Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

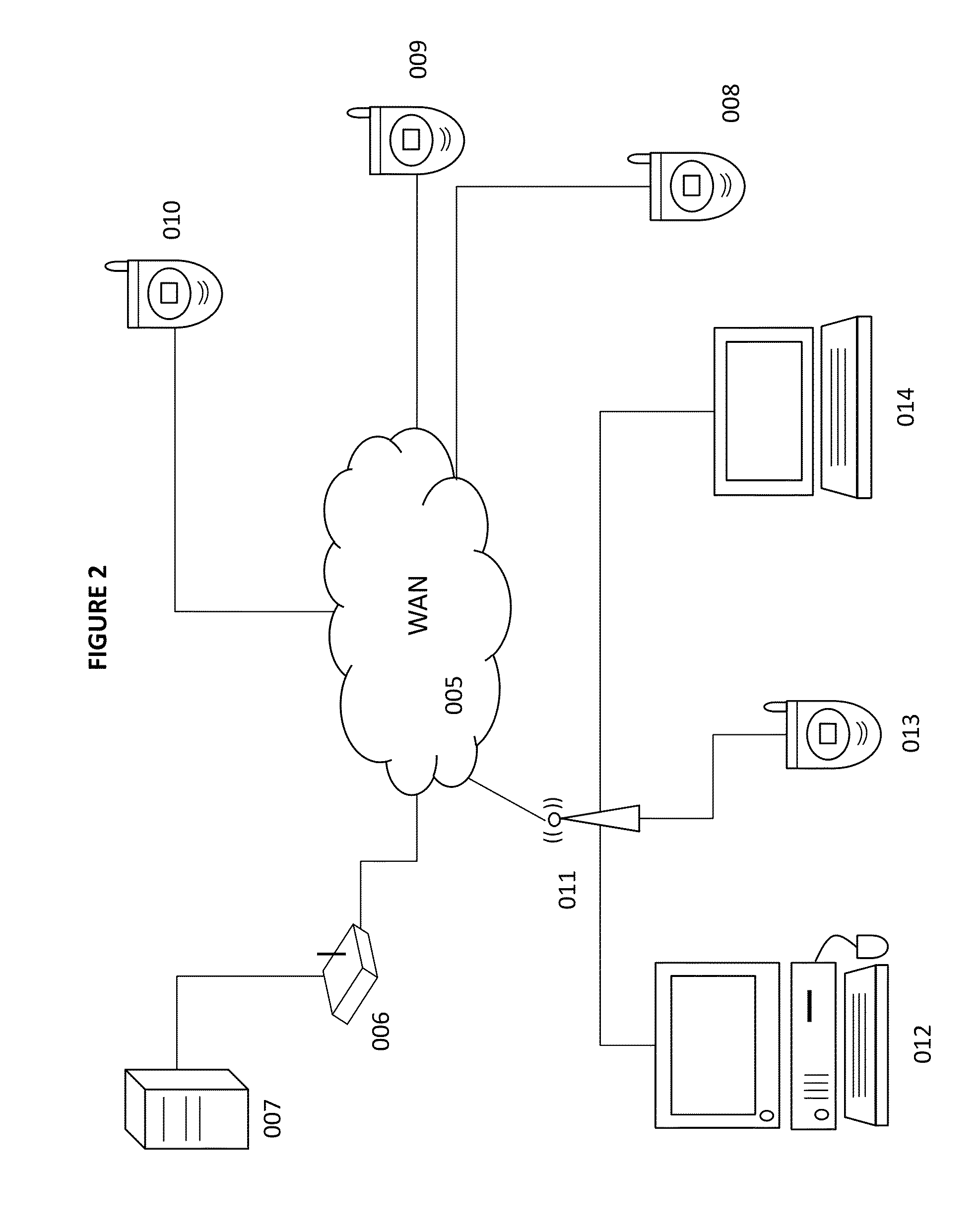

323 results about "Risk indicators" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A key risk indicator ( KRI) is a measure used in management to indicate how risky an activity is. Key risk indicators are metrics used by organizations to provide an early signal of increasing risk exposures in various areas of the enterprise.

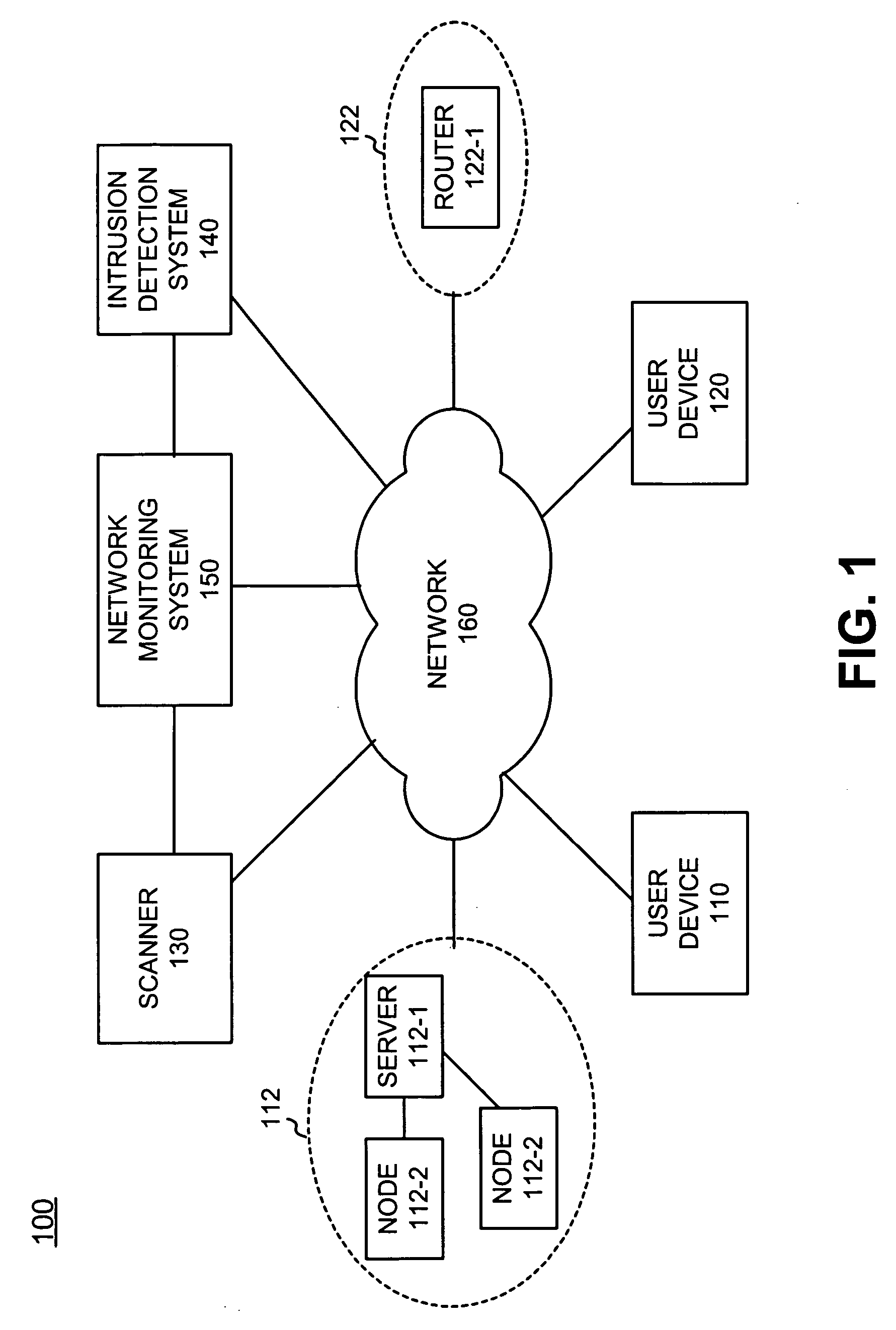

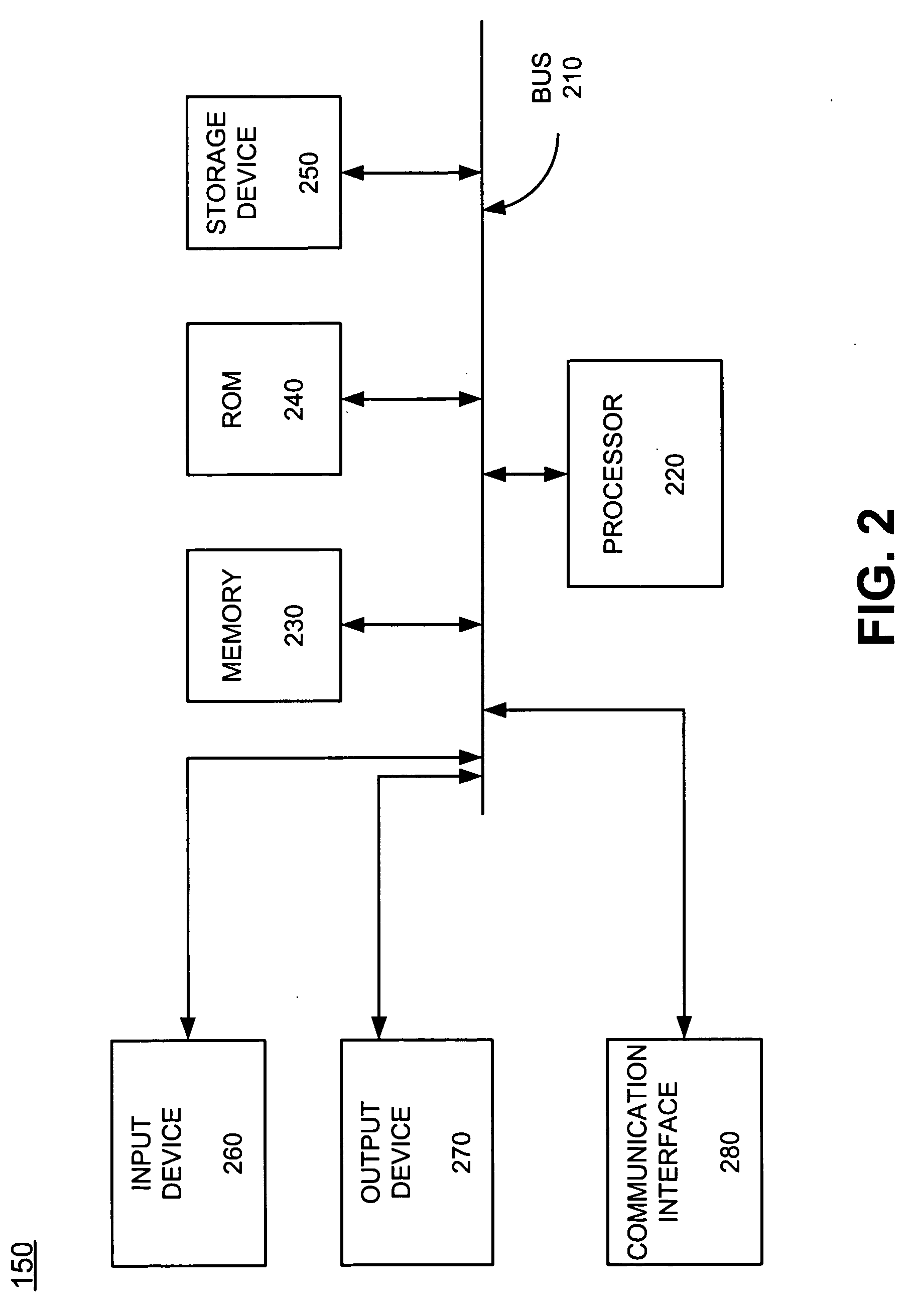

Systems and methods for performing risk analysis

A method for analyzing a network element may include assigning values to each of a plurality of vulnerabilities. The method may also include identifying a vulnerability associated with the network element and generating a risk indicator for the network element based on the assigned value associated with the identified vulnerability.

Owner:EBATES PERFORMANCE MARKETING

System and method for modeling and quantifying regulatory capital, key risk indicators, probability of default, exposure at default, loss given default, liquidity ratios, and value at risk, within the areas of asset liability management, credit risk, market risk, operational risk, and liquidity risk for banks

The present invention is in the field of modeling and quantifying Regulatory Capital, Key Risk Indicators, Probability of Default, Exposure at Default, Loss Given Default, Liquidity Ratios, and Value at Risk, using quantitative models, Monte Carlo risk simulations, credit models, and business statistics, and relates to the modeling and analysis of Asset Liability Management, Credit Risk, Market Risk, Operational Risk, and Liquidity Risk for banks or financial institutions, allowing these firms to properly identify, assess, quantify, value, diversify, hedge, and generate periodic regulatory reports for supervisory authorities and Central Banks on their credit, market, and operational risk areas.

Owner:MUN JOHNATHAN

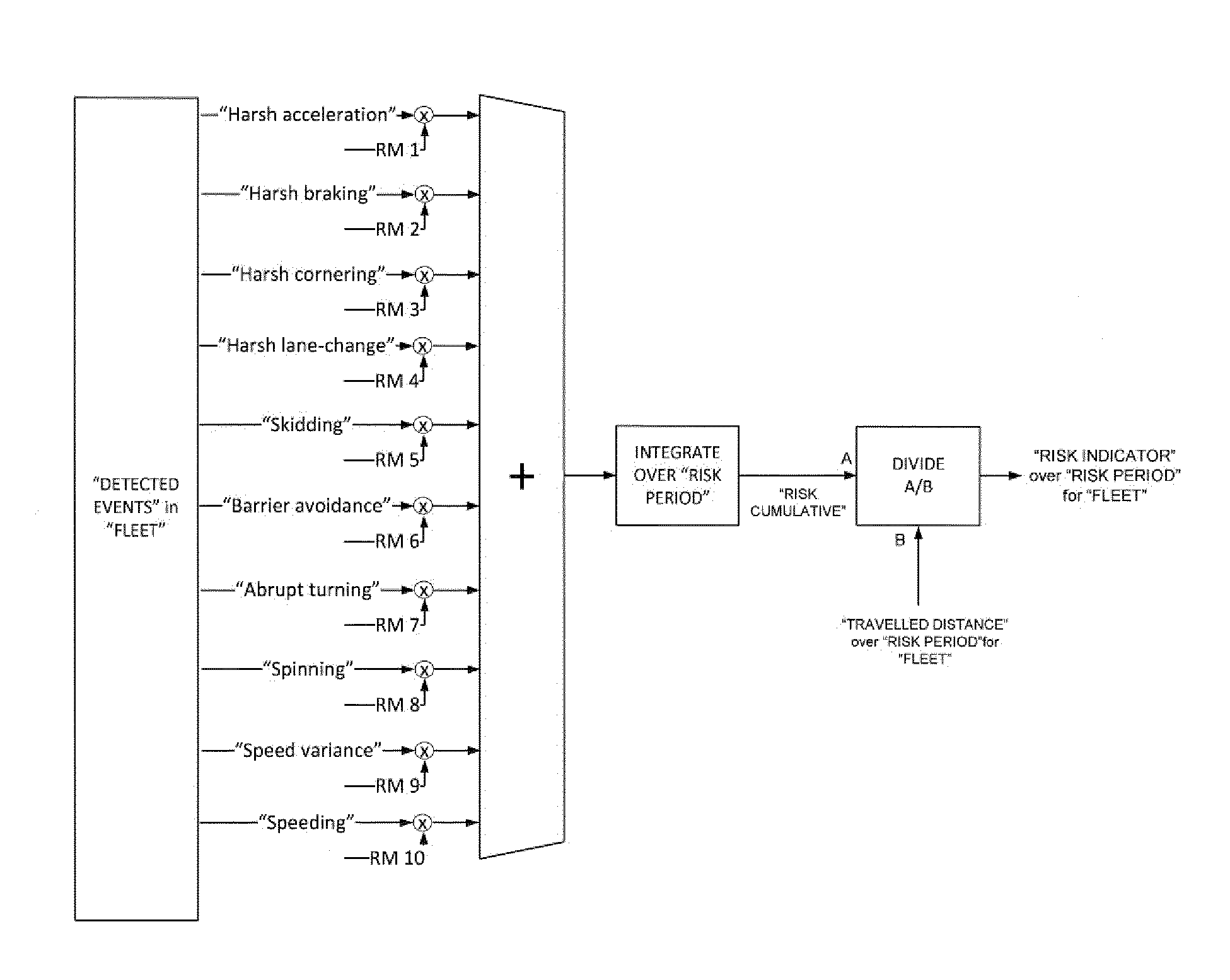

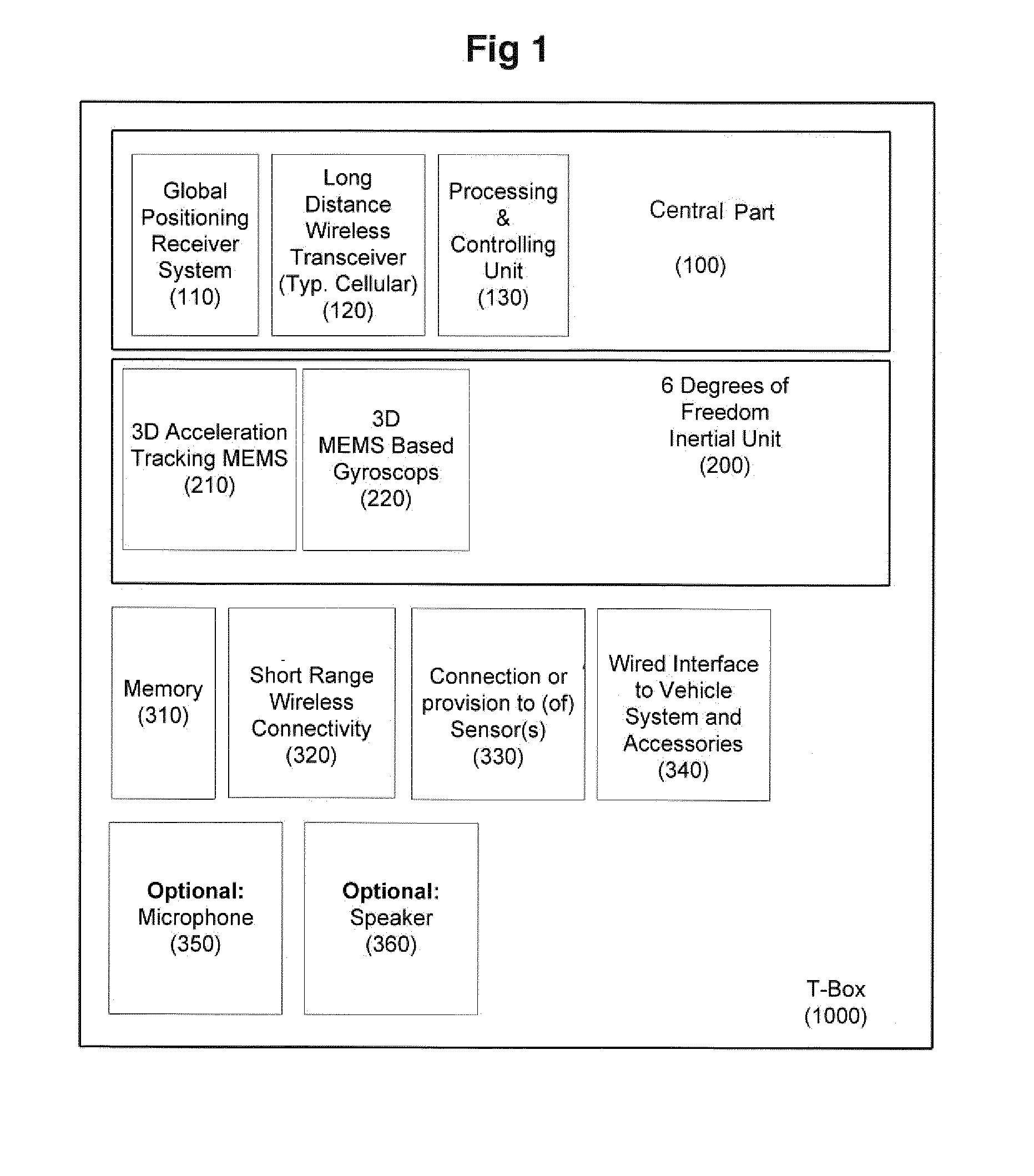

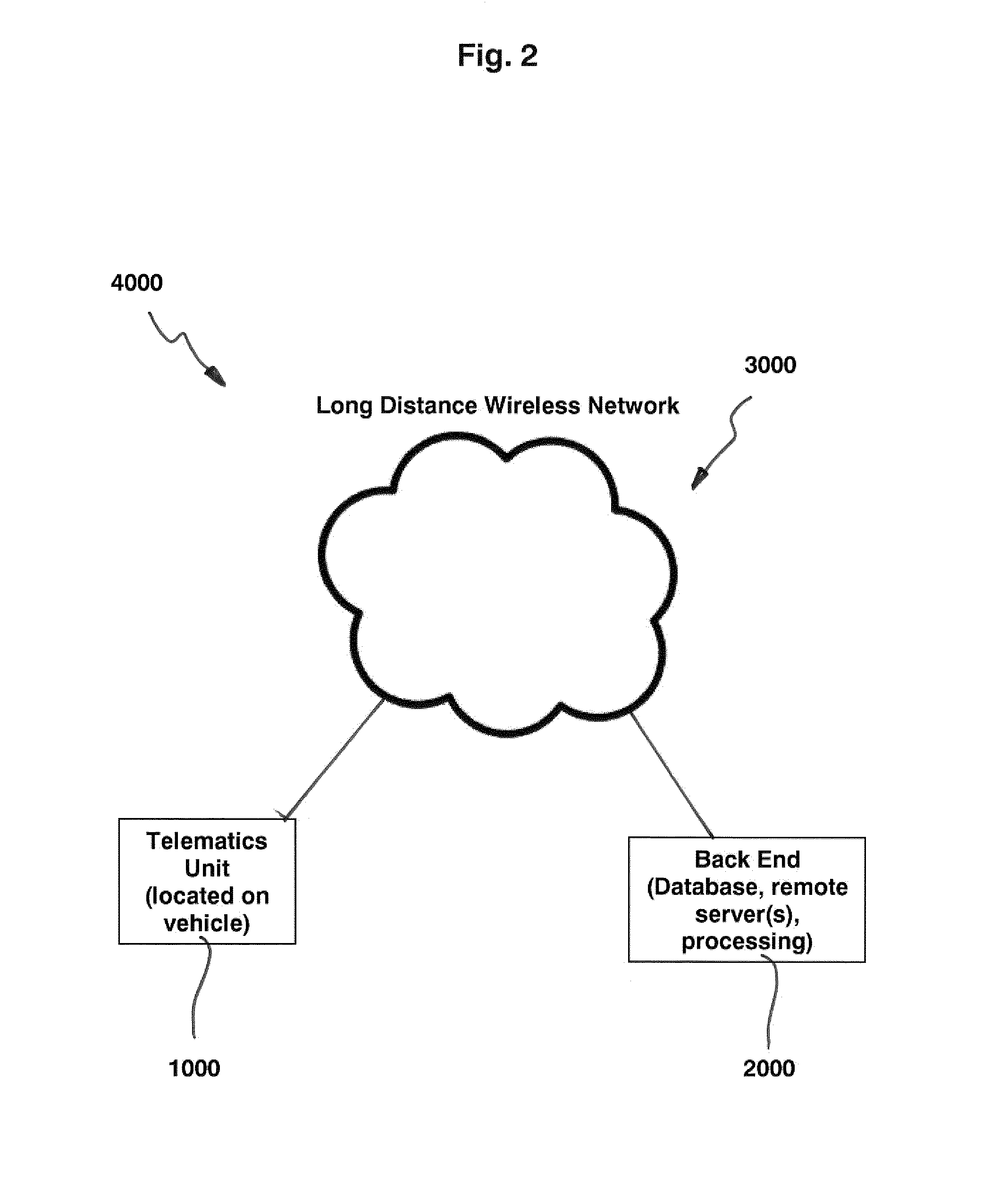

Apparatus, system and method for risk indicator calculation for driving behaviour and for reconstructing a vehicle trajectory

InactiveUS20140358840A1Acceleration measurement using interia forcesRegistering/indicating working of vehiclesGyroscopeEngineering

A first aspect relates to an apparatus, system and method for calculating a driving behaviour risk indicator for a driver of a vehicle. Said aspect involves obtaining a count of events occurring in each of a plurality of predetermined categories based on inputs from an inertial unit mounted on the vehicle, the inertial unit including a 3D inertial sensor with 3D gyroscope functionality, each event being indicative of at least one of dangerous and aggressive driving; and calculating a driving behaviour risk indicator based on the number of events in each category. According to a second aspect, an apparatus and method for reconstructing a vehicle trajectory is provided. Said aspect includes updating a sensor error model.

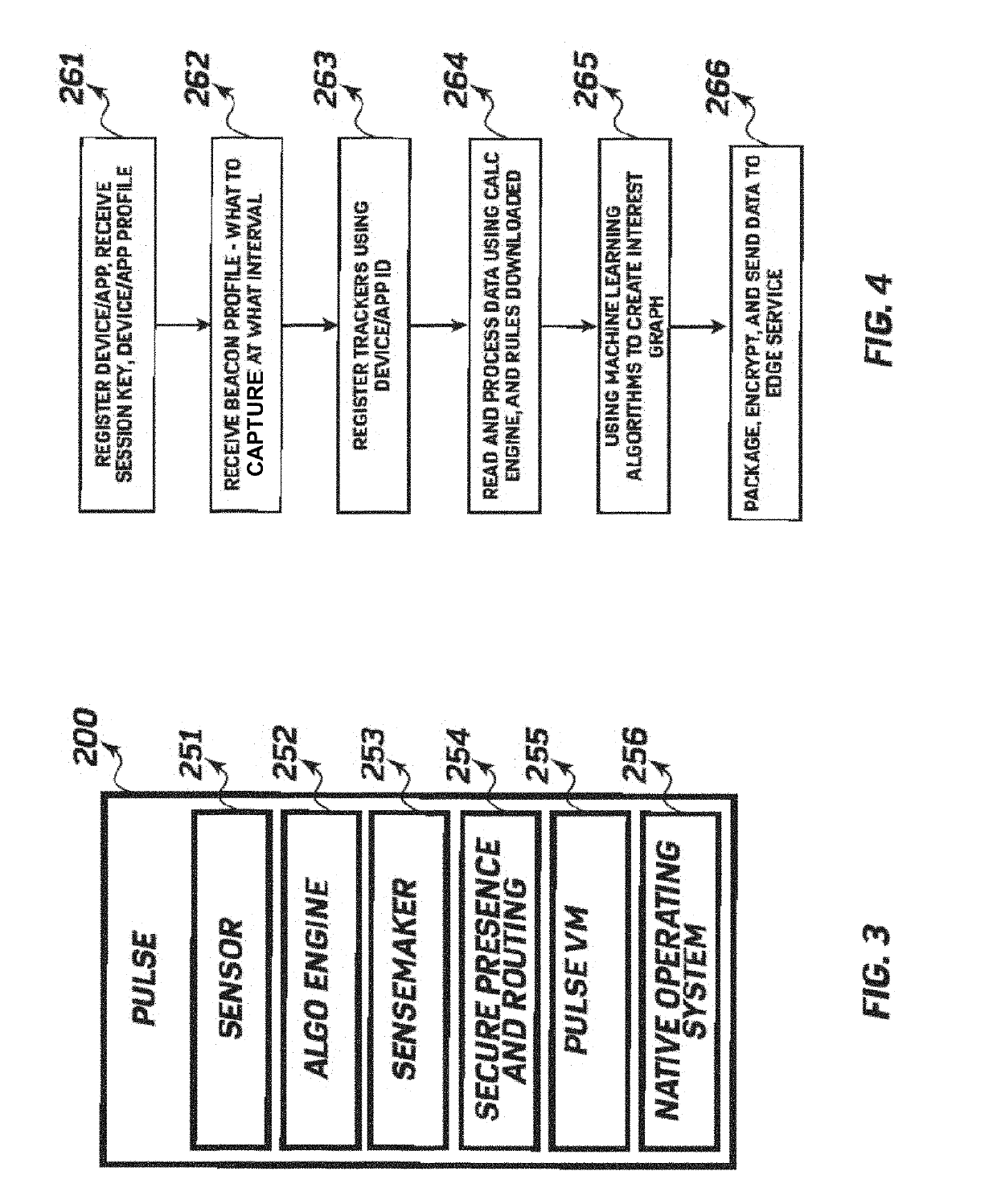

Owner:PULSE FUNCTION F6

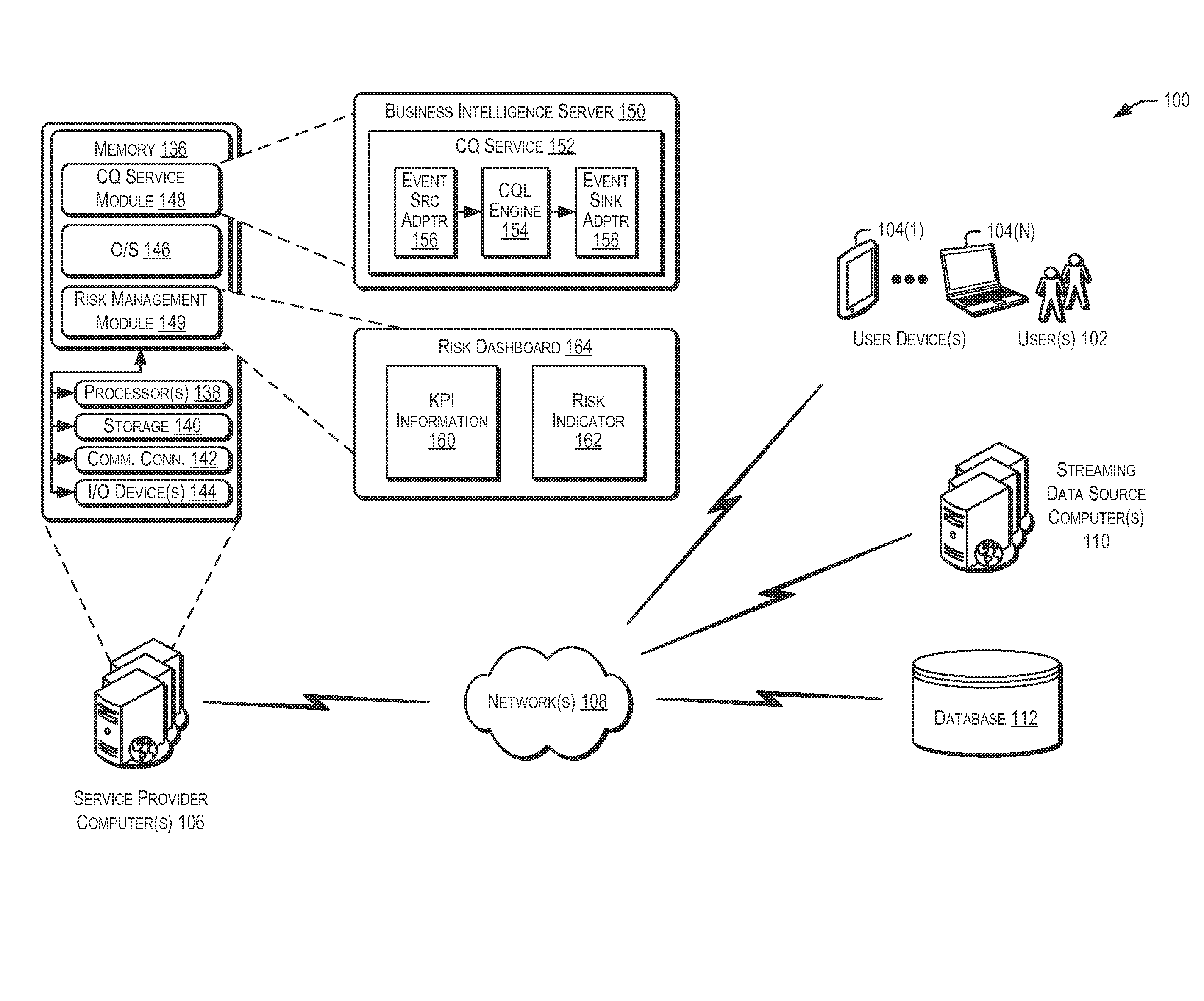

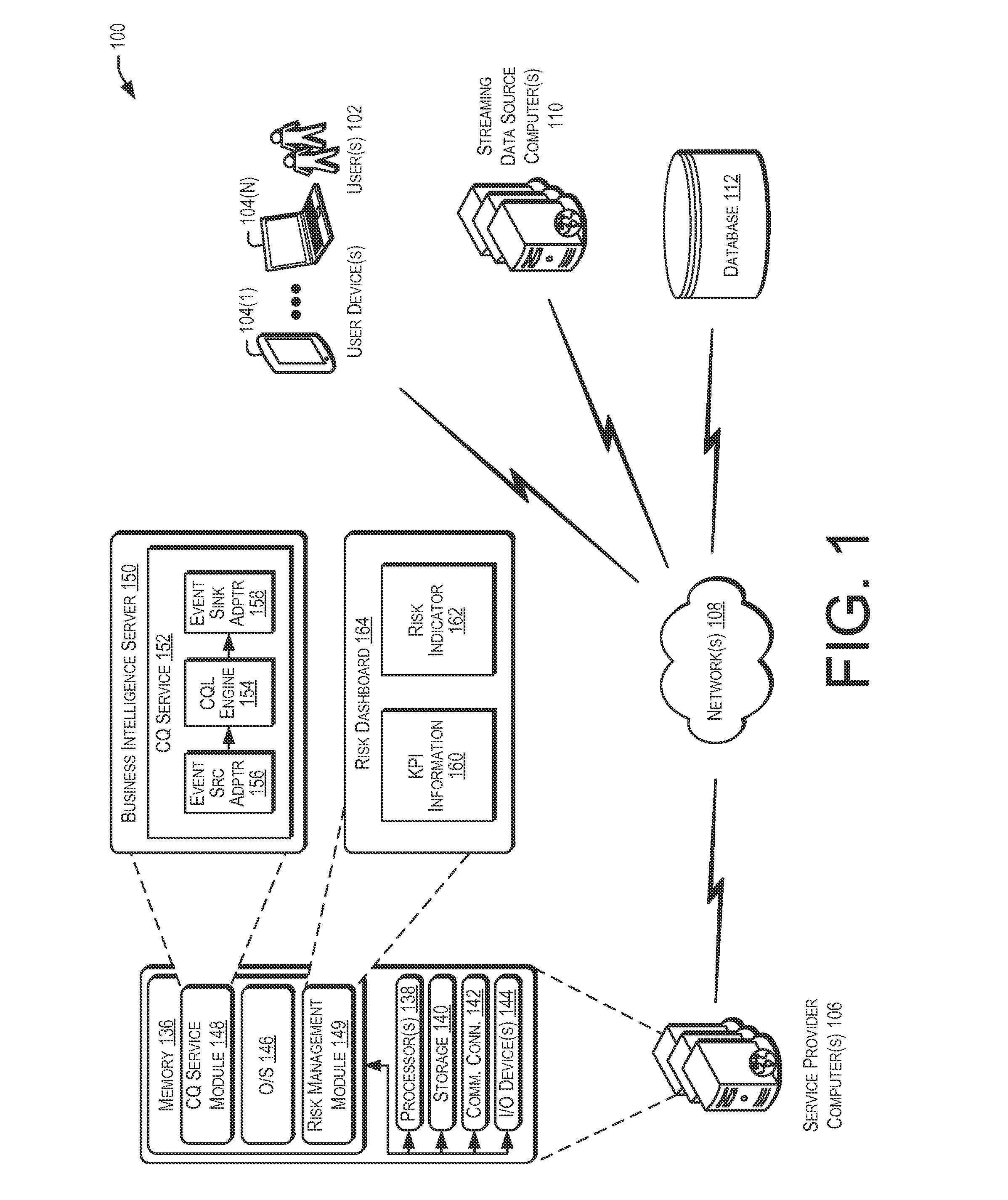

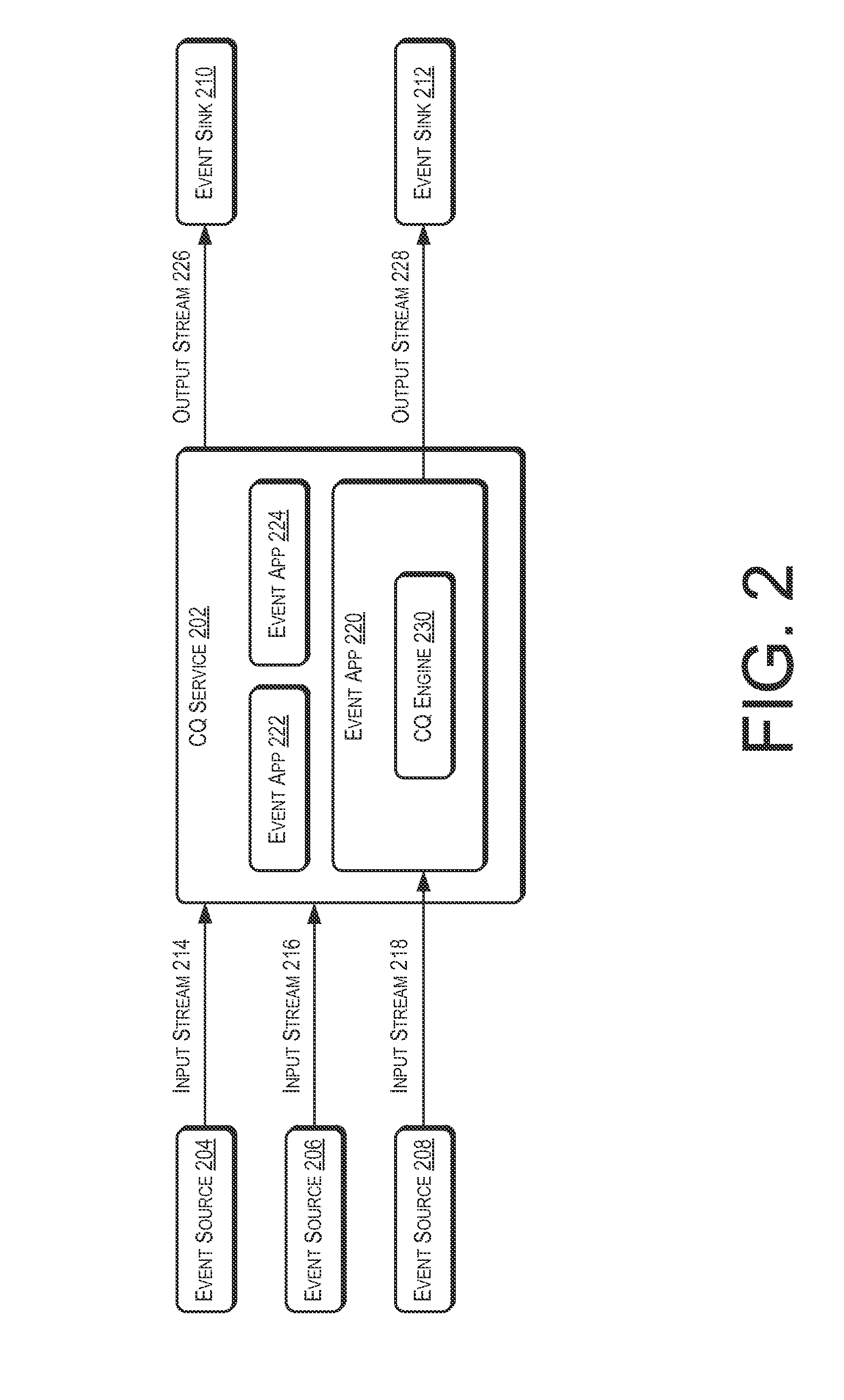

Managing risk with continuous queries

ActiveUS20140095541A1Database management systemsWithout separate inflatable insertsEvent dataQuery language

Techniques for managing risks with continuous queries are provided. In some examples, a selection of a data object enabled to provide a real-time stream of business event data may be received. The selection may be received by a user associated with the business event data. Additionally, a continuous query language query may be generated. The query may be configured to monitor the real-time stream of business event data for a first metric. In some examples, the a risk indicator associated with a second metric that affects the first metric may be identified. Output events of a pre-existing continuous query language query may be listened to. Further, a real-time visualization of the first metric and / or the second metric may be provided.

Owner:ORACLE INT CORP

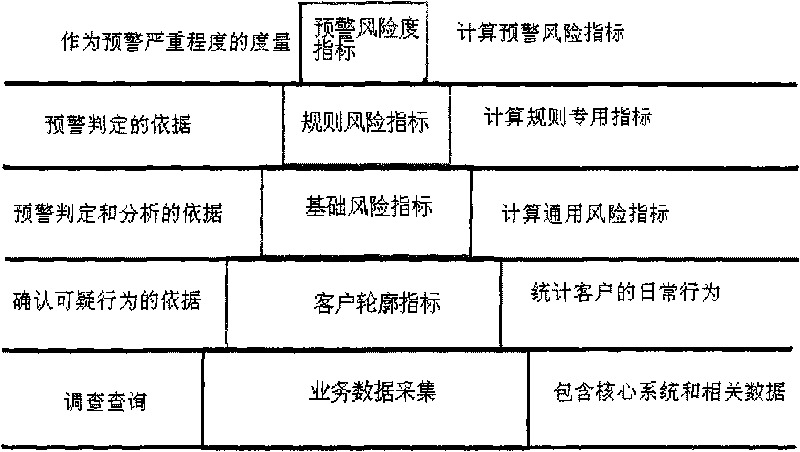

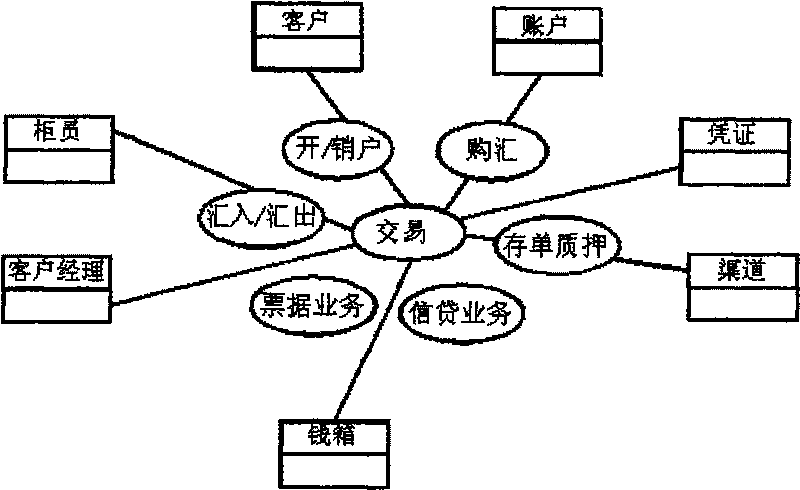

Rule engine-based method and system for monitoring exceptional service of bank

The invention provides a rule engine-based method and a rule engine-based system for monitoring exceptional service of bank. The method mainly comprises the followings steps: defining and describing operational risk factors of bank service flows, products and service units; determining a lost data and risk data collecting frame to analyze important lost data to determine a cause-and-effect relationship between loss events and risk factors; determining a key risk indicator (KPI); measuring a possible loss amount and a risk probability; measuring the effectiveness of the current management and control method, and making a more effective management and control scheme; deciding and implementing an efficiency and phase equilibrium-based management and control system; and effectively monitoring risk early warning indexes, risk reports aiming at senior management and the risk management and control method. Operational risks of commercial banks are comprehensively monitored, and risks are ensured to be controlled. The system is divided according to logical levels and comprises a service data layer, a data acquisition layer, a data storage layer, a risk processing layer, a risk management layer and an information presentation layer.

Owner:BEIJING YINFENG XINRONG TECH DEV

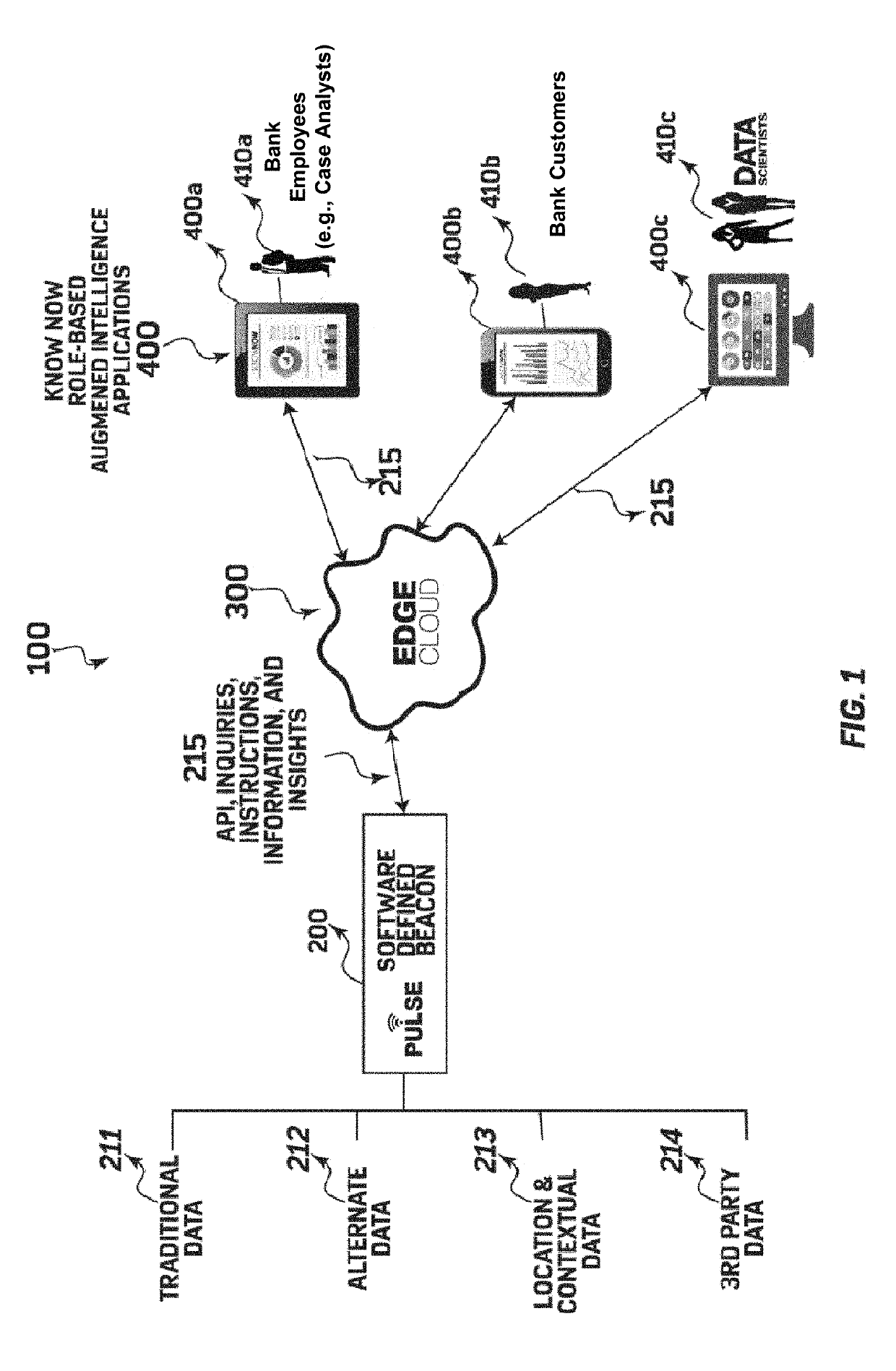

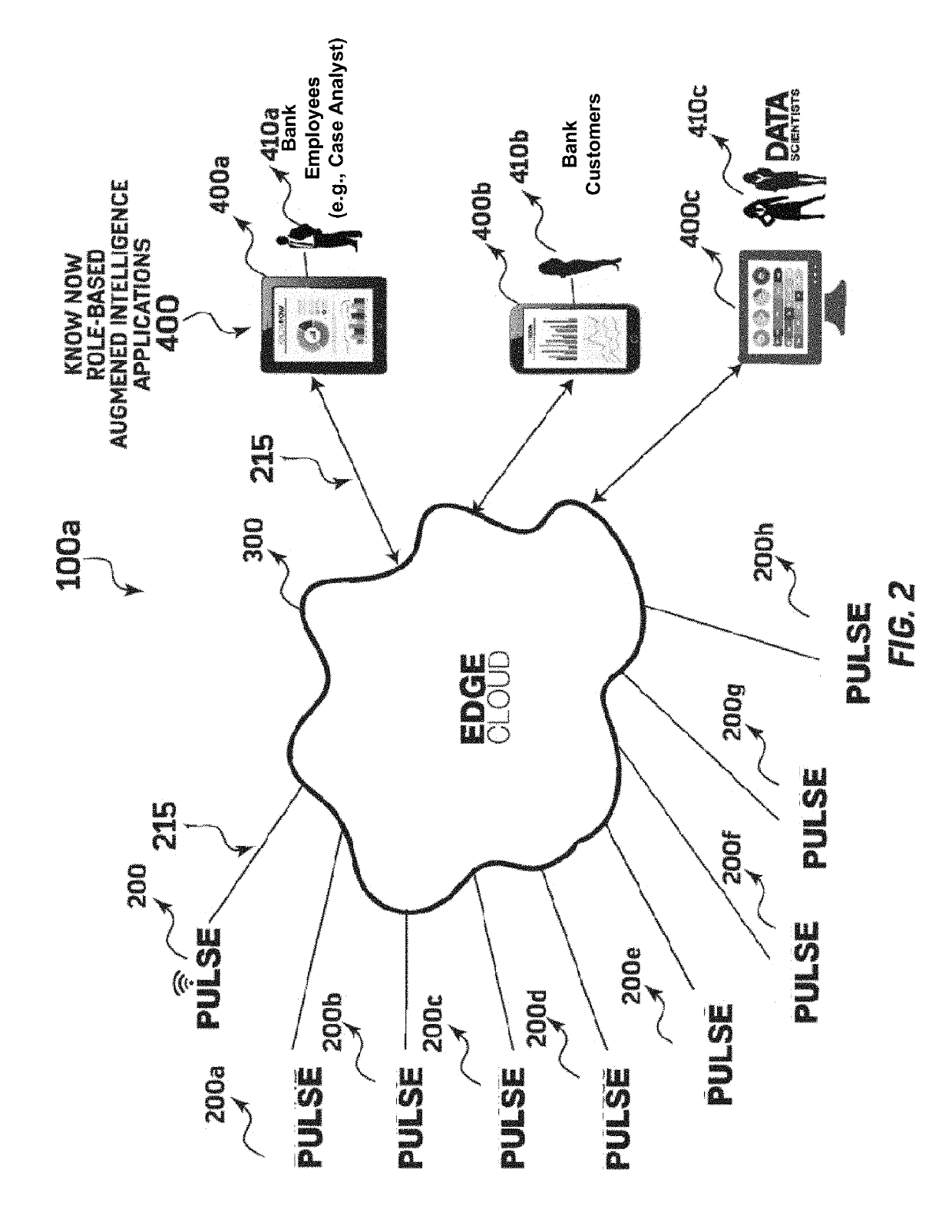

System and method for using a data genome to identify suspicious financial transactions

A system and method for using a data genome to identify suspicious financial transactions. In one embodiment, the method comprises receiving a data set of financial activity data of multiple participants; configuring a deep neural network and thresholds, wherein the thresholds enable detection of what is within abnormal range of financial activity, patterns, and behavior over a period of time; converting the data set to a genome containing a node for each participant among the multiple participants; computing threat vectors for each node within a graphical representation of the genome that represents behavioral patterns of participants in financial activities, including determining when a key risk indicator (KRI) value computed for a particular threshold within the data set falls outside of a dynamically determined range bounded by thresholds, wherein the threat vectors automatically identify one or more of suspicious participants and suspicious activities in a provided financial activity pattern; and determining a particular edge in the network whose behavior falls outside the dynamically determined range associated with normal activity as a suspicious.

Owner:EVENTUS SYST INC

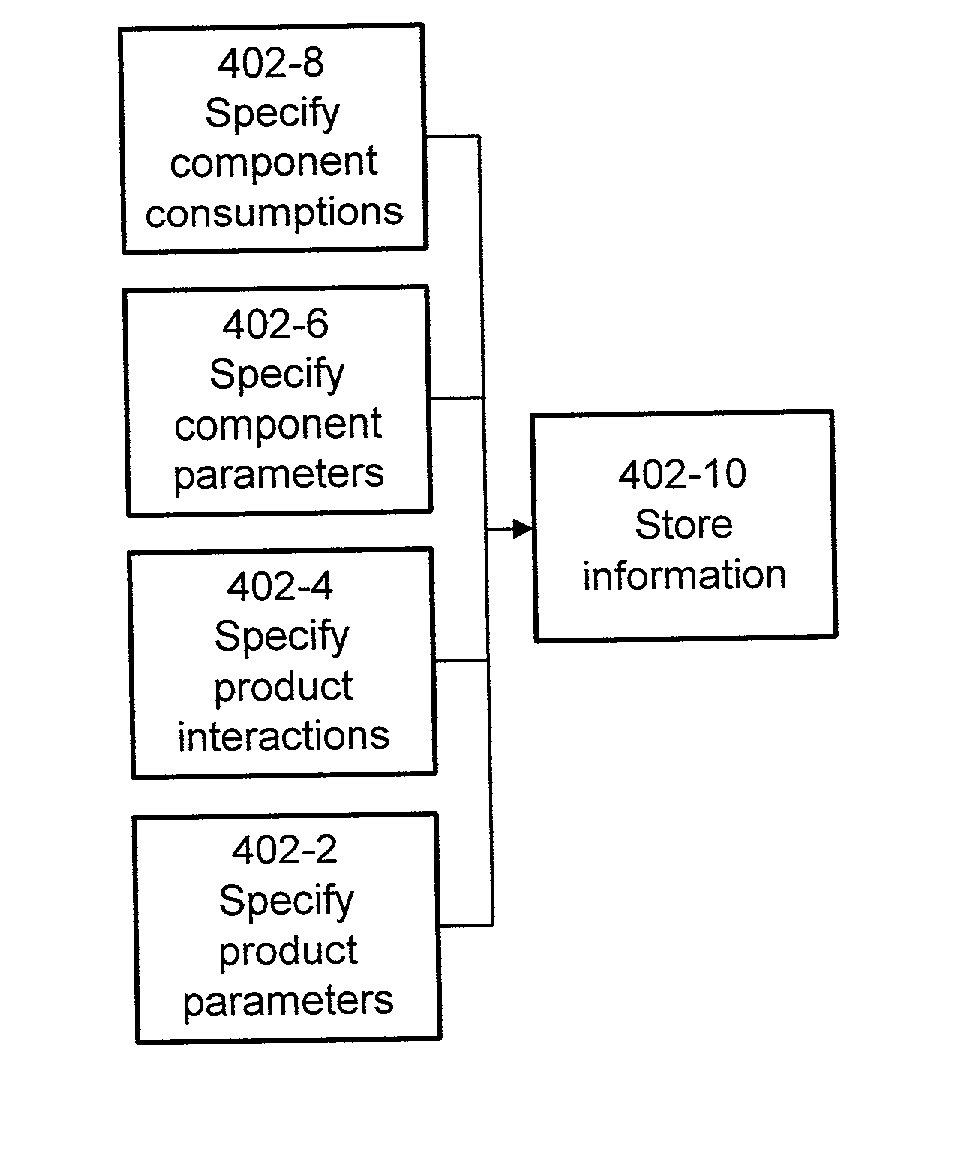

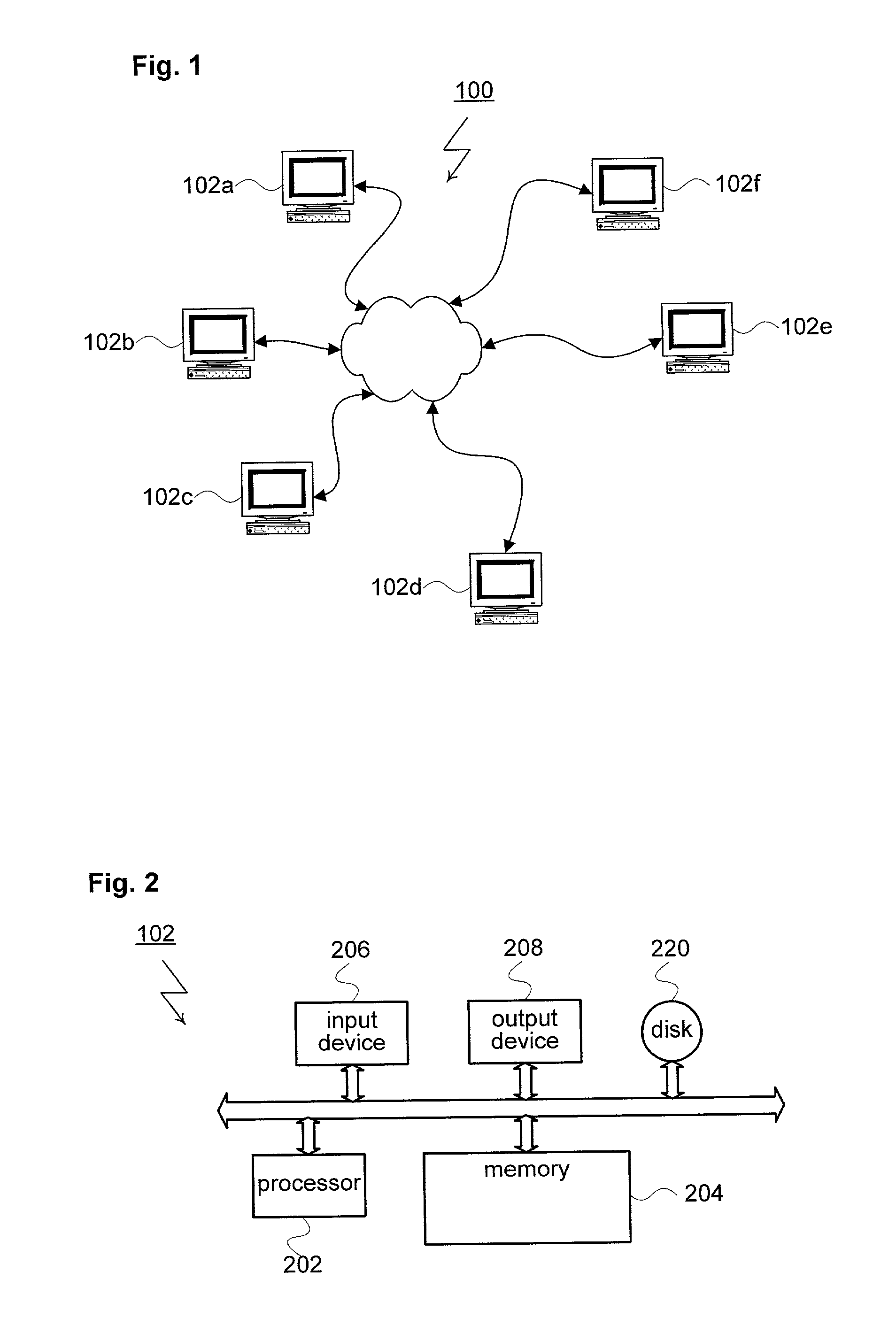

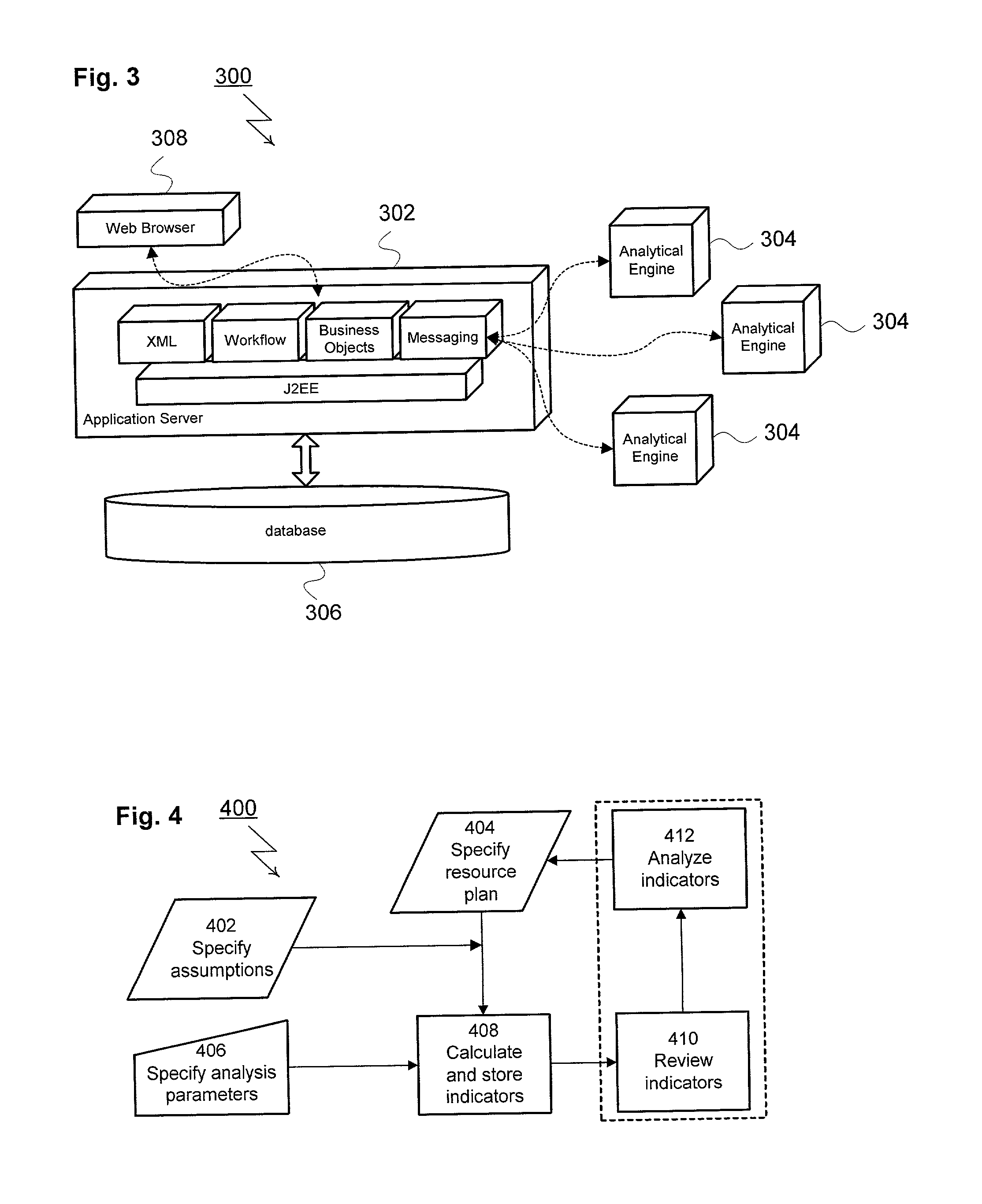

Method and apparatus for component plan analysis under uncertainty

A method and apparatus for component plan analysis under uncertainty is disclosed. A representative implementation of this method begins when a planner captures assumptions about products and components in an entity called a “scenario.” A scenario is the parameterization of all the demand, financial, and operational information for a portfolio of products and components across a set of time buckets (planning periods). The planner then specifies a component plan to be analyzed. The component plan identifies the quantities of each resource that will be used or procured during each planning period. The planner then generates a request for analysis including one or more analysis parameters that will be used in order to evaluate the performance and the risks associated with the component plan and scenario. The request for analysis is submitted to an analysis engine for calculation of risk indicators. The analytical engine calculates all the performance indicators and returns the results. The results are then typically stored in a database or other persistent storage system.

Owner:MICROSOFT TECH LICENSING LLC

Predictive Key Risk Indicator Identification Process Using Quantitative Methods

Methods, computer-readable media, and apparatuses are disclosed for identifying predictive key risk indicators (KRIs) for organizations and / or firms through the application of specific statistical and quantitative methods that are well integrated with qualitative adjustment. An indicator is a variable with the purpose of measuring change in a phenomena or process. A risk indicator is an indicator that estimates the potential for some form of resource degradation using mathematical formulas or models. Organization / enterprise key risk indicators are an essential arsenal in the risk management framework of any firm or organization and may be required by regulatory agencies.

Owner:BANK OF AMERICA CORP

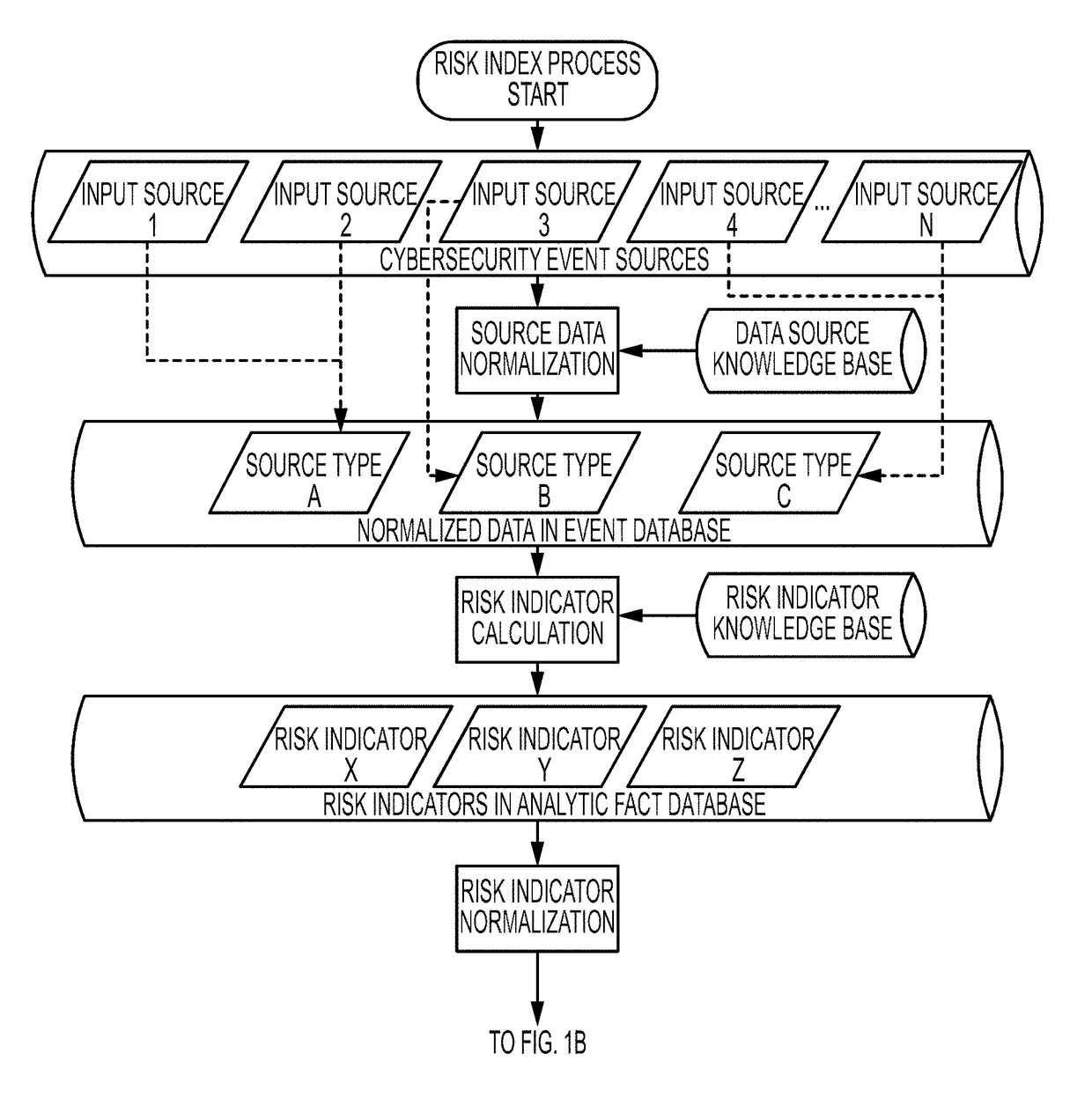

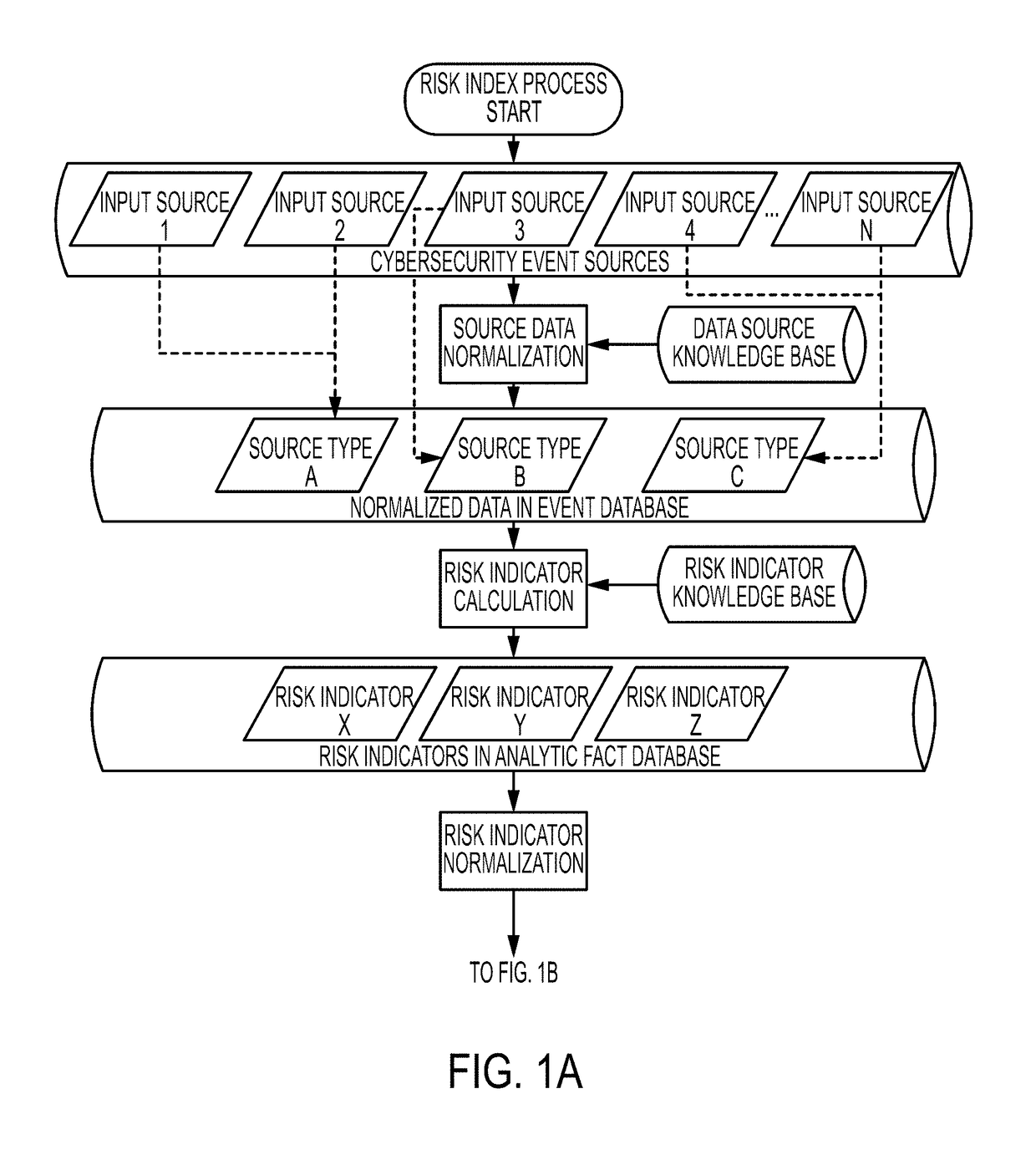

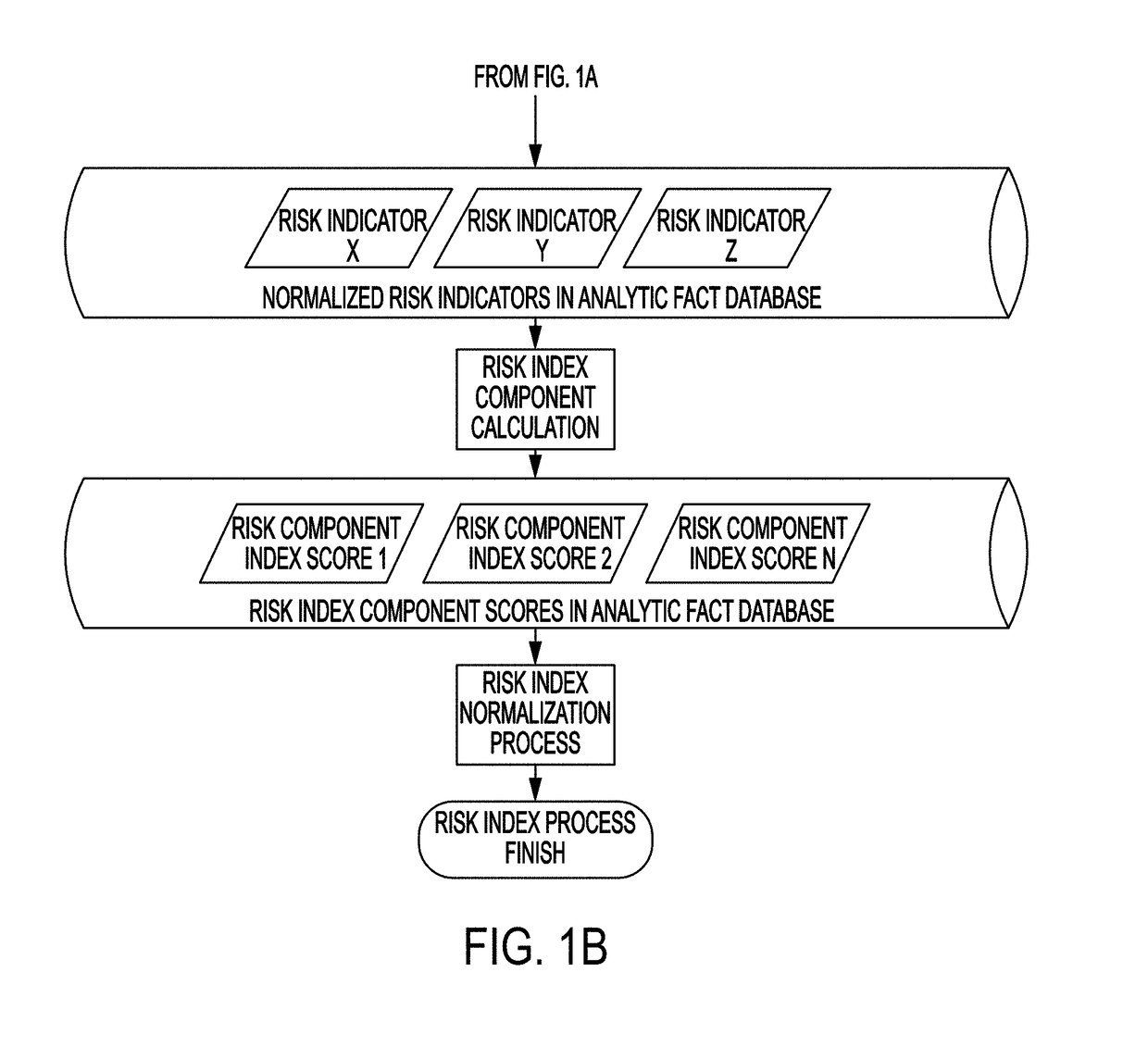

Method for the Continuous Calculation of a Cyber Security Risk Index

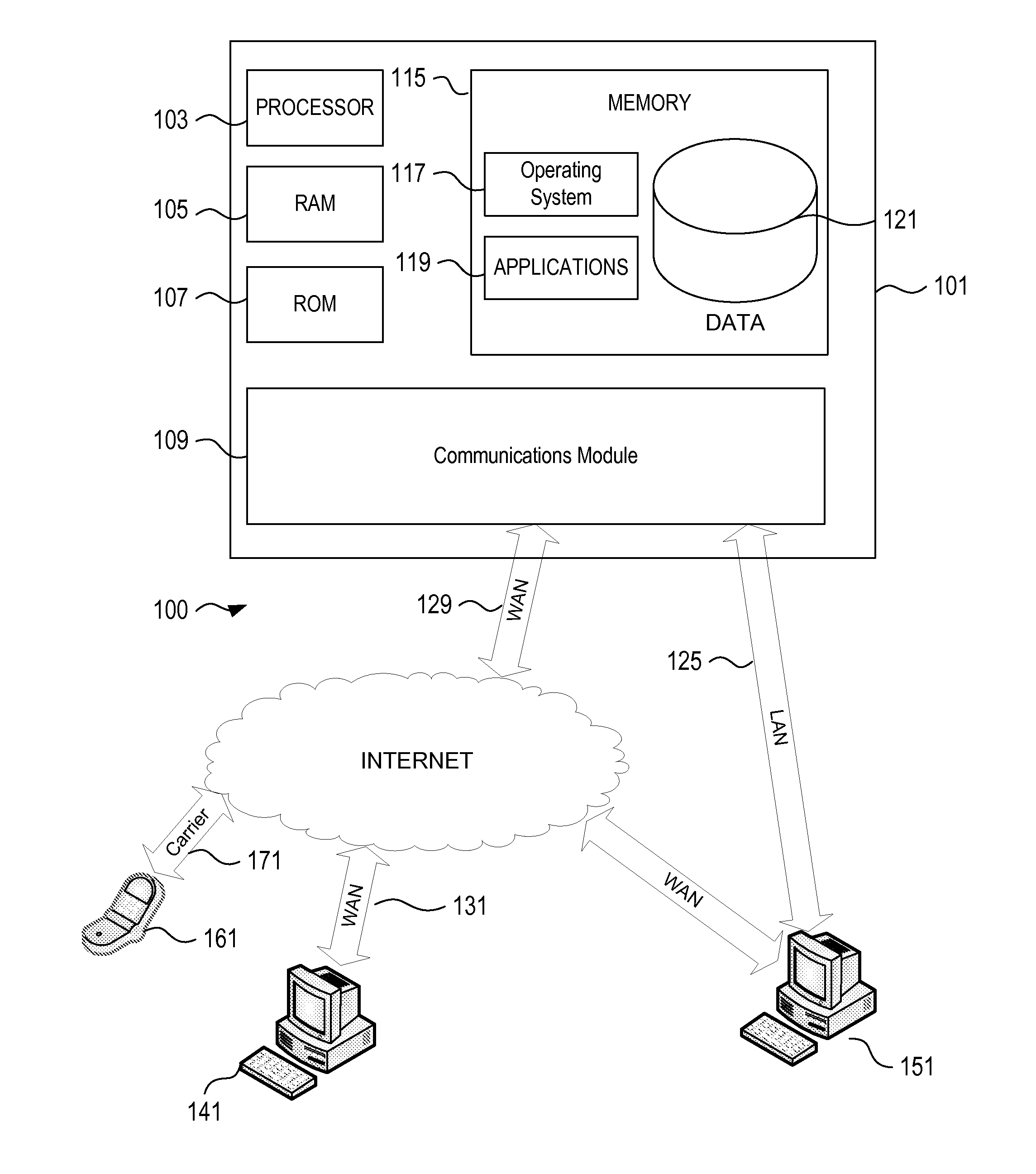

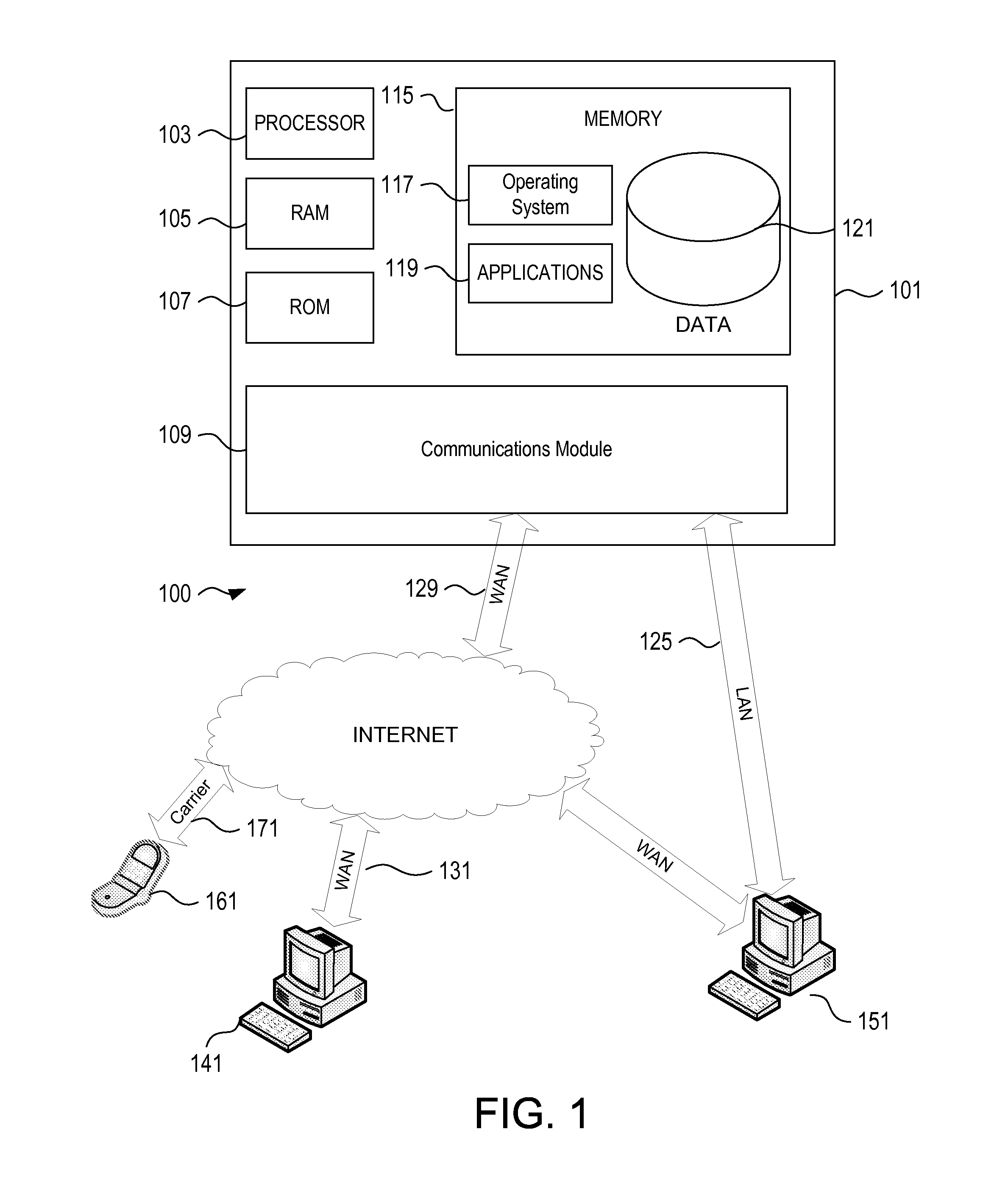

ActiveUS20180124091A1Measure securityDigital data information retrievalComputer security arrangementsInternet privacyRisk index

A method for assessing a cyber security risk, the method comprising the steps of: obtaining cyber security precursor information from a plurality of sources, wherein the cyber security precursor information can be obtained from one or more online or offline sources; normalizing the obtained cyber security precursor information to a common information model; generating, from the normalized cyber security precursor information, one or more events; producing, from the one or more generated events, one or more facts; calculating a plurality of risk indicators from the one or more facts; normalizing the plurality of risk indicators to a common model; calculating, using the normalized plurality of risk indicators, one or more cyber risk index component scores; and calculating, using the one or more cyber risk index component scores, a cyber risk indicator index.

Owner:FORTINET

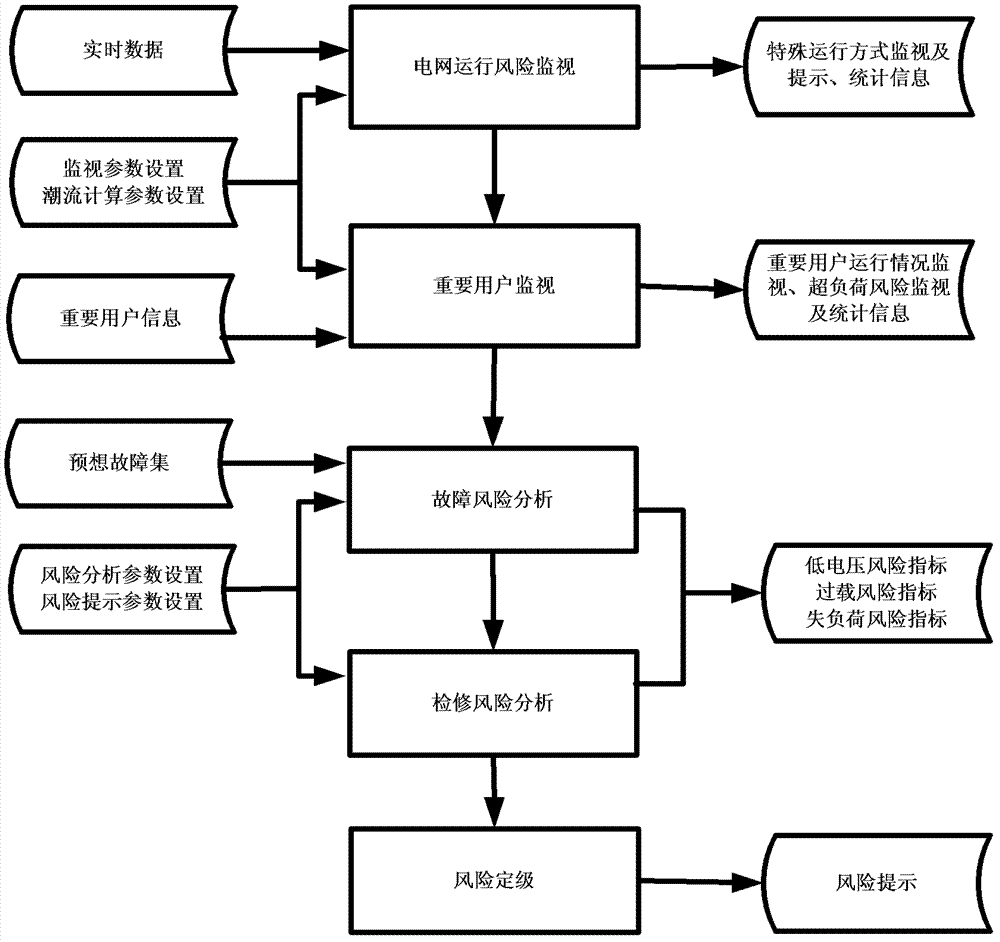

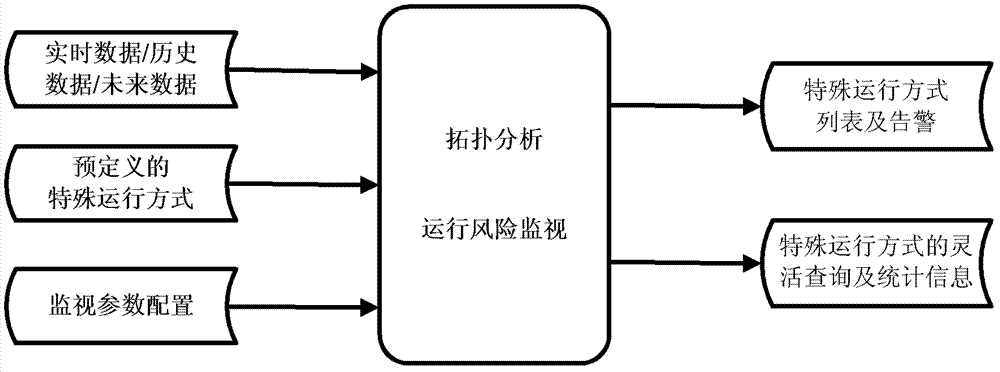

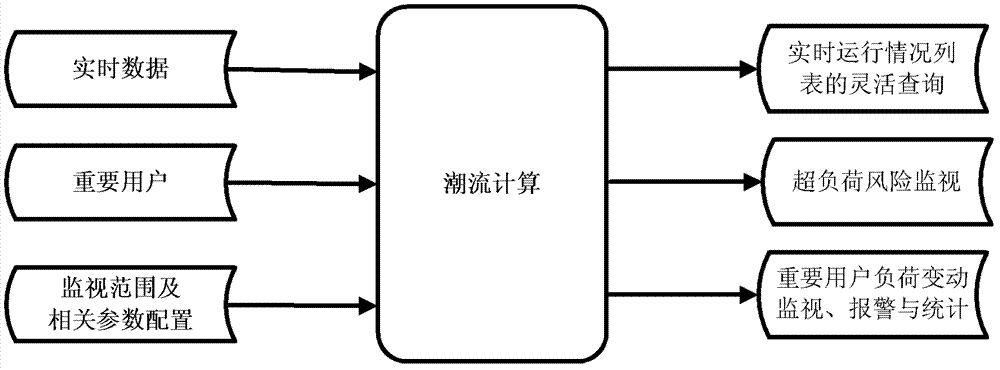

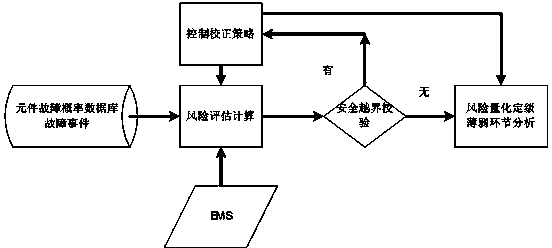

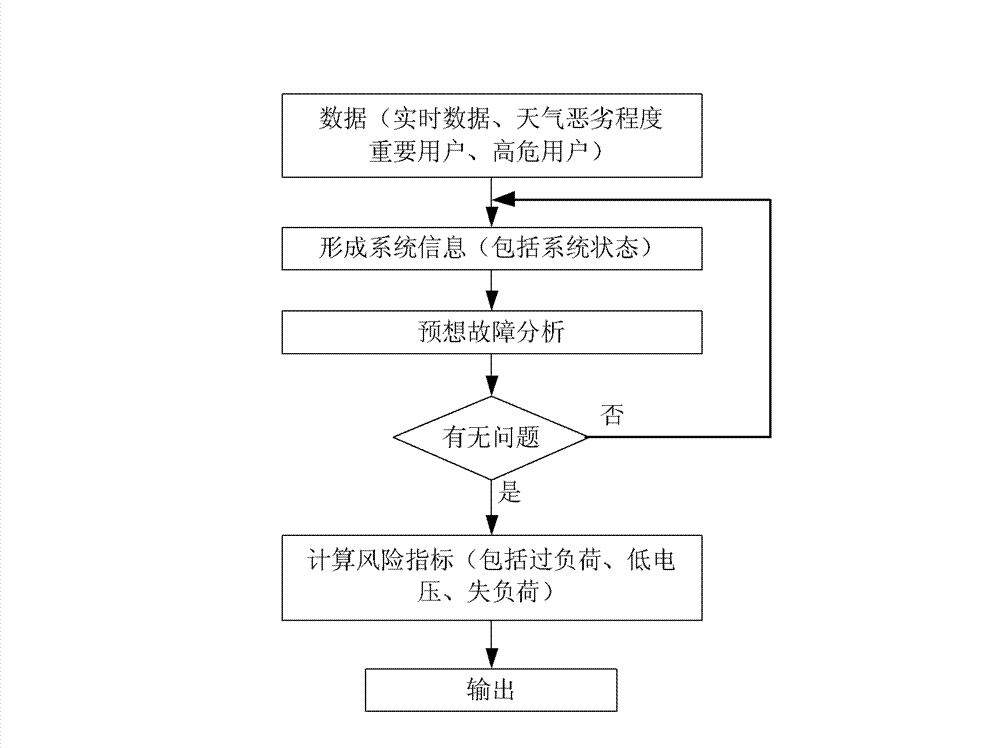

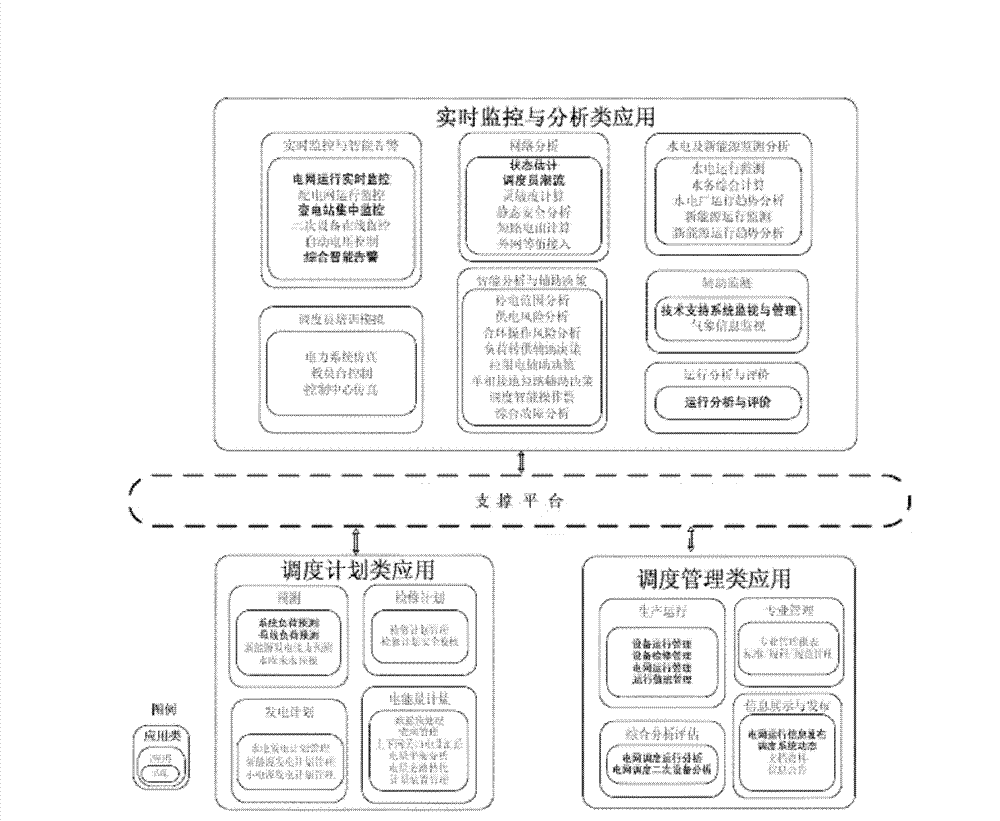

Online risk analysis system and method for regional power grid

The invention provides online risk analysis system and an online risk analysis method for a regional power grid. The system comprises a display unit, a power grid running risk monitoring unit, an important user monitoring unit, an analysis unit and a risk grading unit; the method comprises the following steps: (1). acquiring the power grid running data and system state; (2). conducting expect fault set selection and fault analysis; (3). judging the result caused by the power grid according to the expect fault, if power supply risk exists, conducting the step (4), otherwise returning the step 2; and (4). calculating risk indicator, and conducting risk grade prompt according to the indicator. The online risk analysis system and the online risk analysis method for the regional power grid comprehensively consider the current state probability, fault possibility and fault seriousness of the system, and help a dispatcher analyze and find hidden risk of the system.

Owner:CHINA ELECTRIC POWER RES INST +1

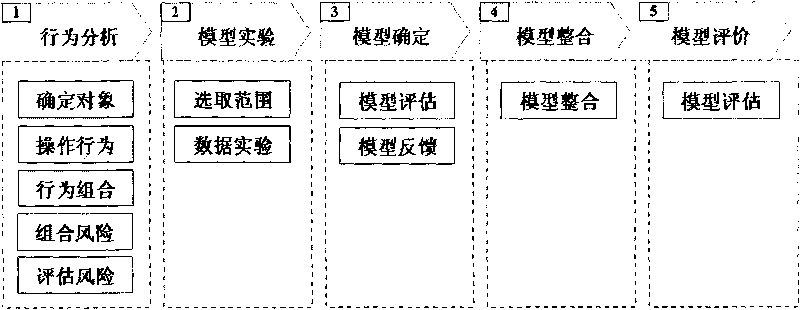

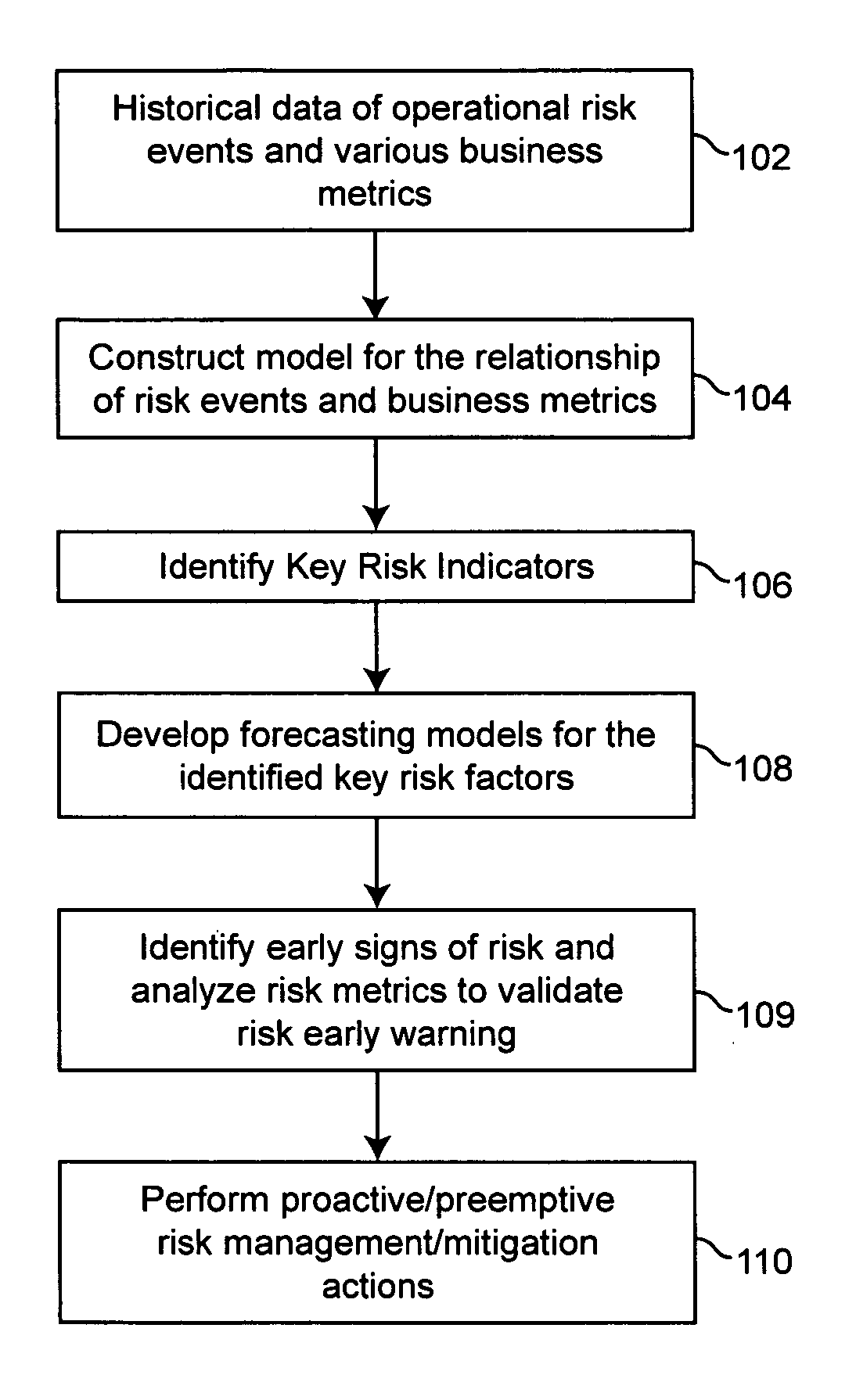

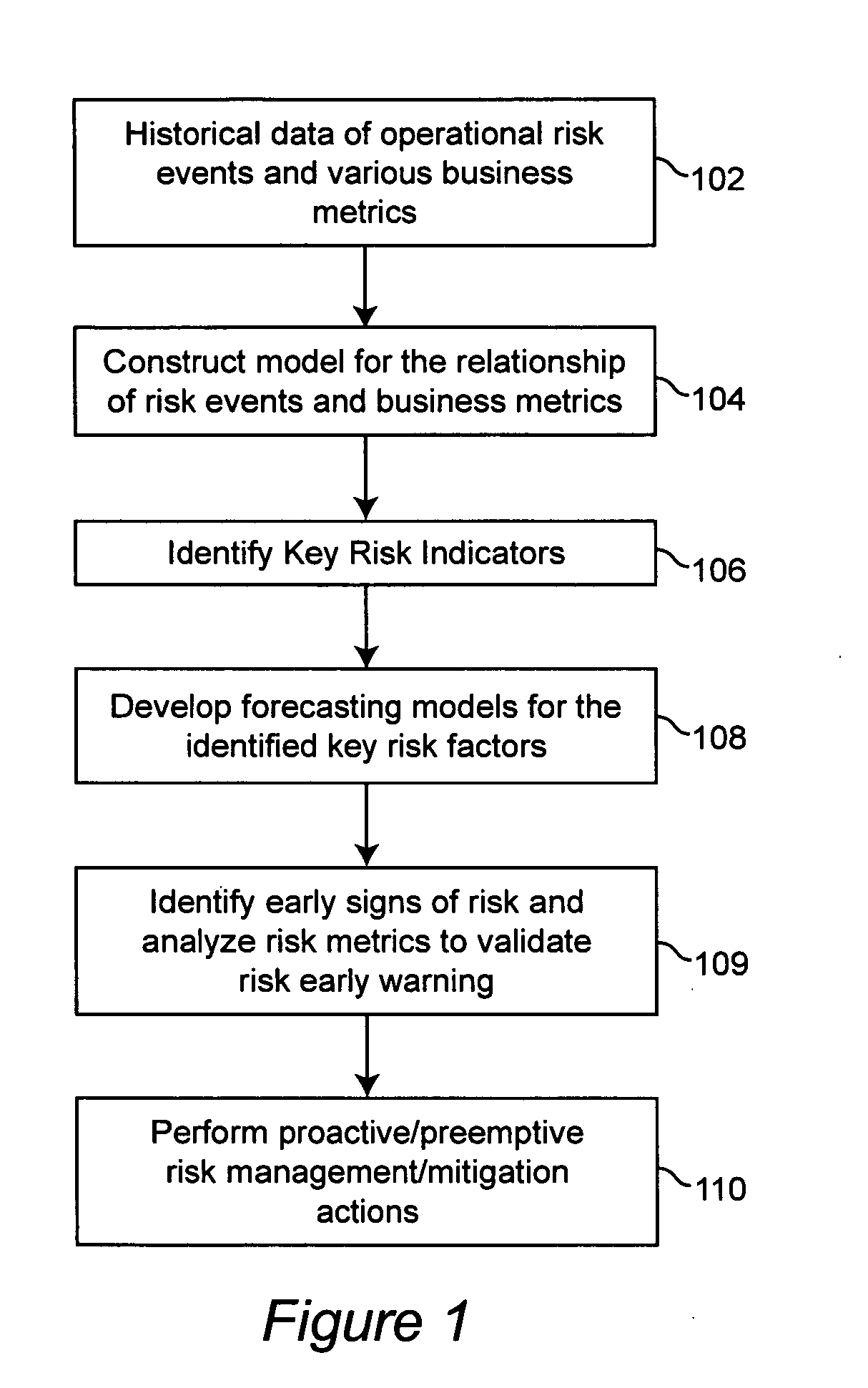

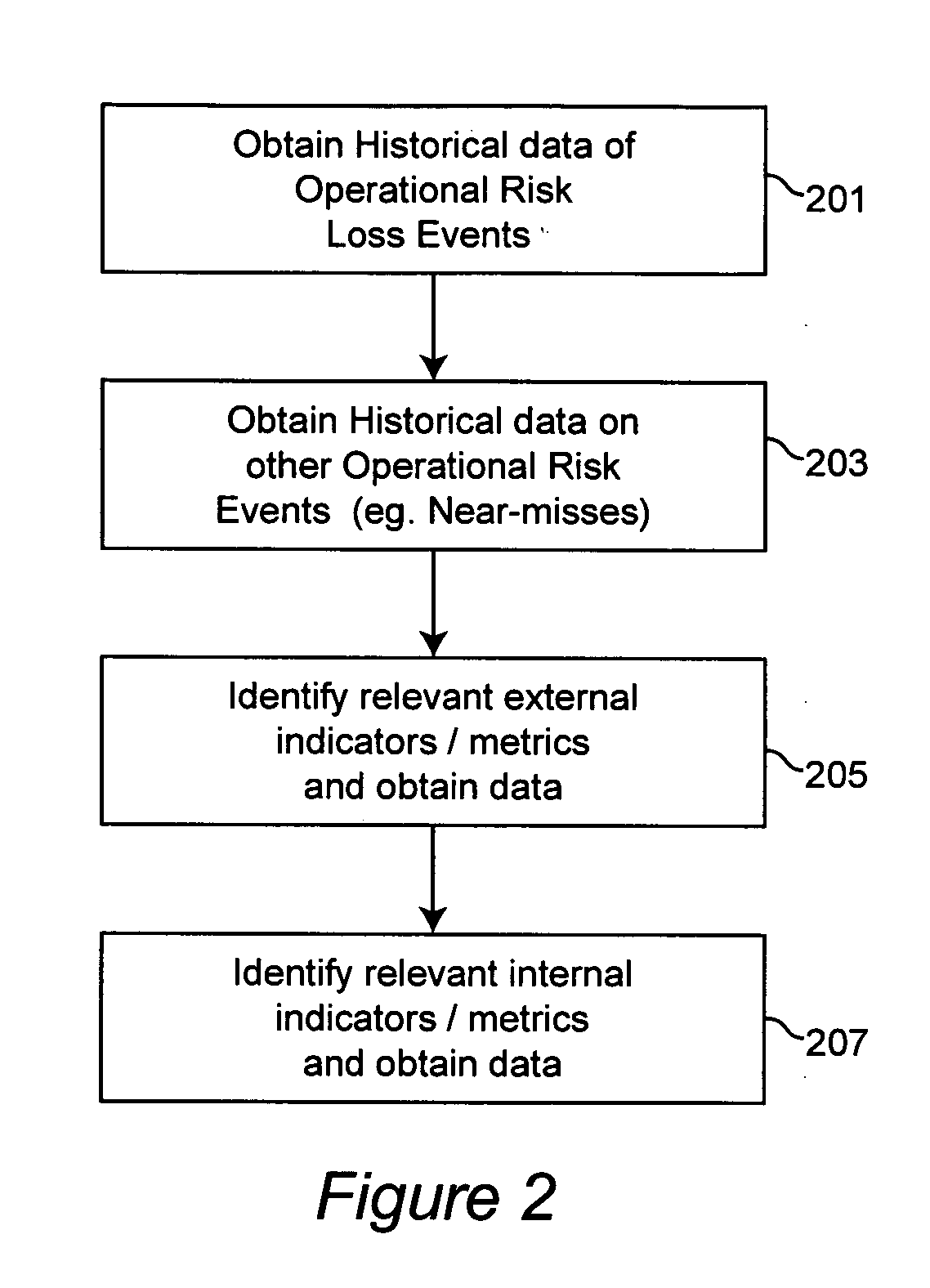

Method and apparatus for pre-emptive operational risk management and risk discovery

A computer implemented method and a computer system implementing the method provide enterprises with pre-emptive / proactive operational risk management. First, historical data on the occurrence of operational risk events and other internal business / external metrics and indicators are collected. This is followed by construction of a model for correlating the risk events with internal and external metrics and indicators. This can result in the estimation of the probability of occurrence of risk events and a model for the severity of a loss event (in termns of, say, dollar amount) as a function of the various variables that are related to or have leverage on the business operation. The Key Risk Indicators for the business are then identified based on the model. Following this, the identified key risk factors are forecasted for future time periods and used to identify early warnings of risk and is further validated. This is used as a basis for the identification and execution of appropriate proactive / pre-emptive risk management and mitigation actions.

Owner:IBM CORP

Risk evaluation method for operation of large power grid

InactiveCN103632310AReal-timeRealization riskData processing applicationsLoad lossLoad following power plant

The invention belongs to a risk evaluation method for the operation of a large power grid. The method comprises the following steps of (1) statistics of fault and risk factors; (2) computation of risk probability; (3) risk quantitative evaluation based on the load loss; (4) classification and result evaluation on risk index. According to the risk evaluation method for the operation of the large power grid, the occurring probability of power system accidents and the number of load loss of the system are combined to form a new quantitative index, so a scheduling person can be helped to perform real-time risk evaluation and analysis, can further comprehensively master the safe operation condition of the power grid, and controls the risk level of the system within a reasonable range by adopting necessary measures, and the occurrence of the disaster fault is avoided. The real-time evaluation and management and control on the risk are realized by a power gird scheduling center and the method belongs to a load loss-based risk evaluation method for the operation of the large power grid.

Owner:CHINA SOUTHERN POWER GRID COMPANY

Power system weak link identification method based on risk evaluation

ActiveCN103426056AImprove weak linksRealize precise identificationResourcesSystem failureRisk evaluation

The invention relates to a power system weak link identification method based on risk evaluation and belongs to the field of power system analysis. The method includes acquiring fault probability of elements of a power system, a future load curve of the power system, states of the elements and load of nodes of the power system; utilizing a minimum load shedding loss optimization model to judge the failure state of the power system and determining the optimum load shedding quantity of each node under each element sampling state; finishing calculation of risk indicators of the power system through repeated sampling and power system failure state judgment; conducting statistics on the weak link characteristic quantity corresponding to faults of generators and an electric transmission and transformation device, calculating five element weakness recognition indicators of the elements according to the risk indicators and the weak link characteristic quantity and finally sorting the recognition indicator values to recognize the weak link of a generator set and the electric transmission and transformation device. By means of the method, the weak link of the power system is improved, large-area power failure of the power system is prevented, and operation safety of the power system is improved.

Owner:TSINGHUA UNIV

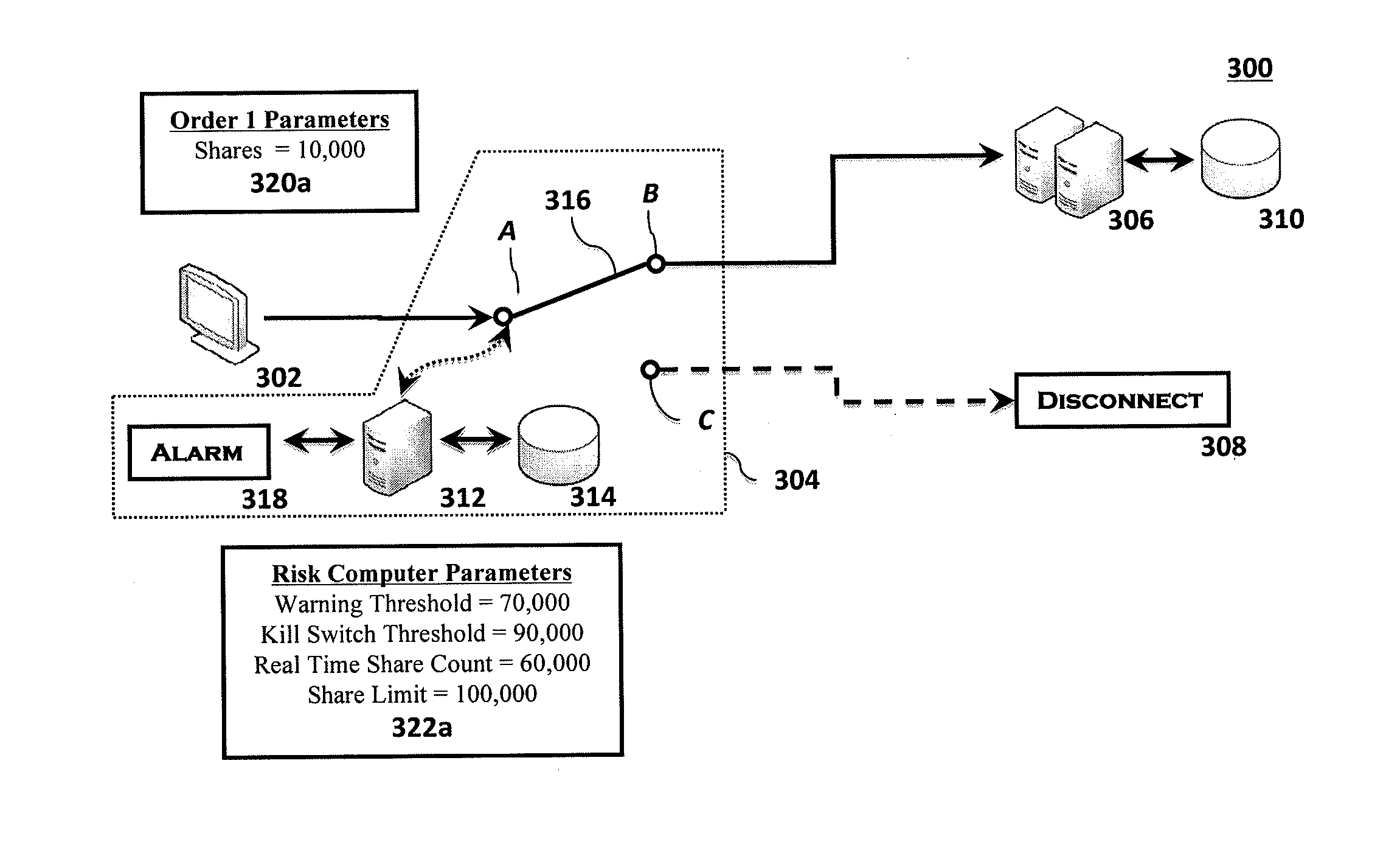

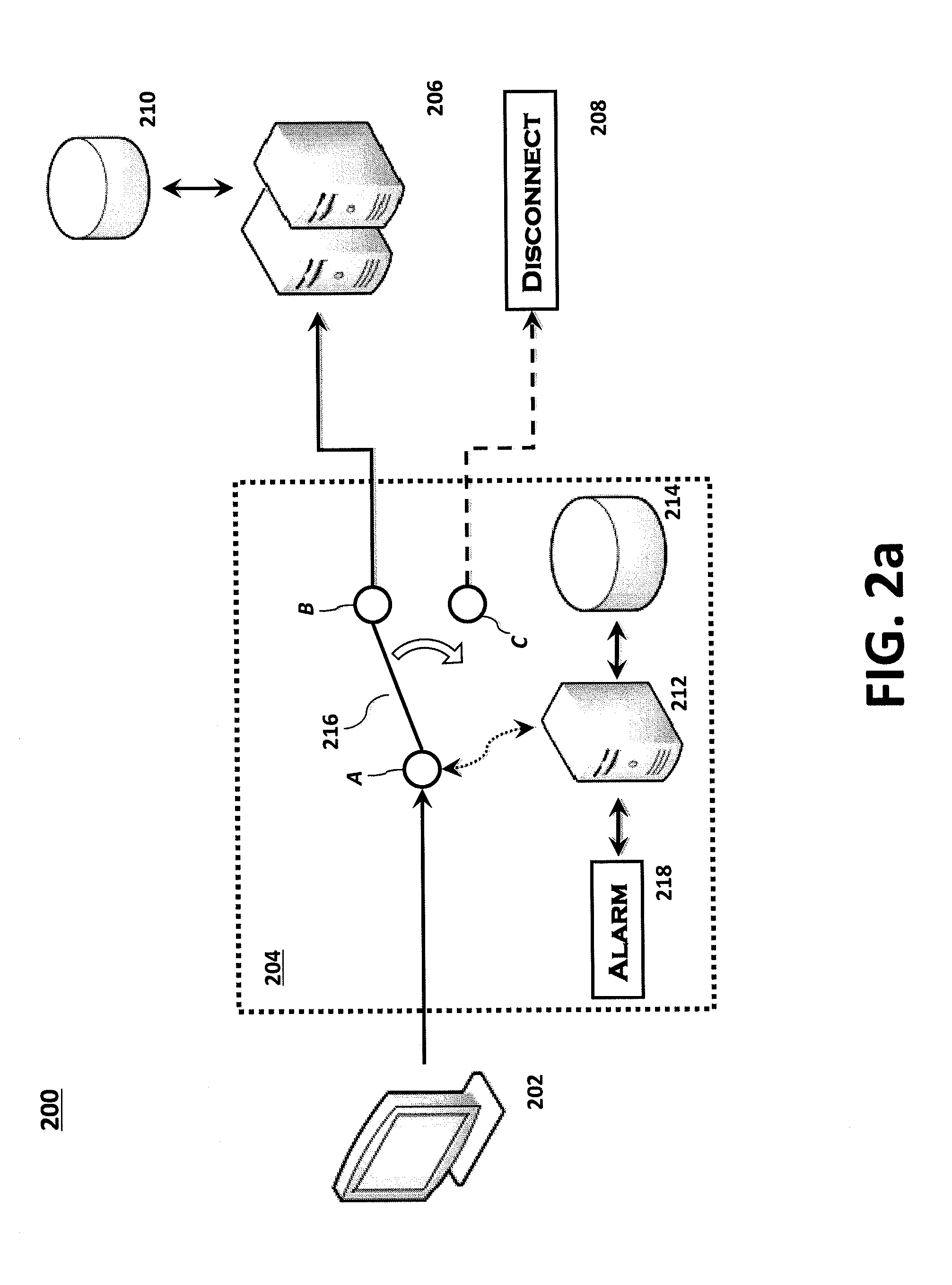

Zero-latency risk-management system and method

InactiveUS20120284158A1Zero latency riskImprove the zero-latency risk-management systemFinanceRisk levelComputer monitor

A zero-latency risk-management system and method useful in, for example, sponsored market access or in-house trades. The zero-latency risk-management system comprises an out-of-band risk monitor computer and a kill-switch. The kill-switch is in-line between order receipt and trade placement, but the out-of-band risk monitor computer operates in parallel with the order processing, thus eliminating latency in the trade. The out-of-band risk computer monitors orders as they flow through the system and updates any risk metrics based on those orders. Kill-switch threshold levels may be set in the risk computer to be, for example, the desired level of risk, minus the maximum amount of risk that a subsequent new order could incur. If the risk computer determines that an order has breached this kill-switch threshold, it activates the kill-switch to prevent additional order entry that could breach the actual threshold.

Owner:VIRTU FINANCIAL SERVICES

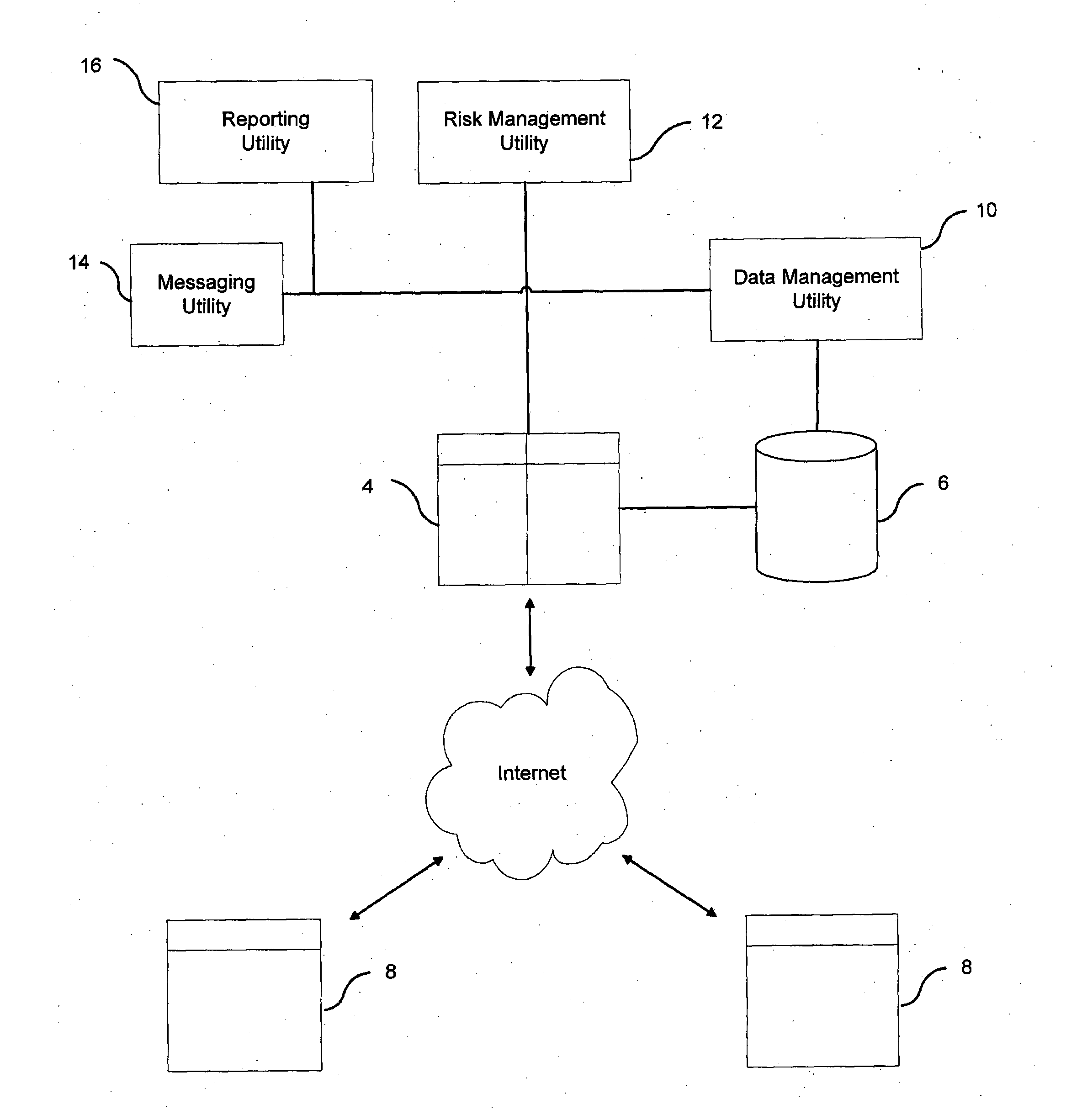

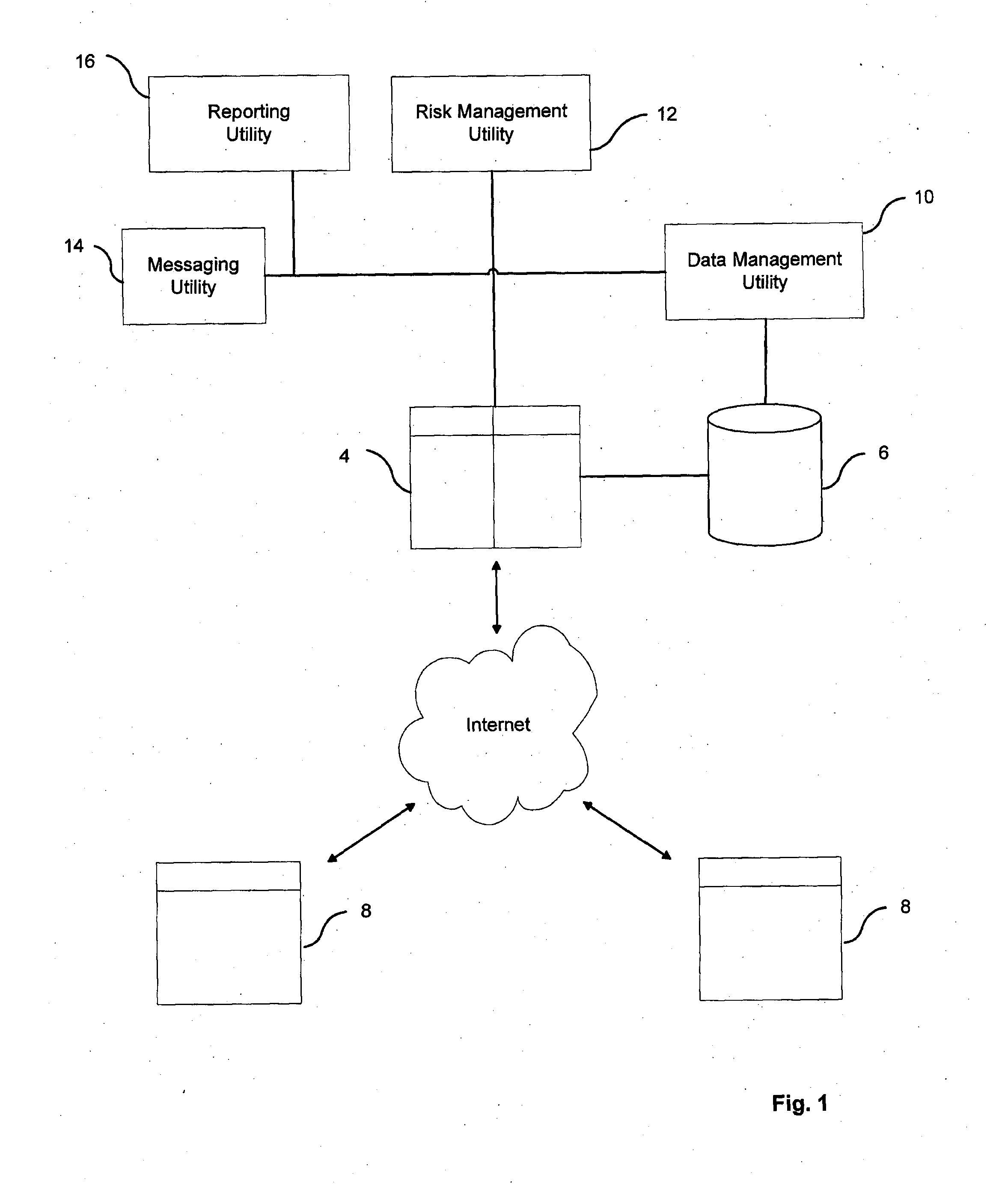

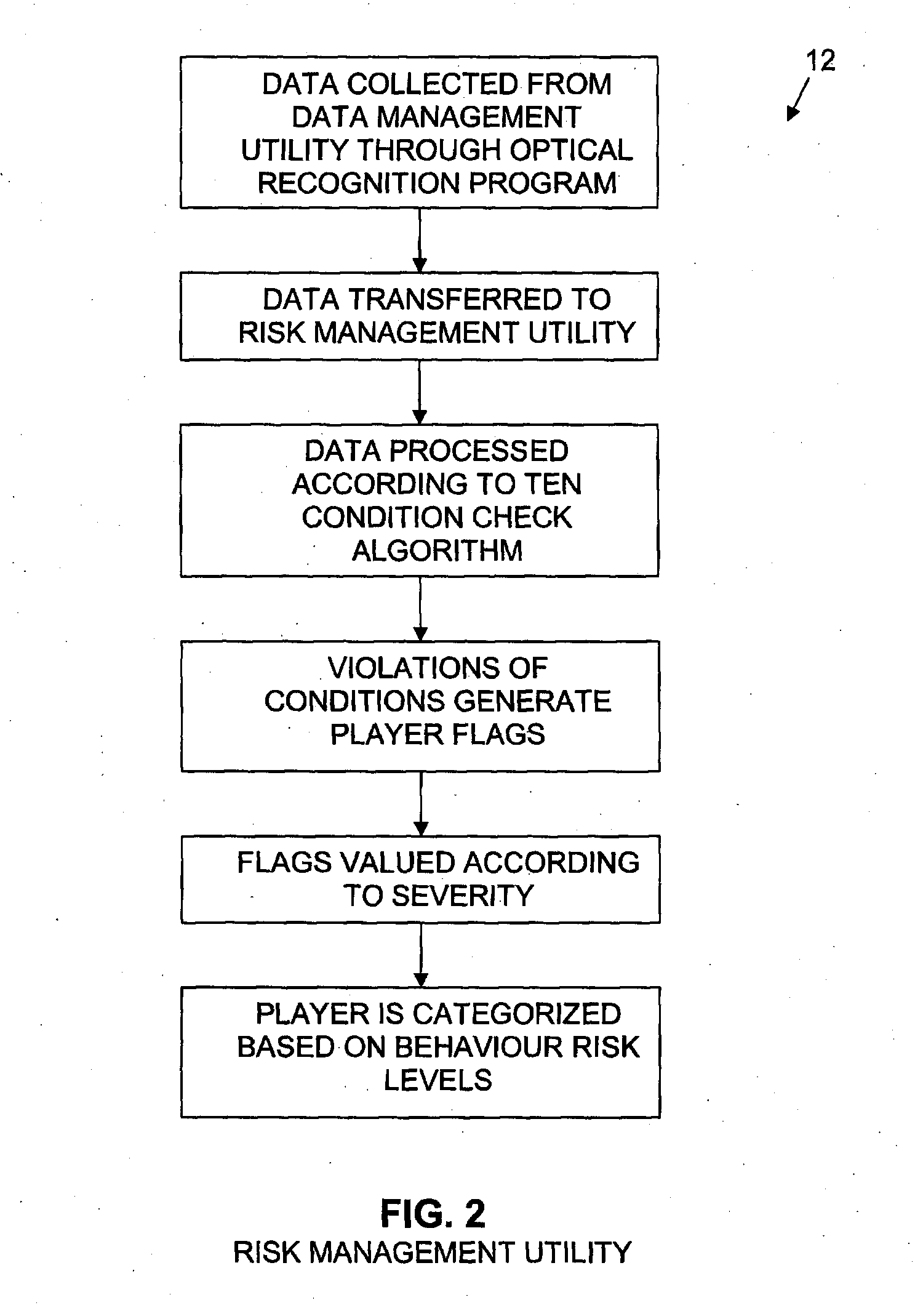

System, method and computer program for retention and optimization of gaming revenue and amelioration of negative gaming behaviour

InactiveUS20110250972A1Reduce potentially harmful behaviourReduce the possibilityApparatus for meter-controlled dispensingOffice automationHuman–computer interactionSurveillance data

A method of ameliorating negative gaming behaviour is provided. One or more gaming users are monitored, or monitoring data regarding their gaming behaviour is obtained. The gaming behaviour is analyzed to identify behaviour that may result in potentially harmful or addictive gaming behaviour (negative gaming behaviour). In the event of occurrence of such negative gaming behaviour, based on the specific negative behaviour one or more interactions are initiated between a system and the one or more users, such interactions being directed to ameliorating the negative gaming behaviour by preventative action. The gaming behaviour is analyzed based on a plurality of gaming behaviour risk indicators.

Owner:2169244 ONTARIO

Method for evaluating risk of regional grid on line

InactiveCN102708411AImprove standardizationStable supportData processing applicationsPower gridFailure analysis

The invention provides a method for evaluating the risk of a regional grid on line by using a D5000 system, which comprises the following steps: (1) acquiring the grid operation data and the state of a system; (2) selecting an expected fault set and analyzing the fault; (3) judging the effect caused by the grid according to the expected fault, carrying out the step (4) if the power supplying risk appears, and otherwise, returning to the step (2); and (4) calculating the risk indicator and the prompting risk according to the risk indicator. According to the method for evaluating the risk of the regional grid on line, the probability of the current state of the system, the probability of the possibility of the fault and the severity of the fault are considered comprehensively, so as to help the dispatchers to analyze and find out the potential risk of the system.

Owner:CHINA ELECTRIC POWER RES INST +1

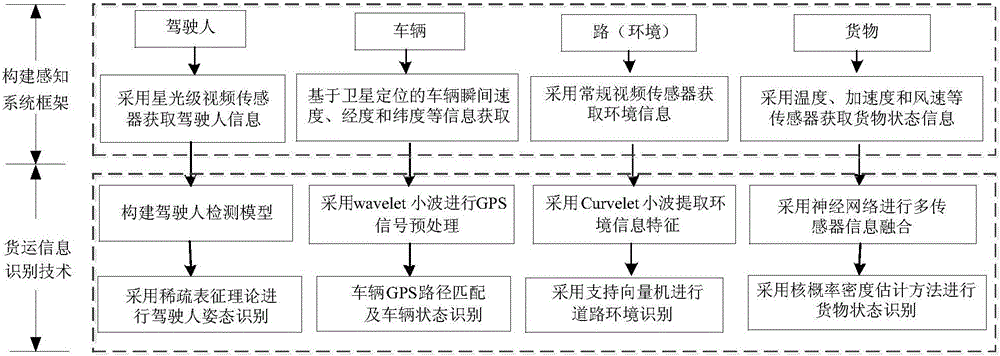

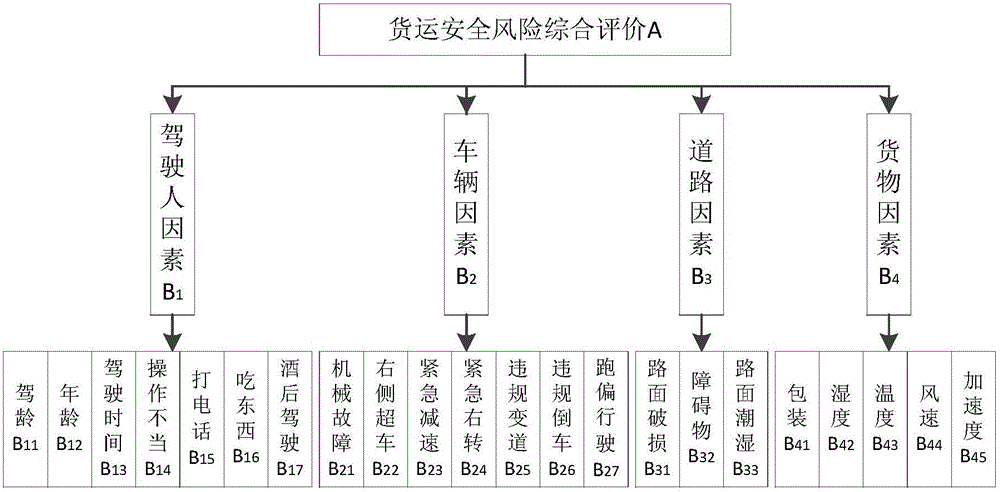

Freight transportation safety evaluation model based on man-vehicle-road-freight multi-risk source

The invention discloses a freight transportation safety evaluation model based on a man-vehicle-road-freight multi-risk source. The model is characterized in that a freight transportation safety sensing system is constructed and driver, vehicle, road (environment) and freight information is obtained; a causing factor of a freight vehicle accident is analyzed by using an accident causation theory, attribute sets of four kinds of man, vehicle, road, and freight risk sources are defined, and the attributed sets are analyzed and screened by using an accident tree analysis method; according to the screened attribute sets, a freight transportation safety risk index system is built by using an analytic hierarchy process and weights of the driver, vehicle, road(environment) and freight information factors for accident occurrence are determined; and according to the established integrated freight risk evaluation index system as well as all evaluation index weights, a freight transportation safety risk evaluation model is established by using a fuzzy evaluation theory. Therefore, the technical support for intelligent early warning can be provided for the road freight transportation safety work.

Owner:SOUTHEAST UNIV

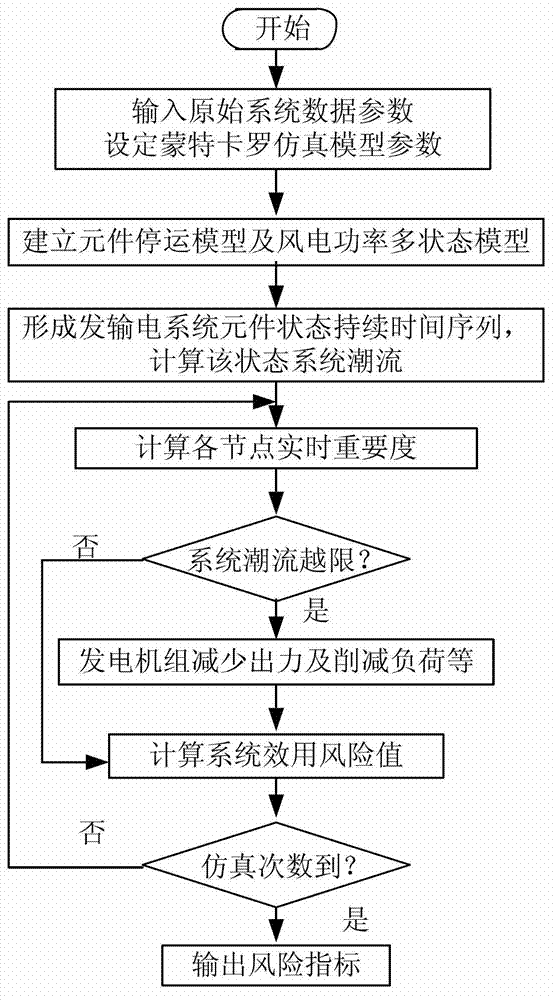

Operation risk evaluation method comprising wind- power plant electric system

InactiveCN103246806AAvoiding Situations Where Monitoring Runs IgnoredPrevent or reduce shadowingData processing applicationsSpecial data processing applicationsElectric power systemState parameter

The invention discloses an operation risk evaluation method comprising a wind-power plant electric system. With view to affection on the electric system from a wind-power plant, the operation risk evaluation method traces back to nodes and includes that real-time importance degree weights of the nodes are introduced into risk indexes, affection of a network topology and real-time tide state information is comprehensively reflected, real-time risk variation of the electric system under the action of the wind-power plant can be truly reflected, updating of various state parameters and risk level sequence is completed in real time in a short calculation period of system running risk evaluation, the problem that operating monitoring of power plants or substation busses high in importance degree is ignored is avoided, value-at-risk is converted into a dimensionless utility value by evaluating a function through consequence severity of exponential risk-preferred utility function, the risk-at-value is increased at different degrees so as to increase risk level difference identification degree and differentiation degree under same low-loss-load probability and scientifically compare different risk levels.

Owner:ZHEJIANG UNIV +2

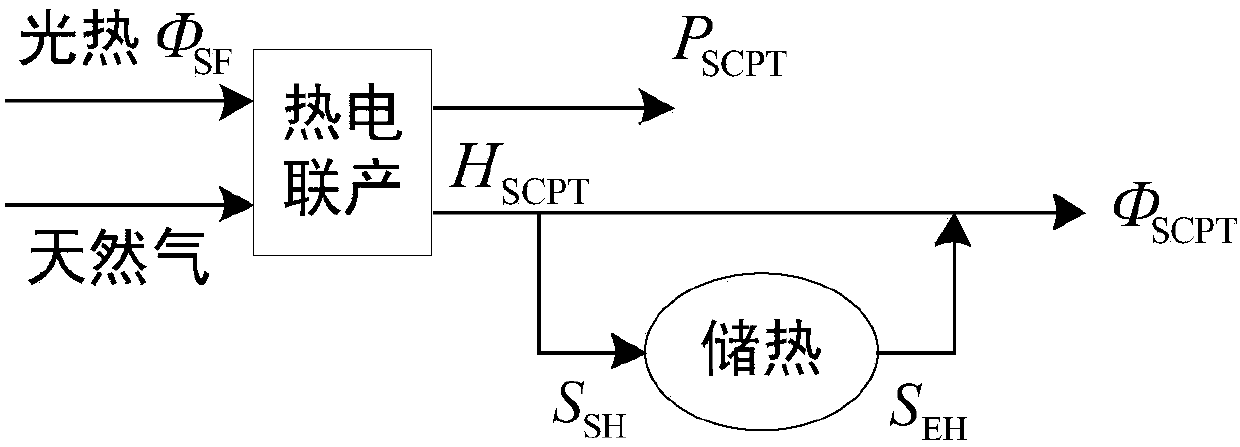

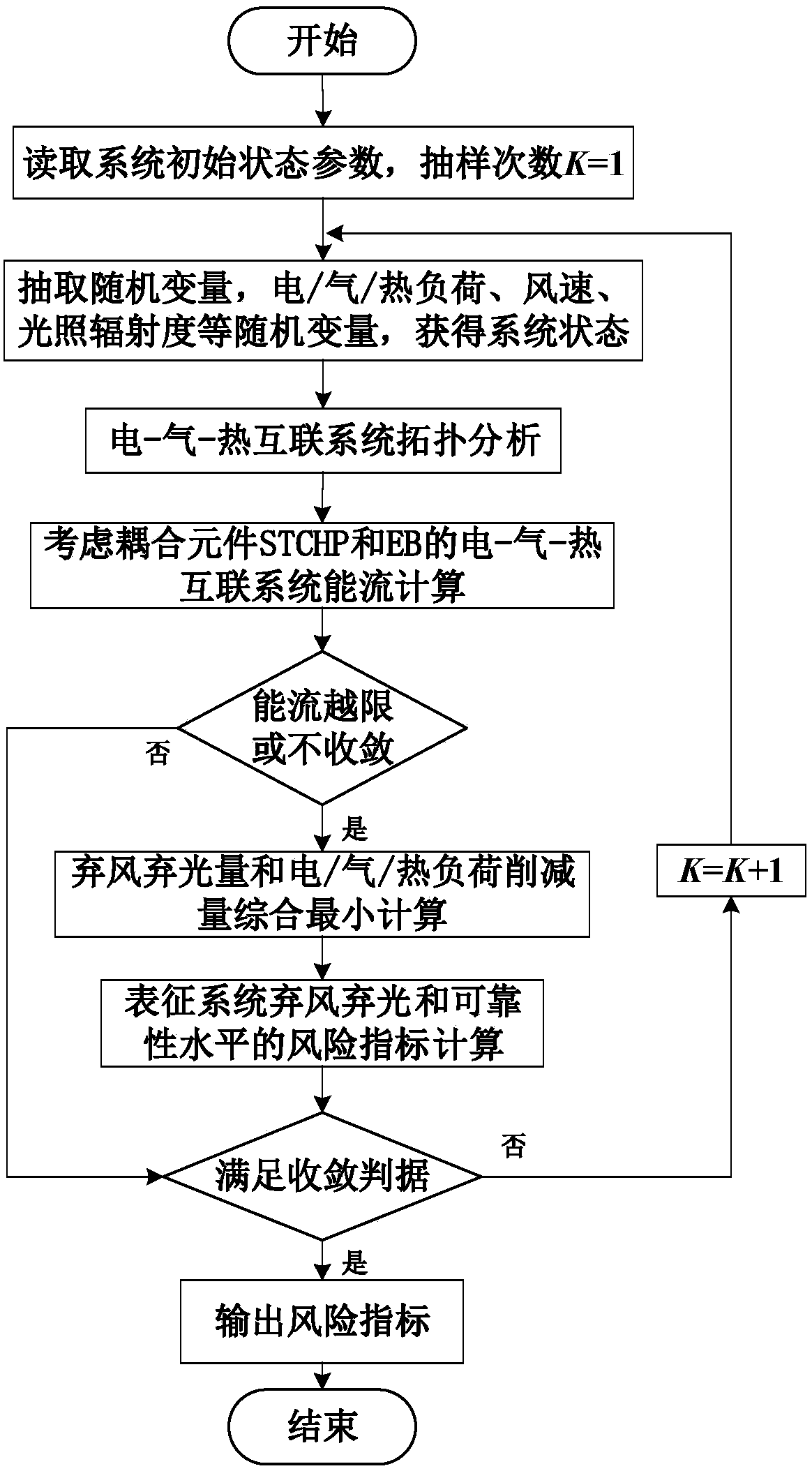

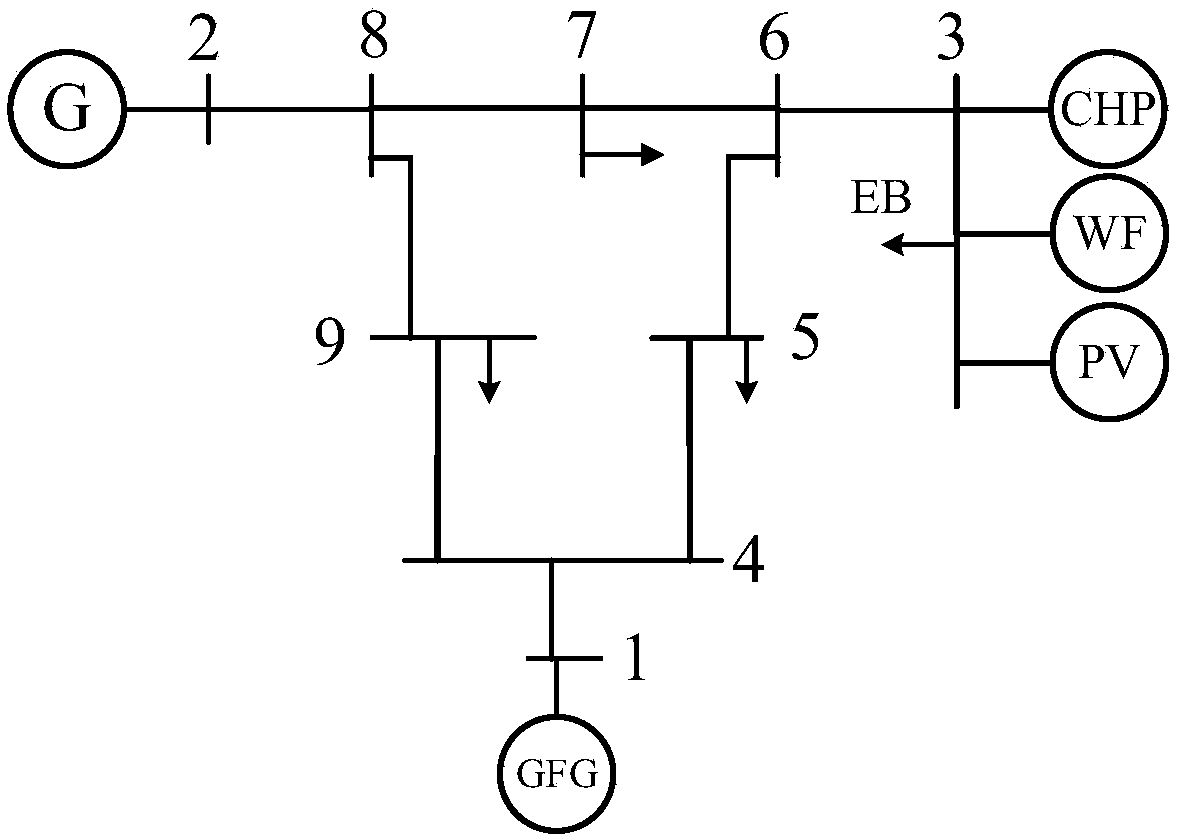

Electric-gas-heat interconnection system risk evaluation method for considering solar thermal CHP plants and electric boiler

ActiveCN107730129APreserve actual operating characteristicsReasonable quantification of the severity of wind and solar curtailmentDesign optimisation/simulationResourcesCogenerationEngineering

The invention discloses an electric-gas-heat interconnection system risk evaluation method for considering solar thermal CHP plants (STCHP) and an electric boiler (EB). The method comprises steps of establishing an energy flow model based on a coupling element STCHP and EB, and a wind and light abandoning and electric / gas / heat load reduction composite minimal optimization model; establishing a system level risk index of electric power / gas quantity / heating power insufficient expectations and wind abandoning / light abandoning expectations of the electric-gas-heat interconnection system; based onthe established energy flow model, the established load reduction model and the evaluation index, further considering various random factors of element faults, electric / gas / heat load, wind electricitypower and photoelectric power and providing a step and schedule graph about electric-gas-heat interconnection system risk evaluation for considering the STCHP and the EB; and finally, achieving calculation and analysis work of the electric-gas-heat interconnection system risk evaluation for considering the STCHP and the EB on an MATLAB platform through programs.

Owner:CHONGQING UNIV

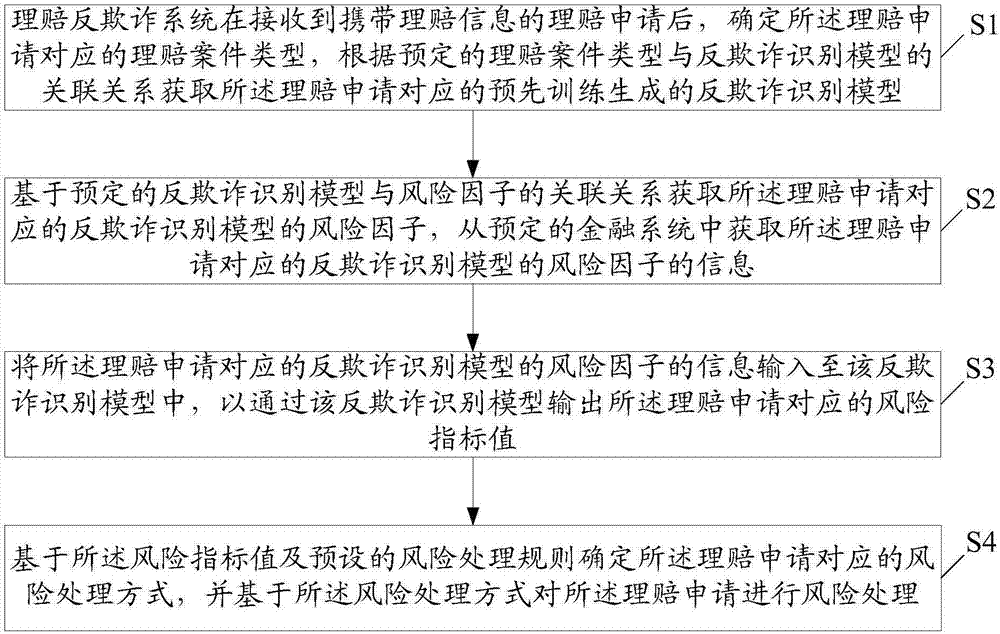

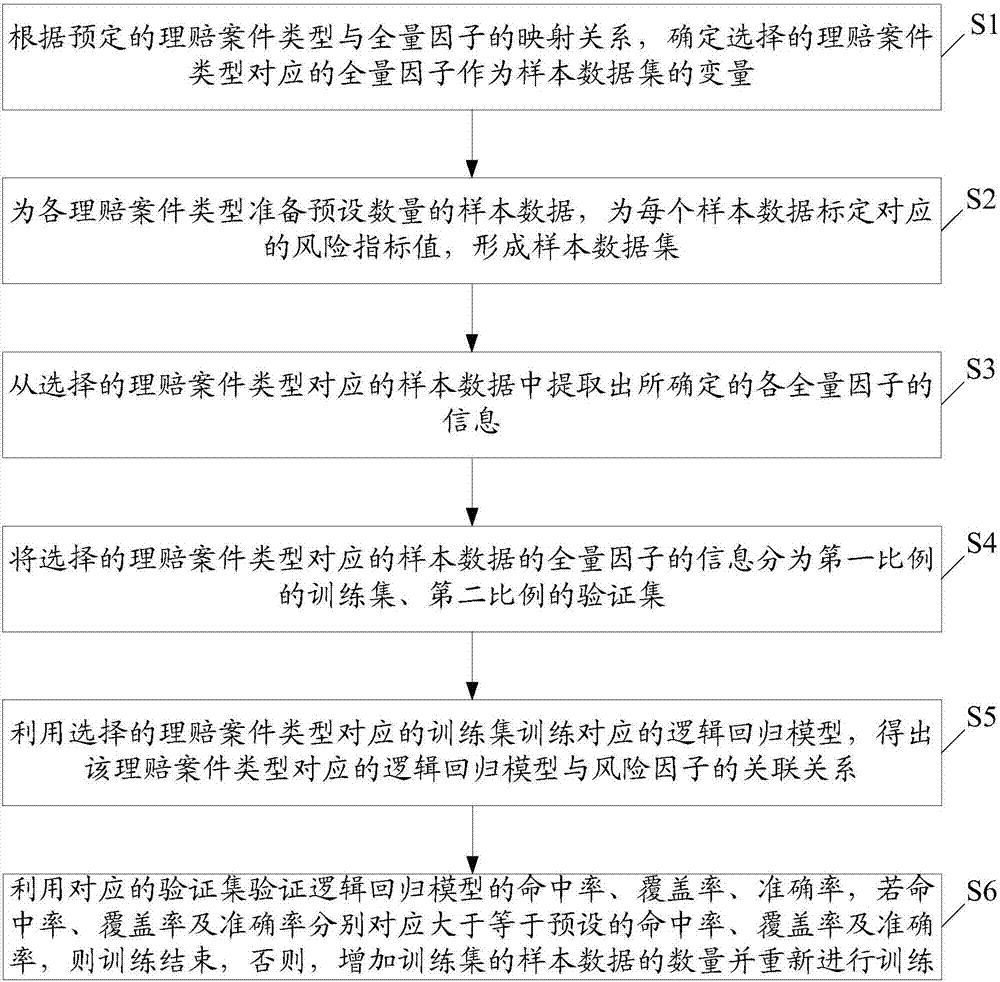

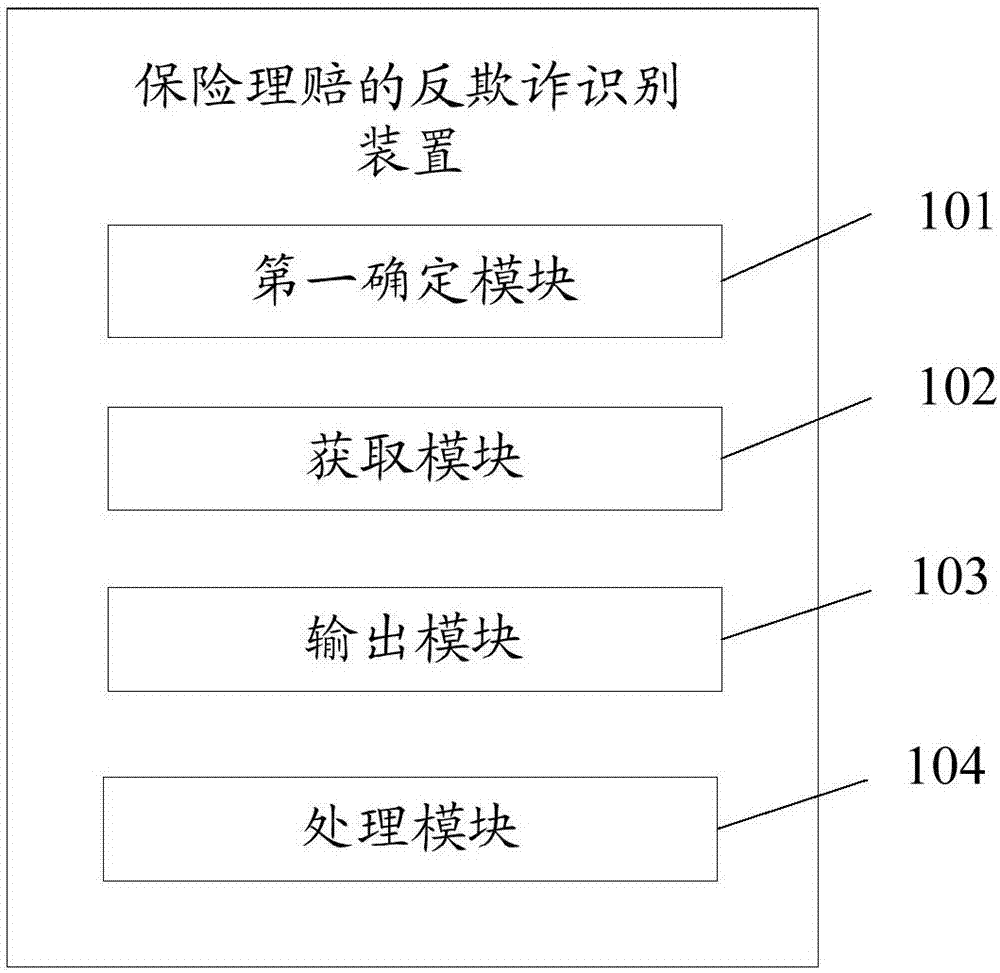

Anti-fraud identification method and apparatus for insurance claim settlement

InactiveCN107240024AEasy to handleStrengthen the identification of hidden risksFinanceCommerceRisk indexComputer science

The invention relates to an anti-fraud identification method and an apparatus for insurance claim settlement, wherein the method comprises: after a claim settlement anti-fraud system receives a claim settlement application with the claim settlement information, determining the type of the claim settlement case corresponding to the claim settlement application; obtaining a pre-trained and generated anti-fraud identification model corresponding to the claim settlement application; obtaining the risk factors for the anti-fraud identification model corresponding to the claim settlement application; obtaining from a booked financial system the risk factor information of the anti-fraud identification model corresponding to the claim settlement application; inputting the risk factor information to the anti-fraud identification model; outputting the risk index value corresponding to the claim settlement application; based on the risk index value and the preset risk processing rules, determining the risk processing manner corresponding to the claim settlement application; and based on the risk processing manner, performing risk processing to the claim settlement application. With the method and the apparatus of the invention, it is possible to quickly process the claim settlement applications in batch, to increase the efficiency of anti-fraud identification, and to identify the hidden fraud risks to the largest extent.

Owner:CHINA PING AN LIFE INSURANCE CO LTD

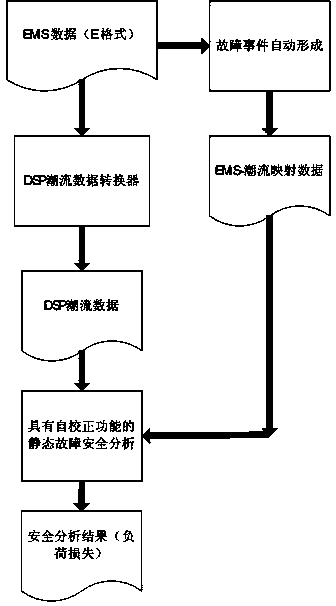

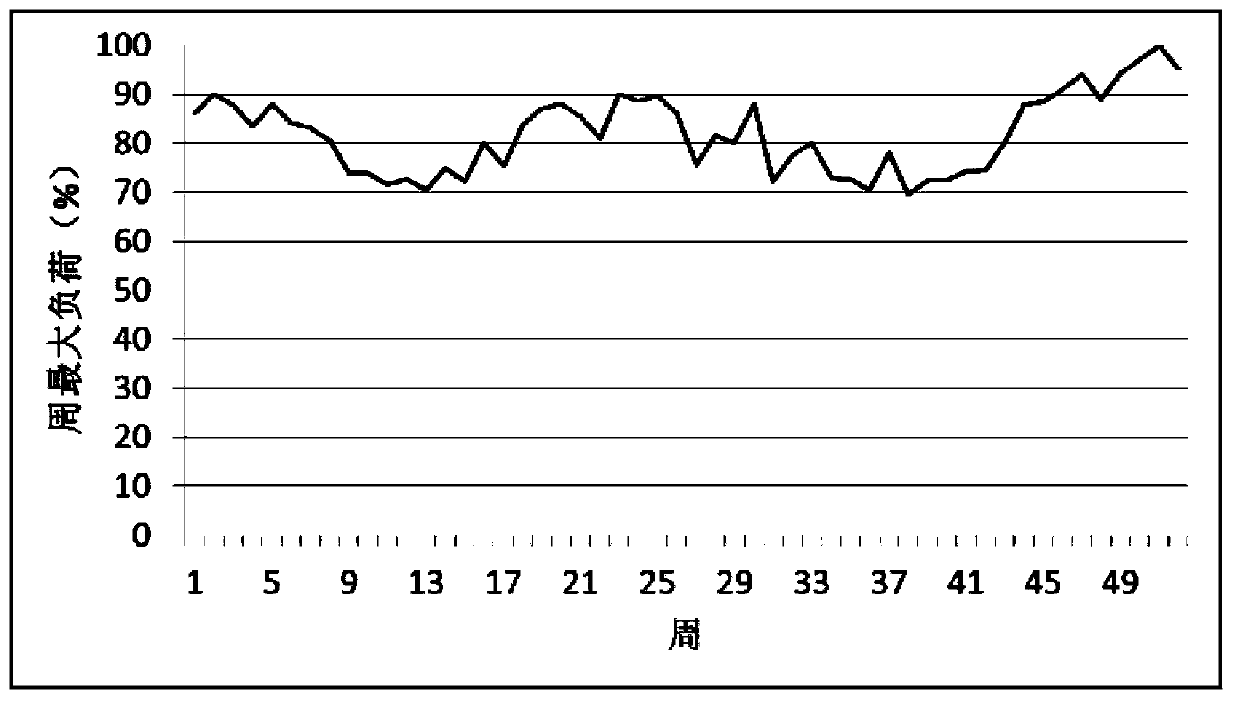

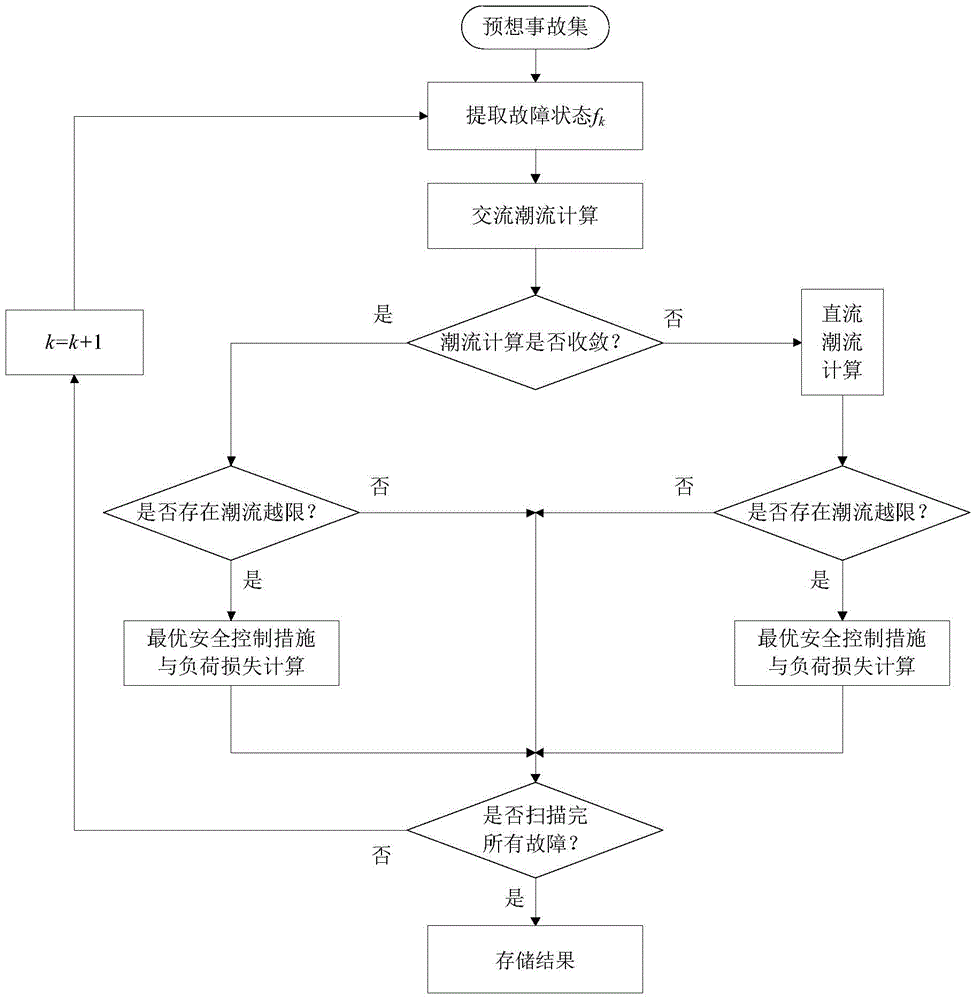

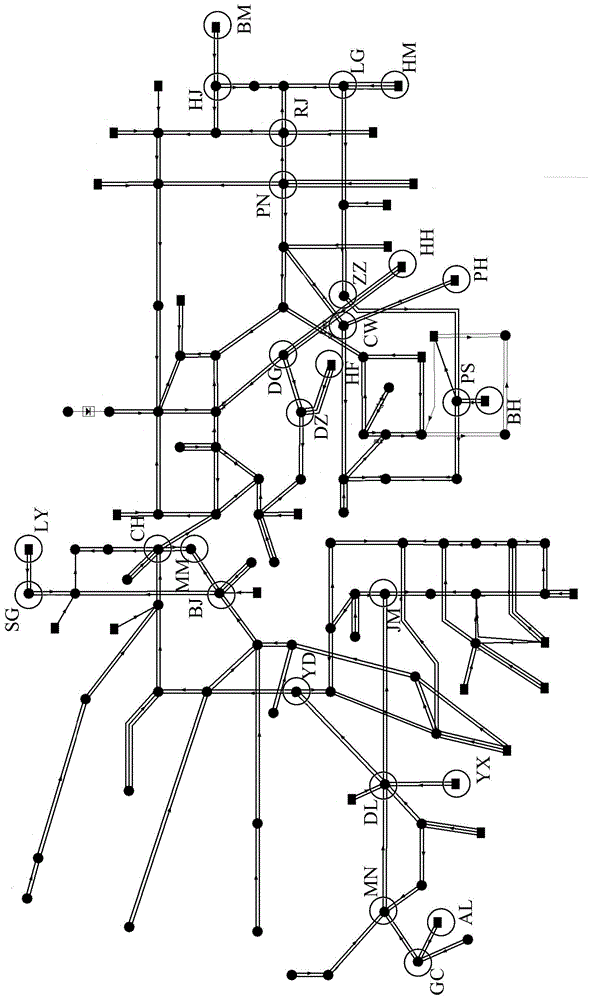

Method for evaluating power system static risk based on hybrid power flow

ActiveCN103985066AAvoid Pessimistic EvaluationsAvoid the problem of non-convergence of resultsData processing applicationsElectric power systemPower grid

The invention discloses a method for evaluating the power system static risk based on hybrid power flow. The method comprises the steps that (1) according to the current structure of a power system and a planning scheme, a corresponding planning scheme model is established; (2) according to equipment data and the structure of a power grid, predicated faults of the power grid and the possibility of the predicated faults are analyzed, and then a predicated fault set is established; (3) the power flow corresponding to all the faults in the predicated fault set is worked out through the risk state based on the hybrid power flow, and for the fault with power flow out of range, load loss is used as a fault consequence; (4) according to the load loss of the fault states and the possibility of the fault, the system risk indicator is worked out; (5) according to the system risk indicator, the weak link of the system is found. According to the method for evaluating the power system static risk based on the hybrid power flow, the problem that when high-order fault occurs in a large complicated power grid, misconvergence of power flow is caused due to the fact that only alternating-current power flow is applied during risk evaluation is solved through the hybrid power flow.

Owner:TIANJIN UNIV +1

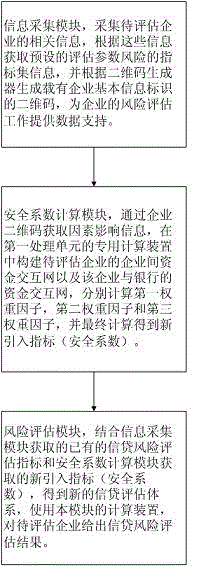

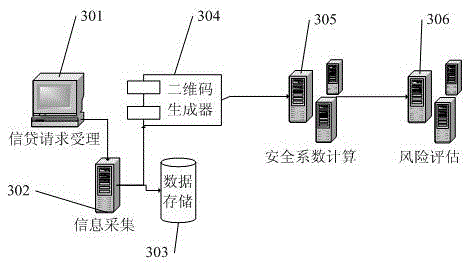

Bank credit system risk assessment method and device

The invention discloses a bank credit system risk assessment method and device. When enterprise credit risk assessment is performed, enterprise profit capability and assets and other traditional indexes are examined, and business contact activity between enterprises and the cash flow situation are also comprehensively considered. Mass data are utilized, potential useful new evaluation indexes are mined, and the current new technologies, such as data mining and social networks, are integrated in the assessment process so that accuracy of the assessment result can be enhanced. Therefore, the new indexes are combined with the conventional indexes, and a new enterprise credit risk assessment system is given and applied to a BP algorithm of machine learning so that a concrete and feasible support model is provided for formulation of the risk avoiding scheme of the financial system, and the problems in the prior art that accuracy is low and overall performance is poor due to the fact that only the conventional risk indexes or part of financial phenomena act as the risk assessment method can be solved.

Owner:JILIN UNIV

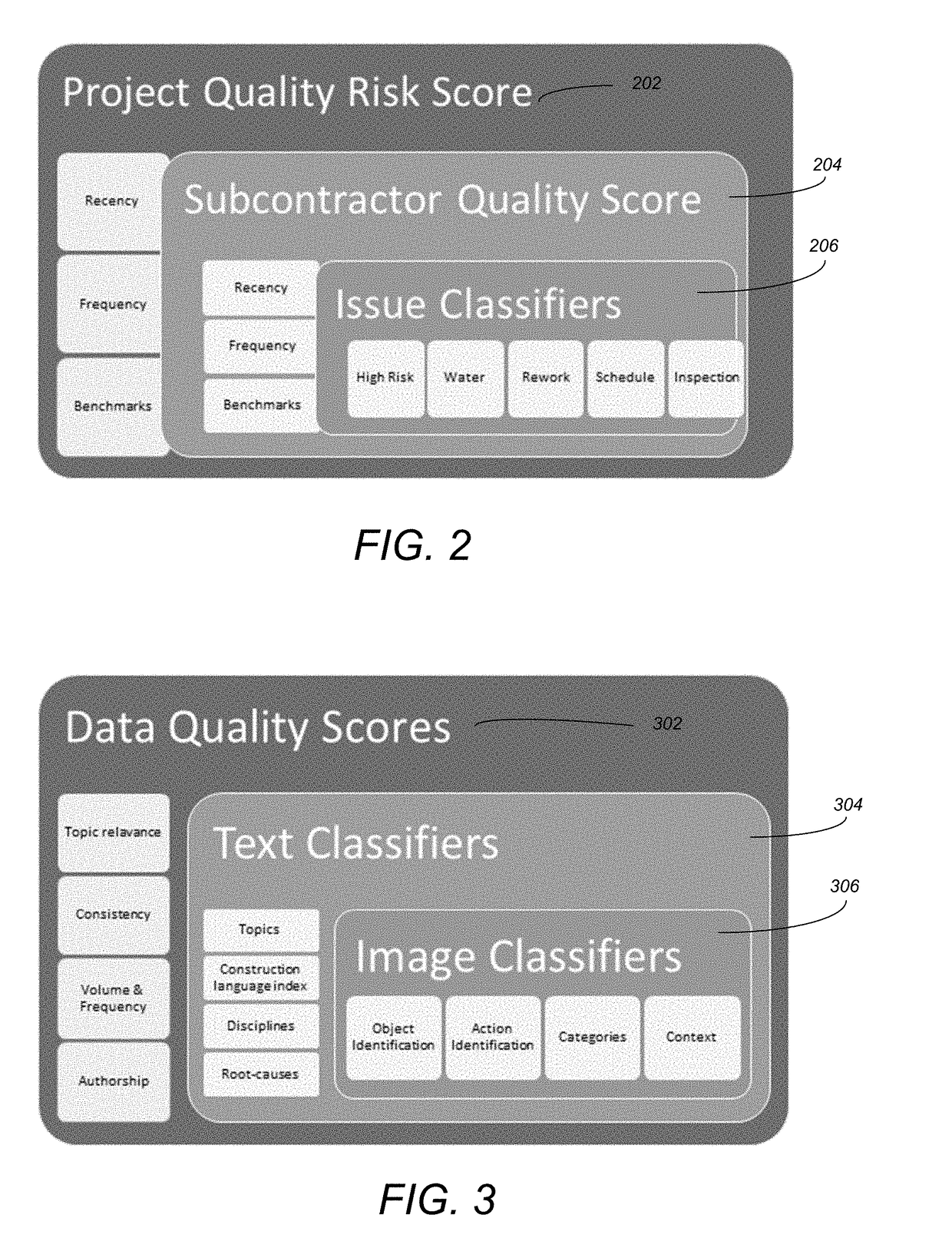

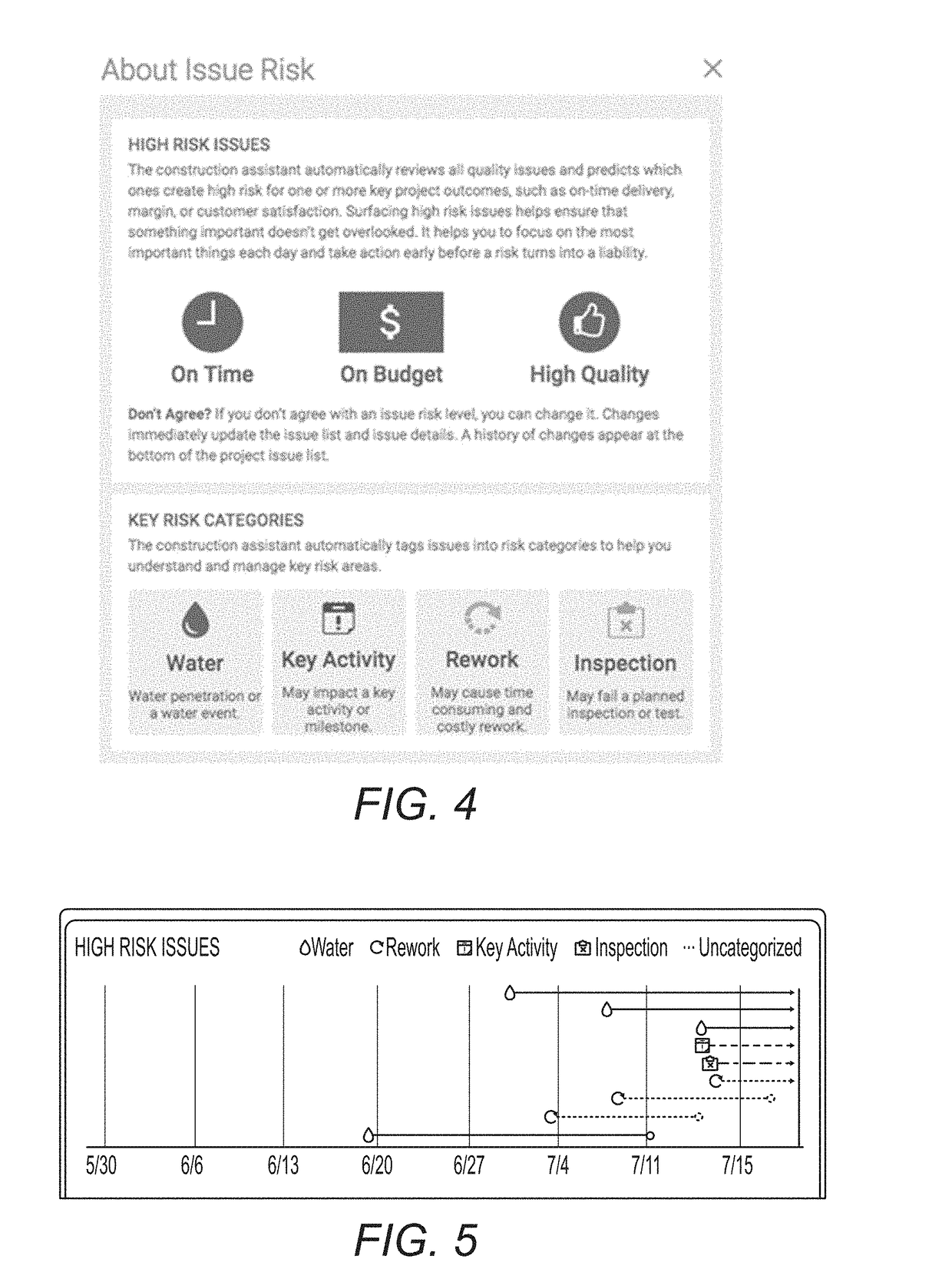

Architecture, engineering and construction (AEC) risk analysis system and method

ActiveUS20180349817A1Geometric CADCharacter and pattern recognitionQuestion generationDisplay device

A system and method provide the ability to control an architecture, engineering, and construction (AEC) project workflow. AEC data regarding a quality of construction is obtained. A set of classifiers and machine learning models are obtained. The AEC data is augmented based on the set of classifiers and machine learning models. A risk metric is generated for one or more issues in the AEC data based on the augmented AEC data. The risk metric is interactively generated and presented on a display device. Work, project resourcing, and / or training are prioritized based on the risk metric.

Owner:AUTODESK INC

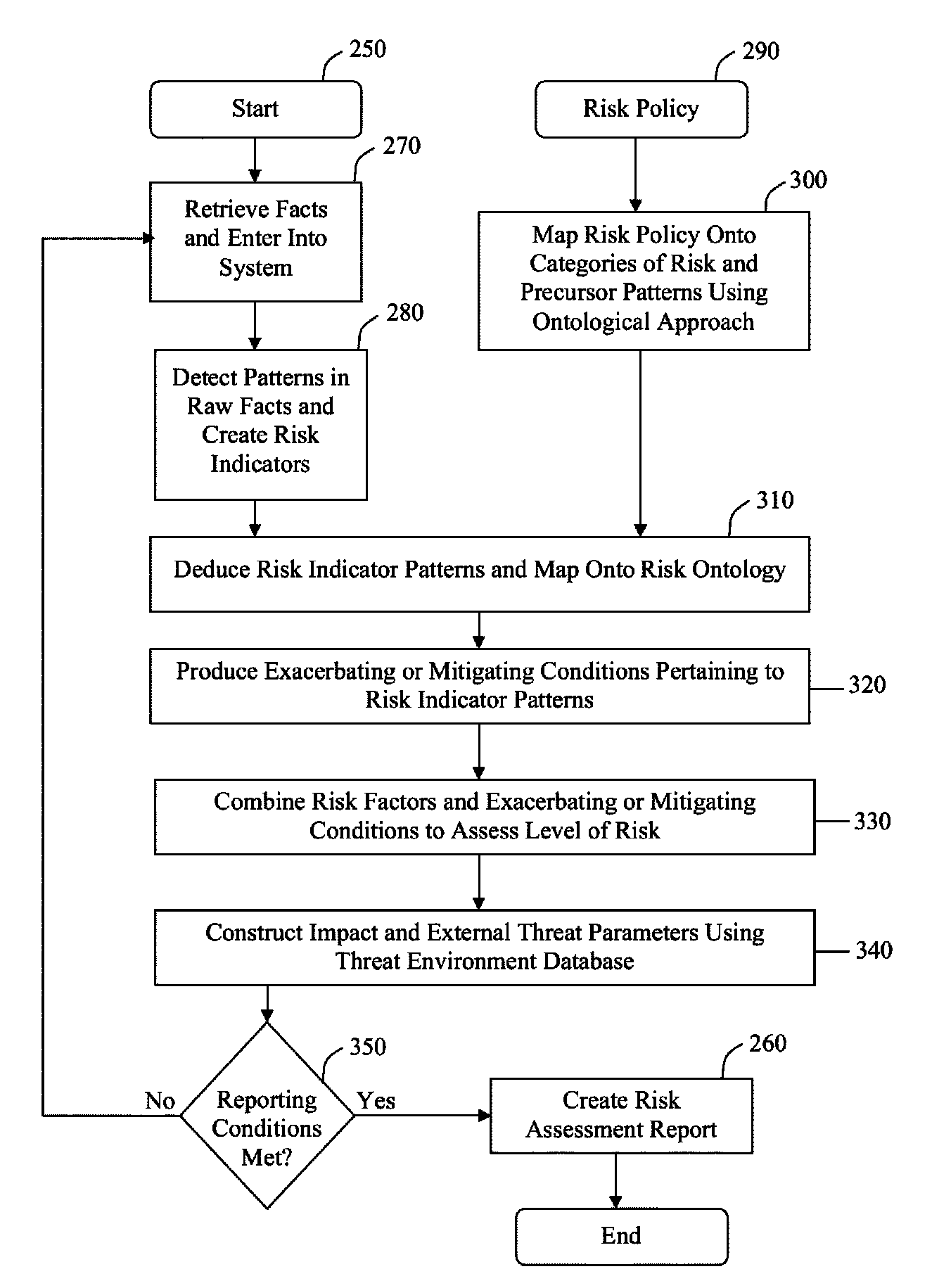

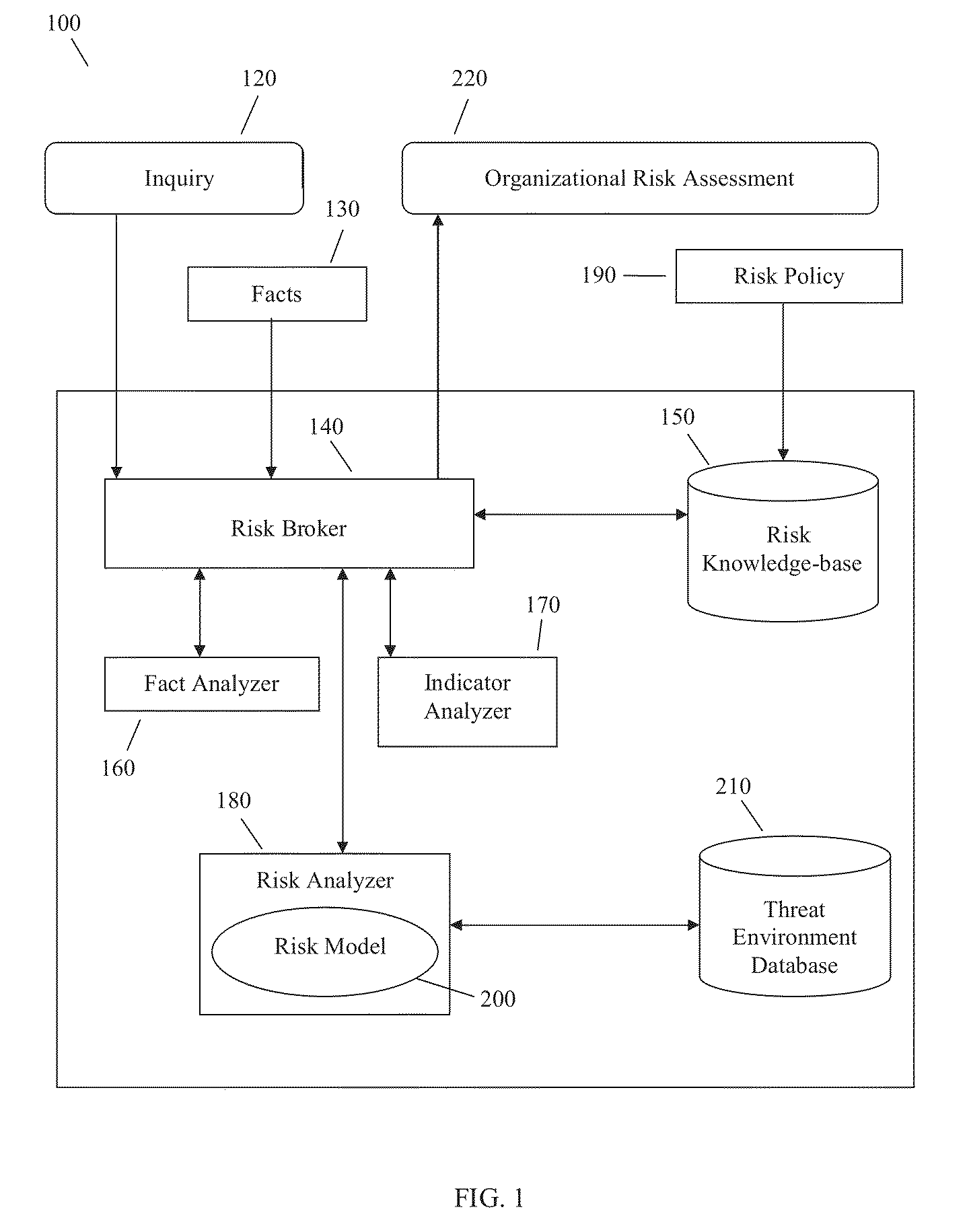

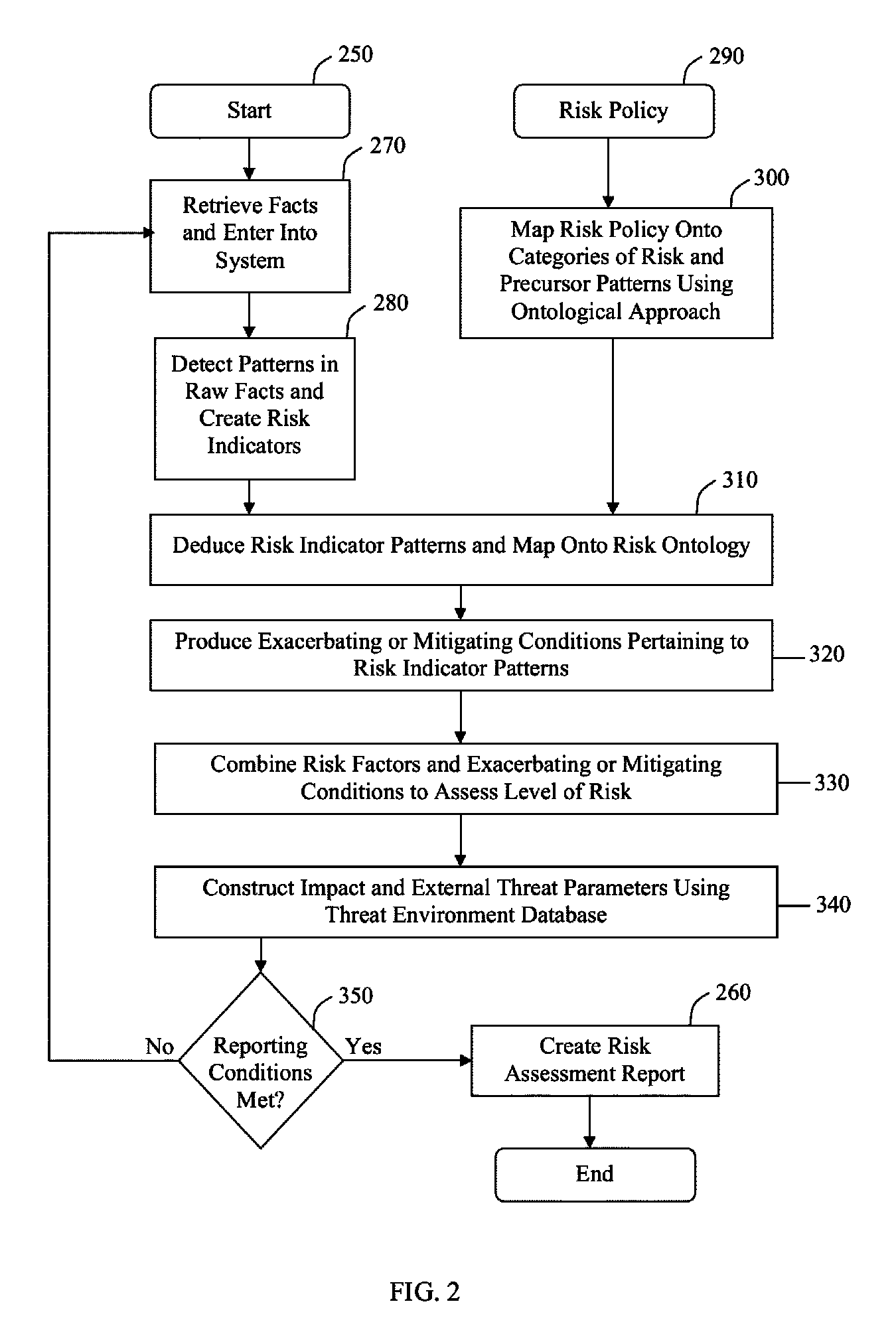

System and method for organizational risk analysis and reporting by mapping detected risk patterns onto a risk ontology

A method for characterizing risk using an adaptive risk analysis engine. Following a user request for a risk analysis, online and / or offline factual information is retrieved by the engine and is used to produce risk indicators. The risk indicators are mapped onto risk ontology to produce risk factors which are then used to assess the level of risk. Parameters for the likelihood, impact, and external threat of the risk are calculated, and a risk assessment report is produced for the user.

Owner:FORTINET

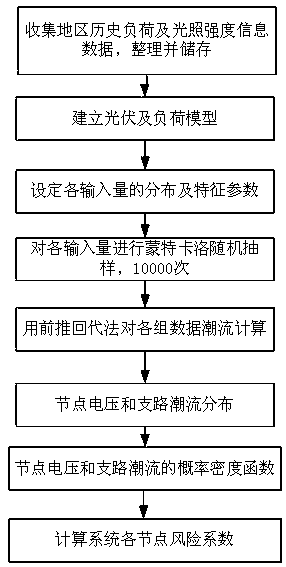

Operational risk assessment method for large-scale photovoltaic grid-connected distribution networks

InactiveCN108898287AReal-time forecast outputPredict load fluctuations in real timeLoad forecast in ac networkResourcesNODALRisk evaluation

Provided is an operational risk assessment method for large-scale photovoltaic grid-connected distribution networks. The method comprises: establishing a real-time prediction model of photovoltaic output and load fluctuation; obtaining a probability density function and a cumulative distribution function of branch power flow and node voltage by using probability distribution of node voltage and branch power flow calculated by a Monte Carlo method; according to the cumulative distribution function, solving off-limit probability of each node voltage and branch power flow, calculating probabilityindexes, severity indexes and risk indexes of node voltage and branch power flow according to probability distribution of variables to be obtained, and evaluating security risk of photovoltaic connection to a distribution network, and based on a result, providing corresponding control measures. The method fully considers randomness and uncertainty of photovoltaic and load, adopts typical parameters as risk evaluation indexes, and accurately predicts risk of the distribution network based on Monte Carlo probability power flow, and has important practical significance for improving safety, reliability and economy of distribution network operation after photovoltaic grid connection.

Owner:STATE GRID JIANGXI ELECTRIC POWER CO LTD RES INST +2

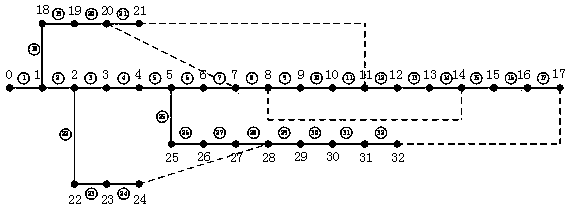

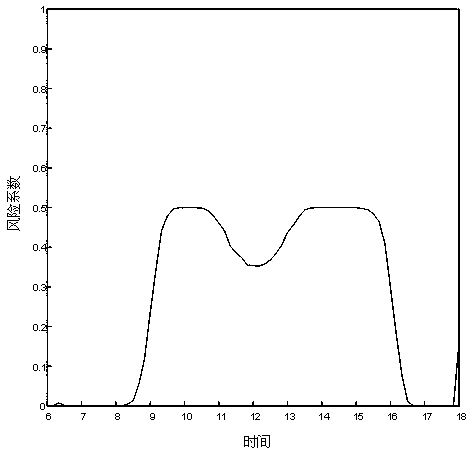

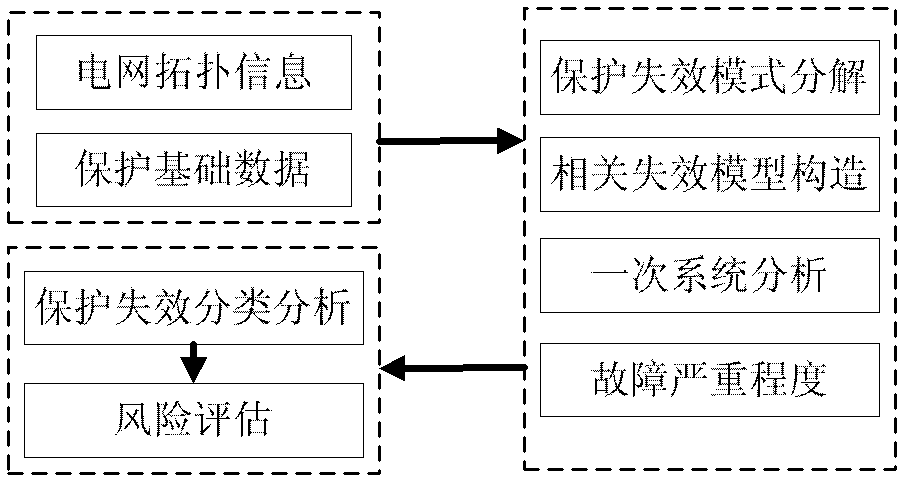

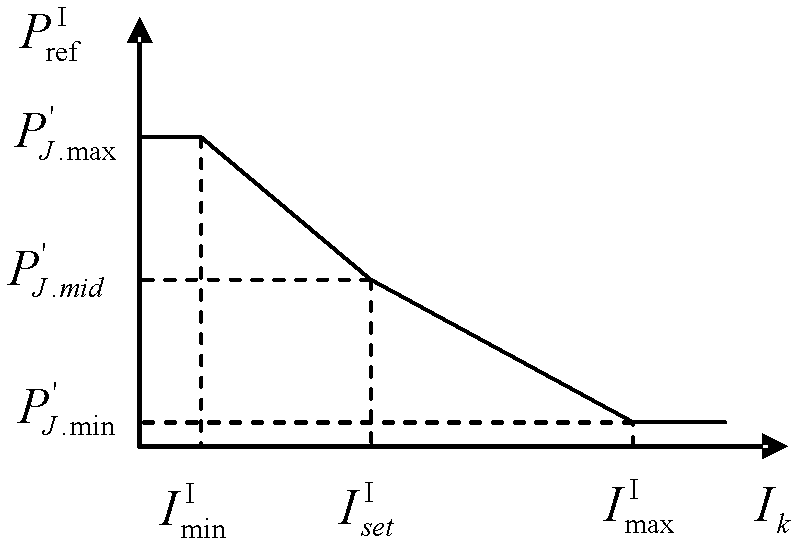

Probability assessing method for stage type protection operational risk of electric power system

InactiveCN102521667AIncrease authenticityImprove accuracyData processing applicationsElectric power systemPower grid

The invention discloses a probability assessing method for a stage type protection operational risk of an electric power system, and the probability assessing method belongs to the field of the relay protection of the electric power system and the reliability of the electric power system. The probability assessing method comprises the following steps: determining a protection system to be assessed and a false action source set; carrying out invalidation classification analysis on the protection system to be assessed; calculating the instantaneous false action probability of a protection element in the false action source set in a new electric network structure and in a power flow state; if the false action of the protection system in the false action source set also cuts off a line where the false action is positioned, carrying out N-2 power flow calculation to obtain load loss corresponding to a current faulty line; calculating the instantaneous non-startup probability of the protection element in the false action source set and the load loss caused by a remote backup action; calculating the risk indicator, the total instantaneous false action probability and the total instantaneous non-startup probability of the protection system to be assessed; and judging a weakest protection link in the electric network. The probability assessing method has the beneficial effects that the principle characteristic of protection is reflected, and the action rejection probability, the false action probability and the corresponding operational risk of the protection can be quantitatively calculated.

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING)

Power system voltage stability risk assessment method capable of considering load fluctuation limit

ActiveCN104659782AVerify validityHigh engineering practical valueSpecial data processing applicationsAc network circuit arrangementsMultiple pointControl theory

The invention relates to a power system voltage stability risk assessment method, and in particular relates to a power system voltage stability risk assessment method capable of considering load fluctuation limit, aiming at solving the problem that the existing voltage stability assessment is single in point of view. According to the method, a probabilistic power flow simulation method of Latin hypercube sampling is applied to voltage stability analysis of a power system, and the situation of system crash caused by load power radical change and system network framework structure change can be studied. The voltage risk index, load node type risk index, network load bearing capacity risk index and financial loss risk index are taken as basis, and the voltage stability of the system is comprehensively analyzed by the multiple indexes from multiple points of view, so that the nodes with weak voltage in the system, the nodes with weak load fluctuation, the range of load bearing capacity of the system and the nodes with high financial loss risk in the system can be found. The power system voltage stability risk assessment method provides powerful basis for carrying out voltage monitoring, load monitoring, network planning and economic evaluation on the power system.

Owner:TAIYUAN UNIV OF TECH

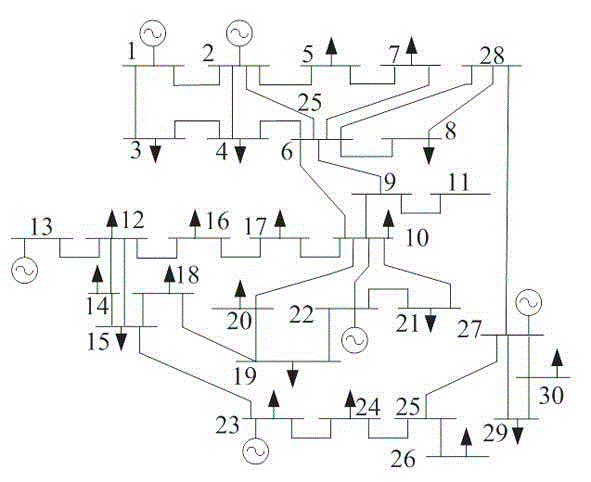

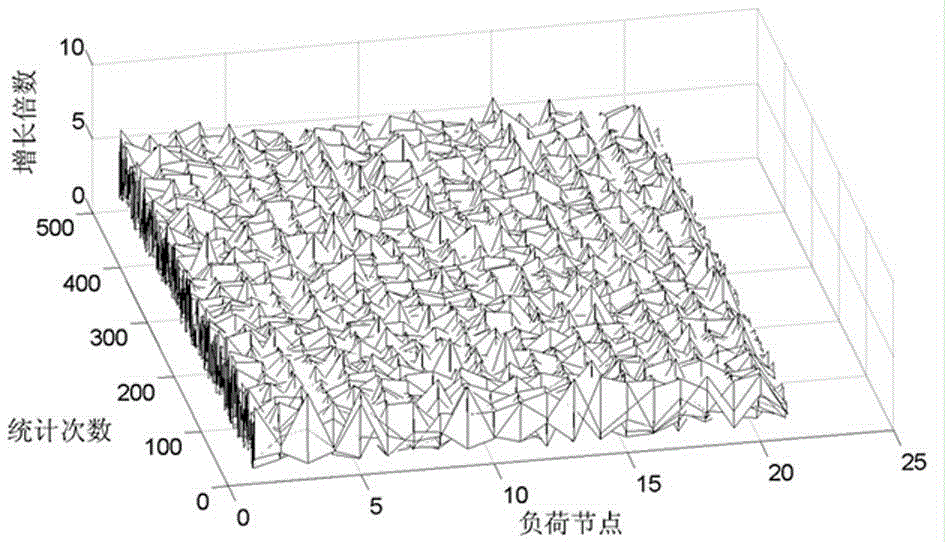

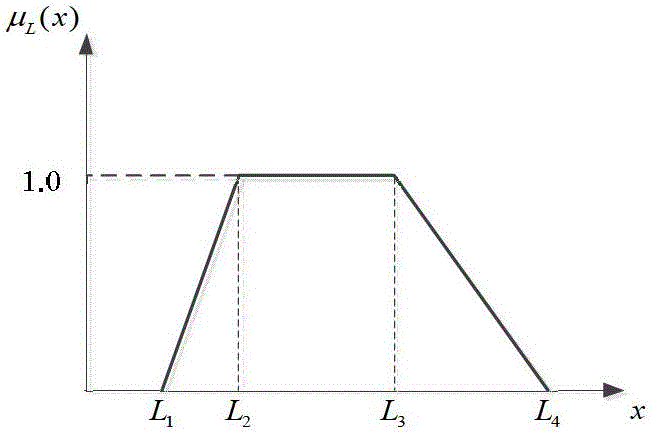

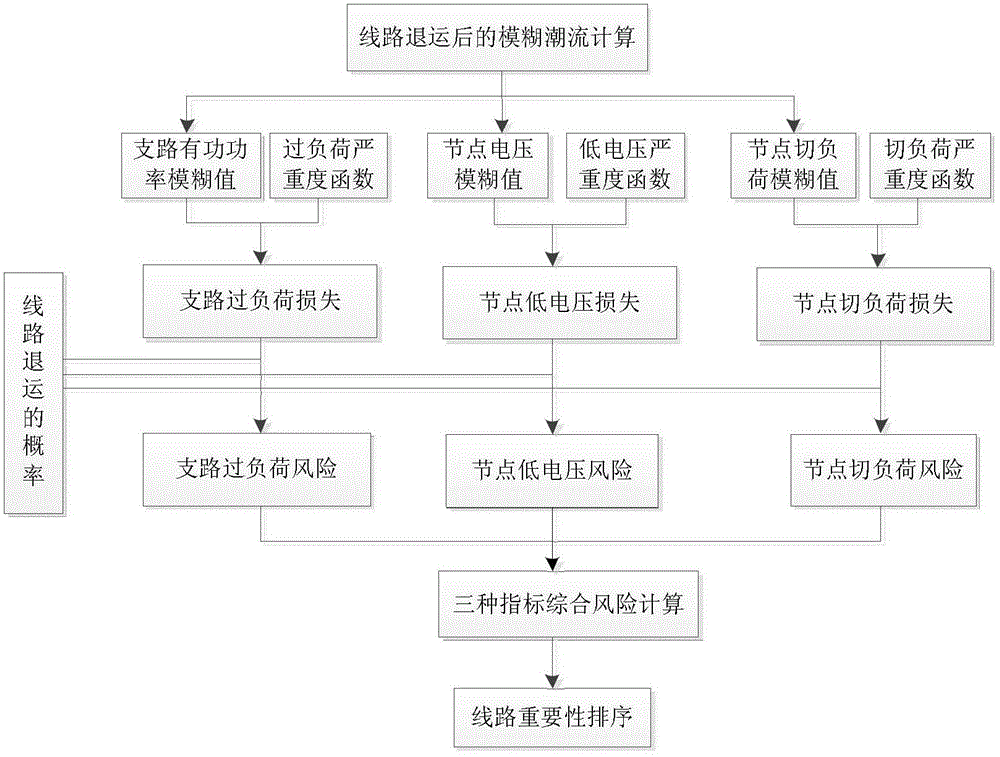

Power grid differentiation-based core backbone network architecture construction method

ActiveCN103151777AHas practical significanceFast convergenceAc network circuit arrangementsNODALAlgorithm

The invention discloses a power grid differentiation-based core backbone network architecture construction method. The importance of lines and nodes in a power system are taken into comprehensive account, the knowledge of a risk theory is referenced, the importance of the lines is obtained by calculating risk indicators of the lines, and the importance of the nodes is evaluated based on the knowledge of a graph theory; and a core backbone network architecture searching model is constructed based on the importance of the lines and the nodes, and network architectures are searched by a particle swarm algorithm to obtain the lines and the nodes for constructing a core backbone network architecture. The importance of the lines is evaluated by line returning risks, so that the importance of the lines can be better reflected from the point of electrical quantity variation; and a fuzzy-membership-based line returning risk evaluation method more consistent with actual conditions is provided, and the influence of uncertain factors of the power system is taken into comprehensive account.

Owner:STATE GRID CORP OF CHINA +2

Power grid enterprise electricity-selling side risk assessment method based on triangular fuzzy number and improved analytic hierarchy process

The invention relates to a power grid enterprise electricity-selling side risk assessment method based on a triangular fuzzy number and an improved analytic hierarchy process. The method specifically includes following steps: establishing a power grid enterprise electricity-selling side risk assessment index system; establishing a power grid enterprise electricity-selling side risk assessment index scoring standard; establishing a triangular fuzzy conversion function; establishing an index scoring mapping relation; establishing a determination matrix; determining the matrix consistency verification; returning to the previous step if the consistency is not satisfied; moving to the next step if the consistency is satisfied; calculating a weight coefficient; and determining an important risk factor. According to the method, risk assessment of various risk indexes is conducted through an expert scoring method, the electricity-selling side risk can be comprehensively evaluated, the assessment method is simple and easy to operate, but the subjectivity is relatively high; and the subjectivity of expert scoring can be reduced with the cooperation of a multi-dimensional expert scoring set based on the triangular fuzzy number so that the accuracy of results output by the subsequent analytic hierarchy process is improved.

Owner:STATE GRID ZHEJIANG ELECTRIC POWER COMPANY ECONOMIC TECHN INST +2

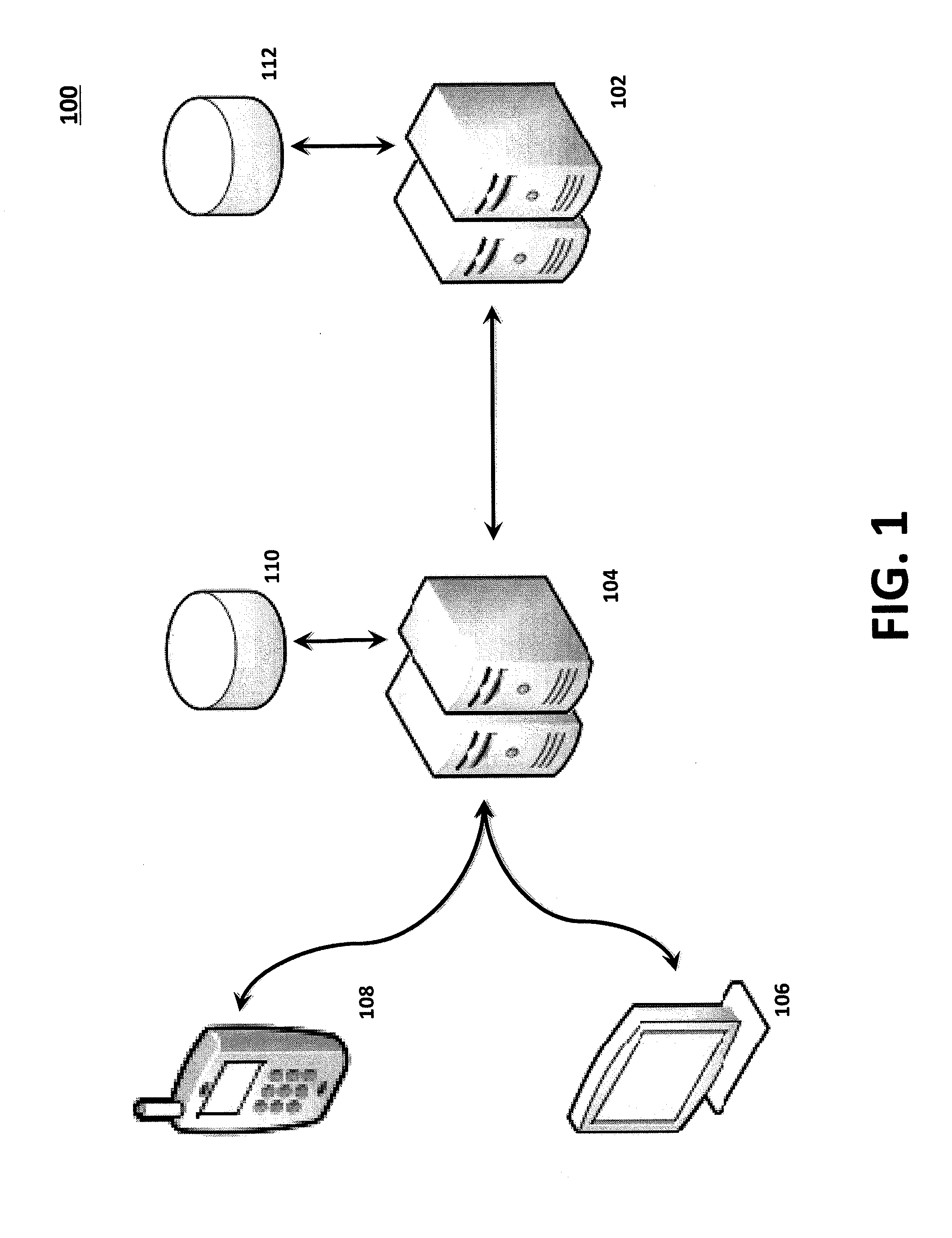

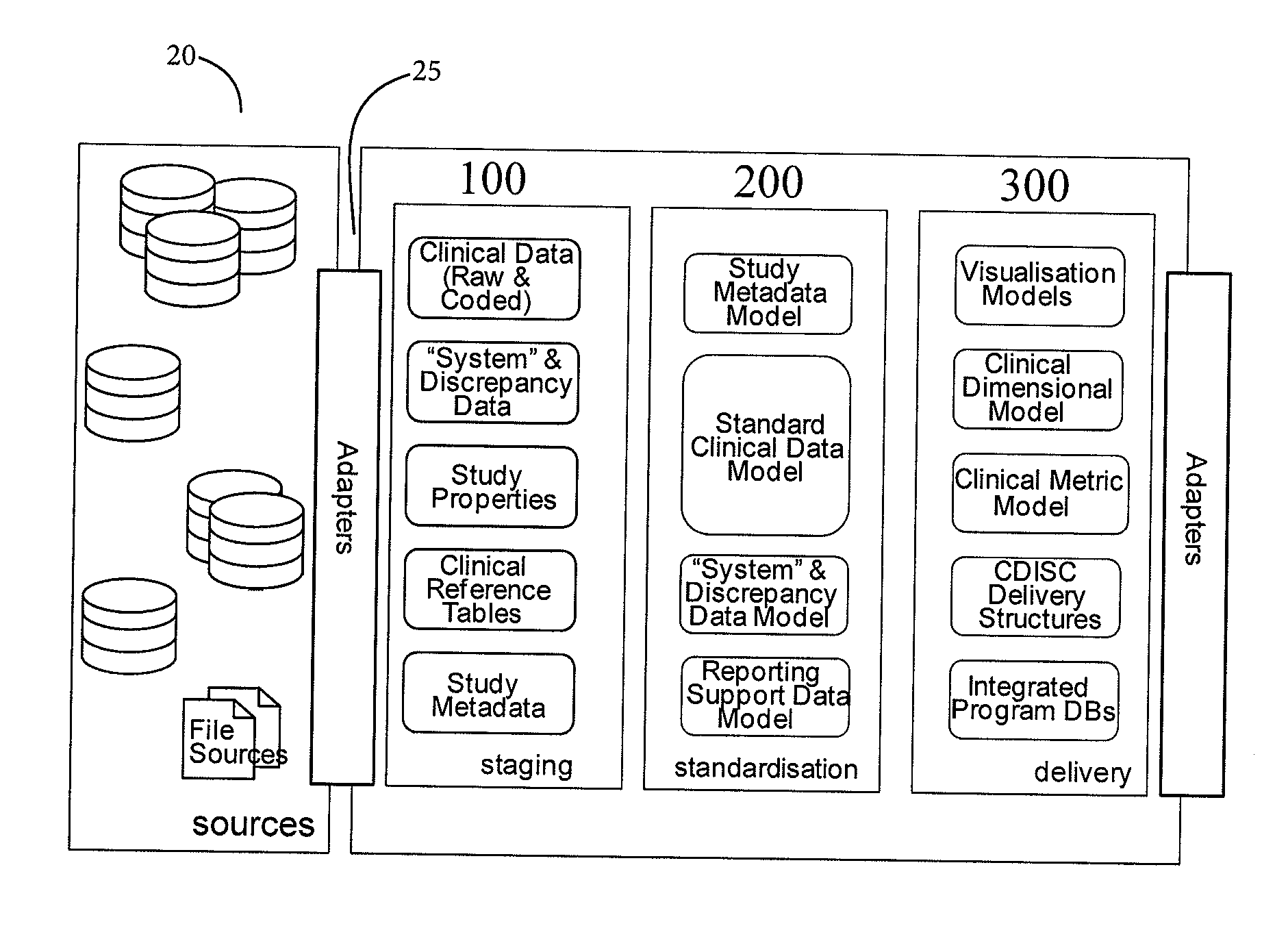

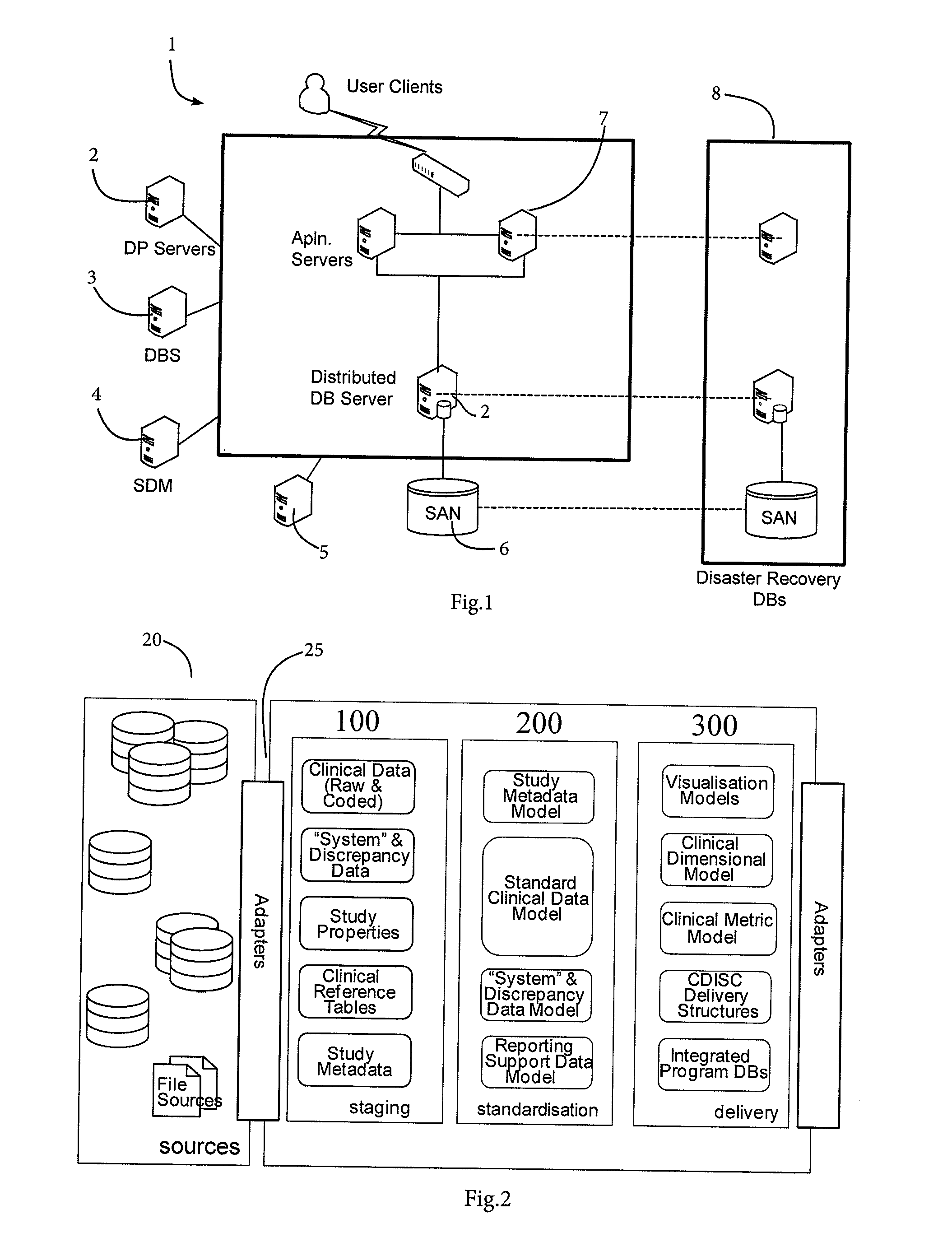

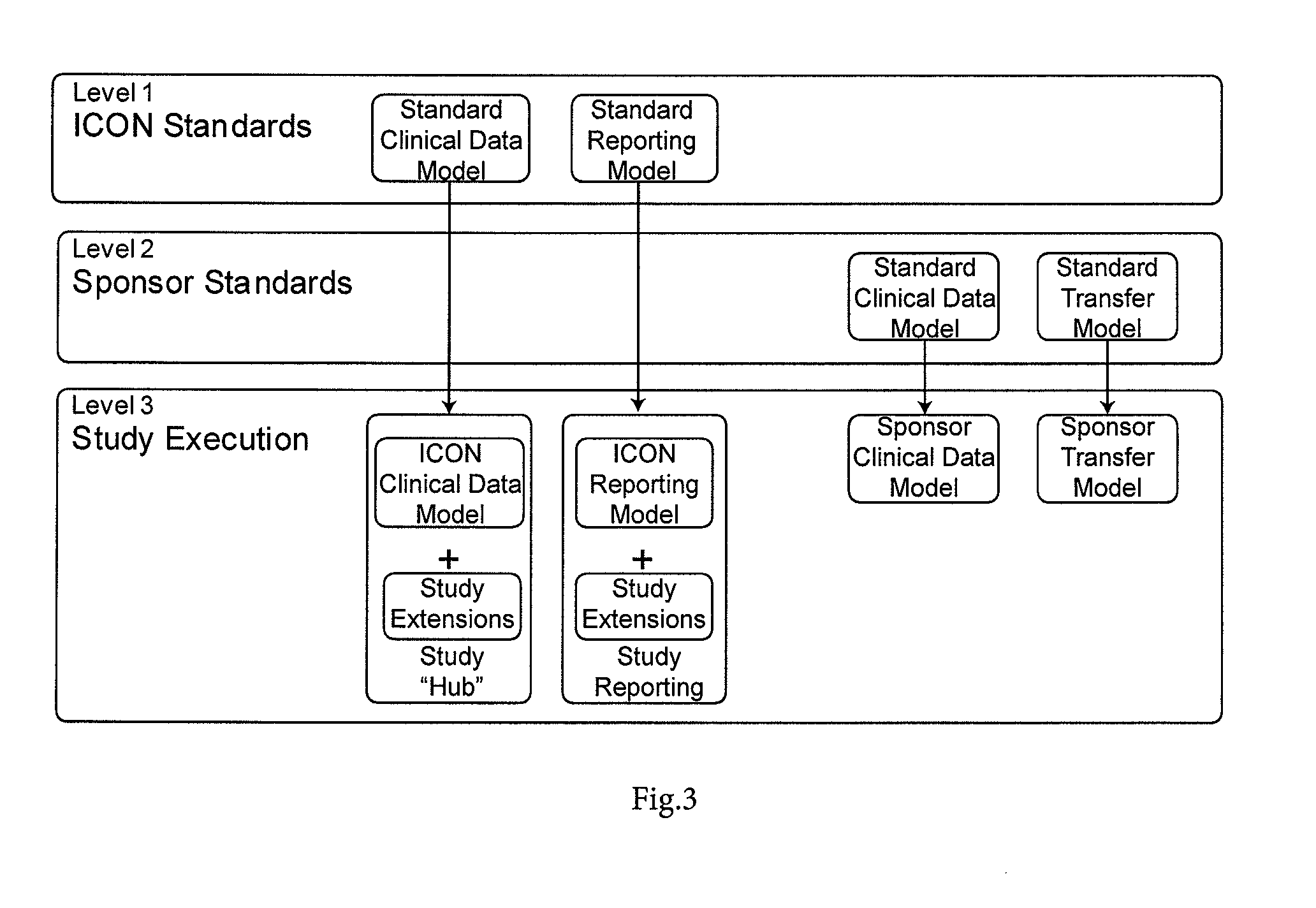

Clinical data management system

ActiveUS20130238351A1Data processing applicationsComputer-assisted medical data acquisitionClinical studyData transport

A clinical data management system (1) has databases (20), processors in servers (2-4) which are programmed to process clinical data and communicate with user interfaces and external systems interfaces, and at least one database. The system imports source data from disparate clinical site sources into staging databases at refresh intervals, maintains data models, and maps data from the staging databases into the data models, and feeds data from the data models into data delivery databases. There is a uniform refresh frequency for the staging databases. The system output is regularly updated data for clinical site performance, quality and risk metrics to a clinical study team. The data mapper servers identify each of a plurality of source data stages, and transform data from each stage to one or more data models according to one or more mapsets, each mapset defining a transformation.

Owner:ICON CLINICAL RESERCH LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com