Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

45013results about "Control devices" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

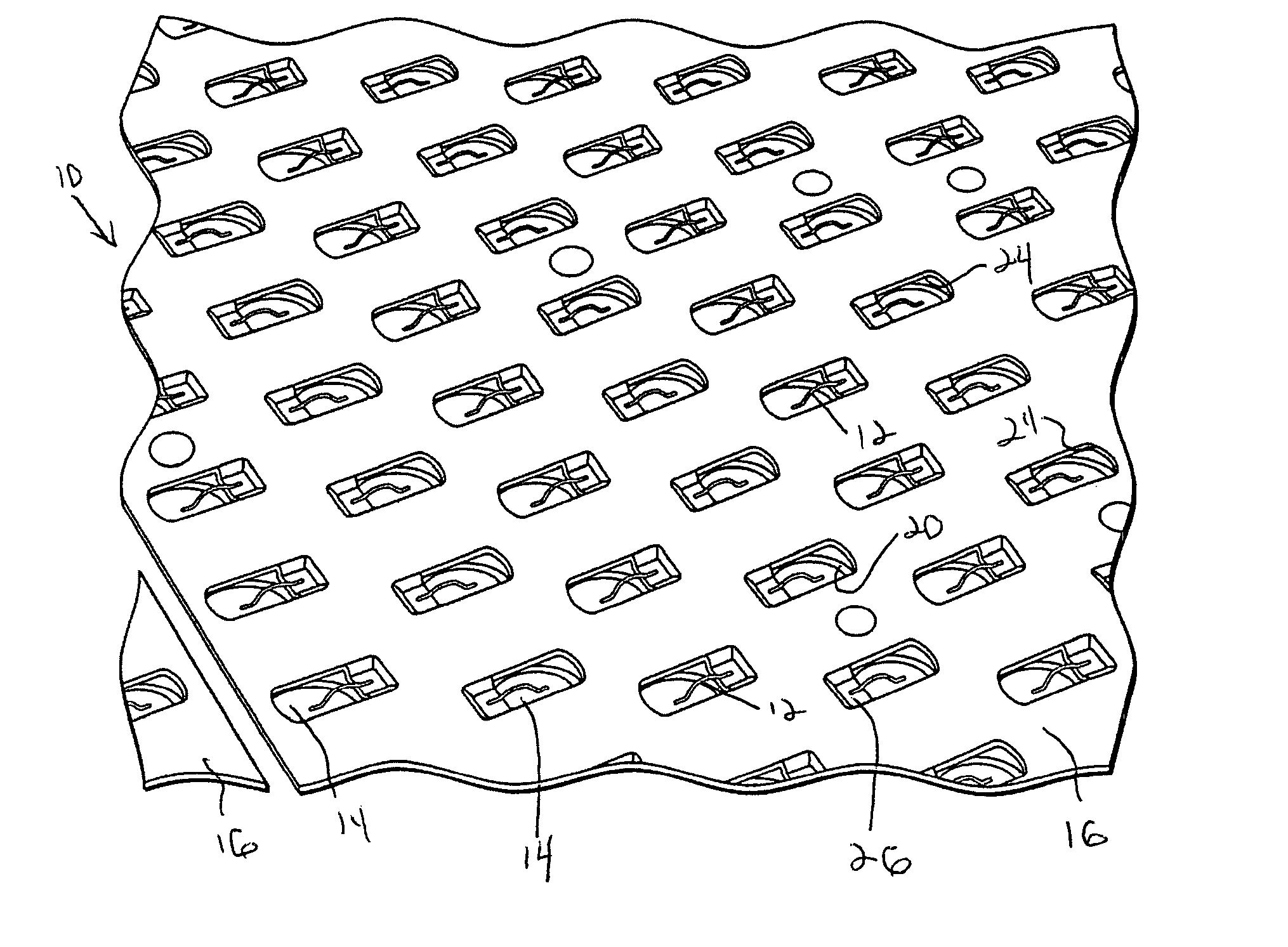

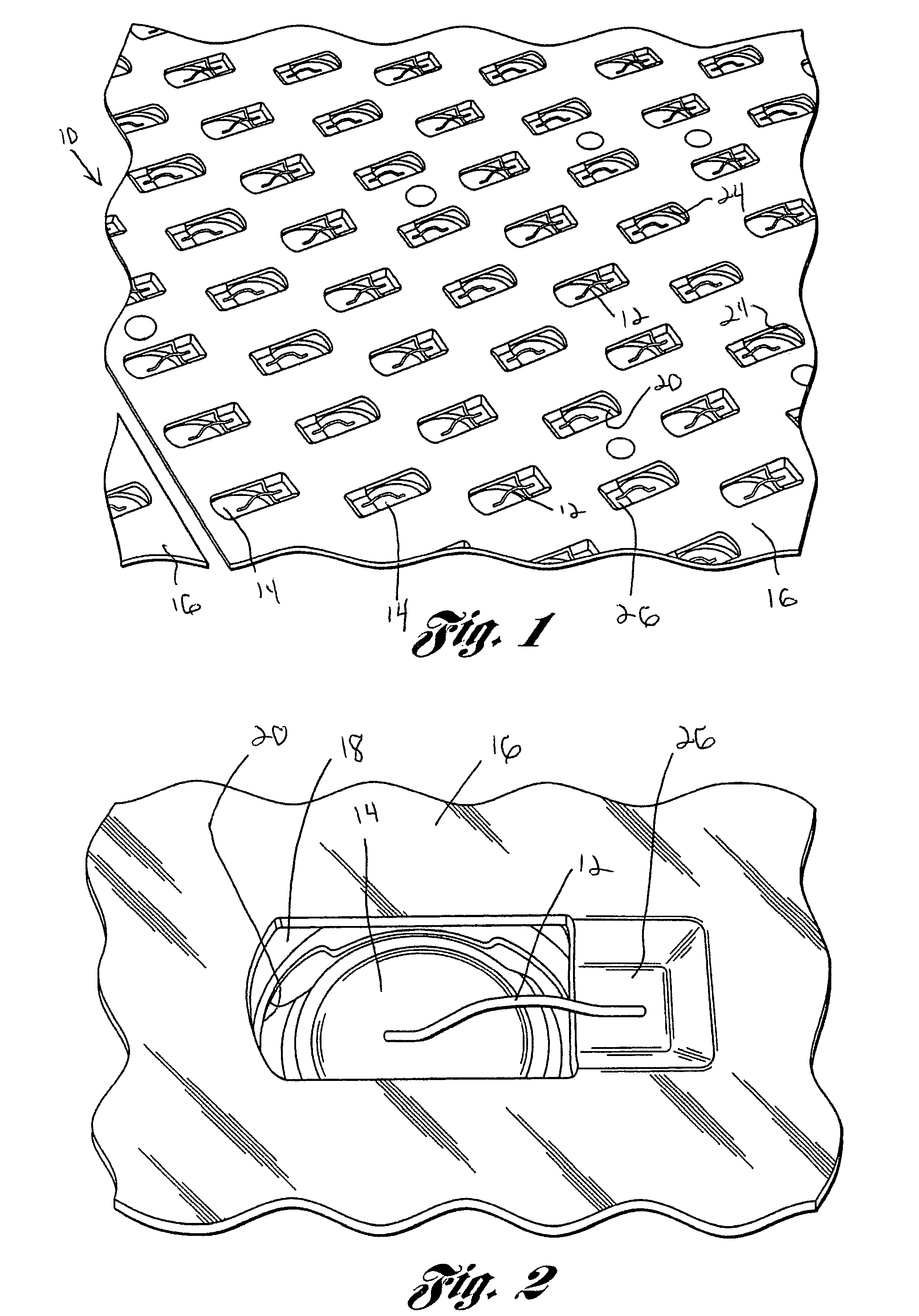

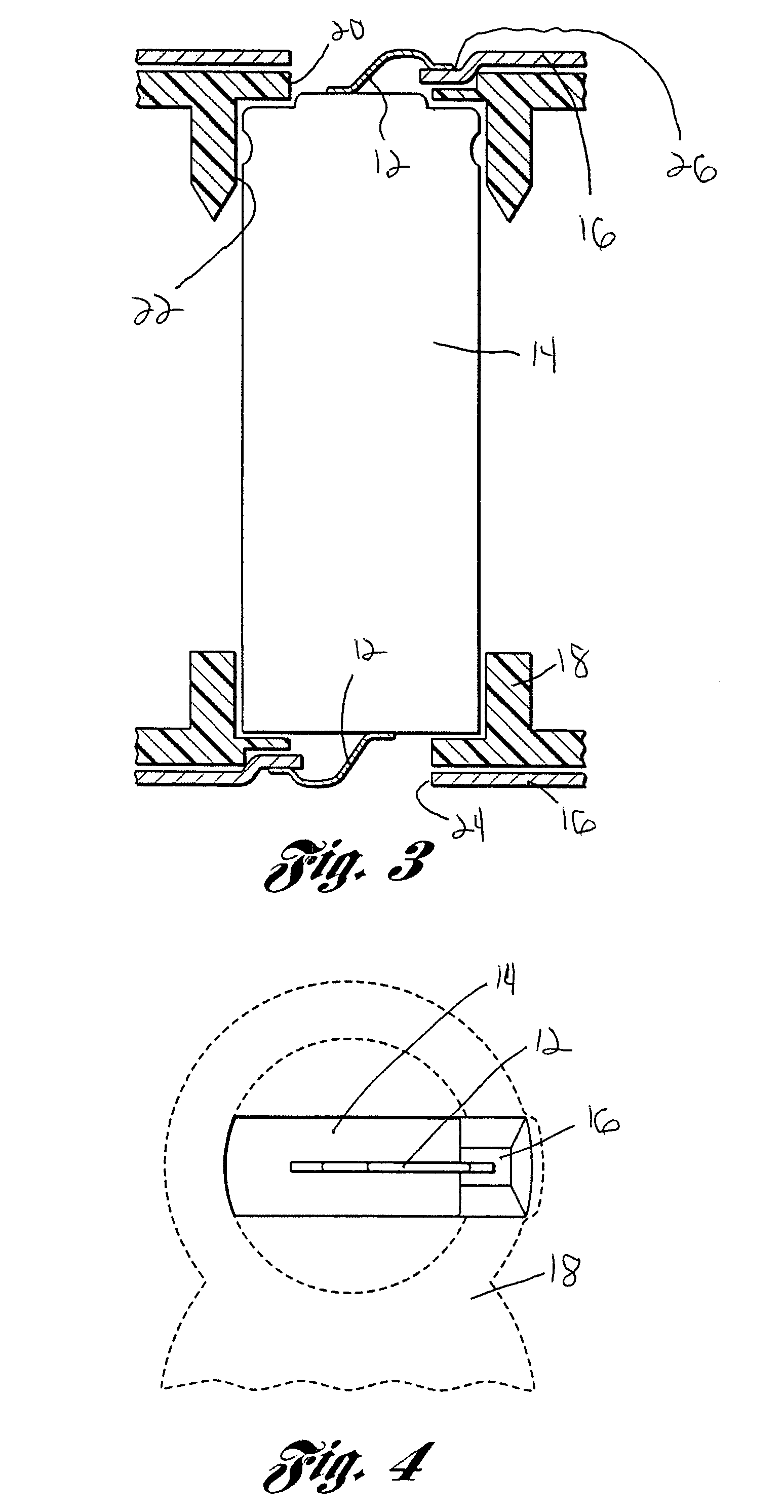

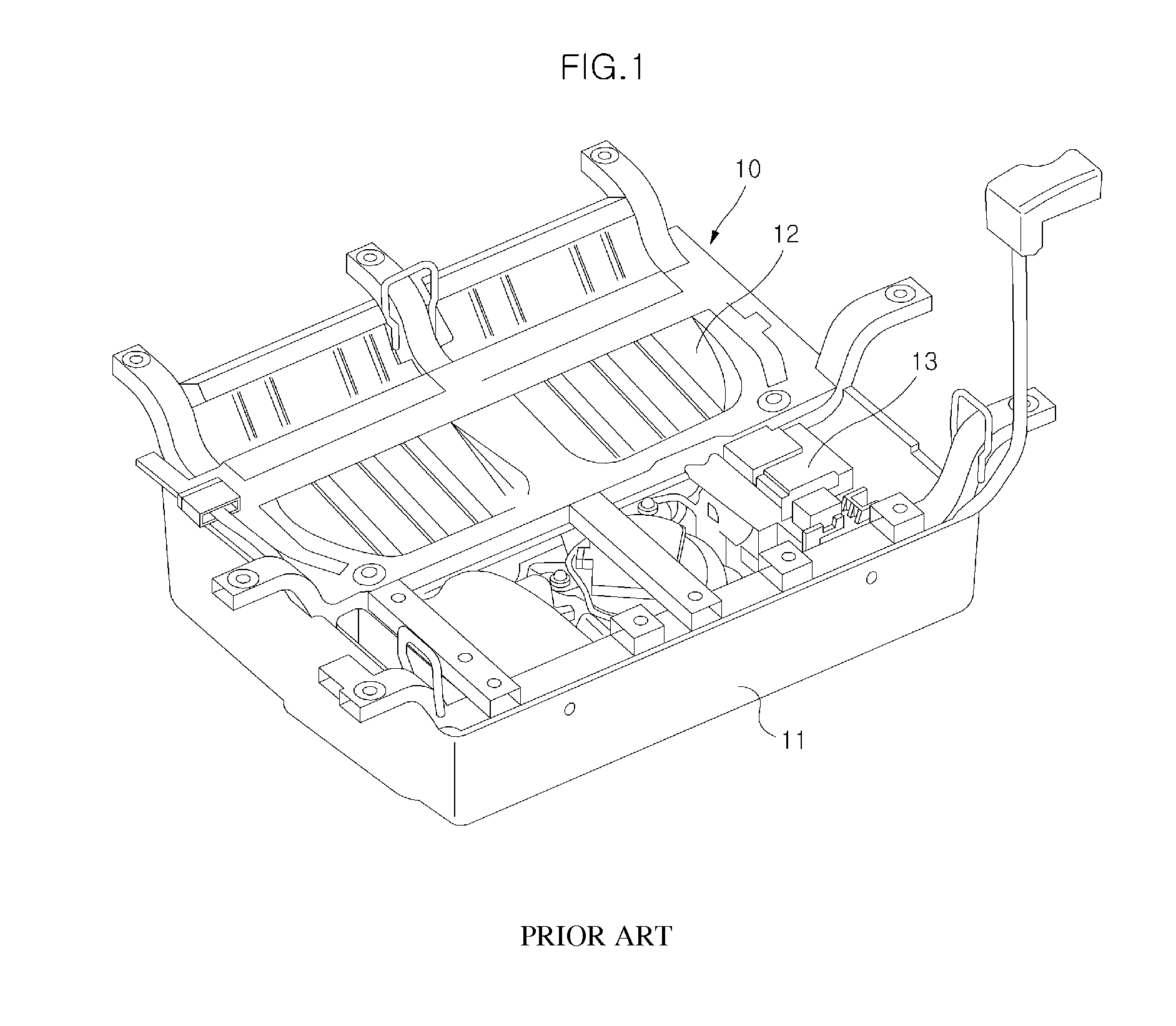

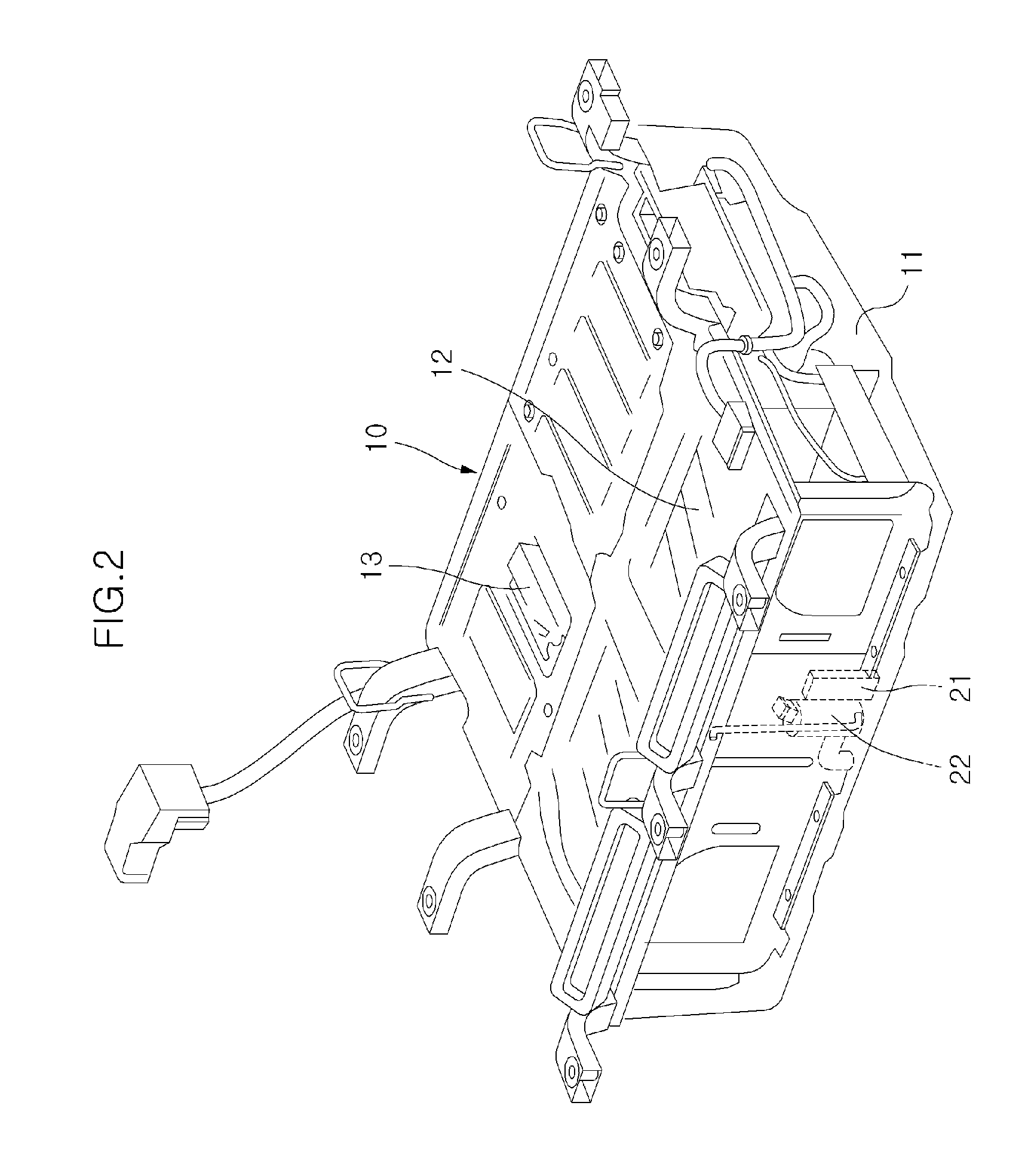

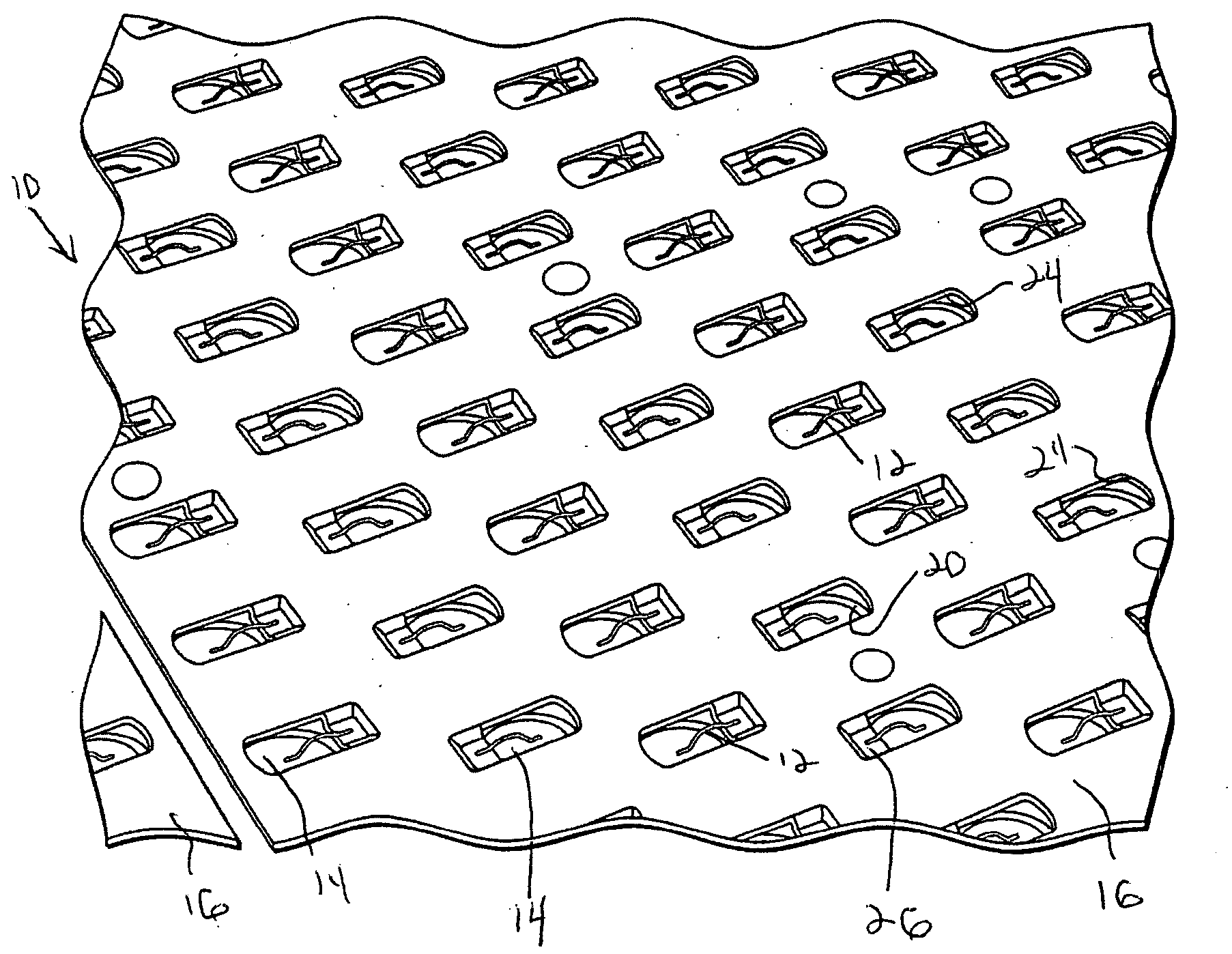

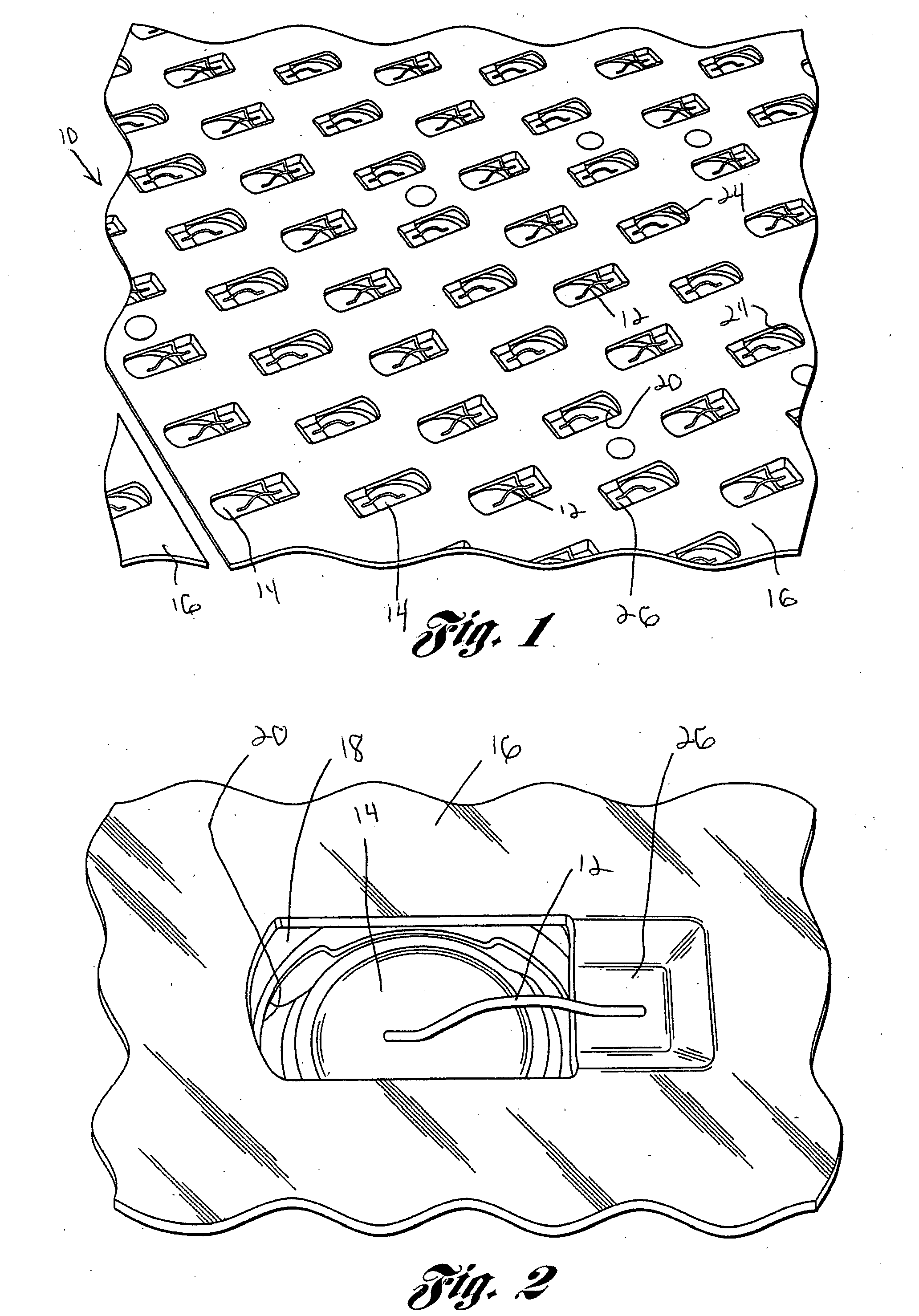

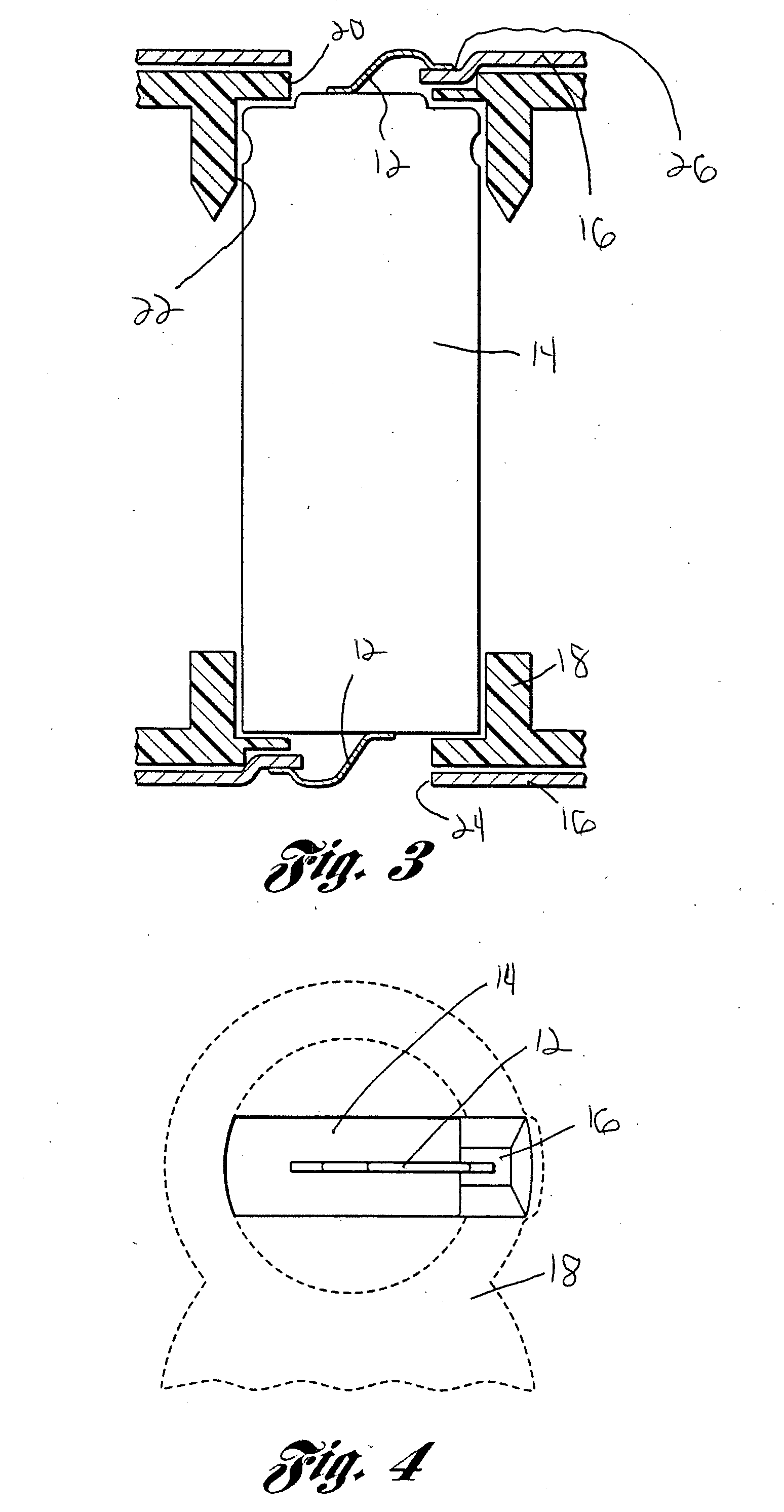

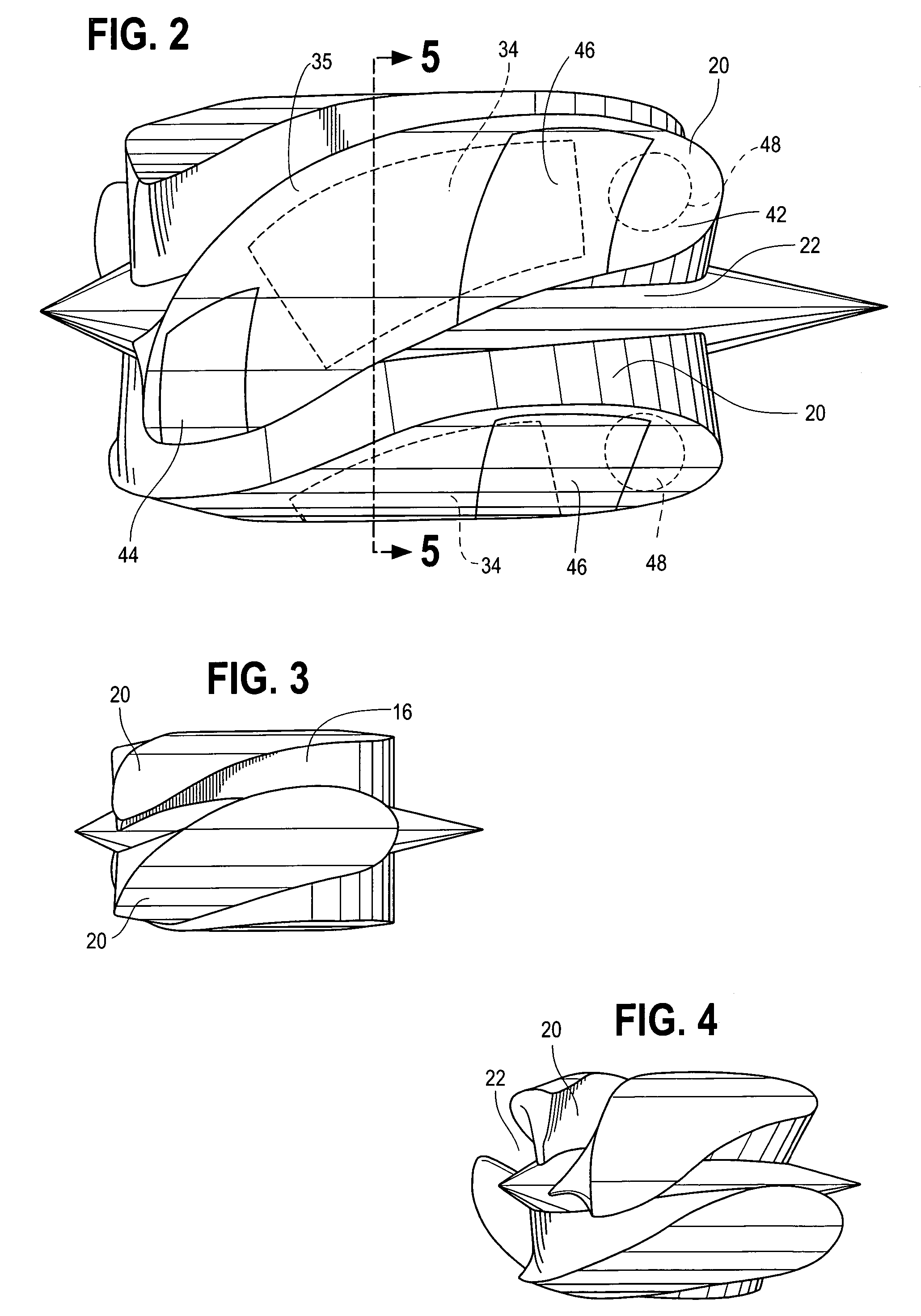

Tunable frangible battery pack system

ActiveUS7923144B2Minimize the possibilityReduce exposurePrimary cell to battery groupingElectric devicesElectrical conductorThermal force

A tunable frangible battery pack system for use in an electric vehicle is disclosed. The tunable frangible battery pack system includes a two piece clamshell housing. The system also includes a plurality of battery cells arranged within the housing and a collector plate secured to each piece of the housing. The system also includes a wire conductor arranged between each of the battery cells and collector plates to create a frangible disconnect system when the battery pack system and electric vehicle are exposed to a predetermined mechanical or thermal force or event.

Owner:TESLA INC

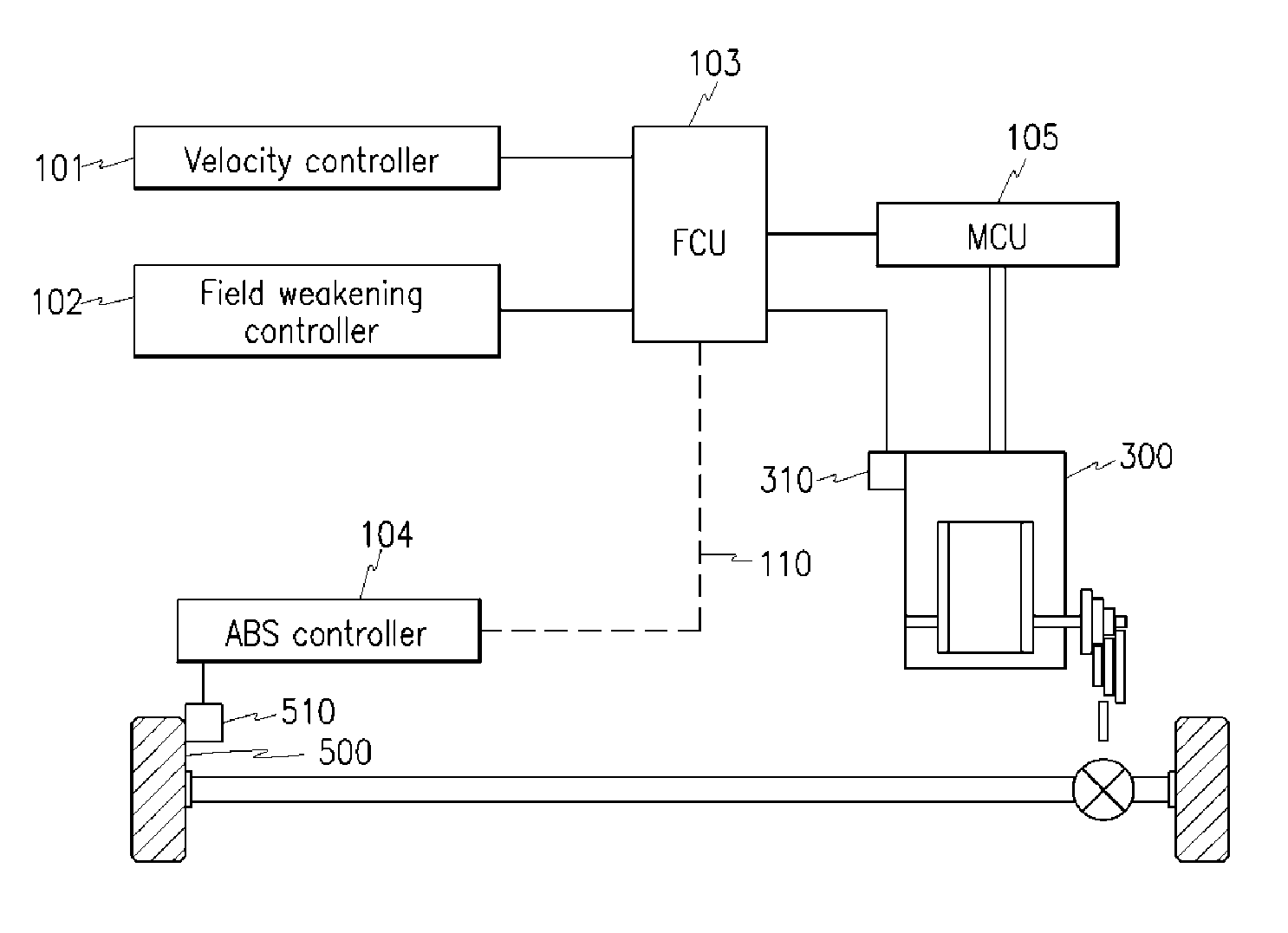

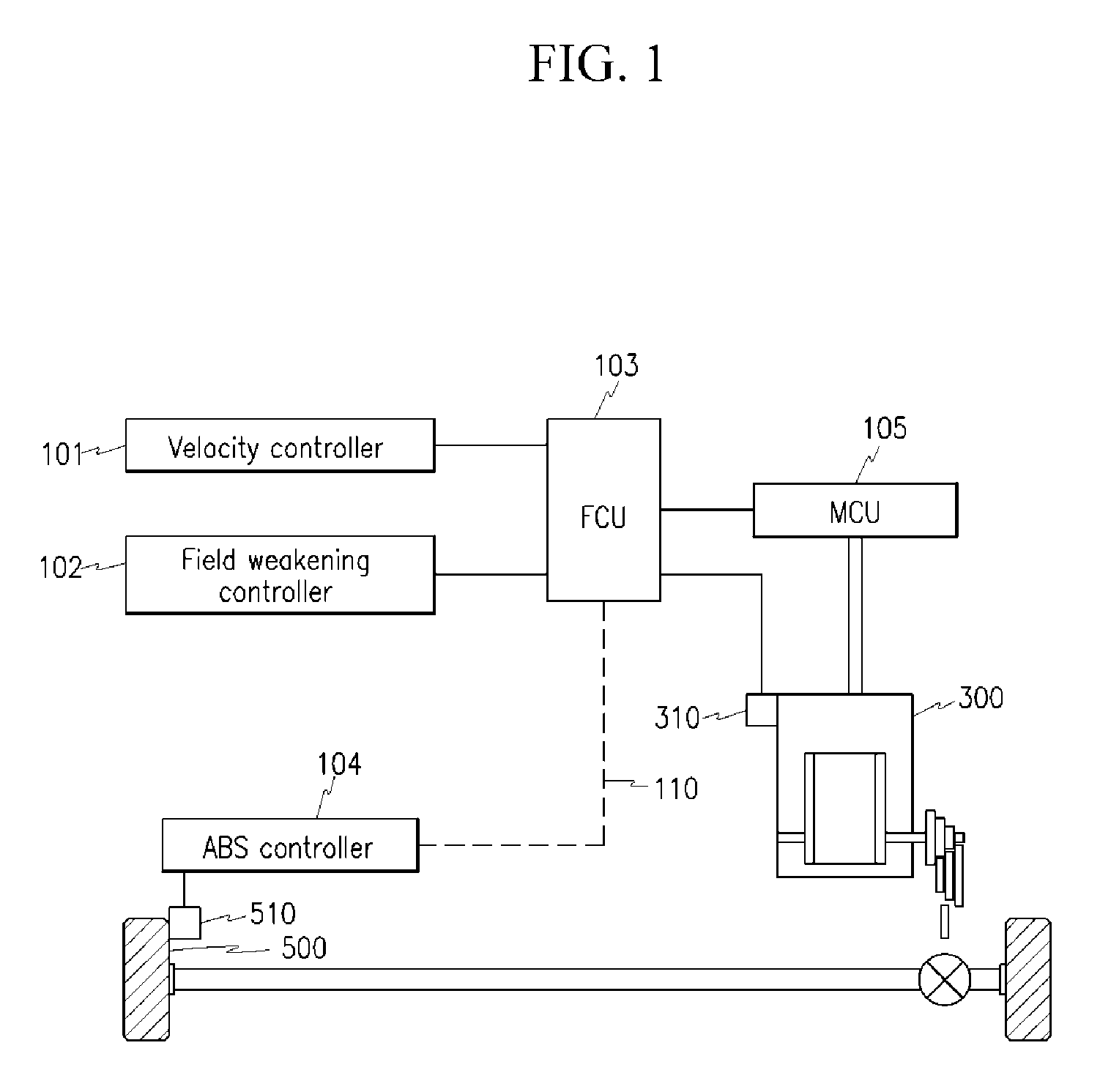

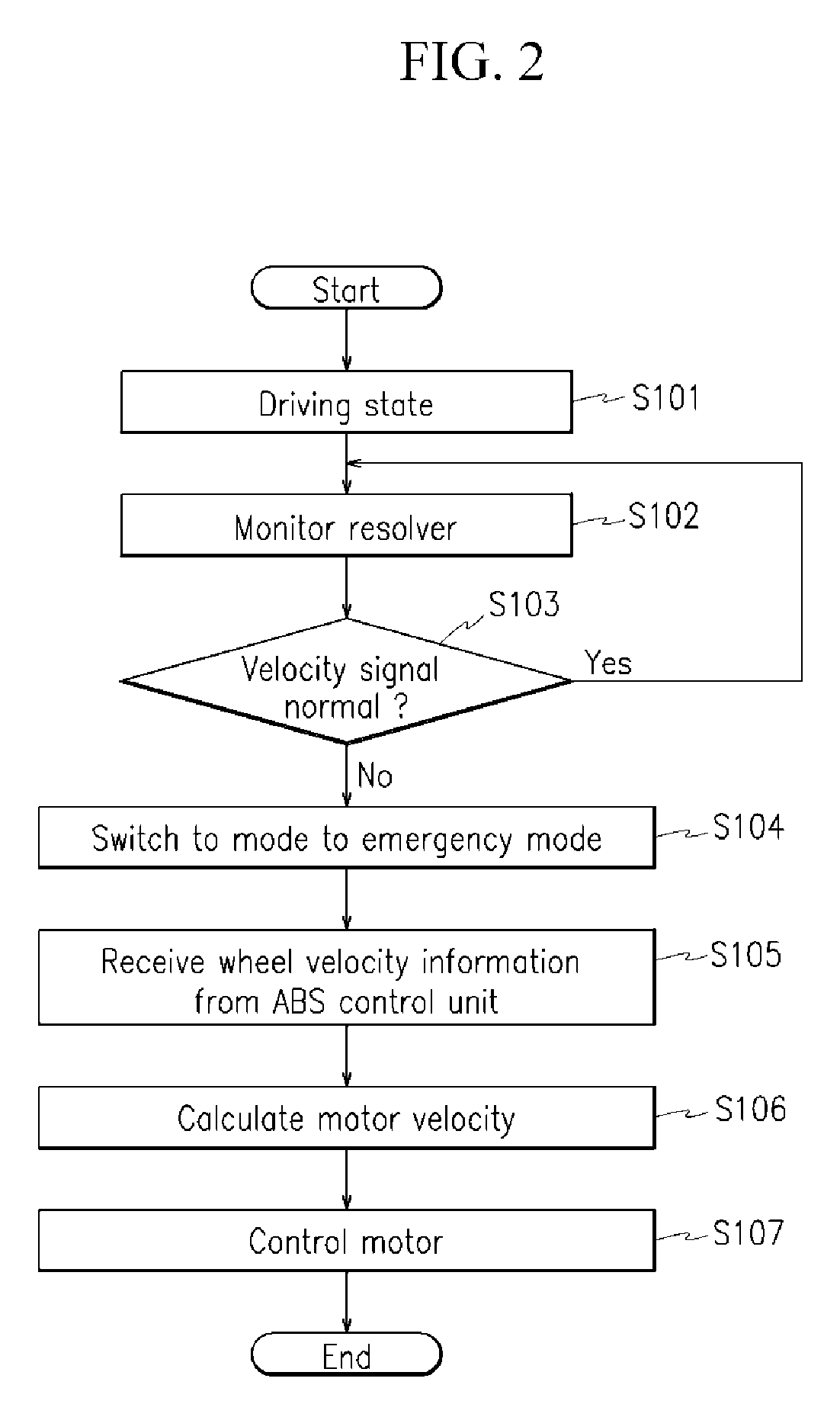

Apparatus and method of compensating for motor velocity of fuel cell vehicle

ActiveUS9233610B2Improve stabilityImprove reliabilitySpeed controllerElectric devicesData controlFuel cells

A method and apparatus that compensates for a velocity of a motor of fuel cell vehicle when a resolver is determined to have failed is provided. In particular, a wheel velocity sensor is configured to detect a wheel velocity of a driving wheel, and an ABS controller is configured to calculate an average wheel velocity and transmit the calculated average to a fuel cell controller (FCU). The FCU is configured to receive information related to the wheel velocity upon detecting that the resolver has failed, and control driving of the motor based on the data related to the wheel velocity so that the motor may maintain operation.

Owner:HYUNDAI MOTOR CO LTD

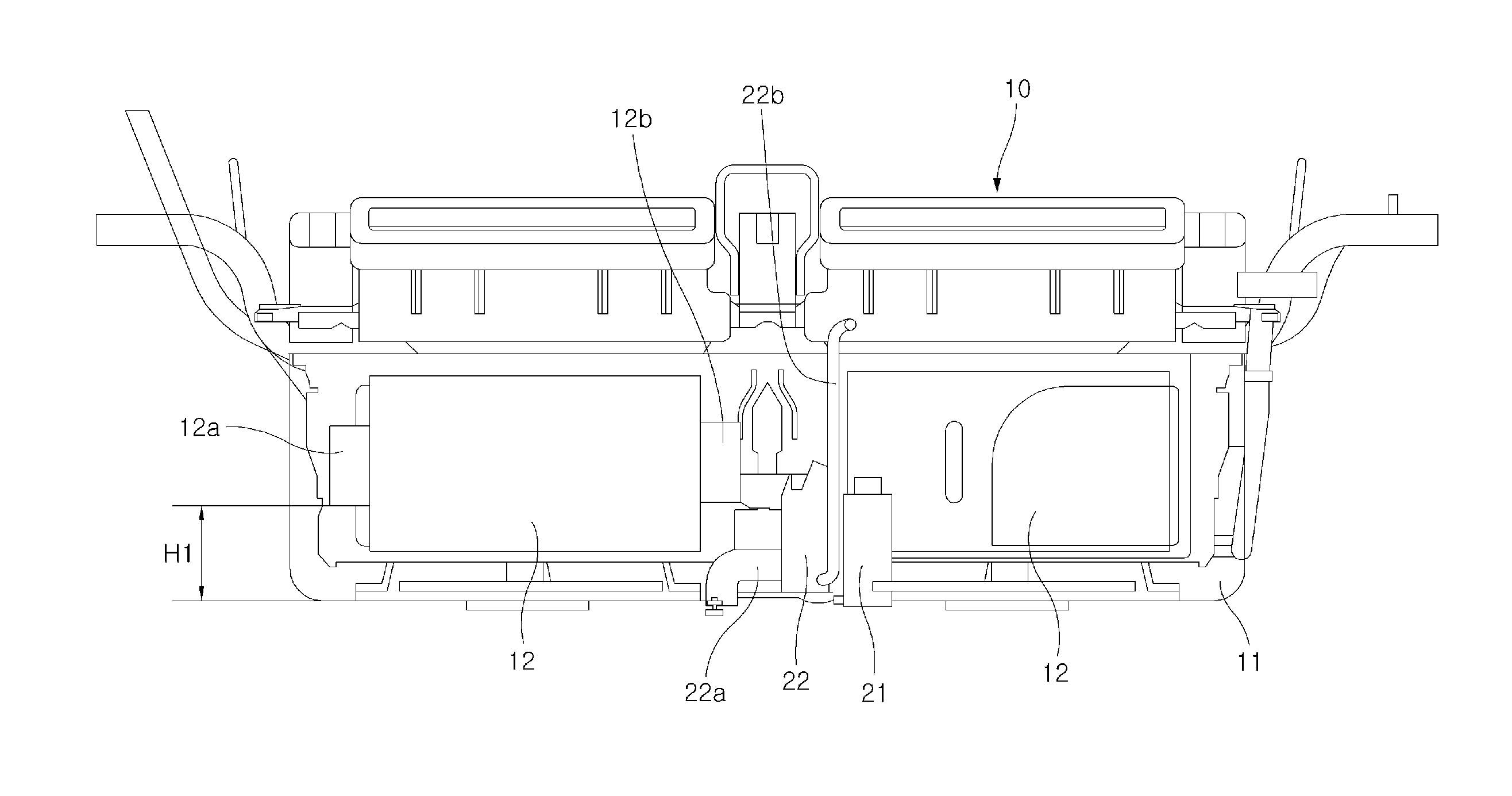

Water-discharging device of high voltage battery pack

InactiveUS20120132286A1Not to damageFunctional valve typesLevel controlAuto regulationWater discharge

Disclosed is a water-discharging device of a high voltage battery pack that can automatically adjust the level of water collecting in an under cover such that high voltage parts, such as an expensive battery module and a BMS, equipped in the under cover are not damaged by the water, by making the BMS operate a water pump to forcibly discharge the water out of the under cover, when the water collects and increases in level in the under cover having a sealed structure.

Owner:HYUNDAI MOTOR CO LTD +1

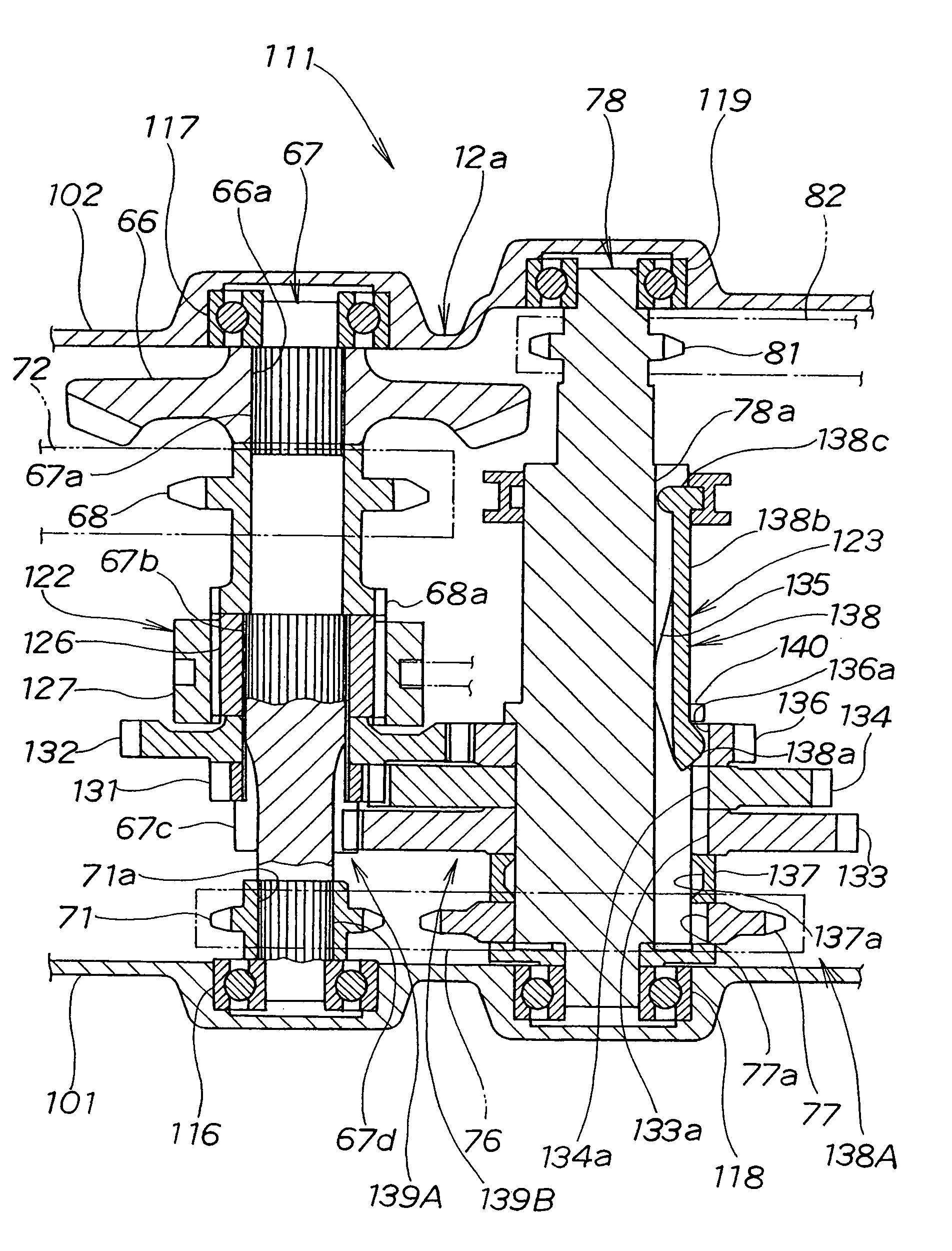

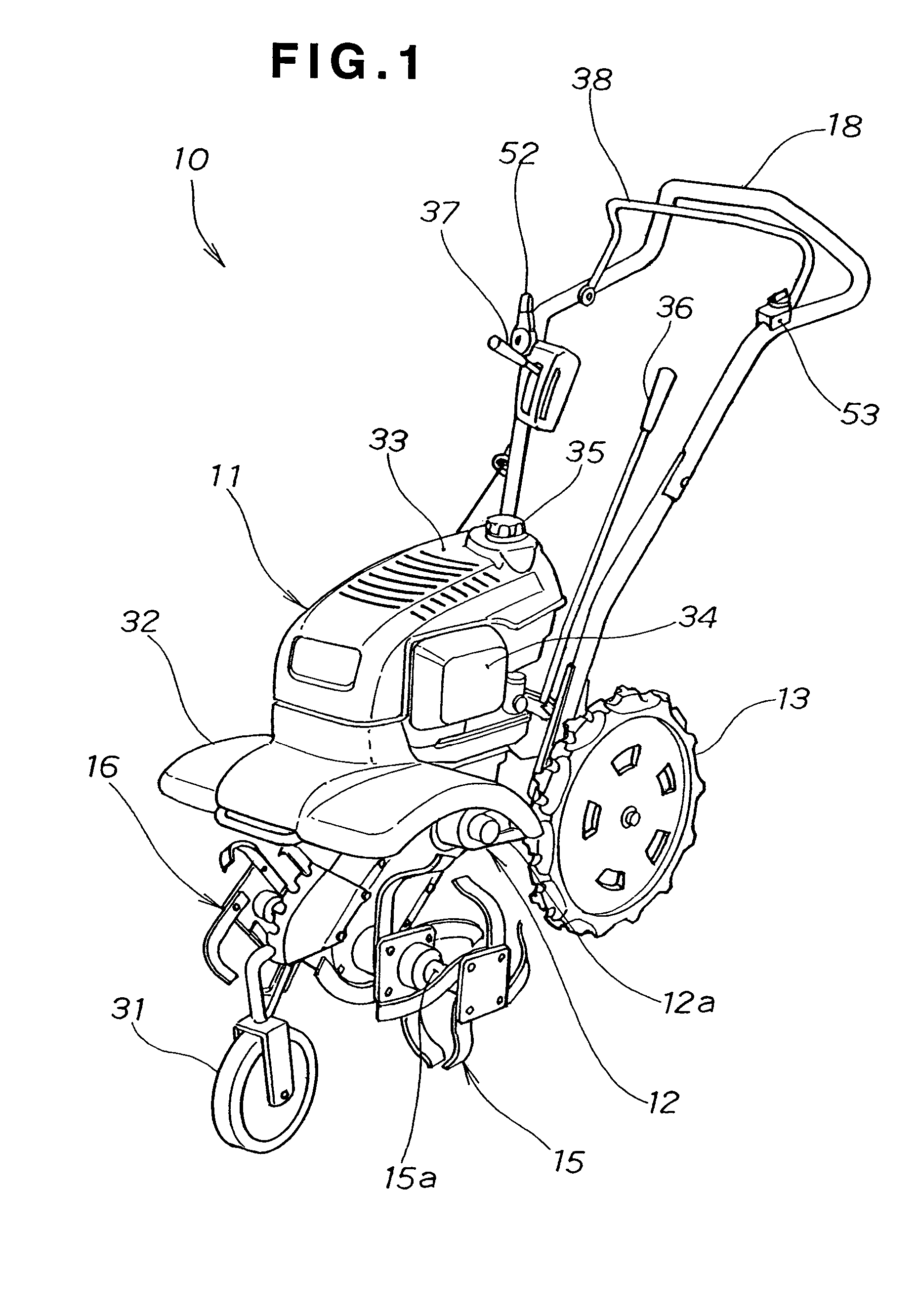

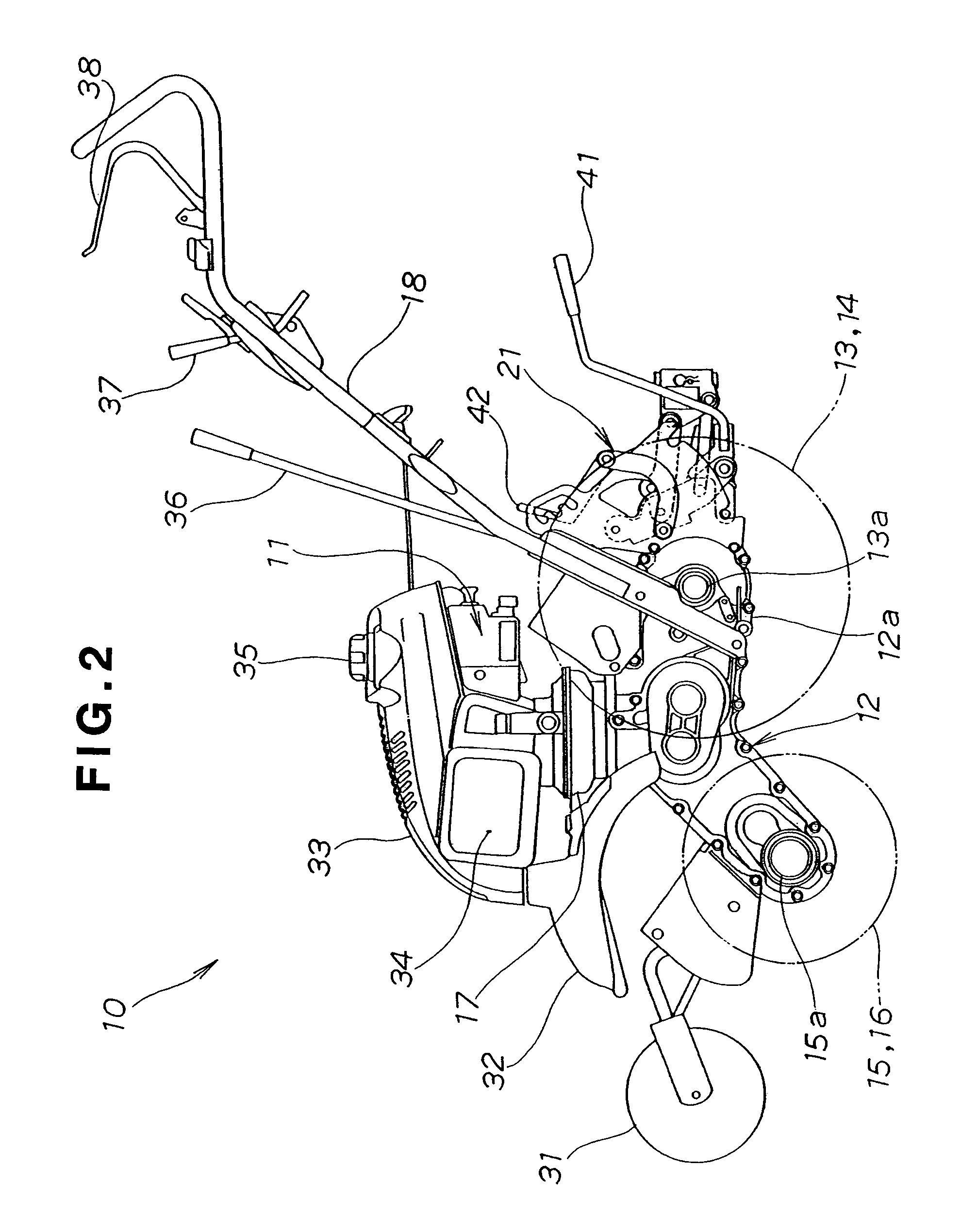

Transmission

InactiveUS7028570B2Easy to participateSmooth connectionTilling equipmentsToothed gearingsDrive wheelTransmitted power

A transmission for a working machine including a drive transmission mechanism and a working transmission mechanism operated by swinging a shift lever is provided. The drive transmission mechanism has a key-sliding transmission mechanism axially mounted on a drive shaft. The key-sliding transmission mechanism causes a selected one of a plurality of gears rotatably mounted on the drive shaft and the drive shaft to rotate together to transmit power to drive wheels.

Owner:HONDA MOTOR CO LTD

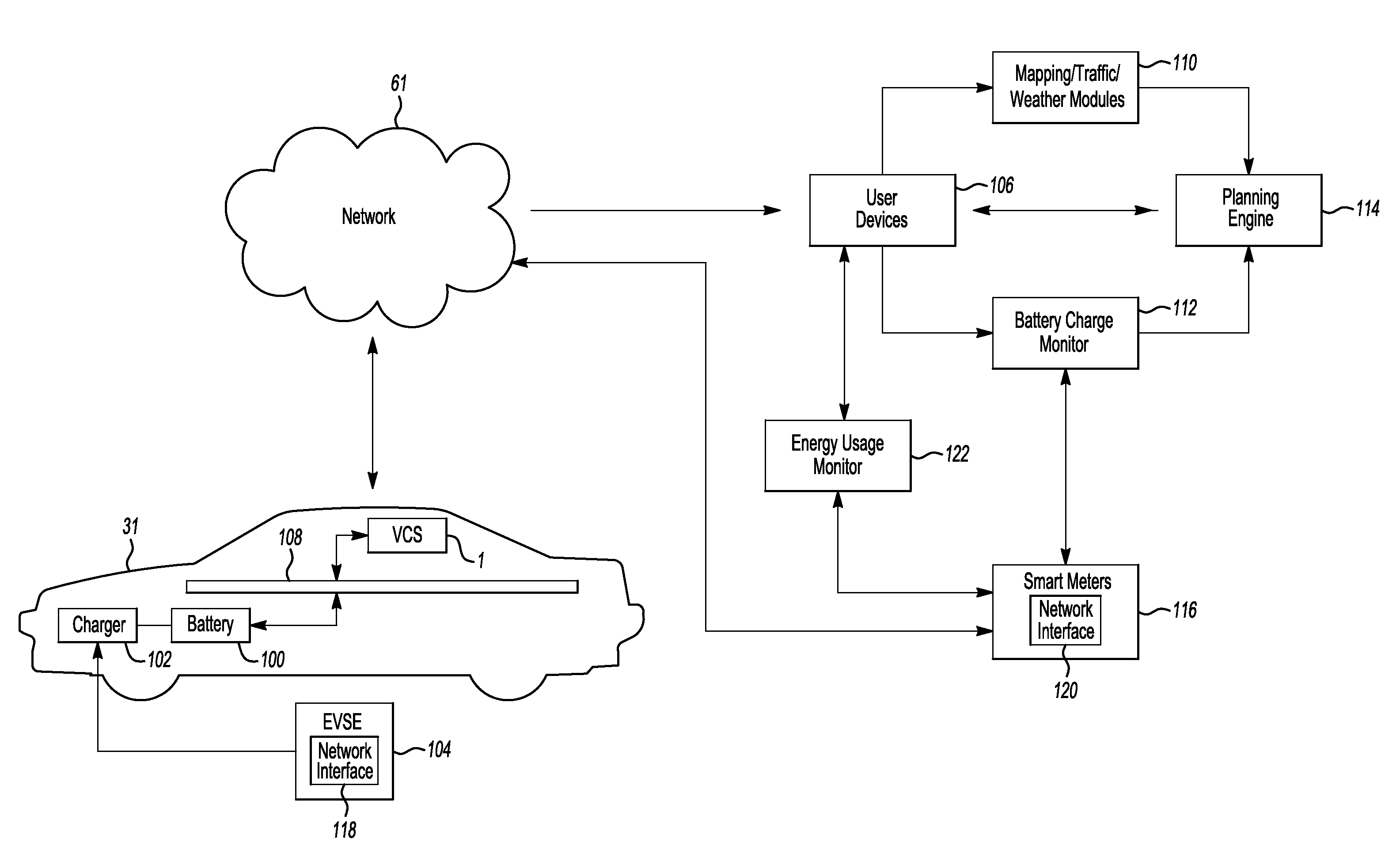

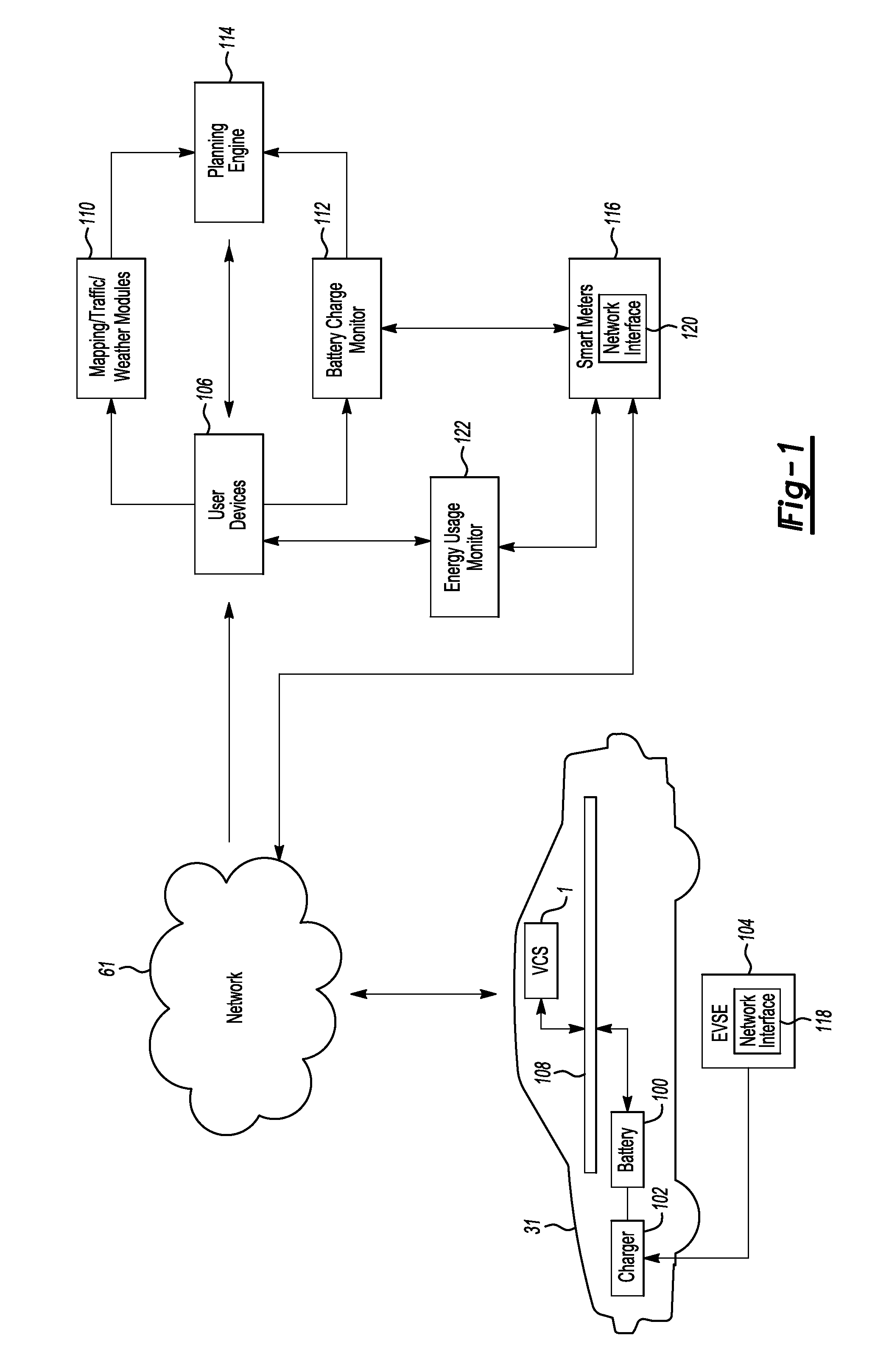

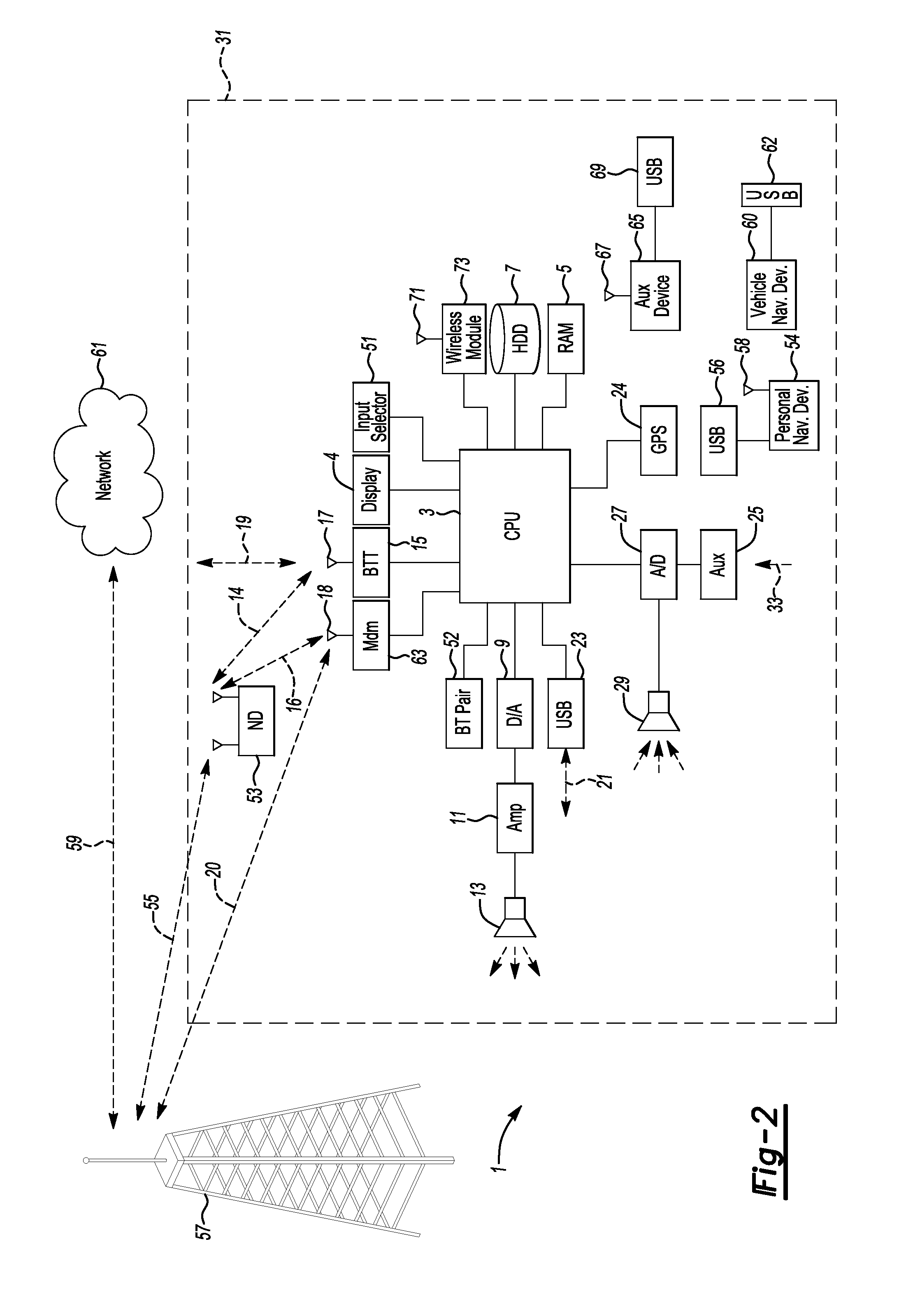

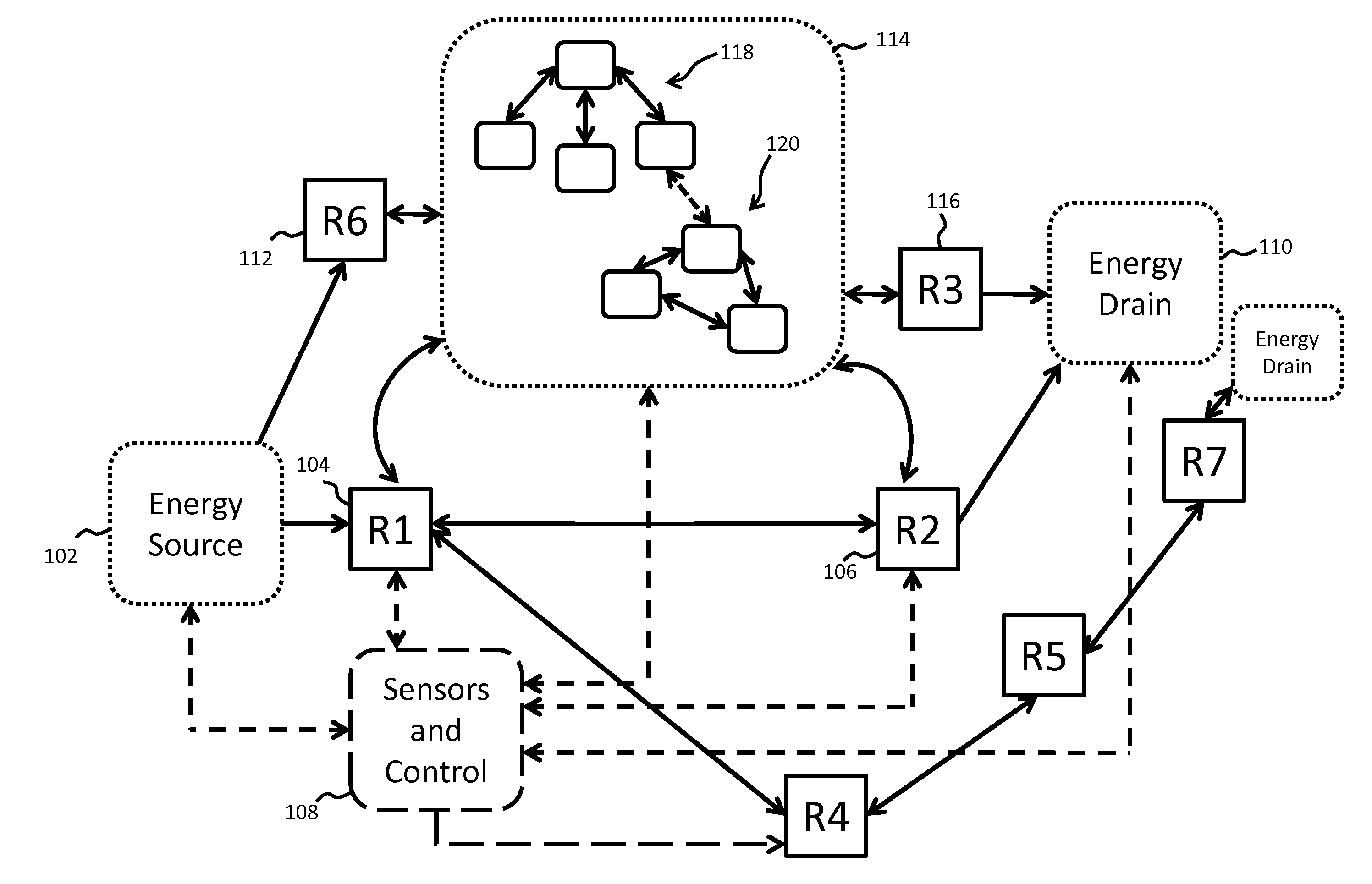

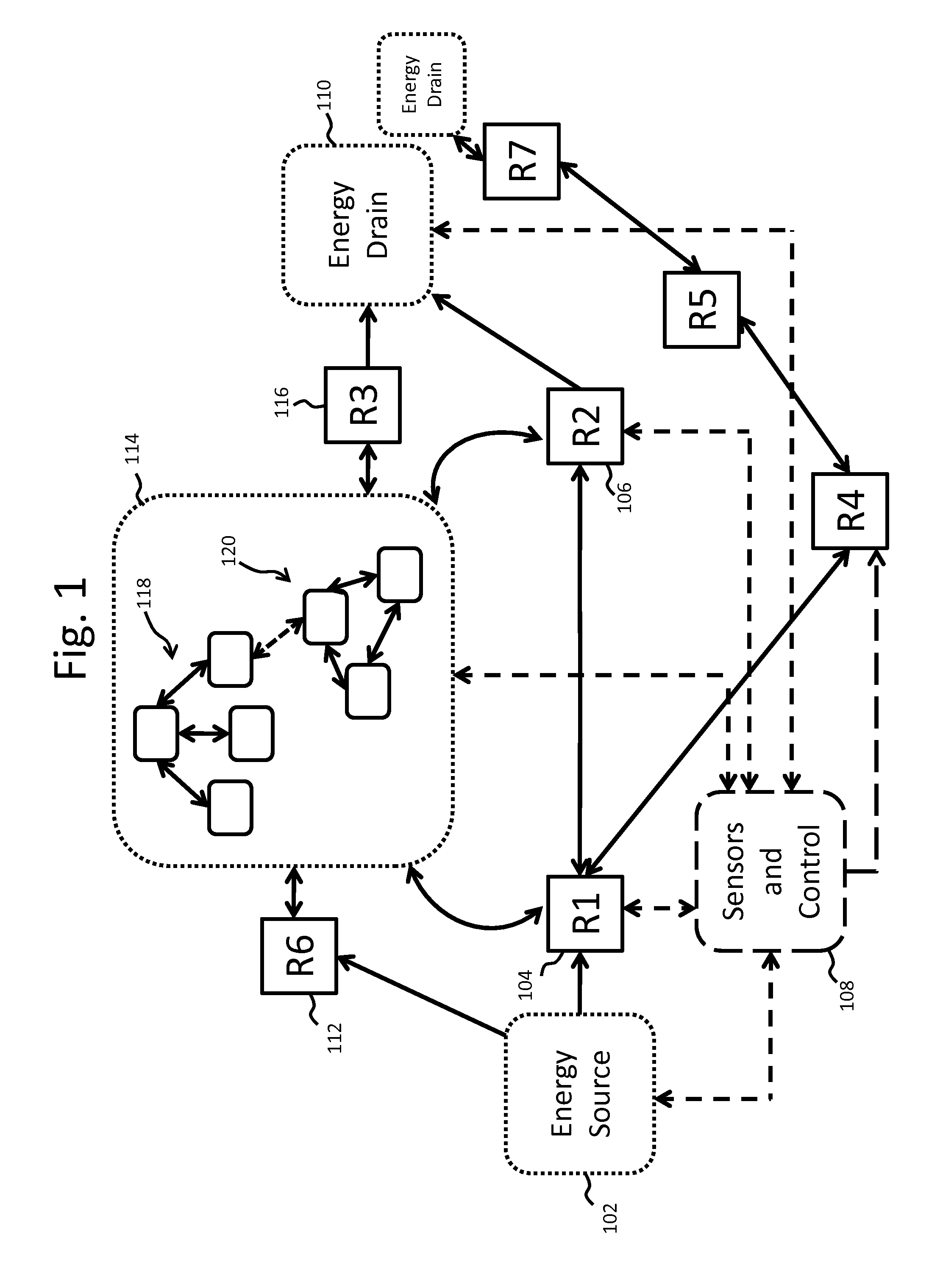

Method and system for monitoring an energy storage system for a vehicle for trip planning

One or more embodiments may include a trip planning system for planning a trip based on the charge of an electric vehicle battery. The trip planning system may include one or more computers located remotely from an electric vehicle which may have one or more battery packs for powering the electric vehicle. The computer(s) may be configured to receive geographic parameters defining a trip and a battery charge status of the one or more electric vehicle battery packs. The computer(s) may be further configured to determine that the trip cannot be completed based on the battery charge status. The computer(s) may additionally be configured to present a battery charge requirement for completing the trip.

Owner:FORD GLOBAL TECH LLC

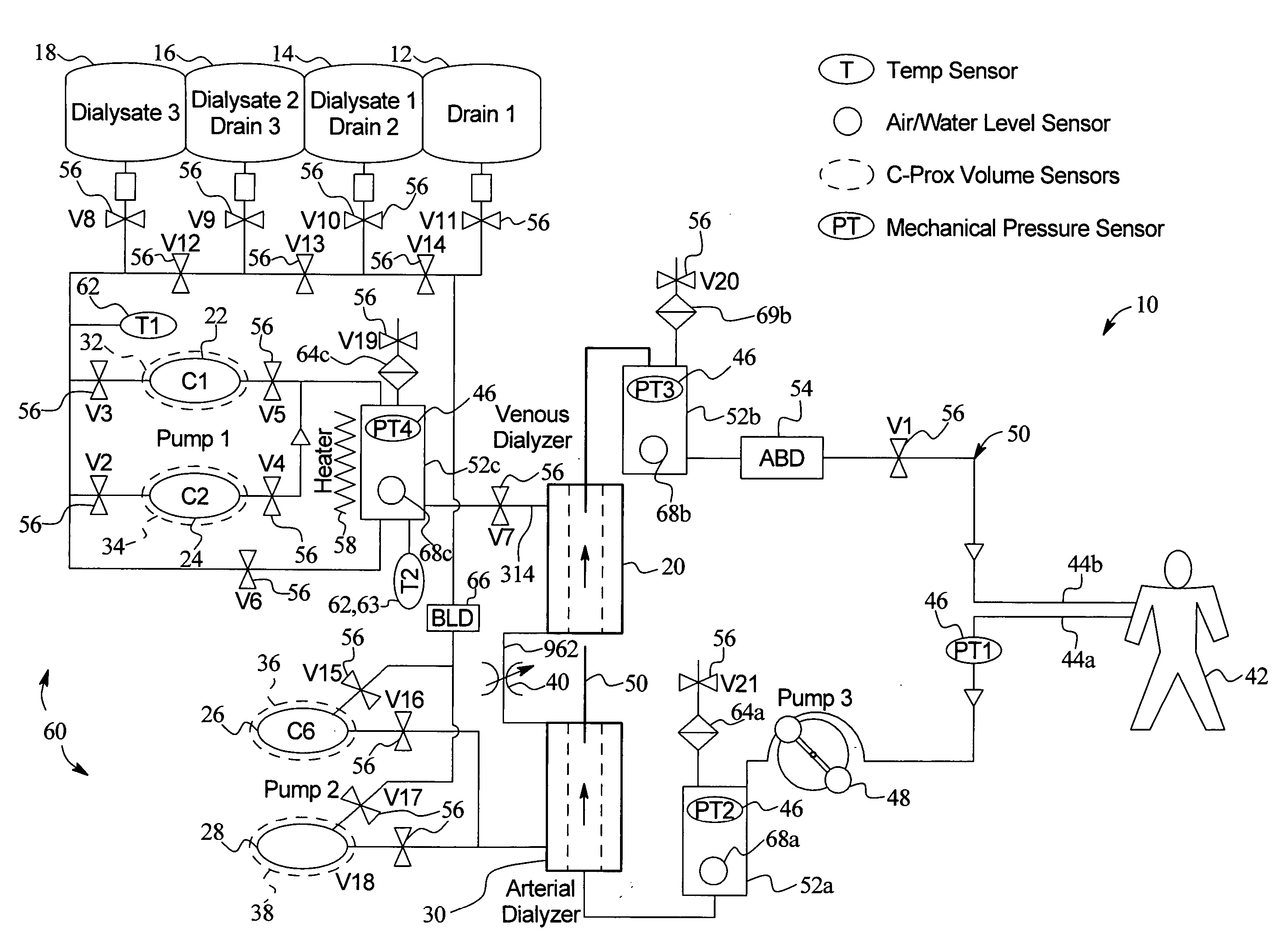

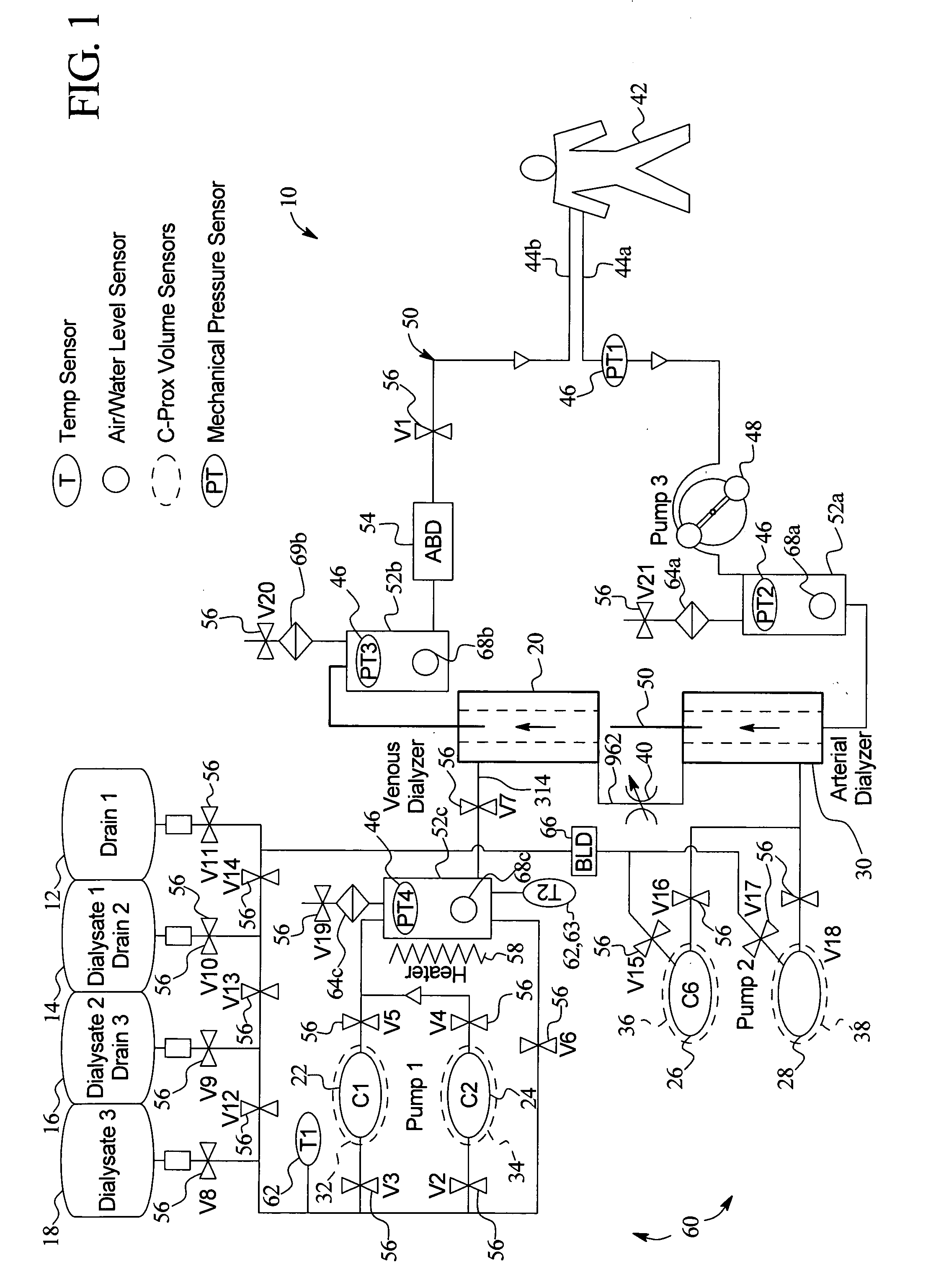

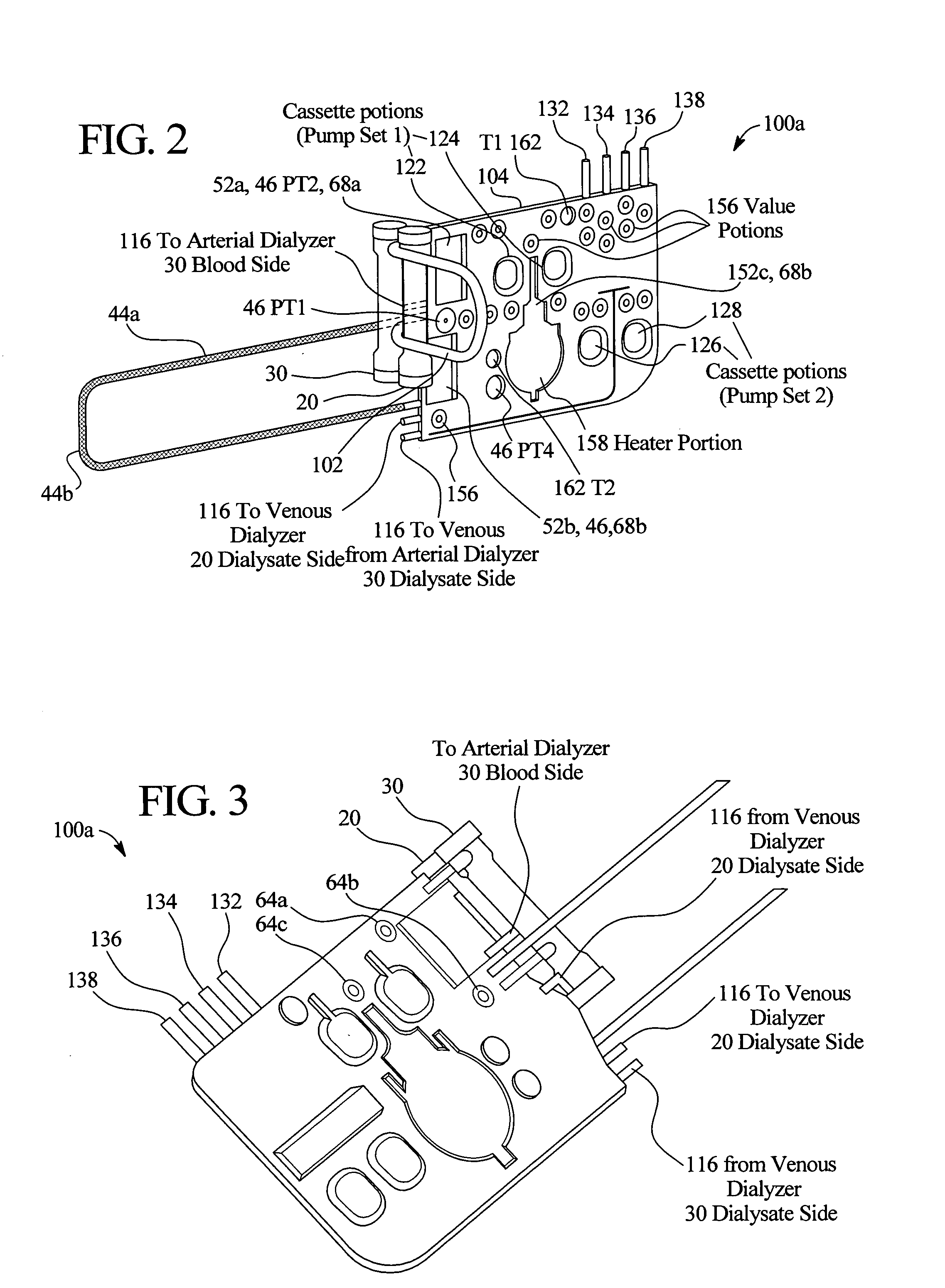

High convection home hemodialysis/hemofiltration and sorbent system

InactiveUS20050131332A1Easily set up sterile blood therapy systemImprove efficiencySemi-permeable membranesHaemofiltrationPositive pressureSorbent

A system, method and apparatus for performing a renal replacement therapy is provided. In one embodiment, two small high flux dialyzers are connected in series. A restriction is placed between the two dialyzers in the dialysate flow path. The restriction is variable and adjustable in one preferred embodiment. The restriction builds a positive pressure in the venous dialyzer, causing a high degree of intentional backfiltration. That backfiltration causes a significant flow of dialysate through the high flux venous membrane directly into the patient's blood. That backfiltered solution is subsequently ultrafiltered from the patient from the arterial dialyzer. The diffusion of dialysate into the venous filter and removal of dialysate from the arterial dialyzer causes a convective transport of toxins from the patient. Additionally, the dialysate that does not diffuse directly into the patient but instead flows across the membranes of both dialyzers provides a diffusive clearance of waste products.

Owner:BAXTER HEALTHCARE SA +1

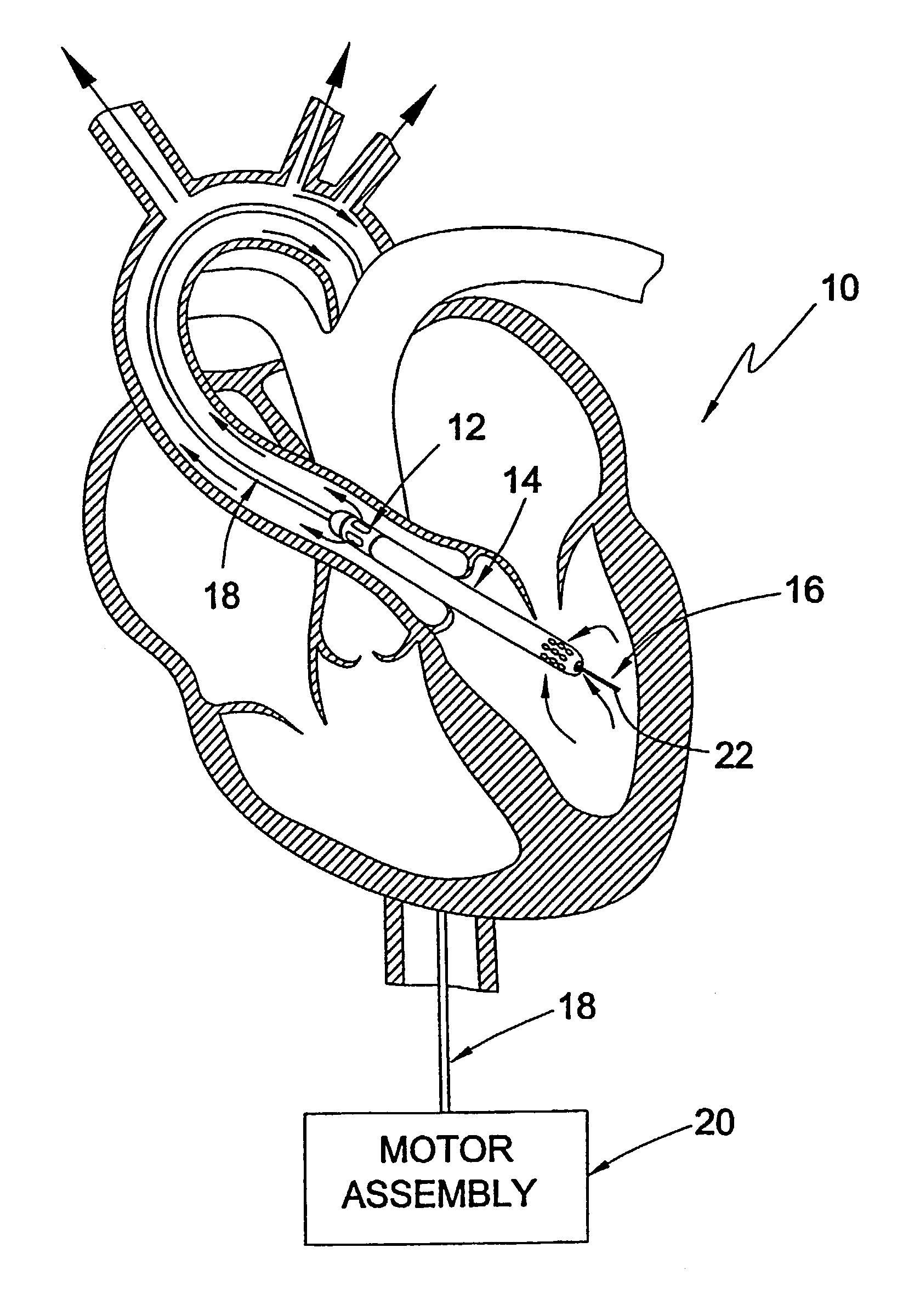

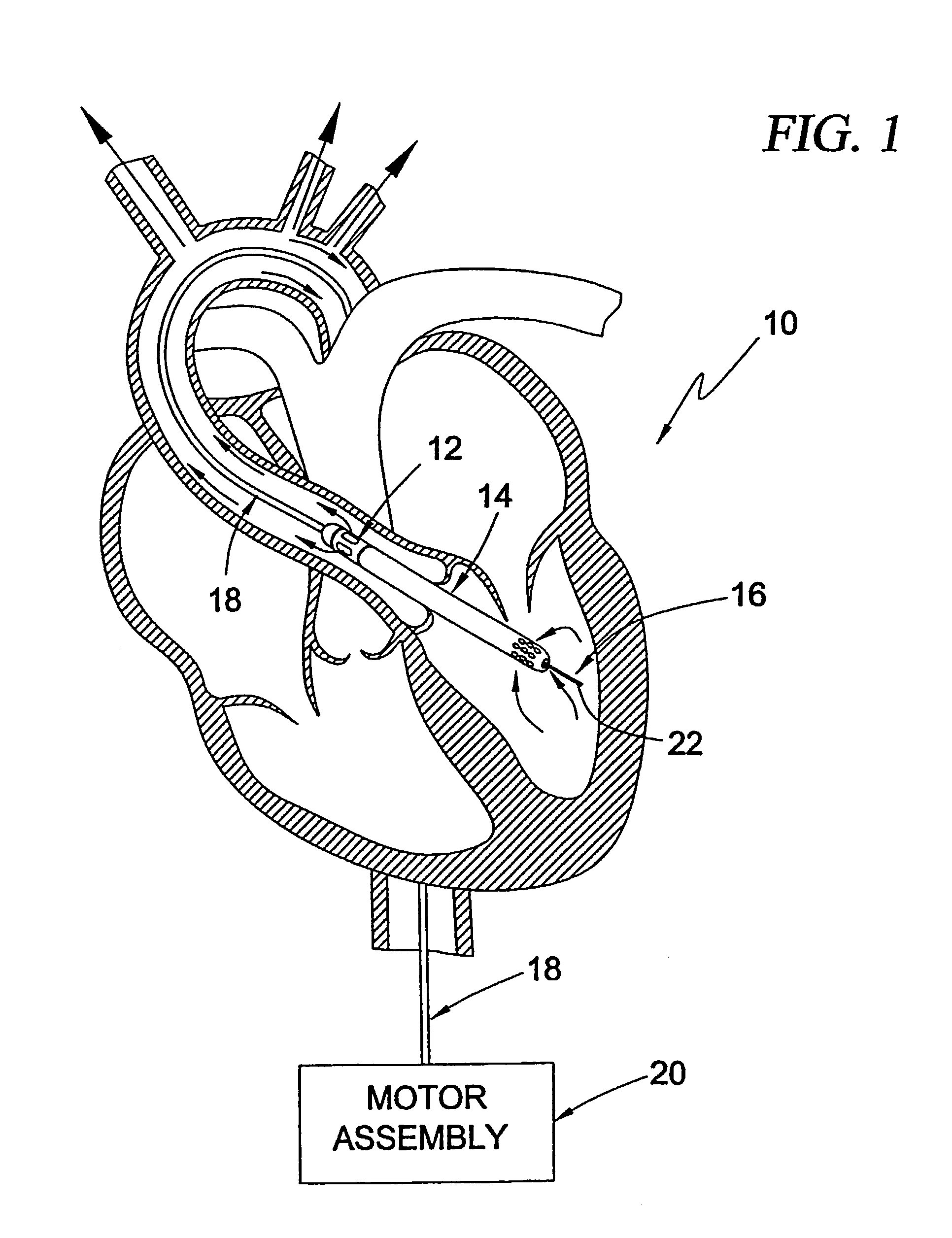

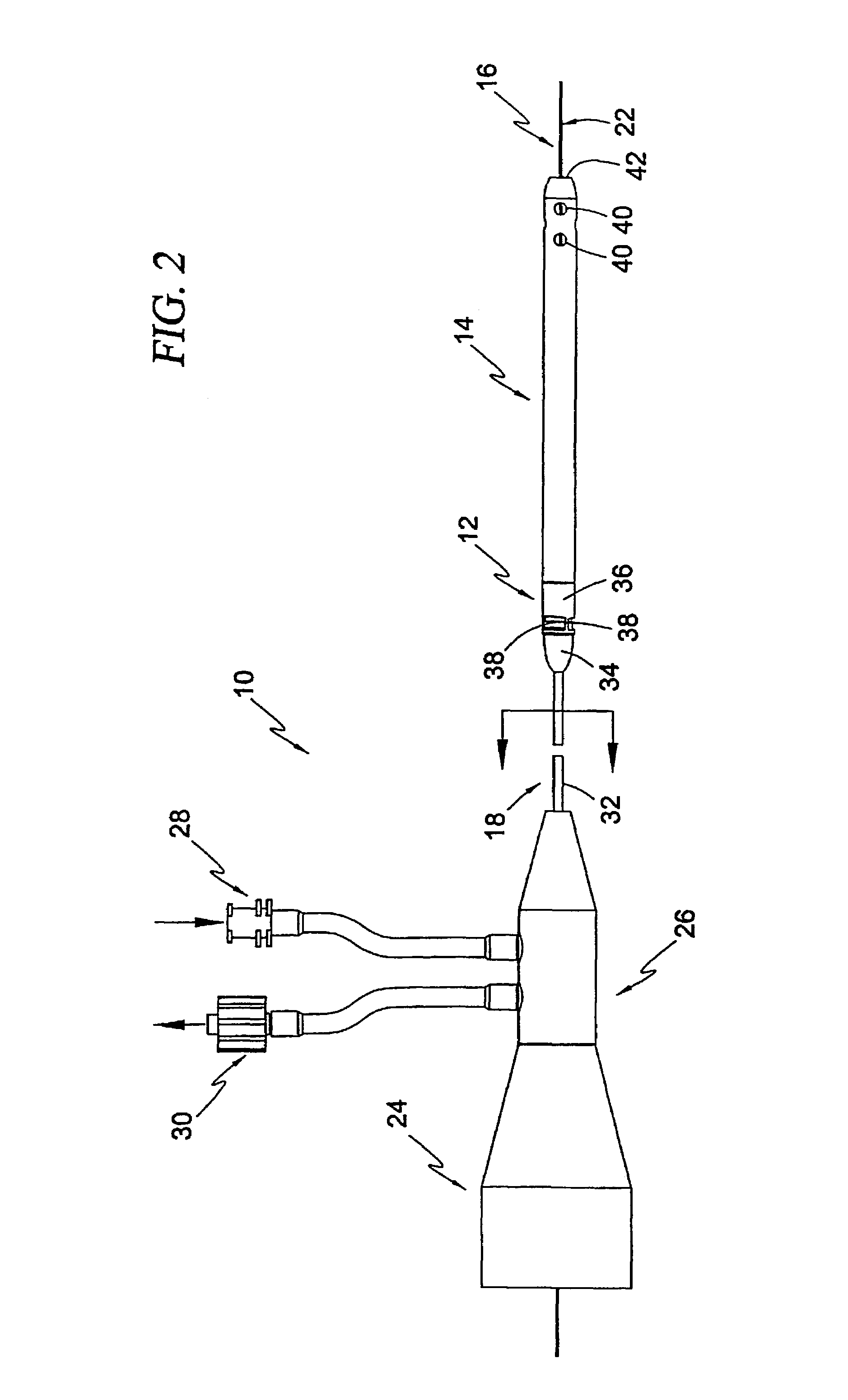

Guidable intravascular blood pump and related methods

InactiveUS7022100B1Integration of featureEliminate needGuide wiresControl devicesBlood pumpBlood vessel

An improved intravascular blood pump system (10) and related methods involving the broad inventive concept of equipping the intravascular blood pump (12) with guiding features such that the intravascular blood pump can be selectively positioned at a predetermined location within the circulatory system of a patient.

Owner:MAQUET CARDIOVASCULAR LLC

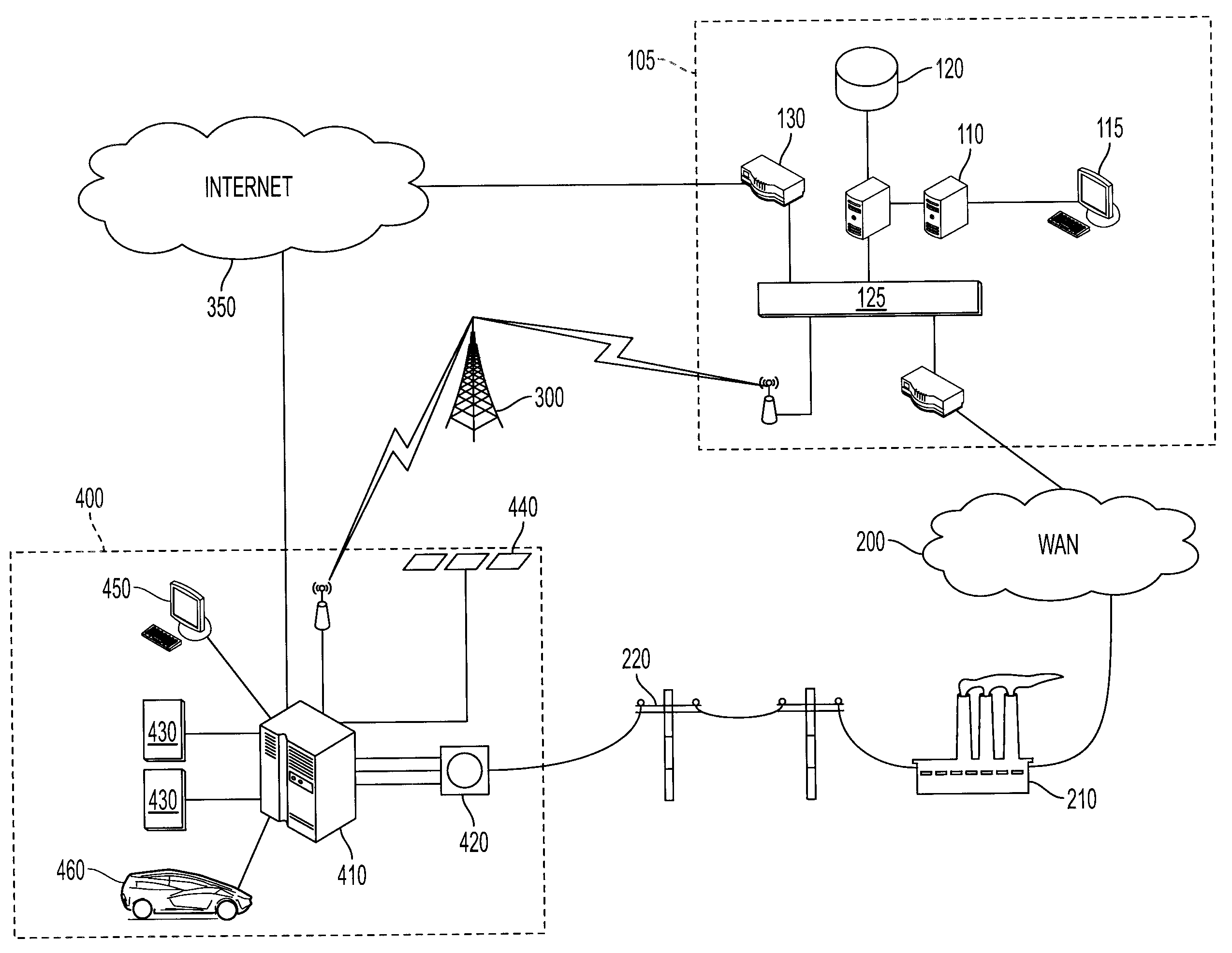

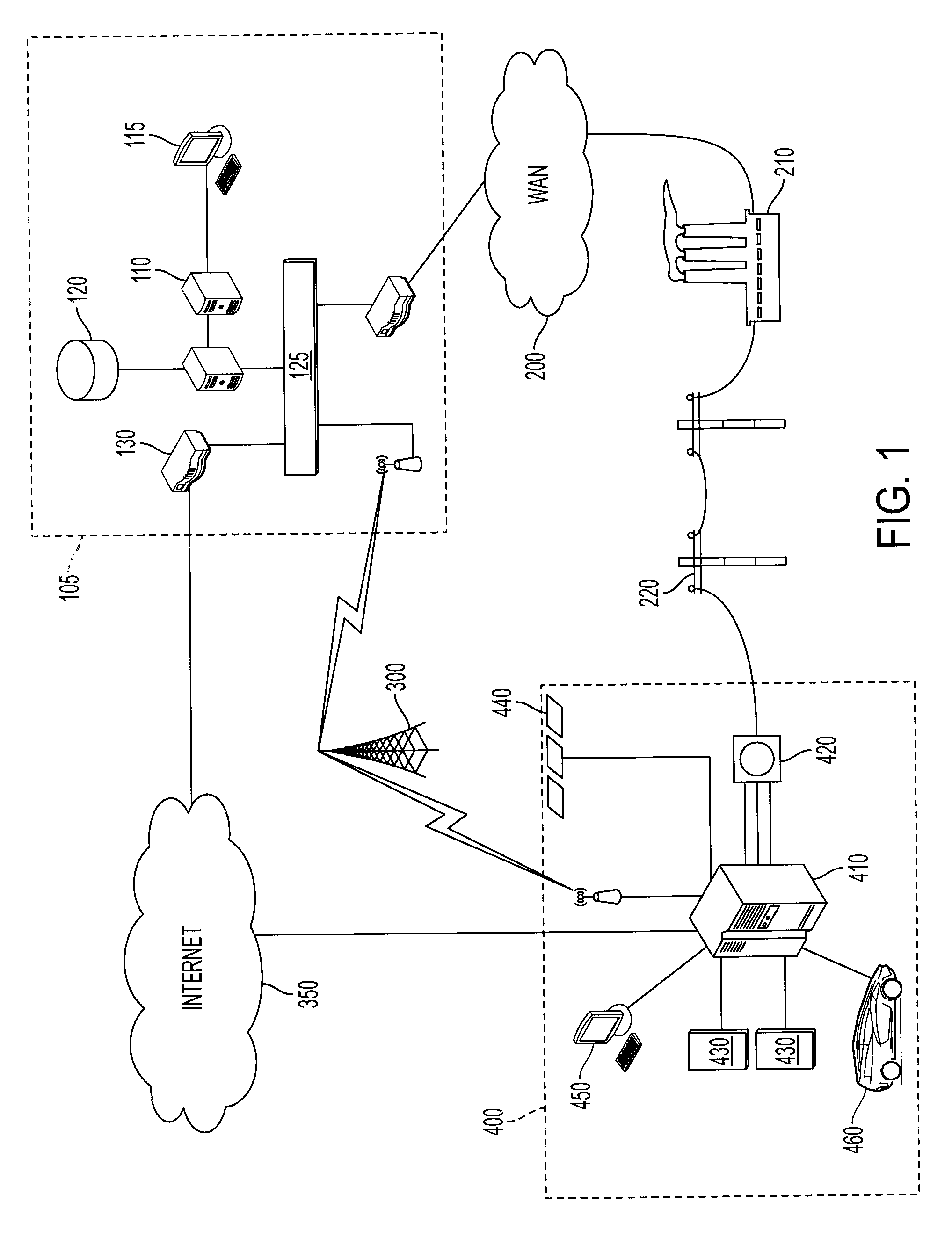

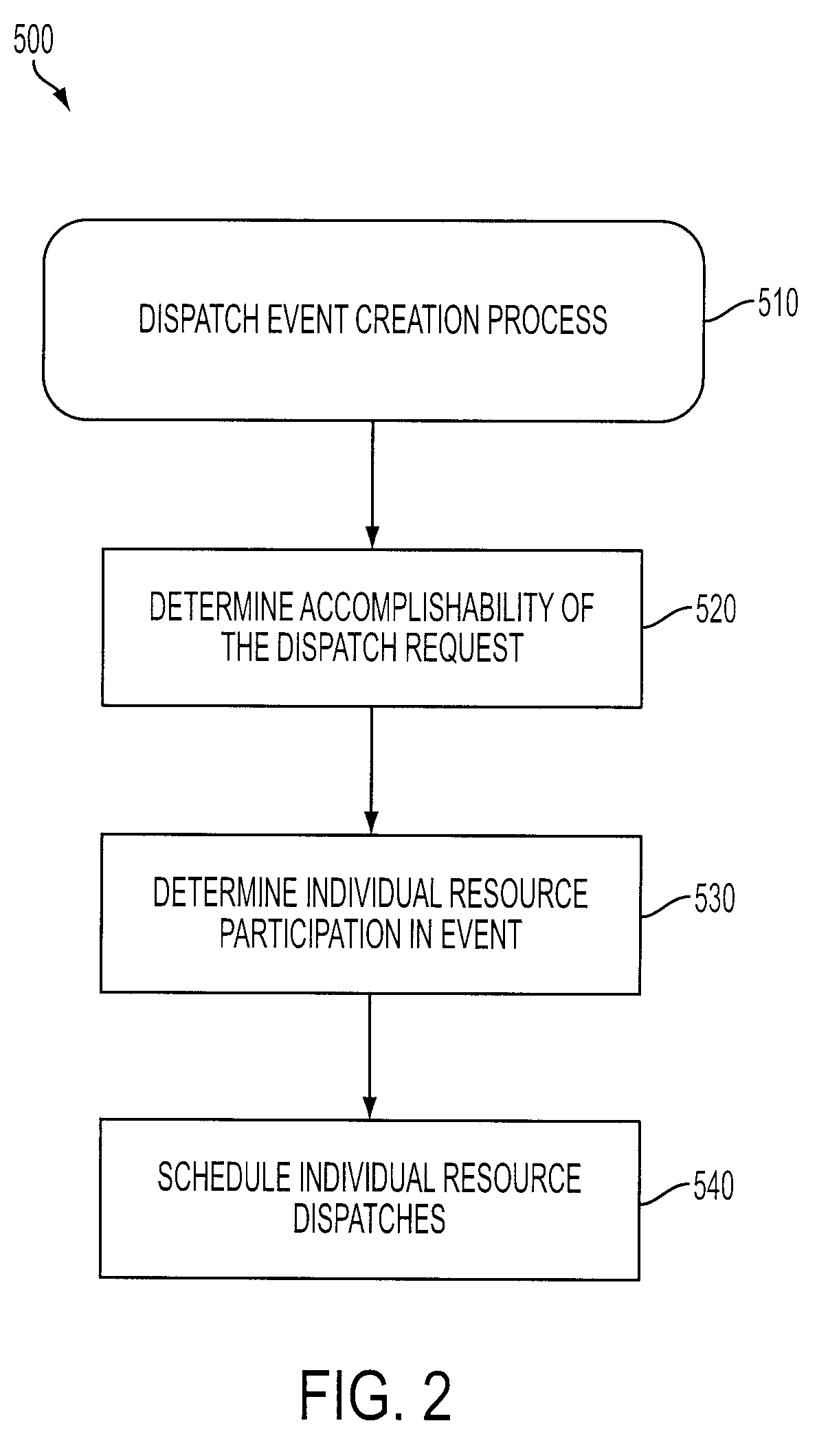

Method and system for scheduling the discharge of distributed power storage devices and for levelizing dispatch participation

Disclosed is a computerized method for dispatching energy from distributed resources in a discharge event so that the energy stored in individual devices is levelized, or so that an operator request is met. Evaluation of event parameters may be deferred. The method may be utilized to dispatch energy from plug-in electric vehicles. Systems and methods to account for electricity dispatched to or from electric vehicles are disclosed. Systems and methods for incentivizing consumers to participate in a dispatch event or curtail energy use are disclosed.

Owner:GRIDPOINT

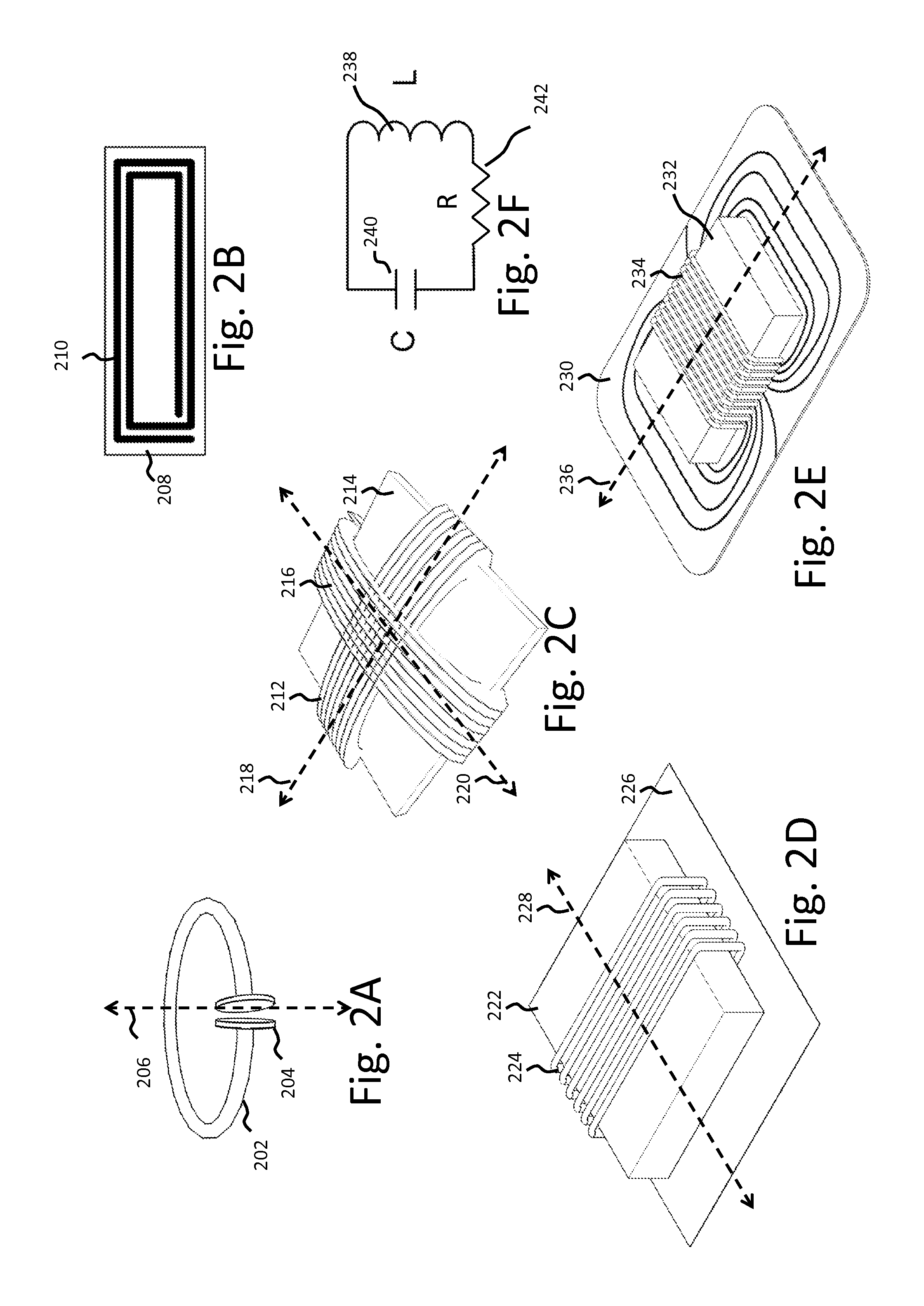

Tunable wireless power architectures

ActiveUS20130033118A1Tune performanceCharging stationsElectromagnetic wave systemEnergy transferPower Architecture

Described herein are improved configurations for a wireless power transfer. The parameters of components of the wireless energy transfer system are adjusted to control the power delivered to the load at the device. The power output of the source amplifier is controlled to maintain a substantially 50% duty cycle at the rectifier of the device.

Owner:WITRICITY CORP

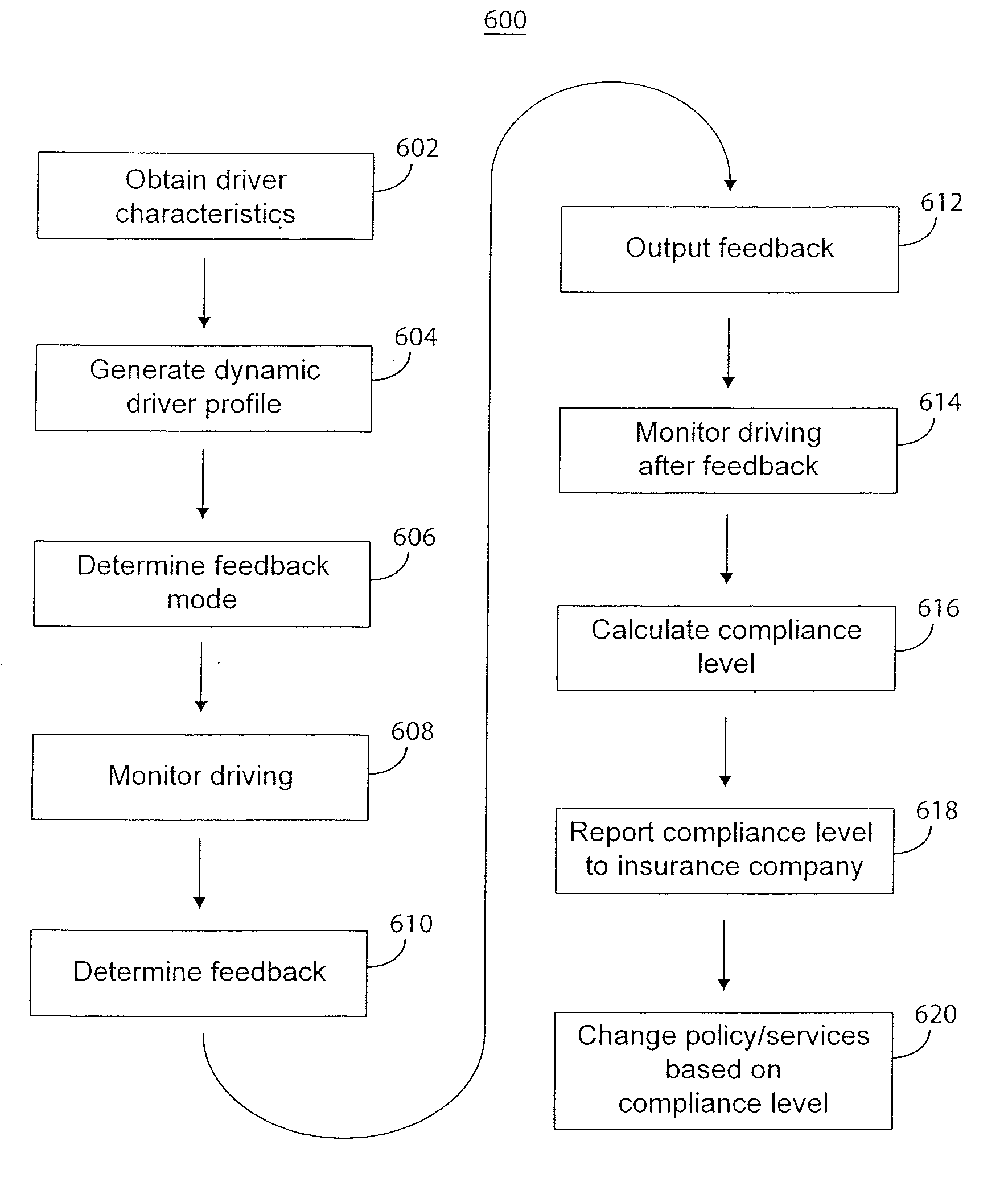

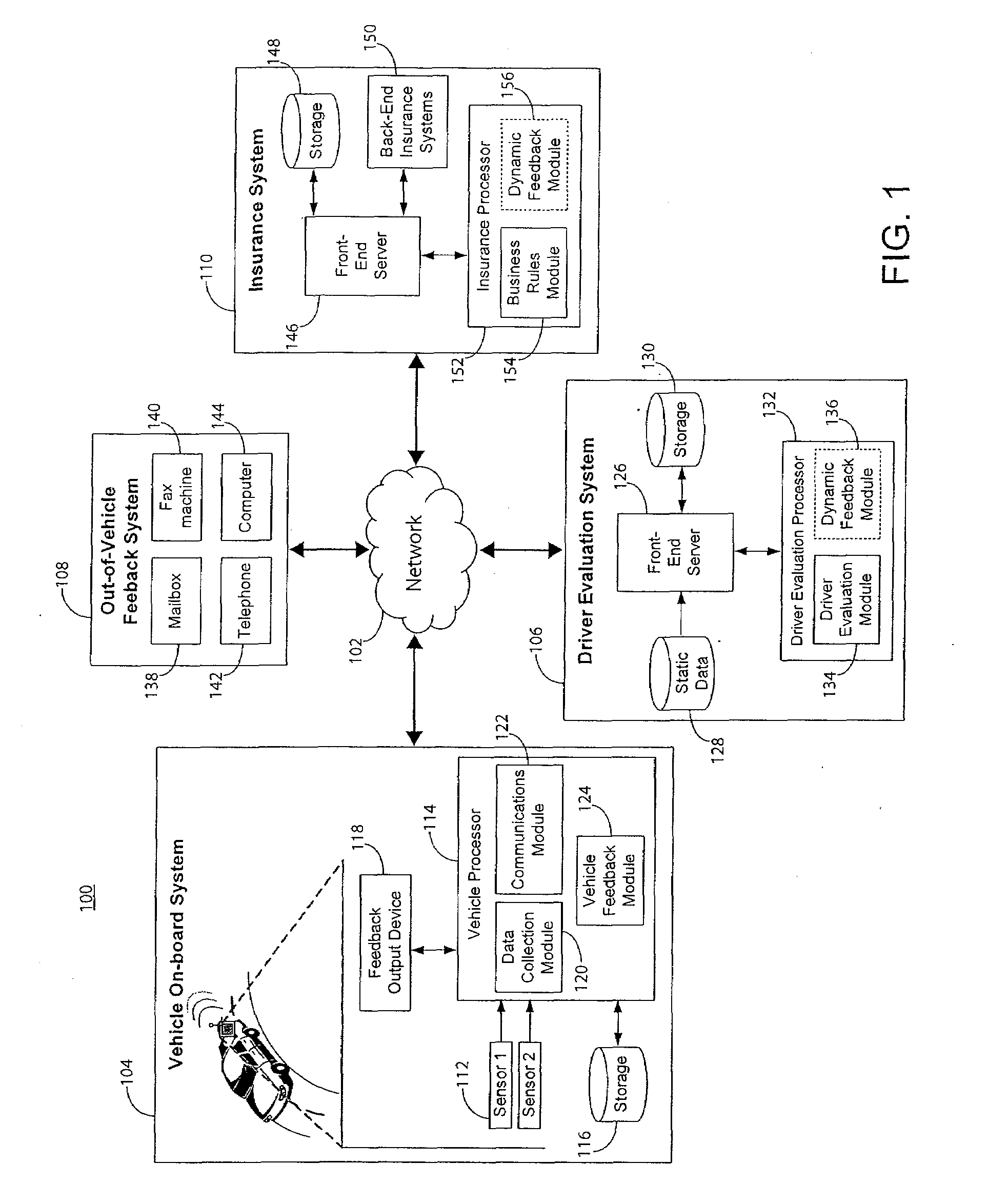

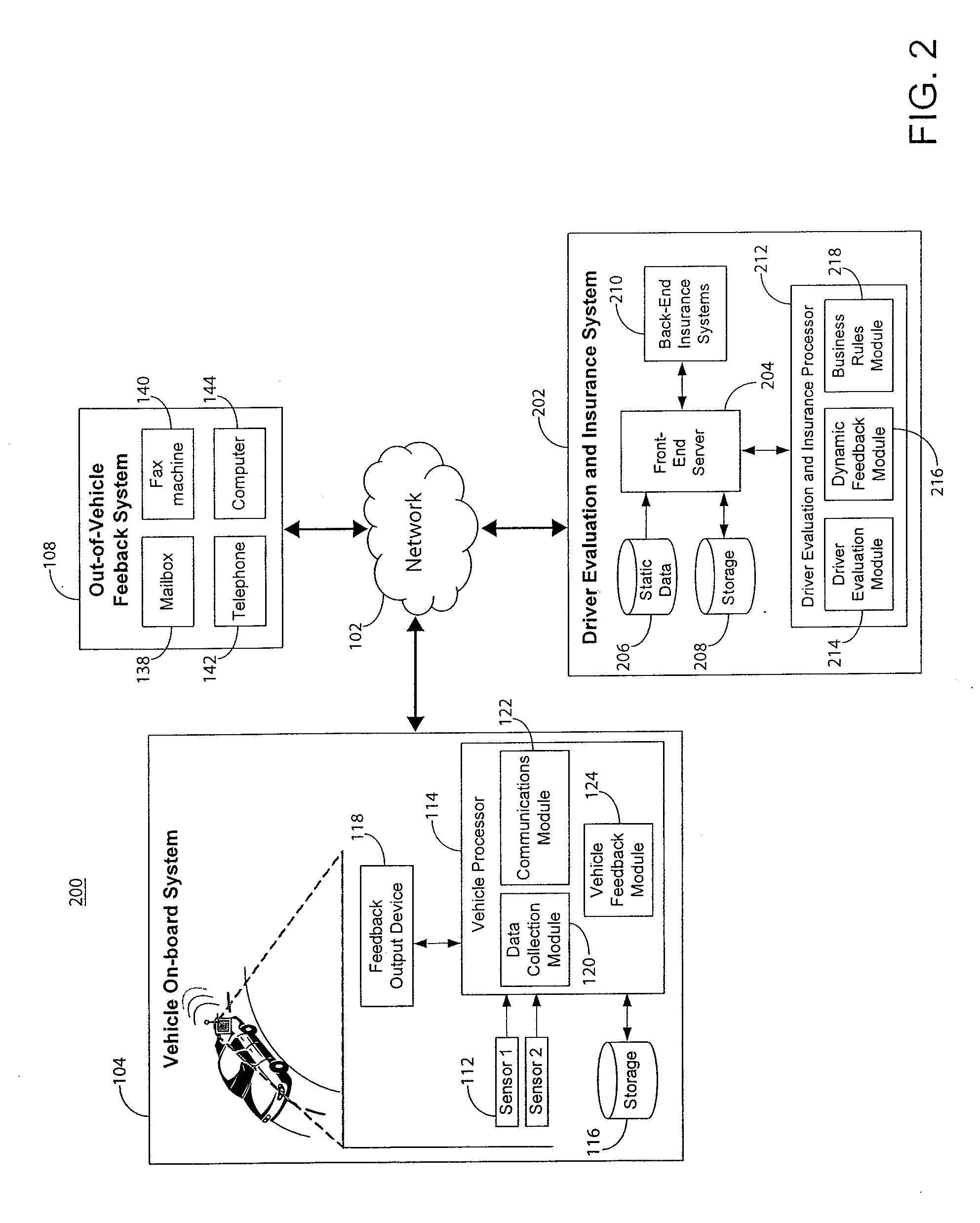

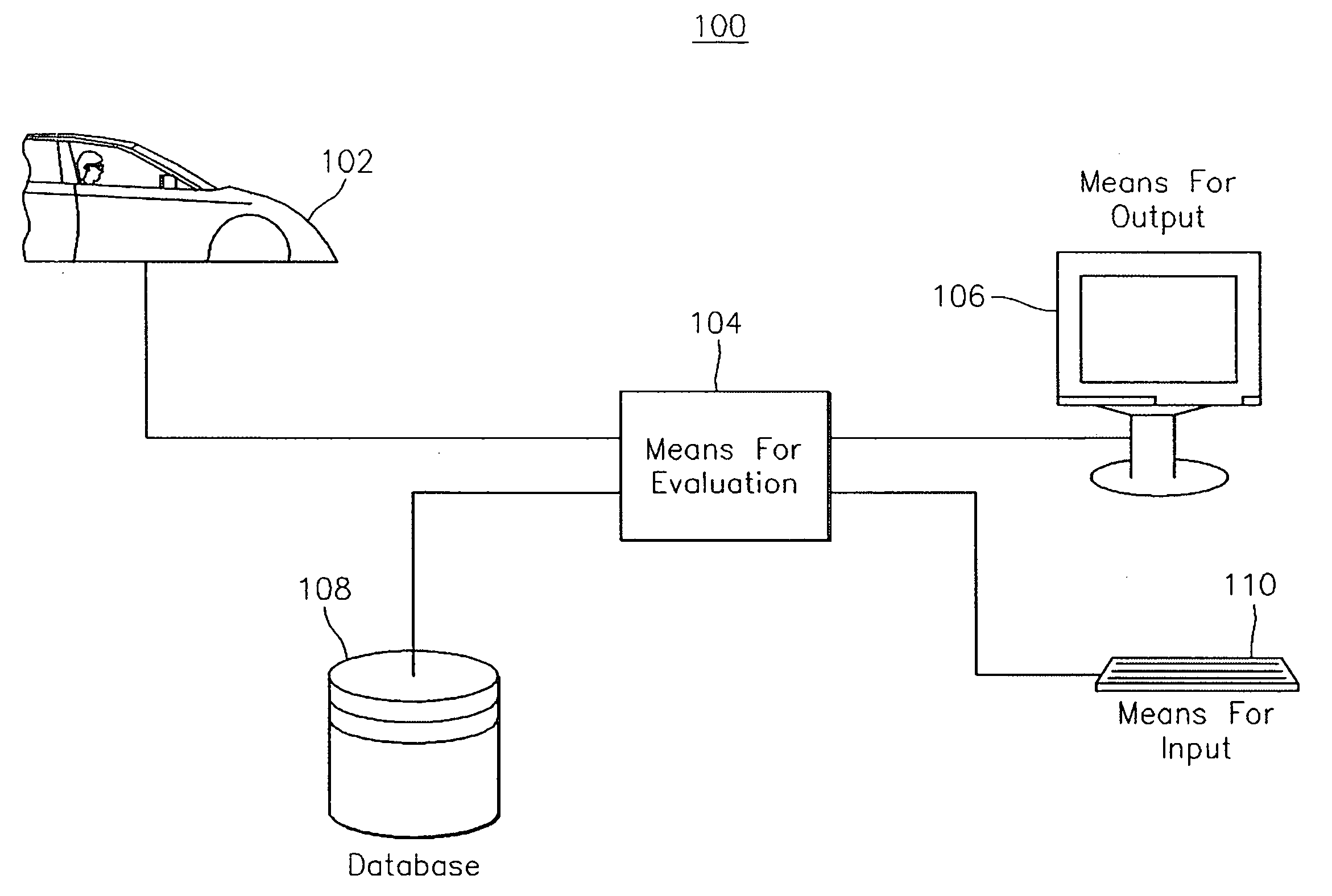

System and method for providing customized safety feedback

ActiveUS20090210257A1Exceeds speed limitImprove fuel economyFinanceControl devicesDriver/operatorEngineering

The present invention relates generally to systems and methods for monitoring driving behavior and providing feedback to the driver. The systems evaluate driving behavior and relay feedback to the driver in a fashion that is customized to take into account individual characteristics and demographic characteristics of the driver.

Owner:HARTFORD FIRE INSURANCE

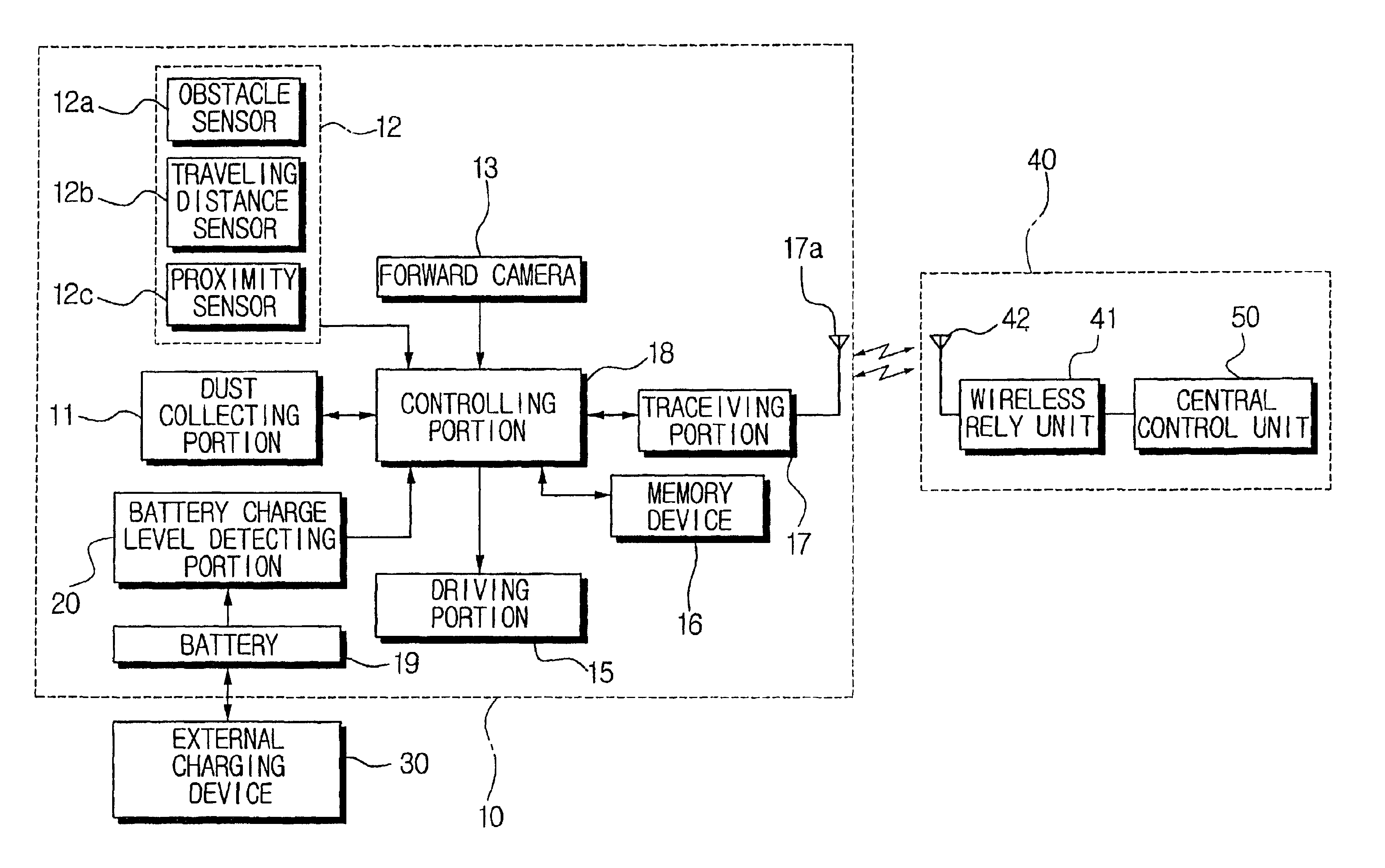

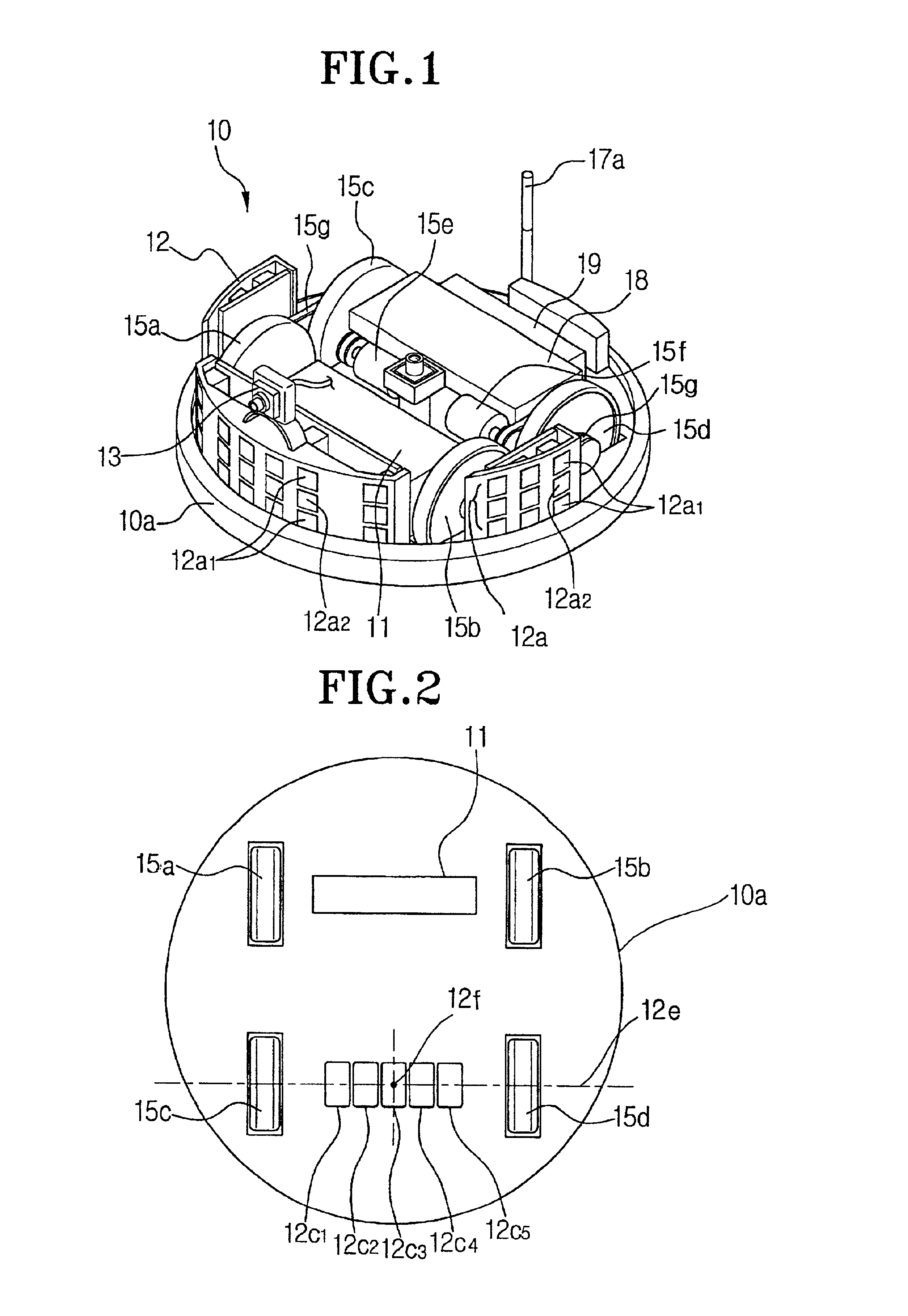

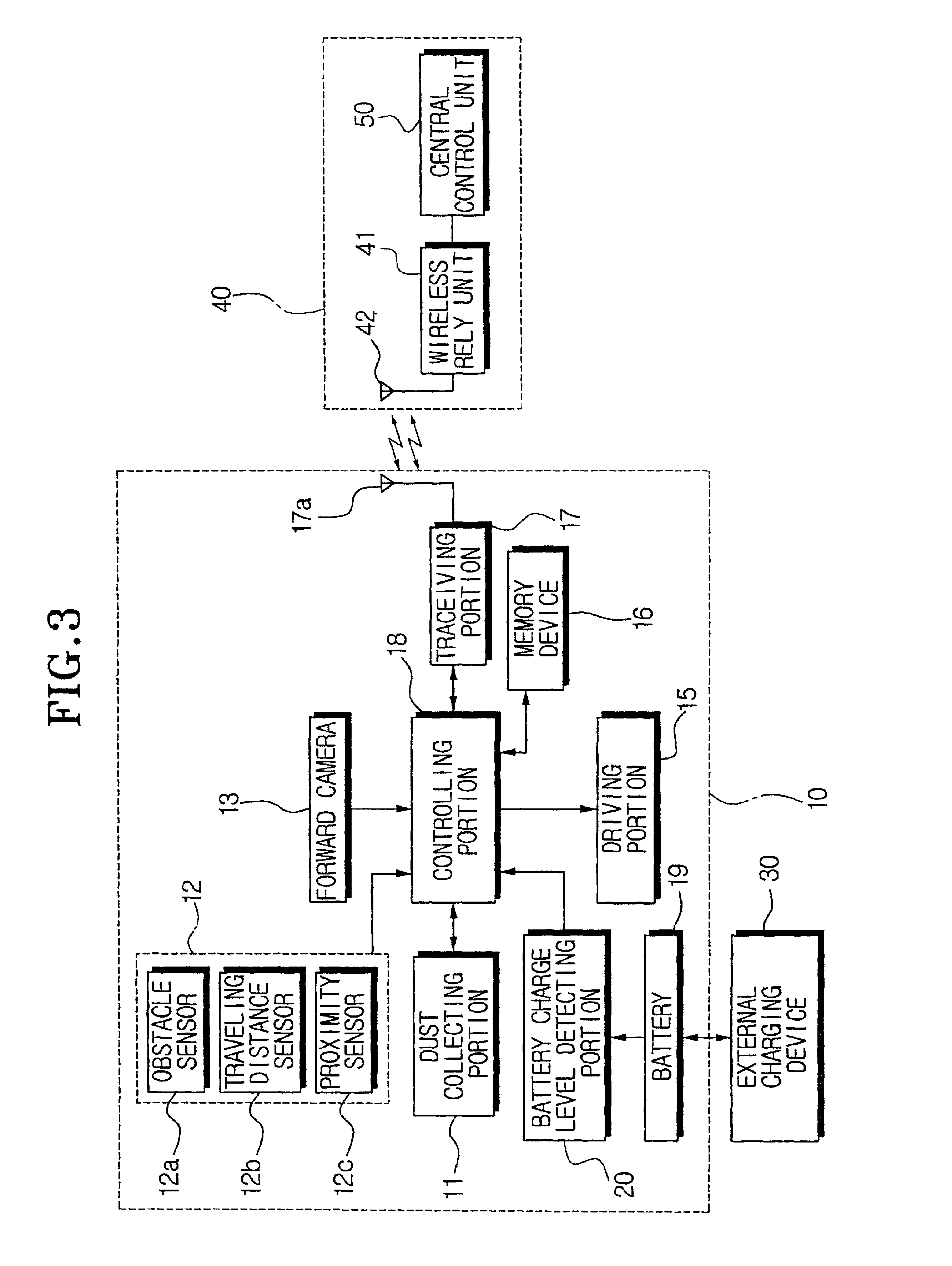

Robot cleaner, system thereof and method for controlling same

InactiveUS6841963B2Accurate identificationReduce the burden onAutomatic obstacle detectionTravelling automatic controlControl theoryPeripheral

A robot cleaner, a system thereof, and a method for controlling the same. The robot cleaner system includes a robot cleaner that performs a cleaning operation while communicating wirelessly with an external device. The robot cleaner has a plurality of proximity switches arranged in a row on a lower portion of the cleaner body. A guiding plate is disposed in the floor of the work area, the guiding plate having metal lines formed in a predetermined pattern, the metal lines being detectible by the proximity switches. Since the recognition of the location and the determination of traveling trajectory of the cleaner within a work area becomes easier, performance of the robot cleaner is enhanced, while a burden of having to process algorithms is lessened.

Owner:SAMSUNG GWANGJU ELECTRONICS CO LTD

Systems, methods and apparatus for vehicle battery charging

ActiveUS20110025267A1Circuit authenticationHybrid vehiclesElectric vehicleElectrical and Electronics engineering

A system for charging a battery within an at least partially electric vehicle. The system includes a charging device wherein the charging device configured to electrically connect to the at least partially electric vehicle and charge at least one battery by a predetermined amount. The system also includes a network configured to determine the location of the charging device.

Owner:DEKA PROD LLP

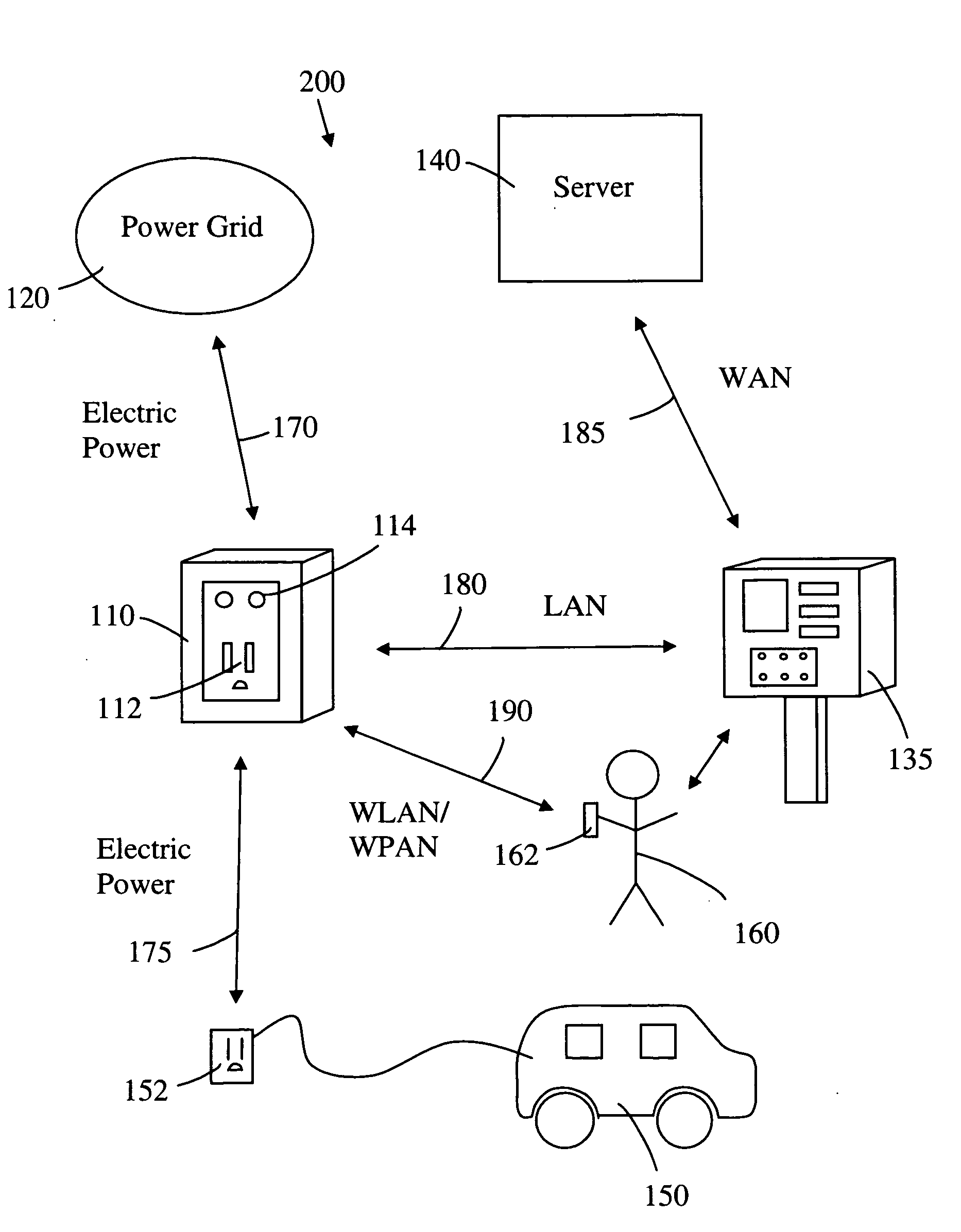

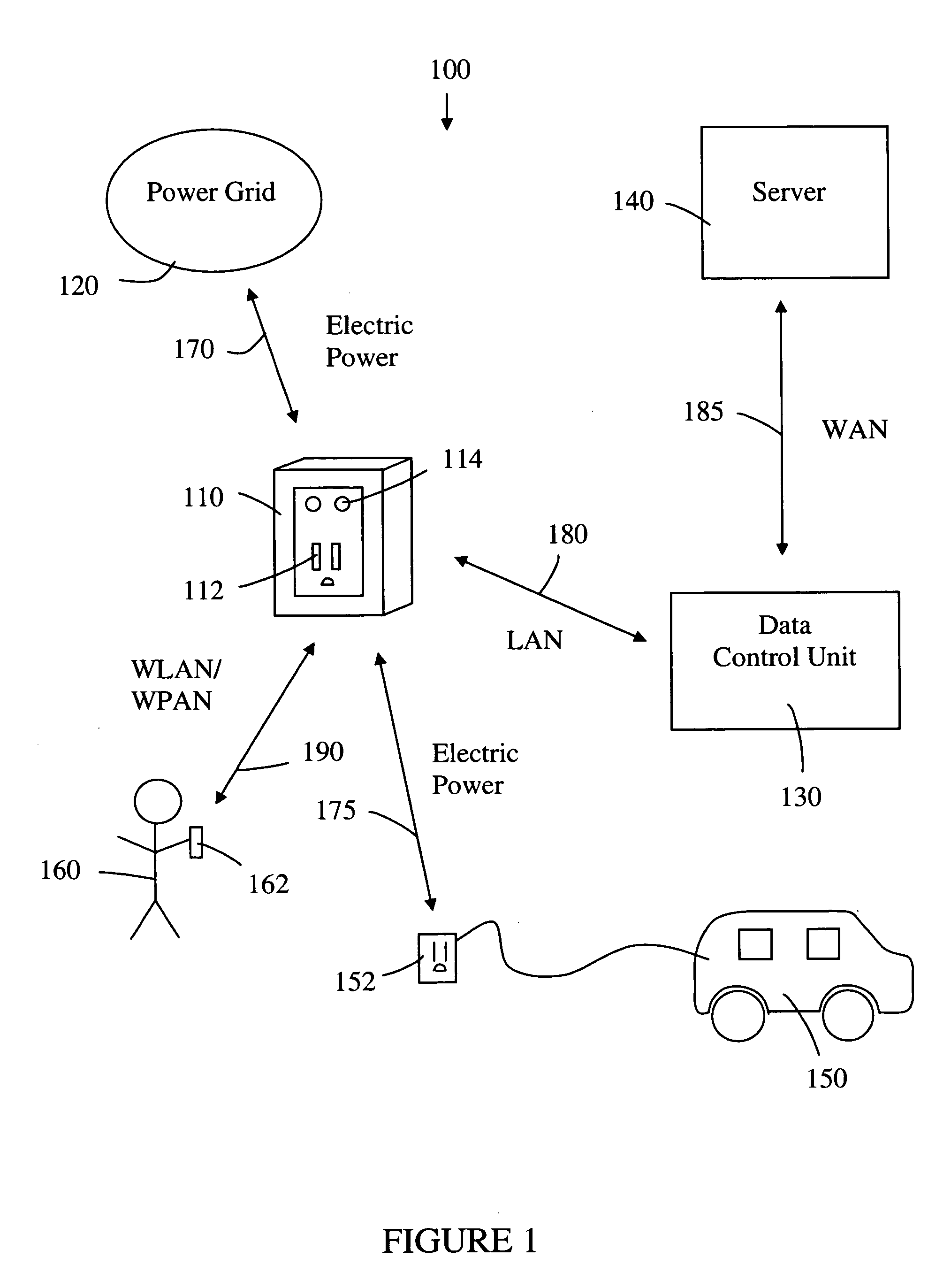

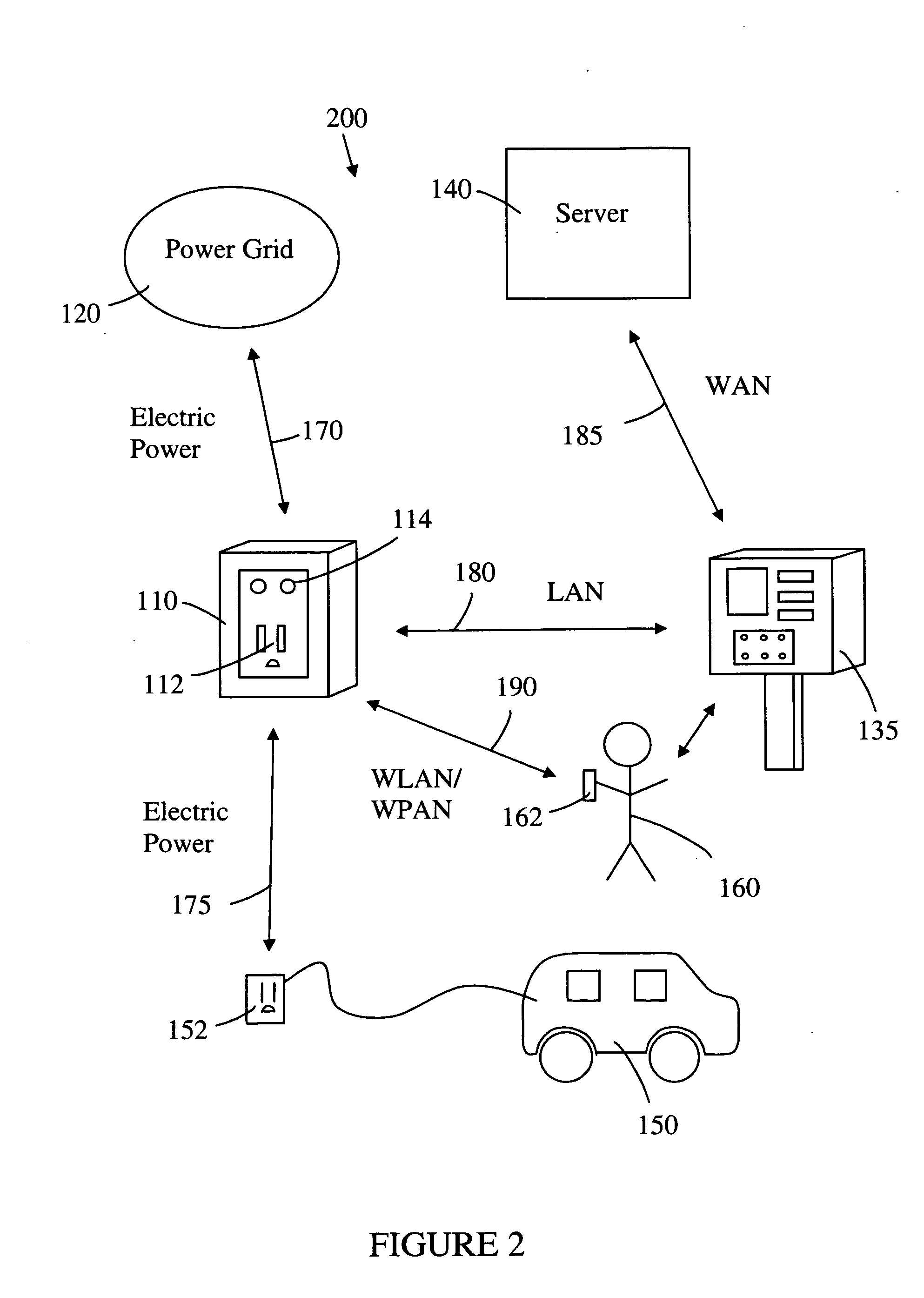

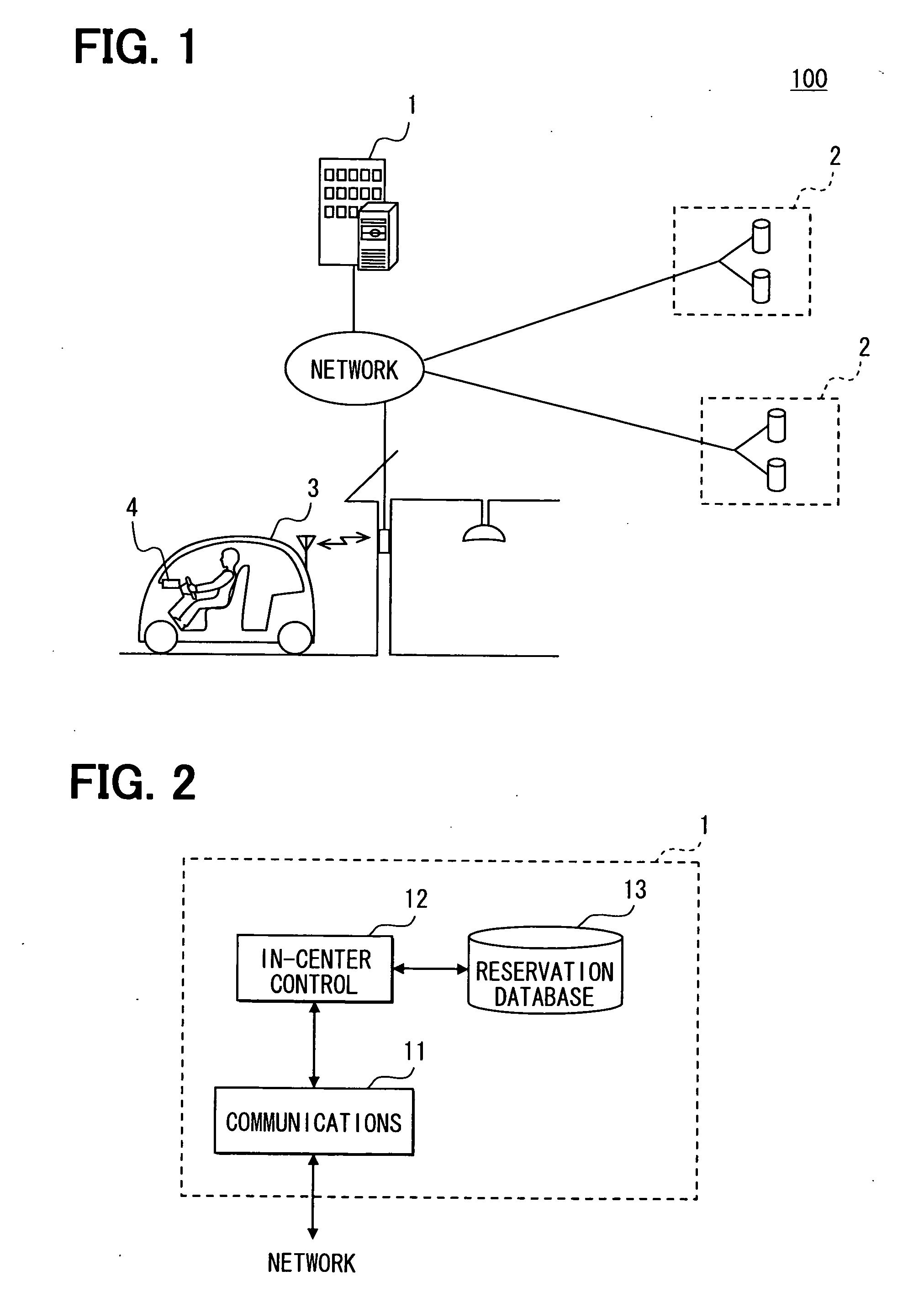

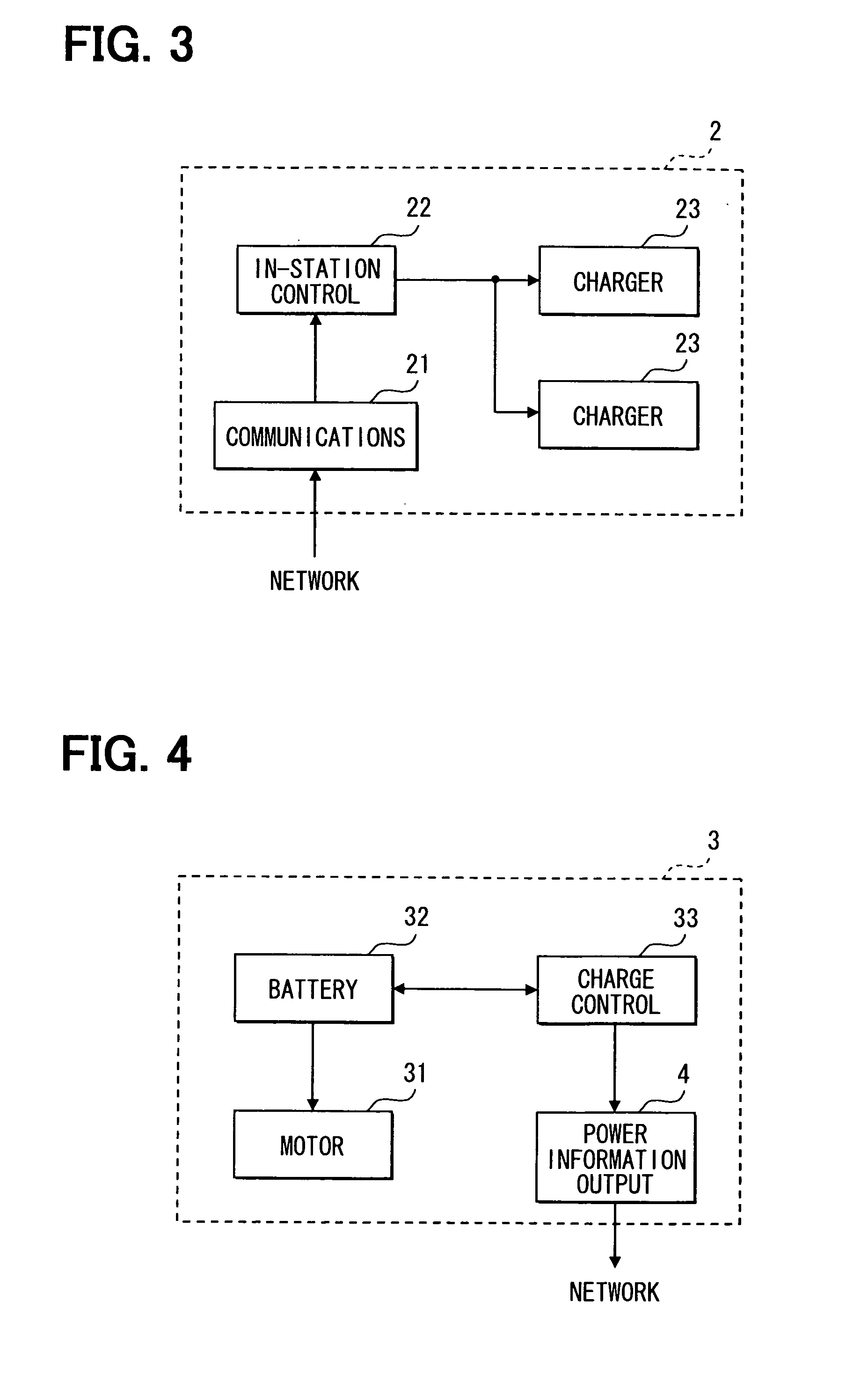

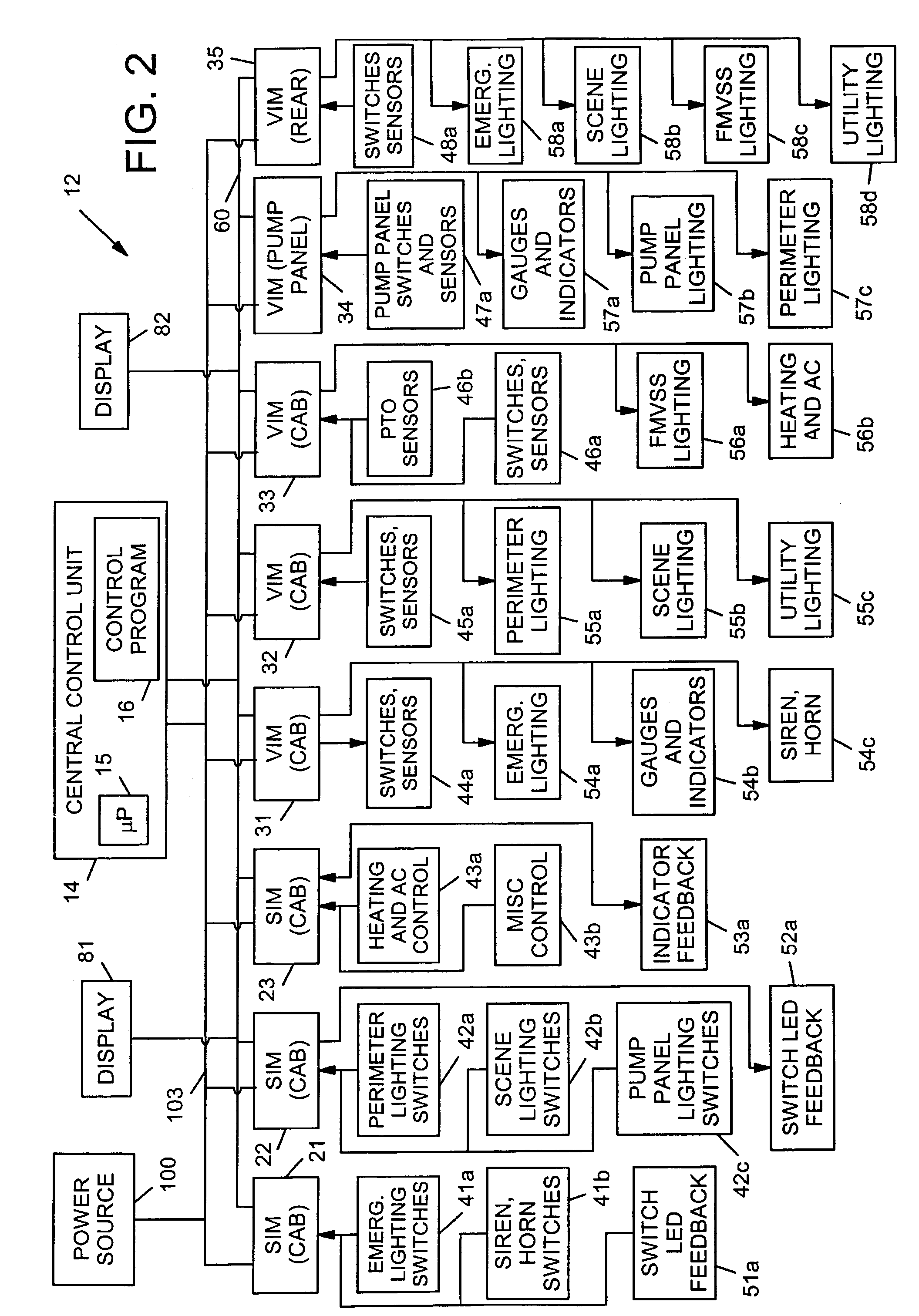

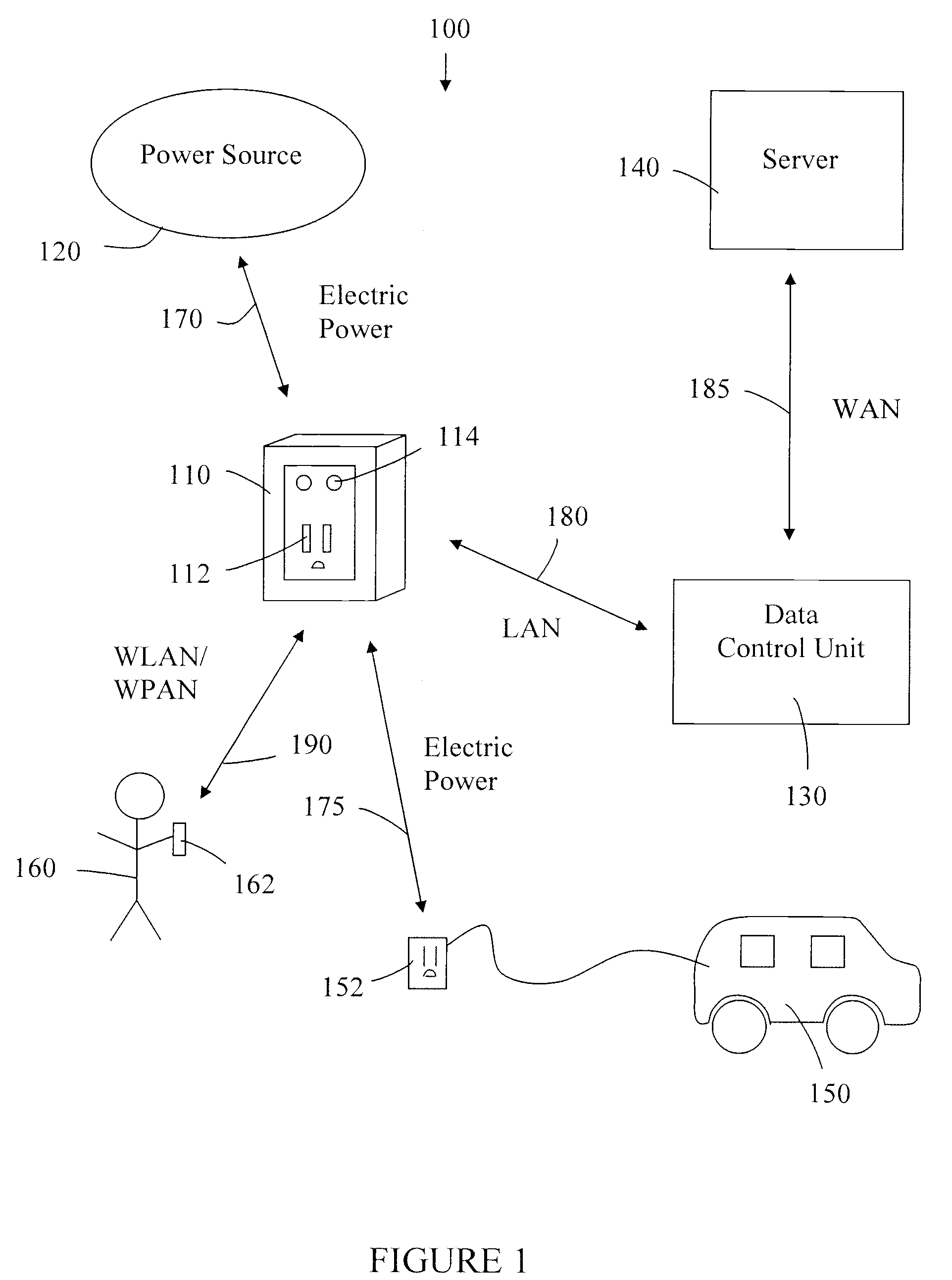

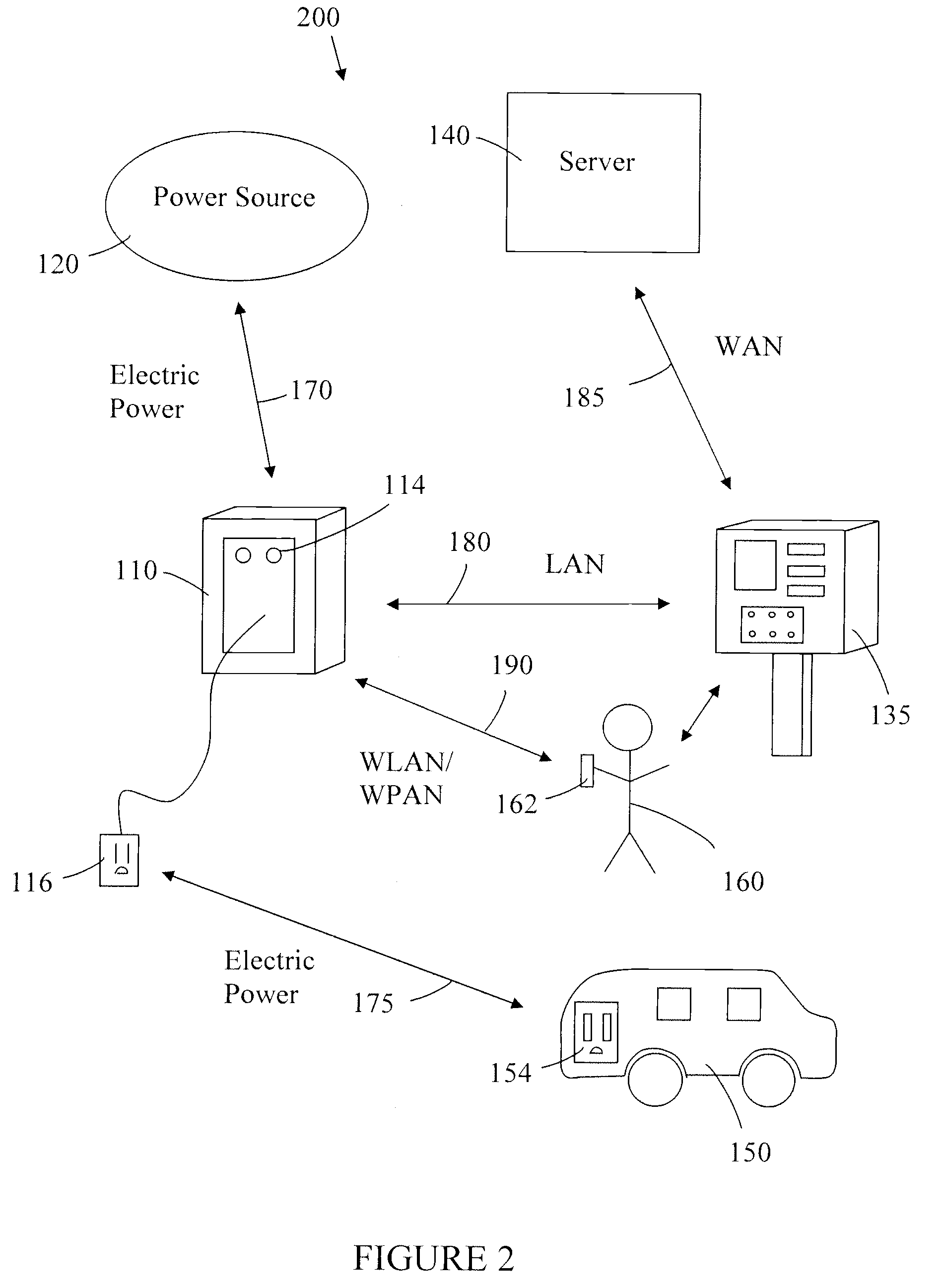

Network-controlled charging system for electric vehicles

ActiveUS20090174365A1Circuit authenticationTicket-issuing apparatusTransceiverTelecommunications link

A system for network-controlled charging of electric vehicles comprises charge transfer devices networked as follows: charge transfer devices and electric vehicle operators communicate via wireless communication links; charge transfer devices are connected by a local area network to a data control unit, which is connected to a server via a wide area network. The server stores consumer profiles and utility company power grid load data. A charge transfer devices comprises: an electrical receptacle for receiving an electrical connector for recharging an electric vehicle; an electric power line connecting the receptacle to a local power grid; a control device on the electric power line, for switching the receptacle on and off; a current measuring device on the electric power line, for measuring current flowing through the receptacle; a controller for operating the control device and monitoring the output from the current measuring device; a local area network transceiver connected to the controller, for connecting the controller to the data control unit; and a communication device connected to the controller, for wireless communication between the operator of the electric vehicle and the controller.

Owner:COULOMB TECHNOLOGIES

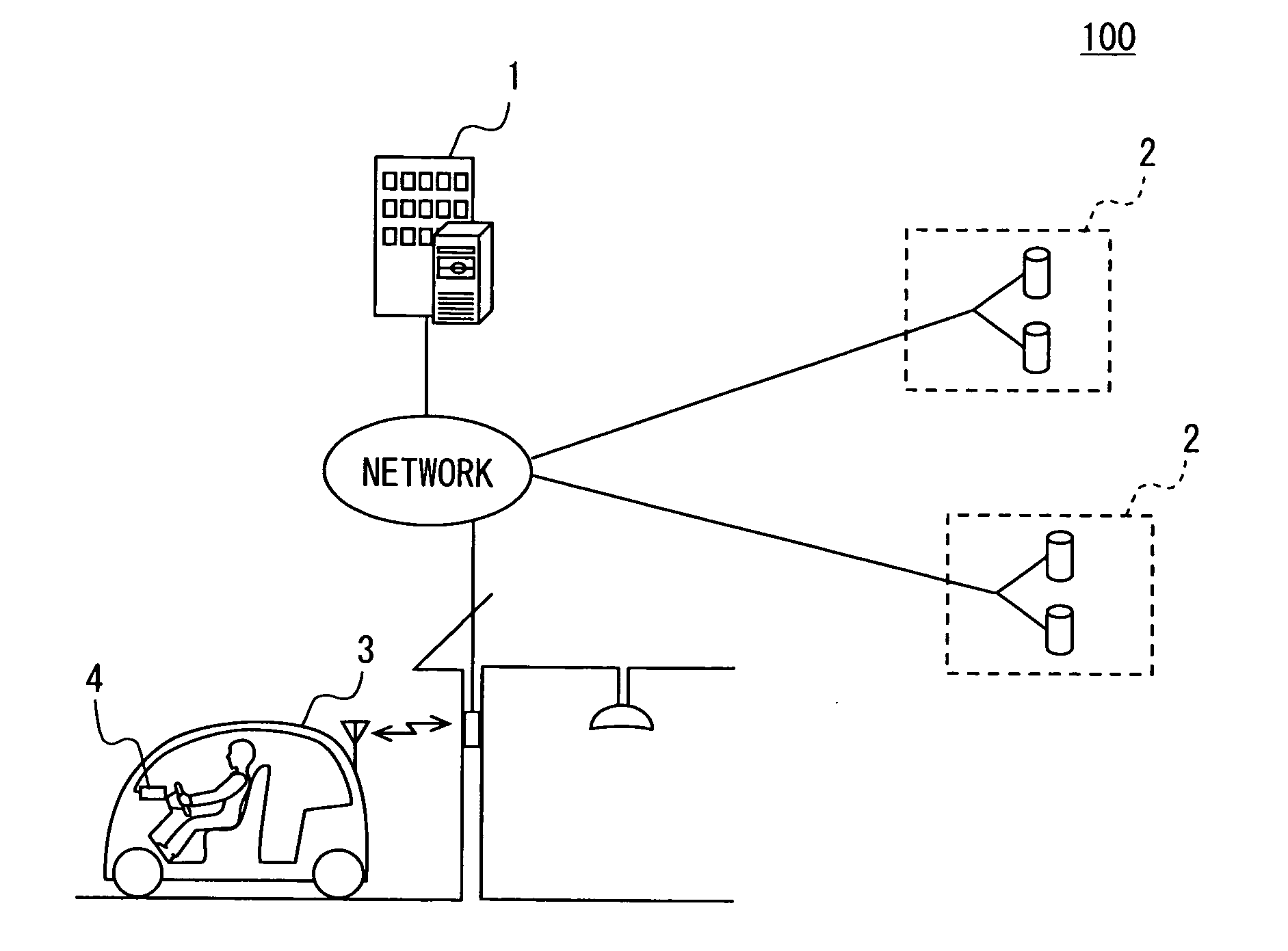

Electric power amount information output device and system

ActiveUS20110032110A1Sufficient time allowanceElectrical testingNavigation instrumentsElectricityElectric power system

In an electric power amount information output device for a vehicle, a control section checks whether a remaining electric power amount of a battery of a motor-driven vehicle at a departure point is less than a total electric power amount required for the vehicle to travel to a destination point. The control section drives an output section to output insufficiency information indicating that the remaining electric power amount of the battery is insufficient, if the remaining electric power amount is less than the required total electric power amount.

Owner:DENSO CORP

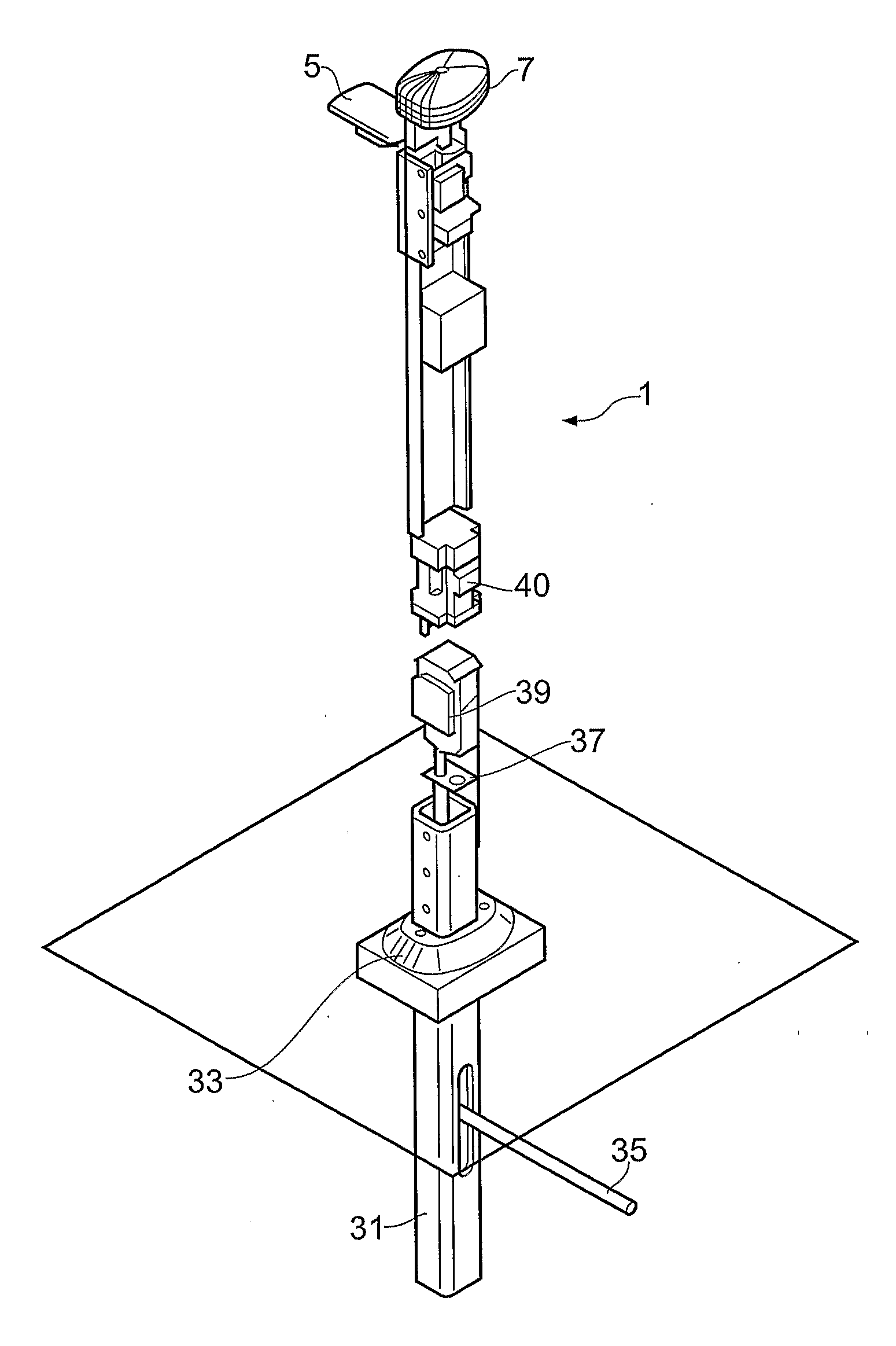

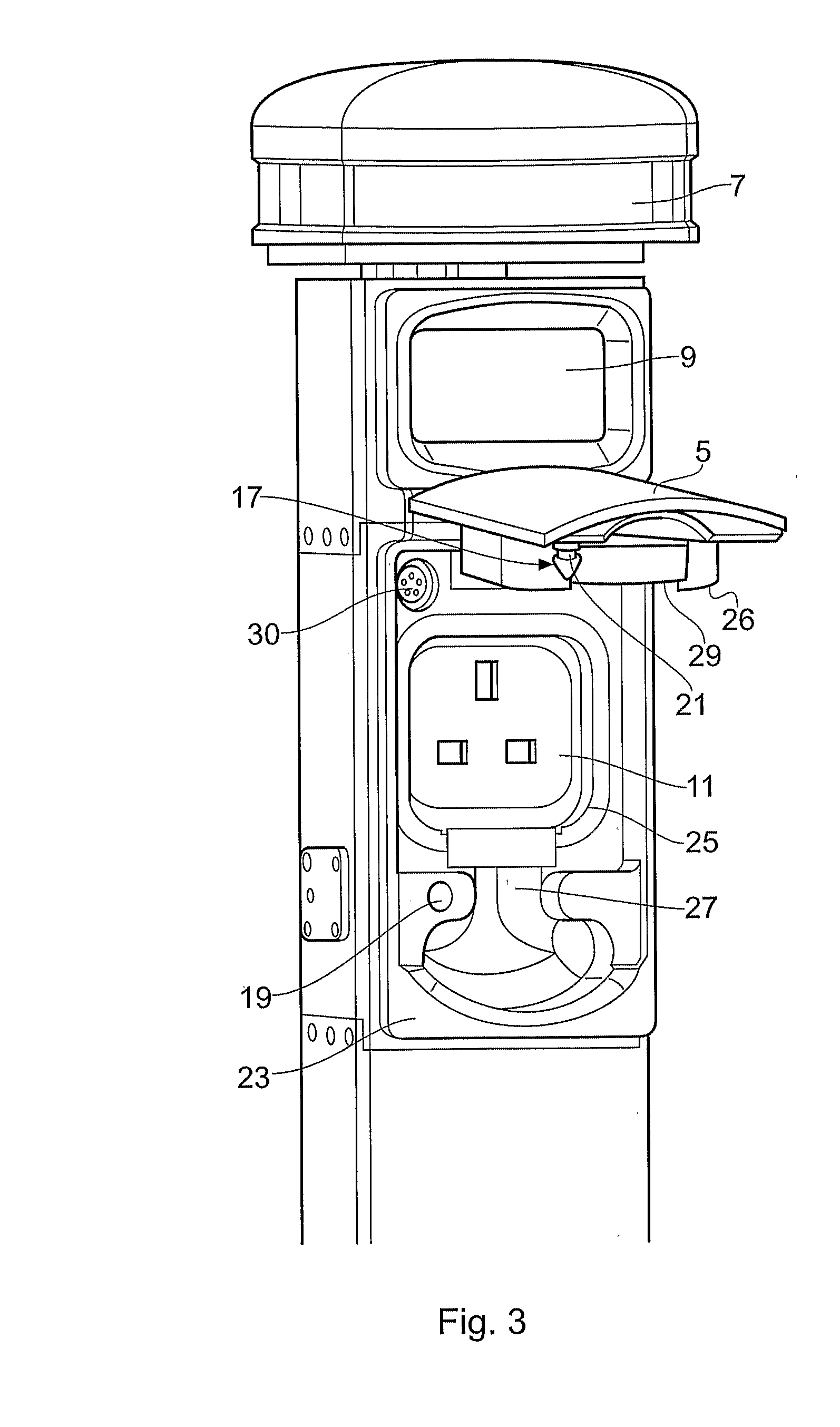

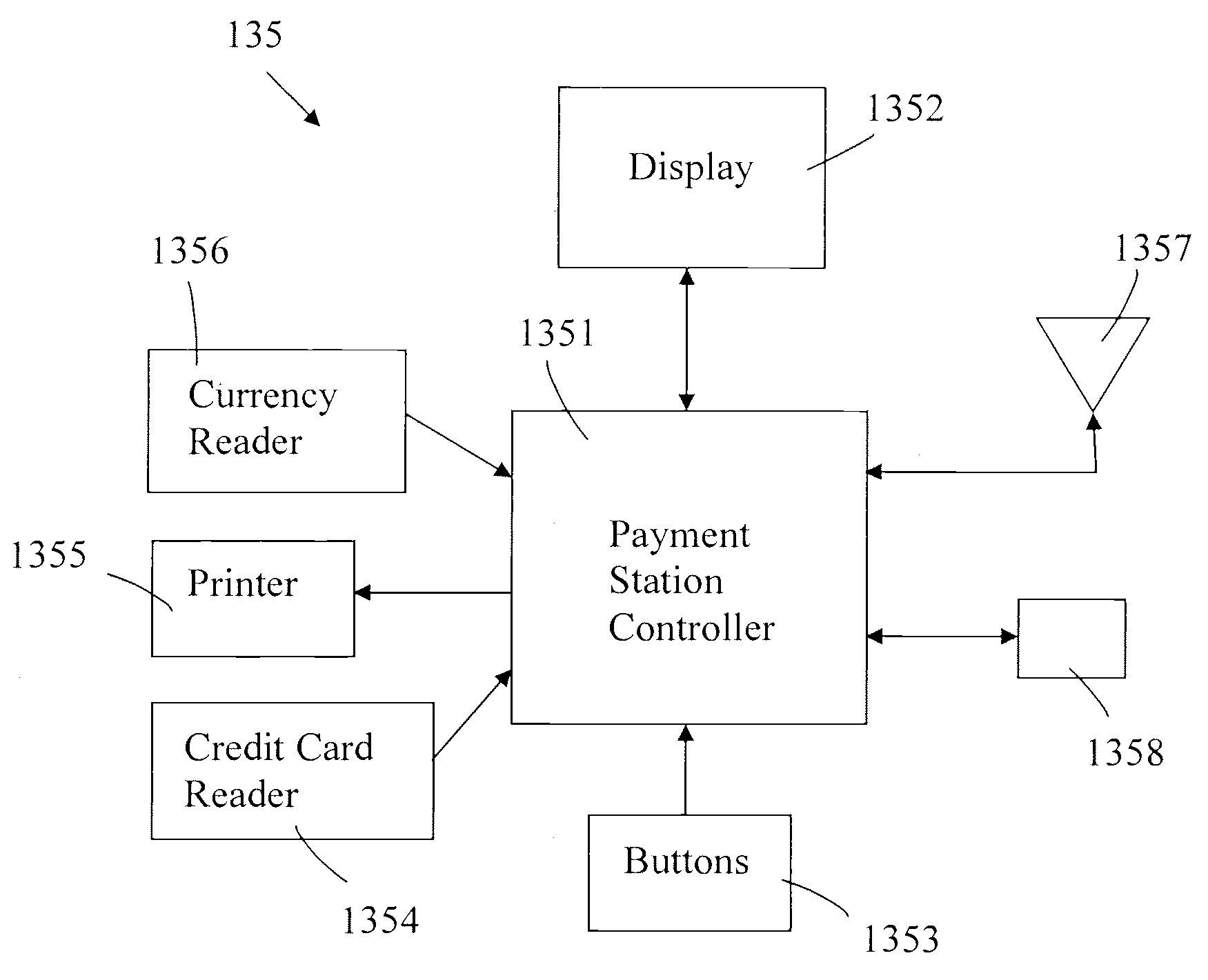

Charging station

InactiveUS20100013434A1Function increaseHybrid vehiclesCredit registering devices actuationElectricityLocking mechanism

The present application relates to a charging station operable in a charging cycle for charging an electric vehicle. The charging station has a key-activated controller for controlling the charging cycle. The application also relates to a key for operating the charging station. Furthermore, the application relates to a charging station having an interface for connecting the charging station to a data network. The application also relates to a charging station having a socket for receiving a plug and a key-operated locking mechanism for locking a plug in said socket. A frangible panel movable between an open position and a closed position may be provided. A processor may be provided for generating data to impose a financial charge on an individual for using the charging station. The application also relates to methods of operating a charging station including the steps of obtaining user identification data; supplying electricity to a charging socket; and generating data for levying a financial charge on the user.

Owner:ELEKTROMOTIVE

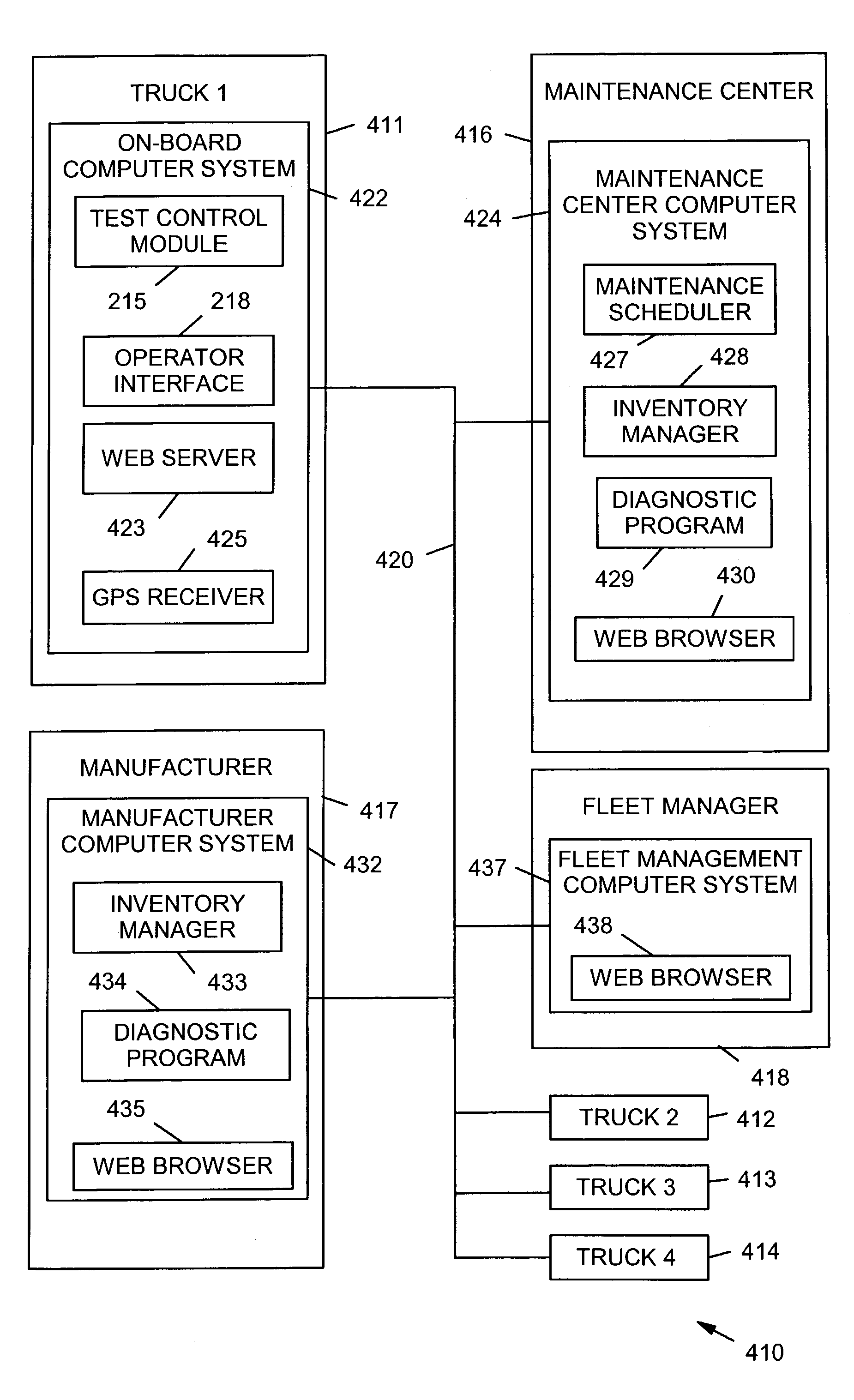

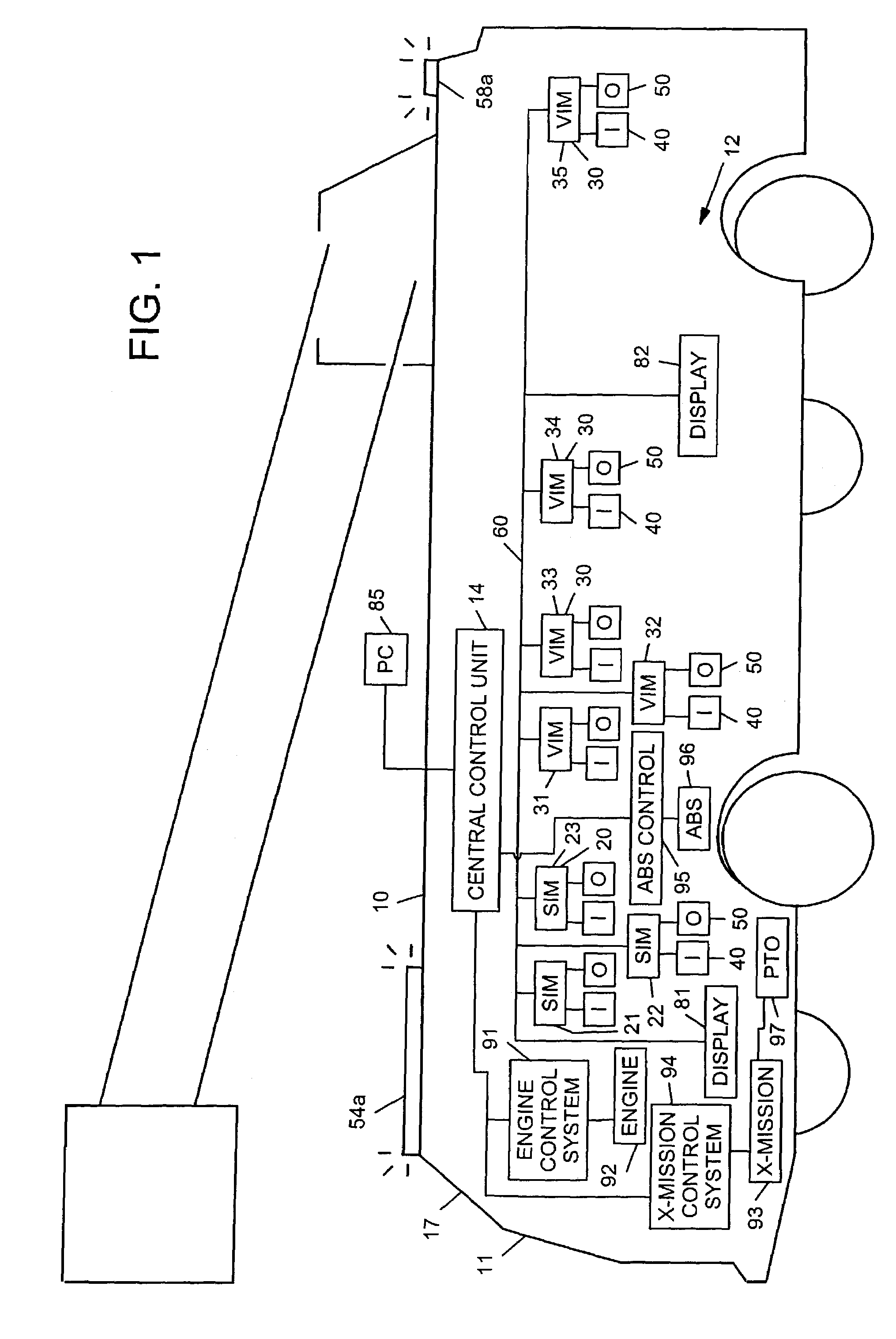

Equipment service vehicle with remote monitoring

InactiveUS7184866B2Vehicle testingRegistering/indicating working of vehiclesElectric power transmissionTelecommunications link

A system comprises an equipment service vehicle and an off-board computer system. The equipment service vehicle further includes a power source, a power transmission link, a plurality of input devices, a plurality of output devices, and an on-board computer system. The on-board computer system further includes a plurality of microprocessor-based interface modules and a communication network. The plurality of interface modules are coupled to the power source by way of the power transmission link and are interconnected to each other by way of the communication network. Each of the plurality of interface modules is coupled to respective ones of the plurality of input devices and the plurality of output devices by way of respective dedicated communication links. The on-board computer system stores I / O status information for the plurality of input devices and the plurality of output devices. The on-board computer system transmits at least some of the I / O status information by way of a wireless radio-frequency communication link to the off-board computer system.

Owner:OSHKOSH CORPORATION

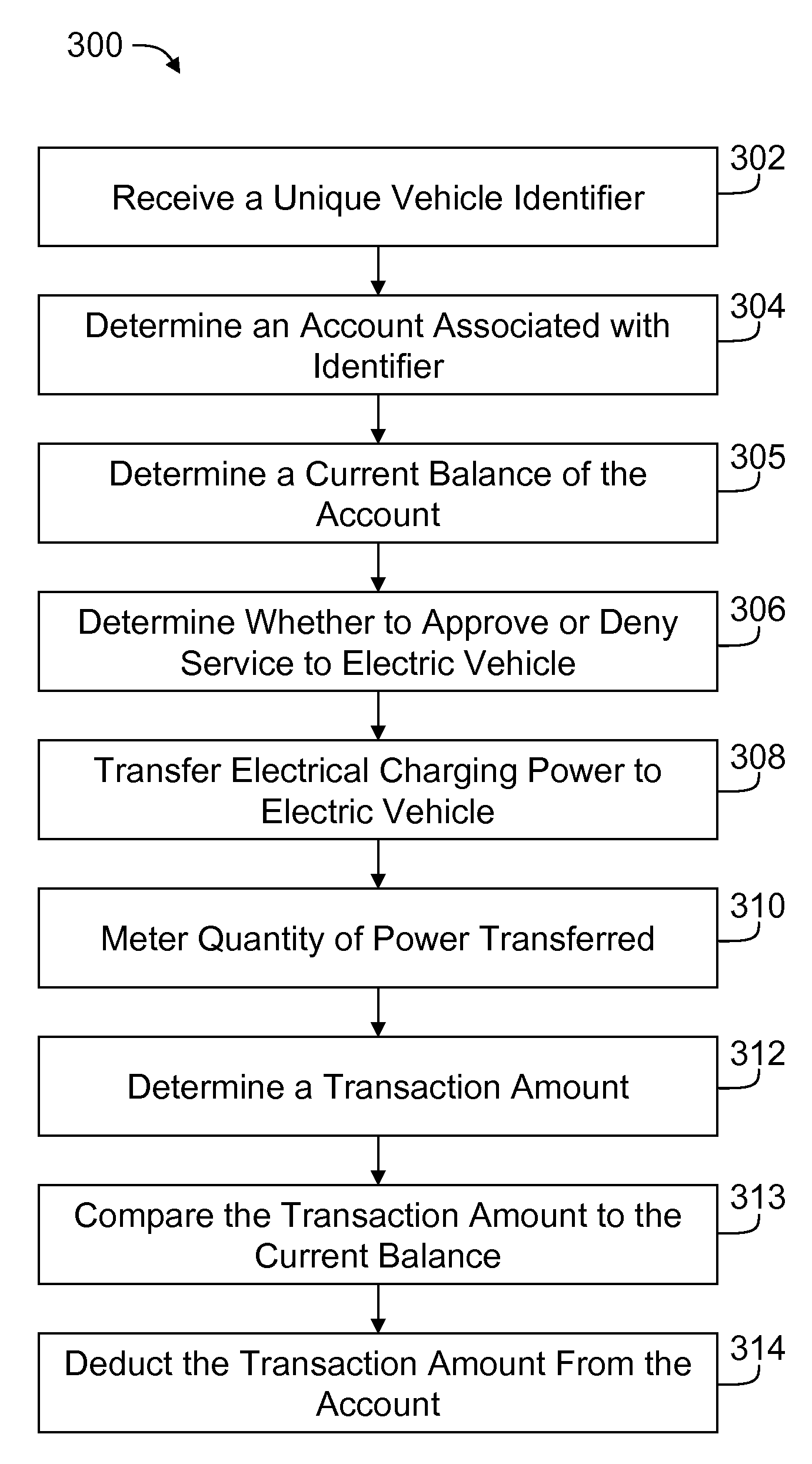

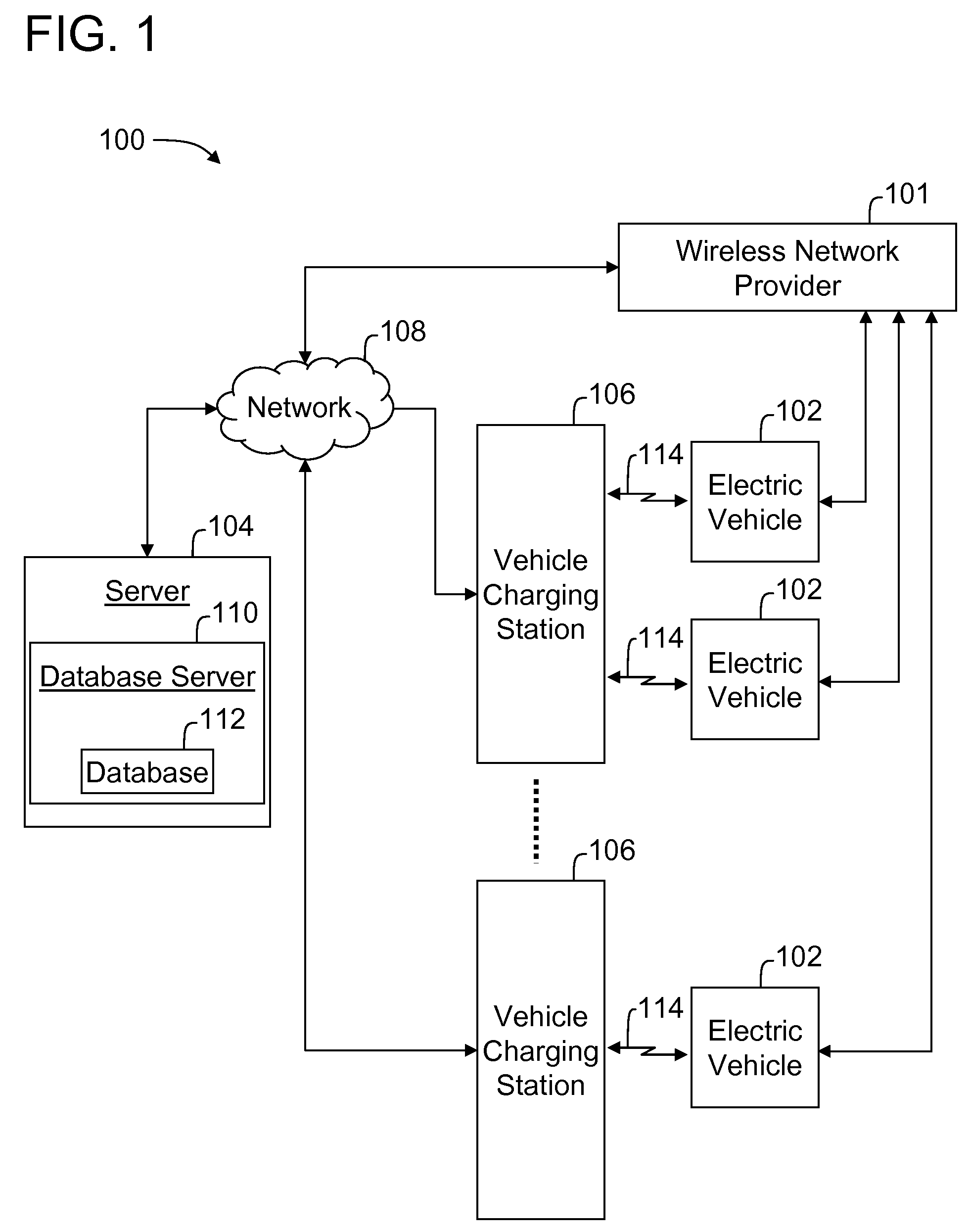

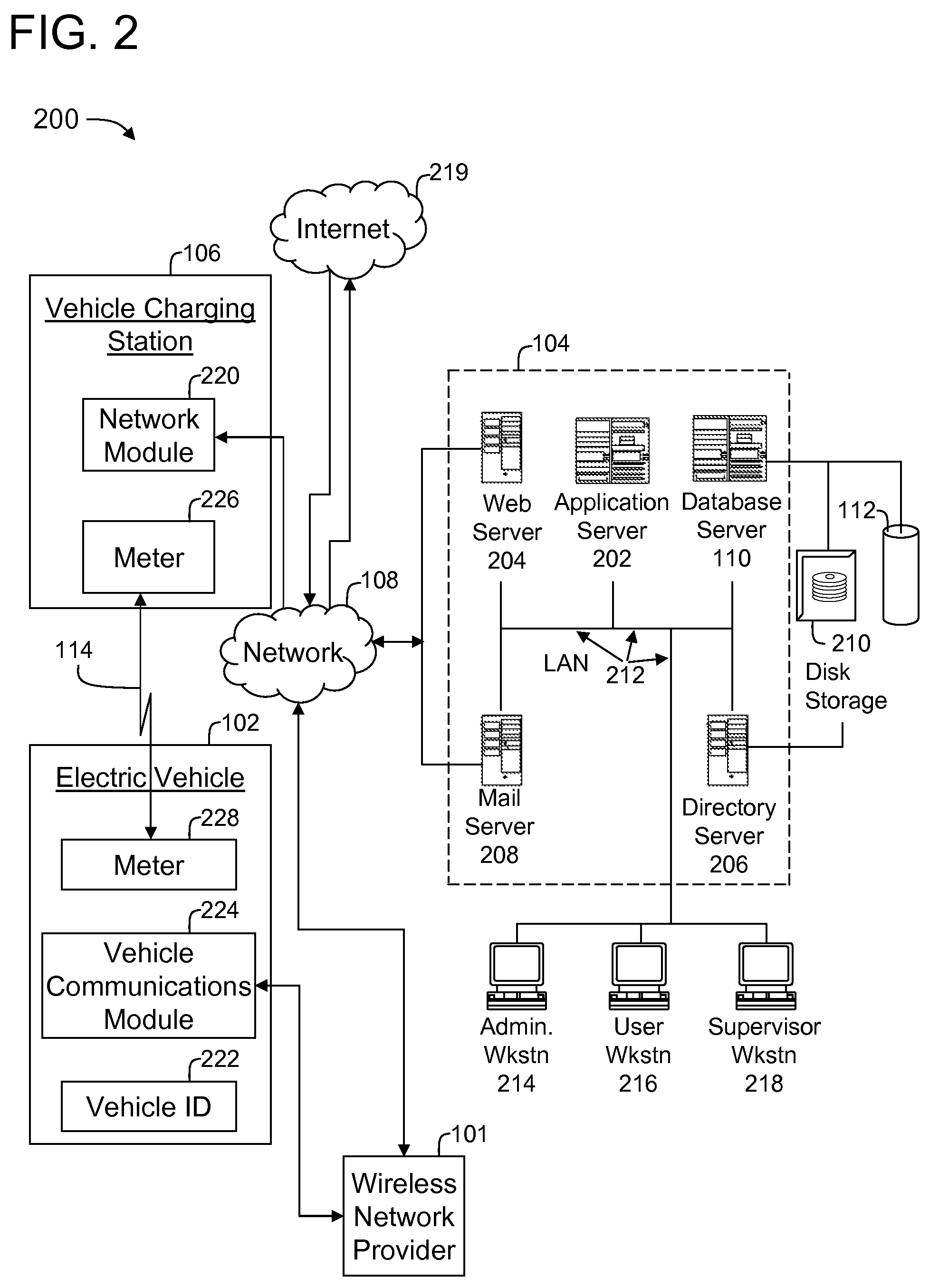

System and method for electric vehicle charging and billing using a wireless vehicle communciation service

ActiveUS20100161481A1Batteries circuit arrangementsSpecial tariff metersElectricityNetwork connection

A vehicle charging station for use in transmitting charging power to an electric vehicle for use in charging the vehicle is configured to communicatively couple to the electric vehicle via a network connection to a wireless network provider and electrically couple to the electric vehicle via a connector. Vehicle charging station is further configured to receive a unique identifier from the electric vehicle via the network connection, deliver a quantity of electrical charging power to the electric vehicle via the connector, and meter the quantity of electrical charging power delivered to the electric vehicle

Owner:GENERAL ELECTRIC CO

Collection of electric vehicle power consumption tax

InactiveUS20090177580A1Accurate measurement and reportingCharging stationsFinancePaymentMeasurement device

A method of collecting electric vehicle power consumption tax for charge transferred between a local power source and an electric vehicle comprises: providing a network-controlled charge transfer device, charge transfer being controlled by a controller, the controller being connected to a network for communication to a server; requesting by an operator of the electric vehicle to the controller for charge transfer; relaying the request from the controller to the server; determining by the server, from geographical tax rate data and the geographical location of the network-controlled charge transfer device, an applicable tax rate on the charge transfer; enabling charge transfer by communicating from the server to the controller to activate the control device; monitoring the charge transfer using a current measuring device, the controller being configured to monitor the output from the current measuring device and to maintain a running total of charge transferred; detecting completion of the charge transfer; and on detecting completion, processing payment with said payment source, which may include deducting the cost of charge transfer from a subscriber account containing pre-transferred funds, and disabling charge transfer; wherein the request for payment includes the electric vehicle power consumption tax.

Owner:COULOMB TECHNOLOGIES

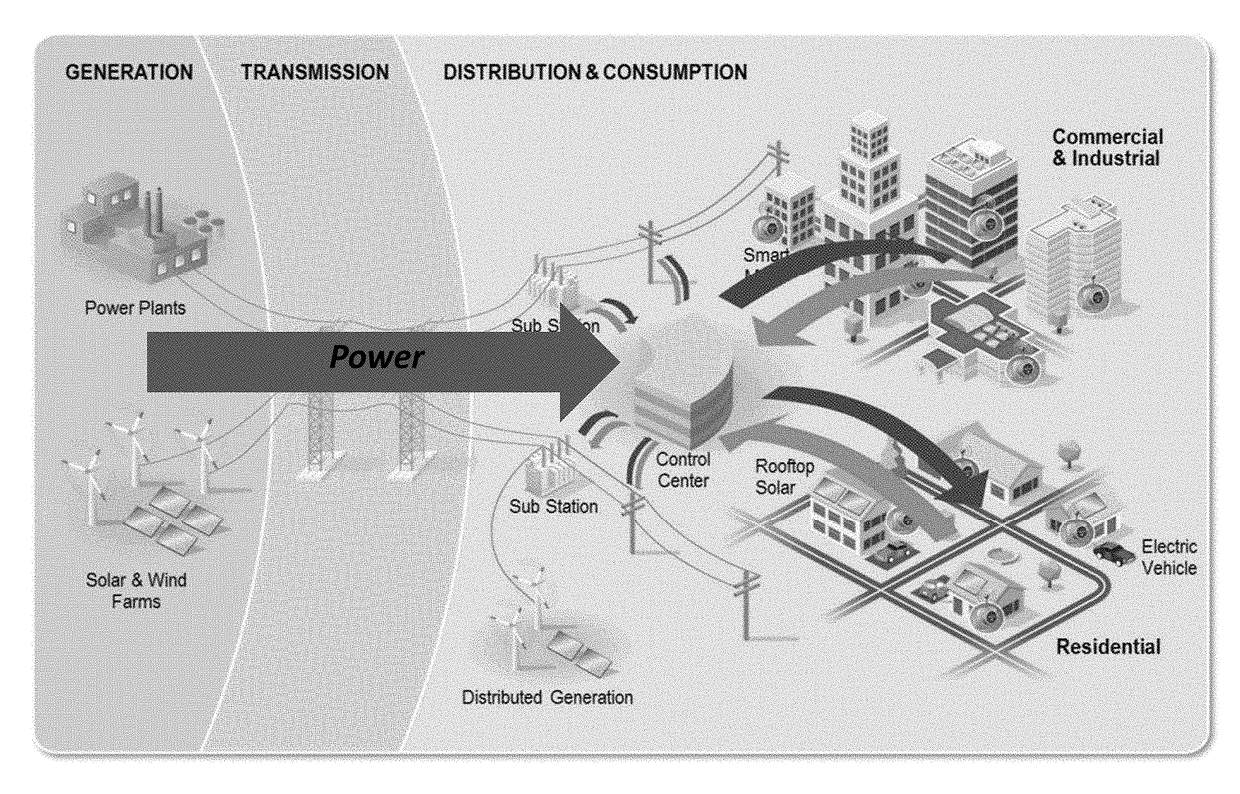

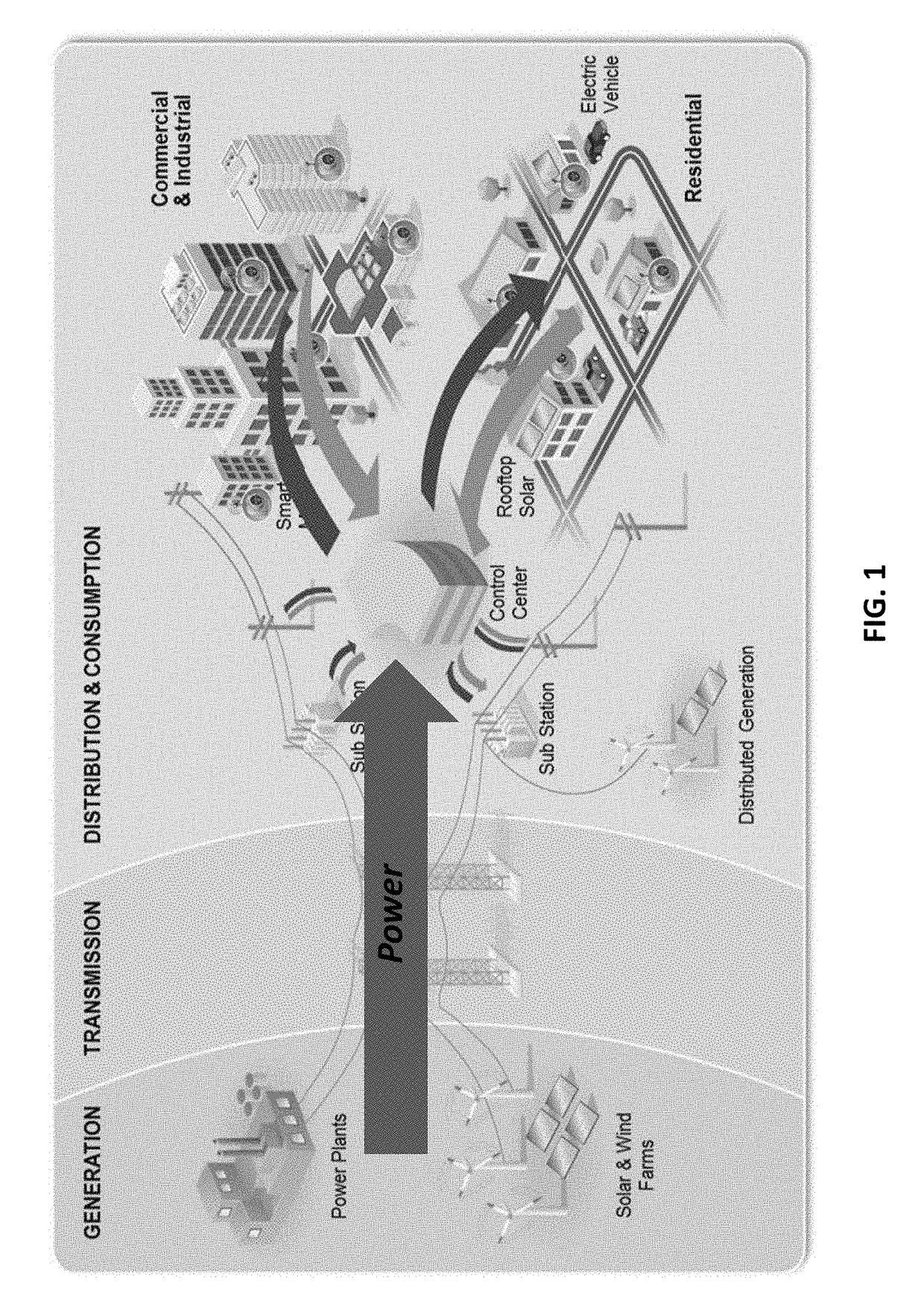

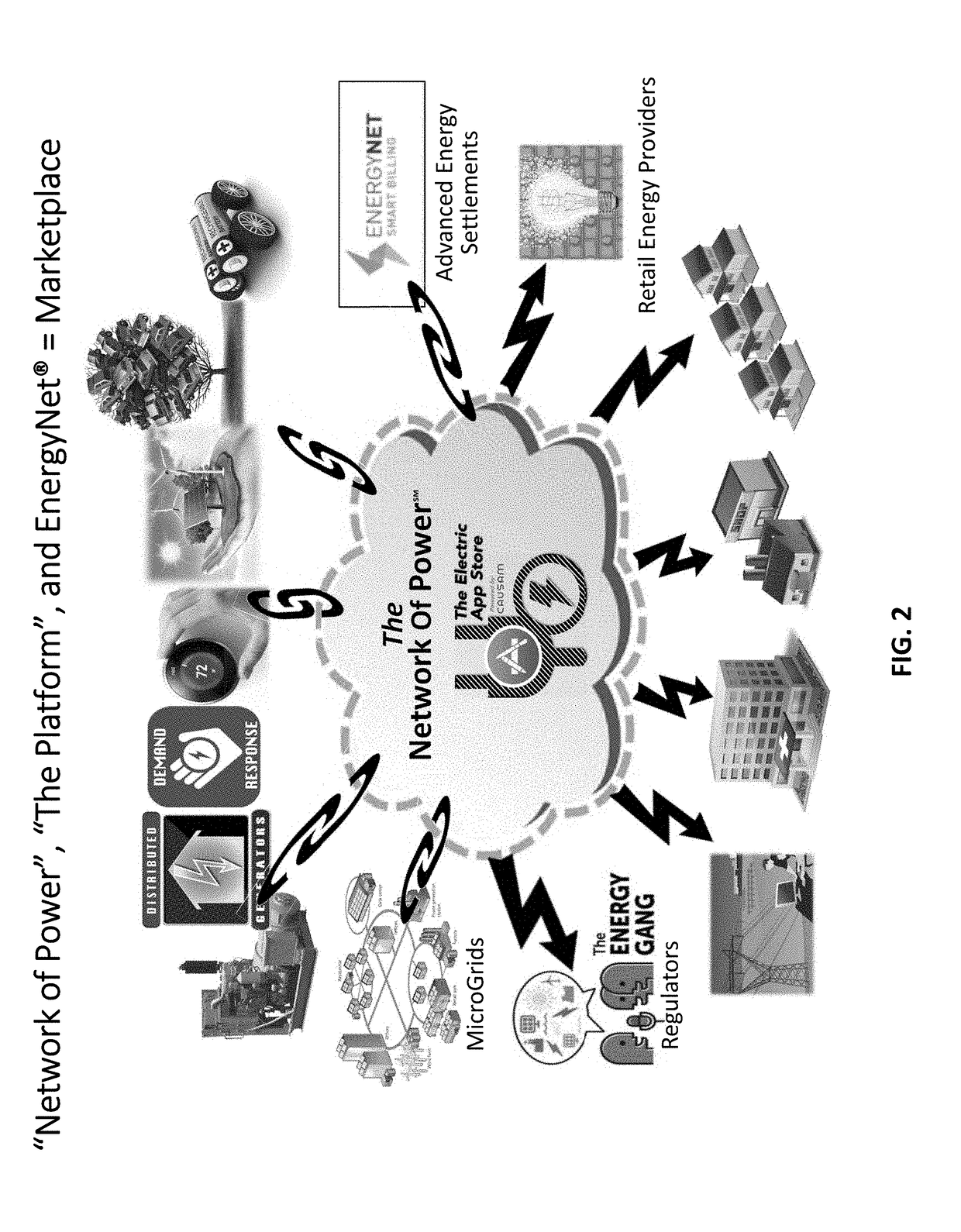

Systems and methods for advanced energy settlements, network-based messaging, and applications supporting the same on a blockchain platform

Systems and methods for financial settlement of transactions within an electric power grid network are disclosed. A multiplicity of active grid elements are constructed and configured for electric connection and network-based communication over a blockchain-based platform. The multiplicity of active grid elements are operable to make peer-to-peer transactions based on their participation within the electric power grid by generating and executing a digital contract. The multiplicity of active grid elements generate messages autonomously and / or automatically within a predetermined time interval. The messages comprise energy related data and settlement related data. The energy related data of the multiplicity of active grid elements are based on measurement and verification. The energy related data and the settlement related data are validated and recorded on a distributed ledger with a time stamp and a geodetic reference.

Owner:CAUSAM ENERGY INC

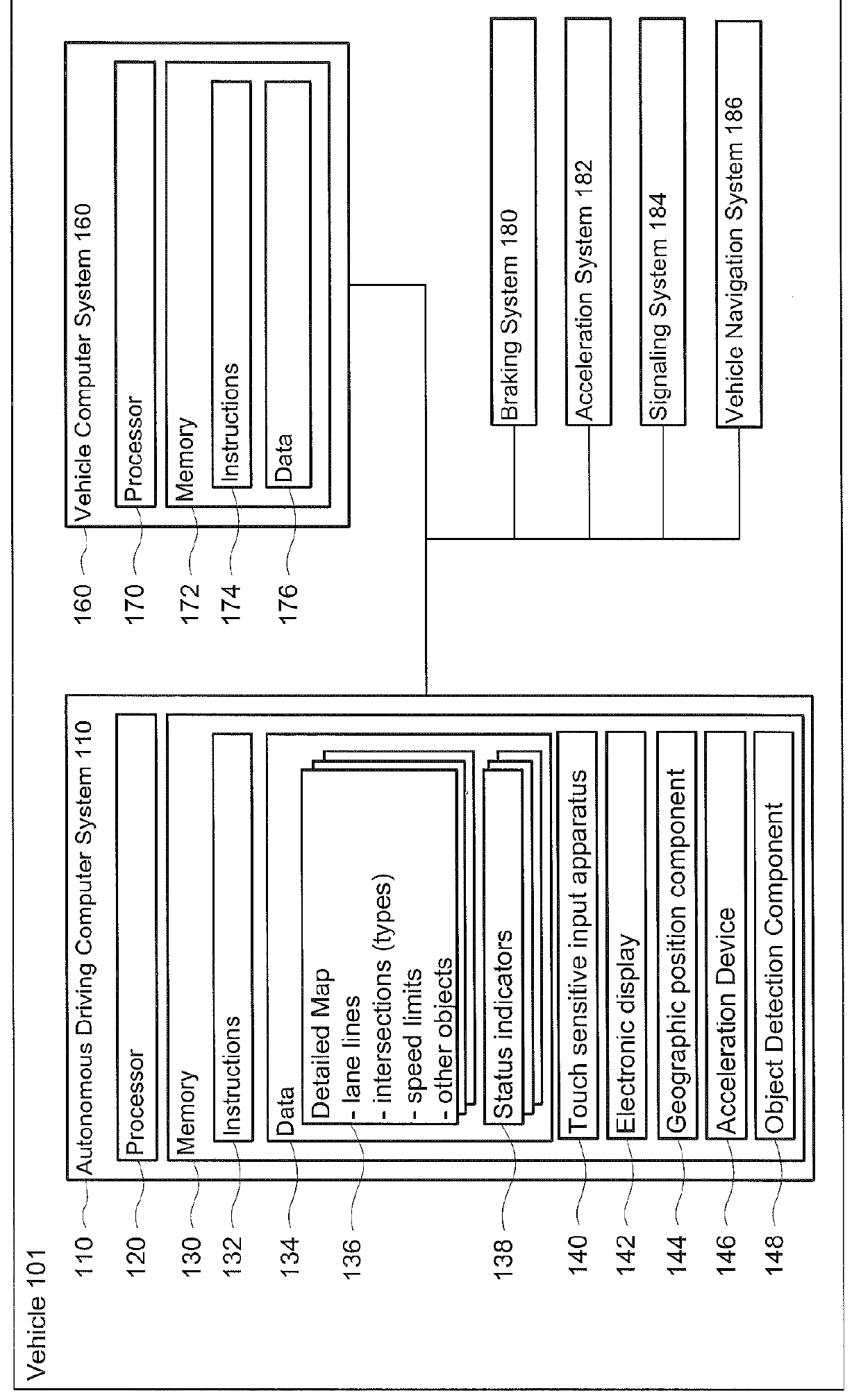

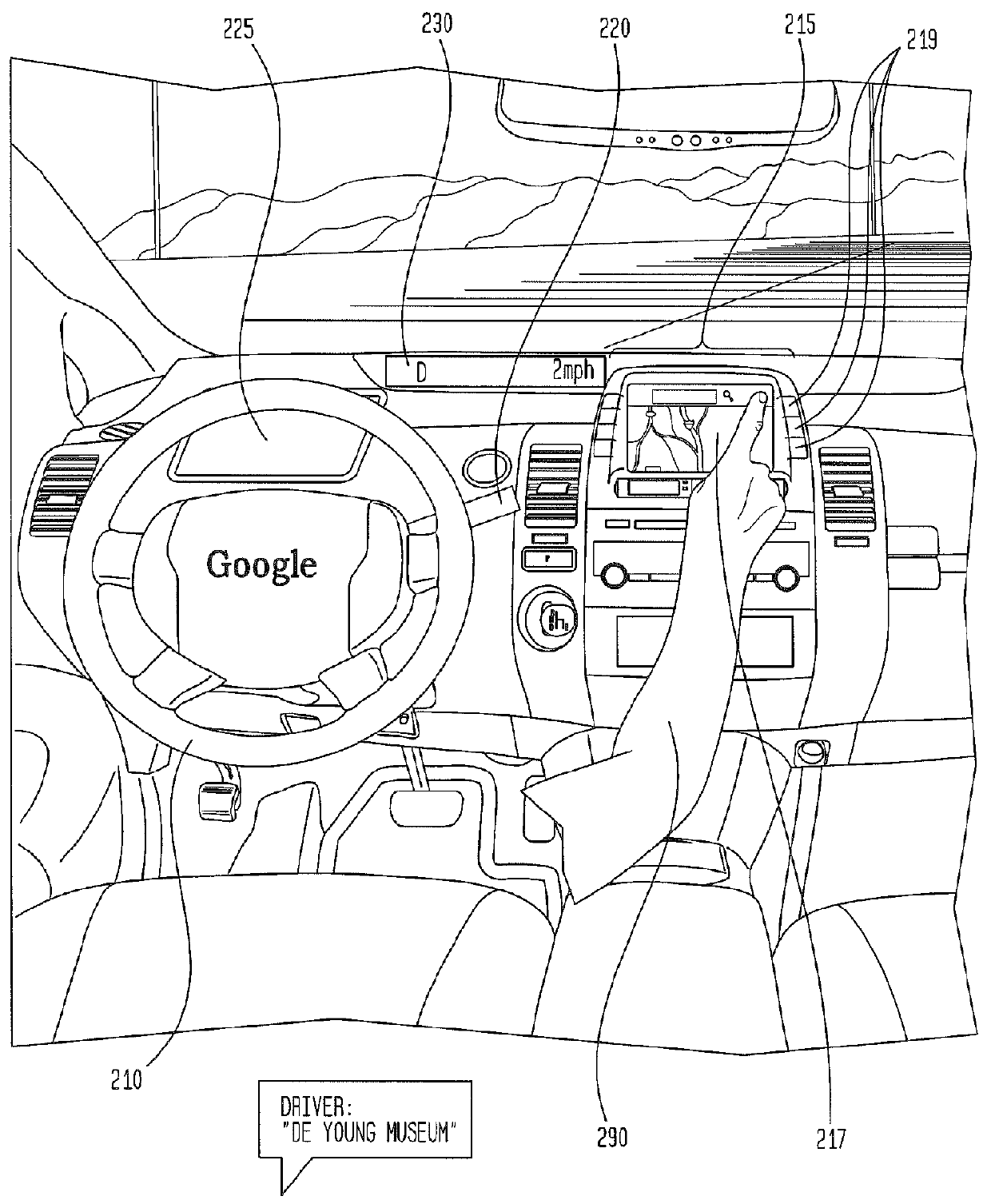

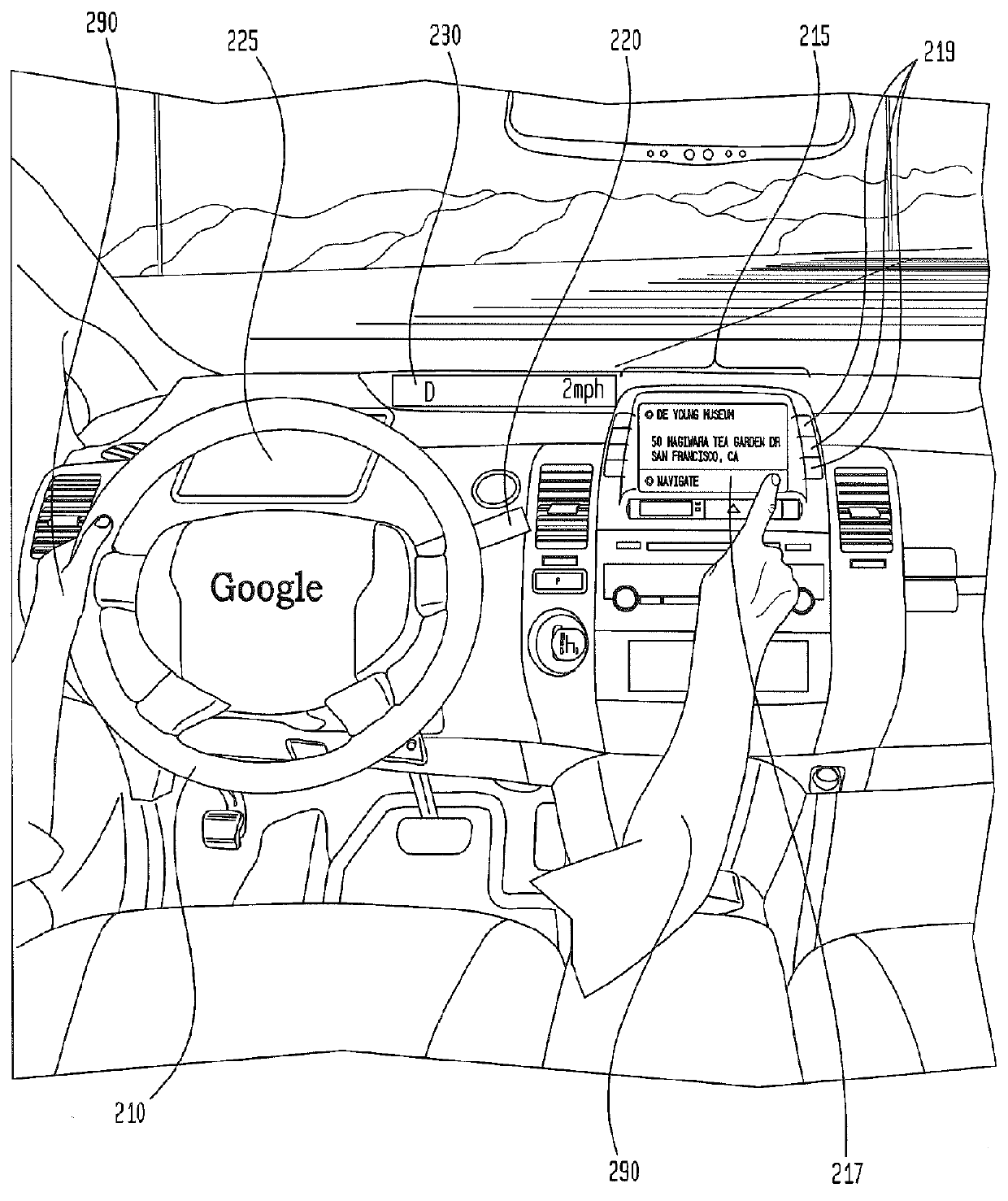

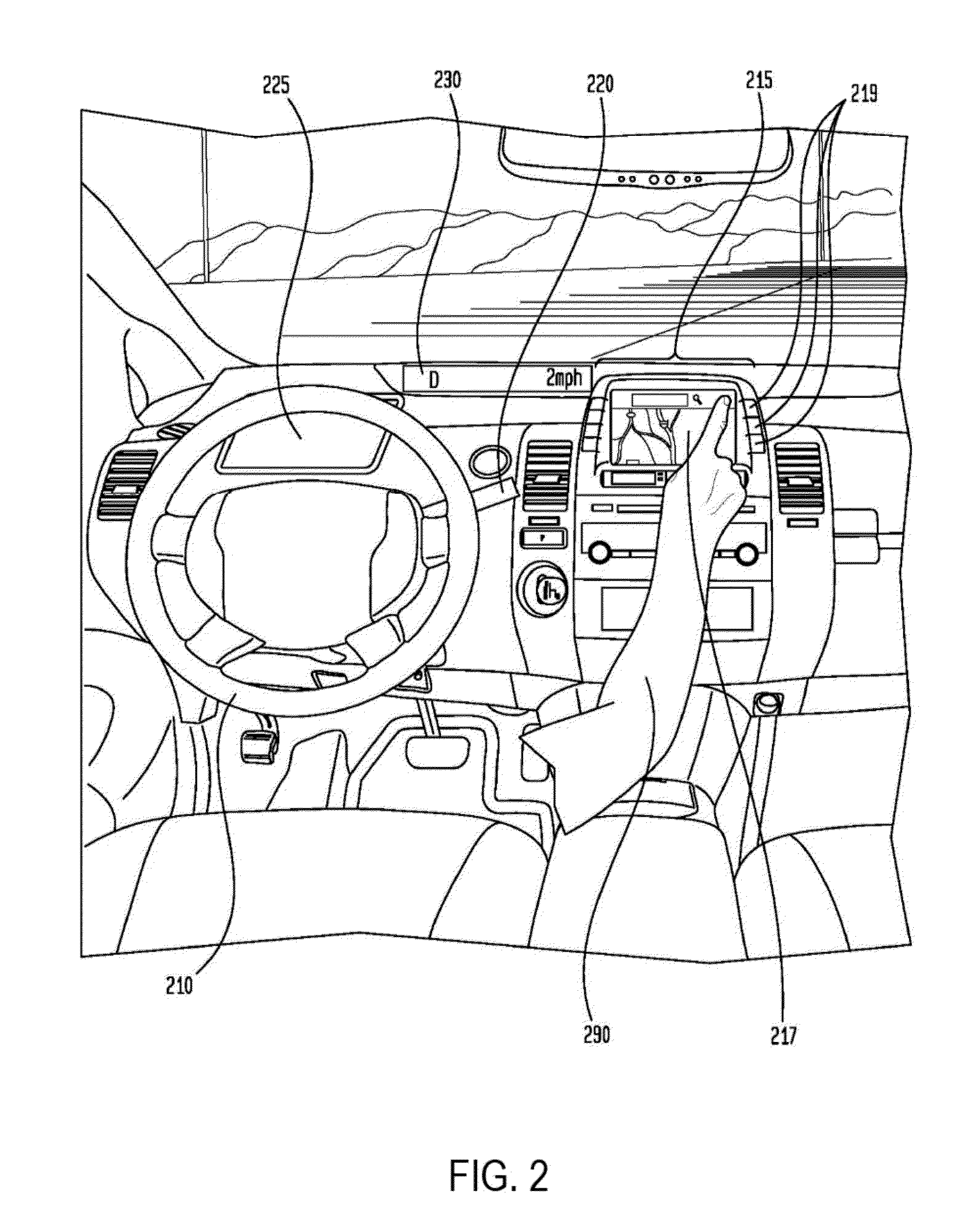

User interface for displaying internal state of autonomous driving system

ActiveUS8260482B1Control process safetyDigital data processing detailsNavigation instrumentsSteering wheelEmbedded system

A passenger in an automated vehicle may relinquish control of the vehicle to a control computer when the control computer has determined that it may maneuver the vehicle safely to a destination. The passenger may relinquish or regain control of the vehicle by applying different degrees of pressure, for example, on a steering wheel of the vehicle. The control computer may convey status information to a passenger in a variety of ways including by illuminating elements of the vehicle. The color and location of the illumination may indicate the status of the control computer, for example, whether the control computer has been armed, is ready to take control of the vehicle, or is currently controlling the vehicle.

Owner:WAYMO LLC

Tunable frangible battery pack system

ActiveUS20080241667A1Allow useMinimize the possibilityPrimary cell to battery groupingElectric devicesElectrical conductorThermal force

A tunable frangible battery pack system for use in an electric vehicle is disclosed. The tunable frangible battery pack system includes a two piece clamshell housing. The system also includes a plurality of battery cells arranged within the housing and a collector plate secured to each piece of the housing. The system also includes a wire conductor arranged between each of the battery cells and collector plates to create a frangible disconnect system when the battery pack system and electric vehicle are exposed to a predetermined mechanical or thermal force or event.

Owner:TESLA INC

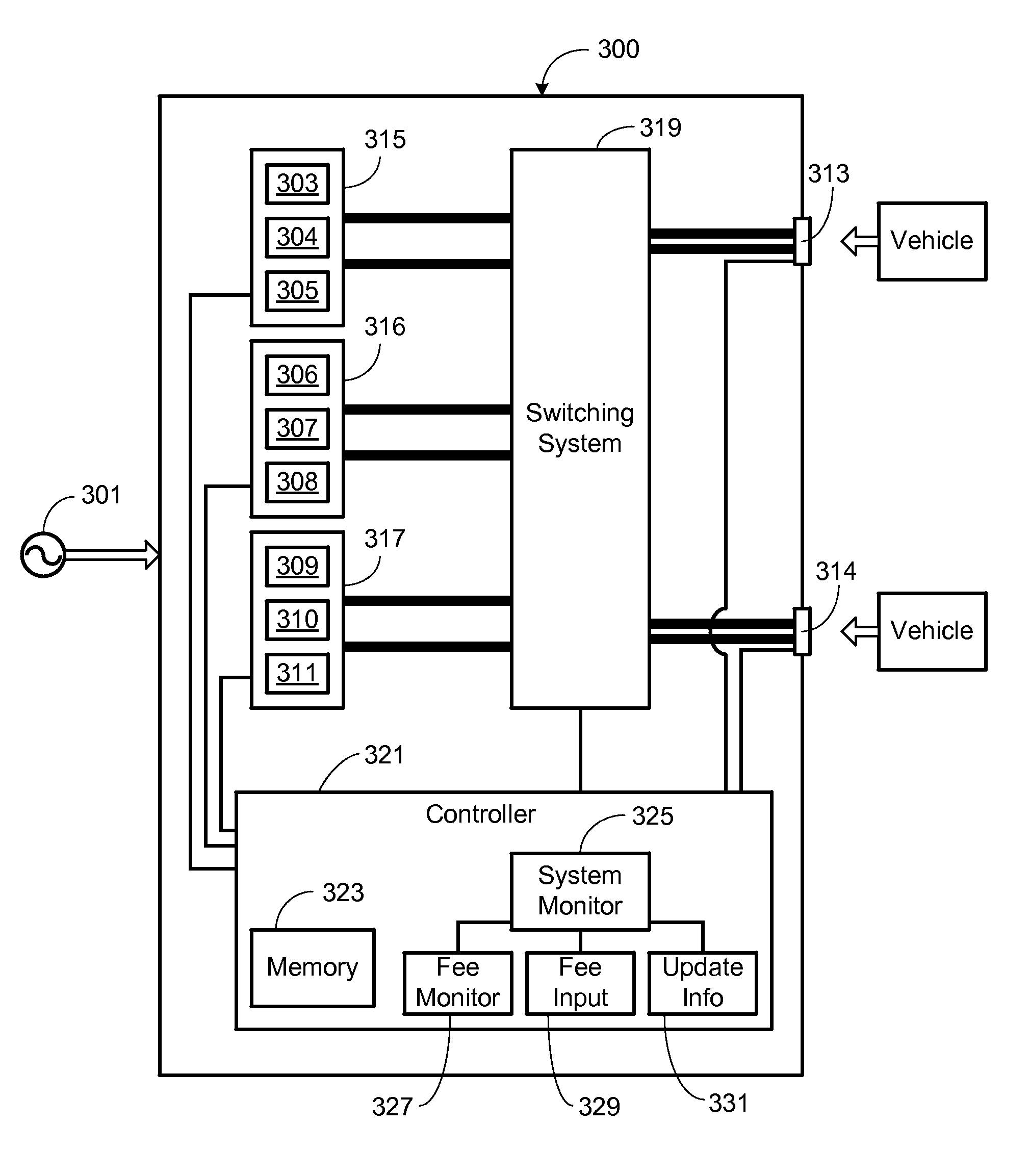

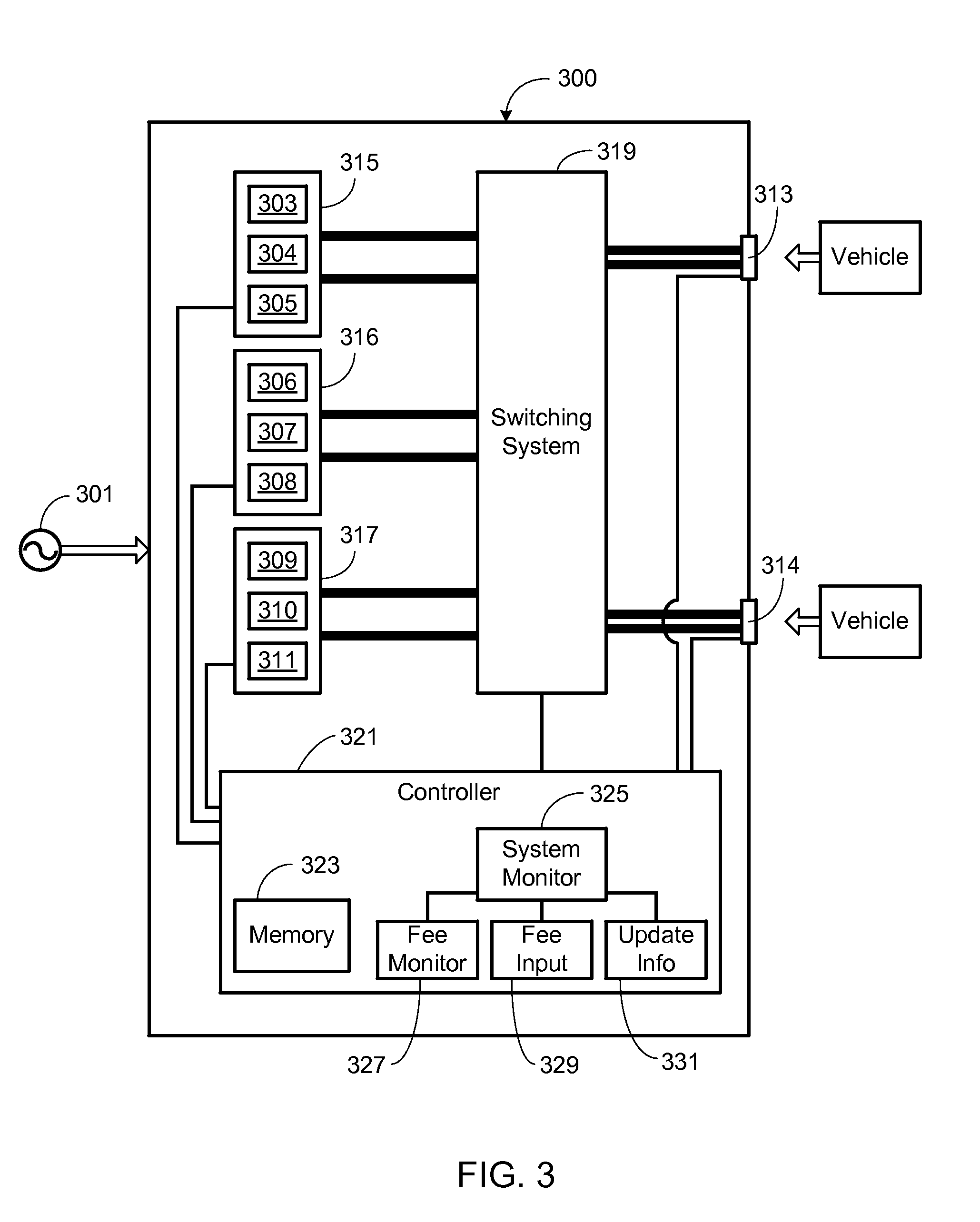

Method of Operating a Multiport Vehicle Charging System

ActiveUS20130057210A1Avoid direct connectionMobile unit charging stationsPower to auxillary motorsBattery chargeElectrical battery

A method of distributing charging power among a plurality of charge ports of a battery charging station is provided, where the battery charging station includes a plurality of power stages where each power stage includes an AC to DC converter and provides a portion of the charging station's maximum available charging power, the method comprising the steps of (i) monitoring battery charging station conditions and operating conditions for each charging port; (ii) determining current battery charging station conditions, including current operating conditions for each charging port; (iii) determining power distribution for the battery charging station and the charging ports in response to the current battery charging conditions and in accordance with a predefined set of power distribution rules; and (iv) coupling the power stages to the charging ports in accordance with the power distribution.

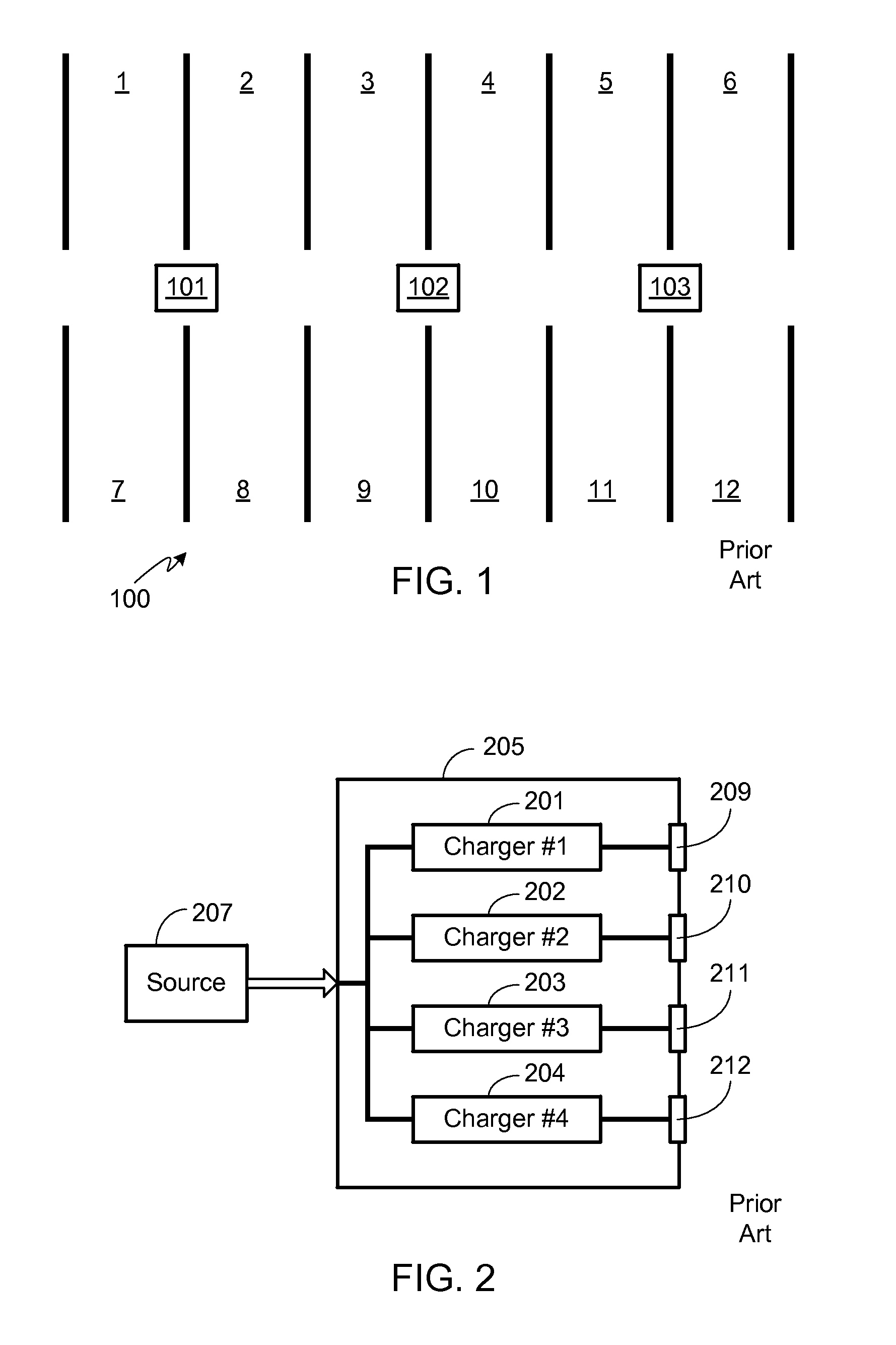

Owner:TESLA INC

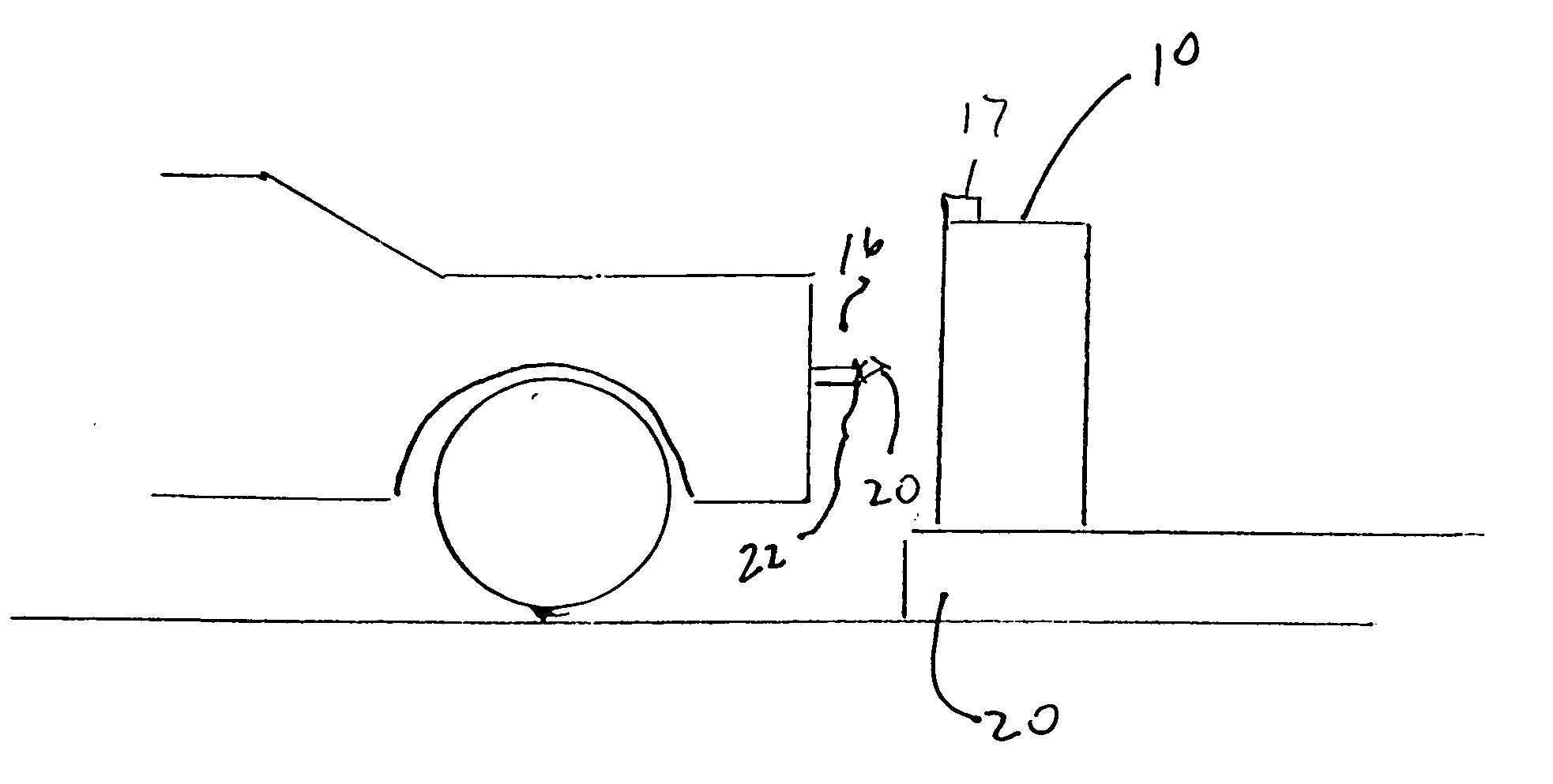

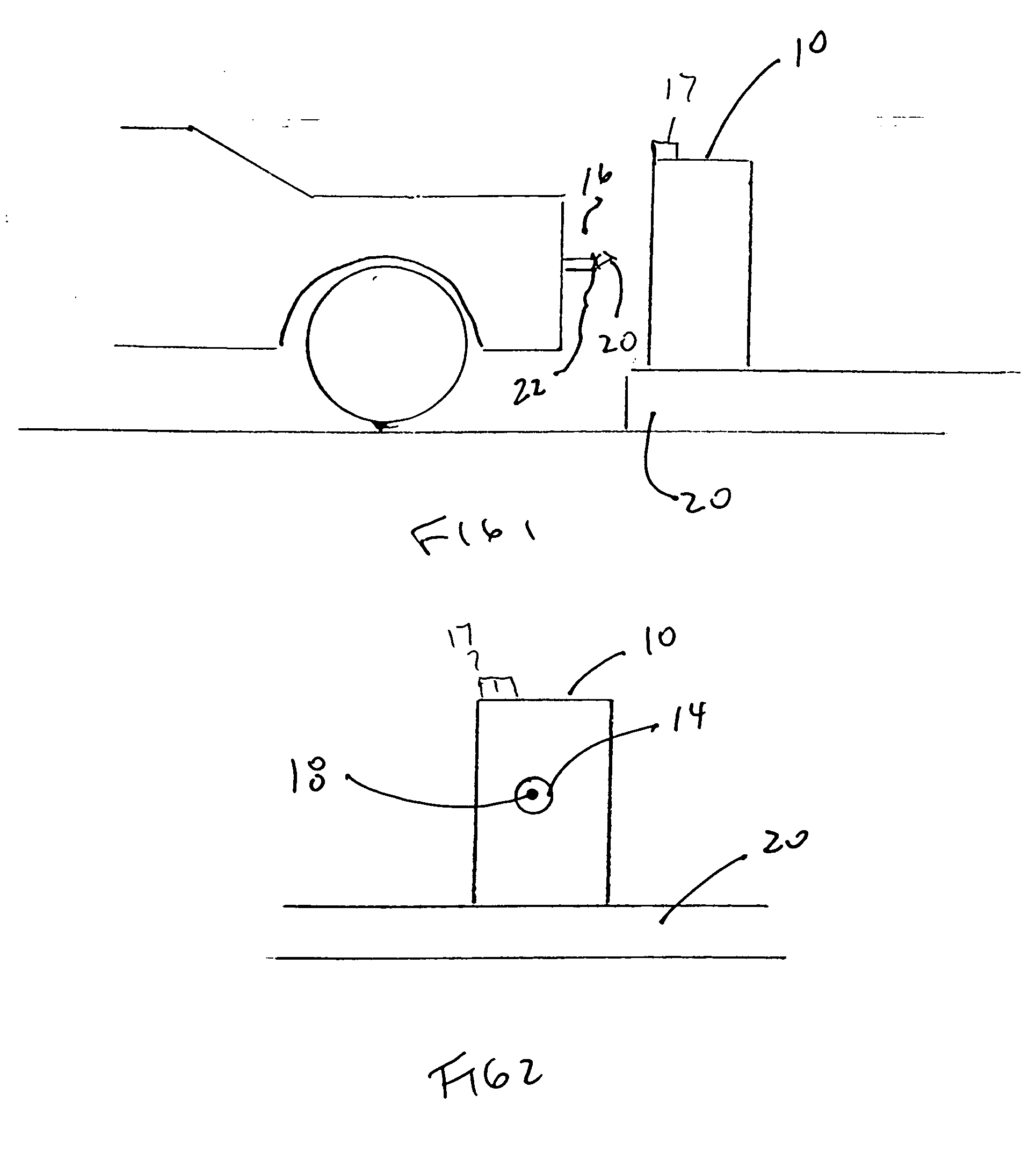

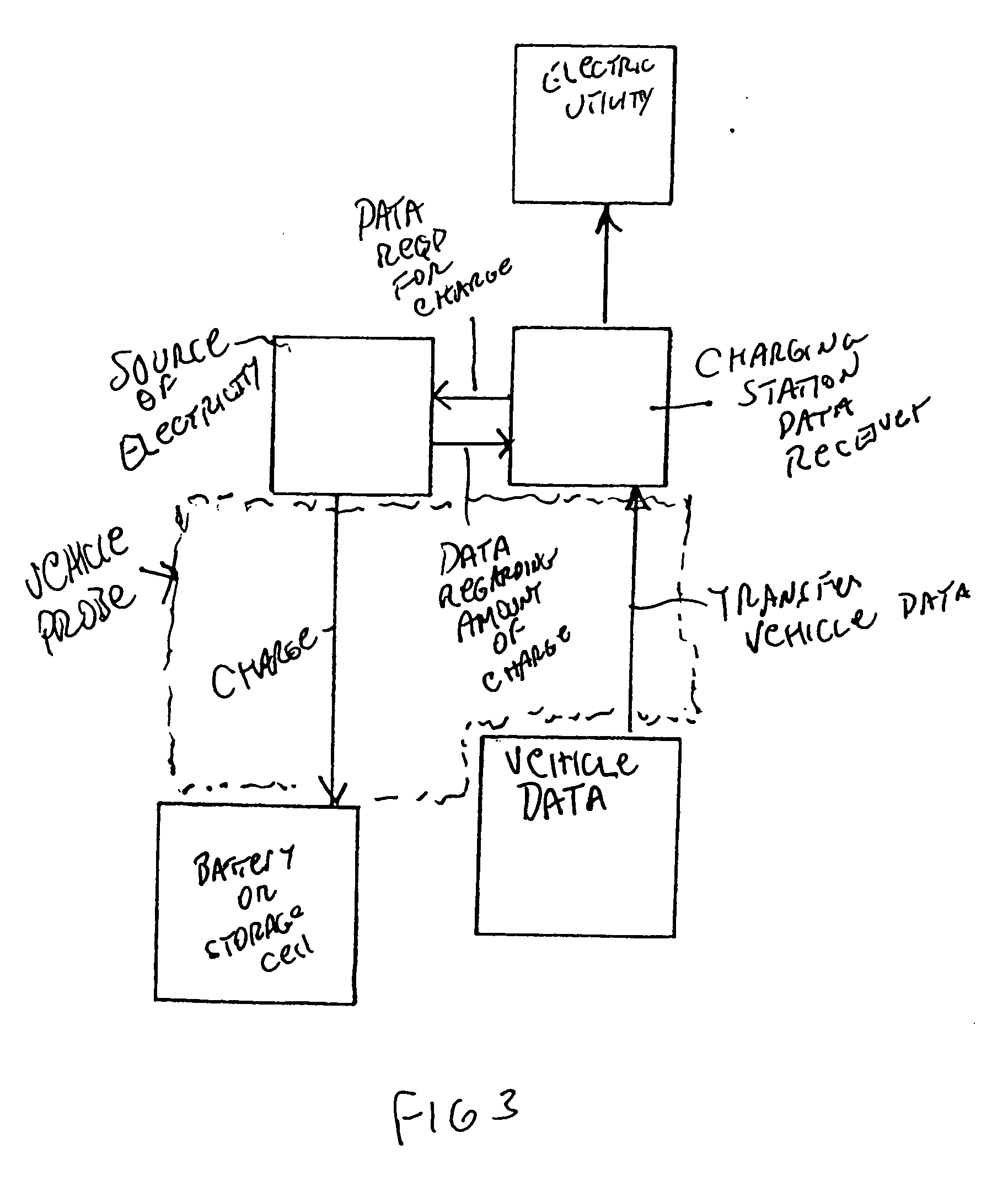

Automatic recharging docking station for electric vehicles and hybrid vehicles

An automatic recharging docking station for electric vehicles or hybrid electric vehicles in which standardized uniform charging stations are positioned in public parking facilities, private parking facilities, rest stops, or the like, and by means of a retractable vehicle probe, allow the owner / user of the vehicle to attach to the charging station and recharge the batteries or storage cells of the vehicle while the owner / user is at work, shopping, or otherwise not requiring the use of the vehicle. The particular vehicle and vehicle probe would have an encrypted identification means so that its identity would be recorded when it connected to a particular recharging station, regardless of which electrical jurisdiction that charging station was located, such that the respective electric utility companies or other entity would be able to identify and bill the owner / user for the quantity of electricity drawn during a specified time period.

Owner:SUCHAR MICHAEL J

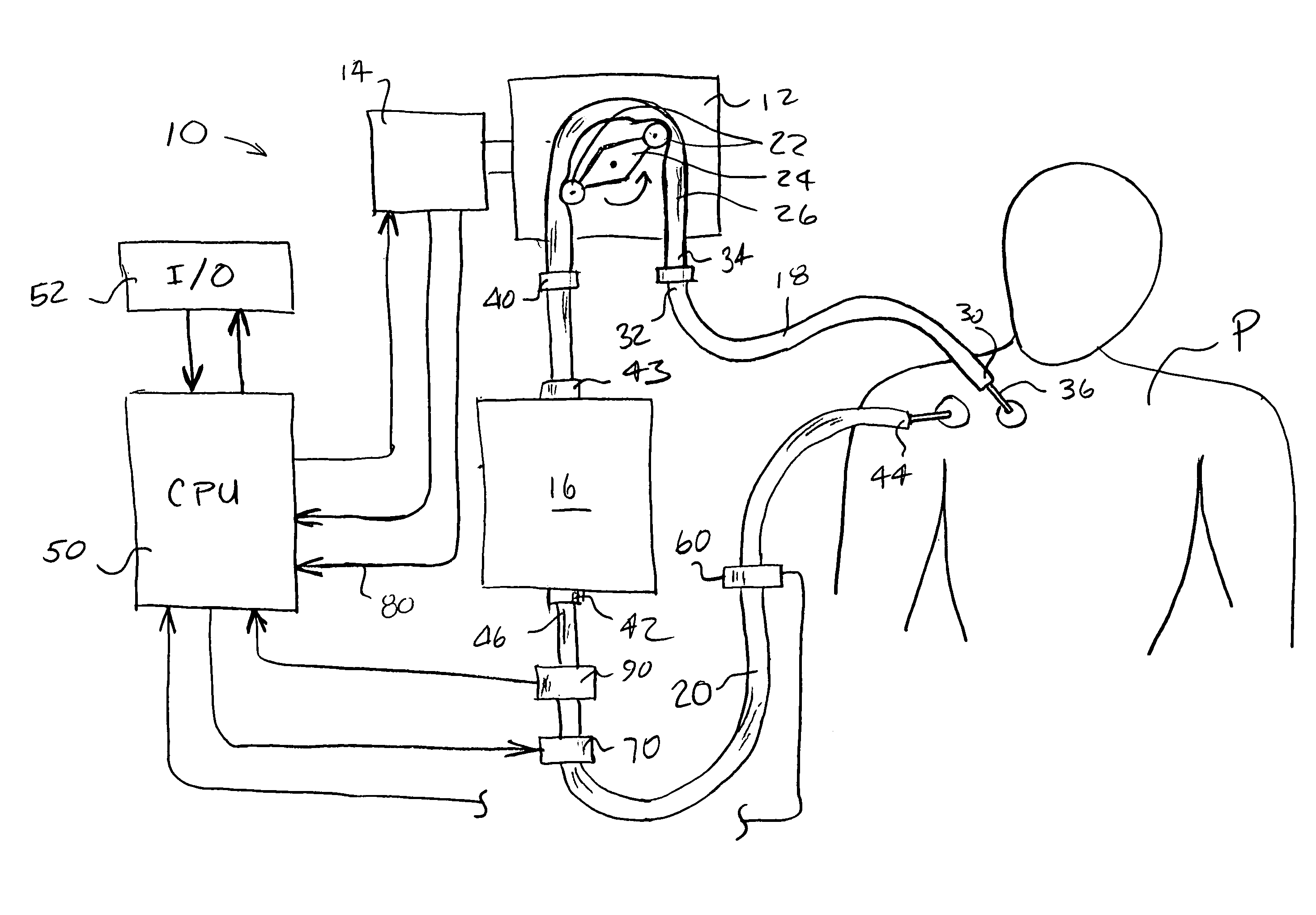

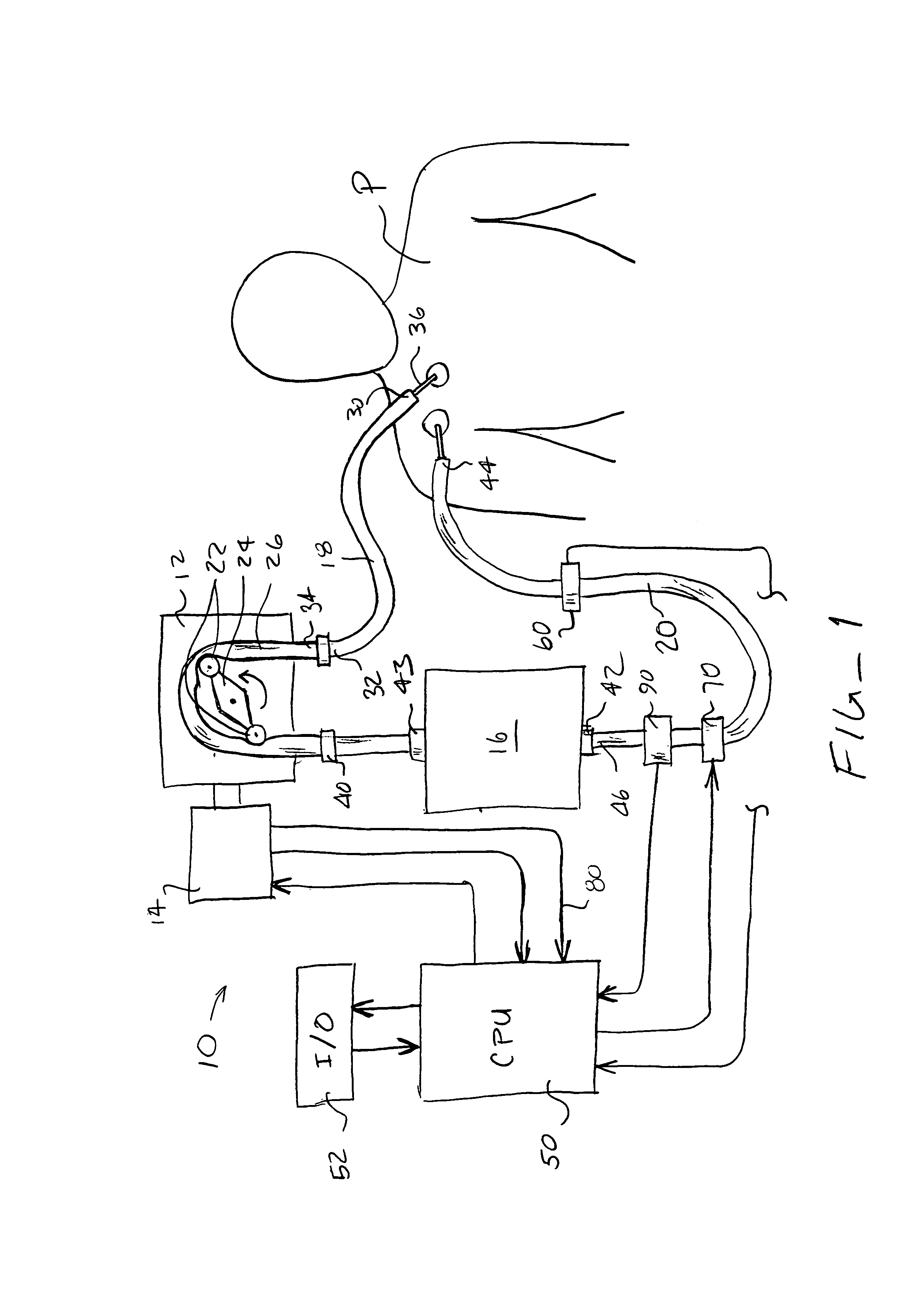

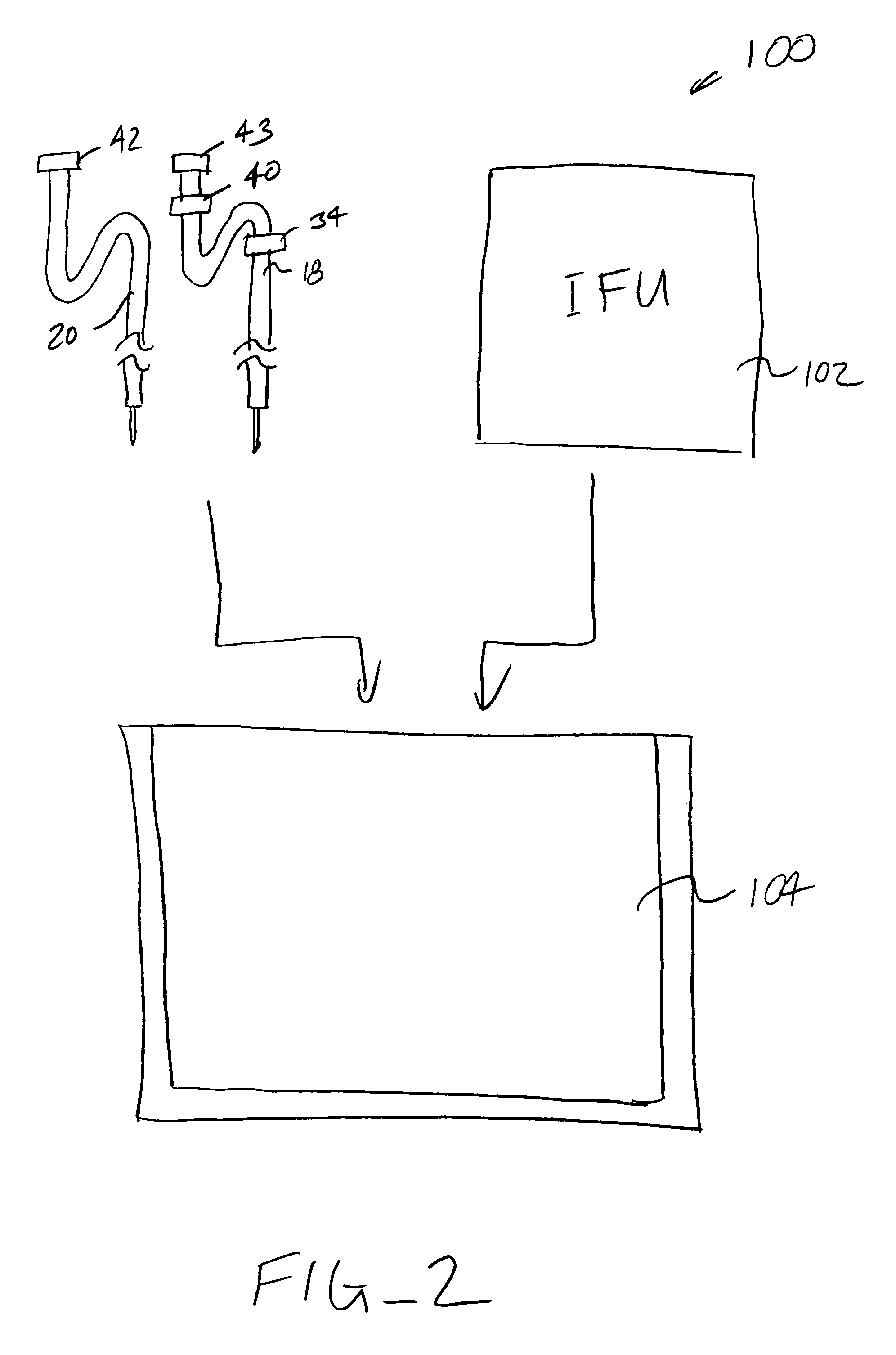

Methods, systems, and kits for the extracorporeal processing of blood

InactiveUS7004924B1Easy to detectOther blood circulation devicesControl devicesExtracorporeal circulationLine tubing

Methods, systems, and kits for extracorporeally circulating and processing blood are described. The systems include a pump, a processing unit, and blood drawn return lines for accessing a patient's vasculature. Blood flow through the return line is measured and pump speed controlled to maintain a desired blood flow rate. Alarm conditions can be initiated when expected pump performance differs from that needed to maintain the control point flow rate. By using a ultrasonic flow detector, gas bubbles in the blood flow can be detected.

Owner:NXSTAGE MEDICAL

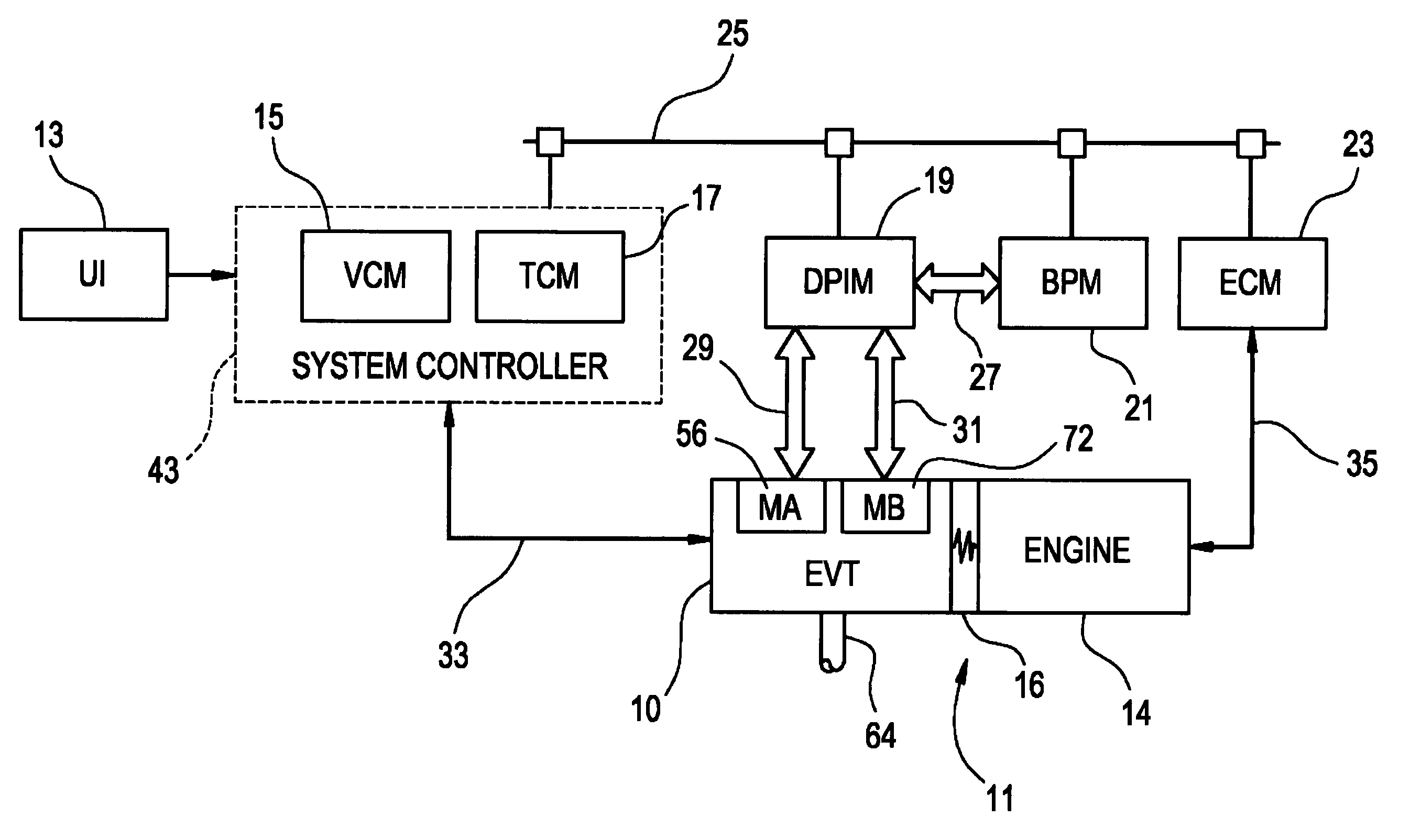

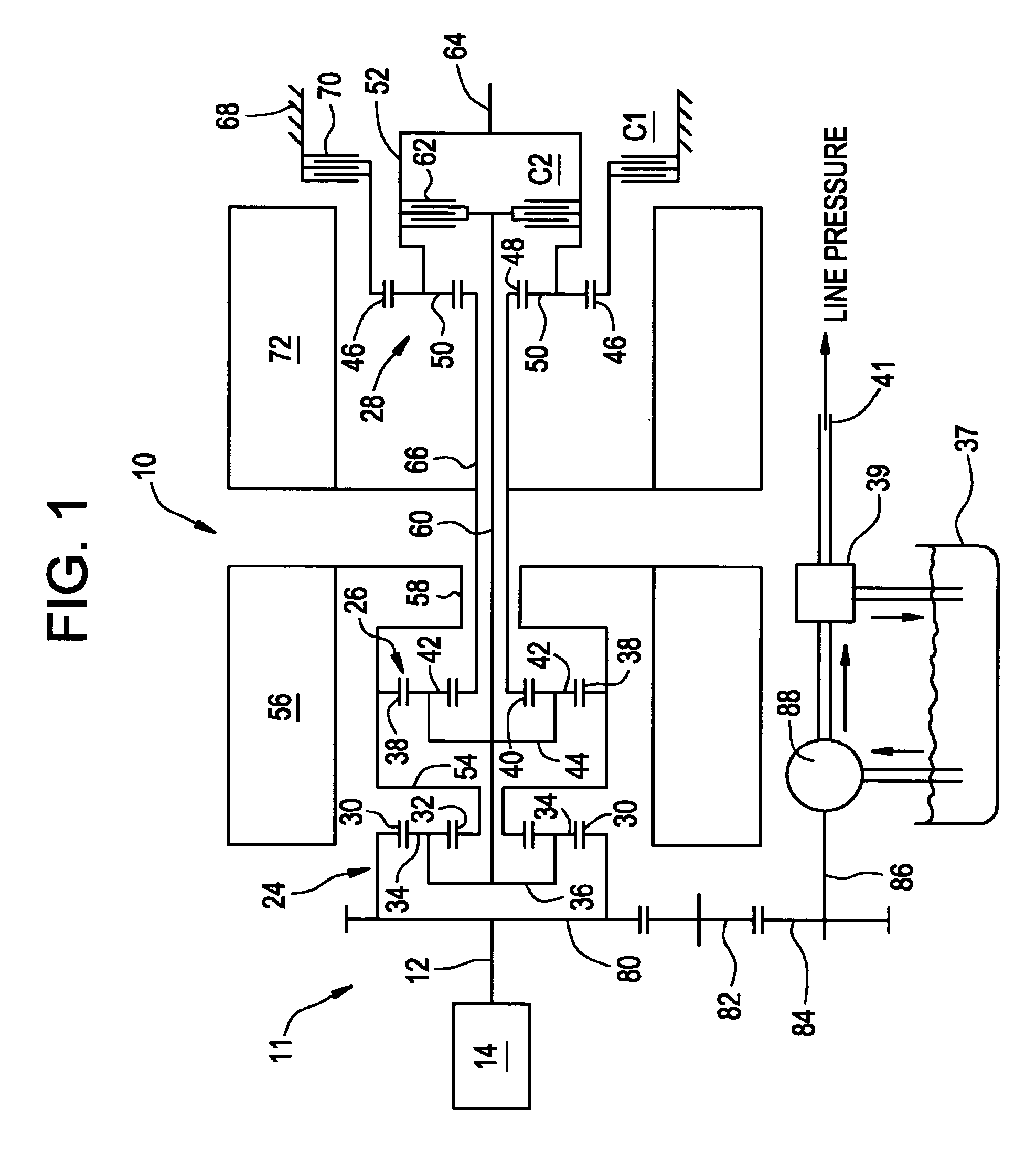

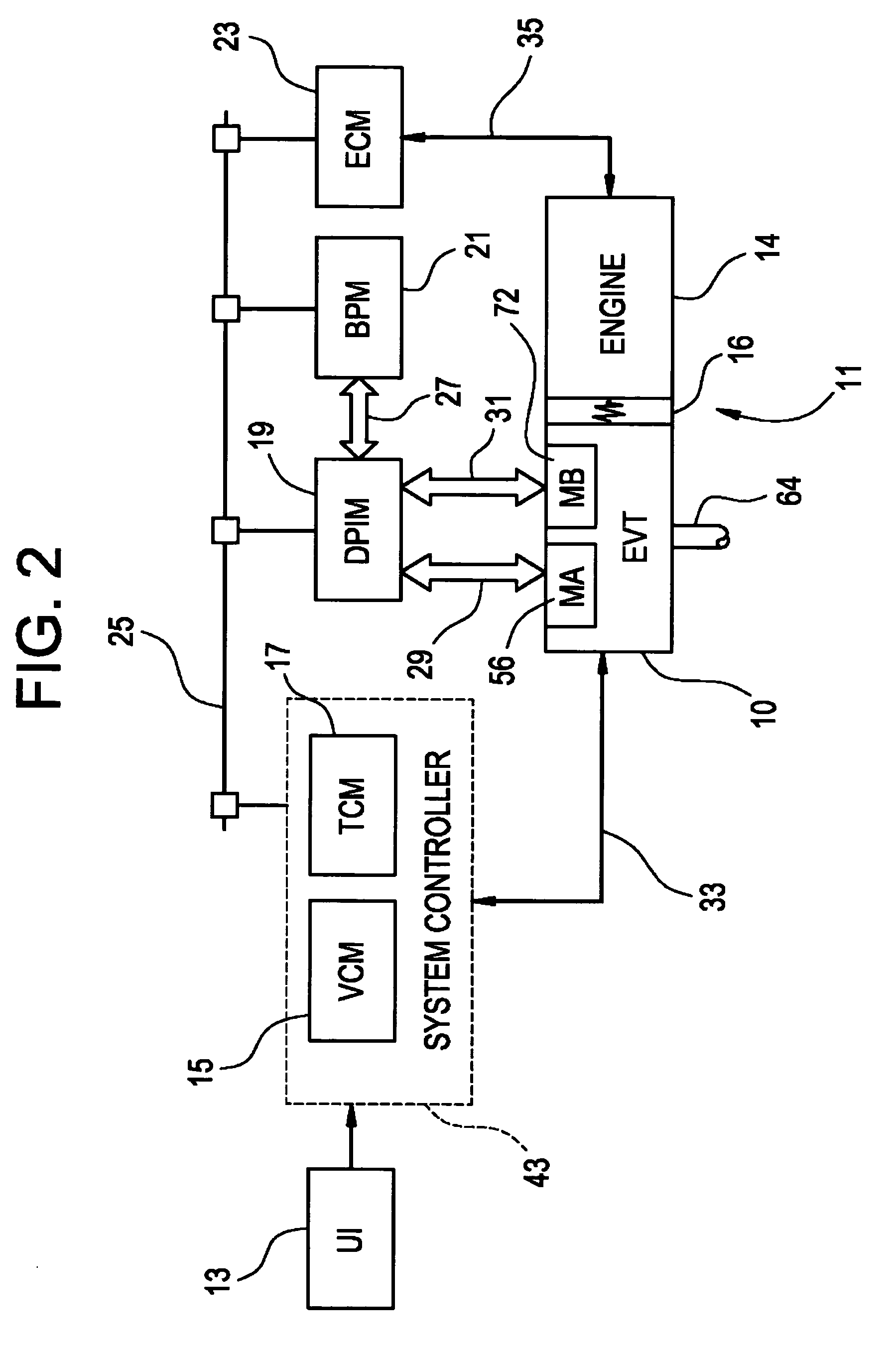

Real-time operating parameter selection in a vehicular transmission

Preferred operating points for a vehicle powertrain including an engine and a transmission are determined in accordance with a comprehensive operational mapping of input and output conditions and corresponding aggregate system losses corresponding to engine and transmission losses. In a hybrid transmission application, additional losses from motors and batteries are aggregated into the system losses and battery constraints are considered in determining preferred operating points. Preferred operating points are provided in one or more sets of minimized data for on-vehicle implementation.

Owner:GM GLOBAL TECH OPERATIONS LLC

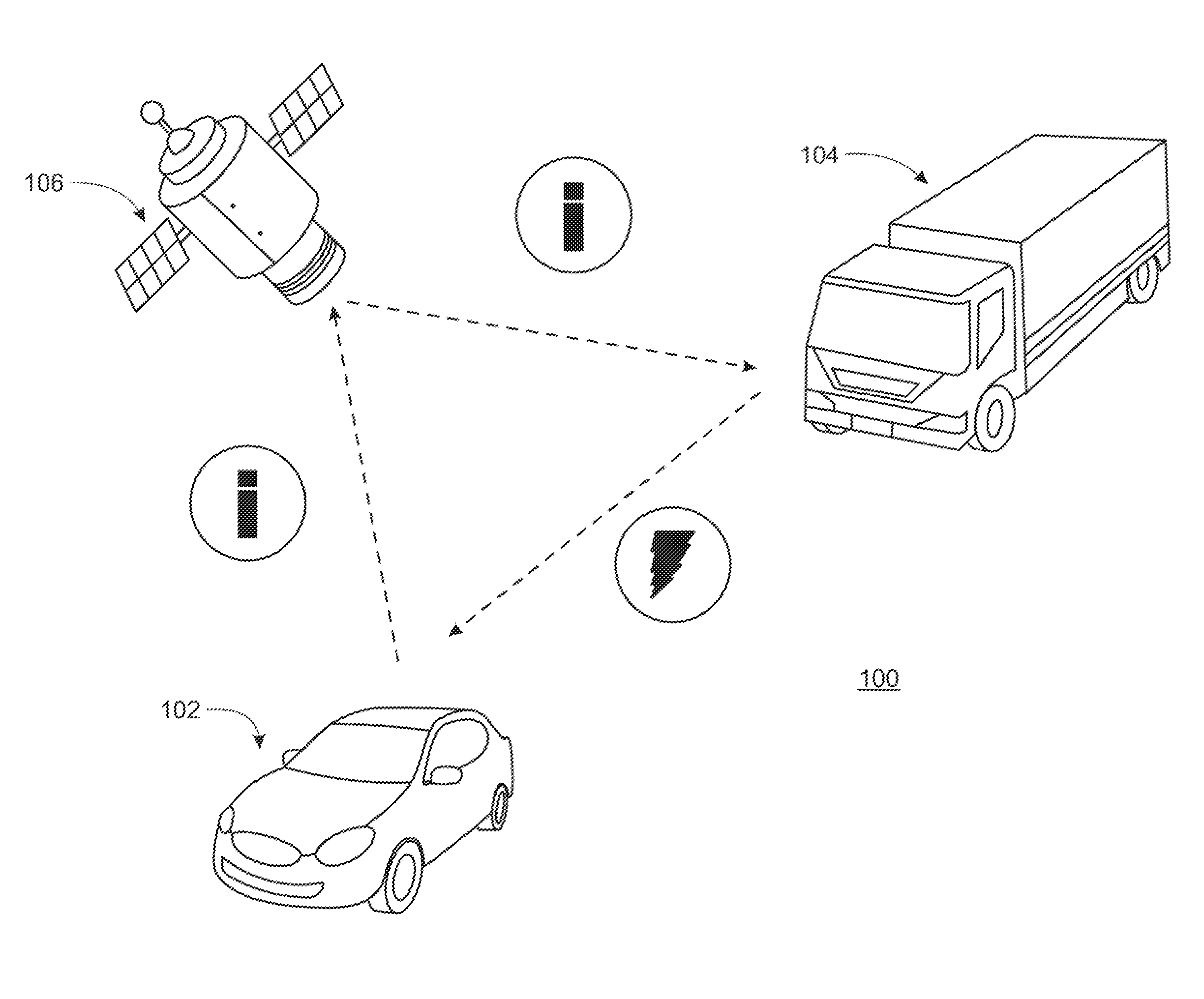

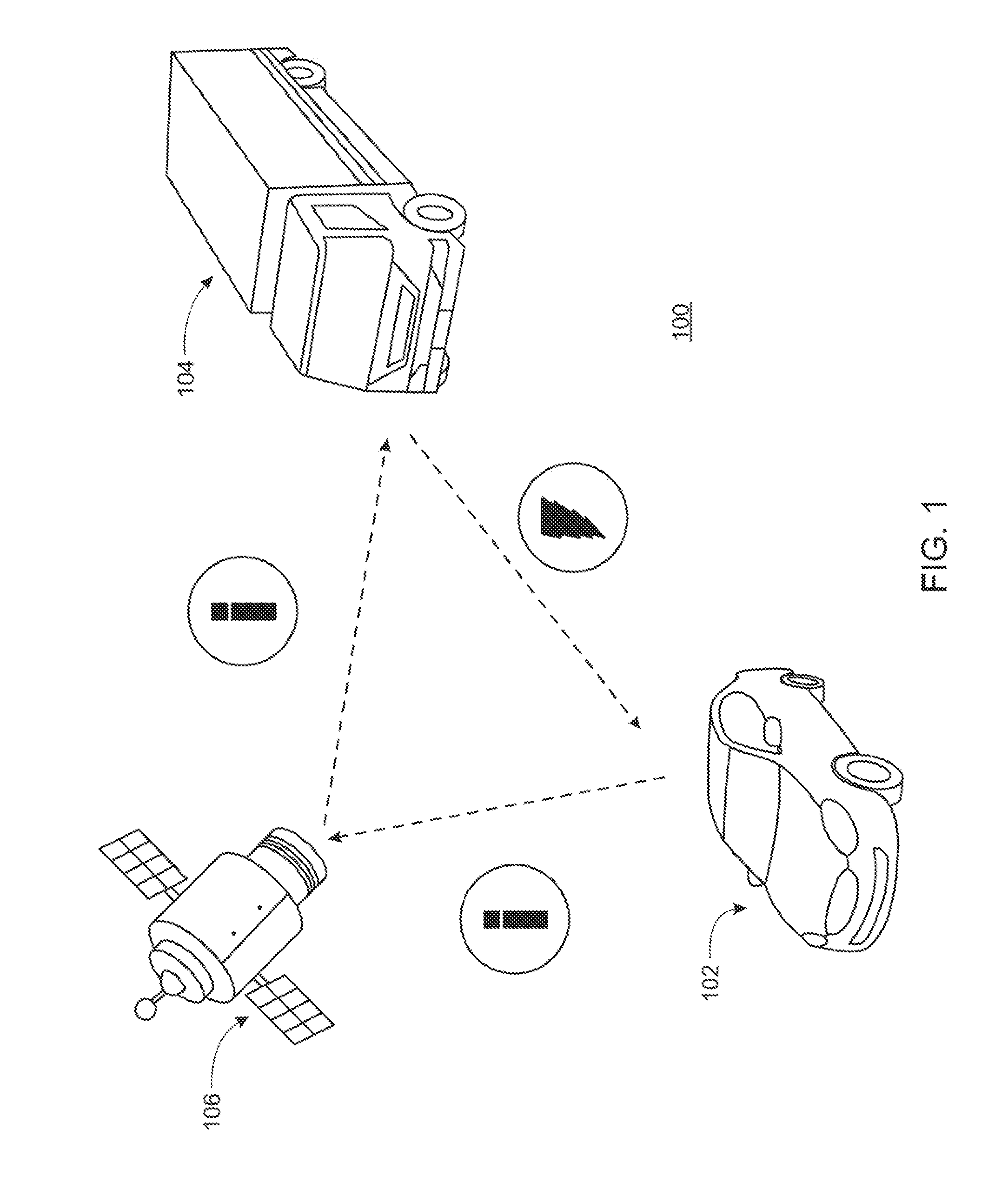

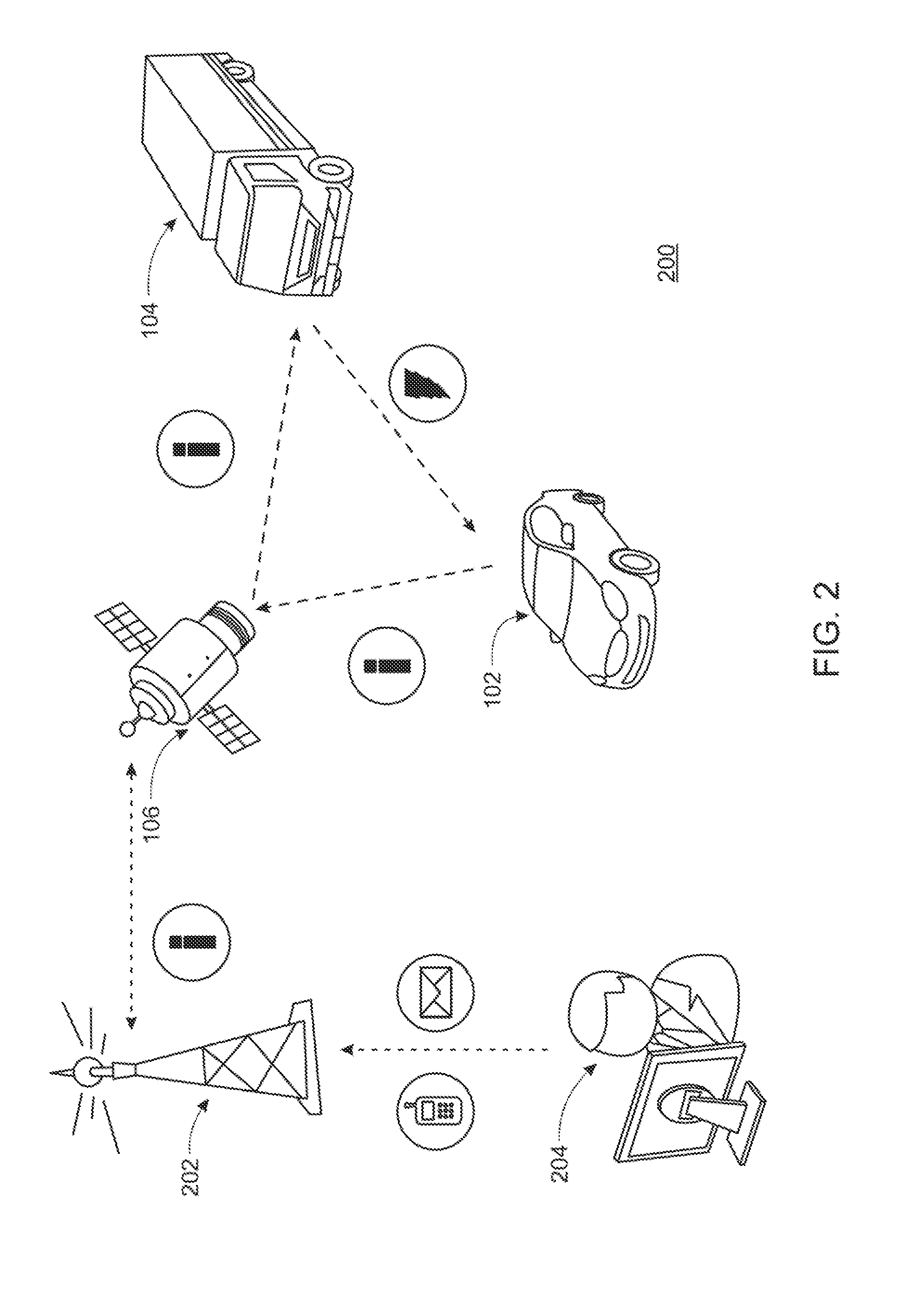

Cross-validating sensors of an autonomous vehicle

ActiveUS9221396B1Road vehicles traffic controlCharacter and pattern recognitionObject labelEmbedded system

Owner:WAYMO LLC

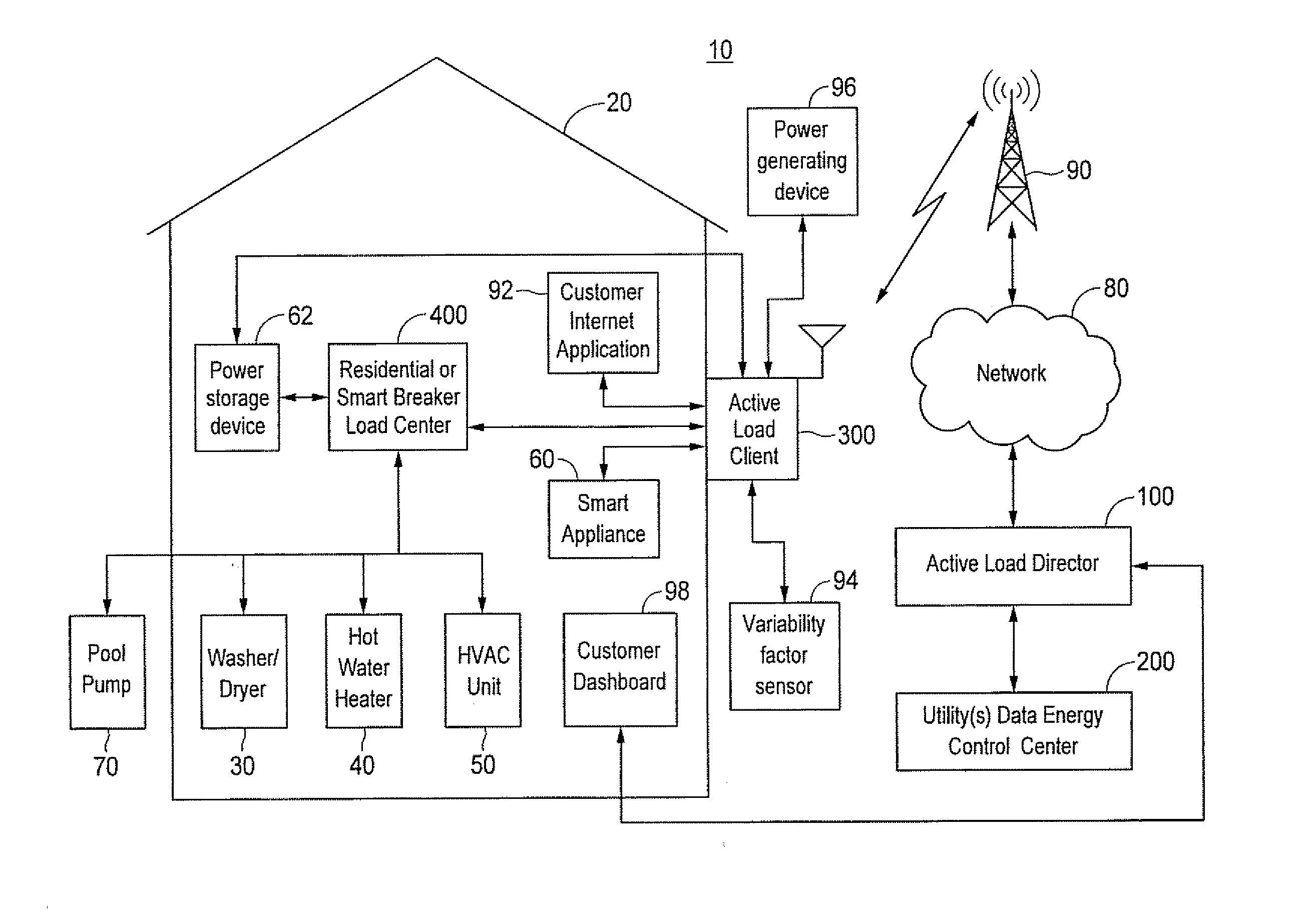

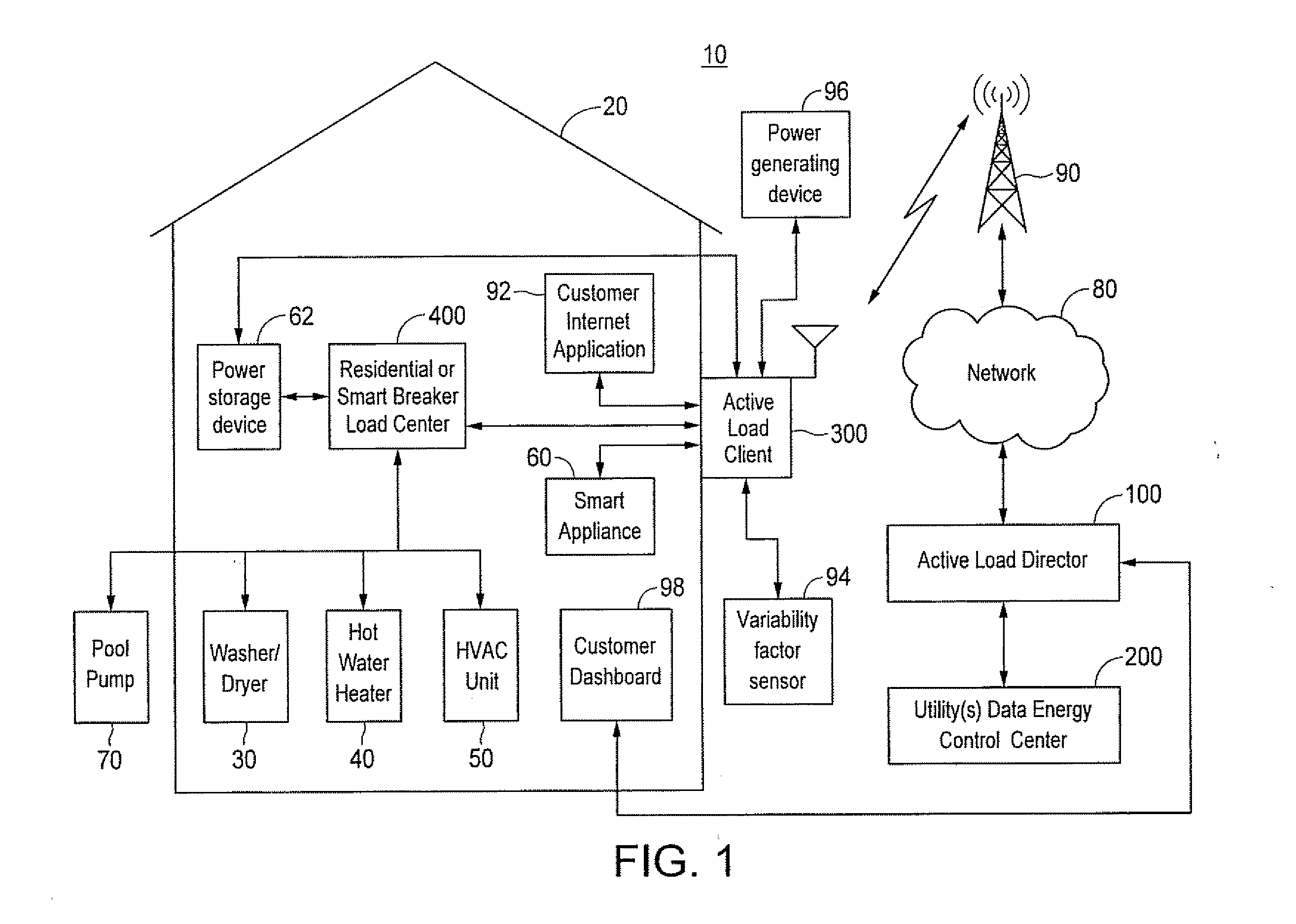

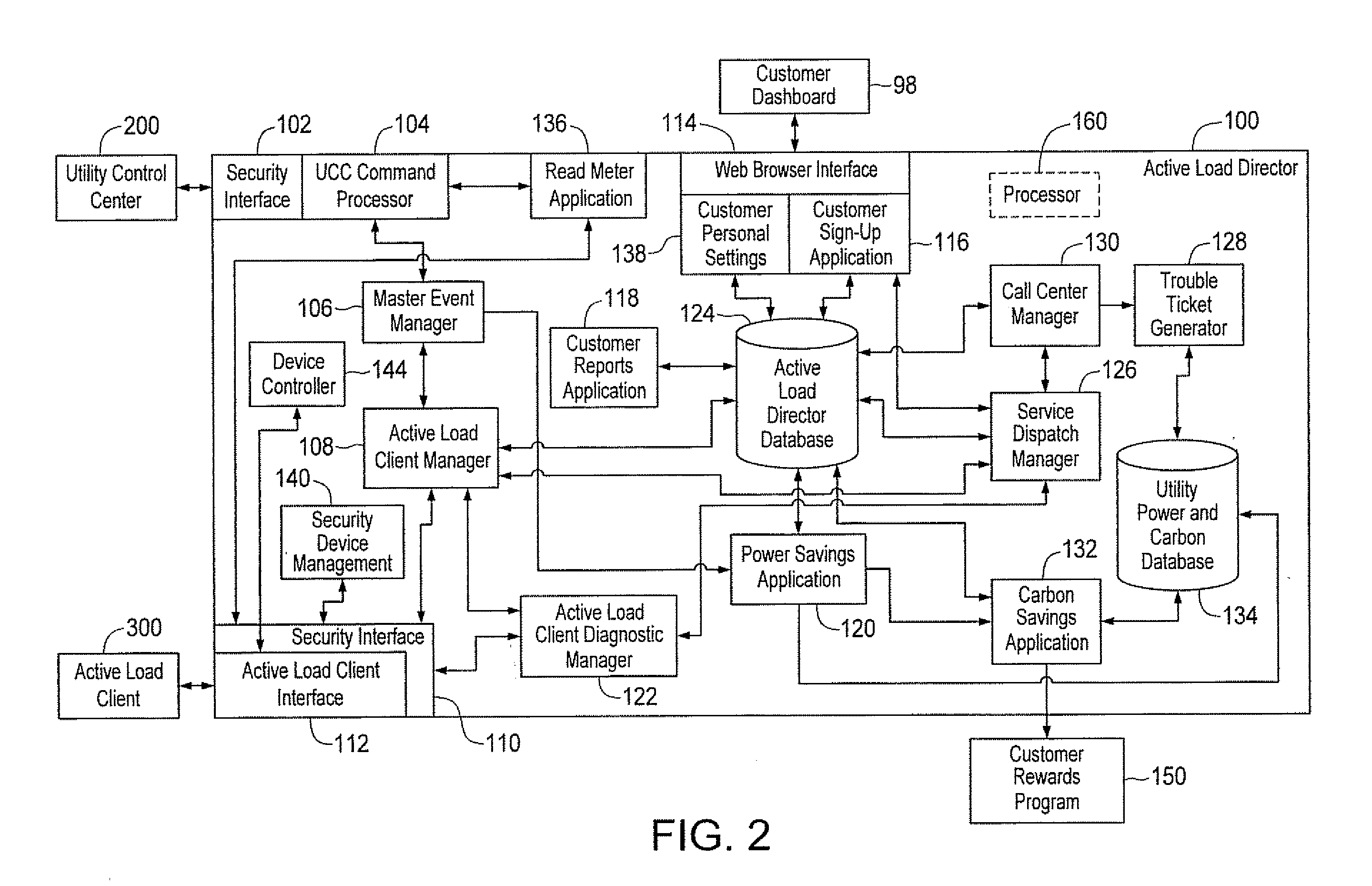

System and method for determining carbon credits utilizing two-way devices that report power usage data

InactiveUS20100235008A1Reduce the amount requiredReduce amount of powerElectric signal transmission systemsLevel controlCarbon creditPower usage

A load management system controller employs a method for determining carbon credits earned as a result of a control event in which power is reduced to at least one service point serviced by a utility. The controller is located remotely from the service point(s) and determines power consumed over time by at least one device located at the service point(s) to produce power consumption data. The controller stores the power consumption data. At some later point in time, the controller initiates a control event and determines an amount of power reduced during the control event based on the stored power consumption data. The controller also determines a generation mix for power that would have been supplied to the service point(s) if the control event had not occurred. The controller then determines a quantity of carbon credits earned based at least on the amount of power reduced and the generation mix.

Owner:CONSERT INC +1

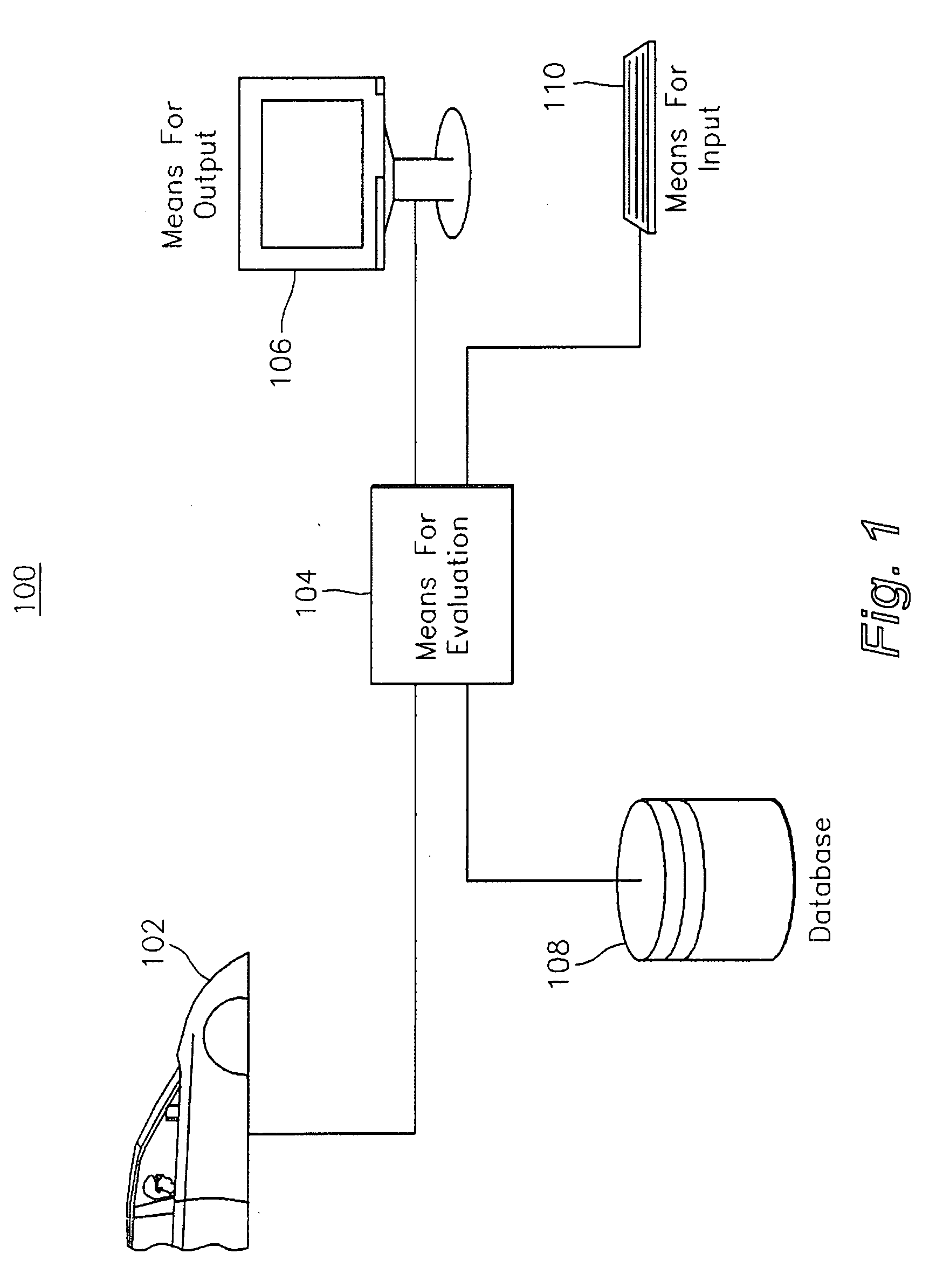

Driving simulator and method of evaluation of driver competency

A method determines insurability of drivers. The method includes simulating a driving experience for a driver in an interactive driving simulator. Performance of the driver in the simulated driving experience is evaluated to generate a driving proficiency score for the driver. The method also includes evaluating insurability of the driver based on the driving proficiency score. A system also determines insurability of drivers.

Owner:BURCH LEON A

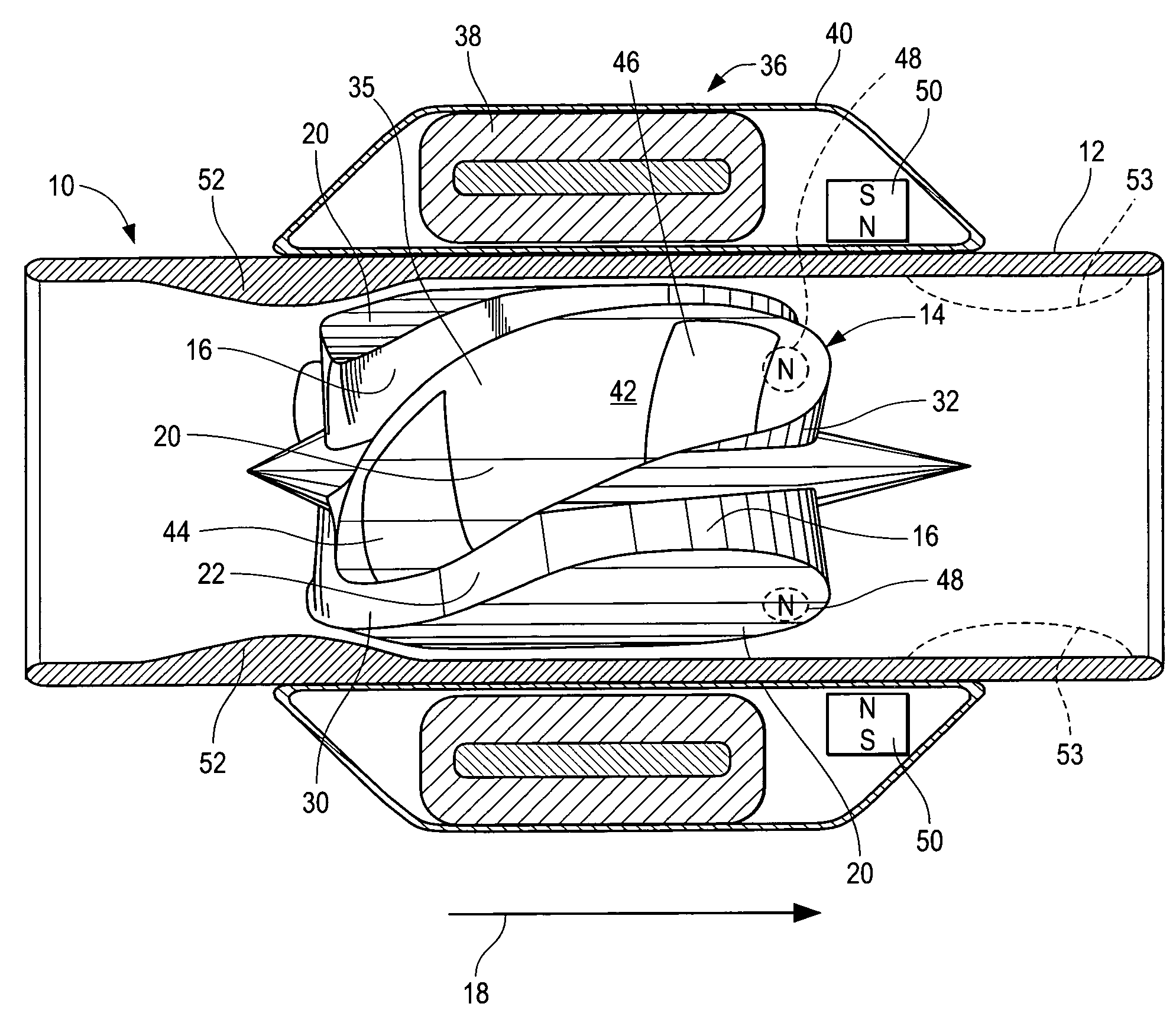

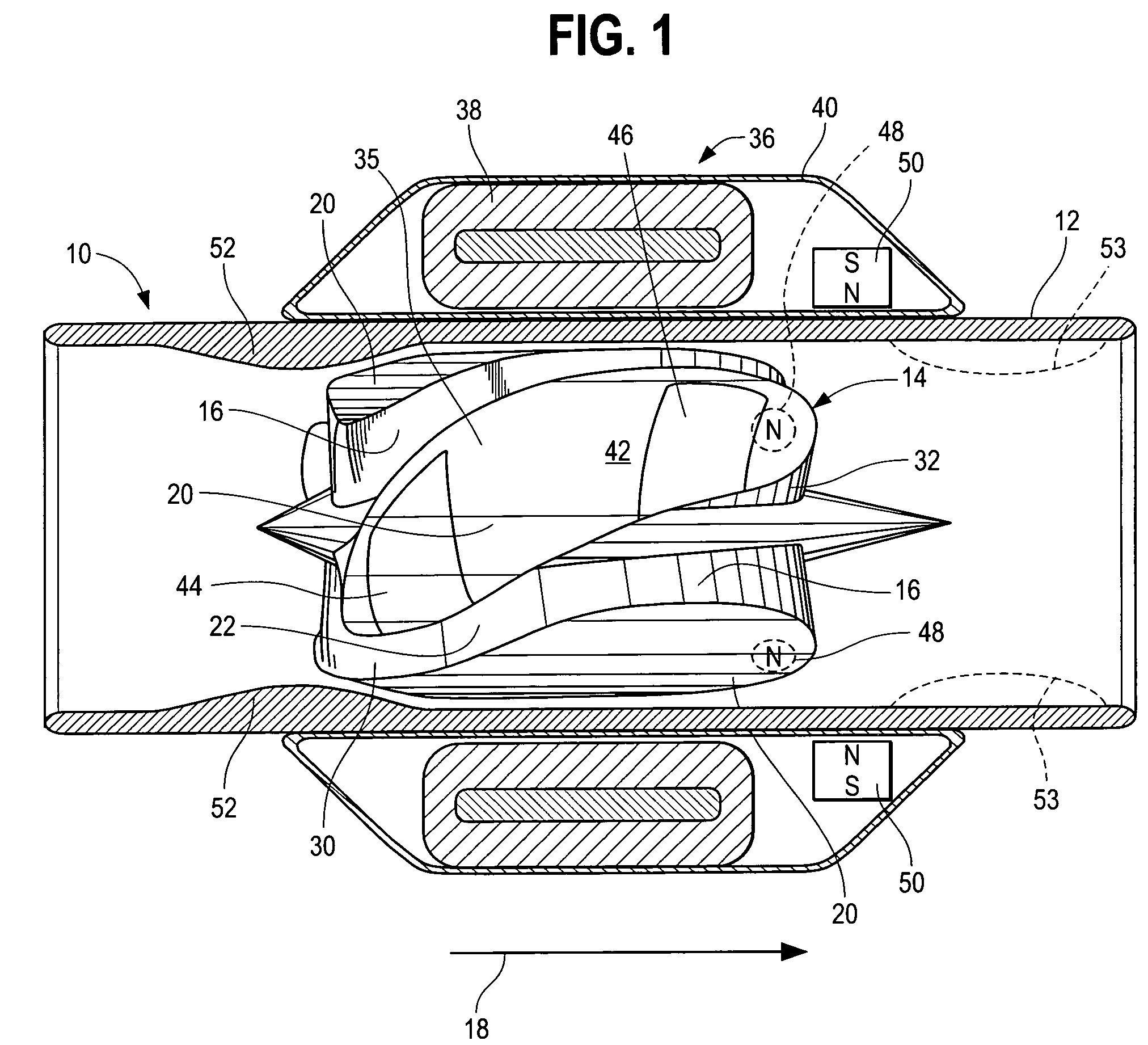

Wide blade, axial flow pump

ActiveUS7699586B2Increase the magnetic fluxReduce air gapControl devicesBlood pumpsAxial-flow pumpImpeller

A blood pump comprises a pump housing; a rotor positioned in the housing and comprising an impeller having a hydrodynamic surface for pumping blood; and a motor including a plurality of magnets carried by the impeller, plus a rotor stator, including an electrically conductive coil located adjacent to or within the housing. The impeller comprises radially outwardly extending, bladelike projections that define generally longitudinally extending spaces between the projections. The shape of the projections and the spaces therebetween tend to drive blood in the spaces in an axial direction as the impeller is rotated. The spaces collectively have a total width along most of their lengths at the radial periphery of the rotor, that is substantially equal to or less than the collective width of the projections along most of their lengths at the radial periphery. Thus, the bladelike projections are thicker, achieving significant advantages.

Owner:HEARTWARE INC

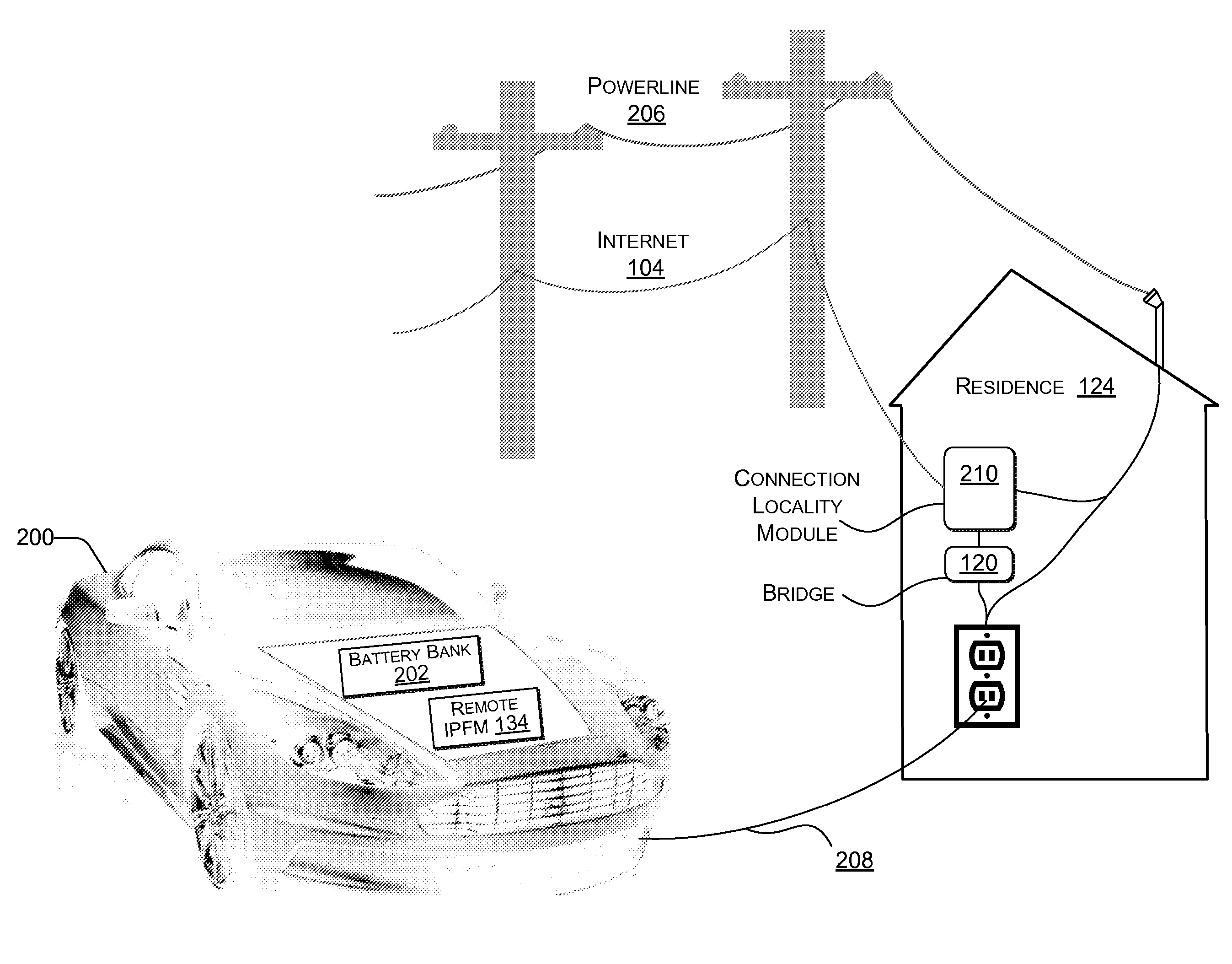

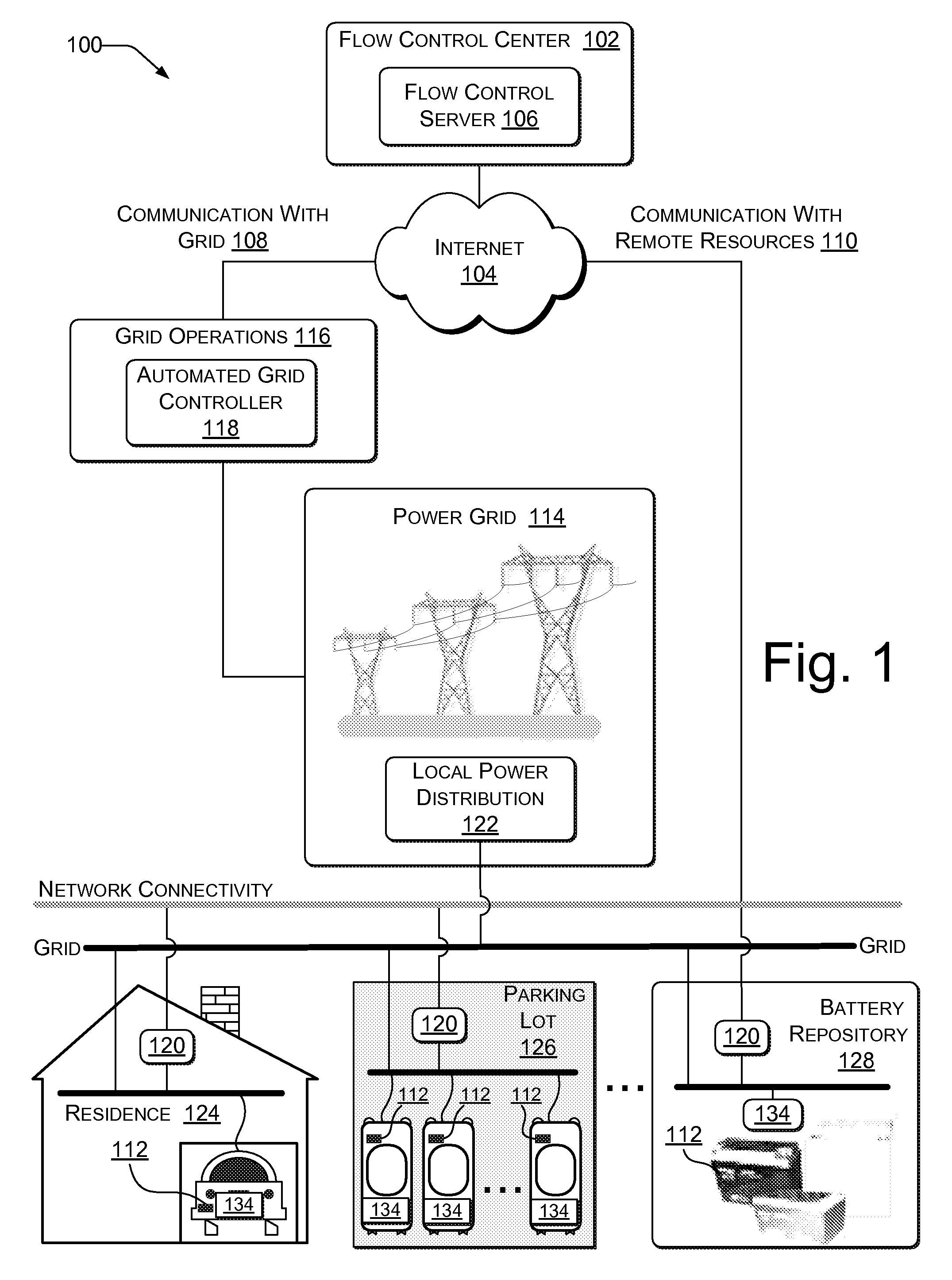

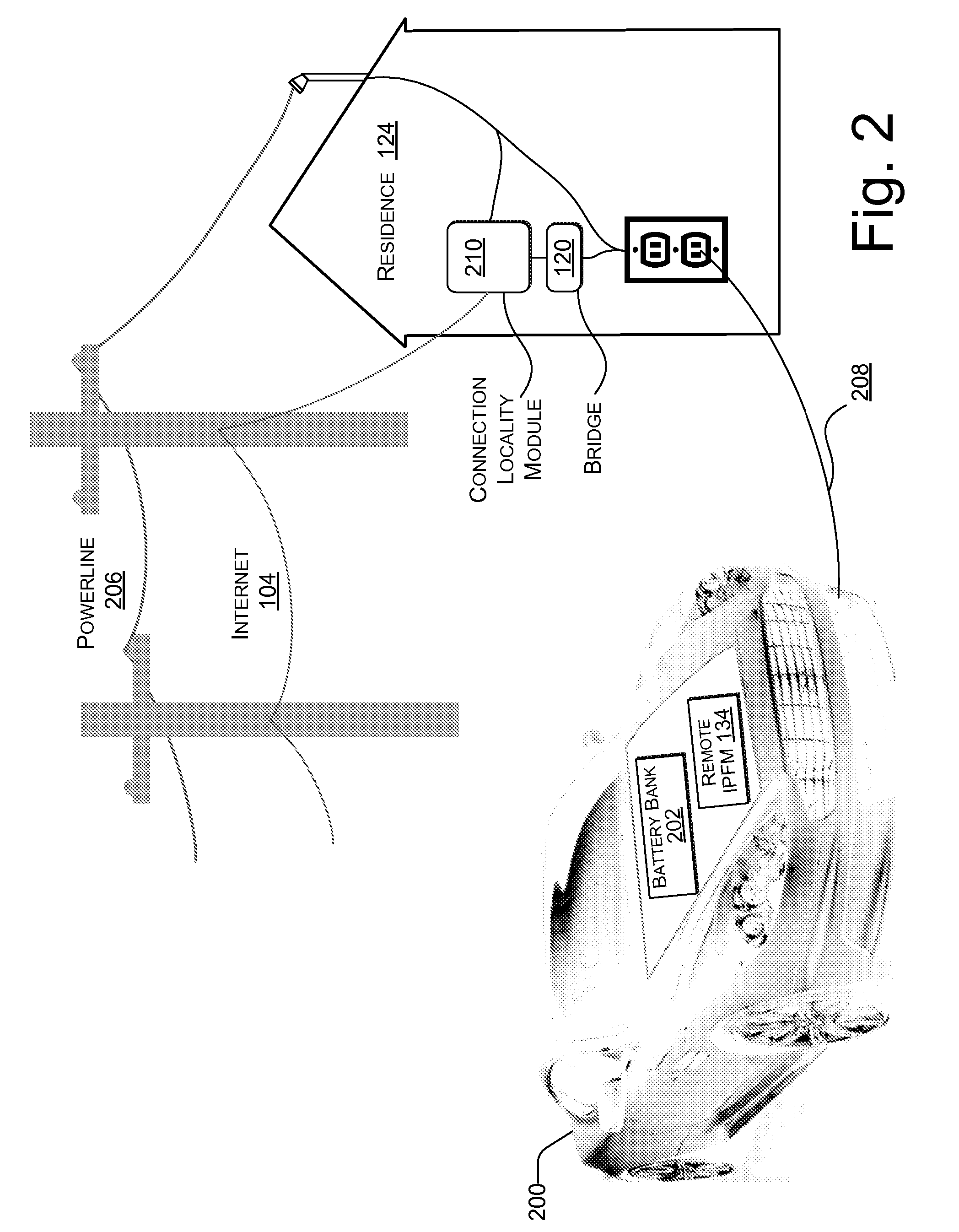

User interface and user control in a power aggregation system for distributed electric resources

Systems and methods are described for a power aggregation system. In one implementation, a service establishes individual Internet connections to numerous electric resources intermittently connected to the power grid, such as electric vehicles. The Internet connection may be made over the same wire that connects the resource to the power grid. The service optimizes power flows to suit the needs of each resource and each resource owner, while aggregating flows across numerous resources to suit the needs of the power grid. The service can bring vast numbers of electric vehicle batteries online as a new, dynamically aggregated power resource for the power grid. Electric vehicle owners can participate in an electricity trading economy regardless of where they plug into the power grid.

Owner:GRIDPOINT

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com