Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

41 results about "Investment analysis" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Investment analysis and reporting system and method

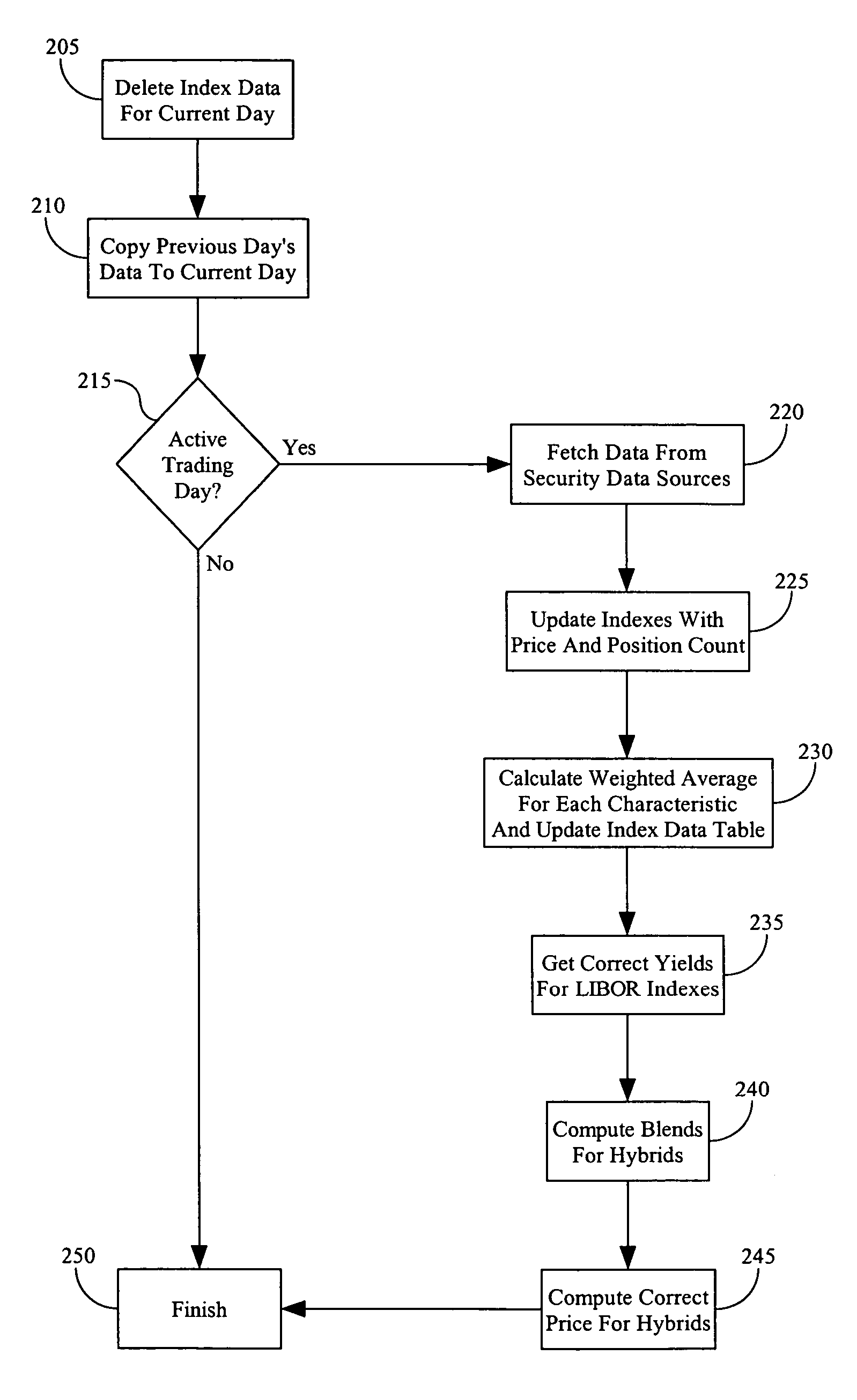

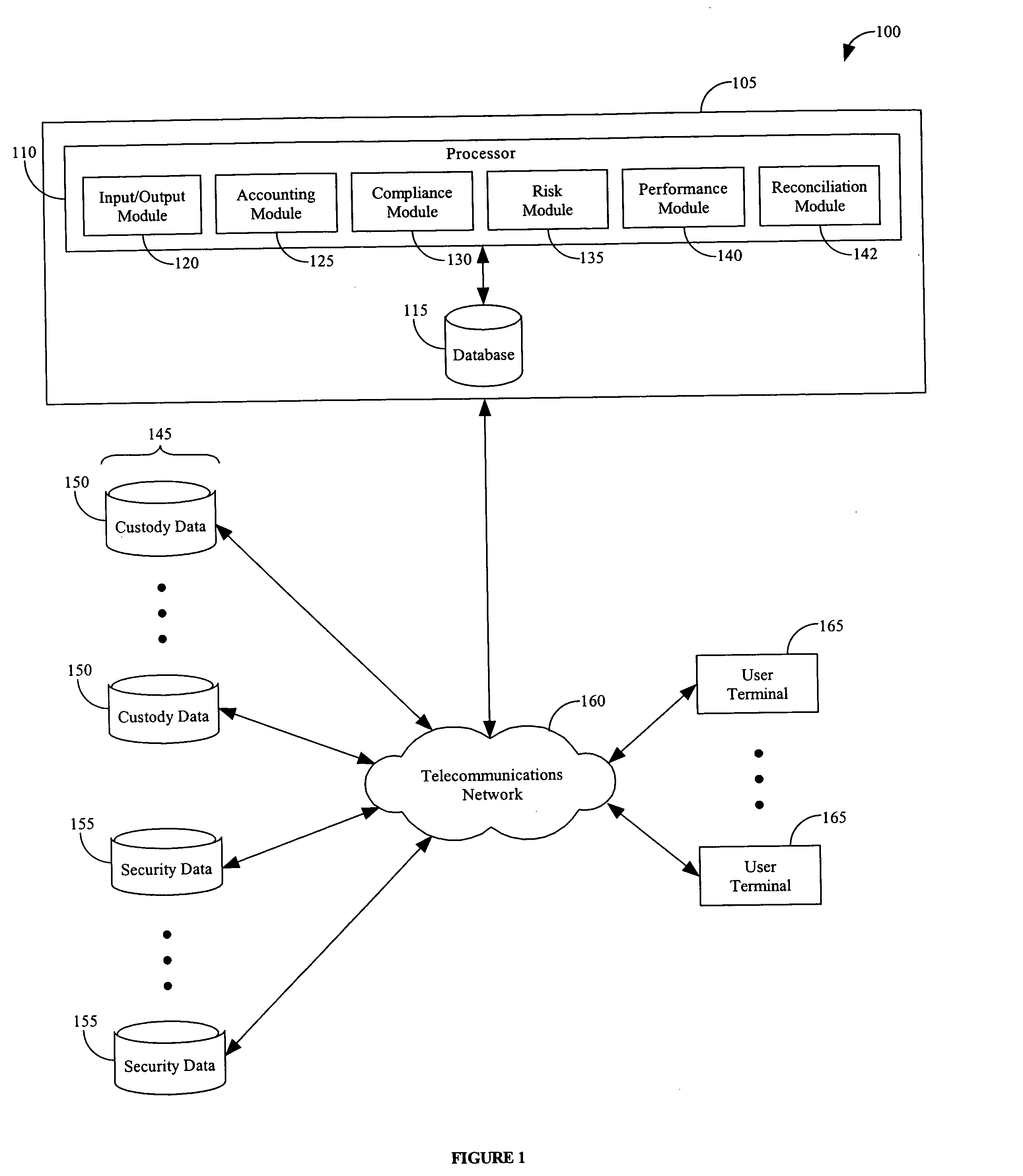

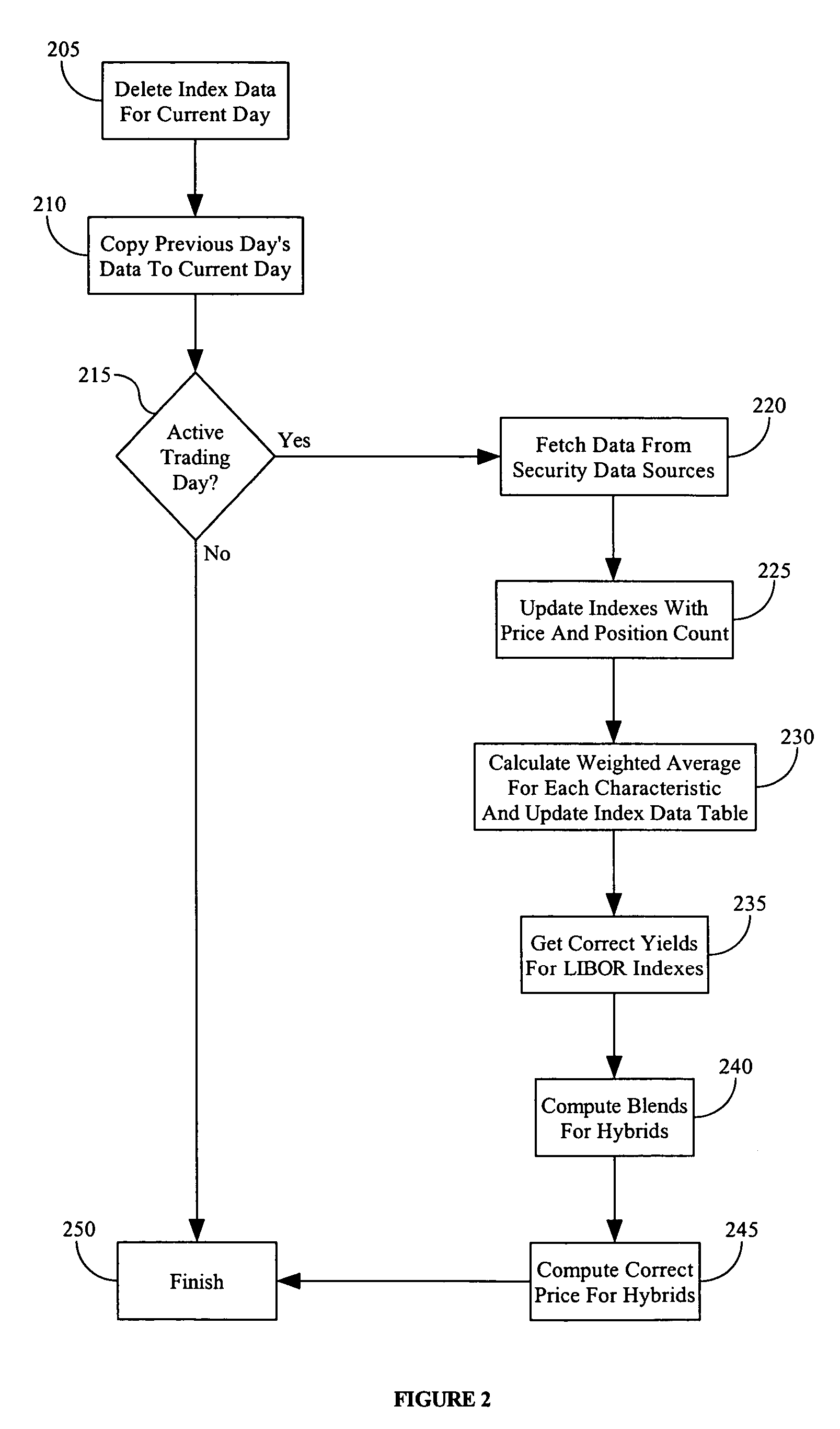

A method and system for analyzing and reporting institutional investments provides a single platform for daily investment accounting, compliance, performance, and risk reports for investment portfolios held at single or multiple custody / safekeeping locations. The method involves retrieving transaction data from multiple independent financial institutions and storing it in a database in a standardized format and retrieving security data from one or more security information service providers and storing it in the database. The method further involves applying a uniform set of customized accounting, compliance, risk and performance parameters to the transaction data and security data stored in the database and, in response to a user request, calculating and reporting selected data to the user in accordance with the uniform accounting, compliance, risk and performance parameters.

Owner:CLEARWATER ANALYTICS

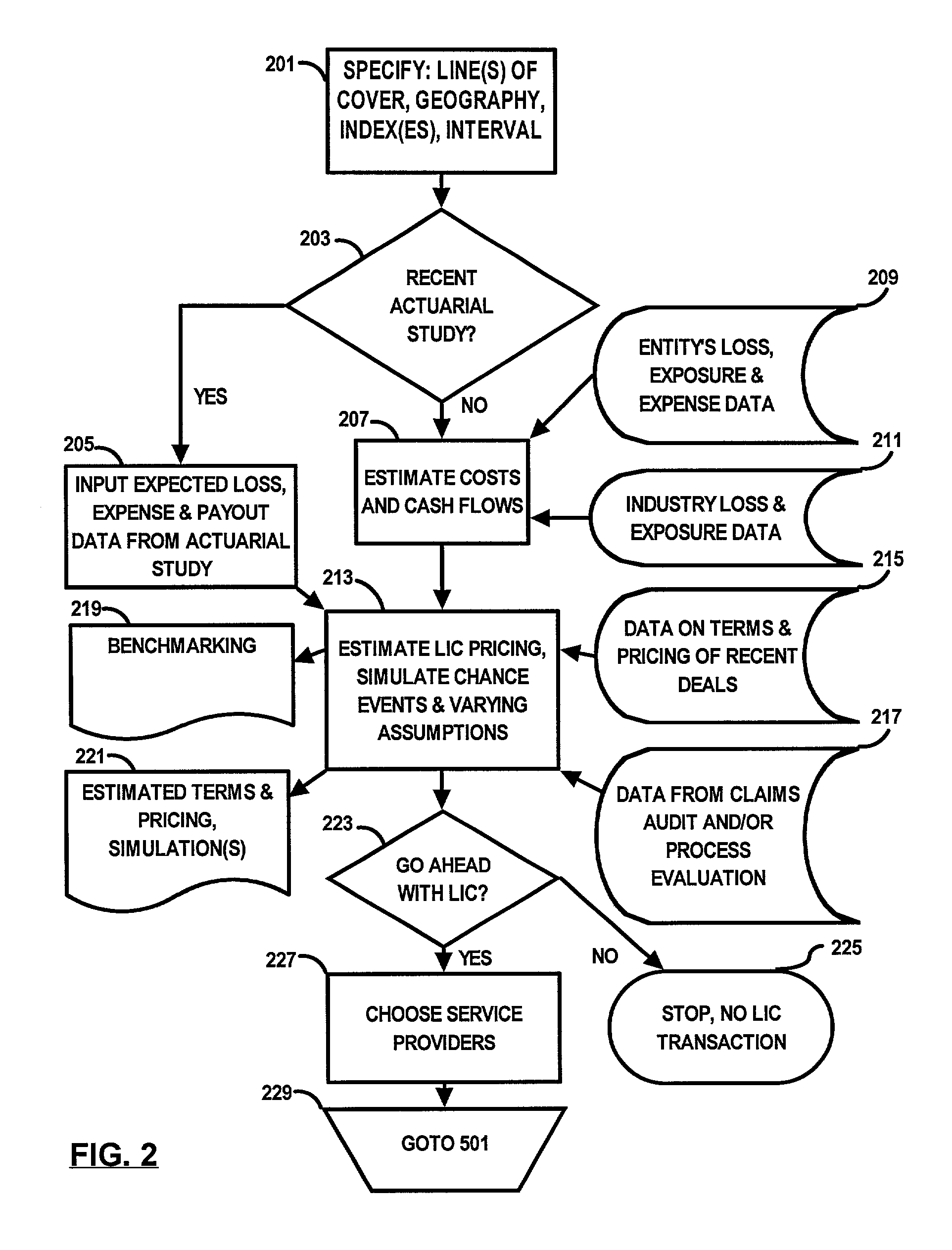

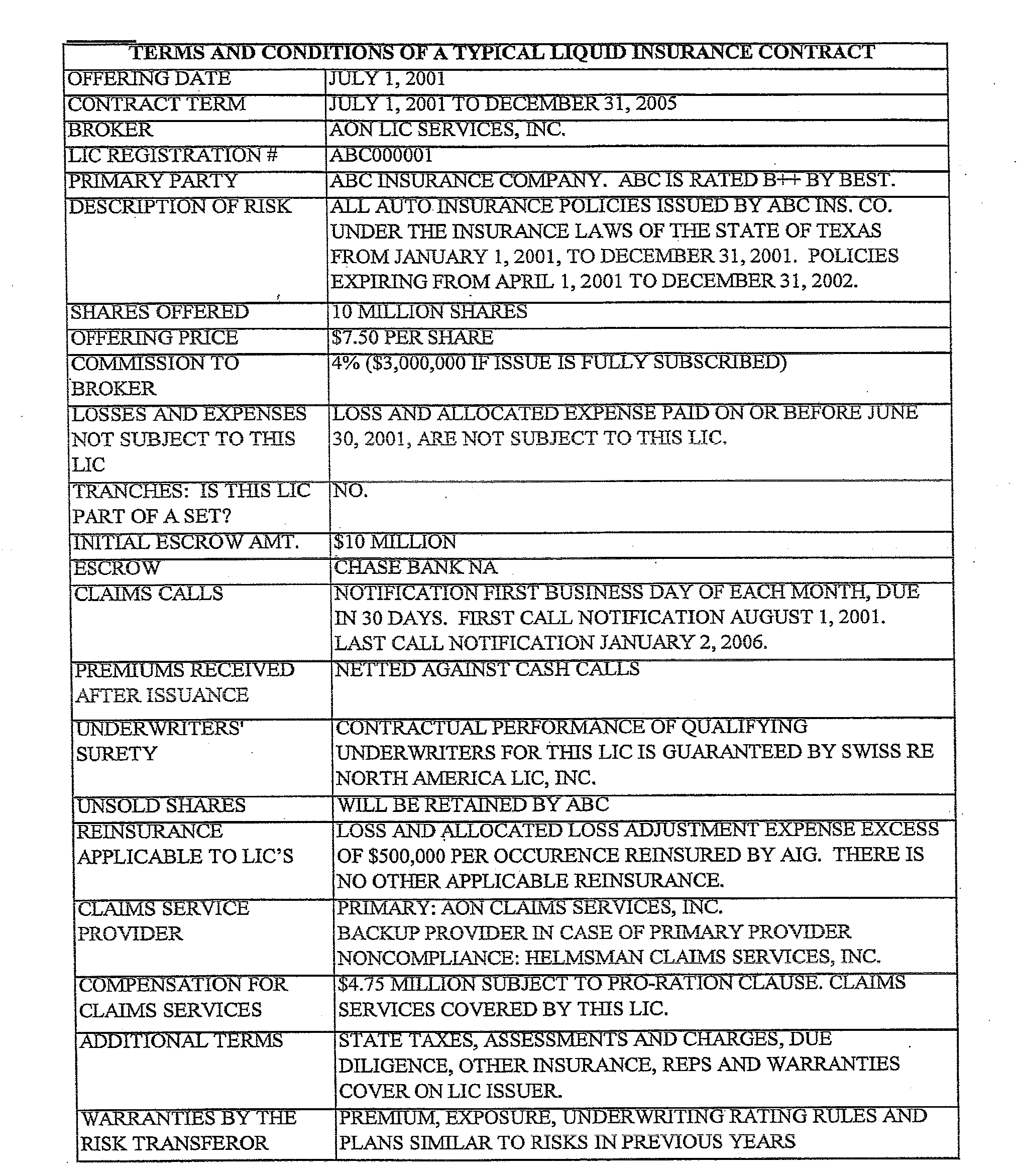

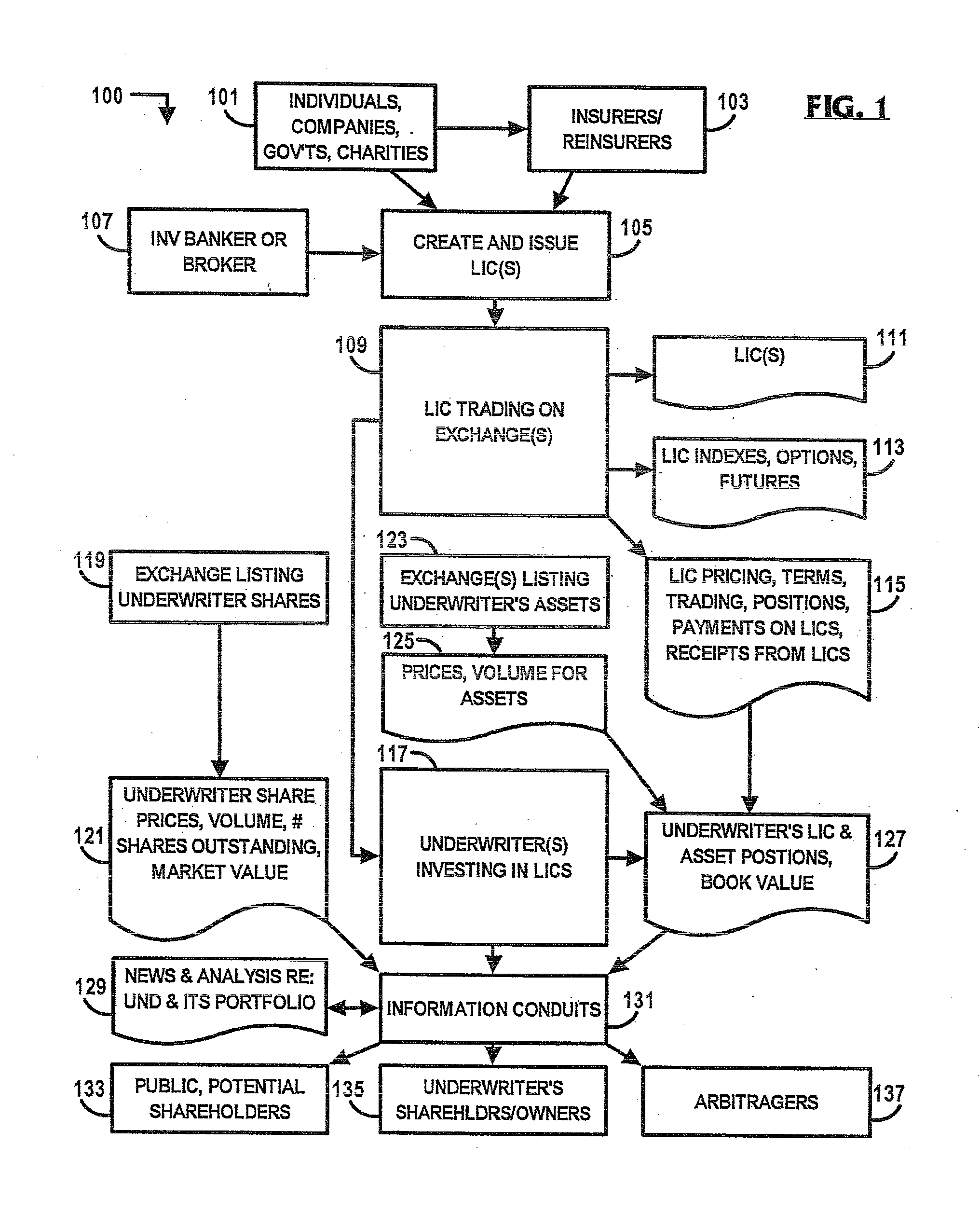

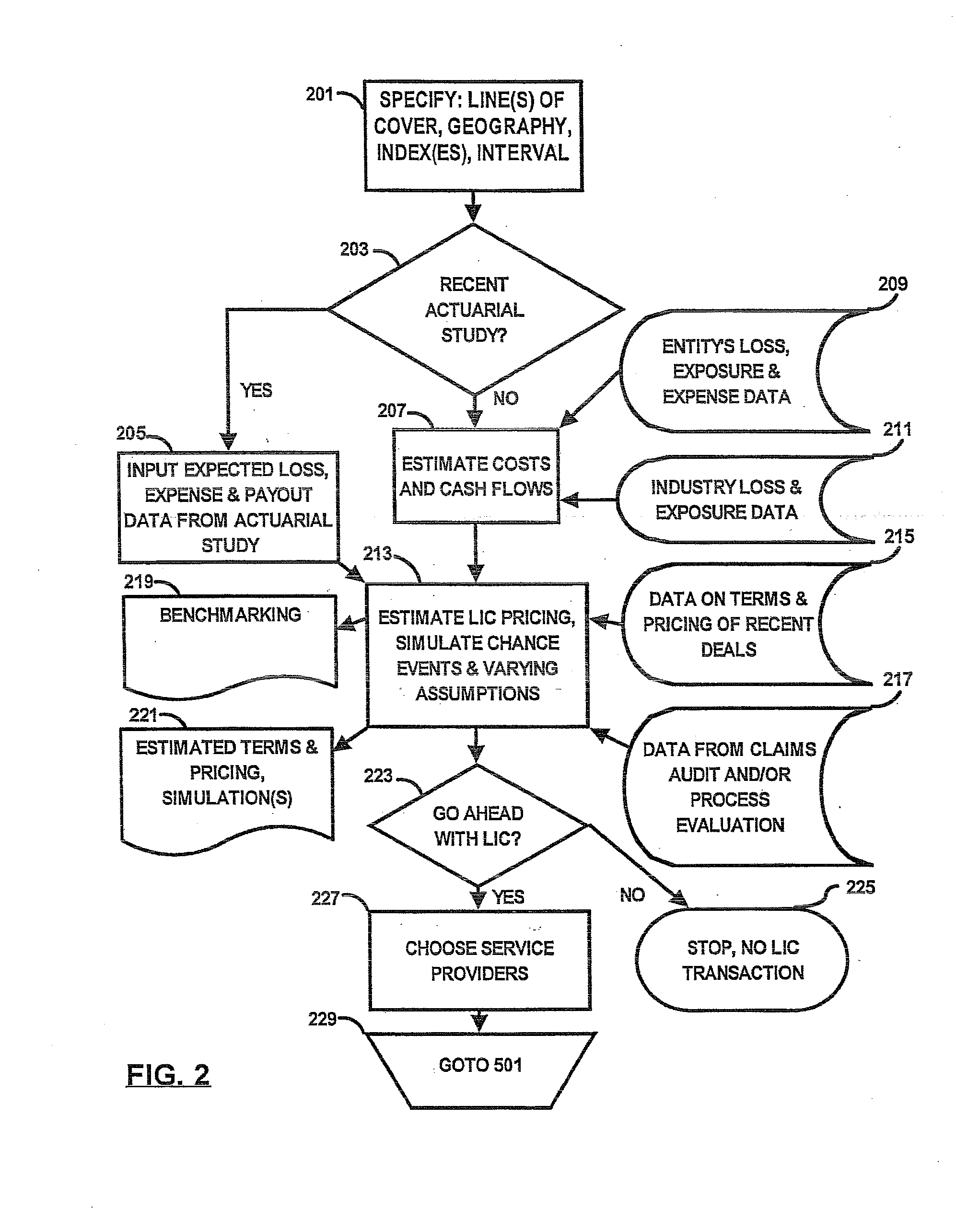

Liquid insurance contracts

A liquid insurance contract (LIC) comprises a security which is traded or tradable and which has cash flows to the issuer based upon a liability whose exact value is unknown at the time of issuance. A method for creating and trading these LICs, as well as other financial products derived from LICs, may include any of the following steps: writing at least one LIC; preparing regulatory filings for at least two LICs; issuing the two LICs; preparing regulatory filings for a financial product which includes at least one detachable LIC provision; issuing the financial product; creating at least one underwriter as a closed end fund owned by a parent company; placing ownership of at least a portion of an issue of the financial product in an underwriter owned by a parent company; spinning off the underwriter from the parent company using at least one stock dividend; trading shares of the underwriter; reporting information on trades and positions of the underwriter; and valuing the underwriter using analytic modeling, sensitivity testing, portfolio analysis, and / or investment analysis.

Owner:EXTRAORDINARY RE HLDG INC

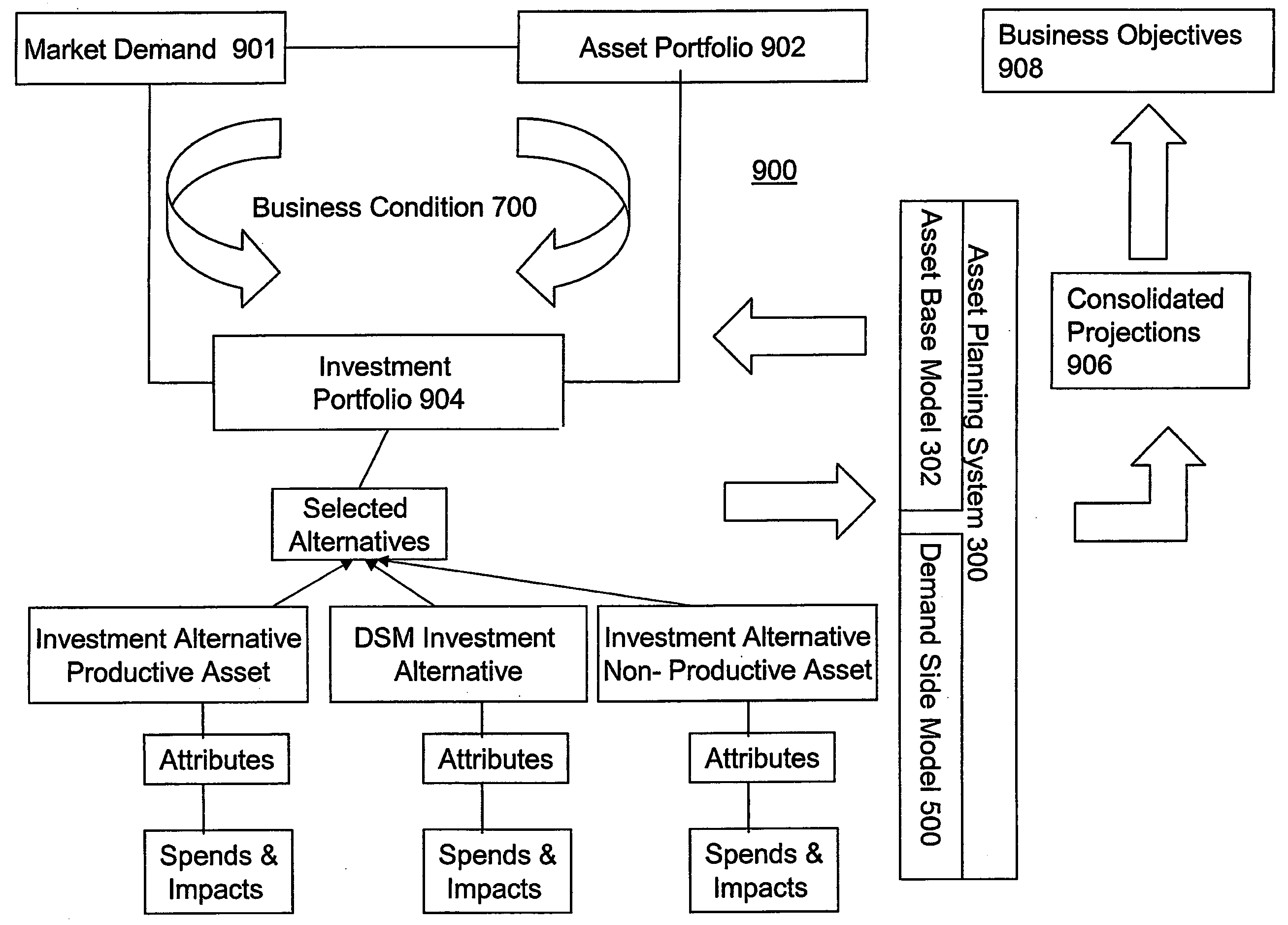

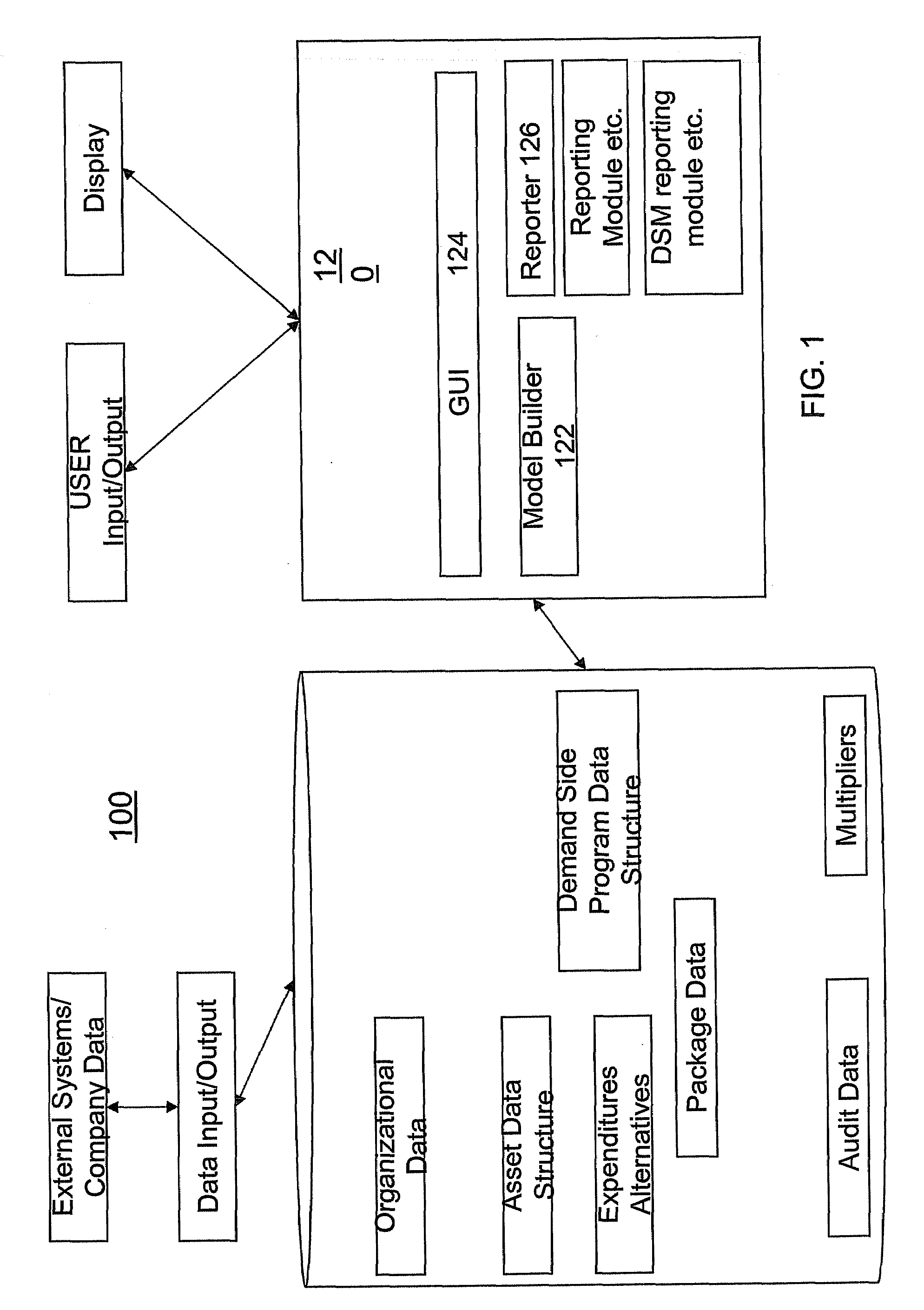

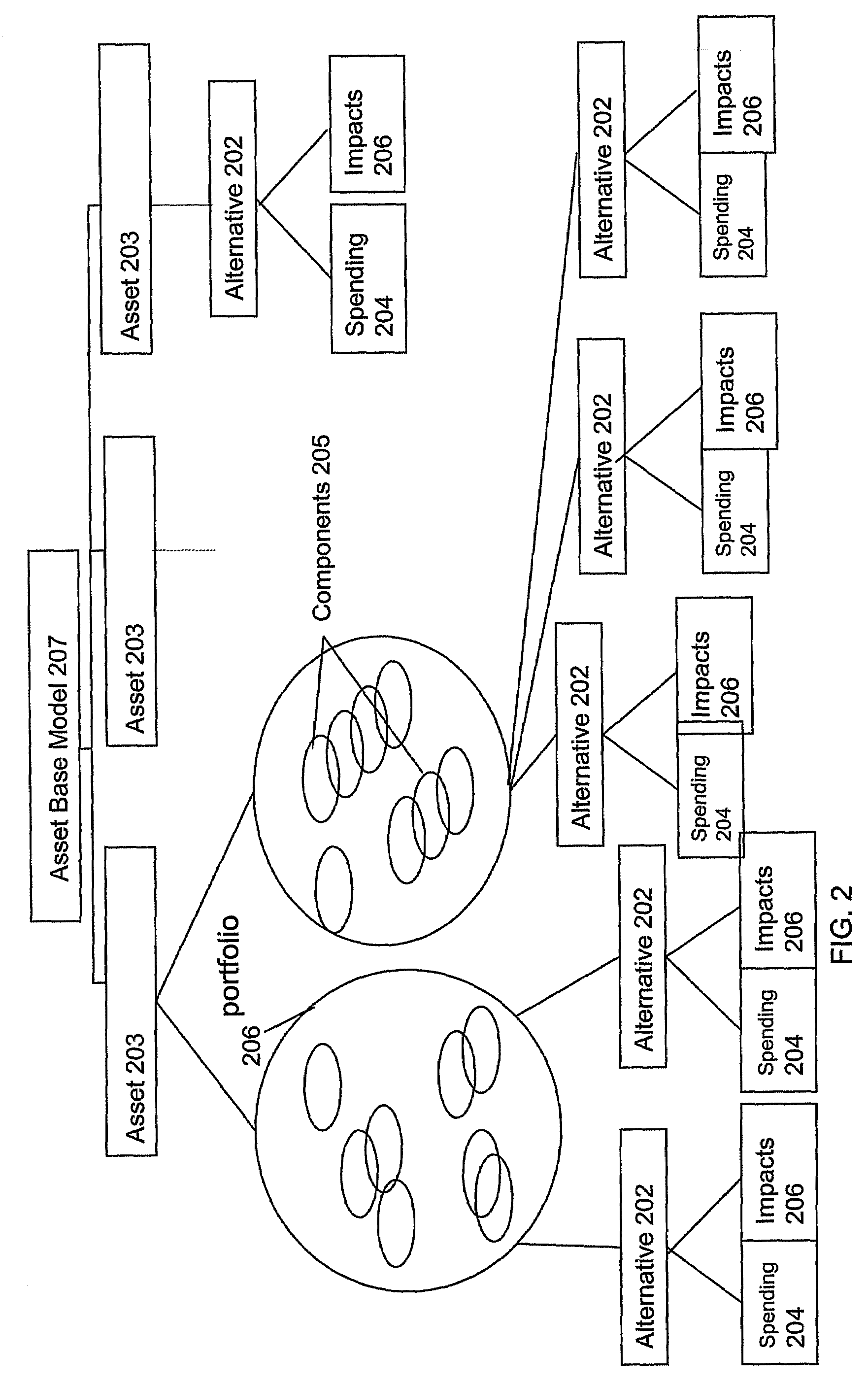

Investment Analysis and Planning System and Method

A system for modeling and comparing supply of and demand for output of productive assets in an asset based business, the system including a database having one or more demand data structures each comprising a device field for storing data representing a device which consumes said output of the productive assets; and an expenditure data structure associated with each device for storing one or more attribute values corresponding to cost and benefits of the device over time.

Owner:COPPERLEAF TECH

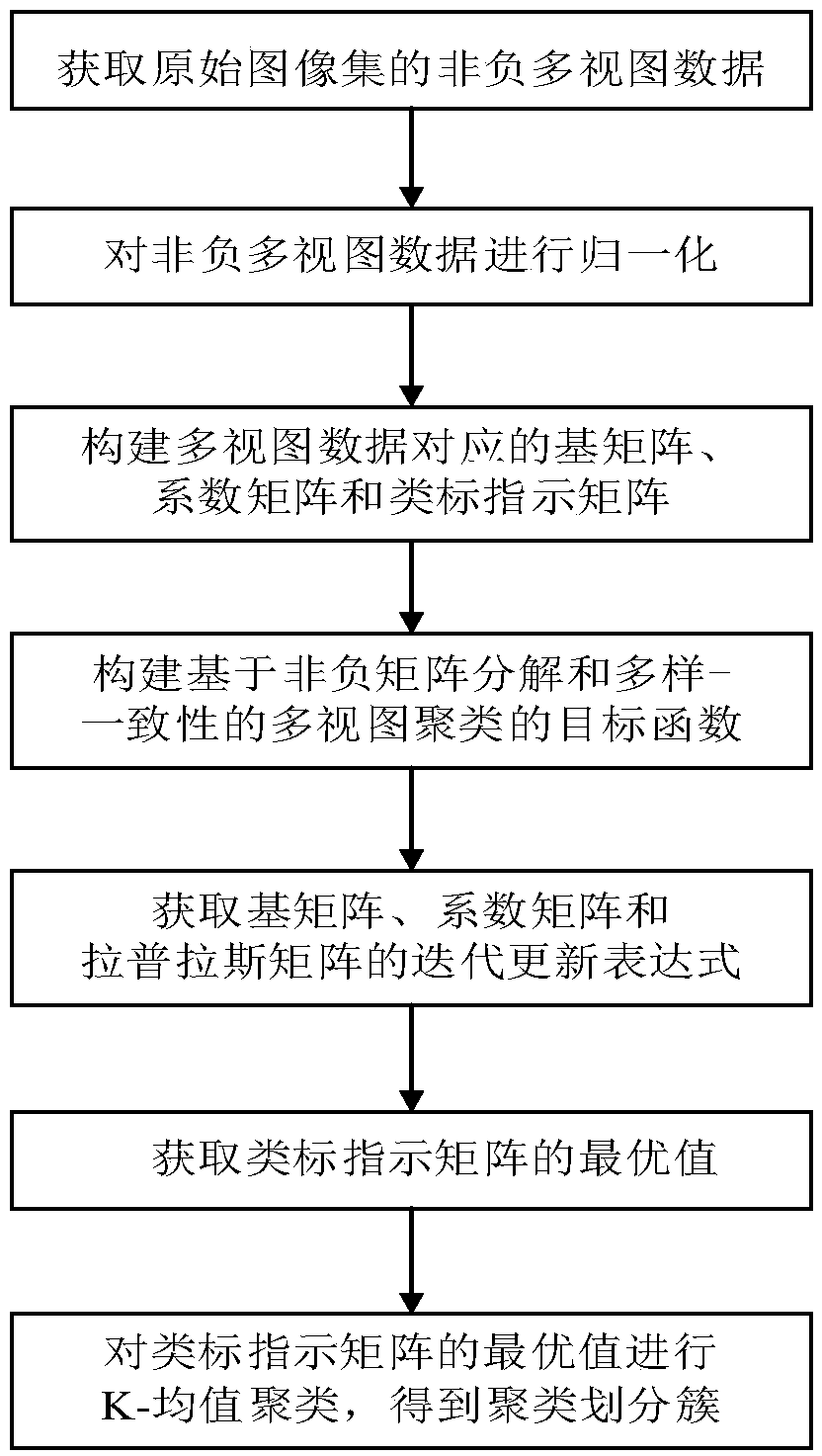

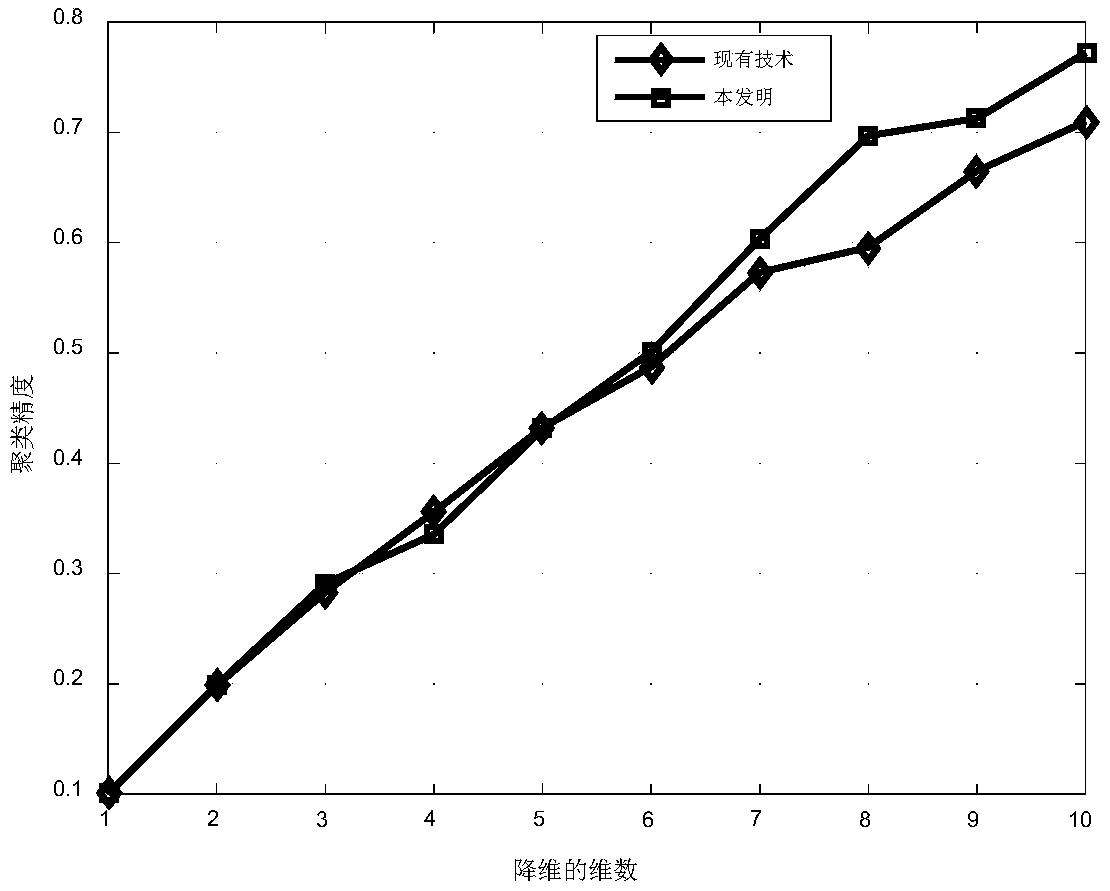

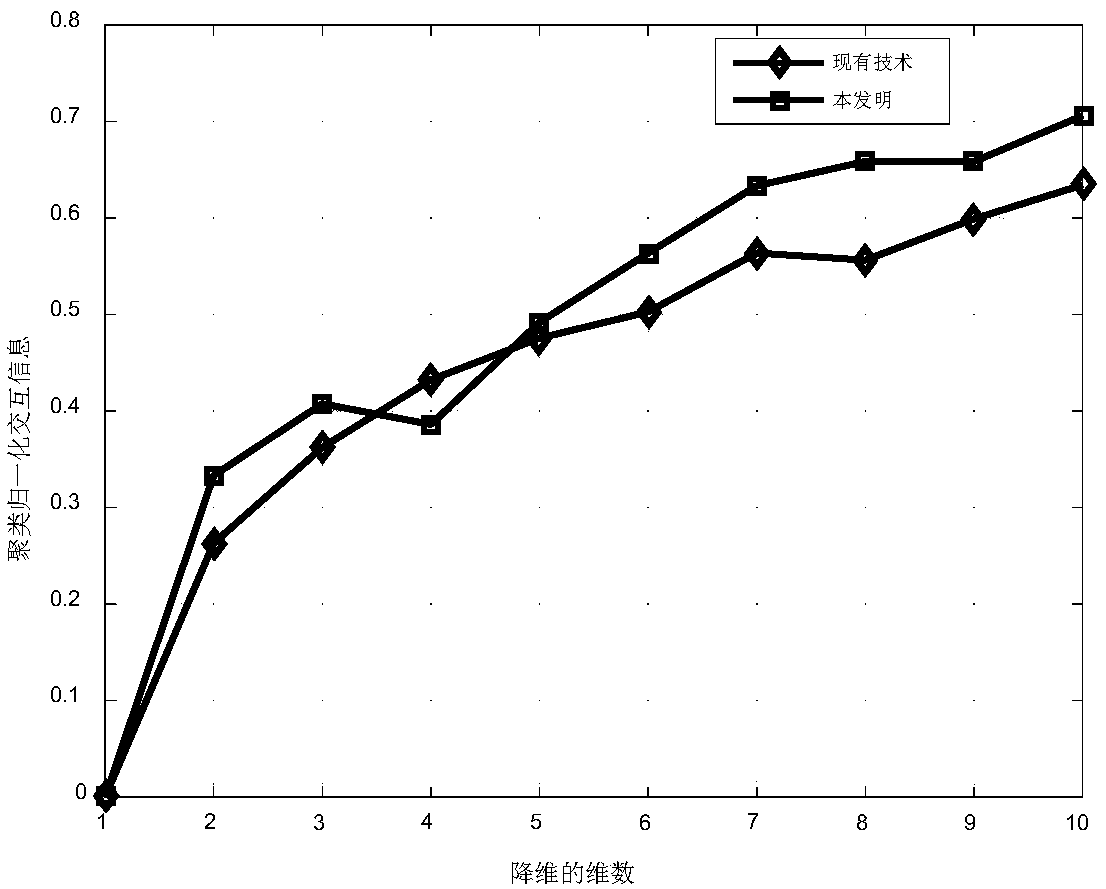

Multi-view clustering method based on non-negative matrix factorization and diversity-consistency

InactiveCN108776812AHigh precisionCharacter and pattern recognitionInformation analysisInvestment analysis

The present invention provides a multi-view clustering method based on non-negative matrix factorization and diversity-consistency. The technical problem is solved that the clustering precision and the normalization interaction information are low in a current multi-view clustering method. The method comprises the steps of: obtaining normalization non-negative multi-view data of an original imageset; constructing a base matrix, a coefficient matrix and a standard-similar indication matrix corresponding to the multi-view data; constructing a target function based on the non-negative matrix factorization and diversity-consistency multi-view clustering; obtaining an iteration updating expression of the base matrix, the coefficient matrix and the Laplacian matrix; obtaining the optimal valueof the standard-similar indication matrix; and performing K-mean clustering for the optimal value of the standard-similar indication matrix, and obtaining a clustering cluster corresponding to the multi-view data. The multi-view clustering method employs expression diversity and standard-similar consistency to learn the complementation and common information in the multi-view data so as to effectively improve the performances of the multi-view clustering, and can be applied to the field of biology information analysis and financial investment analysis, etc.

Owner:XIDIAN UNIV

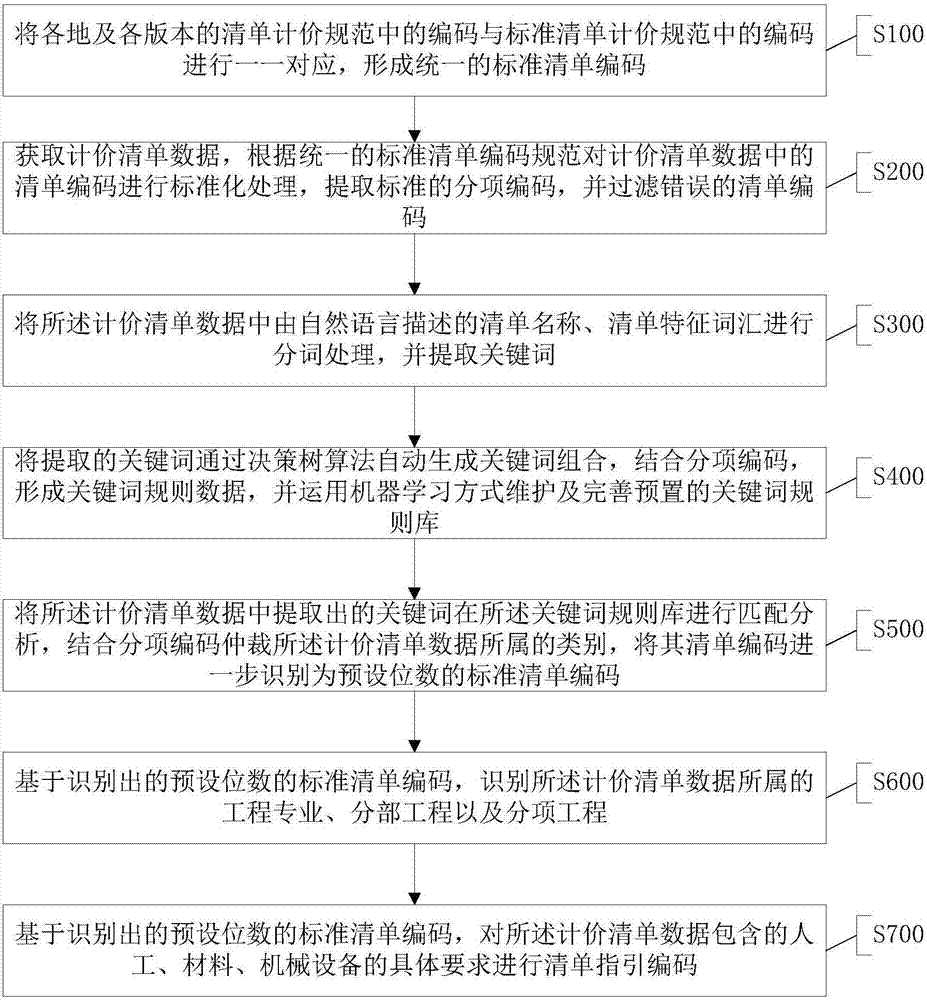

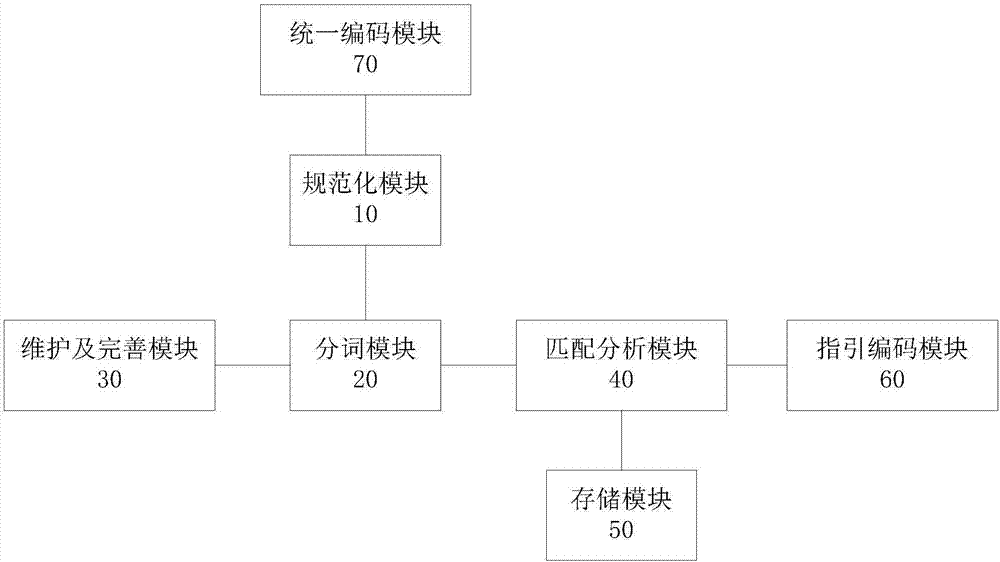

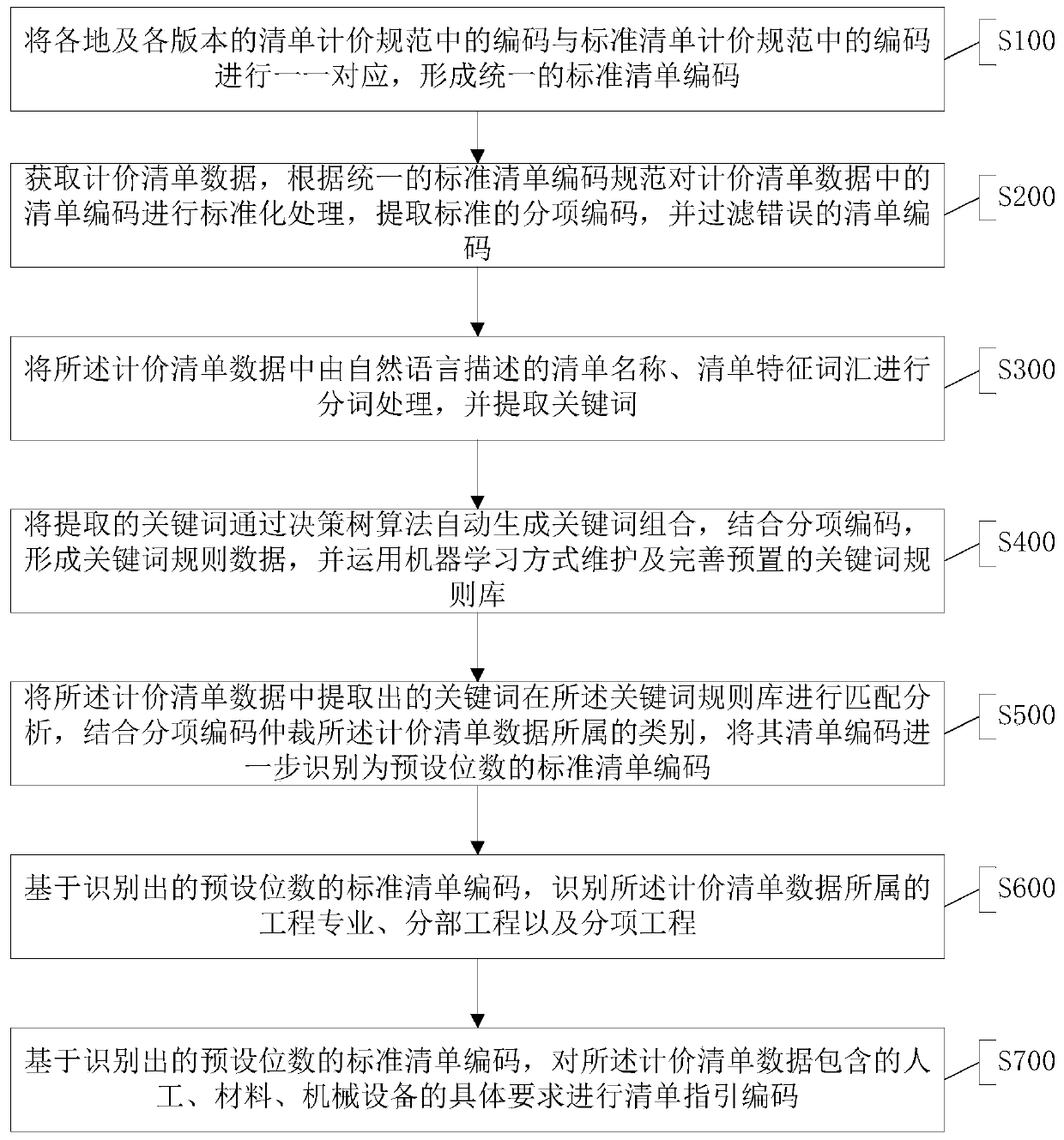

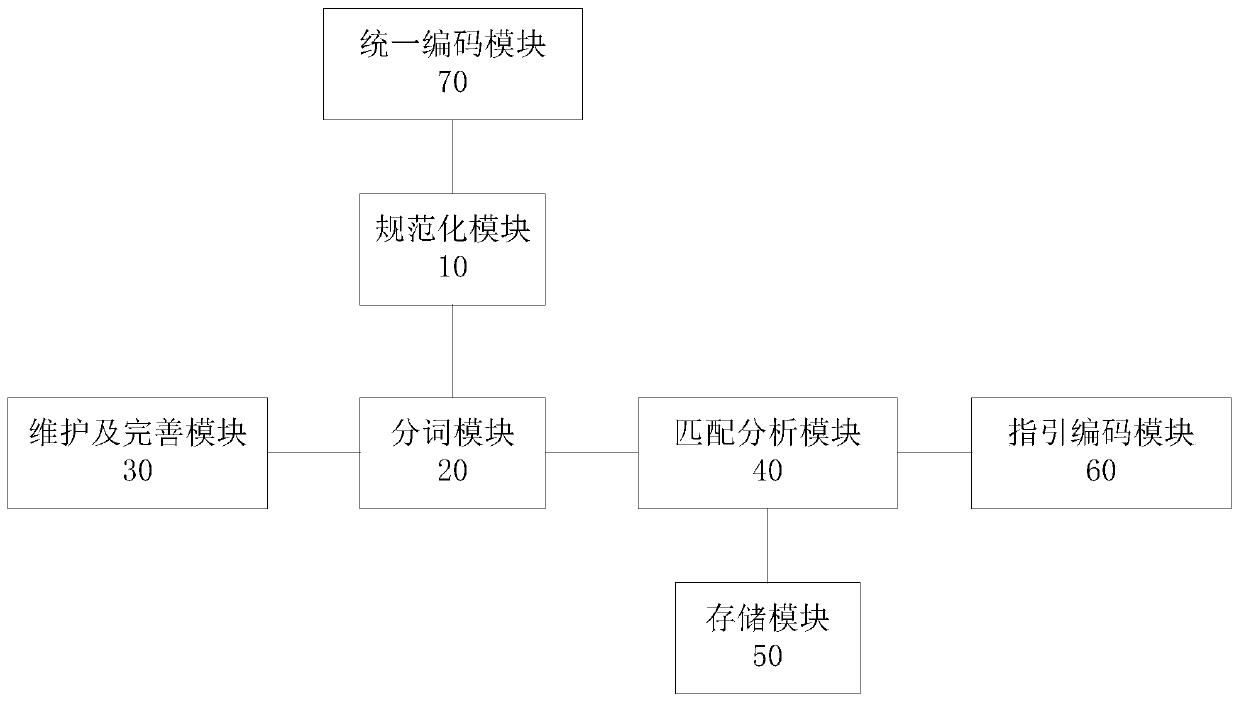

Construction industry engineering pricing bill data automatic coding and recognition method and system

The invention relates to a construction industry engineering pricing bill data automatic coding and recognition method and a system. Thus, pricing bill data described by a human natural language can be subjected to intelligent recognition, unified standard coding and automatic accumulation, the pricing bill data after processing have the unique corresponding code, automation of functions such as intelligent recognition, conversion, analysis, classification and statistics can be realized, manual operation is not needed, the working efficiency can be improved, the enterprise cost is reduced, and investment analysis and whole process cost management on the construction project can be promoted more quickly.

Owner:广东中建普联科技股份有限公司

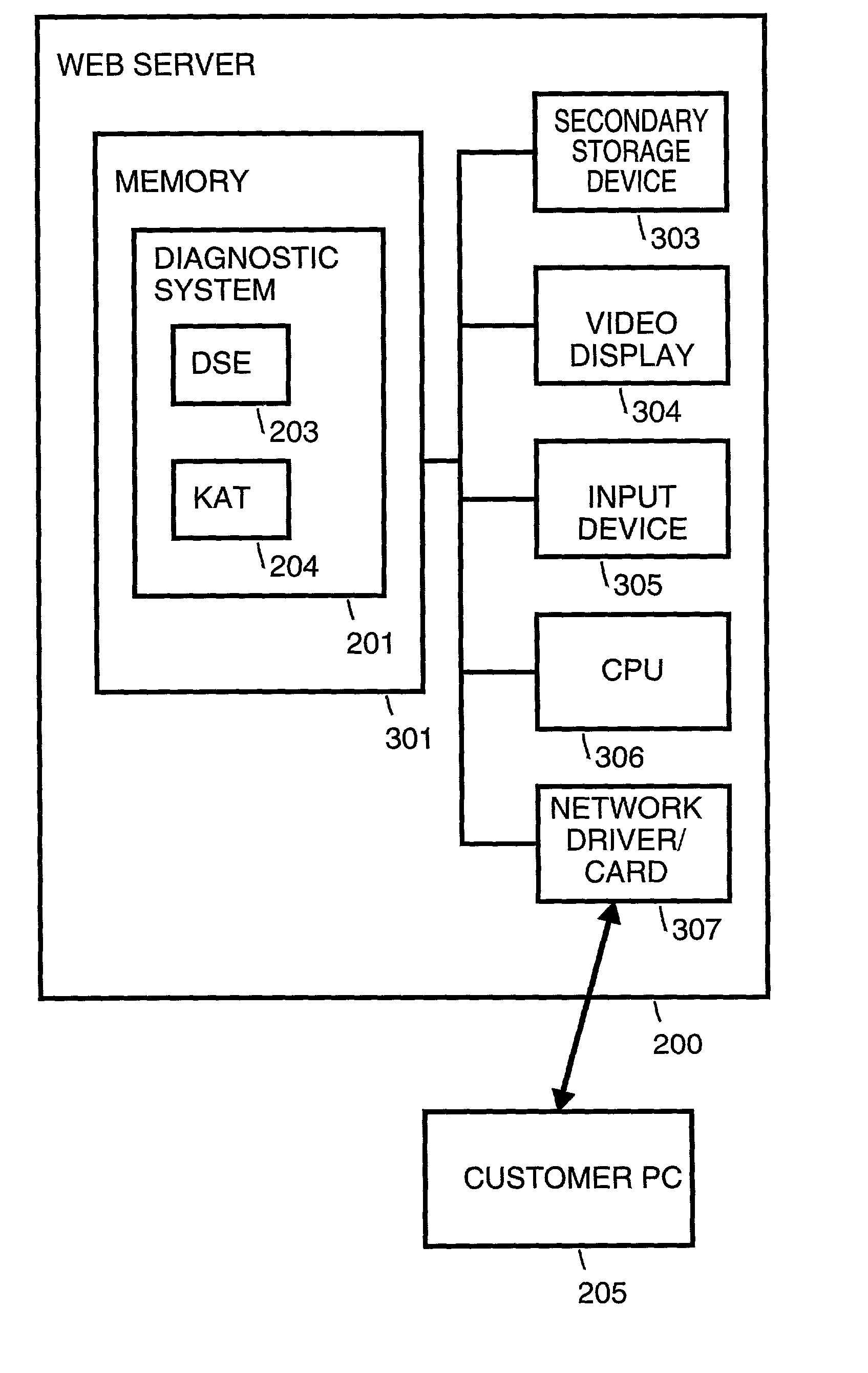

Investment analysis tool and service for making investment decisions

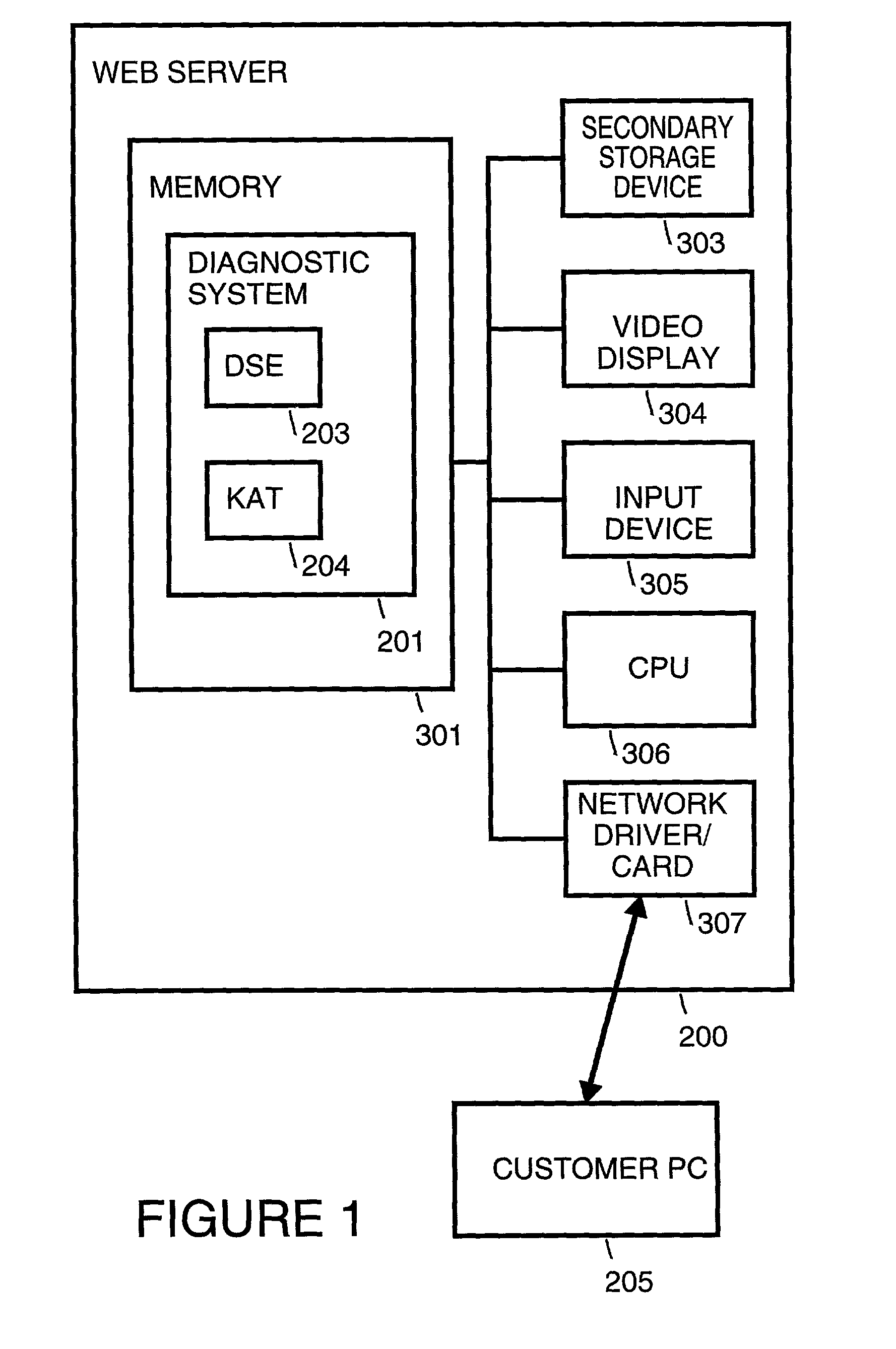

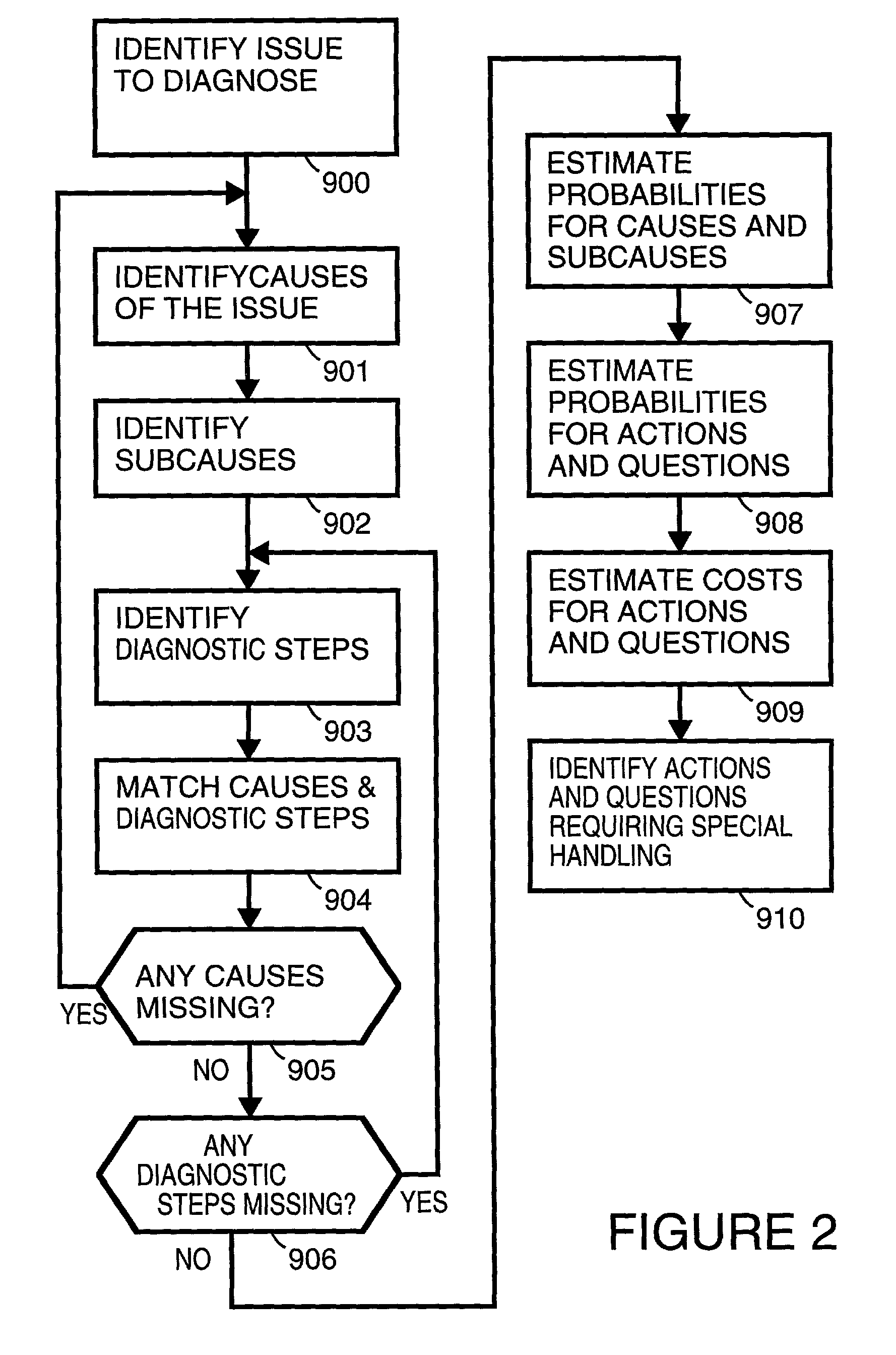

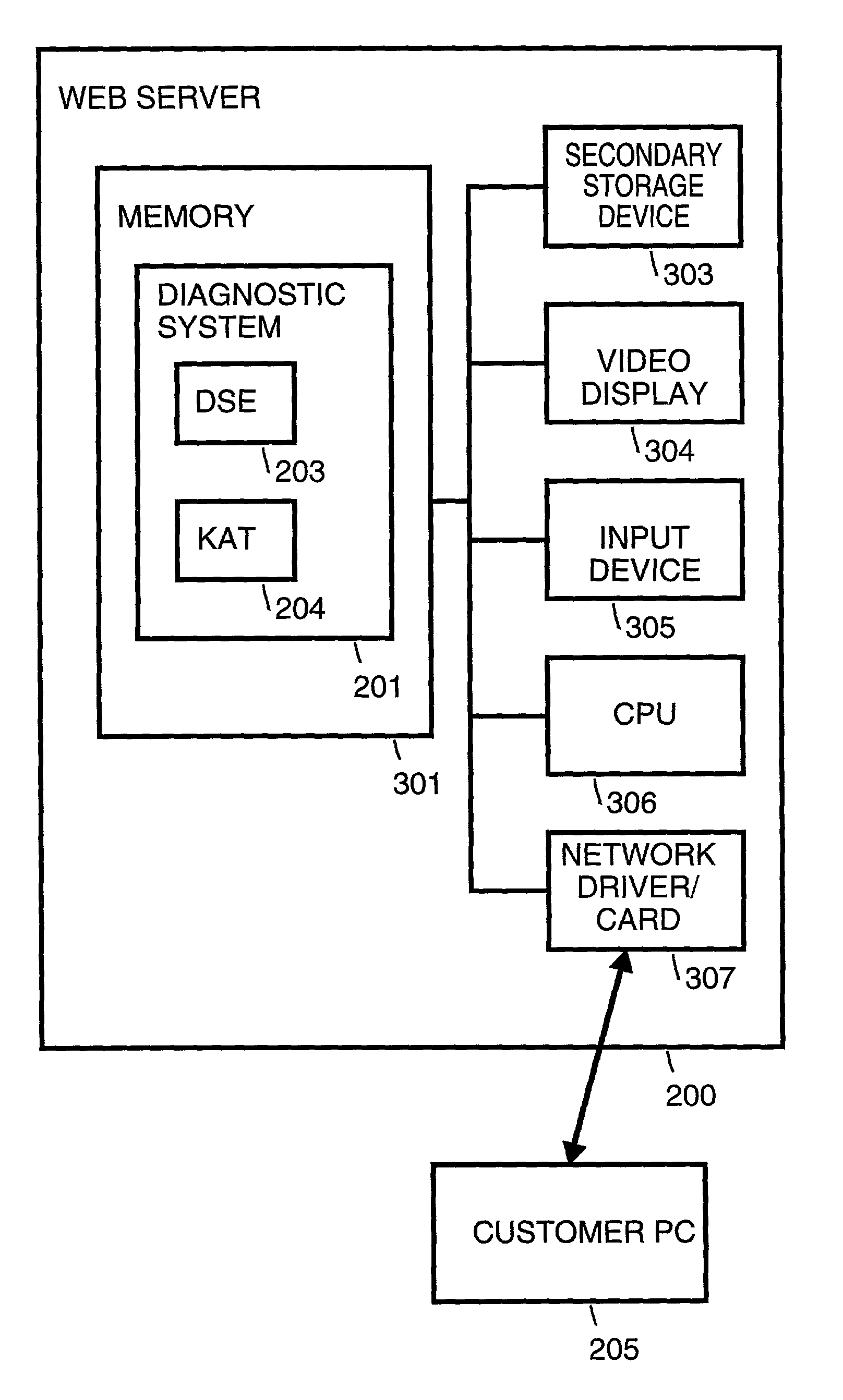

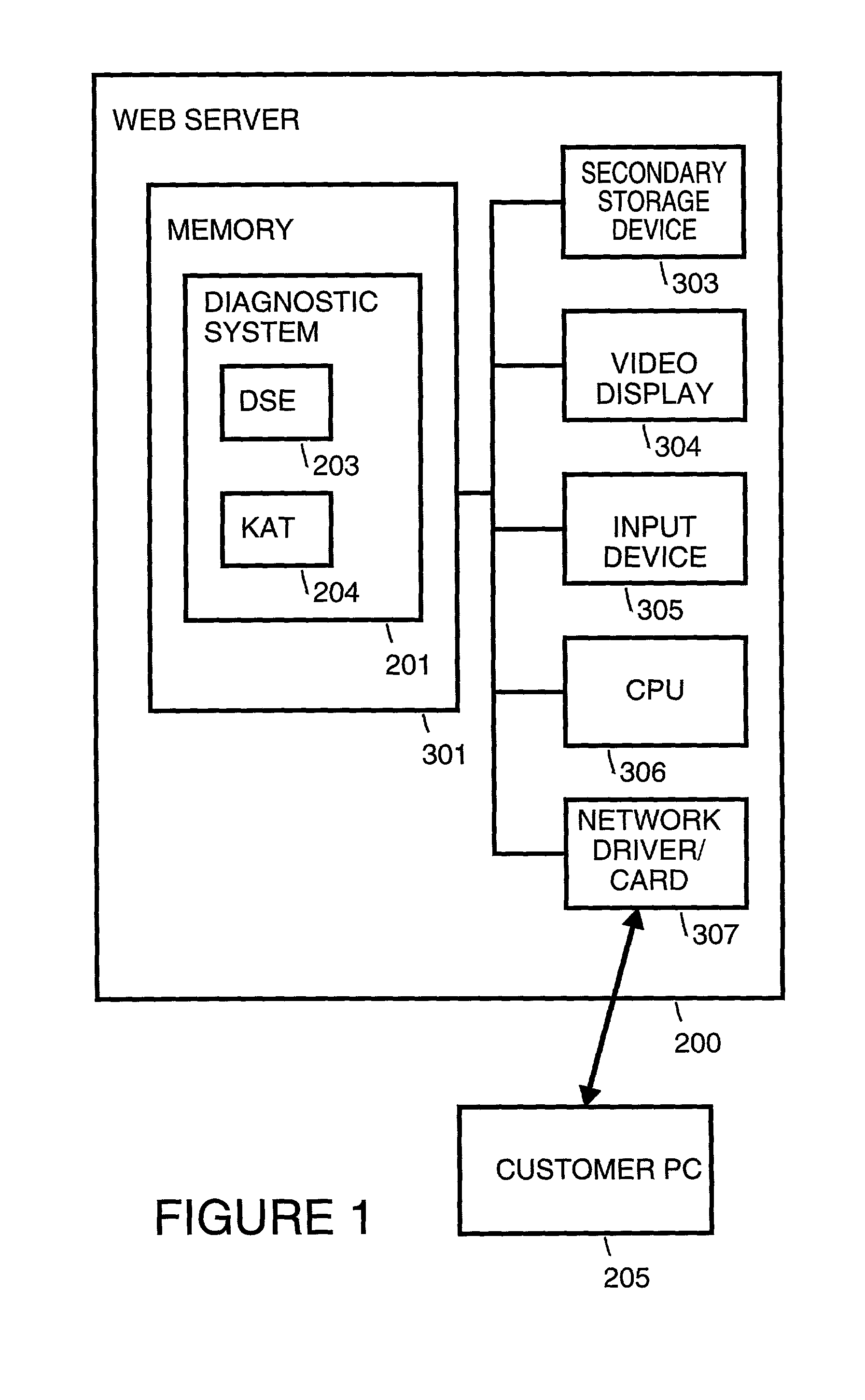

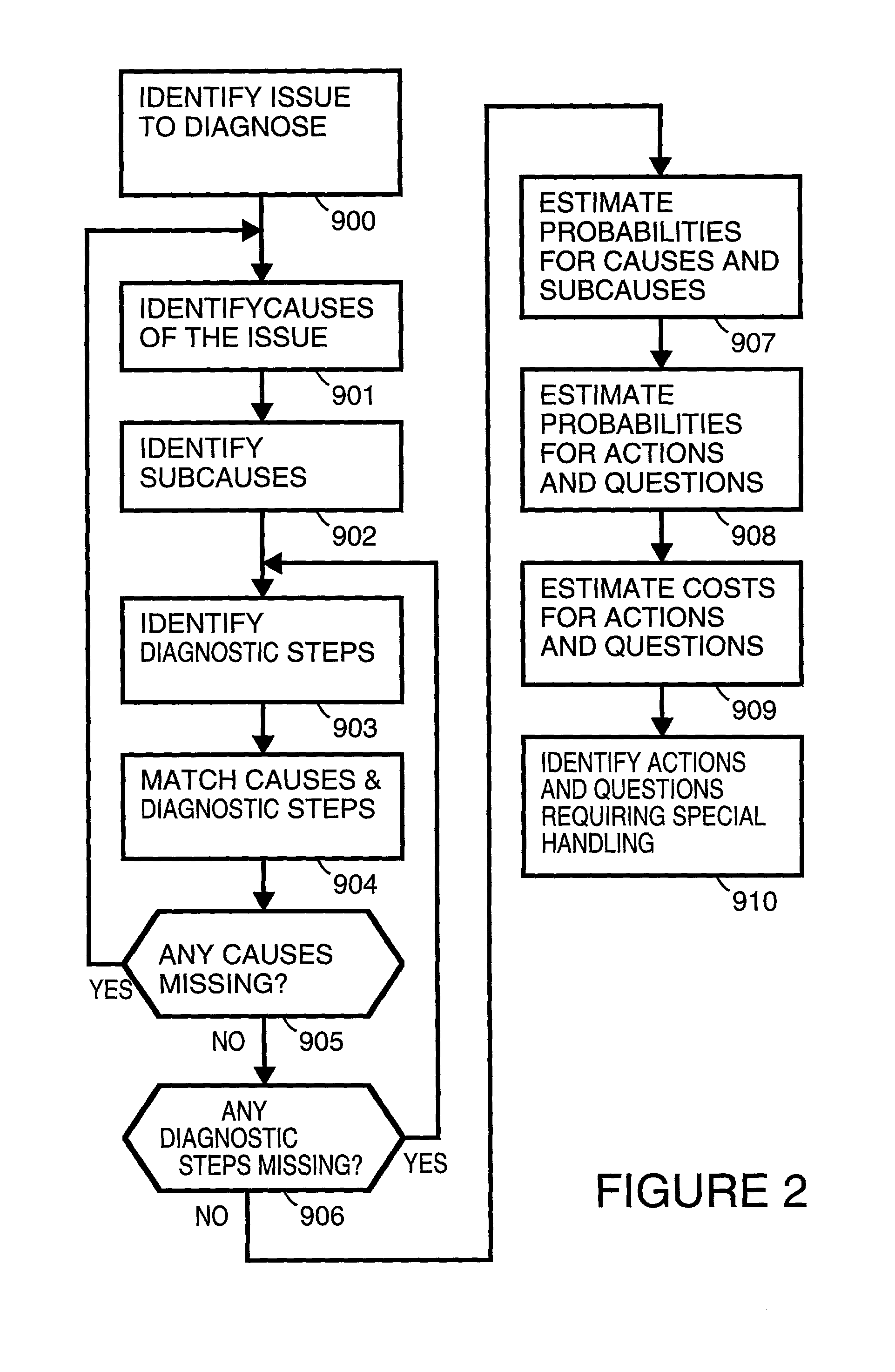

InactiveUS20020128943A1Reliable informationFinanceElectric testing/monitoringInvestment analysisBayesian network

A decision support system supports investment decisions. The decision support system includes a decision support engine and a Bayesian network. The Bayesian network is traversed by the decision support engine. The Bayesian network includes an investment decision node, potential investment nodes, and information nodes. The investment decision node identifies an investment decision. The potential investment nodes identify potential investments. The information nodes identify information to be obtained. The information to be obtained is matched to potential investments. Reliability of the information is estimated, for example, with the help of domain experts.

Owner:HEWLETT-PACKARD ENTERPRISE DEV LP

Investment analysis tool and service for making investment decisions

A decision support system supports investment decisions. The decision support system includes a decision support engine and a Bayesian network. The Bayesian network is traversed by the decision support engine. The Bayesian network includes an investment decision node, potential investment nodes, and information nodes. The investment decision node identifies an investment decision. The potential investment nodes identify potential investments. The information nodes identify information to be obtained. The information to be obtained is matched to potential investments. Reliability of the information is estimated, for example, with the help of domain experts.

Owner:HEWLETT-PACKARD ENTERPRISE DEV LP

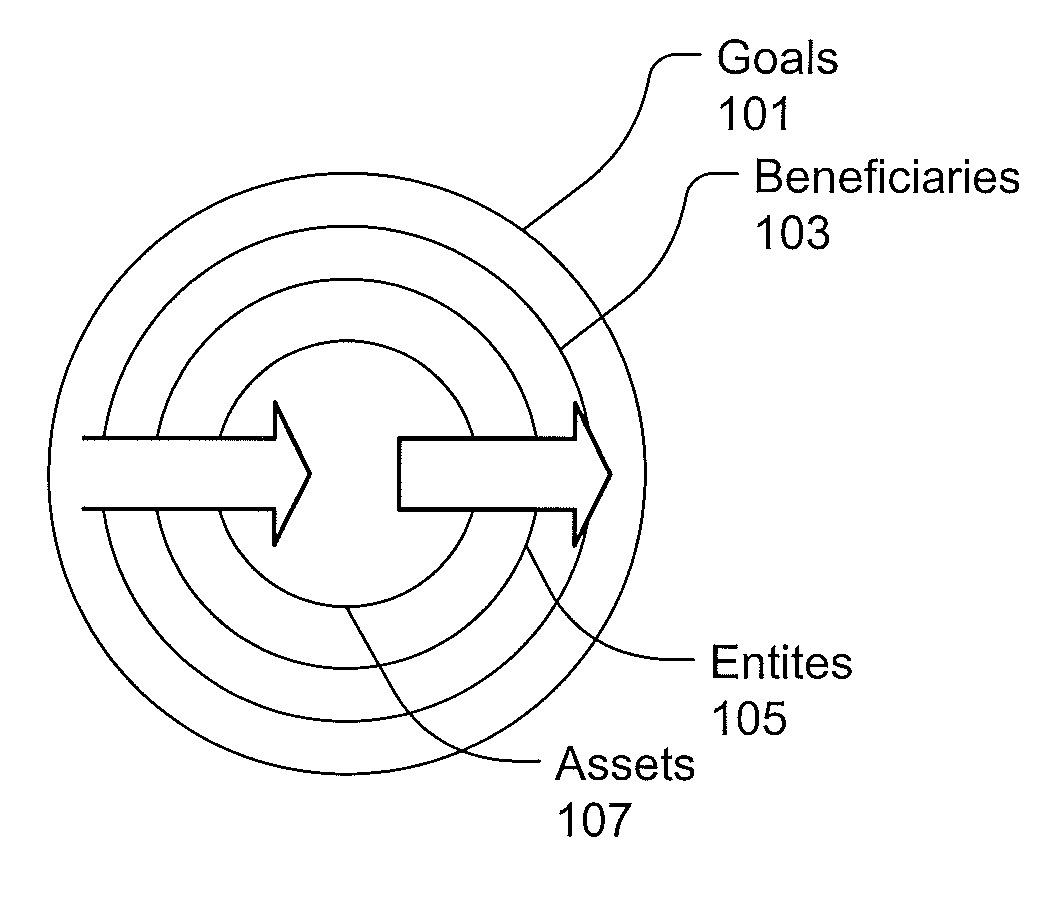

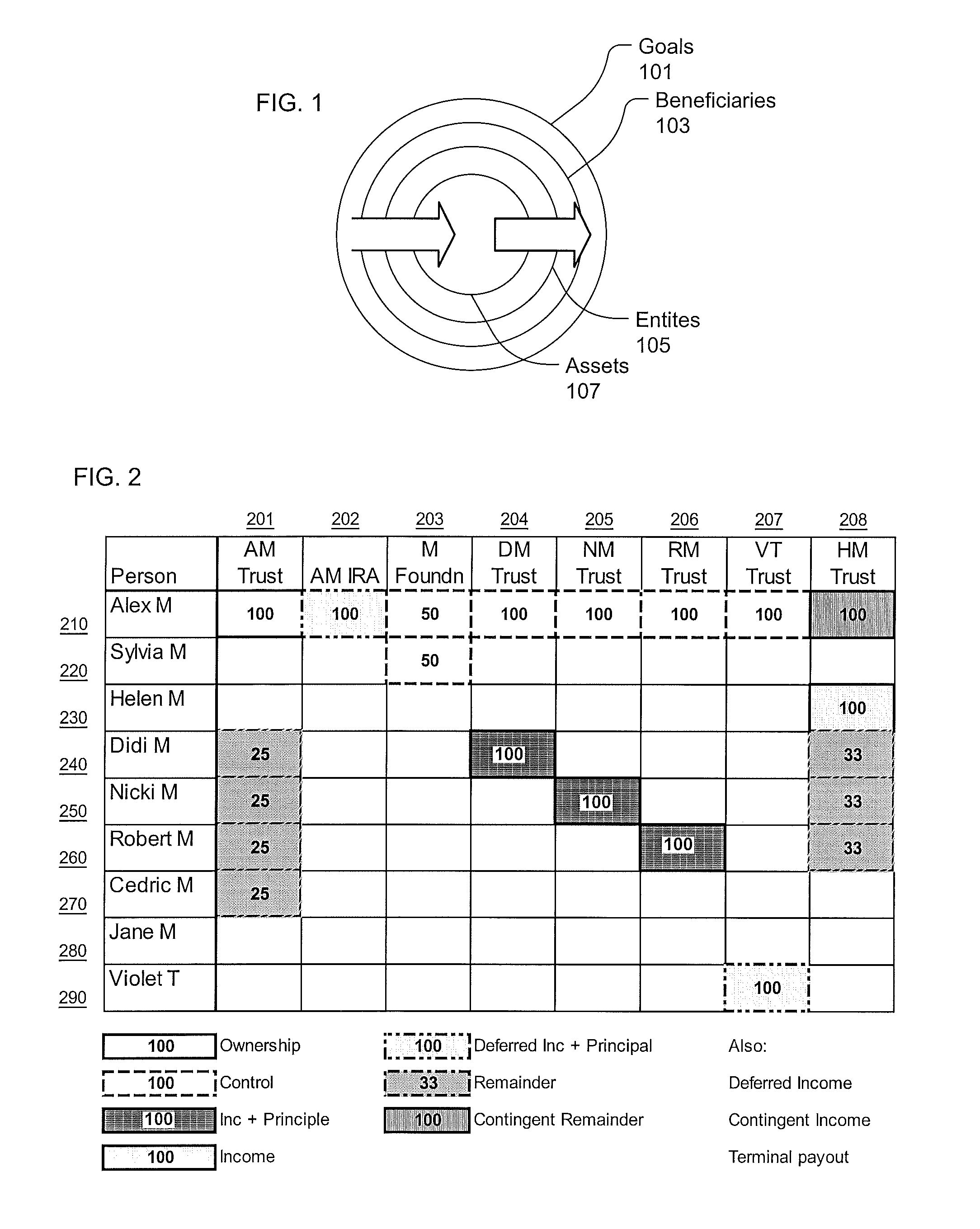

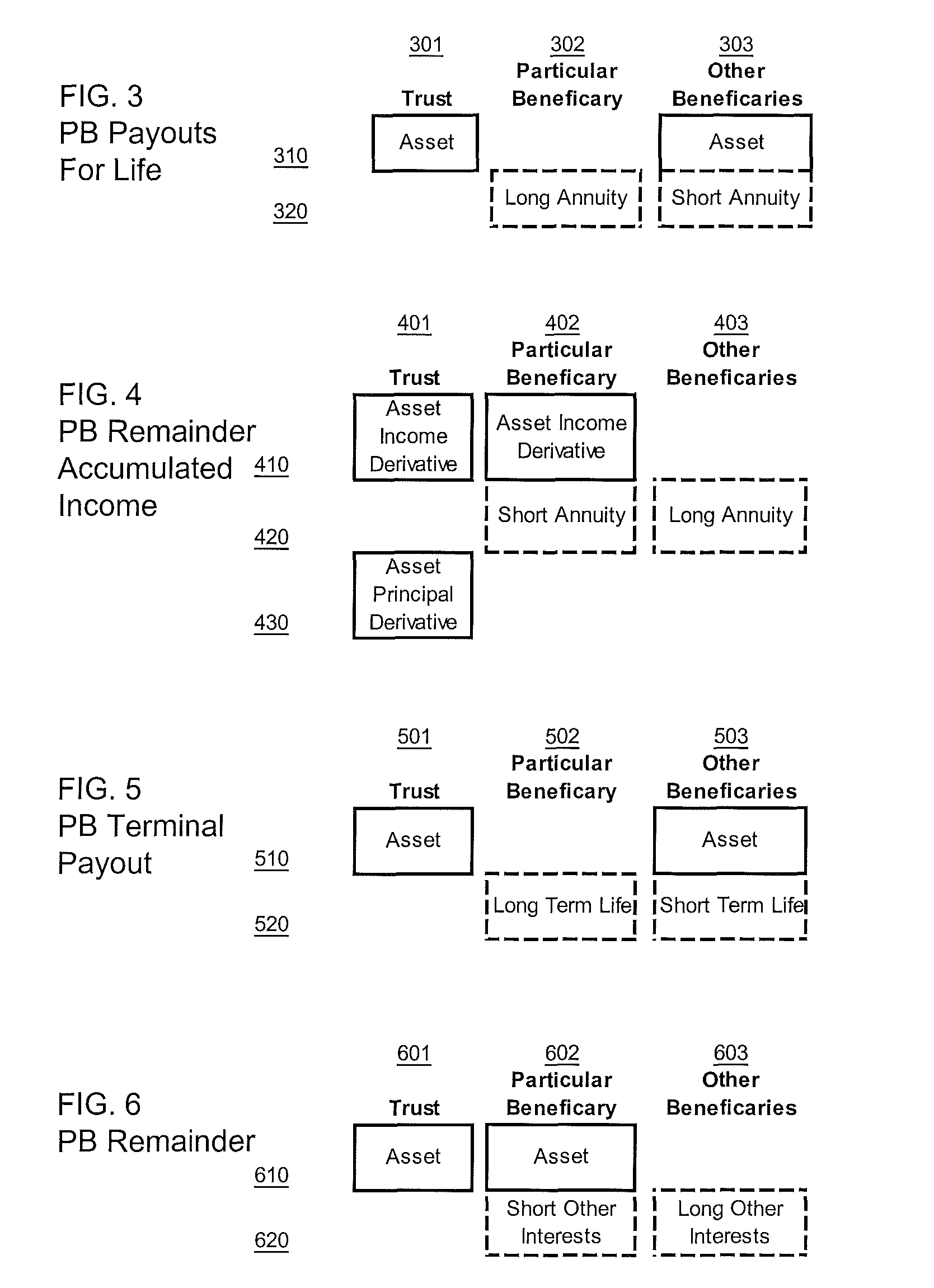

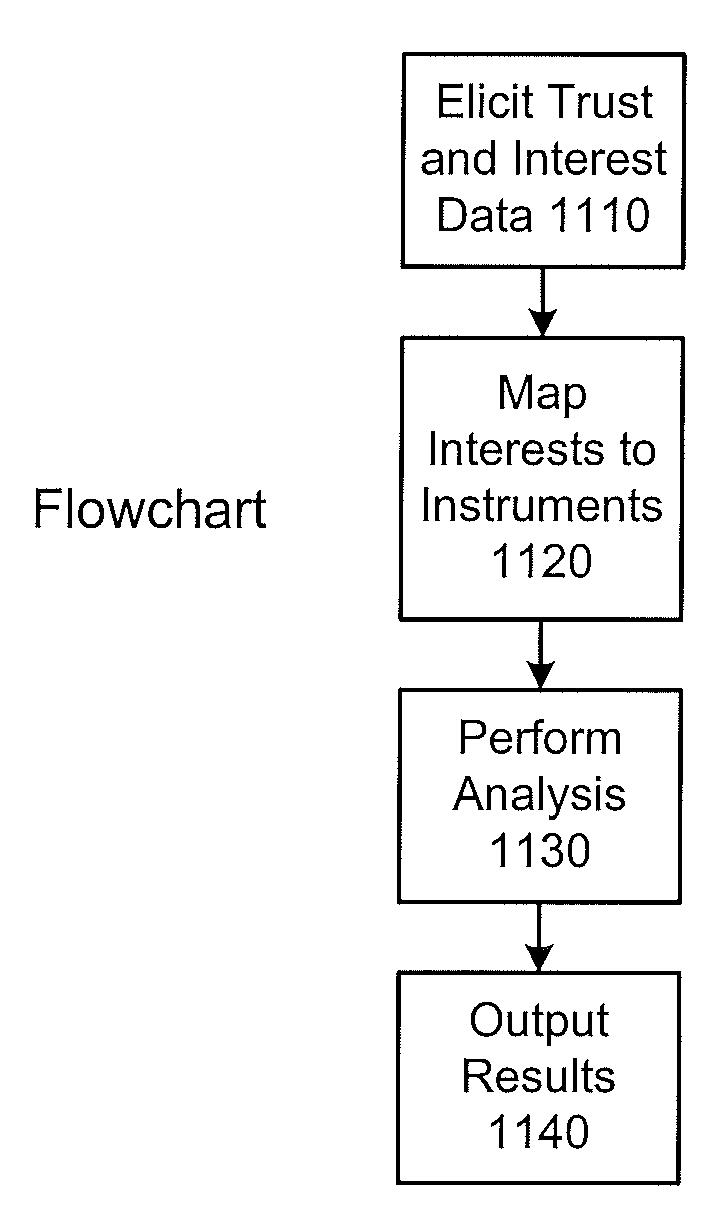

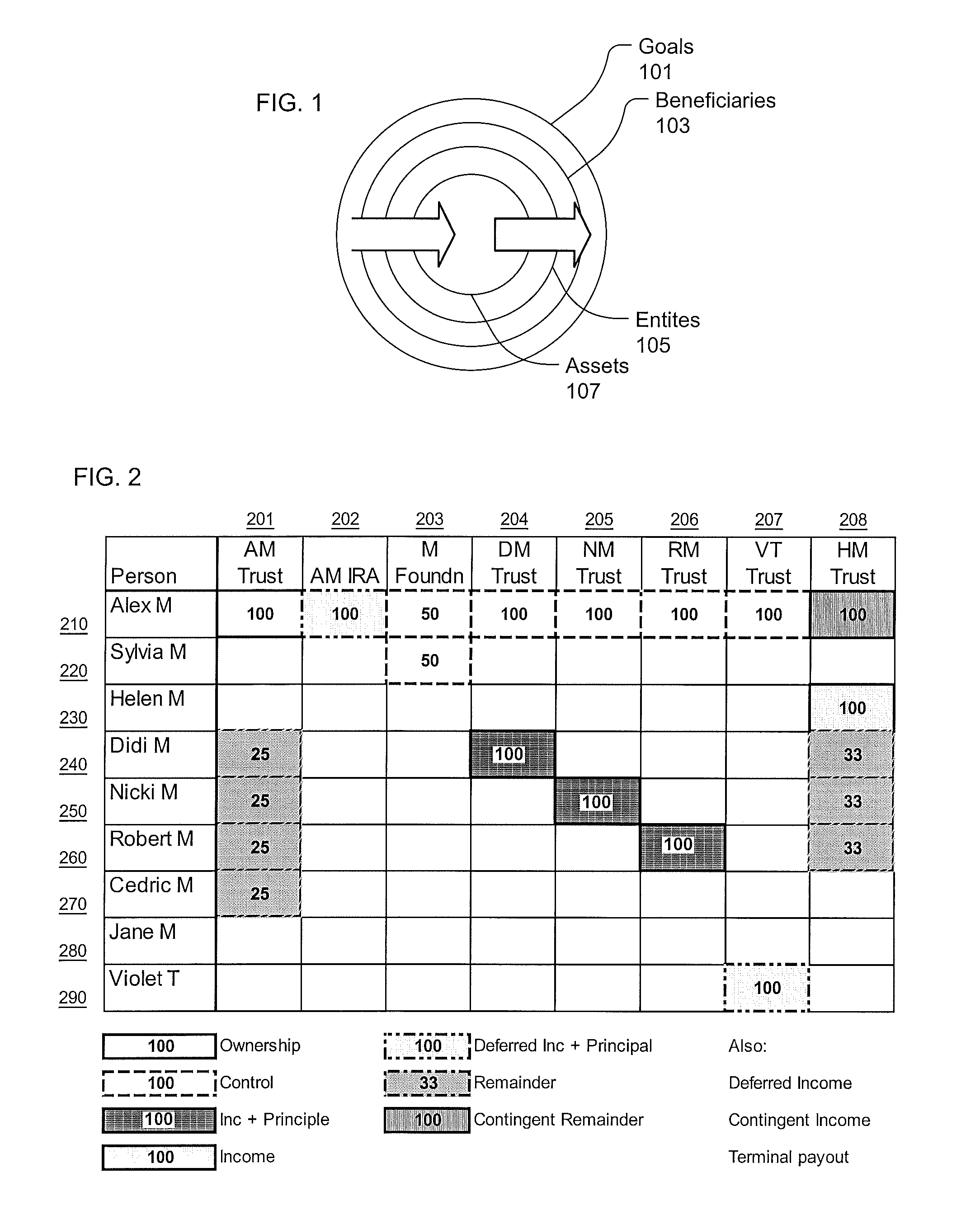

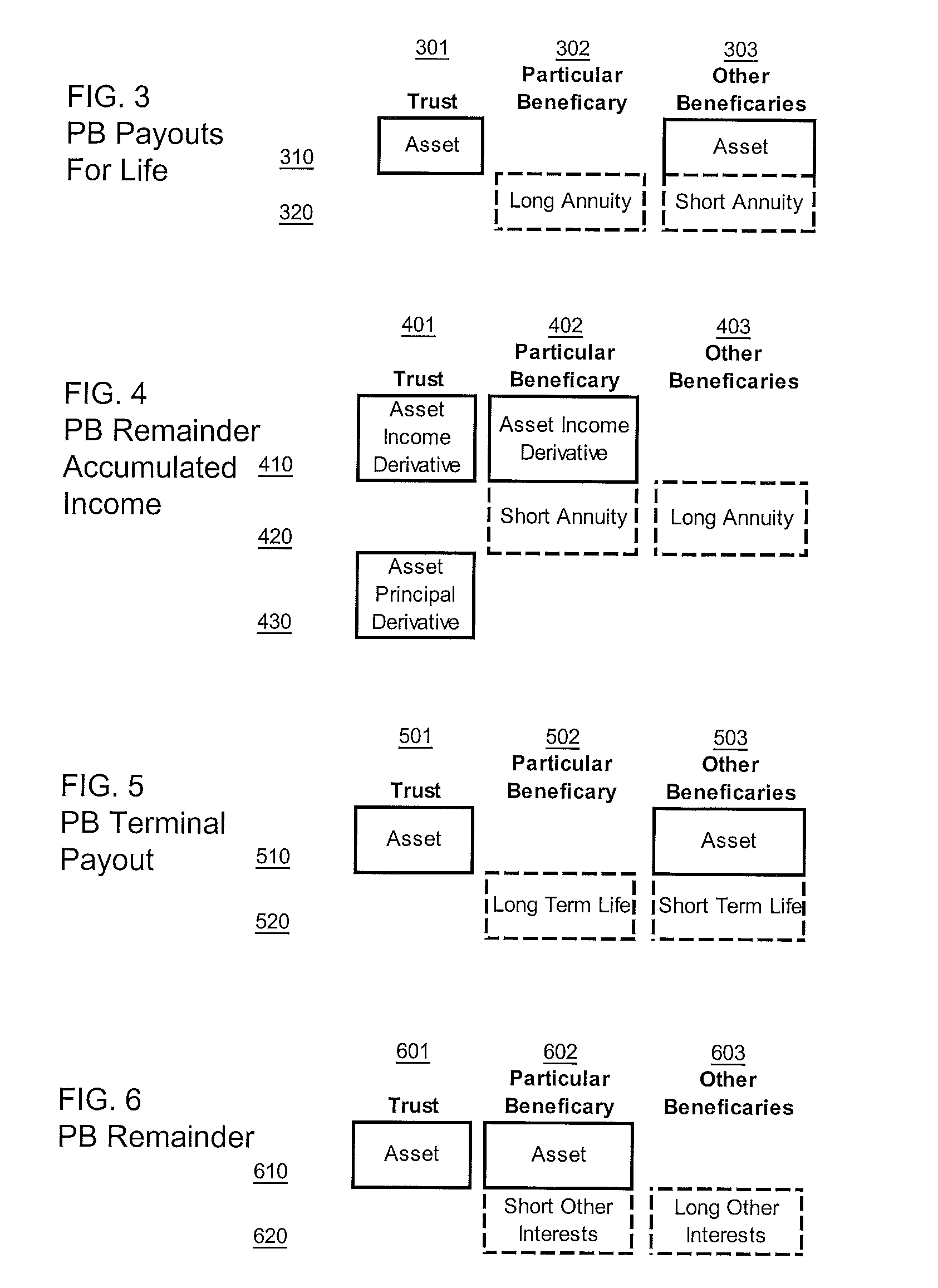

Automatic mapping and allocation of beneficial interests in trusts for portfolio analysis

Owner:REFINITIV US ORG LLC

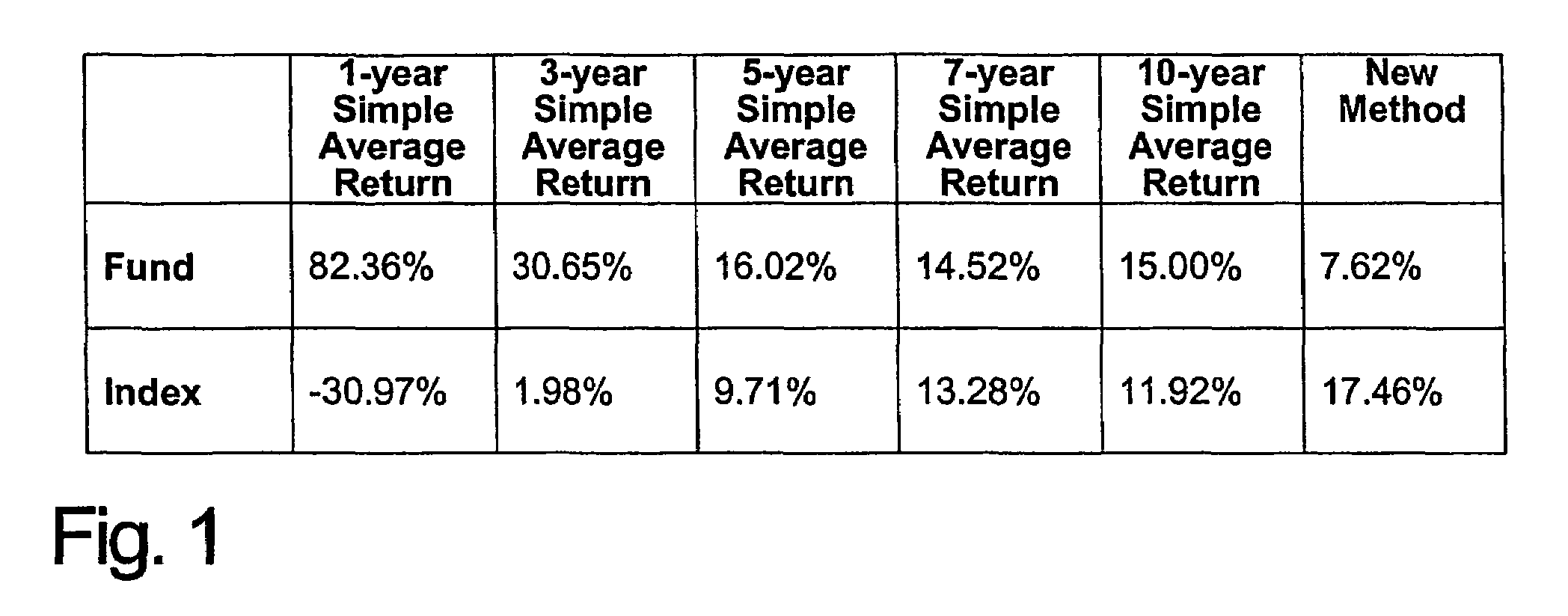

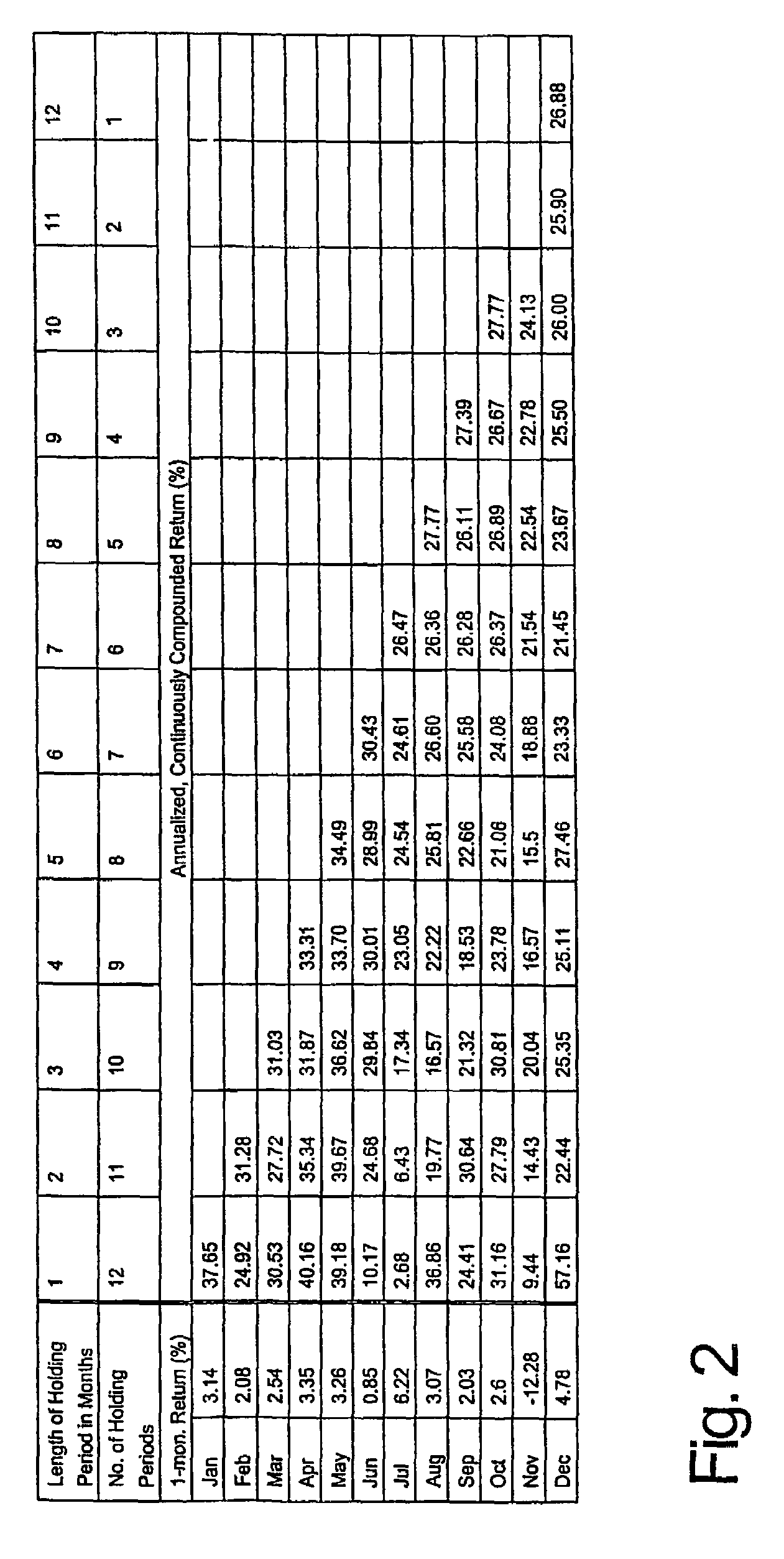

Consensus Investment Analysis/Stock Selection Methodology

InactiveUS20110307414A1Narrowing down a potential pool of promising investmentsFinanceInvestment analysisTheoretical computer science

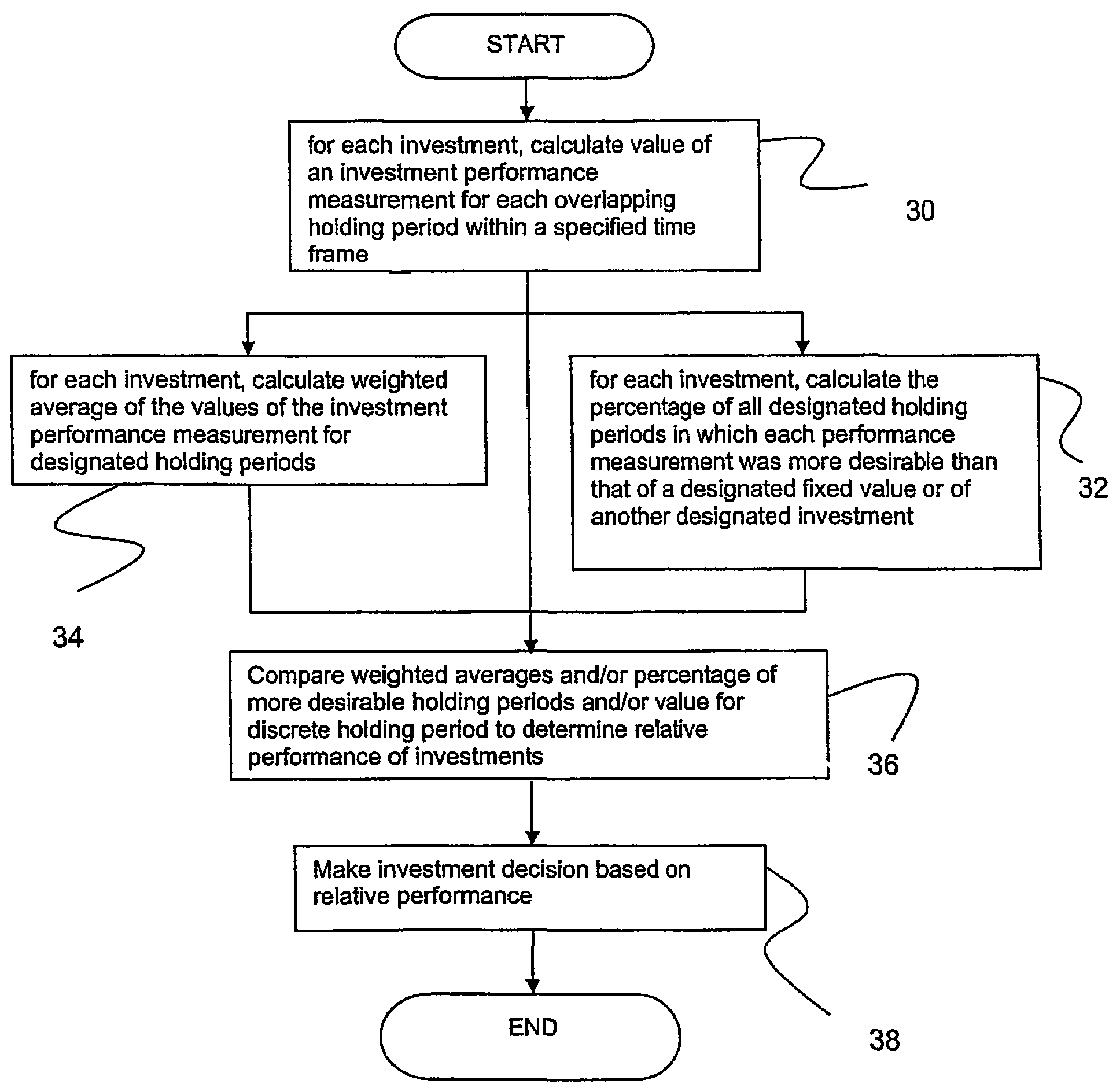

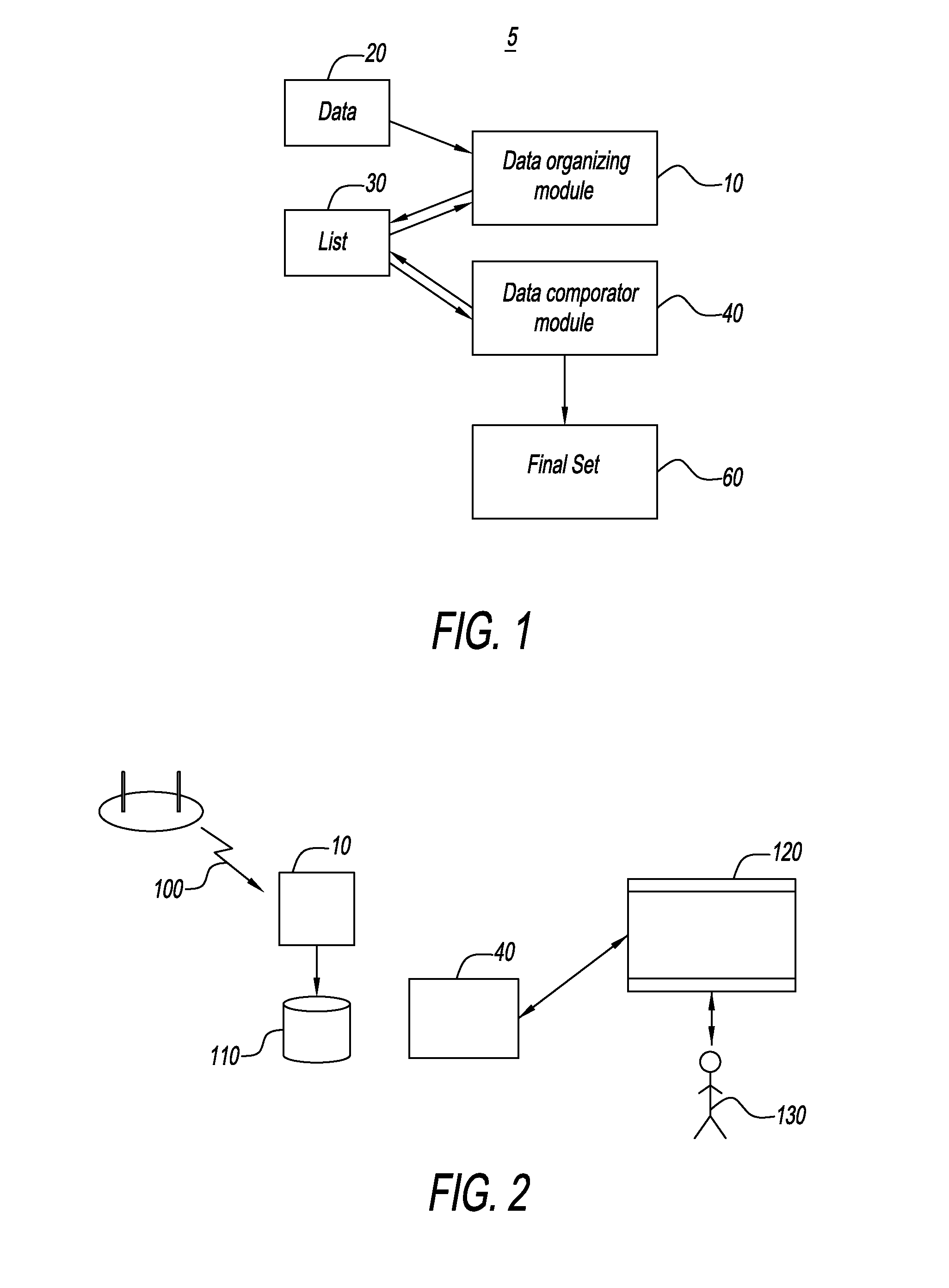

A computer system for predicting investment performance trends is disclosed. The computer system has a data organizing module capable of organizing an investment data into at least one list. Furthermore the computer system has a data comparator module that is capable of sorting data into performance categories within at least one said list to arrive at a consistent top set. Further disclosed is a computer-enabled method of arriving at consistent investment performance set having the steps of obtaining an investment pricing list; organizing an investment data into lists; comparing investment assertions within said lists against said pricing list; sorting said investment data by a performance category; determining the best performing investment within said list; and isolating a consistently performing investment combination.

Owner:HANSEN HANS P

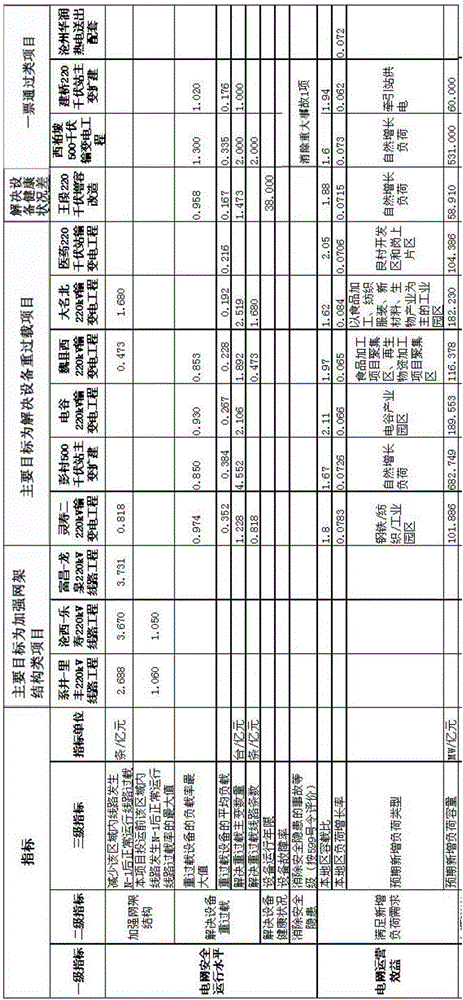

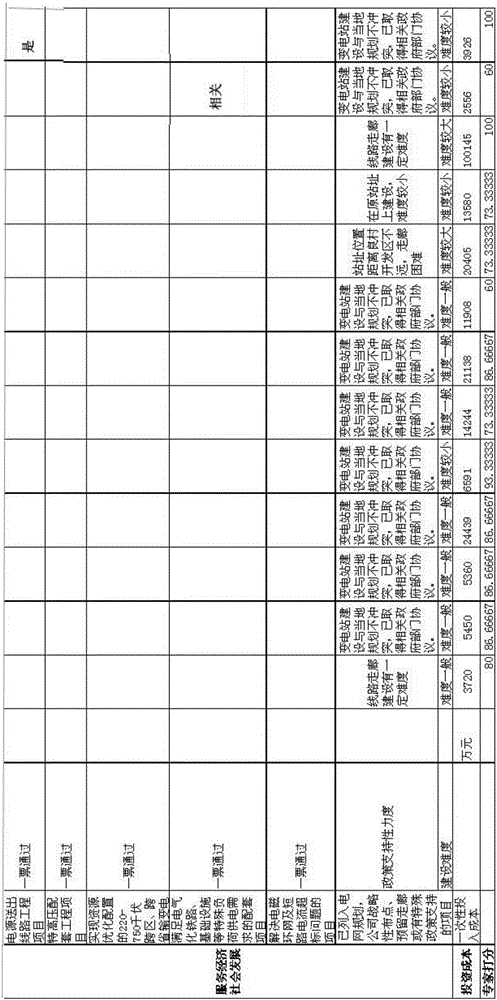

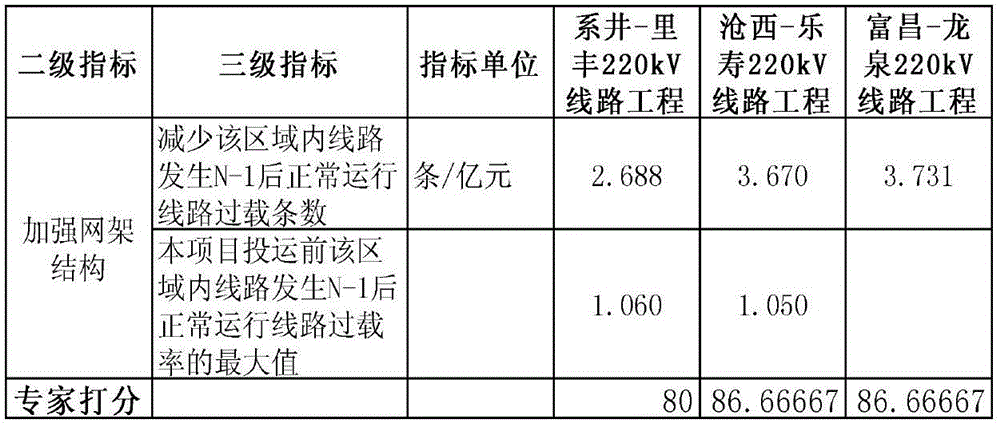

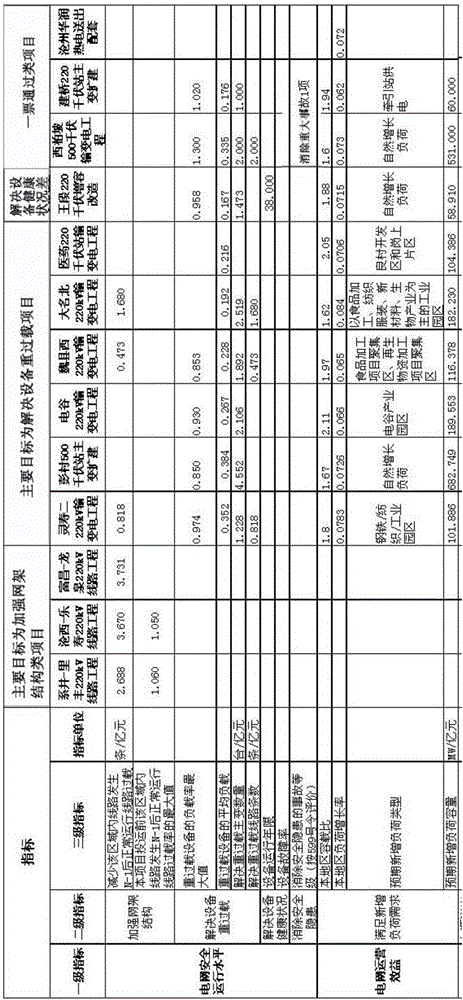

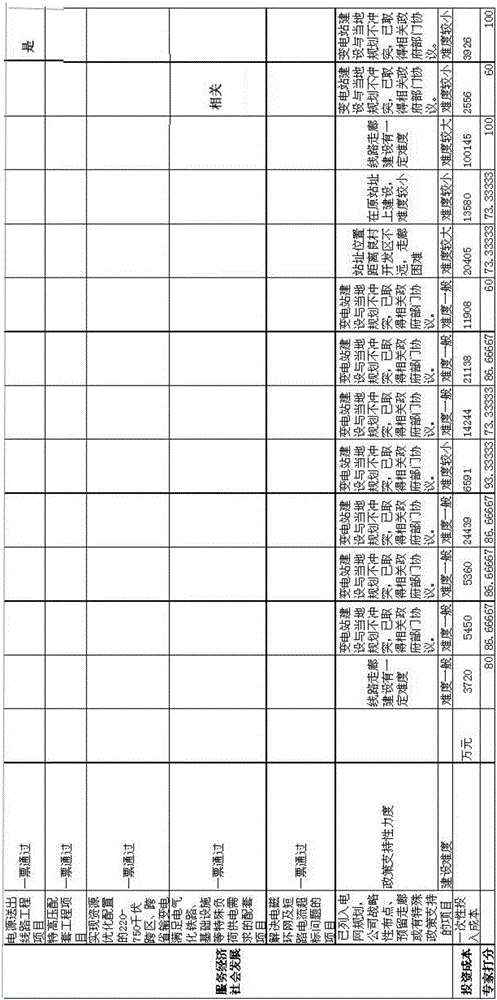

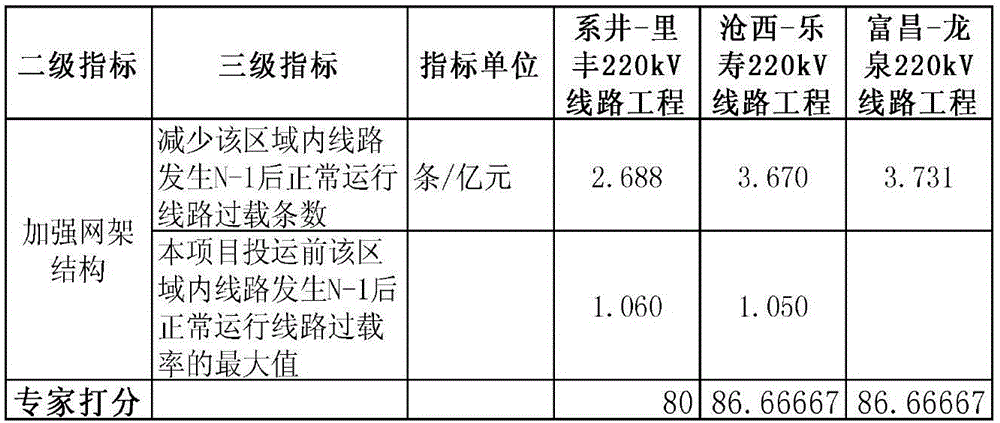

Method for calculating the index parameter of grid investment analysis model

InactiveCN106530139AObjectively reflect the value of expected incomeImprove reliabilityData processing applicationsAnalytic modelThree level

The invention discloses a method for calculating the index parameter of a grid investment analysis model, wherein the model comprises a plurality of investment key directions as second-level indexes, and the evaluation factor of each investment key direction is used as a three-level index, and the method comprises: setting a second-level index score calculating rule and a three-level index score calculating rule; selecting a specific investment project as training calculation basic data to be substituted into the corresponding three-level index, calculating a three-level index score according to the set three-level index score calculating rule; according to the second index score calculating rules, substituting into the three-level index score to calculate second-level index scores; using the sum of the second-level index scores as the investment project score. The method is based on the grid investment analysis model, provides scoring rules according to grid investment analysis models of different voltage classes, such as the formula or added and subtracted items; can performing scoring based on the actual investment project data, and reflects the prospective earning value of the investment project objectively.

Owner:STATE GRID HEBEI ELECTRIC POWER CO LTD

Liquid insurance contracts

InactiveUS20090313051A1Overcome deficienciesMove quicklyFinanceInvestment analysisSensitivity testing

A liquid insurance contract (LIC) comprises a security which is traded or tradable and which has cash flows to the issuer based upon a liability whose exact value is unknown at the time of issuance. A method for creating and trading these LICs, as well as other financial products derived from LICs, may include any of the following steps: writing at least one LIC; preparing regulatory filings for at least two LICs; issuing the two LICs; preparing regulatory filings for a financial product which includes at least one detachable LIC provision; issuing the financial product; creating at least one underwriter as a closed end fund owned by a parent company; placing ownership of at least a portion of an issue of the financial product in an underwriter owned by a parent company; spinning off the underwriter from the parent company using at least one stock dividend; trading shares of the underwriter; reporting information on trades and positions of the underwriter; and valuing the underwriter using analytic modeling, sensitivity testing, portfolio analysis, and / or investment analysis.

Owner:LIC DEV

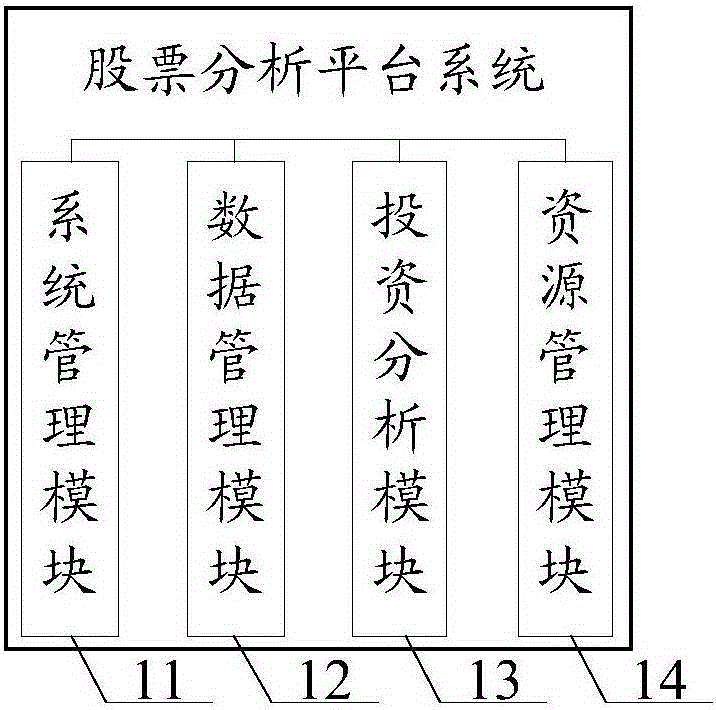

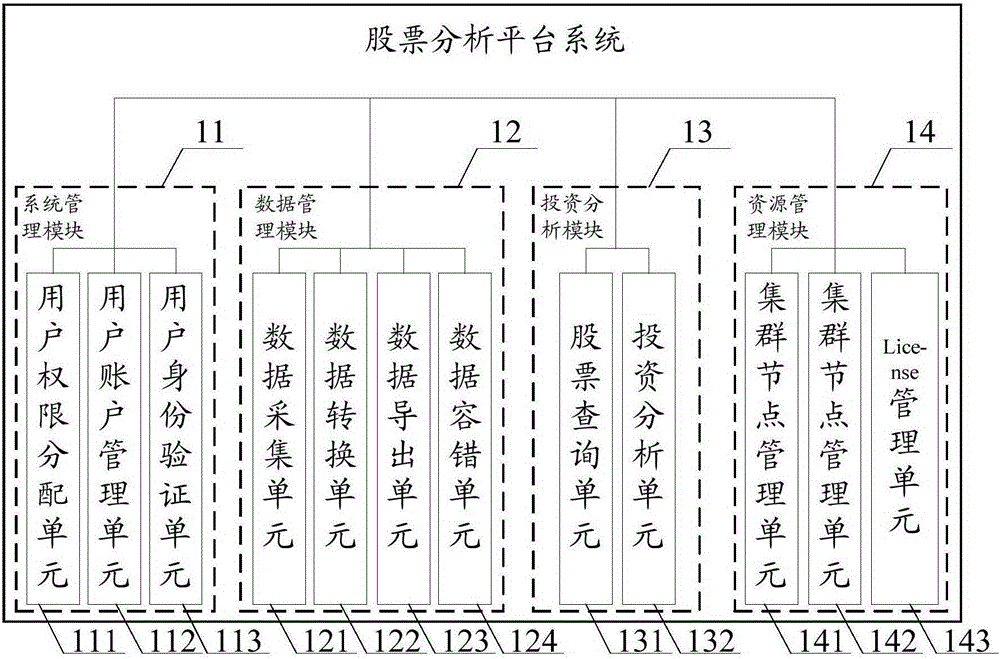

Could computation based stock data analysis system

InactiveCN105354642AReduce difficultyMeet real-time requirementsFinanceForecastingInvestment analysisSystems management

The application discloses a cloud computation based stock data analysis system. The system is constructed on a stock analysis platform system built in advance and comprises a system management module, a data management module, an investment analysis module and a resource management module, wherein the system management module is used for managing user information, the data management module is used for storing all stock data in a cloud server cluster and carrying out unified management on the stock data stored in the cloud server cluster; the investment analysis module is used for carrying out big data analysis on a target stock needed to be inquired by a user according to the stock data stored in the cloud server cluster and calculation resources of the cloud server cluster to obtain a stock predicted trend of the target stock, and the resource management module is used for monitoring the usage conditions of system resources of the stock analysis platform system in real time. The process for stock analysis is developed on the basis of a cloud computation technology, manual analysis is not needed, the difficulty of an investor on the stock analysis is reduced, and thus, the real-time requirement of the investor for the stock analysis is met.

Owner:INSPUR BEIJING ELECTRONICS INFORMATION IND

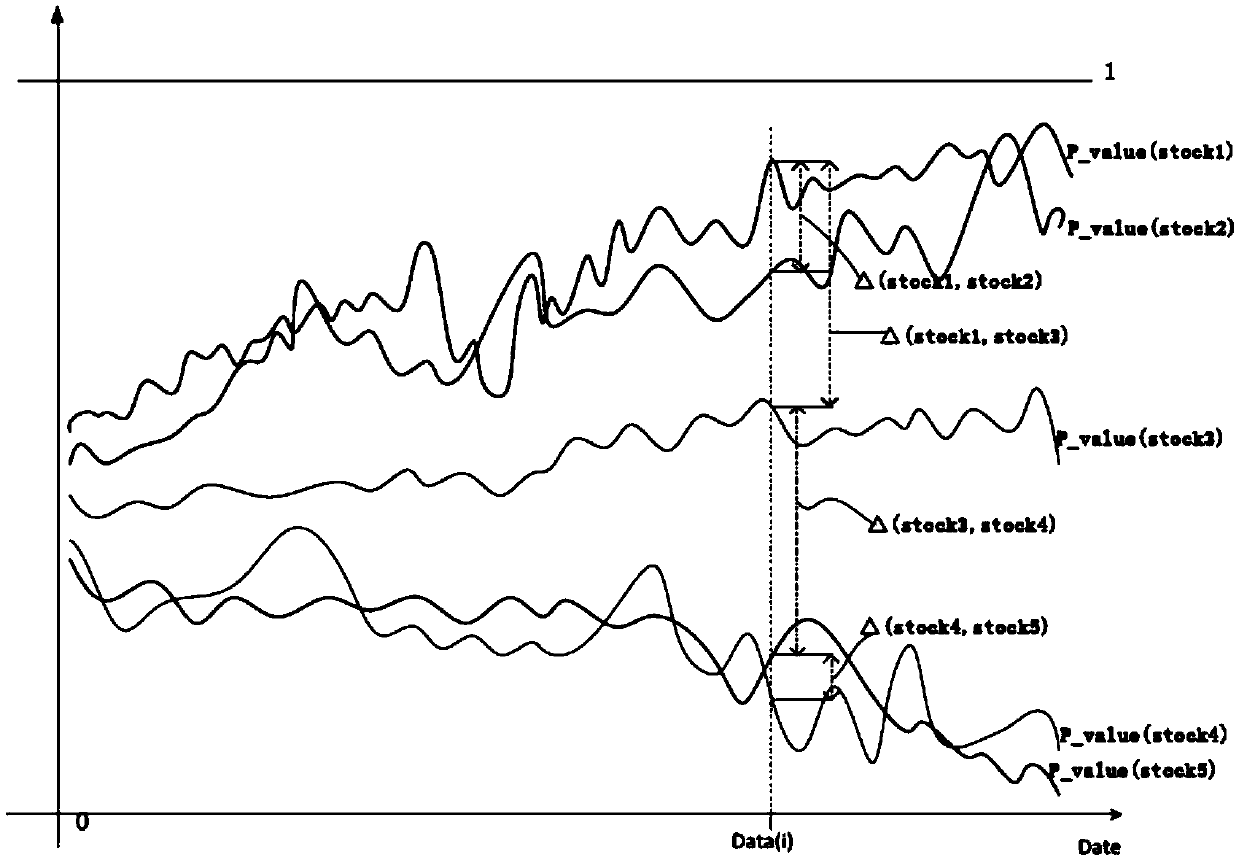

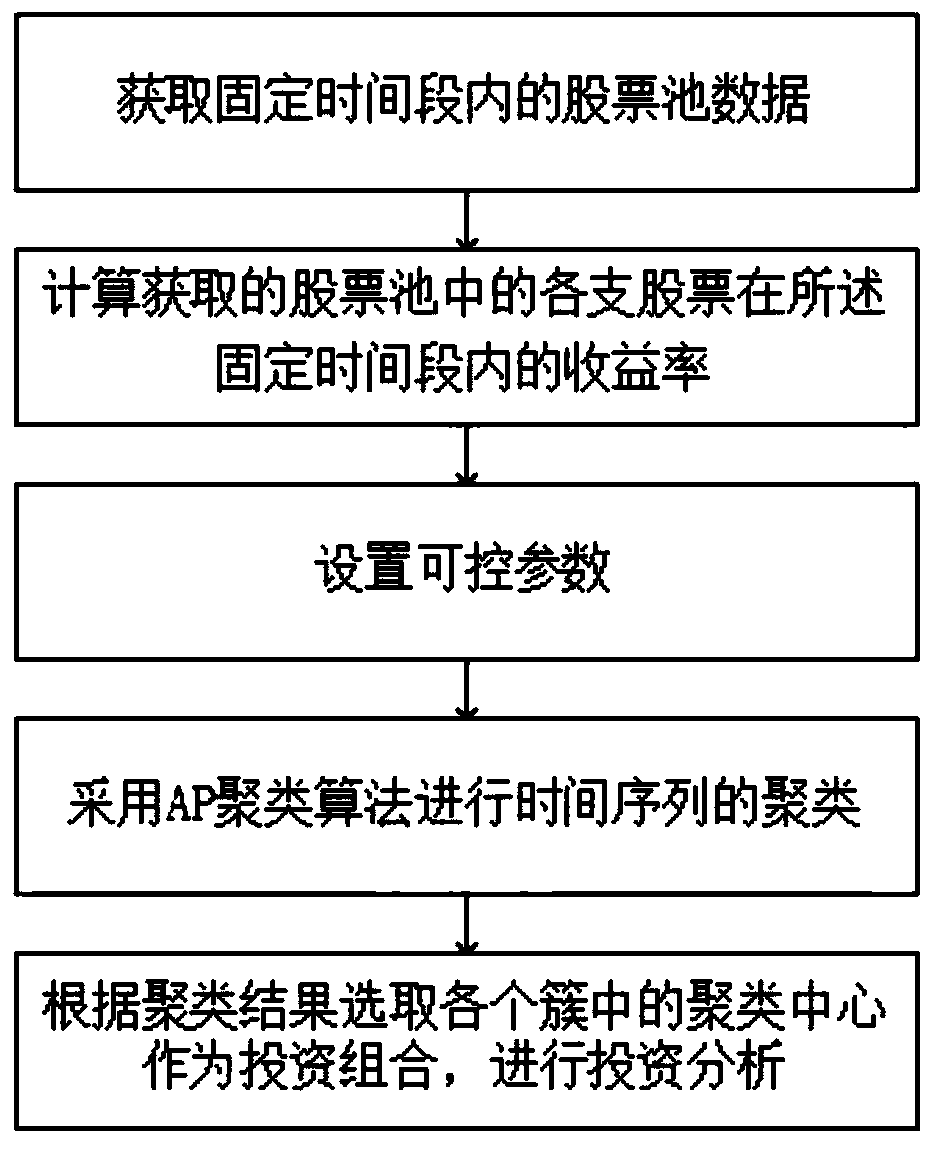

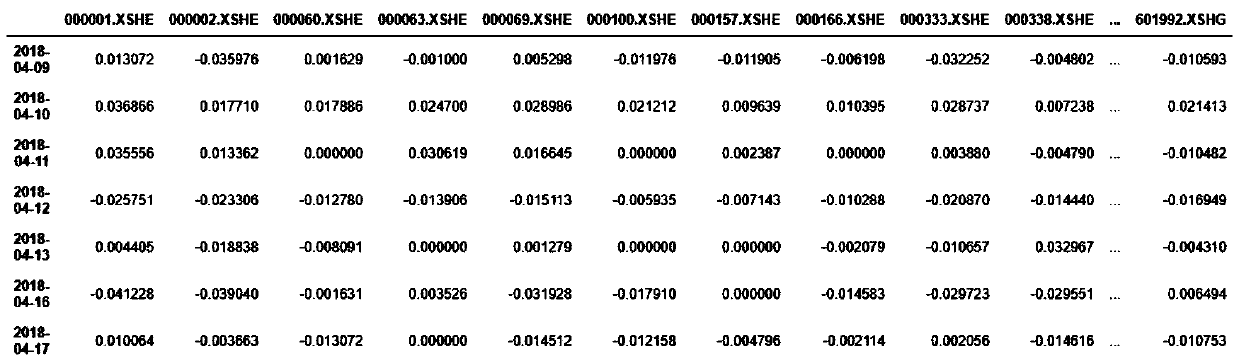

A controllable portfolio stock selection method based on an AP clustering algorithm

InactiveCN109544346AIncrease independenceControls can't make the right portfolio issuesFinanceCharacter and pattern recognitionCluster algorithmInvestment analysis

The invention discloses a controllable portfolio stock selection method based on an AP clustering algorithm, The steps include: acquiring stock pool data for a fixed period of time, calculating a return rate of each stock in the acquired stock pool over the fixed period of time, setting controllable parameters, wherein the AP clustering algorithm is used to cluster the time series, and the similarity matrix, attraction matrix and belonging matrix of each stock in the stock pool are calculated, and the clustering results are obtained, and judged by combining the controllable parameters until the clustering results satisfy the controllable parameters. According to the clustering results, the clustering centers in each cluster are selected as the investment portfolio for investment analysis.By adopting controllable AP clustering for stock selection, the invention greatly controls the problem that the number of clusters in the AP clustering is too much / too little to carry out correct portfolio, improves the independence of each stock in the selected portfolio and reduces the investment risk.

Owner:GUANGDONG UNIV OF TECH

Power grid investment analysis model evaluation method

The invention discloses a power grid investment analysis model evaluation method, and the method comprises the steps: building two types of power grid investment analysis models, wherein each type of power grid investment analysis model comprises four dimensions which form first-level indexes, each dimension is provided with an investment key direction serving as a second-level index, and the evaluation factor of each investment key direction serves a third-level index; calculating target values of the third-level indexes determining the scores of the second-level indexes; integrating the scores of the second-level indexes, and calculating the scores of the first-level indexes. According to the invention, the method achieves the evaluation of an investment project through the power grid investment analysis model in scientific and reasonable design and structure, and can automatically calculate the comprehensive assessment score of the investment project through the target values of all expected targets inputted into the investment project. The method also can order a plurality of investment projections according to the result of an evaluation score of a single index, is high in reliability, and has the popularization value in serving as an industrial evaluation standard.

Owner:STATE GRID HEBEI ELECTRIC POWER CO LTD

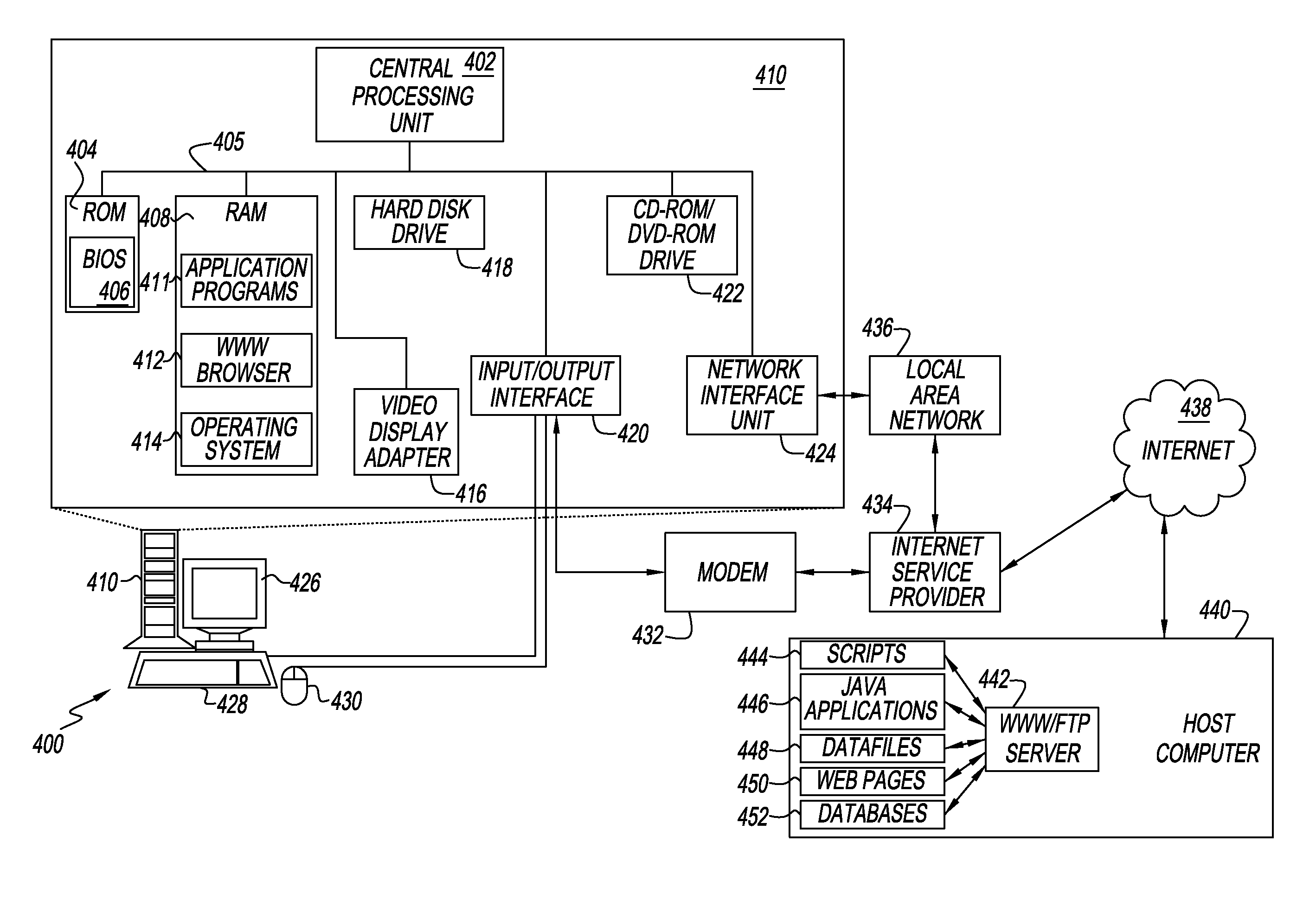

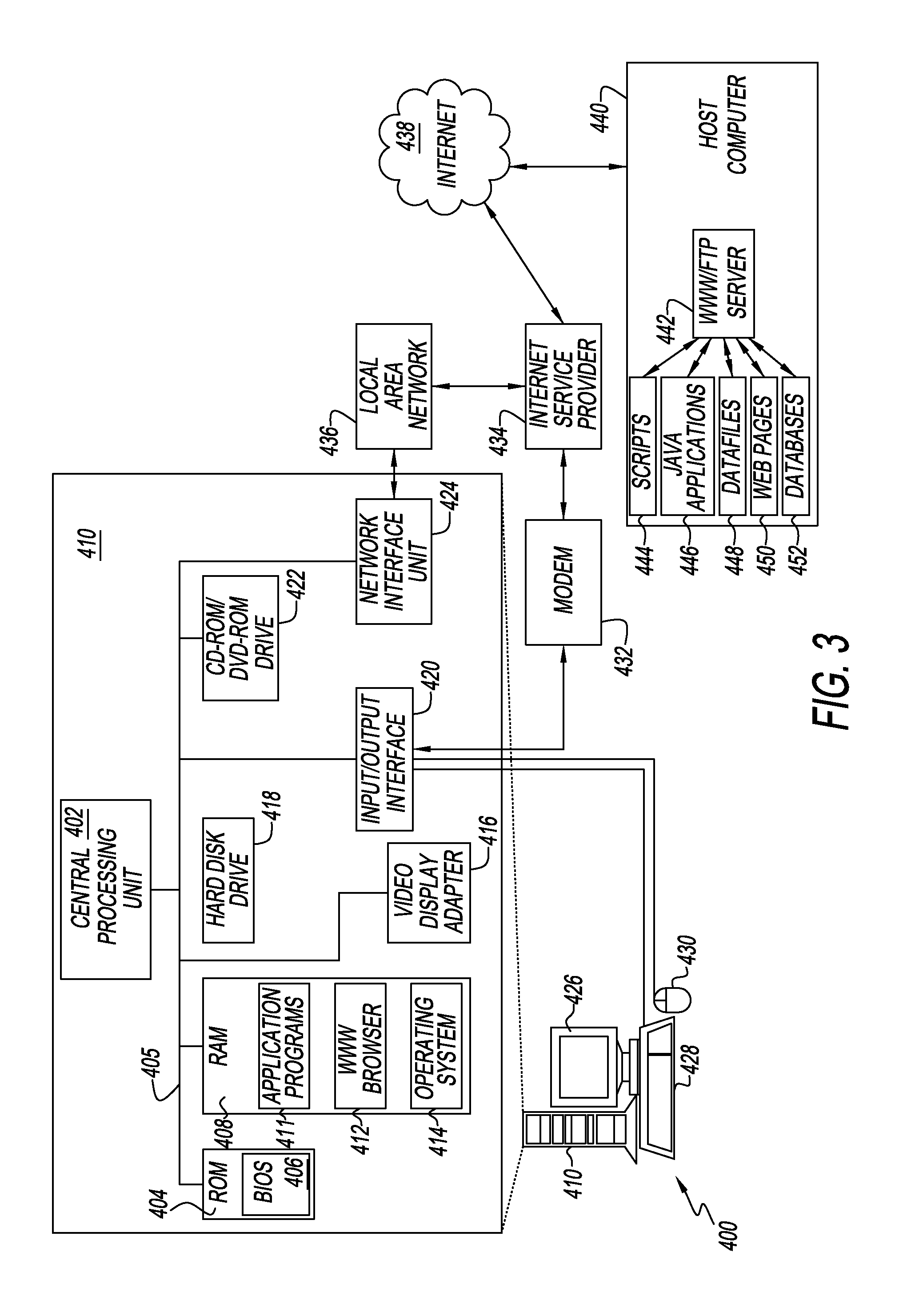

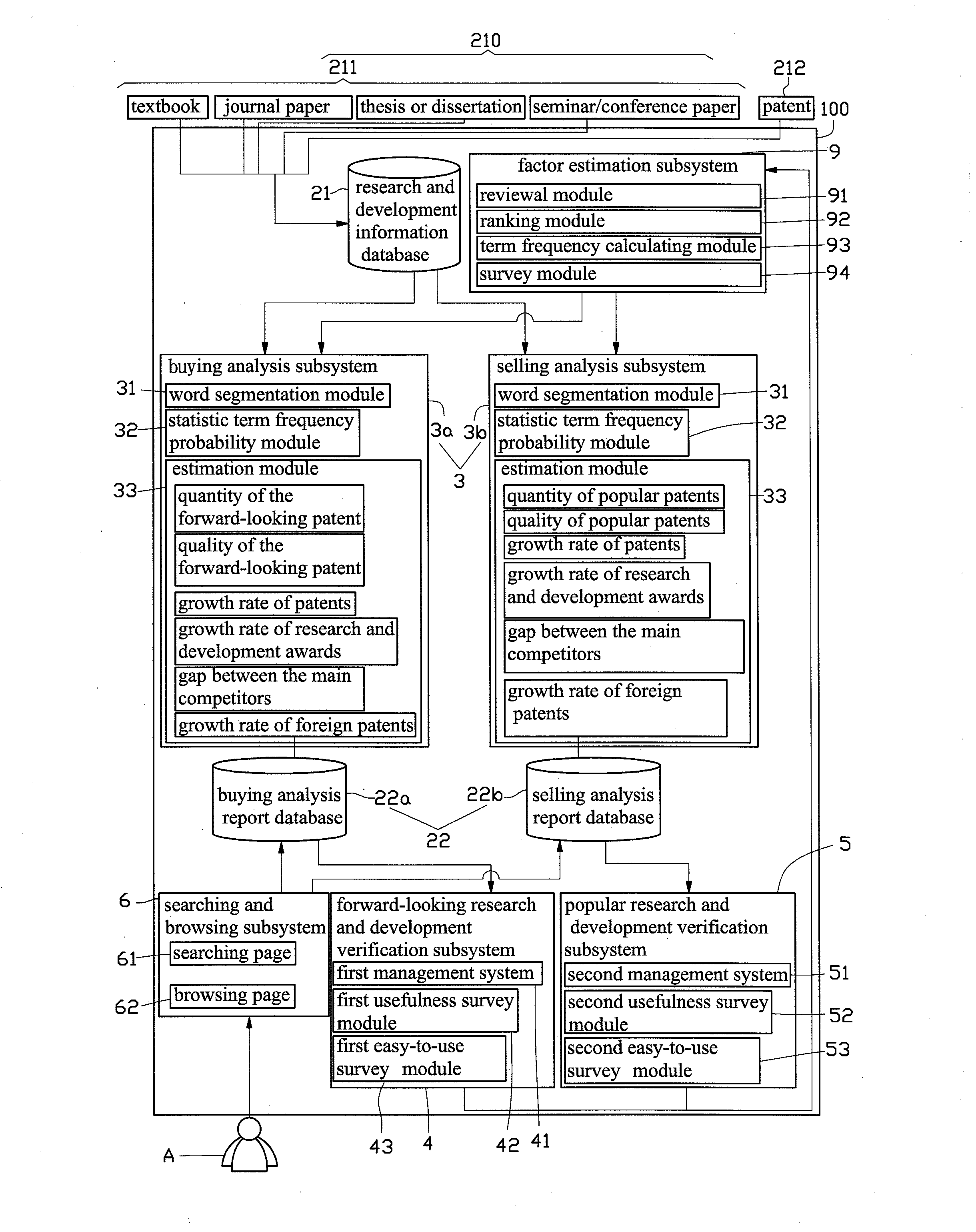

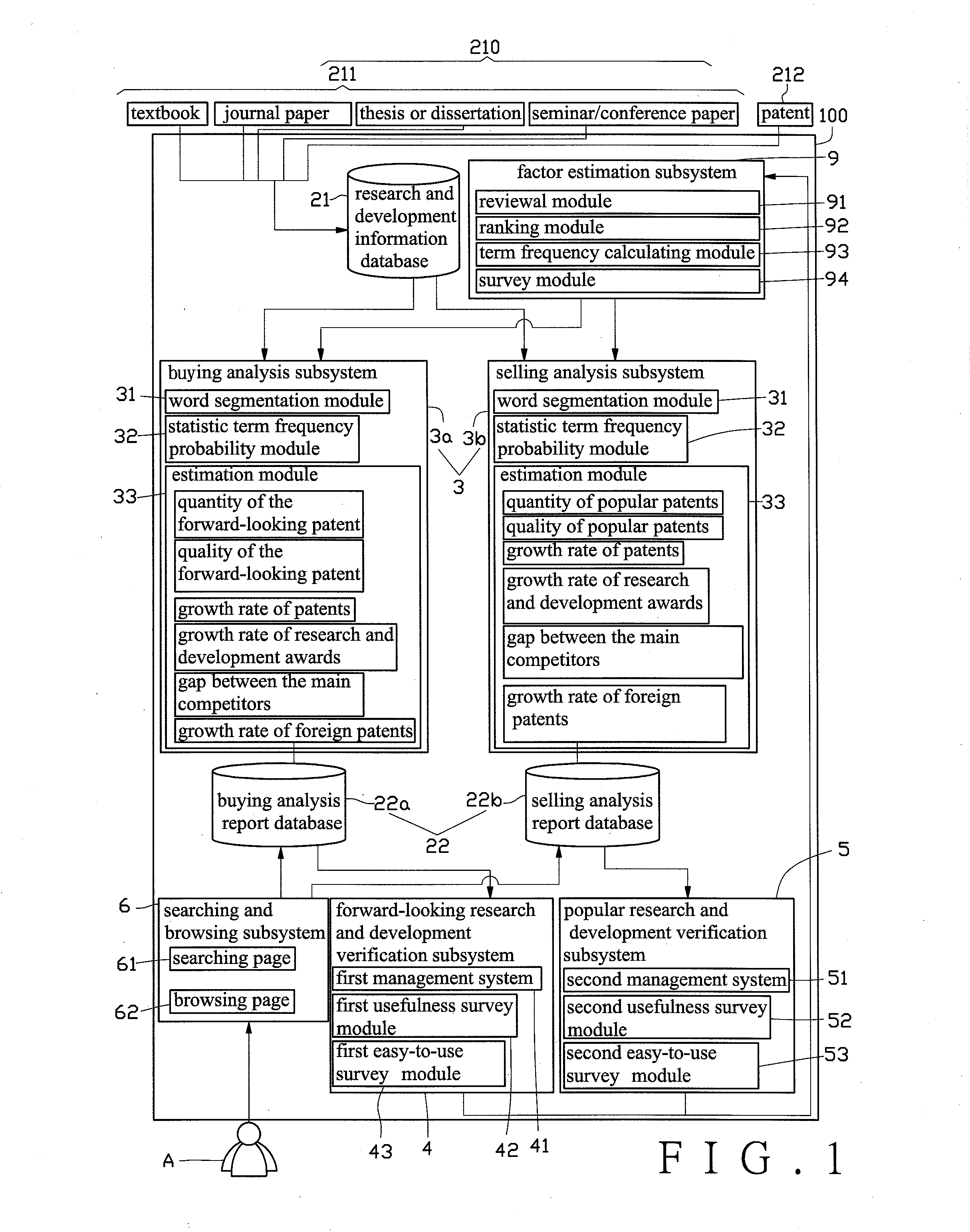

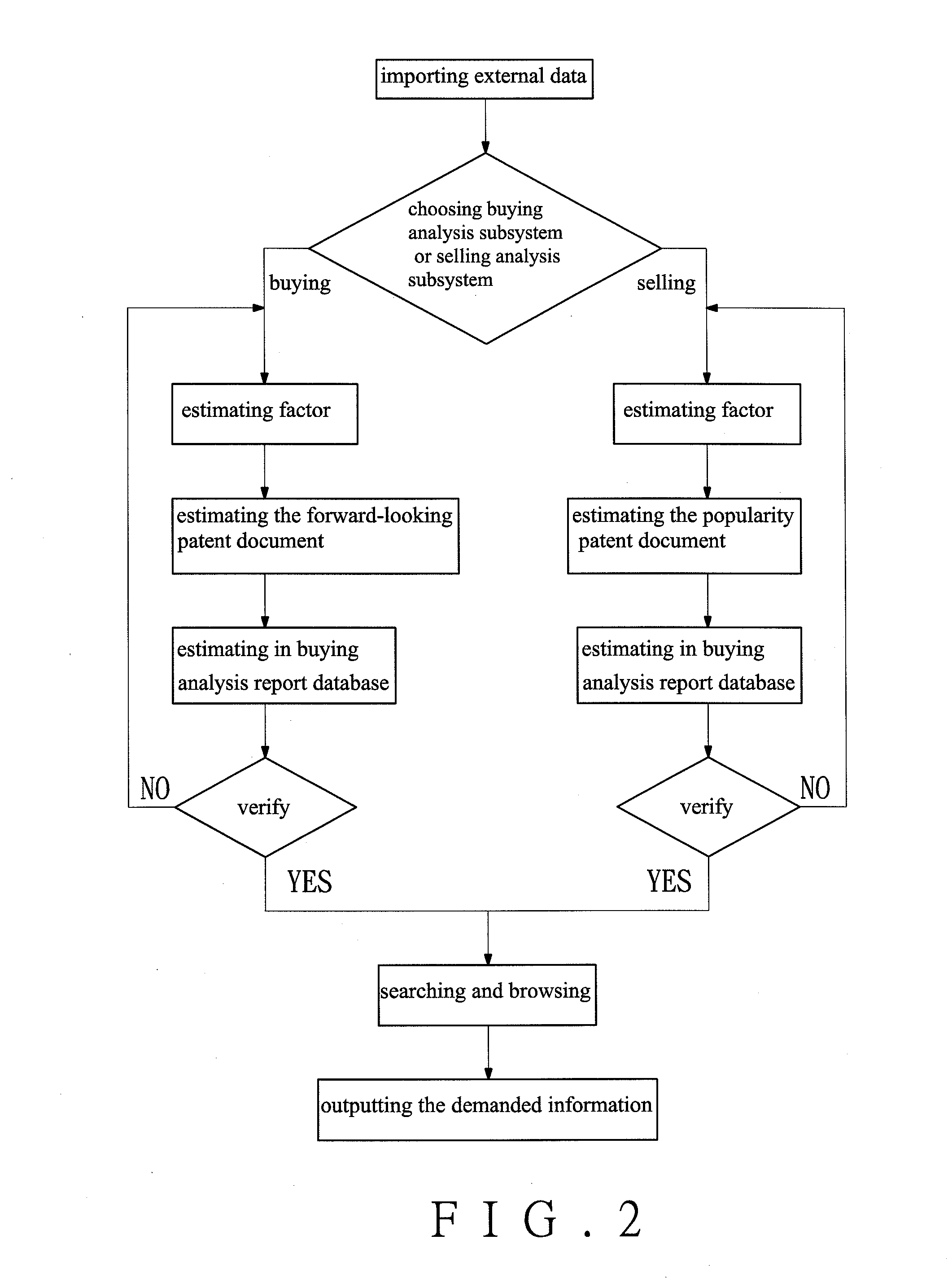

System for research and development information assisting in investment, and a method, a computer program, and a readable and recordable media for computer thereof

A system for research and development information assisting in investment, and a method, a computer program, and a readable and recordable media for computer thereof are disclosed. The system comprises a processing unit, a database module, an investment analysis subsystem, and an output unit, and provides a method, a computer program or a readable and recordable media for computer. The investment analysis subsystem compares an academic document with a patent document to generate a technical relevancy, providing the user to determine whether a patent document of the target enterprise is forward-looking or whether too many popular patents are owned. Therefore, users can choose to enter the market earlier when the stock price of the enterprise is underestimated or exit earlier before the invested enterprise reduces the turnover and the enterprise value due to a vicious competition and a price reduction strategy of competitors, thereby ensuring investors' profits.

Owner:NAT CHENG KUNG UNIV

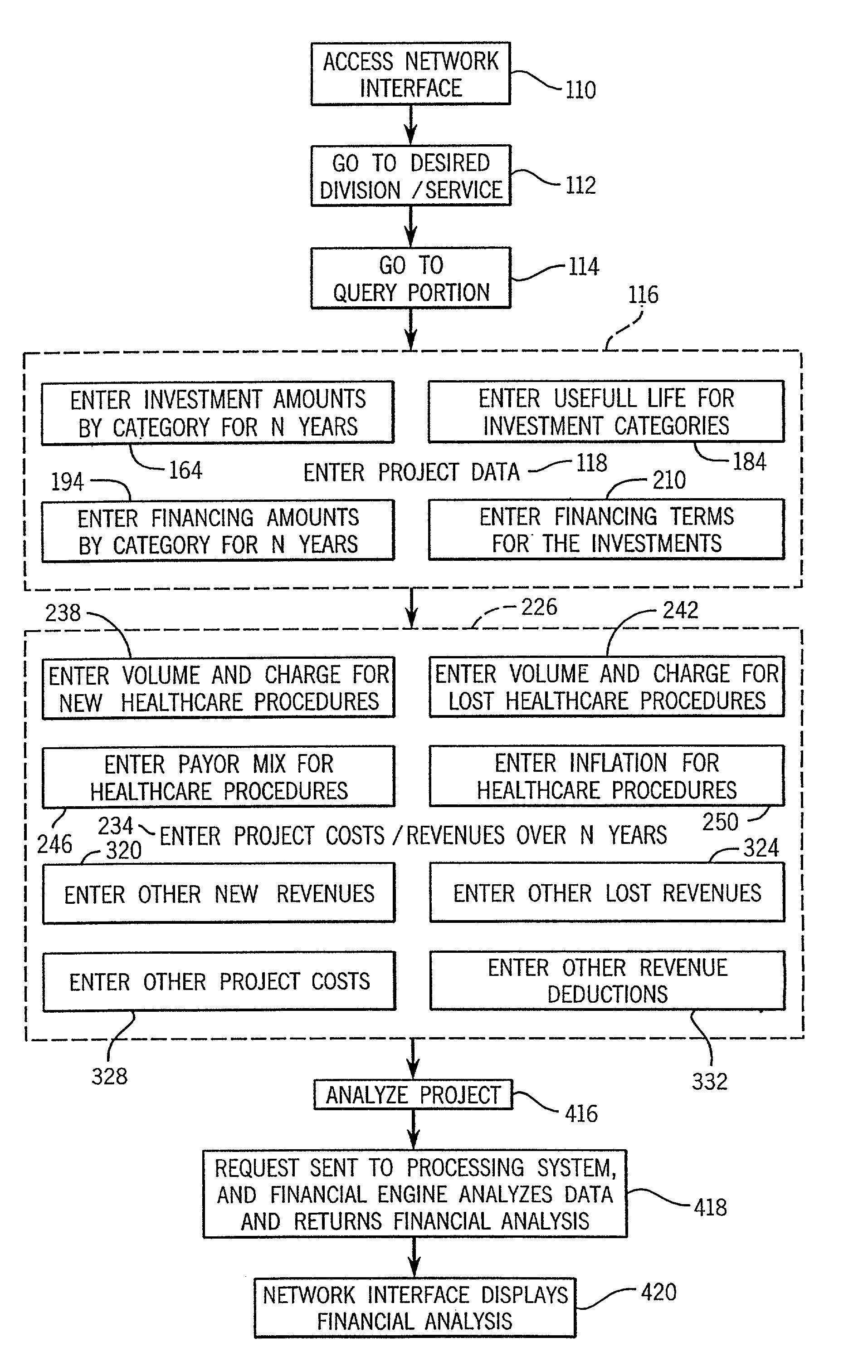

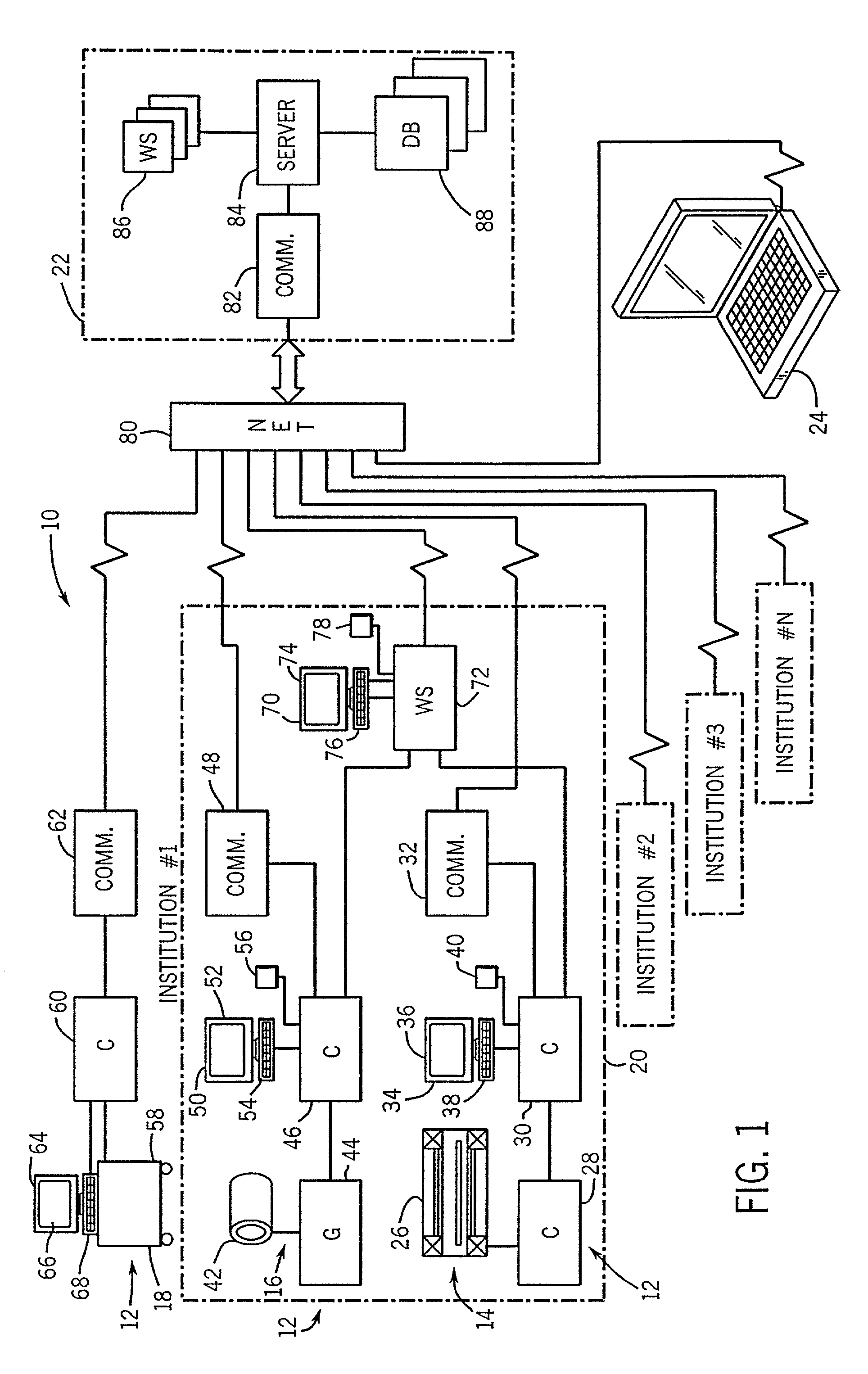

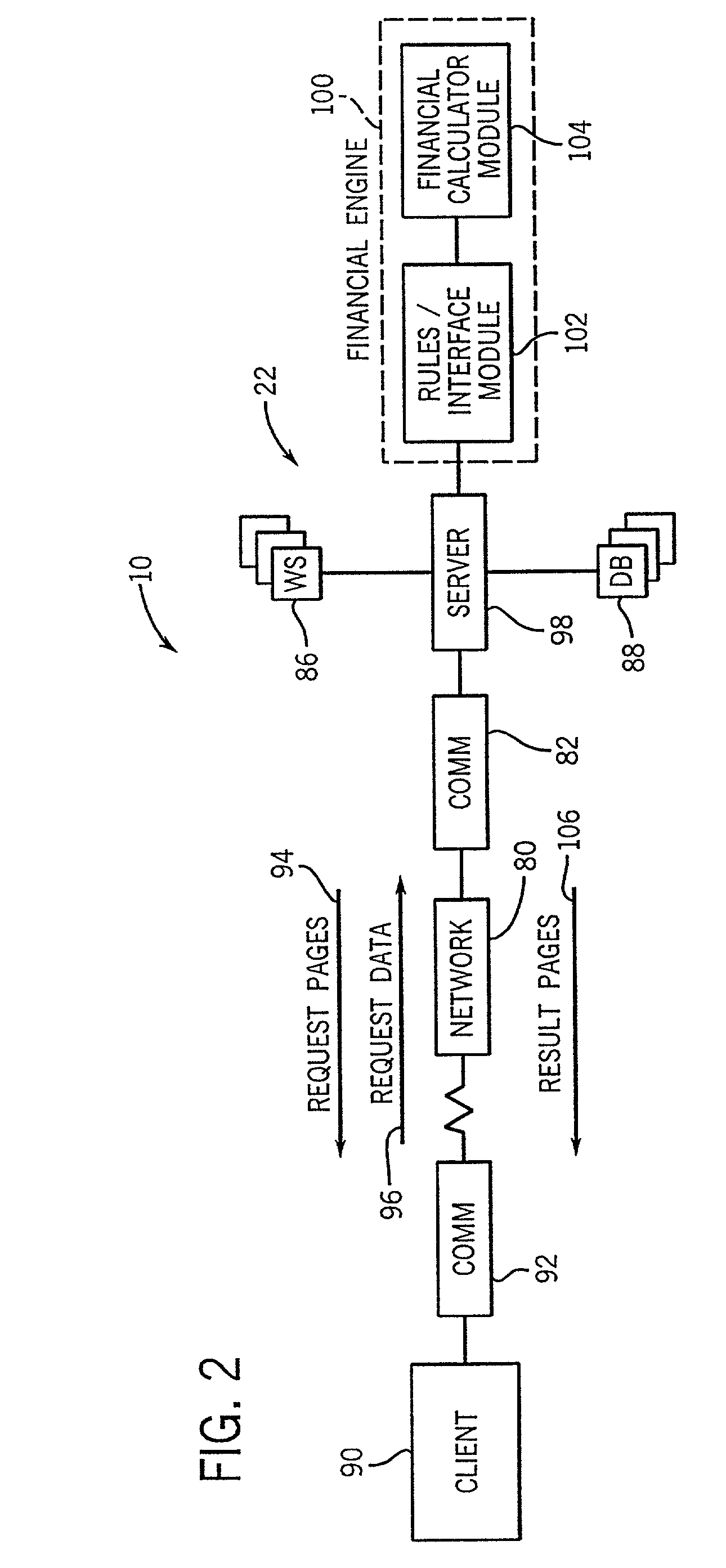

Capital analysis tool for medical diagnostic systems and institutions

InactiveUS7117174B2High feasibilityEvaluating the feasibility of the investmentFinanceInvestment analysisAnalysis tools

The present technique is associated with financial analysis of a capital investment in medical resources. The technique allows a client to interact with a remote financial analysis system via a network interface, and to enter and transmit client data associated with a desired capital investment to the financial analysis system for an investment analysis. The financial analysis system then provides a customized investment report for the desired capital investment to assist the client in evaluating the feasibility of the investment.

Owner:GENERAL ELECTRIC CO

Power customer resource refined management method based on TEM

InactiveCN110309932AImprove satisfactionIncrease loyaltyCustomer relationshipForecastingElectricityInvestment analysis

The invention relates to the field of power marketing, in particular to a power customer resource refined management method based on TEM. The method comprises the following steps of 1, acquiring internal data and external data; 2, establishing a customer future power utilization prediction model and a customer complaint mining analysis model, wherein the customer future power utilization prediction model comprises short-term prediction and medium-and-long-term prediction. The beneficial effects of the invention are as follows: clustering analysis is performed on multi-dimensional information of a client; client classification is carried out; based on a layered sampling technology, on-site investigation and research is carried out on the sample client in extraction; the overall condition isrelefected by using samples, customer actual needs are mastered, a customer comprehensive analysis model (mainly comprising a customer future electricity consumption prediction model, an electricitycharge recovery risk prediction model, an electric energy replacement investment analysis model and a customer complaint mining analysis model) is established from the actual needs of customers, and differentiated management service strategies are formulated based on an analysis result, so that the customer satisfaction and loyalty are improved.

Owner:HUZHOU ELECTRIC POWER SUPPLY CO OF STATE GRID ZHEJIANG ELECTRIC POWER CO LTD

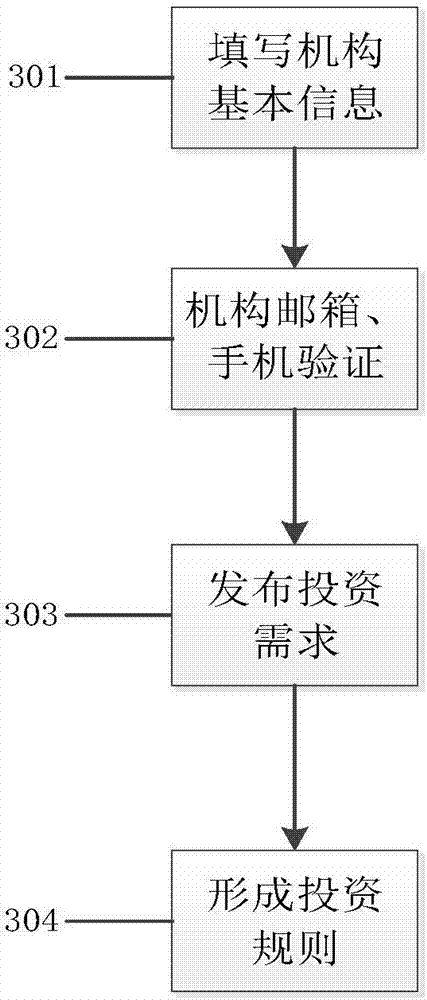

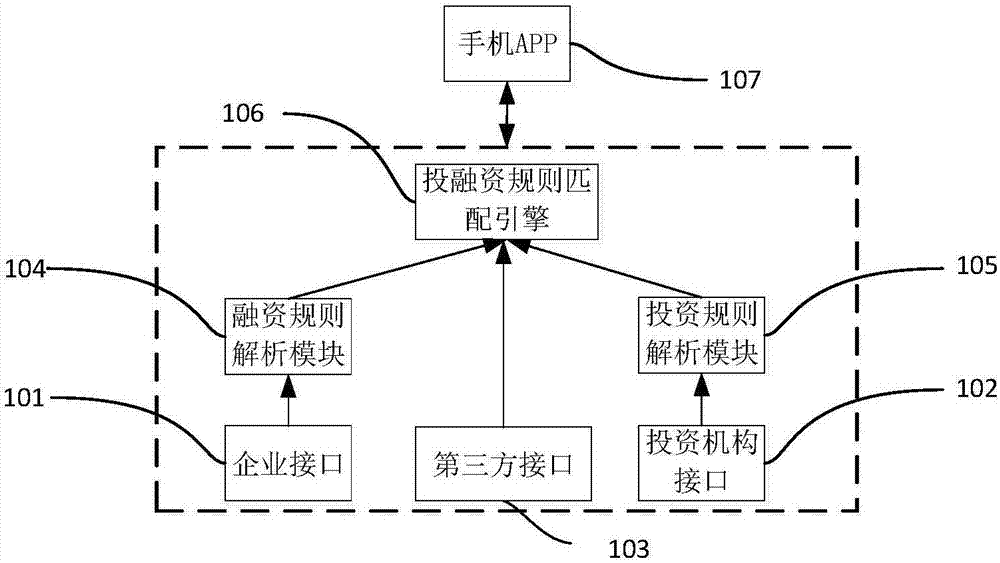

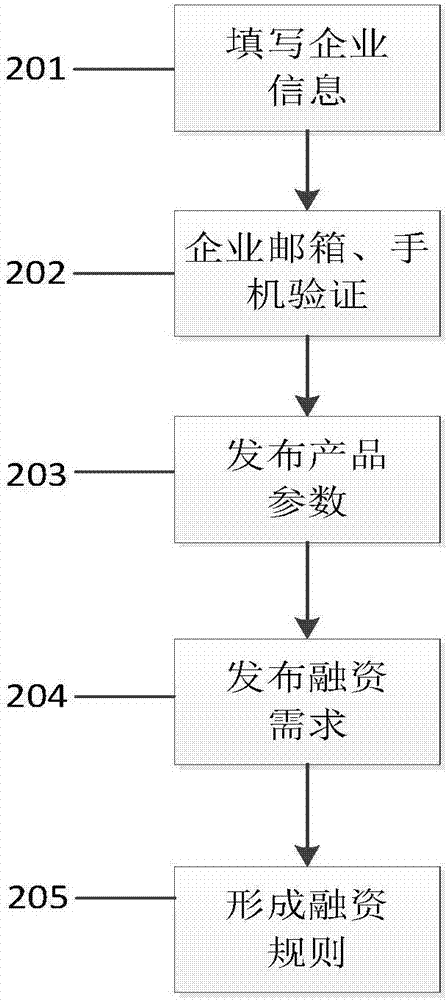

Big data based investment and financing bridging method and platform

The invention discloses a big data based investment and financing bridging method and platform. The method includes steps of (1) acquiring enterprise information and enterprise financing information so as to form a financing rule base; (2) acquiring investment mechanism information and investment information so as to form an investment rule base; (3) matching the financing rule base and the investment rule base and acquiring a matching scheme with high demand matching degree between investment mechanisms and enterprise users planning financing. The platform is provided with an enterprise interface facing enterprises and an investment mechanism interface facing the investment mechanisms, and a financing rule analysis module, an investment analysis module and an investment and financing rulematching engine. Signal interaction is achieved between the financing rule analysis module and the enterprise interface, between the investment analysis module and the investment mechanism interfaceand between the investment and financing rule matching engine financing rule analysis module as well as the investment analysis module. The method and the platform realize intelligent bridging betweenenterprises and investment mechanisms.

Owner:武汉市科技金融创新促进中心 +1

Automatic mapping and allocation of beneficial interests in trusts for portfolio analysis

Owner:REFINITIV US ORG LLC

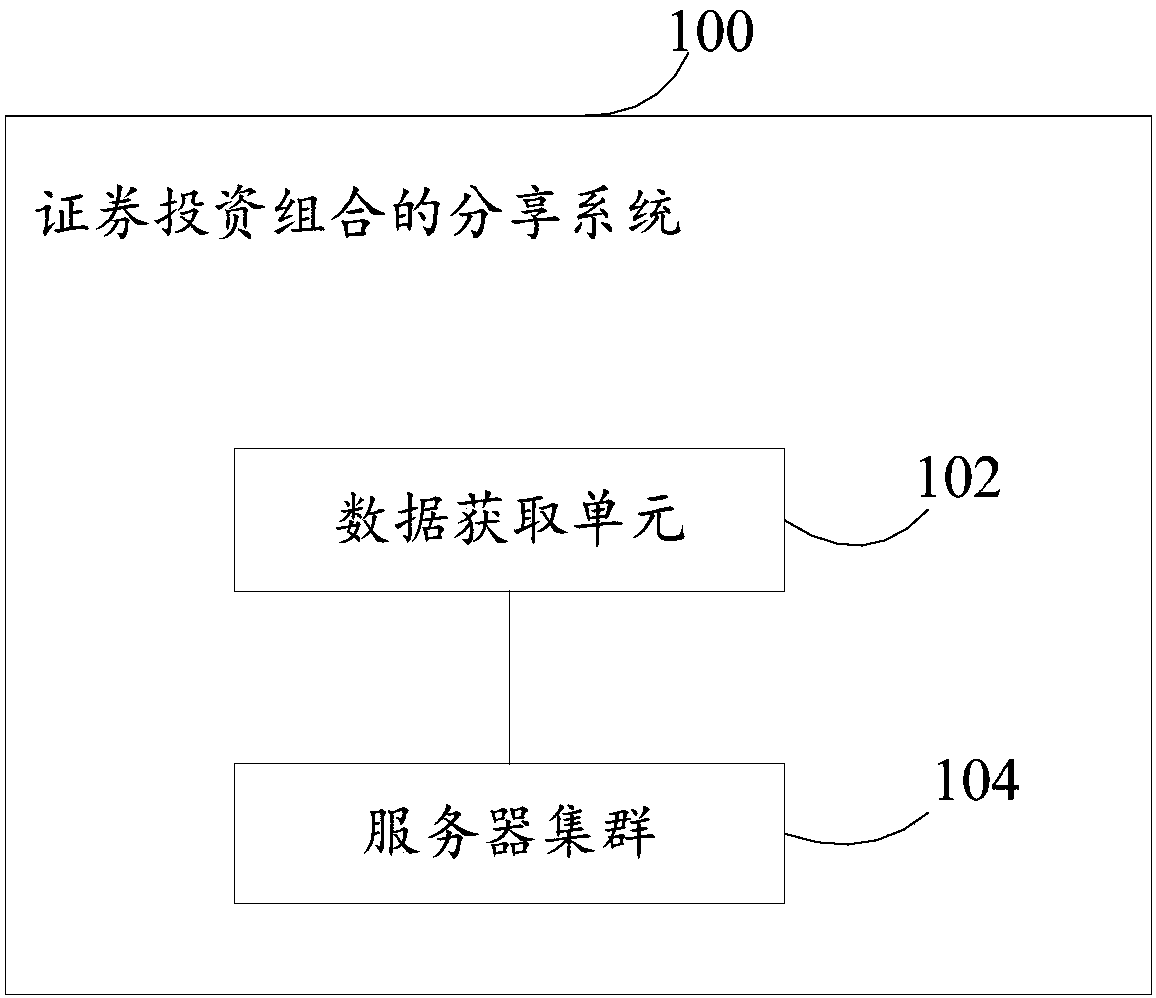

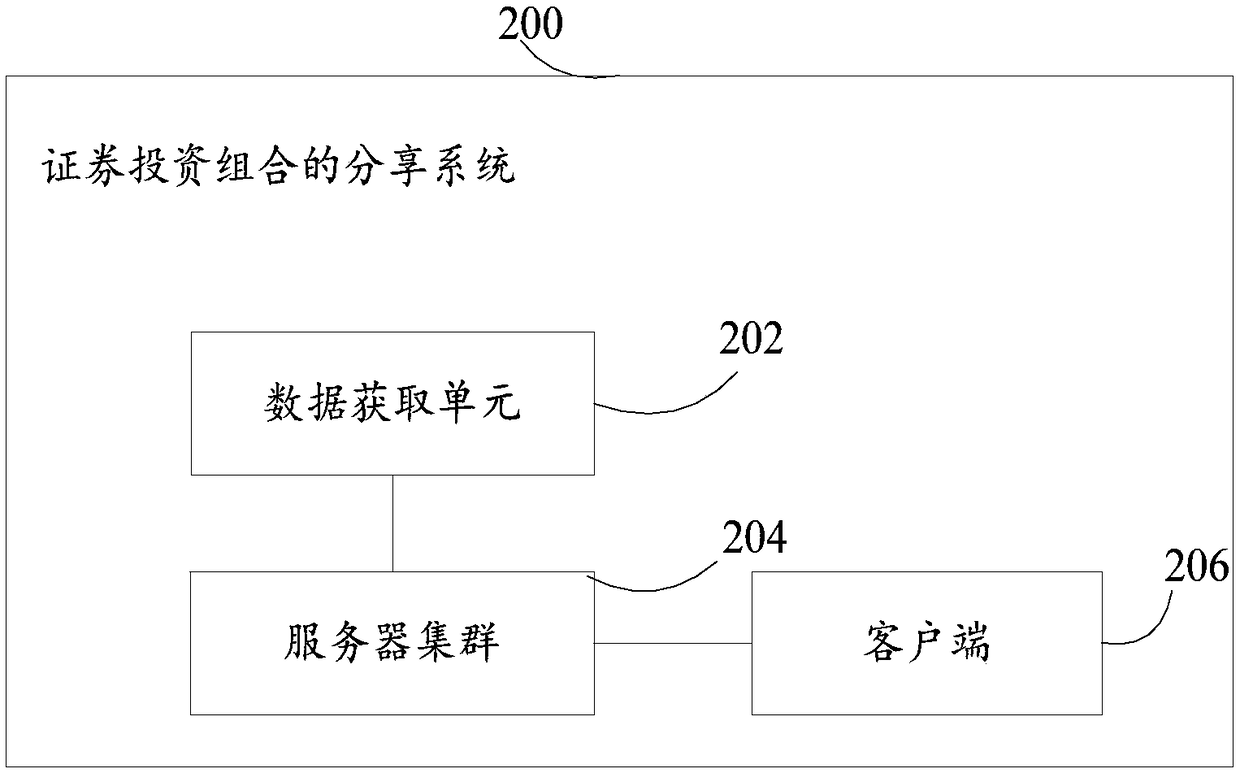

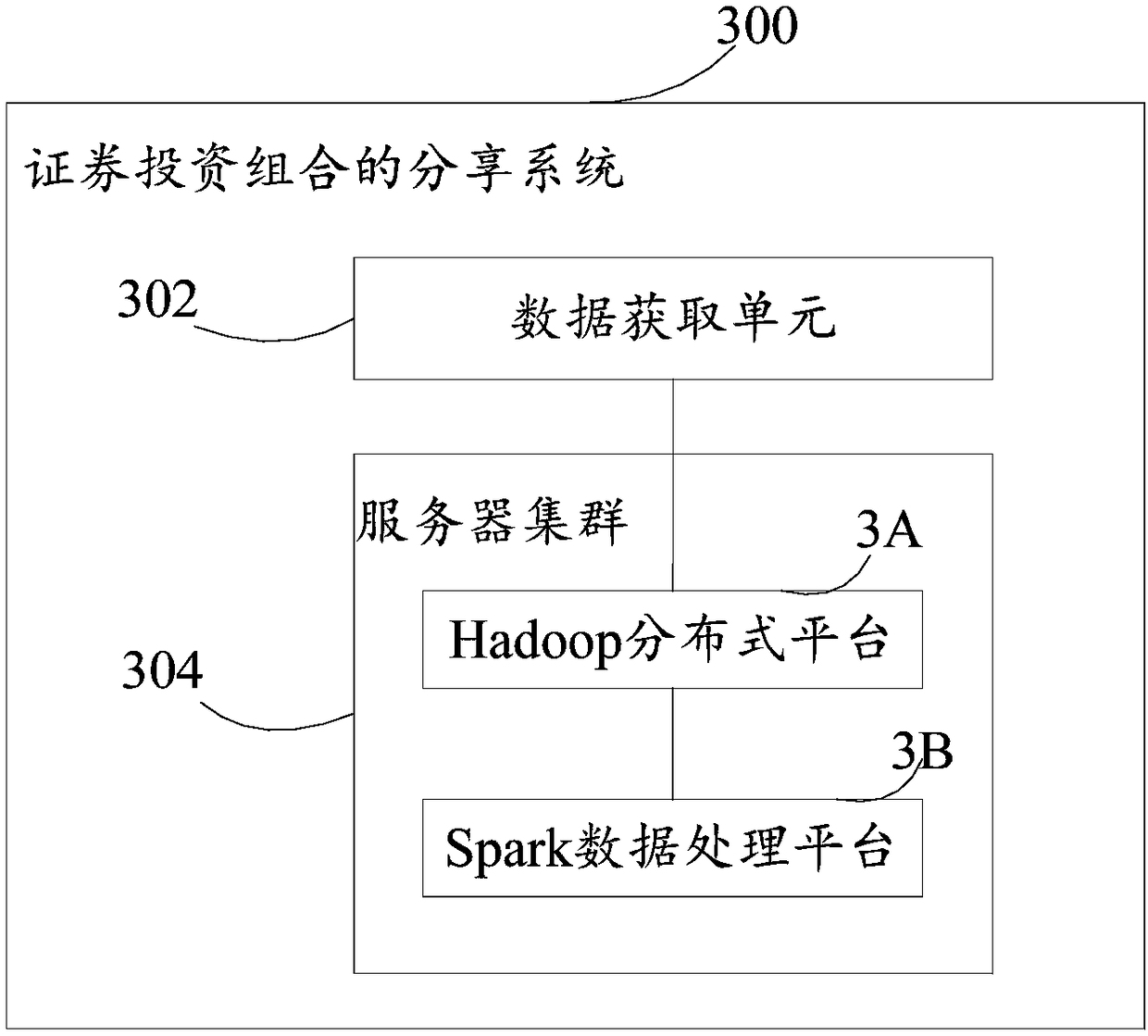

Sharing system and method of securities portfolio

InactiveCN108446985AUnderstanding the Reasons for Changes in EarningsFinanceInvestment analysisData mining

The invention provides a sharing system and method of securities portfolios and relates to the technical field of securities investment. The system comprises a data acquisition unit and a server cluster. The data acquisition unit is used for acquiring financial data in real time and distributing the financial data to the server cluster, wherein the financial data includes stock information and company financial information. The server cluster is used for analyzing and processing pre-stored securities portfolios on the basis of the financial data so as to obtain an investment analysis report corresponding to the securities portfolios, wherein the investment analysis report at least includes characteristic information, income information and income reasons of the securities portfolios and the income information includes corresponding profits and losses of securities in the portfolios. According to the invention, a detailed investment analysis report can be provided to investors to allowthe investors to understand reasons of income changes of the securities portfolios.

Owner:张家林

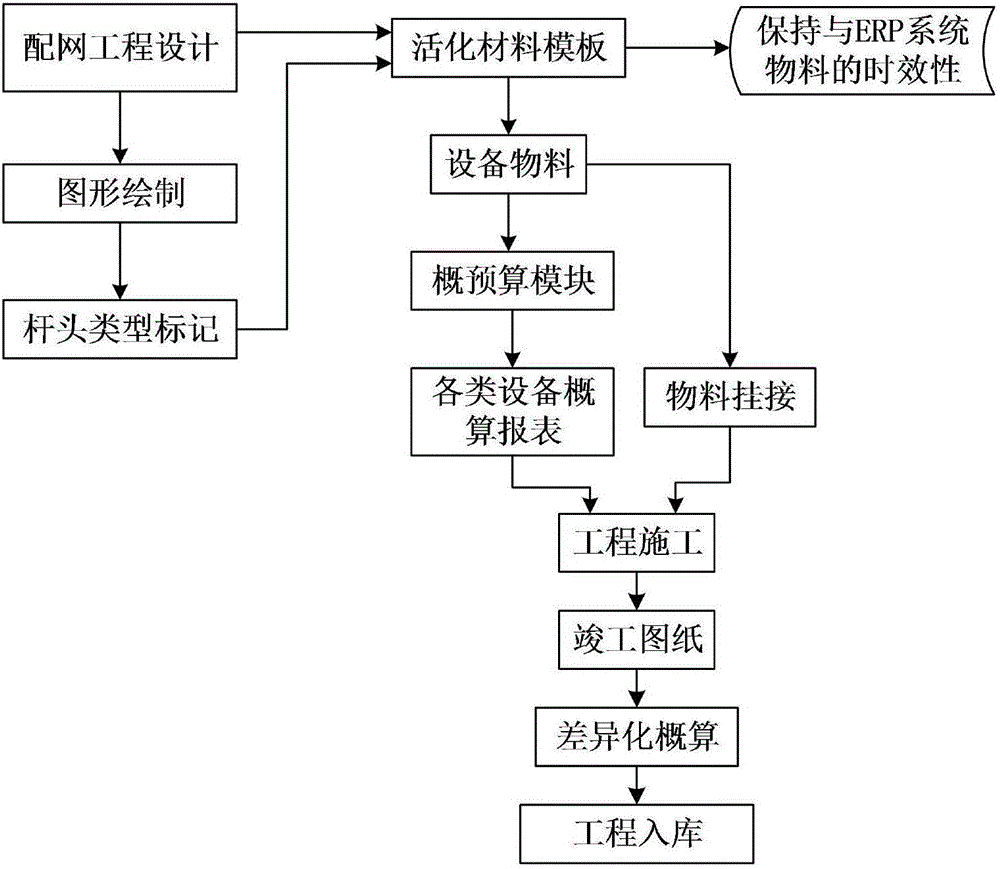

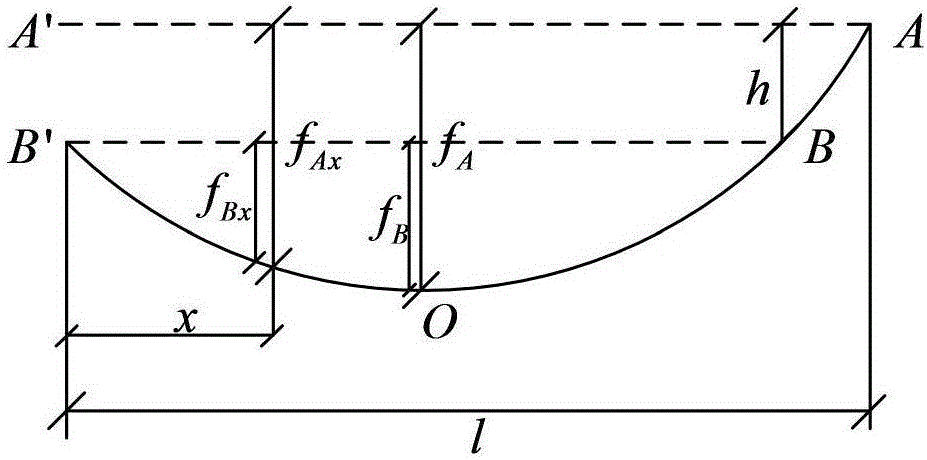

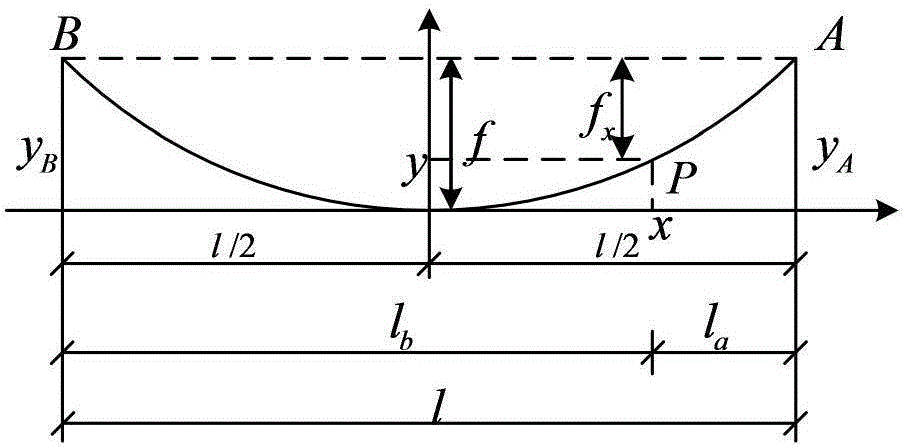

Standardized grid distributing method suitable for upgrading and transformation of rural power grid

InactiveCN106354907AAdapt to the needs of rural constructionLive tracking updatesGeometric CADData processing applicationsInvestment analysisQuality by Design

The invention provides a standardized grid distributing method suitable for upgrading and transformation of a rural power grid. The method comprises the steps that design personnel transform measuring results of exploration personnel into a standard grid distribution design drawing according to power distribution line design requirements, all rod types in the engineering design drawing are marked with numbers and classified, an activated material template is adjusted in real time along with a state grid corporation material system, a statistical result of the rod types is substituted into the activated material template, and various equipment material report forms are formed; a total material report form is automatically embedded in a rural power grid general estimation module, and various engineering general estimation report forms are generated; after completion, fine-adjustment parts in an as-built drawing are input into the activated material template, the generated material report forms are embedded into a rural power grid general estimation template, and balanced investment analysis is carried out. Compared with the mode that typical rod head type combination is adopted in existing popular design software, design to the rural power grid is higher in pertinence, the design quality of the rural power grid is effectively improved, and limited grid distribution fund is utilized to the maximum, so that resources are saved, and favorable conditions are created for managing fixed assets of a national grid system in a later stage.

Owner:CHINA UNIV OF GEOSCIENCES (WUHAN)

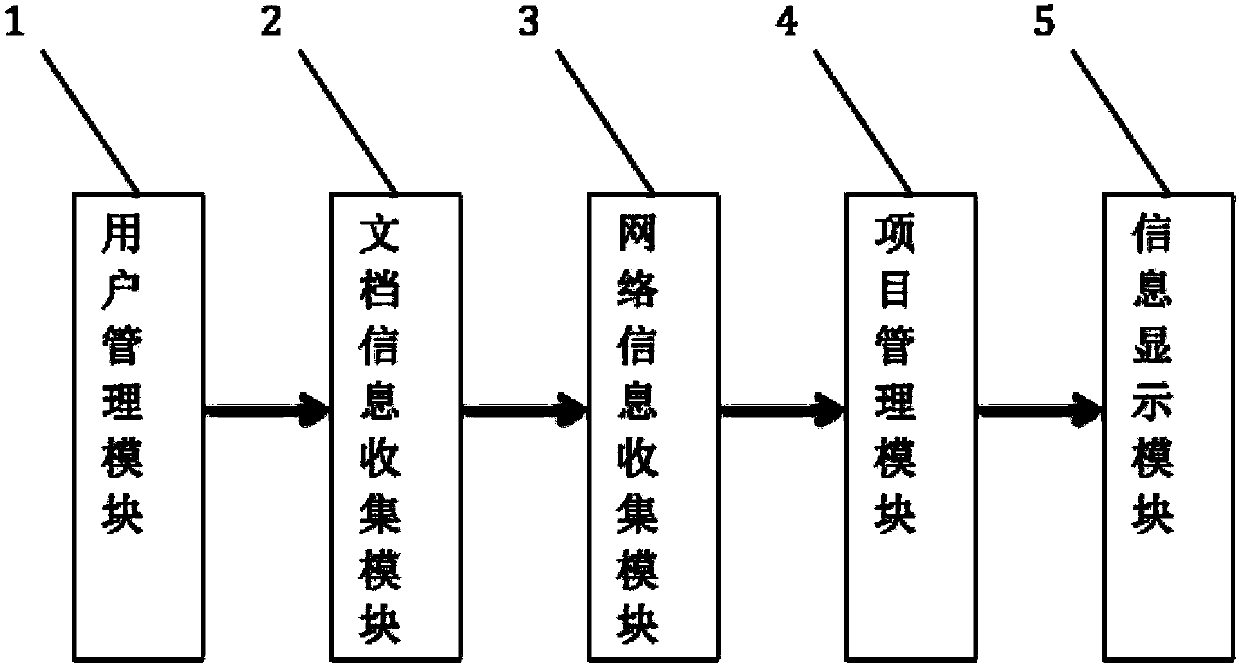

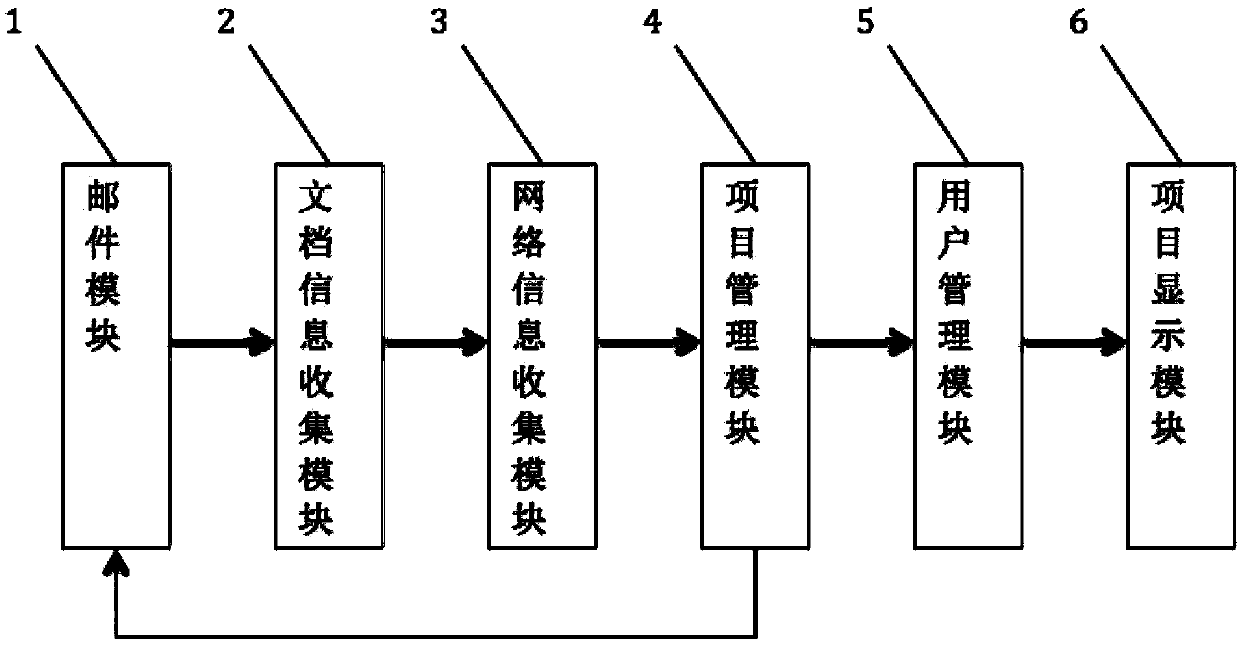

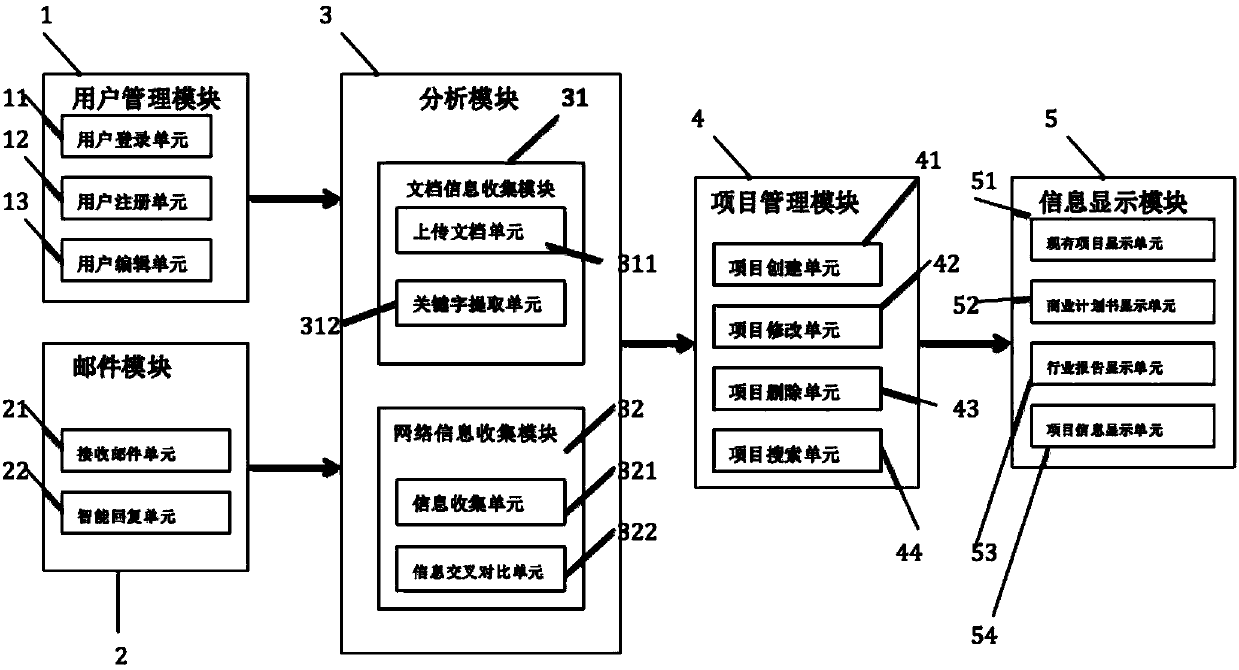

Investment analysis tool for automated and intelligent analysis of business plan

ActiveCN107844960AShorten the timeEasy to understandFinanceOffice automationInvestment analysisKnowledge management

The invention provides an investment analysis tool for automated and intelligent analysis of a business plan. The investment analysis tool comprises a user management module, an information collectingmodule, an information display module and a mail module, wherein the user management module is used for operating user login and registration, editing user information, and acquiring operation authority; the information collecting module is used for acquiring information from the business plan and a network, and creating a project; the information display module is used for displaying project information and company information related to the business plan to an investor; and the mail module is connected with the information collecting module, and is used for collecting the business plan froman mail, and sending a feedback report. The investment analysis tool can perform intelligent analysis on the business plan uploaded on a web side or forwarded through the mail by the investor, and can analyze and detect basic content such as the company information, team member information and the project information in the business plan, so as to save the time of manually searching and inquiringthe project information for the investor.

Owner:辅投帮(武汉)科技有限公司

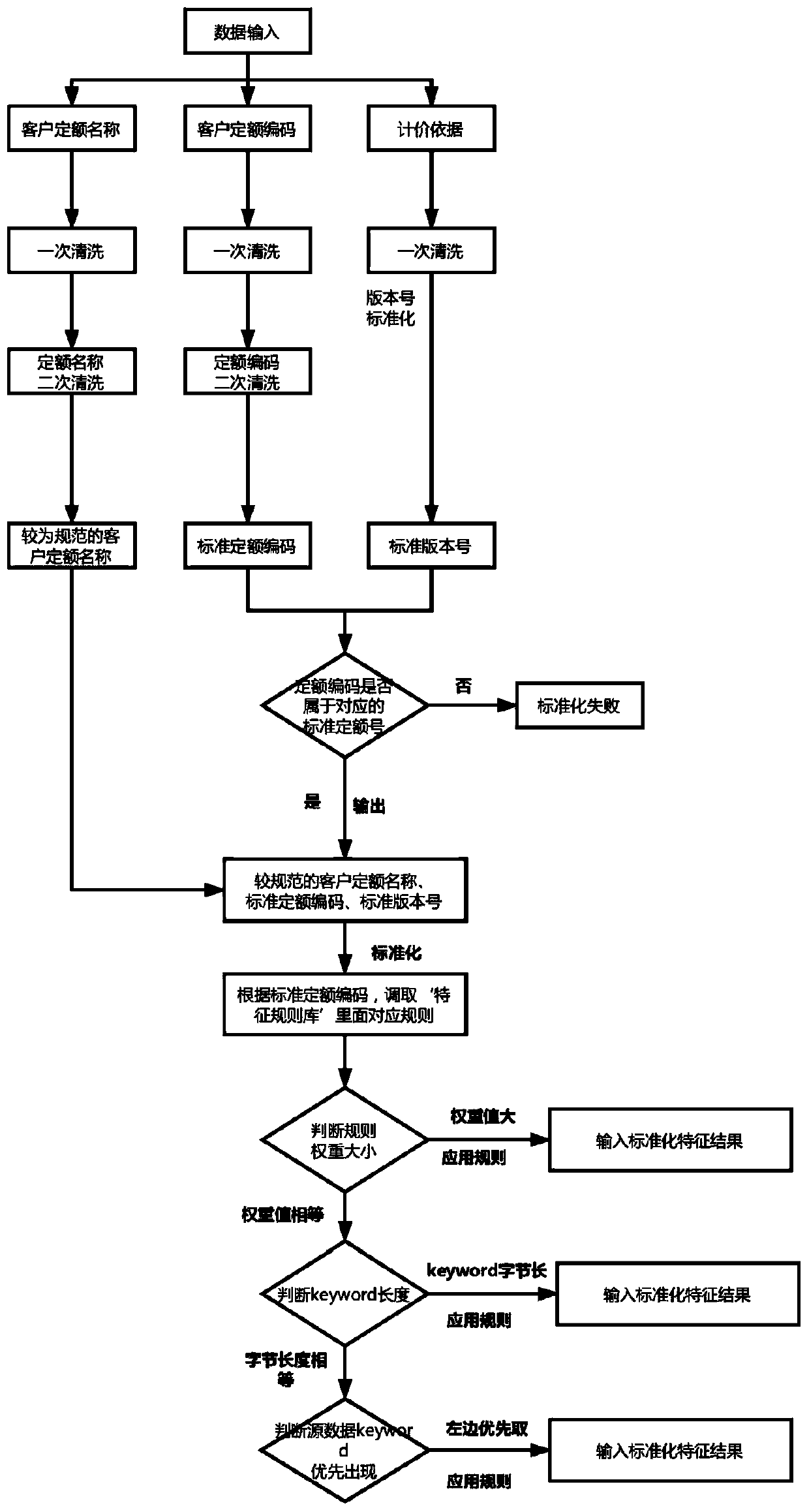

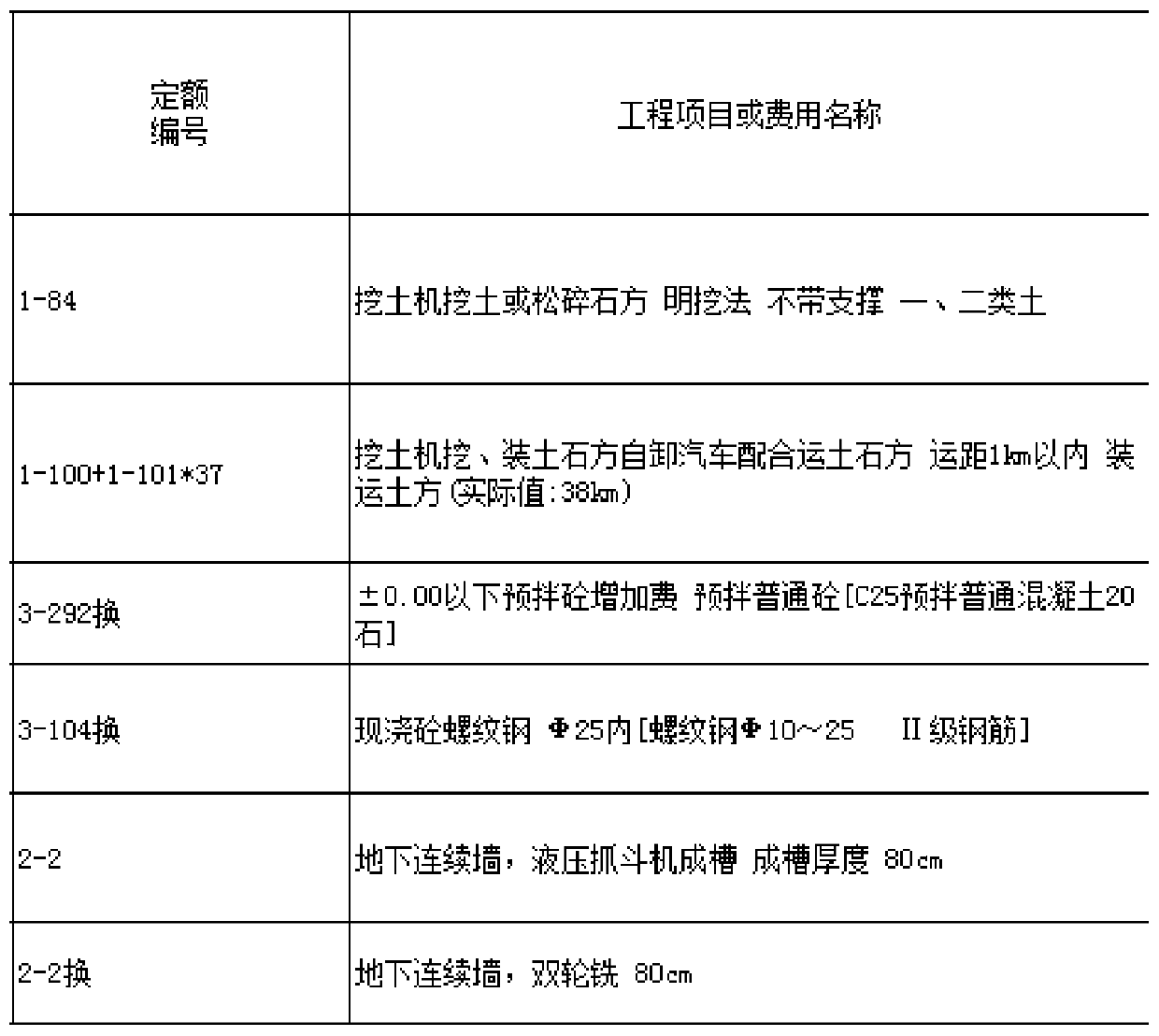

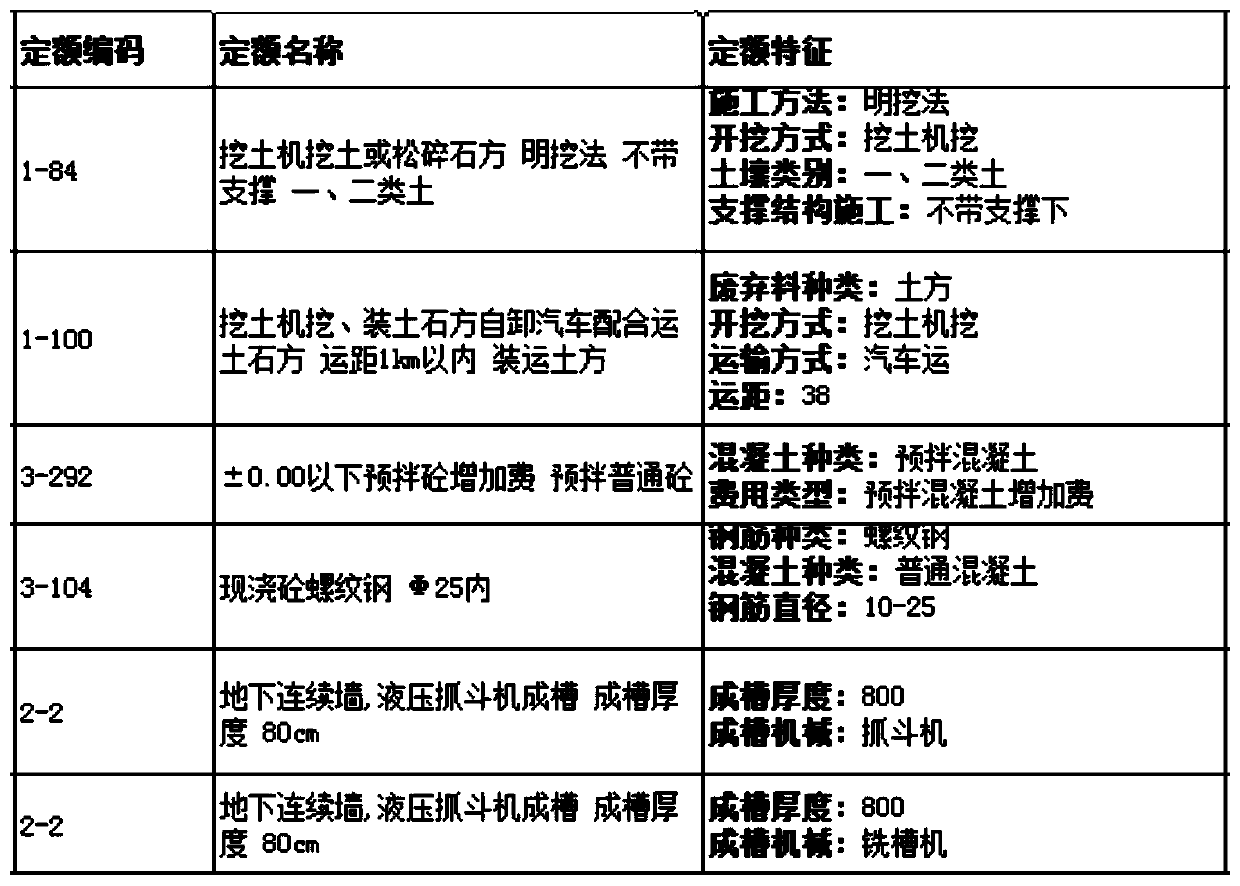

Quota standardization method for engineering summary table

ActiveCN110309132ALow costFast forward investment analysisData processing applicationsDatabase management systemsInvestment analysisComputer science

The invention discloses a quota standardization method for an engineering summary table. The method comprises the following steps of: splitting the quota name of the national quota standard into a plurality of feature words; then, extracting the feature words into feature items, establishing a feature rule base and inputting feature items, feature words and historical engineering project data; carrying out data cleaning on the historical engineering project data, and finally, carrying out standardization processing on the cleaned normative quota name and standard quota code according to corresponding rules in a characteristic rule base, and outputting characteristic words and characteristic items as standardized characteristic results of the historical engineering project data. According to the invention, the formed historical engineering project quota data described by different languages of different workers can be intelligently identified, unified standard coding and automatic collection are realized; automation of the functions of intelligent recognition, conversion, cleaning, analysis, classification, statistics and the like is achieved, the work efficiency is improved, the enterprise cost is reduced, and investment analysis and whole-process cost management of construction engineering projects are promoted more quickly.

Owner:广东中建普联科技股份有限公司

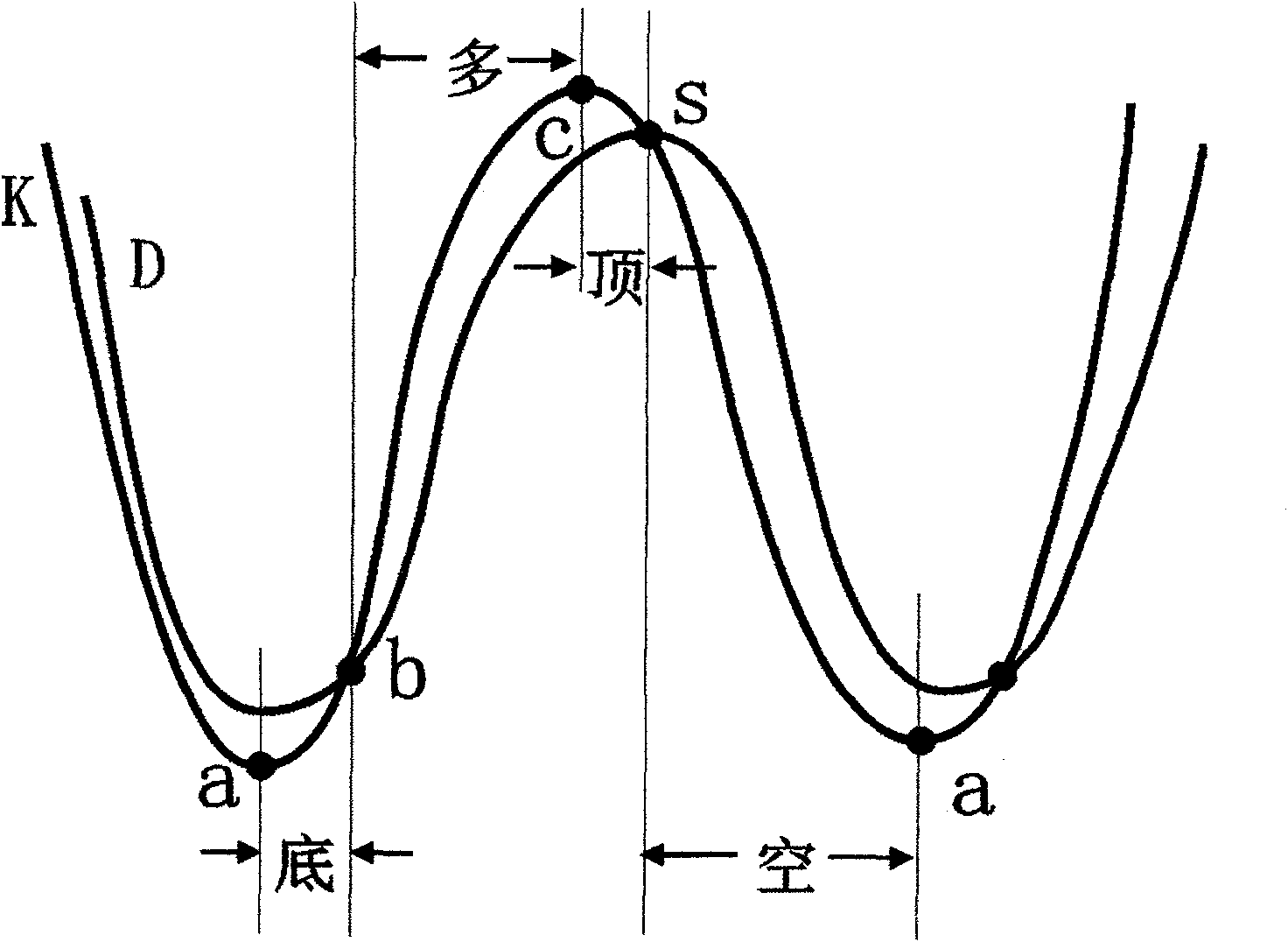

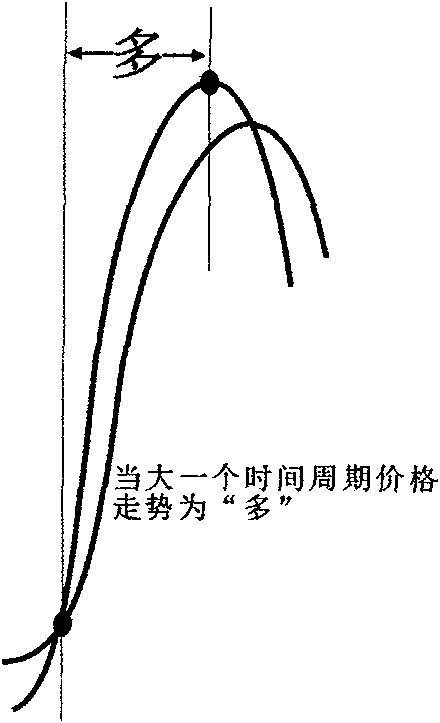

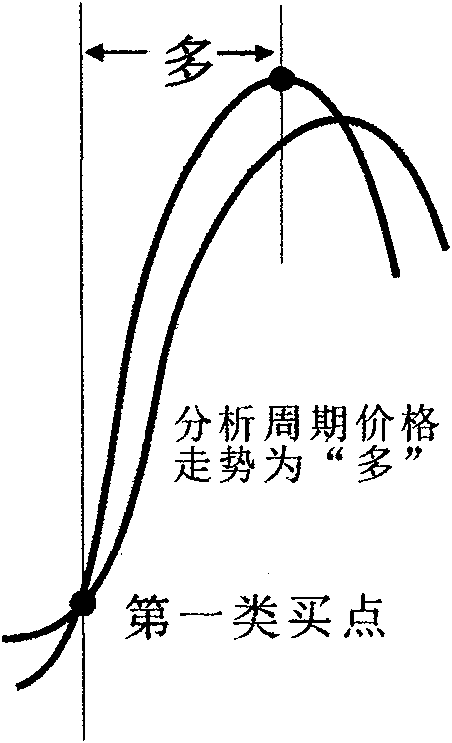

Multi-cycle three-category buying/selling point security investment method based on unique decomposition of price trend

InactiveCN102081783AOvercome subjectivityOvercome uncertaintyFinanceInvestment analysisDecomposition

The invention aims to solve the subjectivity and uncertainty in traditional security investment analysis technology at present, and provides a multi-cycle three-category buying / selling point security investment method based on unique decomposition of price trend. The method determines a unique three-category buying / selling point objectively existing in different cycles by performing a unique decomposition of price trend of ''bottom'', ''multiple'', ''top'' and ''empty'' on KD random technical index morphology, so that the complex security price trend can be decomposed uniquely and mastered by investors; and stable security investment benefits can be obtained.

Owner:尹红卫 +2

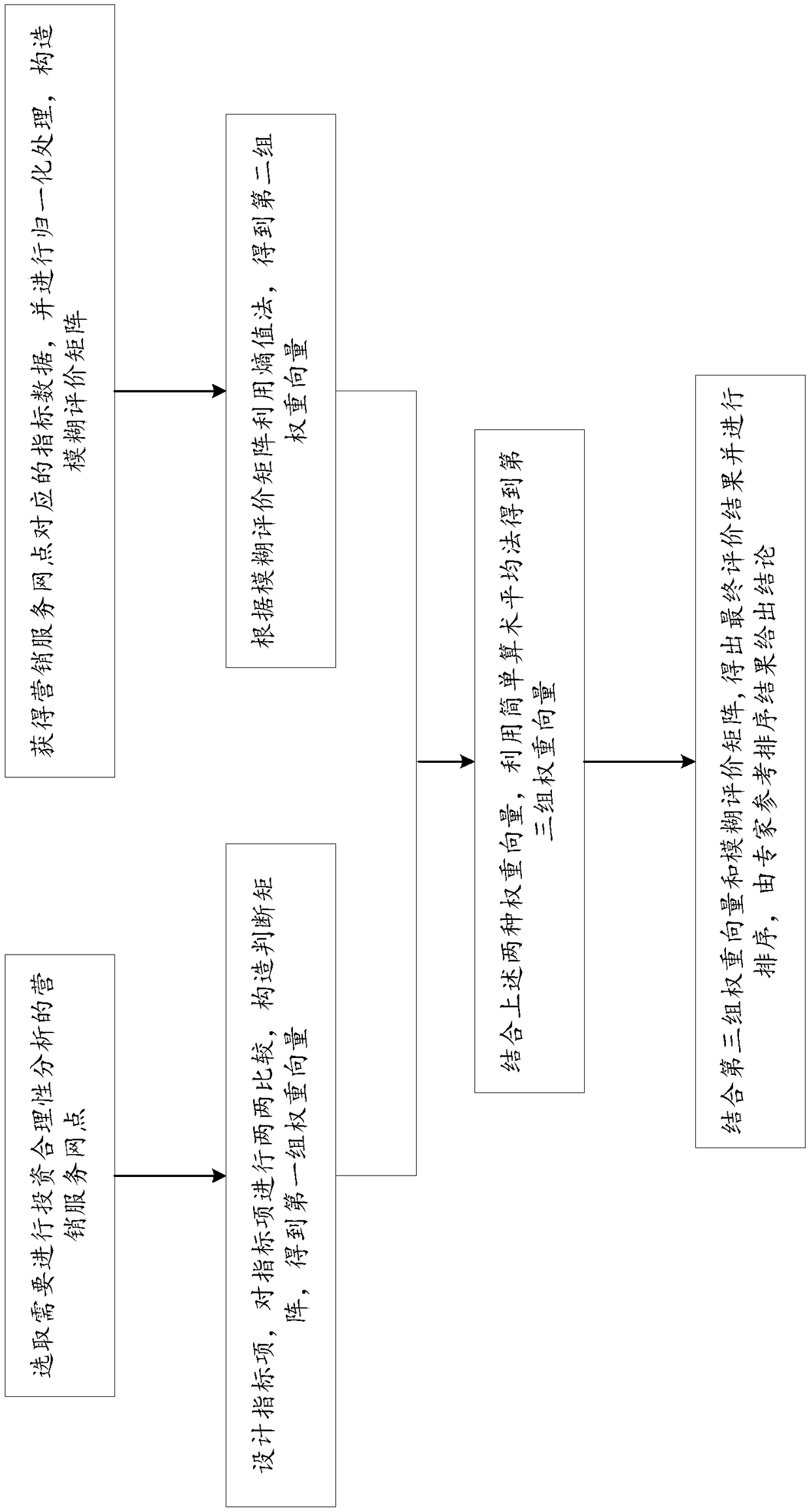

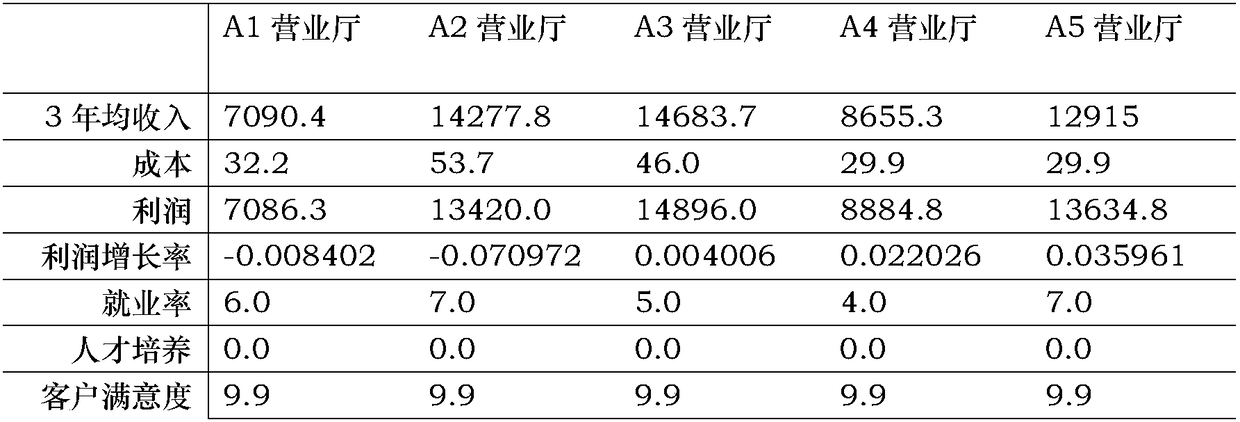

Marketing service outlet investment analysis method

InactiveCN108694671AReflect the role of subjectivity and objectivity in evaluationReduce redundancyFinanceInvestment analysisAnalysis method

The invention discloses a marketing service outlet investment analysis method, which comprises the following steps: s1, selecting marketing service outlets that require investment rationality analysis; s2, through a questionnaire survey, conducting an investment rationality analysis index item design; comparing the multiple index items of the design in pairs, constructing a judgment matrix, and obtaining the first set of weight vectors through calculation on the judgment matrix; s3, acquiring the corresponding marketing service outlet data and normalizing the data to obtain a fuzzy evaluationmatrix; the fuzzy evaluation matrix calculating by the entropy evaluation method to obtain the second set of weight vectors; s4, applying a simple arithmetic average method to the first set of weightvectors and the second set of weight vectors to obtain a third set of weight vectors, that is, a combined weight vector; s5, combining the third set of weight vectors and the fuzzy evaluation matrix,obtaining comprehensive evaluation results, ranking the comprehensive evaluation results, and giving the final conclusion according to the ranking result.

Owner:BEIJING CHINA POWER INFORMATION TECH +5

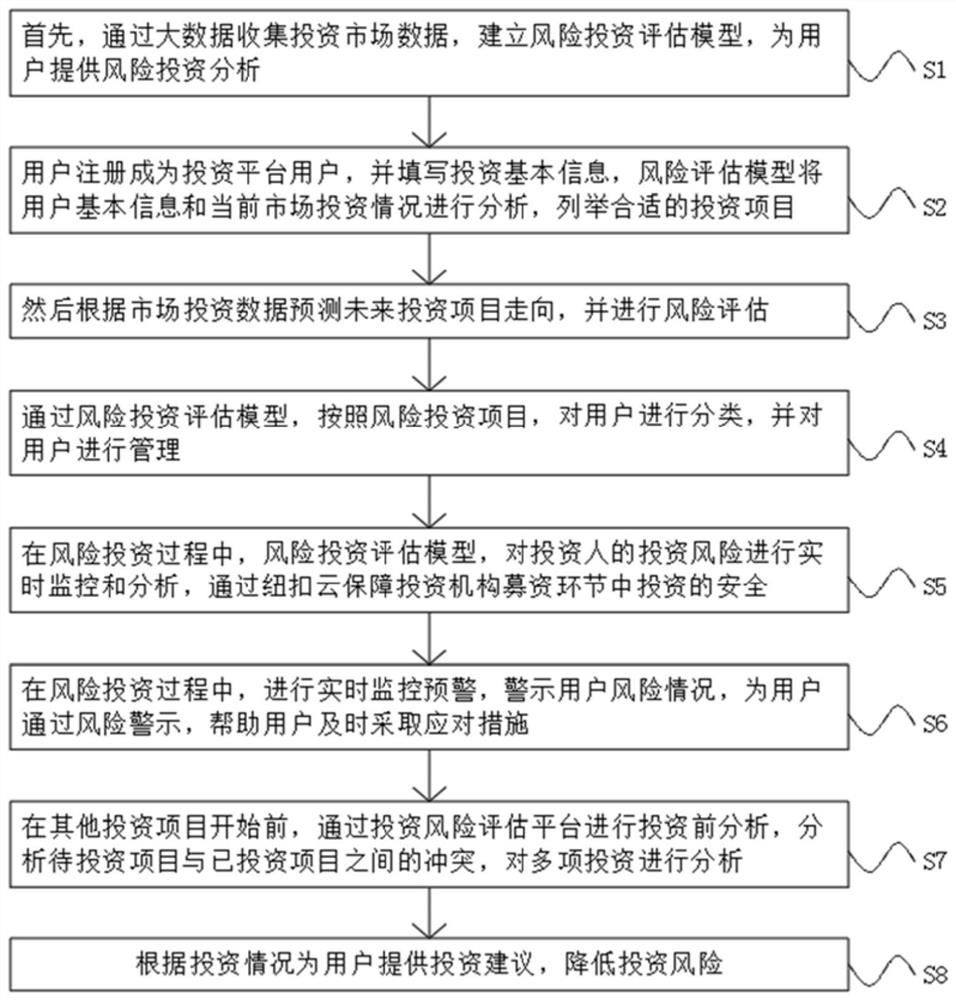

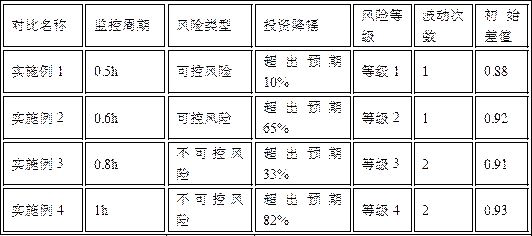

Investment risk assessment method based on big data and artificial intelligence technology

PendingCN113408873AMaster quicklyEarly warning is timely and intuitiveFinanceOffice automationRisk levelInvestment analysis

The invention discloses an investment risk assessment method based on big data and an artificial intelligence technology, and the method comprises the following assessment steps: S1, collecting investment market data through big data, building a risk investment assessment model, and providing risk investment analysis for a user; and S2, enabling the user to register as an investment platform user, and filling basic investment information. The investment project is monitored in real time through the investment risk assessment model, the risk early warning level is set, monitoring and analysis are performed according to the cycle, when the investment encounters the risk, the risk is analyzed and the risk level is assessed in time through big data, the controllable risk and the uncontrollable risk are distinguished, the fluctuation range between the risk and the expectation is determined, the user can master the risk and know the specific level and fluctuation amplitude of the risk more quickly, so that the user can know early warning of the risk timely and intuitively, and when the early warning occurs, reasonable measures are given for reference to the user, and the investment loss is reduced.

Owner:南京超募数字科技有限公司

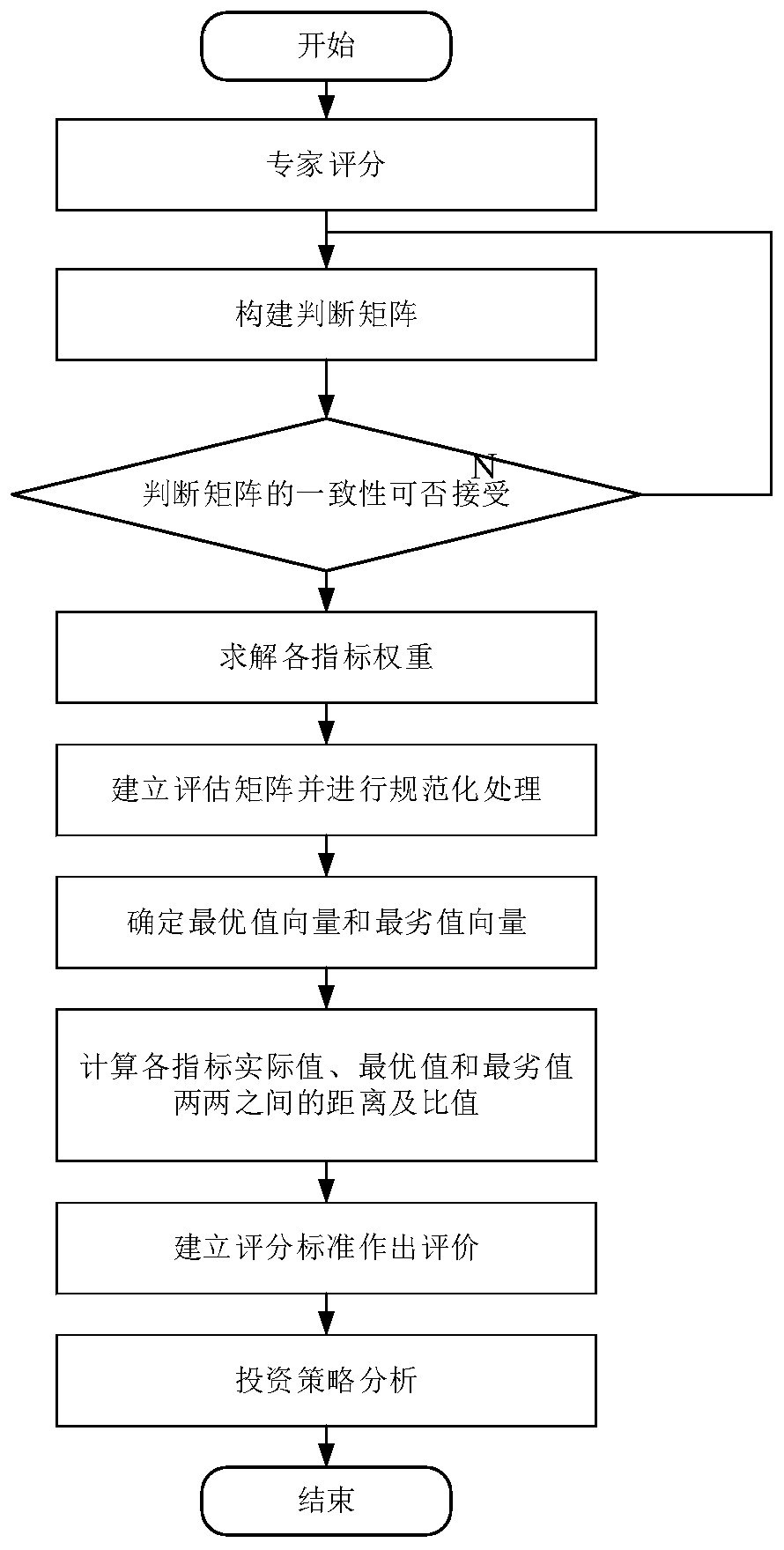

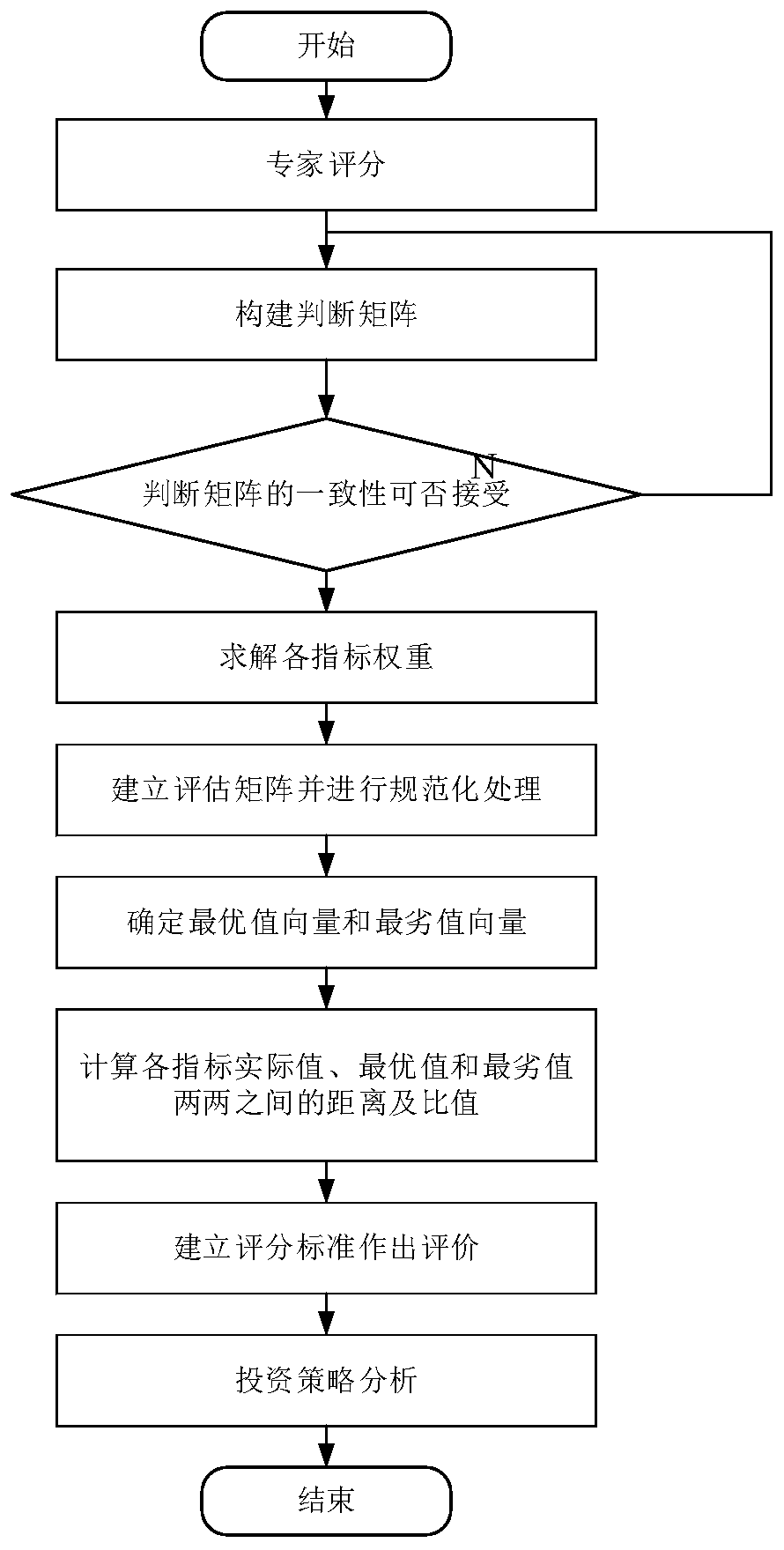

An economic development area power distribution network comprehensive evaluation and investment strategy guidance method

PendingCN109711669AOptimize investment strategyFinanceResourcesInvestment analysisIntermediate stage

The invention discloses a comprehensive evaluation and investment strategy guidance method for a power distribution network in an economic development area. The method comprises the following steps: S1, establishing each level of index judgment matrix under a target layer through expert scoring, and checking the consistency of the judgment matrixes; S2, solving the weight of each index; S3, establishing an evaluation matrix and performing standardization processing on the evaluation matrix; S4, determining an optimal value vector and a worst value vector through the weighted standard matrix; S5, calculating the distance and the ratio of every two of the actual value, the optimal value and the worst value of each index; S6, establishing a scoring standard to make an evaluation and carryingout investment analysis through the evaluation. For the power distribution network in the economic development area in the early and middle stages of development, the comprehensive evaluation of the development level and the future investment strategy problem are considered, the evaluation characteristics and the index applicability are comprehensively considered, and the power distribution network is evaluated, and the development and improvement of the power distribution network in the economic development area can be more reasonably and efficiently promoted.

Owner:LIUAN POWER SUPPLY COMPANY STATE GRID ANHUI ELECTRIC POWER +1

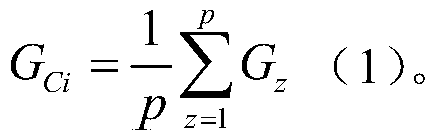

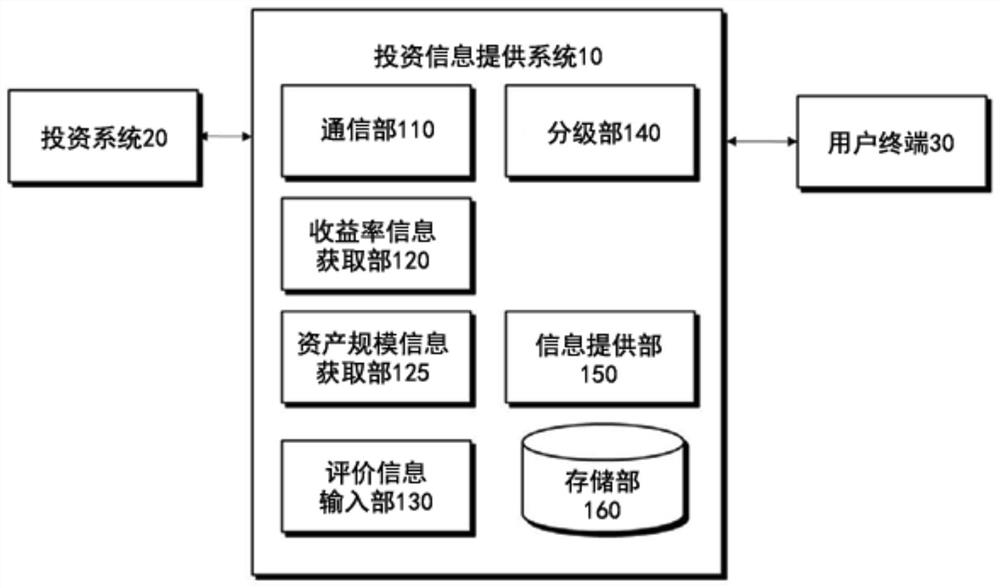

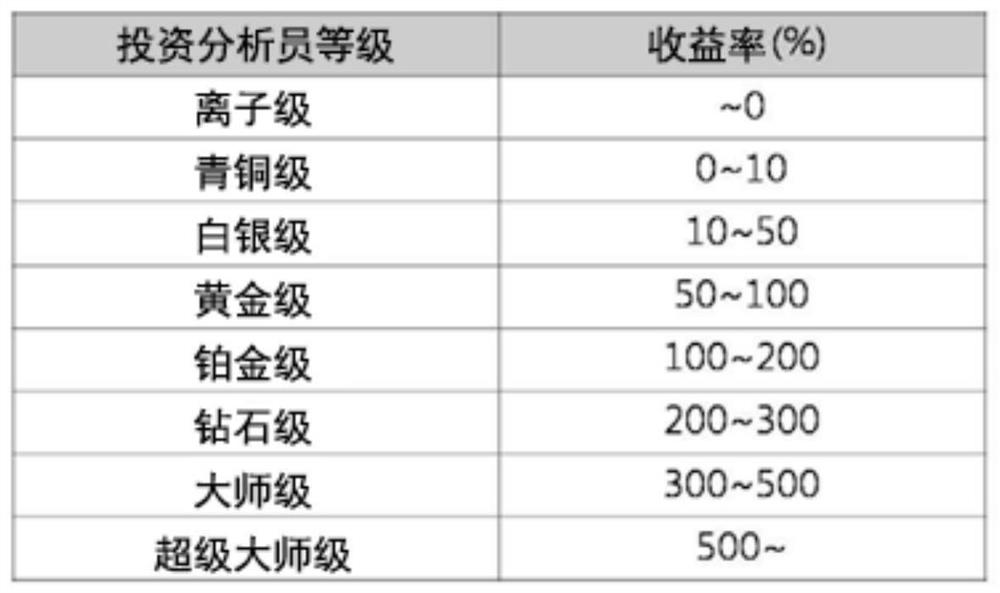

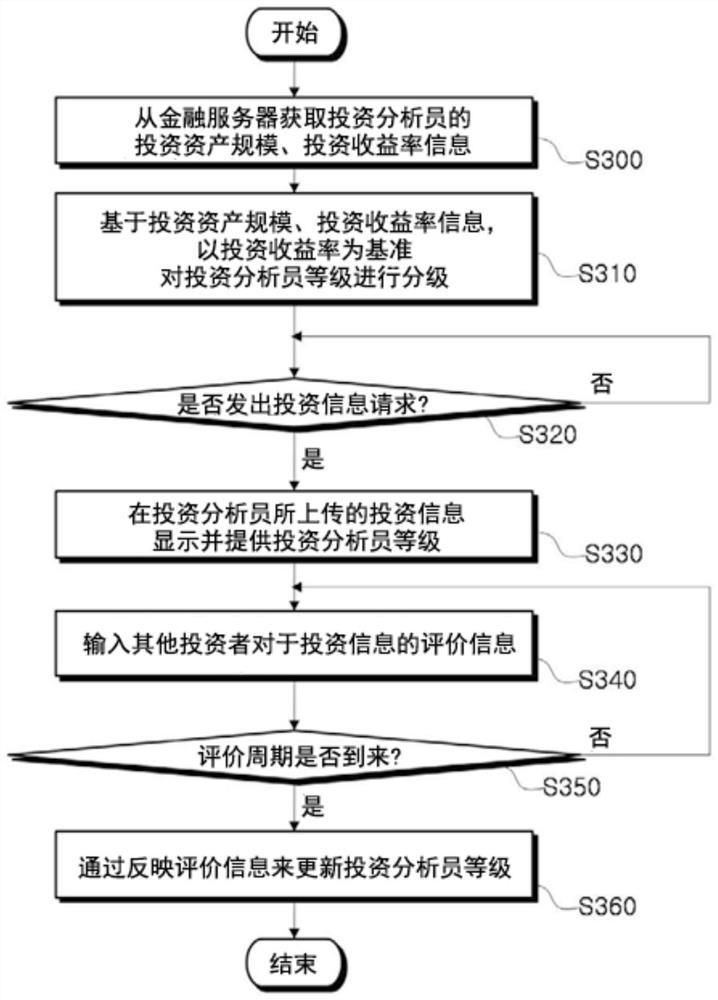

System and Method for Providing Investment information

PendingCN113869624AAccurate and Quick AcquisitionImprove information qualityFinanceResourcesInvestment analysisInformation acquisition

The present invention relates to a system and a method for providing investment information. The system includes: an asset size information acquisition unit acquiring the investment asset size of an investment analyzer from an investment system; a grading unit grading an investment analyzer level with reference to the investment asset size based on the investment asset size acquired by the asset size information acquisition unit; and an information providing unit displaying and providing the investment analyzer level graded with reference to the investment asset size by the grading unit on the investment information uploaded by the investment analyzer at an investment information request. With the system and the method for providing the investment information, people can acquire quality information necessary for financial investment quickly and accurately.

Owner:崔钟卓

Method and system for automatic coding and identification of bill of quantities calculation data in construction industry

ActiveCN106934536BLow costFast forward investment analysisResourcesInvestment analysisBusiness enterprise

The invention relates to a construction industry engineering pricing bill data automatic coding and recognition method and a system. Thus, pricing bill data described by a human natural language can be subjected to intelligent recognition, unified standard coding and automatic accumulation, the pricing bill data after processing have the unique corresponding code, automation of functions such as intelligent recognition, conversion, analysis, classification and statistics can be realized, manual operation is not needed, the working efficiency can be improved, the enterprise cost is reduced, and investment analysis and whole process cost management on the construction project can be promoted more quickly.

Owner:广东中建普联科技股份有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com