Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

63 results about "Alternative payments" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

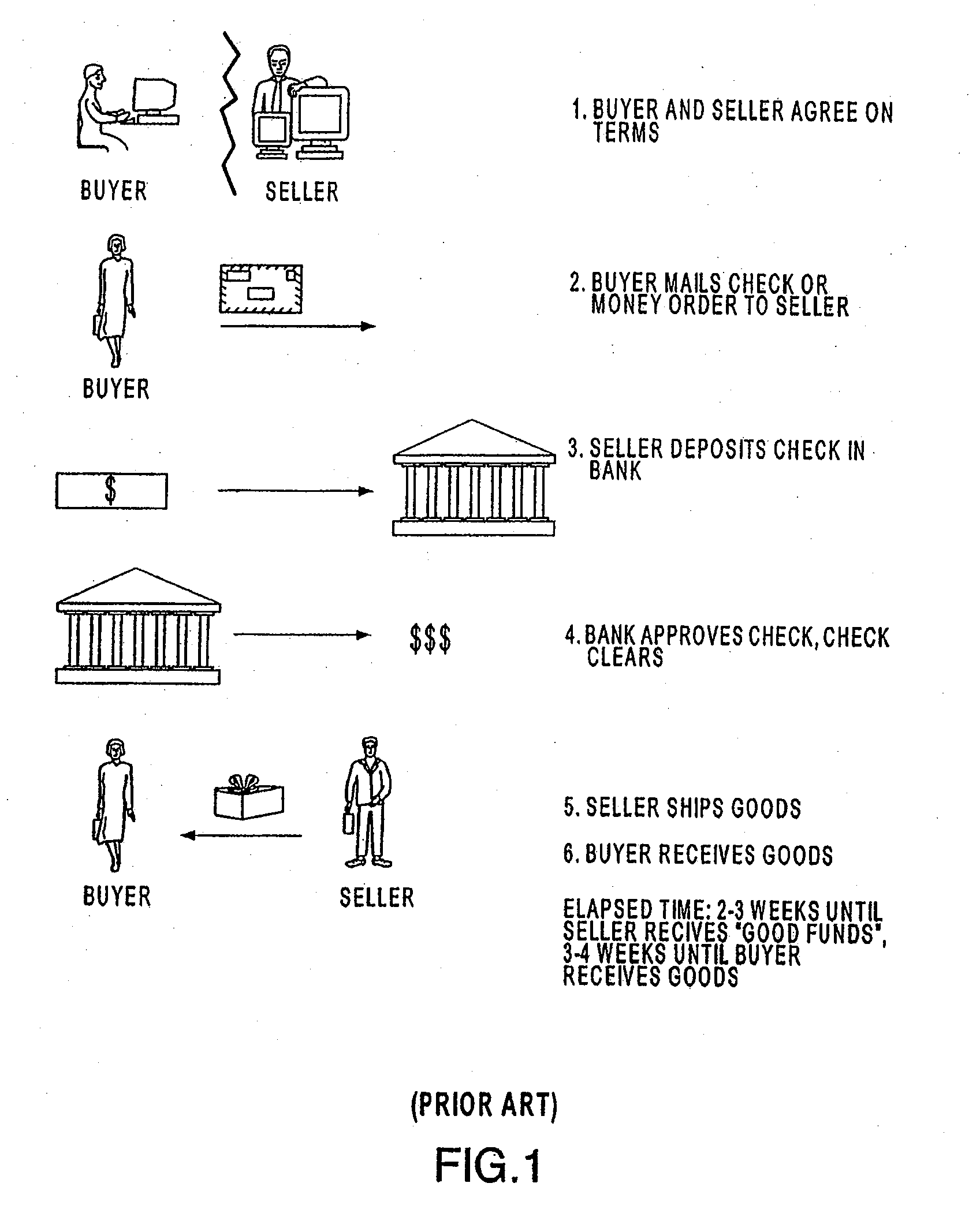

Alternative payments refers to payment methods that are used as an alternative to credit card payments. Most alternative payment methods address a domestic economy or have been specifically developed for electronic commerce and the payment systems are generally supported and operated by local banks. Each alternative payment method has its own unique application and settlement process, language and currency support, and is subject to domestic rules and regulations.

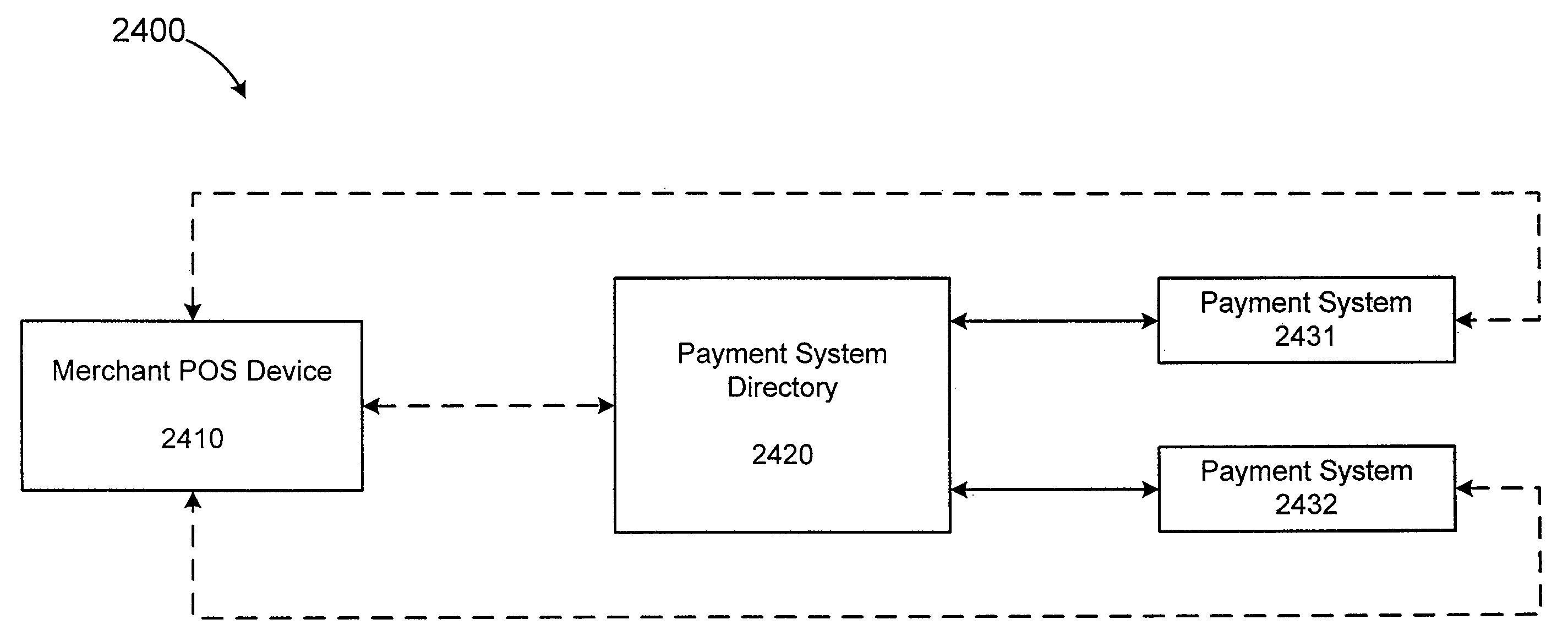

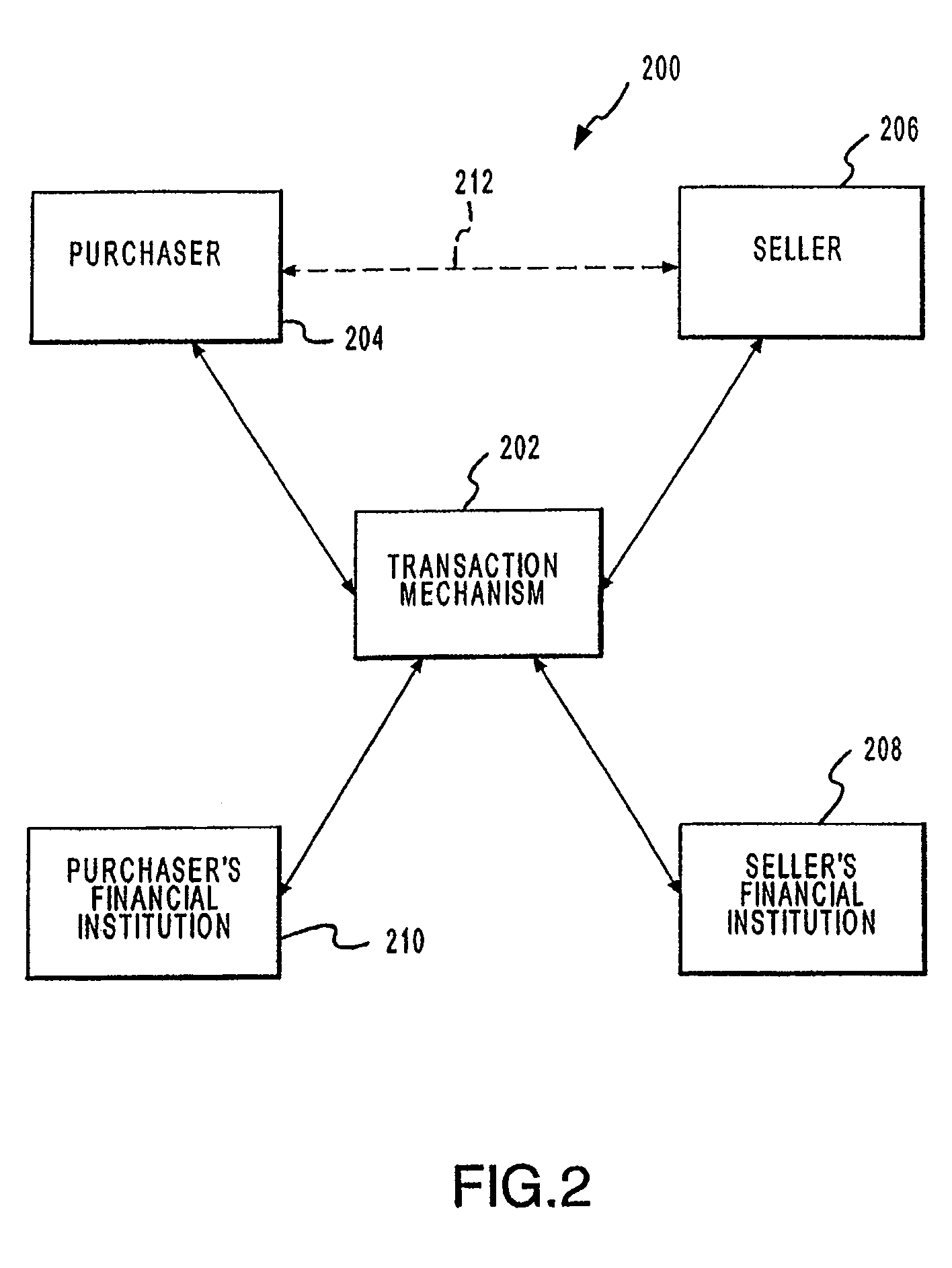

Methods for processing a payment authorization request utilizing a network of point of sale devices

InactiveUS8814039B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

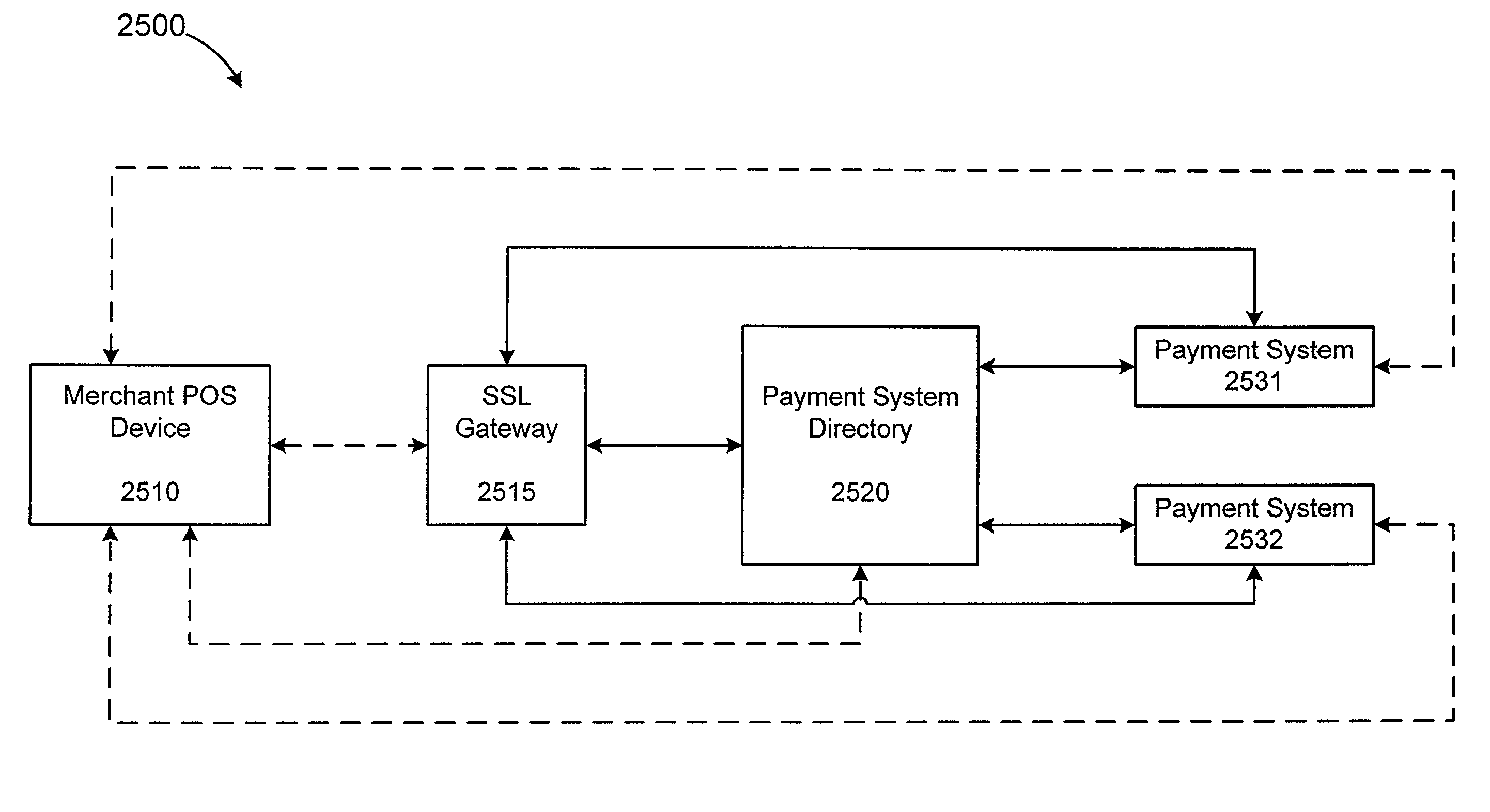

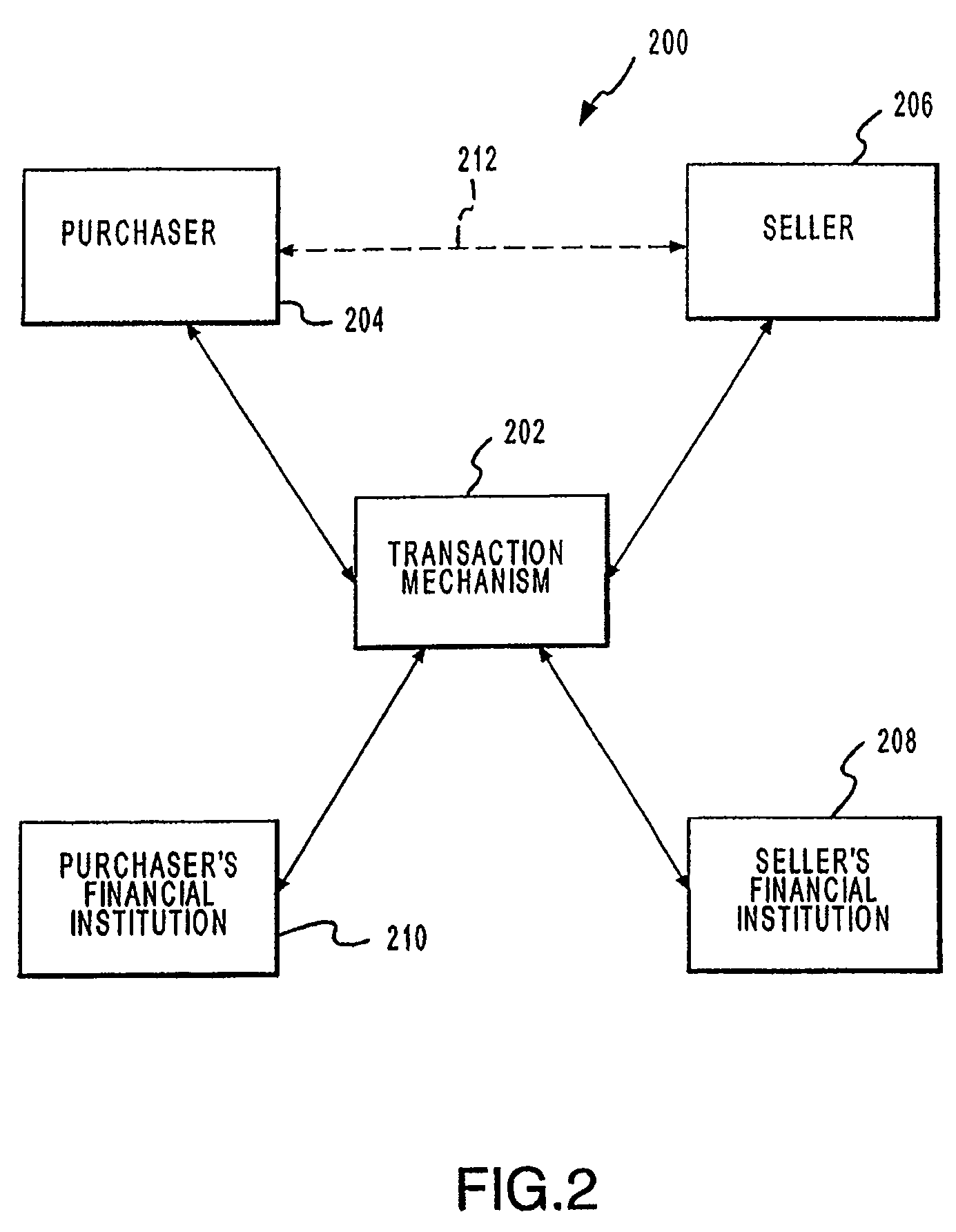

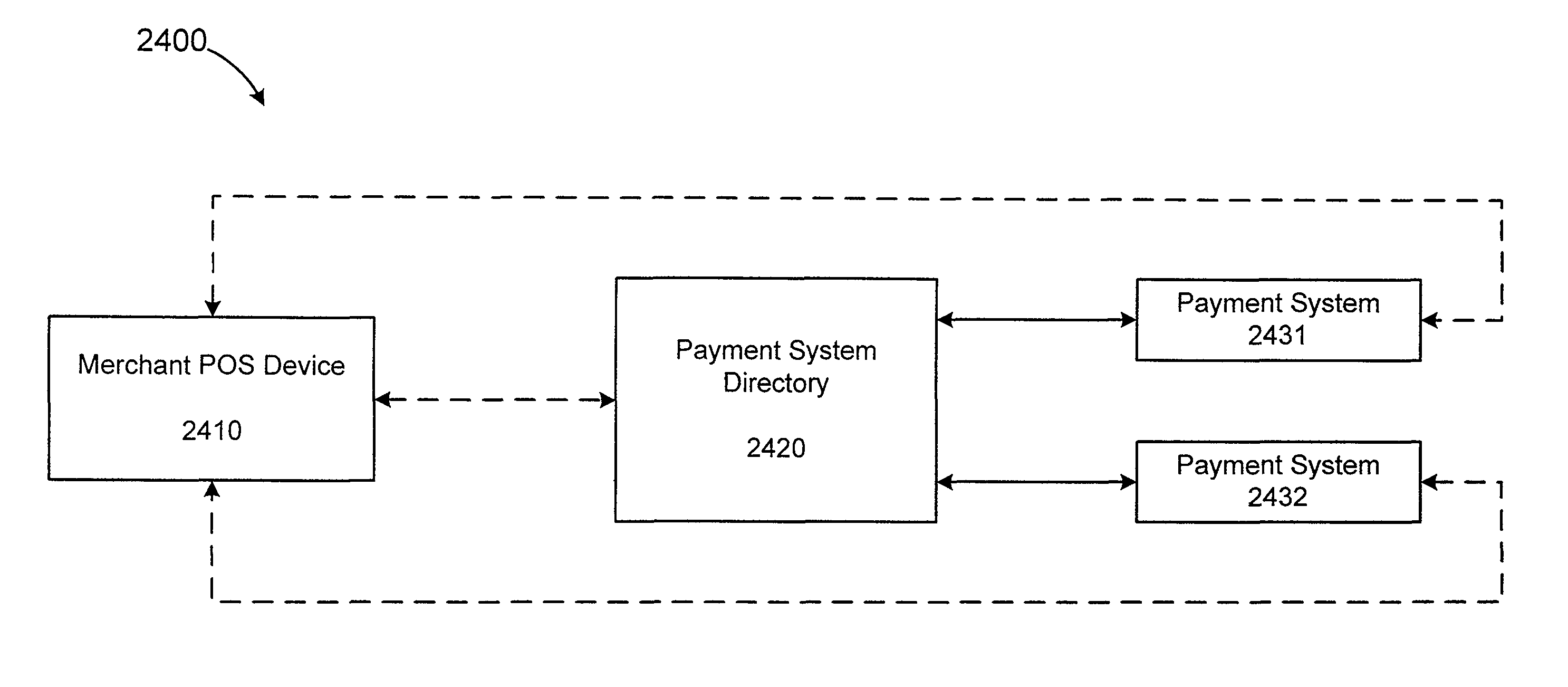

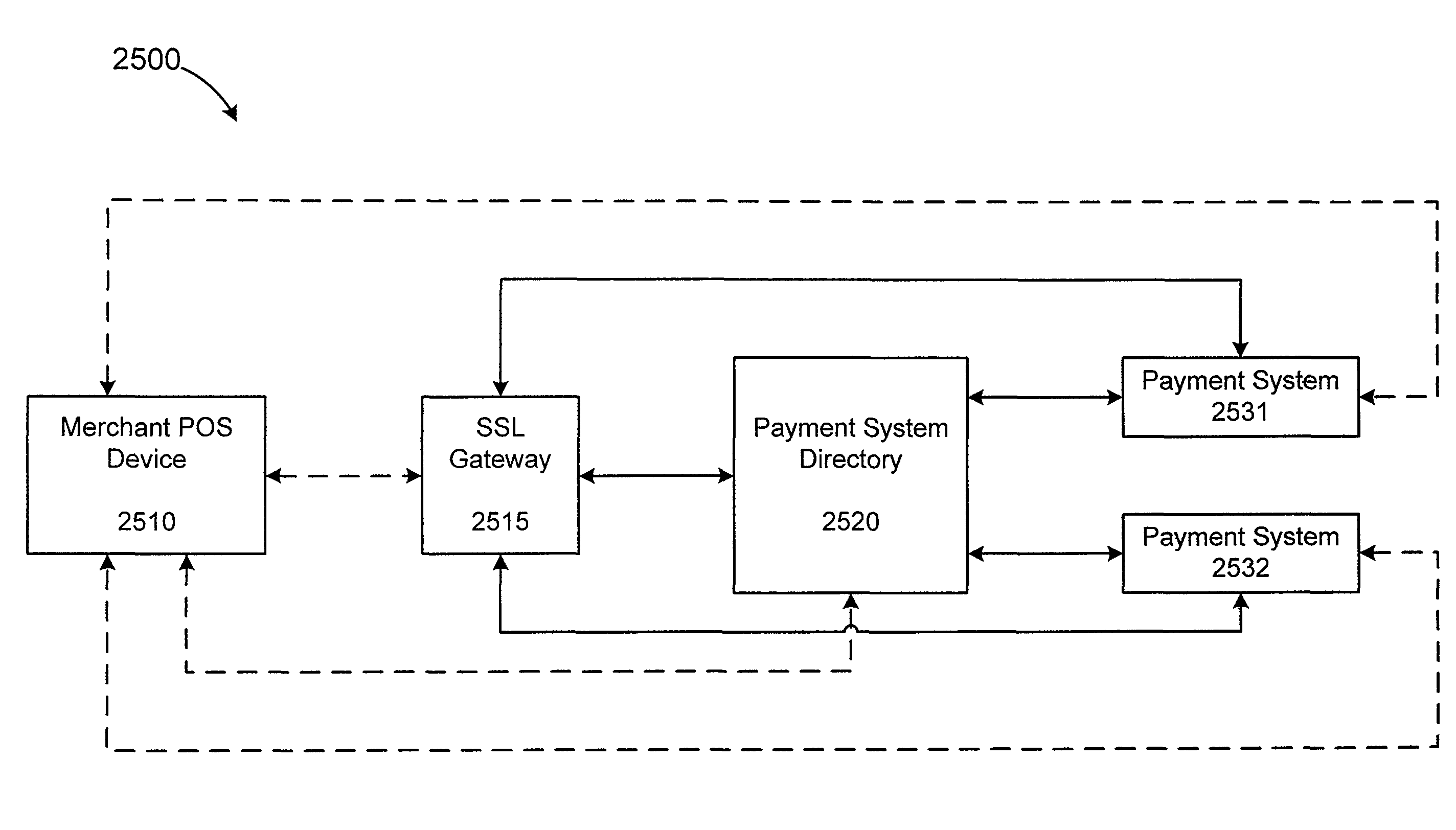

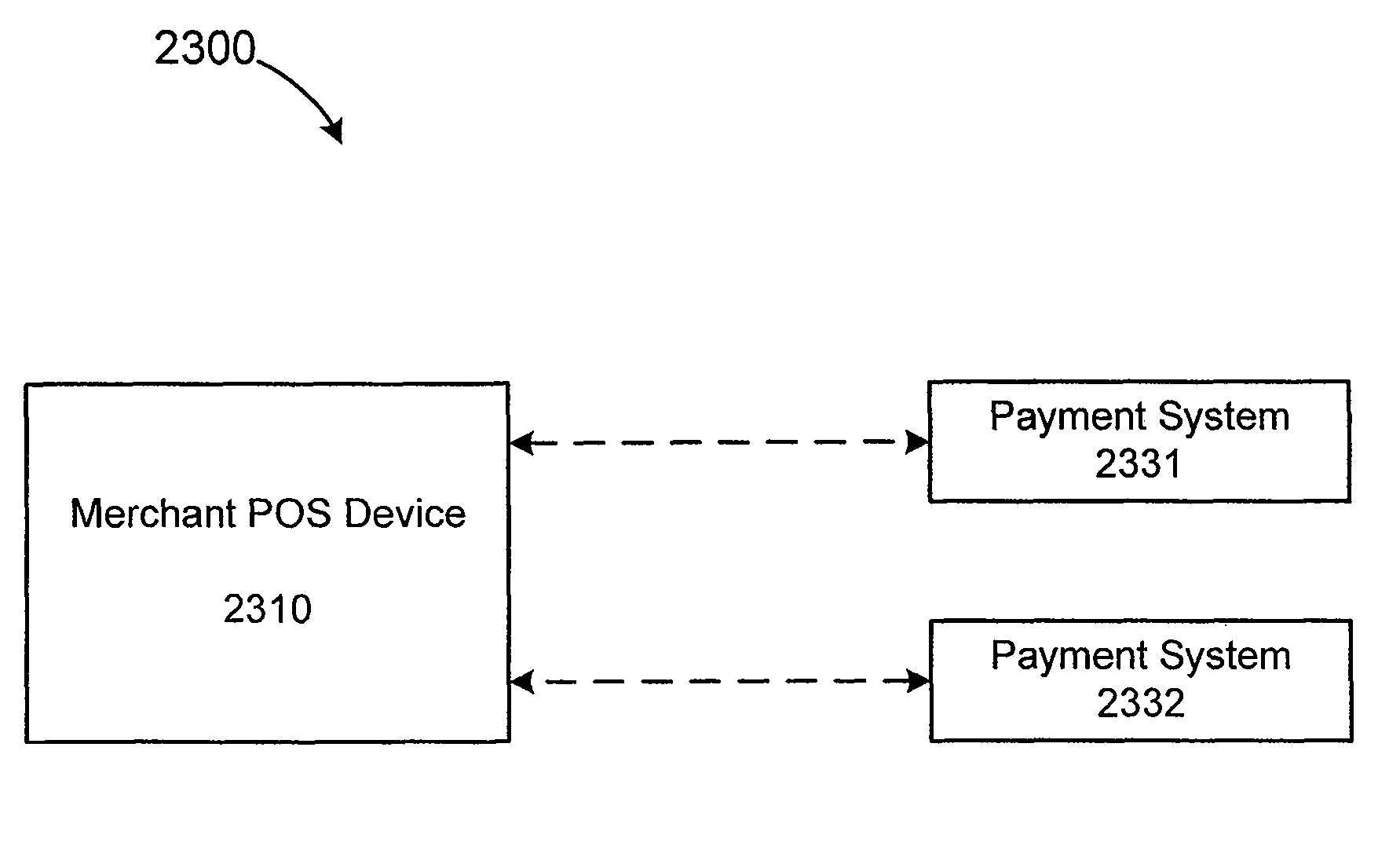

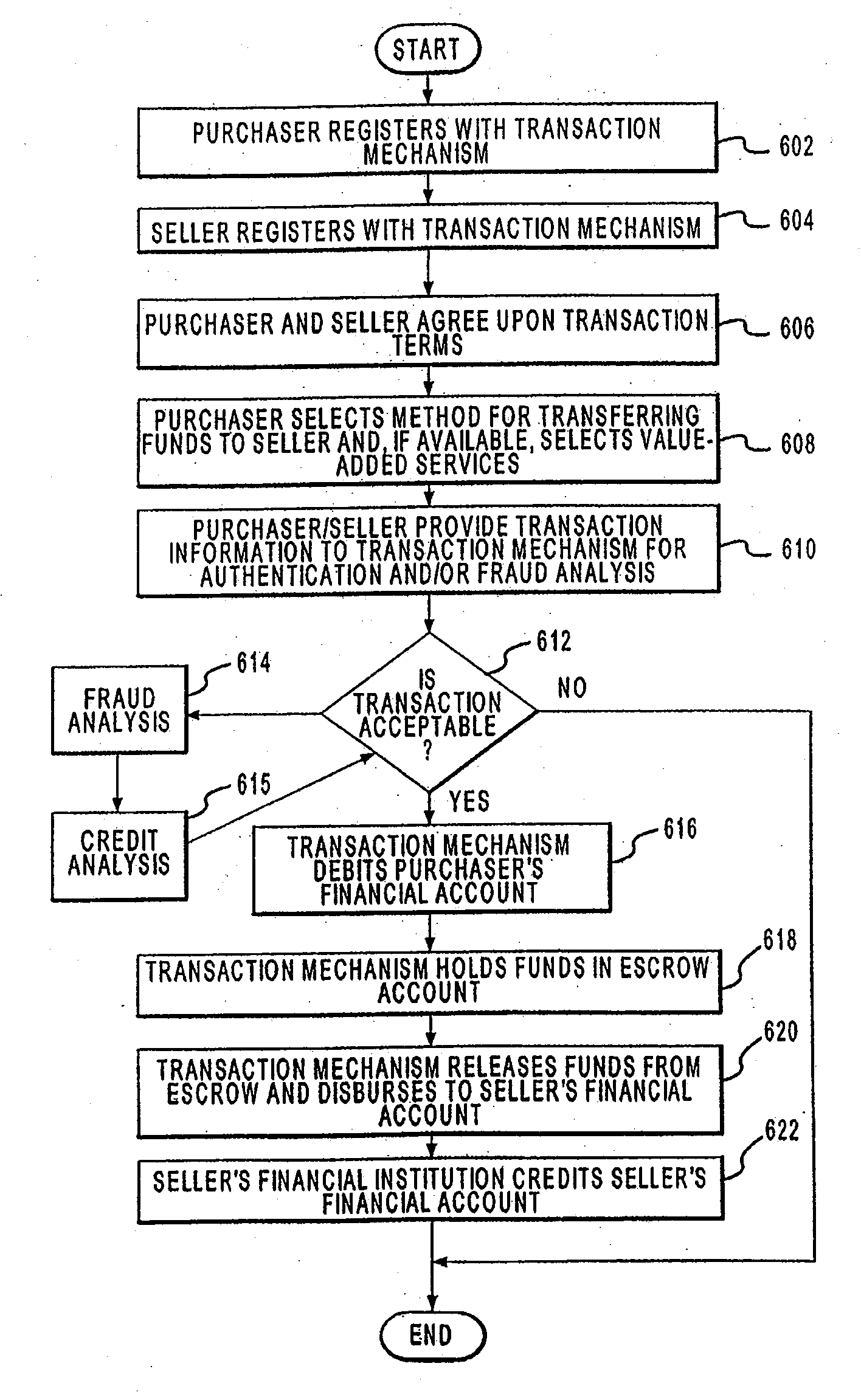

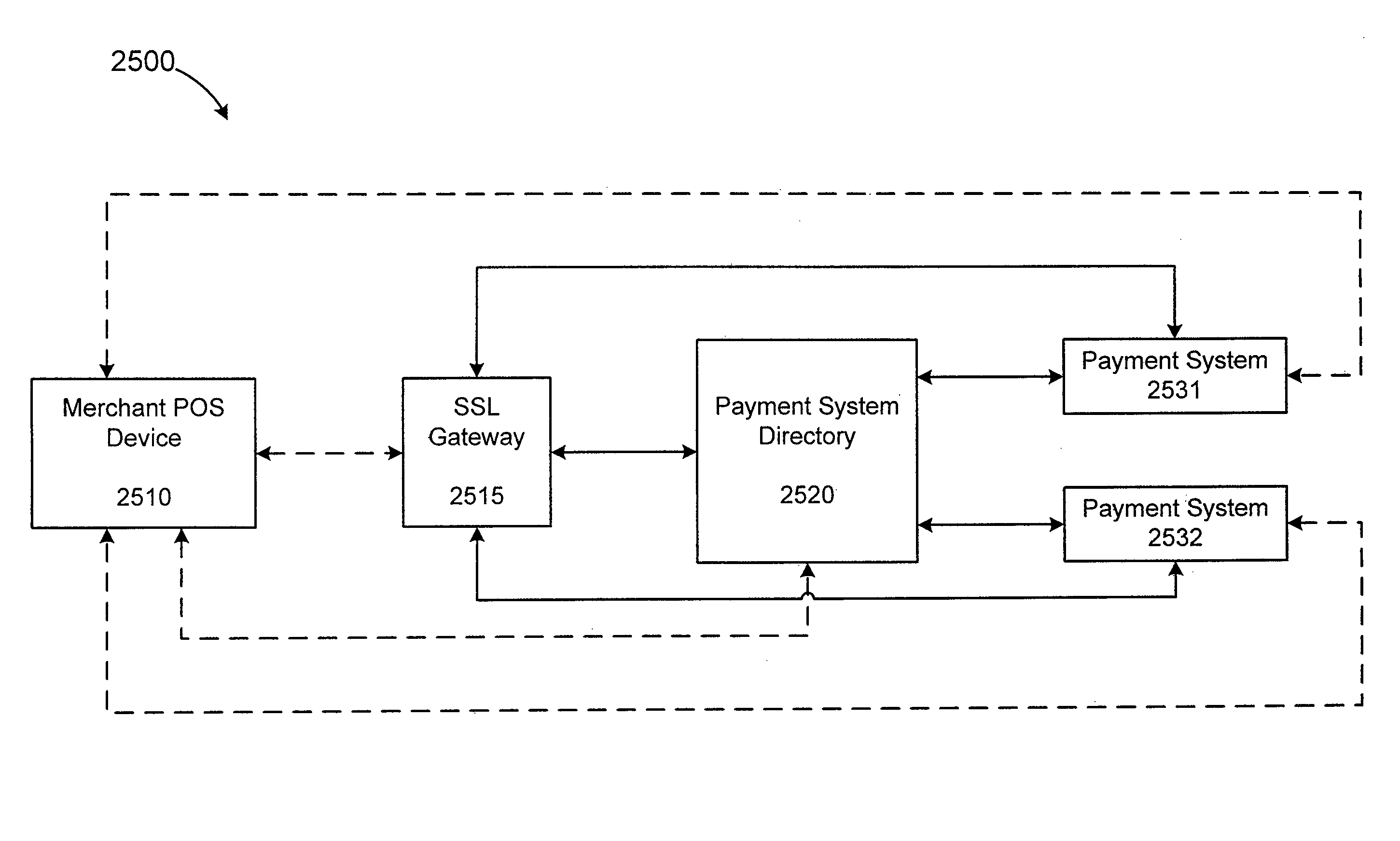

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Systems and methods for processing a payment authorization request over disparate payment networks

InactiveUS8794509B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesIssuing bankThird party

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

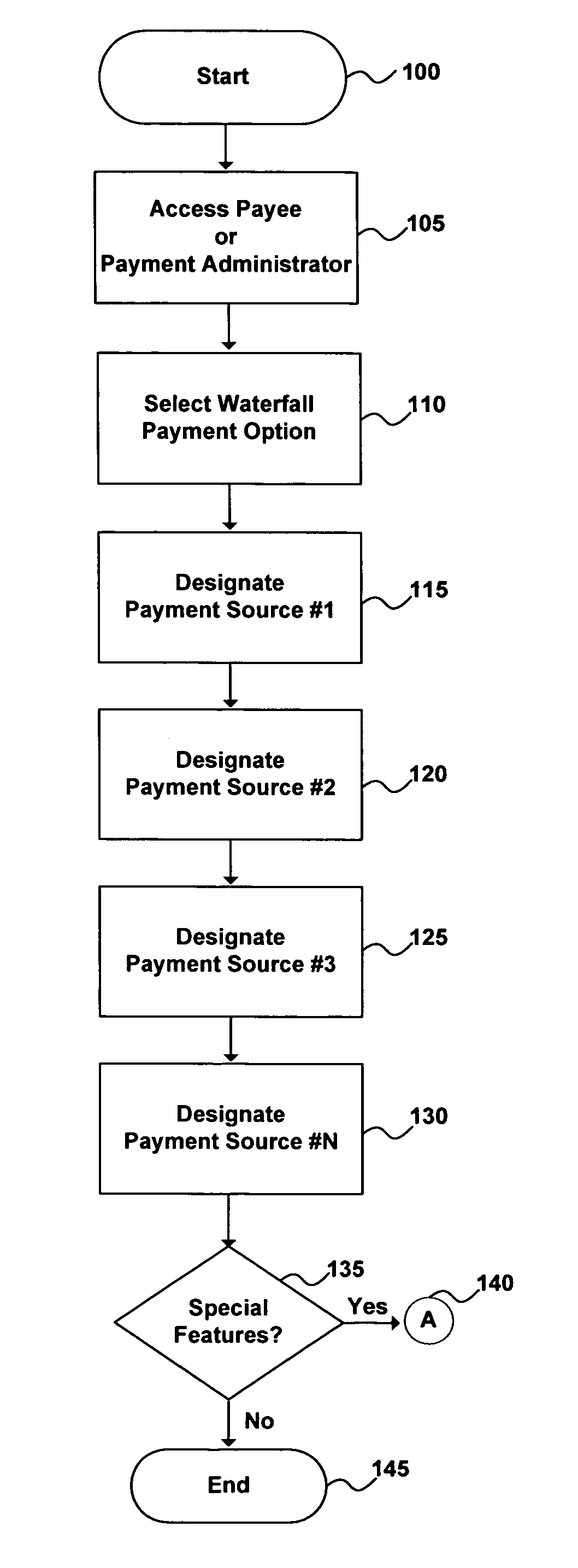

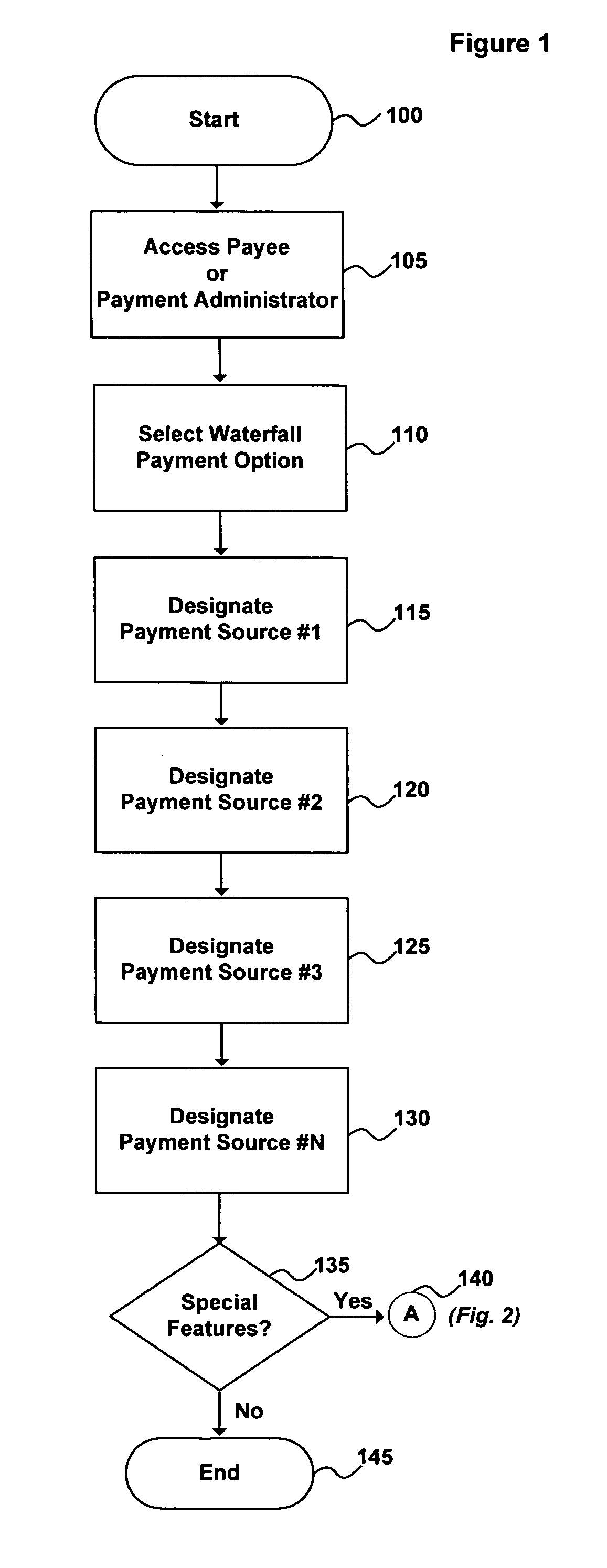

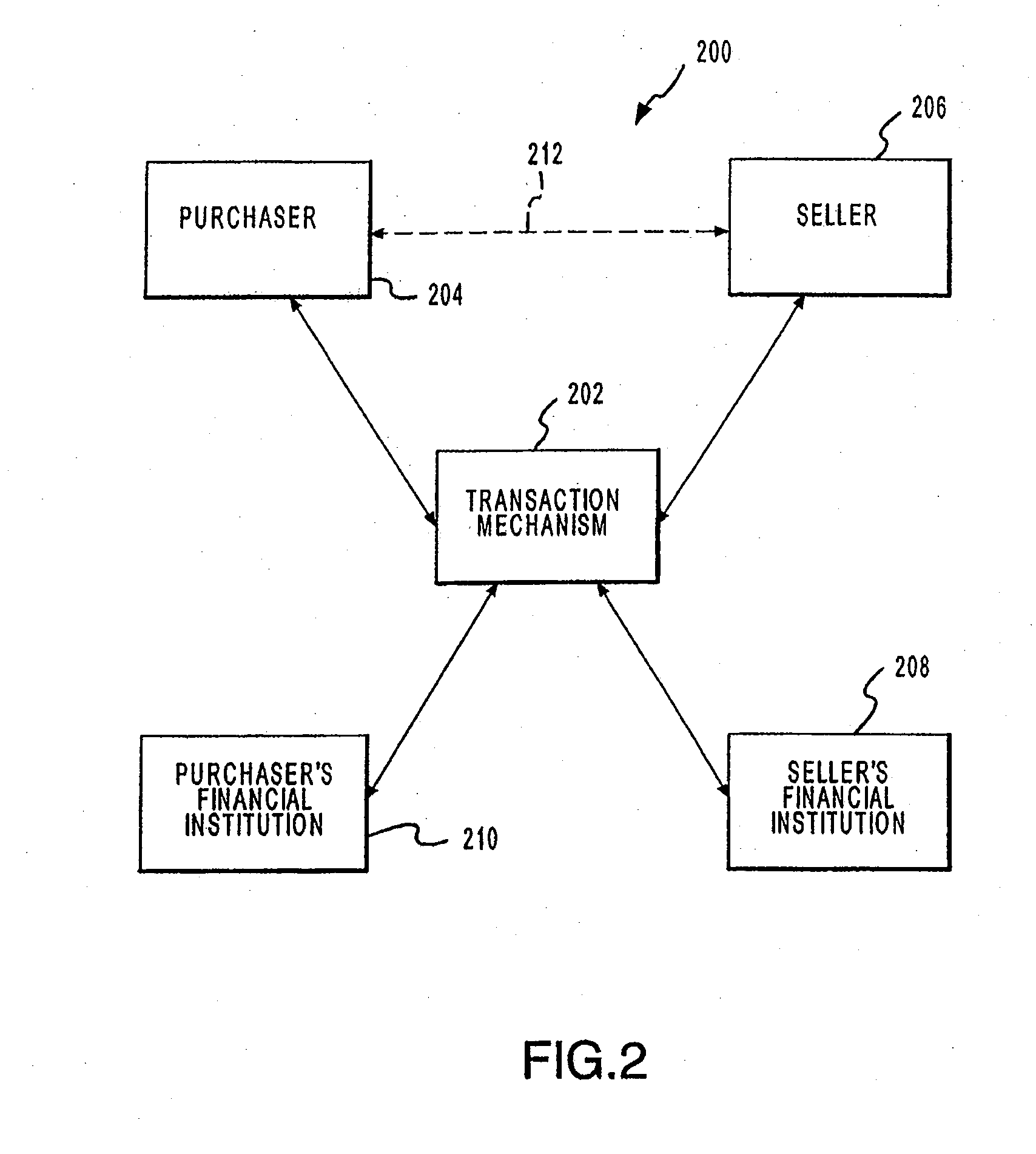

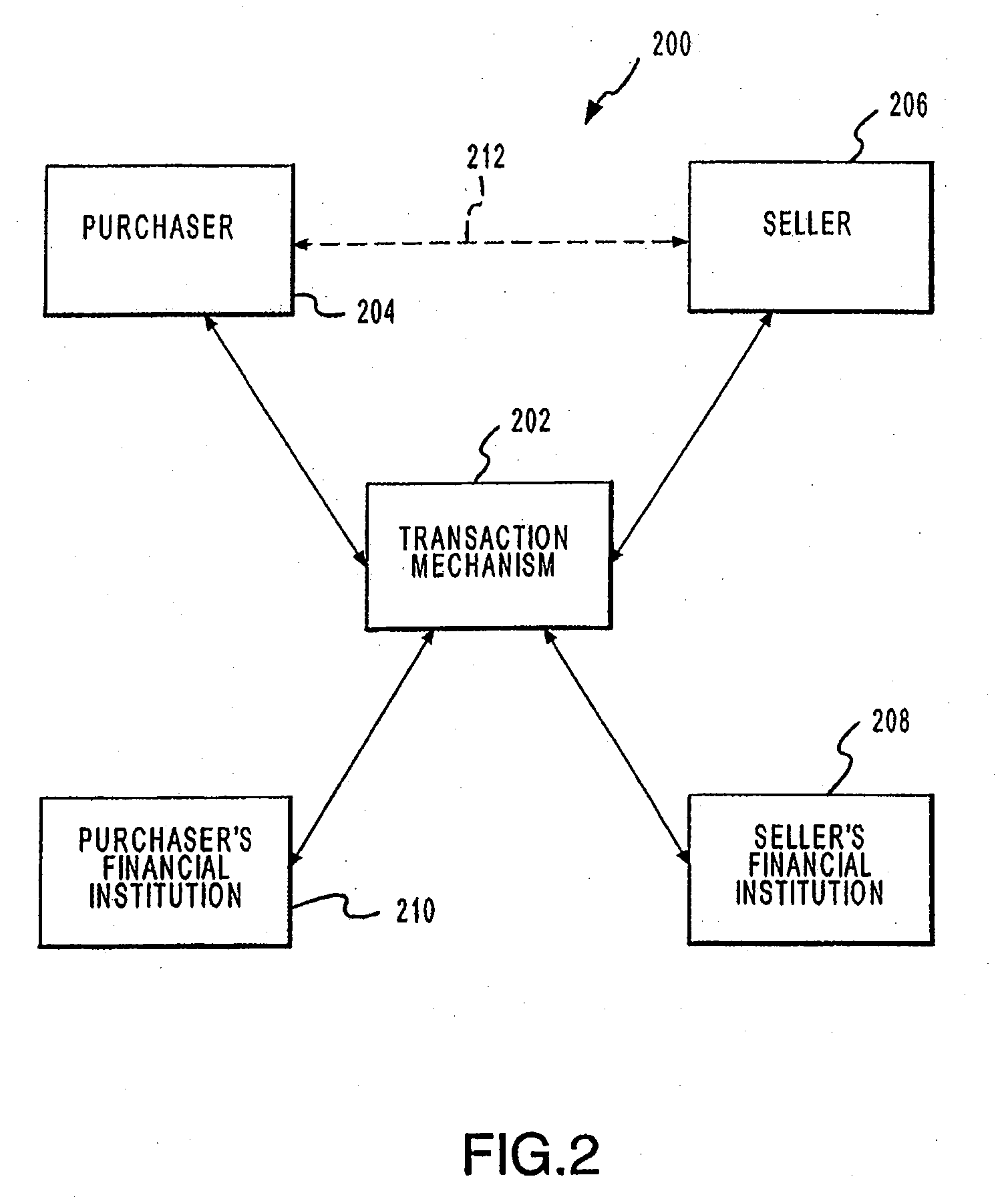

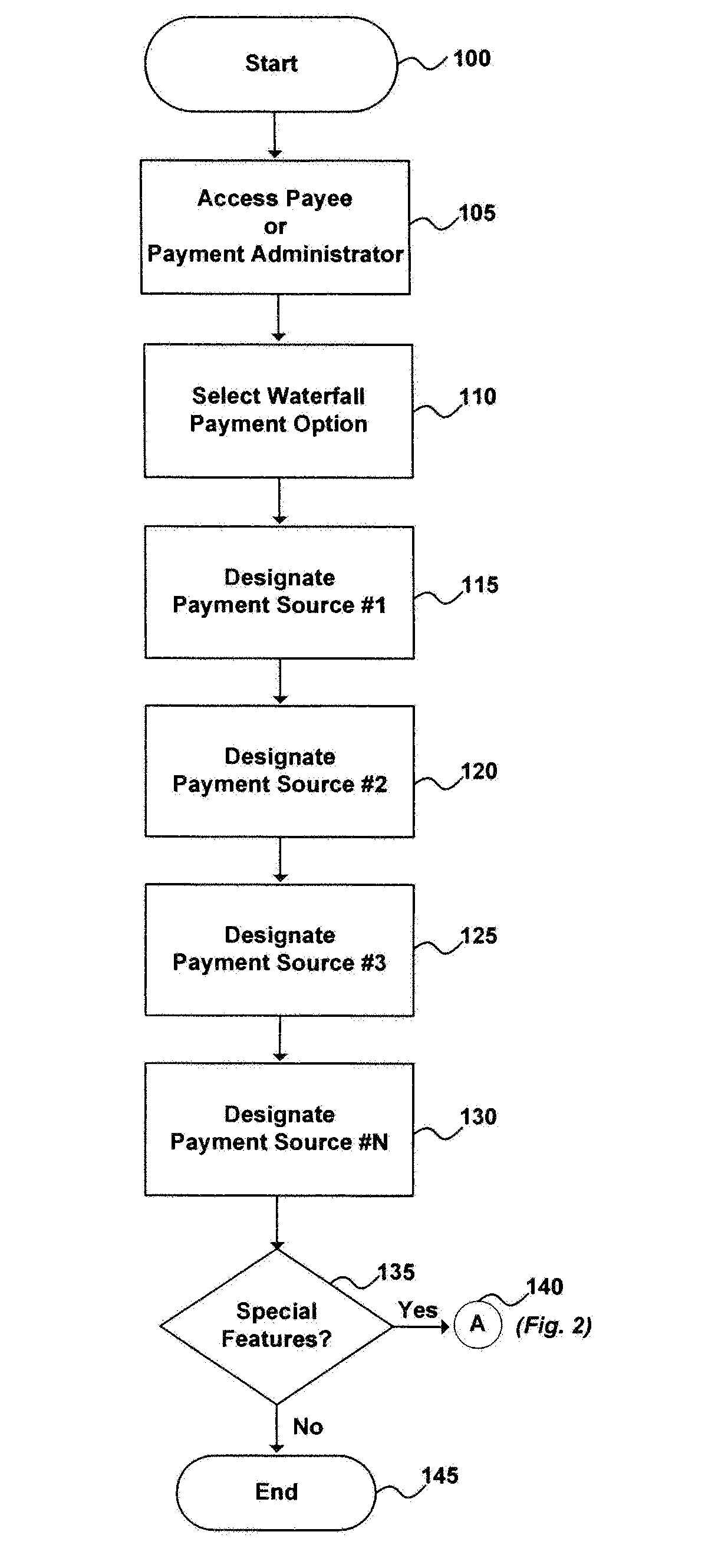

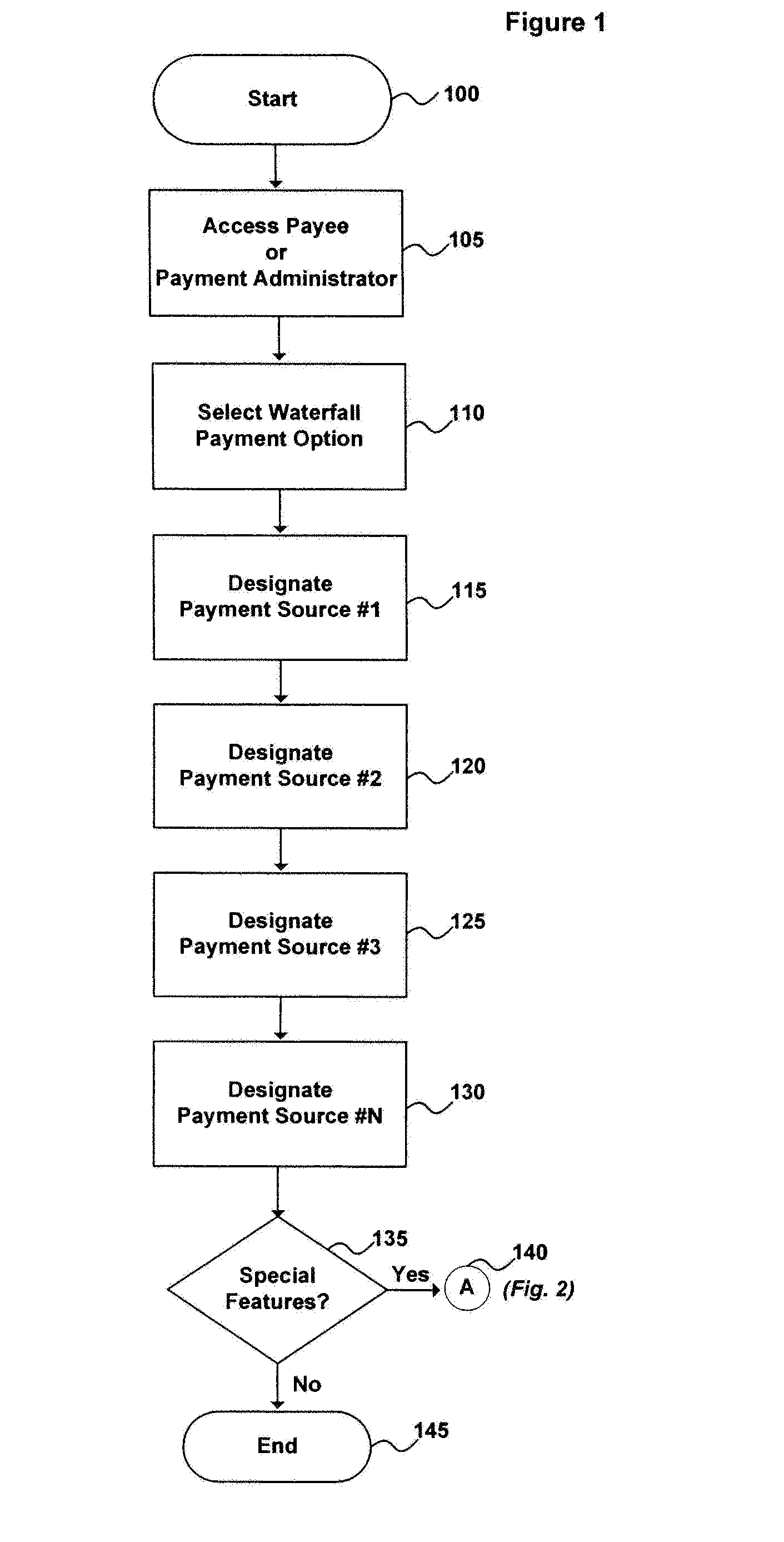

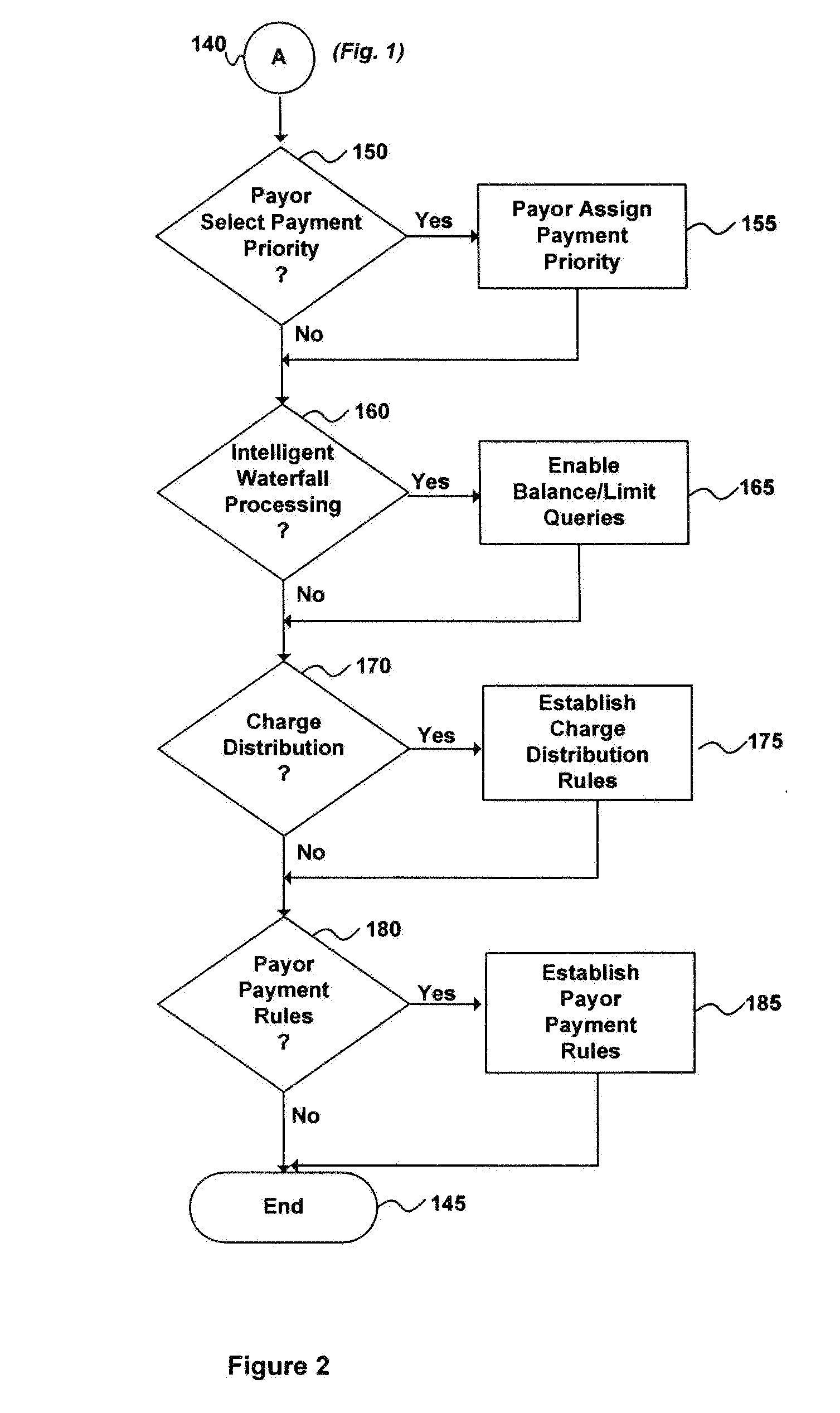

Waterfall prioritized payment processing

The invention comprises a system and method for “waterfall” type payment processing using multiple alternative payment sources. A payor provides account information for multiple payment sources, such as a bank checking account, savings account, first credit card account, second credit card account, and so forth. The multiple payment sources are prioritized so that one is a primary payment source, another is a secondary payment source, another is a tertiary payment source, and so forth. After setting up the waterfall payment arrangement, when a bill becomes due a payee or third party payment administrator submits transactions against the payment sources in their order of priority until the payment is satisfied. Other variations and enhancements are disclosed.

Owner:U S BANK NAT ASSOC +1

Methods for Processing a Payment Authorization Request Utilizing a Network of Point of Sale Devices

InactiveUS20090164327A1Easy to identifyEasy to calculateHand manipulated computer devicesFinanceThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

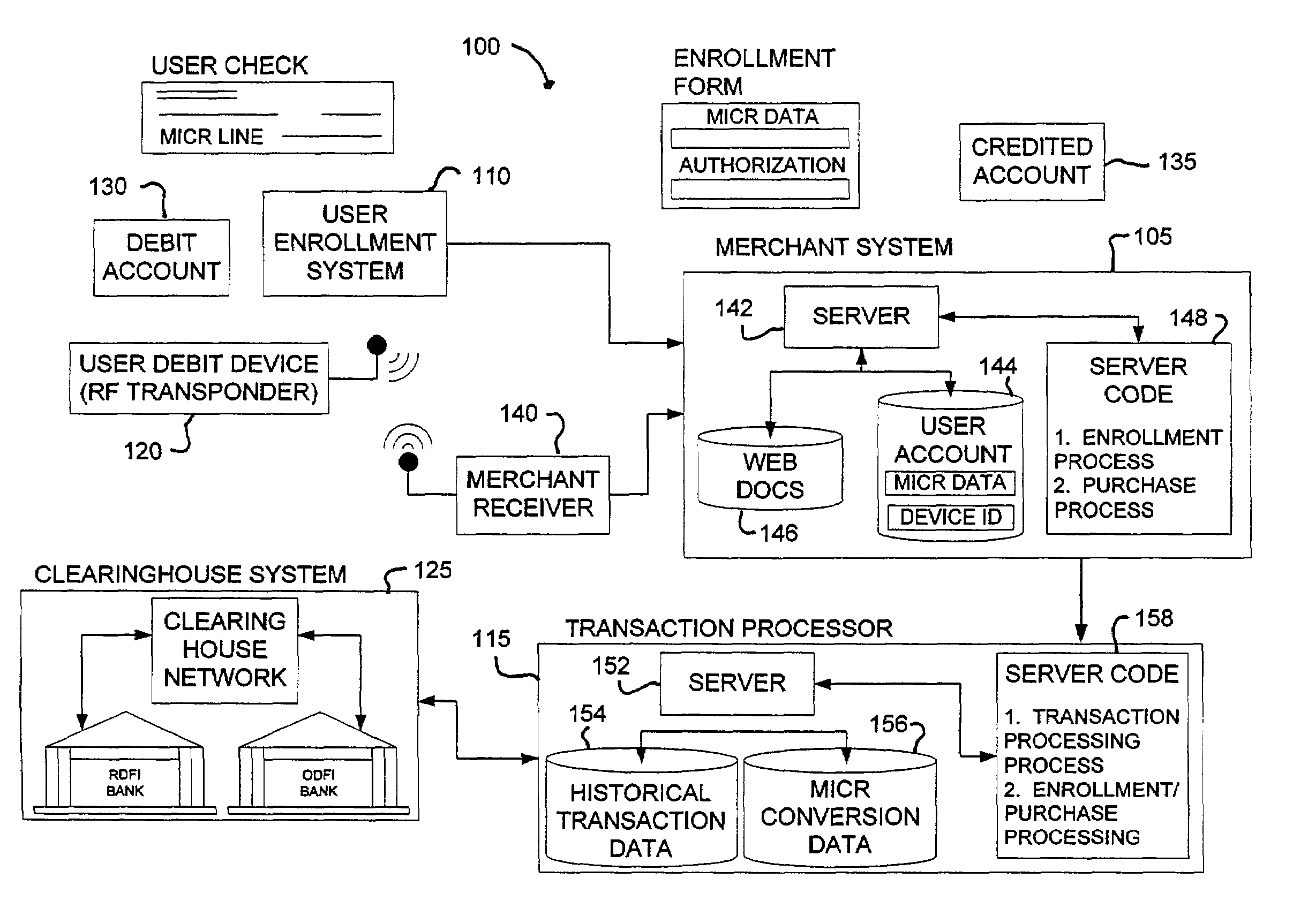

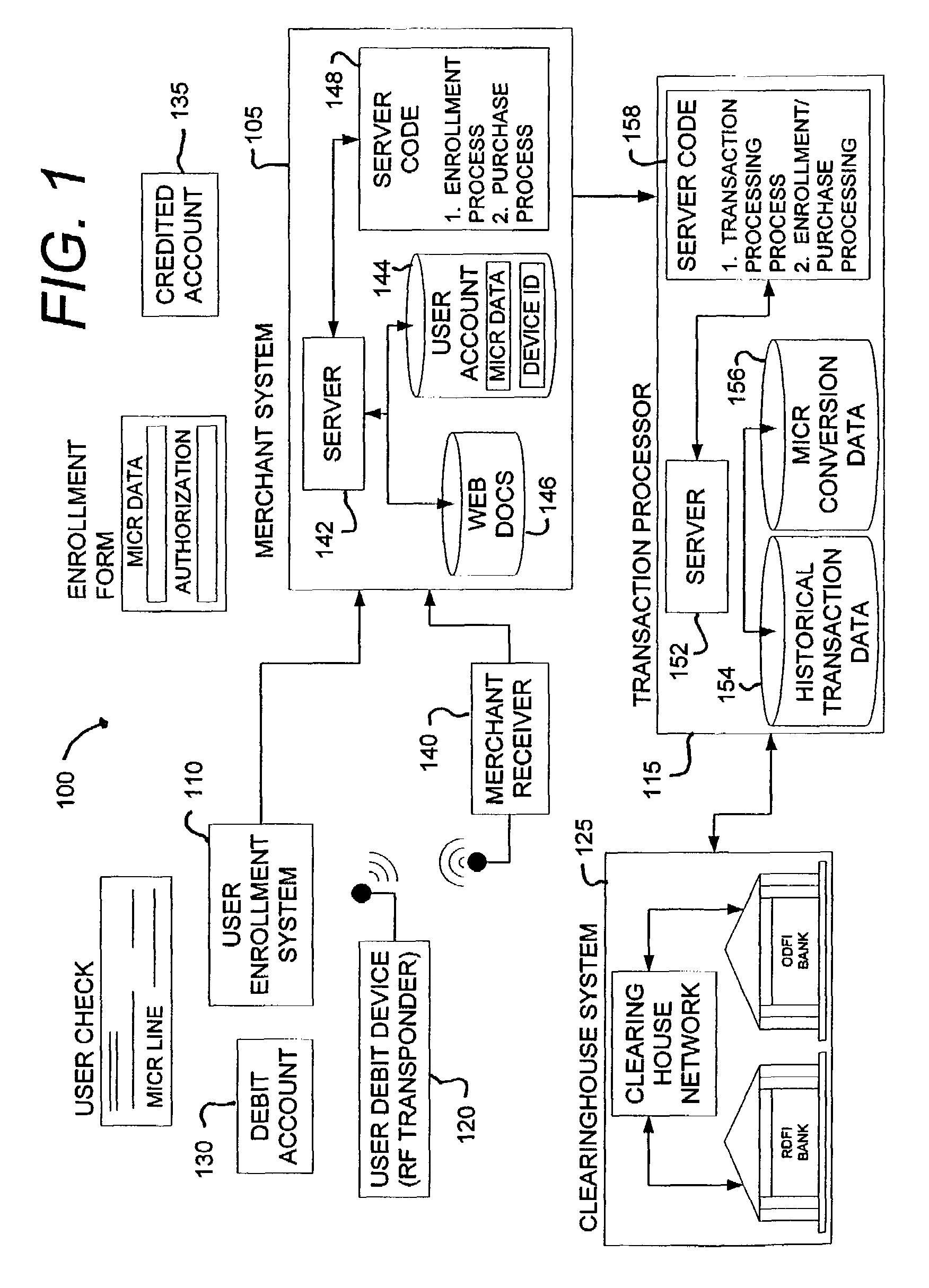

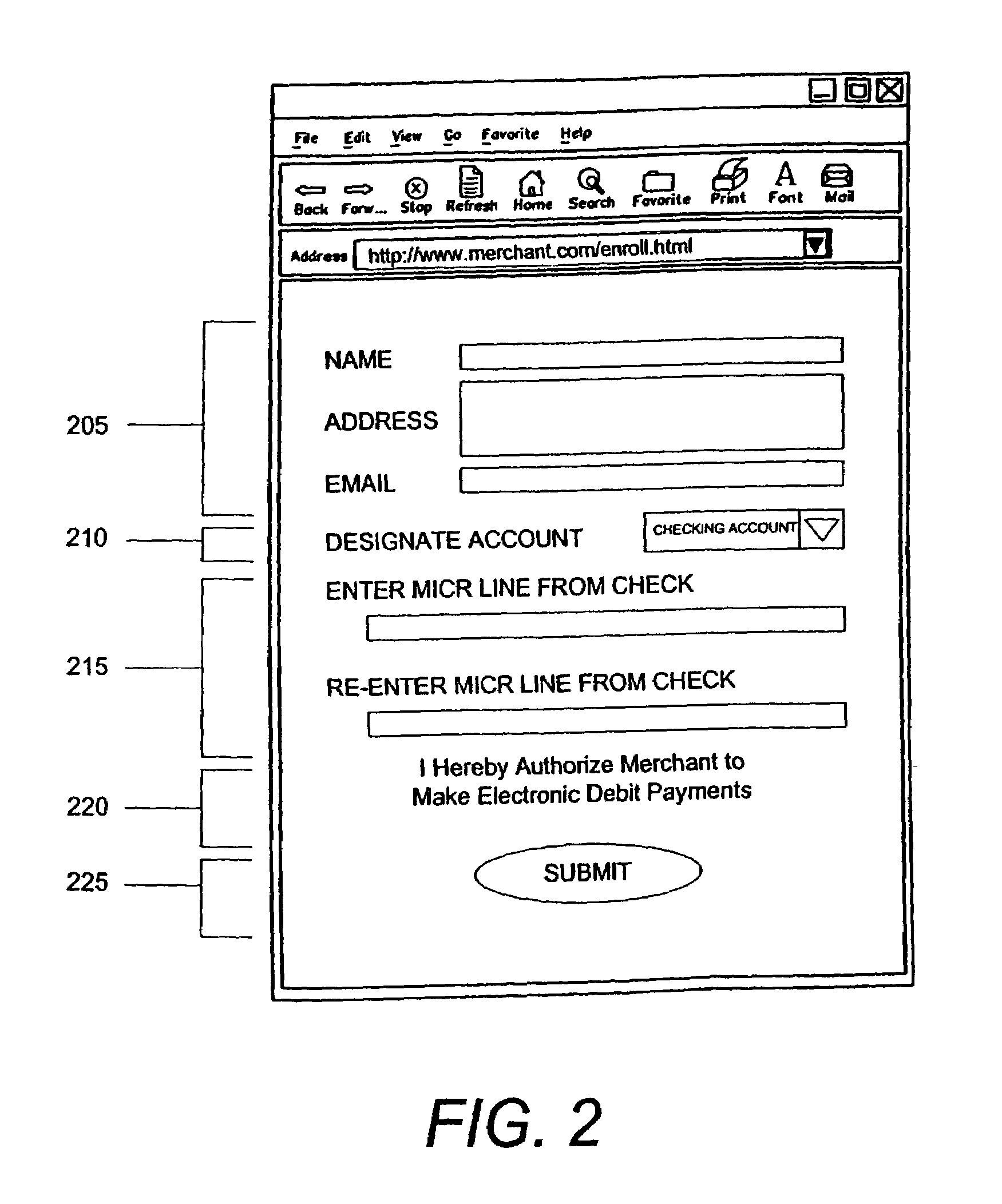

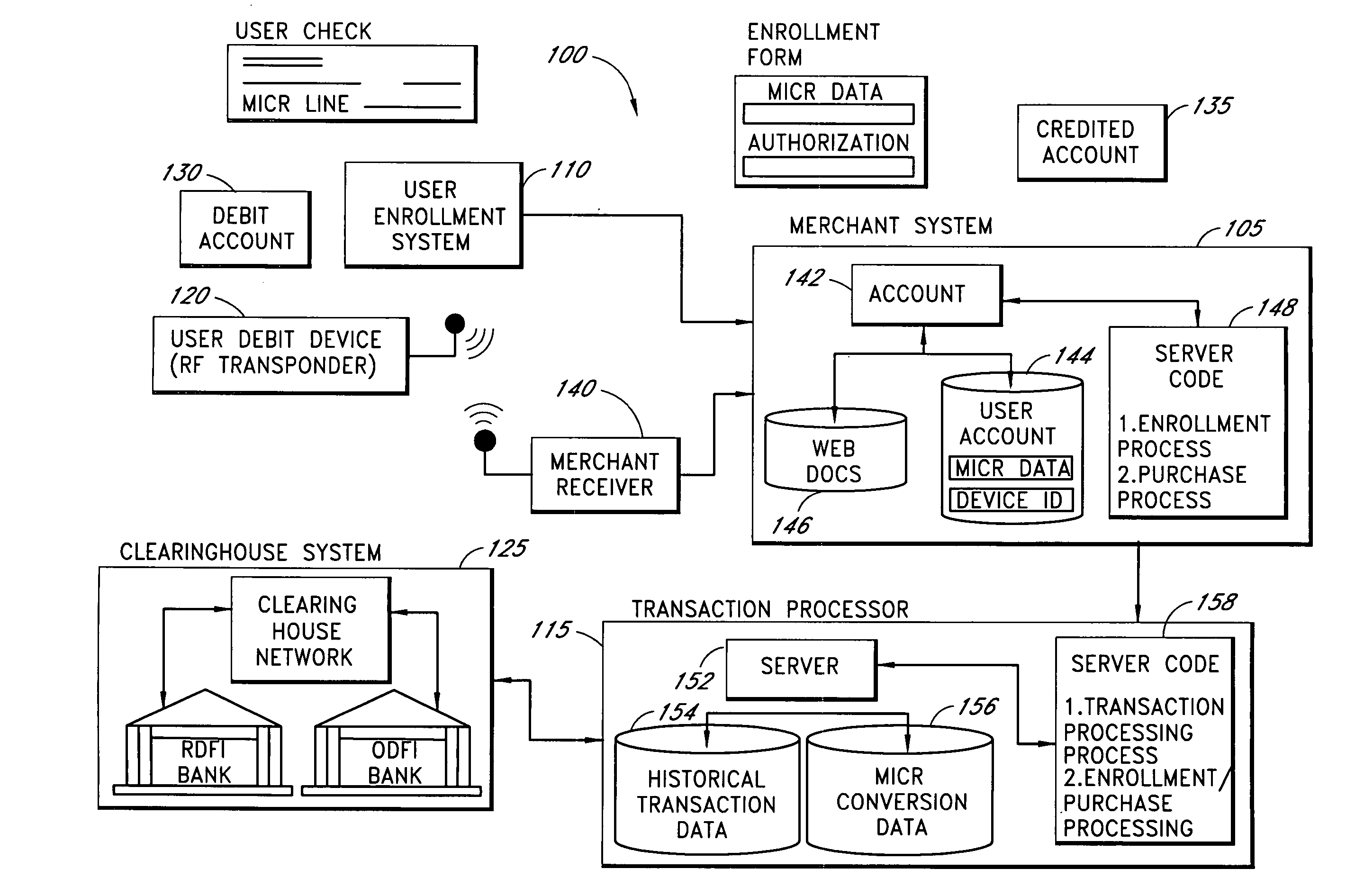

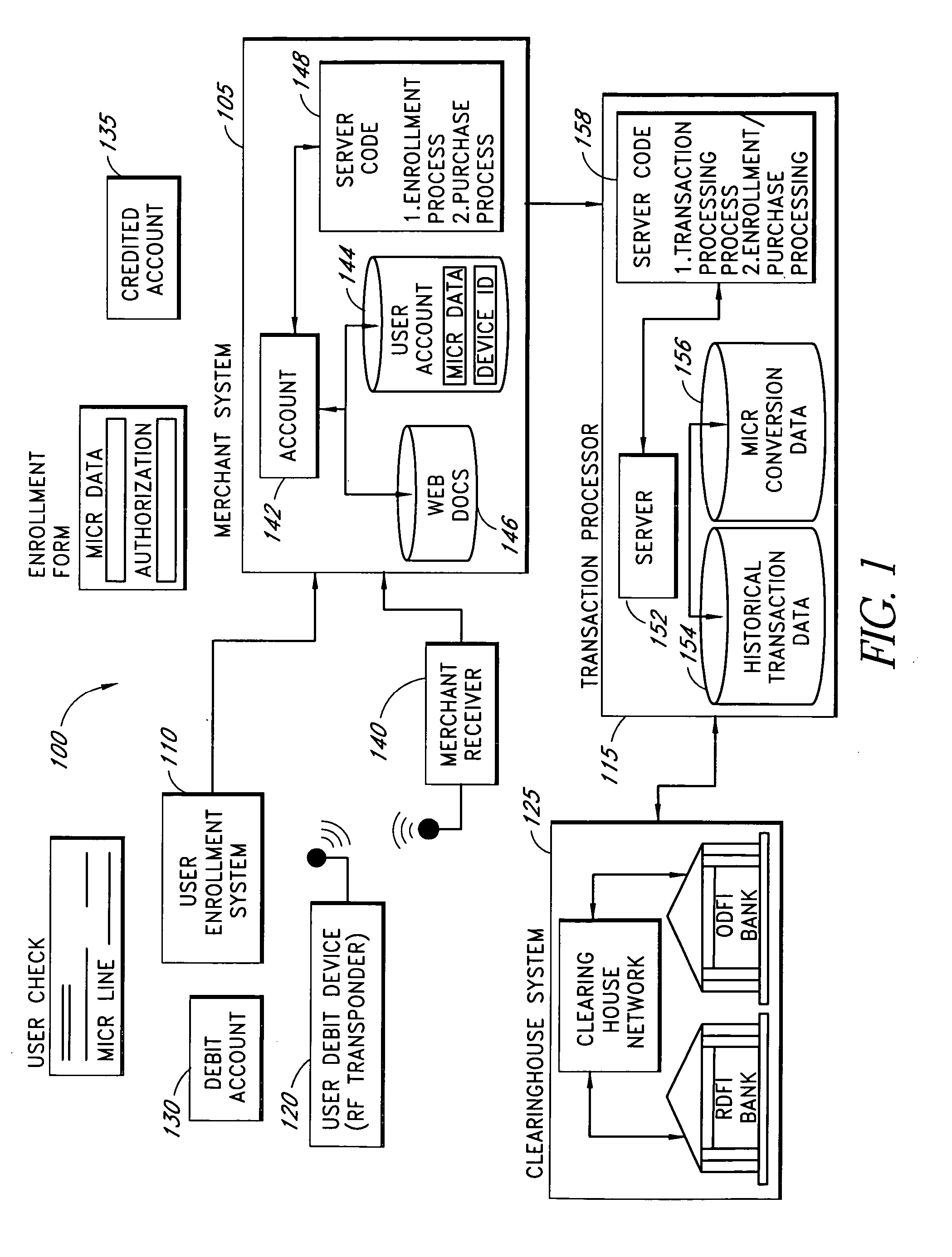

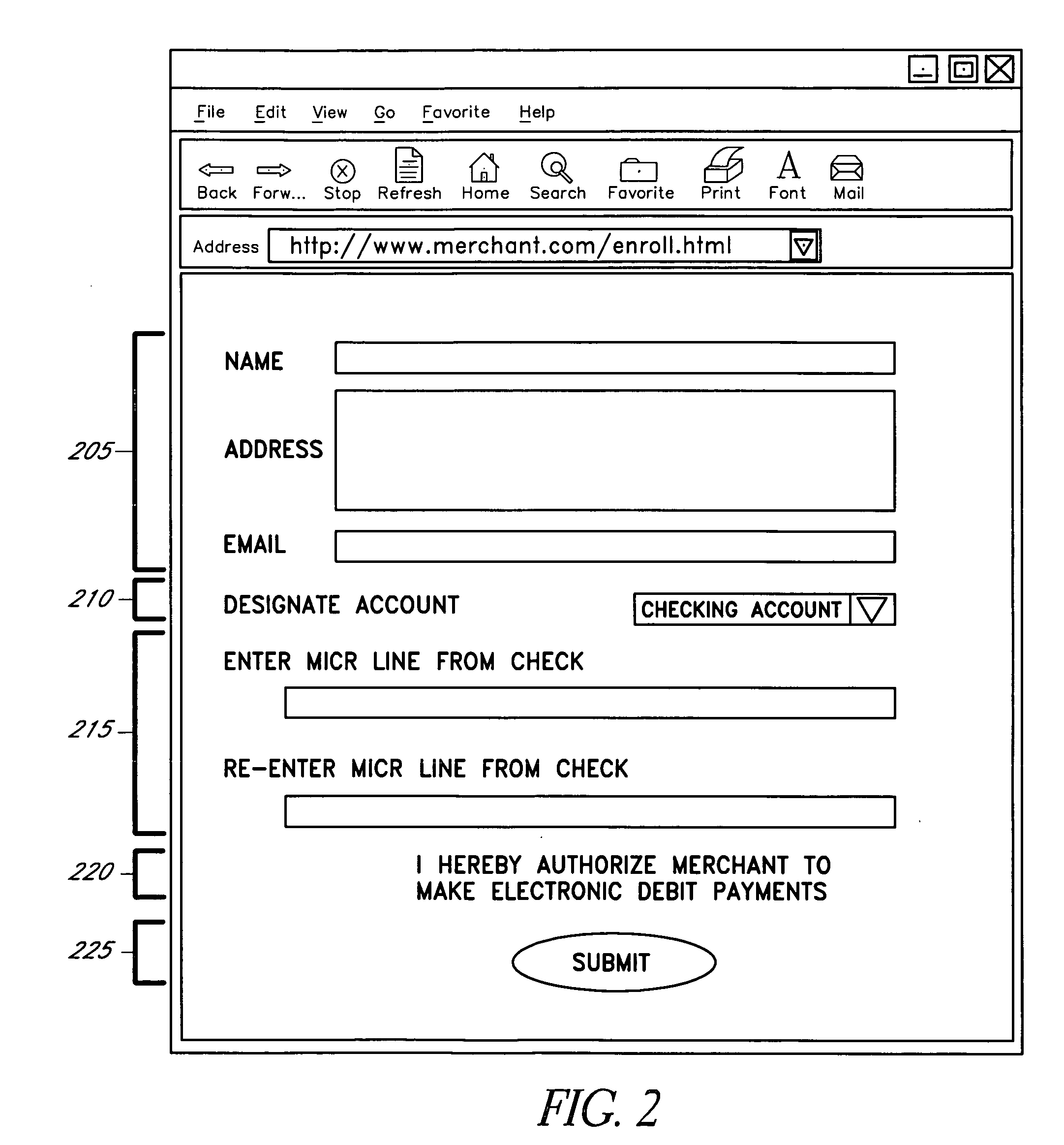

Alternative payment devices using electronic check processing as a payment mechanism

InactiveUS7131571B2Avoids negative drawbackComplete banking machinesFinanceAlternative paymentsCheque

The present invention includes a merchant system that recognizes virtually any payment device or technology that uses electronic check processing as a payment mechanism. For example, the merchant system associates presentation of the payment device with information used to electronically debit a checking account, such as MICR data, and submits the same to a transaction processor capable of settling electronic debit transactions.

Owner:THE WESTERN UNION CO +1

Systems and Methods for Allocating a Payment Authorization Request to a Payment Processor

InactiveUS20090157518A1Easy to identifyEasy to calculateHand manipulated computer devicesFinanceThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Methods for a third party biller to receive an allocated payment authorization request

InactiveUS8820633B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

Owner:LIBERTY PEAK VENTURES LLC

Methods for locating a payment system utilizing a point of sale device

InactiveUS20090164326A1Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Systems and Methods for Locating an Automated Clearing House Utilizing a Point of Sale Device

InactiveUS20090164325A1Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC +1

Systems and Methods for Processing a Payment Authorization Request Over Disparate Payment Networks

InactiveUS20090164330A1Easy to identifyEasy to calculateHand manipulated computer devicesFinanceThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Systems and Methods for Locating a Payment System and Determining a Taxing Authority Utilizing a Point of Sale Device

InactiveUS20090164328A1Easy to identifyEasy to calculatePayment circuitsPoint-of-sale network systemsIssuing bankThird party

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC +1

Alternative payment devices using electronic check processing as a payment mechanism

InactiveUS20060273165A1Avoids negative drawbackComplete banking machinesFinanceAlternative paymentsCheque

The present invention includes a merchant system that recognizes virtually any payment device or technology that uses electronic check processing as a payment mechanism. For example, the merchant system associates presentation of the payment device with information used to electronically debit a checking account, such as MICR data, and submits the same to a transaction processor capable of settling electronic debit transactions.

Owner:FIRST DATA +1

Device for allocating a payment authorization request to a payment processor

InactiveUS8646685B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesIssuing bankThird party

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

Methods for a Third Party Biller to Receive an Allocated Payment Authorization Request

InactiveUS20090164324A1Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesIssuing bankThird party

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

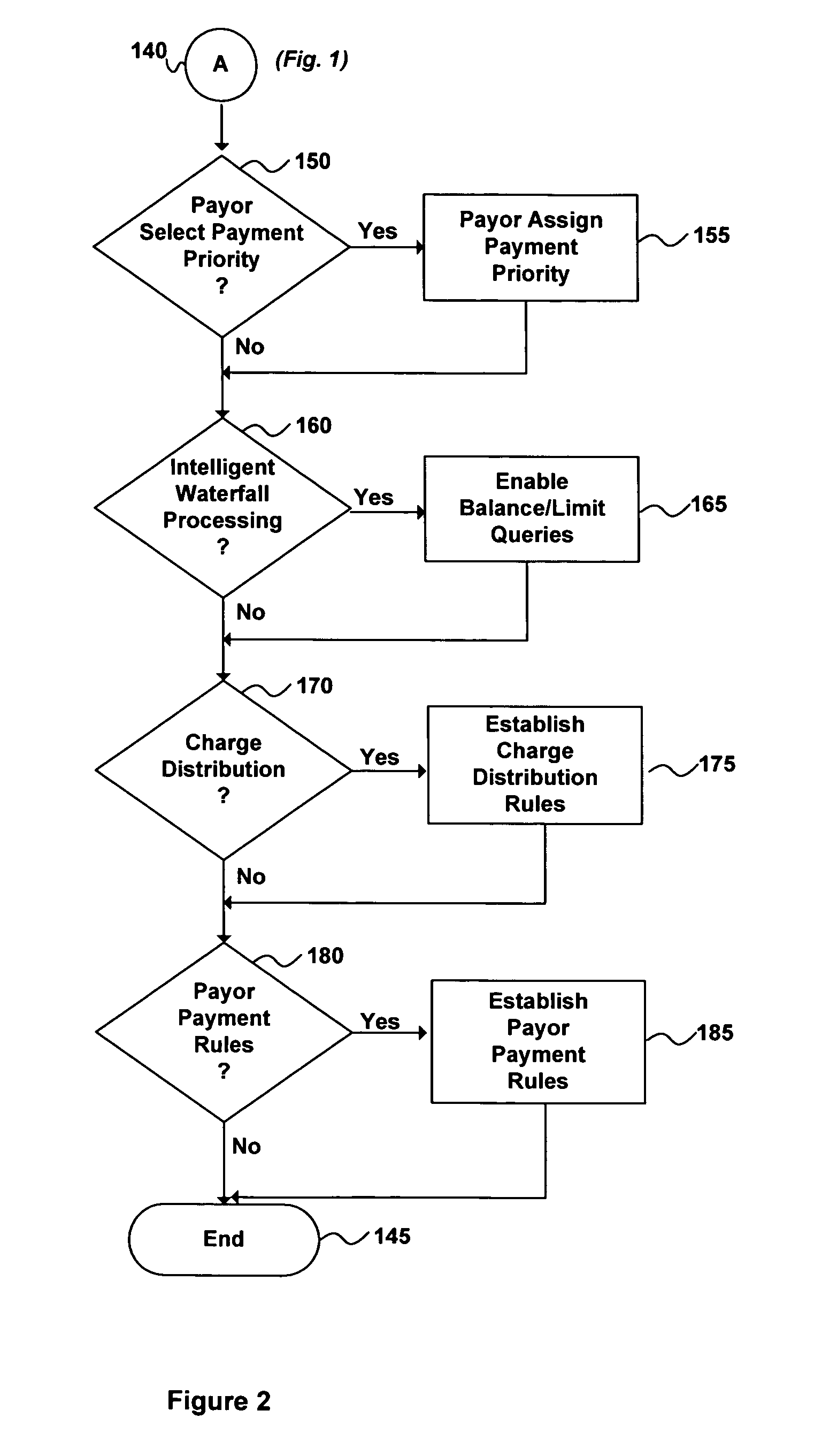

System and method for waterfall prioritized payment processing

The invention comprises a system and method for “waterfall” type payment processing using multiple alternative payment sources. A payor provides account information for multiple payment sources, such as a bank checking account, savings account, first credit card account, second credit card account, and so forth. The multiple payment sources are prioritized so that one is a primary payment source, another is a secondary payment source, another is a tertiary payment source, and so forth. After setting up the waterfall payment arrangement, when a bill becomes due a payee or third party payment administrator submits transactions against the payment sources in their order of priority until the payment is satisfied. Other variations and enhancements are disclosed.

Owner:U S BANK NAT ASSOC +1

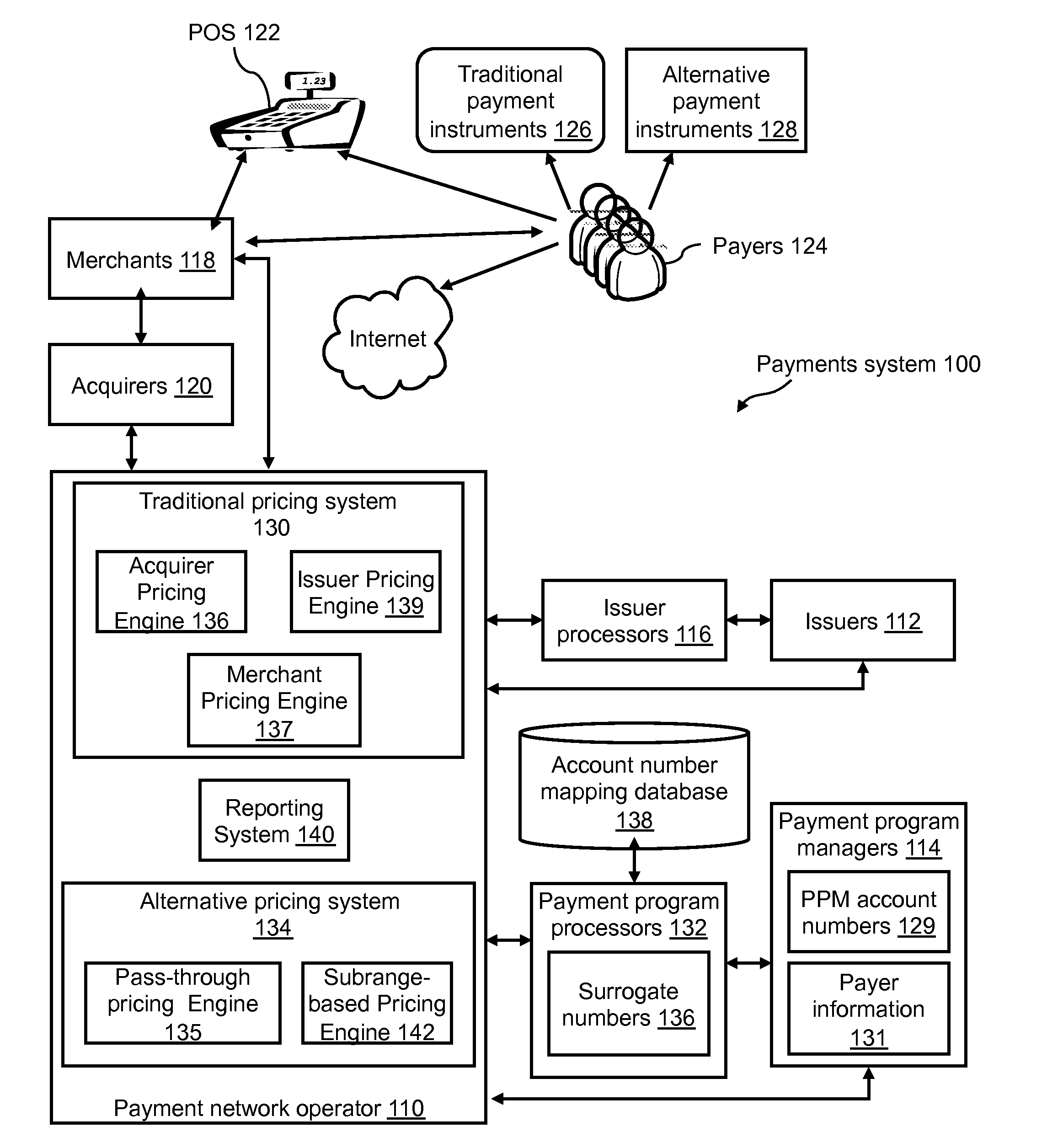

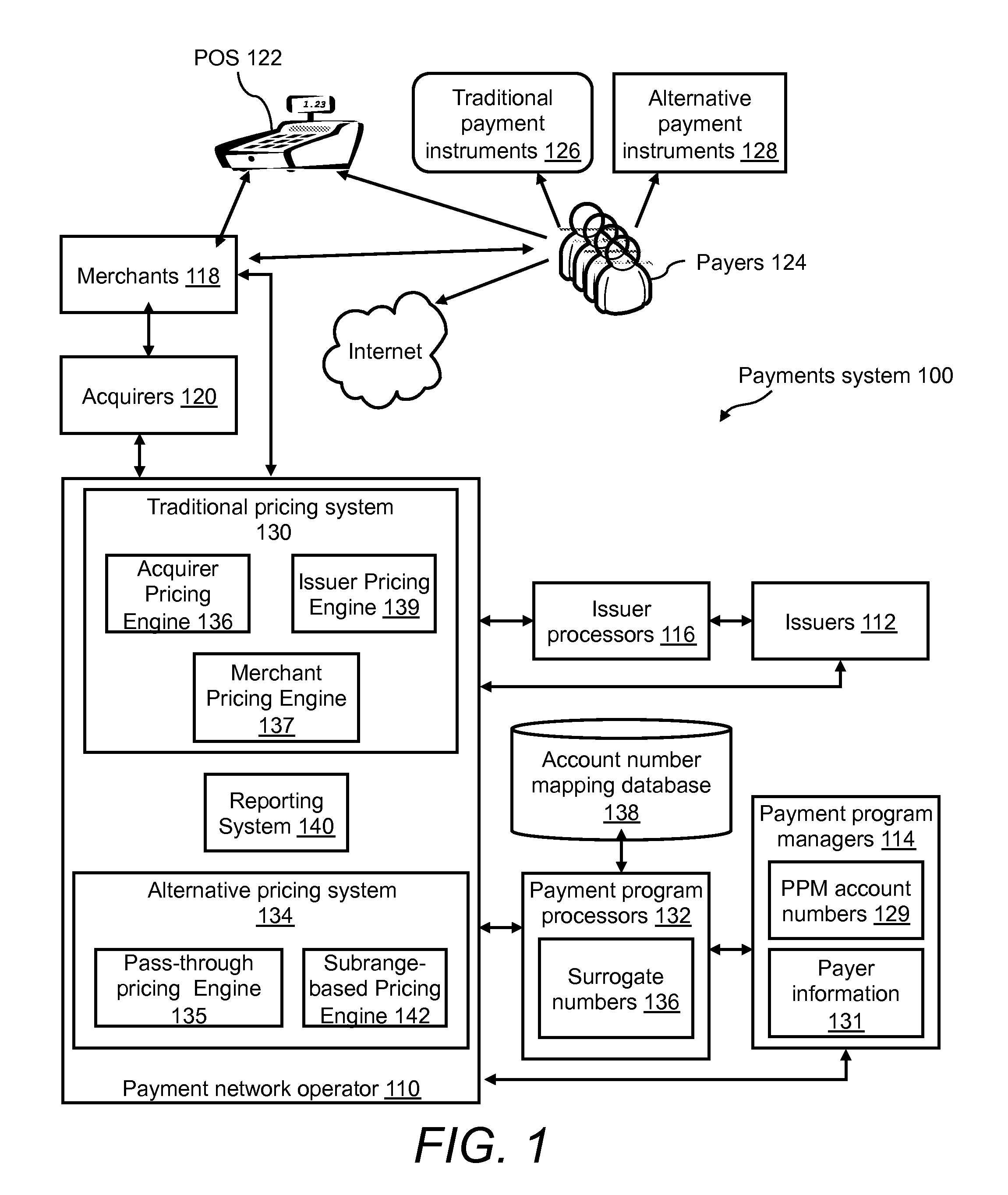

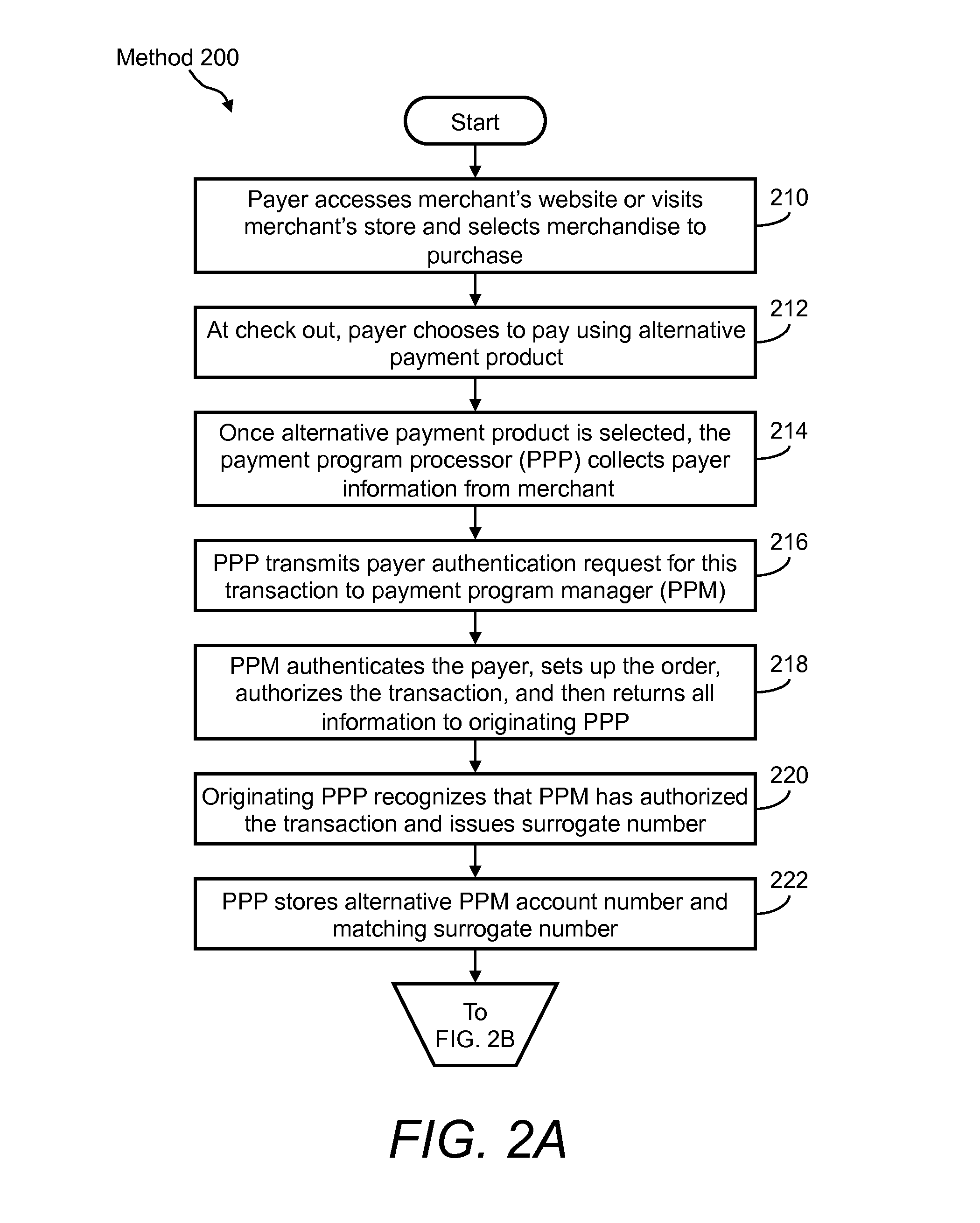

Processing non-traditional transactions on a traditional payment network

ActiveUS20120016728A1Little technical resourceEnhanced and differentiated reportingComplete banking machinesFinancePayment transactionAlternative payments

A system for and methods of processing non-traditional payment transactions on a traditional payment network is disclosed. More specifically, a payments system includes one or more payment program managers (PPMs), which are the providers of alternative payment products, in combination with one or more payment program processors (PPPs), which serve as processors for the PPMs. The PPMs and PPPs operate on a payment network, such as a traditional payment network. The payments system includes the utilization of traditional bank identification numbers (BINS) in order to process non-traditional transactions on a traditional payment network. Surrogate numbers are issued on BIN ranges to the non-traditional transactions in order to process them on the traditional payment network. Additionally, the payments system includes pricing structures that are associated with alternative payment products. These pricing structures are implemented and processed on the payment network, alongside the pricing structures of traditional payment products.

Owner:DFS SERVICES

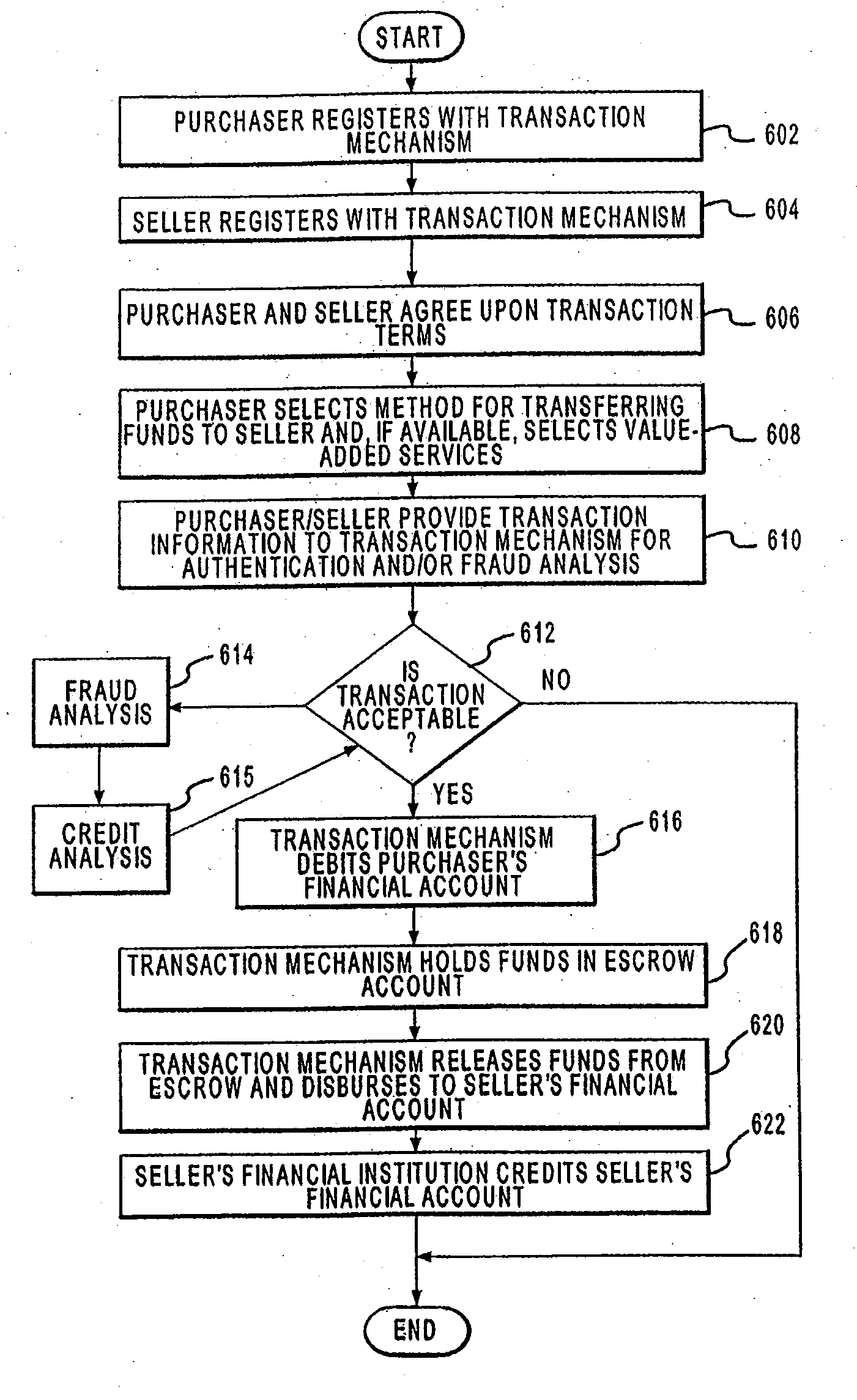

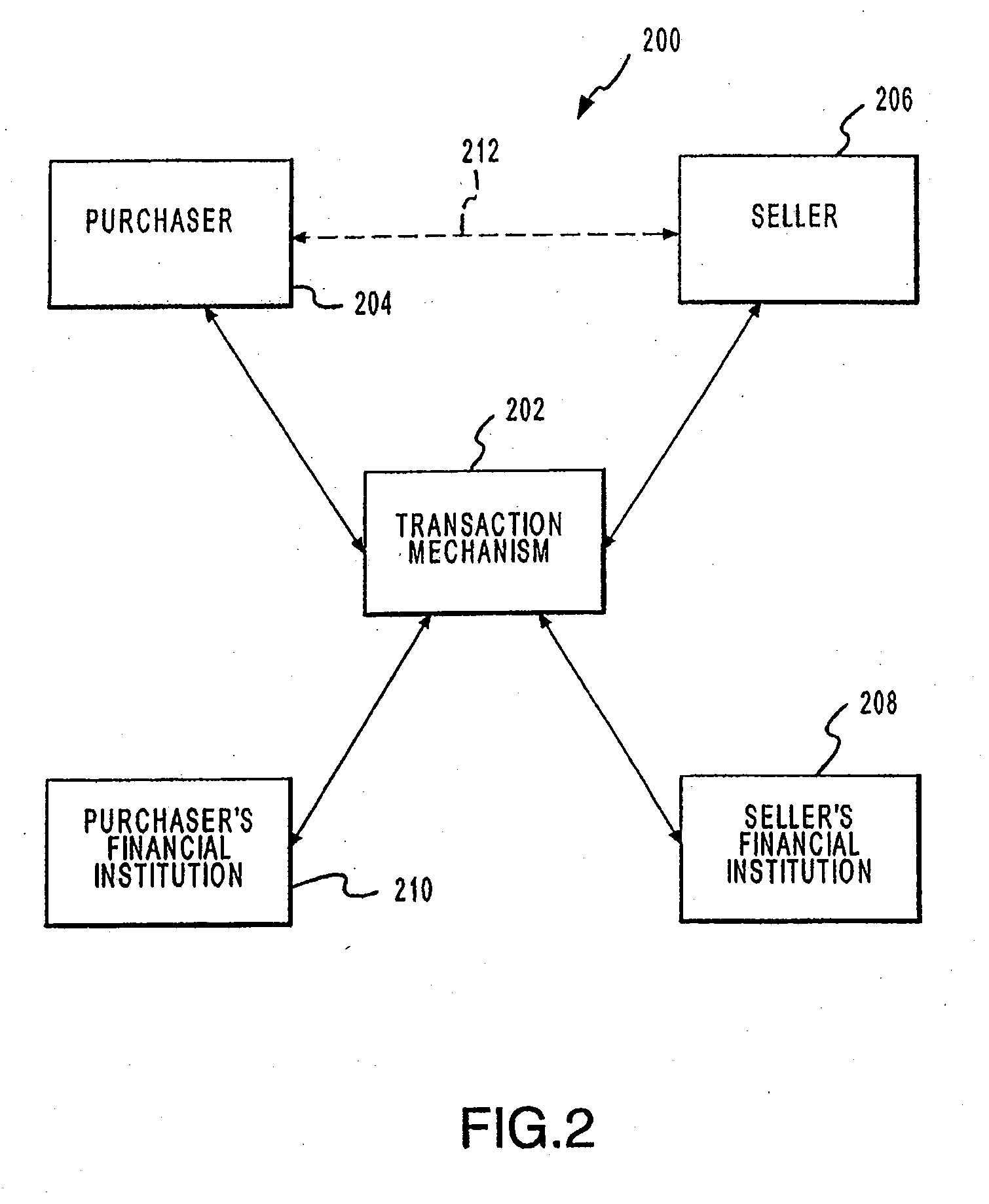

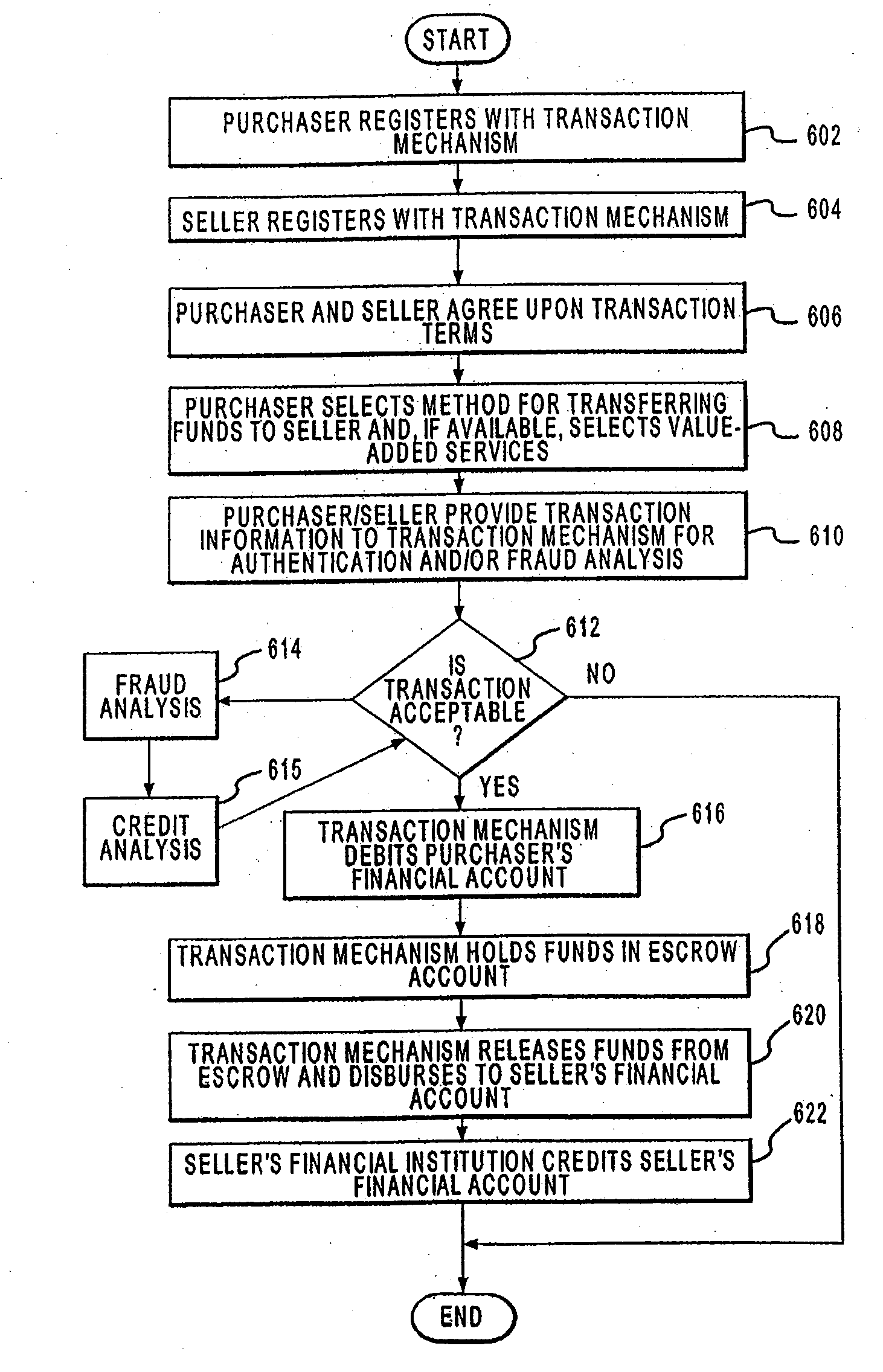

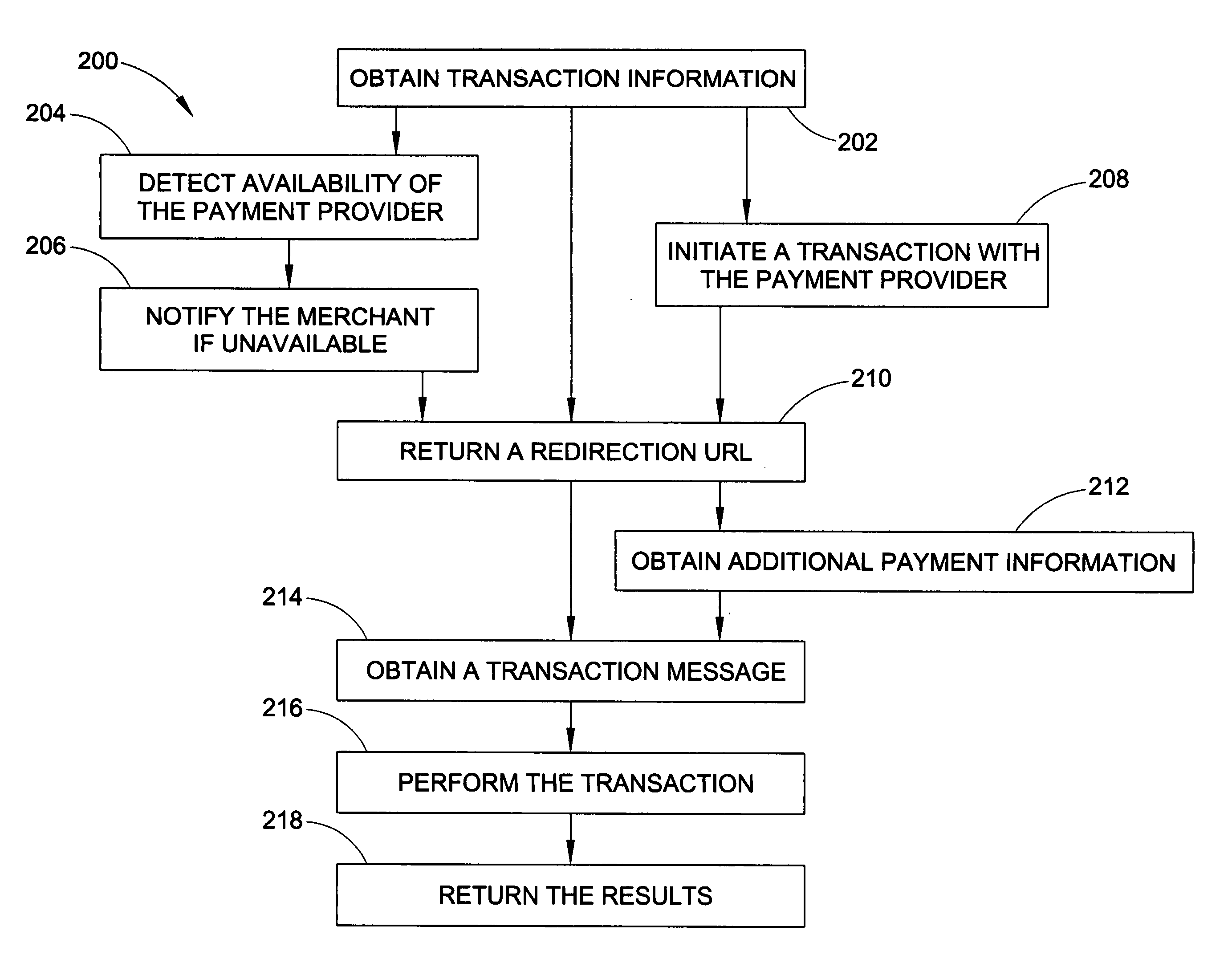

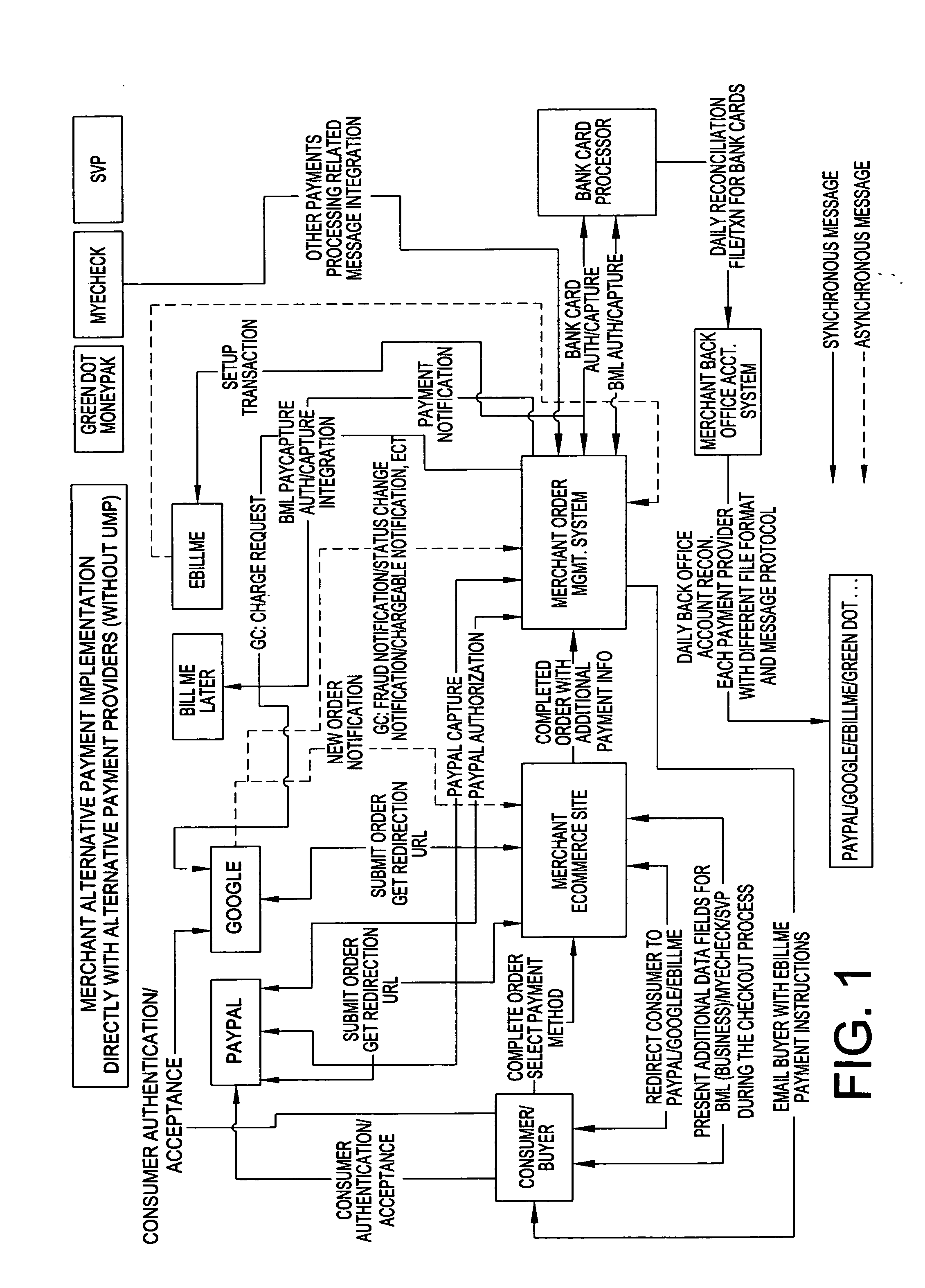

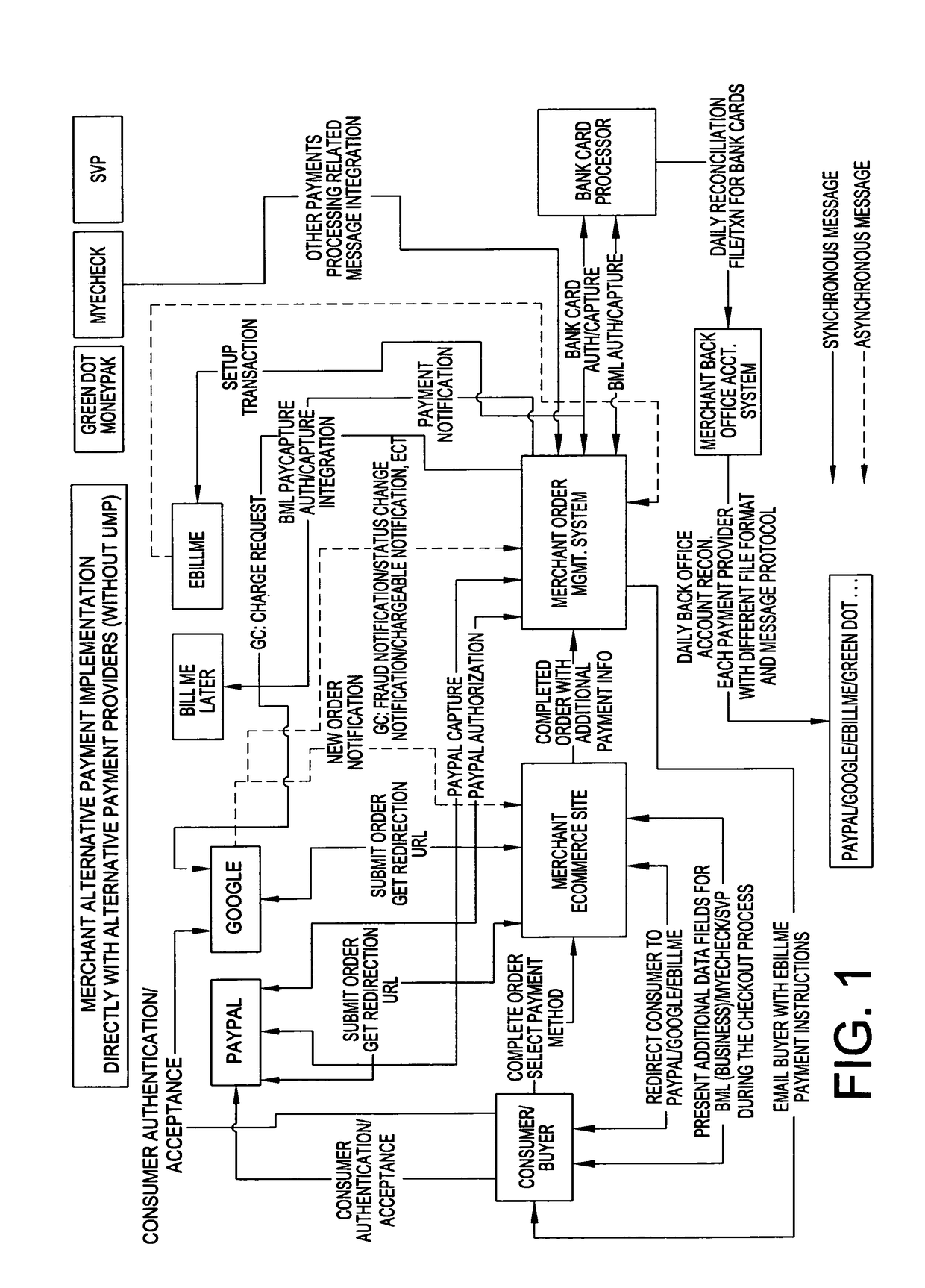

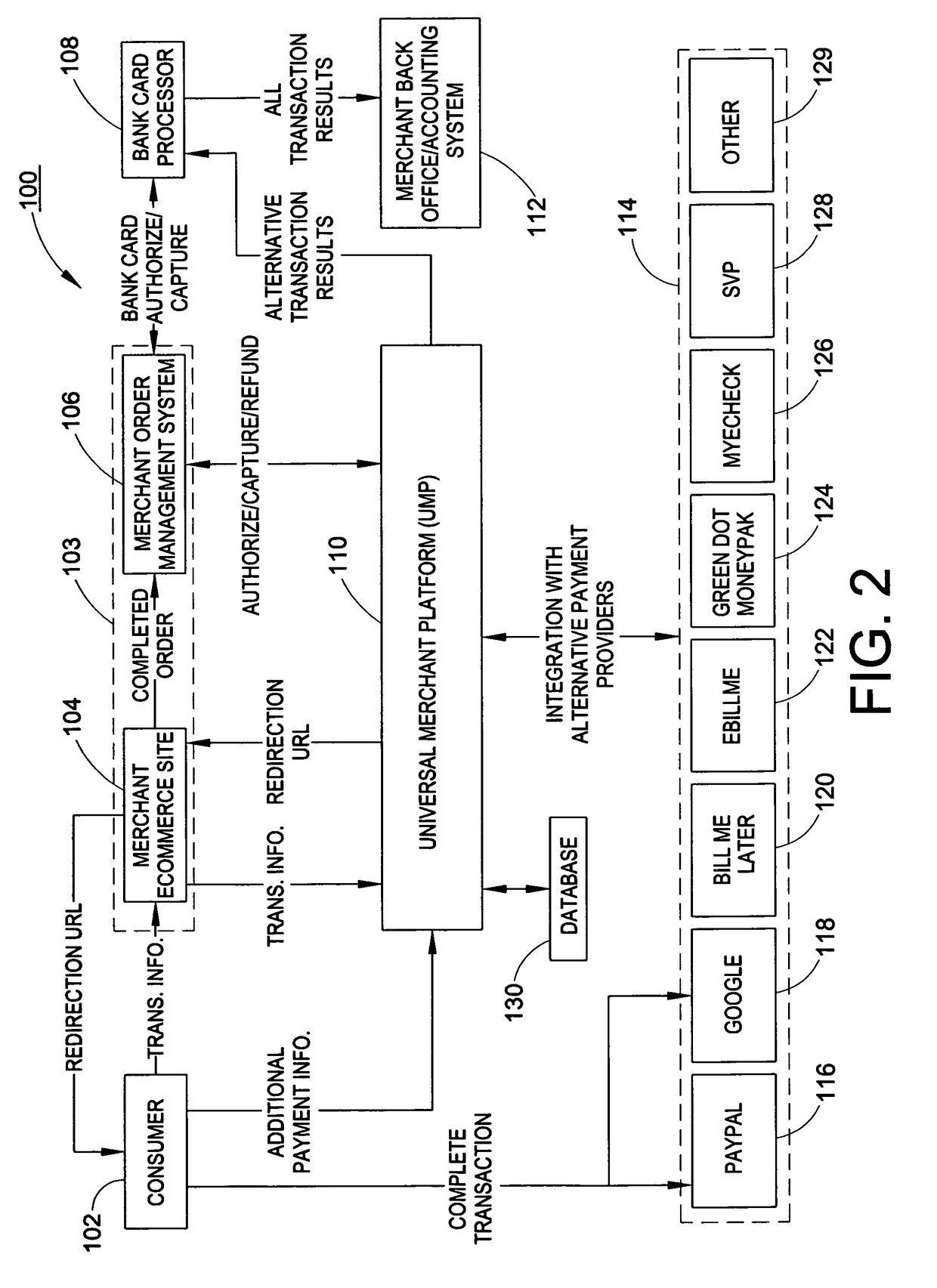

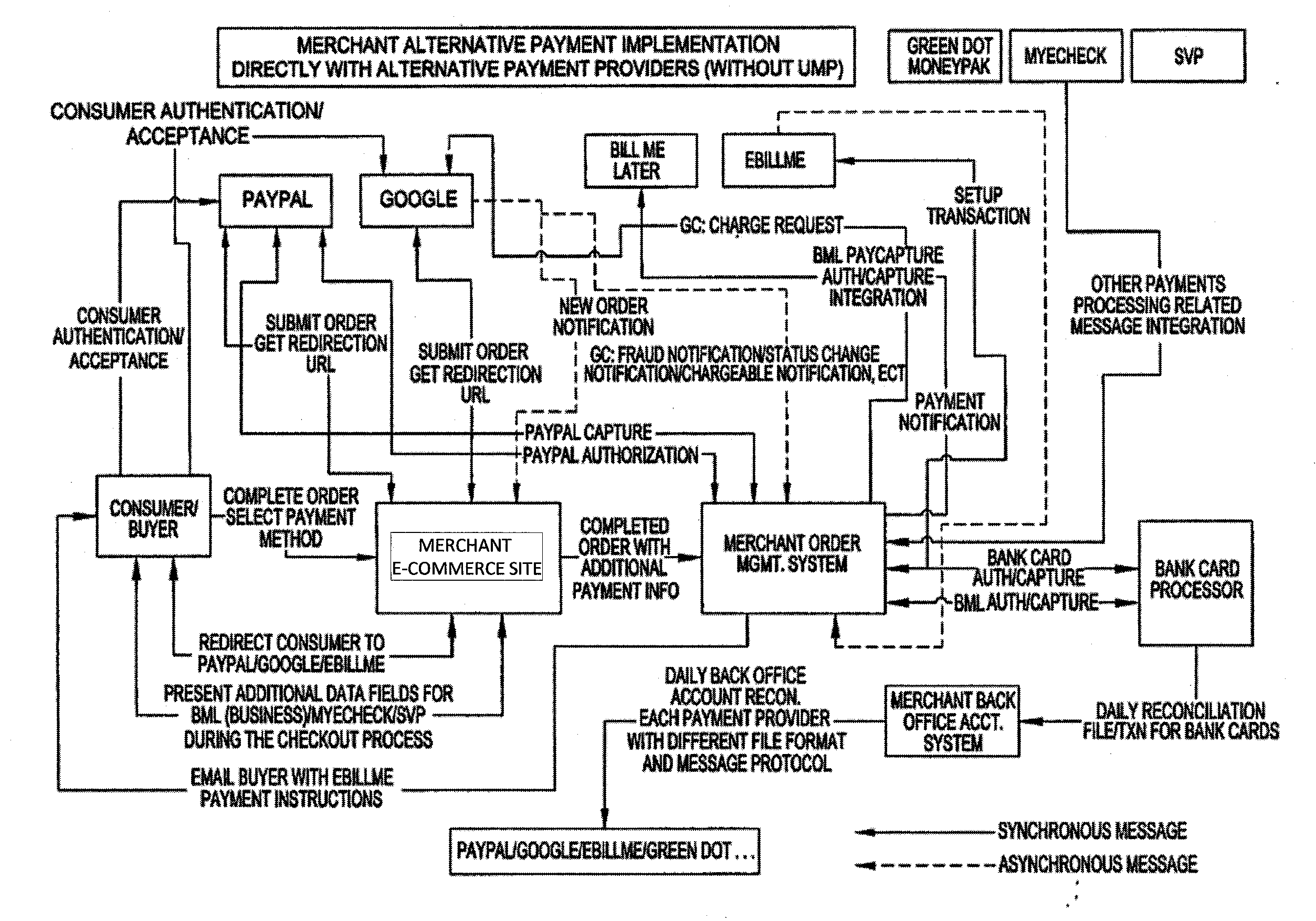

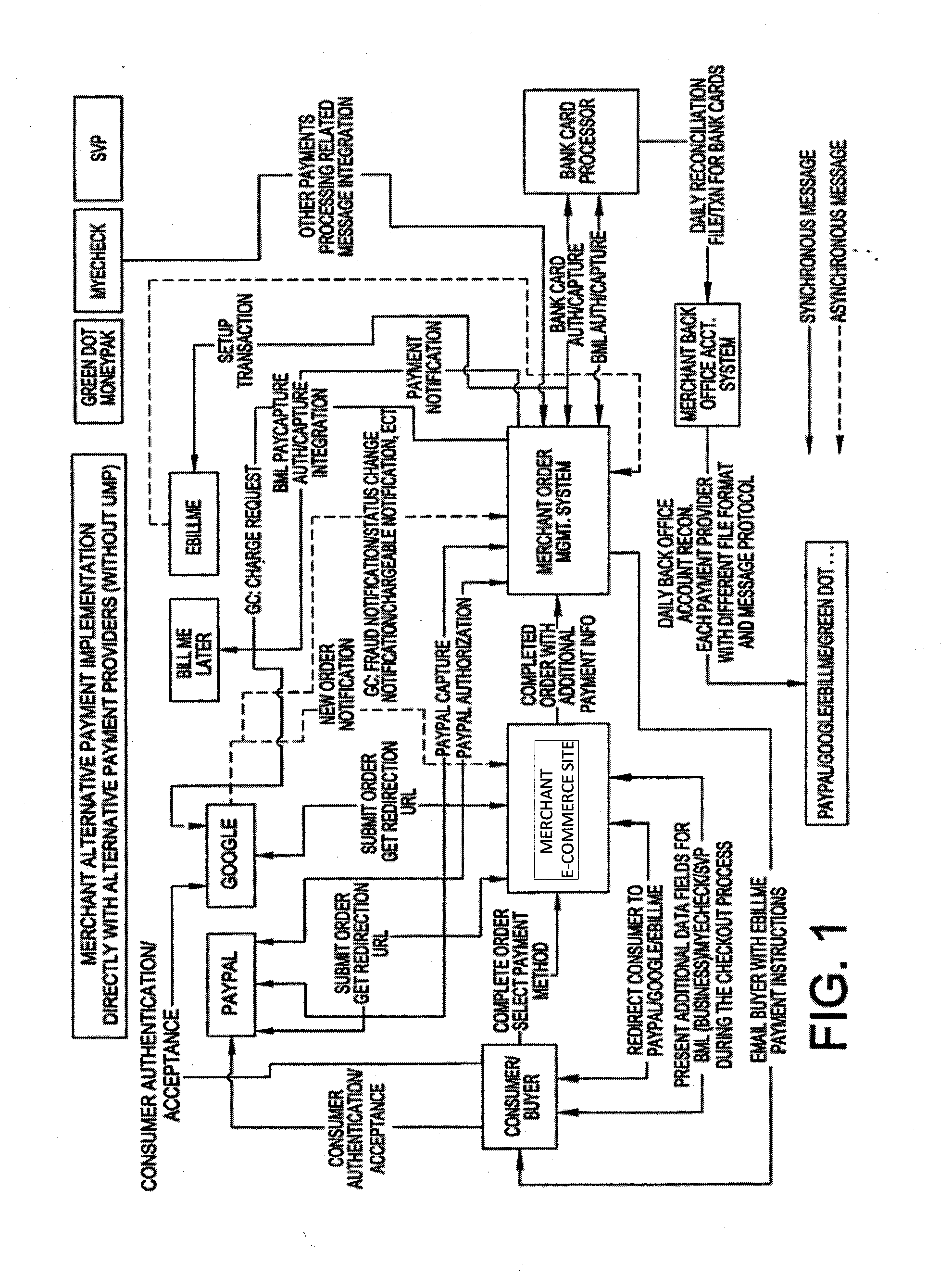

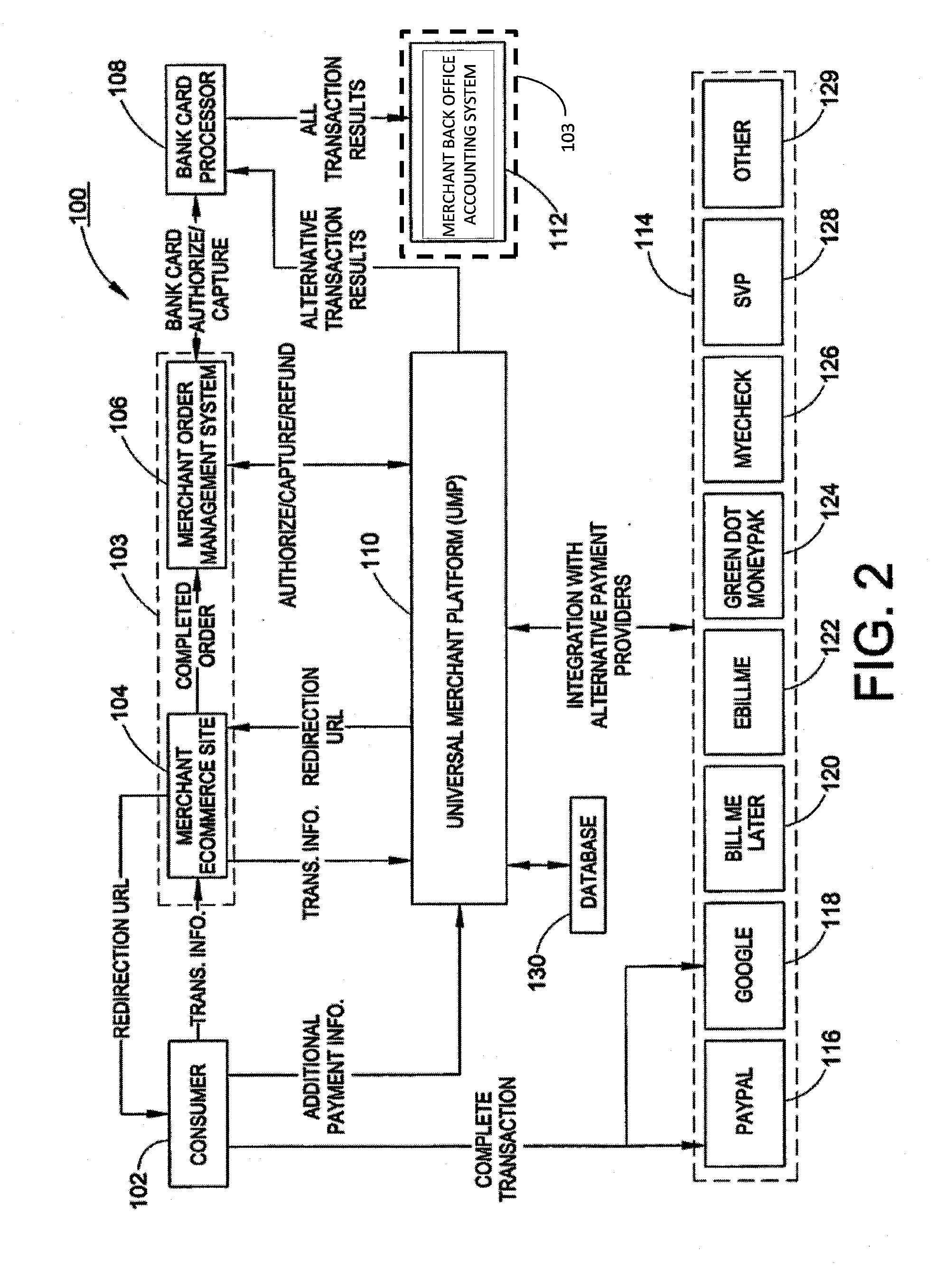

Alternative payment implementation for electronic retailers

A method of processing a transaction between a merchant and a buyer over a communication network is provided. The transaction is processed using one of a plurality of alternative payment options and each of the alternative payment options are provided by one of a plurality of alternative payment providers. Each of the alternative payment providers uses a different alternative payment implementation. The method includes: obtaining transaction information from the merchant; returning a redirection URL and an order identifier to the merchant; obtaining a transaction message from the merchant, where the transaction message specifies the type of operation; performing the operation type specified in the transaction message with the appropriate alternative payment provider; and returning a processing message to the merchant containing the results from performing the operation type specified in the transaction message.

Owner:CARDINALCOMMERCE CORP

Methods for locating a payment system utilizing a point of sale device

InactiveUS8596527B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

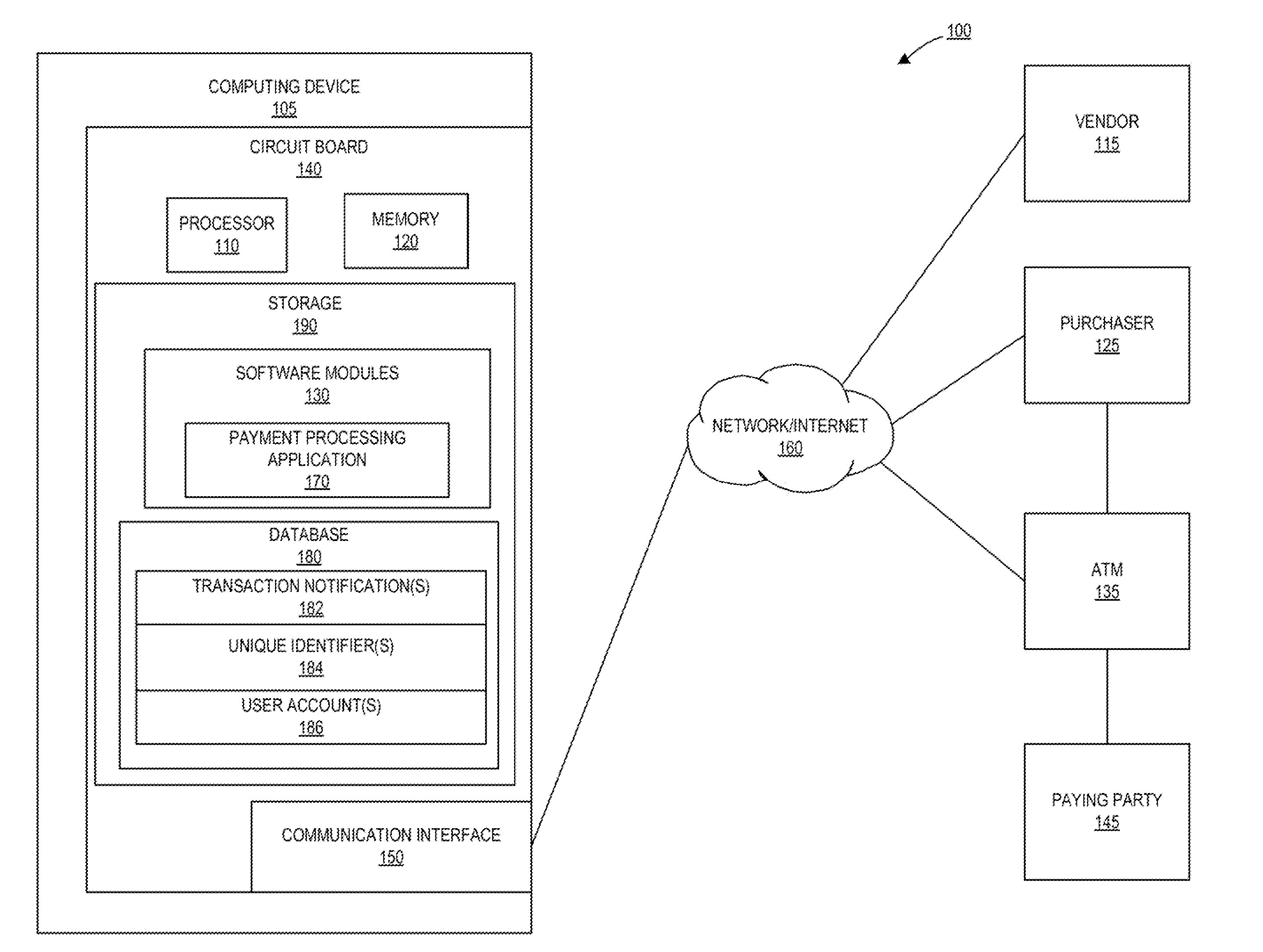

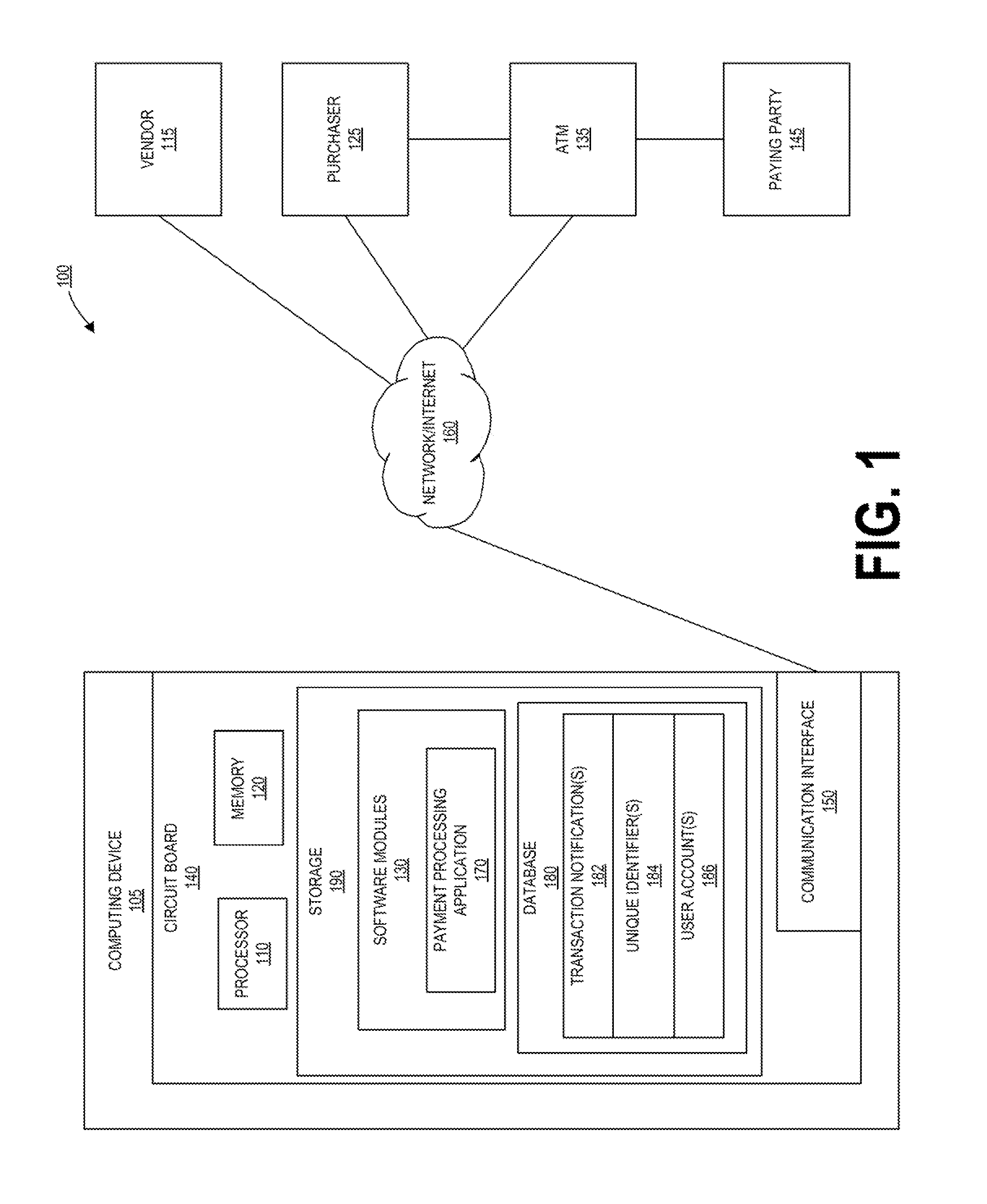

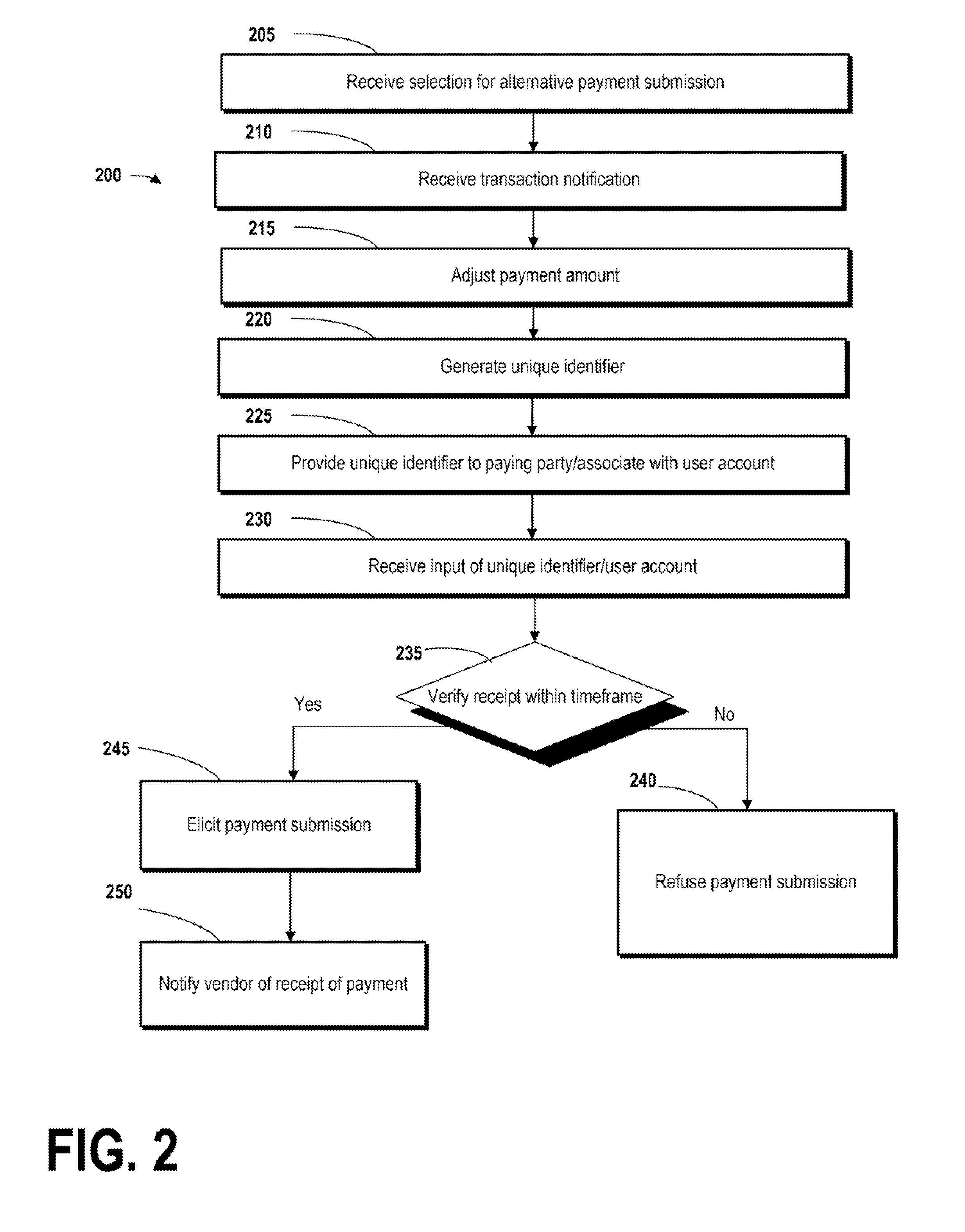

System and method for facilitating cash-based ecommerce transactions

InactiveUS20130226794A1Easy to optimizeEasy to receiveFinancePayment schemes/modelsUnique identifierAlternative payments

Systems and methods are provided for facilitating alternative payment submissions. According to a one aspect, responsive to a selection by a purchaser that enables receipt of an alternative payment submission in furtherance of a transaction between the purchaser and a vendor, a transaction notification is received, the transaction notification including a payment amount and corresponding to the transaction, a unique identifier is generated, the unique identifier corresponding to the transaction notification, and the unique identifier is provided to a paying party in order to facilitate receipt of the alternative payment submission in furtherance of the transaction. An input of the unique identifier is received at an automated teller machine (ATM), the alternative payment submission is elicited at the ATM, and the vendor is notified of receipt of the alternative payment submission.

Owner:MASTERCARD INT INC

Systems and methods for allocating a payment authorization request to a payment processor

InactiveUS8875990B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesIssuing bankThird party

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

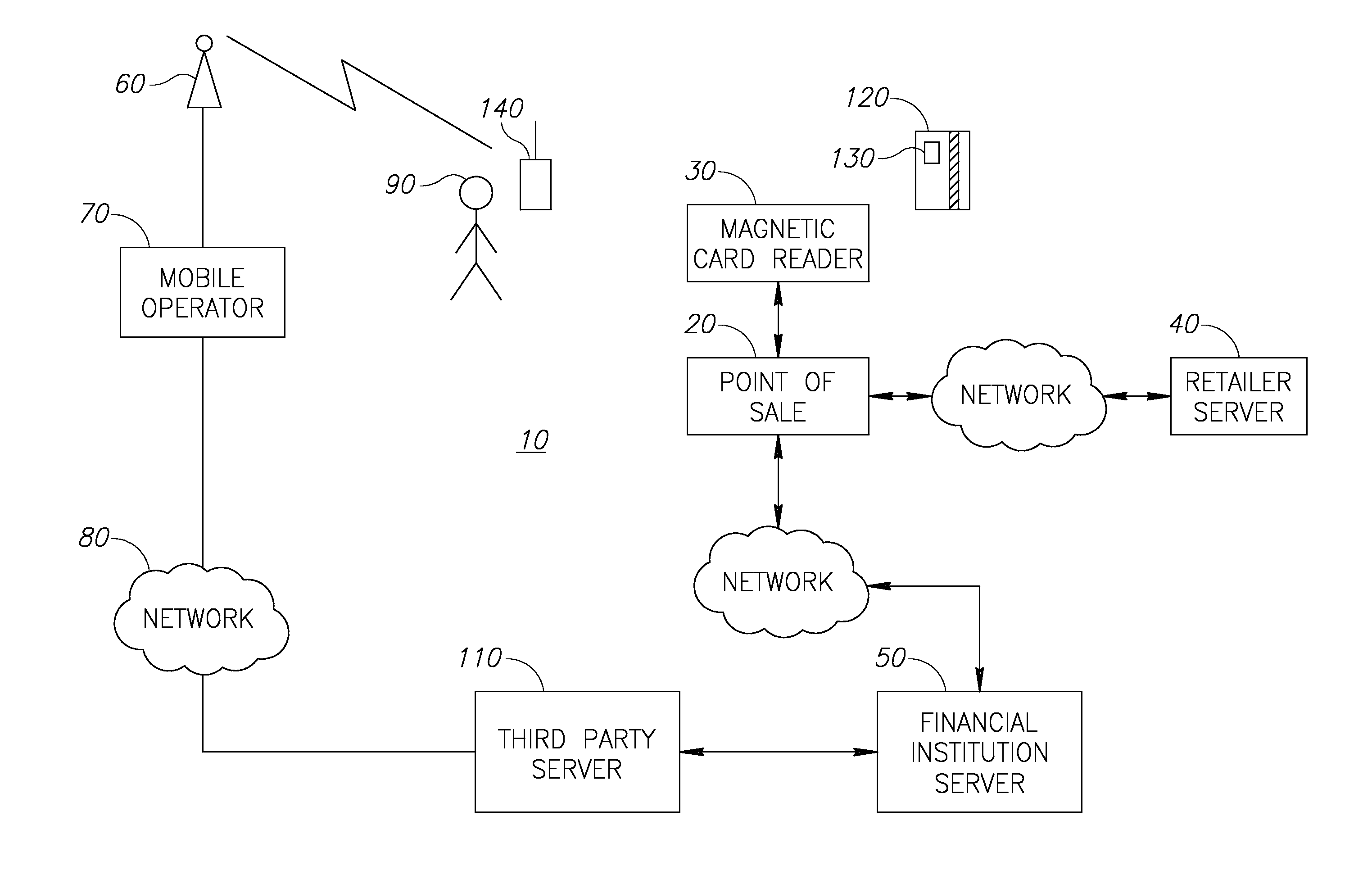

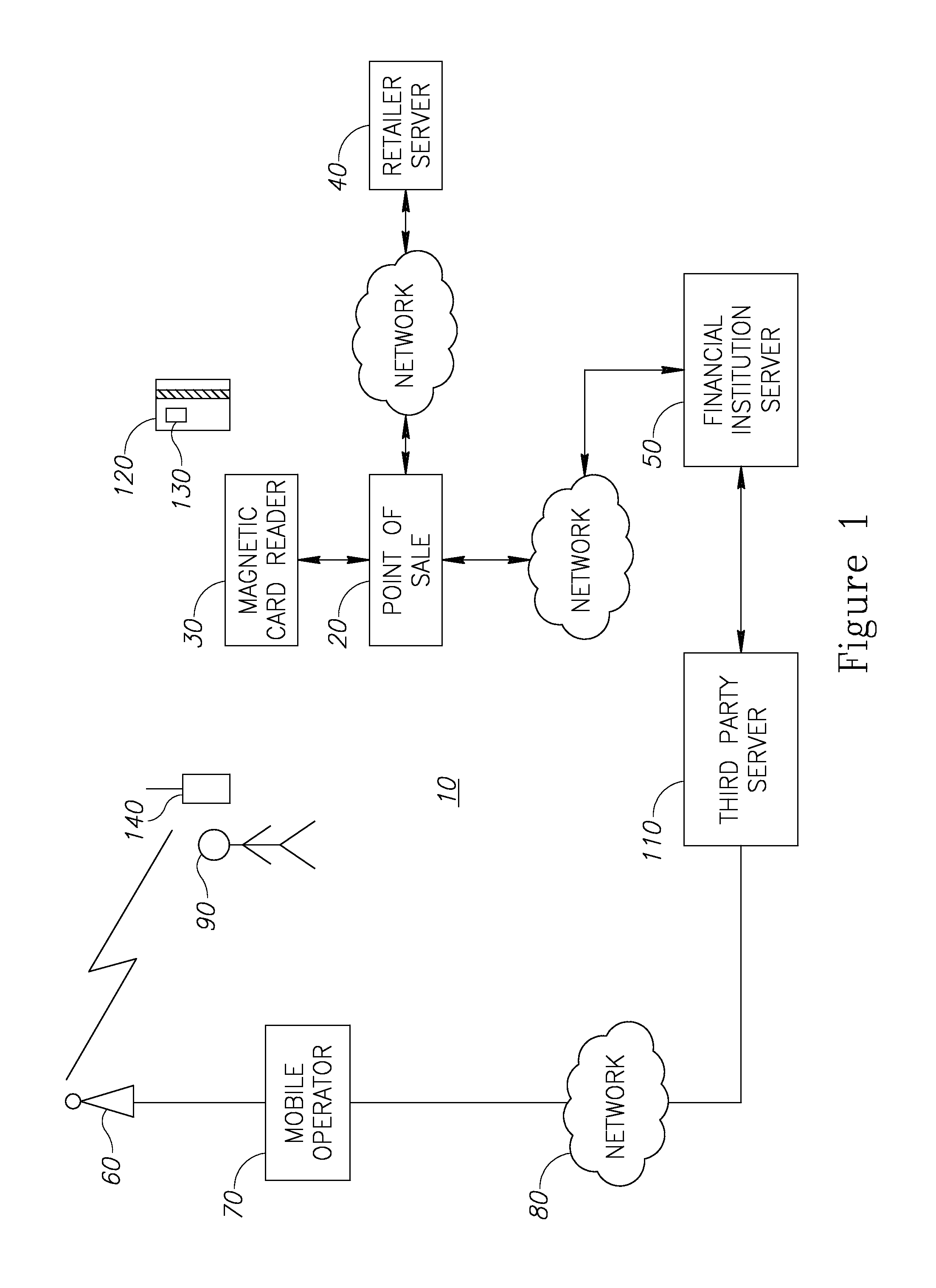

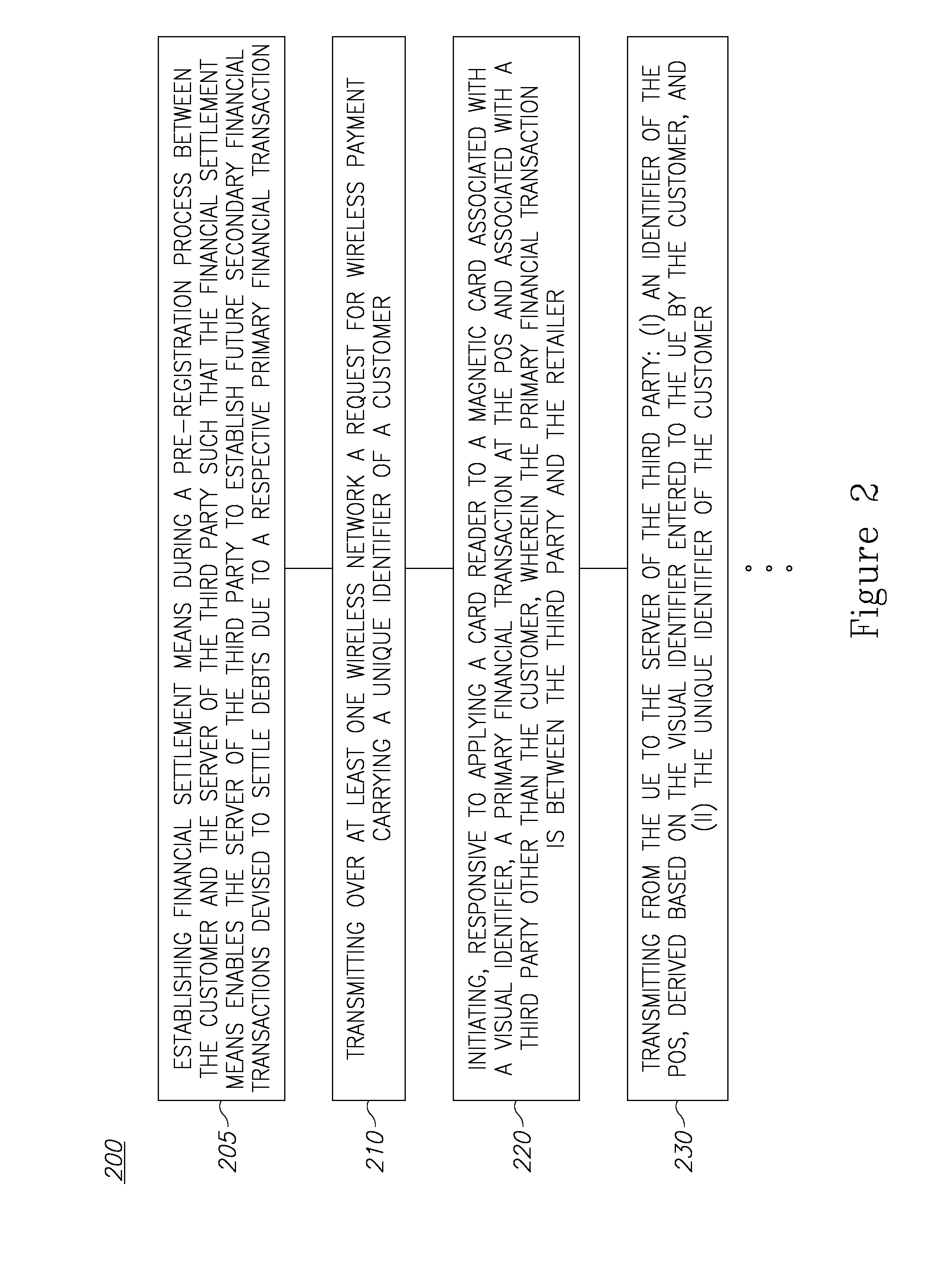

Carrying out an alternative payment via a user equipment over a wireless network at a point of sale without altering the point of sale

A system for carrying out an alternative payment via user equipment (UE) over a wireless network at a point of sale (POS) without altering the POS is provided herein. The system includes a third party server and a plurality of preregistered UEs. Each UE is configured to: receive a visual identifier associated with a magnetic card at the POS and transmit to the server a unique identifier of the POS / card and the unique identifier of the customer. The server is configured to: obtain financial details regarding the primary transaction generated by the POS, receive the unique identifier of the POS and the unique identifier of the customer from the UE, approve the primary transaction if financial settlement means associated with the customer are sufficient, and establish a secondary financial transaction between the customer and the third party, for settling the debt of the customer to the third party.

Owner:DIGIMO GROUP

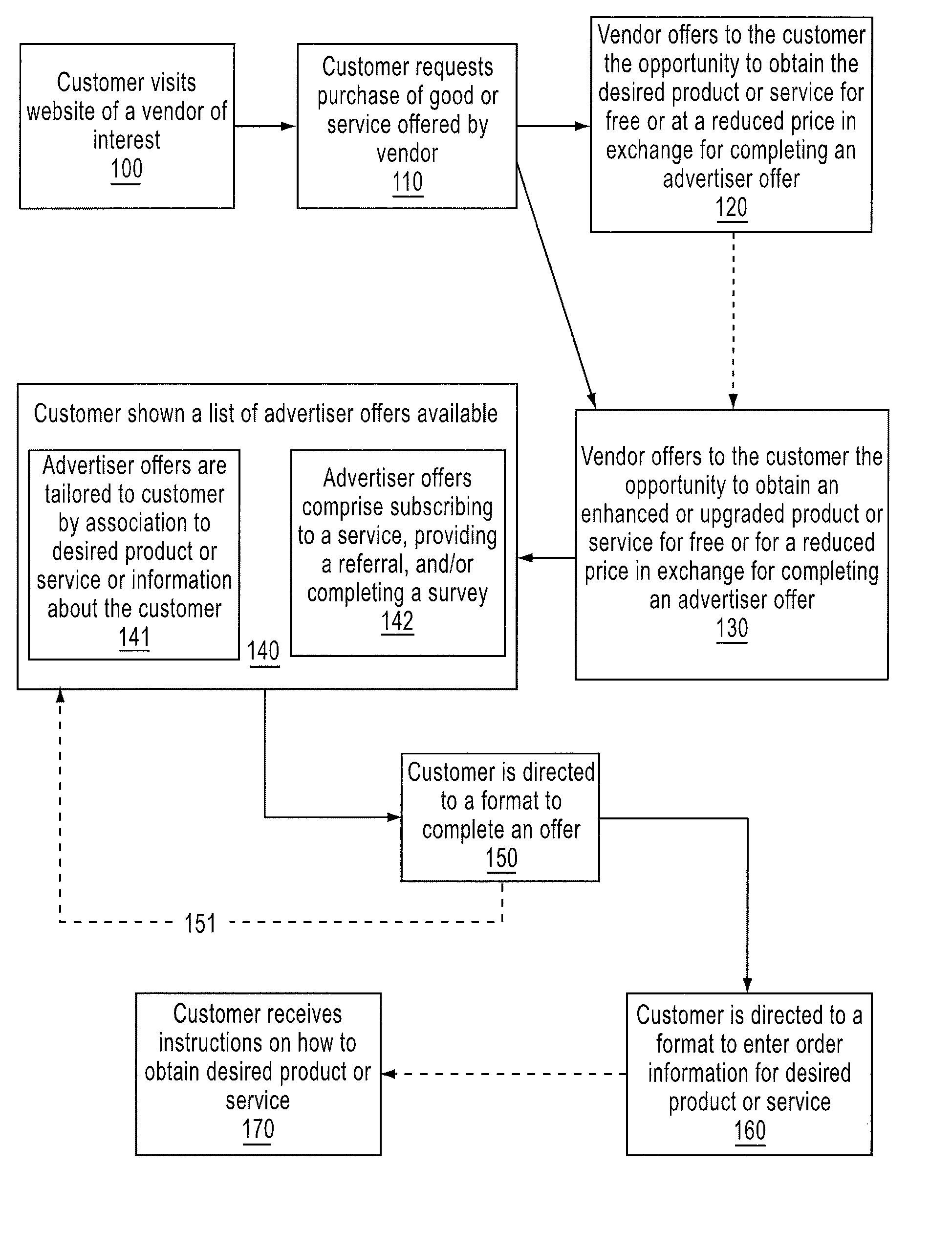

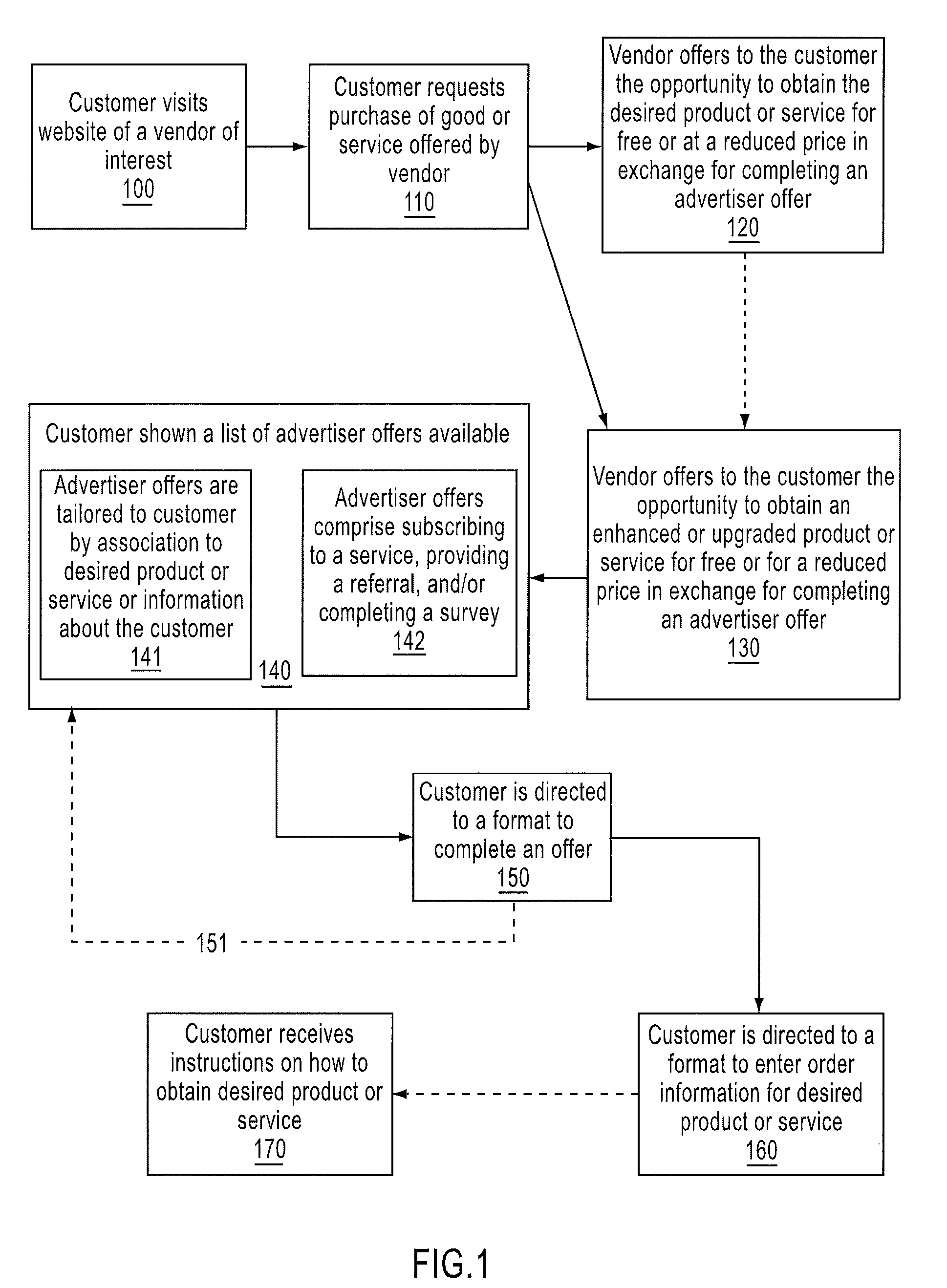

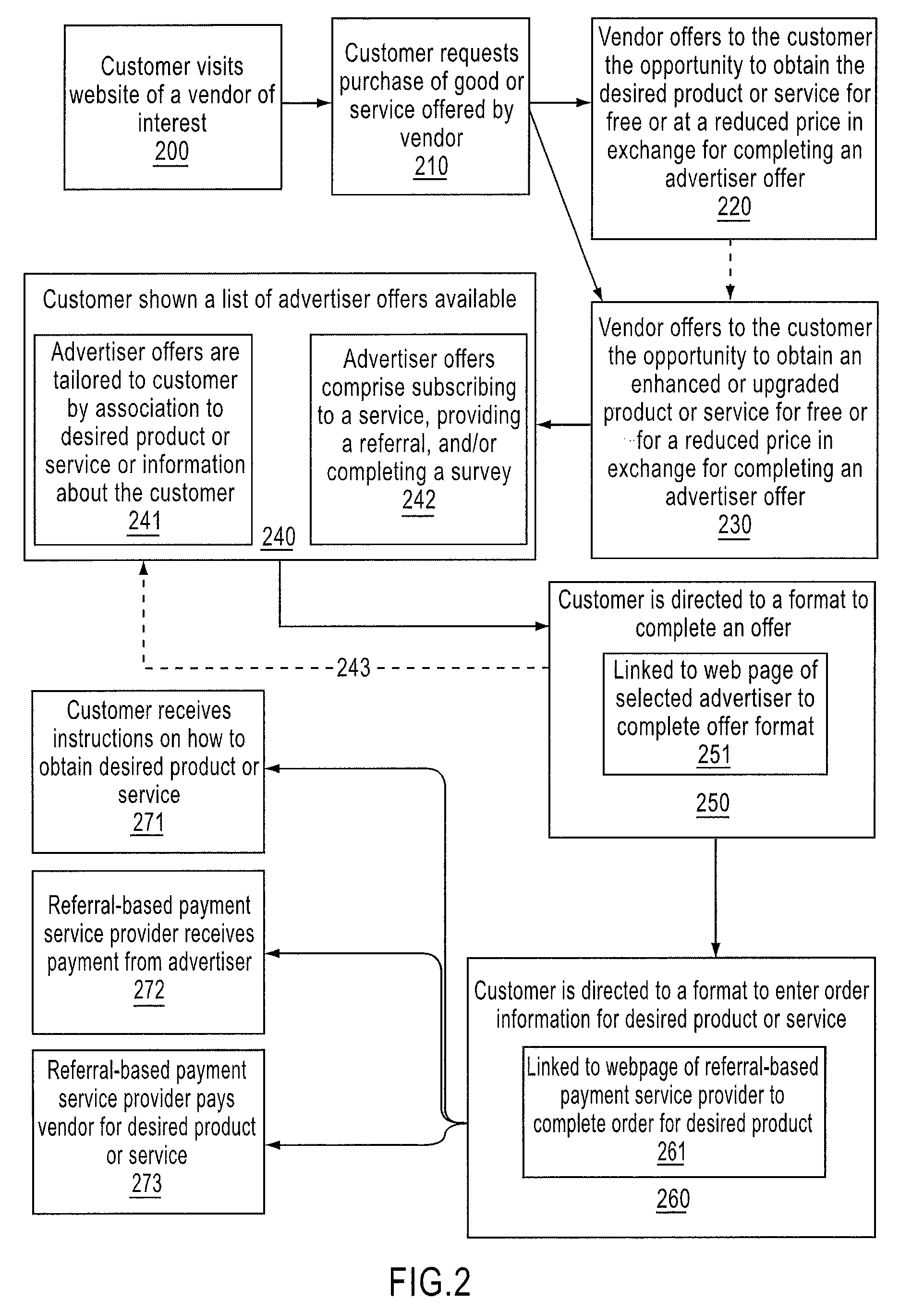

Alternative payment system and method

InactiveUS20080071619A1Address rising pricesFinanceAdvertisementsAlternative paymentsLibrary science

A system and method, including offering to a customer as a part of a purchase transaction an option of completing an activity in exchange for a reduction in a purchase price, and targeting offers of such activities based on the interested customer.

Owner:CHARLTON DON +3

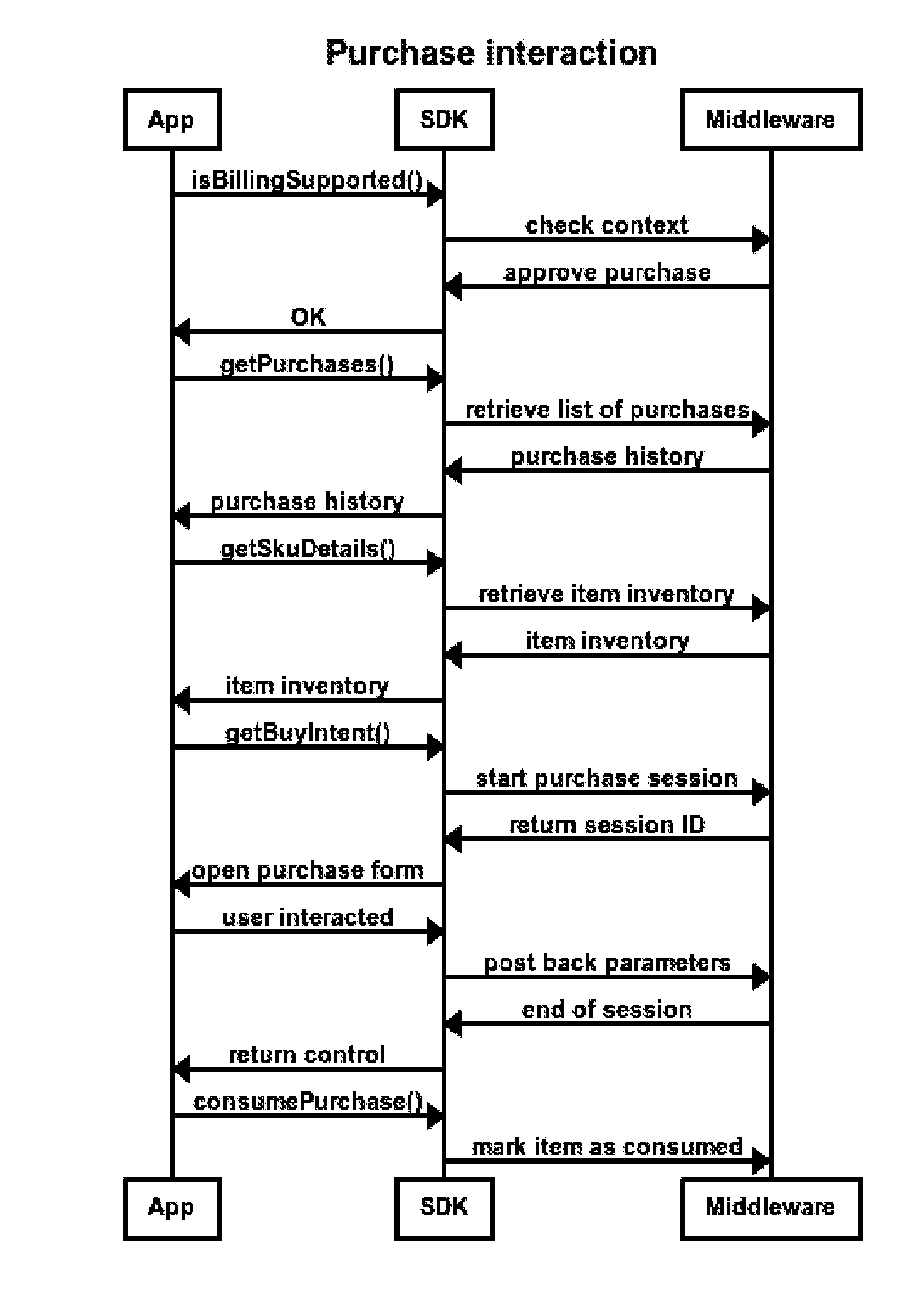

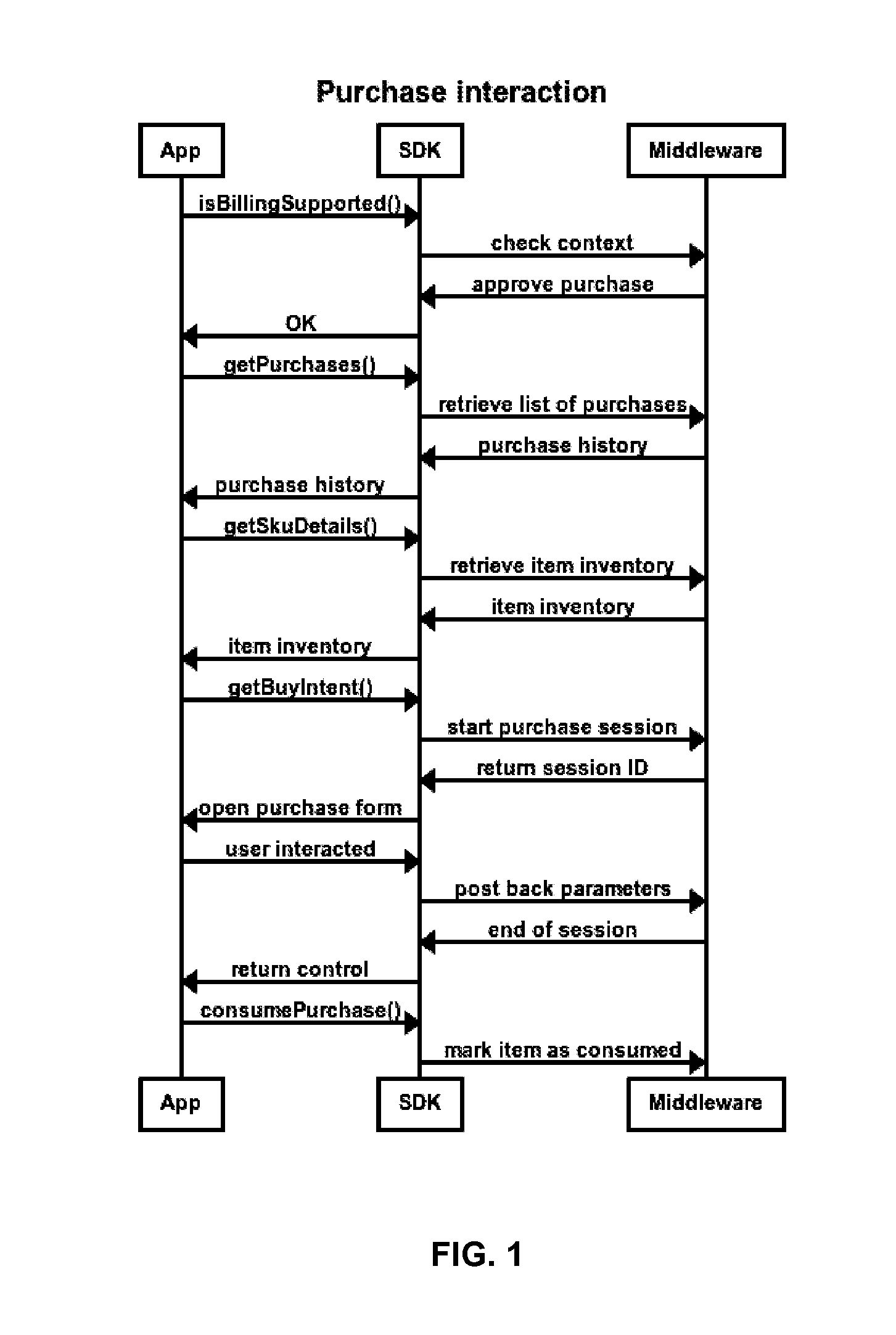

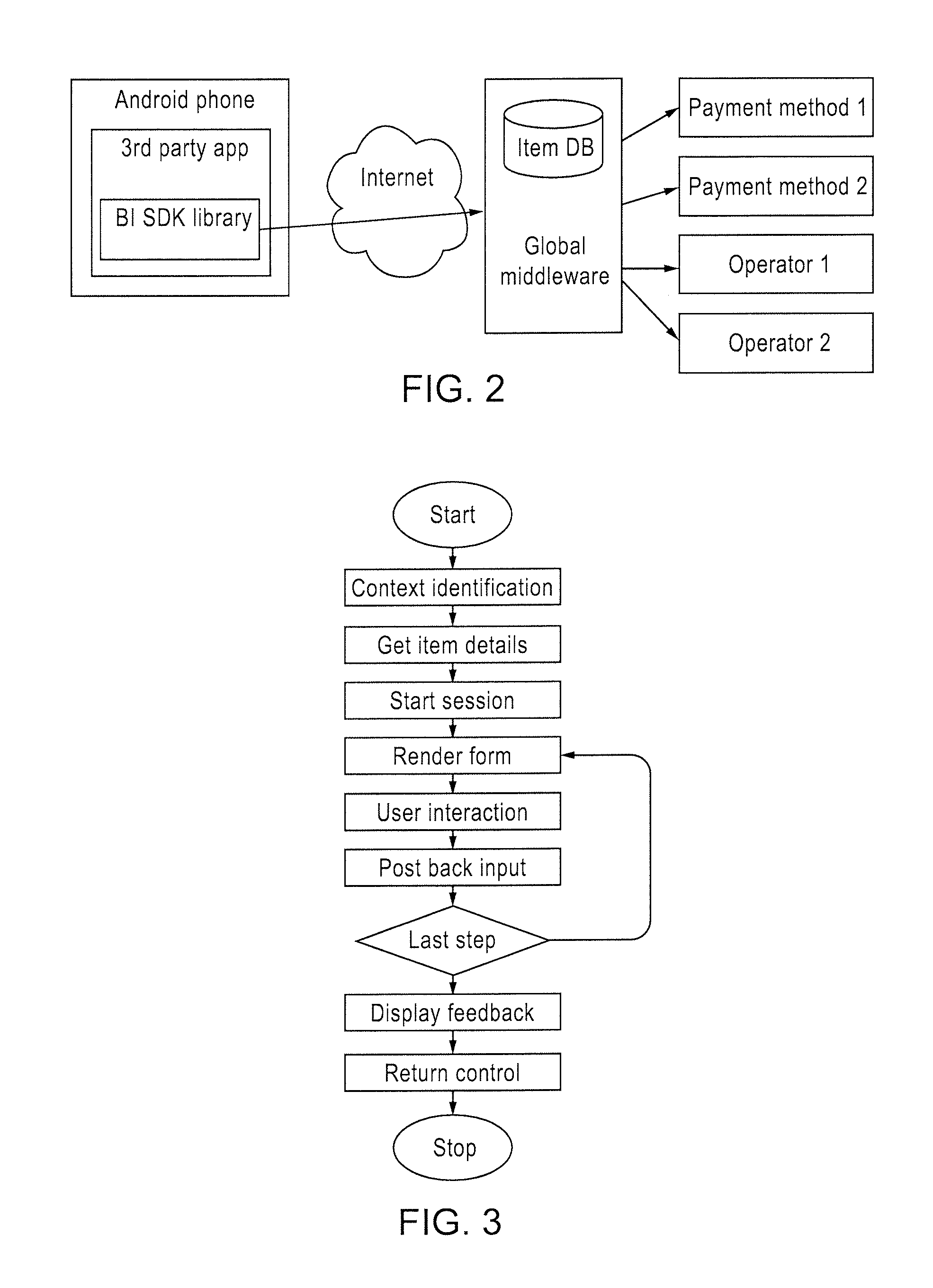

Method and system for implementing in-app software development kits

ActiveUS20150186123A1Minimal effortSimple processLink editingSoftware designApplication programming interfaceAlternative payments

The invention refers to technical methods and systems to easily provide existing software applications, for example Android applications built for In-App Billing with Google Play application programming interface (“API”), with compatibility with other alternative payment platforms, preferably direct carrier billing, with no additional development effort.

Owner:BUONGIORNO

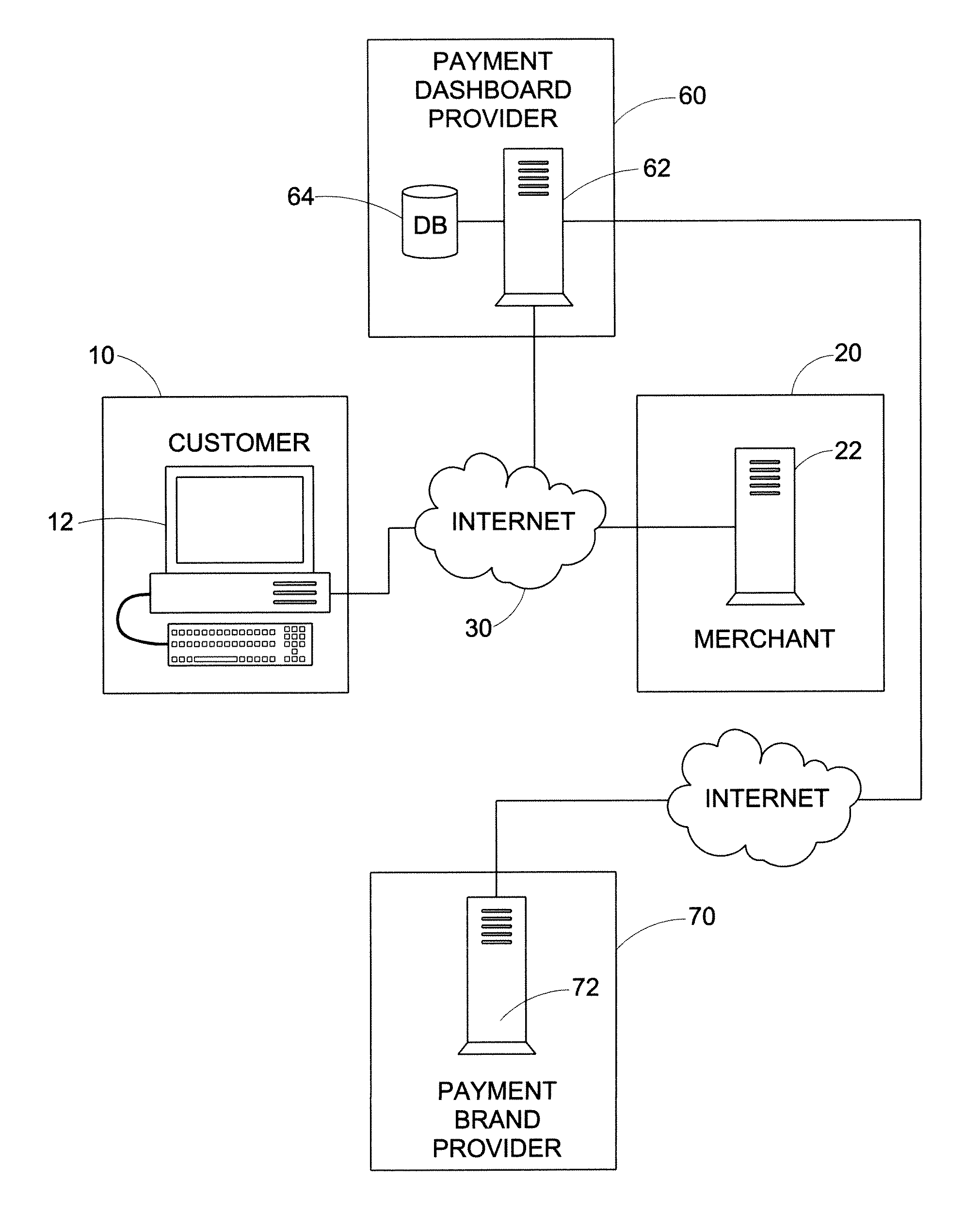

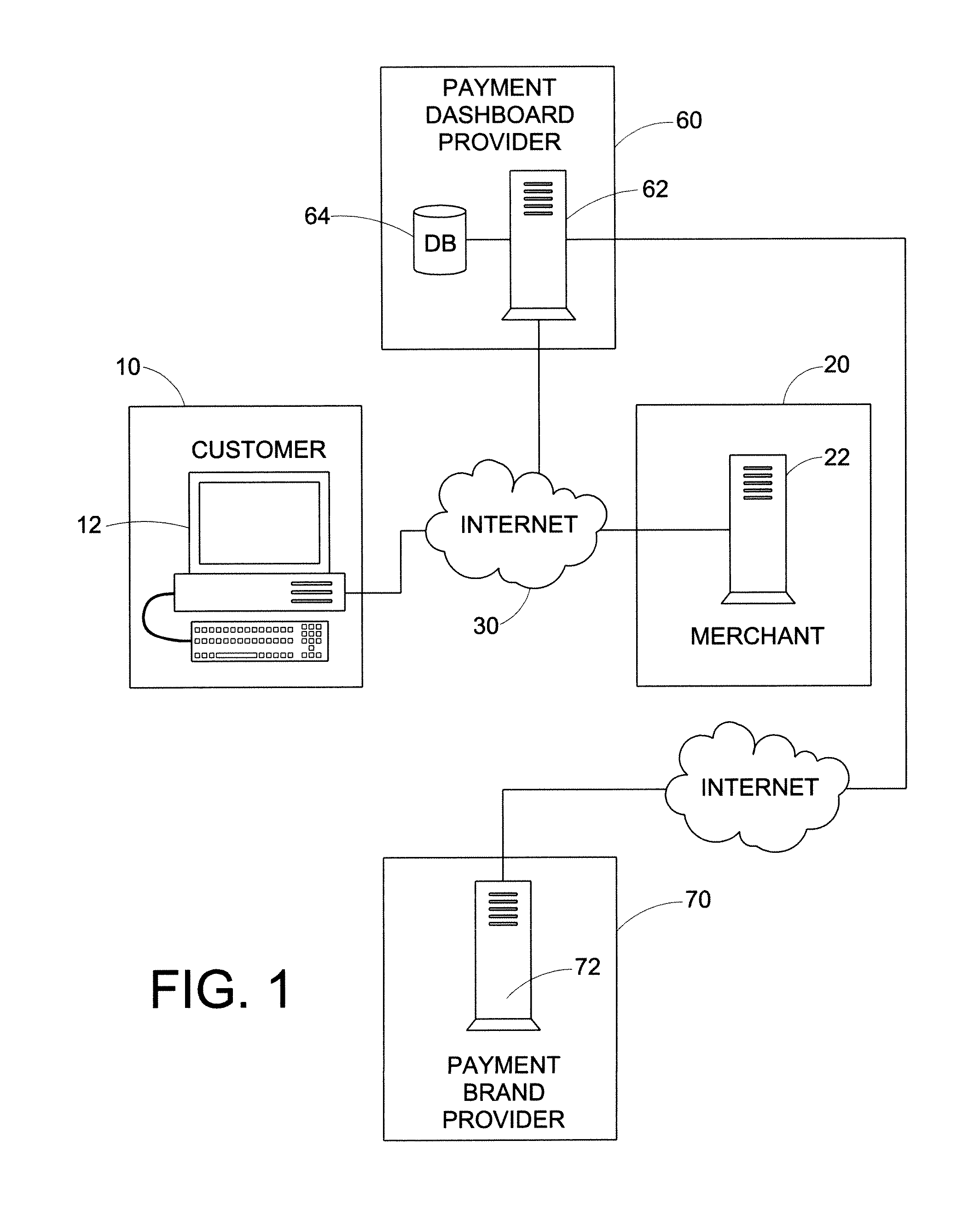

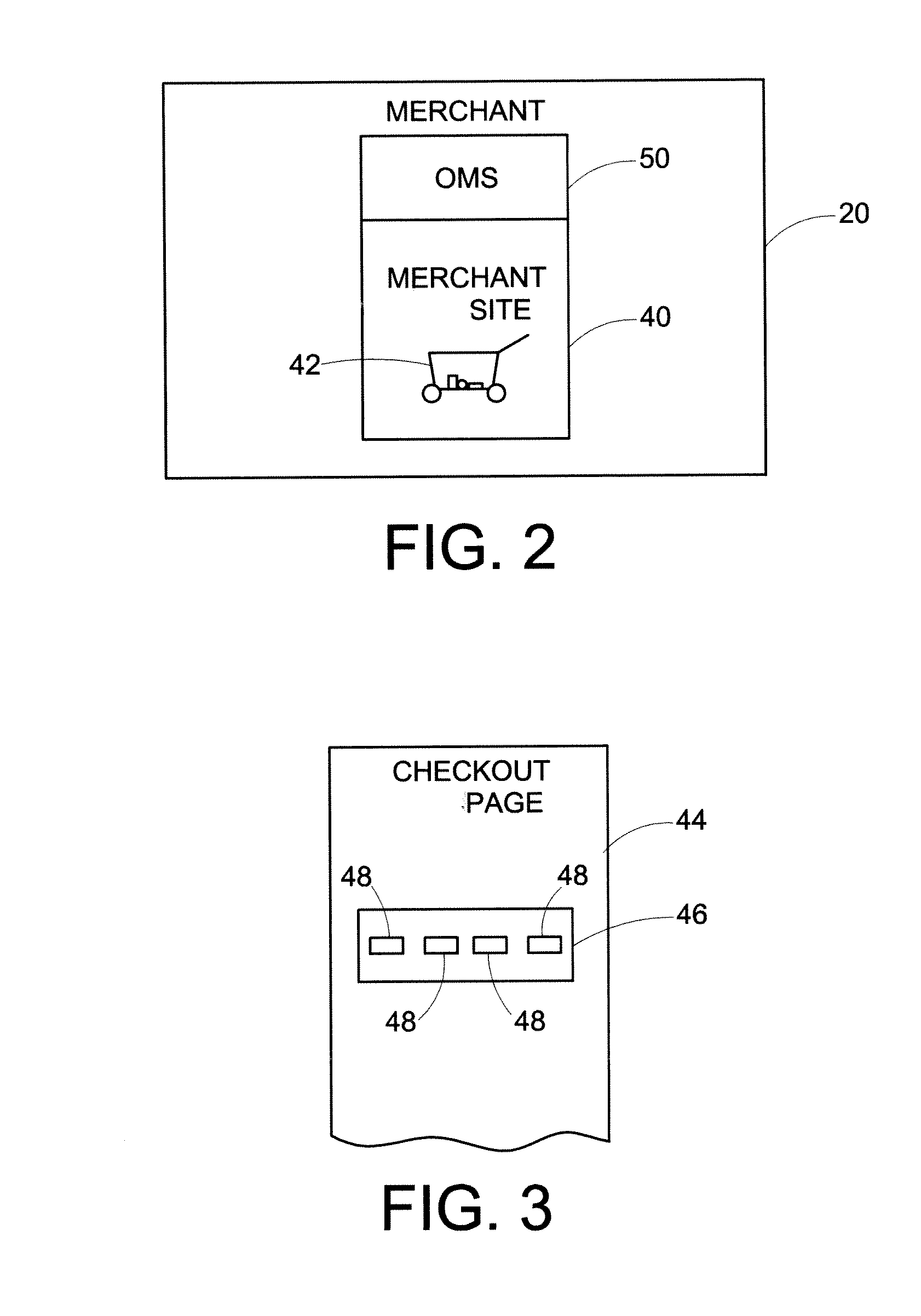

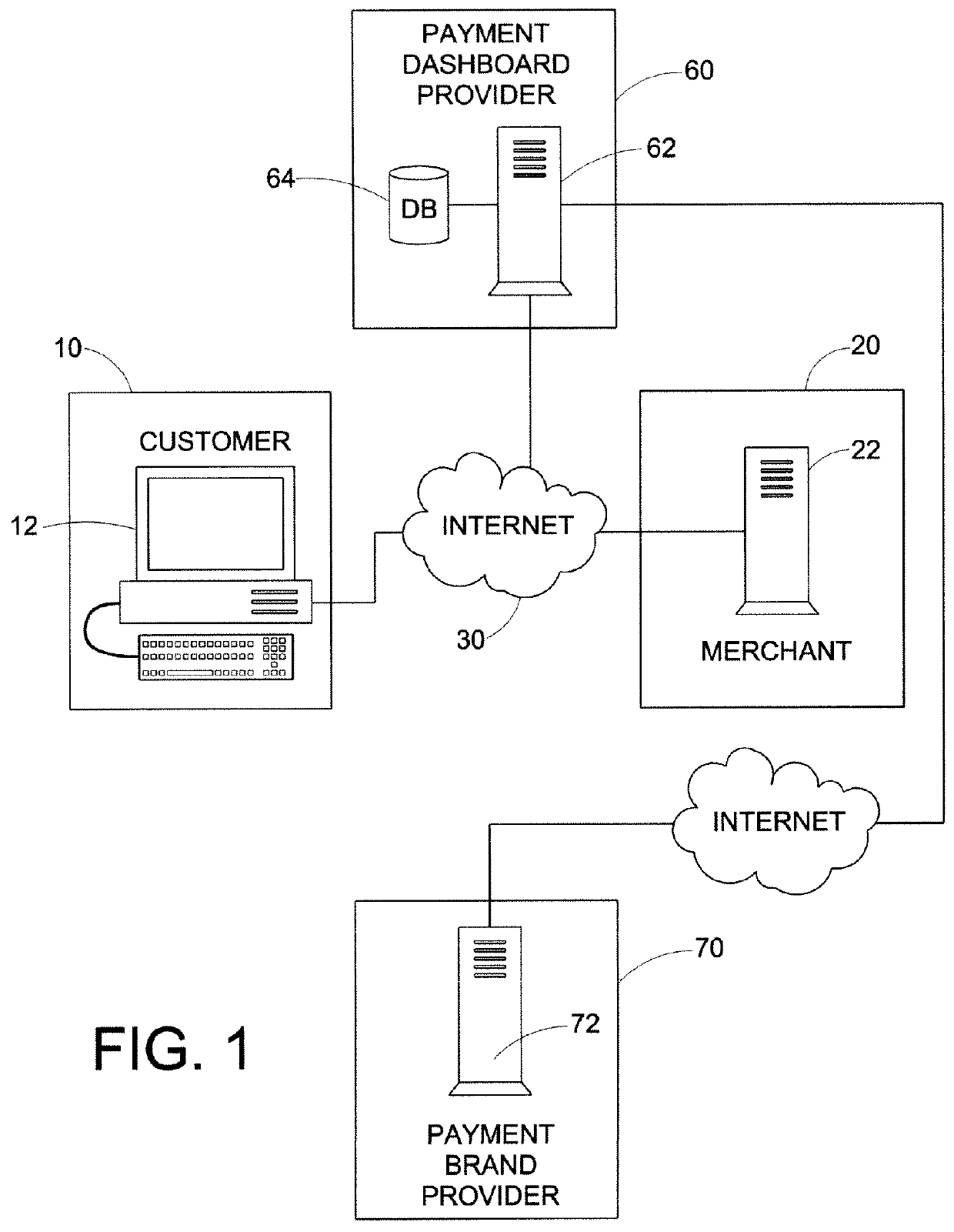

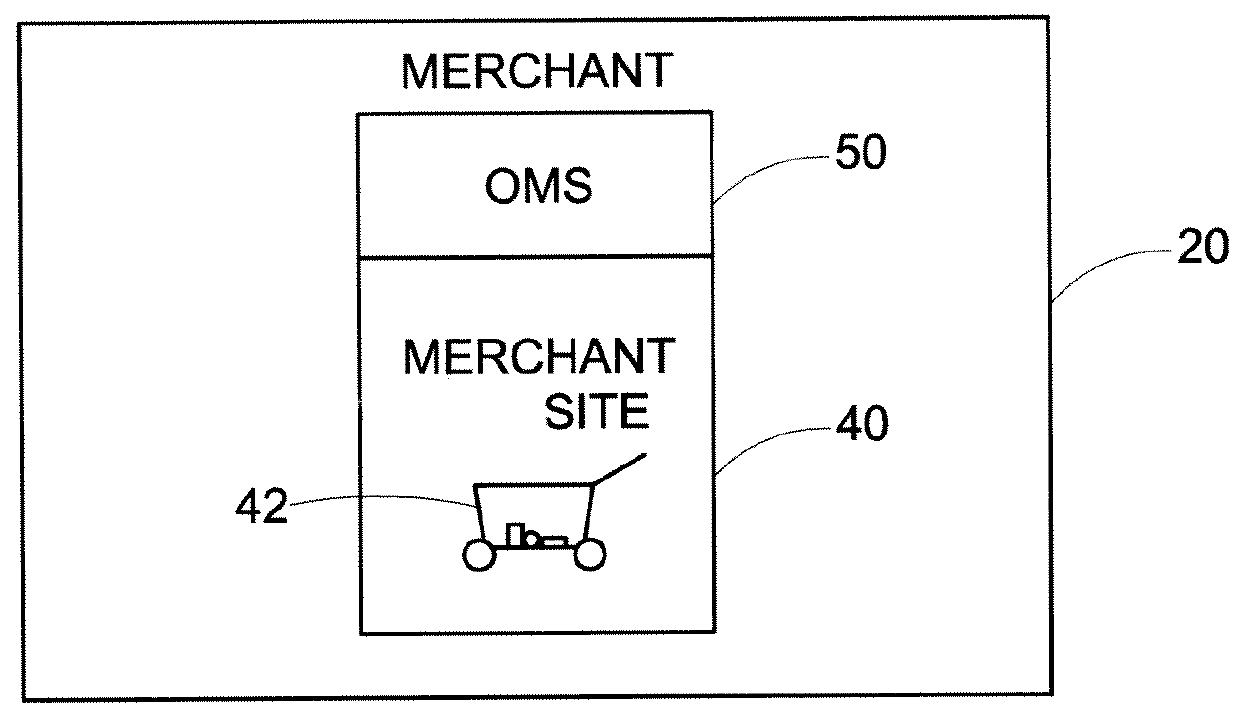

Universal payments dashboard

A universal payments dashboard system provides eCommerce merchants with an easy to integrate web page (inline frame) that displays all alternative payment button options that consumers can use on the merchant website(s) to pay for the purchase. Such merchants can display the dashboard on their shopping cart page(s) and on their checkout page(s) at the point where users select the payment option. The dashboard communicates with a payment dashboard provider to complete the payment for the transaction, including any consumer interaction such as entering checking account information, personal details, etc. Upon completing the payment for the order, the dashboard provides the merchant with the completed order information (e.g., a prepaid order) along with all the payment information. The dashboard supports all alternative payment options, payment transaction notifications to enable single cash register functionality and work in conjunction with alternative payment initiatives.

Owner:CARDINALCOMMERCE CORP

Alternative payment implementation for electronic retailers

A method of processing a transaction between a merchant and a buyer over a communication network is provided. The transaction is processed using one of a plurality of alternative payment options and each of the alternative payment options are provided by one of a plurality of alternative payment providers. Each of the alternative payment providers uses a different alternative payment implementation. The method includes: obtaining transaction information from the merchant; returning a redirection URL and an order identifier to the merchant; obtaining a transaction message from the merchant, where the transaction message specifies the type of operation; performing the operation type specified in the transaction message with the appropriate alternative payment provider; and returning a processing message to the merchant containing the results from performing the operation type specified in the transaction message.

Owner:CARDINALCOMMERCE CORP

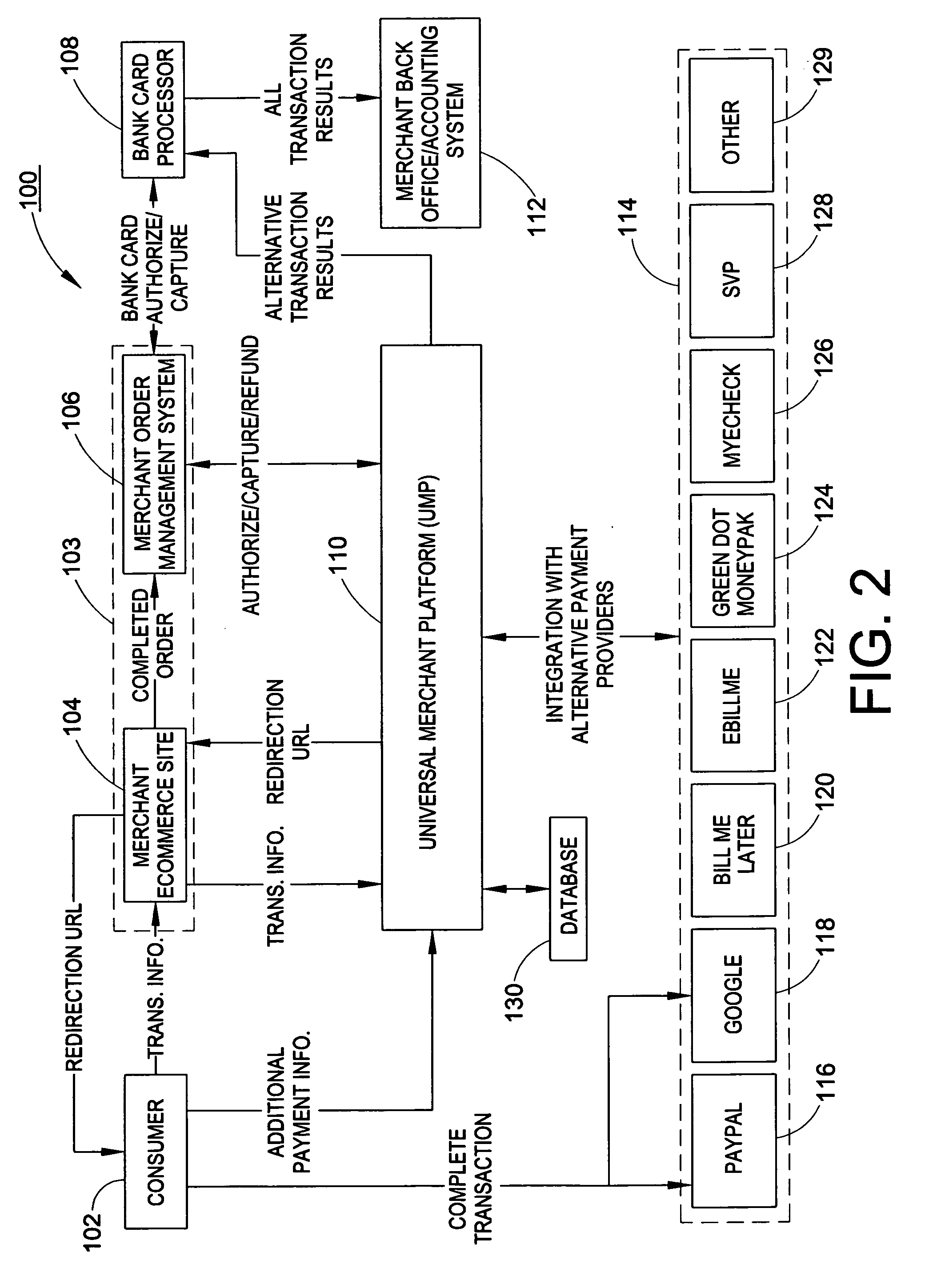

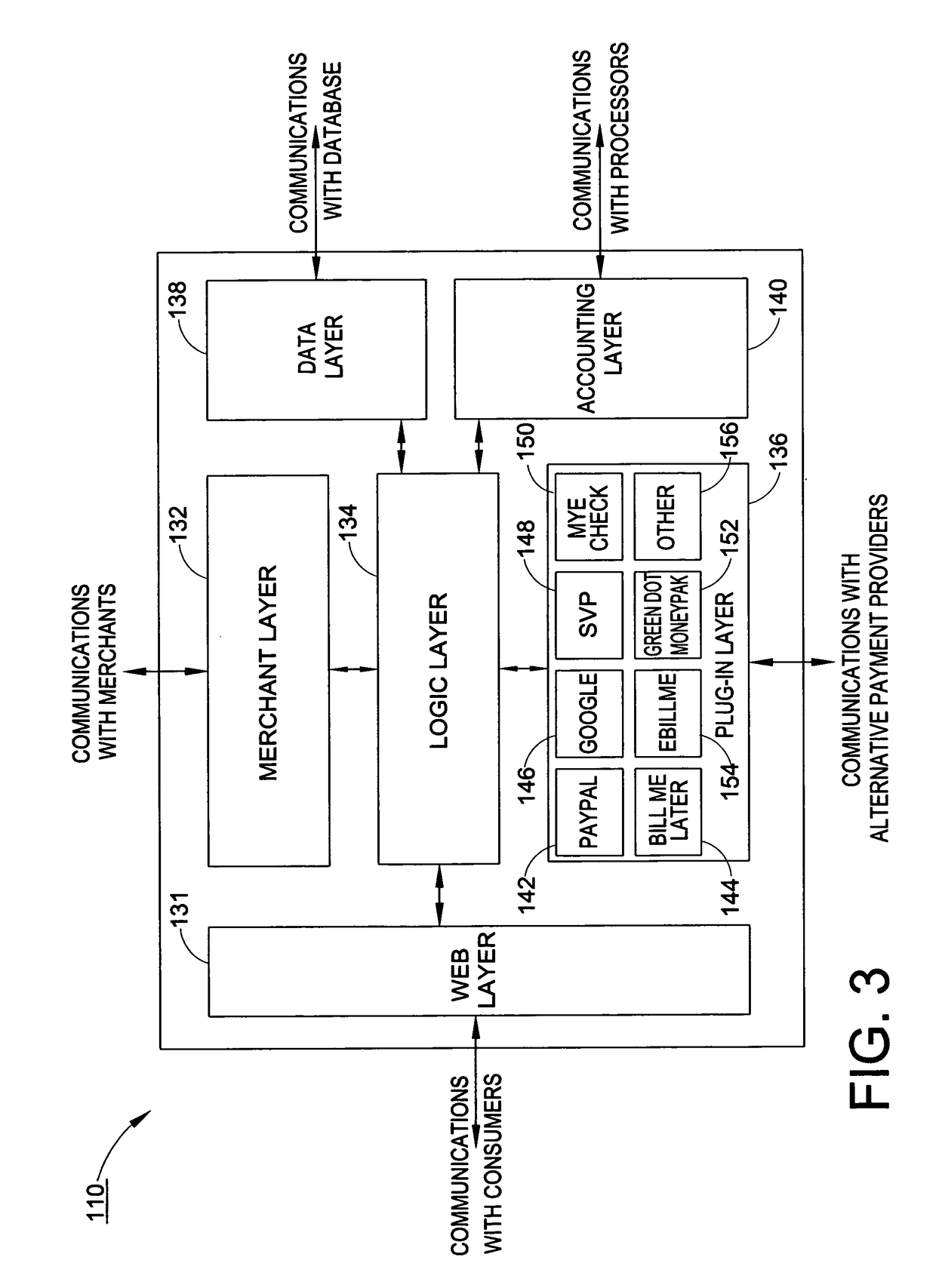

Alternative payment implementation for electronic retailers

A system and method process a transaction between a merchant and a consumer at a point of sale (POS). Transaction information for the transaction is received from the consumer at the POS. The transaction information identifies an alternative payment option of an alternative payment provider to use for the transaction. A universal merchant platform (UMP) is requested to approve the transaction with the alternative payment provider of the identified alternative payment option. The request includes the received transaction information and is provided to the UMP according to a unified payment implementation. In response to approval of the transaction, an order identifier is received from the UMP. The order identifier uniquely identifies the transaction. The UMP is requested to authorize and / or capture funds for the transaction using a payment implementation specific to the alternative payment provider of the identified alternative payment option.

Owner:EAGLE HARBOR HLDG +1

Universal payments dashboard

A universal payments dashboard system provides eCommerce merchants with an easy to integrate web page (inline frame) that displays all alternative payment button options that consumers can use on the merchant website(s) to pay for the purchase. Such merchants can display the dashboard on their shopping cart page(s) and on their checkout page(s) at the point where users select the payment option. The dashboard communicates with a payment dashboard provider to complete the payment for the transaction, including any consumer interaction such as entering checking account information, personal details, etc. Upon completing the payment for the order, the dashboard provides the merchant with the completed order information (e.g., a prepaid order) along with all the payment information. The dashboard supports all alternative payment options, payment transaction notifications to enable single cash register functionality and work in conjunction with alternative payment initiatives.

Owner:CARDINALCOMMERCE CORP

Engine, system and method of providing business valuation and database services using alternative payment arrangements

InactiveUS20120310686A1Easy to useImprove effectivelyFinanceResourcesGraphicsGraphical user interface

A computer-implemented engine, system and method for generating business valuations, scoring, and / or flagging over a network, responsively to information input by a user remote from the engine, system and method. The invention may include a graphical user interface capable of locally querying a user to input the company information, at least one network port capable of remotely receiving the company information from the graphical user interface, and at least one engine communicatively connected to the at least one network port, which engine preferably includes a plurality of rules to generate, responsively to the input company information, at least one of a business valuation, a business score, and / or one or more business flags to be used as indicators in a network marketplace, for the company associated with the inputted company information.

Owner:BIZEQUITY

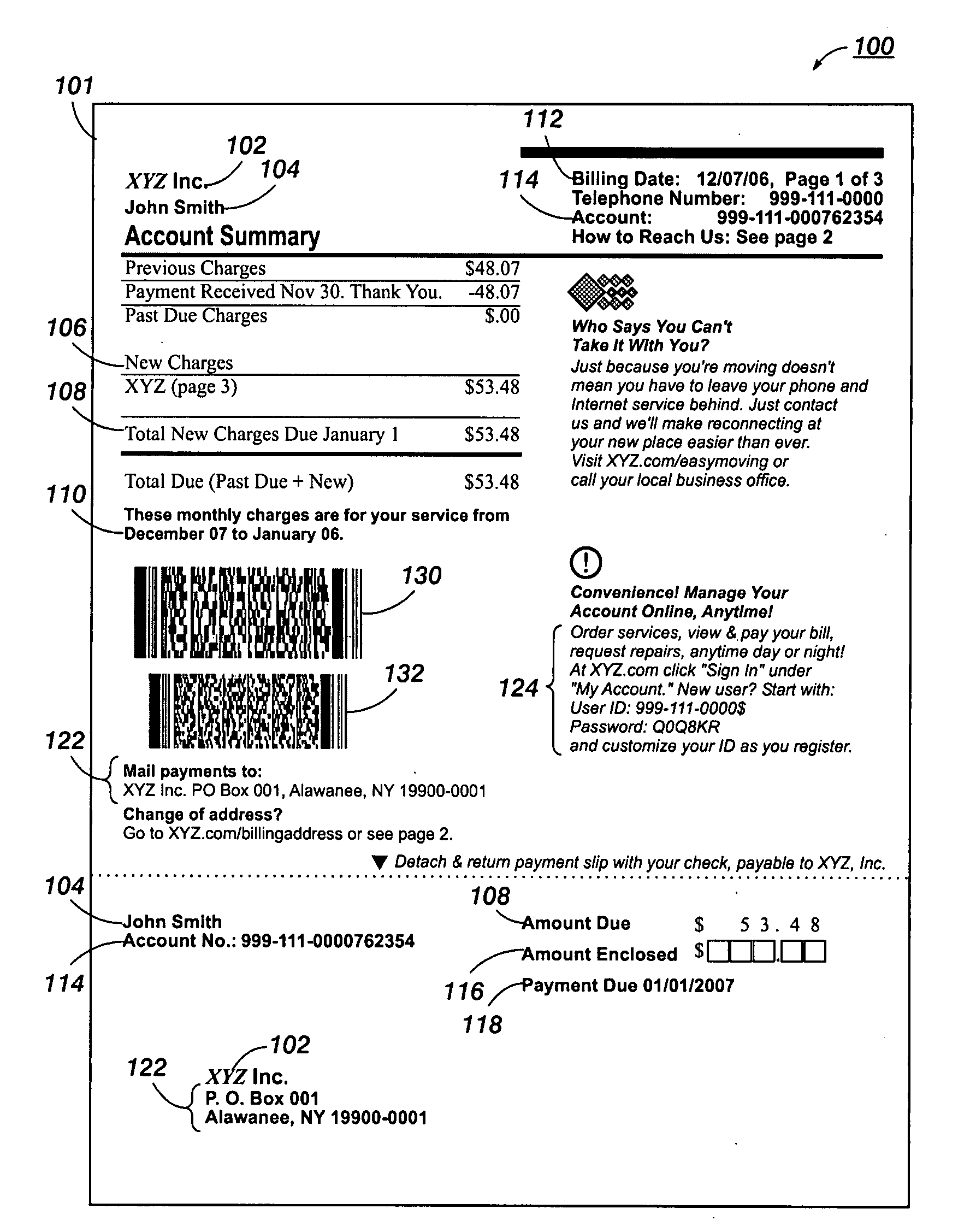

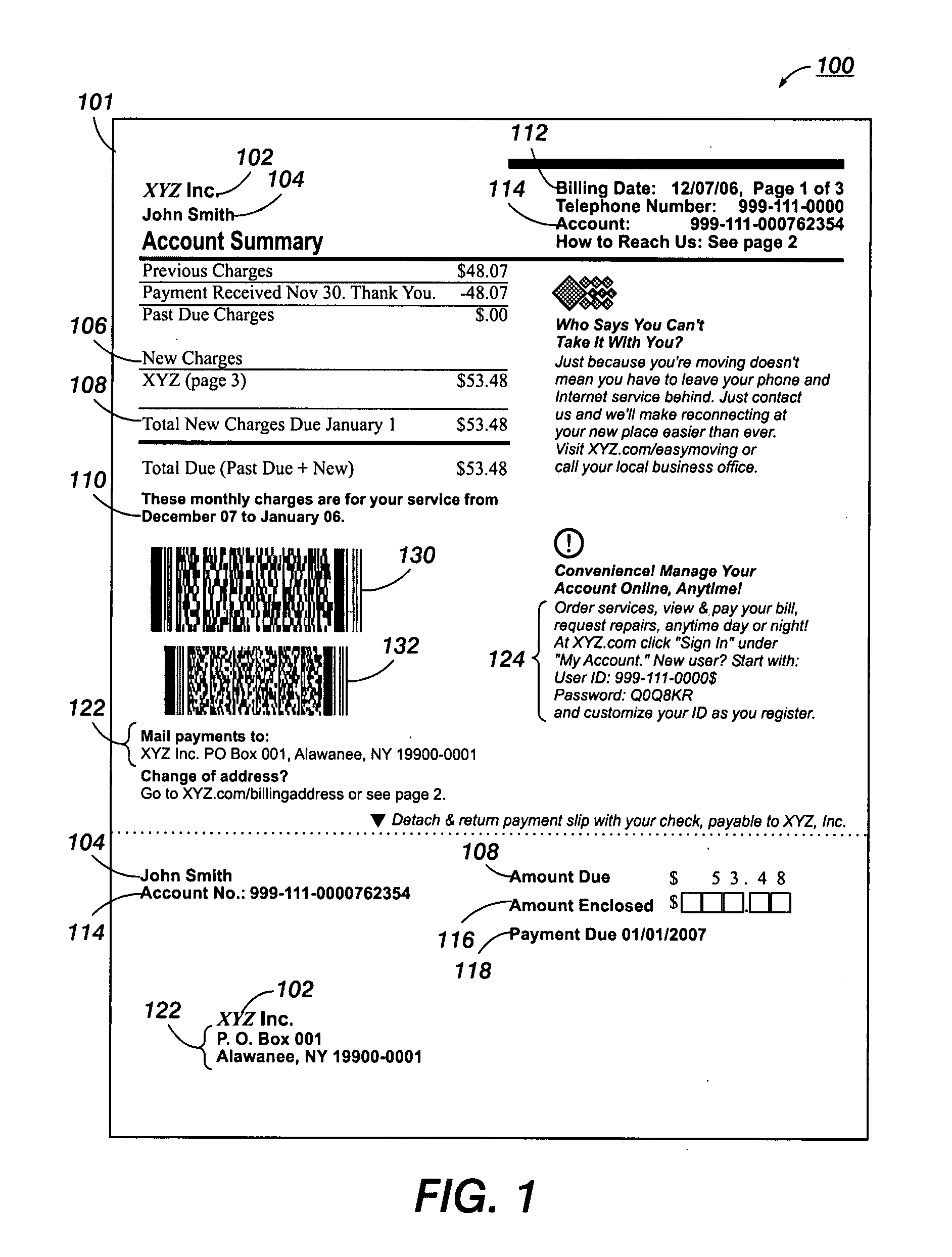

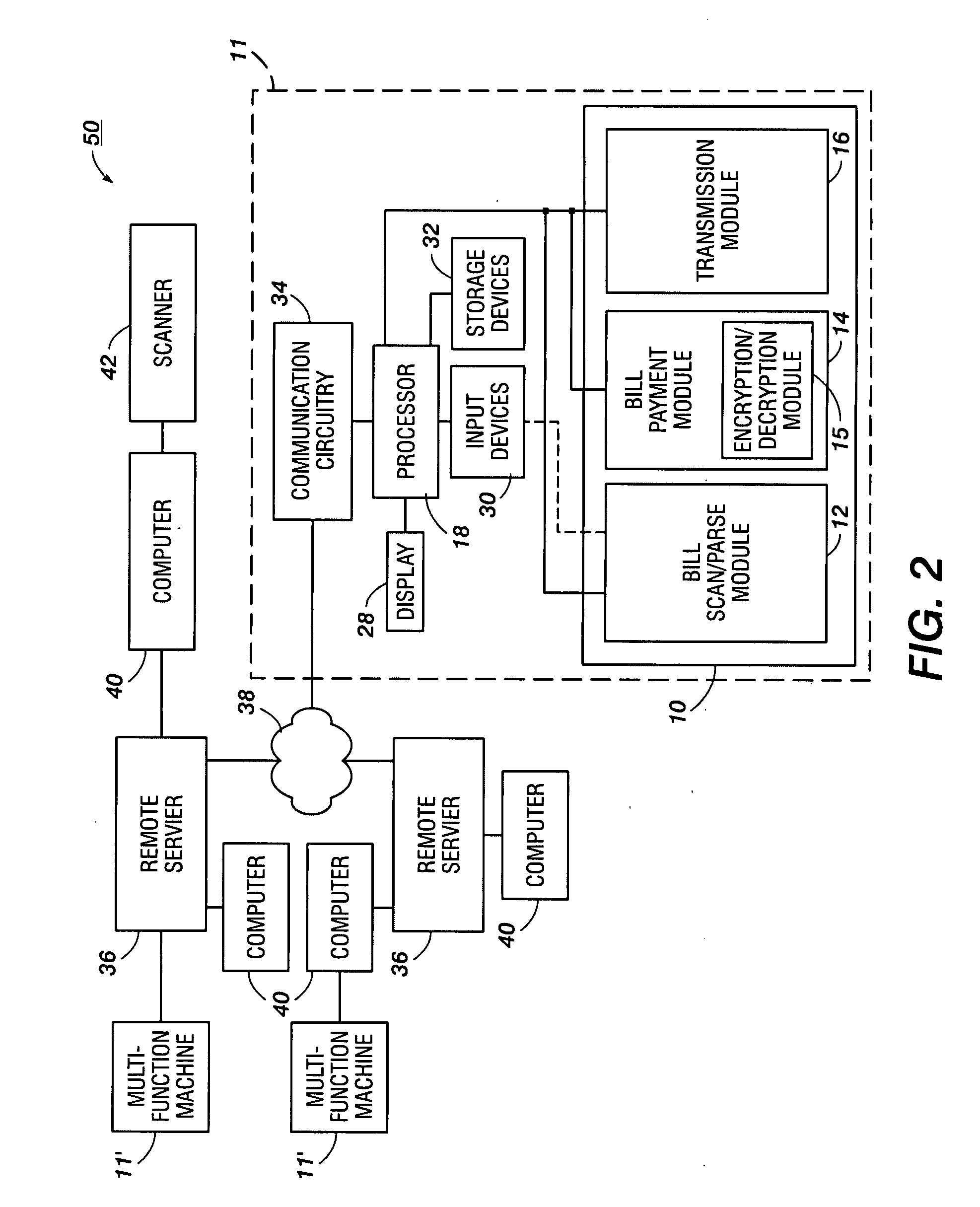

Optical character reading machine having bill payment capability

An optical character reading machine includes at least one processor and a bill payment system. The bill payment system includes a bill scanning and bill information parsing module for: scanning a bill to obtain bill paying information; parsing the bill paying information; and verifying the bill paying information, and a bill payment module effecting a payment to a payee identified from the bill paying information. Verification is for completeness and accuracy. If the bill paying information is not complete or accurate, the user is prompted to make corrections. Either a pre-established payment method or an alternative payment method may be used to effect payment of the bill. The bill may include first and second data encoded marking codes encoding fixed and variable billing information for the bill scanning and parsing module to read and decode for effecting payment of the bill.

Owner:XEROX CORP

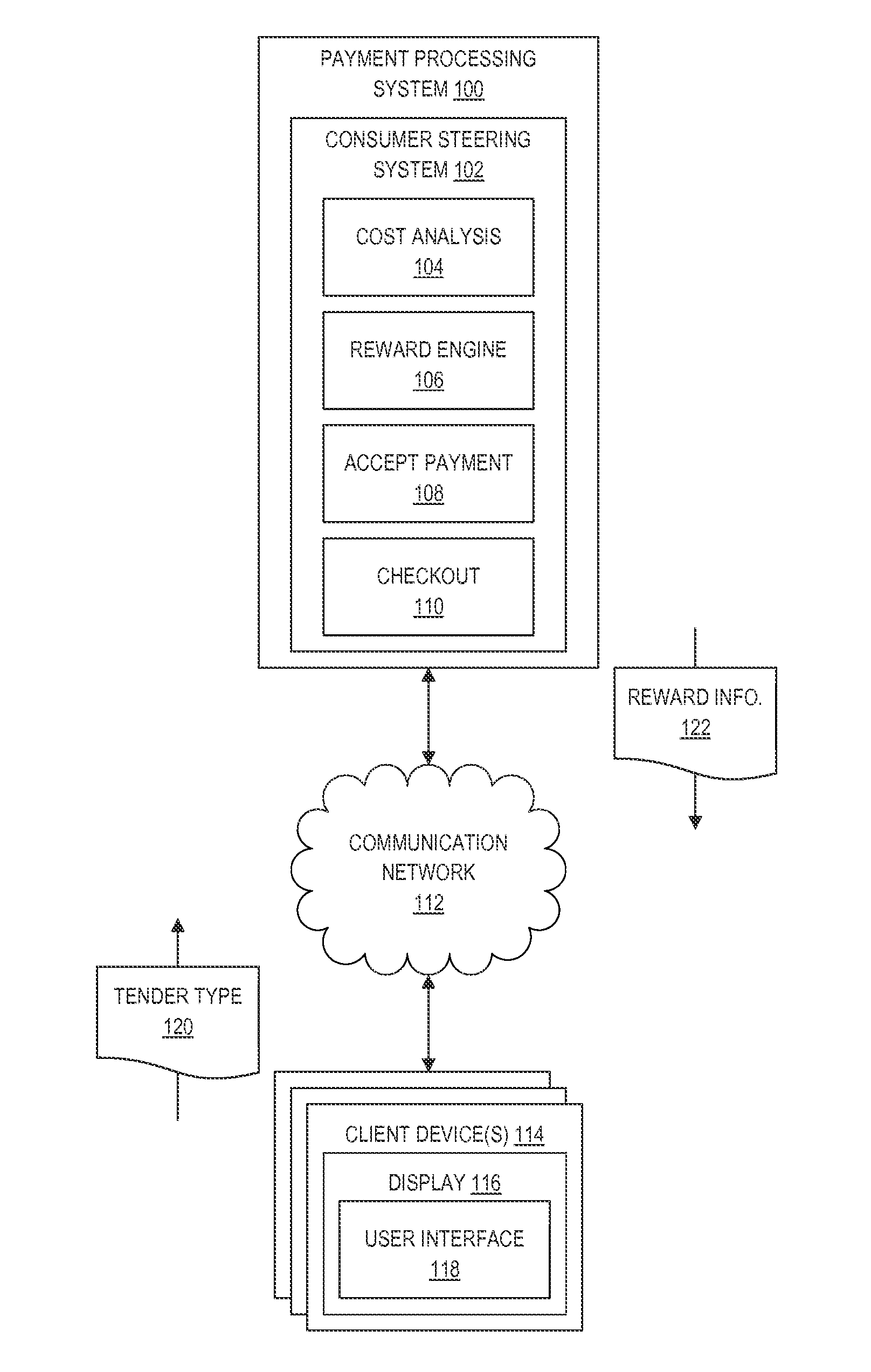

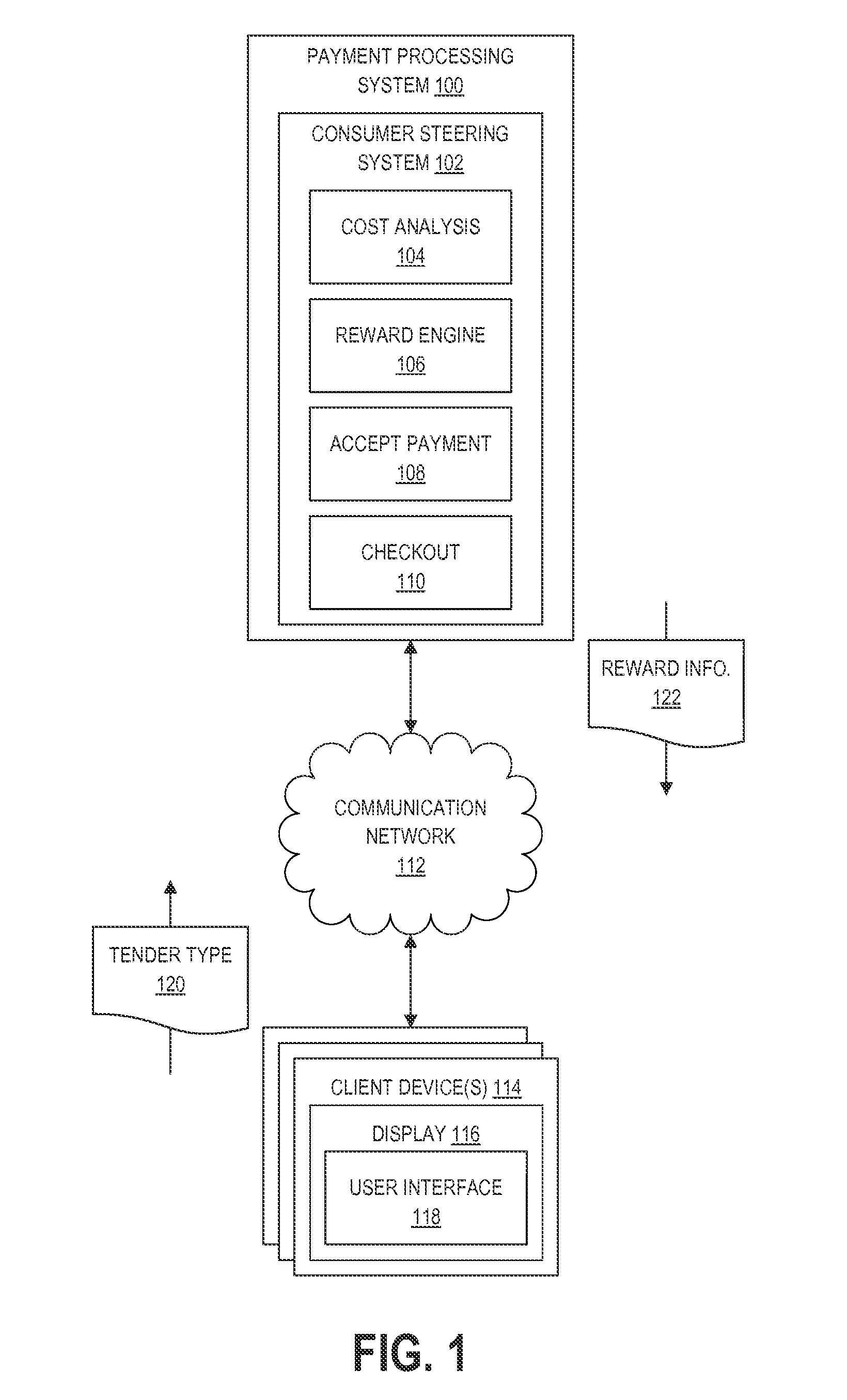

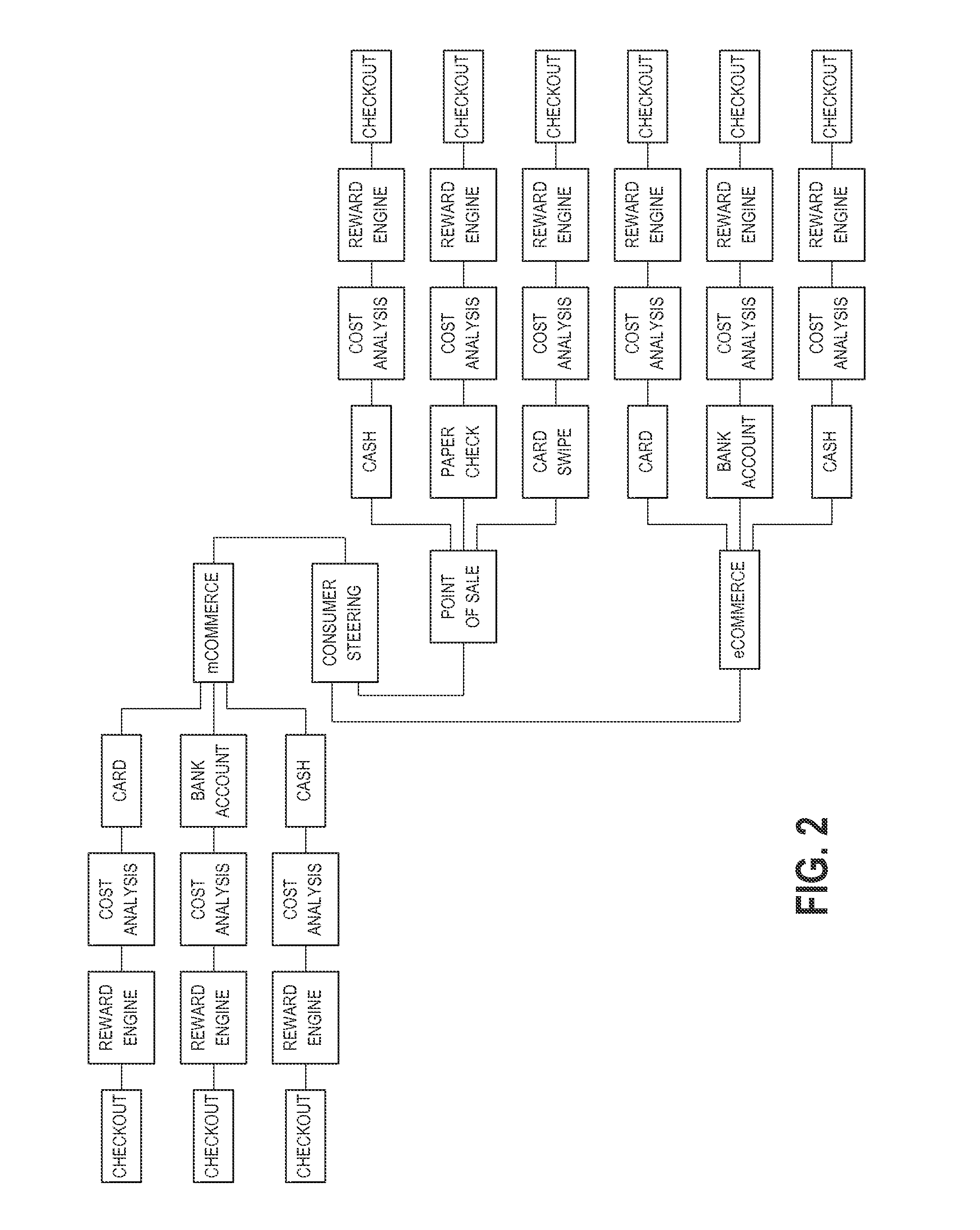

Systems and methods for consumer steering based on real-time transaction cost information

A computing device for consumer steering during a commercial transaction comprises a communication element, a memory element, and a processing element. The communication element communicates with a client computing device. The memory element stores a plurality of software components. The processing element executes software components including a cost analysis component for receiving original payment type information from a consumer and computing a cost score associated with the original payment type, a reward engine for determining a reward associated with an alternative payment type, an accept payment component for receiving information indicating either the original payment type or the alternative payment type, and a checkout component for transferring a receipt to the consumer and visually presenting the lost reward to the consumer if the original payment type was received or transferring the reward to the consumer if the alternative payment type was received.

Owner:ACI WORLDWIDE

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com