Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

30 results about "Risk class" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An insurance risk class is a group of individuals or companies that have similar characteristics, which are used to determine the risk associated with underwriting a new policy and the premium that should be charged for coverage. Determining the insurance risk class is a primary component of an insurance company’s underwriting process.

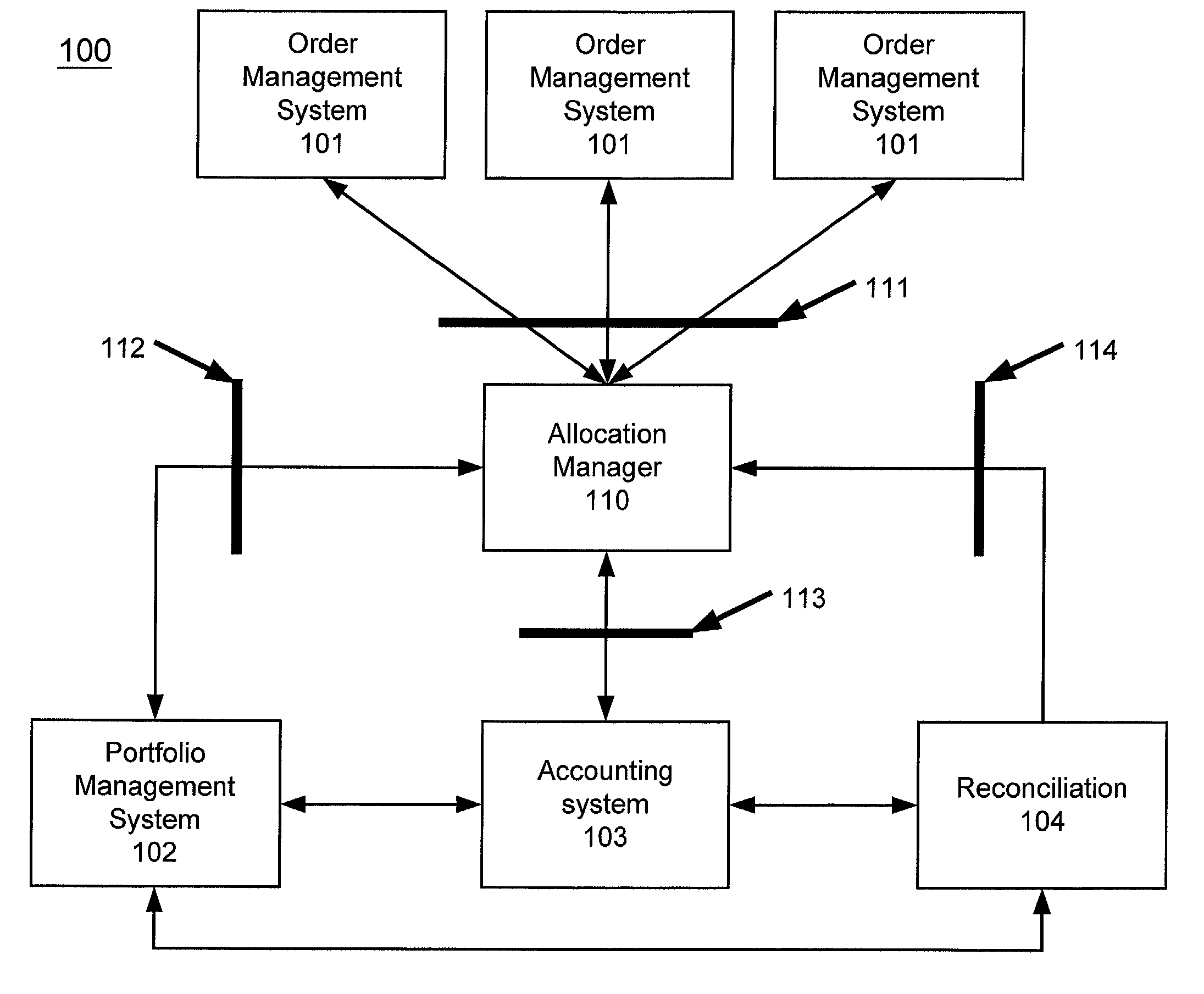

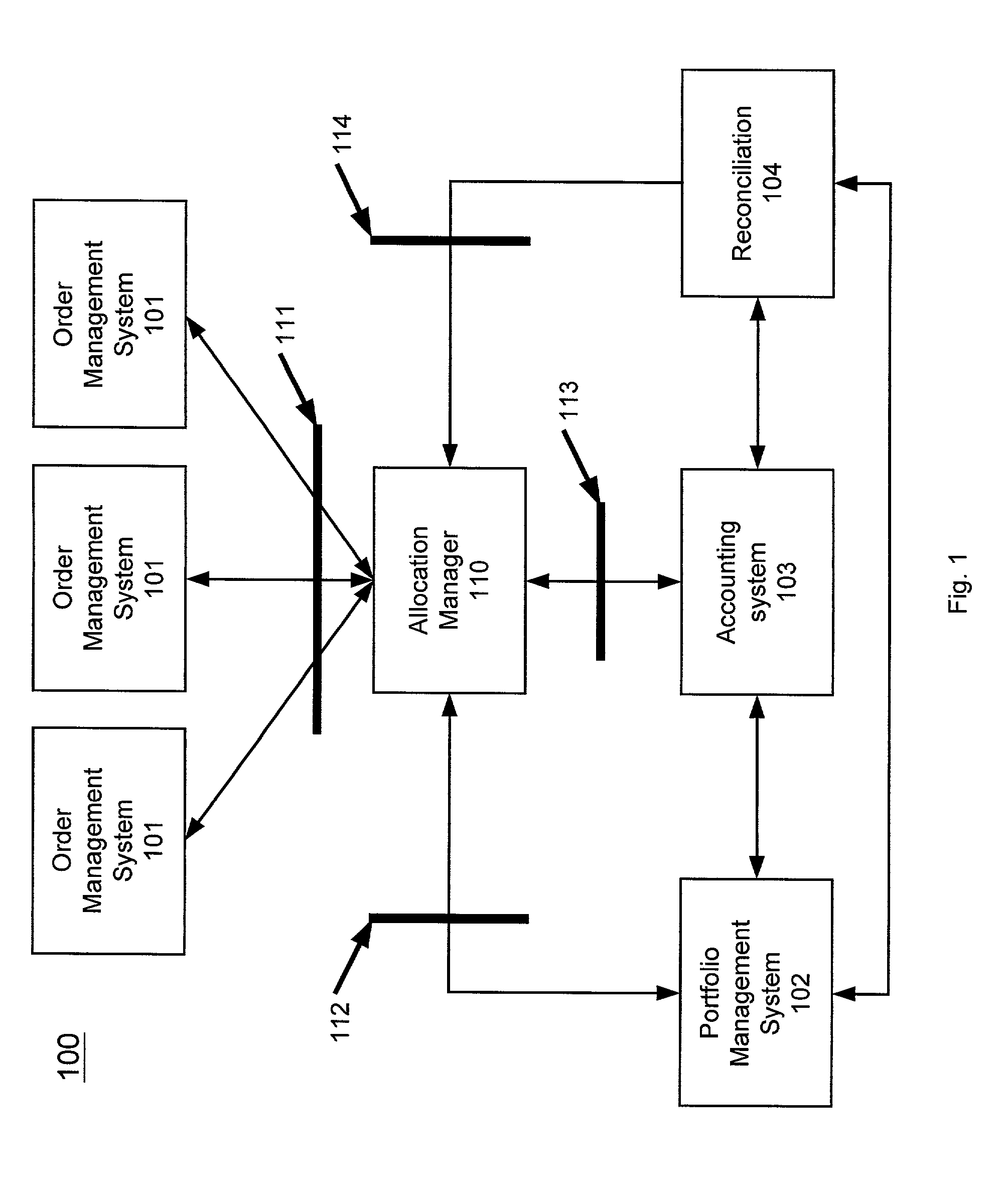

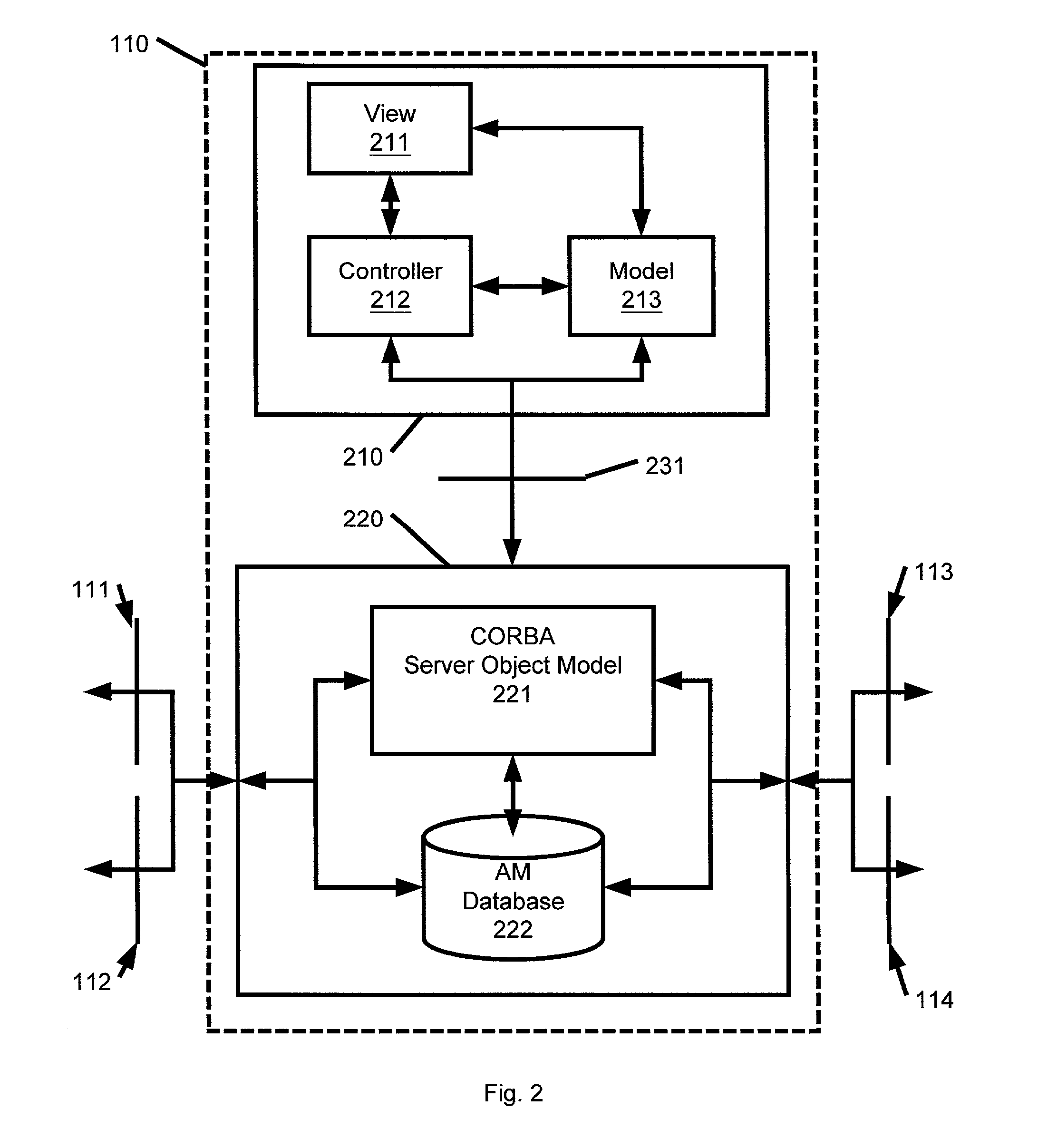

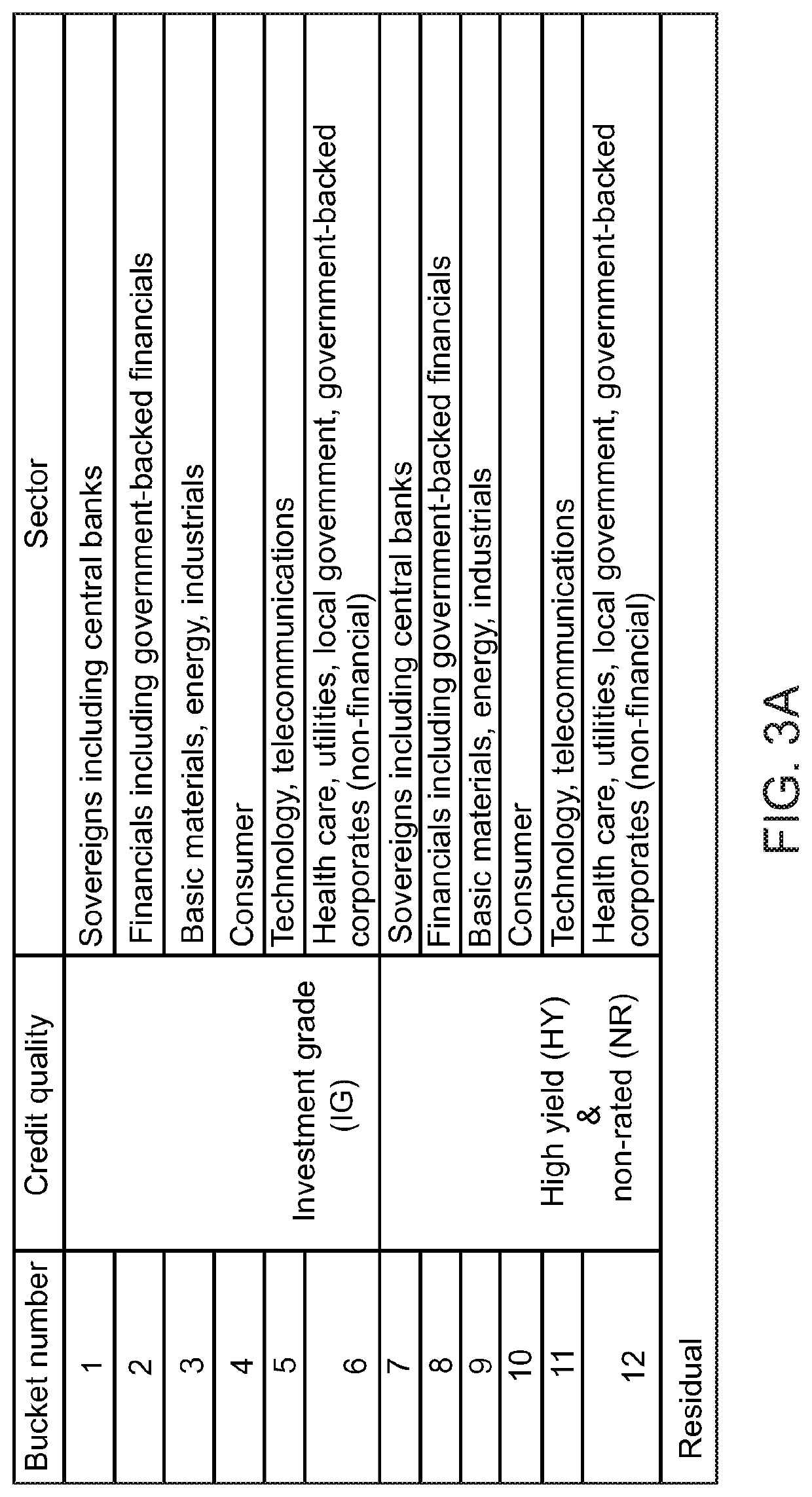

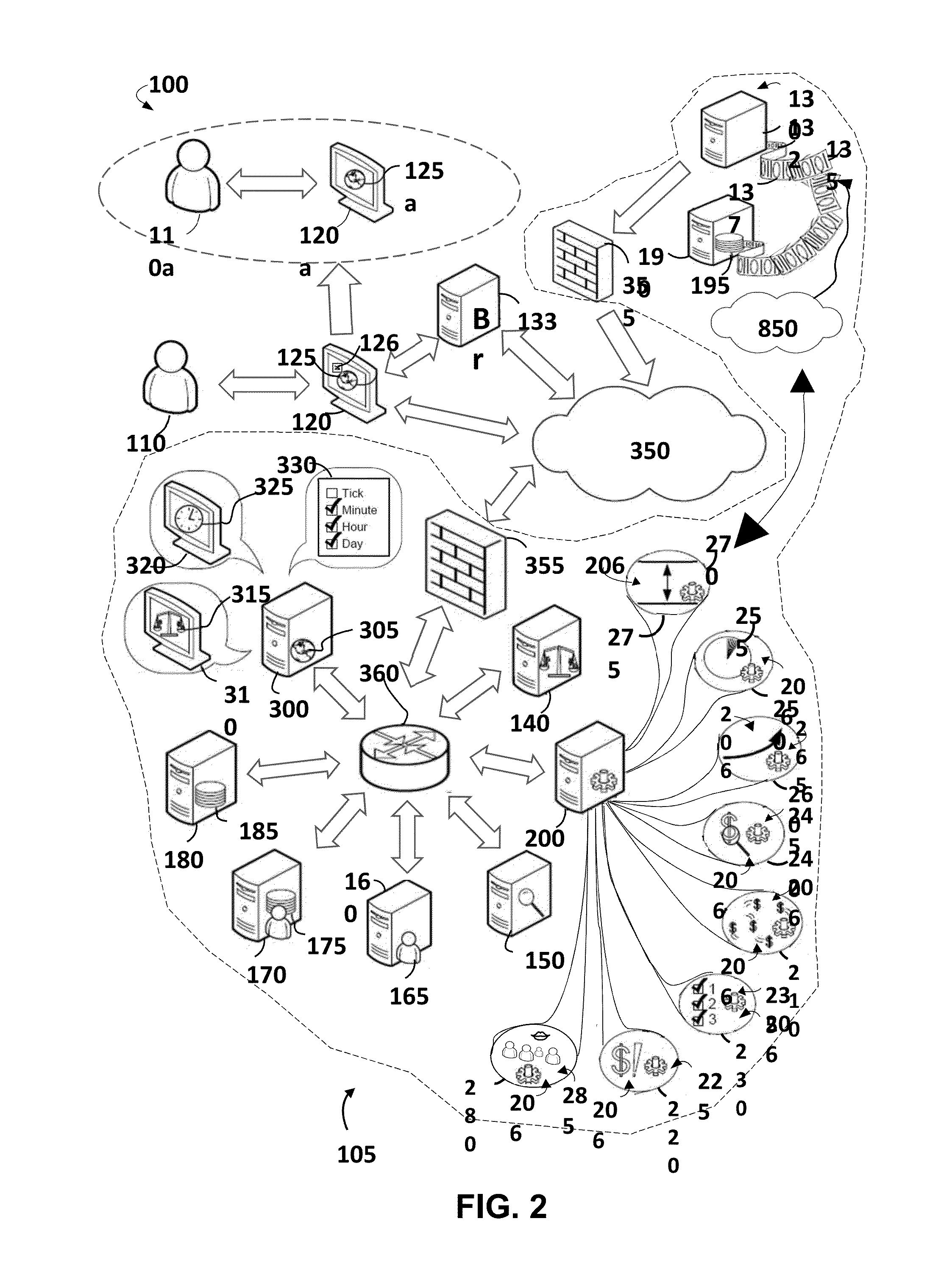

Trade allocation

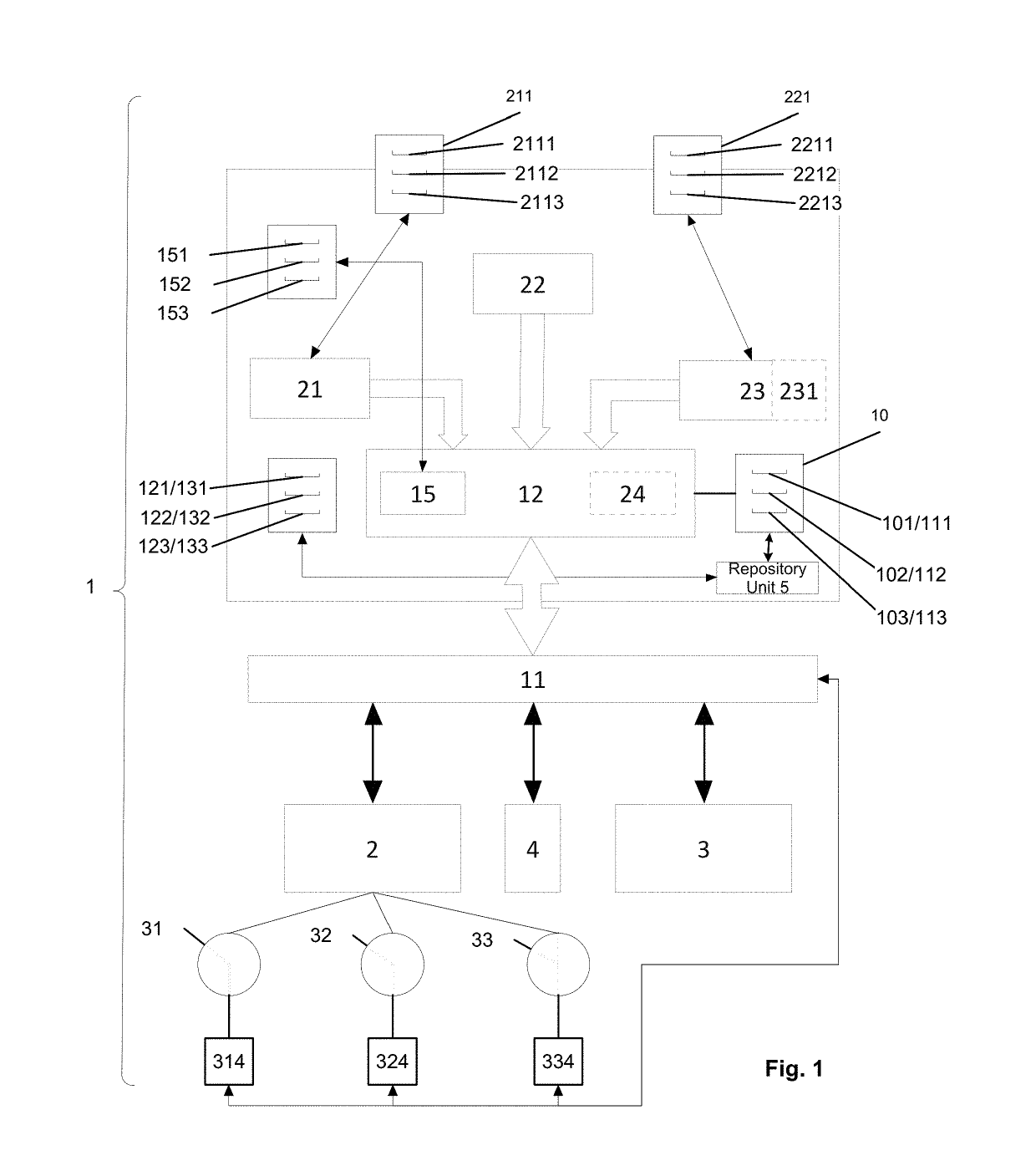

A trade allocation system includes a computer system having a network interface over which messages can be exchanged with an order management system. The computer system is also coupled to a first database that stores data associating portfolios with risk classes and target ratios. A second database stores instructions to configure the system to receive from order management systems messages describing trades of financial instruments. Each message can include a financial instrument identifier, a size of the trade, and a risk class identifier. The instructions also configure the processor to query the first database to determining a portfolios that are associated with a risk class identified by a risk class identifier in a message as well as to determine a target ratio for each of the portfolios. The processor then allocates the trade of the financial instrument among each of the portfolios based on the target ratios. Allocating a trade of a financial instruments among a group of portfolios include receiving a message descriptive of a trade of a financial instrument. The message can include a financial instrument identifier and a size of the trade. A collection of portfolios are then identified based on a match between a risk class of the portfolio and the risk class of the traded financial instrument. The trade is then allocated among each of the portfolios based on a target ratio associated with each portfolio.

Owner:UBS BUSINESS SOLUTIONS AG

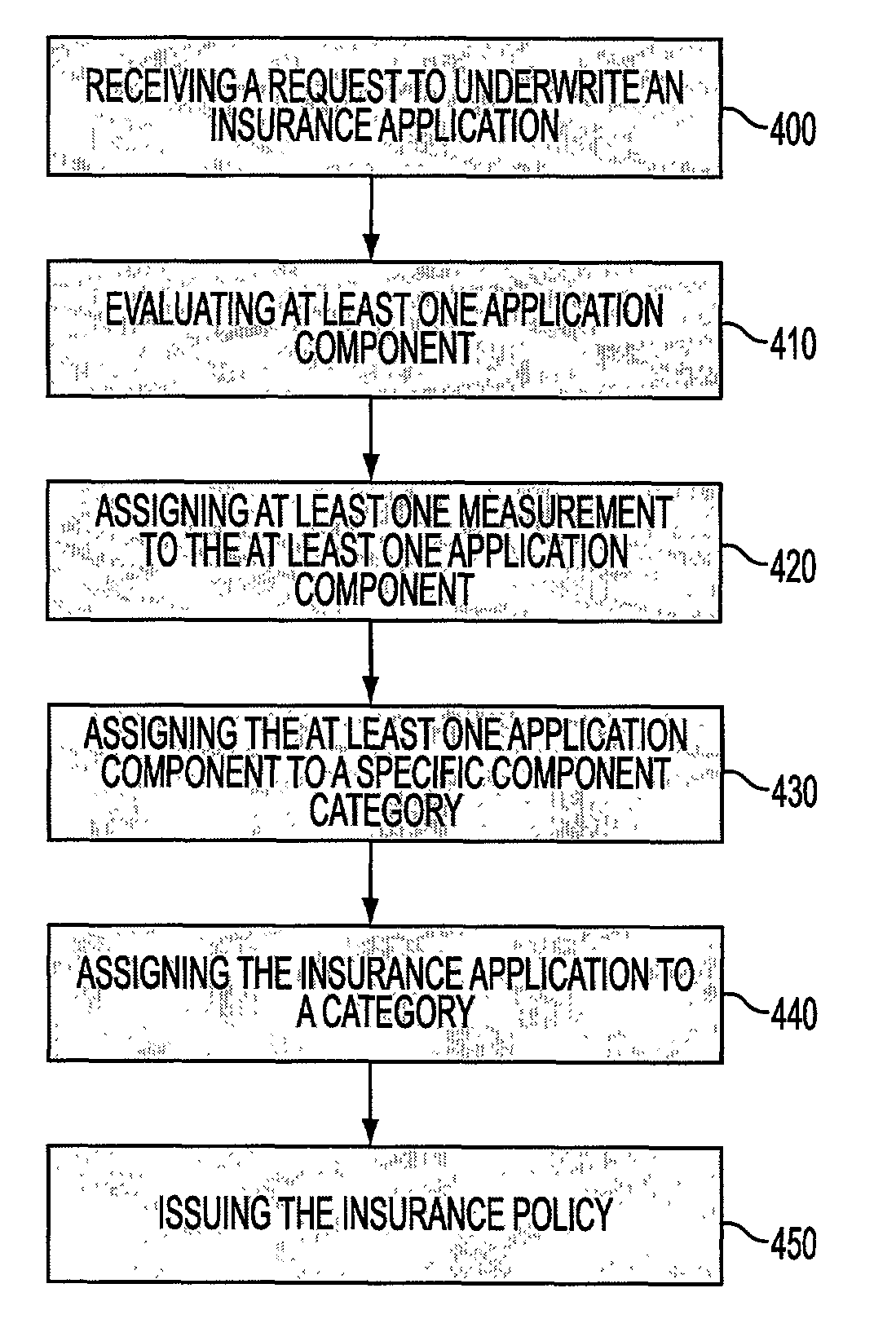

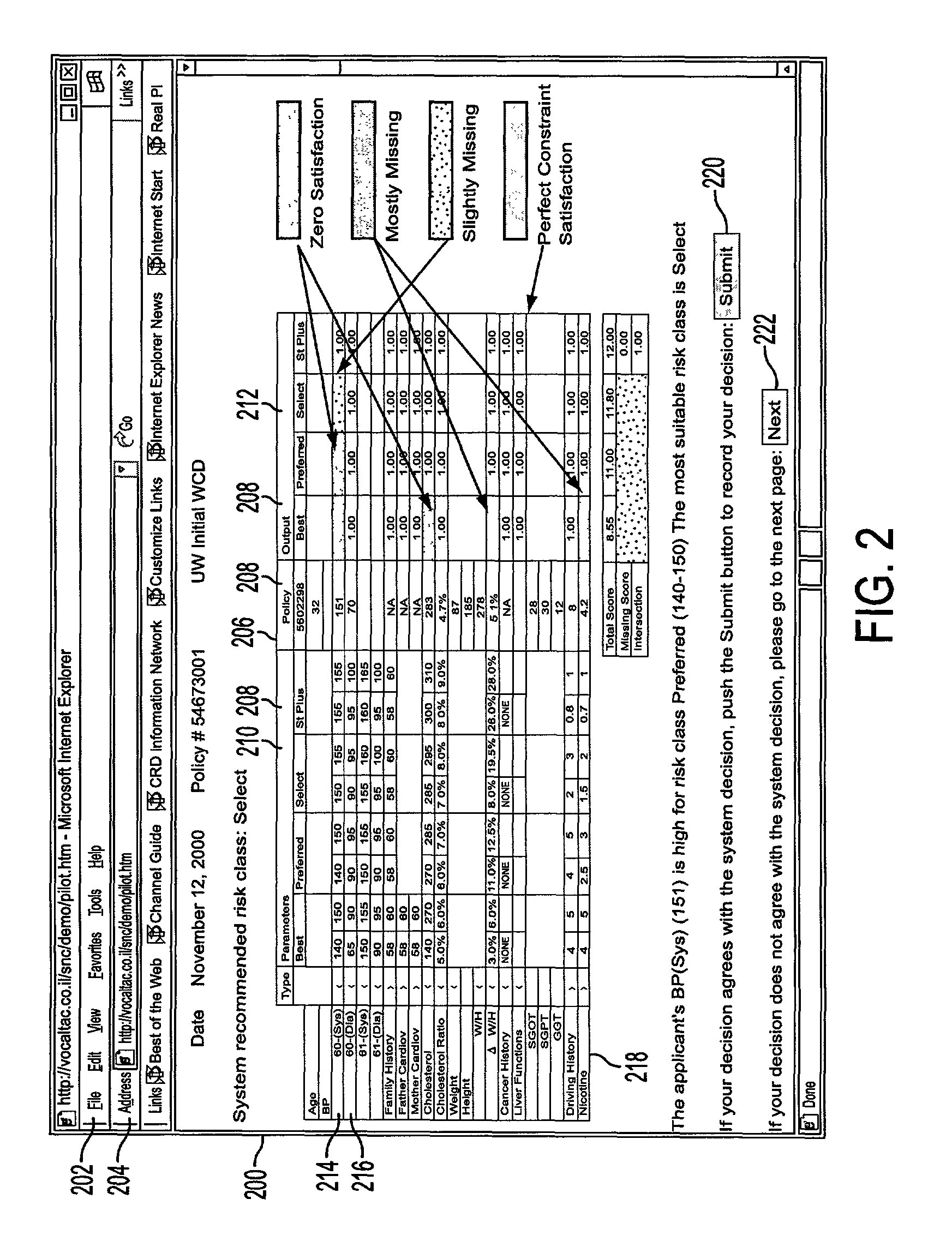

System and process for dominance classification for insurance underwriting suitable for use by an automated system

A risk classification technique that exploits the existing risk structure of the decision problem in order to produce risk categorizations for new candidates is described. The technique makes use of a set of candidates for which risk categories have already been assigned (in the case of insurance underwriting, for example, this would pertain to the premium class assigned to an application). Using this set of labeled candidates, the technique produces two subsets for each risk category: the Pareto-best subset and the Pareto-worst subset by using Dominance. These two subsets can be seen as representing the least risky and the most risky candidates within a given risk category. If there are a sufficient number of candidates in these two subsets, then the candidates in these two subsets can be seen as samples from the two hypothetical risk surfaces in the feature space that bound the risk category from above and below respectively. A new candidate is assigned a risk category by verifying if the candidate lies within these two bounding risk surfaces.

Owner:GE FINANCIAL ASSURANCE HLDG INC A RICHMOND

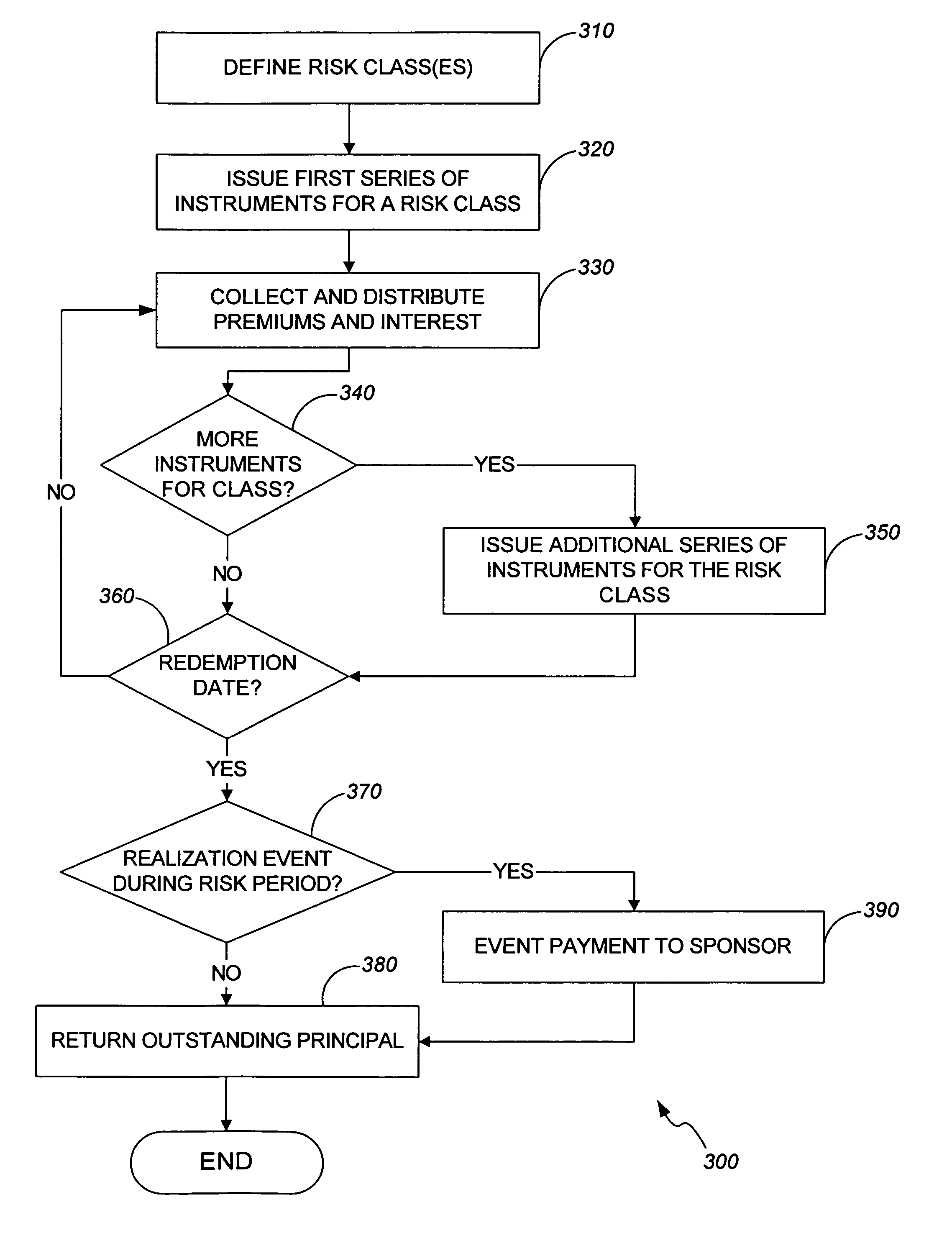

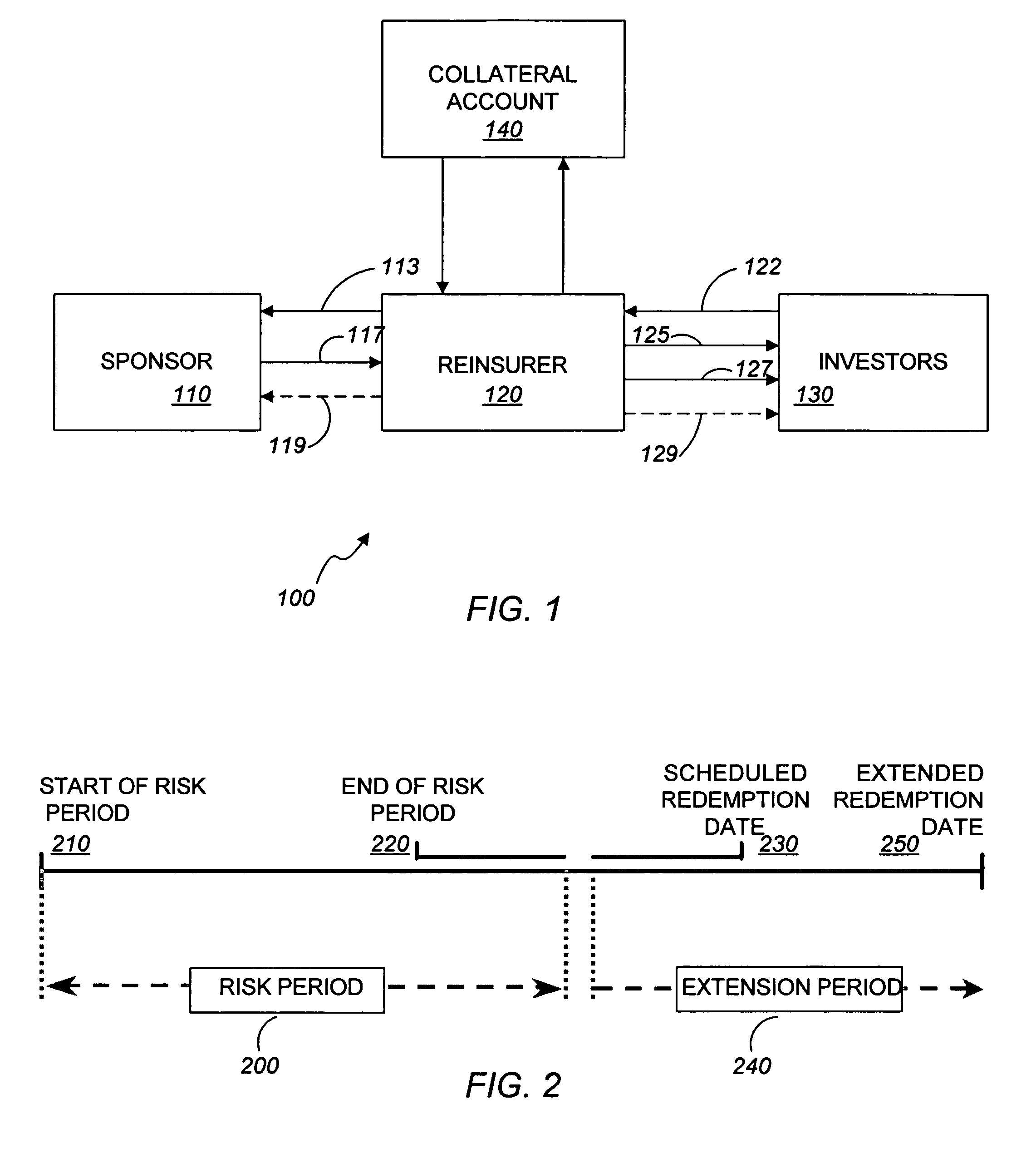

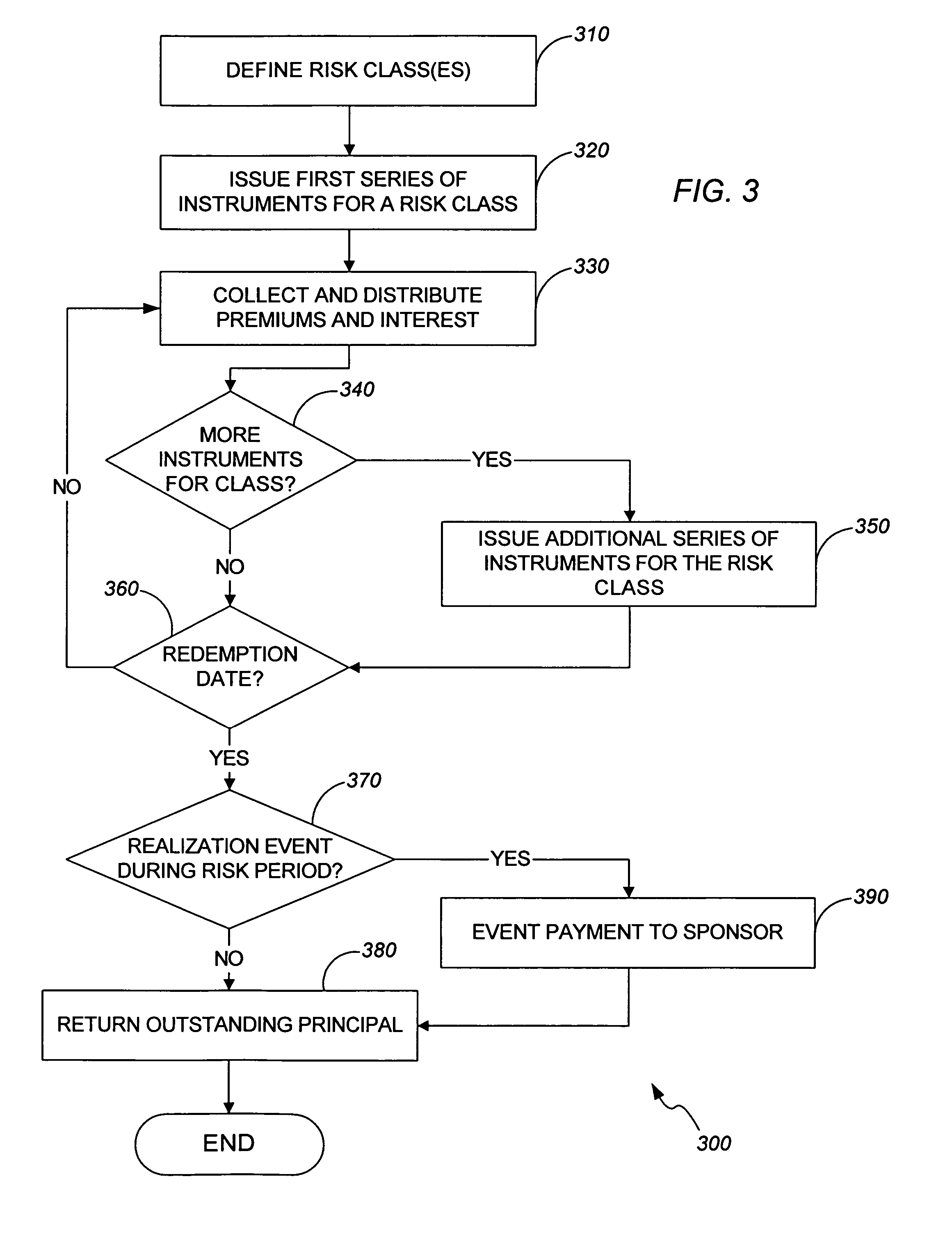

Flexible catastrophe bond

ActiveUS20050216386A1Reduce transaction costsImprove scalabilityFinanceSpecial data processing applicationsNatural disasterComputer science

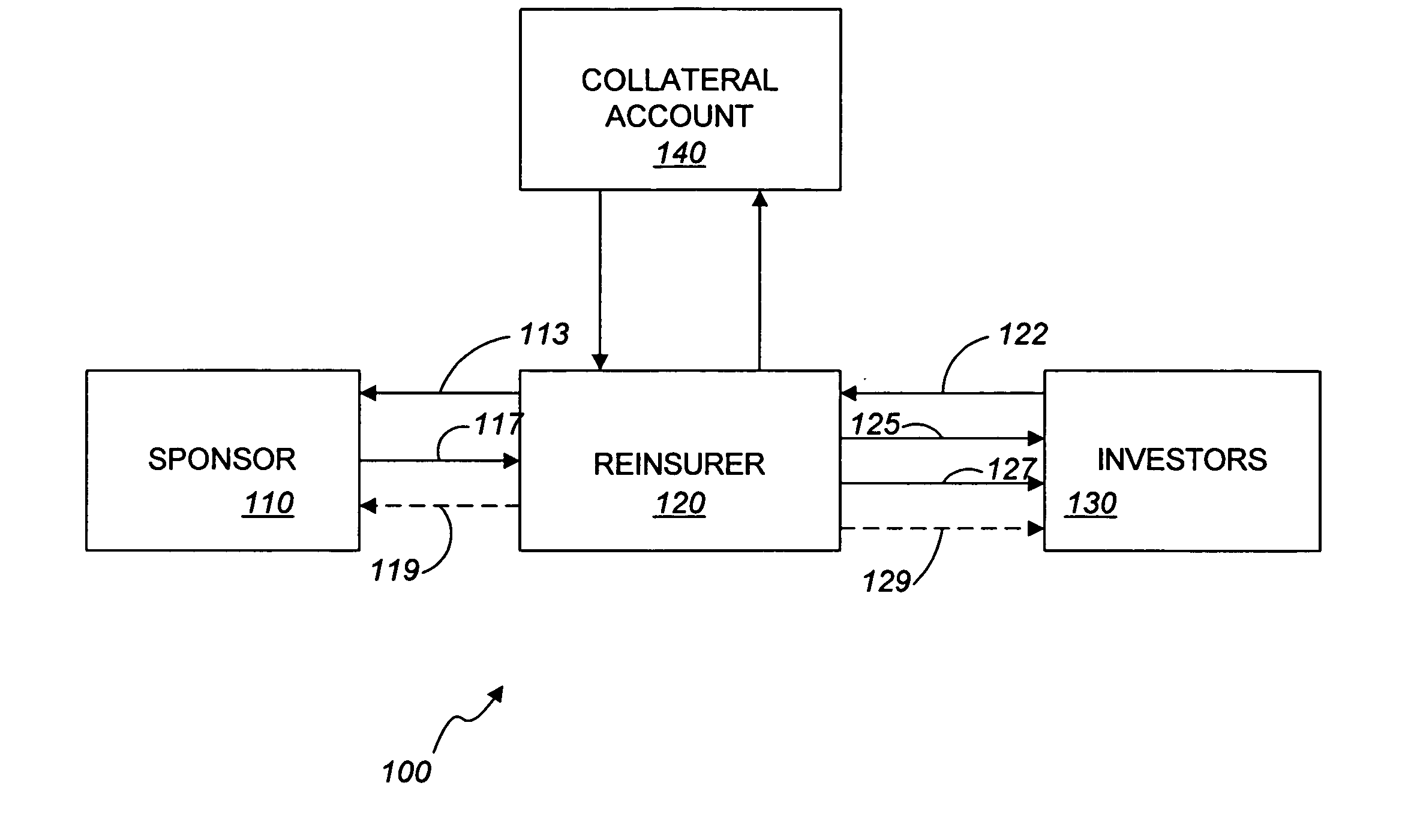

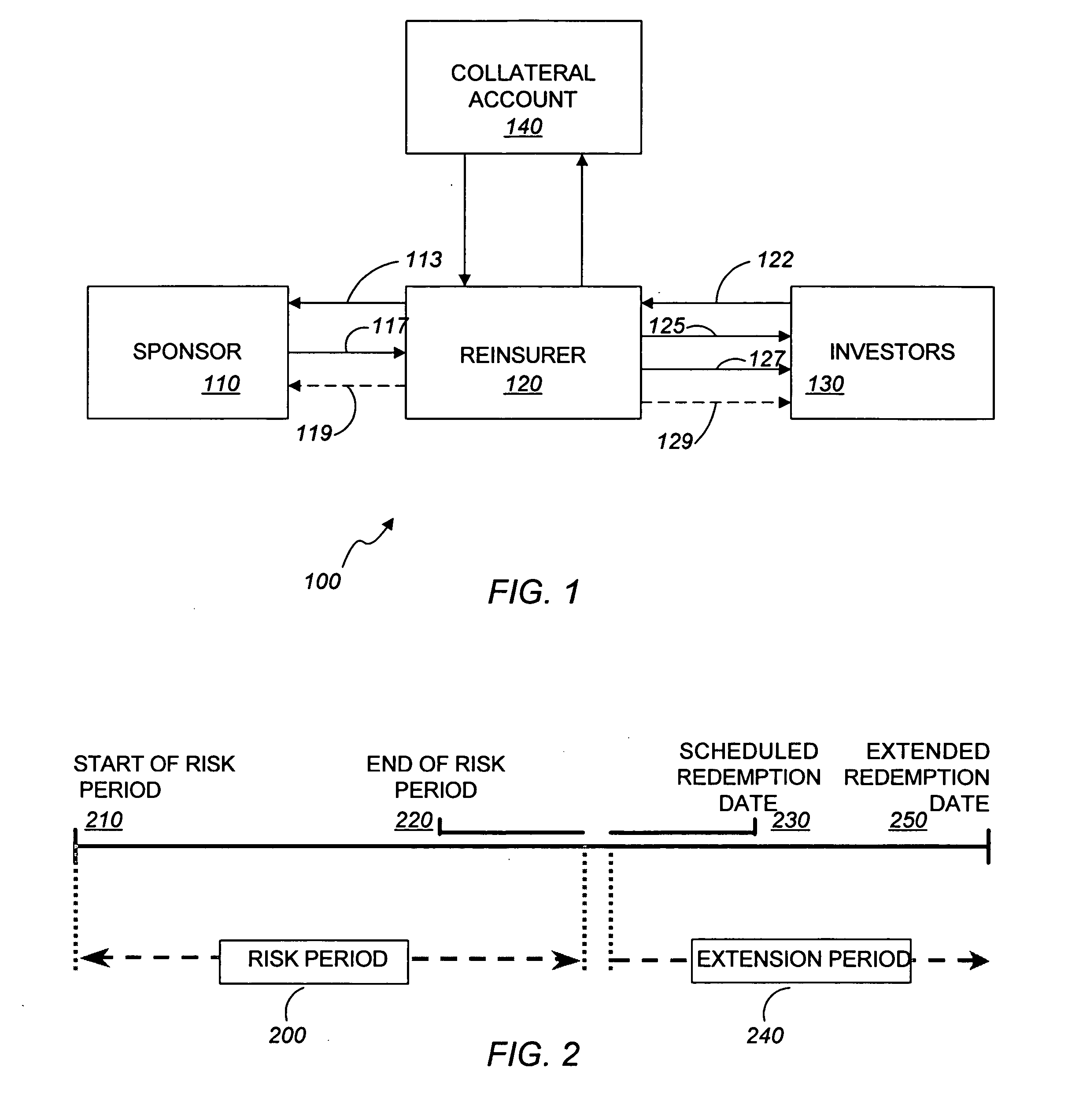

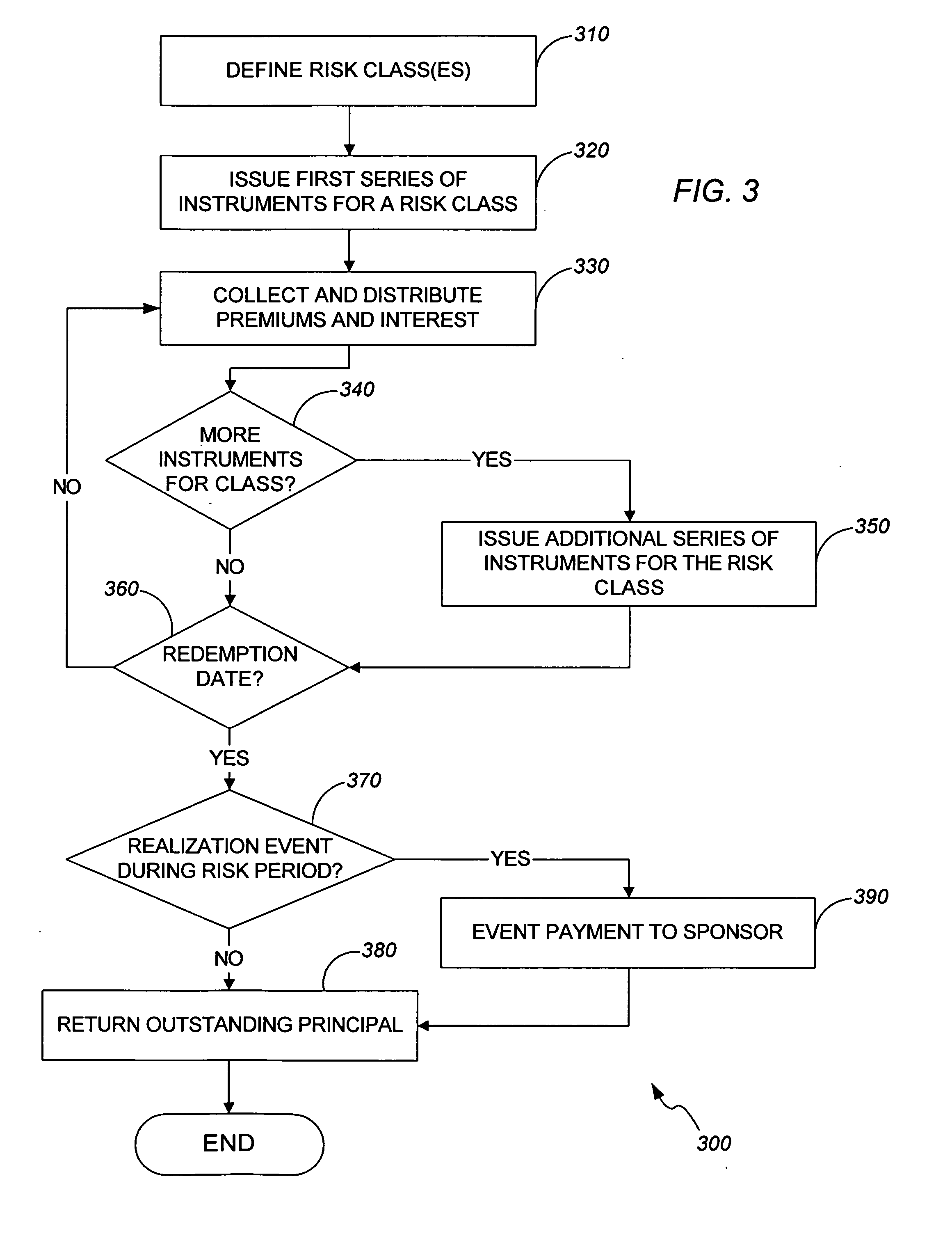

Methods and apparatus, including computer program products, for securitizing natural catastrophe risk. One or more risk classes representing natural catastrophe risks is are established, and a first collection of risk instruments of a first risk class of the one or more risk classes is issued. Each risk class is recurringly issuable as risk instruments providing a return on an investment. The amount of the return for a risk instrument is contingent upon the occurrence of a realization event for the corresponding represented natural catastrophe risk. Collections of risk instruments issued from recurringly issuable risk classes are also described.

Owner:SWISS REINSURANCE CO LTD

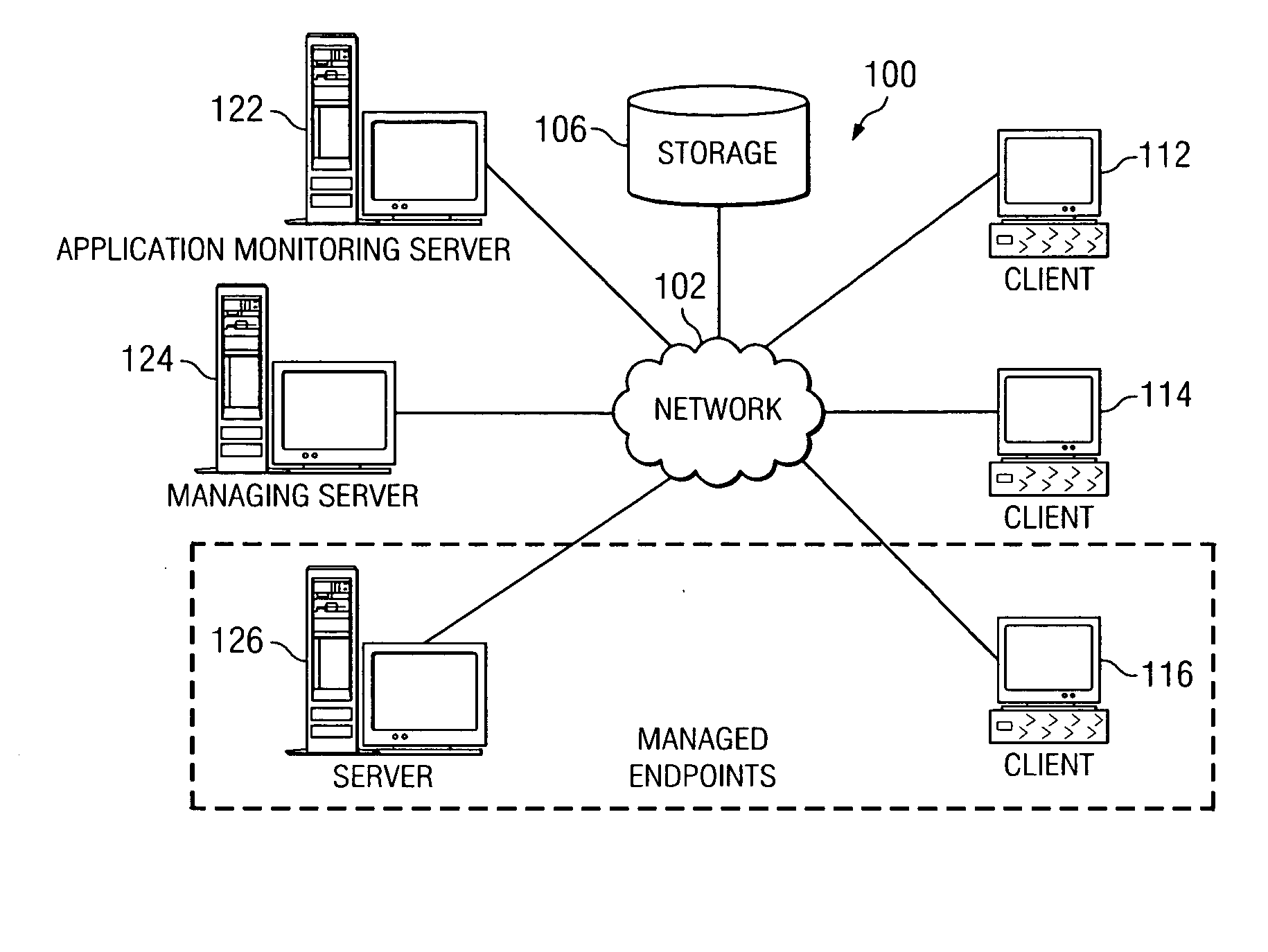

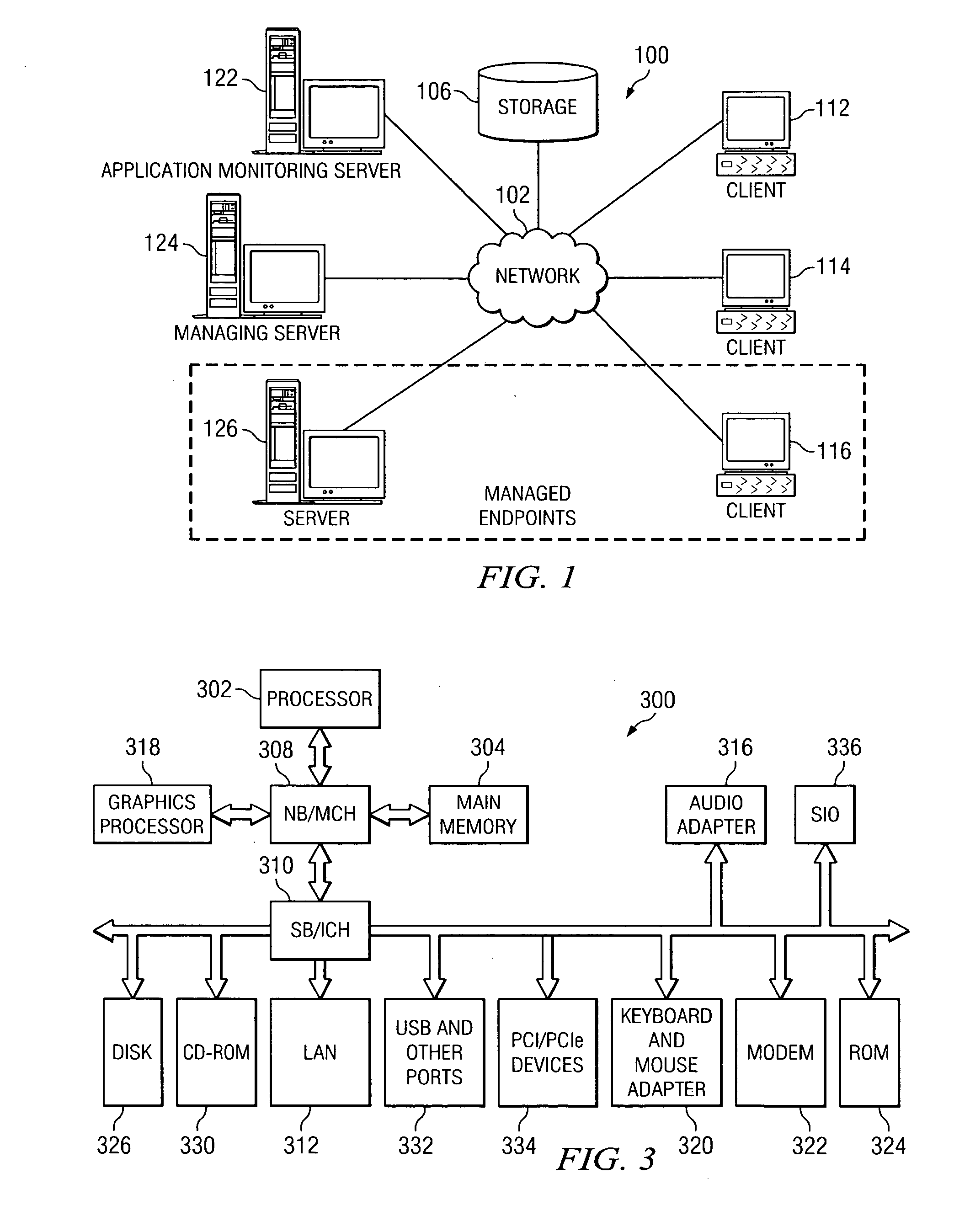

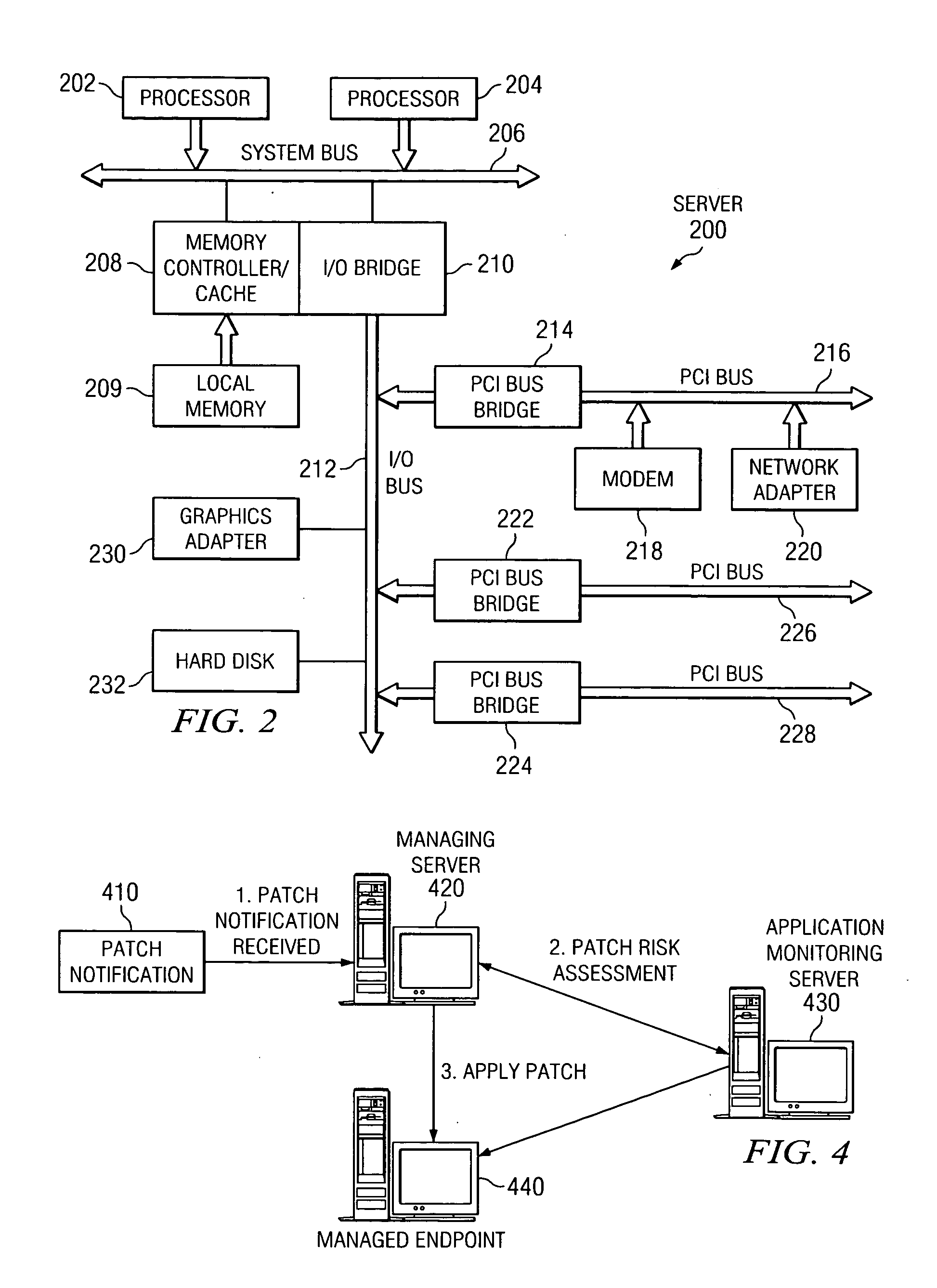

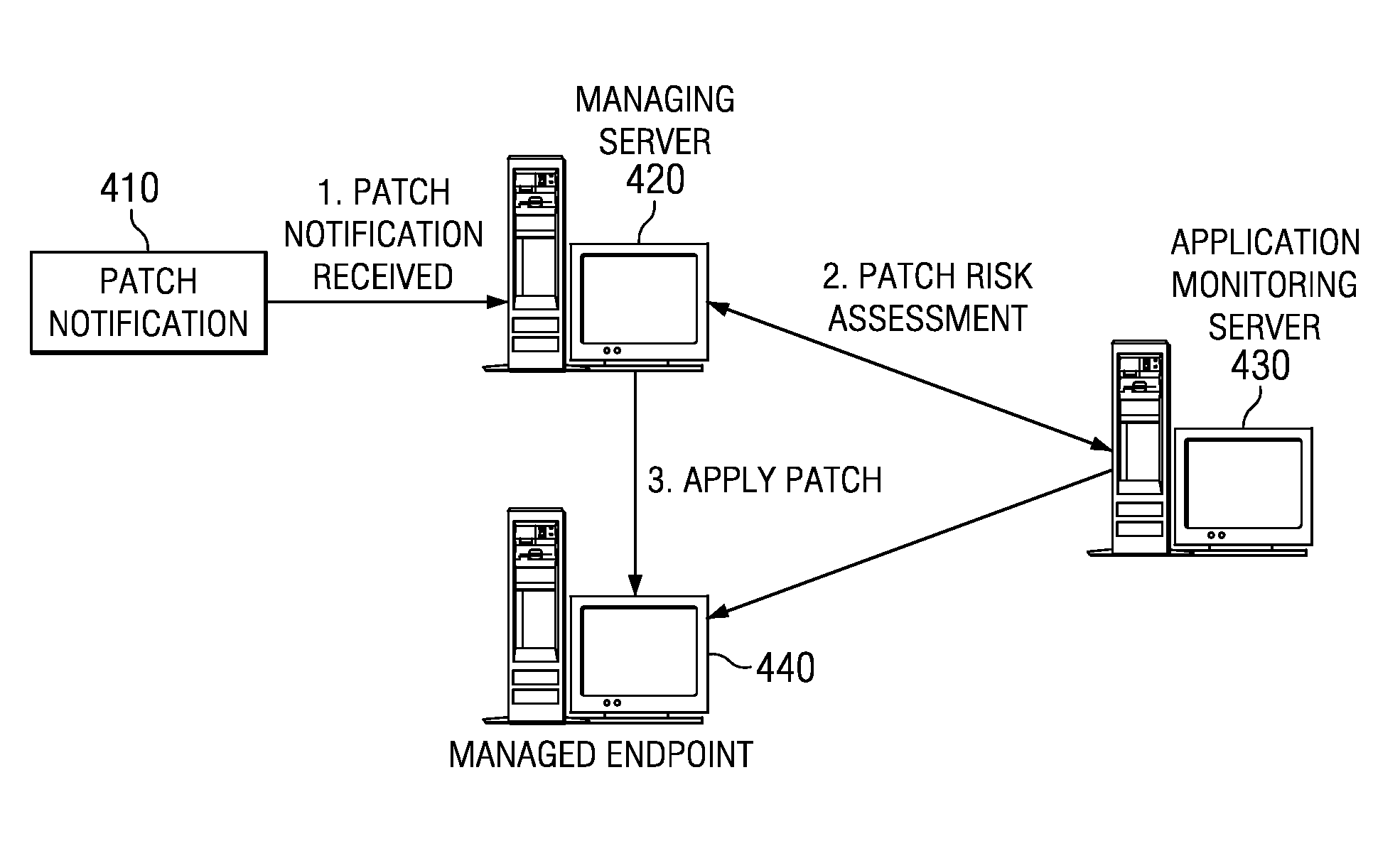

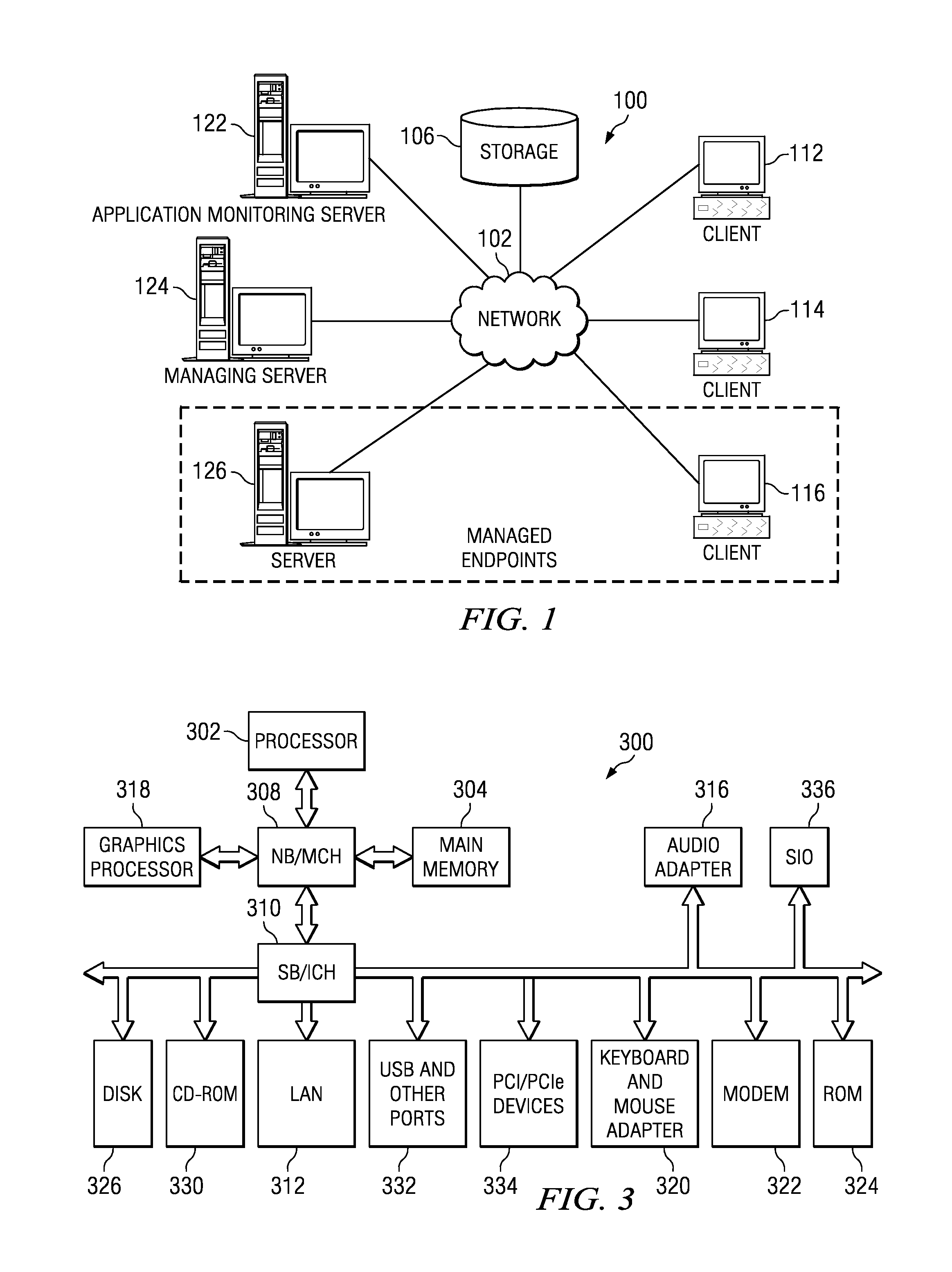

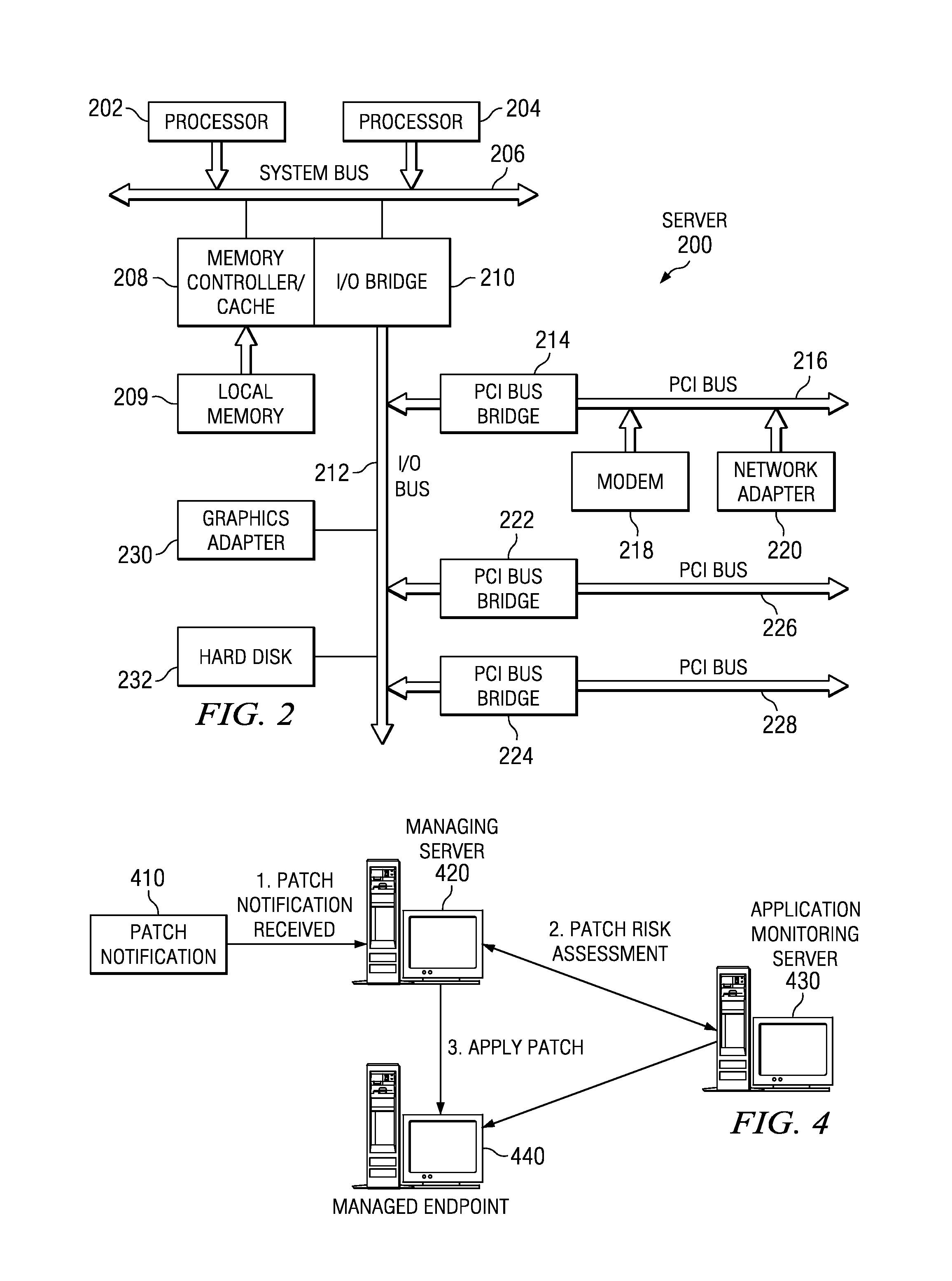

Method, apparatus, and program product for autonomic patch risk assessment

An automatic risk assessment system is provided that determines a risk for the patch based on collected activity metrics, file weights, a list of files affected by the patch, and other factors. An application monitor collects metrics from the application to determine the level of activity of the application or other component to be patched. The patch may have associated therewith metadata including a list of files that will be affected by the patch. Policies may store information about how risk is to be assessed. This information may include, for example, file weights and information defining categories of risk.

Owner:IBM CORP

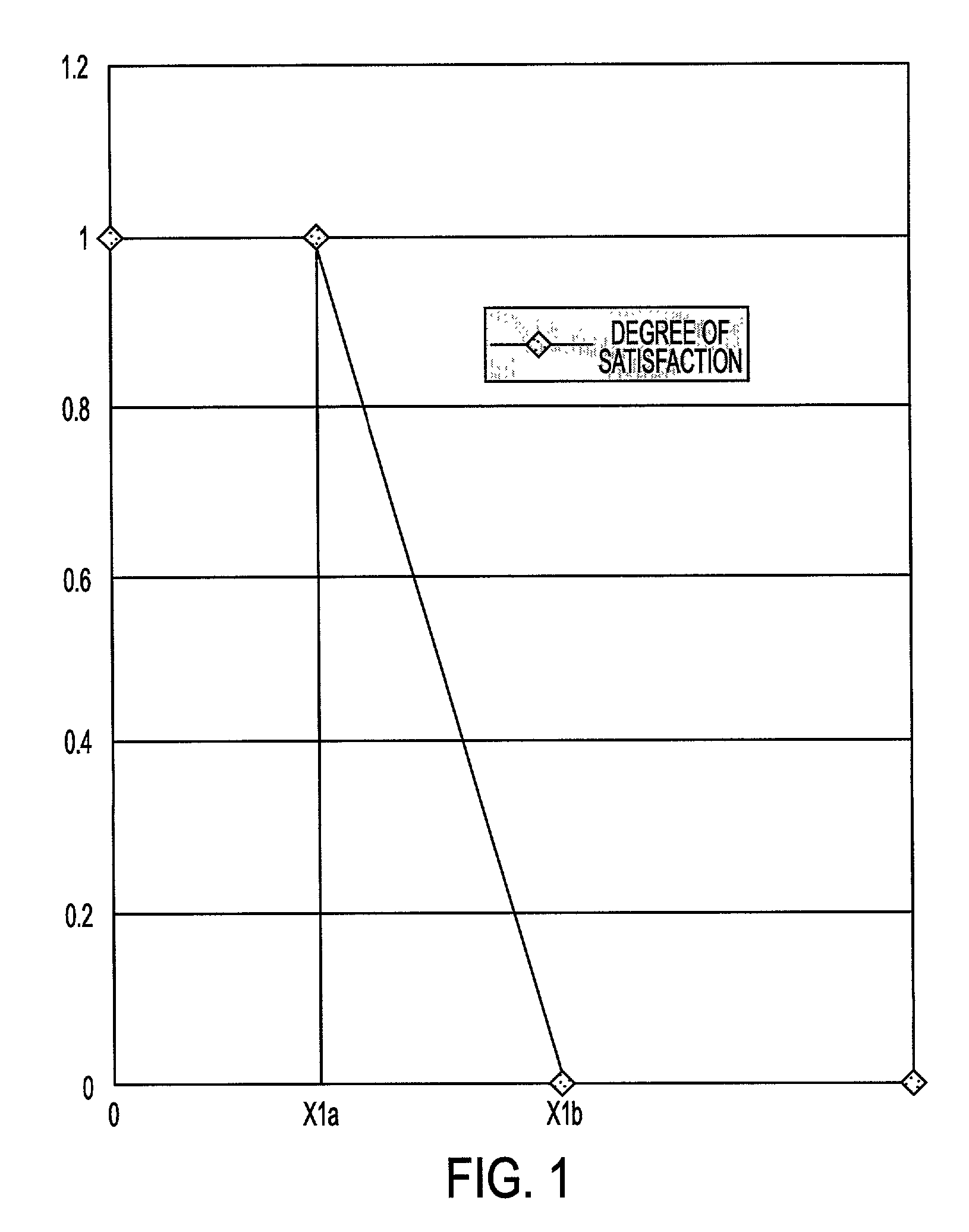

Process for optimization of insurance underwriting suitable for use by an automated system

A robust process for automating the tuning and maintenance of decision-making systems is described. A configurable multi-stage mutation-based evolutionary algorithm optimally tunes the decision thresholds and internal parameters of fuzzy rule-based and case-based systems that decide the risk categories of insurance applications. The tunable parameters have a critical impact on the coverage and accuracy of decision-making, and a reliable method to optimally tune these parameters is critical to the quality of decision-making and maintainability of these systems.

Owner:GE FINANCIAL ASSURANCE HLDG INC A RICHMOND

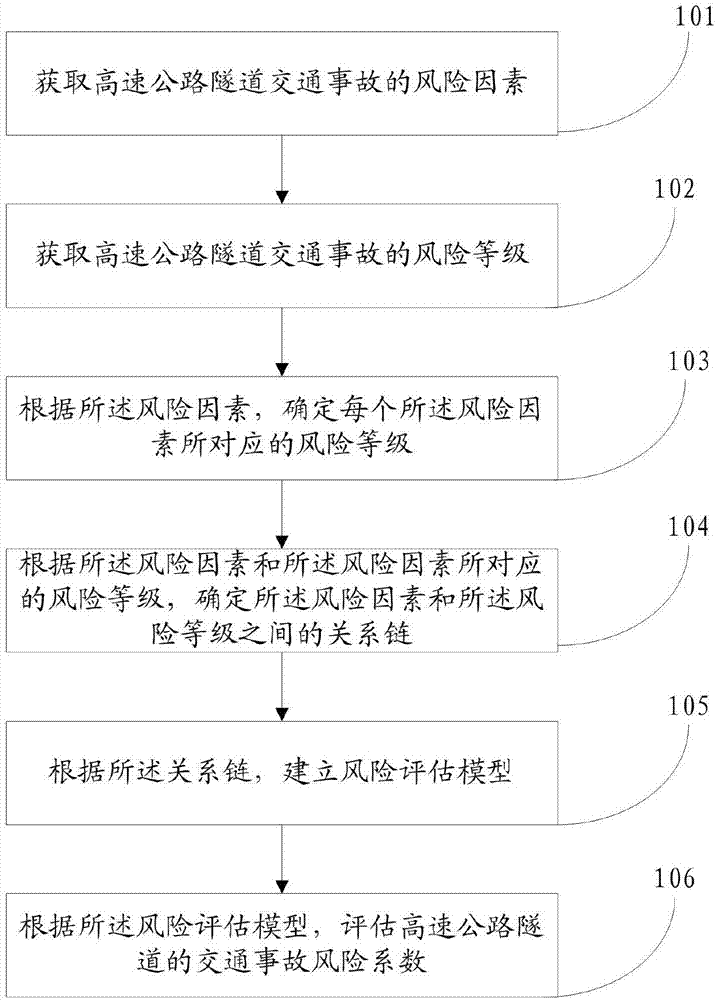

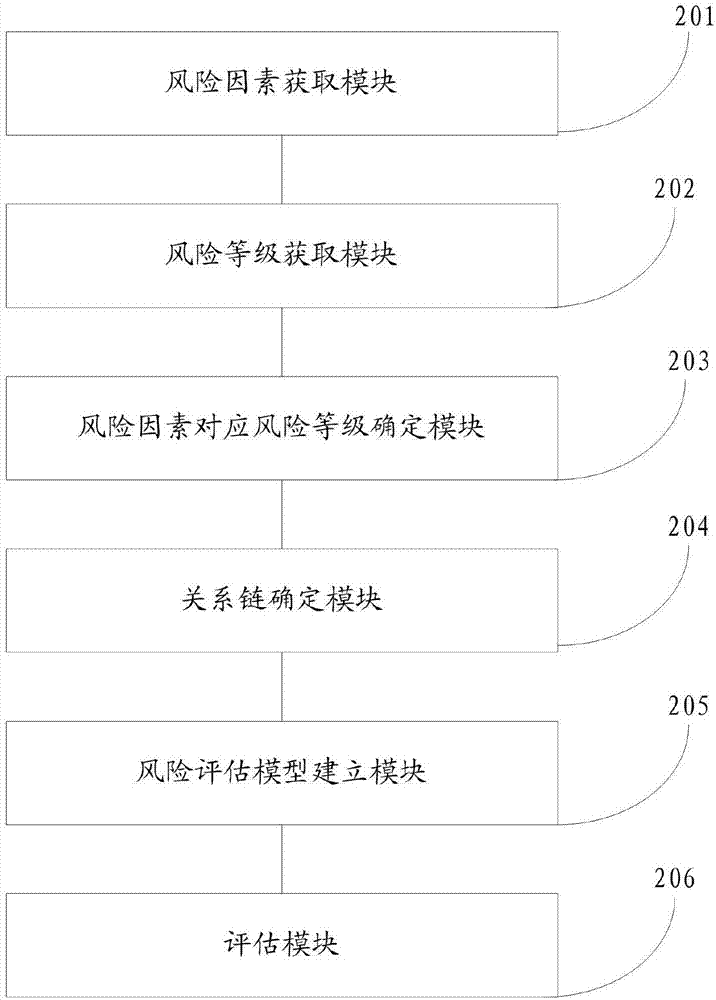

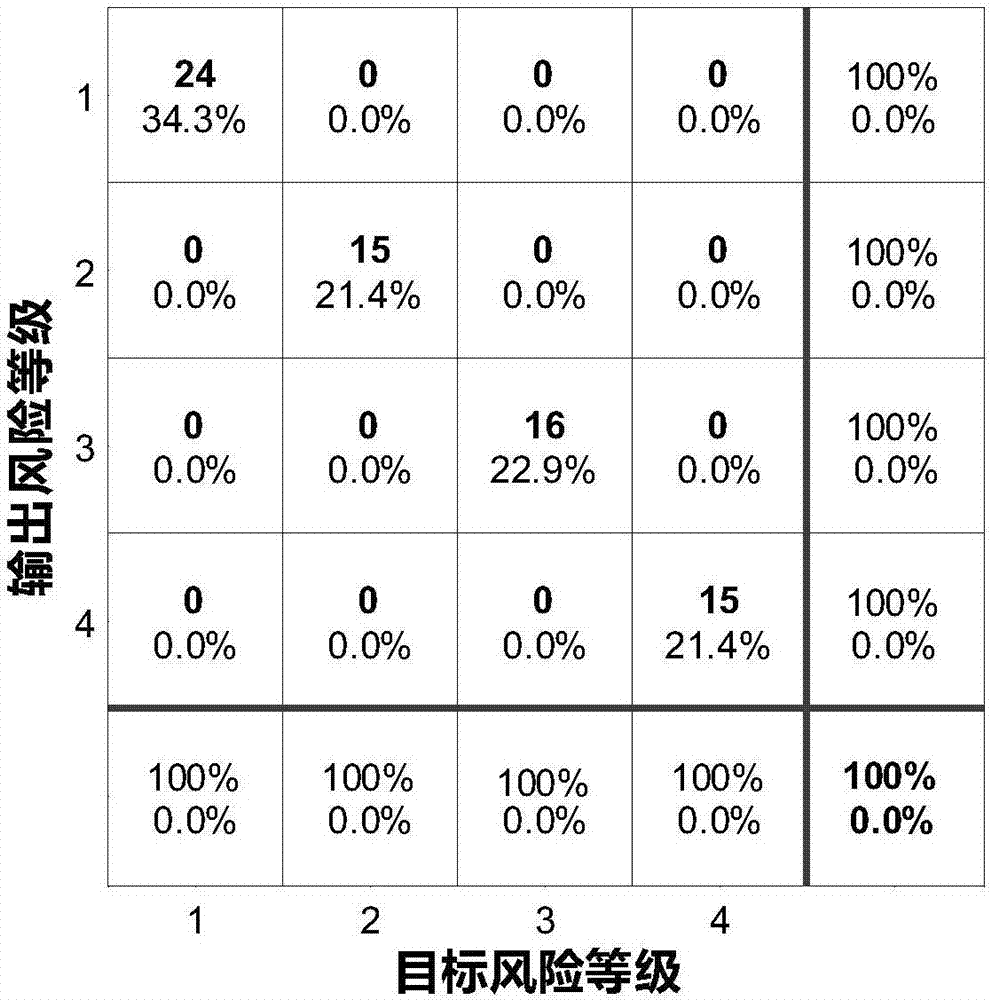

Traffic accident risk estimation method and system

InactiveCN106897826AImproving the Efficiency of Traffic Accident Risk AssessmentImprove risk assessment efficiencyCharacter and pattern recognitionMachine learningSpectral clustering algorithmEstimation methods

The invention discloses a traffic accident risk estimation method and system. According to the method and the system, a corresponding relation chain between a risk factor and a risk class is calculated and determined by acquiring an expressway tunnel traffic accident risk factor and an expressway tunnel traffic accident risk class and employing a spectral clustering algorithm; a risk estimation model is constructed according to the relation chain and an extreme learning algorithm; and the final risk class corresponding to the risk factor can be obtained by inputting arbitrary risk factor data to the risk estimation model. Therefore, with the adoption of the method or the system provided by the invention, the expressway tunnel traffic accident risk estimation efficiency is effectively improved, so that the expressway tunnel traffic accident risk estimation efficiency process is more high-efficiency and convenient, and the safety evaluation of expressway tunnel operation period is accurately and effectively achieved.

Owner:JILIN UNIV +1

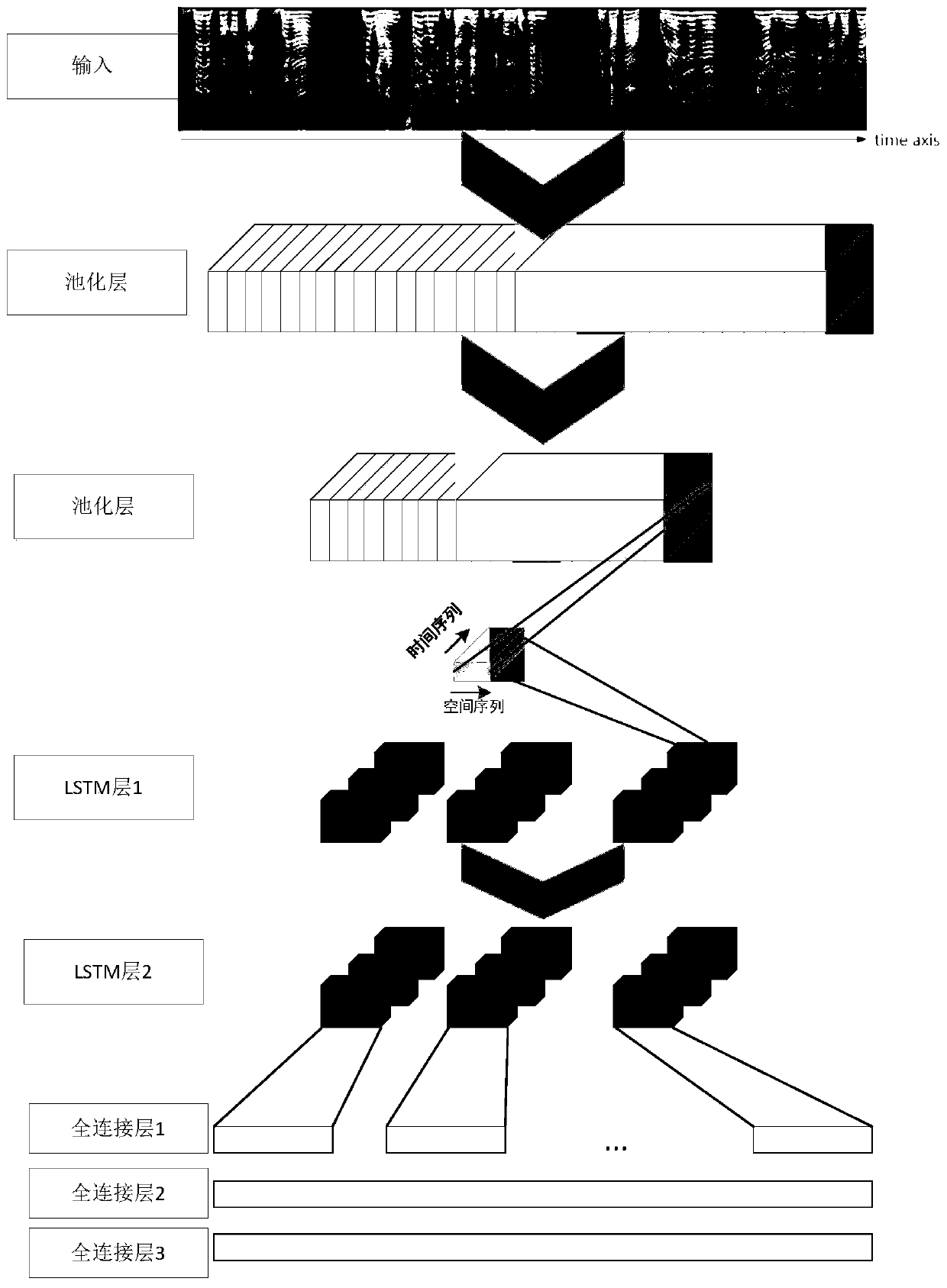

Fault prediction method based on synthetic minority class oversampling and deep learning

InactiveCN109871862AIncrease the number ofEasy to trainCharacter and pattern recognitionNeural architecturesPredictive methodsMinority class

The invention provides a fault prediction method based on synthetic minority class oversampling and deep learning. The Means method is used for clustering a few types of samples in the sample set; deleting the noise class cluster after clustering; dividing the class cluster into noise class samples in each class cluster by using a KNN method; fault samples and risk samples, deleting the noise samples; and finally, inputting a random number into each class cluster, and selecting a certain sample as an output sample according to a proportional relation between the random number and the fault class sample and the risk class sample in the class cluster;realizing oversampling of the SMOTE method ; and then increasing the number of a few types of samples through multiplication operation, so thatthe types of the samples in the finally obtained fusion sample are more balanced, and the acquired feature data are balanced, thereby facilitating model training, maximally mining the law behind thedata, and realizing a better fault prediction effect.

Owner:BEIJING AEROSPACE MEASUREMENT & CONTROL TECH

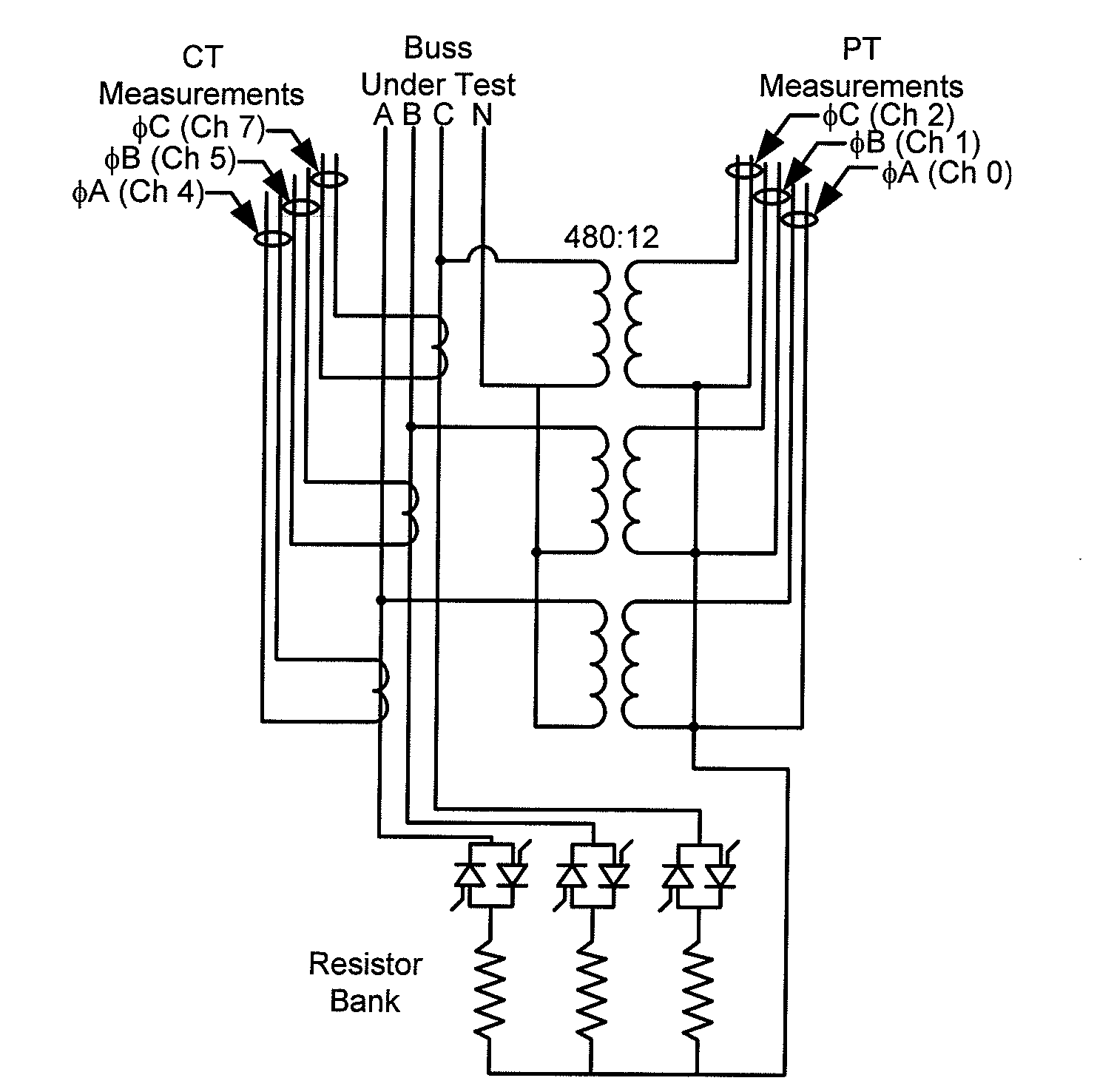

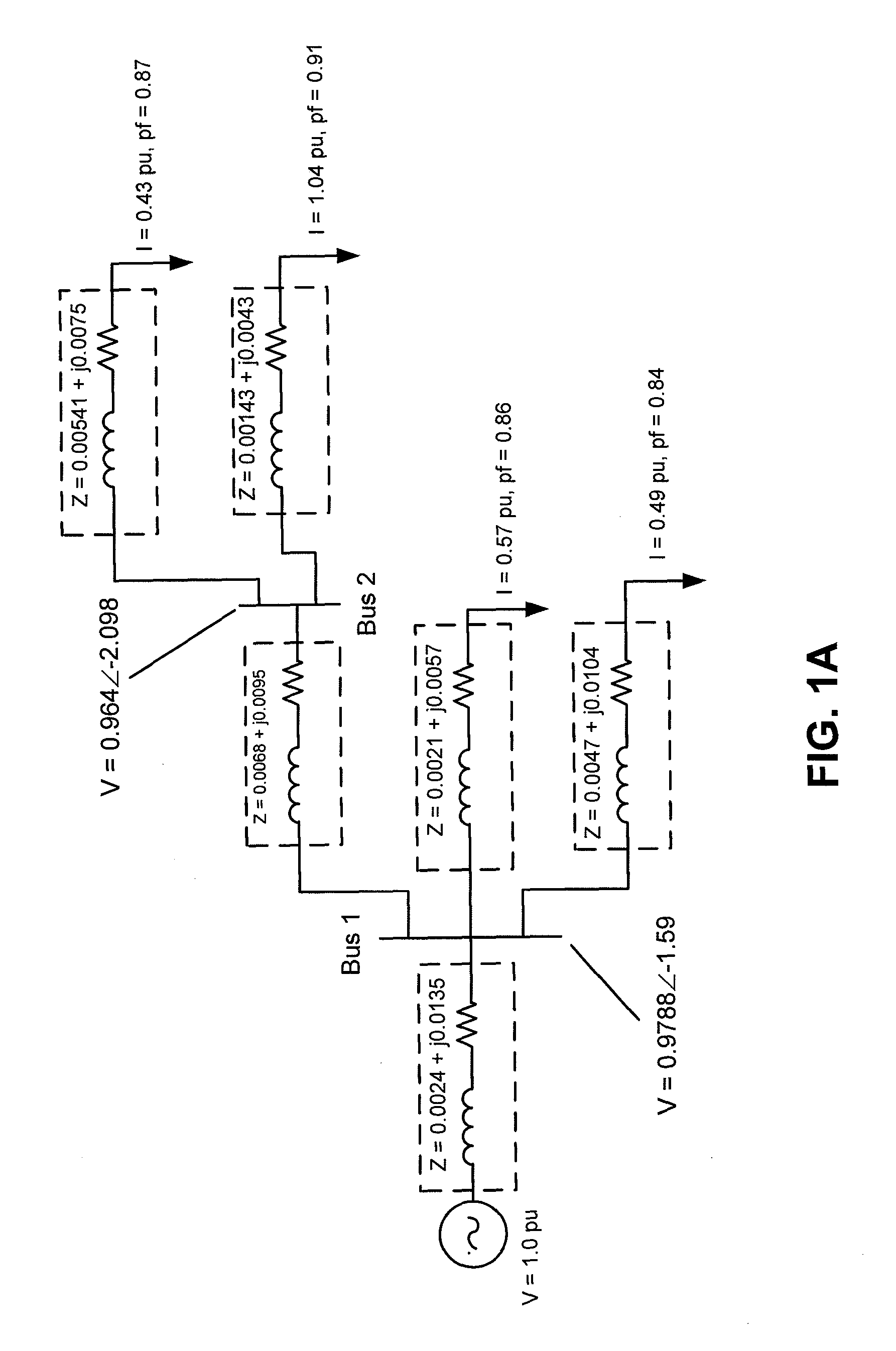

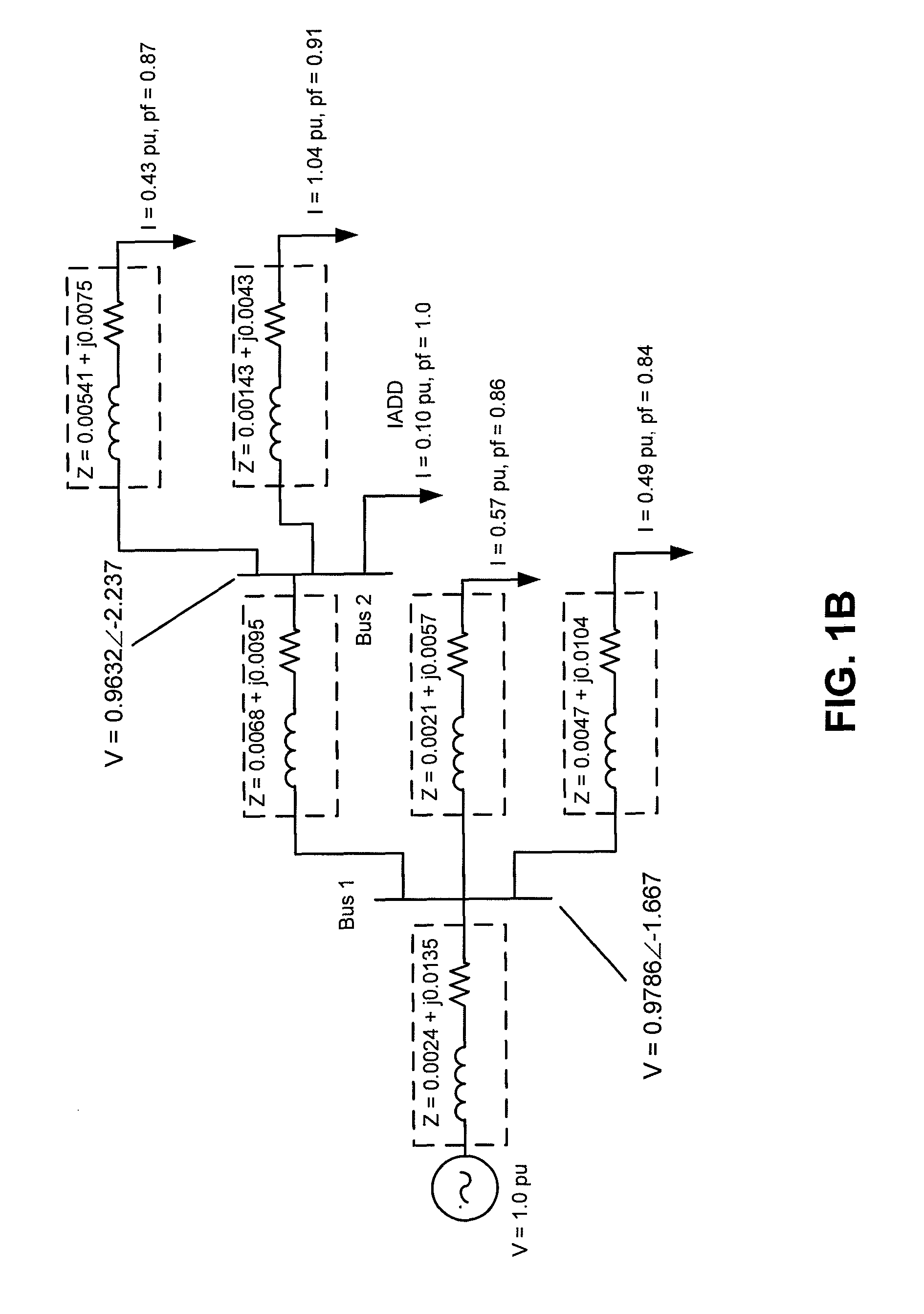

Impedance-based arc fault determination device (IADD) and method

ActiveUS20100026317A1Accurately and correctly predictAccurately determinedCurrent/voltage measurementImpedence measurementsPhase shiftedElectric power system

Embodiments according to the present invention provide an Impedance-based Arc-Fault Determination Device (IADD) and method that, when attached to an electrical node on the power system and through observations on voltage, current and phase shift with a step load change, determine the effective Thevenin equivalent circuit or Norton equivalent circuit at the point of test. The device and method determine the expected bolted fault current at the test location of interest, which enables calculation of incident energy and the assignment of a flash-hazard risk category.

Owner:CLEMSON UNIV RES FOUND +1

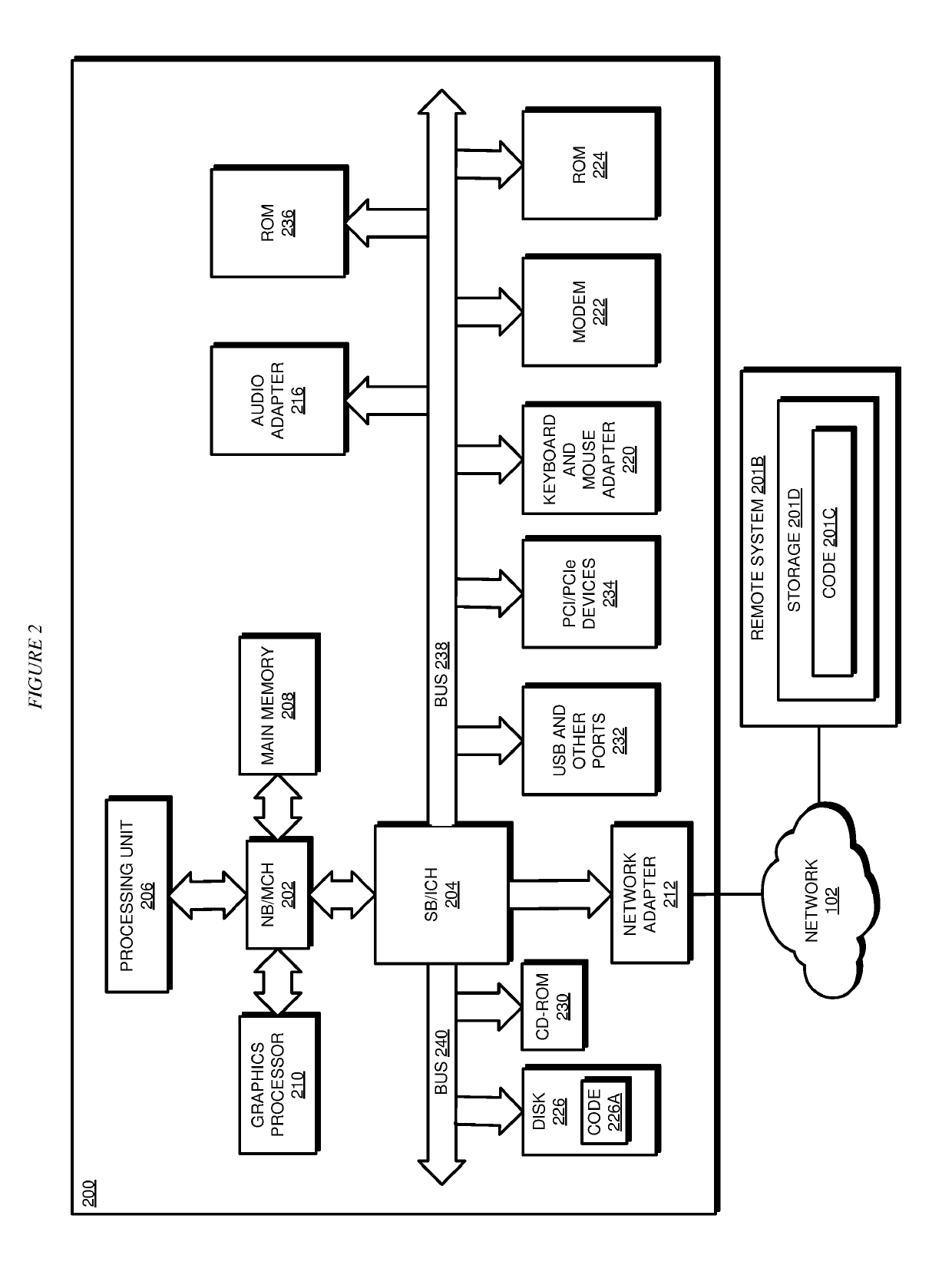

Method, Apparatus, and Program Product for Autonomic Patch Risk Assessment

InactiveUS20080222626A1Error detection/correctionSpecific program execution arrangementsApplication softwareRisk class

An automatic risk assessment system is provided that determines a risk for the patch based on collected activity metrics, file weights, a list of files affected by the patch, and other factors. An application monitor collects metrics from the application to determine the level of activity of the application or other component to be patched. The patch may have associated therewith metadata including a list of files that will be affected by the patch. Policies may store information about how risk is to be assessed. This information may include, for example, file weights and information defining categories of risk.

Owner:IBM CORP

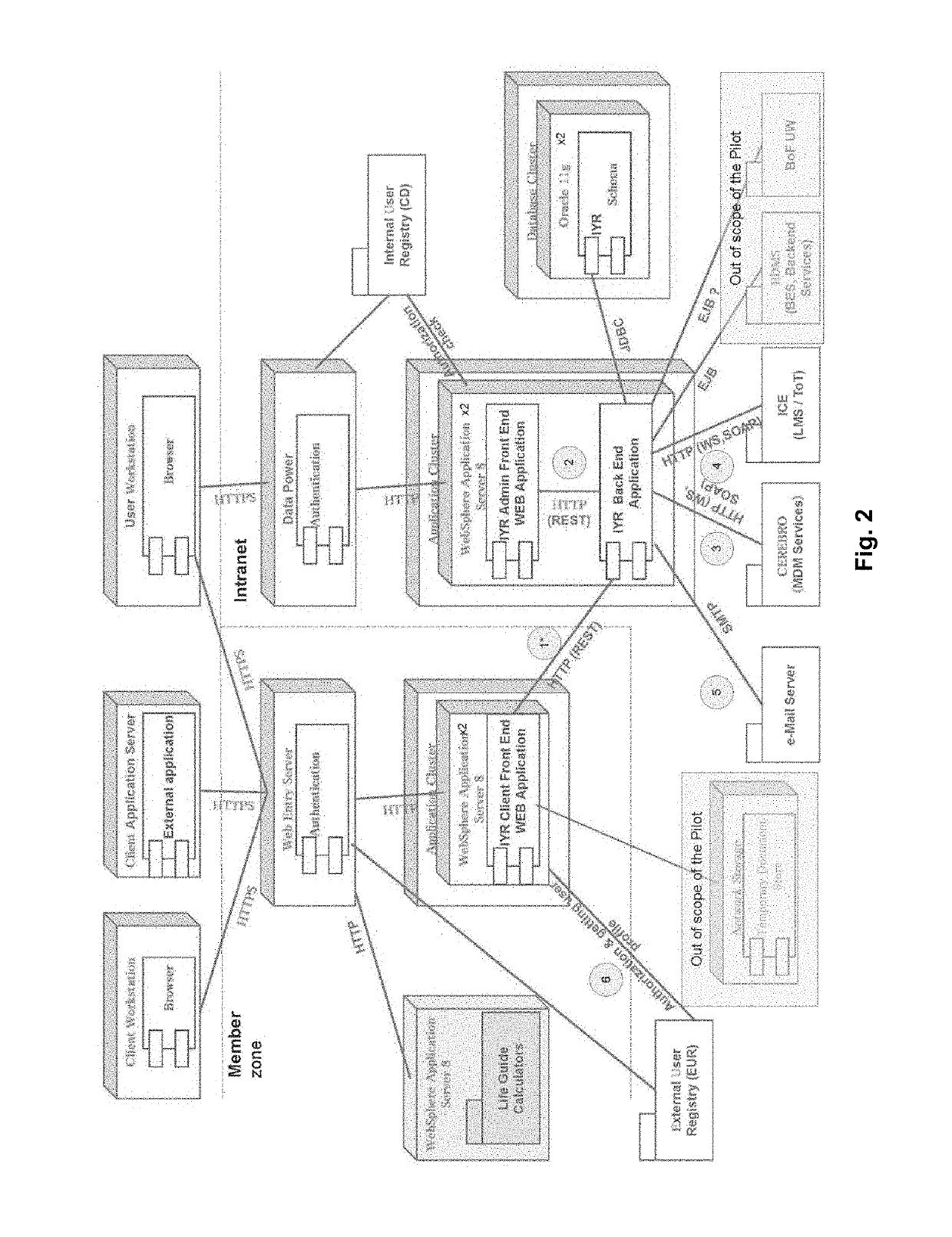

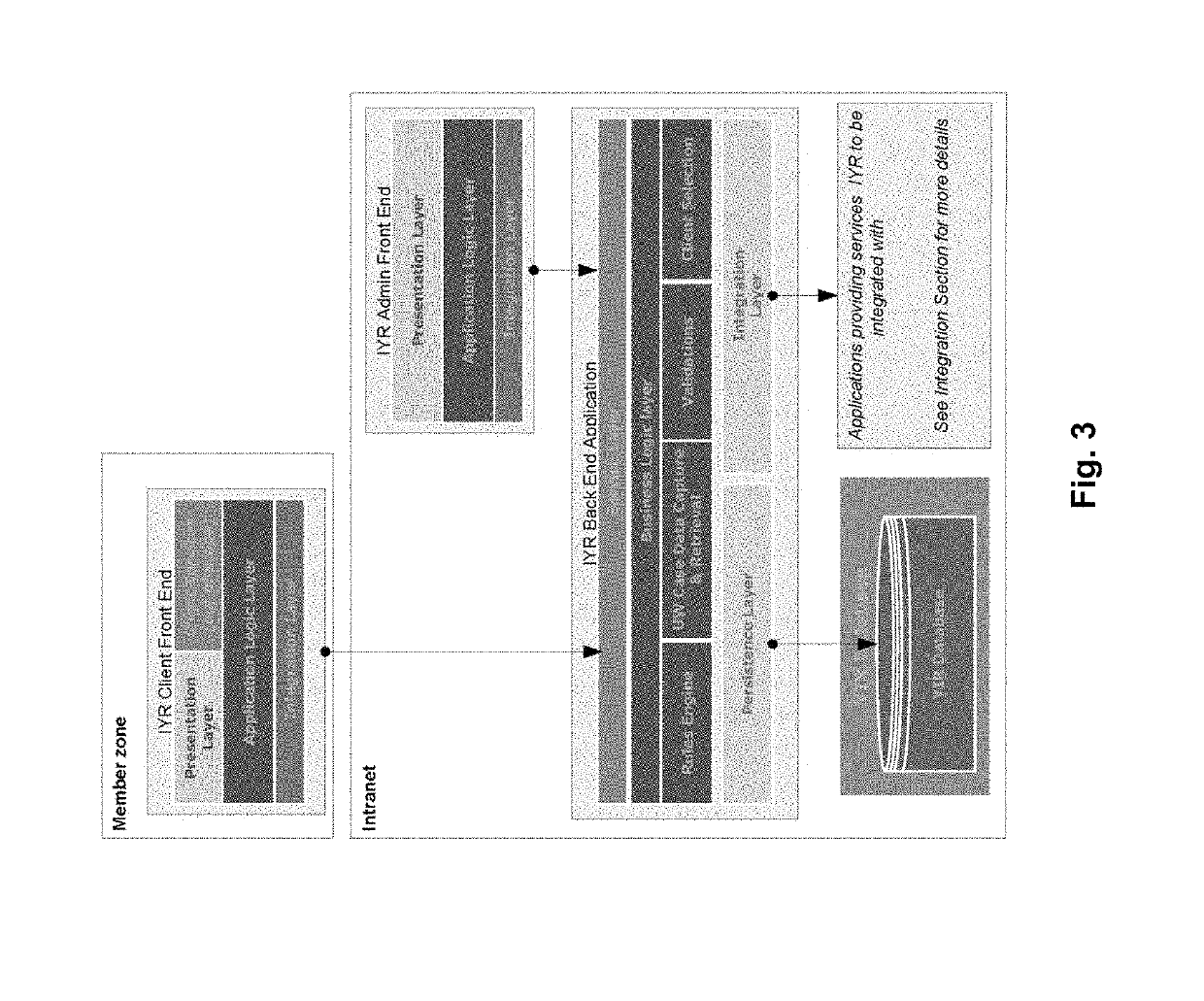

Life insurance system with fully automated underwriting process for real-time underwriting and risk adjustment, and corresponding method thereof

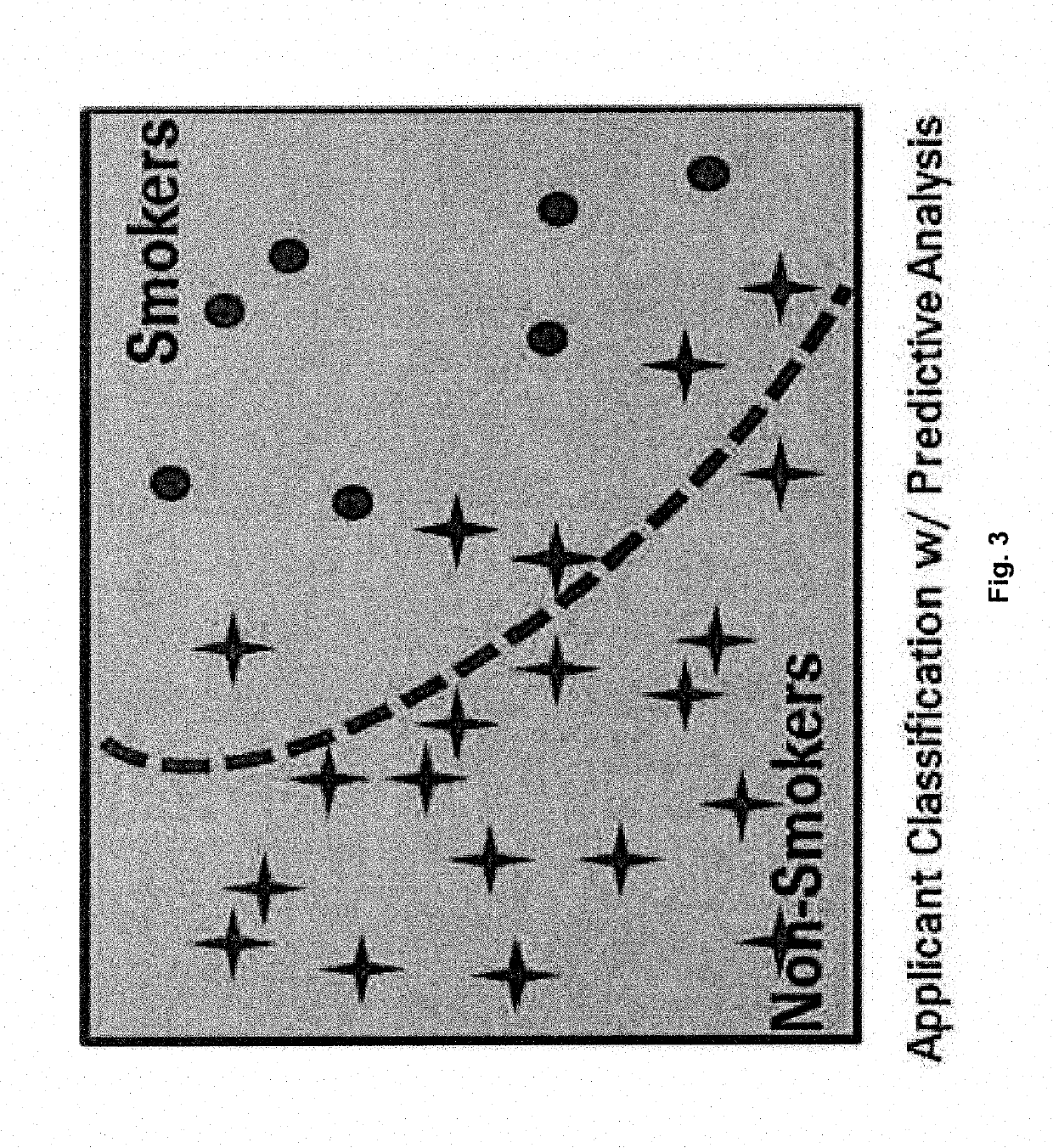

An automated, real-time mortality classification and signaling system for real-time risk assessment, and adjustment based on an automated selective multi-level triage process, where risks associated with a plurality of risk-exposed individuals are at least partially transferable from a risk-exposed individual to a first insurance system and from the first insurance system to an associated second insurance system, the real-time mortality classification and signaling system accesses a database stored in a memory to retrieve risk classes, identifies and selects a specific risk class associated with the risk of the exposed individual, processes specific parameters of the exposed individual using a machine learning-based pattern recognition to automatically assign risk-exposed individuals with detected non-smoking patterns to a second triage channel, and automatically assigning risk-exposed individuals with detected smoking patterns to a third triage channel as predicted smokers. Based on the classified risk, the system provides an alert notification to a third-party system.

Owner:SWISS REINSURANCE CO LTD

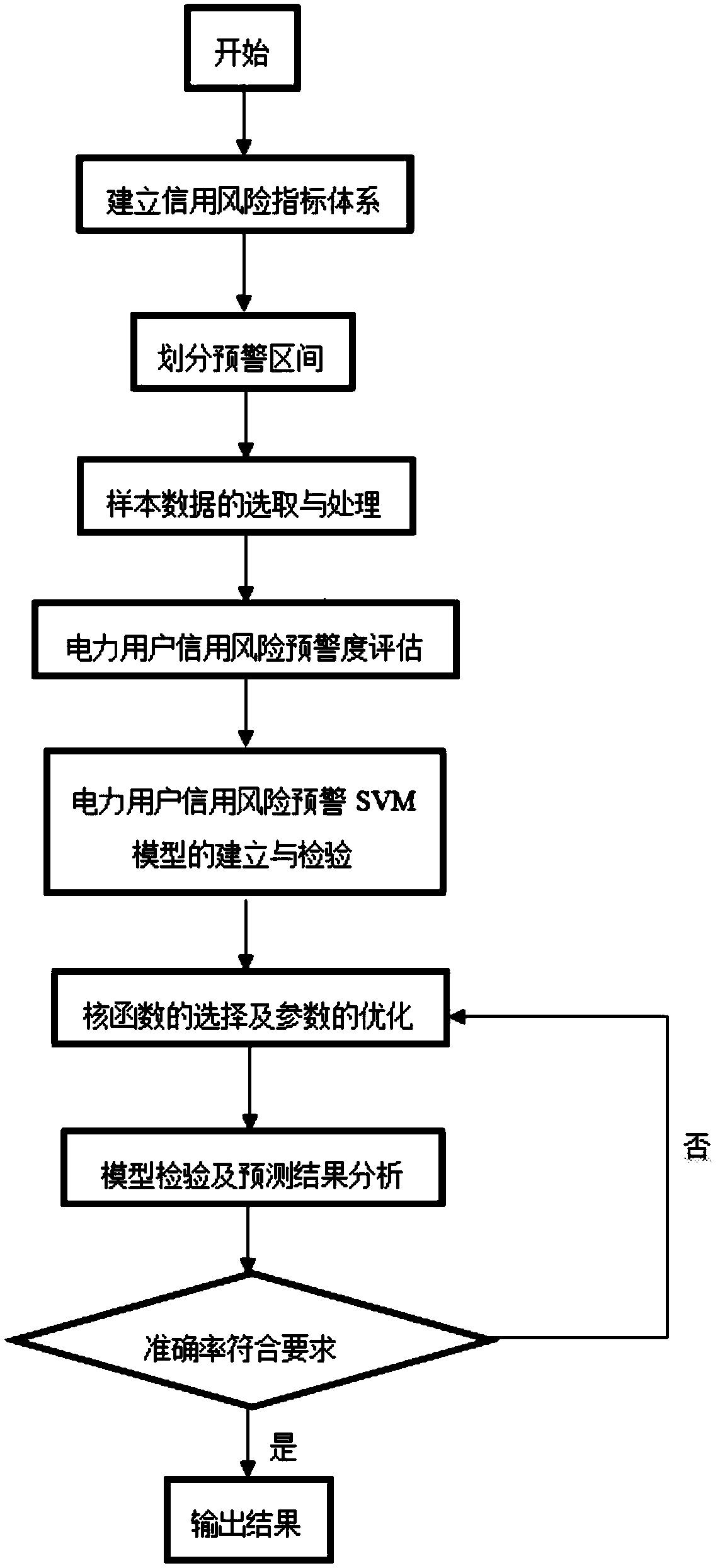

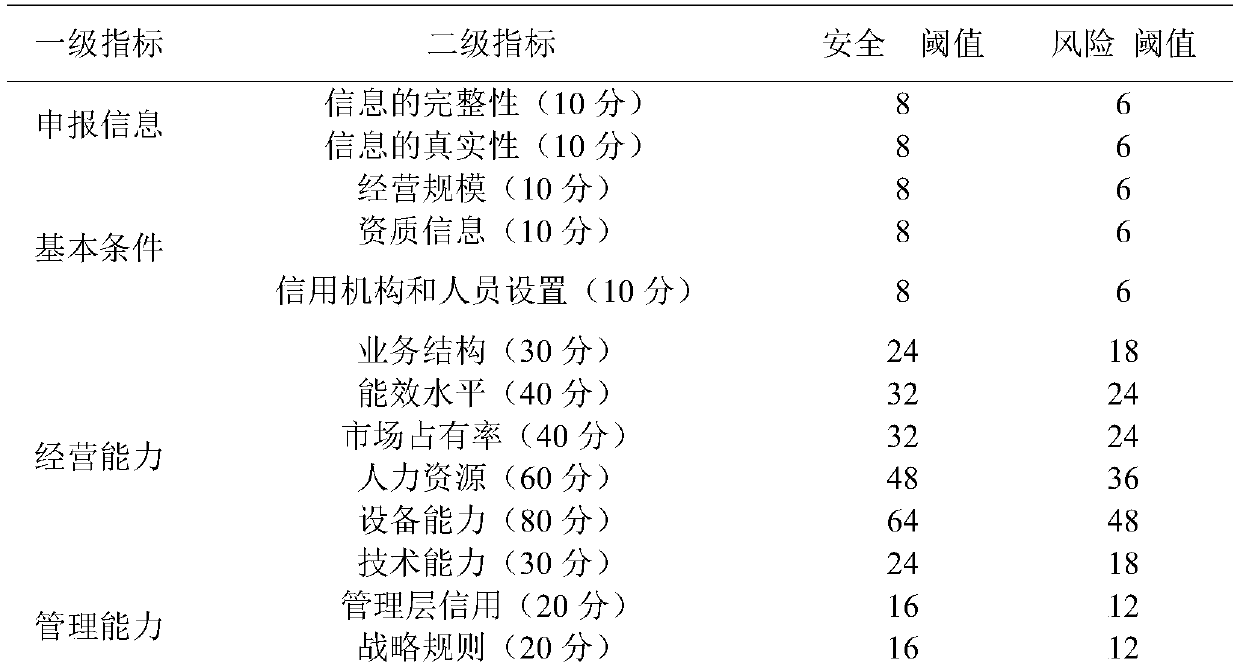

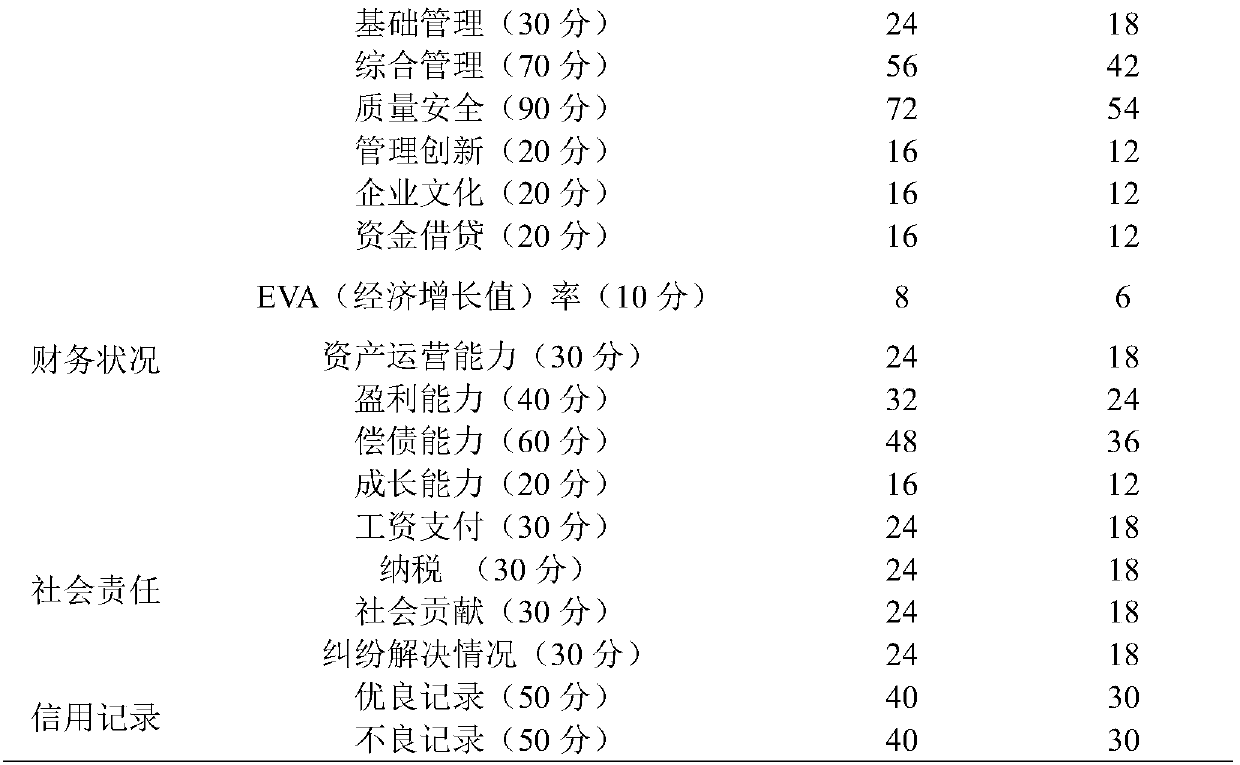

SVM-based power consumer credit risk early warning method and system

InactiveCN110458313AImprove forecast accuracyGood warningForecastingResourcesSmall samplePrincipal component analysis

The invention relates to an SVM-based power consumer credit risk early warning method and system, and the method comprises the steps: setting a threshold value for a power consumer credit risk basic index, and dividing risk early warning intervals of different power consumer credit risk basic indexes according to the threshold value; selecting sample data, processing the sample data, distributingcorresponding weights to the power consumer credit risk basic indexes by using a principal component analysis method, calculating a risk early warning evaluation value of the sample data, and dividingrisk categories where the risk early warning evaluation value is located according to the risk early warning evaluation value; establishing a power consumer credit risk early warning SVM model, and predicting the power consumer credit risk; and taking the obtained optimal parameter value as a parameter value of a power consumer credit risk early warning SVM model, and optimizing the power consumer credit risk early warning SVM model. According to the method, parameter optimization is carried out through the SVM classification model, the prediction accuracy for the nonlinear relationship and the small sample model is high, and a good early warning effect is achieved in credit risk early warning.

Owner:SHENYANG INST OF AUTOMATION - CHINESE ACAD OF SCI +2

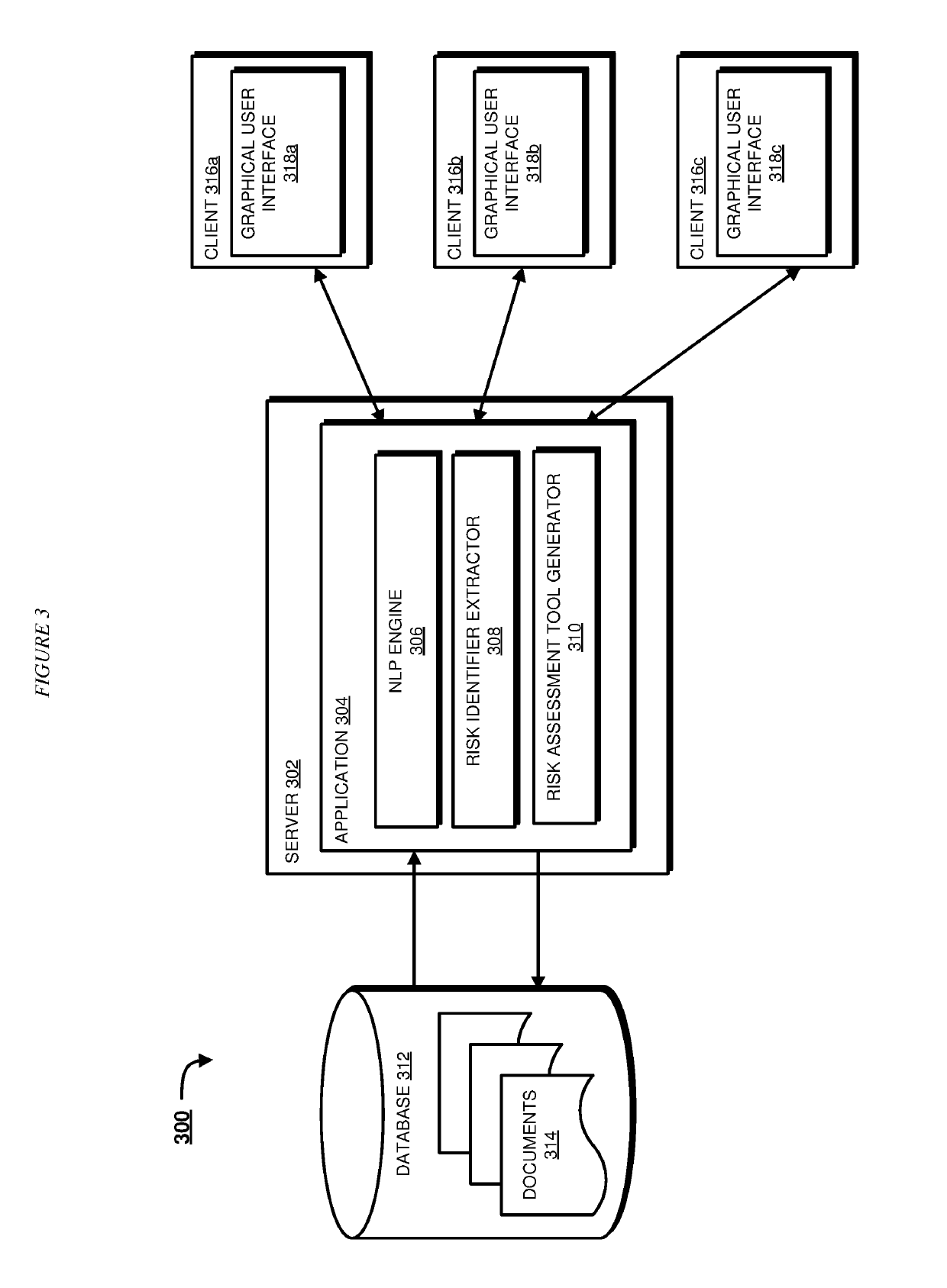

Generating risk assessment software

One or more portions of a text corpus indicative of operational risk from a set of risk assessment documents is identified. Contextual features from the one or more portions of the text corpus are determined by applying a natural language processing (NLP) algorithm on the one or more portions. Risk identifiers are extracted based on the determined contextual features. A risk assessment software is generated based on the extracted risk identifiers and an operational risk category.

Owner:IBM CORP

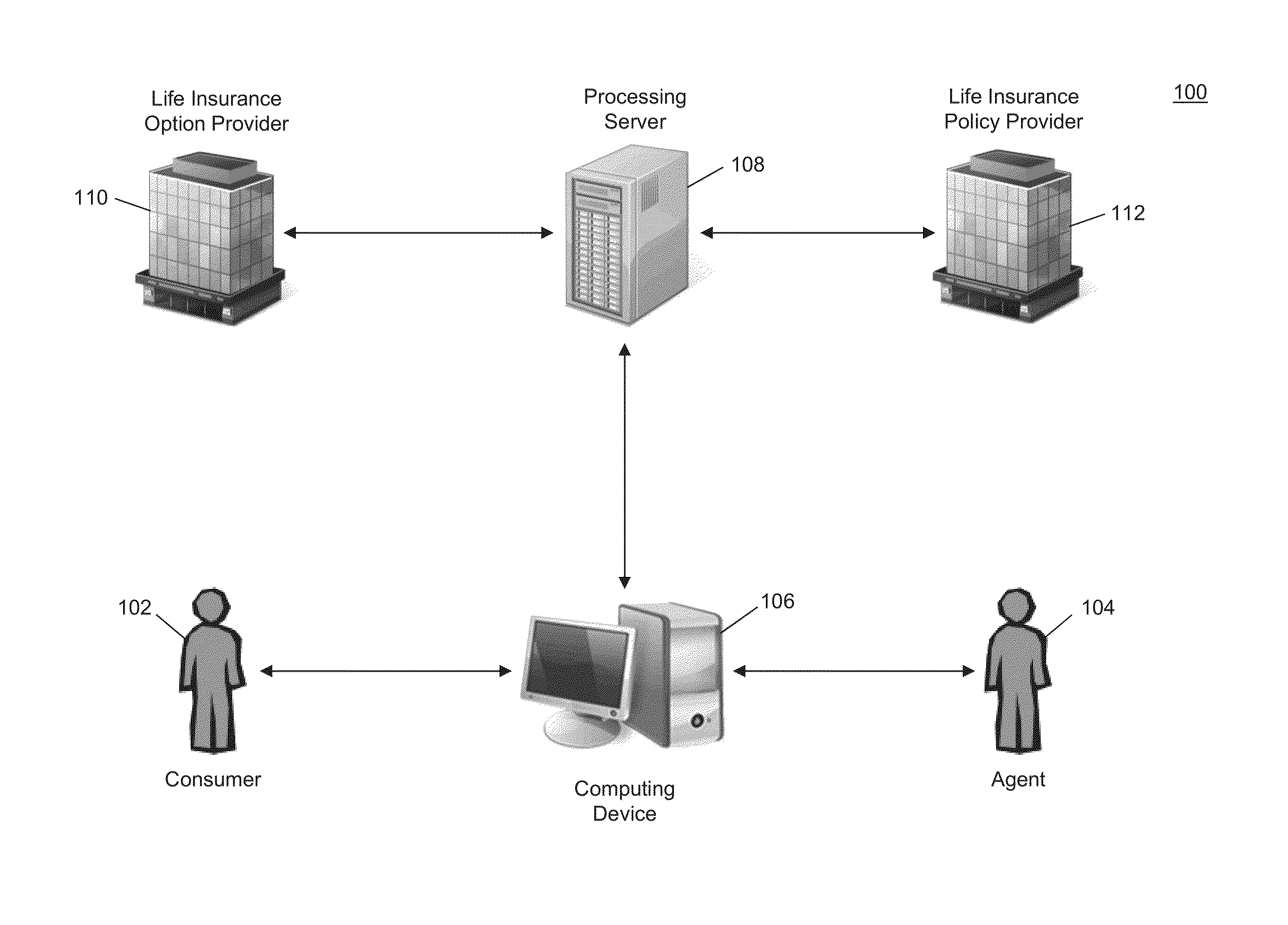

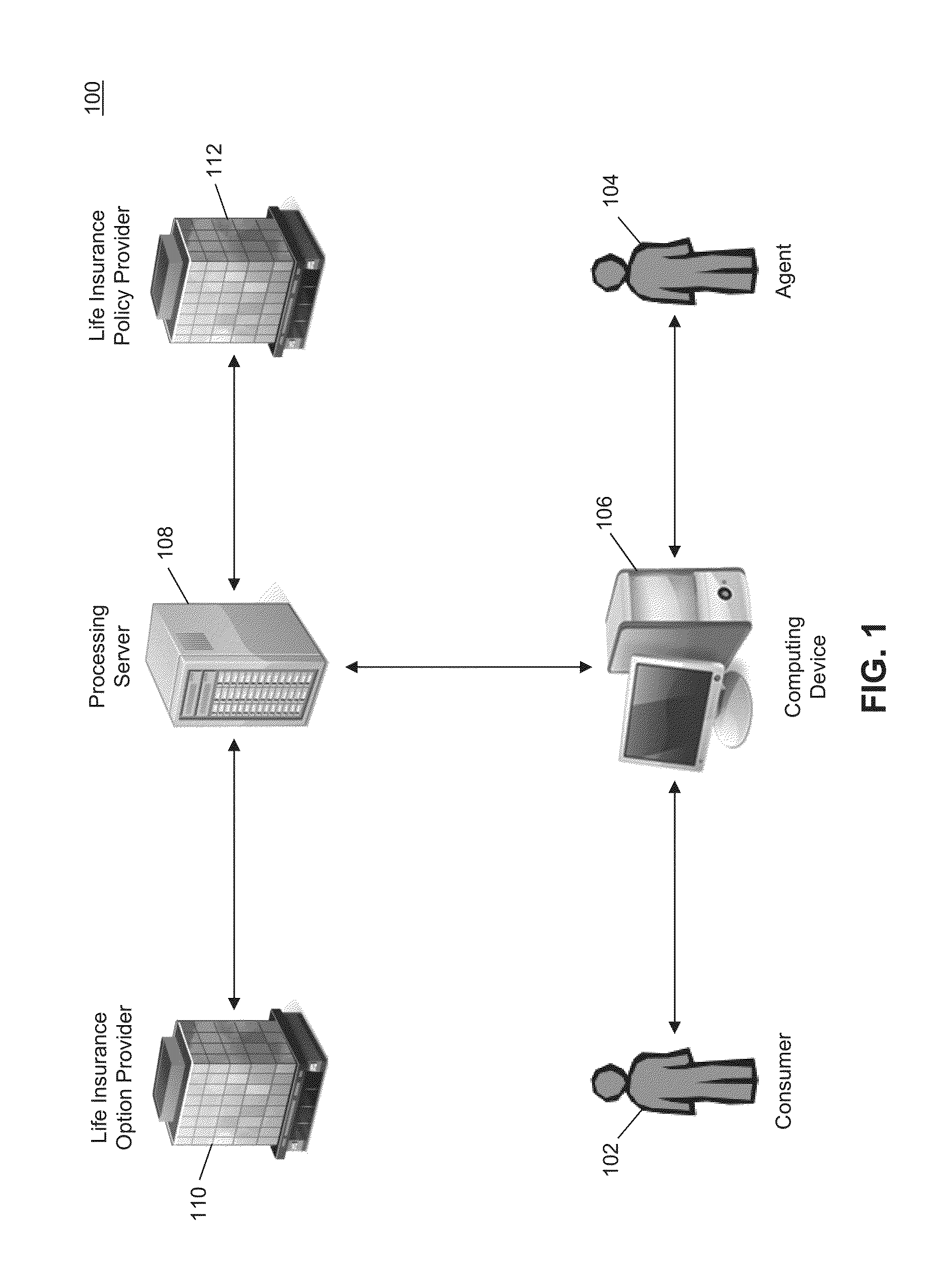

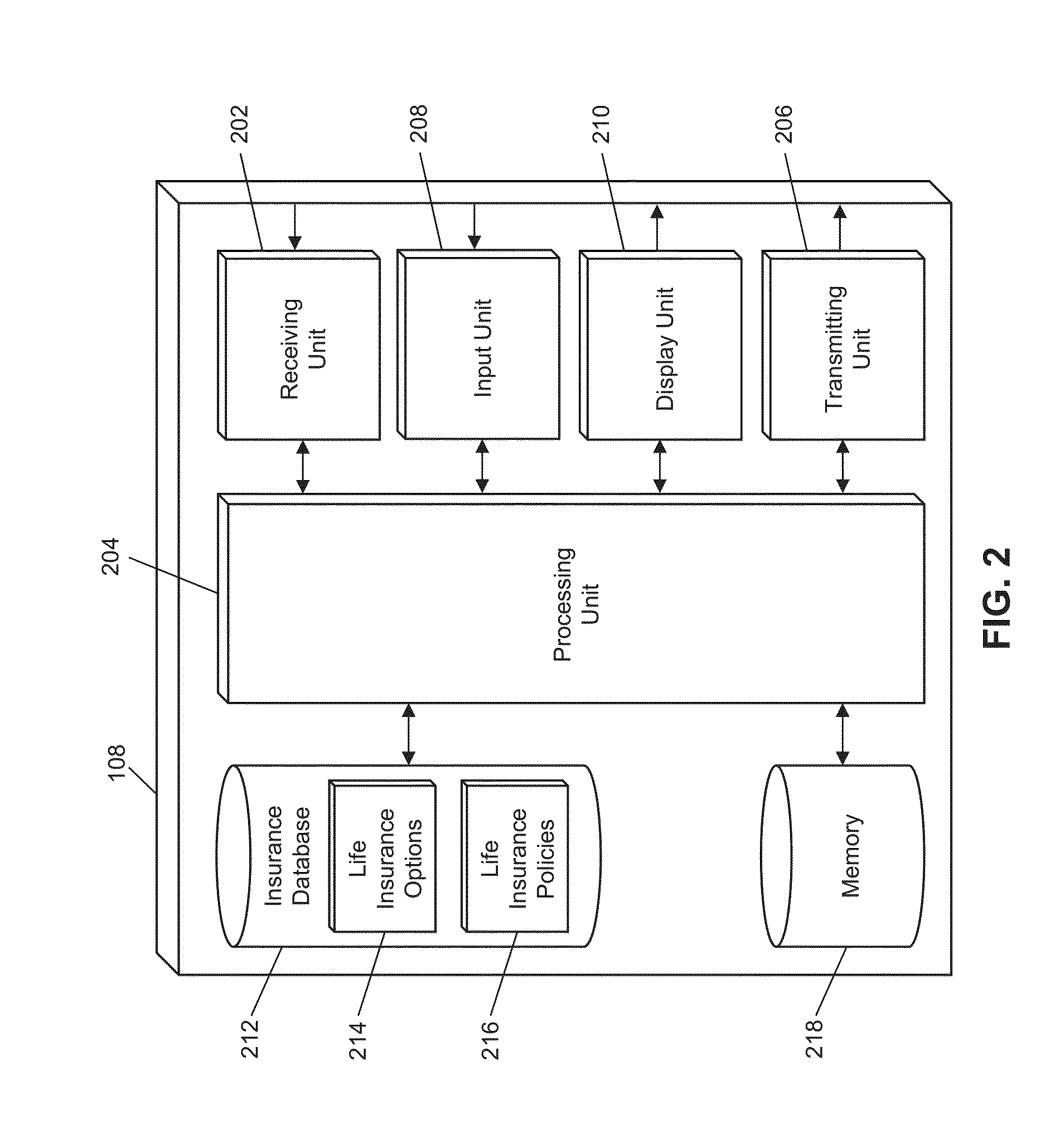

Method and System for Generating and Distributing Optimized Life Insurance Packages and Visual Representations Thereof

A method for generating an optimized life insurance package includes the steps of collecting consumer data comprising an age and a risk class, determining a match between at least one life insurance policy and at least one Life Insurance Option, wherein the match is determined based at least partially on a period of coverage for the at least one life insurance policy and at least a portion of the consumer data, generating an optimized life insurance package comprising the at least one Life Insurance Option, and transmitting data configured to generate at least one graphical user interface comprising a visual representation of the optimized life insurance package. Other methods, systems, and computer program products are also disclosed.

Owner:INSAMCO HLDG

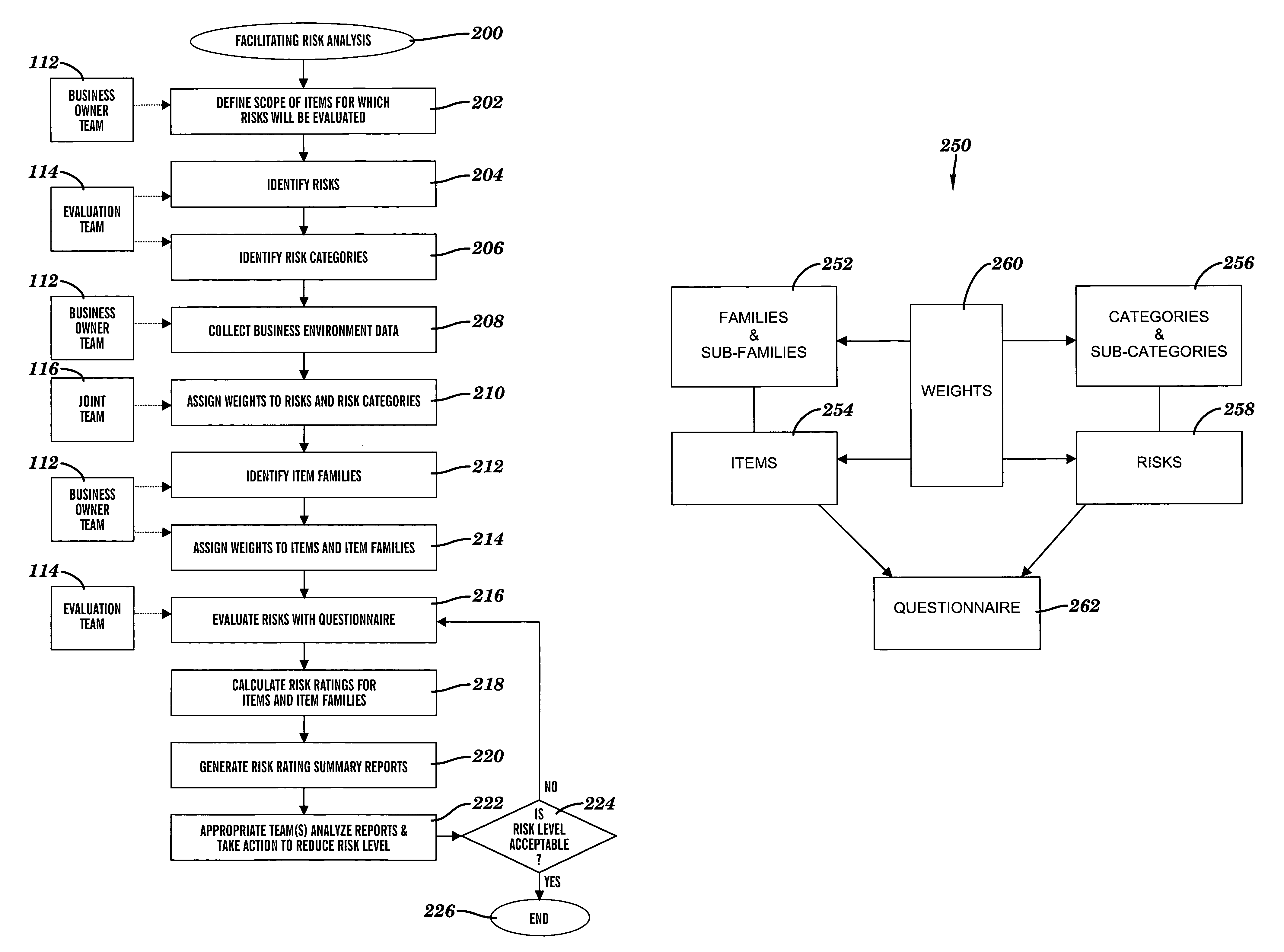

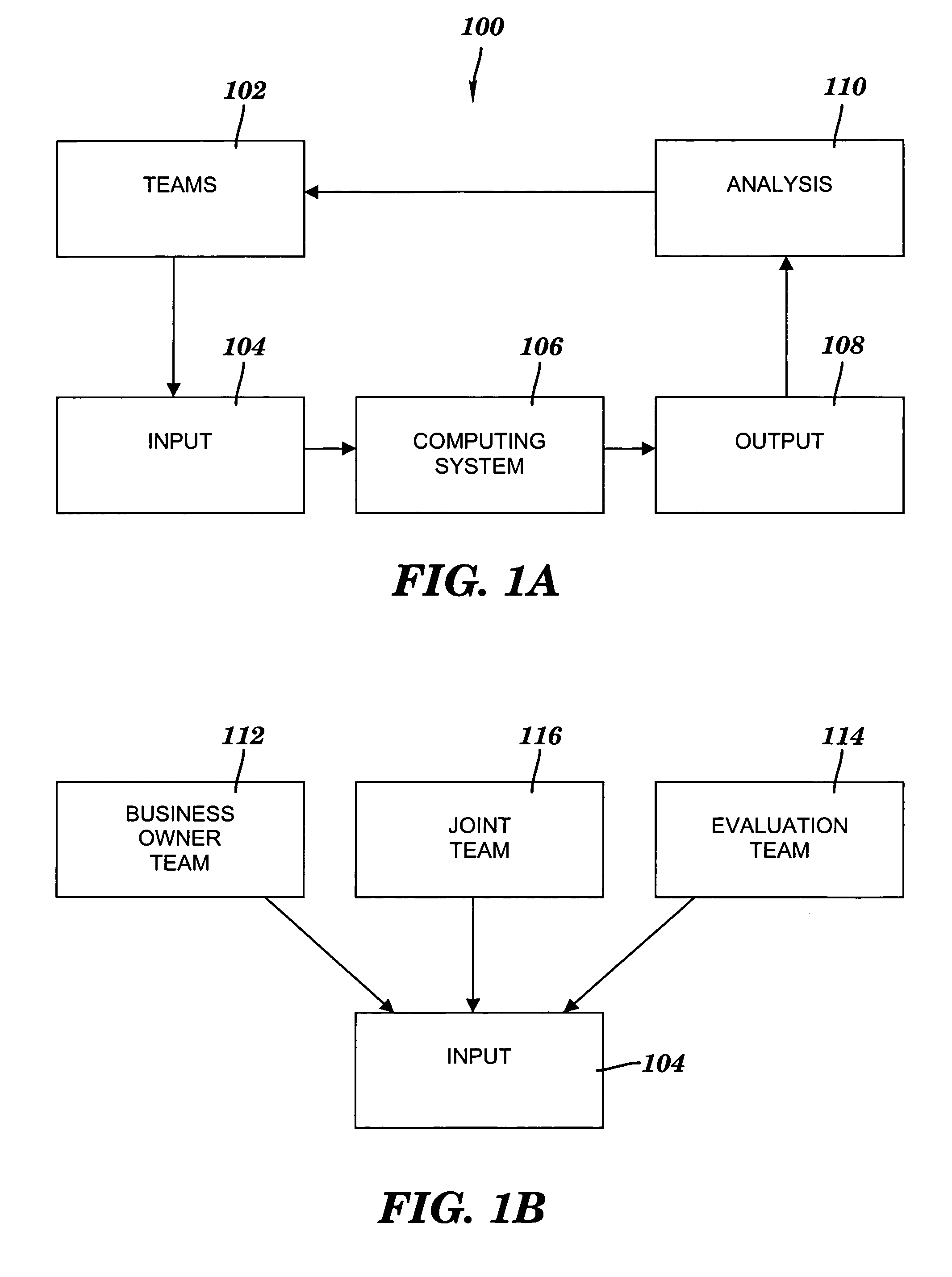

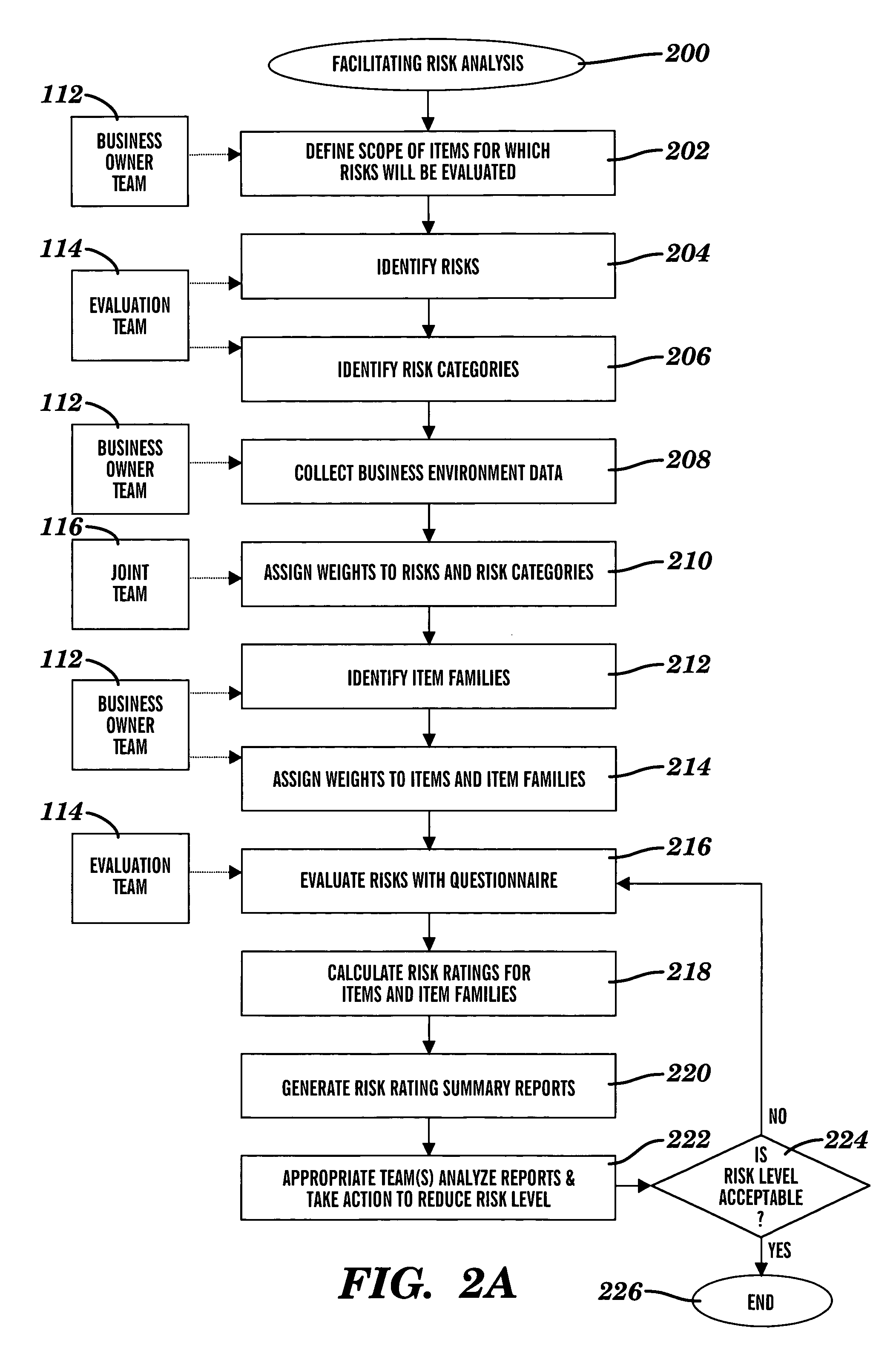

Summarizing risk ratings to facilitate an analysis of risks

A method and system for summarizing risk ratings to facilitate an analysis of risks. Items related by a common business function, risks associated with each item, sub-categories of risks, and categories of risks are weighted. For each item, each associated risk is evaluated by comparing responses on a questionnaire to predetermined acceptable answers. A first summarized risk rating based on weights of risks, a sub-category, a category, and an item is calculated. A second summarized risk rating based on weights of risks, the sub-category, and the item is calculated. A first summary report that includes a hyperlink and the first summarized risk rating is displayed. In response to selecting the hyperlink, a second summary report that includes the second summarized risk rating is automatically displayed. Actions are performed to mitigate risks in response to determining that the first and second summarized risk ratings exceed predetermined values.

Owner:SERVICENOW INC

Flexible catastrophe bond

ActiveUS7711634B2Reduce transaction costsImprove scalabilityFinanceCommerceNatural disasterNatural catastrophe

Methods and apparatus, including computer program products, for securitizing natural catastrophe risk. One or more risk classes representing natural catastrophe risks is are established, and a first collection of risk instruments of a first risk class of the one or more risk classes is issued. Each risk class is recurringly issuable as risk instruments providing a return on an investment. The amount of the return for a risk instrument is contingent upon the occurrence of a realization event for the corresponding represented natural catastrophe risk. Collections of risk instruments issued from recurringly issuable risk classes are also described.

Owner:SWISS REINSURANCE CO LTD

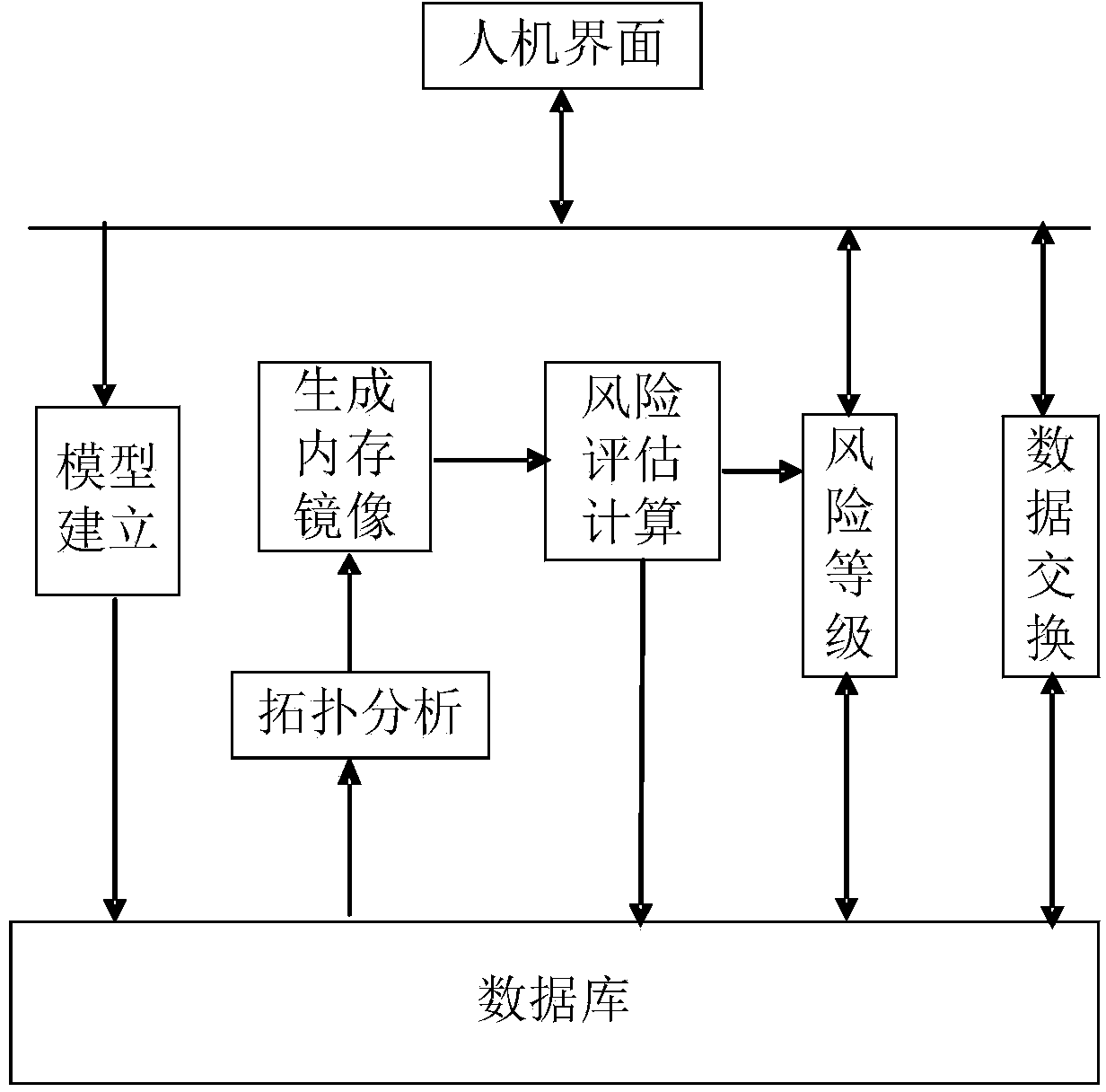

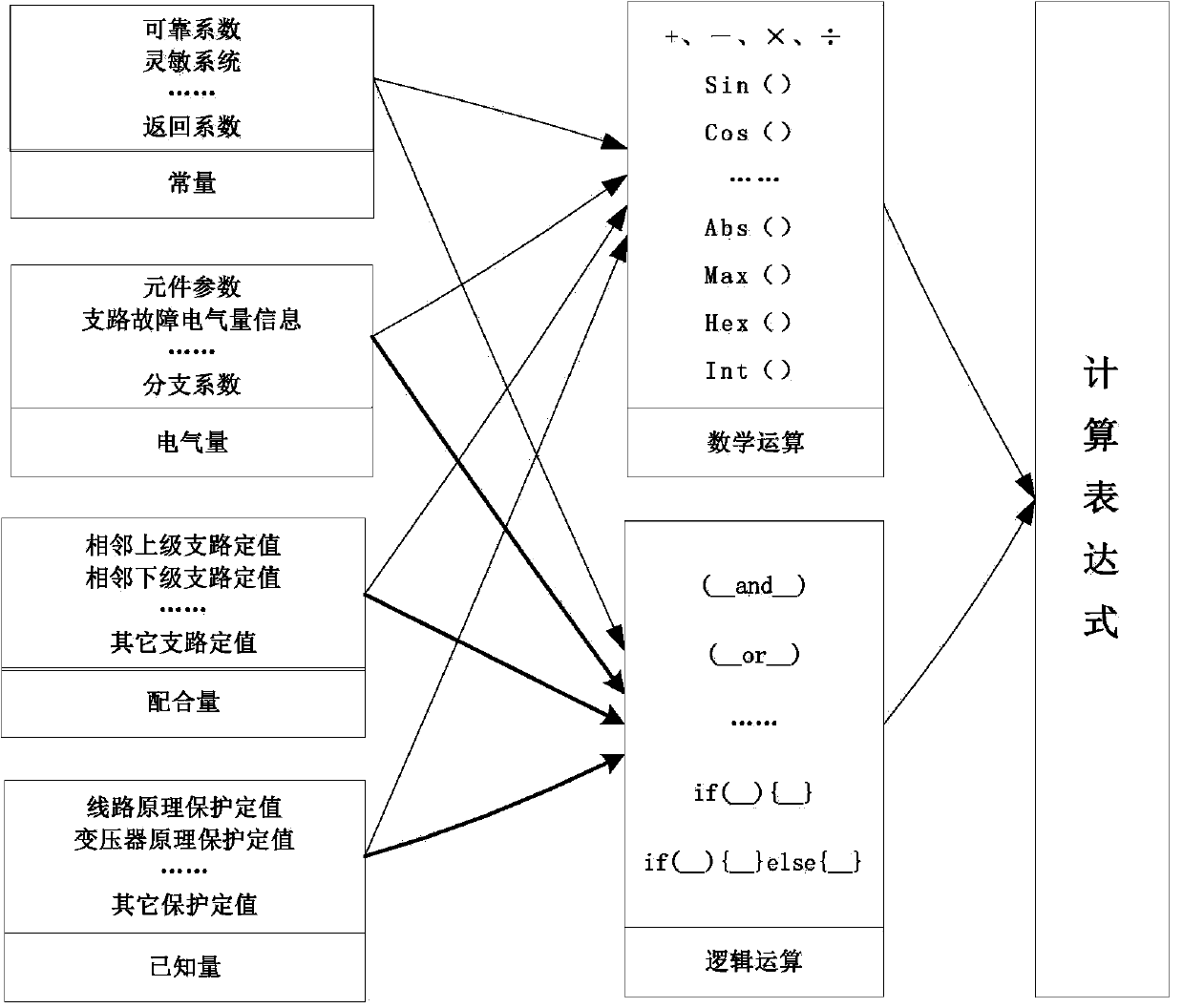

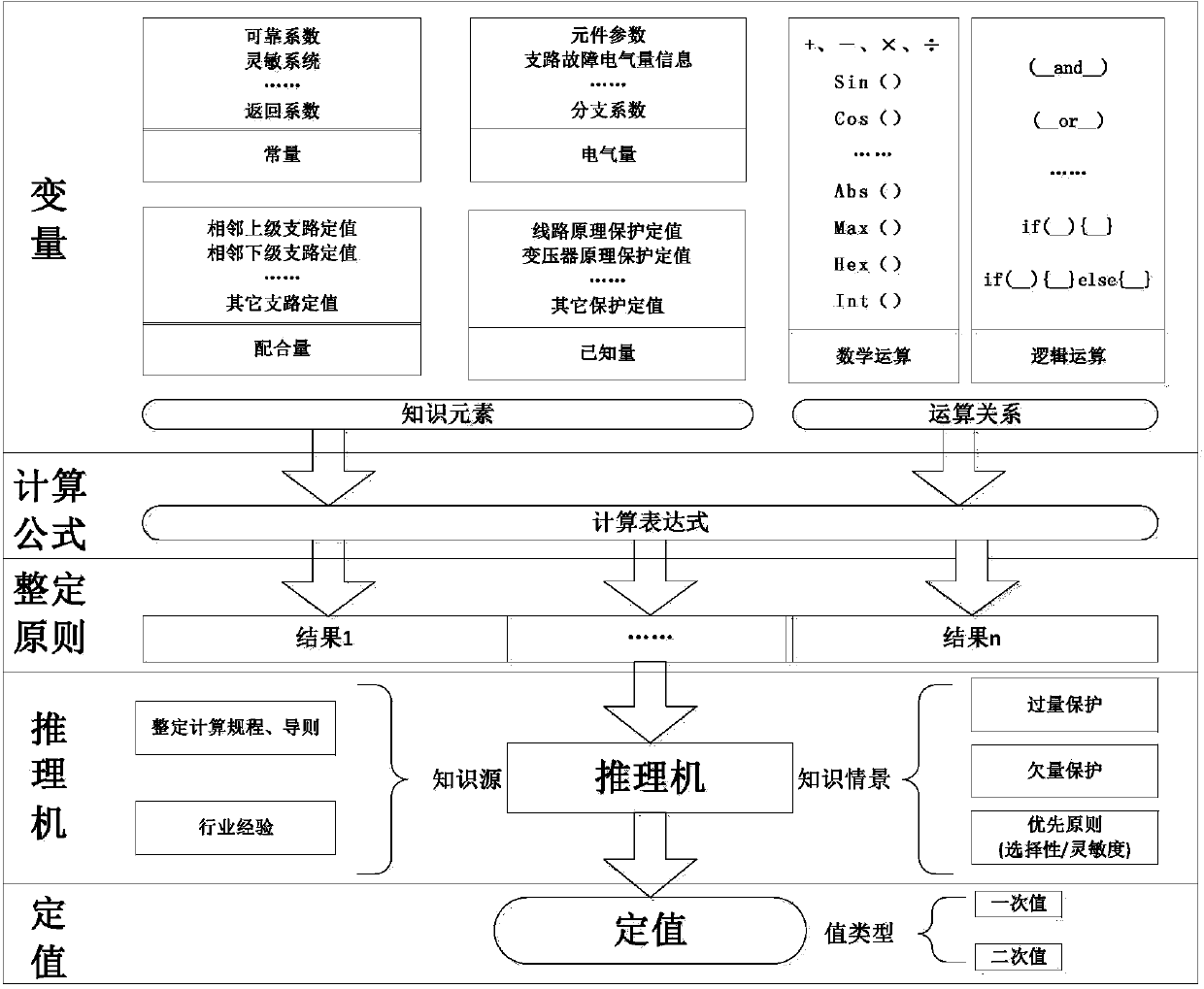

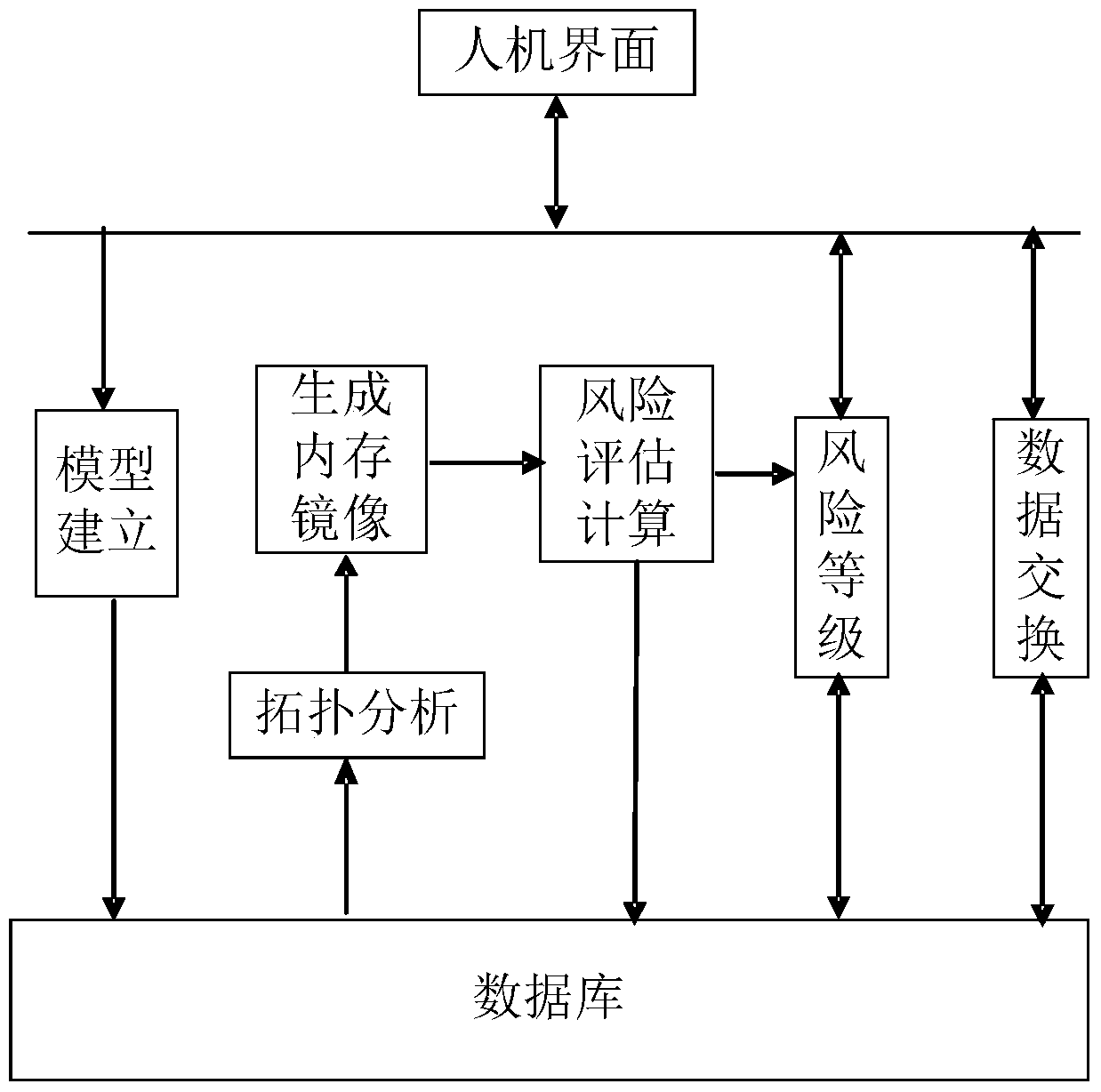

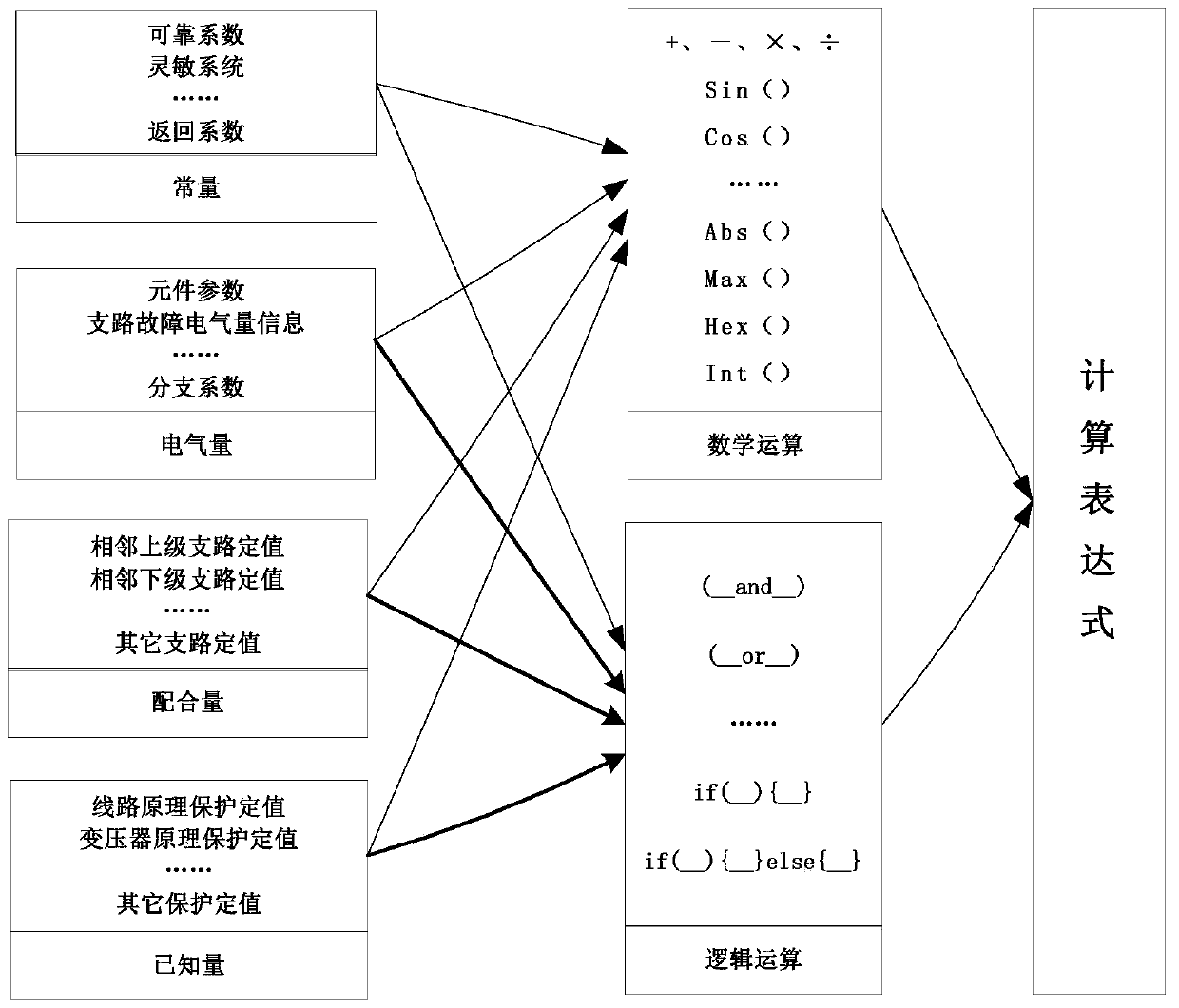

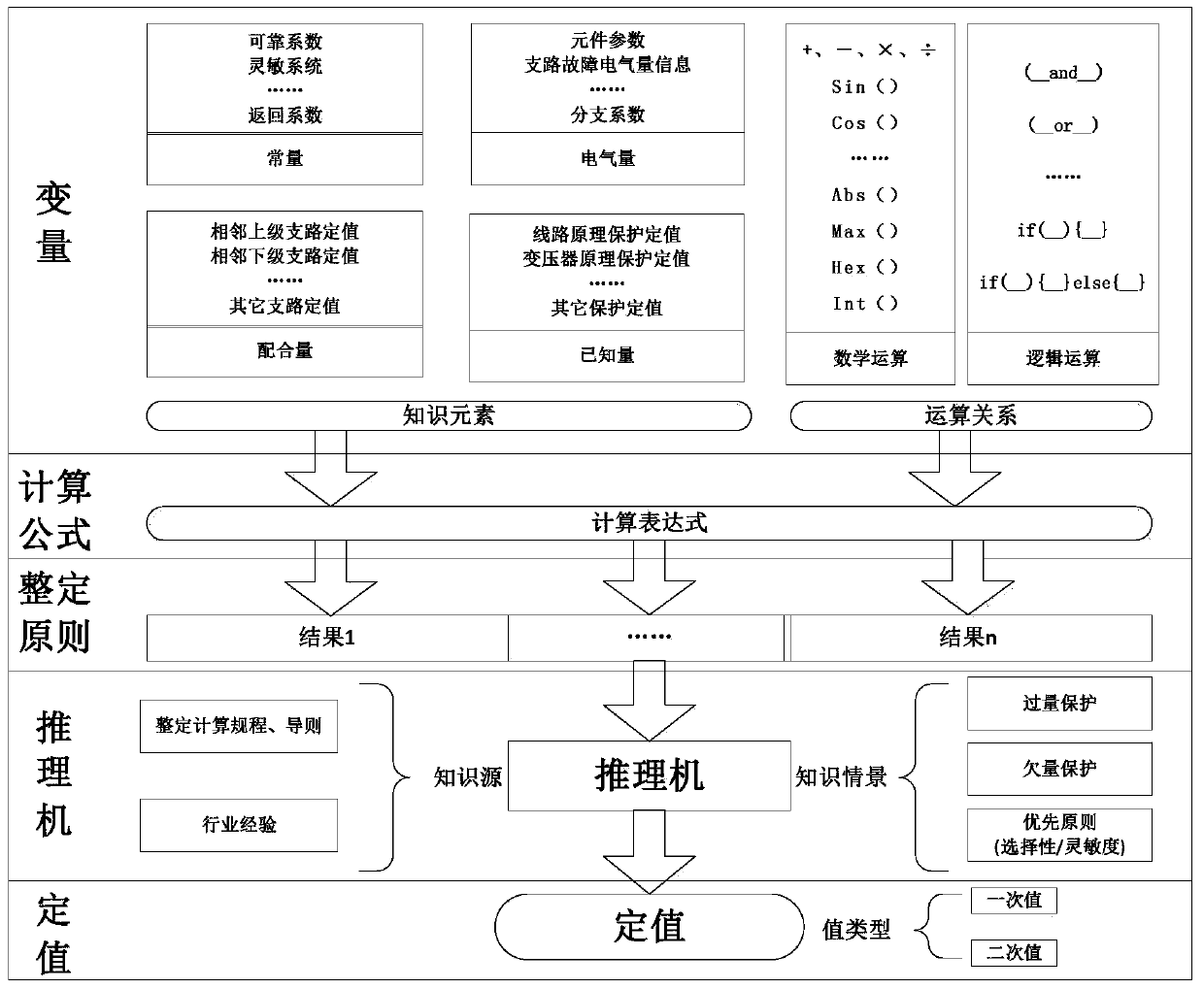

Grid-related power plant relay protection fixed value risk evaluation system based on expert system

ActiveCN103632308AReduce the risk of unreasonableEasy to operateData processing applicationsOperabilityEngineering

The invention discloses a grid-related power plant relay protection fixed value risk evaluation system based on an expert system. The grid-related power plant relay protection fixed value risk evaluation system is high in operability, high in efficiency and scientific and comprises building of a model, risk evaluation calculation, determination of the risk class and input / output of data.

Owner:POWER DISPATCHING CONTROL CENT OF GUANGDONG POWER GRID CO LTD +1

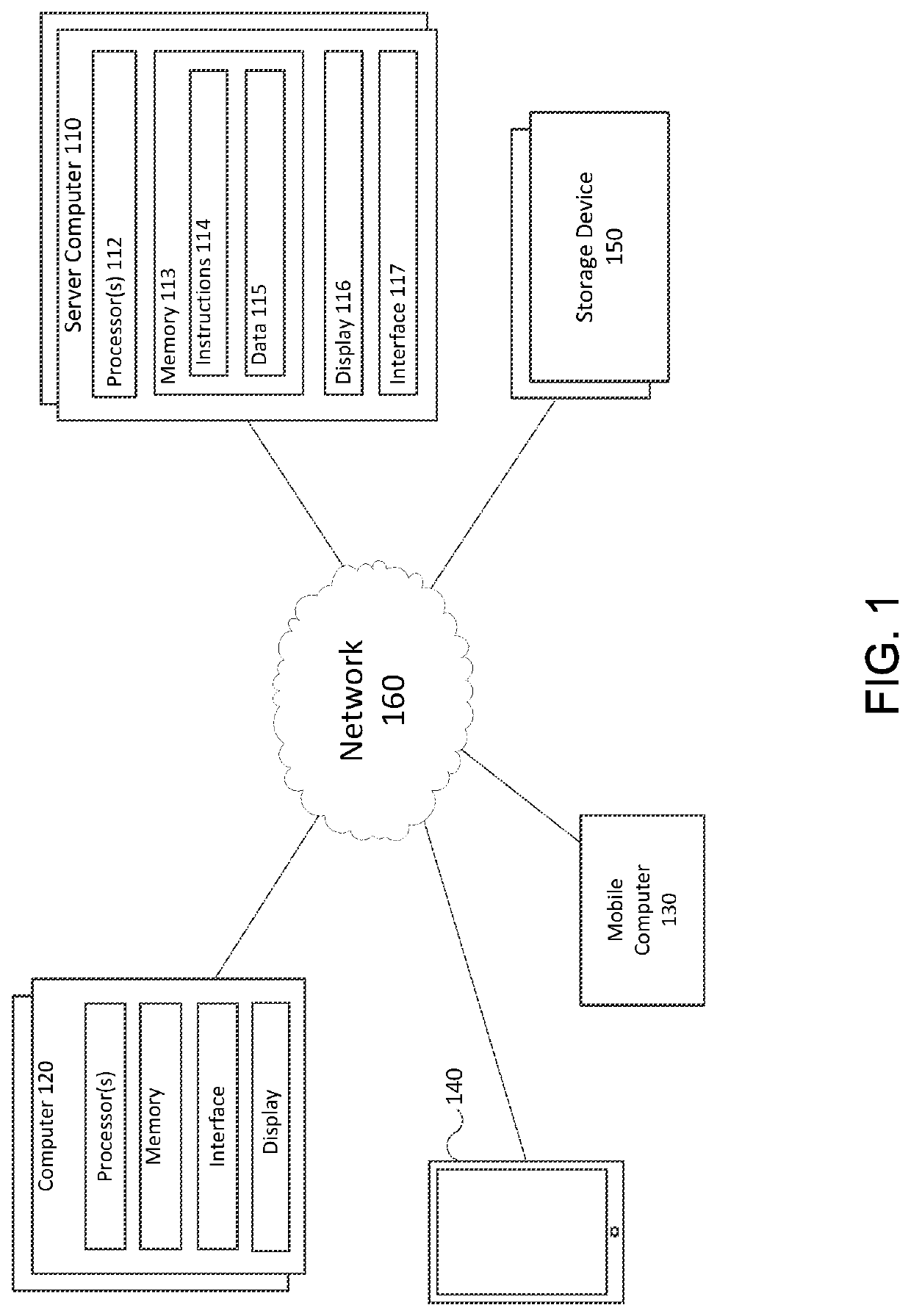

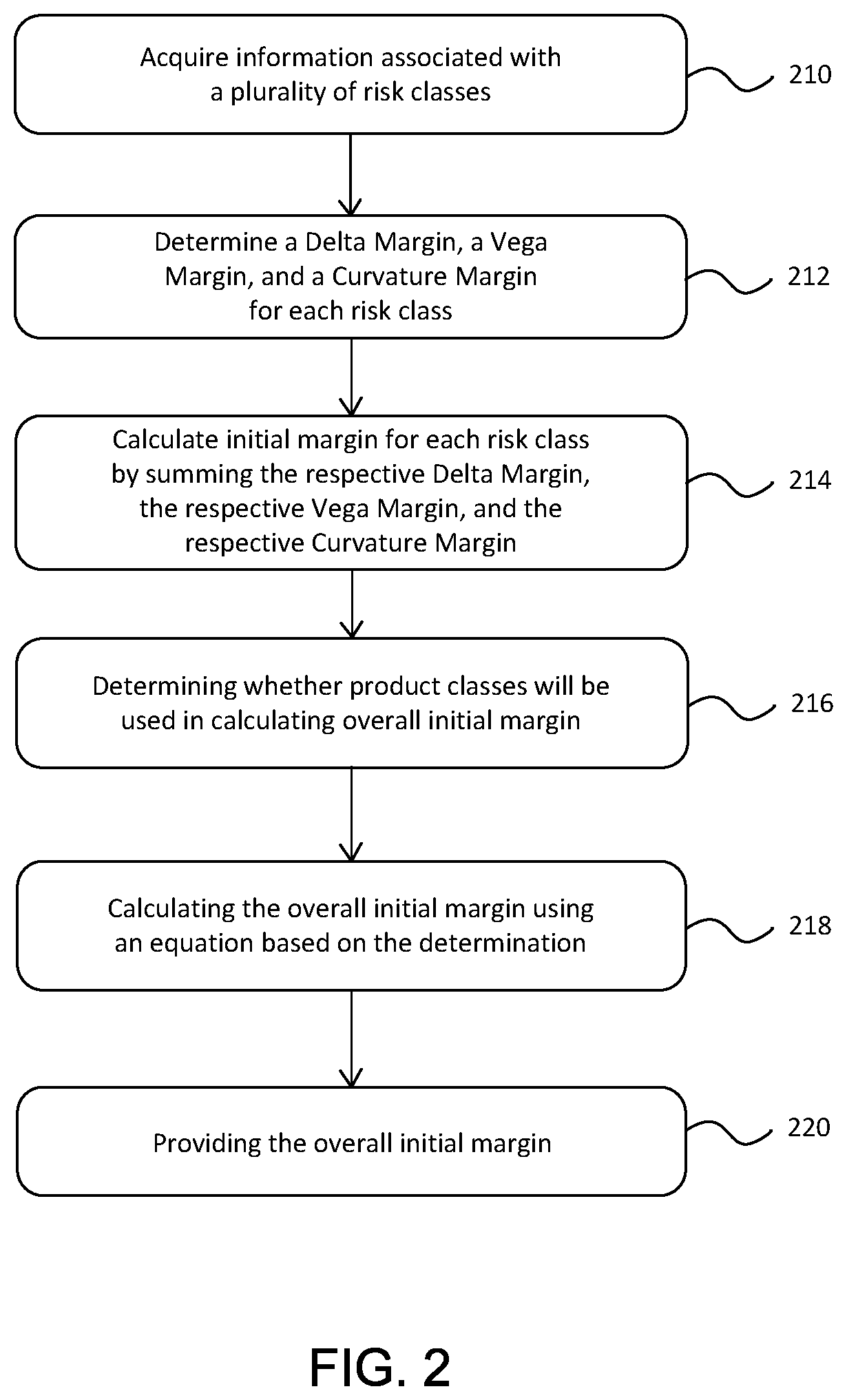

Method and system for calculating and providing initial margin under the standard initial margin model

A Standard Initial Margin Model (SIMM) is calculated and provided as an overall initial margin for non-cleared derivatives. In certain embodiments, using at least one computing device, information associated with a plurality of risk classes is acquired, and a delta margin, a vega margin, and a curvature margin for each risk class based on the acquired information associated is determined. The at least one computing device calculates initial margin for each risk class by summing the respective delta margin, the respective vega margin, and the respective curvature margin. The at least one computing device determines whether product classes will be used in calculating the overall initial margin, calculates the overall initial margin using an equation based on the determination, and provides the overall initial margin. The amount of the initial margin call for the underlying derivatives contract may then be generated based on the calculated initial margin.

Owner:INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION

Automated mortality classification system for real-time risk-assessment and adjustment, and corresponding method thereof

A system and method for real-time risk-assessment and adjustment, risks associated with a plurality of risk exposed individuals being at least partially transferable from a risk exposed individual to a first insurance system and / or from the first insurance system to an associated second insurance system. The system including a table with retrievable stored risk classes each comprising assigned risk class criteria, individual-specific parameters of the risk exposed individuals being captured relating to criteria of the stored risk classes by the system and stored in a memory, and a specific risk class associated with the risk of the exposed individual being identified out and selected of the stored risk classes by the system based on the captured parameters.

Owner:SWISS REINSURANCE CO LTD

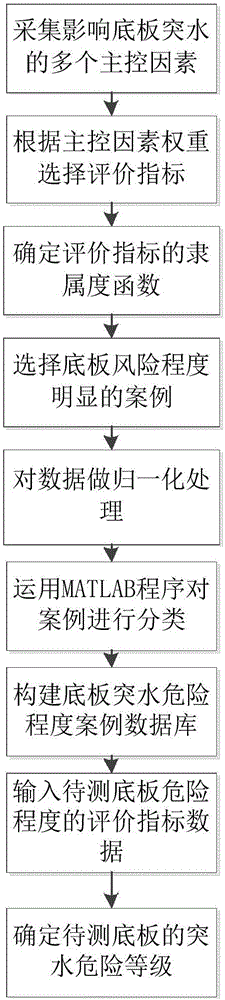

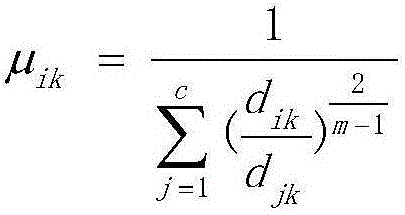

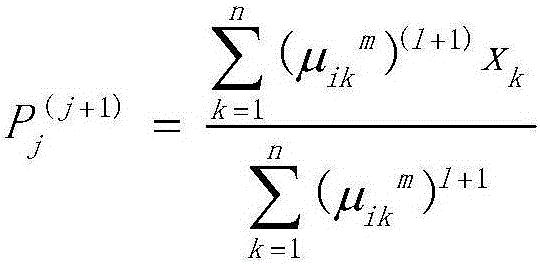

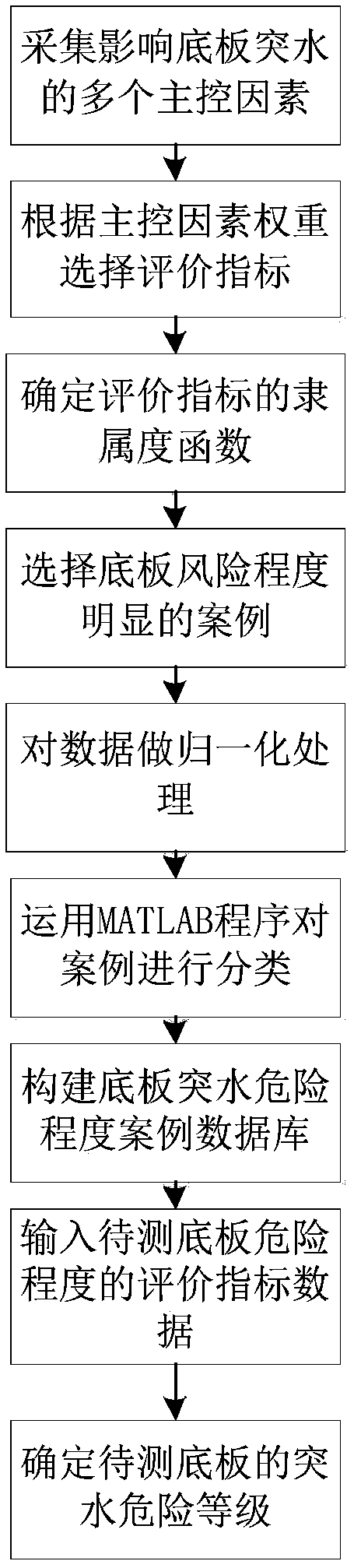

Method for judging floor water inrush risk degree of deep well

The invention discloses a method for judging the floor water inrush risk degree of a deep well and belongs to the field of mine safety analysis. A plurality of main controlling factors affecting the floor water inrush are collected firstly, evaluation indexes are weighed and selected according to the main controlling factors, the subordinating degree function of the evaluation indexes is determined, a floor water inrush obvious case is selected by the combination of the practical floor water inrush condition, sample data of the floor water inrush are subjected to normalization processing, cases are classified by an MATLAB program, and a floor water inrush risk degree case data base is constructed; finally the evaluation index data of the to-be-tested floor water inrush risk degree are input to determine the to-be-tested floor water inrush risk class. The method can evaluate the plurality of main controlling factors, and technical support is provided for deep mine exploitation safety.

Owner:SHANDONG UNIV OF SCI & TECH

Multidimensional risk analysis

InactiveUS20160247227A1Limit number of unnecessaryEconomical environmentFinanceComputer scienceRisk class

Owner:DALAL PANKAJ B +1

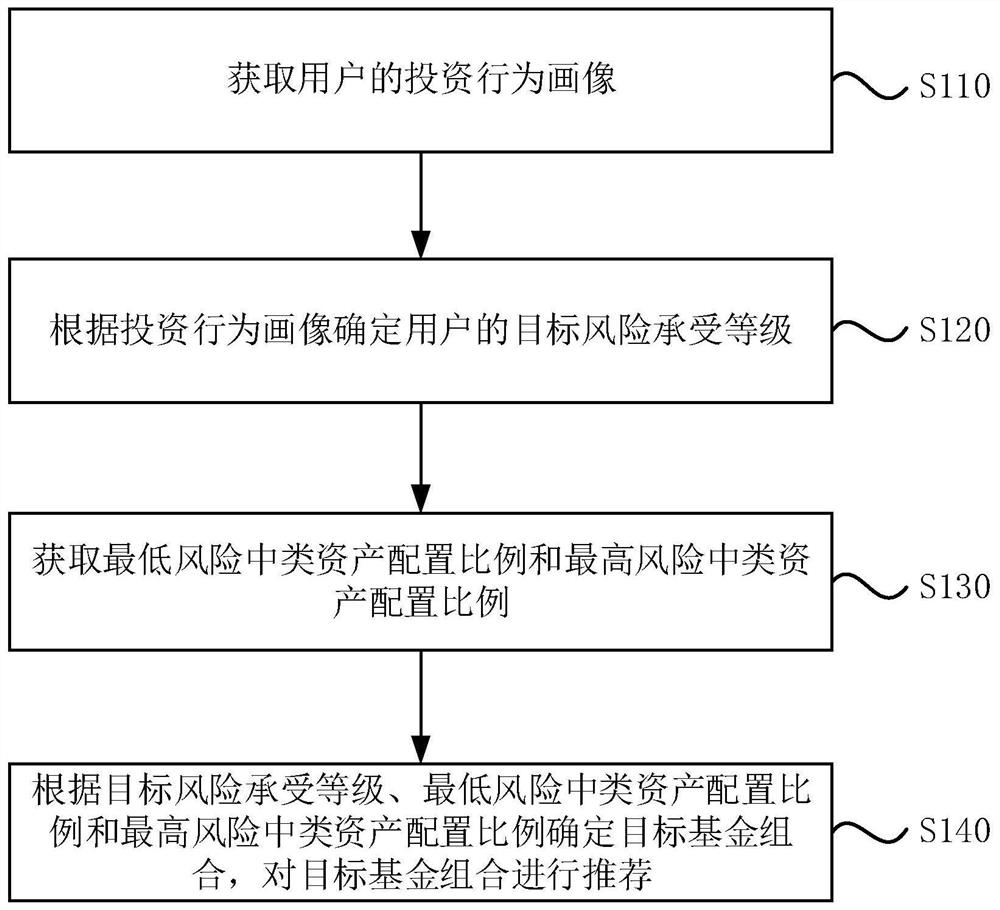

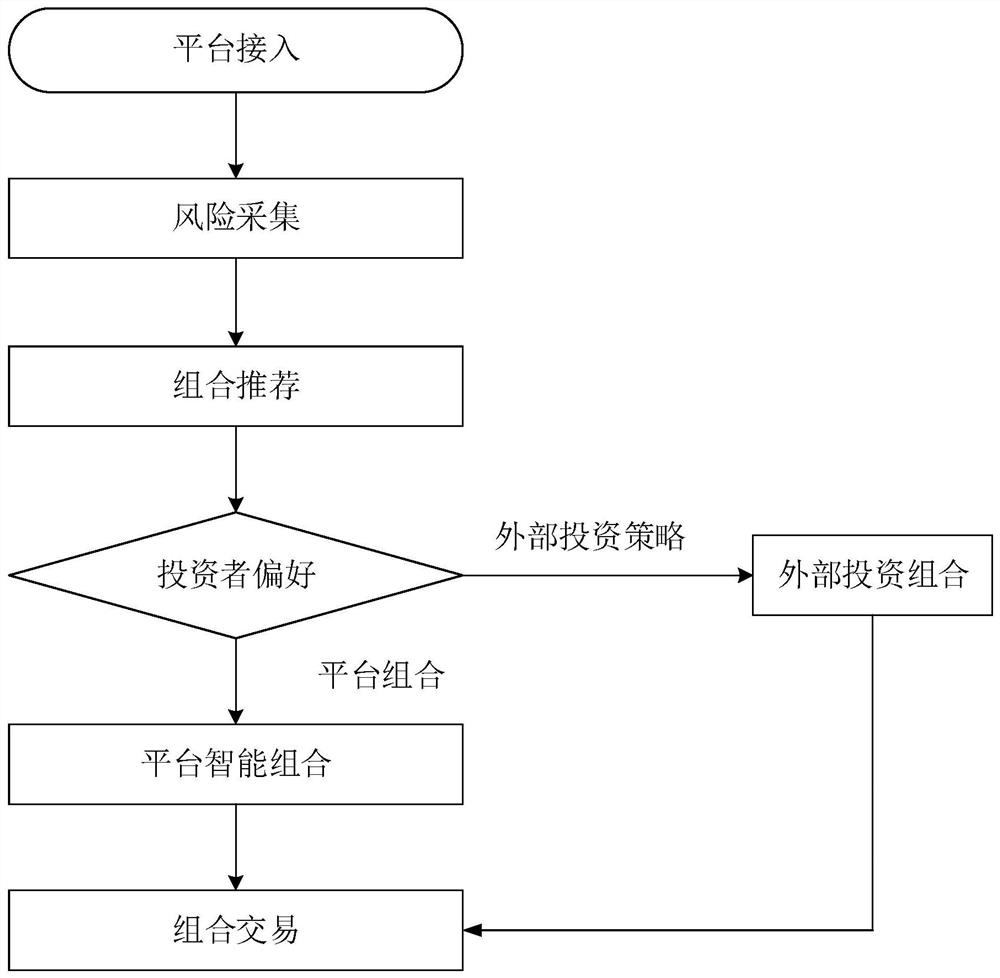

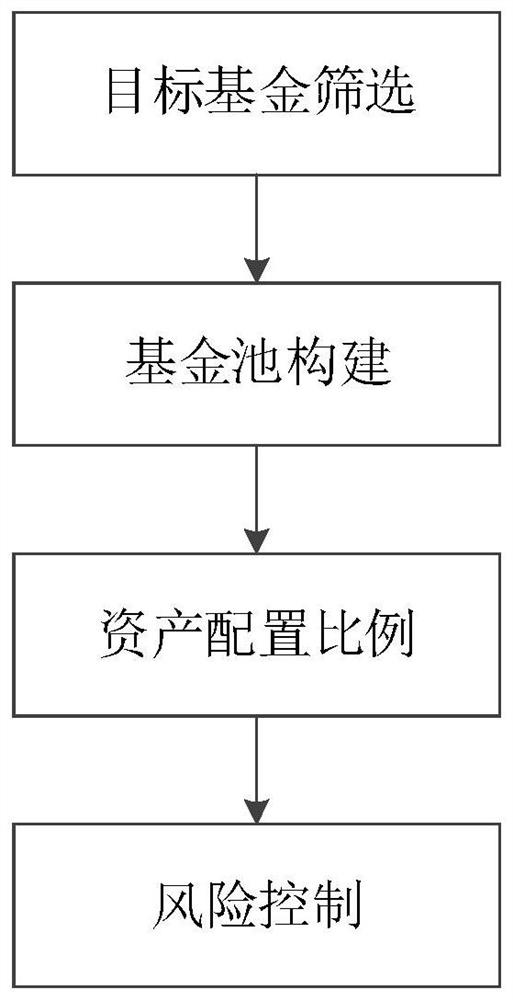

Fund portfolio recommendation method and device, equipment and storage medium

PendingCN113781238ATimely dynamic adjustmentSolve the problem of insufficient controlFinancePersonalizationRisk class

The invention discloses a fund portfolio recommendation method and device, equipment and a storage medium. The method comprises the steps of obtaining an investment behavior portrait of a user; determining a target risk tolerance level of the user according to the investment behavior portrait; obtaining the allocation proportion of the class assets in the lowest risk and the allocation proportion of the class assets in the highest risk; and determining a target fund portfolio according to the target risk tolerance level, the lowest risk class asset allocation proportion and the highest risk class asset allocation proportion, and recommending the target fund portfolio. Through the technical scheme of the invention, a personalized investment scheme can be specially customized for a user, the latest situation of the market can be continuously tracked, and timely dynamic adjustment is carried out on the asset allocation scheme, and fund combinations held by the user are continuously optimized.

Owner:SHANGHAI PUDONG DEVELOPMENT BANK

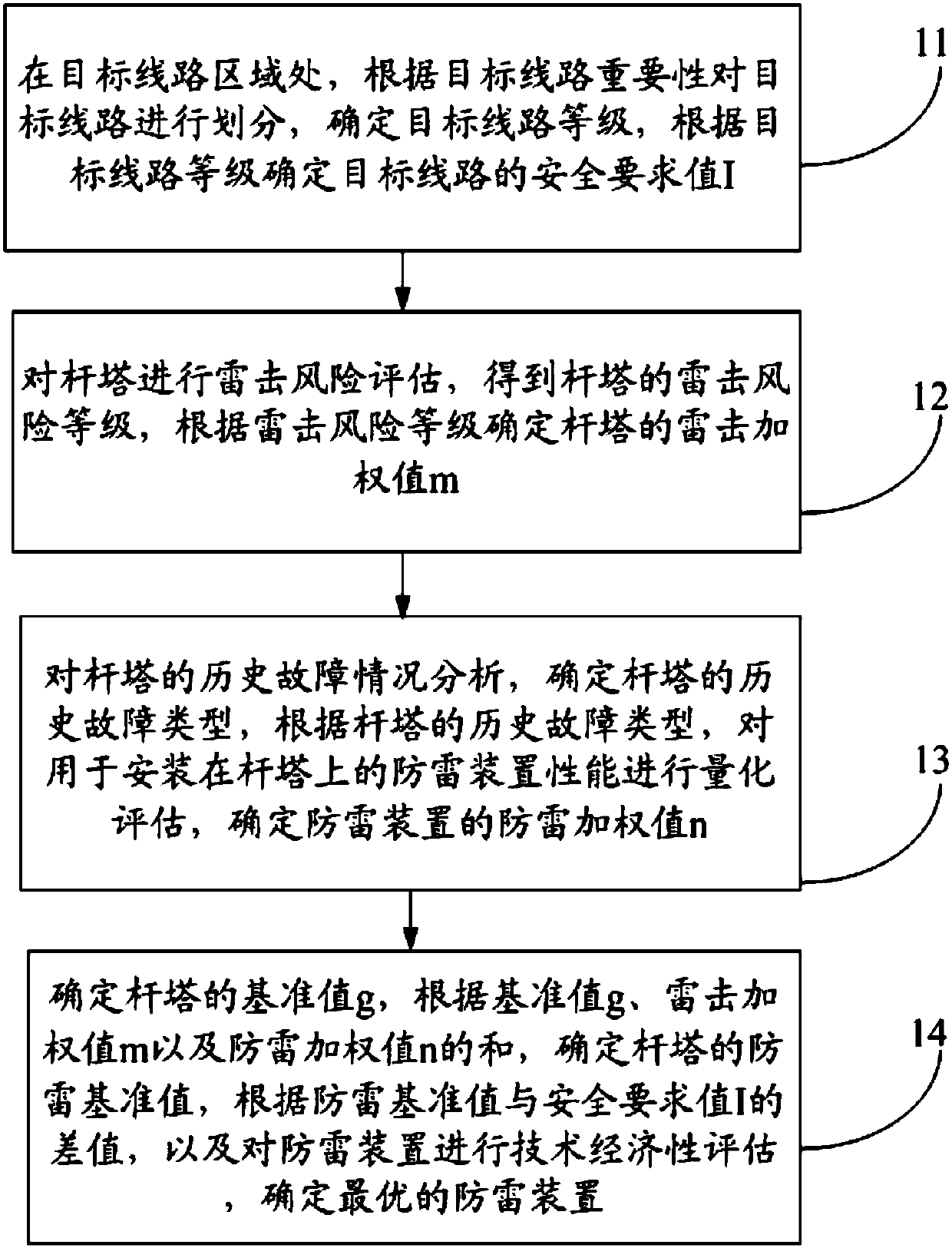

Selection method for lightning protection device of pole tower of power distribution line

InactiveCN107800072ADoes not affect normal operationImprove lightning protection effectResourcesApparatus for overhead lines/cablesLightning strokesEngineering

The invention provides a selection method for a lightning protection device of a pole tower of a power distribution line, and belongs to the technical field of lighting protection. The selection method comprises the steps of determining a target circuit class and a safety request value I at a target circuit region; performing lightning stroke risk estimation on the pole tower to obtain a lightningstroke risk class and a lightning stroke weighted value m of the pole tower; performing quantitative evaluation on performance a lightning protection device; determining a lightning protection weighted value n of the lightning protection device; and determining a reference value g of the pole tower, performing technological economic evaluation on the lightning protection device according to the reference value g, the lightning stroke weighted value m, the lightning protection weighted value n and the safety request value I, and determining optimal lightning protection device. By the steps, the determined lightning protection device with low cost and good lightning protection performance is arranged on the pole tower connected with the power distribution line, so that the lightning protection performance of the power distribution line is accurately corresponding to local lightning protection demand, a power supply circuit is difficult to generate power failure even when lightning strikes weather, and daily and normal running of industrial production are not further affected.

Owner:NINGBO POWER SUPPLY COMPANY STATE GRID ZHEJIANG ELECTRIC POWER +1

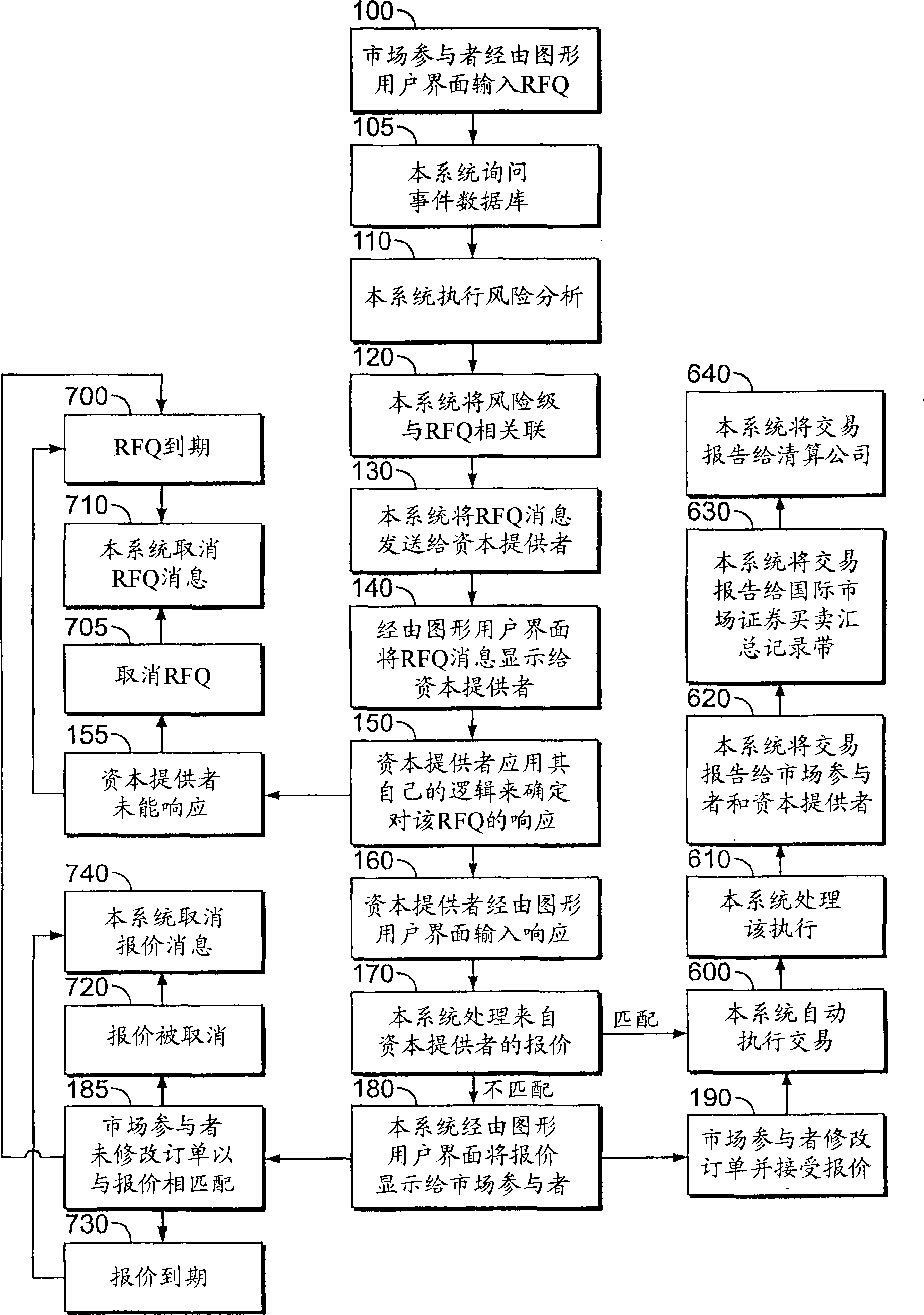

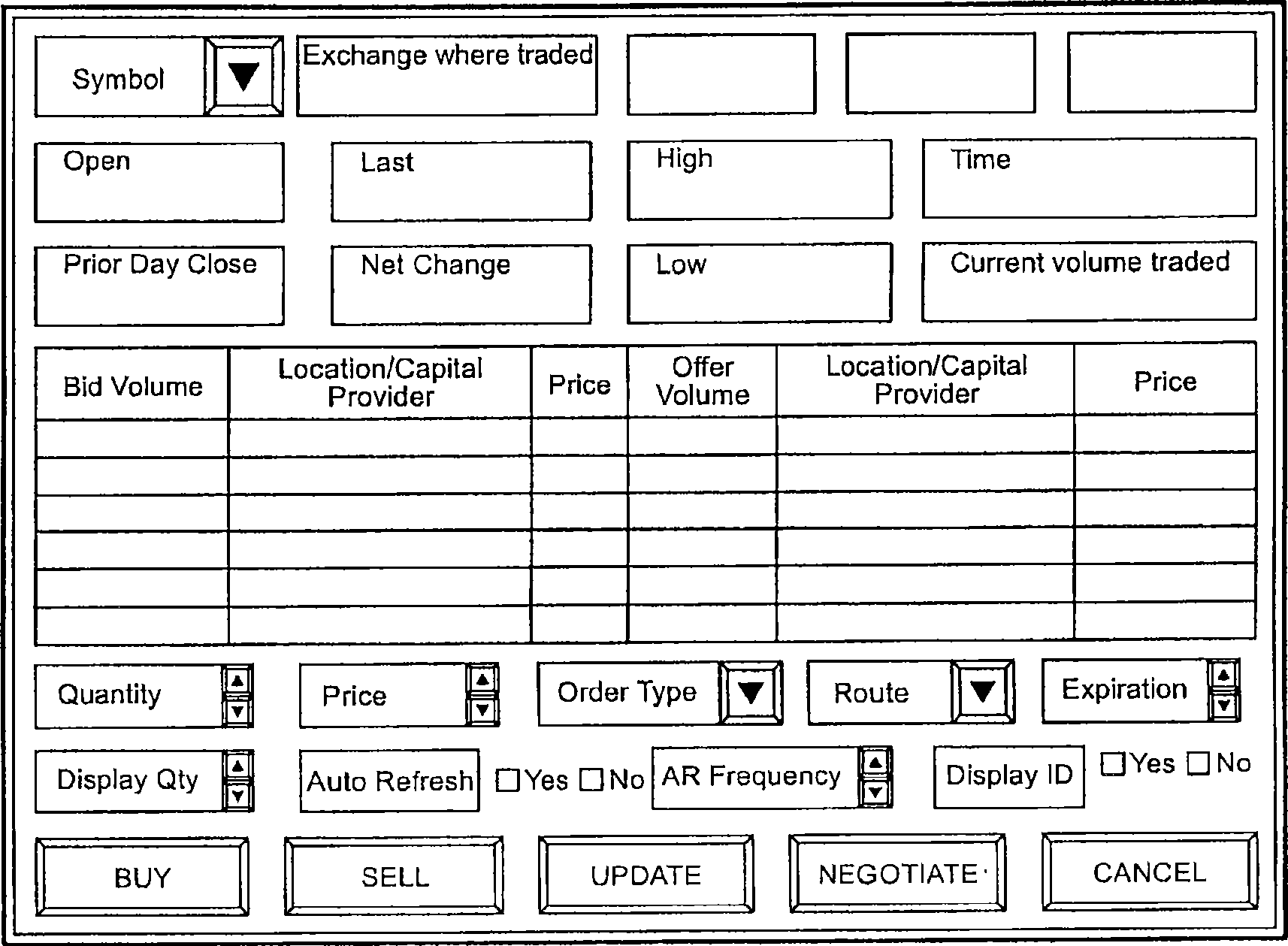

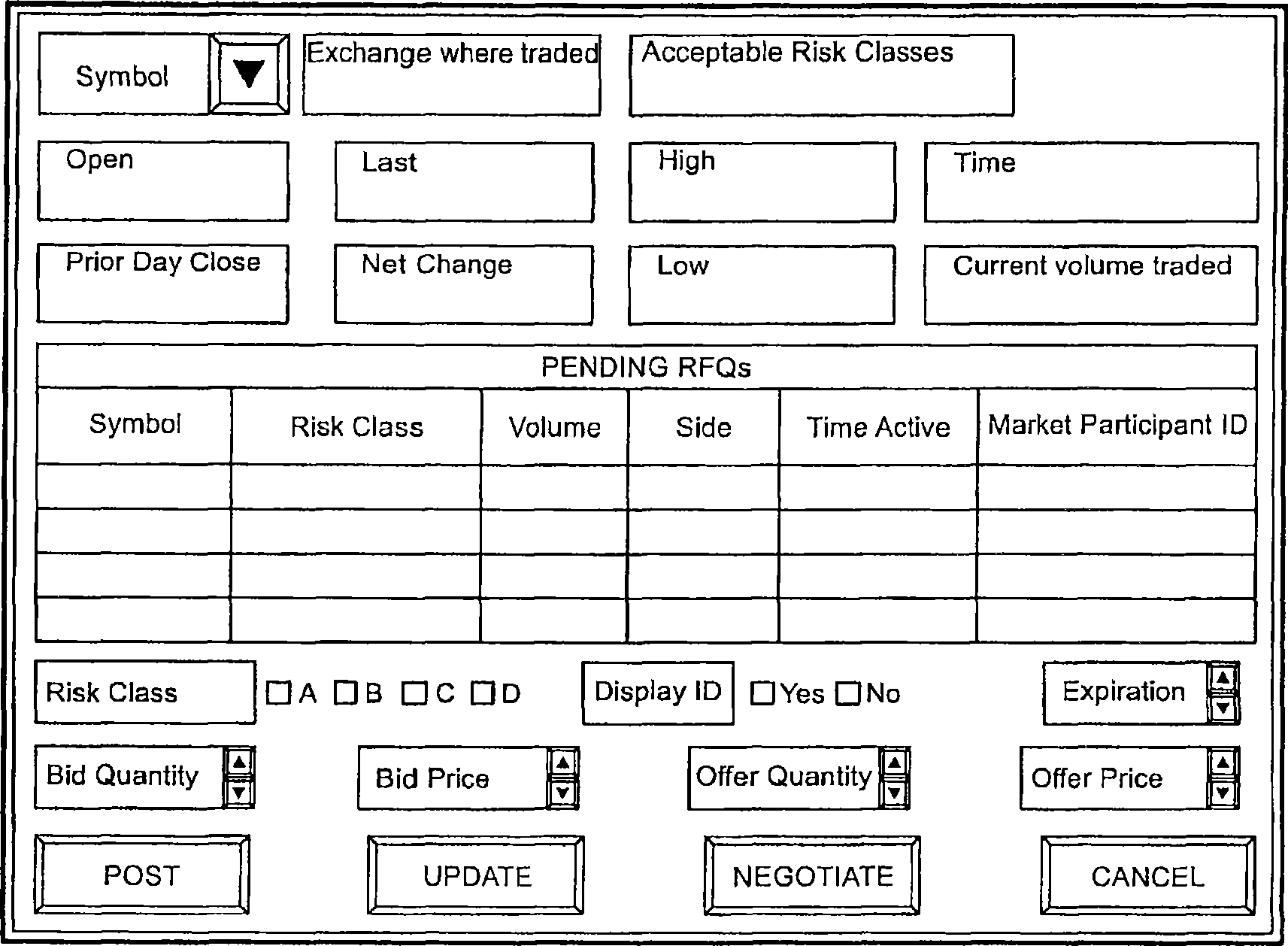

Systems and methods for providing anonymous requests for quotes for financial instruments

InactiveCN101449286AResolve inherent conflictsQuote adjustableFinanceRequest for quotationInternet privacy

Embodiments of the invention provide an anonymous RFQ system for financial instruments that resolves the inherent conflict between a capital provider's need for information and a market participant's need for confidentiality by creating an environment where market participants and capital providers can realize the benefits of sharing confidential trading interest (CTI) information without sacrificing anonymity or enabling information leakage. This secure environment preferably is created within an electronic matching book that distills all CTI information related to each Request for Quote (RFQ) into a risk class that is sent to capital providers in lieu of order-identifying or trader-identifying information. These risk classes give capital providers enough information to offer customized, risk-adjusted quotes without requiring the market participant to reveal confidential information about herself or her order.

Owner:PIPELINE FINANCIAL GROUP

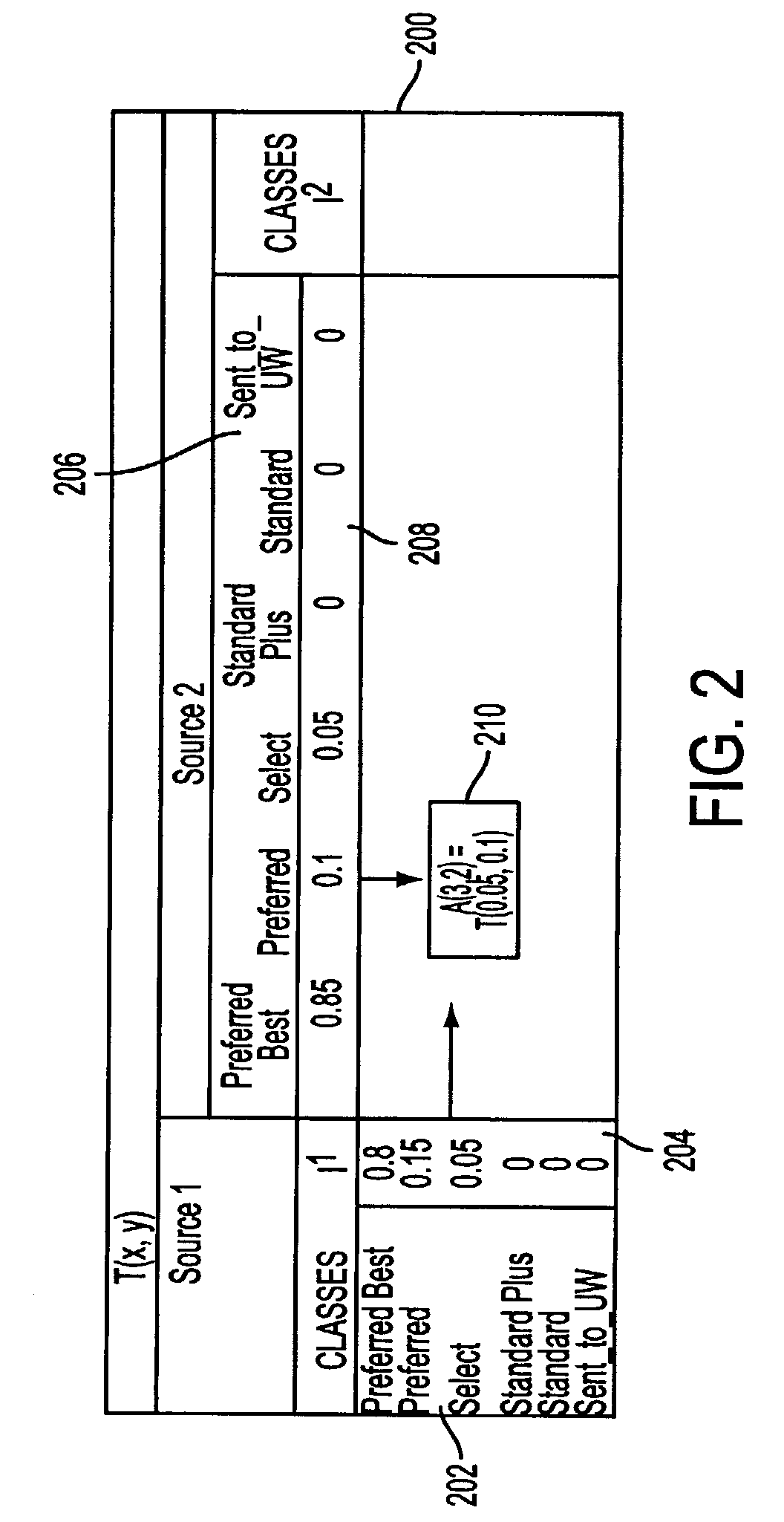

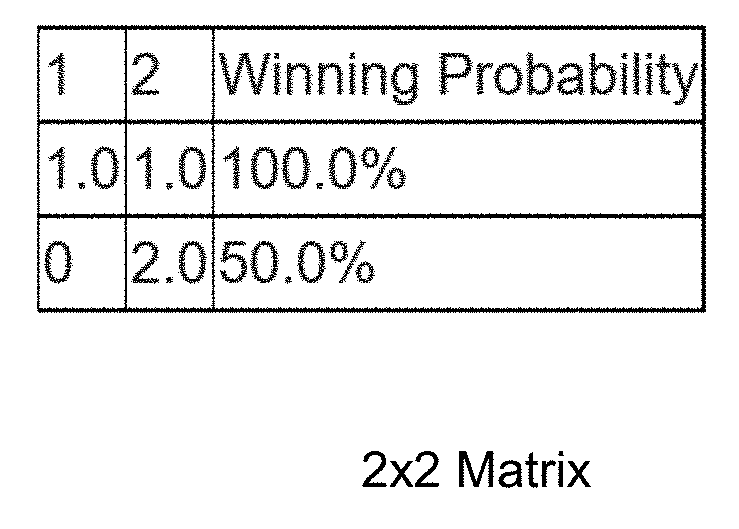

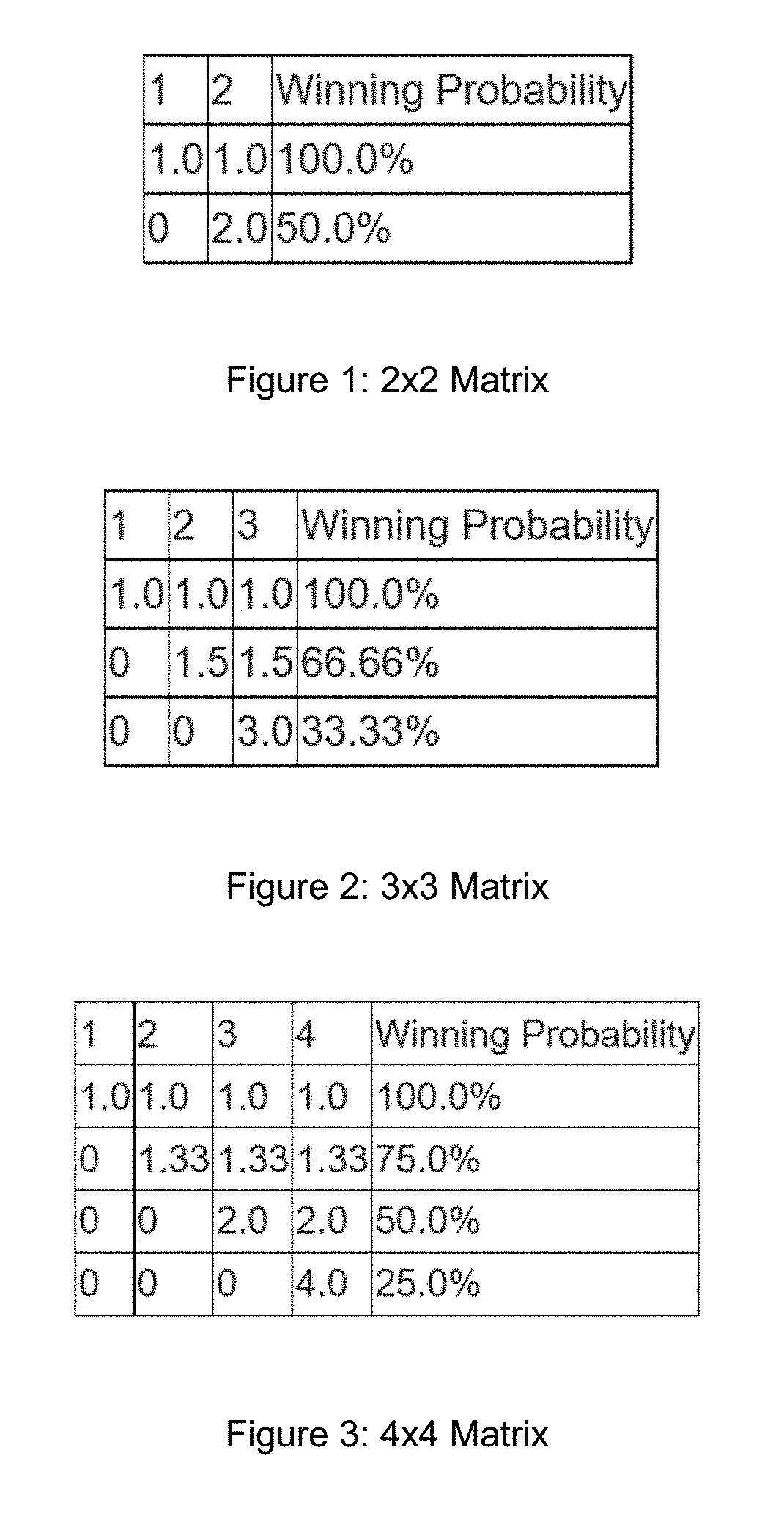

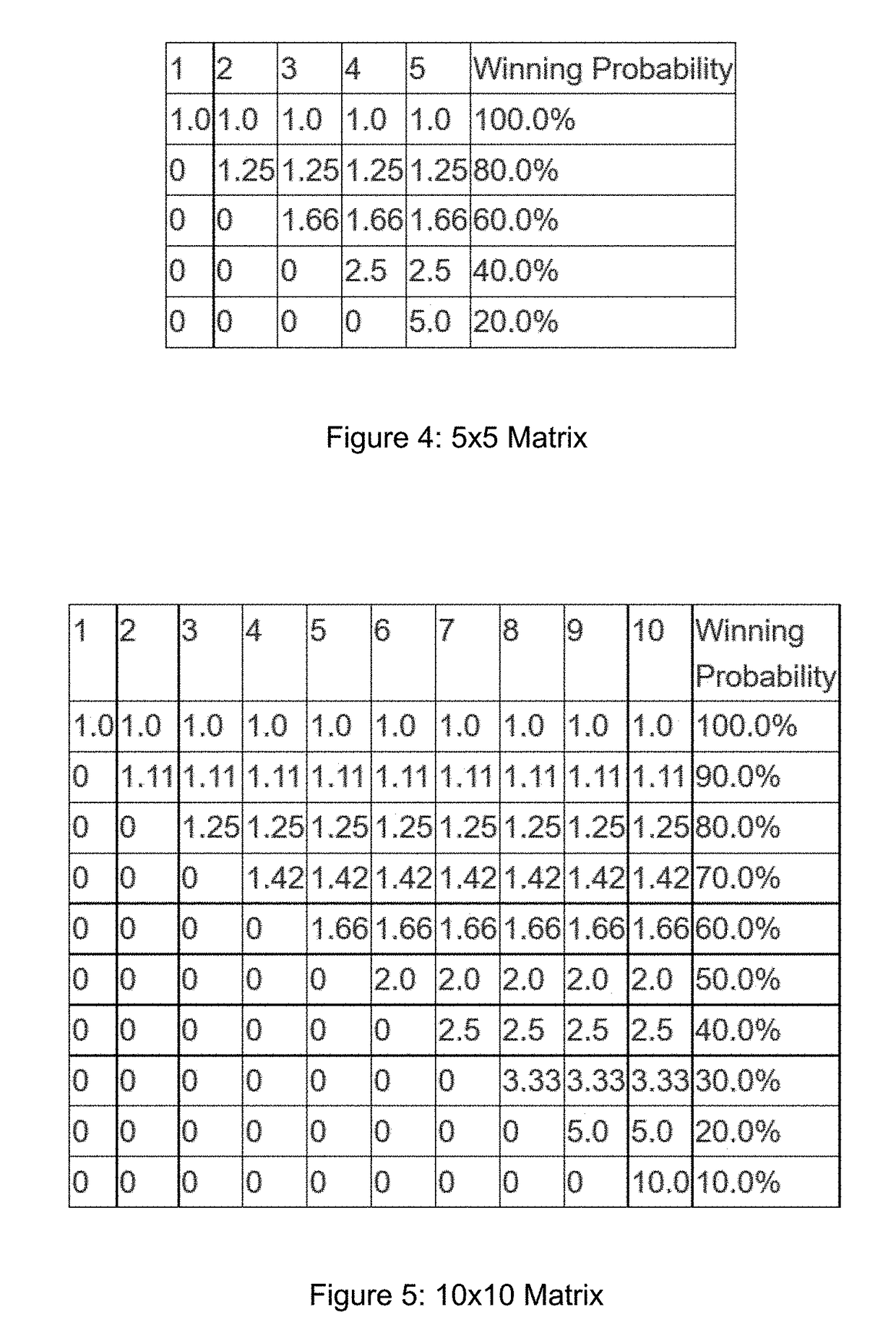

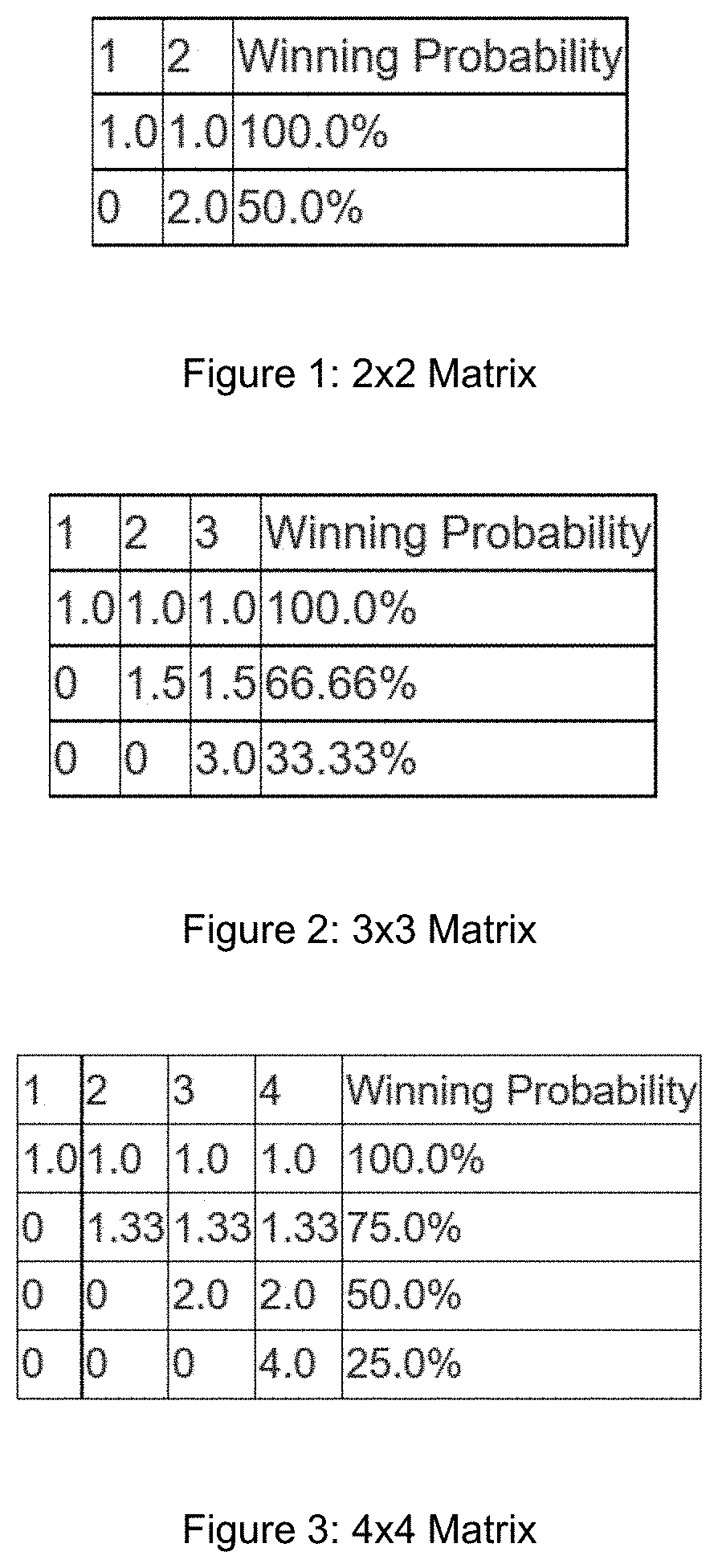

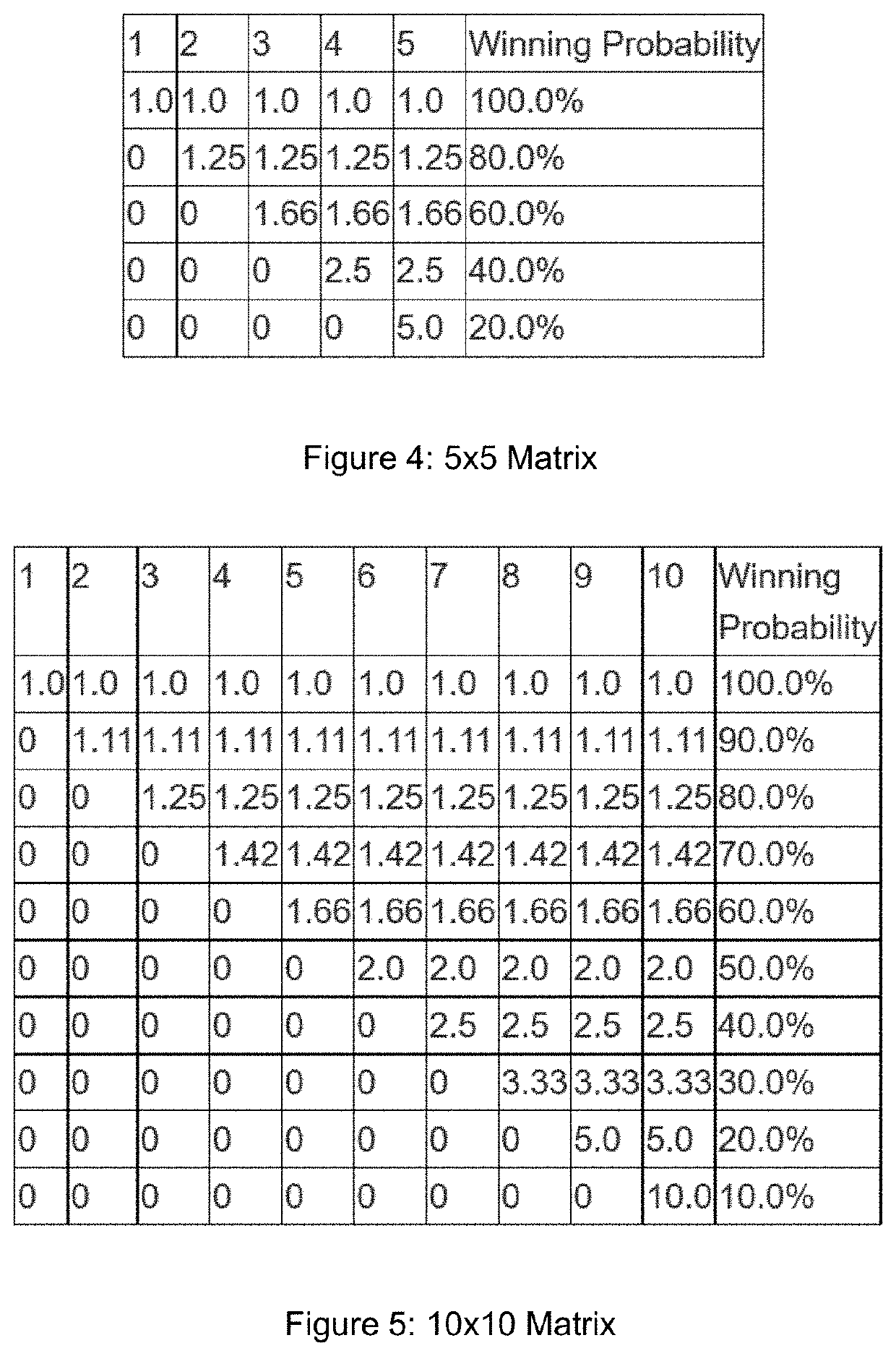

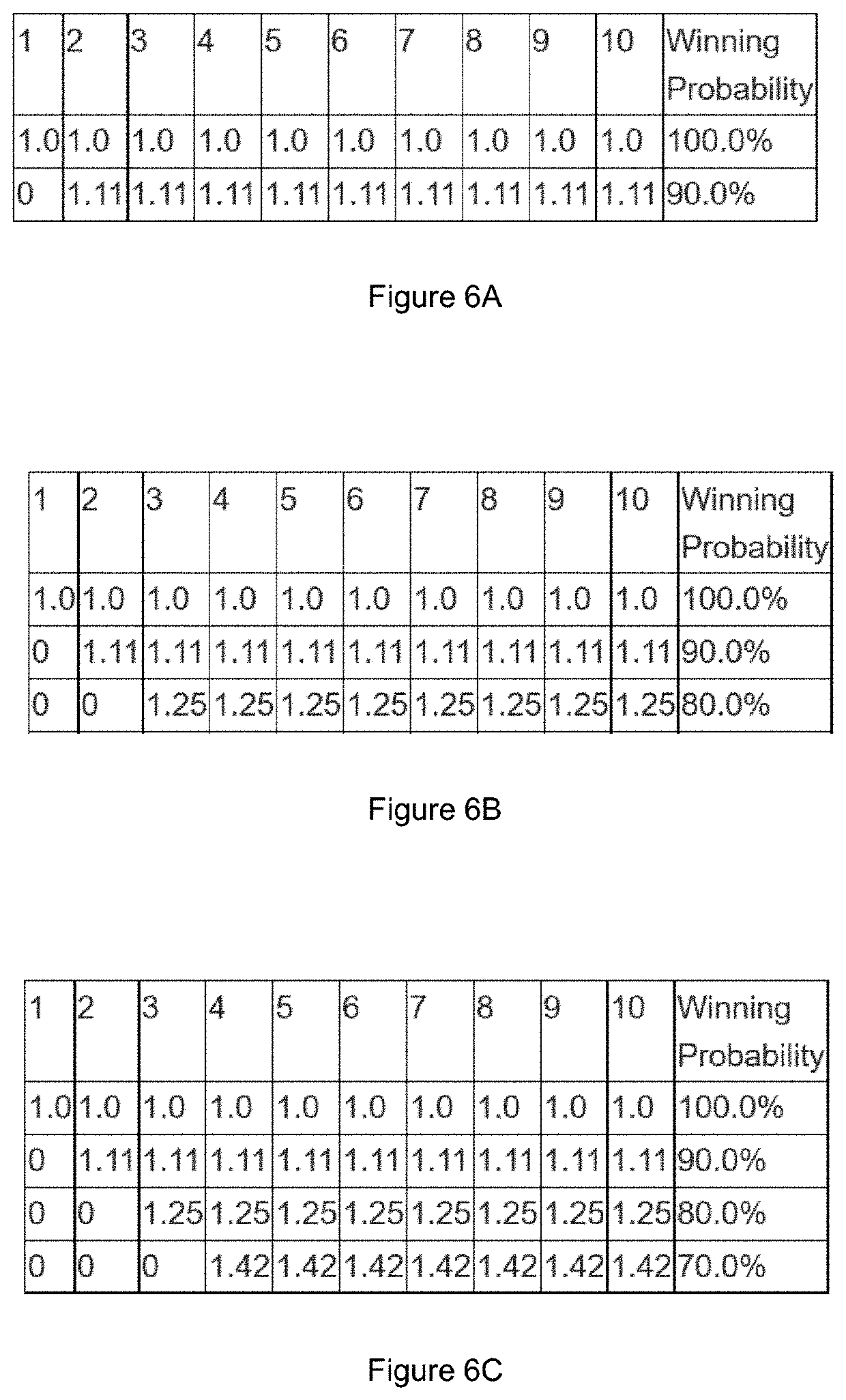

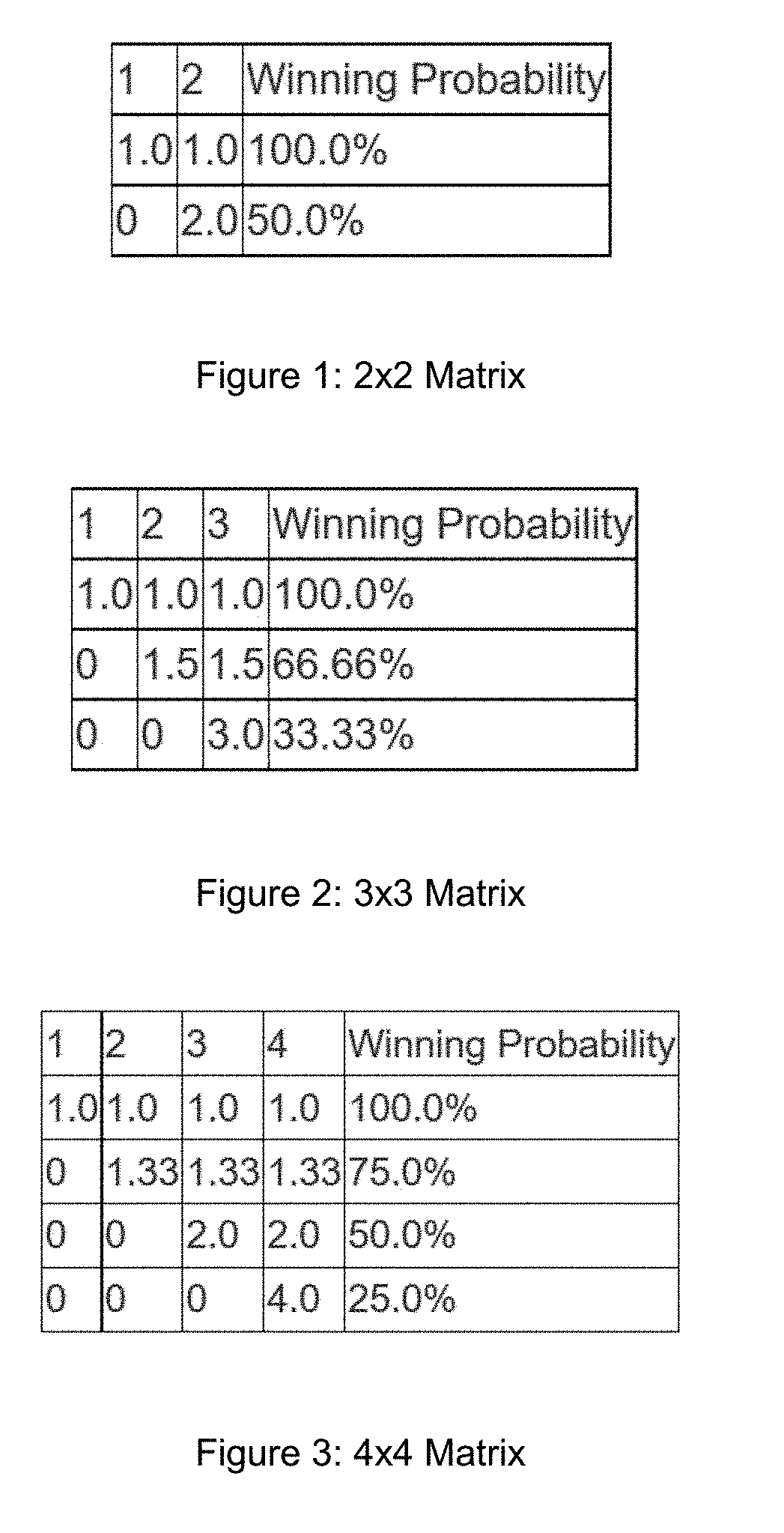

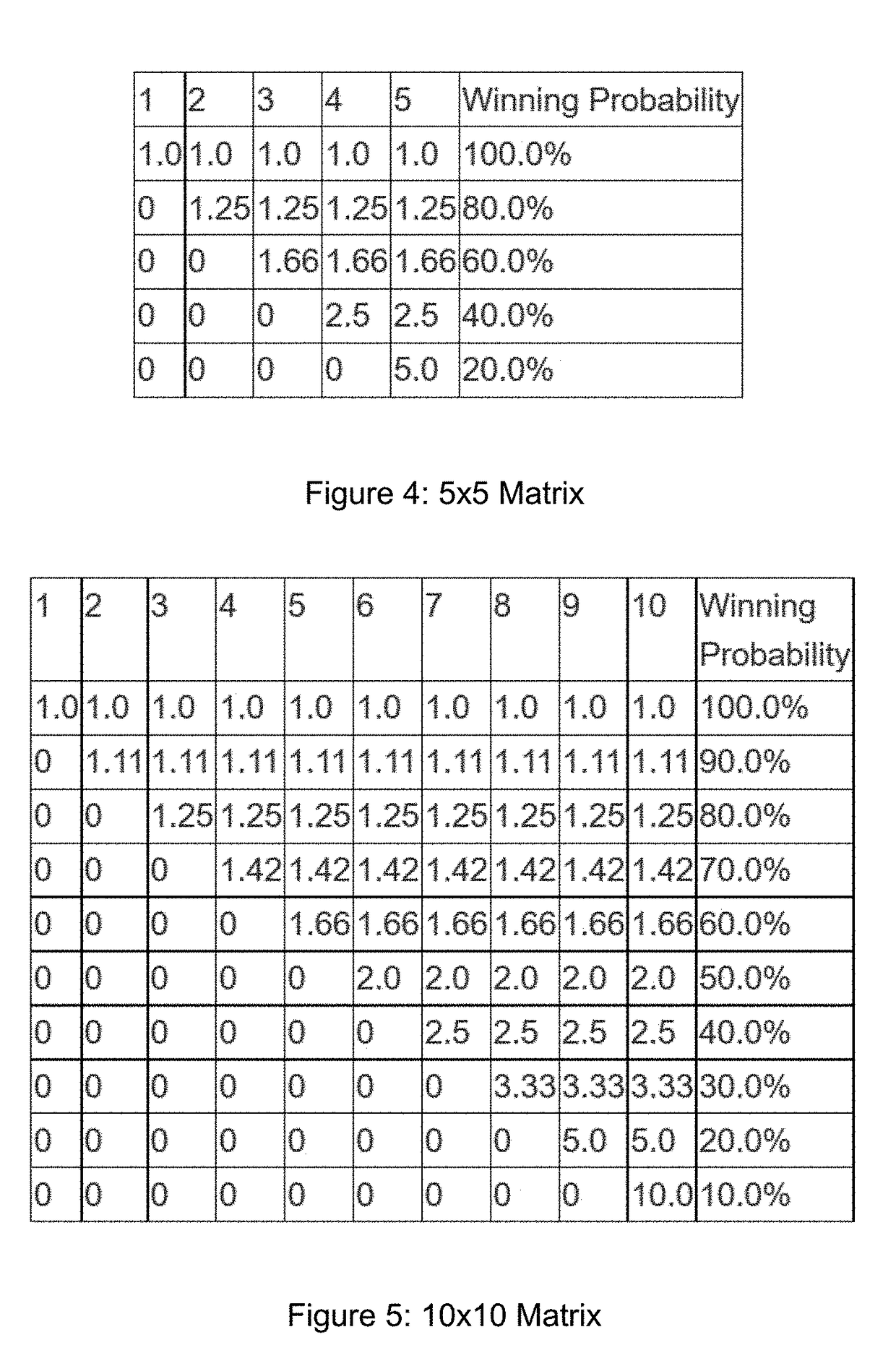

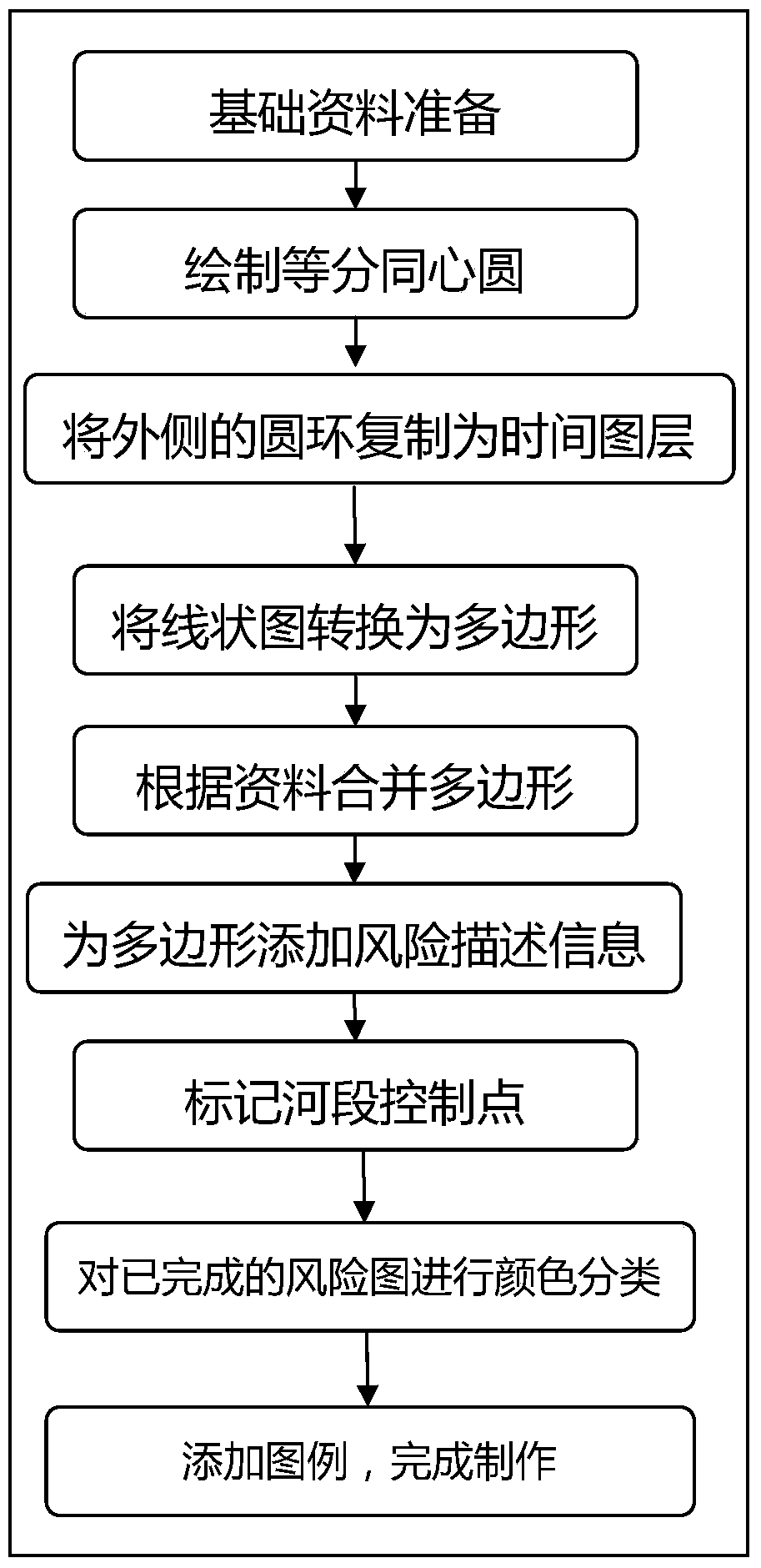

Investor controlled risk matrix

A system and method for user created 2-dimensional risk classes and levels is described. These classes are implemented as a matrix of real numbers. In one embodiment, this matrix allows the user to create and select risk thresholds for the placement of bets that from an investment perspective can lead to the construction of a new type of financial instrument similar to low yield, low risk government issued bonds. In a second embodiment this is a zero-consideration contest where users compete at no cost for prizes to be awarded. In a third embodiment (and where it is legal to do so), this is a gambling application. The risk matrix is created and managed by the user and no one else. The construction of the matrix is described in detail. Included are computer runs that highlight important aspects of the invention.

Owner:MACDONALD BRUCE A

A method for judging the risk degree of water inrush from deep well floor

Owner:SHANDONG UNIV OF SCI & TECH

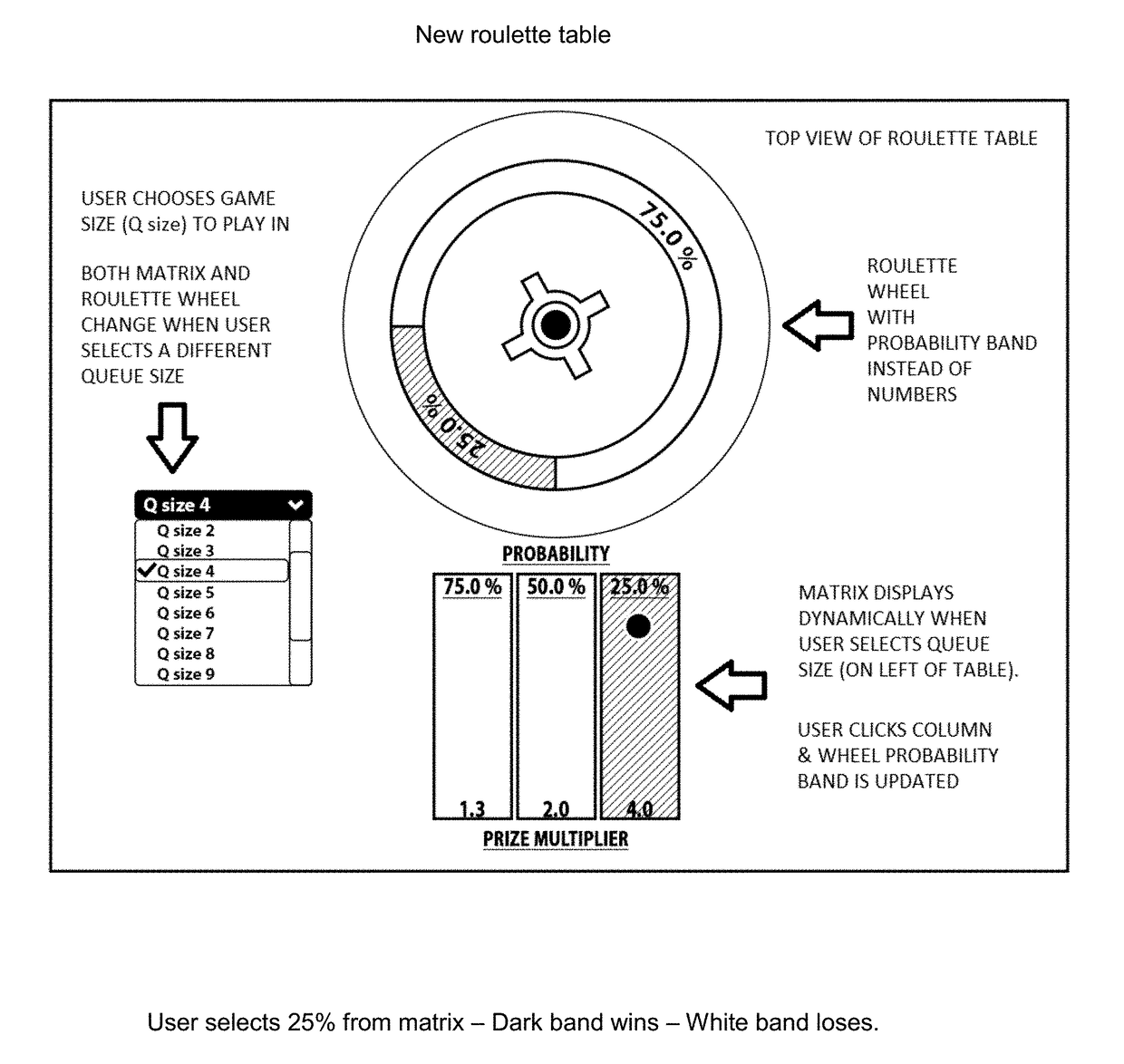

Investor controlled risk matrix

ActiveUS10497209B2Complete banking machinesApparatus for meter-controlled dispensingLower riskComputer science

A system and method for user created 2-dimensional risk classes and levels is described. In one embodiment, this matrix allows the user to create and select risk thresholds for the placement of bets that from an investment perspective can lead to the construction of a new type of financial instrument similar to low yield, low risk government issued bonds. In a second embodiment this is a zero-consideration contest where users compete at no cost for prizes to be awarded. In a third embodiment (and where it is legal to do so), this is a gambling application. The risk matrix is created and managed by the user and no one else. Included are computer runs that highlight important aspects of the invention. Finally, a tangible new game embodiment is described that replaces a standard Roulette table surface and wheel with new embodiments that implement the 2-dimensional risk classes described herein.

Owner:MACDONALD BRUCE A

Investor controlled risk matrix

A system and method for user created 2-dimensional risk classes and levels is described. In one embodiment, this matrix allows the user to create and select risk thresholds for the placement of bets that from an investment perspective can lead to the construction of a new type of financial instrument similar to low yield, low risk government issued bonds. In a second embodiment this is a zero-consideration contest where users compete at no cost for prizes to be awarded. In a third embodiment (and where it is legal to do so), this is a gambling application. The risk matrix is created and managed by the user and no one else. Included are computer runs that highlight important aspects of the invention. Finally, a tangible new game embodiment is described that replaces a standard Roulette table surface and wheel with new embodiments that implement the 2-dimensional risk classes described herein.

Owner:MACDONALD BRUCE A

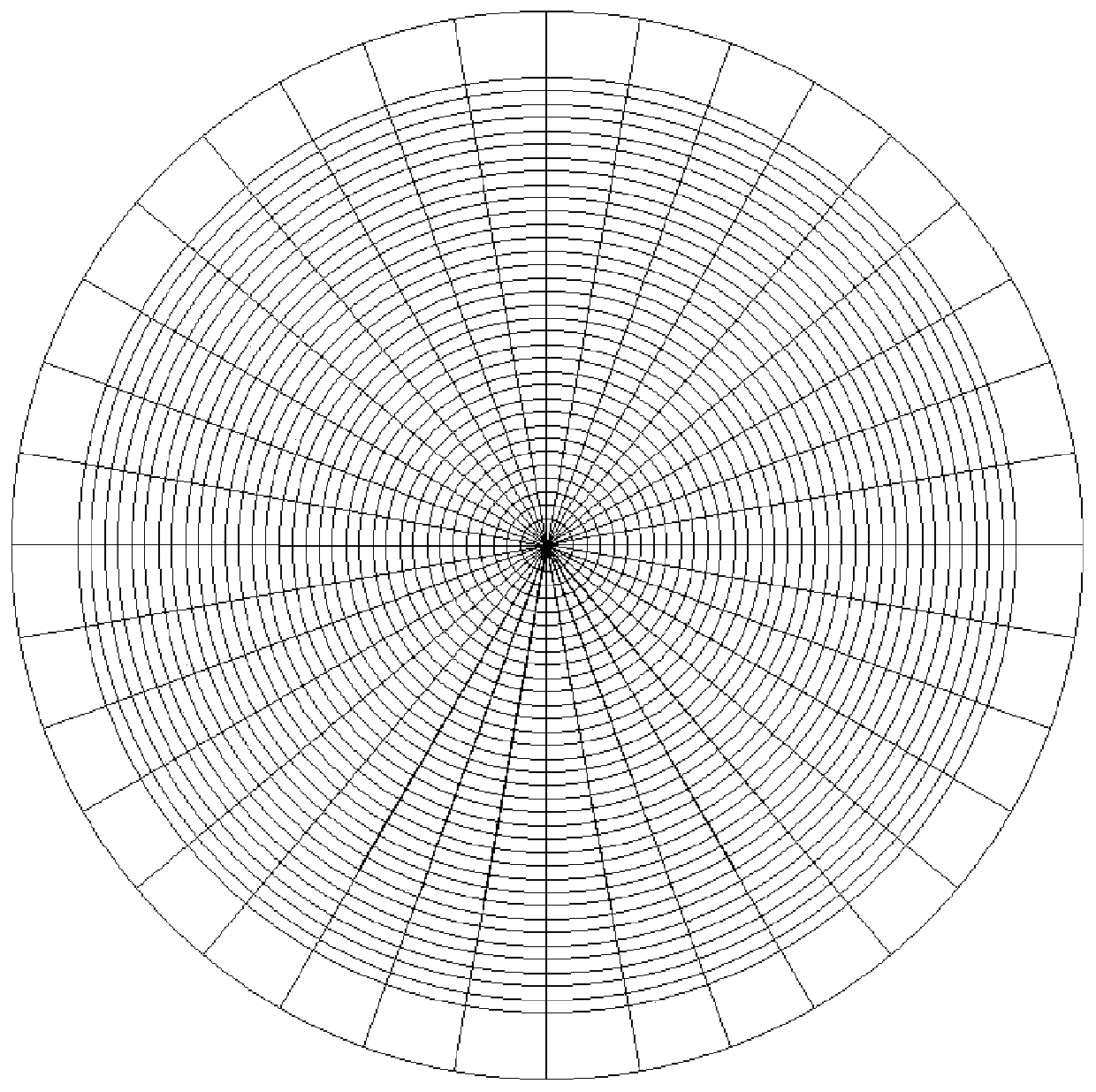

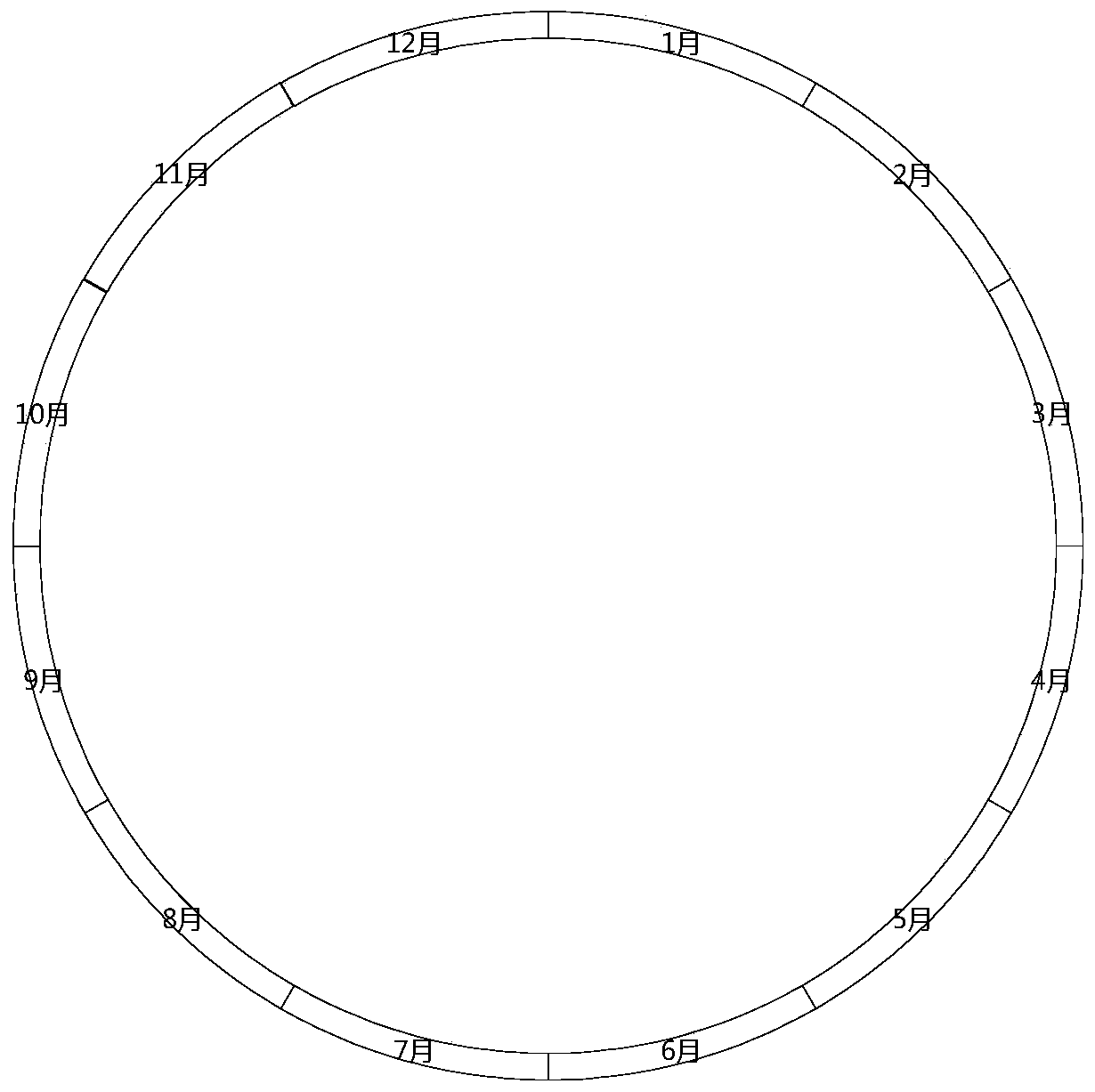

A Risk Identification Method for Reservoir Operation

ActiveCN105243481BRealize process drawingQuickly understand the global risks of schedulingResourcesGraphicsPie chart

A reservoir scheduling risk identification method comprises: preparing basic patterns and materials, determining risk description, risk time and a probable risk river section, and forming a table; determining the probable risk river section, and according to the length of the river section, estimating a proportion; drawing a plurality of concentric circles, and dividing the concentric circles into multiple parts; converting the generated concentric circles into a polygon; according a time calendar, combining elements in arcgis; adding a comment field in the generated polygon, and adding risk description; marking a river section control point; according to risk types, classifying generated risk maps, assigning different colors for different types; and adding legends to finish risk map creation, and identifying a reservoir scheduling risk by using the risk maps. According to the reservoir scheduling risk identification method provided by the invention, time and space elements are rapidly displayed by using a pie chart, thereby guiding the reservoir scheduling risk identification and improving the working efficiency of reservoir scheduling.

Owner:CHINA YANGTZE POWER

Automated mortality classification system for real-time risk-assessment and adjustment, and corresponding method thereof

A system and method for real-time risk-assessment and adjustment, risks associated with a plurality of risk exposed individuals being at least partially transferable from a risk exposed individual to a first insurance system and / or from the first insurance system to an associated second insurance system. The system including a table with retrievable stored risk classes each comprising assigned risk class criteria, individual-specific parameters of the risk exposed individuals being captured relating to criteria of the stored risk classes by the system and stored in a memory, and a specific risk class associated with the risk of the exposed individual being identified out and selected of the stored risk classes by the system based on the captured parameters.

Owner:SWISS REINSURANCE CO LTD

Risk assessment system for power plant relay protection setting value based on expert system

InactiveCN103632308BReduce the risk of unreasonableEasy to operateData processing applicationsEngineeringOperability

The invention discloses a grid-related power plant relay protection fixed value risk evaluation system based on an expert system. The grid-related power plant relay protection fixed value risk evaluation system is high in operability, high in efficiency and scientific and comprises building of a model, risk evaluation calculation, determination of the risk class and input / output of data.

Owner:POWER DISPATCHING CONTROL CENT OF GUANGDONG POWER GRID CO LTD +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com