Systems and methods for providing anonymous requests for quotes for financial instruments

A quotation request and anonymity technology, applied in finance, data processing applications, instruments, etc., can solve the problems of not being able to review multiple quotations and decisions, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

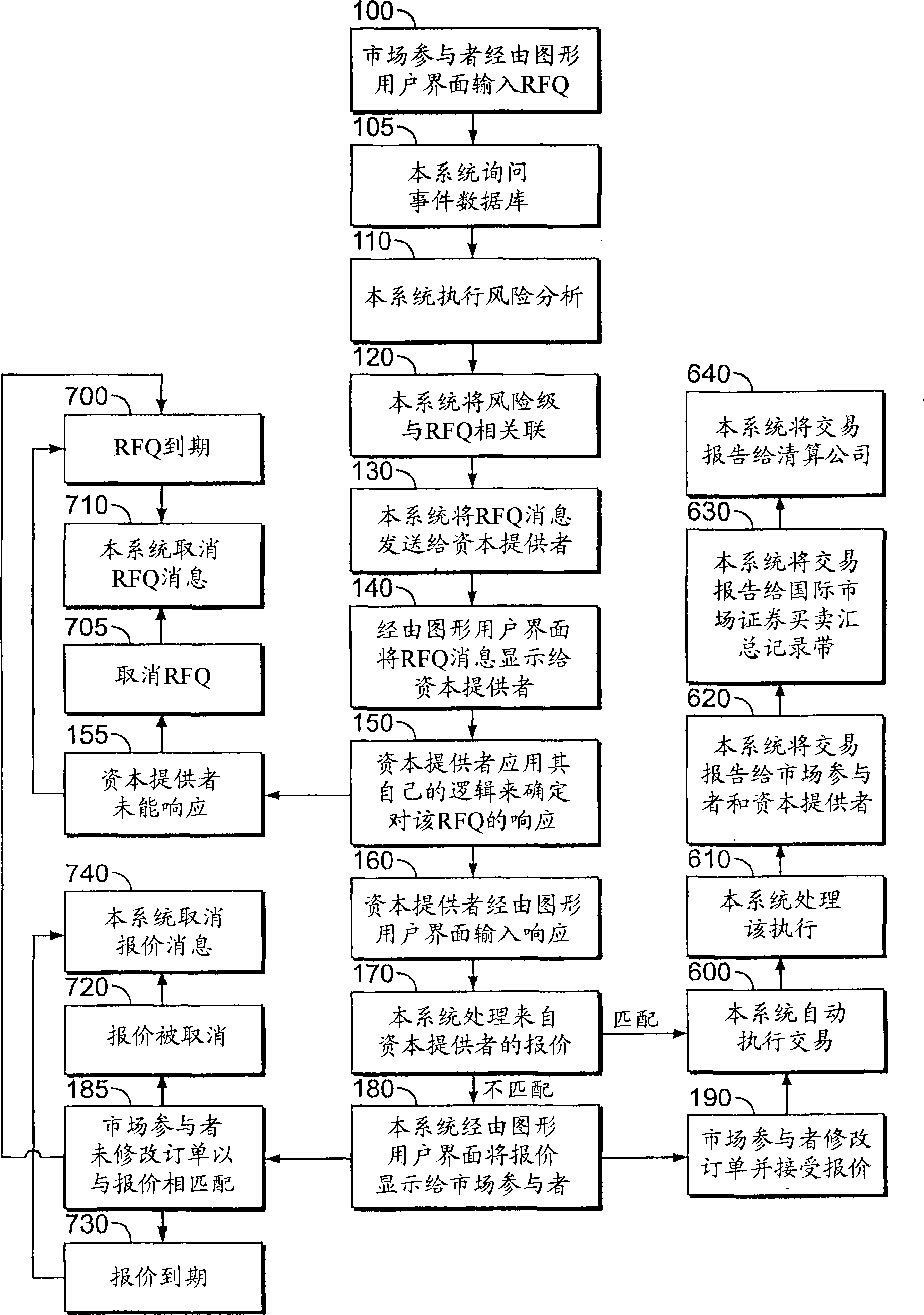

[0026] The following is a functional description of preferred and alternative embodiments of the invention. A preferred system embodiment of the invention includes a trading system capable of receiving and executing customer orders, reporting completed trades to clearing firms and back office operations of market participants (MPs) and capital providers (CPs), and providing The necessary user interface and desktop help interface are known in the art. Preferably, the system facilitates capital provision transactions through the following steps (e.g. figure 1 ):

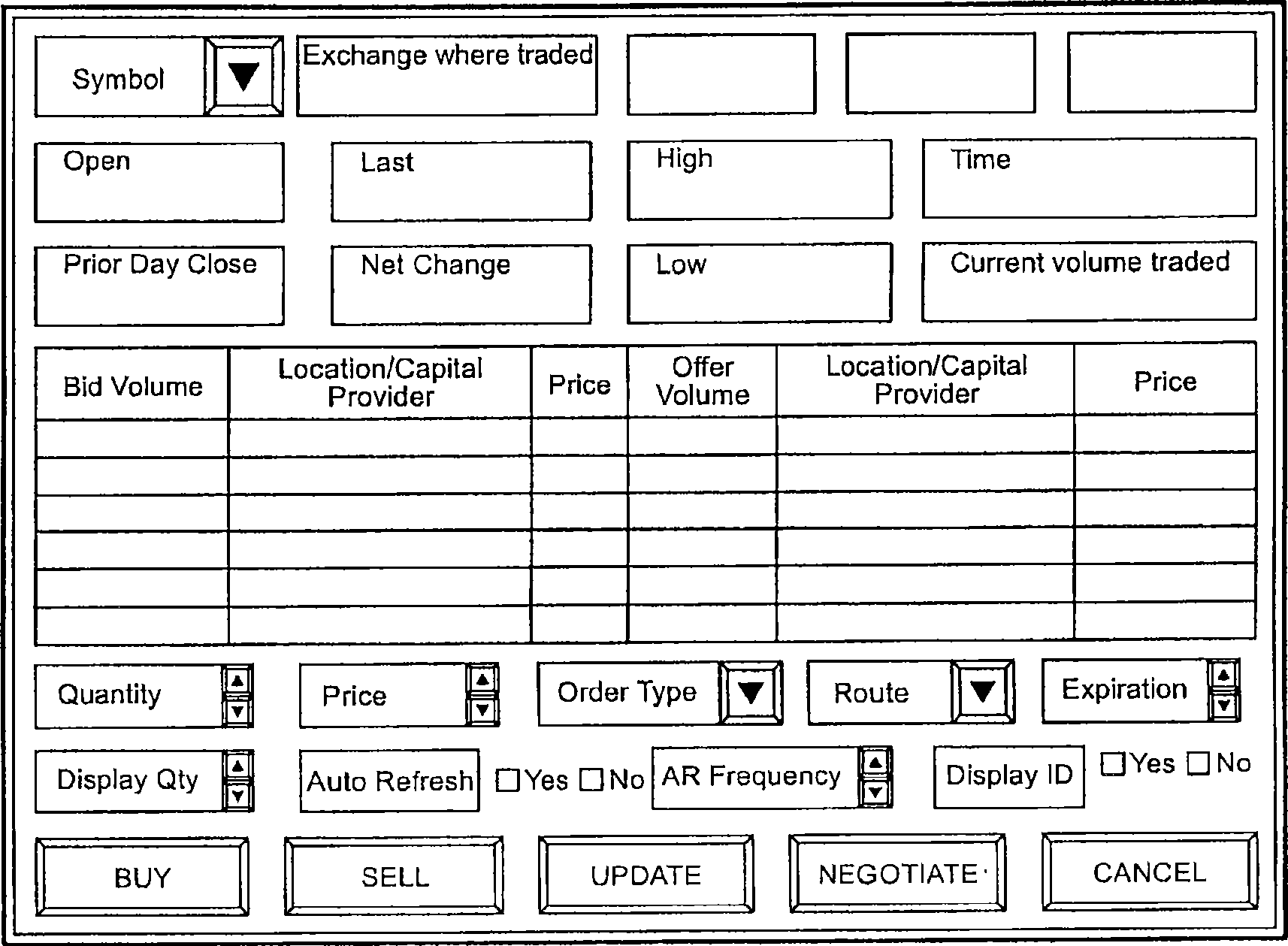

[0027] In step 100, a market participant enters an RFQ into the system. The RPQ is preferably entered through a graphical user interface (GUI) or electronic interface conforming to the Financial Information Exchange (FIX) protocol. figure 2 An embodiment of a graphical user interface for order entry is shown that supports the selection fields that will be described in this application. The order entry can include,...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com