Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

84 results about "Customer retention" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Customer retention refers to the ability of a company or product to retain its customers over some specified period. High customer retention means customers of the product or business tend to return to, continue to buy or in some other way not defect to another product or business, or to non-use entirely. Selling organizations generally attempt to reduce customer defections. Customer retention starts with the first contact an organization has with a customer and continues throughout the entire lifetime of a relationship and successful retention efforts take this entire lifecycle into account. A company's ability to attract and retain new customers is related not only to its product or services, but also to the way it services its existing customers, the value the customers actually generate as a result of utilizing the solutions, and the reputation it creates within and across the marketplace.

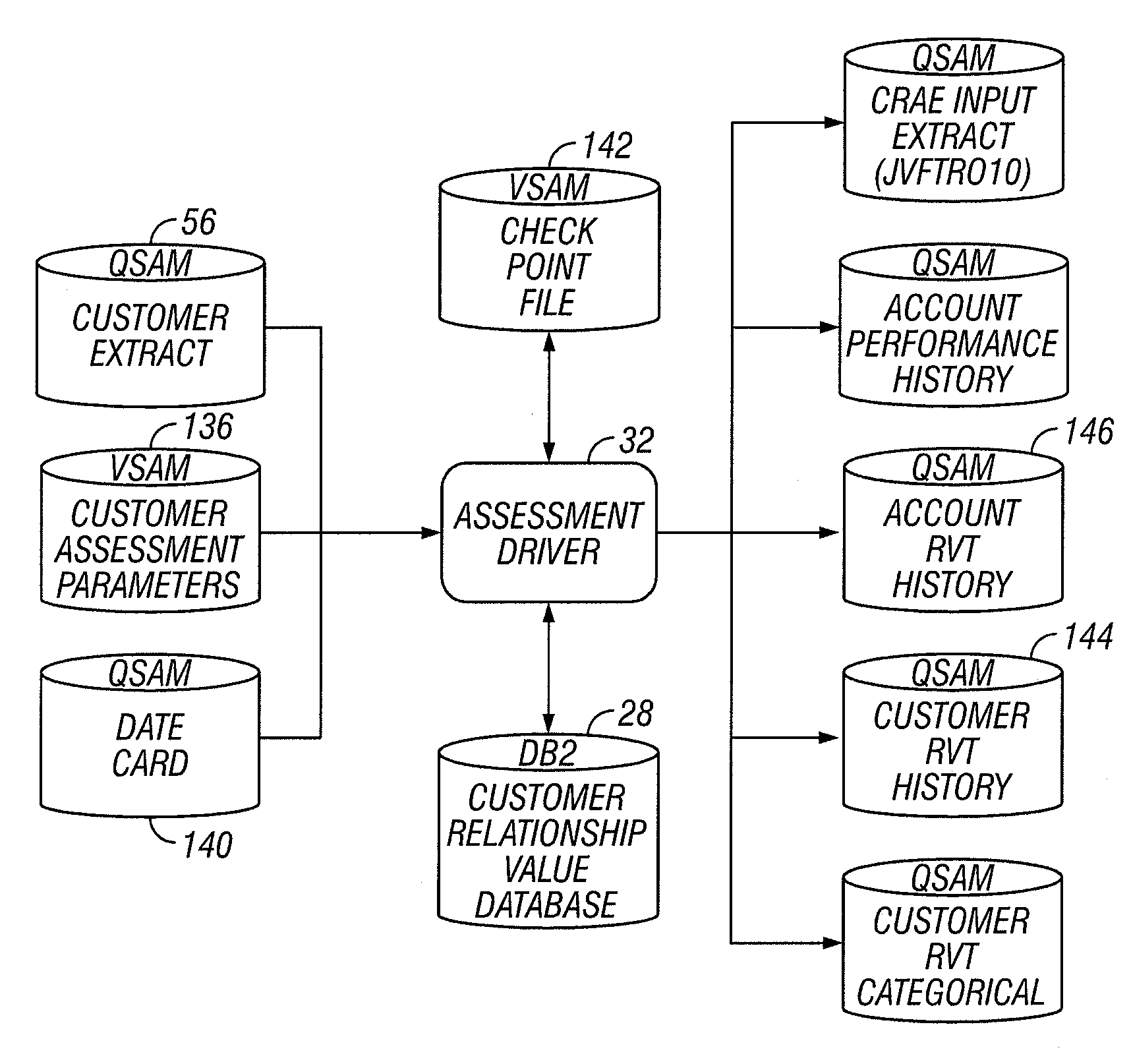

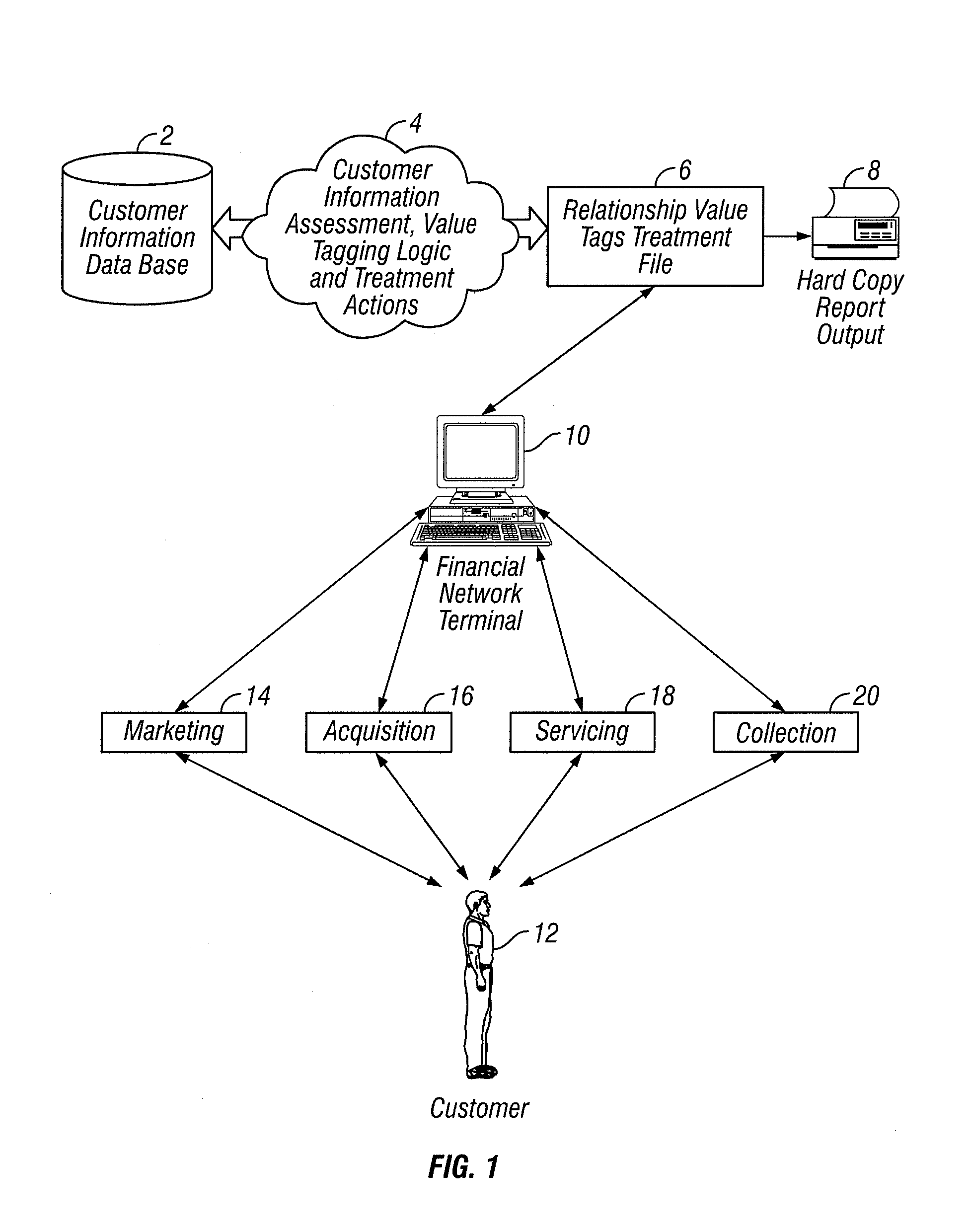

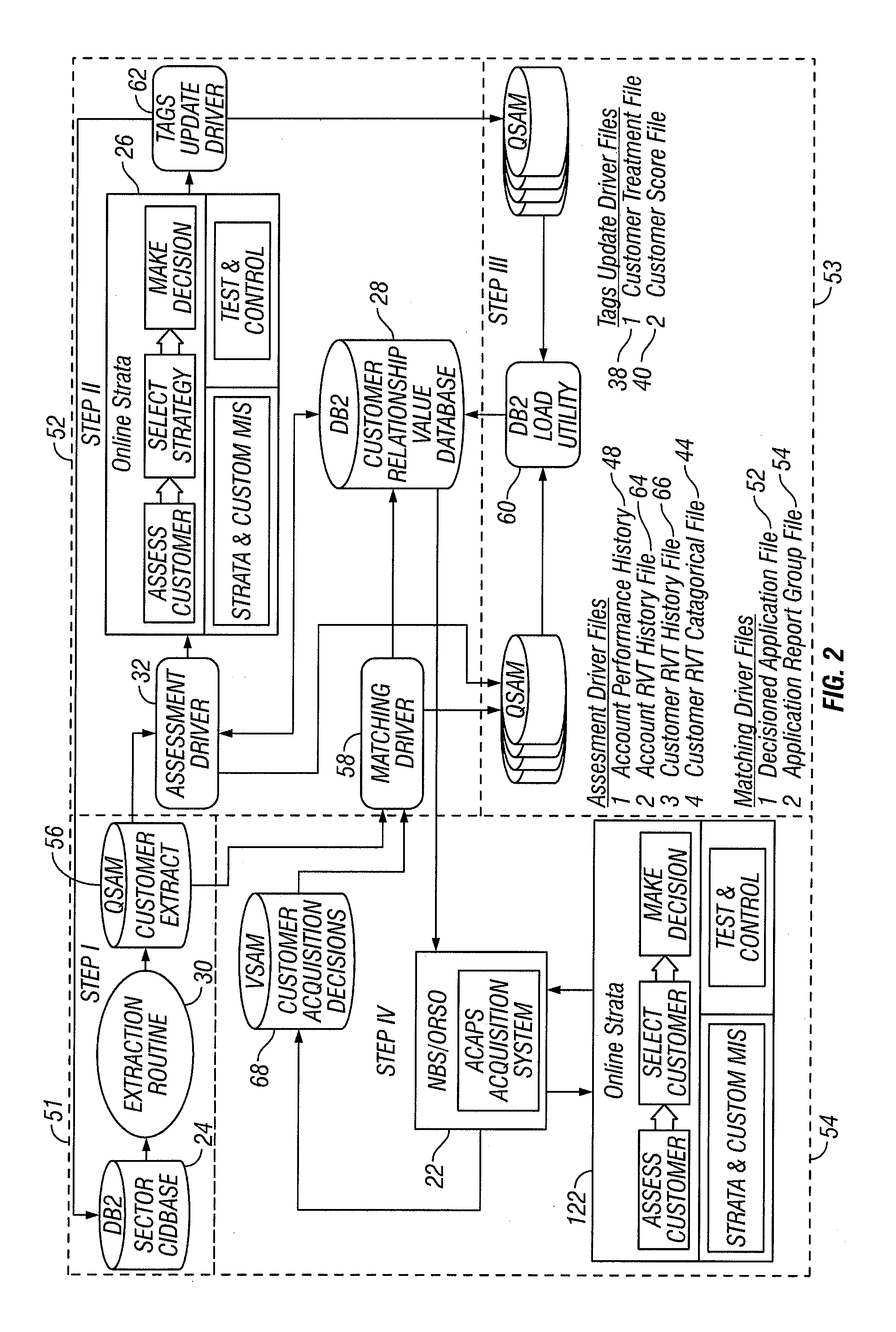

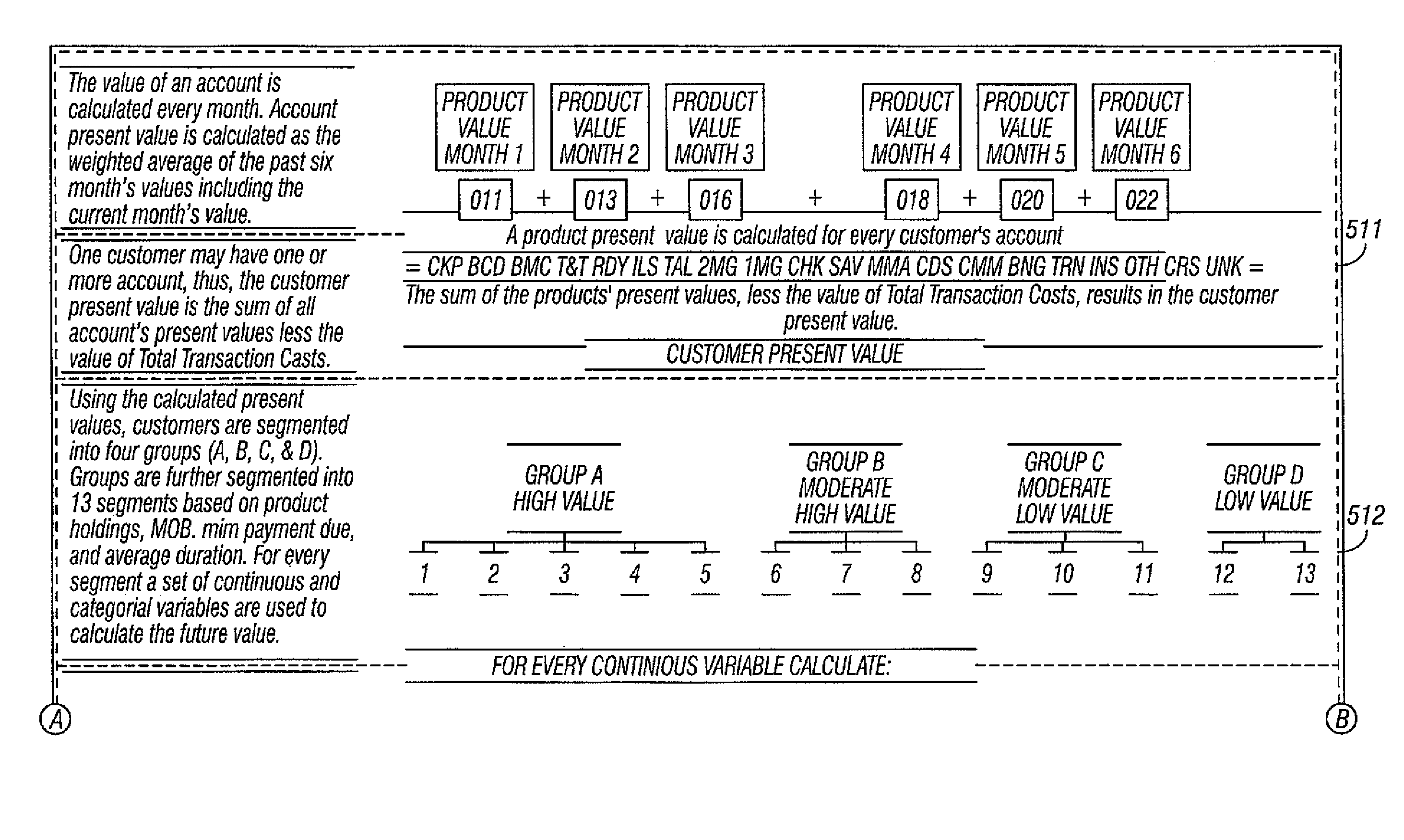

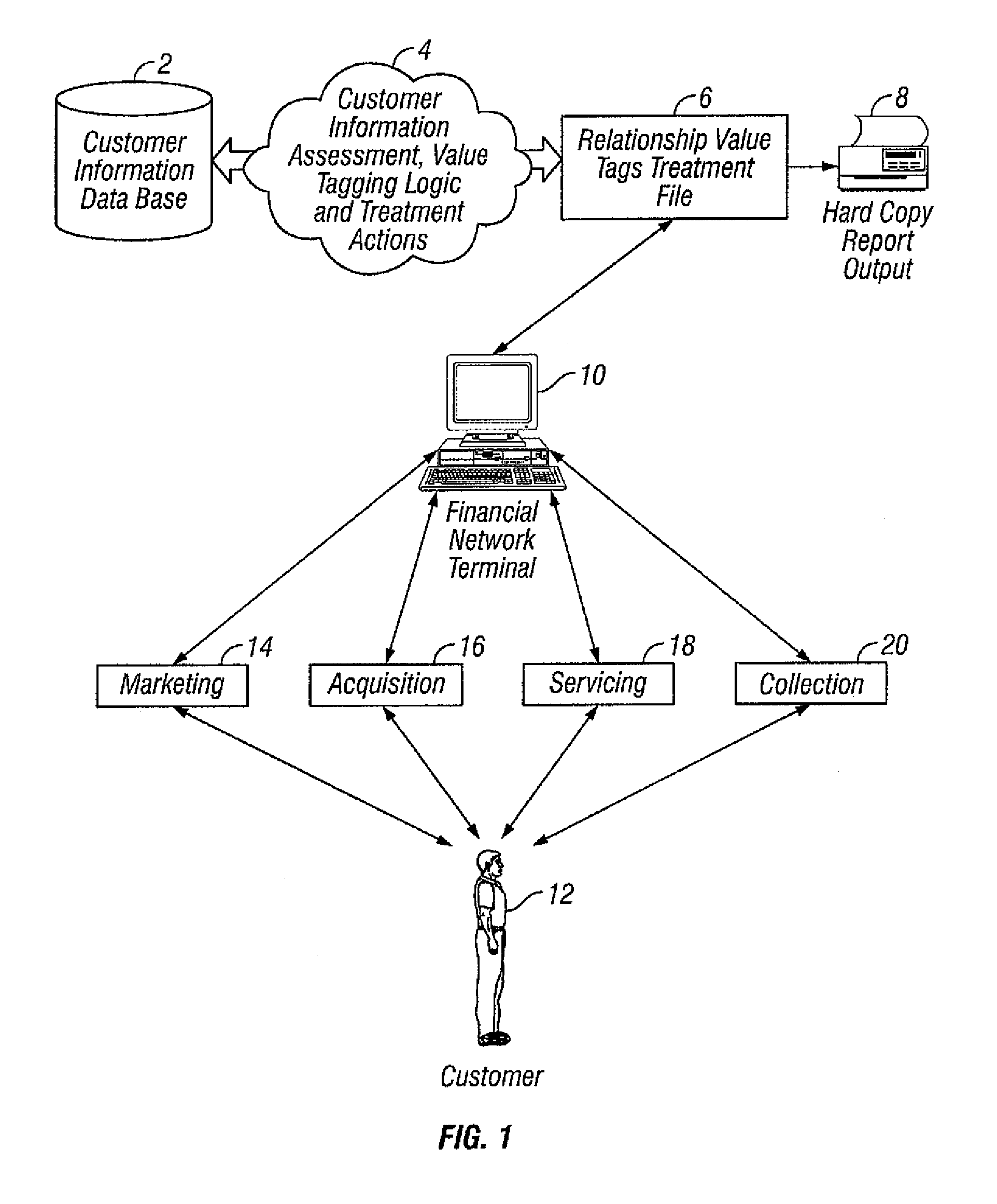

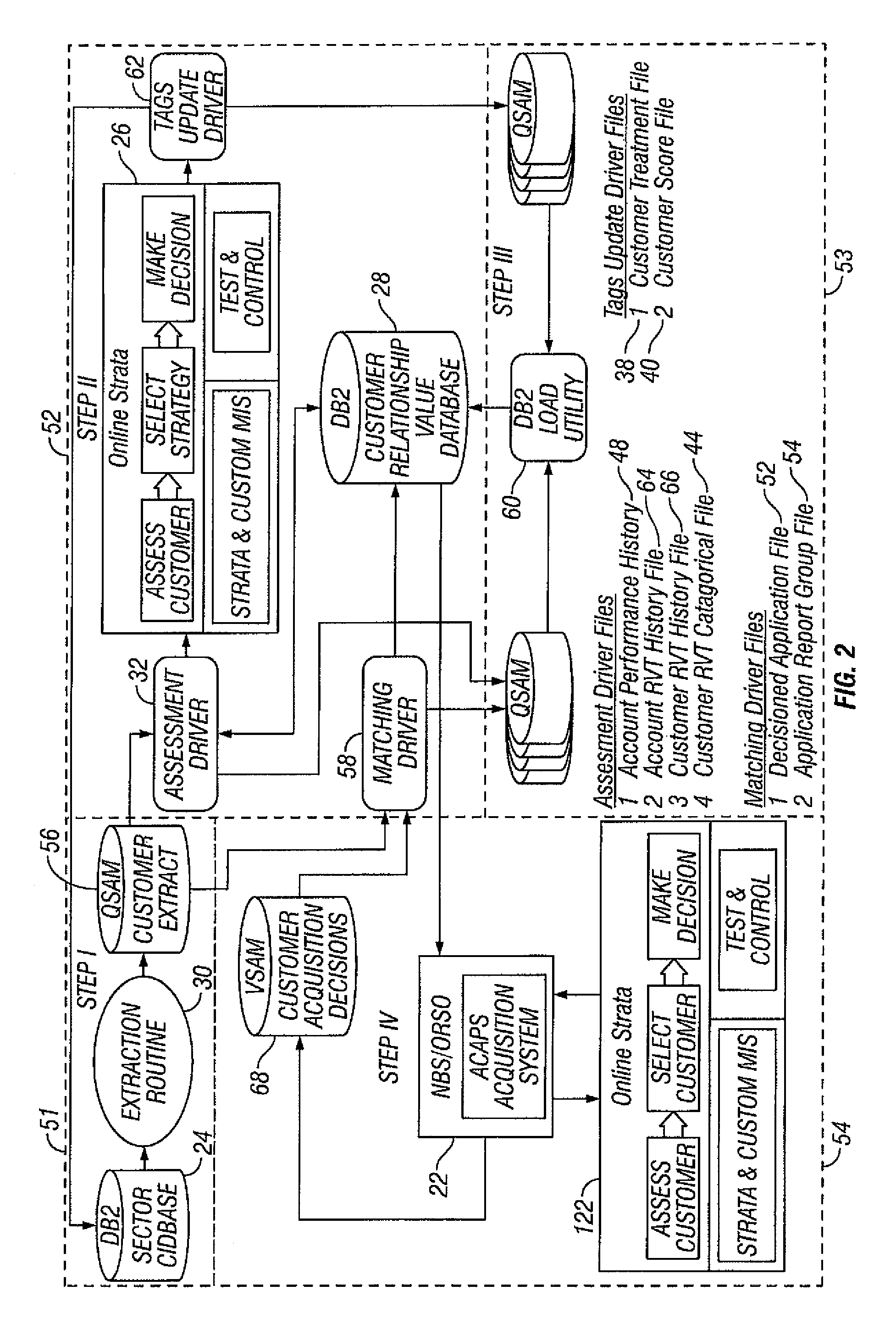

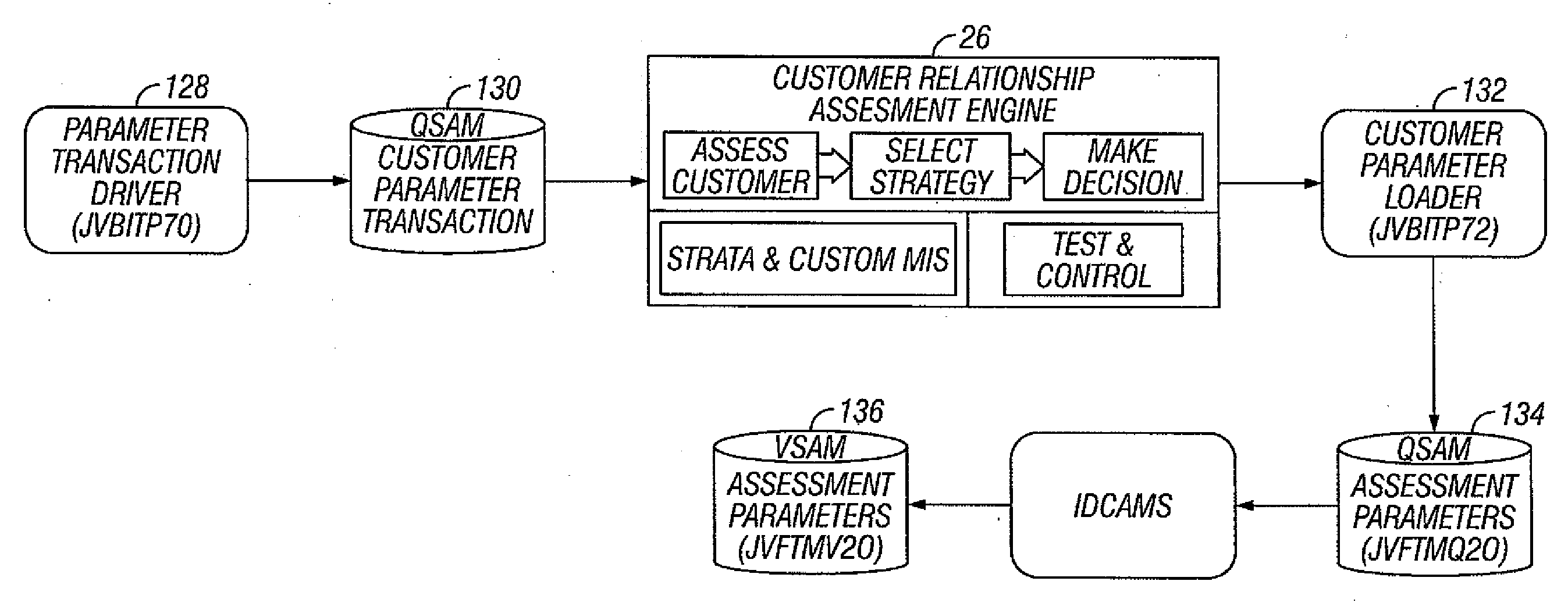

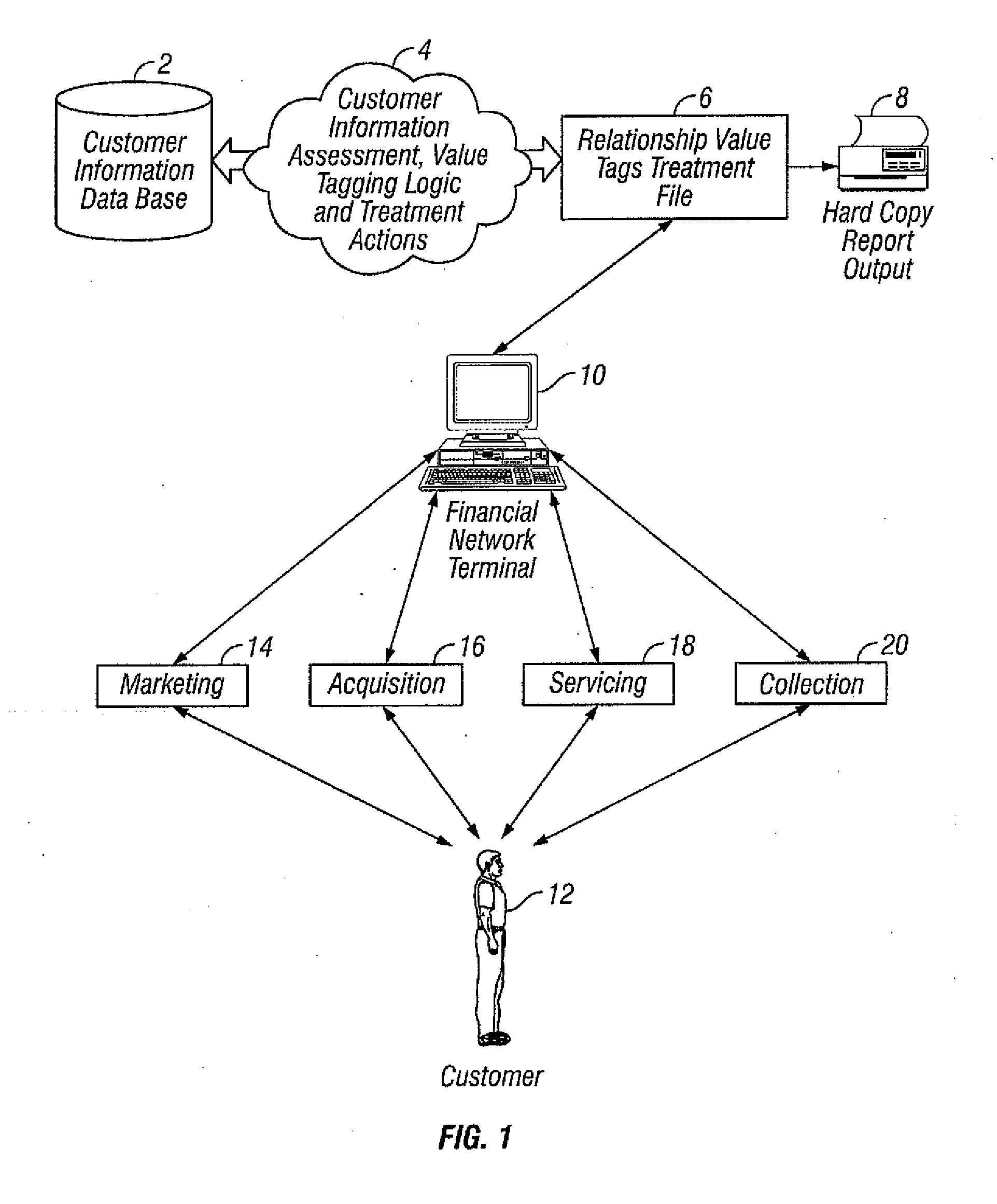

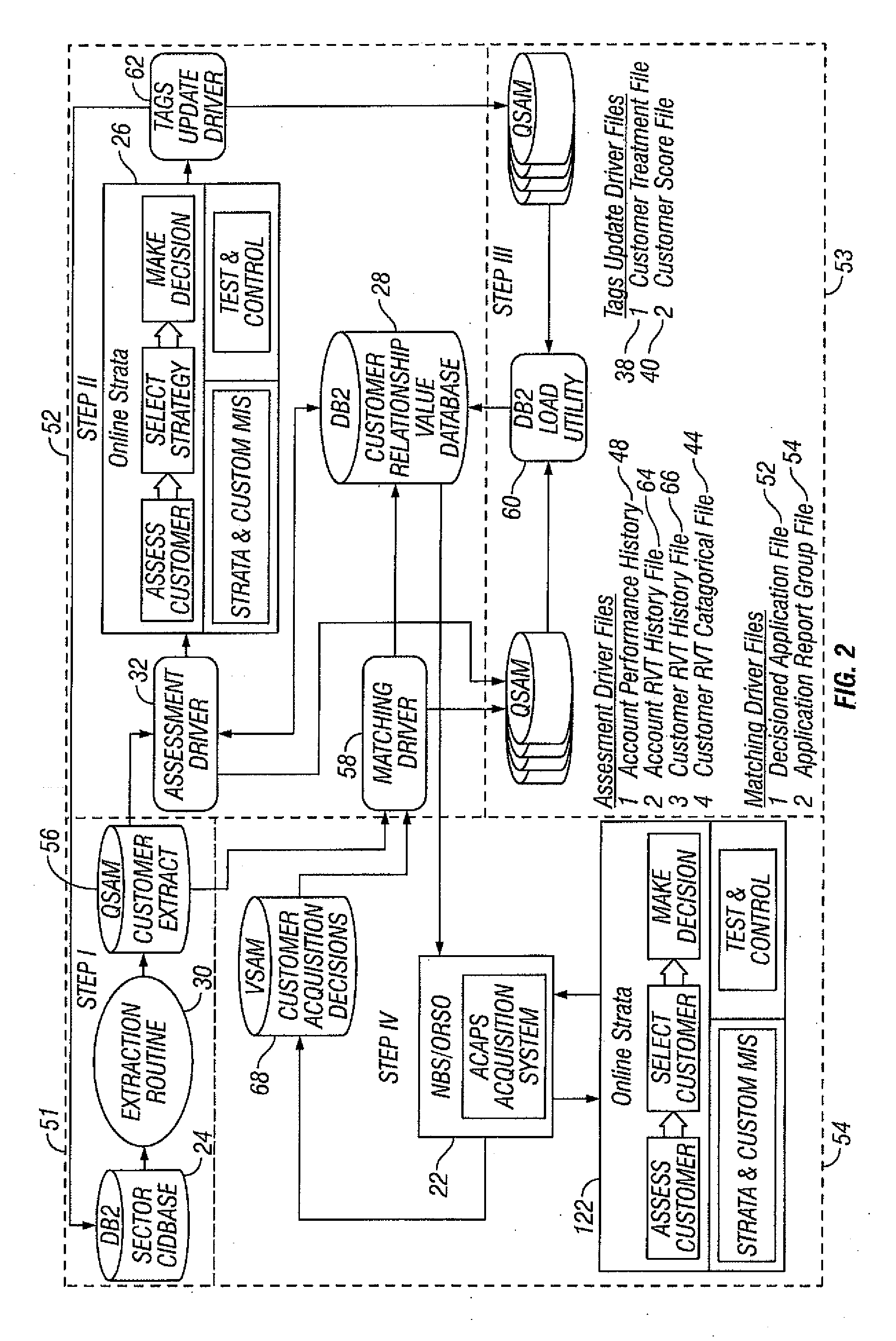

Method and system for evaluating customers of a financial institution using customer relationship value tags

InactiveUS7376603B1Improve understandingMaximize revenue and profitMarket predictionsFinanceCustomer representativeLibrary science

A computerized method and system for evaluating customers of a financial institution using customer relationship value tags and associated customer treatment actions includes automatically analyzing information about a customer from a database of the financial institution by a customer assessment engine using a predefined statistical model to assess the value of the customer to the financial institution. At least one customer treatment action associated with the assessed value is identified by the assessment engine, and the assessment engine marks a file associated with the customer with a mark representing the assessed value and the associated customer treatment action. The marked file is then accessed by other financial systems of the financial institution, or by customer representatives of the financial institution, and the associated customer treatment action is implemented by such systems or representatives in dealing with the customer.

Owner:CITIBANK +1

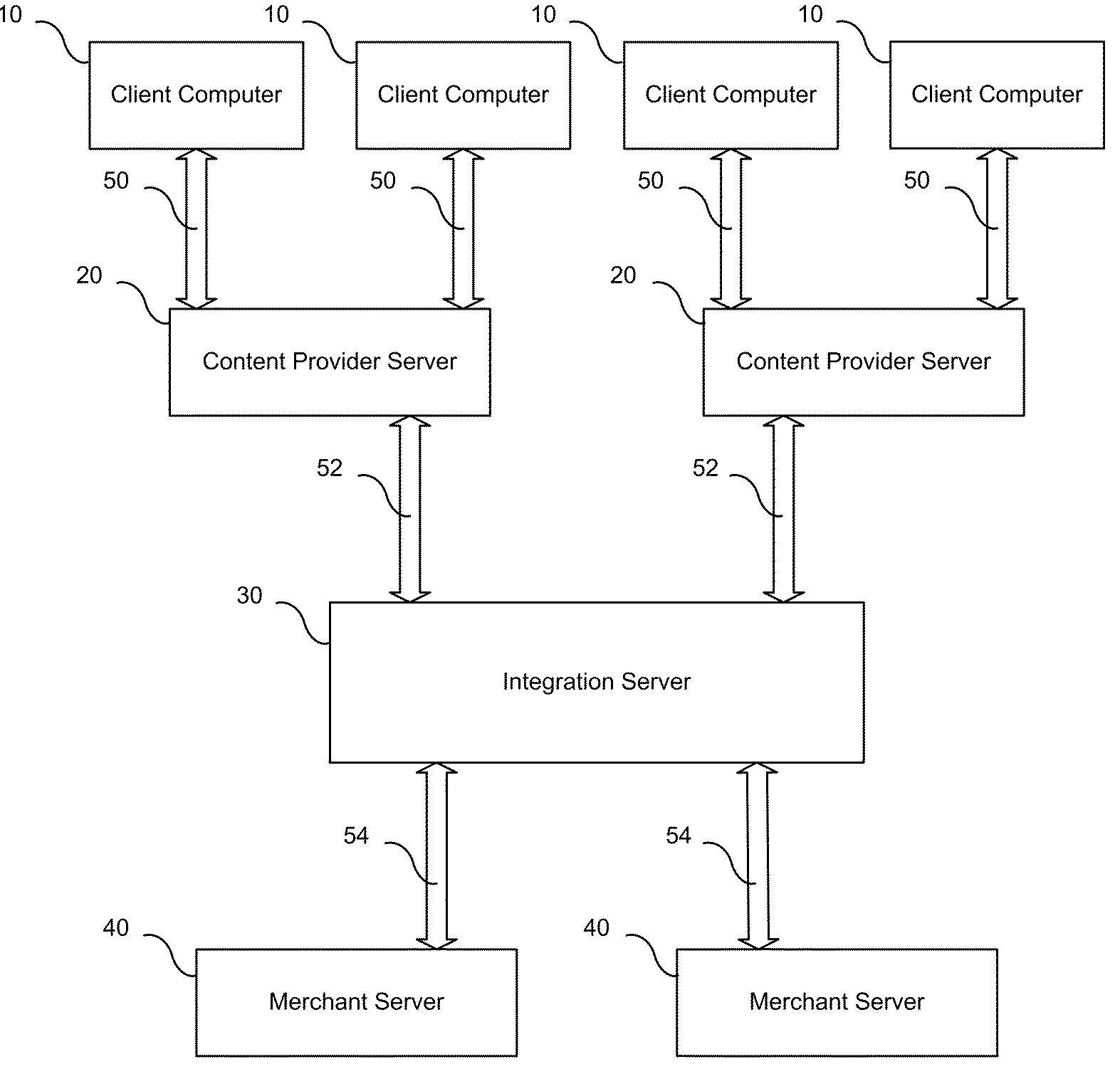

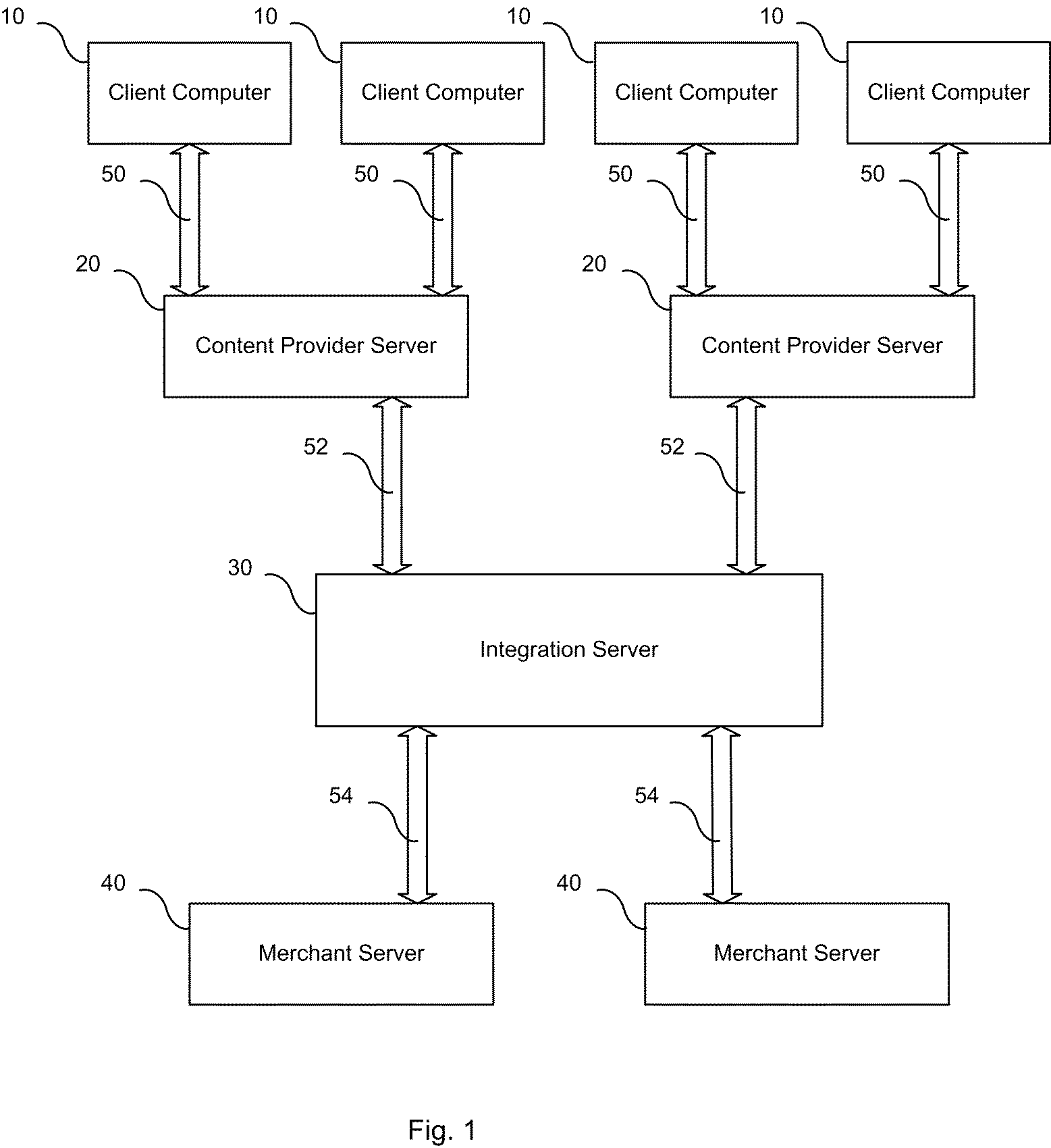

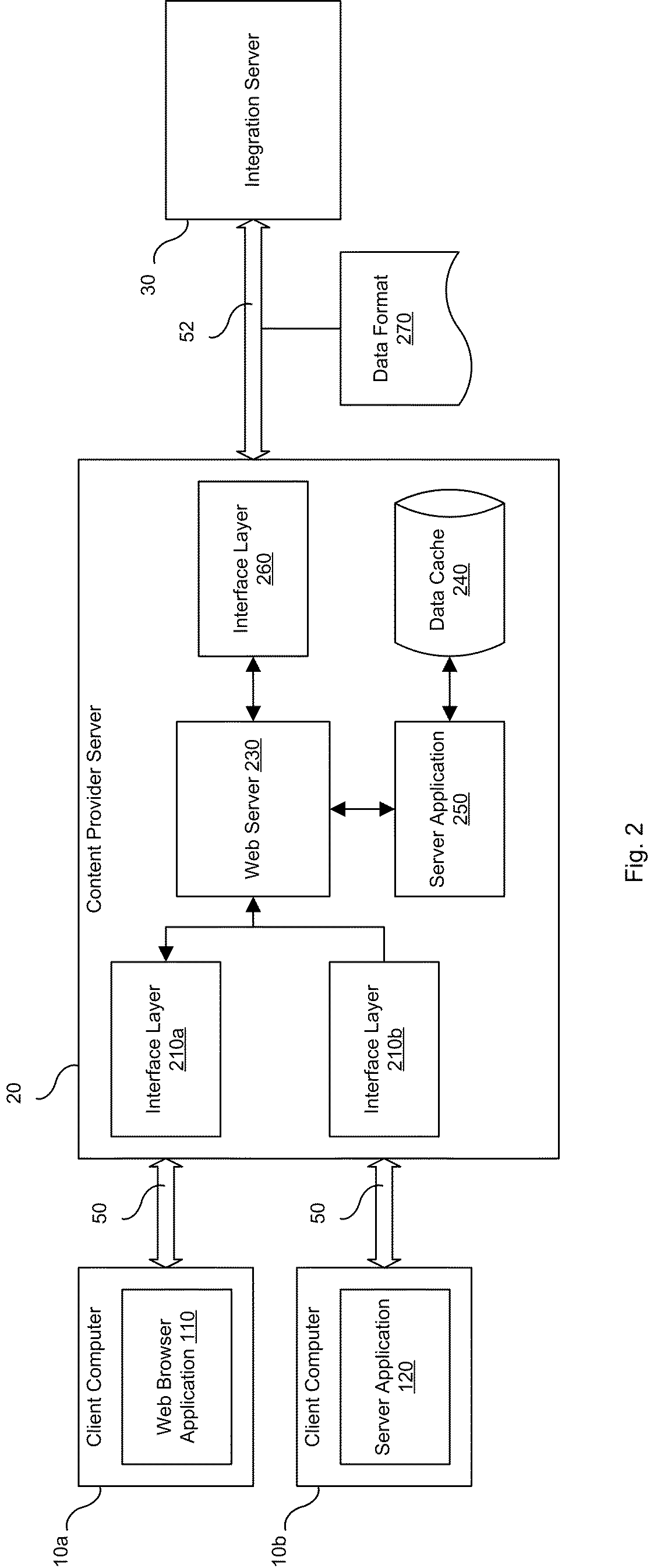

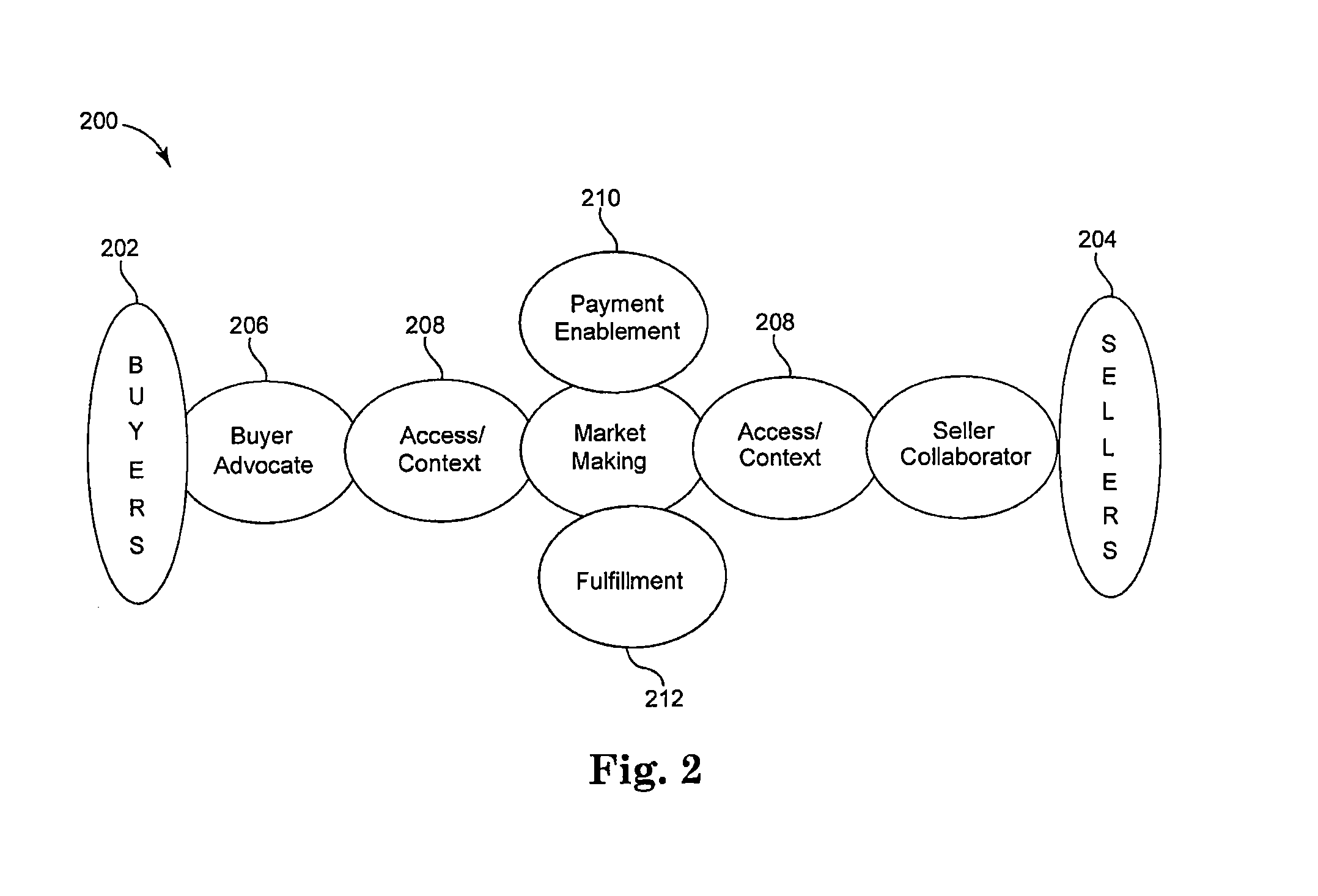

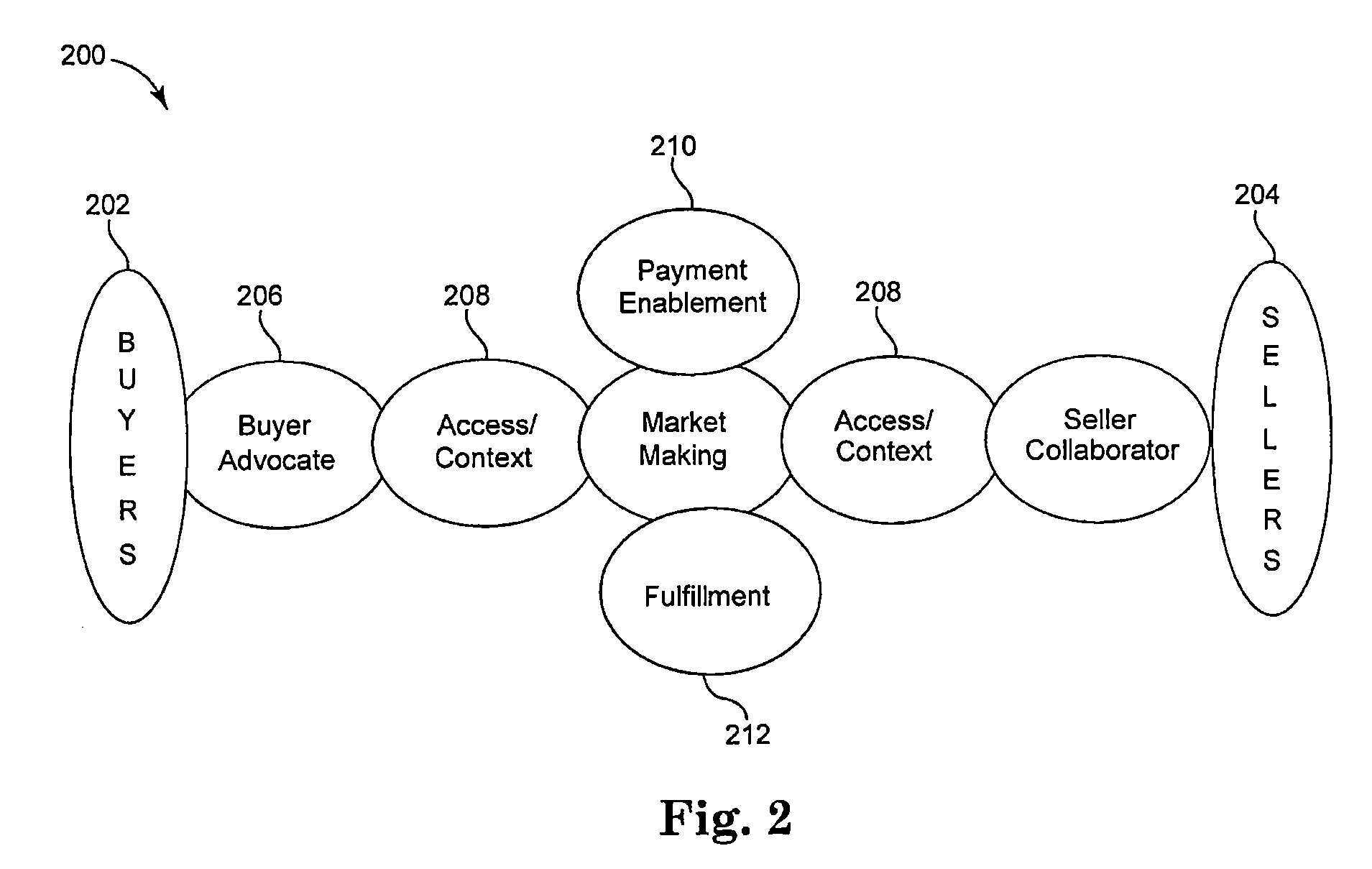

Electronic commerce method and system utilizing integration server

InactiveUS20050102227A1Customer retentionFacilitate and reduce costFinancePayment architectureMerchant servicesE-commerce

An electronic commerce system integrating plurality of content provider servers with plurality of merchant servers having integration server communicating request for commercial transaction to at least one merchant server, thus enabling the user of the client computer connected to the content provider server to initiate commercial transactions to at least one merchant server without being redirected to the merchant server away from the content provider server. The system increases customer retention on the content provider server, thereby increasing incentive for content providers to join the commerce system, thereby increasing the number of sites advertising products offered by merchants. The system also simplifies integration of multitude of servers, thereby reducing cost and time required for such integration.

Owner:SOLONCHEV ALEKSEY

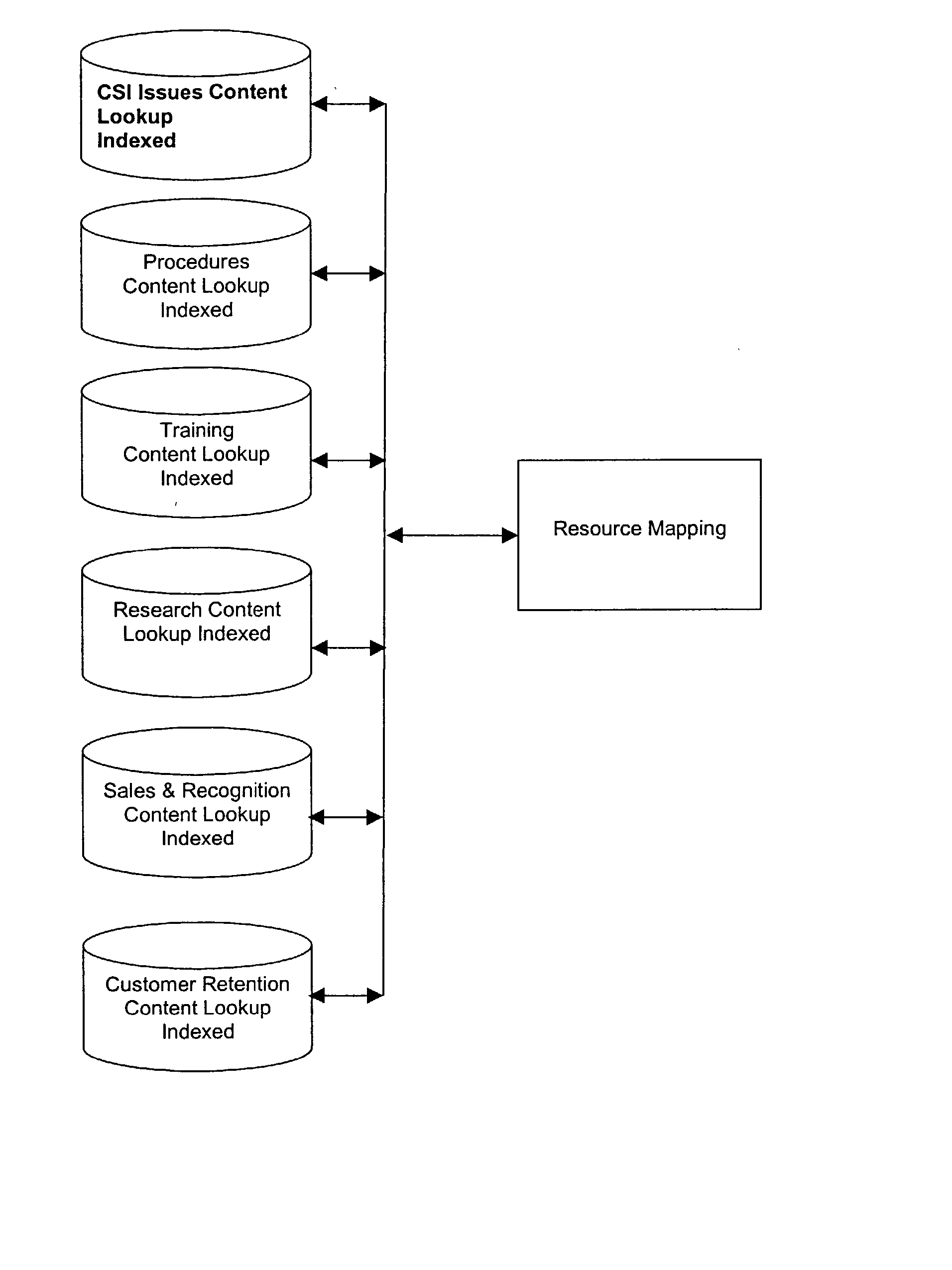

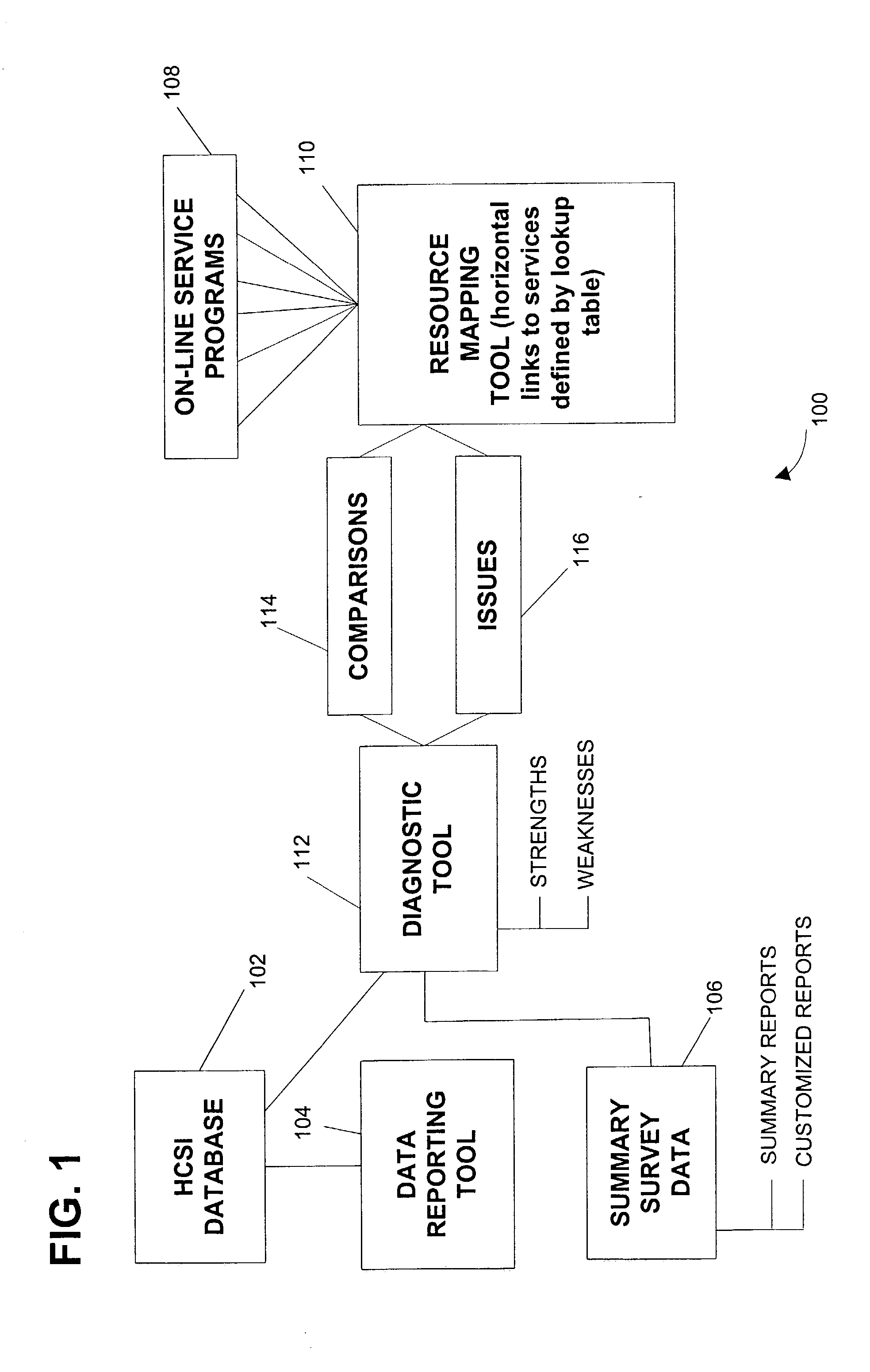

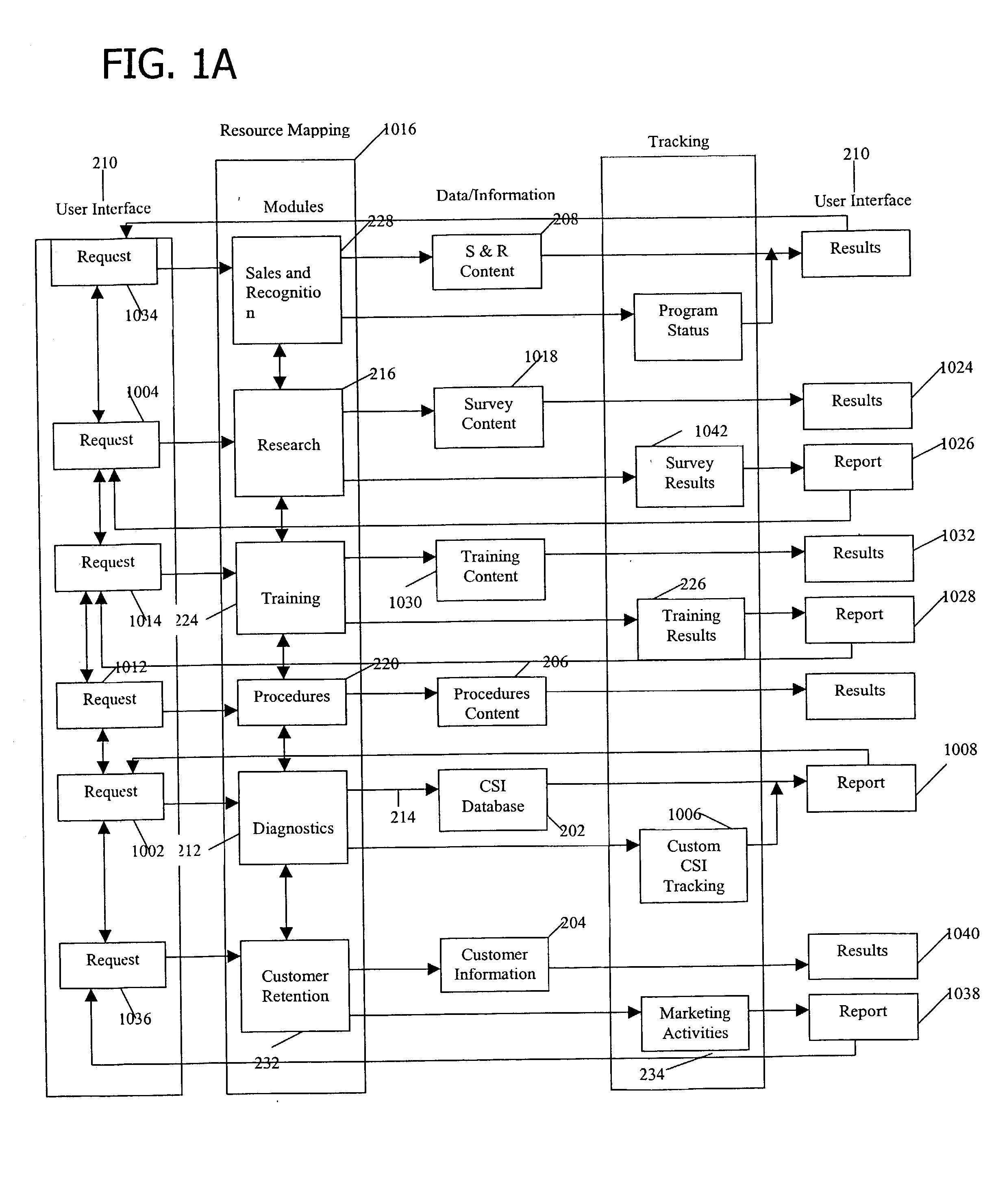

System and method for addressing a performance improvement cycle of a business

InactiveUS20030009373A1Improve customer satisfactionAccurate comparisonMarket predictionsResourcesComputer scienceCustomer retention

A system for evaluating and responding to customer satisfaction index (CSI) data generated by businesses such as automotive dealers and call centers. The system includes a reporting module providing on-line reporting of the CSI data, a diagnostic module for generating comparisons and for identifying issues relating to the CSI data, a research module for conducting on-line research relating to the generated comparisons and identified issues, a procedures module for viewing business procedures relating to the generated comparisons and identified issues, a training module for providing and tracking via on-line and / or off-line training affecting the generated comparisons, the identified issues and / or the procedures, a sales and recognition building module tracking motivation programs, and a customer retention module.

Owner:MARITZ LLC

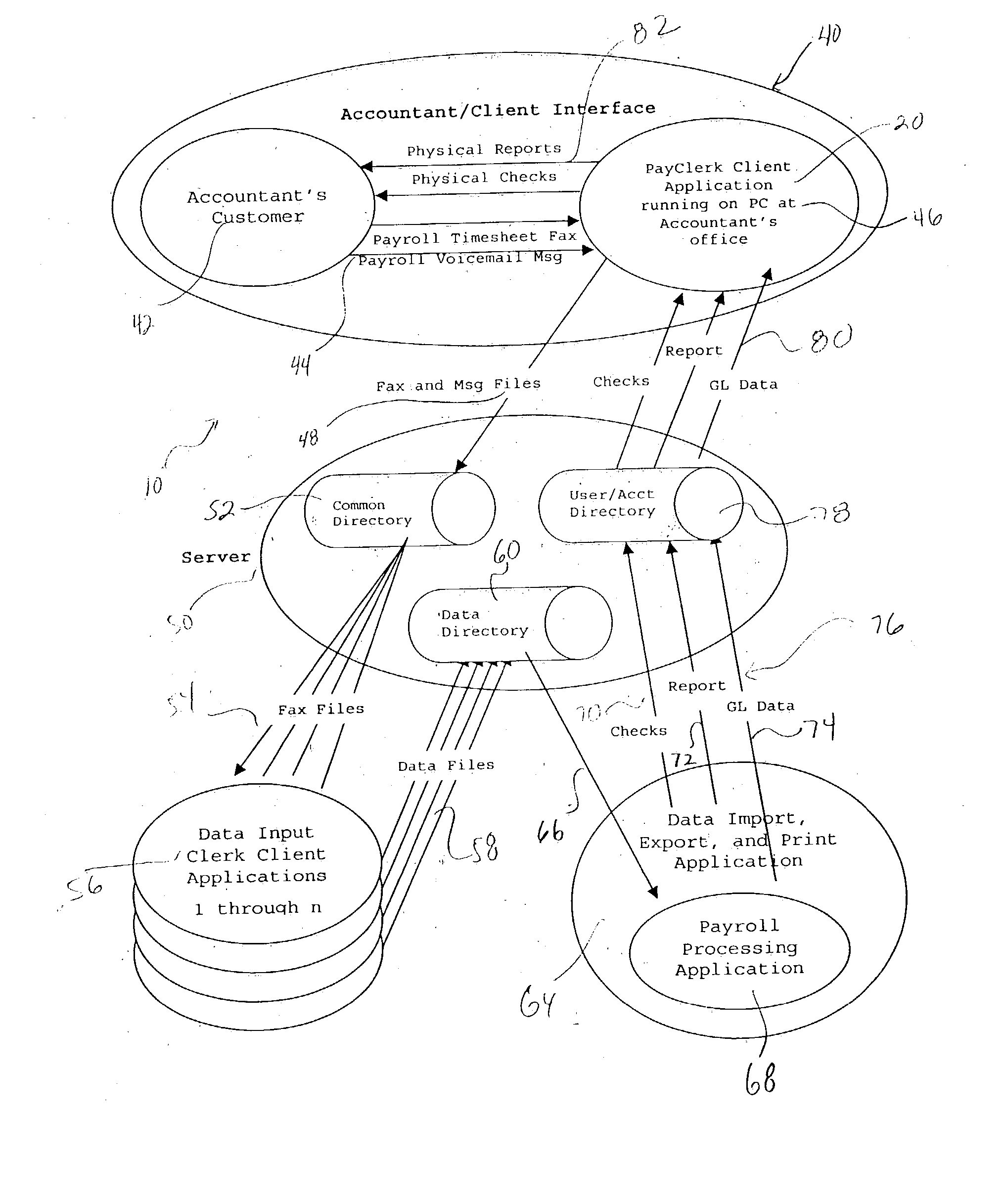

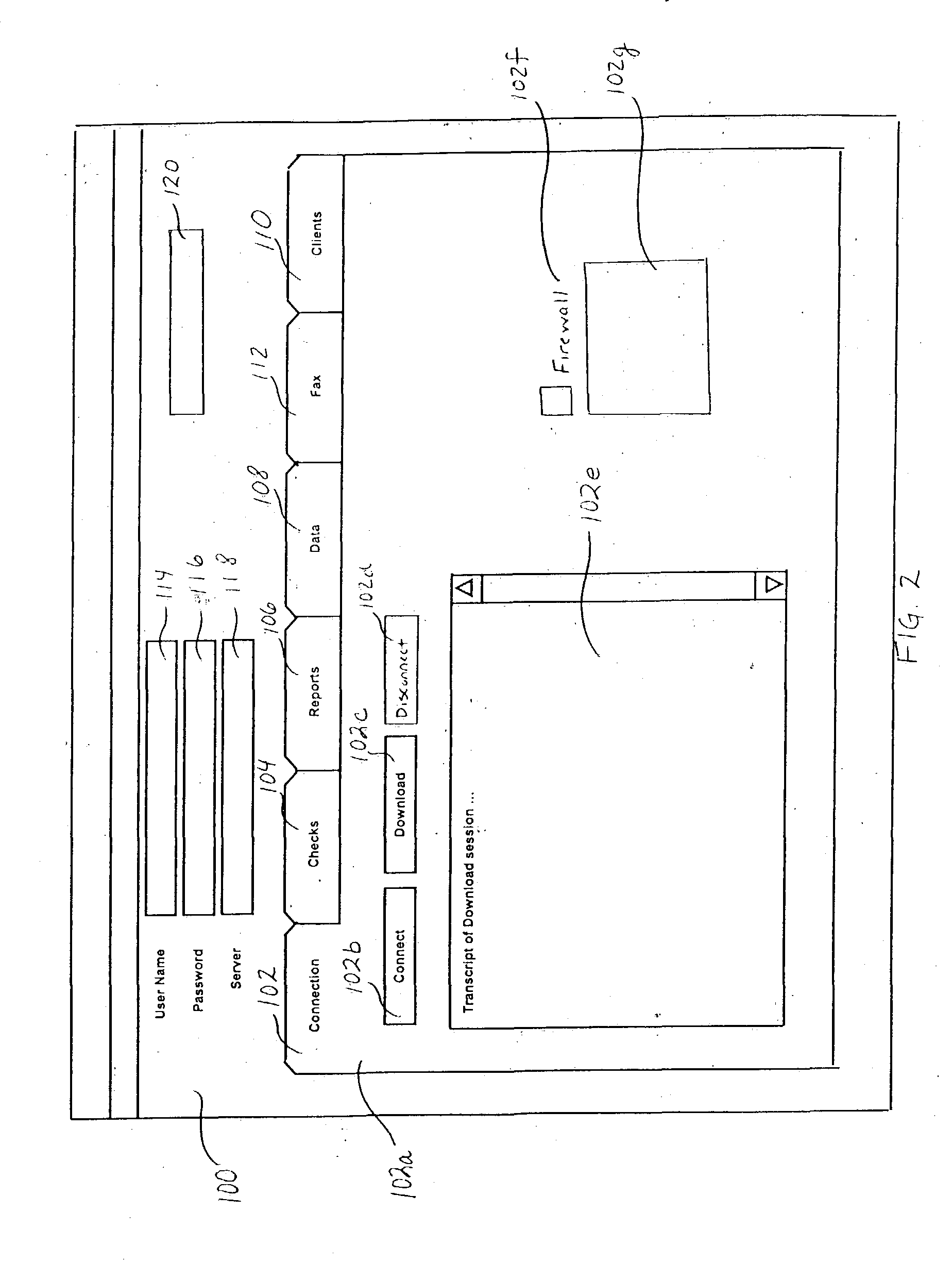

Internet-based back office payroll service and method thereof

InactiveUS20050010501A1Enhance the imageImprove client retentionComplete banking machinesFinanceService provisionComputer science

An internet-based back office payroll service and method thereof that provides an accounting firm or other nonpayroll service provider with the ability to provide its clients with payroll processing services without the associated labor and management overhead by outsourcing such services, yet still retaining the appearance of a direct relationship between the accounting firm and its clients, thereby permitting the accounting firm to retain its “brand” image as the actual payroll processor, enhance its image as a full-service provider, and thus improve client retention.

Owner:WARD LYCURGUS B JR

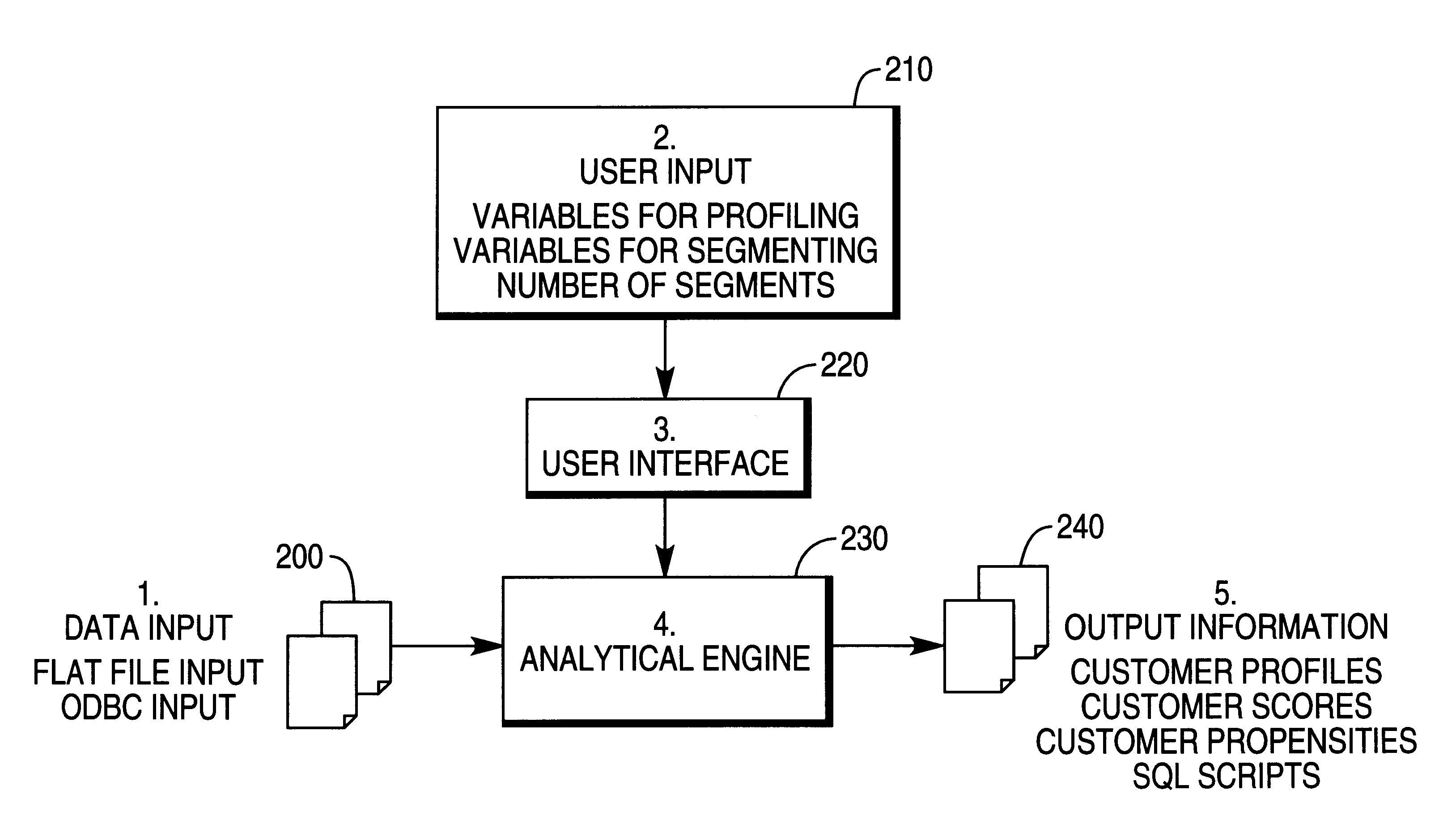

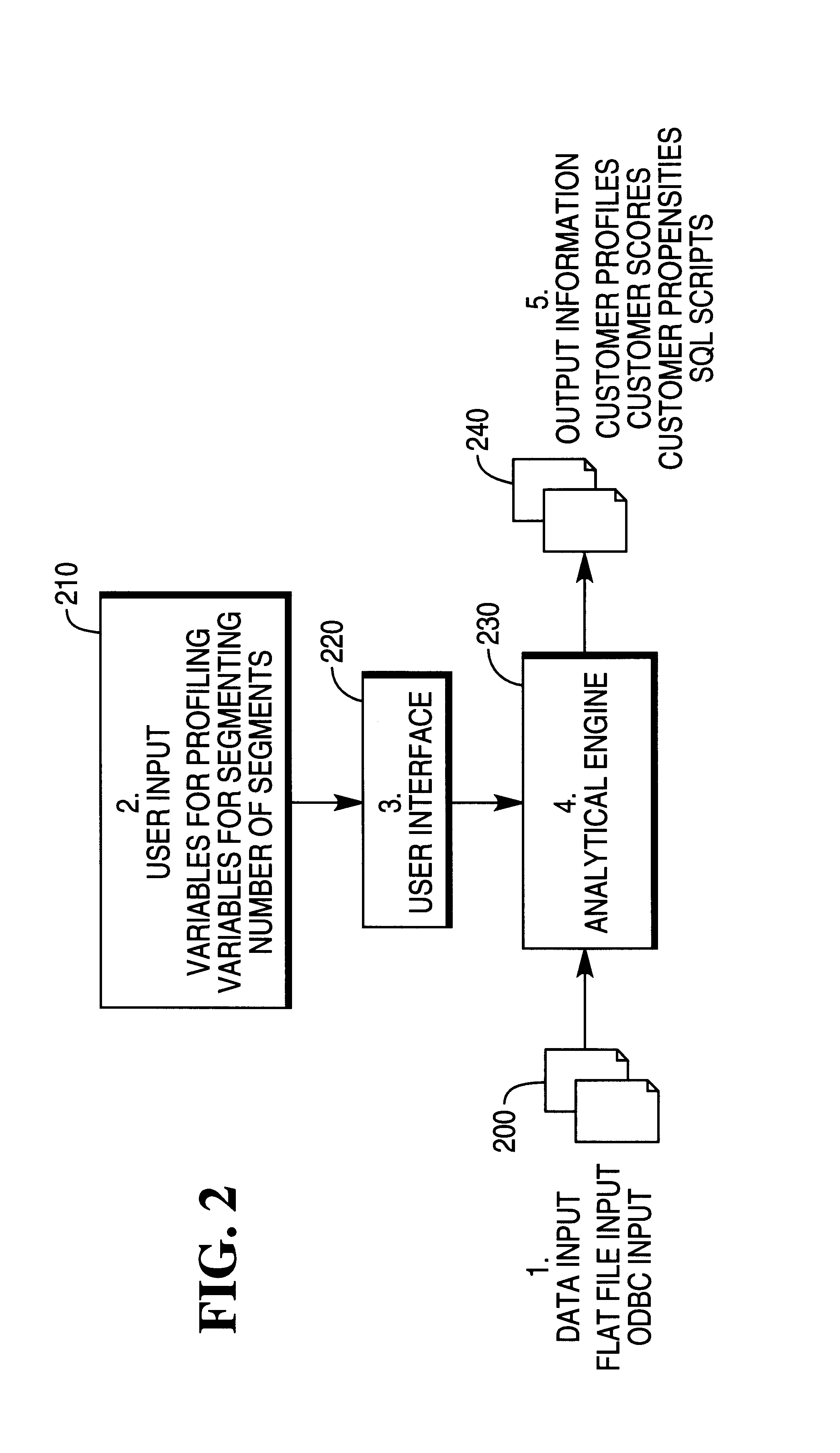

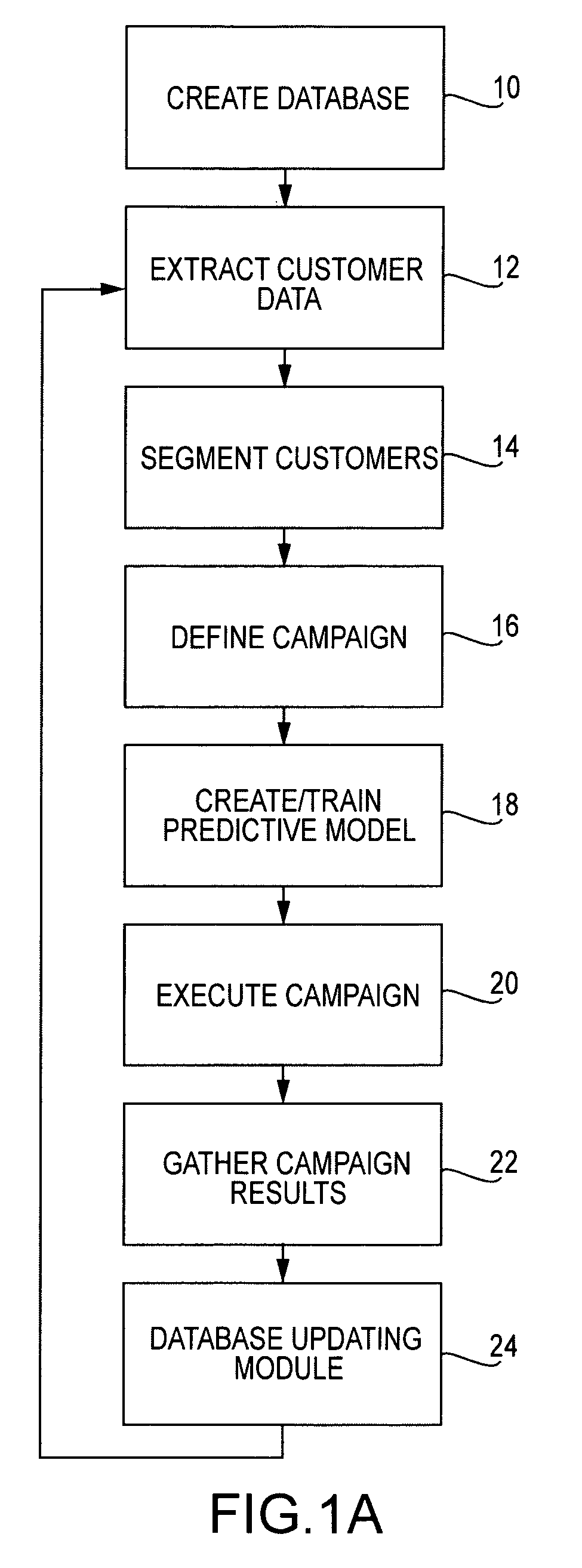

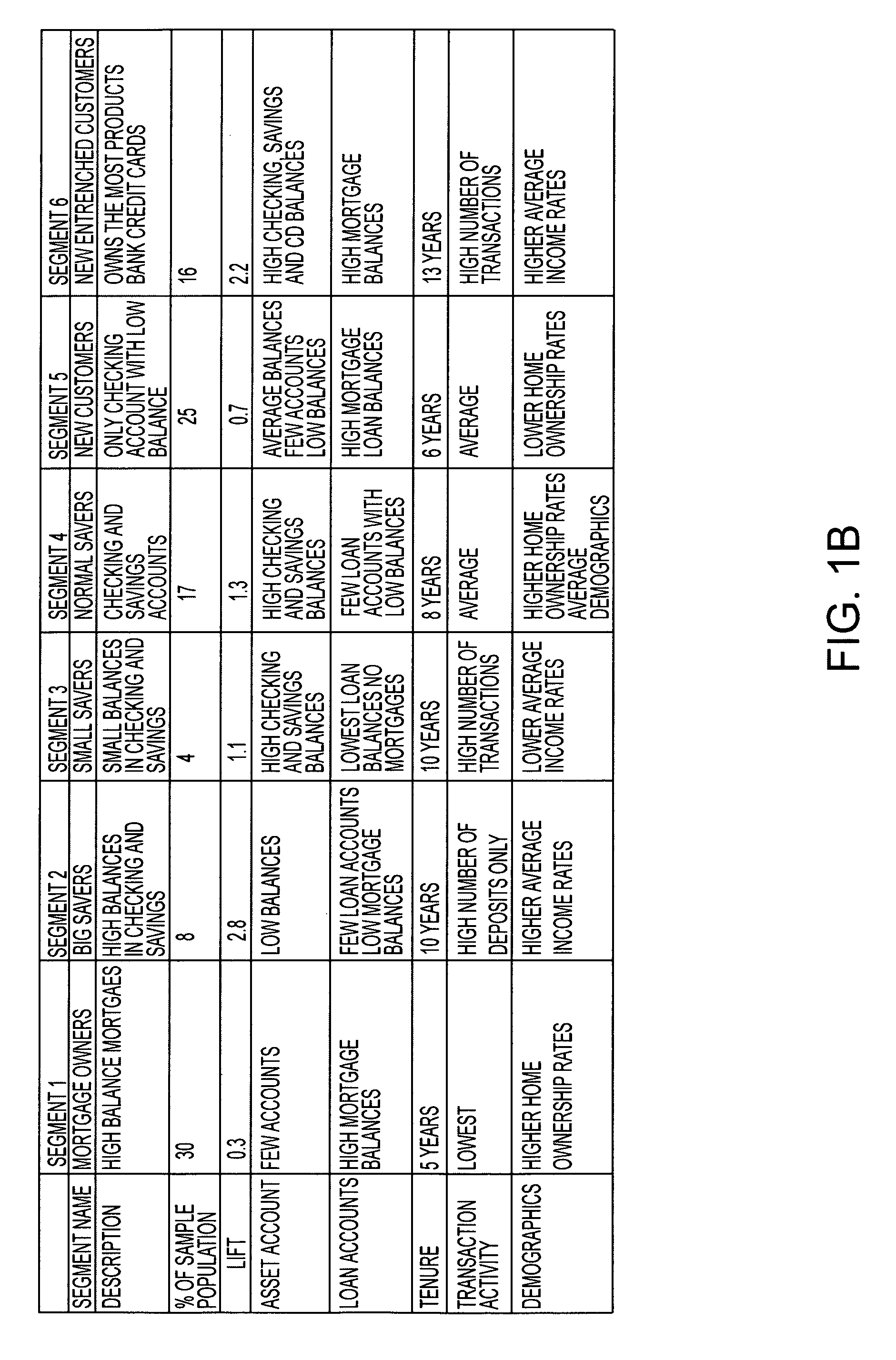

Method for customer segmentation with applications to electronic commerce

The customer segmentation software according to the present invention automatically finds or creates profiles of prototypical customers in a large e-commerce database. The software matches all existing customer data in the database to one or more of the prototypical customers. The resulting customer segmentation is an effective summarization of the database and is useful for a range of business applications. Applications of the customer segmentation system include the development of customized web sites, the creation of targeted promotional offers and the prediction of consumer behavior.

Owner:TERADATA US

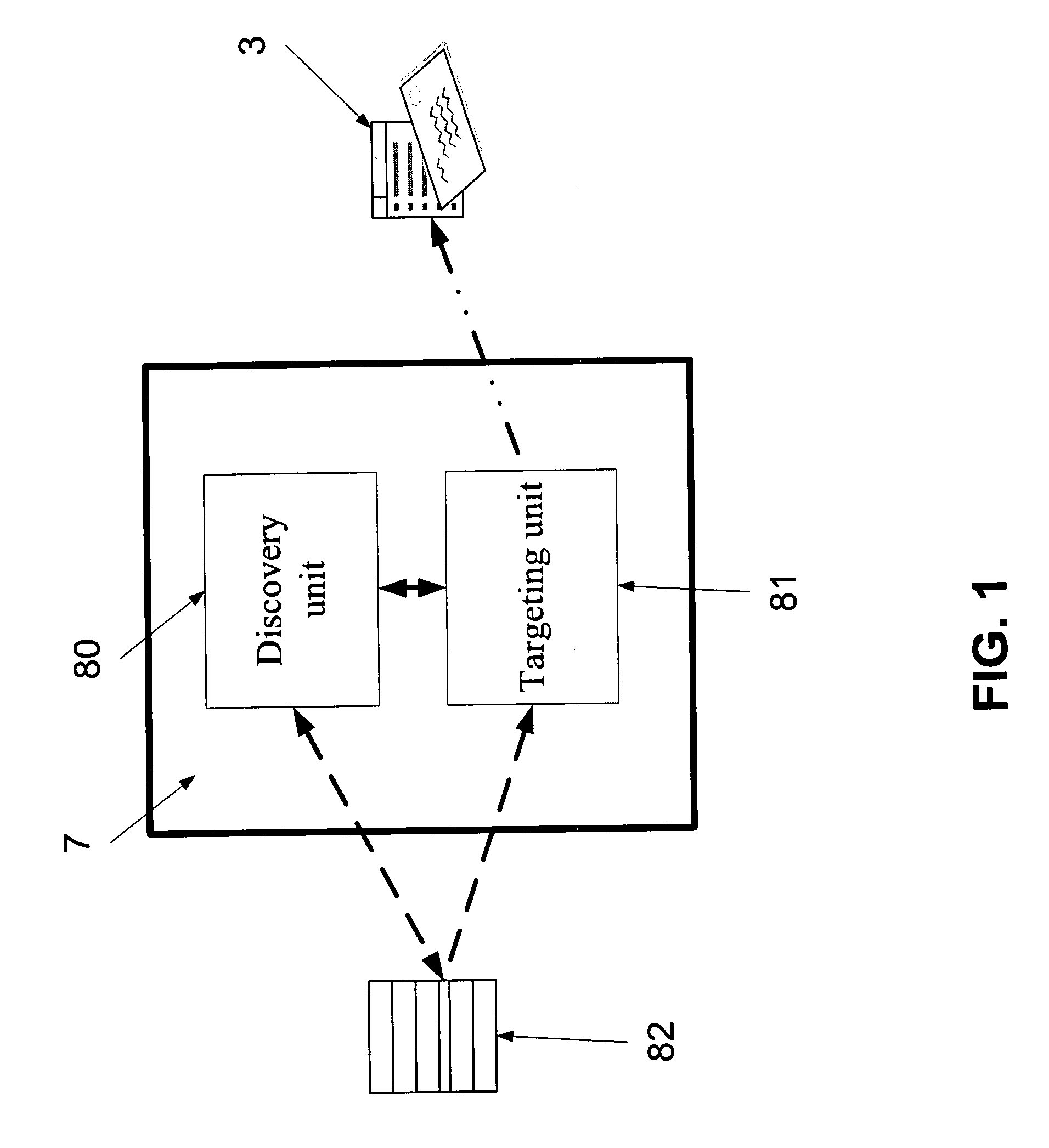

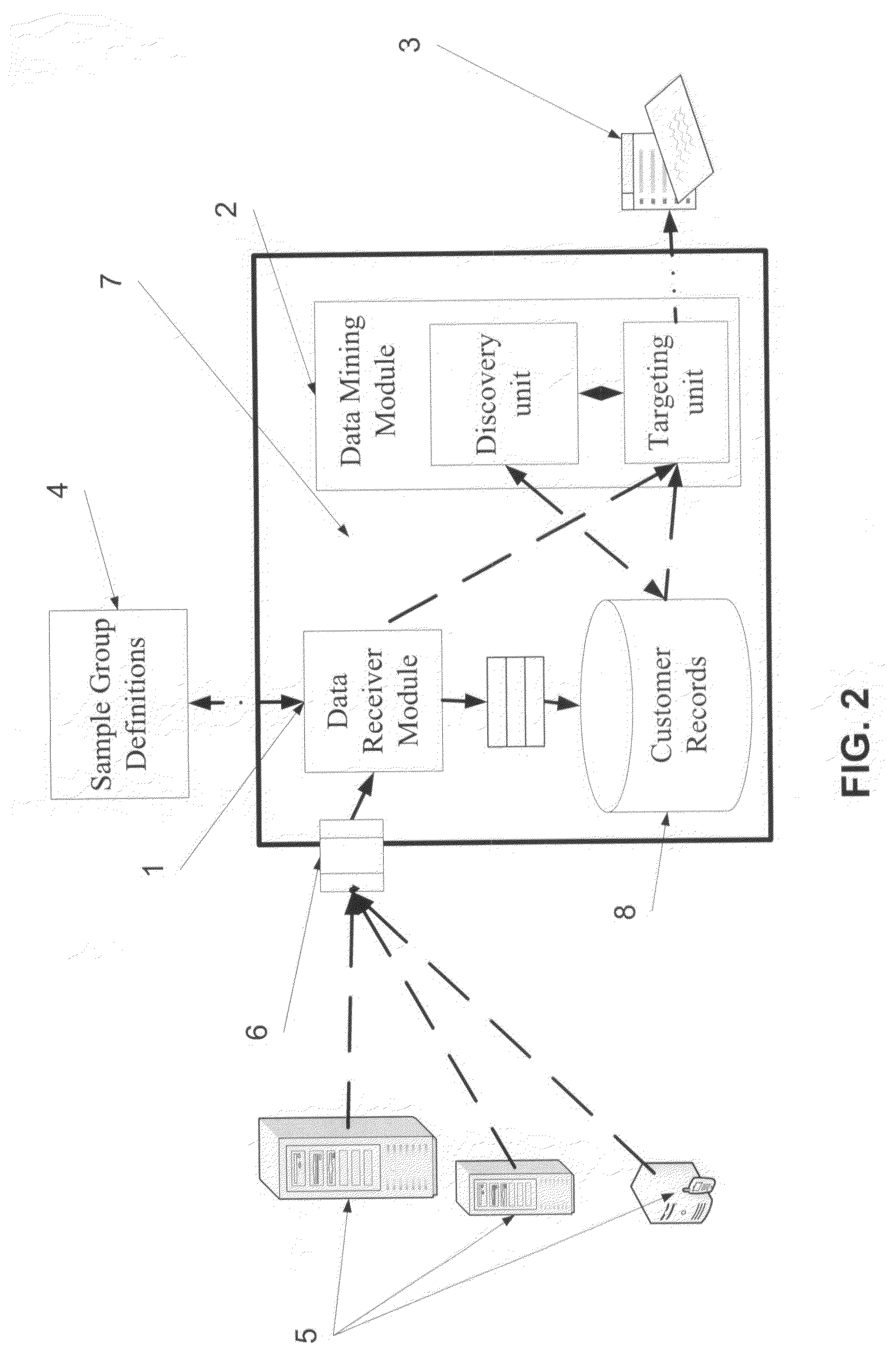

Customer Discovery and Identification System and Method

Owner:MASSIVE IMPACT INT

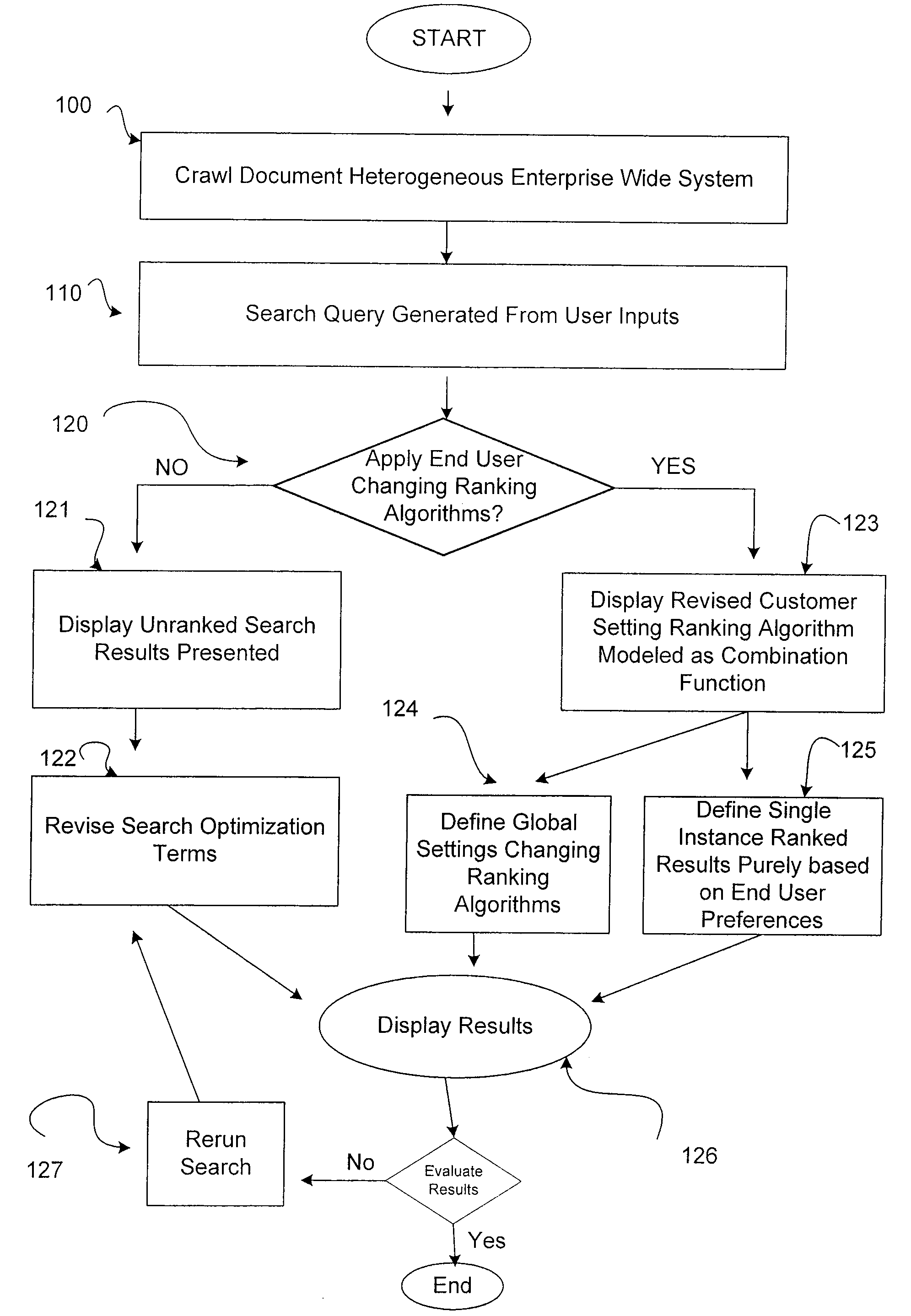

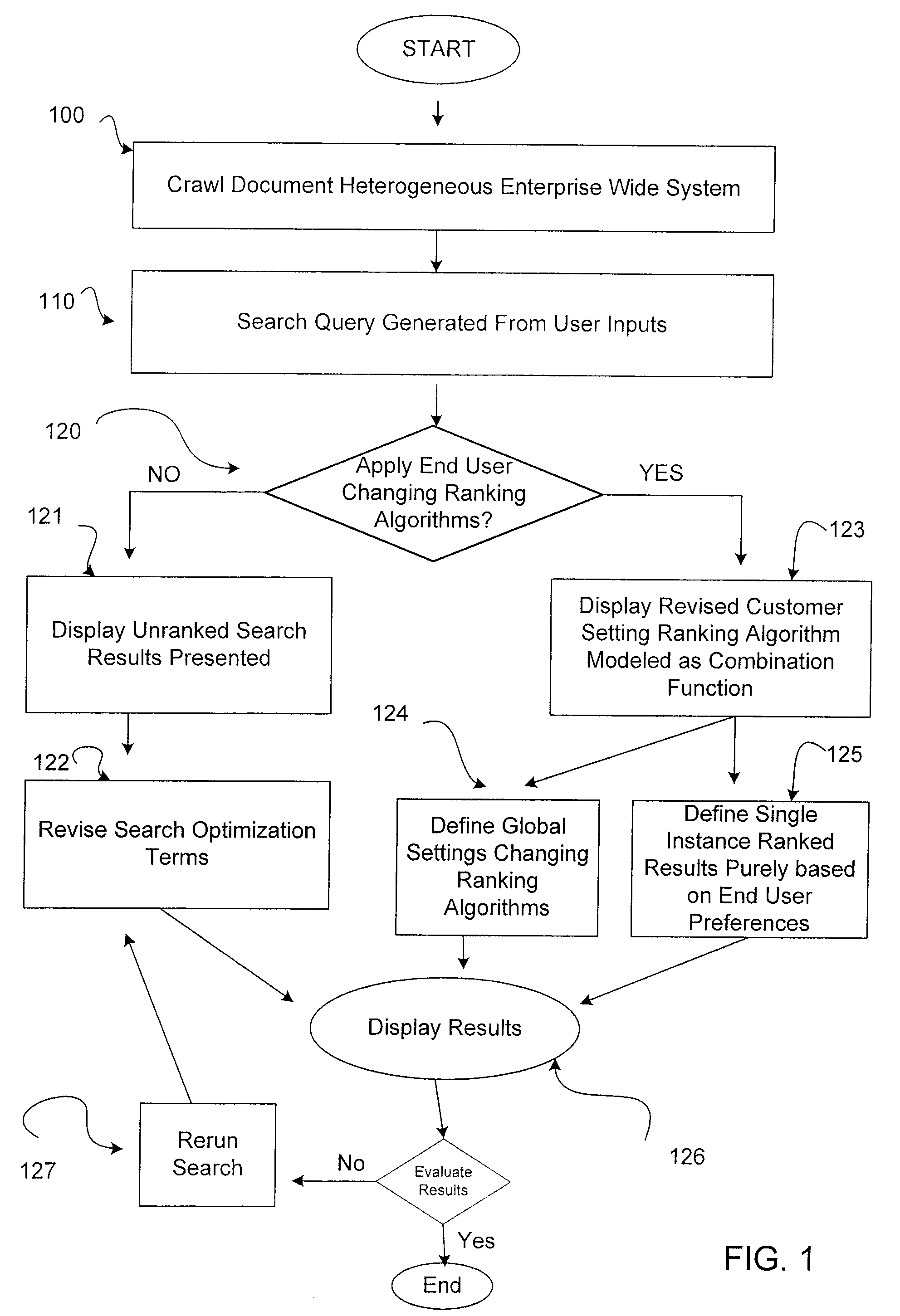

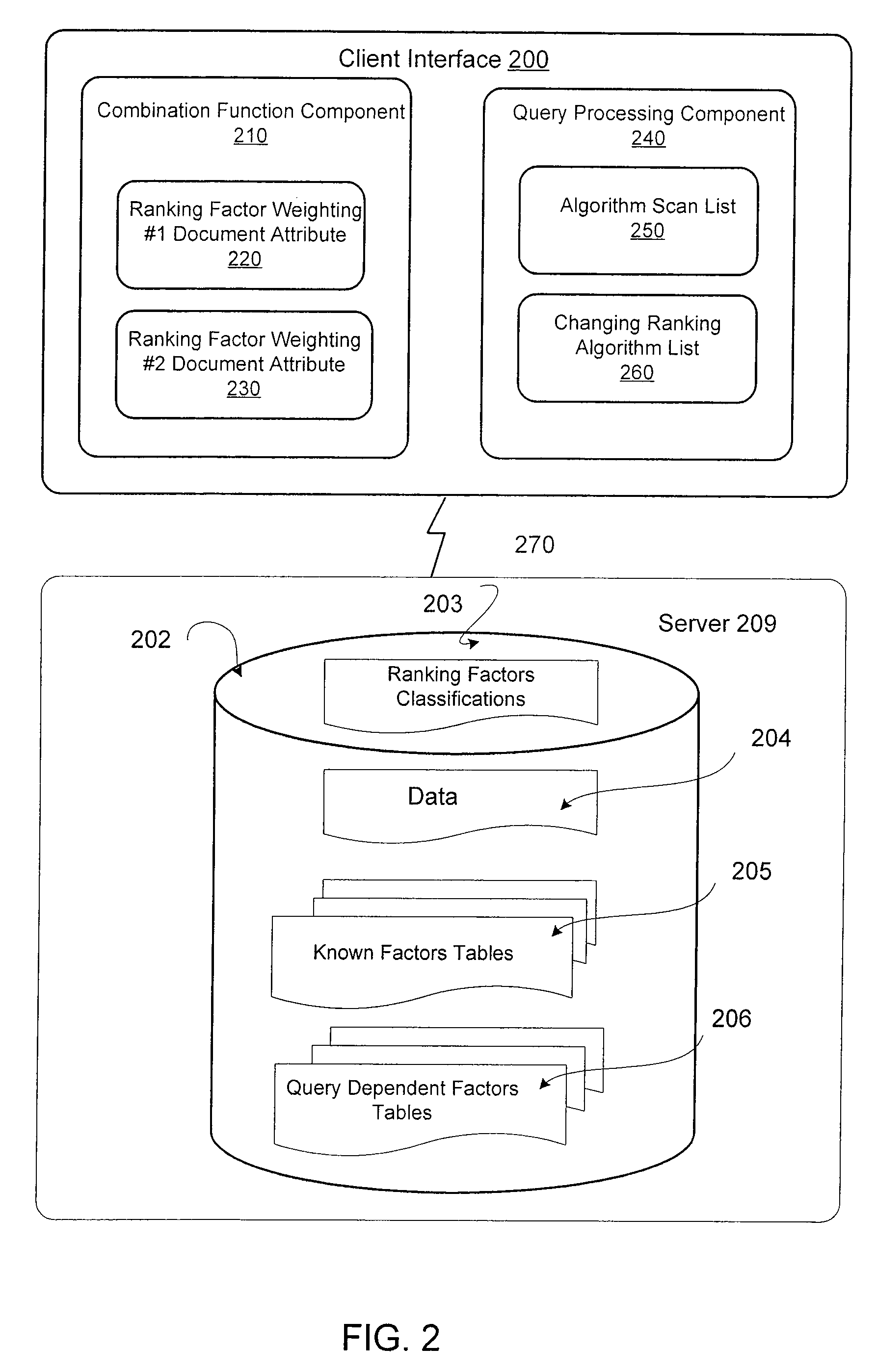

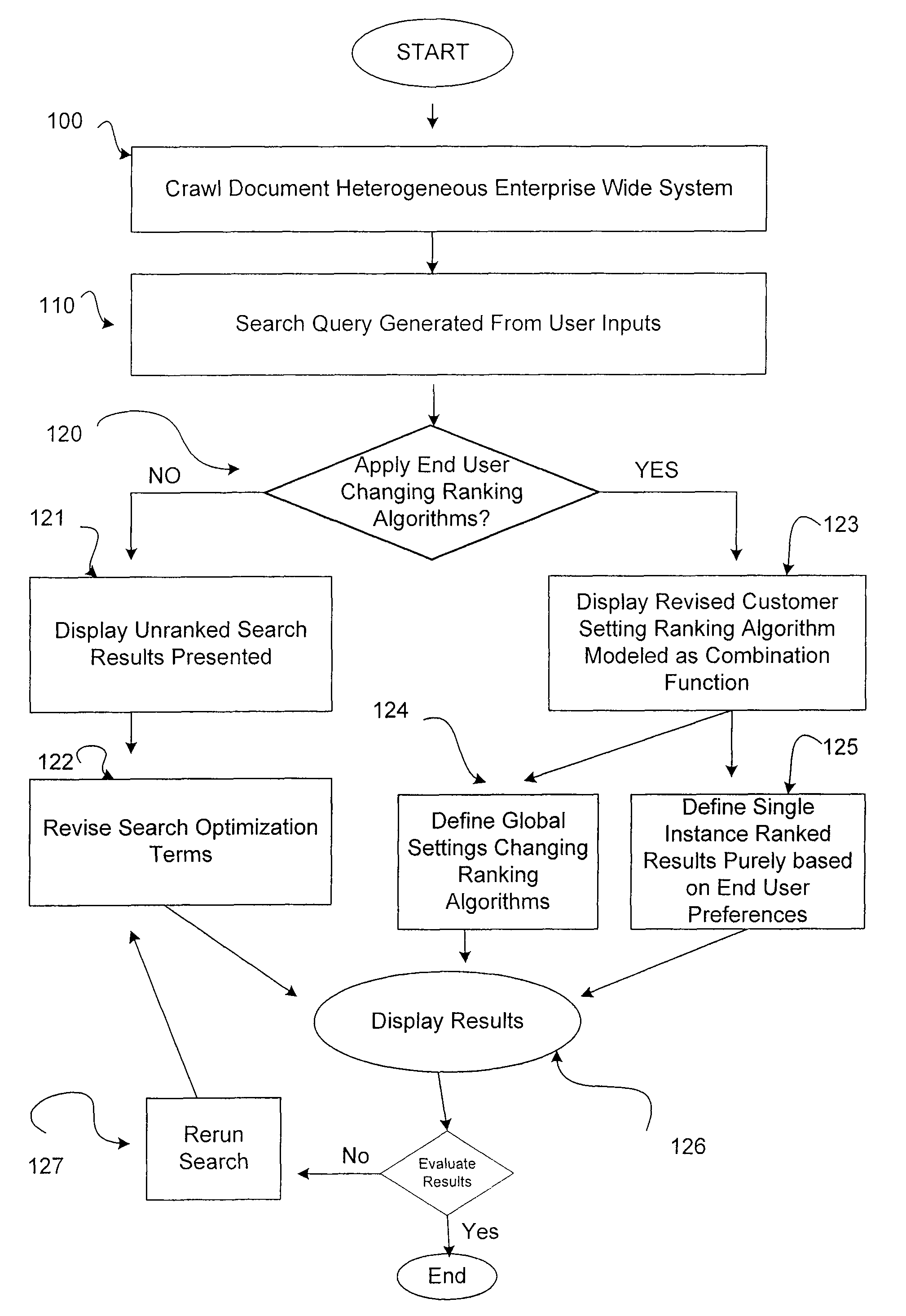

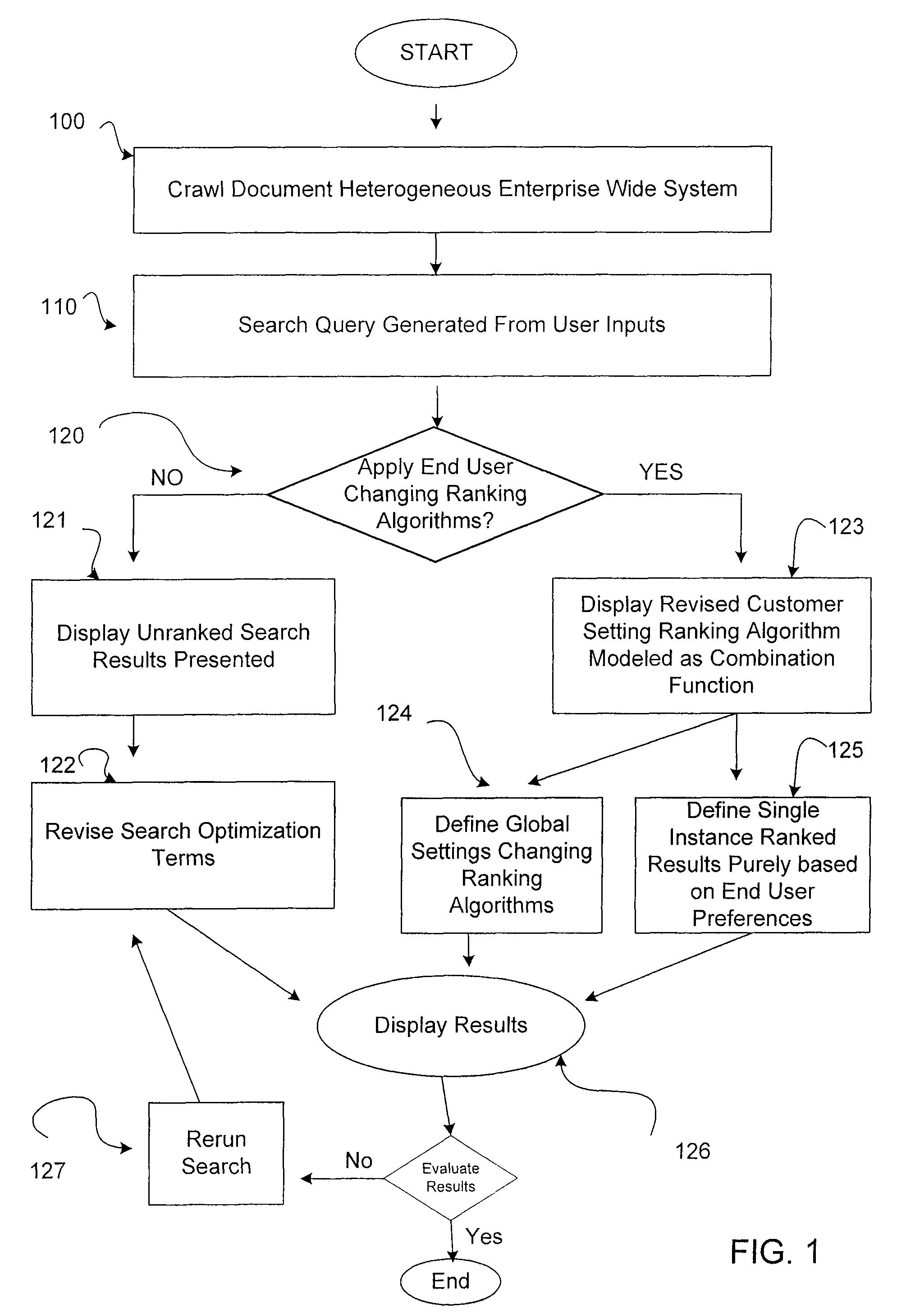

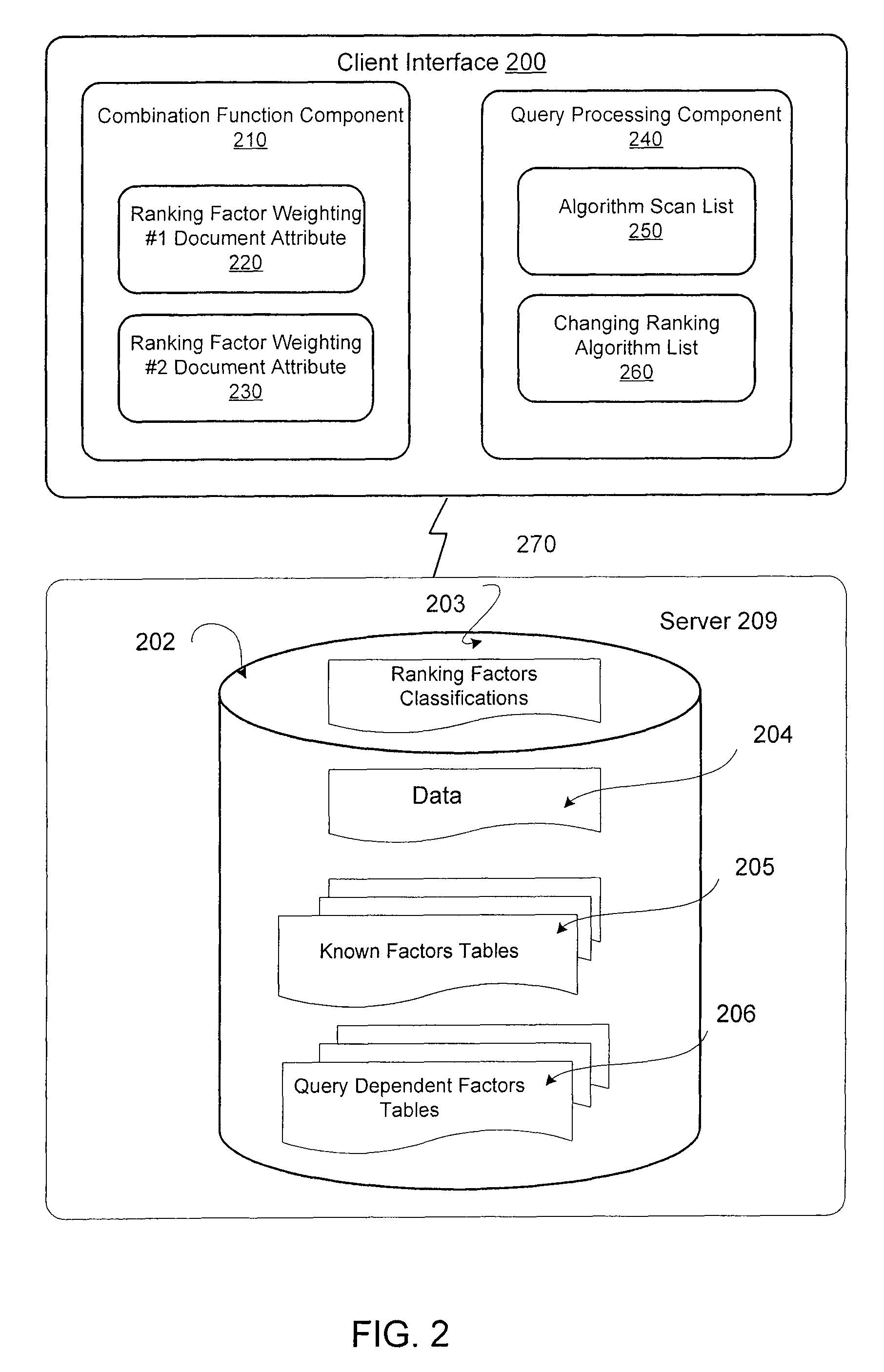

Changing ranking algorithms based on customer settings

ActiveUS20090006356A1Digital data information retrievalDigital data processing detailsPersonalizationAttribute weight

Search term ranking algorithms can be generated and updated based on customer settings, such as where a ranking algorithm is modeled as a combination function of different ranking factors. An end user of a search system provides personalized preferences for weighted attributes, generally or for a single instance of the query. The user also can indicate the relative importance of one or more ranking factors by specifying different weights to the factors. Ranking factors can specify document attributes, such as document title, document body, document page rank, etc. Based on the attribute weights and the received user query, a ranking algorithm function will produce the relevant value for each document corresponding to the user preferences and personalization configurations.

Owner:ORACLE INT CORP

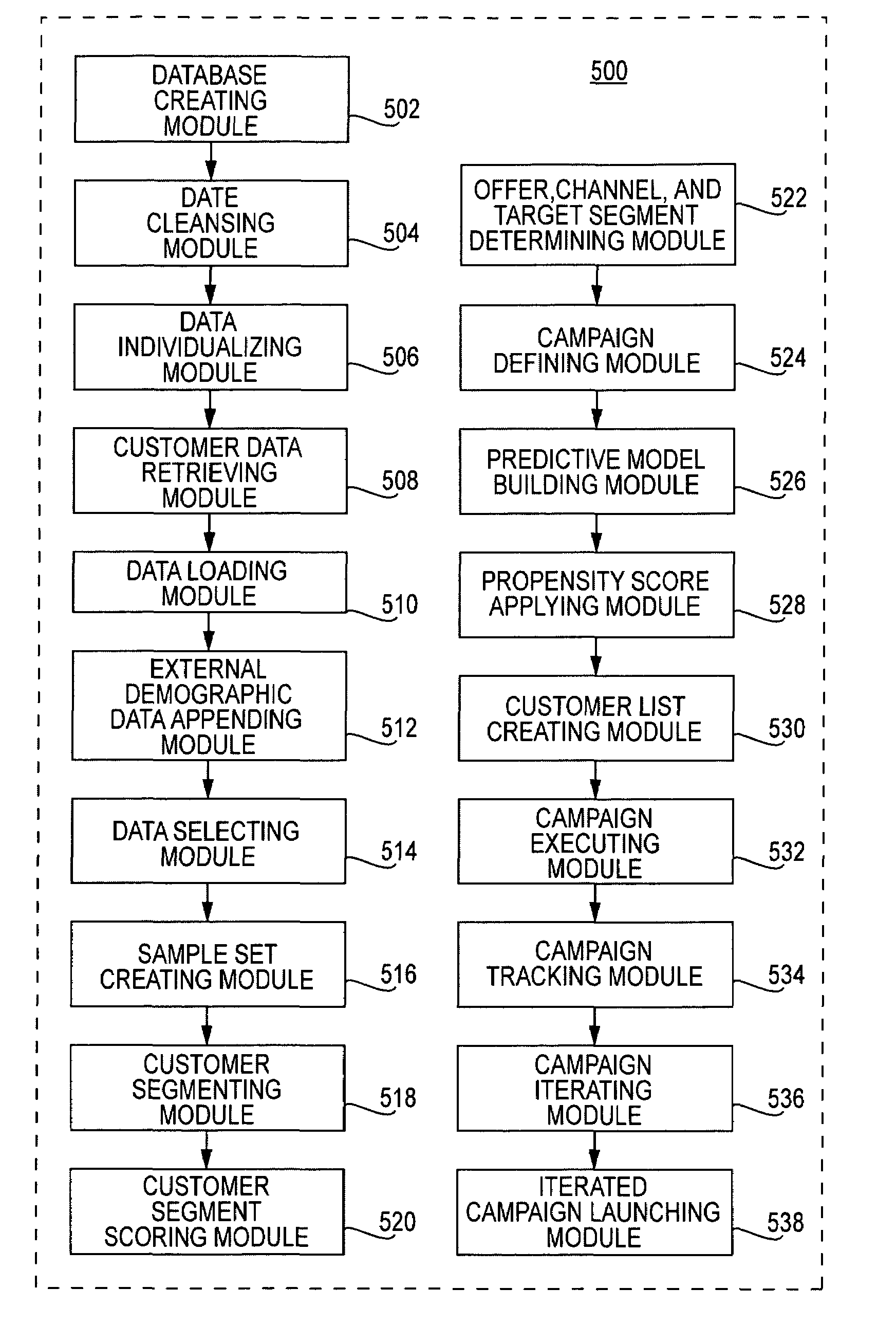

Building analytical models with standardized virtual flat files

A system and method for creating virtual flat customer records derived from database customer data that may be used as standardized input for analytical models. A Customer Analytic Record (“CAR”) application may be created as a database object to extract, transform, and format all of the customer data needed for customer segmentation and predictive modeling. The CAR may be a set of database views that are defined using virtual stored queries The CAR application may dynamically calculate additional variables using predetermined transformations, including custom transformations of an underlying behavior. The CAR is preferably a dynamic view of the customer record that changes whenever any update is made to the database. The definition of the CAR provides documentation of each data element available for use in models and analytics.

Owner:ACCENTURE GLOBAL SERVICES LTD

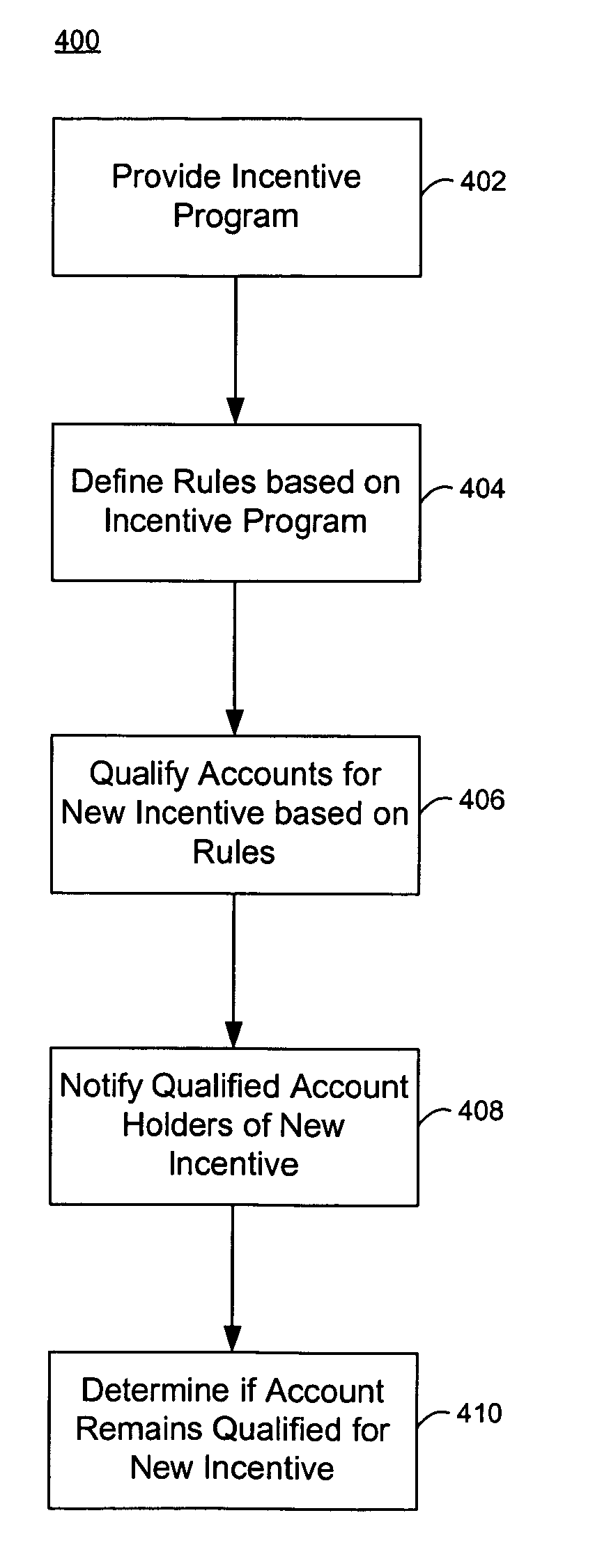

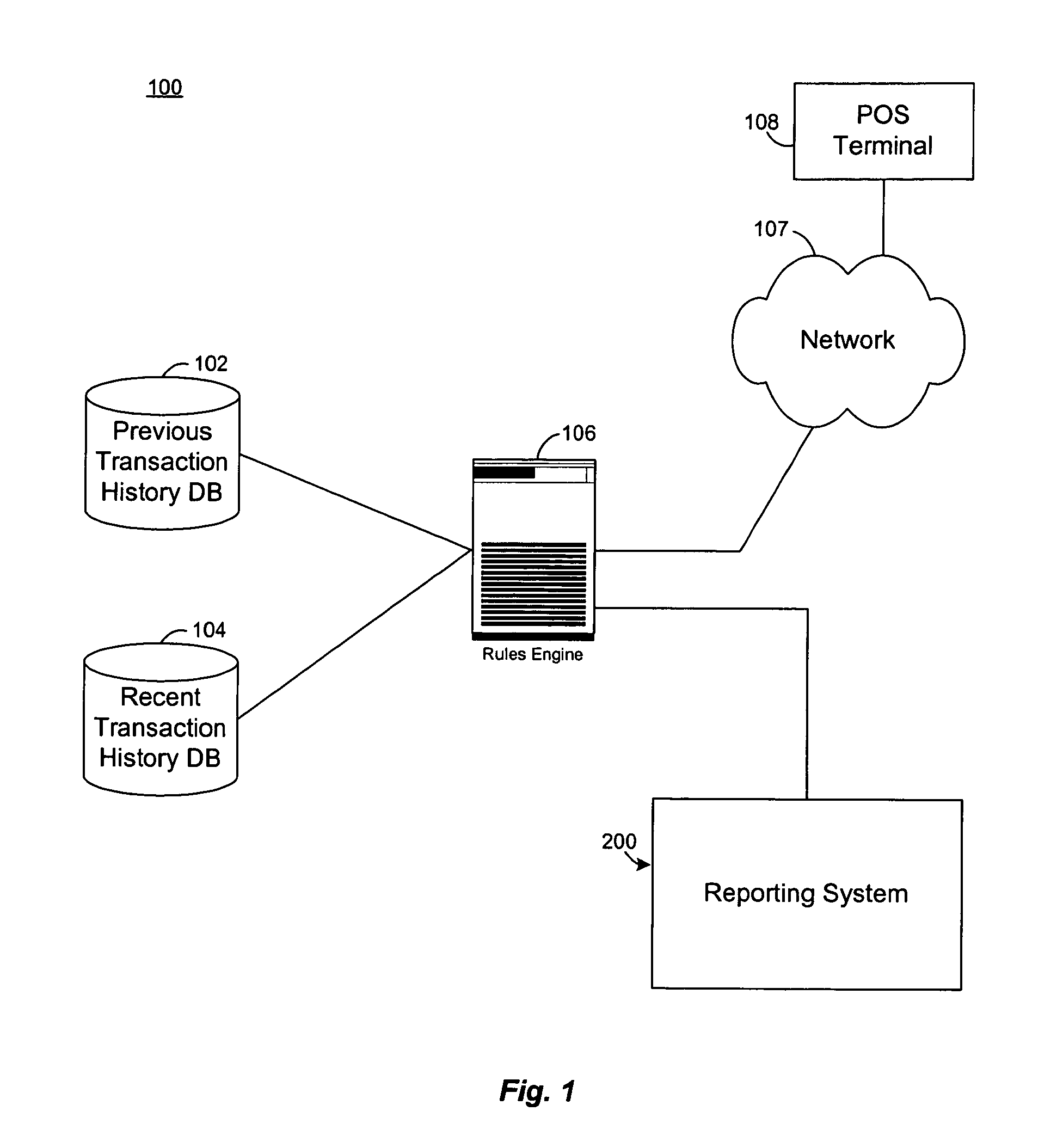

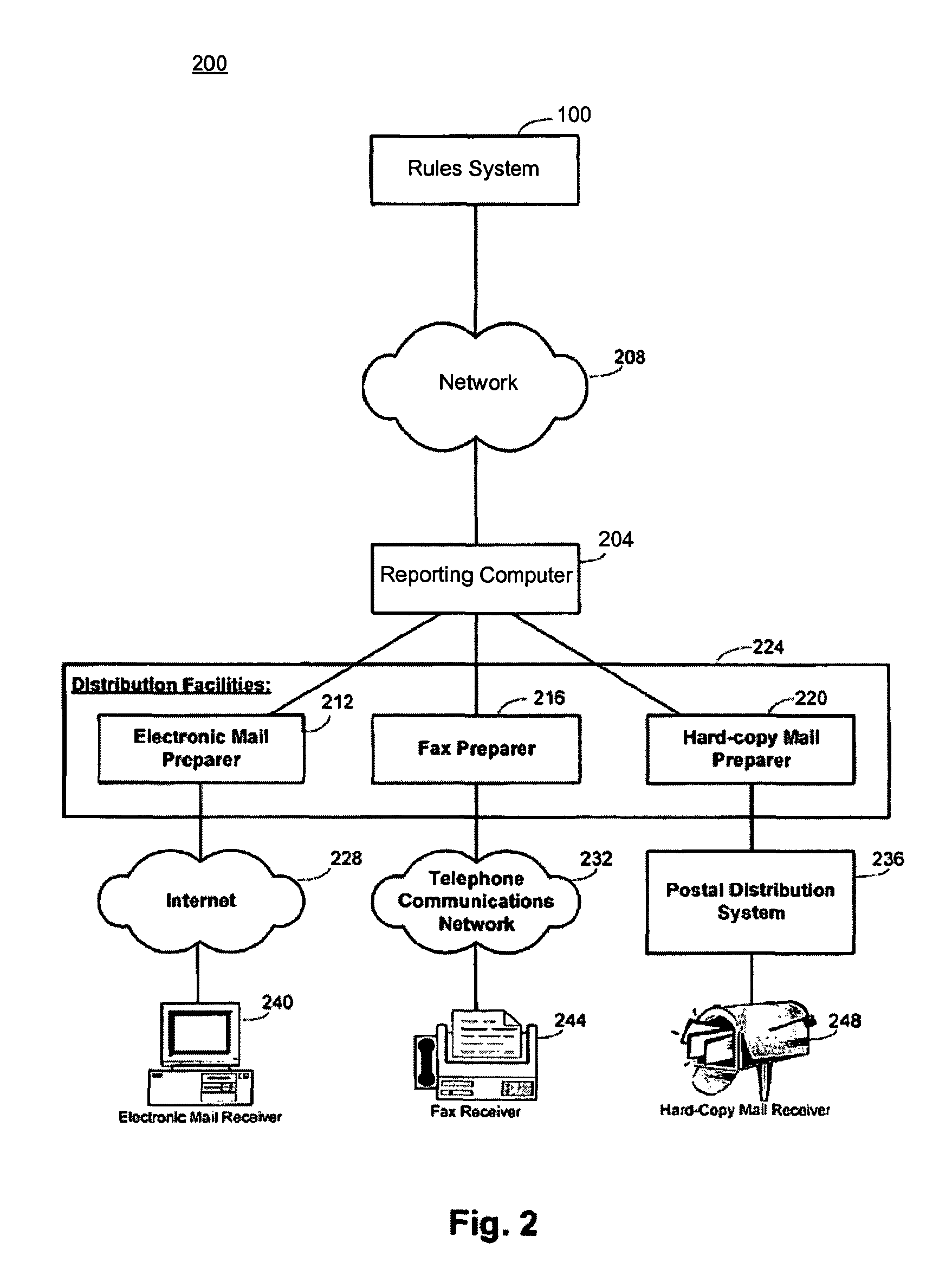

Customer retention systems and methods

Owner:FIRST DATA

Changing ranking algorithms based on customer settings

ActiveUS7996392B2Digital data information retrievalDigital data processing detailsPersonalizationAttribute weight

Owner:ORACLE INT CORP

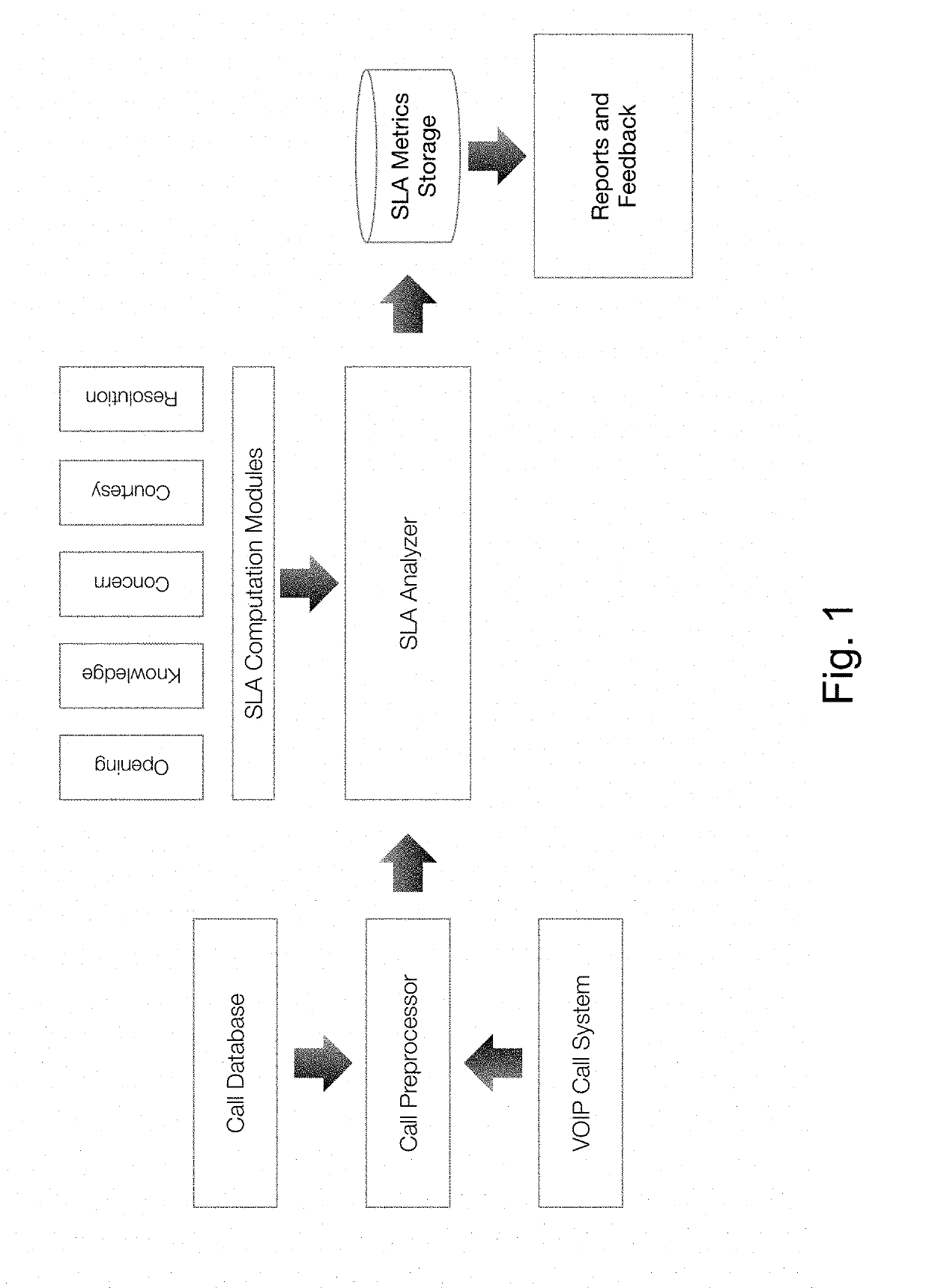

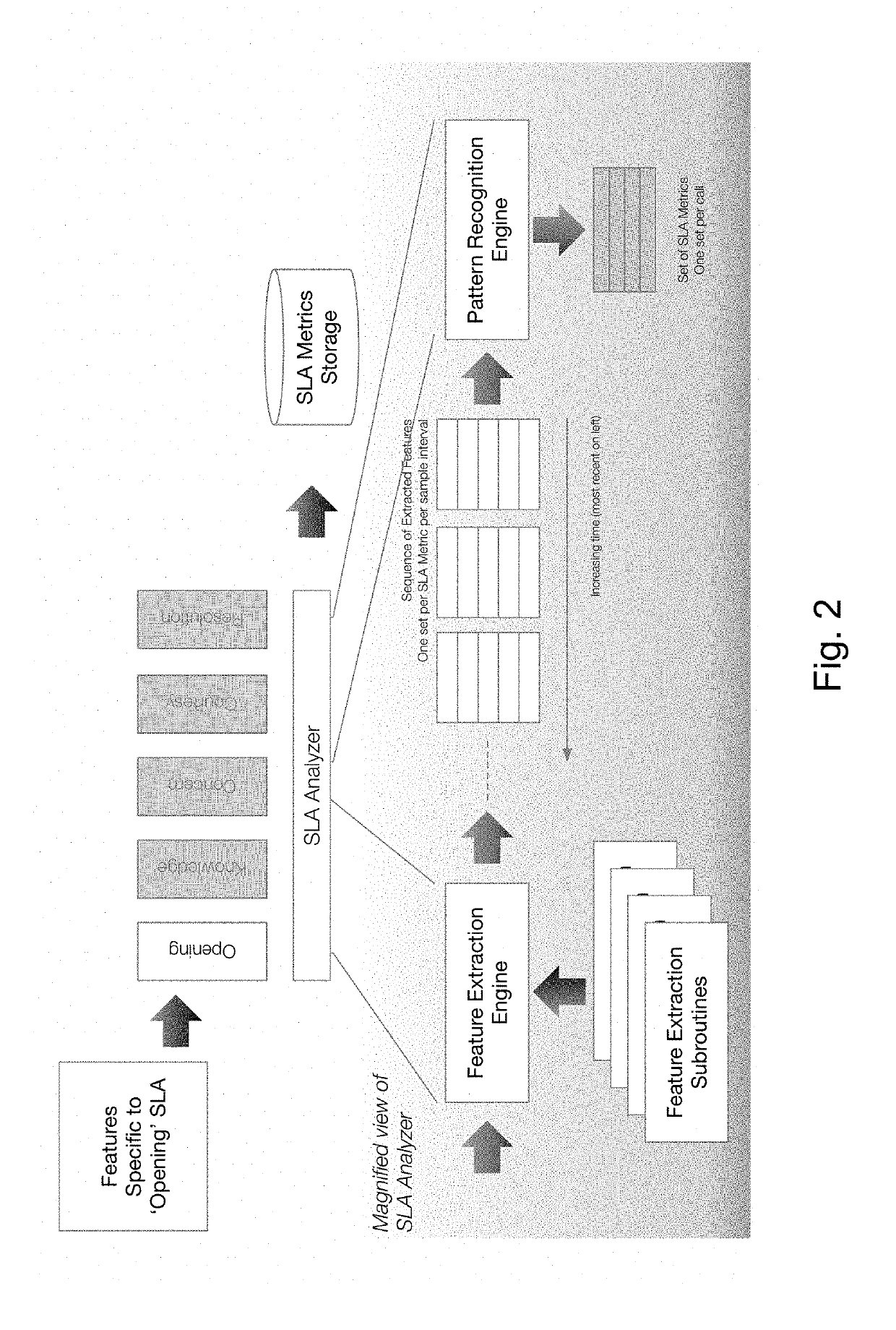

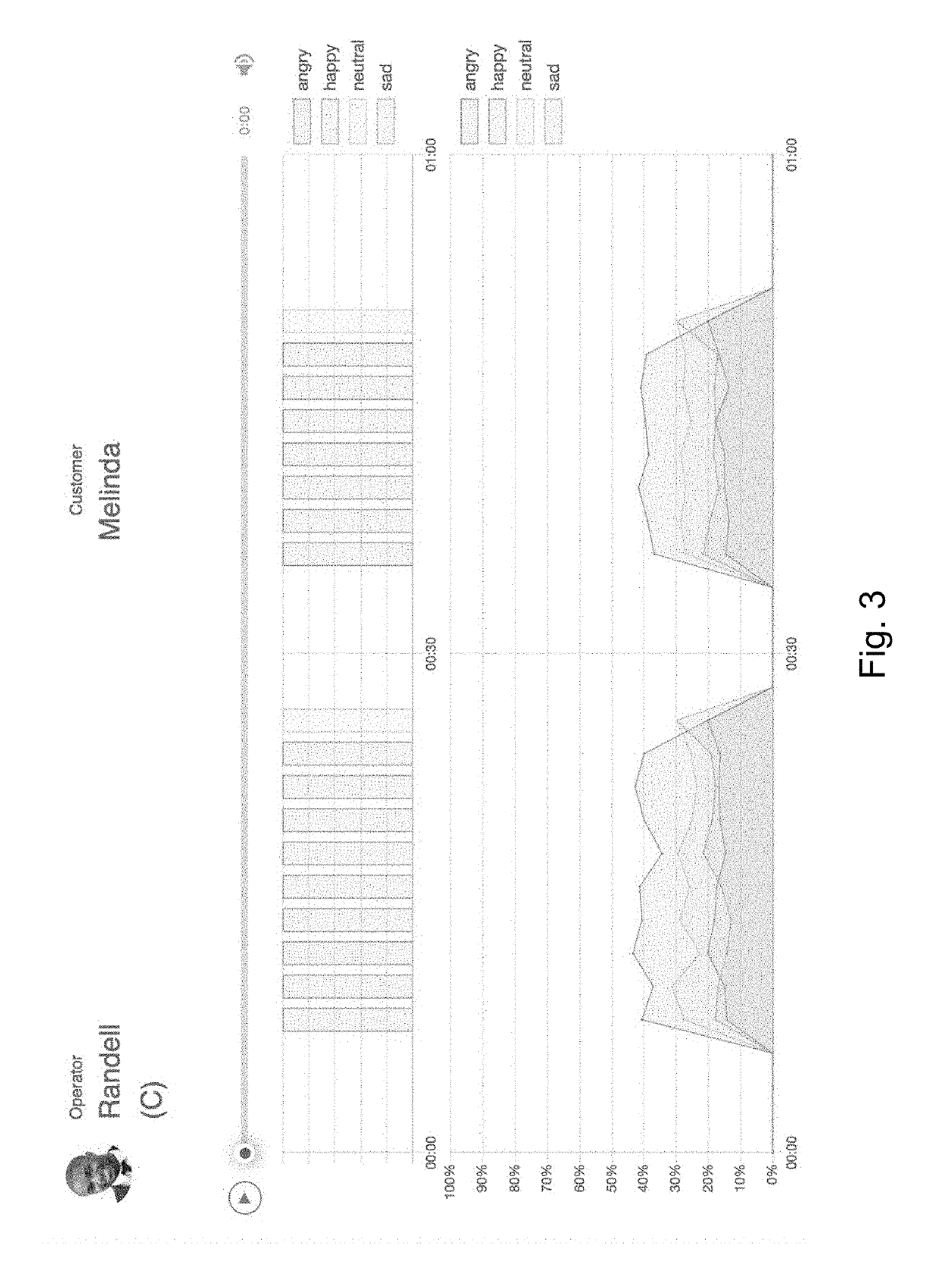

System and method to automatically monitor service level agreement compliance in call centers

InactiveUS20190253558A1Efficient deliverySemantic analysisSpecial service for subscribersService-level agreementSatisfaction rate

A system and method for comprehensive automated call center customer / agent interaction monitoring and service level agreement (SLA) compliance. The system reduces a massive volume of call center activity into readable data points and SLA metrics for measuring agent and overall call center performance levels. The system allows for the scaling up of the SLA compliance process, which is currently done manually by quality assurance personnel for a limited sample set. With the system, customer calls are computationally sampled for speaker diarization and voice isolation, speech emotion recognition, unique salient feature extraction, reference pattern template matching, and automatic speech recognition. The system is adaptively programmable for recognizing and predicting SLA metrics such as: customer satisfaction, issue resolution, appropriate agent greeting and identification, customer understanding, acknowledgment, abandonment, sales attempts, and customer retention, etc. Rating scores are assigned to SLA metrics by intelligent speech emotion pattern recognition and machine learning algorithm. The system provides for cost-effective SLA metrics and quality assurance at scale, with agent performance statistics, customer satisfaction data, and additional insights, via system generated reports and live activity streams.

Owner:HAUKIOJA RISTO +3

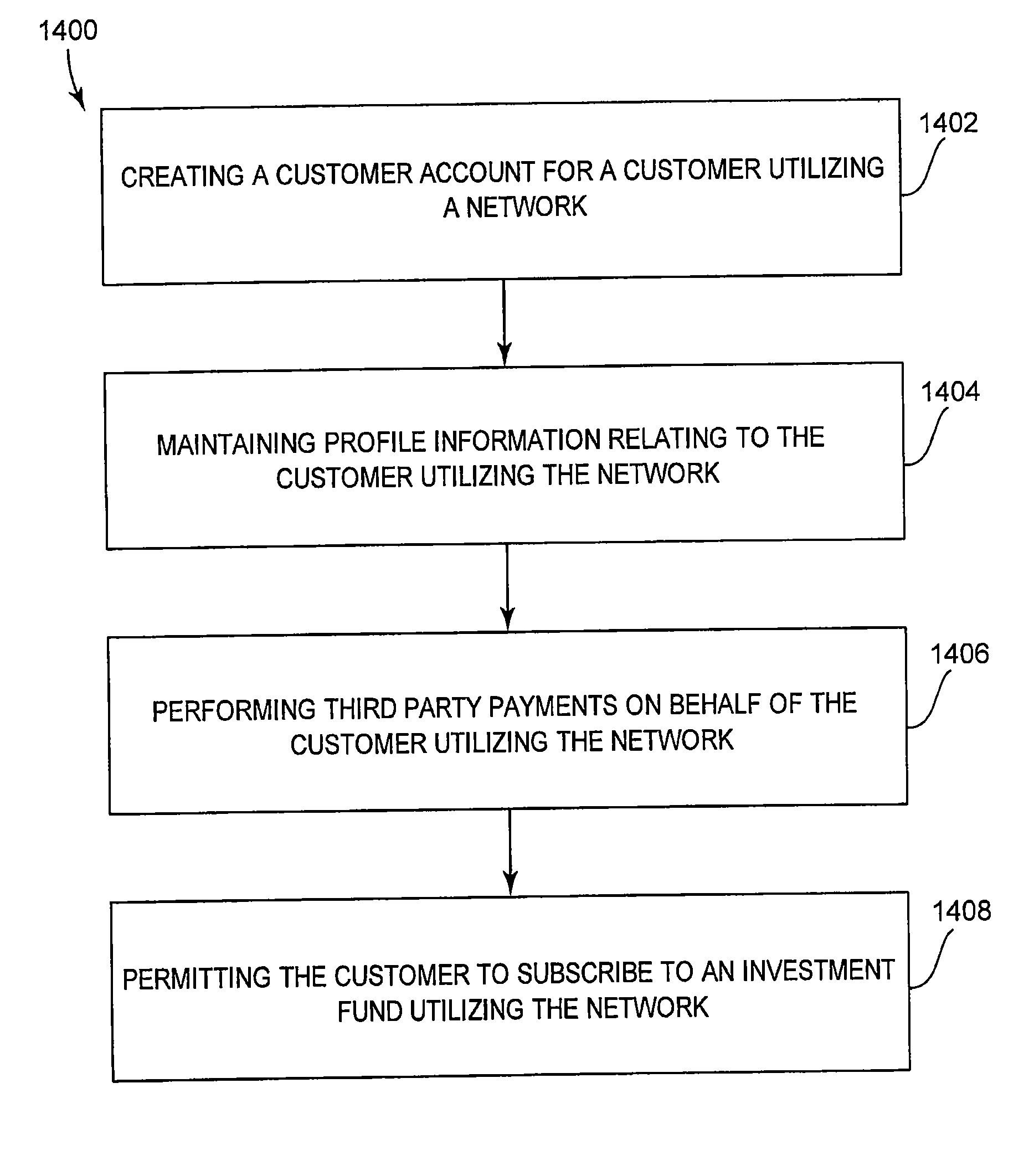

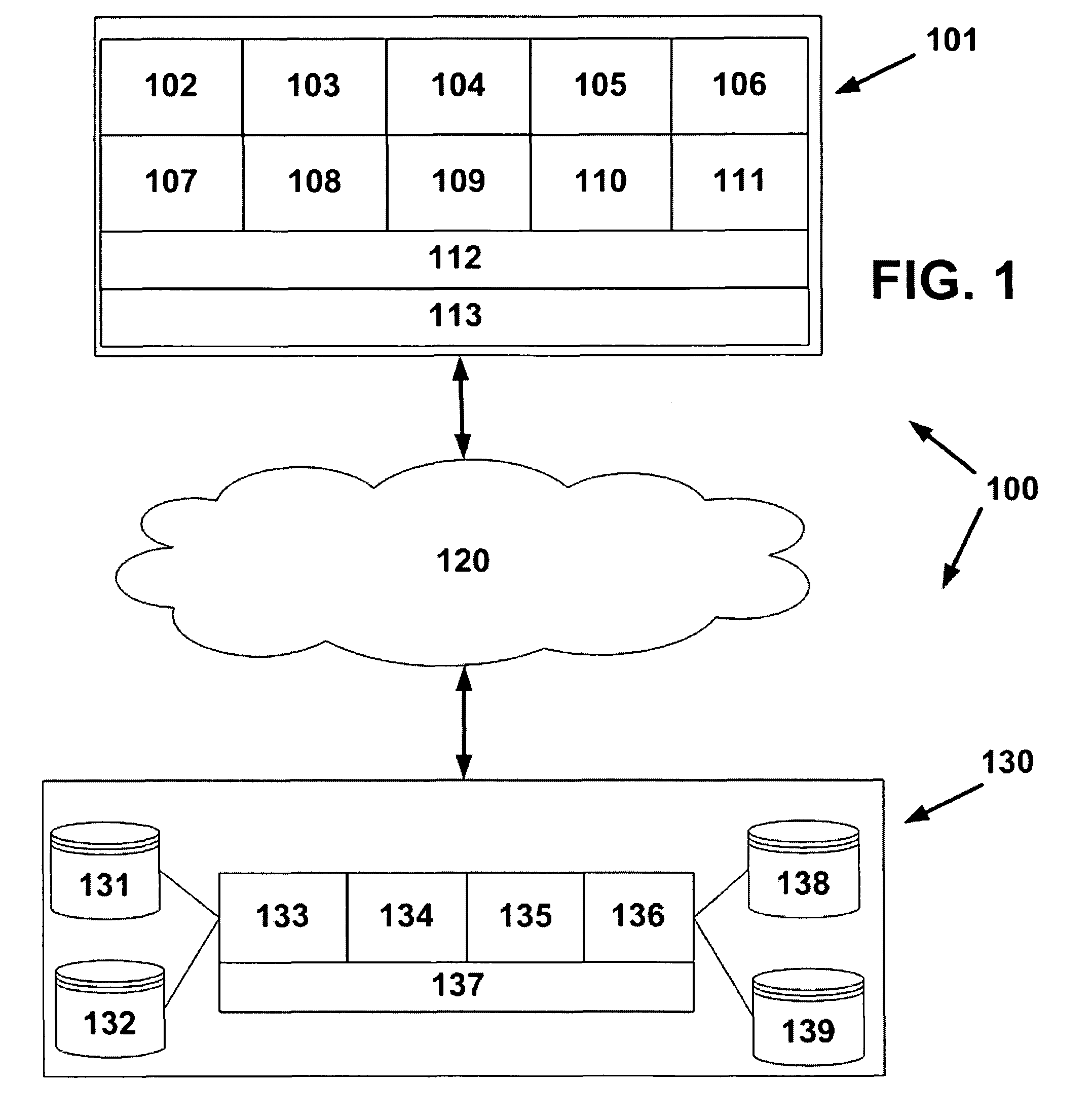

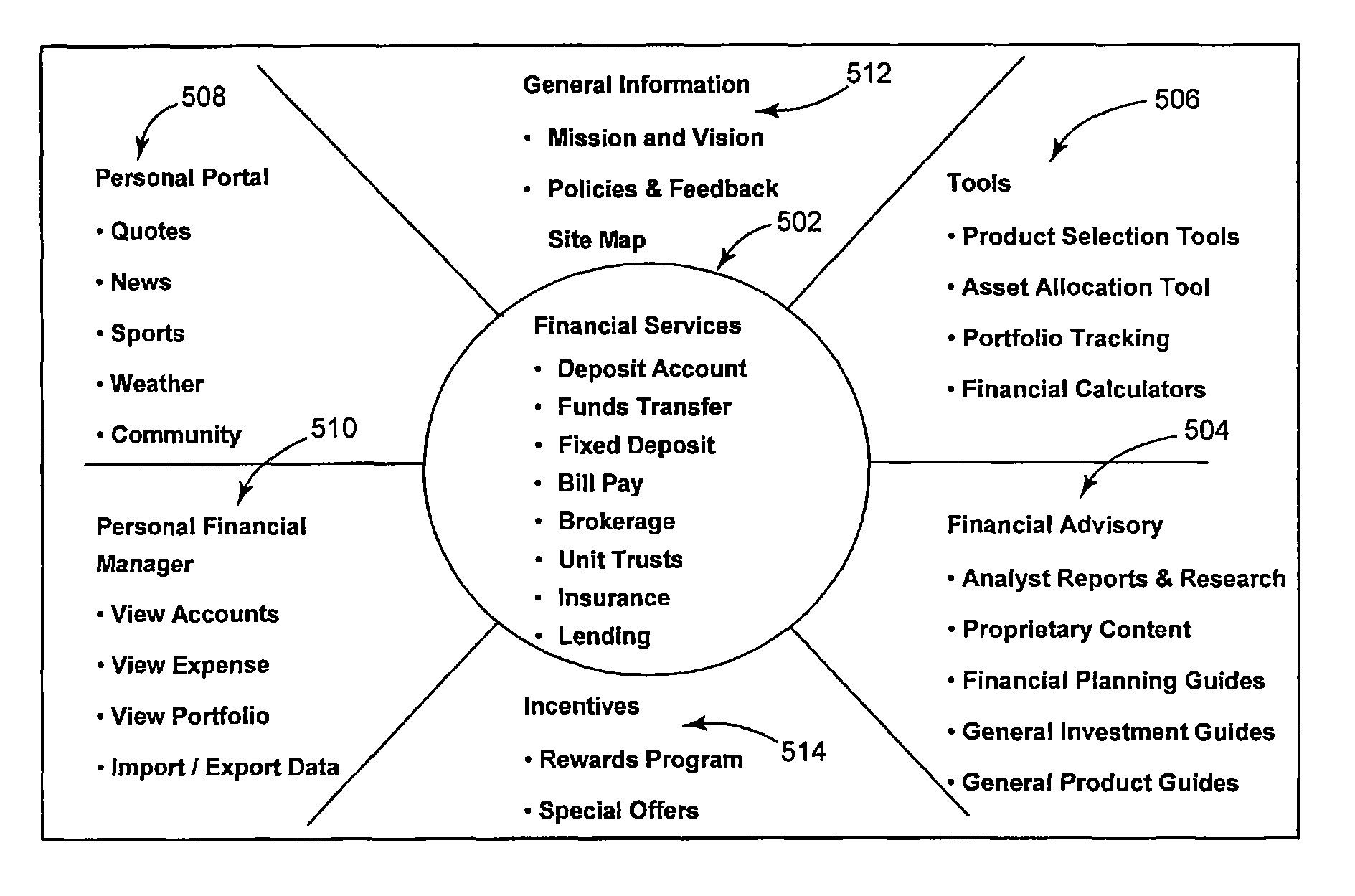

Account and customer creation in an on-line banking model

A system, method and article of manufacture are provided for account and customer creation in an online banking model. An application is received from a customer. The application includes information relating to the user and also documentation relating to the user. A first computer is utilized to create a profile for the customer based on the application received from the customer. The first computer is also utilized to create an account for the customer. Information relating to the created profile and account is transmitted from the first computer to a second computer where a notification is generated. The notification indicates that the account has been created. The notification is transmitted from the second computer to the customer utilizing a network.

Owner:ACCENTURE GLOBAL SERVICES LTD

Method and system for evaluating customers of a financial institution using customer relationship value tags

InactiveUS8600854B2Improve understandingMaximize revenue and profitMarket predictionsFinanceCustomer representativeLibrary science

A computerized method and system for evaluating customers of a financial institution using customer relationship value tags associated customer treatment actions includes automatically analyzing information about a customer from a database of the financial institution by a customer assessment engine using a predefined statistical model to assess the value of the customer to the financial institution. At least one customer treatment action associated with the assessed value is identified by the assessment engine, and the assessment engine marks a file associated with the customer with a mark representing the assessed value and the associated customer treatment action. The marked file is then accessed by other financial systems of the financial institution, or by customer representatives of the financial institution, and the associated customer treatment action is implemented by such systems or representatives in dealing with the customer.

Owner:CASA +1

Electric charge sensitivity assessment method based on logistic regression

InactiveCN106600455AHigh transparencyImprove intelligibilityData processing applicationsDifferentiated servicesDifferentiated service

The invention discloses an electric charge sensitivity assessment method based on logistic regression. According to the method, electric charge sensitivity models are respectively established for high-voltage users, low-voltage non-resident customers, and resident customers by regarding customer sensitivity as the entry point. The main steps comprise: collecting modeling indexes from a plurality of dimensions including customer basic information, electricity consumption information, and payment information etc., screening variables by employing information values (IV) and related coefficients, grouping the variables based on the optimal grouping algorithm and the optimal clustering algorithm, performing conversion of weight of evidence (WOE), establishing the customer electric charge sensitivity assessment model by employing a logistic regression algorithm, constructing a standard scoring card which is easily understood and implemented according to model parameter estimation values, and finally determining the weights of the variables through an advantage analysis method. According to the method, data support is provided for development of accurate marketing and differentiated service by departments of electric power marketing and customer service through recognition of customers with high electric charge sensitivity, the overall satisfaction degree of the customers is improved, and the customer perception is improved.

Owner:STATE GRID HENAN ELECTRIC POWER ELECTRIC POWER SCI RES INST +1

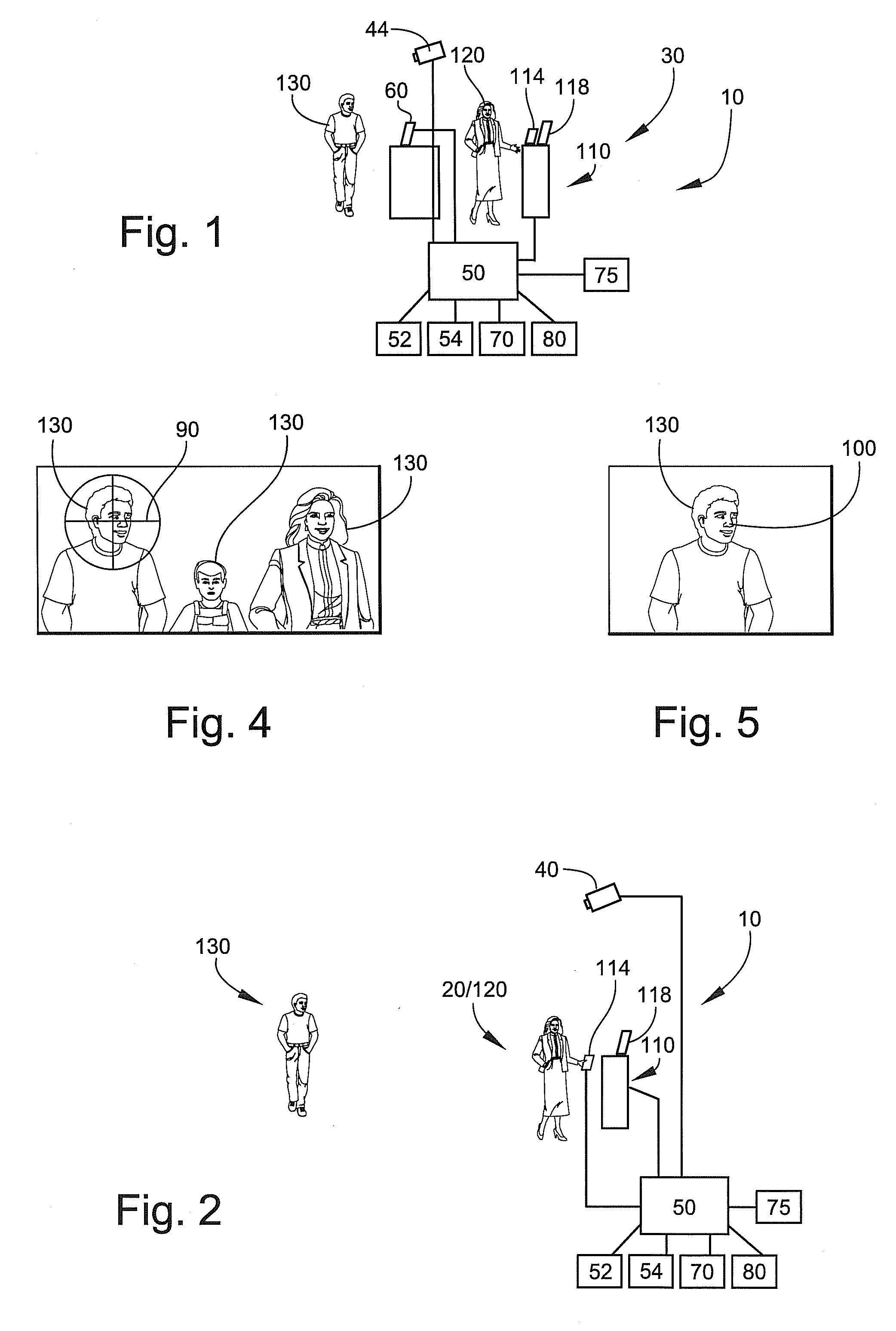

Biometric aid for customer relations

A system for welcoming a customer to a retail outlet to be used by a greeter comprising a customer recognition system (CRS) operatively associated with the greeter. When a customer is recognized by the CRS, the CRS sends a message to the greeter comprising information about the customer. The greeter may then welcome the customer with a personalized greeting.

Owner:THE INTERTECH GROUP

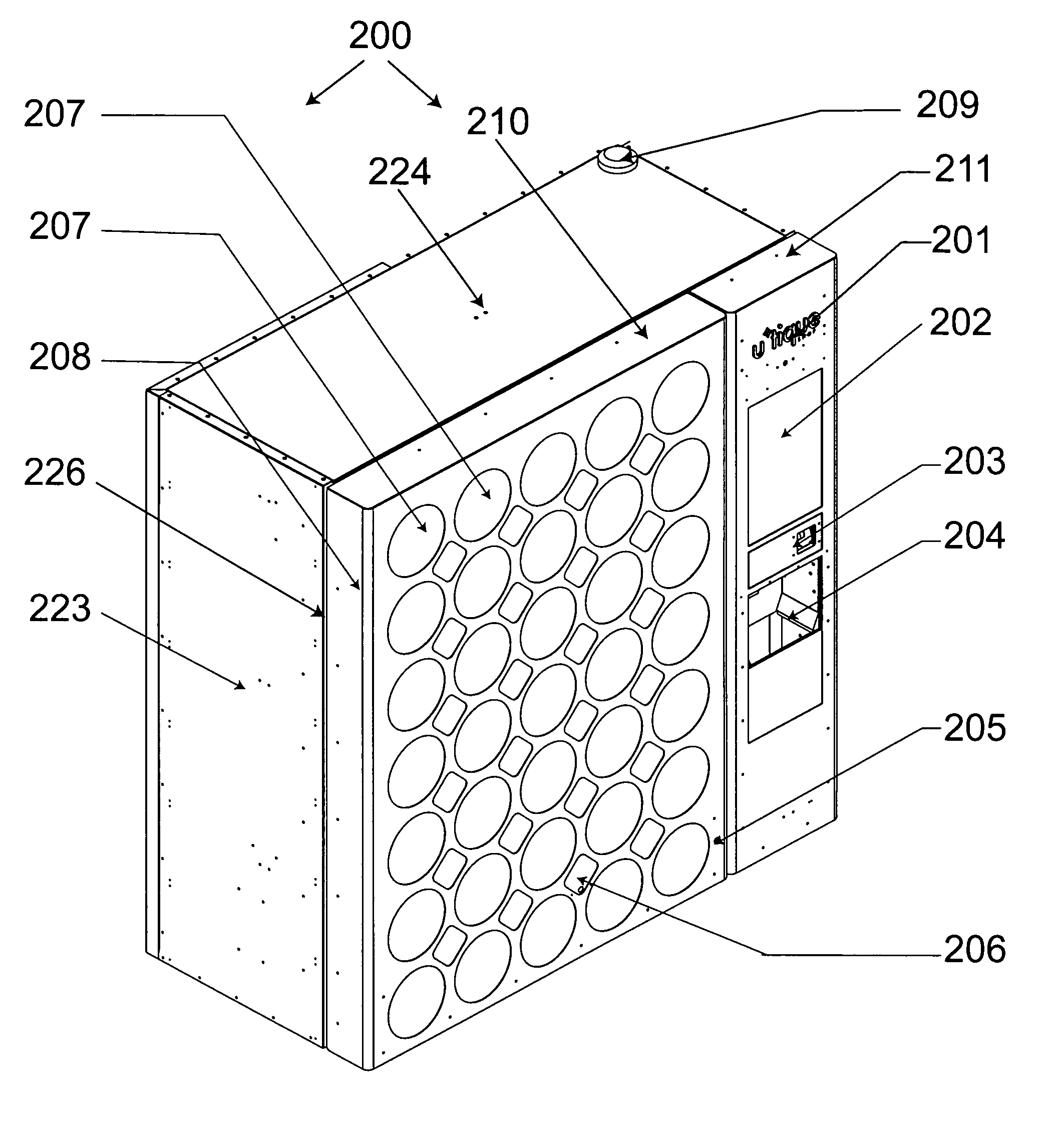

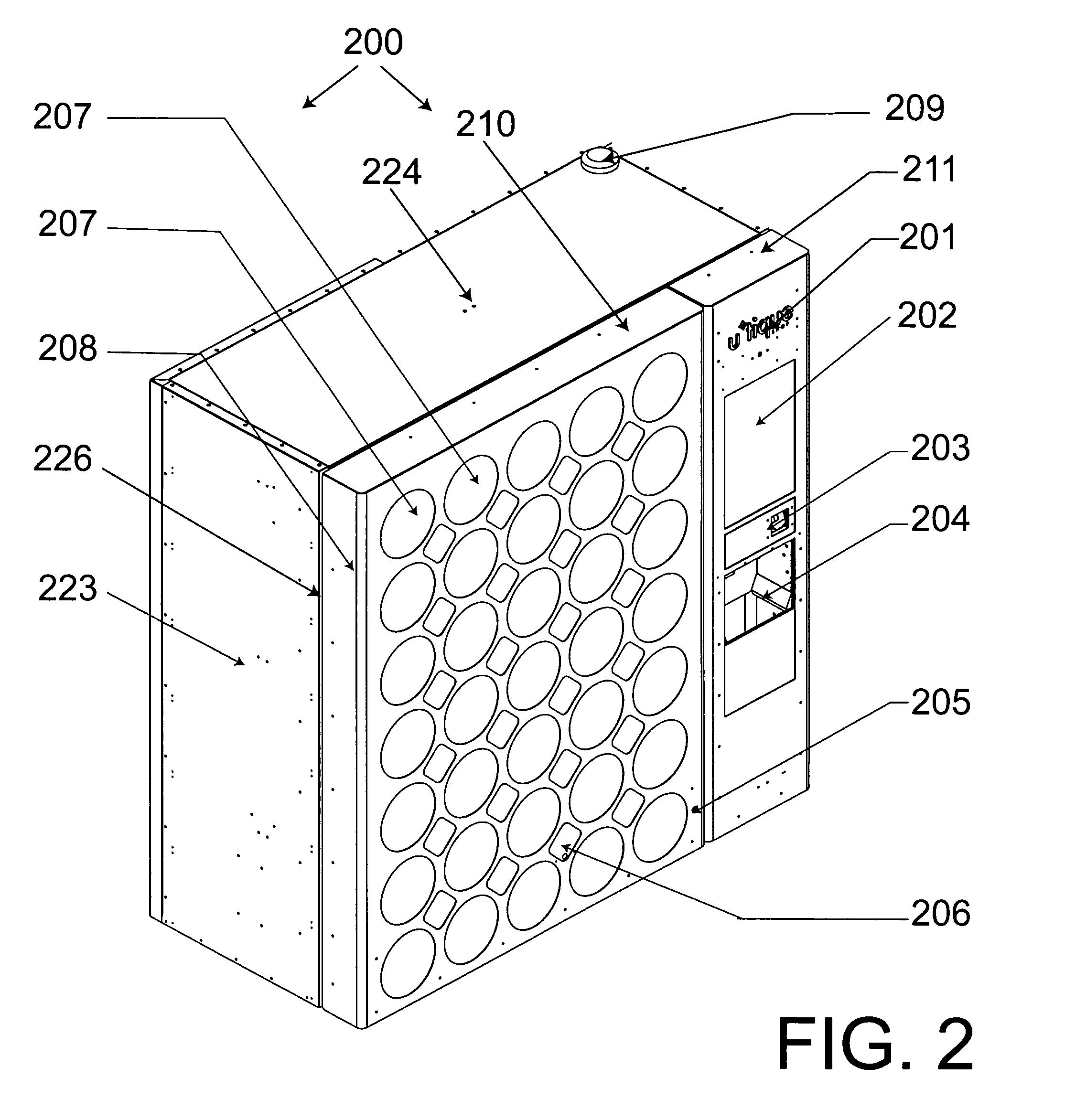

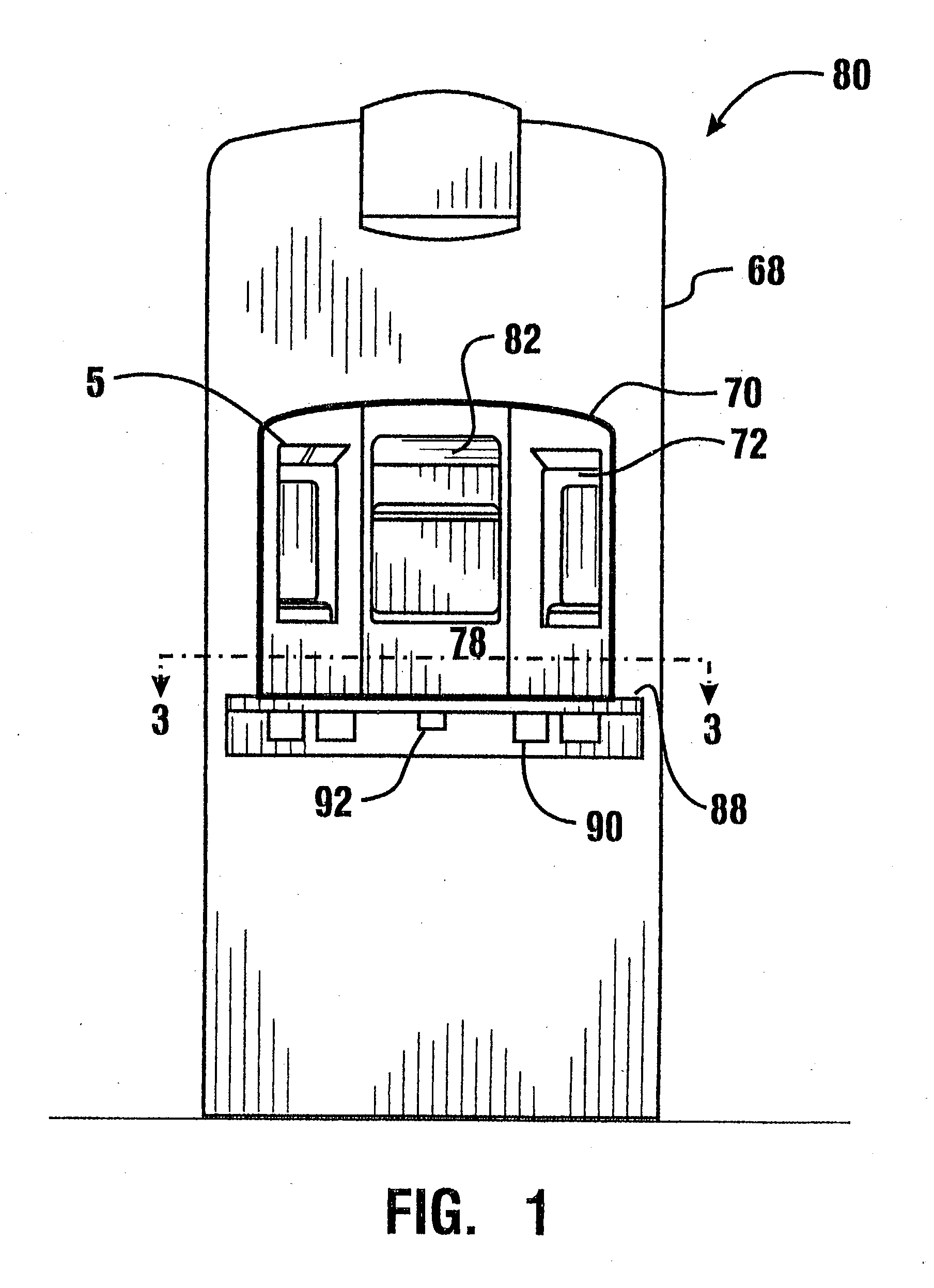

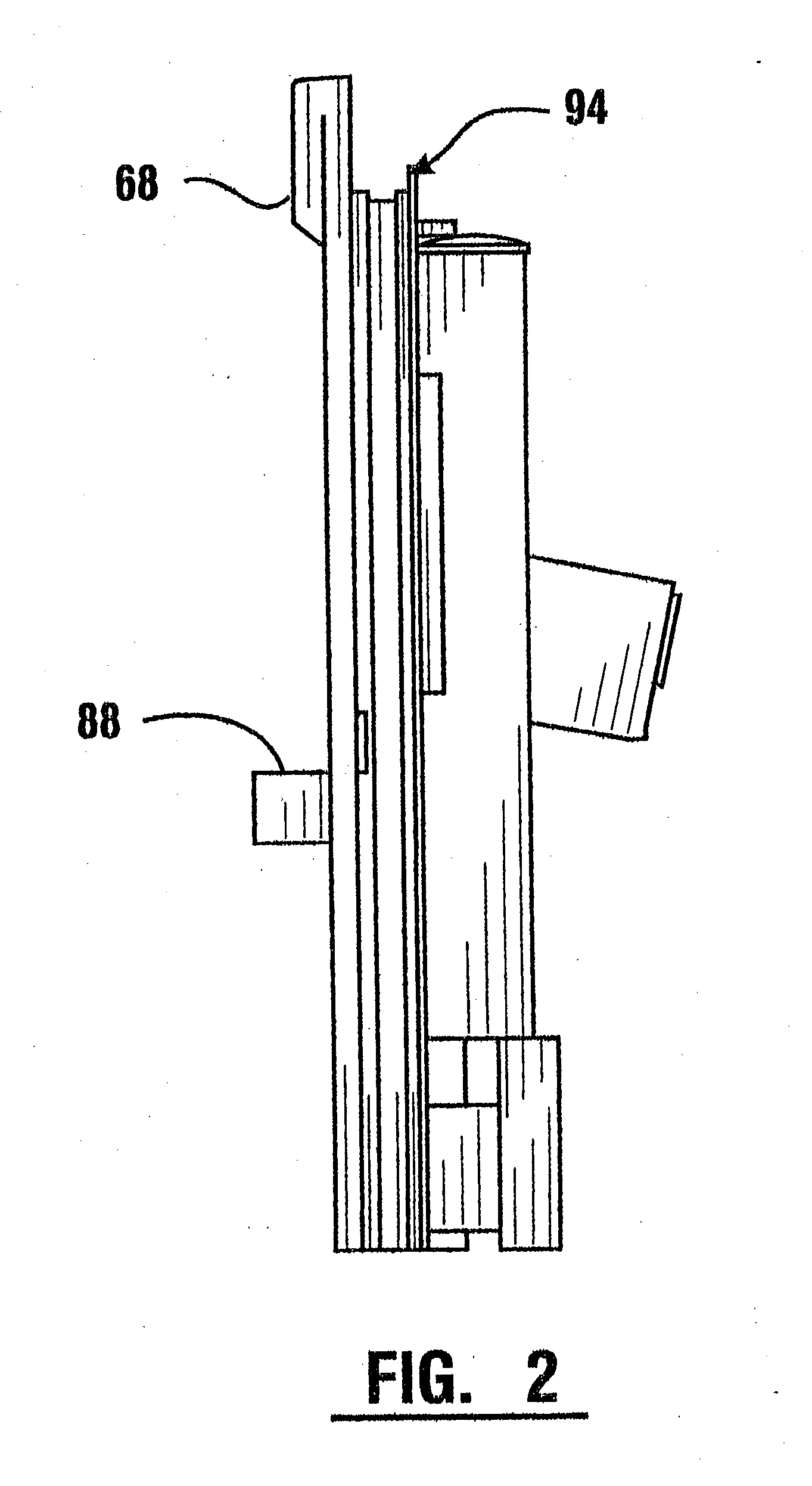

Customer retention system and process in a vending unit, retail display or automated retail store

A vending system comprising numerous remote vending machines, retail displays, and automated retail stores connected to a communication network access a central database so that each remote machine provides and responds to personalized customer information. Each machine comprises a display containing products to be vended and a plurality of touchable product viewing areas for initiating a vend. A computer recognizes customer data derived from peripheral inputs. Software communicates with the database for establishing customer profiles and either recognizing customers or registering customers by generating a global unique identifier. Subroutines initiate the dispensing of items in response to preselected conditions associated with each GUID.

Owner:UTIQUE

Account and customer creation in an on-line banking model

Owner:ACCENTURE GLOBAL SERVICES LTD

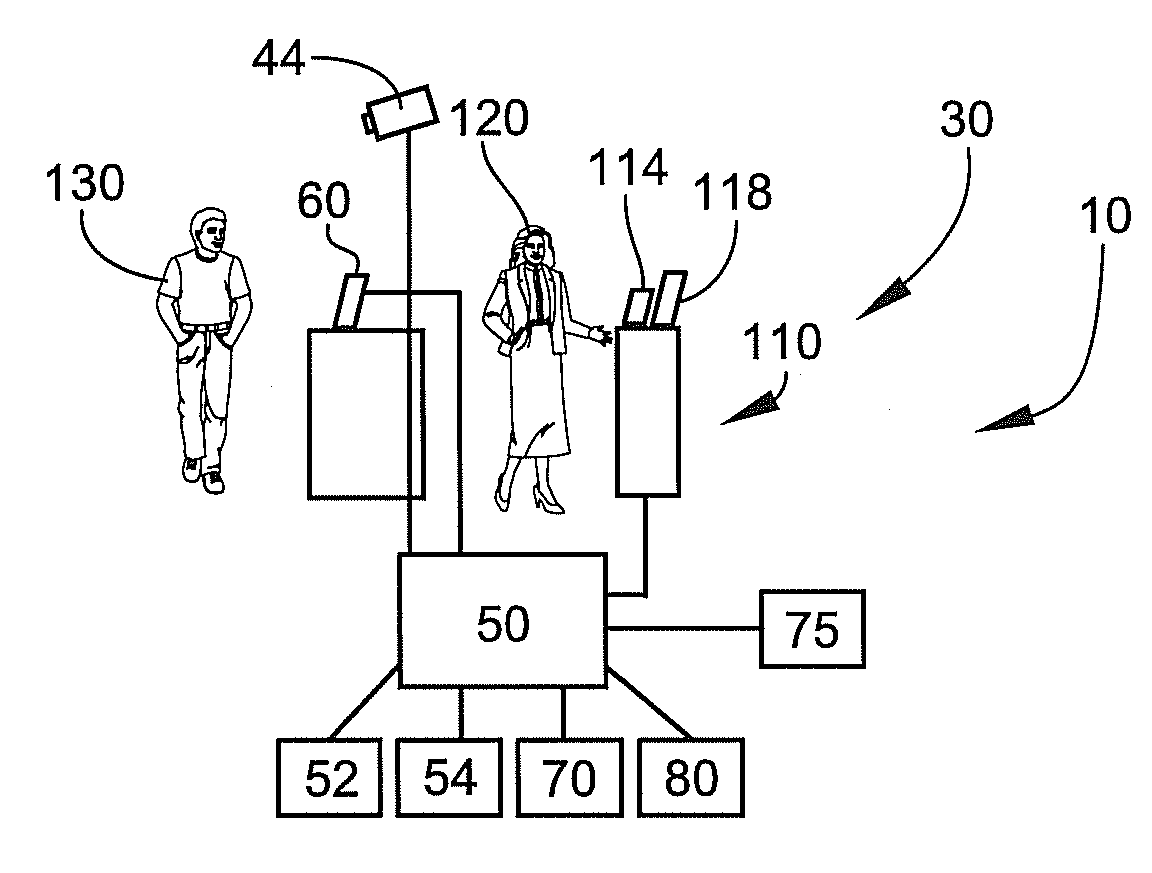

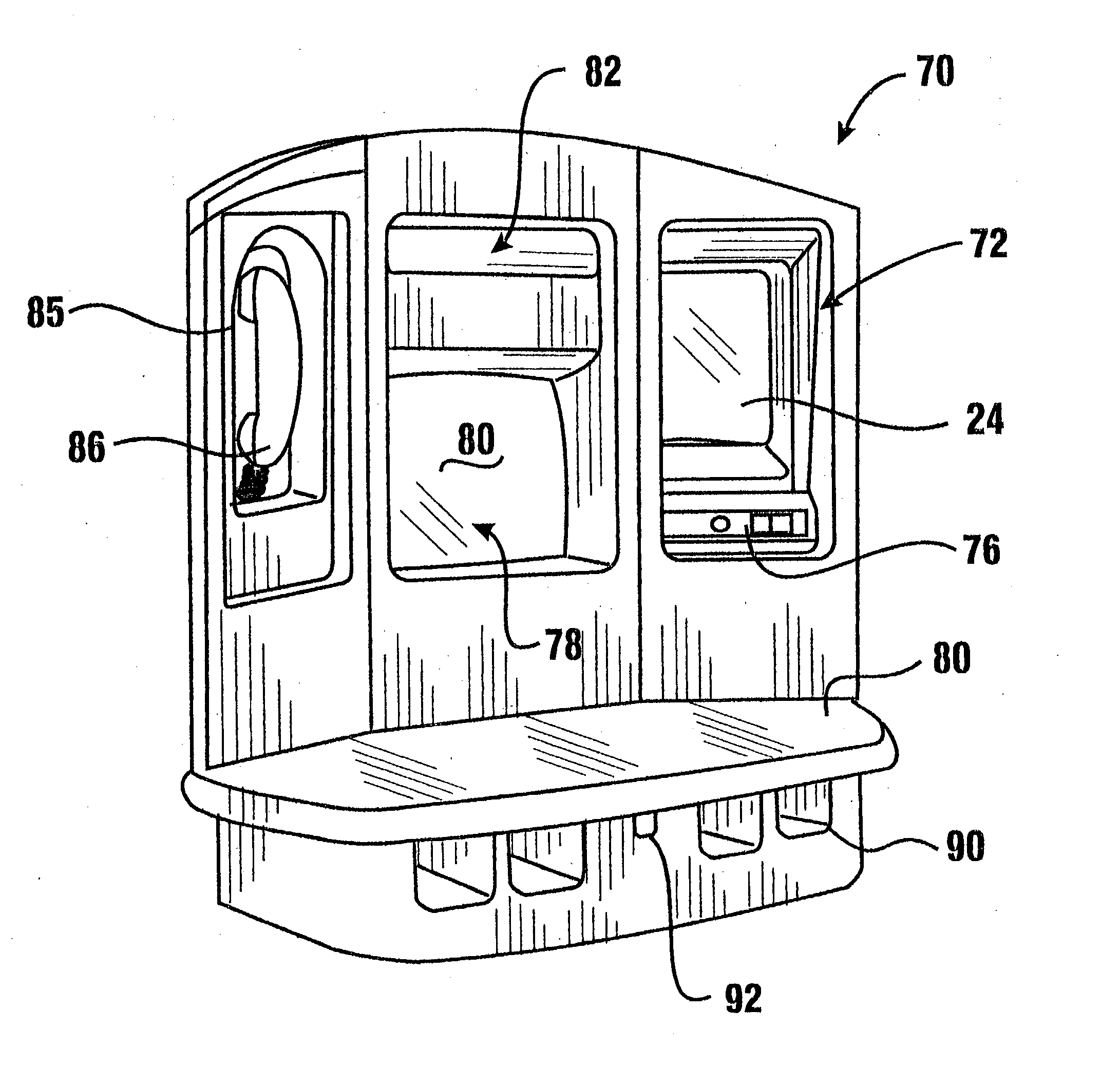

Transaction system

InactiveUS20030179290A1Minimize unproductive timeGood serviceComplete banking machinesColor television detailsService provisionDisplay device

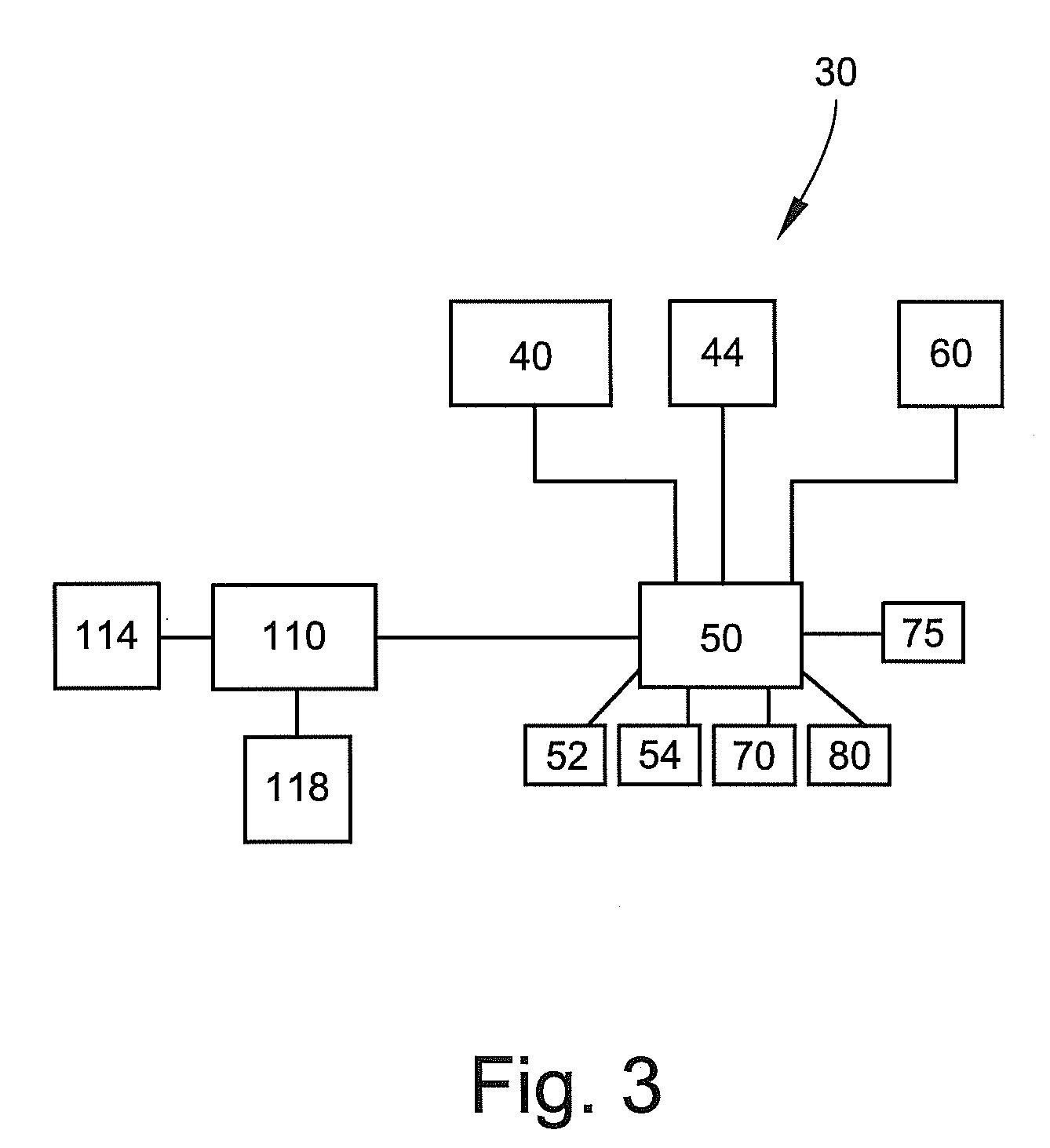

A system for carrying out transactions includes customer stations (118) and ATM stations (120) and a service provider station (114). The service provider station and customer stations are operated in a building (116) or other facility in which a service provider operates the service provider station in a secure room. Audio and video communications are established between the service provider and customers at the customer stations and ATM stations. Items can be exchanged between customer station customers and the service provider through carriers (26) transmitted through a pneumatic tube system (22). A video material presentation device (50) provides promotional or other video material which may be presented on displays at the customer stations. The video material may be presented to customers when the customer terminal is not in communication with the service provider terminal.

Owner:DIEBOLD NIXDORF

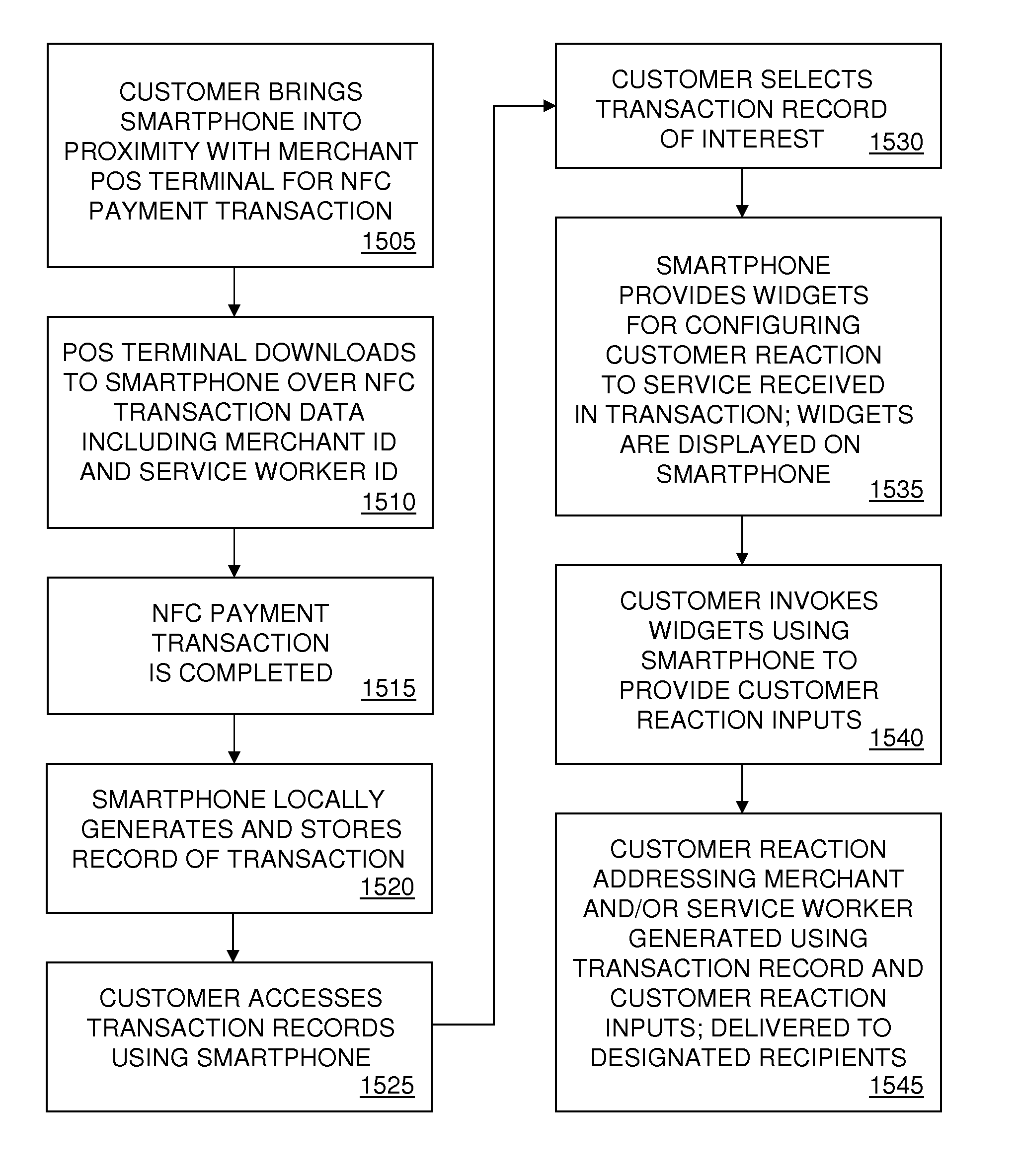

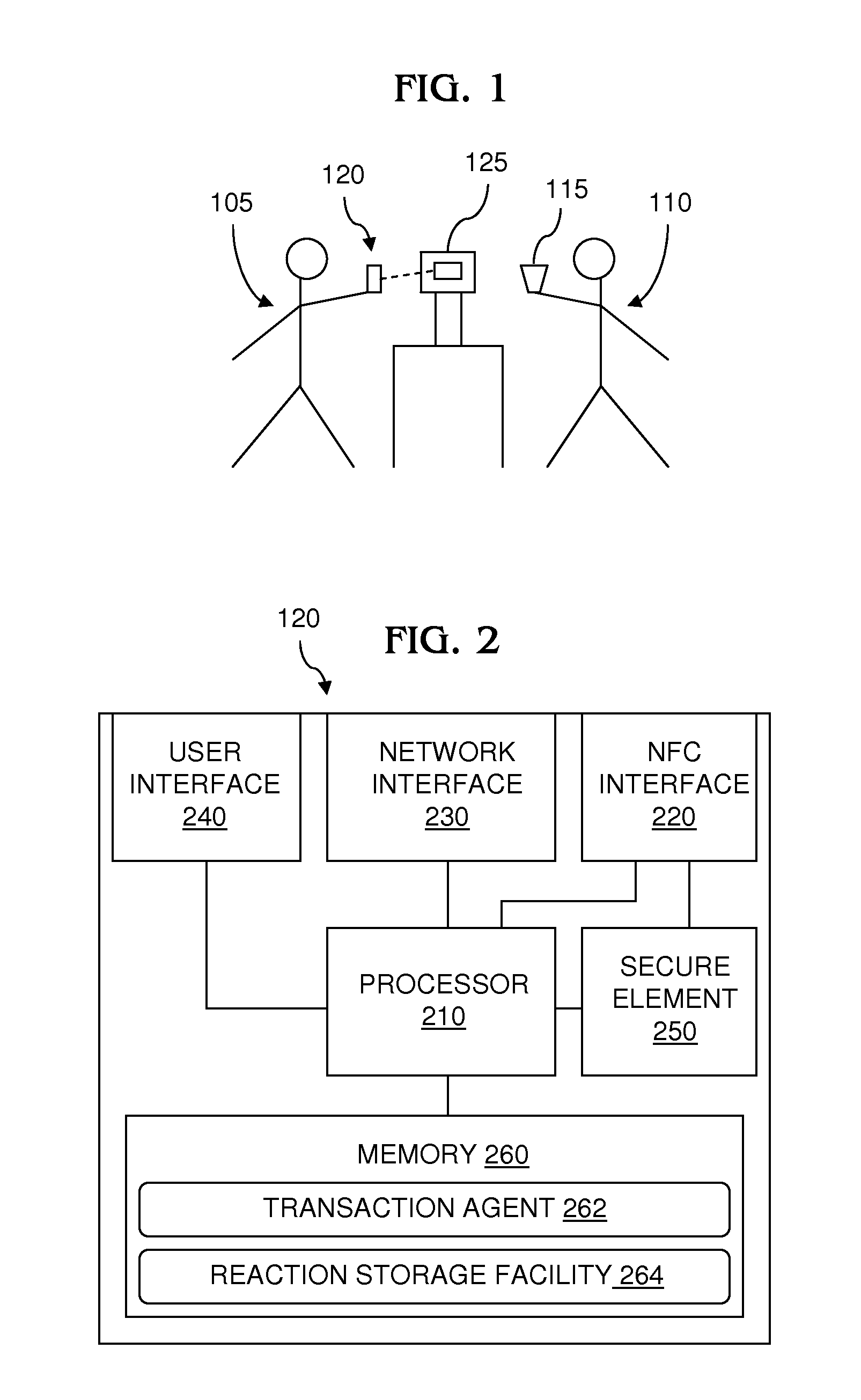

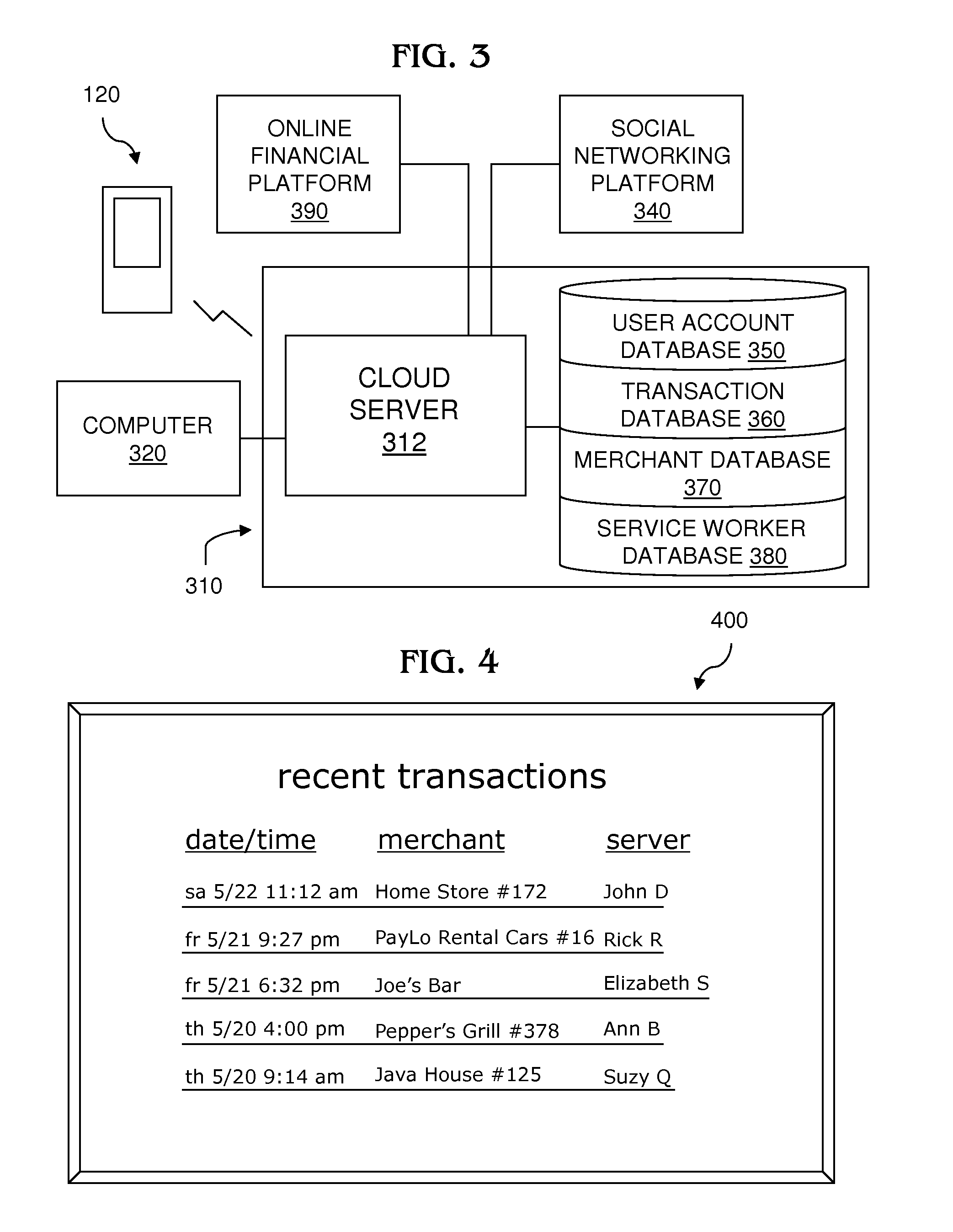

Method and System for Facilitating Customer Reactions to Proximity Mobile Payment Transactions

A method and system for facilitating customer reactions to service received in proximity mobile payment transactions, such as near field communication payment transactions. In the method and system, when a customer smartphone is brought into proximity with a merchant point of sale terminal to conduct a proximity mobile payment transaction, an identifier of the merchant, an identifier of a service worker representing the merchant, or both, are downloaded from the terminal to the smartphone and stored in a transaction record. When the customer wishes to react to the service received in the transaction, the customer interacts with the system to select the transaction record and formulate a customer reaction addressing the merchant, service worker, or both, by invoking customer reaction widgets. The customer reaction is delivered to recipients designated by the customer. The customer reaction may be a rating, recommendation, correspondence, reservation request, deferred tip or preset tip.

Owner:READER SCOT ANTHONY

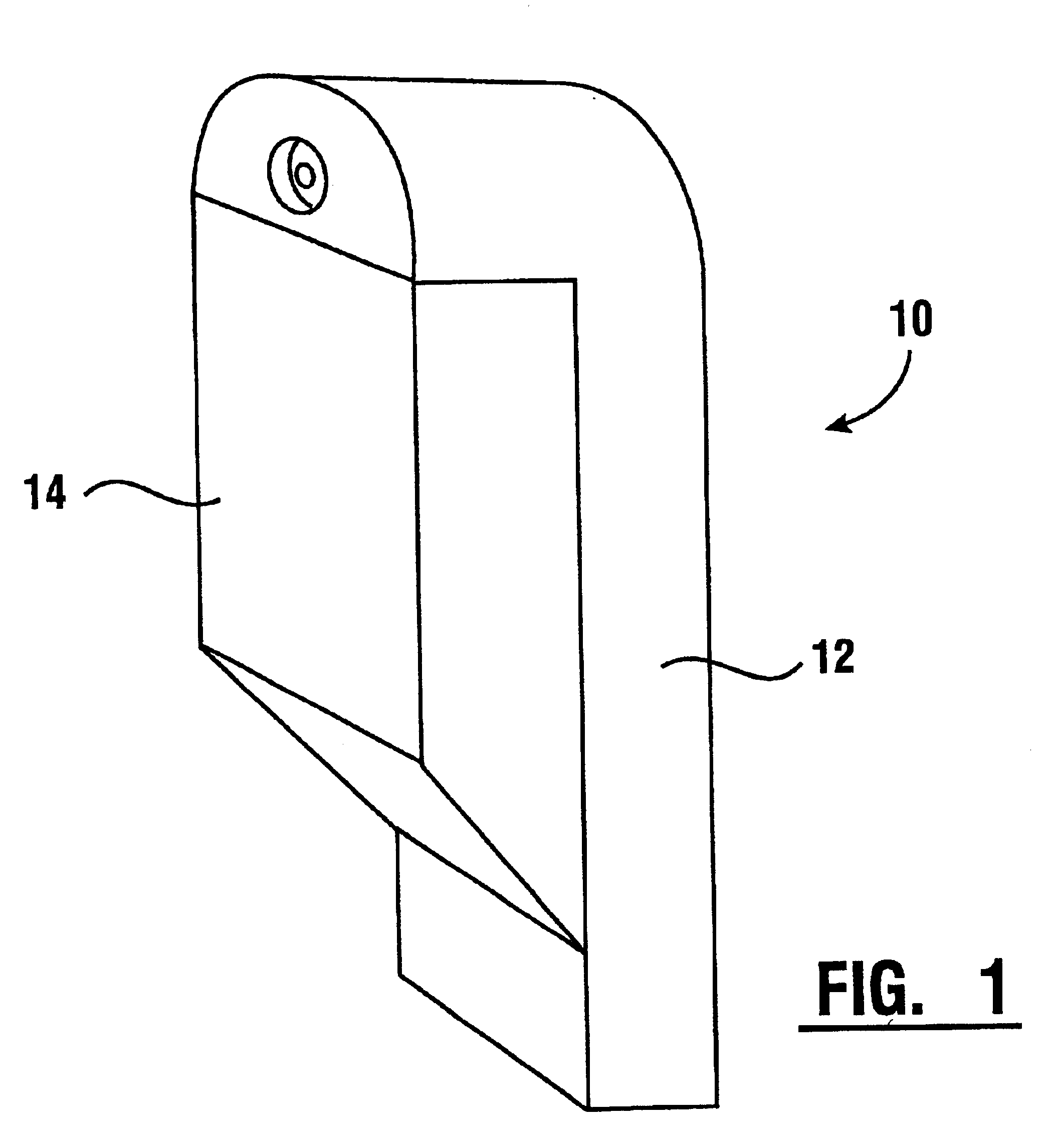

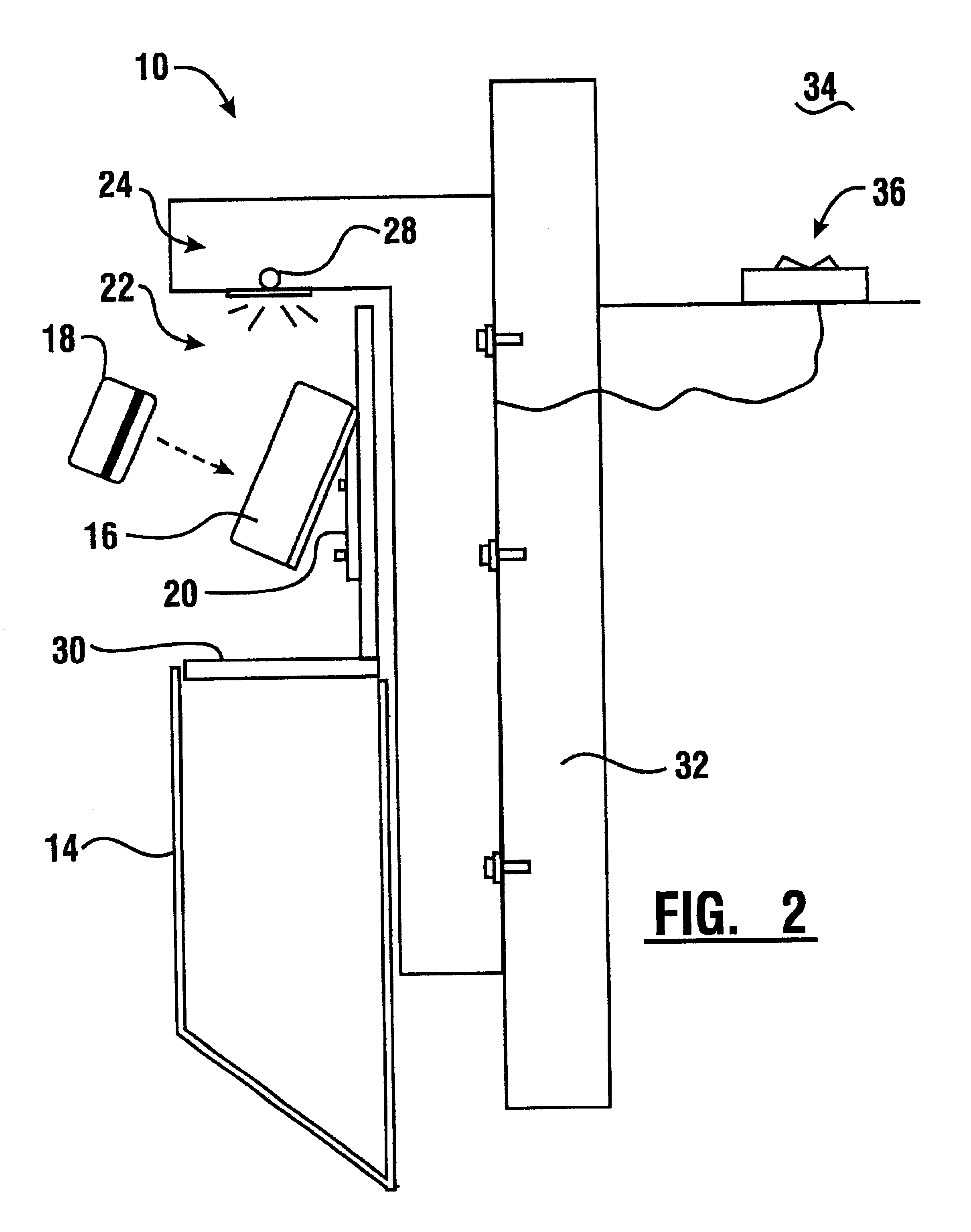

Electronic transaction terminal system

InactiveUS6726101B1Convenient transactionAvoid accessComplete banking machinesConveying record carriersService provisionRemote control

A transaction system (104, 144) includes a customer station (116, 146) and a service provider station (112, 148). Items such as medical items, are passed between the service provider and the customer station through item transport devices (118, 154). An enclosure (10) positioned at the customer station houses a payment terminal (16) therein. A movable cover (14) is moved responsive to inputs to a remote control device (36) at the service provider station to enable a customer at the customer station to access the payment terminal. Through inputs to the payment terminal, the customer is enabled to make payment for items that are provided to the customer by the service provider.

Owner:DIEBOLD NIXDORF

Method and system for evaluating customers of a financial institution using customer relationship value tags

InactiveUS20080208677A1Improve understandingMaximize revenue and profitMarket predictionsFinanceCustomer representativeLibrary science

A computerized method and system for evaluating customers of a financial institution using customer relationship value tags associated customer treatment actions includes automatically analyzing information about a customer from a database of the financial institution by a customer assessment engine using a predefined statistical model to assess the value of the customer to the financial institution. At least one customer treatment action associated with the assessed value is identified by the assessment engine, and the assessment engine marks a file associated with the customer with a mark representing the assessed value and the associated customer treatment action. The marked file is then accessed by other financial systems of the financial institution, or by customer representatives of the financial institution, and the associated customer treatment action is implemented by such systems or representatives in dealing with the customer.

Owner:CASA +1

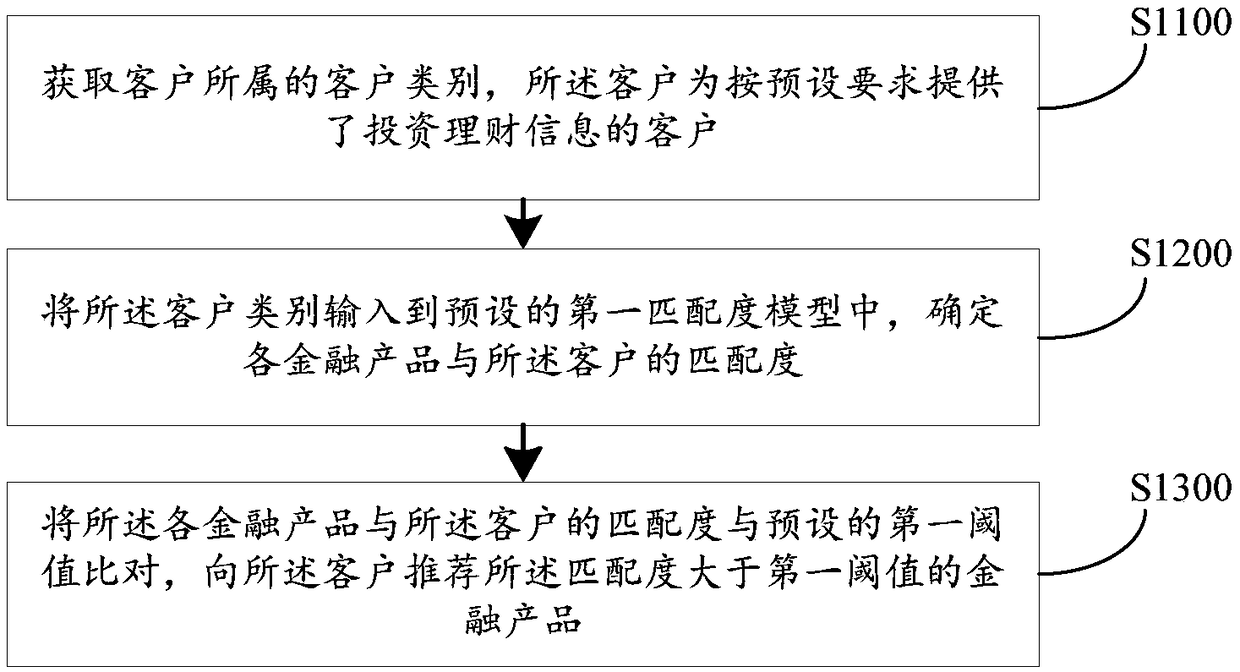

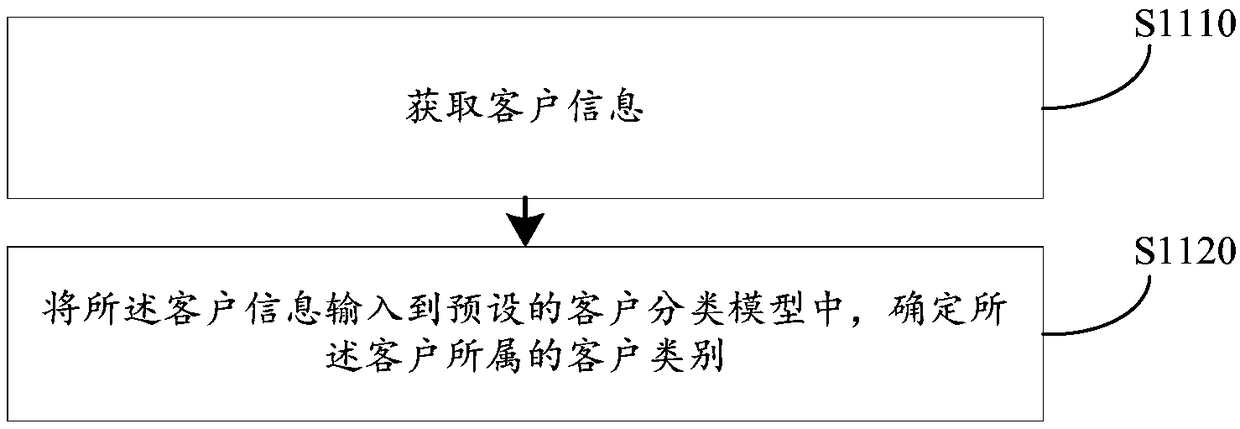

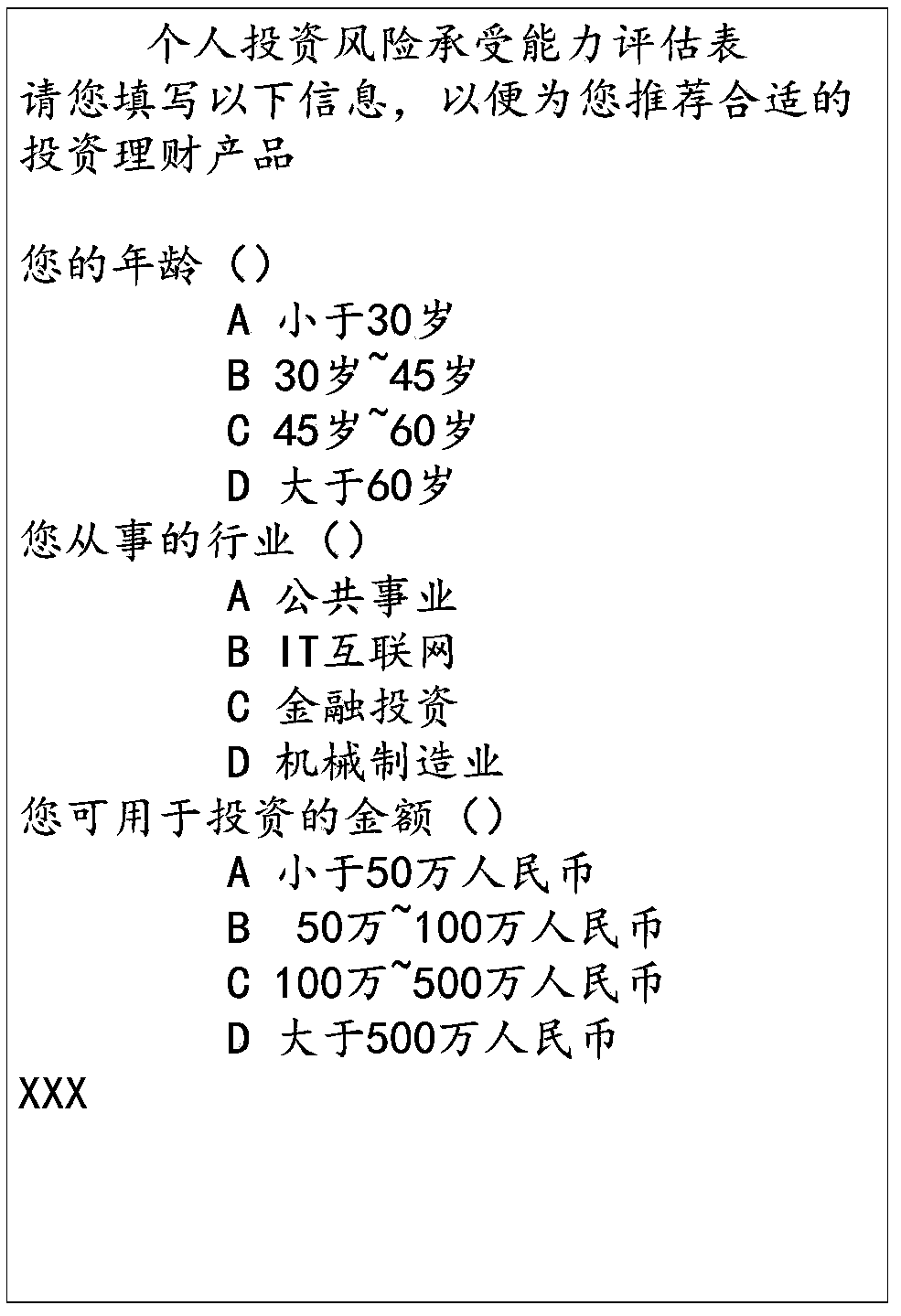

Financial product recommendation method and device , computer device and storage medium

PendingCN109447728AFast deliveryThe recommendation method is more accurate and smarterFinanceBuying/selling/leasing transactionsNetwork modelCustomer information

The embodiment of the invention discloses a financial product recommendation method and device , a computer device and a storage medium. The method comprises the following steps of determining that acustomer belongs to a customer category with the greatest similarity by comparing customer information with various customer characteristics, calculating a matching degree between a financial productand various customers, and recommending the financial product to the customer when the matching degree is greater than a preset threshold value. Among them, the matching degree between financial products and various customers is calculated by a BP neural network model trained by historical investment records. After developing a new financial product, an investment institution can quickly launch amatching customer base. When a customer invests and manages money, the investment institution can also recommend the appropriate financial products to the customer pertinently. Customer segmentation and matching between financial products and customers are based on the historical data analysis, making this recommendation more accurate and intelligent.

Owner:PING AN TECH (SHENZHEN) CO LTD

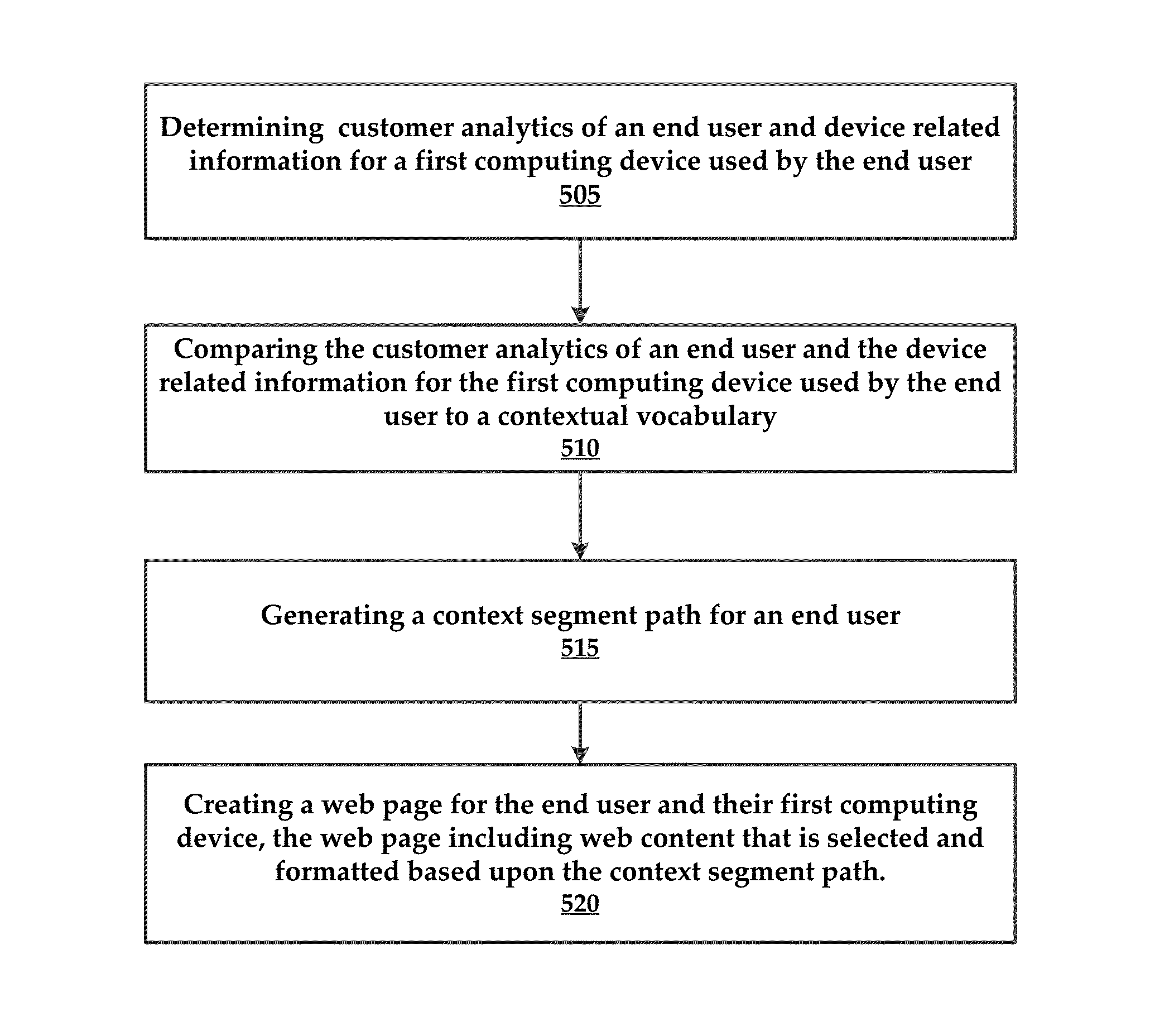

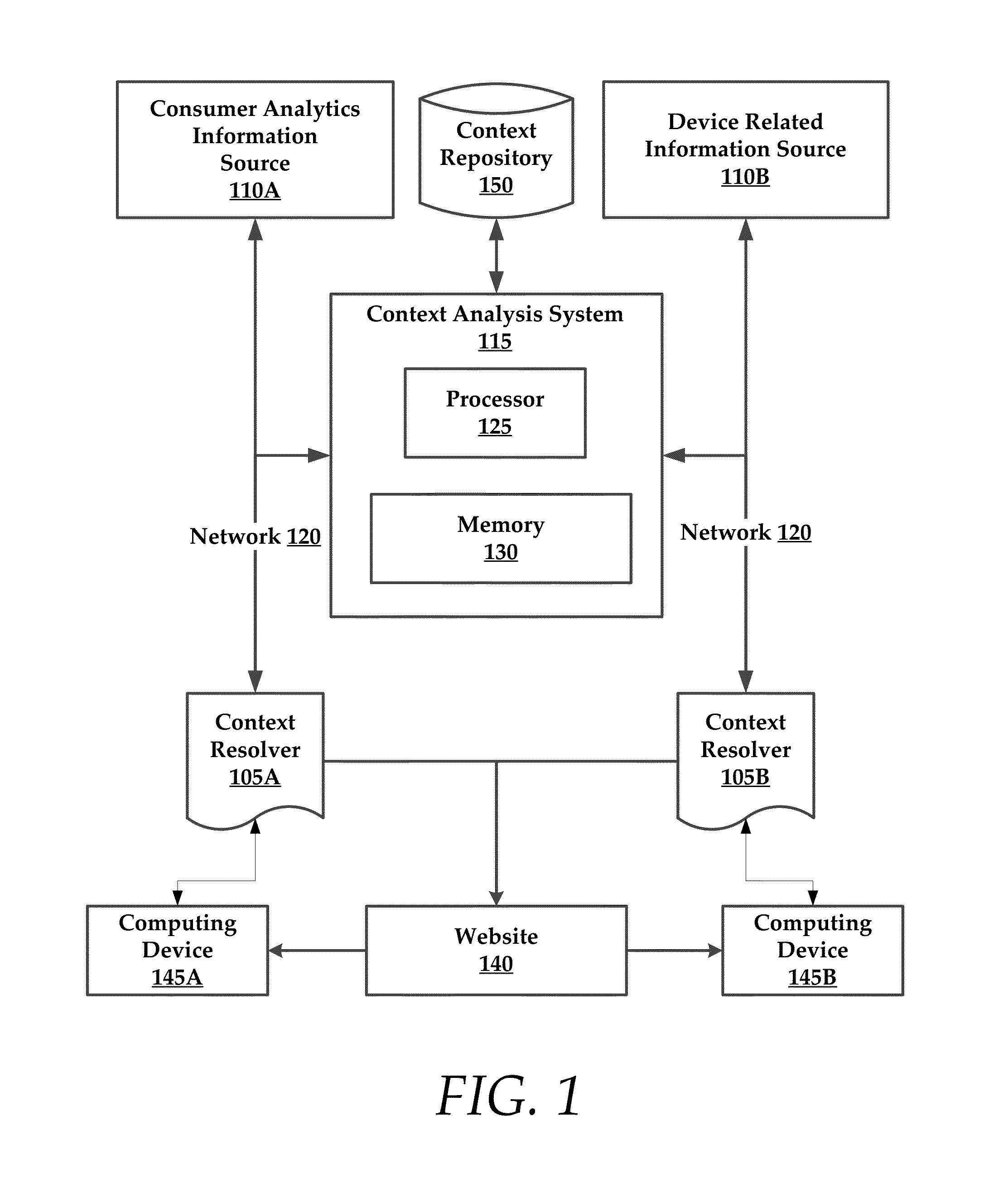

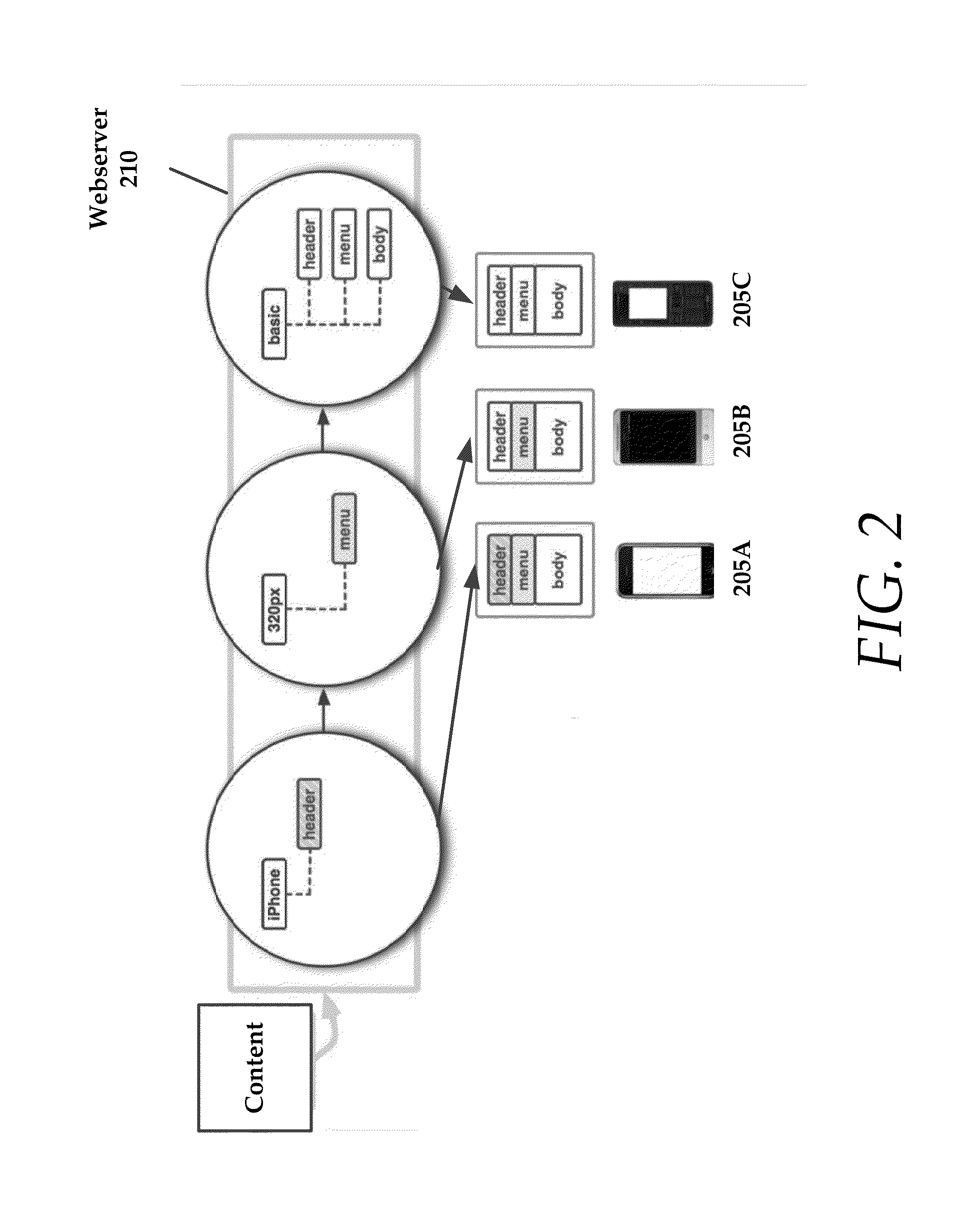

Systems and methods that utilize contextual vocabularies and customer segmentation to deliver web content

ActiveUS20150149886A1Natural language data processingOhmic-resistance heatingMultiple contextComputer terminal

Systems and methods for dynamically delivering web content are provided herein. A method may include determining behavior analytics of an end user and device related information for a first computing device used by the end user, as well as comparing the behavior analytics, and other contextual information, of an end user and the device related information for the first computing device used by the end user to a contextual vocabulary that includes context segments that define contextual information of a plurality of end users and device related information for computing devices used by the plurality of end users. The method includes generating a context segment path for an end user, the context segment path having a plurality of context segments that have been selected from the contextual vocabulary, and dynamically creating a web page having web content that is selected and formatted based upon the context segment path.

Owner:SDL NETHERLANDS BV

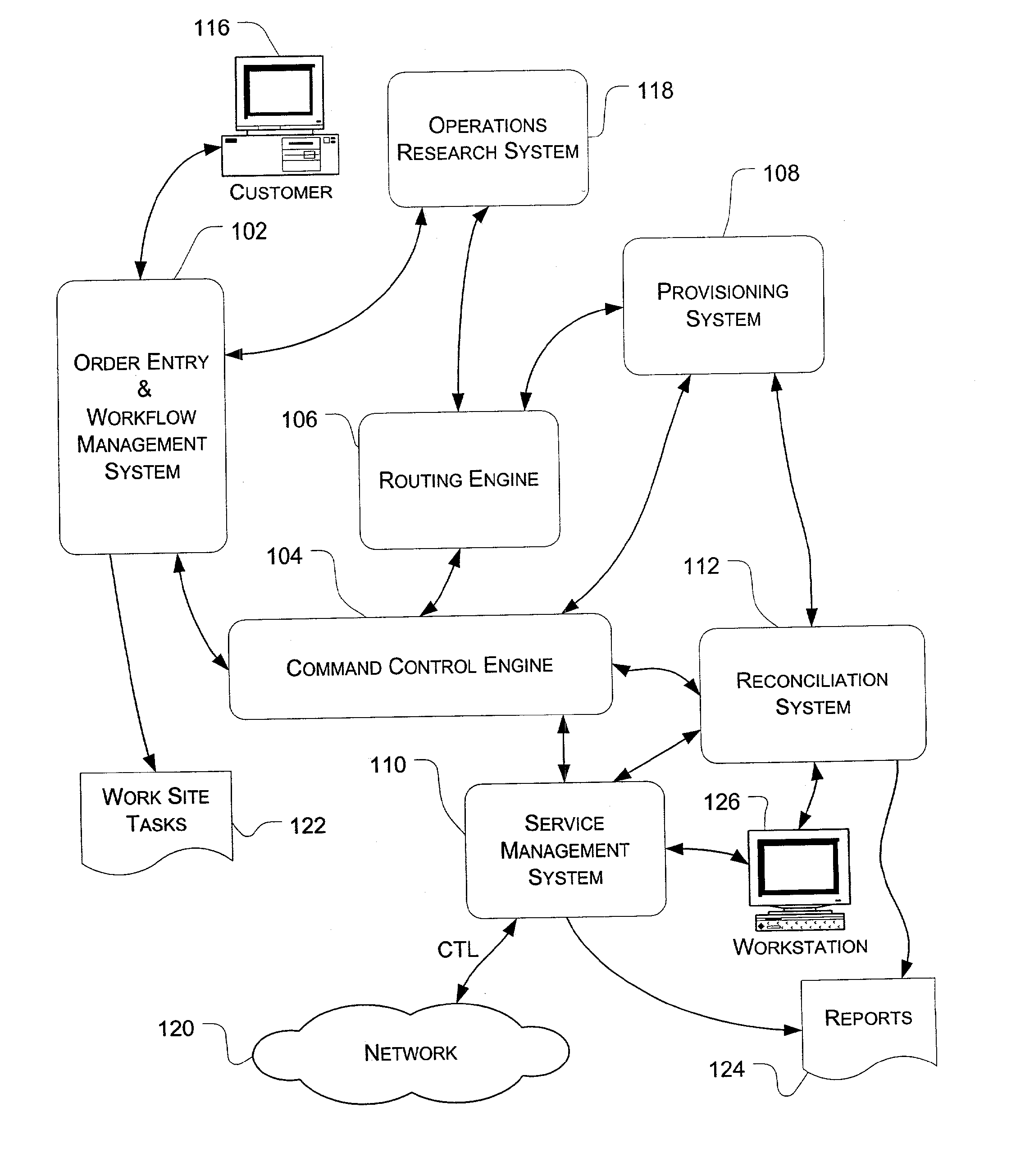

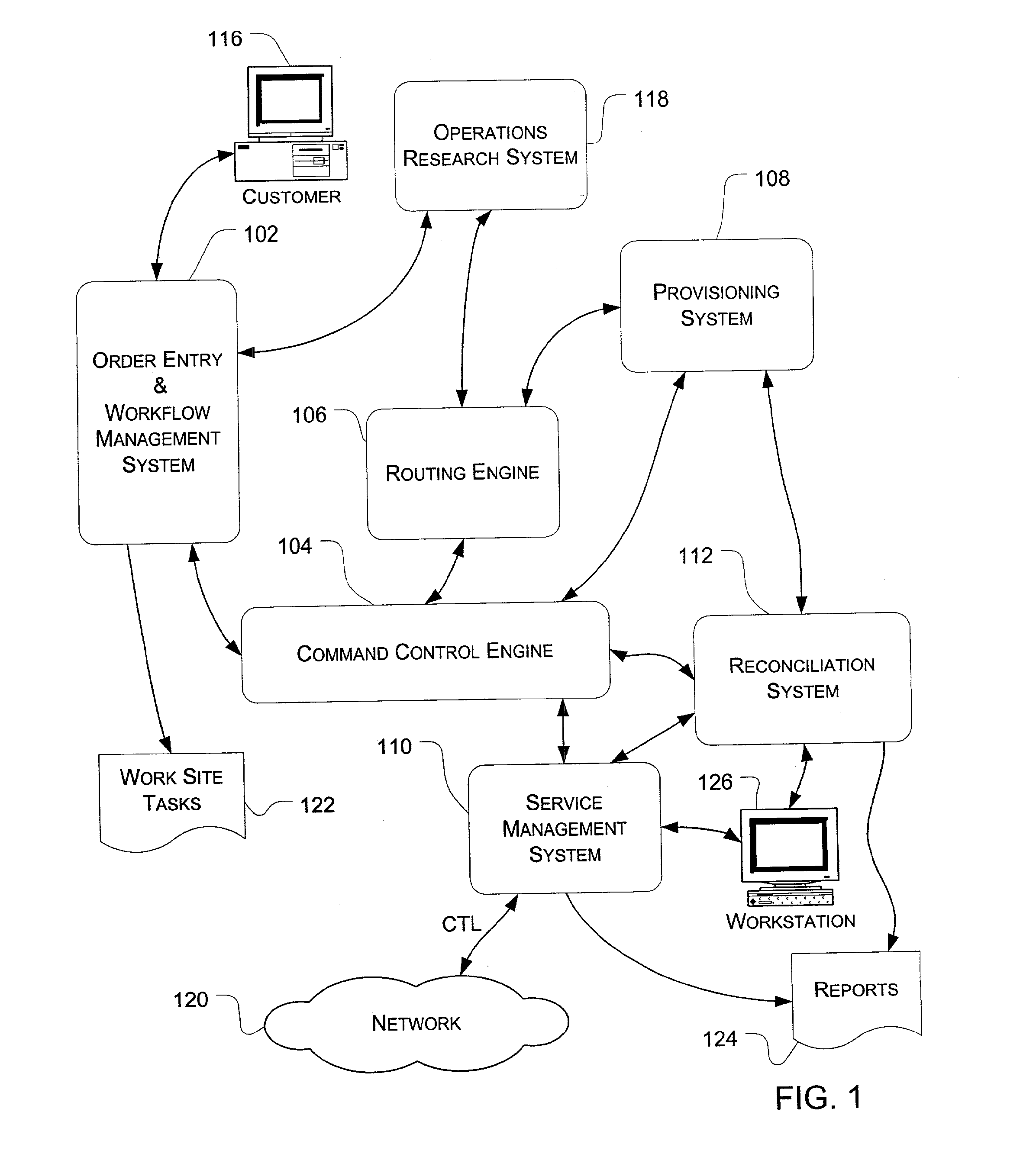

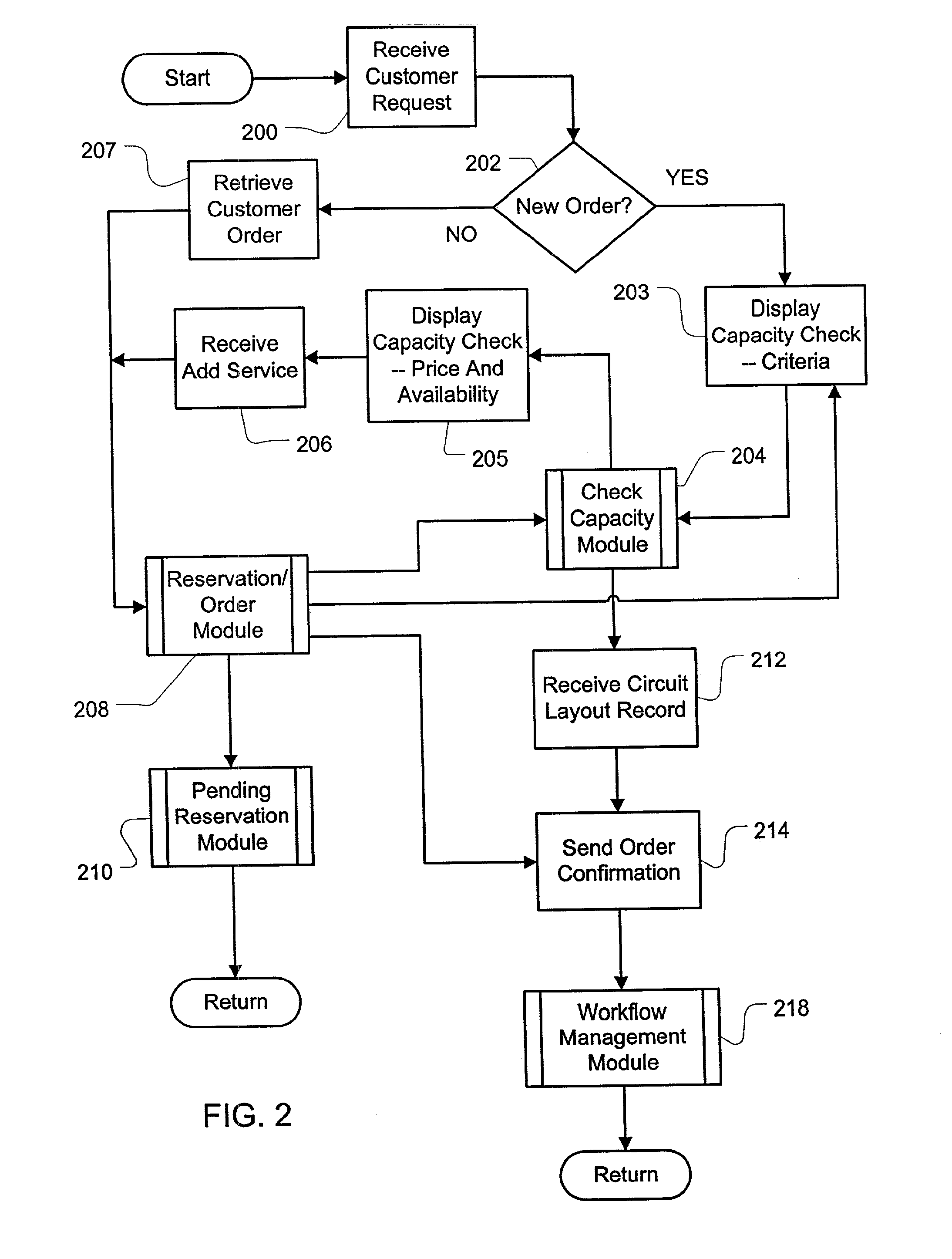

Order entry system for telecommunications network service

ActiveUS20110211686A1Special service for subscribersCustomer communicationsTelecommunications networkSystems design

Owner:LEVEL 3 COMM LLC

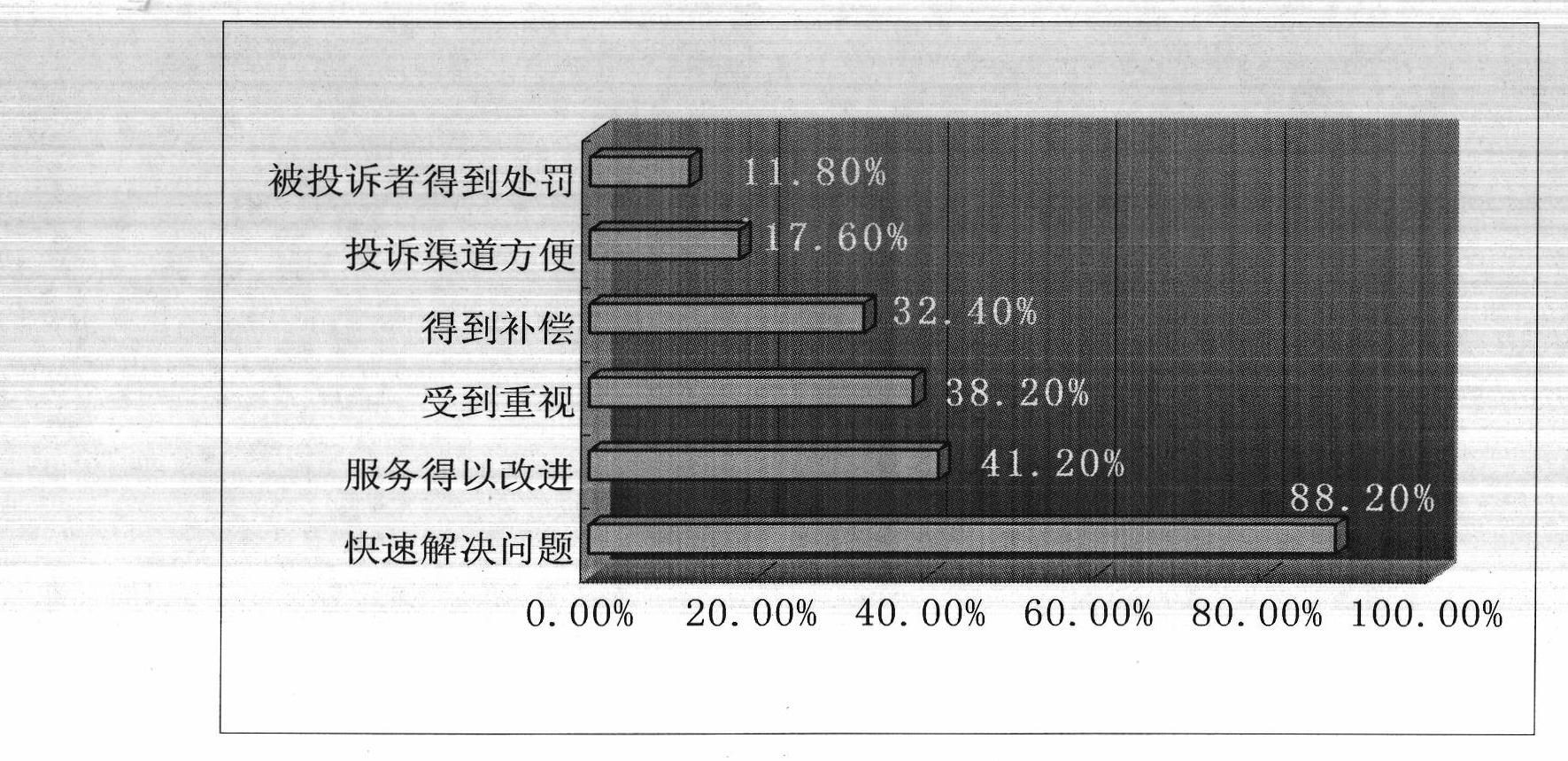

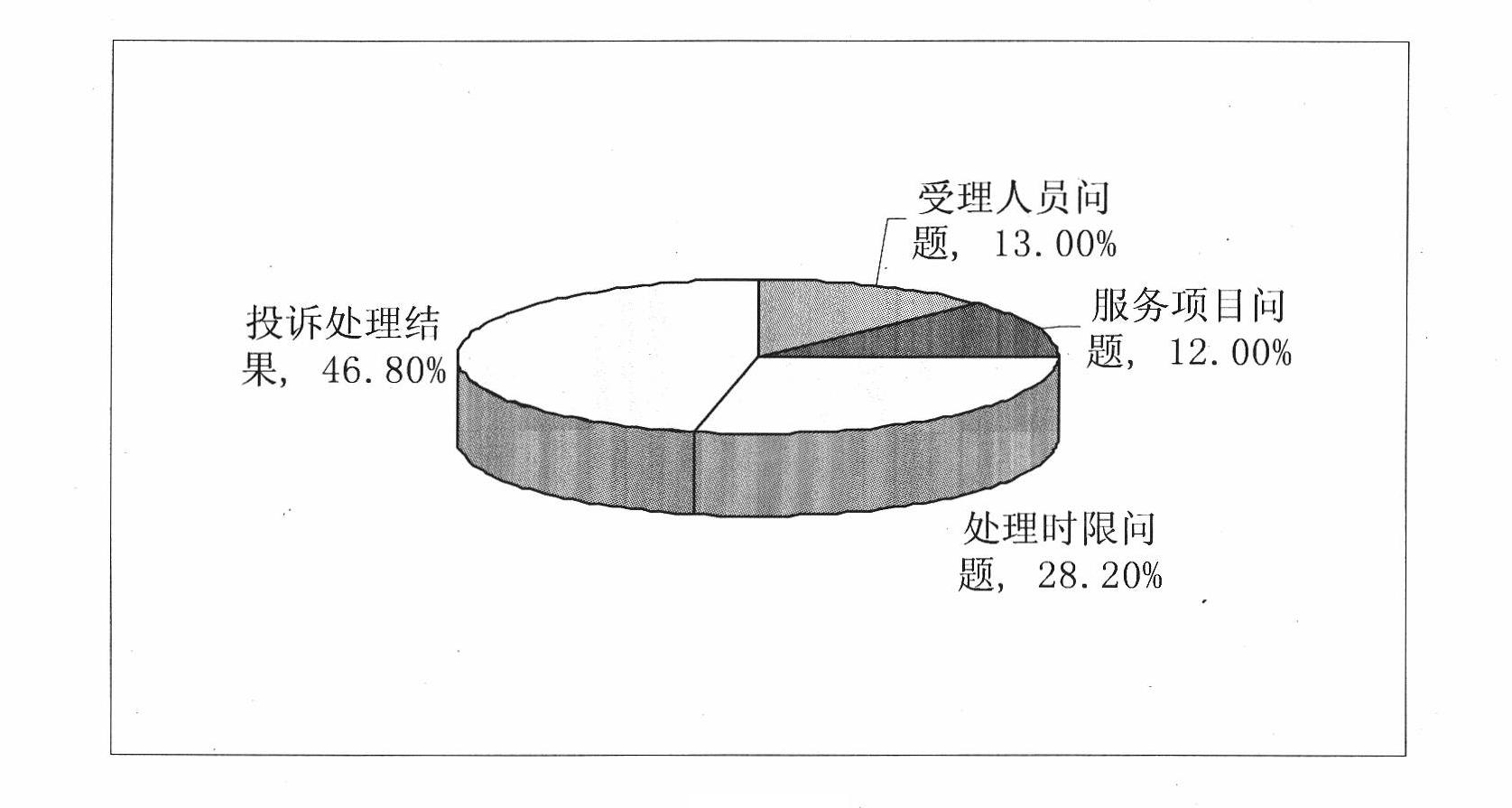

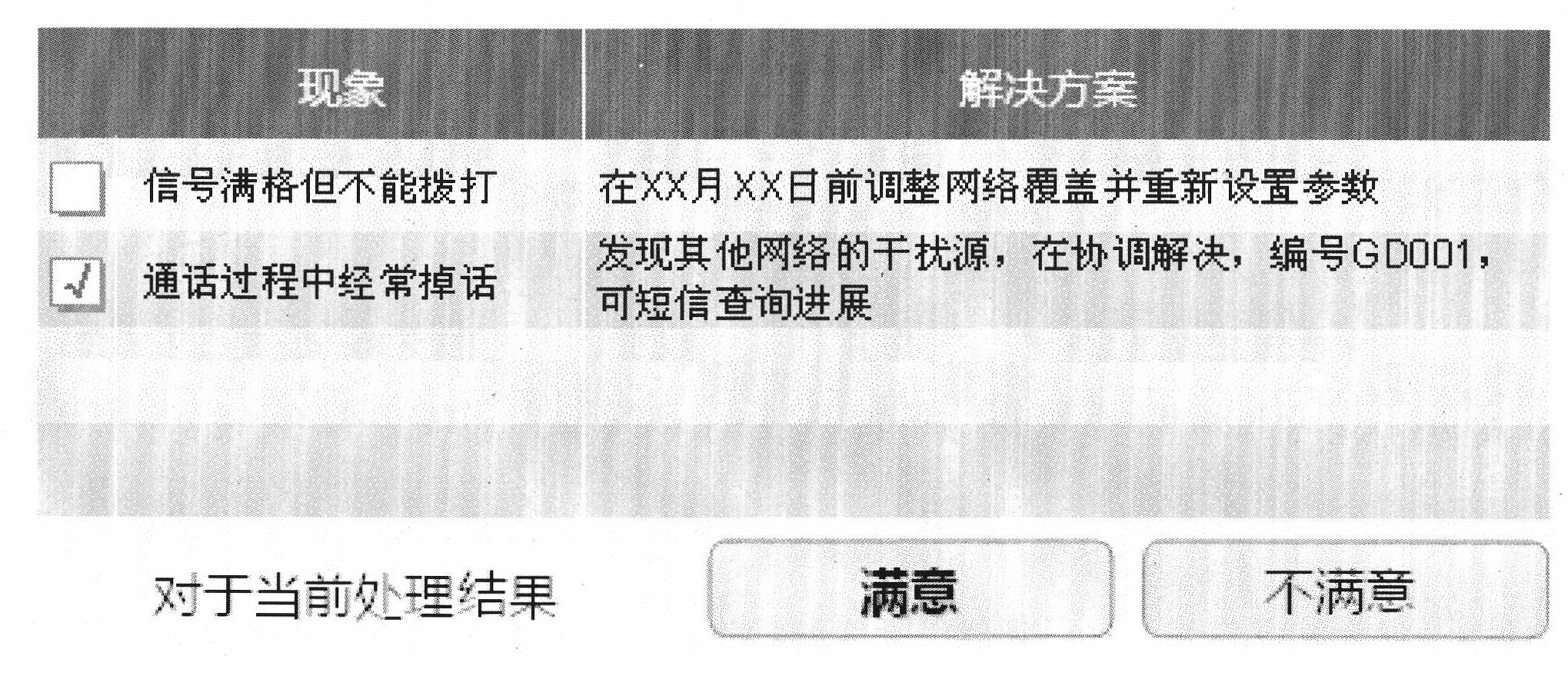

Method for handling communication network quality complaints based on customer perception

ActiveCN102137155AImprove complaint handling resultsGood application effectMessaging/mailboxes/announcementsTransmissionThe InternetCustomer engagement

The invention provides a method for handling communication network quality complaints based on customer perception, relating to the field of complaint handling in communication operation, wherein the method is used for solving the problems concerned by customers in the complaint process by using an information technology (IT) means and promoting the degree of satisfaction of handling and solving the complaints. Aiming at specific customers (the customers are convenient to surf the internet or can use internet-capable mobile phones) in the complaints, network information is provided based on maps, and an interactive mode is adopted, thus being convenient for the customers to complaint, and solving the complaint problems from the customers as soon as possible. By using the instant interaction, the customers can be independent, the satisfaction of customer participation can be promoted, the complaint handling number for customer service representatives can be reduced, and the manual labor is saved, the complaint positions of the customers are obtained more exactly so as to provide a data support for follow-up network adjustment.

Owner:INSPUR TIANYUAN COMM INFORMATION SYST CO LTD

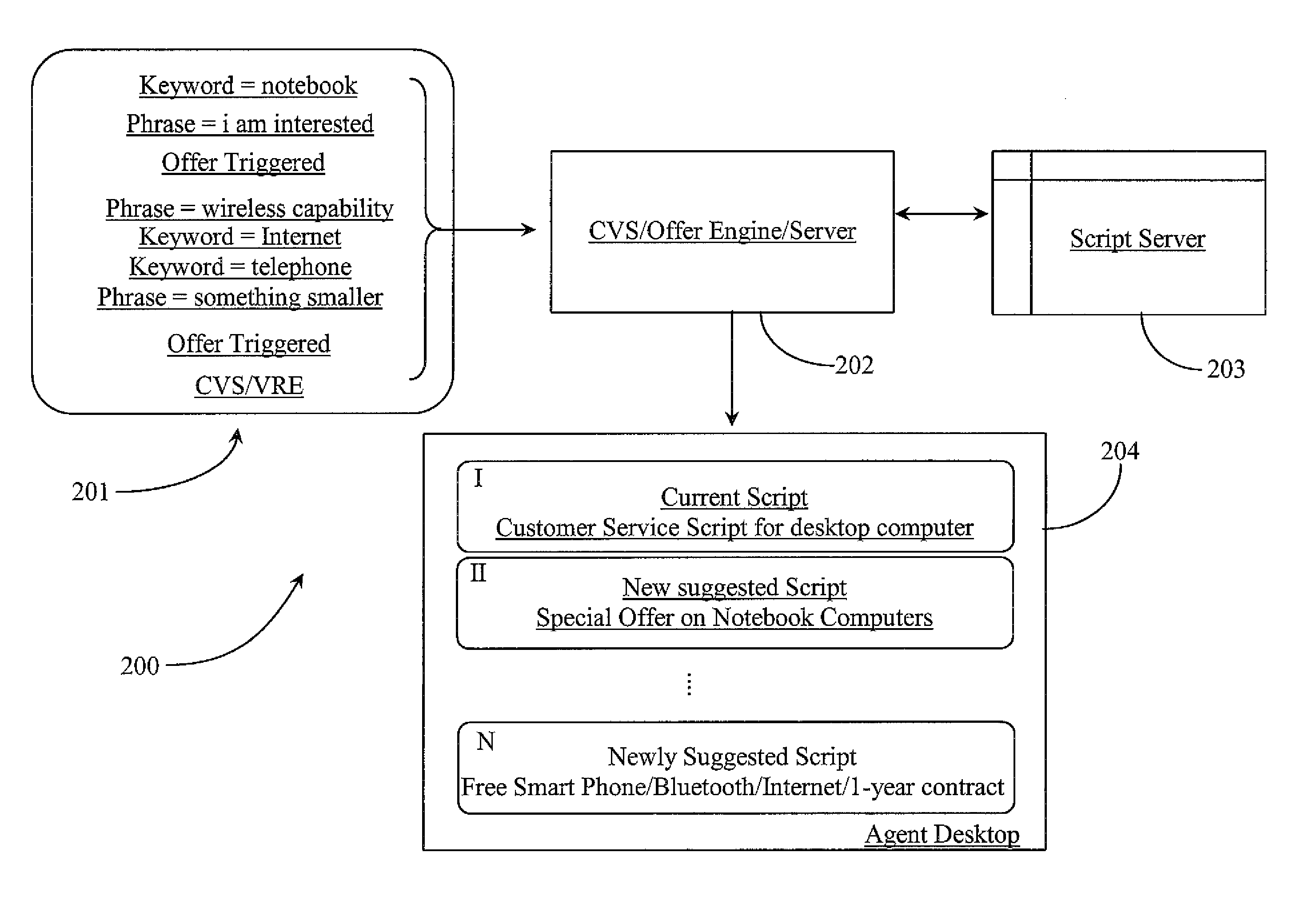

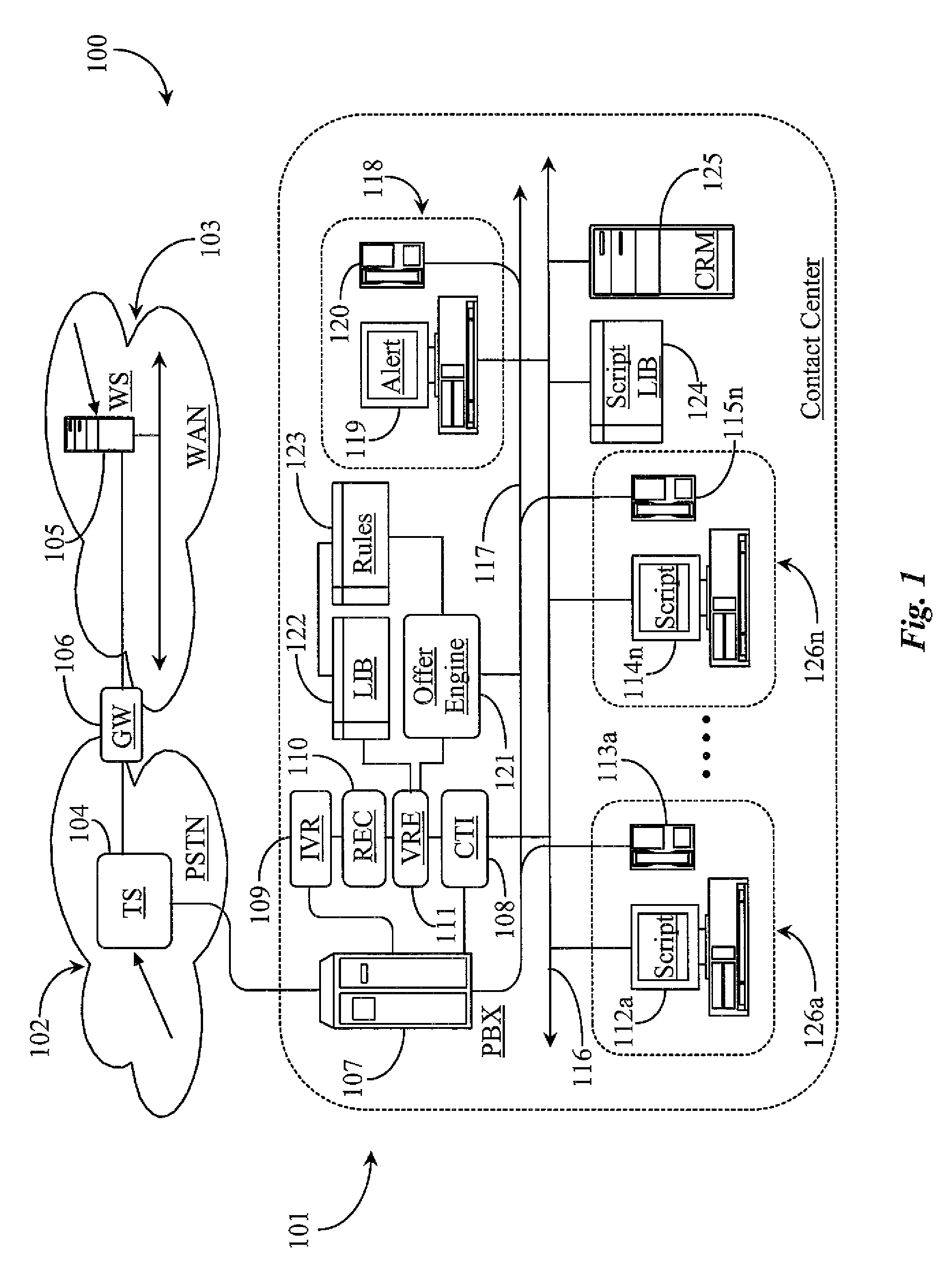

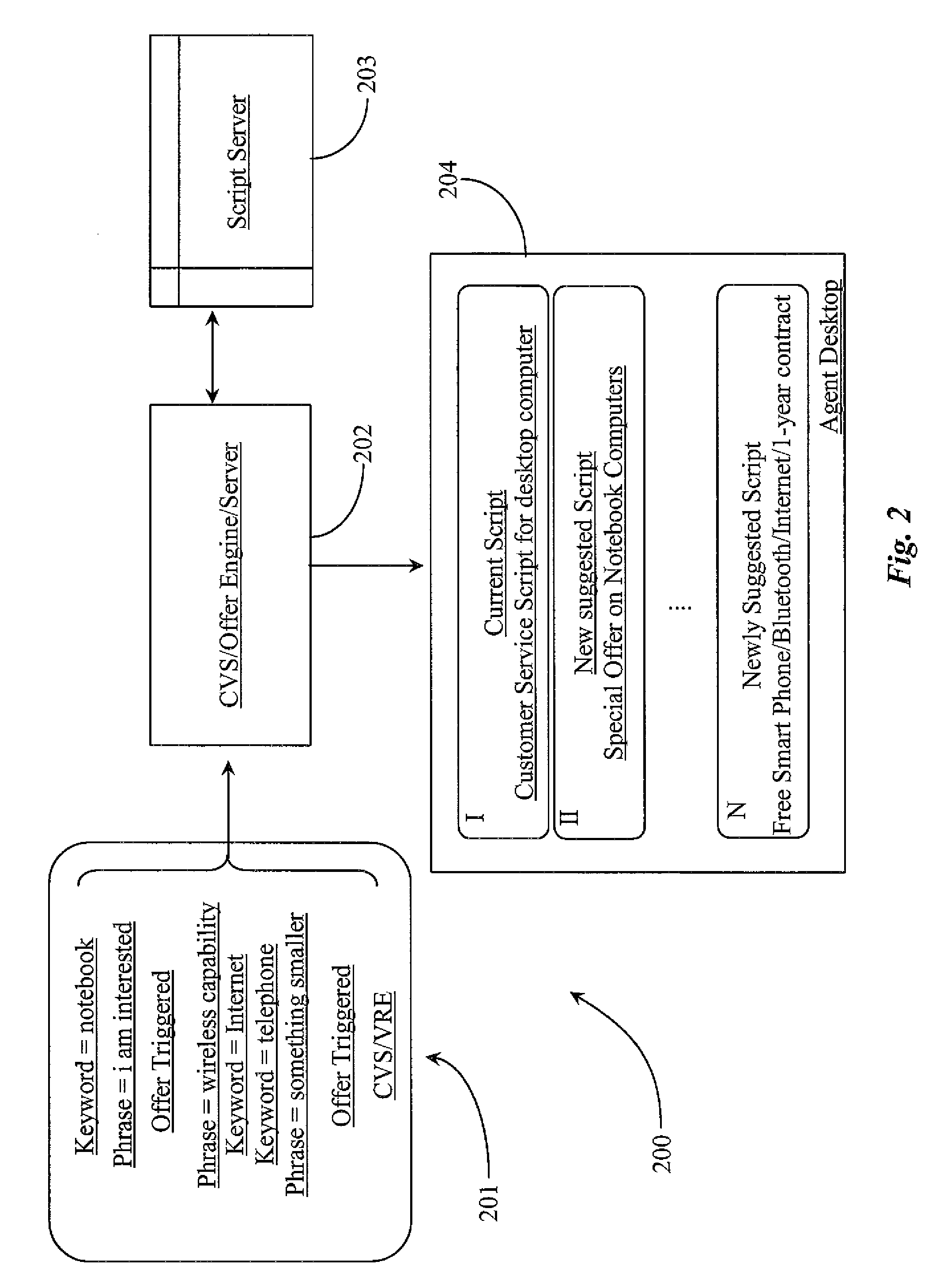

System for dynamic management of customer direction during live interaction

ActiveUS8706498B2Improve customer experienceQuick correctionManual exchangesAutomatic exchangesApplication serverDynamic management

A system for customer interaction includes a telephony-enabled device for receiving voice calls from customers, a voice recognition engine connected to the telephony-enabled device for monitoring the voice channel, and an application server connected to the voice recognition engine for receiving notification when specific keywords phrases or tones are detected. The system is characterized in that the application server selects scripts for presentation to the customer based at least in part on the notifications received from the voice recognition engine.

Owner:ASTUTE

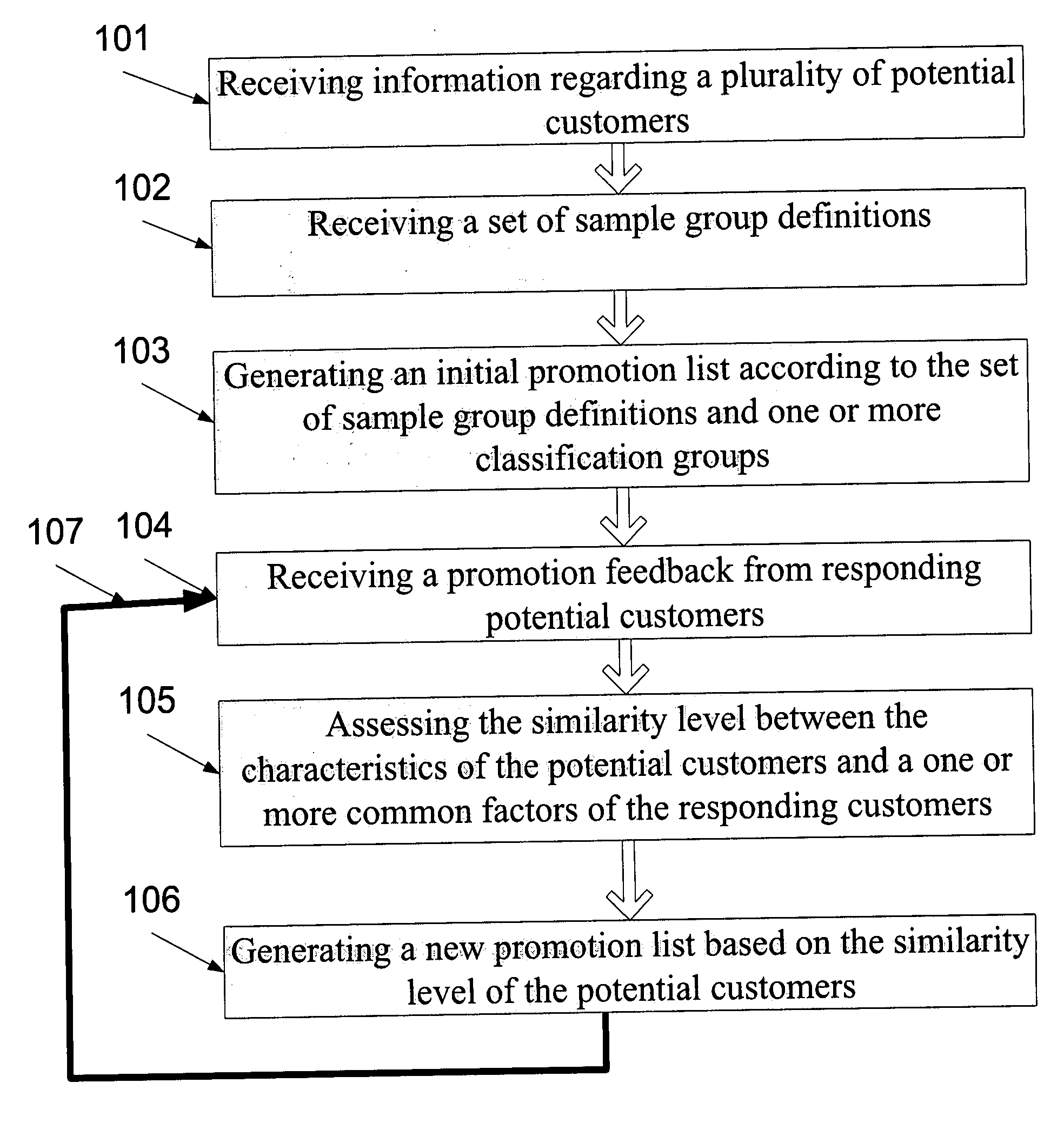

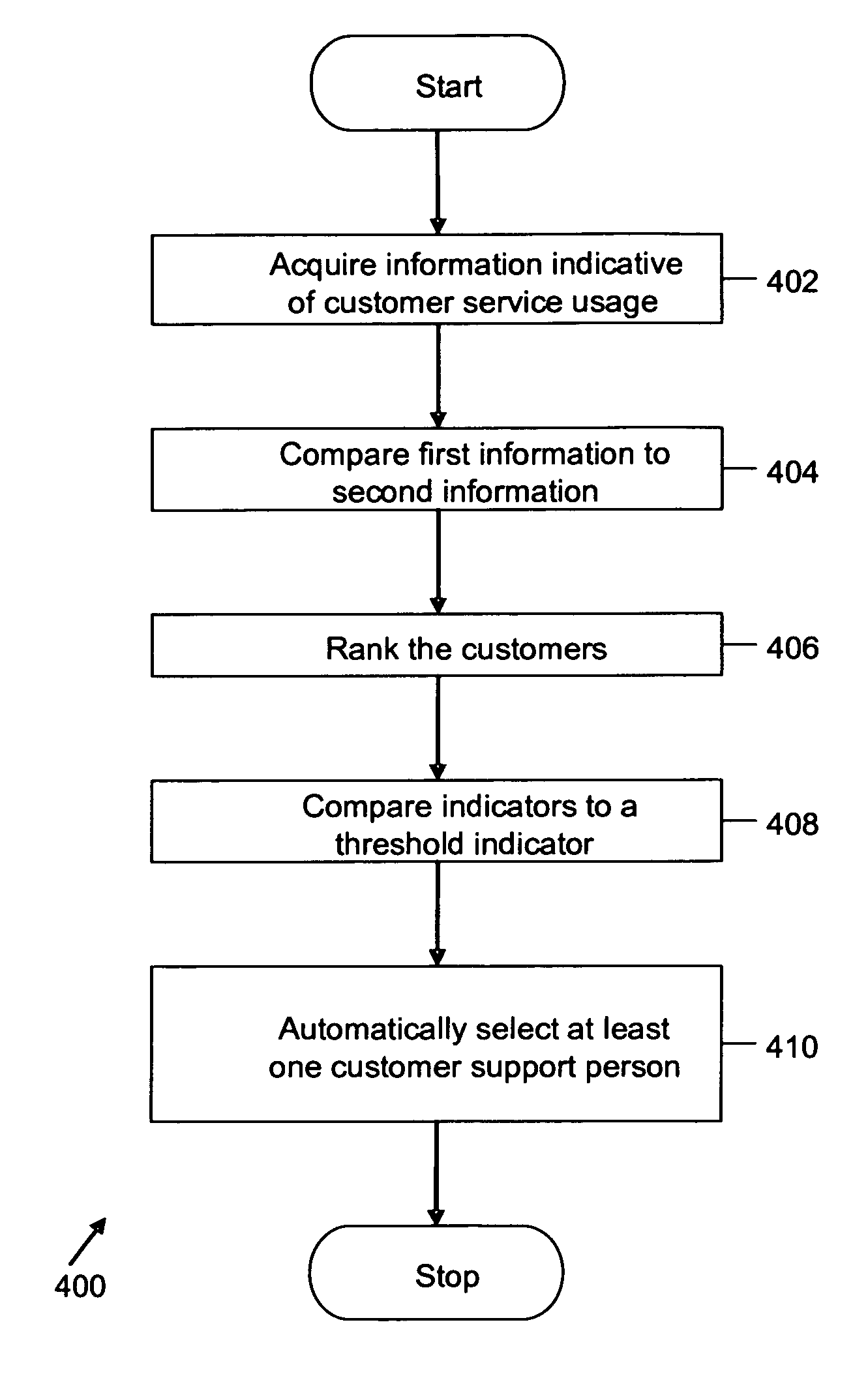

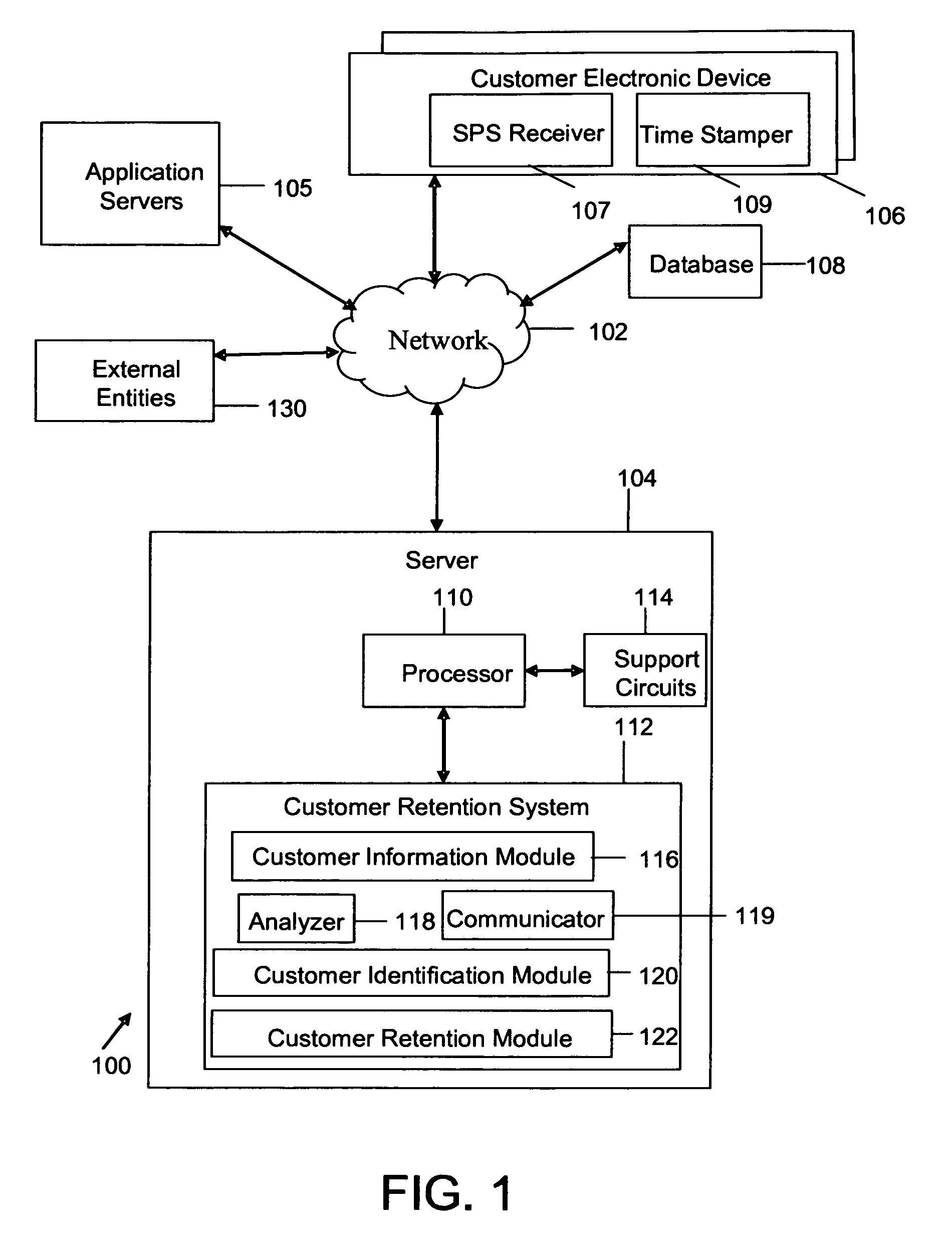

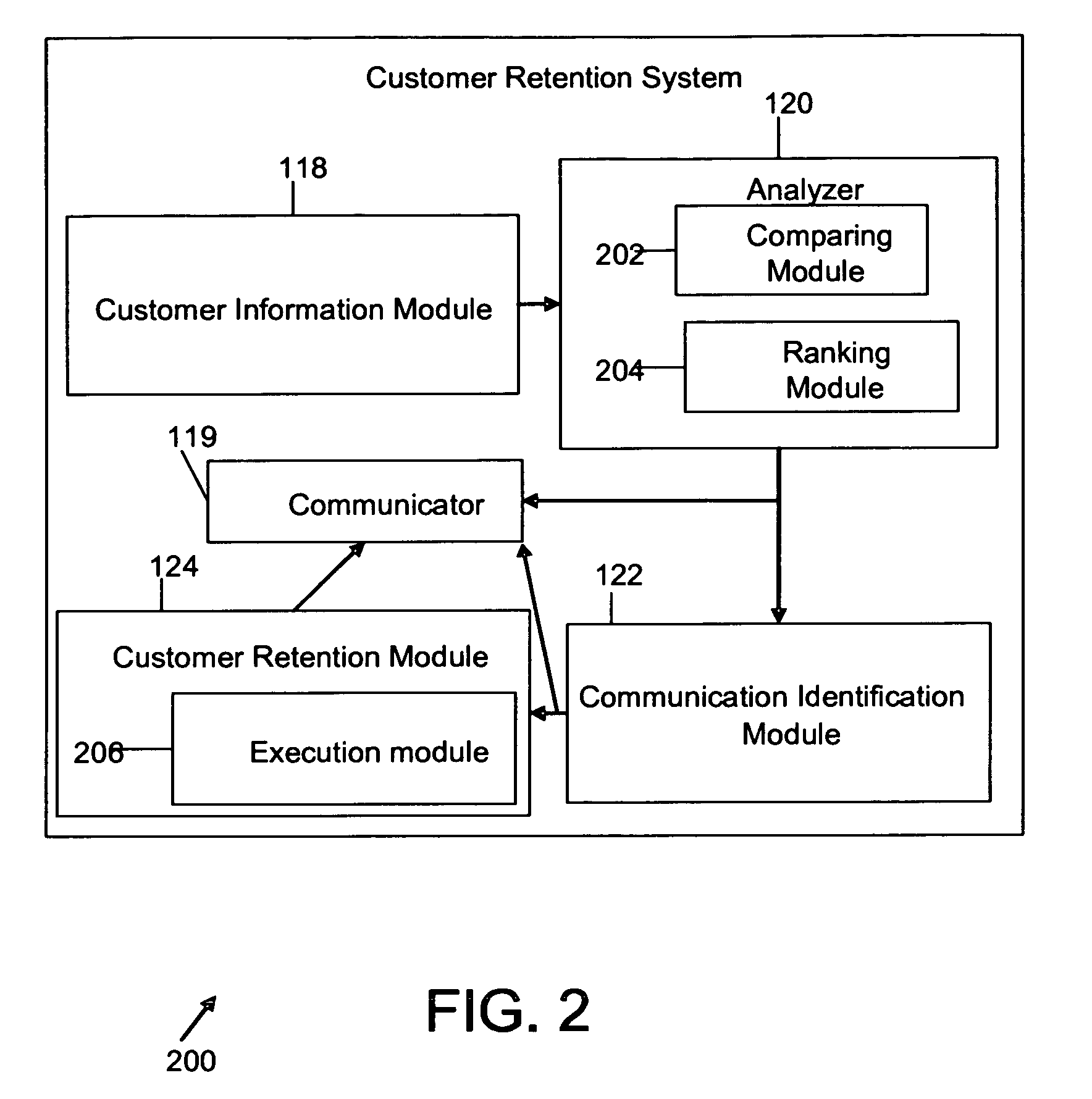

Method and apparatus for customer retention

ActiveUS8199901B2Easy retentionEasy to satisfyHand manipulated computer devicesAutomatic call-answering/message-recording/conversation-recordingSkill setsCustomer support

Method and apparatus that facilitates customer retention, churn reduction, and customer satisfaction by predicting customer churn and taking an appropriate action to retain a customer is described. In an example, a customer retention method acquires information indicative of customer service usage by customers. The customer retention method then provides an analysis of the acquired information. The analysis predicts the likelihood of churn for each customer. The customer retention method then identifies affected customers based on the analysis. The customer retention method then automatically selects customer support executives to initiate an action for each of the affected customers. The customer retention method selects the customer support executives based on skill in handling the affected customers, among other factors.

Owner:CLICKSOFTWARE TECHNOLOGIES

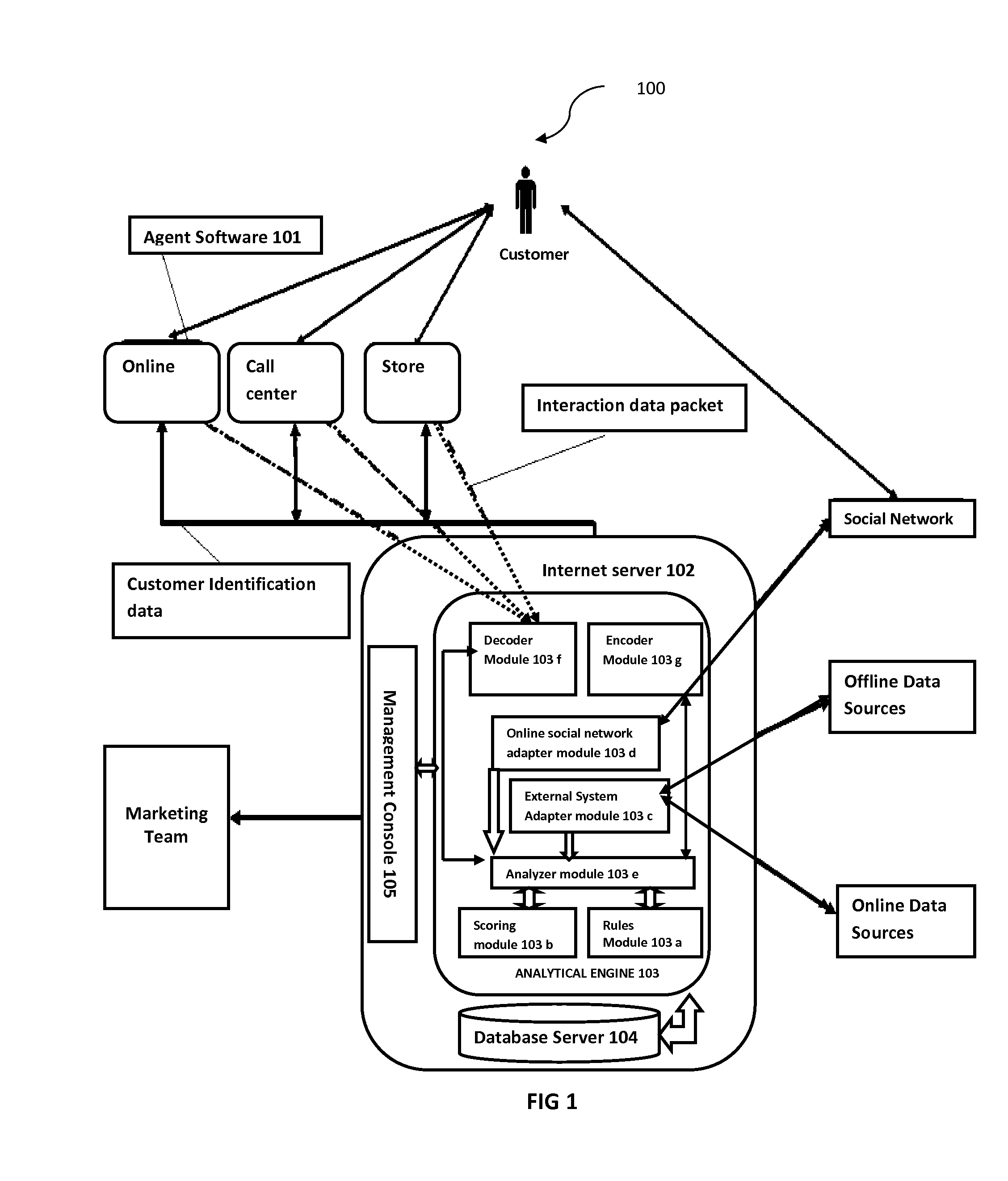

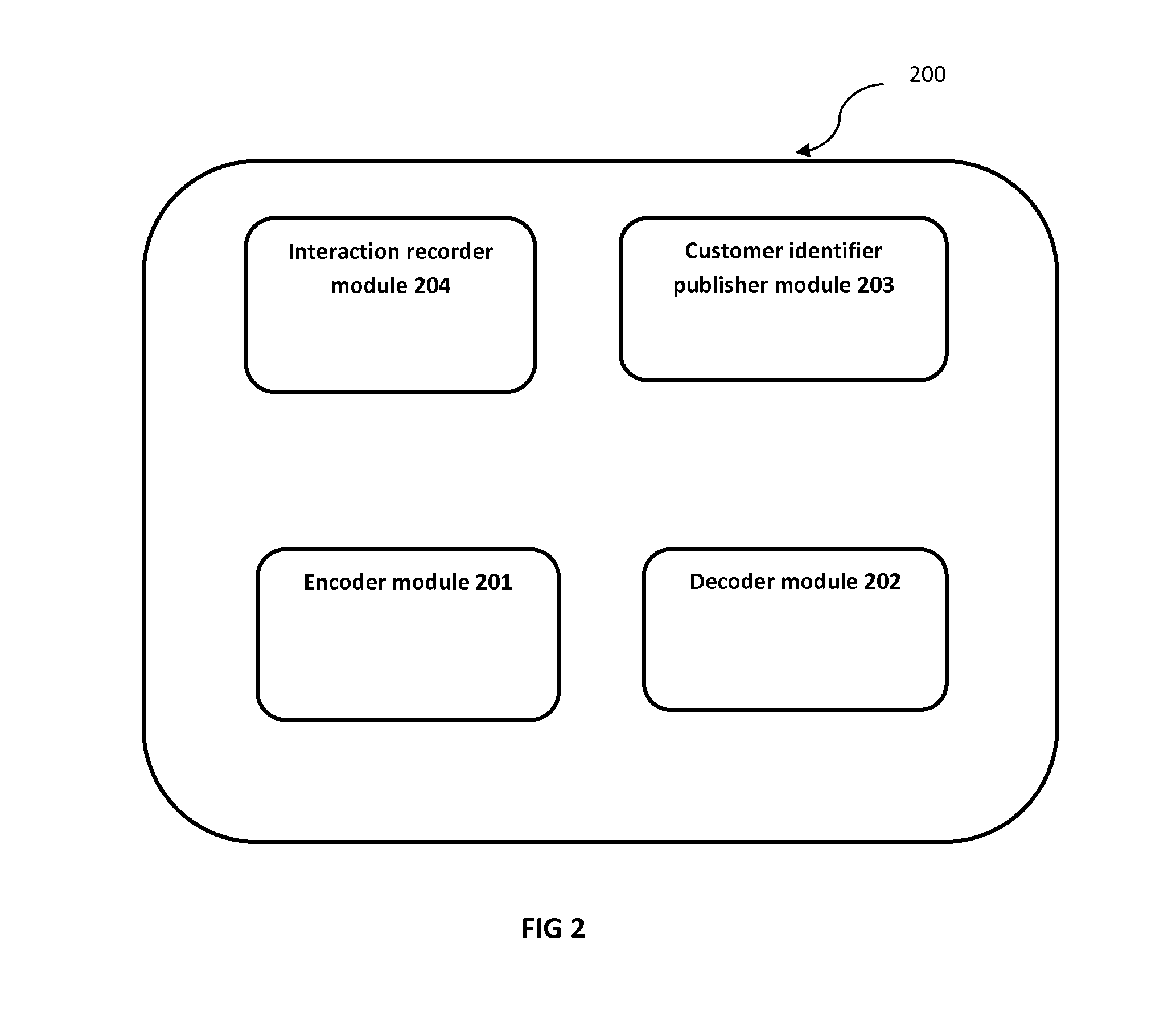

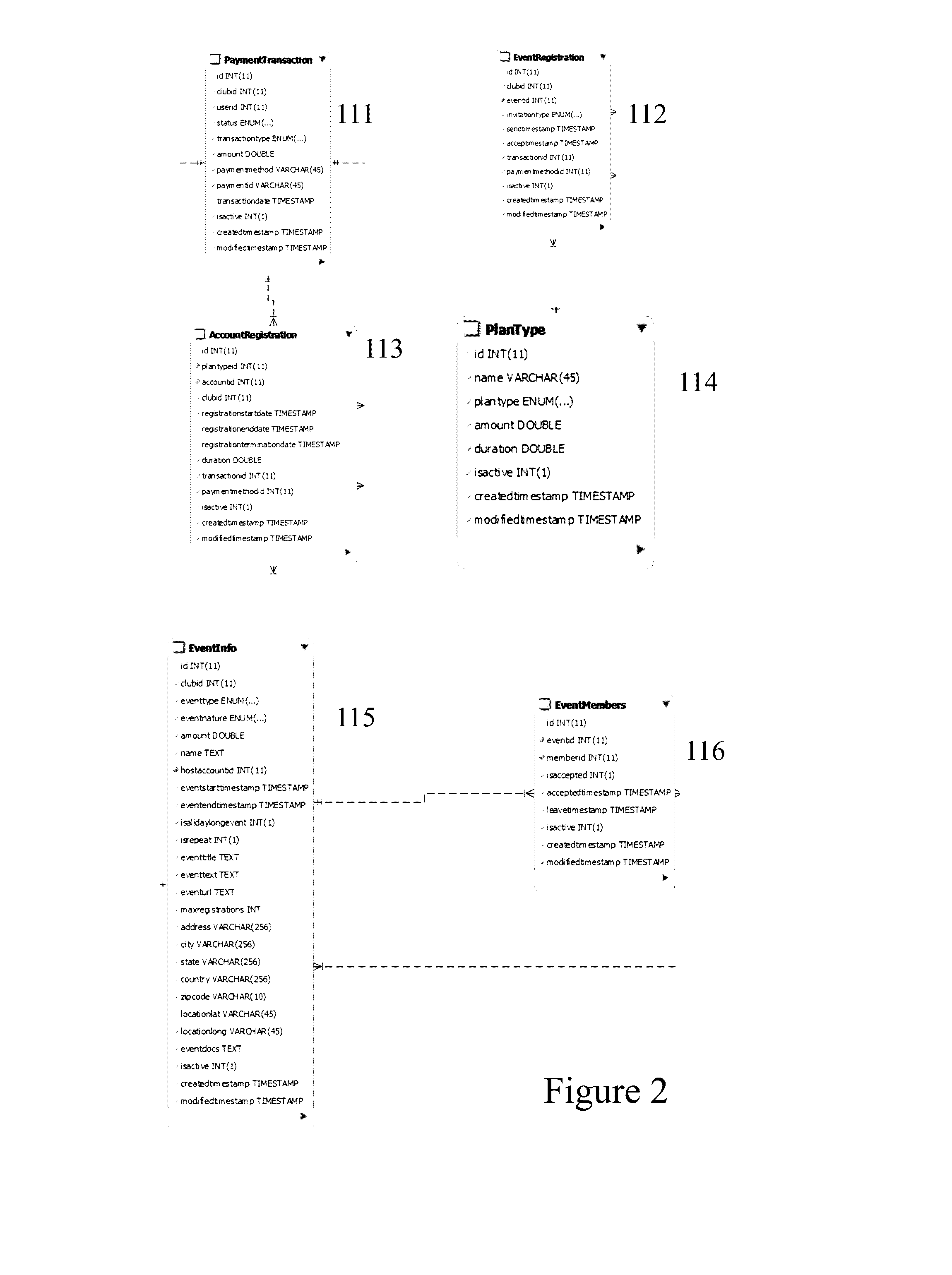

System and Method for Customer Evaluation and Retention

The present invention provides a system and method for customer evaluation and retention. The system is adapted to receive and record all data concerning customer's interaction during the transaction from various touch points and sends the data to a server for further processing. The scoring module of the system allocates values to each customer by assigning score based on various scoring attributes. The final updated information about each customer is pushed back to all touch points that will be further used by business owners for formulating customer retention programs. The availability of real time information regarding customer net present value is beneficial in computing and proposing retention program as the evaluation data is based on past trends taking into consideration recency, frequency, monetary history and individual sentiment scores.

Owner:DECISIVE ANALYTICAL SYST

Methods and systems relating to auto-generated private communities

ActiveUS20170024832A1Improve satisfactionMultimedia data browsing/visualisationCryptography processingVisibilitySkill sets

Establishing online social communications for enterprises whilst beneficial to them in terms of revenue, customer retention etc. require skills and time, both of which the enterprises personnel do not possess. The inventors have established an inventive turn-key software application that allows an enterprise to create invitation only private groups on mobile device platforms and monetize aspects of this online private group through direct payments to the club owner. An individual, a group, a society, a business or enterprise irrespective of whether they are active on other social networks can exploit the inventive turn-key software application augmenting their business with clear visibility of the return on investment. As such the inventive turn-key software application provides an effective “one-stop shop” for those looking to establish and build their brand on mobile technology.

Owner:MOBILITHINK SOLUTIONS

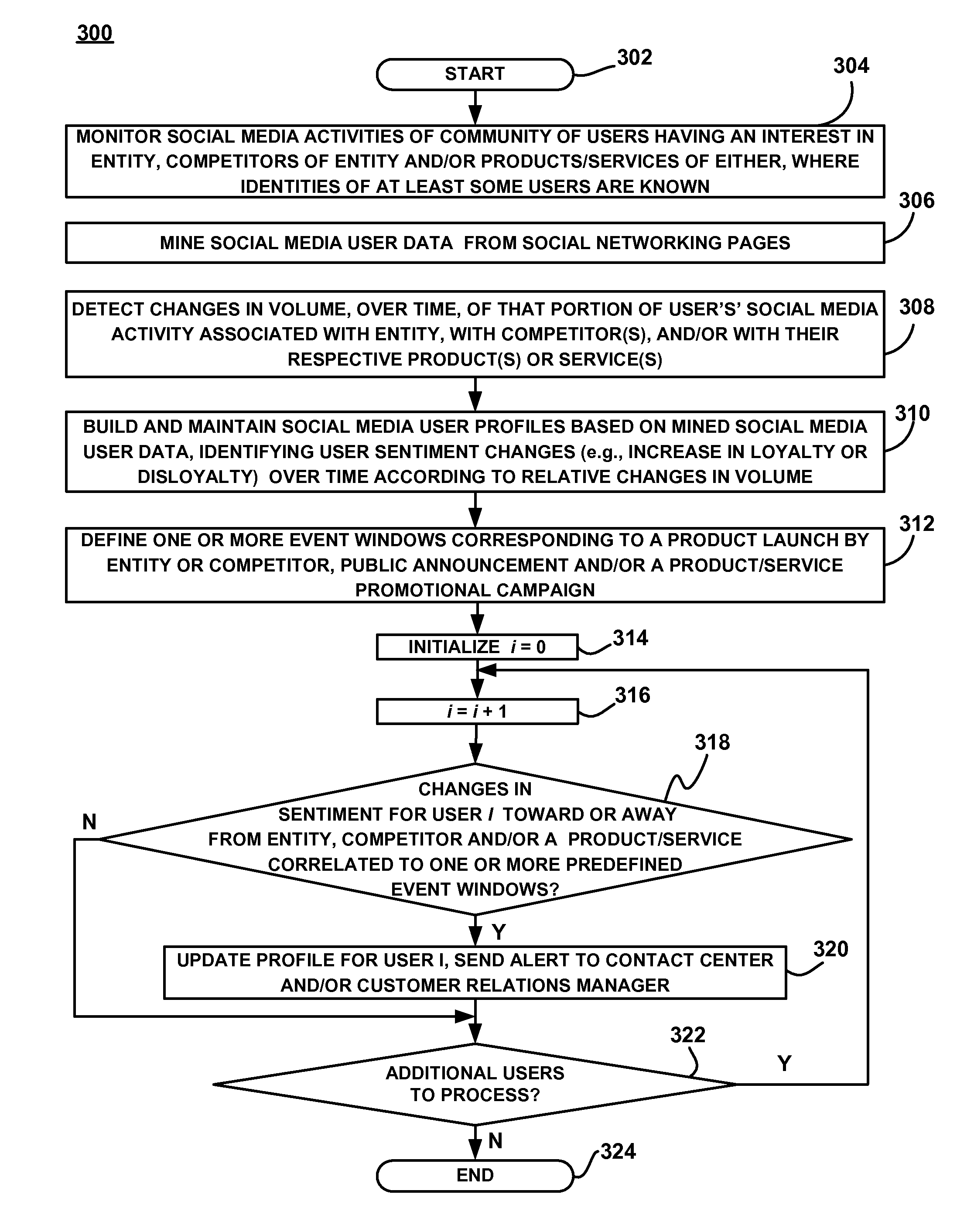

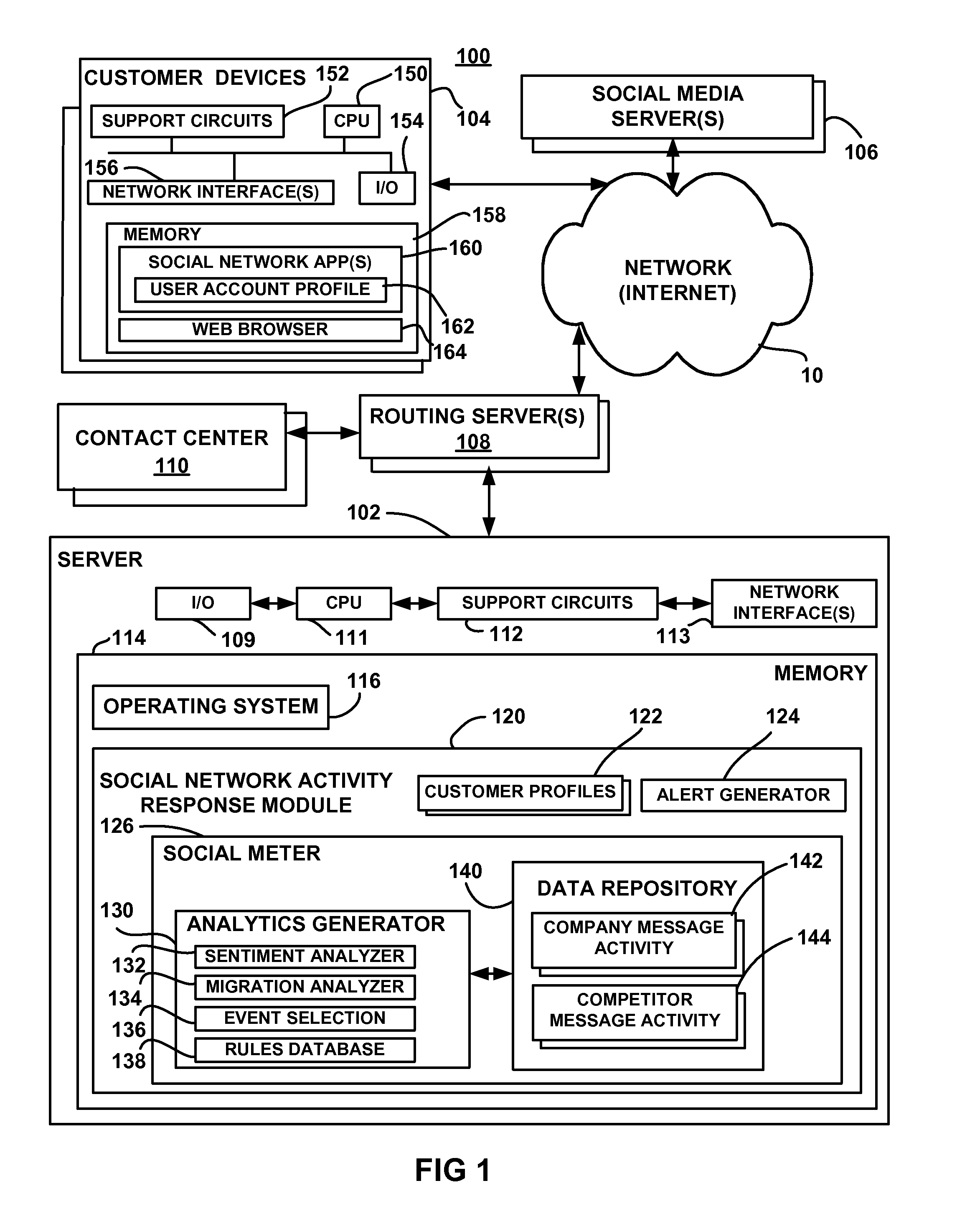

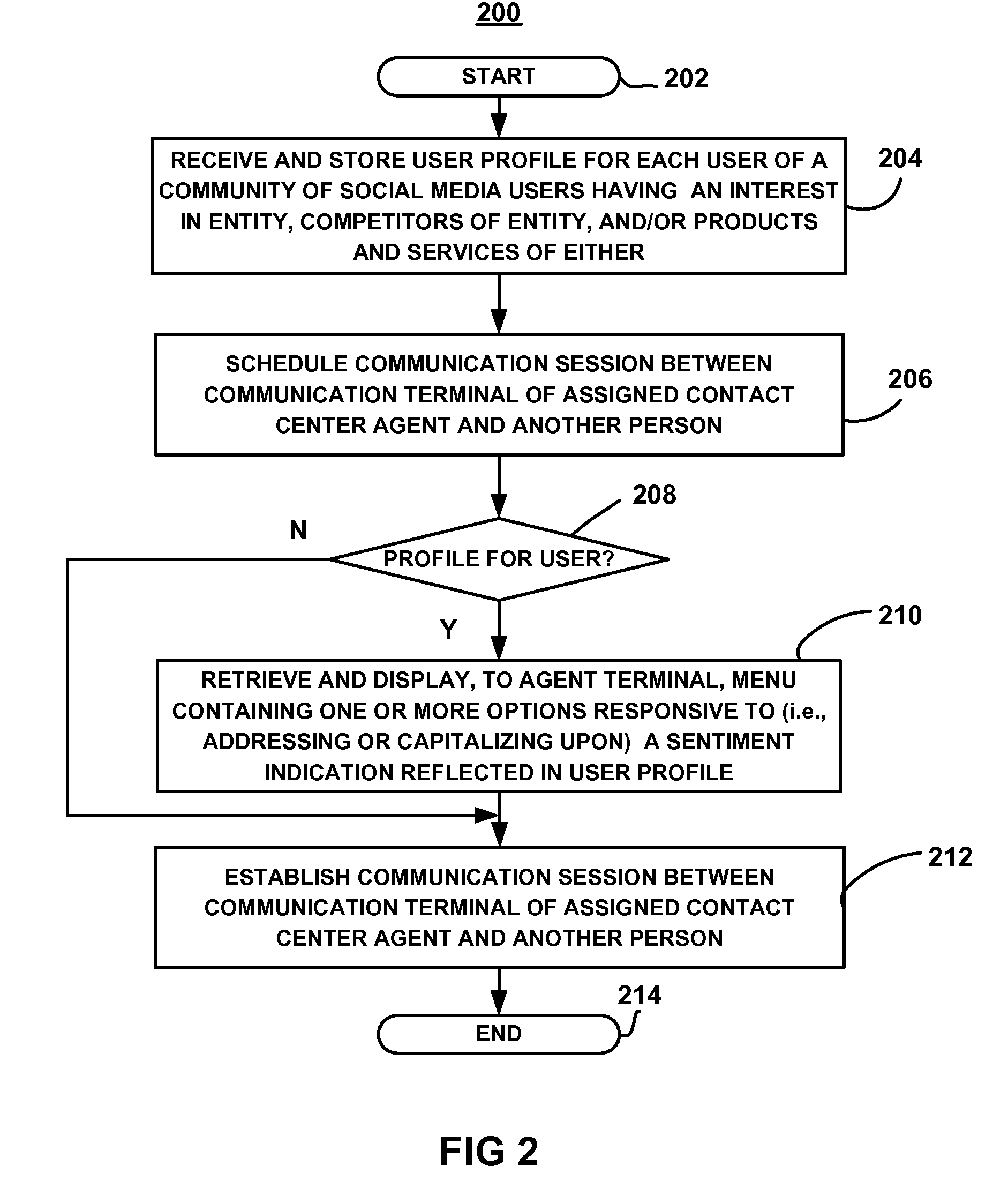

Systems and methods for influencing customer treatment in a contact center through detection and analysis of social media activity

A contact center is operated, on behalf of an entity, by reference to social media analytics. A user profile, acquired for each of a plurality of social media users, identifies the user and includes at least one of three indications of sentiment derived over time through analysis of social media event activities and / or behavior. The sentiment indications of a profile include user sentiment toward the entity, user sentiment toward one or more competitor(s) of the entity, and / or user sentiment toward a particular product or service offered by the entity or a competitor(s) of the entity. A communication session is established between a communication terminal of a contact center agent and one of the users for whom a user profile is stored. A menu including at least one option for addressing or capitalizing on a change of sentiment reflected in the user's profile is displayed to the agent.

Owner:AVAYA INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com