Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

36 results about "Group insurance" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Group insurance is an insurance that covers a group of people, for example the members of a society or professional association, or the employees of a particular employer for the purpose of taking insurance. Group coverage can help reduce the problem of adverse selection by creating a pool of people eligible to purchase insurance who belong to the group for reasons other than the wish to buy insurance, which might be because they are a worse than average risk. Grouping individuals together allows insurance companies to give lower rates to companies, "Providing large volume of business to insurance companies gives us greater bargaining power for clients, resulting in cheaper group rates."

System and method for managing information in a group participant purchasing environment

InactiveUS20050102156A1Improve efficiencySpread quicklyBuying/selling/leasing transactionsSpecial data processing applicationsGroup PurchasingProgram planning

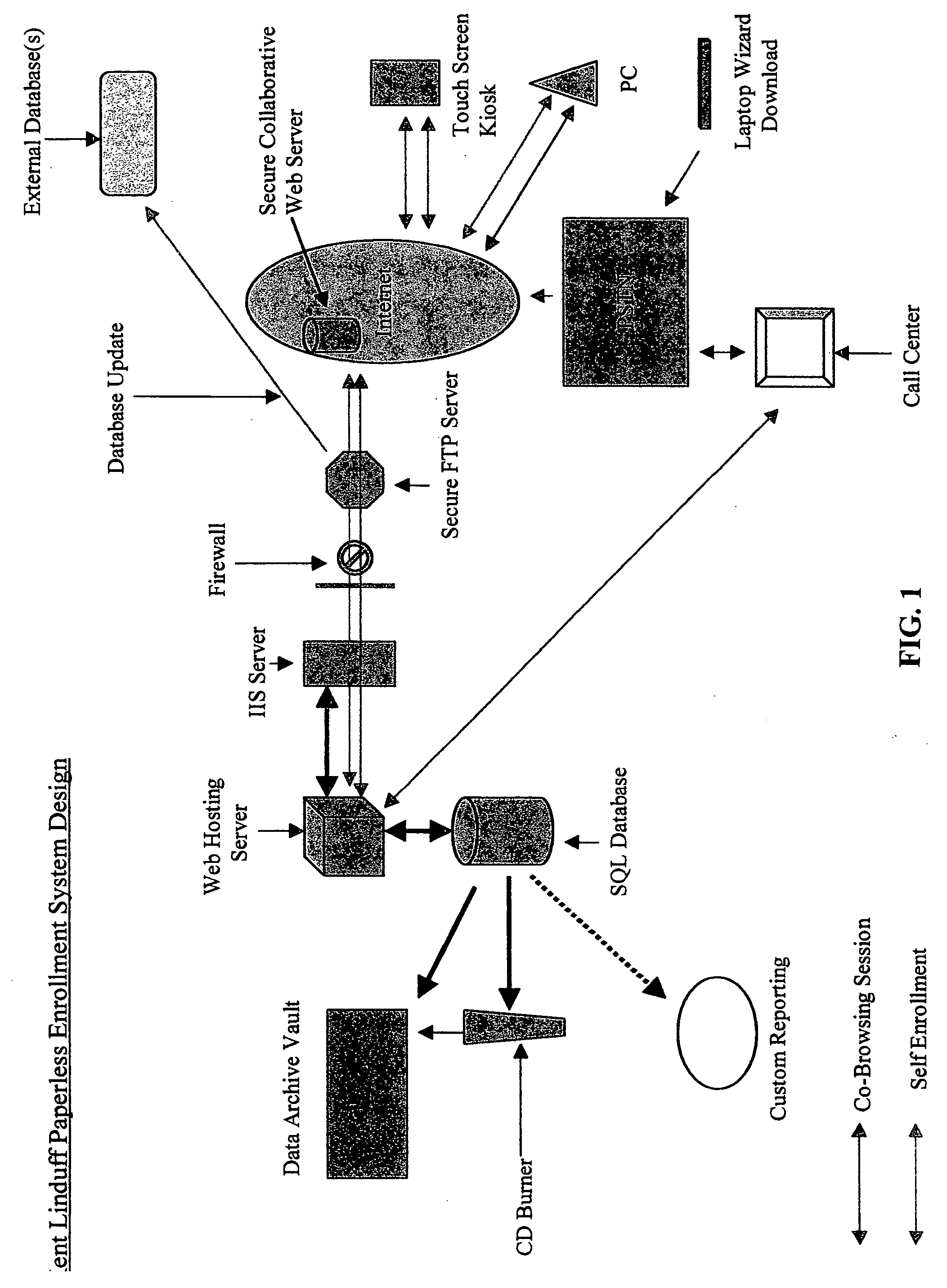

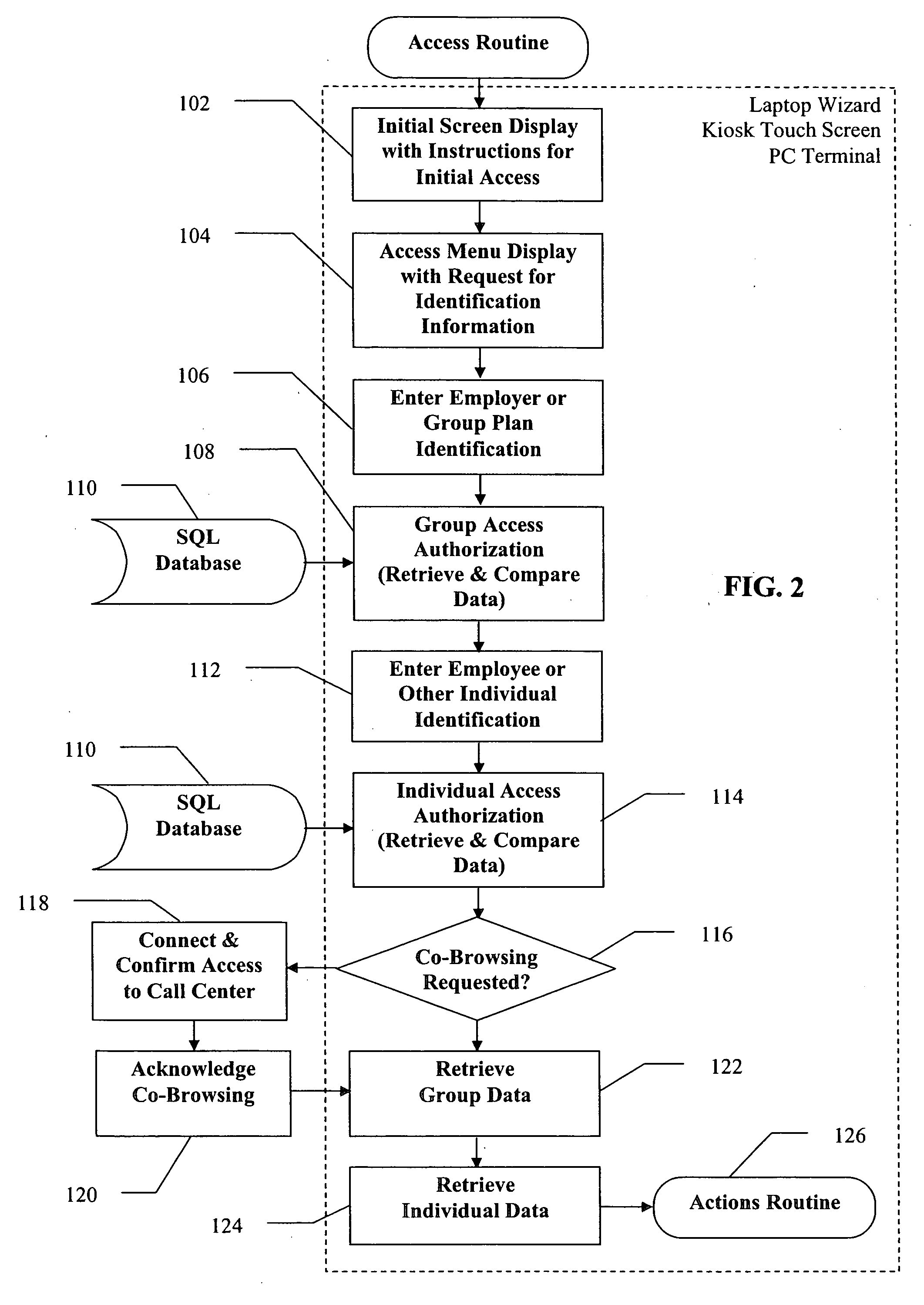

Improved systems and methods for soliciting, acquiring and managing information associated with both buyers and sellers in a purchasing transaction. The system includes the computer hardware infrastructure necessary to allow specific input and management access to databases maintained by or through sellers of products and services, by the individual participants / purchasers of the products and services. The improved systems and methods permit paperless enrollment and information management into individual purchasing transactions and group purchasing transactions. The improved methods allow noncomputer literate individuals to readily understand, access and accurately manage information about themselves in association with an individual purchase transaction or an association with group purchasing transactions. The present invention finds particular application in such fields as employee benefit enrollment plans, group insurance plans and other types of goods and services purchasing transactions where significant amounts of information regarding the buyer might be required.

Owner:EBL TECH HLDG

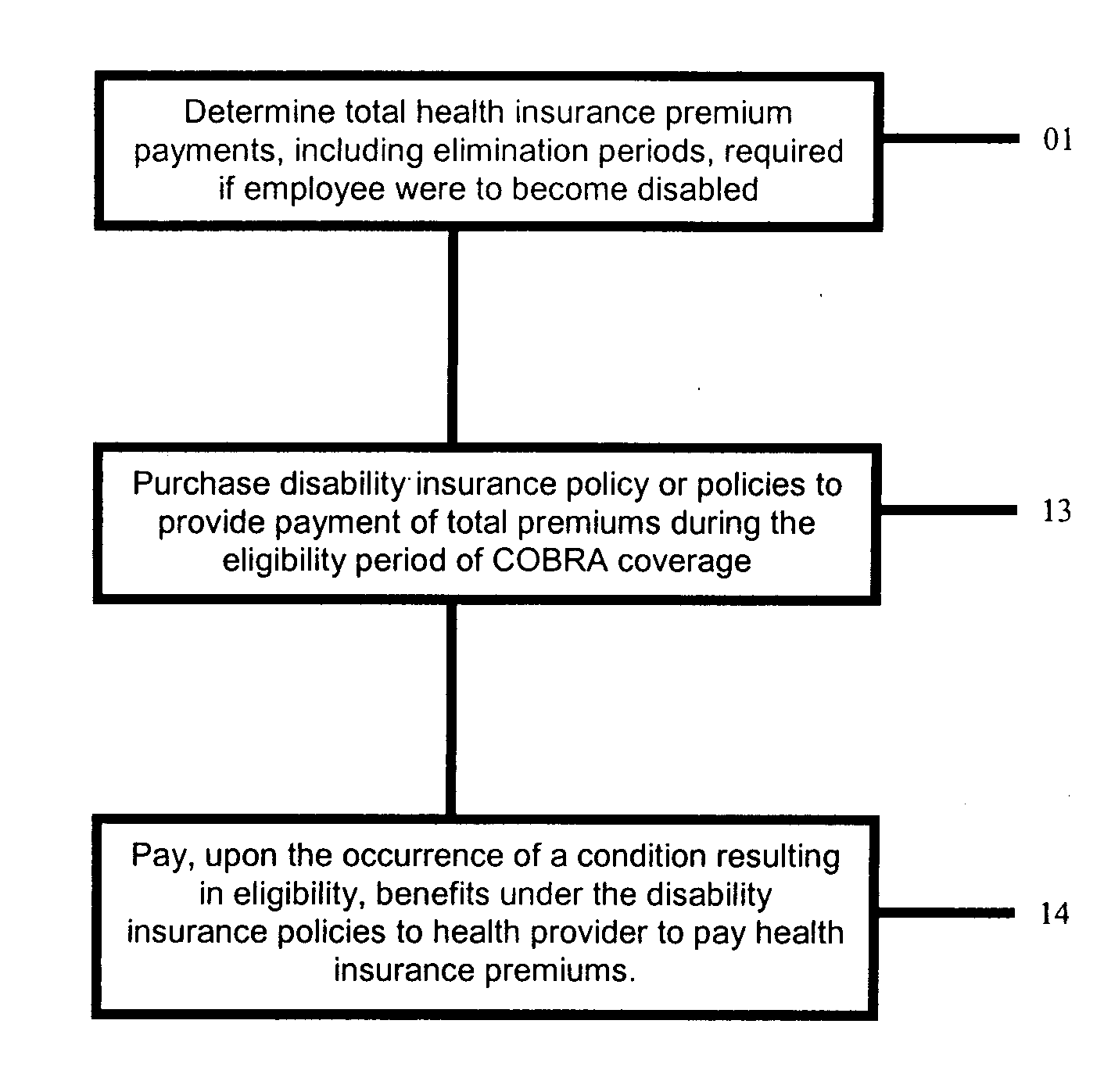

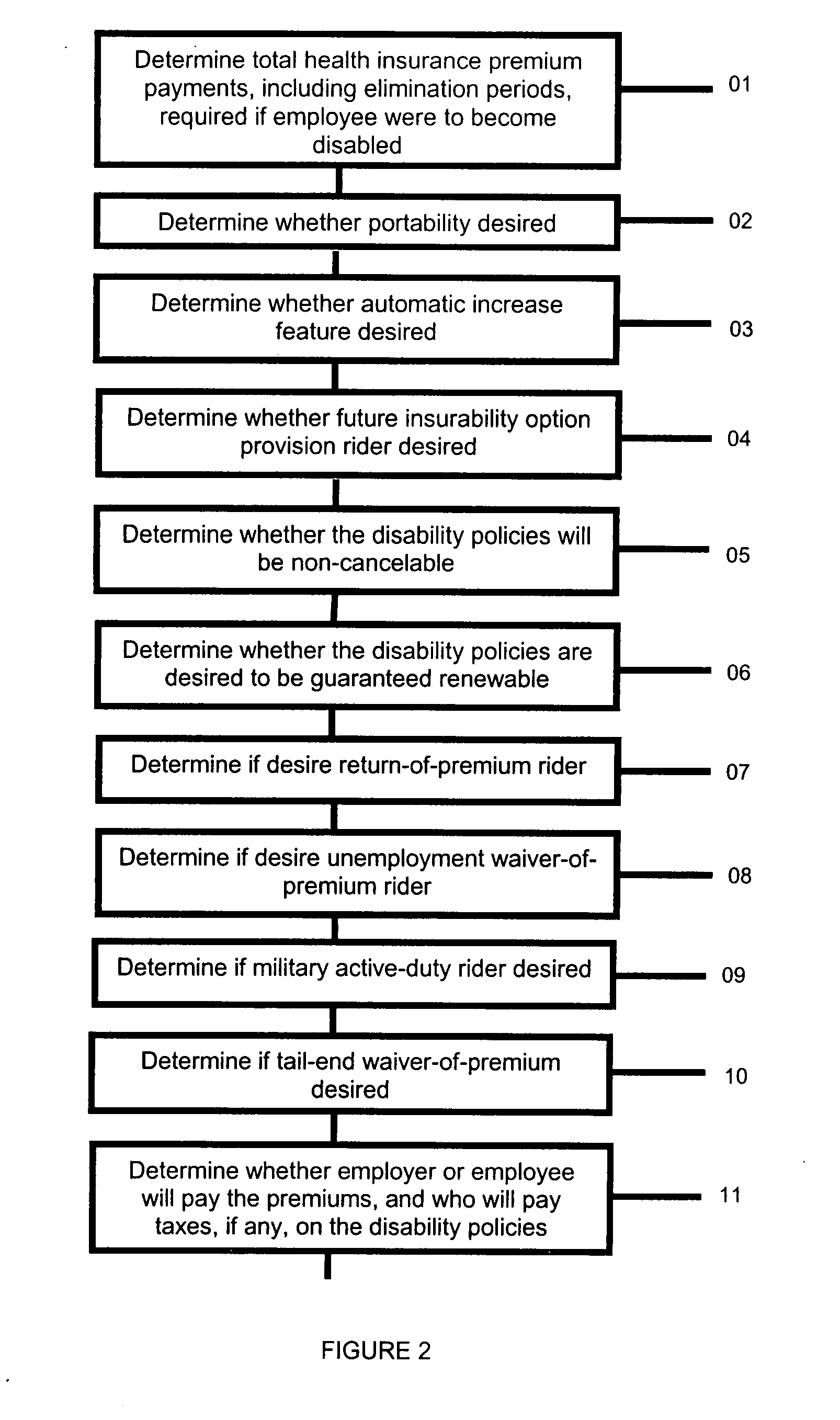

Method for providing insurance protection against the loss of group health insurance coverage in the event of a disability of a plan participant

Owner:GABRIEL MARK J

Systems and Methods for Customizing Product Selections Based on Member Parameters and Providing the Selections to Members for Purchase

The present disclosure relates to systems and methods for identifying at least one health plan option for an individual or employee, where the health plan option(s) identified have been selected based on the unique characteristics and profile of the individual or the unique characteristics and profile of the employee and format selections of the employer. The health plan option(s) identified may also be based on criteria provided by the individual or the employer, such as for instance, the amount of deductible and / or premium the individual is willing to pay, or for example, the health insurers the employer has selected to provide employee group coverage.

Owner:BLOOM HEALTH CORP

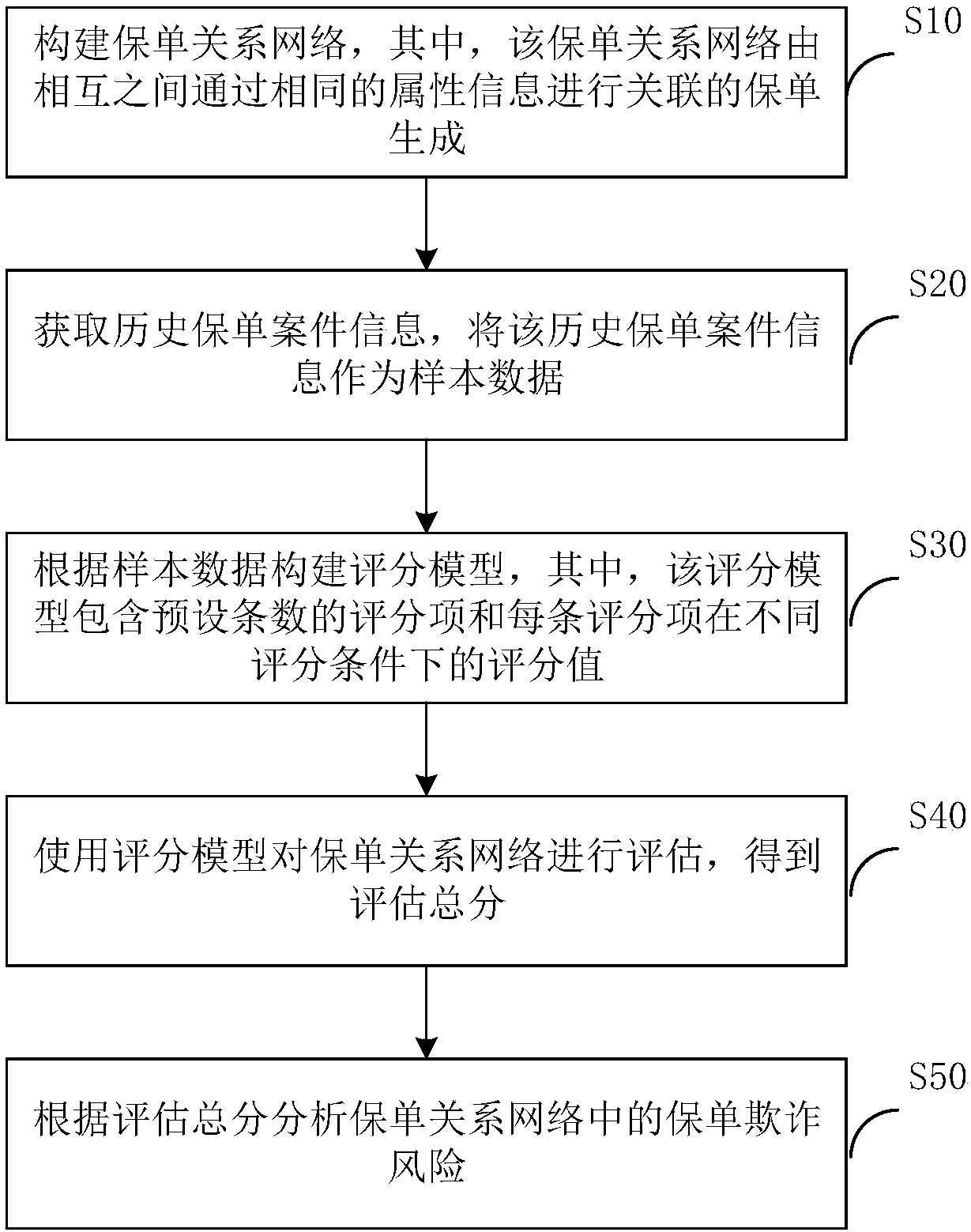

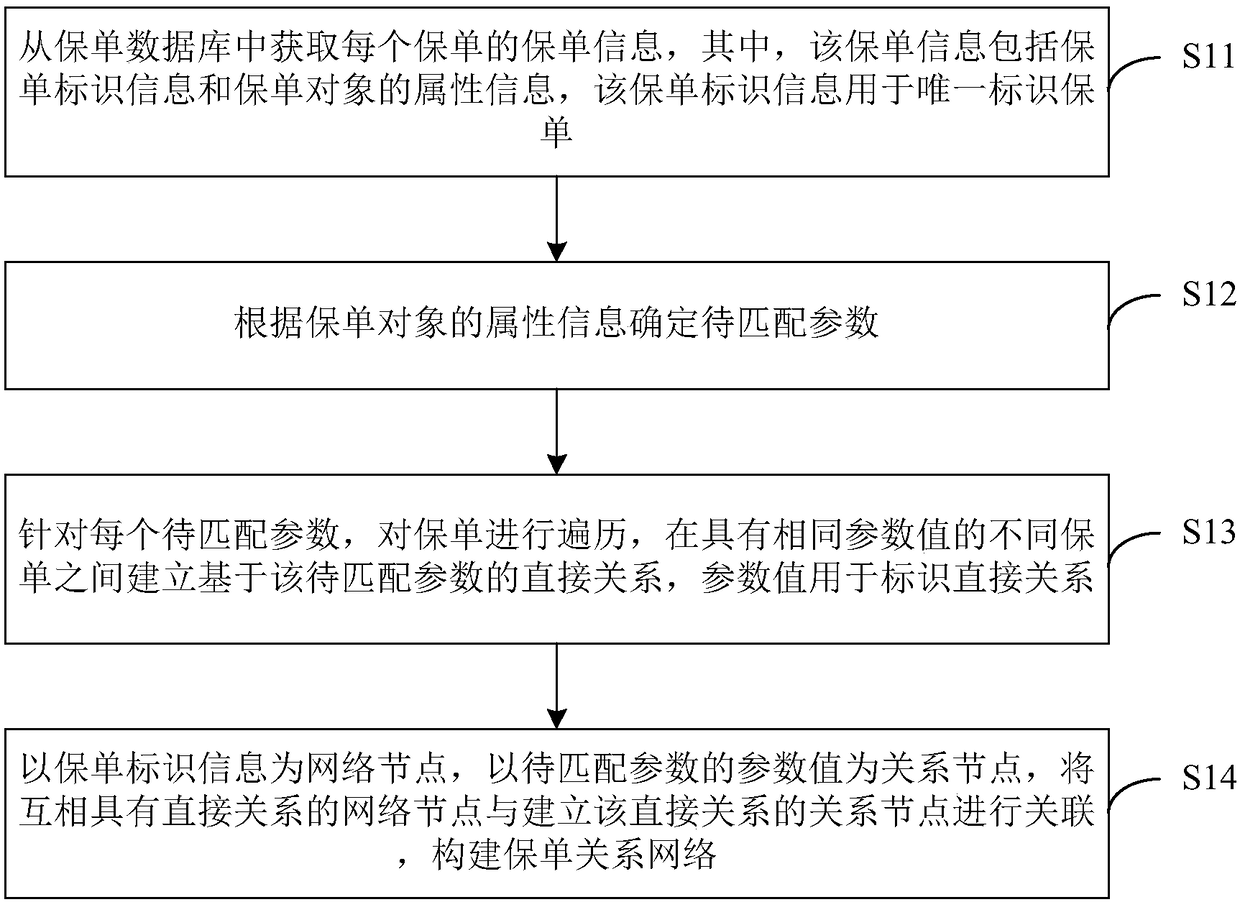

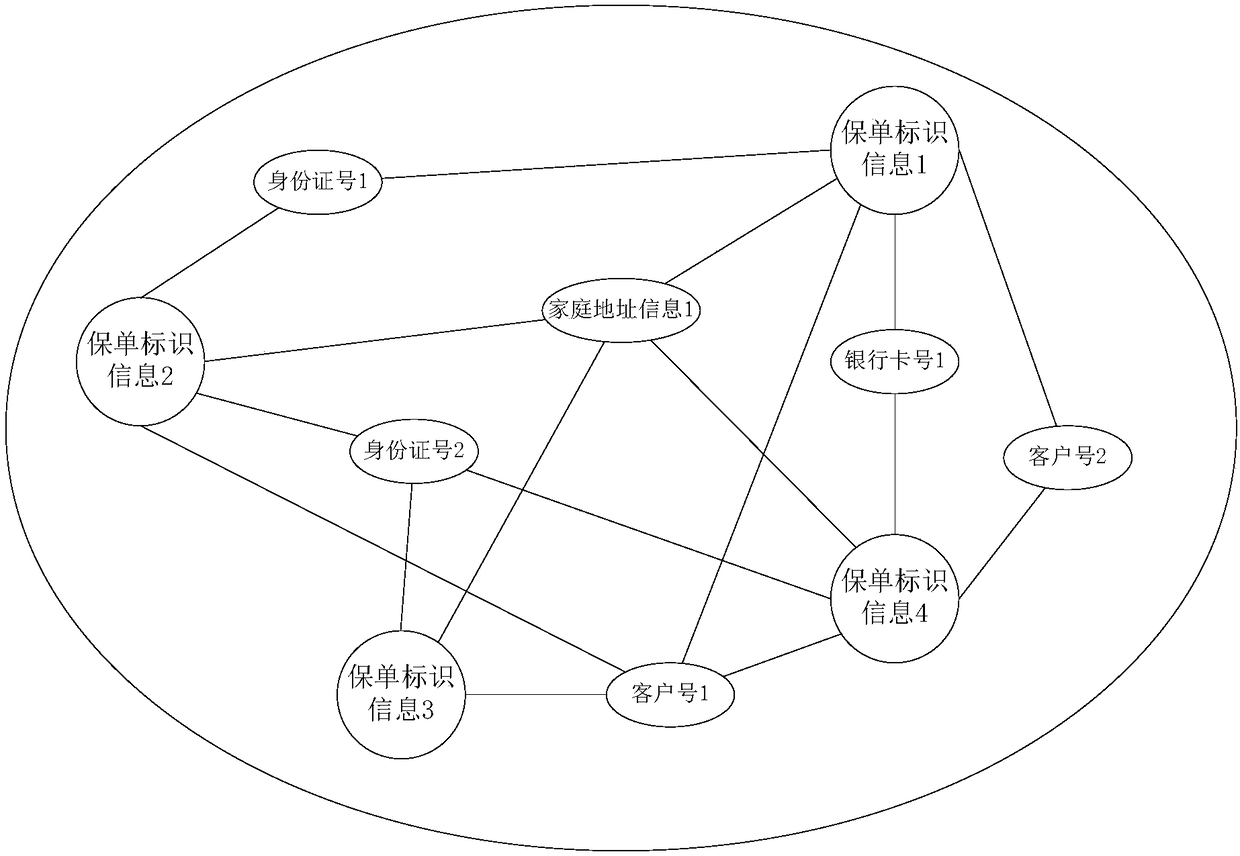

Insurance policy risk evaluating method and device, terminal equipment and storage medium

InactiveCN108364233AEffective Mining AnalysisEfficient and accurate identificationFinanceResourcesTerminal equipmentRisk identification

The invention provides an insurance policy risk evaluating method and device, terminal equipment and a storage medium. The method comprises that an insurance policy relation network composed of insurance policies associated with one another according the same attribute information is established; case information of historical insurance policies is obtained and serves as sample data; a scoring model which comprises a preset number of scoring items and scores of each scoring item in different scoring conditions is constructed according to the sample data; the scoring model is used to evaluate the insurance policy relation network, and a total evaluation score is obtained; and an insurance policy fraud risk in the insurance policy relation network is analyzed according to the total evaluation score. Insurance policy data is dug and analyzed in the associated way, the evaluation model is constructed, related staff are helped identify the risk of group insurance fraud precisely and efficiently, and the insurance policy identification efficiency and group insurance fraud identification rate are improved.

Owner:CHINA PING AN LIFE INSURANCE CO LTD

Providing cargo insurance in a full service trade system

The present invention provides a comprehensive, integrated, computerized system for facilitating transactions in goods or services. The system is capable of facilitating transactions from early or initial stages, such as an electronically proposed purchase order, through to later or final stages, such as payment on an invoice or invoices relating to the transaction. The system is integrated to include the participation of various providers of services ancillary to transactions, such as guarantors, insurers, and shippers.The system may allow sellers or buyers to electronically propose amendments and counter-amendments to, and to amend, through mutual agreement, a purchase order agreement. Any amendments are accounted for in later stages of the transaction facilitated by the system. The system may monitor, utilizing stored transaction information, present and anticipated future credit exposures of buyers, and utilizes the buyer credit exposure information for purposes including facilitating providing buyer credit assurance to sellers. The system may facilitate sellers obtaining financing or advance payment relating to transactions. The system may provide opportunities for sellers or buyers to obtain cargo insurance on goods or services shipped in accordance with transactions.

Owner:INFOR US LLC

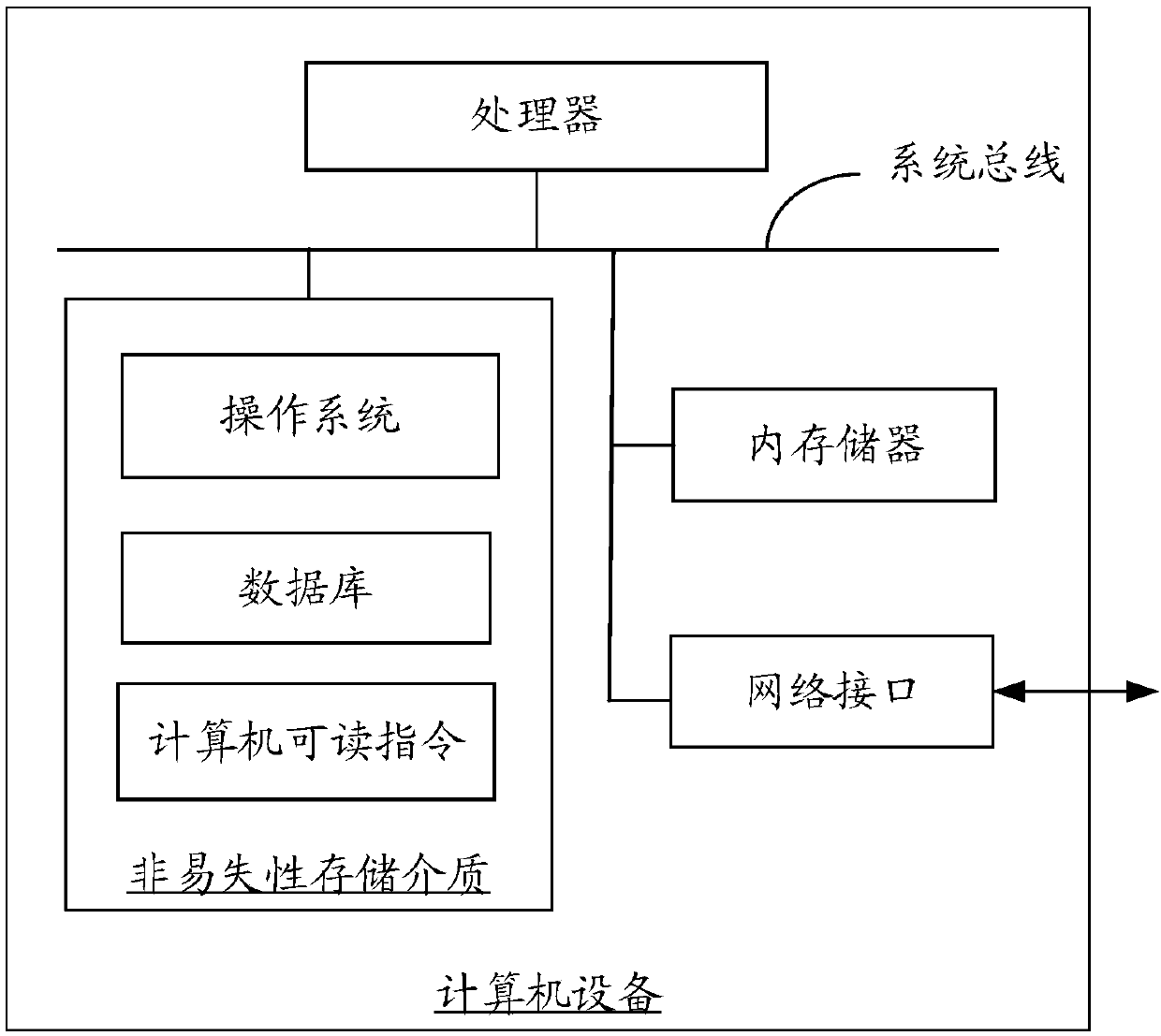

Group insurance premium assessment method and apparatus, computer equipment and storage medium

InactiveCN107679884AUnified standards for evaluationImprove accuracyFinanceProduct appraisalComputer scienceComputer equipment

The invention provides a group insurance premium assessment method. The method comprises the following steps of acquiring a target insurance buying scheme of an insurance premium to be assessed from adatabase; extracting an insurance buying factor which influences an insurance premium price in the target insurance buying scheme; according to the insurance buying factor, searching a historical insurance buying scheme set matching with the target insurance buying scheme; acquiring the insurance premium price corresponding to each insurance buying scheme in the historical insurance buying schemeset; according to the acquired insurance premium price corresponding to each insurance buying scheme, determining an initial price range corresponding to the target insurance buying scheme; acquiringa total amount of insurance premiums in a previous period; according to the total amount of insurance premiums, determining a corresponding adjusting factor; and according to the adjusting factor andthe initial price range, determining an insurance premium price range corresponding to the target insurance buying scheme. In the method, a whole process can be completed automatically, labor savingand time saving are achieved, an assessment standard is uniform and accuracy is high. In addition, the invention also provides a group insurance premium assessment apparatus, computer equipment and astorage medium.

Owner:PING AN TECH (SHENZHEN) CO LTD

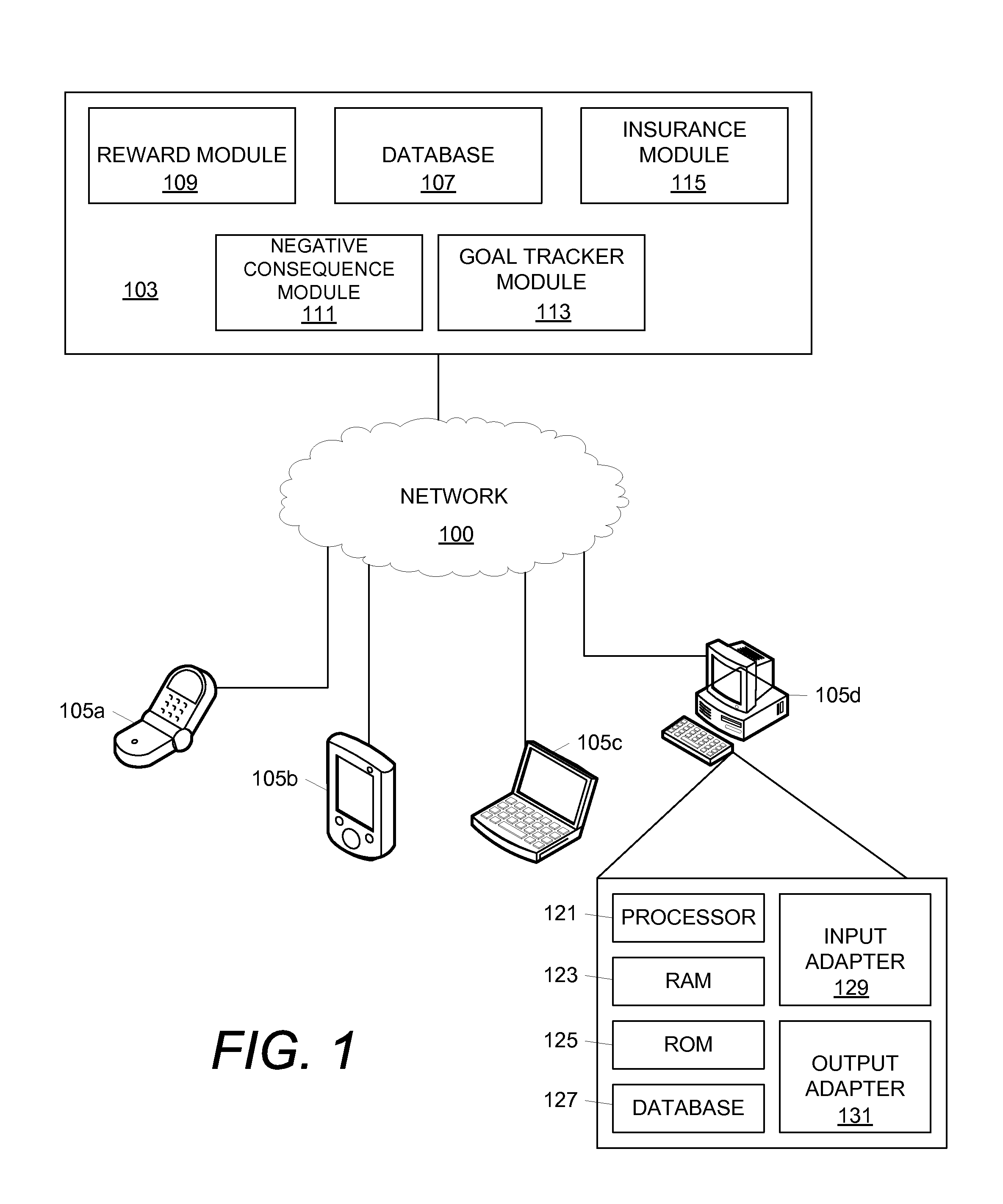

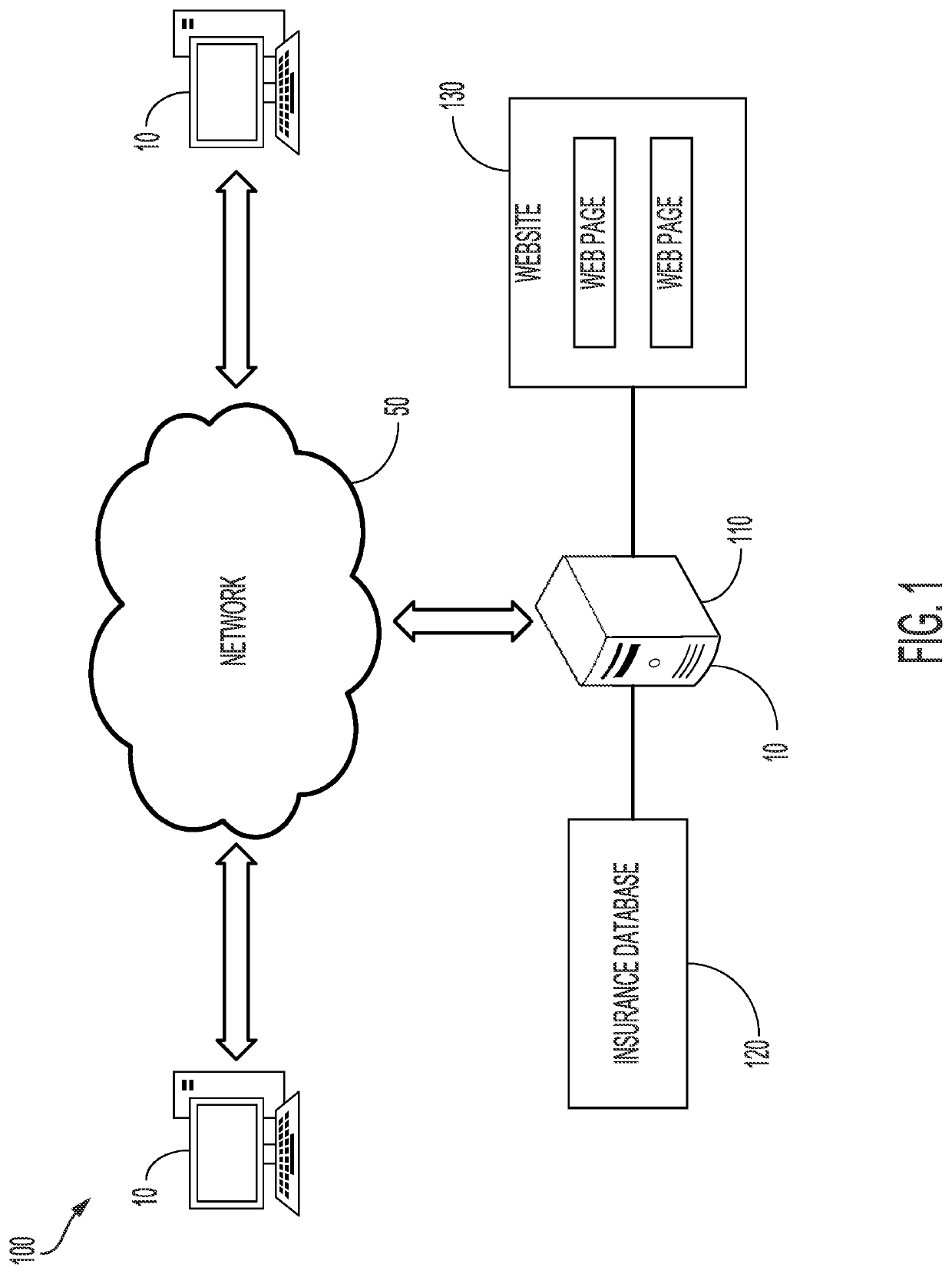

Systems and methods for providing group insurance

The present application discloses systems and methods for providing group insurance. An exemplary insurance system identifies or manages data relating to group membership based on a web portal associated with the membership. The insurance system may develop one or more insurance products based on risks that are shared amongst members.

Owner:METLIFE

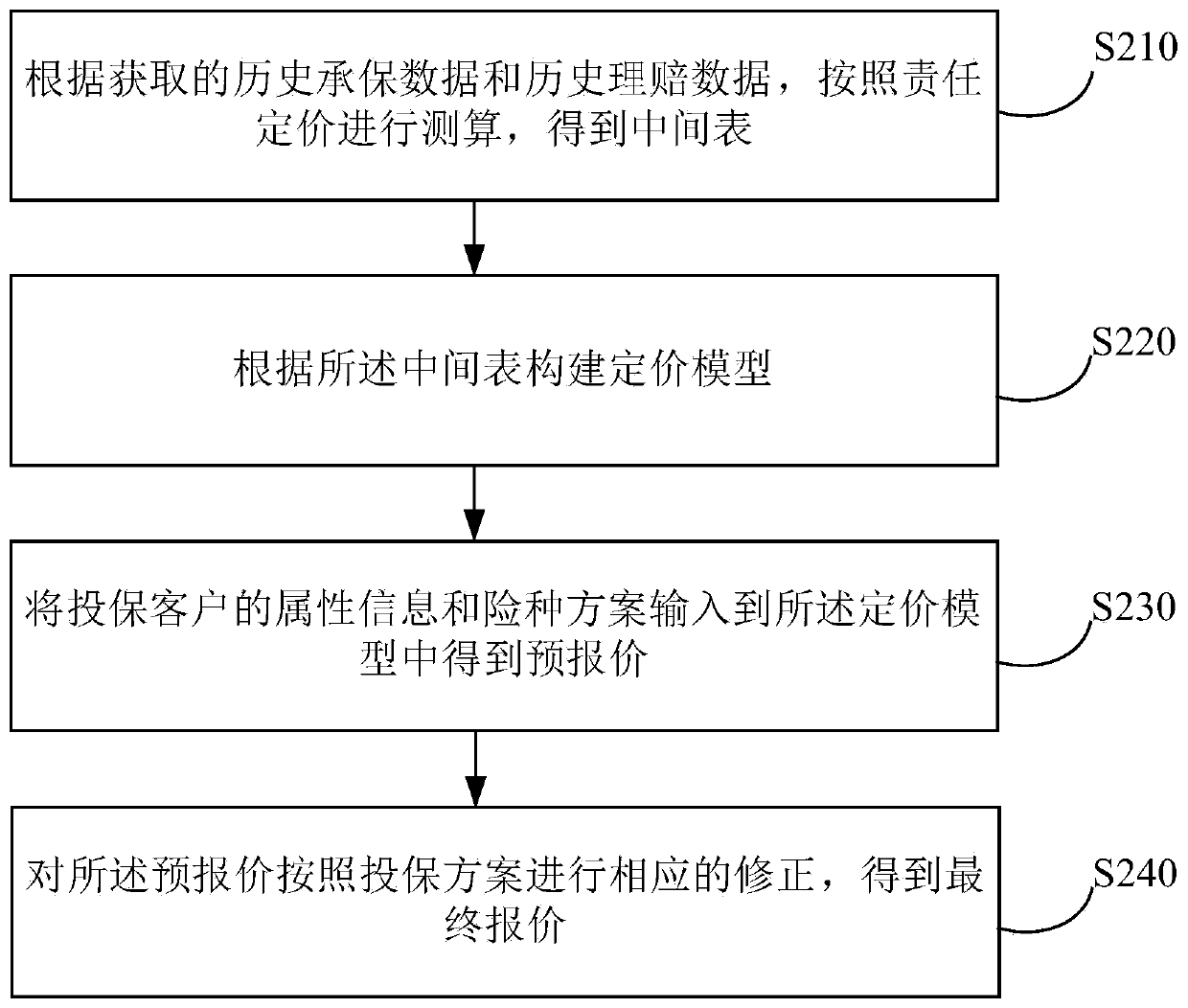

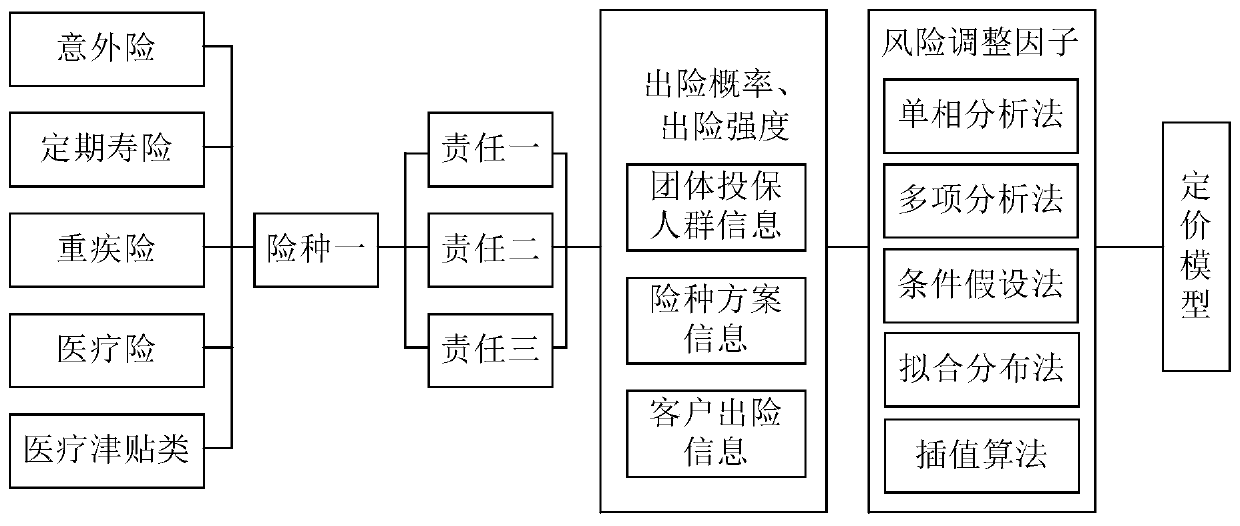

Insurance intelligent quotation method and device, medium and electronic equipment

InactiveCN110136011AReduce workloadReduce consumption costFinanceMarketingReference ratePrice prediction

The embodiment of the invention relates to the technical field of information, and provides an insurance intelligent quotation method and device, a medium and electronic equipment, and the method comprises the steps: carrying out the measurement and calculation according to the responsibility pricing according to the obtained historical underwriting data and historical claim settlement data, and obtaining an intermediate table; constructing a pricing model according to the intermediate table; inputting the attribute information of the insured customer and the insurance type scheme into the pricing model to obtain a forecast price; and carrying out corresponding correction on the forecast price according to an insuring scheme to obtain a final quotation. According to the embodiment of the invention, aiming at the group insurance, the forecast price is calculated by the installed and constructed pricing model, and the forecast price is correspondingly corrected, so that more accurate final quotation is obtained. According to different types of insurance type responsibilities, an intermediate table composed of a multi-dimensional risk factor table, a reference rate table and the likeis established to construct a pricing model, the future compensation condition of the group can be predicted more accurately, the precision of the model is improved, and the precision of price prediction is further improved.

Owner:TAIKANG LIFE INSURANCE CO LTD +1

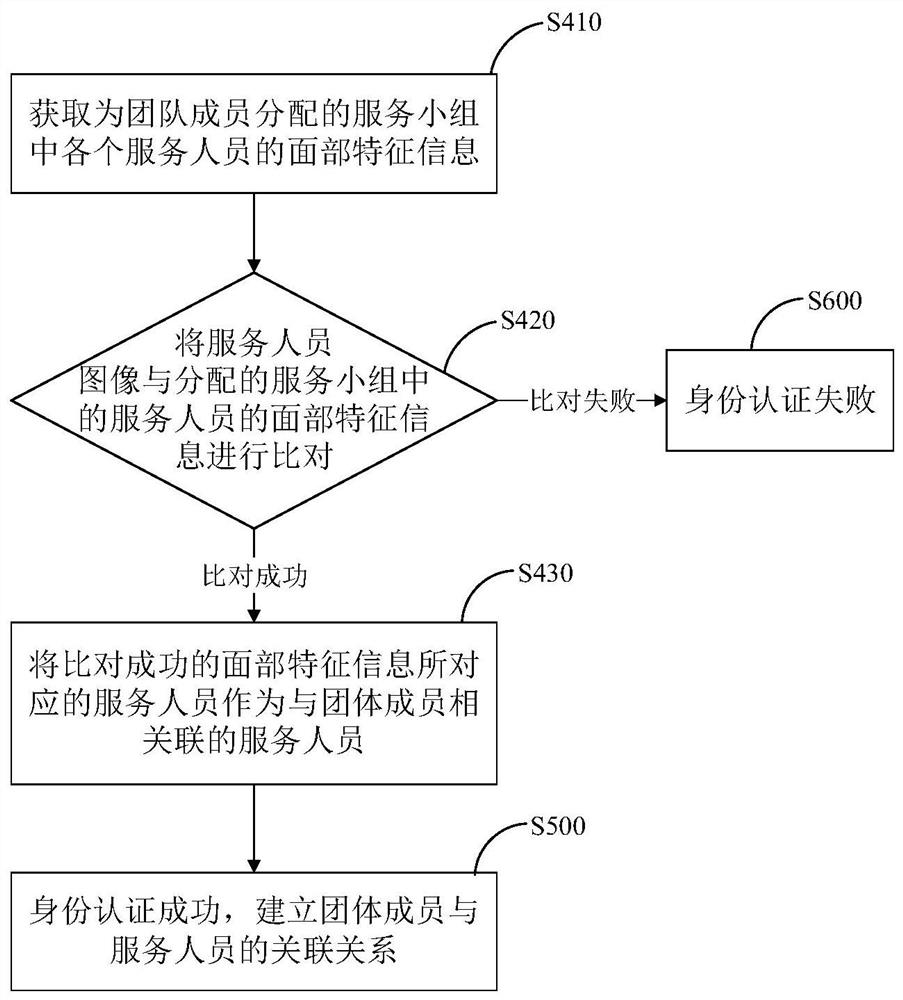

Group insurance service management method, system and device and storage medium

ActiveCN111340402AImplement identity authenticationAvoid undocumentedFinanceResourcesService experienceEngineering

The invention provides a group insurance service management method, system and device and a storage medium. The method comprises the steps that of acquiring group member information in group users isacquired from a user information management system; allocating a service group to each group member in the group user, wherein each service group comprises at least one service person; receiving a service personnel image sent by the group member from a user terminal, and carrying out identity authentication to judge whether the service personnel image corresponds to service personnel in the service group or not; if so, establishing an association relationship between the group members and the service personnel; and sending the identity authentication result to the corresponding user terminal,establishing an association relationship between the service order and the service personnel when a new service order is generated, and counting the service data. According to the invention, based onface recognition and process automation management, the accuracy and integrity of insurance service management are improved, and better service experience can be provided for users.

Owner:TAIKANG LIFE INSURANCE CO LTD +1

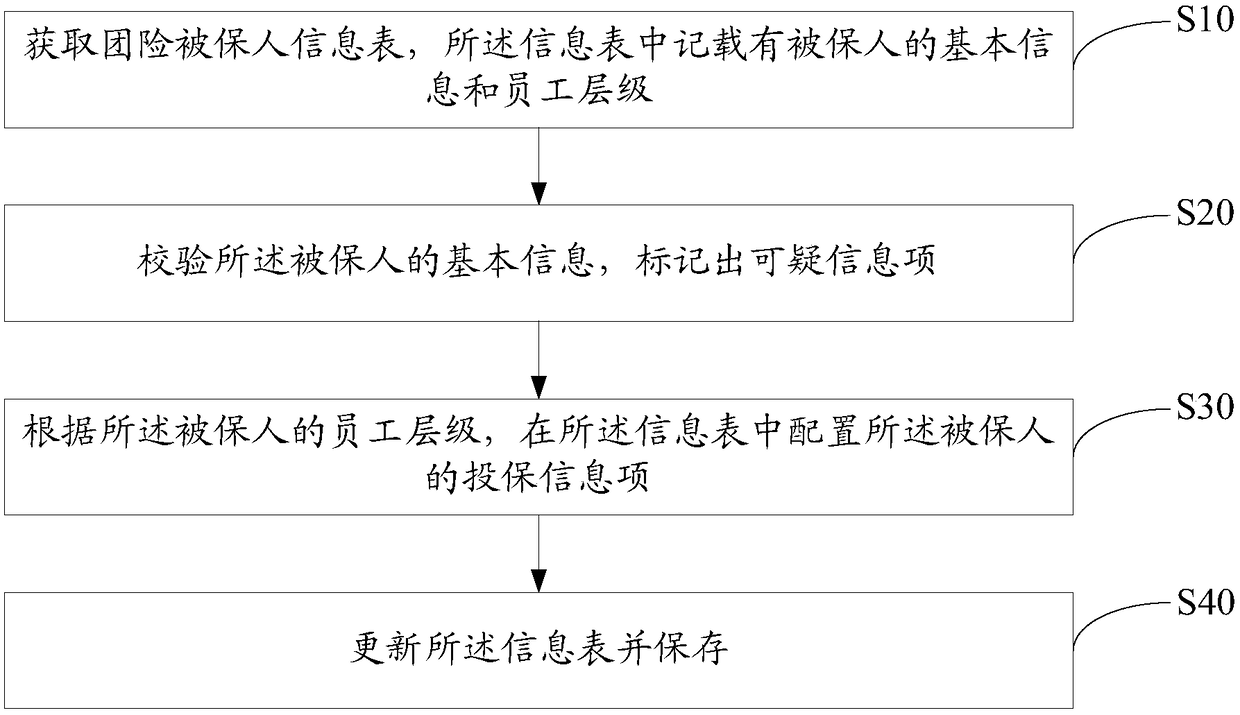

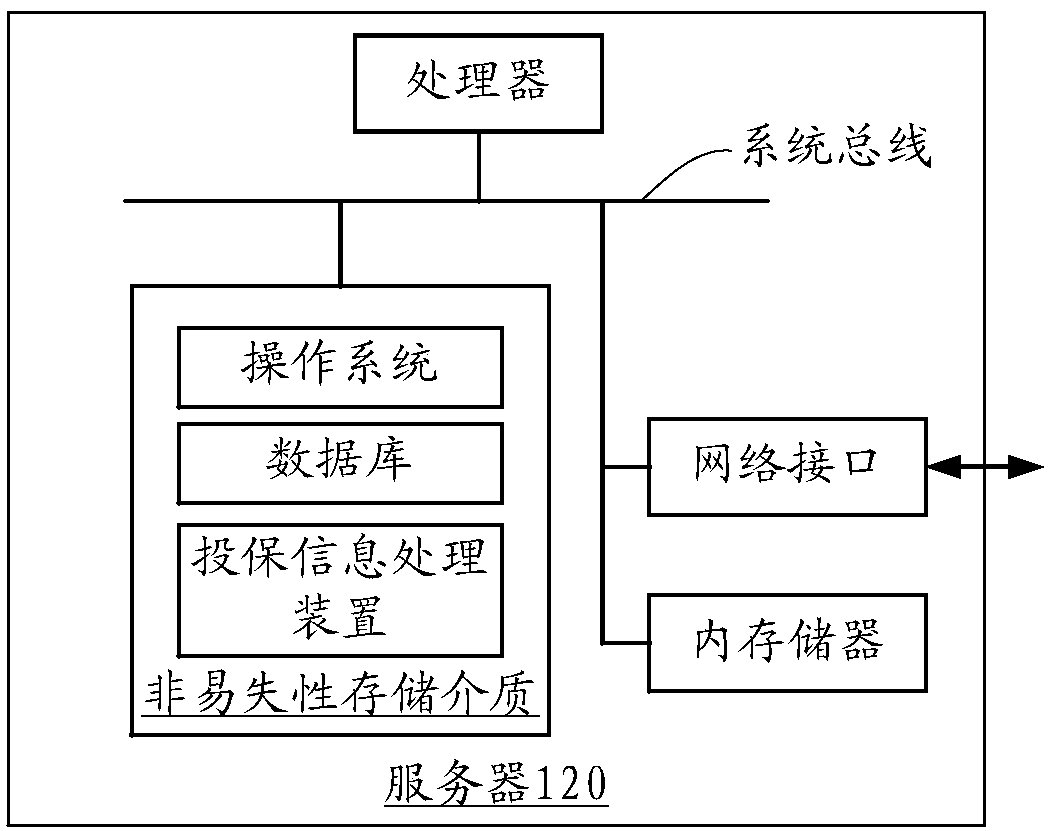

Group insurance insured person information table maintenance method and system

ActiveCN108470019AImprove maintenance work efficiencyReduce workloadFinanceNatural language data processingComputer scienceGroup insurance

The invention discloses a group insurance insured person information table maintenance method. The method includes the following steps of: obtaining a group insurance insured person information table,wherein the information table records basic information and an employee level of an insured person; verifying the basic information of the insured person and marking suspicious information items; configuring a cover insurance information item of the insured person in the information table according to the employee level of the insured person; and updating and preserving the information table. Theinvention also discloses a group insurance insured person information table maintenance system. According to the invention, the efficiency of group insurance insured person information table maintenance work is improved.

Owner:PING AN TECH (SHENZHEN) CO LTD

Goal insurance

Owner:BANK OF AMERICA CORP

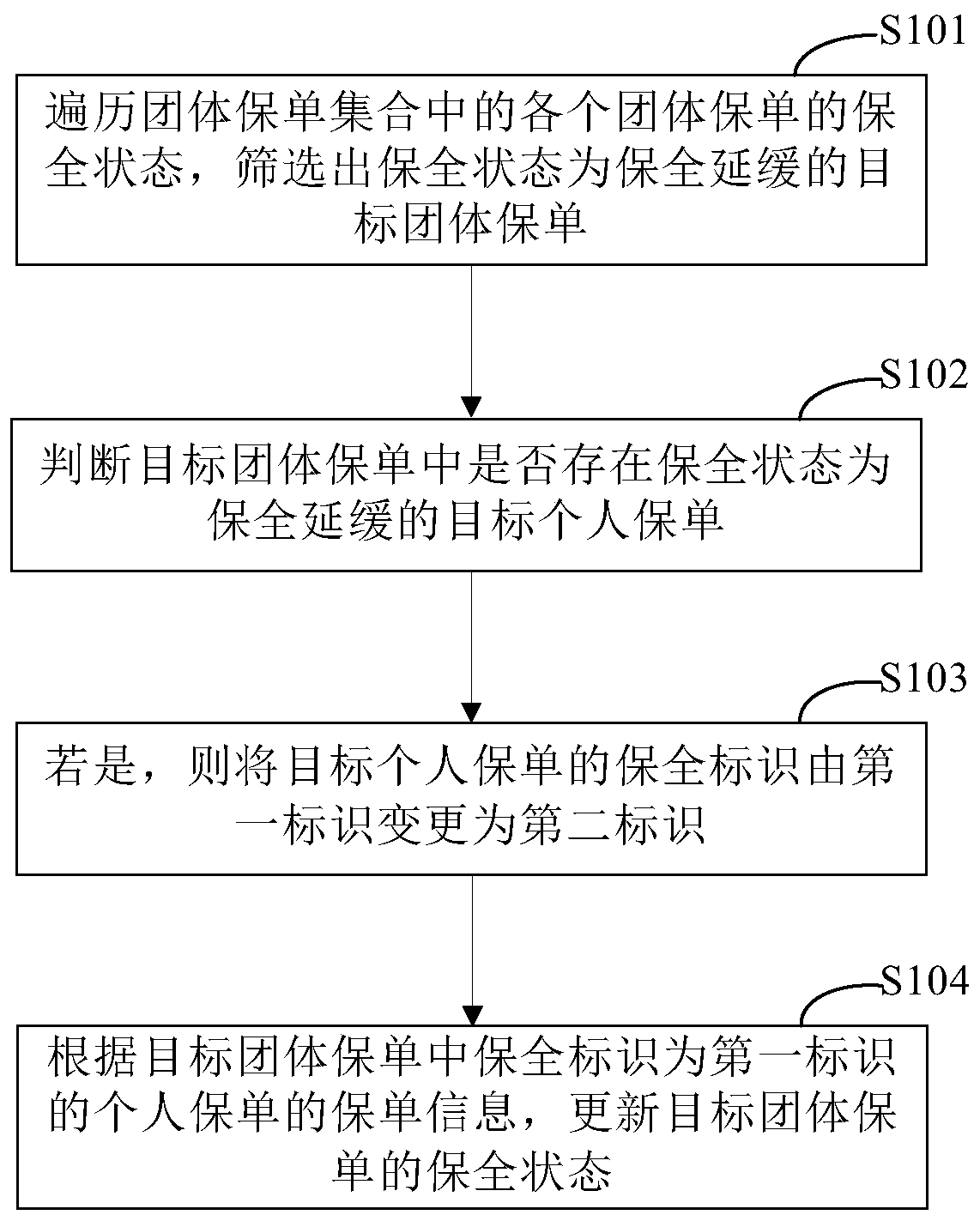

Preserved data processing method and device, electronic equipment and storage medium

ActiveCN111126935ASecurity process extendedFinancePayment architectureOperations researchElectronic equipment

The invention discloses a preserved data processing method and a device, electronic equipment and a storage medium, and relates to the technical field of computers. A specific embodiment of the methodcomprises the steps of traversing a preservation state of each group insurance policy in a group insurance policy set, and screening out a target group insurance policy of which the preservation state is preservation delay; judging whether a target personal insurance policy of which the preservation state is preservation delay exists in the target group insurance policies; if yes, changing the preservation identifier of the target personal insurance policy from the first identifier to the second identifier, so that the target personal insurance policy is separated from the target group insurance policy; and updating the preservation state of the target group insurance policy according to the insurance policy information of the personal insurance policy with the preservation identifier asthe first identifier in the target group insurance policy. According to the method of the invention, the method can solve a problem that the preservation execution time of the group insurance policy is prolonged because the preserved data of the whole group insurance policy cannot be processed normally because all personal insurance policies in the group insurance policy use the same preservationidentification and the preserved data of the personal insurance policies cannot be executed in sequence.

Owner:TAIKANG LIFE INSURANCE CO LTD

A fast group security docking platform based on service orchestration technology

InactiveCN109101543AAvoid disunityImprove reusabilityFinanceInterprogram communicationMessage queueReusability

The invention relates to a fast group insurance policy preservation docking platform based on service arrangement technology, which comprises a unified input verification interface module which provides a unified input interface for insurance company users. The security service orchestration module is used to realize the process customization and high reusability of micro-service. The insurance company protocol configurator module is used for fast docking the security service dockers of different insurance companies. The message to be processed in the micro-service consumption message queue MQis preserved and transmitted to the insurance company system through the insurance company protocol mapping configurator module. The Unified Output Interface Module is that the insurance company processes the received data for preservation, generates the preservation batch PDF document after the preservation process, and sends the PDF document to the mailbox designated by the brokerage company bymail. At the same time, the data standard message is transmitted to the insurance brokerage company through the interface, and the insurance brokerage company carries on the fast preservation micro service to the received data standard message. The invention can avoid repeatedly developing a docking insurance company interface.

Owner:北京众信易保科技有限公司

Insurance information processing method and device

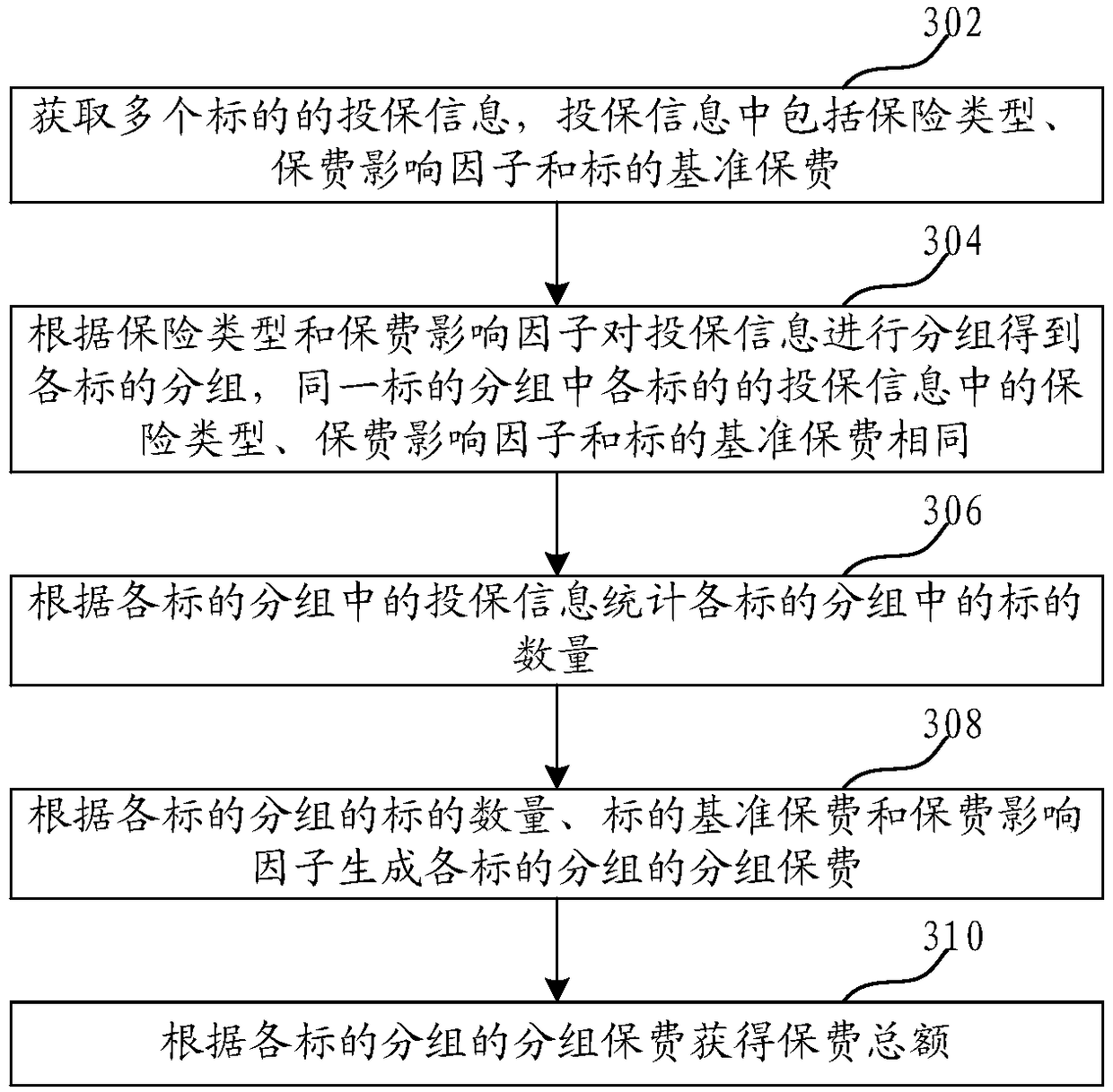

InactiveCN108230156AReduce the number of calculationsShorten the timeFinanceInformation processingResource consumption

The invention relates to an insurance information processing method and device. The method includes acquiring insurance information of a plurality of objects, wherein the insurance information includes insurance types, insurance premium impact factors and object standard premium; grouping the insurance information according to the insurance types and the insurance premium impact factors and obtaining different object groups; counting the object number of each object group according to the insurance information of each object group; generating group insurance premium of each object group according to the object number of each object group, the object standard premium and the insurance premium impact factors; obtaining a premium total amount according to the group insurance premium of each object group. According to the invention, the number of objects in each object group is counted and the group insurance premium of each object group is calculated according to the object number of eachobject group and the insurance premium impact factors, the premium total amount is obtained according to the group premium of each insurance information group, so that premium calculation frequency is reduced substantially and resource consumption for premium calculation is saved.

Owner:PING AN TECH (SHENZHEN) CO LTD

Group policy data processing method, device, server and storage medium

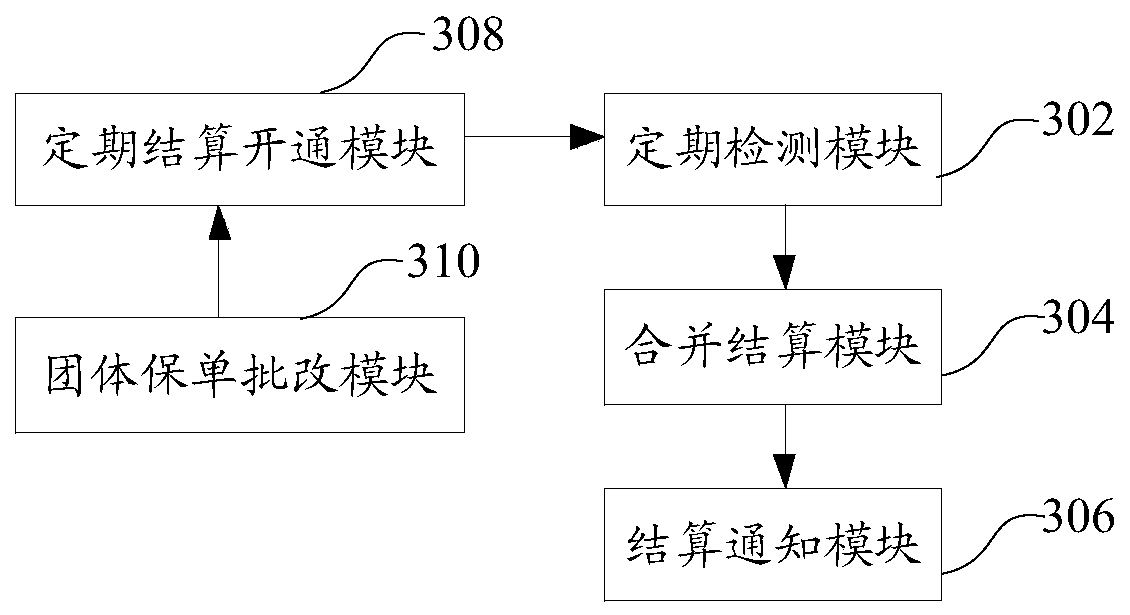

ActiveCN107944011BImprove policy settlement efficiencyReduce review timeFinanceOffice automationData packData mining

The invention relates to a processing method, a device, a server and a storage medium for group insurance policy data. The method comprises the following steps: to obtain insurance policy data of a group insurance policy, wherein the insurance policy data comprises multiple sub-policy identifications and corresponding sub-policy data, and the sub-policy data comprises multiple fields; detecting whether the group insurance policy reaching a settlement interval has a regular settlement tag; while the group insurance policy has the regular settlement tag, extracting field names in the corresponding sub-policy data, executing the de-weight processing to multiple field names; using the sub-policy identifications and the de-weighted multiple field names, generating a combined settlement notice corresponding to the group insurance policy, wherein the de-weighted field name comprises insurance premium; calculating the total premium corresponding to the multiple sub-policies, extracting a fieldvalue in the corresponding sub-policy data, and updating the combined settlement notice by using the total premium and the extracted field value, and sending the updated combined settlement notice toa terminal corresponding to a client identification. The method is capable of improving the processing efficiency of the group insurance policy data.

Owner:CHINA PING AN PROPERTY INSURANCE CO LTD

Systems and methods for providing group insurance

An insurance server accesses communications from at least one social media platform. The accessed communications include at least one of text data or image data. The insurance server determines a portion of the communications corresponds to a category of activity. For this category of activity, the insurance server determines a level of risk based on a potential for injury. Based on the level of risk for the category of activity, the insurance server identifies at least one insurance product. The insurance server further identifies a set of users associated with the portion of the communications and insures this set of users for the category of activity based on the at least one insurance product.

Owner:METLIFE

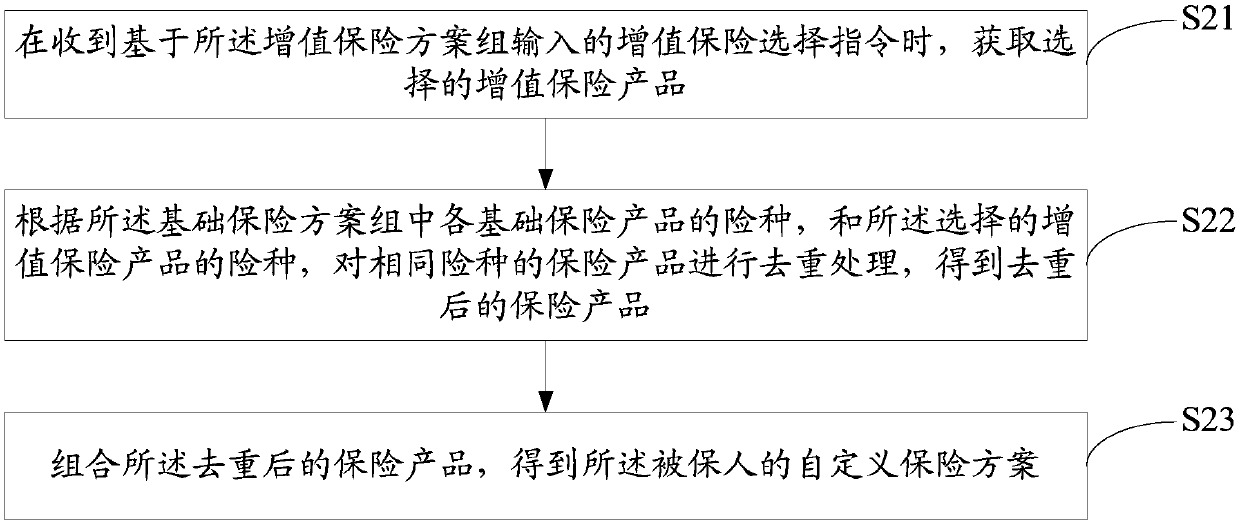

Group insurance buying method and system

InactiveCN107689004AEasy to insureGuaranteed unified insuranceFinanceGroup insuranceComputer science

The invention discloses a group insurance buying method. The method comprises the steps that when it is detected that insured persons of group clients log in, corresponding alternative insurance plangroups are configured; insurance products selected by the insured persons on the basis of the alternative insurance plan groups are obtained and combined to obtain self-defined insurance plans of theinsured persons; the self-defined insurance plans of all the insured persons of the group clients are classified, the same self-defined insurance plans are classified as one class, and the self-defined insurance plans of all the classes are obtained; the insured persons corresponding to the self-defined insurance plans of each class is counted, and according to the self-defined insurance plans ofall the classes and the corresponding insured persons, group insurance policies of the group clients are generated and insurances are bought. The invention further discloses a group insurance buying system. The method and the system achieve self-definition of the insurance plans of the insured persons of the group clients.

Owner:PING AN TECH (SHENZHEN) CO LTD

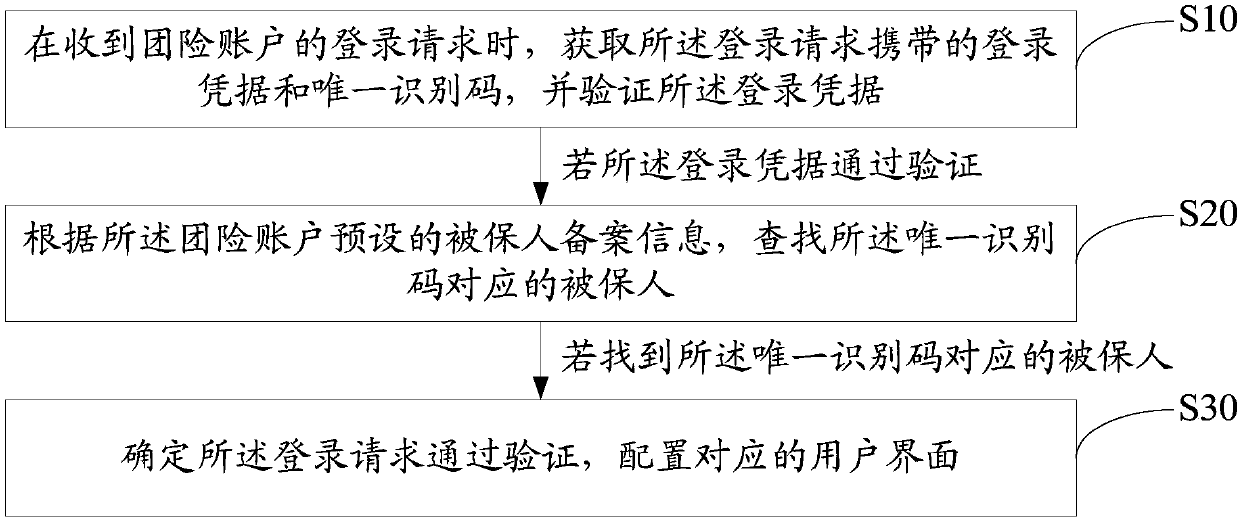

Group insurance account login method and system

ActiveCN107864114AEnsure safetySimplify administrationFinanceUser identity/authority verificationDatabaseUser interface

The invention discloses a group insurance account login method. The method comprises the following steps of when a group insurance account login request is received, acquiring a login credential and aunique identification code carried by the login request, and verifying the login credential; if the login credential passes the verification, according to preset insured person record information ofa group insurance account, searching an insured person corresponding to the unique identification code; and if the insured person corresponding to the unique identification code is found, determiningthat the login request passes the verification and configuring a corresponding user interface. The invention also discloses a group insurance account login system. In the invention, for a same group client, only one public group insurance account is configured, the group client and an insurance company do not need to spend a lot of energy to maintain employee accounts and management work of the group insurance account is greatly simplified.

Owner:PING AN TECH (SHENZHEN) CO LTD

Group insurance information processing method and device

InactiveCN107038549AImprove processing efficiencyEliminate the effects ofFinanceOffice automationInformation processingUser identifier

The invention provides a group insurance information processing method. The method comprises the following steps of: receiving a task request, wherein the task request carries a user identifier; detecting whether an on-passage task exists in a group insurance or not according to the user identifier; if the on-passage task exists, detecting whether the on-passage task mutually expels the task request or not, when the on-passage task mutually expels the task request, deciding whether to execute the task request or not according to a preset rule, and when the on-passage task does not mutually expel the task request, executing the task request; and if the on-passage task does not exist, executing the task request. Through above method, a user is permitted to initiate a new task request when an on-passage task exists, and when a to-be-executed task request mutually expels the on-passage task, the on-passage task is automatically cancelled to eliminate the influences, on the task request, of the on-passage task, so that the group insurance information processing efficiency is improved. Moreover, the invention correspondingly provides a group insurance information processing device.

Owner:PING AN TECH (SHENZHEN) CO LTD

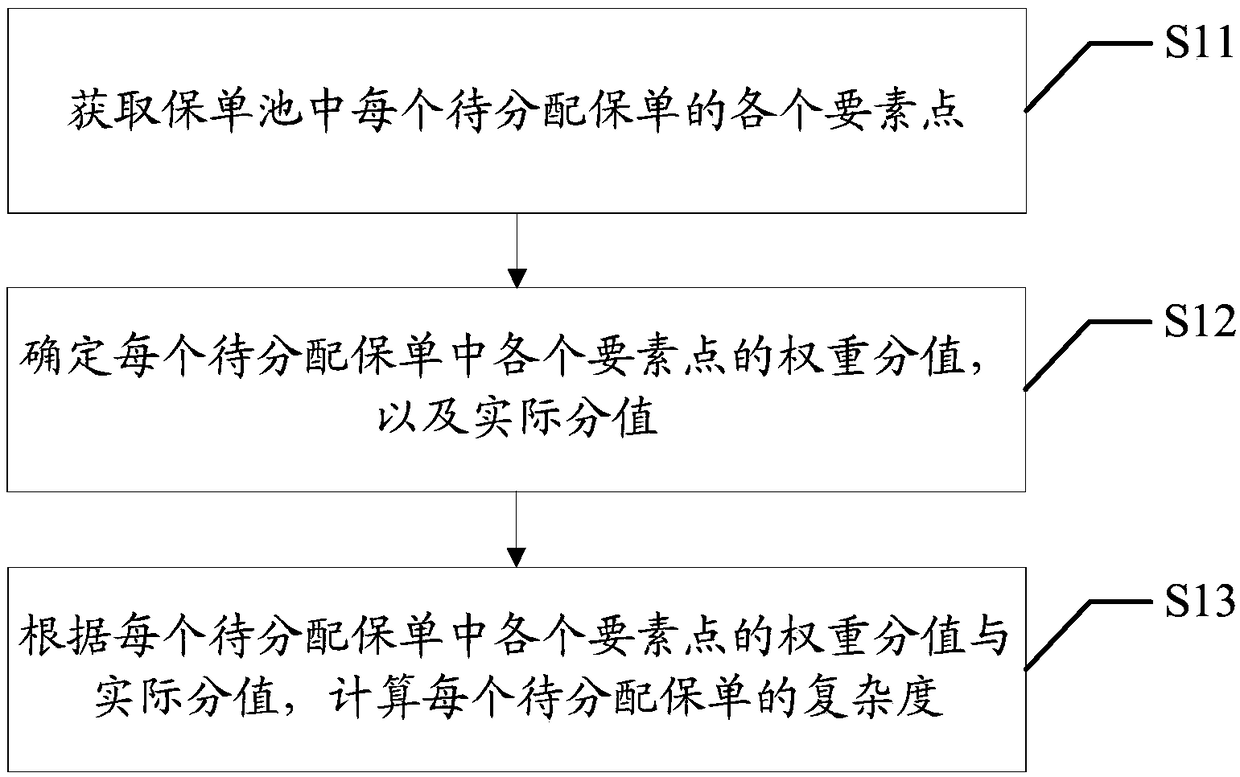

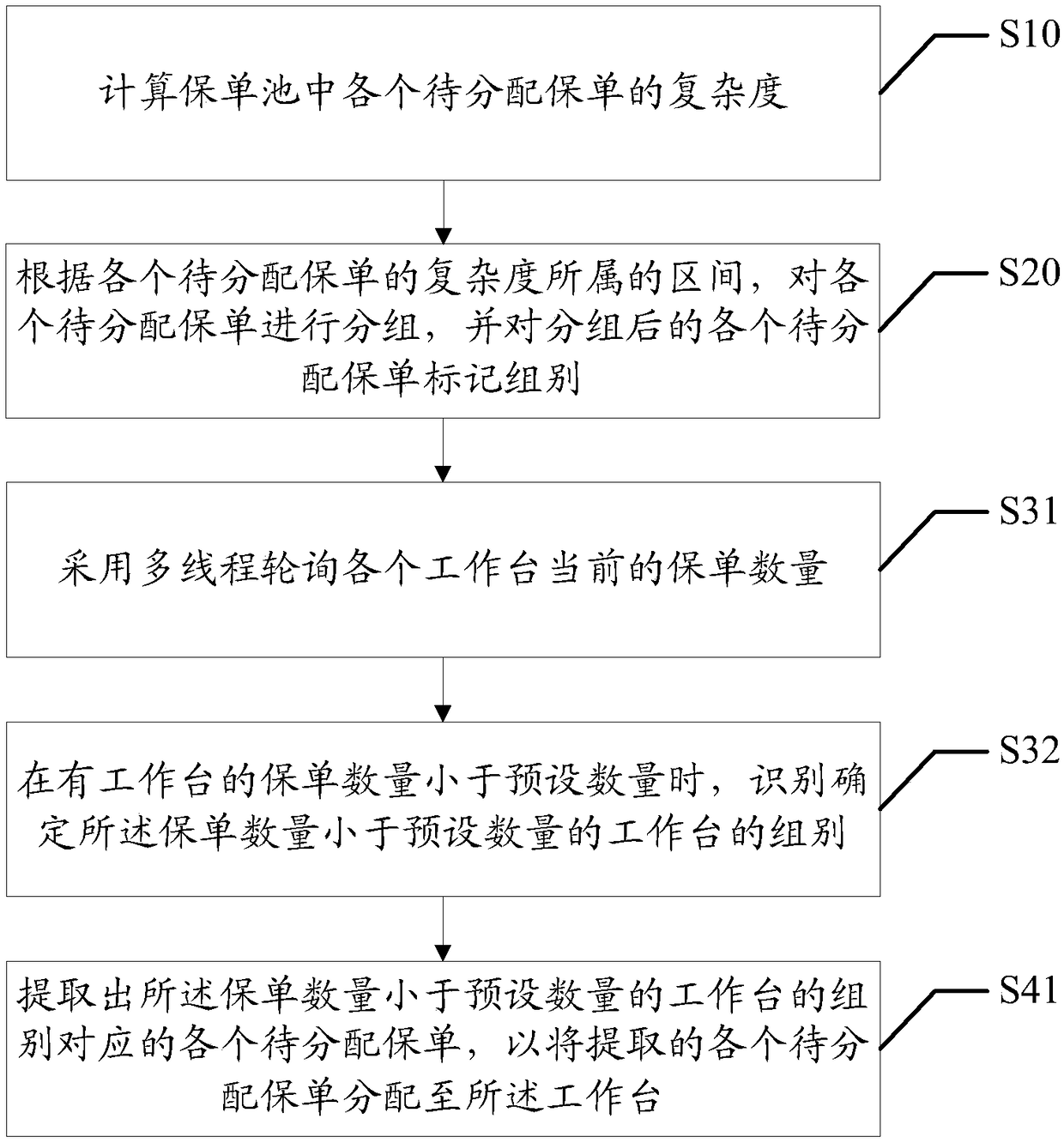

Insurance policy allocation method and device

ActiveCN108074190AImprove distribution efficiencySave human effortFinanceOffice automationComputer scienceWorkbench

Owner:PING AN TECH (SHENZHEN) CO LTD

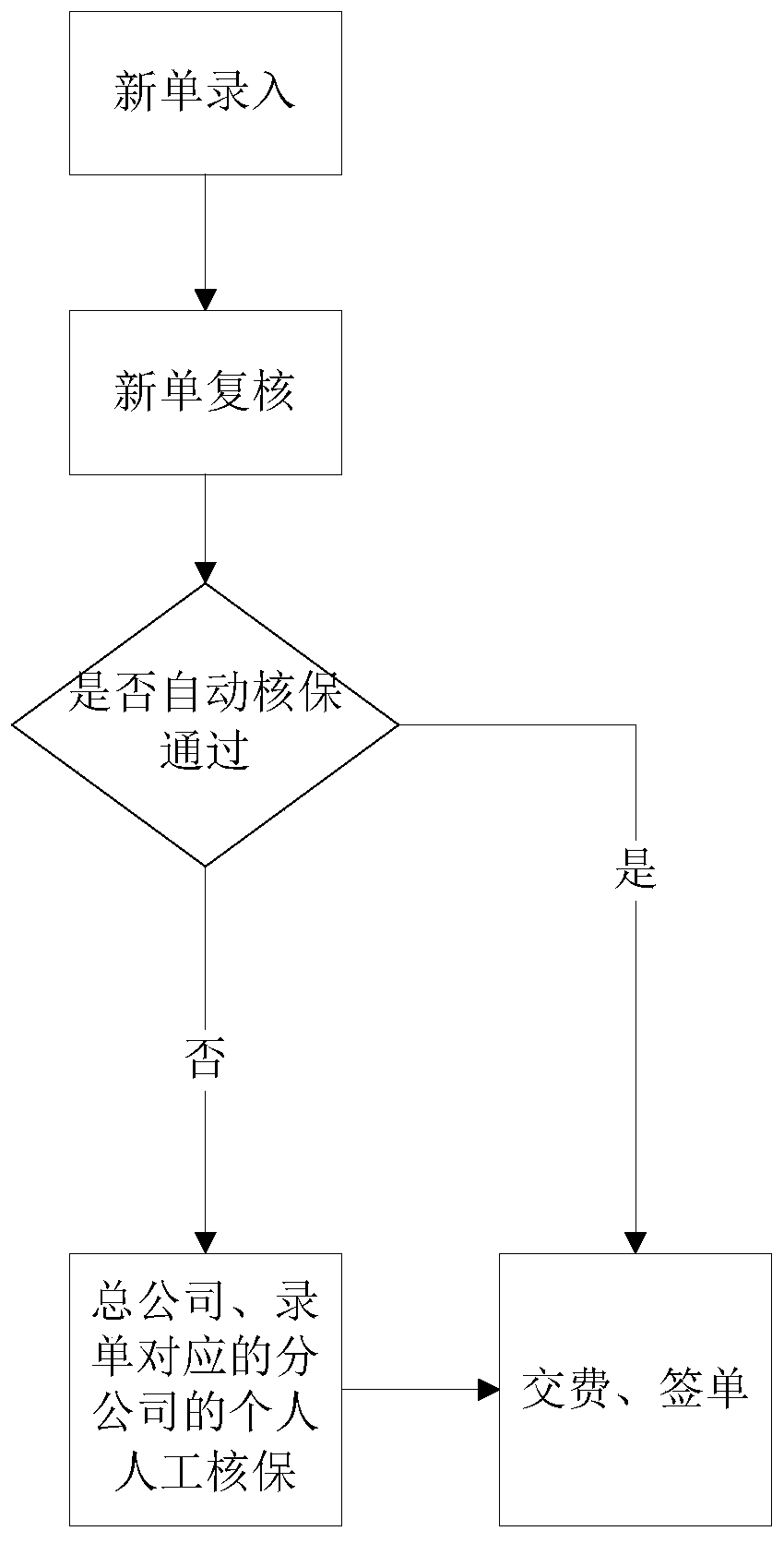

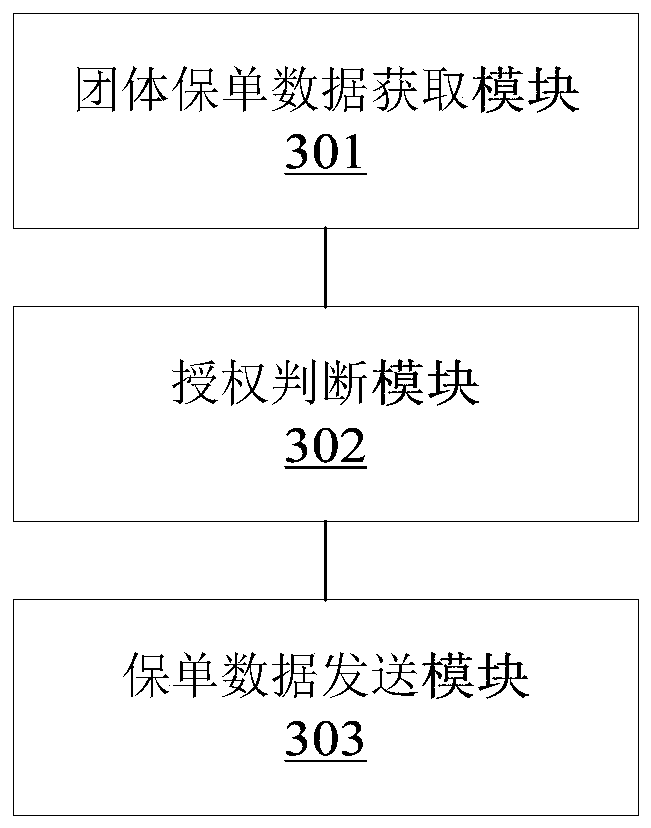

Group insurance policy underwriting data processing method and device

ActiveCN111507853ARealize underwriting diversion reviewImprove working timeFinanceOffice automationInternet privacyIdentity recognition

The invention provides a group insurance policy underwriting data processing method and a group insurance policy underwriting data processing device. The group insurance policy underwriting data processing method comprises the following steps of: acquiring group insurance policy data which does not pass automatic underwriting; performing underwriting shunting authorization judgment on the group insurance policy data based on identity recognition identifiers of the group insurance policy data; if judging that the group insurance policy data is authorized for underwriting shunting, whether an underwriting client is authorized or not is judged based on the identity recognition identifiers of personal insurance policy data in the group insurance policy data; and if judging that the underwriting client is authorized, sending the personal insurance policy data to the underwriting client and displaying the personal insurance policy data based on the identity recognition identifiers of the personal insurance policy data. According to the group insurance policy underwriting data processing method and the group insurance policy underwriting data processing device, underwriting shunt auditingof the group insurance policy data is realized through authorization of the group insurance policy data or the underwriting client, so that the working timeliness is improved.

Owner:TAIKANG LIFE INSURANCE CO LTD +1

System and methods for tracking the relative interests of the parties to an insurance policy

Systems and processes are provided for projecting, tracking and assessing the performance of and relative interests of the parties to one or more cooperatively-funded insurance policies, such as split-dollar or jointly-owned life insurance policies. Certain embodiments can also optimize the structure and function of existing insurance policies. Input data regarding actual and potential parties to an insurance contract, regulatory considerations, as well as the objectives that the parties intend to achieve, is used to propose, create, track, maintain, and implement an insurance policy or a group insurance plan. The input data is communicated to an enterprise platform via a web server. The enterprise platform includes applications which process the data. Data processing functions performed include proposal and policy generation, policy reevaluation and re-proposal, policy conversion, and report generation. The systems and processes optimize achievement of policy objectives and minimize tax consequences under applicable tax codes.

Owner:LINCOLN NAT LIFE INSURANCE

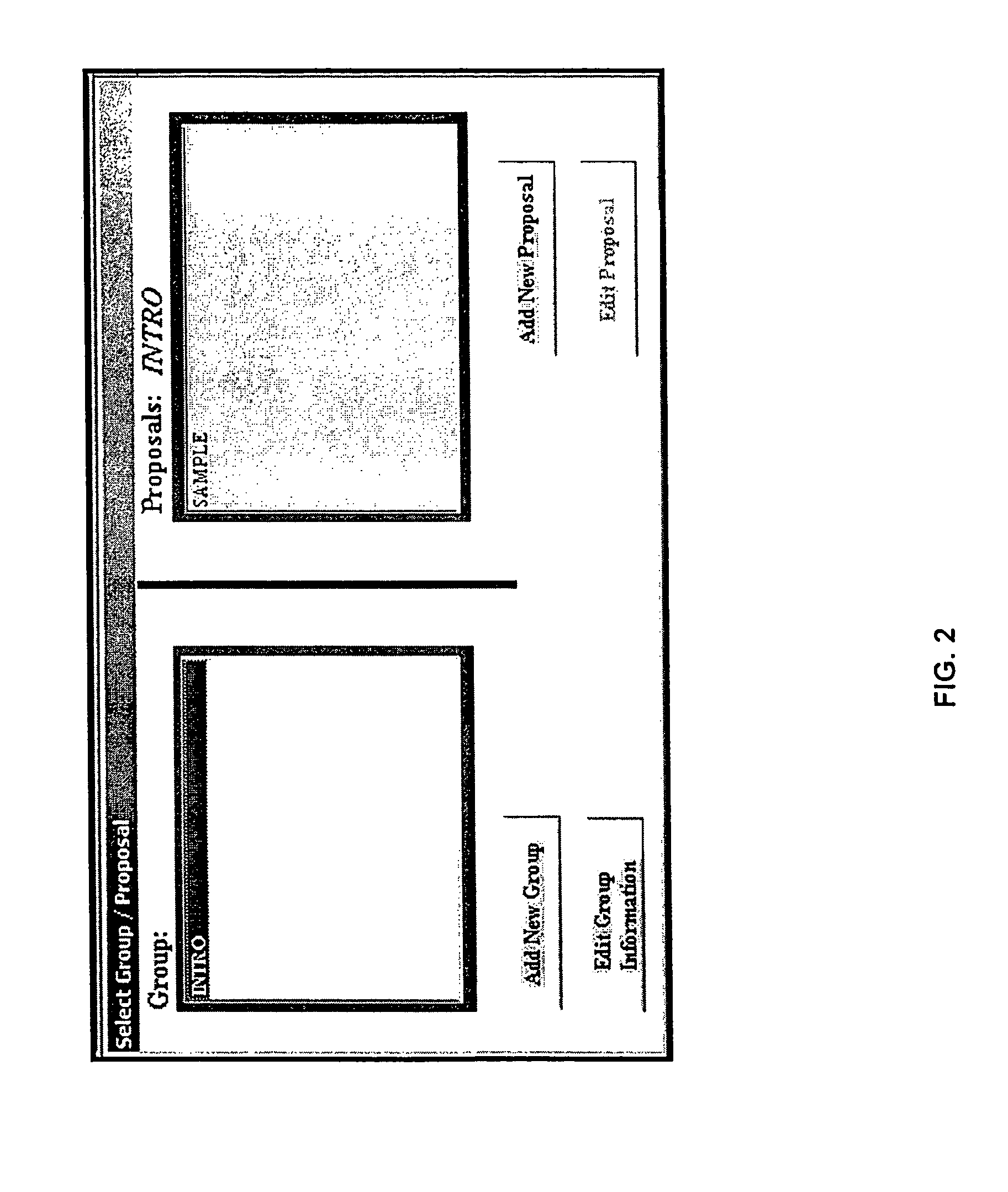

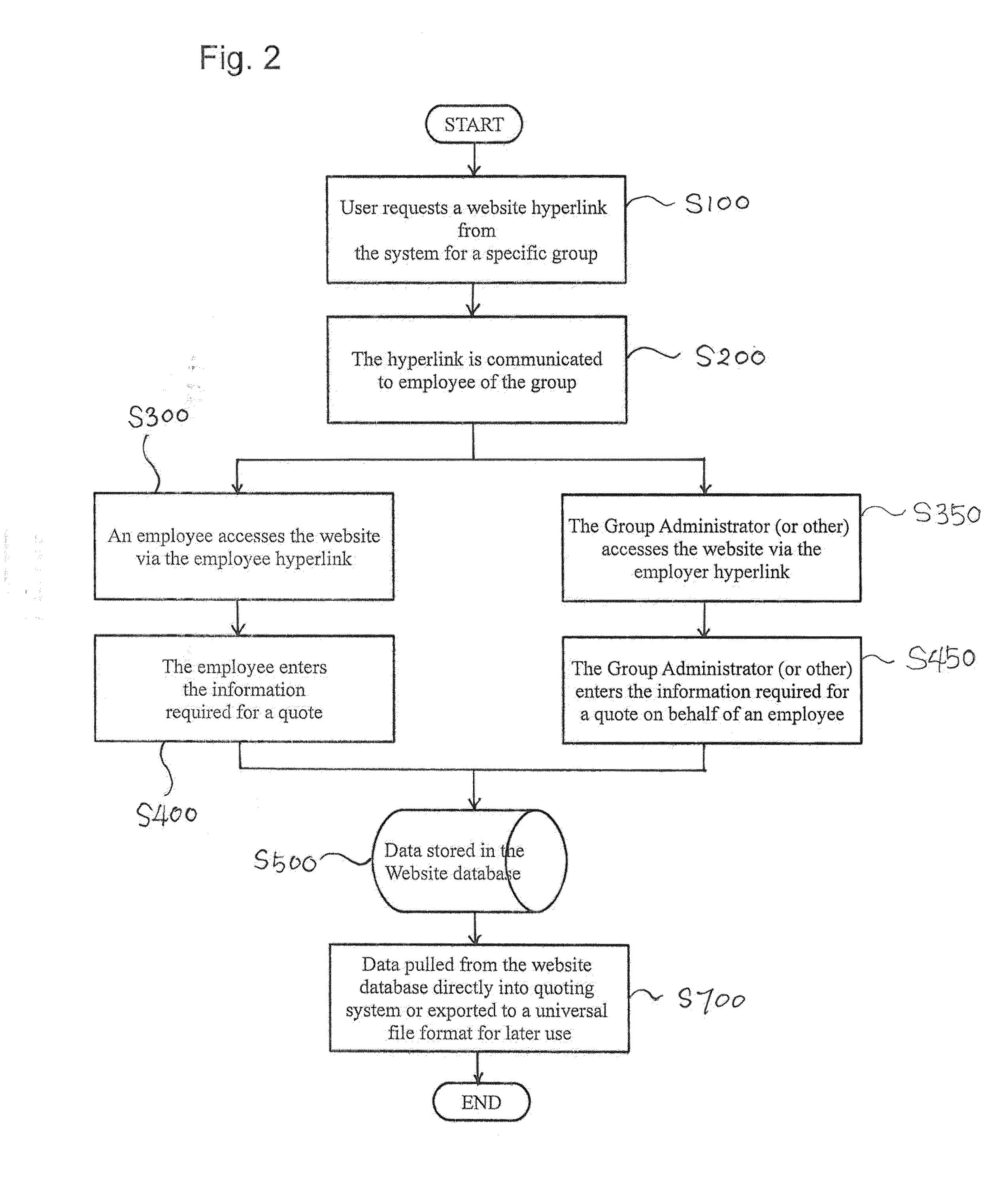

Method for Gathering Employee Data for Insurance Quote Including Submission and/or Enrollment

A method for gathering employee data for insurance quote including submission and / or enrollment is provided. The method comprising steps for a user providing a website for a specific group in a group insurance comprising a plurality of employees or group of individual employees, the user specifying selected information to be gathered from a group of employees, the user sending a hyperlink information of the website to at least one of the plurality of employees, at least one employee using the hyperlink information to access the website, at least one employee entering the specified information, and a server storing and polling the information, and an administrator of the specific group notifying the user of the completion of information entered by the employees.

Owner:JOHN J NELSON LIVING TRUST +1

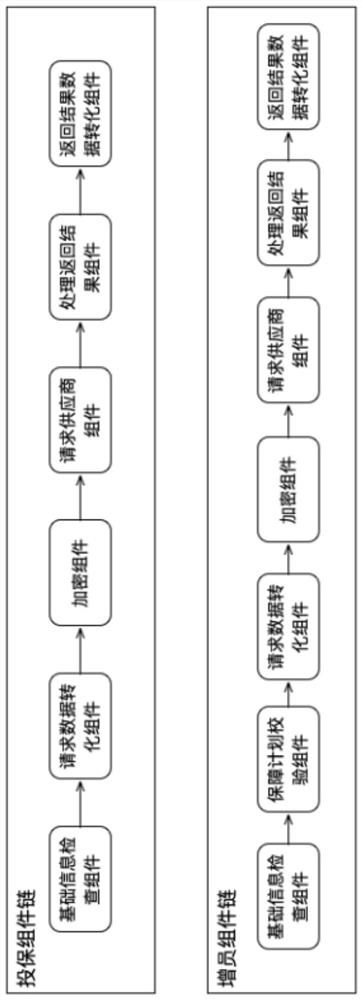

Group insurance service processing method and system based on component responsibility chain

PendingCN113706123AReduce operational complexityCommission accuracyFinanceOffice automationComputer networkBasic service

The invention provides a group insurance service processing method and system based on a component responsibility chain. The method specifically comprises the following steps: receiving a group insurance service request sent by a user, wherein the group insurance service request comprises basic service information, a group insurance service type and an insurance company code; obtaining a component responsibility chain of the insurance company corresponding to the insurance company code, wherein the component responsibility chain at least comprises one component chain, and each component chain at least comprises one component; based on the group insurance service type, configuring basic service information in the component responsibility chain, and executing information check and rule verification on the configured component responsibility chain in a chain calling mode; based on the interface mapping relationship, converting the on-chain data of the component responsibility chain from a standard data structure to a specific data structure to obtain a request message, and sending the request message to an insurance company for authentication processing; and receiving an authentication processing result of the insurance company, converting the authentication processing result into a standard data structure based on the interface mapping relationship, and returning the standard data structure to the user.

Owner:北京鲸鹳科技有限公司 +1

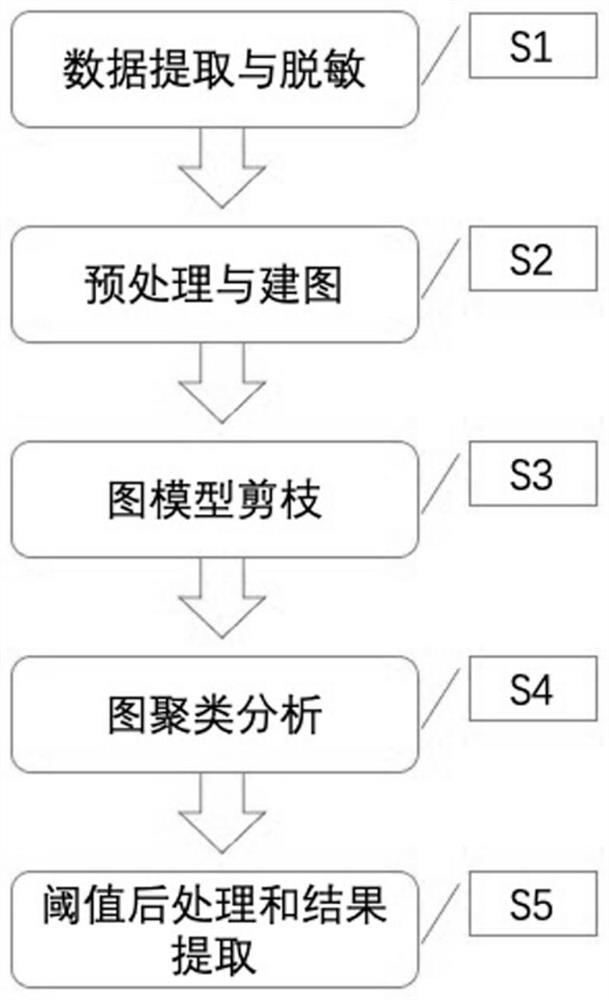

Medical insurance fraud behavior detection method and early warning device based on graph clustering analysis

PendingCN112884593AImprove efficiencySave time and spaceFinanceCharacter and pattern recognitionData ingestionEngineering

The invention belongs to the technical field of data mining of medical health big data, and particularly relates to a medical insurance fraud behavior detection method and early warning device based on graph clustering analysis. The invention discloses a medical insurance fraud behavior detection method based on graph clustering analysis. The method comprises the following steps: S1, data extraction and desensitization; s2, preprocessing and mapping; s3, pruning the graph model; s4, performing graph clustering analysis; and S5, threshold post-processing and result extraction. According to the graph clustering analysis-based medical insurance fraud behavior detection method and the early warning device provided by the invention, continuously updated medical insurance big data is used as input, and suspicious group insurance fraud behaviors can be found in time through calculation.

Owner:SHANDONG IND TECH RES INST OF ZHEJIANG UNIV

Insurance policy printing task automatic distribution method and device, equipment, and medium

PendingCN113791744AThe printing process is simpleImprove printing efficiencyFinanceDigital output to print unitsComputer printingDistribution method

The invention provides an insurance policy printing task automatic distribution method, device and system, equipment, and a medium. The method comprises the following steps: receiving printing requests submitted by operators; according to the printing requests and a preset printing task distribution mode, distributing printing tasks to printers, specifically, grouping insurance policies, distributing the insurance policies, in a same insurance policy group as a printing task, to one same printer, and allowing the insurance policies in different insurance policy groups not to be distributed to the same printer, so as to obtain an insurance policy printing task distribution information list and construct printing tasks; generating summarized information of printing tasks for all the operators for checking, and providing a one-key printing starting function and a task list reconstructing function; processing in series the printing tasks according to to-be-processed task lists in the printers, and quitting a circulation until no to-be-processed printing task exists in the printers. The printing tasks of the insurance policies are automatically distributed, the printing process is simplified, the production efficiency is improved, and the error probability is reduced.

Owner:西安立人行档案文件管理咨询有限公司

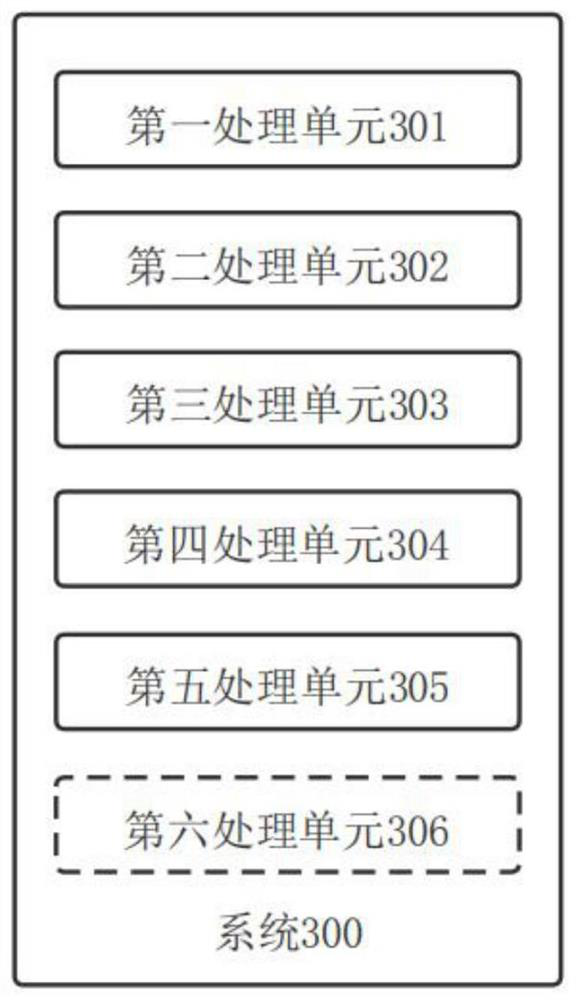

Group insurance service management method, system, equipment and storage medium

ActiveCN111340402BImplement identity authenticationImprove service experienceFinanceResourcesService personnelService experience

The present invention provides a group insurance service management method, system, equipment and storage medium. The method includes: obtaining group member information among group users from a user information management system; assigning services to each group member among the group users Group, each of the service groups includes at least one service person; receiving the image of the service person sent by the group members from the user terminal, and performing identity authentication to determine whether the image of the service person corresponds to the service person in the service group ; If so, establish the association relationship between the group members and the service personnel; send the identity authentication result to the corresponding user terminal, when generating a new service order, establish the association relationship between the service order and the service personnel, and collect service data. Based on face recognition and process automation management, the present invention improves the accuracy and completeness of insurance service management, and can provide users with better service experience.

Owner:TAIKANG LIFE INSURANCE CO LTD +1

Enterprise group insurance processing method and device, server, medium and product

InactiveCN114511412AReduce waiting timeReduce the number of operationsFinancePaymentBusiness enterprise

The invention discloses an enterprise group insurance processing method and device, a server, a medium and a product, which can be applied to the financial field or other fields. For each employee who wants to pay the insurance expense, if the personal fee which needs to be paid by the employee is successfully deducted from the bank card associated with the employee, generating an insurance purchase success instruction with an insurance identifier; and the second server generates the insurance policy of the employee. According to the invention, after the personal payment is successfully deducted, the online operation is executed once, and the insurance purchase can be completed, so that compared with the prior art that the insurance purchase can be completed only by two online operations, the online operation times are reduced, the insurance purchase transaction is rapidly completed, and the waiting time of employees is shortened.

Owner:中银金融科技有限公司

Insurance data processing method, device and equipment and storage medium

The invention provides insurance data processing method, device and equipment and a storage medium, and relates to the technical field of computers. The method comprises the steps of: enabling a claimsettlement system to receive a claim settlement application of an insurance policy; when the claim settlement system determines that the insurance policy contains the common insurance type, calling acalculation factor query interface to obtain a calculation factor of the insurance policy, the calculation factor comprising an insurance amount shared by the insurance policies of the group where the insurance policy is located and an insurance amount shared by multiple insurance types of the insurance policy; enabling the claim settlement system to obtain the past claim settlement amount of allthe insurance policies in the group insurance policies where the insurance policies are located and the past claim settlement amount of all the insurance types of the insurance policies from the multiple service systems by calling a past claim settlement query interface; and enabling the claim settlement system to determine the claim settlement amount of the claim settlement application of the insurance policy according to the past claim settlement amounts of all insurance policies in the group insurance policy where the insurance policy is located and the past claim settlement amounts of allinsurance types of the insurance policies. The method can solve the problems that a claim settlement system is low in efficiency of processing insurance policies containing common insurance types andis liable to make mistakes.

Owner:TAIKANG LIFE INSURANCE CO LTD

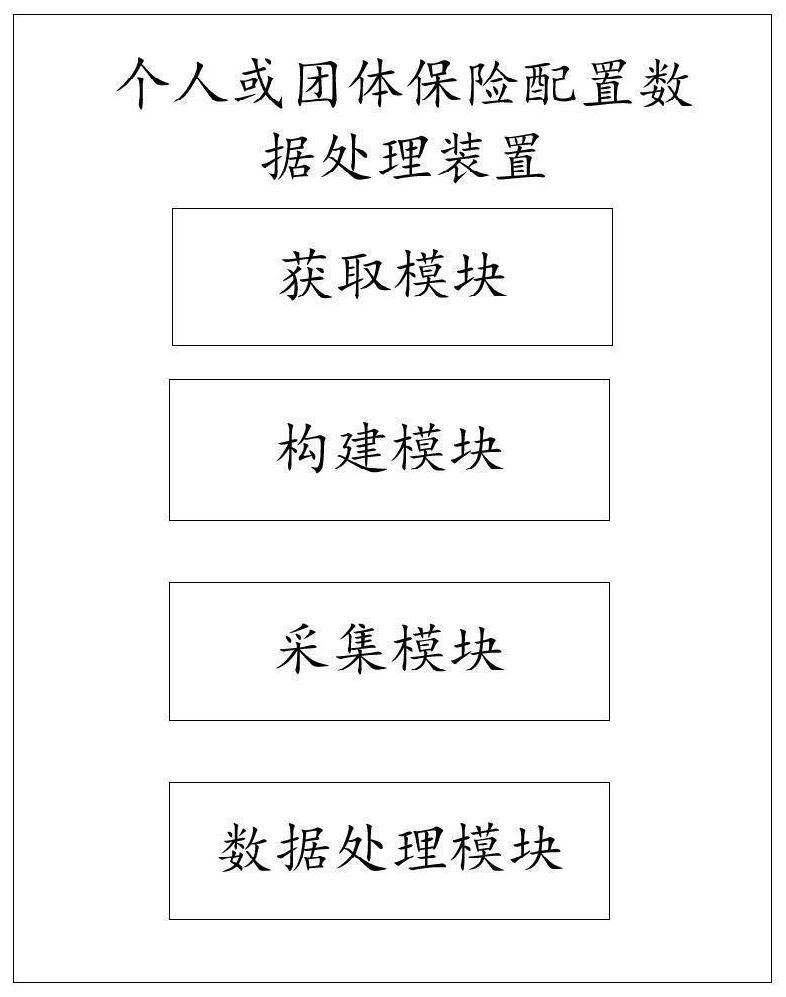

Personal or group insurance configuration data processing method and device, equipment and medium

PendingCN113850682AImprove purchasing efficiencyGuaranteed validityFinanceOther databases clustering/classificationData acquisitionOperations research

The invention discloses a personal or group insurance configuration data processing method and device, electronic equipment and a computer readable storage medium. The personal or group insurance configuration data processing method is applied to the electronic equipment, and comprises the following steps: acquiring insurance configuration data and risk occurrence probability data; constructing insurance configuration basic data in combination with the insurance configuration data and the risk occurrence probability data; collecting product data of the insured insurance of the consumer and consumer basic information; and according to the product data and the consumer basic information, performing adaptation in the insurance configuration basic data to generate an insurance configuration difference evaluation report of the consumer. According to the insurance configuration item information of the consumer and the existing insurance product, the consumer can clearly know whether the purchased insurance product is completely configured, so that the effectiveness of purchasing the insurance by the consumer is improved.

Owner:杨小琼

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com