Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

212 results about "Time horizon" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A time horizon, also known as a planning horizon, is a fixed point of time in the future at which point certain processes will be evaluated or assumed to end. It is necessary in an accounting, finance or risk management regime to assign such a fixed horizon time so that alternatives can be evaluated for performance over the same period of time. A time horizon is a physical impossibility in the real world.

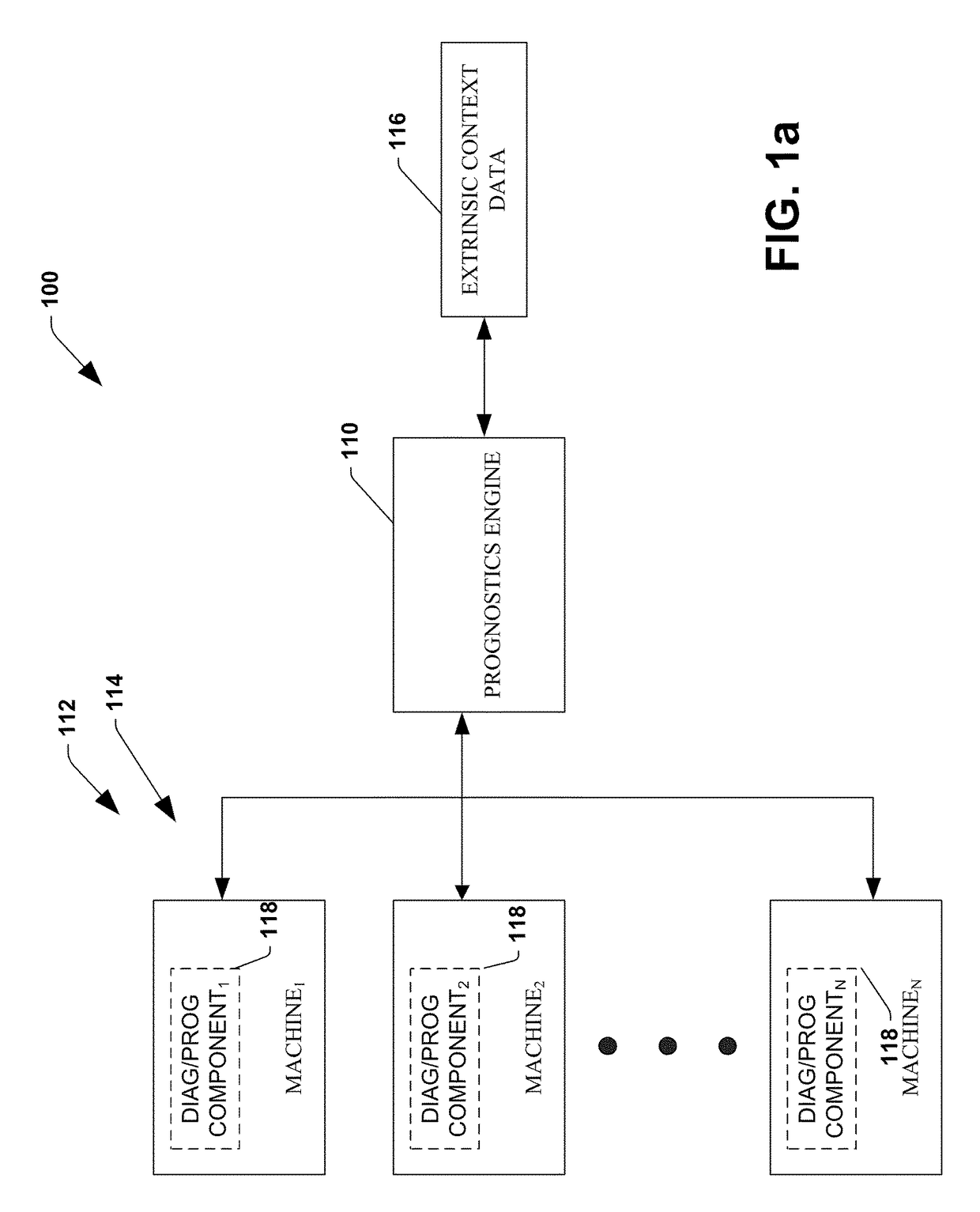

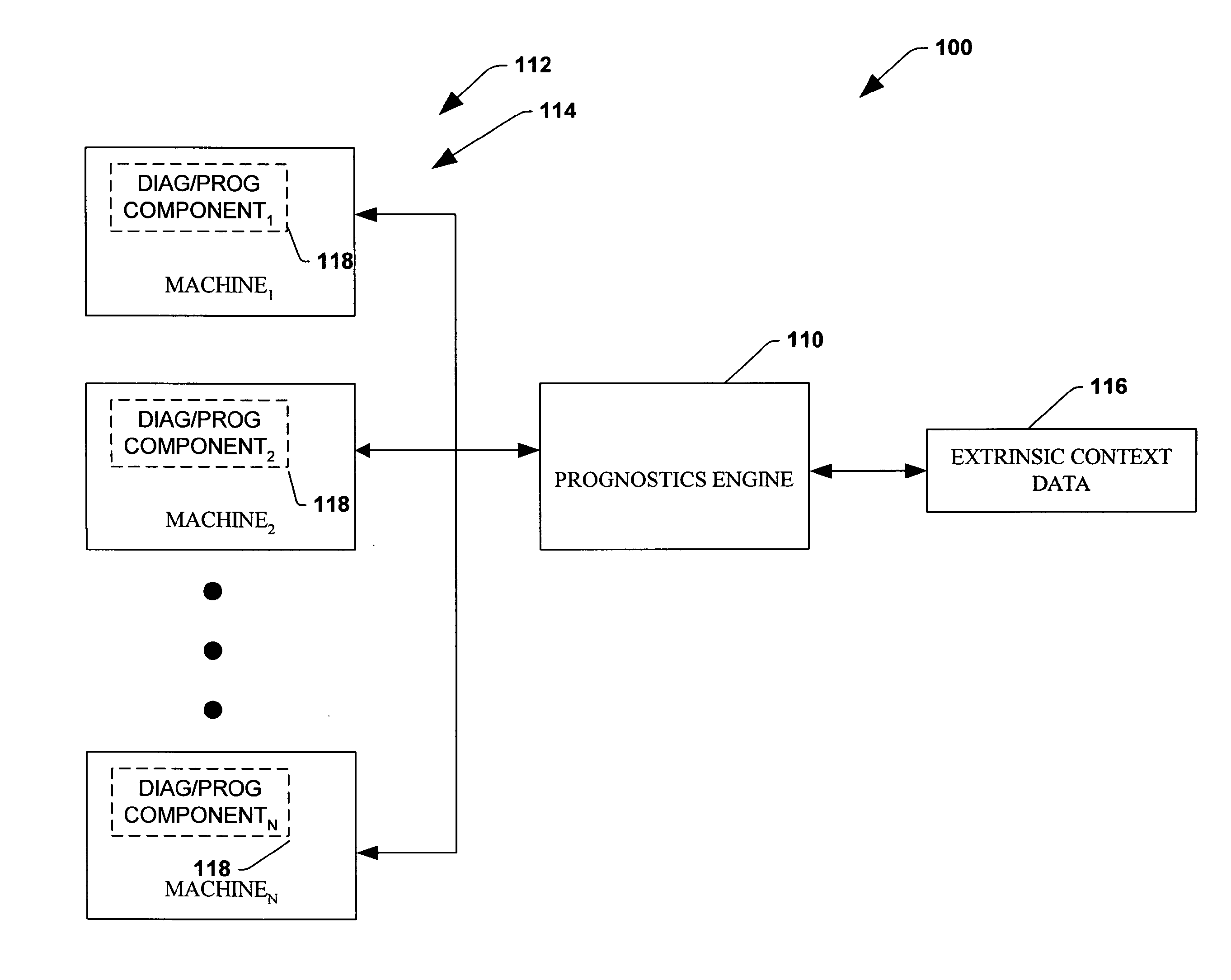

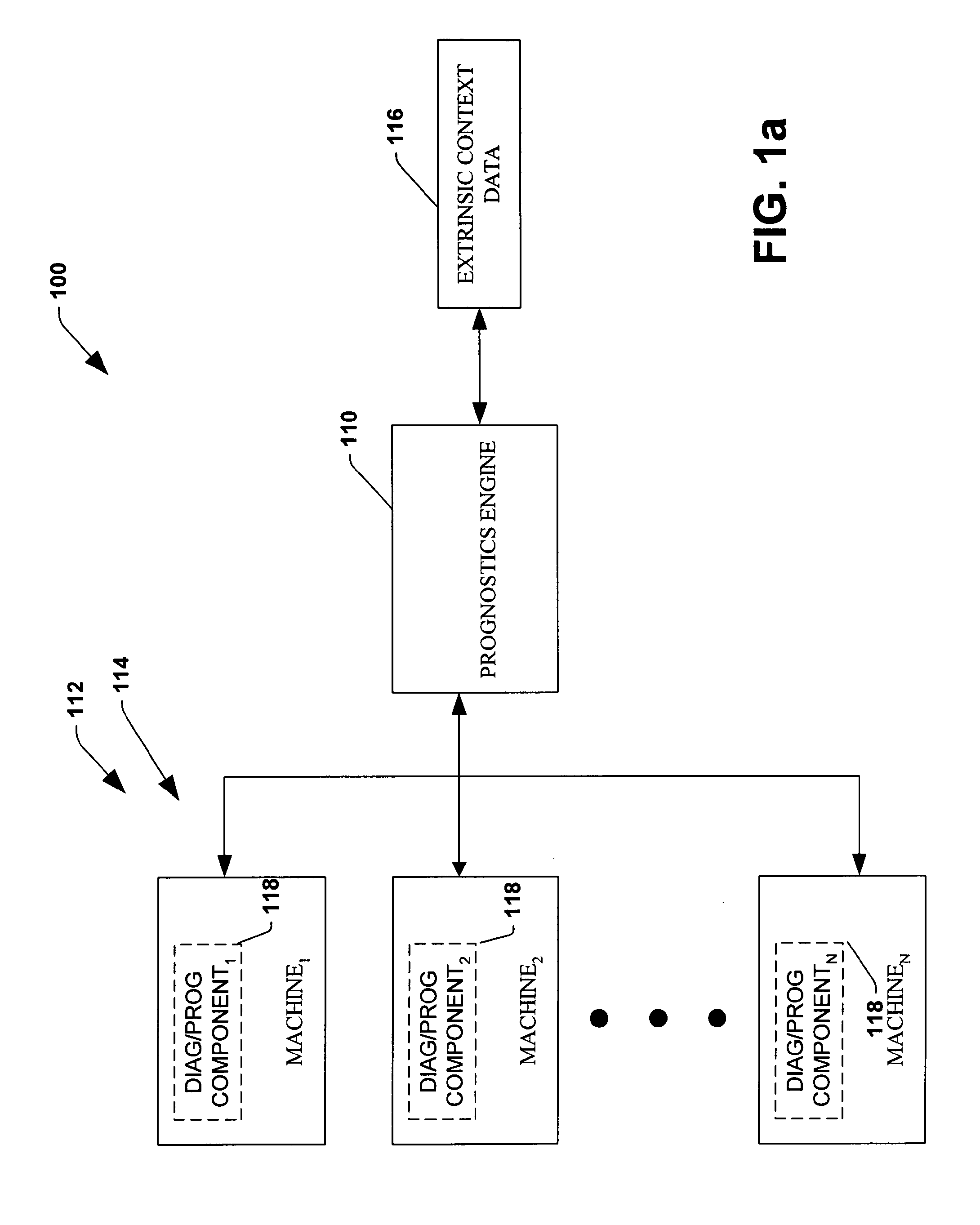

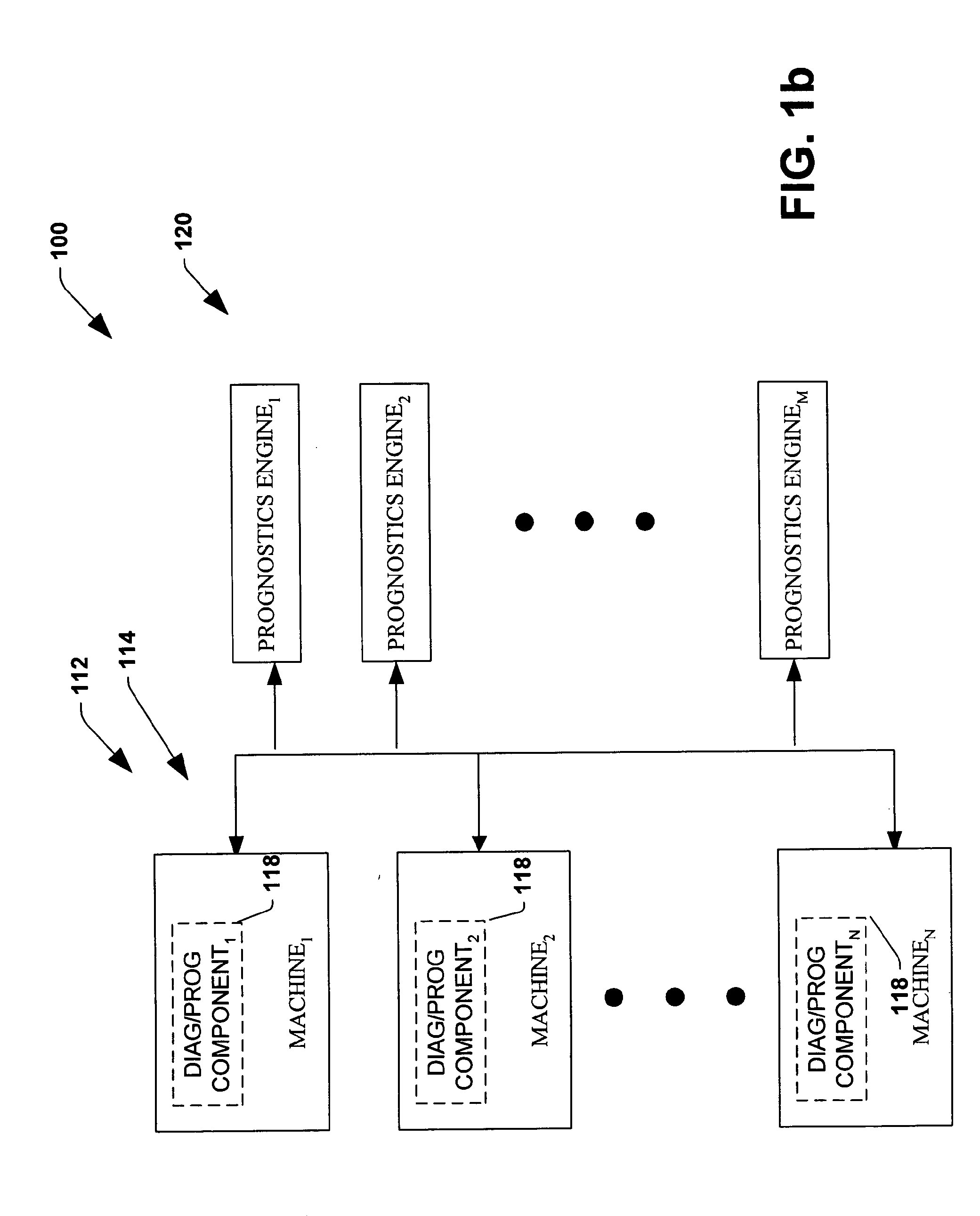

System and method for dynamic multi-objective optimization of machine selection, integration and utilization

InactiveUS20090210081A1Improve overall utilizationImprove efficiencyInput/output for user-computer interactionForecastingMachine selectionOperational costs

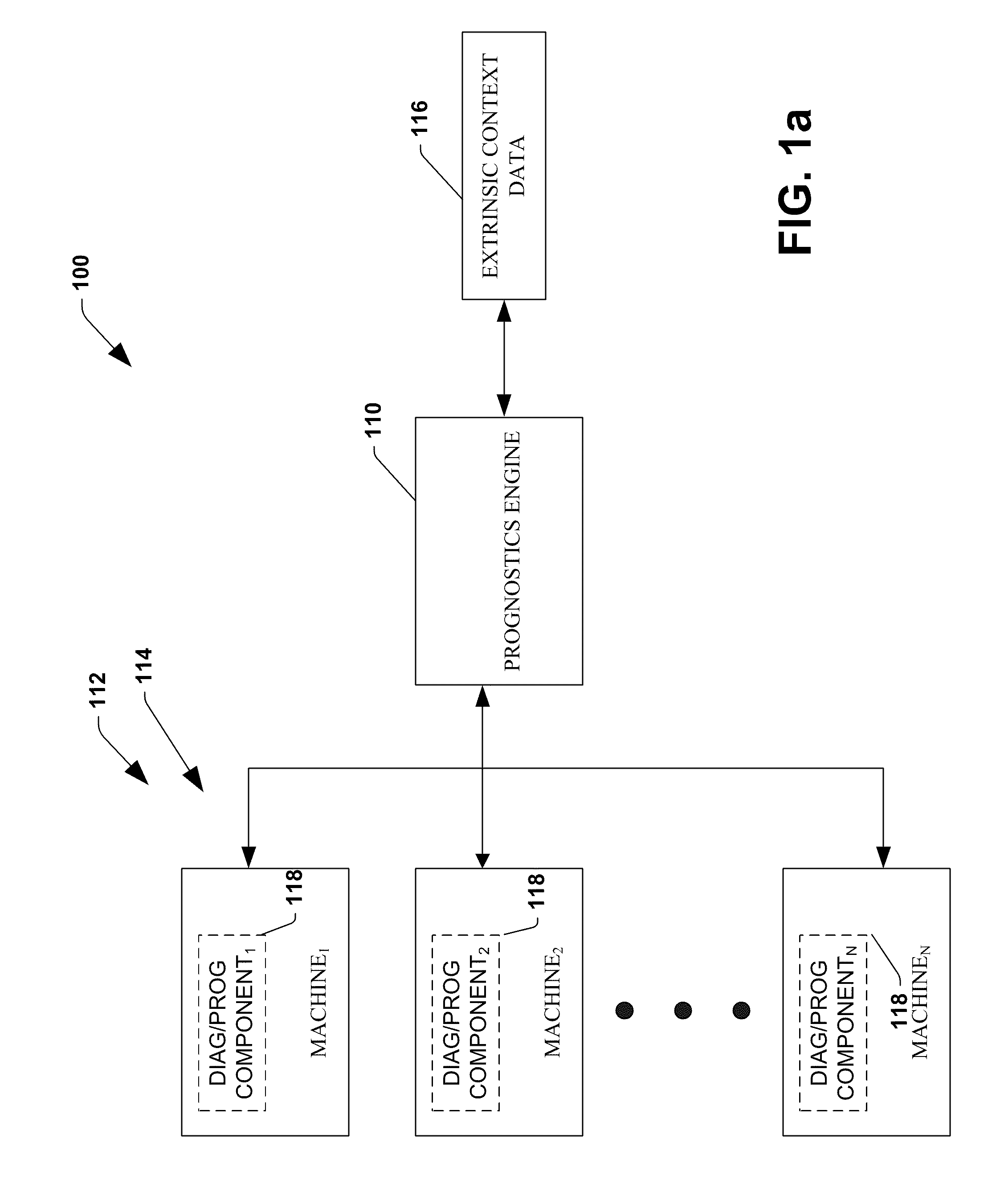

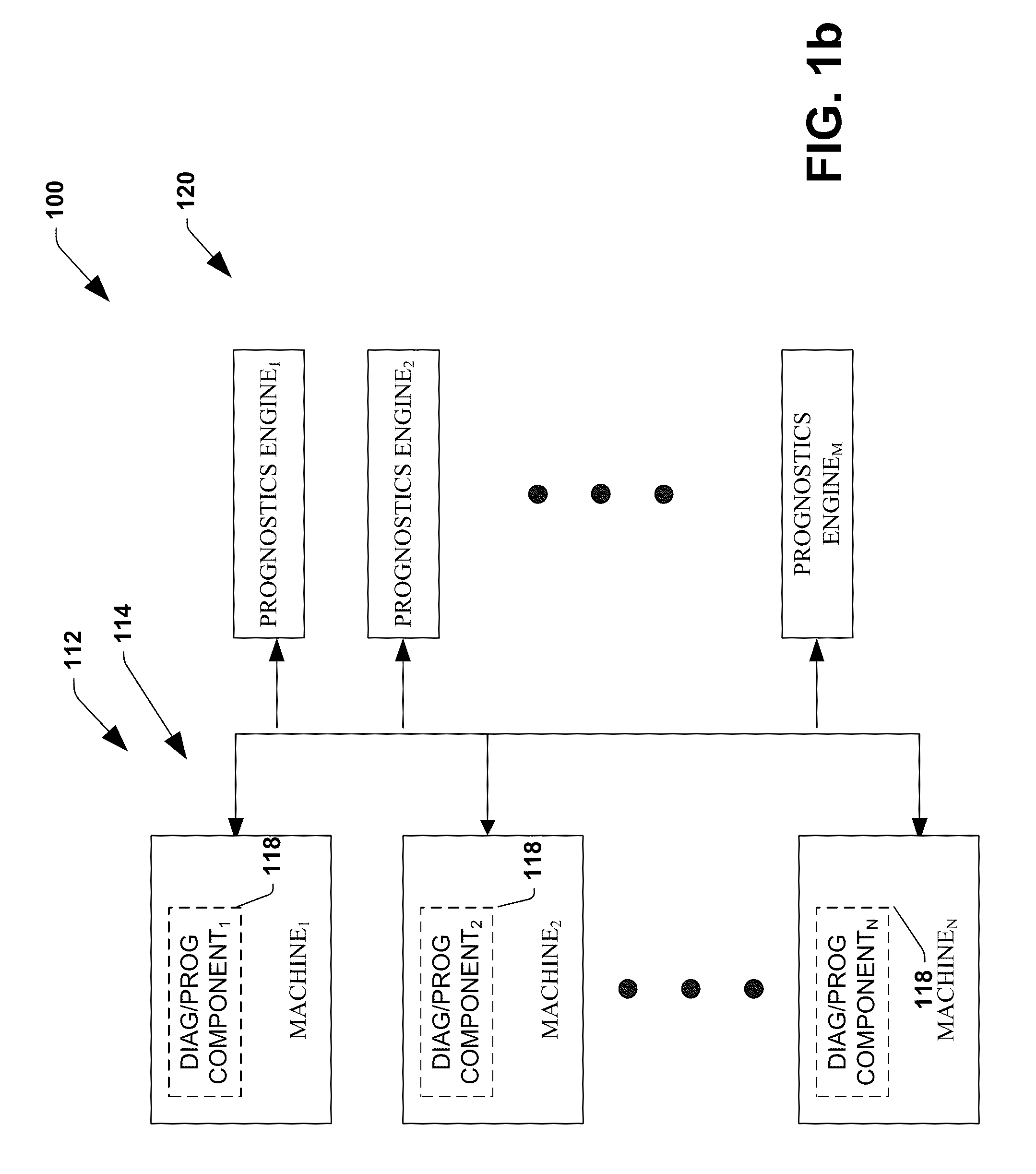

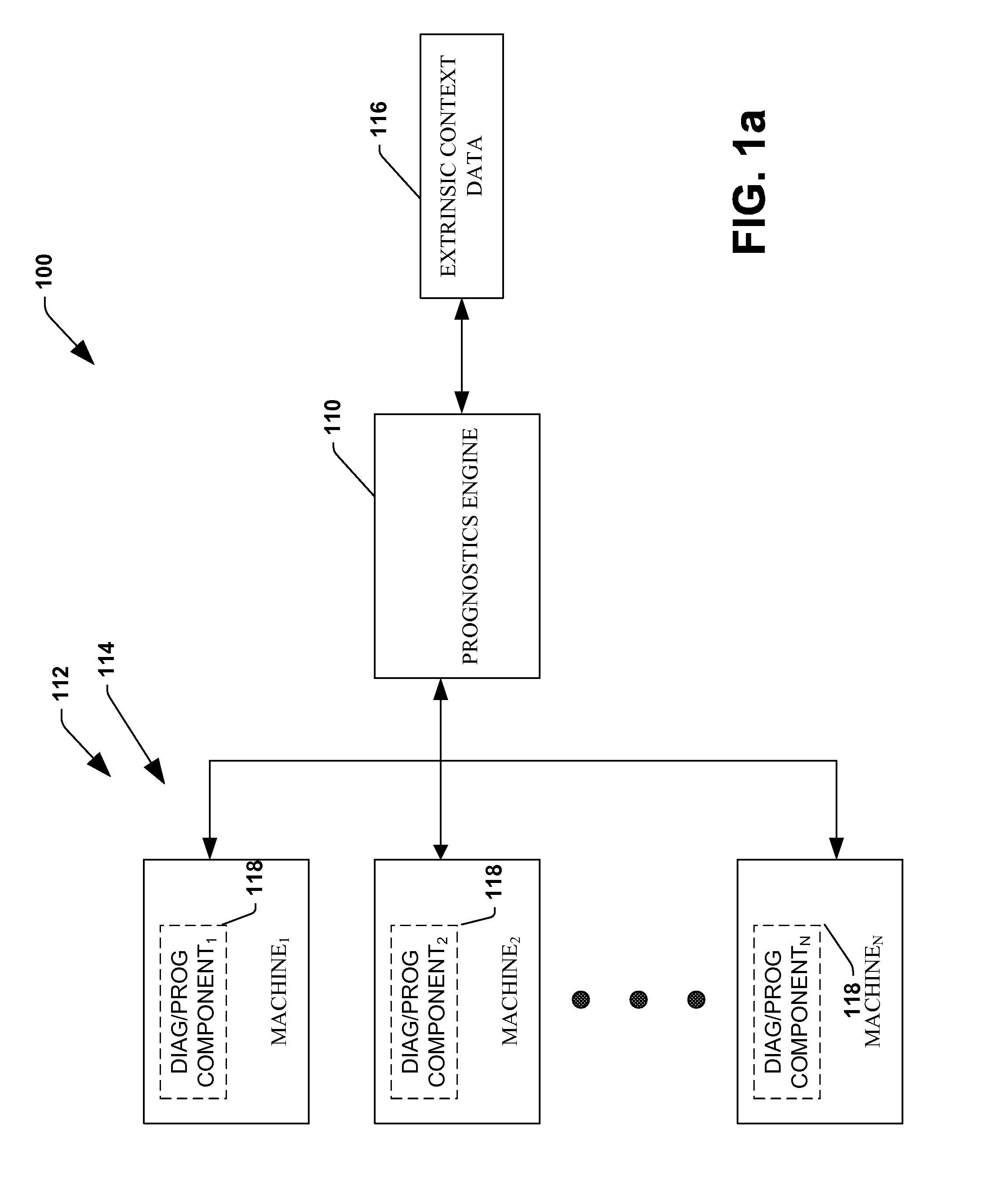

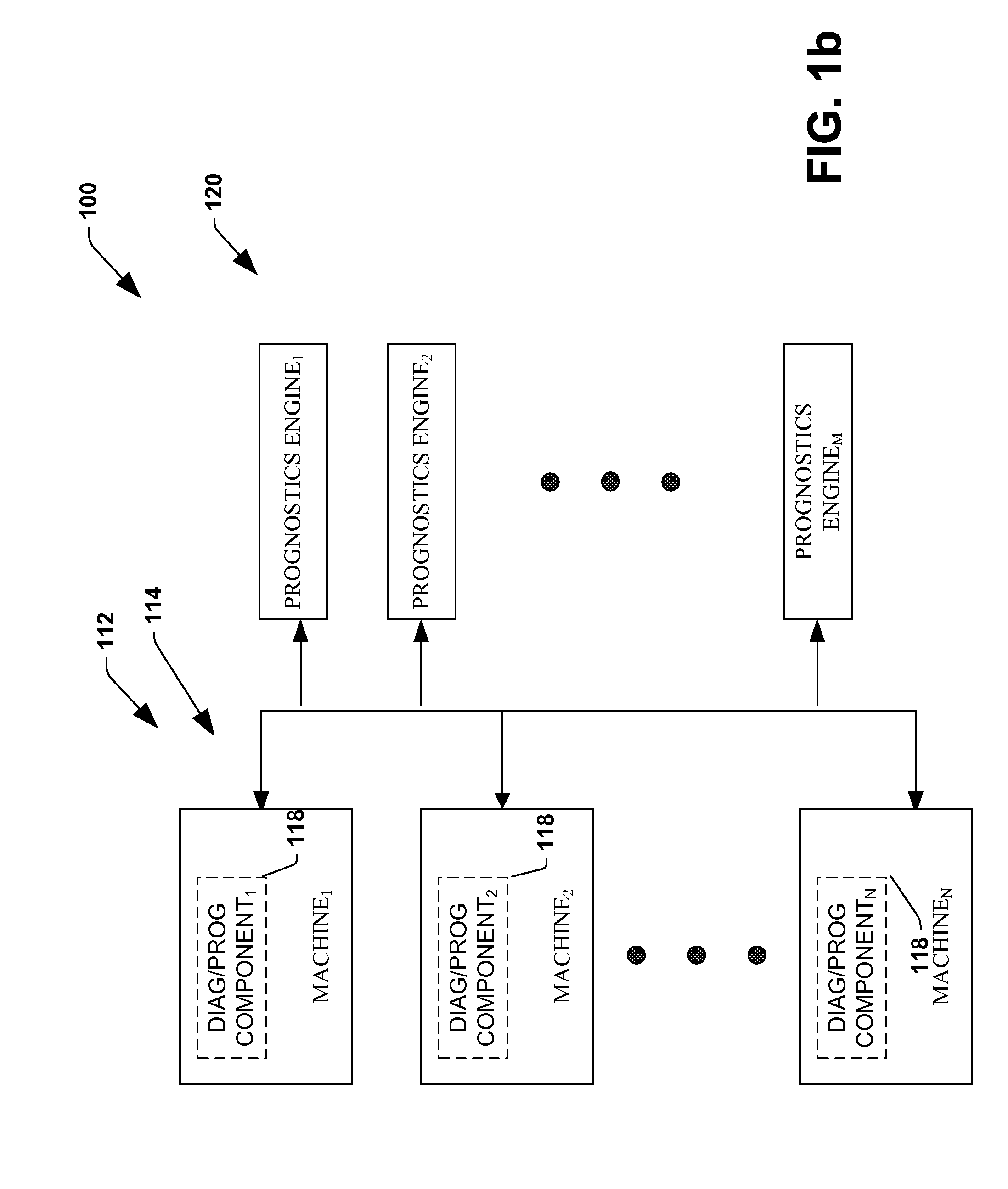

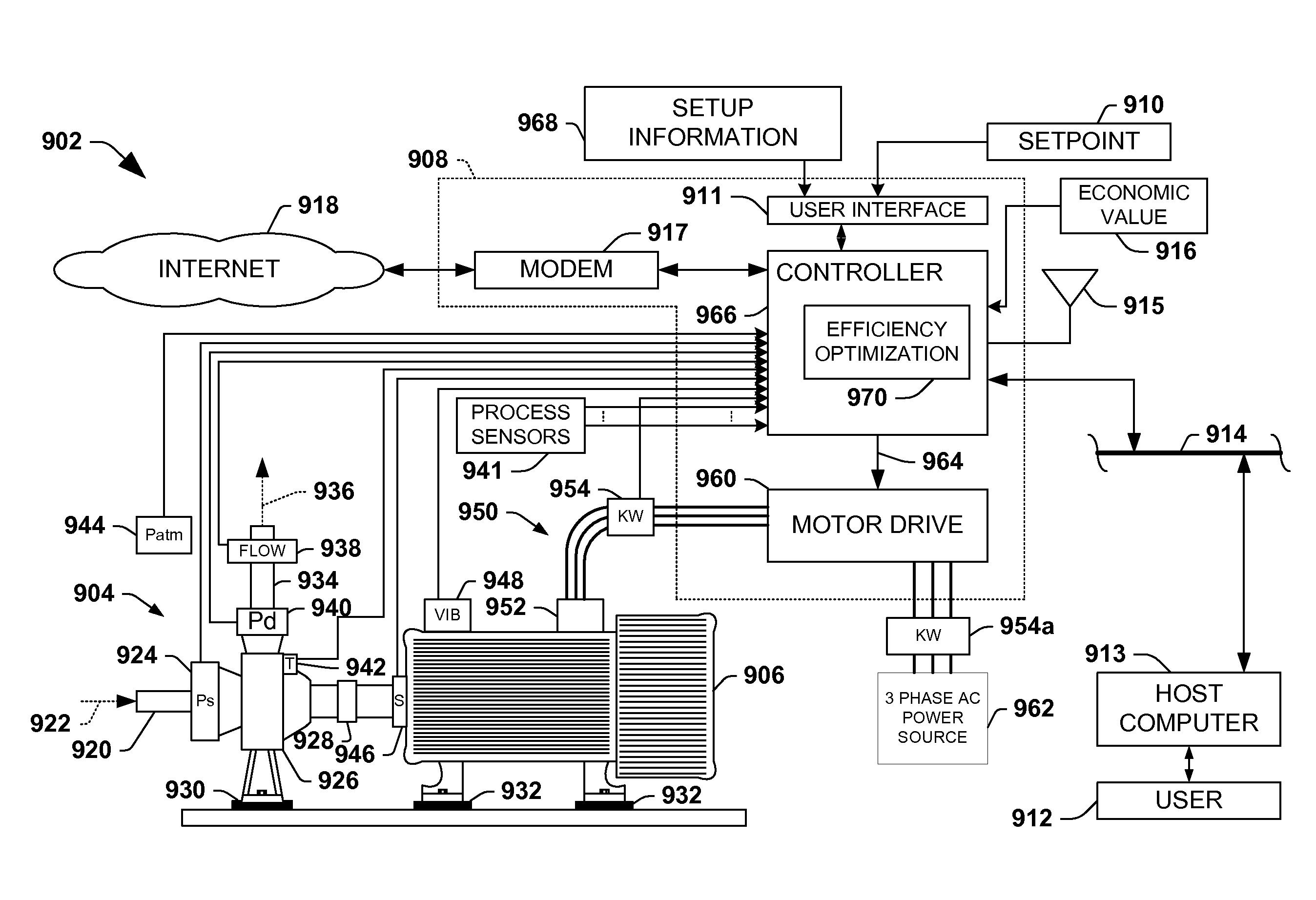

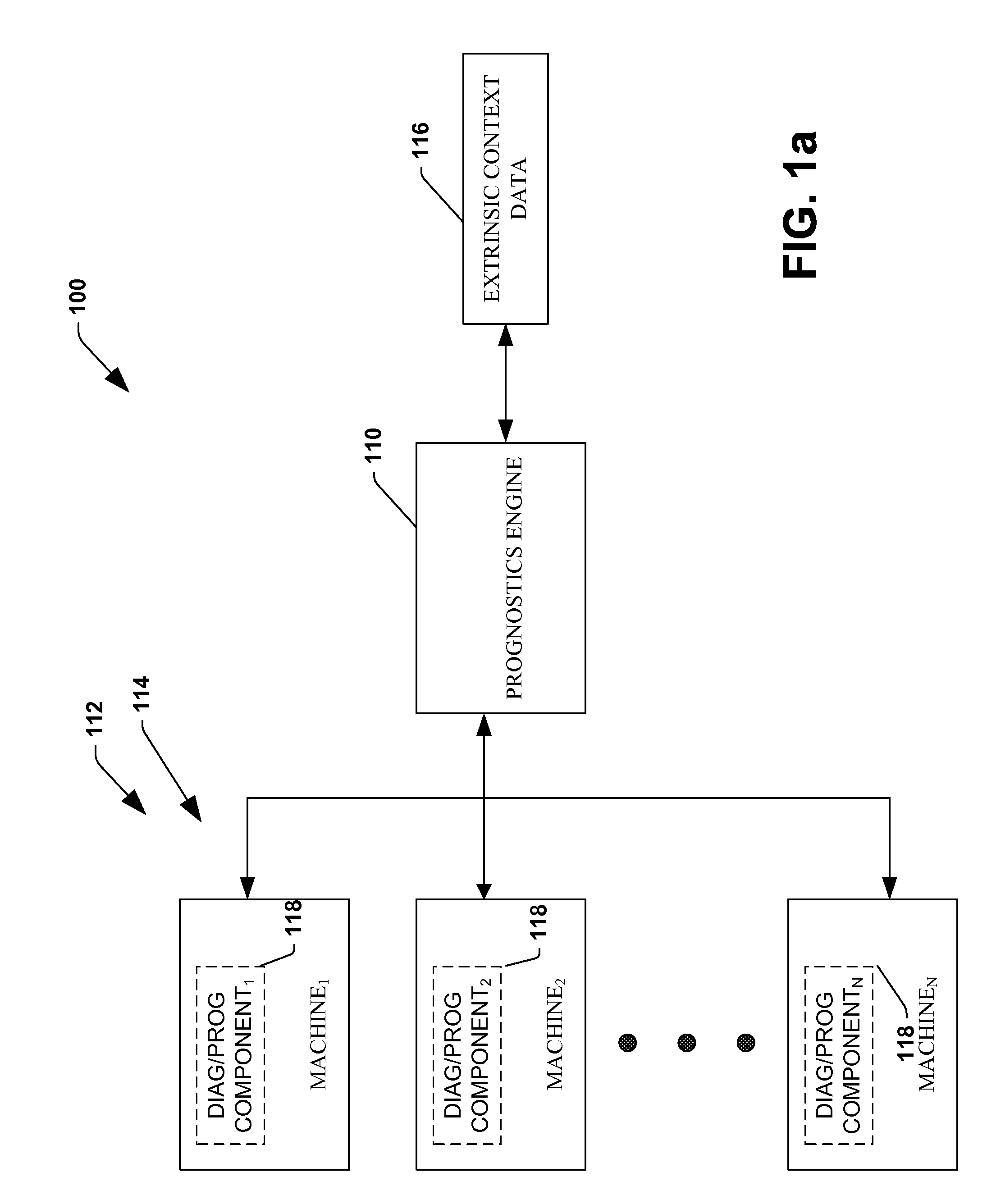

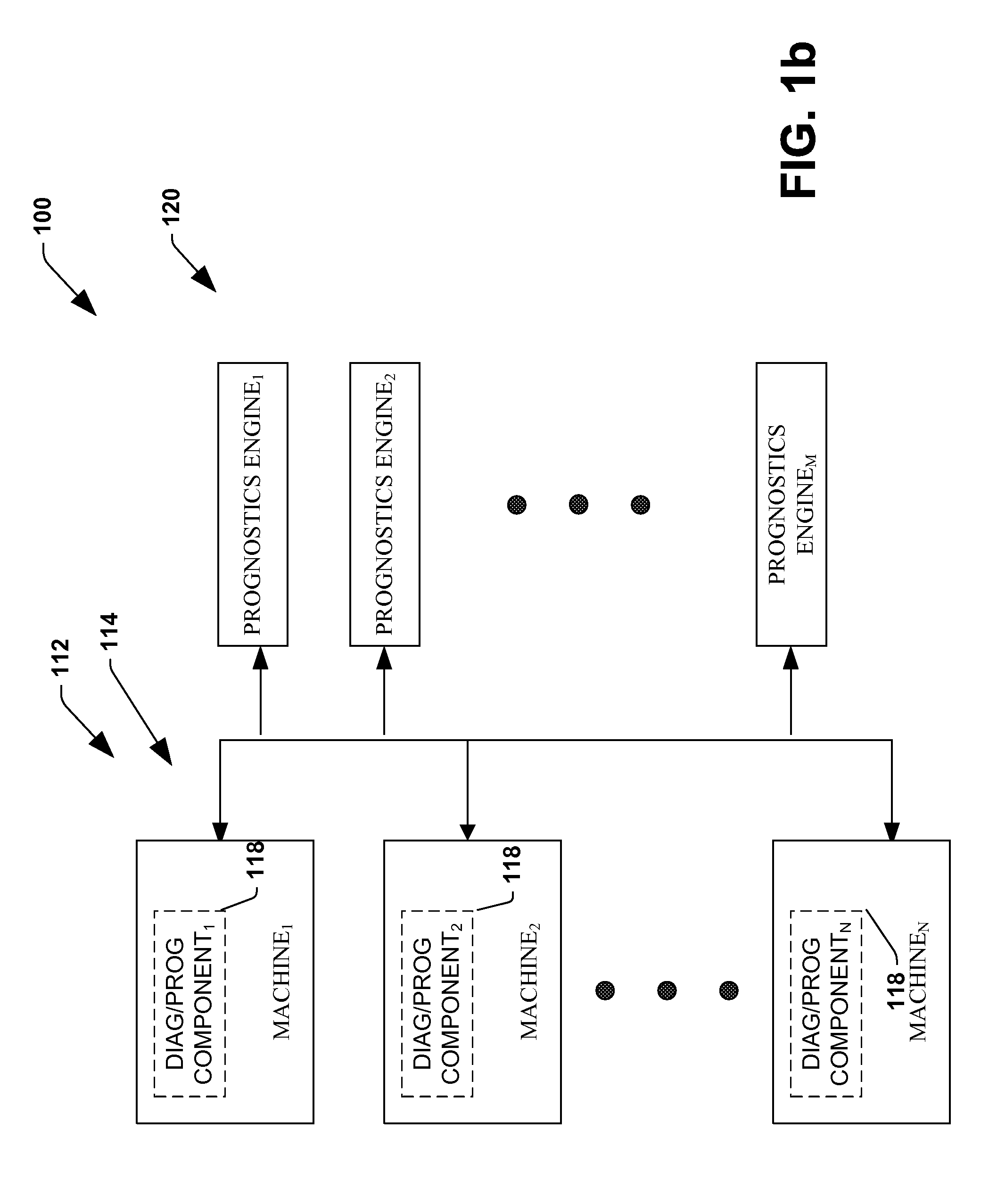

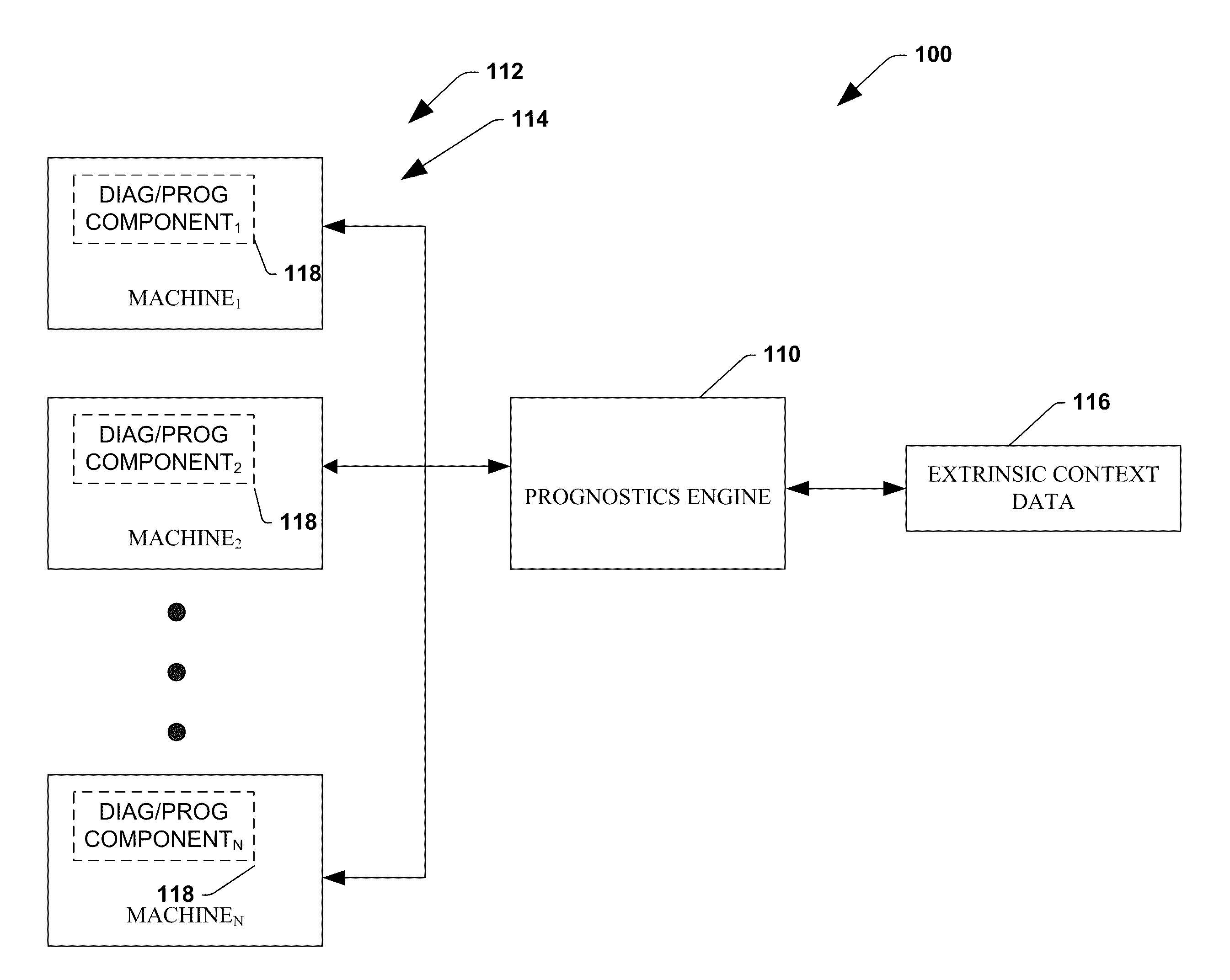

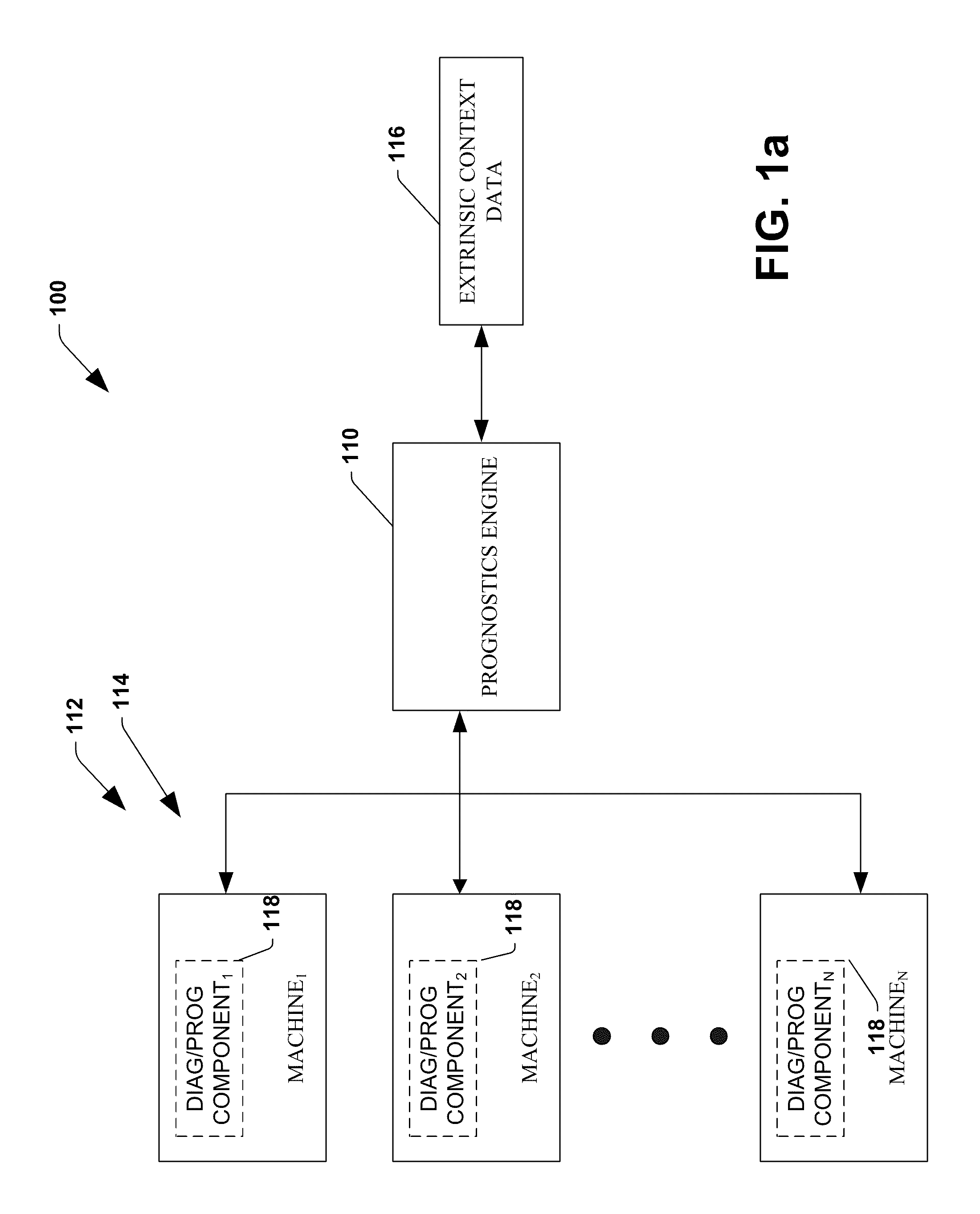

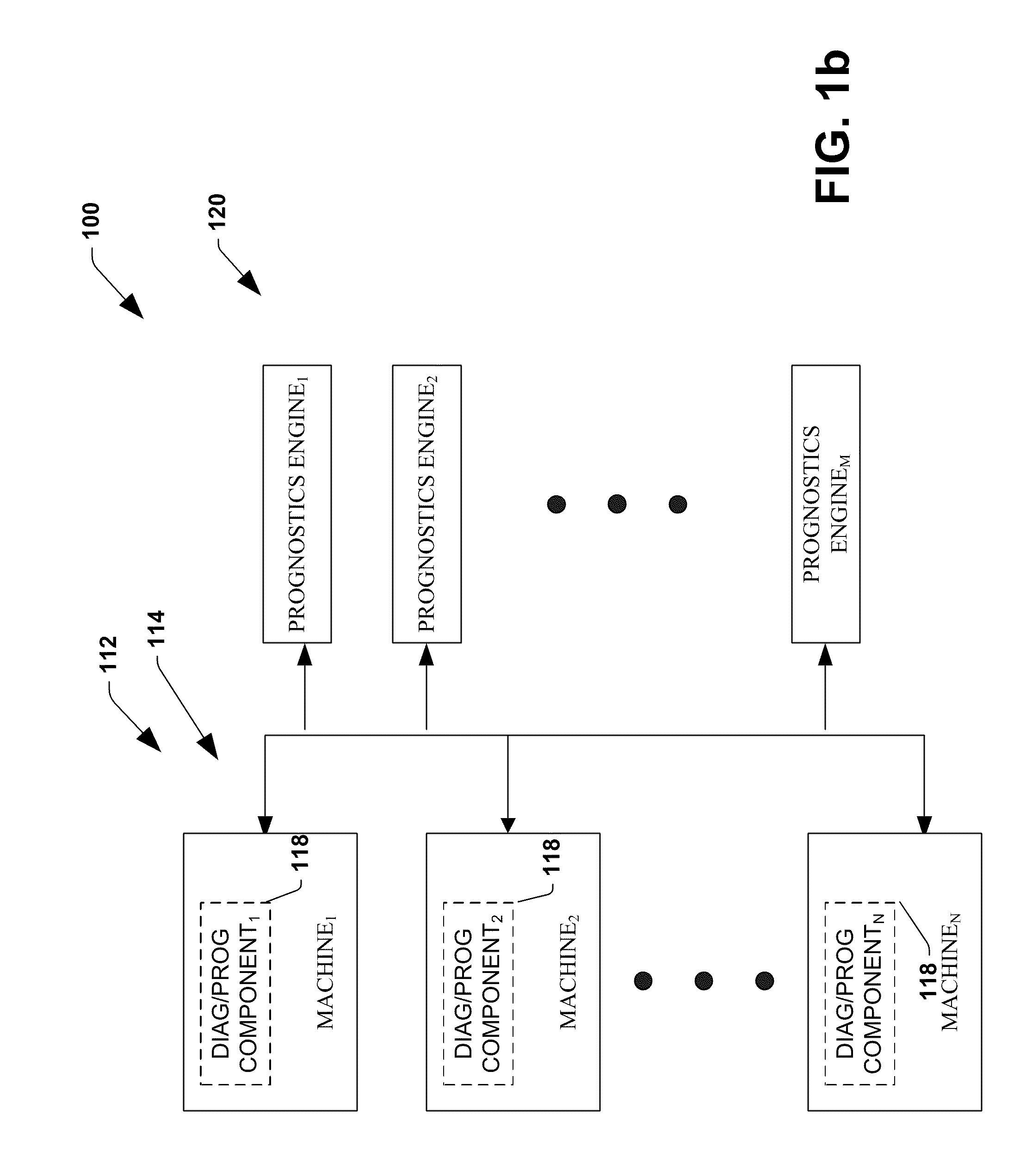

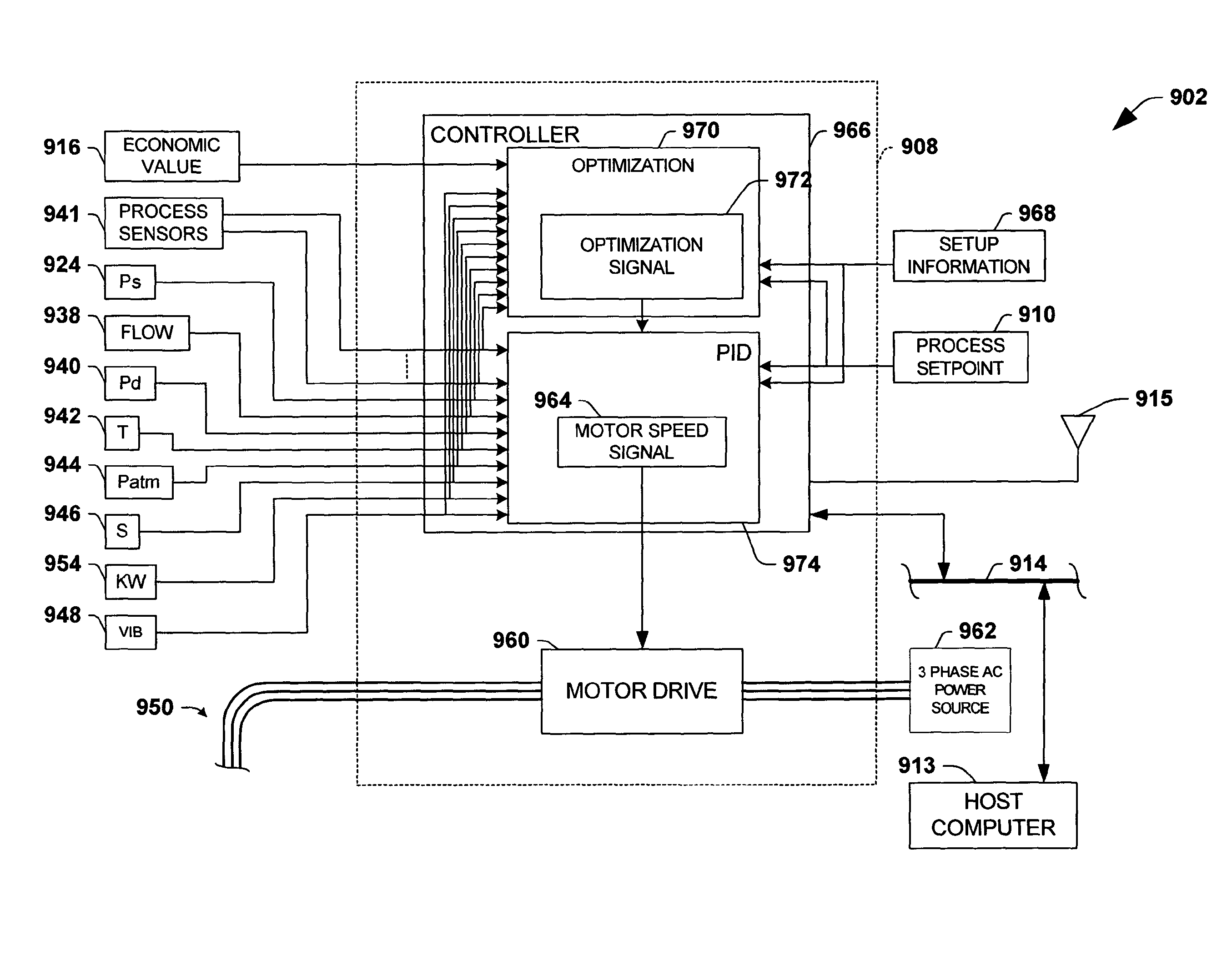

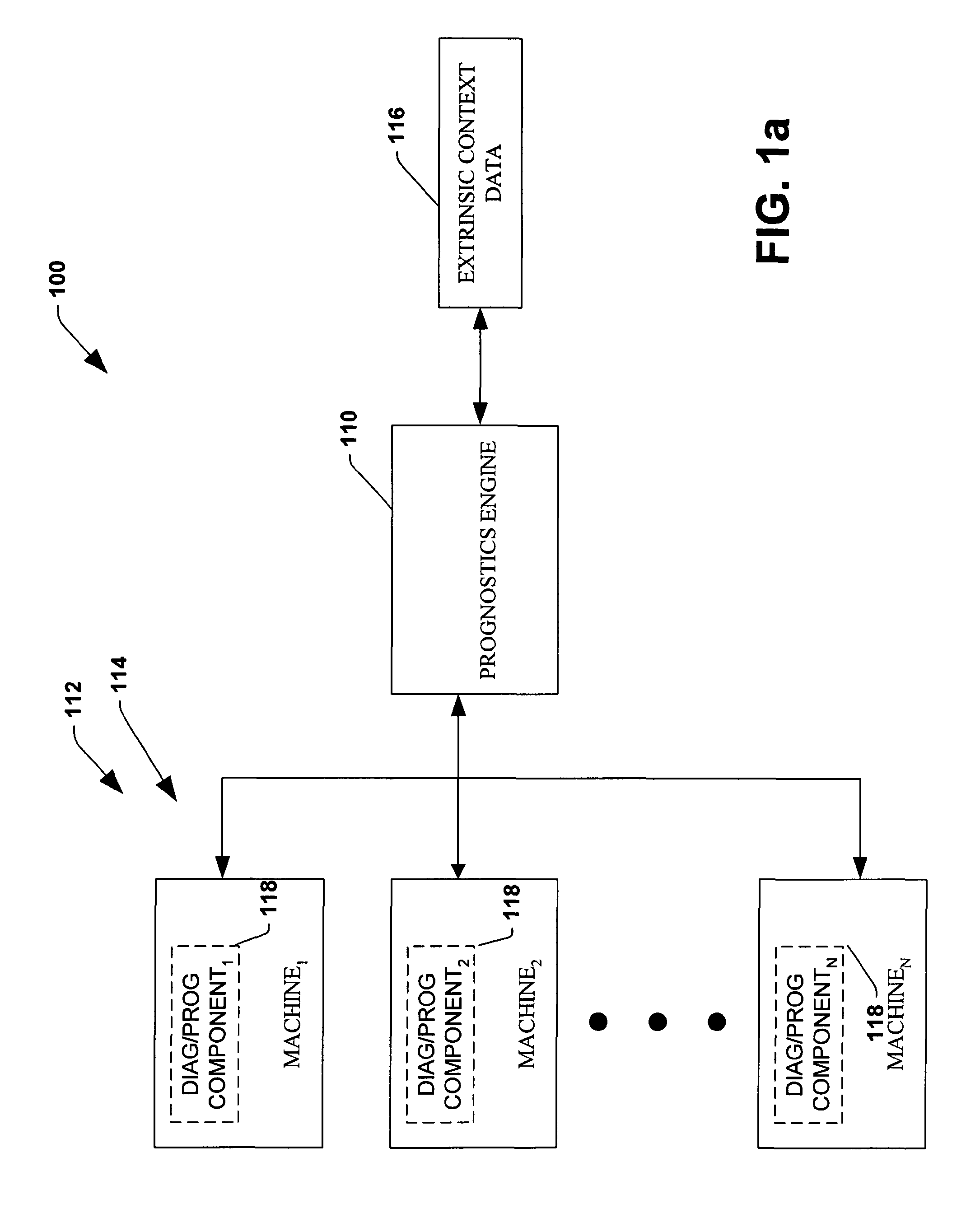

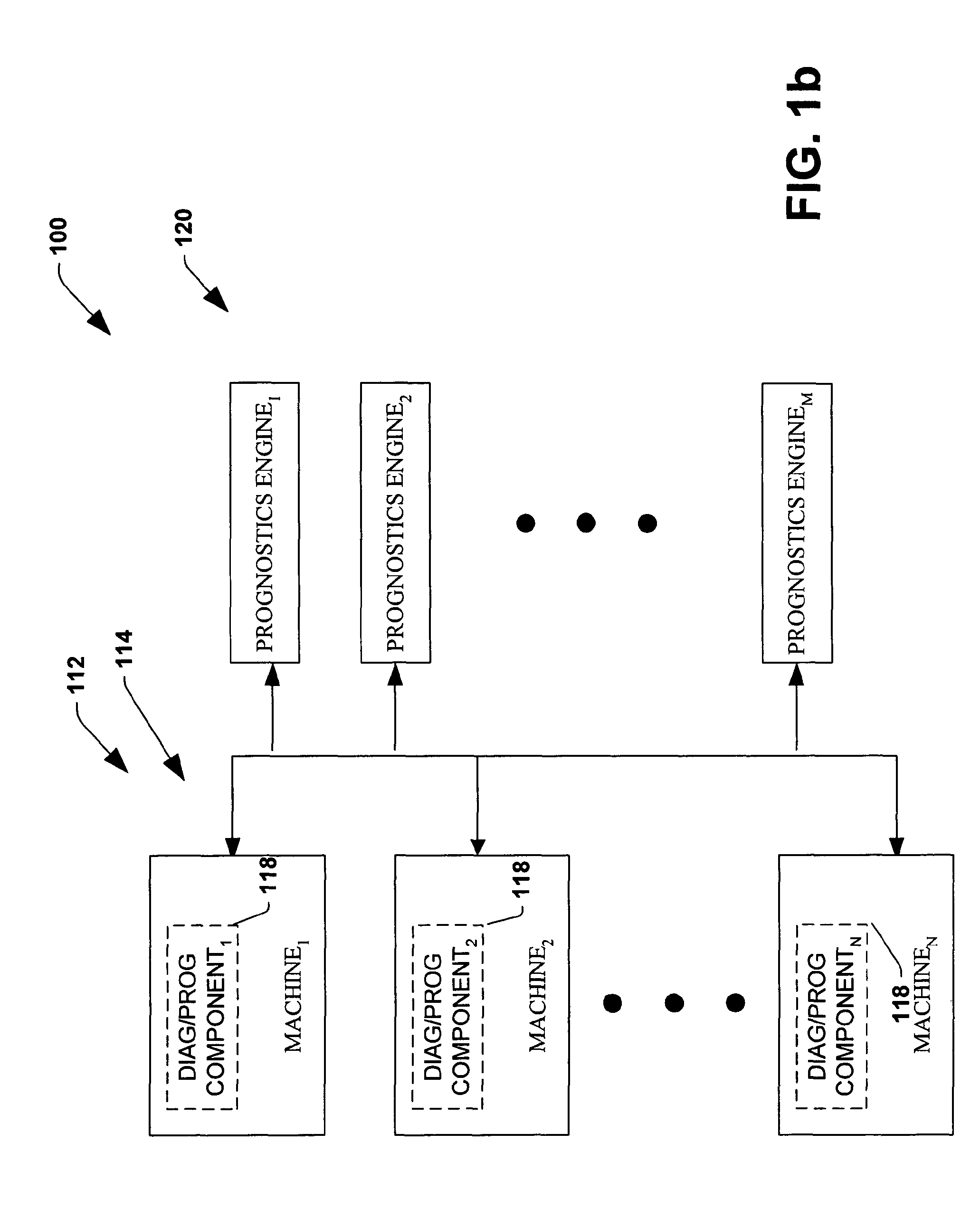

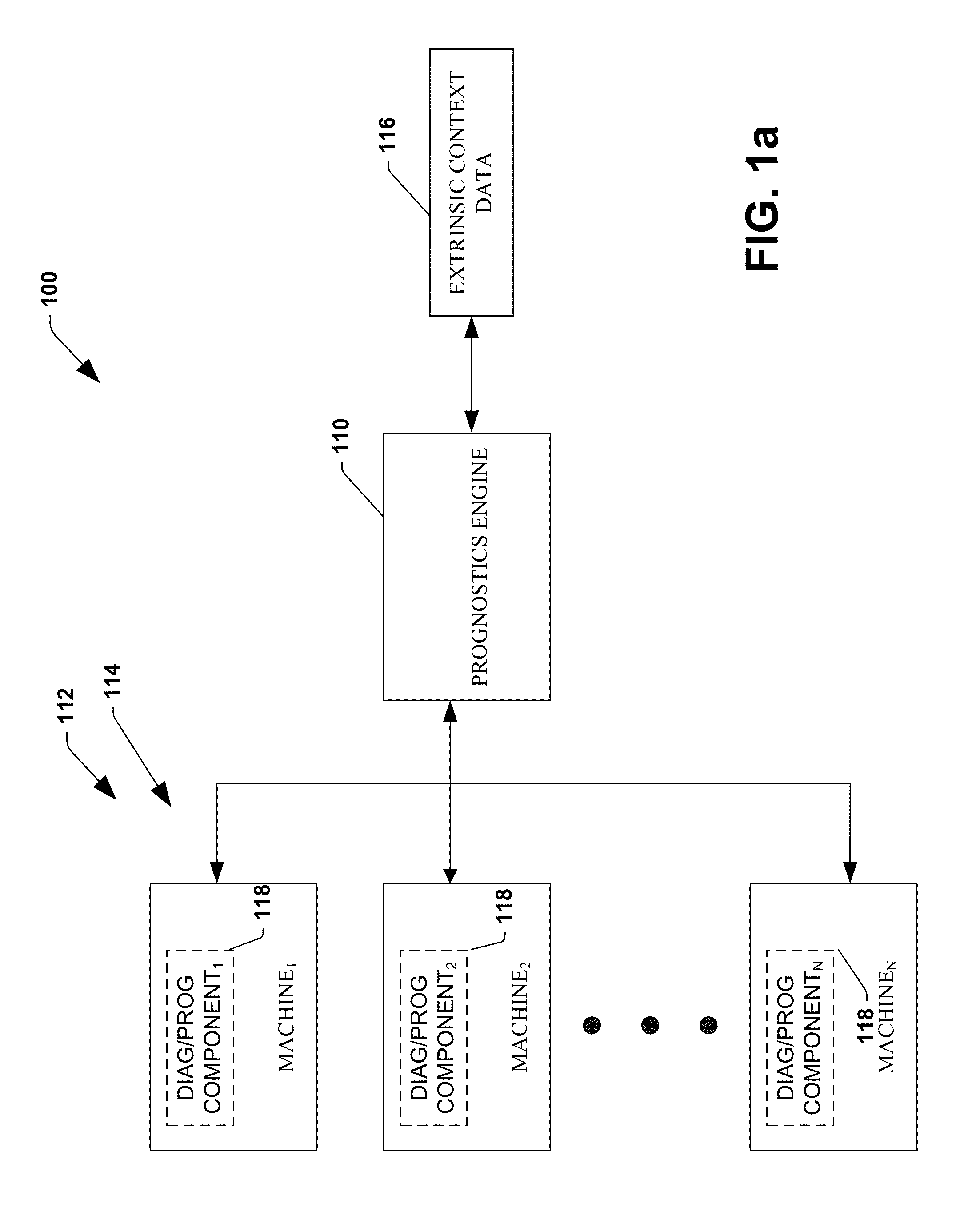

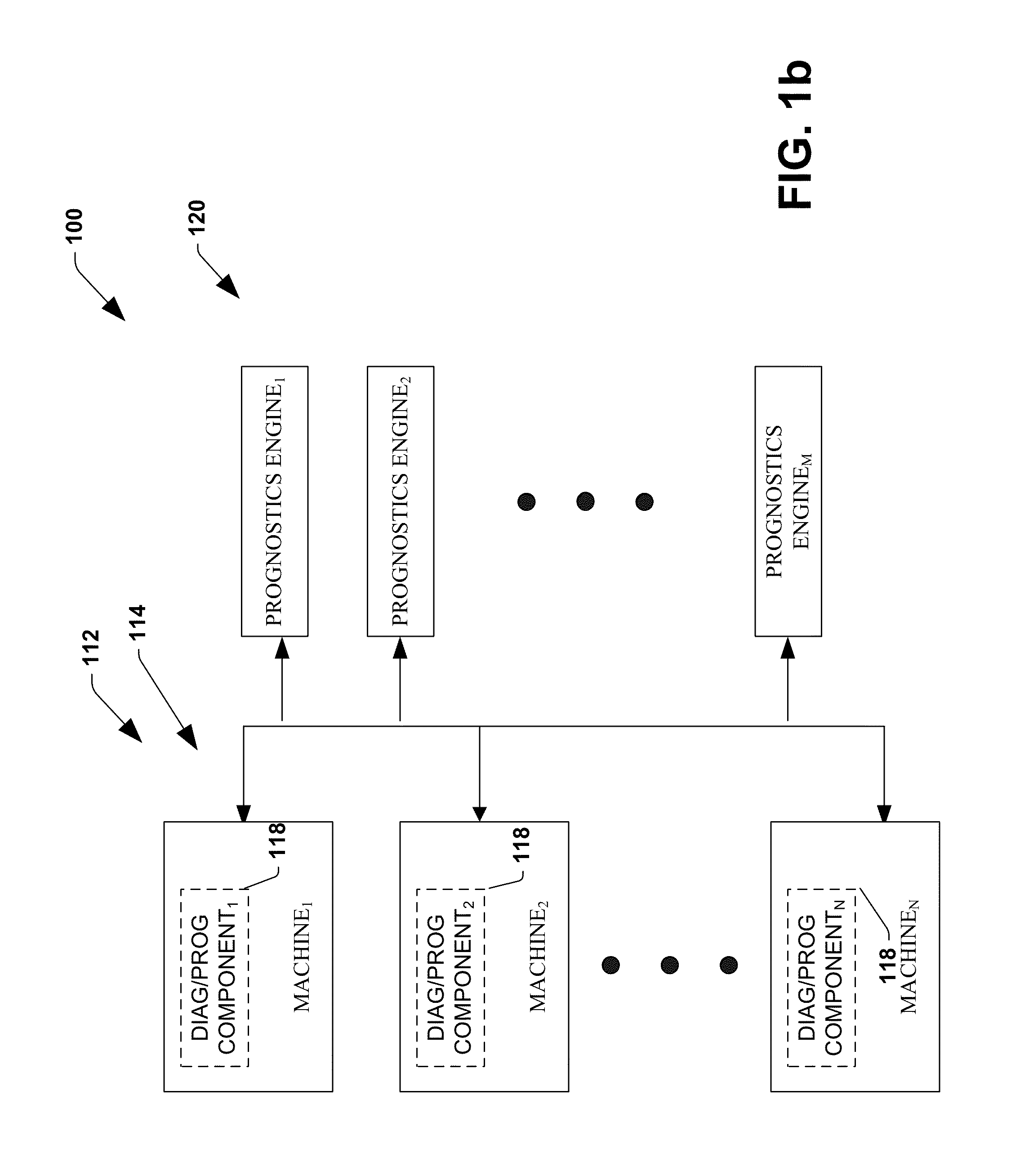

The invention provides control systems and methodologies for controlling a process having computer-controlled equipment, which provide for optimized process performance according to one or more performance criteria, such as efficiency, component life expectancy, safety, emissions, noise, vibration, operational cost, or the like. More particularly, the subject invention provides for employing machine diagnostic and / or prognostic information in connection with optimizing an overall business operation over a time horizon.

Owner:ROCKWELL AUTOMATION TECH

System and method for dynamic multi-objective optimization of machine selection, integration and utilization

ActiveUS20090204234A1Minimize power consumptionLow costSimulator controlForecastingMachine selectionOperational costs

The invention provides control systems and methodologies for controlling a process having computer-controlled equipment, which provide for optimized process performance according to one or more performance criteria, such as efficiency, component life expectancy, safety, emissions, noise, vibration, operational cost, or the like. More particularly, the subject invention provides for employing machine diagnostic and / or prognostic information in connection with optimizing an overall business operation over a time horizon.

Owner:ROCKWELL AUTOMATION TECH

System and method for dynamic multi-objective optimization of machine selection, integration and utilization

ActiveUS20090204245A1Minimize power consumptionLow costForecastingTechnology managementOperational costsMachine selection

The invention provides control systems and methodologies for controlling a process having computer-controlled equipment, which provide for optimized process performance according to one or more performance criteria, such as efficiency, component life expectancy, safety, emissions, noise, vibration, operational cost, or the like. More particularly, the subject invention provides for employing machine diagnostic and / or prognostic information in connection with optimizing an overall business operation over a time horizon.

Owner:ROCKWELL AUTOMATION TECH

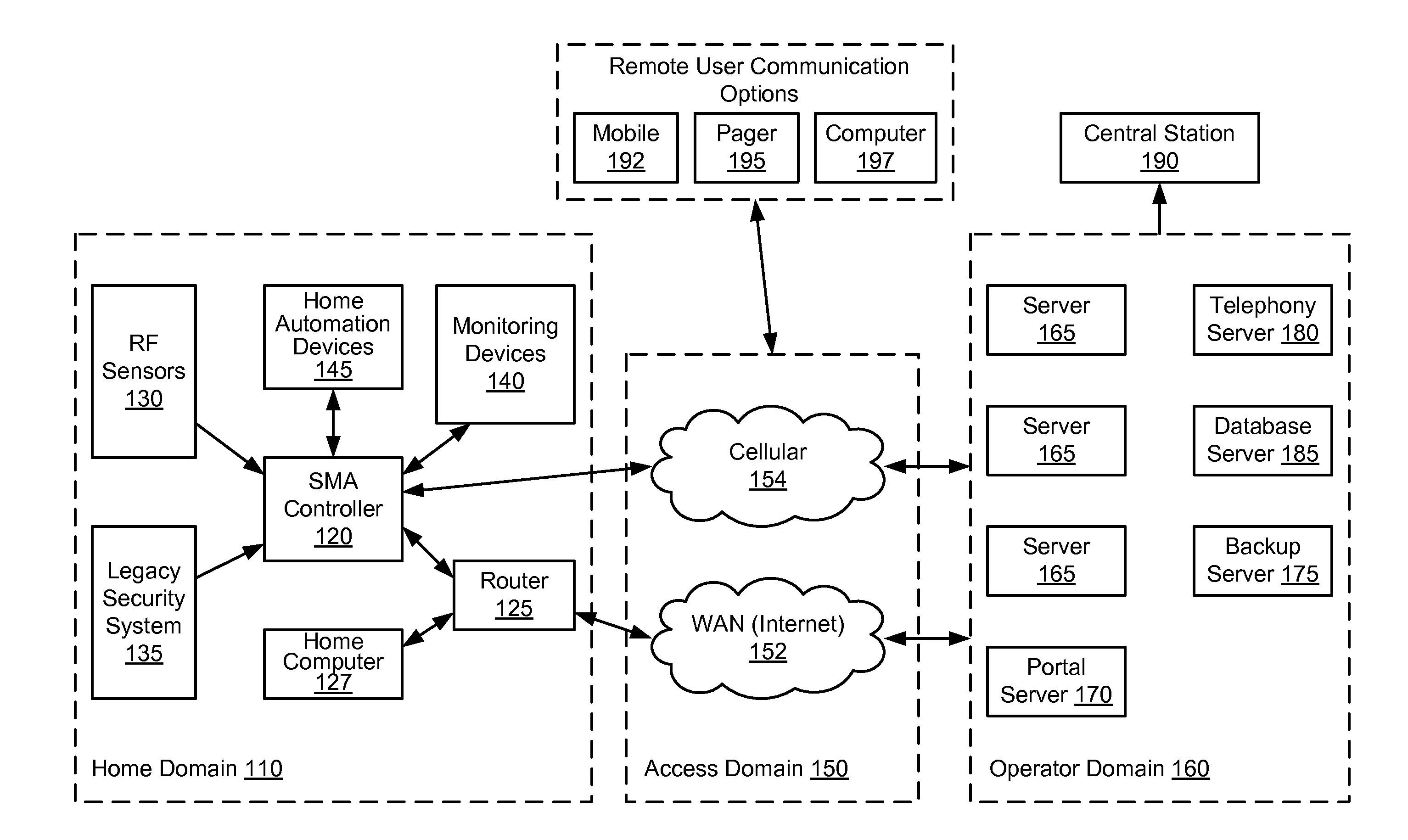

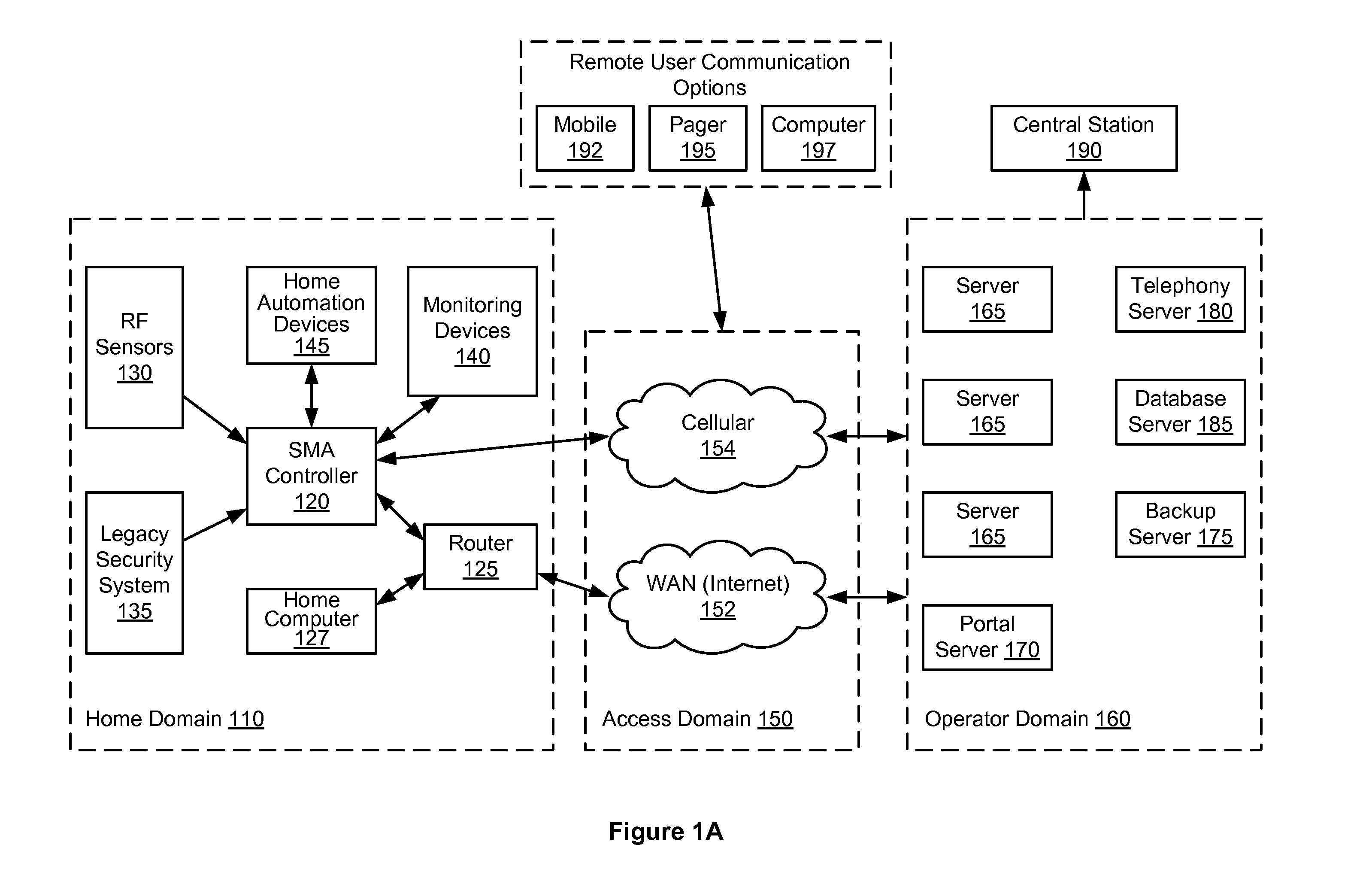

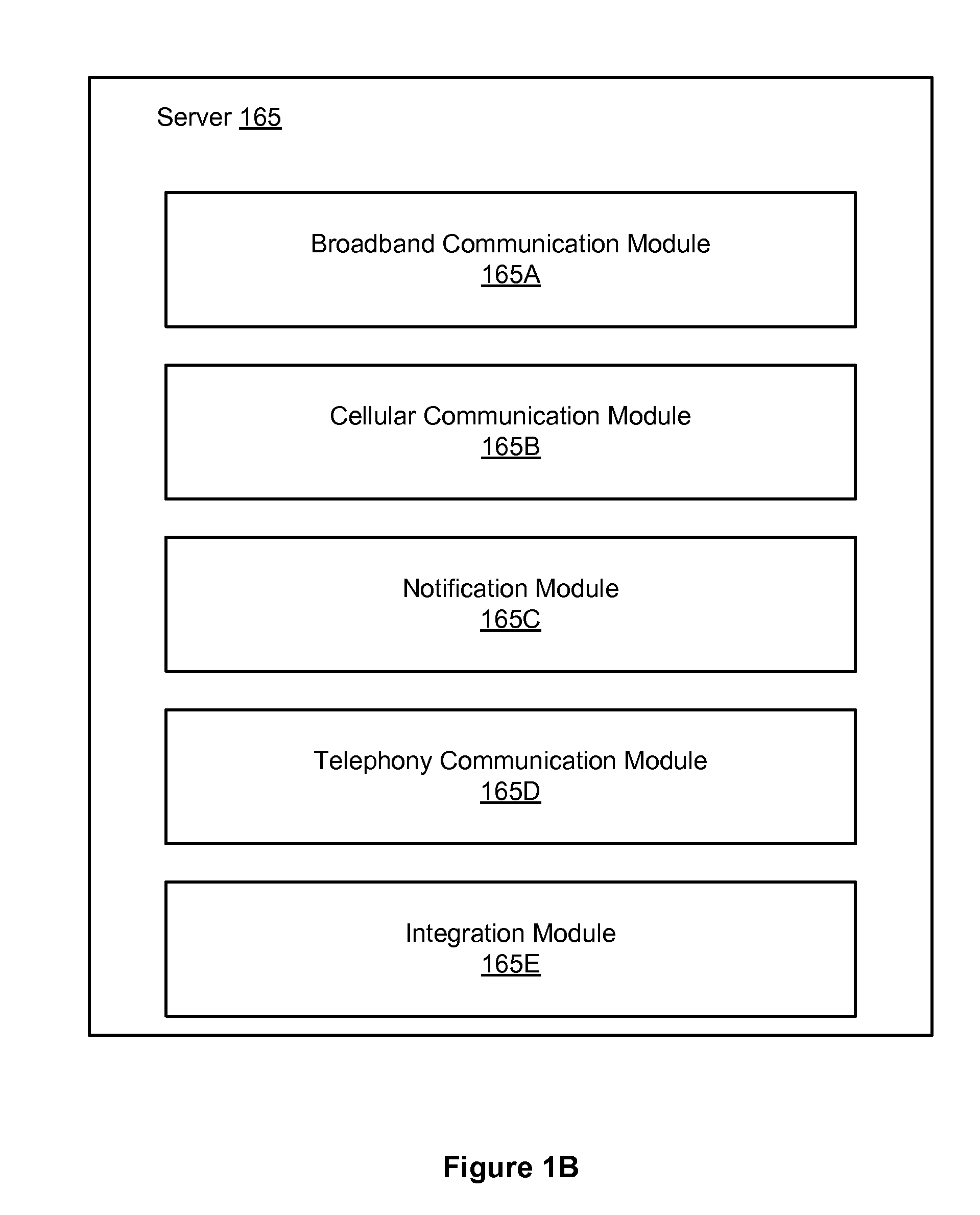

Method and System For Logging Security Event Data

Through the use of a persistent connection between security, monitoring and automation controller devices and provider supported servers in an operator domain, recordation of sensor fault events, SMA controller events, and communication events is provided. Servers in the operator domain can record events and provide a filtered log of events surrounding an alarm event or other selected timeframe.

Owner:ICONTROL NETWORKS

System and method for dynamic multi-objective optimization of machine selection, integration and utilization

InactiveUS20090204237A1Minimize power consumptionLow costForecastingTechnology managementOperational costsMachine selection

The invention provides control systems and methodologies for controlling a process having computer-controlled equipment, which provide for optimized process performance according to one or more performance criteria, such as efficiency, component life expectancy, safety, emissions, noise, vibration, operational cost, or the like. More particularly, the subject invention provides for employing machine diagnostic and / or prognostic information in connection with optimizing an overall business operation over a time horizon.

Owner:ROCKWELL AUTOMATION TECH

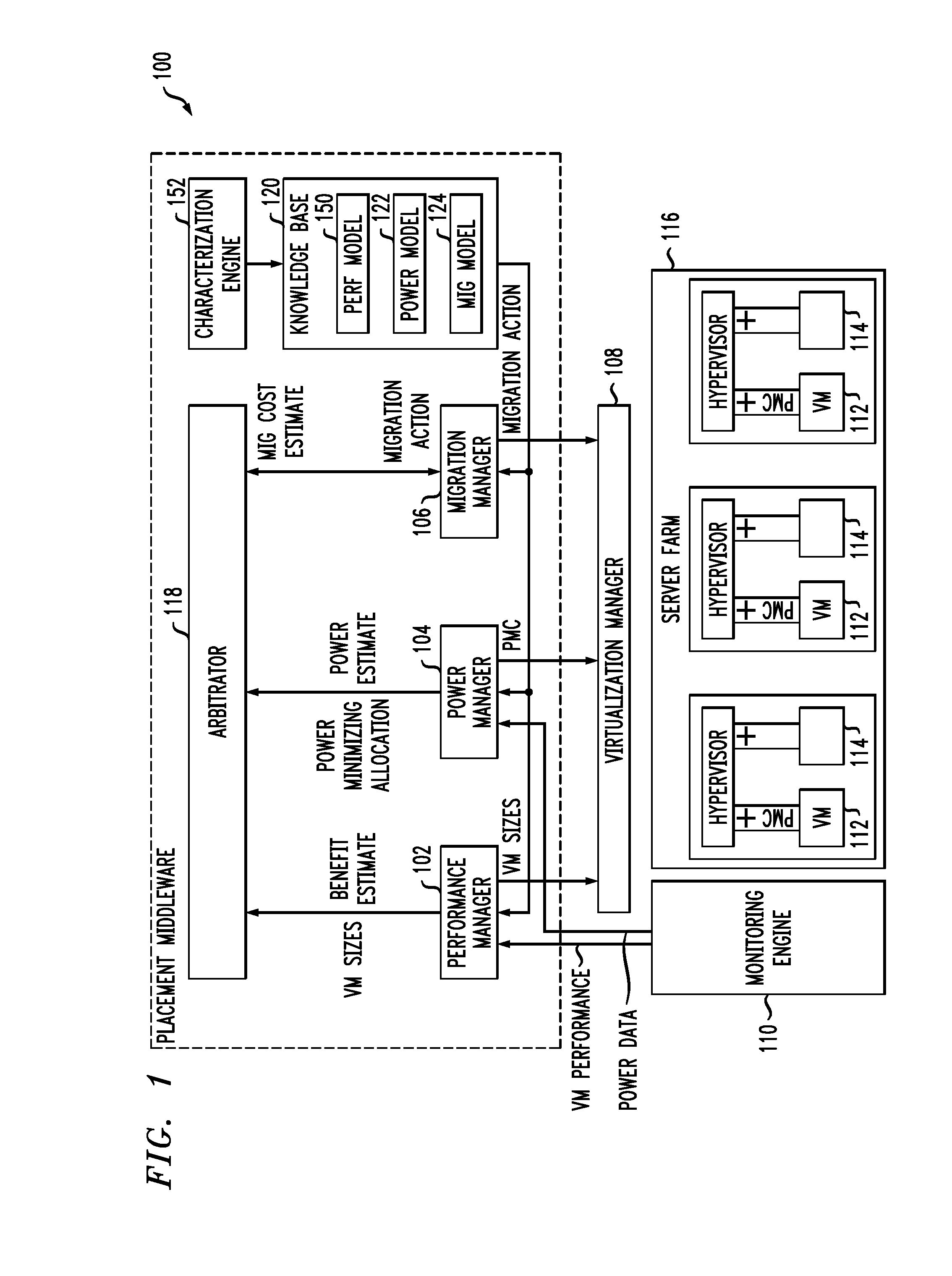

Techniques for placing applications in heterogeneous virtualized systems while minimizing power and migration cost

ActiveUS20100180275A1Minimizing migrationMinimize powerVolume/mass flow measurementPower supply for data processingVirtualizationN application

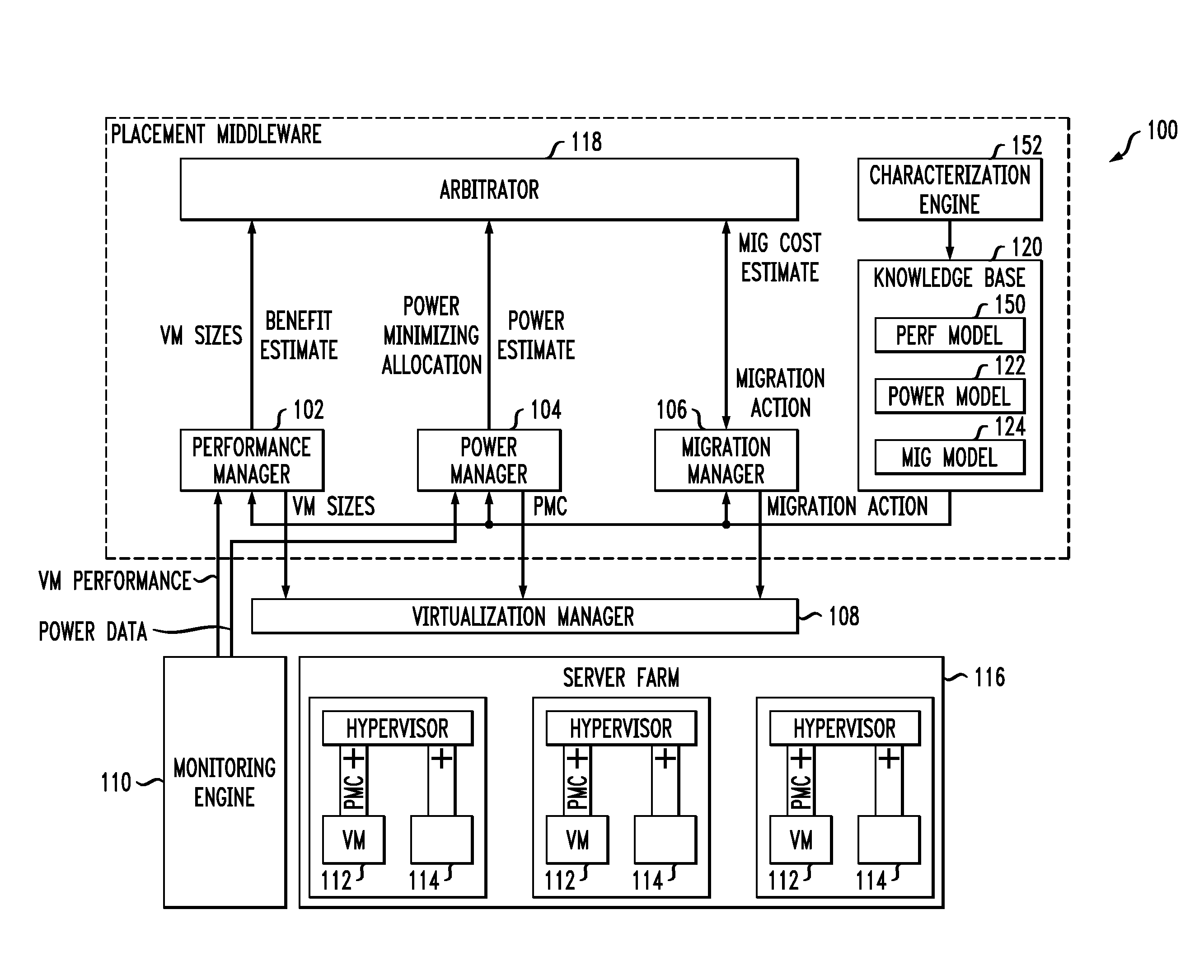

N applications are placed on M virtualized servers having power management capability. A time horizon is divided into a plurality of time windows, and, for each given one of the windows, a placement of the N applications is computed, taking into account power cost, migration cost, and performance benefit. The migration cost refers to cost to migrate from a first virtualized server to a second virtualized server for the given one of the windows. The N applications are placed onto the M virtualized servers, for each of the plurality of time windows, in accordance with the placement computed in the computing step for each of the windows. In an alternative aspect, power cost and performance benefit, but not migration cost, are taken into account; there are a plurality of virtual machines; and the computing step includes, for each of the windows, determining a target utilization for each of the servers based on a power model for each given one of the servers; picking a given one of the servers with a least power increase per unit increase in capacity, until capacity has been allocated to fit all the virtual machines; and employing a first fit decreasing bin packing technique to compute placement of the applications on the virtualized servers.

Owner:IBM CORP

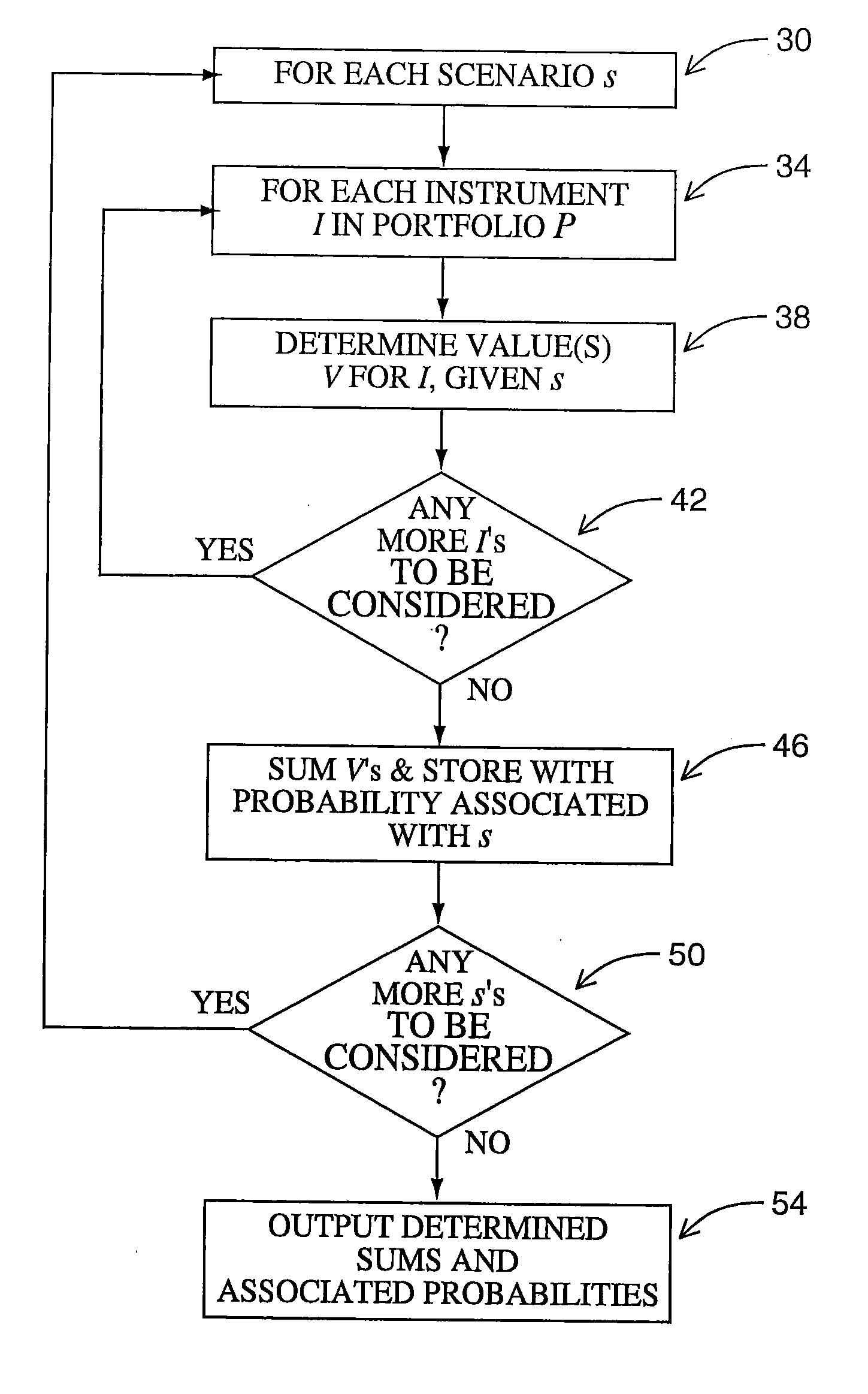

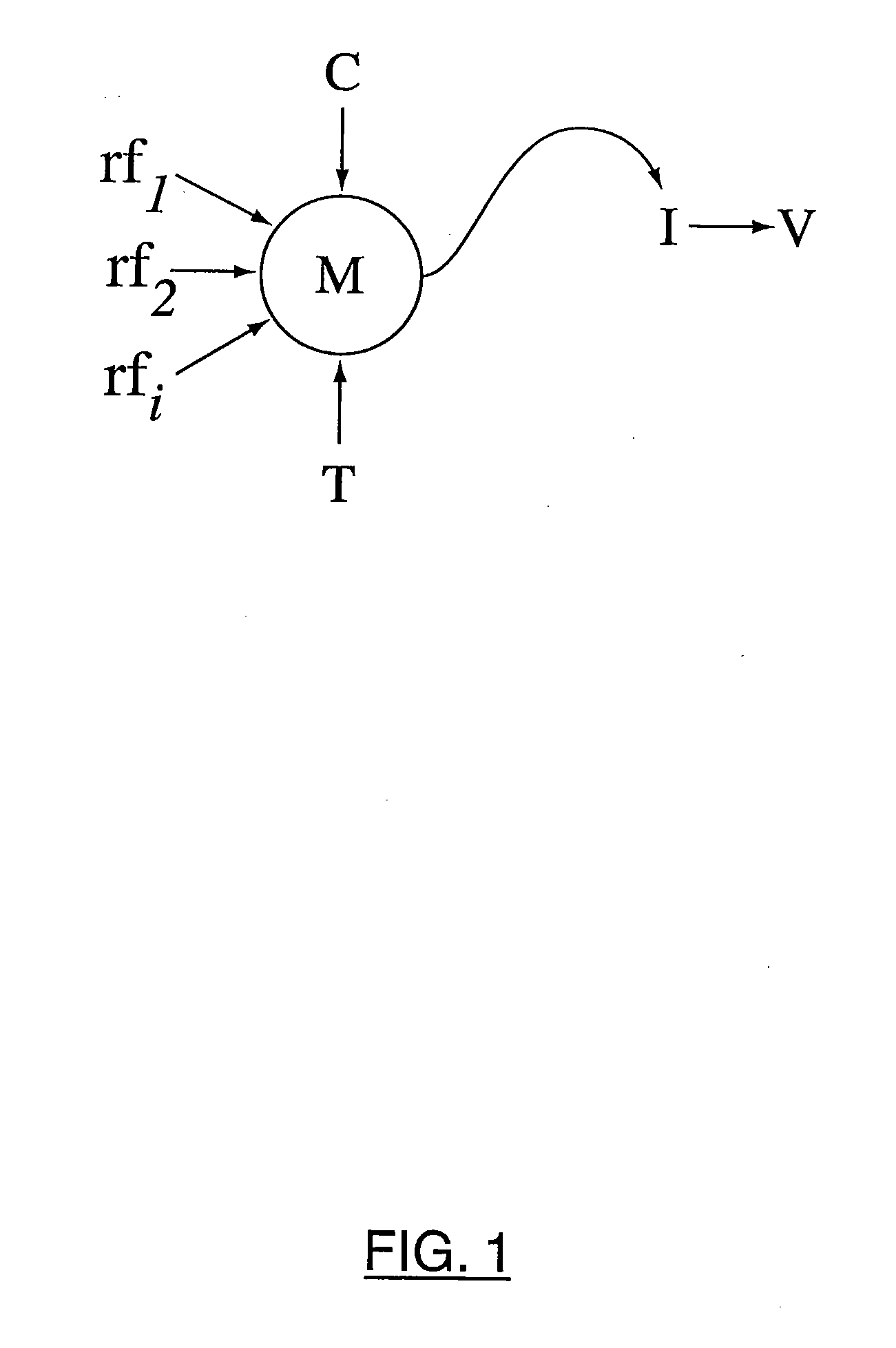

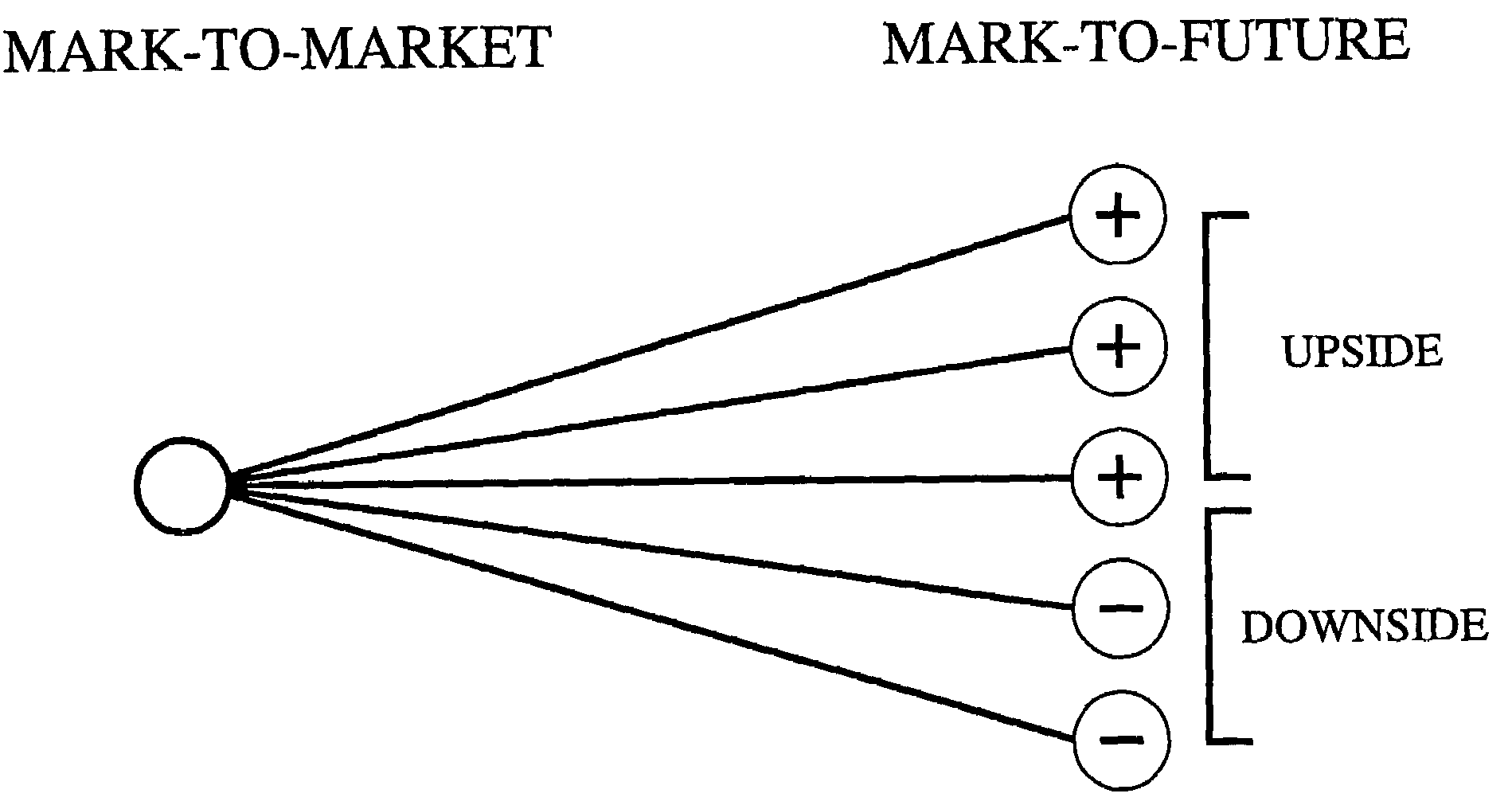

System and method for trading off upside and downside values of a portfolio

InactiveUS20070124227A1FinanceSpecial data processing applicationsComputer scienceOperations research

A system and method for valuing a portfolio in terms of its performance relative to a specified benchmark under a range of future scenarios is disclosed. In particular, a portfolio is taken and two values related to the portfolio are calculated: the first value corresponding to an amount by which the value of the portfolio is expected to fall below the value of a benchmark over a given time horizon, and a second value corresponding to an amount by which the value of the portfolio is expected to exceed the value of a benchmark over a given time horizon, in view of the range of different future scenarios. Means for determining the portfolio which optimally trades-off these two values, and to evaluate risk / reward performance measures using these two values which can be used to rank instruments, securities or portfolios are disclosed. Means for pricing portfolio insurance for optimal portfolios are also disclosed.

Owner:IBM CORP

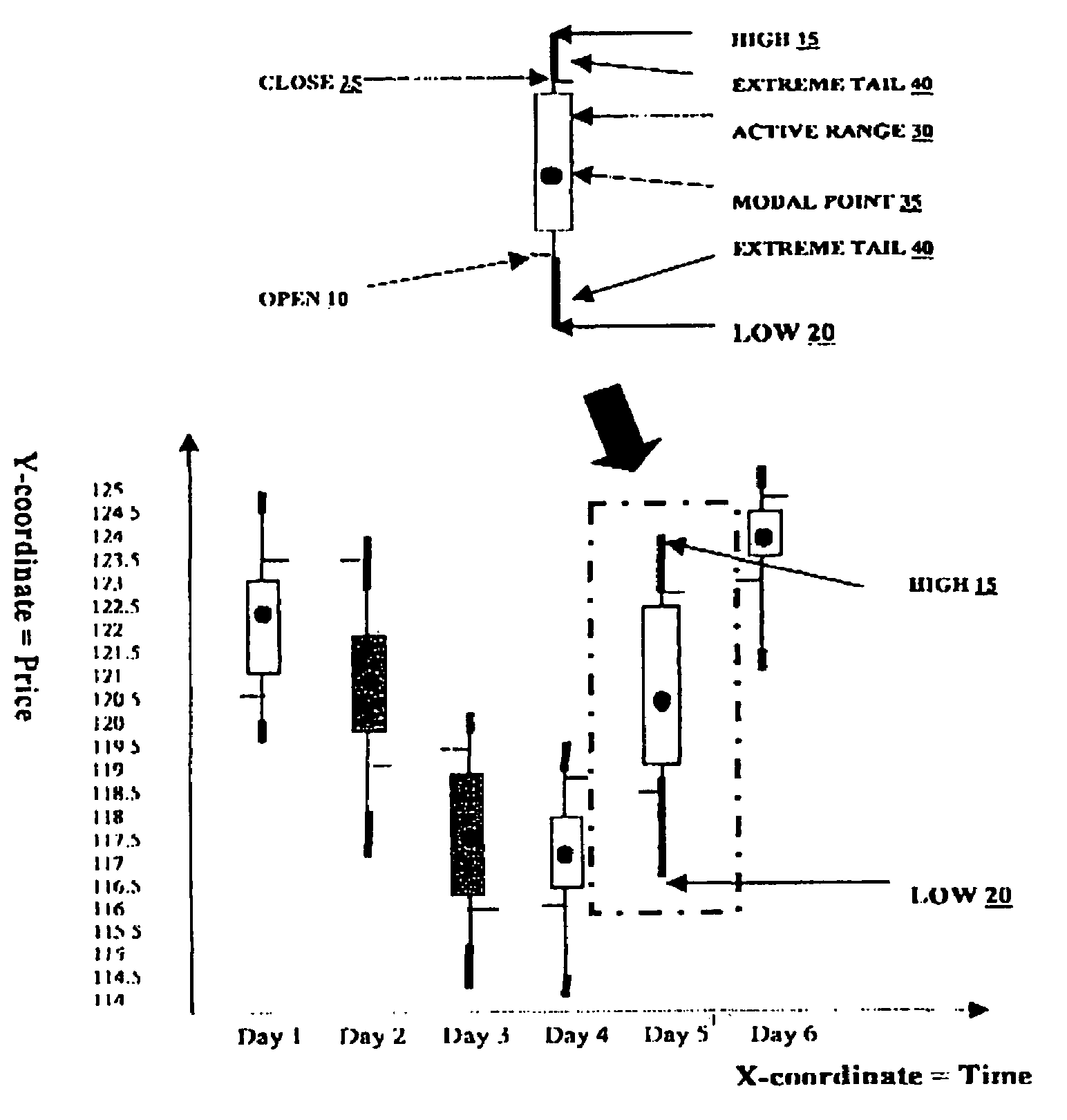

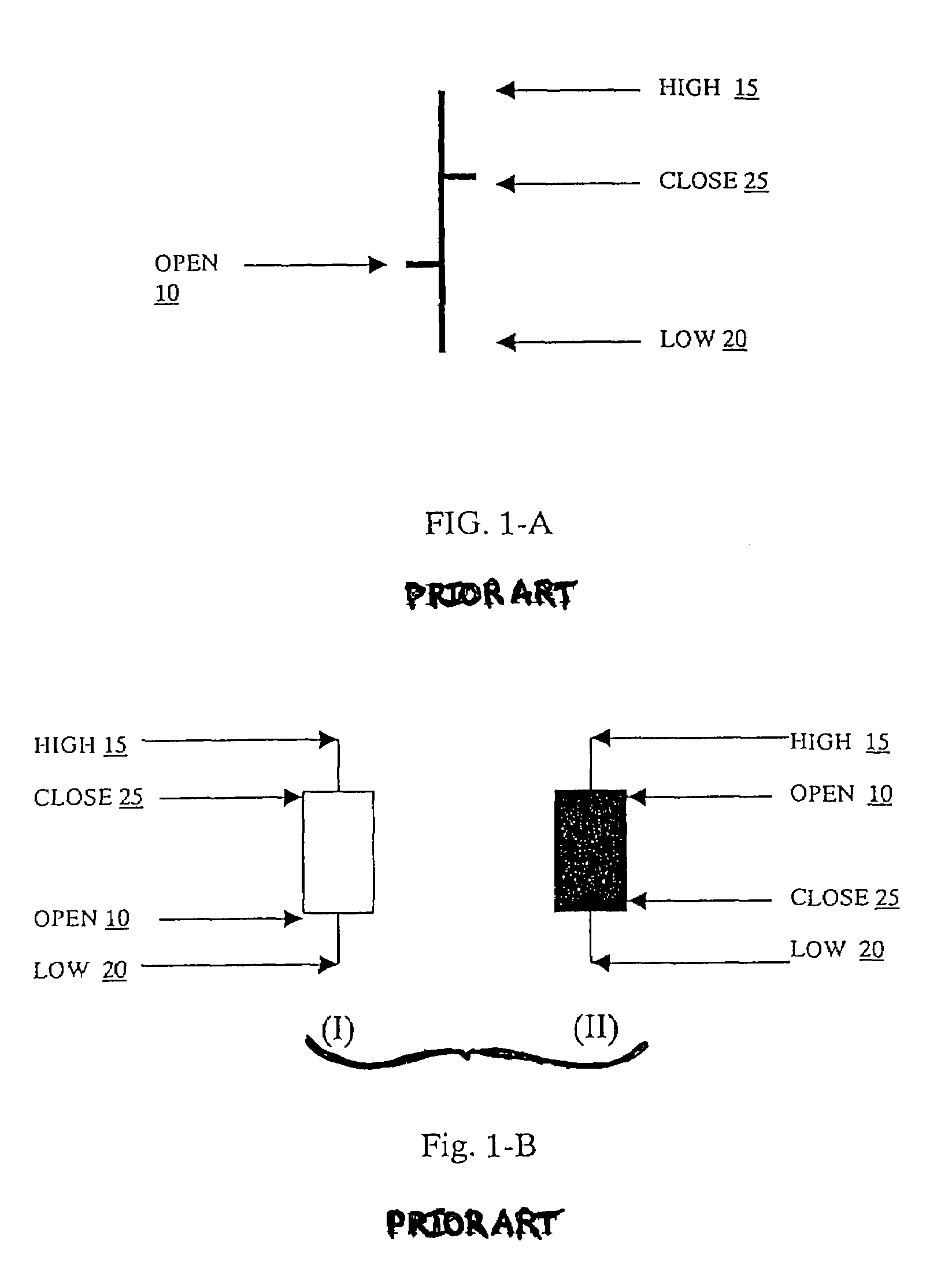

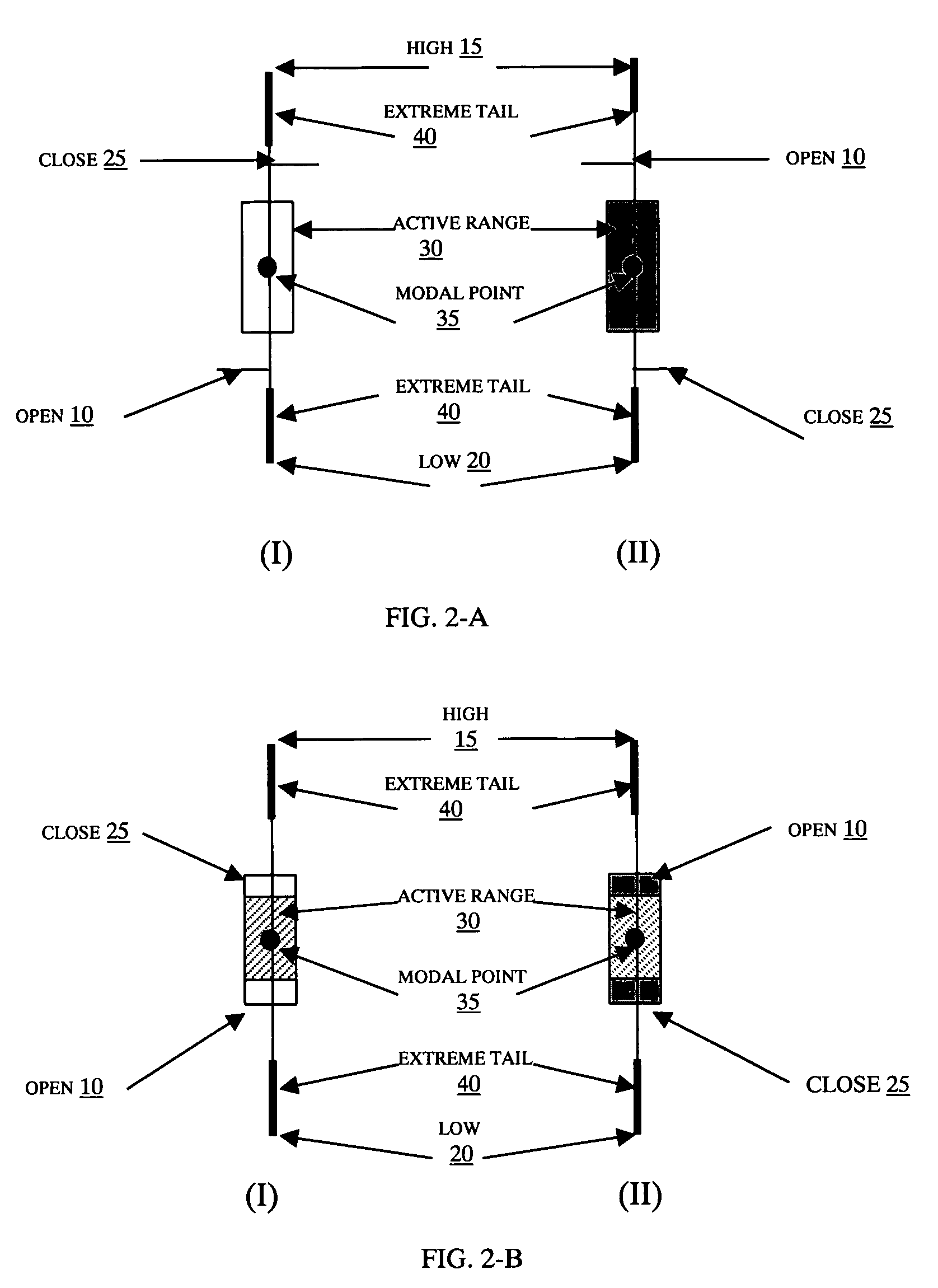

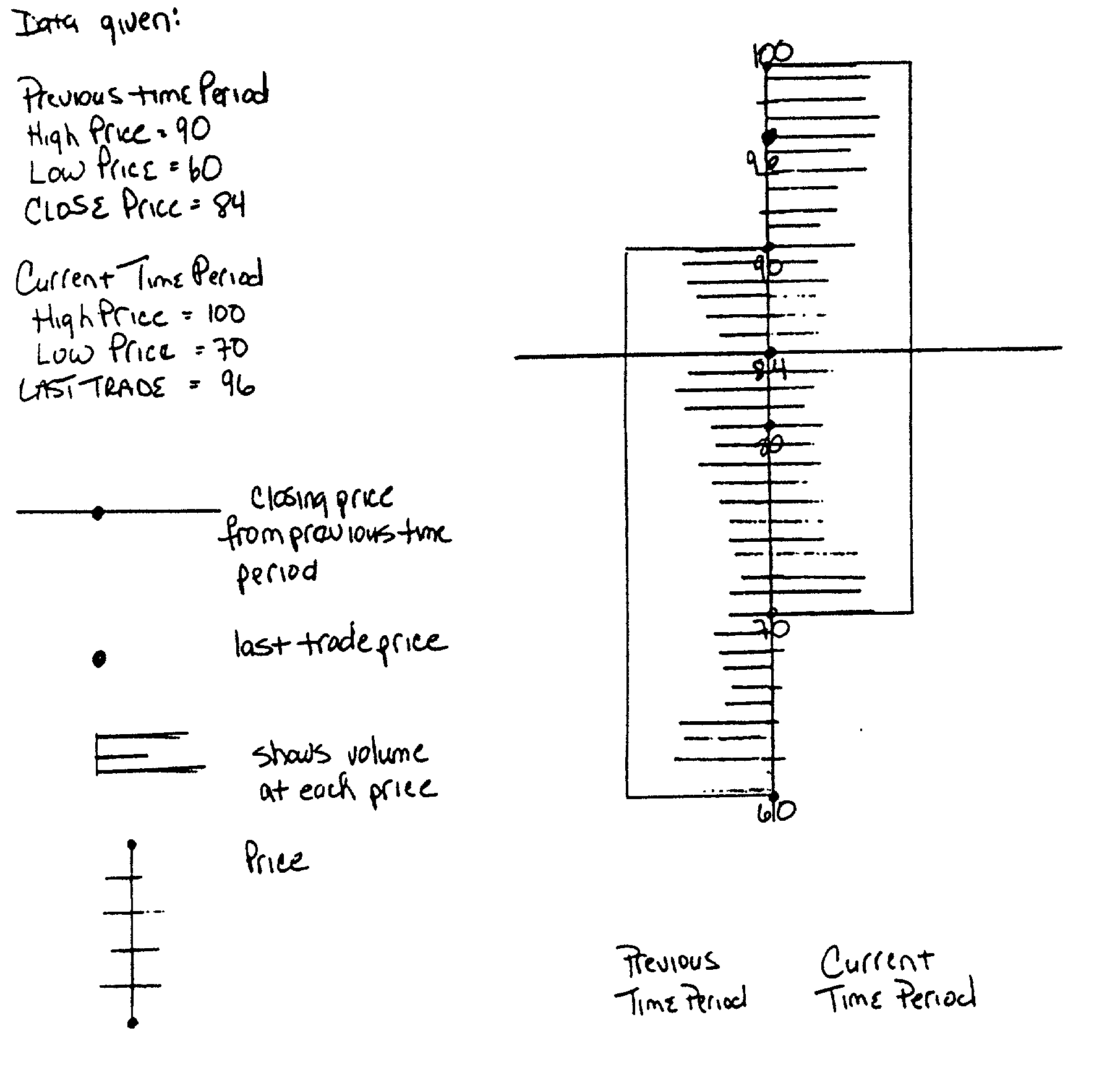

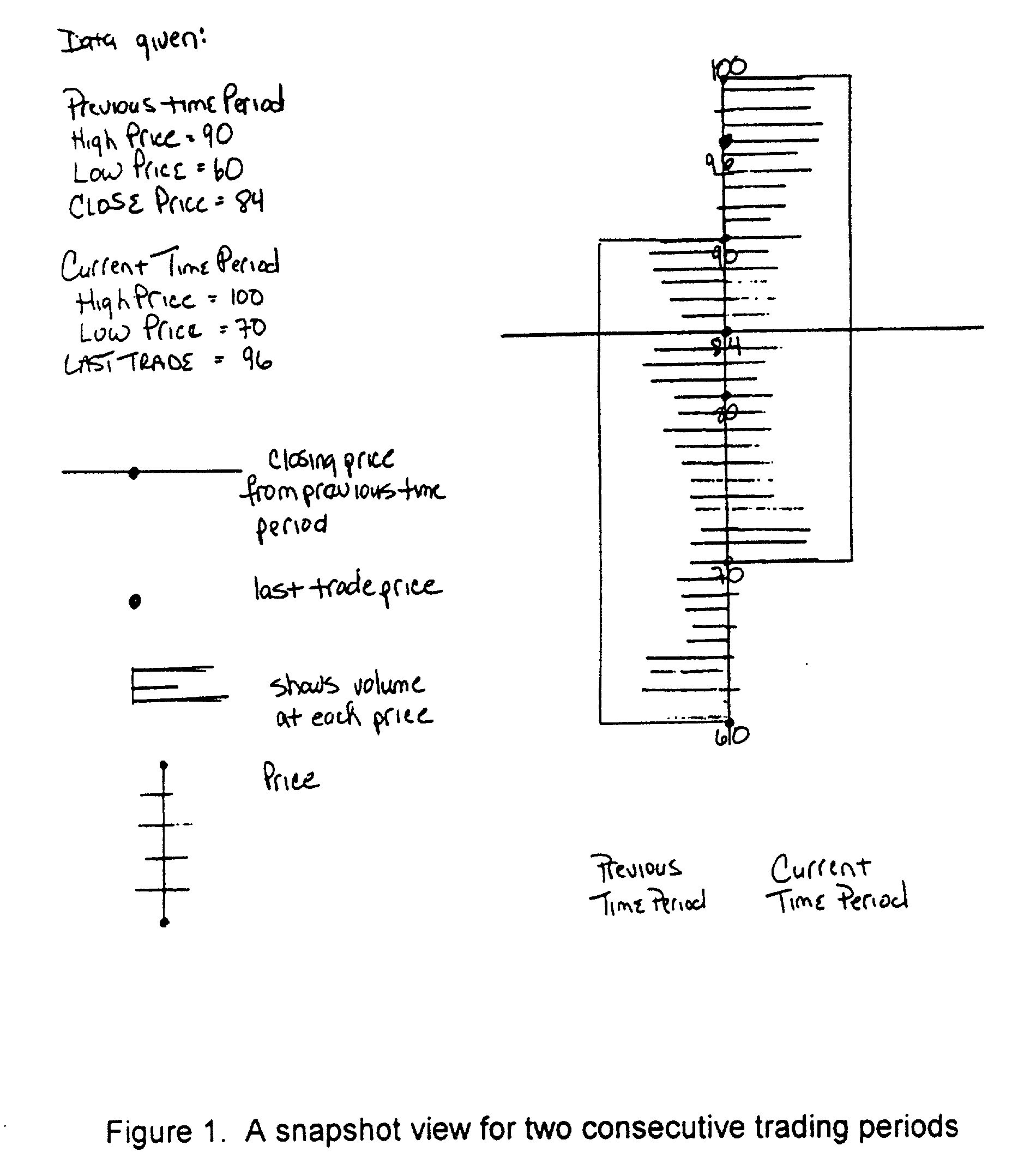

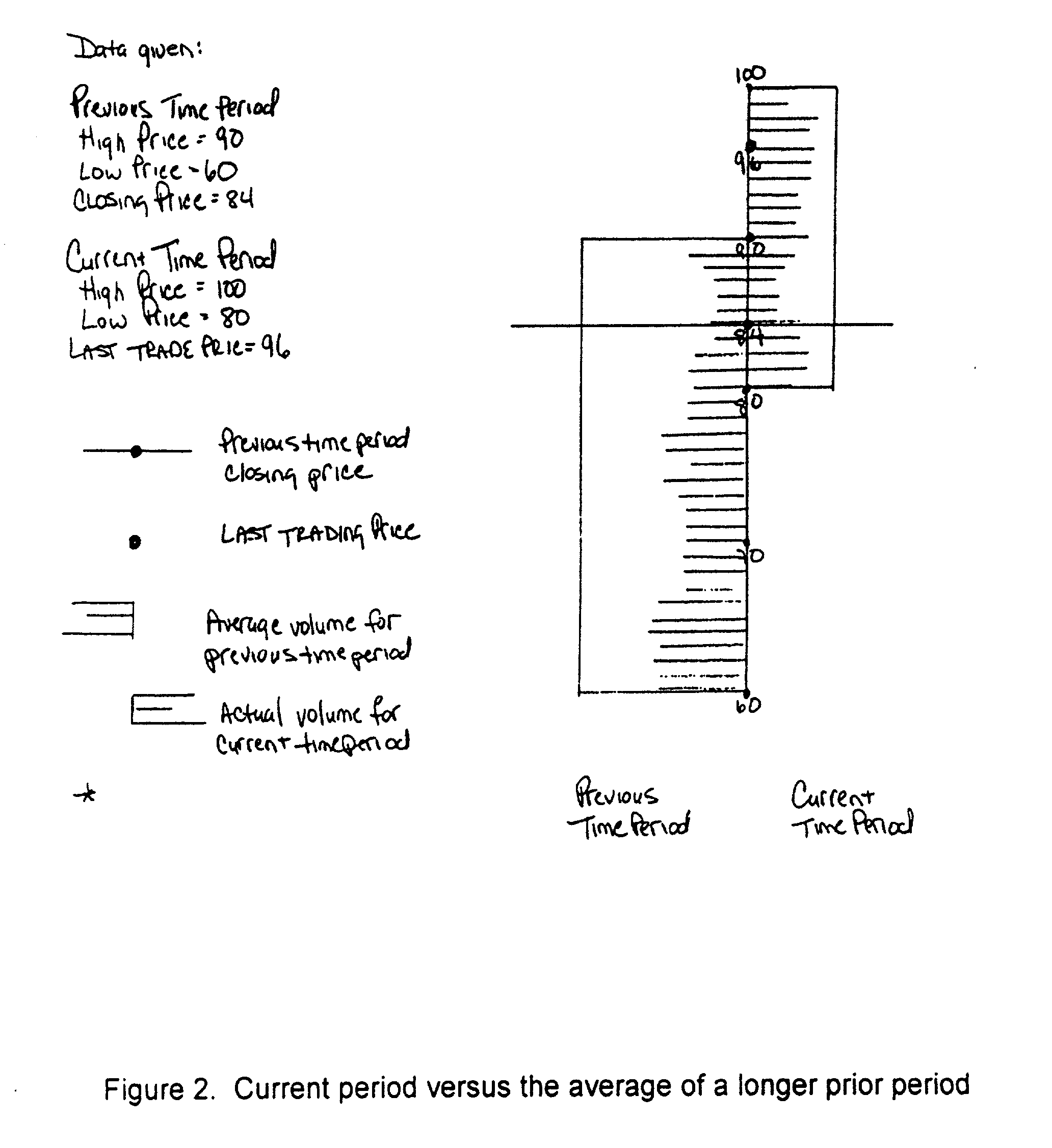

Method for charting financial market activities

A method and apparatus for augmenting the conventional price-time chart used for technical analysis of securities price movements. In a preferred embodiment, the method takes a conventional Bar Chart or Japanese Candlestick Chart with a definite timeframe and then for each bar on the chart; it statistically quantifies the volume and time distribution throughout the range of the bar into discrete elements, using price and volume data within the bar interval from a sub-timeframe. The discrete elements are then graphically overlaid on the bar in a way which preserves its original appearance as close as possible. The apparatus is an application software which implements the method by displaying the conventional price-time chart, calculating the relevant elements and overlaying the values on the chart bars, either in a static or real-time market setting.

Owner:PROSTICKS COM

System and method for dynamic multi-objective optimization of machine selection, integration and utilization

ActiveUS9729639B2Improve overall utilizationImprove efficiencyMechanical power/torque controlLevel controlOperational costsMachine selection

The invention provides control systems and methodologies for controlling a process having computer-controlled equipment, which provide for optimized process performance according to one or more performance criteria, such as efficiency, component life expectancy, safety, emissions, noise, vibration, operational cost, or the like. More particularly, the subject invention provides for employing machine diagnostic and / or prognostic information in connection with optimizing an overall business operation over a time horizon.

Owner:ROCKWELL AUTOMATION TECH

Multi-dimensional representation of financial data

A method is described which enables a user to present on a single graph several attributes of the market behaviors of securities such as common stocks, options, commodities, and the like. It also enables a user to compare such attributes either along different time horizons, or to compare such attributes of two or more securities. In general, the prices are shown along the vertical direction, whereas an attribute such as volume would be shown as horizontal lines proportional to said volumes in length, and intersecting the price line at positions corresponding to the strike price. Comparisons of several securities as well as comparisons could be easily made, and historical information such as open, close, average, high, and low prices could also be provided though the use of proper legends such as colored lines, asterisks, and the like.

Owner:ERDMIER LISA M

System and method for dynamic multi-objective optimization of machine selection, integration and utilization

InactiveUS8126574B2Improve overall utilizationImprove efficiencyLevel controlTechnology managementOperational costsMachine selection

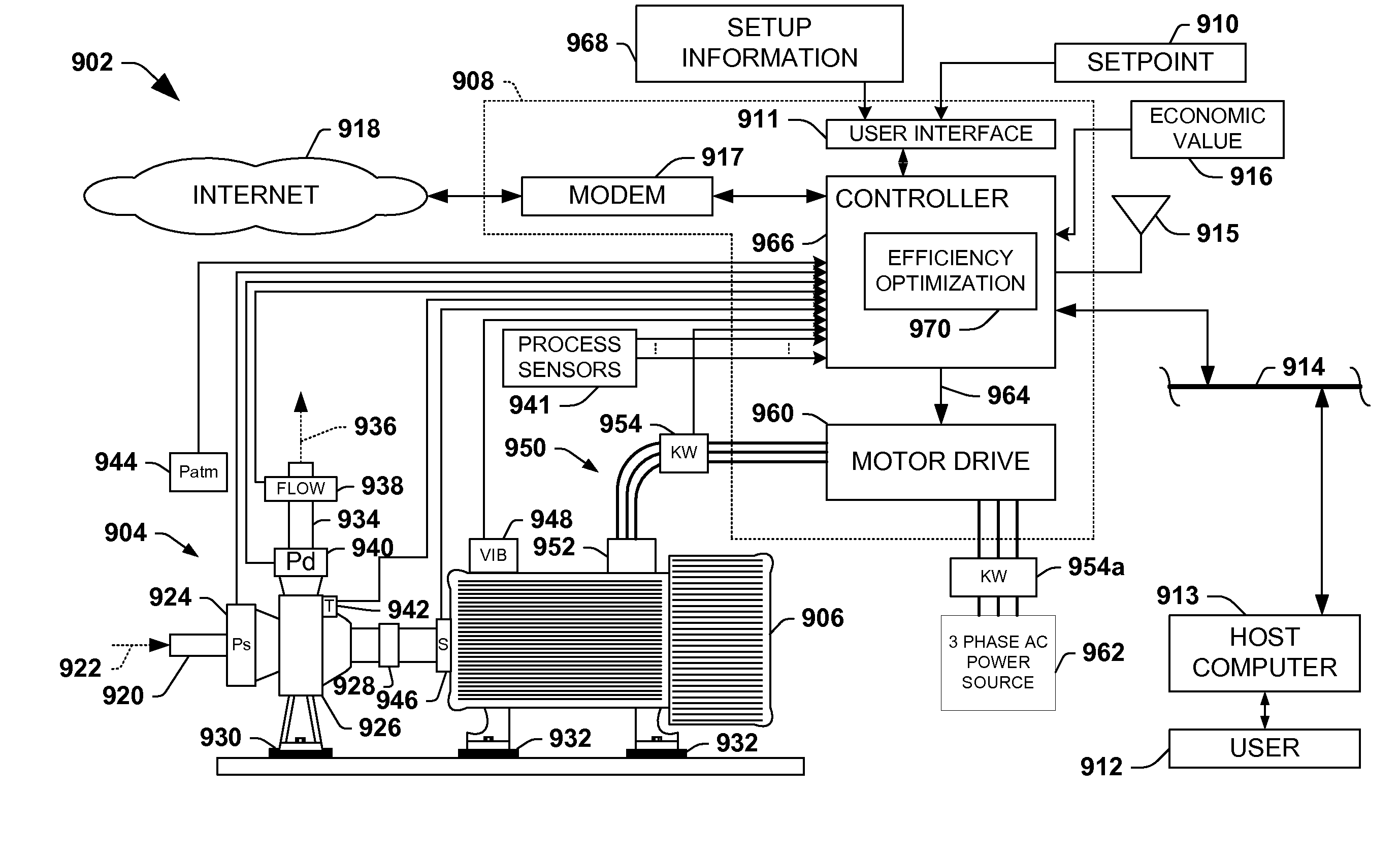

The invention provides control systems and methodologies for controlling a process having one or more motorized pumps and associated motor drives, which provide for optimized process performance according to one or more performance criteria, such as efficiency, component life expectancy, safety, emissions, noise, vibration, operational cost, or the like. More particularly, the subject invention provides for employing machine diagnostic and / or prognostic information in connection with optimizing an overall business operation over a time horizon.

Owner:ROCKWELL AUTOMATION TECH

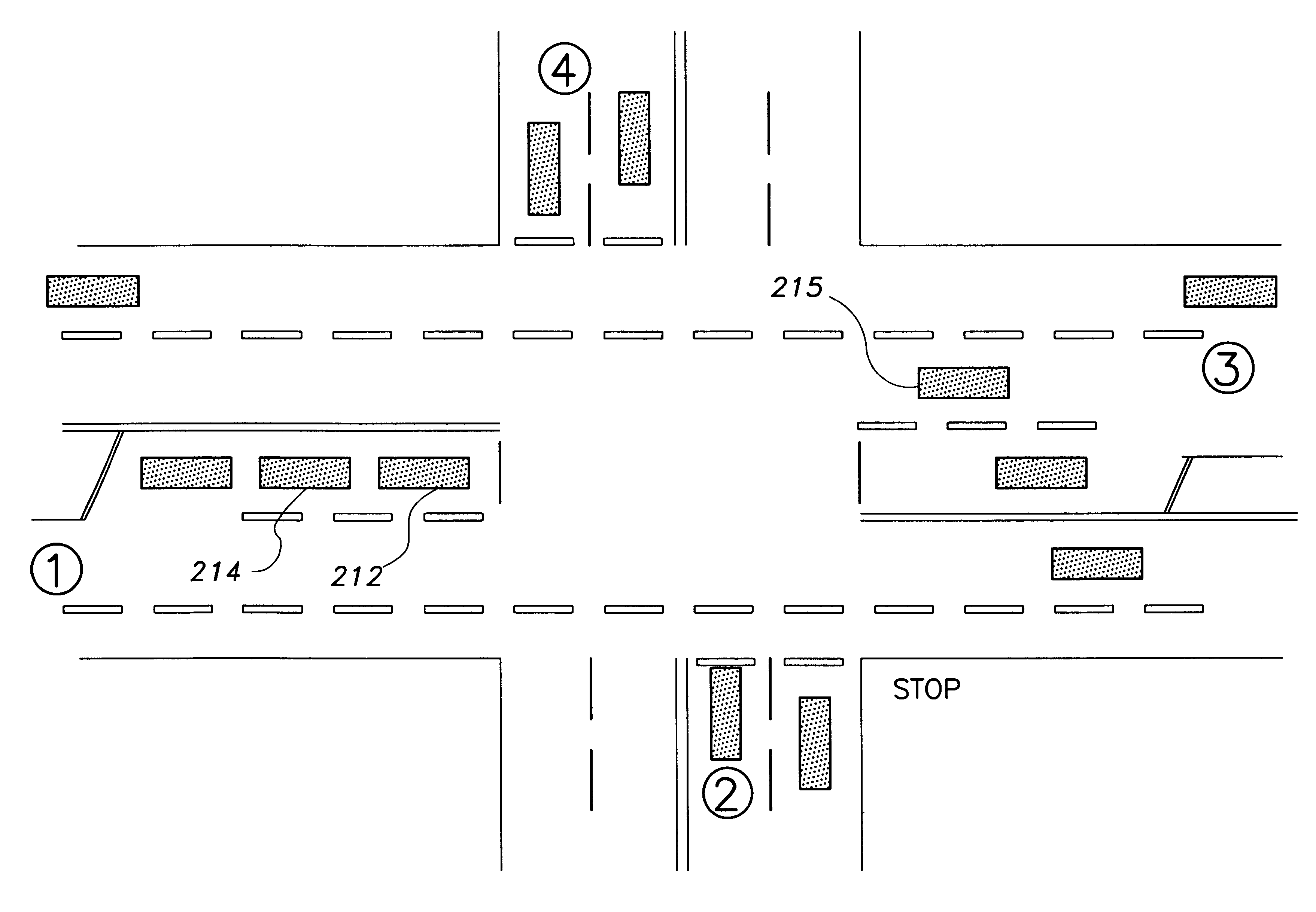

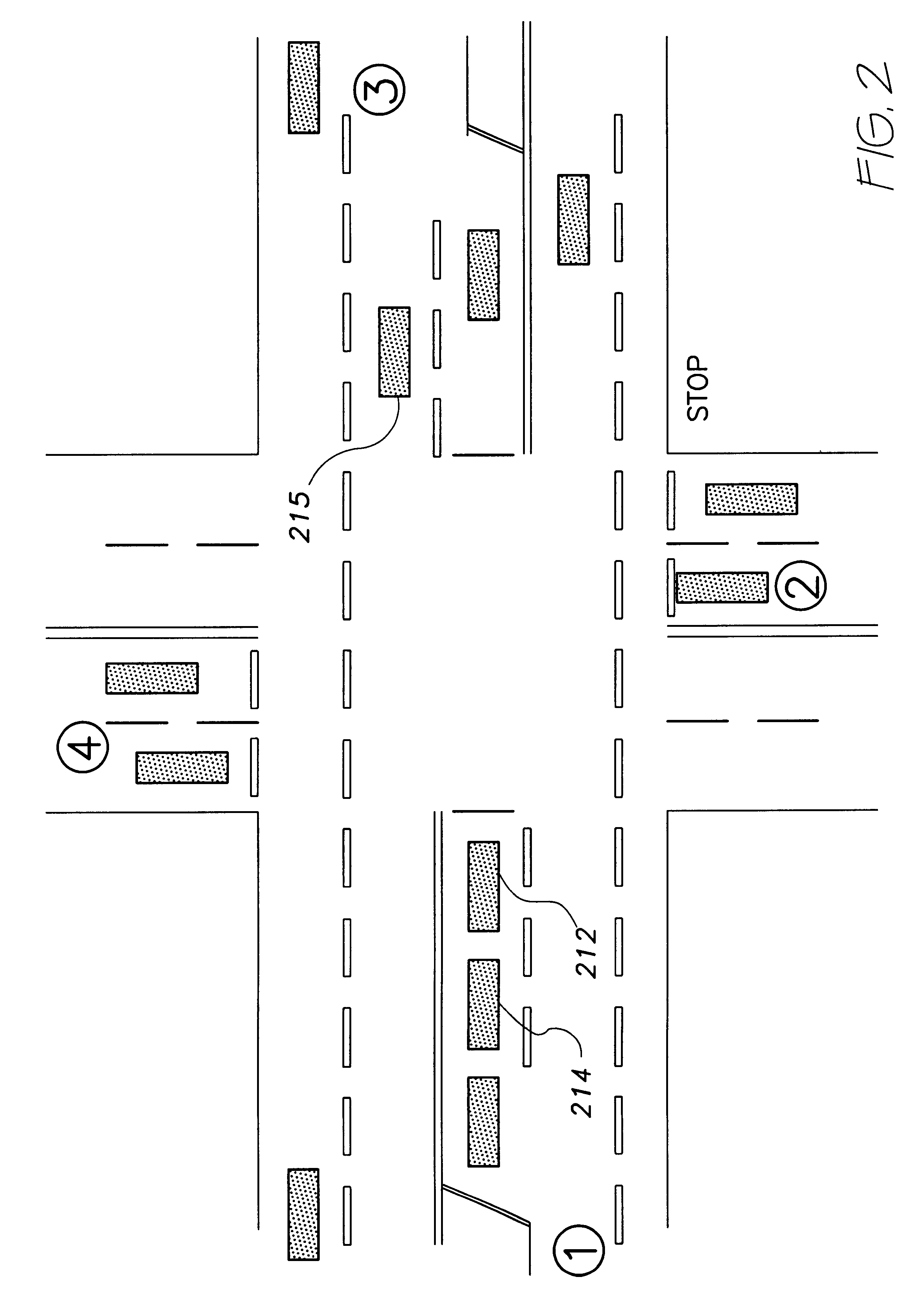

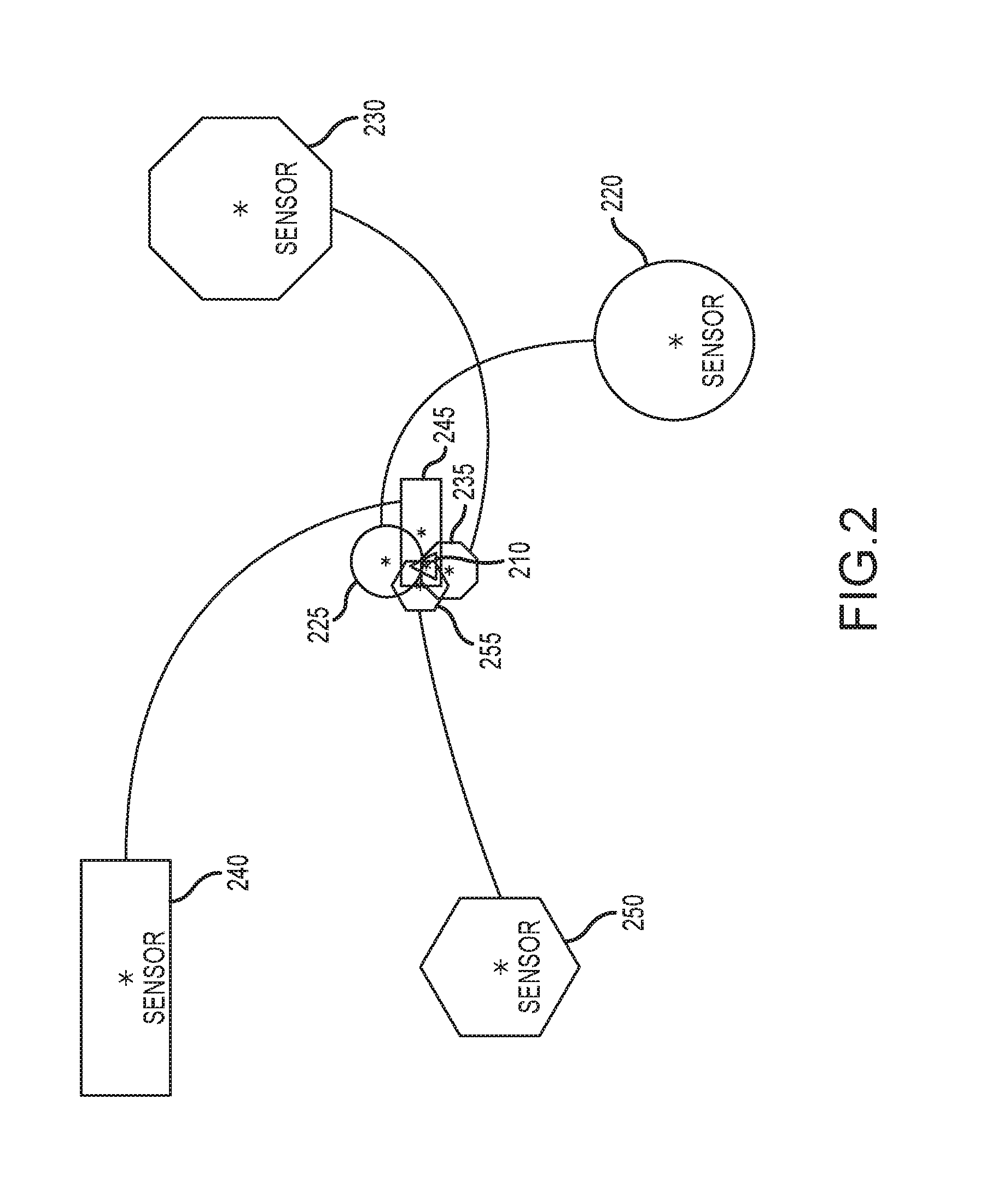

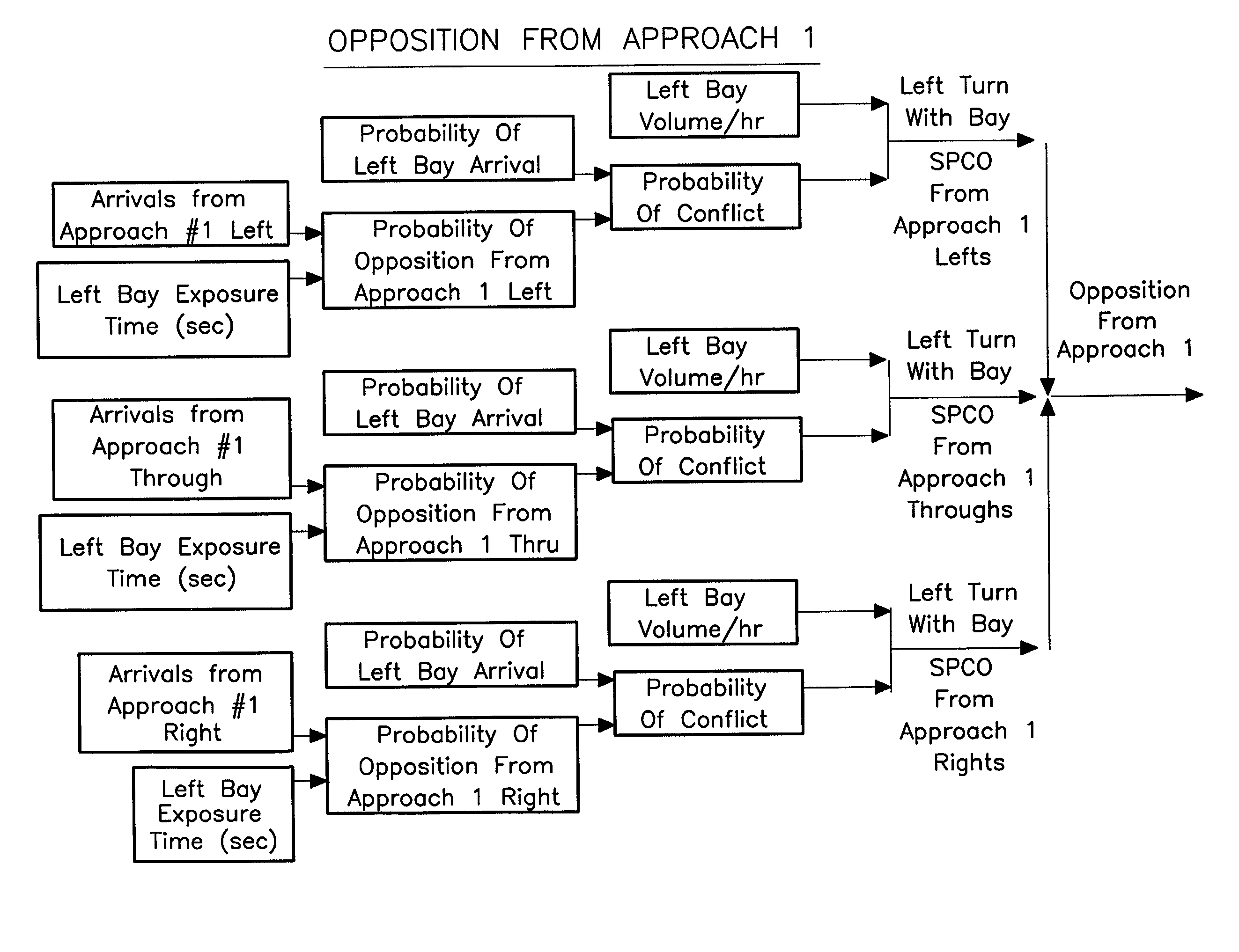

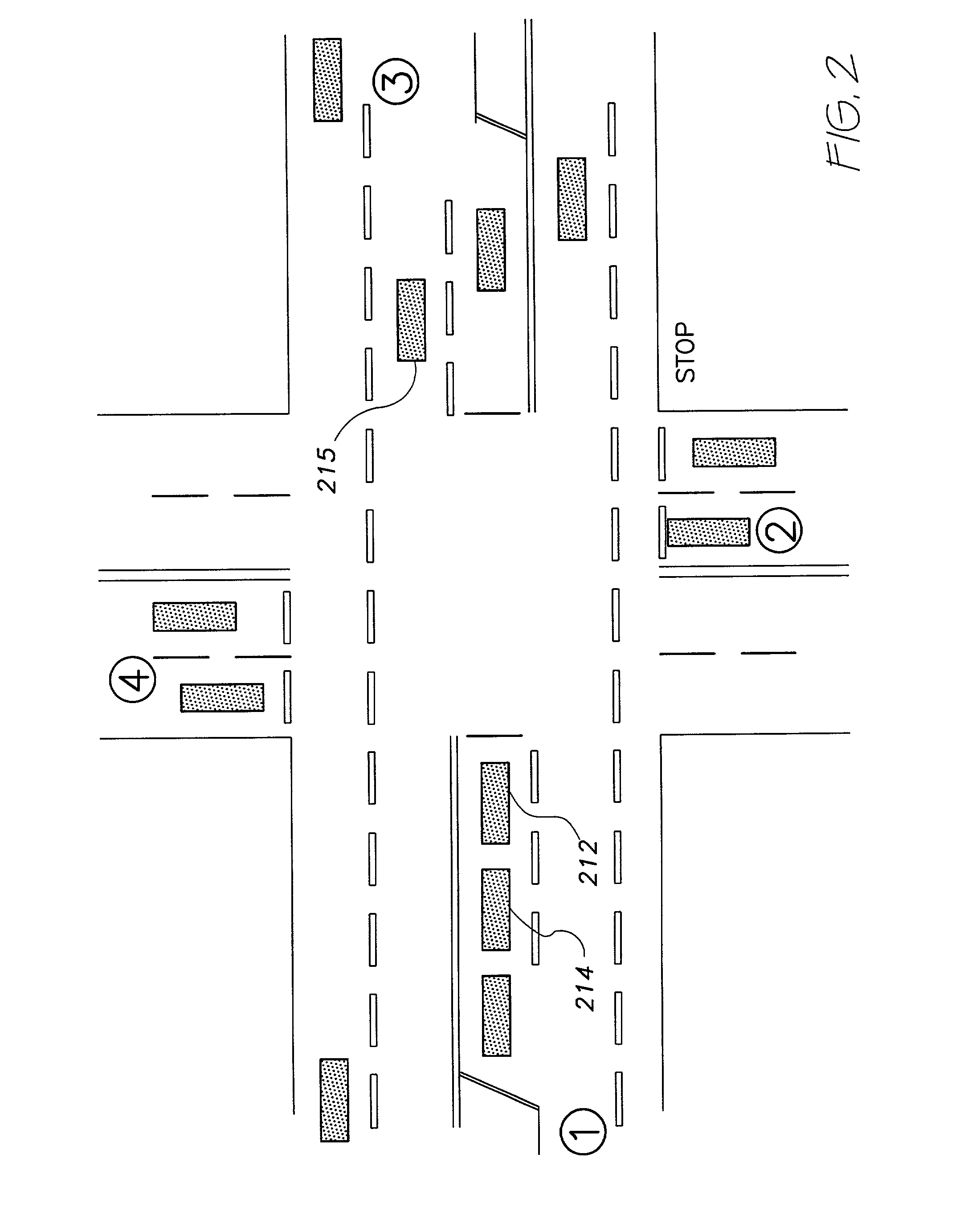

Traffic safety prediction model

InactiveUS6662141B2Minimizing developmentDetection of traffic movementAnti-collision systemsS distributionControl signal

Owner:KAUB ALAN R

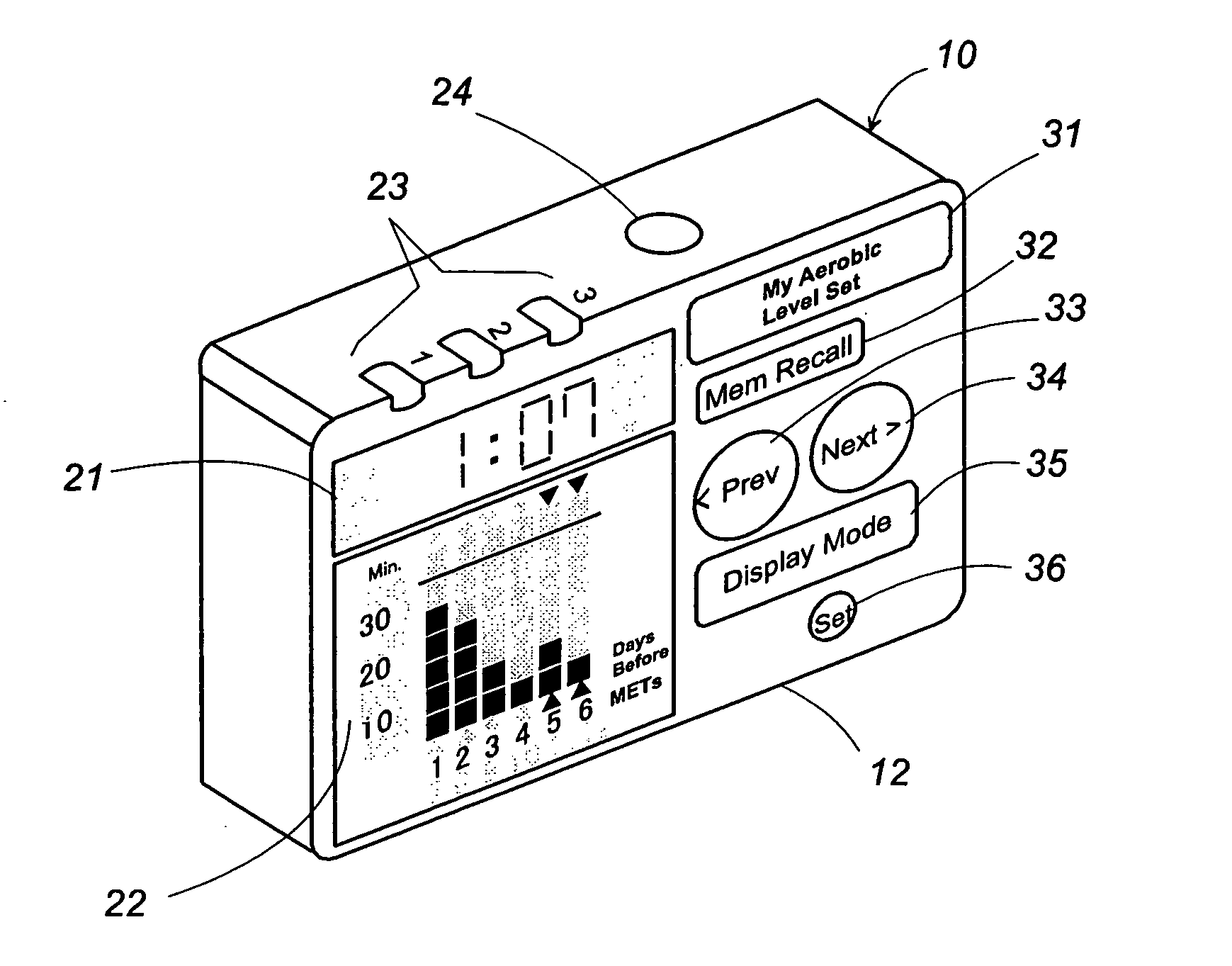

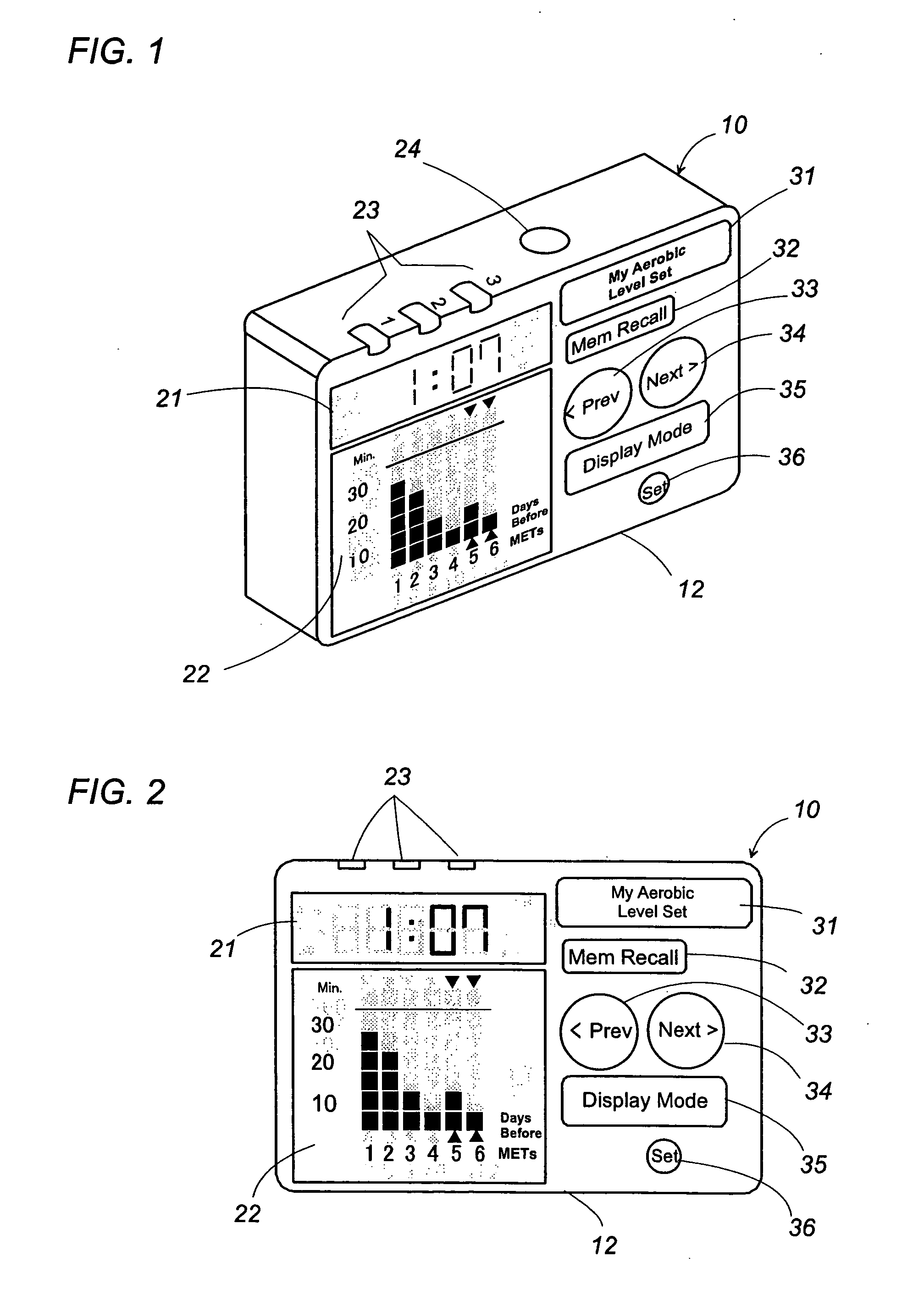

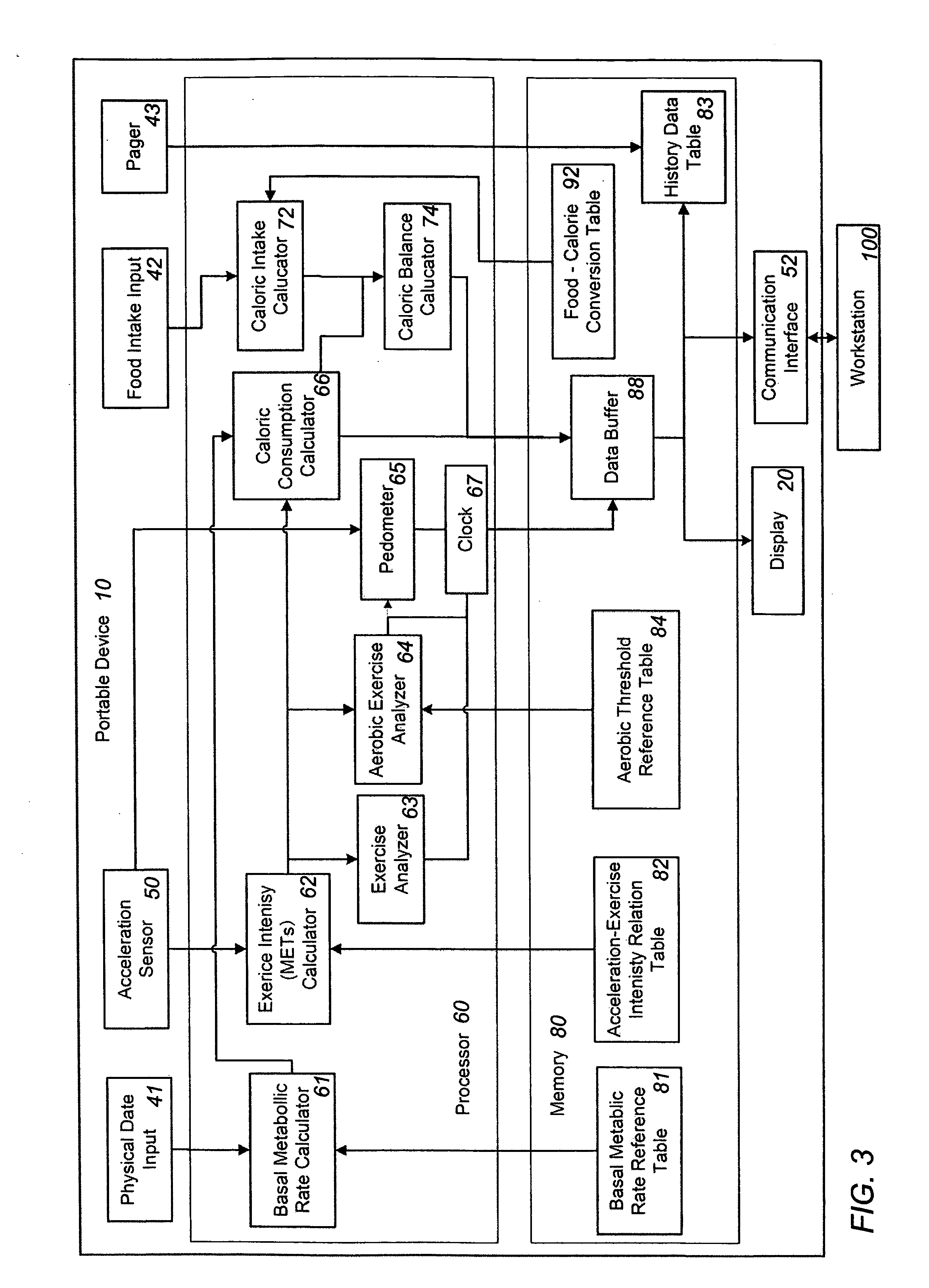

Physical activity measuring system

InactiveUS20060020174A1Accurate exercise intensityAccurately determineInertial sensorsNavigation instrumentsIntensity scalingBody sensors

A physical activity measuring system analyzes analyzing body motions of a user to accurately determine the exercise intensity. The system includes a portable device which is adapted to be carried by the user and is equipped with a body sensor and an indicator for indication of the exercise intensity. The body sensor senses the user's body motions to give corresponding motion strength. The portable device has a processor which constitutes an exercise calculator which has a predetermined relationship between a default standard deviation of the motion strength and an exercise intensity scale. The exercise intensity calculator collects a time series data of the motion strengths within a predetermined first time frame, obtains a standard deviation of thus collected motion strengths, and converting the standard deviation into an instant exercise intensity within the intensity scale in accordance with the predetermined relationship. The standard deviation with regard to the motion strengths can be well concordant with the exercise intensity, and therefore gives the accurate exercise intensity on a real-time basis.

Owner:MATSUSHITA ELECTRIC WORKS LTD

System and method for dynamic multi-objective optimization of machine selection, integration and utilization

InactiveUS20100306001A1Improve overall utilizationImprove efficiencyTesting/monitoring control systemsForecastingOperational costsMachine selection

The invention provides control systems and methodologies for controlling a process having one or more motorized pumps and associated motor drives, which provide for optimized process performance according to one or more performance criteria, such as efficiency, component life expectancy, safety, emissions, noise, vibration, operational cost, or the like. More particularly, the subject invention provides for employing machine diagnostic and / or prognostic information in connection with optimizing an overall business operation over a time horizon.

Owner:ROCKWELL AUTOMATION TECH

System and method for trading off put and call values of a portfolio

This invention relates to a system and method for valuing a portfolio in terms of its performance relative to a specified benchmark under a range of future scenarios. In particular, the invention takes a portfolio and calculates two values related to the portfolio: the first value corresponding to an amount by which the value of the portfolio is expected to fall below the value of a benchmark over a given time horizon, and a second value corresponding to an amount by which the value of the portfolio is expected to exceed the value of a benchmark over a given time horizon, in view of the range of different future scenarios. The invention provides a means for determining the portfolio which optimally trades-off these two values, and to evaluate risk / reward performance measures using these two values which can be used to rank instruments, securities or portfolios. The invention also provides a means for pricing portfolio insurance for optimal portfolios.

Owner:IBM CORP

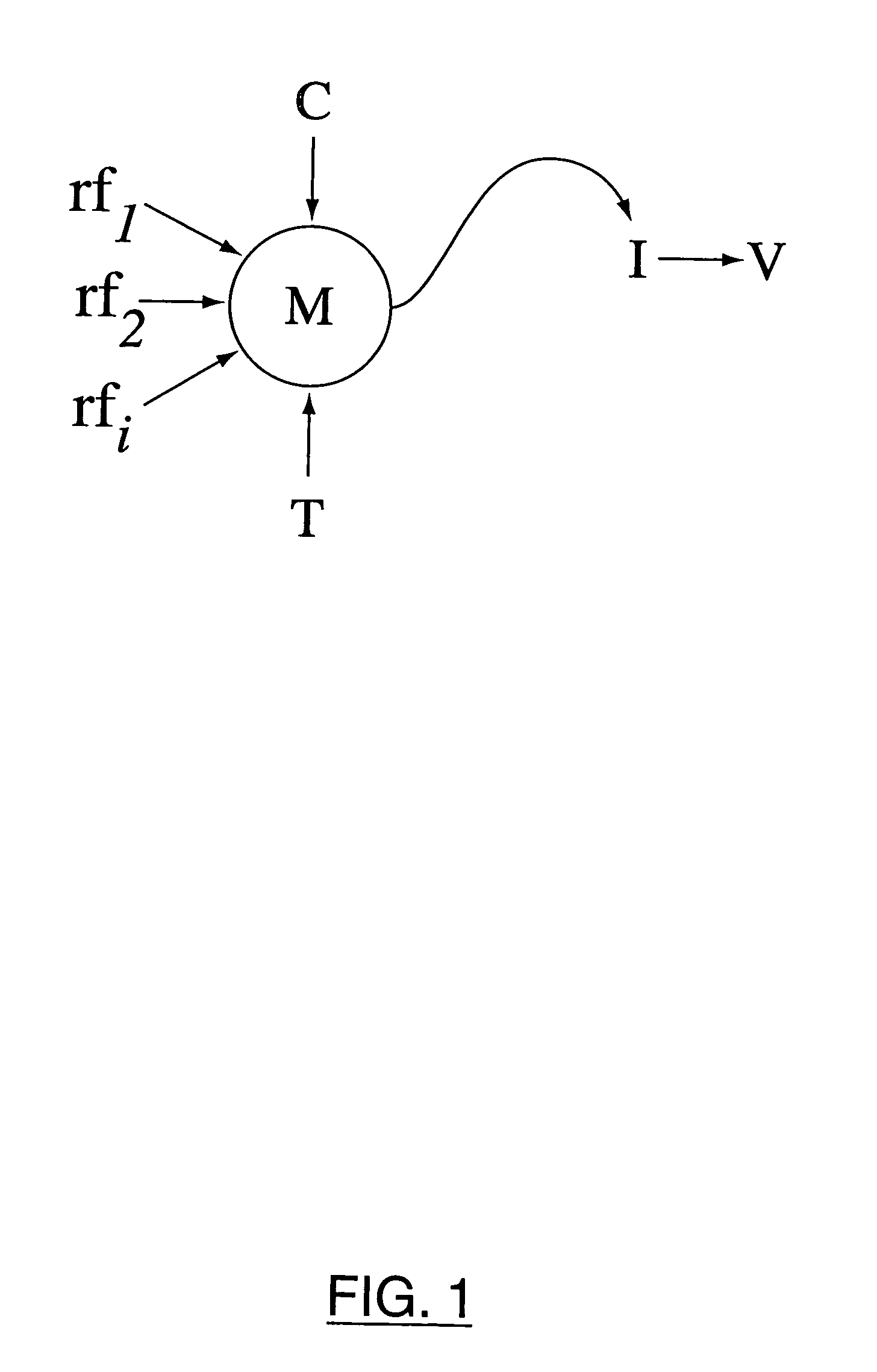

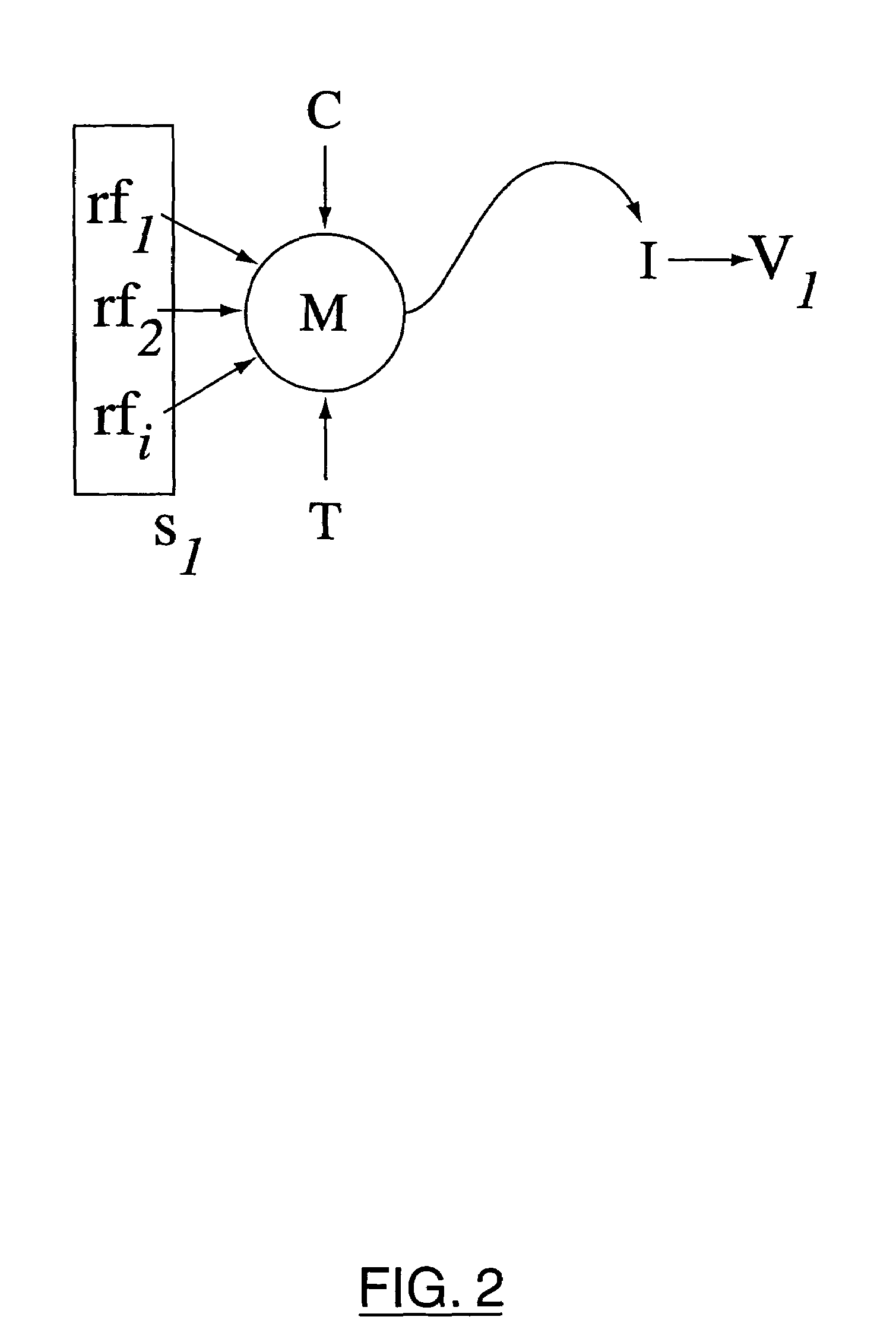

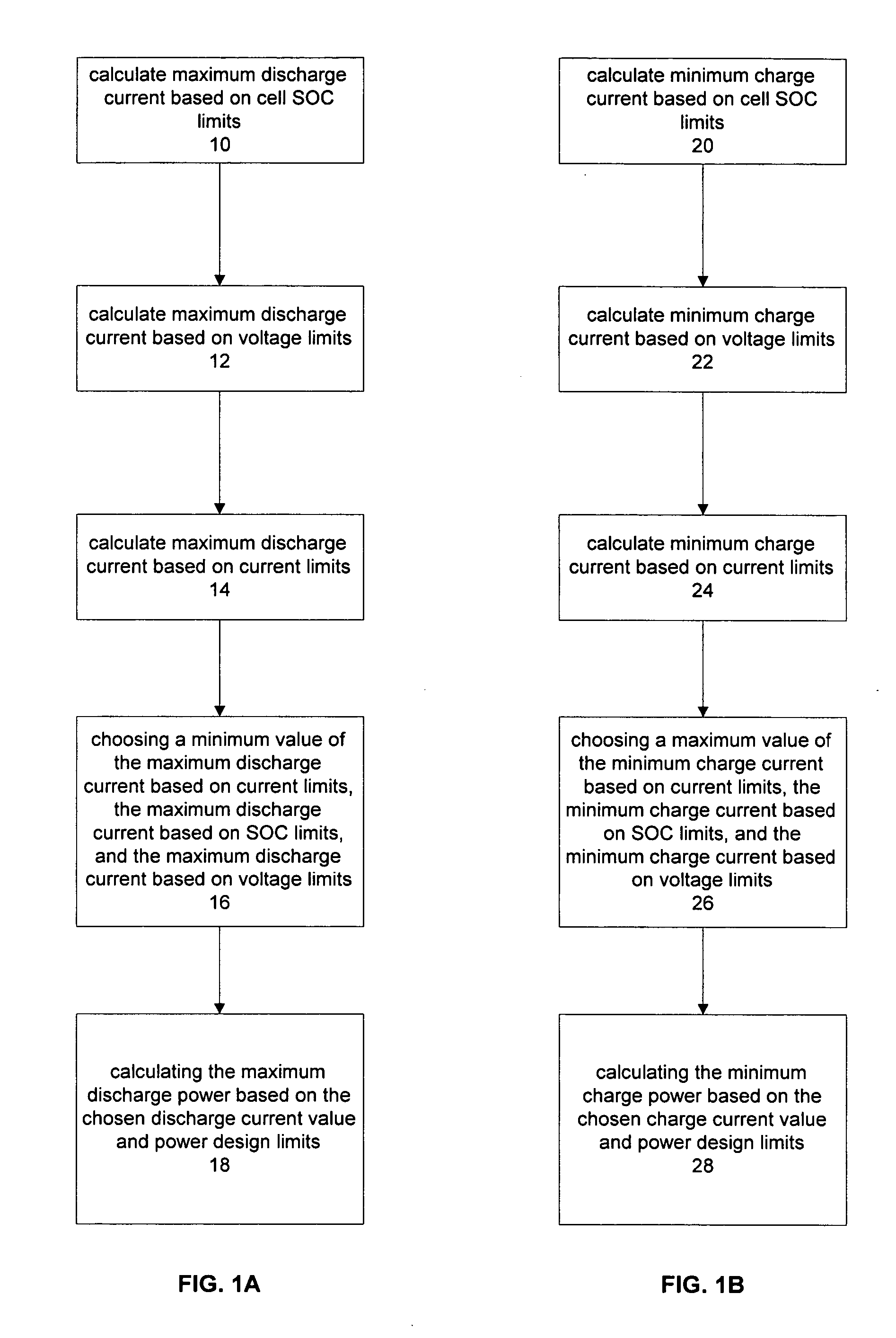

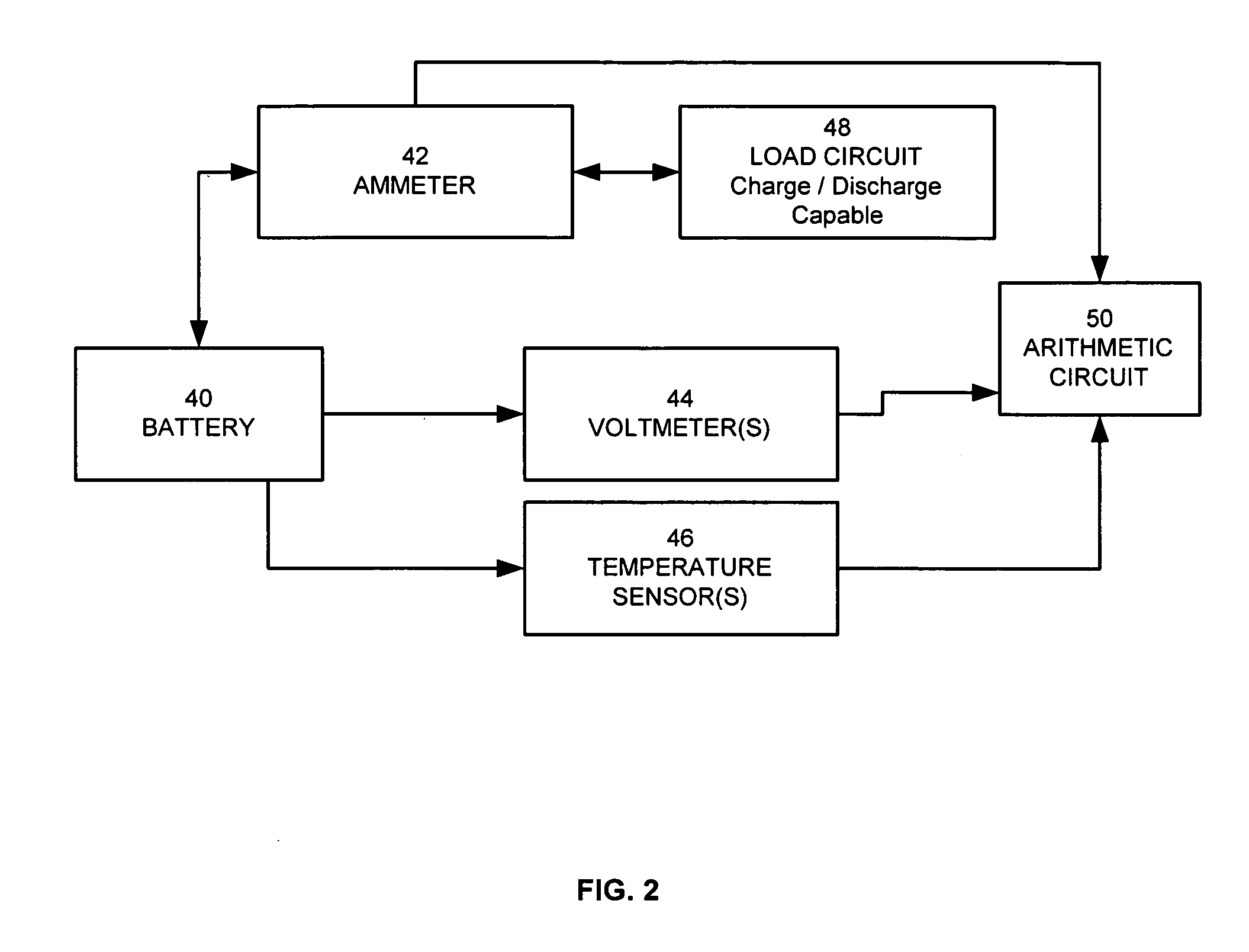

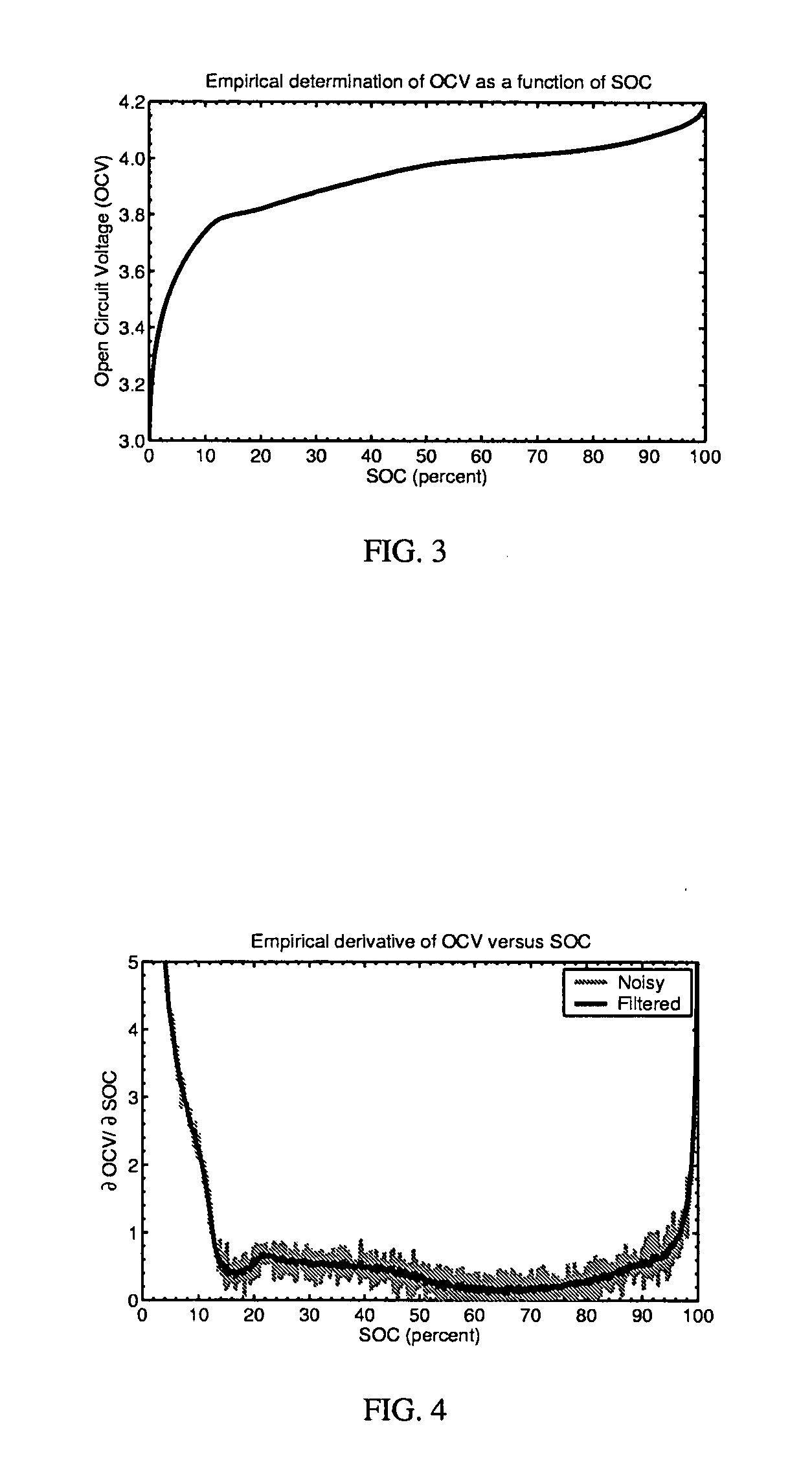

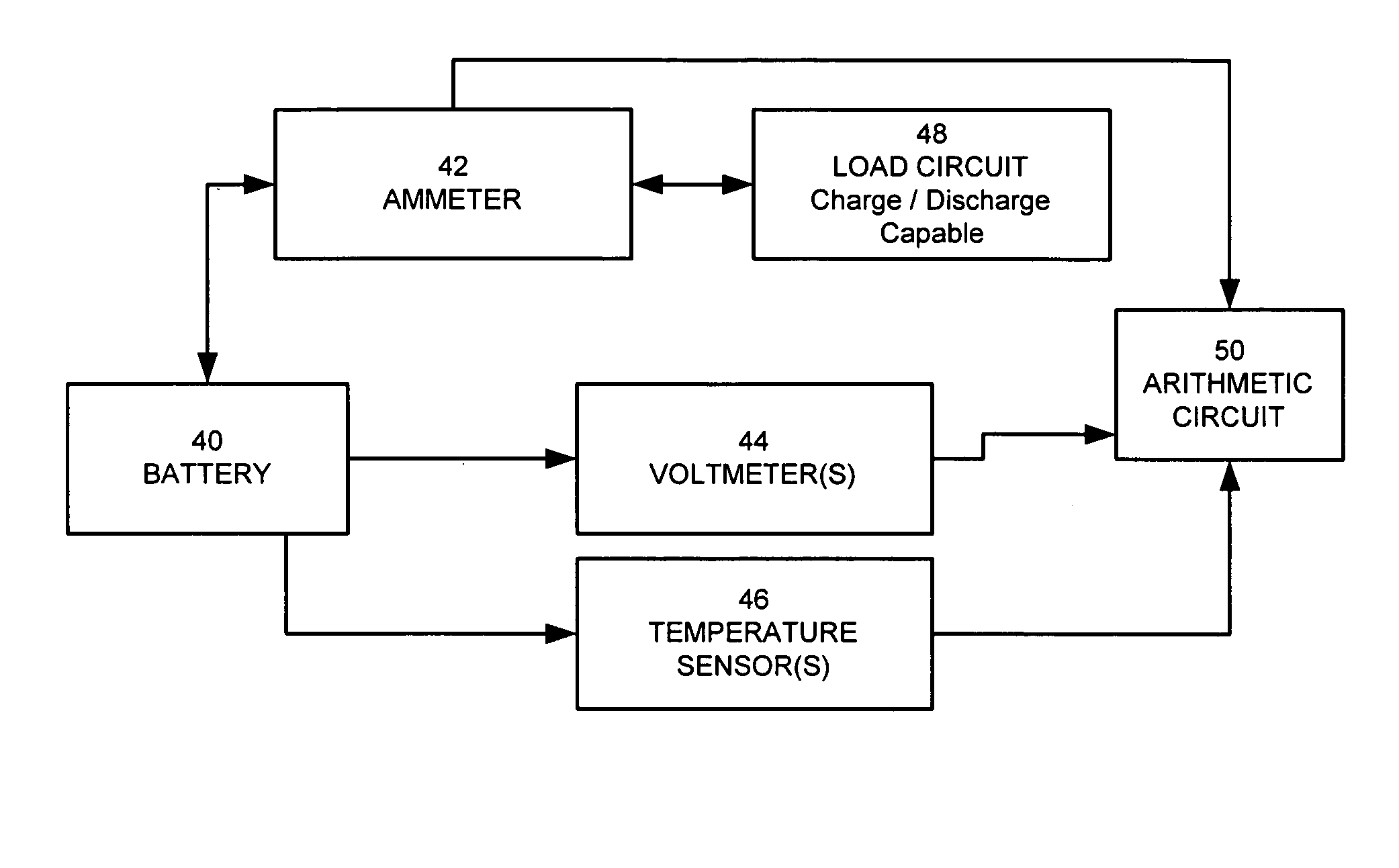

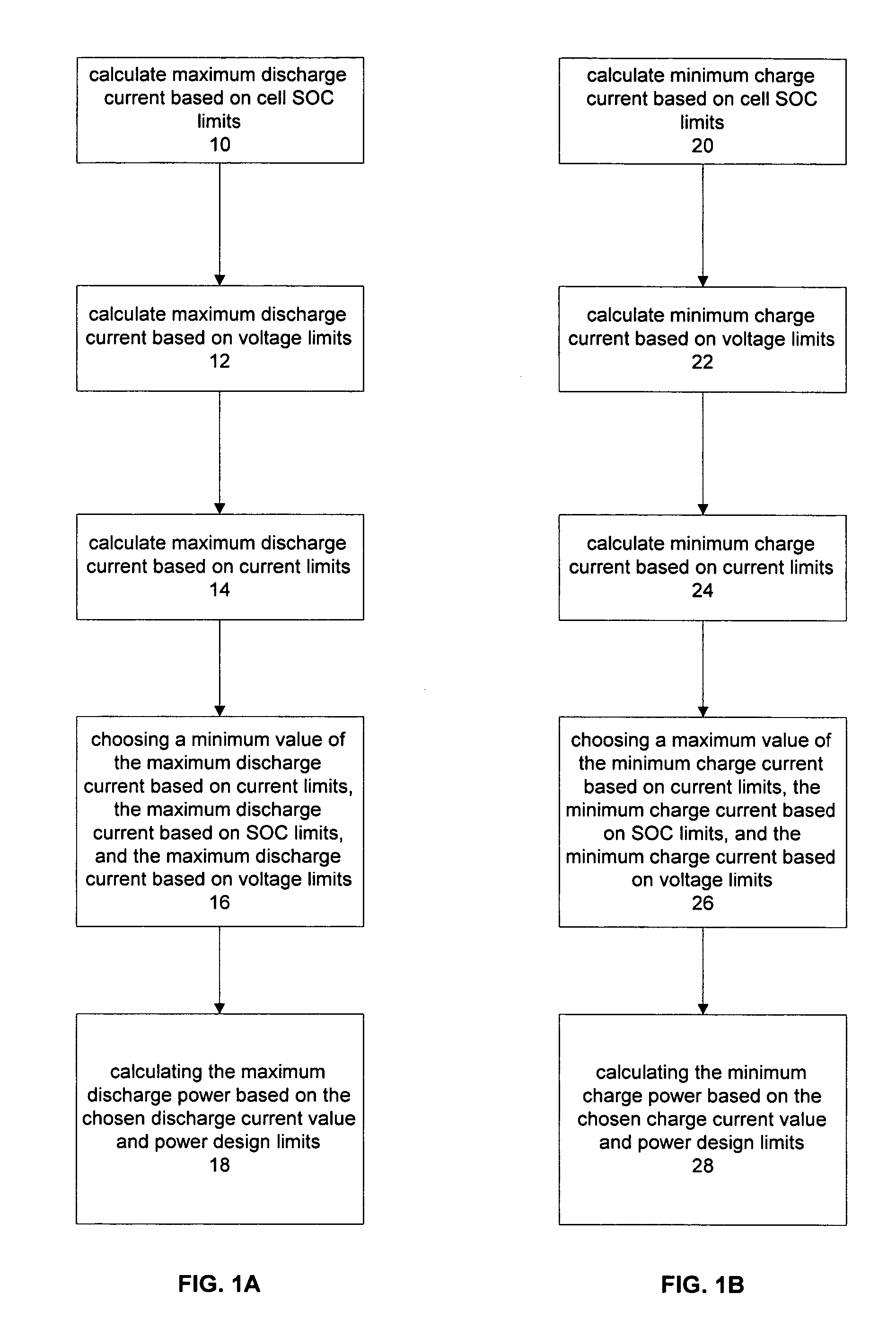

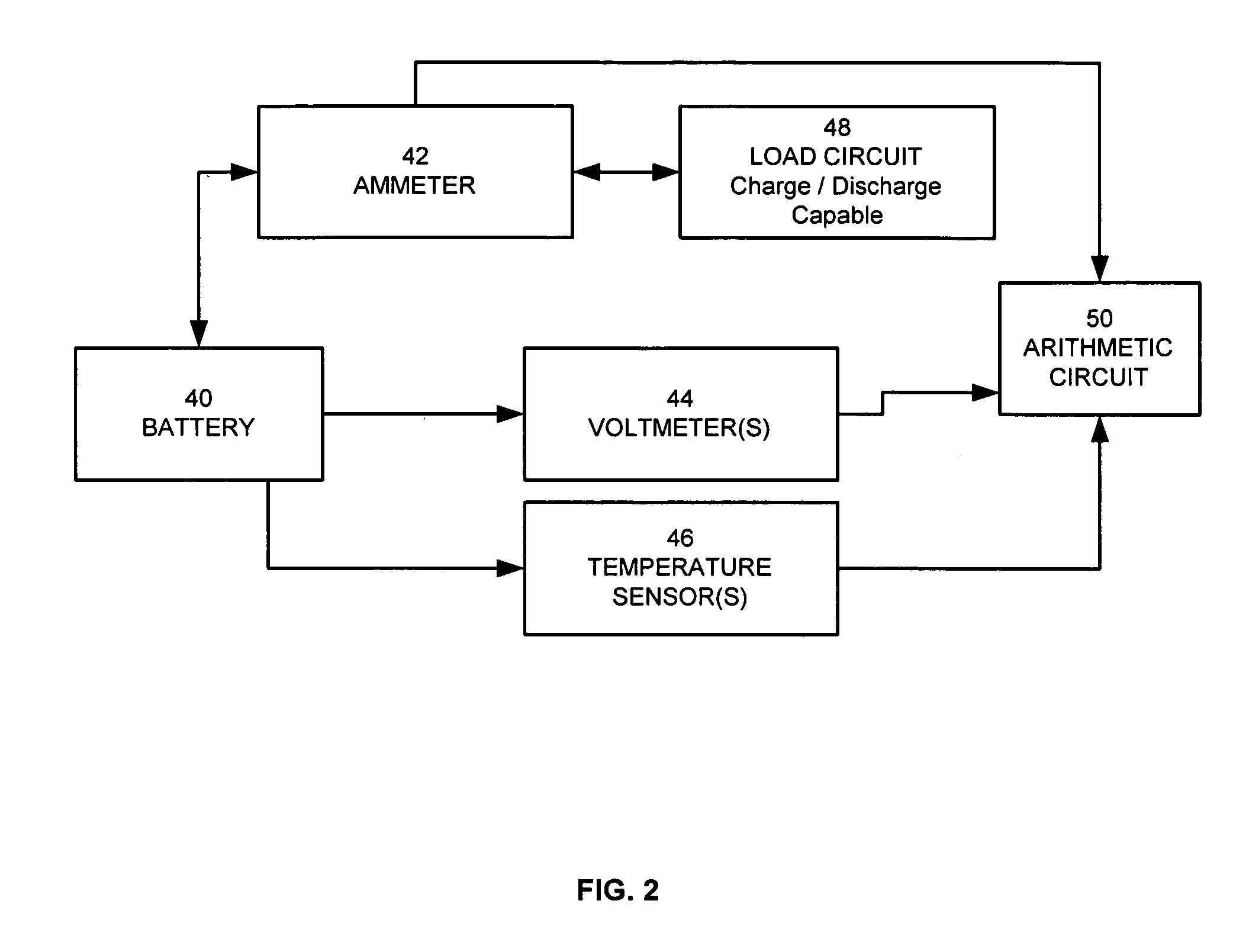

Method for calculating power capability of battery packs using advanced cell model predictive techniques

ActiveUS20050110498A1Batteries circuit arrangementsMaterial analysis by electric/magnetic meansPower capabilityElectrical battery

The present invention relates to a method and an apparatus for estimating discharge and charge power of battery applications, including battery packs used in Hybrid Electric Vehicles (HEV) and Electric Vehicles (EV). One charge / discharge power estimating method incorporates voltage, state-of-charge (SOC), power, and current design constraints and works for a user-specified prediction time horizon Δt. At least two cell models are used in calculating maximum charge / discharge power based on voltage limits. The first is a simple cell model that uses a Taylor-series expansion to linearize the equation involved. The second is a more complex and accurate model that models cell dynamics in discrete-time state-space form. The cell model can incorporate a inputs such as temperature, resistance, capacity, etc. One advantage of using model-based approach is that the same model may be used in both Kalman-filtering to produce the SOC and the estimation of maximum charge / discharge current based on voltage limits.

Owner:LG ENERGY SOLUTION LTD

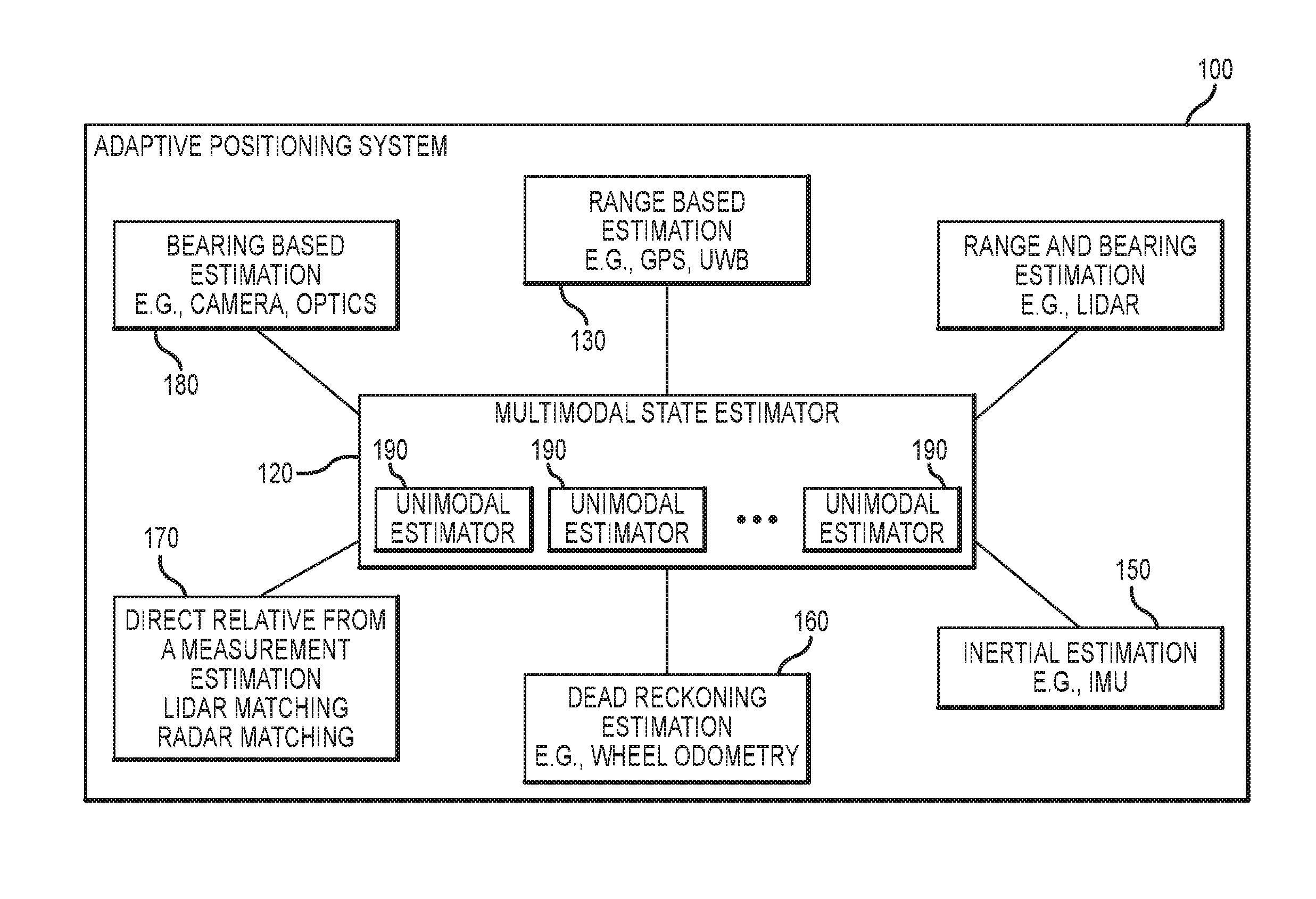

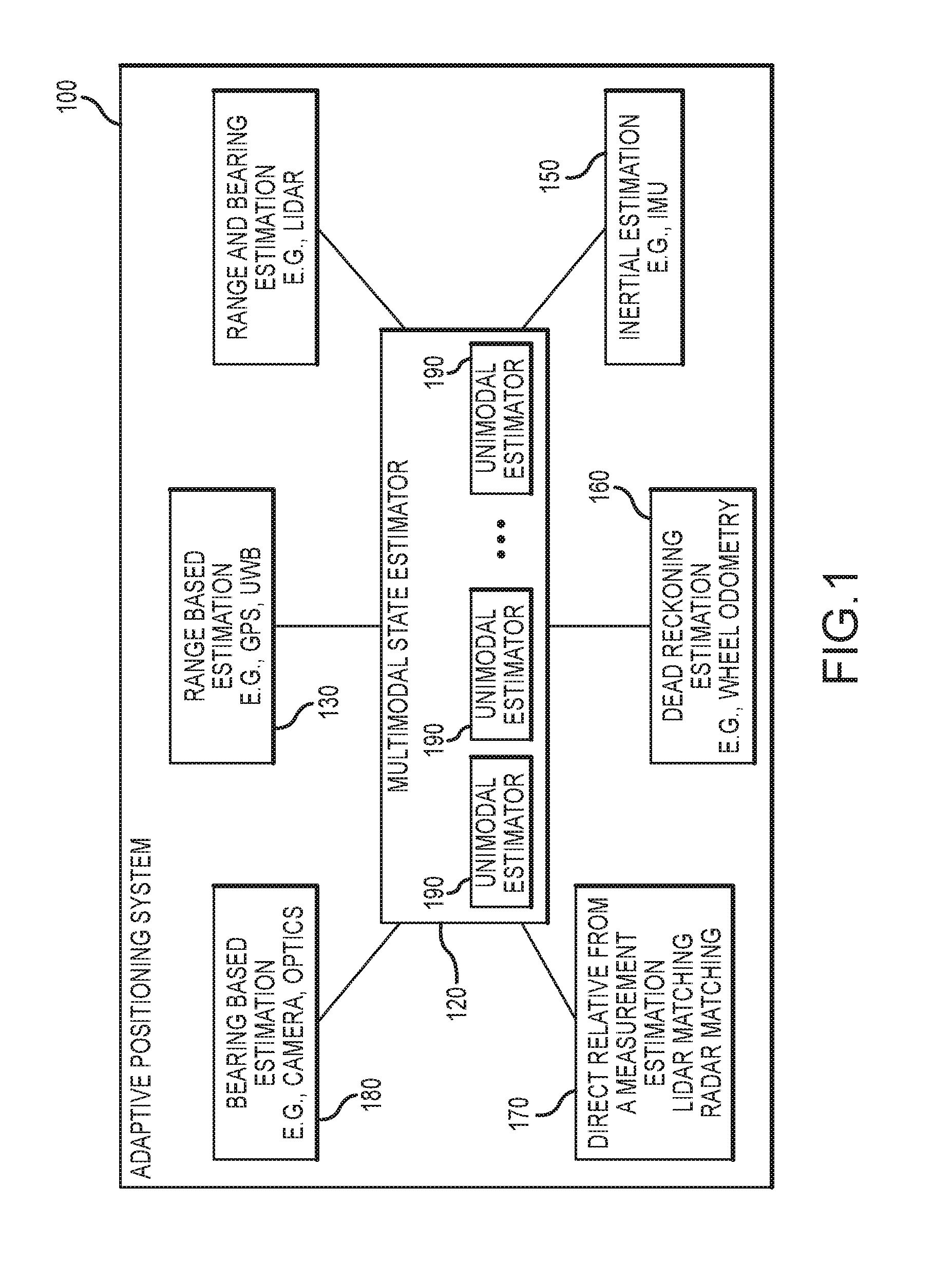

Mobile localization using sparse time-of-flight ranges and dead reckoning

ActiveUS20160349362A1Reduce odometric driftReduce errorsInstruments for road network navigationPosition fixationTransceiverWide band

Mobile localization of an object having an object positional frame of reference using sparse time-of-flight data and dead reckoning can be accomplished by creating a dead reckoning local frame of reference, including an estimation of object position with respect to known locations from one or more Ultra Wide Band transceivers. As the object moves along its path, a determination is made using the dead-reckoning local frame of reference. When the object is within a predetermine range of one or more of the Ultra Wide Band transceivers, a “conversation” is initiated, and range data between the object and the UWB transceiver(s) is collected. Using multiple conversations to establish accurate range and bearing information, the system updates the object's position based on the collected data.

Owner:HUMATICS CORP

Traffic safety prediction model

InactiveUS20020082806A1Minimizing developmentImprove securityDetection of traffic movementAnti-collision systemsS distributionControl signal

A Traffic Safety prediction Computer Program (TRAF-SAFE) and sub-models for predicting the number of accidents, injuries and fatalities expected annually at an intersection or series of intersections based on the particular intersection and roadway features. A finite analysis approach to an intersection is used to break the intersection into discrete elements such as lanes, turnbays, stop control signals, and traffic flow rates. The total annual expected accidents can then be calculated as a summation of the interrelation of the individual elements. A Poisson's distribution is used to statistically estimate the likelihood of the individual vehicles occurring within a discrete time frame being investigated. The conflict probabilities between various permutations of the traffic flow is then calculated and summed to determine the number of conflicts for the intersection or roadway. The conflicts are then converted to expected accidents, and the accident level is converted to injury involvements and Safety Levels of Service for the intersection and roadway.

Owner:KAUB ALAN R

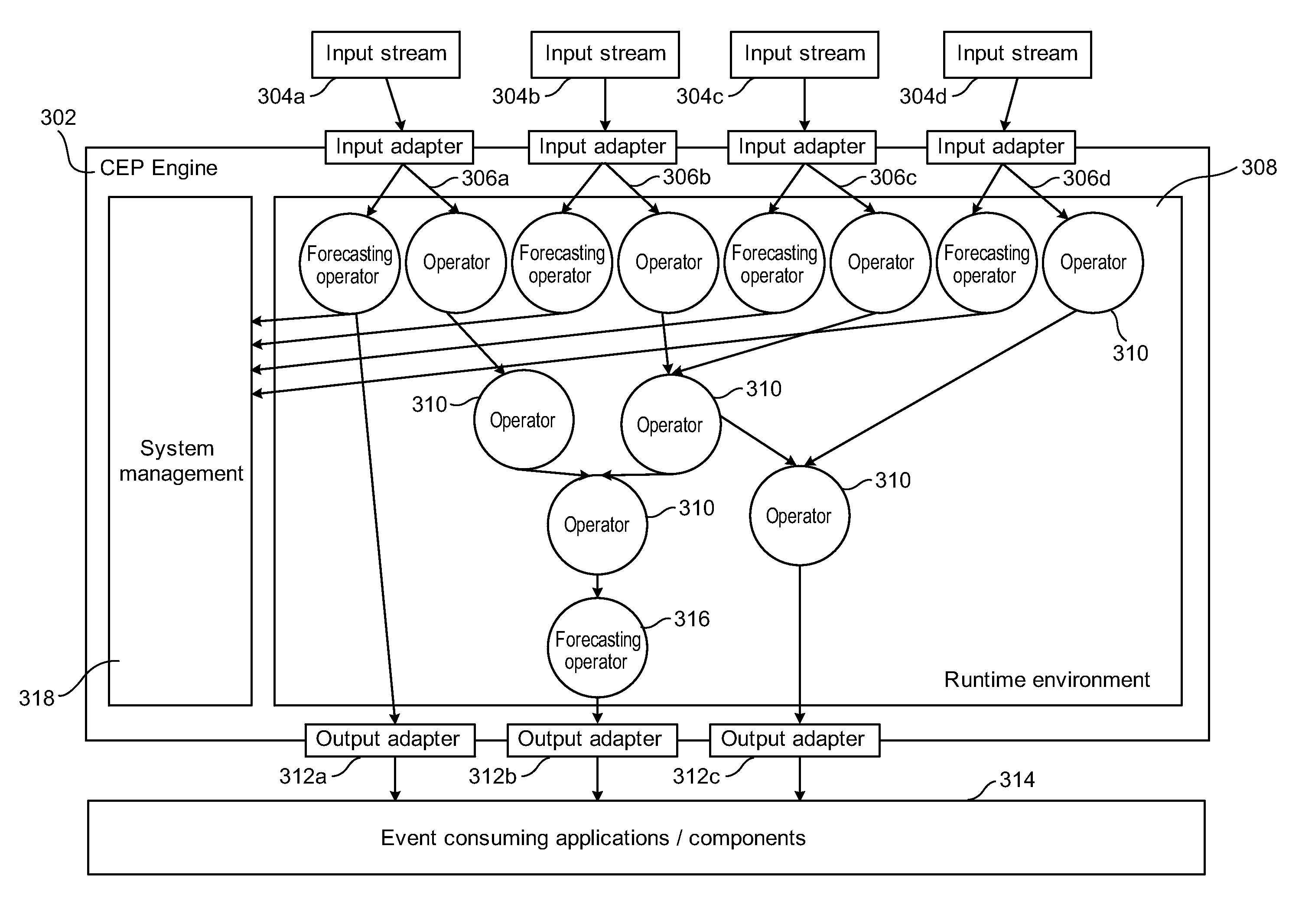

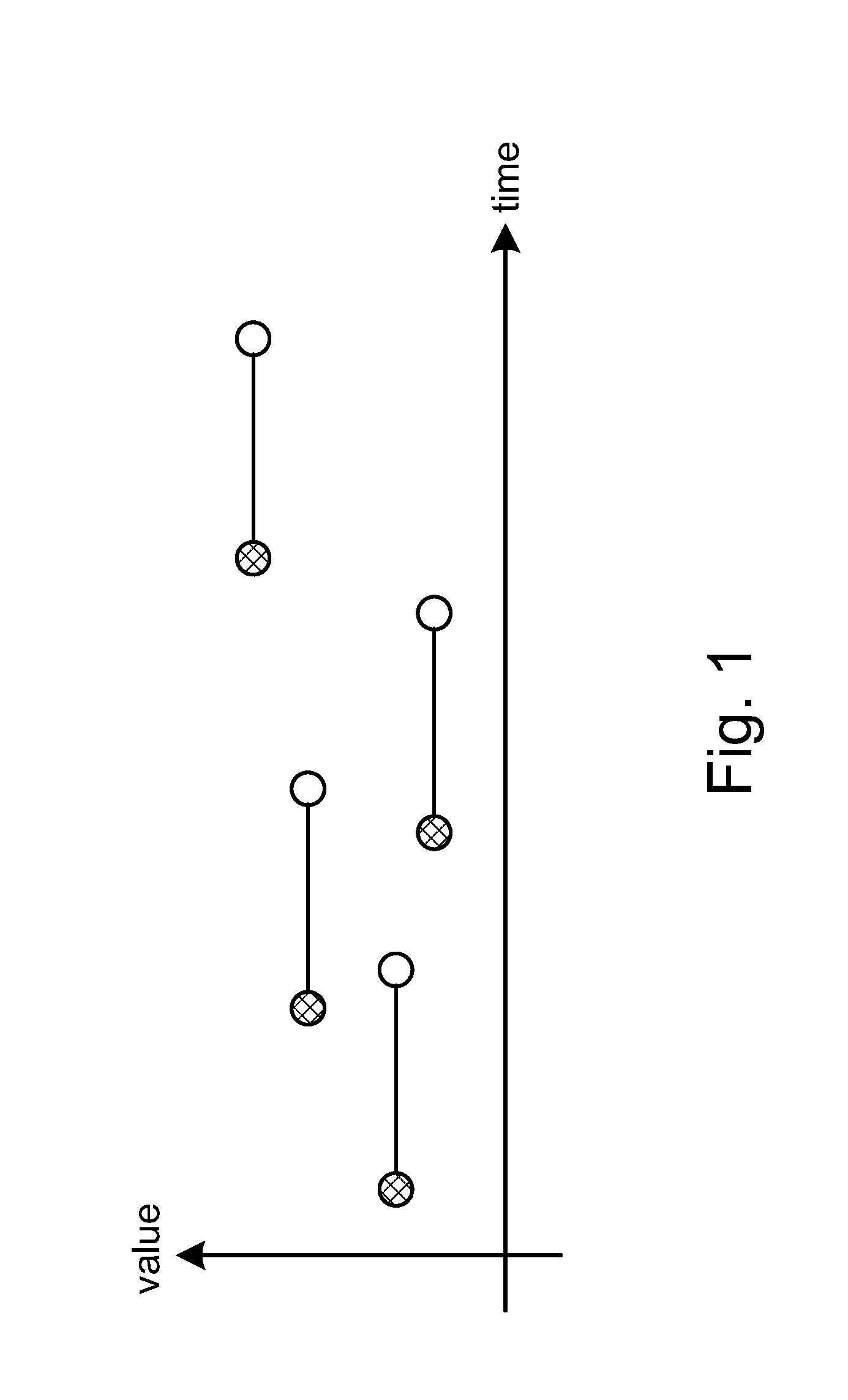

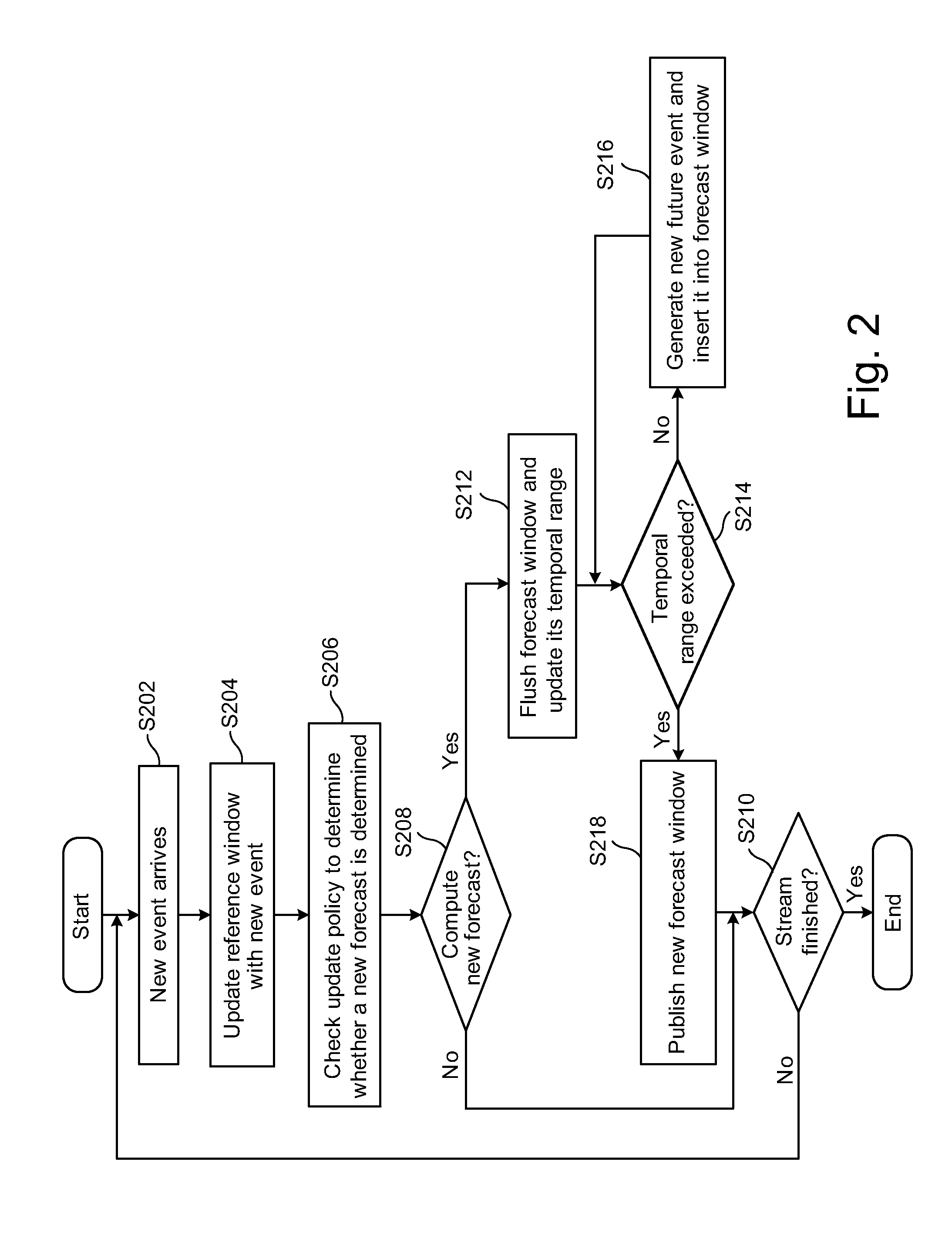

Systems and/or methods for forecasting future behavior of event streams in complex event processing (CEP) environments

ActiveUS20130046725A1Speed up the flowImprove throughputDigital data information retrievalChaos modelsComplex event processingReference window

Certain example embodiments described herein relate to forecasting the future behavior of event streams in Complex Event Processing (CEP) environments. For each received event in an event stream, a reference window indicative of a predefined temporal range during which the forecast is to be computed is updated so that the reference window ends with the received event, with the reference window moving with the event stream. Within this processing loop, when a forecasting update policy indicates that the forecast is to be updated based on the received event: a forecasting window indicative of a temporal range in which events are to be forecasted is updated; and while the time period of the forecasting window is not exceeded, (a) a next forecasted event is generated via at least one processor and (b) the next forecasted event is inserted into the forecast window; and the forecast window is published.

Owner:SOFTWARE AG

Method for calculating power capability of battery packs using advanced cell model predictive techniques

ActiveUS7321220B2Batteries circuit arrangementsMaterial analysis by electric/magnetic meansPower capabilityEngineering

The present invention relates to a method and an apparatus for estimating discharge and charge power of battery applications, including battery packs used in Hybrid Electric Vehicles (HEV) and Electric Vehicles (EV). One charge / discharge power estimating method incorporates voltage, state-of-charge (SOC), power, and current design constraints and works for a user-specified prediction time horizon Δt. At least two cell models are used in calculating maximum charge / discharge power based on voltage limits. The first is a simple cell model that uses a Taylor-series expansion to linearize the equation involved. The second is a more complex and accurate model that models cell dynamics in discrete-time state-space form. The cell model can incorporate a inputs such as temperature, resistance, capacity, etc. One advantage of using model-based approach is that the same model may be used in both Kalman-filtering to produce the SOC and the estimation of maximum charge / discharge current based on voltage limits.

Owner:LG ENERGY SOLUTION LTD

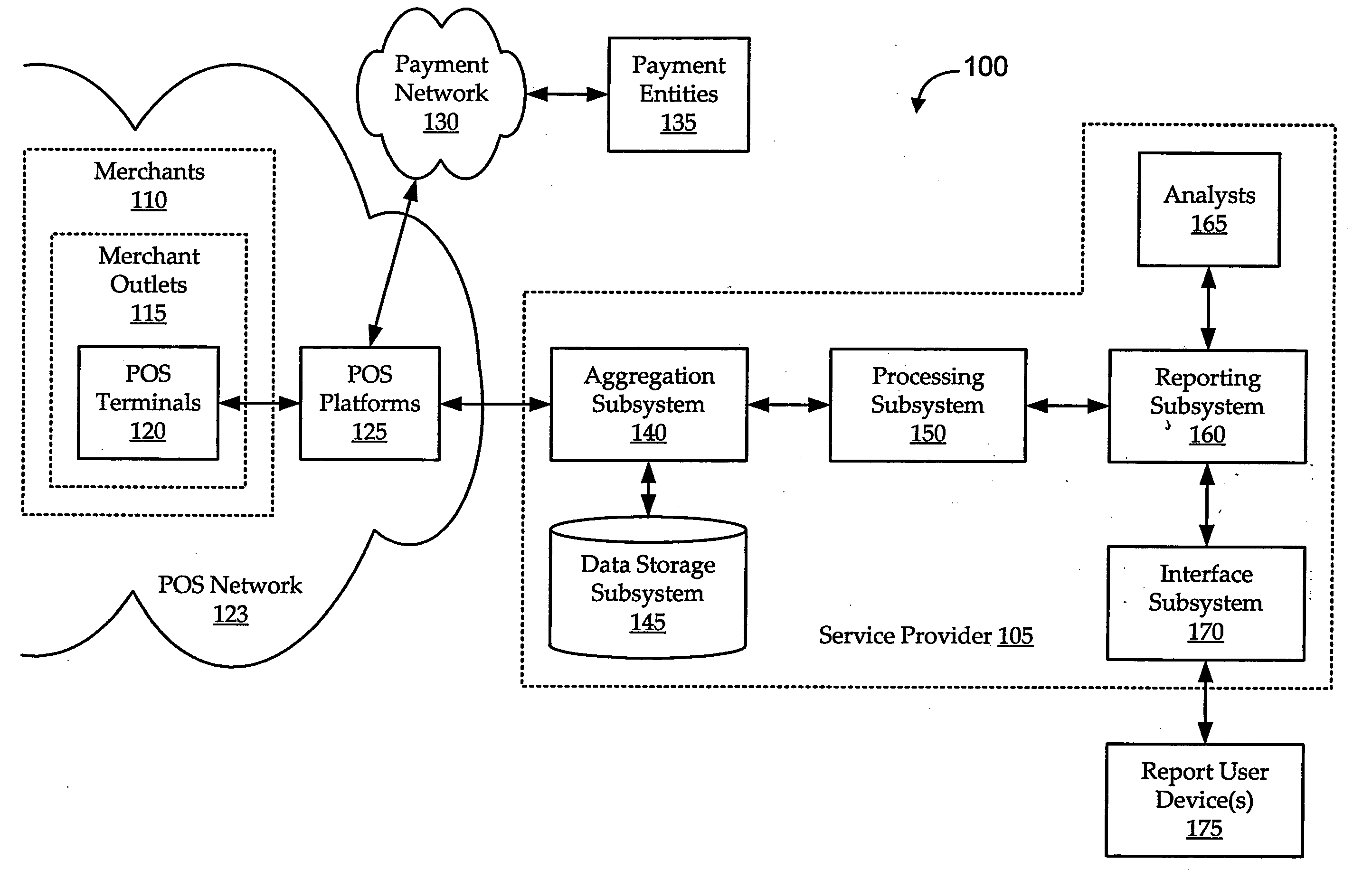

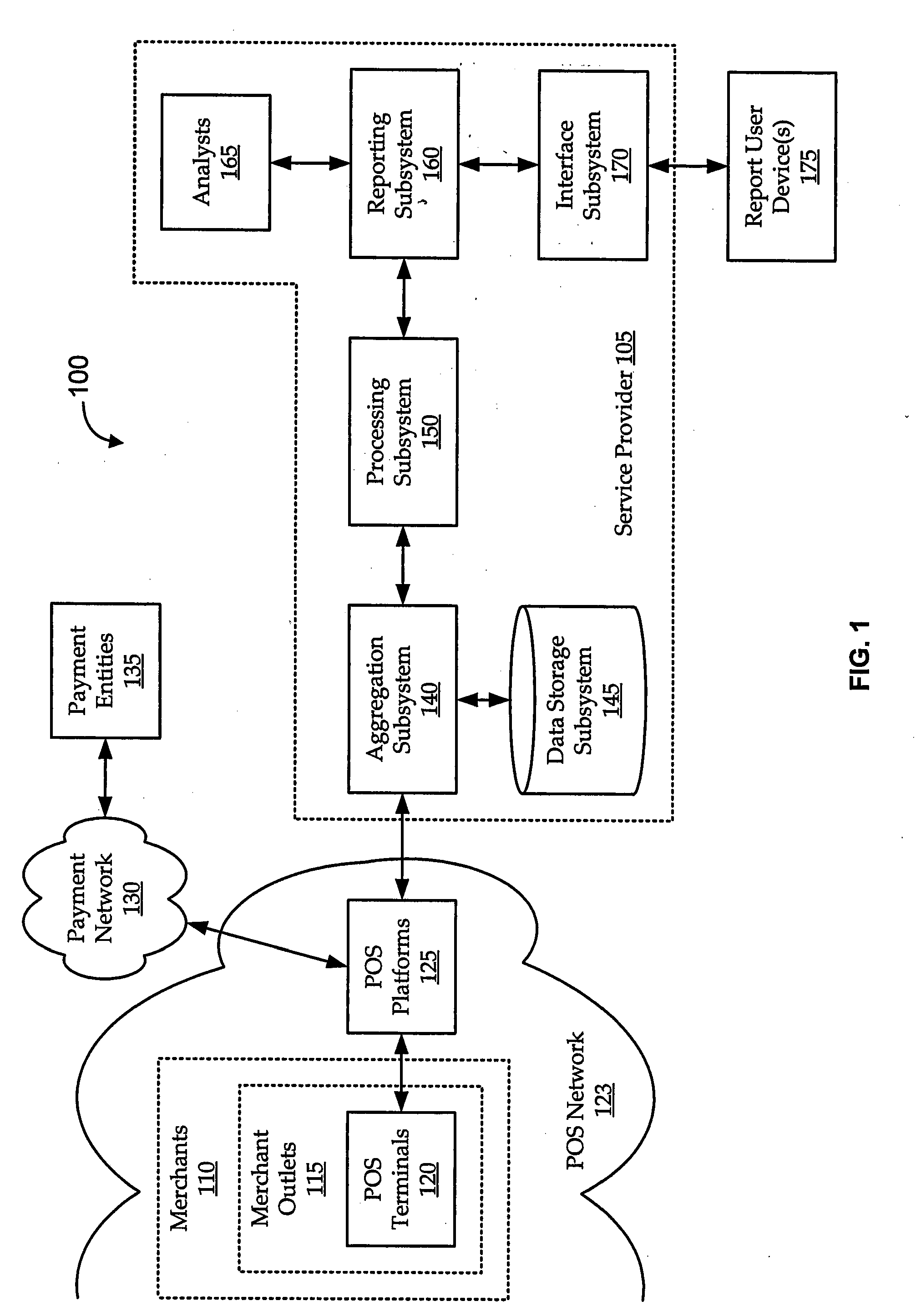

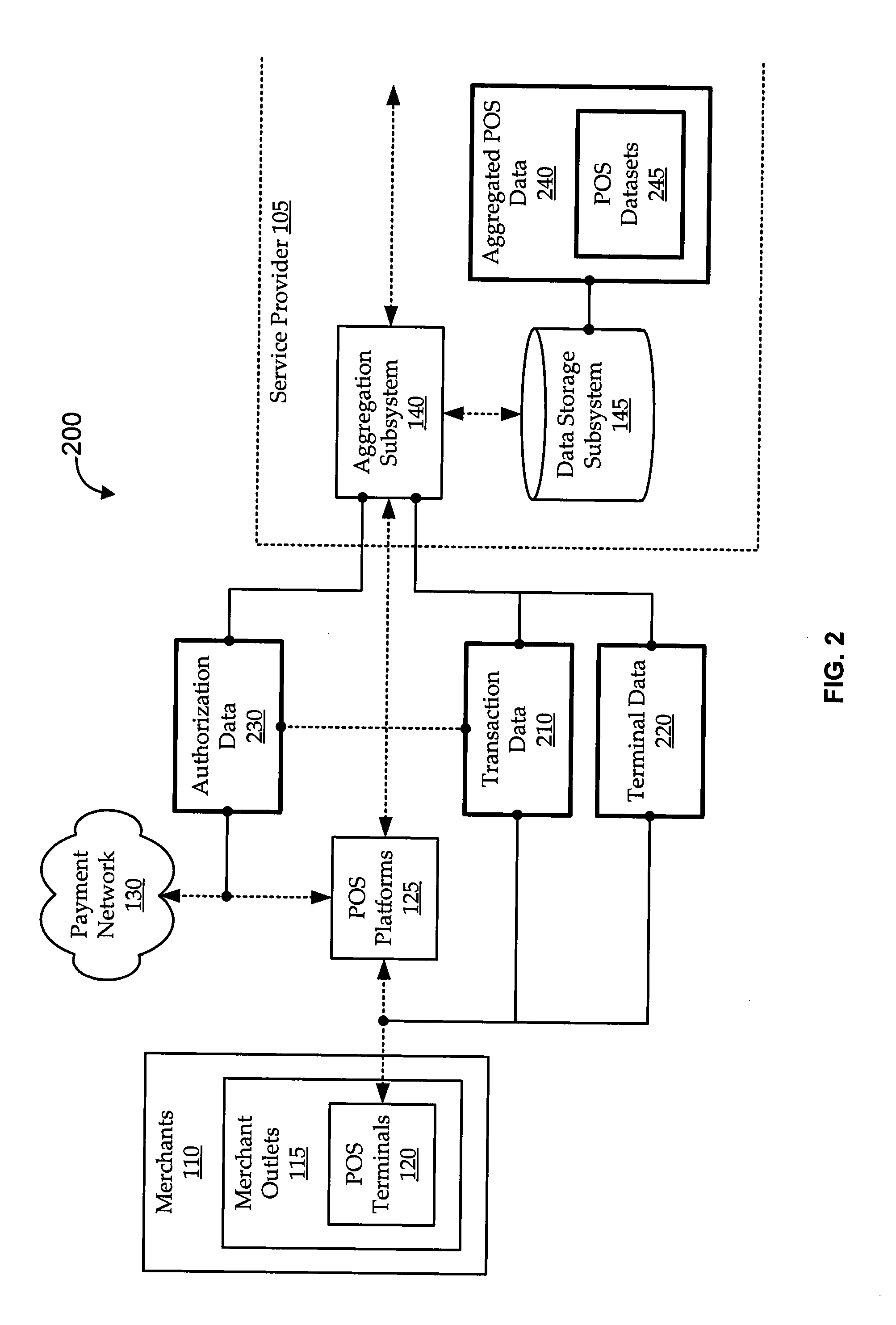

Point-of-sale-based market tracking and reporting

Systems and methods are described for transforming actual aggregated data (e.g., transaction and terminal data) from a large number of POS terminals into market trend reports that include macro-level trend data and analyses. For example, POS datasets are aggregated from POS terminals distributed across many merchant outlet locations, each POS dataset including location data and transaction data for its respective POS terminal. A reporting request is received for a market trend report corresponding to a designated market over a designated timeframe. A market dataset is identified from the portion of the aggregated POS data corresponding to the designated timeframe and market. Unreliable portions of the data may be discarded. Market trend data is then calculated as a function of the reliable portion of the market dataset, and graphical report data is output as a function of the market trend data in response to the reporting request.

Owner:FIRST DATA

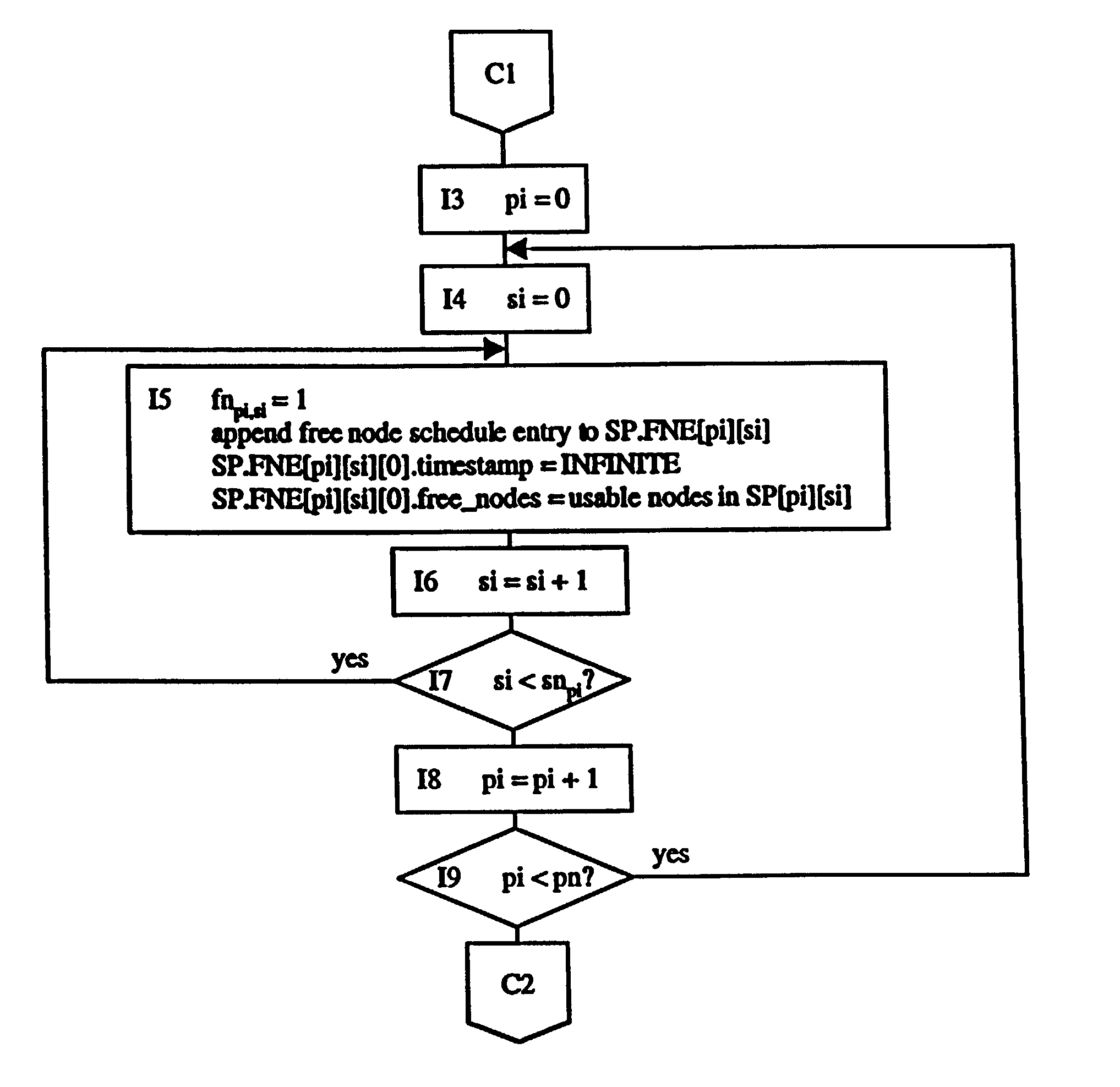

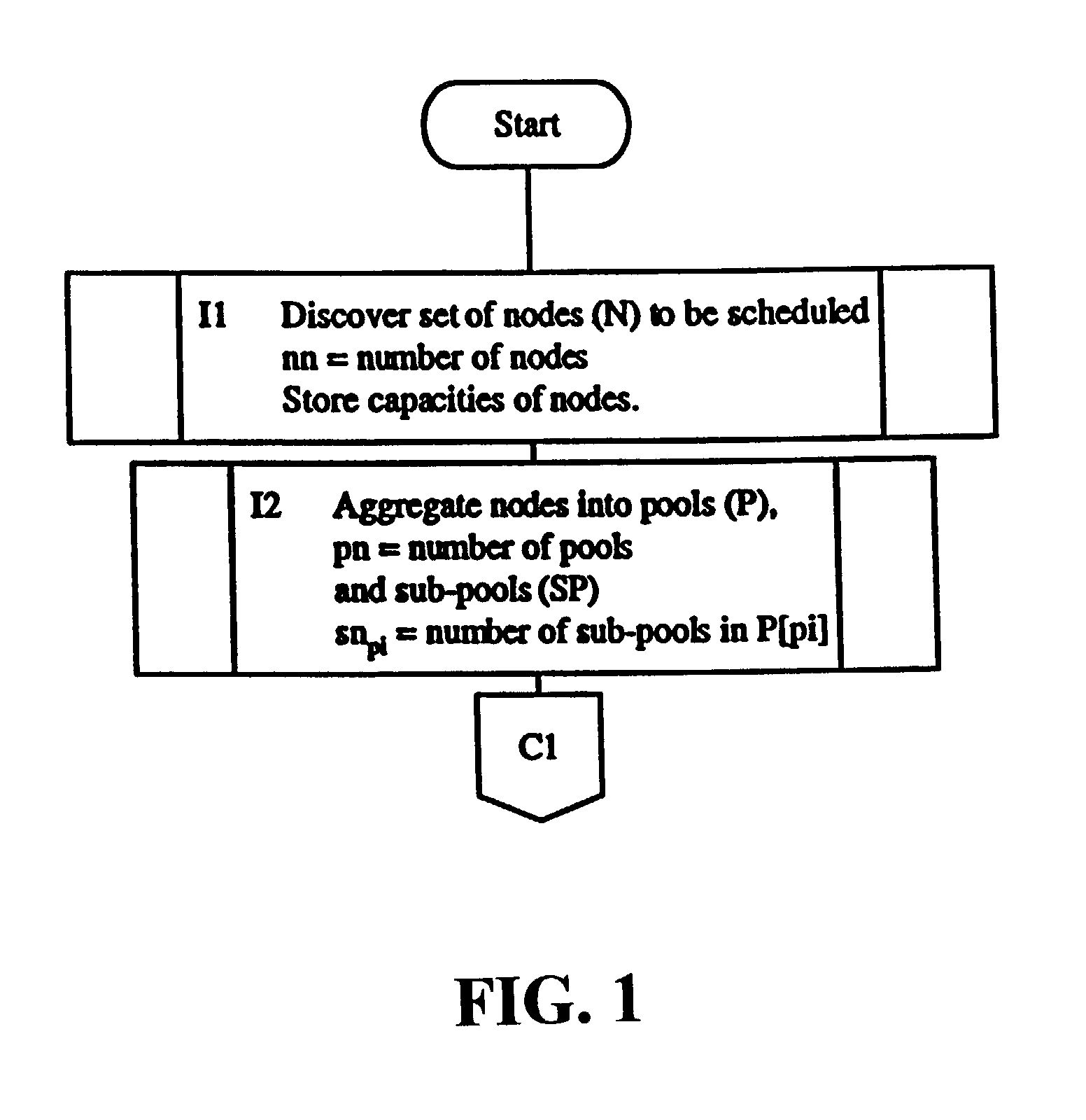

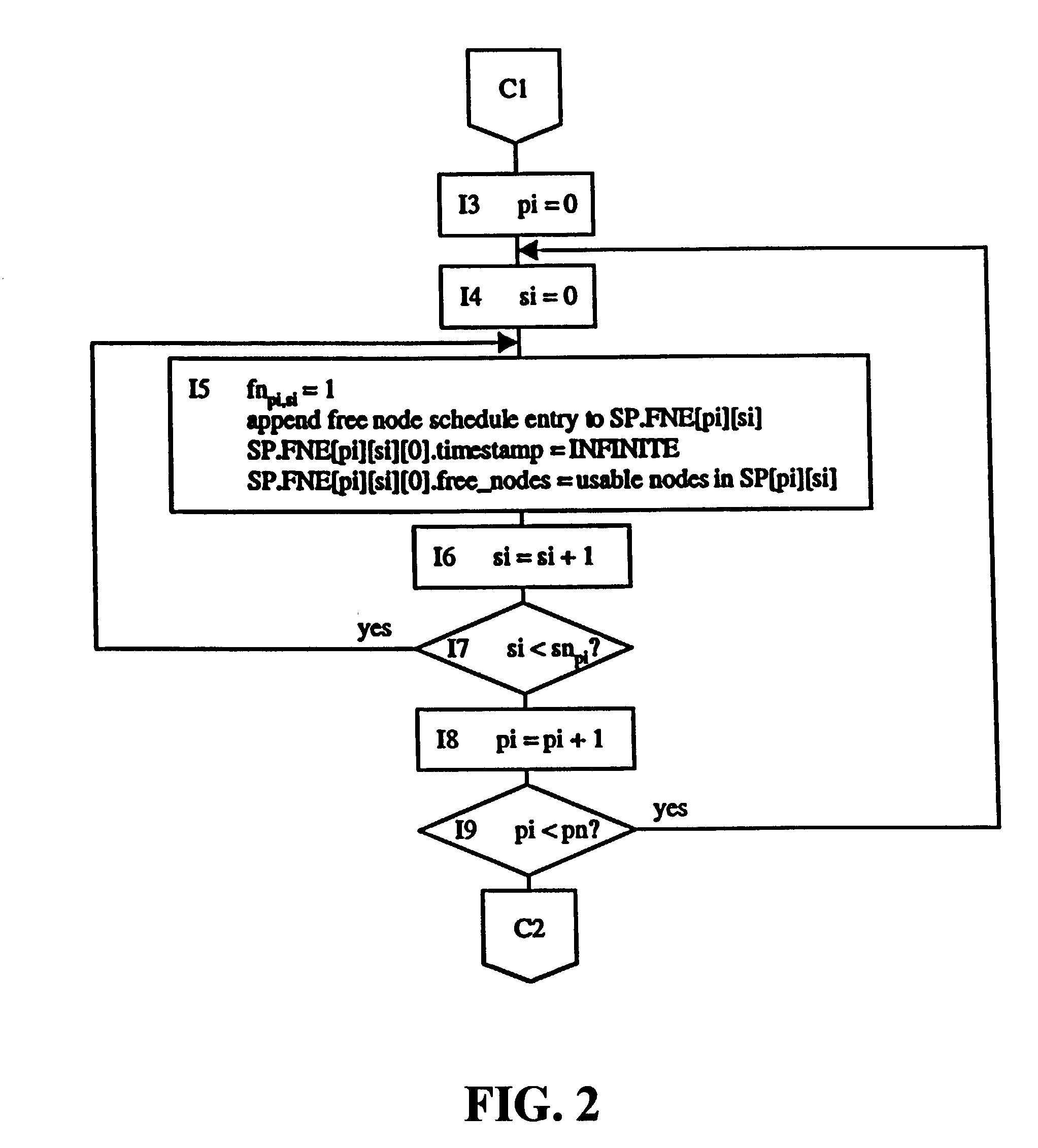

Dedicated heterogeneous node scheduling including backfill scheduling

InactiveUS7082606B2Improve throughputImprove utilizationResource allocationError detection/correctionStart timeParallel computing

A method and system for job backfill scheduling dedicated heterogeneous nodes in a multi-node computing environment. Heterogeneous nodes are grouped into homogeneous node sub-pools. For each sub-pool, a free node schedule (FNS) is created so that the number of to chart the free nodes over time. For each prioritized job, using the FNS of sub-pools having nodes useable by a particular job, to determine the earliest time range (ETR) capable of running the job. Once determined for a particular job, scheduling the job to run in that ETR. If the ETR determined for a lower priority job (LPJ) has a start time earlier than a higher priority job (HPJ), then the LPJ is scheduled in that ETR if it would not disturb the anticipated start times of any HPJ previously scheduled for a future time. Thus, efficient utilization and throughput of such computing environments may be increased by utilizing resources otherwise remaining idle.

Owner:LAWRENCE LIVERMORE NAT SECURITY LLC

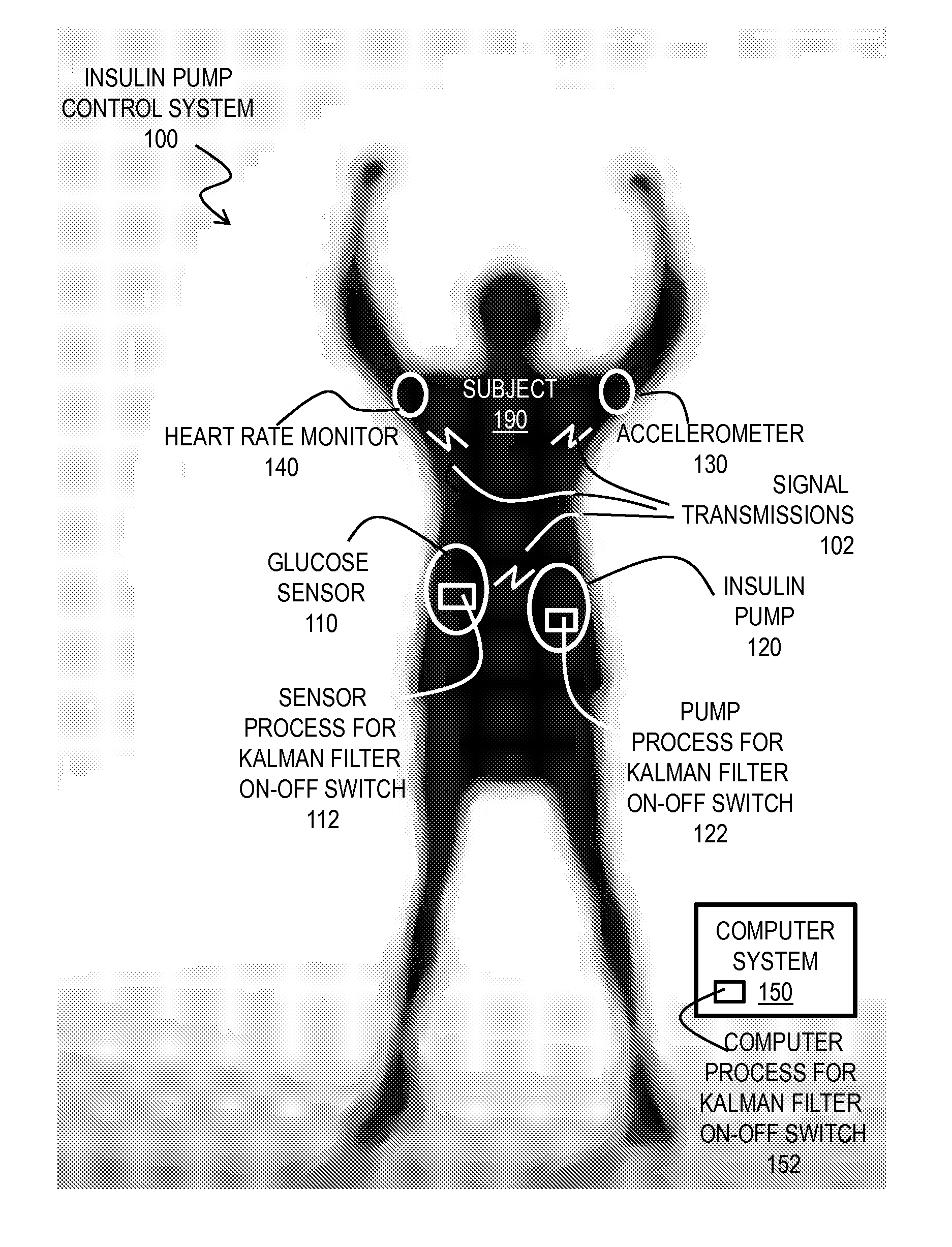

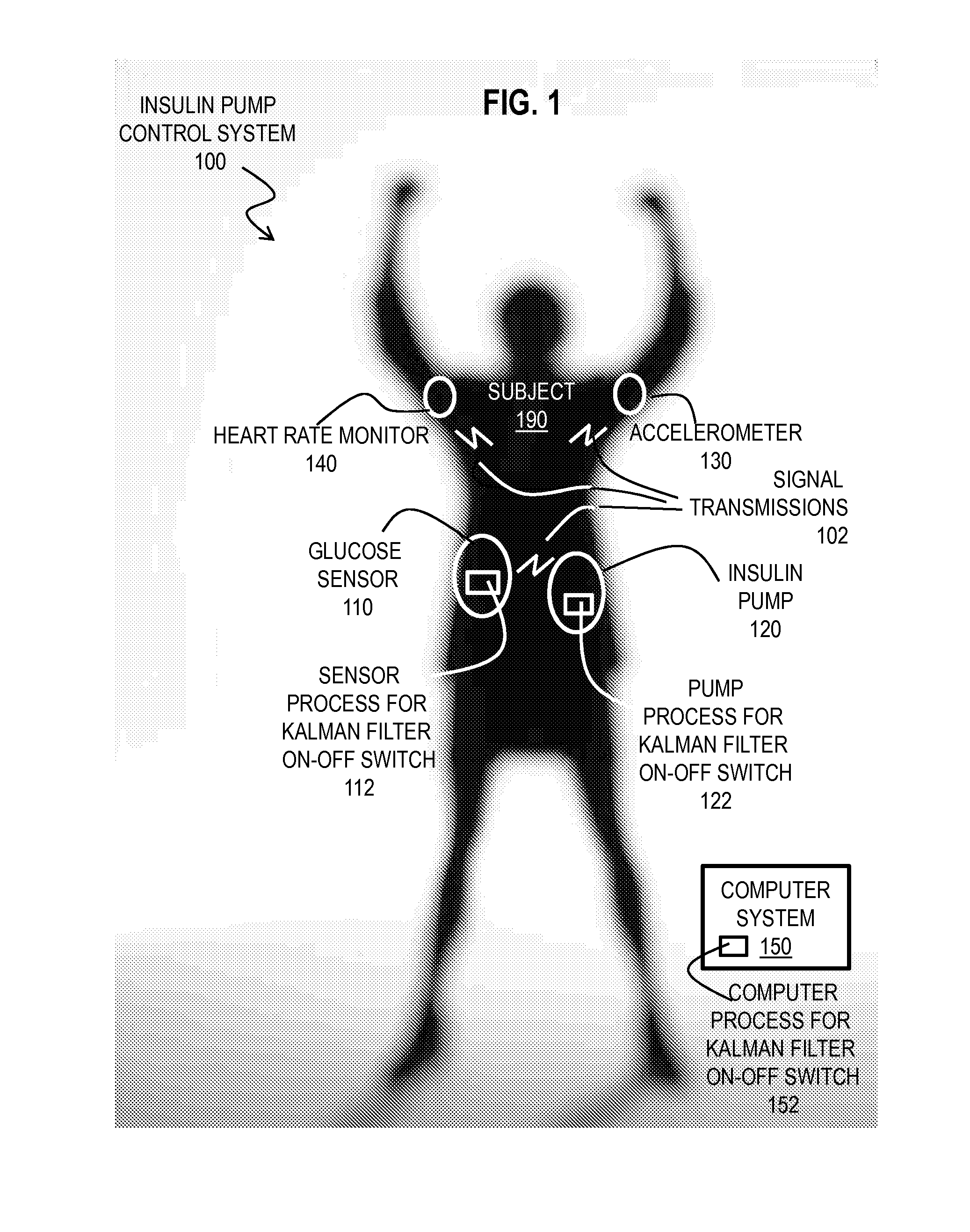

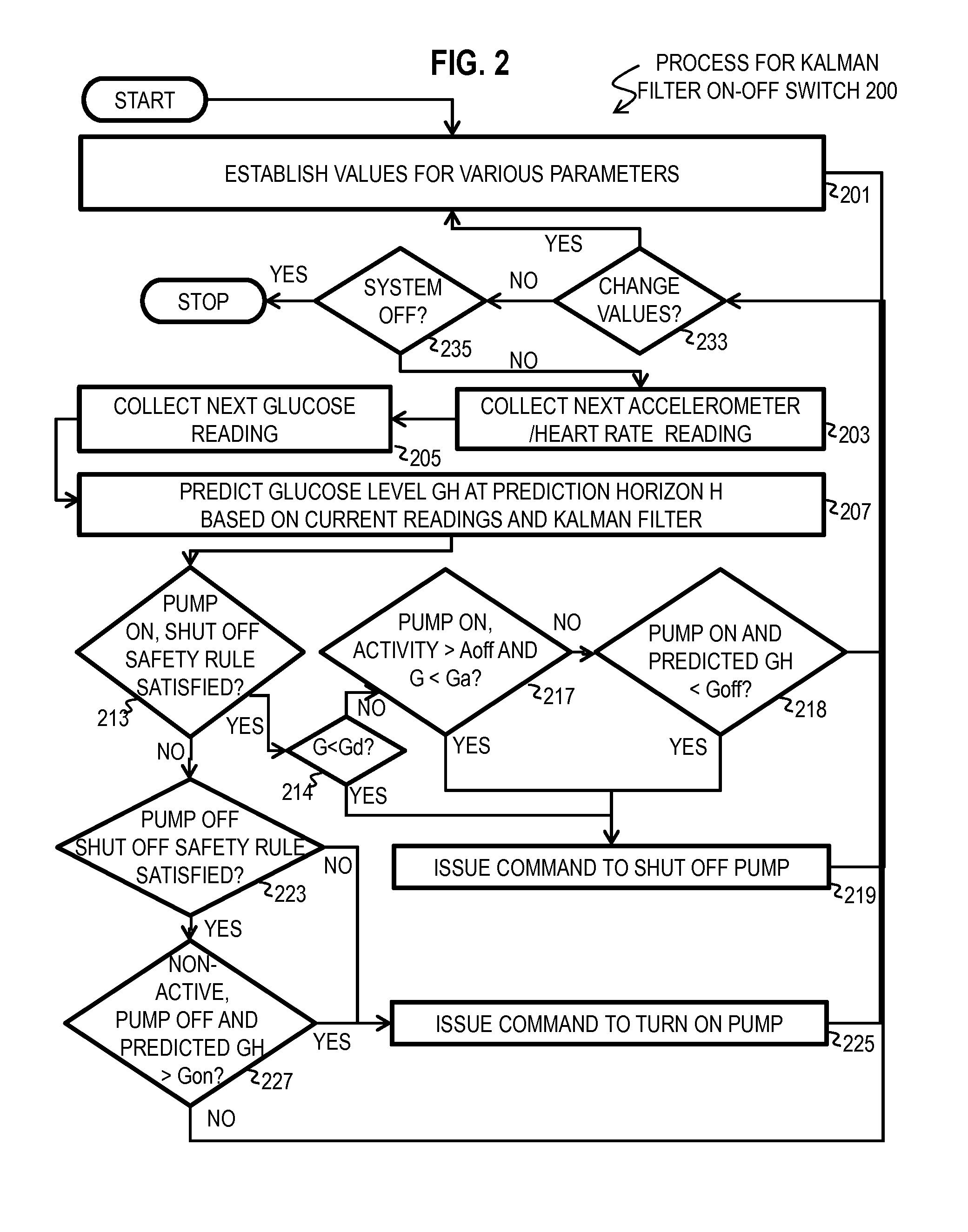

Kalman Filter Based On-Off Switch for Insulin Pump

ActiveUS20140221966A1Mitigate and prevent low blood glucose levelLower blood sugar levelsElectrocardiographyMedical devicesKaiman filterInsulin pump

Techniques for controlling an insulin pump include determining values for parameters selected from a group including a first prediction time horizon, a predicted glucose threshold (Goff) for turning the insulin pump off, a maximum shut off time within a time window, and duration of the time window. A safety rule is determined based on the maximum shut off time within the duration. Glucose readings are collected up to a current time. An expected current glucose value G and glucose temporal rate of change are determined based only on the glucose readings and a Kalman filter configured for noisy glucose readings. A glucose level (Gh1) is predicted for a future time that is the prediction time horizon after the current time. A command is issued to shut off the insulin pump if it is determined both that Gh1 is less than Goff and that the safety rule is satisfied.

Owner:UNIV OF COLORADO THE REGENTS OF +3

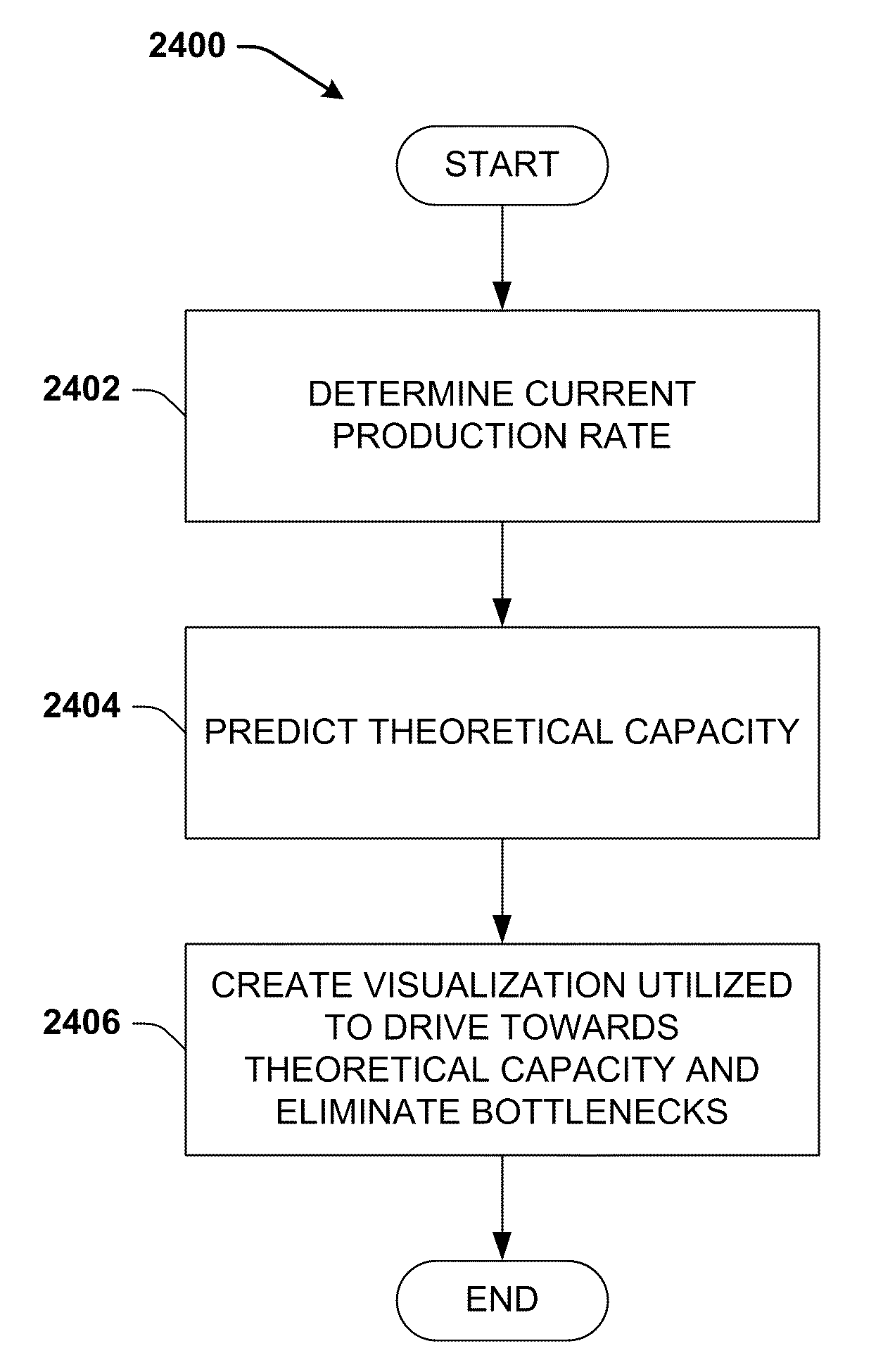

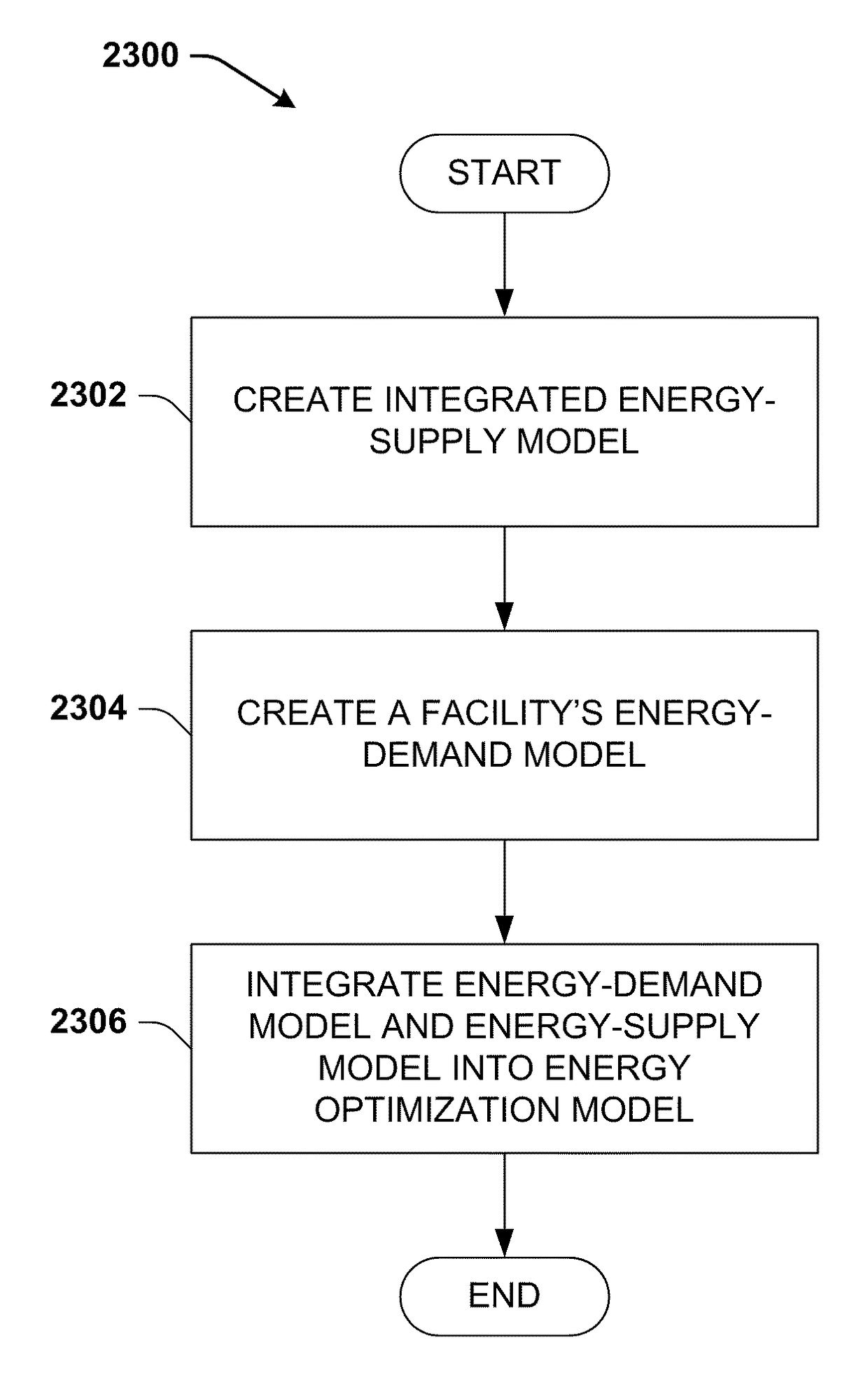

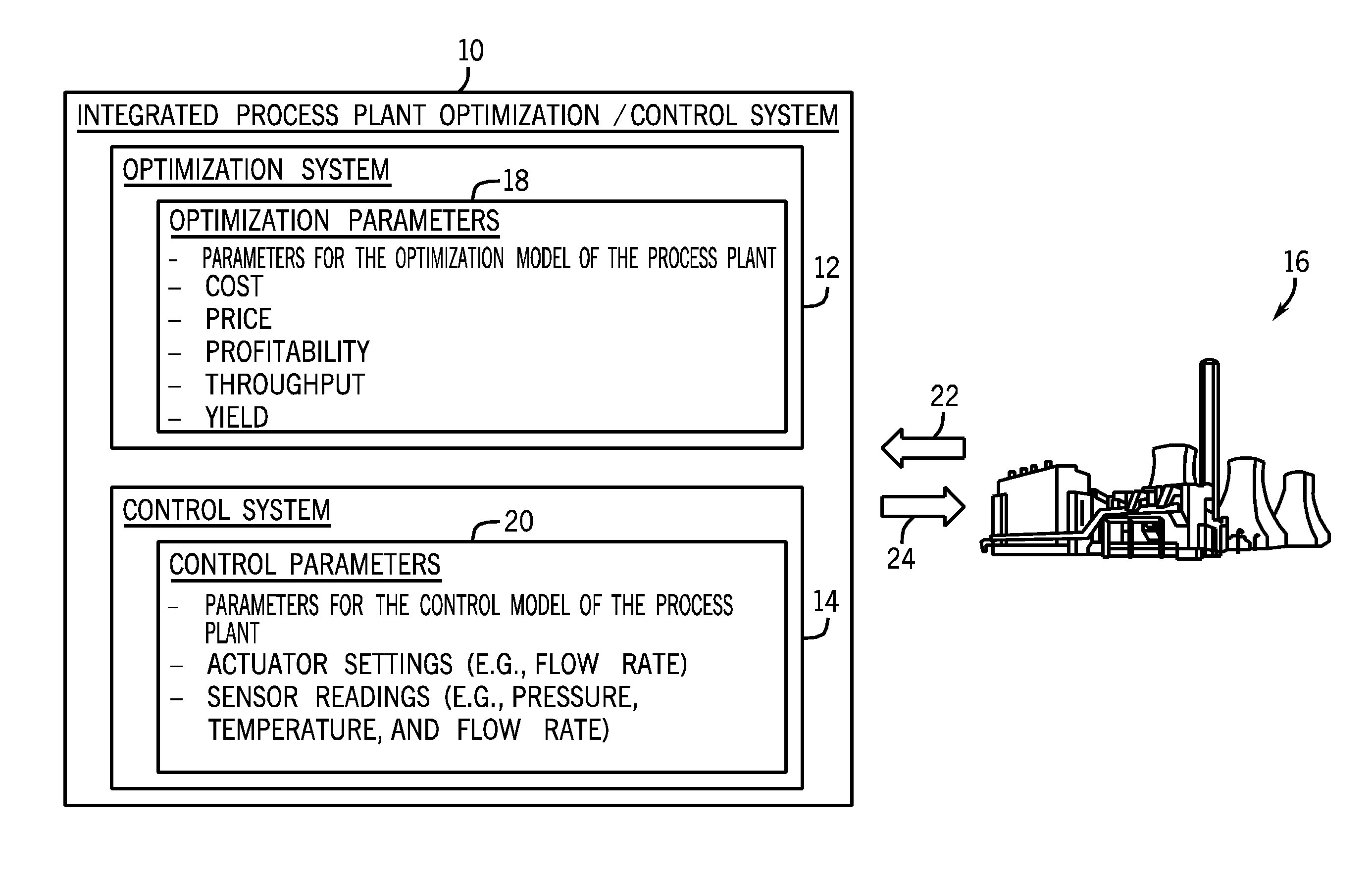

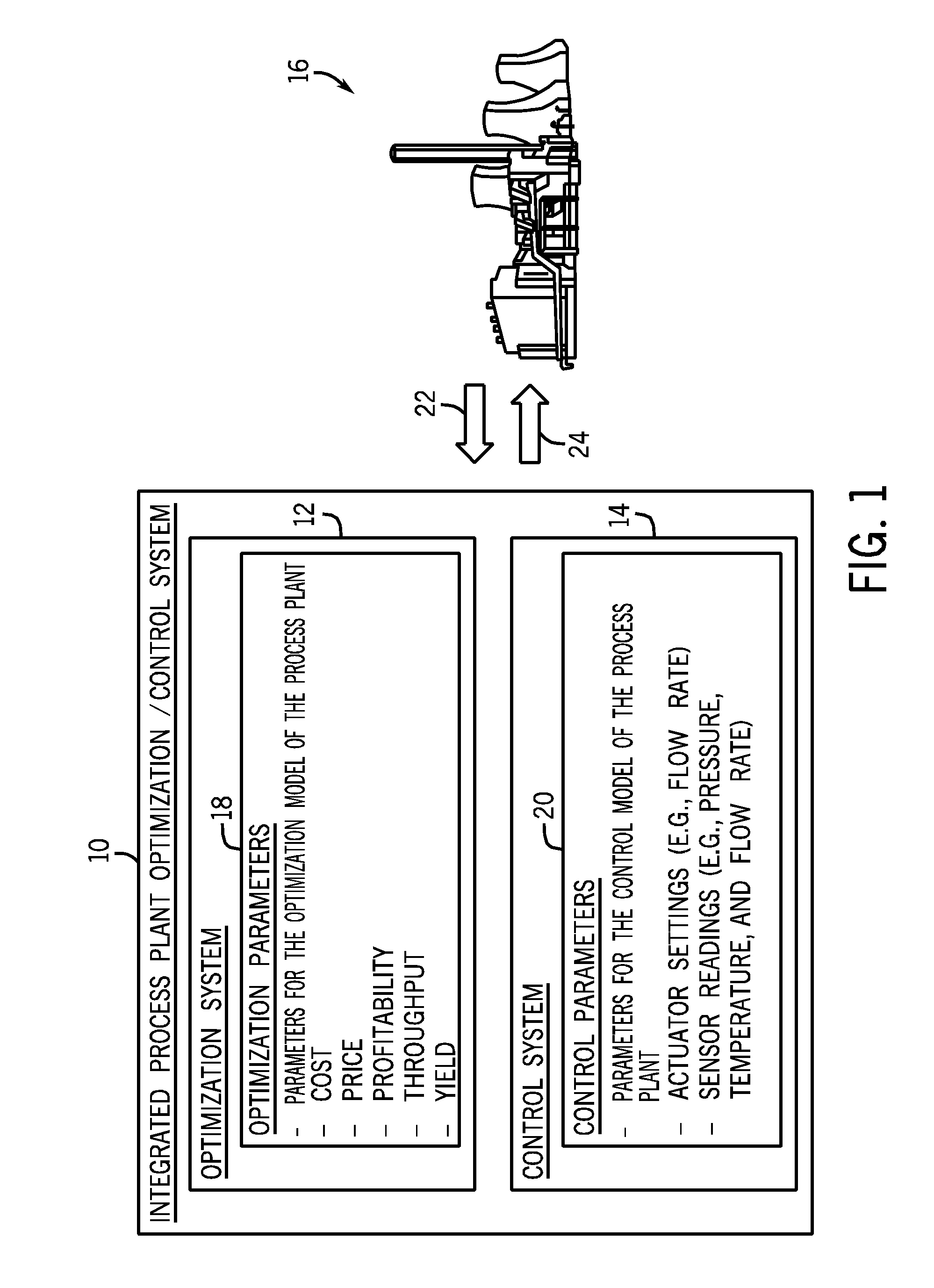

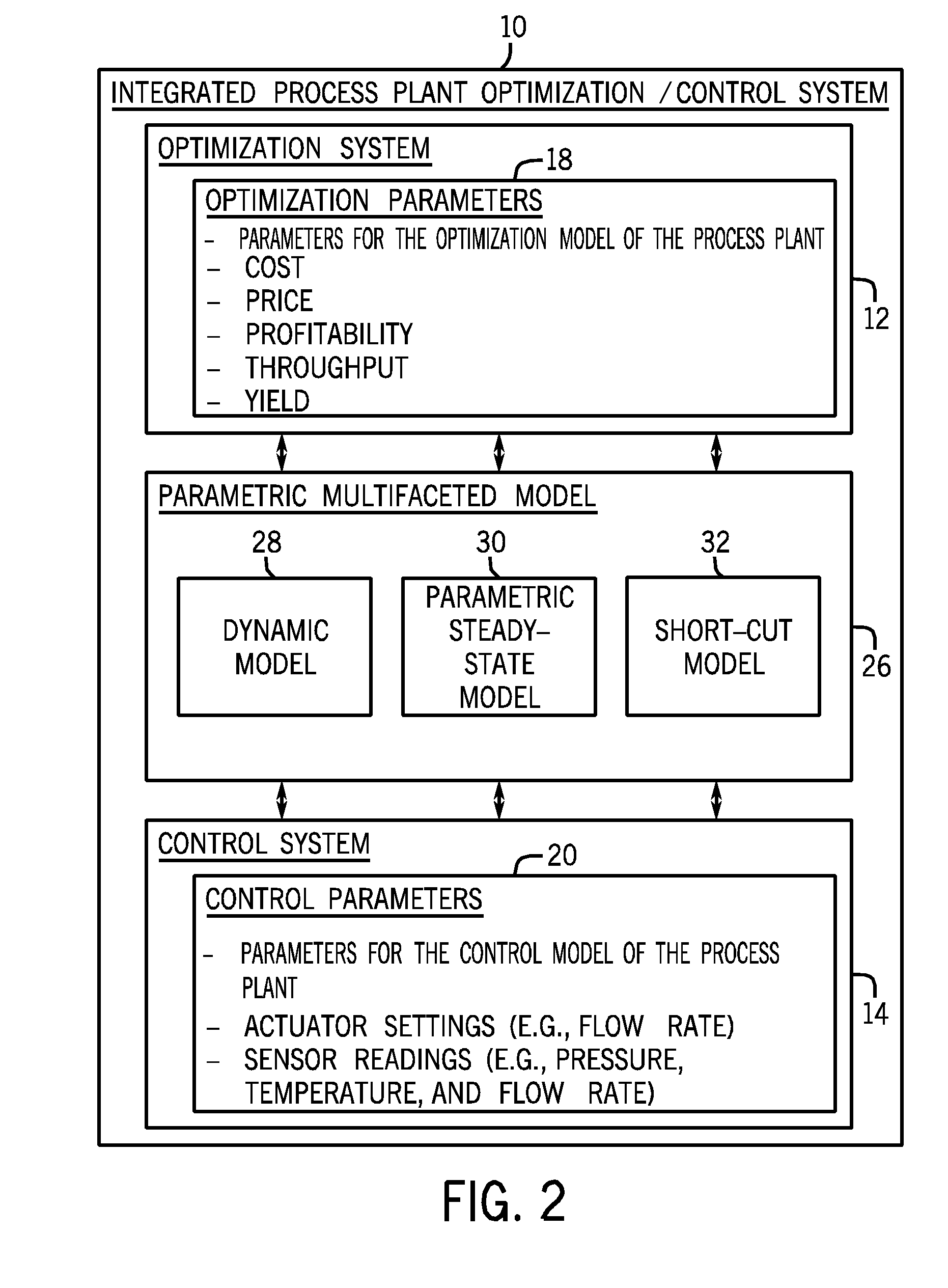

Integrated optimization and control for production plants

The present invention provides novel techniques for optimizing and controlling production plants using parametric multifaceted models. In particular, the parametric multifaceted models may be configured to convert a first set of parameters (e.g., control parameters) relating to a production plant into a second set of parameters (e.g., optimization parameters) relating to the production plant. In general, the first set of parameters will be different than the second set of parameters. For example, the first set of parameters may be indicative of low-level, real-time control parameters and the second set of parameters may be indicative of high-level, economic parameters. Utilizing appropriate parameterization may allow the parametric multifaceted models to deliver an appropriate level of detail of the production plant within a reasonable amount of time. In particular, the parametric multifaceted models may convert the first set of parameters into the second set of parameters in a time horizon allowing for control of the process plant by a control system based on the second set of parameters.

Owner:ROCKWELL AUTOMATION TECH

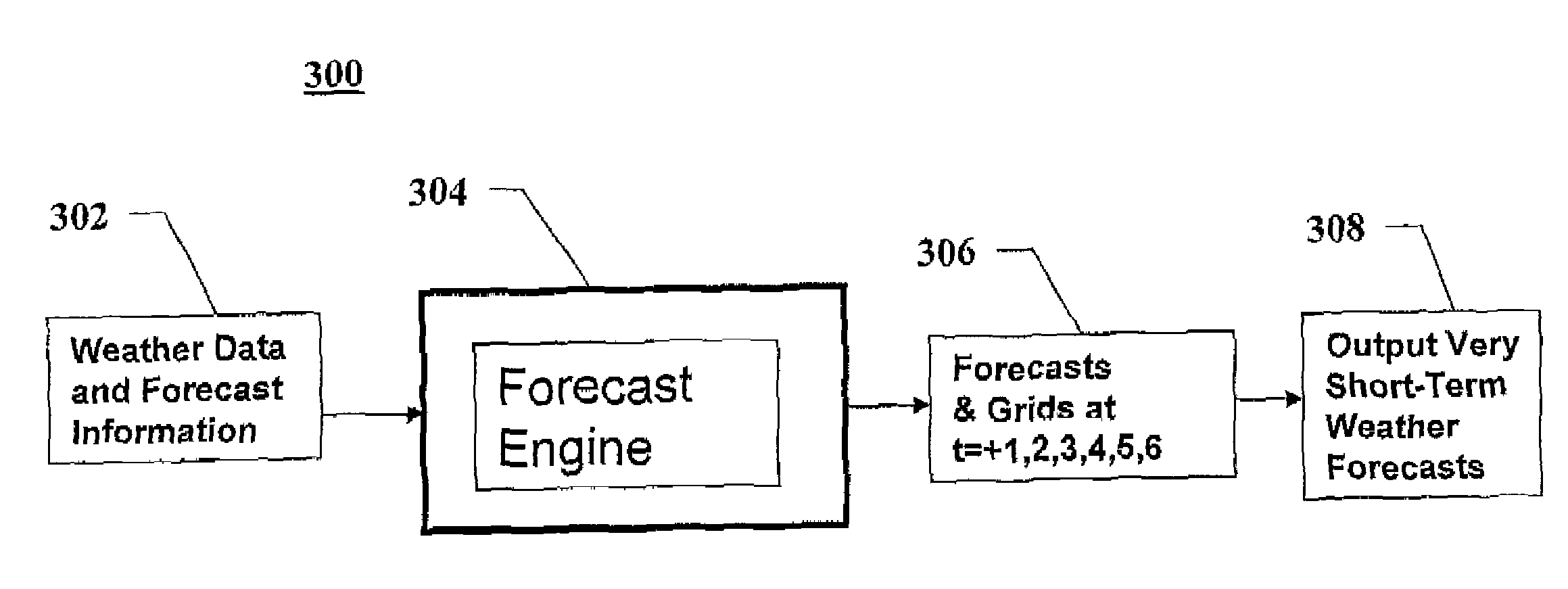

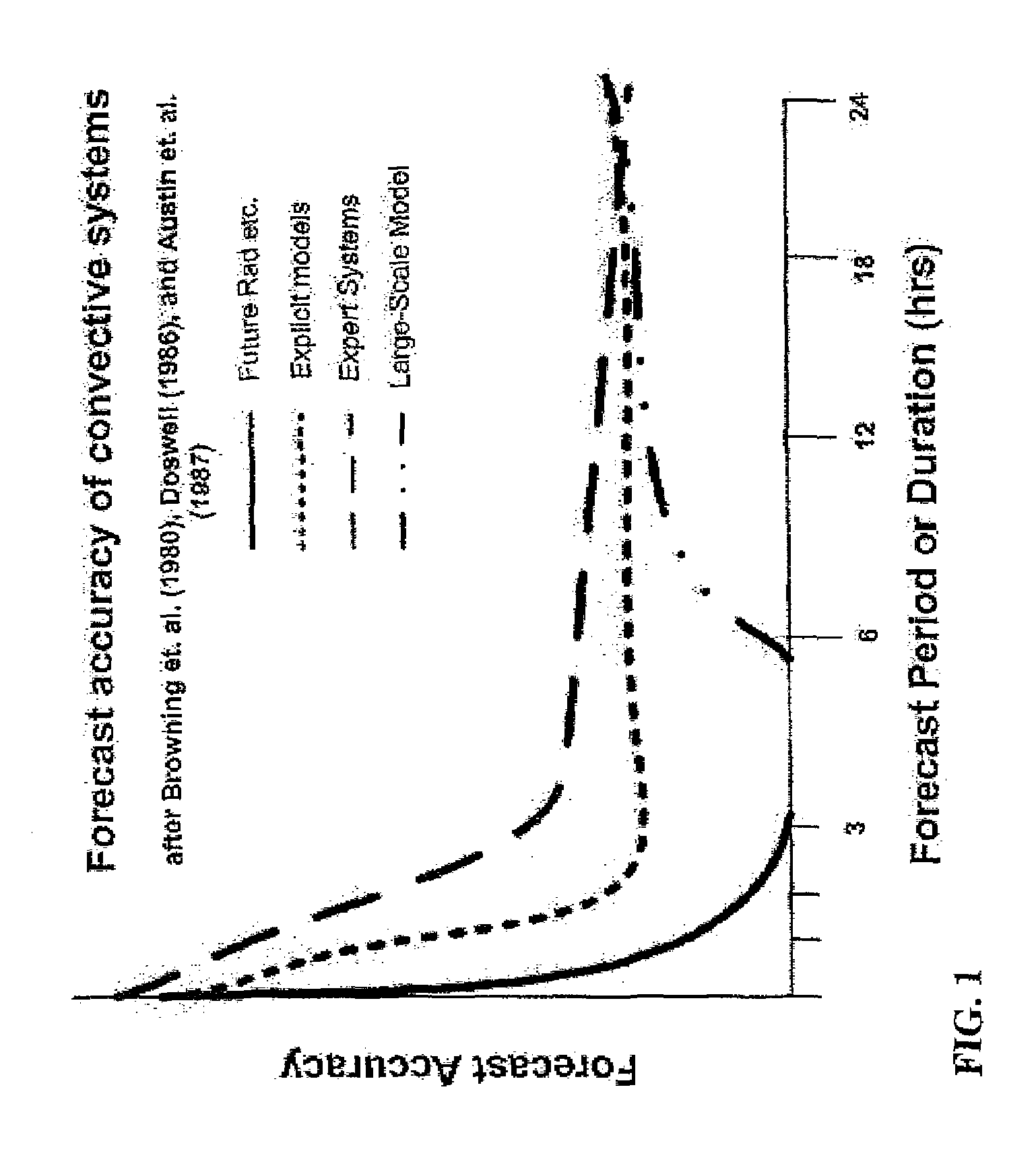

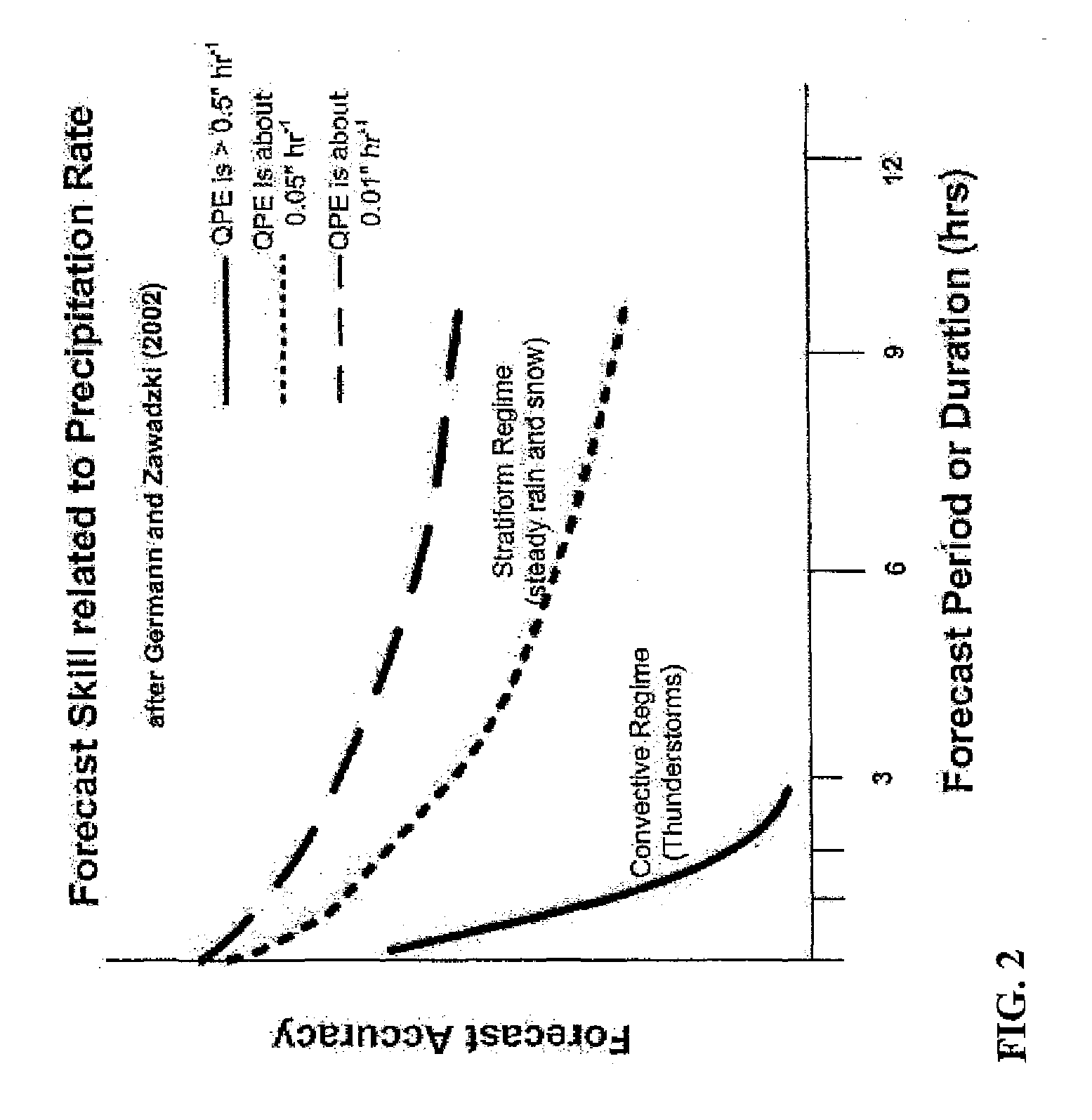

Derivation and production of high-resolution, very short-term weather forecasts

ActiveUS7542852B1Improve accuracyImproved prediction of timing and location and severityNoise figure or signal-to-noise ratio measurementWeather condition predictionGround truthAtmospheric sciences

Weather forecasting systems and methods for deriving and producing very short-term weather forecasts. Weather data and forecast information maybe input to derive very short-term weather forecasts in the 0-6 hour time frame. The system and methods include an expert system employing a hybrid or blending of forecasting approaches, with dynamic or intelligent arbitration of the different numerical, statistical, and human-driven techniques to produce more accurate weather forecasts for very short-term time periods. A calibration or internal verification against ground truth may be run independently with a time lag to produce more accurate future predictions of atmospheric state. The systems and methods may run in modes that produce either high resolution weather forecasts in the short-term period of 0-6 hours or a combination of synthetic, real-time weather observations / conditions and high resolution, short-term weather forecasts.

Owner:DTN LLC

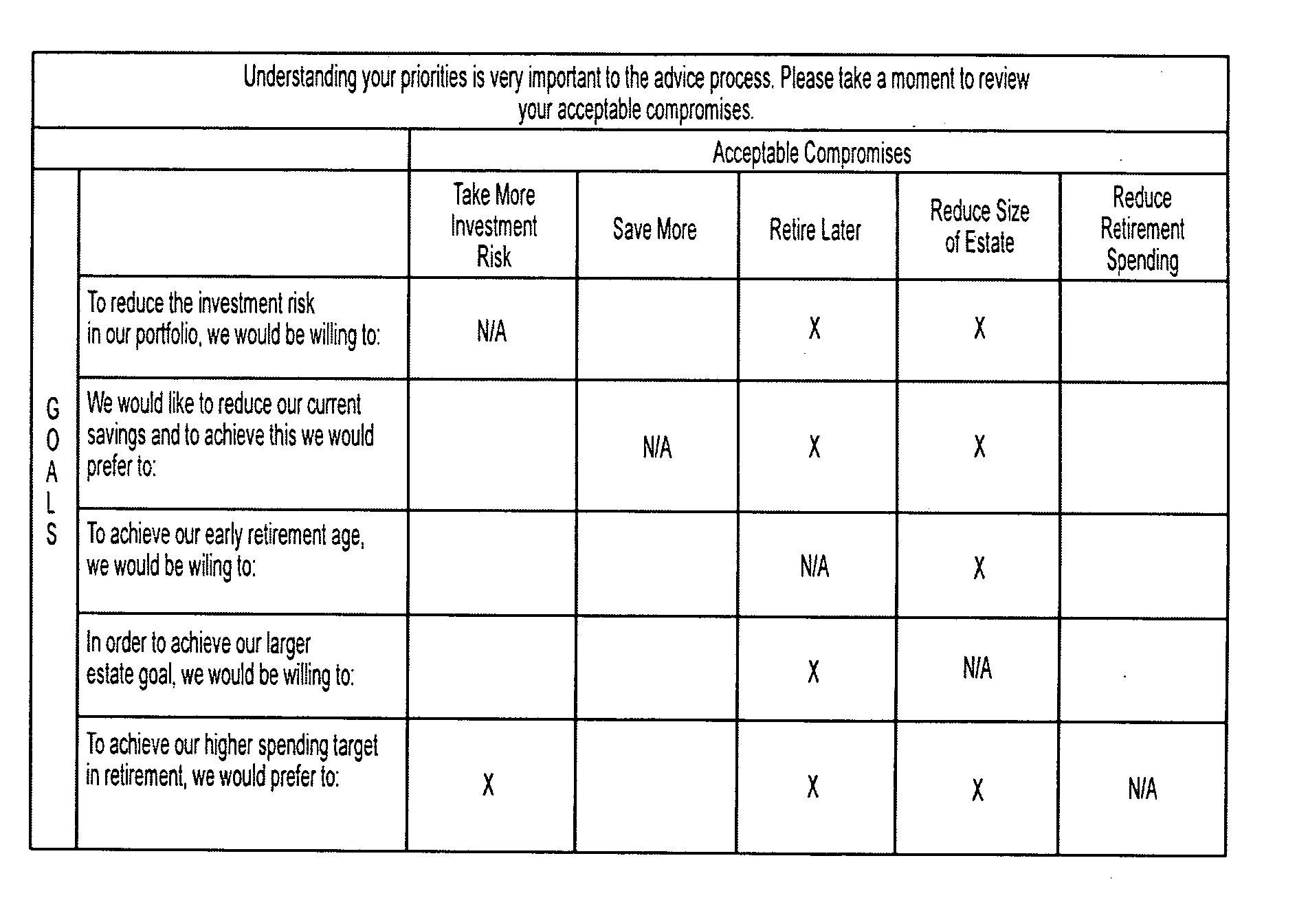

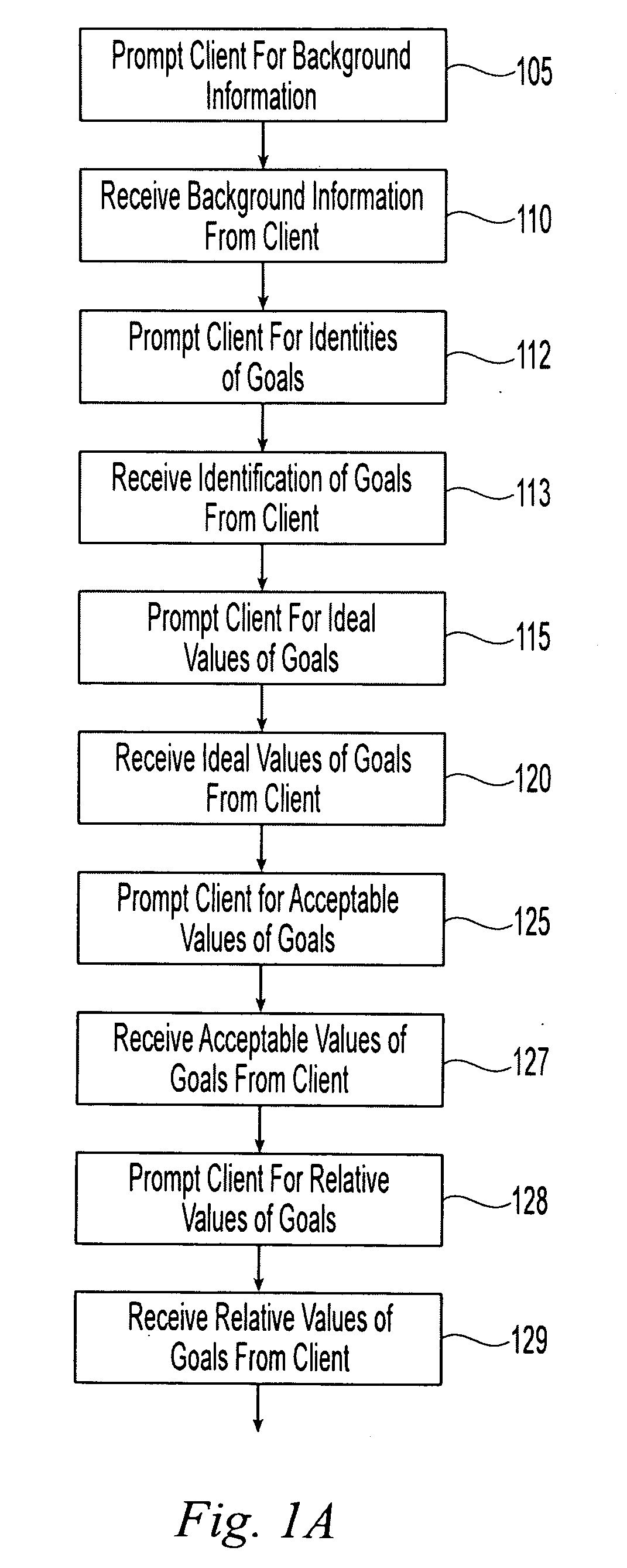

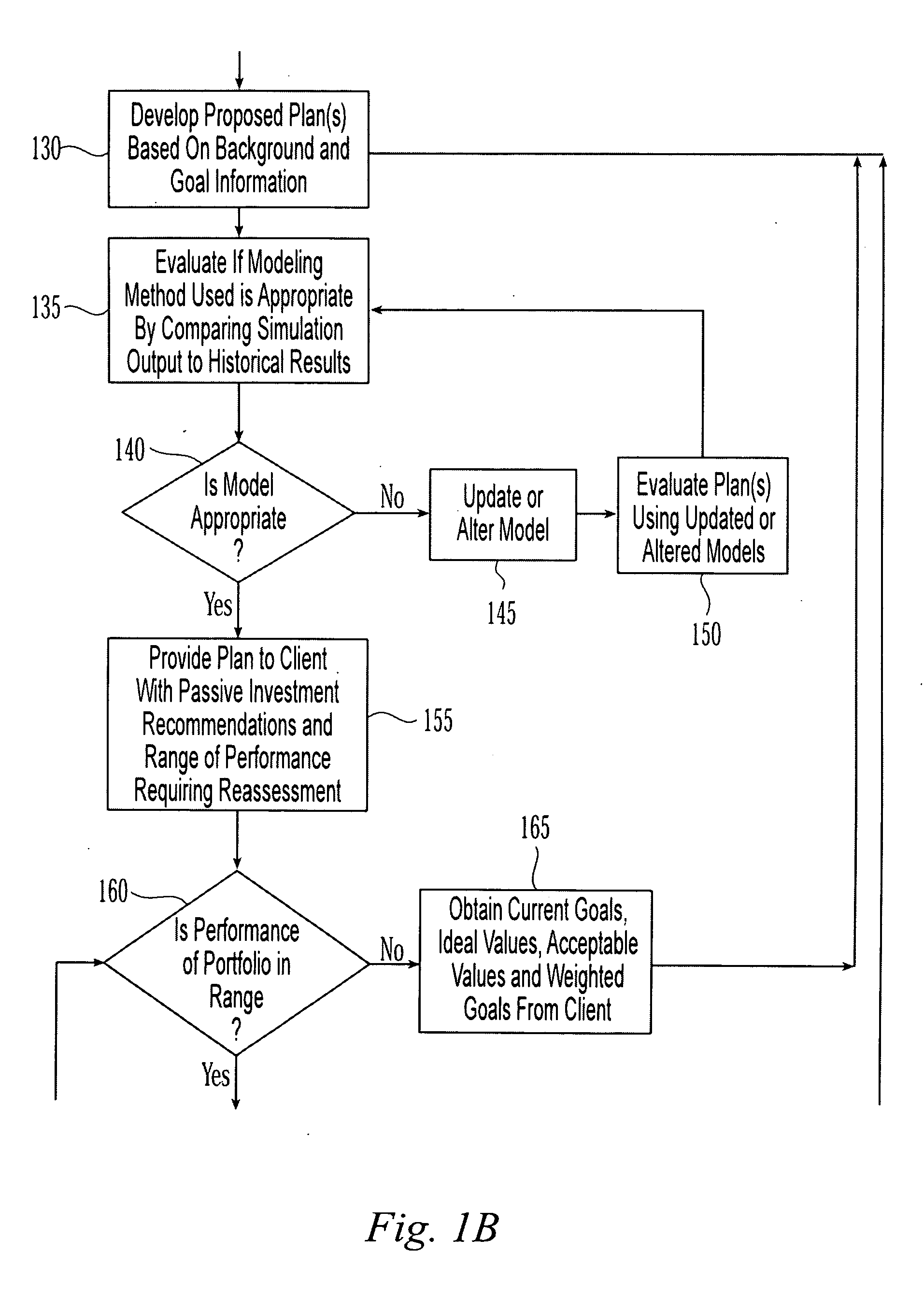

Method and system for financial advising

InactiveUS20050144108A1Minimizes any sacrificeRational and sufficient confidenceFinanceSpecial data processing applicationsBackground informationComputer science

A method of providing financial advice to a client that provides sufficient confidence that their goals will be achieved or exceeded but that avoids excessive sacrifice to the client's current or future lifestyle and avoids investment risk that is not needed to provide sufficient confidence of the goals a client personally values. The method comprises obtaining typical client background information, as well as a list of investment goals, and ideal and acceptable values in dollar amounts and timing for each goal. The client is then asked to provide their preferences for each goal on the list compared to each other goal in the list, wherein the client's preference is expressed in terms of the price, in money or time, that the client is willing to pay in one goal to achieve another goal or a greater amount or sooner timing of other goals on the list. A matrix can be used to express these value contrasts. A recommendation is then created using the portfolio value, and the client goal preferences and the ideal and acceptable values of goals, by simulating models of the relevant capital markets and investing exclusively in passive investment alternatives to avoid the risk of potential material underperformance of active investments under the premise of avoiding investment risk that is not needed to confidently buy the client the goals they personally value. The recommendation may include a range of portfolio values over their life or time horizon within which the client's portfolio should remain in order to ensure the recommendation remains within a “comfort zone”, which represents sufficient confidence that the client's goals will be achieved while avoiding excessive current sacrifice. Periodic monitoring of the recommendation is also performed to capture changes to the client's goals and actual portfolio values based on the results of the capital markets. Appropriate changes to the recommendation can then be made to ensure that the recommendation remains within the “comfort zone”

Owner:WEALTHCARE CAPITAL MANAGEMENT IP LLC

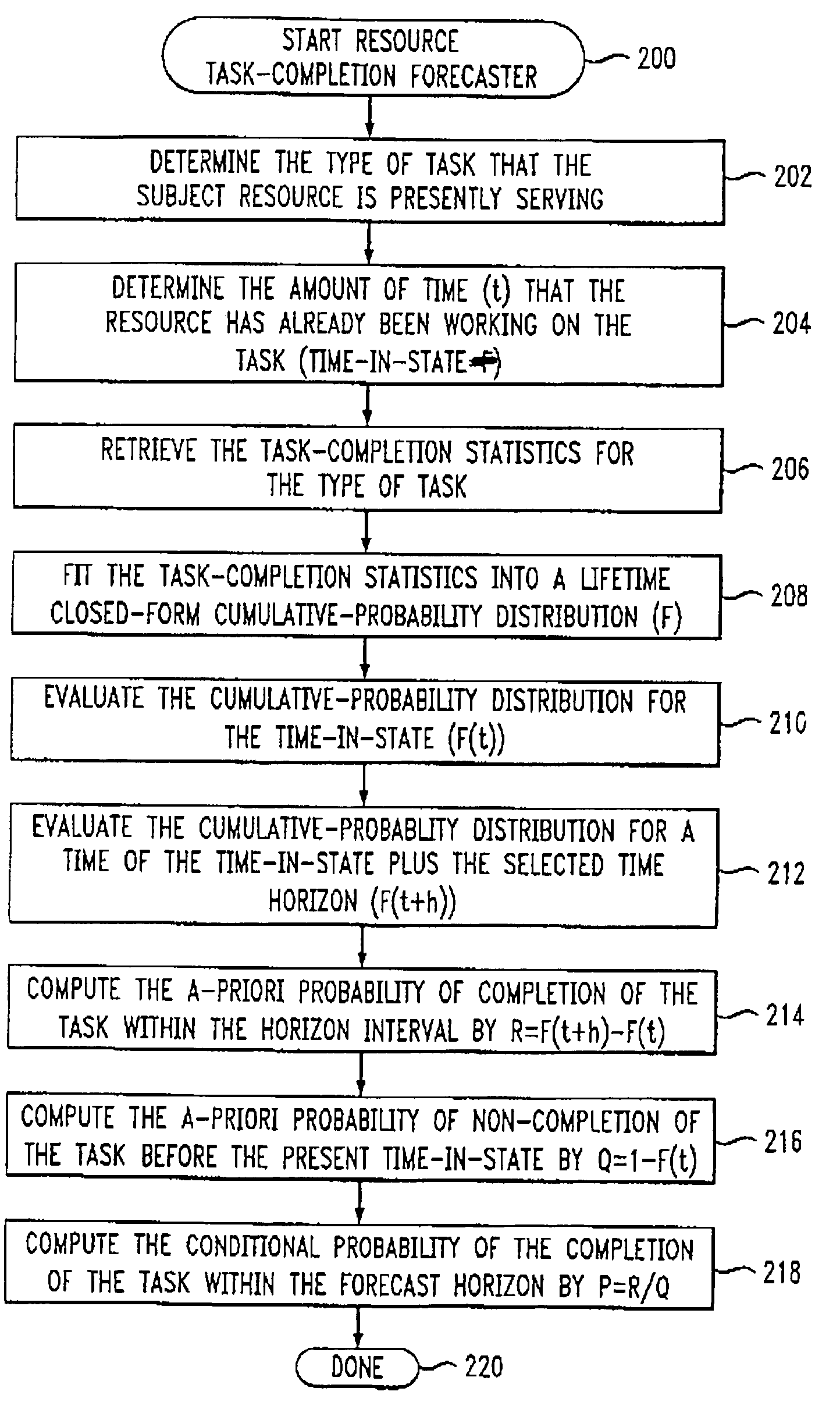

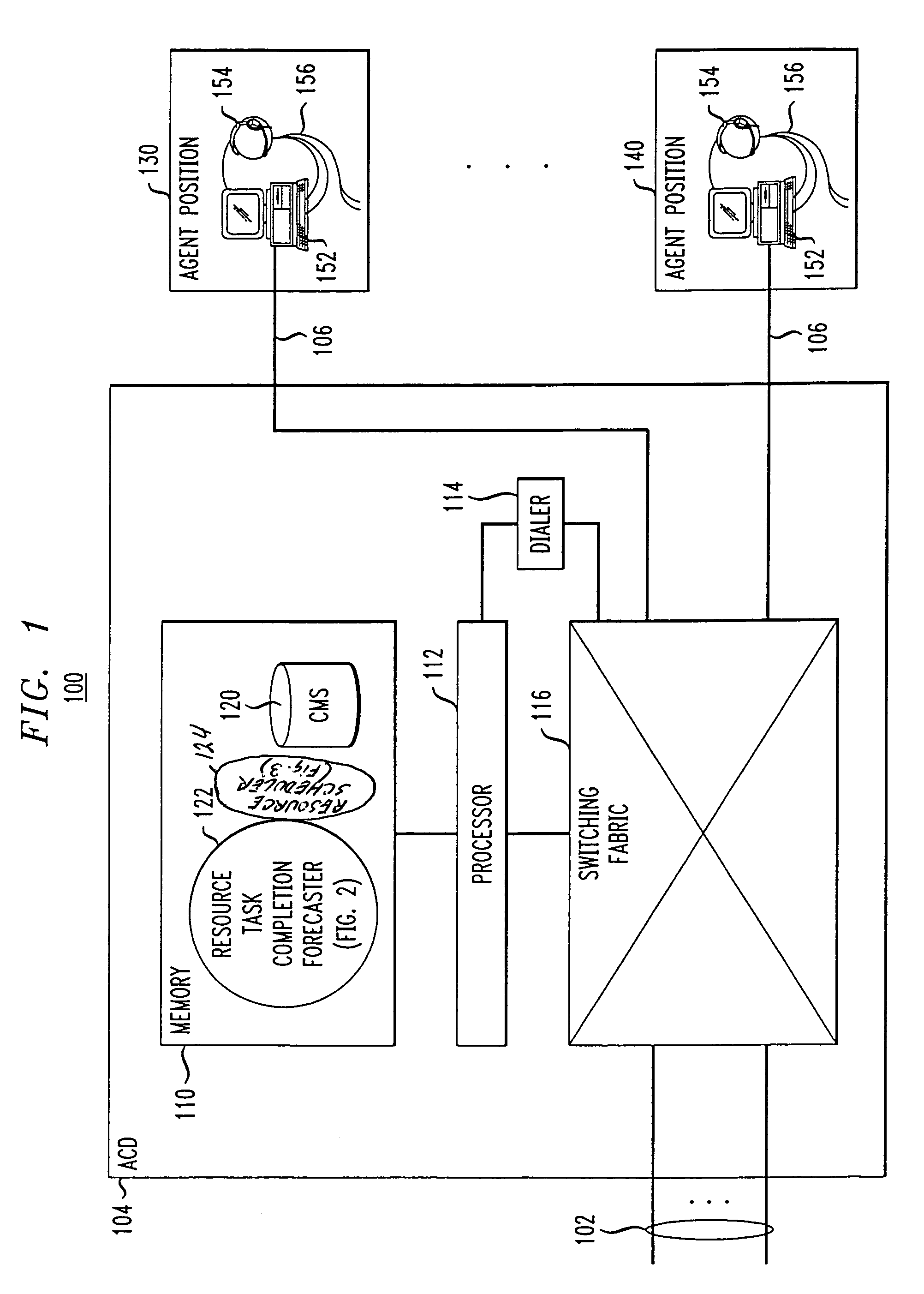

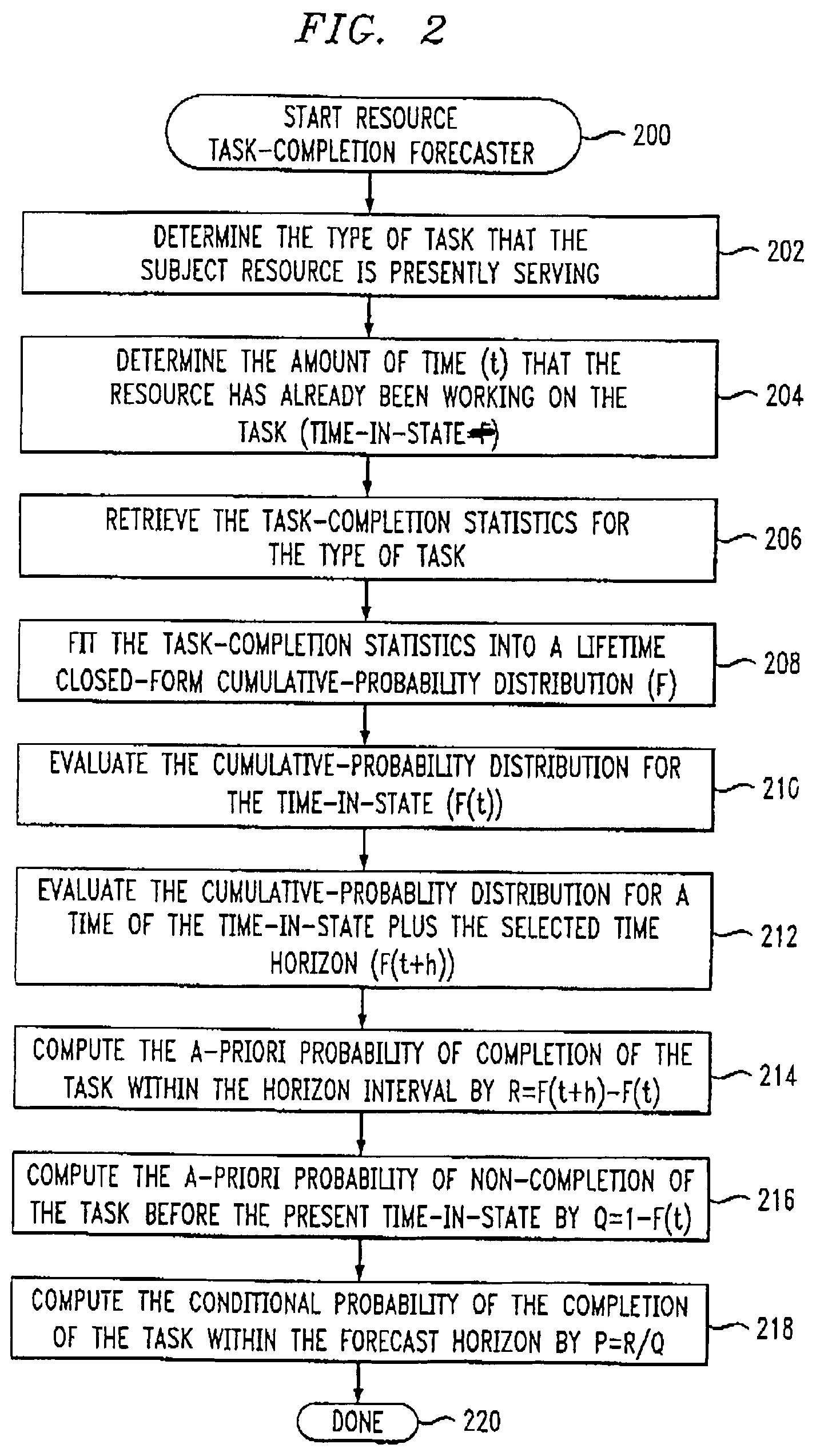

Arrangement for scheduling tasks based on probability of availability of resources at a future point in time

InactiveUS7386850B2High level of serviceImprove customer serviceMultiplex system selection arrangementsDigital computer detailsTask completionComputer science

A resource task-completion forecaster (122) of an ACD (104) determines a probability that an agent (156) will complete servicing a presently-assigned call by a specified time horizon h. The forecaster determines (202) the type of call that the agent is servicing, determines (204) the amount of time t that the agent has already been servicing the call, retrieves (206) the mean and the variance of time historically spent by agents on servicing this type of call to completion, fits (208) the mean and the variance to a lifetime closed-form cumulative-probability distribution F, such as a Weibull distribution, to determine parameters of dispersion and central tendency, evaluates (210, 212) the distribution for t and h+t, computes (216) the probability of the agent not having completed servicing the call by now as Q=1−F(t), and computes (218) the probability that the agent will have completed servicing the call by the time horizon asP=F(t+h)-F(t)Q.A resource scheduler (124) sums (302) the probabilities P for all agents to obtain the number of agents that are expected to be available at the time horizon, and schedules (304) for the time horizon no more than that number of new calls for servicing by the agents.

Owner:AVAYA INC

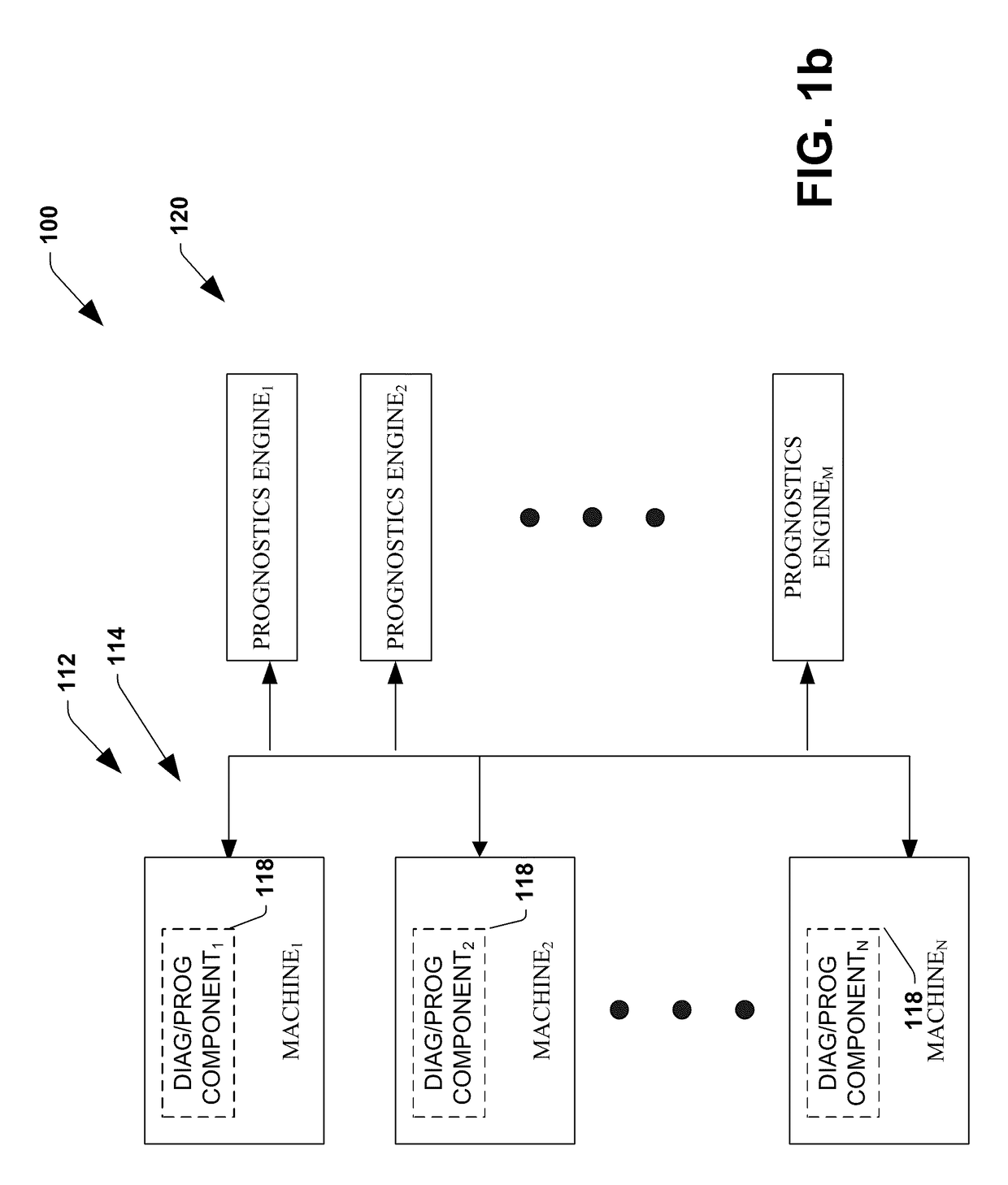

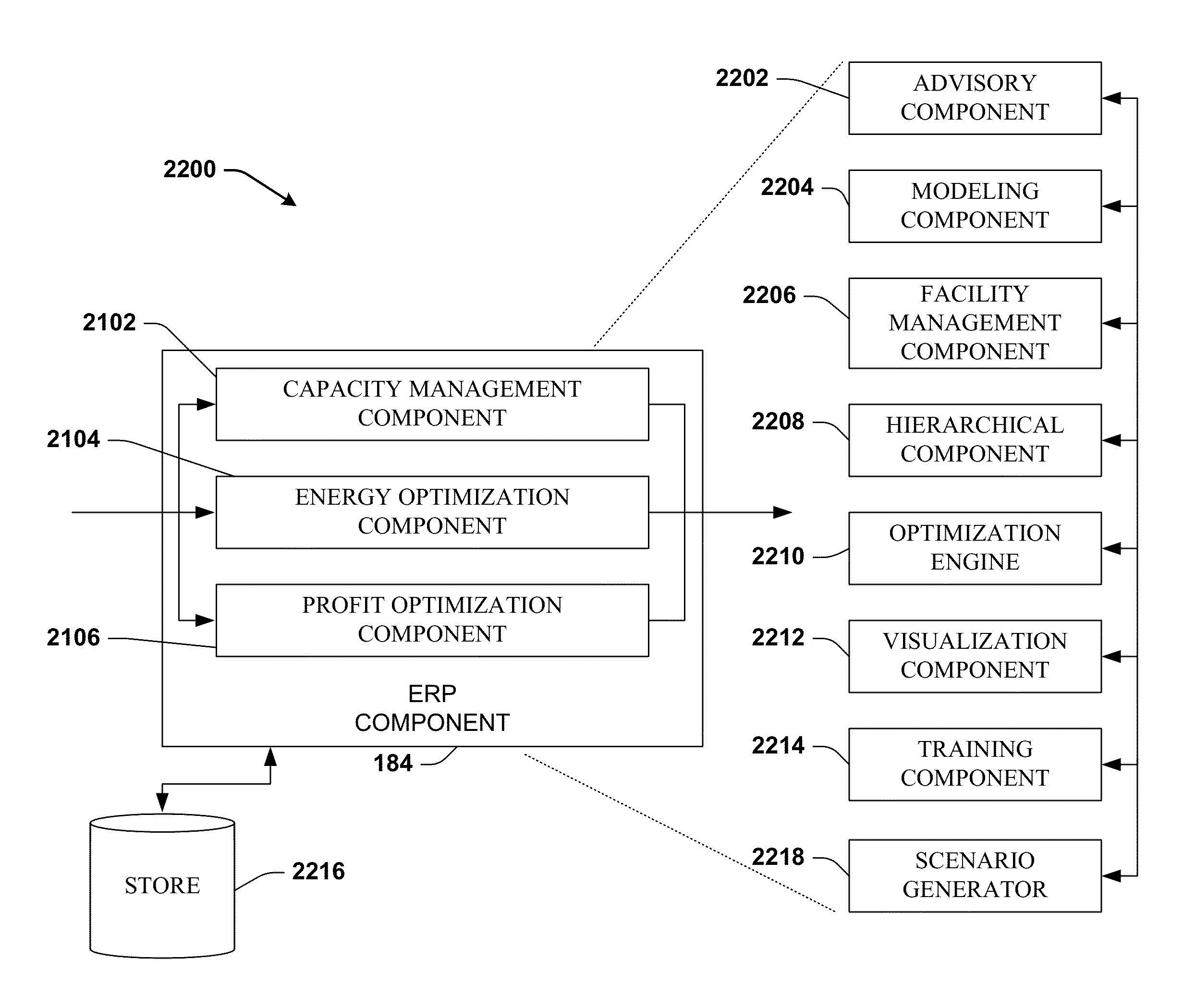

System and method for dynamic multi-objective optimization of machine selection, integration and utilization

ActiveUS8417360B2Improve overall utilizationImprove efficiencySimulator controlForecastingMachine selectionOperational costs

Systems and methodologies are provided for controlling a process having computer-controlled equipment, which provide for optimized process performance according to one or more performance criteria, such as efficiency, component life expectancy, safety, emissions, noise, vibration, operational cost, or the like. The systems and methods provide for employing machine diagnostic and / or prognostic information in connection with optimizing an overall business operation over a time horizon.

Owner:ROCKWELL AUTOMATION TECH

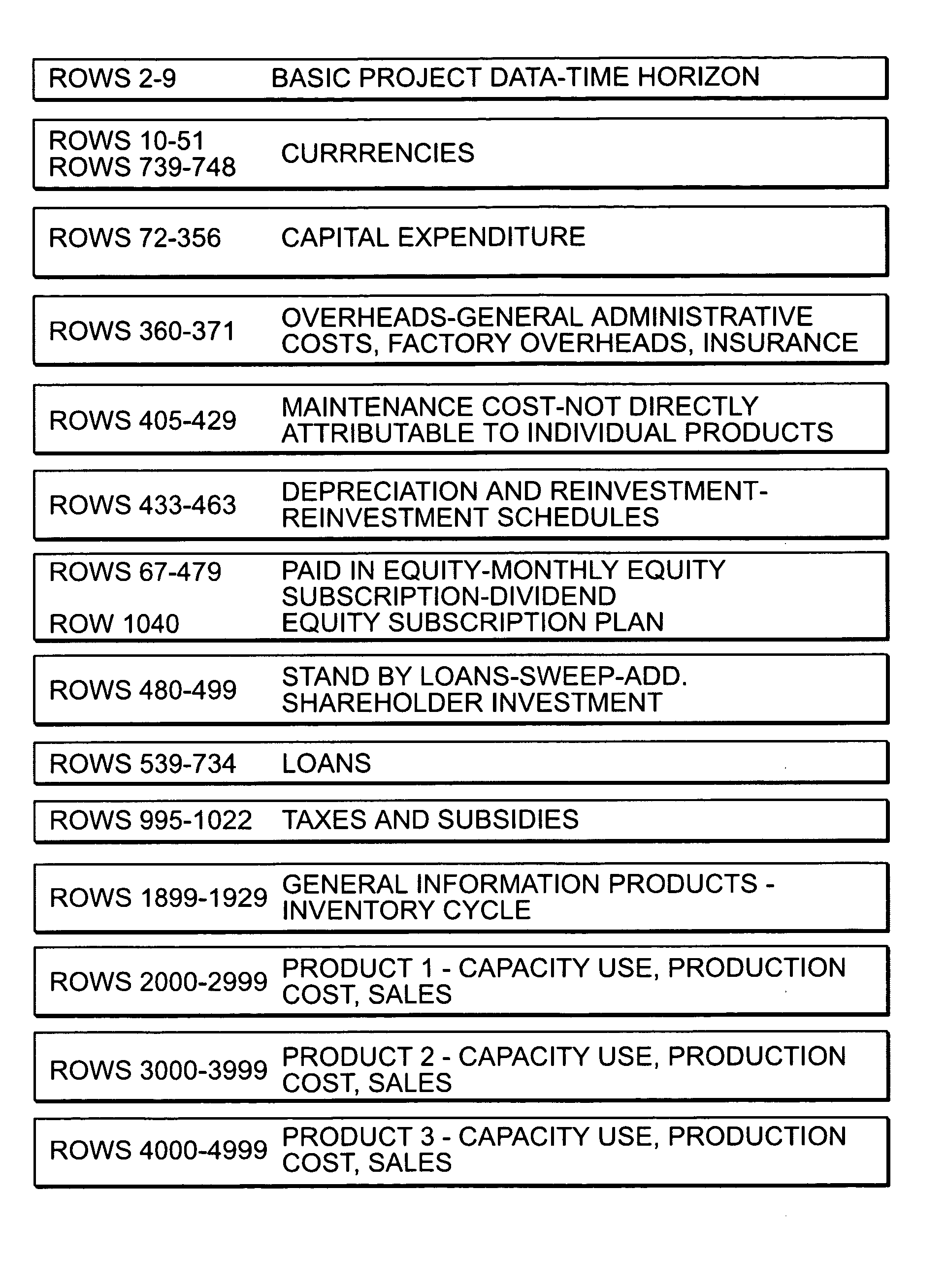

Machine-implementable project finance analysis and negotiating tool software, method and system

A financial simulation computer program product and method to create a project preparation, negotiating, and testing environment using standard project finance tools. A computer usable medium having computer-readable program code is embodied in a medium for generating financial statements, financial data, charts, graphs and reports using the standard project finance tools. The product and method allow automatically generated or manual entry of and editing of capital expenditure time series for multiple contracts in multiple capital expenditure categories. Limited recourse including debt service reserve accounts, stand-by loans and risk-sharing with suppliers and off-takers is taken into account. A desired financing time horizon is selected for each loan. For each loan the user can either manually enter disbursements or select a capital expenditure category and finance a percentage of the category. A loan disbursement time series is automatically generated. A loan disbursement times series is optionally generated independently of changes in capital expenditures and exchange rates based upon an earlier automatically generated loan disbursement time series.

Owner:MAESTLE WILFRIED A

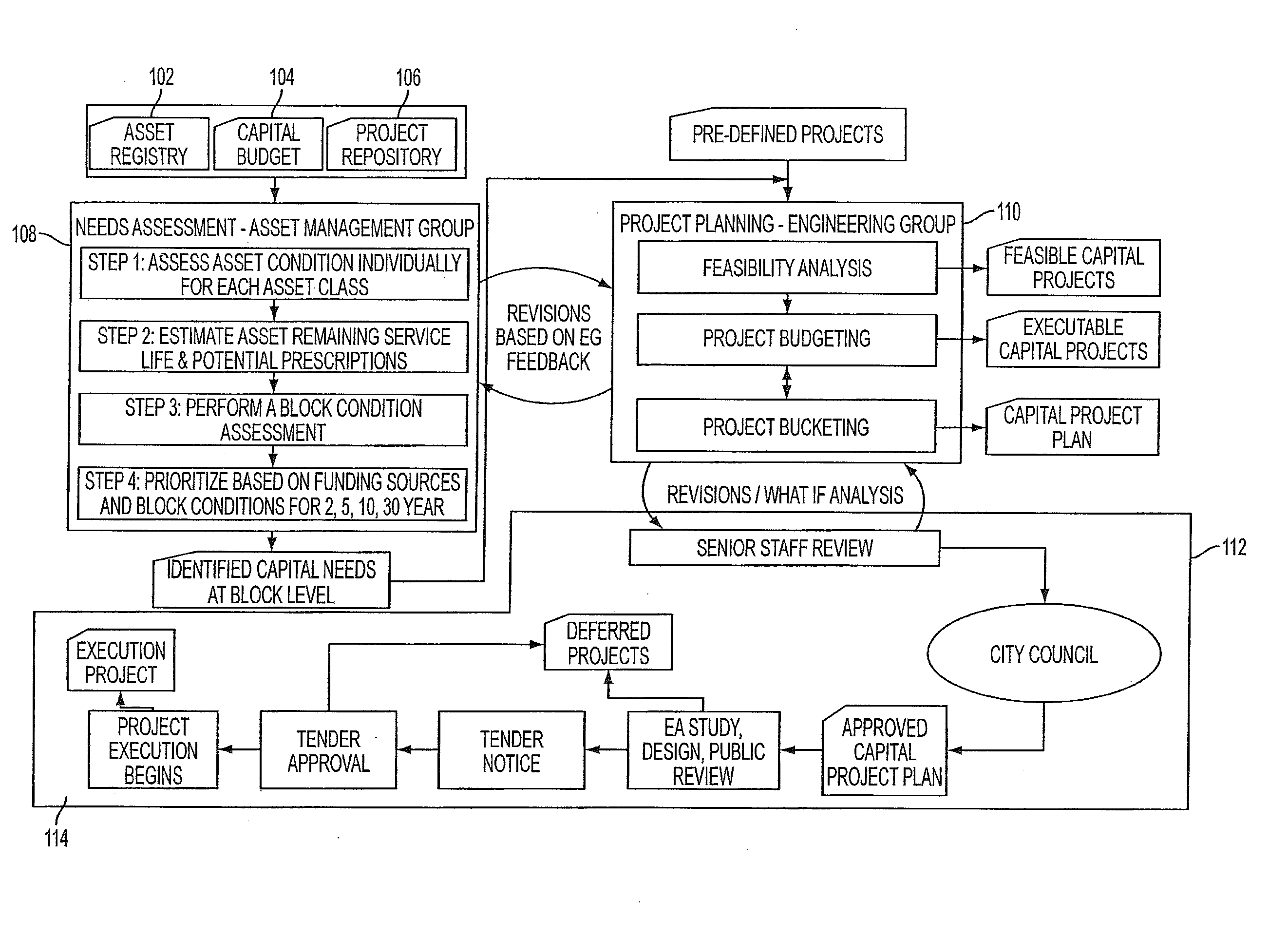

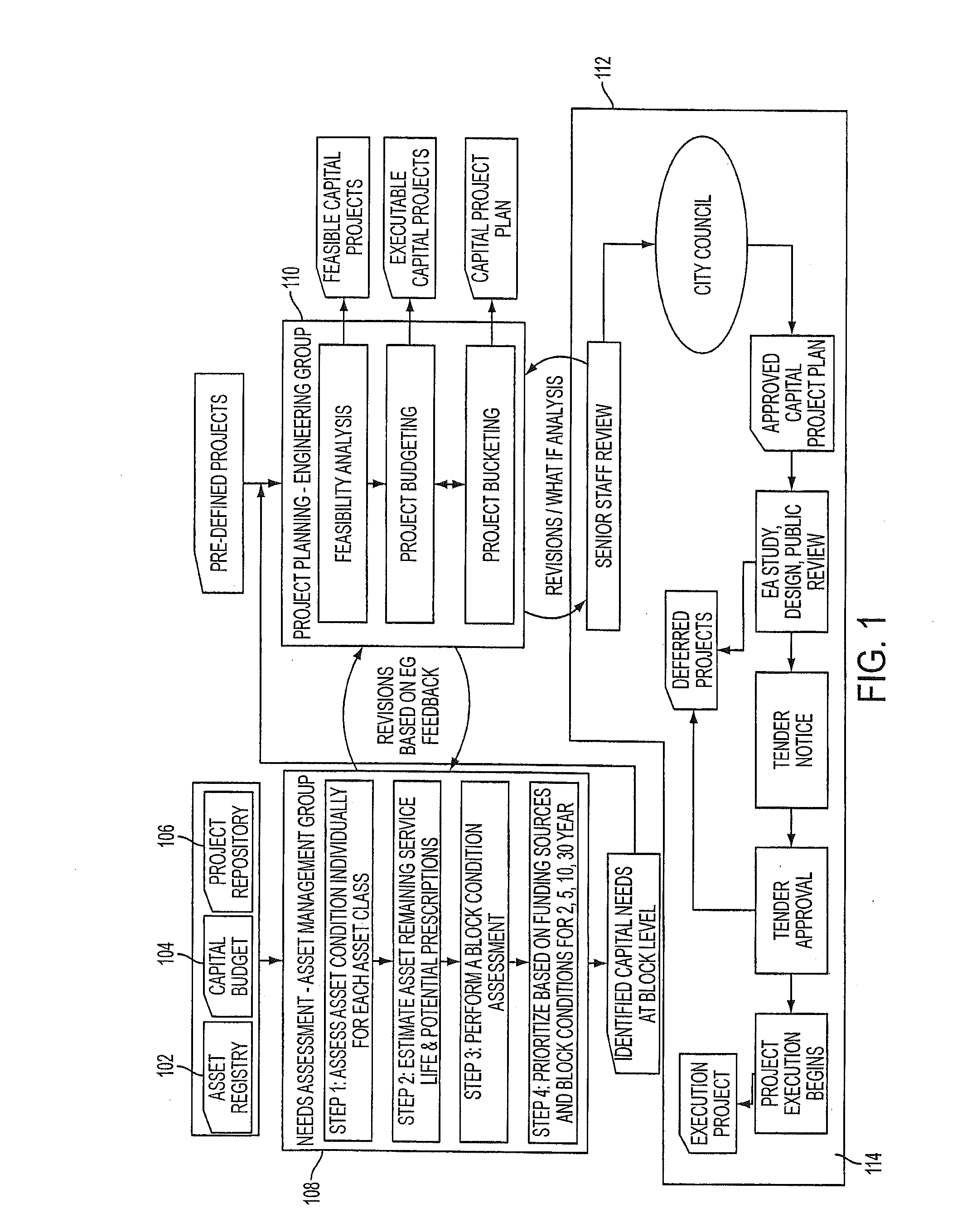

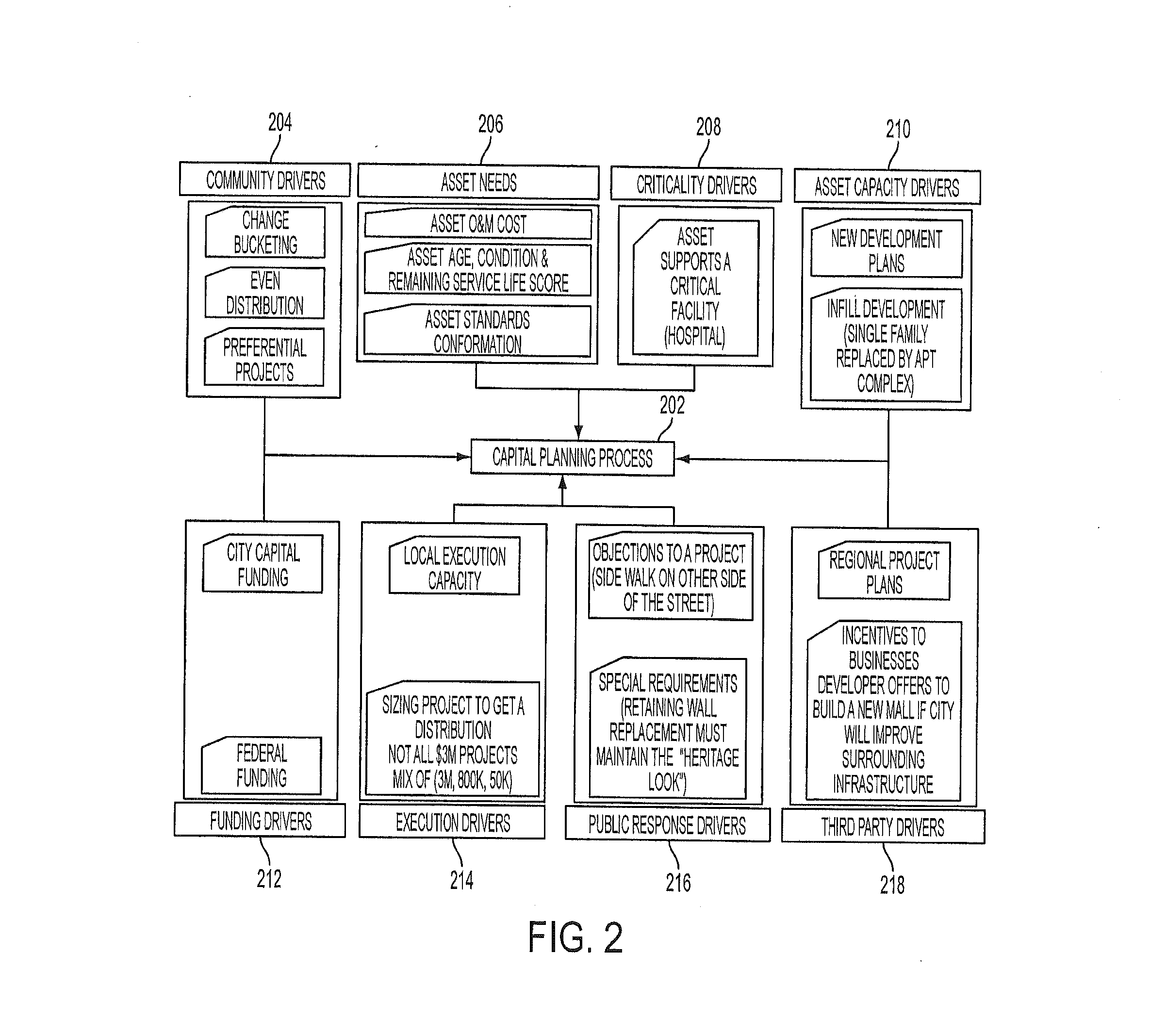

Asset lifecycle management

Embodiments of the invention relate to asset lifecycle management. A method includes assessing a current health condition of a plurality of assets that are managed by a plurality of different entities. Predictive analytics are applied to determine a predicted future health condition of the assets. Prescription options for the assets are determined based on the current health condition and the predicted future health condition of the assets. Each prescription option specifies an asset, a timeframe, an expected cost, and an expected future health condition of the asset. Spatial and temporal analytics are performed to combine individual prescription options into a unified project. The unified project includes prescription options that specify assets that are managed by at least two of the entities. A timeframe to execute the unified project is determined based on financial constraints and spatial constraints. The unified project plan is output.

Owner:GLOBALFOUNDRIES INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com