Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

239 results about "Market participant" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

The term market participant is another term for economic agent, an actor and more specifically a decision maker in a model of some aspect of the economy. For example, buyers and sellers are two common types of agents in partial equilibrium models of a single market. The term market participant is also used in United States constitutional law to describe a U.S. State which is acting as a producer or supplier of a marketable good or service.

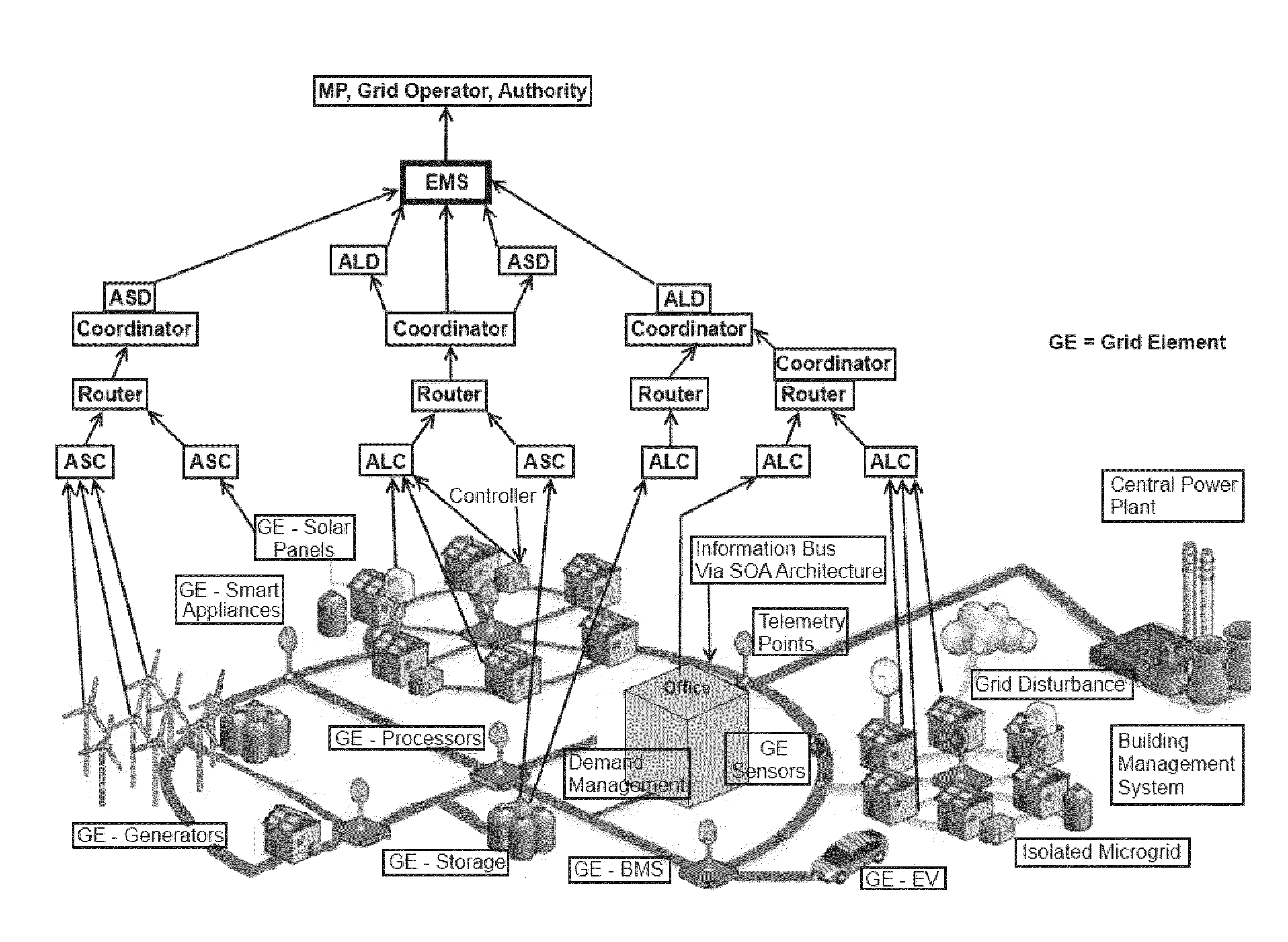

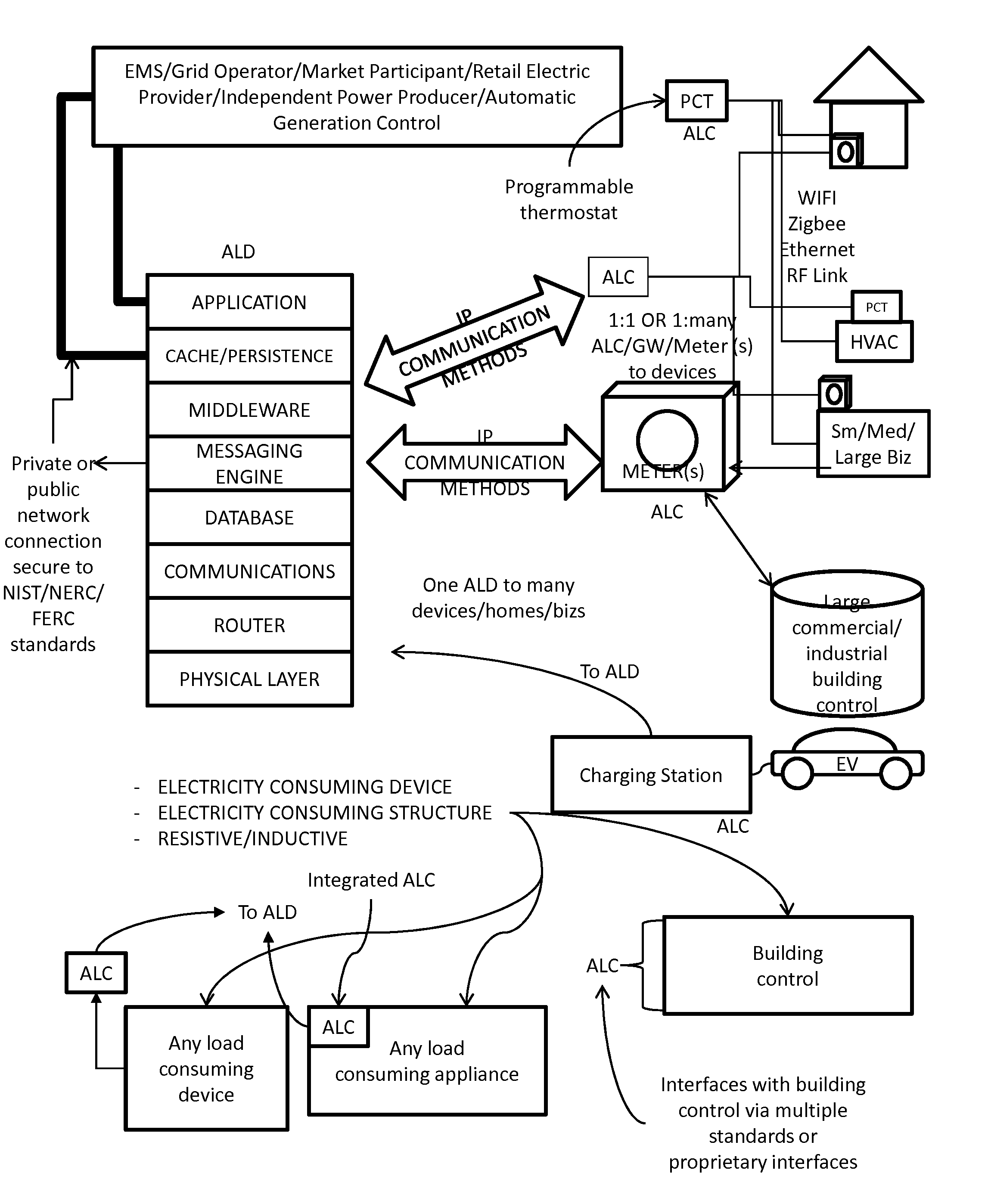

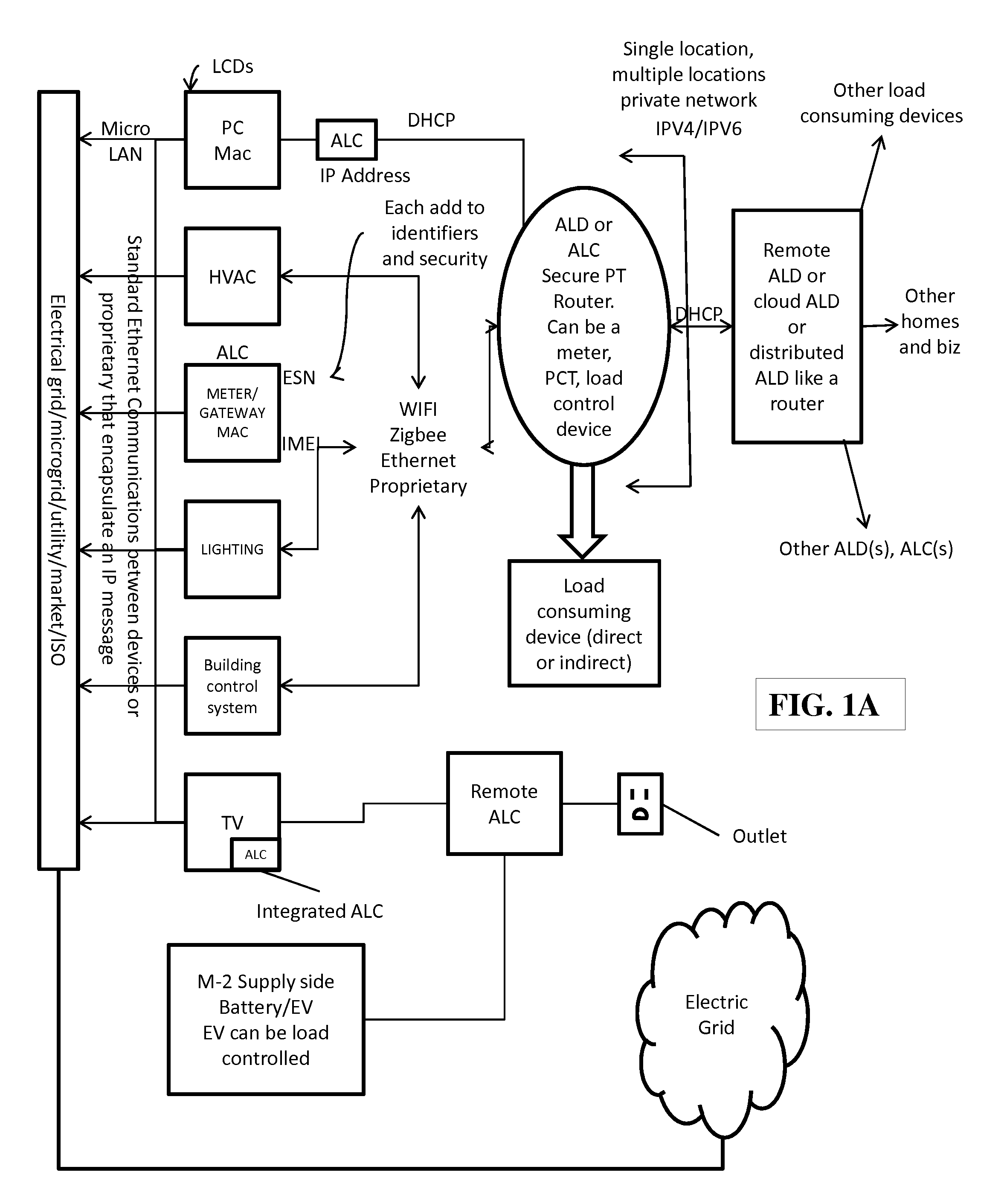

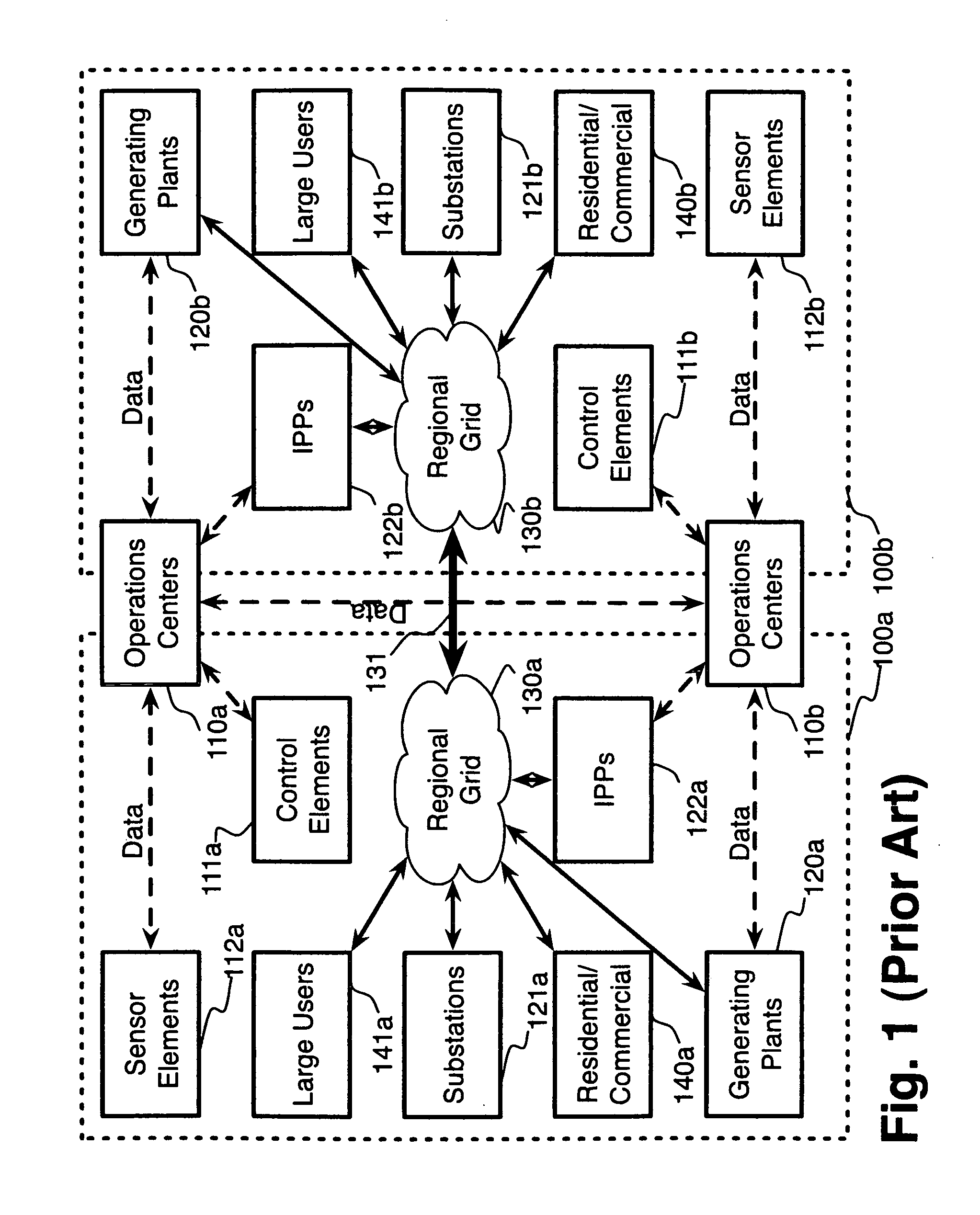

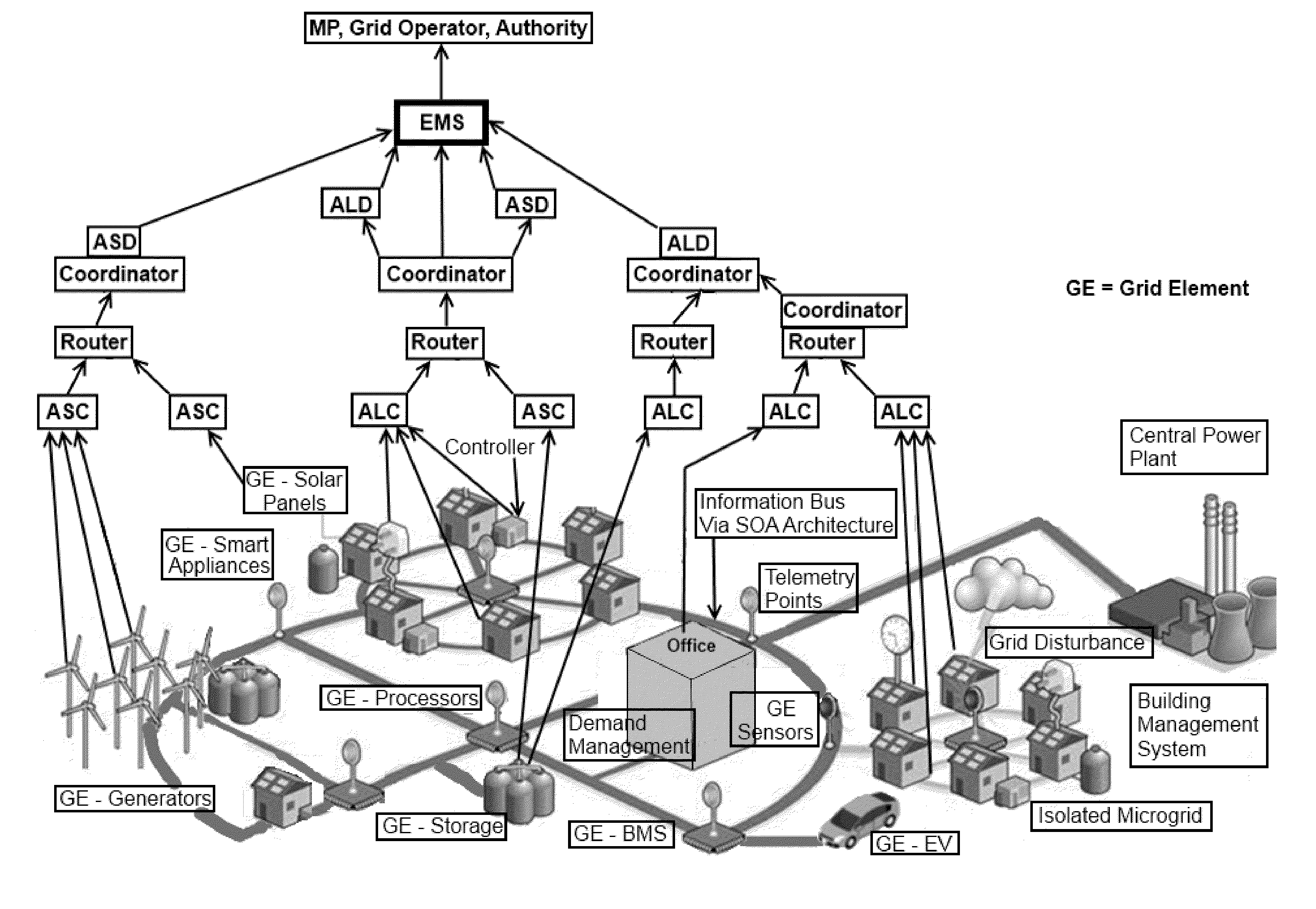

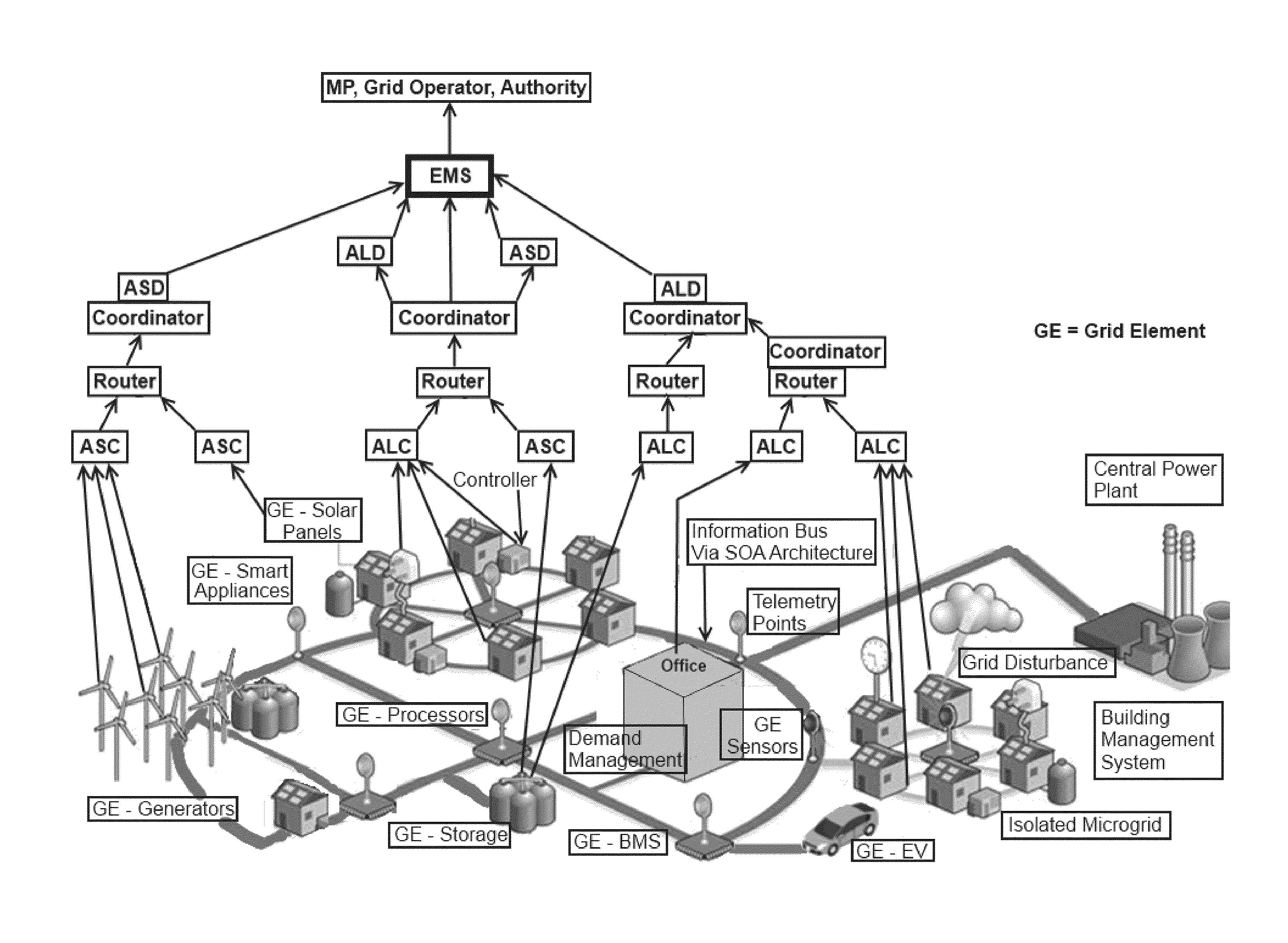

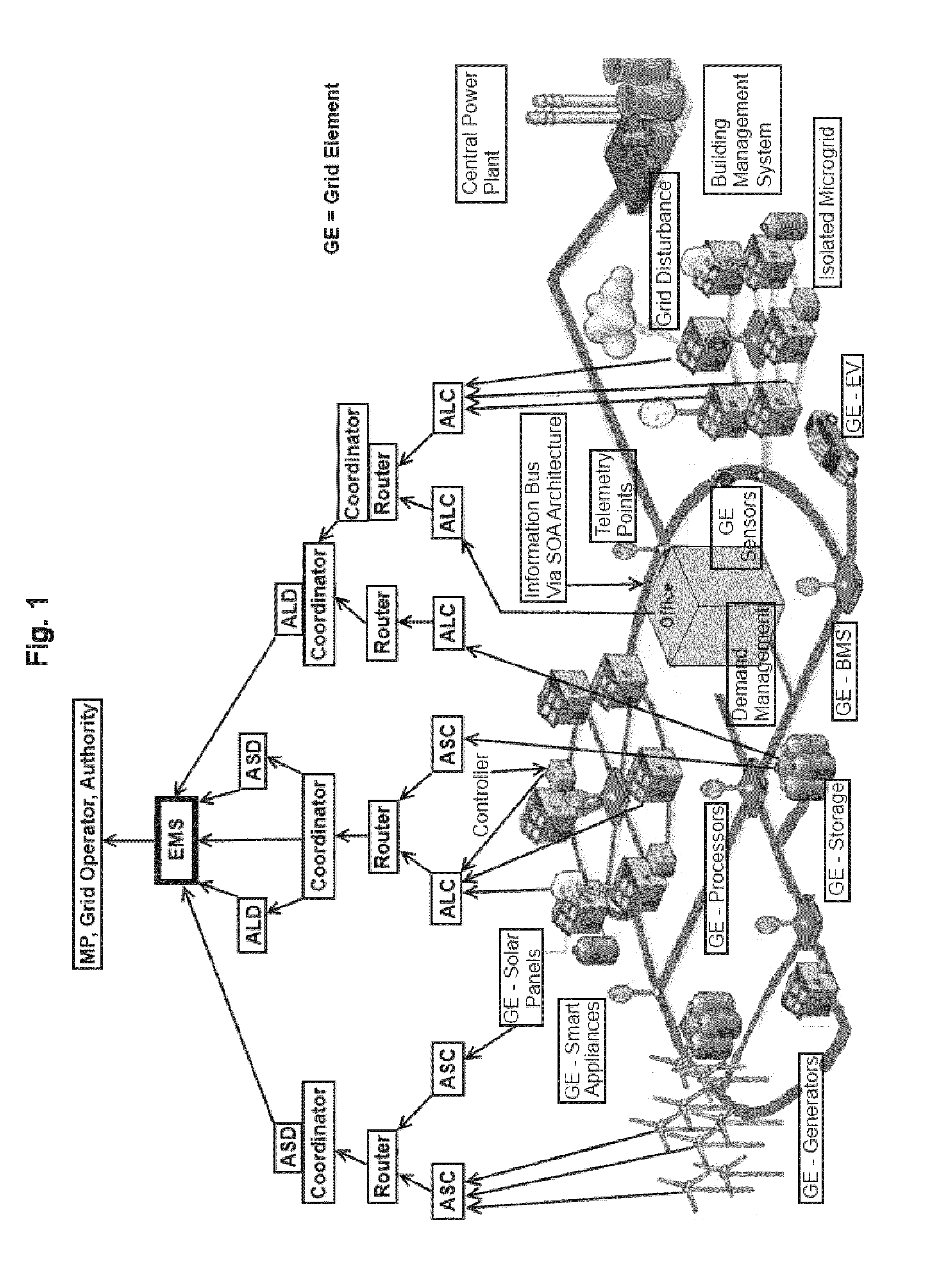

System, method, and apparatus for electric power grid and network management of grid elements

Systems, methods, and apparatus embodiments for electric power grid and network registration and management of active grid elements. Grid elements are transformed into active grid elements following initial registration of each grid element with the system, preferably through network-based communication between the grid elements and a coordinator, either in coordination with or outside of an IP-based communications network router. A multiplicity of active grid elements function in the grid for supply capacity, supply and / or load curtailment as supply or capacity. Also preferably, messaging is managed through a network by a Coordinator using IP messaging for communication with the grid elements, with the energy management system (EMS), and with the utilities, market participants, and / or grid operators.

Owner:CAUSAM ENERGY INC

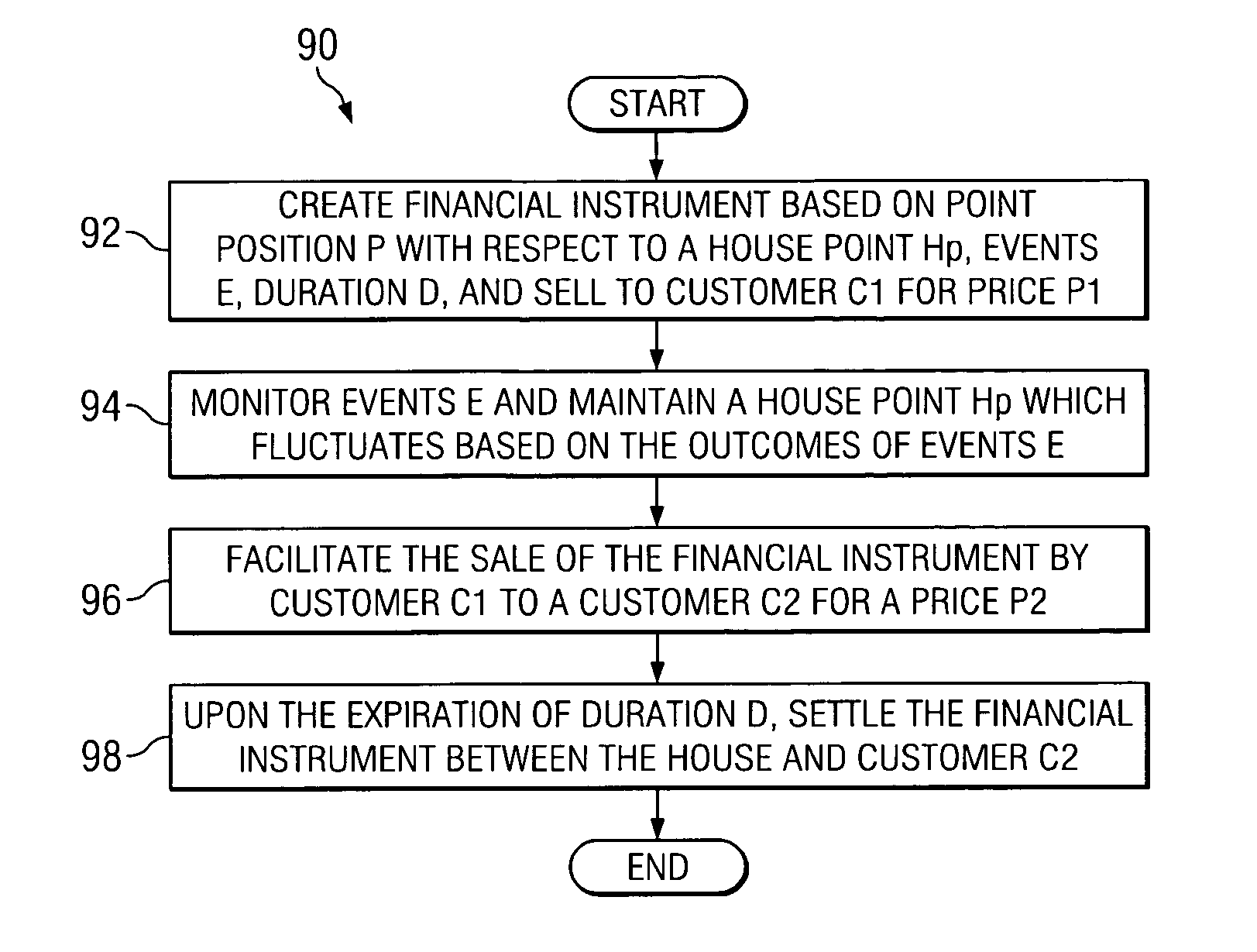

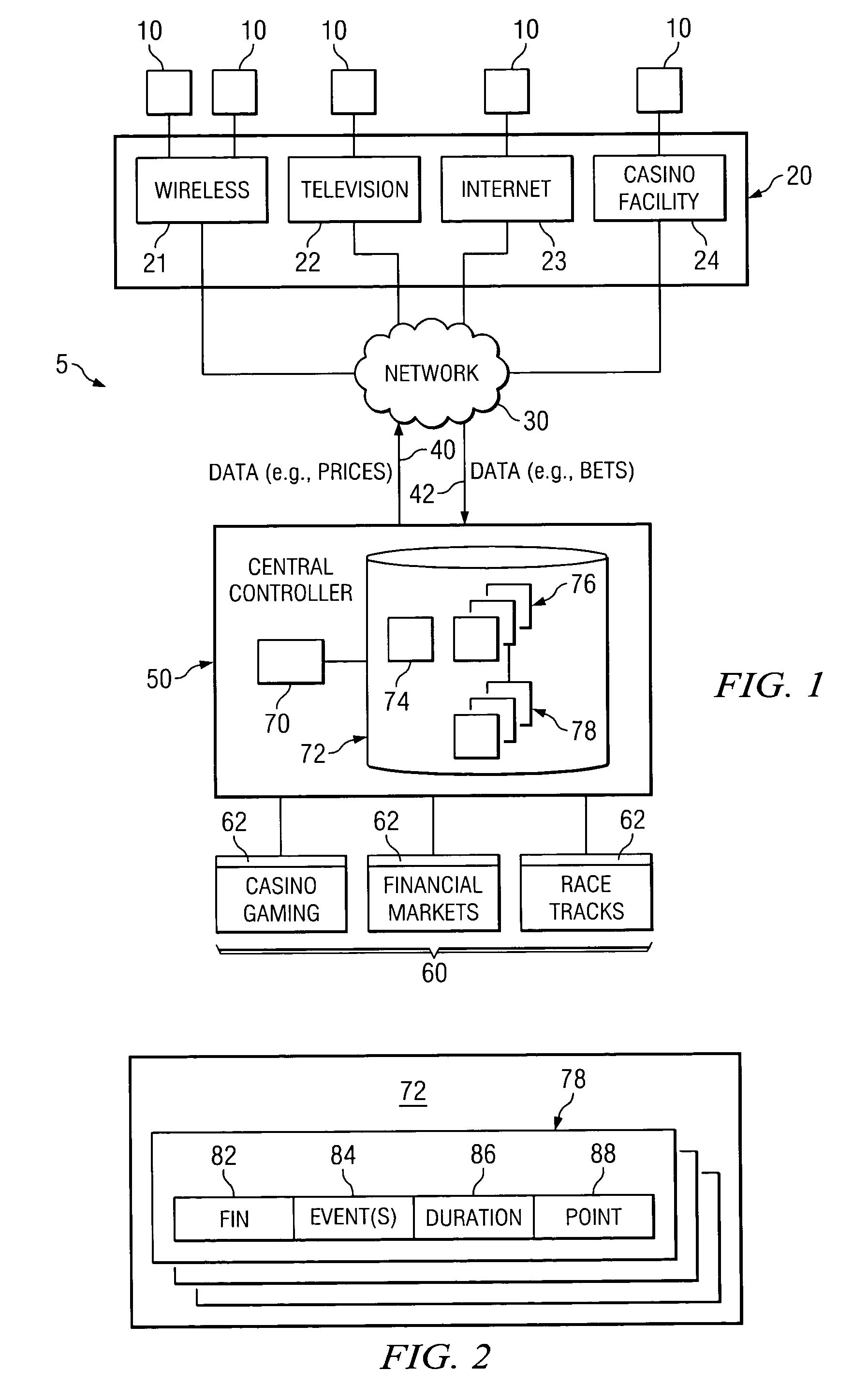

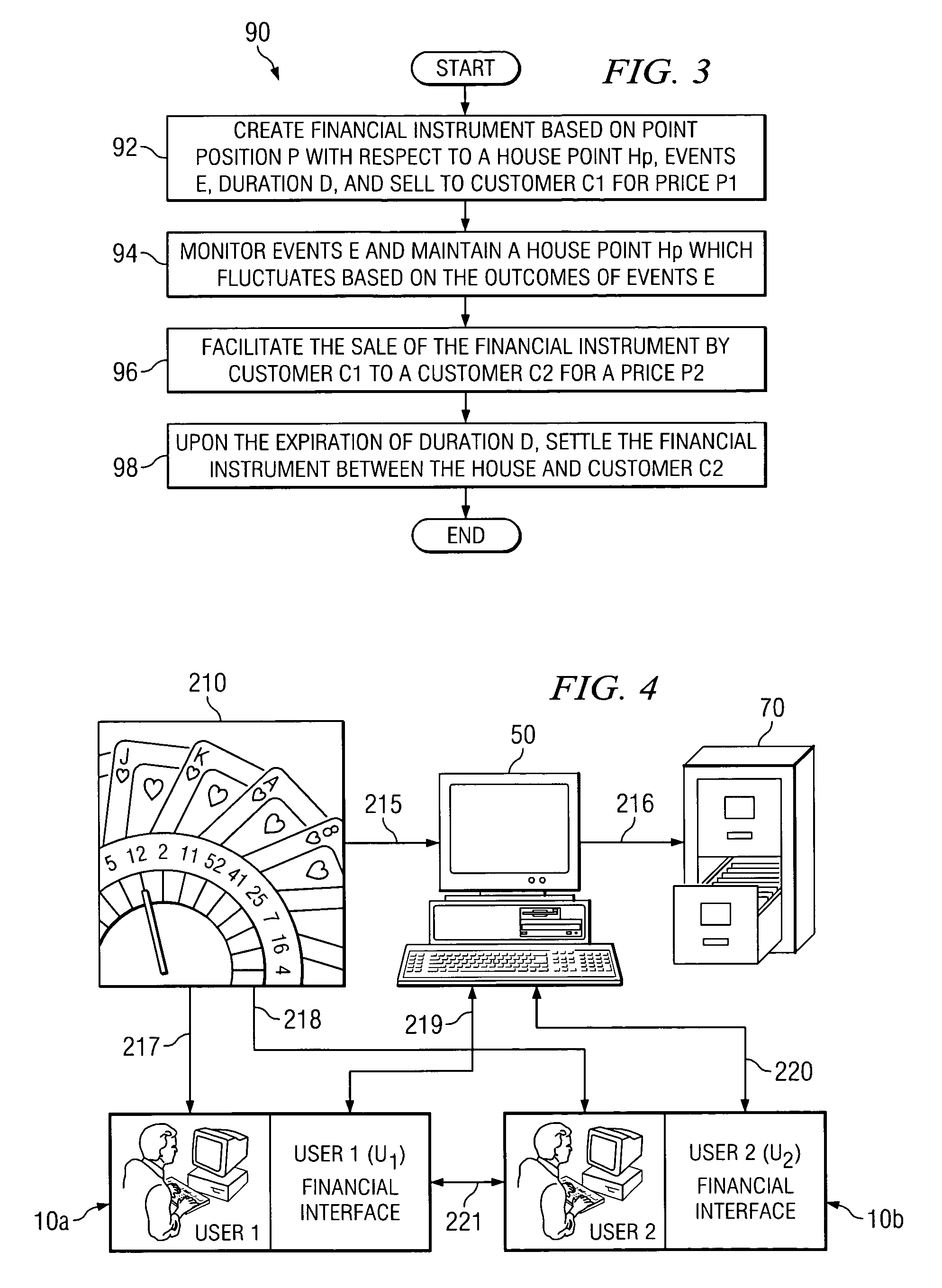

System and method for wagering-based transferable financial instruments

InactiveUS7233922B2Reduce riskFacilitate communicationFinanceApparatus for meter-controlled dispensingSkill setsData science

The invention provides a system and method for creating and facilitating the exchange of wagering-based transferable financial instruments. The instruments may be used to embody multiple various positions based upon the ultimate outcomes of uncertain future contingent events, including but not limited to outcomes of games of skill and chance. The invention further provides systems and platforms for monitoring, displaying information, and facilitating trading as to such instruments among multiple investment market participants, and a hosting or house participant, for time-variable buying and selling of such instruments.

Owner:CANTOR INDEX

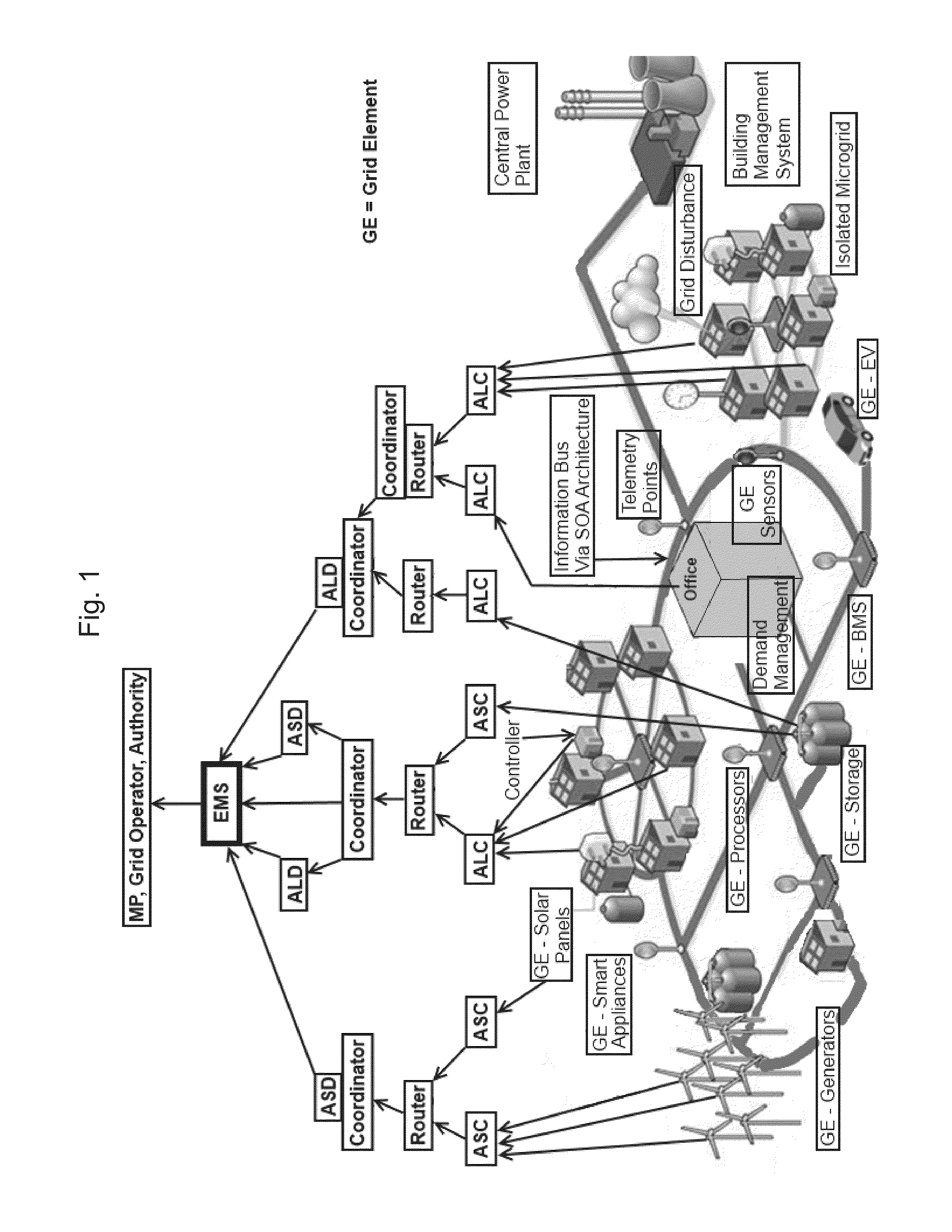

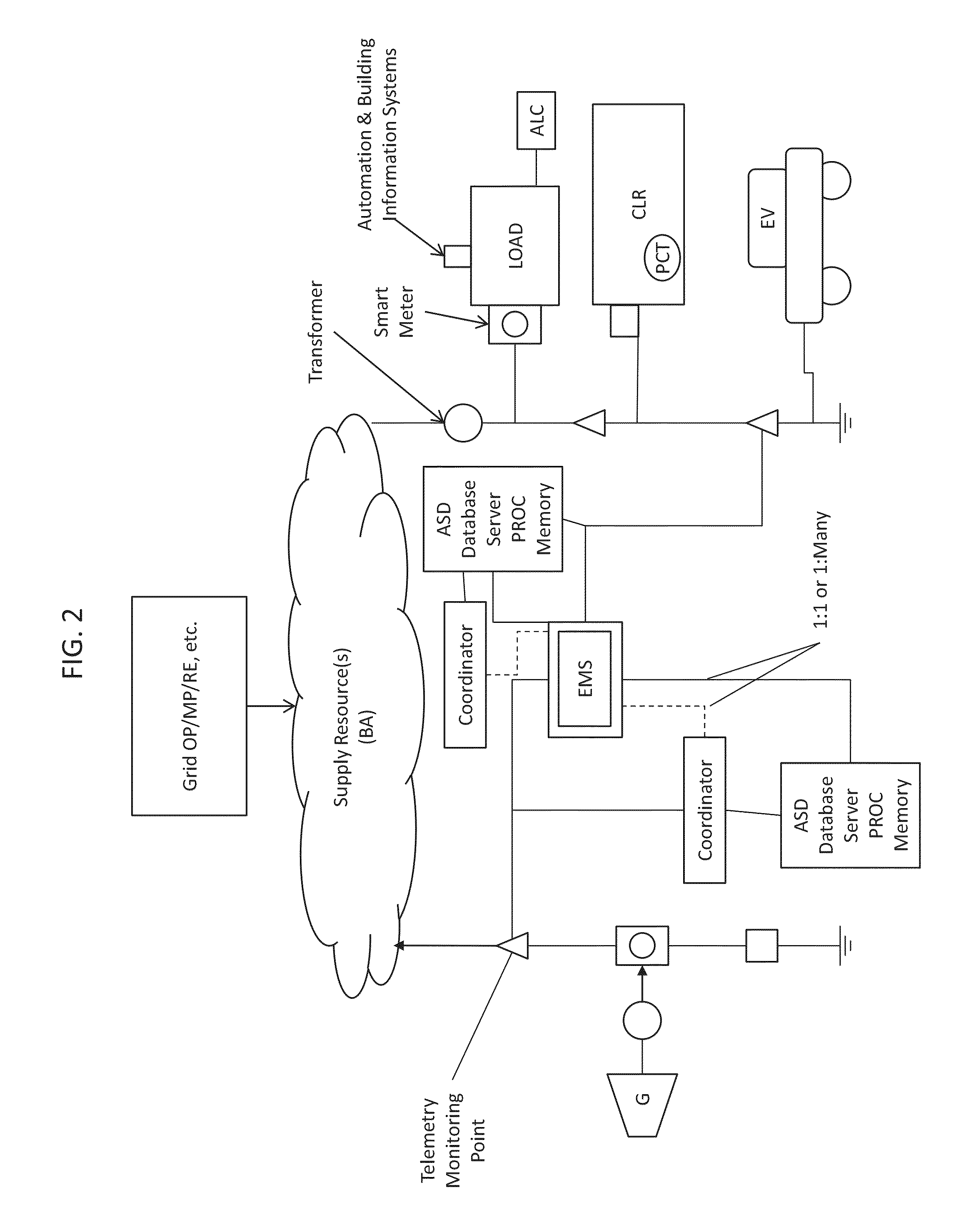

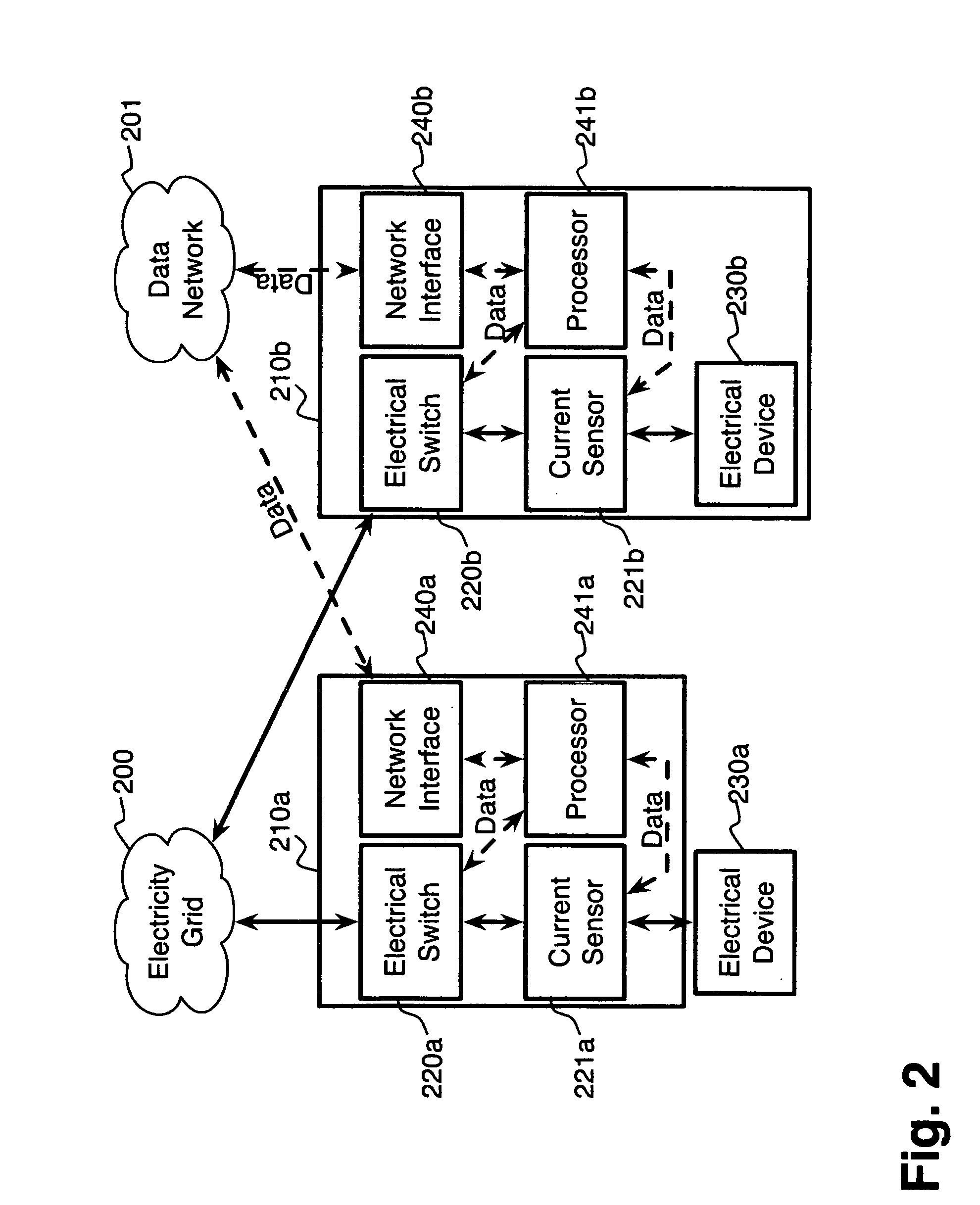

Method and Apparatus for Actively Managing Electric Power Supply for an Electric Power Grid

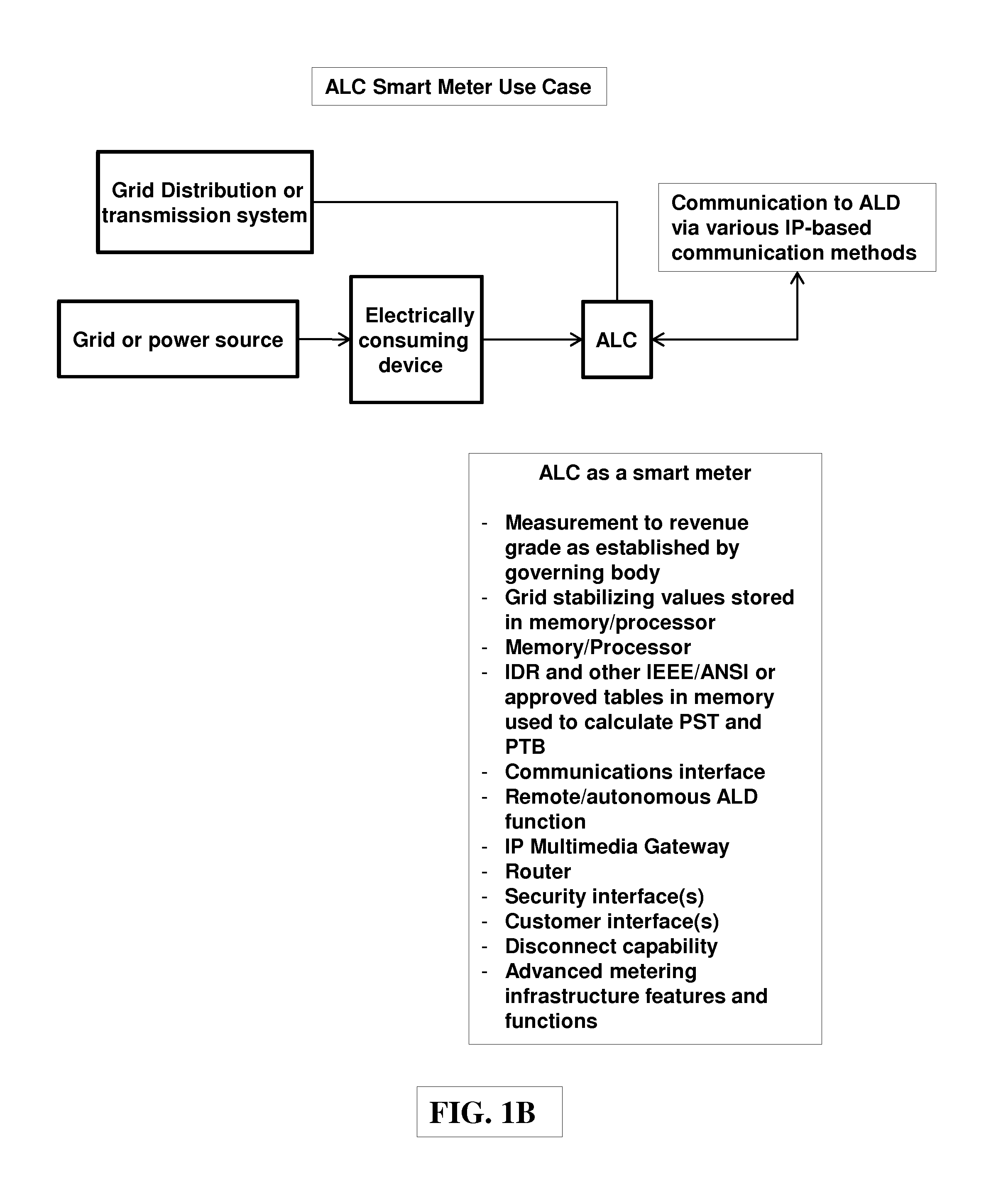

ActiveUS20140018969A1Improve grid stabilityLevel controlVolume/mass flow measurementGrid operatorPower grid

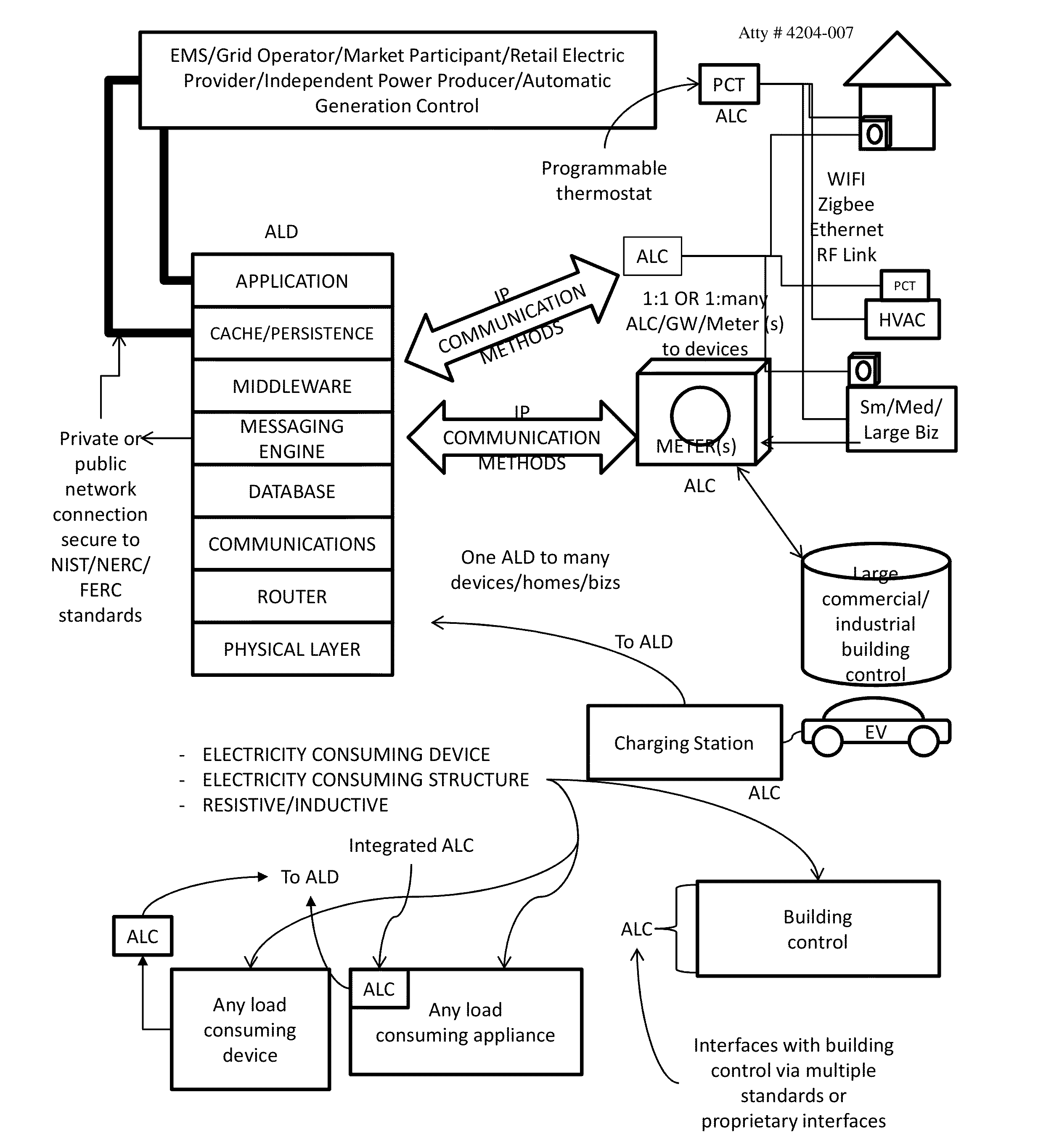

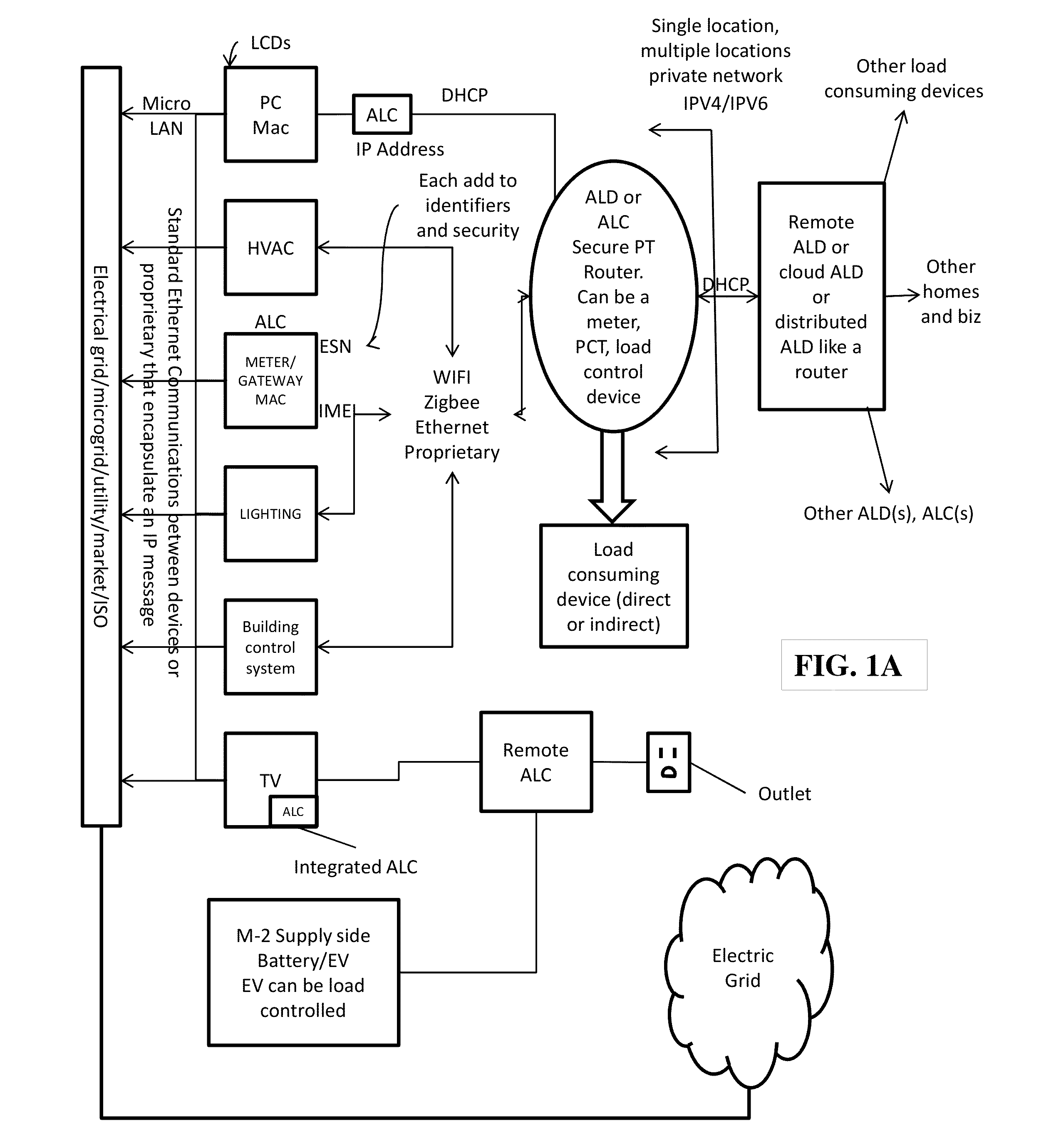

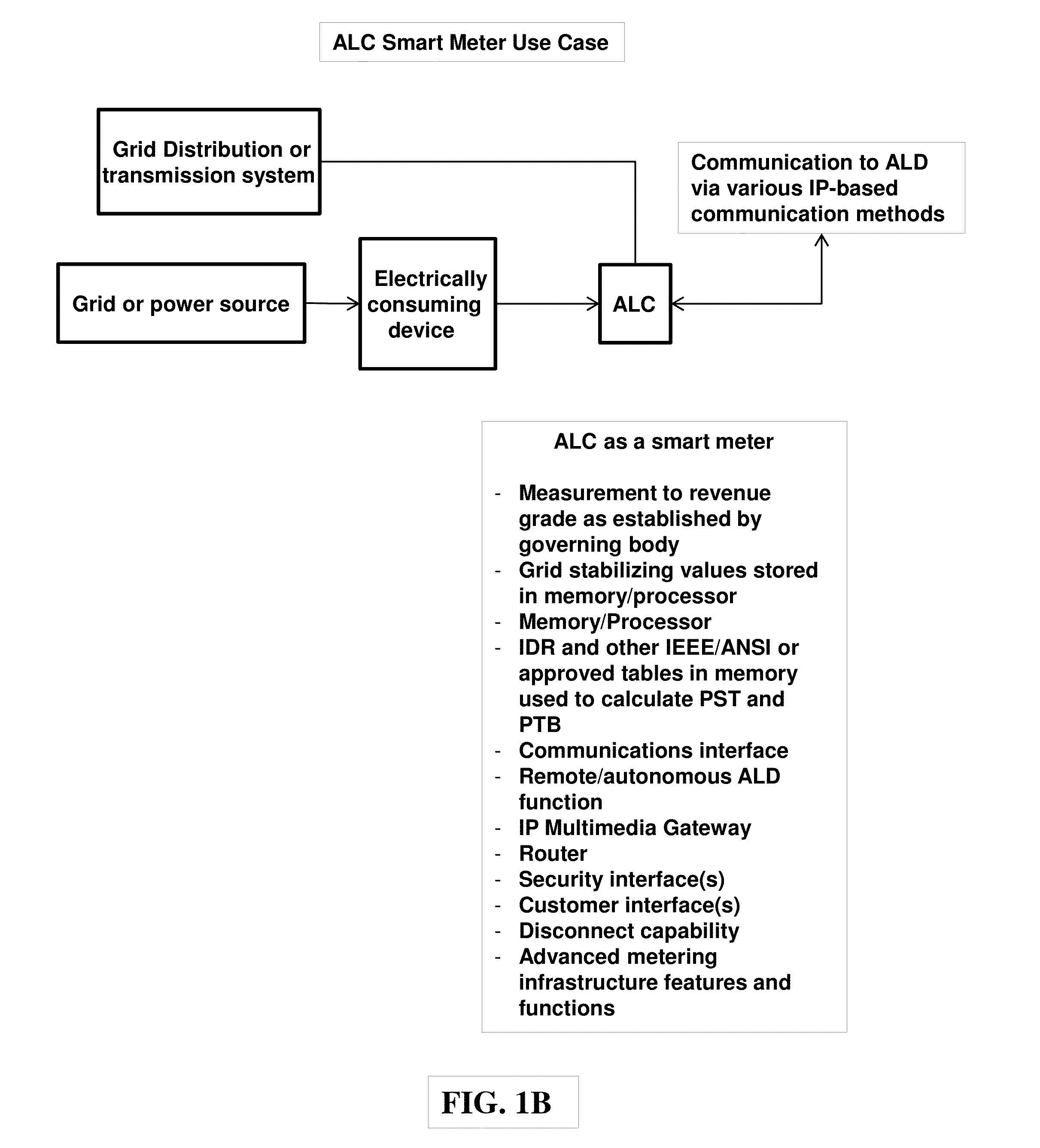

Systems and methods for managing power supplied over an electric power grid by an electric utility and / or other market participants to multiplicity of grid elements and devices for supply and / or load curtailment as supply, each of which having a Power Supply Value (PSV) associated with its energy consumption and / or reduction in consumption and / or supply, and wherein messaging is managed through a network by a Coordinator using IP messaging for communication with the grid elements and devices, with the energy management system (EMS), and with the utilities, market participants, and / or grid operators.

Owner:CAUSAM ENERGY INC

Electronic music/media distribution system

InactiveUS7209892B1Optimize allocationFacilitates continued control over the musical content sentCommerceProgram/content distribution protectionElectronic contractsIntellectual property

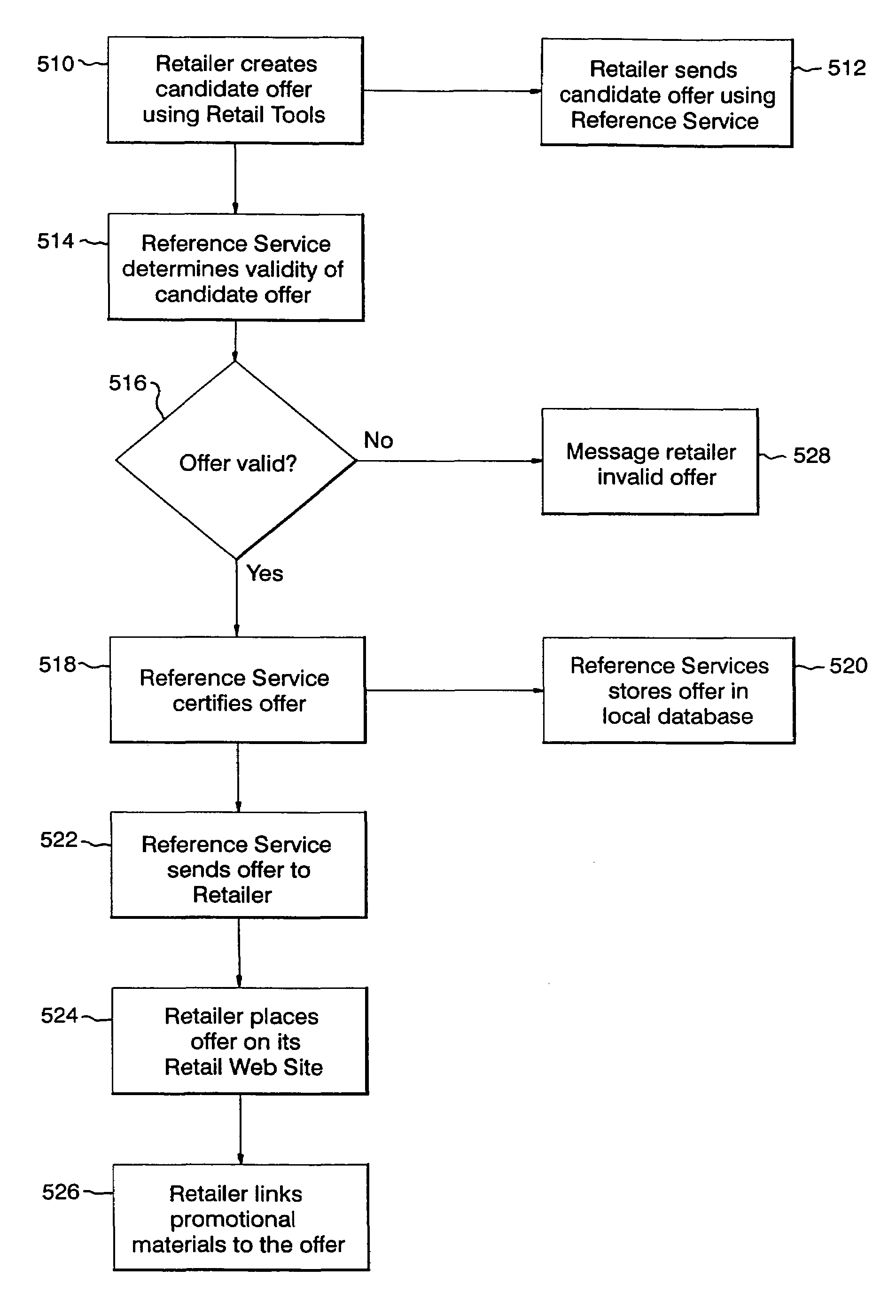

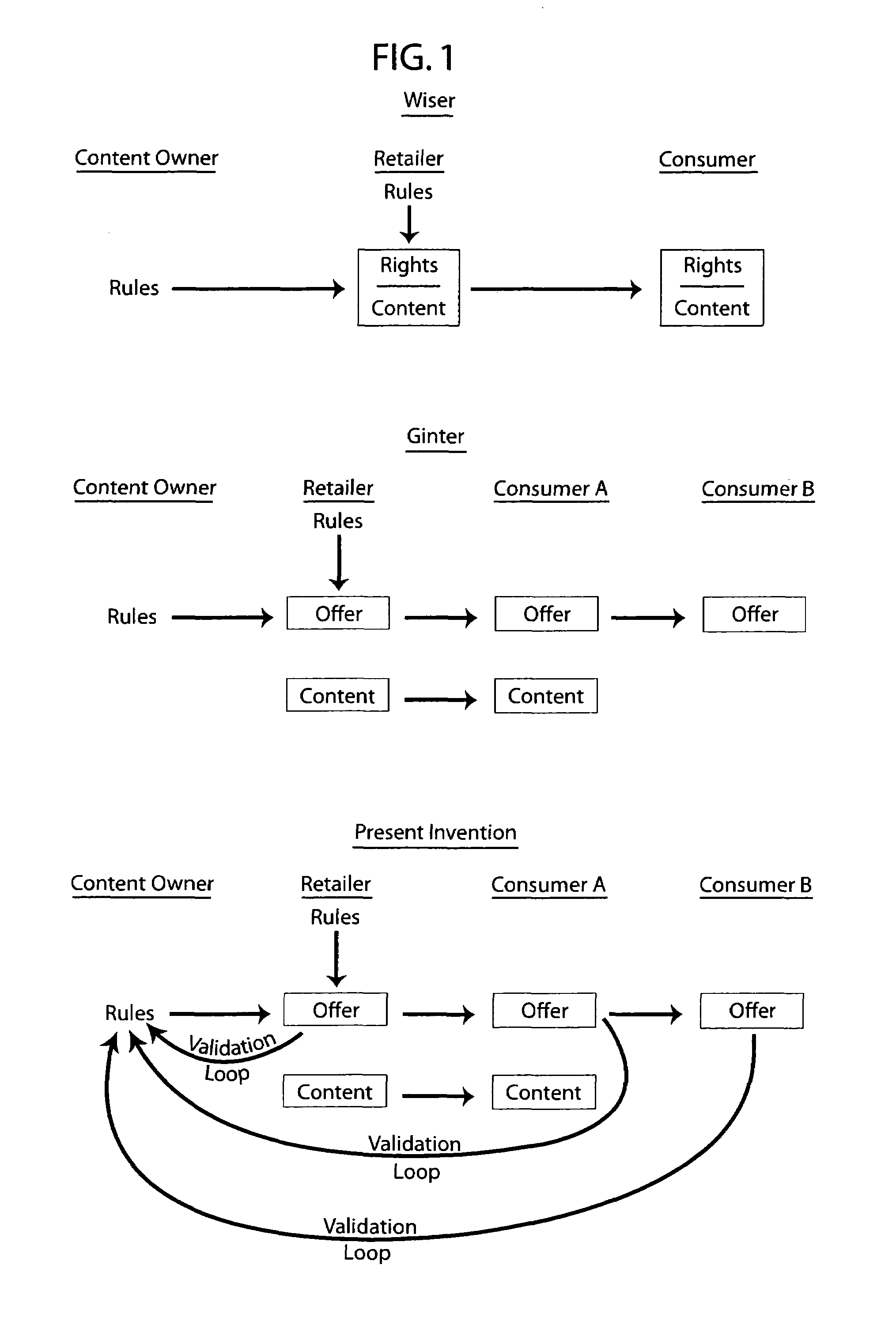

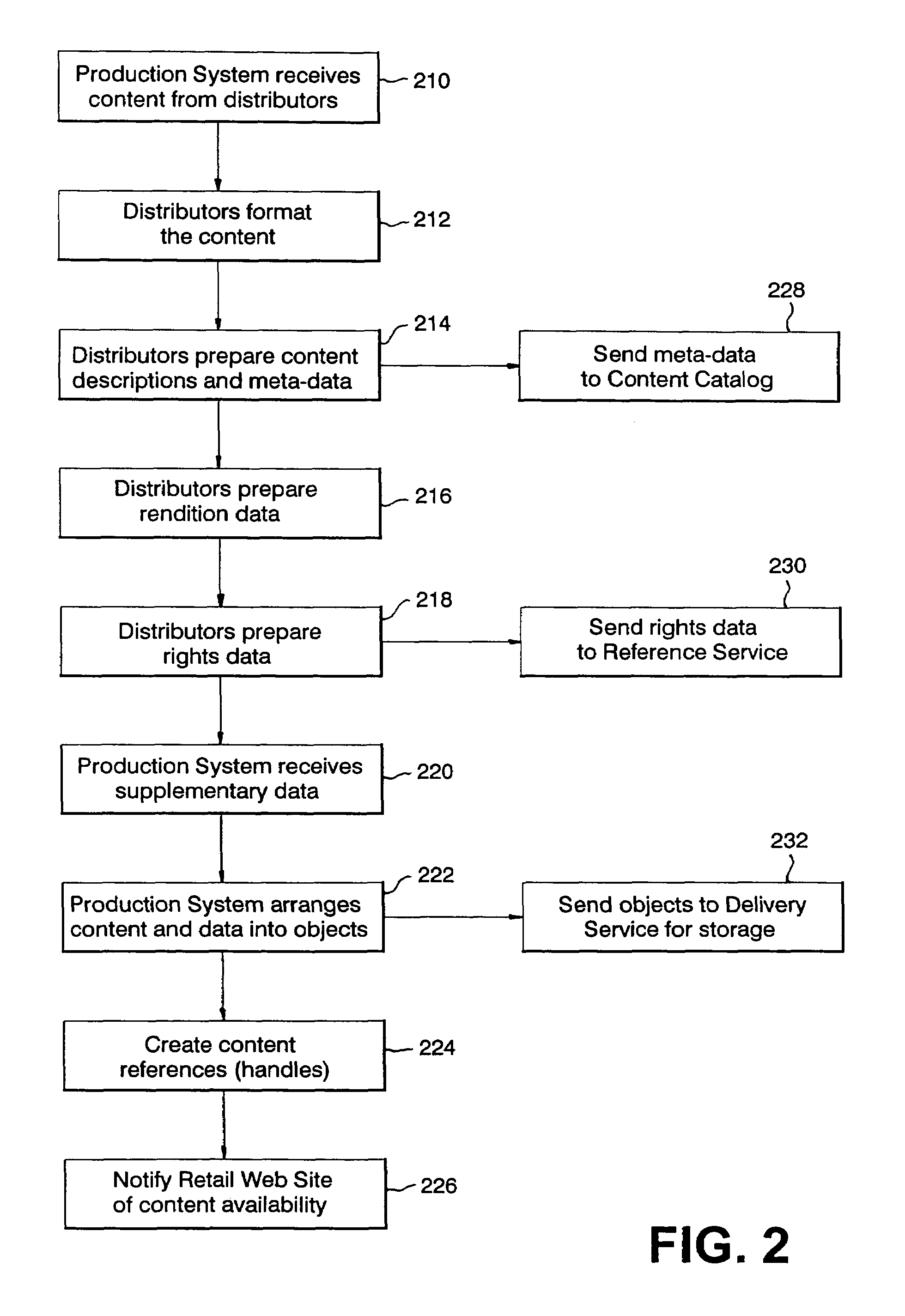

An electronic media distribution system which facilitates the distribution of media to consumers over a network, such as the Internet, while achieving commercial business objectives and protecting the intellectual property rights associated with the media being distributed. The system provides the infrastructure and support for various market participants to engage in buying, selling, finding and distributing music. The system provides an interface for consumers to locate, access and receive musical content over the Internet. The system facilitates continued control over the musical content sent to consumers by dynamically enforcing retailer agreements and restrictions governing the purchase, use, and distribution of the content. The system also provides a service to retailers and distributors in assisting with the management of sales and distribution of music over the Internet. Specifically, the system certifies and distributes retail offers for the content where the offers are dynamically updated by electronic contracts between the retailers and distributors of the music.

Owner:UNIVERSAL MUSIC GROUP

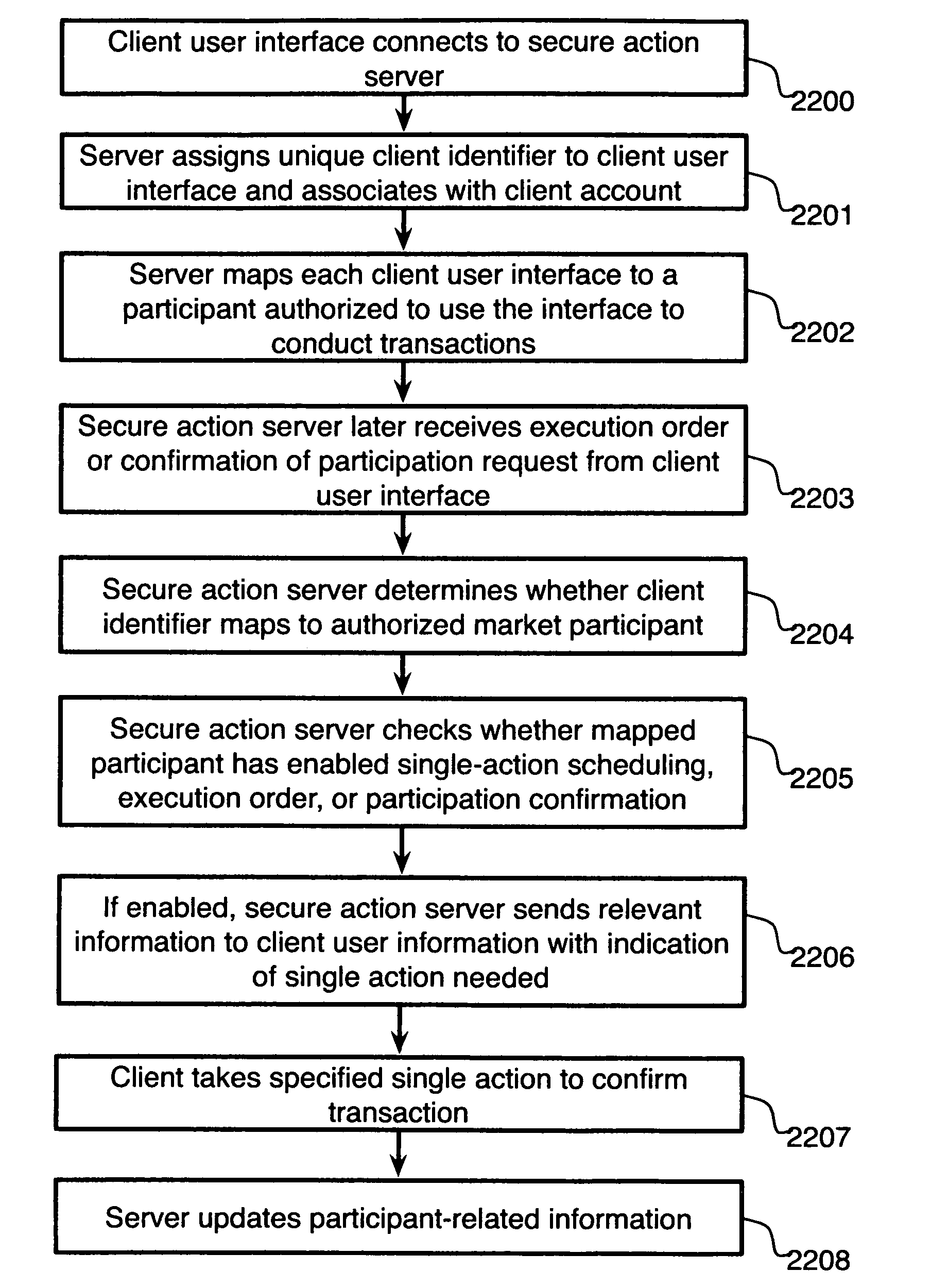

System and method for single-action energy resource scheduling and participation in energy-related securities

InactiveUS20100217642A1Circuit arrangementsDigital data processing detailsCommunication interfaceInformation transmission

A system for single-action energy resource scheduling and participation in energy-related securities, comprising a communications interface executing on a network-connected server and adapted to receive information from a plurality of client user interfaces and a secure action server coupled to the communications interface, wherein the secure action server, on receiving a connection from a client user interface, assigns a unique client identifier to the client user interface and associates the unique identifier with a client account, and wherein the secure action server, on receiving a request from a client user interface, determines whether the client user interface is mapped to an authorized market participant who has enabled single-action scheduling, execution order, or participation confirmation functionality for the client user interface, and passes information to the client user interface pertaining at least to a single action needed to confirm scheduling, execution order, or participation and wherein the secure action server, on receiving indication from the communications interface that a required single action has been taken, at least updates information about the market participant who took the action, is disclosed.

Owner:CRUBTREE JASON +4

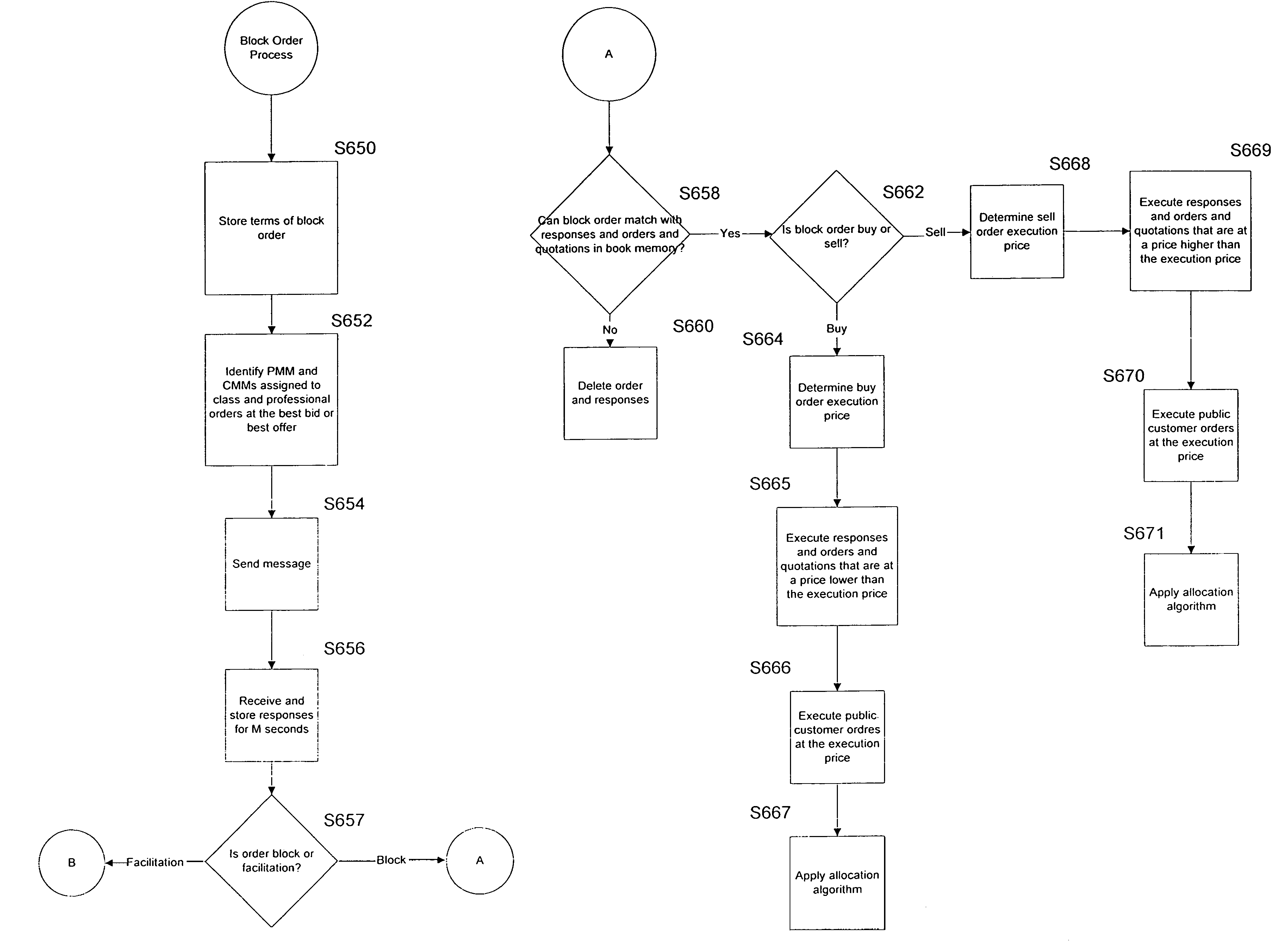

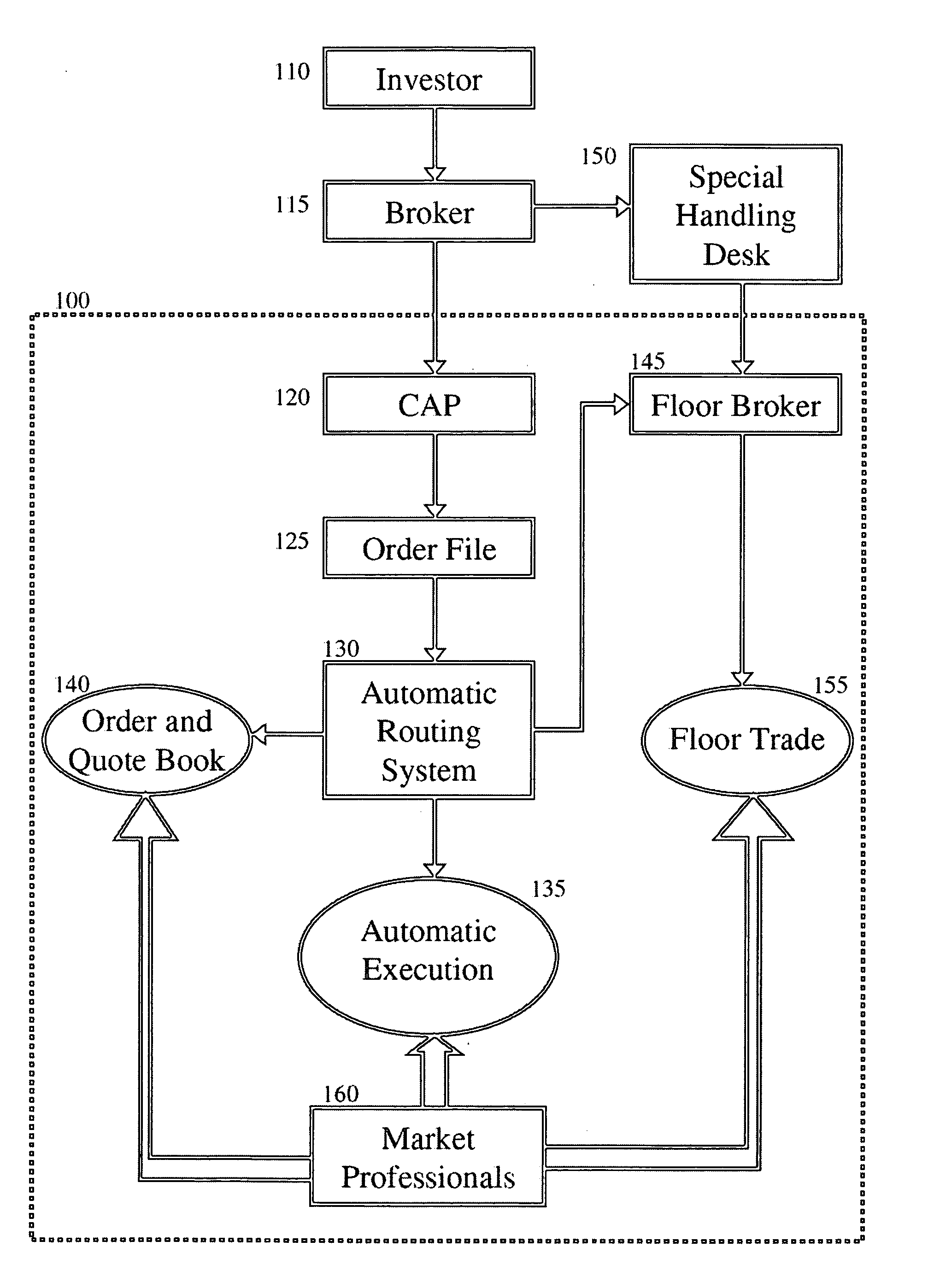

Automated exchange for trading derivative securities

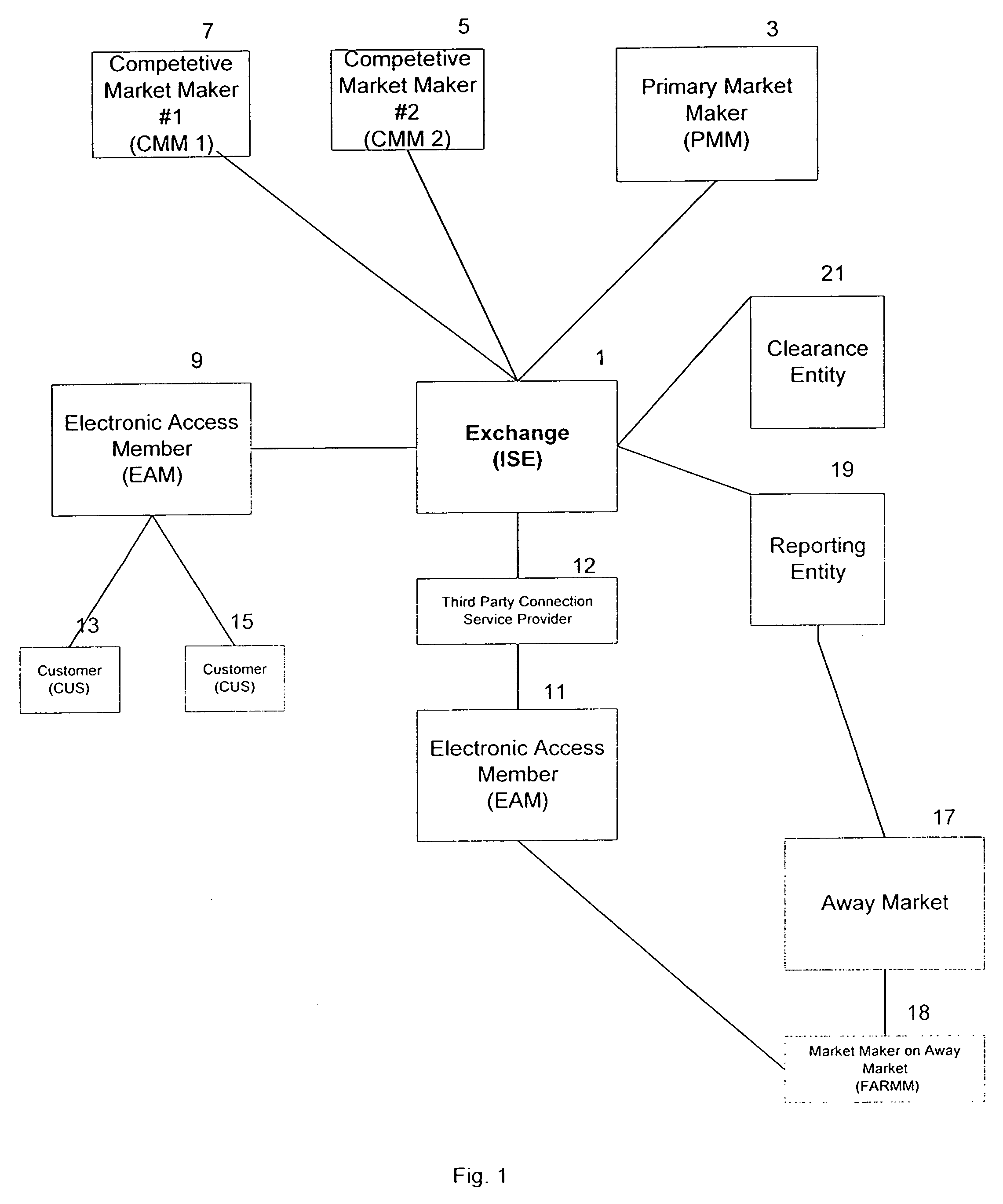

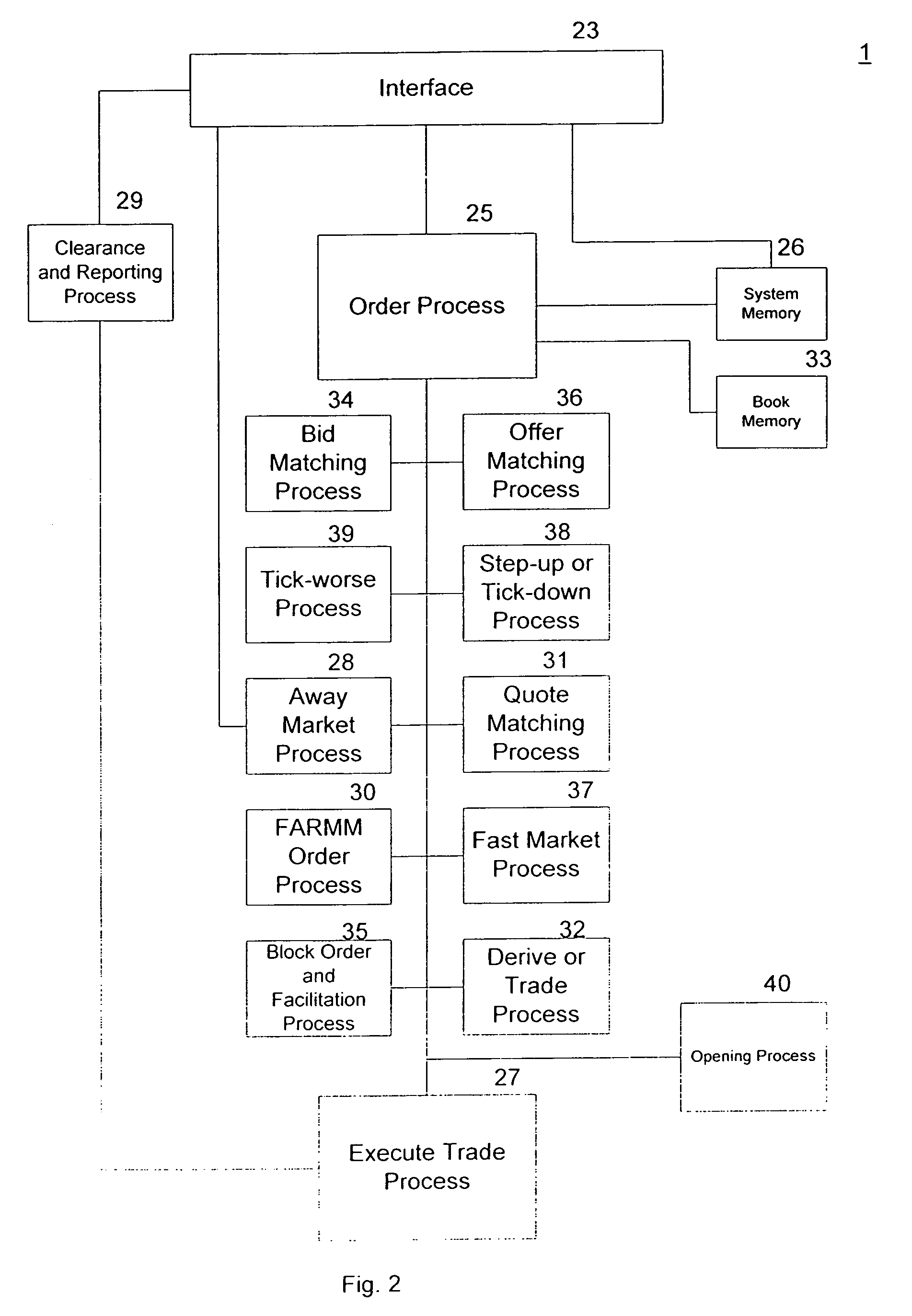

InactiveUS7246093B1Improve liquidityFair handling of orders.FinanceComplex mathematical operationsMedicineMarket participant

Owner:INTERNATIONAL SECURITIES EXCHANGE

Exchange, scheduling and control system for electrical power

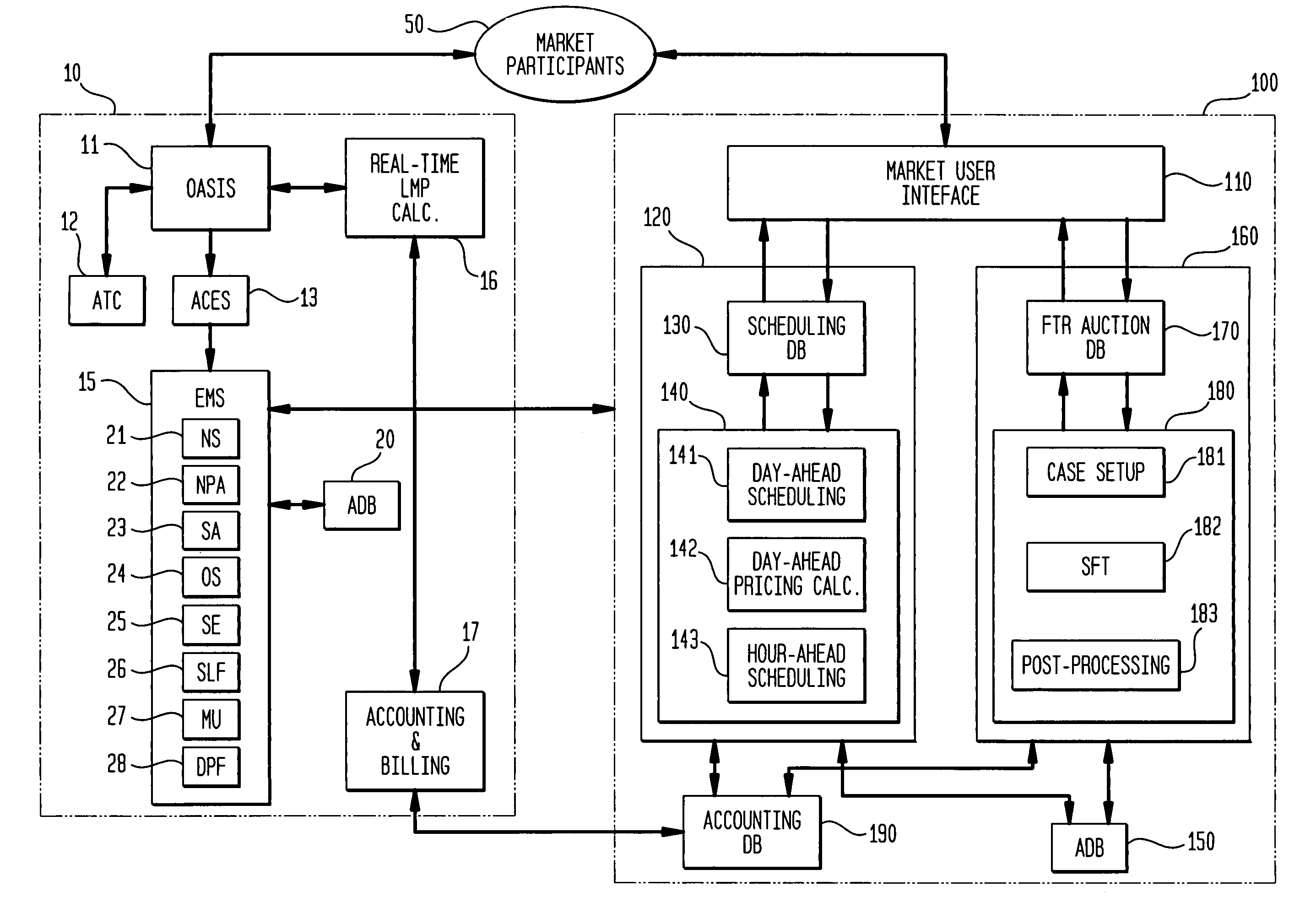

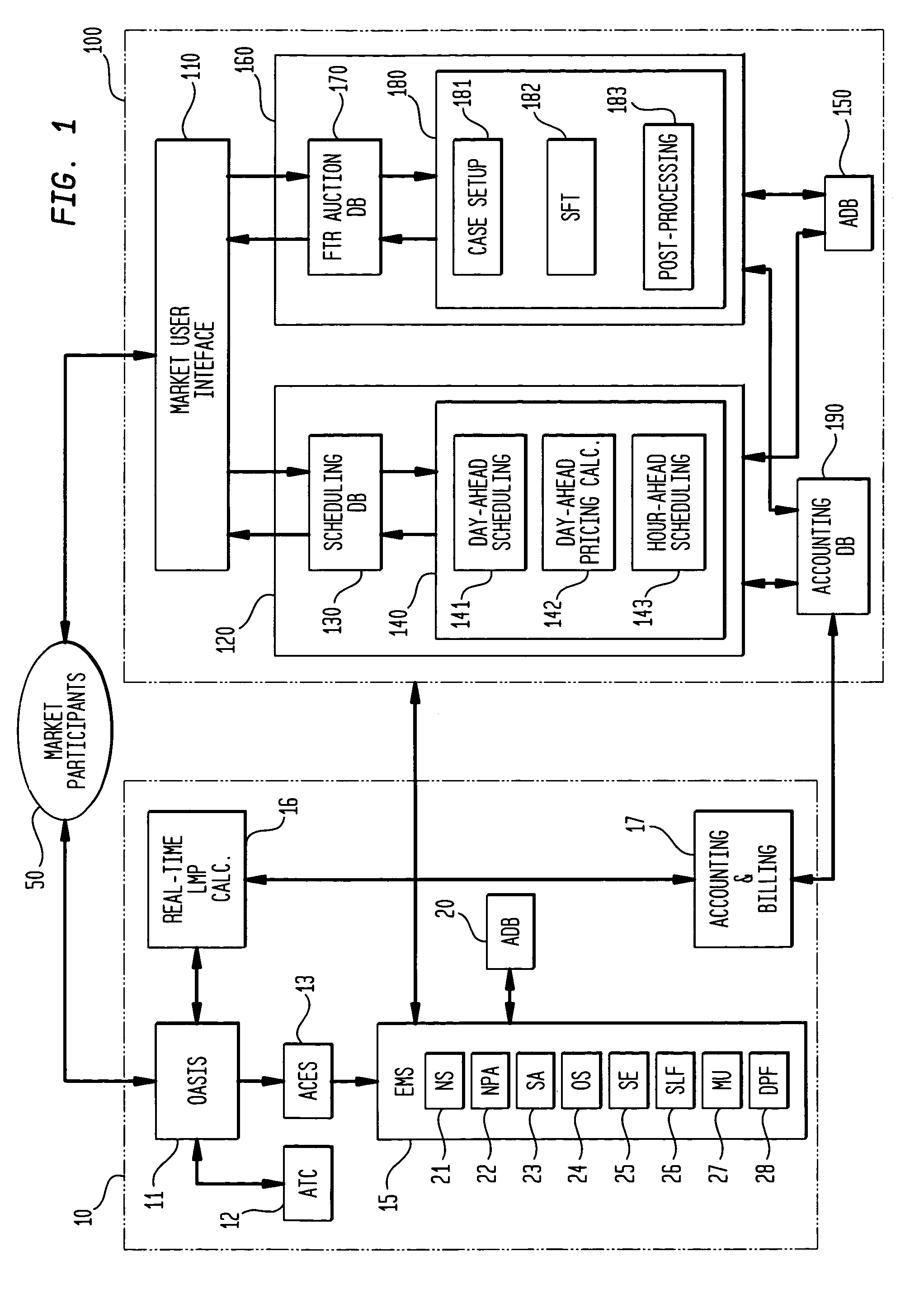

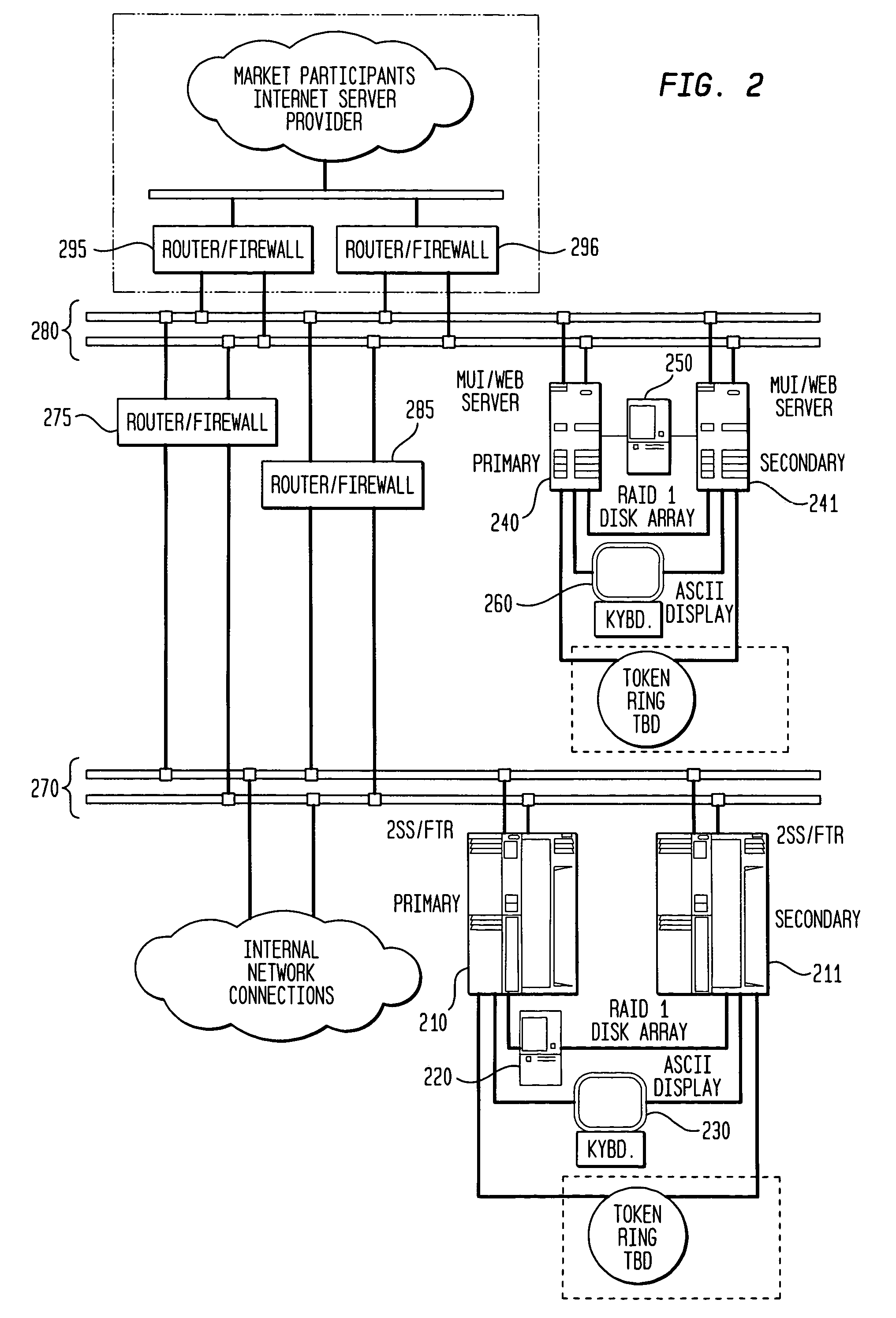

A system for providing an automated, on-line forward market for the exchange and scheduling of electrical power and for the auctioning of fixed transmission rights (FTRs) on a power generation and distribution system. The system provides an on-line interface to multiple, remotely located market participants who can offer to buy or sell energy for next-day scheduling. Settlement of scheduled transactions can be done on a day-ahead as well as on a real-time basis. Scheduled transactions can also be modified on an hour-ahead basis. The market participants can also take part in a monthly auction of FTRs. The market system operates in conjunction with the control facilities of the power system. Both the day-ahead market and the FTR auction are carried out by the system as part of a process which ensures the secure and efficient operation of the power system.

Owner:SIEMENS AG +1

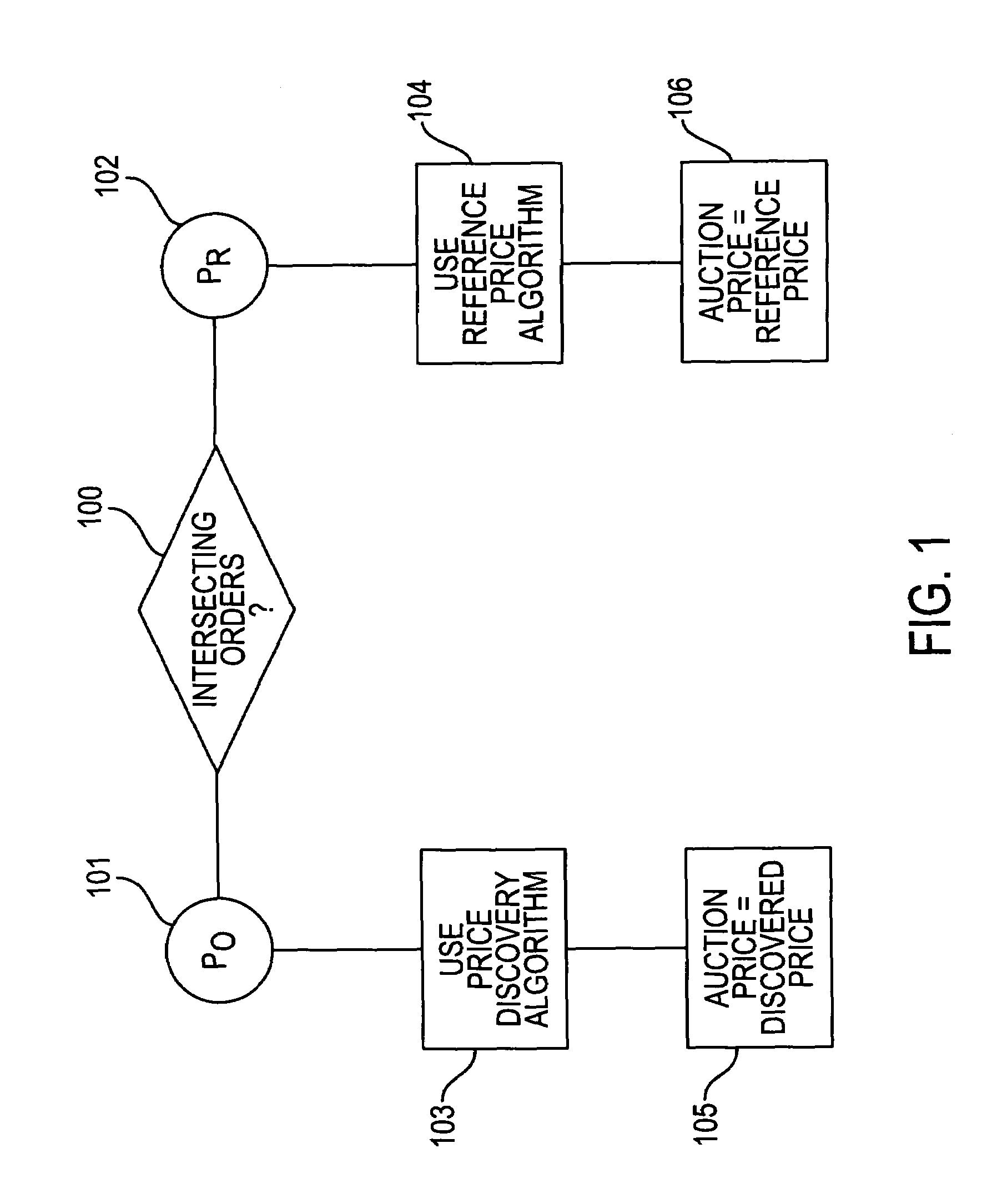

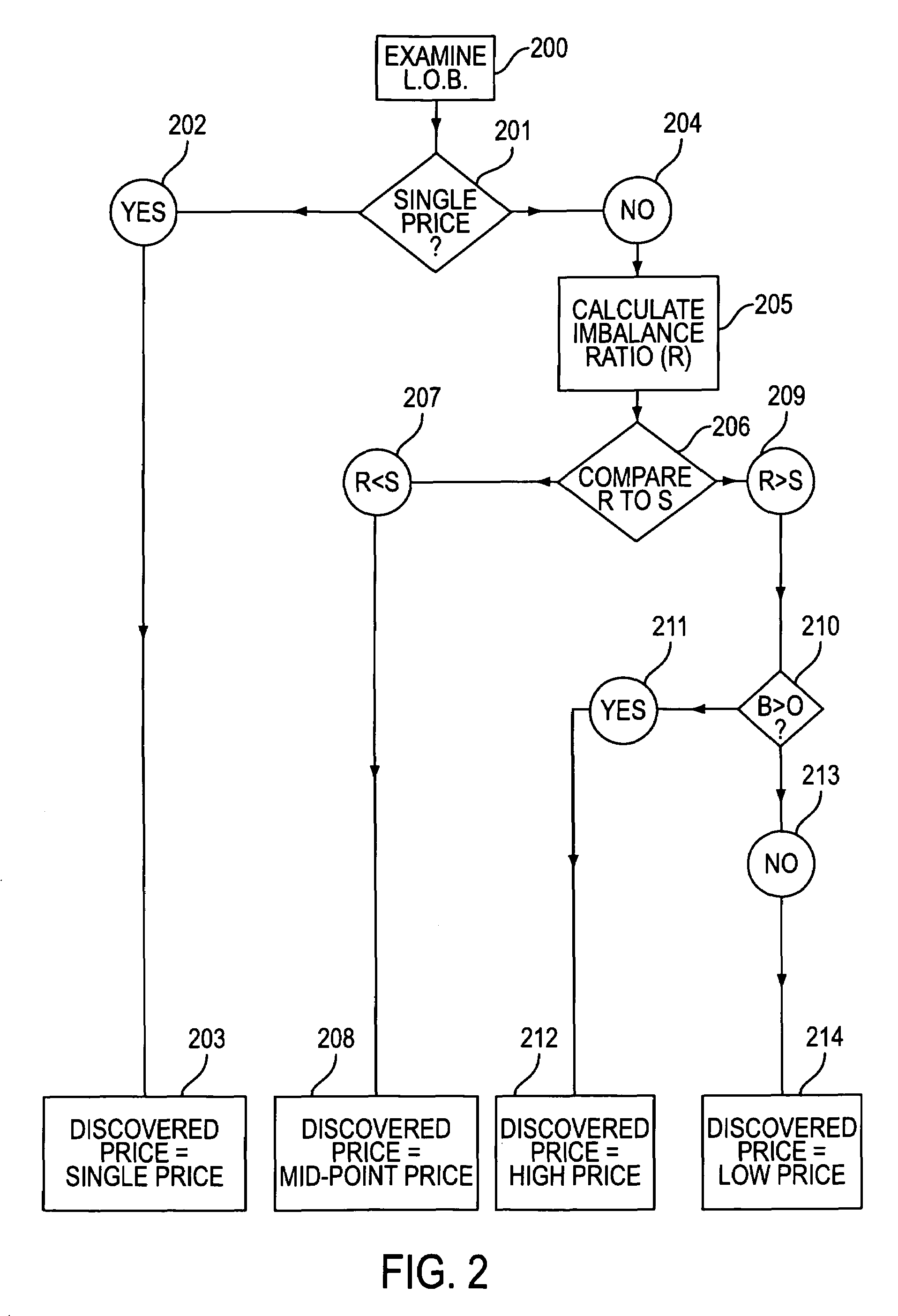

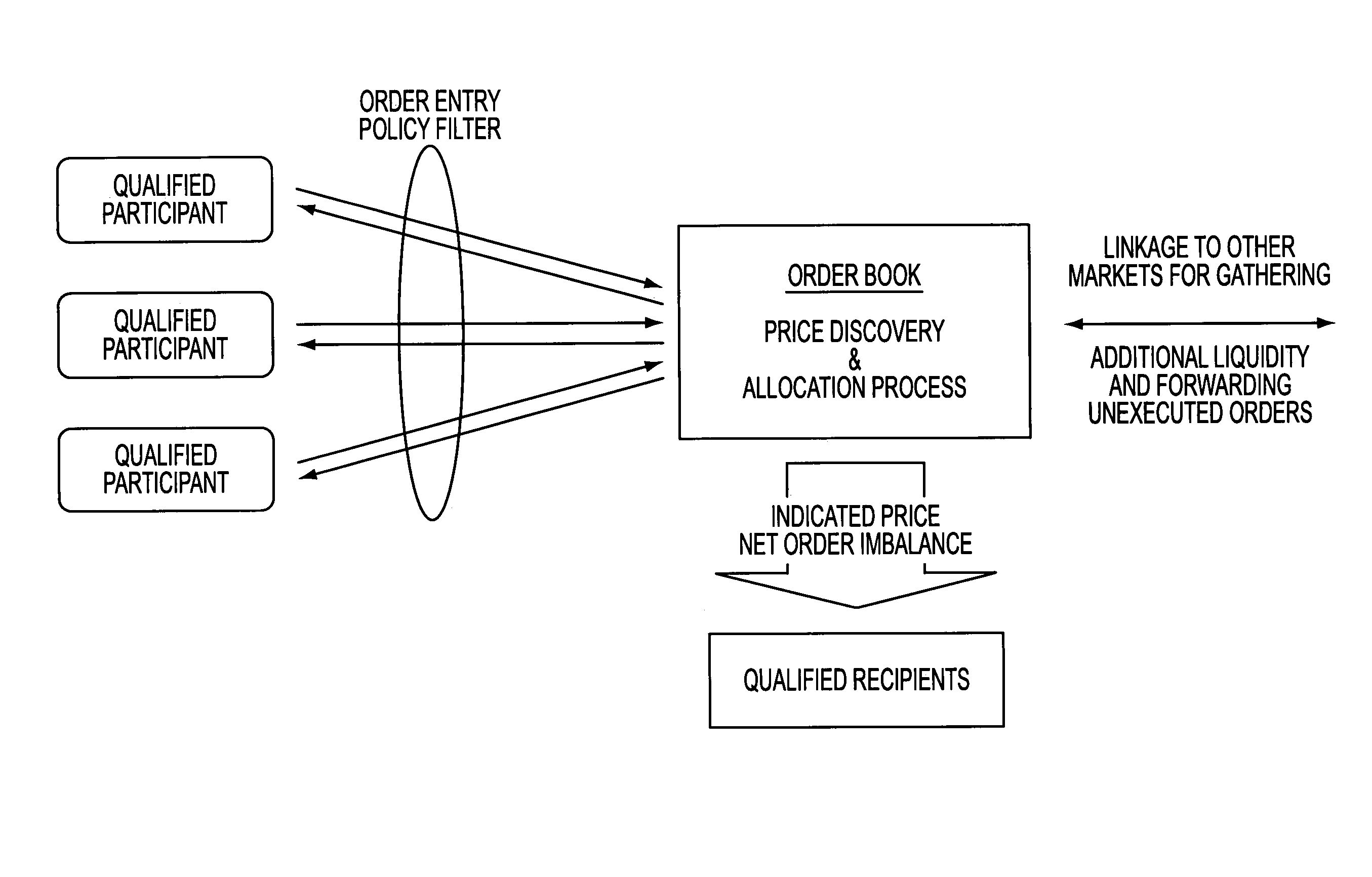

Method and system for obtaining a discovered price

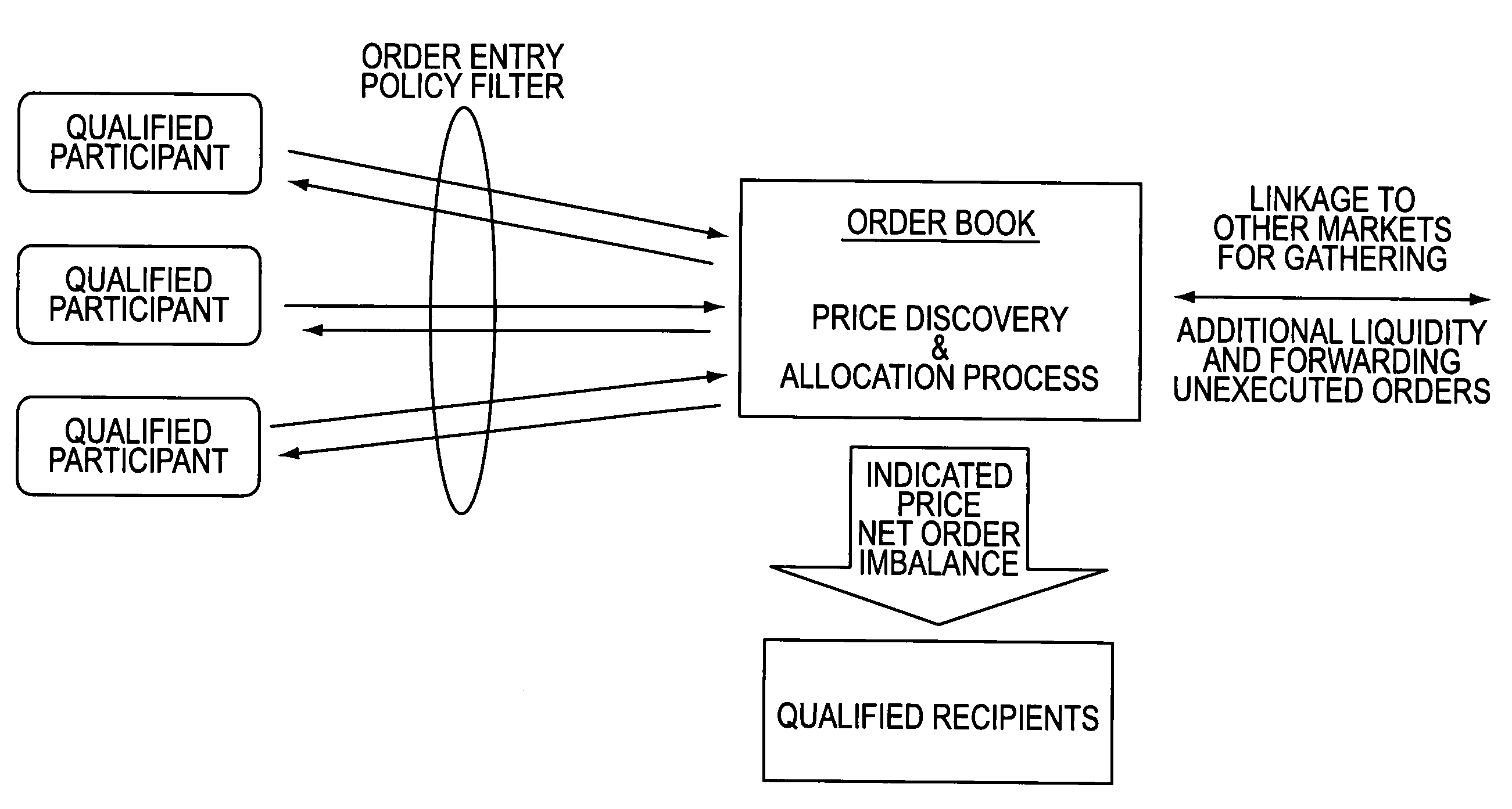

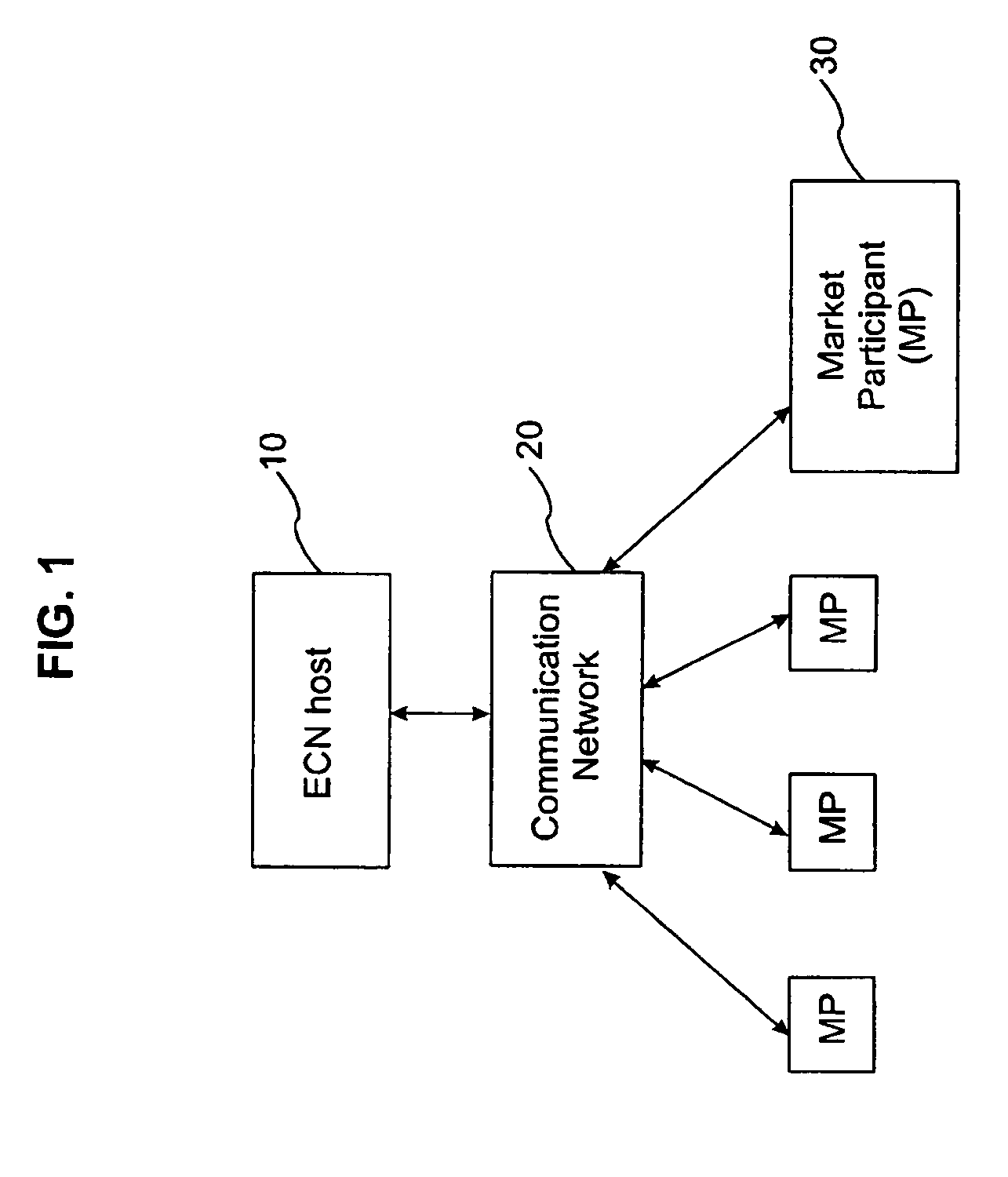

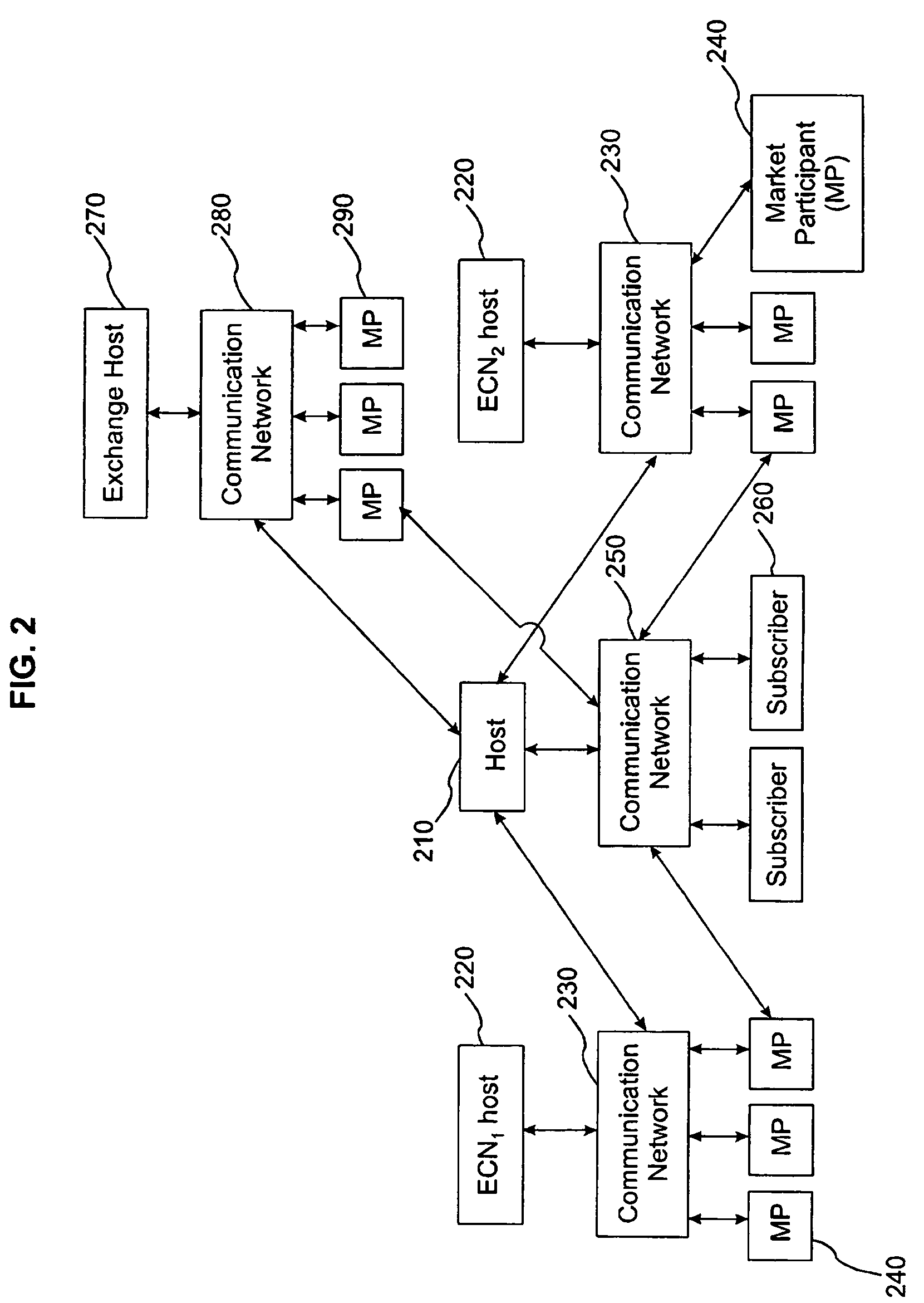

A method and system for determining an optimal price at which to perform a batch auction of financial assets. Orders, according to a variety of predetermined order types, are received from qualified market participants and communicated to an auction system according to the invention. The auction system takes into account each order and its impact upon relative supply and demand to determine by a preset algorithm an optimal price and share transaction quantity. The optimal price is selected by identifying a particular price at which trade volume would be maximized and which reflects the appropriate effect of supply and demand imbalances. Trades are executed at the optimal price, and portions of the transaction quantity are allocated to each investor on a fair basis dependent upon their submitted orders. In another aspect, the auction system includes a computer system and network designed to automatically perform one or more steps of the above method. Such a system is preferably connected to one or more ECNs such that non-executed shares can be automatically sent to outside sources for execution, and connected to real time quote services to obtain current market information.

Owner:ITG SOFTWARE SOLUTIONS INC

Short-term option trading system

InactiveUS20060036531A1High leverageTake advantage ofFinancePayment architectureExpiration TimeShort terms

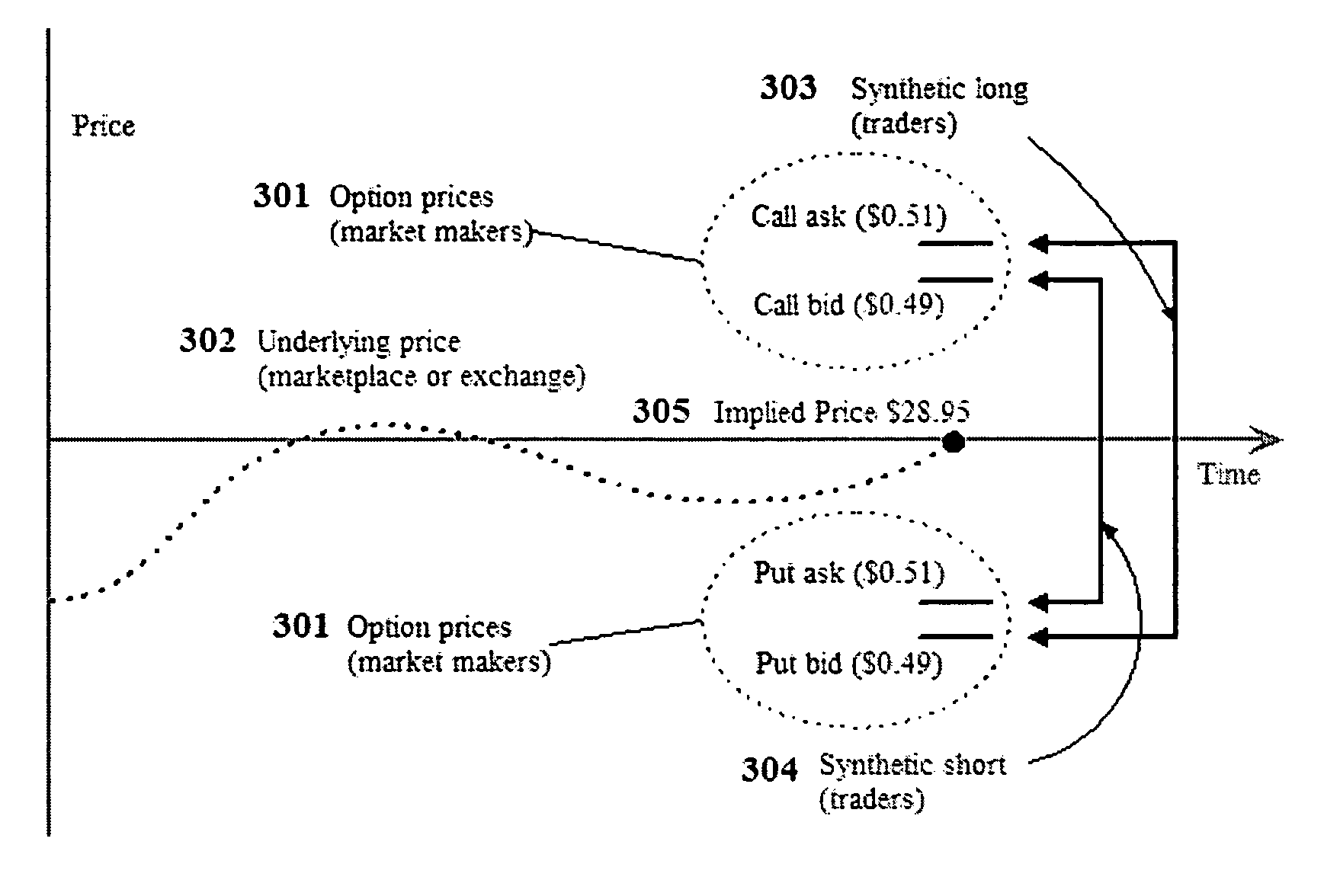

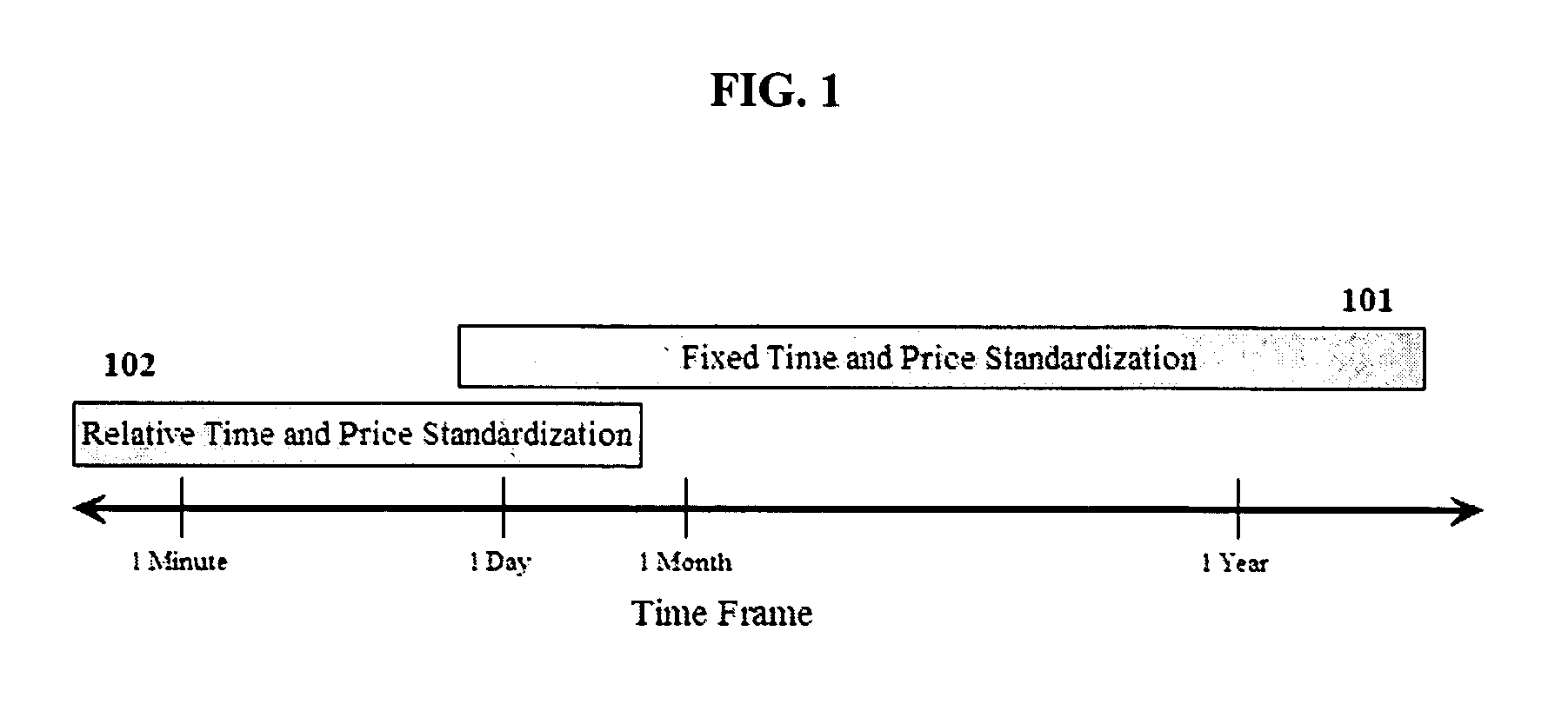

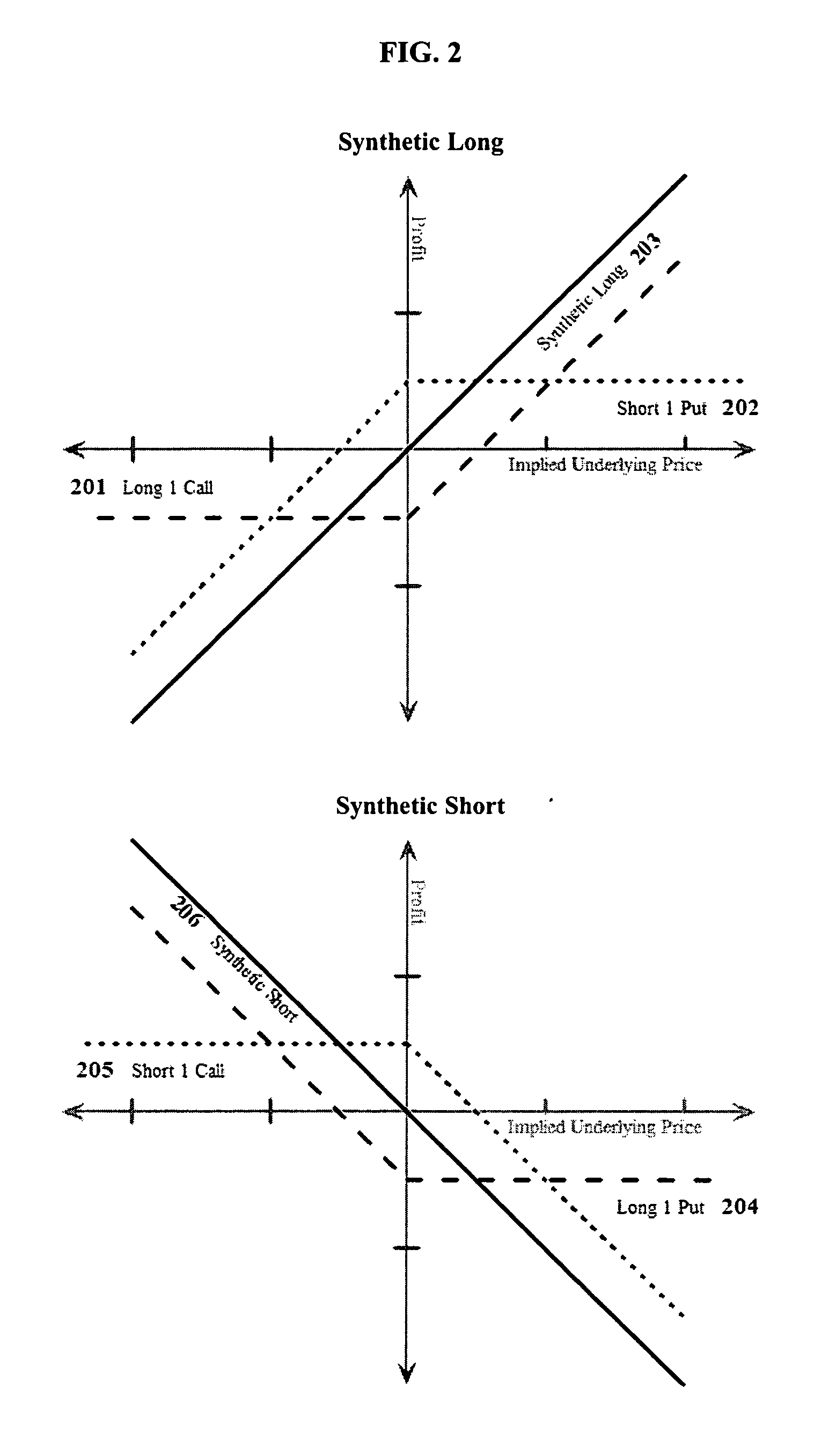

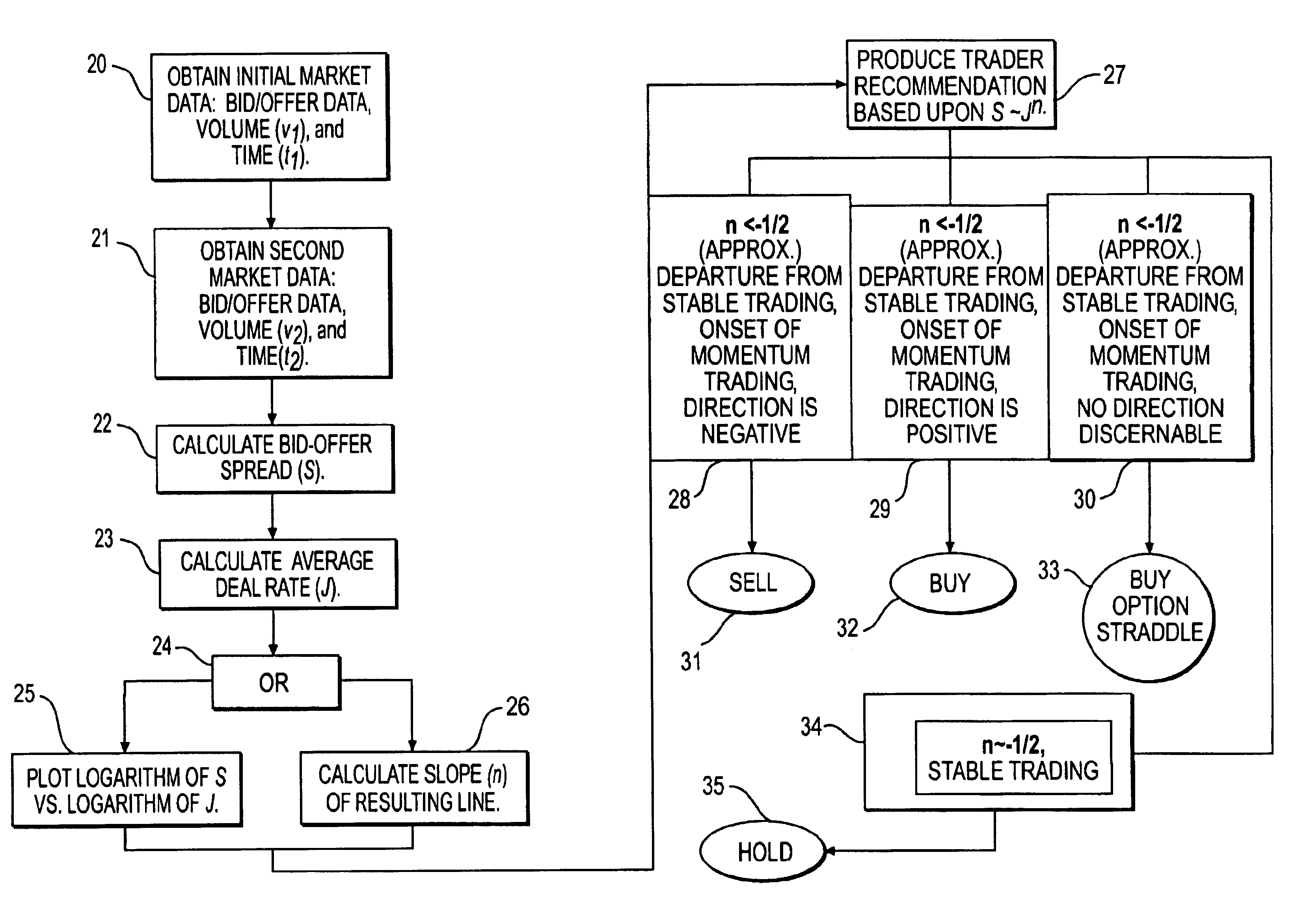

Option contracts are traded by valuing an option that has at least one of a) strike price or b) expiration time unknown at the time the option is valued. The previously unknown values of the option are assigned at the time or after the time the trade is completed. An implied underlying price stream is generated from the option prices through the use of feedback between market participants and the marketplace. The resulting system is useful in trading option contracts of short time duration.

Owner:MICROTICK

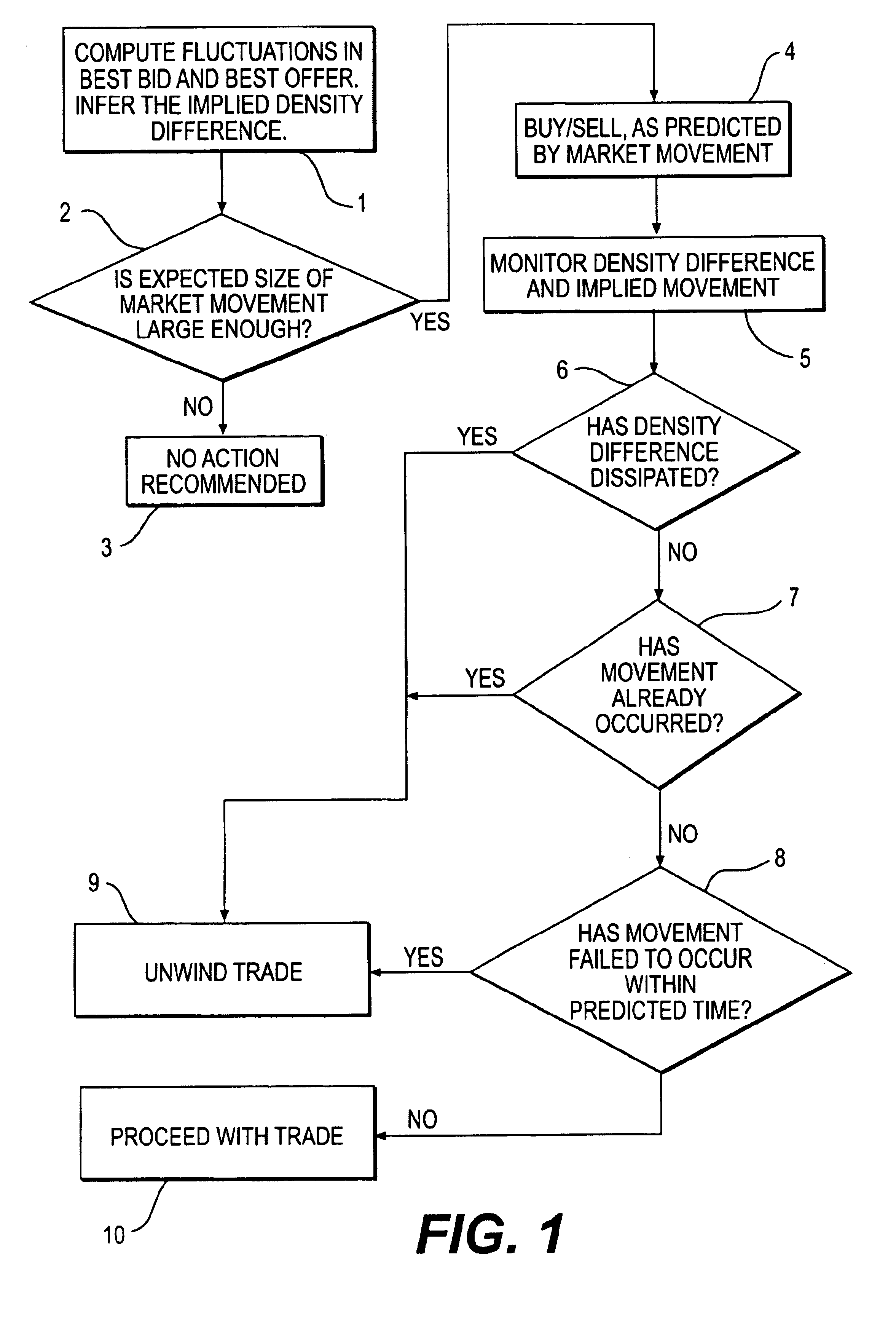

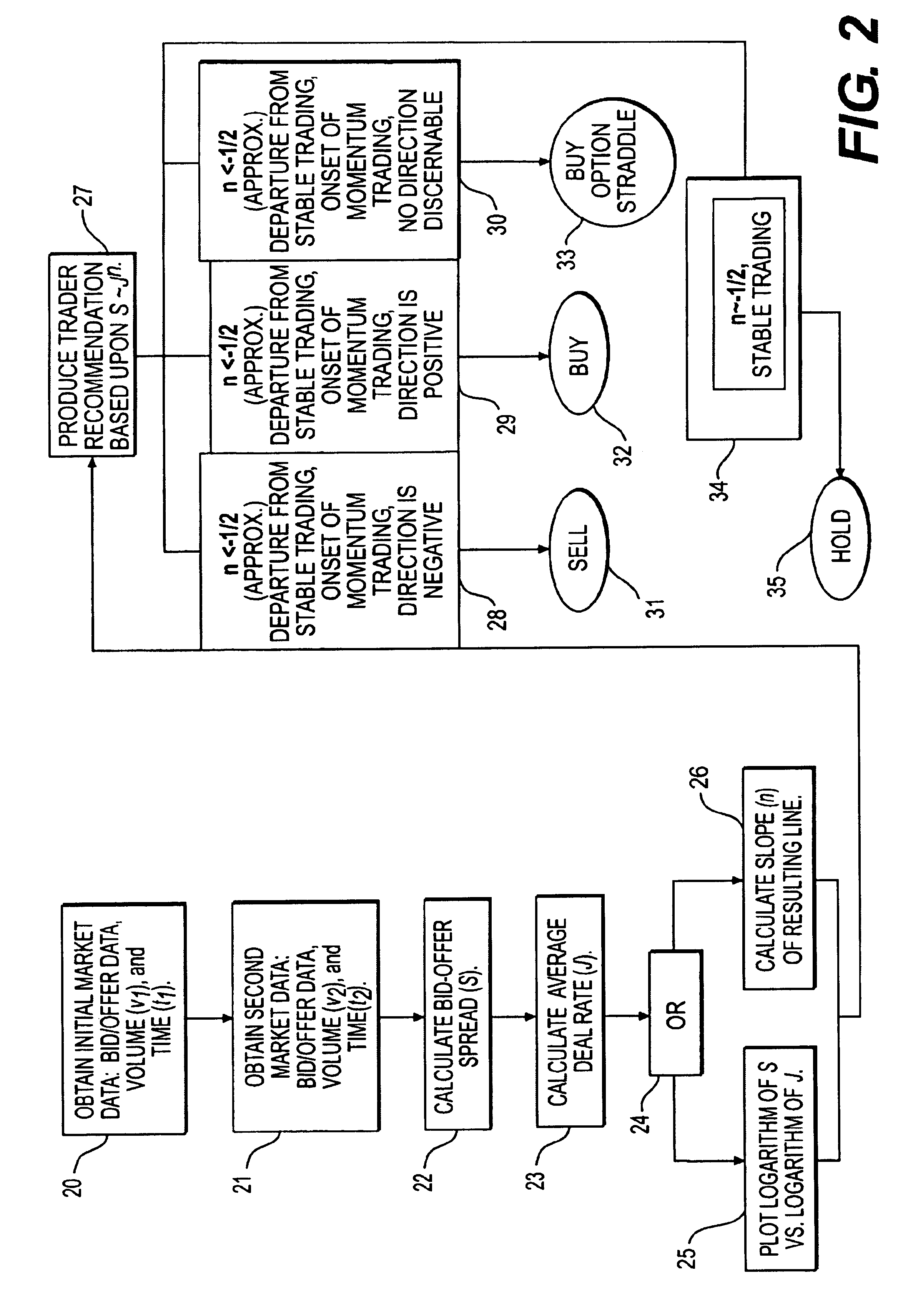

Method of monitoring market liquidity

Owner:ELIEZER DAVID A +1

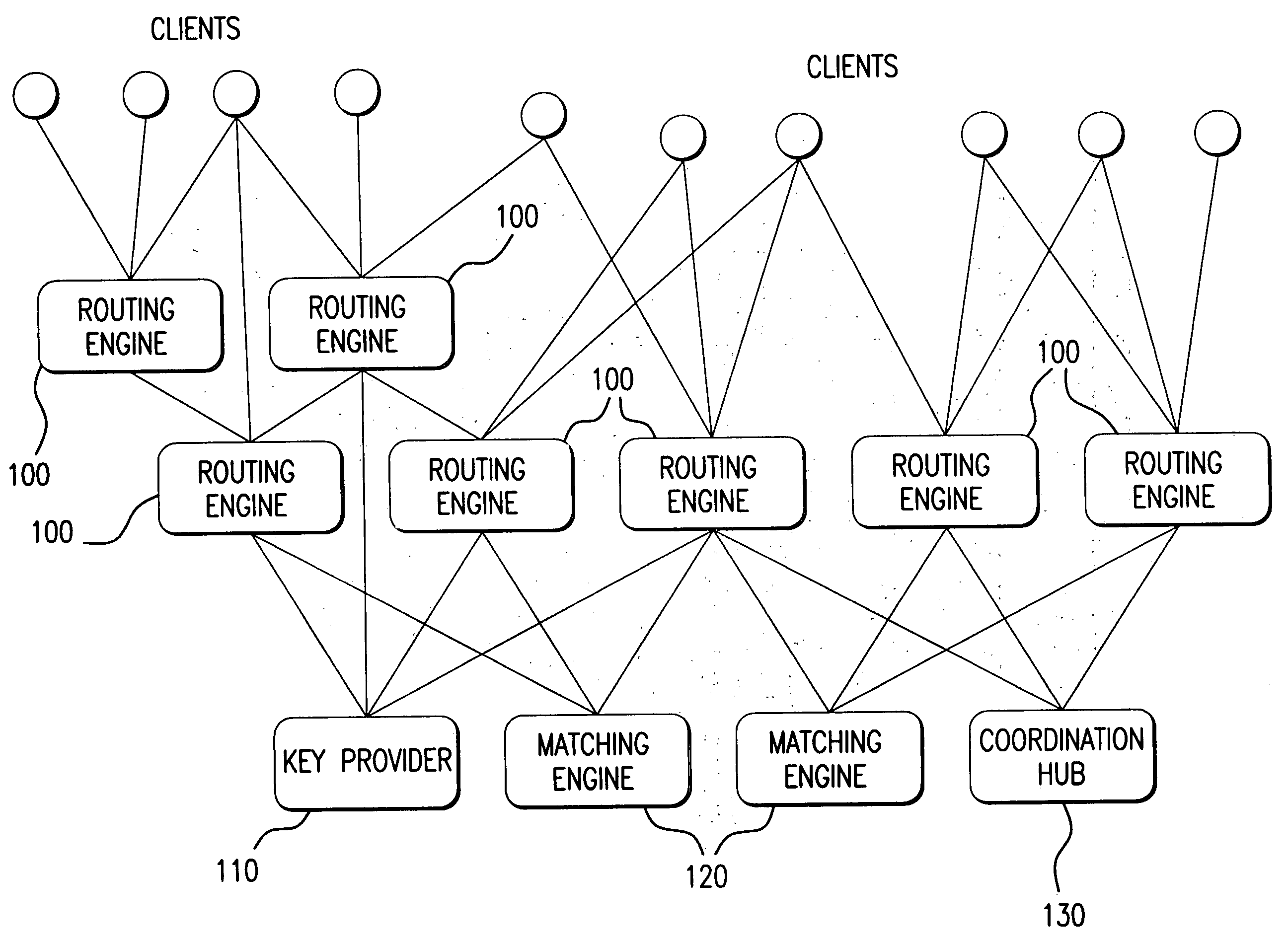

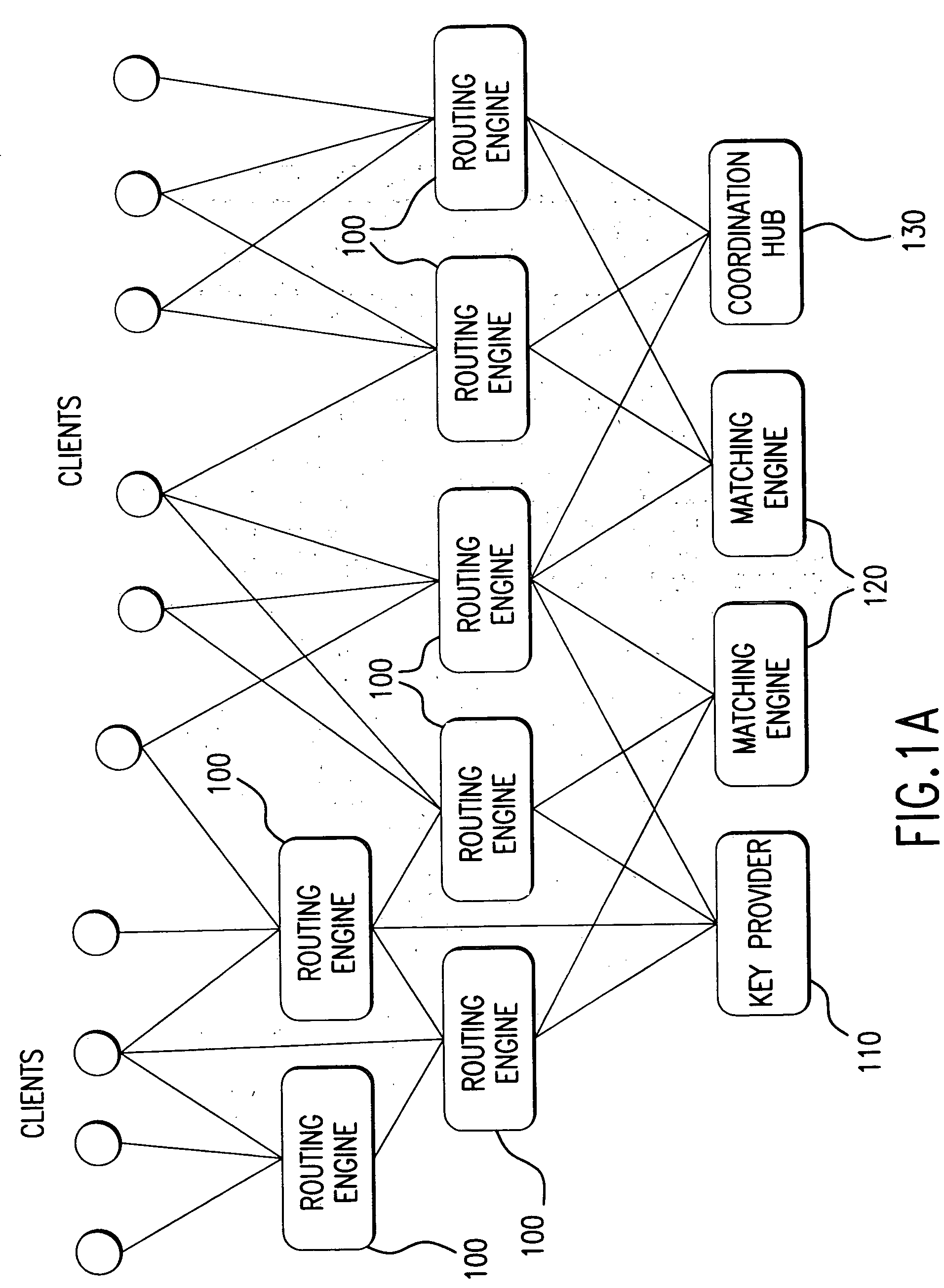

Method and system for managing distributed trading data

InactiveUS7565313B2Avoid misuseMaximizing internalization rateFinanceCommerceData providerTransaction data

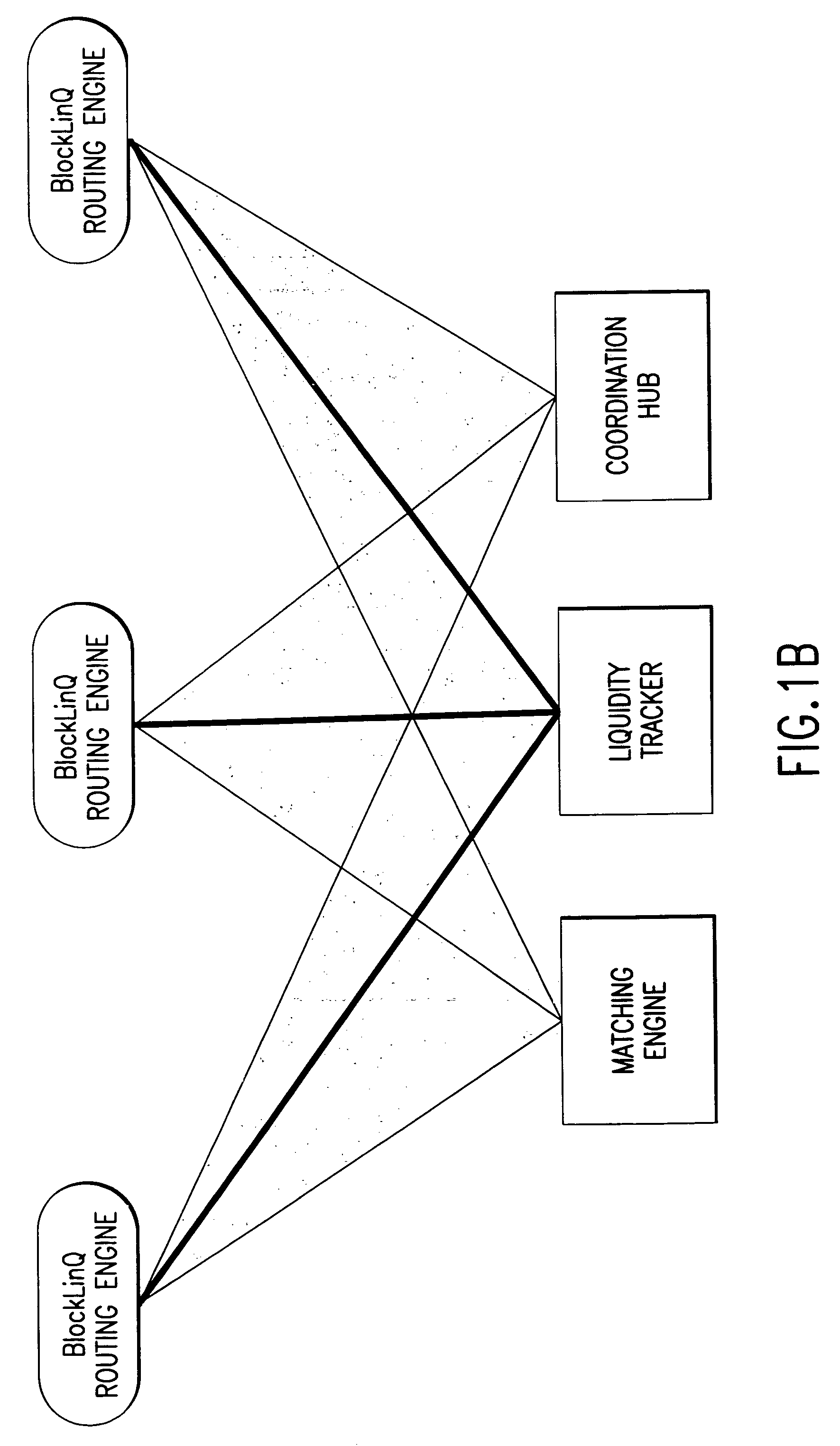

In a preferred embodiment, the invention comprises a computer-implemented system and method of managing market information across a network of data providers, comprising the steps of: (a) electronically receiving first data including confidential information regarding market participants in a first system that protects said first data behind a firewall; (b) electronically receiving second data including confidential information regarding market participants in a second system that protects said second data behind a firewall; (c) electronically receiving an order and targeting parameters from a first market participant; (d) electronically issuing an advertisement request message to said first system and said second system, said advertisement message comprising display attributes of said order and comprising said targeting parameters; (e) electronically prompting said first system and said second system via the advertisement request message to each send a coordination request message to a Coordination Hub, said coordination request message comprising information deduced from said confidential information regarding market participants in said first and second systems, wherein the selection of the information that is sent to the Coordination Hub is based at least in part on said first market participant's targeting parameters; (f) electronically prompting based on the coordination request message said Coordination Hub to issue permissions to advertise the order to selected market participants, wherein market participants are selected based, at least in part, on said received information regarding market participants; and (g) electronically prompting based on the permission to advertise the order said first system and said second system to route information about said order from first participant to said selected market participants.

Owner:ITG SOFTWARE SOLUTIONS INC

Method and apparatus for actively managing electric power over an electric power grid

ActiveUS20130345888A1Reduce amount of electric powerReduce power consumptionLevel controlTechnology managementPower flowPower grid

Systems and methods for managing power supplied over an electric power grid by an electric utility and / or other market participants to multiple power consuming devices, each of which having a Power Supply Value (PSV) associated with its energy consumption and / or reduction in consumption. Power flow to the power consuming devices is selectively enabled and disabled, or power-reduced thereto, by one or more controllable devices controlled by the client device. Power control messages from a controlling server indicate amounts of electric power to be reduced and an identification of at least one controllable device to be instructed to disable or reduce a flow of electric power to one or more associated power consuming devices.

Owner:CAUSAM ENERGY INC

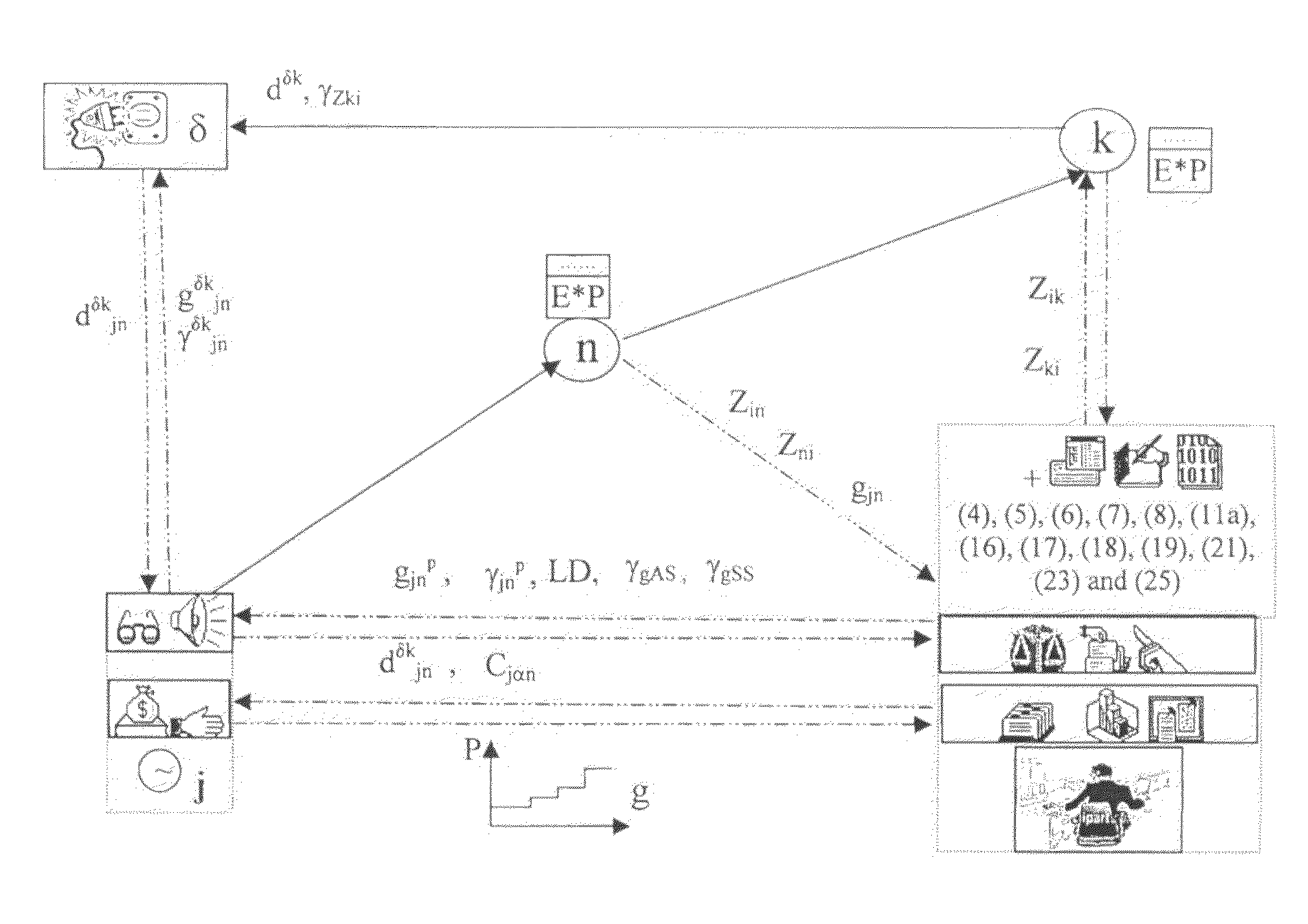

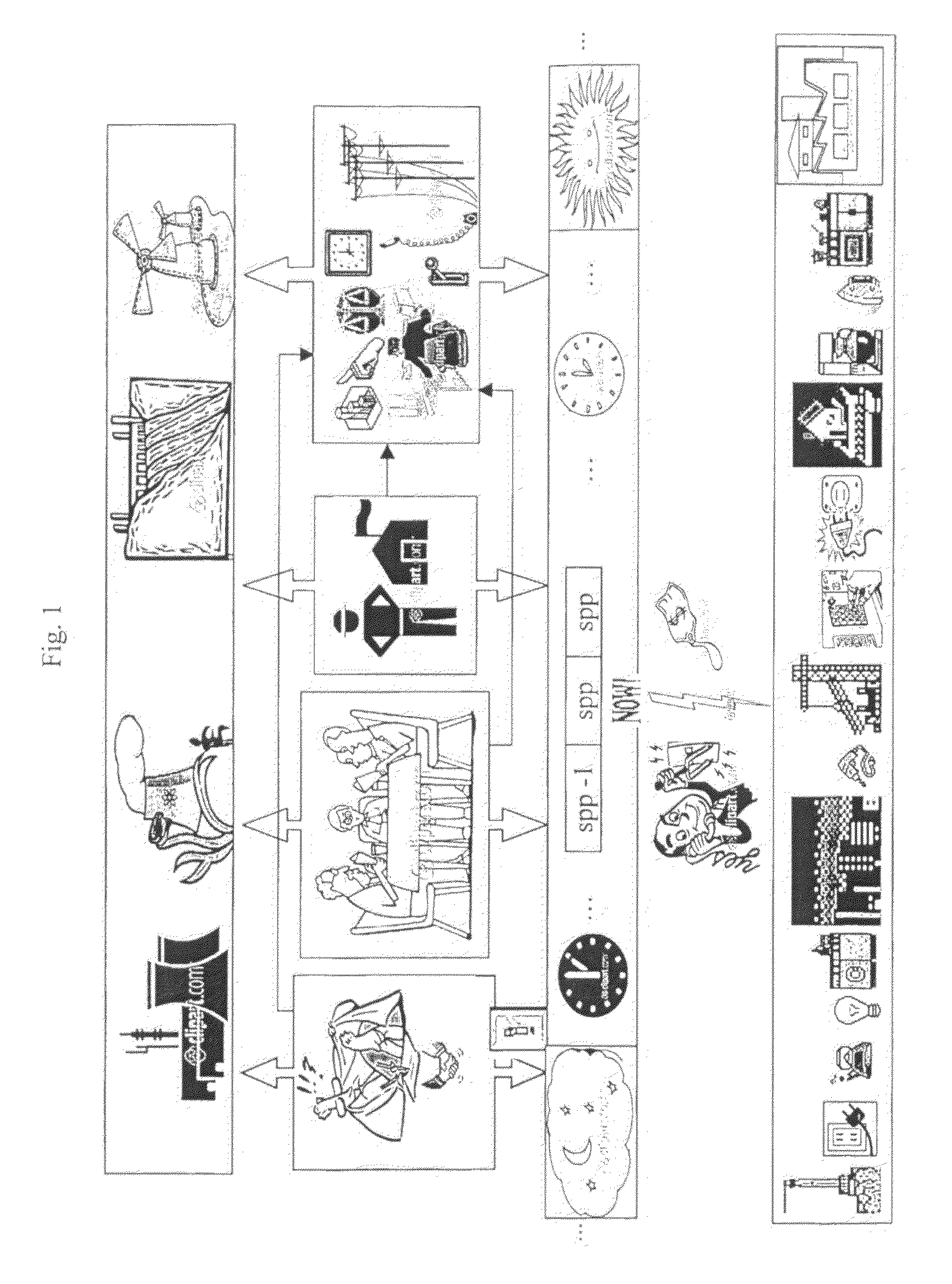

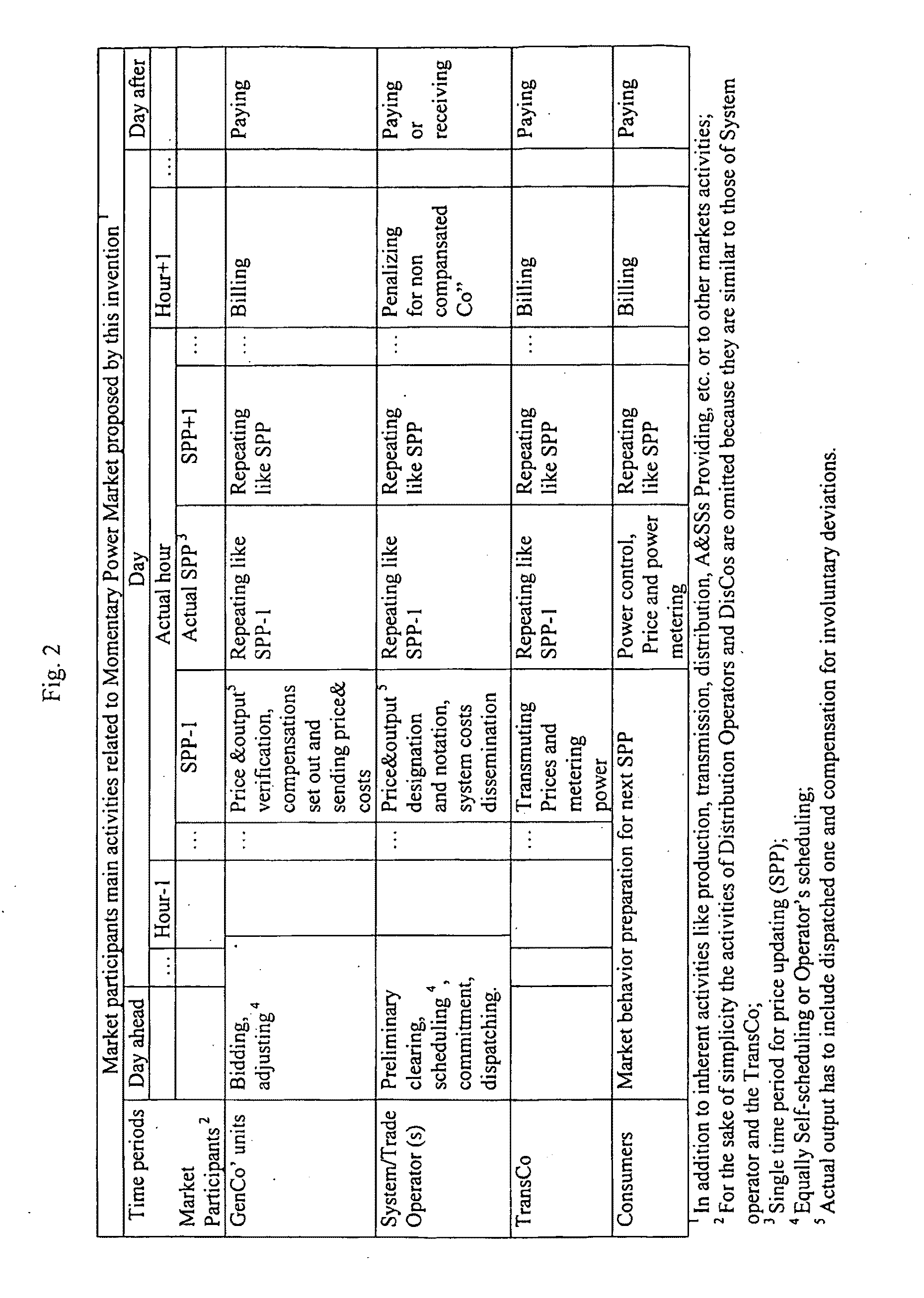

Momentary Power Market

A method and system is proposed for the physical trading of electricity, which is characterized by continuous Dynamic Advanced Prices formation and propagation over a single price period that is a few seconds long. The Node and Branch price equations are applied to the power flows and to the corresponding costs incurred at measure points, as well as to the system-wide costs allocated equitably by means of a Price Designator, Price Announcers, Price Transmuters and Intelligent Meters and by other devices, all of which function together in a sequential and repetitive process of preliminary bidding, clearing, adjustment and dispatching, followed by price designation, confirmation and conversion in a way that takes into account congestion and security costs and the compensation of involuntary deviations. The method provides a common electricity trade environment that allows every market participant, especially every consumer, to respond adequately to last minute price changes.

Owner:STOILOV GEORGI DIMOV +2

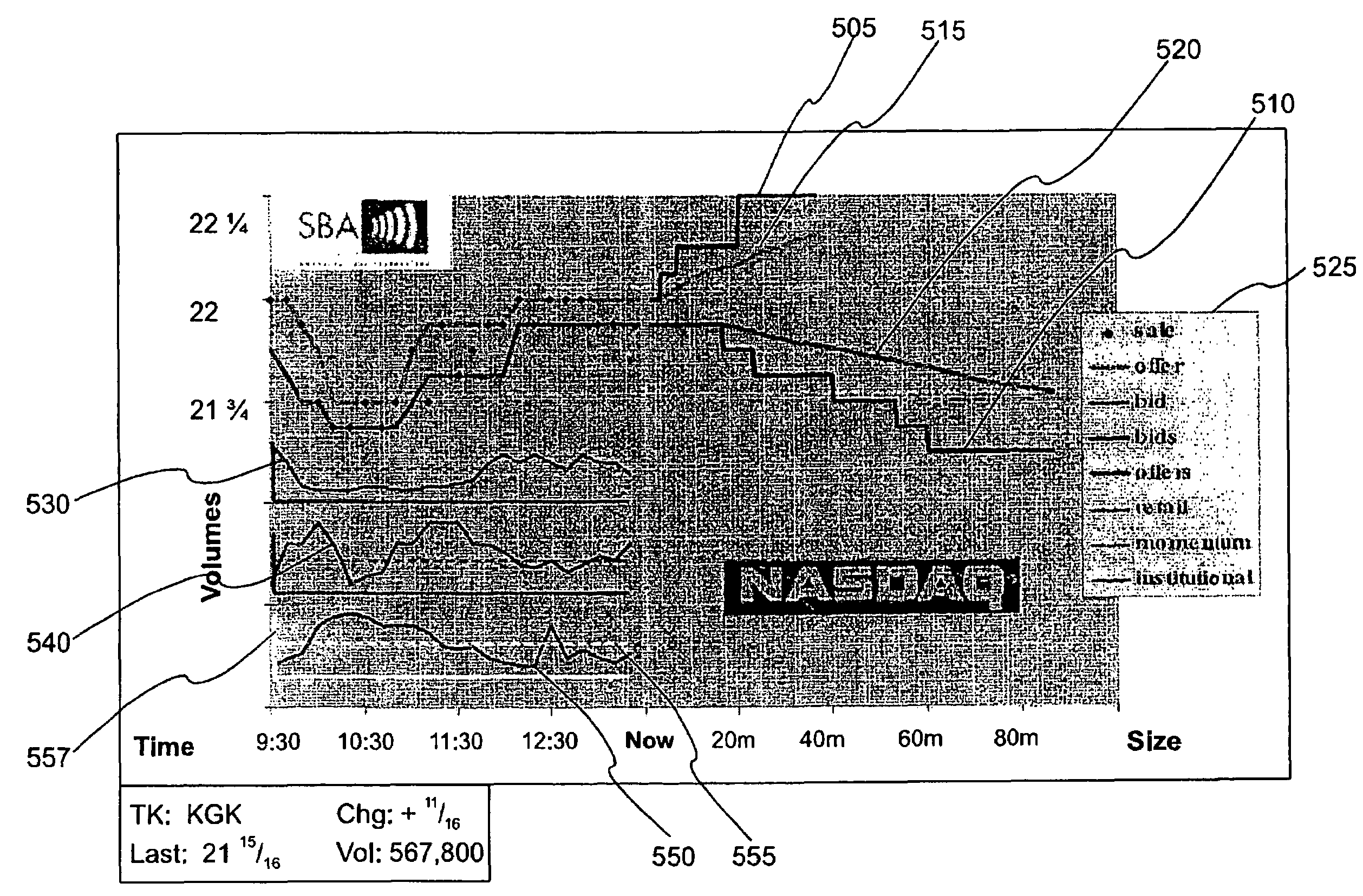

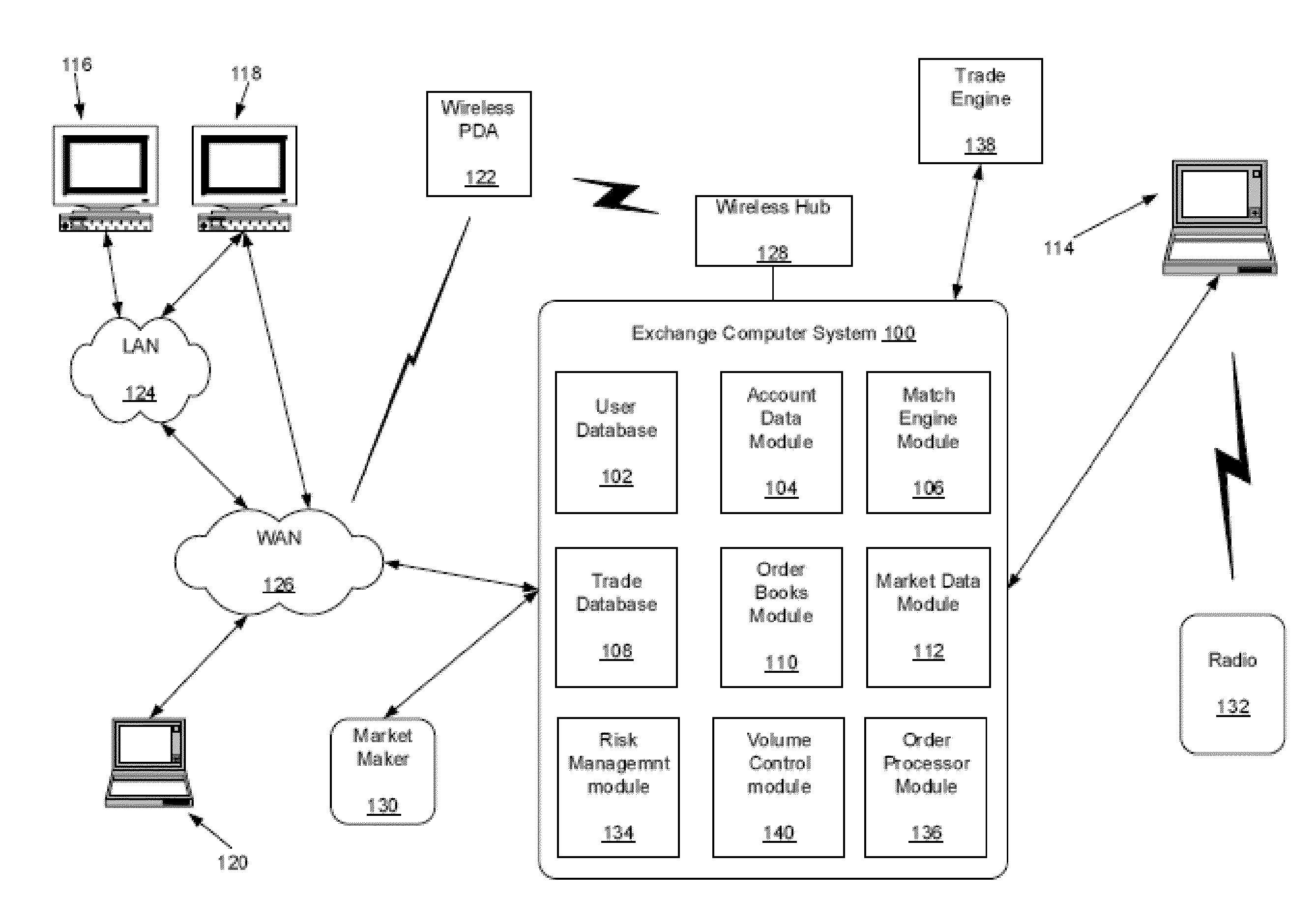

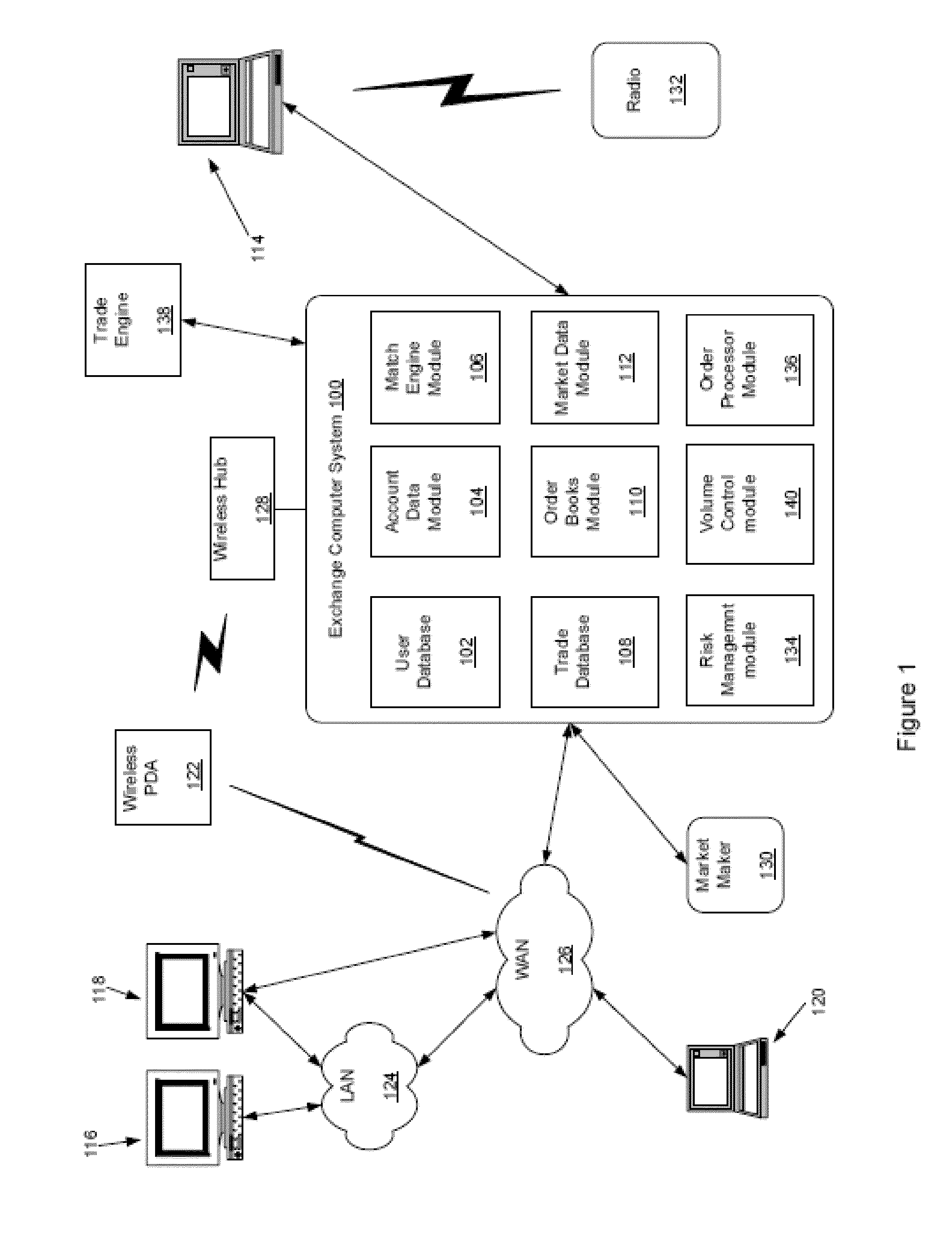

System and method for displaying market information

The subject invention overcomes the limitations of known market data displays by producing a graphical market display that integrates analysis of both 1) intra-day trading activity by classes of market participant, and 2) projected market impact as a function of trade size give the present set of executable orders in an electronic securities trade execution network. In a preferred embodiment, the display is used as the graphic user interface (GUI) of an ECN. In alternate preferred embodiments, the display is offered by a market data analysis service that accesses information form one or more ECNs, exchanges, or stock market. In another alternate embodiment, the display is created by software on a user computer form liquidity information already on that user computer.

Owner:ITG SOFTWARE SOLUTIONS INC

System, method, and apparatus for electric power grid and network management of grid elements

Systems, methods, and apparatus embodiments for electric power grid and network registration and management of active grid elements. Grid elements are transformed into active grid elements following initial registration of each grid element with the system, preferably through network-based communication between the grid elements and a coordinator, either in coordination with or outside of an IP-based communications network router. A multiplicity of active grid elements function in the grid for supply capacity, supply and / or load curtailment as supply or capacity. Also preferably, messaging is managed through a network by a Coordinator using IP messaging for communication with the grid elements, with the energy management system (EMS), and with the utilities, market participants, and / or grid operators.

Owner:CAUSAM ENERGY INC

System, method, and apparatus for electric power grid and network management of grid elements

Systems, methods, and apparatus embodiments for electric power grid and network registration and management of active grid elements. Grid elements are transformed into active grid elements following initial registration of each grid element with the system, preferably through network-based communication between the grid elements and a coordinator, either in coordination with or outside of an IP-based communications network router. A multiplicity of active grid elements function in the grid for supply capacity, supply and / or load curtailment as supply or capacity. Also preferably, messaging is managed through a network by a Coordinator using IP messaging for communication with the grid elements, with the energy management system (EMS), and with the utilities, market participants, and / or grid operators.

Owner:CAUSAM ENERGY INC

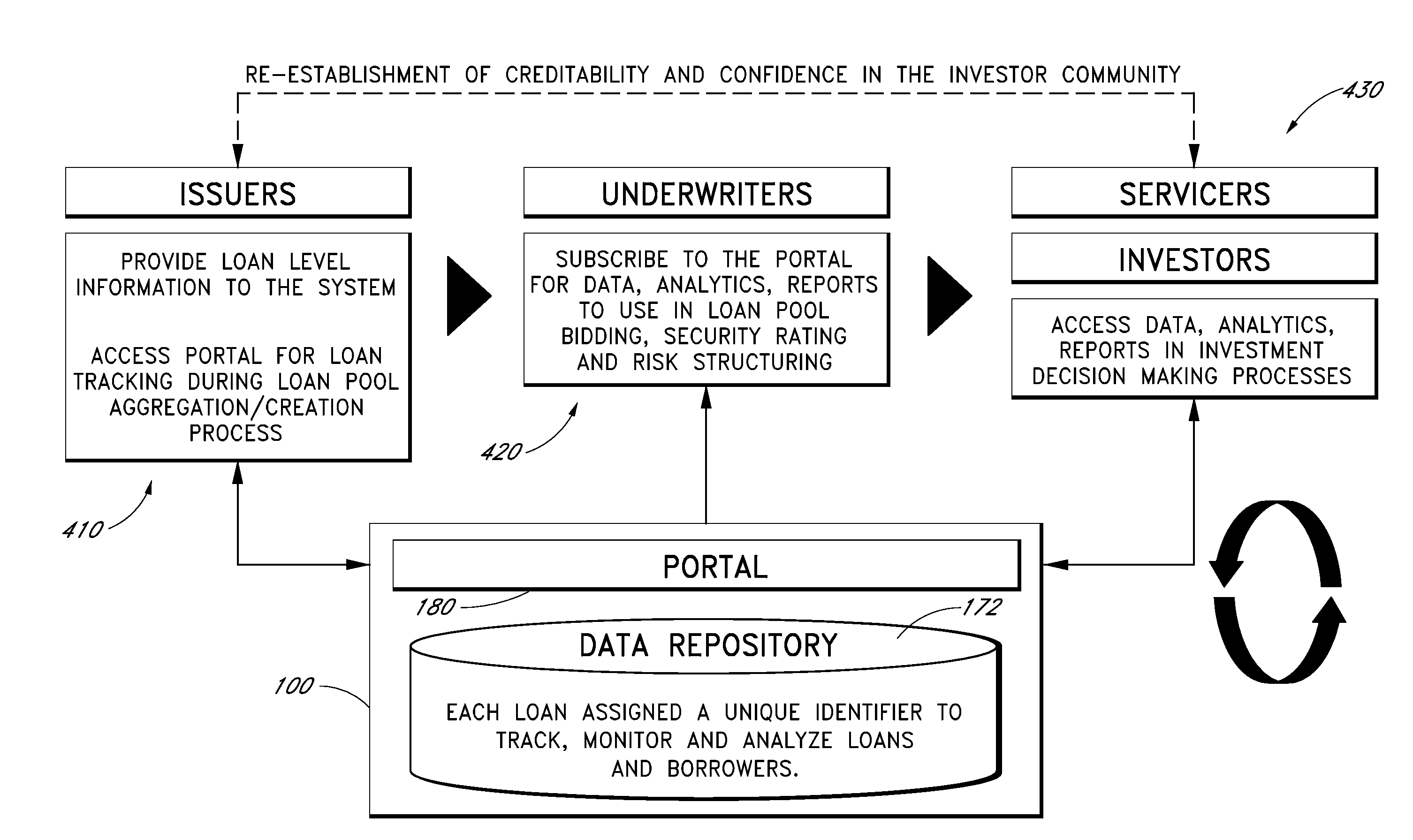

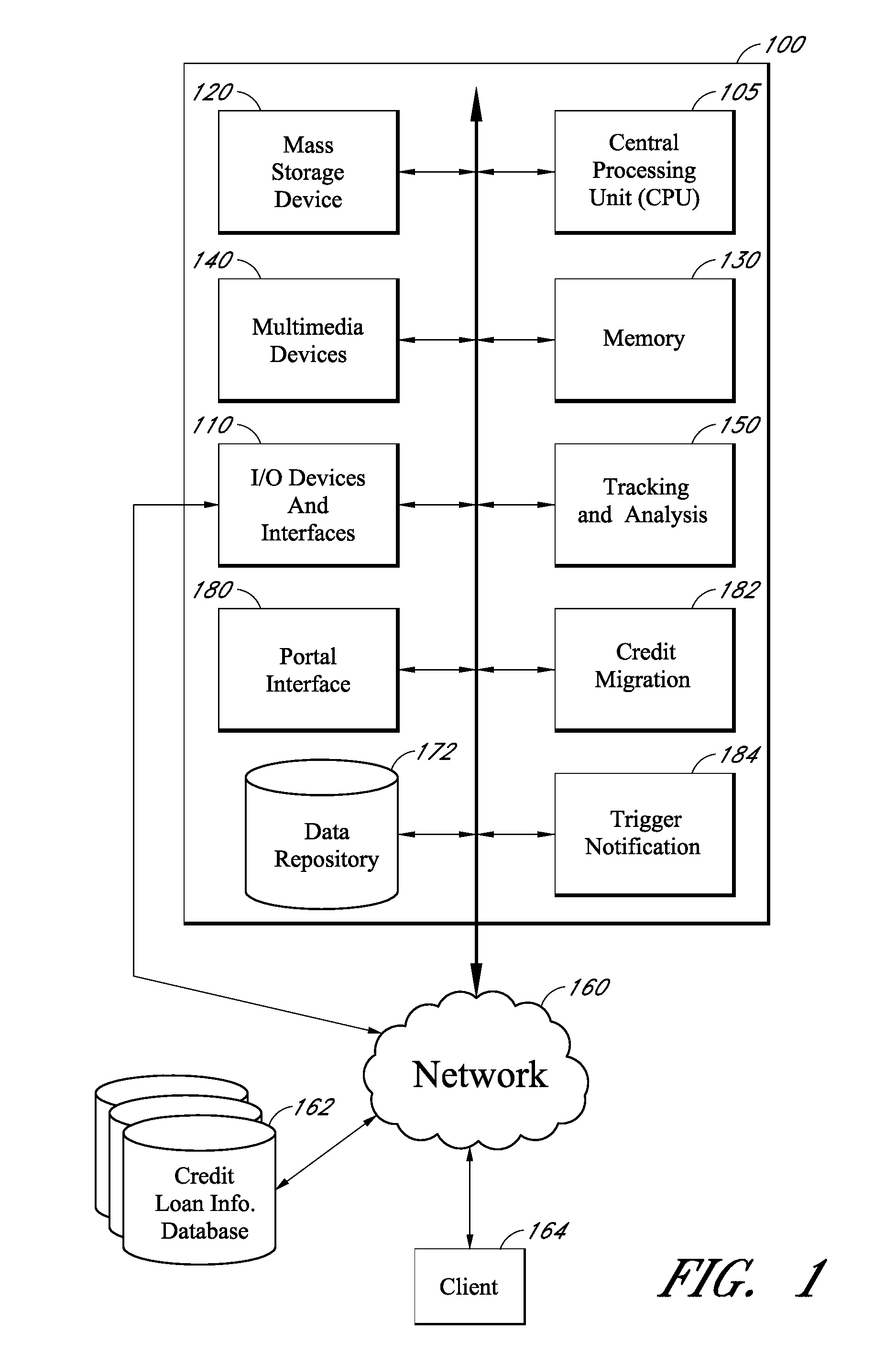

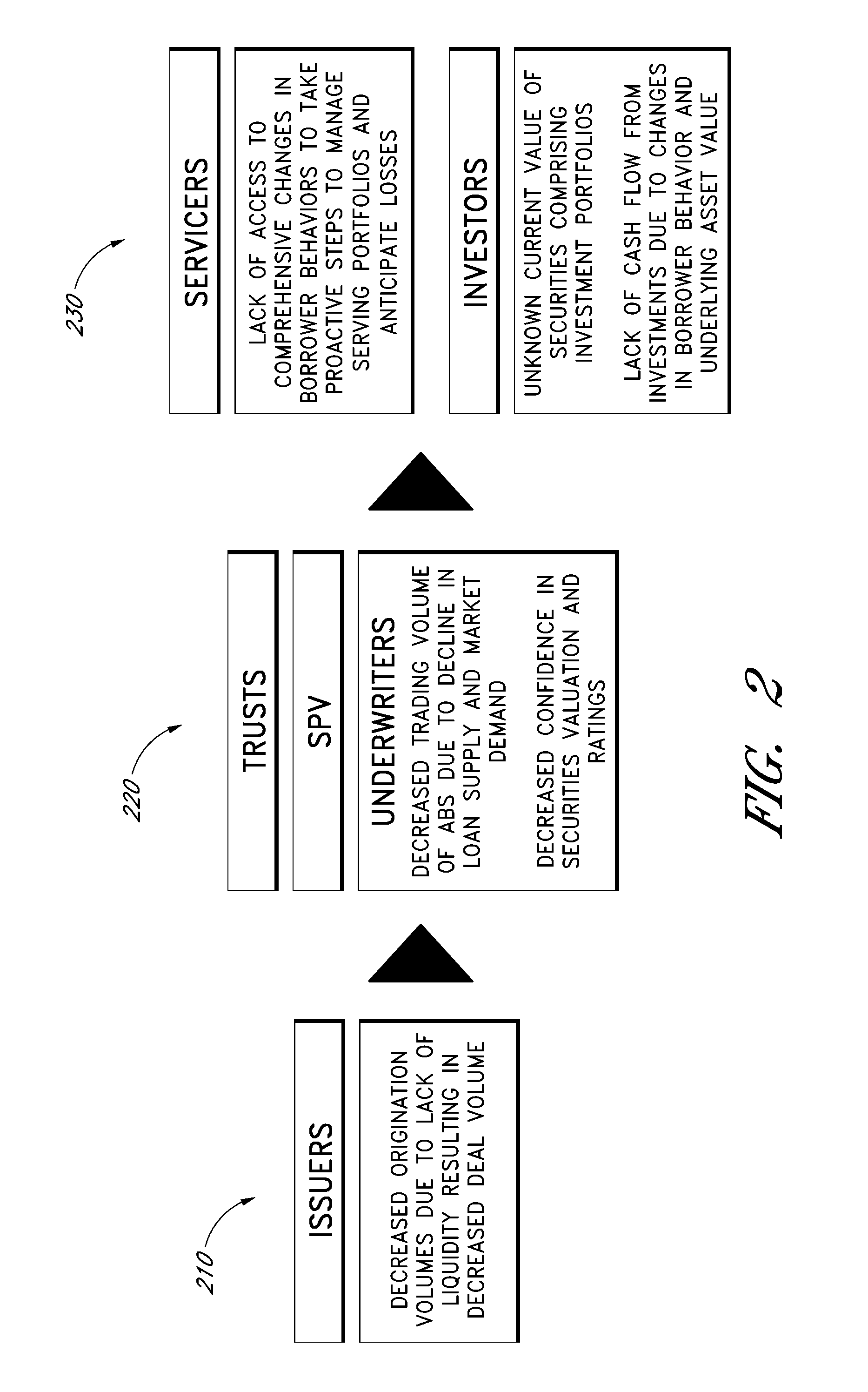

System and method for tracking and analyzing loans involved in asset-backed securities

Embodiments of the disclosure are directed to providing unique loan identifiers to track loans involved in Asset-Backed Securities (ABS) throughout the life-cycle of the individual loans, in one embodiment, a unique loan identifier, for example, a loan number, may be appended to loan data at initiation of each loan, for example, at the application stage, to and / or beyond the retirement of the loan. The unique loan identifiers may allow disparate financial data sources such as the credit histories of the borrowers to be associated with the individual loans, even as the loans are repackaged and resold as ABS in the secondary markets. Thus, market participants such as loan servicers and investors can access current and historical data associated with the loans. Other embodiments are directed to analyzing the data associated with the underlying loans and providing the analysis to the market participants including servicers, investors, and underwriters.

Owner:EXPERIAN INFORMATION SOLUTIONS

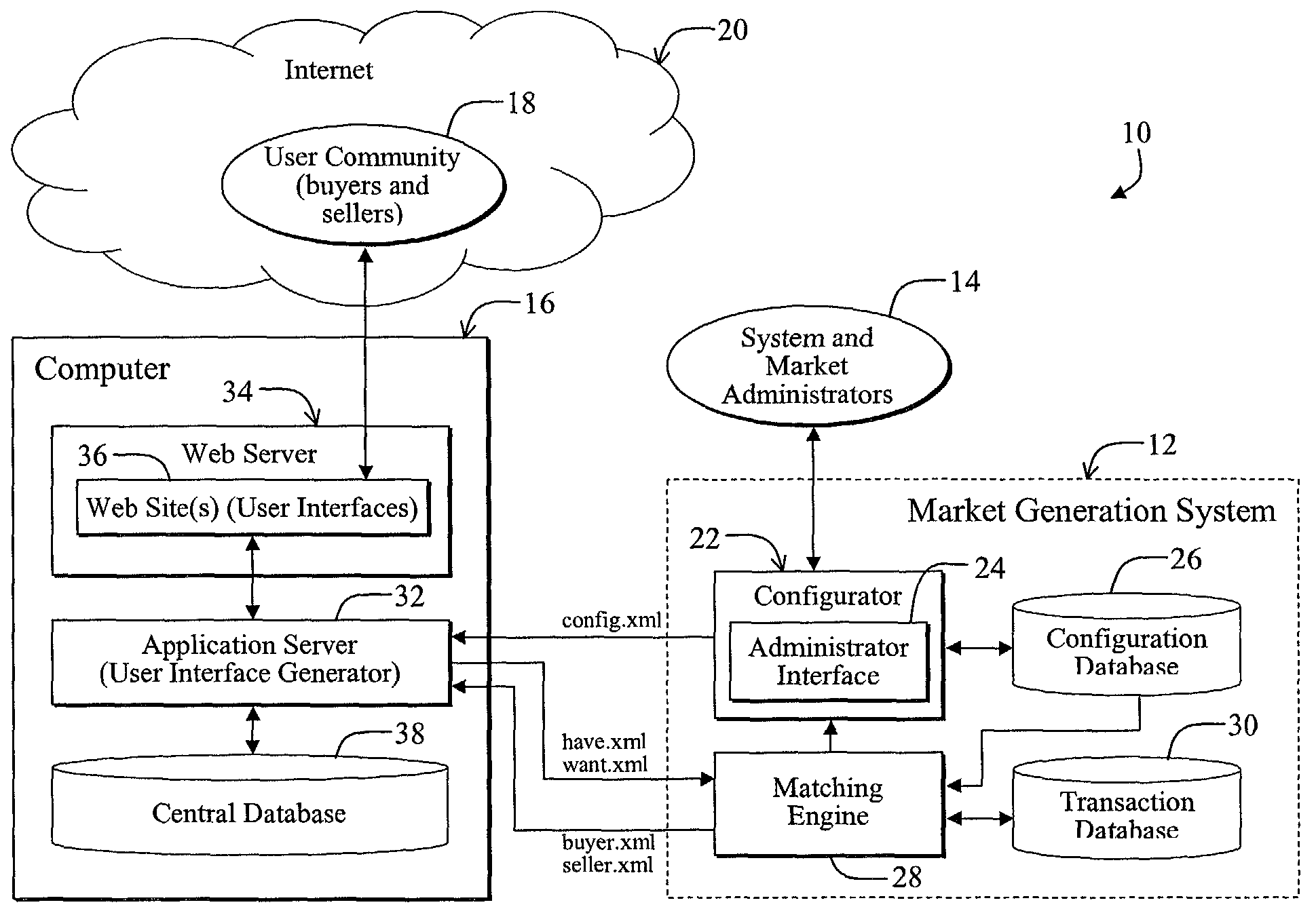

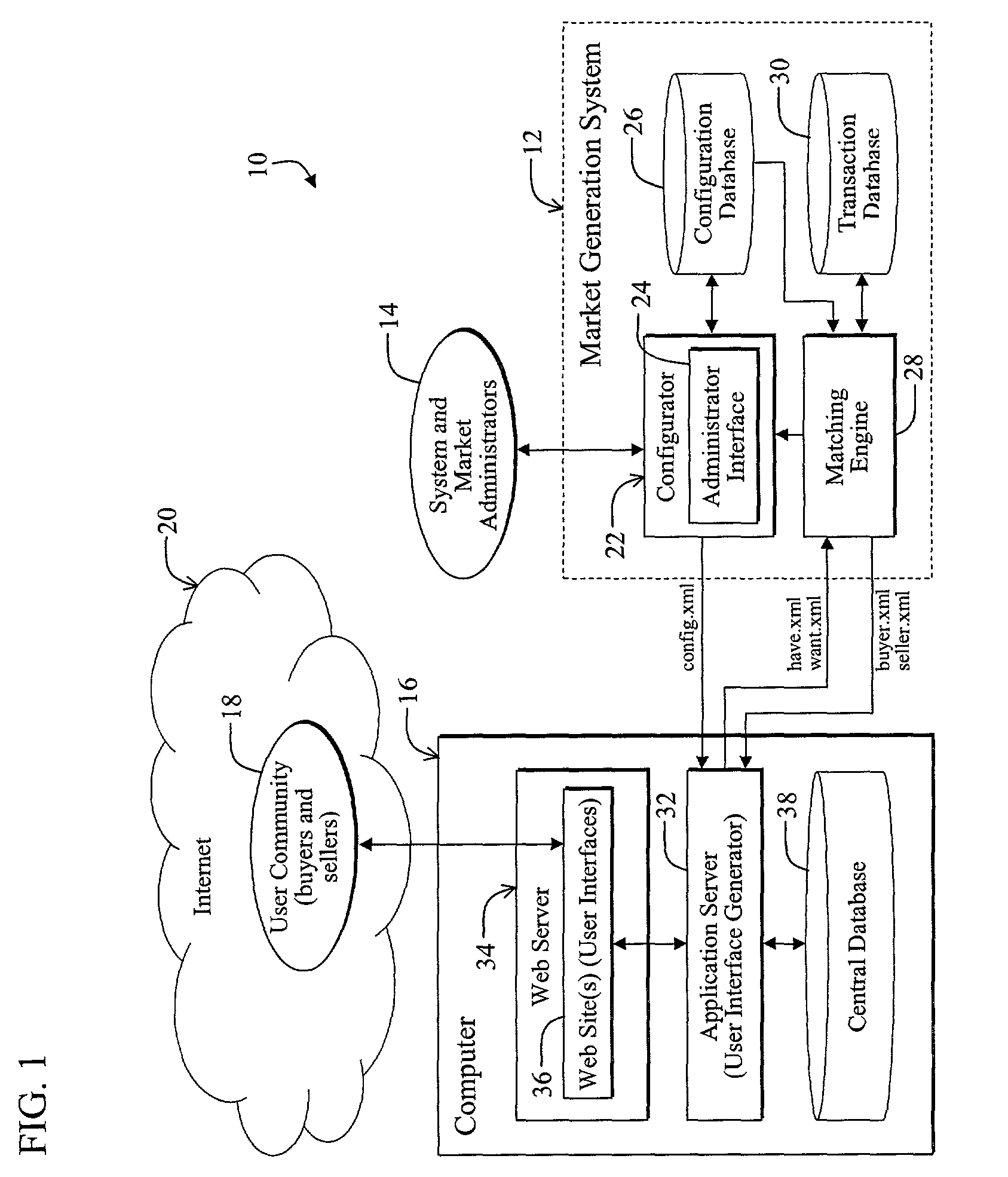

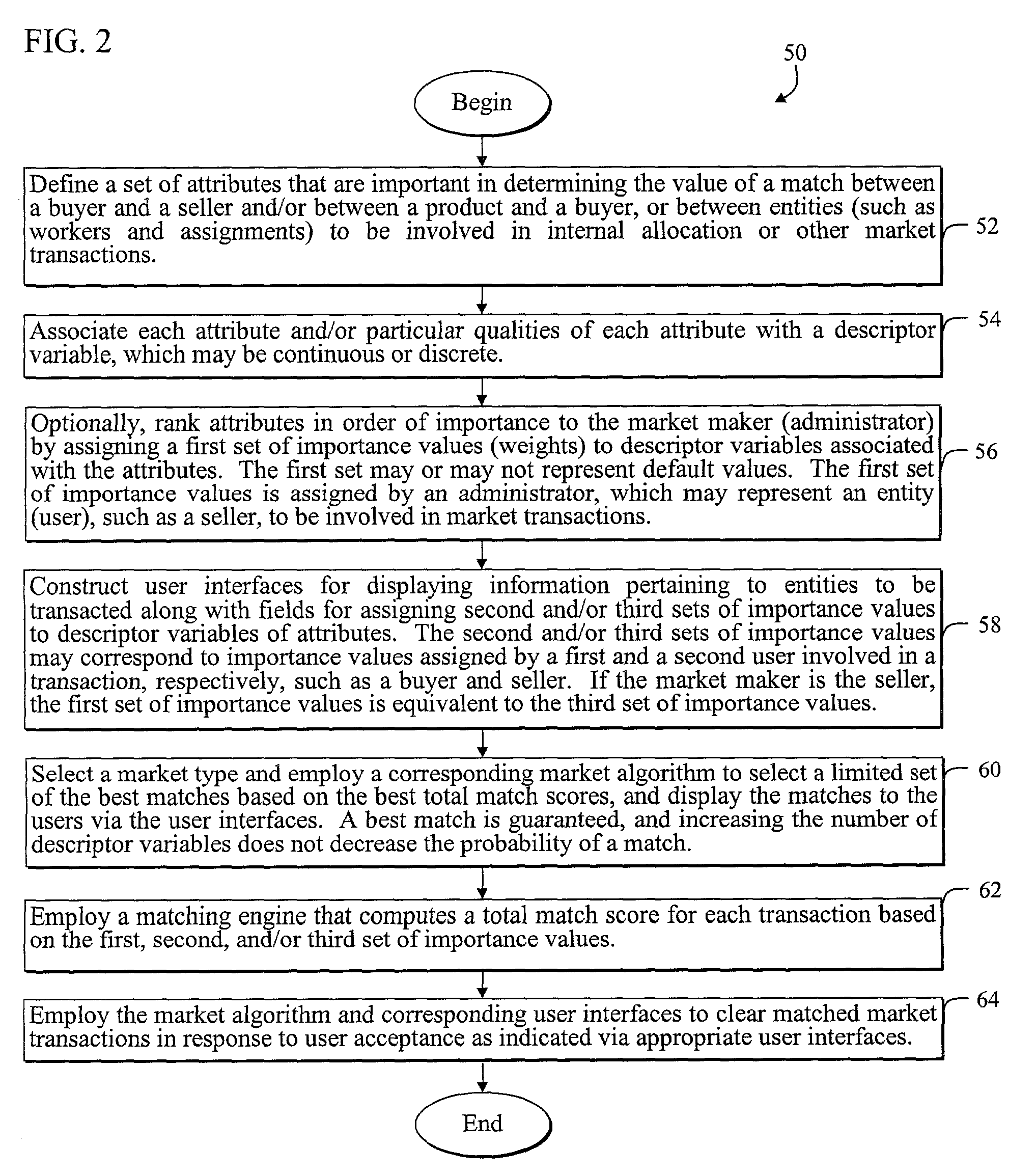

System and method for implementing electronic markets

An efficient system for implementing an electronic market. The system includes a first mechanism for defining a set of attributes and associated descriptor variables involved in market transactions. Importance values are assigned to the descriptor variables by the first mechanism. A second mechanism computes match scores for the market transactions based on the importance values. A third mechanism employs the match scores to clear the electronic market. In the specific embodiment, the first mechanism includes an administrator interface, which allows an administrator to define the descriptor variables. A configurator communicates with the administrator interface and allows the administrator to assign a first set importance values to corresponding descriptor variables. The first set importance values includes default importance values or importance values assigned to the descriptor variables by a seller seeking to transact with a buyer via the electronic market. The administrator interface allows an administrator to configure a user interface of the market to allow market participants to assign a second set of importance values to different descriptor variables. The second set of importance values includes buyer and seller importance values. The descriptor variables and associated descriptor importance values may be continuous or discrete. A matching engine computes the match scores for market transactions based on a predetermined evaluation method specified via the administrator interface and based on a unique match score computation method.

Owner:THOMSON REUTERS TAX & ACCOUNTING

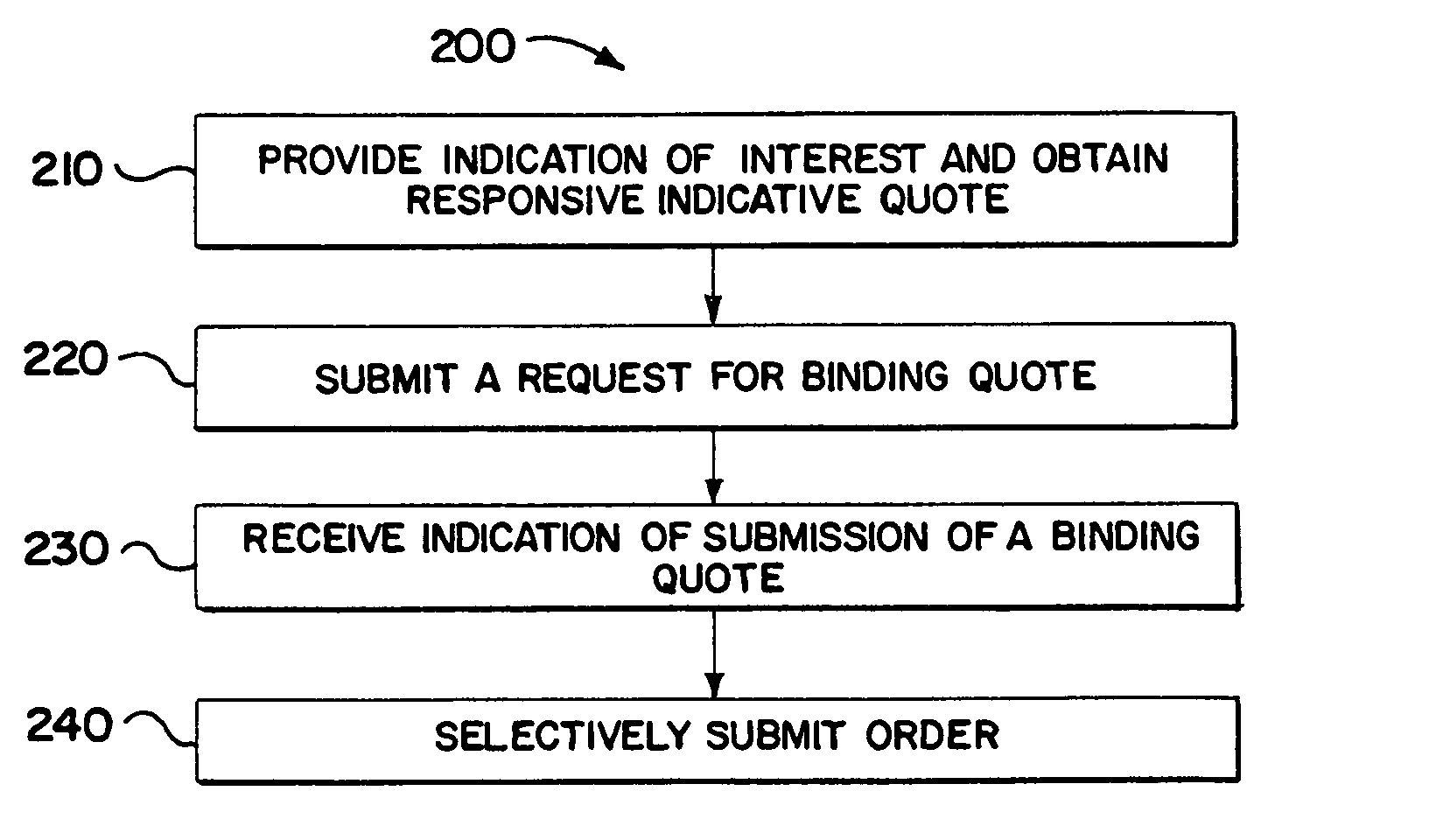

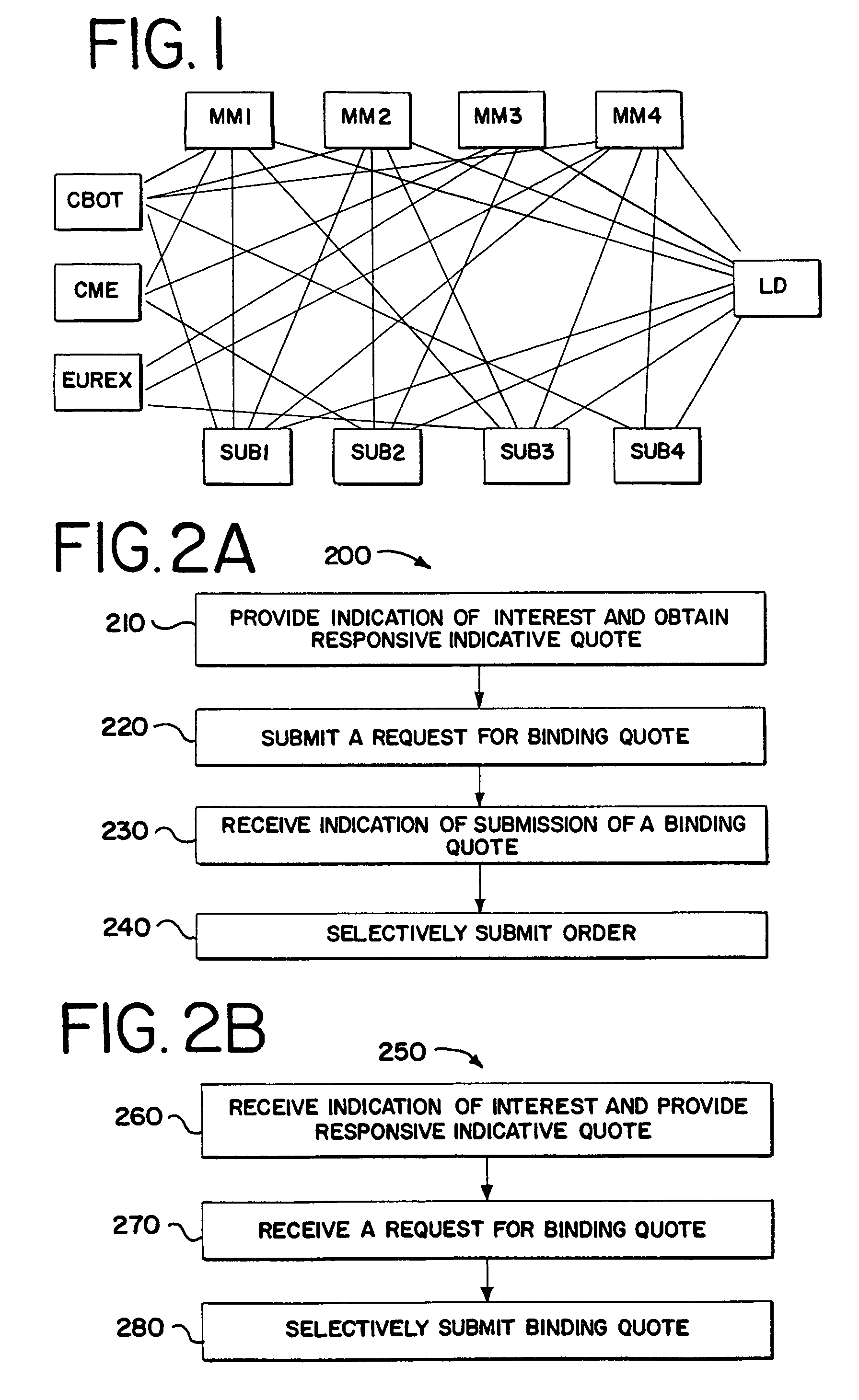

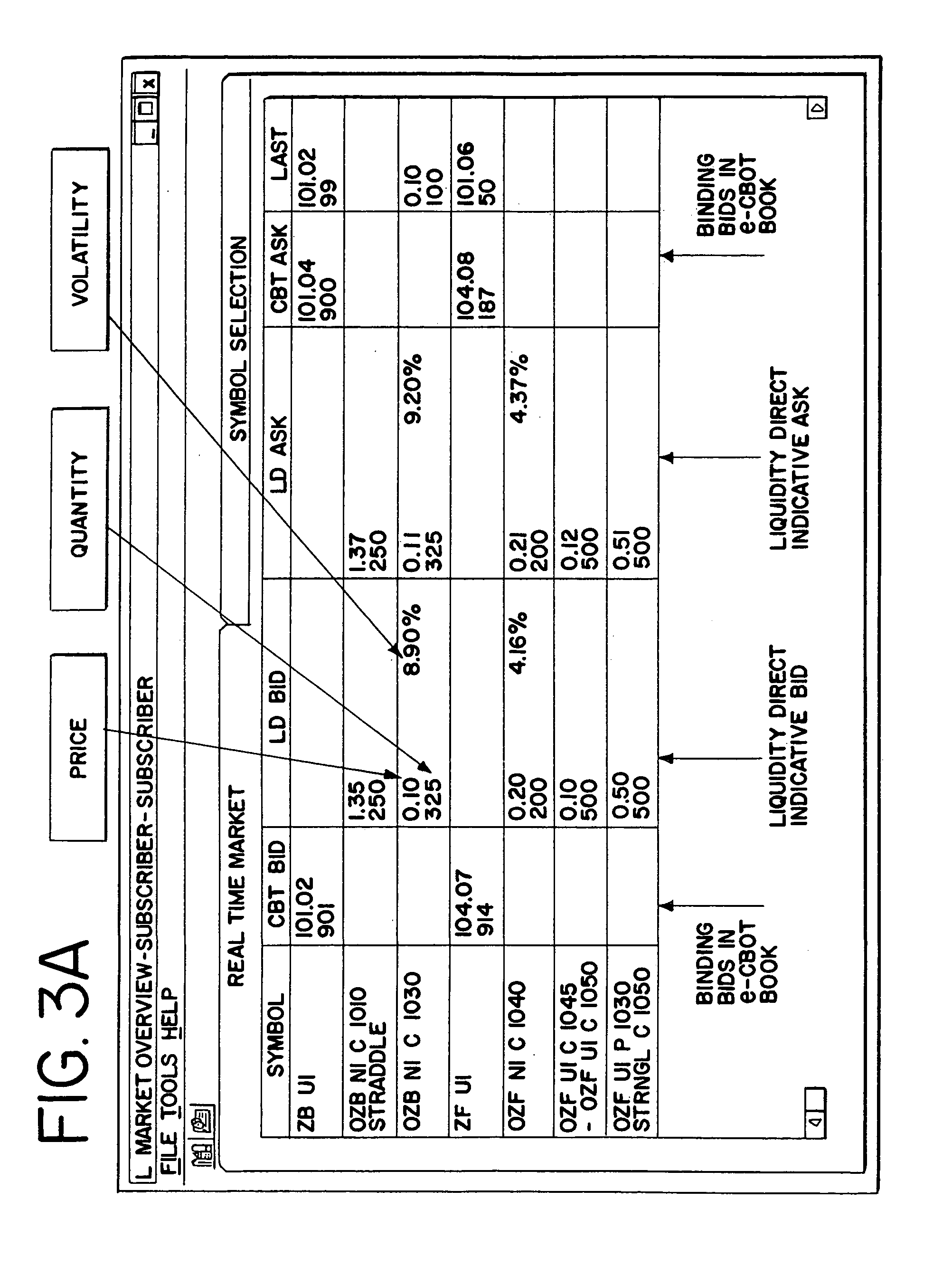

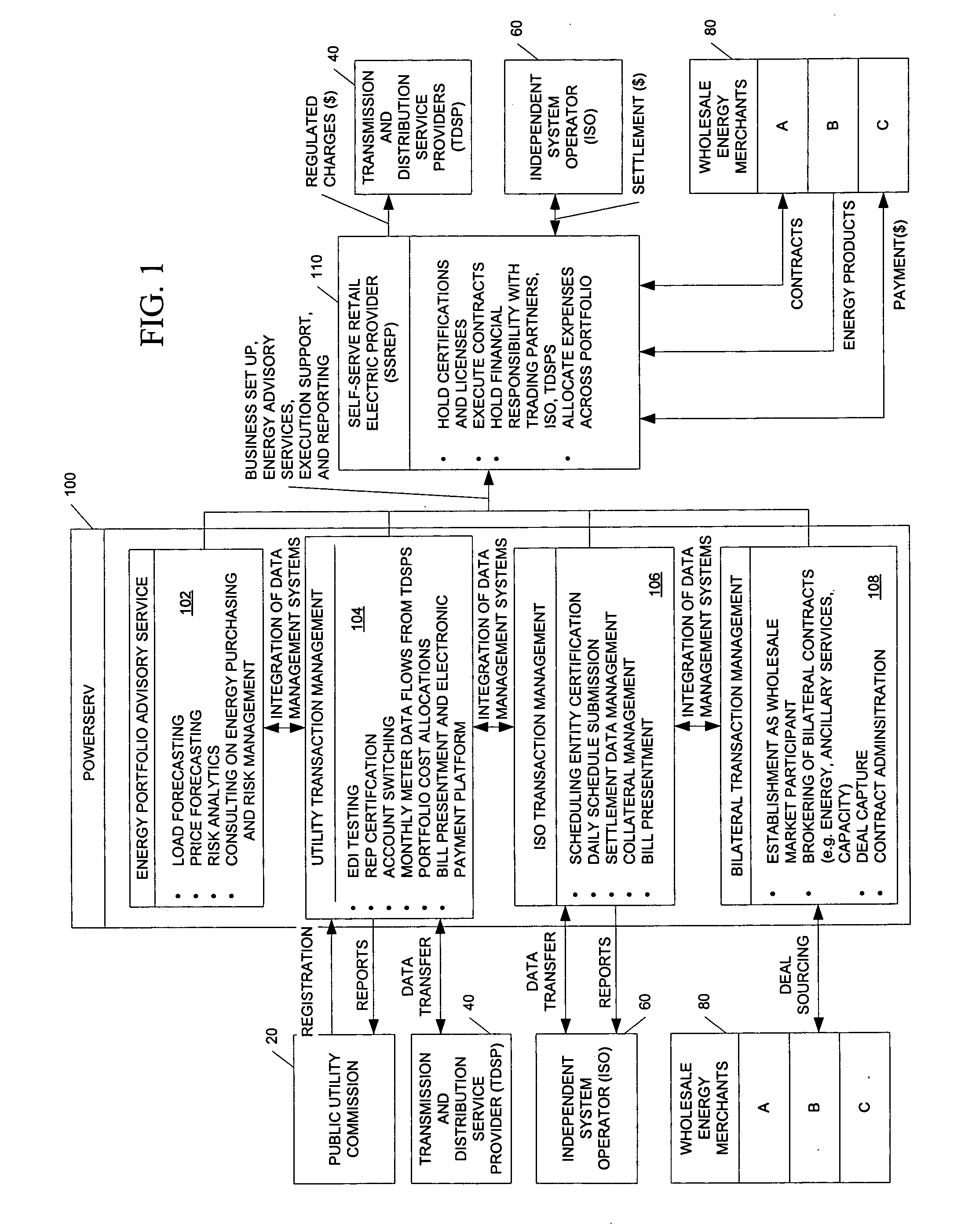

Network and method for trading derivatives by providing enhanced RFQ visibility

ActiveUS7197483B2Easy to participateParticipate more readilyFinanceCommerceVisibilityElectronic trading

A computer network and method for electronically trading derivatives. One preferred method of trading includes providing indicative quotes to market participants (which typically includes subscribers, but may also include market makers) to provide a non-binding indication of how the market makers are likely to price the particular derivative. A participant may then submit an RFQ, which is a request for a binding quote for the derivative. The RFQ preferably causes the current order book to be displayed on all subscribers' terminals, typically in the form of a row indicating the derivative of interest along with the current binding bid and binding ask prices. The indicative bid and ask prices may also be displayed, as well as the quantity (if any) requested in the RFQ. Market participants may then elect to submit an order for the corresponding derivative. Typically, the market participants will await an indication that a market maker has submitted a binding quote.

Owner:CHICAGO MERCANTILE EXCHANGE

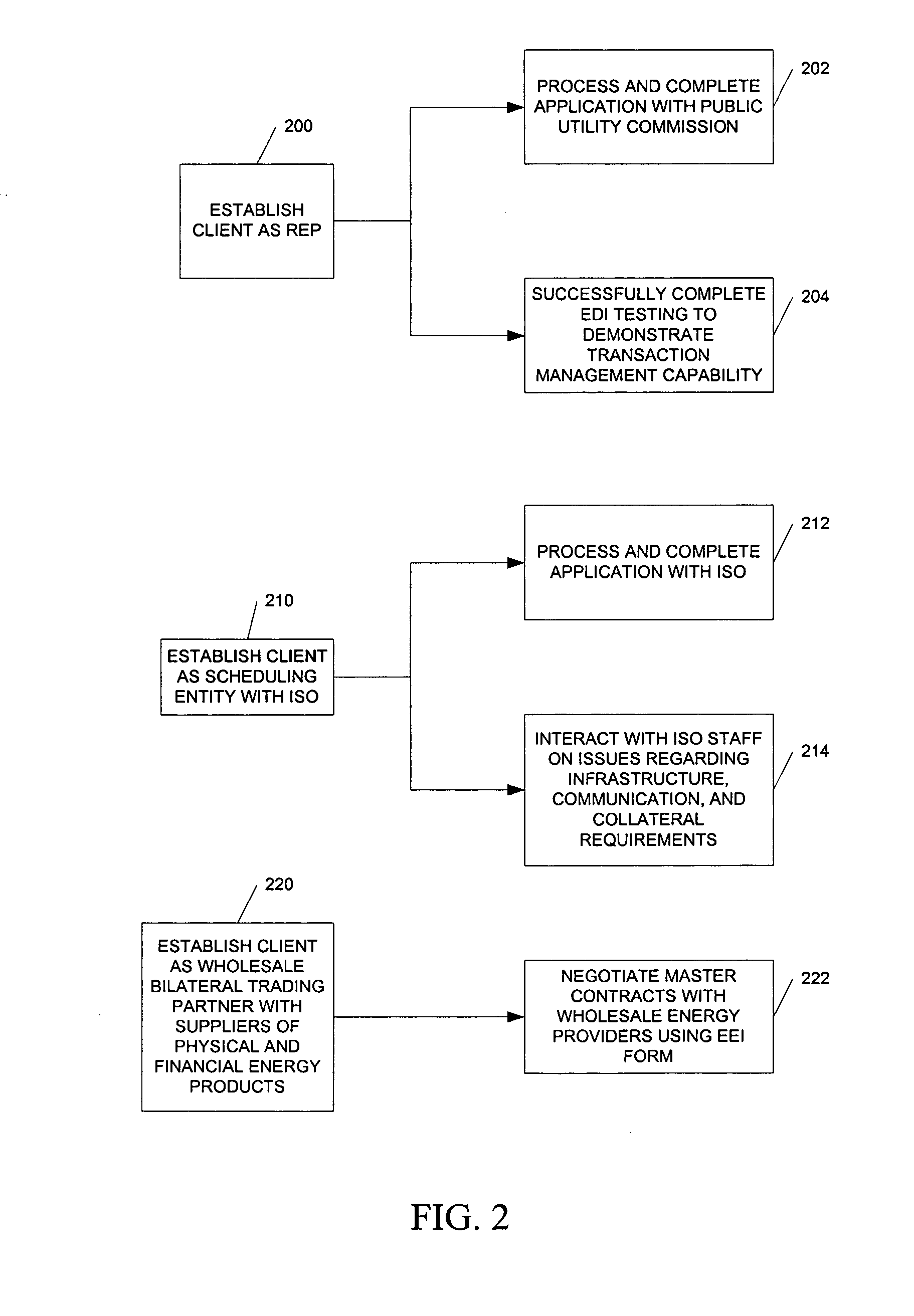

Energy advisory and transaction management services for self-serving retail electricity providers

InactiveUS20050004858A1Reduce energy costsReduce riskFinanceTechnology managementTransaction managementMarket place

Methods for assisting and enabling a large industrial or business consumer of energy to become a self-serving retail electricity provider in a deregulated energy market. Performed by an energy advisory and transaction management service provider, one method registers the large business energy consumer with the state public utility commission, assists the business to qualify as a scheduling entity with an independent service operator, and establishes the business as a bilateral trading partner of wholesale energy merchants. In another method, the business processing outsourcing service assists the business in energy purchasing and risk management decisions by forecasting zonal load requirements for the business. A price forecasting analysis is compared with supply offers from wholesale energy merchants and bilateral transactions for energy supply are brokered between the business and the wholesale energy merchants. In another method, the business process outsourcing service assists the business to manage electronic transactions with an independent service operator and a transmission and distribution service provider. A daily load forecast for the business is updated and compared with energy purchase commitments to identify imbalances between supply and demand. The outsourcing service submits a daily schedule of forecasted sub-hourly load and purchase and sale commitments to the independent system operator. The outsourcing service receives and processes invoices from market participants and generates financial settlement reports for the business.

Owner:SOUTHERN COMPANY ENERGY SOLUTIONS

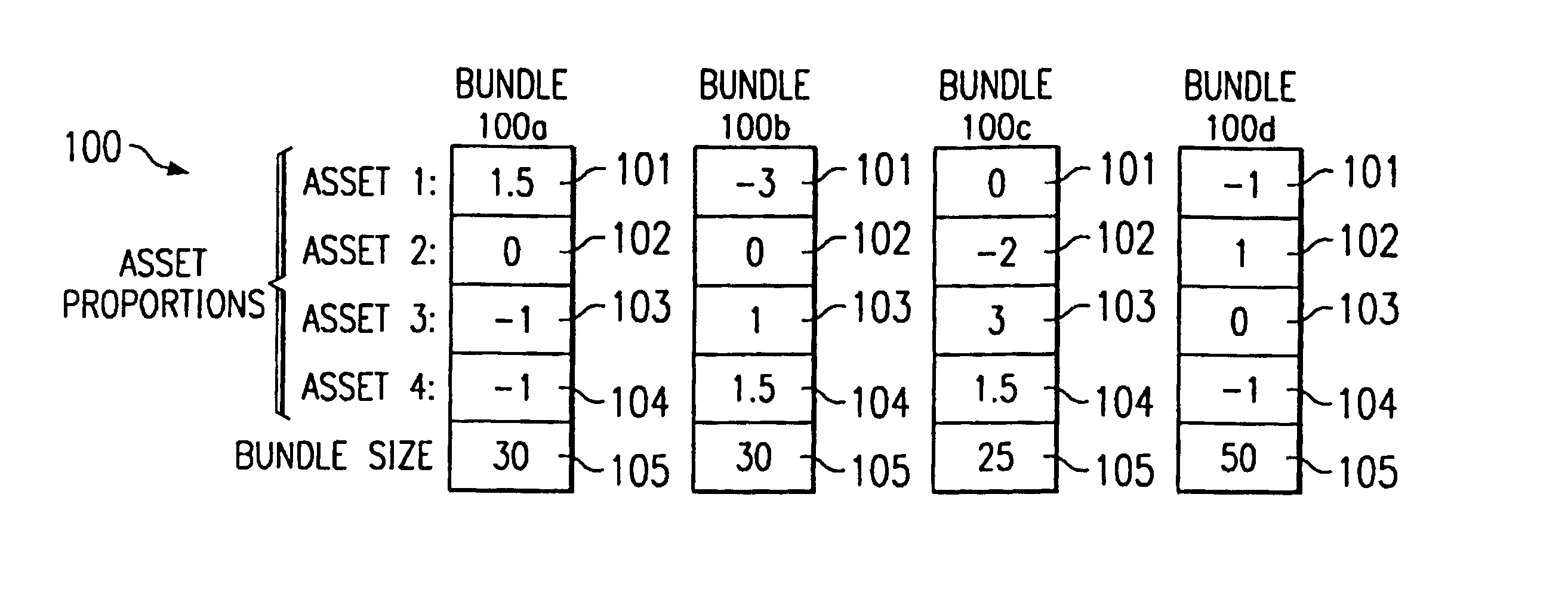

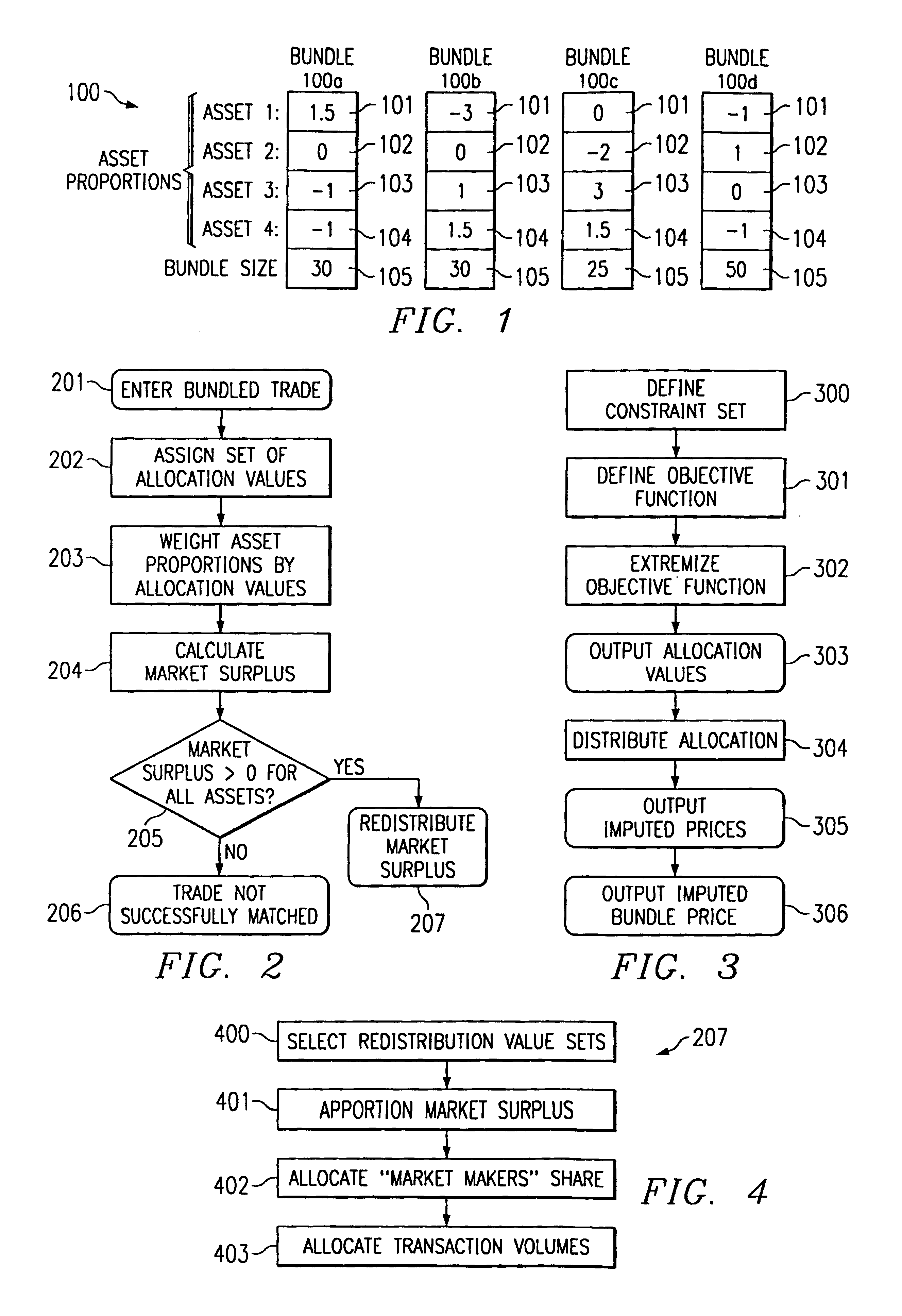

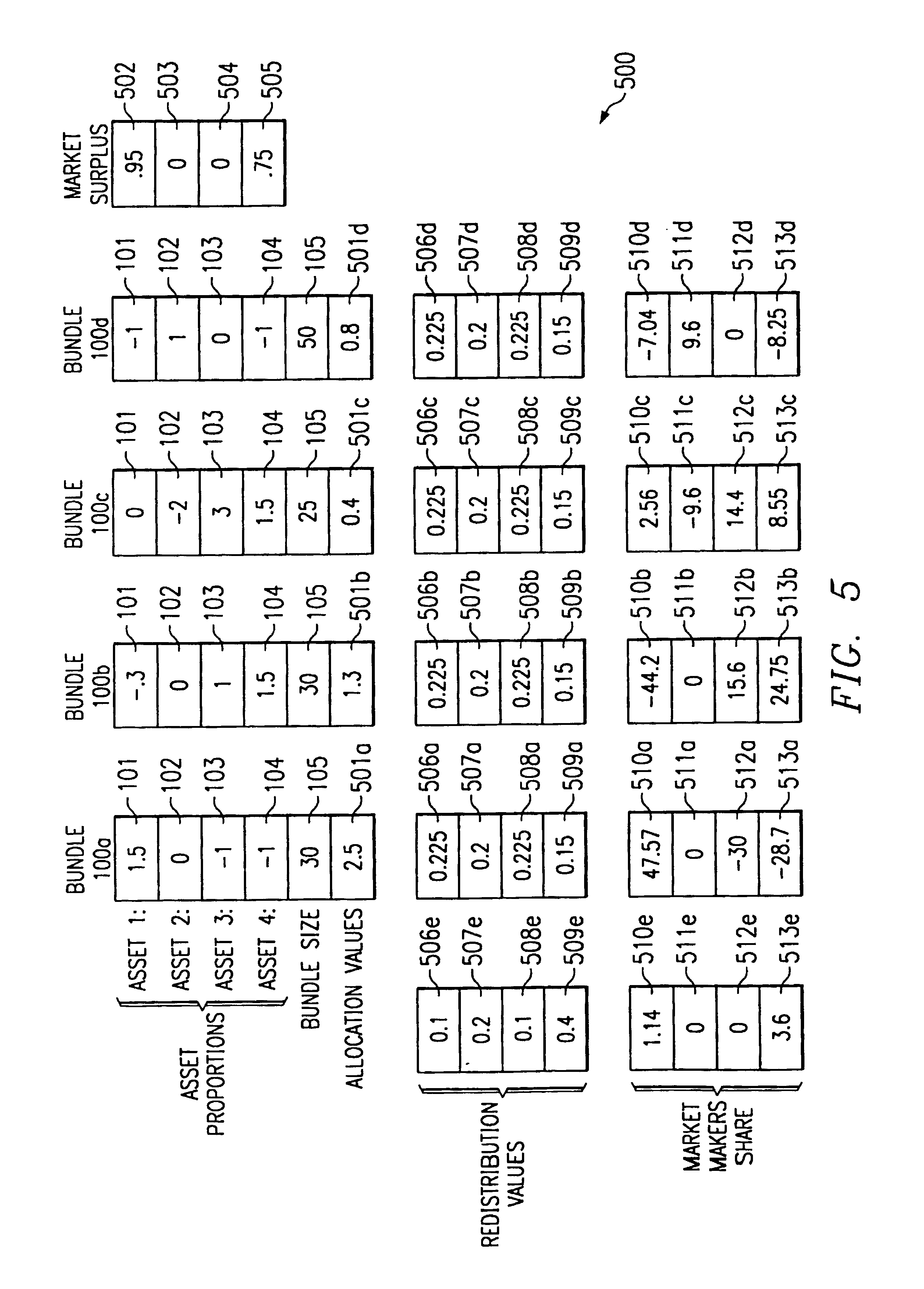

Apparatus for trading of bundled assets including bundle substitution and method therefor

The present invention allows market participants to exchange bundles of assets, including assets in different asset classes. A market participant may value the bundle as an entity, alleviating the need to attempt to attain a value objective in the aggregate by valuing and trading assets individually. A bundle of assets to be traded is entered, wherein proportions of each asset to be traded in units of a specified bundle size are provided by the market participant. Assets to be acquired by one market participant are matched against the same asset which other market participants are seeking to dispose. A market participant may enter multiple bundles, and may specify substitutability among bundles by entering one or more portfolio constraints. An exchange of bundled assets among market participants, in units of the bundles themselves is effected when the exchange satisfies a predetermined set of criteria.

Owner:HANGER SOLUTIONS LLC

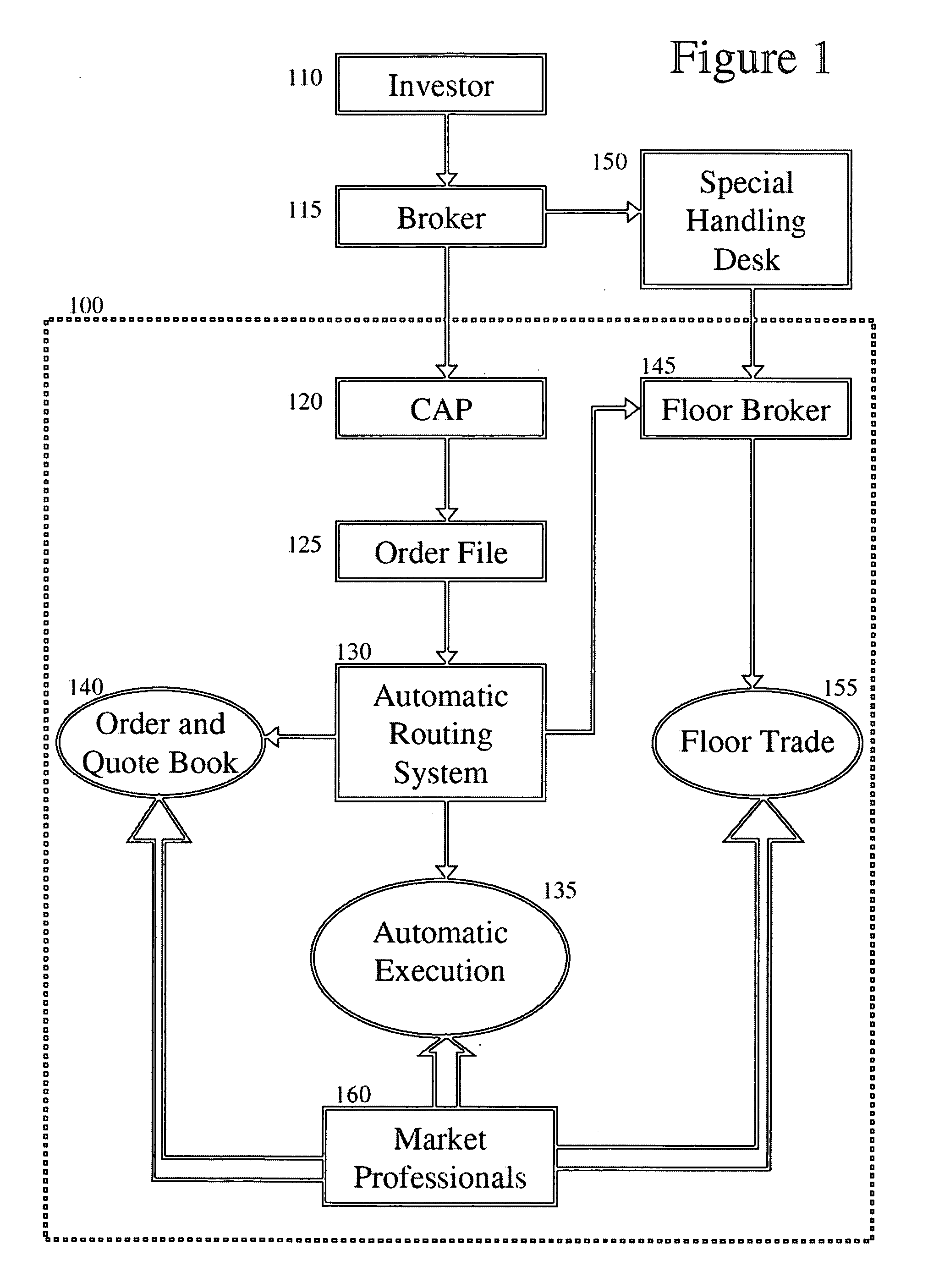

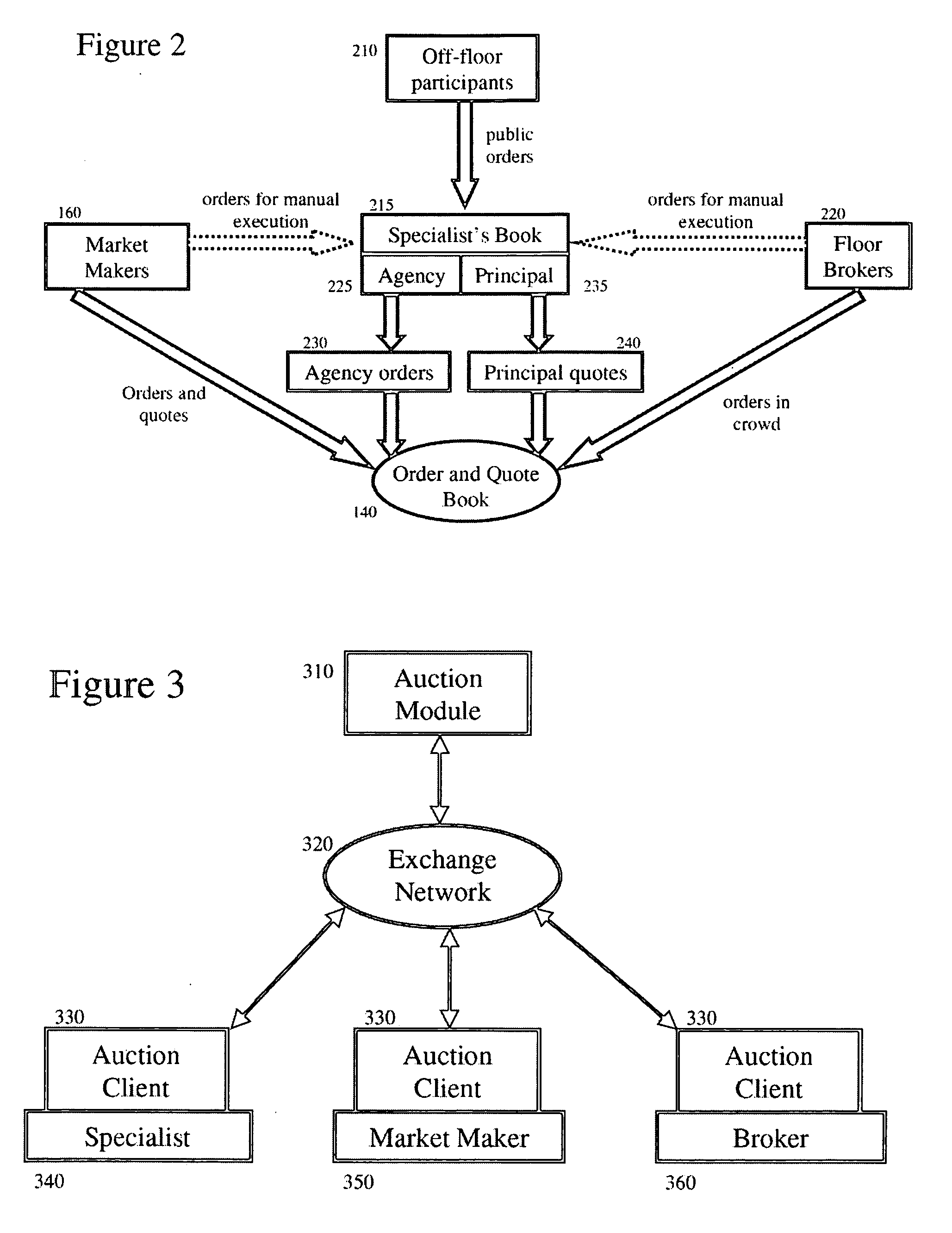

Electronic trading environment with price improvement

The invention includes systems and methods for price improvement in an electronic trading environment. The systems of the invention may include such components as auction clients for market participants to provide best prices and an auction module to coordinate auctions. The methods of the invention may include receiving best price quotes from market participants, the determination of best prices, and order execution based on single matches, multiple matches, and multiple matches on both sides of an order.

Owner:AMERICAN STOCK EXCHANGE

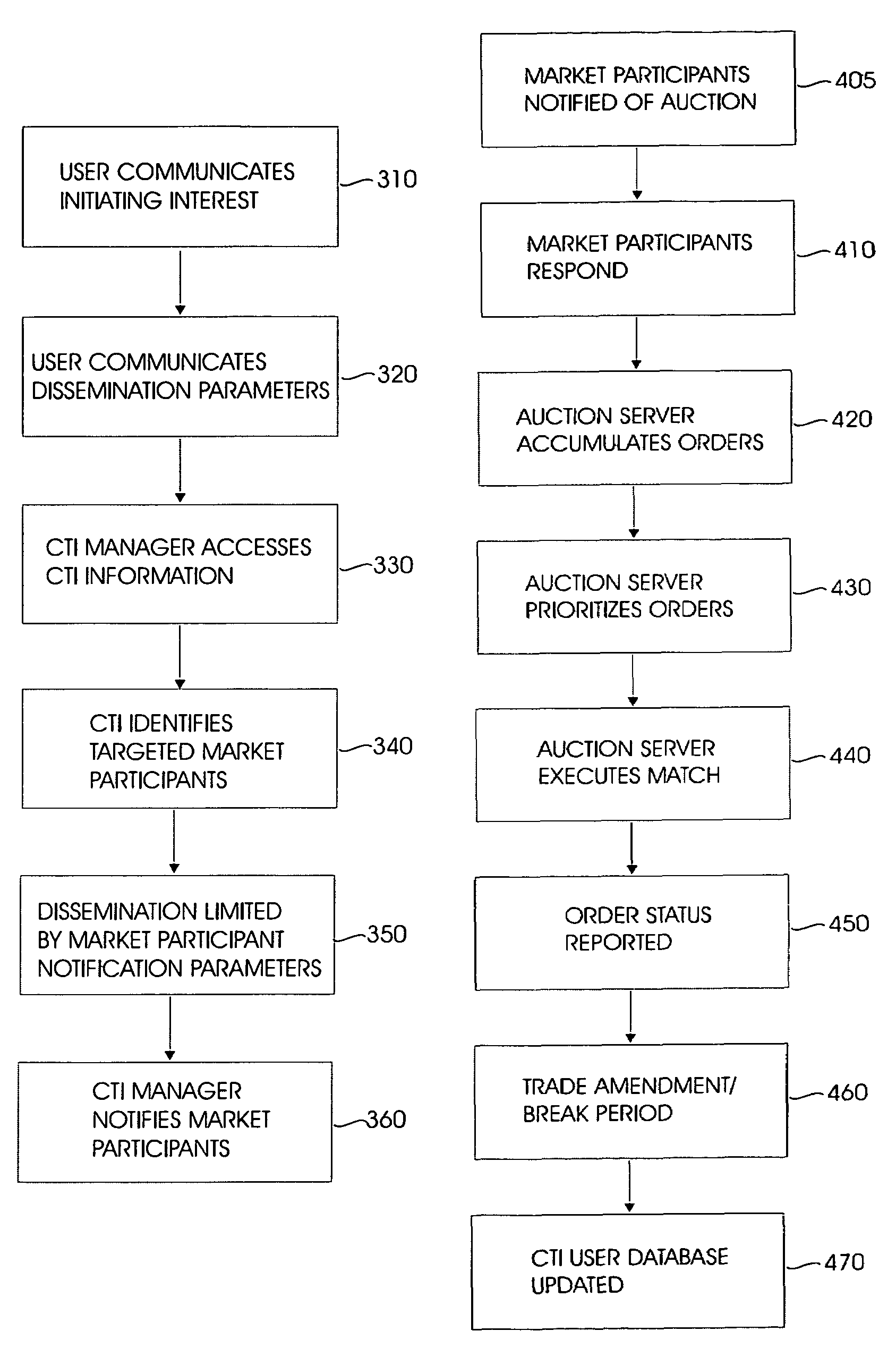

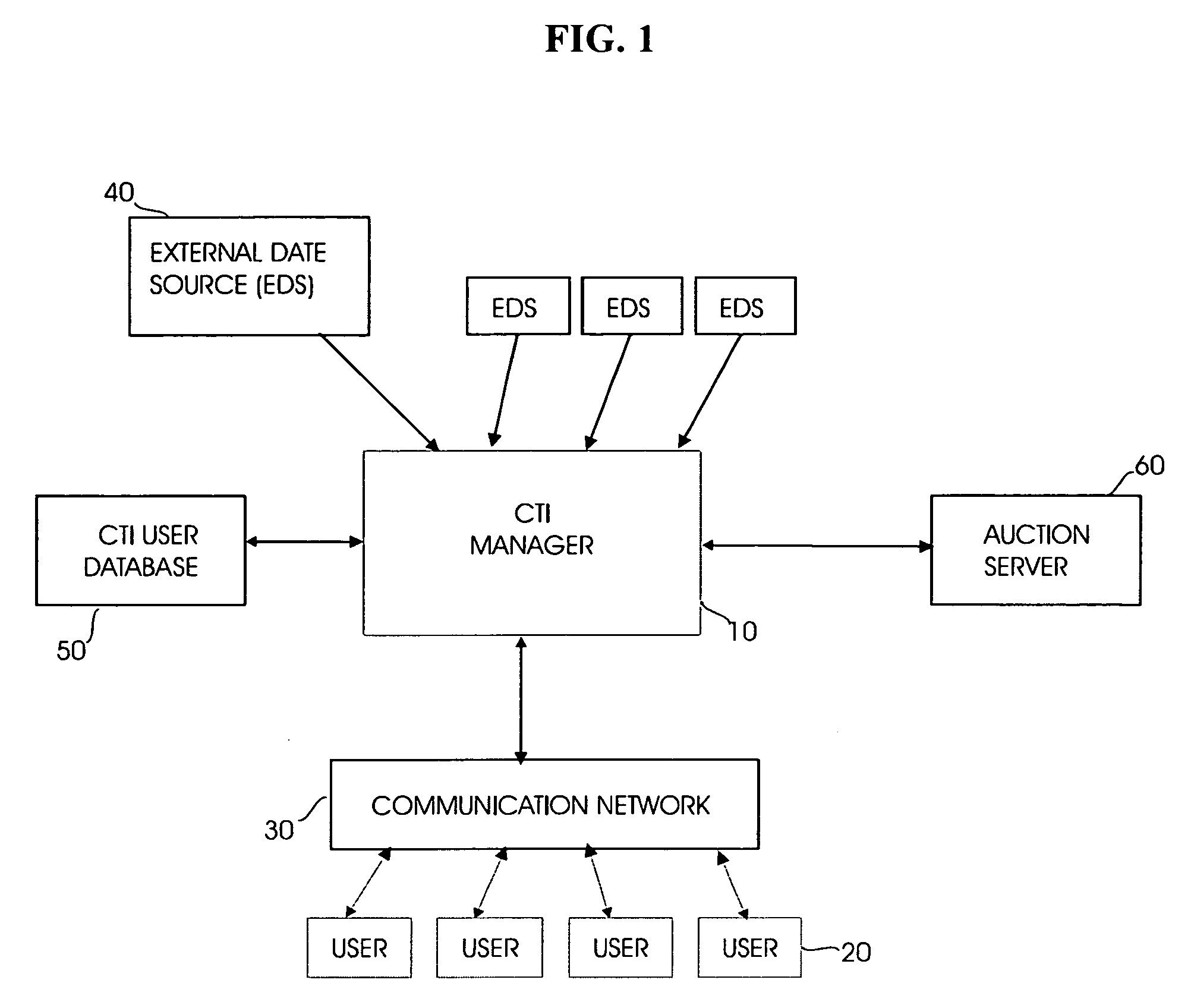

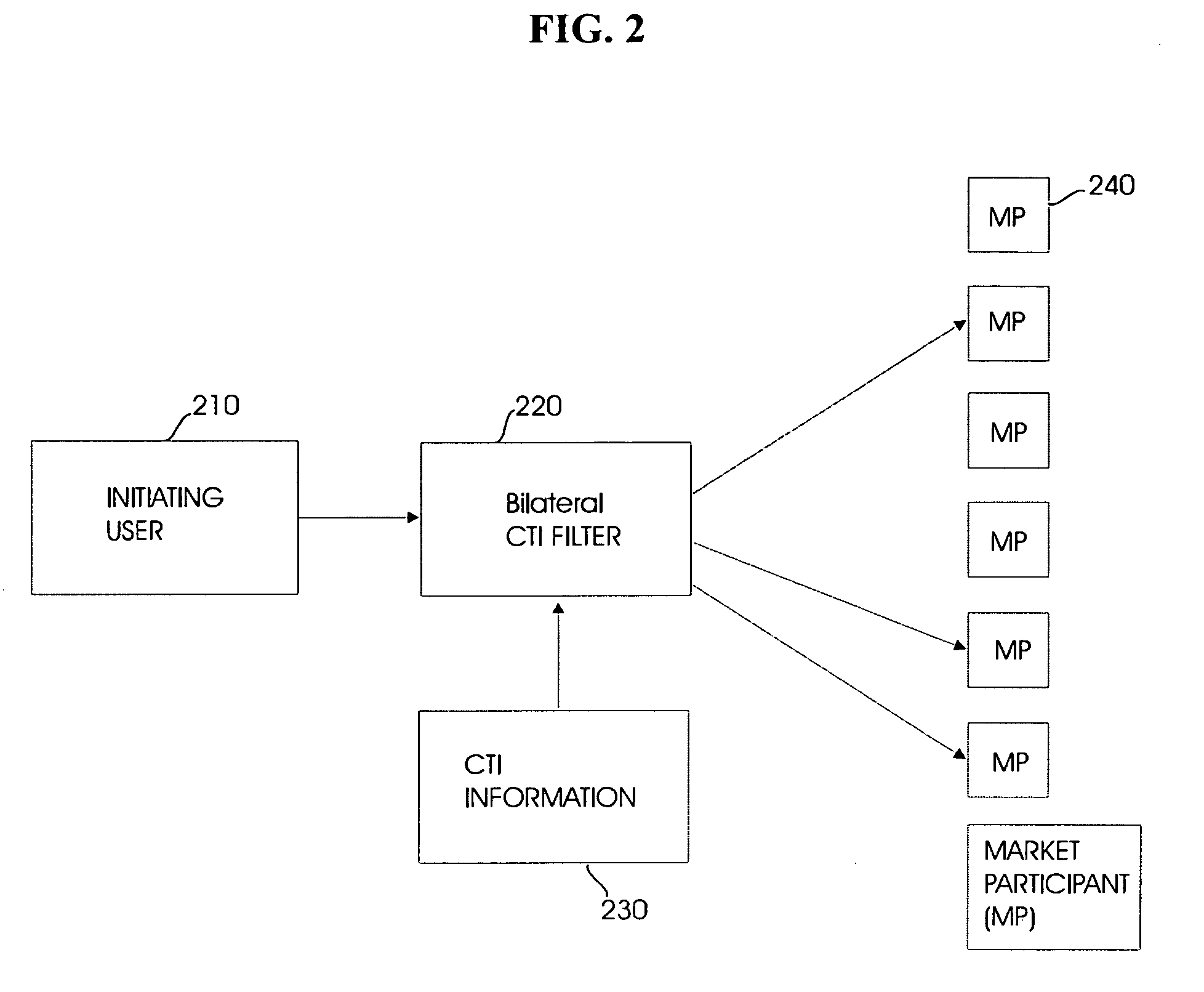

Method for directing and executing certified trading interests

Preferred embodiments of the subject invention overcome the limitations of known trading interest dissemination and execution systems by (1) enabling market participants to limit dissemination of trading interests to only those other market participants likely to have a significant contra-interest, (2) enabling market participants to ensure that other market participants' disseminated trading interests are legitimate, and (3) enabling auctions among trading interests targeted and validated in this manner. Software of a preferred embodiment identifies likely contra-interests by analyzing information from various sources regarding certified trading interests.

Owner:ITG SOFTWARE SOLUTIONS INC

System and method for tracking and analyzing loans involved in asset-backed securities

Embodiments of the disclosure are directed to providing unique loan identifiers to track loans involved in Asset-Backed Securities (ABS) throughout the life-cycle of the individual loans. In one embodiment, a unique loan identifier, for example, a loan number, may be appended to loan data at initiation of each loan, for example, at the application stage, to and / or beyond the retirement of the loan. The unique loan identifiers may allow disparate financial data sources such as the credit histories of the borrowers to be associated with the individual loans, even as the loans are repackaged and resold as ABS in the secondary markets. Thus, market participants such as loan servicers and investors can access current and historical data associated with the loans. Other embodiments are directed to analyzing the data associated with the underlying loans and providing the analysis to the market participants including servicers, investors, and underwriters.

Owner:EXPERIAN INFORMATION SOLUTIONS

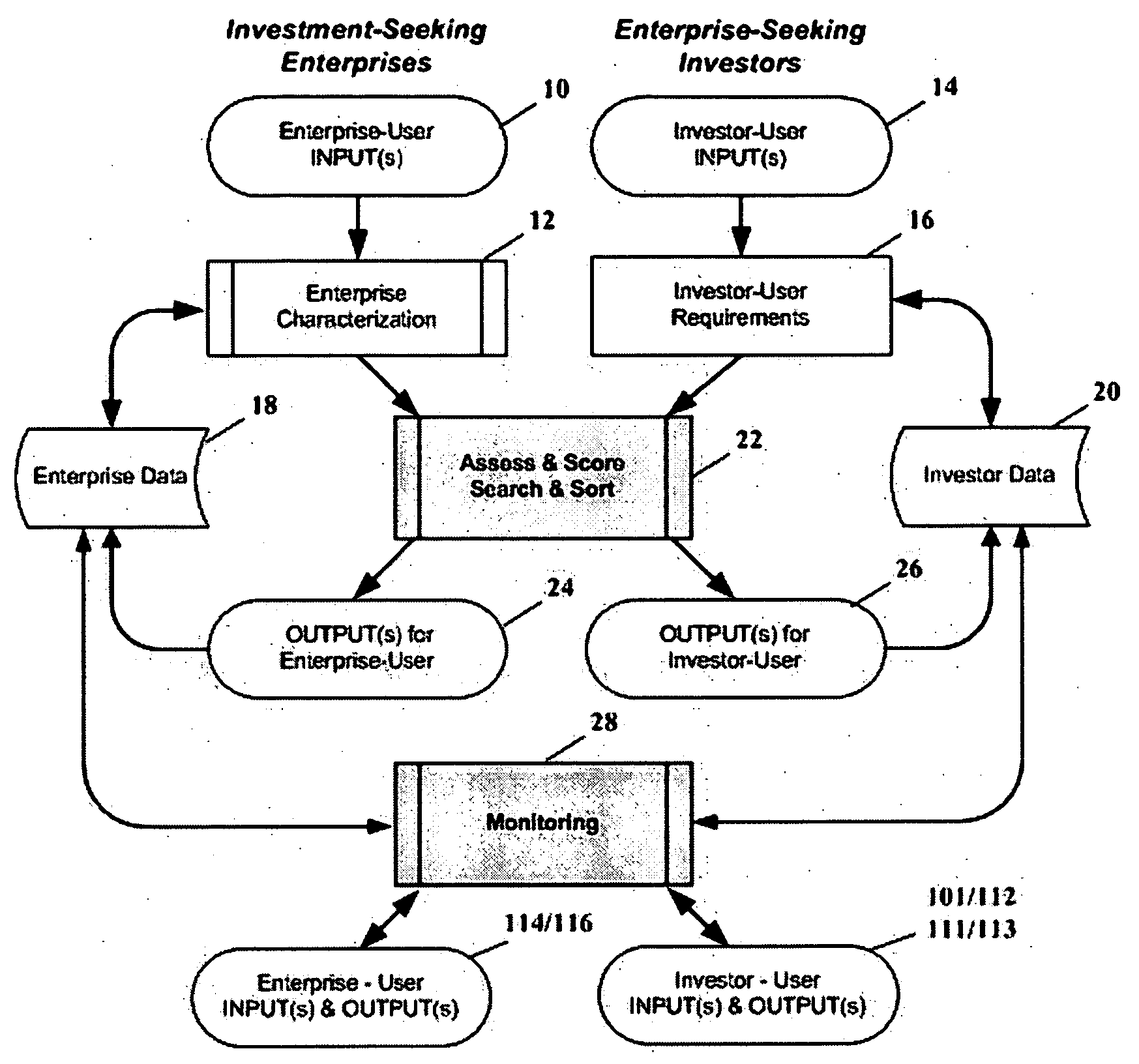

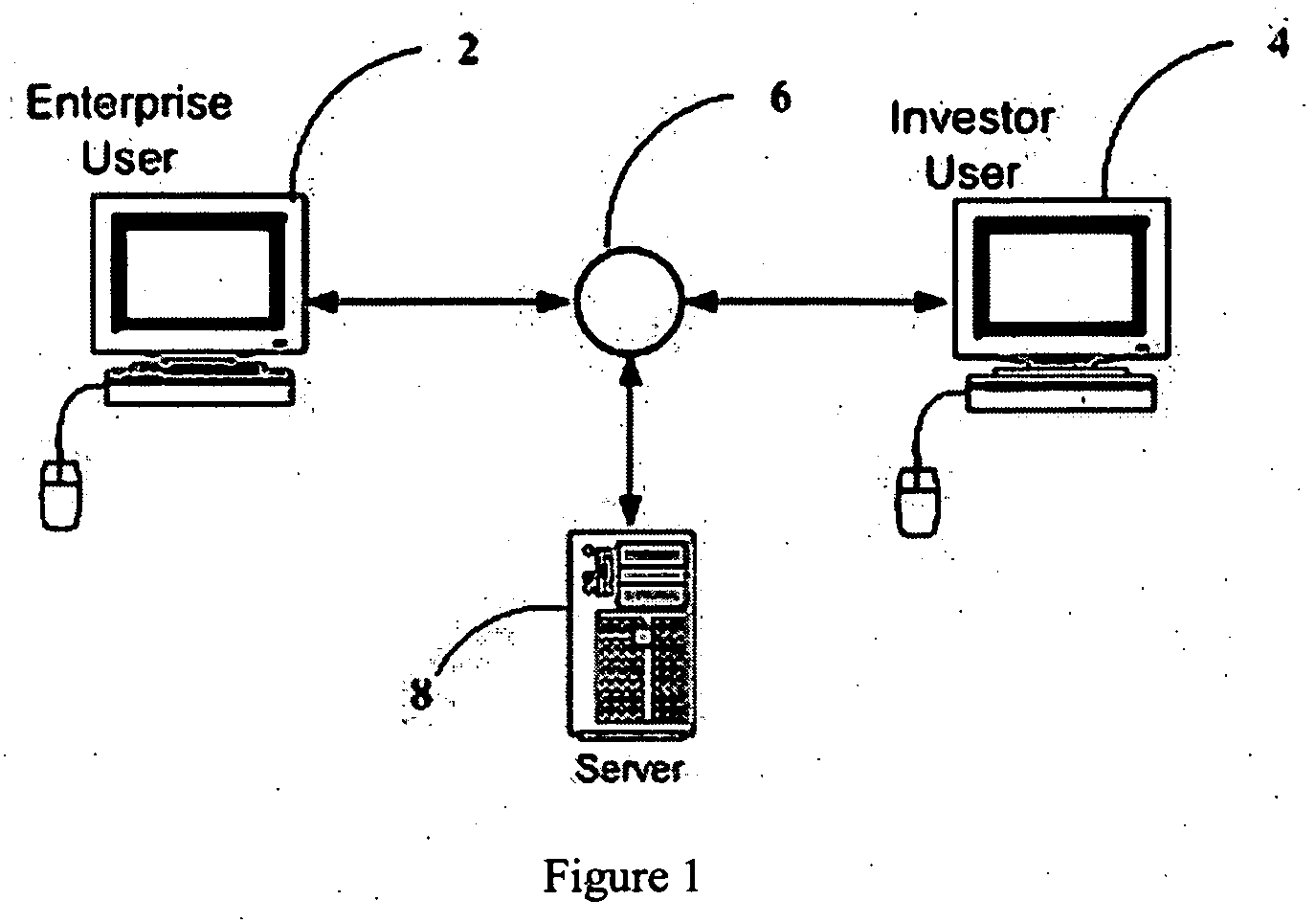

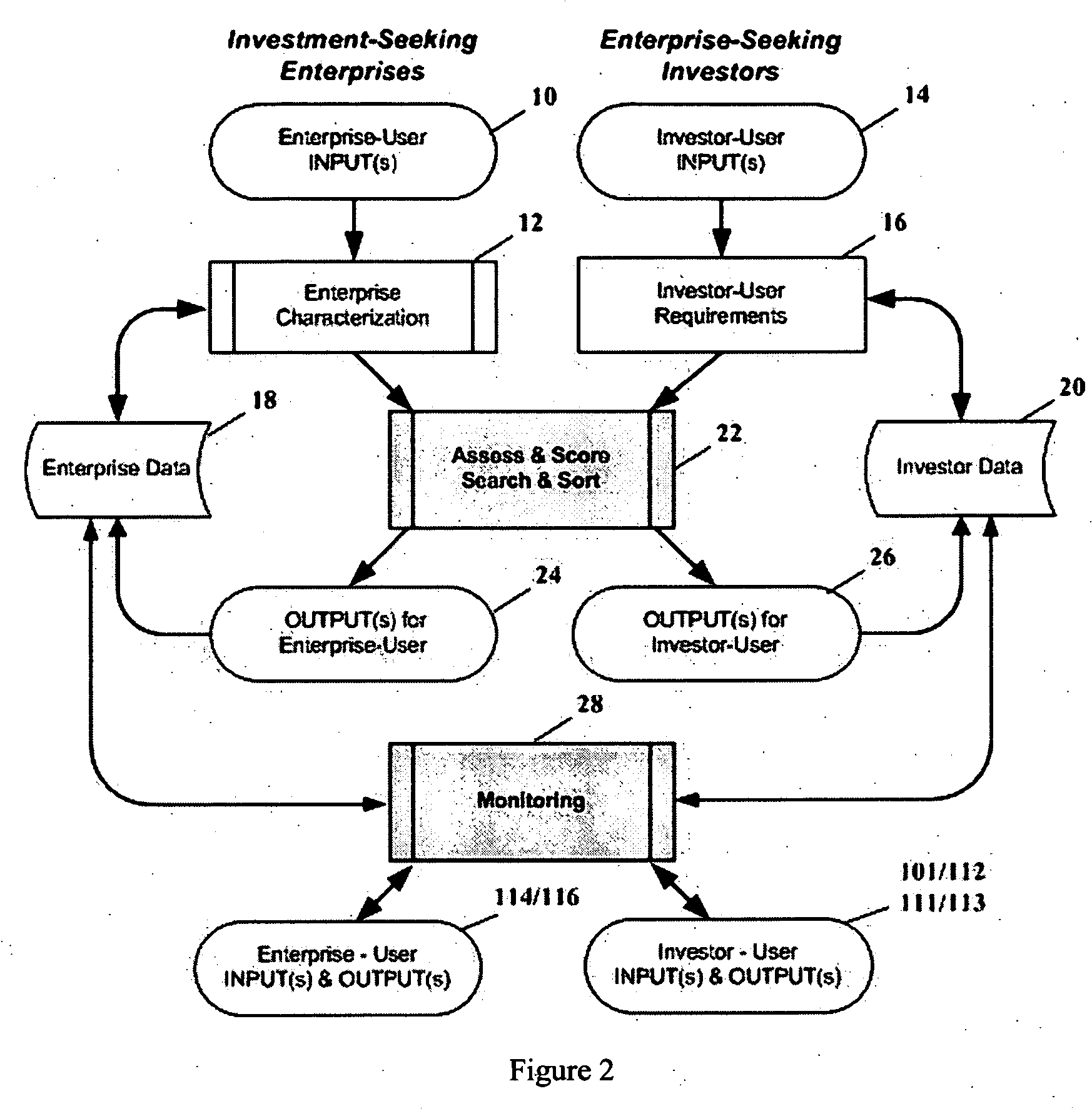

Electronic enterprise capital marketplace and monitoring apparatus and method

ActiveUS20070100724A1Facilitates efficient capitalization/liquidationEfficient identificationFinanceOffice automationFactor scoreElectronic communication

An automated and interactive system that facilitates efficient capitalization / liquidation and monitoring of private and publicly-traded enterprises through a network-driven marketplace is disclosed. The system may be comprised of a dynamic process for enterprise characterization, a customizable computational engine that utilizes statistical reference information to quantify a multi-factor scoring value for each unique enterprise, a customizable system for investor-users to filter, rank, and screen enterprise prospects, a customizable system for monitoring the performance of enterprises, an integrated internal system for electronic communication between market participants, and an empirical feedback system that provides a dynamic knowledge base of statistical reference information for various computational components of the invention.

Owner:GLOBAL EQUITY FINTECH INC

Exchange feed for trade reporting having reduced redundancy

The disclosed embodiments relate to communication of financial messages from an Exchange to market participants whereby messages, or at least a portion of the content thereof, indicative of changes in the market, due to one or more trades between two or more market participants, are structured so as to reduce redundant data therein and prioritize the transmission of that portion of the message which summarizes the event and result thereof. Further, these event reporting messages may further consolidate, or otherwise be combined with, the corresponding directed reporting messages communicated to the particular market participants participating in the reported trade while preserving the anonymity of those market participants to which messages are particularly directed.

Owner:CHICAGO MERCANTILE EXCHANGE

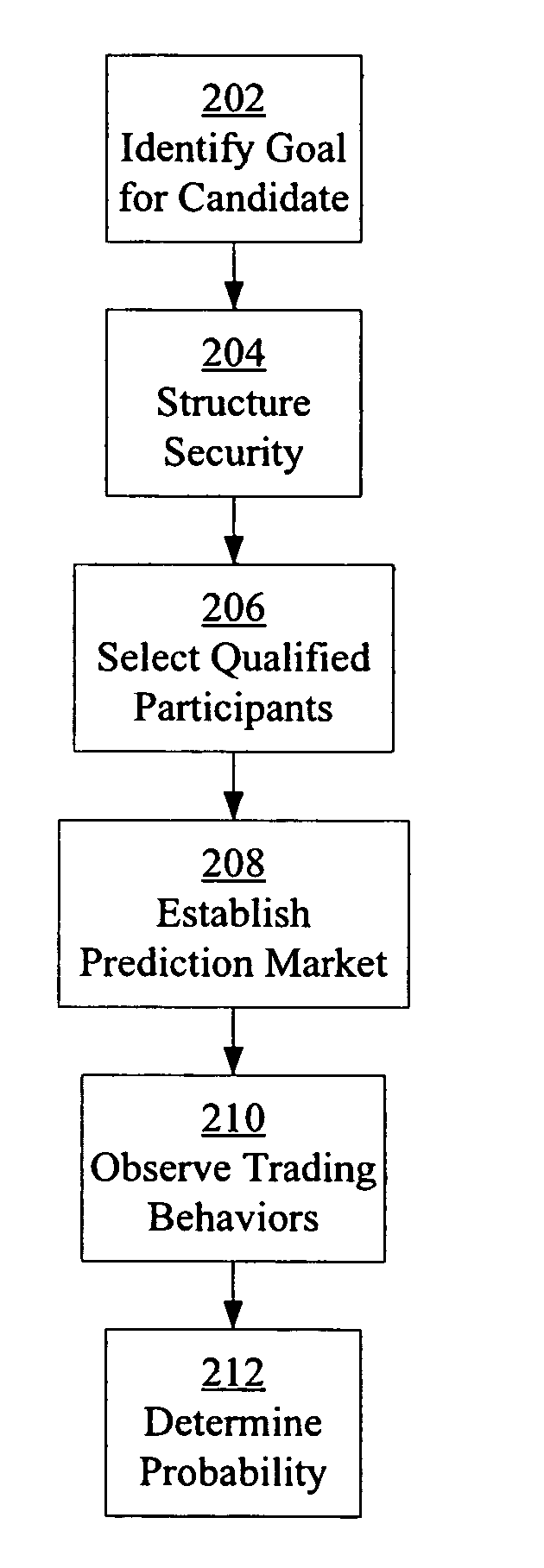

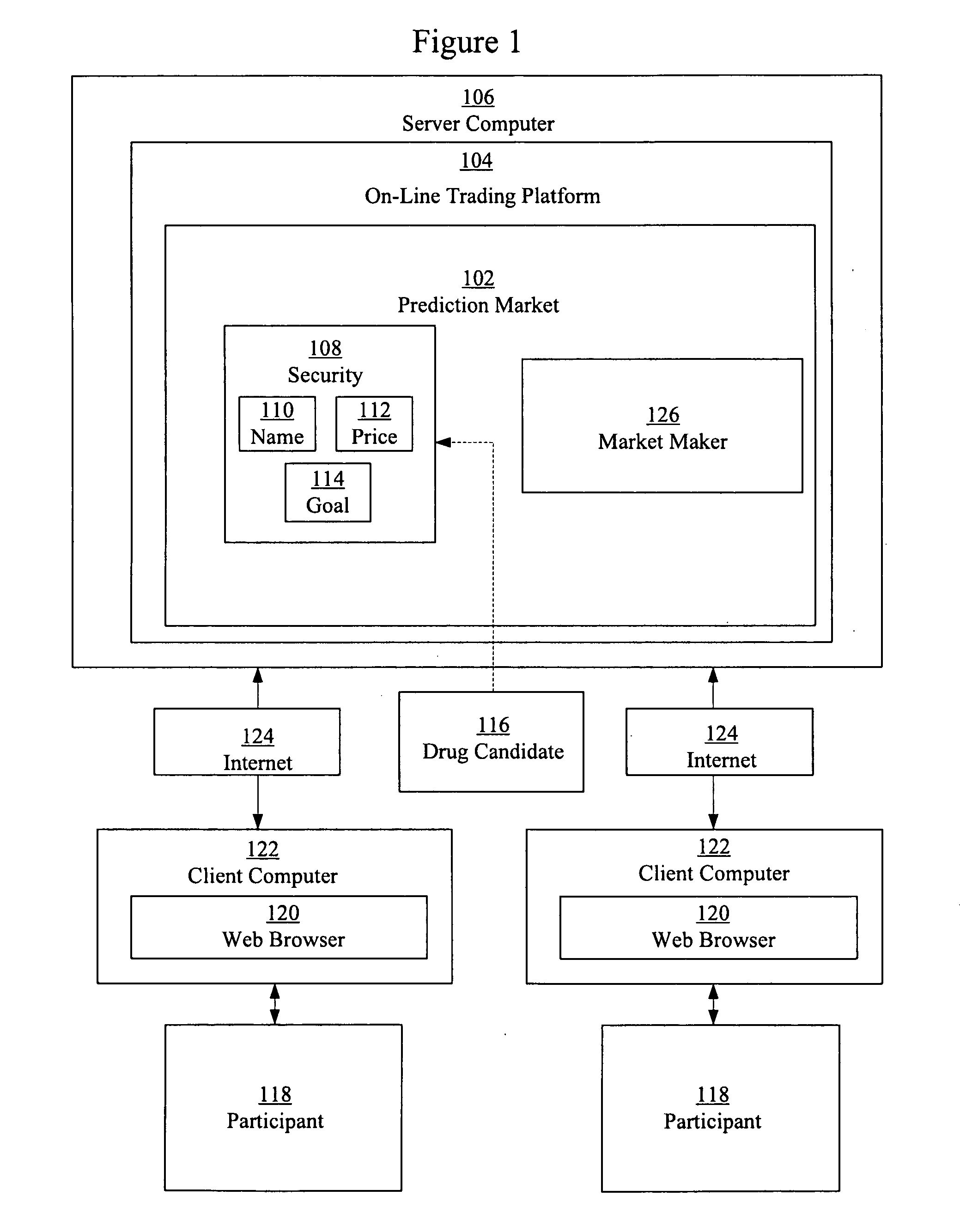

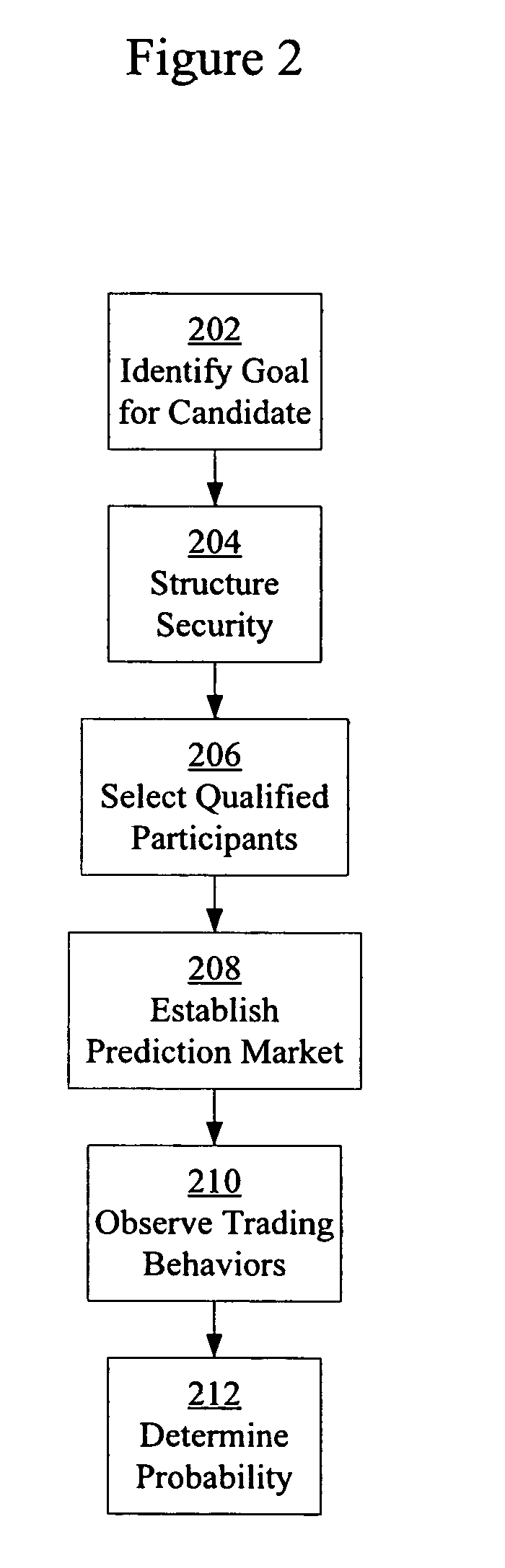

Prediction markets for assessing clinical probabilities of success

Prediction markets are used to determine the probability of an experimental therapeutic, diagnostic, or prophylactic candidate meeting clinical trial and post-trial goals, such as clinical trial endpoints and timelines. The prediction market processes buy and sell orders from market participants, while adjusting the prices of the securities according to the orders. The securities have specific meanings which correspond to goals in clinical trials or other outcomes in clinical candidate development. The price of a security determined by the market corresponds to the probability of the corresponding goal or outcome. The participants are selected for their expert knowledge of specific factors related to candidate development. Using appropriately selected securities and participants, the prediction market may be used to generate probabilities of success useful for long-range planning and valuation, determining production timelines and volumes, management of candidates in a development portfolio, and clinical management of patients by physicians.

Owner:CLINICAL FUTURES

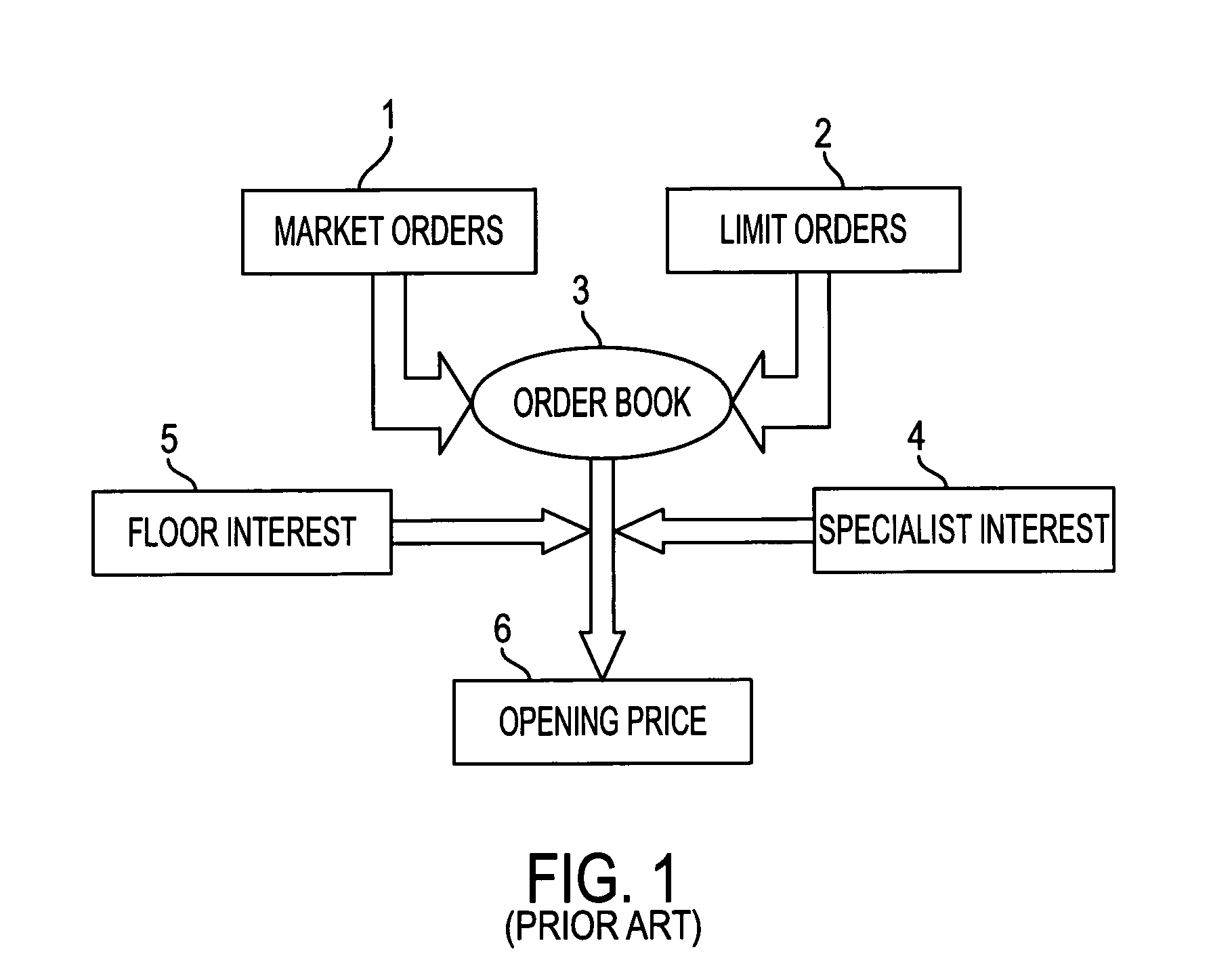

Automated batch auctions in conjunction with continuous financial markets

A method and system for performing a batch auction whereby a series of orders, according to a variety of predetermined order types, are generated by qualified market participants and communicated to an auction system. The auction system takes into account each order and its impact upon relative supply and demand to determine by a preset algorithm a price and share transaction quantity. Trades are executed at the price, and a portion of the transaction quantity is allocated to each investor on a fair basis dependent upon their initial orders. In embodiments of the present invention, the auction system uses a computer system or network designed to automatically perform one or more steps of the above method. Such a system is preferably connected to one or more ECNs such that non-executed shares can be automatically sent to outside sources for execution. In alternative embodiments, the invention includes the use of a one or more intermediaries or market makers to cover certain unexecuted trades at the determined price. The present invention is preferably used to conduct batch auctions at the opening and closing of securities trading markets.

Owner:ITG SOFTWARE SOLUTIONS INC

Using Conflict of Interest [COI] Method and System in Creating Investment Portfolio

InactiveUS20100070347A1Good flexibilityFinanceDigital data processing detailsRisk profilingDirect analysis

In the past, the practice of creating investment portfolio has been focused on the diversification of investment without specifically identifying investment risks. This invention is related to a method of diversification which considers the level of potential for conflict of interest (COI) risk as part of a diversification process. The COI has its origin in the interaction among market participants, market structure, business arrangement and practice. The advantage of the present invention is that the COI becomes a primary factor in creating the portfolio. This method provides a direct analysis of the COI risk that associates with entire investment process and the manager, and it is further integrated into the portfolio creation process. The COI Method opens new paths to perform risk analysis and could be integrated into decision process in other fields of investment.

Owner:CHEN WILLIAM

Detection and mitigation of effects of high velocity price changes

The disclosed embodiments relate to mechanisms to rapidly detect and respond to situations where a market is not operating in a fair and balanced manner or otherwise where the market value is not reflective of a true consensus of the value of the traded products among the market participants. In particular, the disclosed embodiments continually scan for, rapidly detect and respond to extreme changes, either up (“spike”) or down (“dip”) in the market, such as a “flash crash,” where a precipitous market move occurs. Generally, the disclosed embodiments determine when a market for a particular product moves too quickly in too short of period of time, e.g. the velocity of the market exceeds a defined threshold limit.

Owner:CHICAGO MERCANTILE EXCHANGE INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com