Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

71 results about "State specific" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

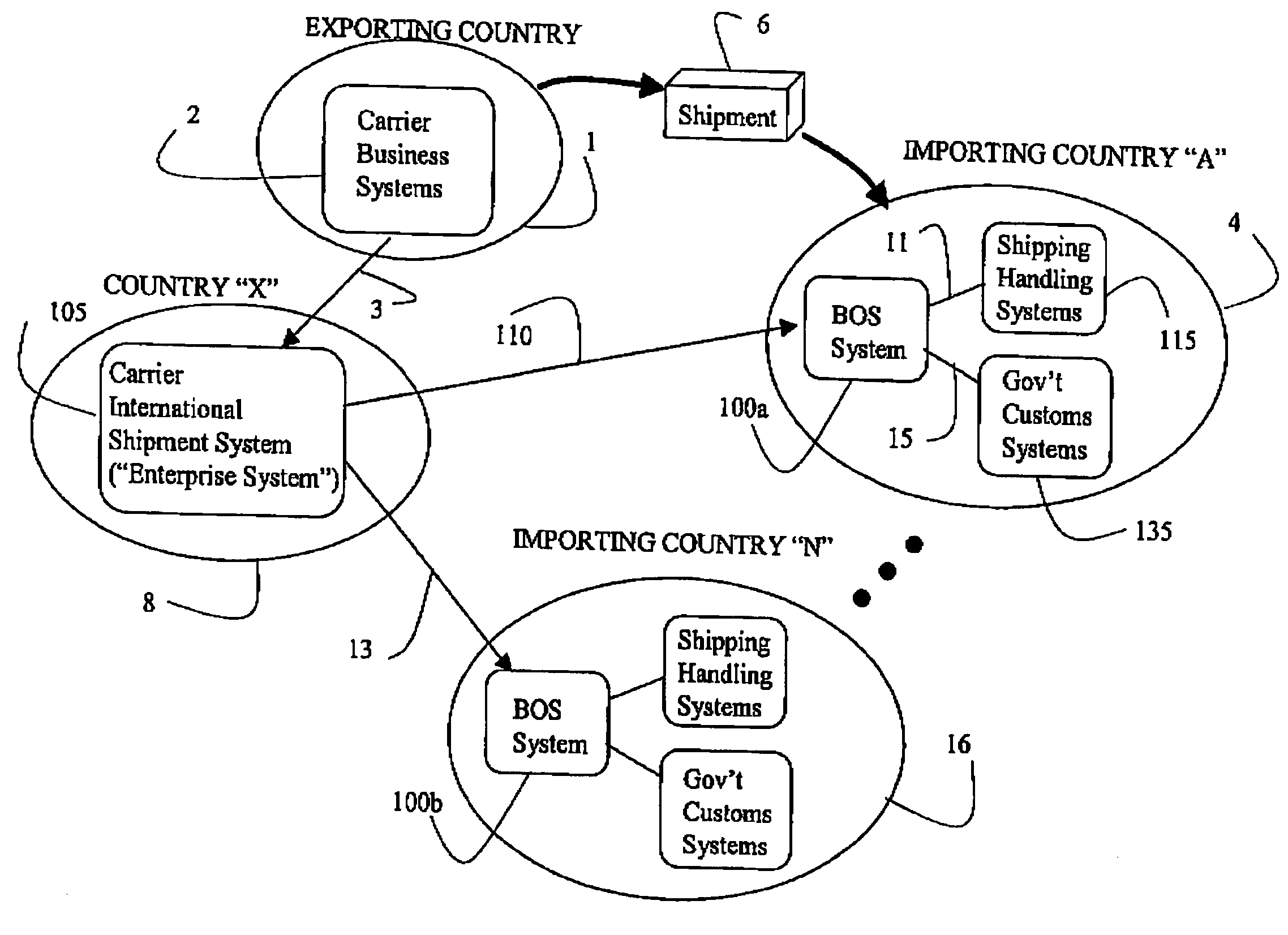

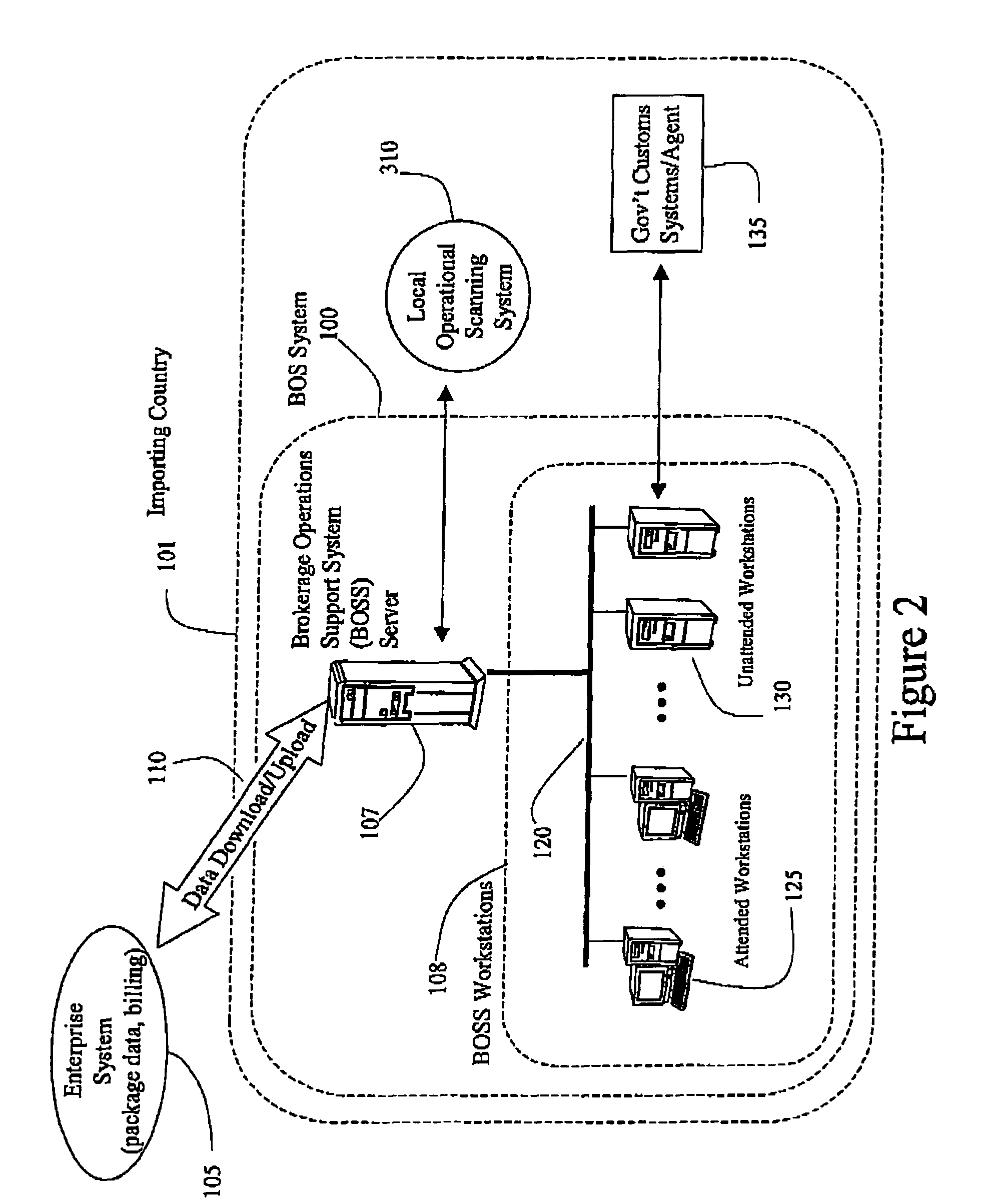

Systems and methods for international shipping and brokage operations support processing

ActiveUS20050222853A1Minimizing delay and storageBilling/invoicingLogisticsInternational shippingNational system

Systems and methods are disclosed for a brokerage operations support system to facilitate international shipping of goods into a country. The system receives information pertaining to a shipment and rates the shipment for a specific country by applying rules defined for the country's customs regulations. Status information of the shipment is received by the system, including whether the shipment has cleared the importing country's customs process. If the shipment has not cleared, the handling systems ensure the shipment is withheld from delivery until clearance is obtained. A flexible system architecture comprising a server and both attended and unattended workstations for a core system that can be modified to allow rating and processing of shipments occur in various modes to accommodate the procedures for each importing country.

Owner:UNITED PARCEL SERVICE OF AMERICAN INC

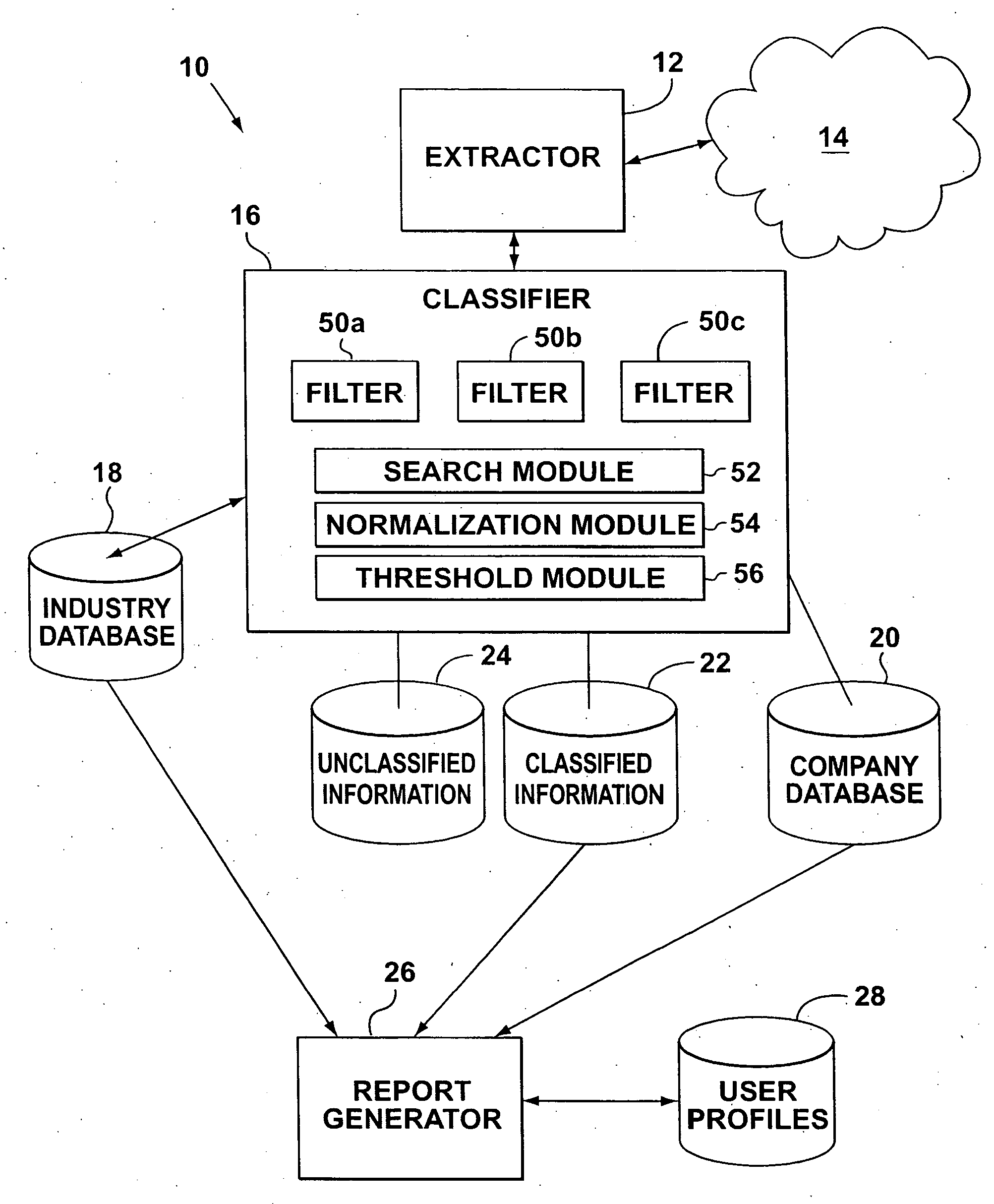

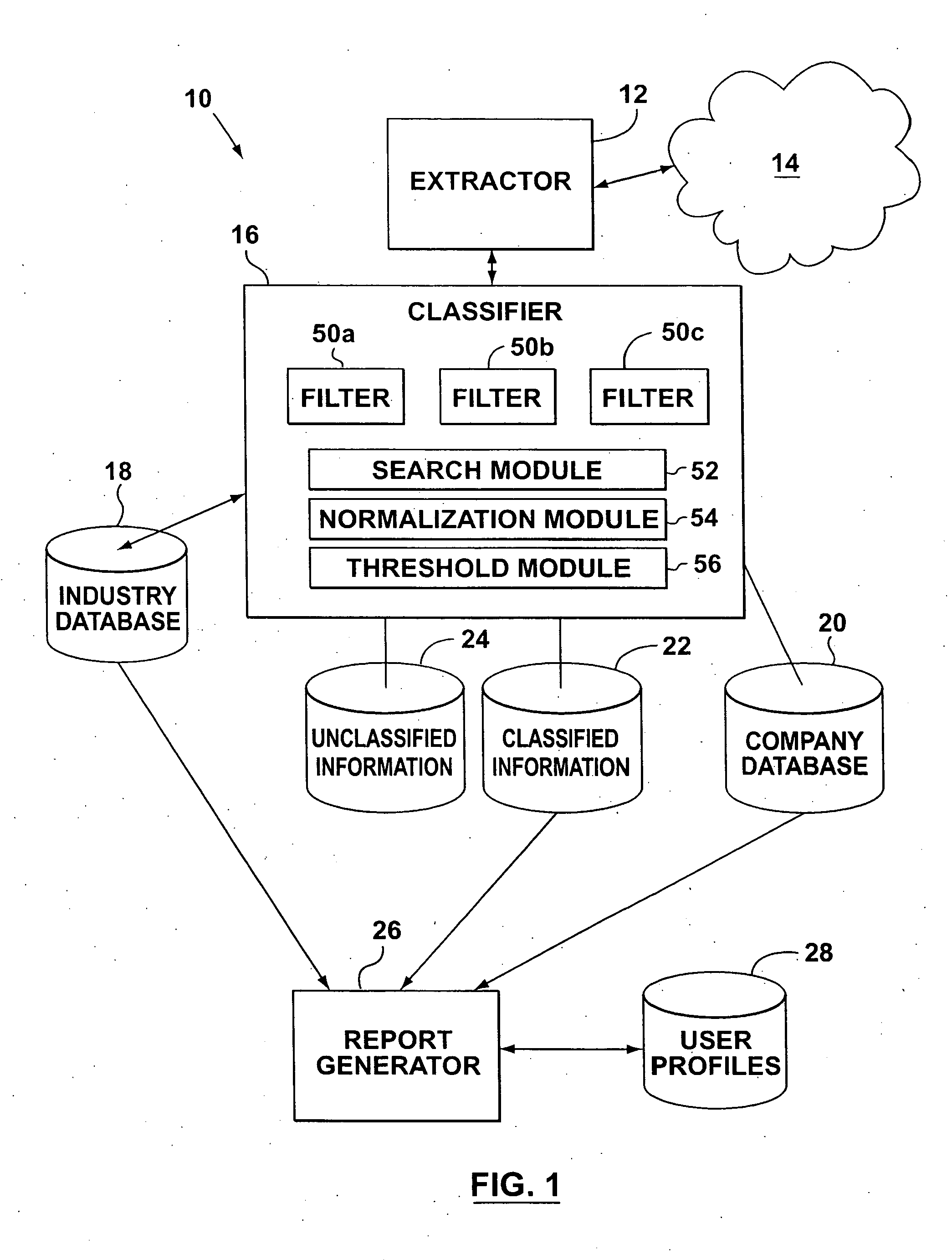

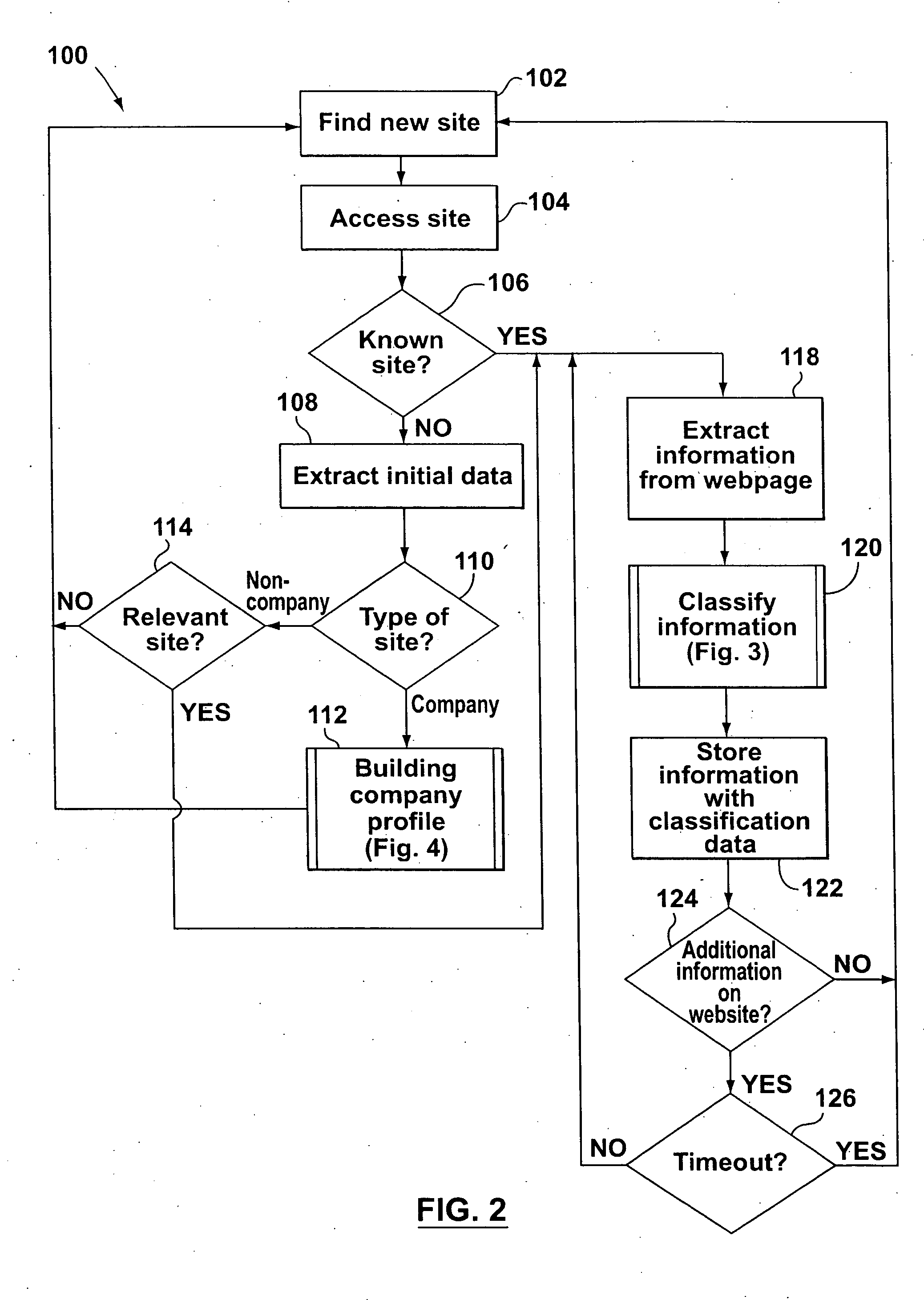

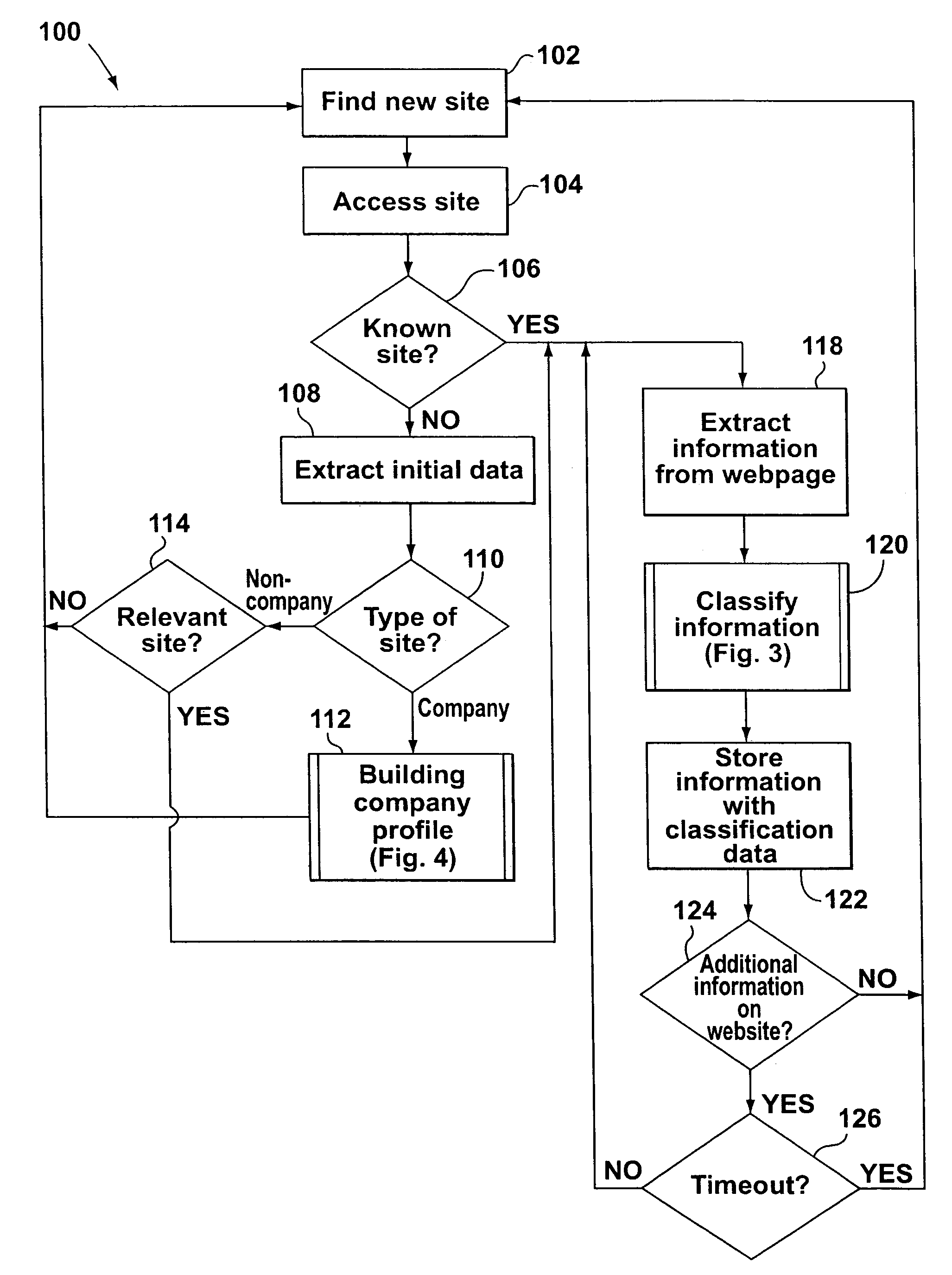

Data gathering and distribution system

InactiveUS20060026114A1Data processing applicationsWeb data indexingDistribution systemBusiness intelligence

A system and method for gathering and distributing data. The system is for extracting information from the world wide web and classifying the information in accordance with certain profiles. The information may include business intelligence, which may be categorized according to its relevance to predefined industry profiles or company profiles. The information may be further categorized according to its relevance to particular countries. If the information relates to a new company, the system builds a new company profile based upon the information. Users may create a user profile containing their information preferences, such as industry groups or particular countries or companies, and the system provides reports or alerts to the users referencing extracted information that is filtered by the user profile.

Owner:MYBIZINTEL

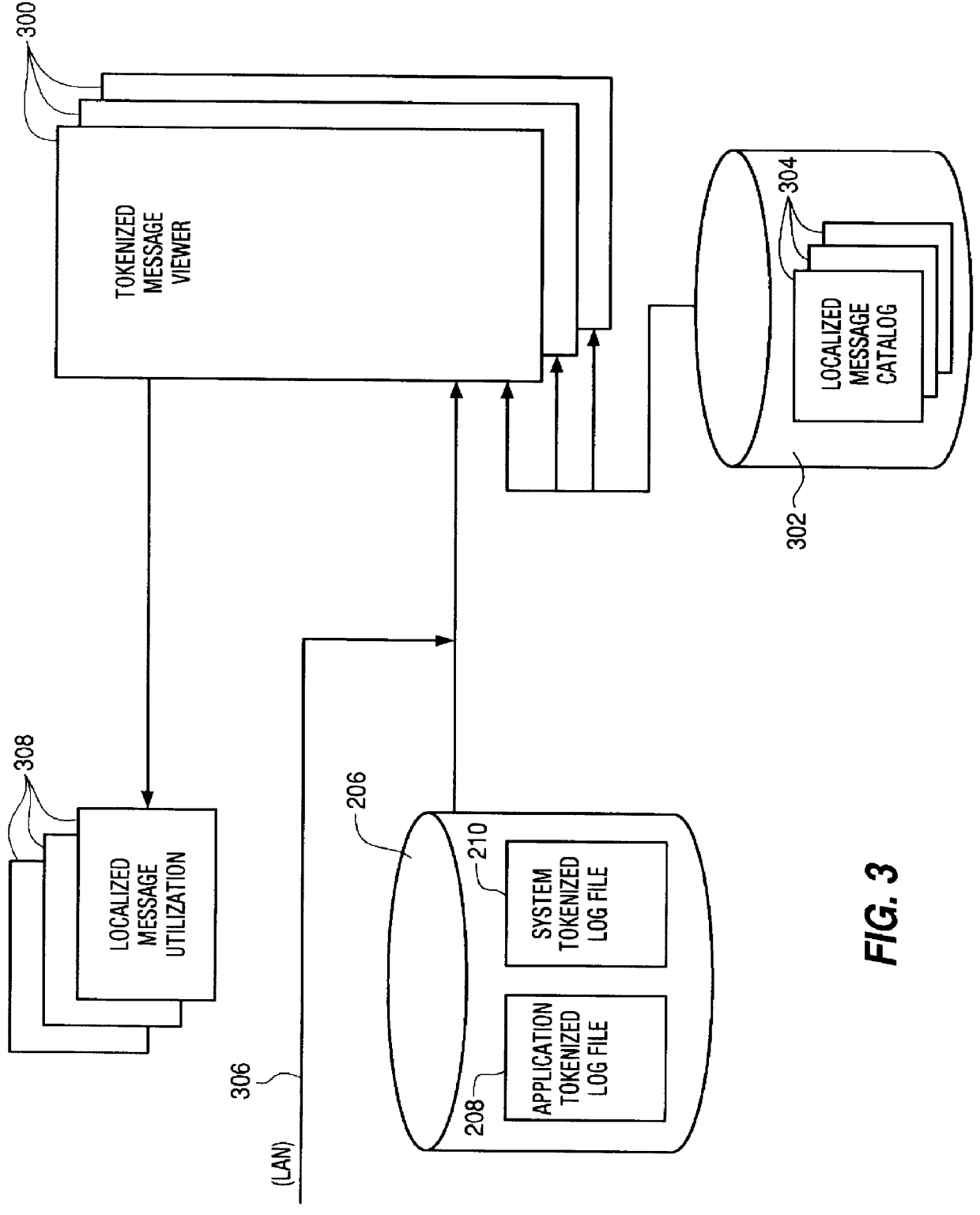

Method and structure for tokenized message logging system

InactiveUS6119079AEasy to parsePrecise positioningDigital computer detailsExecution for user interfacesProgramming languageApplication software

Methods and structure for storing log messages in a tokenized, international format and for presenting (viewing, printing, etc) the tokenized log message in a locally preferred native language. Log messages from a computing system or application are stored in an international tokenized format which remains constant regardless of the particular nation in which the system or application is operated. The tokenized format includes a message ID field which identifies a unique message and includes parameters values which are to replace variable portions, if any, of the identified message. A plurality of localized message catalog files are available to retrieve a localized native language string which corresponds to each tokenized message. The message ID field serves as an index to the localized catalog files. A viewer program then retrieves a localized text string message from a selected message catalog file replacing any variable portions identified therein with parameter values supplied in the tokenized message. The formatted, localized native language message is then presented (e.g., displayed, printed, etc.) to the requesting user in their preferred local native language. The present invention thereby enables users having a first preferred language to review or otherwise process logged messages generated by a system or application operable in an environment having a second preferred language. The present invention also simplifies parsing problems relating to automated analysis and post-processing of logged messages. The tokenized international format of the present invention remains constant regardless of the preferred local language of the system or application which generated the message.

Owner:HEWLETT-PACKARD ENTERPRISE DEV LP

System and method for delivering financial services

InactiveUS8543506B2Custom designFacilitates any offerComplete banking machinesFinancePresentation ManagerModularity

A delivery system and method allow a financial institution to provide financial services to a plurality of remote devices. The system is comprised of a set of re-usable global components which are modular and are organized into services sets. The system and method operate in sessions and, for instance, employ a dialog component for gathering information from a customer, a rule broker component for providing answers to the various legal and regulatory rules in a particular country, a language man component for selecting appropriate language, a transaction executor component for performing transactions, and a presentation manager component for formatting outputs to the customer. The system and method provide state-of-the art interfaces that can be configured and delivered to the customer in a globally consistent format that is based on the customer's account profile, various languages, various currencies, different legal regulatory requirements, as well as, different sets of business products.

Owner:CITICORP CREDIT SERVICES INC (USA)

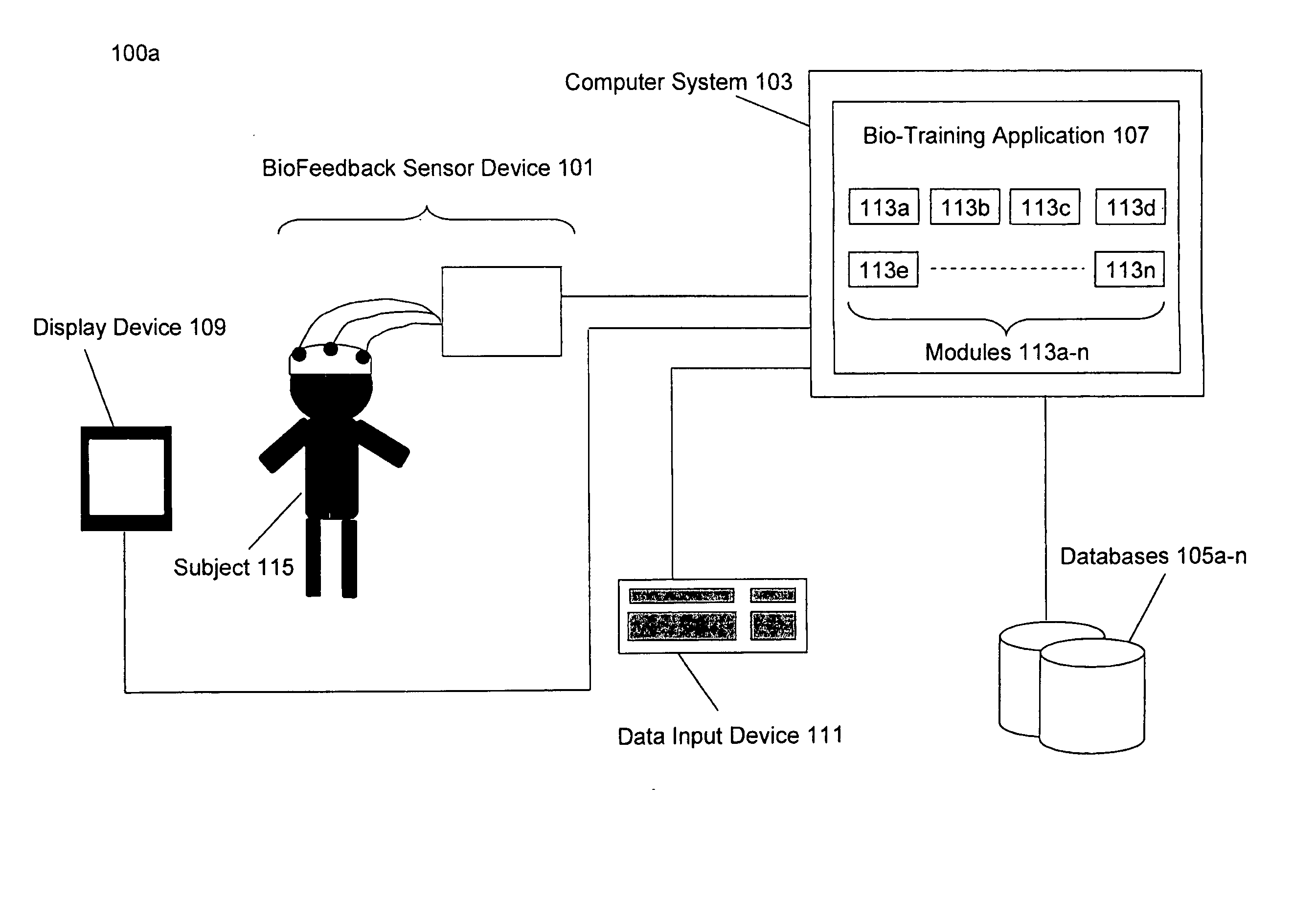

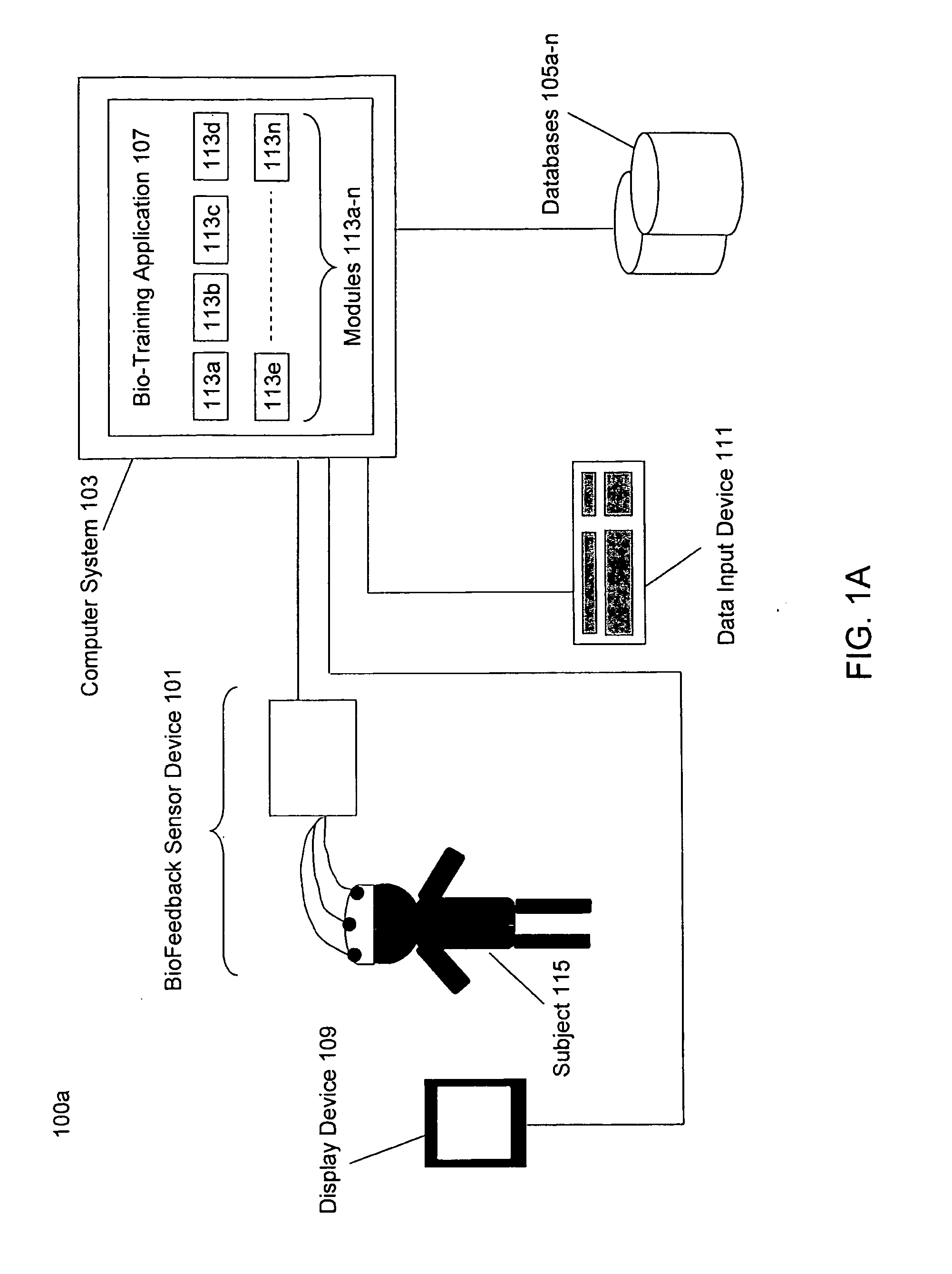

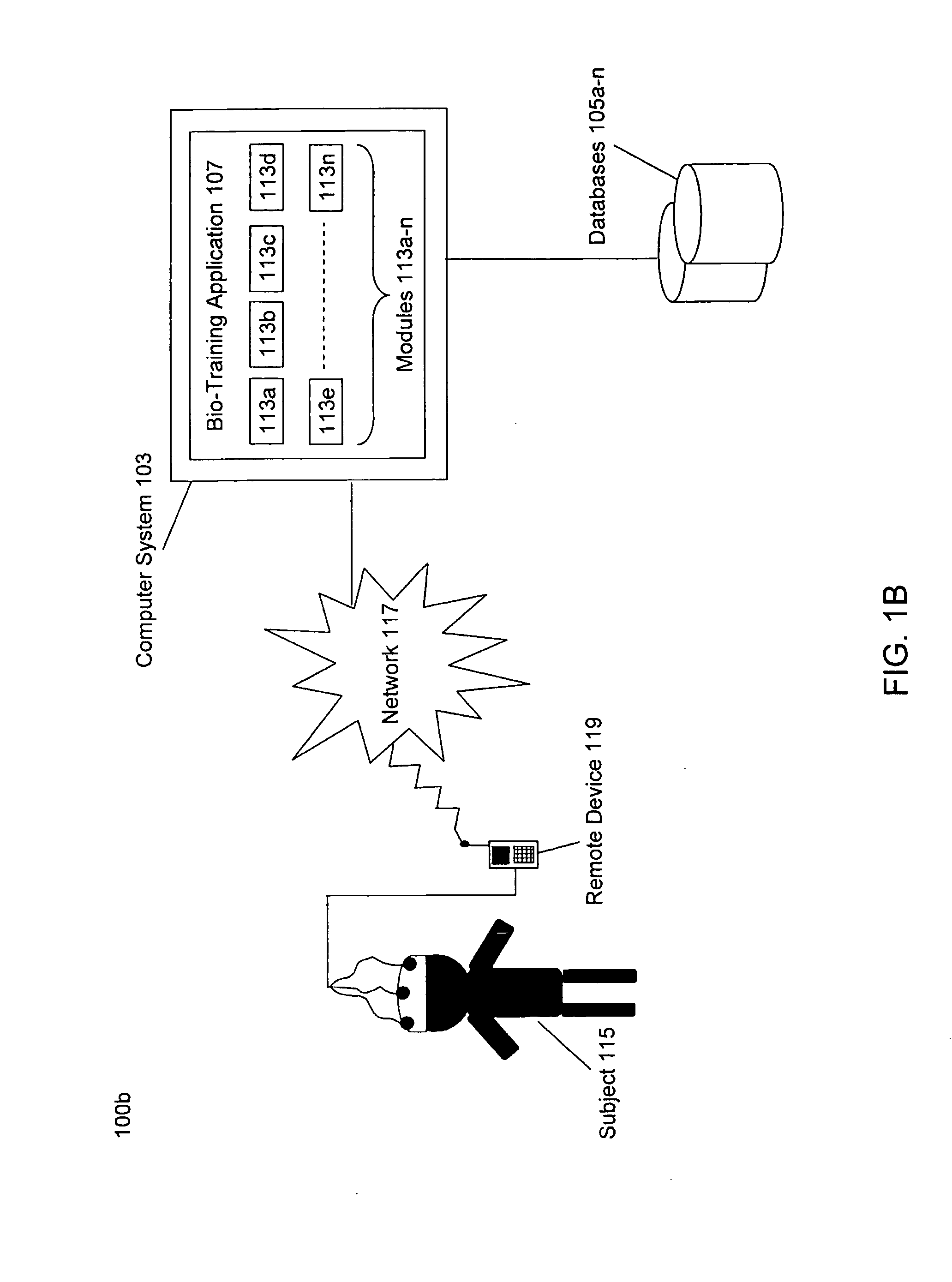

Method, system and apparatus for accessing, modulating, evoking, and entraining global bio-network influences for optimized self-organizing adaptive capacities

InactiveUS20070016096A1Improve abilitiesEnhance priori knowledgeElectroencephalographyAnalogue computers for chemical processesAdaptive learningState variation

The invention interacts with a subject to query, challenge and identify multiple aspects and multidimensional influences that provide access to, allow modulation of, and entrainment of, state-specific global bio-regulatory self-organizing controllers and evocable triggers. Modulation of state-specific regulatory triggers may evoke optimized newly emergent self-organizing principles within the subject and ultimately support up-regulation of “states of presence” that include newly emergent controllers of additional optimal regulation of bio-chemical expressions. The “state” measures of a person may include the status of a combination of any number of identified biological qualities. The invention includes systems and methods that support access to a subject's state controller functions, for various aliments, to empower shifting ones' biology from a symptomatic to an asymptomatic state and to optimal adaptive learning and readiness. The system of the invention investigates and accesses the capacities that control such state shifts so that they can be broadly challenged, expanded, and entrained for optimized global regulatory function in reversing a myriad of pathological symptoms, learning limitation, and adaptive dysregulations.

Owner:MCNABB GARY

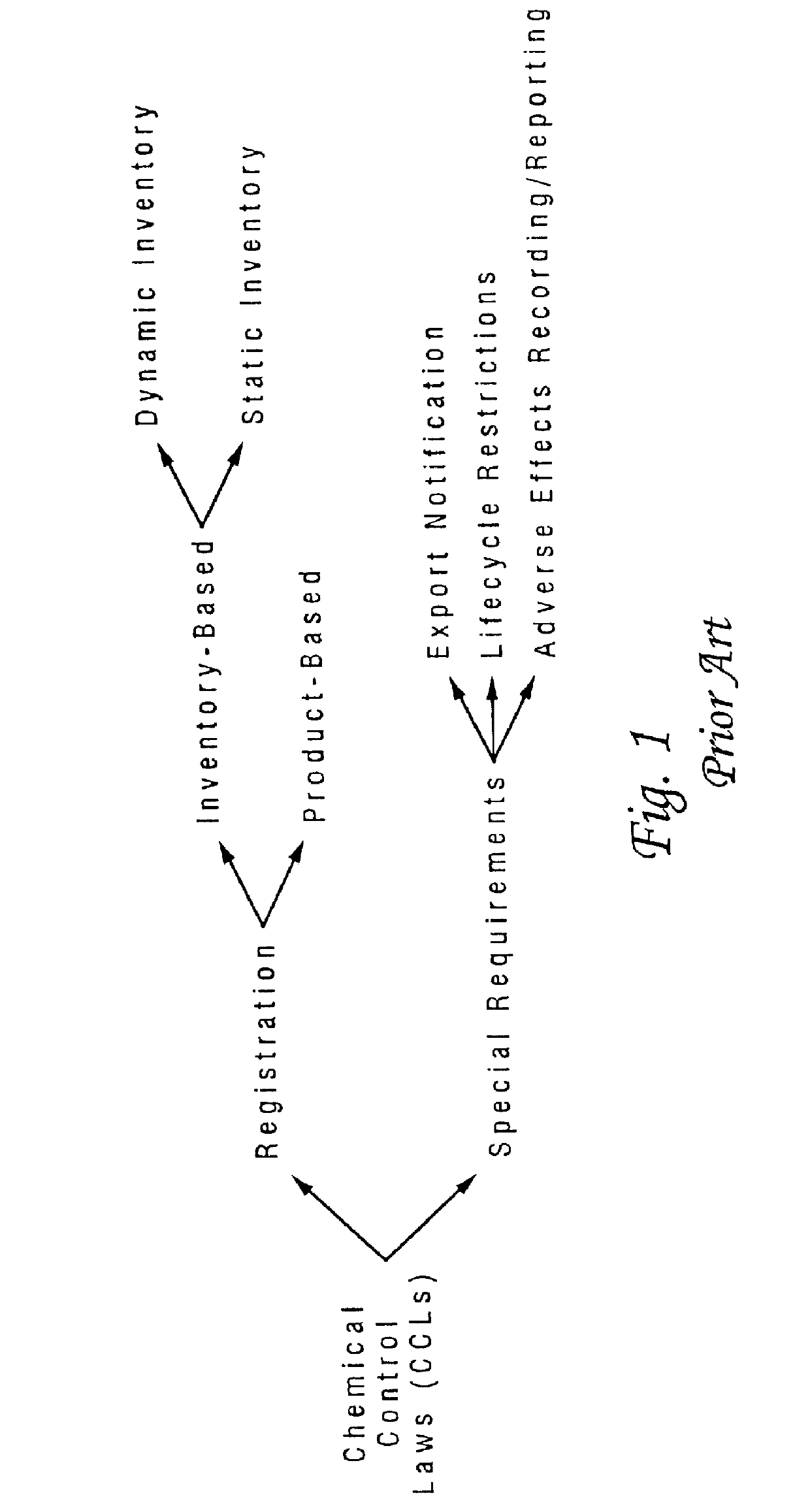

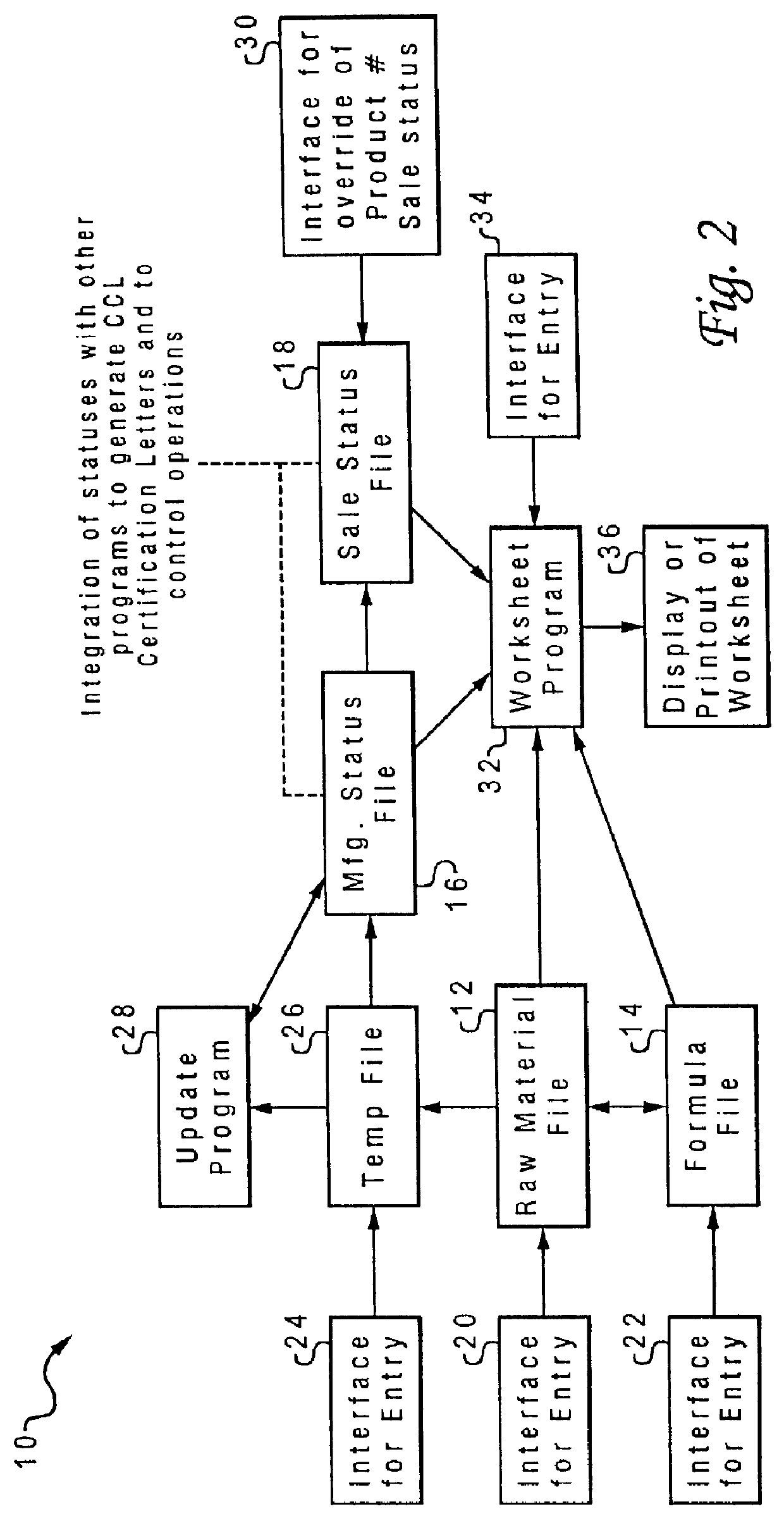

Computer aided system for compliance with chemical control laws

An automated system of integrated computer programs and files facilitates compliance with Chemical Control Laws of different jurisdictions. In one embodiment, the system uses a raw material database file, a formula database file, a manufacturing status database file, a sales status database file, a regulatory worksheet program, and an update program, all residing on a computer system. These files and programs are collectively used to: maintain Chemical Control Law inventories; maintain records of chemical and product Chemical Control Law registrations; provide a basis for automated control of chemical or product manufacturing, distribution, importing and exporting through the generation of country or regional manufacturing and sales status; generate certification letters; generate Chemical Control Law manufacturing and sales statuses for particular countries or regions of the world; and provide real-time updating of a chemical's or product's manufacturing and sales status.

Owner:HB FULLER CO

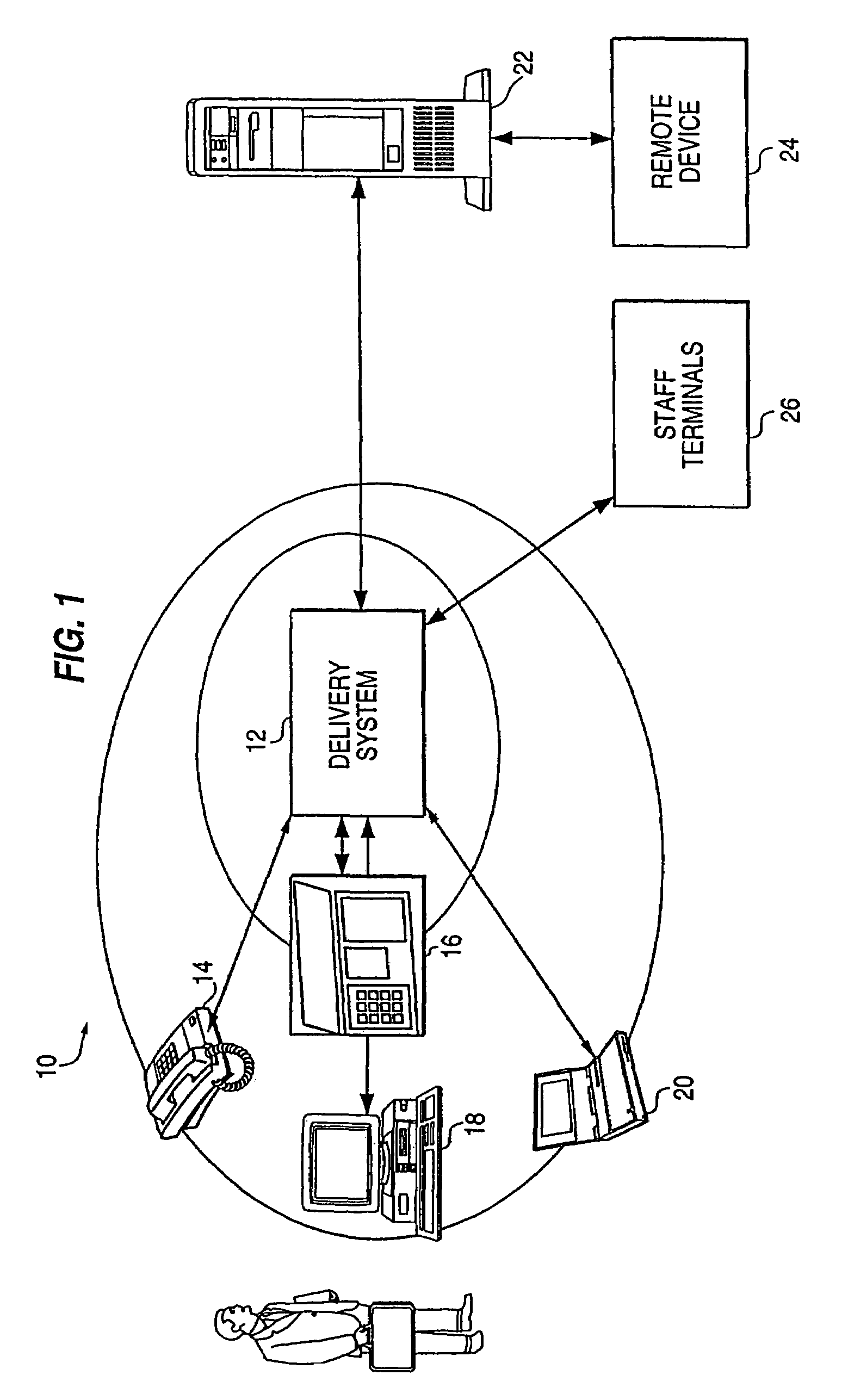

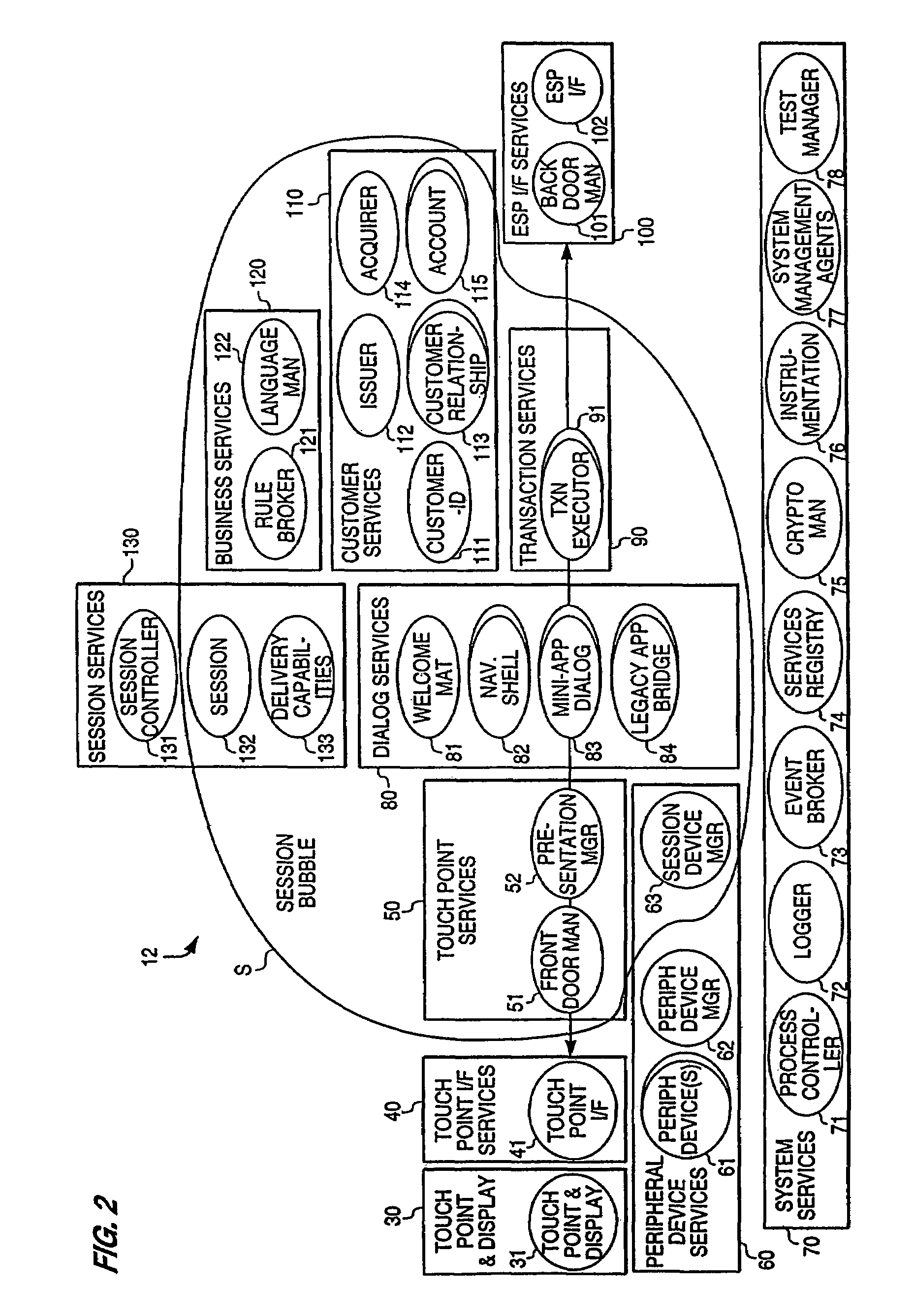

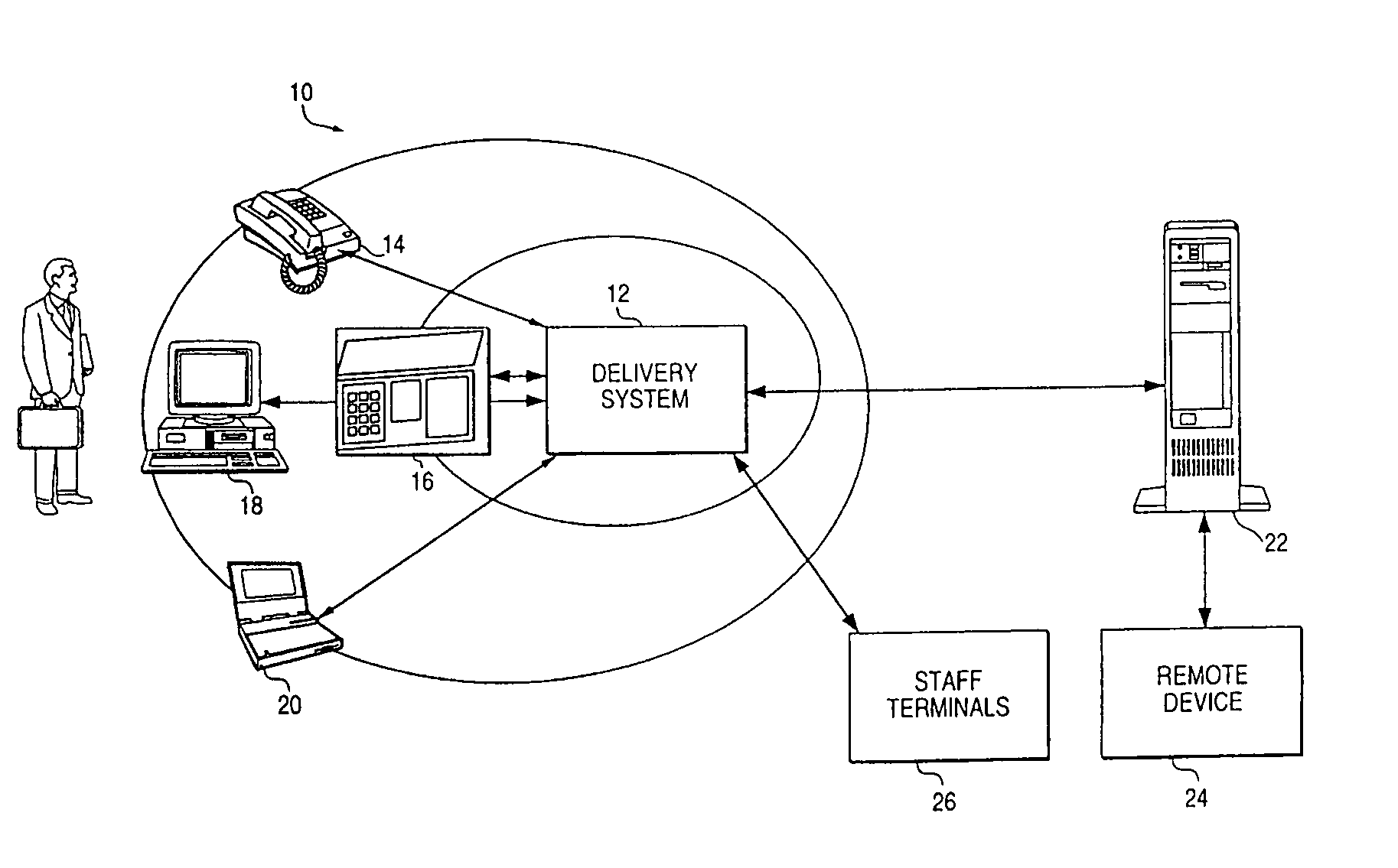

Delivery of financial services to remote devices

InactiveUS7249344B1Custom designEasy maintenanceFinancePayment architectureEngineeringState specific

A financial institution can provide financial services to a plurality of remote devices, such as personal computers, personal data assistants, screen phones, automatic teller machines, external service providers, and internally to staff terminals and individual branches. By separating the components of the system into independent components, the system and method can be developed and tested on a component level rather than the entire system level, thereby reducing the development and maintenance cycle time. The system and method operate in sessions and can employ a dialog component for gathering information from a customer, a rule broker component for providing answers to the various legal and regulatory rules in a particular country, a language man component for selecting appropriate language, a transaction executor component for performing transactions, and a presentation manager component for formatting outputs to the customer.

Owner:CITICORP CREDIT SERVICES INC (USA)

Data gathering and distribution system

A system and method for gathering and distributing data. The system is for extracting information from the world wide web and classifying the information in accordance with certain profiles. The information may include business intelligence, which may be categorized according to its relevance to predefined industry profiles or company profiles. The information may be further categorized according to its relevance to particular countries. If the information relates to a new company, the system builds a new company profile based upon the information. Users may create a user profile containing their information preferences, such as industry groups or particular countries or companies, and the system provides reports or alerts to the users referencing extracted information that is filtered by the user profile.

Owner:MYBIZINTEL

System and method for geocoding diverse address formats

ActiveUS20060041573A1Reduce overheadFacilitate communicationInstruments for road network navigationData processing applicationsState specificData mining

A method and system for providing geocodes in response to complete or partial address information is disclosed. The disclosure teaches embodiments that are naturally upgraded to integrate changing spatial information due to addition of countries, better data, political changes, and other similar changes in geographical data. A single geocoding engine is capable of handling the various address formats in use in different countries and jurisdictions. The disclosed embodiments are error tolerant and capable of overcoming many errors due to spelling, variety of languages and formats used to provide and address. The diversity in addresses due to, for instance country-specific formats such as postal-codes are naturally integrated into existing database of geocoding information. Preferably, the embodiments are based on JAVA to allow platform independence and use XML based communication to use networks without requiring excessive resources while providing fast services.

Owner:PRECISELY SOFTWARE INC

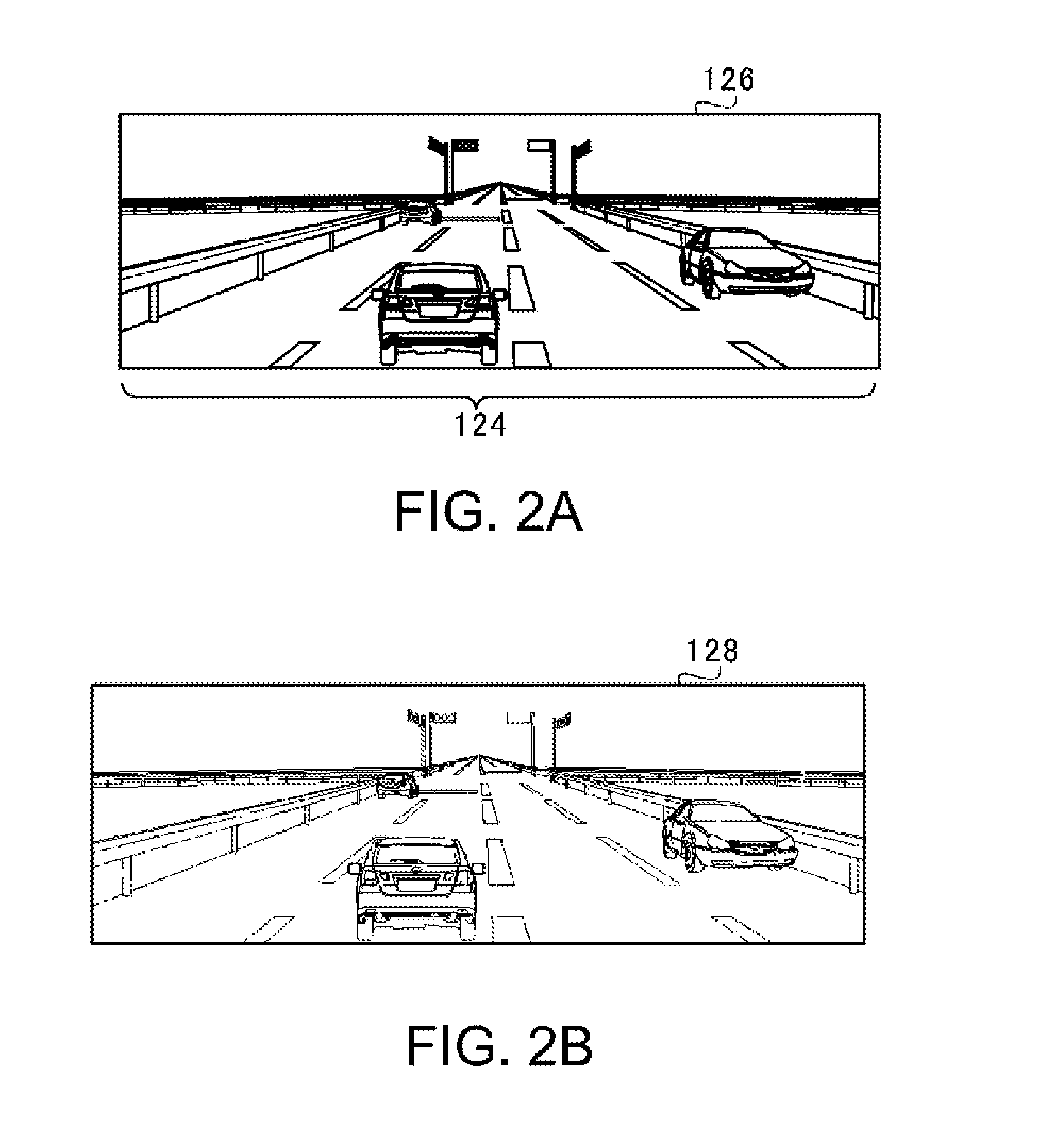

Vehicle exterior environment recognition device

ActiveUS20150278615A1Improve recognition accuracyReduce processing loadTelevision system detailsCharacter and pattern recognitionTraffic sign recognitionIntegration point

A vehicle exterior environment recognition device includes an image acquiring module that acquires an image, a traffic sign identifying module that identifies a circle of a predetermined radius centering on any one of pixels in the image as a traffic sign, a traffic sign content recognizing module that recognizes content of the identified traffic sign, and a traffic sign content determining module that uses at least one template for one certain country to integrate traffic sign integration points based on correlation evaluation values with the content of the recognized traffic sign, uses a template for each of a plurality of countries corresponding to the content of the traffic sign having the traffic sign integration points to integrate total points by country based on overall evaluation values of the content of the recognized traffic sign, and conclusively determines a currently-traveling country.

Owner:SUBARU CORP

System and method for delivering financial services

A delivery system and method allow a financial institution to provide financial services to a plurality of remote devices, such as personal computers, personal data assistants, and screen phones. In addition to providing services to these remote devices, the system and method provide services to automatic teller machines (ATMs), external service providers, and internally within the financial institution to staff terminals and to the individual branches of the financial institution. The delivery of financial services is not limited to any particular network but rather may be provided through dial-in access, Internet access, on-line service provider access, or other types of delivery networks. The system is comprised of a set of re-usable global components which are modular and are organized into services sets. By separating the components of the system into independent components, the system and method can be developed and tested on a component level rather than the entire system level, thereby substantially reducing the development and maintenance cycle time. The system and method operate in sessions and, for instance, employ a dialog component for gathering information from a customer, a rule broker component for providing answers to the various legal and regulatory rules in a particular country, a language man component for selecting appropriate language, a transaction executor component for performing transactions, and a presentation manager component for formatting outputs to the customer. The system and method provide state-of-the art interfaces with interface components and support legacy applications with legacy app bridge components. A system management aspect of invention makes use of an agent set that provides a communication mechanism such that managed components of the system can be queried for their status, as well as the concept of instrumentation in which software monitors the hardware devices that are part of the system.

Owner:CITICORP CREDIT SERVICES INC (USA)

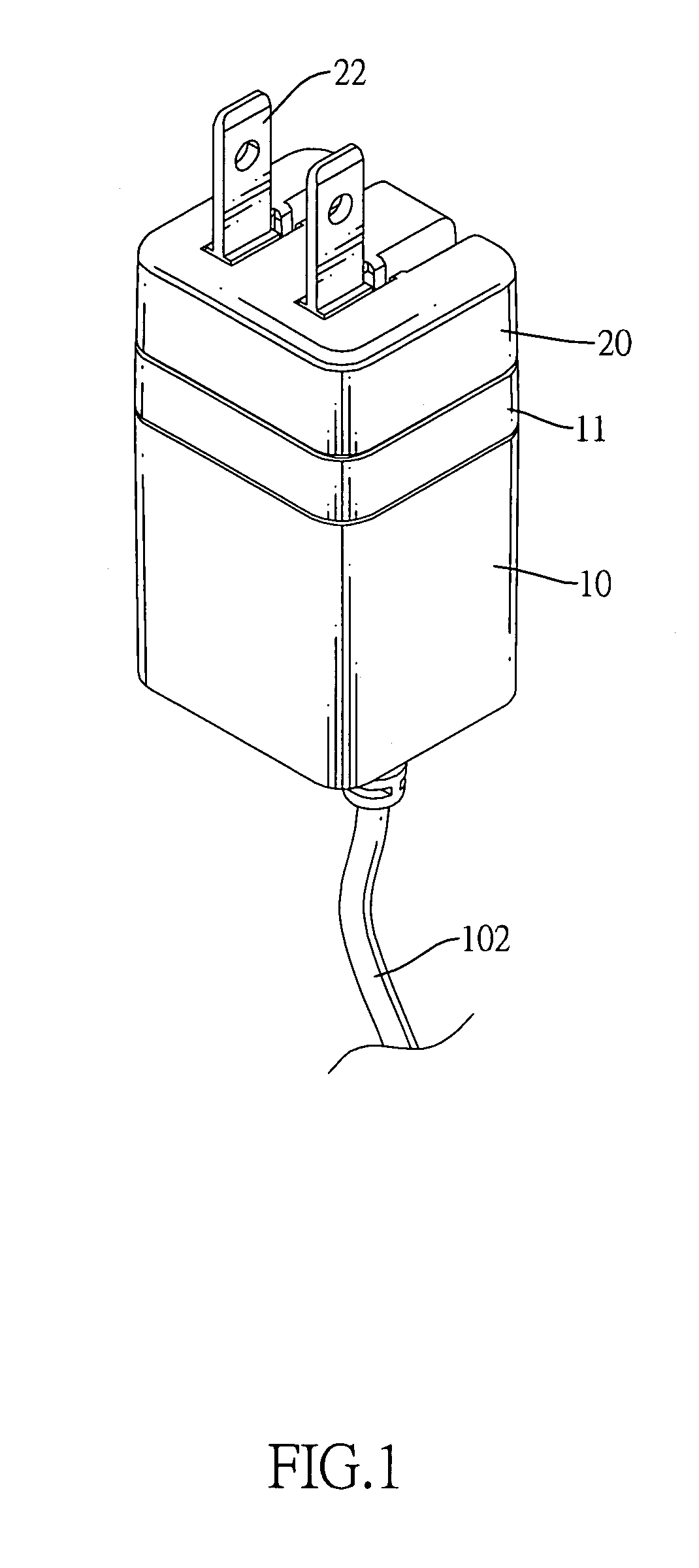

Plug device with a changeable adapter

A plug device with a changeable adapter has a base and an adapter. The base has a transformer circuit and a first connecting component. The adapter is detachably mounted on the base and has two prongs and a second connecting component selectively connected to the first connecting component of the base. When a user goes on a trip abroad, the user is capable of replacing the adapter to fit sockets of a specific country and to supply electrical power to electronic devices that the user carries along.

Owner:WANG TONGT HUEI +2

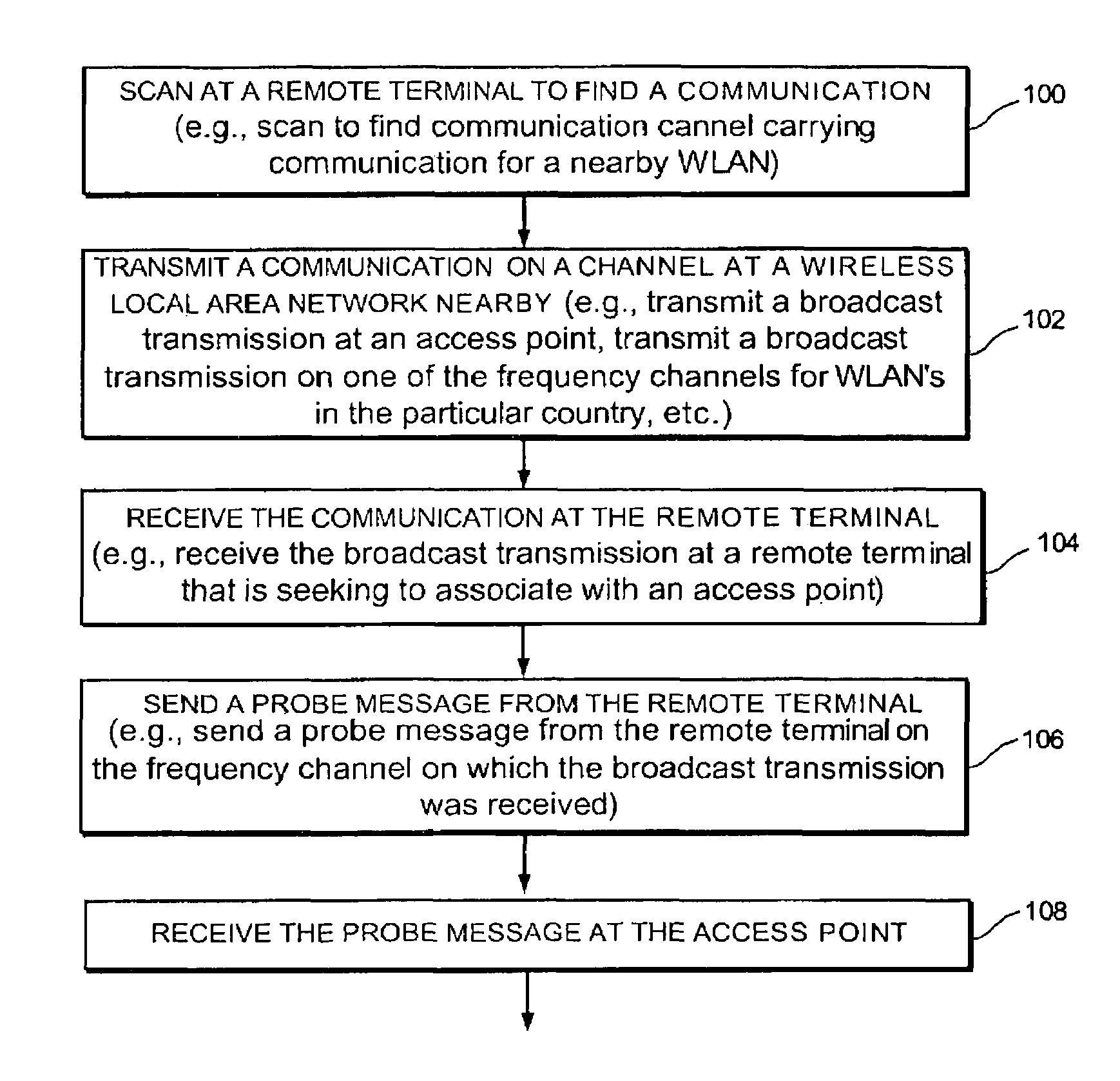

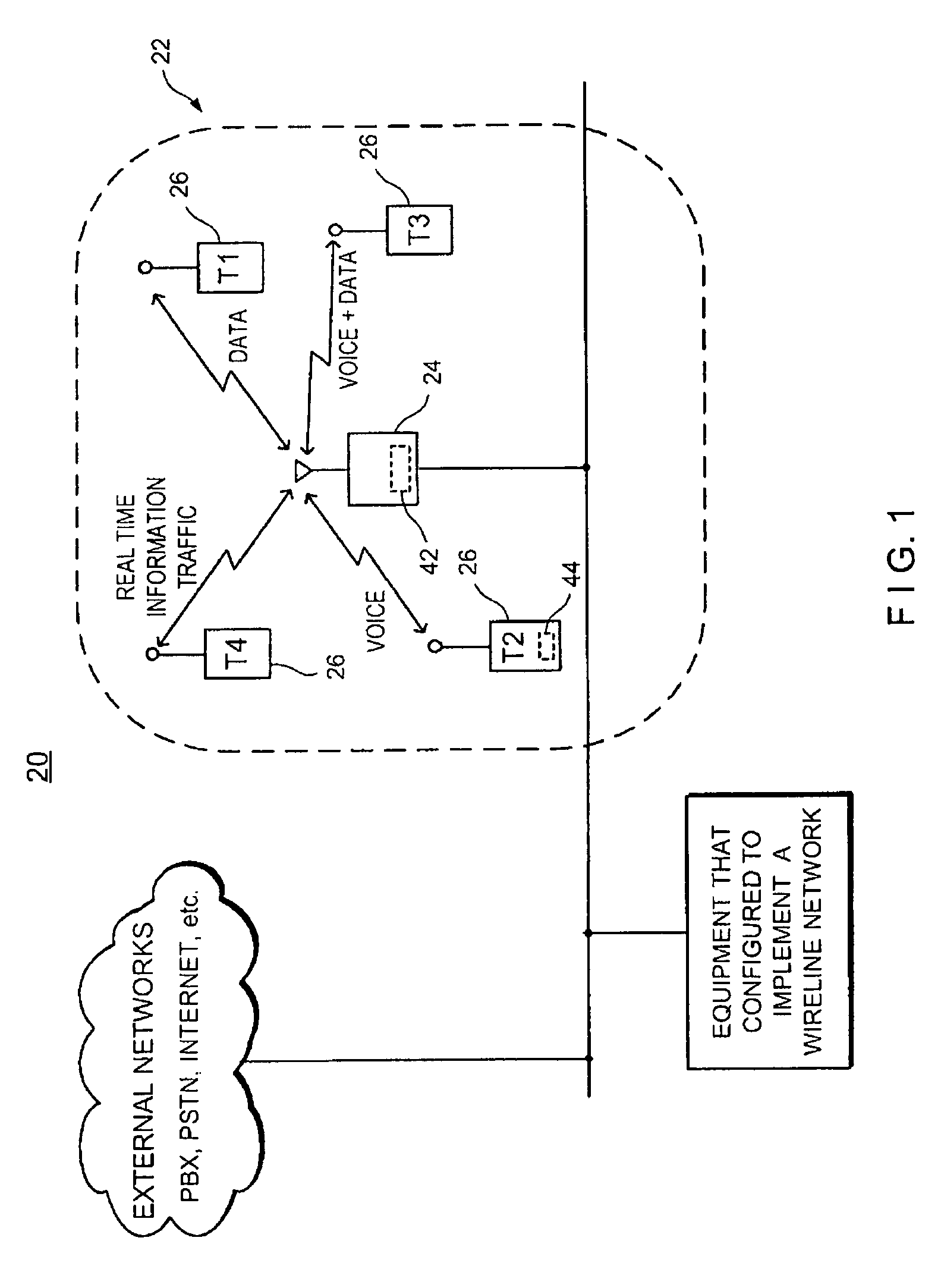

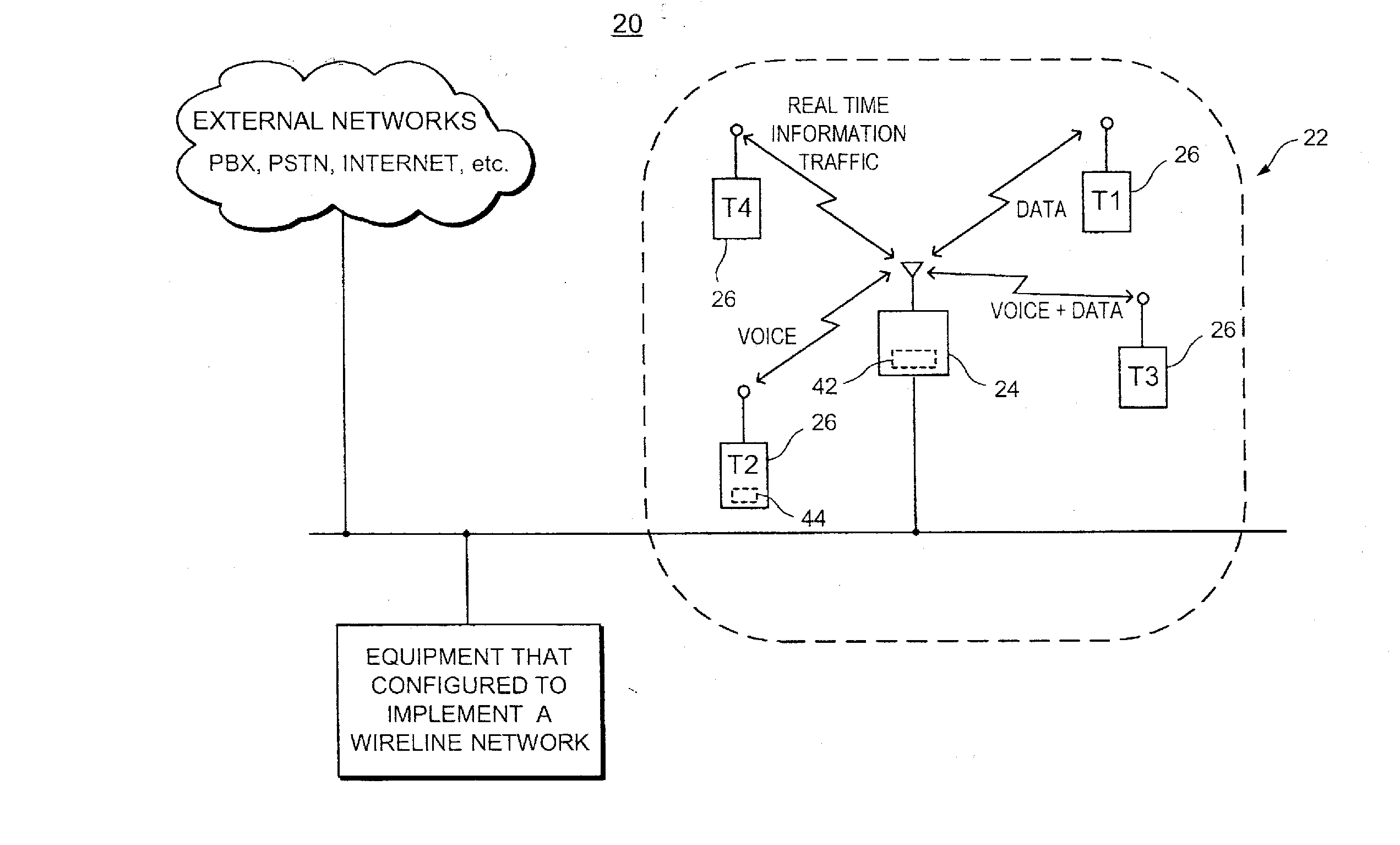

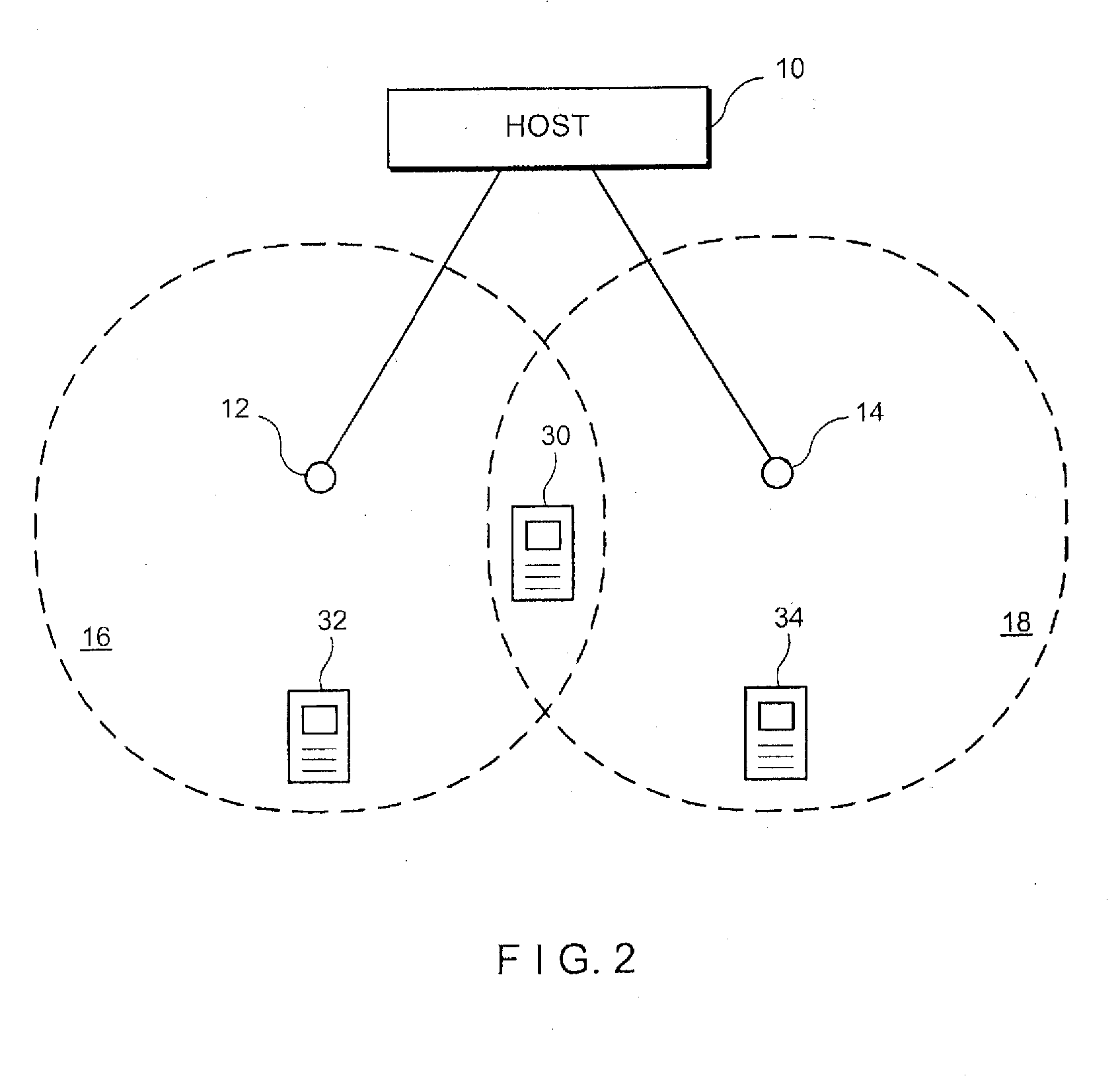

Apparatus and method for wireless local area networks of different countries

The present invention relates to apparatus and methods for adapting a mobile unit to communication requirements of a particular country or geographic region. A wireless local area network communications system may include access points and remote terminals. Remote terminals may use country-specific information in messages from an access point to adapt to the communications requirements of the country in which the access point is operating. The country-specific information may be in a broadcast transmission or a message sent in reply to a remote terminal probe message. The country-specific information may include operating requirements such as channel information, power information, country name, modulation information, etc.

Owner:SYMBOL TECH LLC

System and method for delivering financial services

A delivery system and method allow a financial institution to provide financial services to a plurality of remote devices, such as personal computers, personal data assistants, and screen phones. In addition to providing services to these remote devices, the system and method provide services to automatic teller machines (ATMs), external service providers, and internally within the financial institution to staff terminals and to the individual branches of the financial institution. The delivery of financial services is not limited to any particular network but rather may be provided through dial-in access, Internet access, on-line service provider access, or other types of delivery networks. The system is comprised of a set of re-usable global components which are modular and are organized into services sets. By separating the components of the system into independent components, the system and method can be developed and tested on a component level rather than the entire system level, thereby substantially reducing the development and maintenance cycle time. The system and method operate in sessions and, for instance, employ a dialog component for gathering information from a customer, a rule broker component for providing answers to the various legal and regulatory rules in a particular country, a language man component for selecting appropriate language, a transaction executor component for performing transactions, and a presentation manager component for formatting outputs to the customer. The system and method provide state-of-the art interfaces with interface components and support legacy applications with legacy app bridge components. A system management aspect of invention makes use of an agent set that provides a communication mechanism such that managed components of the system can be queried for their status, as well as the concept of instrumentation in which software monitors the hardware devices that are part of the system.

Owner:CITICORP DEV CENT INC

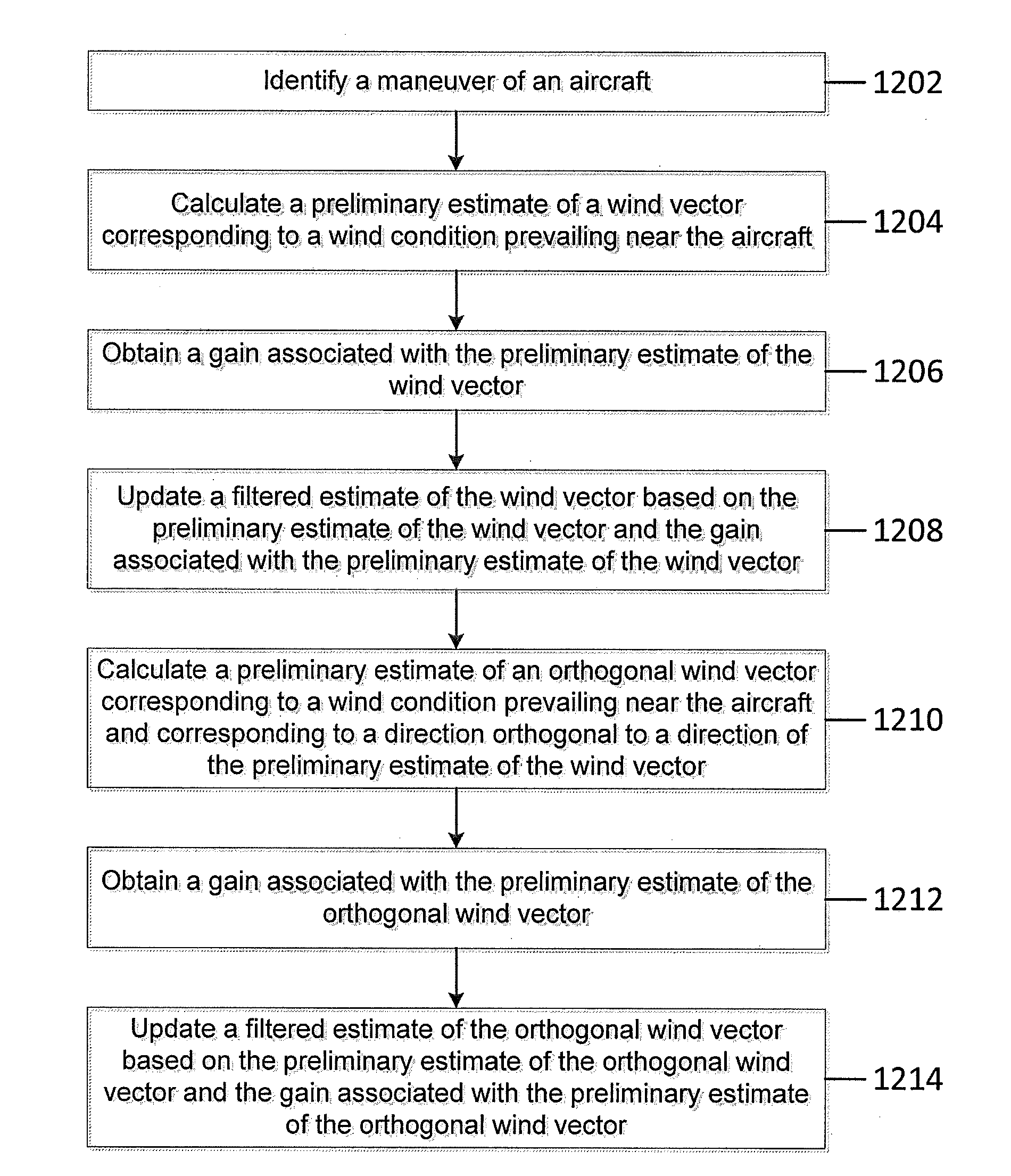

Estimating a wind vector

InactiveUS20140046510A1Analogue computers for trafficIndication/recording movementEngineeringState specific

Methods and devices for calculating an estimate of a wind vector. A maneuver of a platform may be identified as a steady-straight motion maneuver, a partial turn maneuver, or a full turn maneuver. A preliminary estimate of a wind vector corresponding to a wind condition prevailing near the platform may be calculated by applying a maneuver-specific calculating method. A gain associated with the preliminary estimate of the wind vector may be calculated by applying a state-specific calculation method. A filtered estimate of the wind vector may be updated based, at least in part, on the preliminary estimate of the wind vector and the gain associated with the to preliminary estimate of the wind vector.

Owner:LOCKHEED MARTIN CORP

Delivering financial services to remote devices

InactiveUS20070250808A1Custom designEasy maintenanceFinancePayment architectureEngineeringIndependent component analysis

A financial institution can provide financial services to a plurality of remote devices, such as personal computers, personal data assistants, screen phones, automatic teller machines, external service providers, and internally to staff terminals and individual branches. By separating the components of the system into independent components, the system and method can be developed and tested on a component level rather than the entire system level, thereby reducing the development and maintenance cycle time. The system and method operate in sessions and can employ a dialog component for gathering information from a customer, a rule broker component for providing answers to the various legal and regulatory rules in a particular country, a language man component for selecting appropriate language, a transaction executor component for performing transactions, and a presentation manager component for formatting outputs to the customer.

Owner:CITICORP CREDIT SERVICES INC (USA)

System and method for delivering financial services

ActiveUS8112330B1Easy maintenanceReduce developmentComplete banking machinesFinanceModularityPresentation Manager

A delivery system and method allow a financial institution to provide financial services to a plurality of remote devices and internally within the financial institution to staff terminals using a set of re-usable global components which are modular and are organized into services sets. The system and method operate in sessions and, for instance, employ a dialog component for gathering information from a customer, a rule broker component for providing answers to the various legal and regulatory rules in a particular country, a language man component for selecting appropriate language, a transaction executor component for performing transactions, and a presentation manager component for formatting outputs to the customer. The system and method provide interfaces which can be configured and delivered to the customer in a globally consistent format that is based on the customer's account profile, various languages, various currencies, different legal regulatory requirements, as well as, different sets of business products.

Owner:CITICORP CREDIT SERVICES INC (USA)

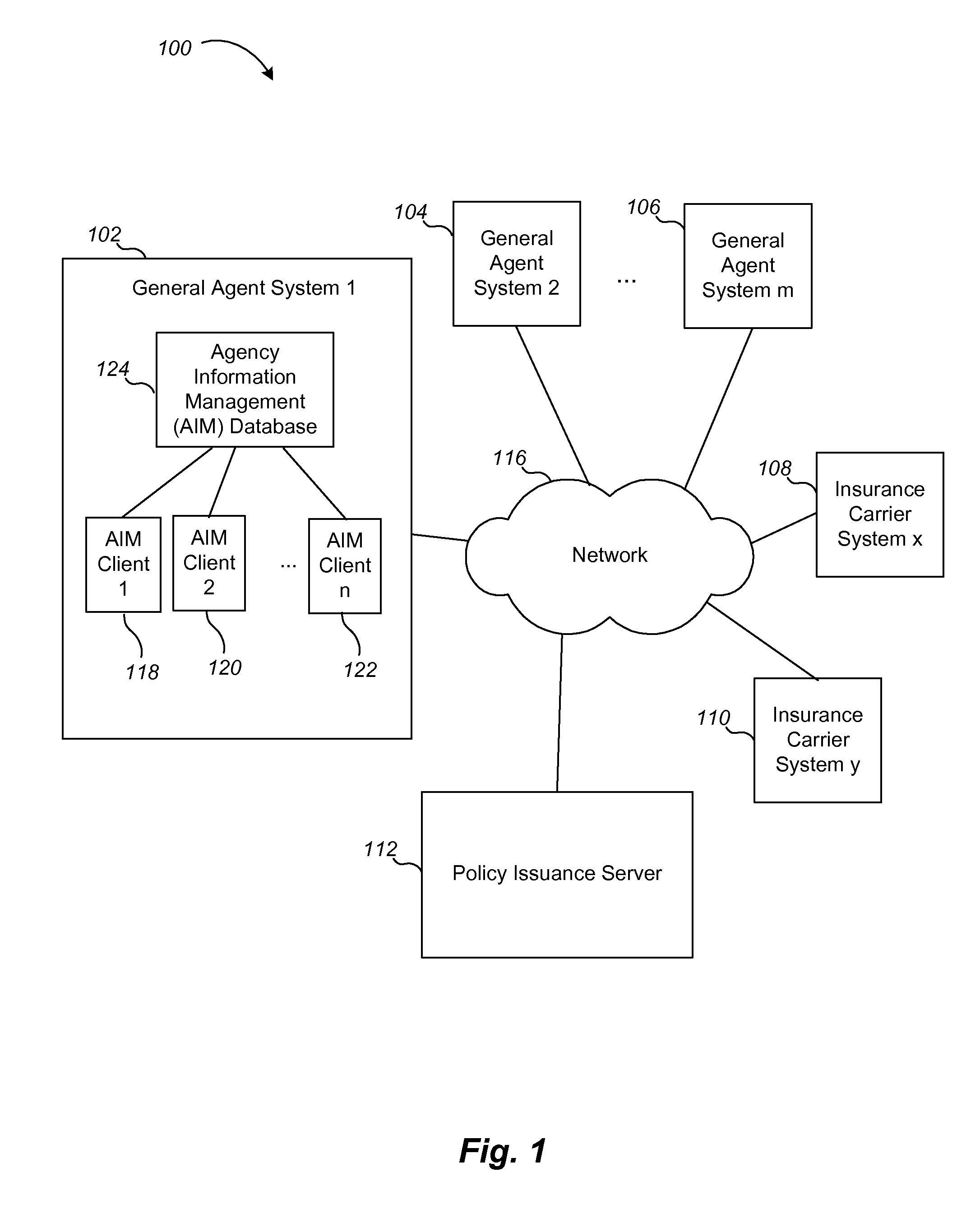

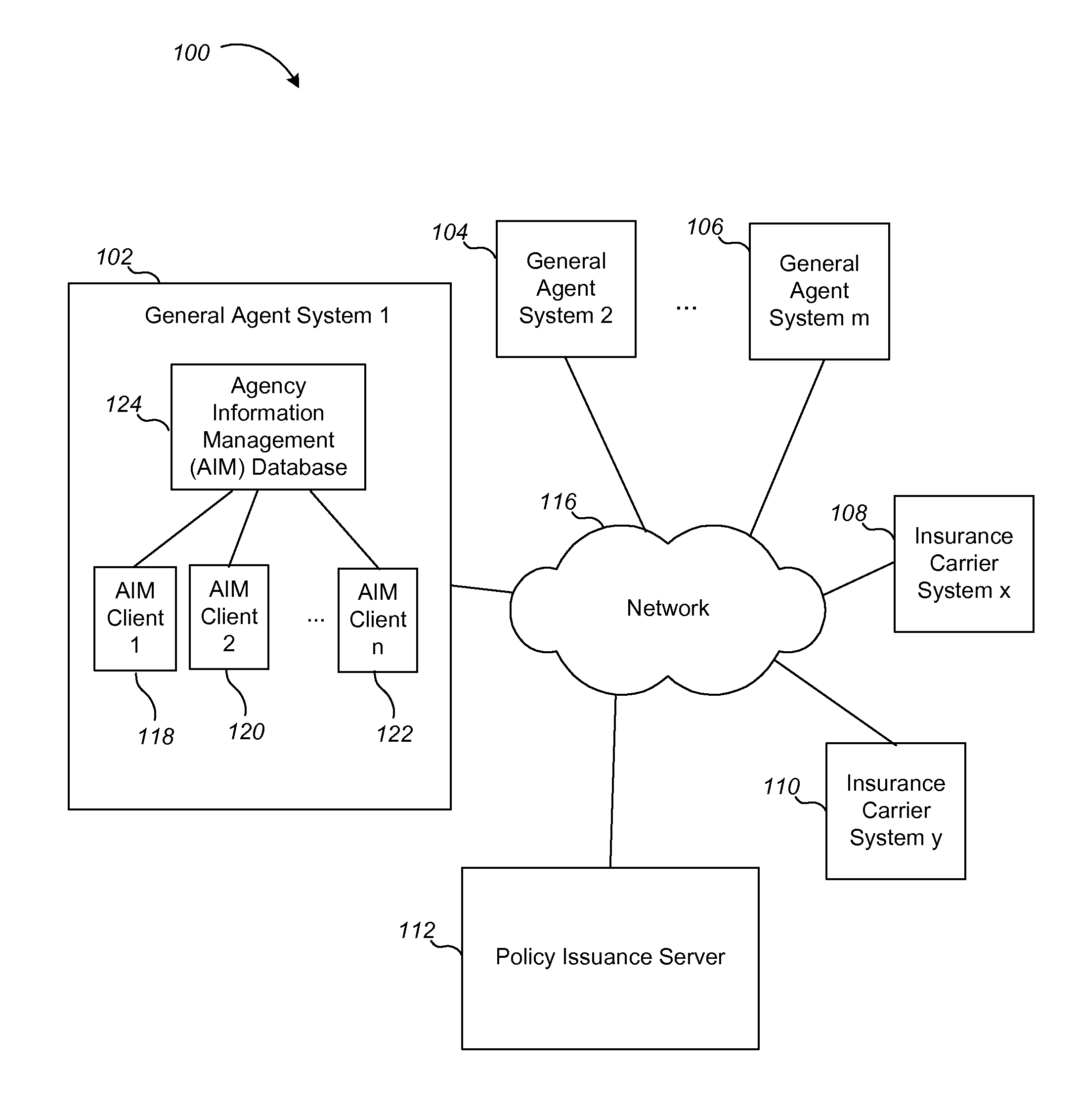

Overlaying images in automated insurance policy form generation

Overlaying images in automated insurance policy form generation includes electronically converting a first form in a first format to a second format to and in response to receiving a Web page request, electronically communicating the second form to be displayed within the Web browser instead of electronically communicating the first form in the first format to be displayed within the Web browser. In the case where the first format is Adobe® portable document format (PDF) and the second format is Joint Picture Expert Group (JPEG) format, this enables the user of the browser to overlay images on the forms within the Web page interface of the browser, while it appears to the user they are overlaying images on the original PDF versions of the forms. The final integrated PDF form is then generated from the data indicating the location of the overlay image on the underlying JPEG form. This process may also apply to insurance policy forms wherein the overlay image is a state specific stamp to be placed on the underlying form.

Owner:VERTAFORE

Overlaying images in automated insurance policy form generation

Overlaying images in automated insurance policy form generation includes electronically converting a first form in a first format to a second format to and in response to receiving a Web page request, electronically communicating the second form to be displayed within the Web browser instead of electronically communicating the first form in the first format to be displayed within the Web browser. In the case where the first format is Adobe® portable document format (PDF) and the second format is Joint Picture Expert Group (JPEG) format, this enables the user of the browser to overlay images on the forms within the Web page interface of the browser, while it appears to the user they are overlaying images on the original PDF versions of the forms. The final integrated PDF form is then generated from the data indicating the location of the overlay image on the underlying JPEG form. This process may also apply to insurance policy forms wherein the overlay image is a state specific stamp to be placed on the underlying form.

Owner:VERTAFORE

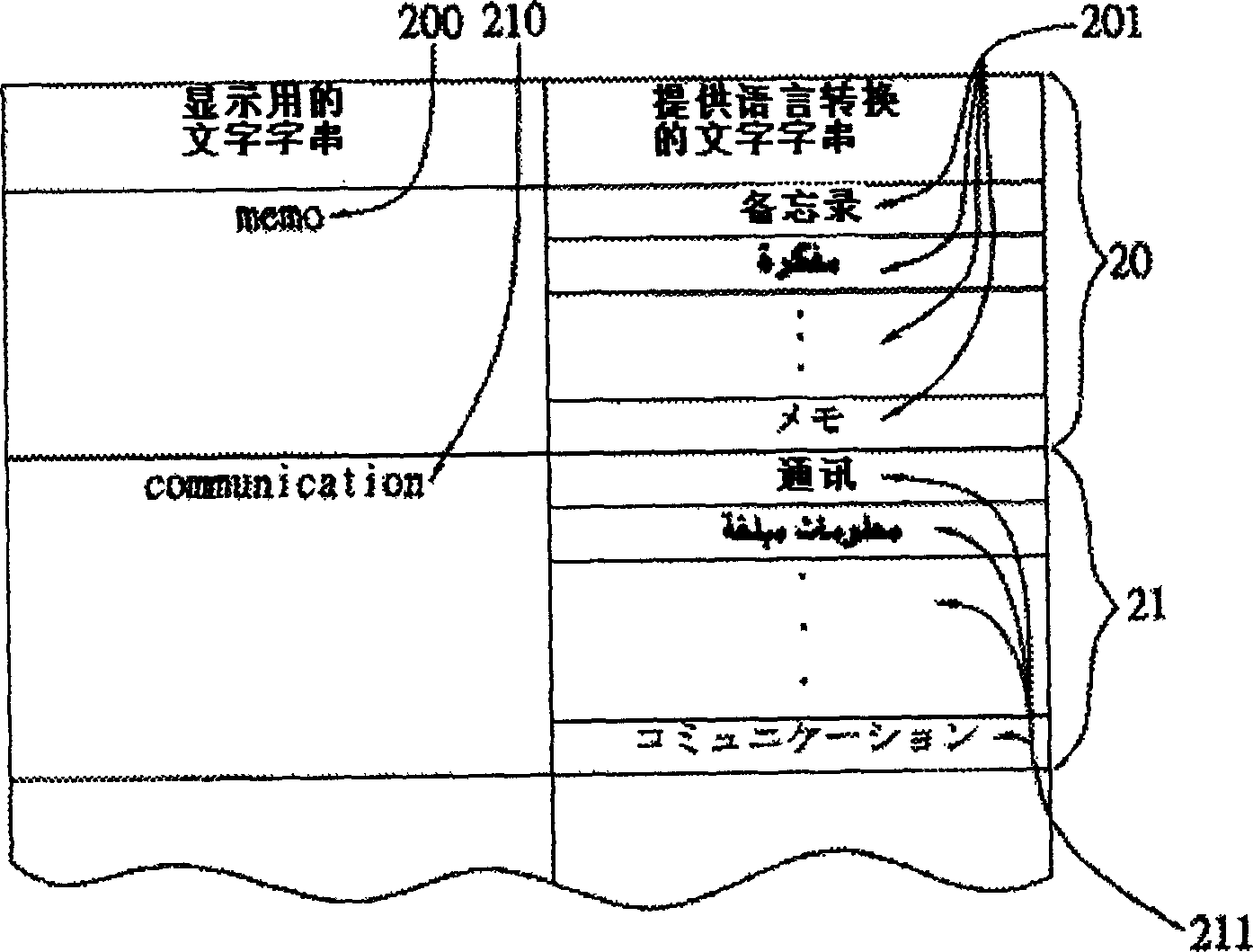

Device capable of supporting multiple languages and its display method

InactiveCN1474312AEasy maintenanceSimple procedureSpecial data processing applicationsDigital output to display deviceApplication softwareElectronic information

The electronic information device has application program interface for display in multiple languages and has preset multiple language data base, which consists of several text character string corresponding lists to store text character strings of some language and corresponding text character strings of other languages in the same meaning. After the electronic information device receives the language converting request, the device will find out the corresponding text character strings for display. The present invention makes the developing persons maintain document in simplified program, less work amount and low cost.

Owner:WUDI SCI & TECH (XIAN) CO LTD

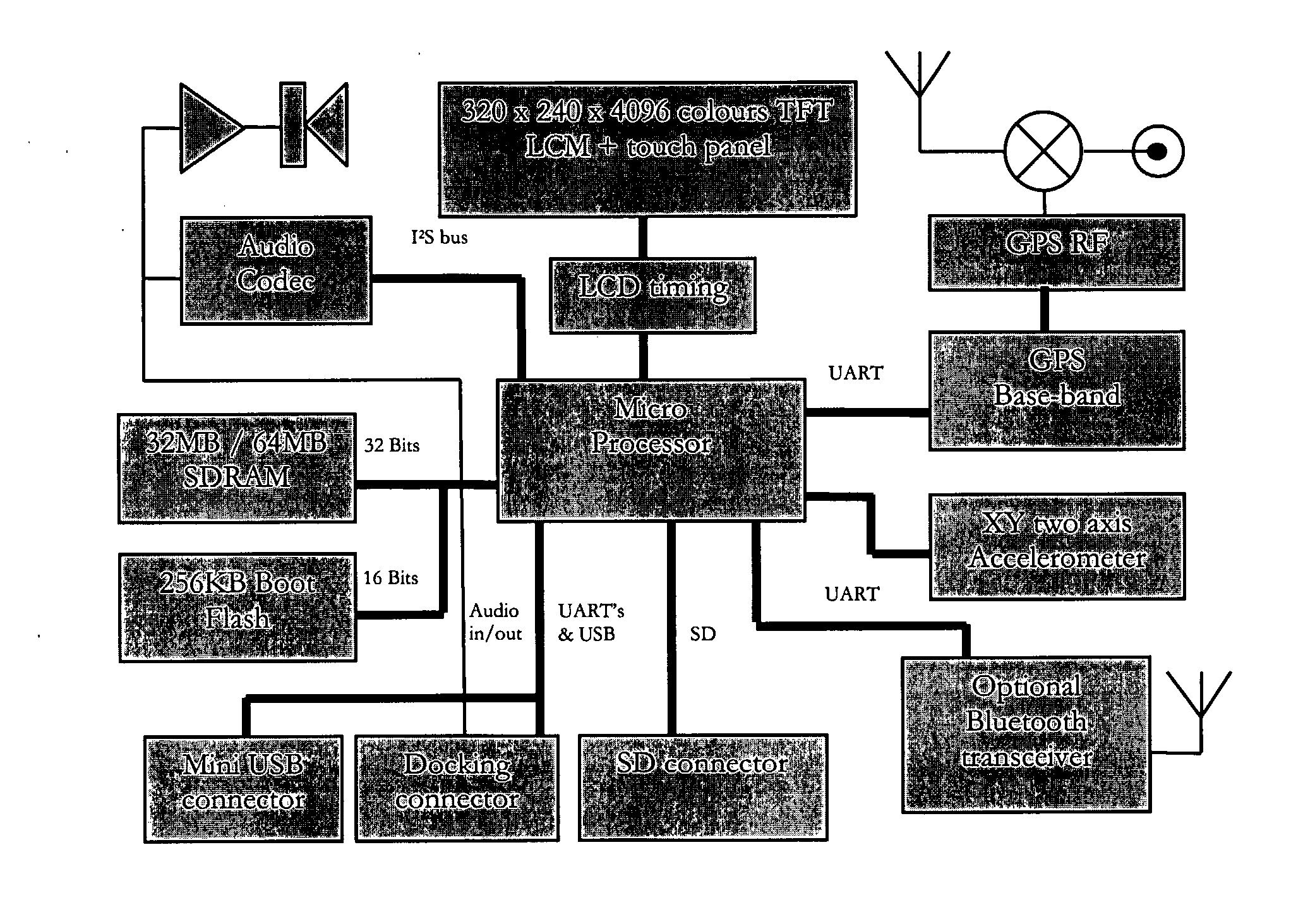

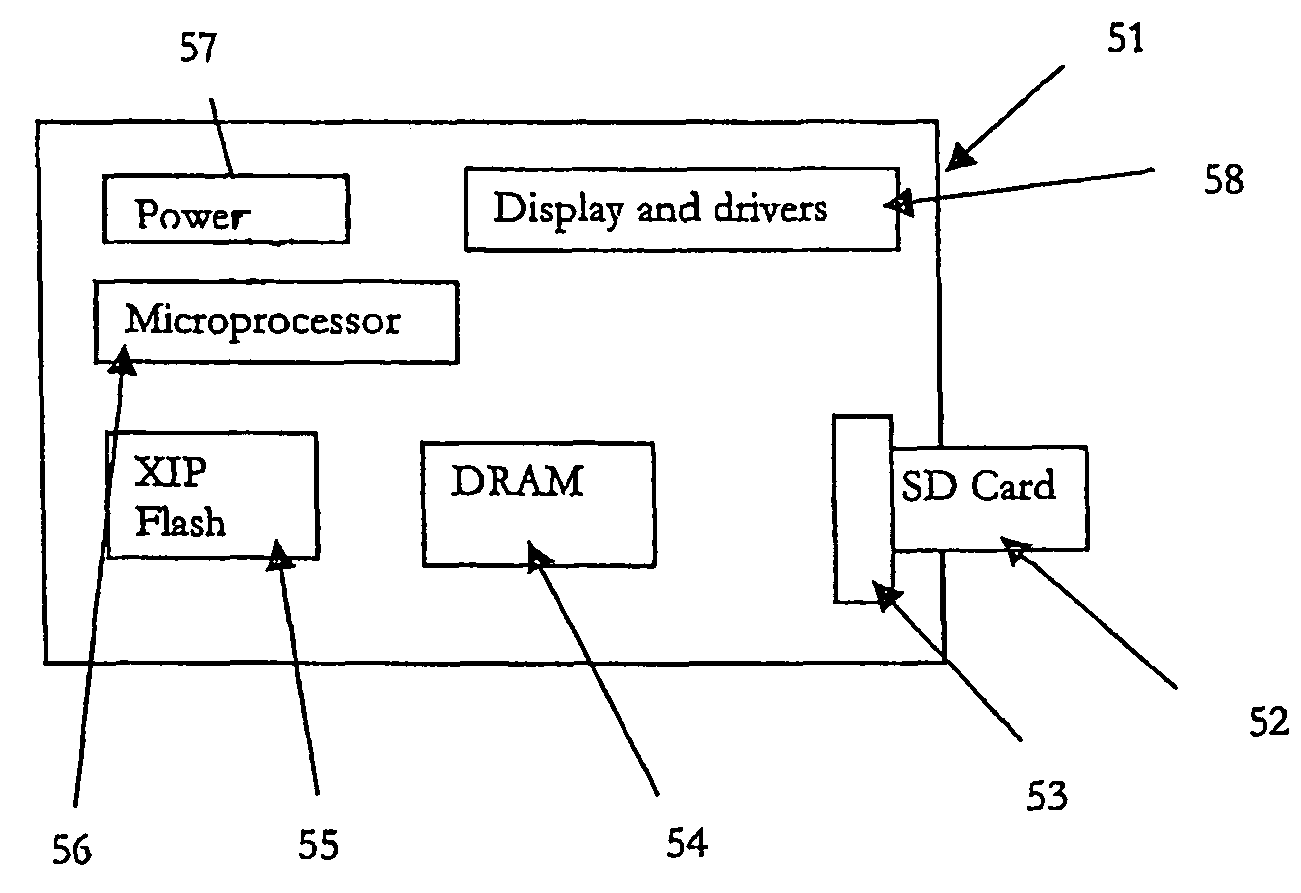

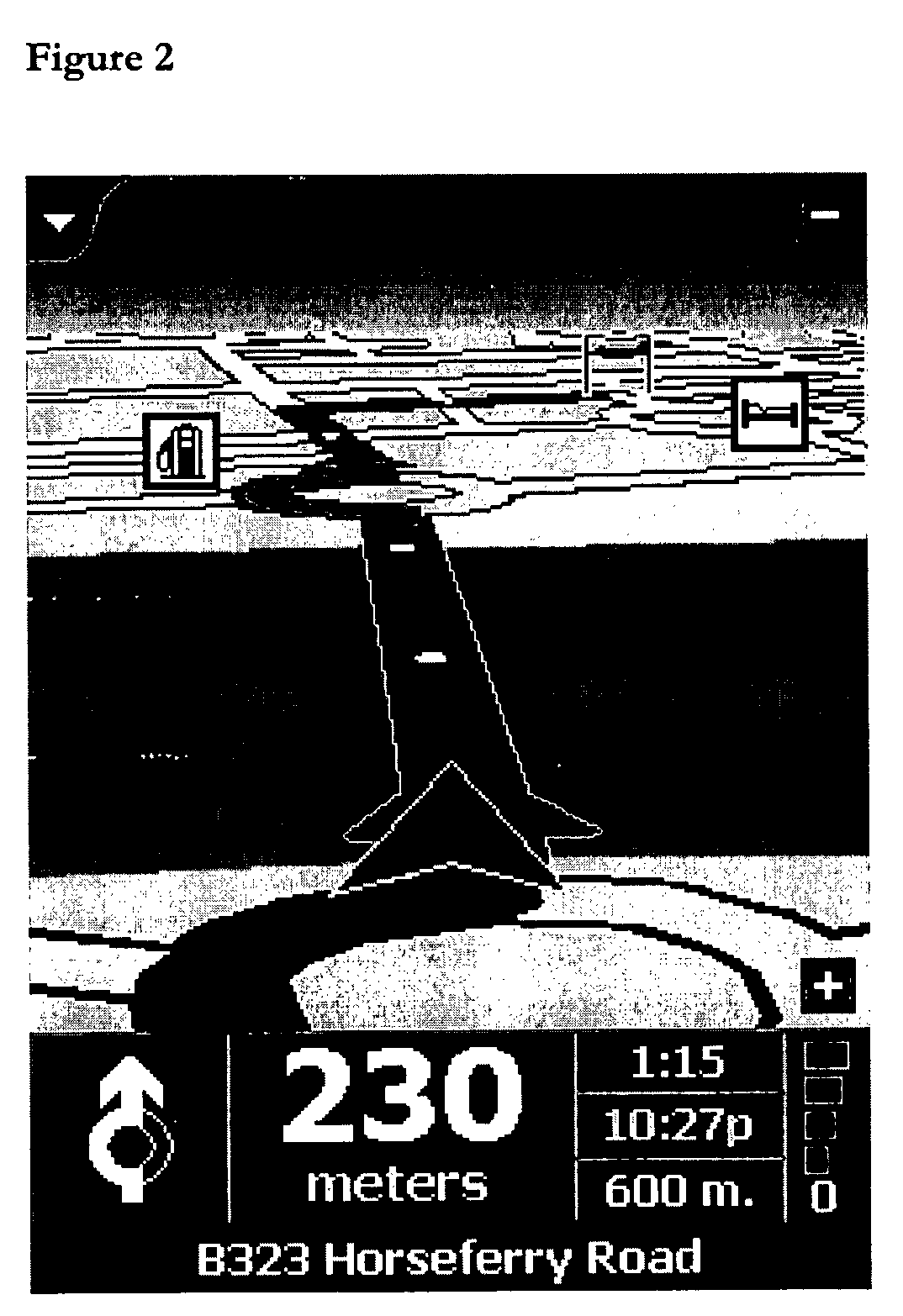

Navigation device displaying travel information

ActiveUS20070185648A1Only be usedInexpensively formedInstruments for road network navigationRoad vehicles traffic controlOperational systemMask ROM

A navigation device, programmable with map data and a navigation application that enables a route to be planned between two user-defined places; the device is operable to read a removable memory card storing the device operating system, the navigation application, and the map data. It does not need to store the operating system in mask ROM; hence, customisation for a specific country requires only that the appropriate memory card be inserted at the time of use.

Owner:TOMTOM INT BV

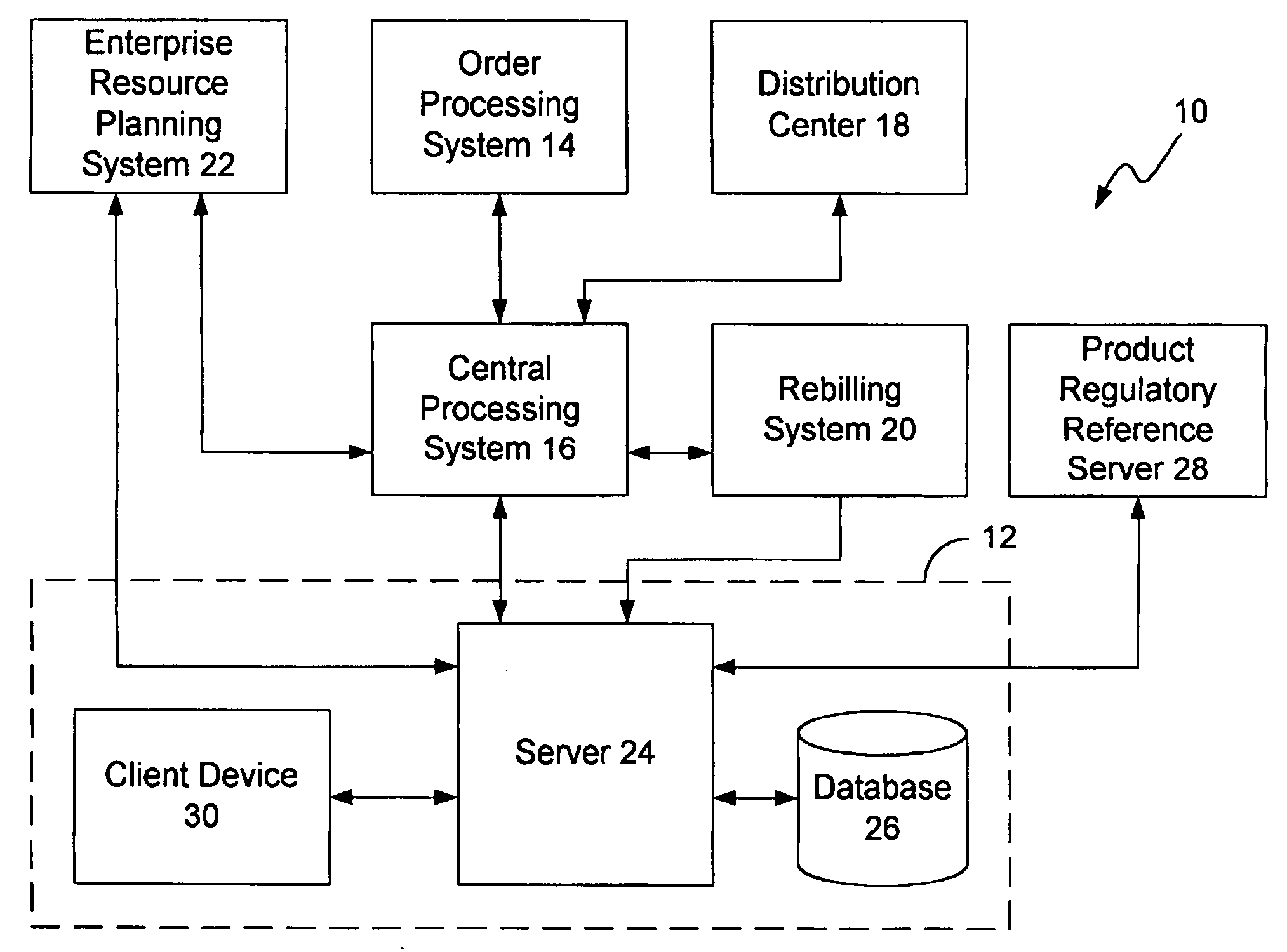

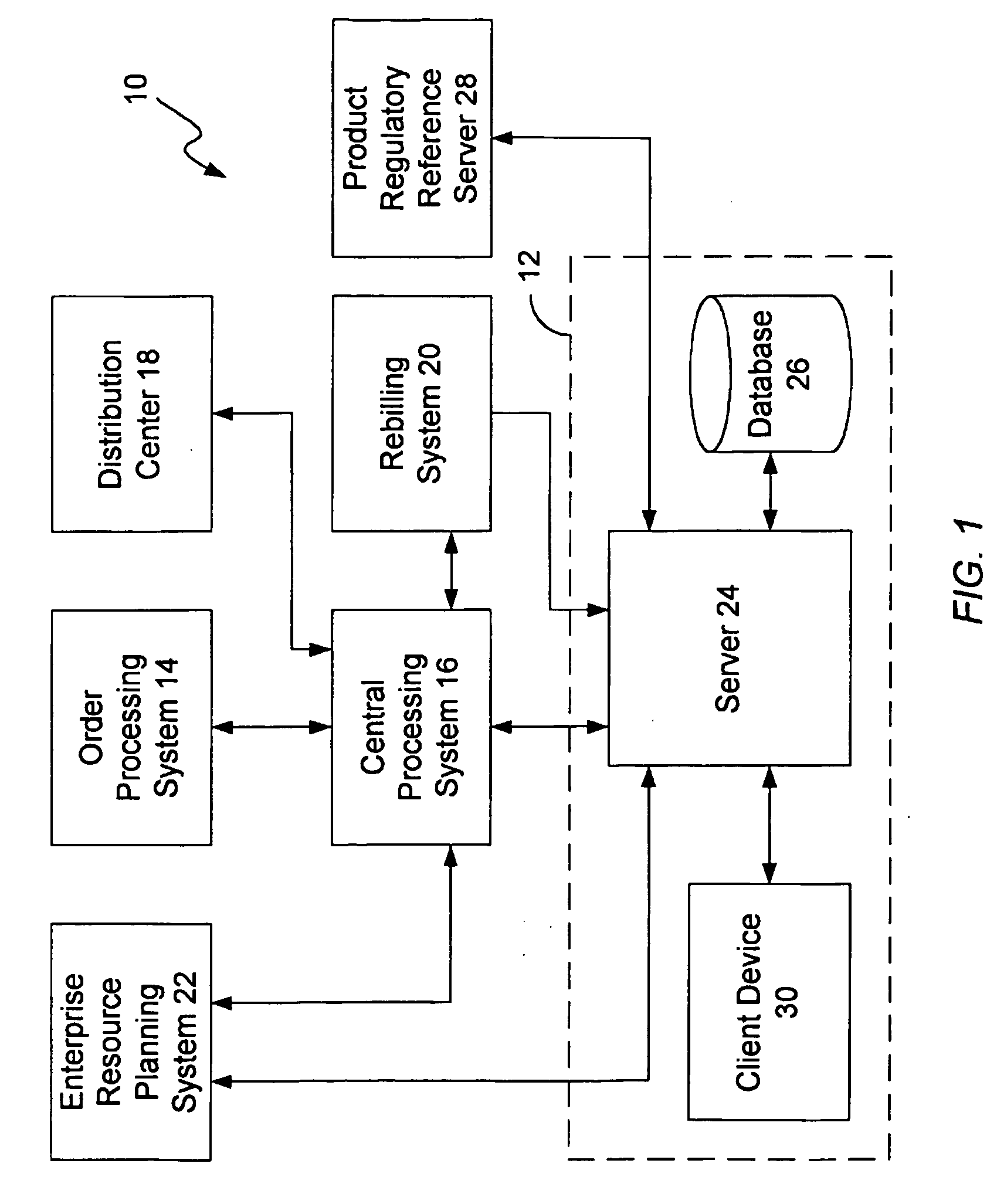

Order fulfillment architecture having an electronic customs invoice system

InactiveUS20050075955A1Allocation is accurateComplete banking machinesFinanceOrder fulfillmentInvoice

An order fulfillment architecture which includes an order processing system configured to receive order information and to create an order request usmg the order information, a central processing system configured to receive the order request, to verify the accuracy of the order request, and to organize the order request into a plurality of categories, and a system configured to generate a billing statement using the order request. The order fulfillment architecture further includes a server configured to receive a billing file that is generated using information from the billing statement, to create an electronic file that has a customs invoice for a particular country using information from the billing file, and to transmit the electronic file via email.

Owner:HEWLETT PACKARD DEV CO LP

Systems and methods for international shipping and brokerage operations support processing

ActiveUS7725406B2Minimizing delay and storageBilling/invoicingLogisticsInternational shippingWorkstation

Owner:UNITED PARCEL SERVICE OF AMERICAN INC

Apparatus and Method for Wireless Local Area Networks of Different Countries

InactiveUS20080037490A1Assess restrictionMultiplex communicationCommunications systemGeographic regions

Described are apparatus and methods for adapting a mobile unit to communication requirements of a particular country or geographic region. A wireless local area network communications system may include access points and remote terminals. Remote terminals may use country-specific information in messages from an access point to adapt to the communications requirements of the country in which the access point is operating. The country-specific information may be in a broadcast transmission or a message sent in reply to a remote terminal probe message. The country-specific information may include operating requirements such as channel information, power information, country name, modulation information, etc.

Owner:SYMBOL TECH INC

Method and System for Geographic-Oriented Graphical Representation of Multivariable Input Data Set

Methods and systems for computerized geographic-oriented graphical representation of multivariable input data sets are disclosed. In one embodiment, a graphical rendering application programming interface and a graphical rendering engine are configured to correlate the multivariable input data sets and other variables with geographical categories represented from geographic and map-related data, which are represented on a three-dimensional globe. In one example, the multivariable input data sets include a first input data set and a second input data set with multiple variables. A first member of the first input data set is represented as a sphere or a cube on top of a particular national or state boundary on the three-dimensional globe. Furthermore, a first member of the second input data set is represented as a stick erected from a geographic landmark, wherein the stick pierces the sphere or the cube representing the first member of the first input data set.

Owner:YOON HARRY

Communication security formalization analysis and verification system in process based on micro kernel prototyping

InactiveCN106802863AMake up for efficiency problemsMake up for limitationsSoftware testing/debuggingCommunications securityEmbedded operating system

The invention discloses a communication security formalization analysis and verification system in process based on a micro kernel prototyping. The communication security formal analysis and verification system comprises a prototype preprocessed module. The prototype preprocessed module comprises a system entrance of the formalization analysis and verification system, and an embedded operating system micro kernel prototype is as input. A pending verified IPC module extracted from the micro kernel module classified processes to generate a collection IPC with related function as inputting pending verified data of each module. An IPC security properties of a particular attribute in a finite state is verified through a denumerable state specific attribute authentication module. The denumerable state specific attribute authentication module is capable of modeling and analyzing the pending verified IPC fault behavior pointedly. An Infinite state and the generalized attribute verification module are used for verifying IPC security properties of infinite and non-specific attributes, verifying the external nature of IPC abstracted from a standardized data structure, and deeply abstracting and further generating different models and refine validation based on abstract properties and each interest point.

Owner:EAST CHINA NORMAL UNIV

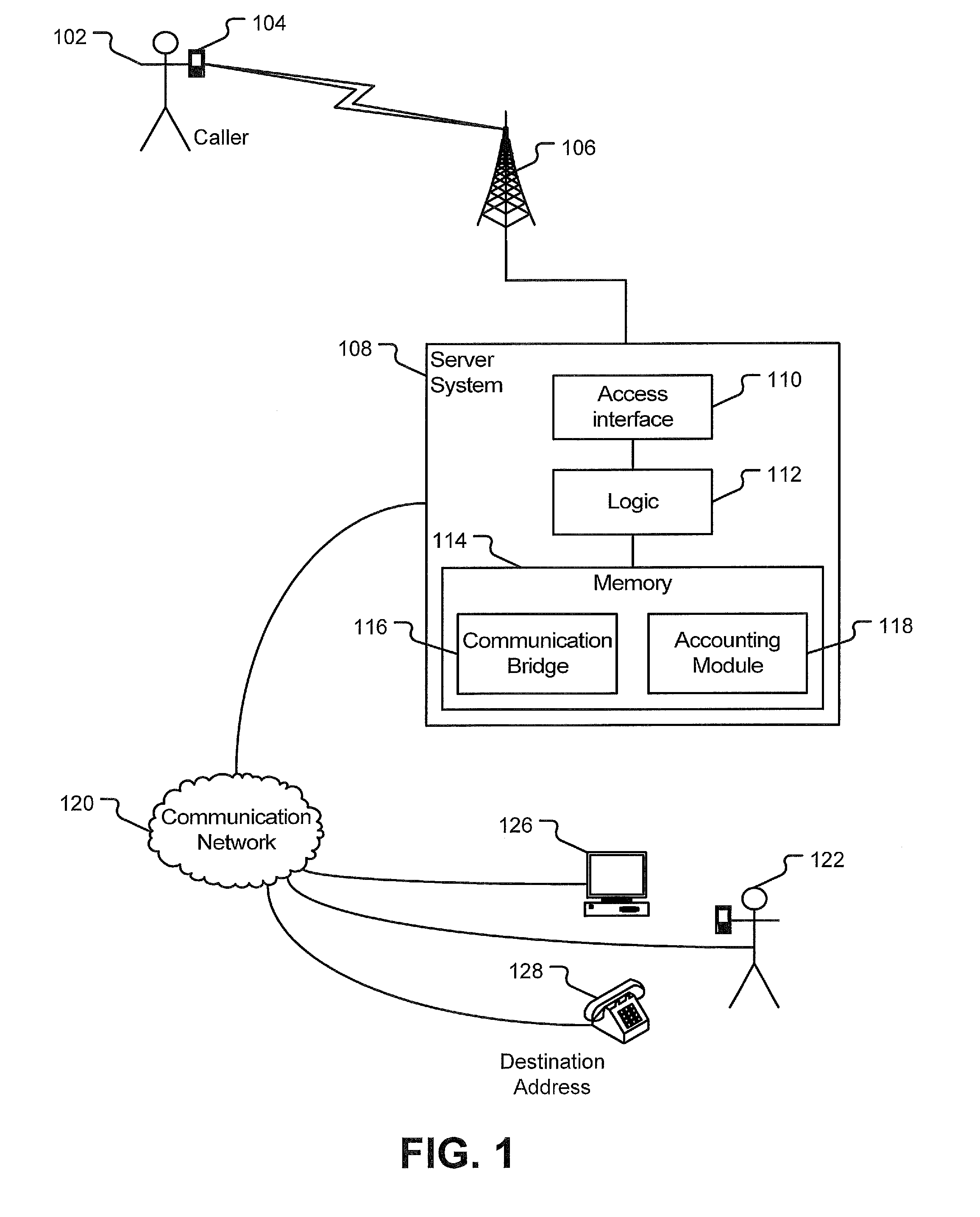

System and method of using a dynamic access number architecture

InactiveUS20110159878A1Interconnection arrangementsSubstation equipmentAutomatic routingState specific

A method of using a dynamic access number architecture of a mobile communication device includes receiving a selection via a user interface of a mobile communication device. The selection indicates a preferred routing number associated with a particular country. The method also includes sending a message from the mobile communication device to a network element to request validation the preferred routing number selection. After a successful validation of the preferred routing number, when the mobile communication device is within the particular country, the mobile communication device automatically routes particular calls via an access device associated with the preferred routing number by dialing the preferred routing number.

Owner:AUGME TECH

Navigation device displaying travel information

ActiveUS7835857B2Late configurabilityInexpensively formedInstruments for road network navigationRoad vehicles traffic controlOperational systemMask ROM

A navigation device, programmable with map data and a navigation application that enables a route to be planned between two user-defined places; the device is operable to read a removable memory card storing the device operating system, the navigation application, and the map data. It does not need to store the operating system in mask ROM; hence, customization for a specific country requires only that the appropriate memory card be inserted at the time of use.

Owner:TOMTOM INT BV

DayMal.com

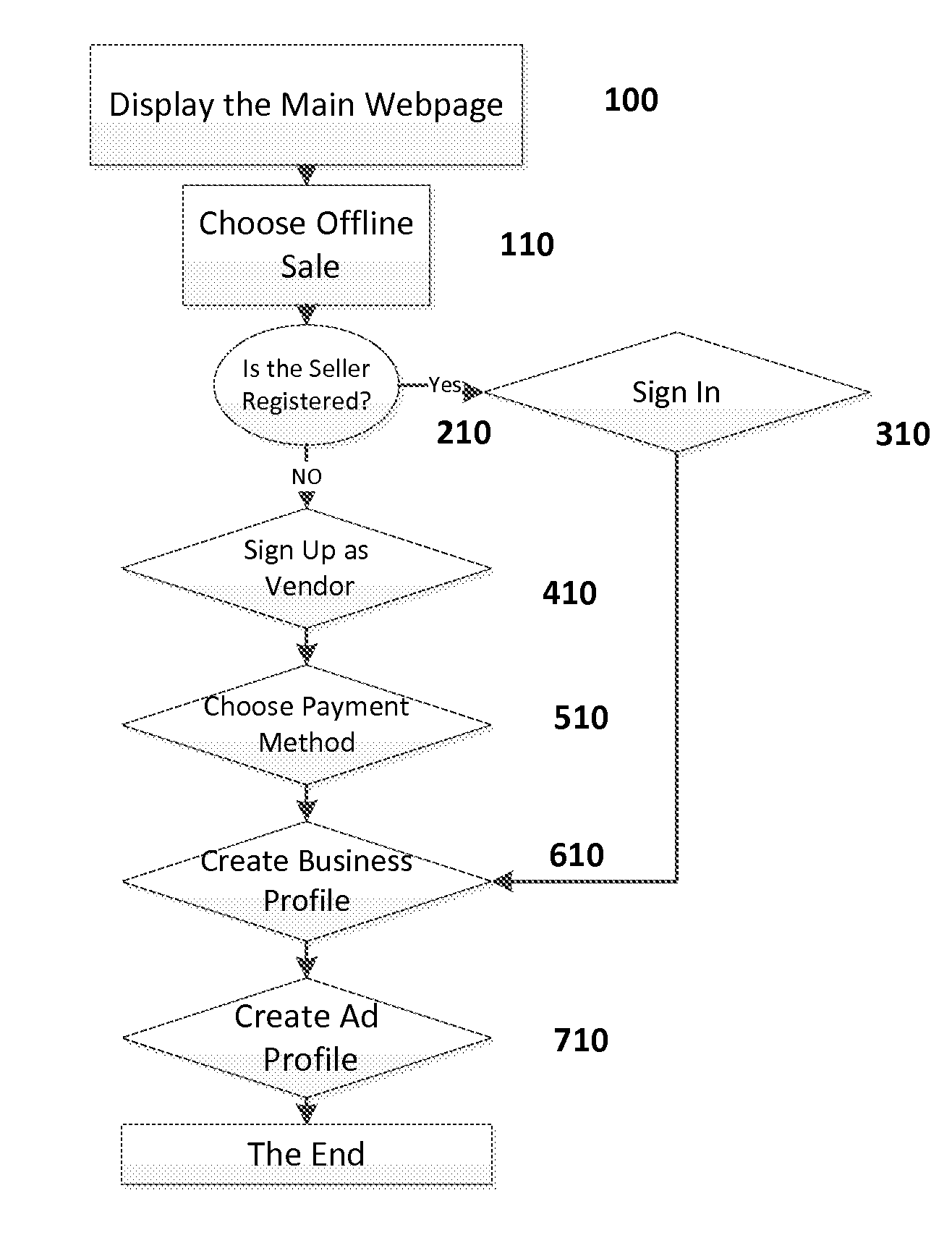

InactiveUS20150039435A1Facilitate discount saleEasy to purchaseMarketingThe InternetOnline and offline

The present invention is an internet technology-based system (e.g., webpage) which facilitates discount sales and shoppings. The system categorizes the discount sales as both online and offline sales. The online and offline sellers are provided some facilities to open and design the interior features of their own shops through this system and target their potential customers. In addition, the offline sellers (by using IP geoilocation) are allowed to restrict their target markets in order to advertise their goods and services to potential customers in a particular country, state, city or distinct in a more effective way.

Owner:SHAHEE MOSTAFA

System and method for running an international telephony messaging campaign

InactiveUS20080102864A1Facilitate communicationRadio/inductive link selection arrangementsMessaging/mailboxes/announcementsInternational direct dialingState specific

Owner:CRE8

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com