Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

33 results about "Stock forecasting" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Method for determining demand and pricing of advertising time in the media industry

The present invention utilizes customer / user generated data and market available data to provide a framework and guidance for a seller to price advertising time and space for programs offered by a media outlet, and to project future demand for advertising time and space. The invention determines the number available advertising spots (avails) that exist in a market, the projected rating of the avail, the historical advertising avail sales price, and a reasonable target price for each avail. It utilizes avail request information from individual advertising agency clients, sellout data from broadcast media, together with ratings and projections from published rating services (such as Neilsen and CMR) to produce a series of reports that provide needed information to create projections of future inventory, demand and pricing ranges. The reports include avail demand and analysis reports, market blueprint reports, market CPP tolerance reports, pricing grids, and market share trend reports.

Owner:WIDEORBIT LLC

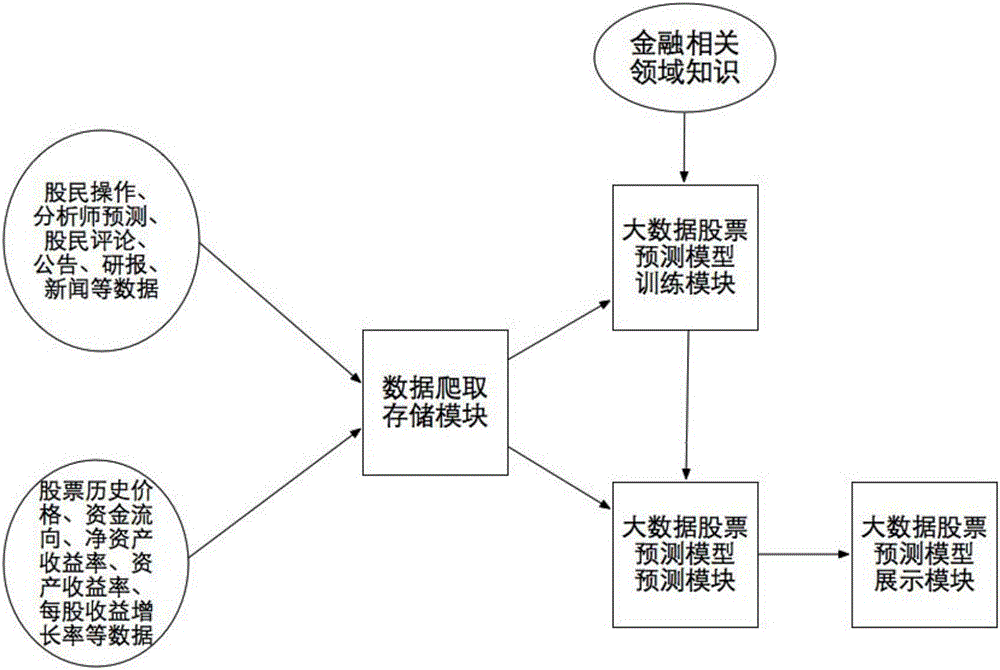

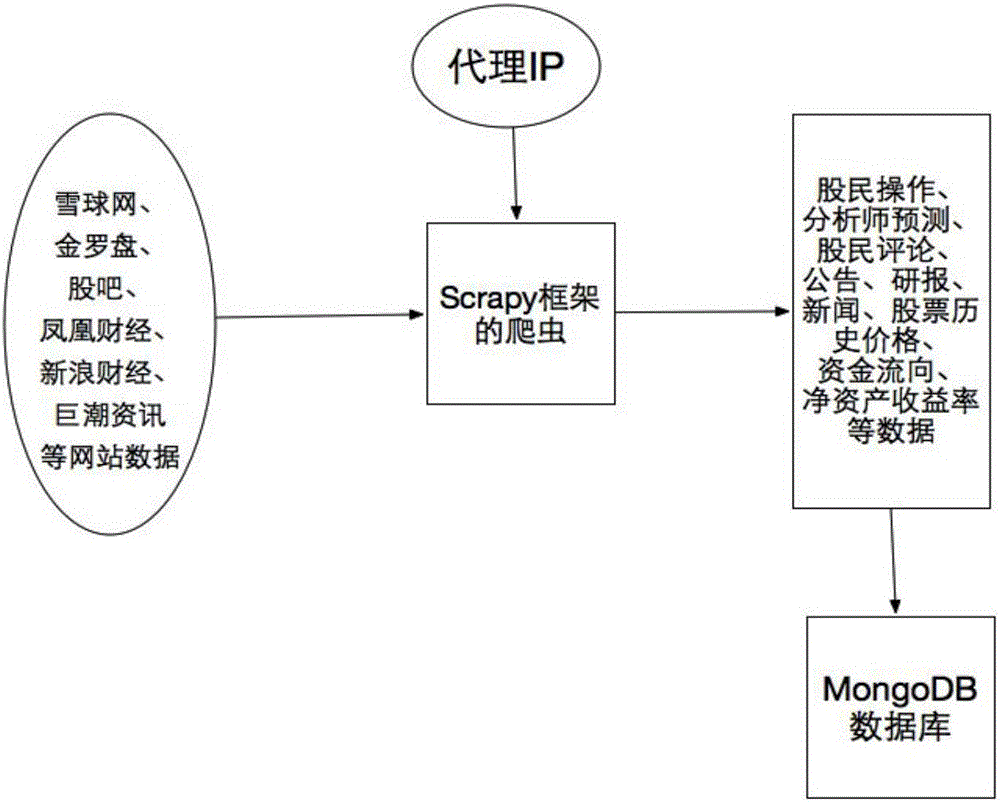

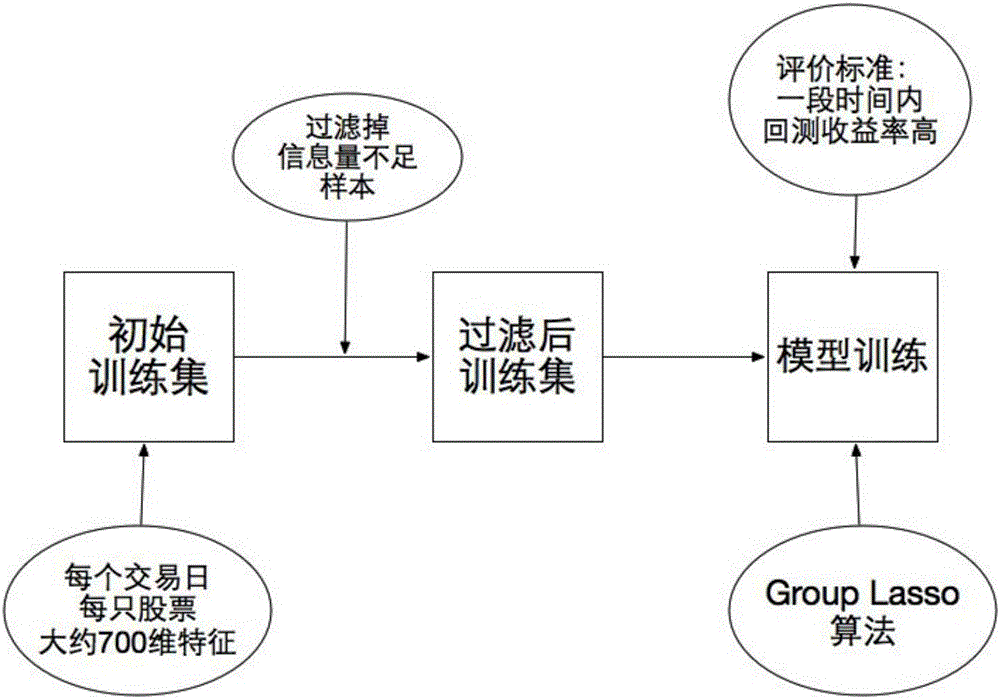

Method and system for predicting stocks based on big data published by internet

InactiveCN106022522ACapture inner workingsIncrease incomeFinanceForecastingData predictionTraining data sets

The invention discloses a method and system for predicting stocks based on big data published by the internet. The method comprises the following steps: crawling related information of the stocks before a business day; and then performing the feature extraction using the crawled data, constructing a training dataset, and using a Group Lasso to perform prediction model training, wherein the evaluation standard of the model is yield rate in a period of time in the operation mode of selling stocks purchased in late trading day and purchasing the stocks recommended at the current trading day at the opening every day; and then constructing a new testing set according to the data crawled at the trading day, predicting using the prediction model trained in former step to obtain the finally recommended stocks. Through the adoption of the method and system disclosed by the invention, a new, useful and reliable information source is provided for quantitative stock selection or stock prediction, the adding of above information can more reflect the market in combination with the traditional information; on the basis of method and system, the stock prediction model obtained using the machine learning technique can more capture the internal operation mechanism of the market, and the benefit of the investor can be effectively improved.

Owner:NANJING UNIV

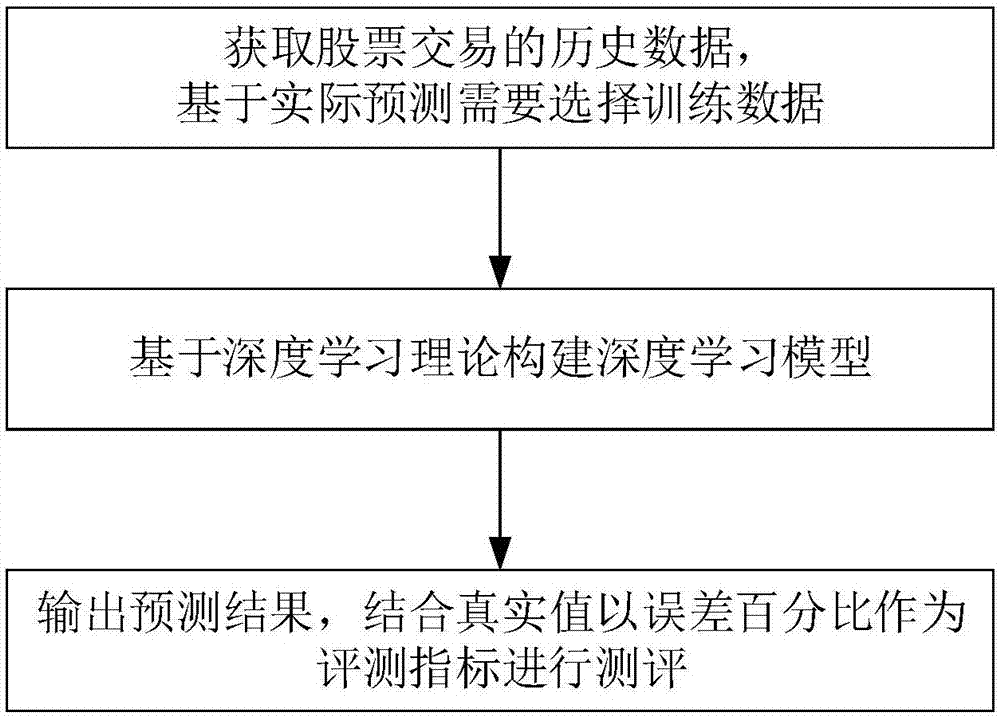

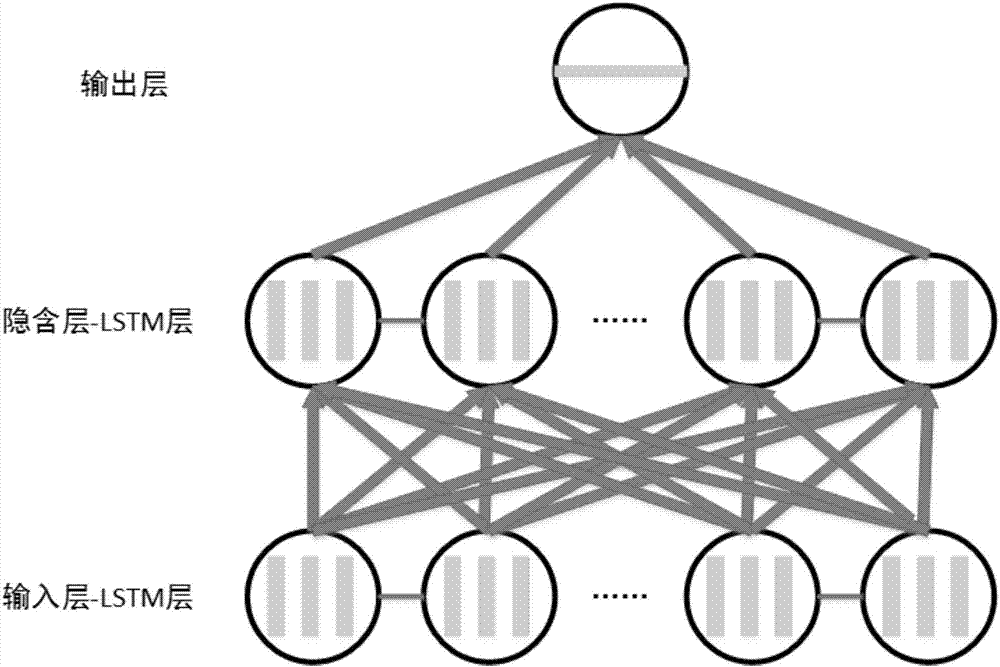

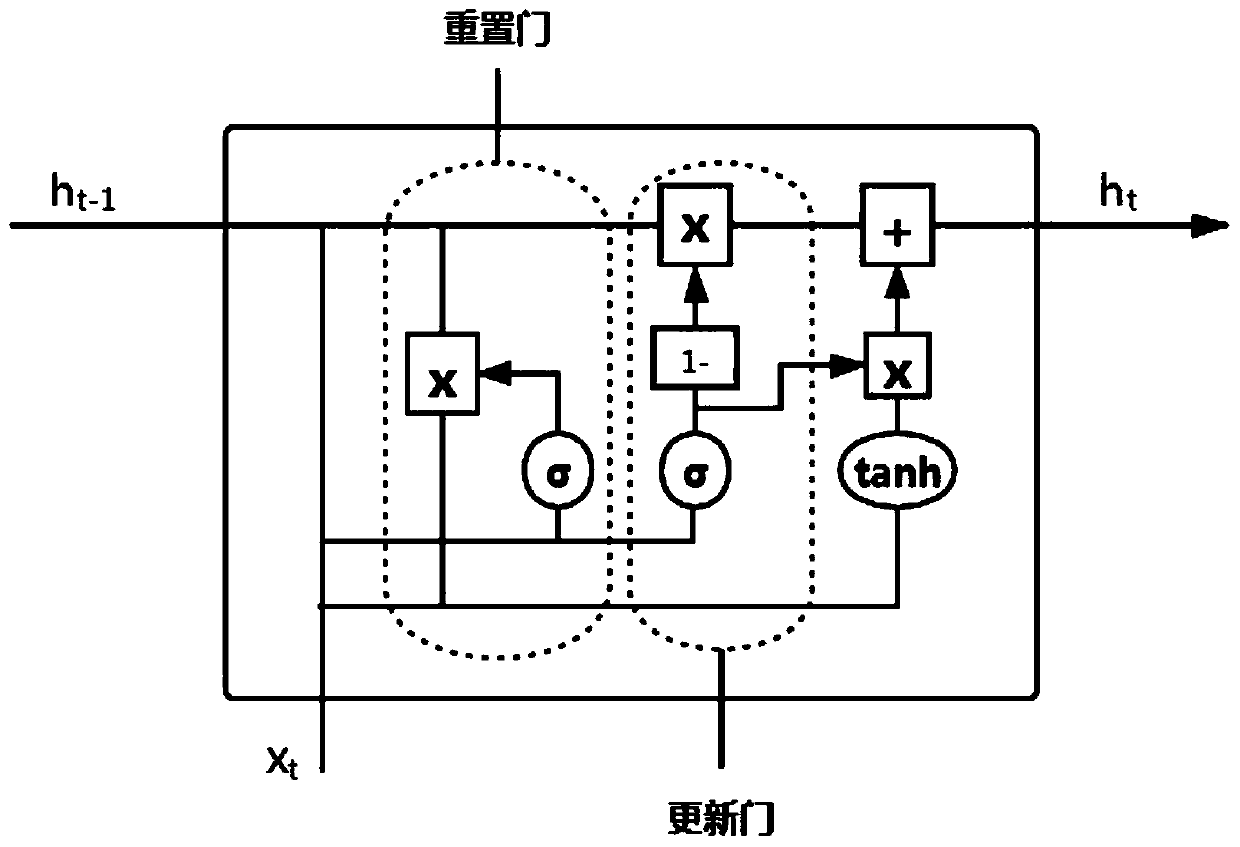

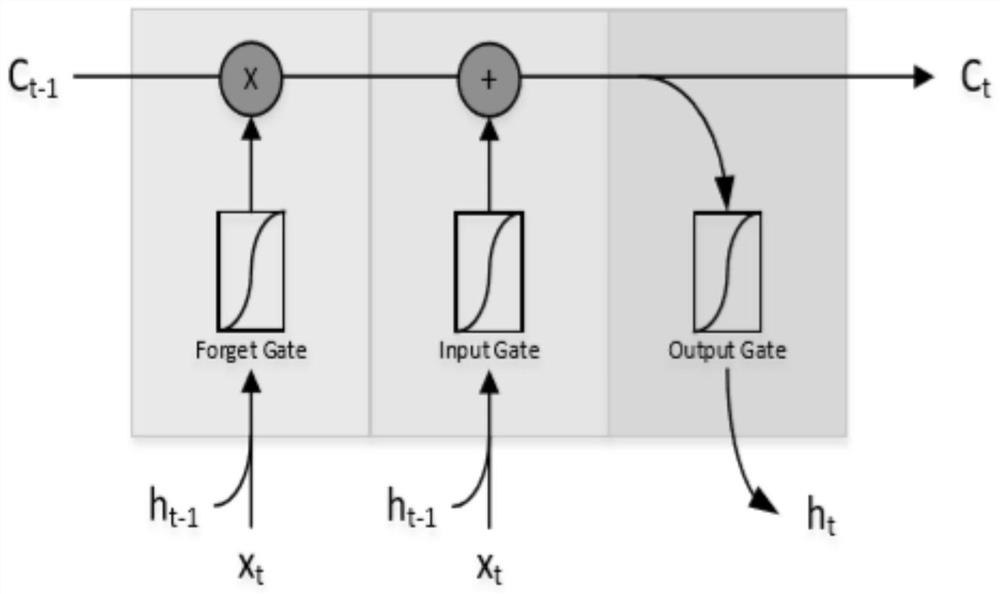

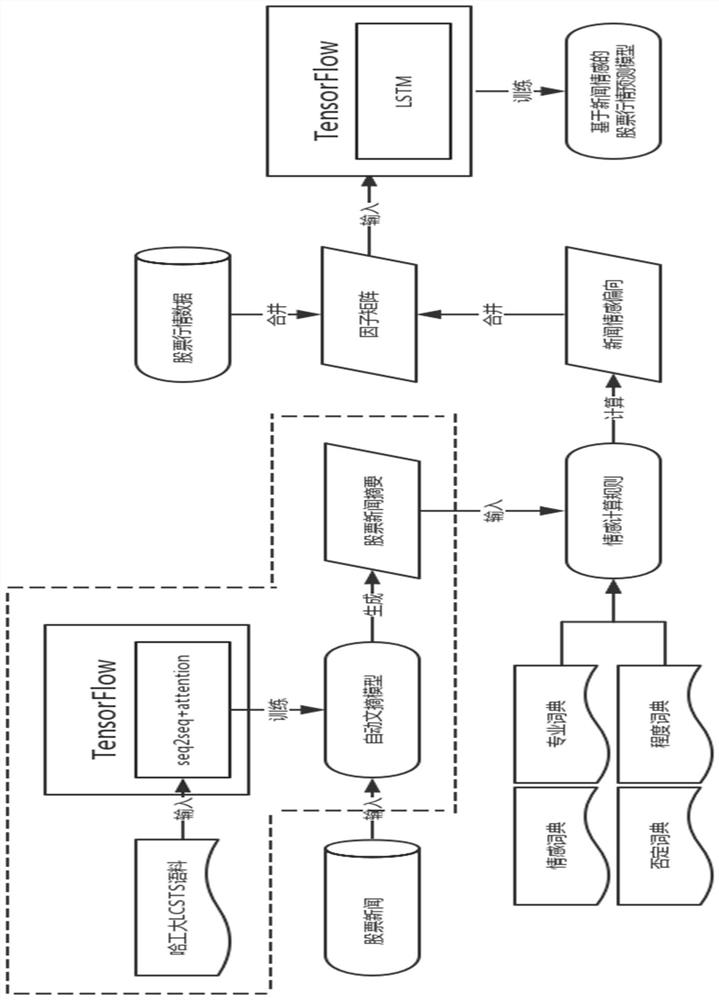

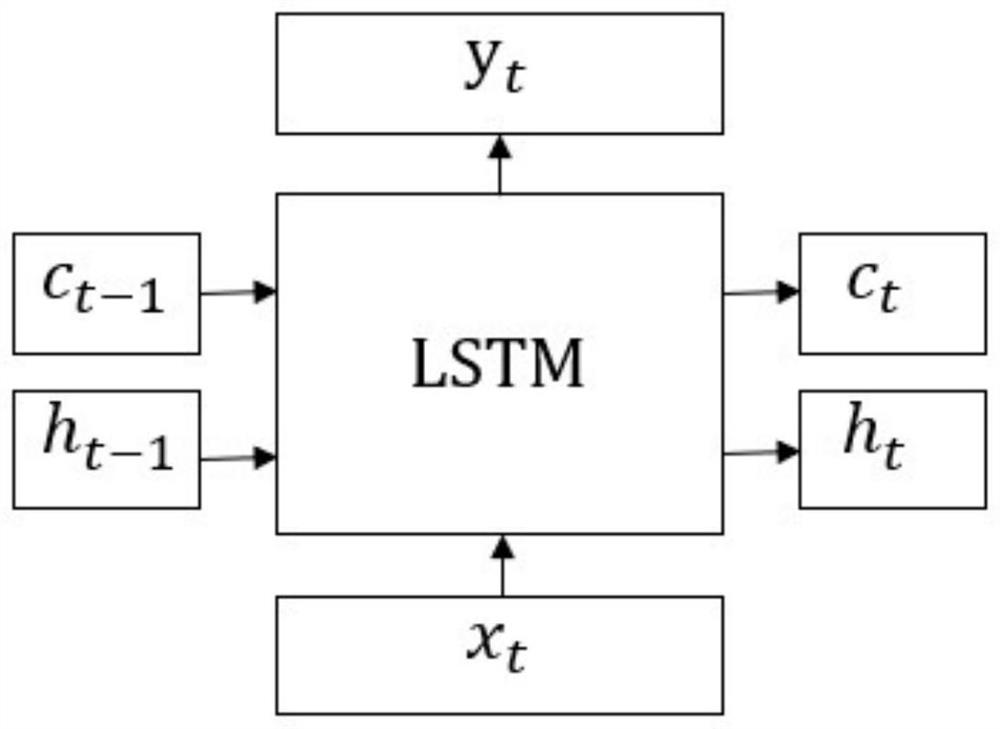

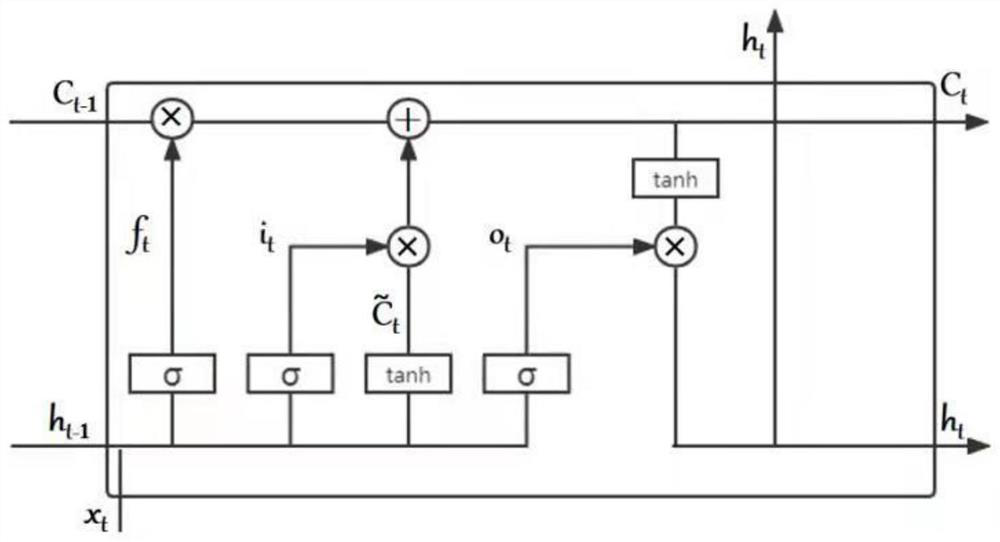

Stock forecasting method and system based on LSTM model

InactiveCN107239855AForecasting cyclical data is goodData change sensitiveFinanceForecastingHidden layerPhase analysis

The present invention discloses a stock forecasting method and a system based on an LSTM model, which belong to the technical field of stock forecasting. The technical method of the invention comprises: grabbing the stock data of a large enterprise in a recent period through establishing a deep learning environment; making a pre-phase analysis of the stock data; re-extracting the key characteristics; selecting the training data; inputting the training data; constructs a stock forecasting model based on the deep learning theory wherein the stock forecasting model comprises an input layer, a hidden layer and an output layer; and finally outputting a forecasting result and in combination with the true value, using the error percent as an evaluation index for evaluations. The invention also realizes a stock forecasting system based on the LSTM model. The invention adopts the LSTM model to construct a stock forecasting model, which is suitable for the periodically strong data and sequence data, solves the long-term dependence problem, and is more flexible than a traditional time sequence model.

Owner:HUAZHONG UNIV OF SCI & TECH

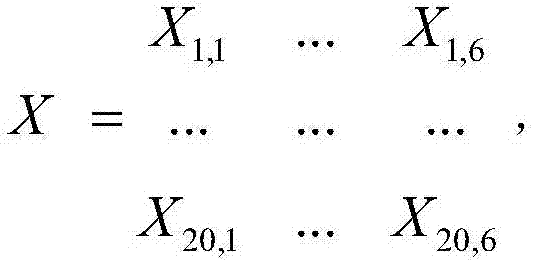

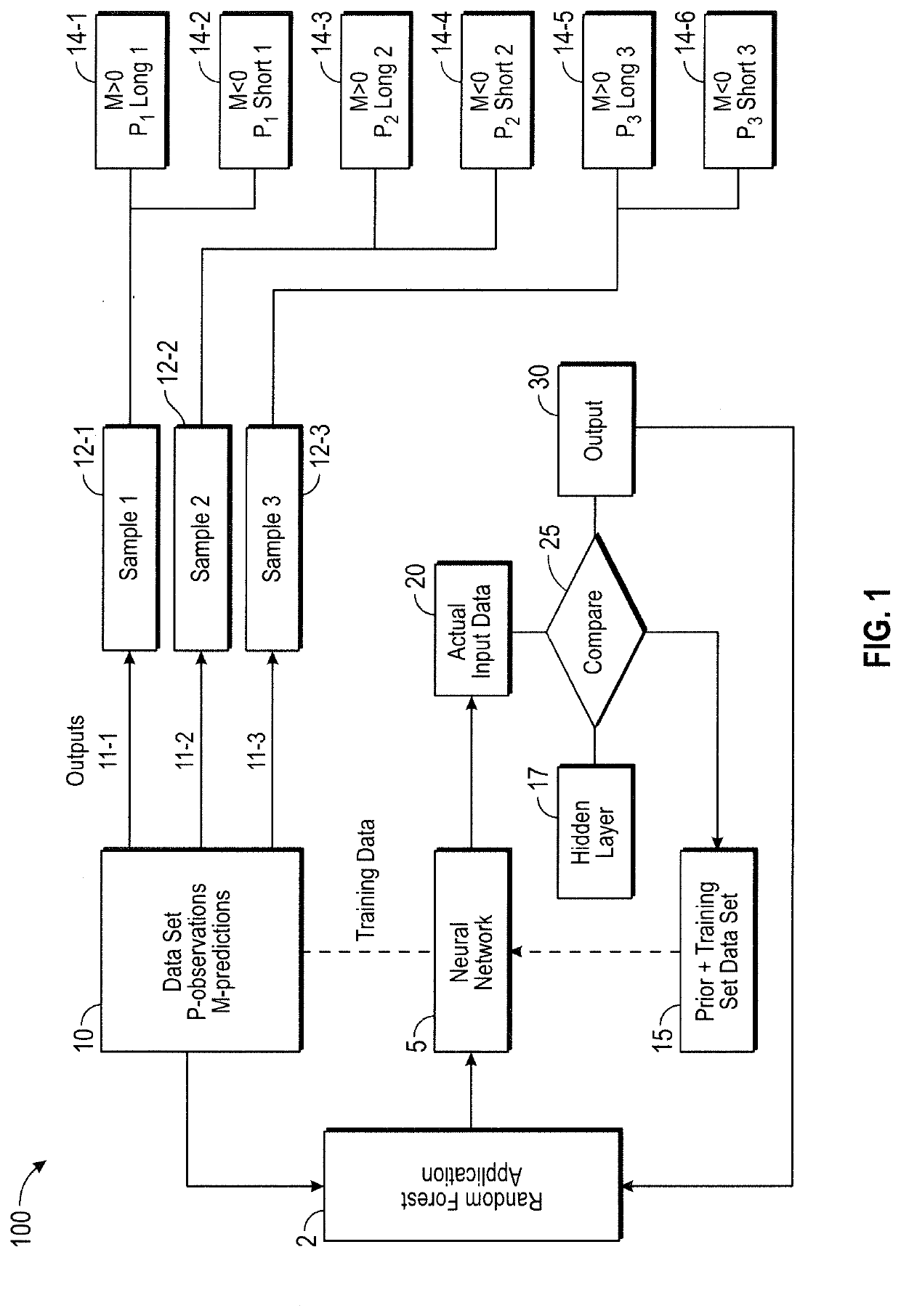

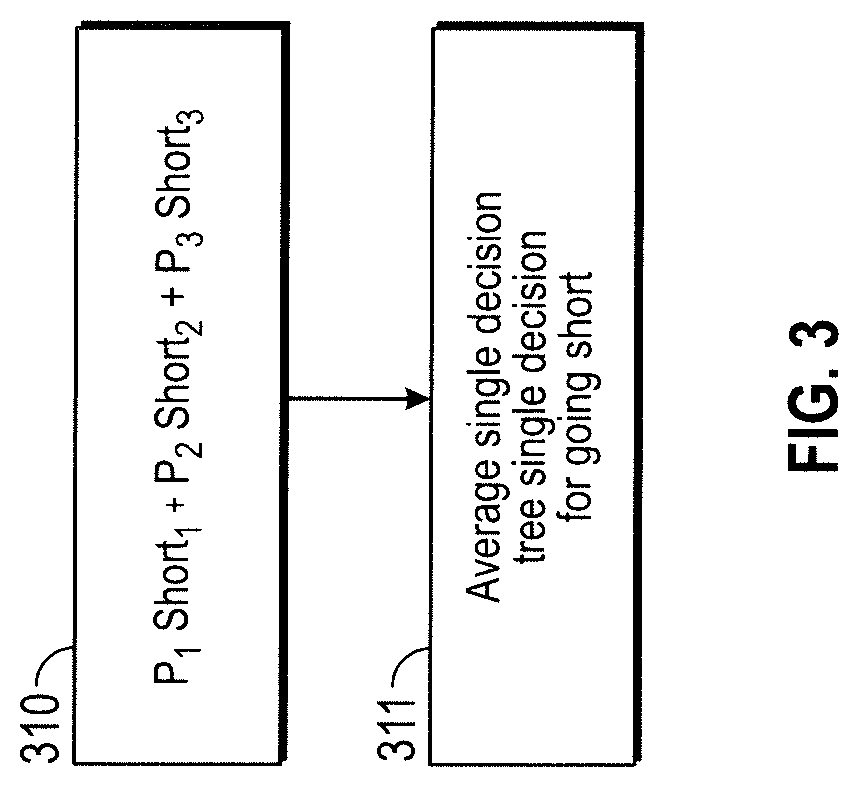

Method and system using machine learning for prediction of stocks and/or other market instruments price volatility, movements and future pricing by applying random forest based techniques

A method for providing stock predictive information by a cloud-based computing system implementing a random forest algorithm via a machine learning model by receiving a set of stock data from multiple sources of stock data wherein the set of stock data at least comprises stock prices at the open and close of a market, changes in stock prices during the open and close of a market, and real-time stock data; defining a range in time contained in a window defined of an initial selected month, a day or real-time period and an end of the selected month, day and real-time period; applying the random forest model to the set of stock data by creating multiple decision trees to predict a stock price in a quantified period, amount or percentage change in a stock price; and presenting the predicted stock price in a graphic user interface to an user.

Owner:KRISHNAN DHRUV SIDDHARTH

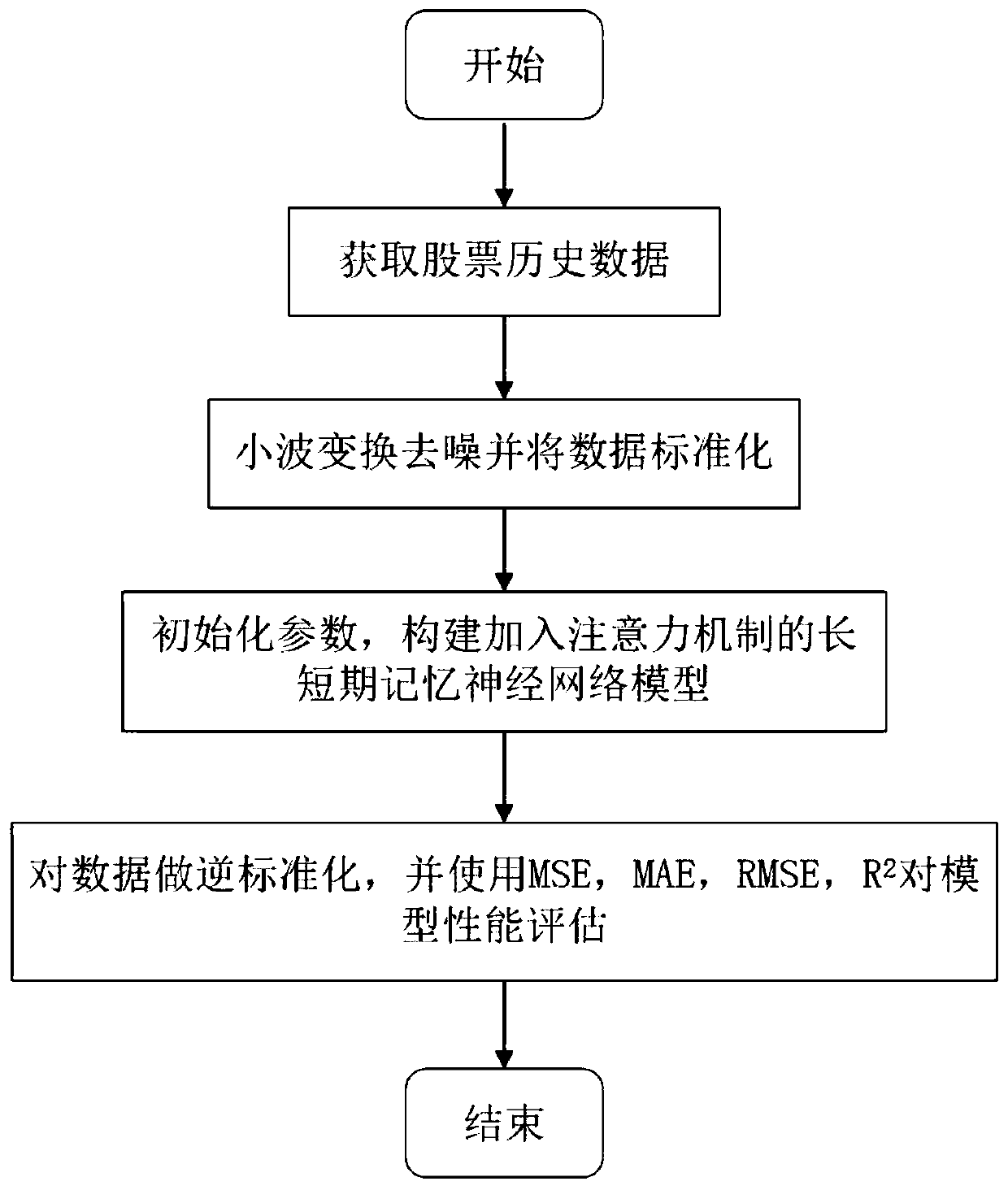

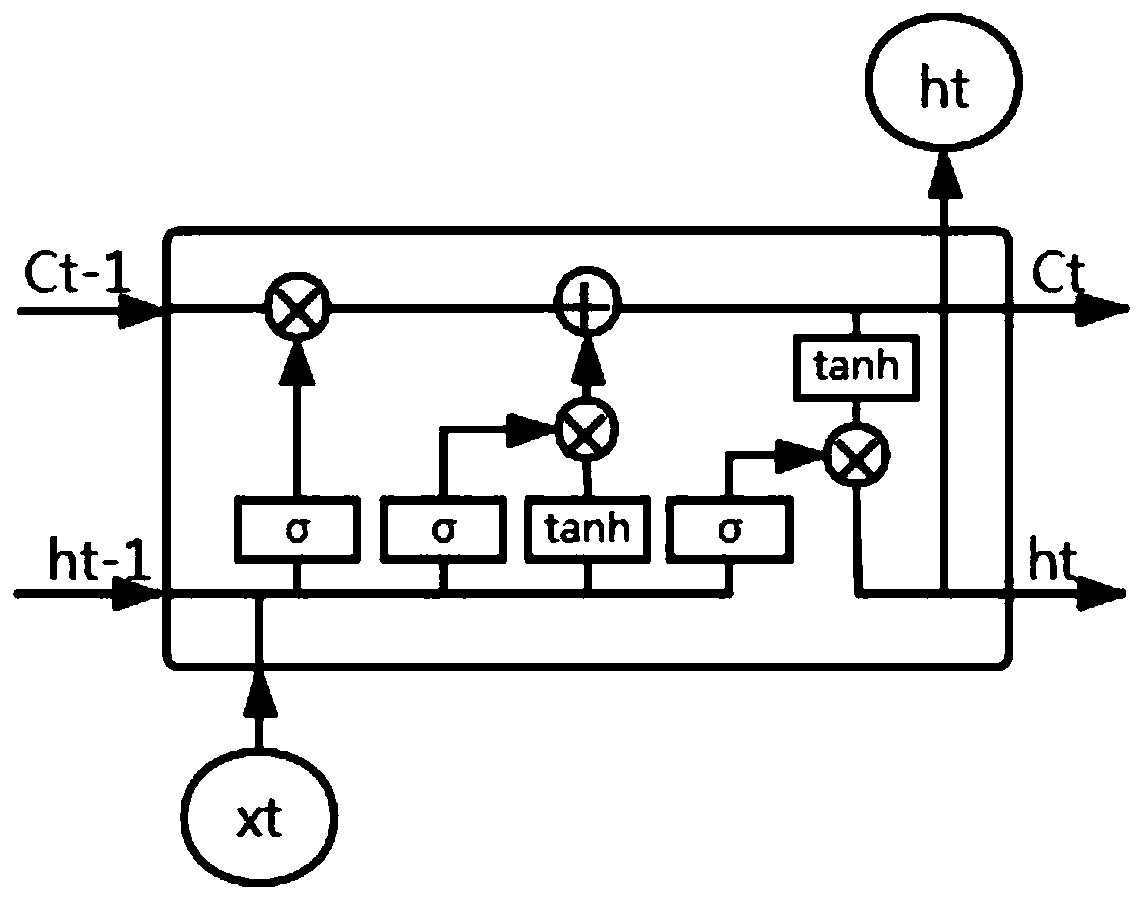

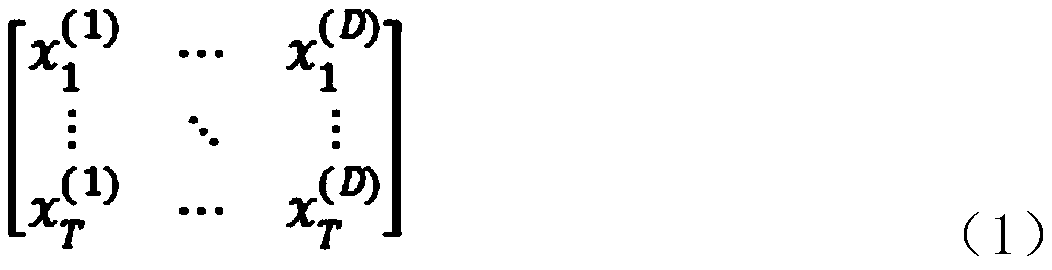

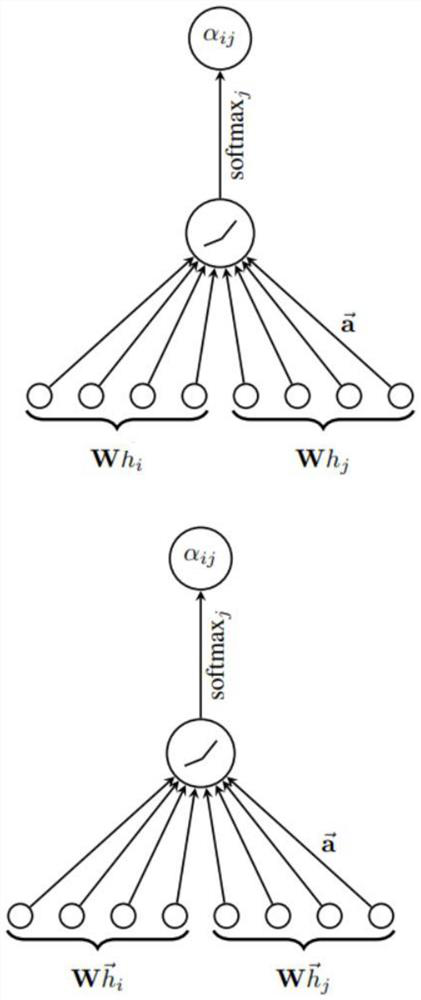

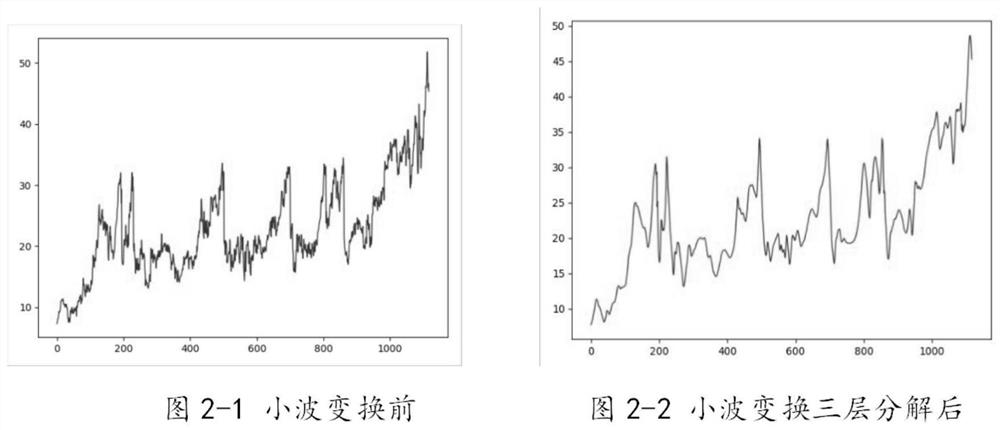

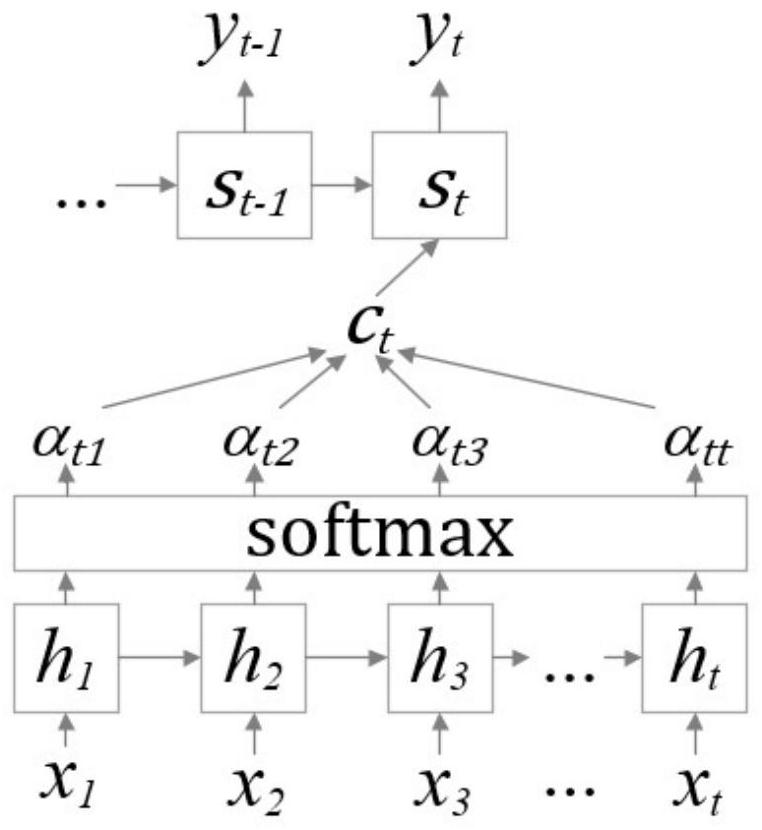

Stock price prediction method of long-term and short-term memory neural network based on attention mechanism

PendingCN111222992AEasy to predictNon-linear variation is goodFinanceNeural architecturesStock price forecastingEngineering

The invention discloses a stock price prediction method based on a long-term and short-term memory neural network of an attention mechanism, and belongs to the field of deep learning and stock prediction. The method comprises the following steps of S1, obtaining stock historical data, performing data preprocessing on the stock historical data, and dividing the stock historical data into a trainingset and a test set; s2, performing data standardization on the training set and the test set, and performing wavelet transform processing on data of the training set to remove noise of the financialsequence; s3, initializing parameters required by the long-term and short-term memory neural network prediction model, constructing the long-term and short-term memory neural network prediction model,adding an attention mechanism layer into the long-term and short-term memory neural network prediction model, and training the long-term and short-term memory neural network prediction model by usingtraining set data; and S4, predicting the test set by using the trained prediction model to obtain a prediction result. According to the invention, the nonlinear change of the stock price can be better predicted.

Owner:DALIAN UNIV

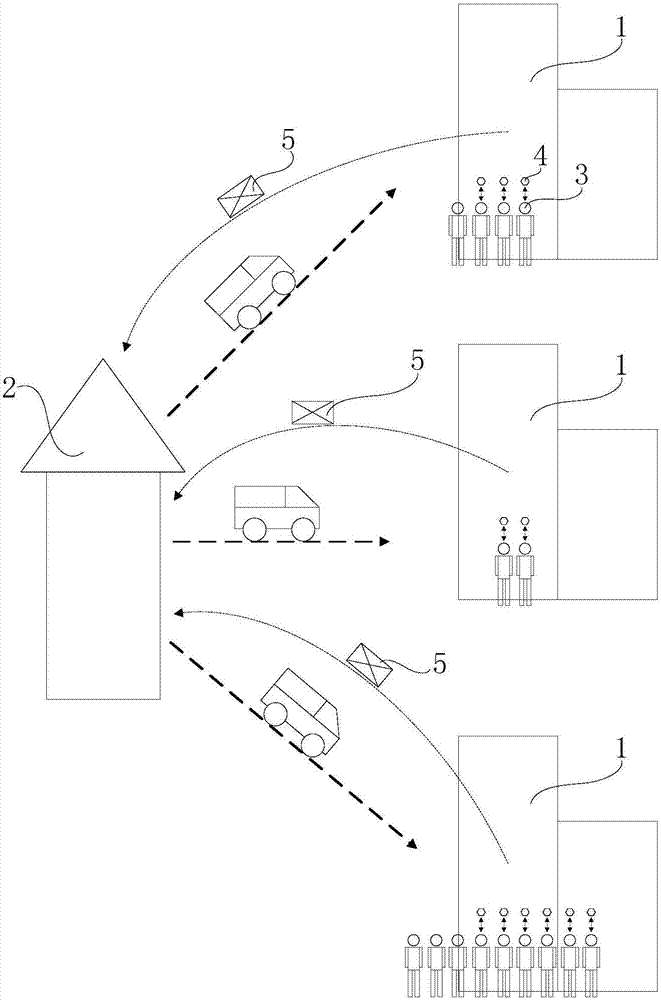

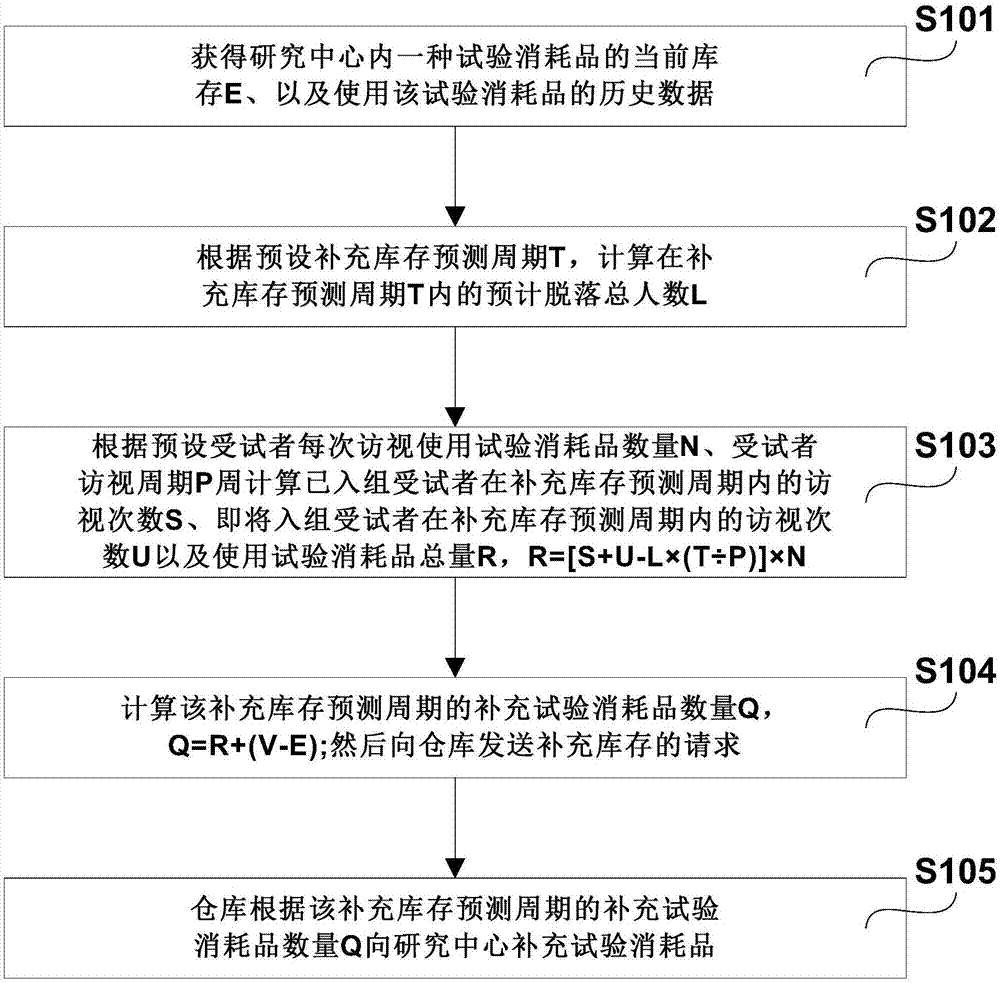

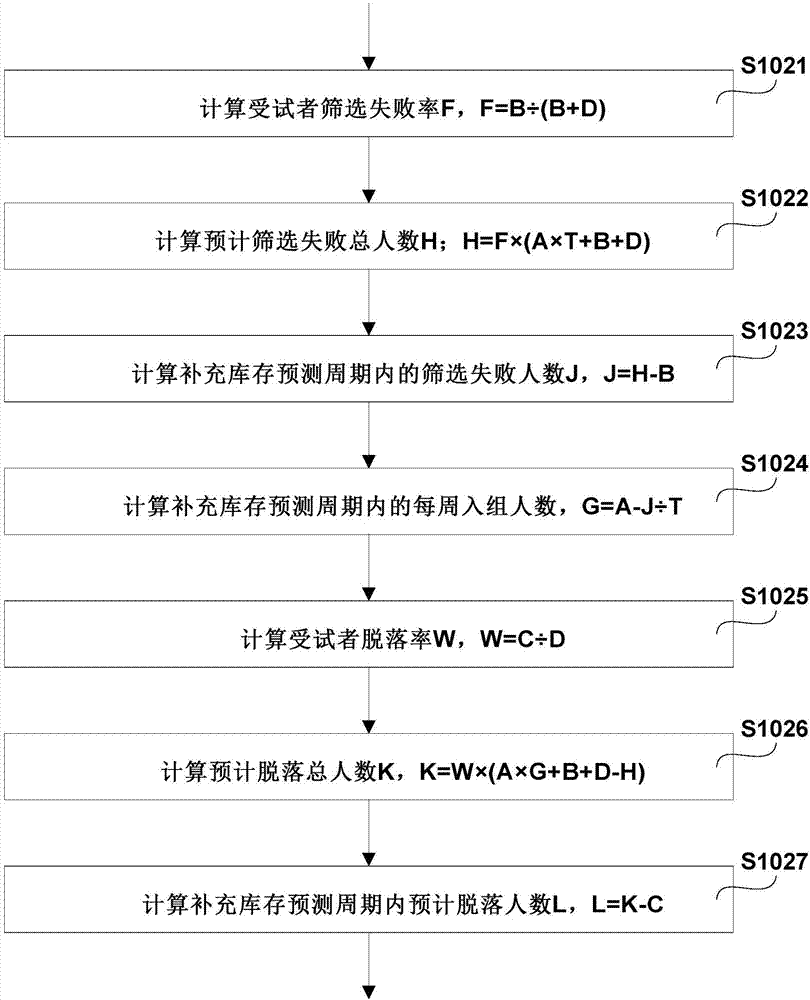

Test consumable automatic stock replenishment method

The invention provides a test consumable automatic stock replenishment method which is applied to a research center. The method comprises the steps that the current stock E of a test consumable within the research center and the historical data of using the test consumable are acquired; according to a preset stock replenishment forecasting period T, the estimated total number of exfoliation L in the stock replenishment forecasting period T is calculated; according to the preset number N of test consumables used by subjects in each interview and the interview period P of the subjects, the number S of the interviews of enrolled subjects in the stock replenishment forecasting period, the number U of the interviews of to-be-enrolled subjects in the stock replenishment forecasting period, and the total number R of used test consumables are calculated; the number Q of replenishment test consumables in the stock replenishment forecasting period is calculated, and then a stock replenishment request is sent to a warehouse; and the warehouse replenishes test consumables for the research center. According to the invention, the method can adaptively replenish the stock of the test consumables, and automatically ensures that the stock of the test consumables is sufficient but not wasted.

Owner:上海杉互健康科技有限公司

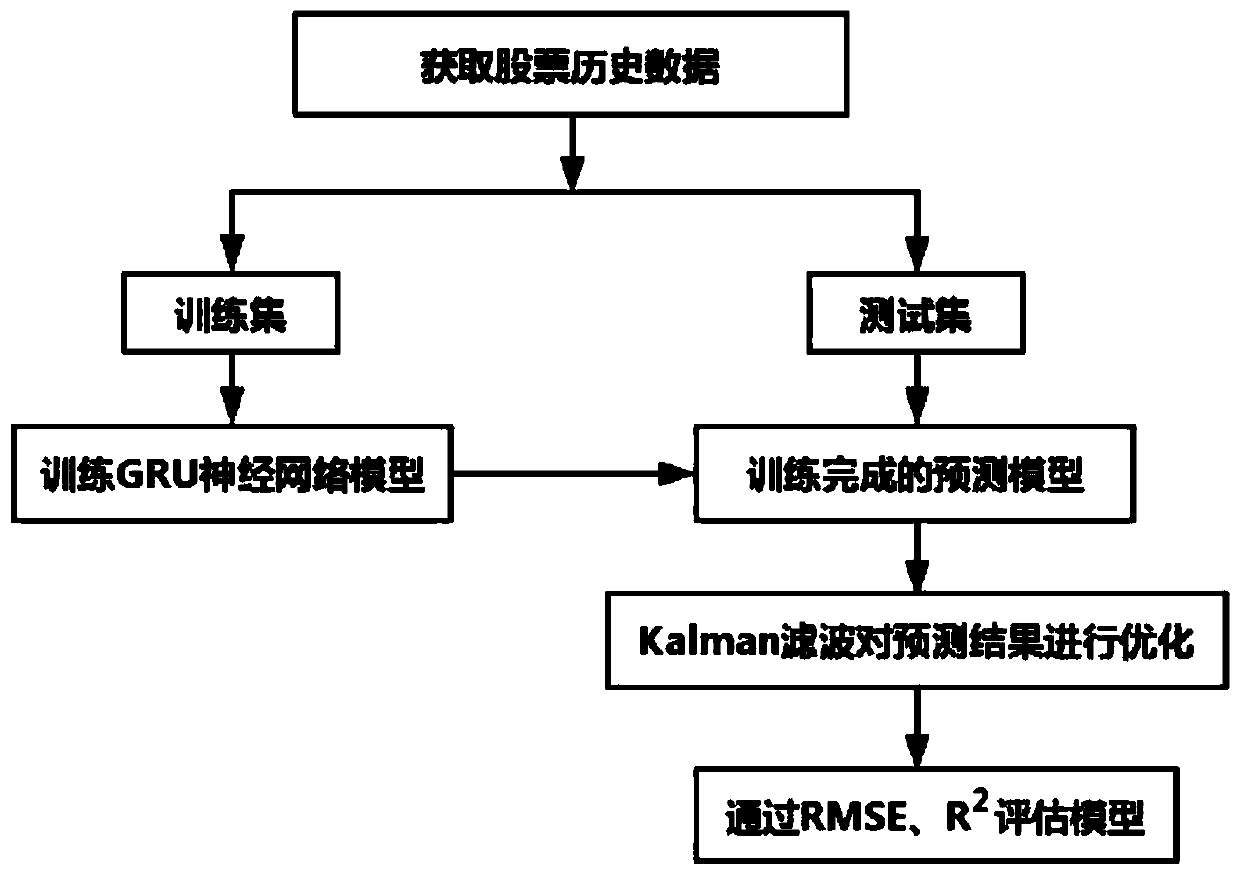

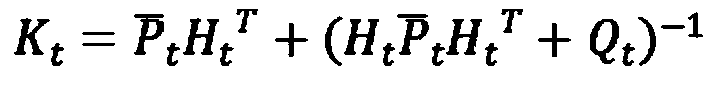

Stock price prediction method of gated cycle unit neural network based on Kalman filtering

PendingCN111210089APredict non-linear changesGood forecastFinanceForecastingStock price forecastingEngineering

The invention discloses a stock price prediction method of a gated recurrent unit neural network based on Kalman filtering, and belongs to the field of deep learning and stock prediction, and the method comprises the steps: S1, obtaining stock historical data, dividing the data into a training set and a test set, and carrying out the preprocessing; S2, initializing parameters required by prediction of the gating cycle unit neural network, constructing a gating cycle unit neural network model, and training and storing the gating cycle unit neural network model; S3, using the trained predictionmodel to predict the test set data, and using a Kalman filtering algorithm to perform denoising optimization on the obtained prediction result sequence; and S4, evaluating the performance of the prediction model for the denoised and optimized result in S3 by using the root-mean-square error and the determination coefficient. The stock price is predicted through the gating cycle unit neural network, and the prediction result sequence and the true value are compared and optimized by using the Kalman filtering algorithm so as to achieve the more accurate prediction effect.

Owner:DALIAN UNIVERSITY

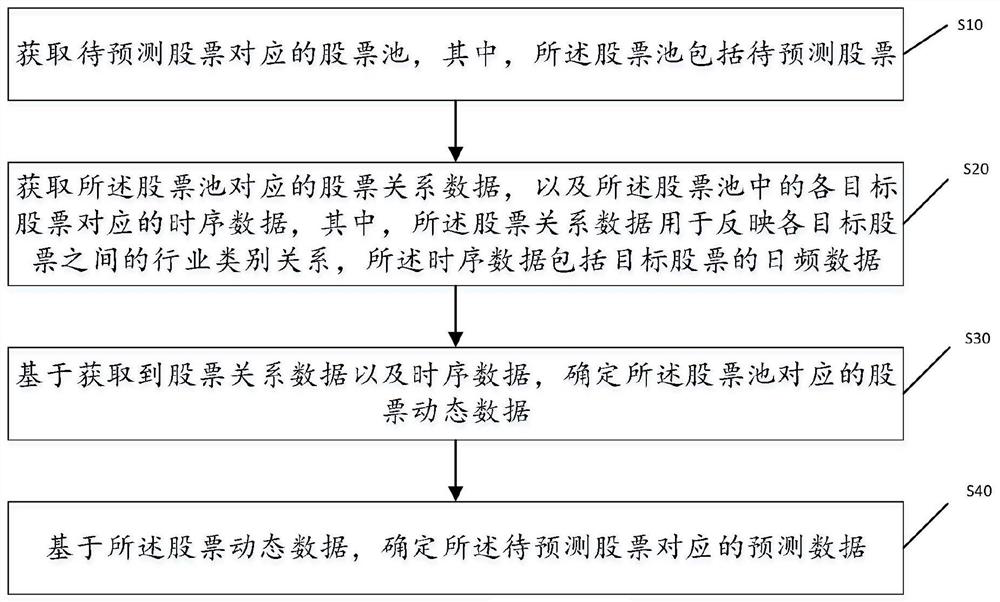

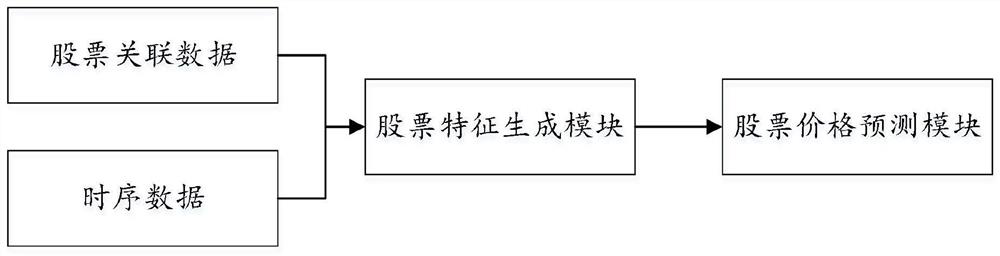

Stock price prediction method based on space-time diagram attention mechanism

The invention discloses a stock price prediction method based on a space-time diagram attention mechanism, and the method comprises the steps: obtaining stock relation data corresponding to a plurality of target stocks and time sequence data corresponding to each target stock, and determining stock dynamic data corresponding to the plurality of target stocks based on the obtained stock relation data and time sequence data; and based on the stock dynamic data, determining stock prediction data corresponding to each target stock in a plurality of target stocks. According to the invention, when the stock prediction data is predicted, the stock relation data used for reflecting the industry correlation between the stocks is determined besides the time sequence data corresponding to each stockis obtained, and the stock prediction is carried out based on the time sequence data and the stock relation data, so that the accuracy of stock prediction can be improved.

Owner:SHENZHEN GRADUATE SCHOOL TSINGHUA UNIV +1

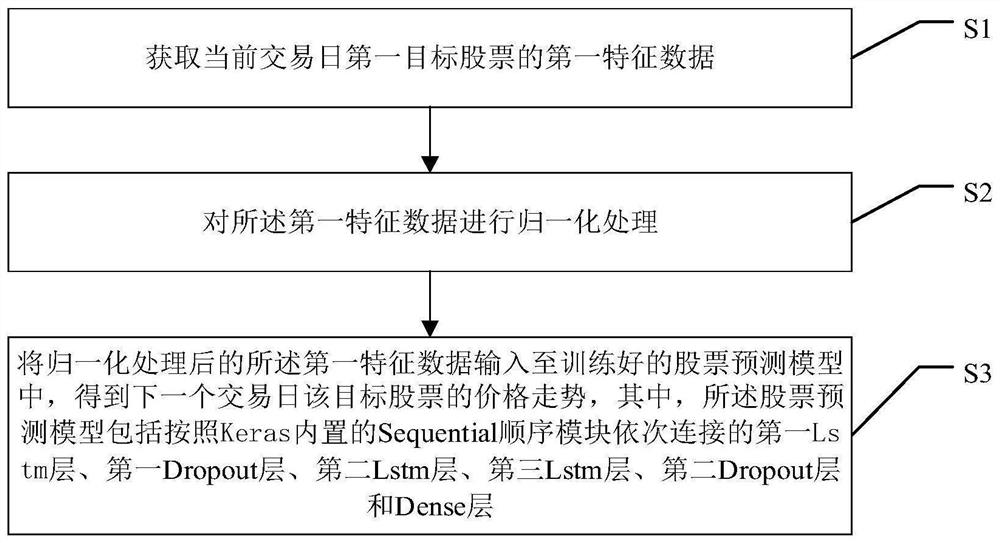

Stock price prediction method based on LSTM neural network

PendingCN113095484APrediction is stableImprove accuracyFinanceForecastingStock price forecastingEngineering

The embodiment of the invention relates to a stock price prediction method based on an LSTM neural network. The stock price prediction method based on the LSTM neural network comprises the steps of obtaining first feature data of a first target stock on a current trading day; performing normalization processing on the first feature data; inputting the first feature data after normalization processing into a trained stock prediction model to acquire the price trend of the target stock on the next trading day, wherein the stock prediction model comprises a first Lstm layer, a first Dropout layer, a second Lstm layer, a third Lstm layer, a second Dropout layer and a Dense layer, which are sequentially connected according to a Sequence sequence module built in Keras. According to the stock price prediction method based on the LSTM neural network provided by the embodiment of the invention, the accuracy of predicting the rising and falling trend of the stock is obviously improved, and the prediction effect of the LSTM network model tends to be stable along with the increase of historical stock data.

Owner:SOUTH CHINA NORMAL UNIVERSITY

Stock prediction method based on investor psychological emotion

InactiveCN112163951AImprove inference speedMitigate Vanishing GradientsFinanceWeb data indexingFinancial transactionData mining

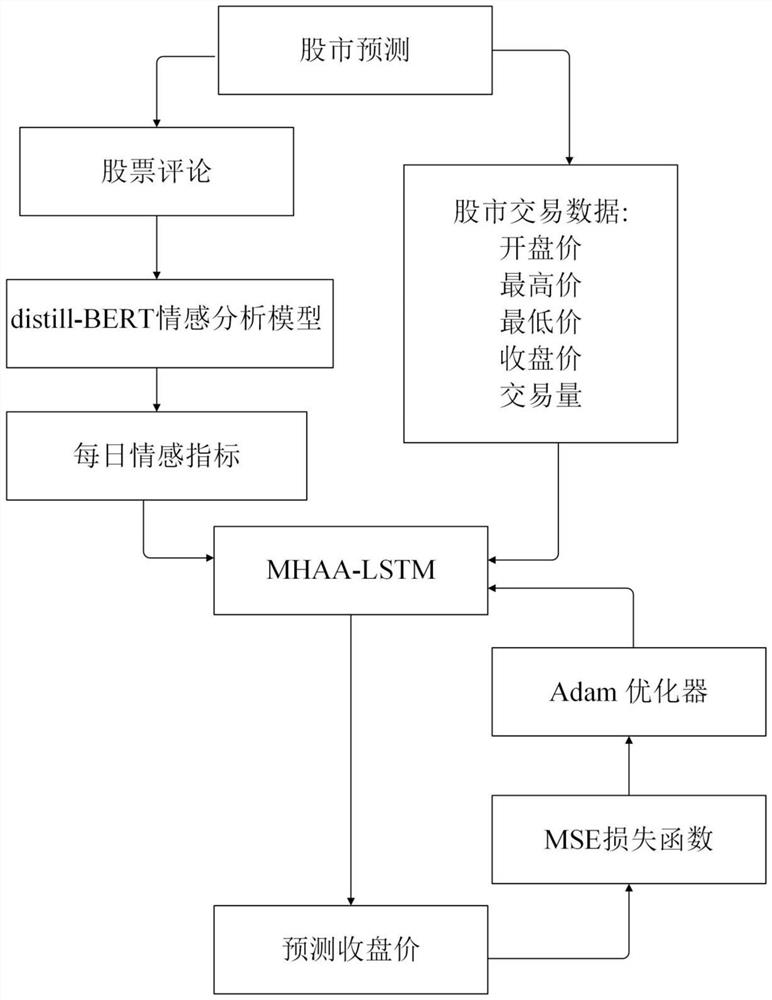

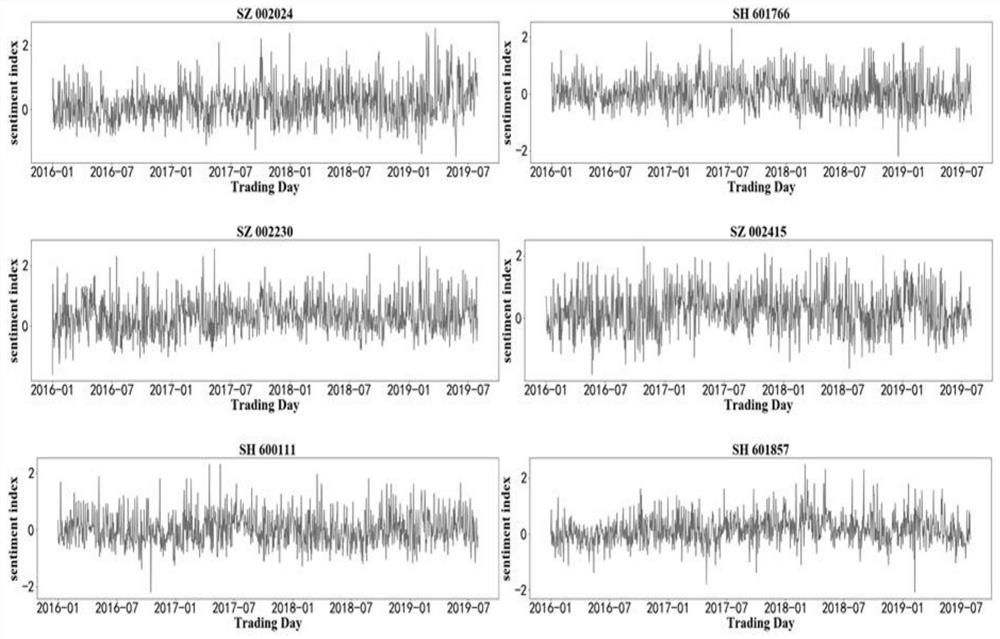

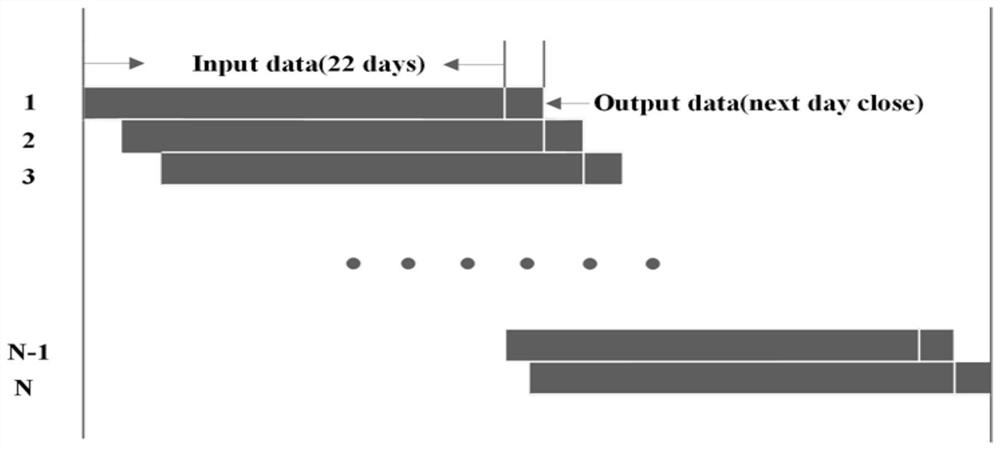

The invention provides a stock prediction method combining investor psychological emotion with stock market historical transaction data, and the method comprises the steps: firstly carrying out the model distillation of a BERT which is a deep bidirectional pre-training language model, obtaining distil-BERT, and meeting the business demands on the prediction precision of emotion analysis through model distillation; and reducing the scale of the sentiment analysis model so as to shorten the reasoning time of the sentiment analysis model. Finally, in the stock prediction stage, the invention designs a stock prediction method based on a multi-head attention mechanism, thereby effectively alleviating the problem of gradient explosion gradient dispersion of the LSTM recurrent neural network, andfurther improving the accuracy of stock market prediction. According to the invention, scientific and technological innovation is achieved through deep learning frontier technologies such as BERT pre-training model, model distillation, multi-head attention mechanism and the like.

Owner:CHINA JILIANG UNIV

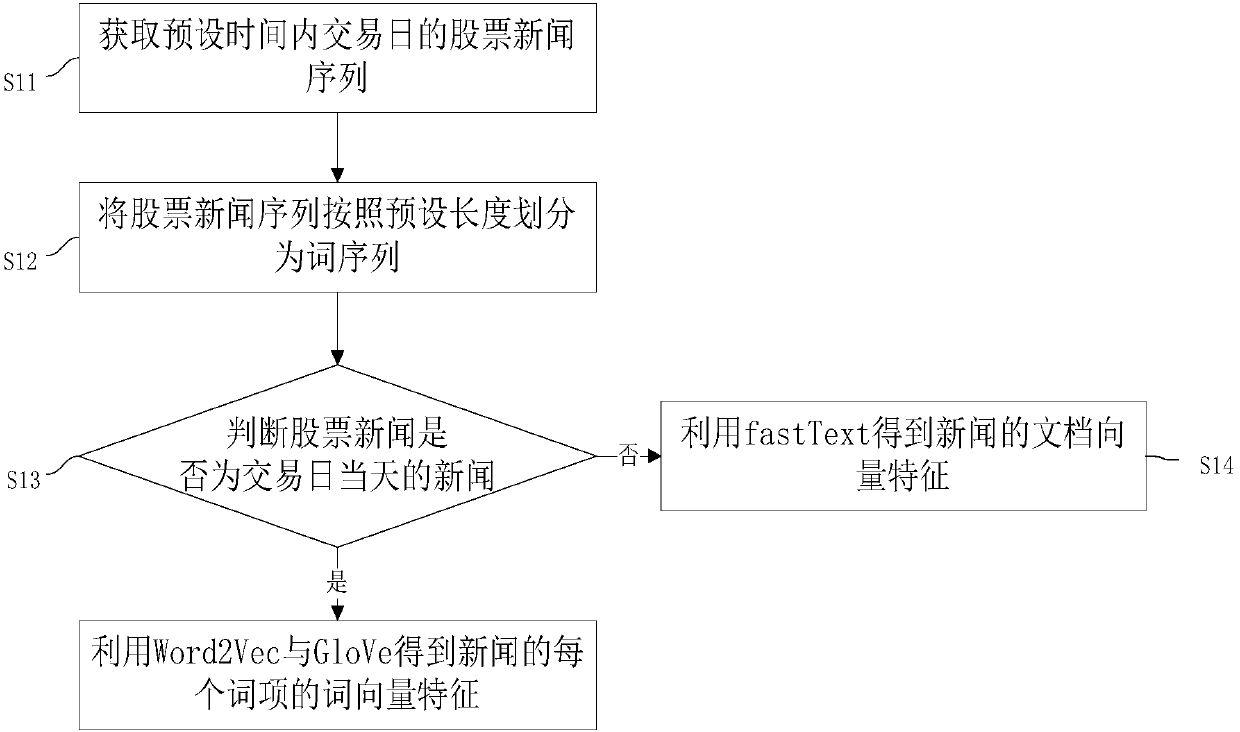

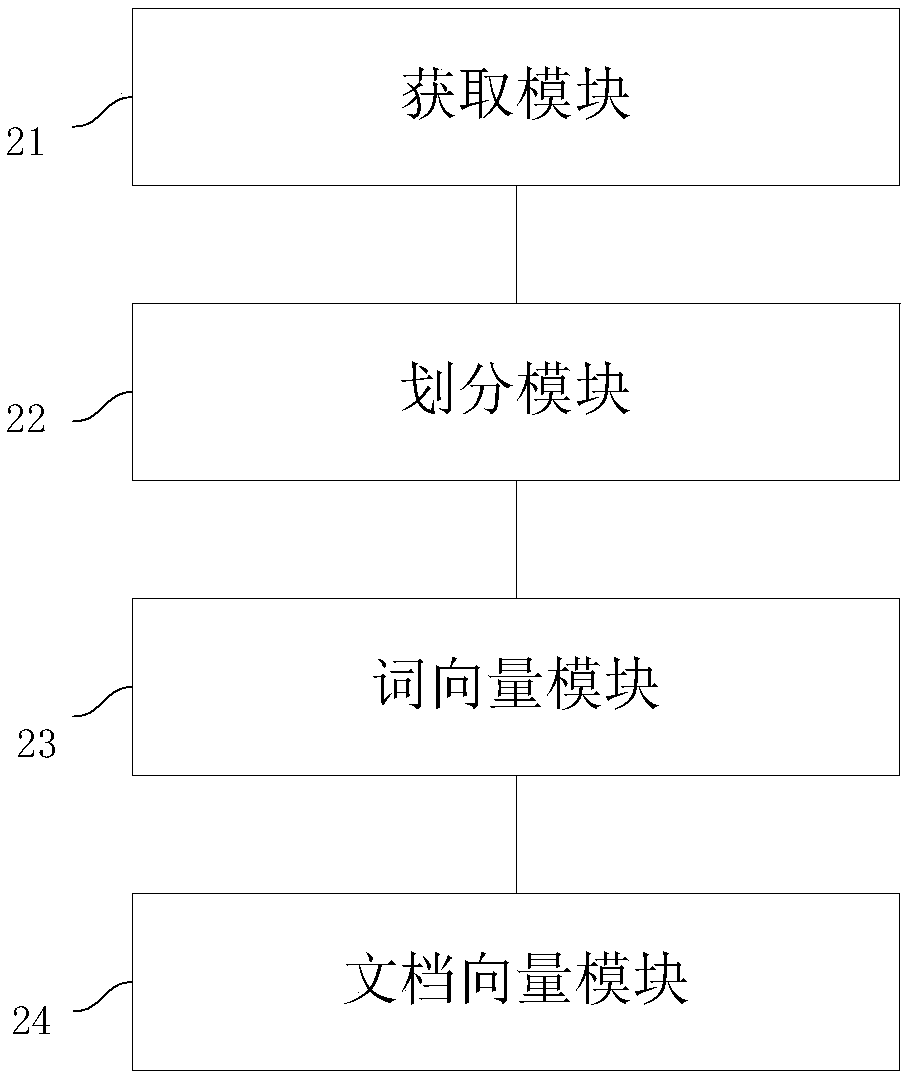

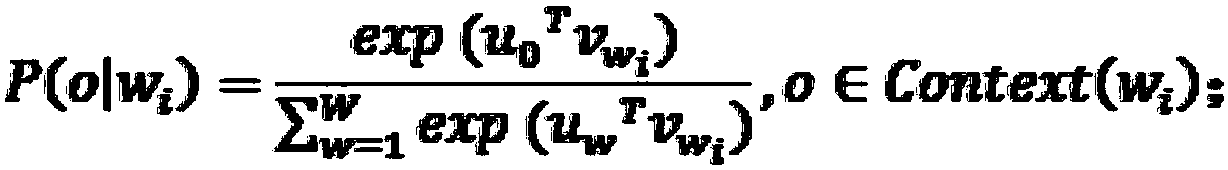

Quantification method and system of stock news based on artificial intelligence

The invention discloses a quantification method and system of stock news based on artificial intelligence, which is used for solving the problem that existing stock forecasting news reference factorshave one-sidedness. The method comprises following steps: acquiring a stock news sequence on a trading day within a preset time; dividing the stock news sequence into word sequences according to a preset length; determining whether the stock news is the news on the day of trading; if the stock news is the news on the day of trading, obtaining word vector characteristics of each word of the news byusing Word2Vec and GloVe; otherwise, using fastText to obtain document vector characteristics of the news. The present invention extracts news features through three different vector representation learning methods, makes news more comprehensive as a reference factor, and has higher prediction accuracy.

Owner:宏谷信息科技(珠海)有限公司 +1

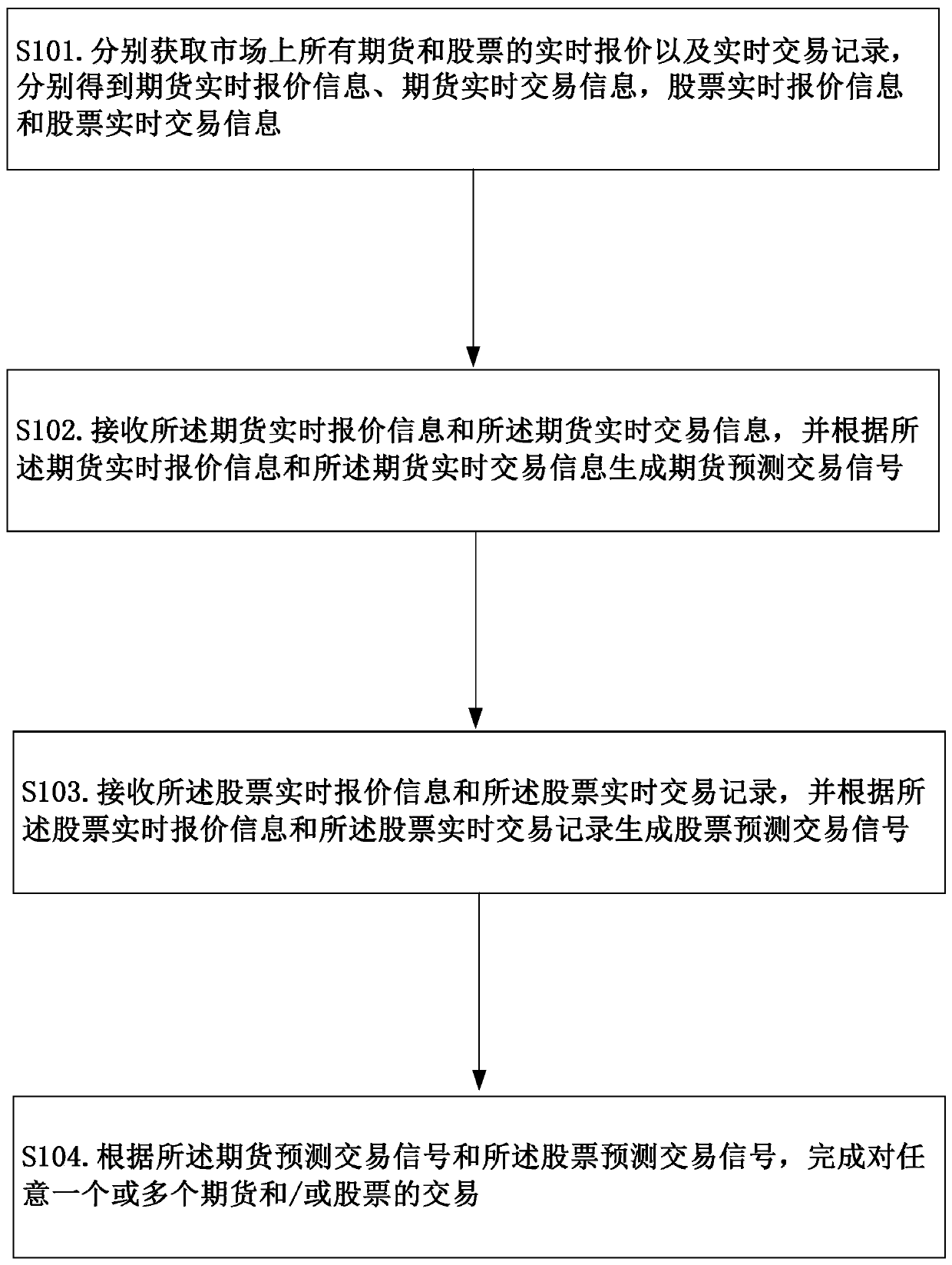

Futures and stock trading method, system and device based on big data

PendingCN111145029ARealize the transactionRealize transaction predictionFinanceForecastingFinancial transactionStock forecasting

The invention discloses a futures and stock trading method, system and device based on big data. According to the invention, real-time quotations and real-time transaction records of all futures and stocks on a market are collected in real time, the above information is used as a data basis, a futures prediction transaction signal and a stock prediction transaction signal are obtained according toa real-time quotation and a real-time transaction record of the futures and the stocks, and finally, a user can buy and sell one or more futures and / or stocks according to the futures prediction transaction signal and the stock prediction transaction signal. Through the design, a stock and futures trading strategy is provided for each investor, data support is provided for each investor to graspthe rise and fall of the stock and futures, and the trading prediction of the stock and futures is realized. In addition, the real-time quotation and the real-time transaction record of the stock andthe futures are used as the data basis of inference, and the accuracy and the rationality of the prediction result are ensured.

Owner:深圳市荣亿达科技发展有限公司

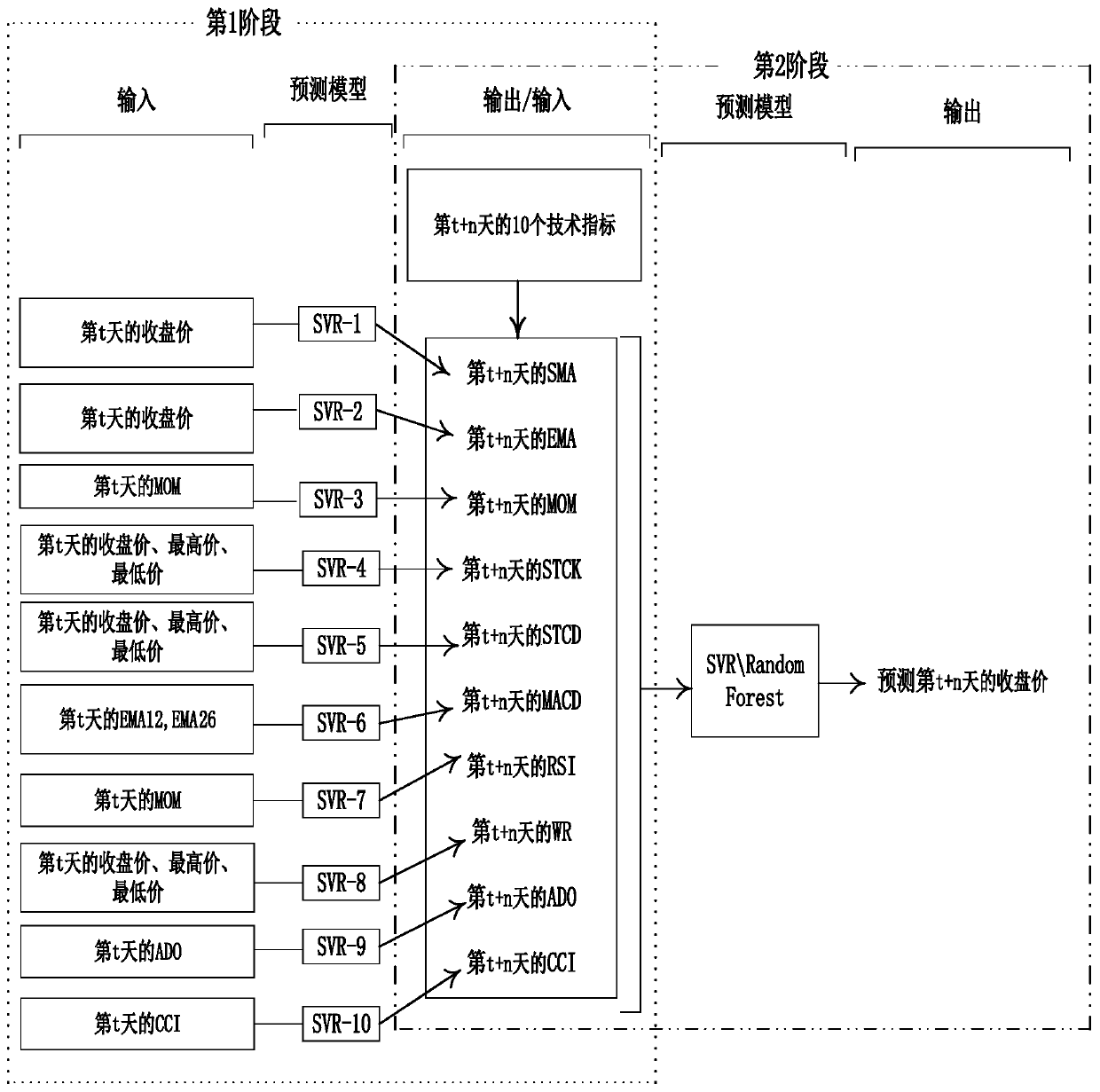

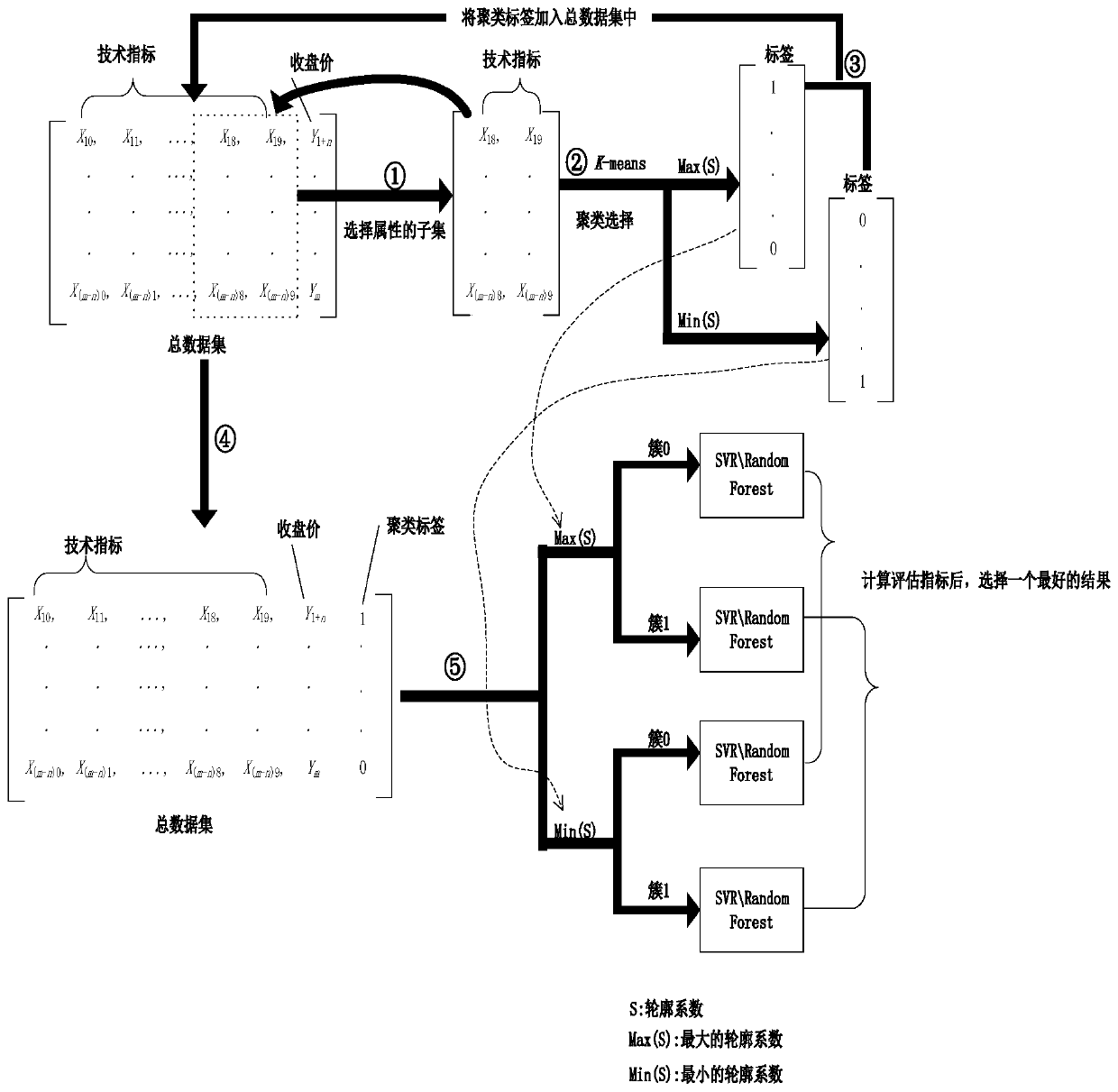

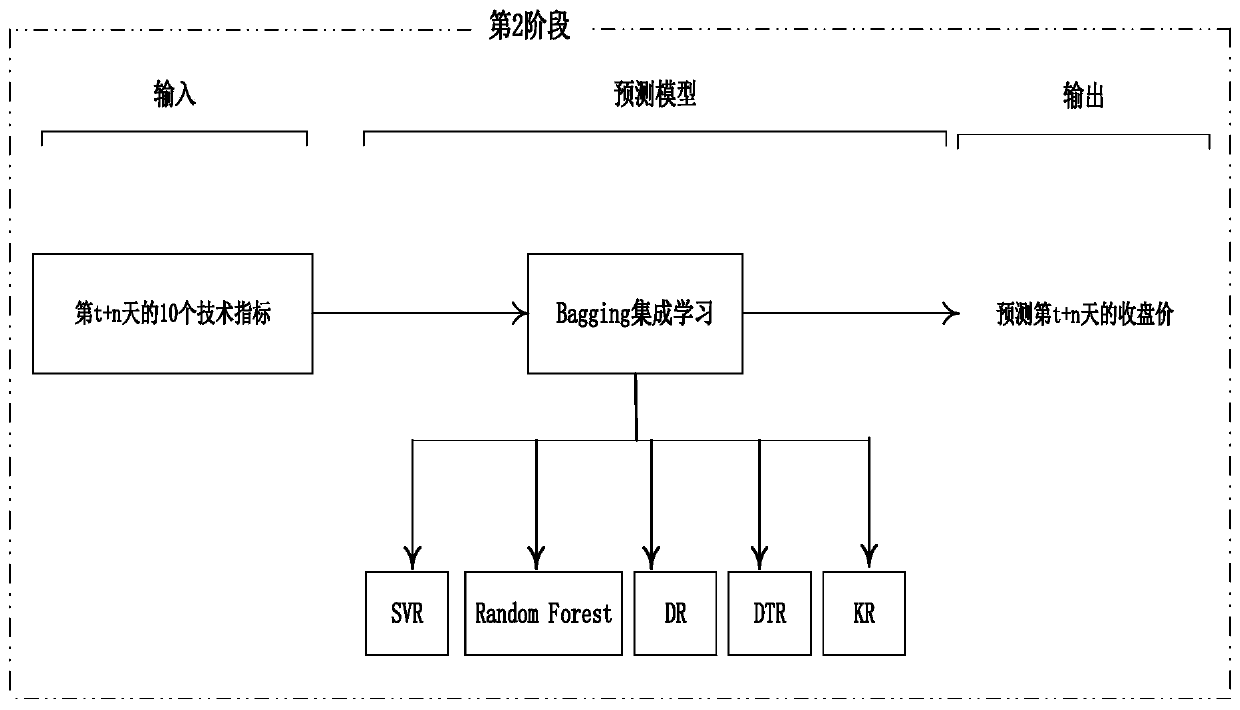

Financial stock prediction method fusing clustering and ensemble learning

The invention discloses a financial stock prediction method fusing clustering and ensemble learning. According to the method, a k-means clustering method is adopted to cluster a plurality of common technical indexes, so that a C-SVR-SVR (Clustering-SVR-SVR) prediction model and a C-SVR-RF (Clustering-SVR-RF) prediction model based on clustering can be provided; and then, a Bagging ensemble learning algorithm is adopted to propose a model E-SVR&RF (Ensemble-SVR&RF). And finally, the k-means clustering algorithm and the Bagging ensemble learning algorithm are combined, and a hybrid model C-E-SVR&RF (Clustering-Ensemble-SVR&RF) is provided. According to the invention, four Chinese stocks, namely SPD Bank (SH: 600000), CITIC Securities (SH: 600030), ZTE Corporation (SZ: 000063) and Le (SZ: 300104), are selected for experimental evaluation. Experimental results show that the C-SVR-SVR and the C-SVR-RF model of the k-means clustering algorithm are independently added, the prediction accuracyof the specific stock price can be improved, but the overall effect is not obvious. And the accuracy of stock price prediction can be improved by independently adding the ensemble learning algorithm.And a k-means clustering algorithm and an ensemble learning hybrid algorithm are fused, so that the stock price prediction accuracy can be further improved, and particularly, the prediction can be advanced by 20 and 30 days.

Owner:HUNAN UNIV

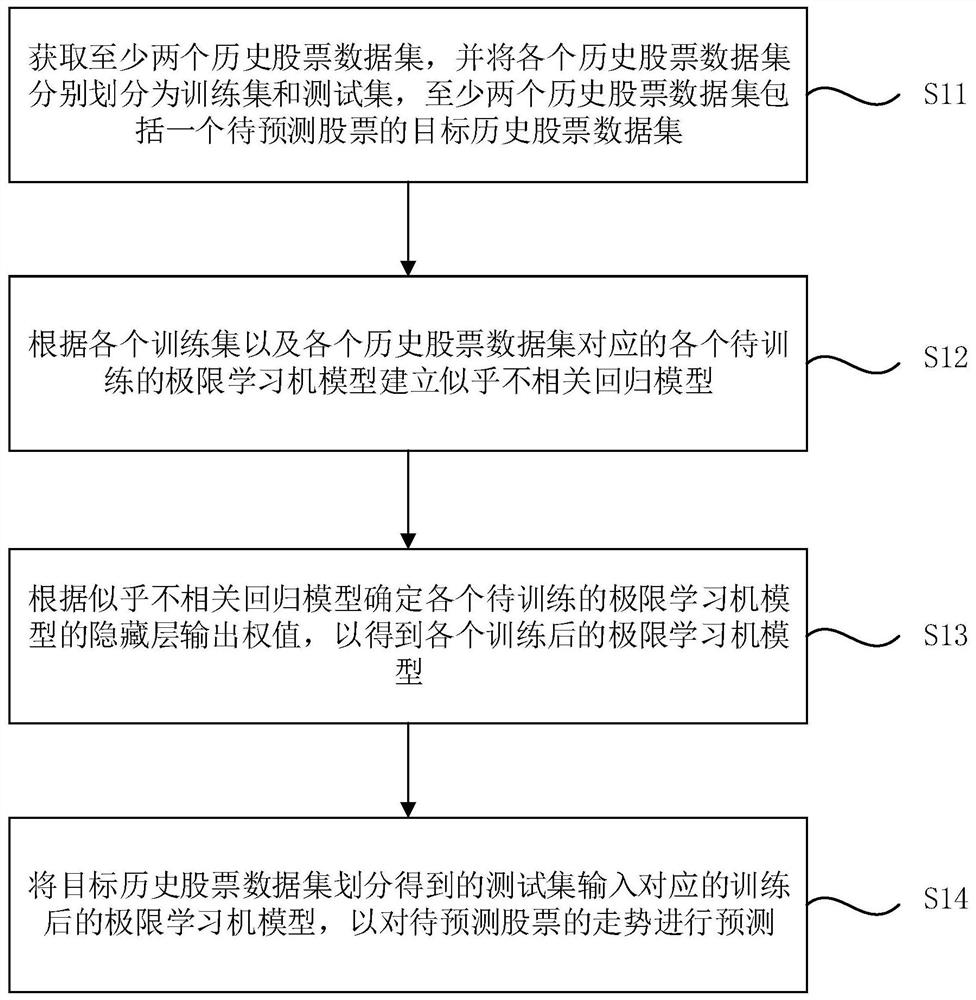

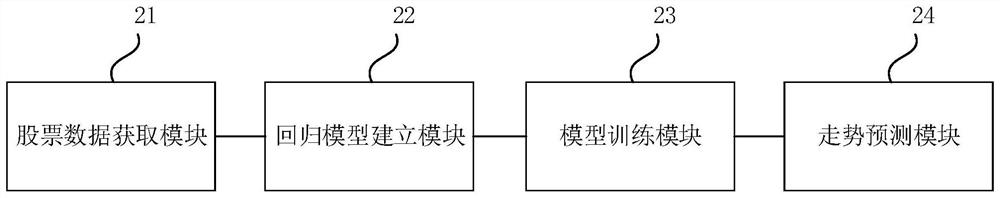

Stock trend prediction method, device, computer equipment and storage medium

InactiveCN112561179AImprove classification performanceAccurate estimateFinanceForecastingLearning machineHidden layer

The embodiment of the invention discloses a stock trend prediction method, a device, computer equipment and a storage medium. The method comprises steps of collecting at least two historical stock data sets, wherein each historical stock data set is divided into a training set and a test set, and the at least two historical stock data sets comprise a target historical stock data set of a to-be-predicted stock; establishing an approximately irrelevant regression model according to each training set and each to-be-trained extreme learning machine model corresponding to each historical stock dataset; determining a hidden layer output weight of each to-be-trained extreme learning machine model according to the approximate irrelevant regression model to obtain each trained extreme learning machine model; and inputting a test set obtained by dividing the target historical stock data set into the corresponding trained extreme learning machine model so as to predict the trend of the to-be-predicted stock. By considering the correlation between different data sets, the classification performance of the prediction model is improved, so that the stock prediction accuracy is improved.

Owner:SHENZHEN UNIV

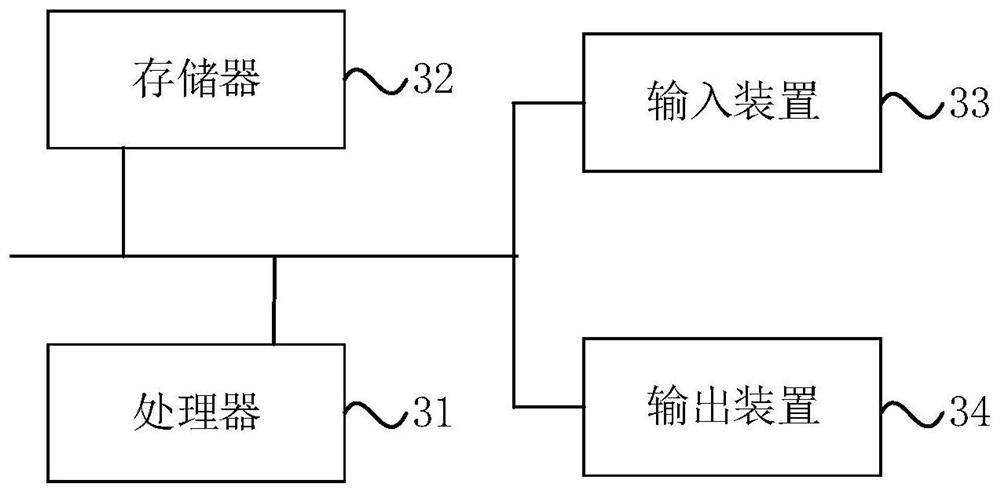

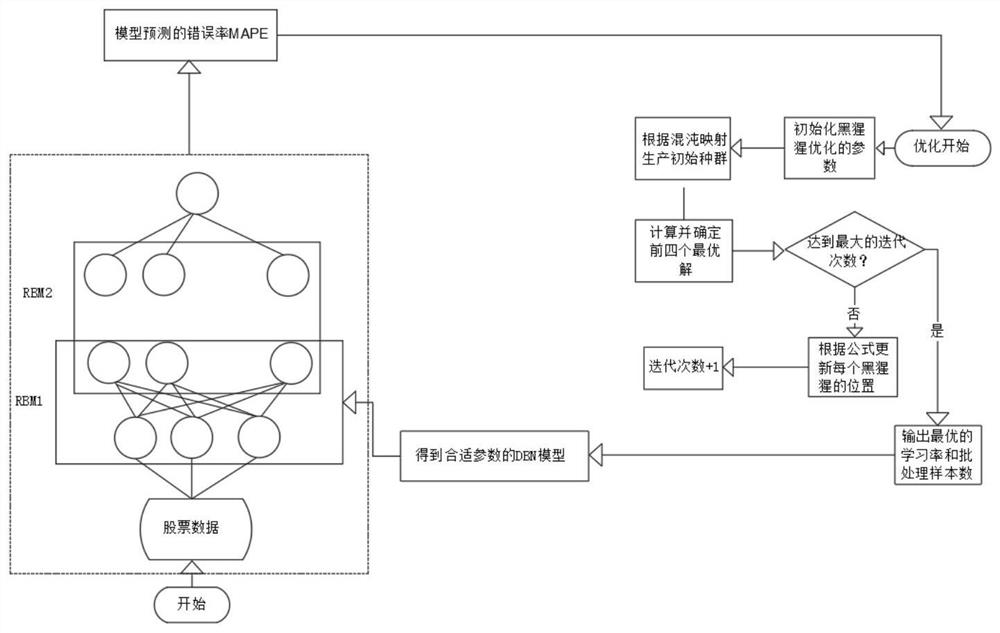

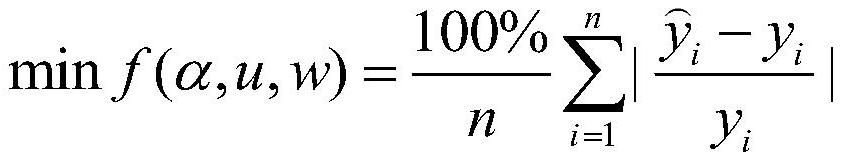

Stock prediction method for optimizing deep belief network based on improved chimpanzee algorithm

PendingCN113902216AAvoid performance instabilityImprove predictive performanceFinanceForecastingDeep belief networkBatch processing

The invention discloses a stock prediction method for optimizing a deep belief network based on an improved chimpanzee algorithm. The method is characterized by comprising the following steps: S1, inputting stock data into a DBN network, wherein the structure of the initial network includes the number of hidden layers of the network, the number of neurons of each layer, a learning rate, and the number of batch processing samples, and training the sample data; and S2, selecting an average percentage error (MAPE) of a predicted value output by the DBN model as an optimization objective function. A chimpanzee optimization algorithm is used to optimize the learning rate of the DBN and batch processing sample number parameters, and network performance instability caused by parameter setting through human experience is avoided, so that an optimal parameter combination is obtained, and the prediction performance of the DBN model for different stock data is improved.

Owner:SHANGHAI NORMAL UNIVERSITY

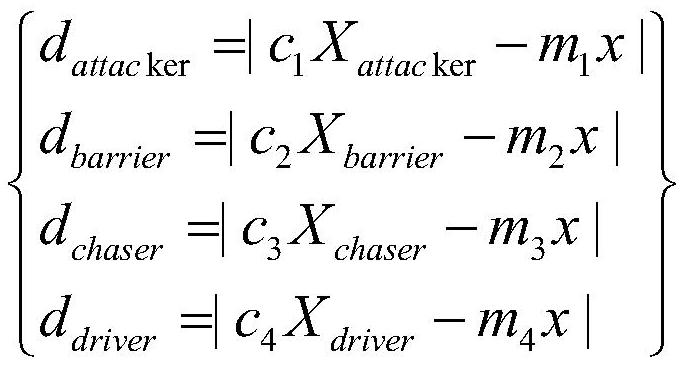

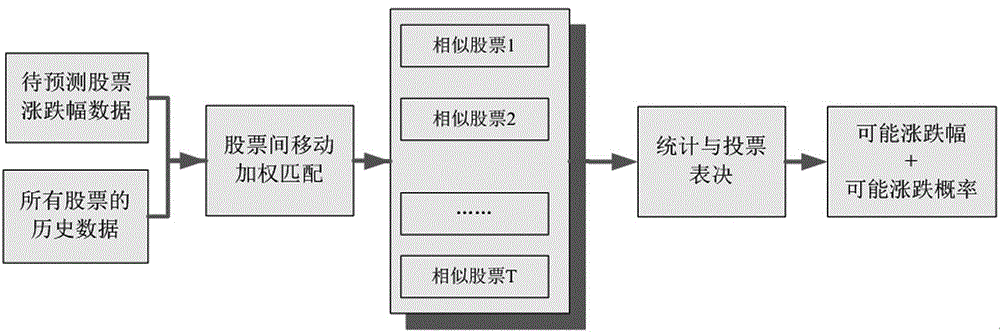

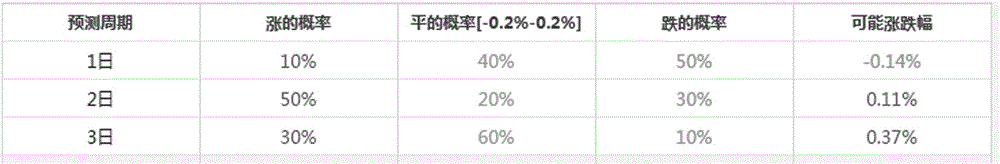

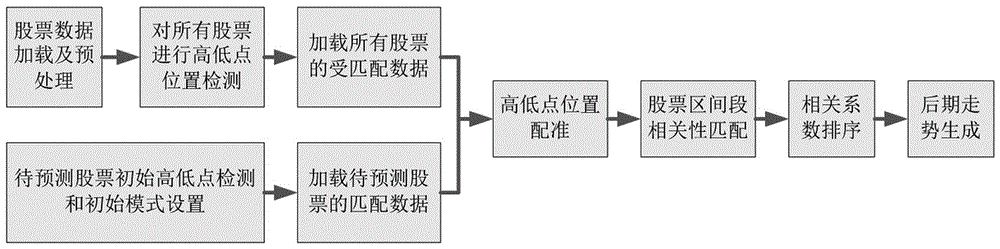

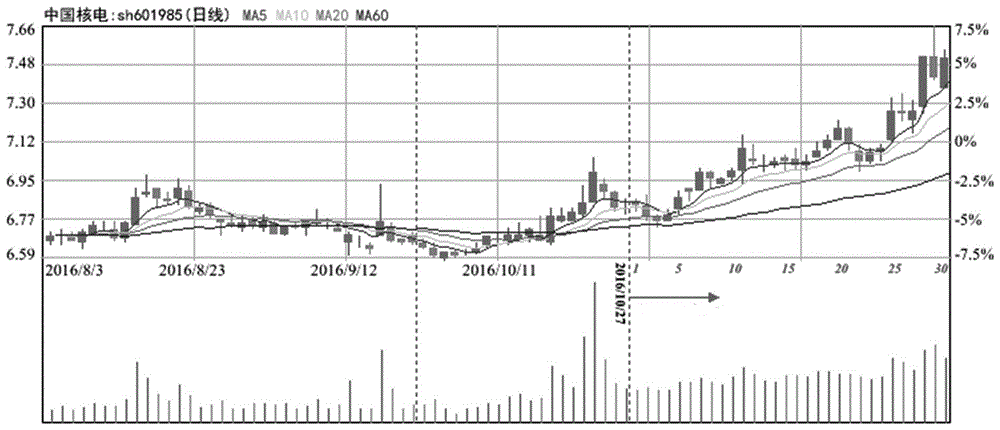

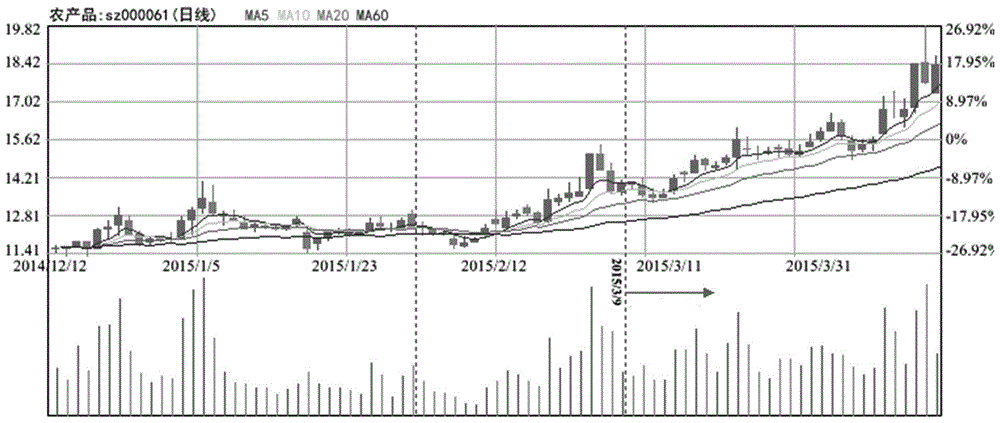

Short-term stock forecasting method based on multi-similar stock voting statistics

The invention discloses a short-term stock forecasting method based on multi-similar stock voting statistics. The main idea of the method is to predict the trends of stocks within a short term in order to match the historical data of all stocks segment by segment, search for the matching segment and the matching date corresponding to the first few stocks with highest similarity, averages the increase and decrease values of the stocks after the matching date, calculate the possible increase and decrease value in a late period, perform positive and negative voting statistics, and calculate the probability of possible increase and decrease. The method can be used to predict the recent increase and decrease values and increase and decrease probability of the stock so as to provide decision support for the short-term operation of the stock.

Owner:洪志令

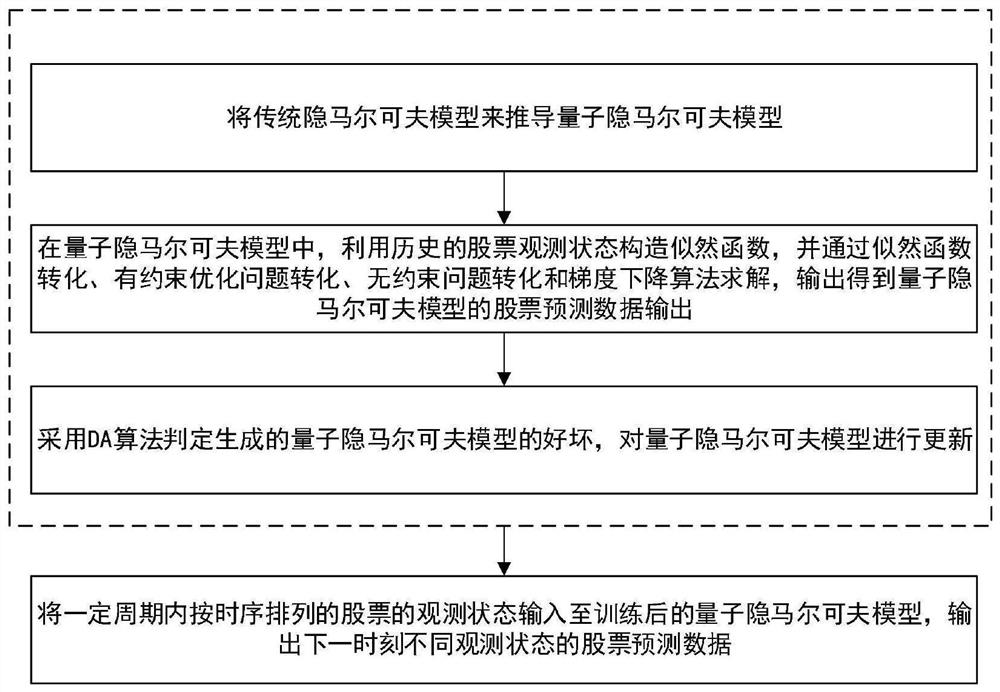

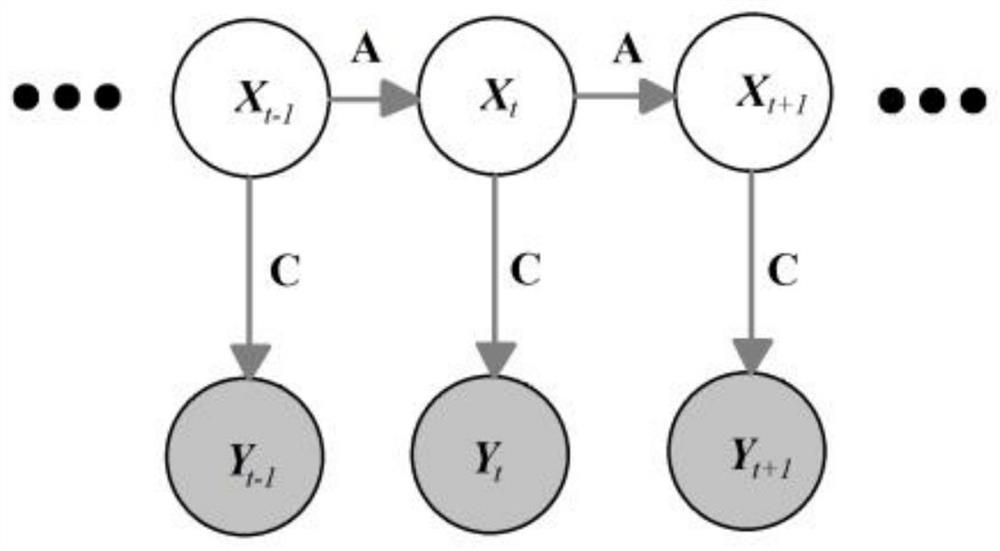

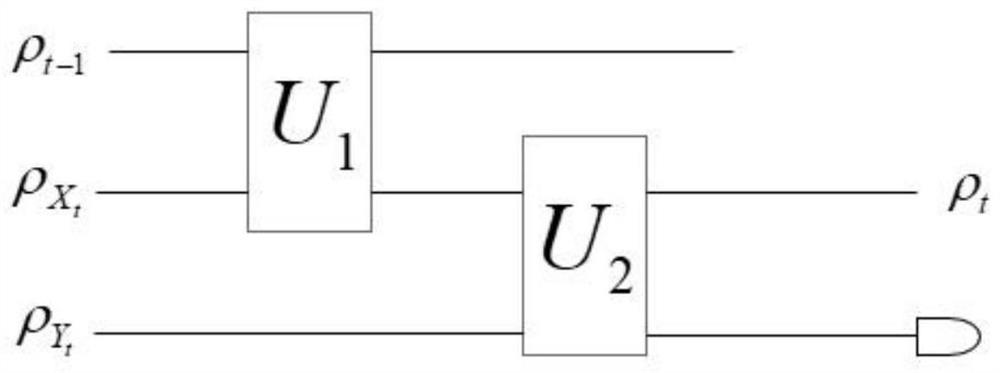

Quantum hidden Markov stock prediction method and system, storage medium and terminal

The invention discloses a quantum hidden Markov stock prediction method and system, a storage medium and a terminal. The method comprises the following steps: inputting the observation states of stocks arranged according to a time sequence in a certain period into a trained quantum hidden Markov model, and outputting the stock prediction data of different observation states at the next moment. Compared with the prior art in which the hidden Markov model is adopted to predict the stock data, the hidden Markov model of the quantum version is added into the stock prediction model, so that the credibility of the combination of the quantum algorithm and the classical algorithm can be verified; and under the condition that fewer parameters are used (two probability matrixes AC in the hidden Markov model are fused into a Karus operator, so that the use of the parameters is reduced), and the effect similar to that of a traditional hidden Markov model is achieved.

Owner:四川元匠科技有限公司

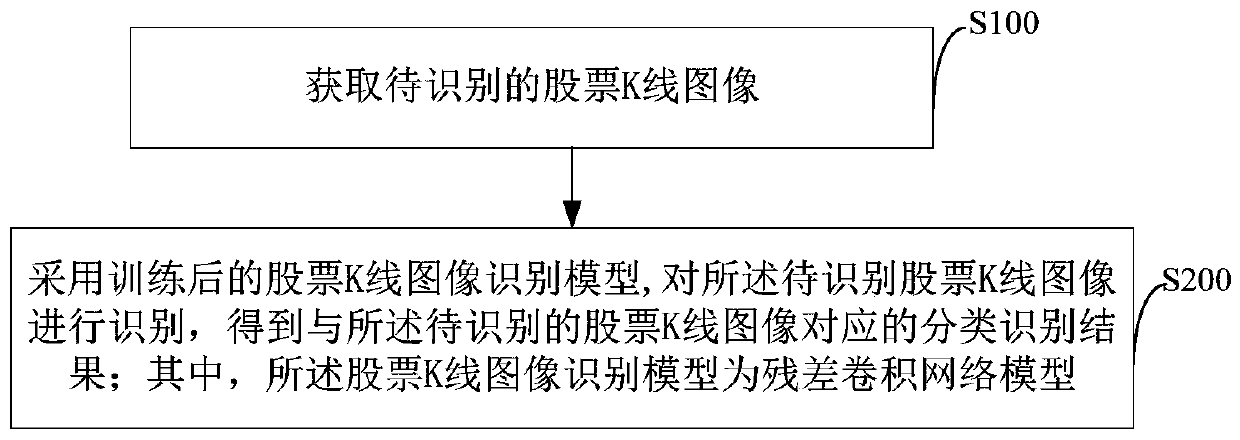

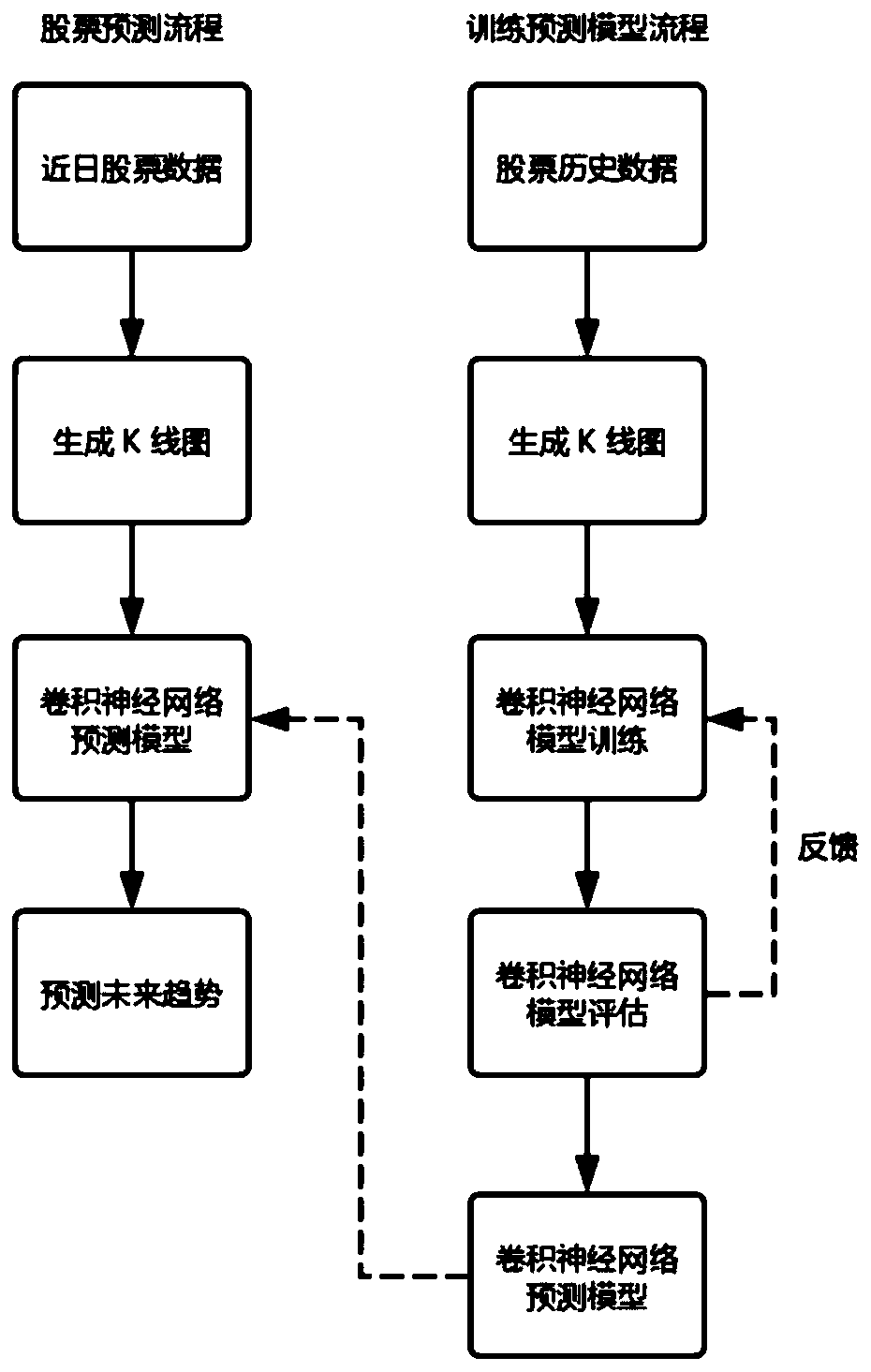

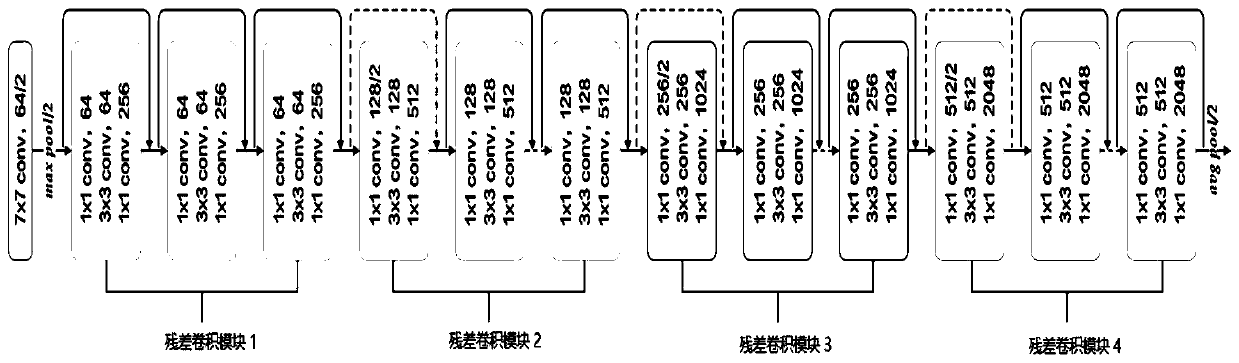

Stock K-line image recognition method and device, intelligent terminal and storage medium

PendingCN110796006AImprove accuracyReasonable and correct trading tipsFinanceForecastingEngineeringNetwork model

The invention discloses a stock K-line image recognition method and device, an intelligent terminal and a storage medium. The method comprises the steps of obtaining a to-be-recognized stock K-line image; using the trained stock K-line image recognition model to recognize the to-be-recognized stock K-line image, and obtaining a classification recognition result corresponding to the to-be-recognized stock K-line image; wherein the stock K-line image recognition model is a residual convolutional network model. According to the method, the convolutional neural network technology in deep learningis utilized to perform intelligent identification on the stock data, the visual features of the stock K-line graph are extracted, the future trend of the stock is predicted by utilizing the visual features, and the stock prediction accuracy is improved. And a reasonable and correct transaction prompt is provided for the user. The problem that the prediction result is inaccurate when the stock trend is predicted by using the stock K-line graph in the prior art is solved.

Owner:PENG CHENG LAB +1

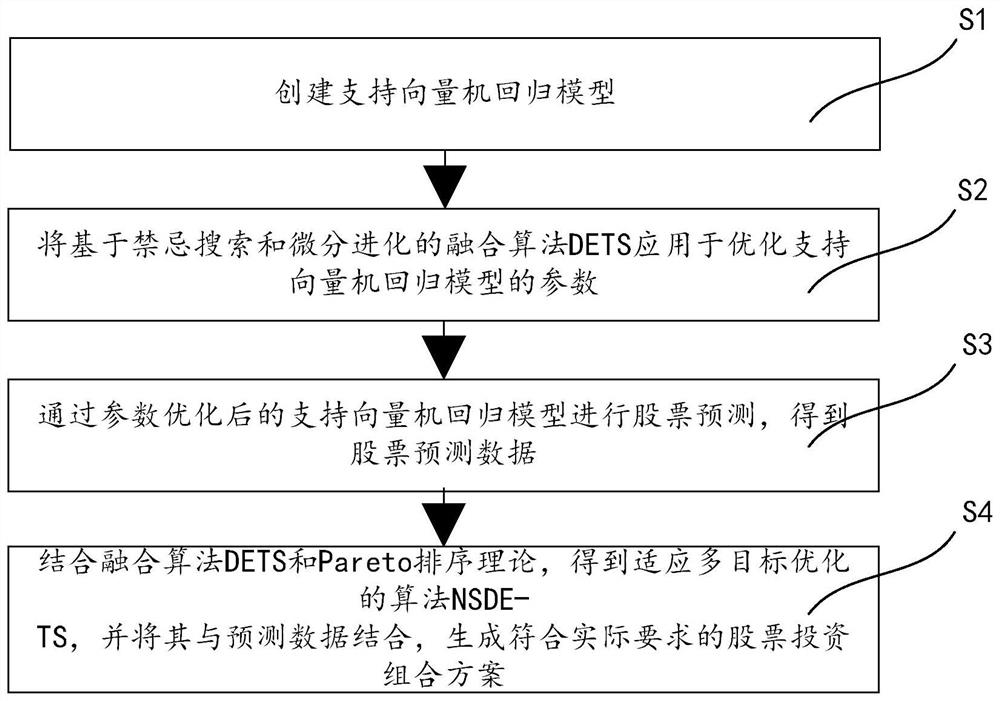

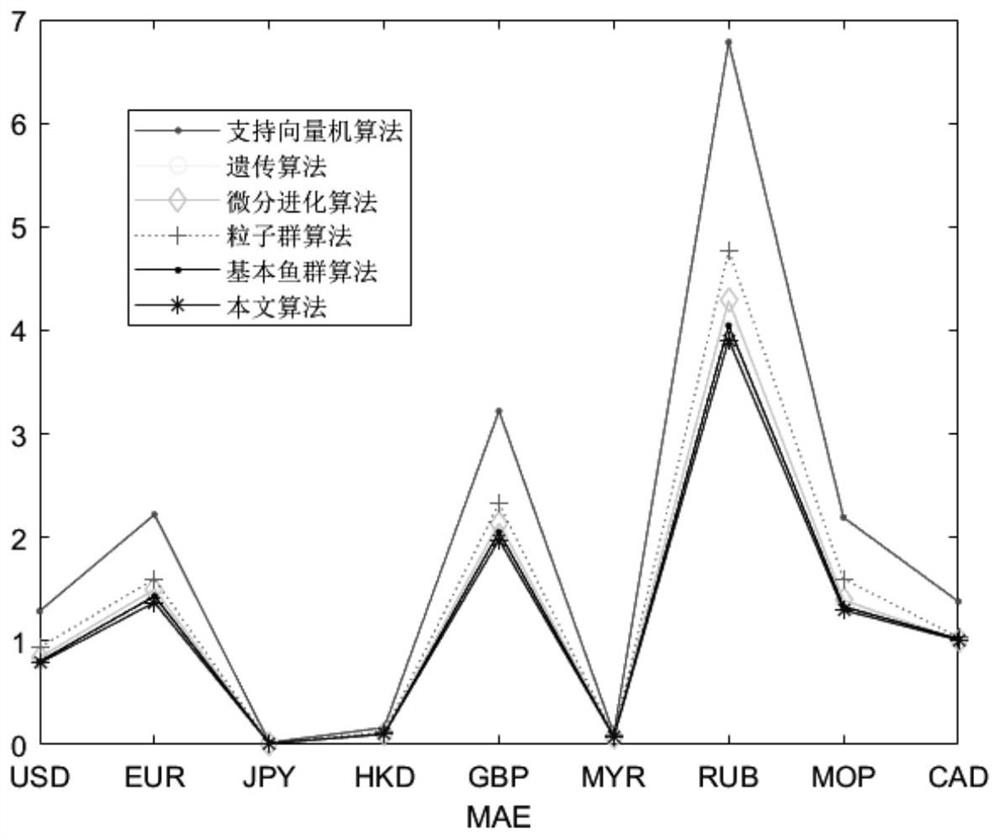

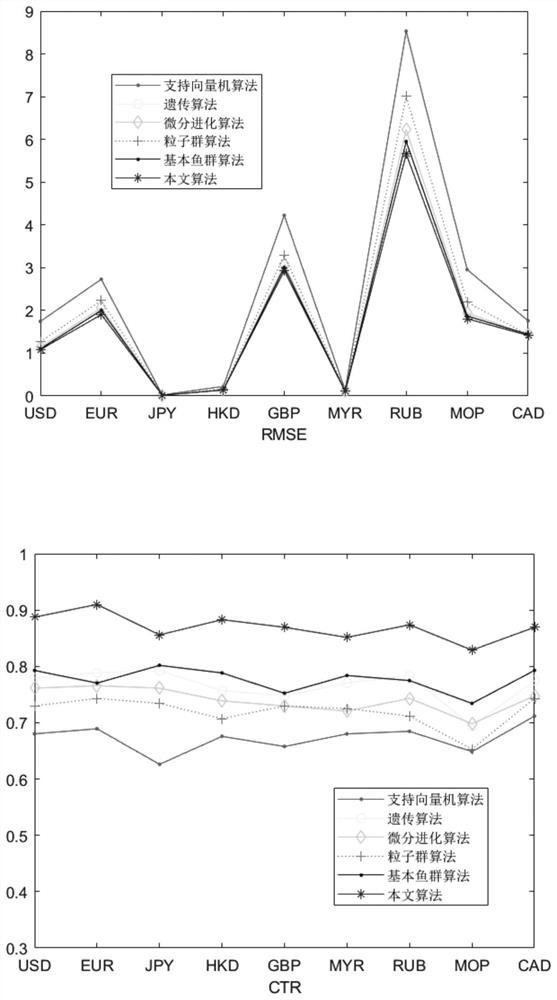

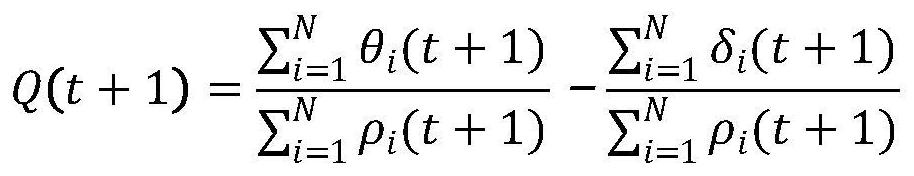

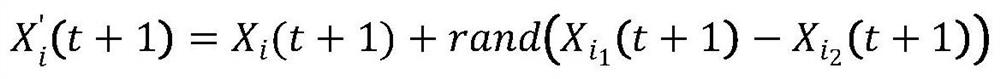

Stock prediction and investment portfolio optimization method and system, computer and storage medium

PendingCN114155097AImprove defectsLow ability to avoid global searchFinanceGenetic algorithmsData setTabu search

The invention discloses a stock prediction and investment portfolio optimization method and system, a computer and a storage medium, historical data and prediction data are fused into new data to improve the defects of a historical data set by adopting a fusion algorithm DETS based on tabu search and differential evolution, then investment portfolio configuration is carried out through combination of the fusion algorithm DETS and a Pareto sorting theory, and the optimization of the stock prediction and investment portfolio is realized. Therefore, the two difficulties of difficult prediction and difficult combinatorial optimization are solved, the defects that an existing investment combinatorial optimization algorithm focuses on historical data and has low global search ability of solutions, high time complexity, low solution set convergence and the like are avoided, the solving speed and the optimization quality of the solution set are greatly improved, and the purposes of improving the income and reducing the risk are achieved.

Owner:JINAN UNIVERSITY

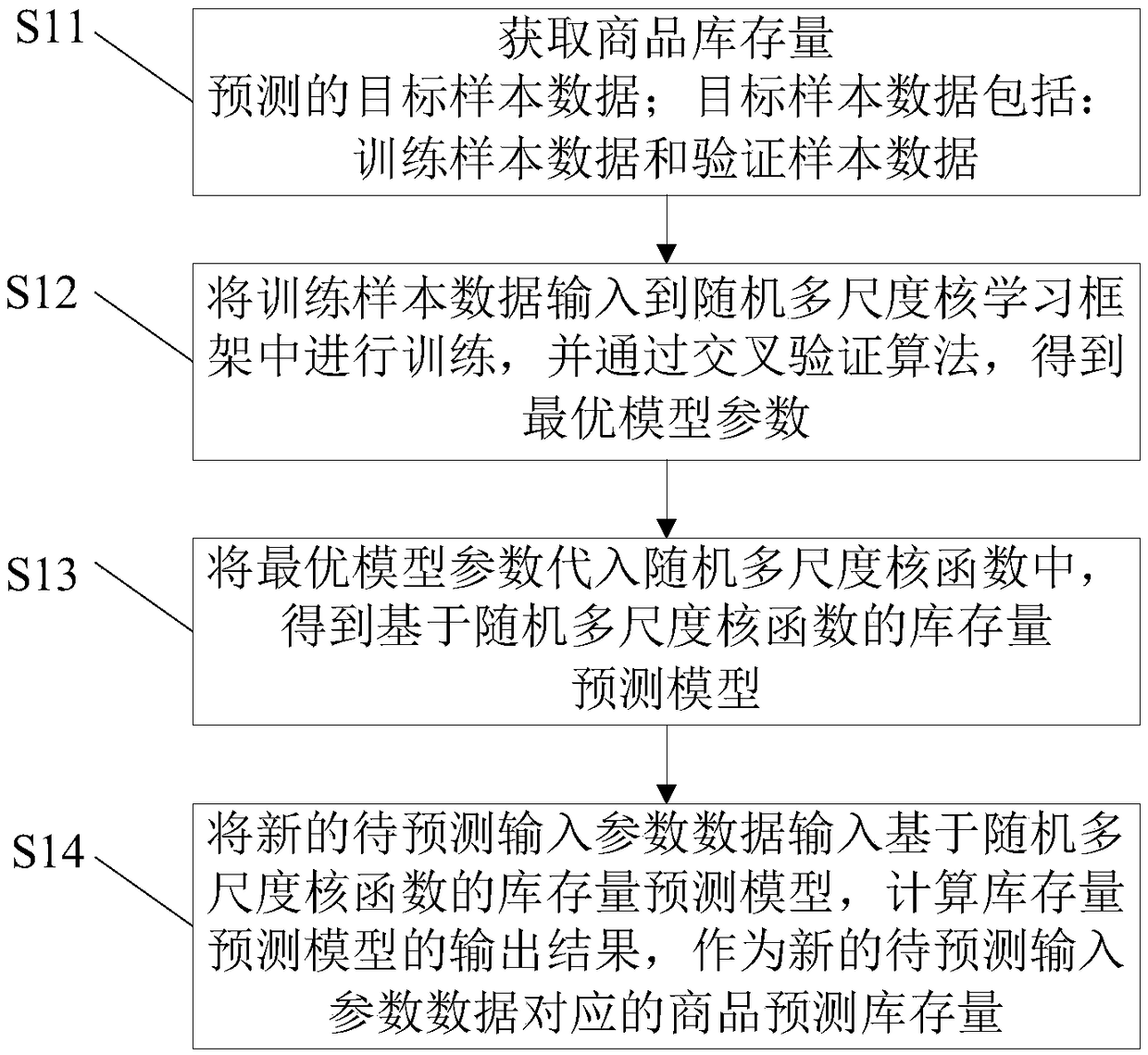

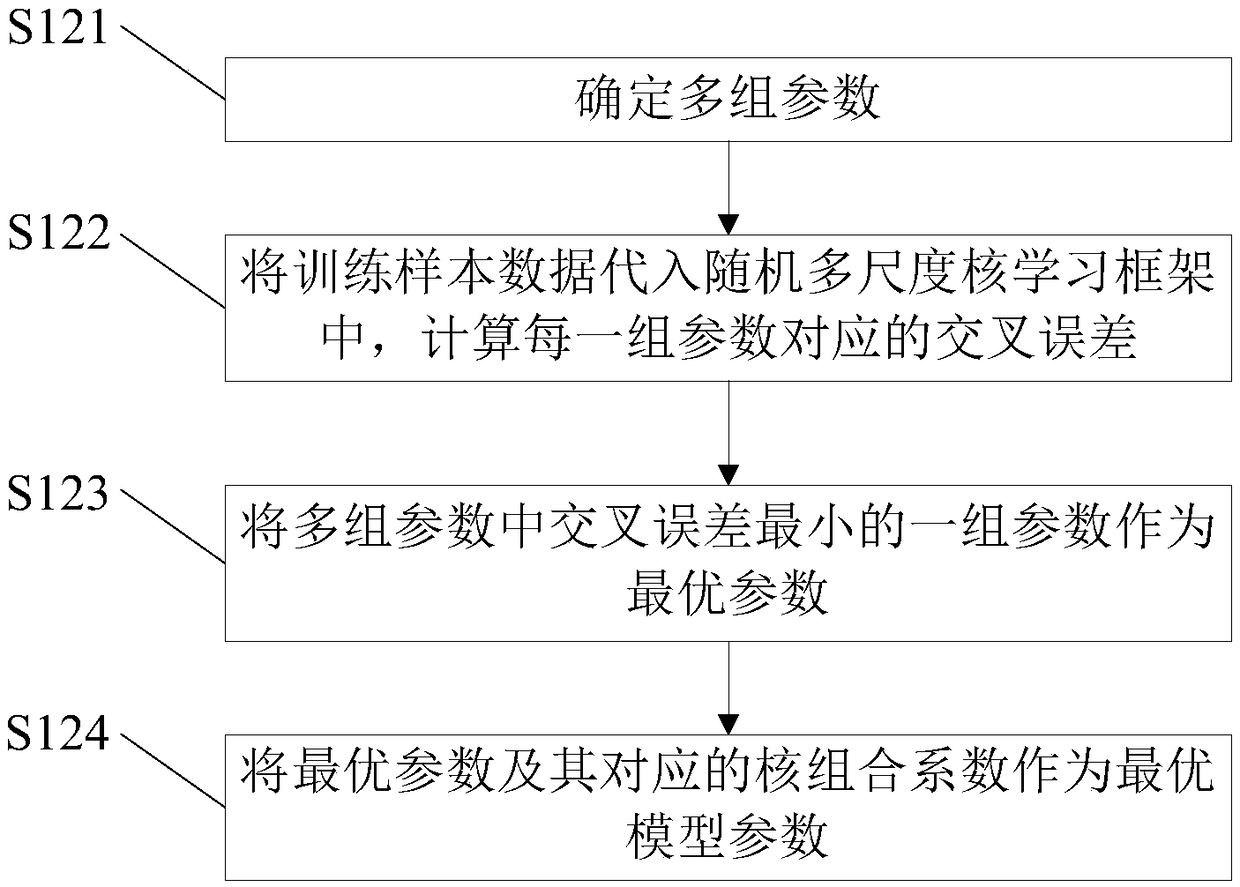

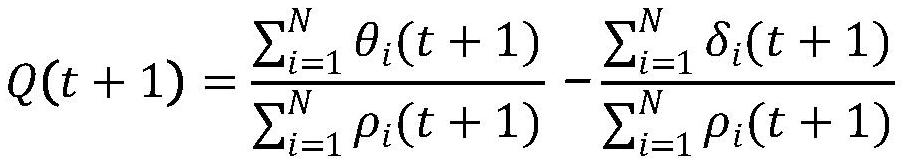

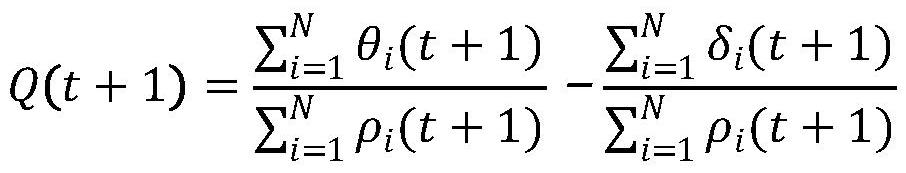

A method and a device for forecasting commodity inventory quantity

The invention provides a method and a device for forecasting commodity stock quantity, which relates to the technical field of data analysis, and obtains target sample data for forecasting commodity stock quantity. Target sample data includes: training sample data; then the training sample data is input into the stochastic multi-scale kernel learning framework for training, and the optimal model parameters are obtained by cross-validation algorithm. The optimal model parameters are substituted into the stochastic multi-scale kernel function, and the stock forecasting model based on the stochastic multi-scale kernel function is obtained. The new input parameter data is inputted into the stock forecasting model based on the stochastic multi-scale kernel function, and the output result of thestock forecasting model is calculated as the commodity forecast stock corresponding to the new input parameter data. The invention can determine a stock quantity prediction model based on a random multi-scale kernel function through training sample data in a random multi-scale kernel learning framework and a cross-validation algorithm, so as to improve the accuracy and credibility of the stock quantity prediction result of commodities.

Owner:杭州汇数智通科技有限公司

Stock trend prediction method and system based on text abstract emotion mining

InactiveCN111723127AEnhanced Representational CapabilitiesComplete input informationFinanceNatural language data processingFeature vectorStock trend prediction

The invention relates to a stock trend prediction method and system based on text abstract emotion mining. The stock trend prediction method comprises the following steps: S1, acquiring a plurality ofnews data related to stocks; s2, obtaining a text abstract of each piece of news through the news data; s3, extracting sentiment words in each text abstract according to a pre-established sentiment lexicon, and scoring sentiment of each text abstract according to sentiment expression intensity of the sentiment words; s4, inputting the emotion score of each text abstract as a feature vector and stock historical change trend data into a pre-established stock prediction model for calculation, and if a calculation result is greater than or equal to zero, determining that the stock is in an risingtrend; and if the calculation result is less than zero, determining that the stock is in a falling trend. According to the method, news text abstracts are extracted, emotion mining is carried out onthe text abstracts, and information influencing stock market fluctuation trends is effectively obtained, so that stock fluctuation prediction is only limited to previous stock information, and the stock trends can be predicted more accurately from more aspects.

Owner:RENMIN UNIVERSITY OF CHINA

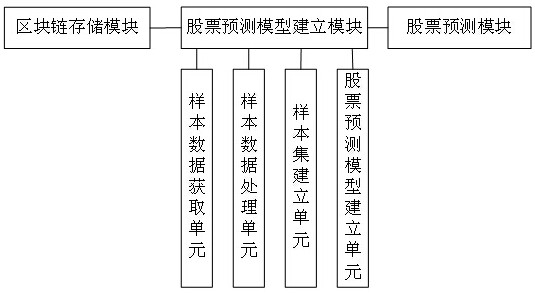

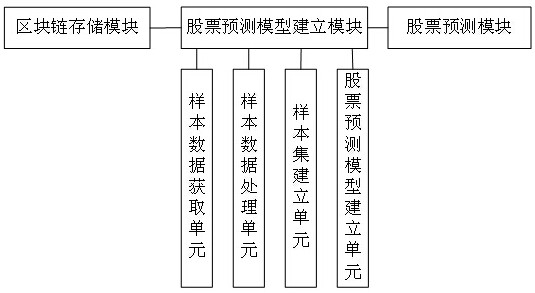

Stock risk early warning system based on blockchain, big data and algorithm

ActiveCN112927085AEffective predictionImprove forecast accuracyFinanceForecastingEarly warning systemStock forecasting

The invention discloses a stock risk early warning system based on blockchain, a big data and a algorithm, and the system comprises a stock prediction model establishment module, a blockchain storage module and a stock prediction module; the stock prediction model establishment module is used for establishing a stock prediction model, and the blockchain storage module is used for storing a sample set for training and testing the stock prediction model; the stock prediction module intercepts a trading day before the prediction day and historical index data of the trading day before the trading day according to a preset sub-sequence length to form a sub-sequence, the normalized sub-sequence serves as an input value and is input into the established stock prediction model, and an output value of the stock prediction model is the stock trend of the prediction day. The invention has the beneficial effects that the BP neural network is trained and tested by using the stock historical index data, and the stock prediction model based on the BP neural network is established to predict the stock trend, so that investors can timely avoid investment loss according to the predicted stock rising and falling trend.

Owner:广州经传多赢投资咨询有限公司

Stock forecasting method based on accurate high and low point segmentation matched with correlation trend

The invention discloses a stock forecasting method based on accurate high and low point segmentation matched with the correlation trend. The main idea of the method is detecting and recording the high and low points of all the stocks in historical time series; afterwards, obtaining the trend of each to-be-forecasted stock for a most recent time period, after measuring the beginning high and low points and setting an initial model, accurately matching with the locations of the high and low points of the recorded, to be matched stocks; on this basis, calculating the trend correlations of the matched points; after having found the most correlated matched segment searched from all the stocks, the later period trend of the known, to-be-matched stocks is used to estimate the later period of to-be-forecasted stocks. The method provides very good decision support for short-term handling of stocks.

Owner:洪志令

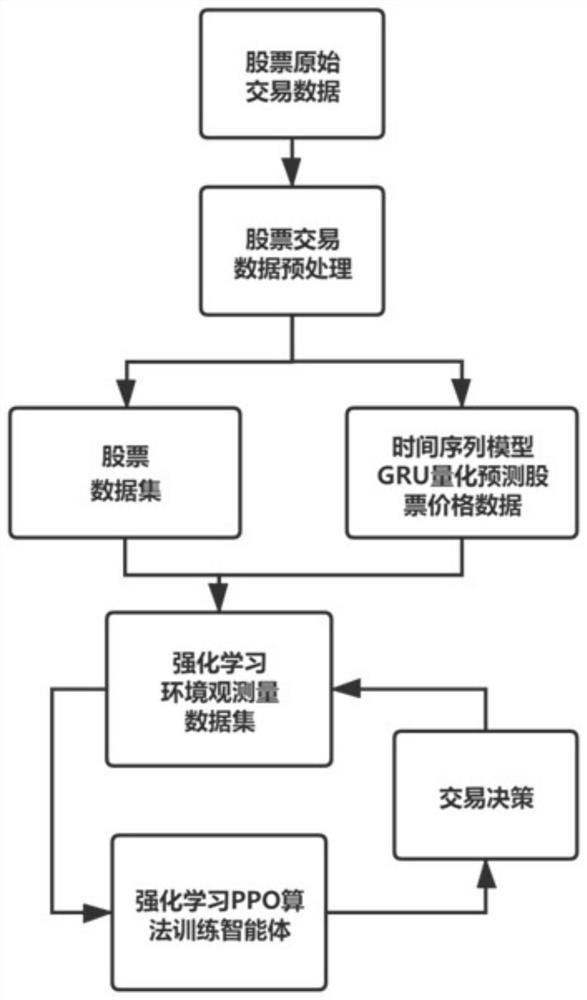

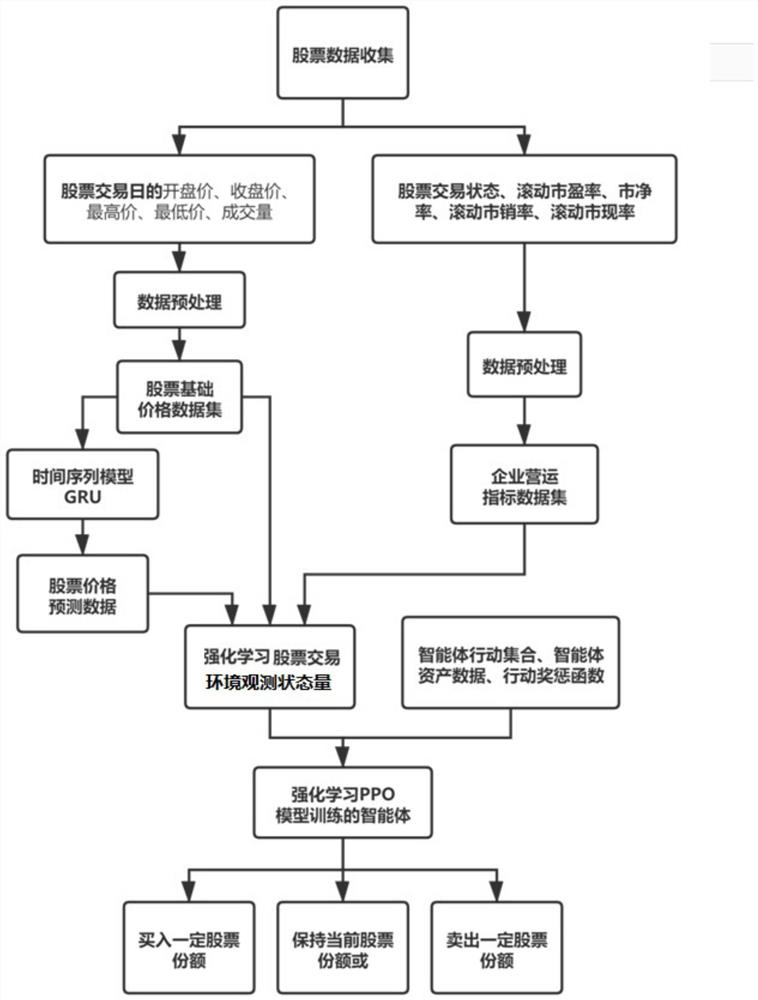

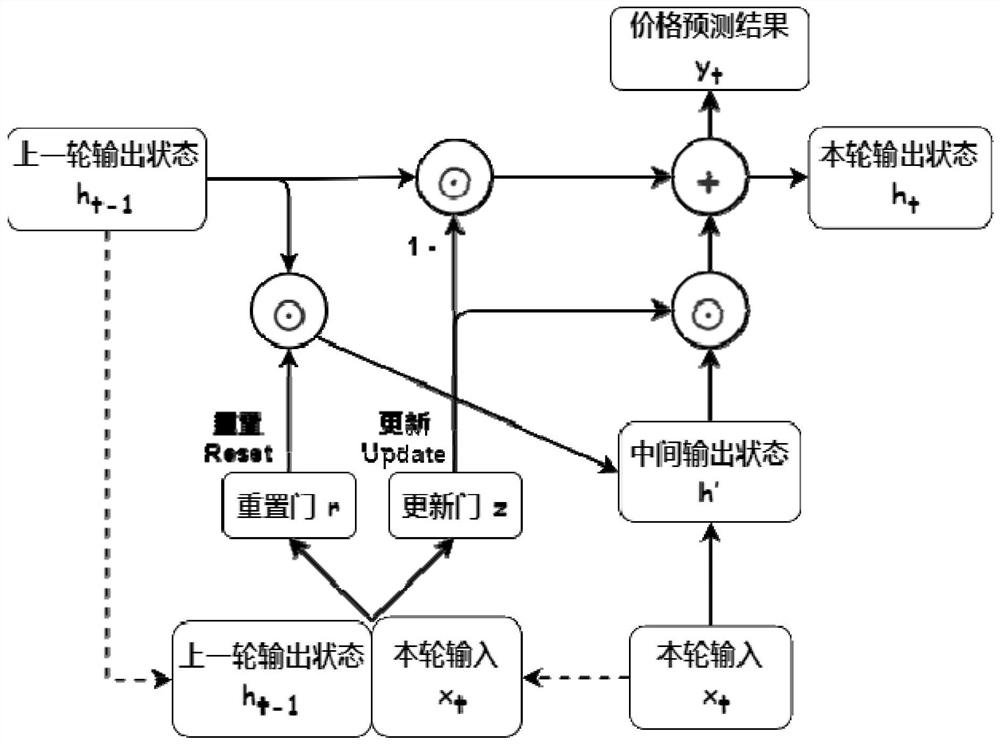

Stock transaction method and system based on reinforcement learning algorithm and time sequence model

The invention relates to the field of deep reinforcement learning and financial quantitative transaction, in particular to a stock transaction method and system based on a reinforcement learning algorithm and a time series model, and the method comprises the steps: data preprocessing, sorting collected stock data according to categories, filtering wrong data and repeated data, normalizing the data, and after preprocessing is completed, obtaining a stock data set; establishing a time sequence model to predict a stock price, dividing a stock basic price data set, establishing and training a time sequence GRU model which can be used for stock basic price data, and outputting a stock prediction price; enabling the stock transaction reinforcement learning model to output a decision, and adopting a PPO algorithm to train an intelligent agent to obtain the reinforcement learning model applied to the stock transaction so as to output an action decision of the stock transaction. According to the invention, information hidden in stock basic data can be fully mined, a reasonable transaction decision is made in a stock transaction environment, and a reference is provided for real stock transaction related personnel.

Owner:JINAN UNIVERSITY

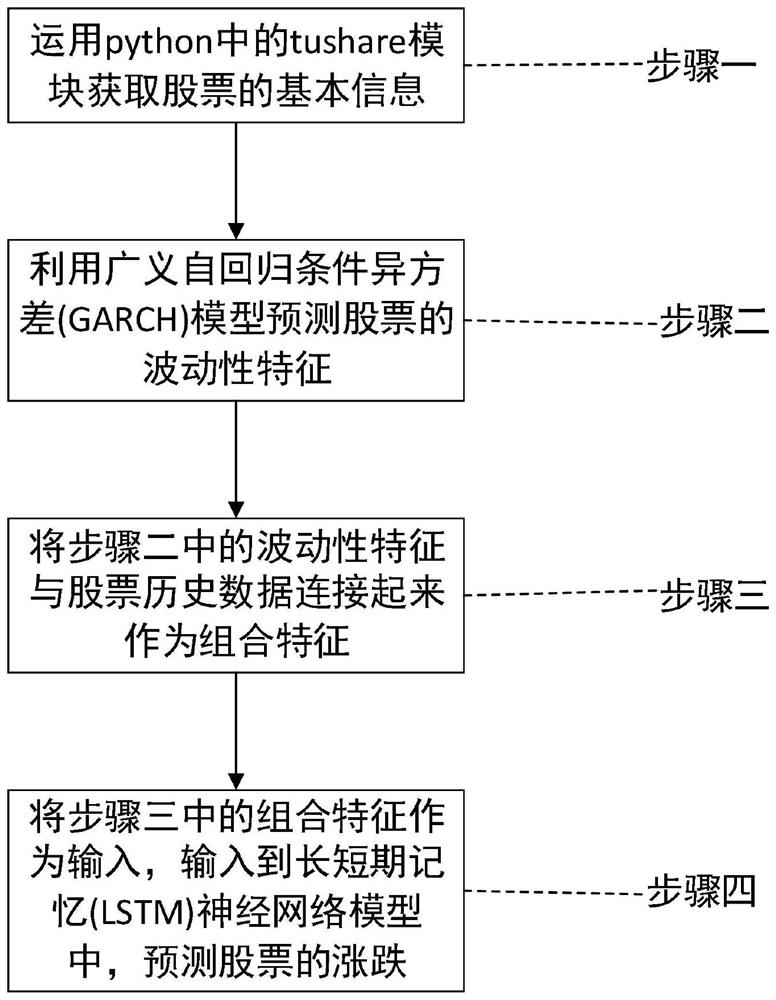

Stock prediction system integrating volatility

PendingCN114819296AGood investment adviceSolve the problem of unsatisfactory forecast accuracyFinanceForecastingPython languageHeteroscedastic model

The invention discloses a stock prediction system fusing volatility. The basic information of the stock is obtained through a push module in the python language, wherein the basic information comprises the opening price, the closing price, the trading volume and the like. The method comprises a generalized autoregressive conditional heterovariance (GARCH)-based model and a long short-term memory neural network (LSTM)-based model. The method is based on a generalized autoregressive conditional heterovariance (GARCH) model, is used for predicting the stock volatility, and predicts the volatility characteristics of the stock by taking basic information of the stock as input. On the basis of a long short-term memory (LSTM) neural network model, the fluctuation characteristics of the stock and basic information of the stock are used as the input of the model, and the LSTM neural network model is utilized to predict the rise and fall of the stock.

Owner:HARBIN UNIV OF SCI & TECH

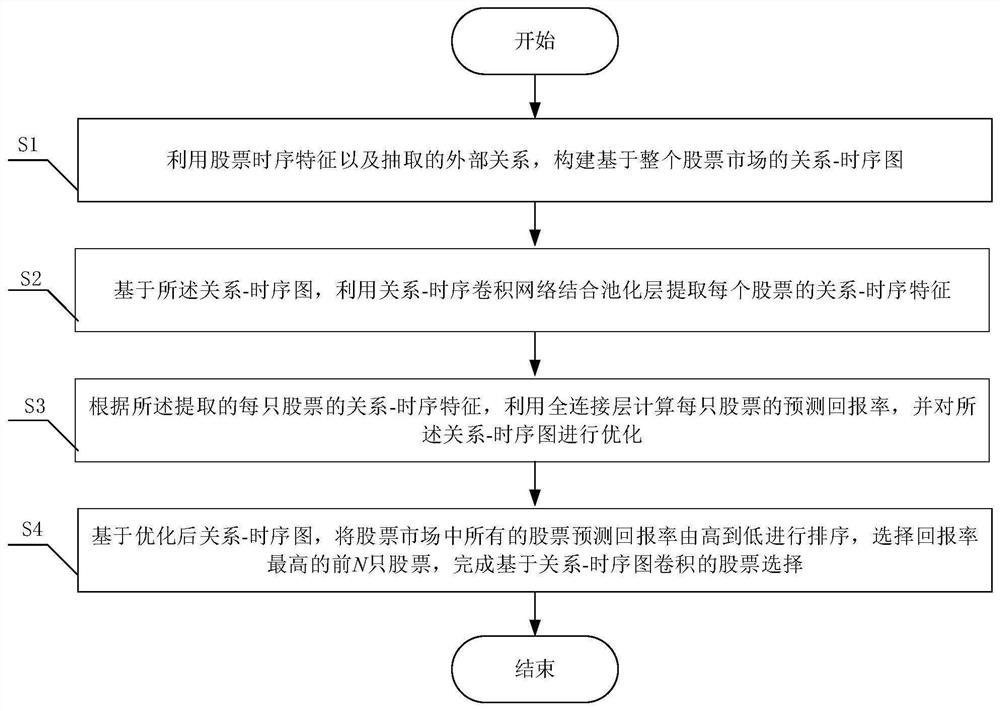

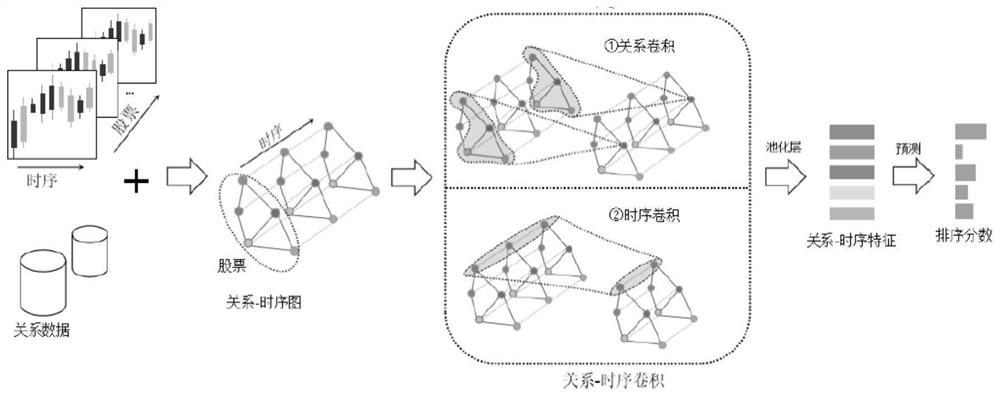

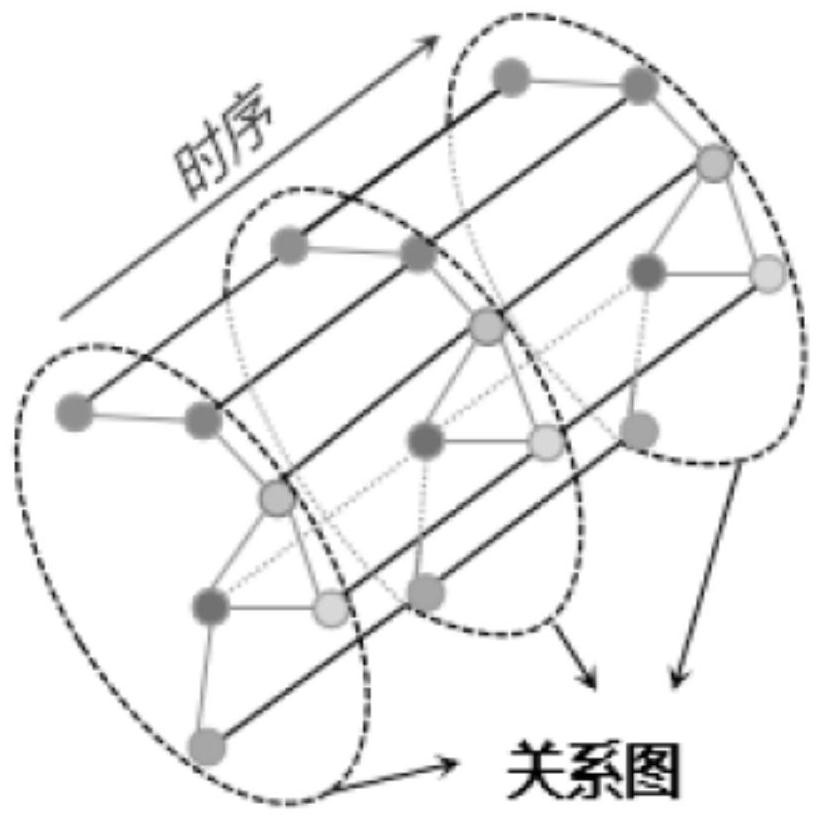

Stock selection method based on relation-time sequence diagram convolution

PendingCN112950377AFaster and more efficient extractionFast trainingFinanceForecastingTiming diagramStock trend prediction

The invention provides a stock selection method based on relation-time sequence diagram convolution, which belongs to the technical field of stock selection and comprises the following steps: constructing a relation-time sequence diagram based on a whole stock market; based on the relation-time sequence diagram of the whole stock market, extracting relation-time sequence features of each stock by using a relation-time sequence diagram convolutional network in combination with a pooling layer; according to the extracted relation-time sequence features of each stock, calculating a predicted return rate of each stock by using a full connection layer, and optimizing a relation-time sequence diagram convolutional network; and based on the optimized relation-time sequence diagram convolutional network, sorting all stock prediction return rates in the stock market from high to low, and selecting the first N stocks with the highest return rate. The stock trend prediction not only needs to consider the time sequence information of each stock, but also needs to consider other stock information associated with the stock in the market, so that the problem that the relationship-time sequence features of stocks are not considered at the same time during stock trend prediction in the prior art is solved through the design.

Owner:四川省人工智能研究院(宜宾)

Stock risk early warning system based on blockchain, big data and algorithms

ActiveCN112927085BEffective predictionImprove forecast accuracyFinanceForecastingEarly warning systemStock forecasting

Owner:广州经传多赢投资咨询有限公司

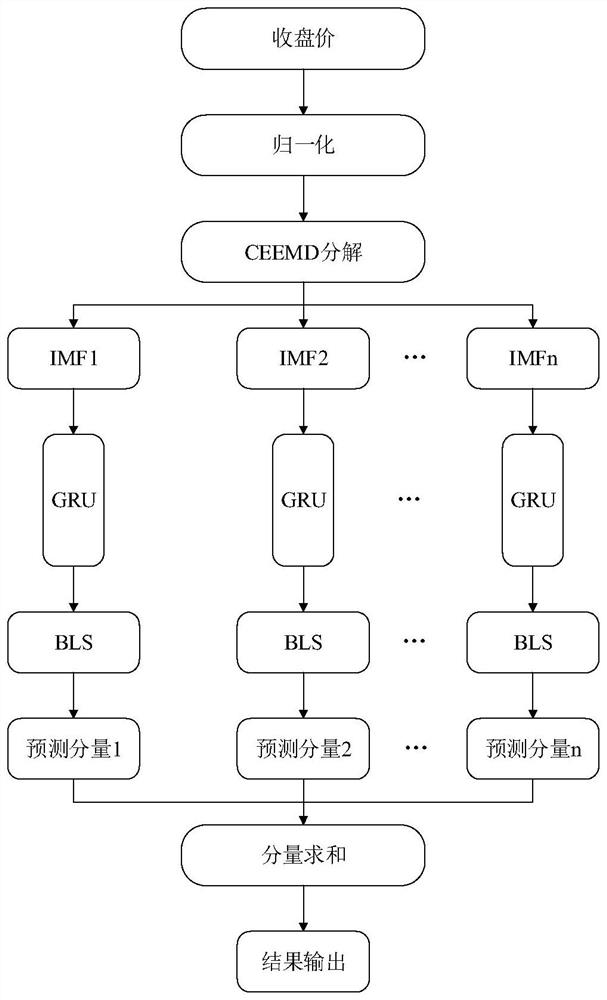

Stock closing price prediction method

PendingCN113837882AImprove forecast accuracyEasy to handleFinanceForecastingPrice predictionData mining

The invention discloses a stock closing price prediction method, and relates to the technical field of deep learning and stock prediction. According to the stock closing price prediction method, stock closing price data is input into a constructed stock closing price prediction model, and a prediction result of the stock closing price is output. The stock closing price prediction model comprises a complementary set empirical mode decomposition module, a gating circulation unit module, a full connection layer and width learning which are connected in sequence. The stock closing price prediction method improves the prediction precision of the stock closing price.

Owner:NANJING UNIV OF INFORMATION SCI & TECH

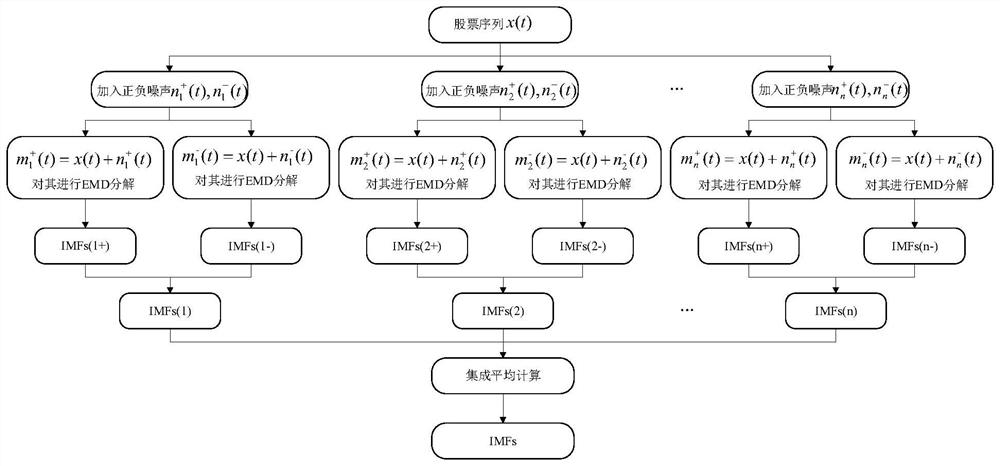

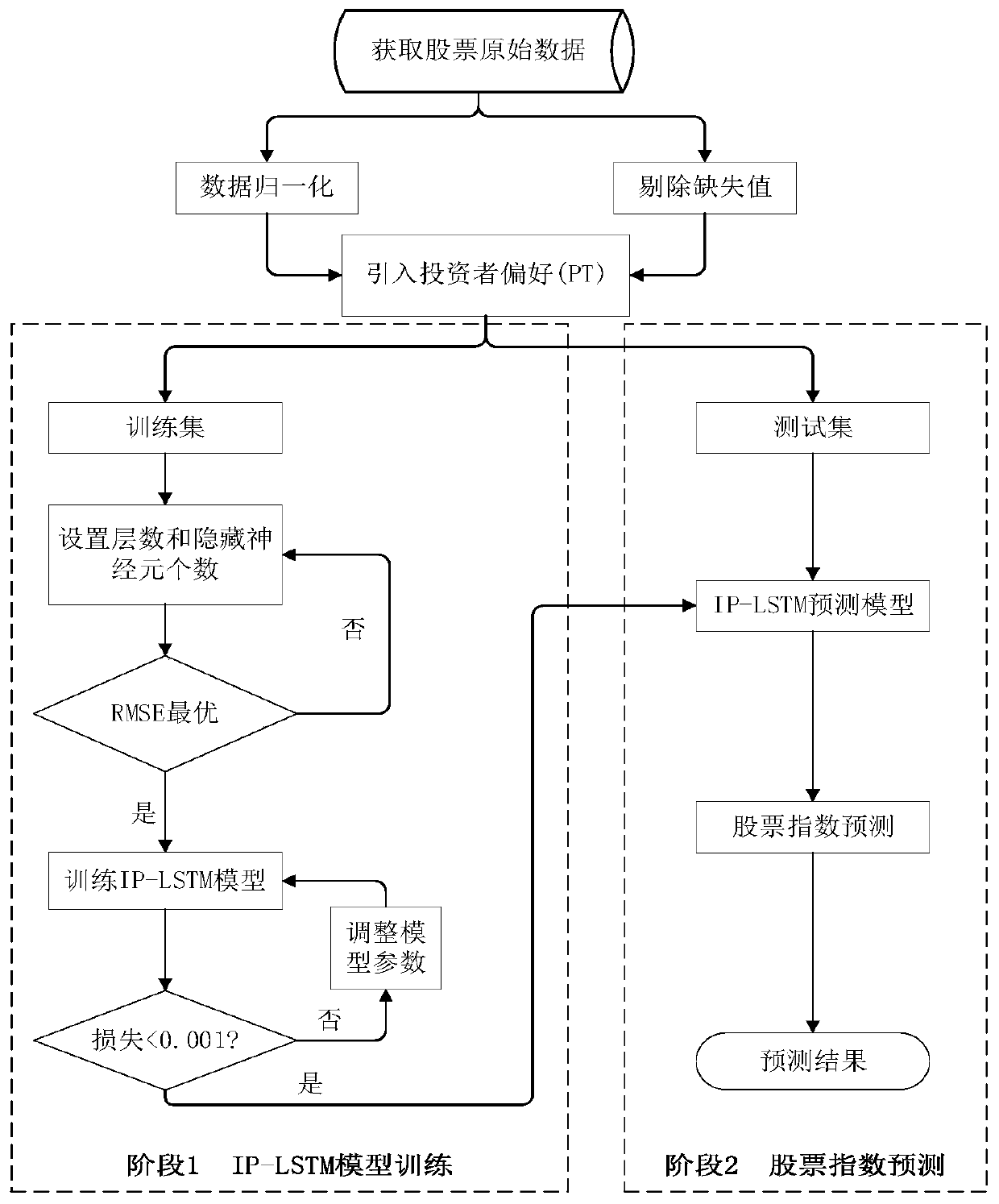

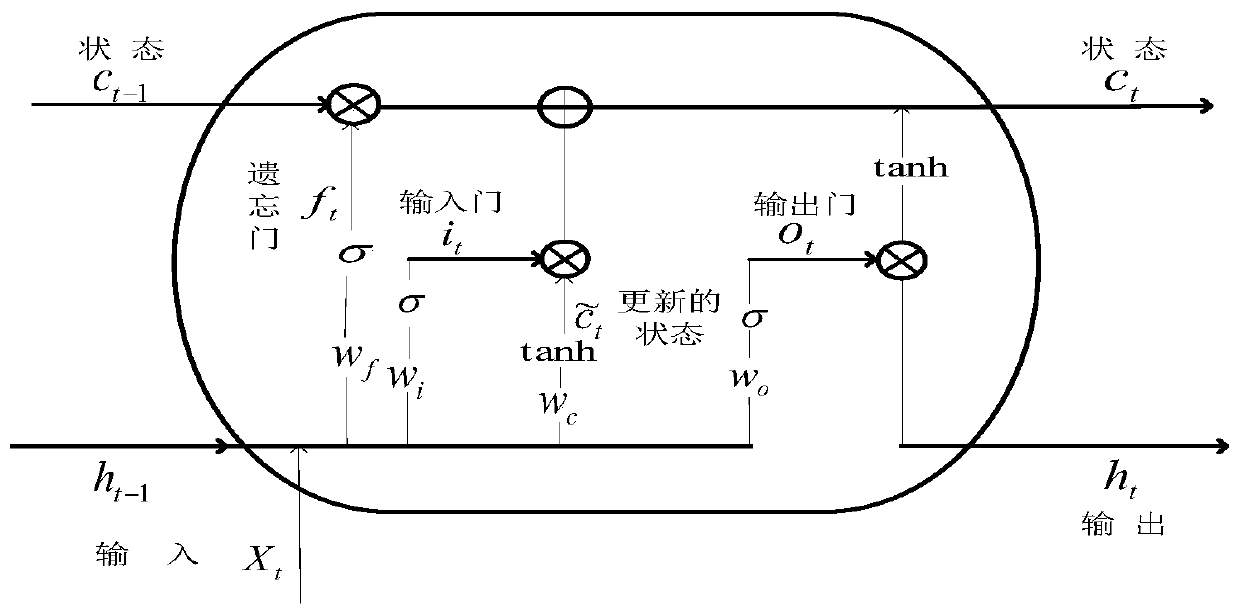

Stock prediction method introducing investor preferences

PendingCN111340629AEffectiveGood long-term predictive abilityFinanceNeural architecturesData miningStock forecasting

The invention relates to the technical field of stock investment, in particular to a stock prediction method for introducingintroducing investor preferences, which utilizes a foreground theoretical value to describe investor behavior preferences and introduces an index into prediction of stock income. The method comprises the following steps: S1, calculating a foreground theoretical value by utilizing historical yield data of stocks; Ss2, carrying out LSTM model construction for introducing investor preferences is carried out; Ss3, predicting a model process.

Owner:ZHENGZHOU UNIV

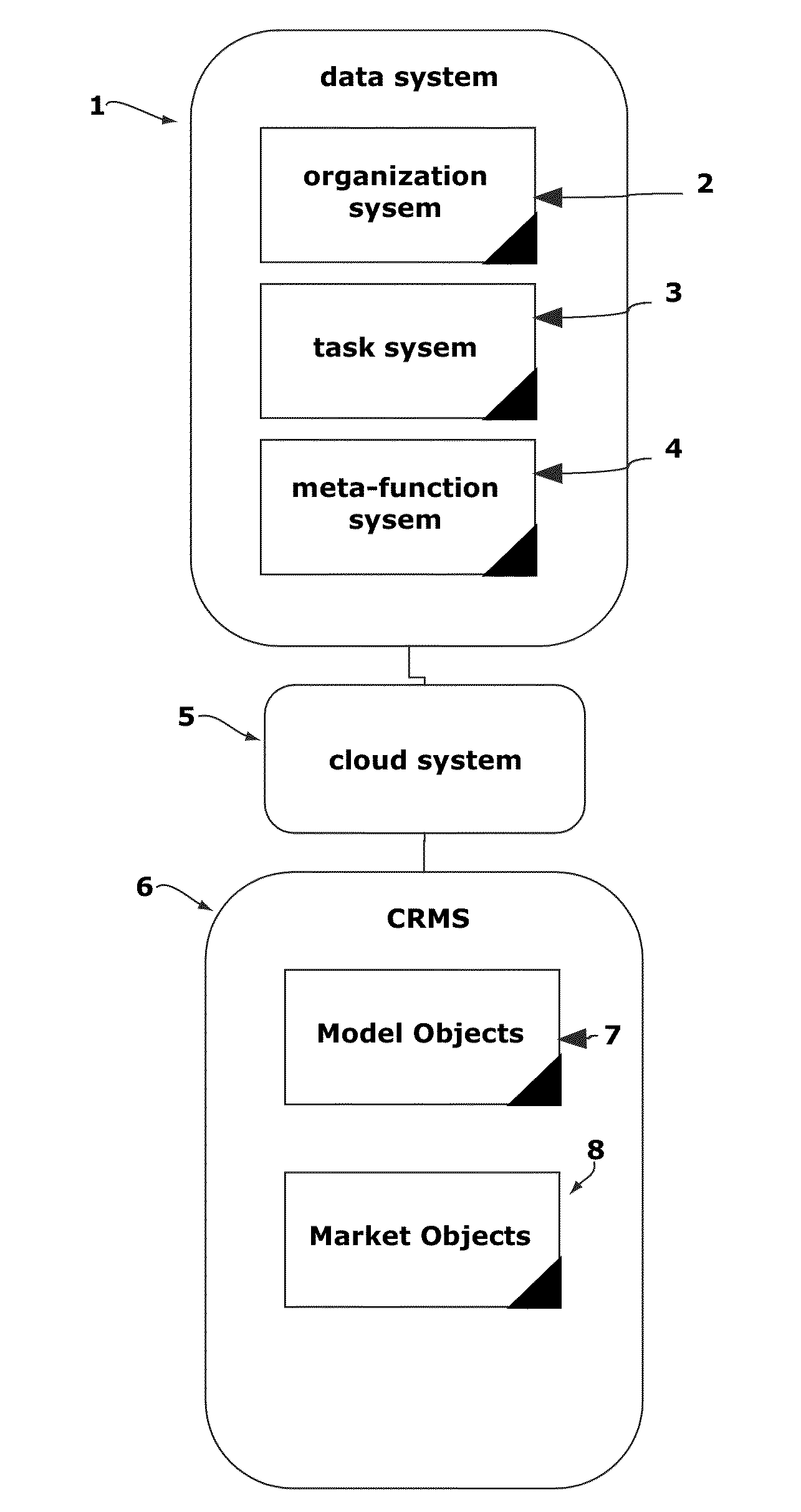

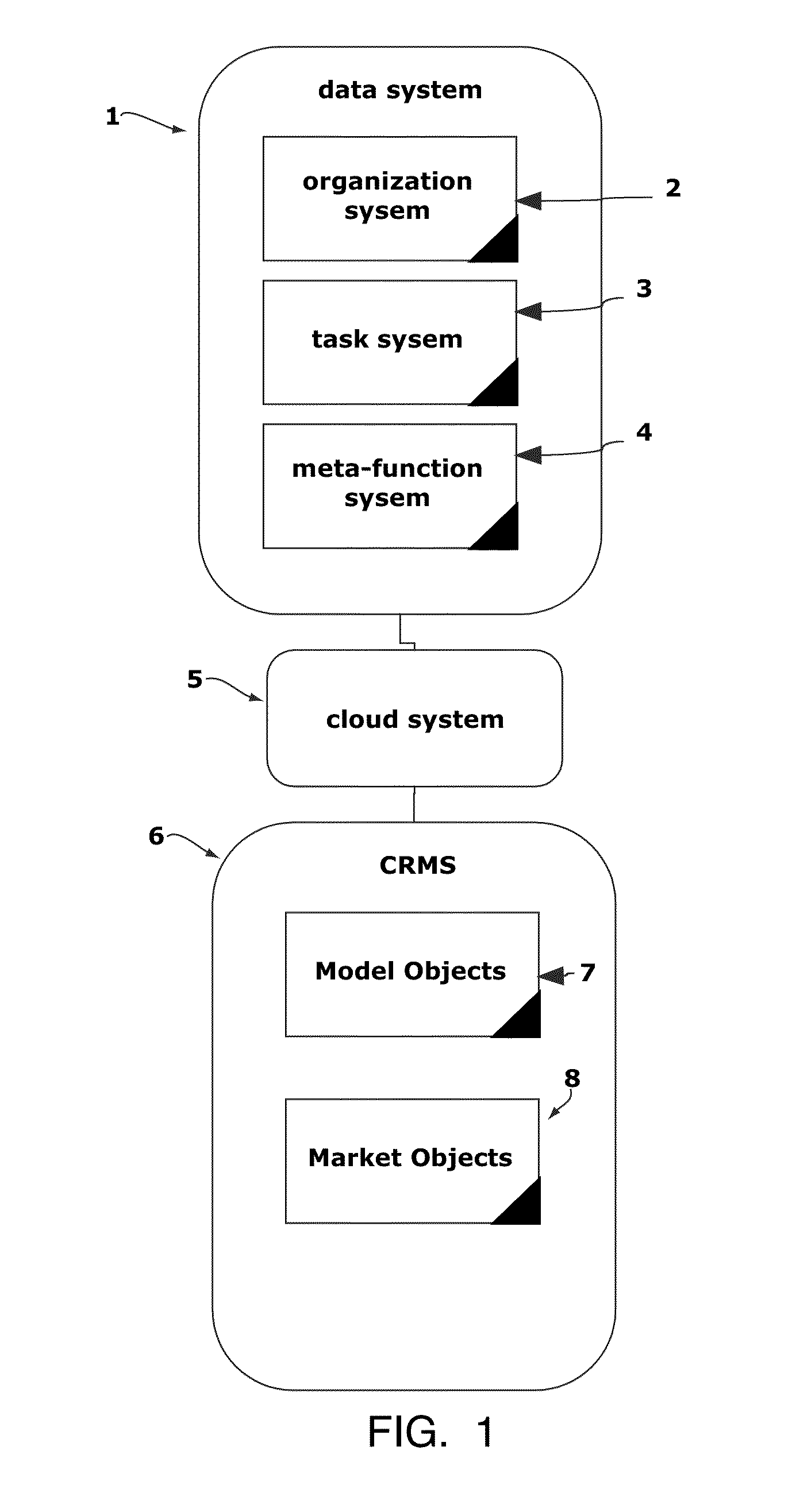

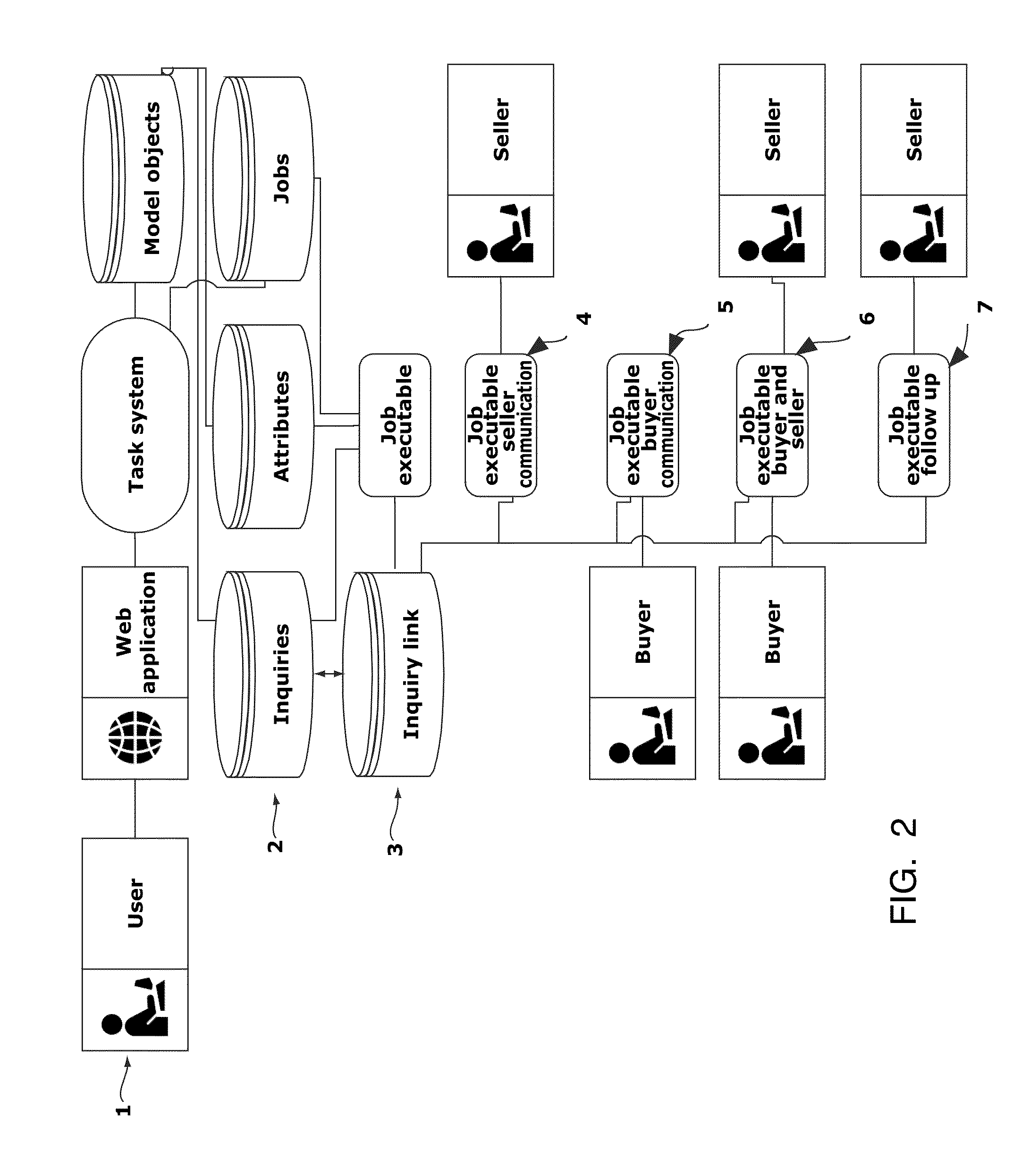

System and method for cloud-based web enabled database driven blind reverse market

InactiveUS20130138462A1Reduce complexityIncrease flexibilityBuying/selling/leasing transactionsLogisticsBusiness forecastingComputer science

The described embodiment of the system includes business methods and software and hardware that operate a confidential reverse blind market in industrial goods that matches buyers and sellers in a confidential manner and enables trade in goods traded in long term supply chains. In addition, the system provides a complete system of supply chain tracking from pre-order planning through ordering, production, seller shipping, buyer shipping, and inventory forecasting.

Owner:LOVE JR THOMAS J +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com