Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

45 results about "Risk adjustment" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Automated Healthcare Risk Management System Utilizing Real-time Predictive Models, Risk Adjusted Provider Cost Index, Edit Analytics, Strategy Management, Managed Learning Environment, Contact Management, Forensic GUI, Case Management And Reporting System For Preventing And Detecting Healthcare Fraud, Abuse, Waste And Errors

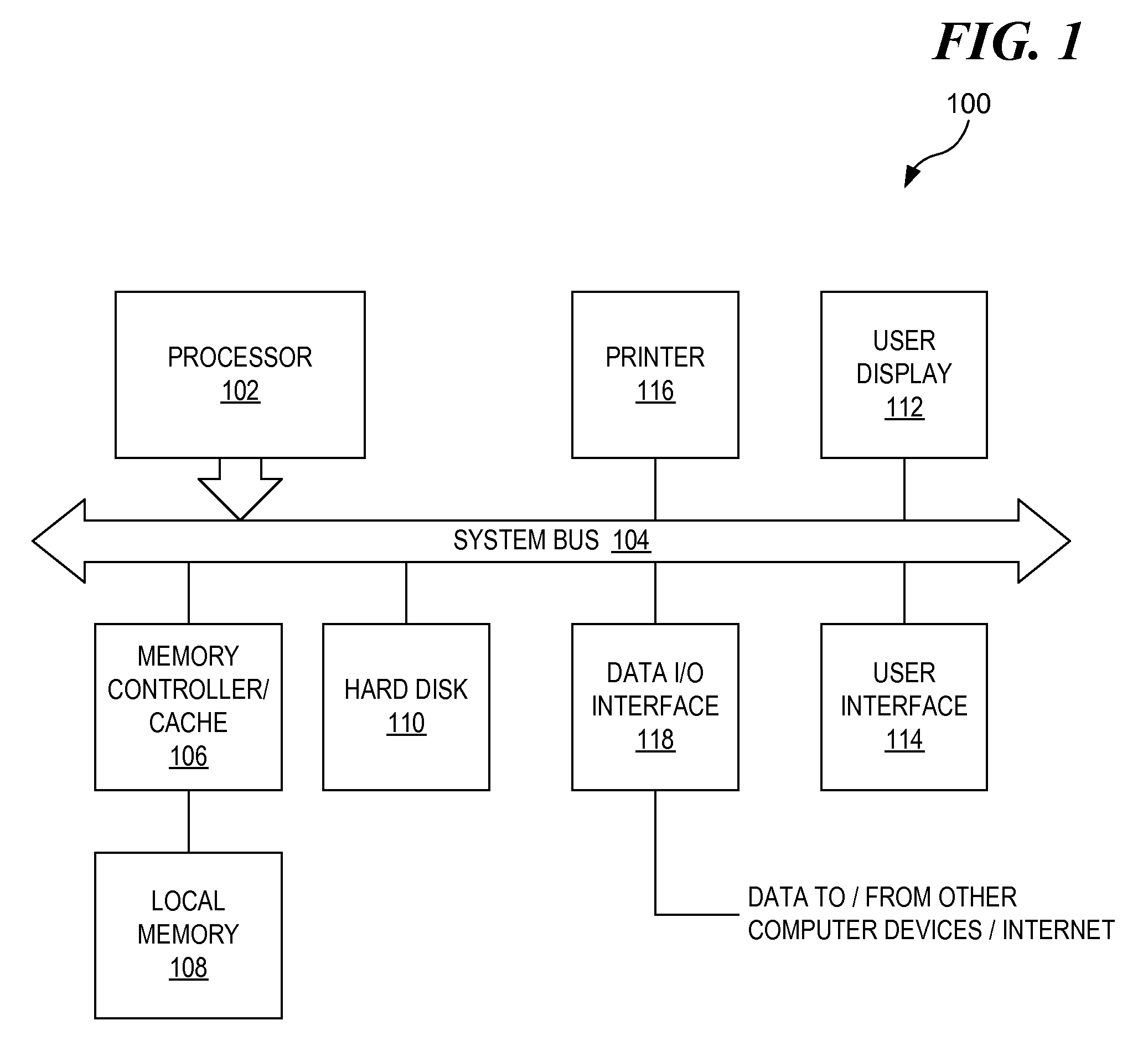

InactiveUS20140081652A1Facilitate and enhance and implement multiple investigator decisionResource optimizationFinancePayment architectureLower riskMedical education

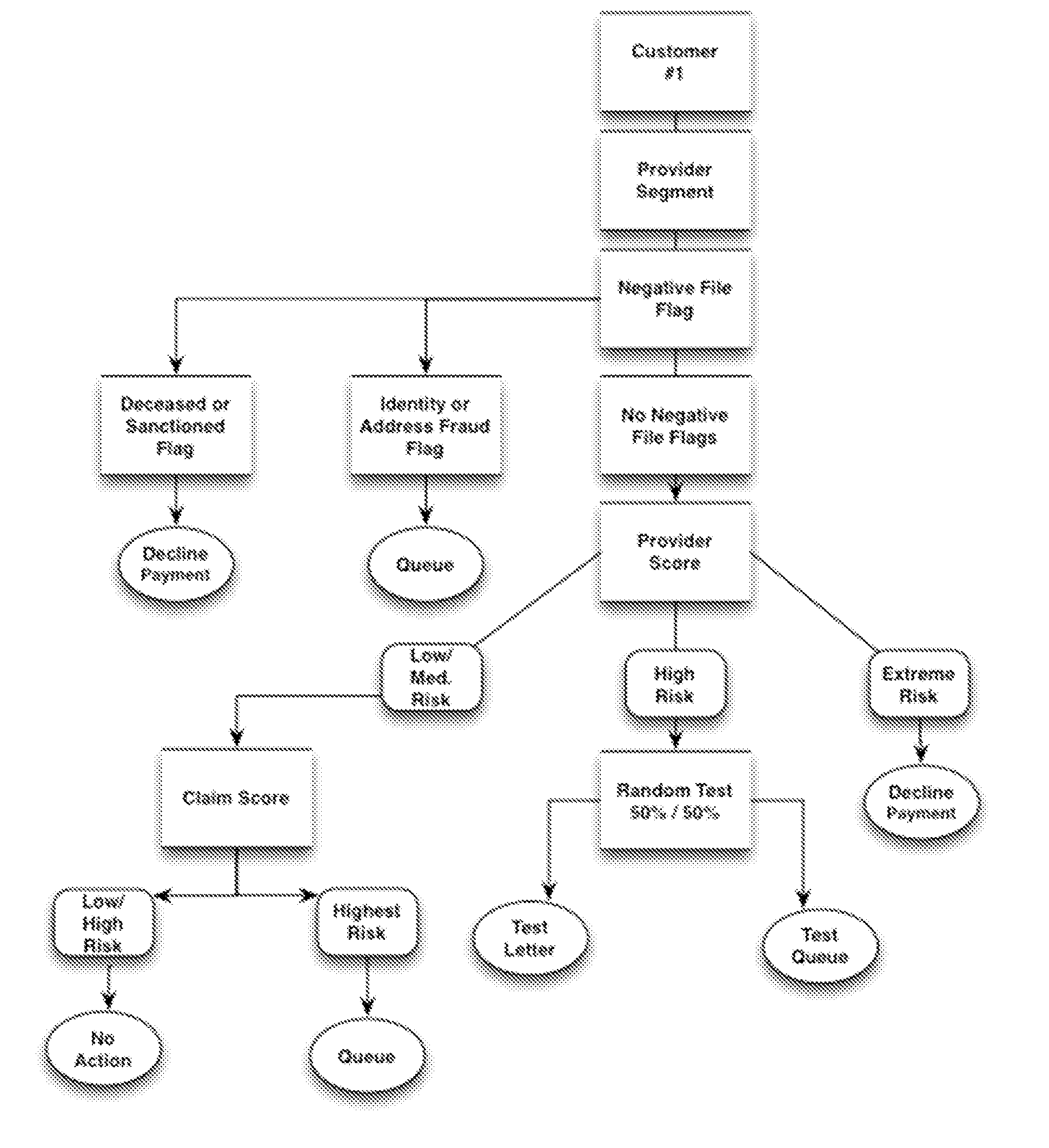

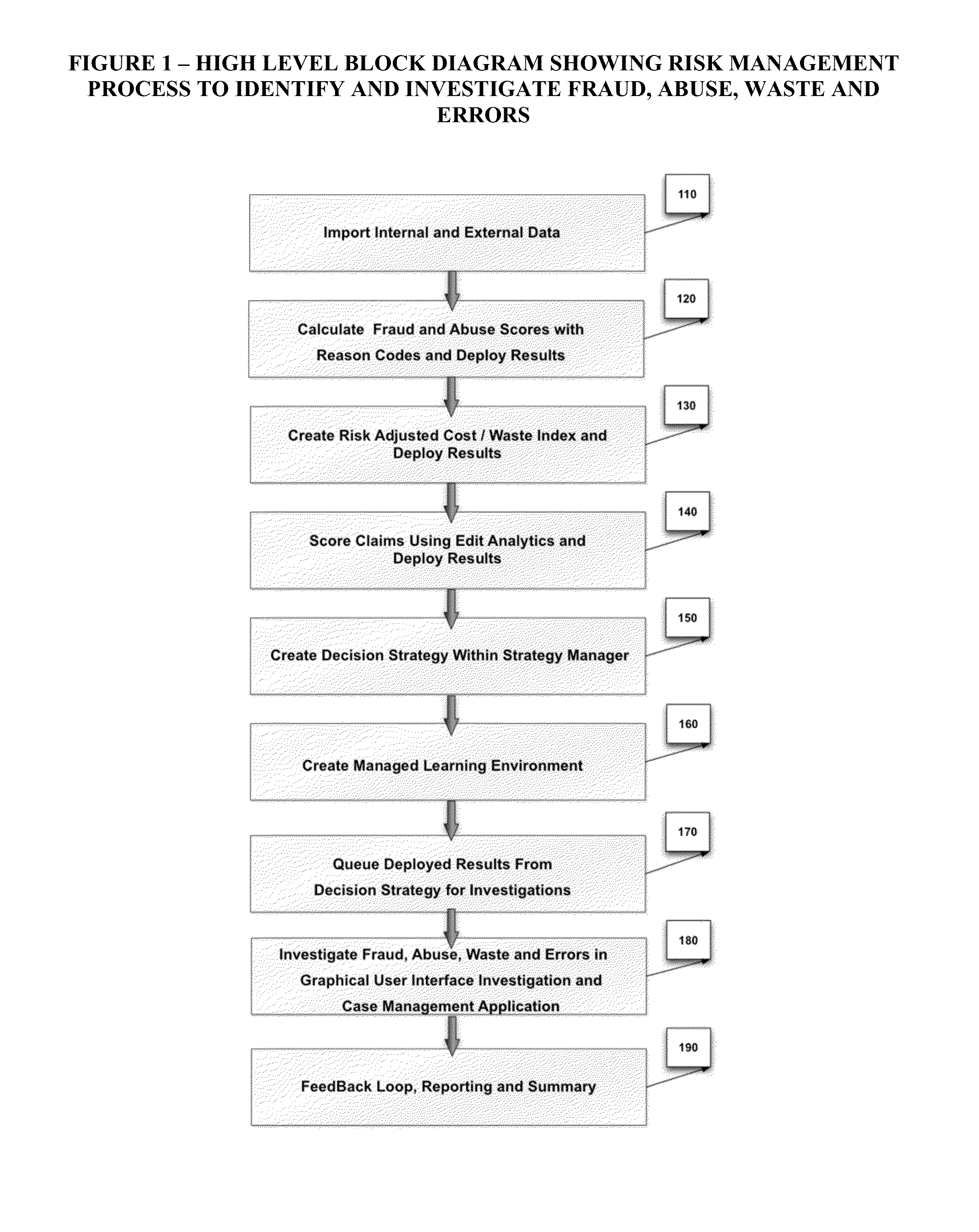

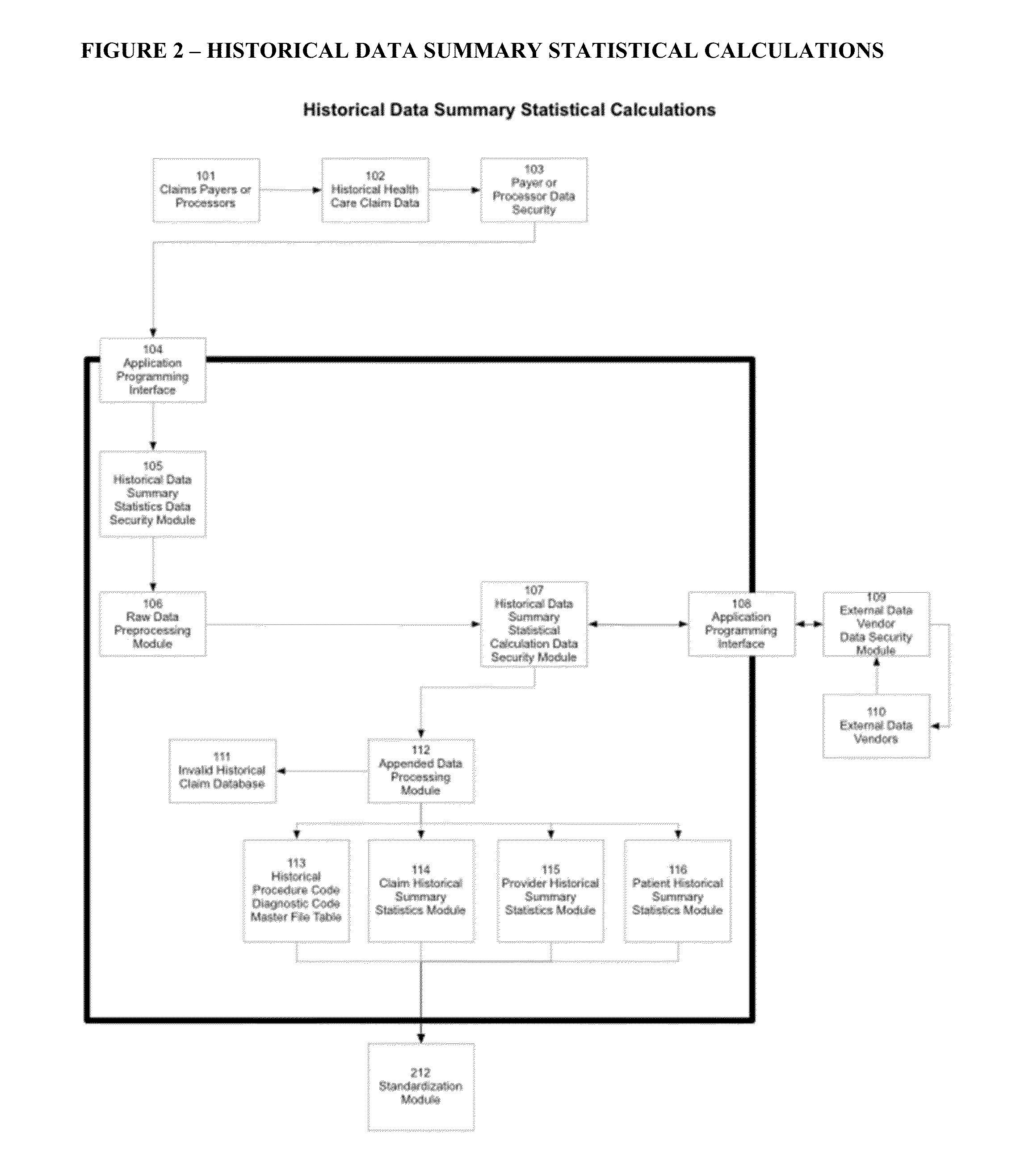

The Automated Healthcare Risk Management System is a real-time Software as a Service application which interfaces and assists investigators, law enforcement and risk management analysts by focusing their efforts on the highest risk and highest value healthcare payments. The system's Risk Management design utilizes real-time Predictive Models, a Provider Cost Index, Edit Analytics, Strategy Management, a Managed Learning Environment, Contact Management, Forensic GUI, Case Management and Reporting System for individually targeting, identifying and preventing fraud, abuse, waste and errors prior to payment. The Automated Healthcare Risk Management System analyzes hundreds of millions of transactions and automatically takes actions such as declining or queuing a suspect payment. Claim payment risk is optimally prioritized through a Managed Learning environment, from high risk to low risk for efficient resolution by investigators.

Owner:RISK MANAGEMENT SOLUTIONS

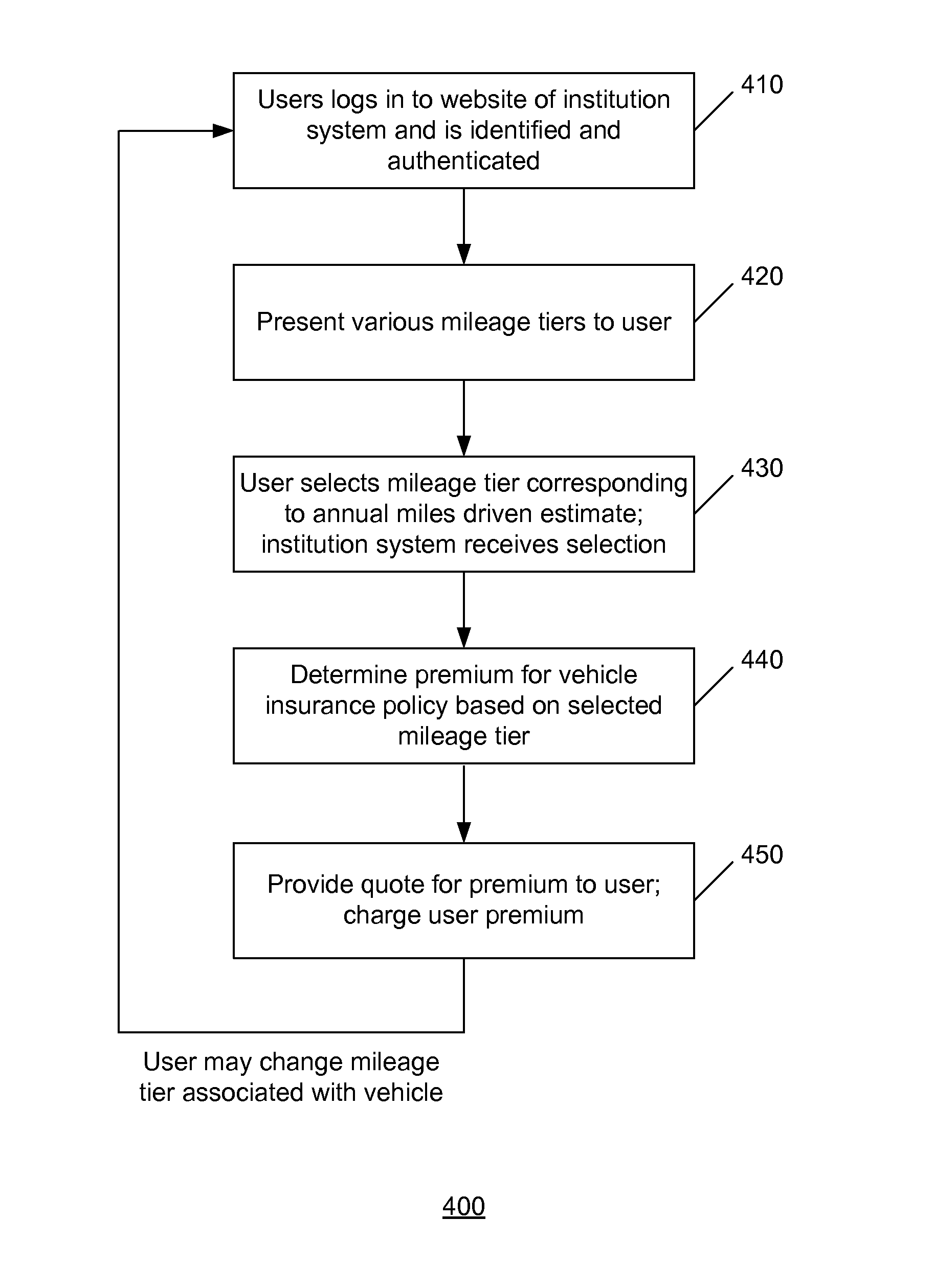

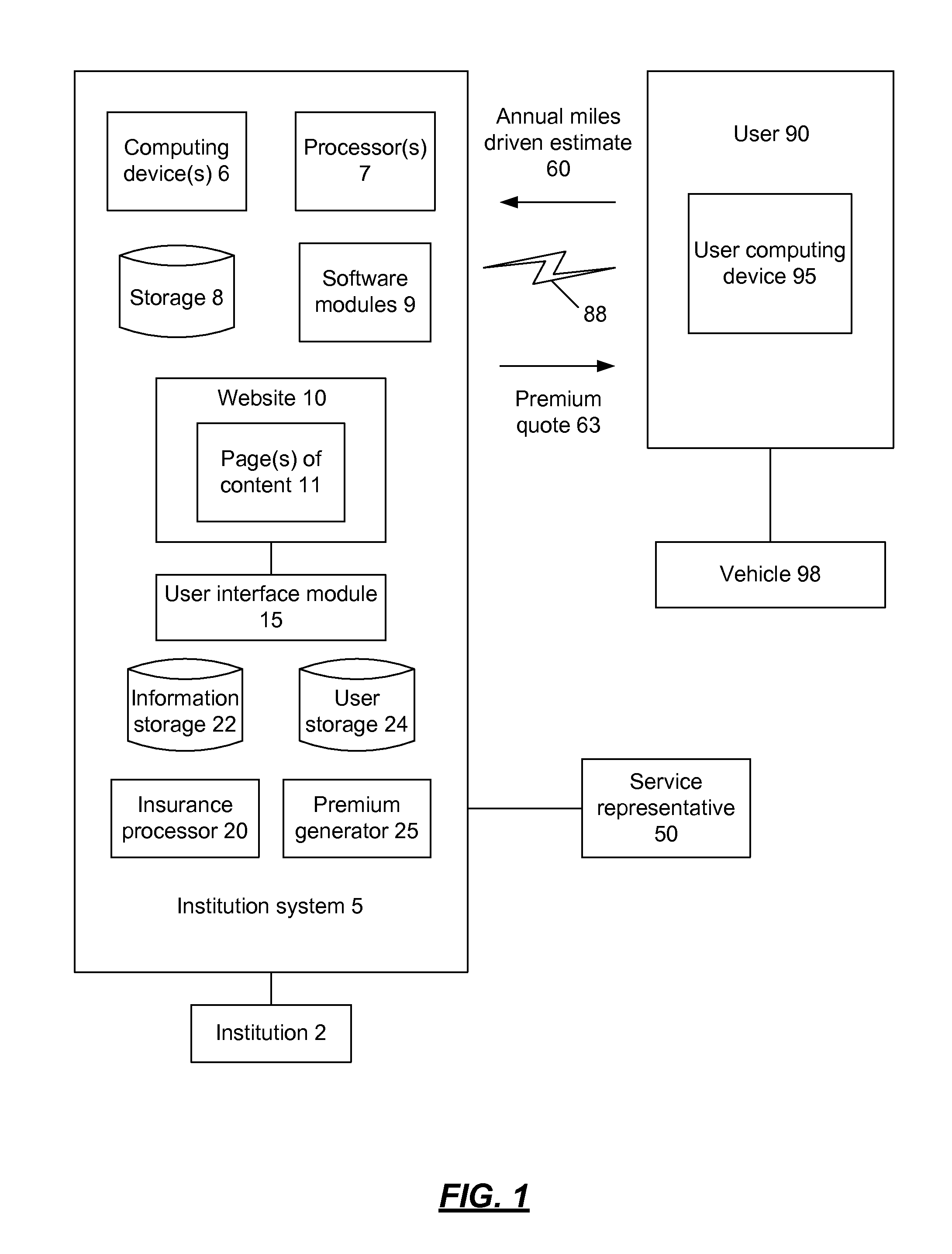

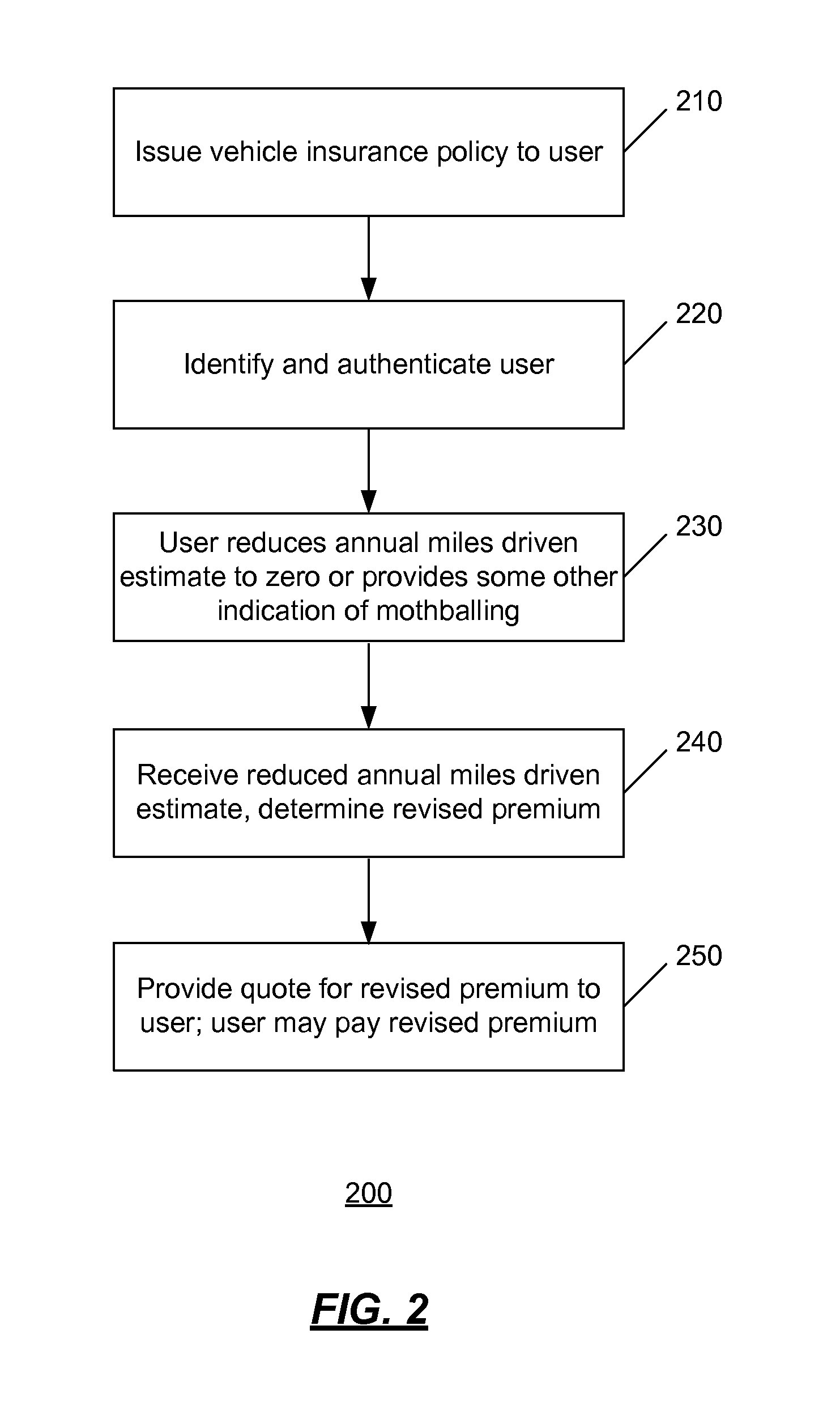

Systems and methods for self-service vehicle risk adjustment

A user may be identified and authenticated to an institution system and may adjust the annual miles driven estimate for their vehicle. The annual miles driven estimate is used in the determination of the premium for the vehicle insurance for the vehicle. The premium for the vehicle insurance may be revised based on the adjustment by the user to the annual miles driven estimate. In an implementation, the user may reduce the annual miles driven estimate to zero to indicate that they are not driving the vehicle. The user may keep some elements of the vehicle insurance coverage and the vehicle insurance policy may remain active although the annual miles driven estimate is zero.

Owner:USAA

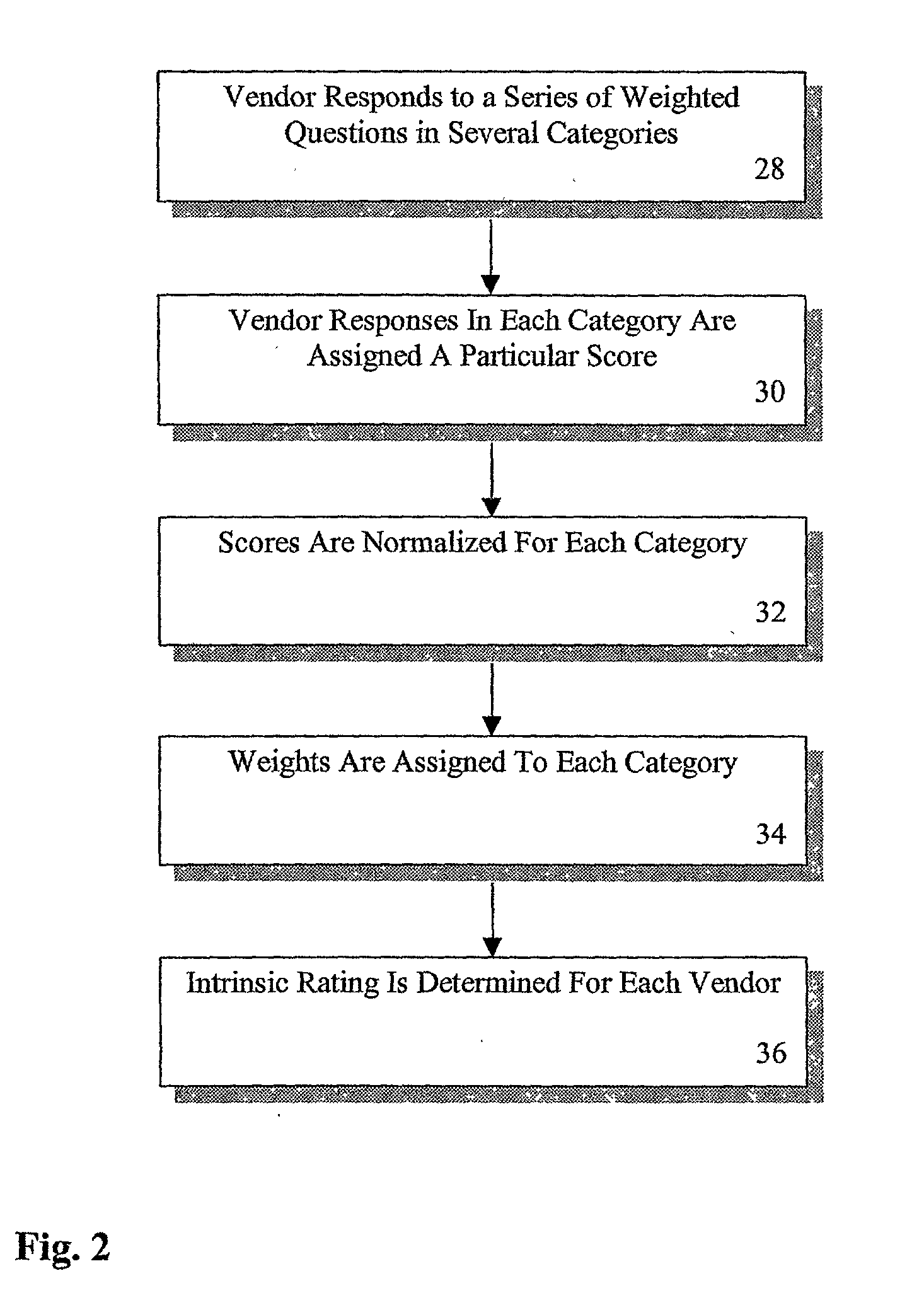

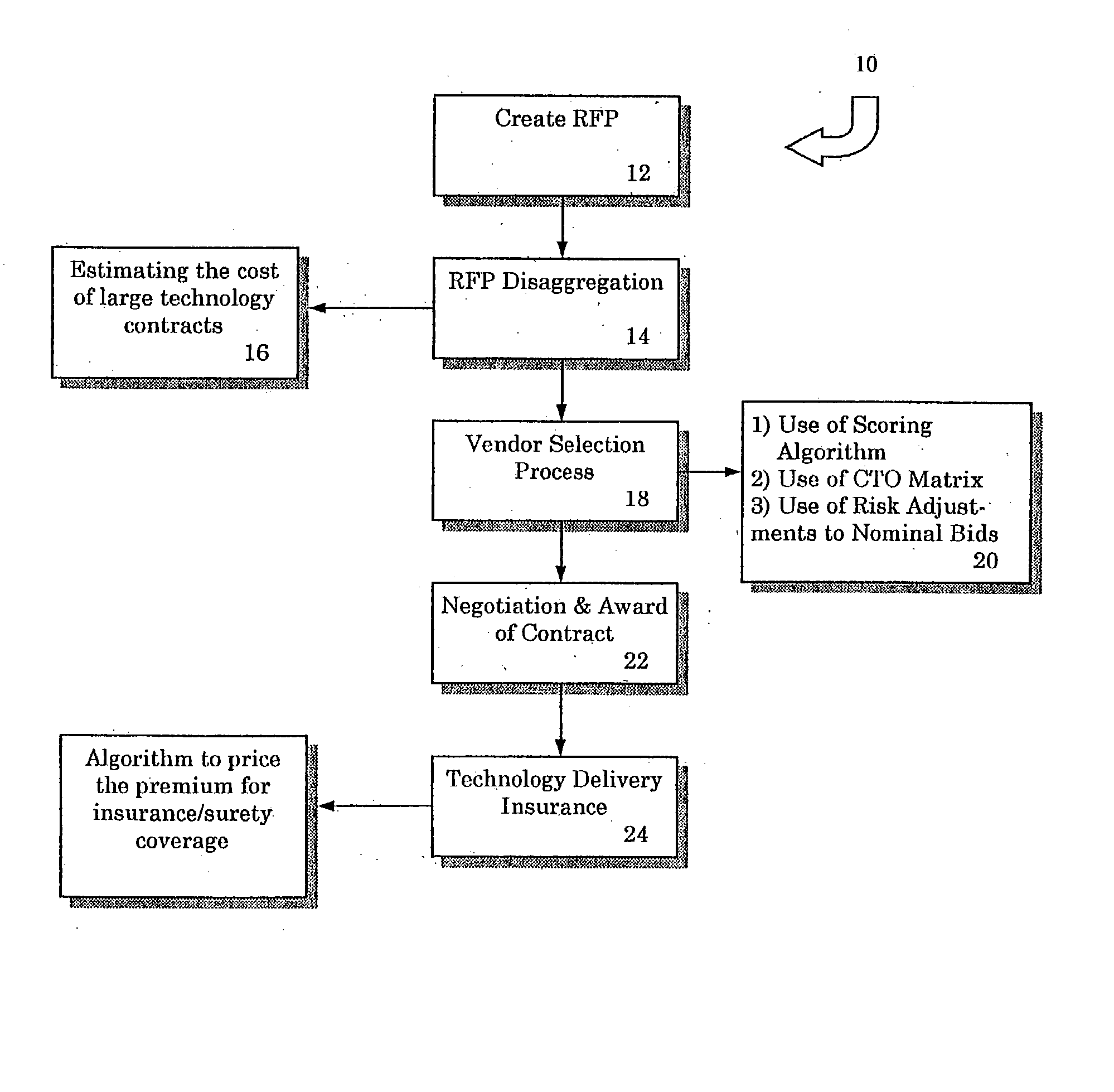

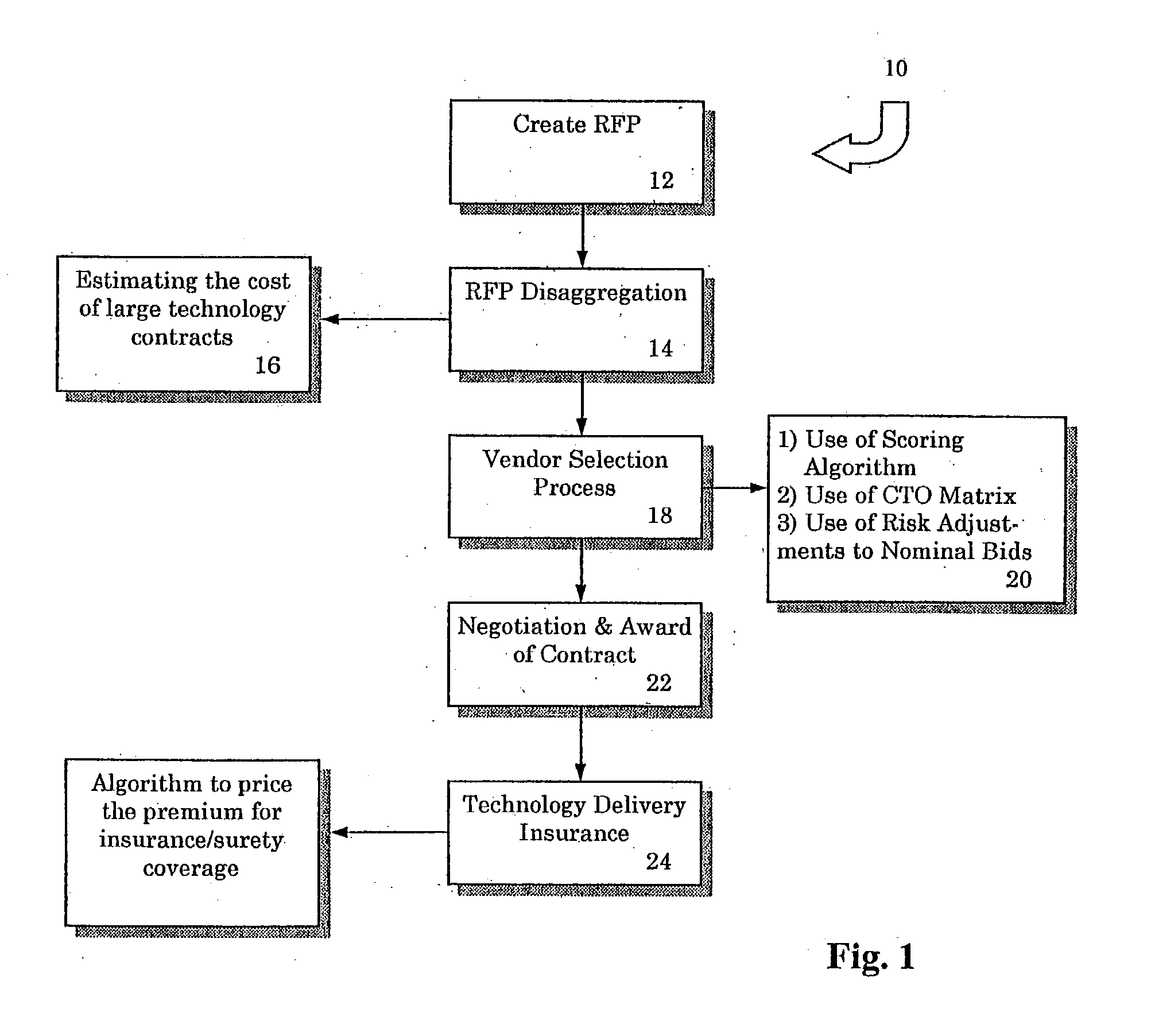

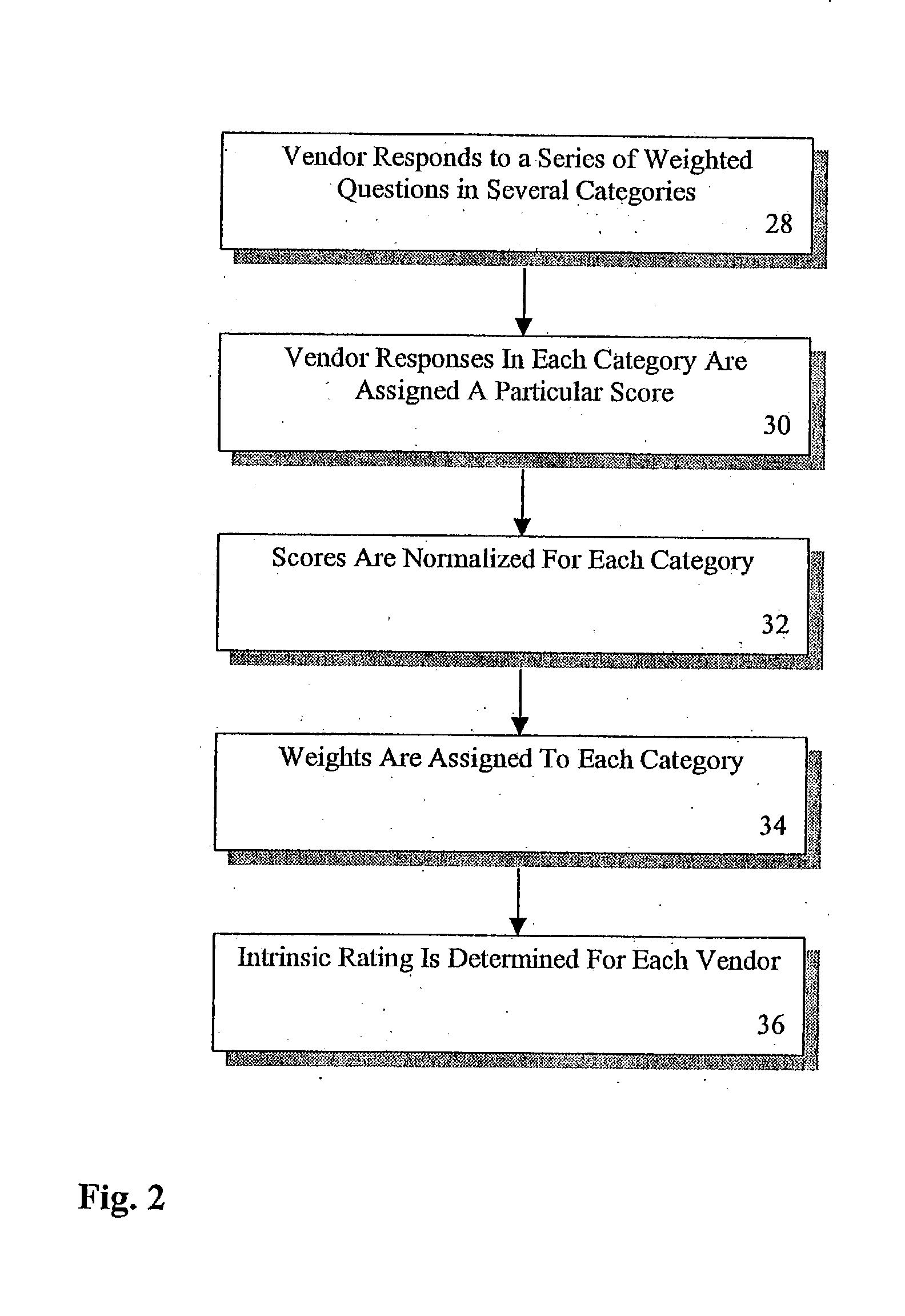

System and method of assessing and rating vendor risk and pricing of technology delivery insurance

A method and system for providing a standardization and commoditizing the process of technology contracts and creating method for assessing, scoring, ranking and rating technology vendors for the purpose of comparing vendor bids on a project and for structuring and pricing insurance / surety contracts. Intrinsic and two-way vendor ratings are established for each of the vendors in a particular project. This two-way rating is used to provide a risk adjustment to the nominal bid of each of the vendors. The two-way rating is also utilized to structure and calculate an insurance premium based upon the probability that the vendor would fail / default on the delivery of a technology project.

Owner:KANSAL NAMITA

System for assessing and rating vendor risk and pricing of technology delivery insurance

A method and system for providing a standardization and commoditizing the process of technology contracts and creating method for assessing, scoring, ranking and rating technology vendors for the purpose of comparing vendor bids on a project and for structuring and pricing insurance / surety contracts. Intrinsic and two-way vendor ratings are established for each of the vendors in a particular project. This two-way rating is used to provide a risk adjustment to the nominal bid of each of the vendors. The two-way rating is also utilized to structure and calculate an insurance premium based upon the probability that the vendor would fail / default on the delivery of a technology project.

Owner:KANSAL NAMITA

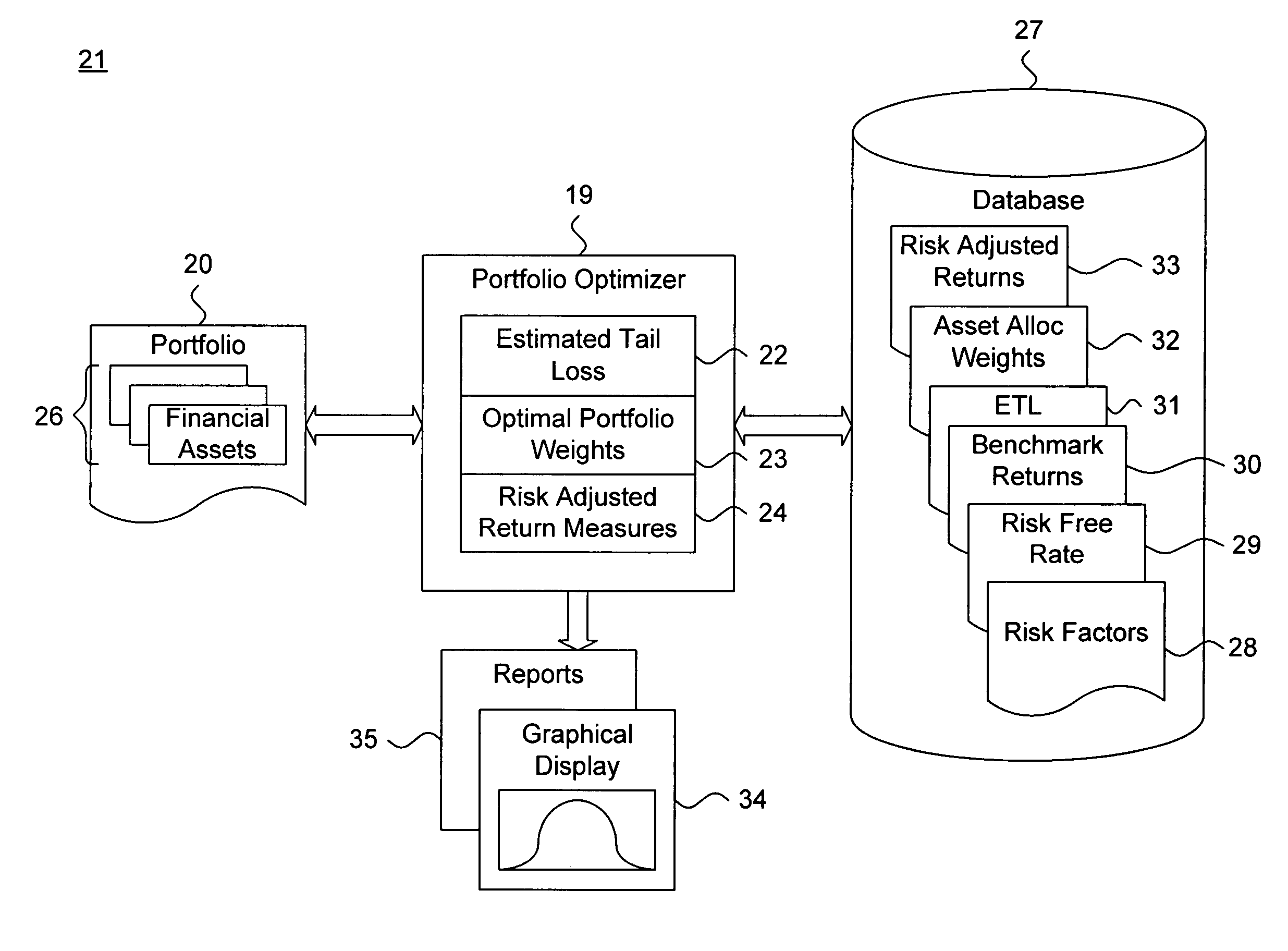

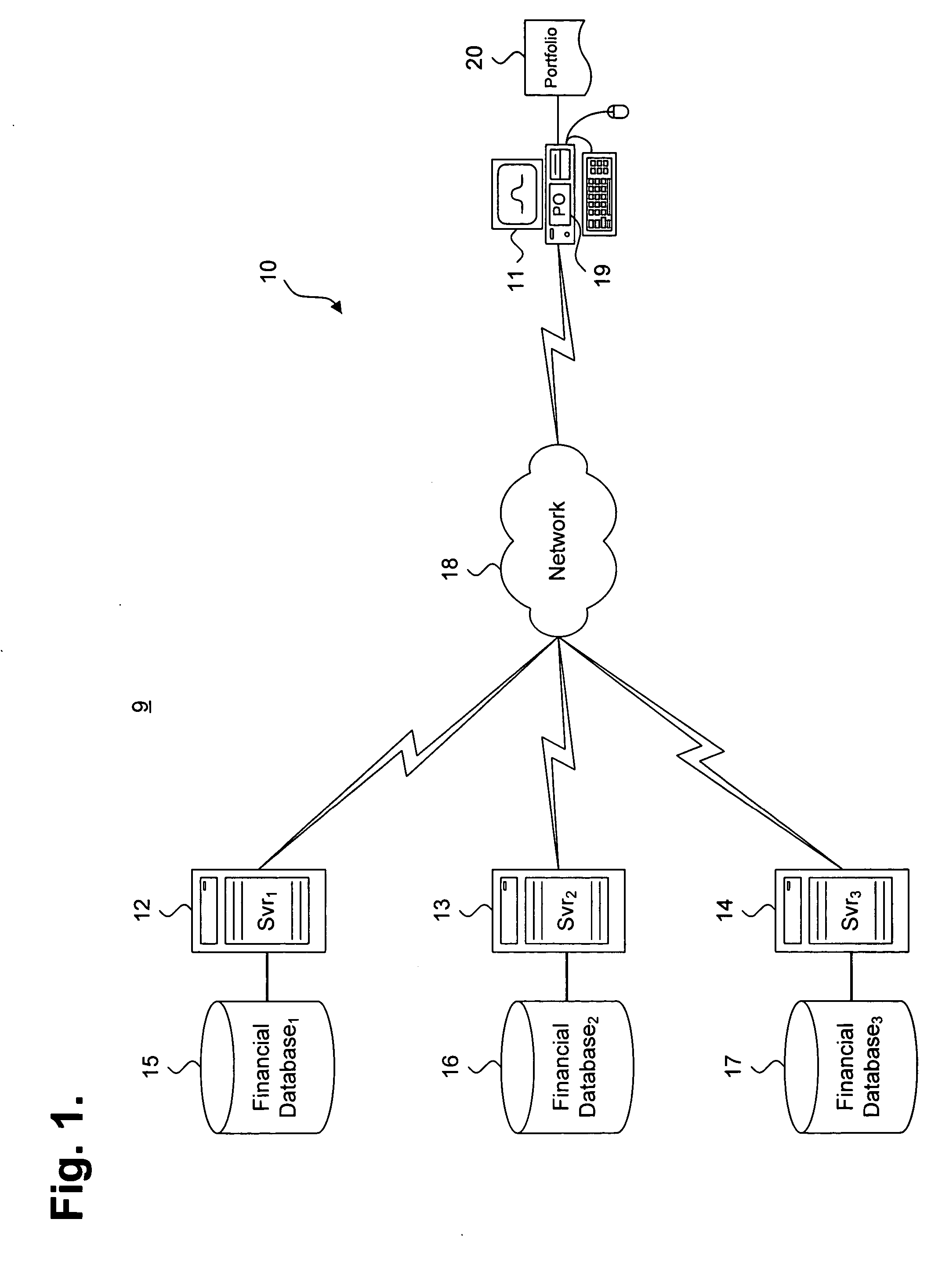

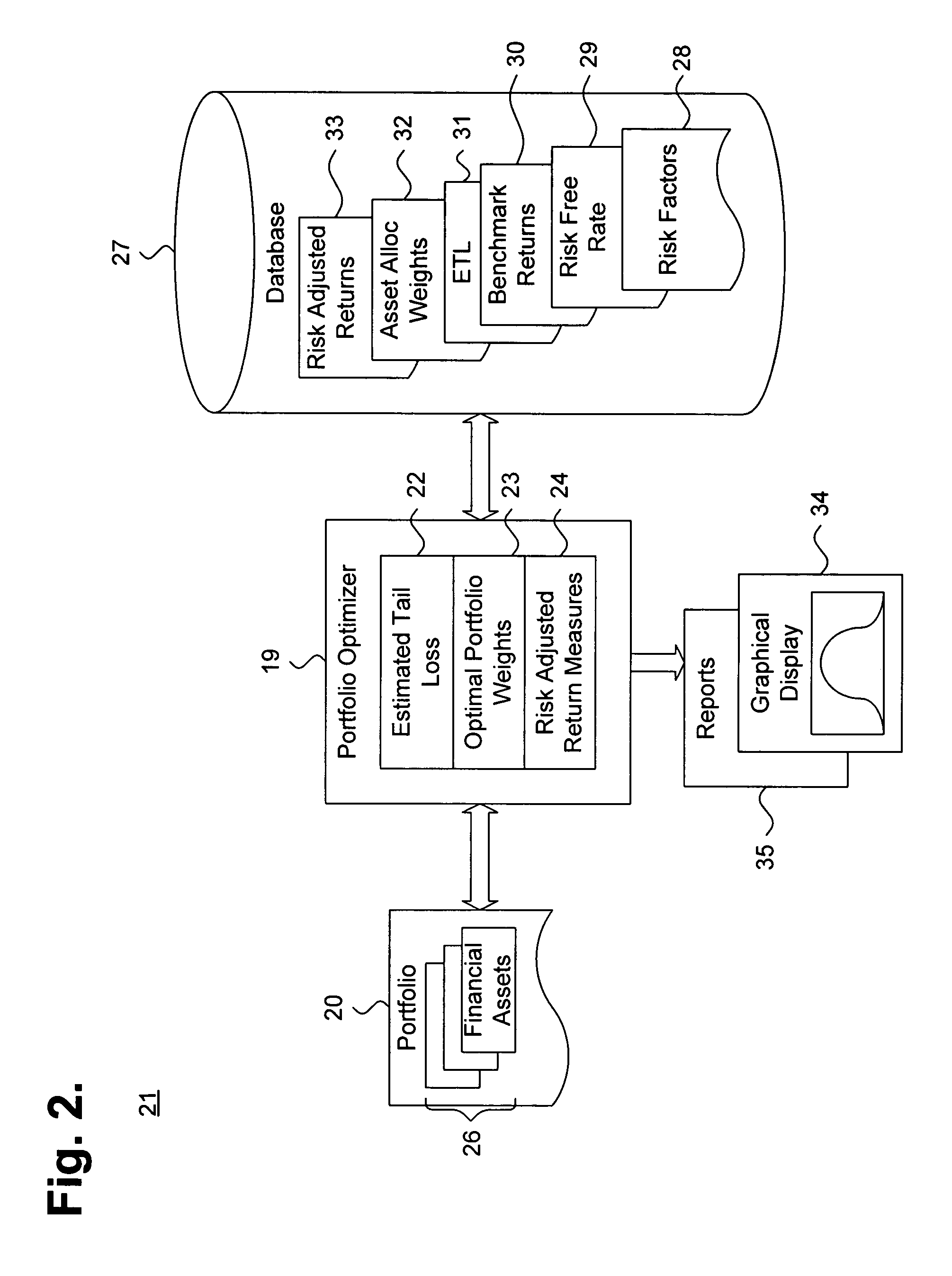

System and method for providing optimization of a financial portfolio using a parametric leptokurtic distribution

ActiveUS20050033679A1Accurately determineAccurately determinedFinanceSpecial data processing applicationsParameter distributionComputer science

A system and method for providing optimization of a financial portfolio using a parametric leptokurtic distribution is presented. One or more risk factors associated with a plurality of financial assets maintained in a portfolio and applicable over at least one time horizon are provided. A subordinated parametric distribution model having leptokurtic behaviors is specified for the risk factors with a measurement of risk expressed as a function of expected tail loss for a significance level or quantile. The subordinated distribution model is applied at each such time horizon to determine a distribution of the risk factors for the financial assets. Portfolio weights providing a substantially maximum risk adjusted return for the portfolio are determined.

Owner:FINANALYTICA

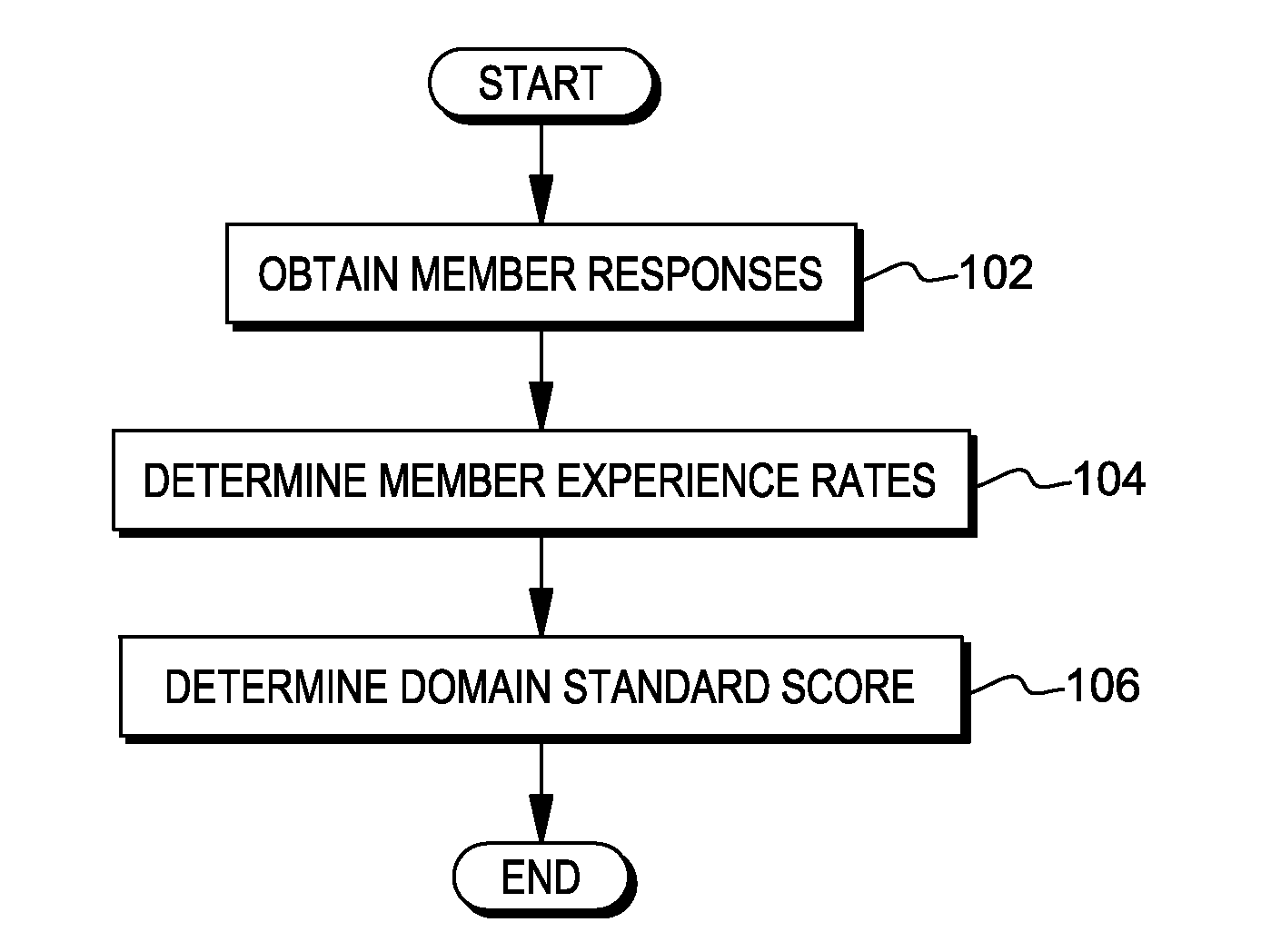

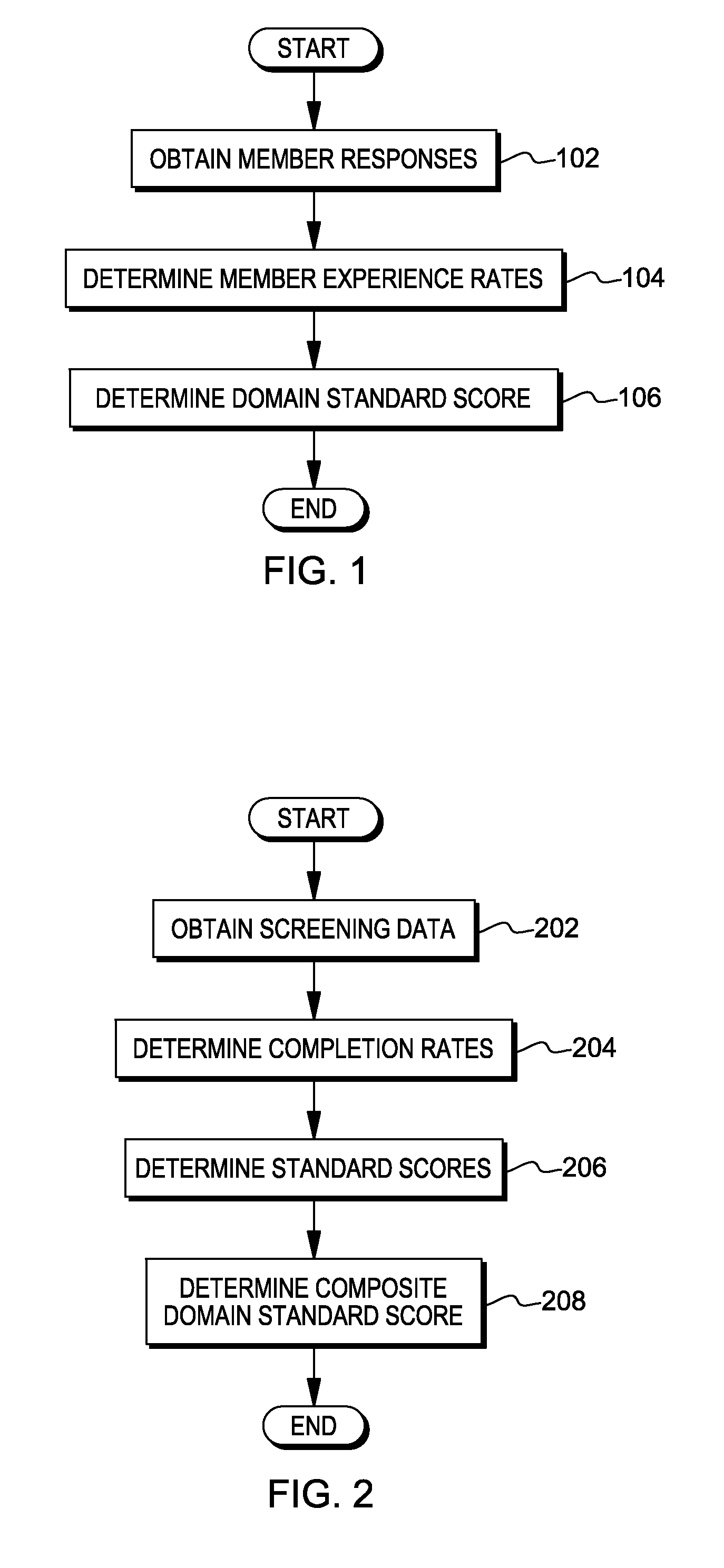

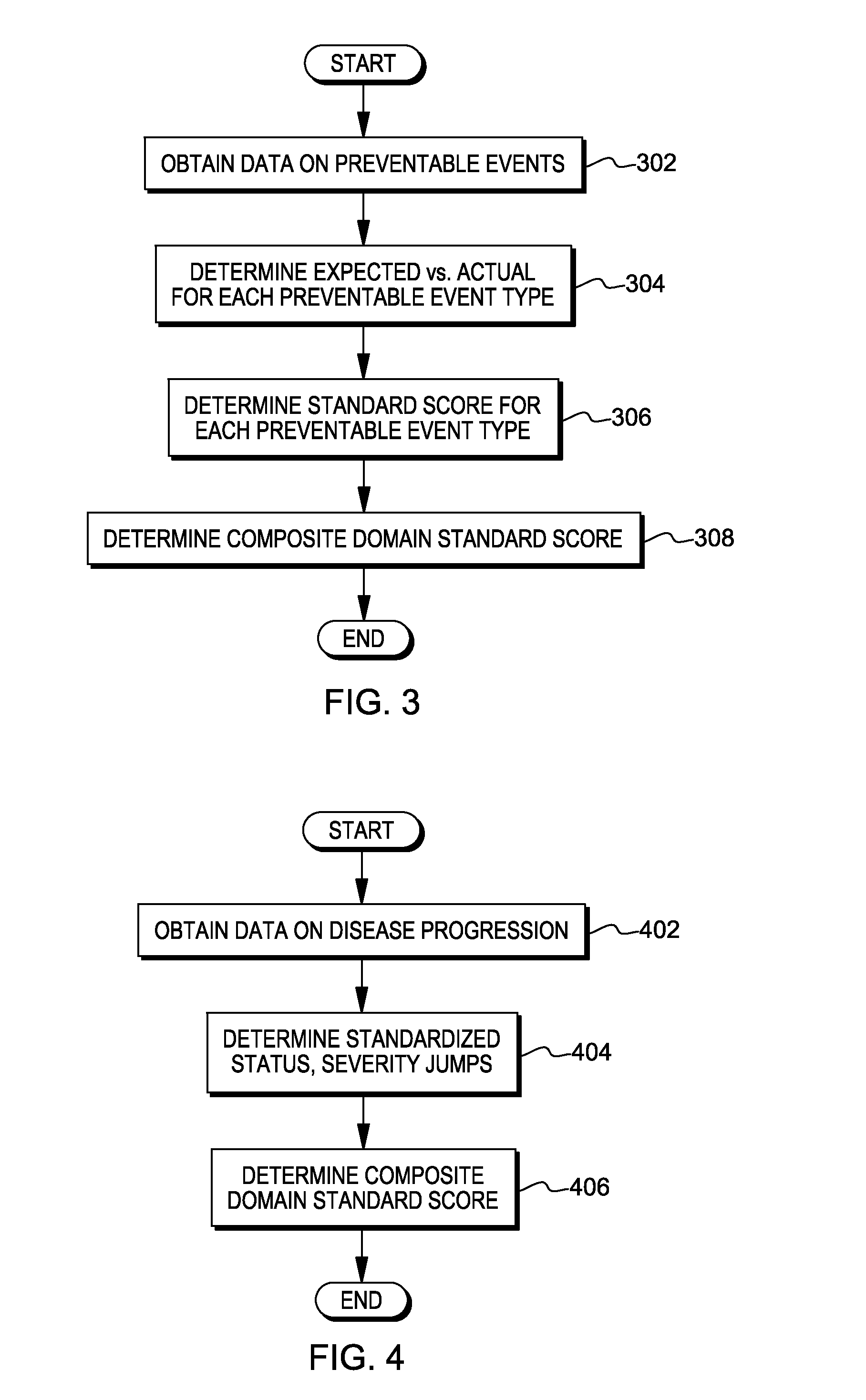

Health provider quality scoring across multiple health care quality domains

InactiveUS20140122100A1Data processing applicationsHealth-index calculationDisease categoryPatient age

Evaluation of health care provider quality is described. Data is obtained, the data including claims data and member data of a member panel of a health care provider, the member panel including patients to which the provider provides health care services. Based on the obtained data, quality scores are determined for the provider across the member panel and across health care quality domains. A composite health provider quality score of the health provider is then determined, where the composite health provider quality score is a composite of the determined quality scores across the member panel and across the multiple health care quality domains. In some embodiments, risk-adjustment is performed for the quality scores, such as risk-adjustment against a peer reference base based on disease categories, patient age, and patient gender.

Owner:3M INNOVATIVE PROPERTIES CO

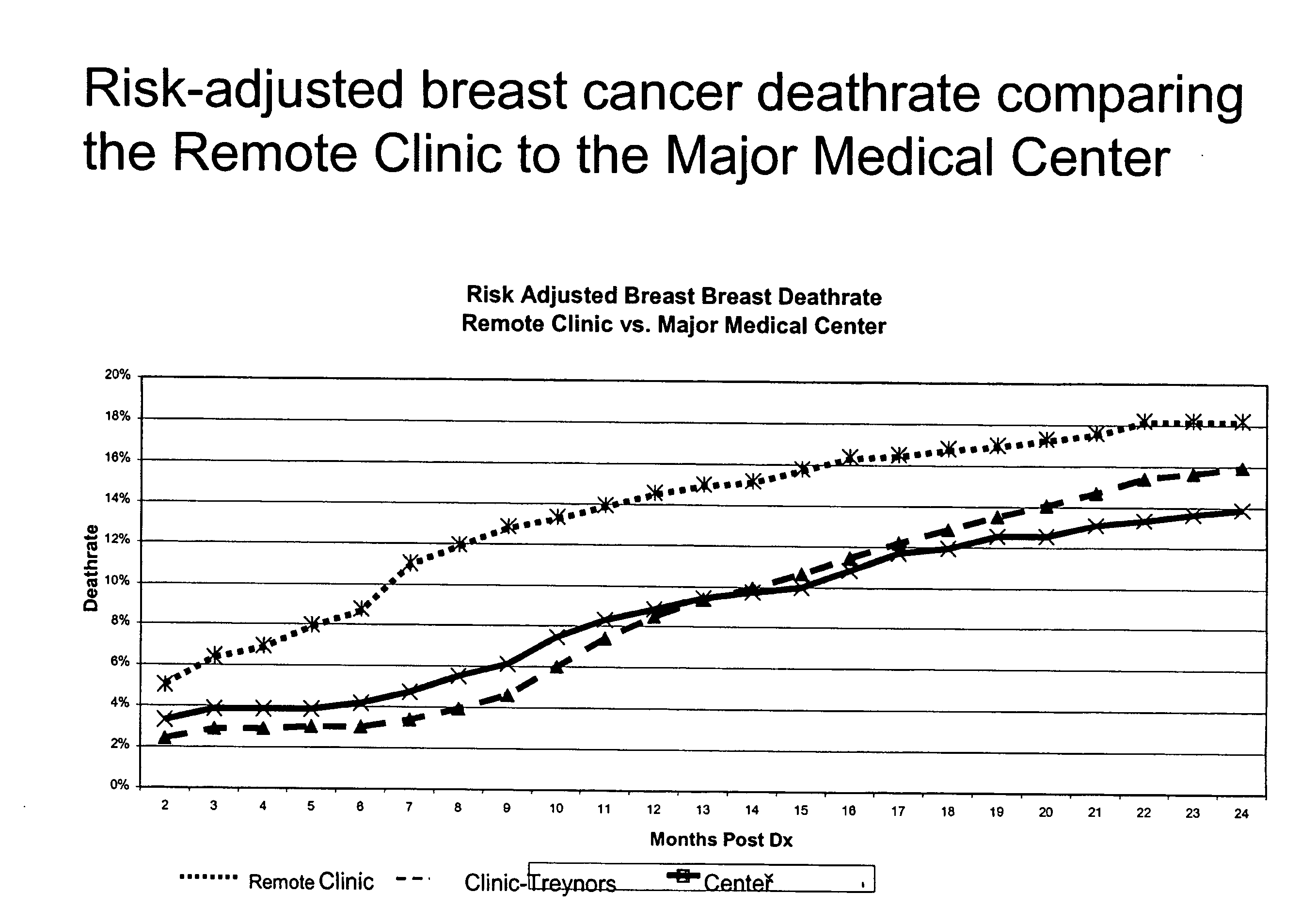

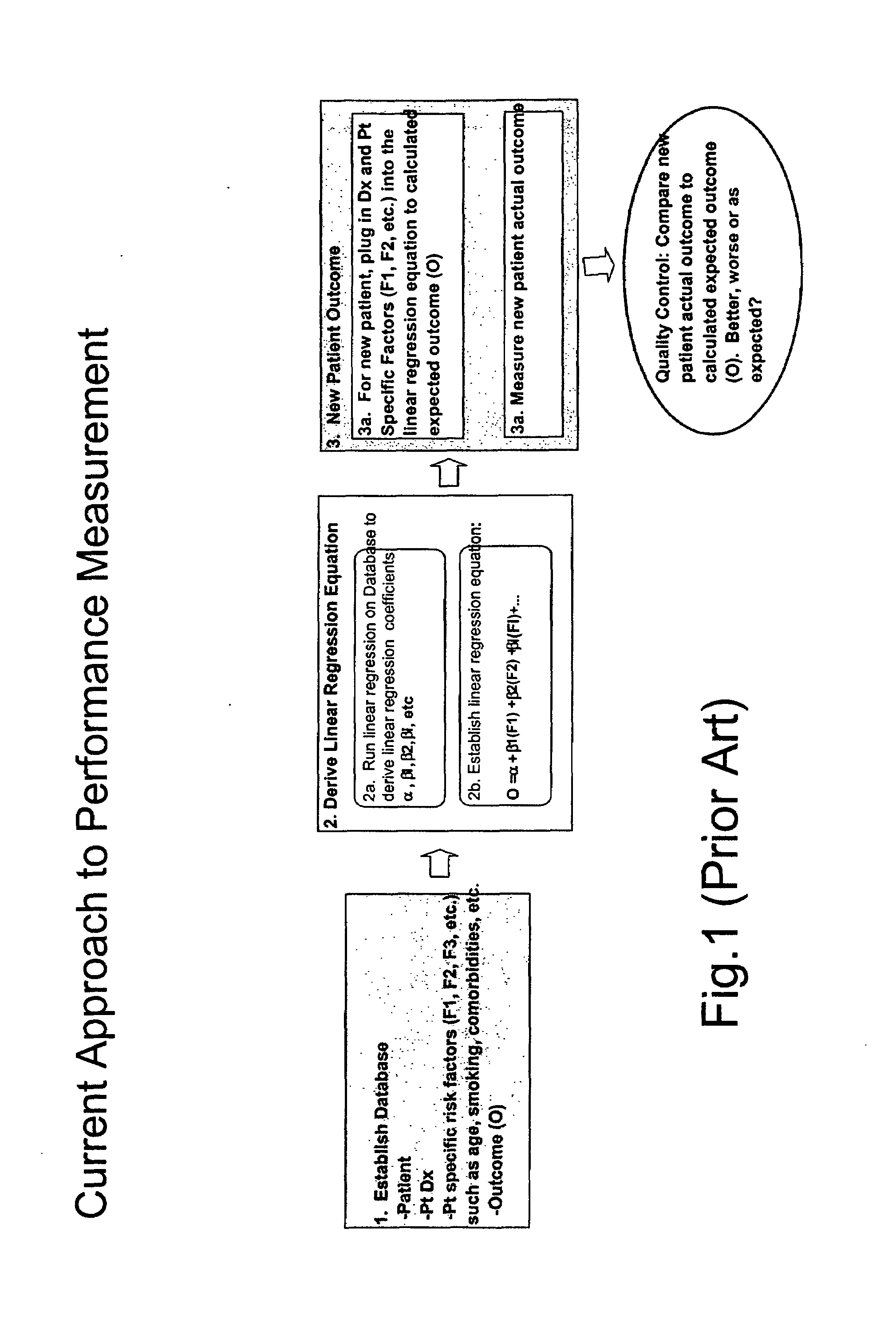

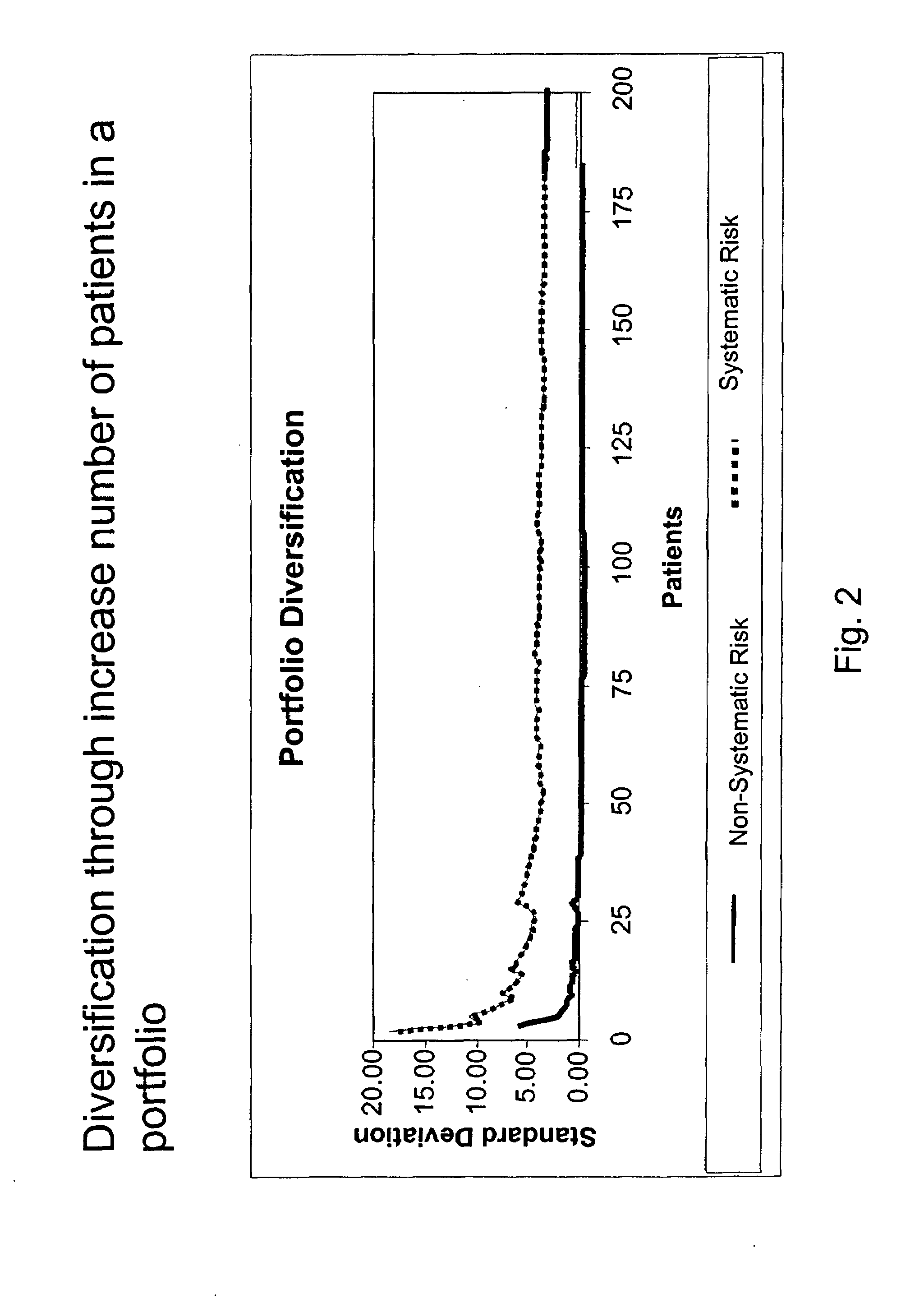

Methods for risk-adjusted performance analysis

The present invention provides systems and methods for risk-adjusted performance analysis for a specific healthcare test, market or opportunity by evaluating patient outcomes against a real-time benchmark portfolio of patient outcomes. The risk-adjusted performance measures are based on financial methods such as CAPM, single-index model and arbitrage pricing theory methods. In place of examining the financial returns for a portfolio of companies against a financial benchmark, the outcomes for a patient or a portfolio of patients is compared to a benchmark portfolio of patient outcomes. The risk-adjusted performance measures including the Sharpe's measure, Treynor's measure, Jensen's measure and similar analysis tools are then used to compare different healthcare groups. The method has utility in many areas of healthcare including management of healthcare facilities, providing insurance reimbursement to a healthcare facility (e.g., “pay-for-performance”), making investment decisions in the healthcare marketplace and developing dynamic prognostic dynamic medical tests.

Owner:BOARD OF RGT THE UNIV OF TEXAS SYST

System and method of assessing and rating vendor risk and pricing of technology delivery insurance

A method and system for providing a standardization and commoditizing the process of technology contracts and creating method for assessing, scoring, ranking and rating technology vendors for the purpose of comparing vendor bids on a project and for structuring and pricing insurance / surety contracts. Intrinsic and two-way vendor ratings are established for each of the vendors in a particular project. This two-way rating is used to provide a risk adjustment to the nominal bid of each of the vendors. The two-way rating is also utilized to structure and calculate an insurance premium based upon the probability that the vendor would fail / default on the delivery of a technology project.

Owner:KANSAL NAMITA

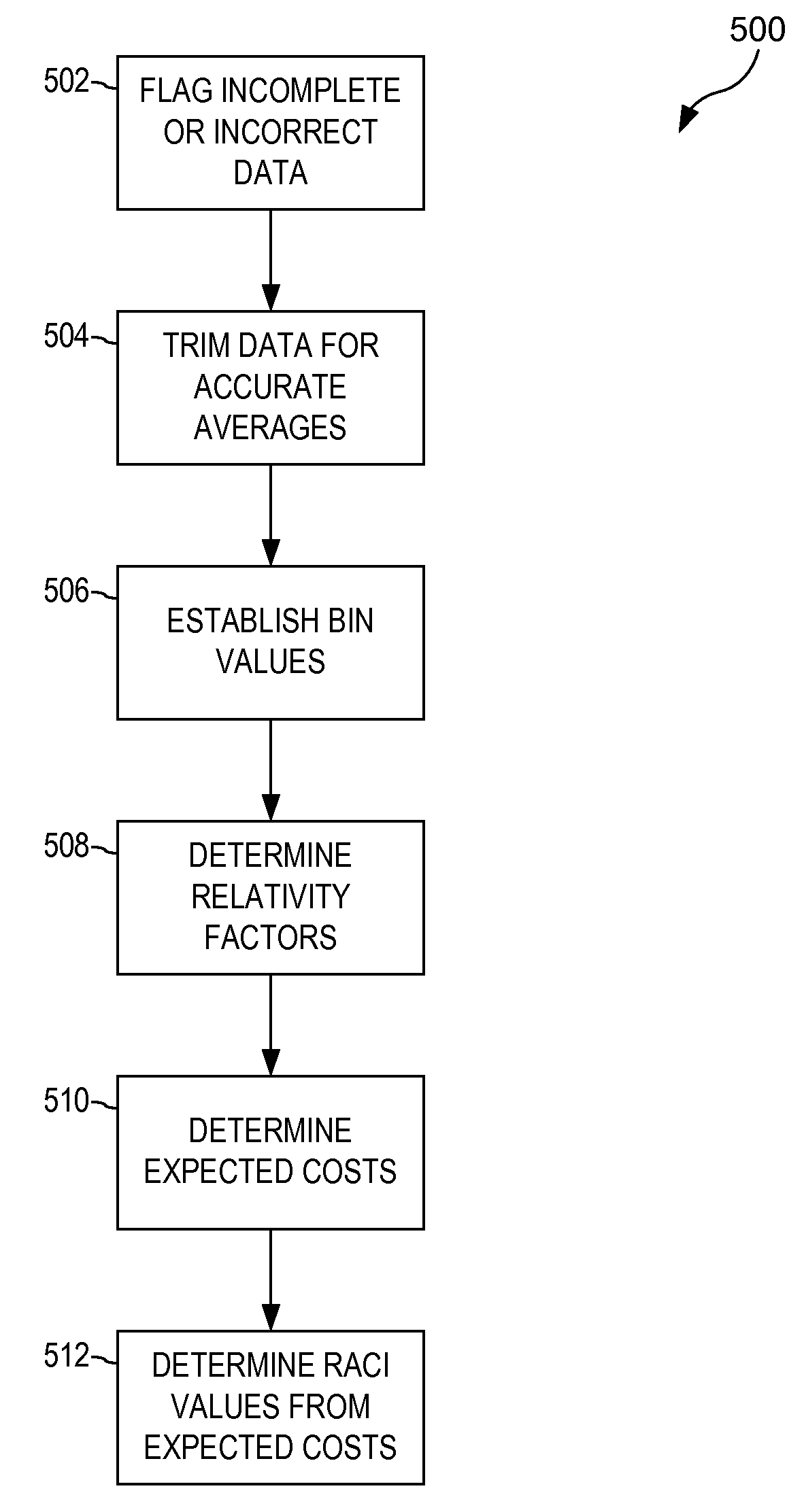

System and method for risk adjusted cost index measurements for health care providers

An improved method of evaluating and comparing the cost-effectiveness of healthcare providers across a wide spectrum of specialties and health conditions of their patients. The method includes the steps of determining criteria for determining a provider's relative cost-effectiveness at providing healthcare at a reasonable cost, and then applying those criteria to assign or exclude a provider from a preferred network of healthcare providers that have an established history of providing the same care at a lower cost than other providers.

Owner:HEALTH CARE SERVICE A MUTUAL LEGAL RESERVE

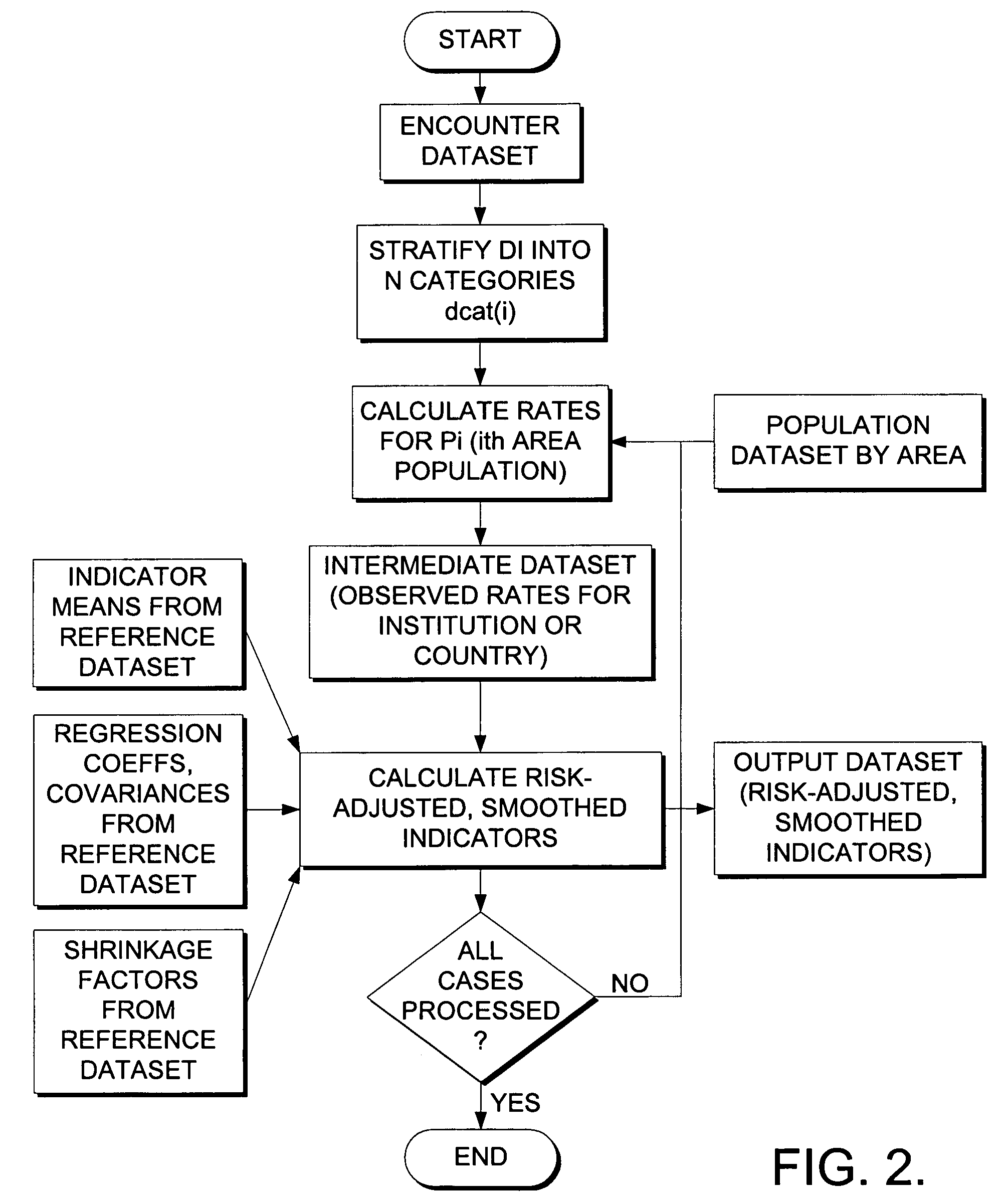

System and method for risk-adjusting indicators of access and utilization based on metrics of distance and time

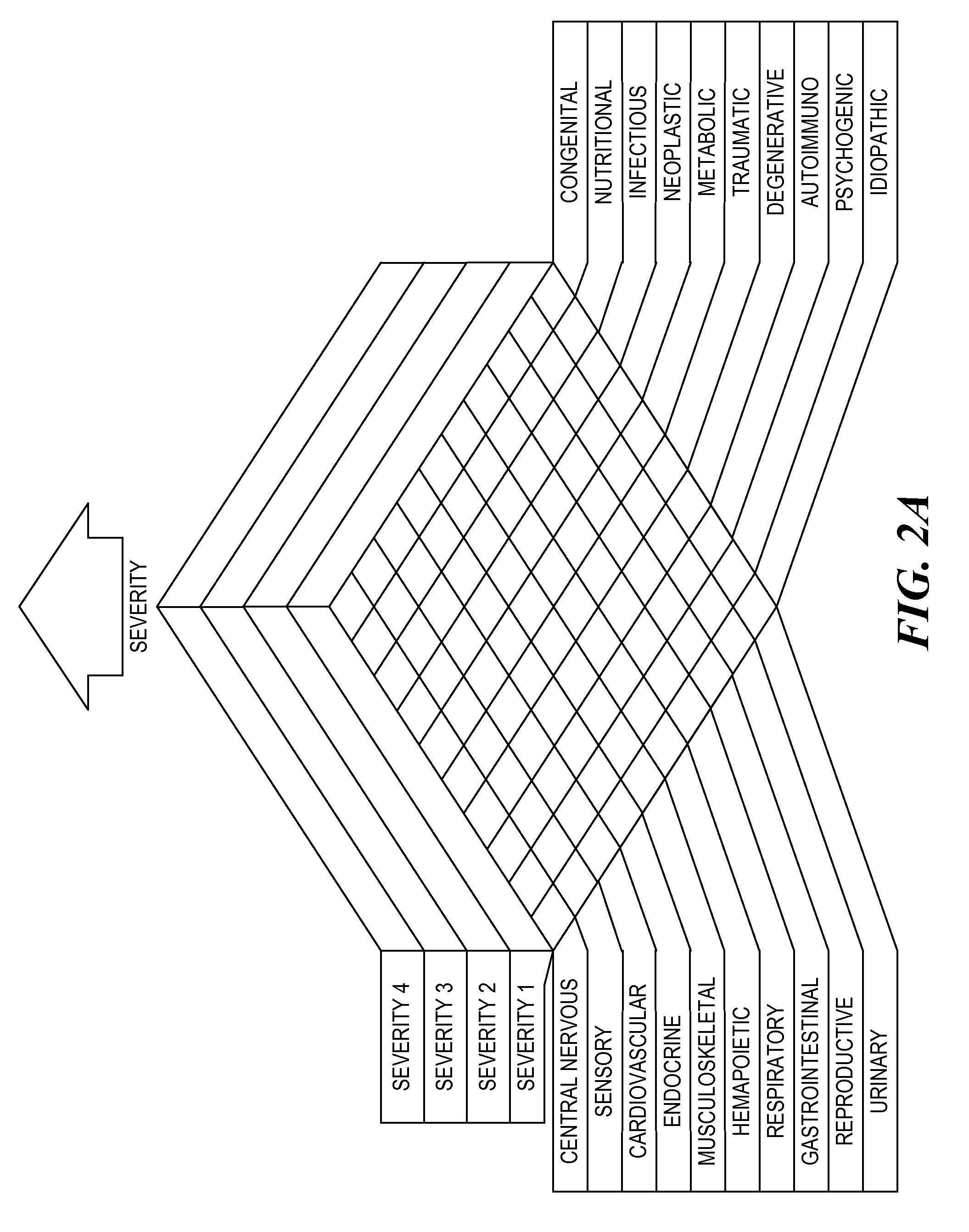

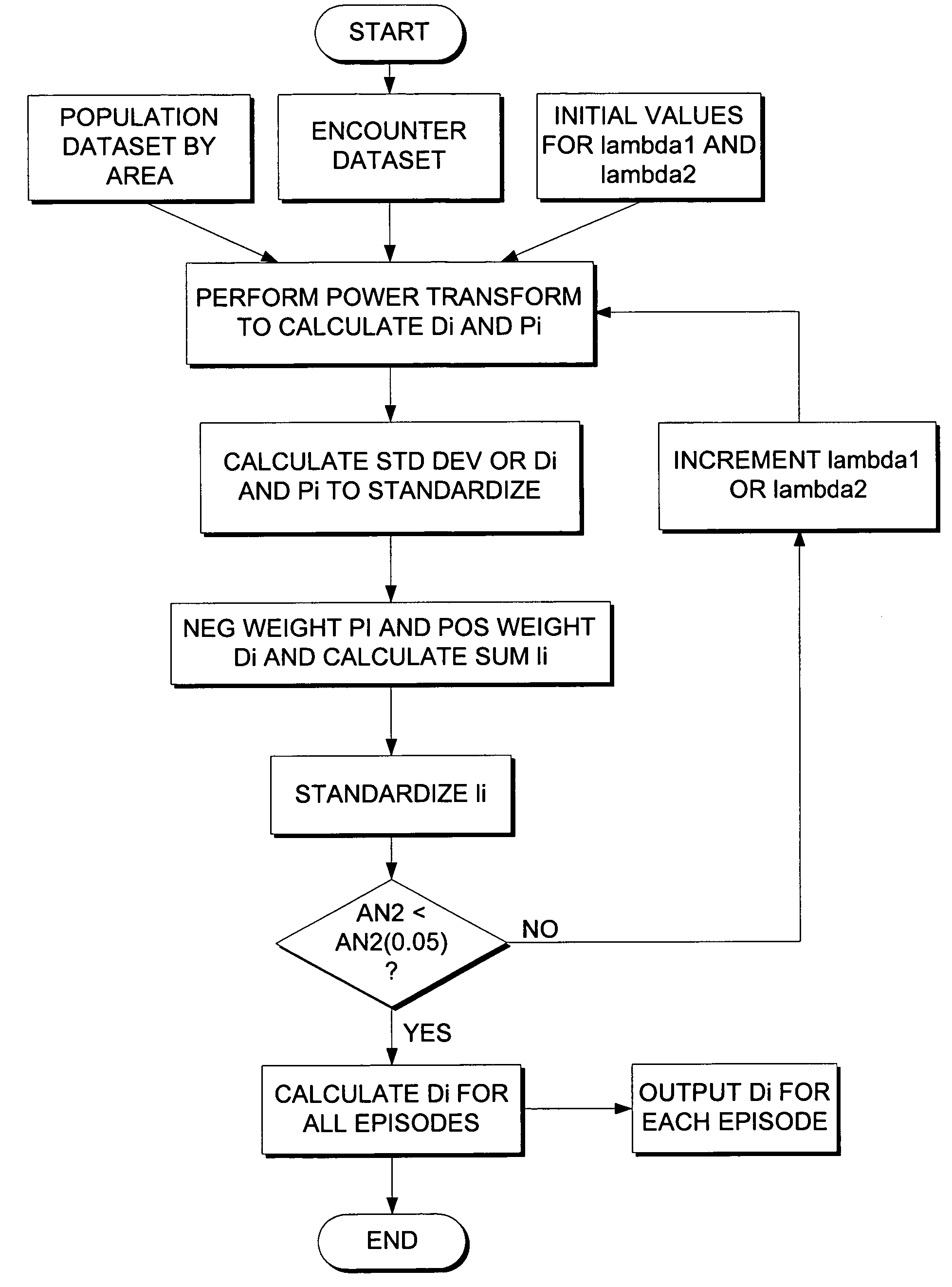

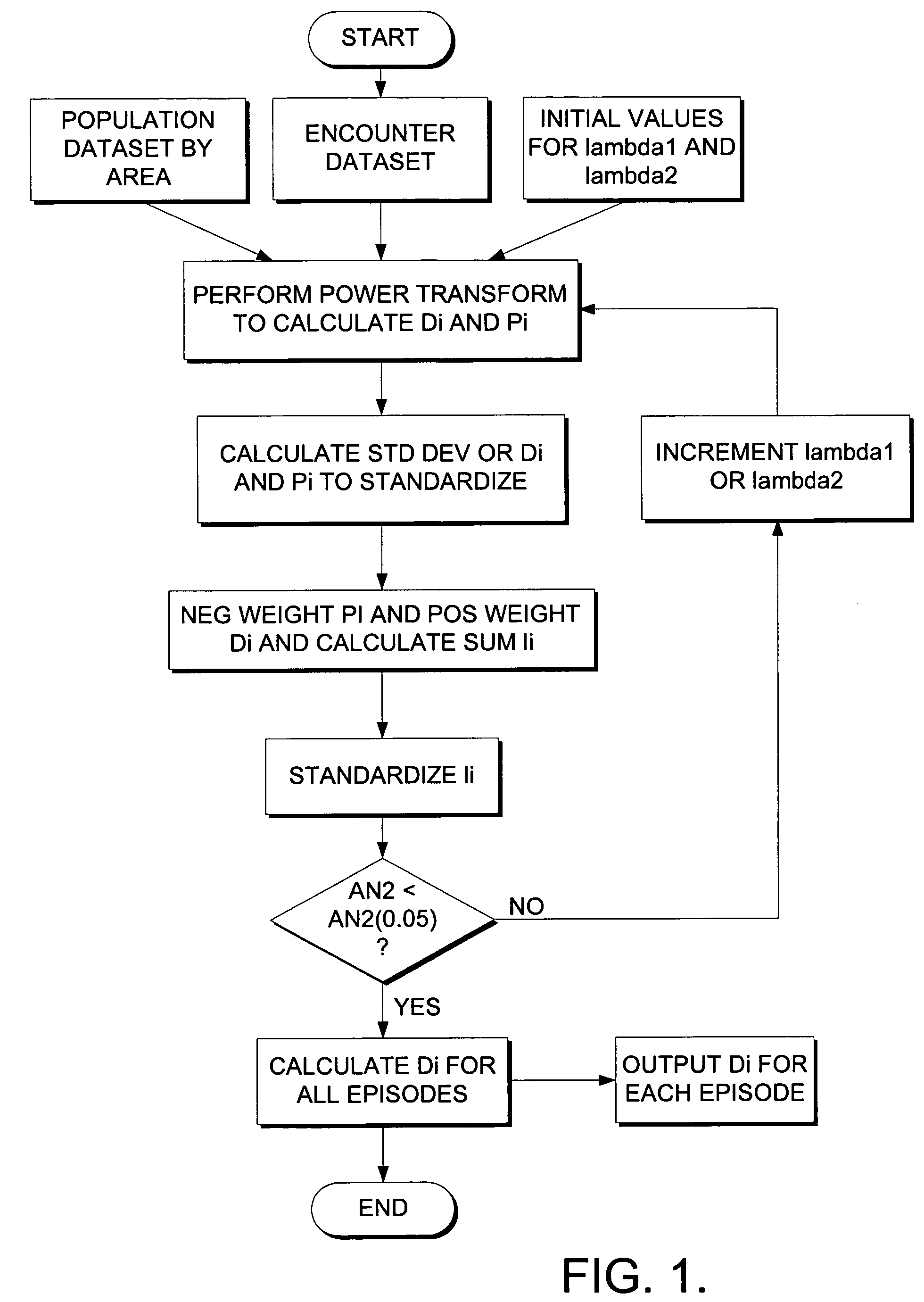

InactiveUS7617115B2Hamper interpretationAccurate distinctionData processing applicationsAverage speed measurementTransportation infrastructurePopulation density

A method and system suitable for automated adjustment of information represented in the transaction order records from clinical information systems of hospitals, clinics, and emergency rooms, in such a manner as to accurately reflect differences in access to care. Techniques from statistical processing are combined in a method that allows for optimization of the parameters such that statistical hypothesis testing using conventional parametric tests are valid and feasible, on account of close approximation to Gaussian normal distribution. The method and system is designed so as to be robust against wide variations in population density and transportation infrastructure, as reflects remote, rural, suburban, and metropolitan environments. Once optimized, the method and system can achieve reliable performance with regard to longitudinal measurement of health access indicators, which are used in planning and managing health services. The performance of this method and system is superior to predicate methods known to those skilled in the art.

Owner:CERNER INNOVATION

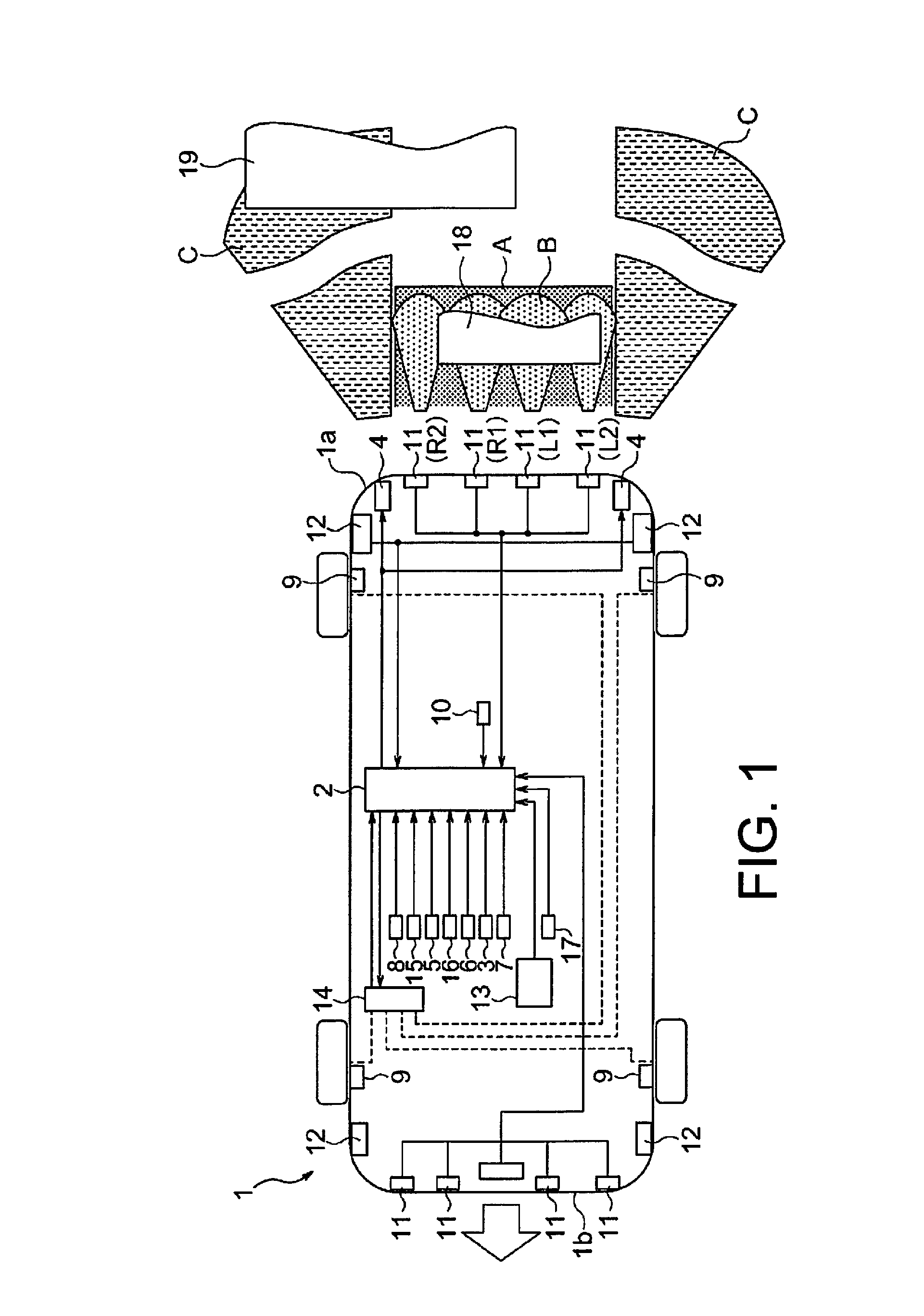

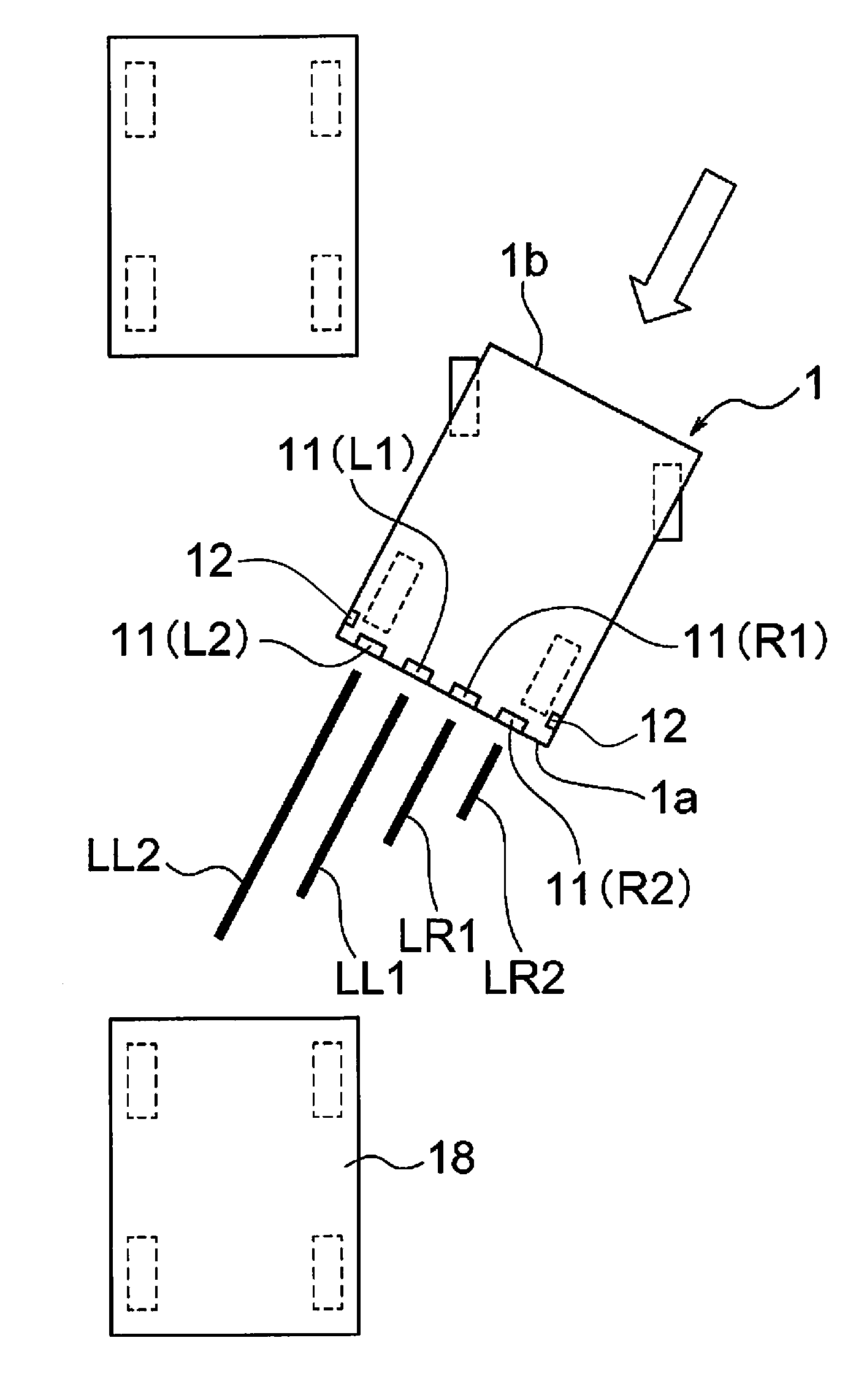

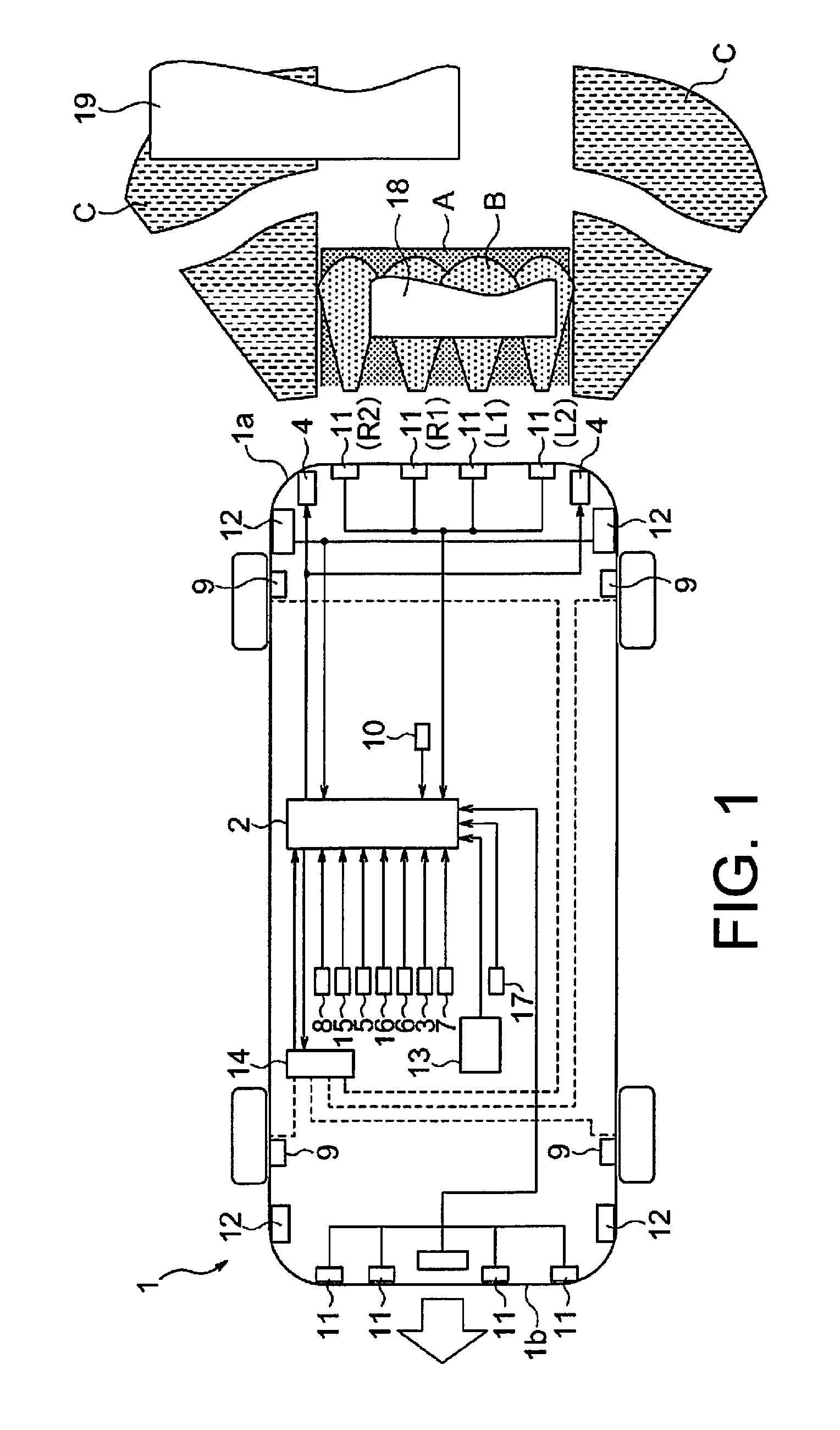

Vehicle control apparatus

A vehicle control device basically includes a first risk computation unit, a second risk computing unit and a first risk adjustment unit. The first risk computation unit calculates a first risk with respect to a nearby obstacle located in a nearby detection region near a host vehicle. The second risk computing unit calculates a second risk with respect to a remote obstacle located further from the nearby detection region. The first risk adjustment unit adjusts at least one of the first and the second risks to preferentially execute a warning or vehicle control based on one of the first risk or the second risk versus a warning or vehicle control based on the other of the first risk or the second risk based on an entry state of the host vehicle of entering a planned parking place, or an exit state of the host vehicle of exiting from a parking place.

Owner:NISSAN MOTOR CO LTD

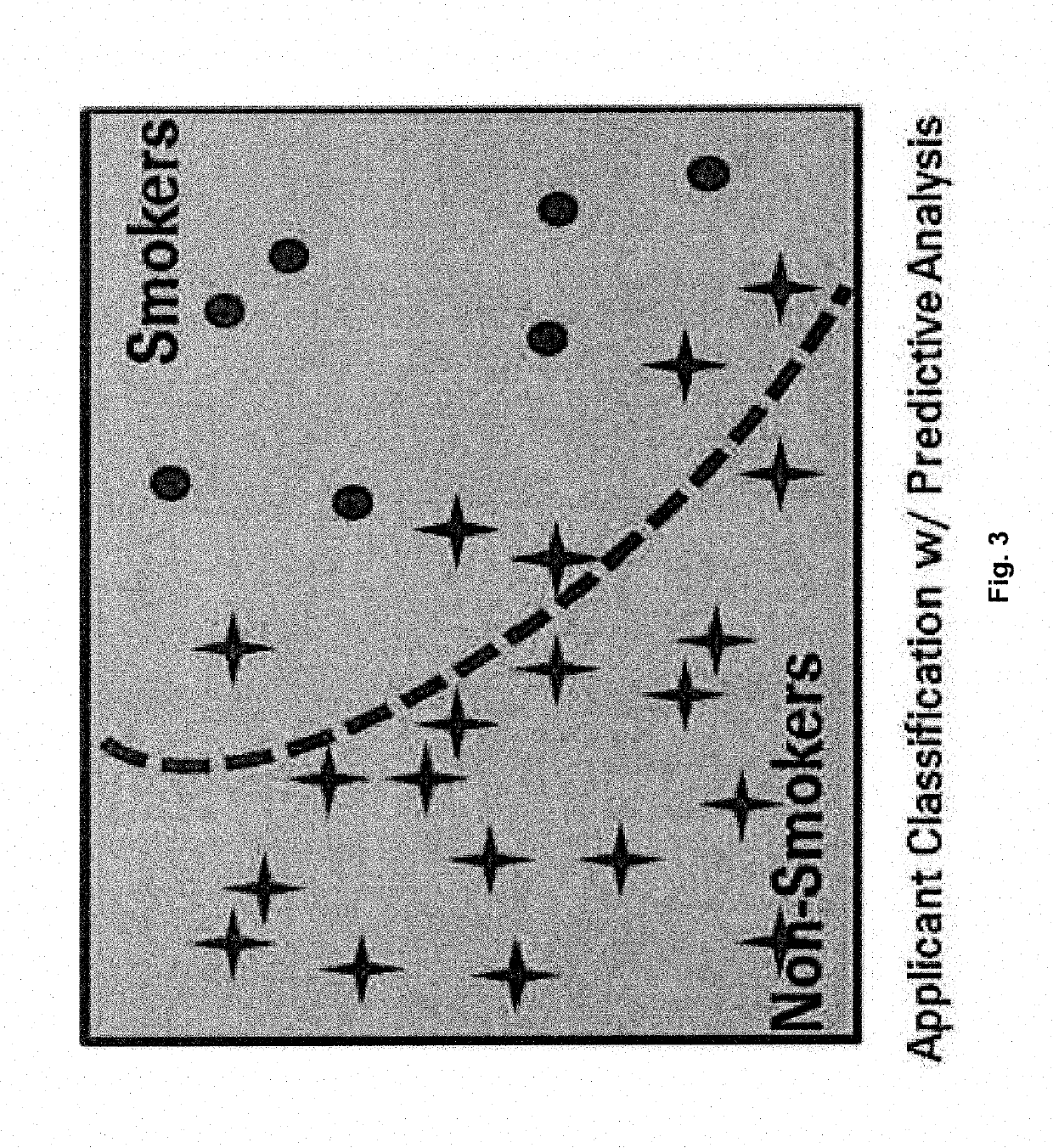

Life insurance system with fully automated underwriting process for real-time underwriting and risk adjustment, and corresponding method thereof

An automated, real-time mortality classification and signaling system for real-time risk assessment, and adjustment based on an automated selective multi-level triage process, where risks associated with a plurality of risk-exposed individuals are at least partially transferable from a risk-exposed individual to a first insurance system and from the first insurance system to an associated second insurance system, the real-time mortality classification and signaling system accesses a database stored in a memory to retrieve risk classes, identifies and selects a specific risk class associated with the risk of the exposed individual, processes specific parameters of the exposed individual using a machine learning-based pattern recognition to automatically assign risk-exposed individuals with detected non-smoking patterns to a second triage channel, and automatically assigning risk-exposed individuals with detected smoking patterns to a third triage channel as predicted smokers. Based on the classified risk, the system provides an alert notification to a third-party system.

Owner:SWISS REINSURANCE CO LTD

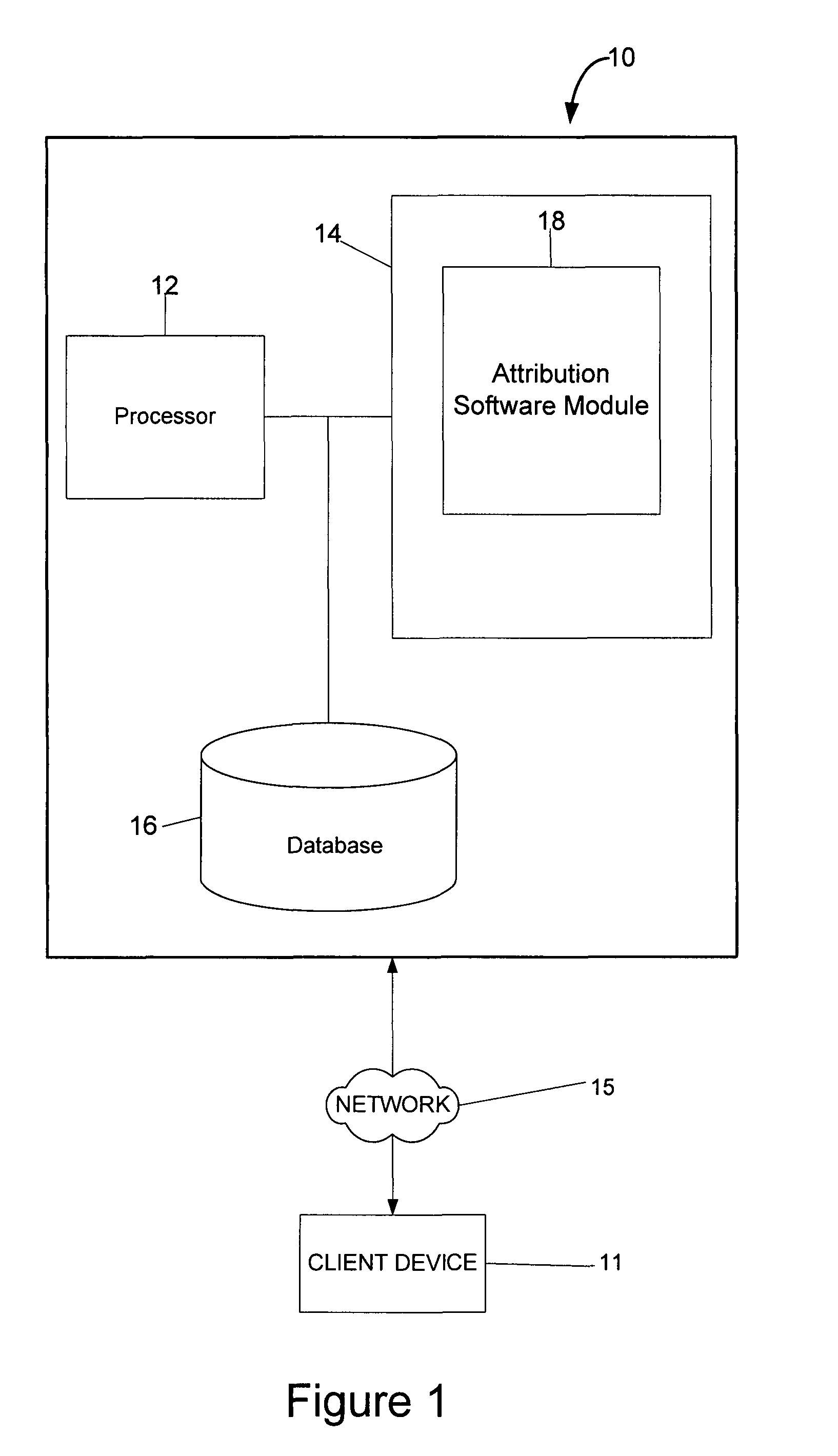

System and method for attributing performance, risk and risk-adjusted performance of an investment portfolio to custom factors

Owner:MORGAN STANLEY CAPITAL INT

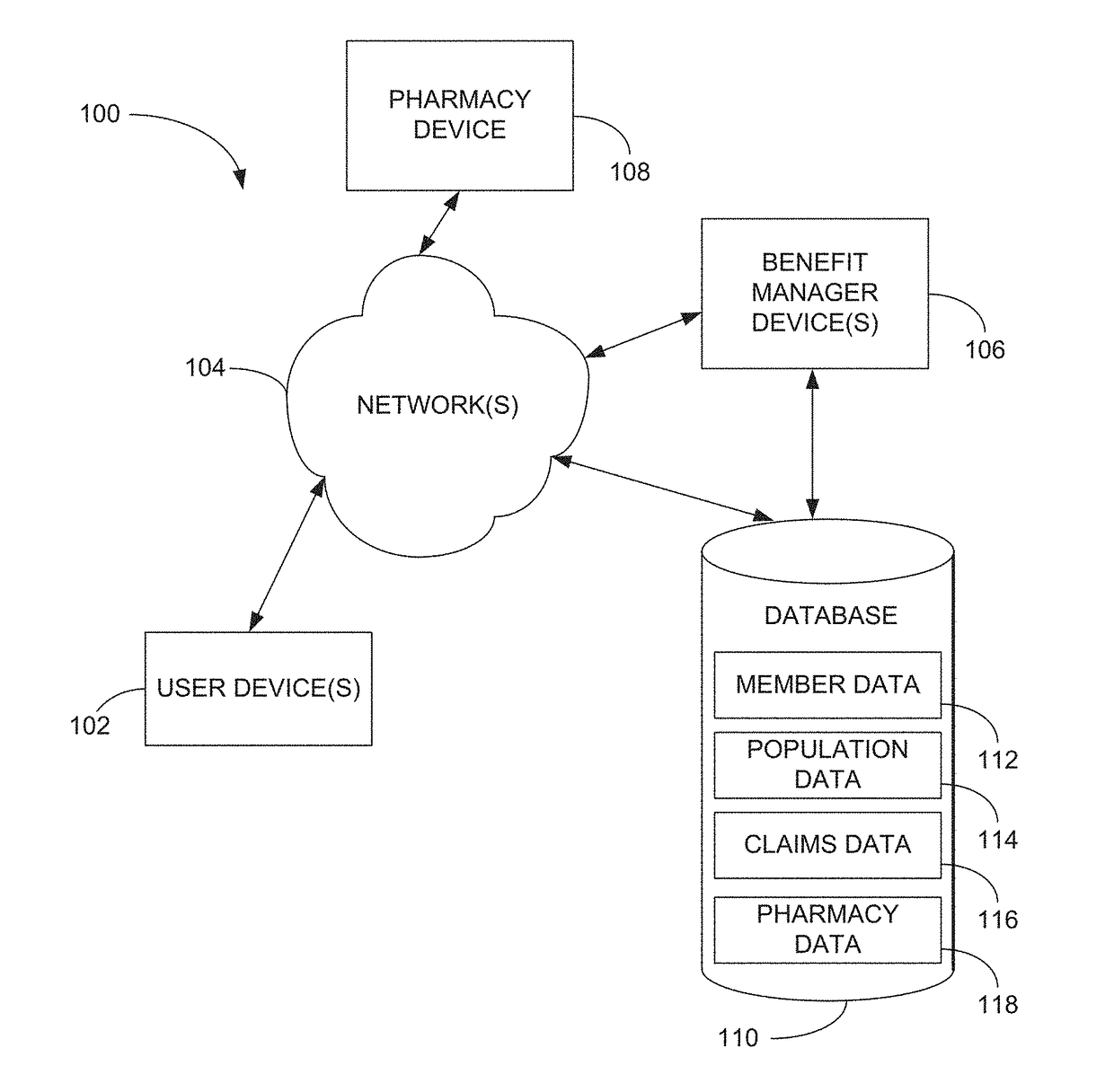

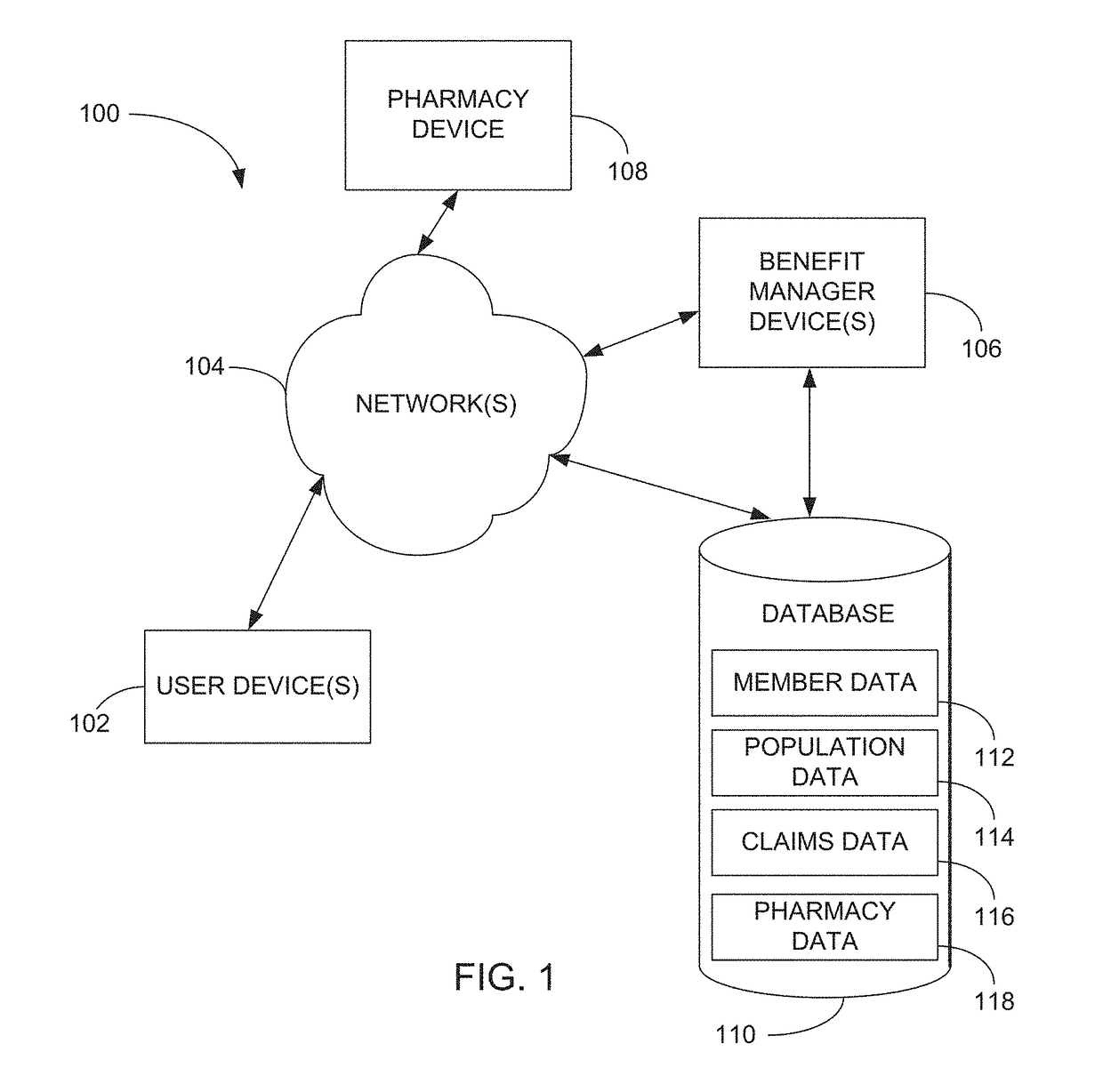

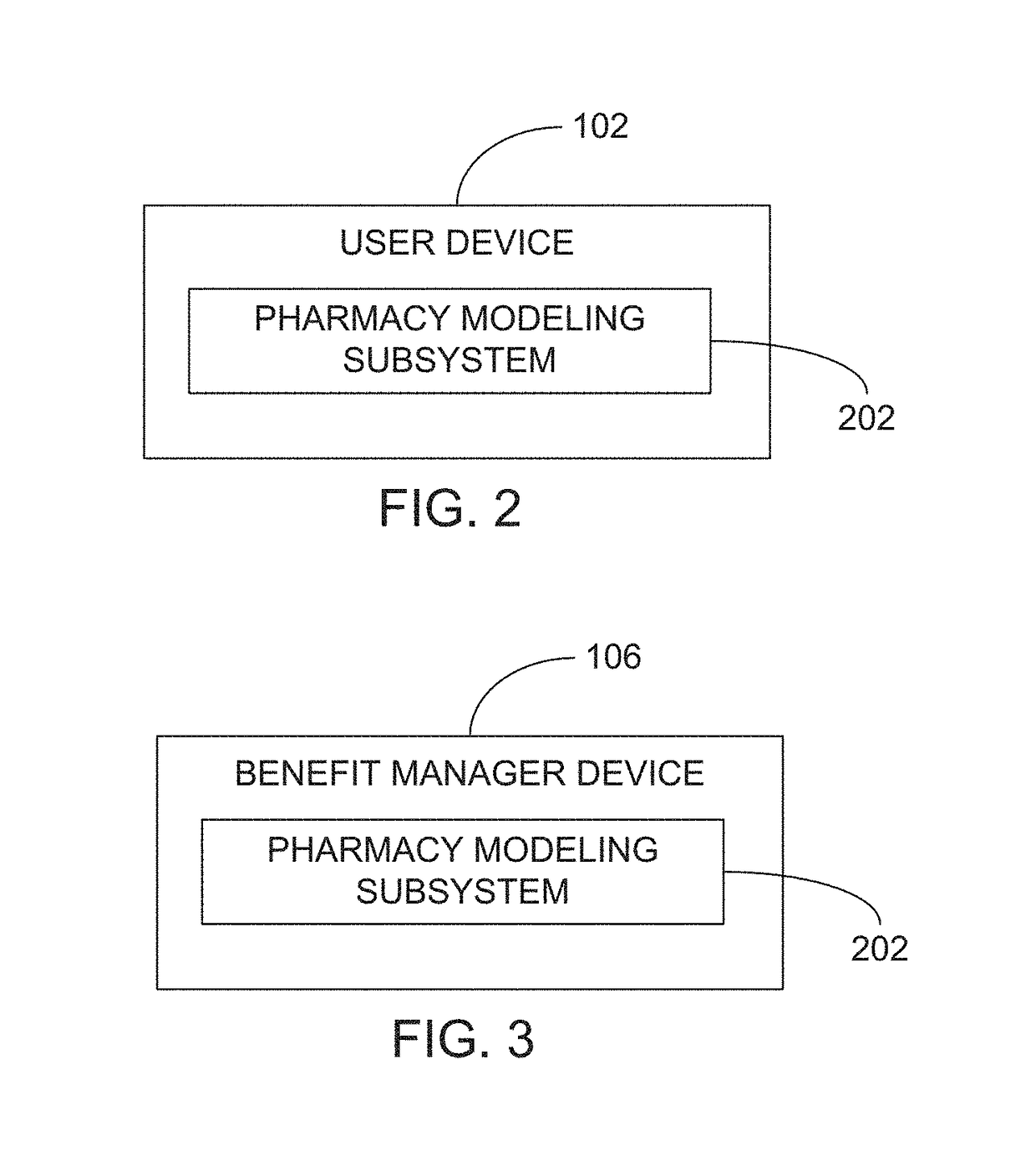

Methods and systems for pharmacy modeling

Methods and systems for pharmacy modeling are described. The risk adjusted pharmacy predictive model is created from member data, claims data, and population data. This model can be used to compare the actual pharmacy performance to an expected actual pharmacy performance value, which can be used to identify pharmacies at risk or not performing to an acceptable level. The model can be used for adherence and generic drug utilization ratings of pharmacies. The pharmacy can be judged on a therapy class by therapy class basis with factors that reflect the demographic, socio-economic, location, benefits attributes, etc. that actually affect the performance of the pharmacy and may assist in determining the quality of care by a pharmacy.

Owner:EXPRESS SCRIPTS STRATEGIC DEV INC

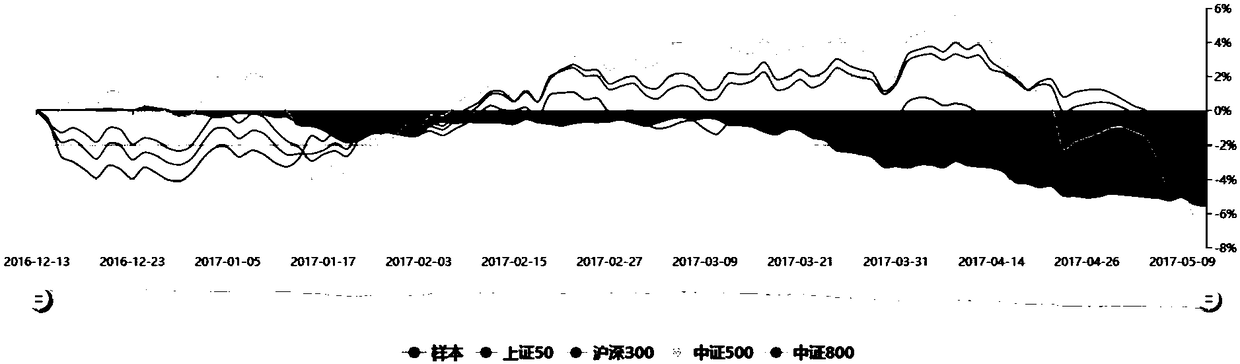

Fund evaluation method and device

The invention, which relates to the technical field of financial data analysis, provides a fund evaluation method and device. The method comprises: a value assessment table of a target fund is obtained; information of first parameters of the target fund is read from the value assessment table and second parameters are calculated based on the first parameters, wherein the second parameters includean annual yield, a scanning statistic value, a winning percentage, a Sharpe ratio, a Calmar ratio, a Sortino ratio, a volatility value, a maximum withdrawing rate, and CVaR; according to the second parameters, ranks of all third parameters are determined, wherein the third parameters include an earning power value, a performance persistence value, a risk adjustment performance value, and a risk control ability value, all rank values are corresponding parameter values; and on the basis of the third parameters, a capability radar chart and / or comprehensive capability value of the target fund are / is obtained. According to the fund evaluation method, attributions of risk sources and earning sources of the equity bulls and stock index future hedging ends in the relative value strategy are analyzed in details; and a complete, comprehensive and reliable fund performance attribution report is provided.

Owner:孙嘉

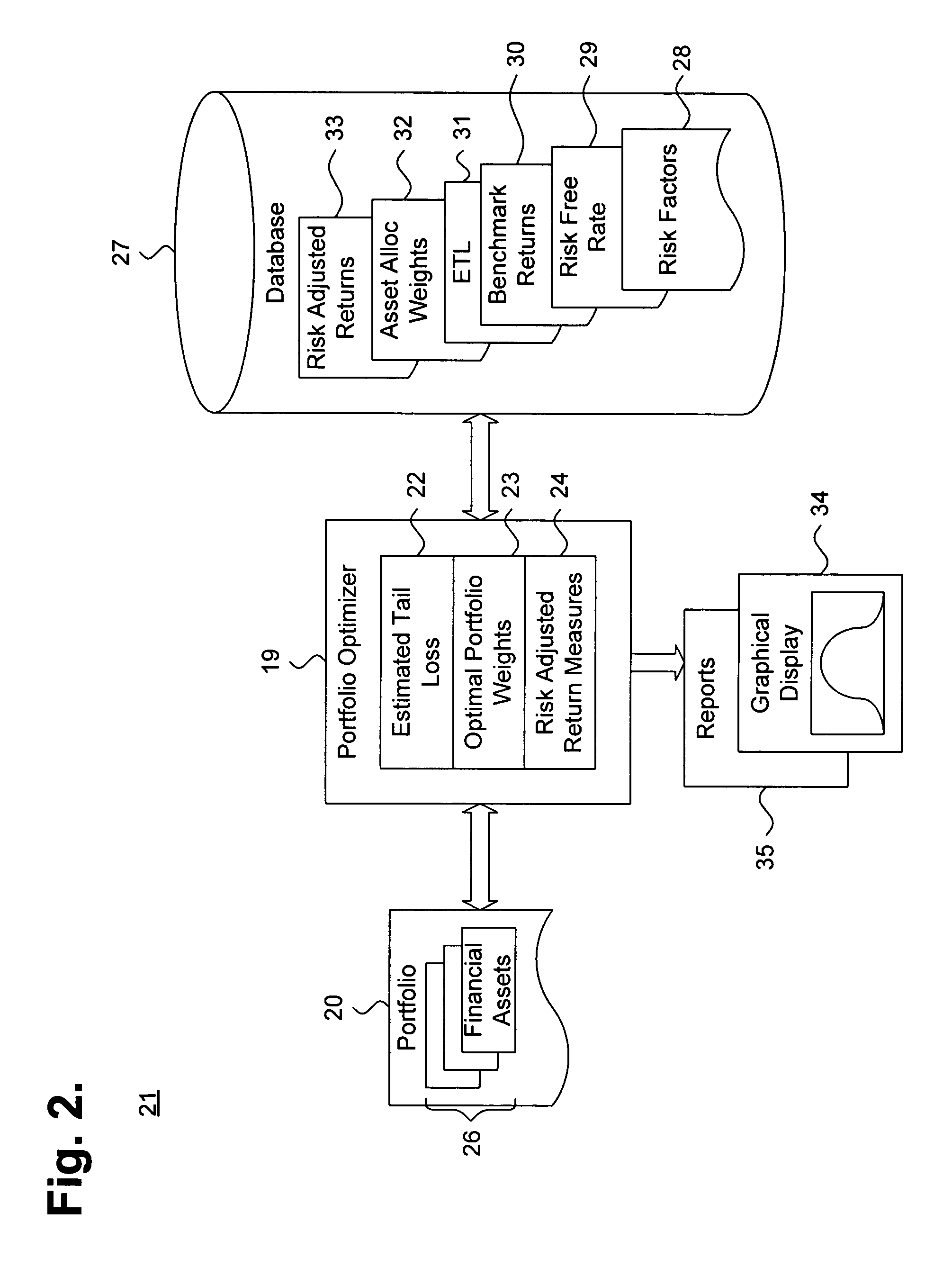

System and method for providing optimization of a financial portfolio using a parametric leptokurtic distribution

ActiveUS7711617B2Accurately determinedOptimize risk adjusted returnFinanceElectric digital data processingParameter distributionRisk adjustment

A system and method for providing optimization of a financial portfolio using a parametric leptokurtic distribution is presented. One or more risk factors associated with a plurality of financial assets maintained in a portfolio and applicable over at least one time horizon are provided. A subordinated parametric distribution model having leptokurtic behaviors is specified for the risk factors with a measurement of risk expressed as a function of expected tail loss for a significance level or quantile. The subordinated distribution model is applied at each such time horizon to determine a distribution of the risk factors for the financial assets. Portfolio weights providing a substantially maximum risk adjusted return for the portfolio are determined.

Owner:FINANALYTICA

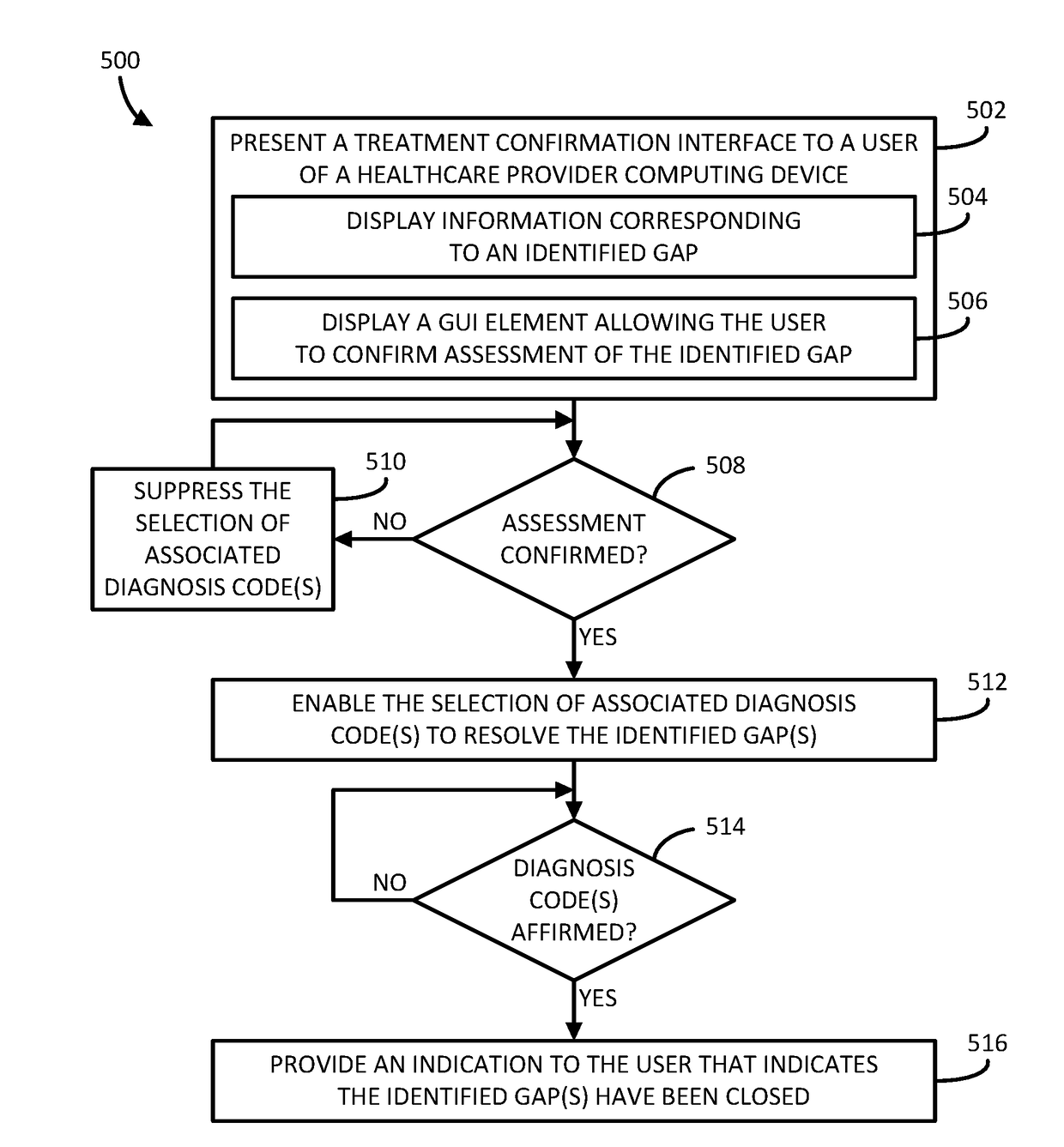

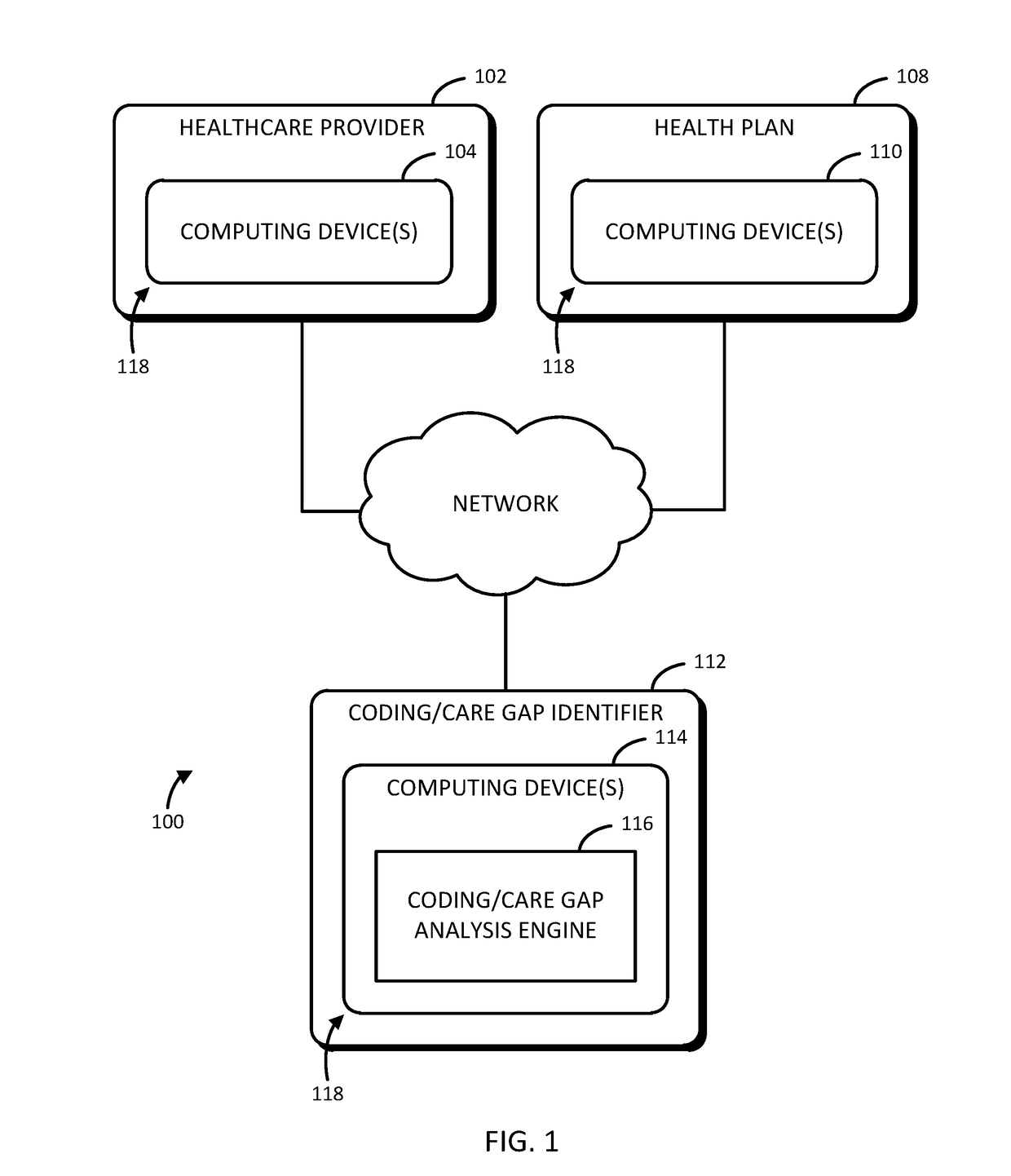

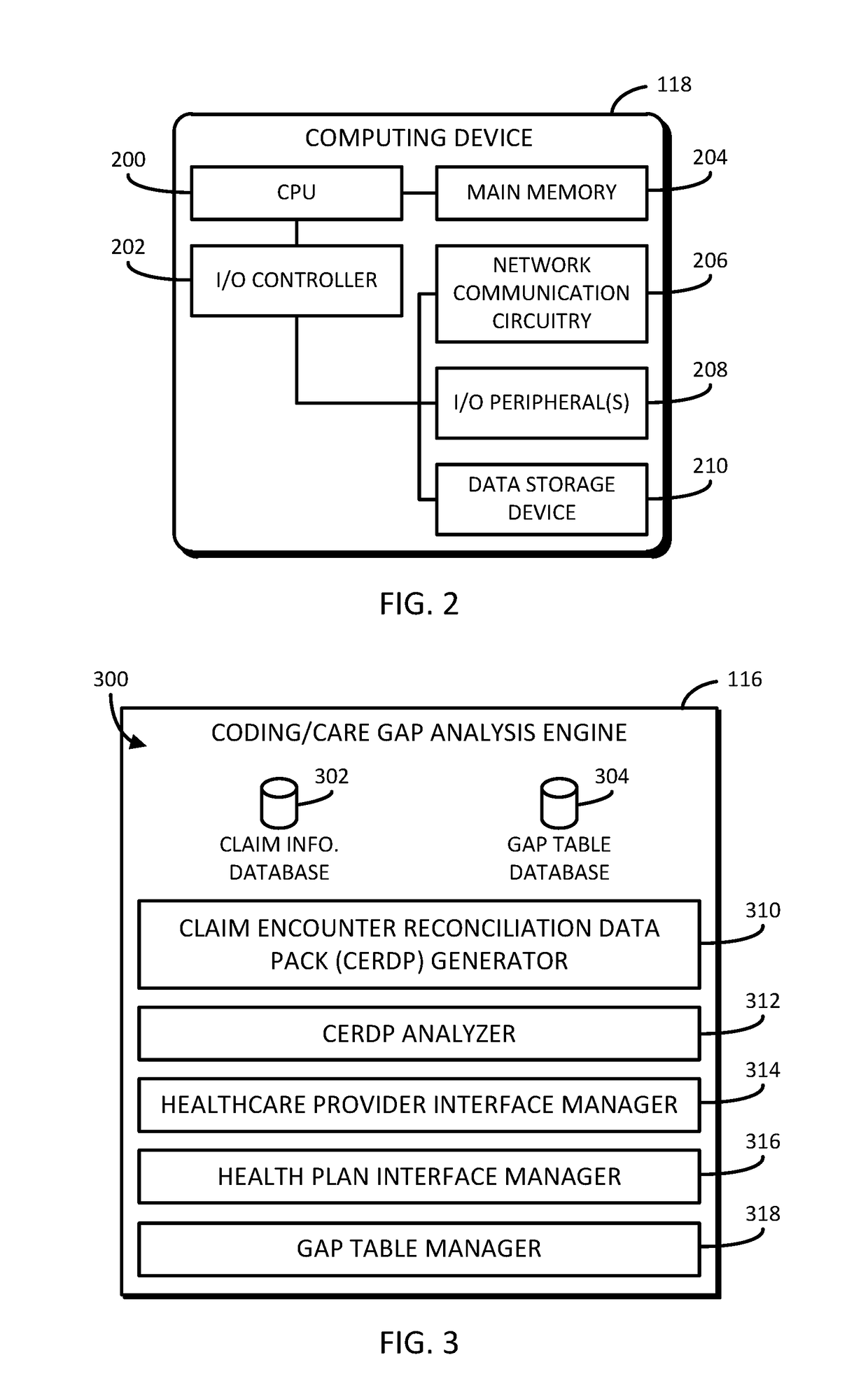

System and method for insurance risk adjustment

Technologies for identifying coding / care gaps of an insurance claim include a computing device configured to receive an insurance claim from a healthcare provider, create a claim encounter reconciliation data pack (CERDP) based on the received insurance claim, and analyze the CERDP to identify whether any coding / care gaps exist in the received insurance claim. Upon determining any coding / care gaps, the computing device is additionally configured to provide an interface to the healthcare provider usable to view and resolve the identified coding / care gaps. The computing device is further configured to receive updated claim information as a function of the resolution of the identified coding / care gaps and transmit a related insurance claim to a corresponding health plan. Other embodiments are described herein.

Owner:AVAILITY LLC

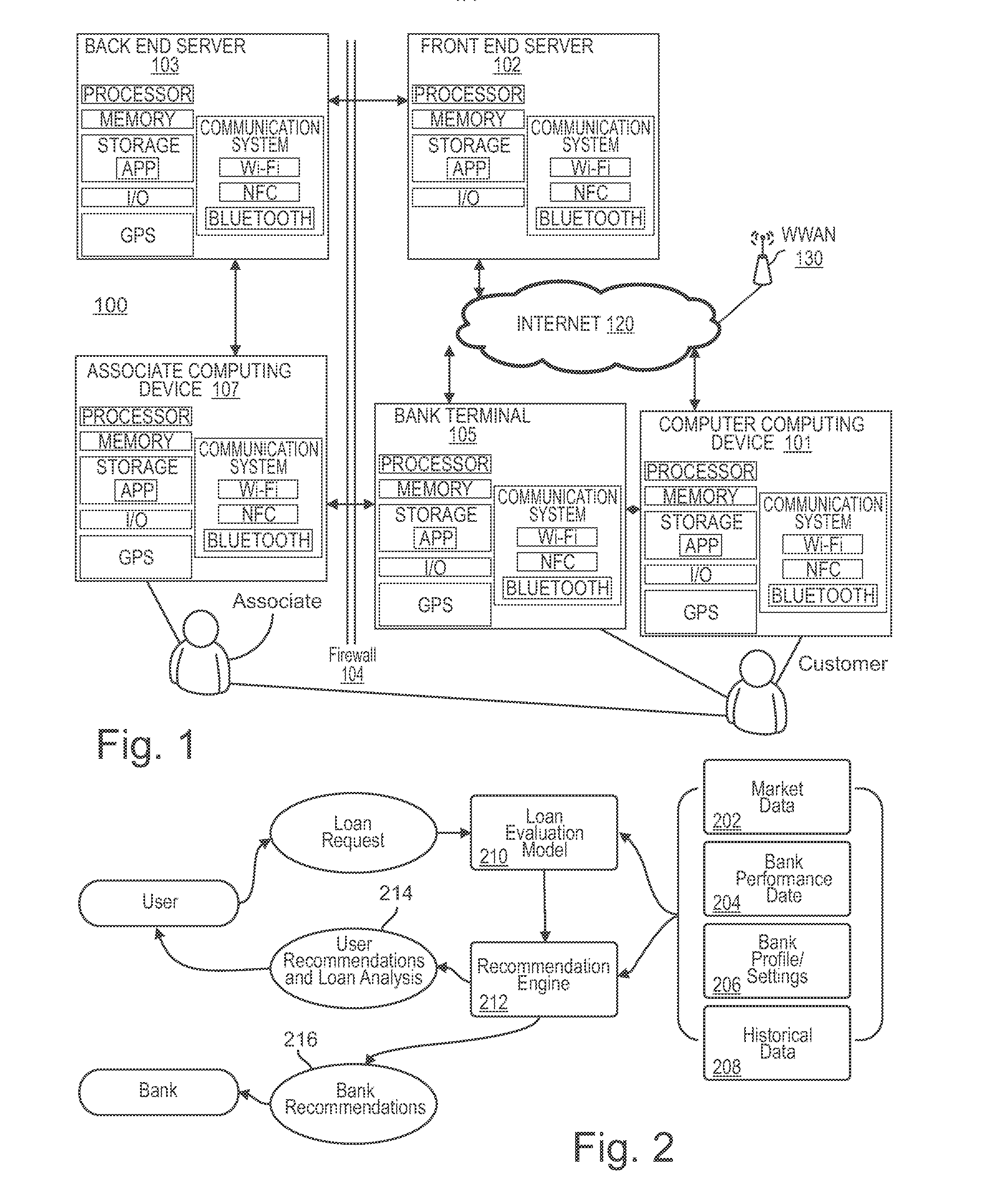

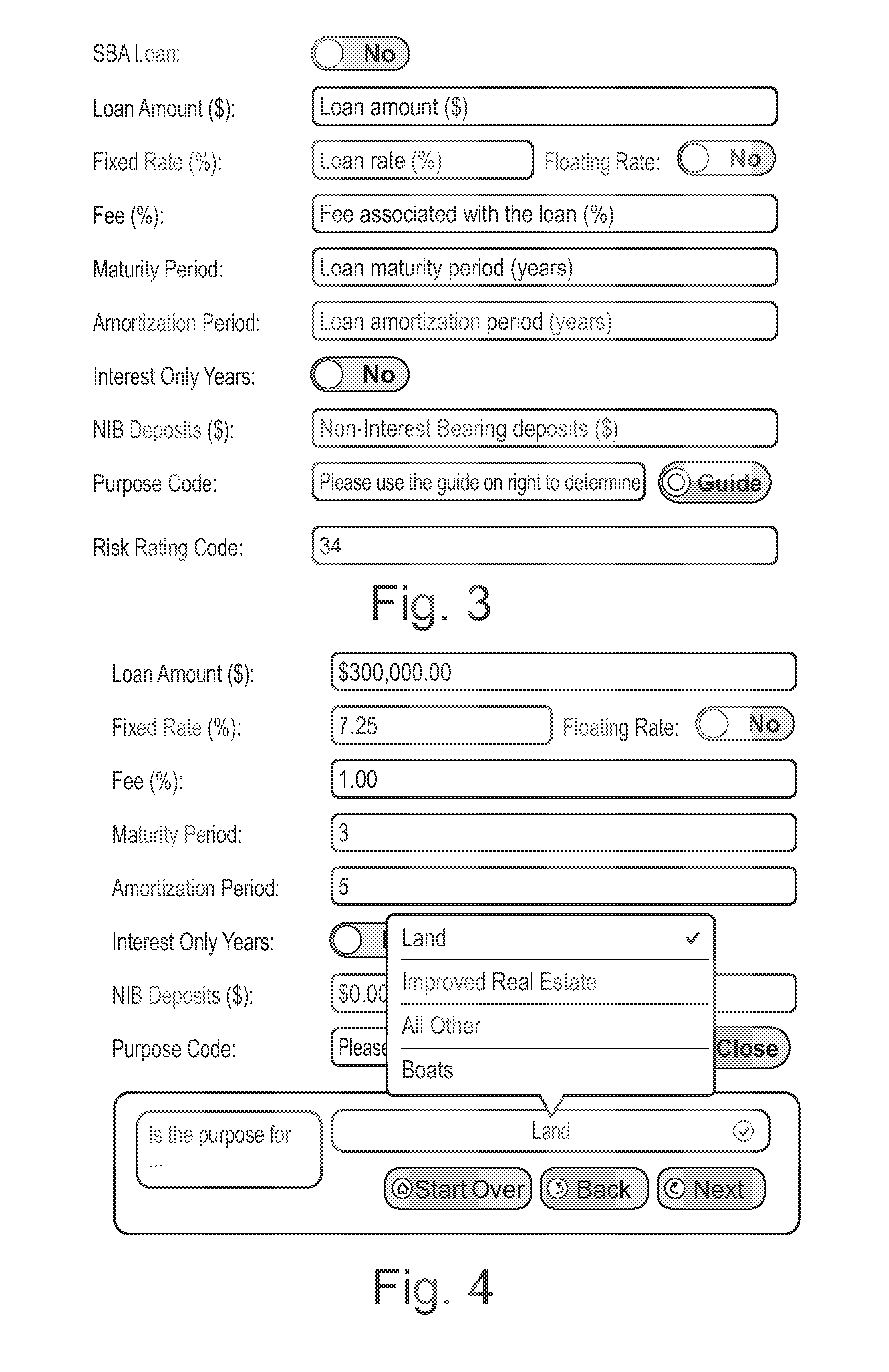

System and method for dynamic customer acquisition probability and risk-adjusted return-on-equity analysis

Disclosed is a method of processing a user's loan request to a bank and making recommendations to the user and the bank. The invention includes using a computer code that evaluates user submitted loan data, public bank data, and private bank data to calculate a bank's risk-adjusted return-on-equity and customer acquisition probability on a given loan. The bank's private data may include bank profile settings and bank historical data. The bank's public data may include UBPR and bank call reports. Also, the method may be utilized to analyze the bank's performance over time.

Owner:BANK OF OZARKS

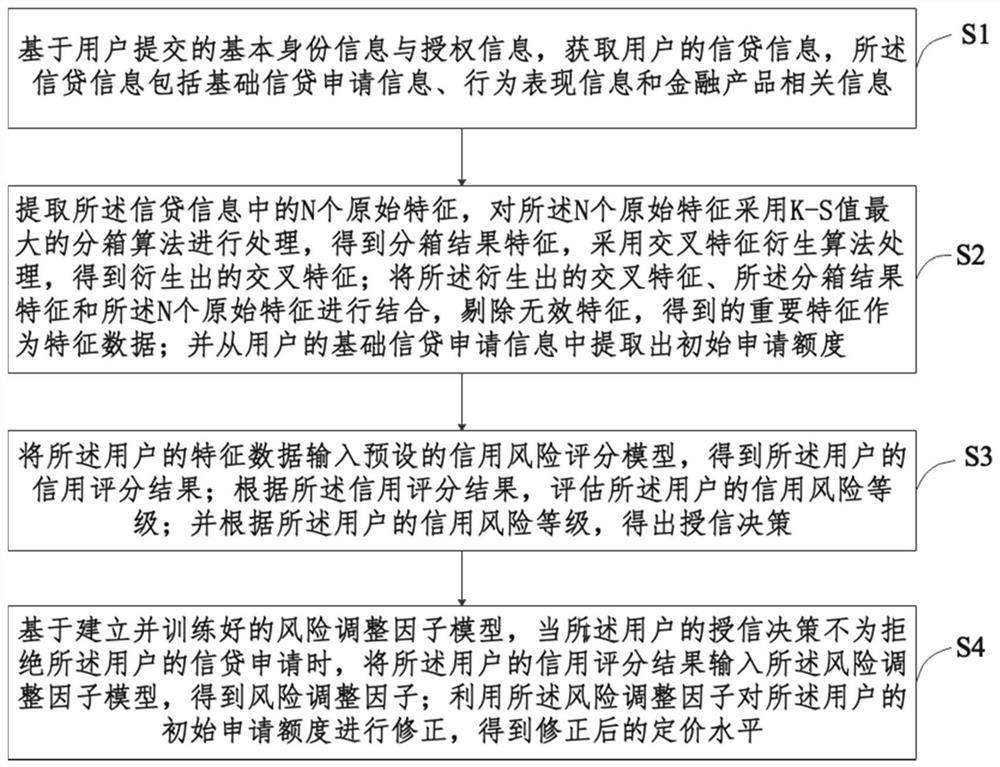

Credit risk control method and system, electronic equipment and readable storage medium

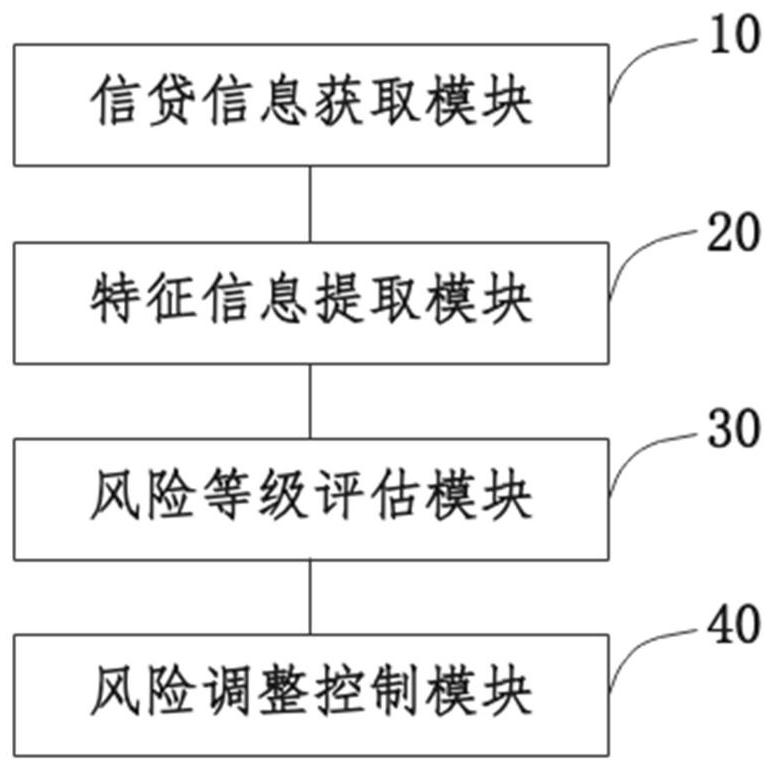

The embodiment of the invention provides a credit risk control method and system, electronic equipment and a readable storage medium, and the method comprises the steps of obtaining the credit information of a user based on basic identity information and authorization information, extracting the original features in the credit information, removing invalid features, and enabling the obtained important features to serve as feature data; extracting an initial application limit from the basic credit application information of the user; inputting the feature data of the user into a preset credit risk scoring model to obtain a credit scoring result of the user; obtaining a risk adjustment factor based on the established and trained risk adjustment factor model; and correcting the initial application quota of the user by using the risk adjustment factor. According to the embodiment of the invention, the credit granting level of the user is adjusted according to the risk level of the user soas to further balance the risk and the income, and maximization of the benefit of the lender can be efficiently, automatically and reasonably realized on the premise that the risk is controllable.

Owner:长安汽车金融有限公司

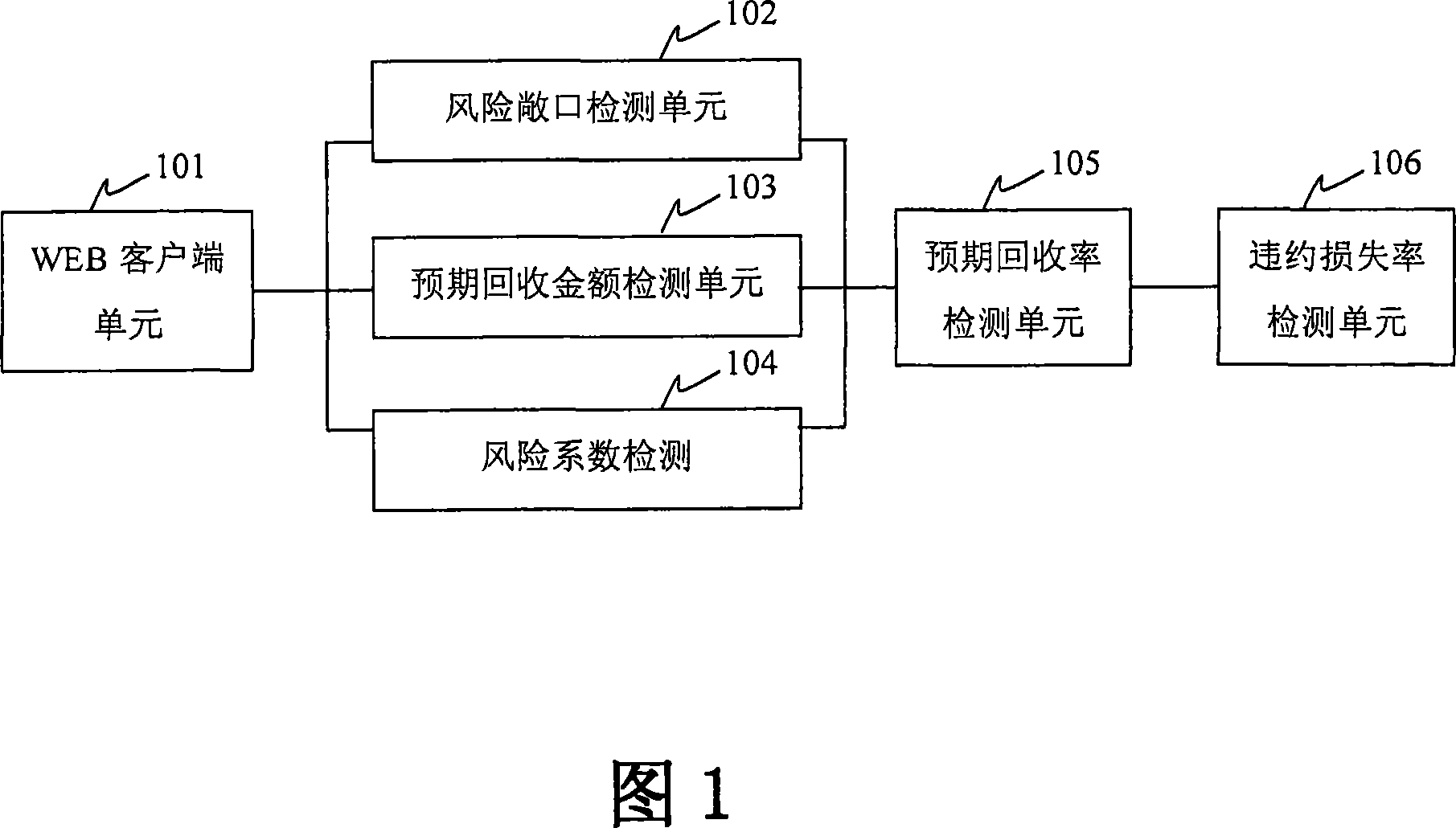

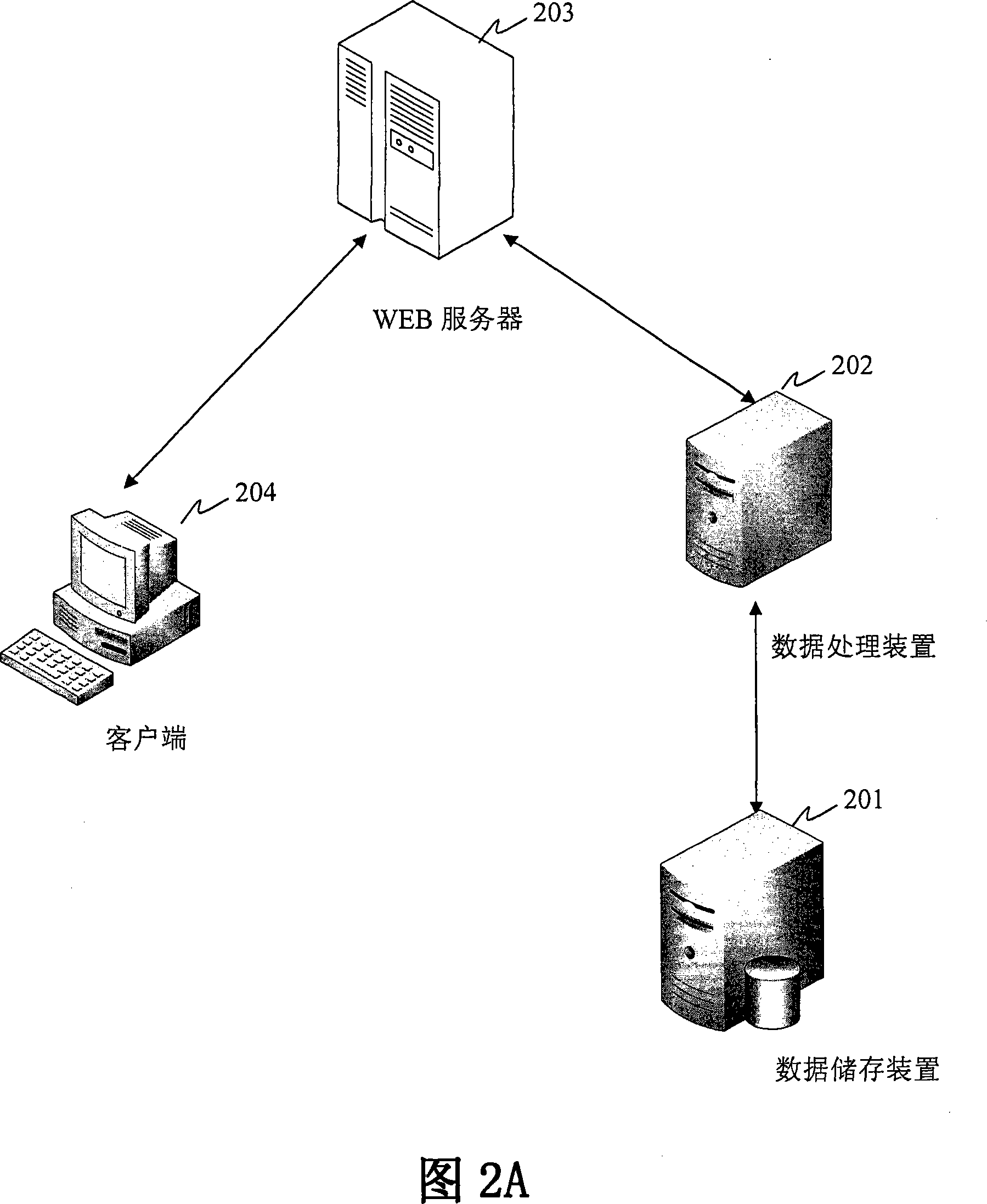

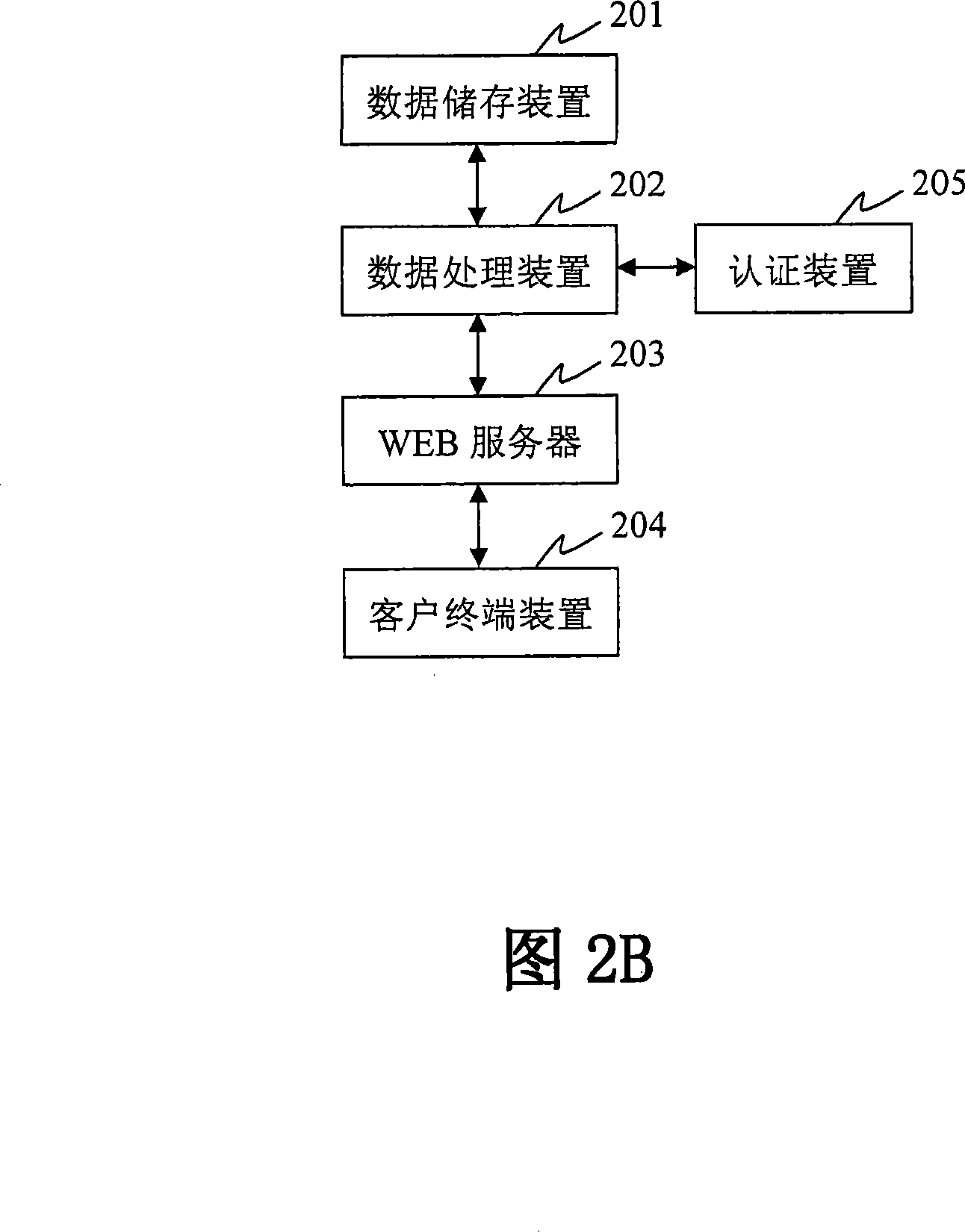

Bank debt risk detecting system based on WEB

The invention provides a bank debt risk detection system based on WEB. The system comprises: a WEB client-side unit used to input the debt data information which at least includes the customer code through a WEB page as well as generate and send a detection request; a risk exposure detection unit used to calculate the debt risk exposure according to the debt data information; an expected recovery amount detection unit used to calculate the total of the expected recovery amount of the debt; a risk coefficient detection unit used to calculate the debt risk coefficient; an expected recovery rate detection unit used to calculate the expected recovery rate of the debt according to the debt risk exposure, the total of the expected recovery amount of the debt and the debt risk coefficient, wherein, the debt expected recovery rate is equal to (the total of the expected recovery amount of the debt / the debt risk exposure) x the debt risk adjustment coefficient; a breach loss rate detection unit used to calculate the debt breach loss rate according to the debt expected recovery rate further to detect the bank debt risk. The bank debt risk detection system and the bank debt risk detection method based on WEB of the invention can quantitatively control the credit risk of the bank to reduce loss and avoid risk.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

Vehicle control apparatus including an obstacle detection device

A vehicle control device basically includes a first risk computation unit, a second risk computing unit and a first risk adjustment unit. The first risk computation unit calculates a first risk with respect to a nearby obstacle located in a nearby detection region near a host vehicle. The second risk computing unit calculates a second risk with respect to a remote obstacle located further from the nearby detection region. The first risk adjustment unit adjusts at least one of the first and the second risks to preferentially execute a warning or vehicle control based on one of the first risk or the second risk versus a warning or vehicle control based on the other of the first risk or the second risk based on an entry state of the host vehicle of entering a planned parking place, or an exit state of the host vehicle of exiting from a parking place.

Owner:NISSAN MOTOR CO LTD

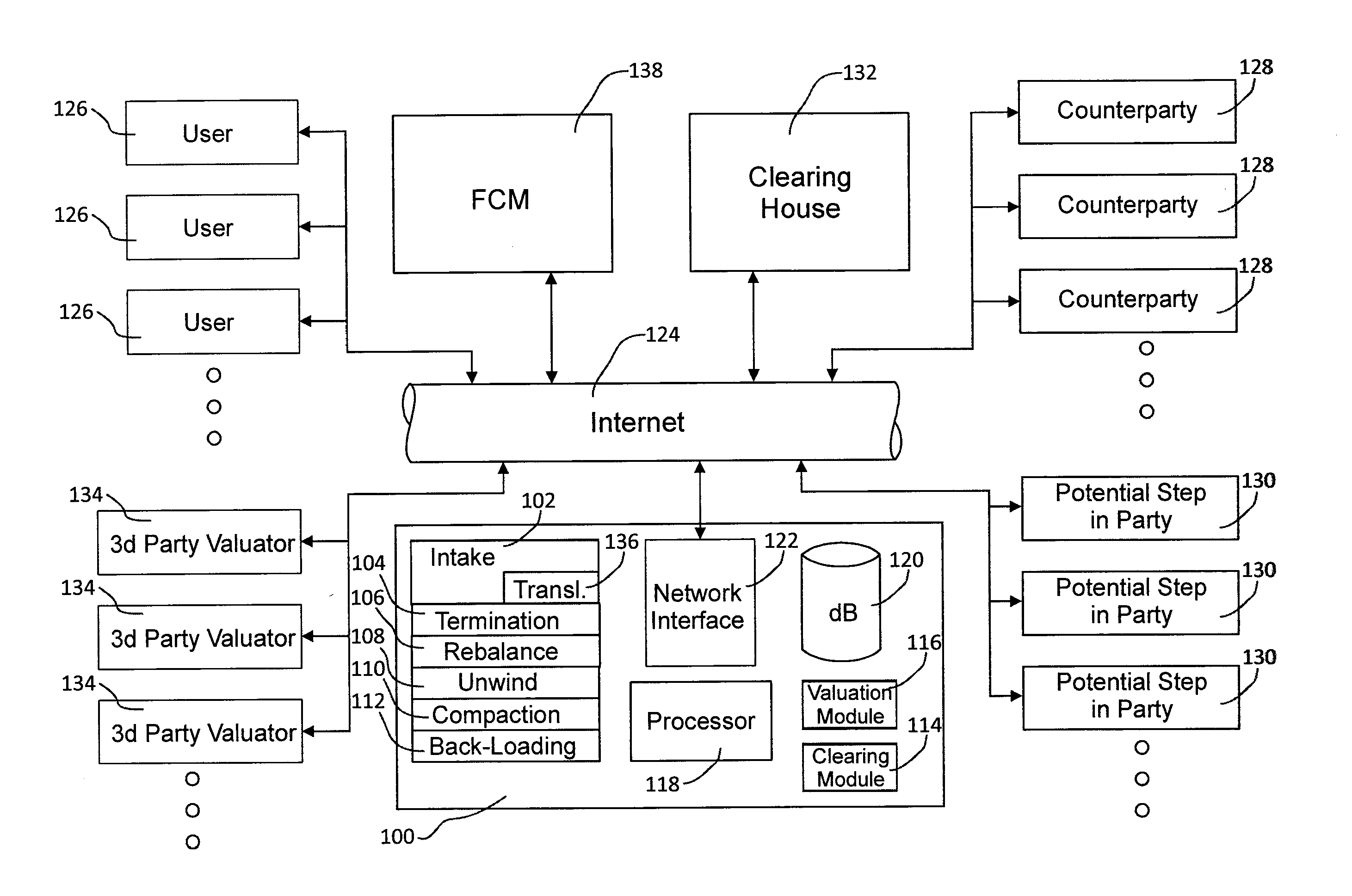

System and Method for Managing Derivative Instruments

The present invention is a system and method for providing improved functionality for management of derivative instruments. The improved system includes functionality implementing single interest rate sale sessions initiated either as a result of market conditions or a user request, risk adjustment sales to allow users to balance portfolio risks, consolidated sweeps to more efficiently allow a user to manage an investment swap portfolio, and credit limit clearance functionality to improve the management of credit limits associated with users and clearance facilities.

Owner:TRUEEX GROUP LLC

Performance evaluation method for open-ended funds based on principal component analysis

The invention discloses a performance evaluation method for open-ended funds based on principal component analysis, which mainly includes selection of sample data, selection and processing of relevantvariables in the model and statistical analysis of the sample data, wherein the selection of sample data includes selection of sample funds, selection of a sample period and determination of a samplerate-of-return frequency and a data source, the selection and processing of relevant variables in the model mainly includes the risk-free interest rate and the market portfolio rate of return, the statistical analysis of the sample data includes fund return and risk analysis, relative return analysis after risk adjustment, fund manager management ability analysis and principal component analysis,and the principal component analysis method aims to convert multiple indexes into a few of comprehensive indexes by using the idea of dimension reduction. The performance evaluation method reduces multiple indexes into a few of principal components by adopting the principal component analysis method so as to evaluate the fund performance more reasonably.

Owner:安徽磐众信息科技有限公司

System and method for analyzing audit risk of claims-based submissions for medicare advantage risk adjustment

Systems and methods have been developed that provide for the examination of data available on members of a Plan and based on the examined data, and on each reported ailment for a member, a determination is made as to the risk level such member presents to the Plan. This risk level is a measure of how likely it is that an assigned ailment identified from a claim will be found to be in error during an official CMS audit of member medical records for a particular year. The examination is made without necessarily reviewing actual physician's charts.

Owner:CENSEO HEALTH

Account risk evaluation method based on relational network

PendingCN114066470AAccurate assessmentChange one-sided defensive thinkingProtocol authorisationData miningRisk adjustment

The invention provides an account risk evaluation method based on a relational network. The method comprises the following steps: S1, recognizing a high-risk device with an abnormal user according to the device model, the number of times of device registration, and whether the number of device login accounts is too many, and obtaining a device recognition result; s2, the behavior similarity between the accounts is calculated based on the relation network, and a behavior similarity result is obtained; s3, performing error analysis on the behavior similarity according to a preset risk adjustment threshold, and obtaining a similarity analysis result; and S4, evaluating the account risk according to the equipment recognition result and the similarity analysis result. The account risk evaluation method based on the relational network provided by the invention has the advantages that the account risk can be assessed through the equipment risk recognition result and the account behavior similarity analysis result, so that a more accurate recognition result is obtained, and misjudgment is avoided.

Owner:WUHAN JIYI NETWORK TECH CO LTD

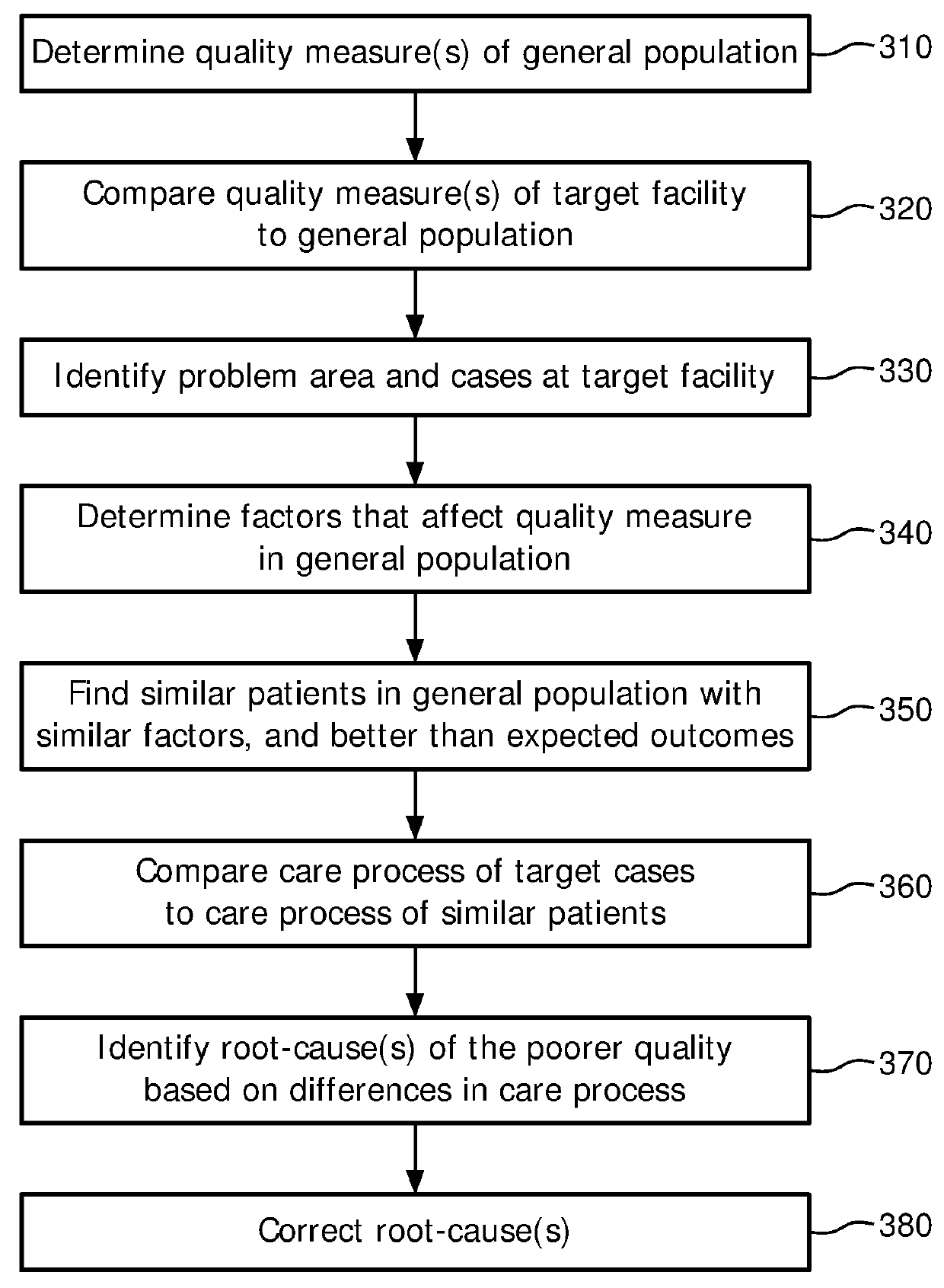

Automated controlled-case studies and root-cause analysis for hospital quality improvement

A risk-adjusted assessment of a target facility's quality measures (e.g. mortality rate, length of stay, readmission rate, complications rate, etc.) is determined with respect to the quality measures of a broader population base. Patient cohorts are identified corresponding to particular ailments or treatments, and the target facility's risk-adjusted quality measures are determined for each cohort. When a particular quality measure for a target cohort indicates poor performance, factors that are determined to be relevant to the patients' outcomes are identified and used to create a control group of patients in the broader population who exhibit similar factors but had better outcomes than the patients of the target cohort. The care process (treatments, medications, interventions, etc.) that each of the target patients received is compared to the care process that each of the control patients received, to identify potential root-causes of the poorer performance.

Owner:KONINKLJIJKE PHILIPS NV

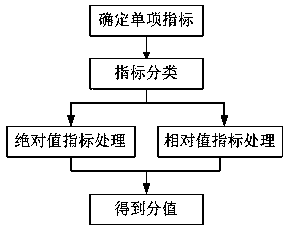

Regional hospital and subject ranking method based on disease risk adjustment

ActiveCN109360635AImprove justiceImprove fairnessMedical data miningMedical automated diagnosisDisease riskRanking

The invention discloses a regional hospital and subject ranking method based on disease risk adjustment. The method comprises the following steps of determining an individual performance indicator inperformance evaluation; dividing the individual performance indicator into an absolute value indicator and a relative value indicator; calculating and quantizing the absolute value indicator and the relative value indicator into scores according to different calculation methods; and acquiring the quantitative score of each individual performance indicator and ranking. By using a medical performance evaluation method, the key indicators of the various processes before, during and after disease treatment are fully considered, a clinical work ability and treatment result comparison and the like are comprehensively and integrally evaluated, and the impartiality and the fairness of an assessment result are effectively increased through an assessment after risk adjusting.

Owner:中科厚立信息技术(成都)有限公司

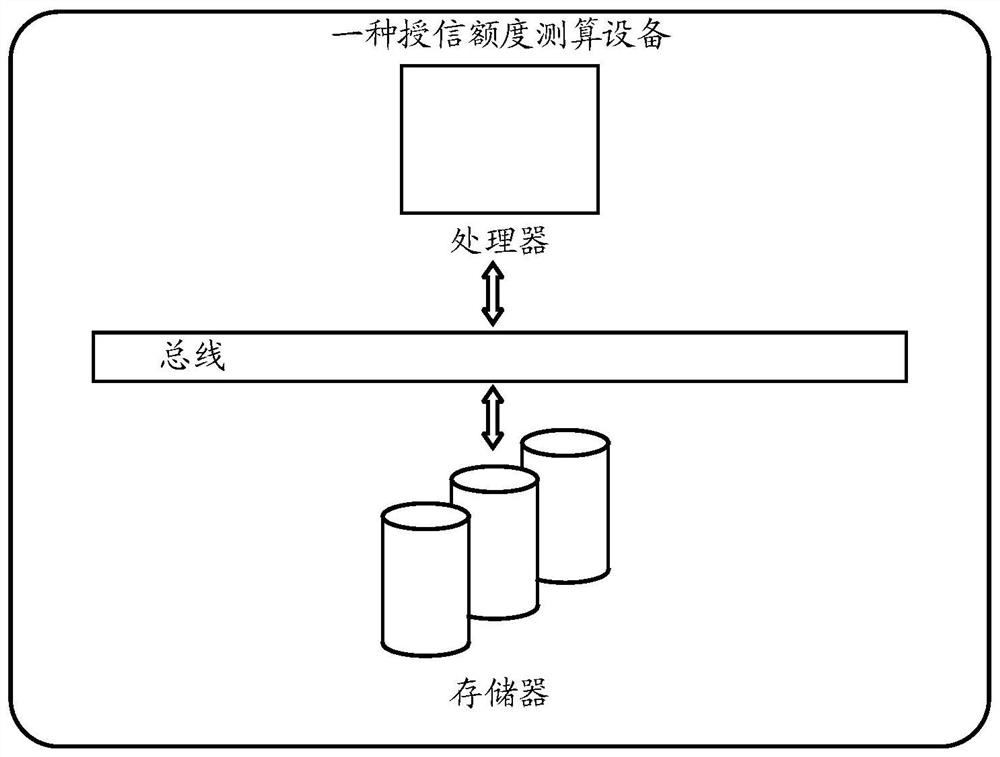

Credit line measuring and calculating method and equipment and medium

PendingCN113643125AImprove business performanceImprove interpretabilityDigital data information retrievalFinanceBusiness enterpriseRisk adjustment

The invention discloses a credit line measuring and calculating method and equipment and a medium. The scheme comprises the following steps: determining a default rate of an enterprise, and constructing a first function; incorporating the first function into a risk adjustment capital return rate model to obtain a first credit line enabling a risk adjustment capital return rate of a commercial bank to be maximum under a preset condition; obtaining modeling indexes related to a preset general scoring model, performing data cleaning, feature screening and model training on sample features corresponding to the modeling indexes, and determining a performance prediction probability of the general scoring model; converting the performance prediction probability of the general scoring model into a scoring rating result of the enterprise, and determining a second credit line of the enterprise according to the scoring rating result of the enterprise and a credit rating amplification coefficient of the enterprise; and comparing and analyzing the first credit line and the second credit line based on credit restrictive conditions to obtain a comparison and analysis result, and determining a credit line of the enterprise according to the comparison and analysis result.

Owner:天元大数据信用管理有限公司

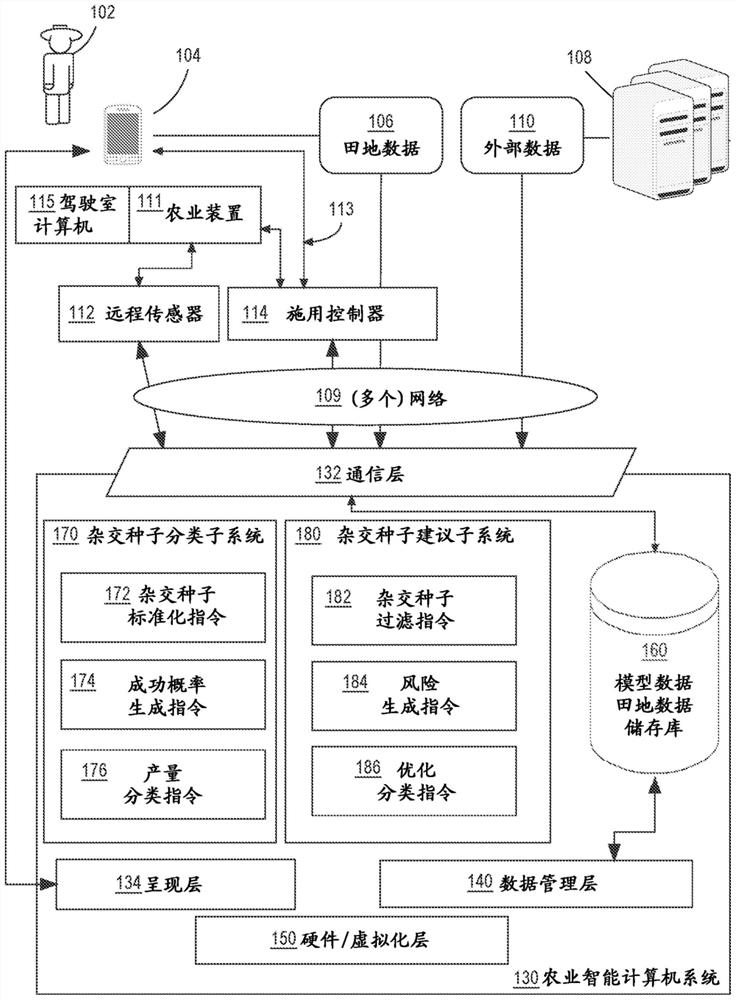

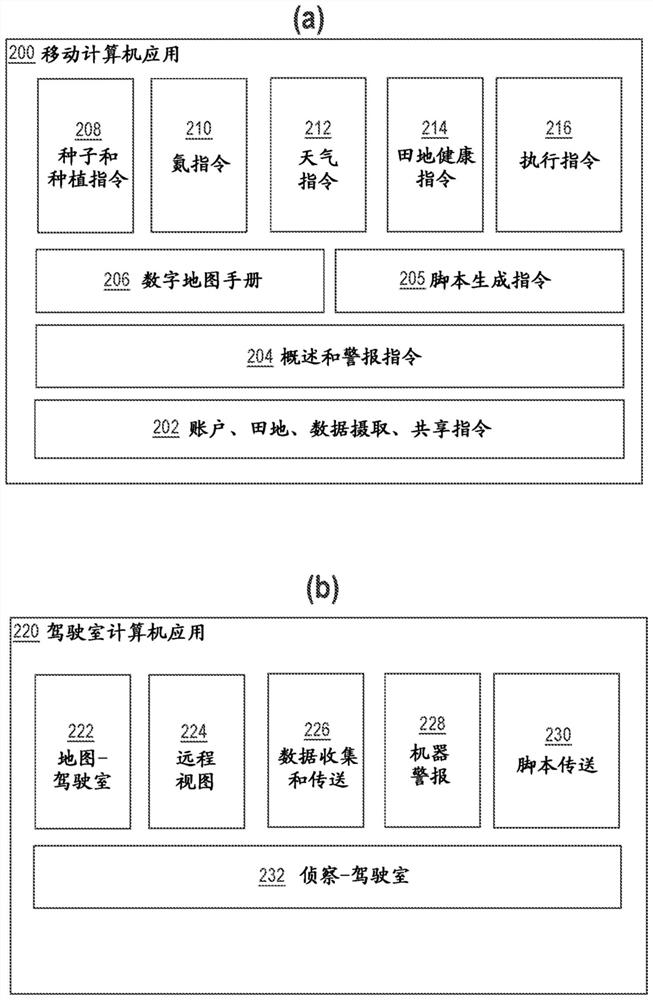

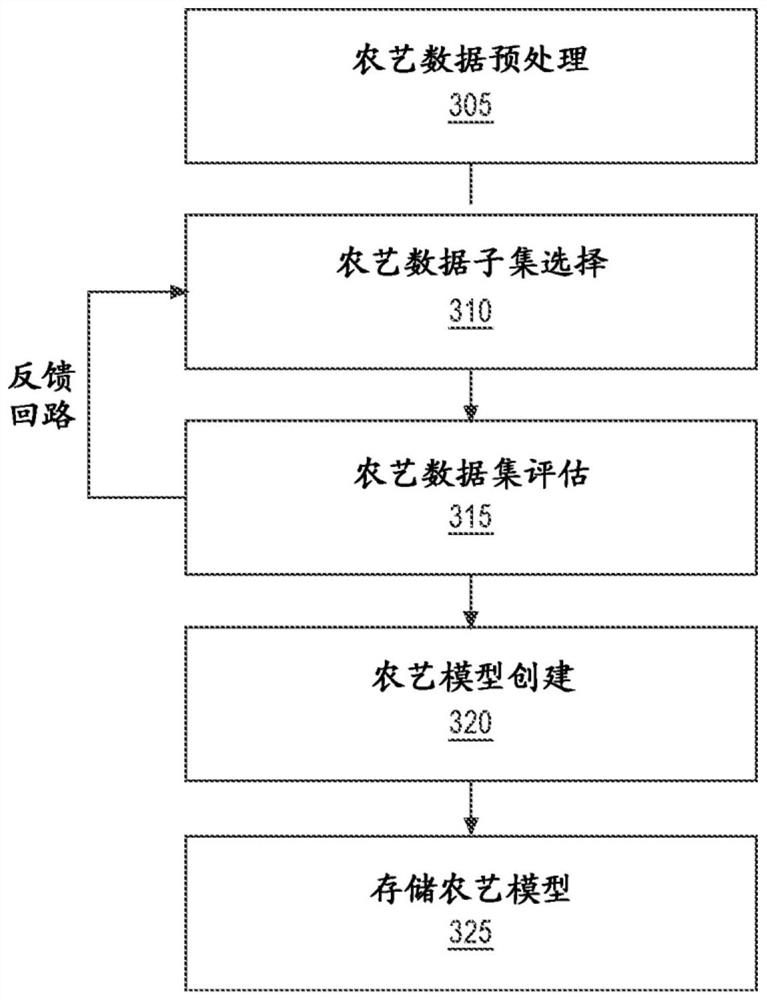

Risk-adjusted hybrid seed selection and crop yield optimization by field

Techniques are provided for receiving a first set of historical agricultural data and a second set of historical agricultural data; generating a plurality of projected target yield ranges using the first set and the second set of historical agricultural data by generating a historic yield distribution; generating one or more yield ranking scores for one or more fields of a grower using the first set of historical agricultural data, and assigning a projected target yield range of the plurality of projected target yield ranges to each of the one or more fields based on the one or more yield ranking scores to generate assigned projected target yield ranges; receiving a third set of historical agricultural data comprising seed optimization data, and generating a recommended change in seed population or a recommended change in seed density; causing displaying the yield improvement recommendation for each of the one or more fields.

Owner:THE CLIMATE CORP

System and method for risk adjusted strategic planning and phased decision management

InactiveUS8527316B2Optimization methodOptimize riskFinanceForecastingProgram planningDecision management

Owner:COGLIANDRO JOHN

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com