Method and system for verifying trader identity on ATM (Automatic Teller Machine)

An ATM machine and identity verification technology, applied in the field of financial transaction security, can solve the problems of modification by criminals, easy to steal deposits, low security, etc., to avoid coerced withdrawals, good attack and threat, and improve account security.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

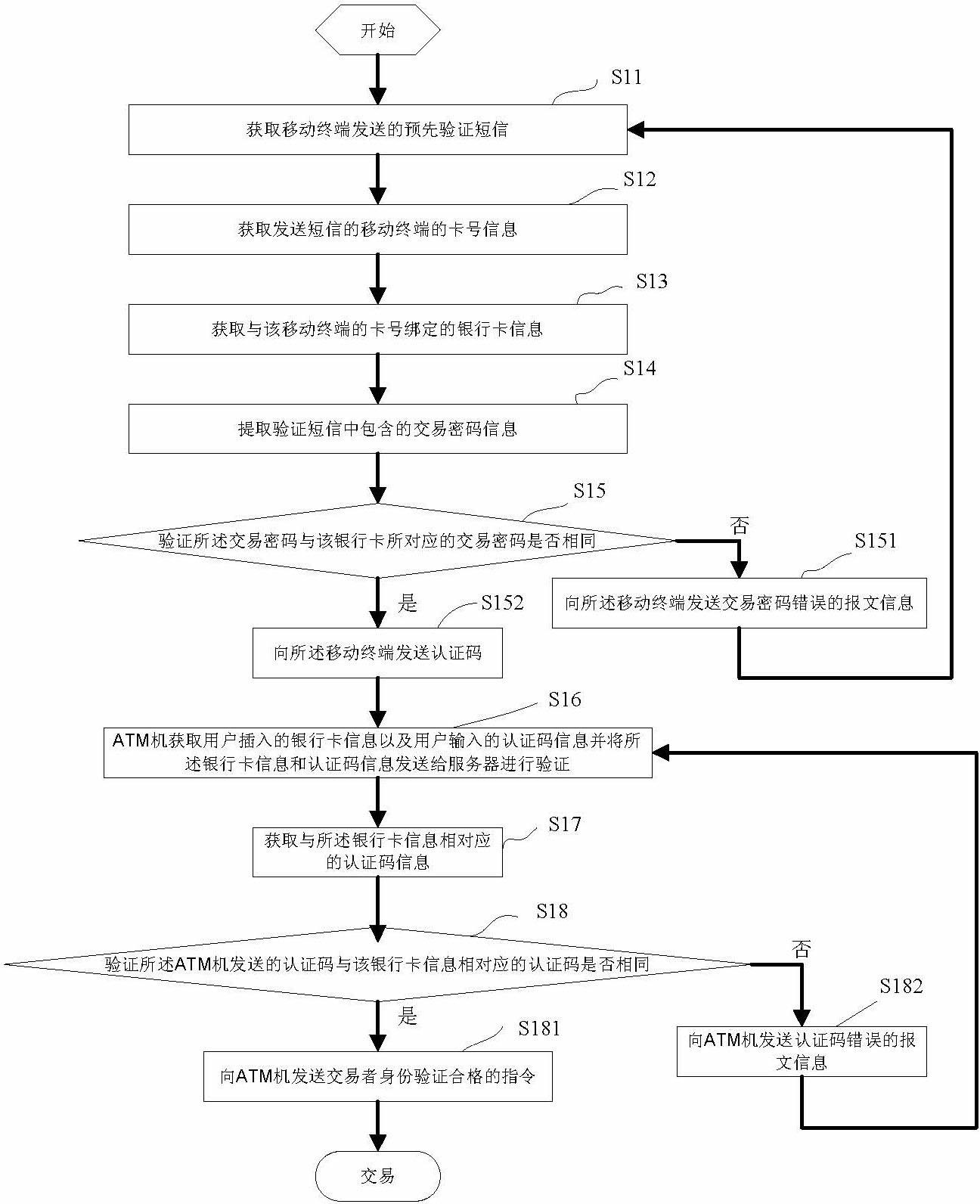

[0077] Such as figure 1 As shown, the present embodiment provides a method for verifying the identity of the trader on the ATM machine, and the method includes the following steps:

[0078] S11: Obtain the pre-authentication short message sent by the mobile terminal;

[0079] This step is specifically: before the user withdraws money on the ATM machine, the user sends a verification message of the transaction password to the server through a mobile terminal (such as a mobile phone) in advance. "'s mobile phone writes a short message with the content of "QK#457523#" (QK is the initial letter of the pinyin for withdrawal) and sends it to "955881000", and the transaction password "457523" is set by the user at the ICBC counter after manual identity verification Legal transaction password, the user can be verified by the bank's server only after sending a short message containing the correct transaction password.

[0080] S12: Obtain the card number information of the mobile ter...

Embodiment 2

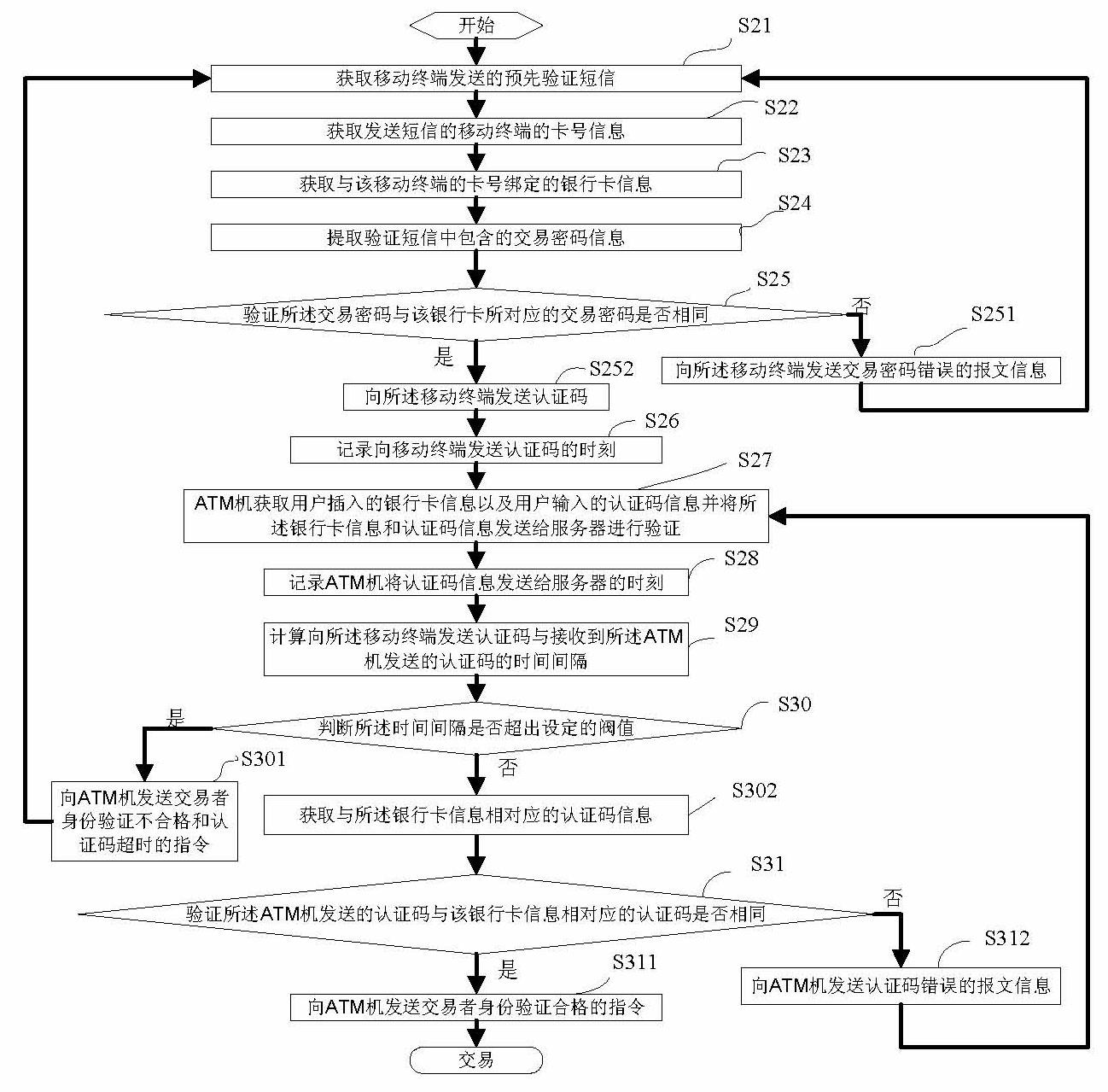

[0115] In order to prevent criminals from peeping or illegally intercepting the authentication code sent by the server to the mobile terminal, the authentication code is set to be valid within a certain period of time, and will automatically become invalid after use. Specifically, such as image 3 As shown, the present embodiment provides another method for verifying the identity of the trader on the ATM machine, and the method includes the following steps:

[0116] S21: Obtain the pre-authentication short message sent by the mobile terminal;

[0117] S22: Obtain the card number information of the mobile terminal sending the short message;

[0118] S23: Obtain bank card information bound to the card number of the mobile terminal;

[0119] S24: Extract the transaction password information contained in the verification SMS;

[0120] S25: Verify whether the transaction password is the same as the transaction password corresponding to the bank card;

[0121] S251: When the tra...

Embodiment 3

[0144] On the basis of the system for verifying the identity of the trader on the ATM machine described in embodiment 2, this embodiment also provides a method for using the system to report to the police, specifically, as Figure 5 As shown, the method includes:

[0145] S41: setting an alarm code corresponding to the bank card;

[0146] S42: Obtain the pre-authentication short message sent by the mobile terminal;

[0147] S43: Obtain the card number information of the mobile terminal sending the short message;

[0148] S44: Obtain bank card information bound to the card number of the mobile terminal;

[0149] S45: extracting the transaction password information contained in the verification text message;

[0150] S46: verify whether the transaction password is the same as the alarm code corresponding to the bank card;

[0151] S461: When the transaction password is different from the alarm code preset by the user, verify whether the transaction password is the same as th...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com