Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

317 results about "Convertible" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A convertible, cabriolet or spyder/spider (/ˌkæbrioʊˈleɪ/) is a passenger car that can be driven with or without a roof in place. The methods of retracting and storing the roof vary between models. A convertible allows an open-air driving experience, with the ability to provide a roof when required. Potential drawbacks of convertibles are reduced structural rigidity (requiring significant engineering and modification to counteract the effects of removing a car's roof) and cargo space.

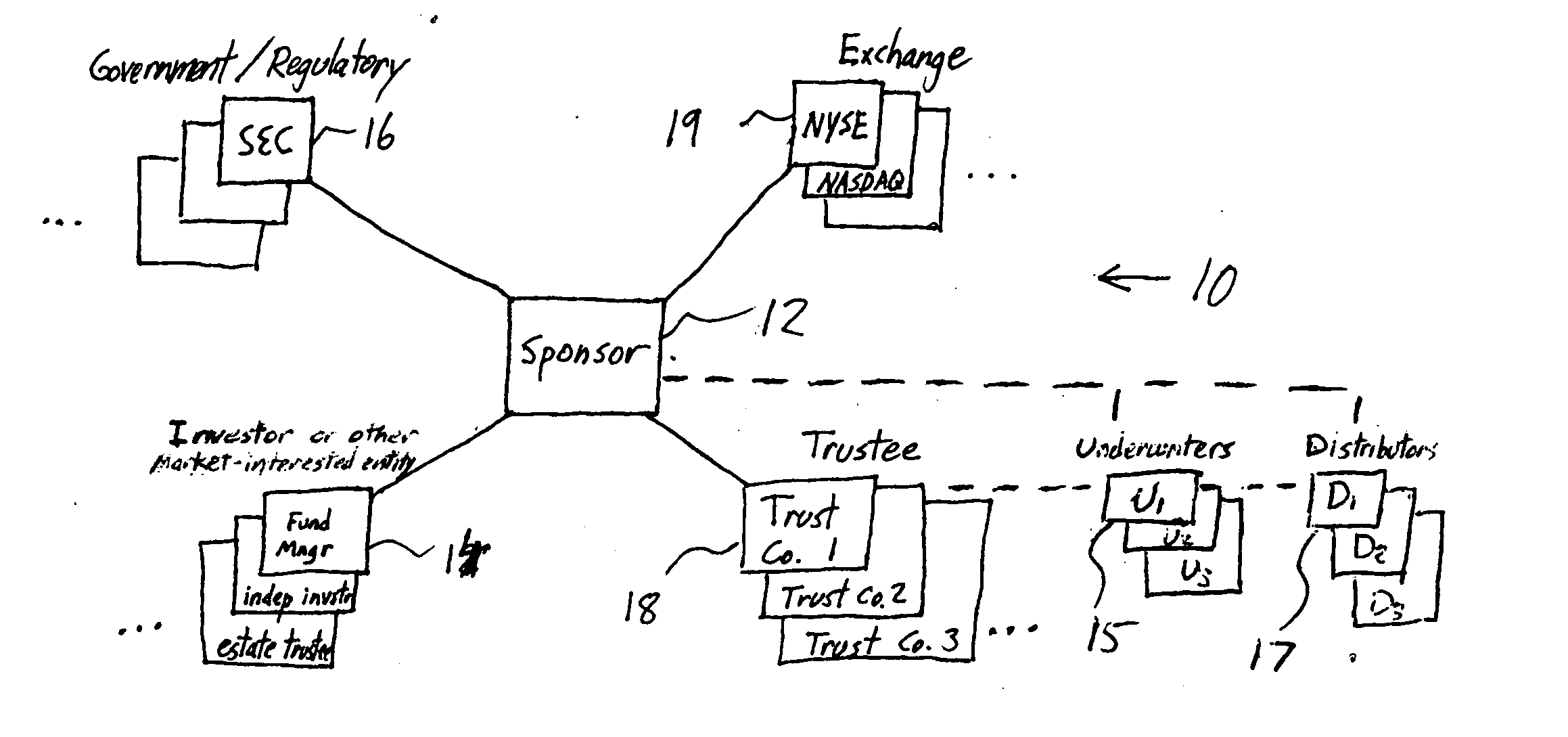

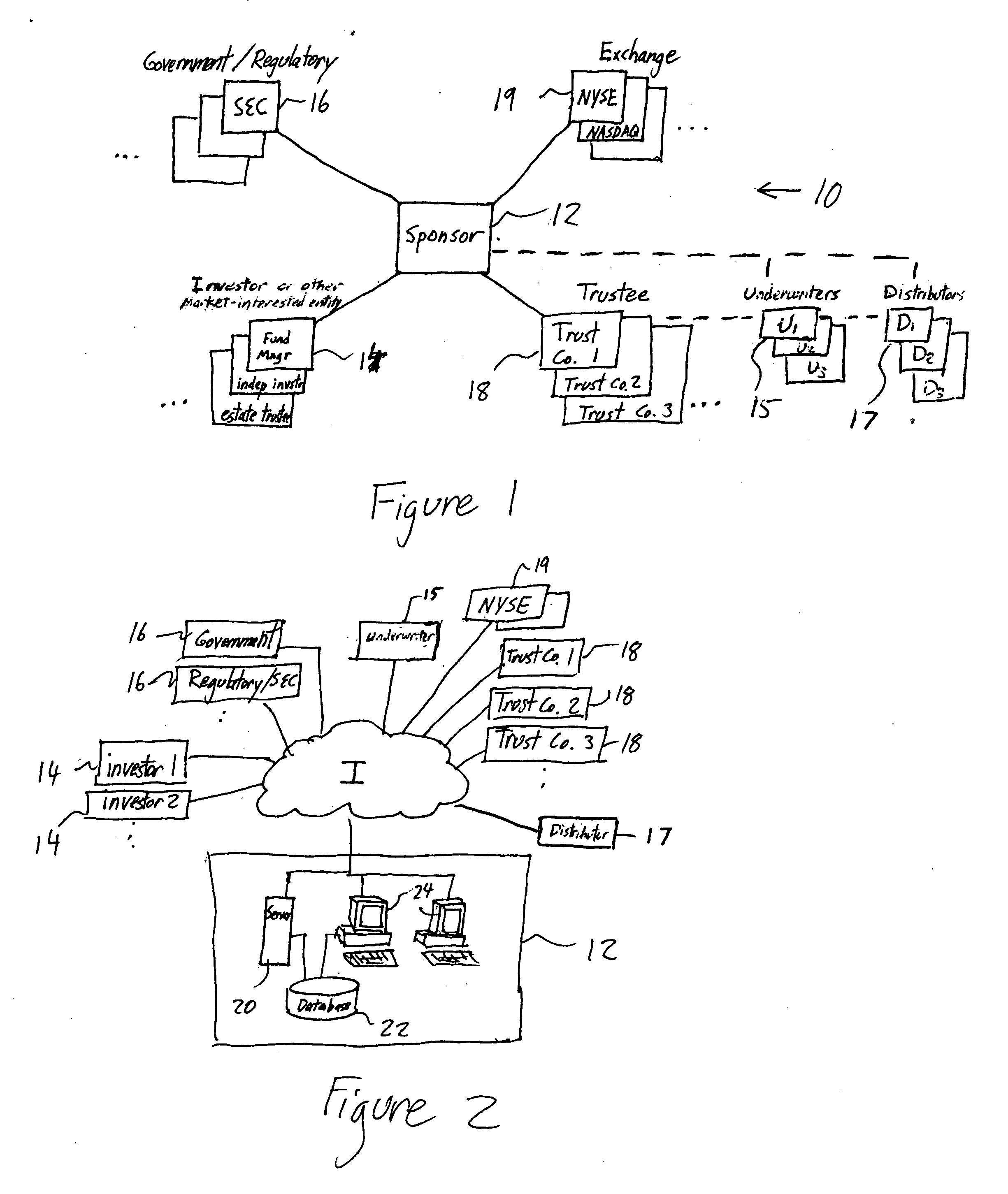

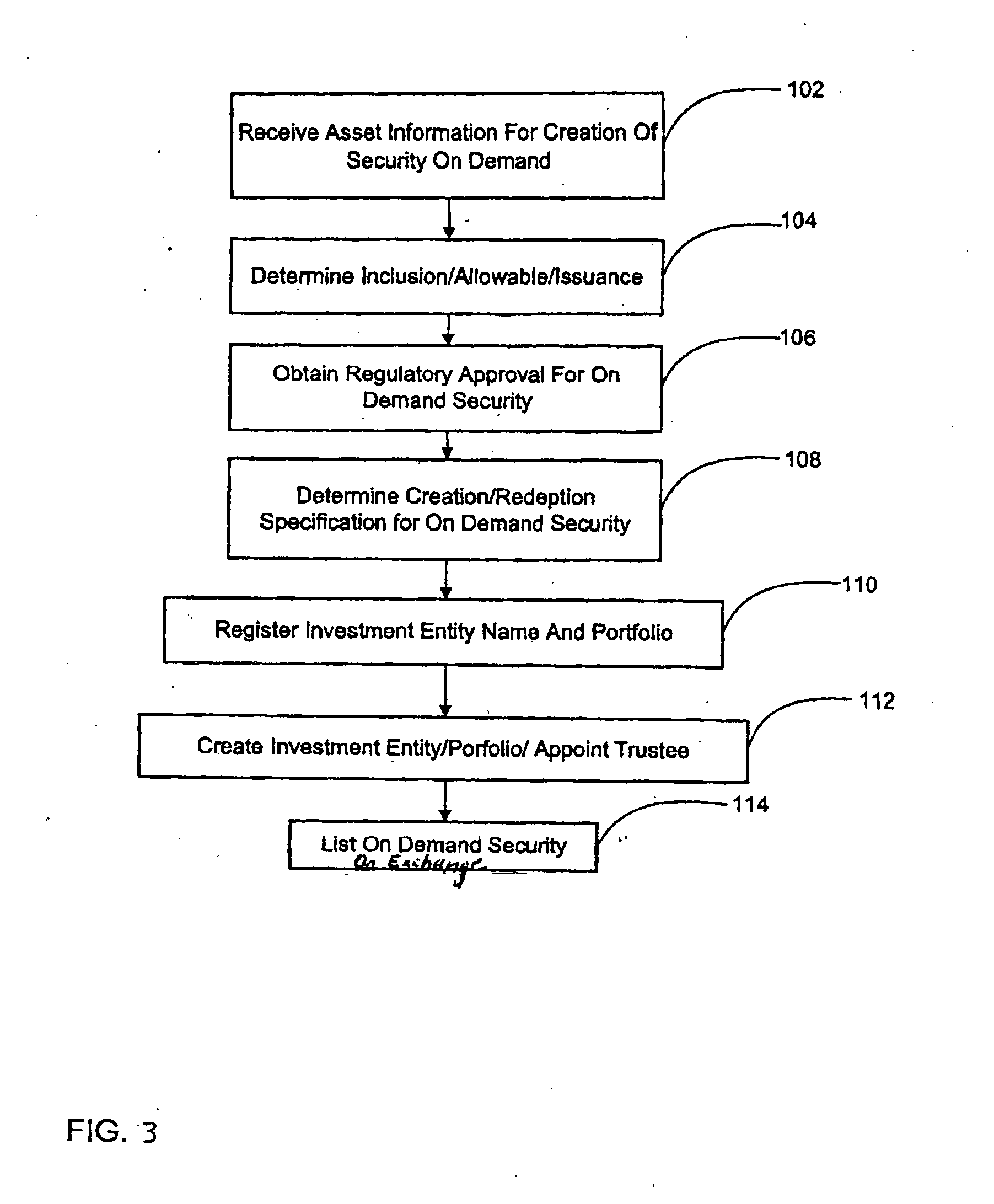

On-demand defined securitization methods and systems

InactiveUS20050038726A1Provide quicklyMinimize timeFinanceSpecial data processing applicationsDatabaseOn demand

Owner:EWT

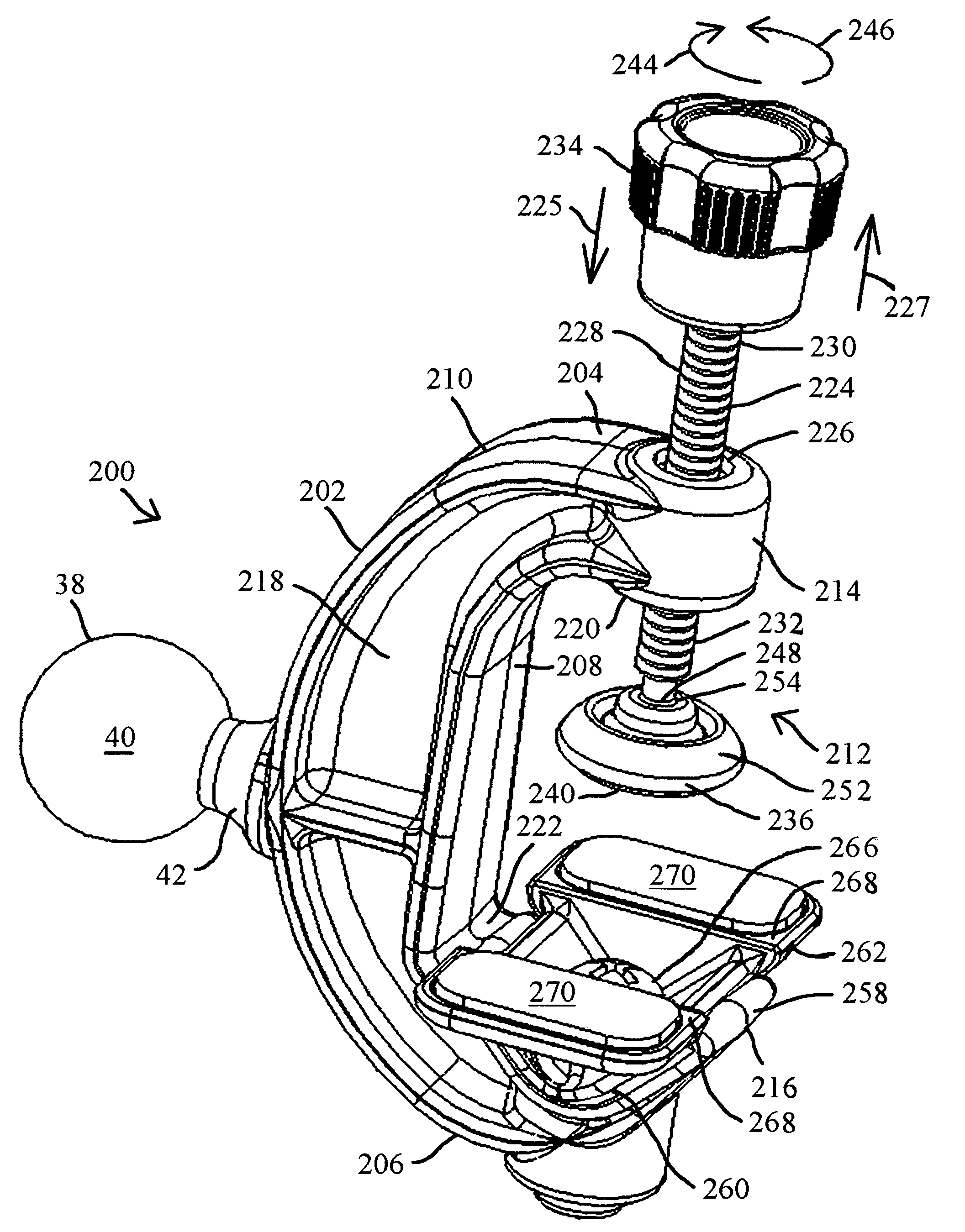

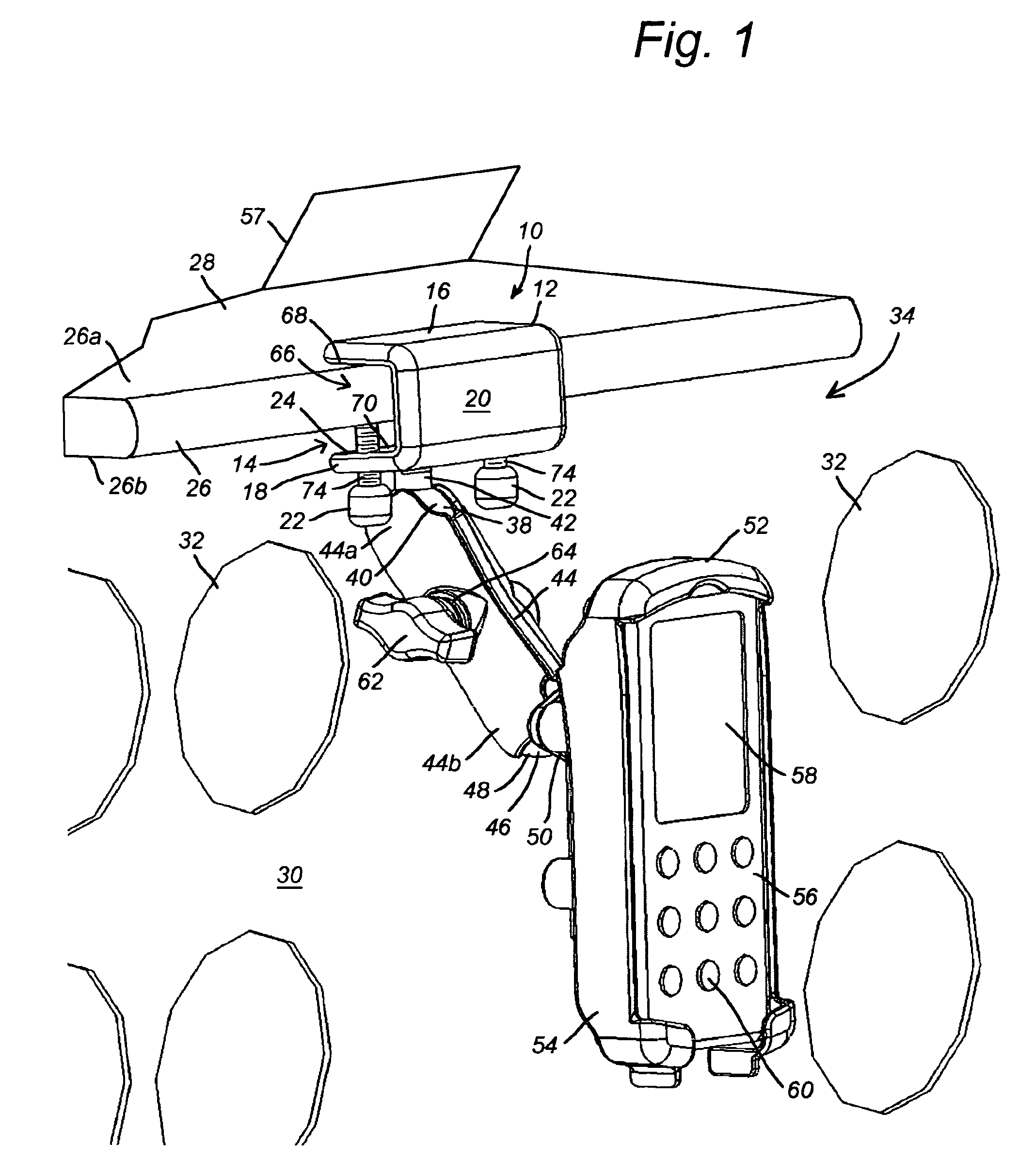

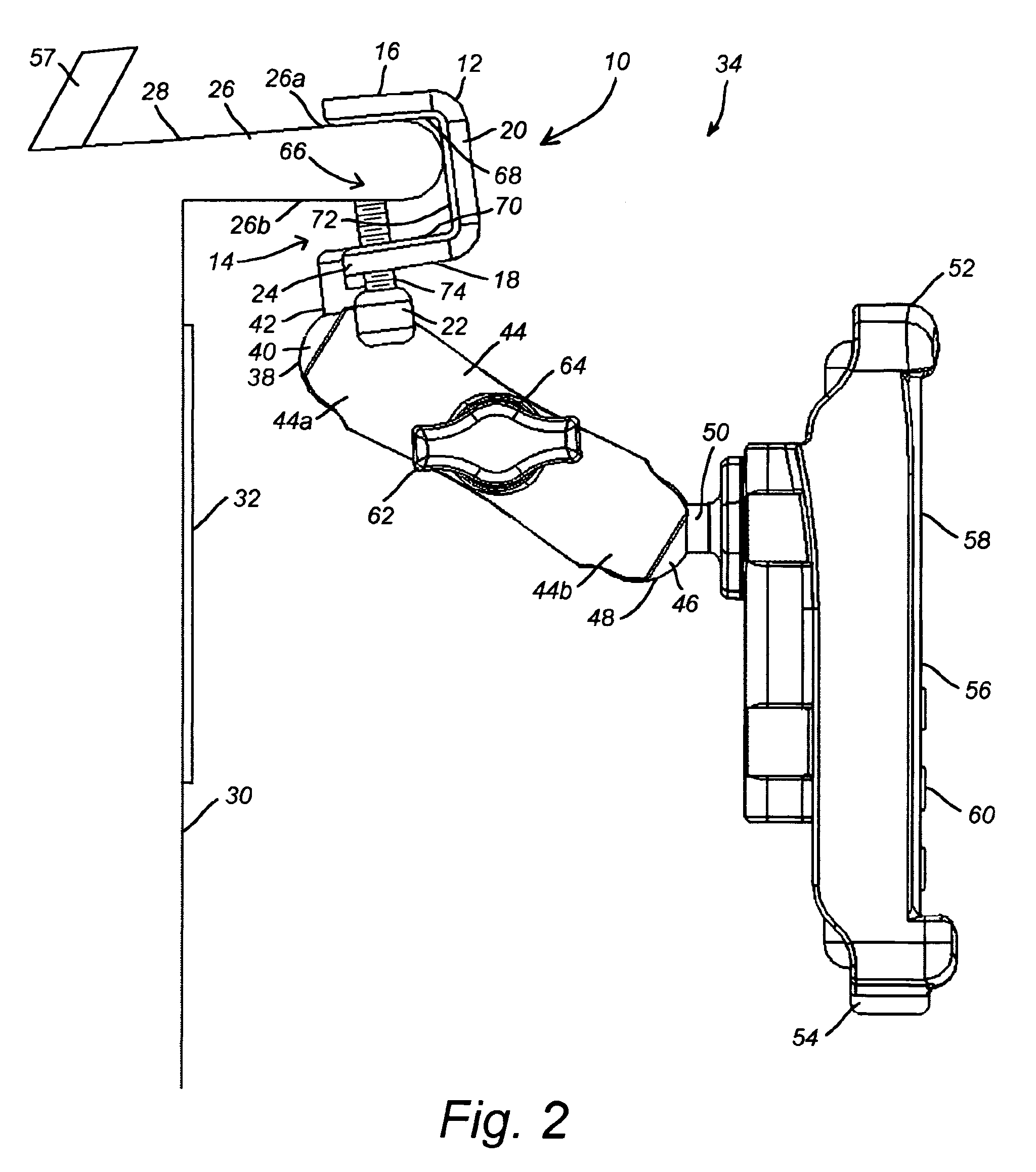

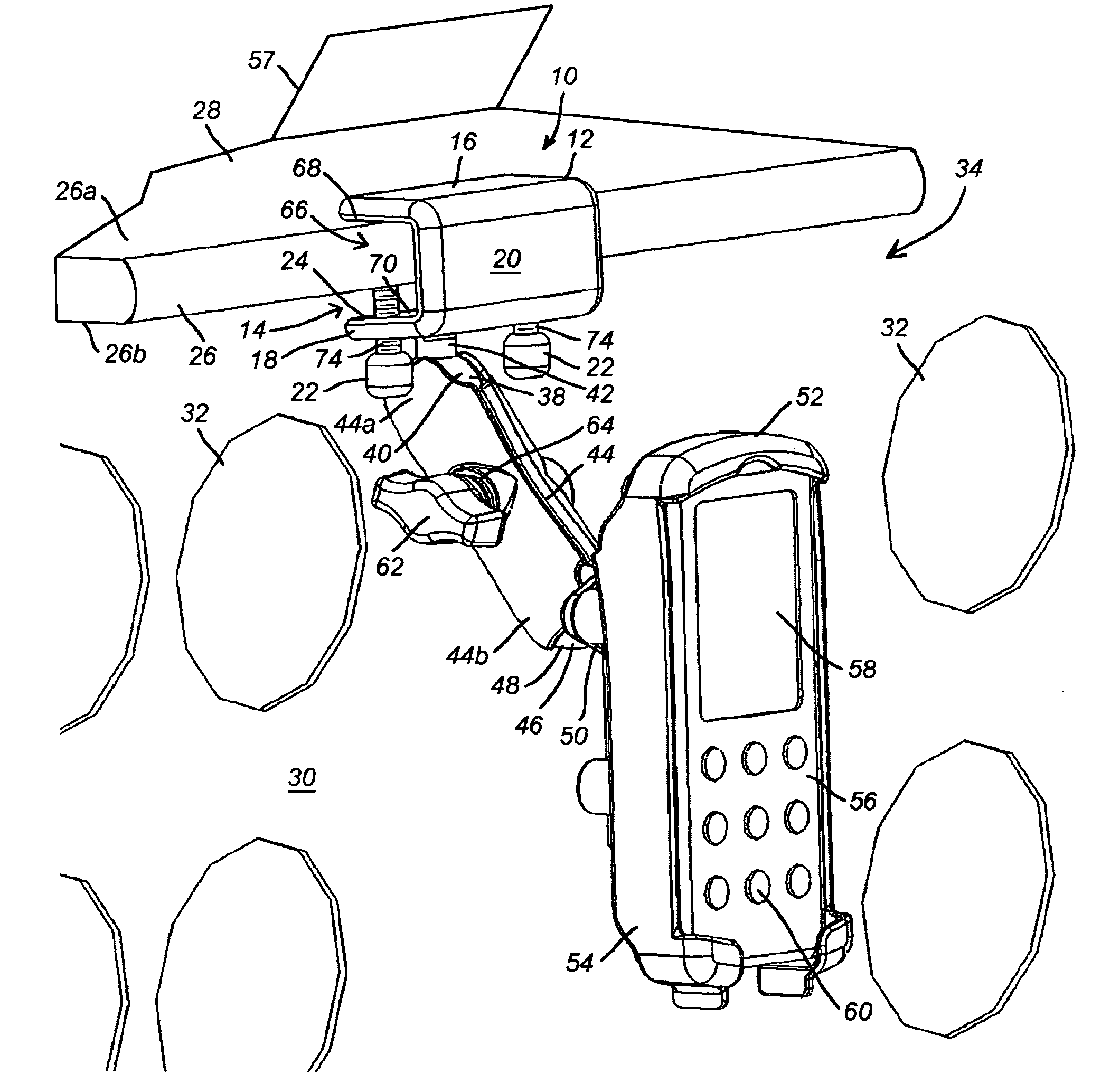

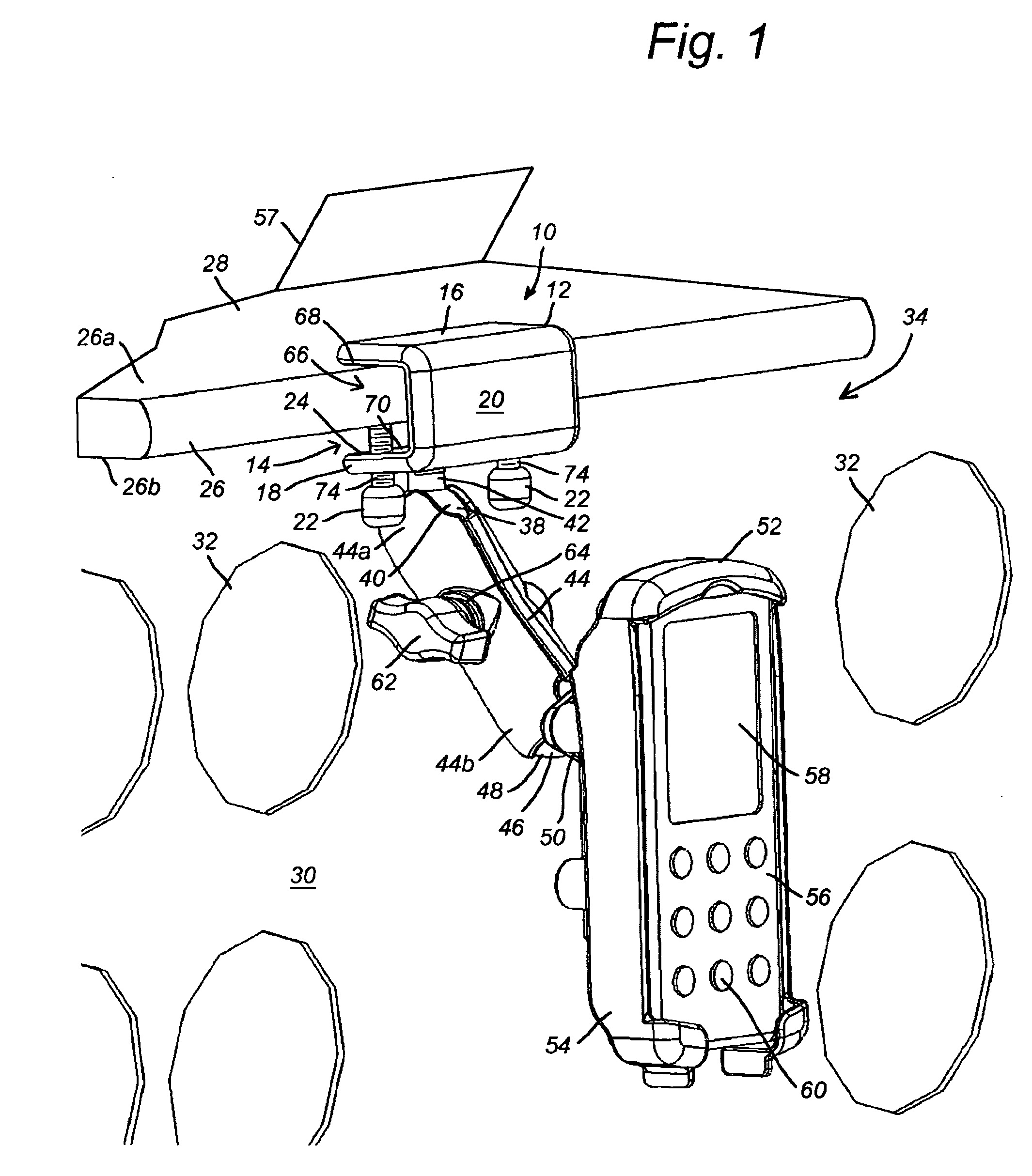

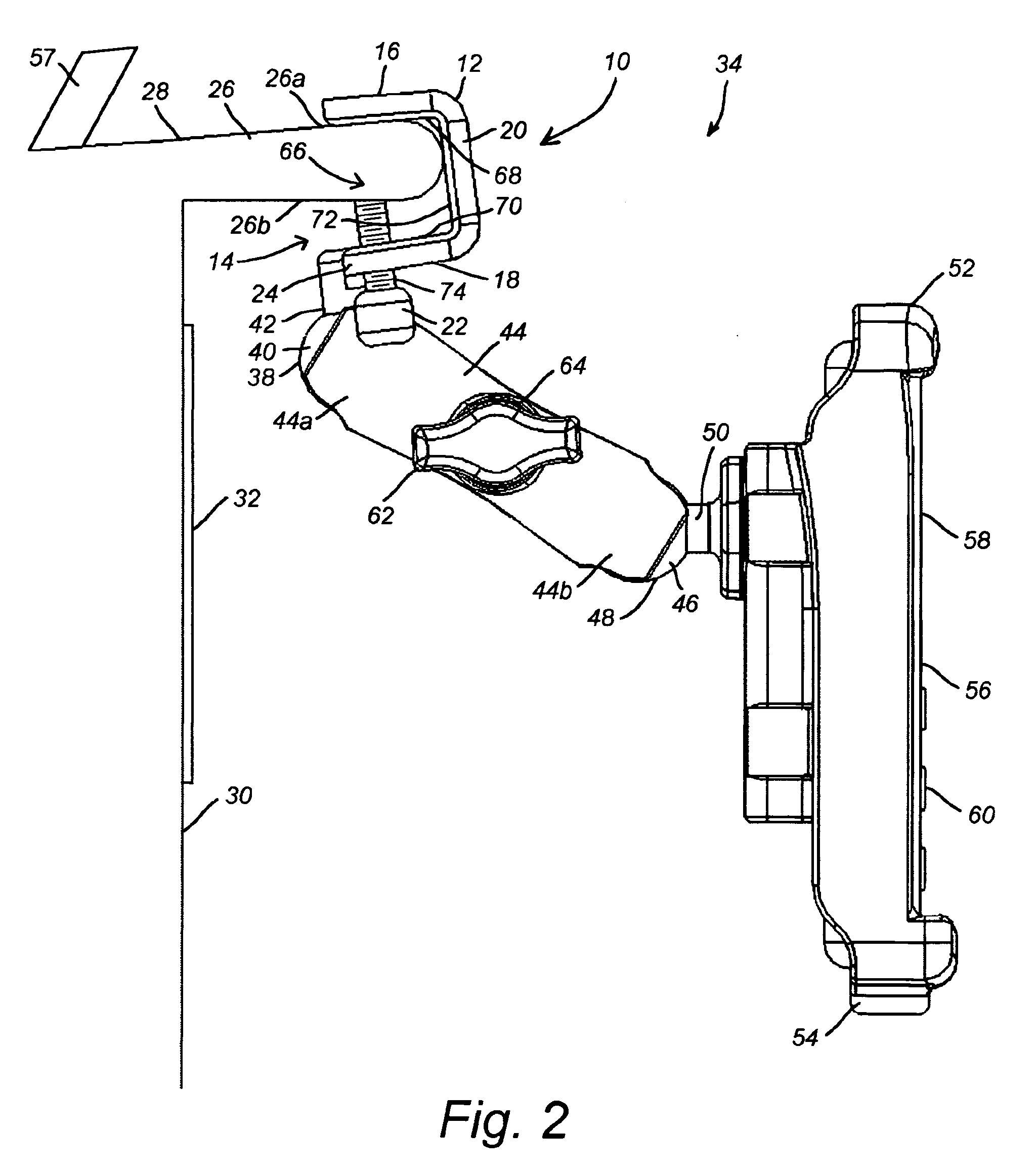

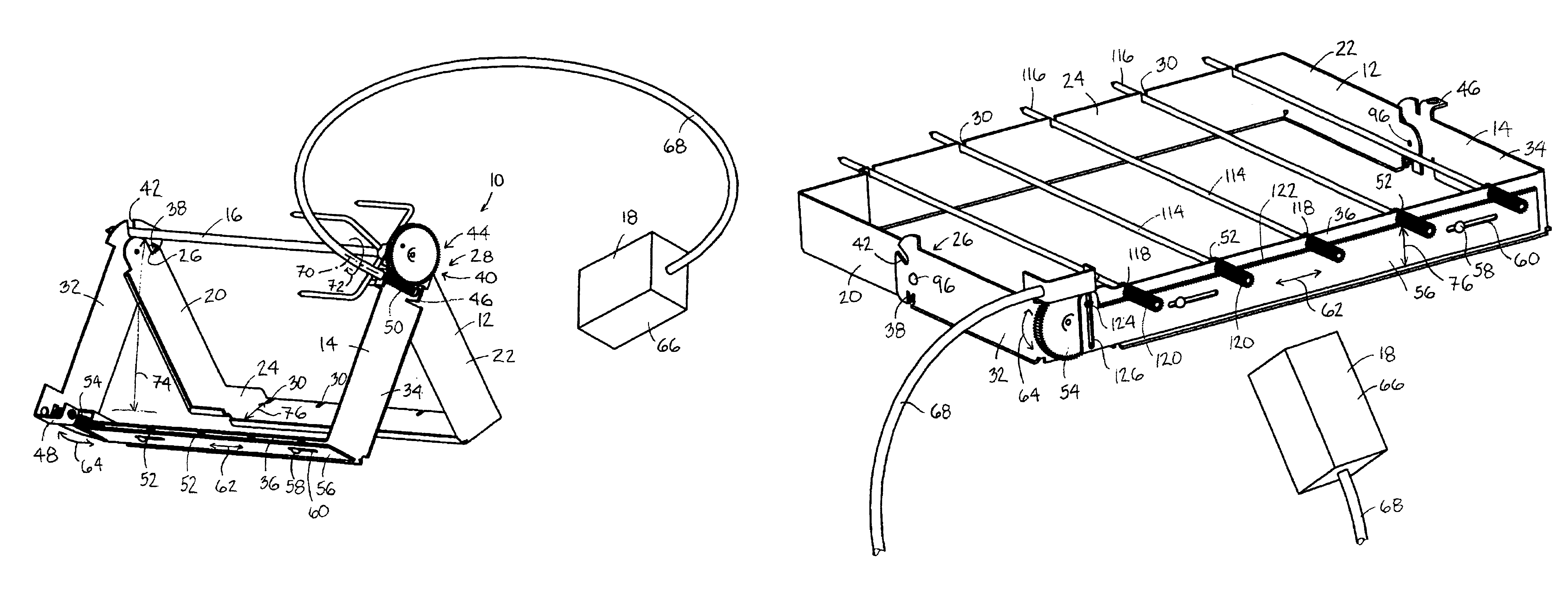

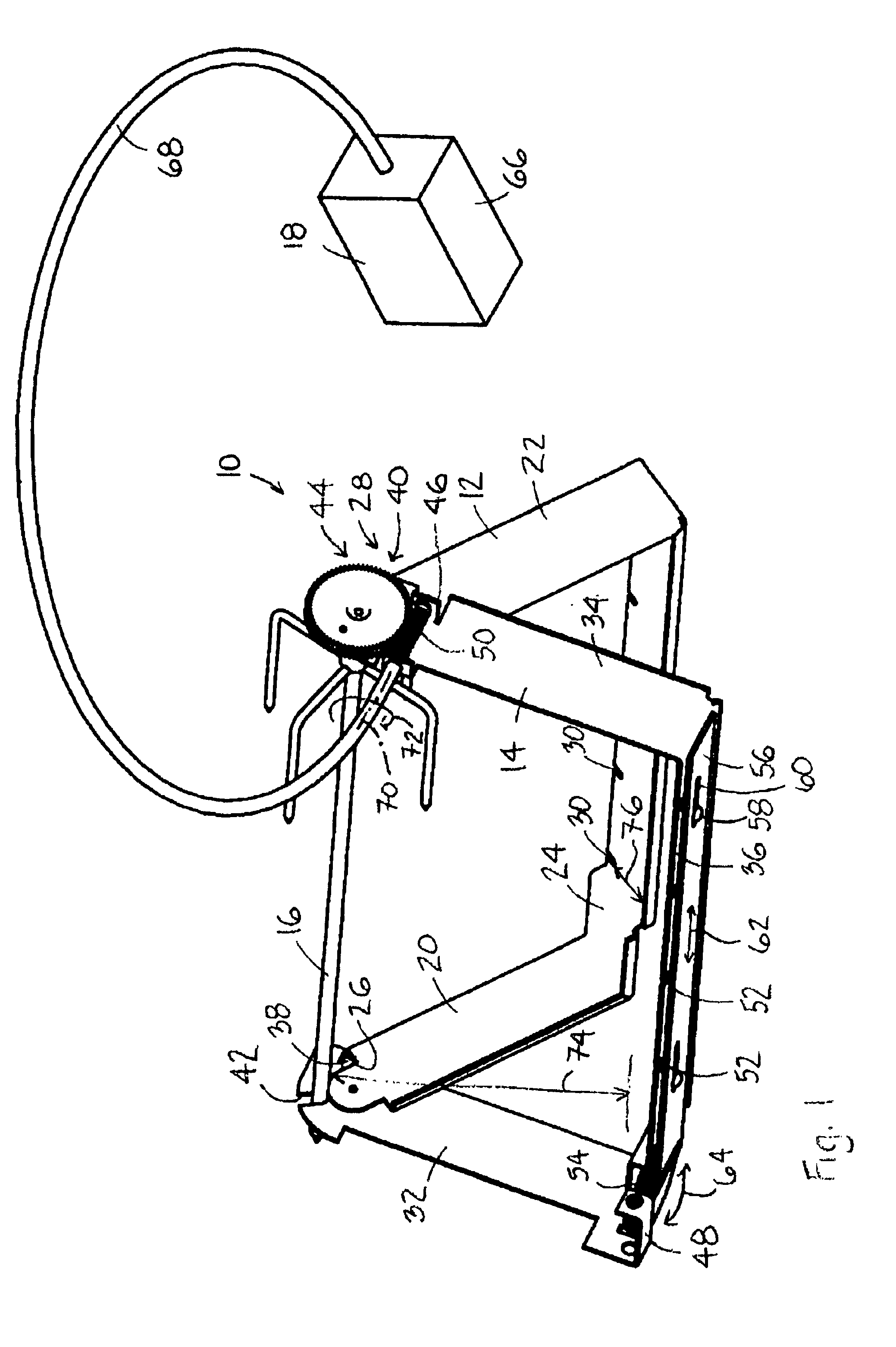

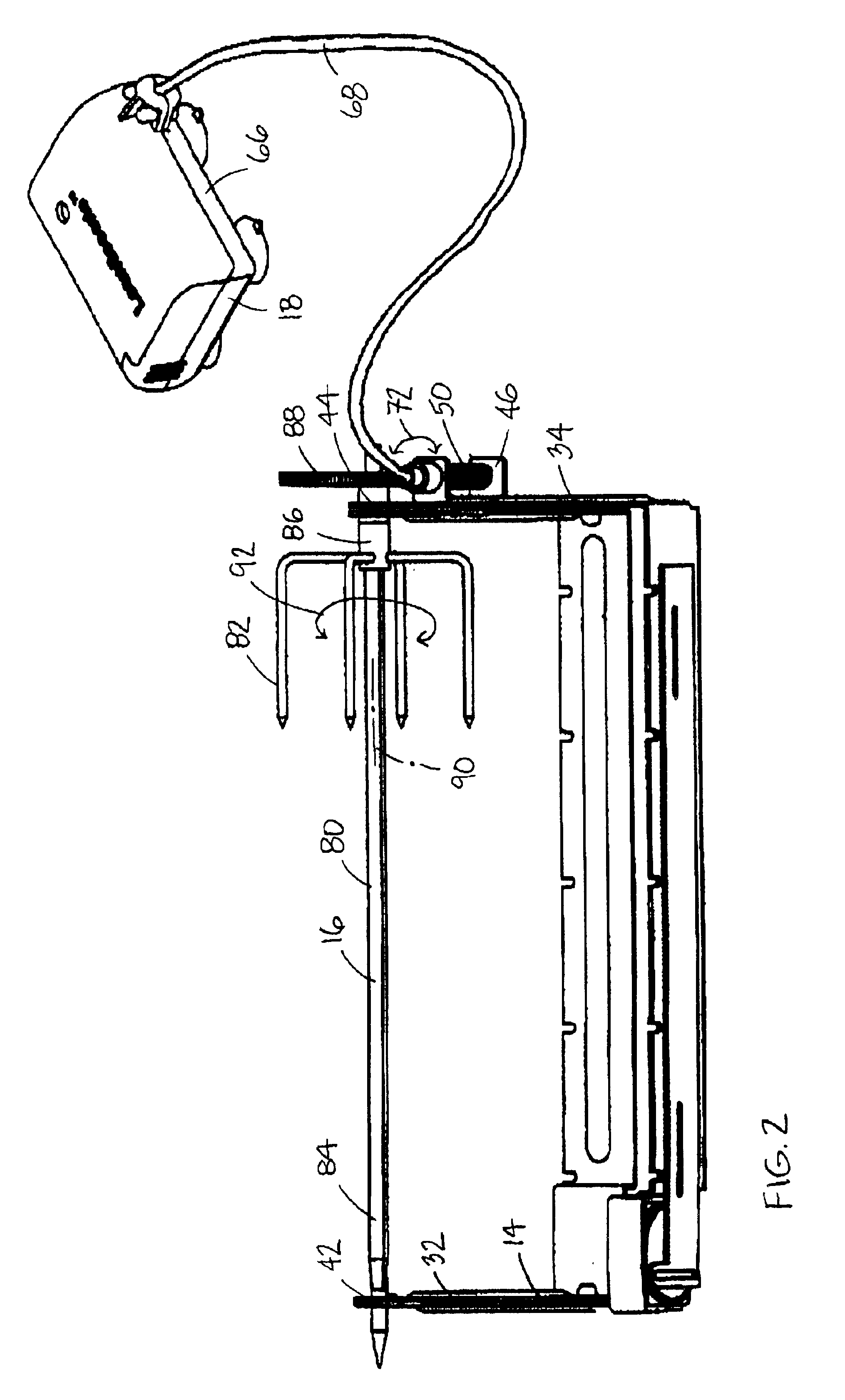

Convertible C-clamp

A convertible clamp device including a C-shaped frame having first and second substantially opposing interconnected arms; a clamping rod carried by the first arm for longitudinal movement in a first clamping direction toward an internal face of the second arm and in a second opposite direction away from the second arm; different first and second movable clamping jaws removably coupleable to a portion of the clamping rod between the arms of the frame; and different first and second stationary clamping anvils being disposable on the internal face of the second arm.

Owner:CARNEVALI JEFFREY D

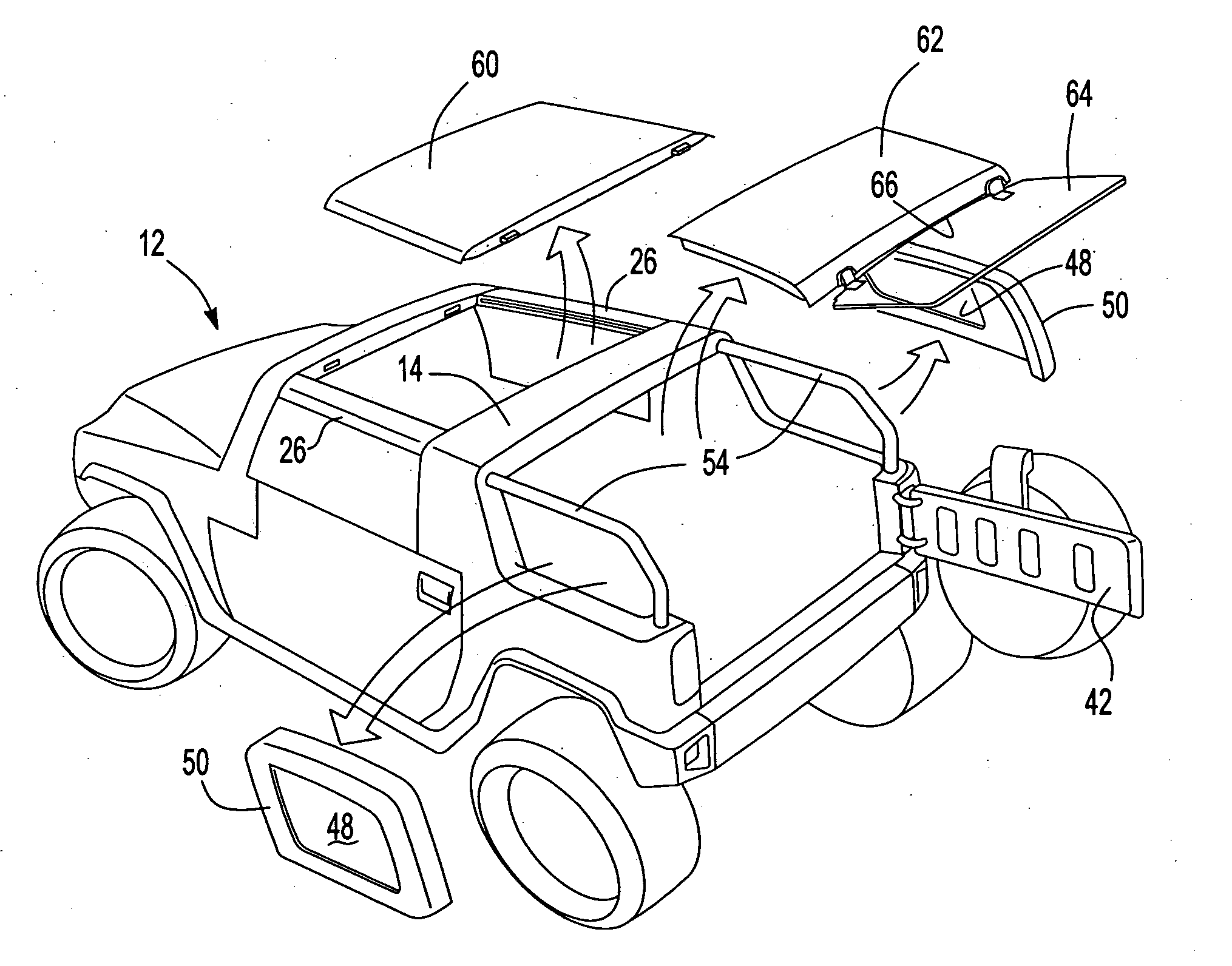

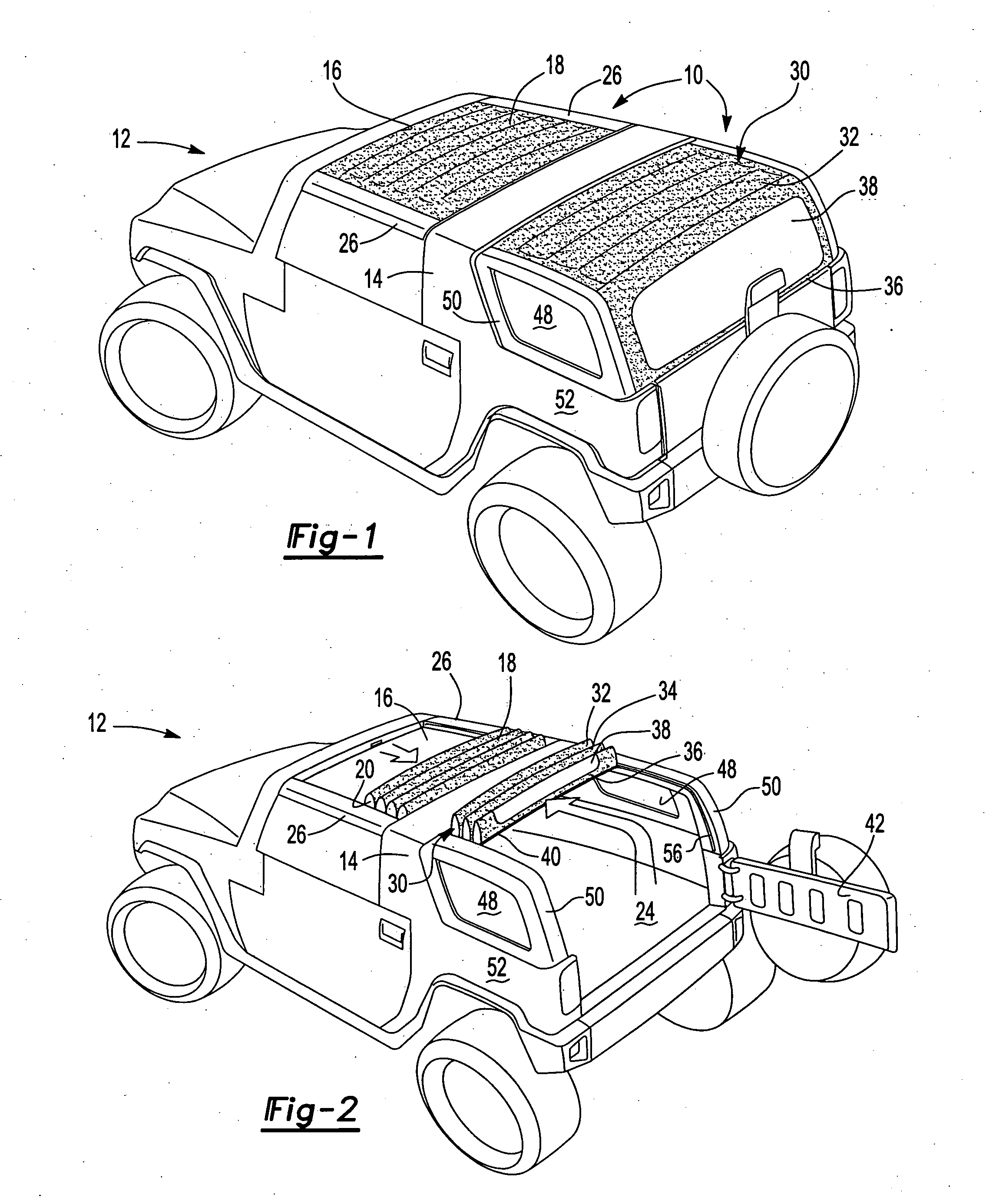

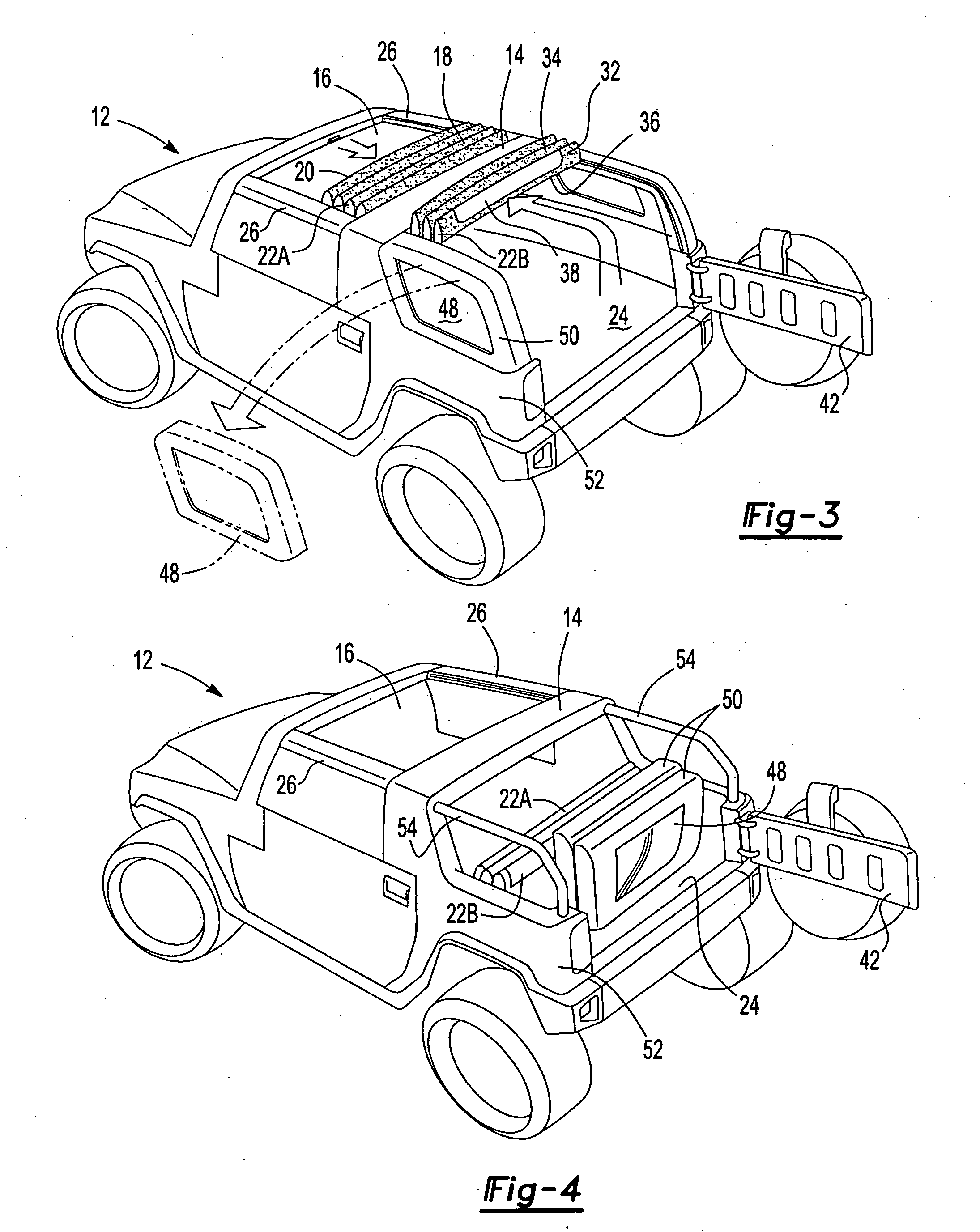

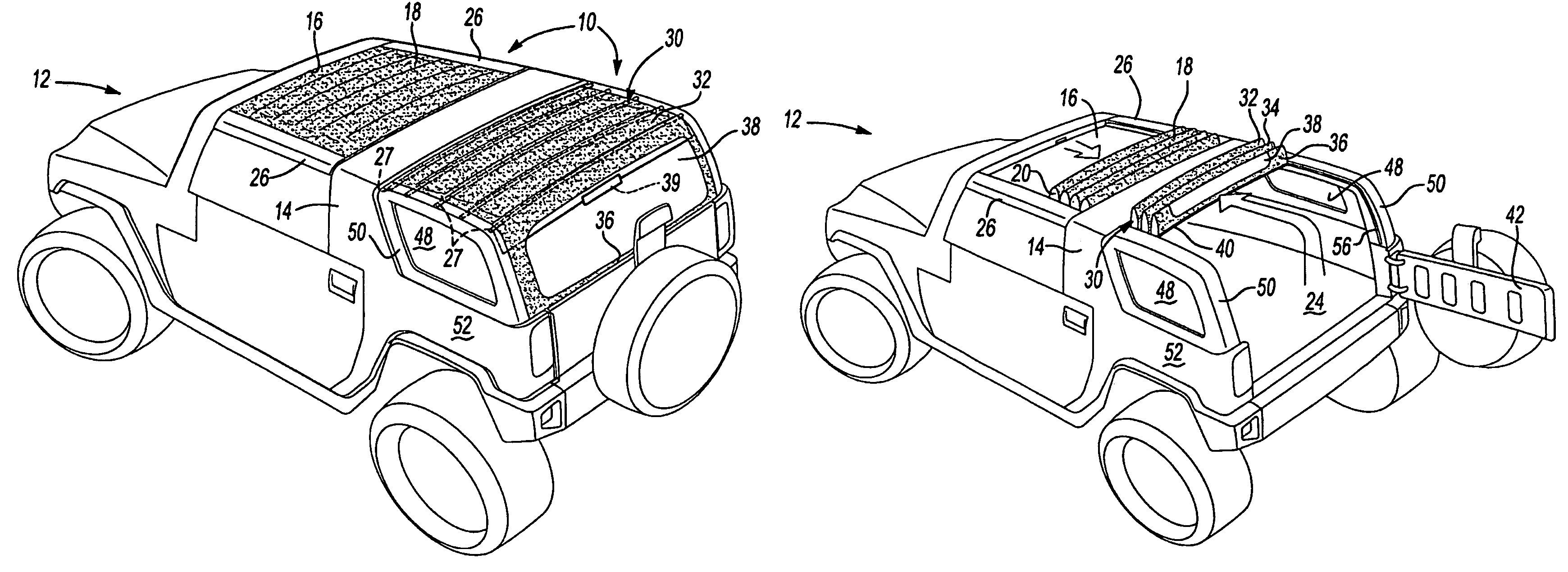

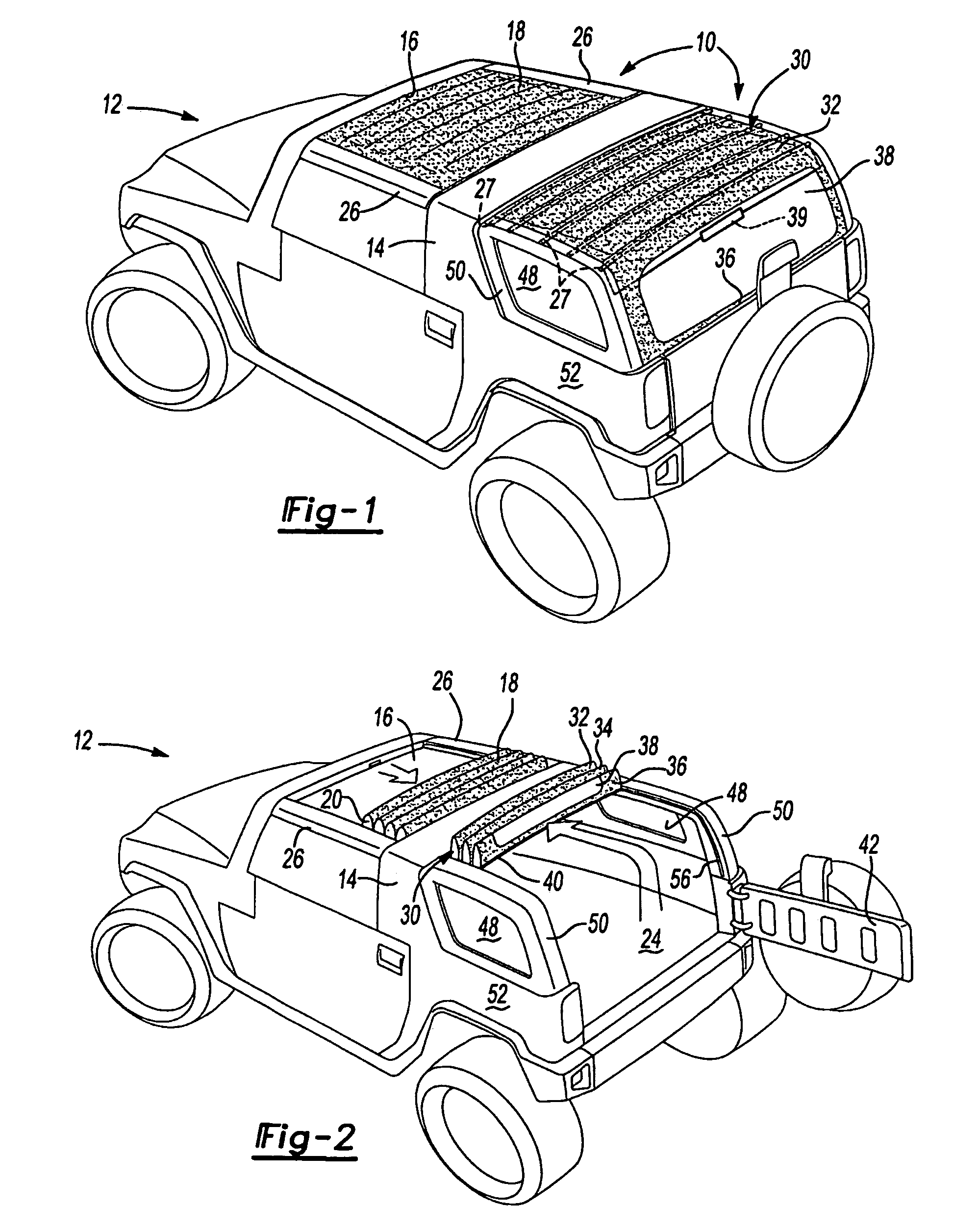

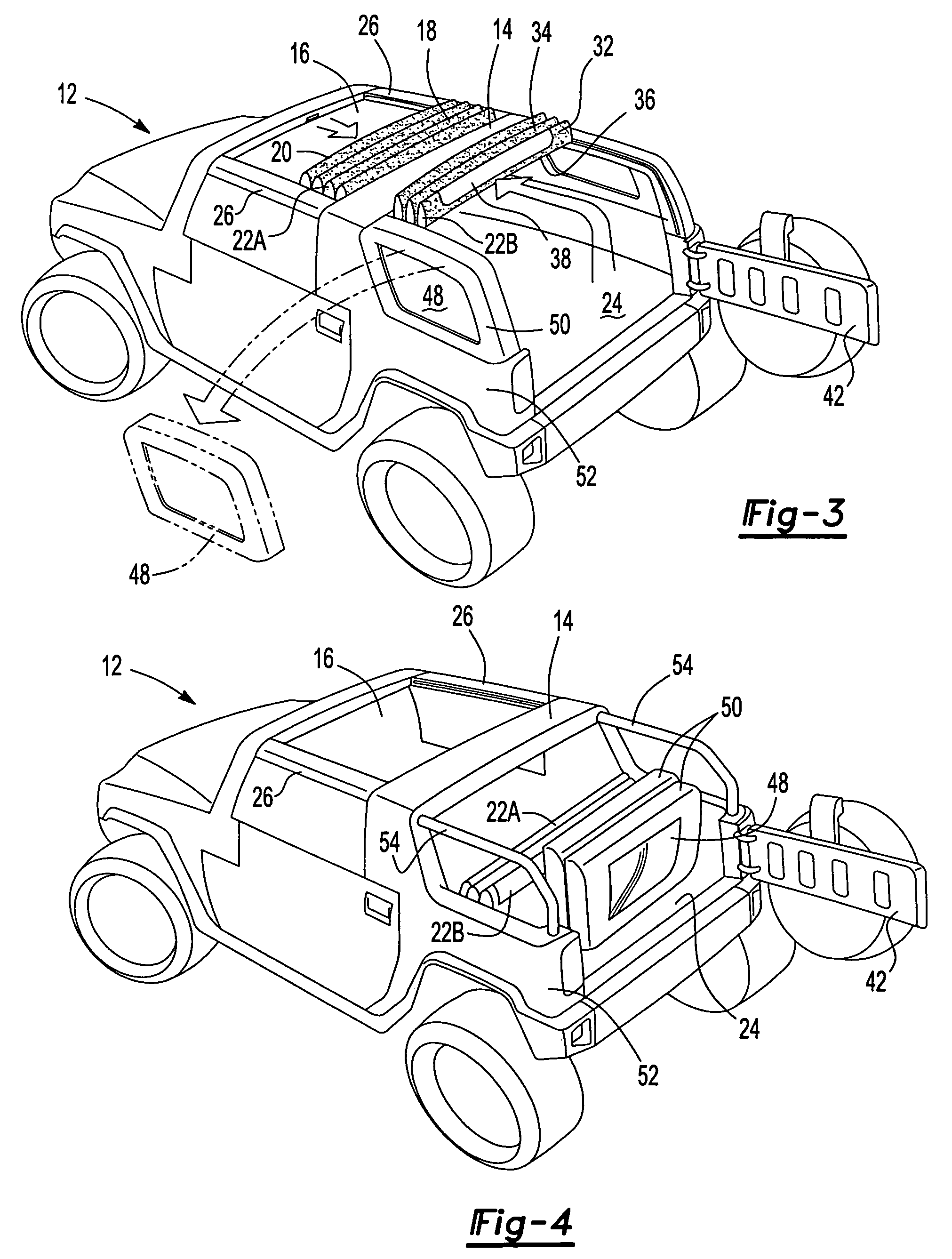

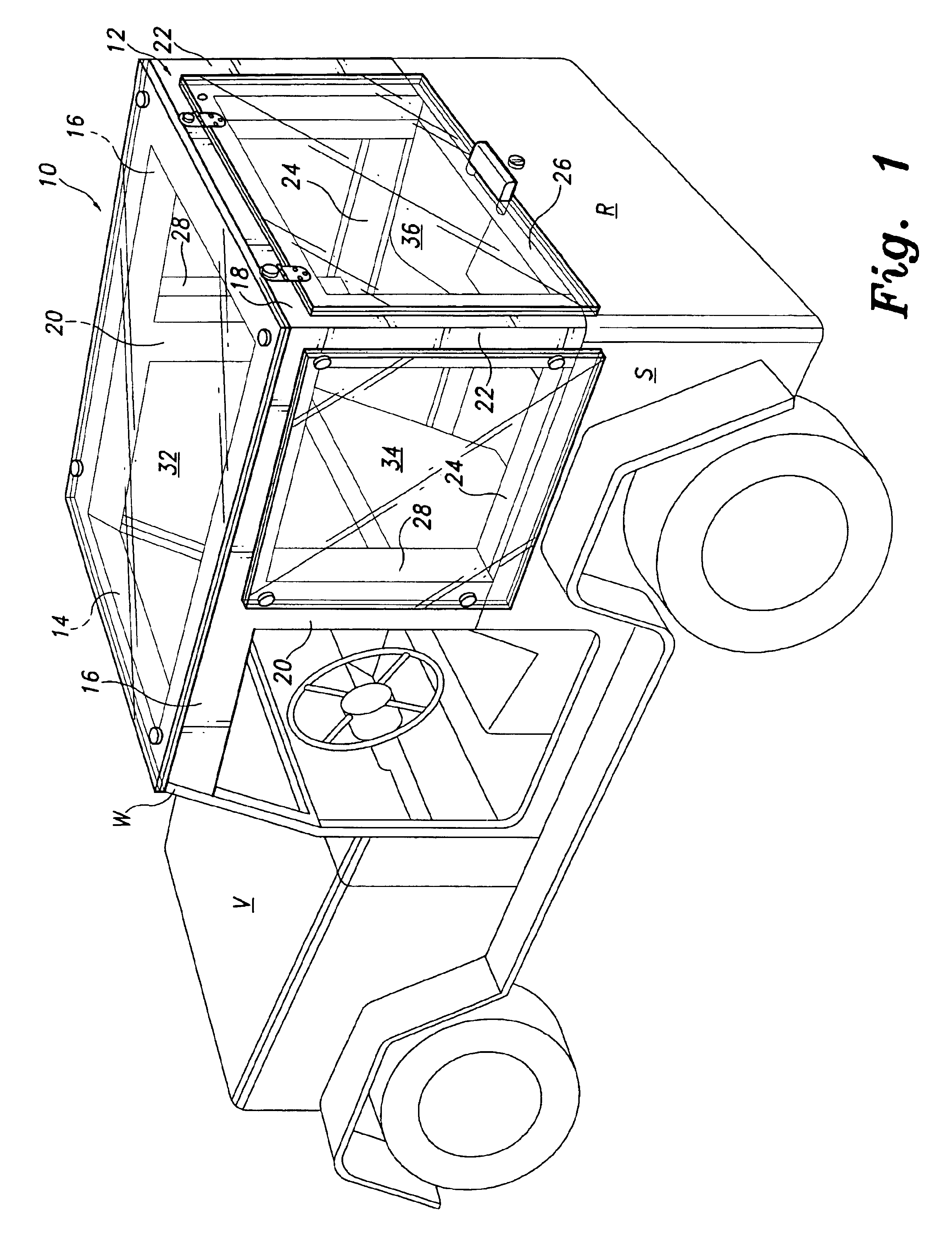

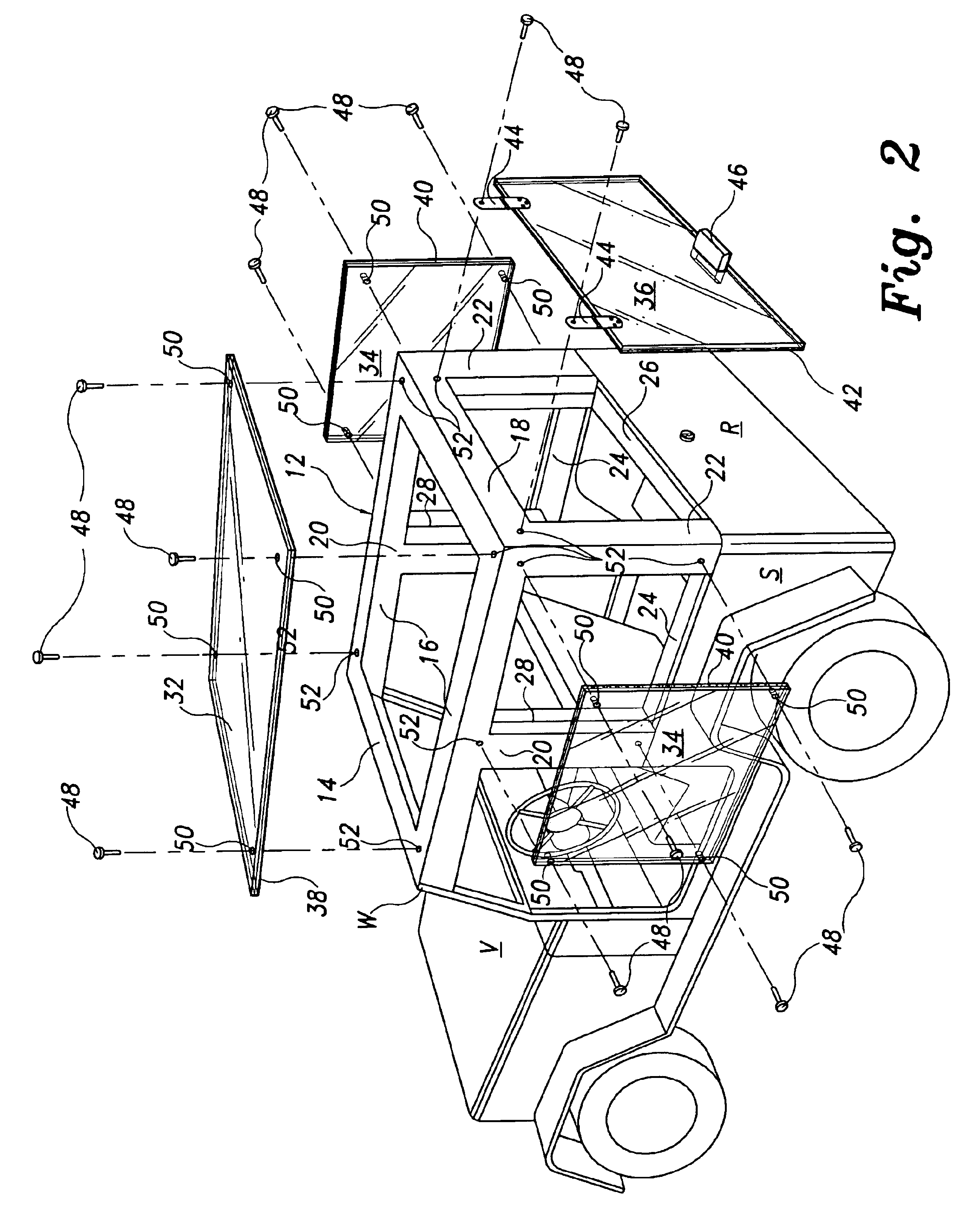

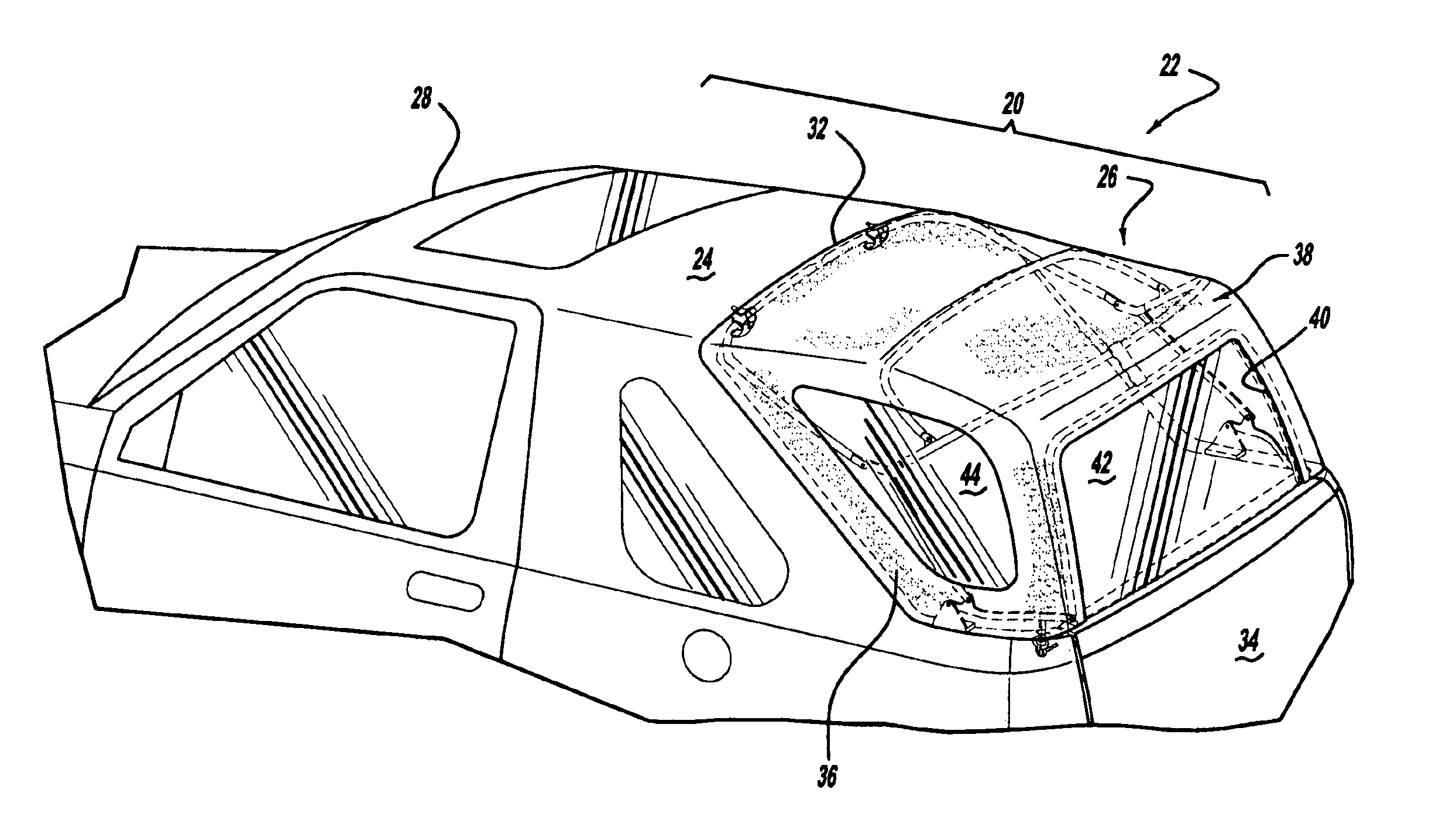

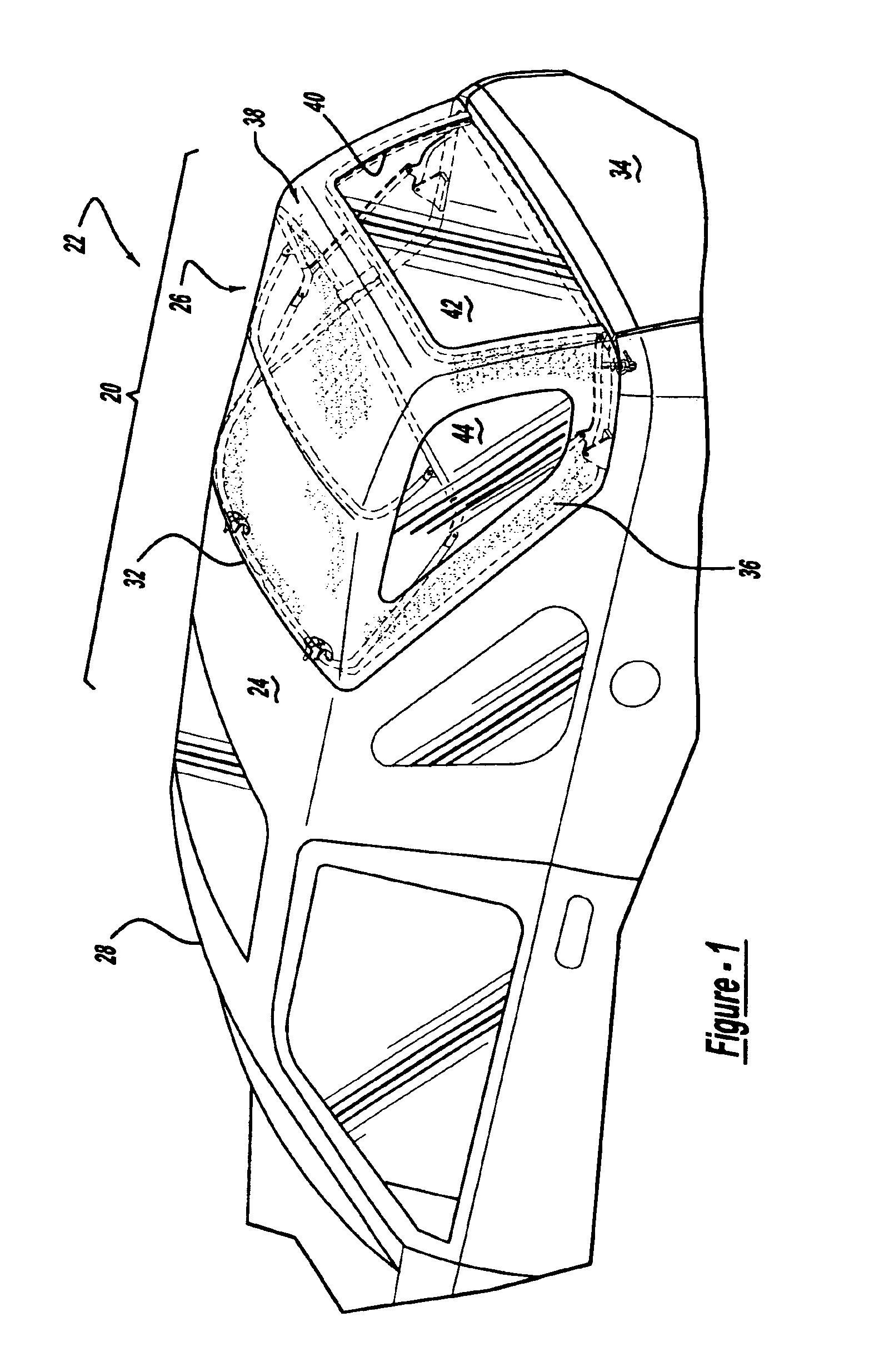

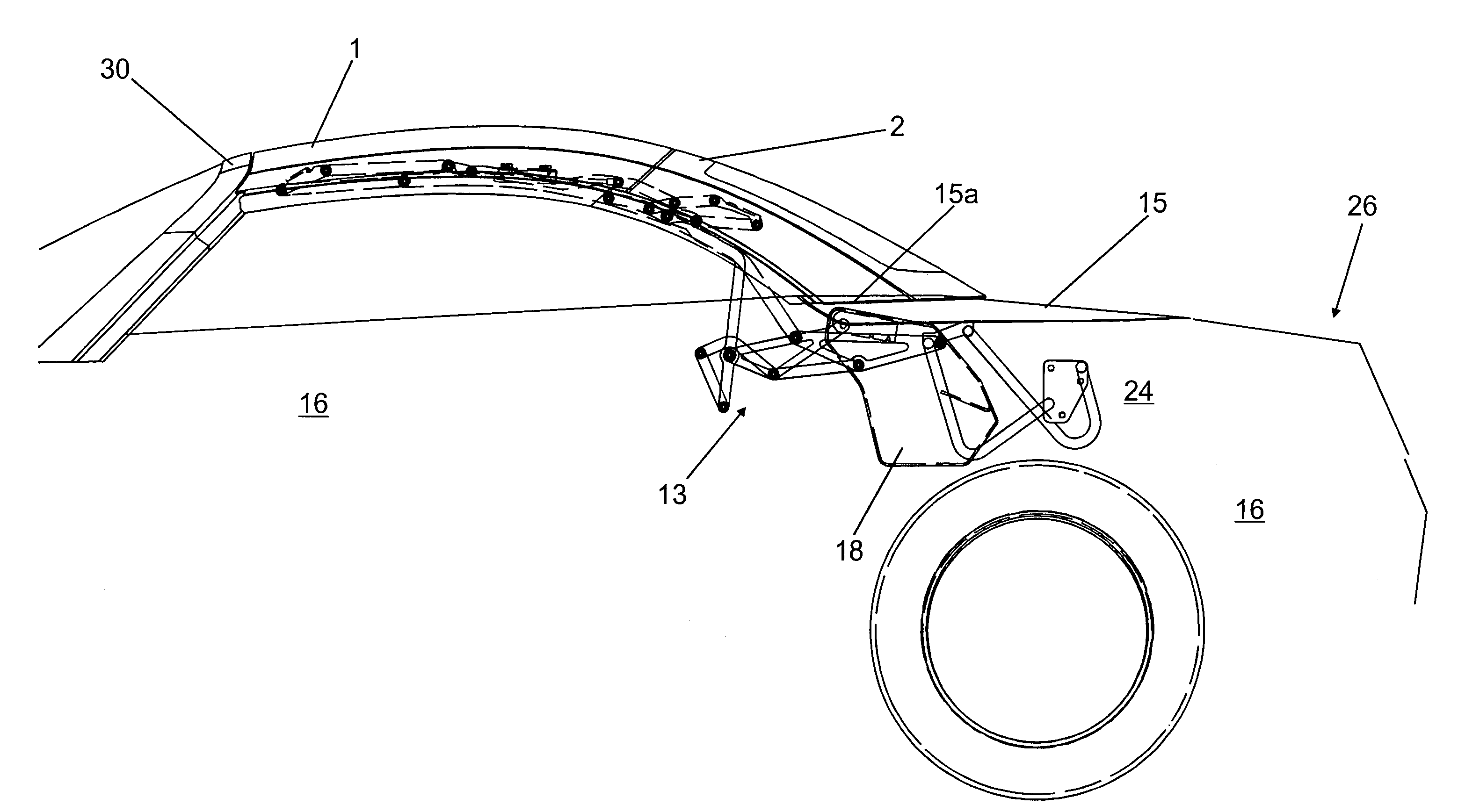

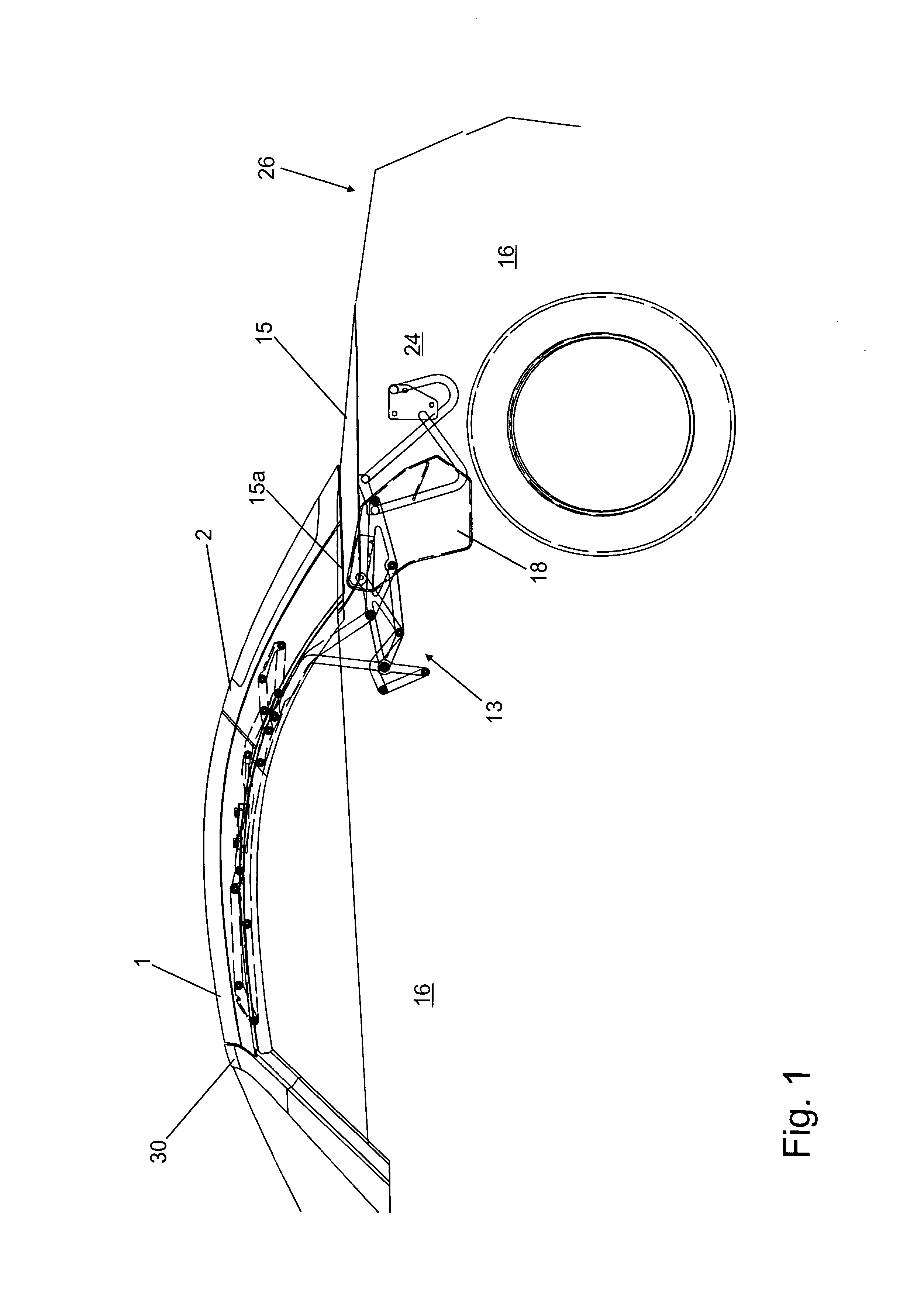

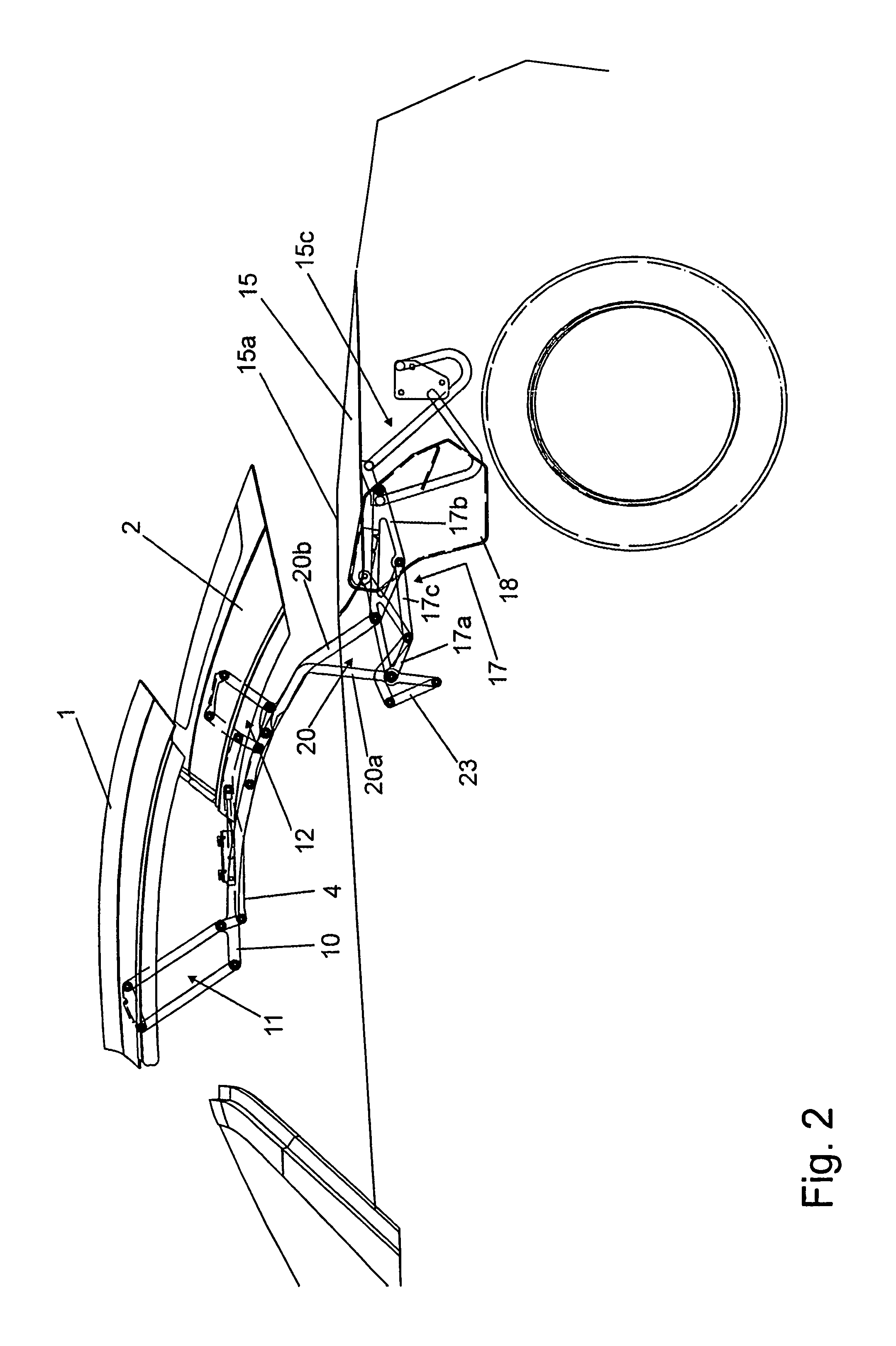

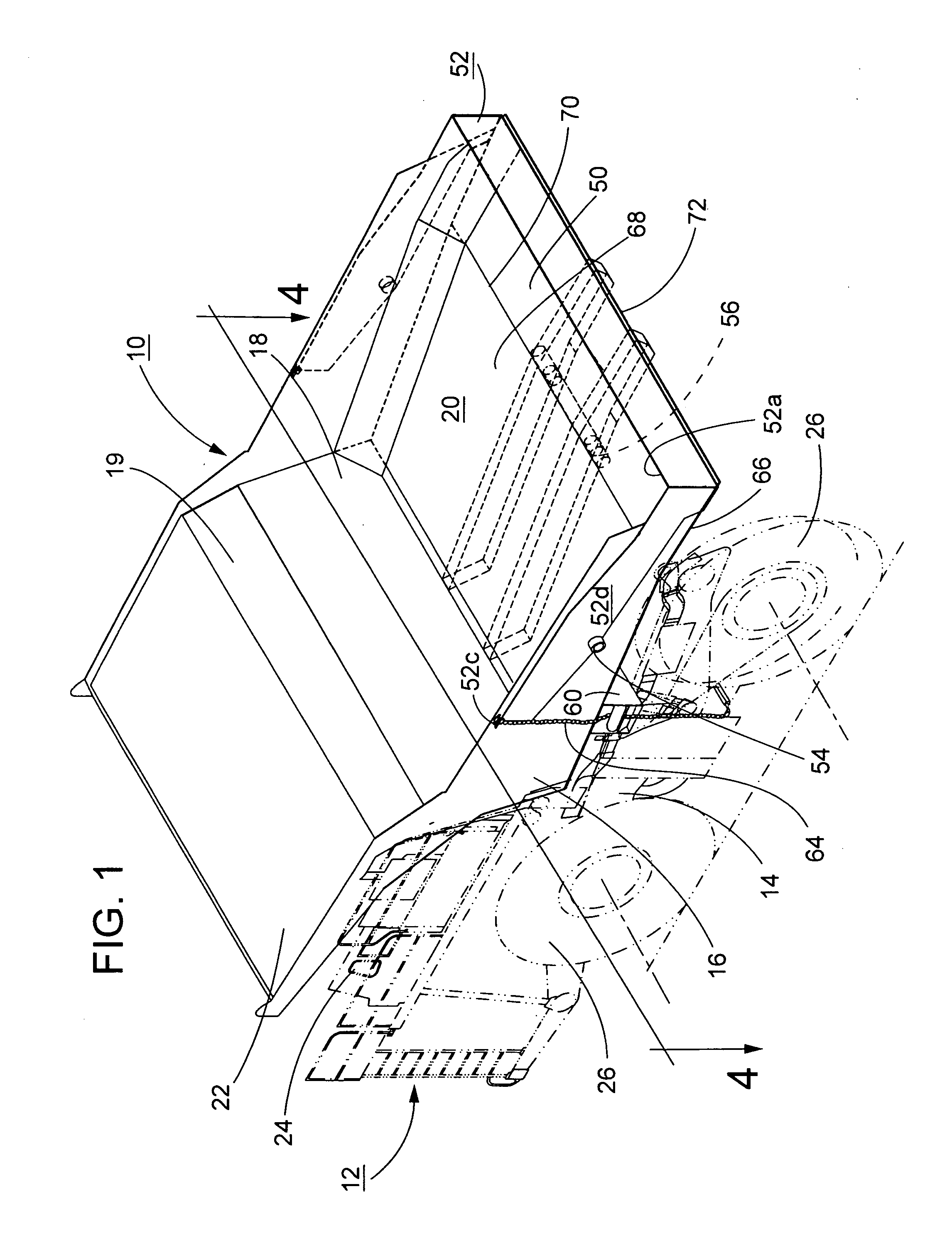

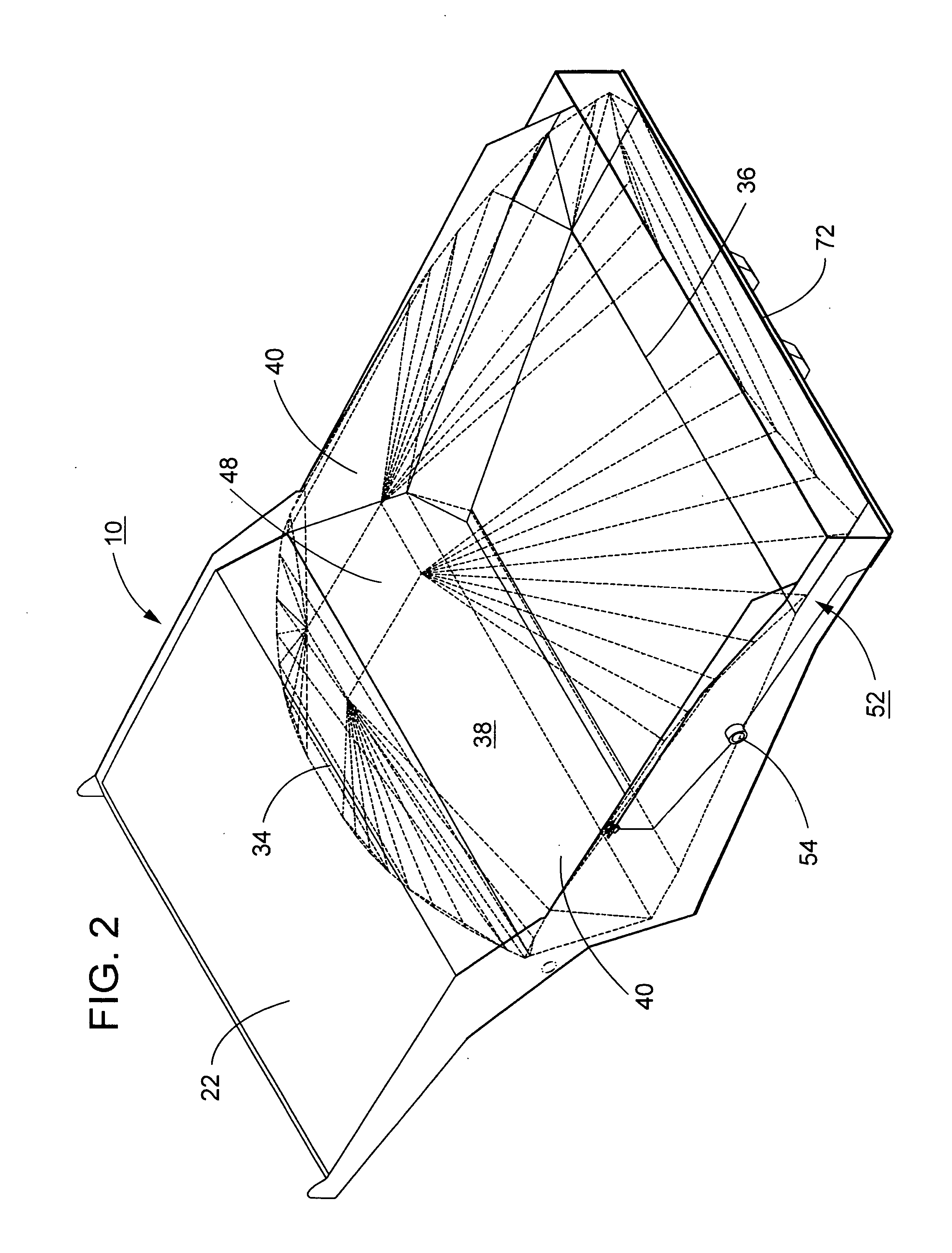

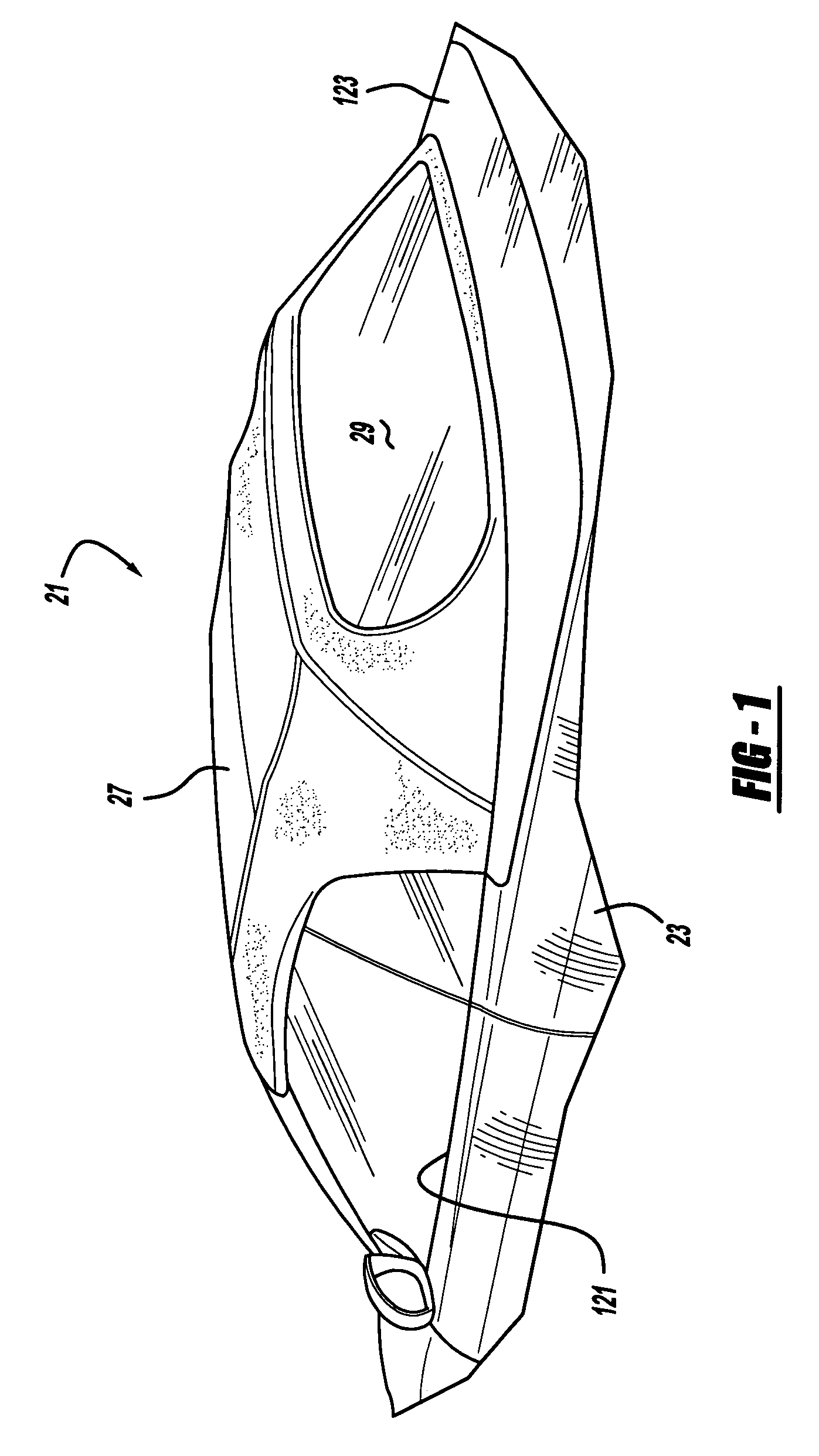

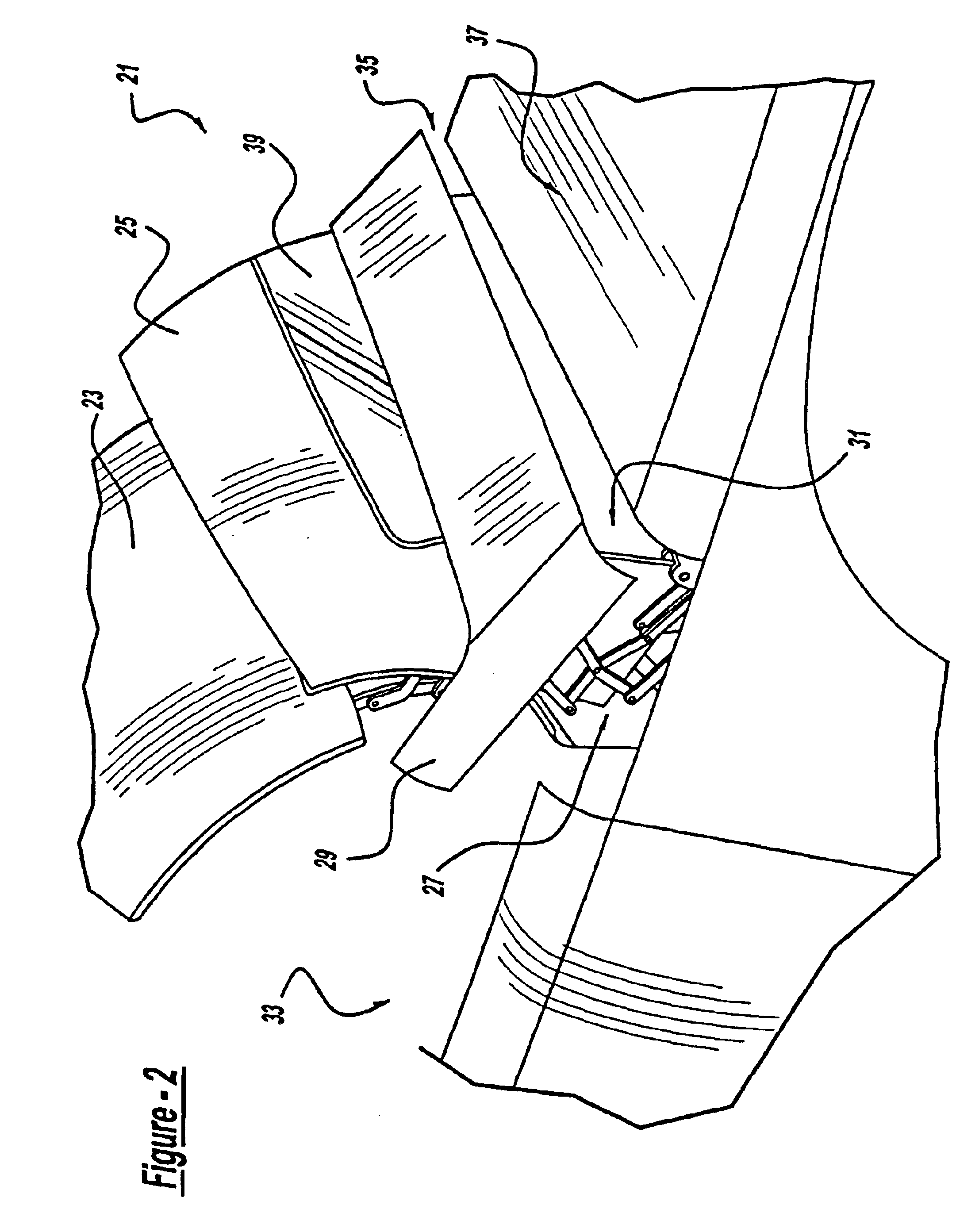

Modular convertible top

A removable top system for a vehicle having a front removable roof section and a rear removable roof section. Different removable roof coverings may be interchangeably combined to provide a complete roof for a sport utility vehicle having a permanent hoop dividing the front and rear roof sections. Soft top and hard top roof coverings are selectively provided. Different retraction mechanisms are disclosed for retracting and storing the removable roof sections.

Owner:MAGNA CAR TOP SYST GMBH

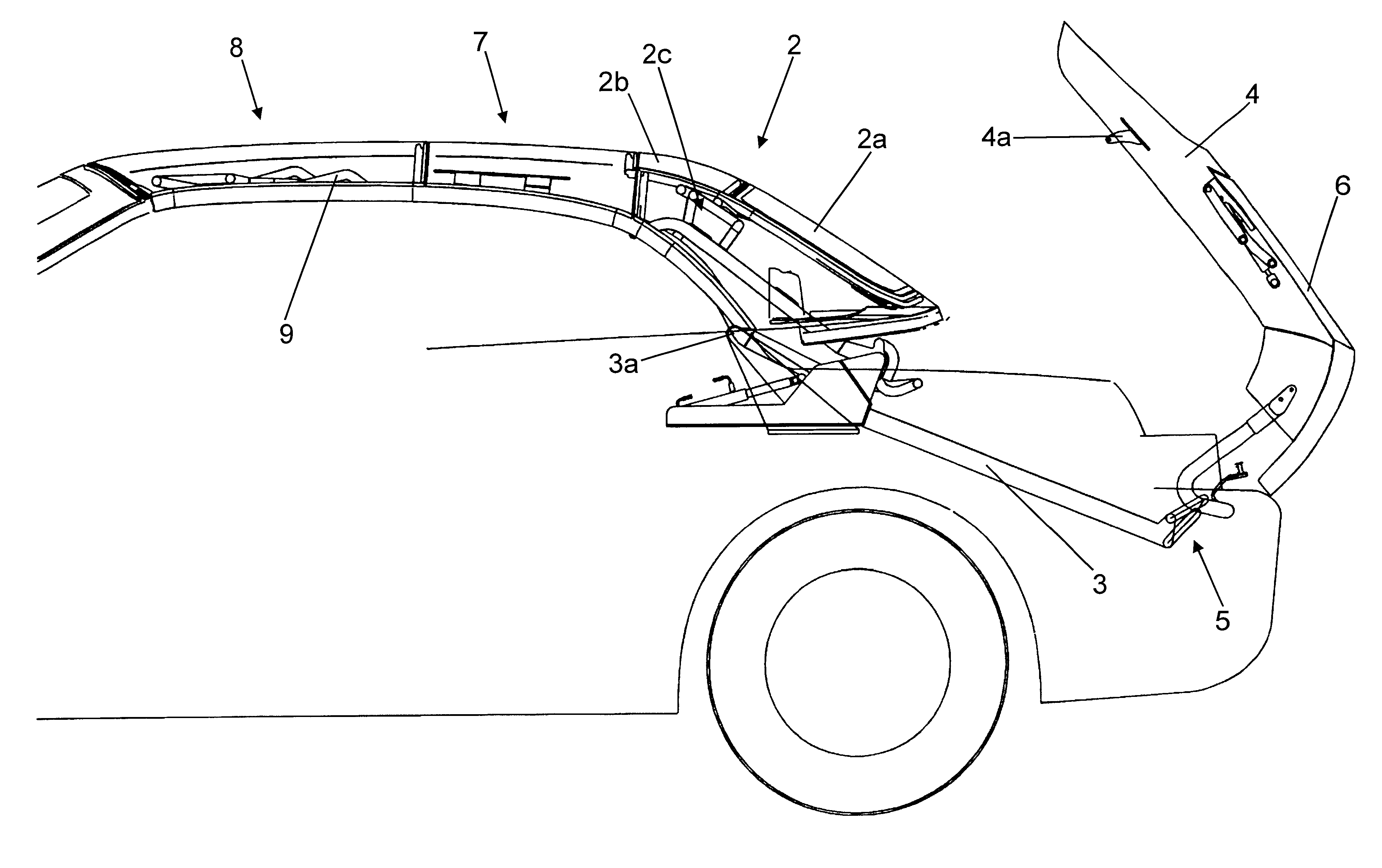

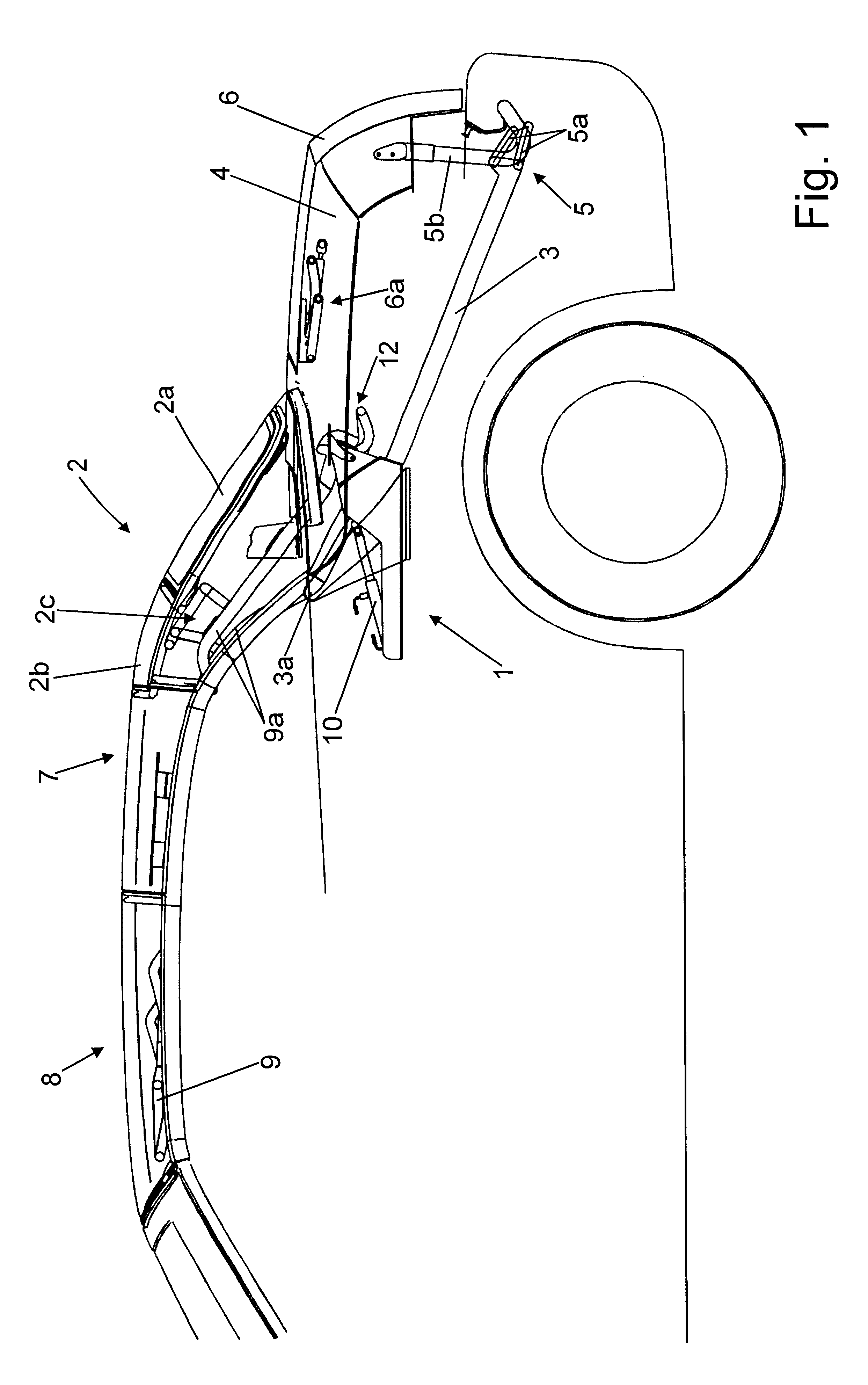

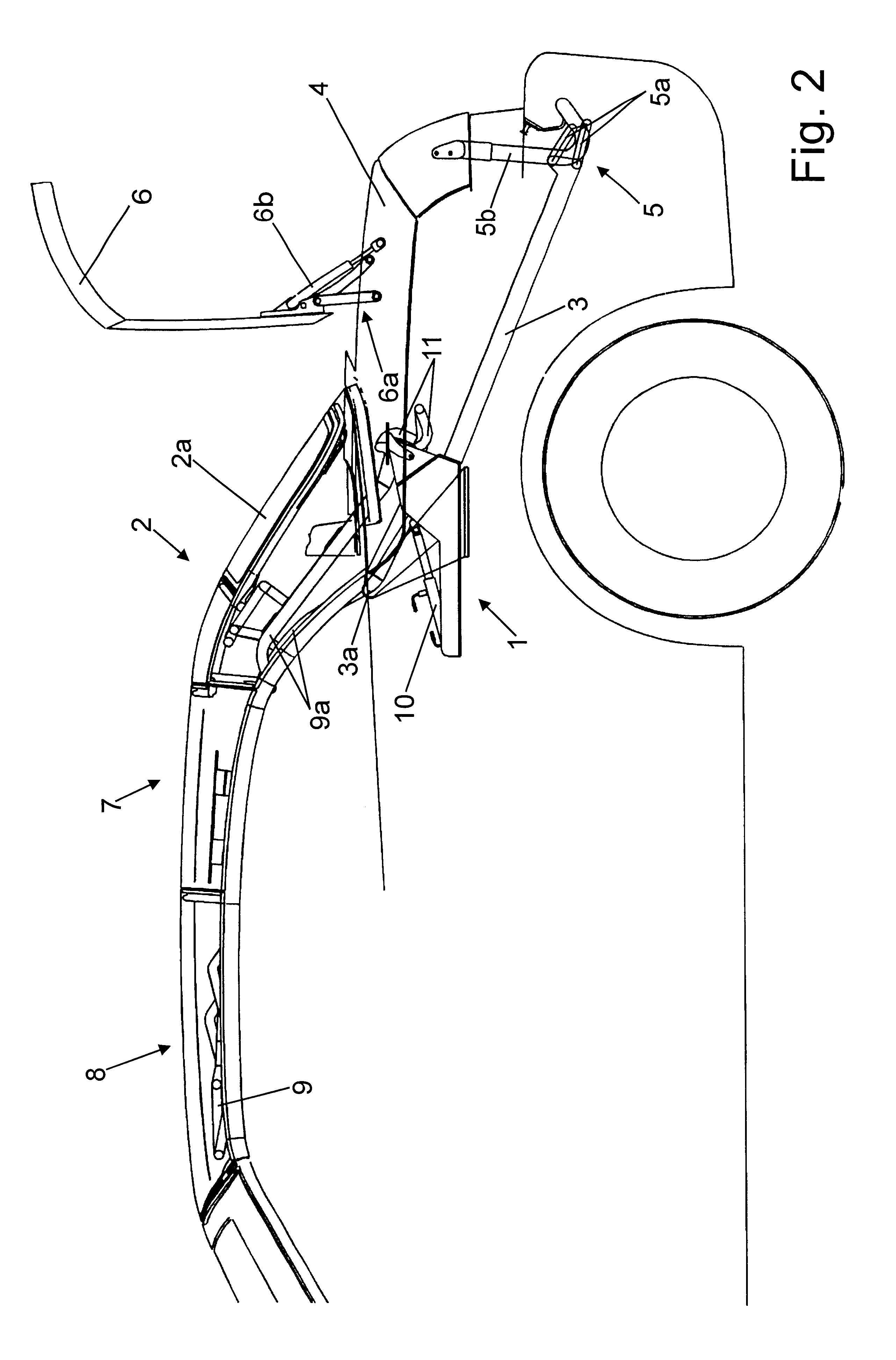

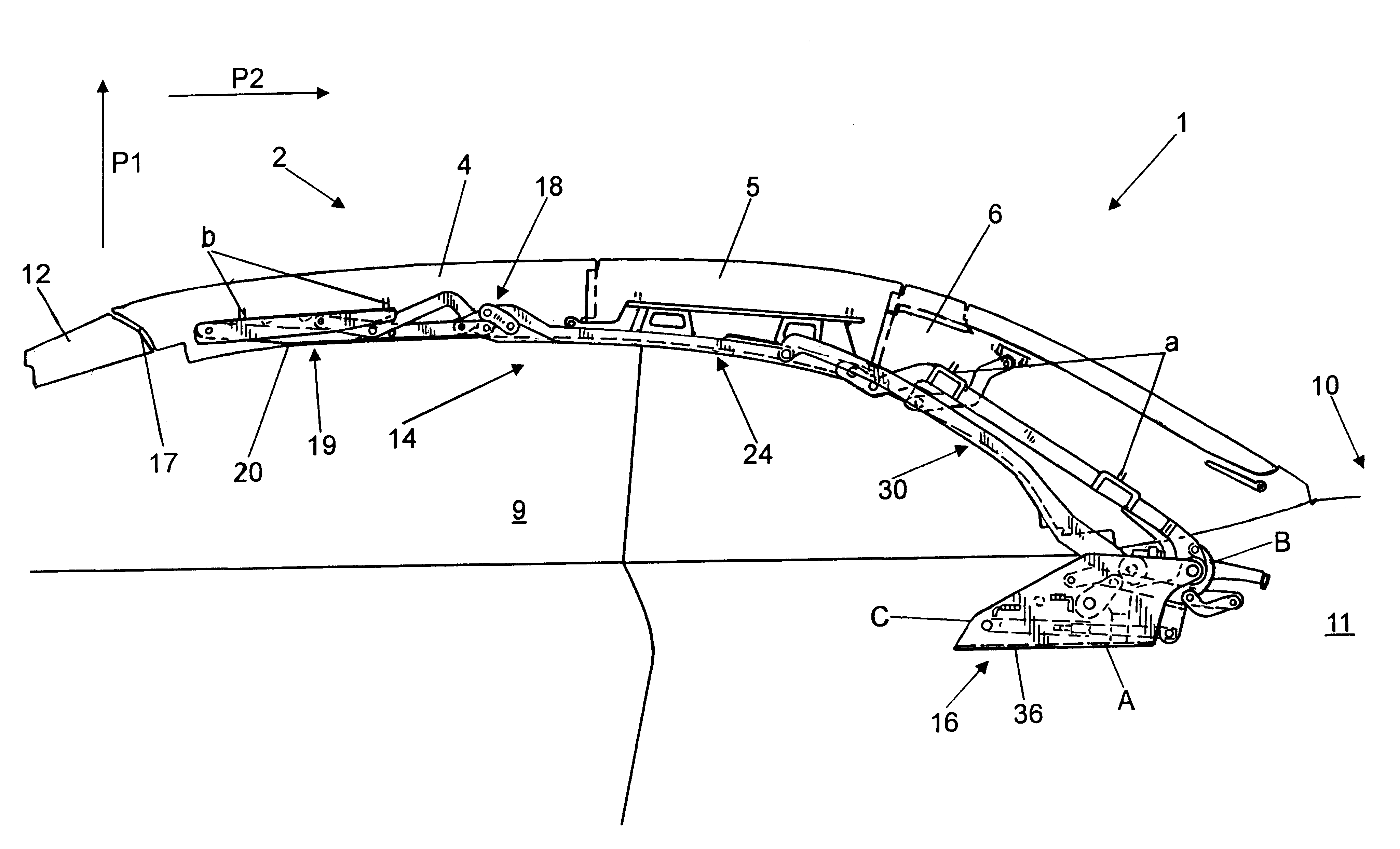

Top for a convertible vehicle

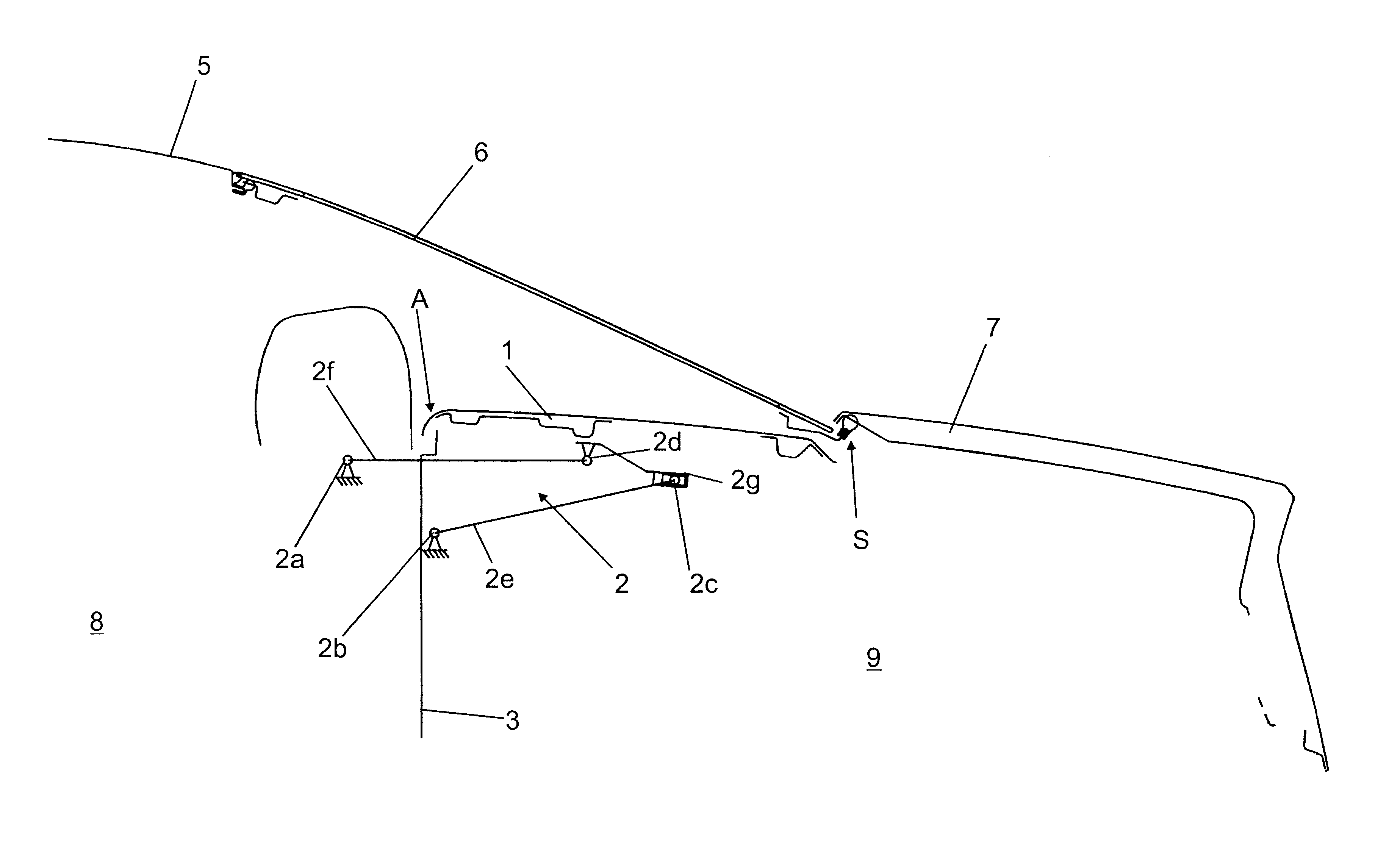

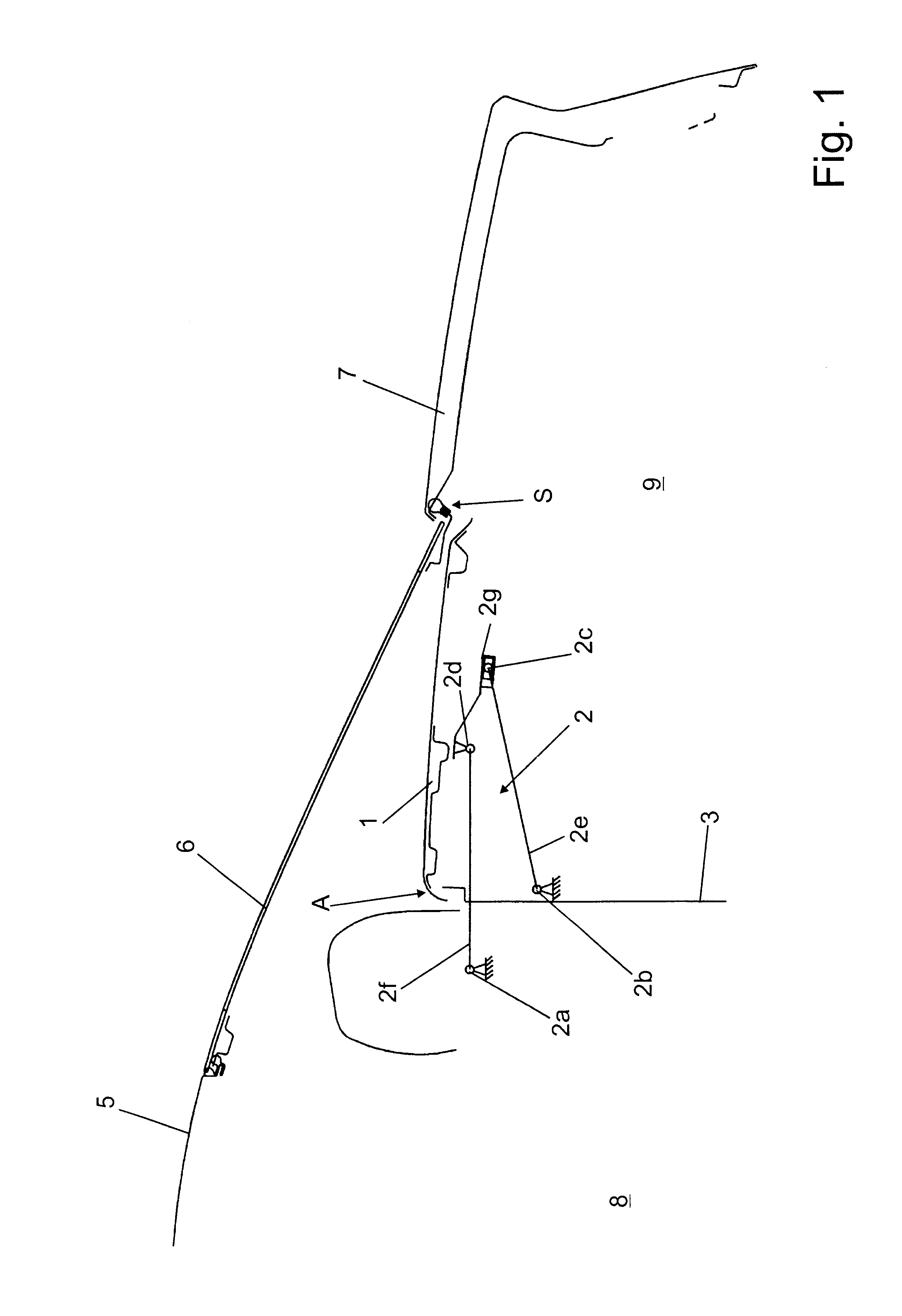

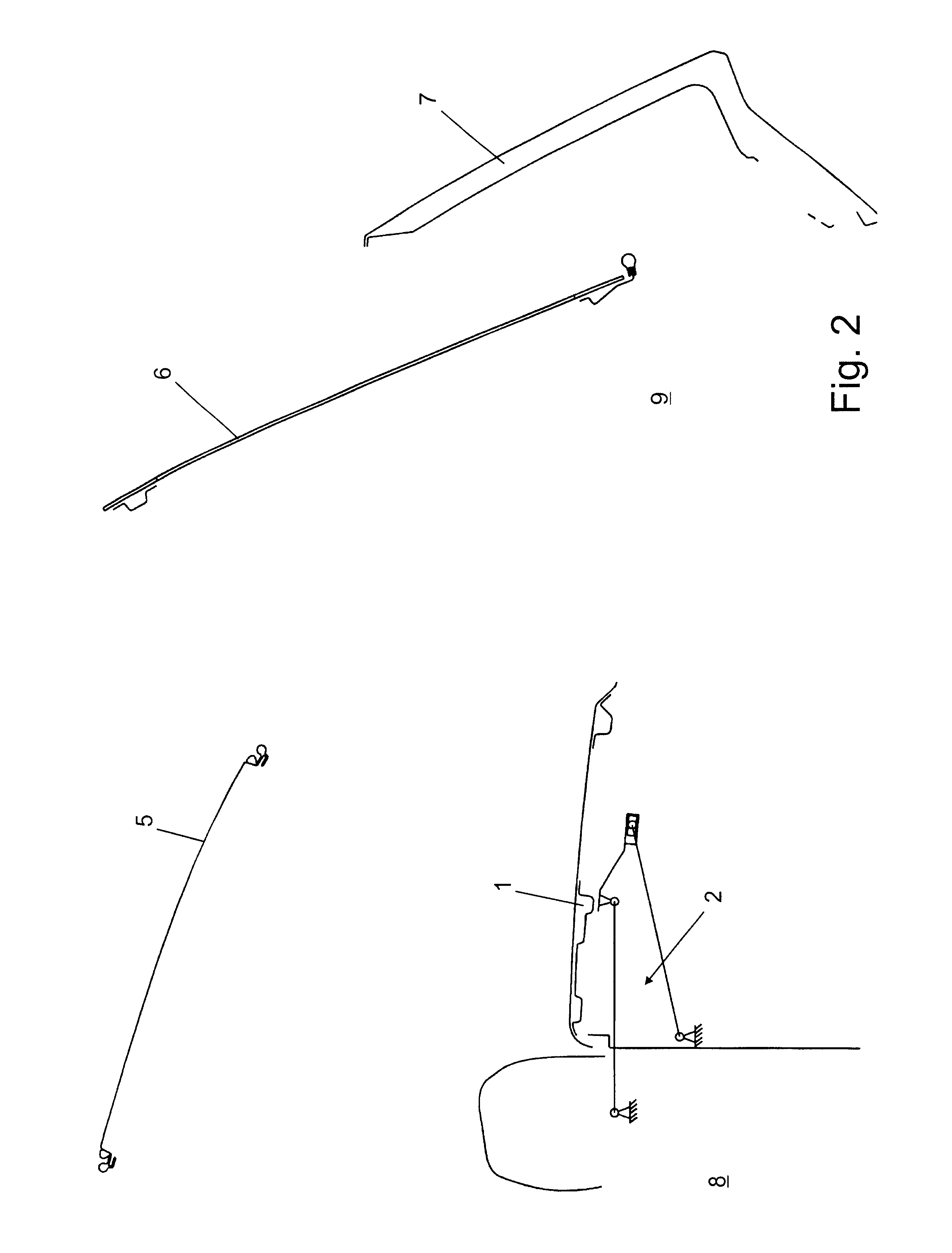

A top for a convertible vehicle, comprising a roof part, said roof part at least partially covering the vehicle in a closed state and being pivotable about a main bearing; a frame element, said frame element being arranged in a rear area of the vehicle; a rear element, said rear element at least partially covering said rear area of the vehicle in a closed state, and a loading lid; said rear element being fixed on said frame element, in such a way as to be pivotable relative to said frame element, by means of a rear bearing arranged at a distance from said main bearing; said frame element being fixed on the vehicle in such a way as to be pivotable relative to the vehicle about an axis arranged in the region of said main bearing; said roof part being pivotable relative to the vehicle about said axis together with the frame element in an open, deposited position of said roof part; said main bearing being firmly connected to said frame element, and said loading lid being fixed on the rear element in such a way as to be pivotable relative to the rear element.

Owner:WEBASTO EDSCHA CABRIO

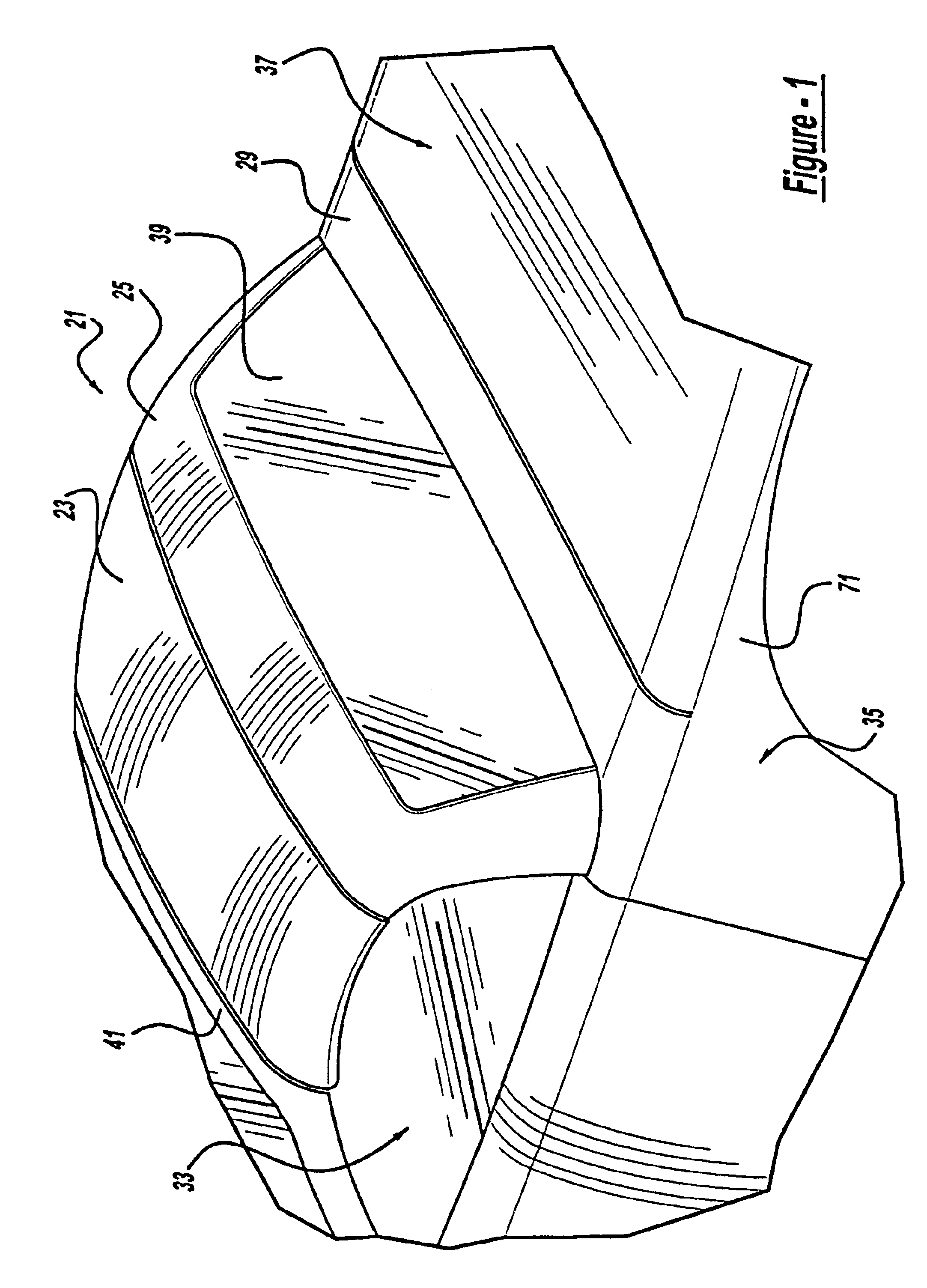

Modular convertible top

A removable top system for a vehicle having a front removable roof section and a rear removable roof section. Different removable roof coverings may be interchangeably combined to provide a complete roof for a sport utility vehicle having a permanent hoop dividing the front and rear roof sections. Soft top and hard top roof coverings are selectively provided. Different retraction mechanisms are disclosed for retracting and storing the removable roof sections.

Owner:MAGNA CAR TOP SYST GMBH

Convertible C-Clamp

A convertible clamp device including a C-shaped frame having first and second substantially opposing interconnected arms; a clamping rod carried by the first arm for longitudinal movement in a first clamping direction toward an internal face of the second arm and in a second opposite direction away from the second arm; different first and second movable clamping jaws removably coupleable to a portion of the clamping rod between the arms of the frame; and different first and second stationary clamping anvils being disposable on the internal face of the second arm.

Owner:CARNEVALI JEFFREY D

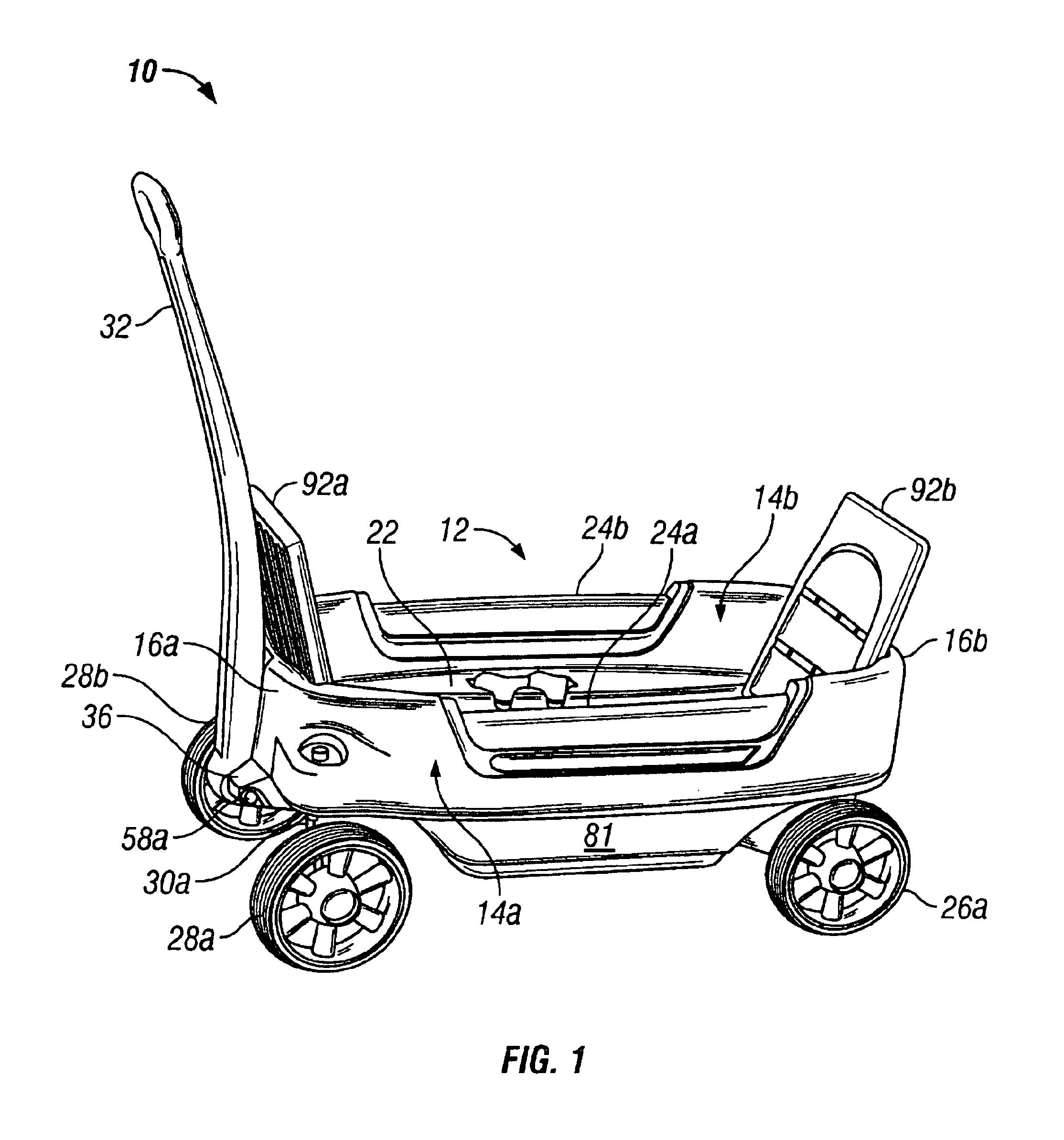

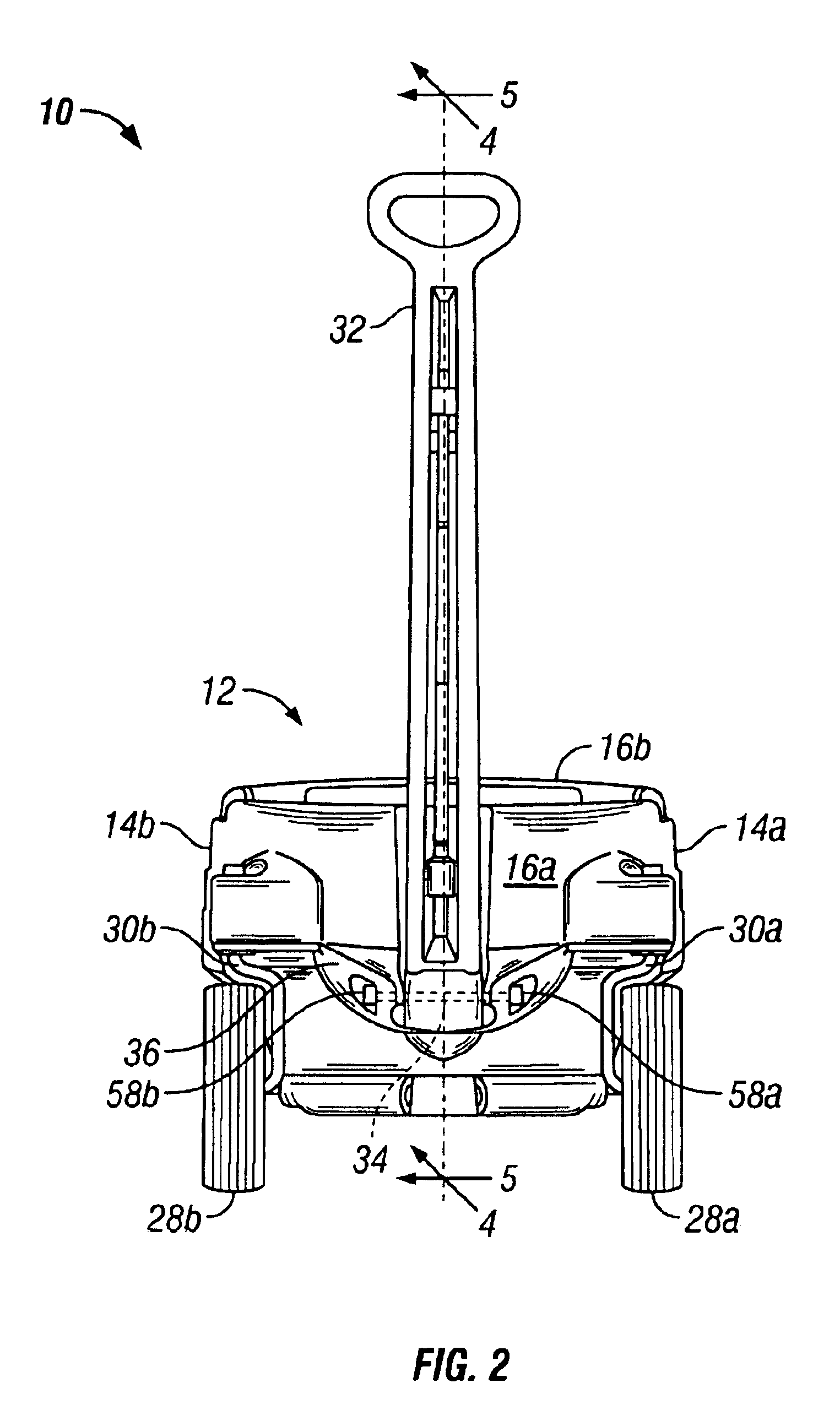

Convertible toy wagon

A convertible toy wagon includes a plastic body with side walls that define a passenger space and a bottom portion that defines a storage compartment. Horizontal seating surfaces are located fore and aft of the opening of the storage compartment. Seatbacks are pivotally attached to the wagon body and close to cover the horizontal seating surfaces and the storage compartment. A handle is pivotally attached to the front of the wagon body by a handle bracket that includes a pair of arms and an arcuate locking surface positioned therebetween. A ridge is formed on a cylindrical lower portion of the handle and interacts with the locking surface of the handle bracket so that the handle may be locked into an upright position.

Owner:RADIO FLYER

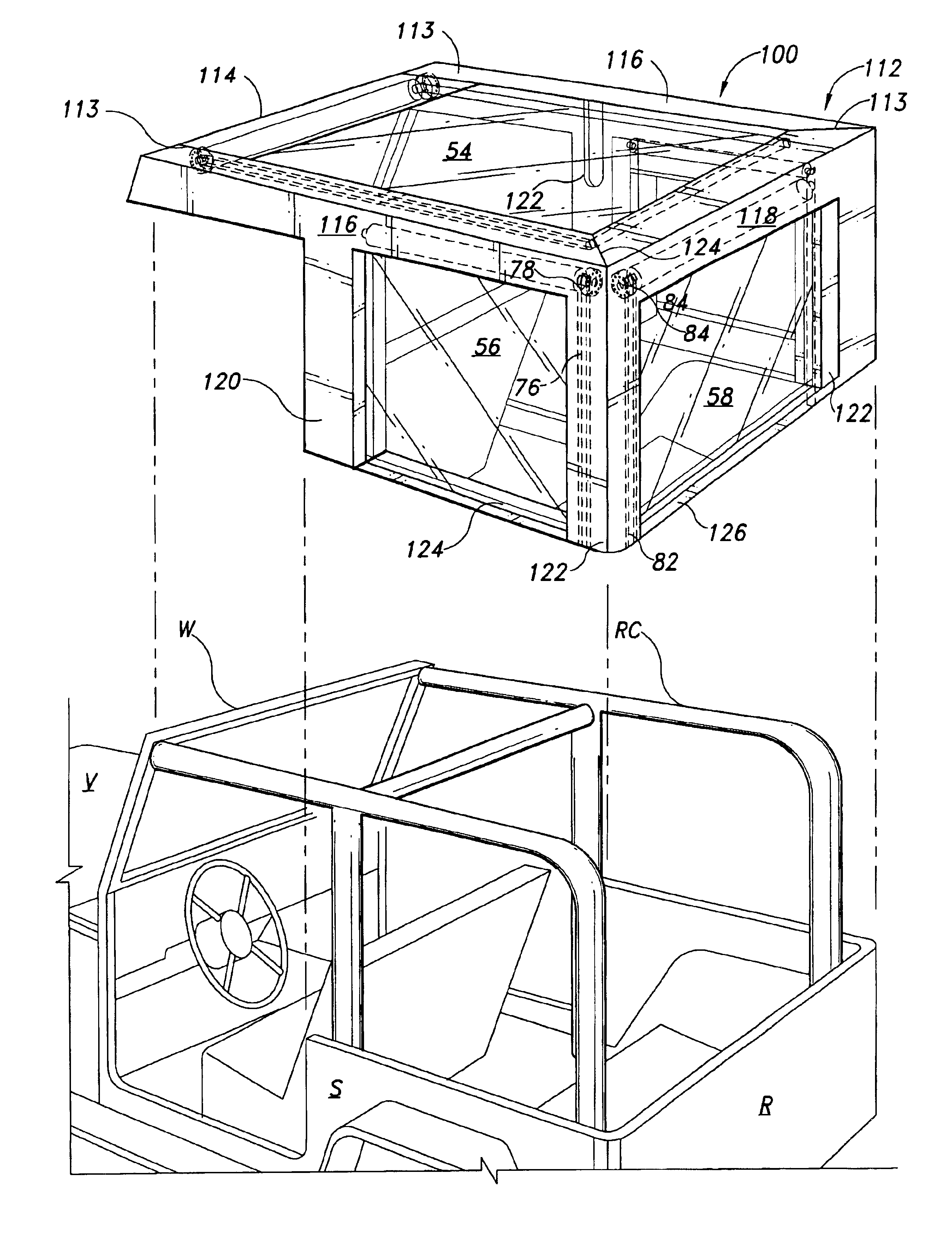

Hard top convertible for jeep-type utility vehicle

A hard top and soft top convertible system for a Jeep-like vehicle which includes, in one embodiment, a replacement for the conventional roll-bar cage with a roll-bar frame that is aligned with the outer edges of the vehicle. The roll-bar frame is made of high strength metal, acting as a substitute for the conventional roll bar. The top includes removable outer hard top, side windows and rear window. The top includes pliable inner soft top, side windows, and rear window, each of which may be rolled into a stored position within the frame using electric motors for open air use of the vehicle. Another embodiment employs a similarly configured frame which is provided in a set of pieces which are assembled over an existing roll bar frame of the Jeep-like vehicle.

Owner:MORLEY DANIEL

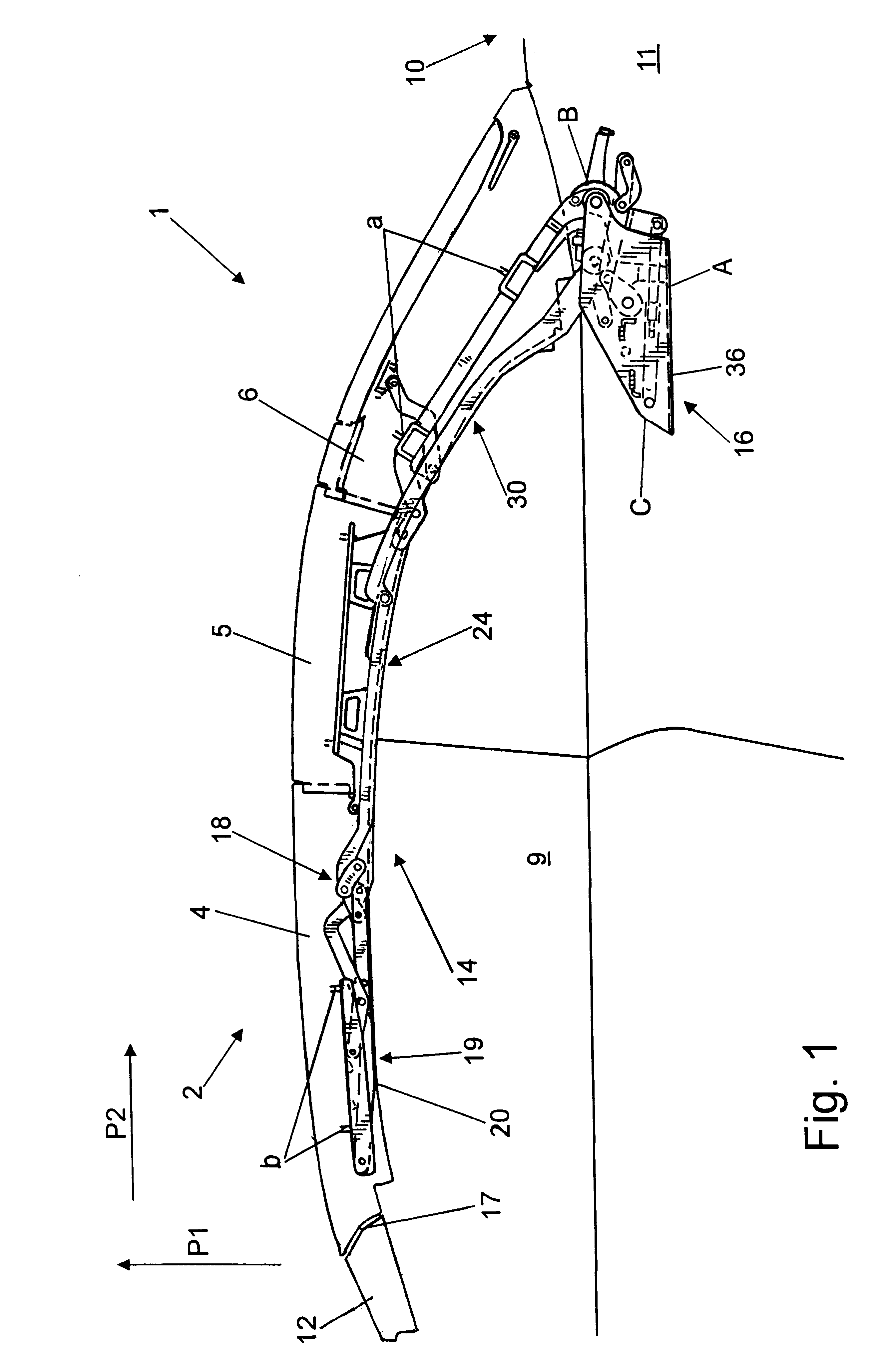

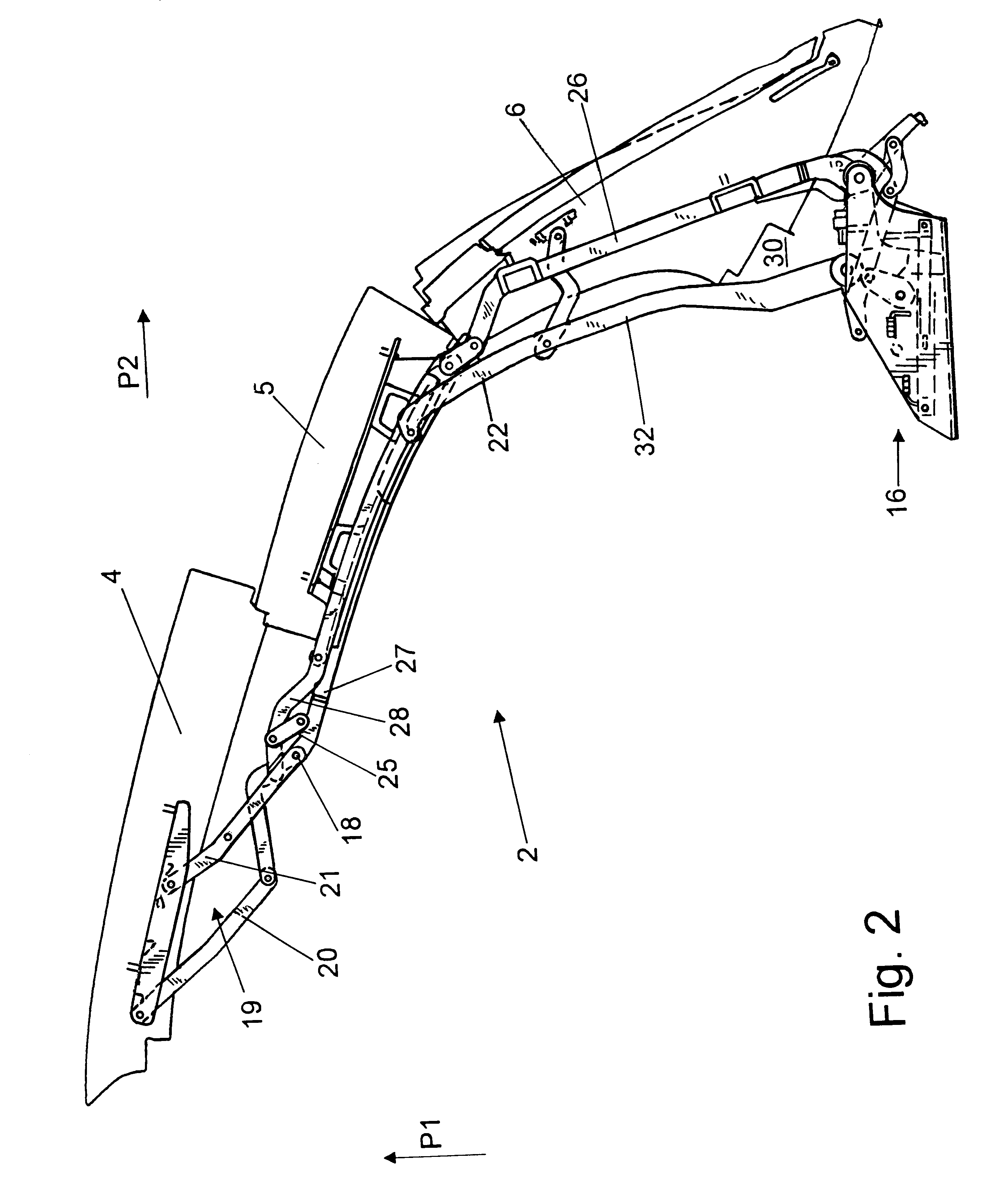

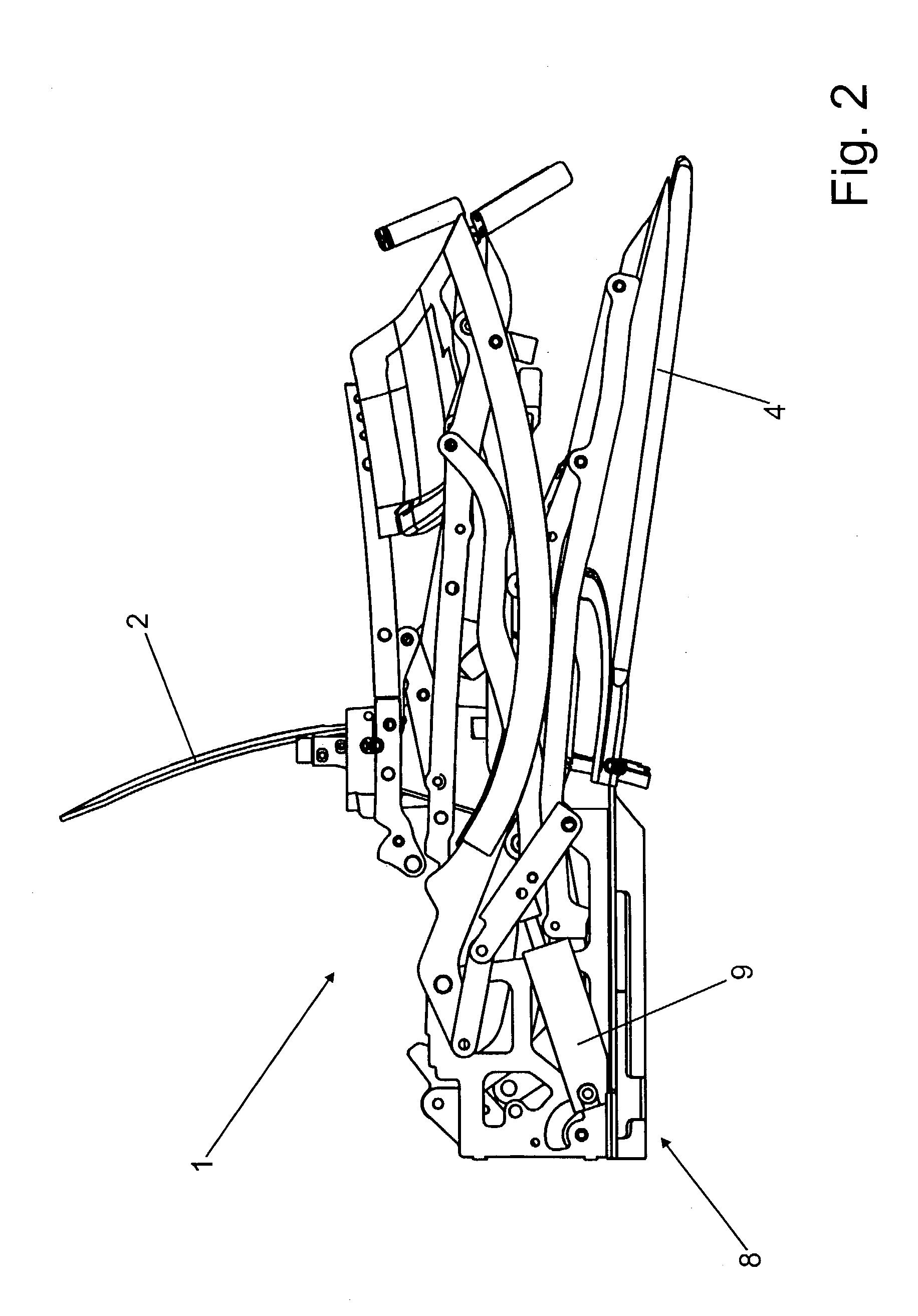

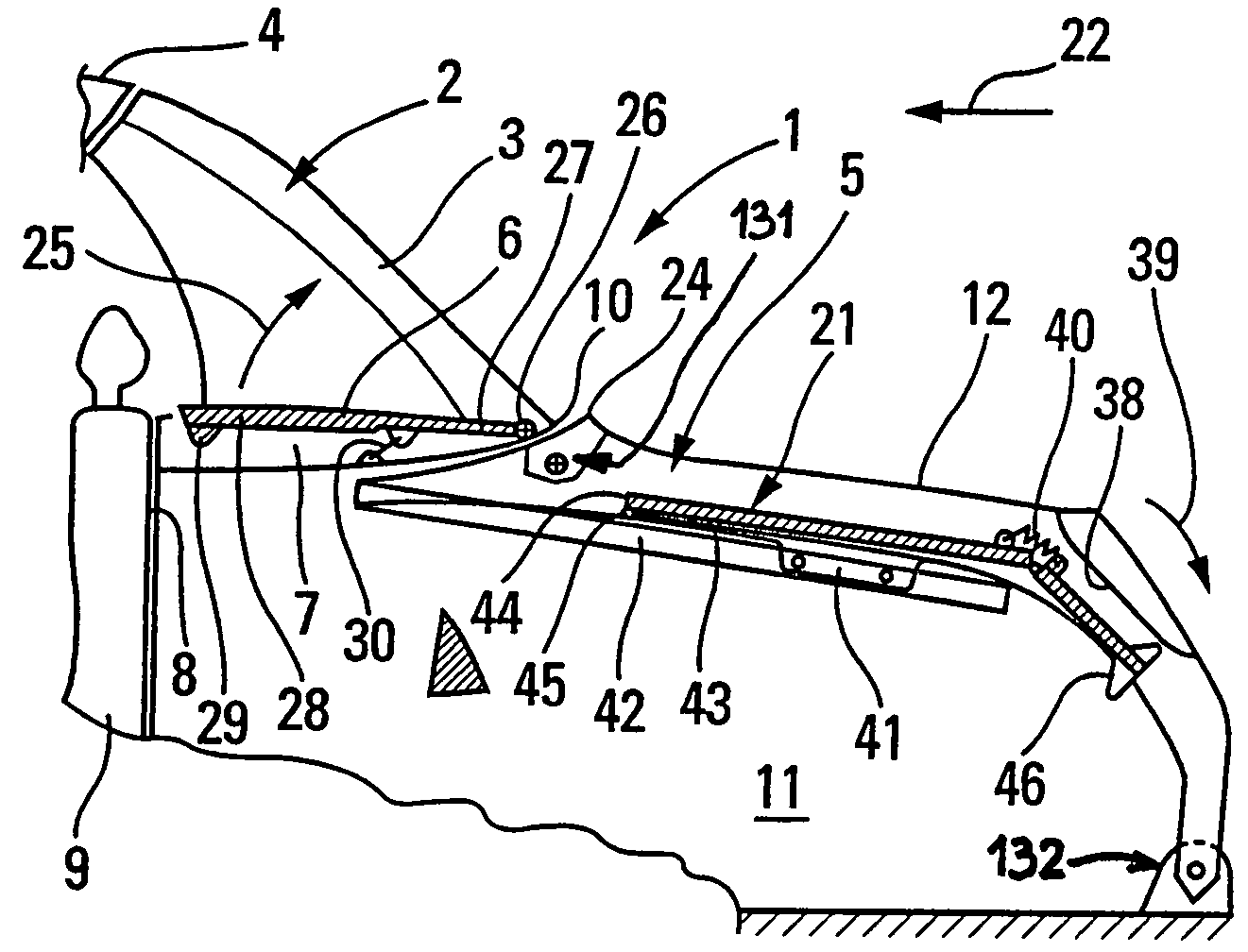

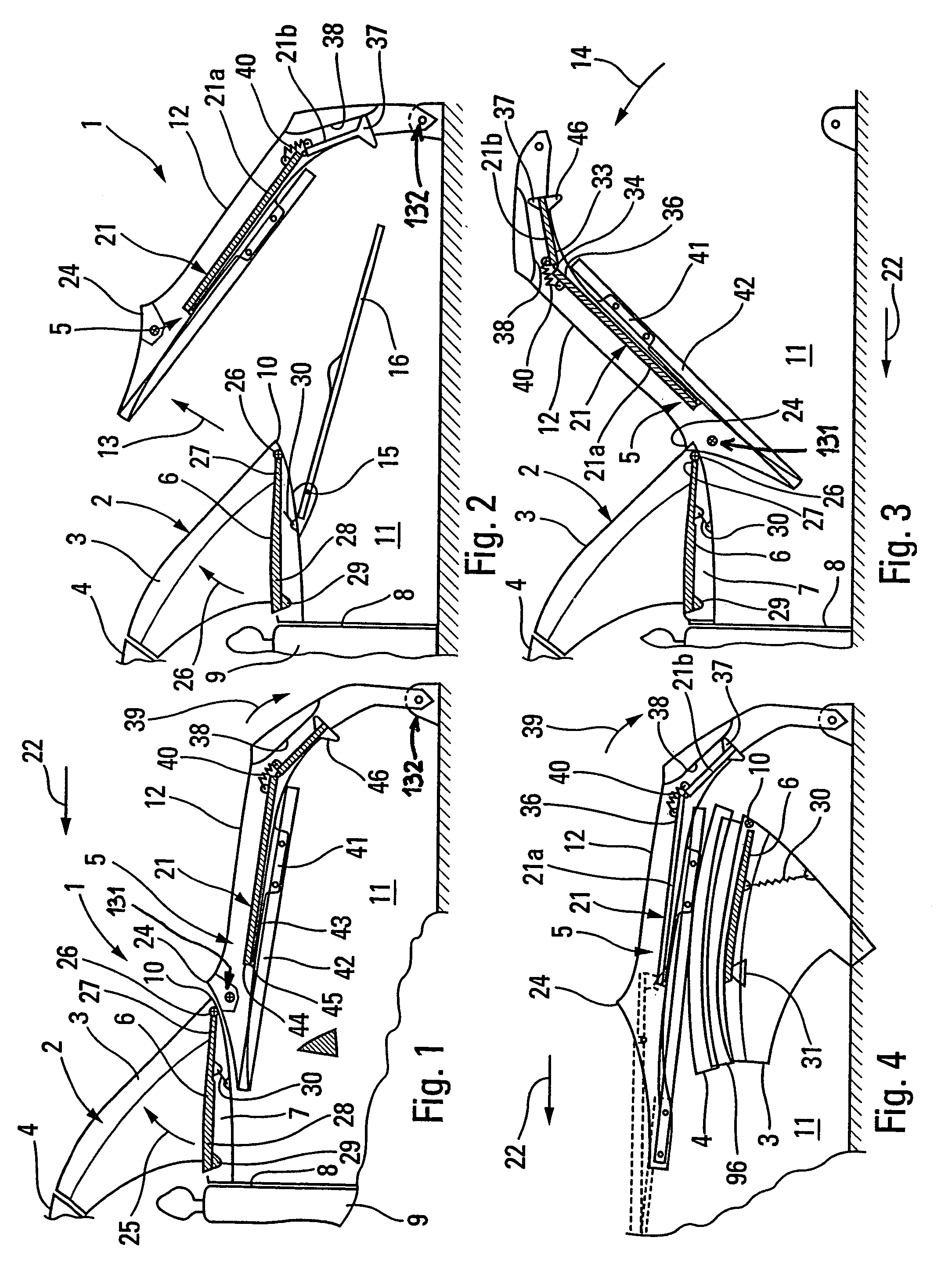

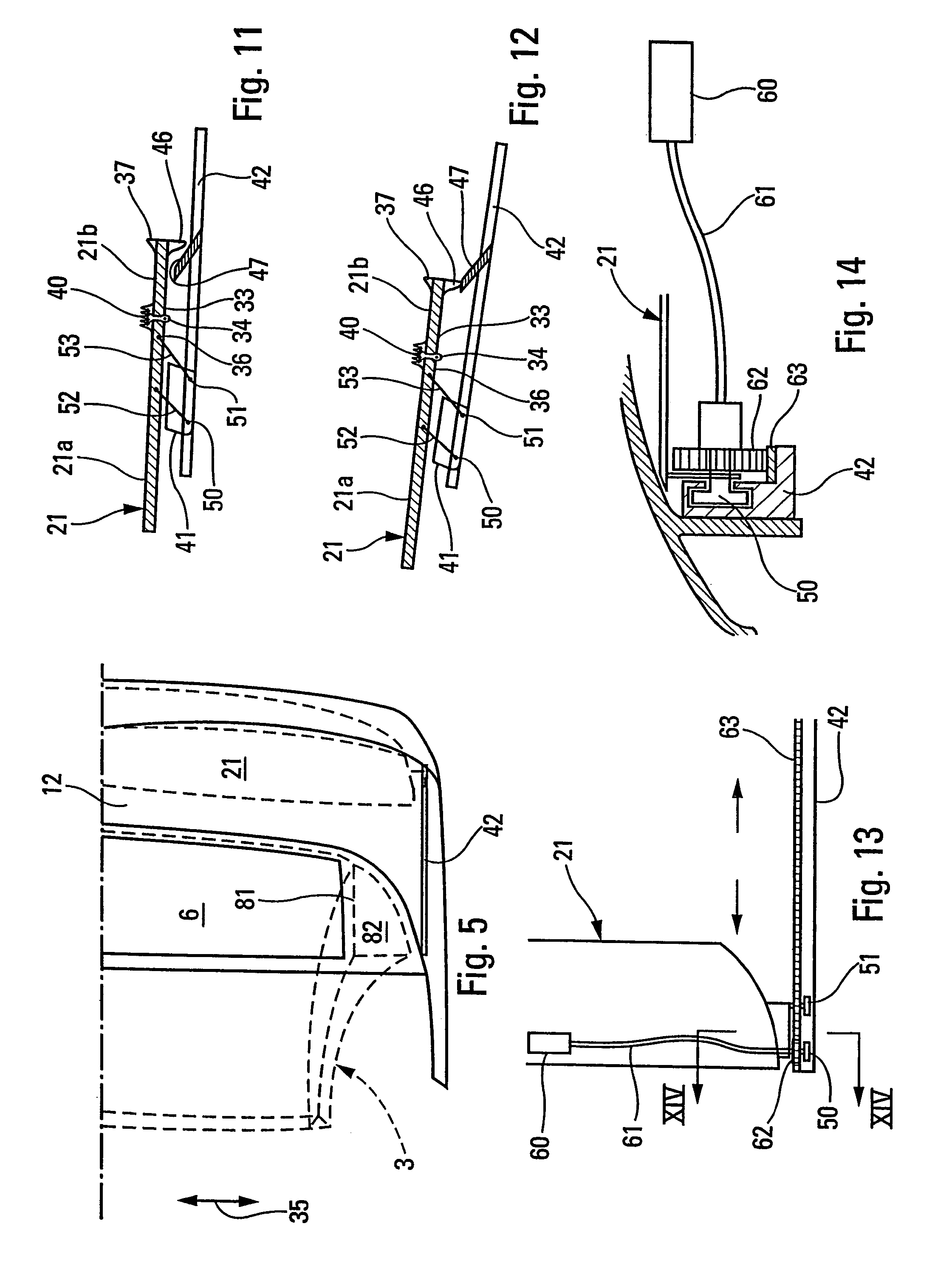

Convertible top and driving device for a convertible top

InactiveUS6478362B2Reliable driveImprove stabilityEngine sealsVehicle sealing arrangementsPush and pullBiological activation

Owner:WEBASTO EDSCHA CABRIO

Top for a convertible vehicle

InactiveUS20030146642A1Accurate and stable mannerOptimized packing positionEngine sealsVehicle sealing arrangementsEngineeringRigid structure

A top for a convertible vehicle moveable between an open state and a closed state: The top includes a flexible top fabric, a top linkage, a laterally disposed top-cloth tensioning bracket, and a fin link including an inherently rigid structural part configured to bear longitudinal and tensile loads. The fin link is connected in an articulated manner on a rear end of the top-cloth tensioning bracket. In the closed state, the top-cloth tensioning bracket is part of a fin of the top and the fin link supports the top-cloth.

Owner:WEBASTO EDSCHA CABRIO

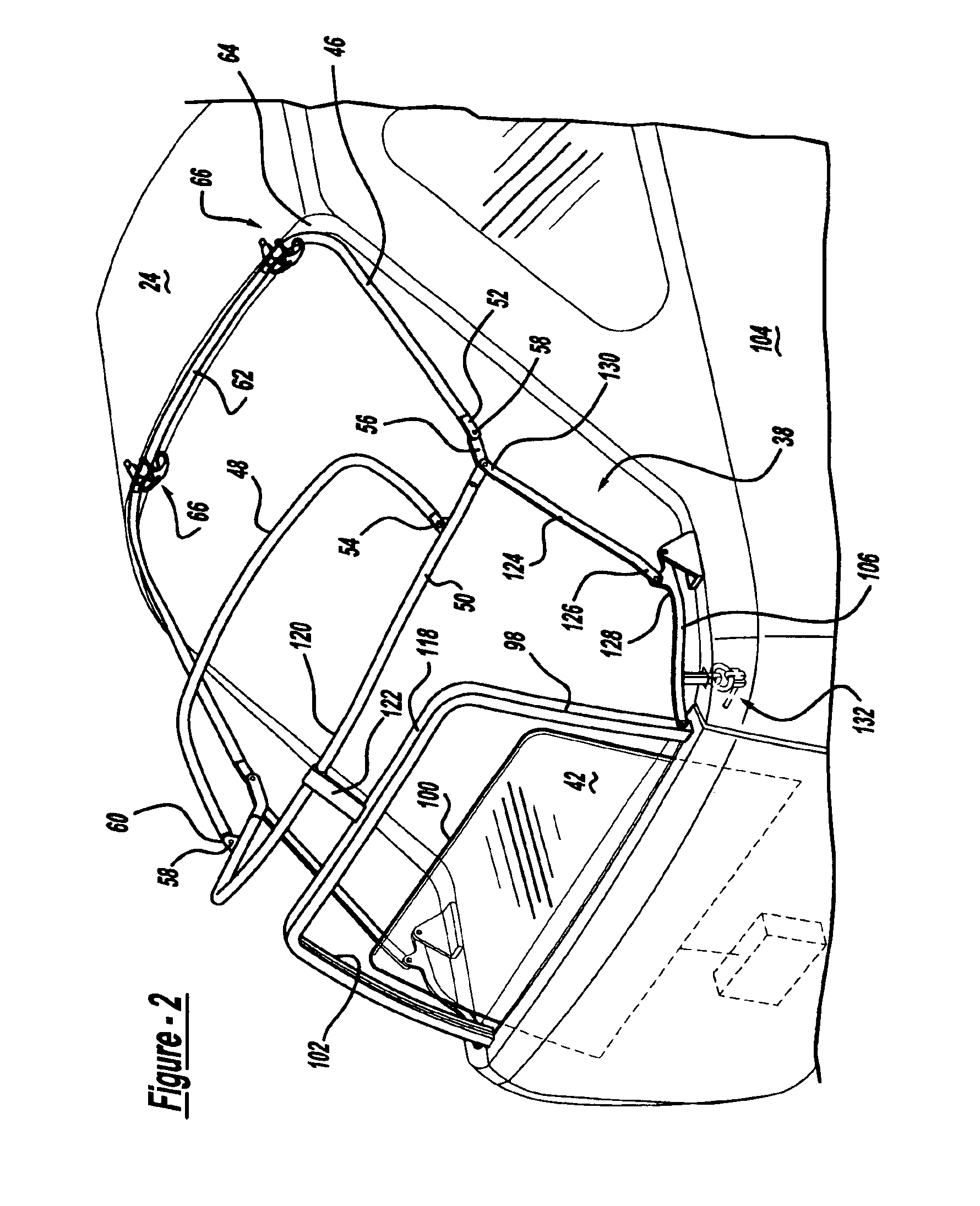

Automotive vehicle roof system having a detachable convertible roof

A preferred embodiment of an automotive vehicle roof system includes a detachable convertible roof that covers a rear storage compartment and at least a portion of a passenger compartment of the vehicle. In another aspect of the present invention, the retracted convertible roof may be removed entirely from the vehicle by disengaging quick release attachment devices. Yet another aspect of the present invention provides the ability to operate the convertible roof independently of the vehicle's rear backlite. In a further aspect of the present invention, an adjustable tensioning device is employed.

Owner:SPECIALTY VEHICLE ACQUISITION

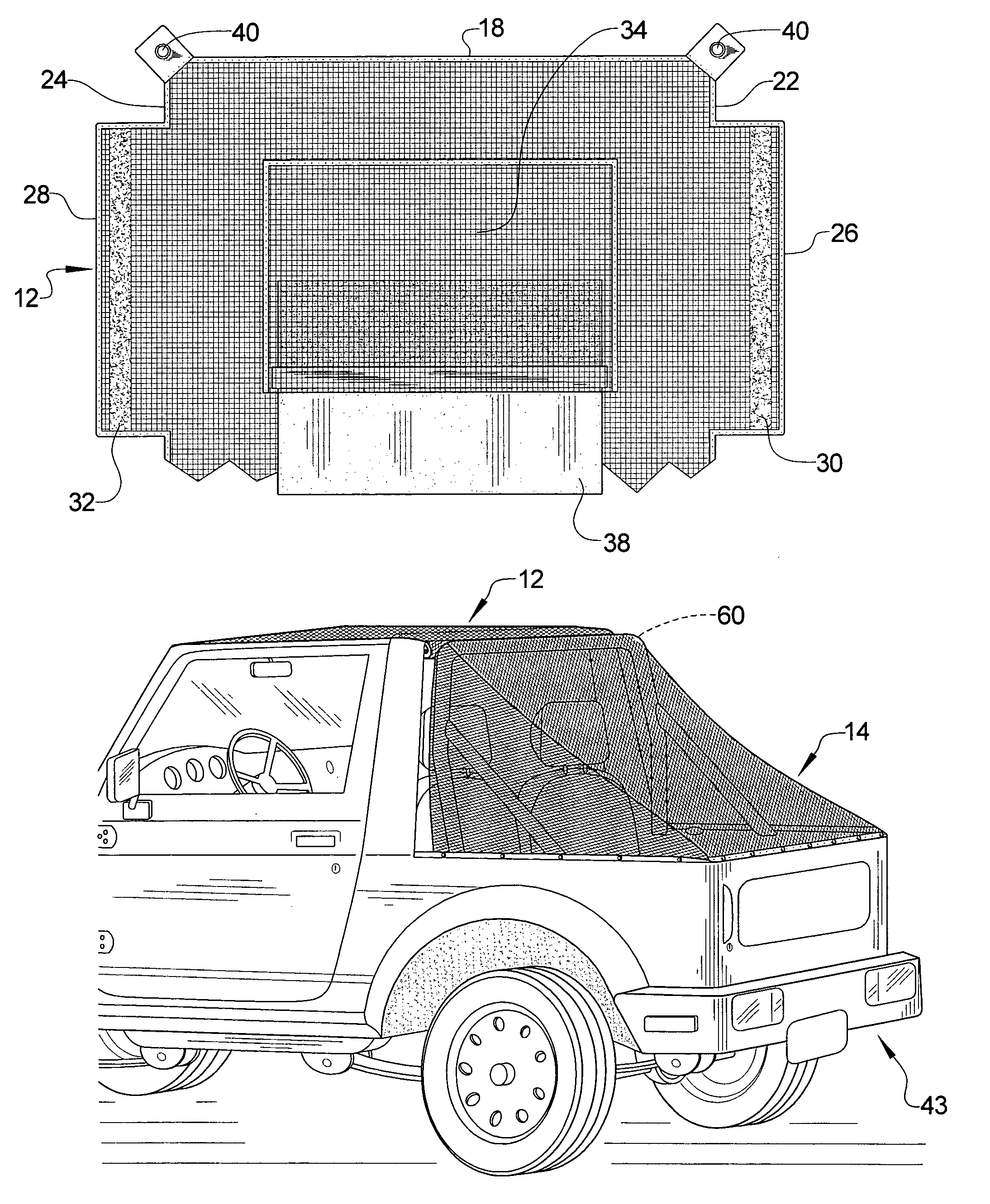

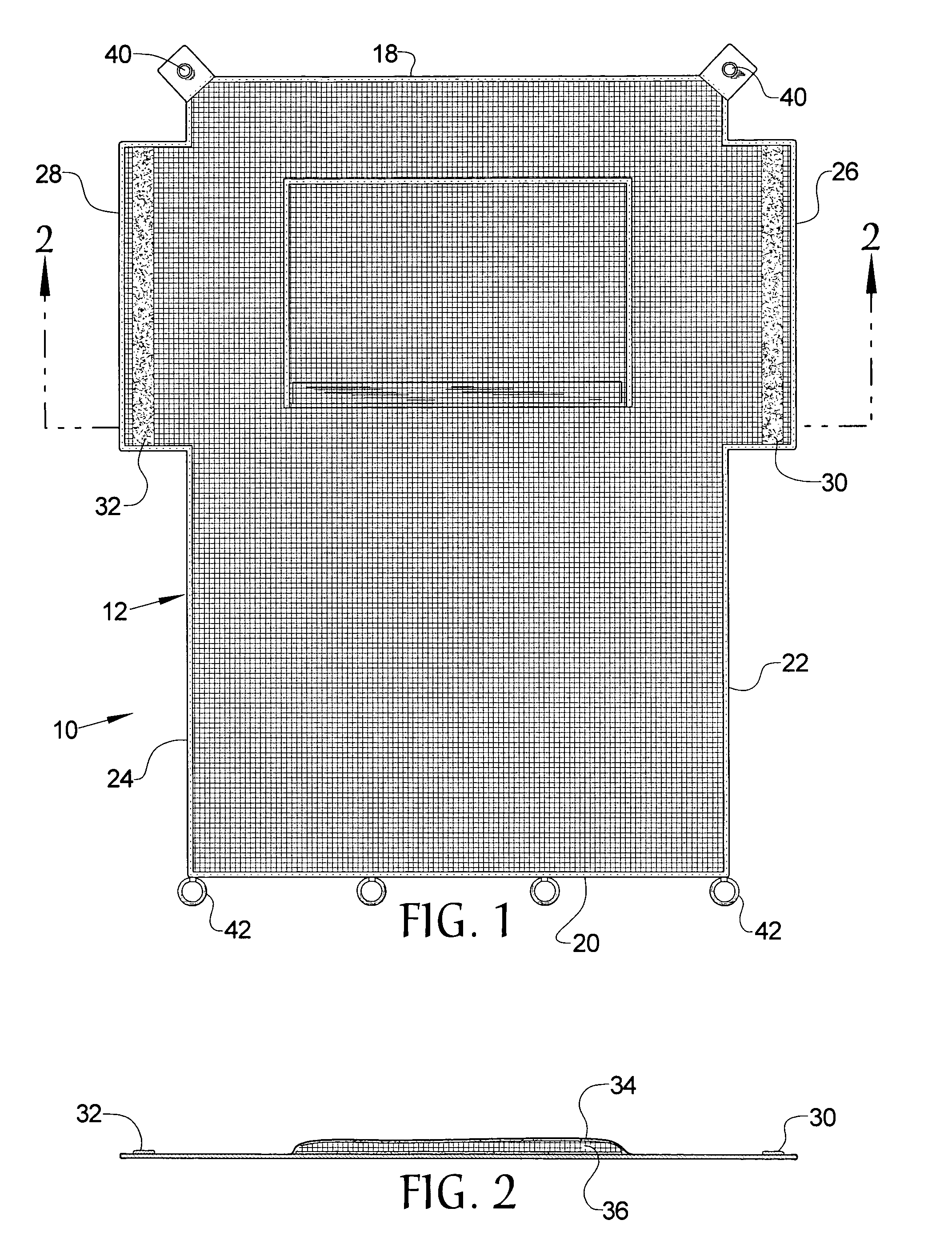

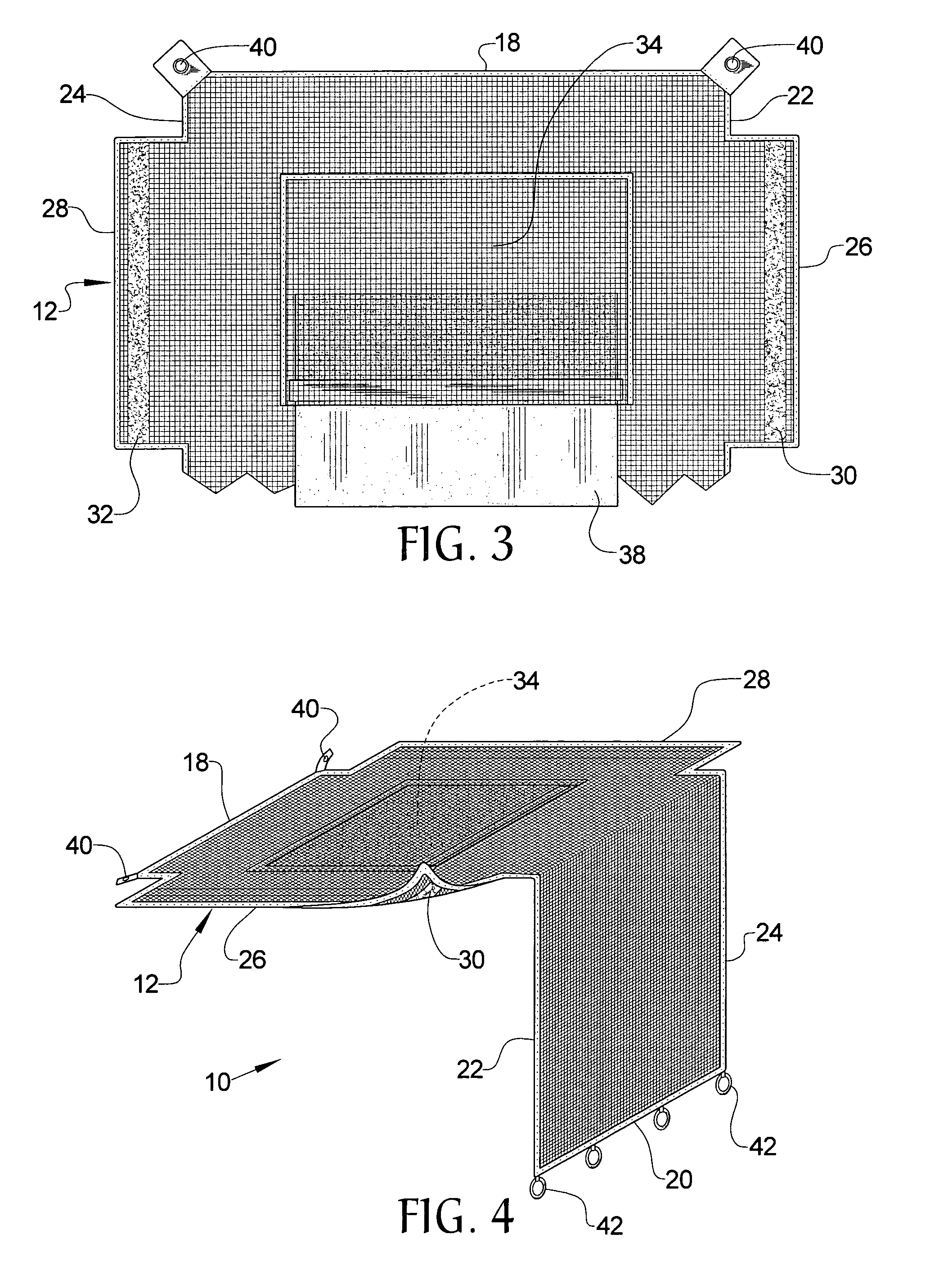

Convertible vehicle mesh cover

InactiveUS7025404B1Convenient design and constructionEasy to installTents/canopiesSuperstructure subunitsAutomotive engineeringConvertible

A convertible vehicle mesh cover has a first section that covers the roof and if desired the back of the passenger compartment of a vehicle and has a pocket for receiving a sun block member for blocking the sun above the passenger compartment. A second section is used to cover the second or cargo section of the vehicle, in square back, fast back, or tarp covering fashion. A cover can cover the vehicle when the vehicle is not in use and can be rolled up with the first section and the second section inside in order for the cover to function as a carrying case.

Owner:GILBERT GLORIA J

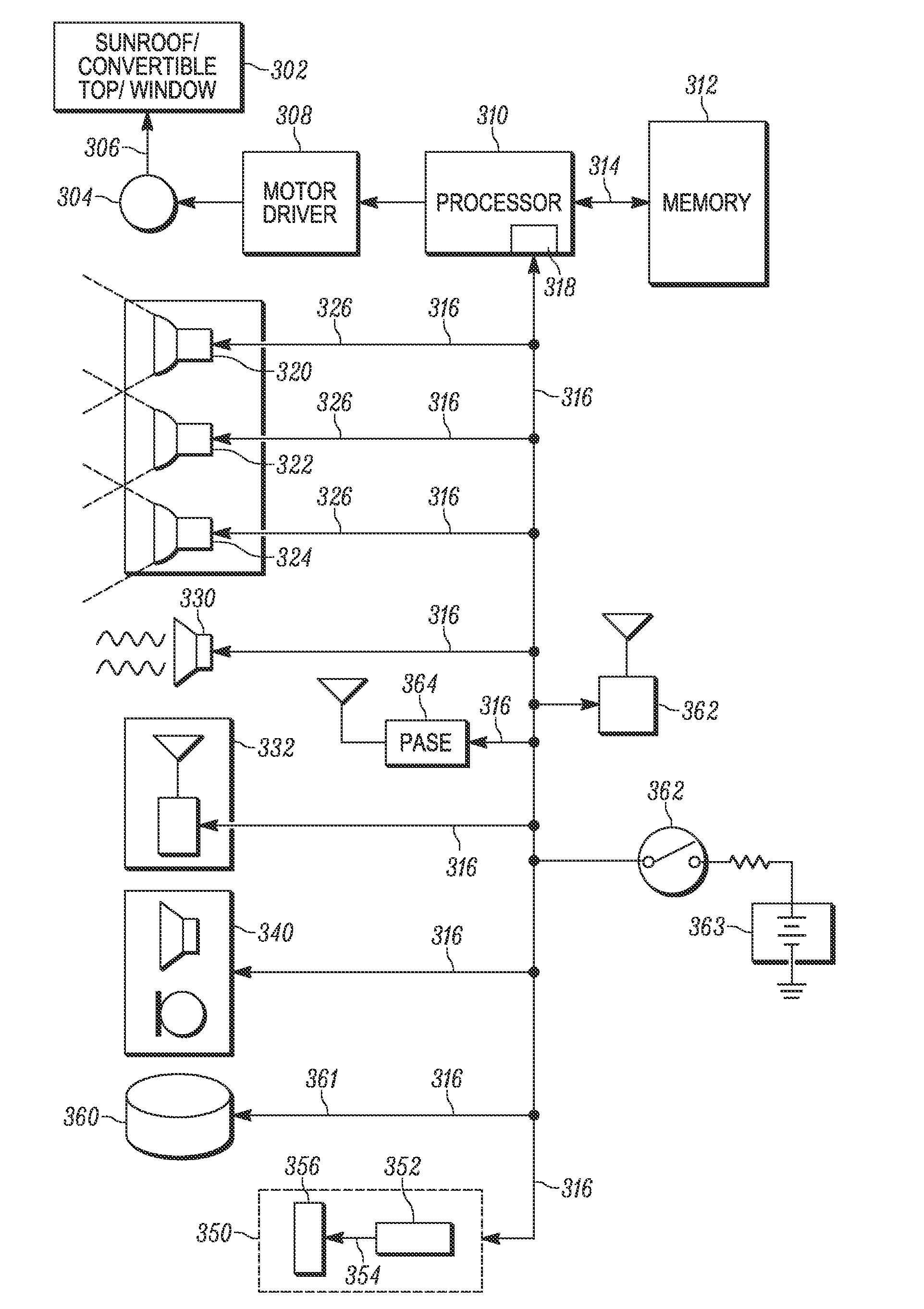

Remote automatic closure of power windows, sun roof and convertible top

InactiveUS20160176375A1Digital data processing detailsPedestrian/occupant safety arrangementPreventing injuryPrecipitation

A precipitation detector, a single actuation of a switch or the departure of a drive triggers operation of a motor to close a window, sun roof or convertible top. In order to prevent injury to a person who might be nearby the vehicle when the motor operates, humanoid detectors monitor the area around a vehicle and detect whether a person is nearby and who could thus be injured by a computer-controlled operation of the window, sun roof or top. The operation of a power window, sun roof or convertible top is stopped or inhibited when a person is detected near the vehicle in order to prevent the person from being injured by the closure of with window, sun roof or top.

Owner:CONTINENTAL AUTOMOTIVE SYST INC

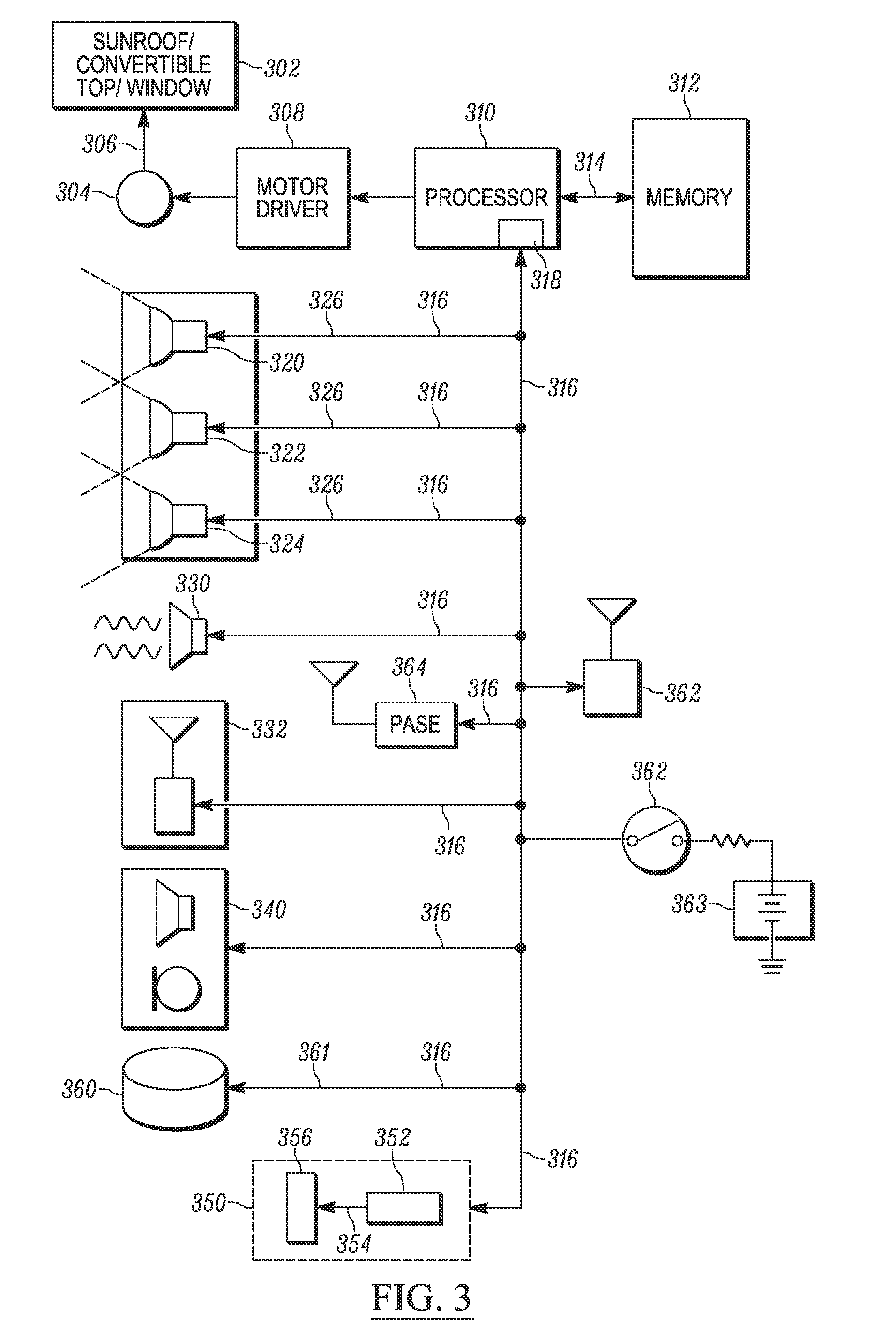

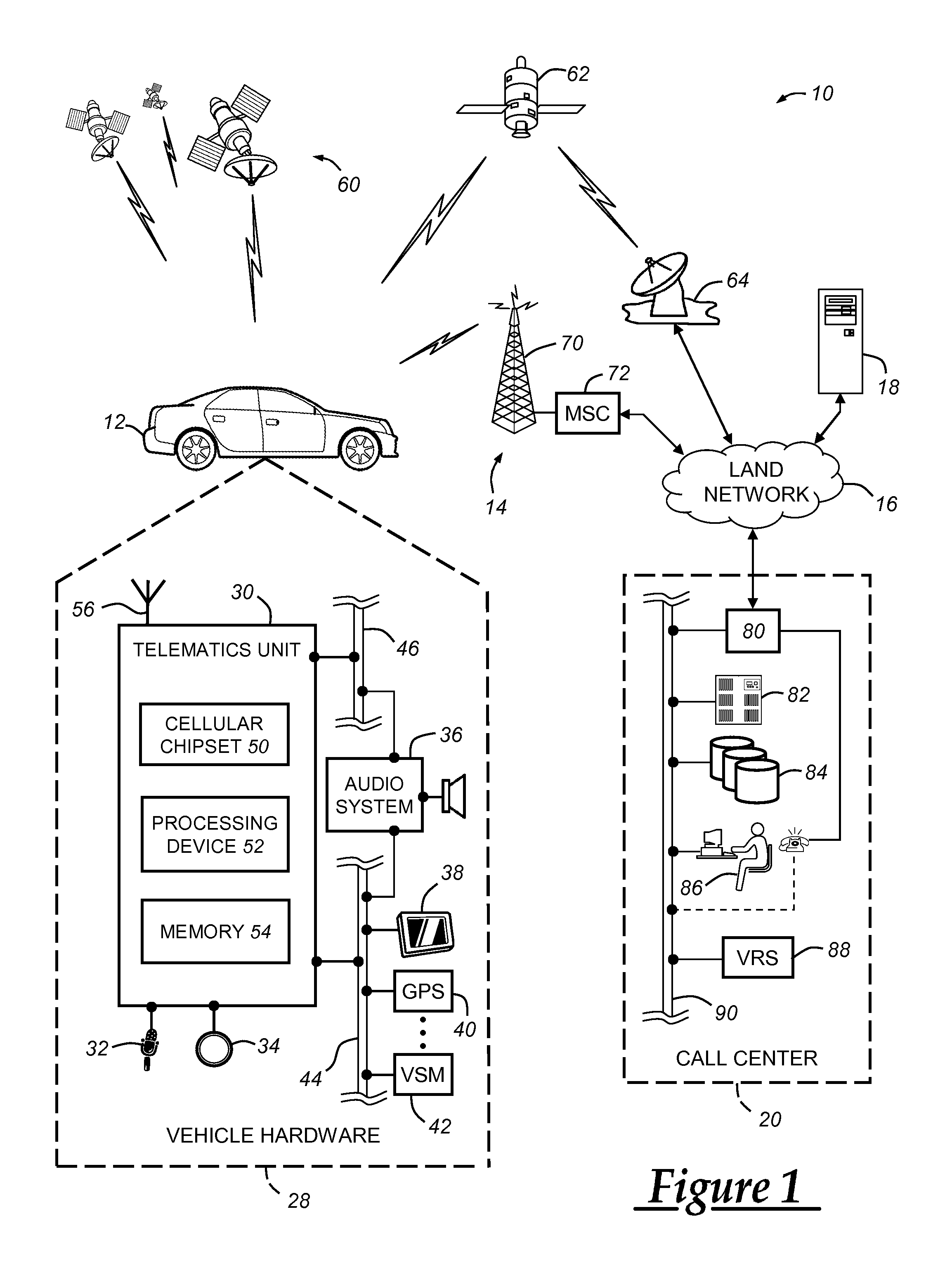

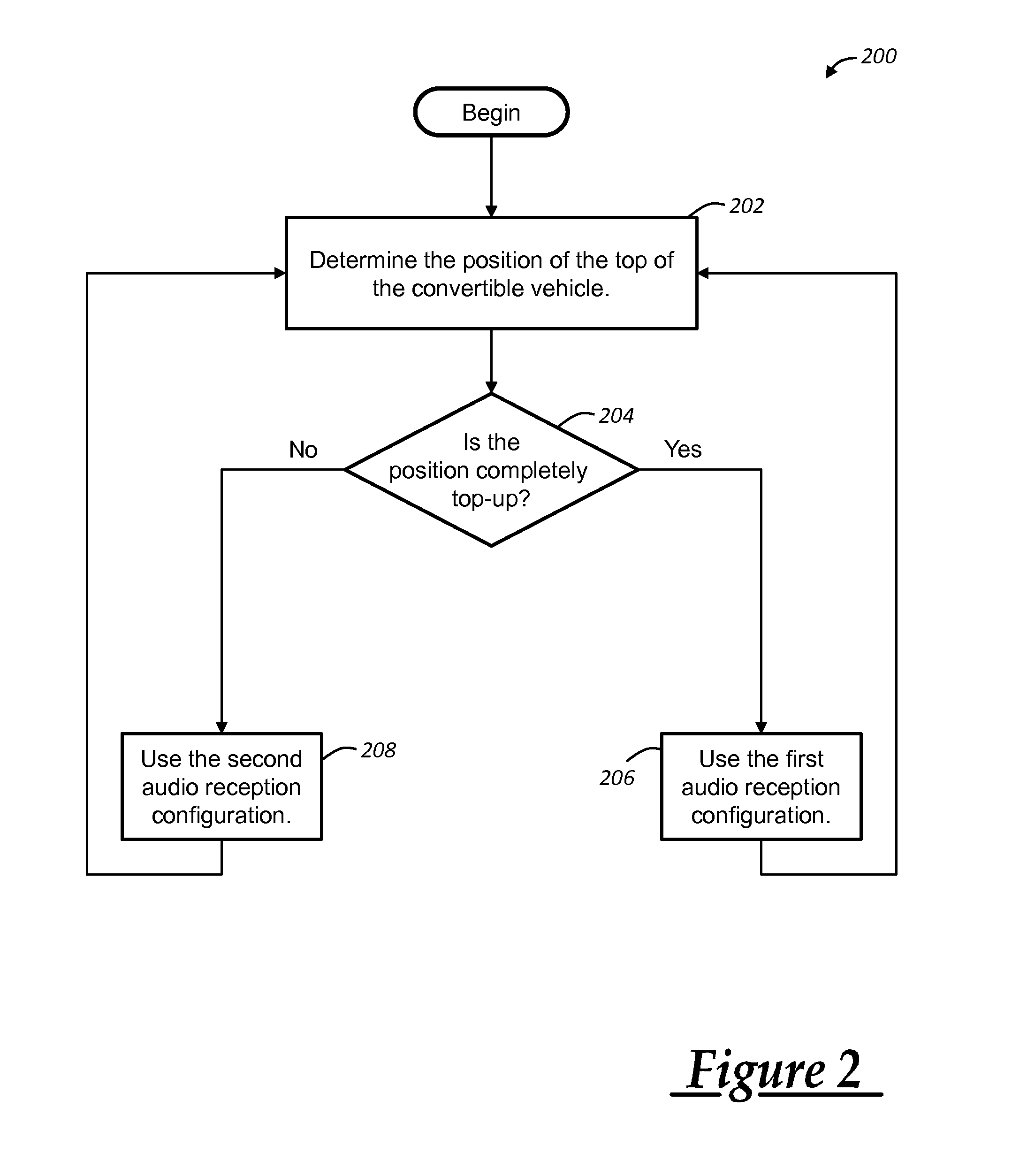

Switching between acoustic parameters in a convertible vehicle

A method of configuring an acoustics system of a convertible vehicle to receive speech from an occupant of the vehicle who is using hand-free technology. The position of the top of the convertible is first determined and based upon whether the top is up or down, an audio reception configuration is selected. The audio reception configuration includes a set of tuning parameters and a microphone arrangement. The acoustics system is then configured based upon the determination of whether the top is up or down.

Owner:GENERA MOTORS LLC

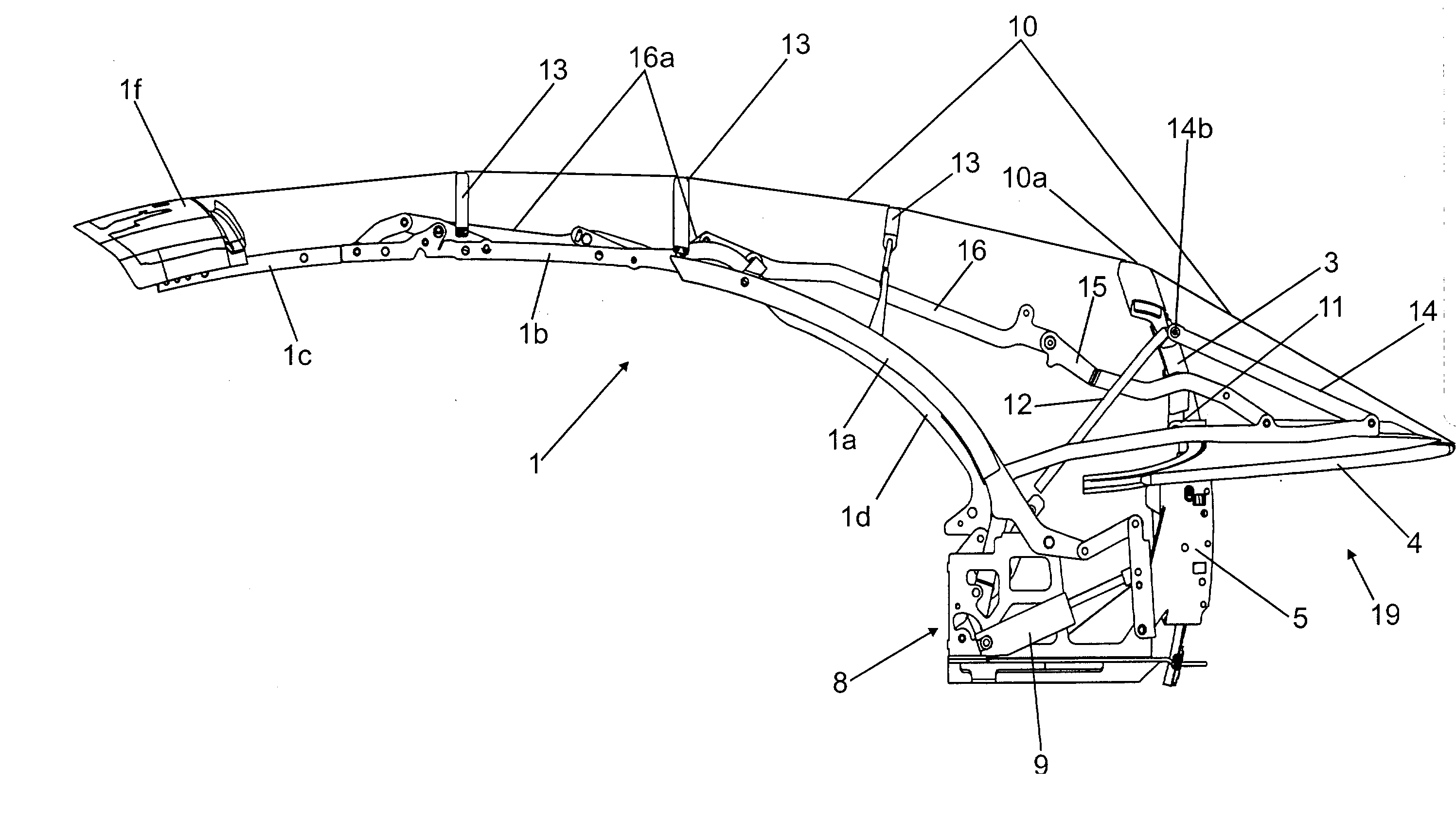

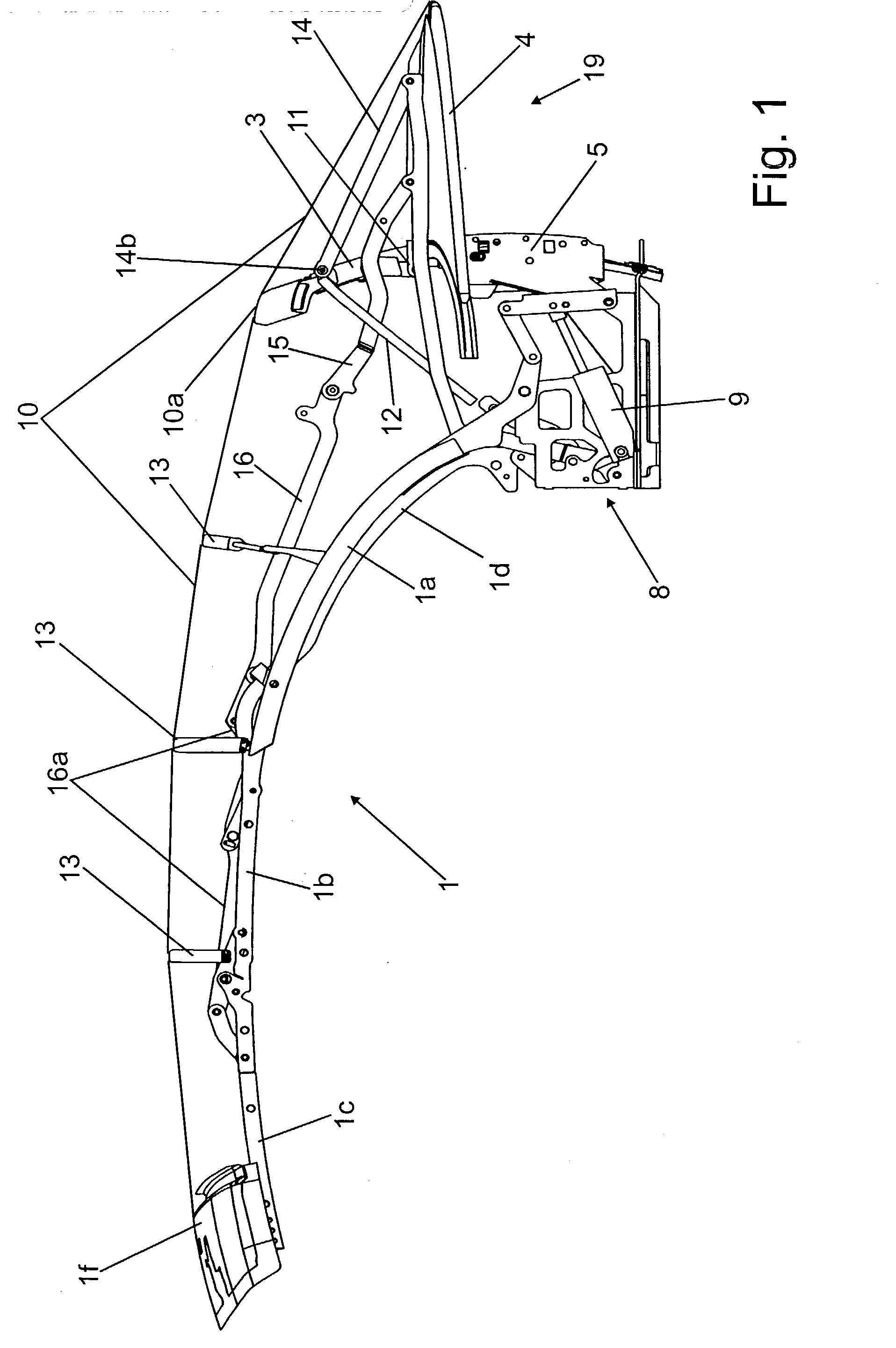

Top for a convertible

InactiveUS7178852B2Good flexibilityIncrease flexibilityEngine sealsSuperstructure subunitsControl mannerFour-bar linkage

A top for a convertible vehicle includes a roof module having at least one rigid roof part, the roof module being connected to the vehicle by way of a main link mechanism. The roof module is movable over the course of an opening movement of the top into a rear-side storage region of the vehicle. The main link mechanism includes a main four-bar linkage and a second four-bar linkage constructed on the main four-bar linkage. The second four-bar linkage is coupled in a positively controlled manner to the main four-bar linkage.

Owner:WEBASTO EDSCHA CABRIO

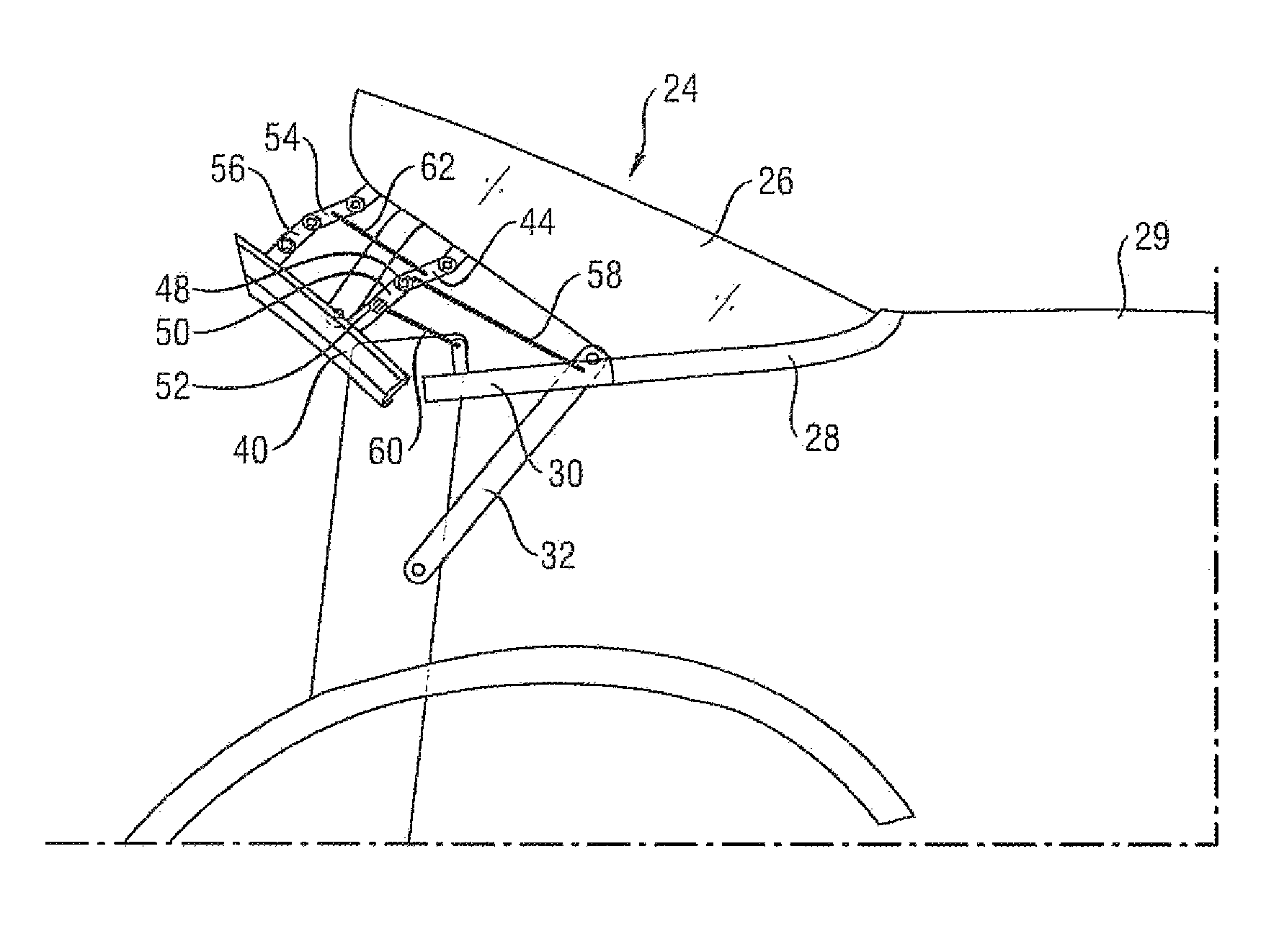

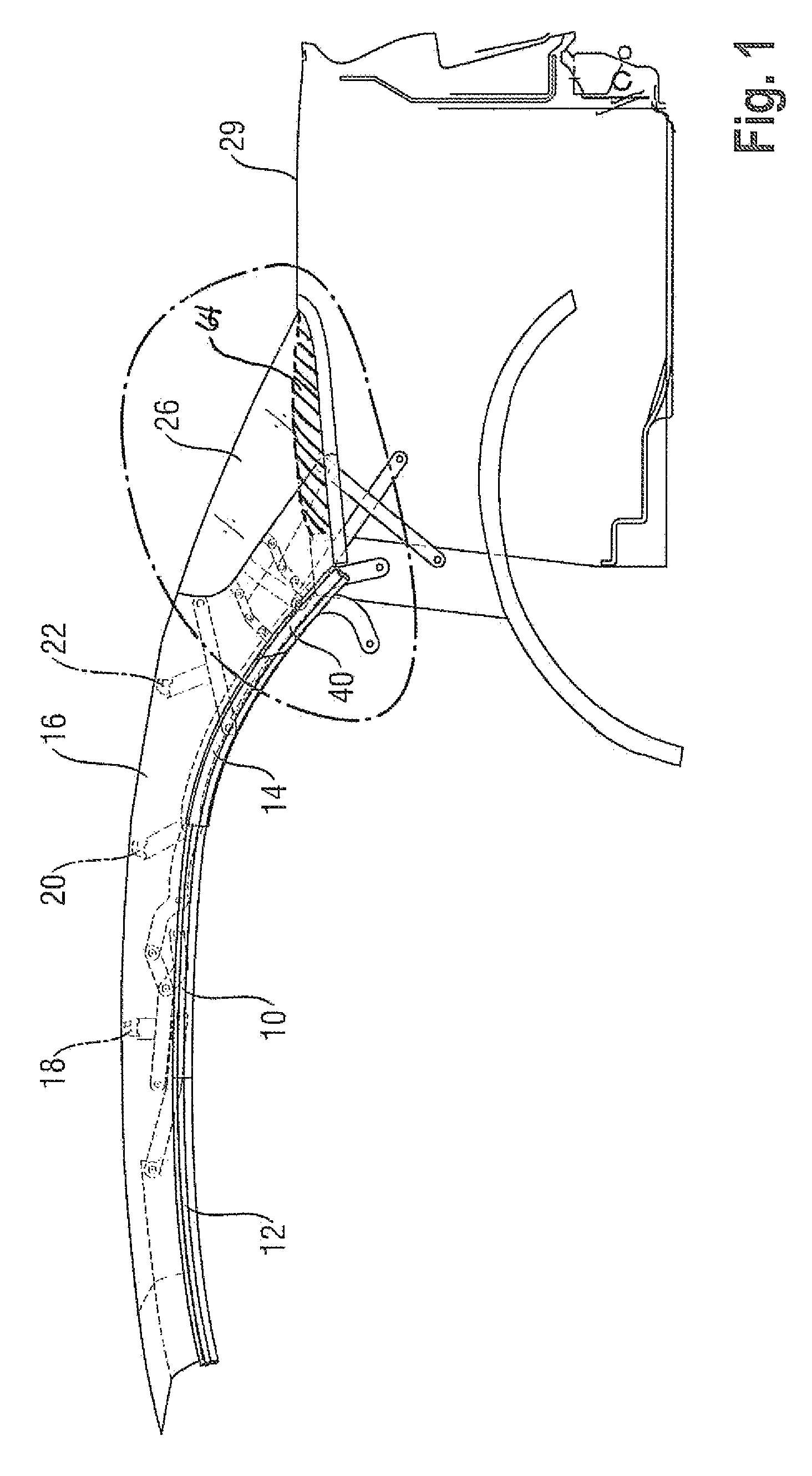

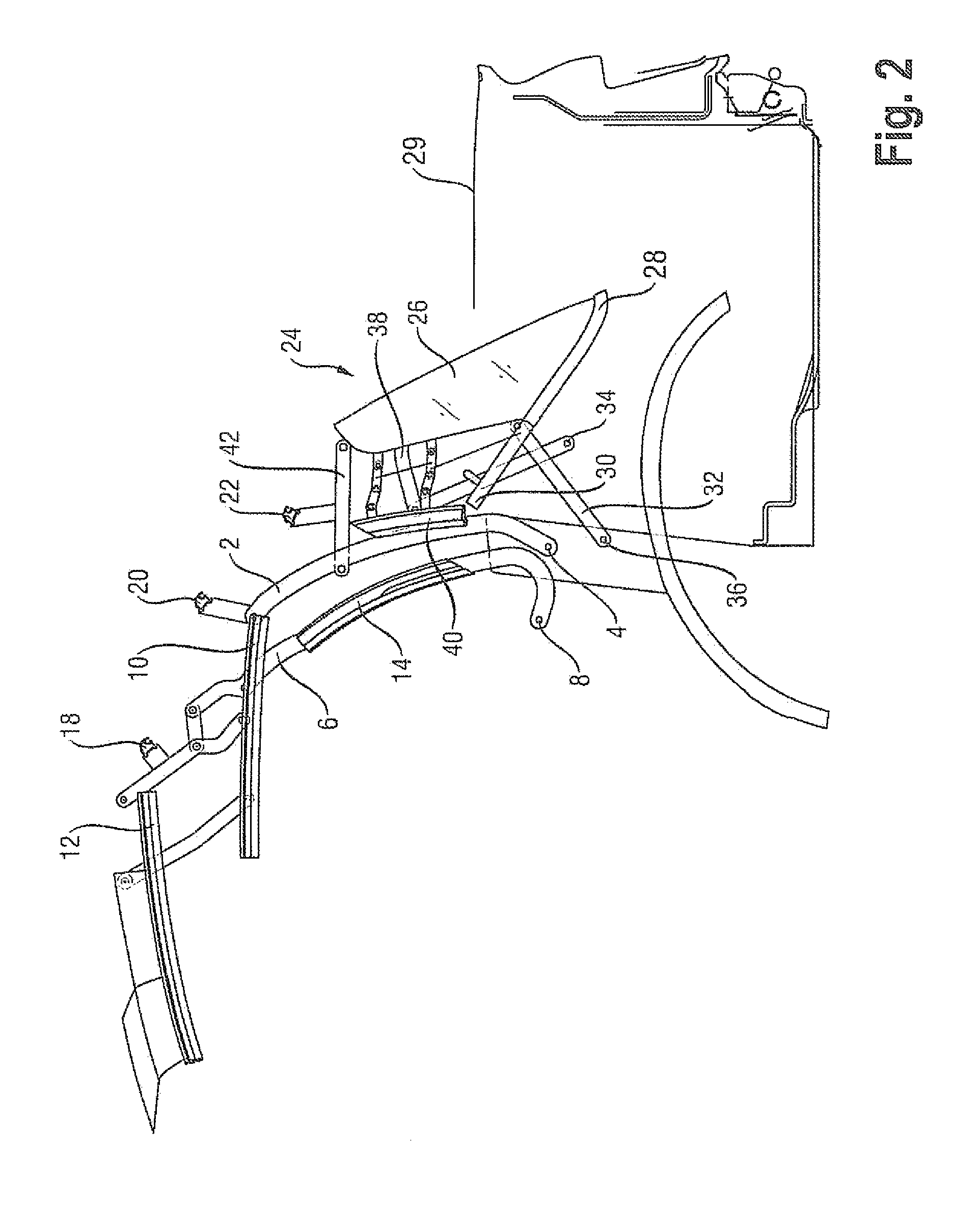

Folding top for a convertible and convertible comprising a folding top

A folding top for a convertible vehicle comprises a rigid rear window assembly (24) and a top framework with side frame parts (10, 12, 14, 40) for supporting a roof covering (16), which parts are at least partially retractable into a rear portion (29) of the vehicle. At least a rear area of the roof covering, which is affixed to the rear window (26) and to the rearmost side frame part (40), is made of a flexible material. The rearmost side frame part is connected via a linkage (44, 50, 54, 56) with the rear window assembly such that the distance between the rearmost side frame part and the side edge of the rear window passes through a maximum shortly before reaching the fully closed position of the folding top, whereby the tensioning of the flexible material counteracts against an opening of the folding top.

Owner:VALMET AUTOMOTIVE

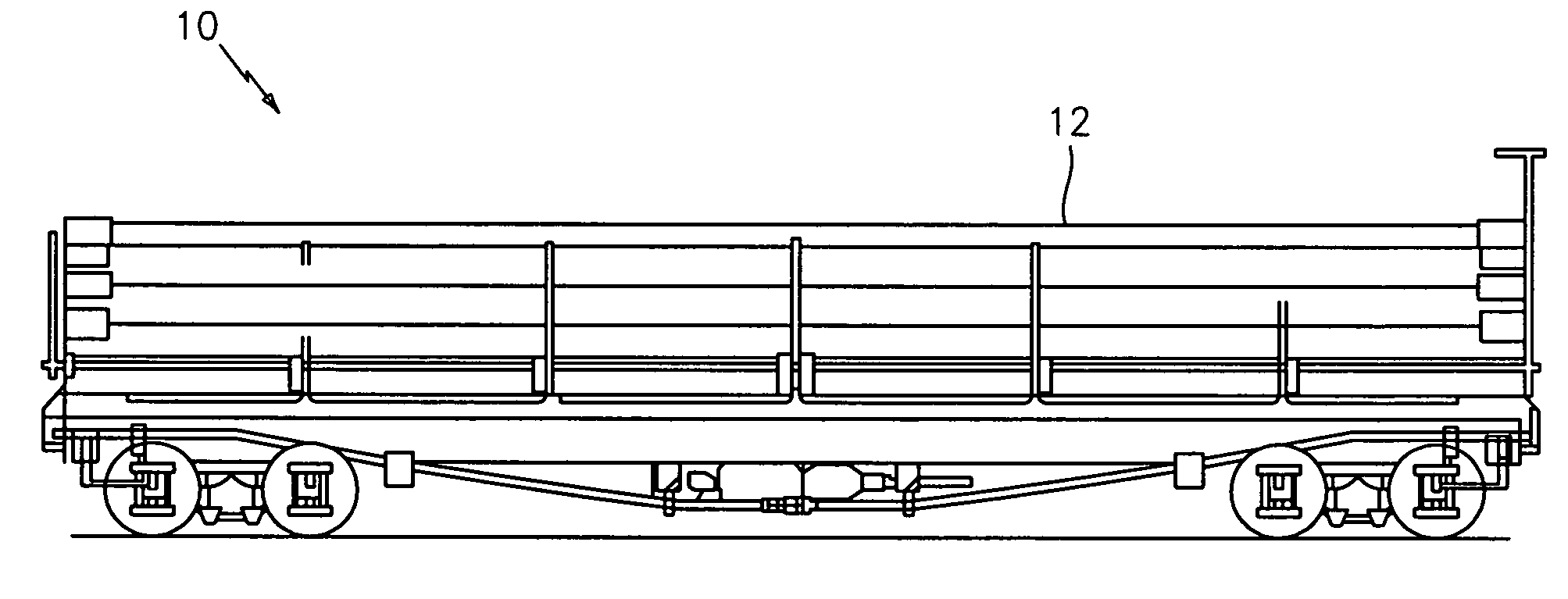

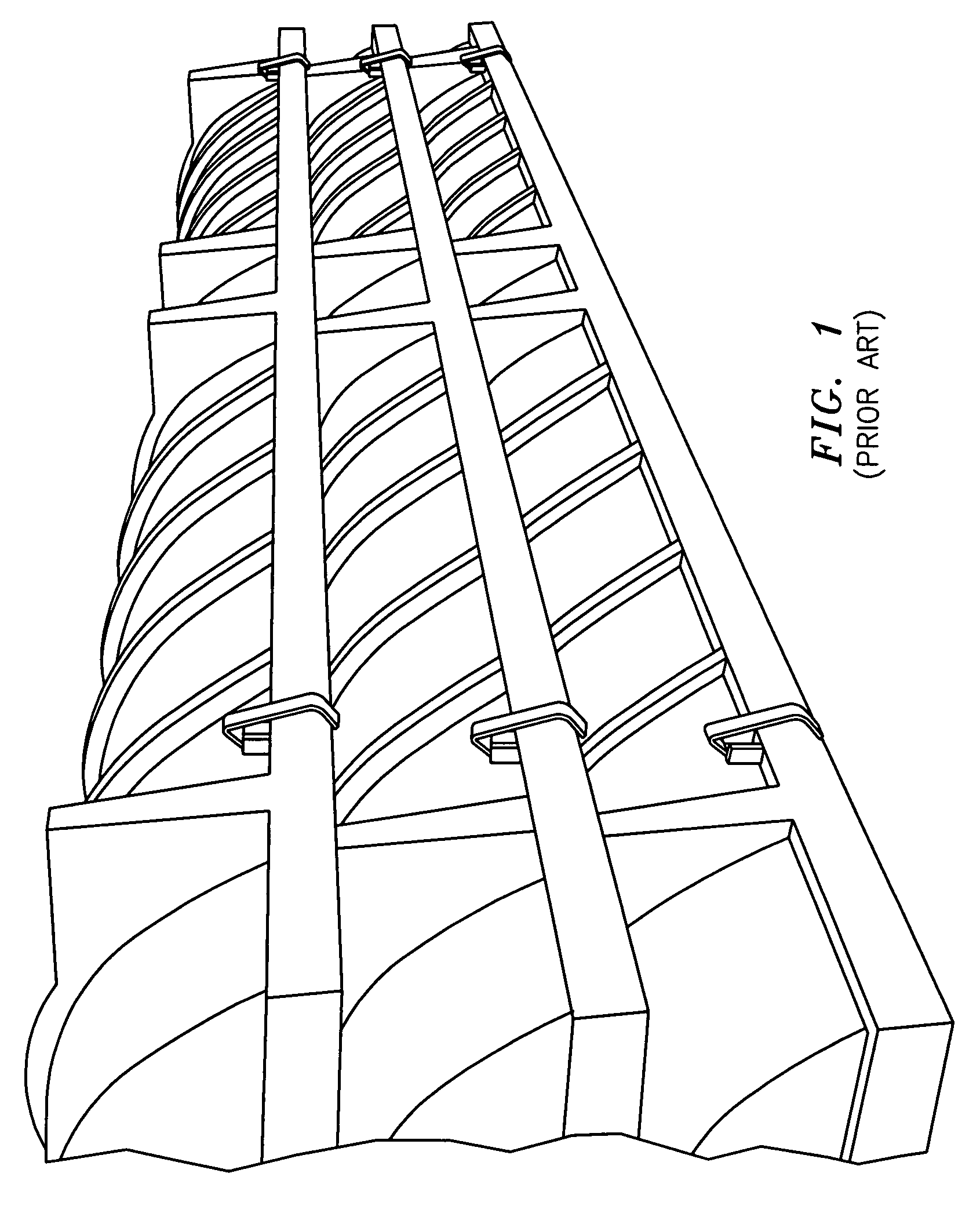

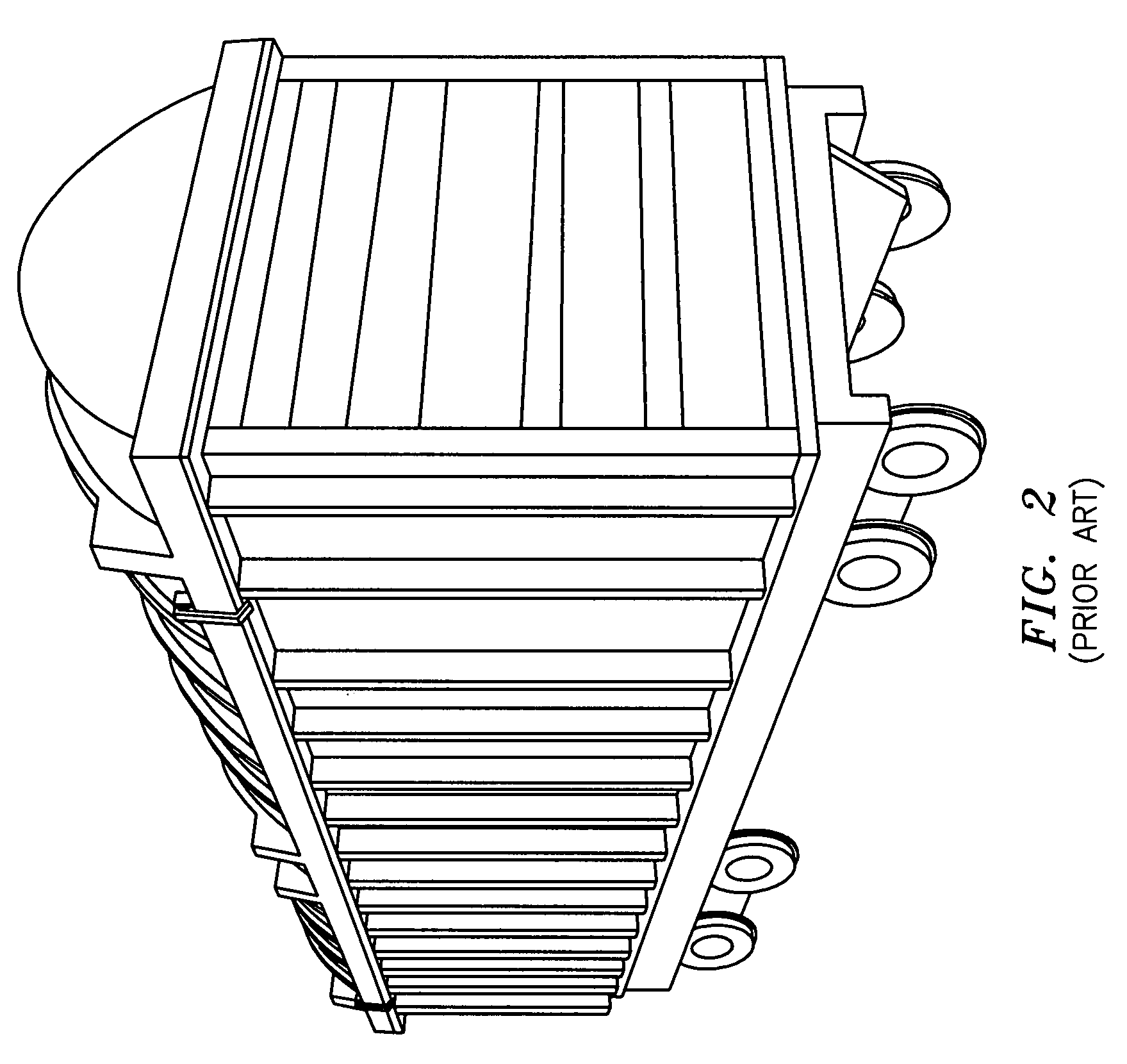

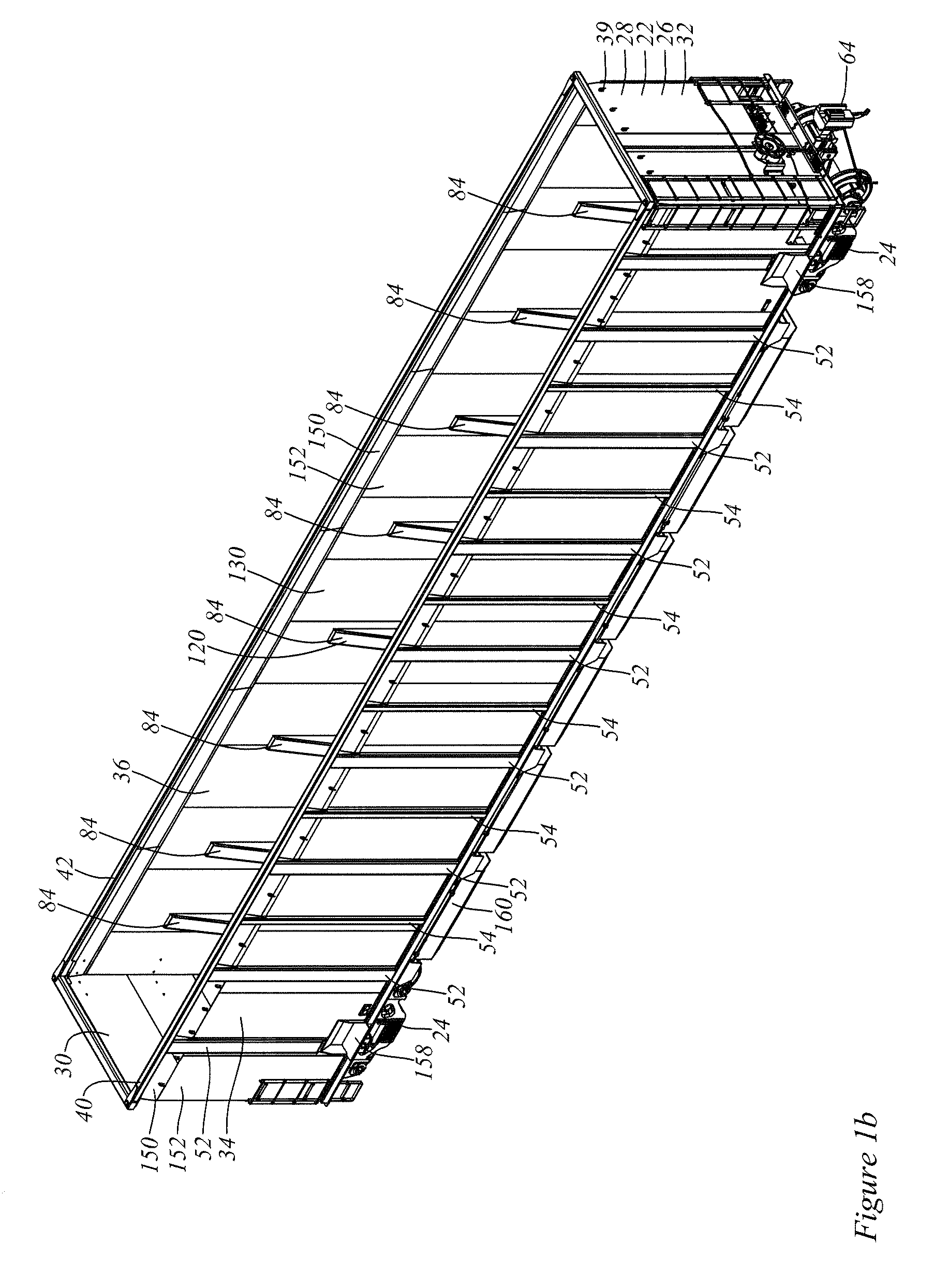

Open-top rail car covers and open-top rail cars employing the same

An open-top rail car cover is defined by a frame having dimensions sufficient to fit an open-top freight car designed in accordance with the Association of American Railroads, a roof and a pair of end walls. A latch disposed about a side of the frame includes a first flange and a second flange that combine to define a means for receiving an engagement member of a rail car. Both the first and second flanges include a at least one first aperture and at least one second aperture designed to receive a means for securing the car cover to the rail car. The first and second apertures have dimensions sufficient to permit movement of the first and second flanges about the means for receiving.

Owner:MARTIN MARIETTA MATERIALS

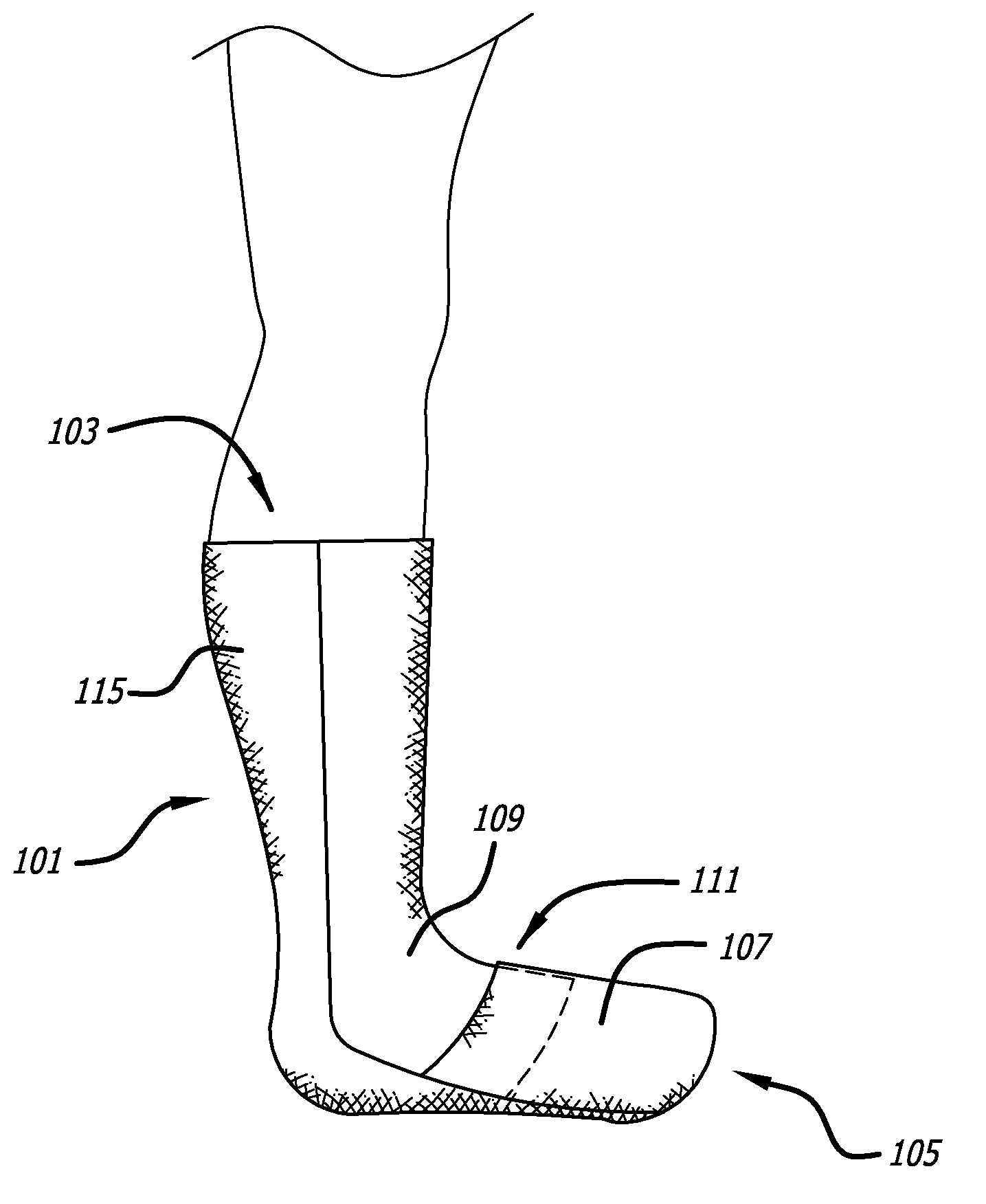

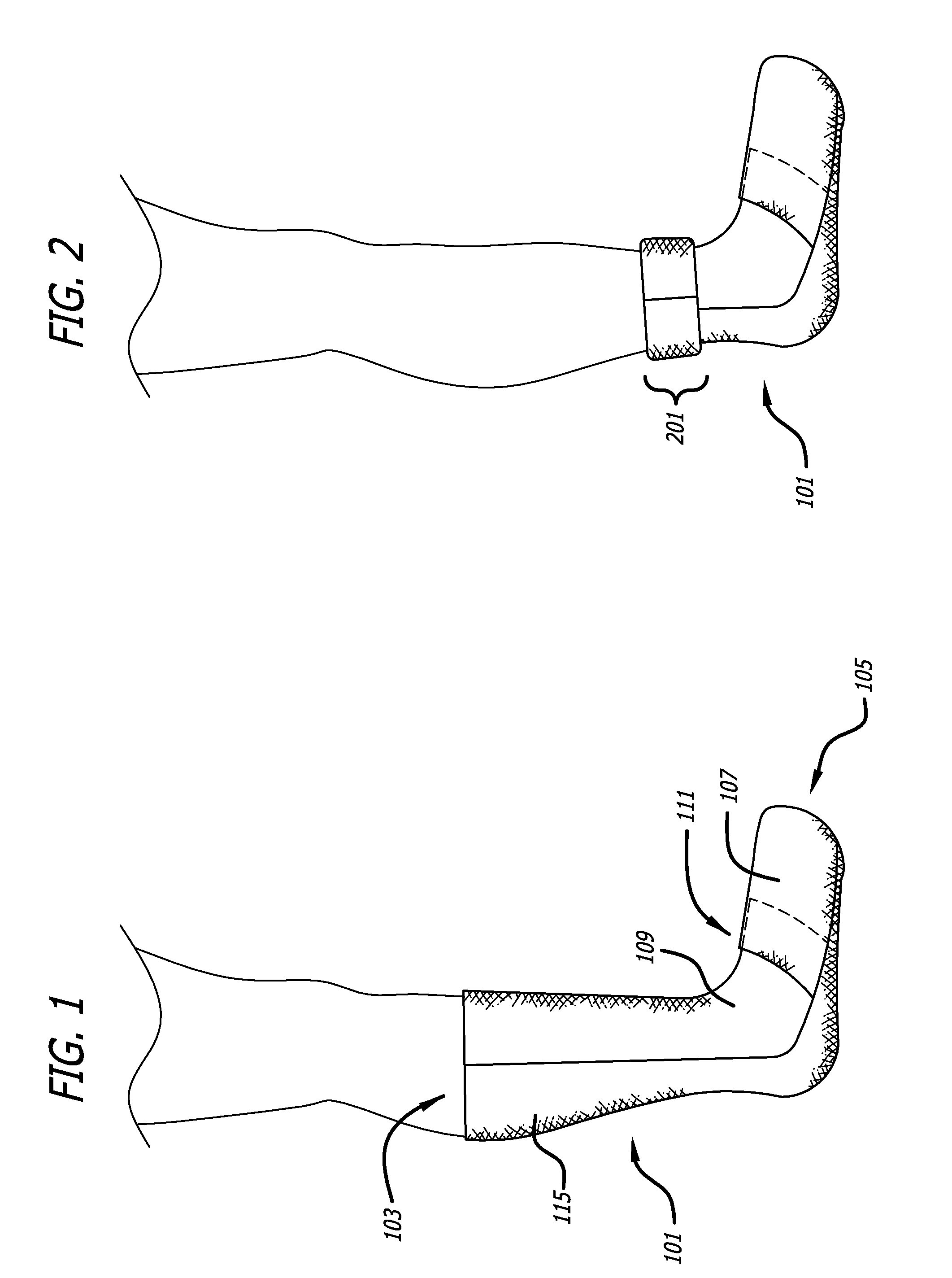

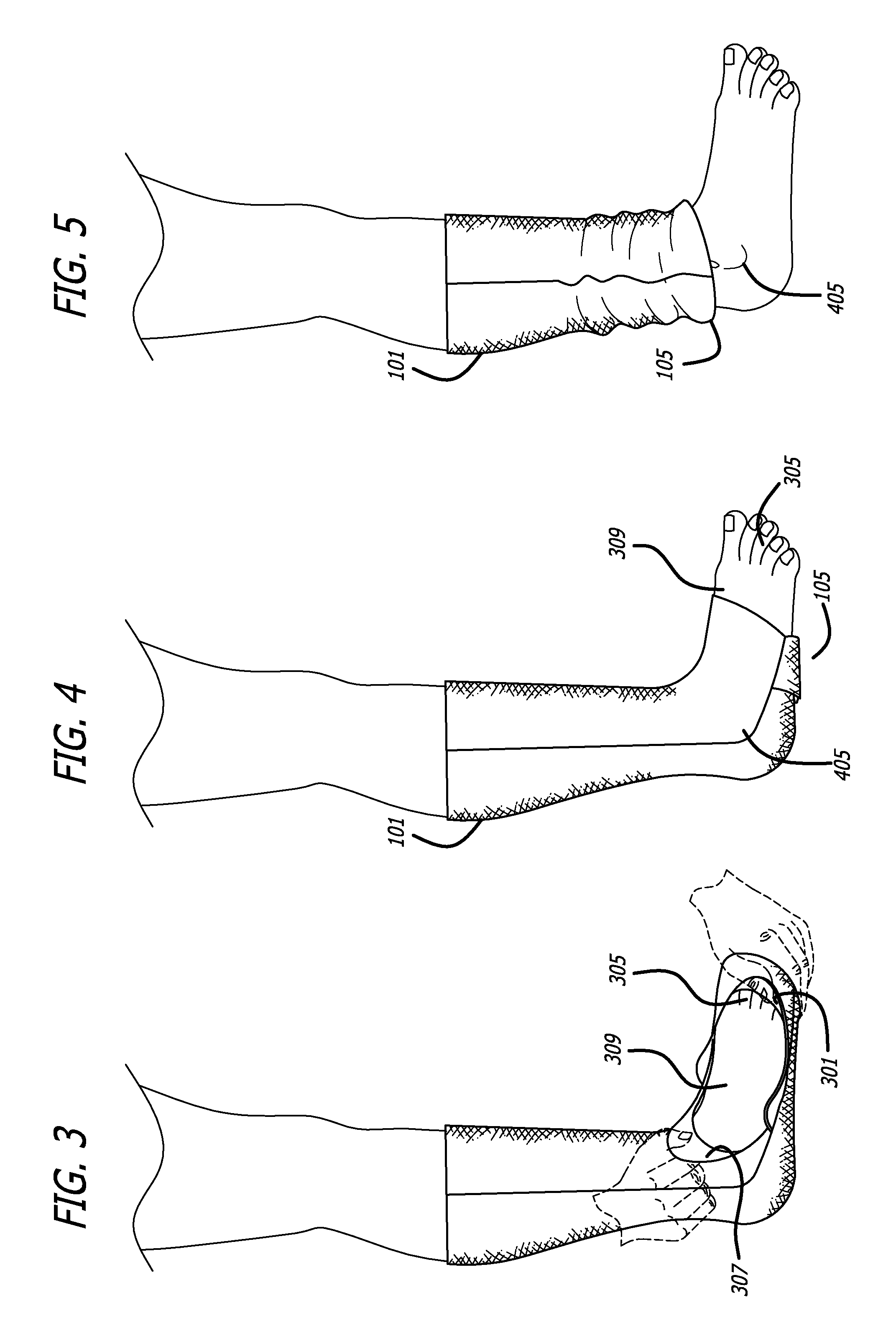

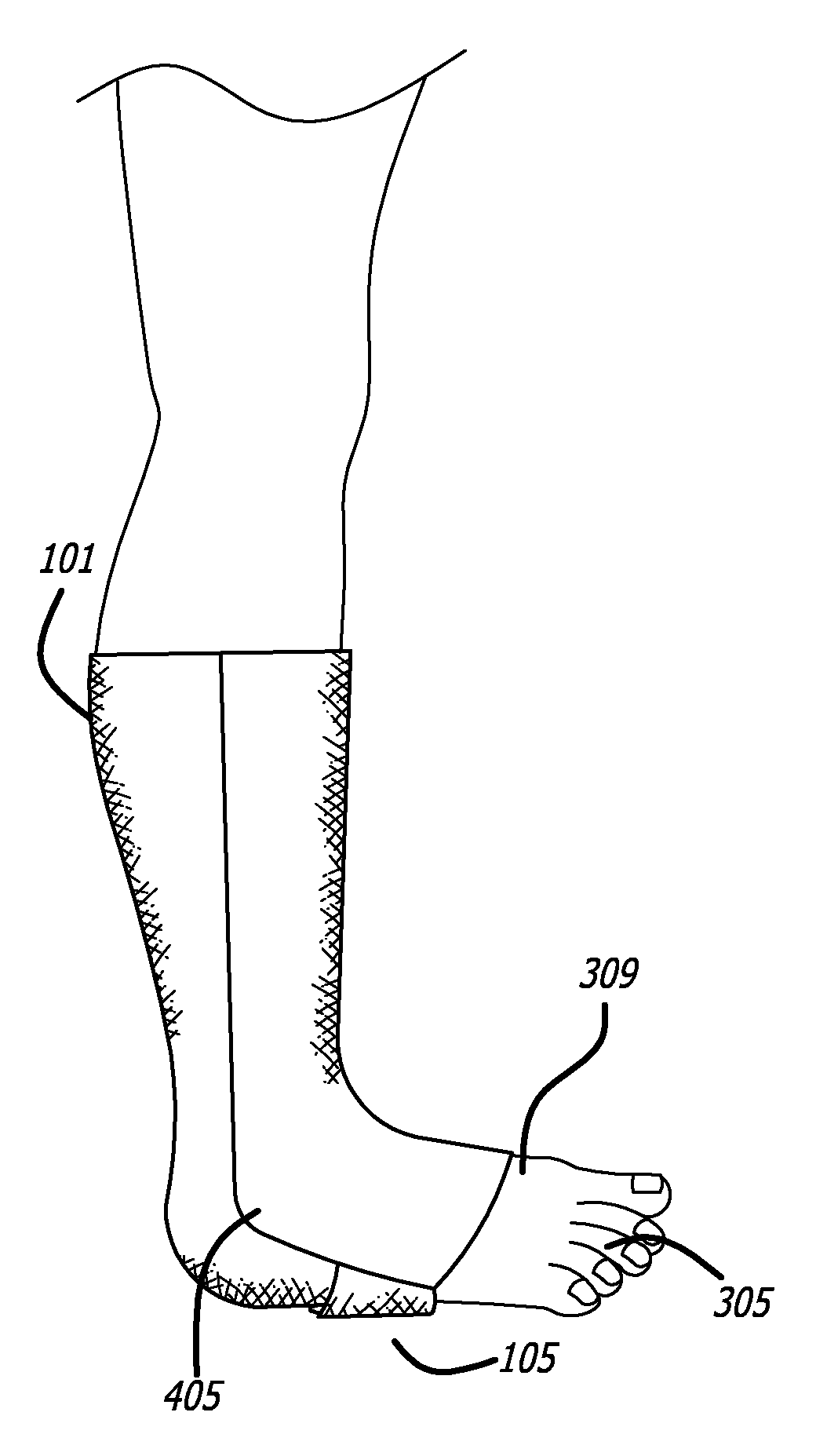

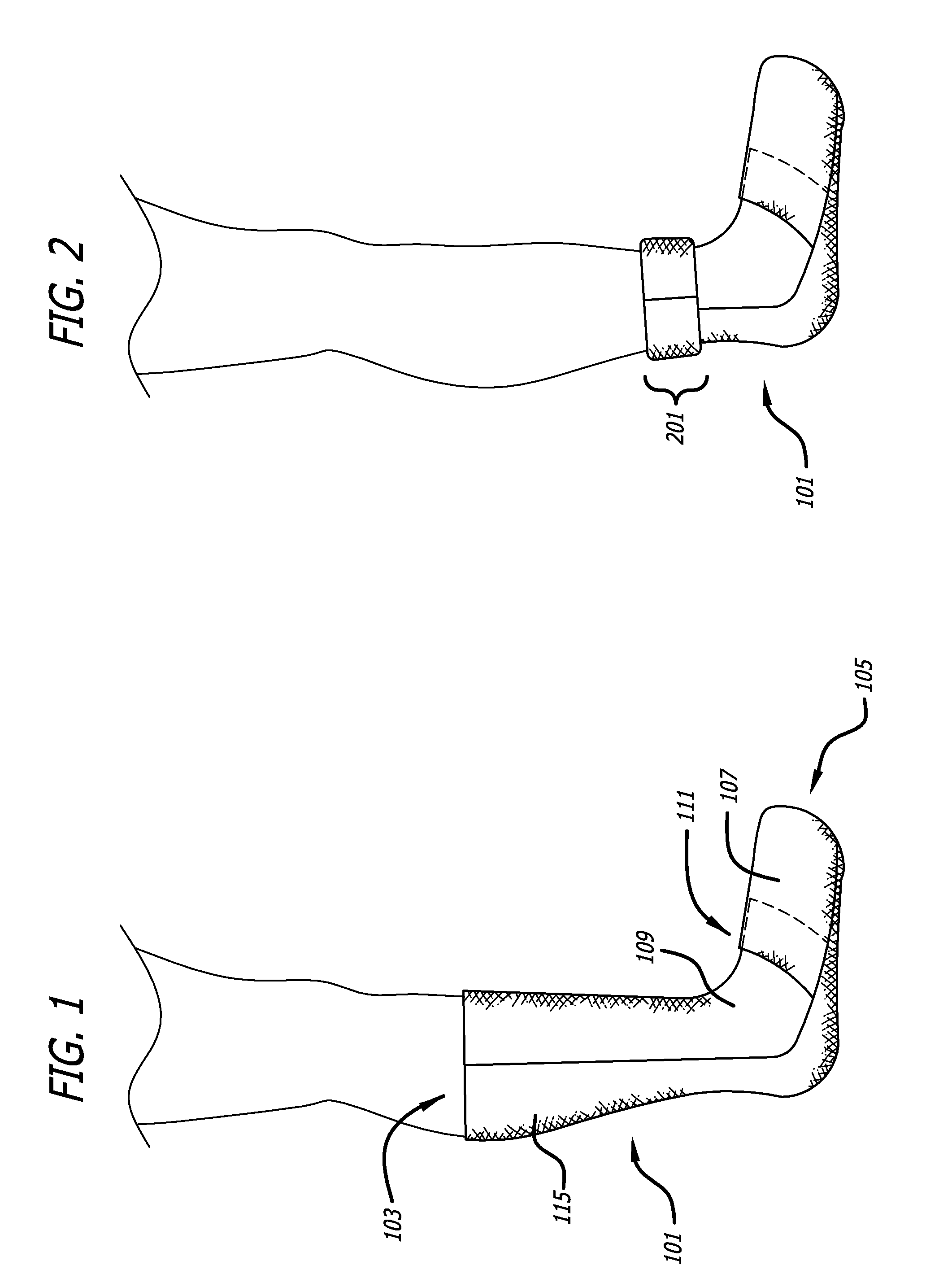

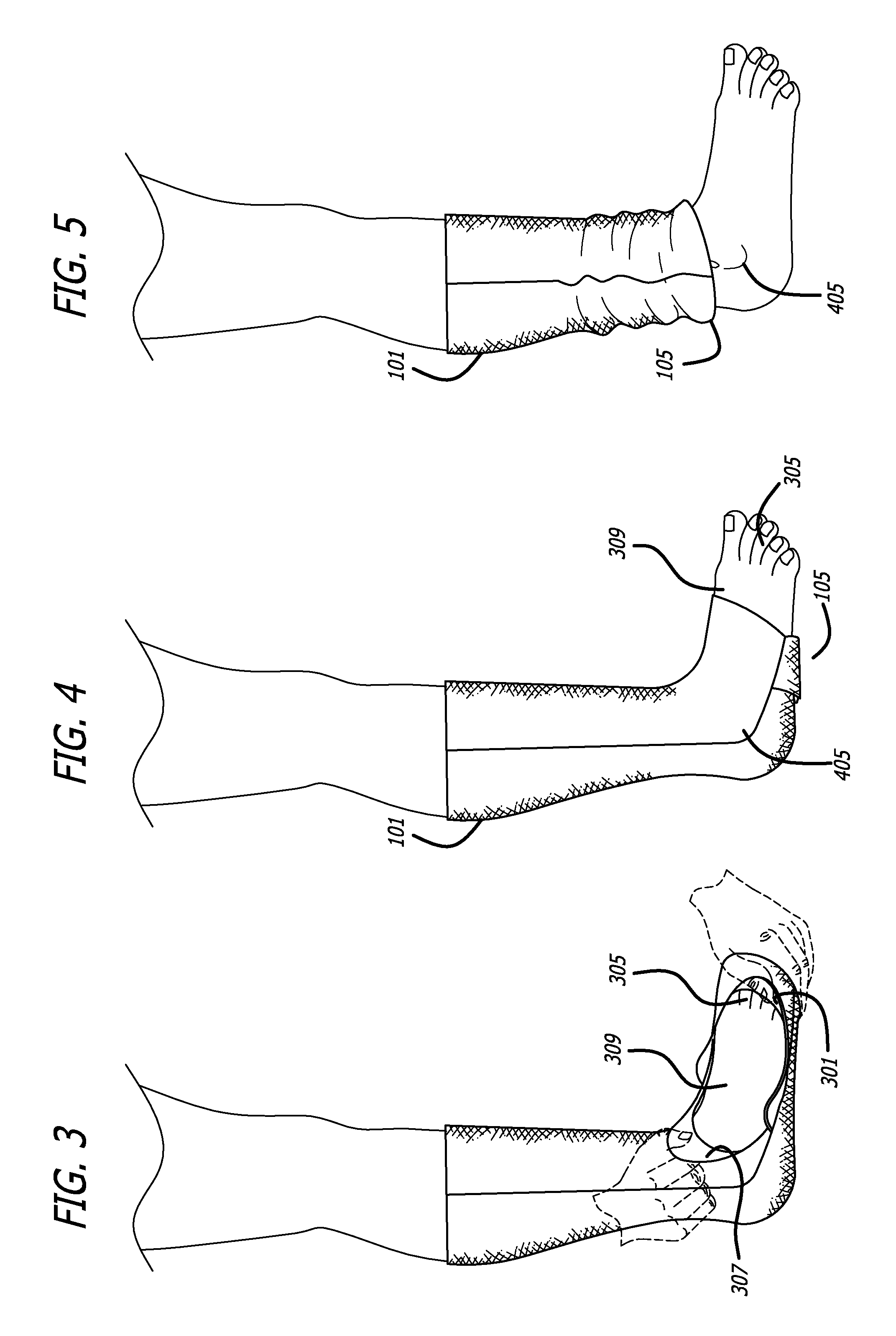

Convertible sock/slipper legwarmer

Owner:ZF FRIEDRICHSHAFEN AG

Top for a convertible vehicle

A top mechanism for a convertible vehicle includes a rear region of the convertible vehicle arranged behind a passenger compartment and is configured to receive a top, in an opened state of the top. The top mechanism also includes a rear element at least partially covering the rear region in a closed state of the top. The top mechanism also includes a covering element, and at least one rear roof part. The covering element, in a first position associated with a closed state of the top, is adjacent at one end to a boundary of the passenger compartment and is adjacent at the other end to the rear roof part. The covering element is movable to a second position for providing a movement space for the top, and is moveable to a third position associated with an opened state of the top, in which the covering element is adjacent at one end to the boundary of the passenger compartment and is adjacent at the other end to the rear element.

Owner:WEBASTO EDSCHA CABRIO

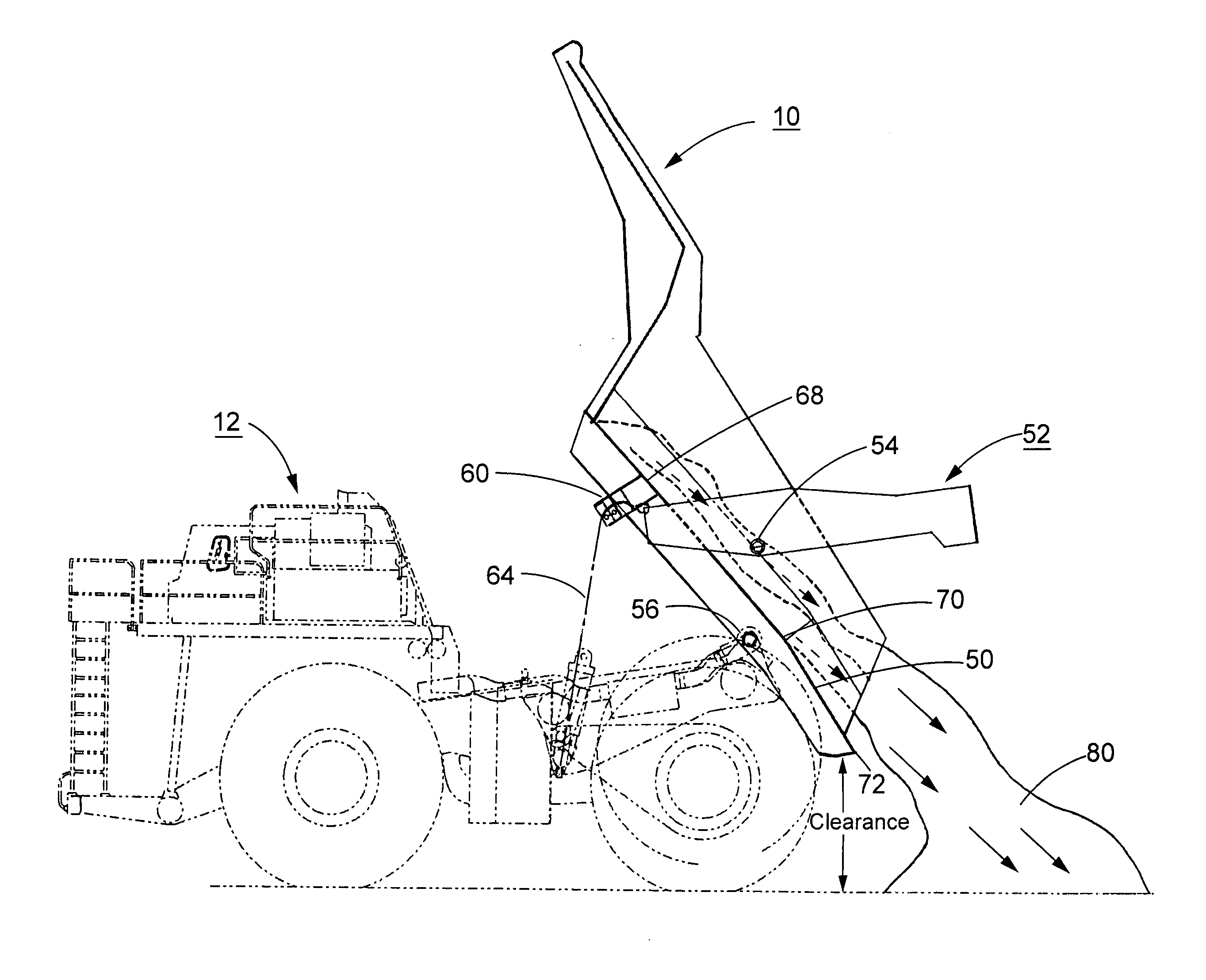

Severe application off-highway truck body

InactiveUS20080067856A1Wear minimizationAvoid excessive wearMonocoque constructionsVehicle bodiesHigh densityEngineering

An open top body of an off-highway haulage vehicle is described for severe hauling applications such as hauling of high density, abrasive material. The body has a floor divided into at least two sections with first and second sections angled at different inclinations. The second section extends to the rear edge of the floor and is at an angle of inclination greater than the first section. The opposing sidewalls of the body extend vertically from the floor are flared or taper along their length such that the body floor is wider at the rear of the body than it is at the front. The body includes a tailgate pivotally attached to the sidewalls for rotation between closed and opened positions in response to the bumping of the load by the body.

Owner:HAGENBUCH LEROY G

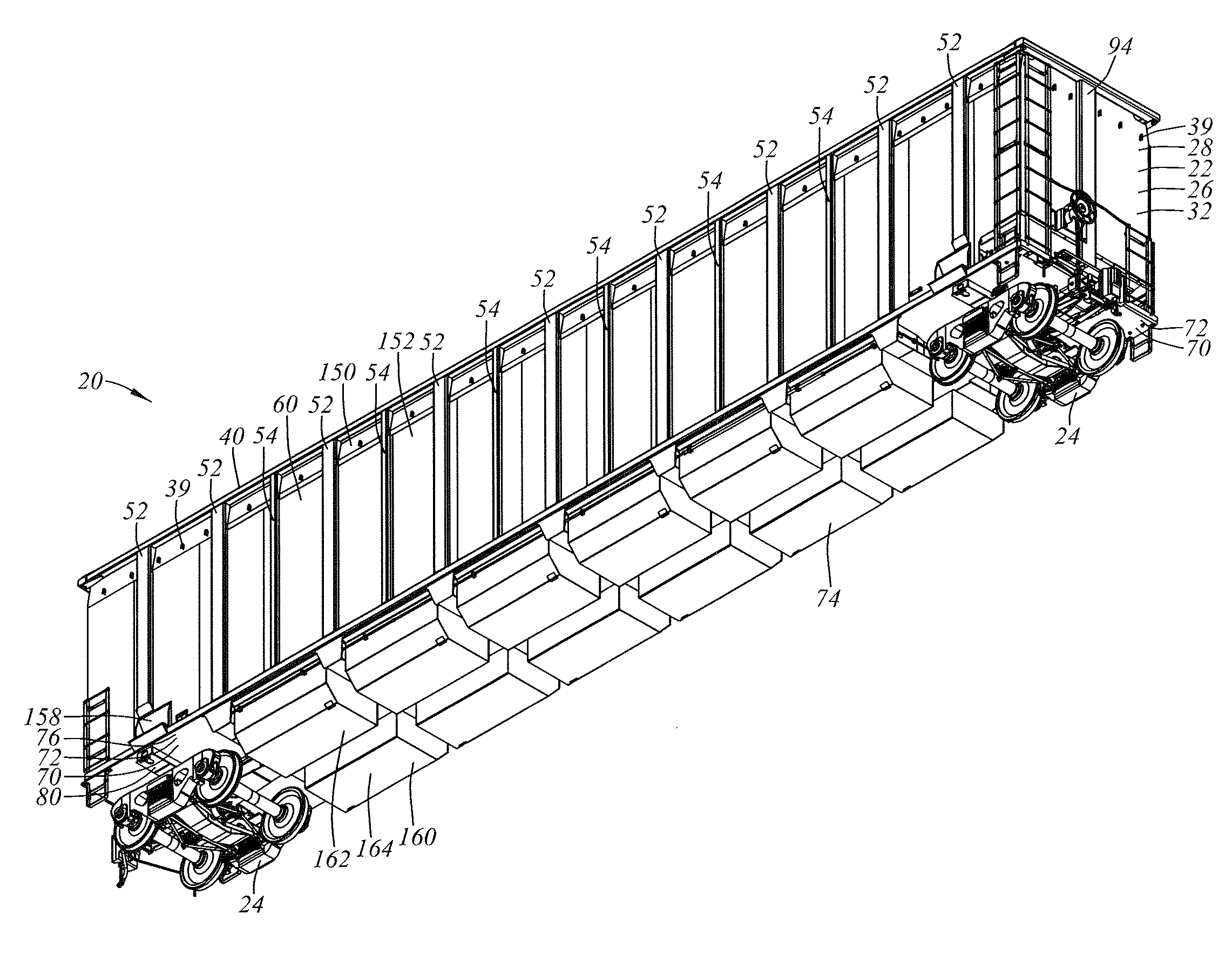

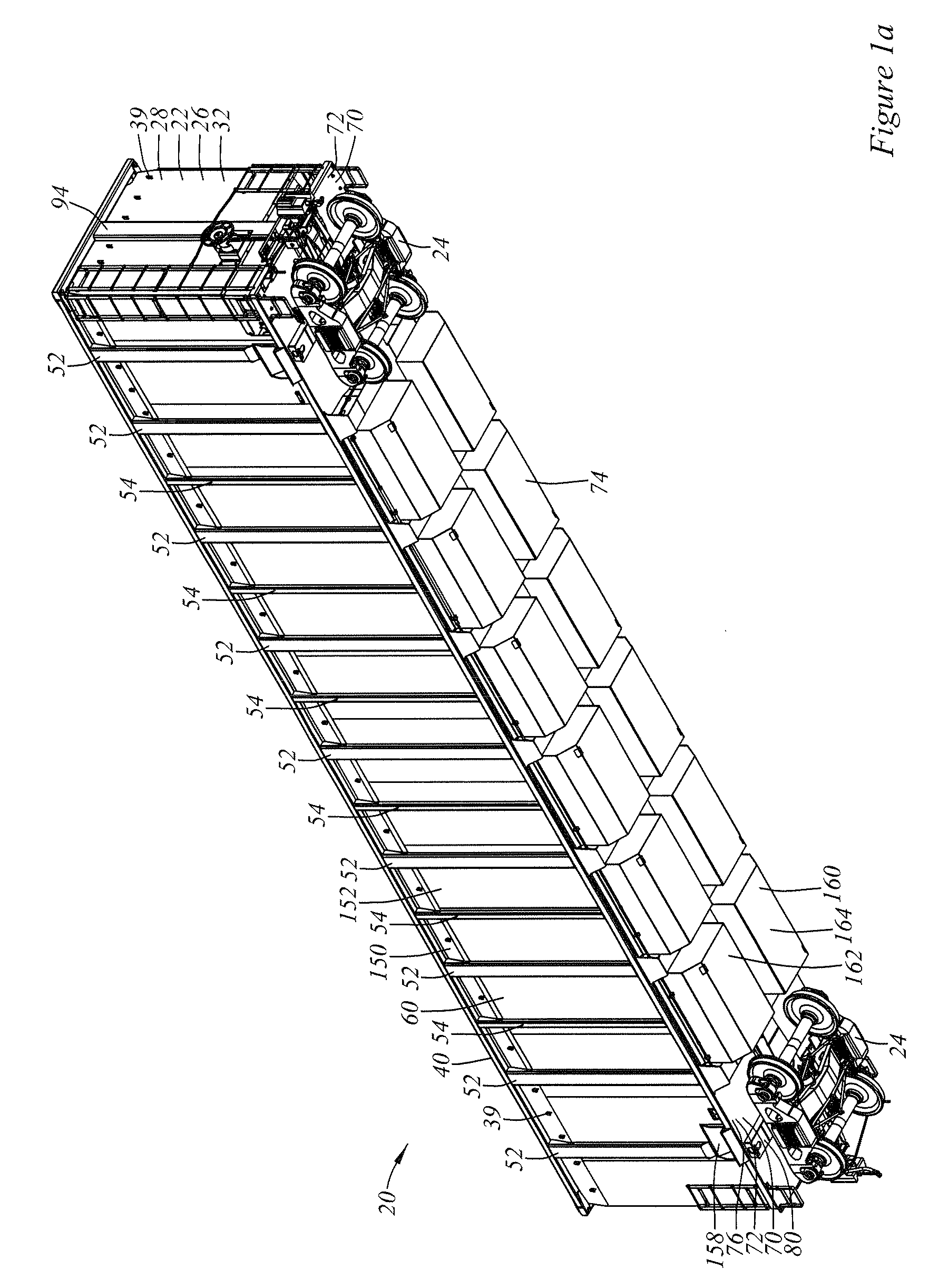

Railroad gondola car structure

Owner:NATIONAL STEEL CAR

Convertible rotisserie/kebab cooking device

InactiveUS6837151B2Reduce manufacturing costCompact storageRoasting apparatusRoasters/grillsEngineeringConvertible

The present invention provides a cooking device that is convertible between a rotisserie cooking device and a kebab cooking device, folds up for compact storage, uses the heat element and enclosure of a conventional oven, and is inexpensive to manufacture.

Owner:CHEN SHANE

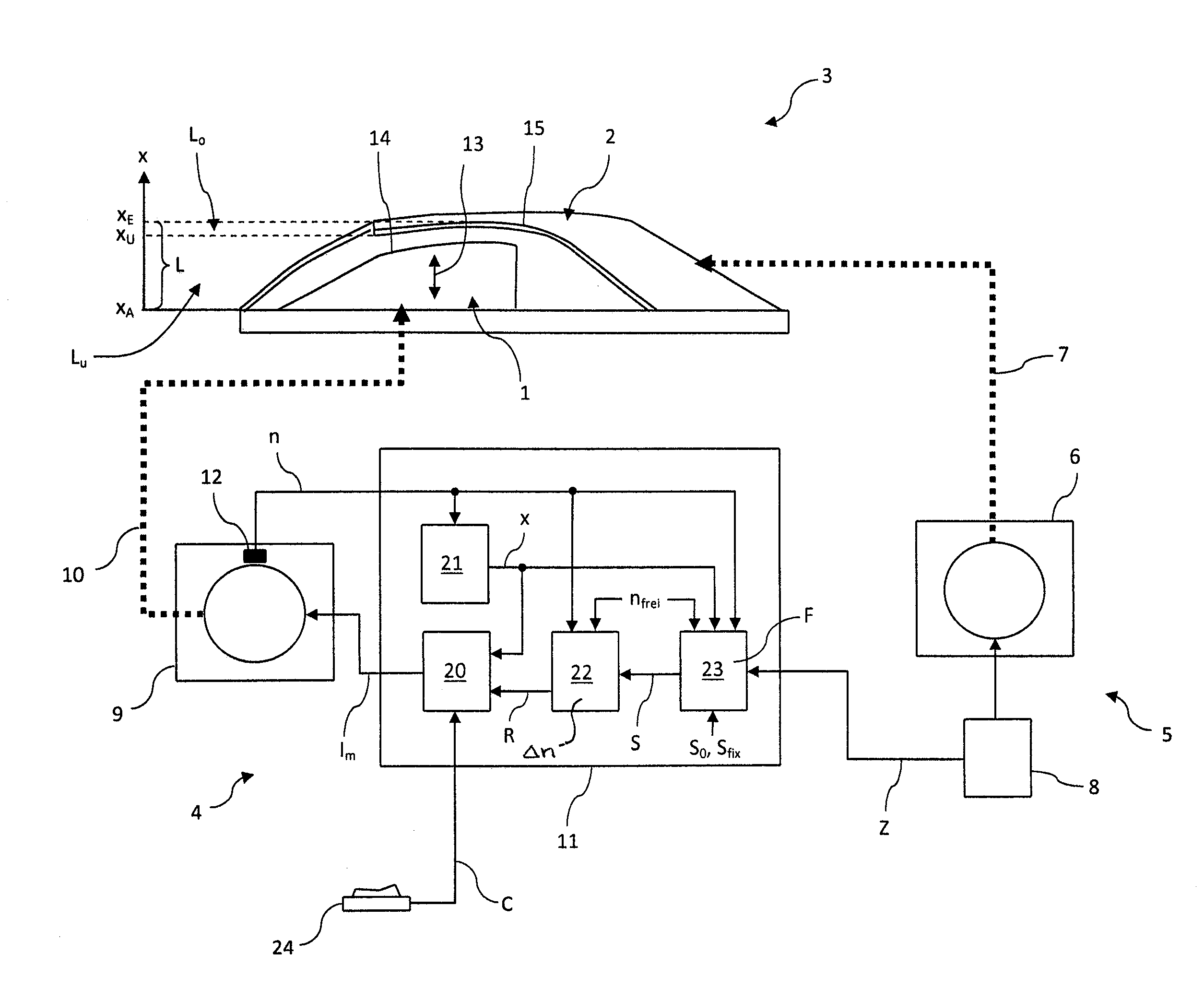

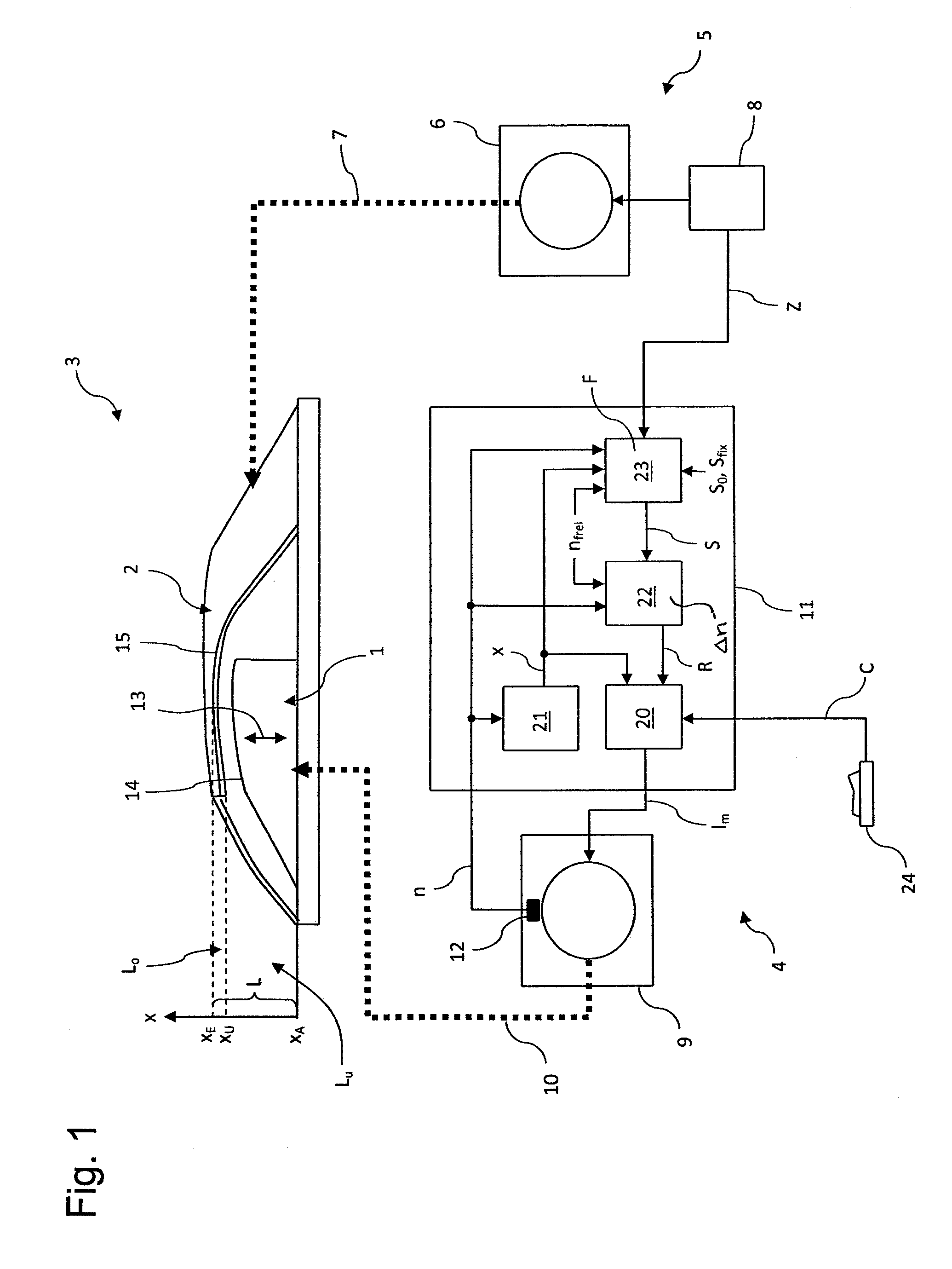

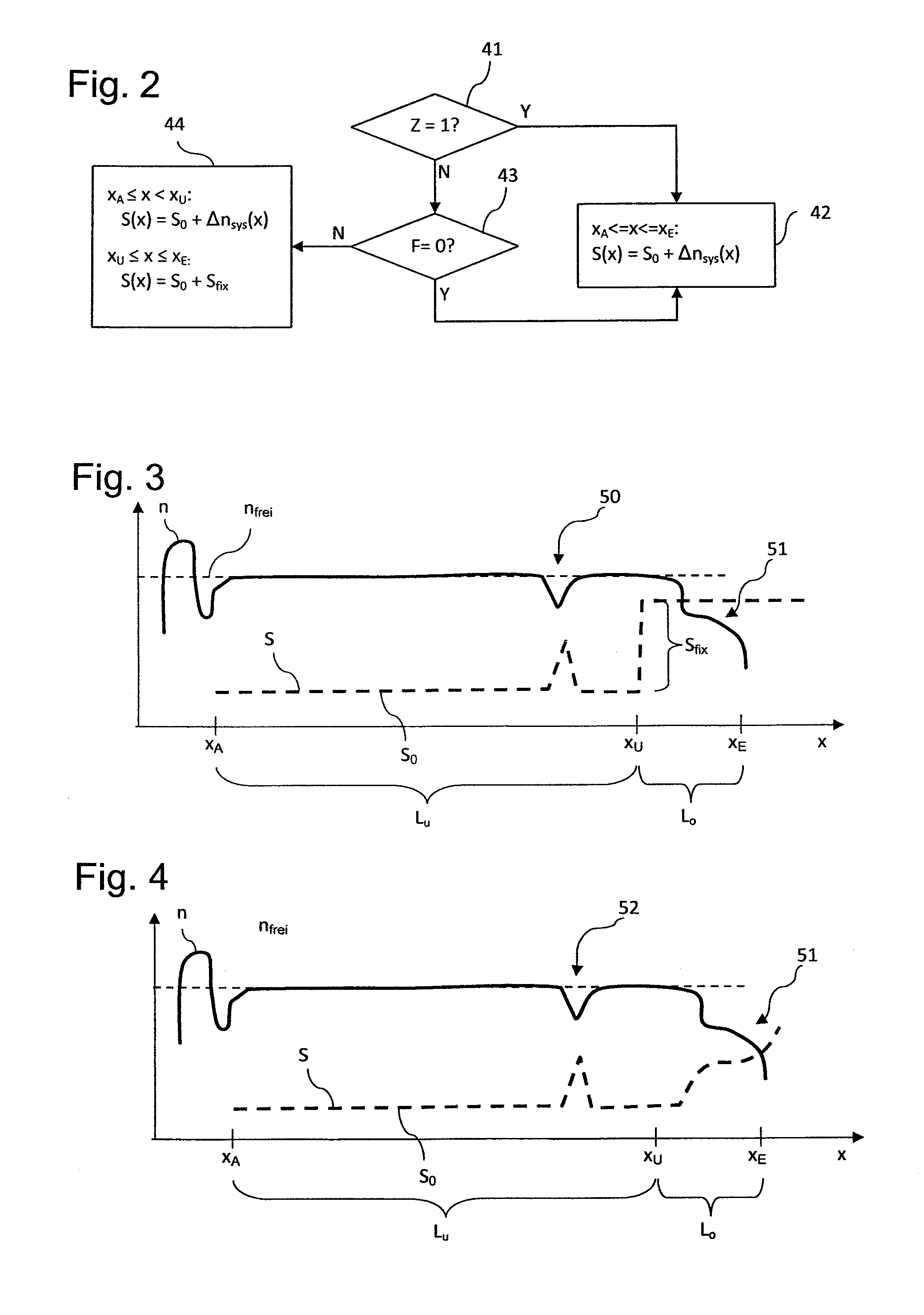

Method for operating an electric window lift of a convertible

InactiveUS20120005963A1Avoid failureReduce gapProgramme controlDC motor speed/torque controlPosition dependentProtection system

An especially failsafe method for operating an electric window lift for closing and opening a window of a convertible is provided. A threshold value that is relevant to the triggering of an anti-pinch protection system of the window lift is regularly adapted to the actuation-position-dependent behavior of a sensed operating quantity of the window lift, at least in a lower region of the actuation path of the window, both when the top of the convertible is closed and when it is open. At least for the first window closing process after a closing of the top, the threshold value is rigidly predefined in an upper region of the actuation path of the window.

Owner:BROSE FAHRZEUGTEILE GMBH & CO KG HALLSTADT (DE)

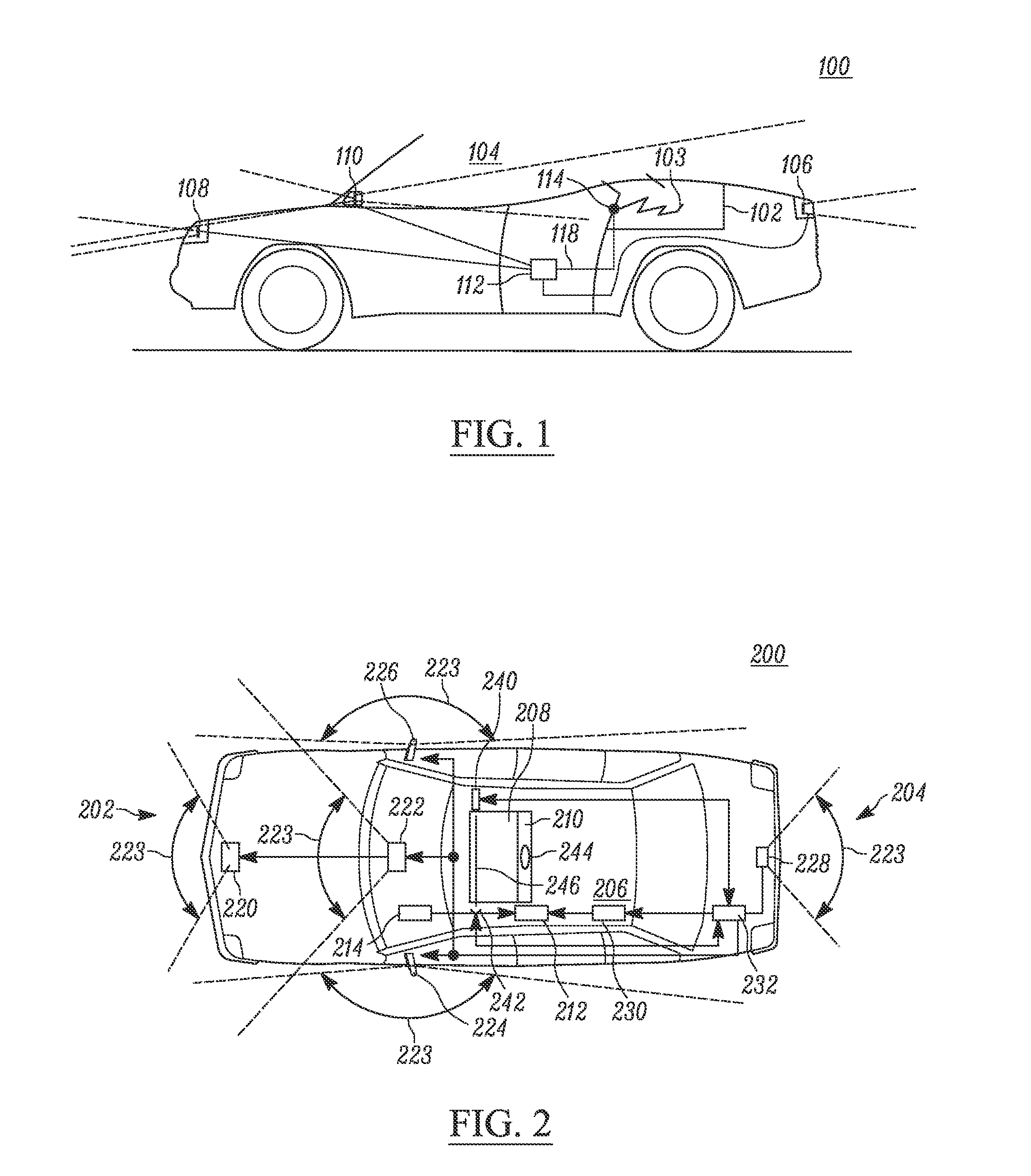

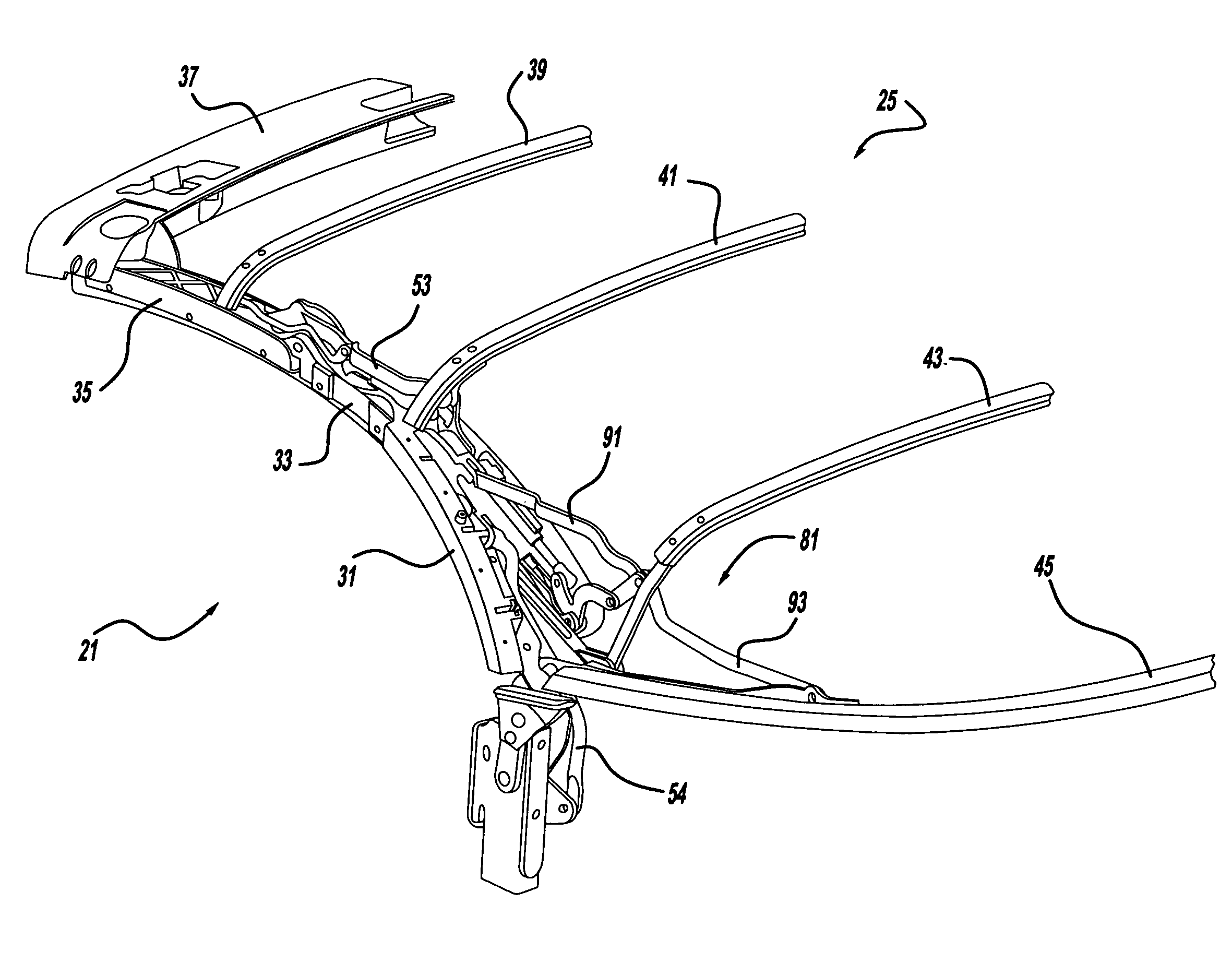

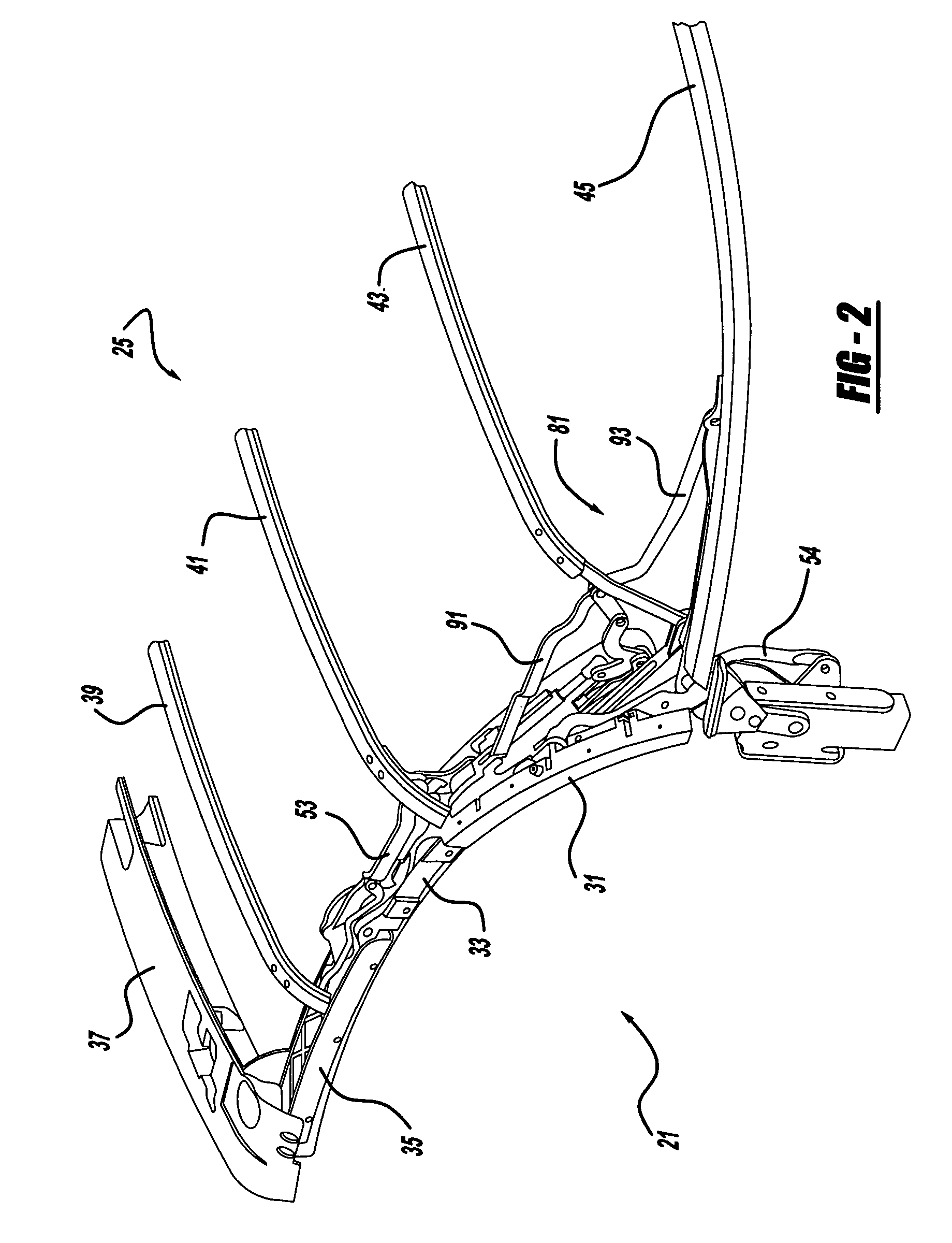

Convertible vehicle top stack mechanism

InactiveUS7032951B2Reduce starting powerEasy to assembleEngine sealsVehicle sealing arrangementsEngineeringActuator

A convertible vehicle top stack mechanism includes a moveable rearmost roof bow and an actuator. In an other aspect of the present invention, a linkage assembly couples a rearmost roof bow to a side rail. A further aspect of the present invention employs a rotatable member or crank to drive a set of buggy links in order to raise and lower an active number five roof bow.

Owner:SPECIALTY VEHICLE ACQUISITION

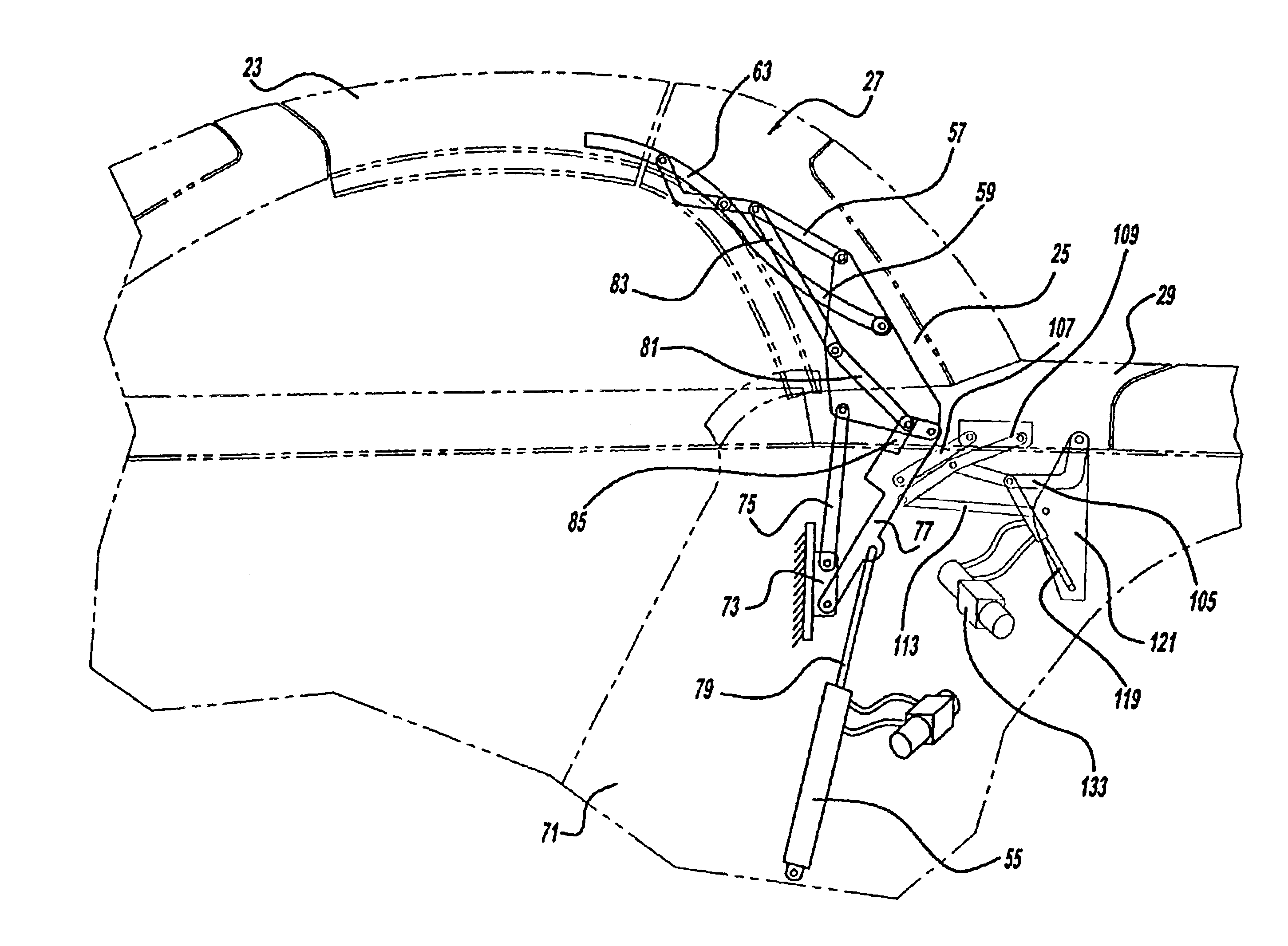

Hard-top convertible roof system

InactiveUS6866325B2MinimizesLess-costly to assembleEngine sealsVehicle sealing arrangementsEngineeringActuator

A convertible roof system includes a front roof section, a rear roof section, an automatically power actuator and a linkage mechanism. In another aspect of the present invention, the front and / or rear roof sections are rigid, hard-top roofs. A further aspect of the present invention provides that the outside surfaces of the roofs have a generally vertical orientation when in their open and retracted positions.

Owner:SPECIALTY VEHICLE ACQUISITION

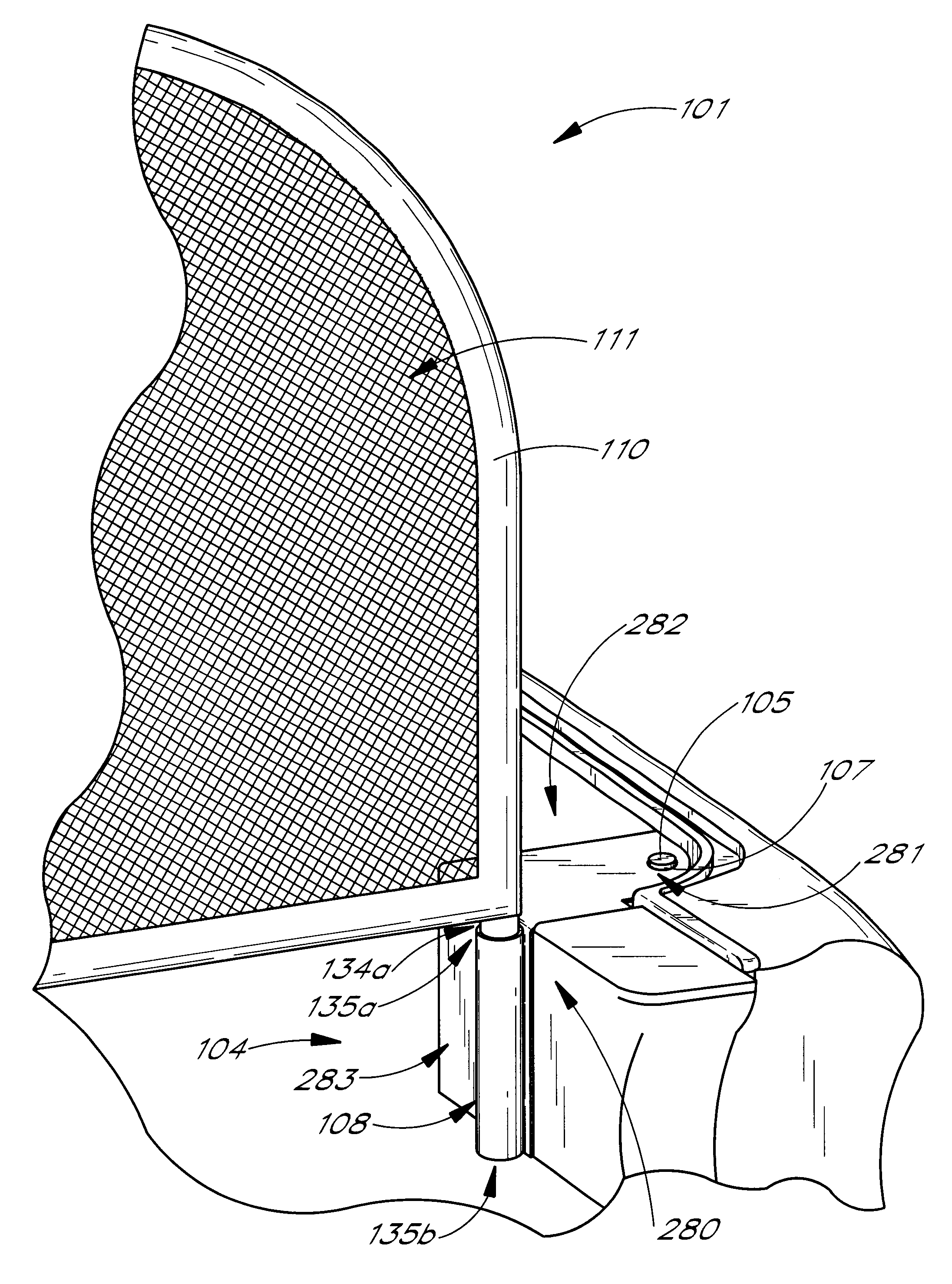

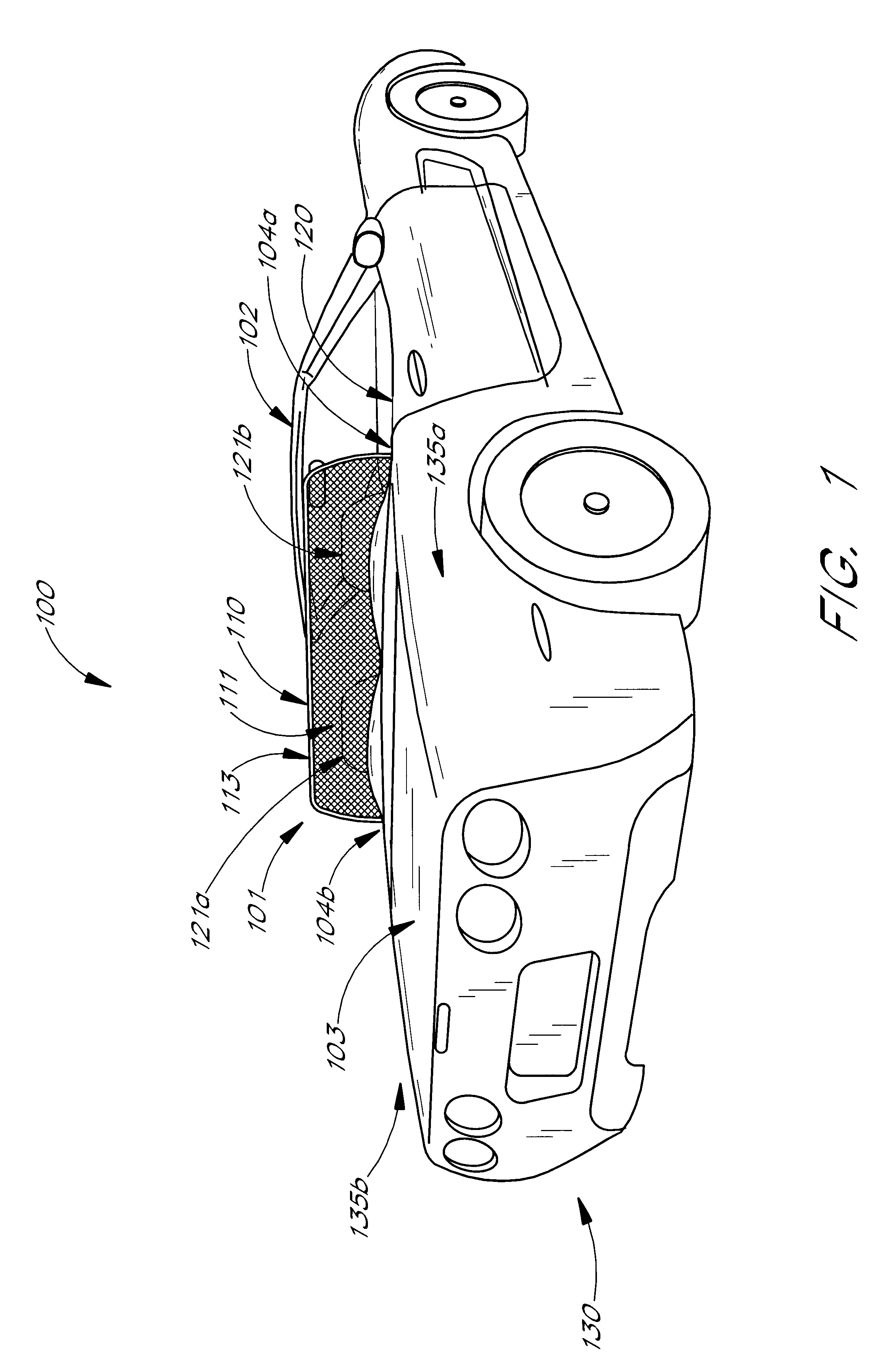

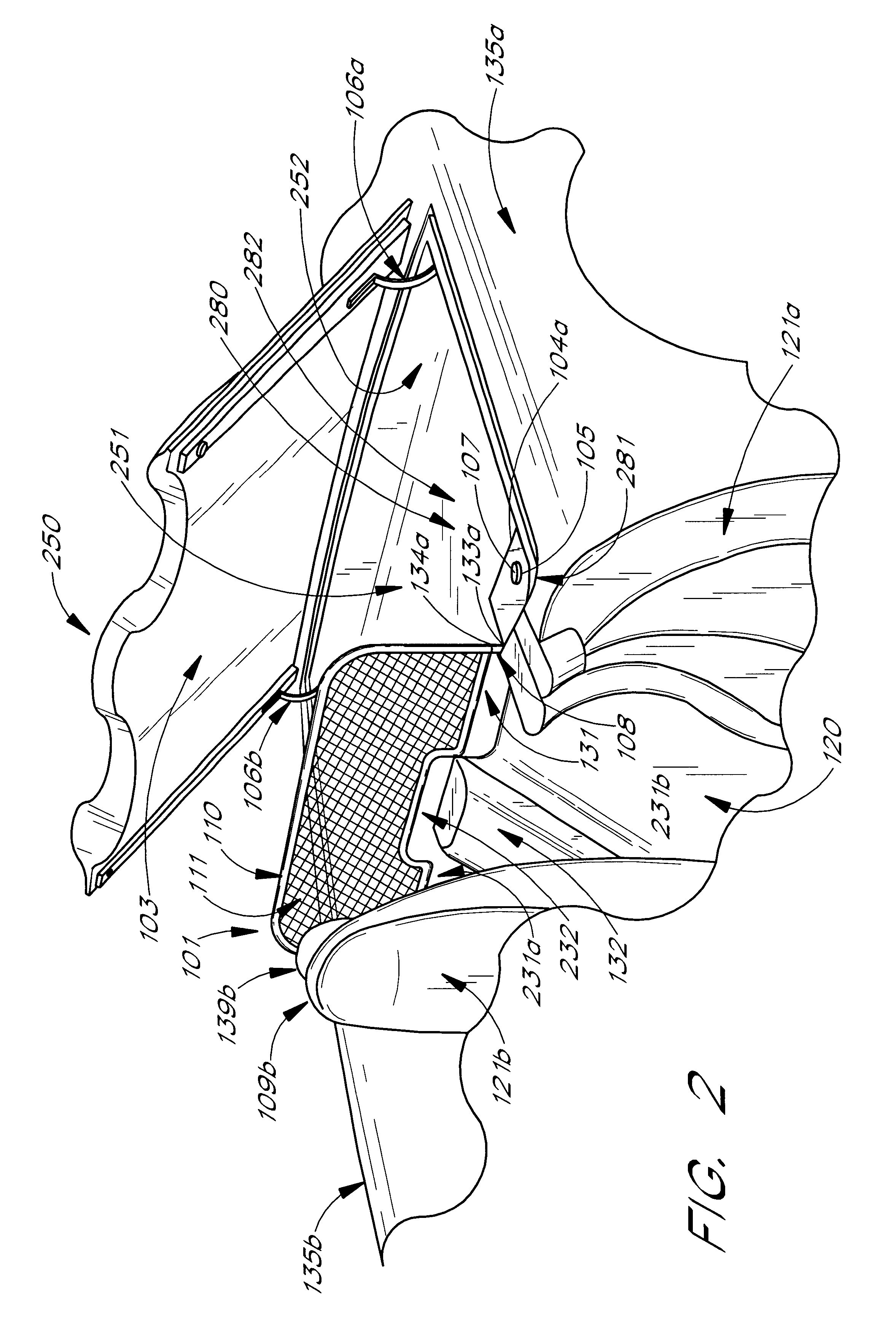

Rear windscreen for convertibles

A windscreen assembly for a Corvette Convertible automobile that comprises a wind breaking mesh net configured to be fastened in the rear of the passenger cockpit of the vehicle and of equivalent height as the windshield. The wind breaking mesh net is to be positioned in an upright manner and attached to the vehicle with an adapter apparatus using adapters located on opposing sides of the vehicle. The adapters positioned in such a way as to allow for their temporary attachment to the vehicle sides when the top of the Corvette Convertible is down. The completed assembly gives a method for securing a removable wind breaking mesh net to the vehicle thereby reducing interior wind noise while driving and does not require any permanent alterations to the existing vehicle design.

Owner:BEAL REBECCA

Convertible camper shell and hard tonneau

ActiveUS7243965B2Vehicle with living accommodationItem transportation vehiclesHydraulic cylinderEngineering

A truck bed camper shell and hard tonneau cover device is provided which is activated for movement between a raised truck bed camper shell position and a lowered hard tonneau cover position by remote activation of actuators such as pneumatics or hydraulic cylinders or a screw drive mechanism.

Owner:WOODWORTH INVESTMENT GROUP

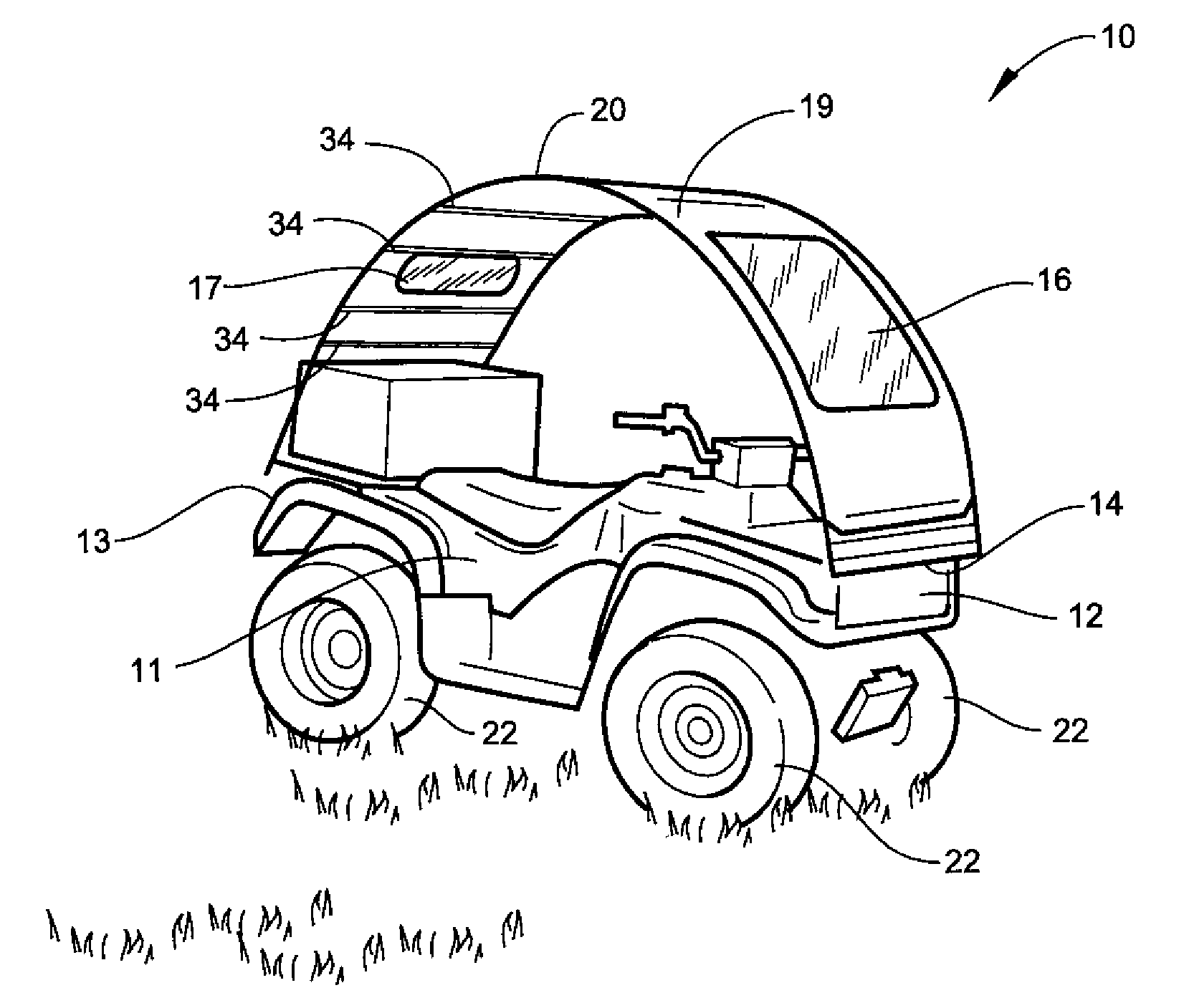

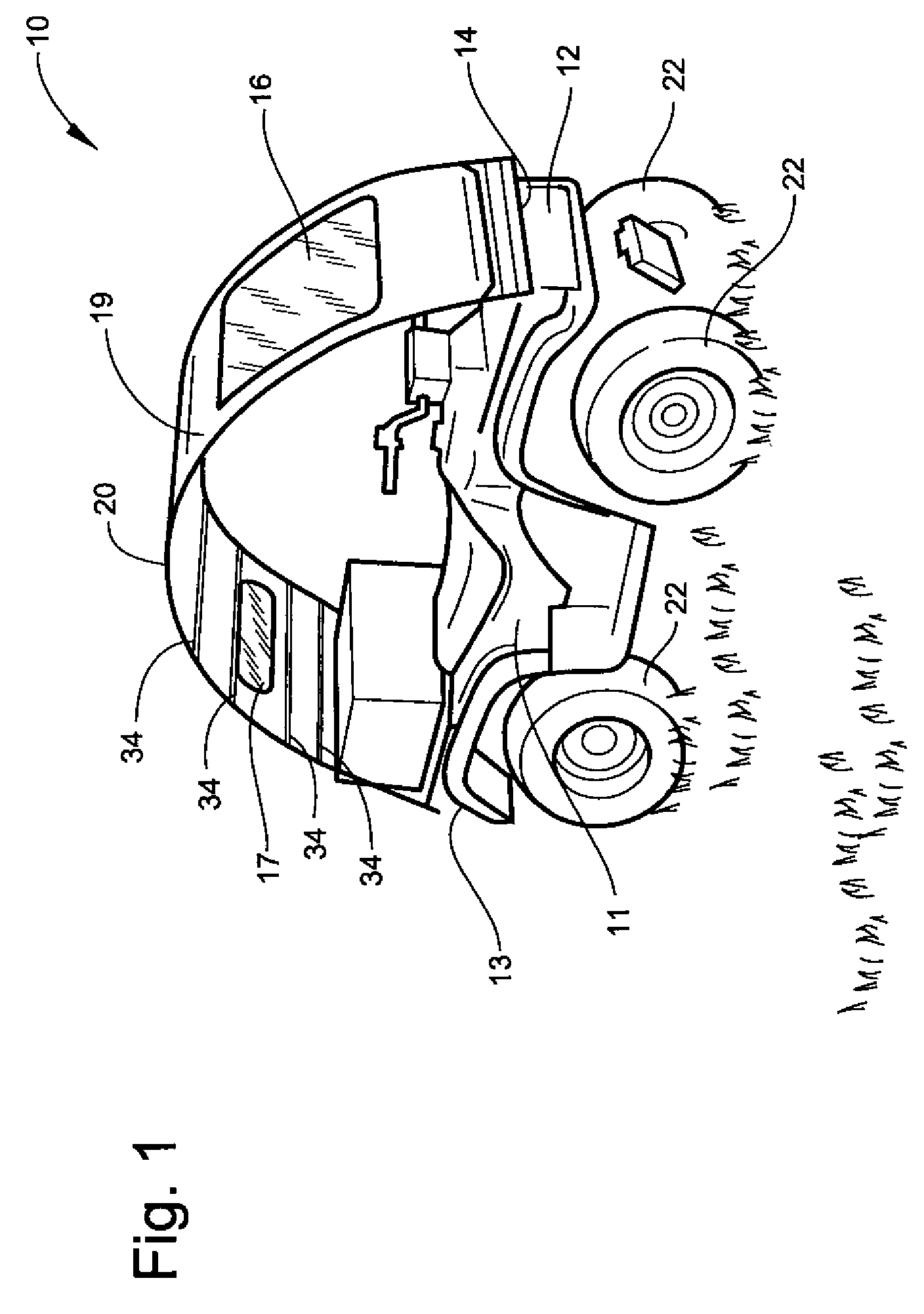

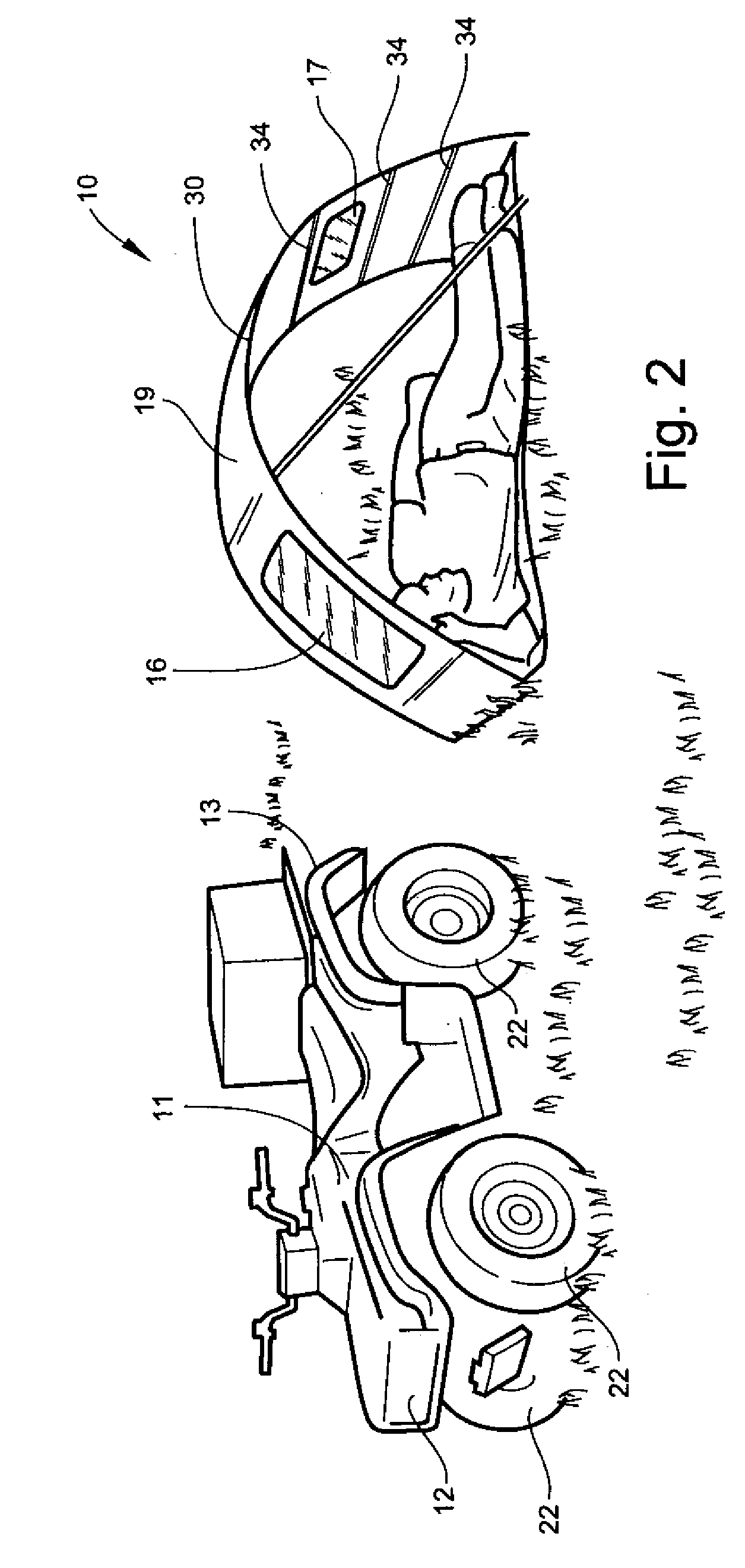

Convertible top for an all-terrain vehicle

InactiveUS7137660B2Easy to disassembleClear visionWindowsUmbrellasFront and back endsAll terrain vehicles

A convertible protective top for a vehicle. The top including a retractable canopy and at least two mounting brackets. The canopy includes at least two spaced-apart side members; at least two spaced-apart cross-members, and a cover attached to the cross-members. The cross-members are positioned between and slidably engaged with the side members, wherein the cross-members and cover are moved along the side members to retract the cover. The mounting brackets are attached to a front end and a rear end of the vehicle. Each of the mounting brackets include at least two vertical tubular members for receiving respective ones of the side members for securing the canopy to the vehicle.

Owner:RAIN RIDERS

Convertible Sock/Slipper Legwarmer

Owner:ZF FRIEDRICHSHAFEN AG

Rear parcel shelf system for a convertible vehicle with a hard folding roof

InactiveUS7093885B2Improve quality and functionalityImprove performanceVehicle arrangementsItem transportation vehiclesEngineeringFront edge

Owner:SOC EUROENNE DE BREVETAB AUTOMOBILES

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com