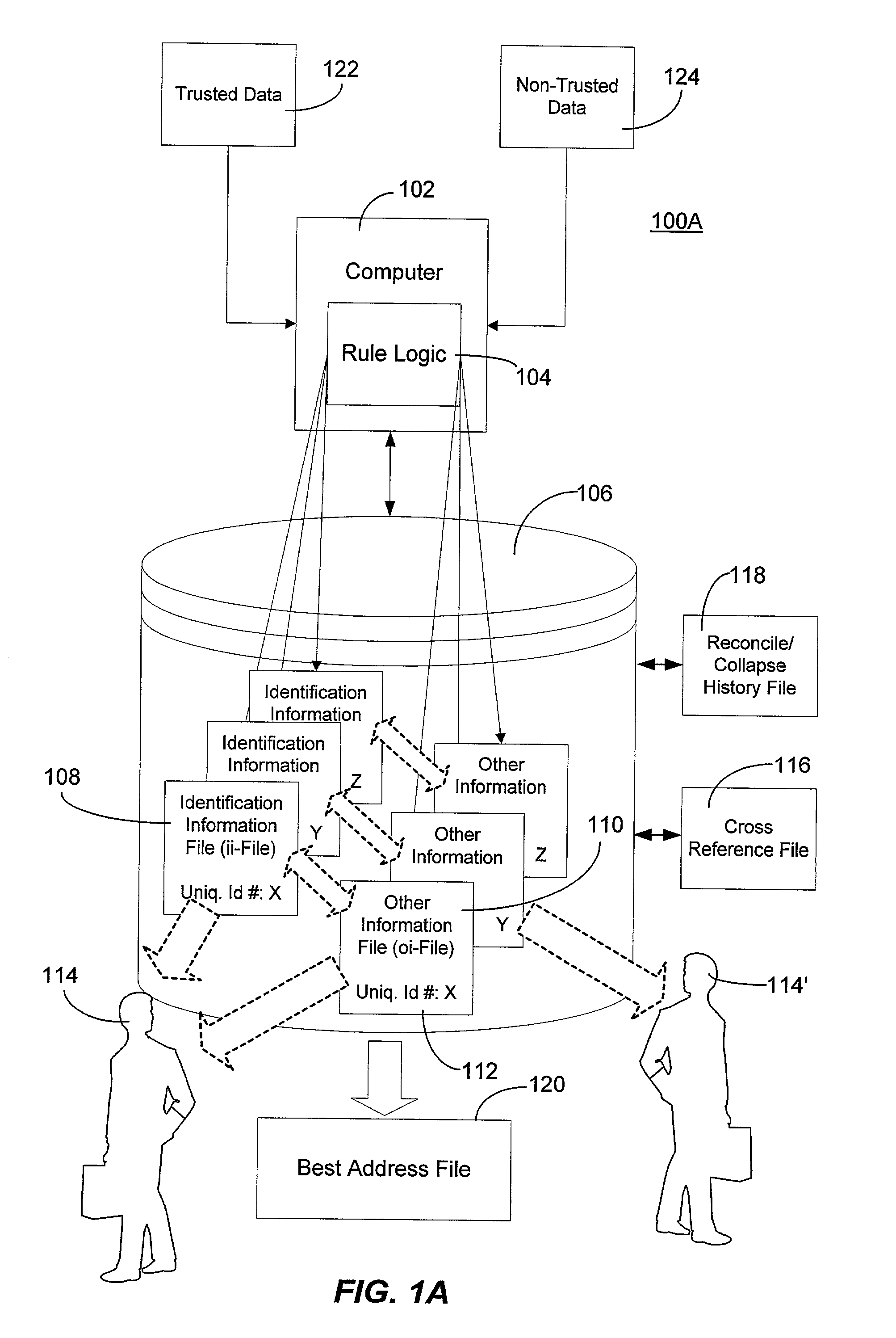

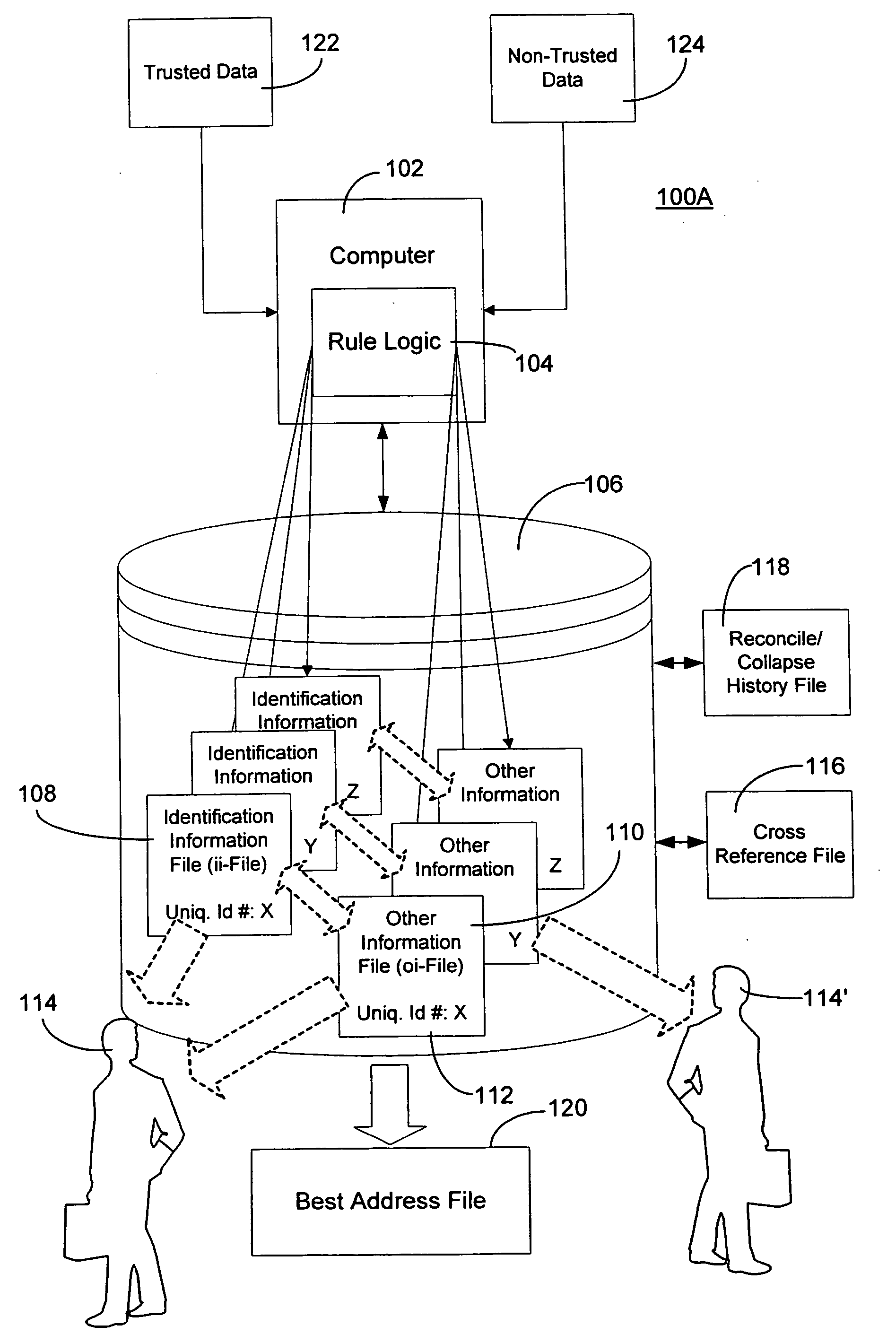

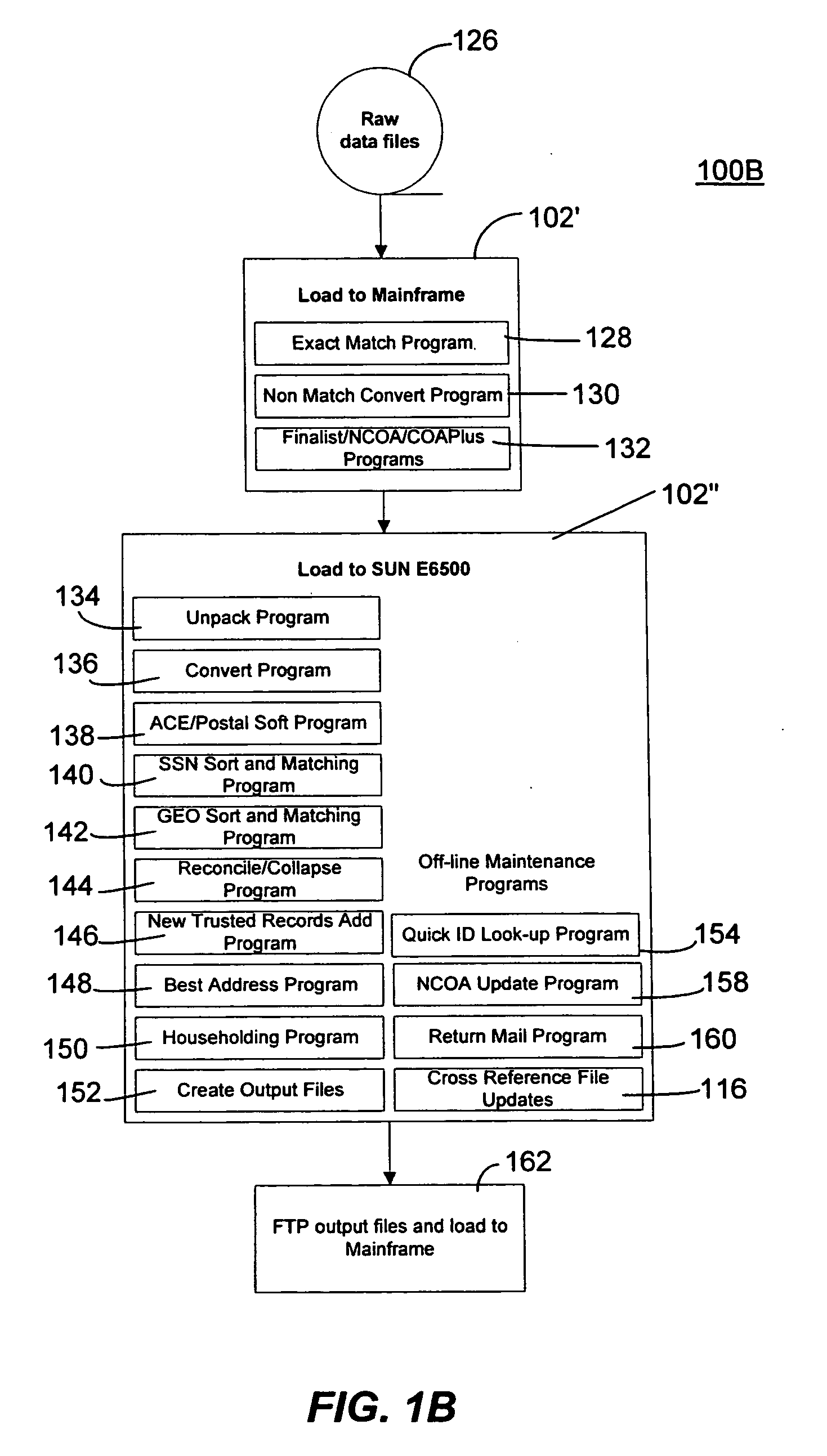

Method and system for creating and maintaining an index for tracking files relating to people

InactiveUS6968348B1Easy accessEasy to manufactureFinanceDigital data processing detailsFile allocationSocial Security number

A computer system creates and maintains an index for tracking information relating to individuals. Such information can include, but is not limited to, social security numbers, names, address information, credit bureau identification numbers, and credit history information on individuals. The invention employs logical rules to this information in order to create and maintain a set of files for each individual. The logical rules can include social security rules, geography rules, and address ranking rules. The invention is designed to evaluate slight variations in information very carefully in order to insure that appropriate files are assigned the same index identification number or that appropriate records are assigned separate and different index identification numbers as a situation warrants. The present invention is designed to maintain numerous files for each individual being tracked instead of merging and purging files as is done in the conventional art.

Owner:PROVIDIAN FINANCIAL CORP +1

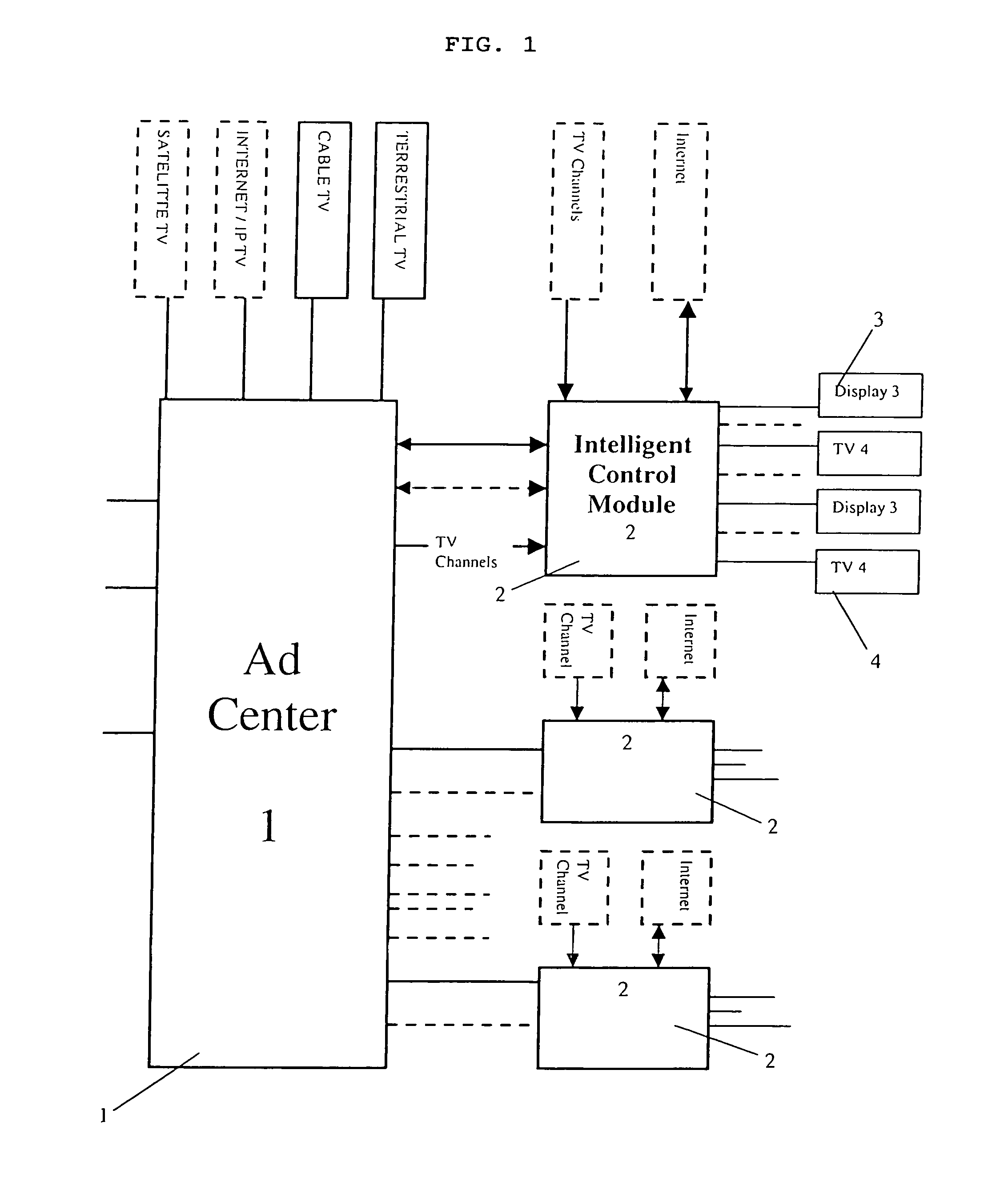

Method and system for personalized and localized tv ad delivery

ActiveUS20090228914A1Improve efficiencyFacilitate information exchangeTwo-way working systemsBuying/selling/leasing transactionsPersonalizationDemographic data

A personalized and localized TV Ad delivery method and system comprise of Ad Center (1), Intelligent Control Module (2), and Display (3) and / or TV (4). Ad Center (1) collects and processes information for ads, ad agencies, advertisers, and TV users. TV user information includes subscriber information associated with a user and public and / or purchasable user information like demographic data, user age group, family group, profession, credit history, etc. Intelligent Control Module (2) interfaces with Ad Center (2) and Display (3) and / or TV (4), collects user viewing program content preference, user ad preference, and user viewing patterns, which, at the discretion of users and based on local rules and regulations, can be uploaded to Ad Center (1). Intelligent Control Module (2) and / or Ad Center (1) also utilize artificial intelligence, mathematical, and statistical techniques for decision processing to produces a user personalized and localized ad schedule and / or ad set pertaining to channels and time, which governs the appropriate ad display during commercial times for certain or all channels. Application of the present invention enables ad agencies and / or advertisers directly and accurately personalize and localize their advertisements to potential buyers and / or locations that might have the interests or needs for the advertised products or services, and greatly enhance the effectiveness of TV advertisements.

Owner:LOREAL SA

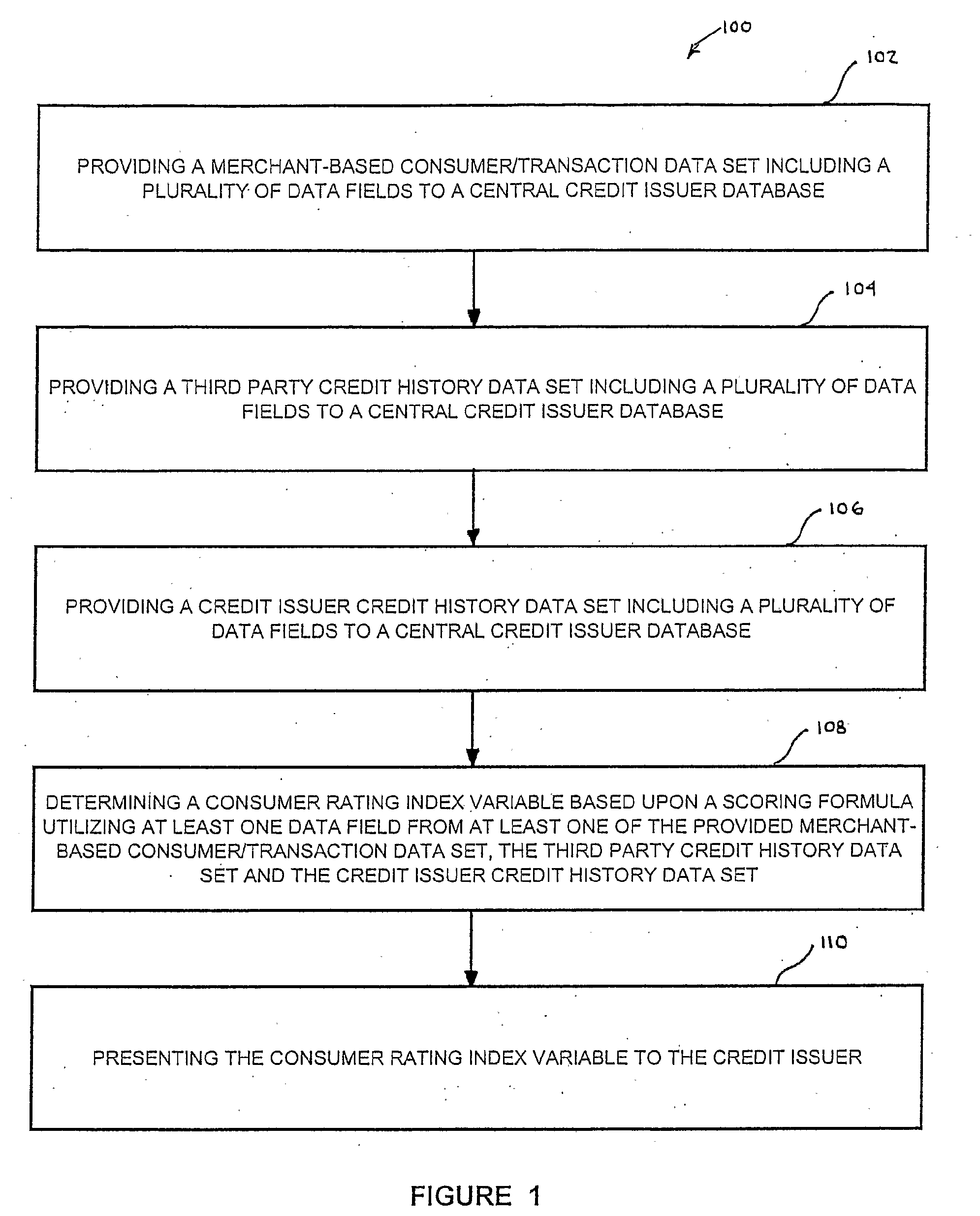

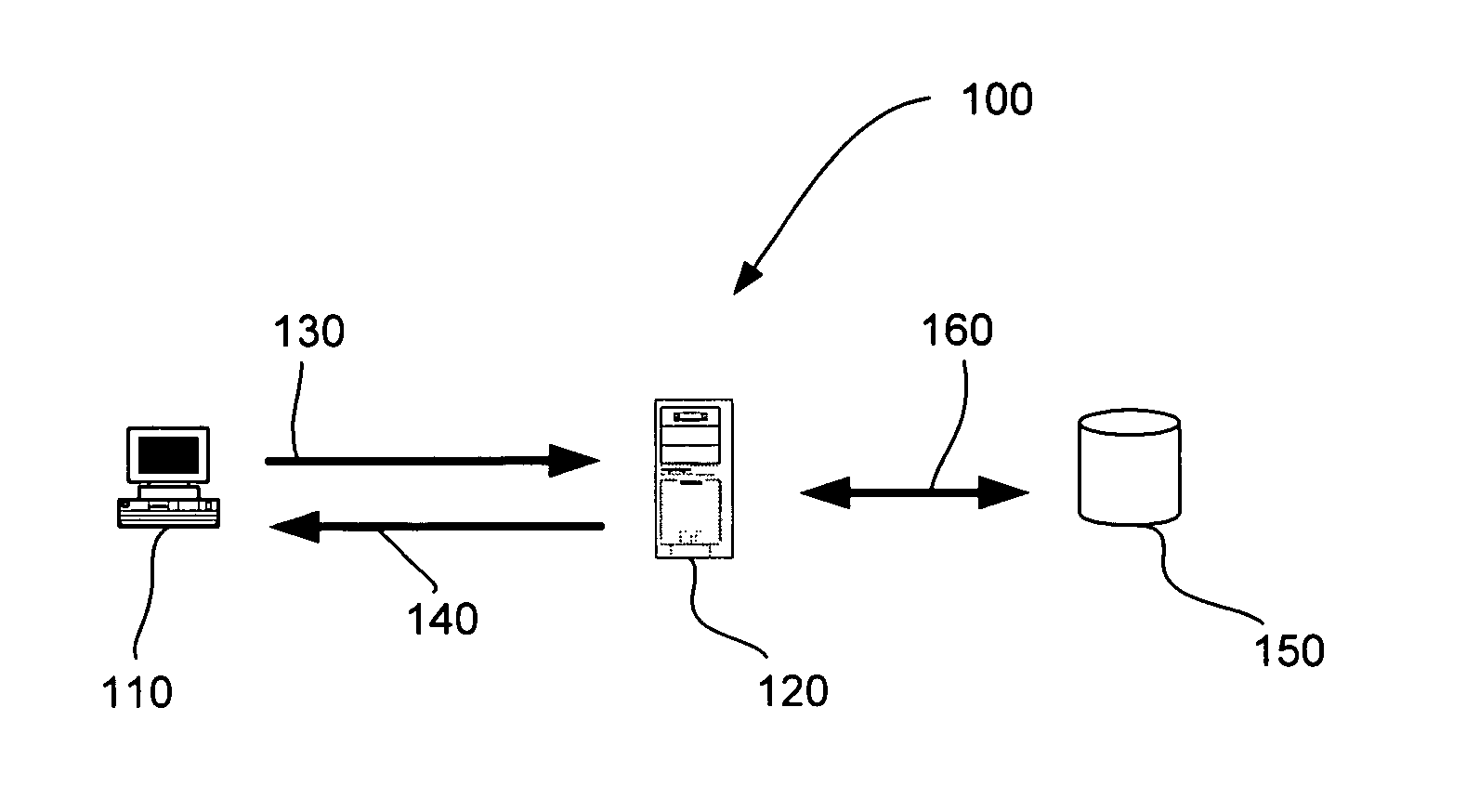

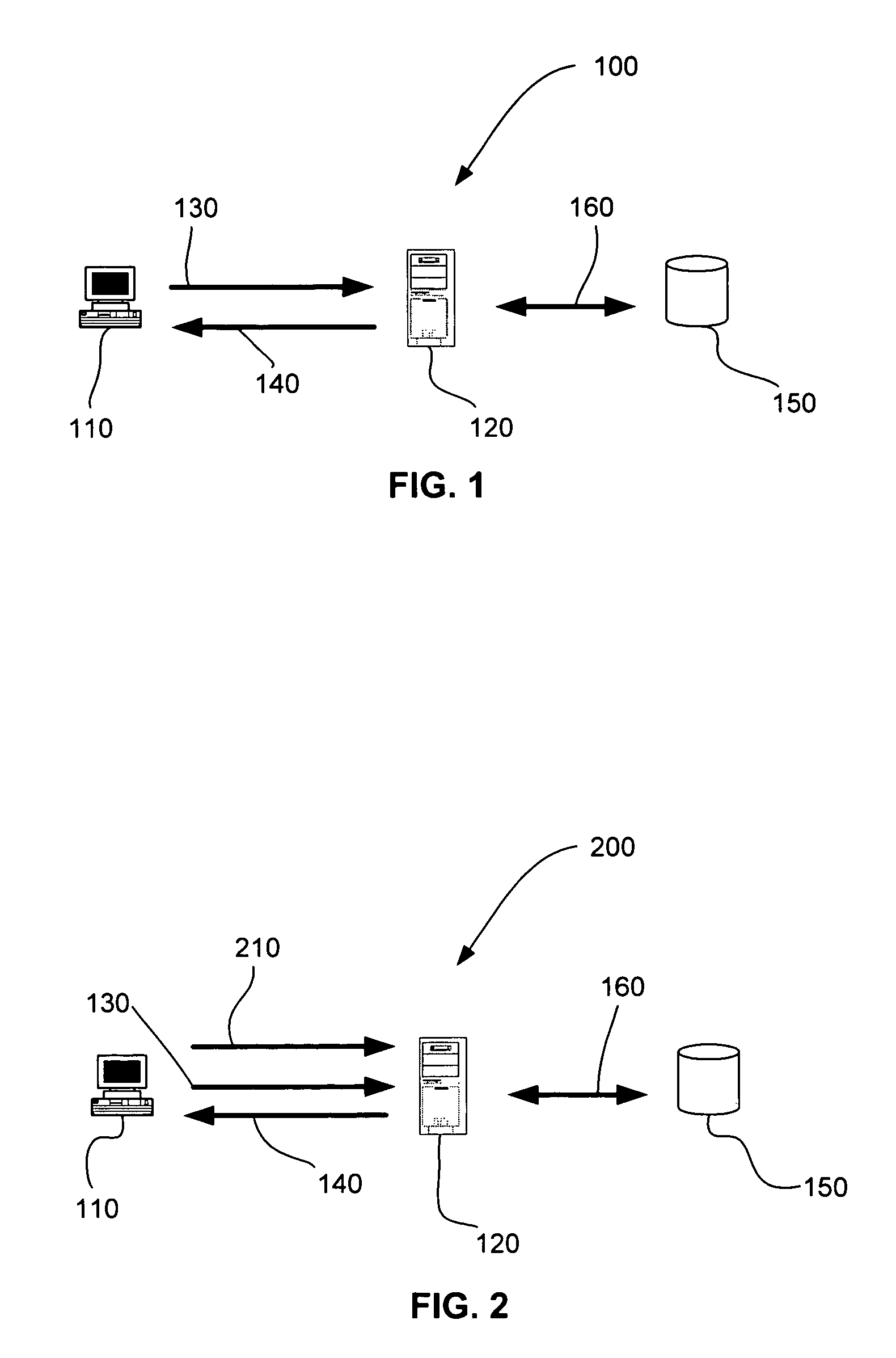

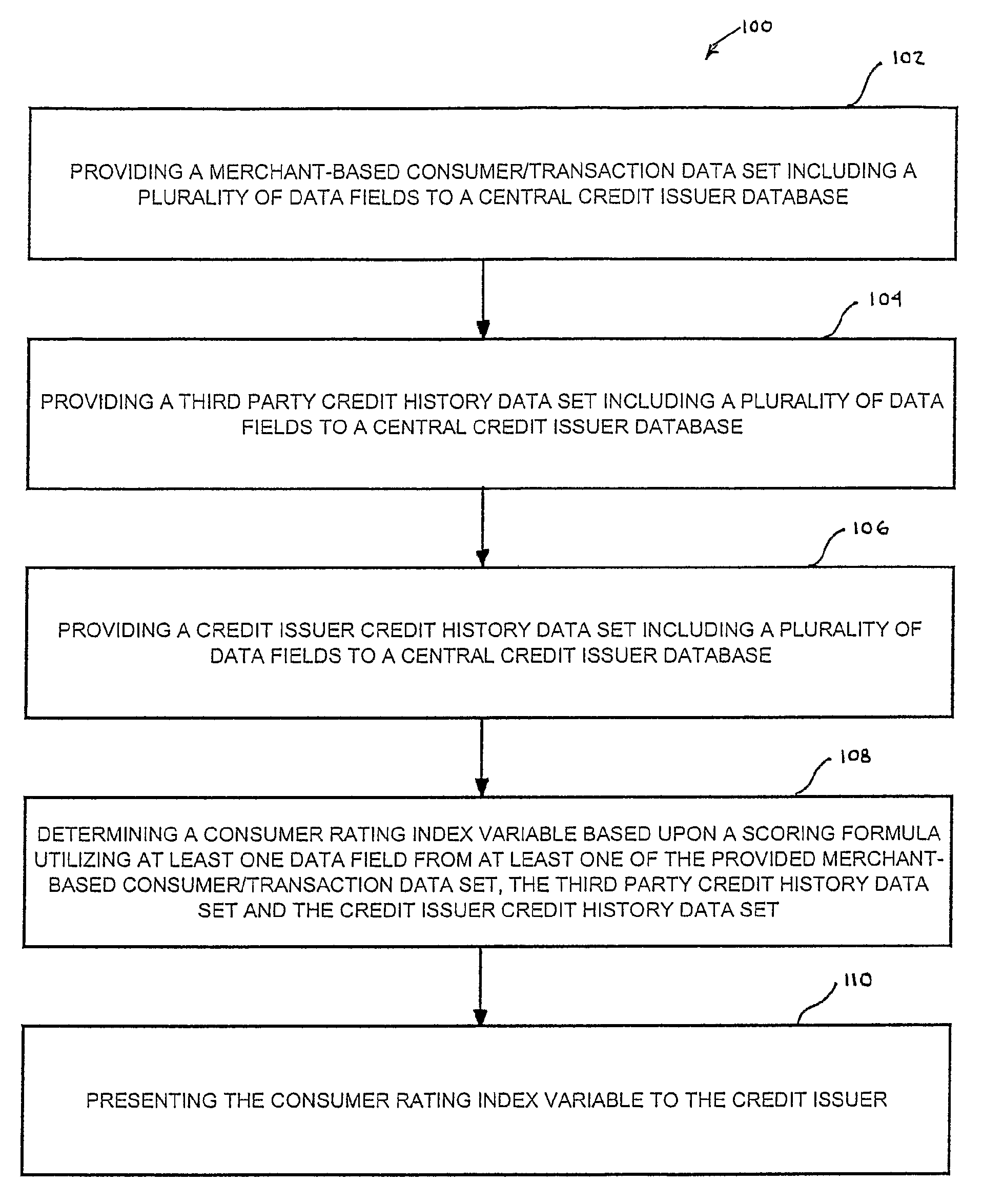

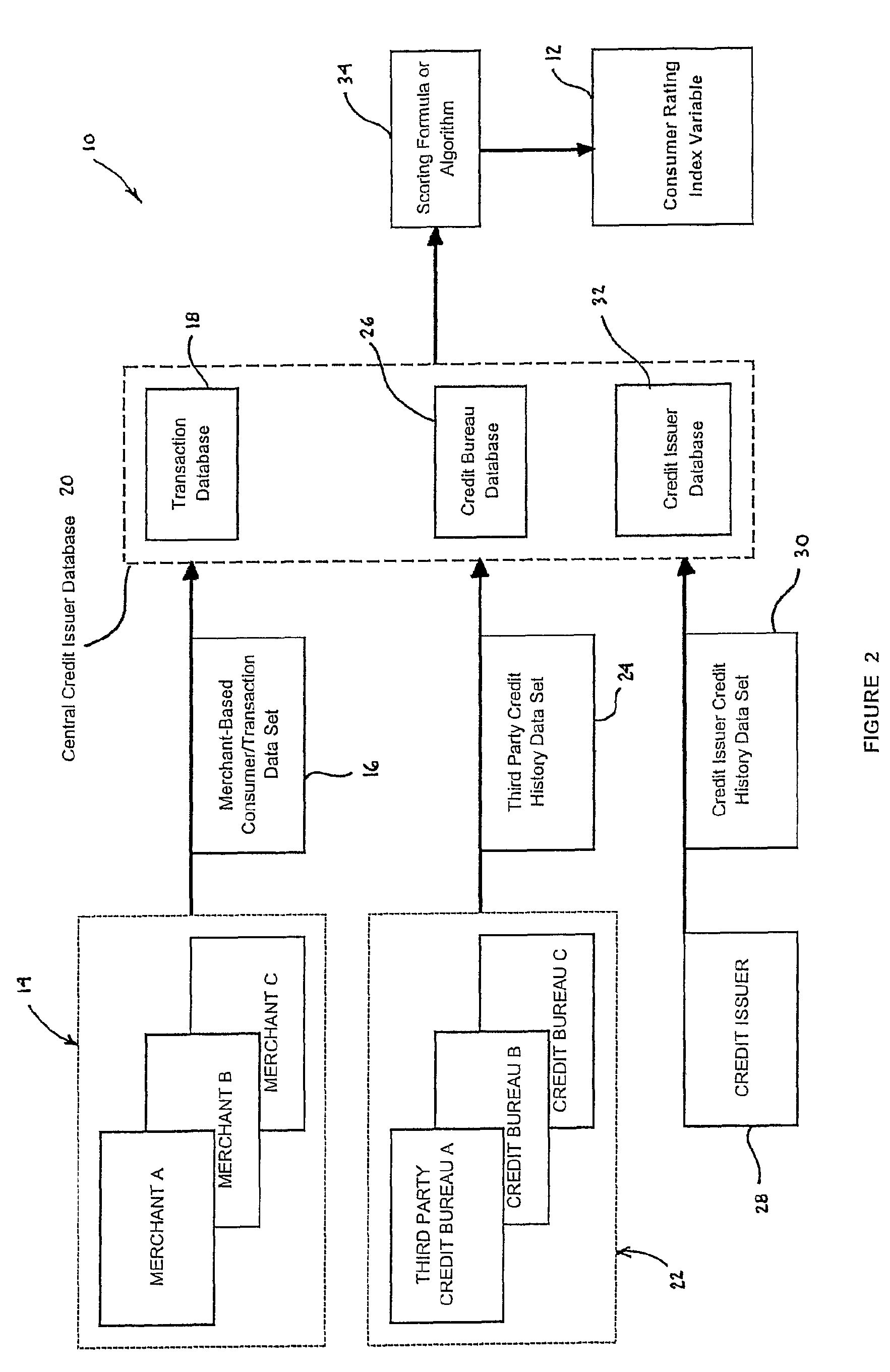

Computer-Implemented Method and System for Dynamic Consumer Rating in a Transaction

Disclosed is a computer-implemented method (100) of rating a consumer in connection with a transaction initiated by the consumer and requesting credit from a credit issuer (28). The method (100) includes the steps of: providing a merchant-based consumer / transaction data set (16) to a central credit issuer database (20); providing a third party credit history data set (24) to the central credit issuer database (20); providing a credit issuer credit history data set (30) to the central credit issuer database (20); determining a consumer rating index variable (12) based upon a scoring formula (34) utilizing at least one data field from the provided data sets; and presenting the consumer rating index variable (12) to the credit issuer (28). A system (10) and apparatus (50) for rating the consumer in connection with this transaction is also disclosed.

Owner:PAYPAL INC

System and method for automated process of deal structuring

InactiveUS6901384B2Free timeTime wastingFinanceSpecial data processing applicationsTemporal informationTime limit

An automated deal processing for customers is disclosed, and includes prompting a customer for at least one deal parameter, such as loan amount, prompting the customer for information relating to the customer, such as income and collateral offered by the customer, optionally accessing in real-time information relating to the credit history of the customer, applying a plurality of origination rules, such as exclusionary rules, pricing rules, risk rules, and edit preference rules, to the at least one deal parameter and the information relating to the customer, applying at least one strategy, such as compensation for risk, repair, or upsell, to the results of the application of the rules, generating at least one deal based on the accessing and applying of the strategy, and presenting the customer with the at least one option which may include a customer-preferred loan, a piggyback loan, a pre-qualification, or reduced term loan option,

Owner:AMERICAN HOME CREDIT

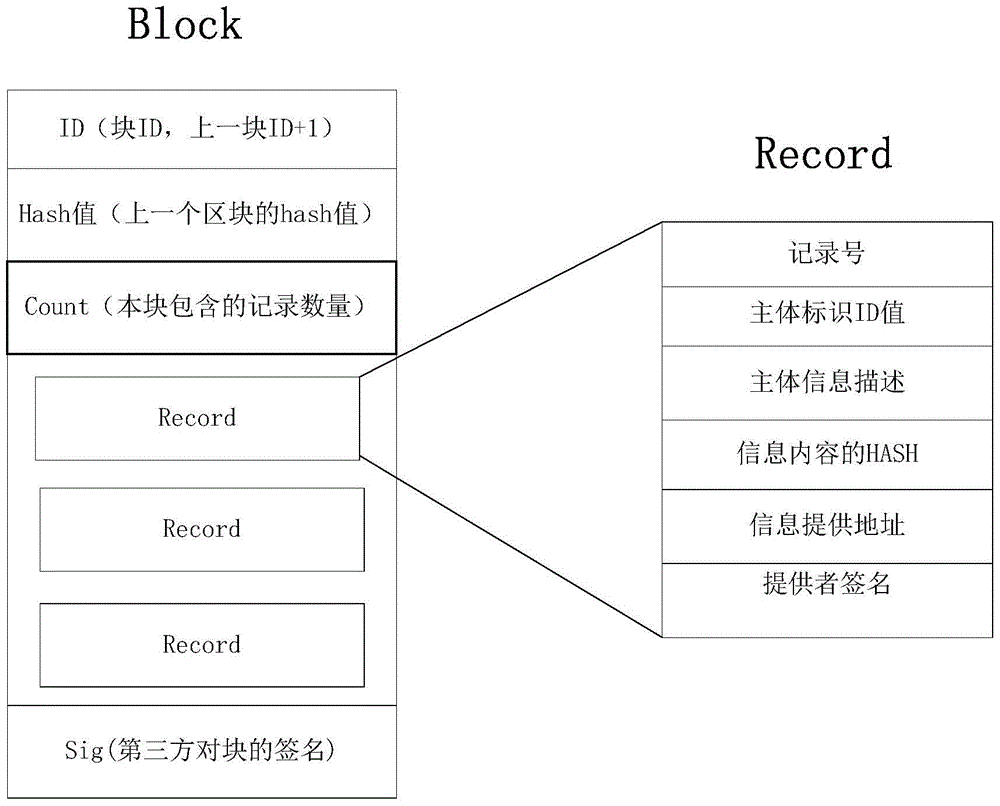

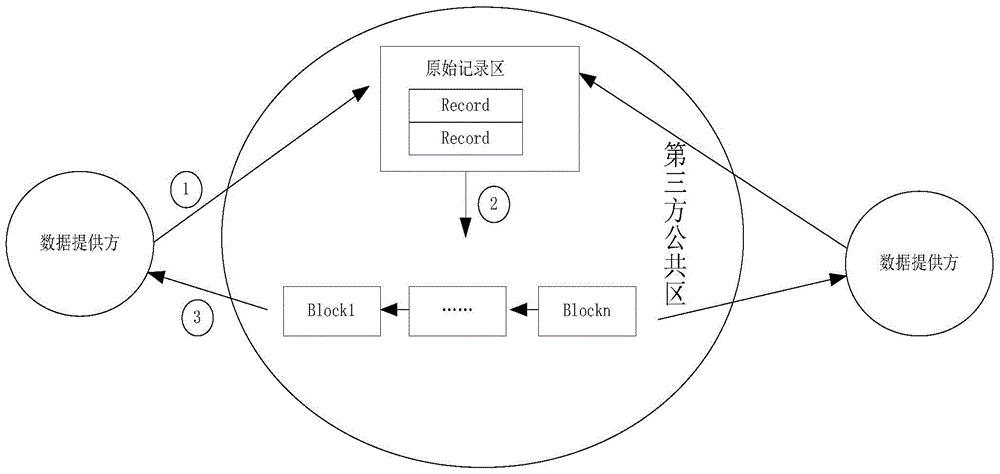

Multi-party co-construction credit record method based on block chains

ActiveCN105761143AGuarantee authenticityGuaranteed validityFinanceSpecial data processing applicationsCredit systemThird party

The present invention discloses a multi-party co-construction credit record method based on block chains. The roles participated in the whole credit system comprises a support third party and a data owner, the support third party is responsible for the building of a communication system and the formulation and the realization of the technology standard, and the data owner provides credit records. The multi-party co-construction credit record method based on block chains is able to completely record information which cannot be changed so as to ensure the authenticity of credit record, is able to complete multi-party construction together through a third party link, wherein the data provider does not need to provide original data in advance, and the data interaction is performed when the data is required, and are able to ensure the authenticity of data providers and the validity of data through digital signature.

Owner:SHANGHAI PINGAN NETWORK TECH CO LTD

Systems and methods for insurance underwriting

Embodiments of the present invention relate to systems and methods for automating insurance underwriting by integrating information from multiple online databases and creating decision making advice useful to insurance underwriters. One system includes a client, database, and server. The client allows an underwriter to enter applicant information, enter customized risk modifiers, and receive an underwriting decision. The database provides additional applicant information. This information can include one or more of prescription drug history, credit history, motor vehicle records, and geocentric mortality risk. The server obtains the applicant information, calculates the applicant's risk, makes an underwriting decision. Another system calculates a prescription drug risk for an applicant from pharmacy benefits management data, drug risk category data, and application data. Another system calculates a geocentric mortality risk for an applicant from census data, mortality data, credit information, and application data. Preset external modifiers are added to systems and methods of calculating risk in order to allow the underwriter to customize the risk results.

Owner:QUANTITATIVE DATA SOLUTIONS

Computer-implemented method and system for dynamic consumer rating in a transaction

Disclosed is a computer-implemented method (100) of rating a consumer in connection with a transaction initiated by the consumer and requesting credit from a credit issuer (28). The method (100) includes the steps of: providing a merchant-based consumer / transaction data set (16) to a central credit issuer database (20); providing a third party credit history data set (24) to the central credit issuer database (20); providing a credit issuer credit history data set (30) to the central credit issuer database (20); determining a consumer rating index variable (12) based upon a scoring formula (34) utilizing at least one data field from the provided data sets; and presenting the consumer rating index variable (12) to the credit issuer (28). A system (10) and apparatus (50) for rating the consumer in connection with this transaction is also disclosed.

Owner:PAYPAL INC

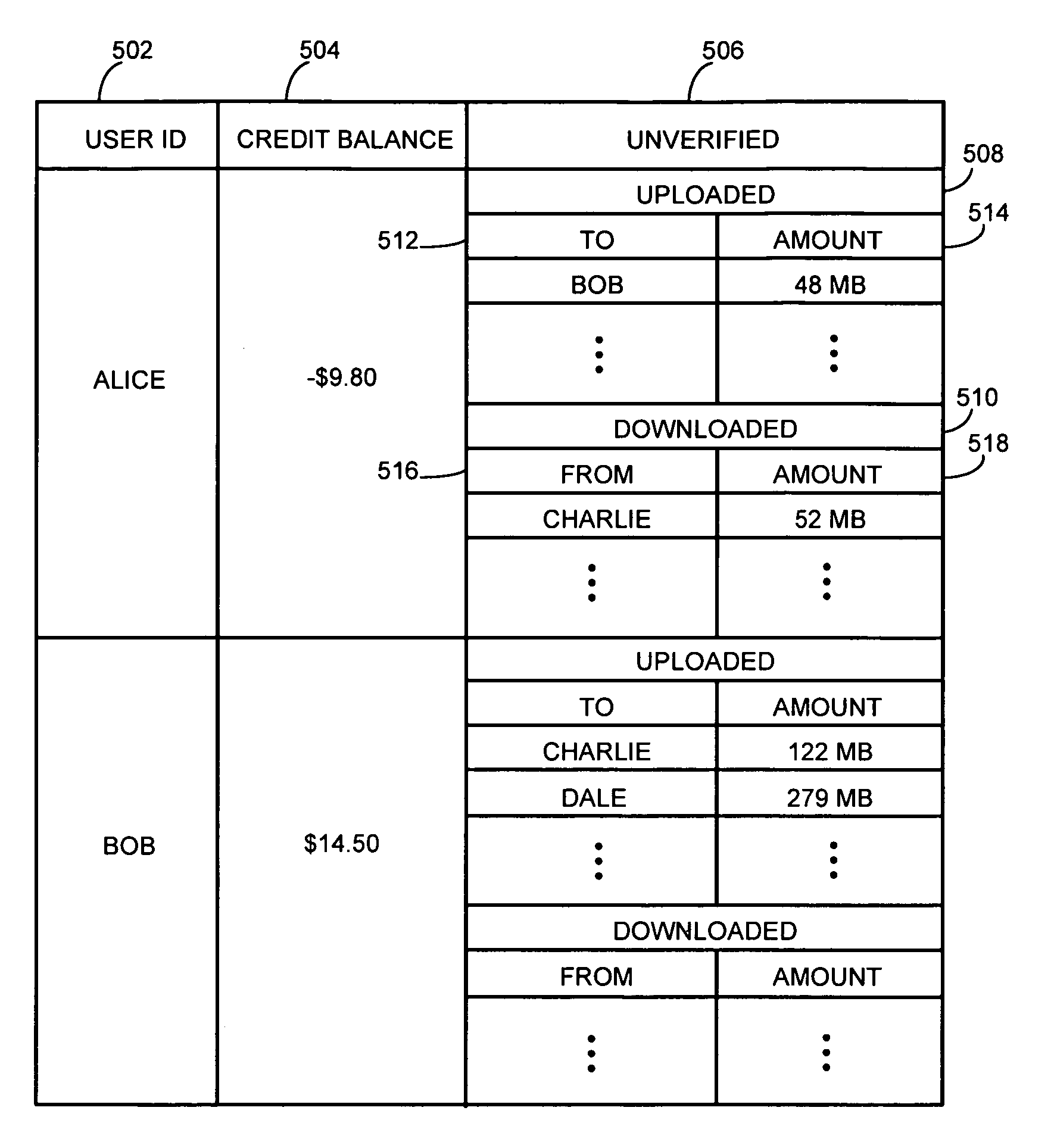

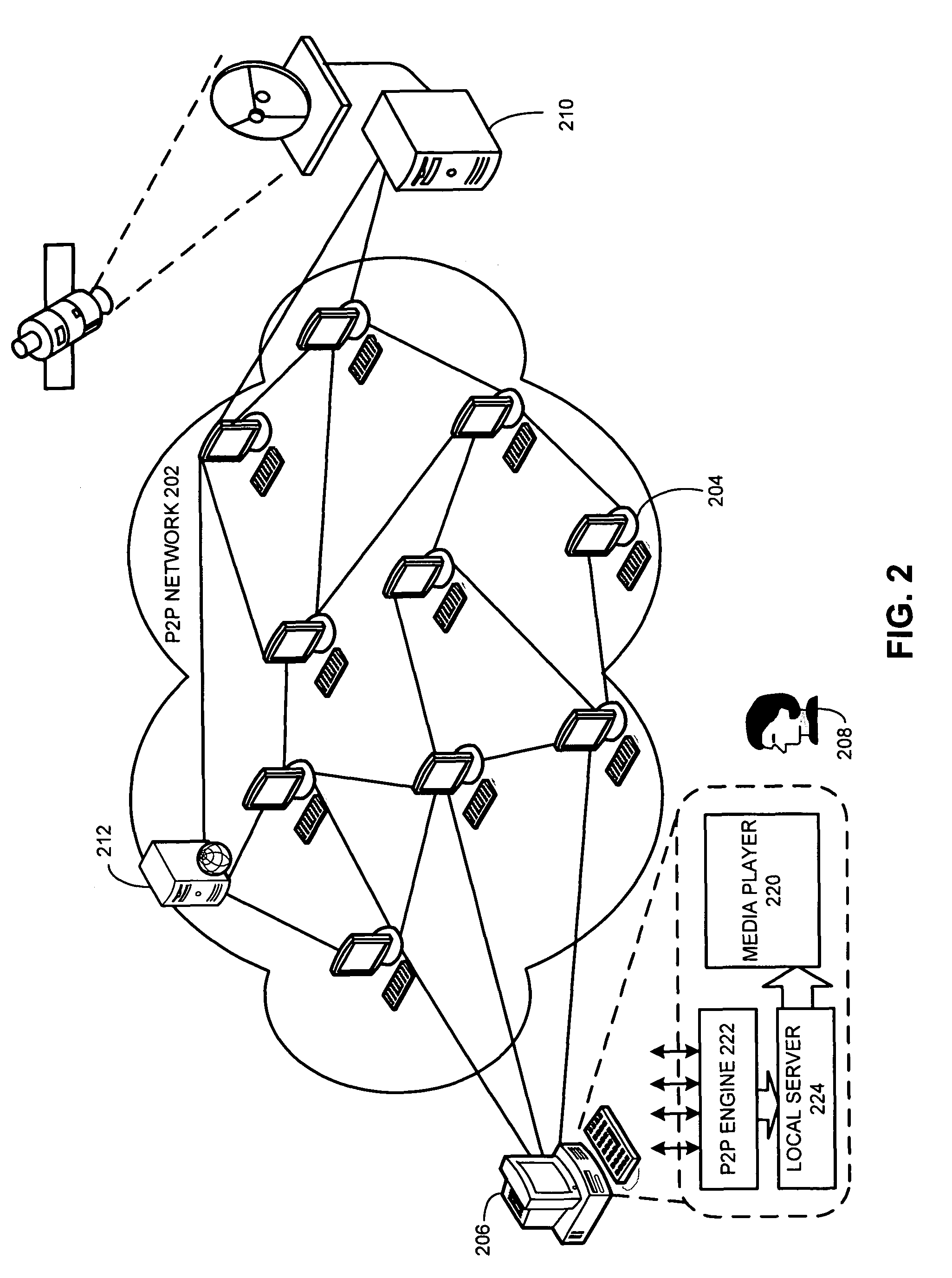

System and method for facilitating a credit system in a peer-to-peer content delivery network

InactiveUS7937362B1Encourage data sharingDigital data processing detailsSpecial data processing applicationsCredit systemPeering

A system and method facilitate a credit system for providing user incentives to encourage data sharing in a P2P network. The credit system maintains a user credit database and respectively increases or decreases a user's credits based on the data uploaded to or downloaded from other peer nodes. The credit system can also associate a user's credits with economic value or rewards to encourage the user to share data with other peer nodes. In one embodiment, the credit system maintains a credit record for each user. The credit system increases the credit for a user based on the amount of data a peer node associated with the user uploads to other peer nodes in the P2P network. The credit system also decreases the credit for the user based on the amount of data downloaded by the peer node associated with the user.

Owner:TV BANK

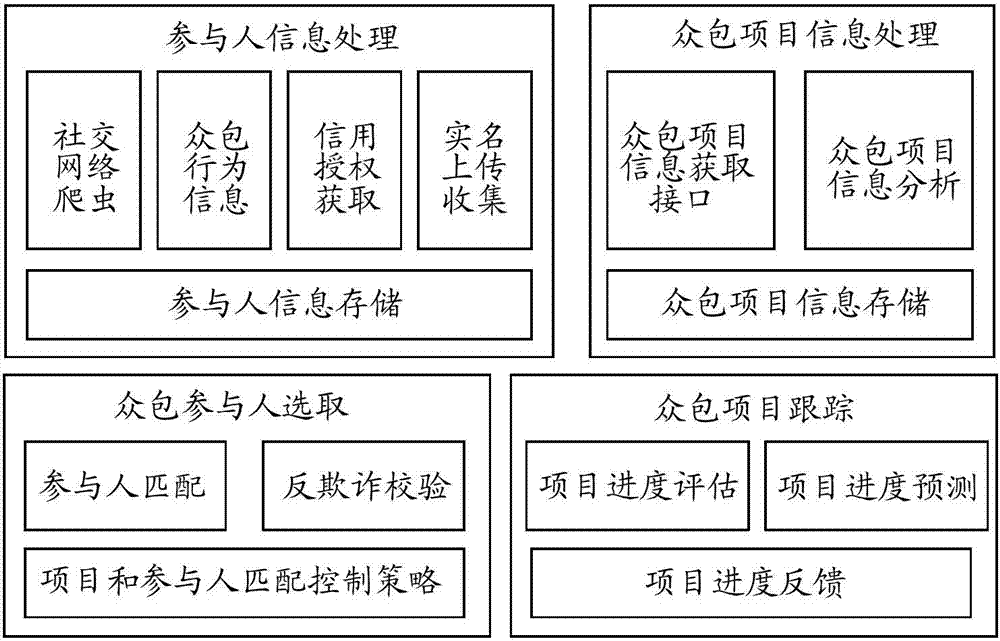

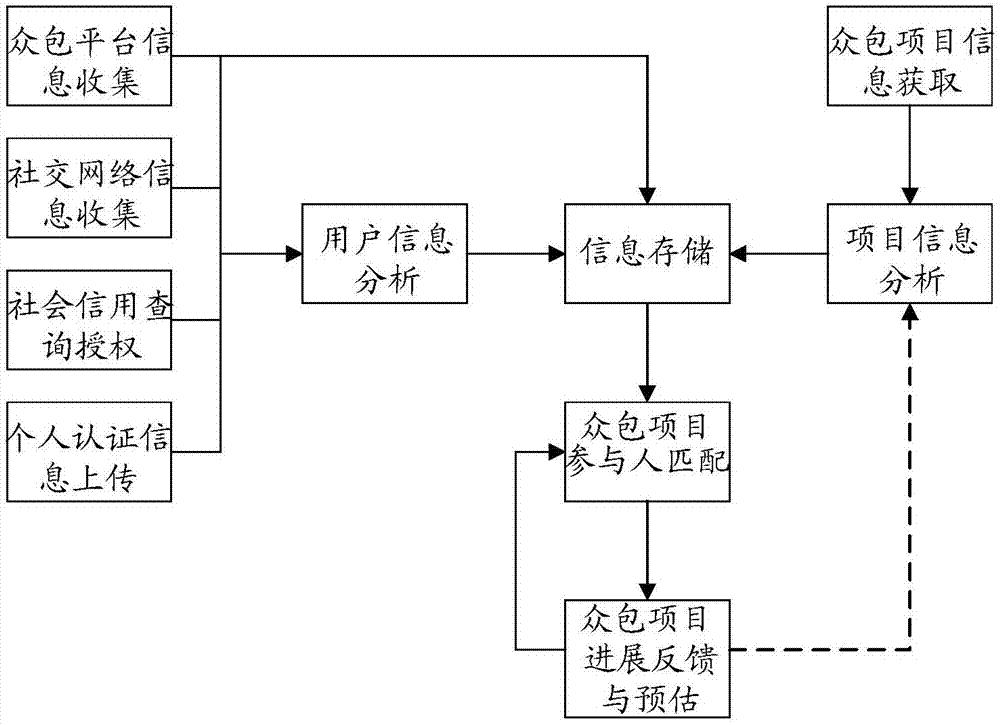

Method and device for selecting crowdsourcing participants in crowdsourcing project

ActiveCN107958317AGuaranteed to be realisticLess likely to be fraudulentResourcesData scienceCredit history

The invention discloses a method and device for selecting crowdsourcing participants in a crowdsourcing project. The method and the device are used for selecting the crowdsourcing participants for thecrowdsourcing project in a crowdsourcing project platform; and the screening reliability can be ensured. In the method provided by the embodiment of the invention, the respective behavior records andcredit records are respectively provided according to a plurality of crowdsourcing participants; the credit information and the ability information of each crowdsourcing participant in the pluralityof crowdsourcing participants are obtained; the crowdsourcing project requiring the participant allocation is determined in the crowdsourcing project platform; the project information is obtained fromthe crowdsourcing project, wherein the project information includes the project task of the crowdsourcing project and the content information of the project task; and the crowdsourcing participants matched with the project information are selected for the crowdsourcing projects according to the credit information and the ability information of each crowdsourcing participant and are used as a candidate set, wherein the candidate set includes the crowdsourcing participants which are selected from the plurality of crowdsourcing participants and are used for executing the project task.

Owner:TENCENT TECH (SHENZHEN) CO LTD

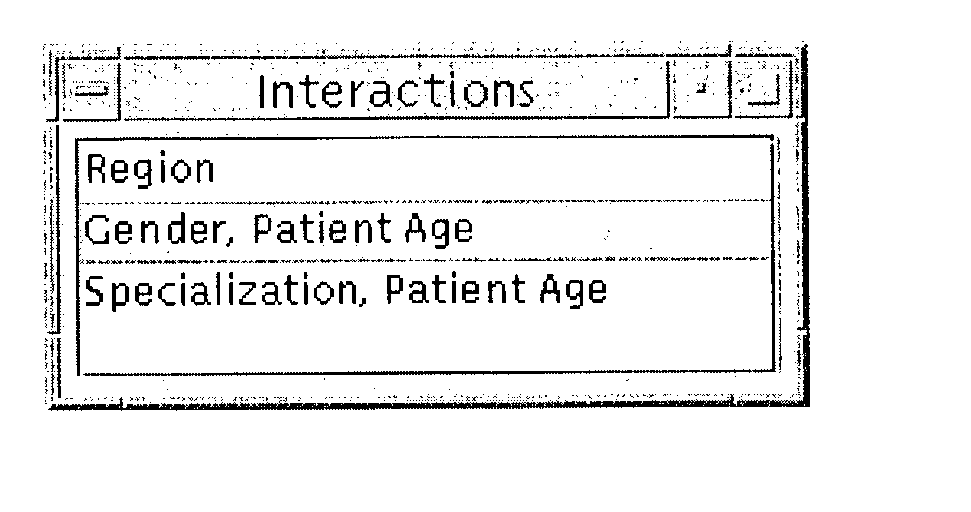

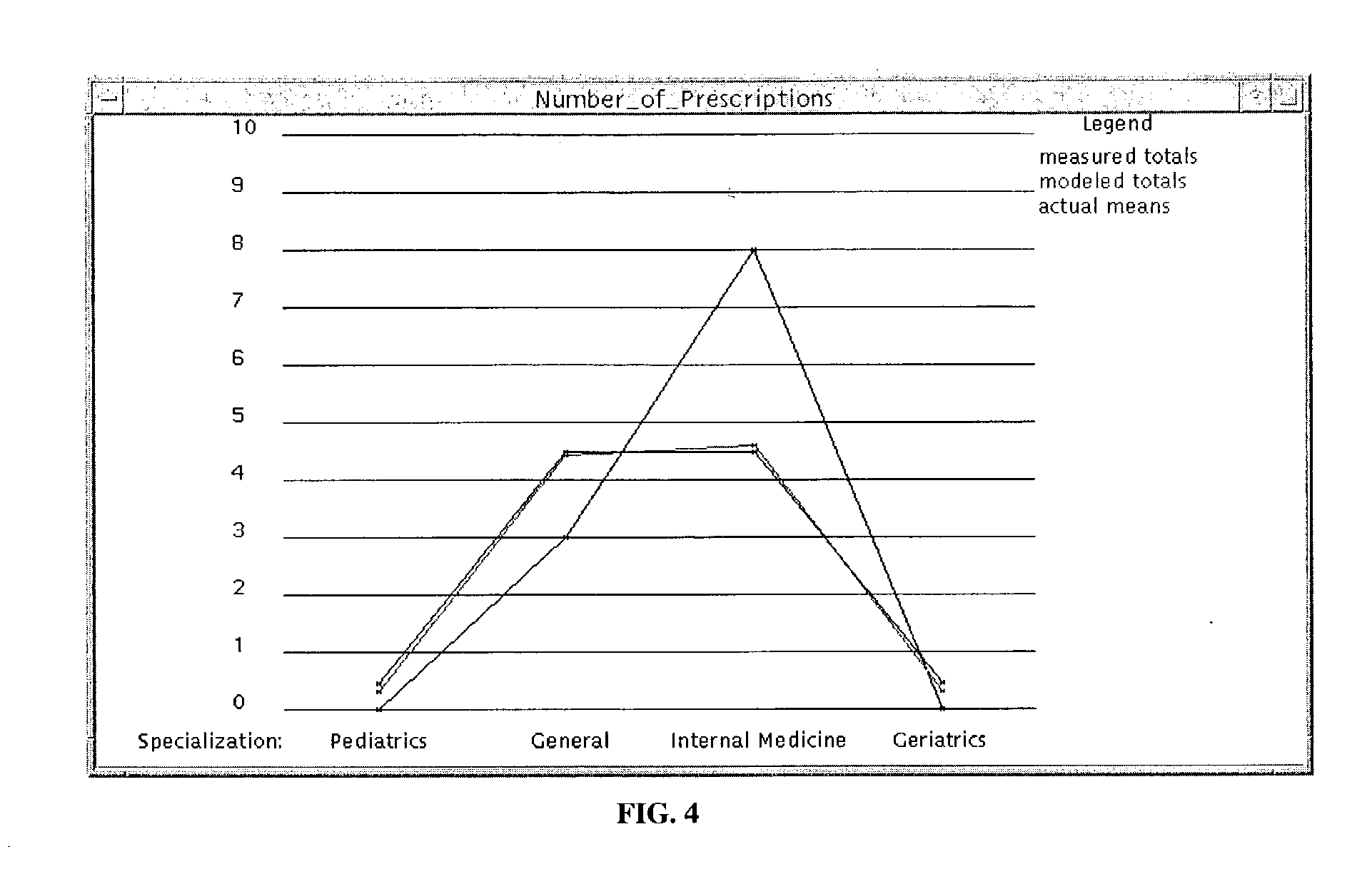

Automated generator of optimal models for the statistical analysis of data

ActiveUS20040220784A1Analogue computers for electric apparatusDigital computer detailsExact statisticsStatistical analysis

Provided is an automated process for producing accurate statistical models from sample data tables. The process solves for the optimal parameters of each statistical model considered, computes test statistics and degrees of freedom in the model, and uses these test statistics and degrees of freedom to establish a complete ordering of the statistical models. In cases where the sample data table is sufficiently small, the process constructs and analyzes all reasonable statistical models that might fit the data table provided. In cases where the number of possible models is prohibitively high, the process begins by constructing and solving more general models and then constructs and solves those more detailed models that are similar to those general models that achieved the highest ordering. In either of these two cases, the process arrives at a statistical model that is highest in the ordering and is thus deemed most suitable to model the sample data table. The result of this process is a statistical model deemed to be most suitable to model the sample data table and a set of average table values produced by this resulting model. This resulting table may include modeled values for table entries for which no initial data was supplied. This invention finds application in the area of credit scoring, where covariates such as age, profession, gender, and credit history are used to determine the likelihood that an individual will default on a loan. It also finds application in analyzing the effectiveness of many types of tools as they are used in various environments (e.g., the effectiveness of radar when used in different weather conditions). It also finds application in the area of insurance, where one wishes to estimate the future number of claims against a specific insurance policy based on a database of past insurance claims.

Owner:DANIEL H WAGNER ASSOCS

Systems and method for managing dealer information

ActiveUS7908210B2Reduce riskSafer and easy to dealFinancePayment architectureComputer scienceCredit history

Embodiments of systems and methods are disclosed that manage transactions and communication between car dealers and lenders. In one embodiment, the system lessens risks for lenders and makes relationships with dealers safer and easier to administer. In one embodiment, a dealer may utilize the system to manage its inventory, obtain and manage credit history information about potential customers, help customers apply for credit, transact credit applications and credit approvals with various lenders, submit applications to multiple lenders, select from among the accepting lenders, and manage forms used to complete a transaction.

Owner:FINANCE EXPRESS

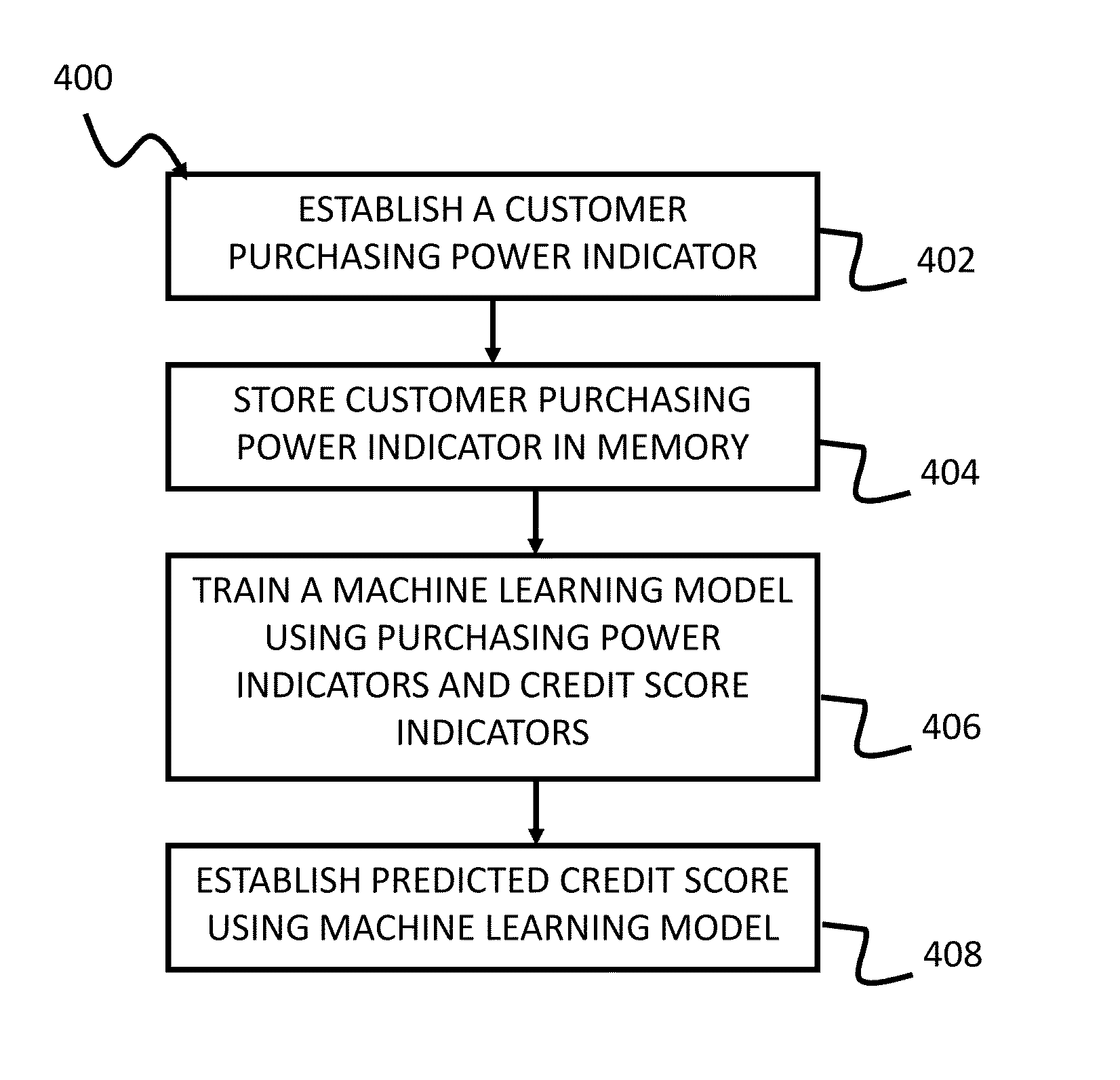

System, method, and non-transitory computer-readable storage media for predicting a customer's credit score

In different embodiments of the present invention, systems, methods, and computer-readable storage media establishes a predicted credit score for a target customer that does not have an established credit history and / or a FICO credit score is provided. An indicator of the purchasing power of the target customer is established as a function of stored purchasing data. A machine learning model is used to establish a predicted credit score associated with the target customer as a function of the purchasing power indicator of the target customer and the machine learning model.

Owner:WALMART APOLLO LLC

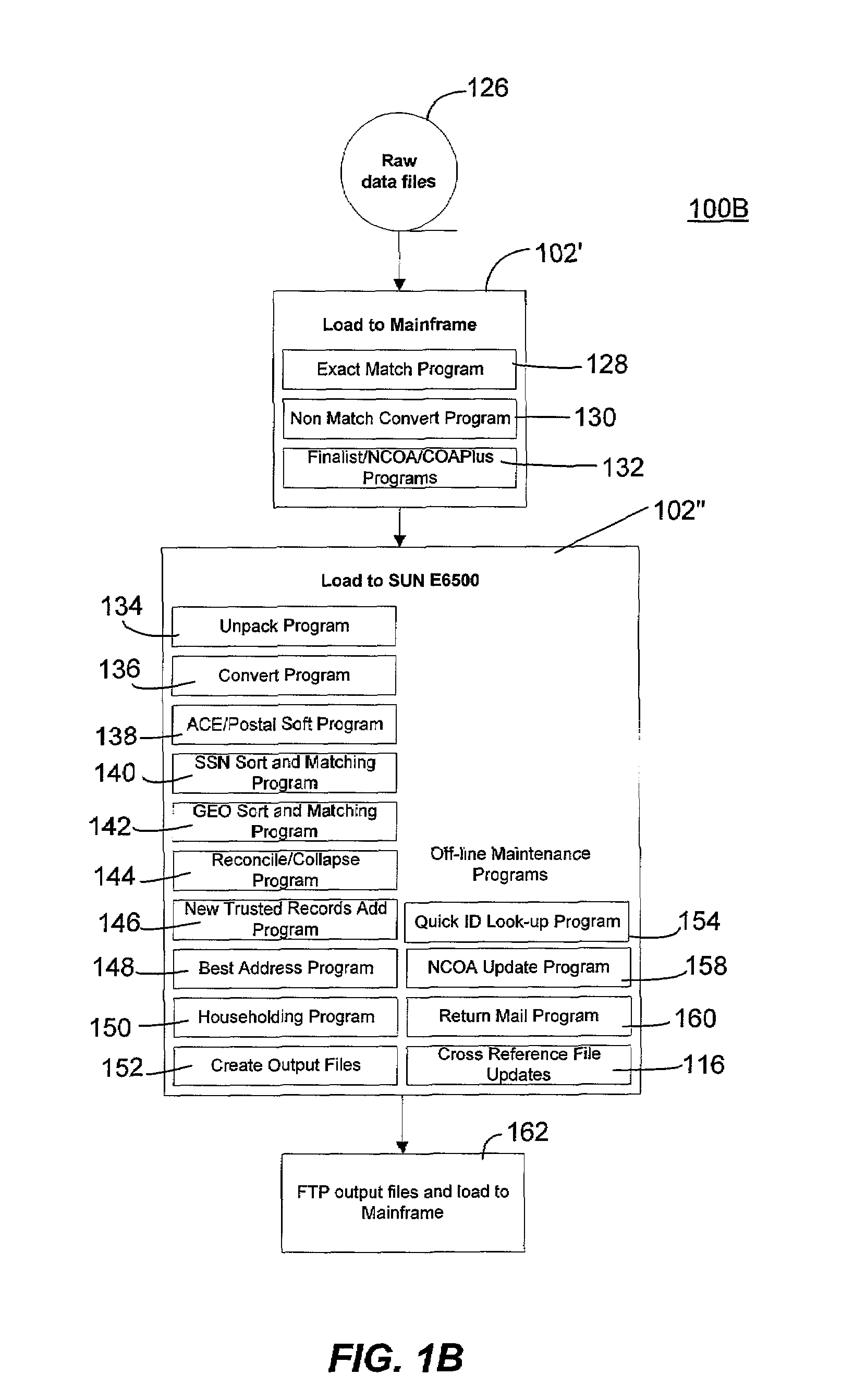

Method and system for creating and maintaining an index for tracking files relating to people

ActiveUS20050234913A1Improve accuracyEasy to manufactureFinanceDigital data processing detailsSocial Security numberSecurity rule

A computer system creates and maintains an index for tracking information relating to individuals. Such information can include, but is not limited to, social security numbers, names, address information, credit bureau identification numbers, and credit history information on individuals. The invention employs logical rules to this information in order to create and maintain a set of files for each individual. The logical rules can include social security rules, geography rules, and address ranking rules. The invention is designed to evaluate slight variations in information very carefully in order to insure that appropriate files are assigned the same index identification number or that appropriate records are assigned separate and different index identification numbers as a situation warrants. The present invention is designed to maintain numerous files for each individual being tracked instead of merging and purging files as is done in the conventional art.

Owner:JPMORGAN CHASE BANK NA

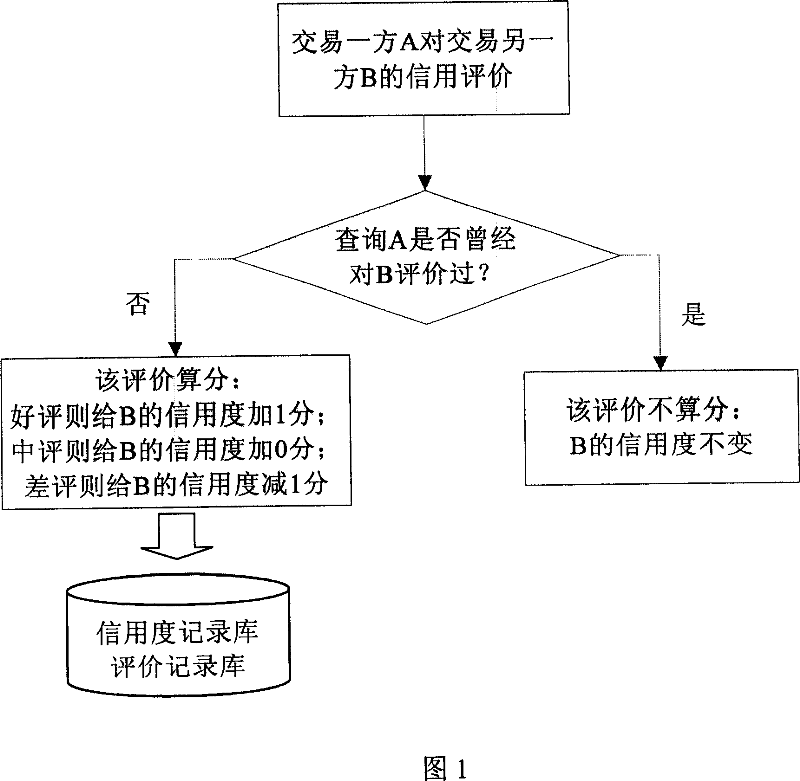

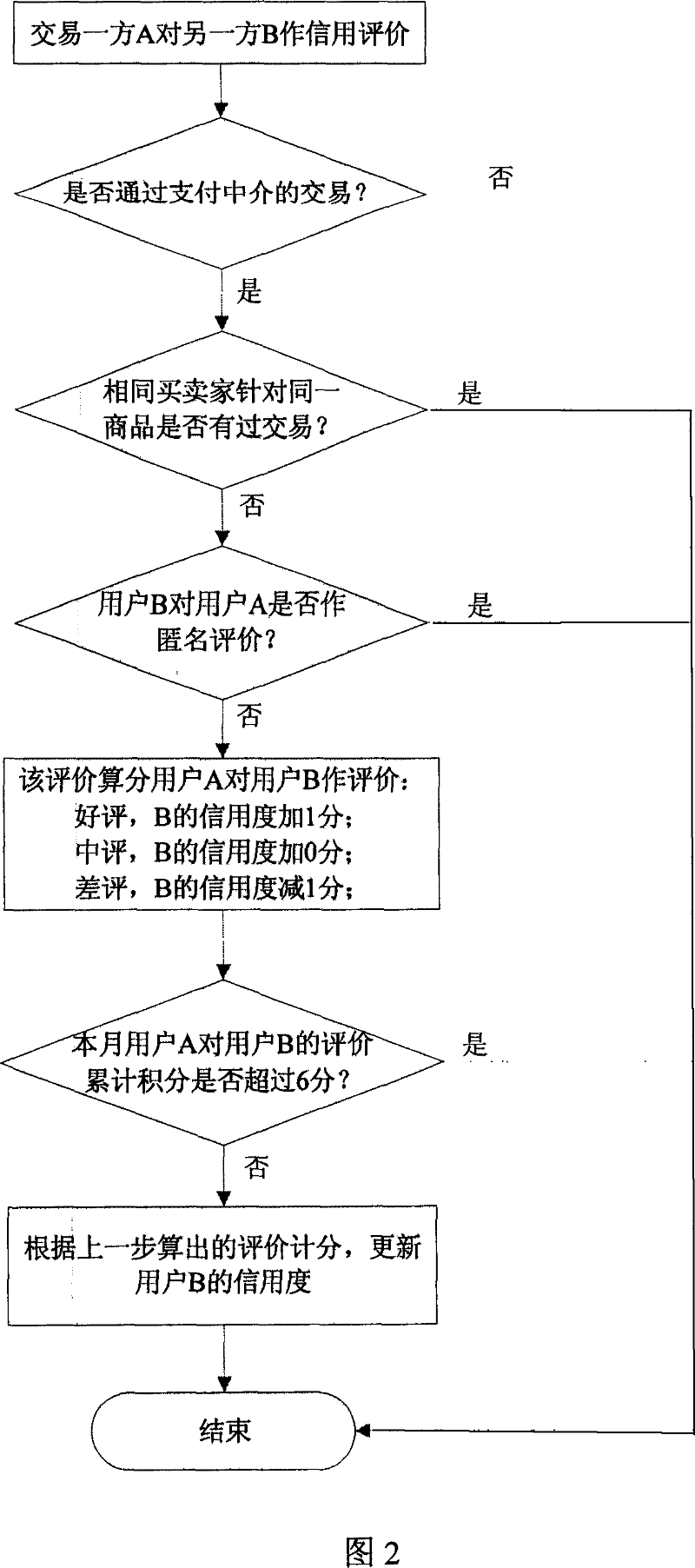

Method for credit scoring method of electronic trade

InactiveCN101038643ACredit balance crediblePrevent gapBuying/selling/leasing transactionsElectronic transactionData science

The invention relates to an electronic transaction credit scoring method, which is applied to the credit evaluation in the buying and saling behavior in the electronic business system, when the first user is to evaluate the second user, the following steps will executed: S1: judging the first user is a buyer or a saler; S2: if the first user is the buyer, then the geneated credit accumulated scores will be updated to the saler credit recording library according to a predetermined credit counting method, if the first user is the saler, then the geneated credit accumulated scores will be updated to the buyer credit recording library according to a predetermined credit counting method. The invention can calculate the credit conditions of the transaction parts in the buying and saling behaviors in a better manner.

Owner:TENCENT TECH (SHENZHEN) CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com