Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

214 results about "Price difference" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Key Differences between Price, Cost and Value Price is what you pay for goods or services you acquire; Cost is the amount of inputs incurred in producing a product and Value is what goods or services pay you i.e. worth. Price is calculated in numerical terms, Cost is also calculated in numerical terms, but Value can never be calculated in numbers.

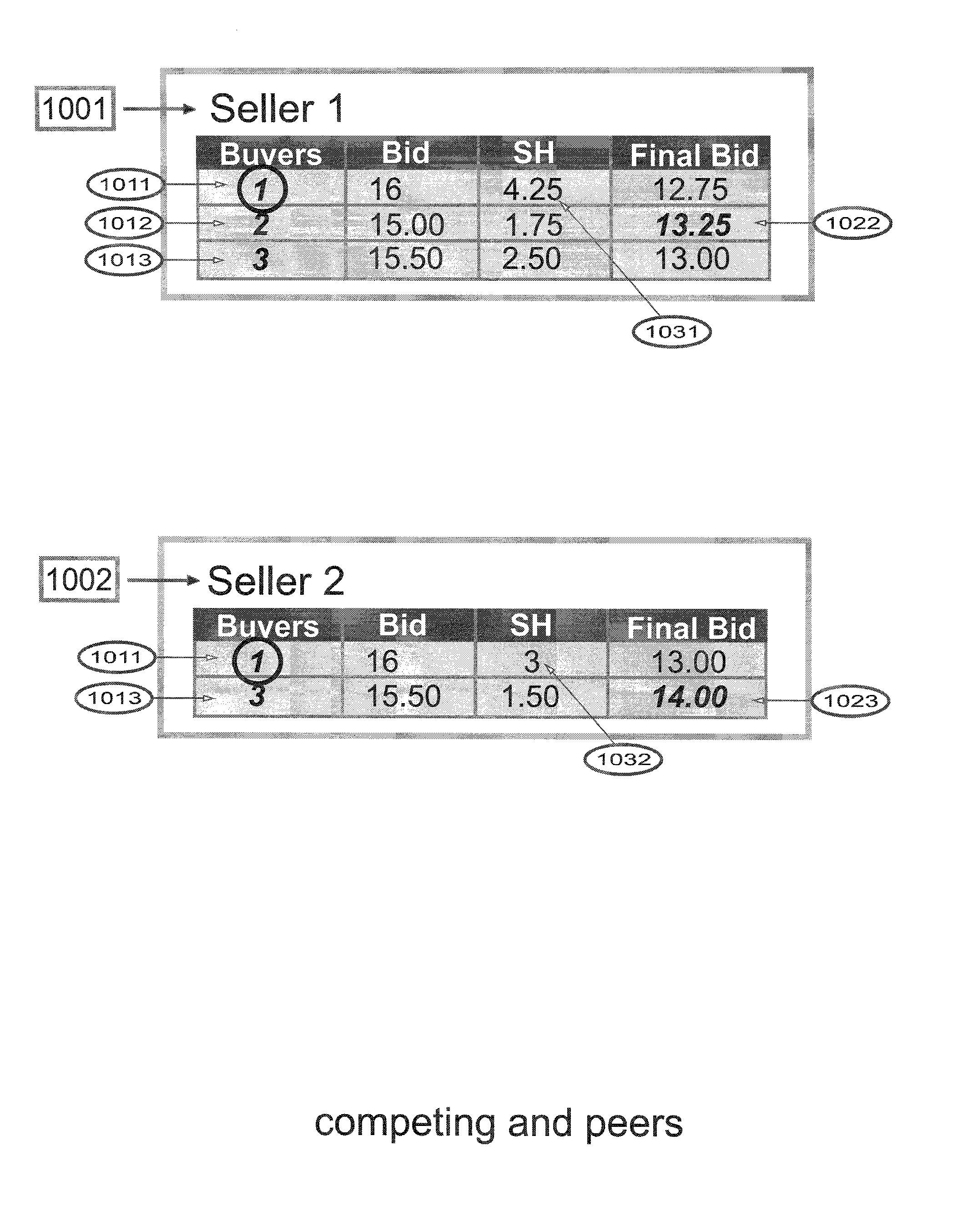

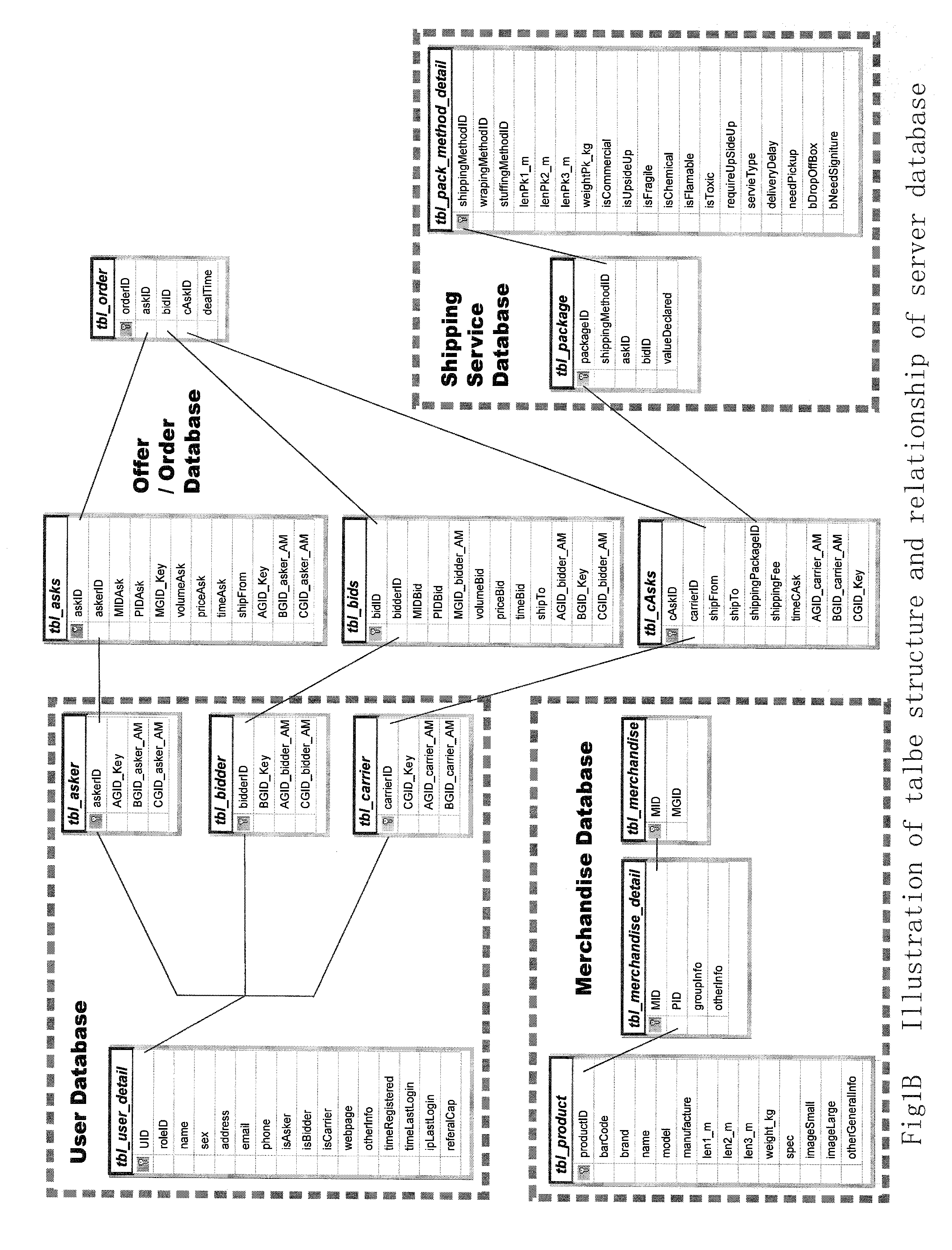

Method and system for grouping merchandise, services and users and for trading merchandise and services

This method groups multiple merchandises (products / services) and multiple traders (buyer / sellers / carriers) that share similar properties with a Merchandise Group ID (MGID) and a User Group ID (UGID), respectively. Each MGID and UGID represents one Merchandise Group and Trader Group, respectively. Different MGIDs and UGIDs represent different merchandise and trader groups. The method also utilize a multi-party matching mechanism to trade Merchandise Groups among Trader Groups by having grouped buyers / sellers / carriers place bid / ask / cAsk offers on both the merchandise and any shipping services required to fulfill the transaction. Based on offers received, the system calculates Gap Values in real-time to determine if deals can be closed. Like stock tickers, MGID enables grouped merchandise to be traded like stocks. UGID enables grouped traders to trade desired merchandise with acceptable counterparties through matching both MGIDs and UGIDs. Based on the grouping, matching and gap value calculating mechanism, this method changes “Instance Trading” into “Group Trading”.

Owner:XIAO QUAN +1

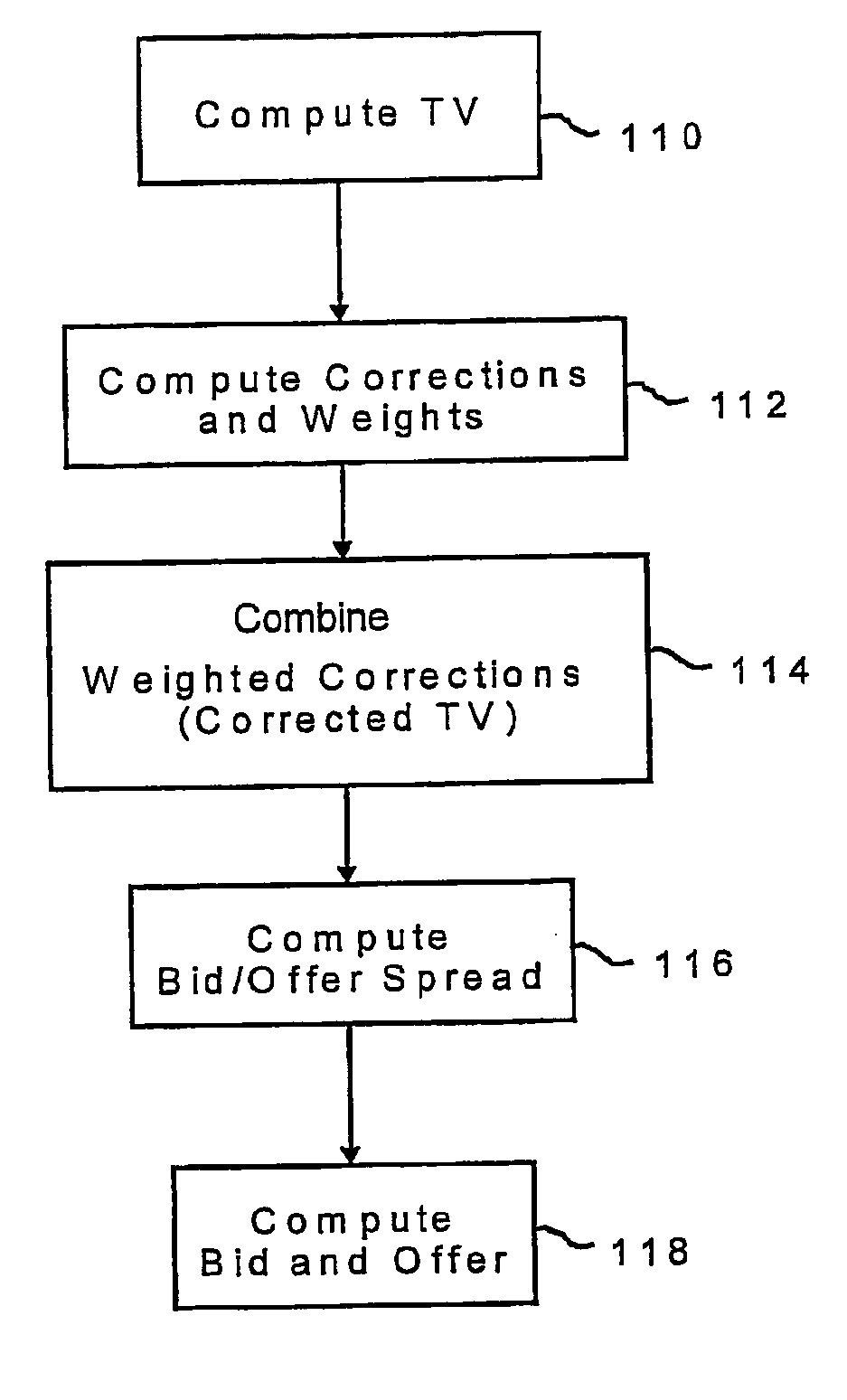

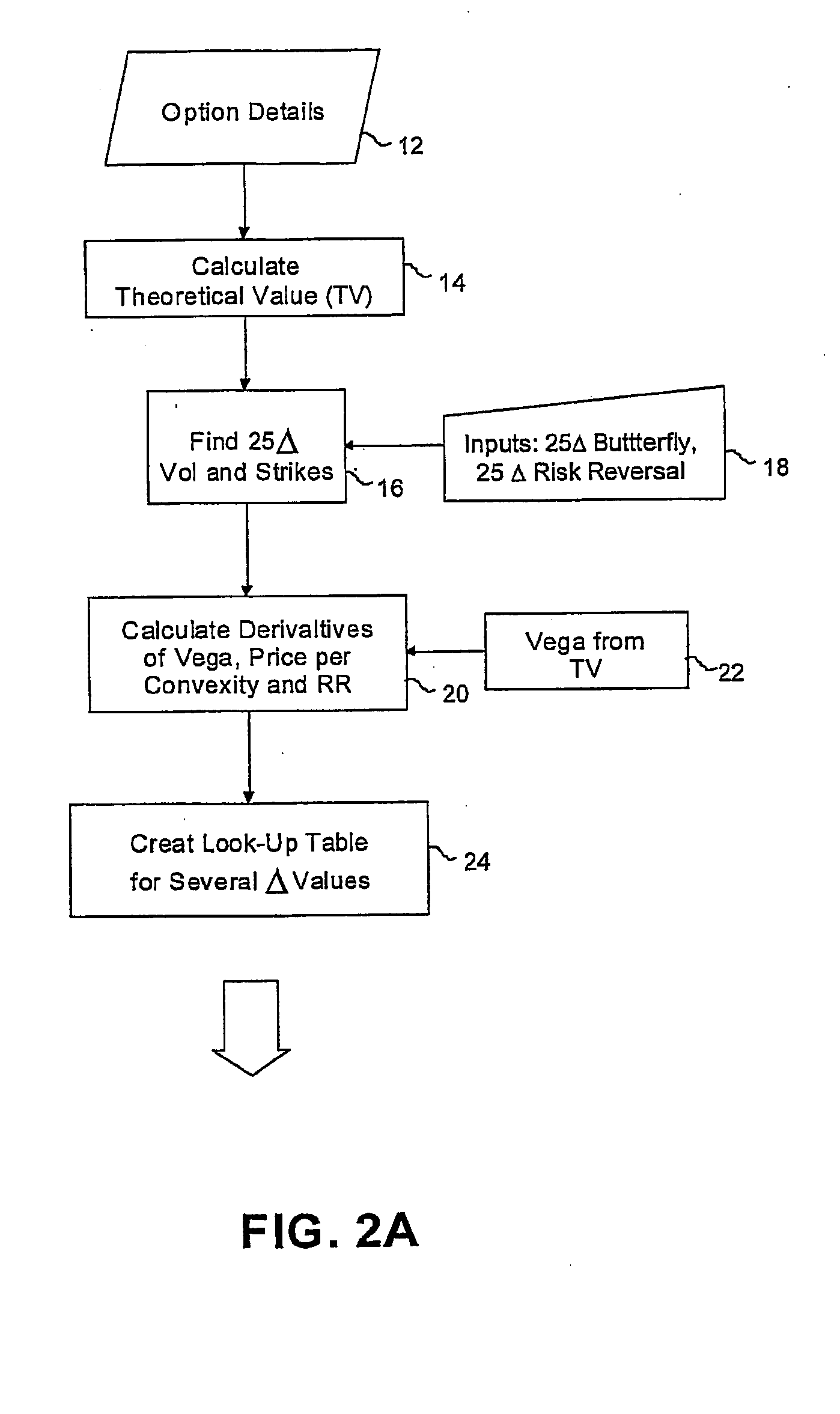

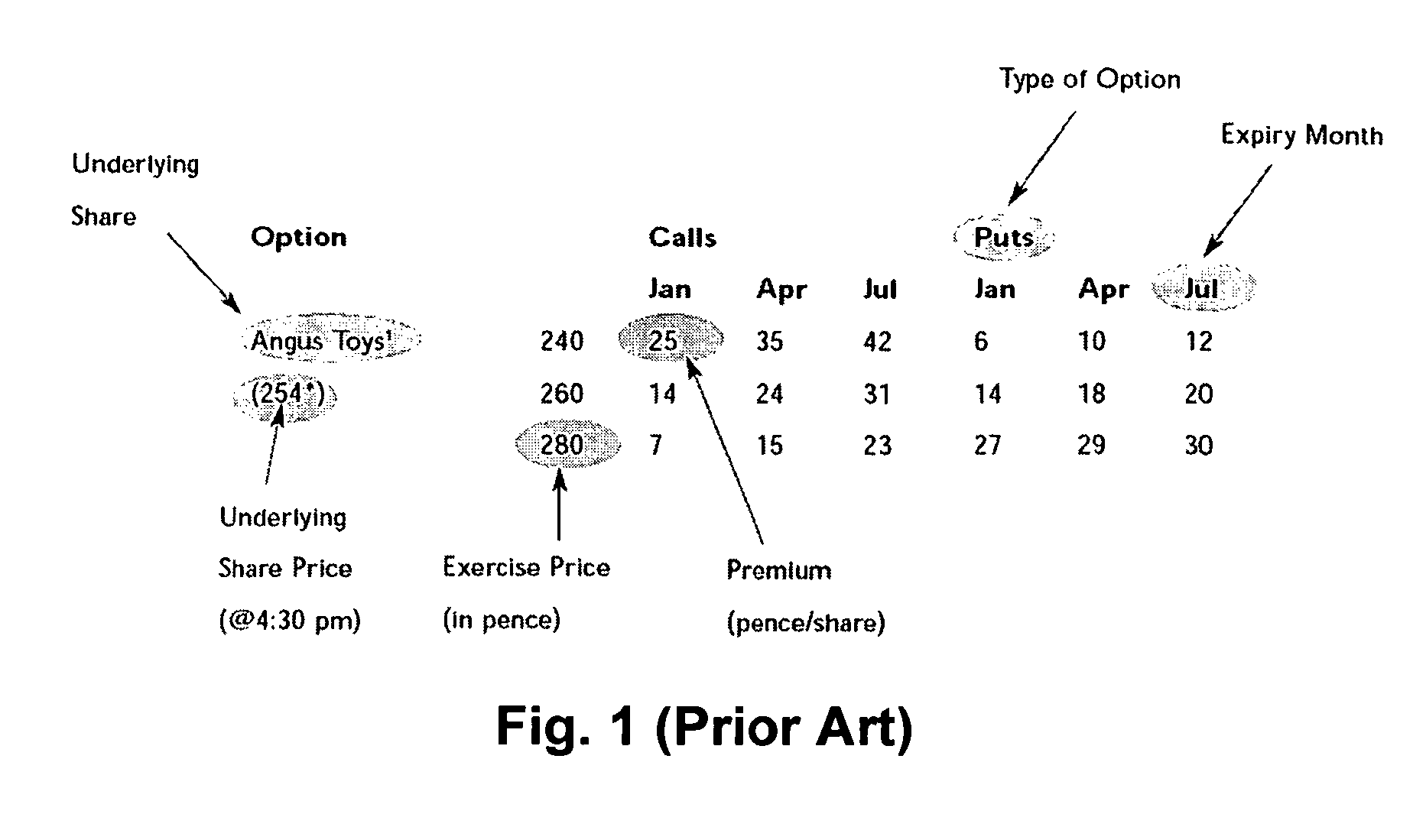

Method and system for pricing financial derivatives

ActiveUS20050027634A1Accurately determineFair priceFinanceSpecial data processing applicationsPrice differenceComputer science

A method for providing a bid price and / or an offer price of an option relating to an underlying asset, the method including the steps of receiving first input data corresponding to a plurality of parameters defining the option, receiving second input data corresponding to a plurality of current market conditions relating to the underlying value, computing a corrected theoretical value (CTV) of the option based on the first and second input data, computing a bid / offer spread of the option based on the first and input data, computing a bid price and / or an offer price of the option based on the corrected TV and the bid / offer spread, and providing an output corresponding to the bid price and / or the offer price of said option.

Owner:SUPERDERIVATIVES INC

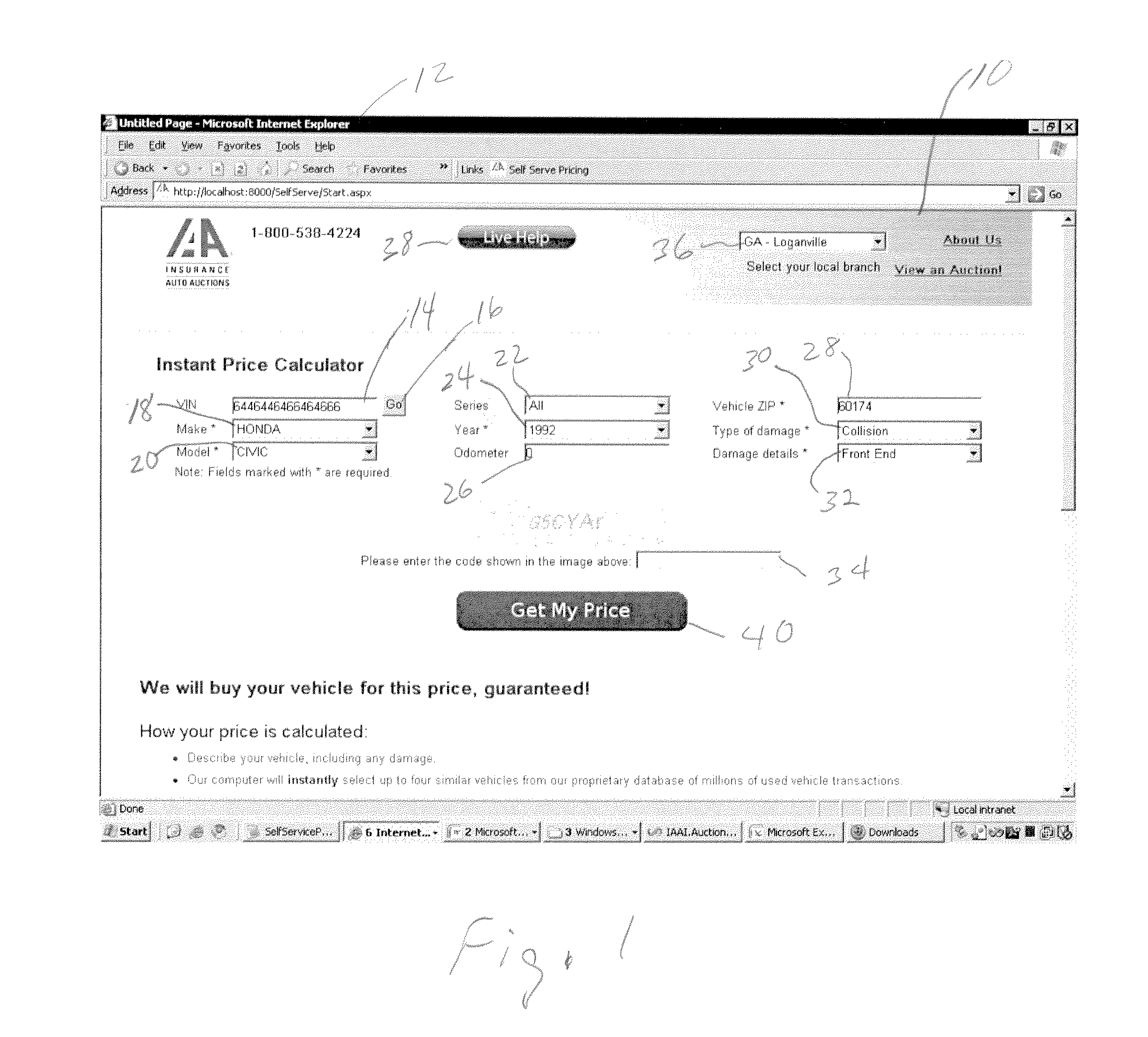

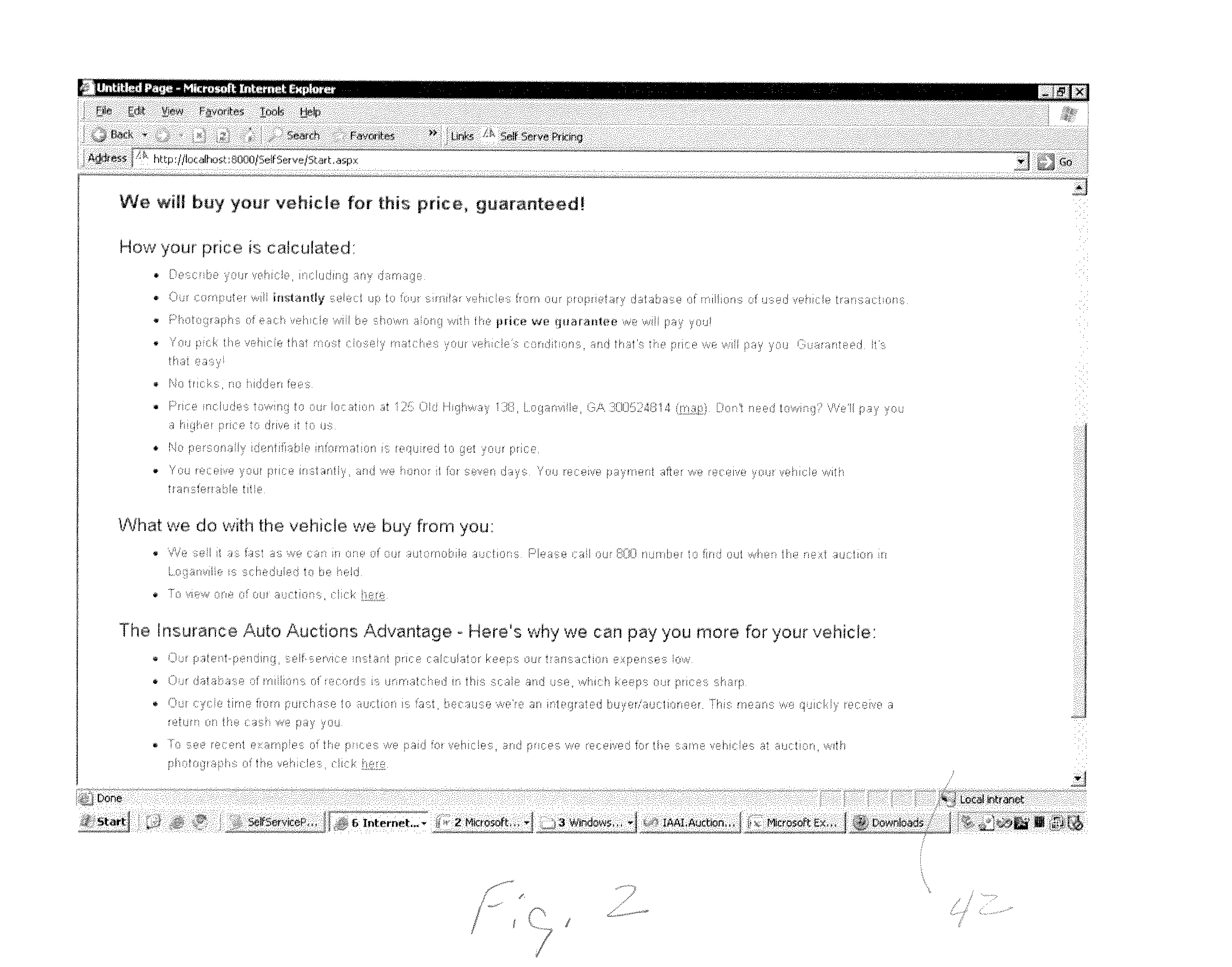

Method and apparatus for estimating value of a damaged vehicle

InactiveUS20110313936A1Product appraisalBuying/selling/leasing transactionsPrice differenceModel Number

A method and apparatus by which a user who wishes to sell a used or damaged vehicle inputs information about the vehicle including make, model and year. The user is shown images of similar vehicles with various degrees of damage and is shown a purchase price at each level of damage. The purchase prices for the displayed vehicles are calculated to include auction price of the vehicle, regional price differences, title transfer costs, towing costs, etc. By selecting an image of a vehicle with damage as the vehicle to be sold, the user may sell the vehicle at that price. An agent embodiment shows images, prices and percentiles of damaged vehicles at different damage levels so that the agent may determine a price to be offered to the seller for a vehicle.

Owner:INSURANCE AUTO AUCTIONS

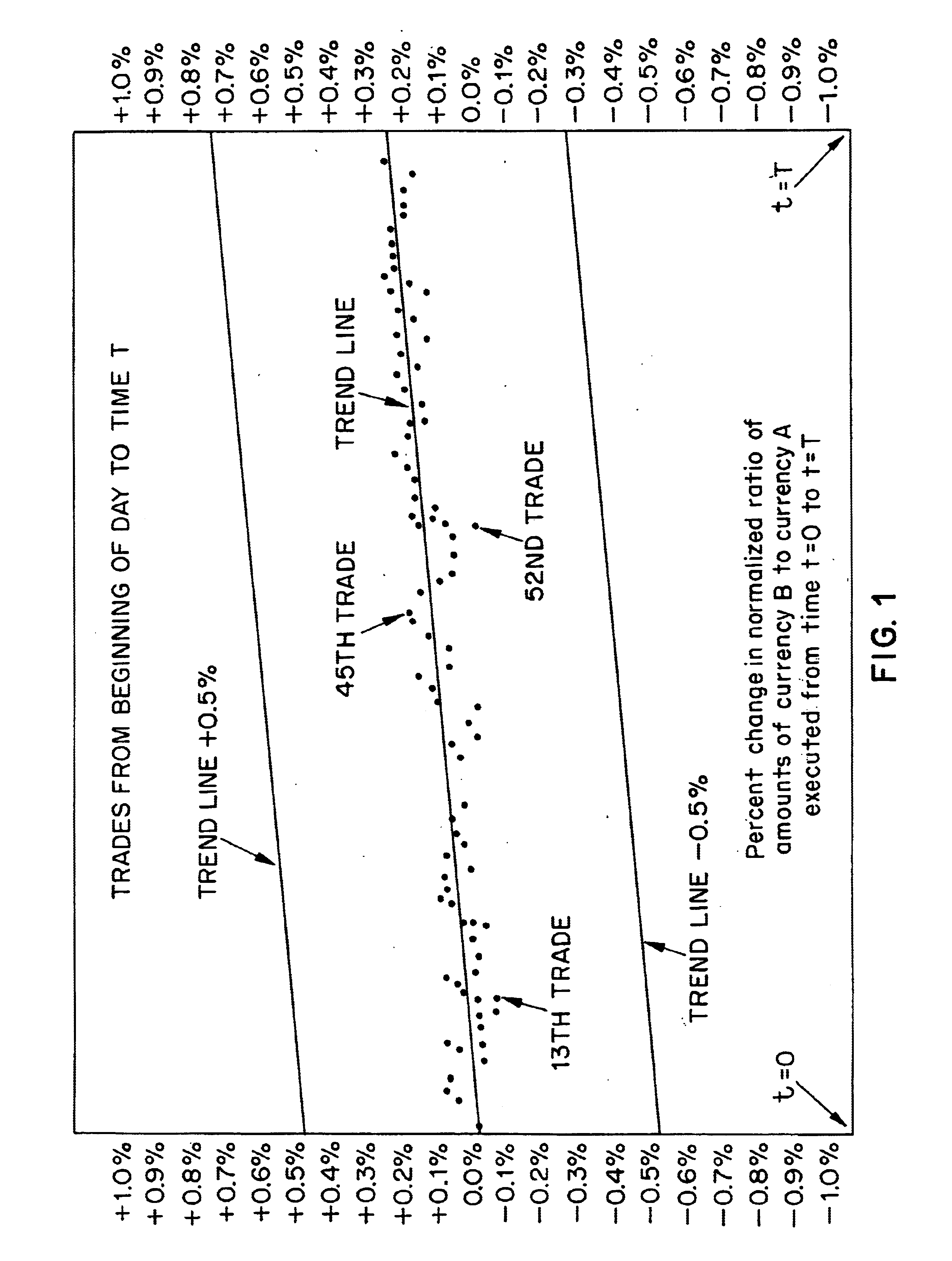

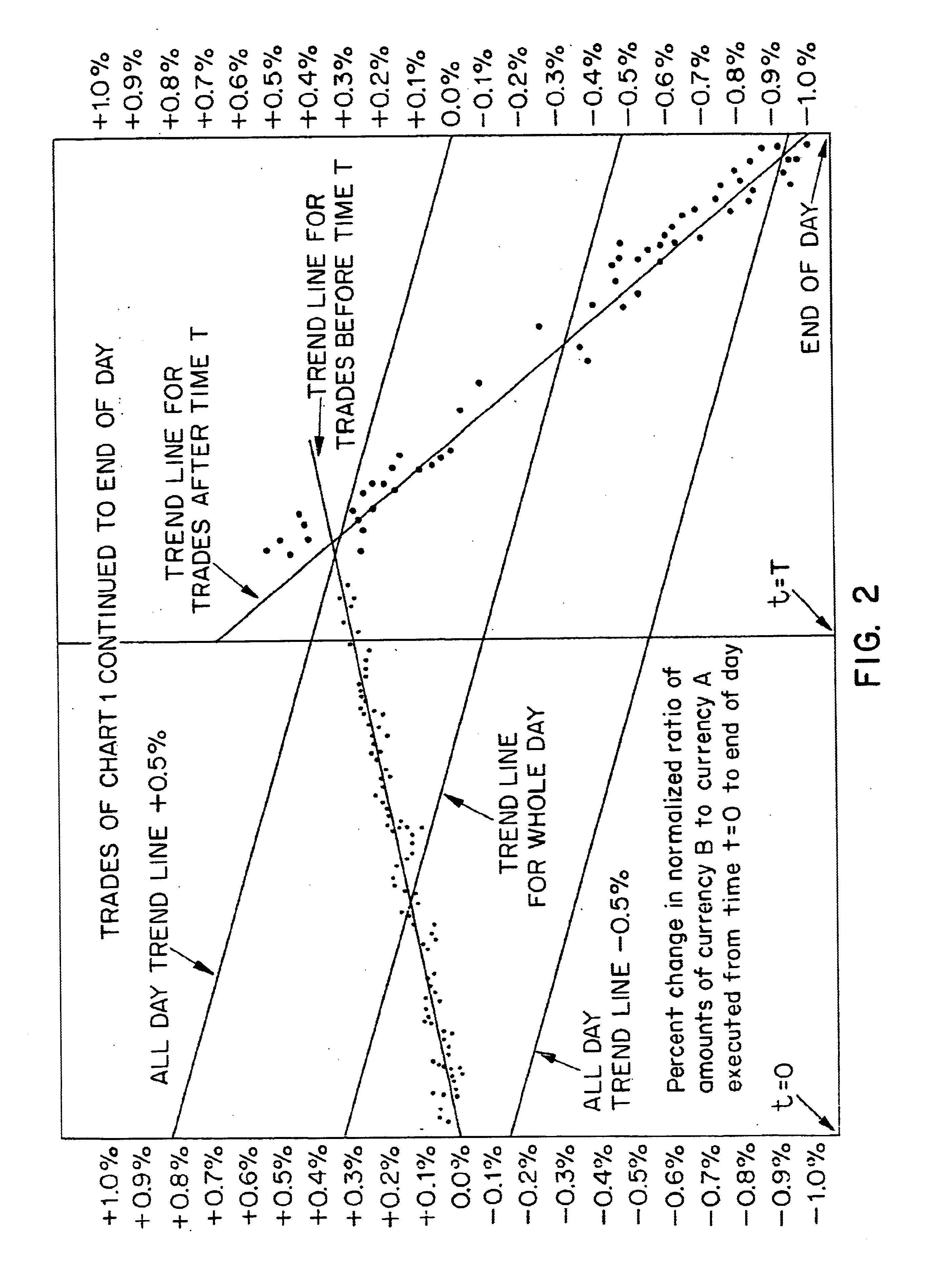

Marketplace system fees enhancing market share and participation

A method for use by buyers and sellers in the execution of trades. The price of each executed trade within the system is logged. Next, a trend line is derived from the logged trades. The trading fee for a particular trade is determined based on the difference between the trade's price and the trend line as well as the size of the trade. This fee is imposed upon the buyer if the price of the trade is below the trend line, or imposed upon the seller if the price of the trade is above the trend line. The market markers in each item are evaluated according to how narrow their spreads were at the time of each transaction, and receive periodic bonuses based on these evaluations. A “crisis fee” is imposed on trades in the system when particularly measured qualities exceed normal bounds.

Owner:KAY ALAN F +1

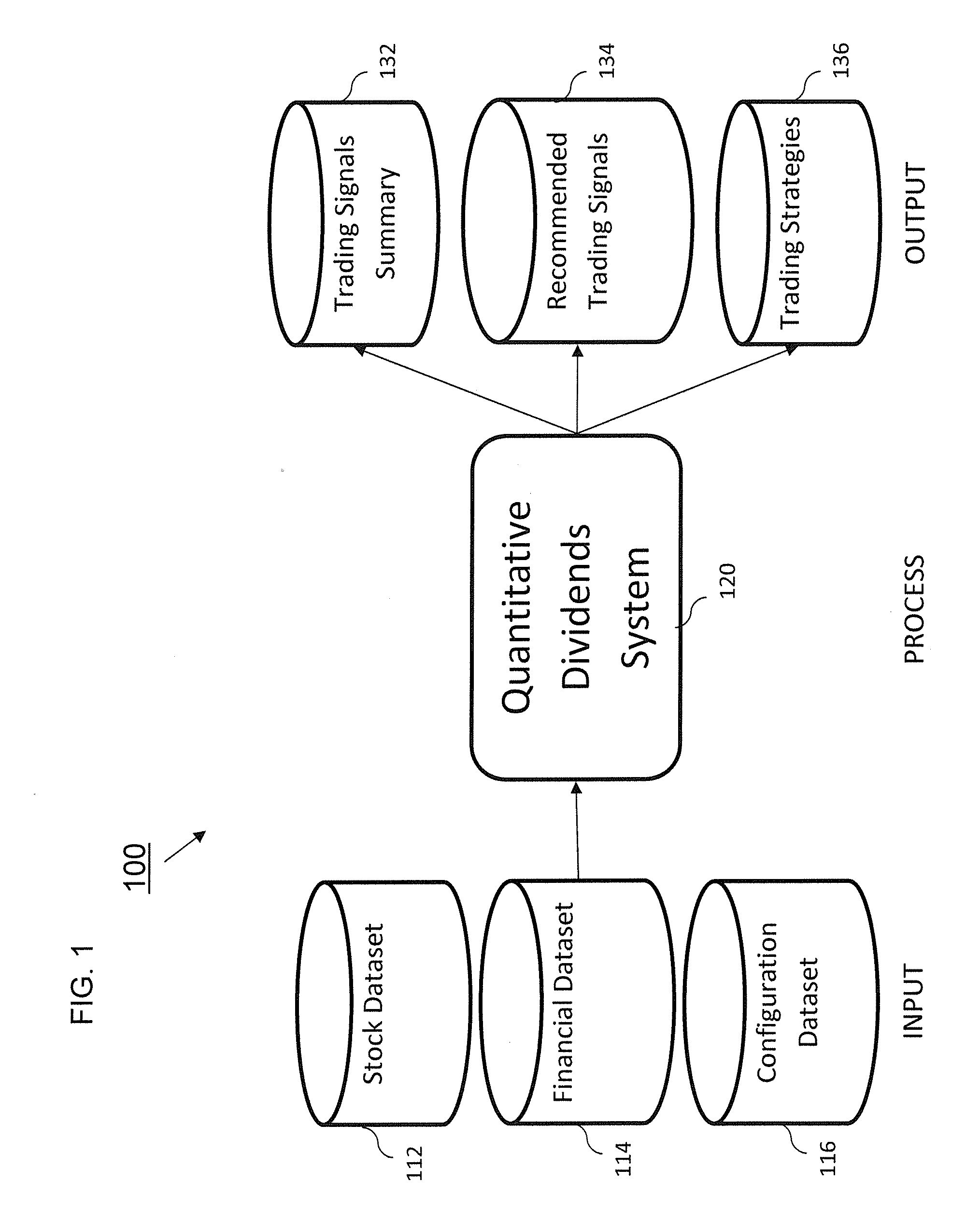

Quantative dividends method and system

A method of generating trading strategies, comprising the steps of: providing a system for generating trading strategies for dividend-based stocks, loading a first database containing basic information of stock and a second database containing financial information of stock into the system, computing maximum trading days of the stock, mapping of the first database and second database of the stock to a trading day and an alternative trading day, computing maximum number of trading pairs based on the maximum trading days of the stock, if trading long, computing historical returns for all trading pairs, computing buy / sell differences and actual trading dates and price of all trading pairs, if trading short, computing historical returns for all trading pairs, compute short / cover price differences and actual trading dates and price of all trading pairs, ranking a list of trading pairs based on one or more corresponding ranking criteria for trading long and trading short.

Owner:INVENTION CAPITAL

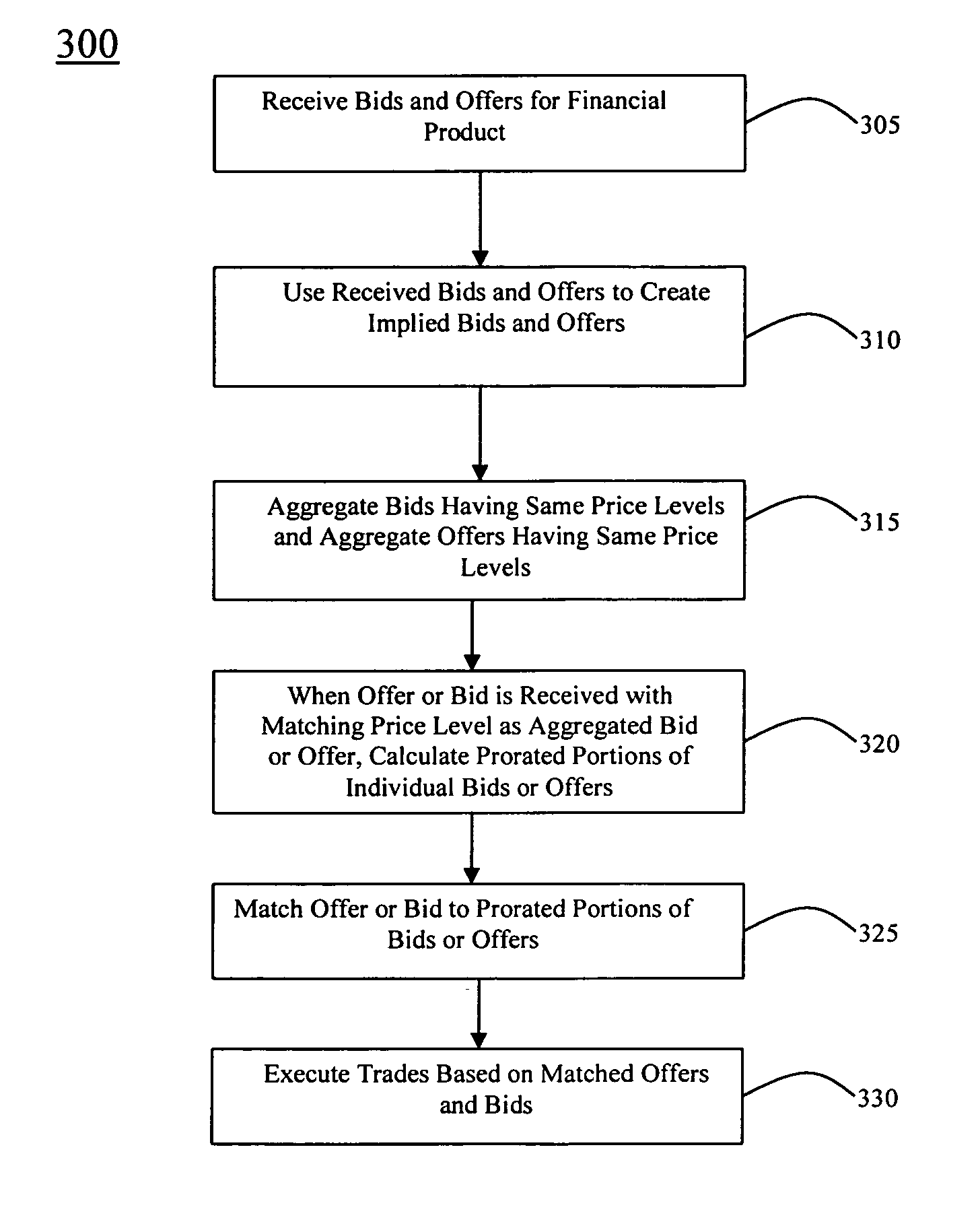

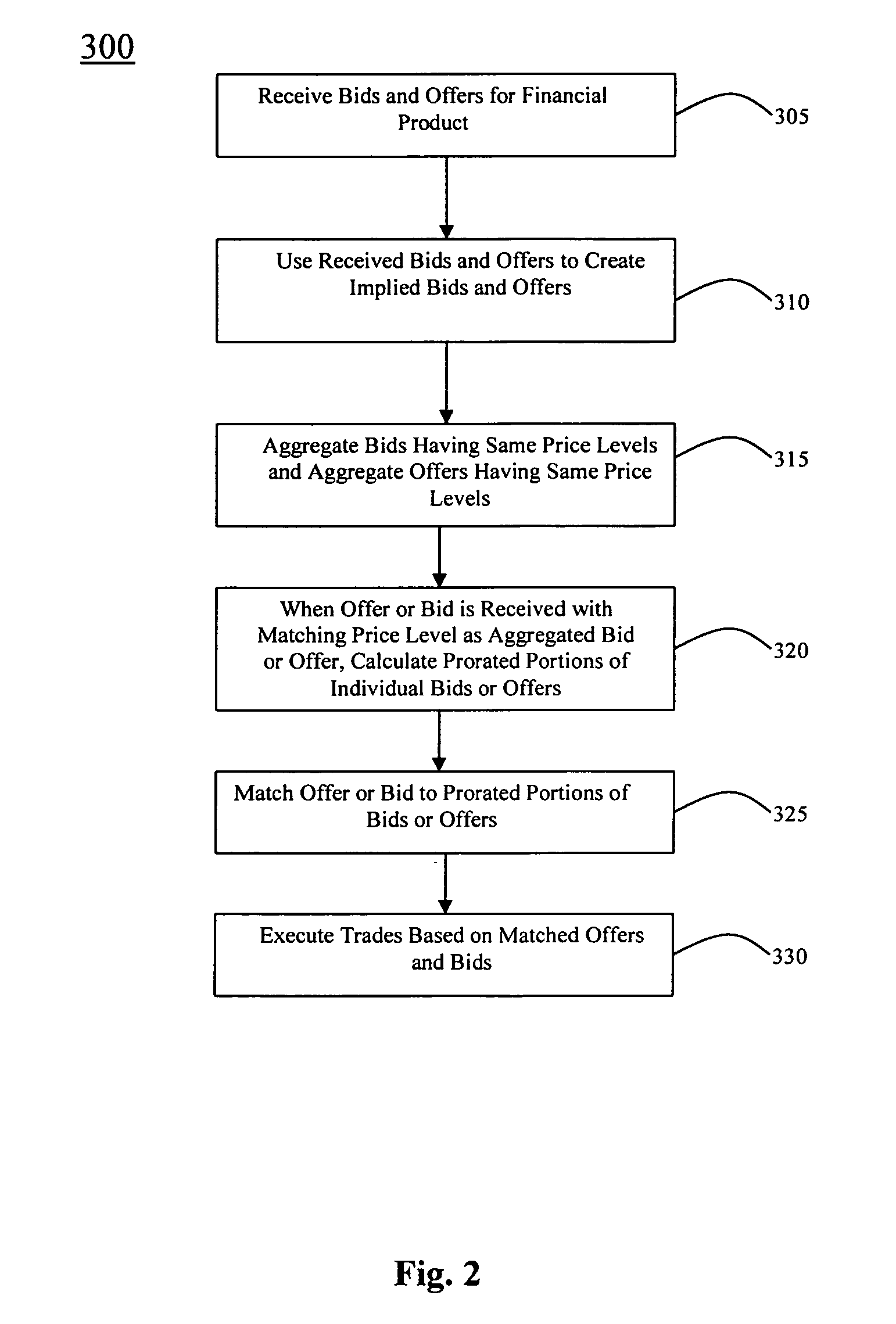

System and method for aggregation of implied bids and offers for short-term interest rate futures and options

A method and system for facilitating trading of financial products is provided. The method includes receiving bids and / or offers for a financial product and aggregating bids and offers that are at the same price level. For financial products that include calendar spreads, such as short-term interest rate futures or options, bids and / or offers may be implied in or implied out of other bids and offers by combining them appropriately. When an offer or bid having a matching price level to the aggregated bid or offer is received, the aggregated bid or offer is divided in a prorated proportion based on the number of lots in the matching offer or bid and based on the numbers of lots in the individual bids and offers that make up the aggregated bid or offer. Trades are then executed using the matching offers or bids and the corresponding prorated portions of the original bids or offers.

Owner:LIFFE ADMINISTRATION & MANAGEMENT

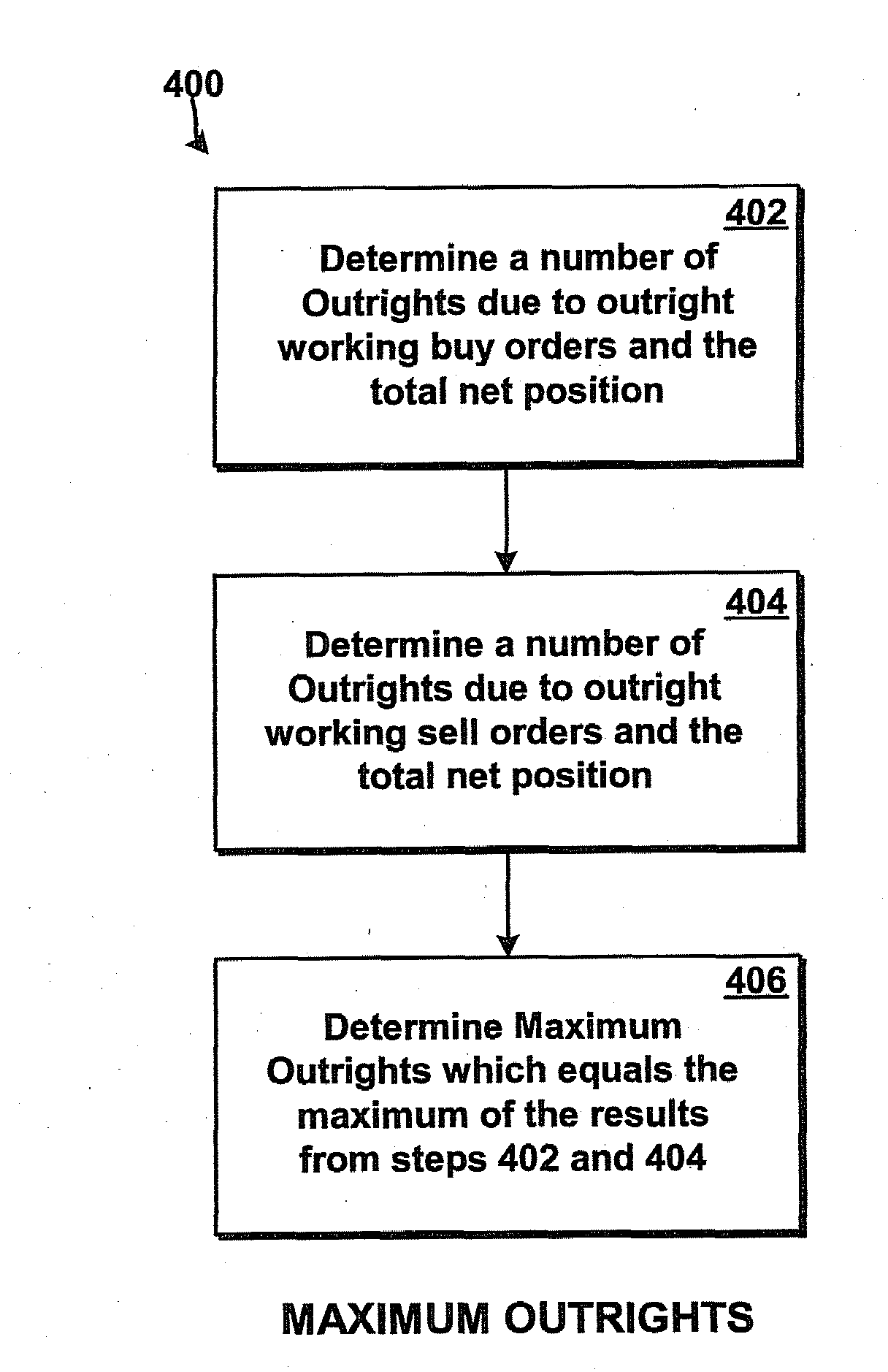

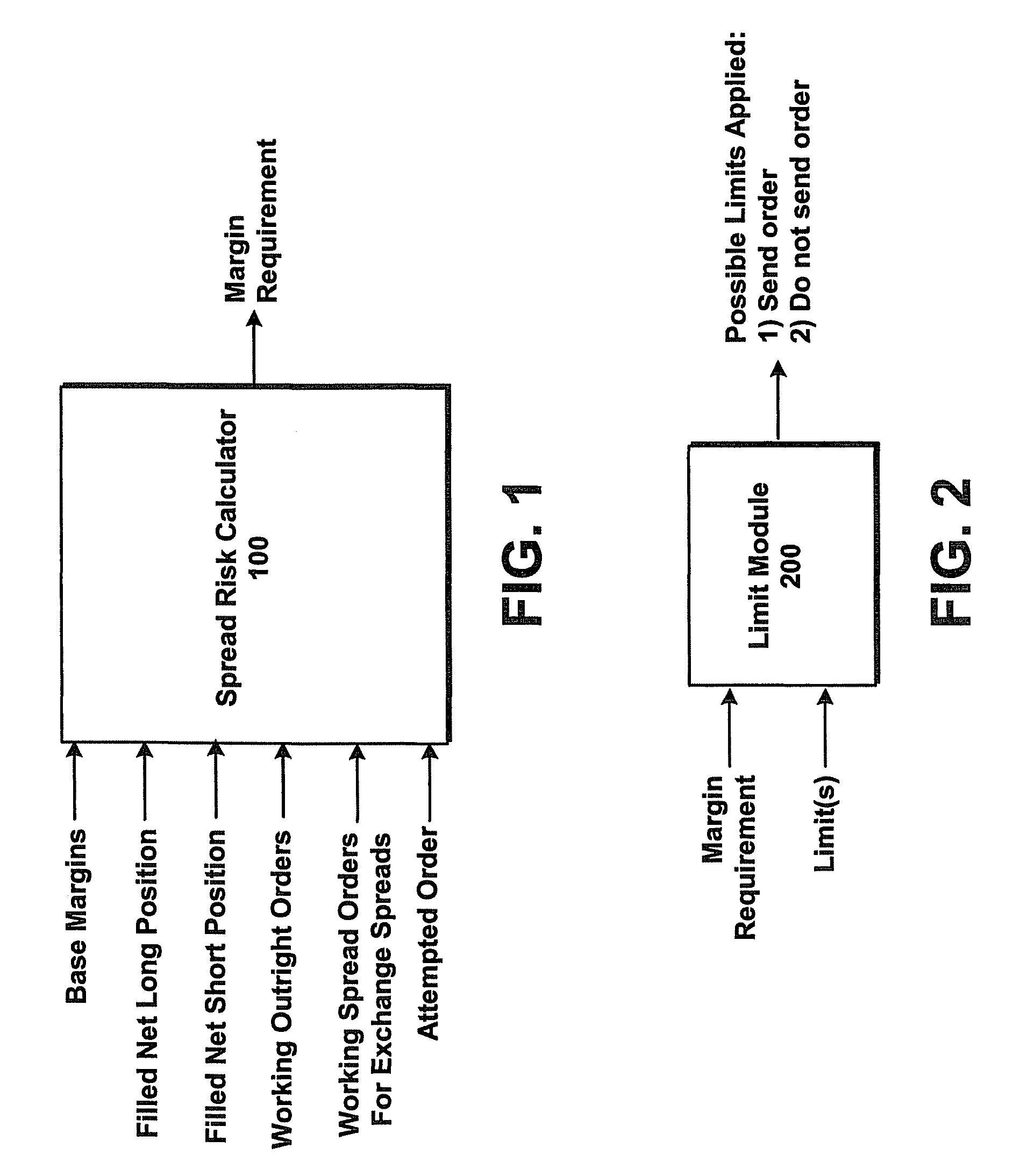

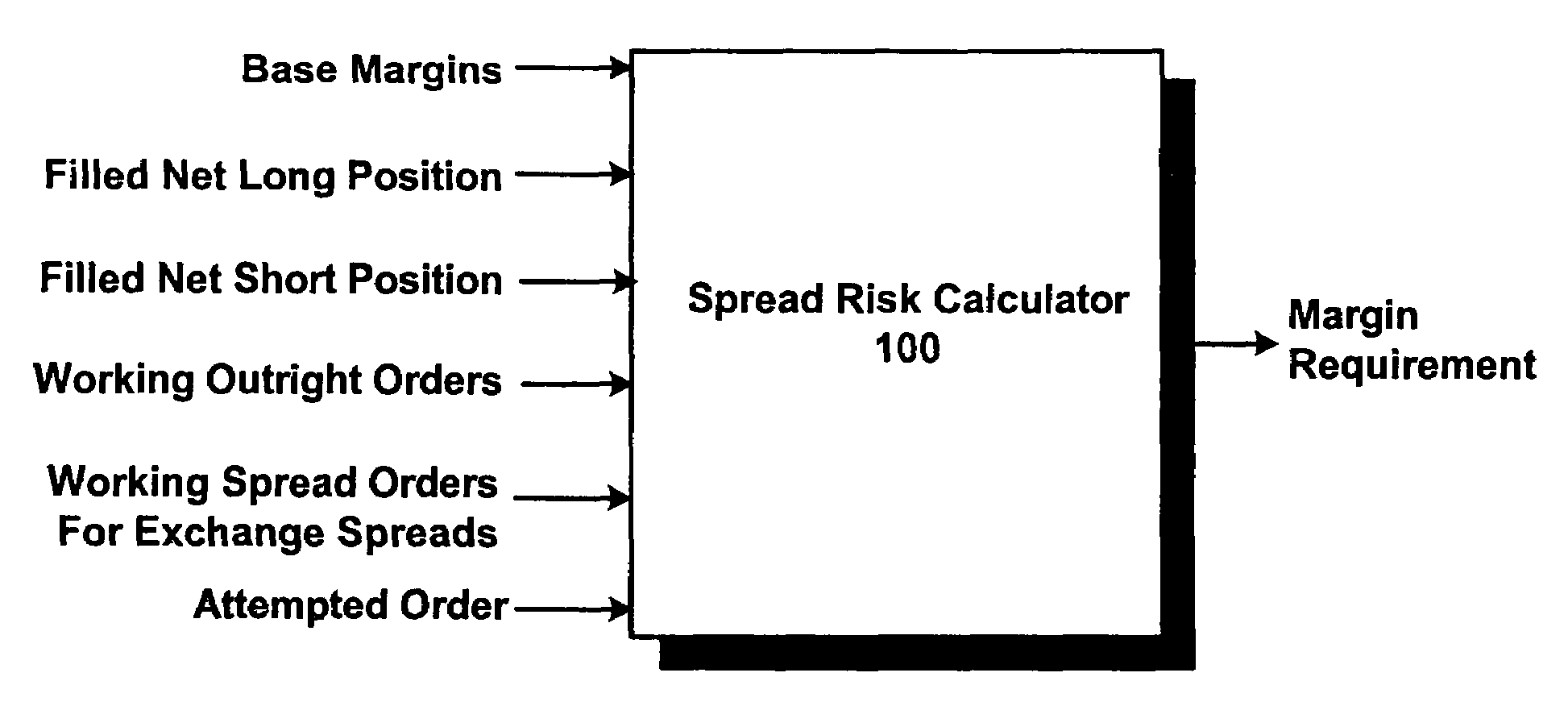

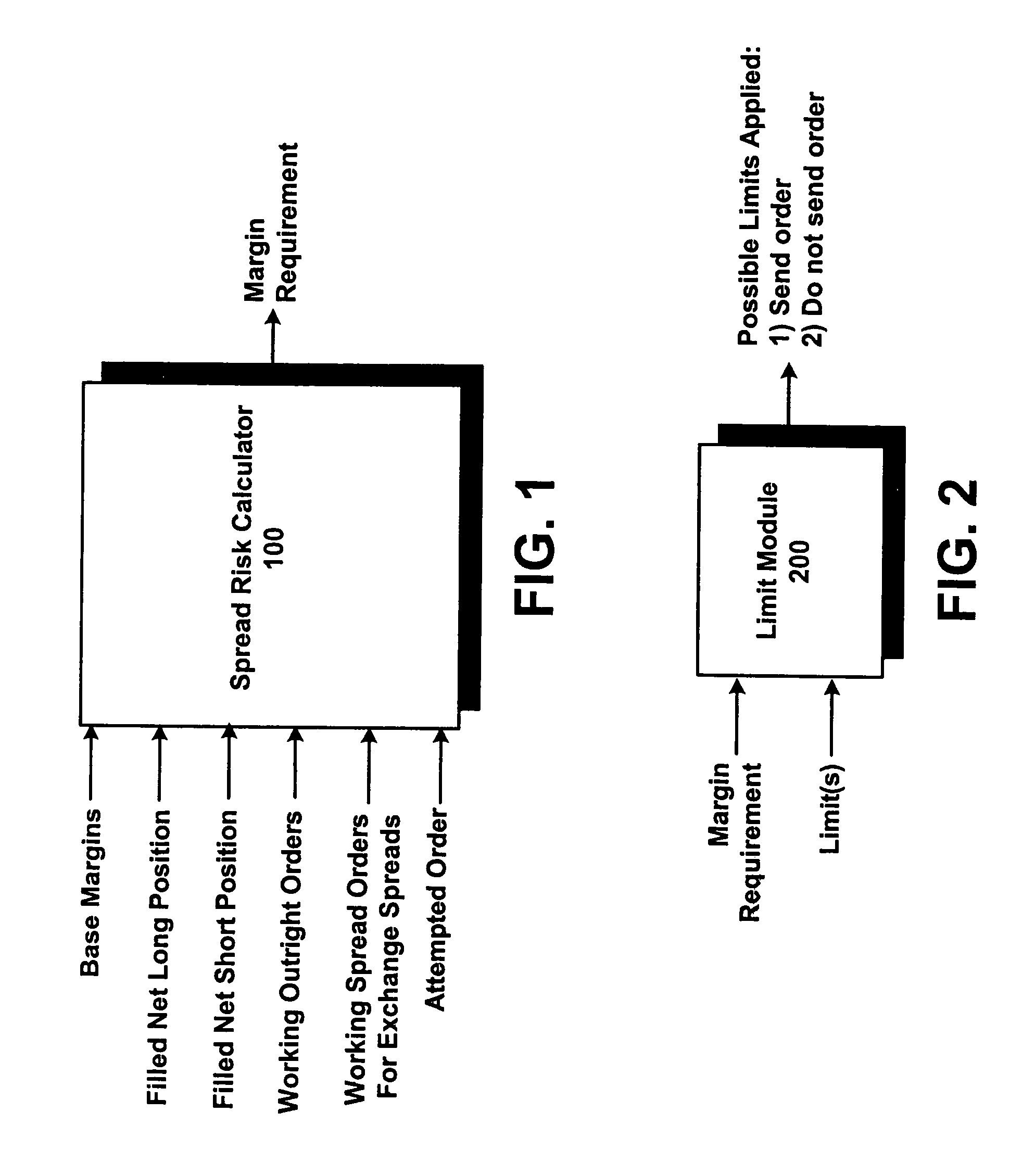

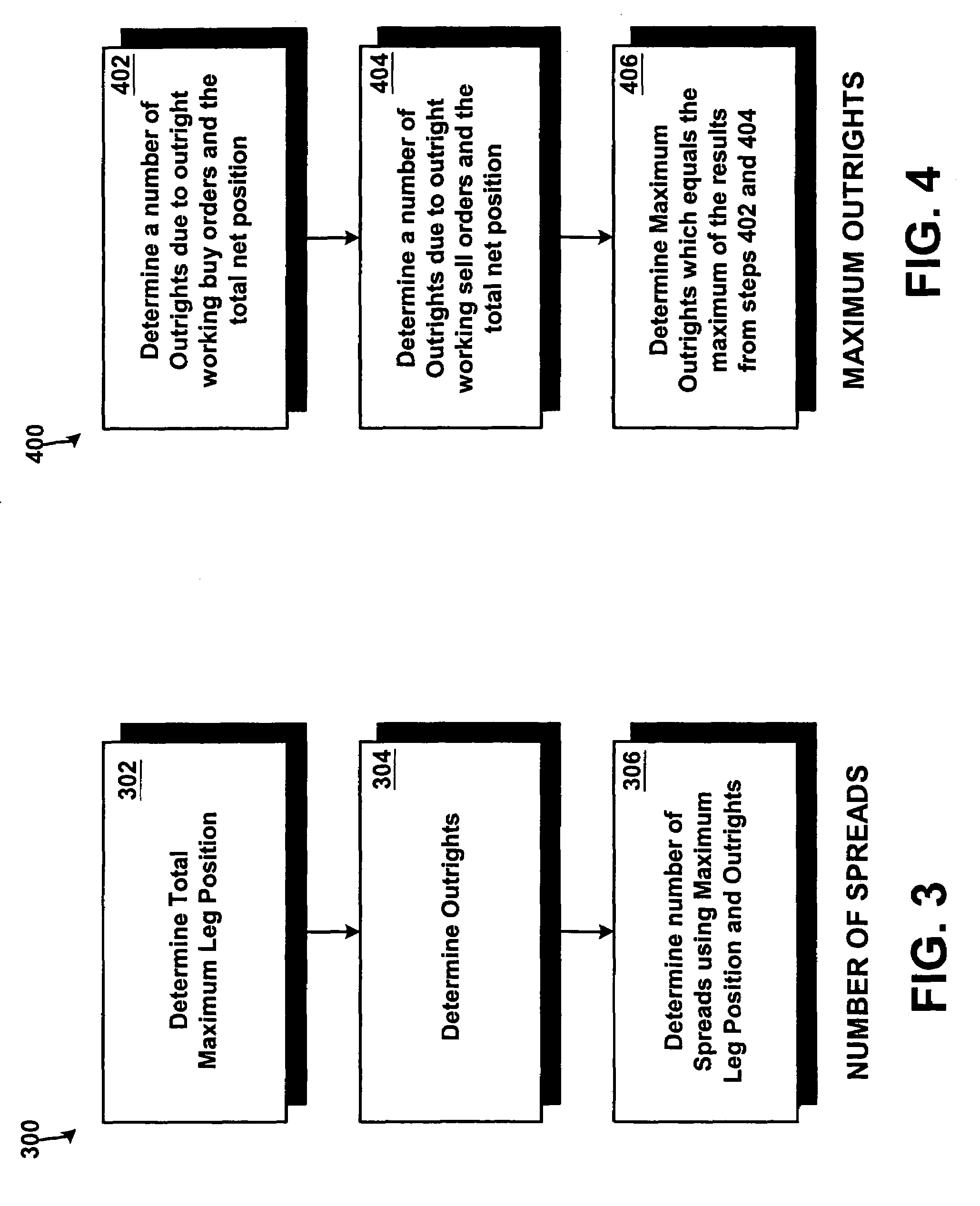

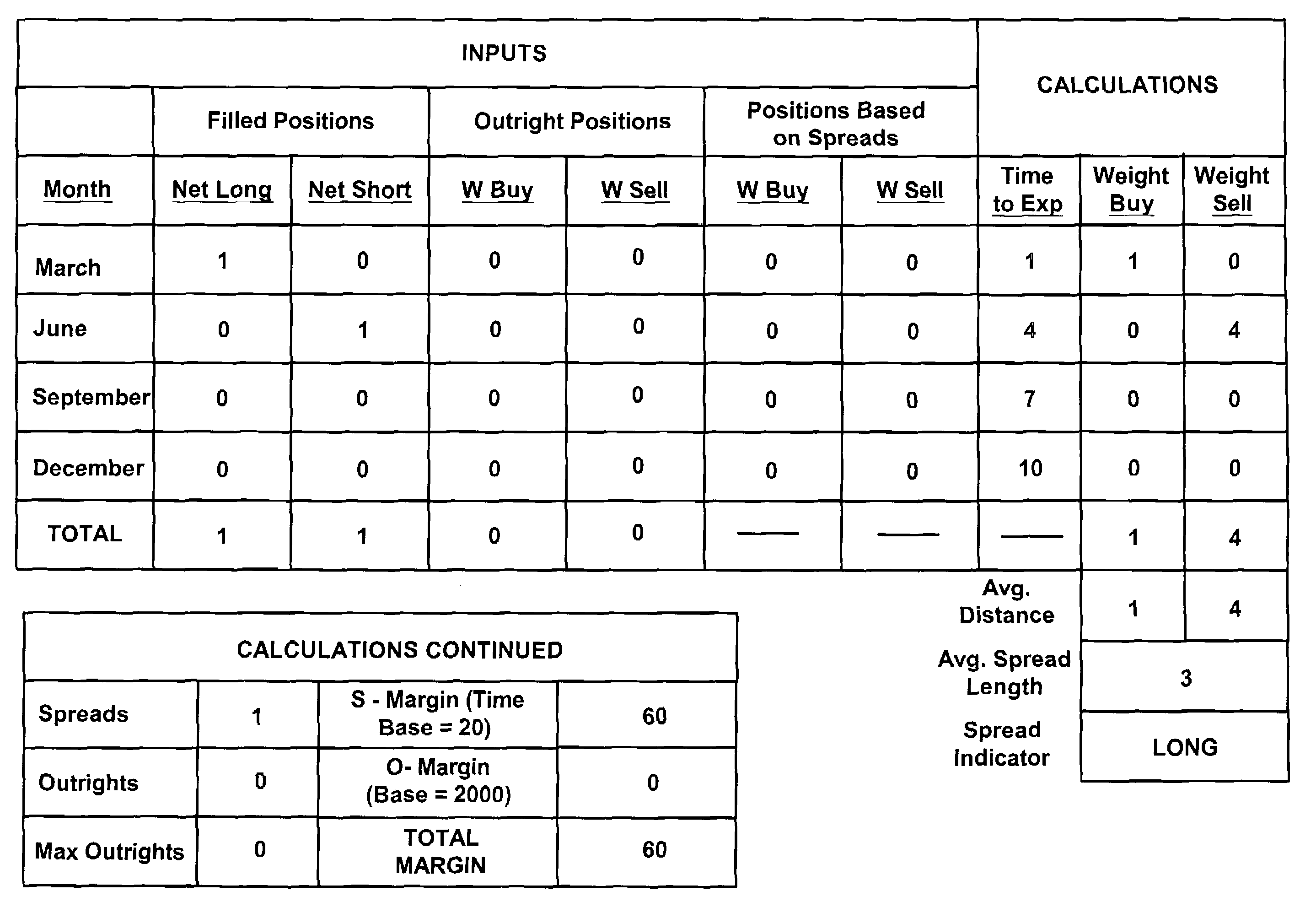

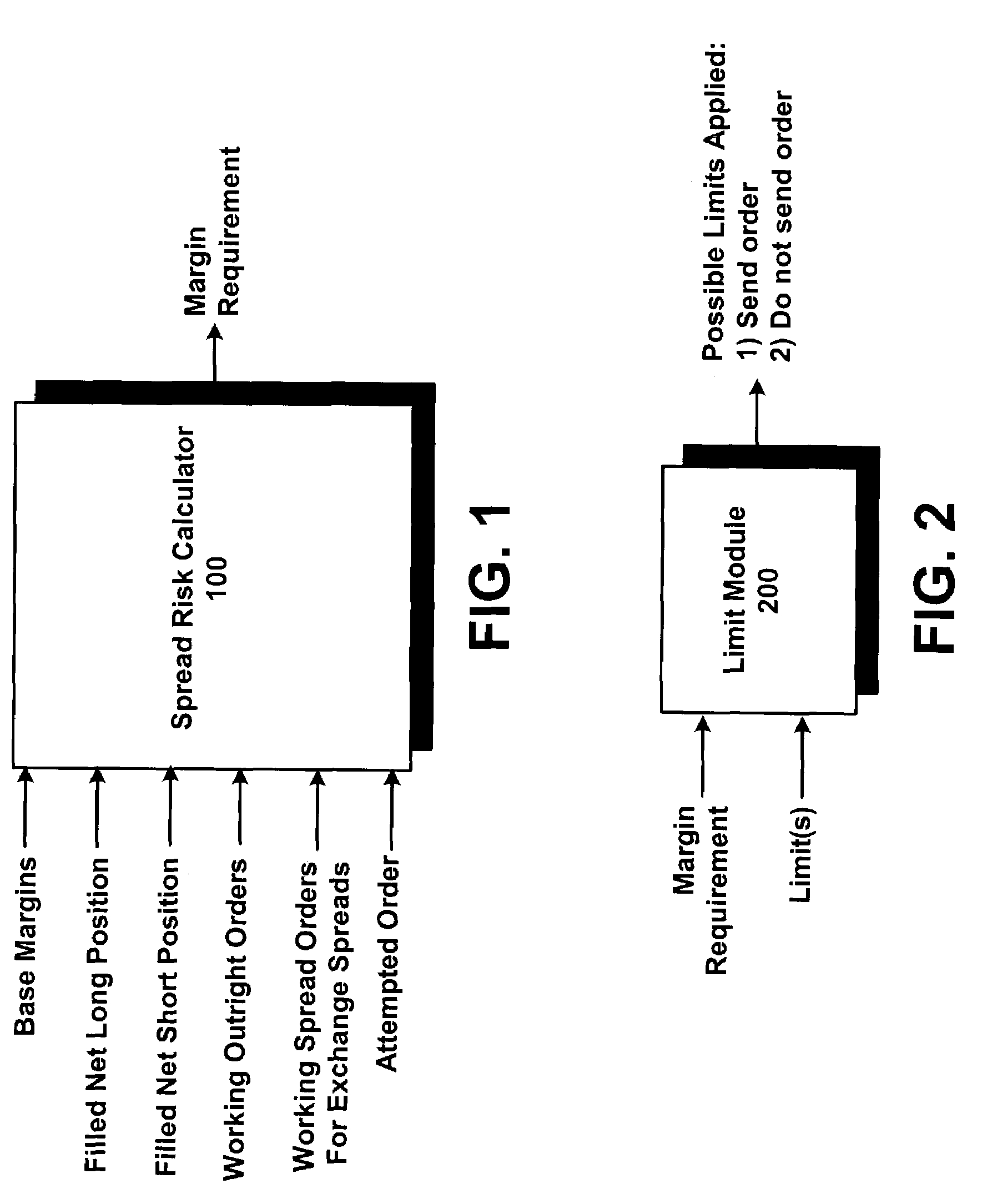

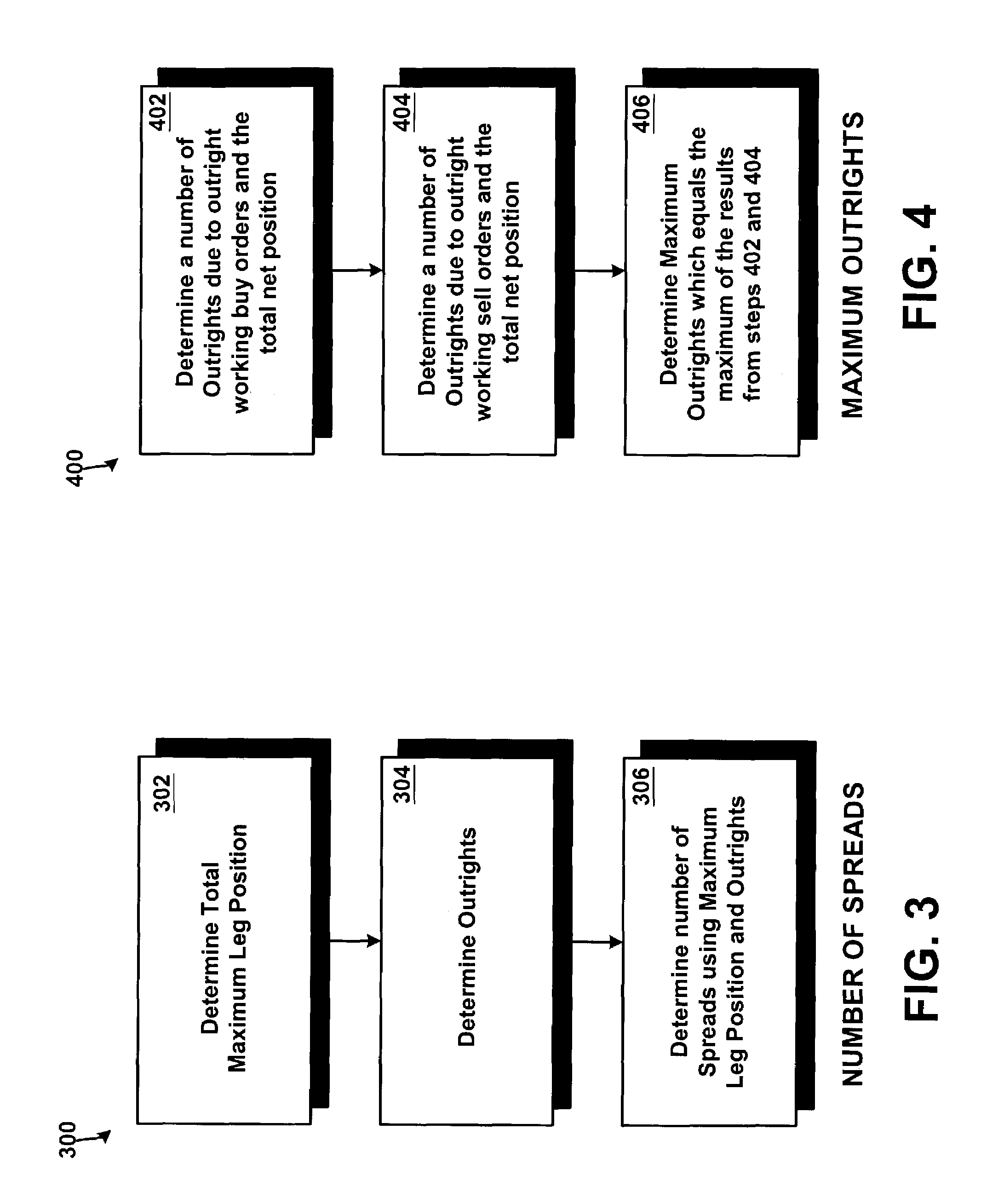

System and Method for Risk Management

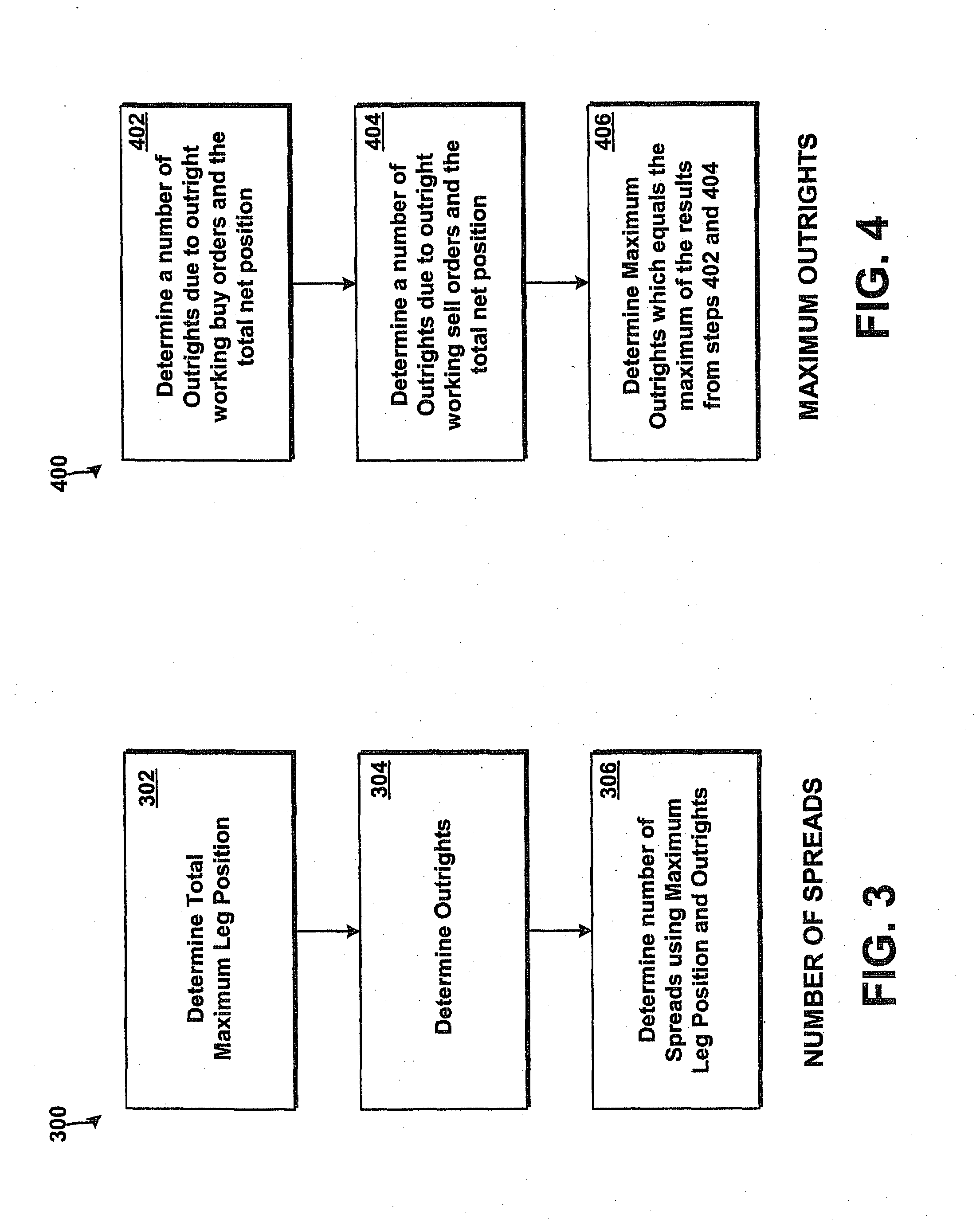

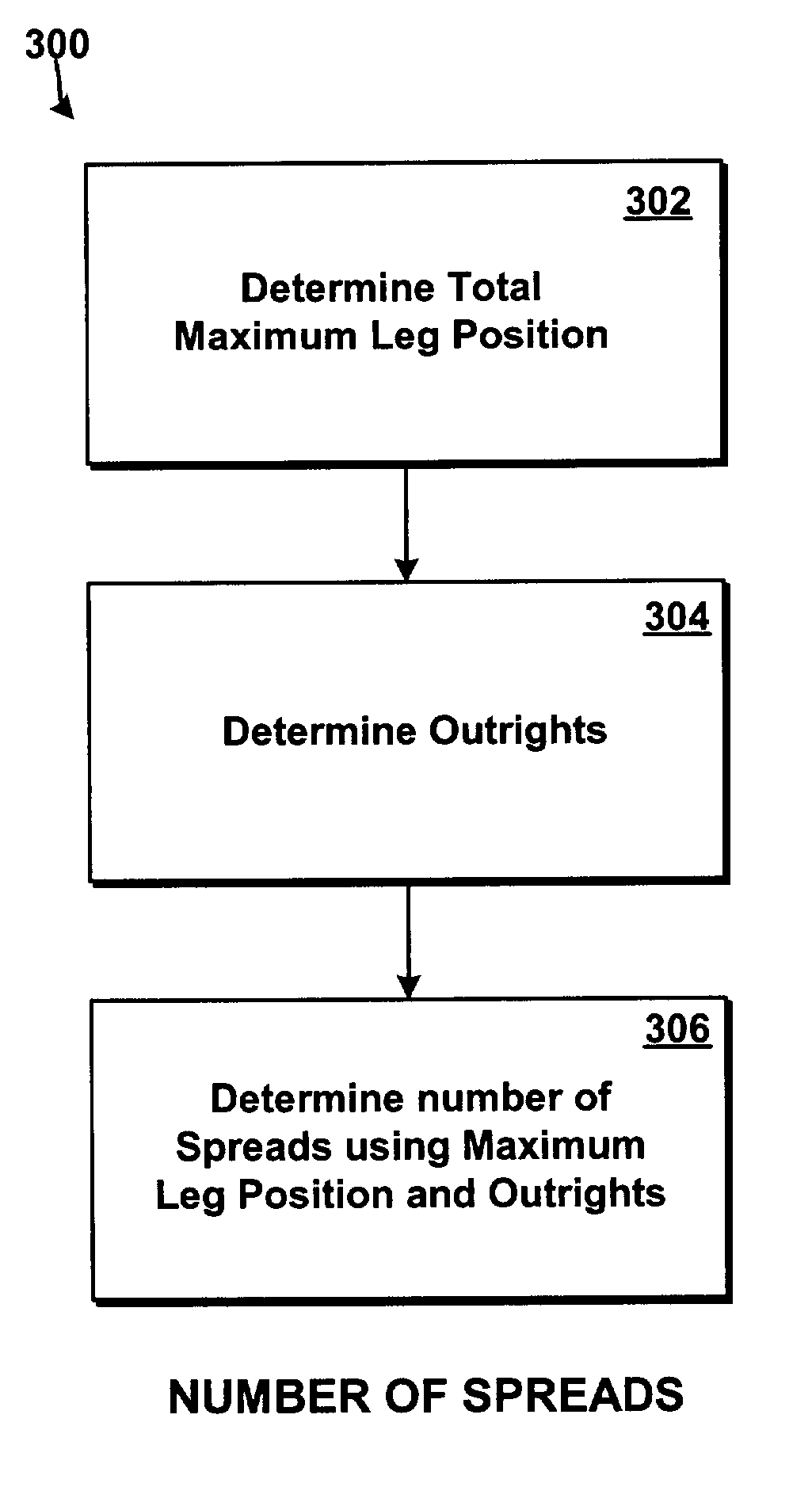

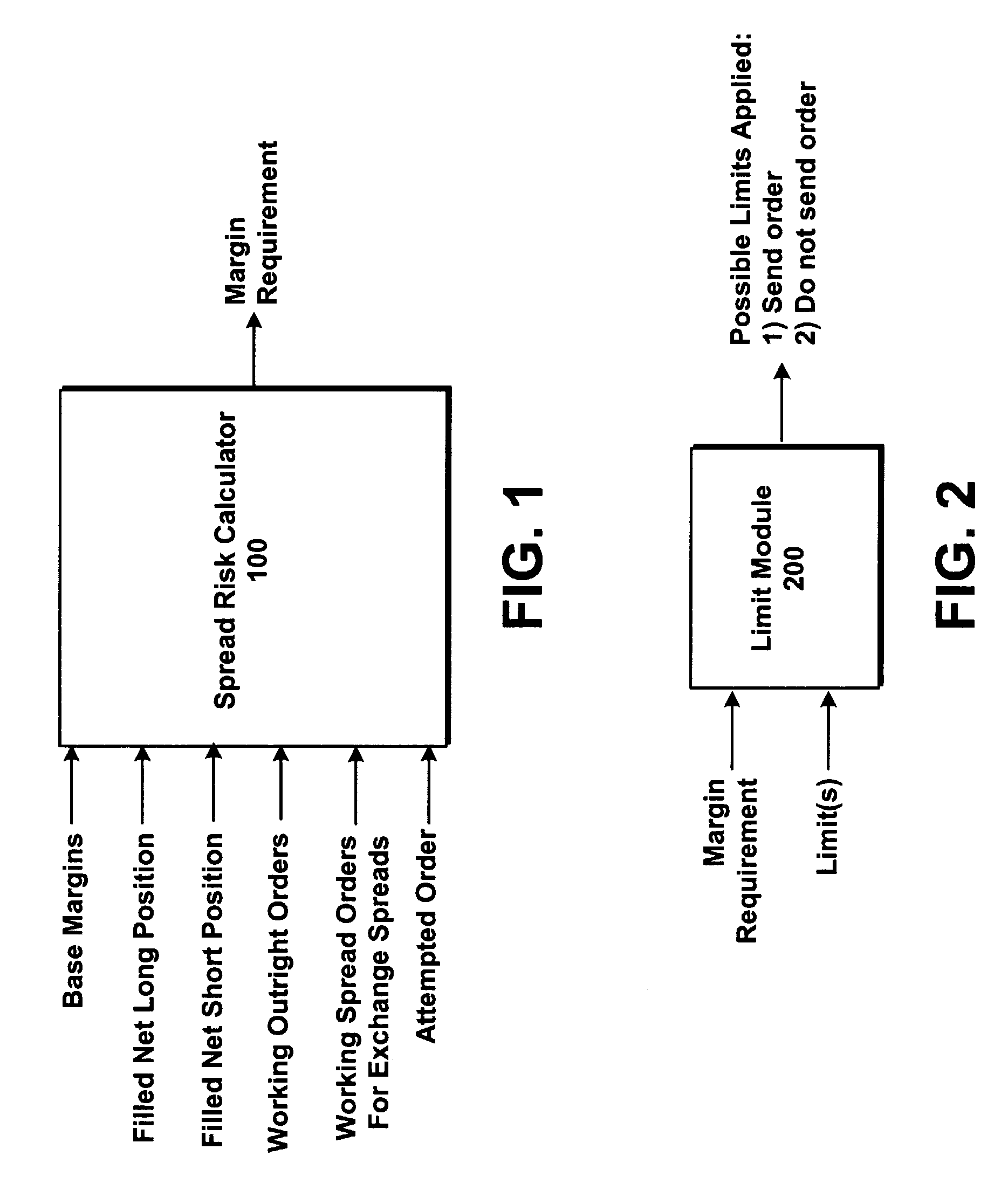

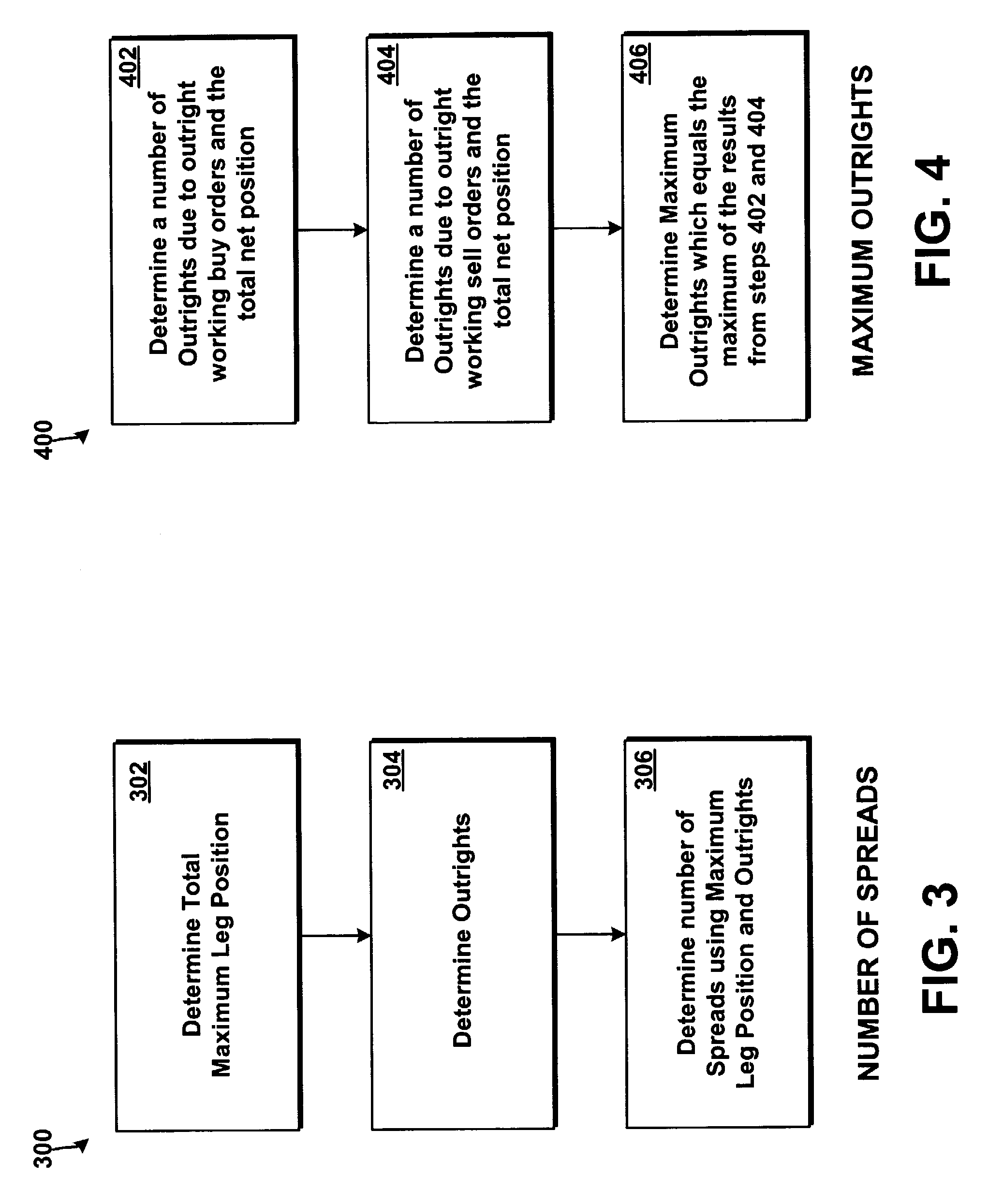

A margin requirement is computed while trading. The margin requirement may be calculated while trading because the preferred system takes into account working orders to generate the margin requirement. The on the fly possibility allows the preferred system to provide pre-trade risk calculations, but can also be used to provide post-trade calculations. A generic spread number and the maximum number of outright positions are determined. Using the spread positions and the maximum number of outright positions, a spread margin and an outright margin are calculated, which when summed provide a total margin requirement. Limits based in part on the total margin requirement may be imposed on one or more traders.

Owner:TRADING TECH INT INC

System and method for risk management

A margin requirement is computed while trading. The margin requirement may be calculated while trading because the preferred system takes into account working orders to generate the margin requirement. The on the fly possibility allows the preferred system to provide pre-trade risk calculations, but can also be used to provide post-trade calculations. A generic spread number and the maximum number of outright positions are determined. Using the spread positions and the maximum number of outright positions, a spread margin and an outright margin are calculated, which when summed provide a total margin requirement. Limits based in part on the total margin requirement may be imposed on one or more traders.

Owner:TRADING TECH INT INC

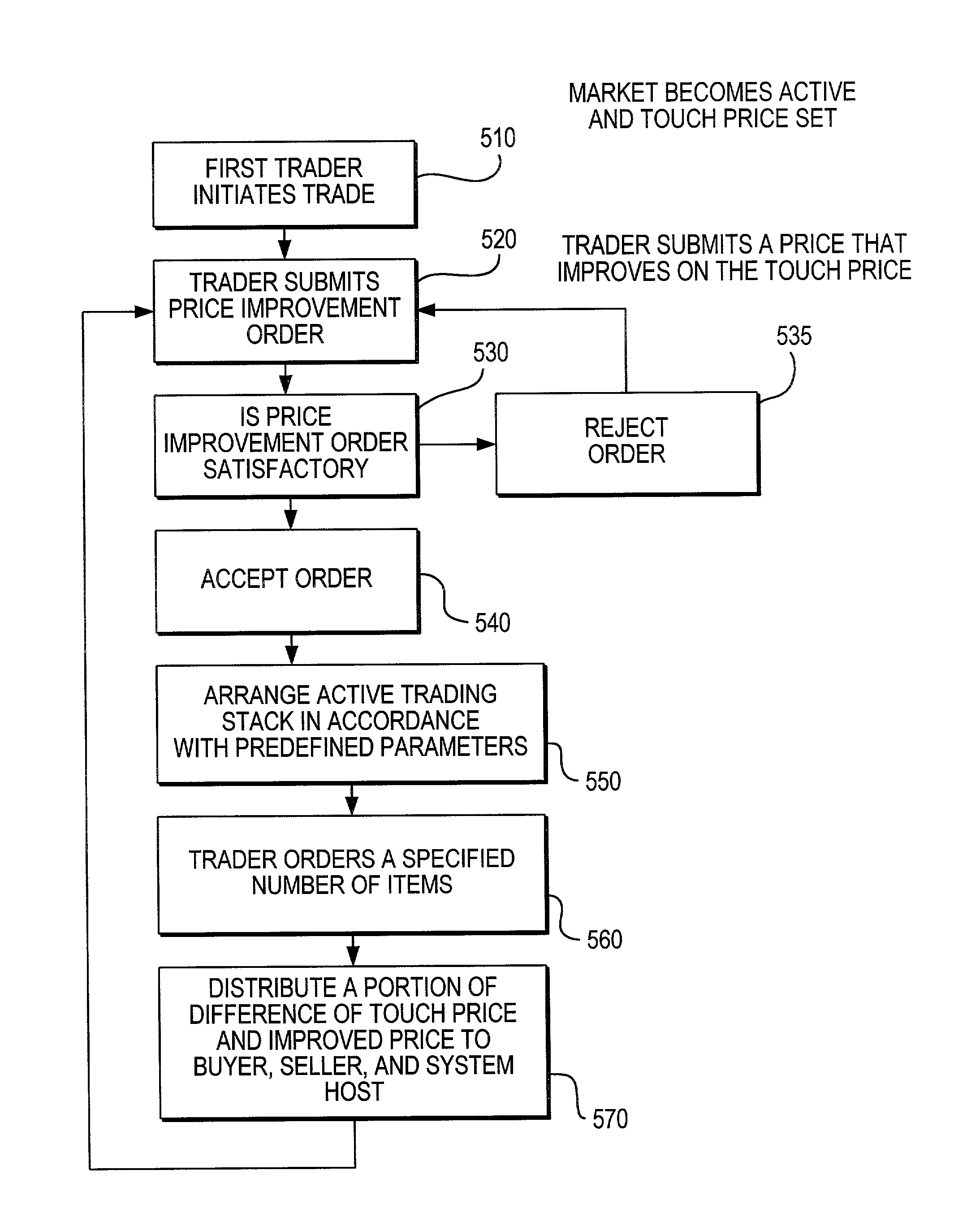

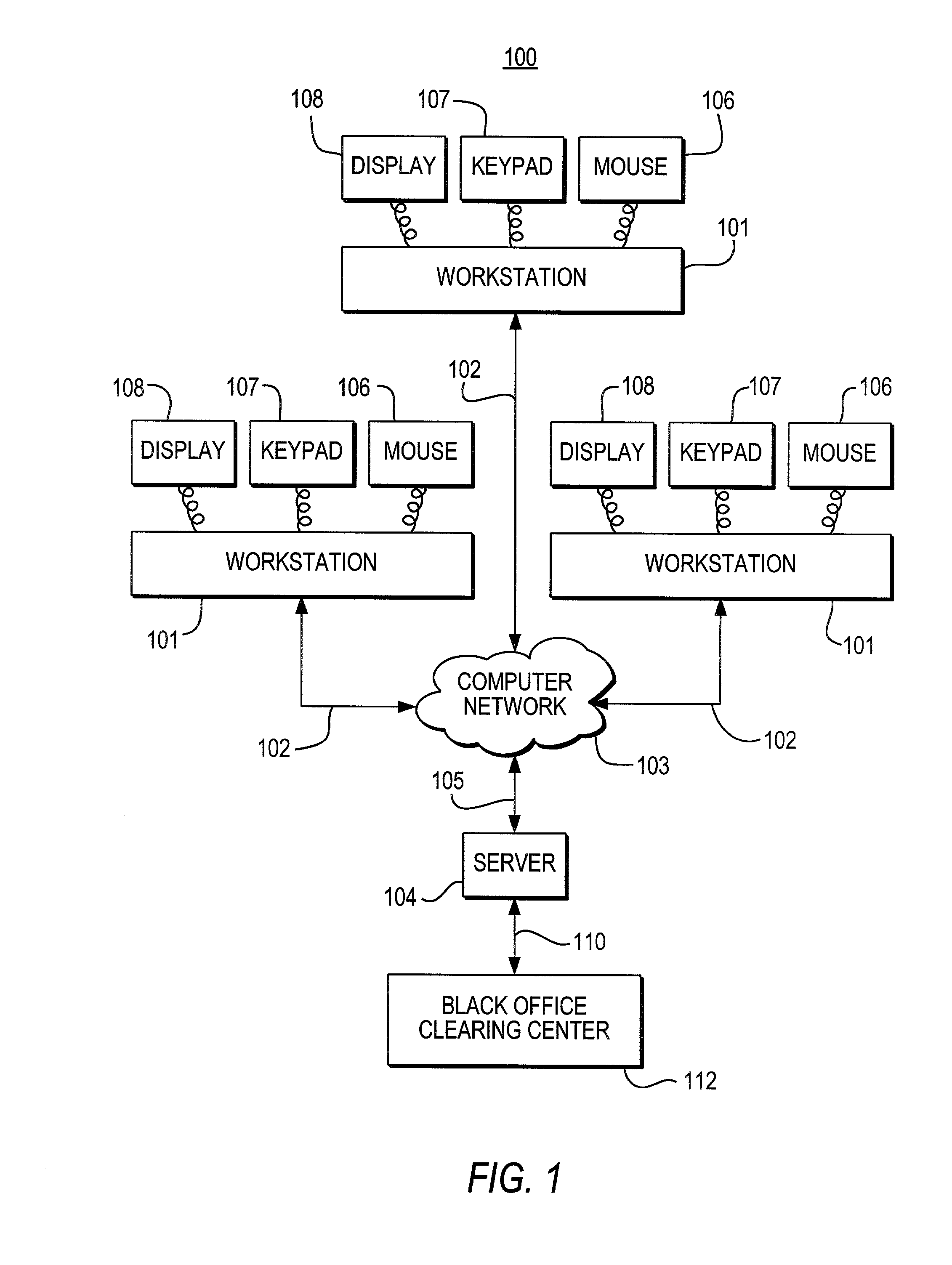

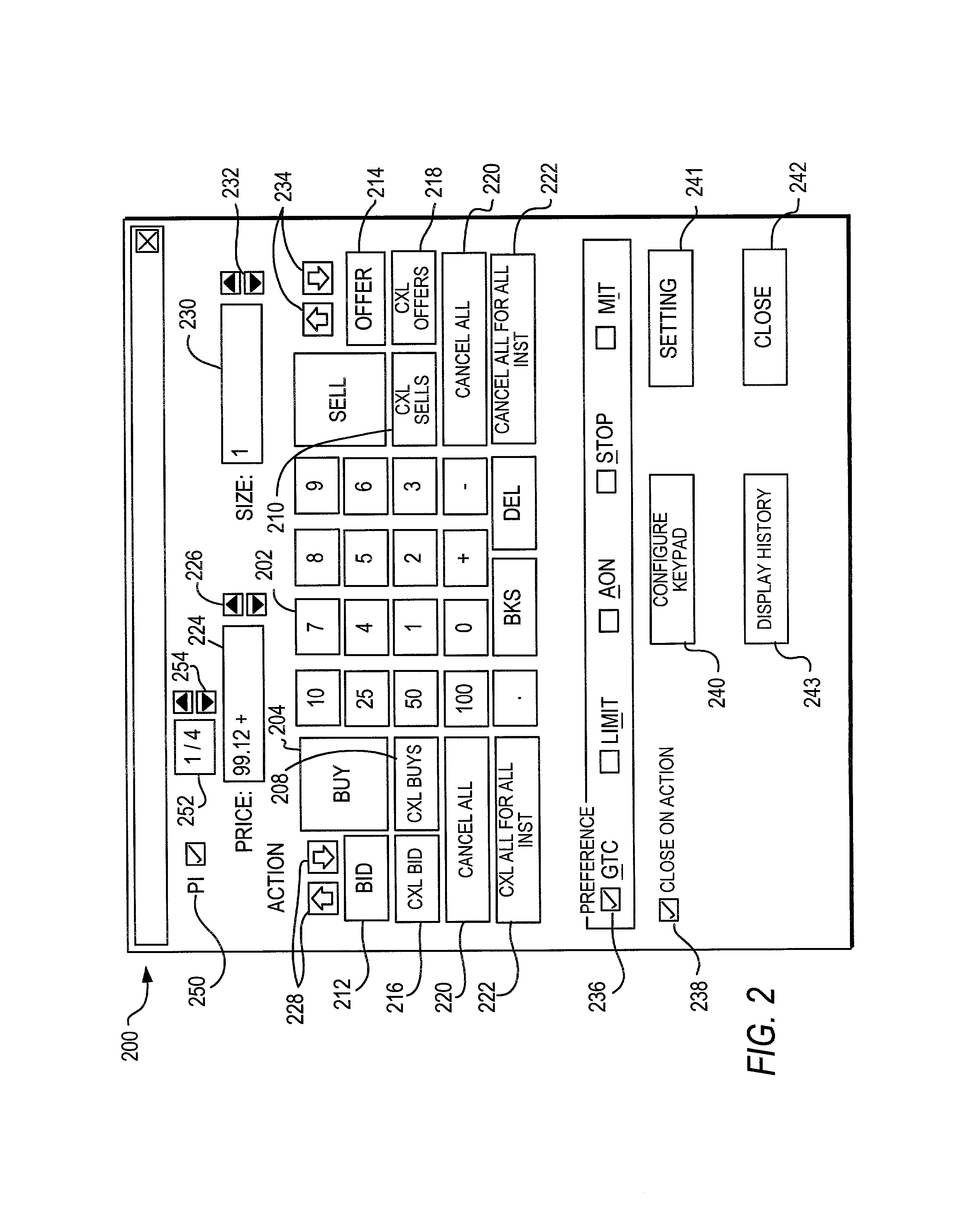

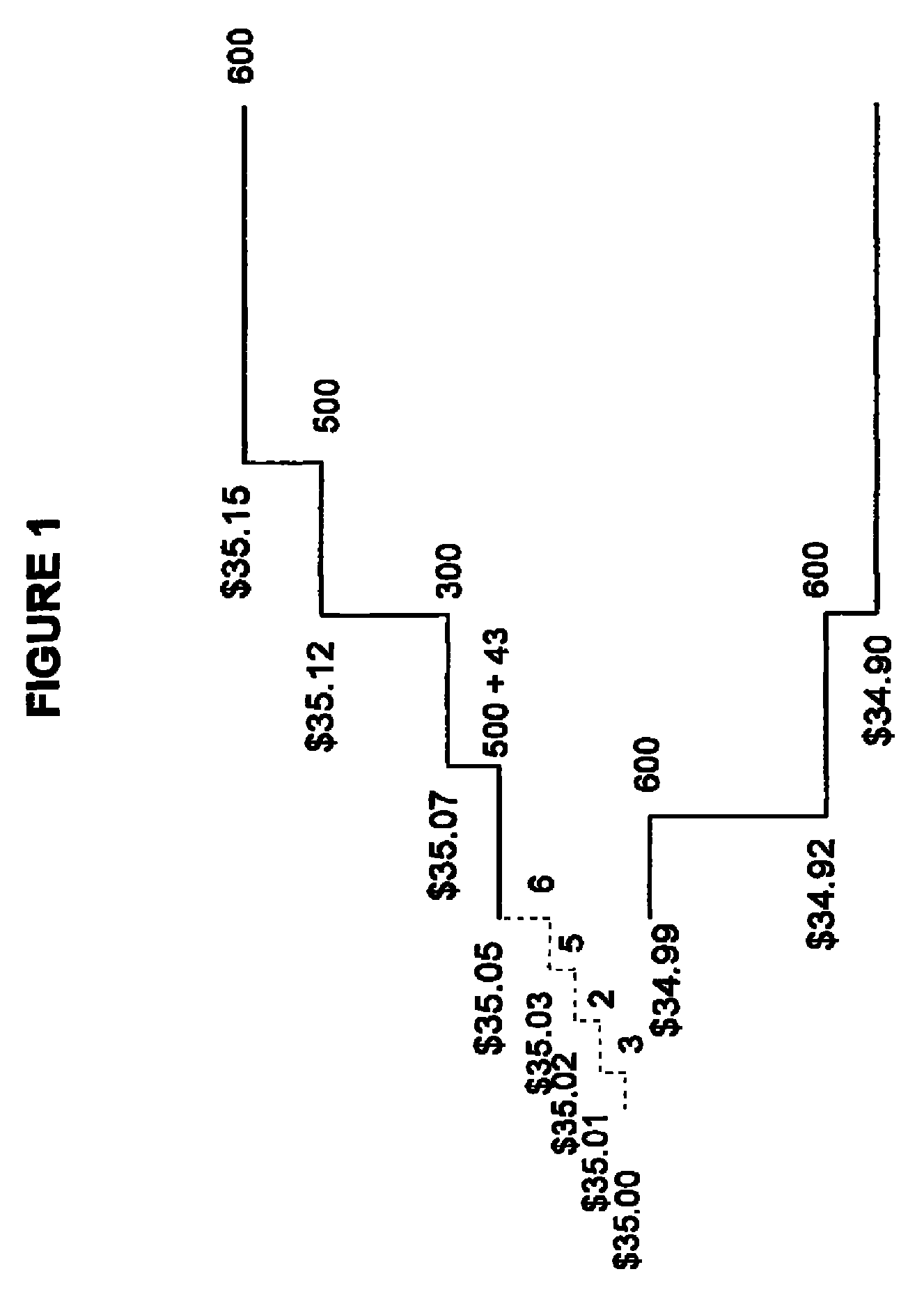

Systems and methods for providing price improvement in an active trading market

Systems and methods for providing traders an opportunity to improve prices for an item trading in an active market are provided. After a trader HITS or LIFTS a bid or offer, a market becomes active. When the market is active, traders can submit orders that improve on the price of the current market price of an item. Whenever a price improvement order is currently available for use in a transaction order, a price improvement indicator is displayed to indicate to other traders that price improvement is occurring. When a price improvement order is used to fill a transaction order, a portion of the difference between the market price and the price improvement price may be divided between the trader associated with the price improvement order, the trader associated with the transaction order, and the system host.

Owner:BGC PARTNERS LP

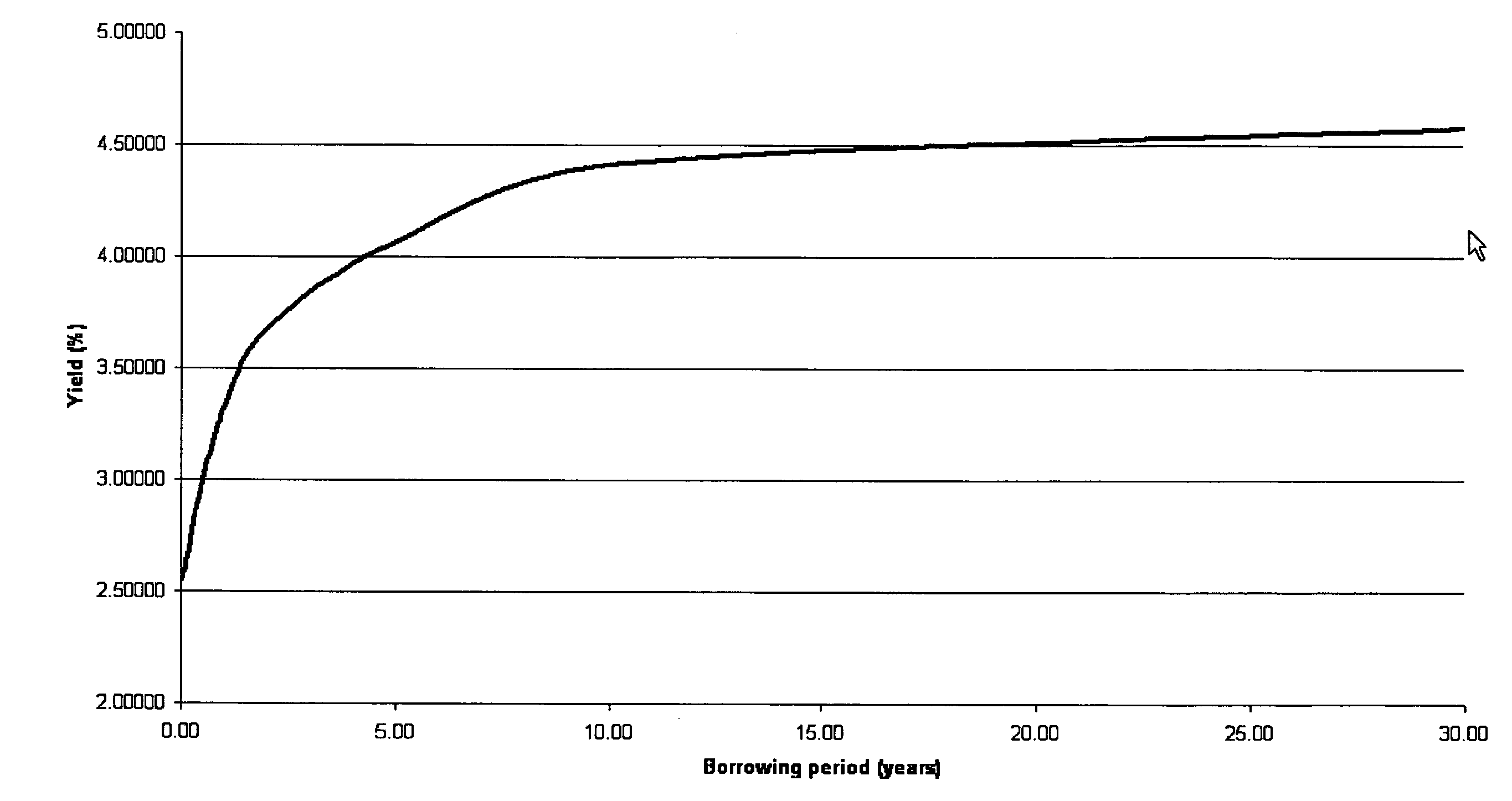

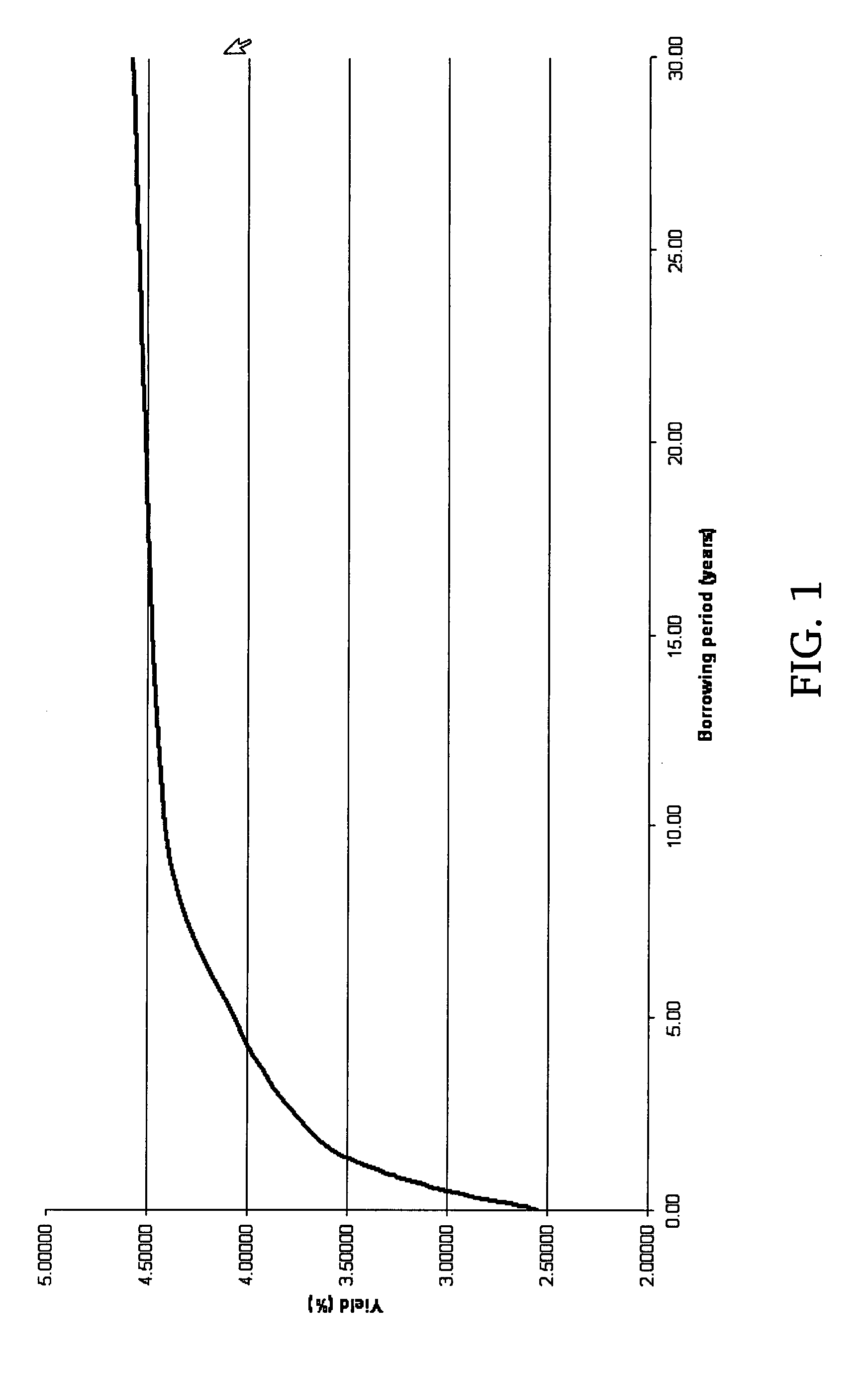

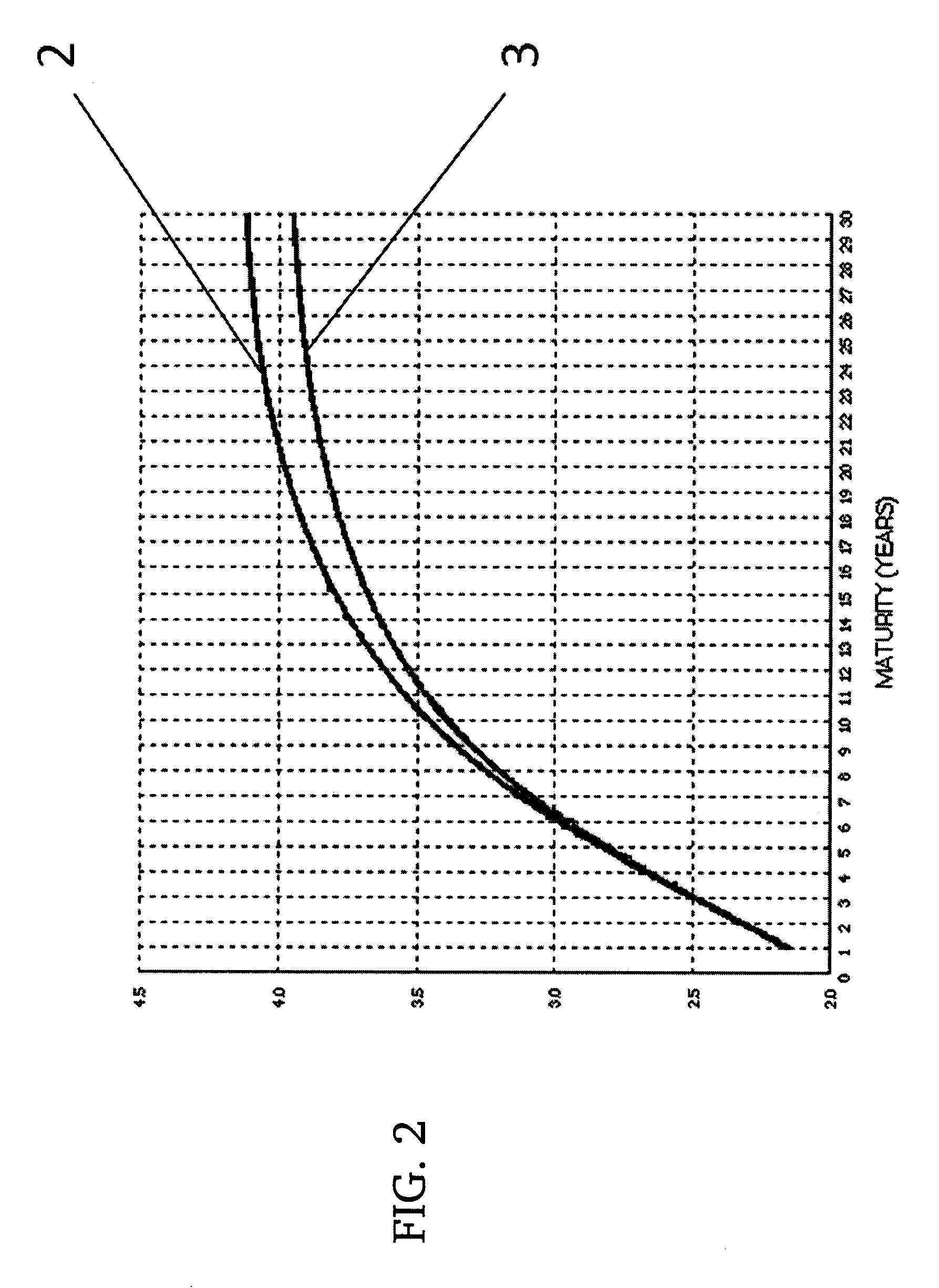

Interest rate swap index

A set of indices is provided which allows accurate tracking of interest rate swap (IRS) markets. The indices are calculated using market data and synthetic purchasing and selling of synthetic interest rate swaps utilizing the present market data. The value of the synthetic interest rate swaps are the basis for the value of a particular index. The purchasing and selling of the synthetic interest rate swap occurs at a frequency to minimize effects of shortening terms on the index. One subset of the IRS indices reflects a plain-vanilla swap for a specific term of years. Another subset of the IRS indices reflects a spread between two specific terms of years. A third subset of the IRS indices reflect two spreads, sometimes referred to as a butterfly, between a middle term of years and a shorter term of years and the same middle term of years and a longer term of years.

Owner:PIPELINE CAPITAL

System and method for risk management

A margin requirement is computed while trading. The margin requirement may be calculated while trading because the preferred system takes into account working orders to generate the margin requirement. The on the fly possibility allows the preferred system to provide pre-trade risk calculations, but can also be used to provide post-trade calculations. A generic spread number and the maximum number of outright positions are determined. Using the spread positions and the maximum number of outright positions, a spread margin and an outright margin are calculated, which when summed provide a total margin requirement. Limits based in part on the total margin requirement may be imposed on one or more traders.

Owner:TRADING TECH INT INC

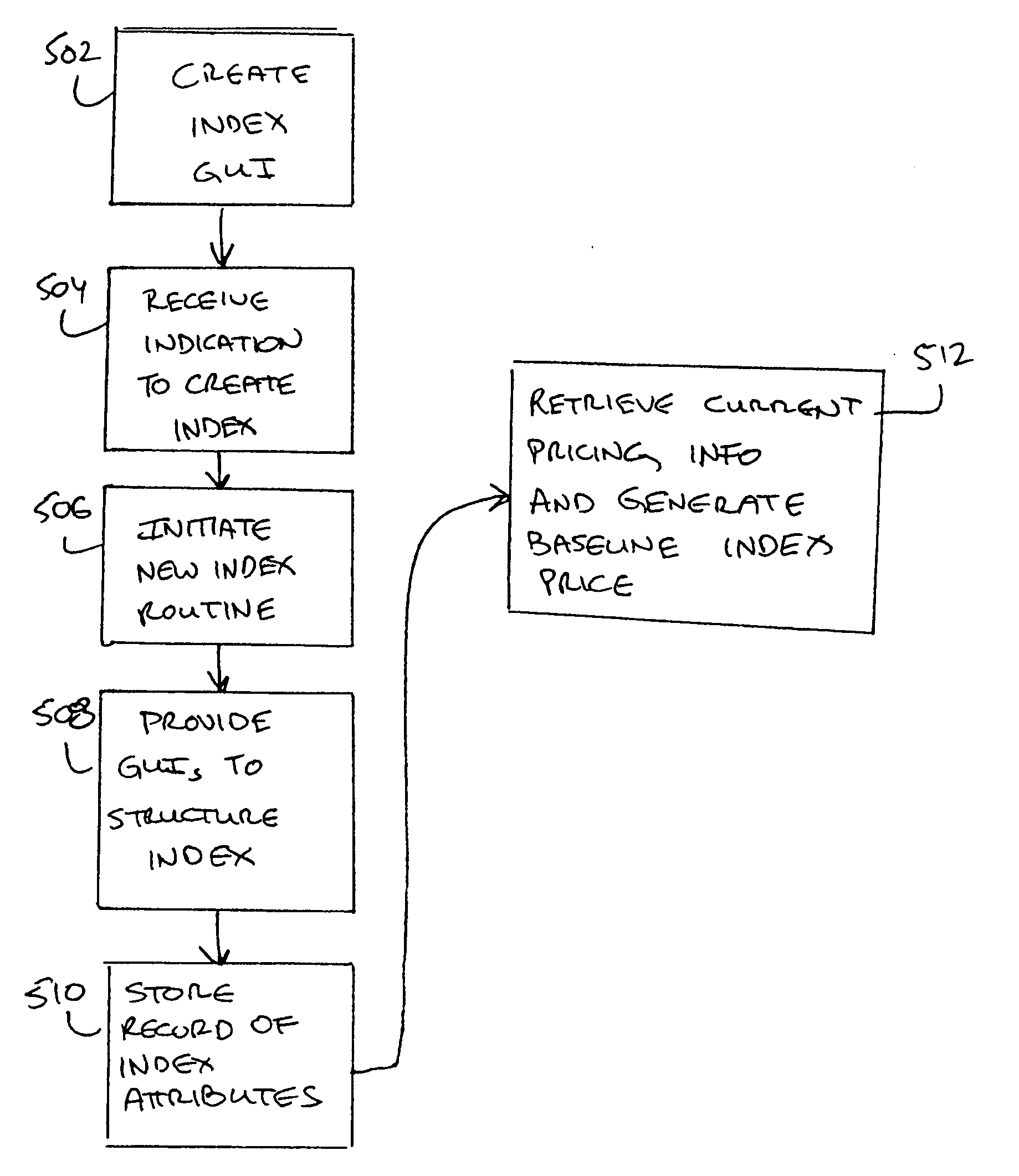

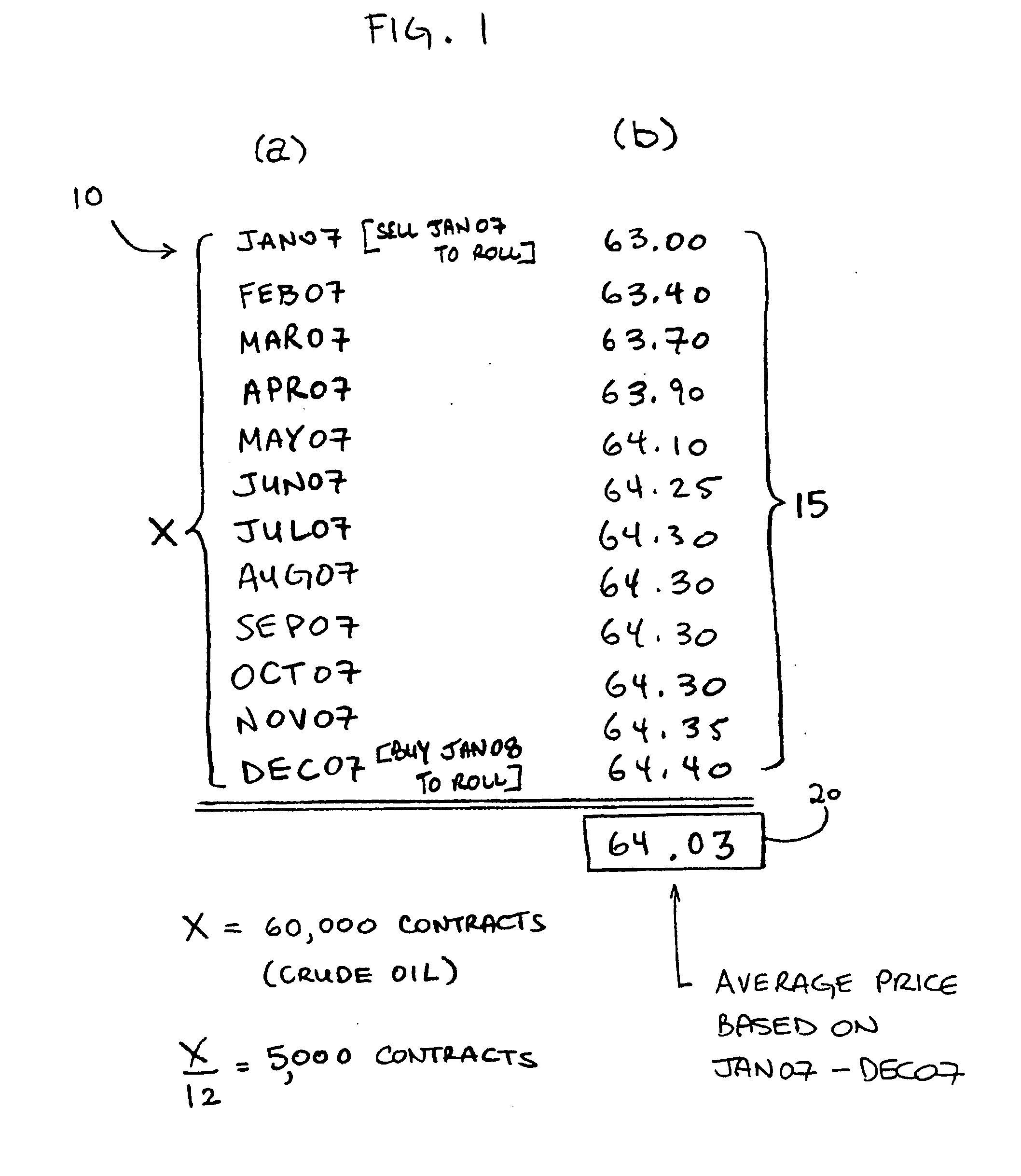

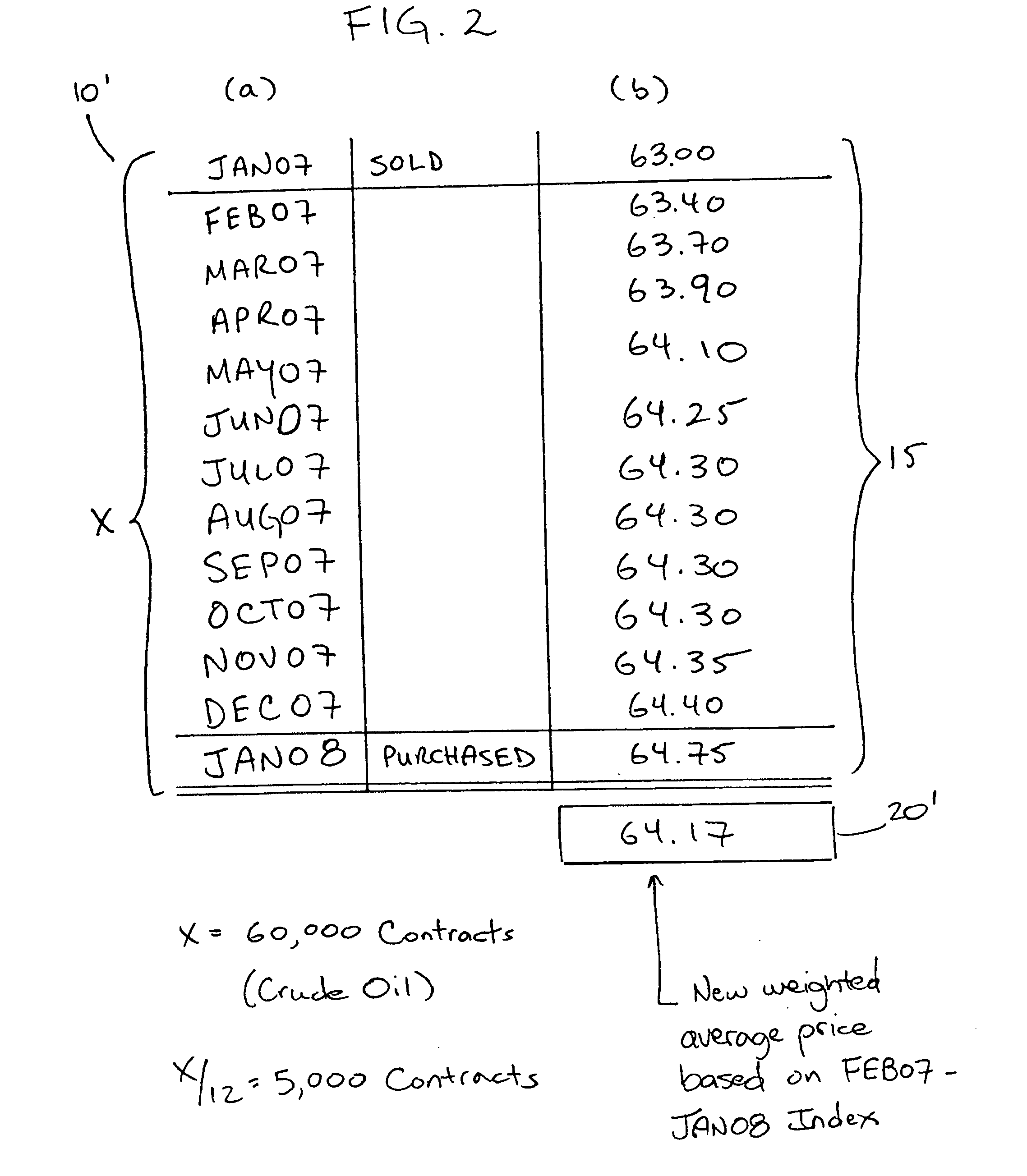

Index and financial product and method and system for managing said index and financial product

An index generally includes two index components. A first index component tracks a basket of futures contracts including at least two or more sets of futures contracts with different delivery months spread over a selected time period. The basket of futures contracts being rolled as certain futures contracts in the basket approach expiration. A second index component tracks a roll differential that indexes to a starting value periodically adjusted by a differential substantially equal in value to a delta between a first value of the futures contracts in the basket approaching expiration and a second value of futures contracts being rolled into a delivery period subsequent to the ending delivery period of the selected time period. The index is priced at least in part based on index values of the basket of futures contracts and the roll differential. Various financial instruments may be created to track the price of the index.

Owner:MBF INDEX HLDG

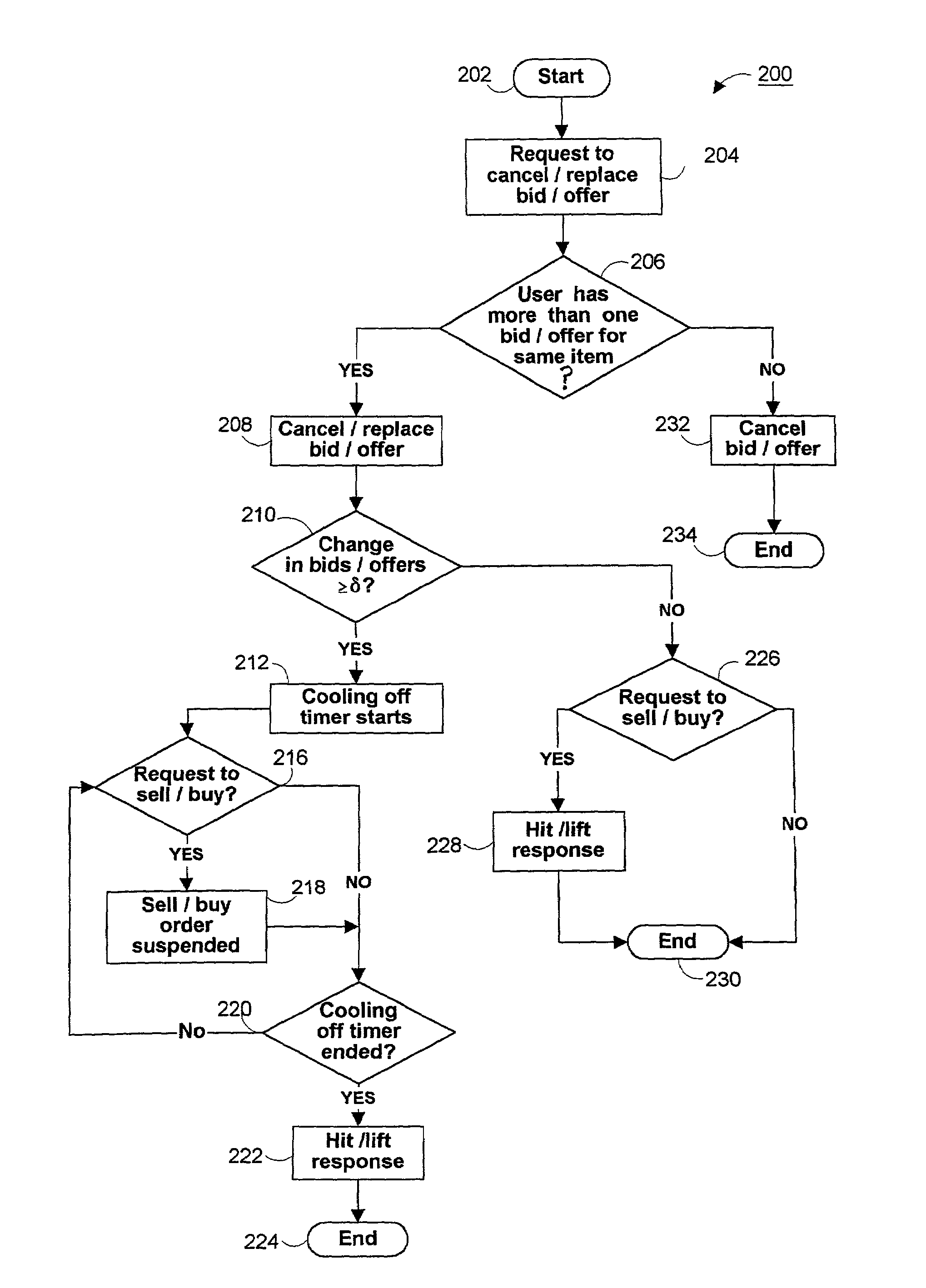

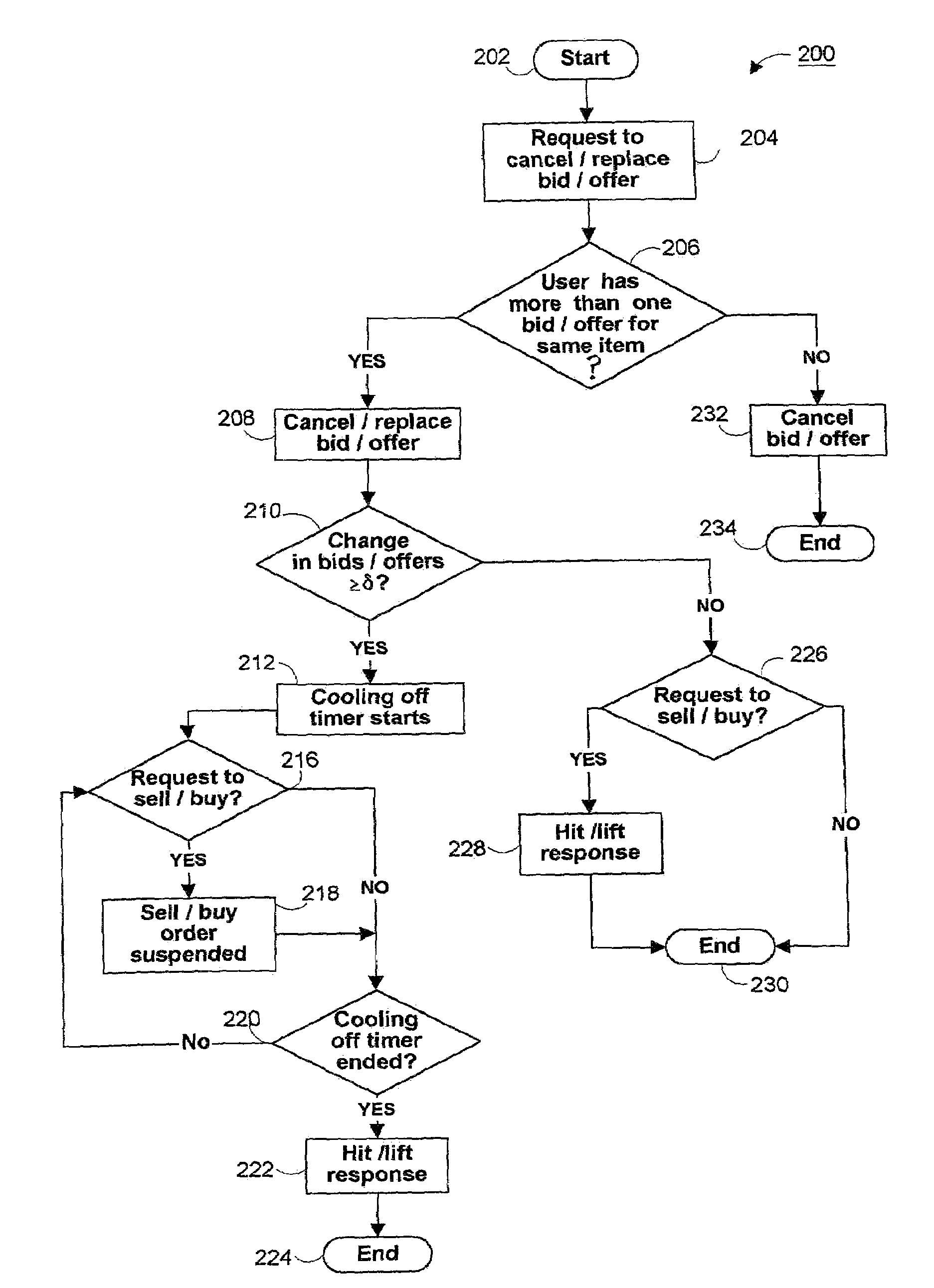

Systems and methods for controlling traders from manipulating electronic trading markets

Systems and methods are provided to control gaming in electronic trading markets. These systems and methods alleviate the problem of a seller or buyer trying to act on a trader's original bid or offer only to trade at an unfavorable level after the trader changes the bid or offer. A pricing method suspends trading for a period of time if a price difference between two bids or offers by the same trader is too great. A timing method prevents a trader from canceling or replacing a bid or offer for a period of time. These methods provide a more fair and efficient way of executing electronic trades.

Owner:BGC PARTNERS LP

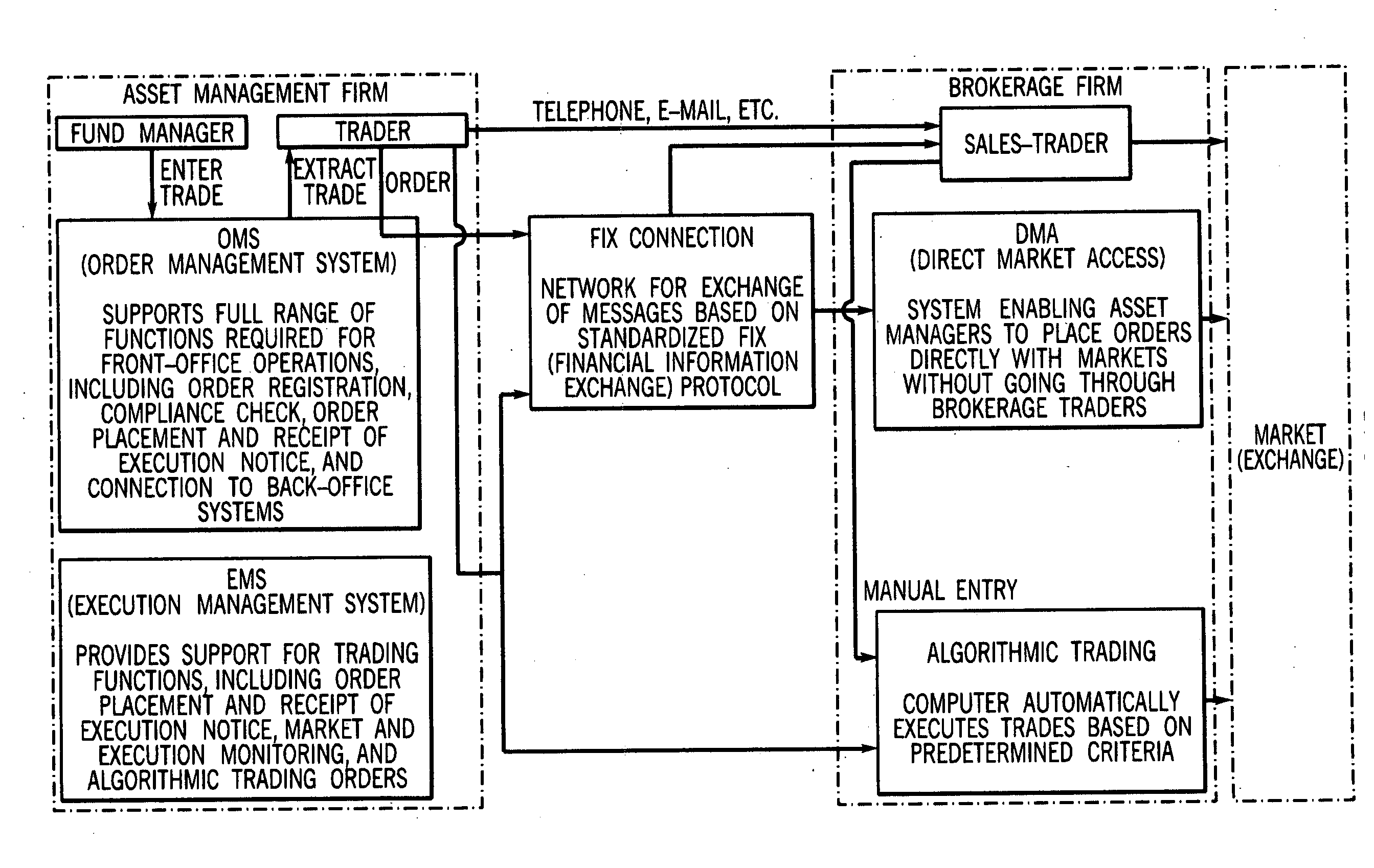

Algorithmic trading system and method

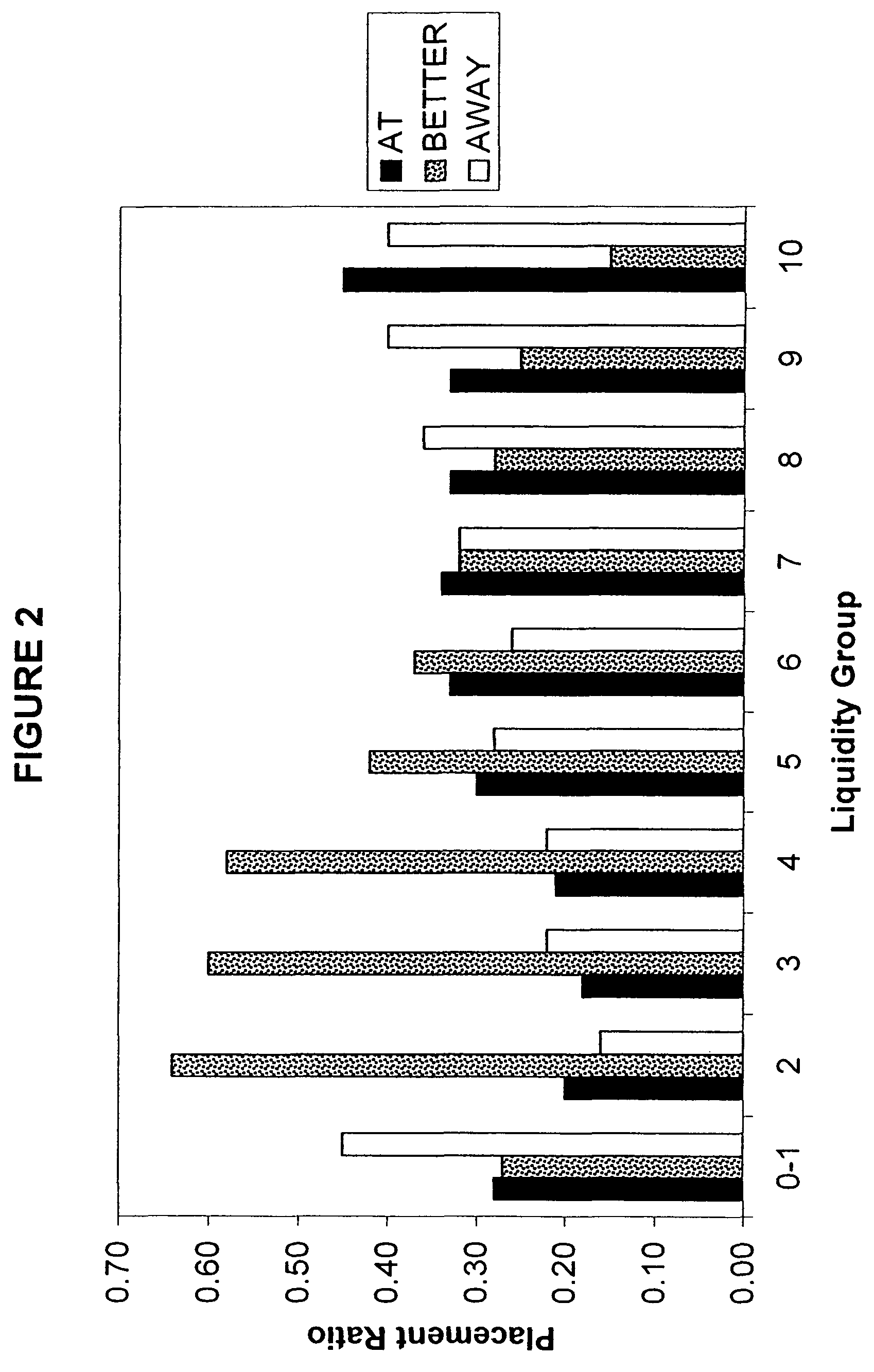

A system and method for allowing market participants to evaluate the likelihood of finding hidden volume. The model can predict hidden volume and assess the probability that a market order will be executed within the spread and better than the mid-quote. The cost per immediate execution can be assessed.

Owner:ITG SOFTWARE SOLUTIONS INC

Bid/offer spread trading

A bid / offer spread market is presented that allows a trader to increase liquidity in traded items. A bid / offer spread market maker may make a bid / offer spread market. This bid / offer spread market may be made available to any market participant. In response to the spread market, an aggressor may respond to a bid or an offer with a hit or a take, respectively. In response to the hit or the take, the aggressor or bid / offer spread market maker, respectively, may create a separate underlying market using the selected (bid or offer) spread within a specified amount of time. The other party, a bid / offer spread trader, may trade on the quoted price within a specified amount of time, at which point a trade has occurred.

Owner:BGC PARTNERS LP

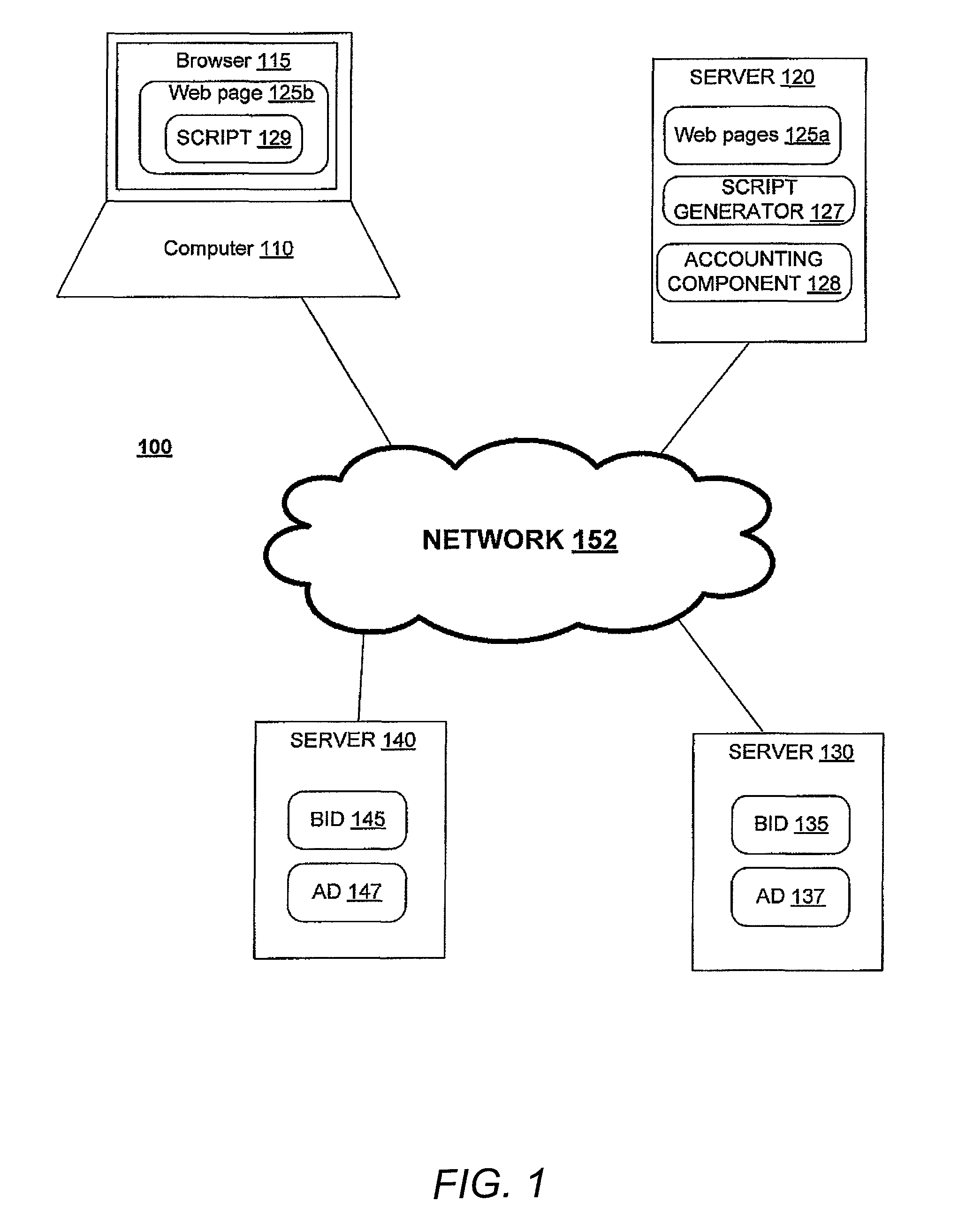

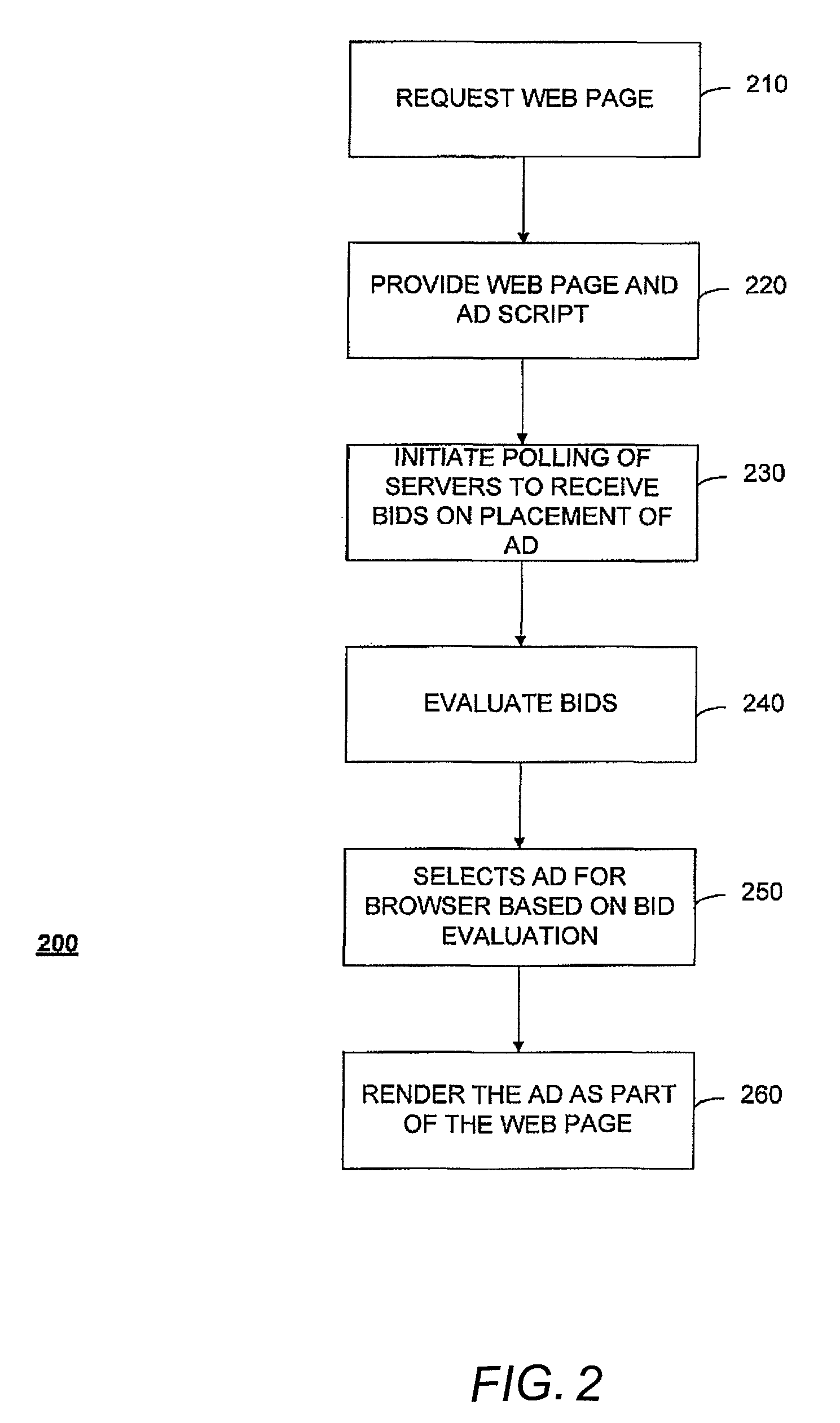

Managing bids in a real-time auction for advertisements

A method and system conduct an auction for advertising across multiple markets. A first market conducts a first auction for a first advertising impression. A first bid is selected as the auction winner and a ratio is computed as the first bid plus a spread to the second highest bid. The price to be paid is the lower of the first bid or the first bid multiplied by the ratio. The first bid, second bid, and spread are transmitted to a second market for a second advertising impression auction. The second market respects the rules of the first market's auction where such that if the first bid is selected as the winner, a ratio is computed as the first bid plus the spread to the next highest bid. The price to be paid for the second impression is the first bid multiplied by the new ratio.

Owner:MAGNITE INC

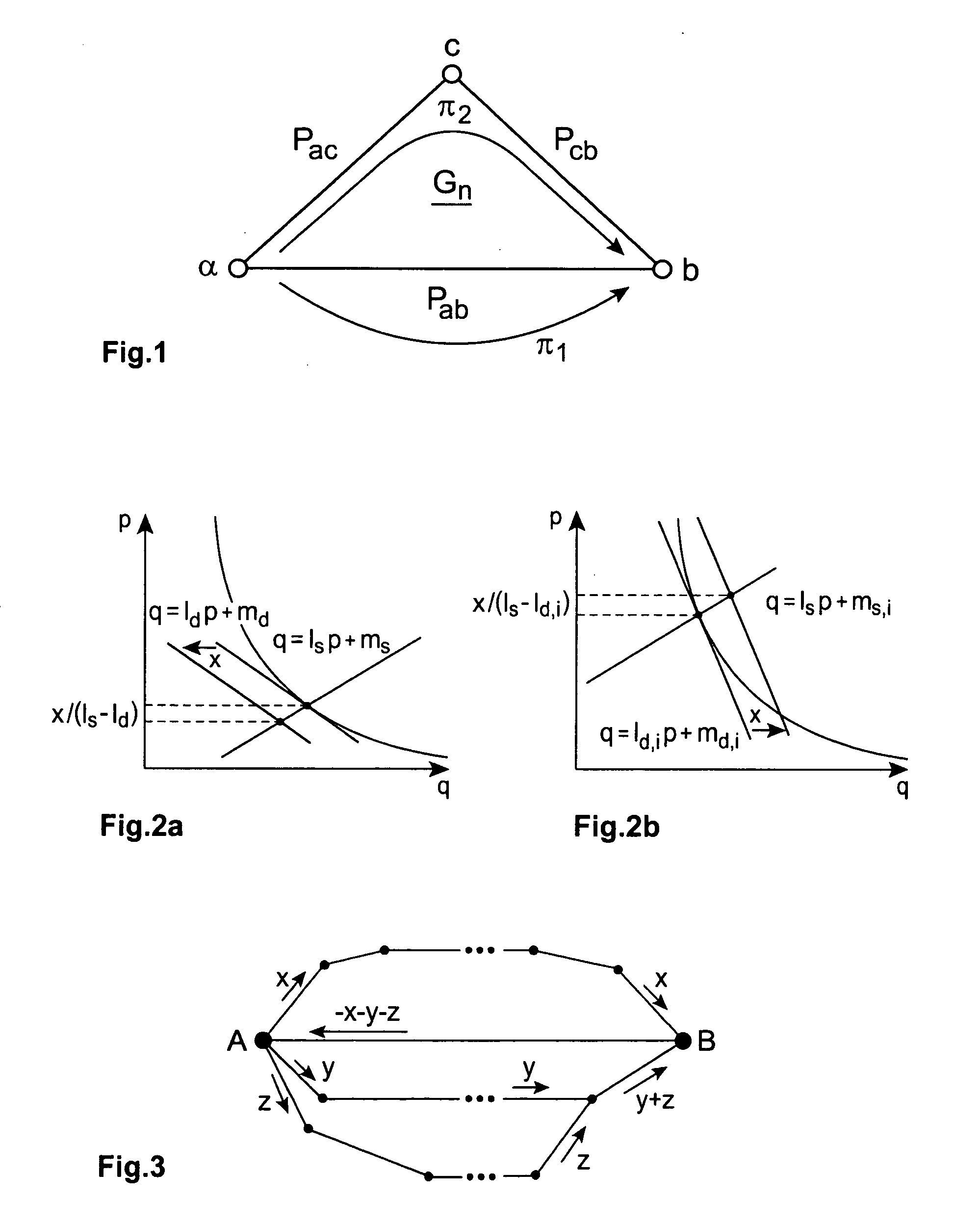

Method and a system related to determining the price of a combination contract

ActiveUS20030004899A1Less processor powerFinanceBuying/selling/leasing transactionsPrice differenceComputer science

Owner:NASDAQ TECHNOLOGY AB

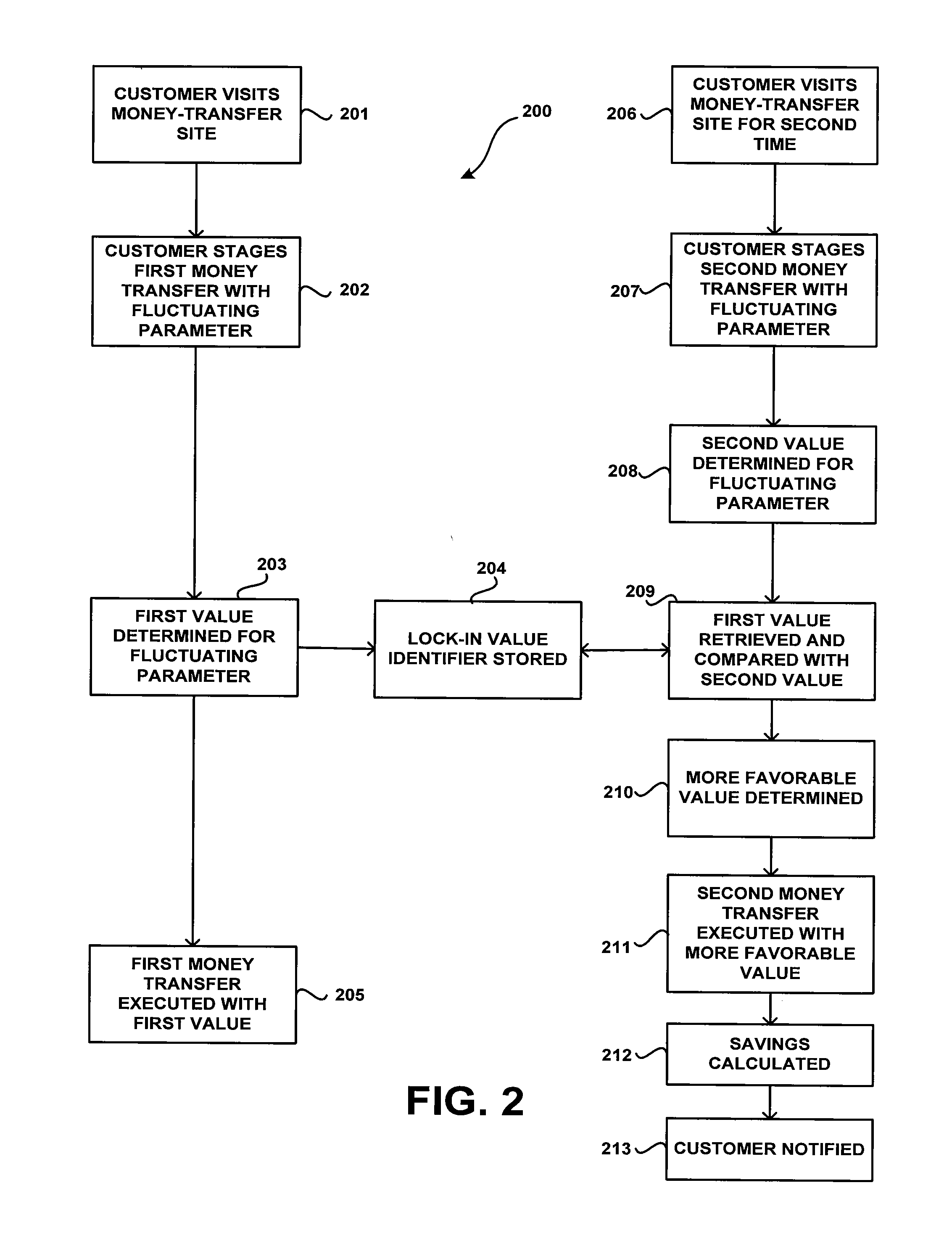

Methods and systems for executing a plurality of money transfers having a fluctuating parameter

Systems and methods are provided for executing a plurality of money transfers, at least one term of which is dependent on the value of a fluctuating parameter, for example a currency exchange rate or the amount of a transaction service fee. The customer may stage a first money transfer at a money-transfer system and a first value of the fluctuating parameter may be determined by a host processor. The first money transfer may then be executed by the money-transfer system using the first value of the fluctuating parameter and a unique lock-in value identifier may be stored in the host processor's memory that associates the first value of the fluctuating parameter with the customer. When the customer stages a second (and any subsequent) money transfer at the money transfer system, a second value of the fluctuating parameter may be determined by the host processor. The first value of the fluctuating parameter may be retrieved from the host processor's memory using the lock-in value identifier and, in one embodiment, a determination may be made as to whether the first value or second value is more favorable to the customer for executing the second money transfer. The second money transfer may then be executed using the more favorable value of the fluctuating parameter. In one embodiment, the customer may be notified of the savings realized.In some embodiments, the second money transfer may be made using the first value of the fluctuating parameter without making a determination as to whether it is more favorable than the second value. In other embodiments, a unique customer identifier, e.g. a loyalty program ID number, may be used to identify the customer as a repeat customer, and the customer identifier may be used to retrieve the lock-in value identifier. In another embodiment, the customer may be required by the money-transfer service provider to pay a lock-in fee or currency spread, all or a portion of which may be used to offset part of any service fees paid by customer for repeat money transfers. In still another embodiment, the risk associated with using the more favorable value of the fluctuating parameter may be hedged by the service provider.

Owner:THE WESTERN UNION CO

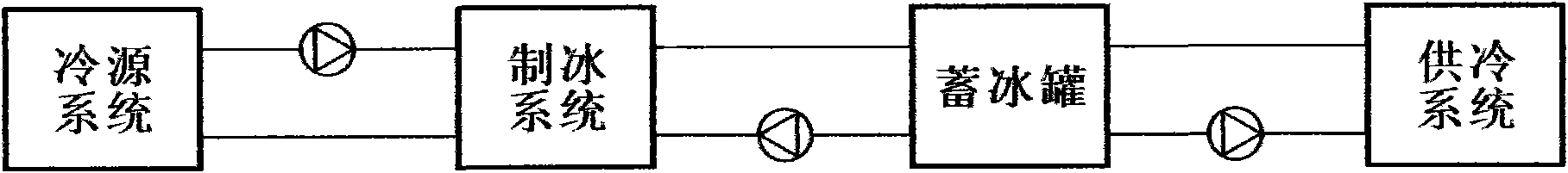

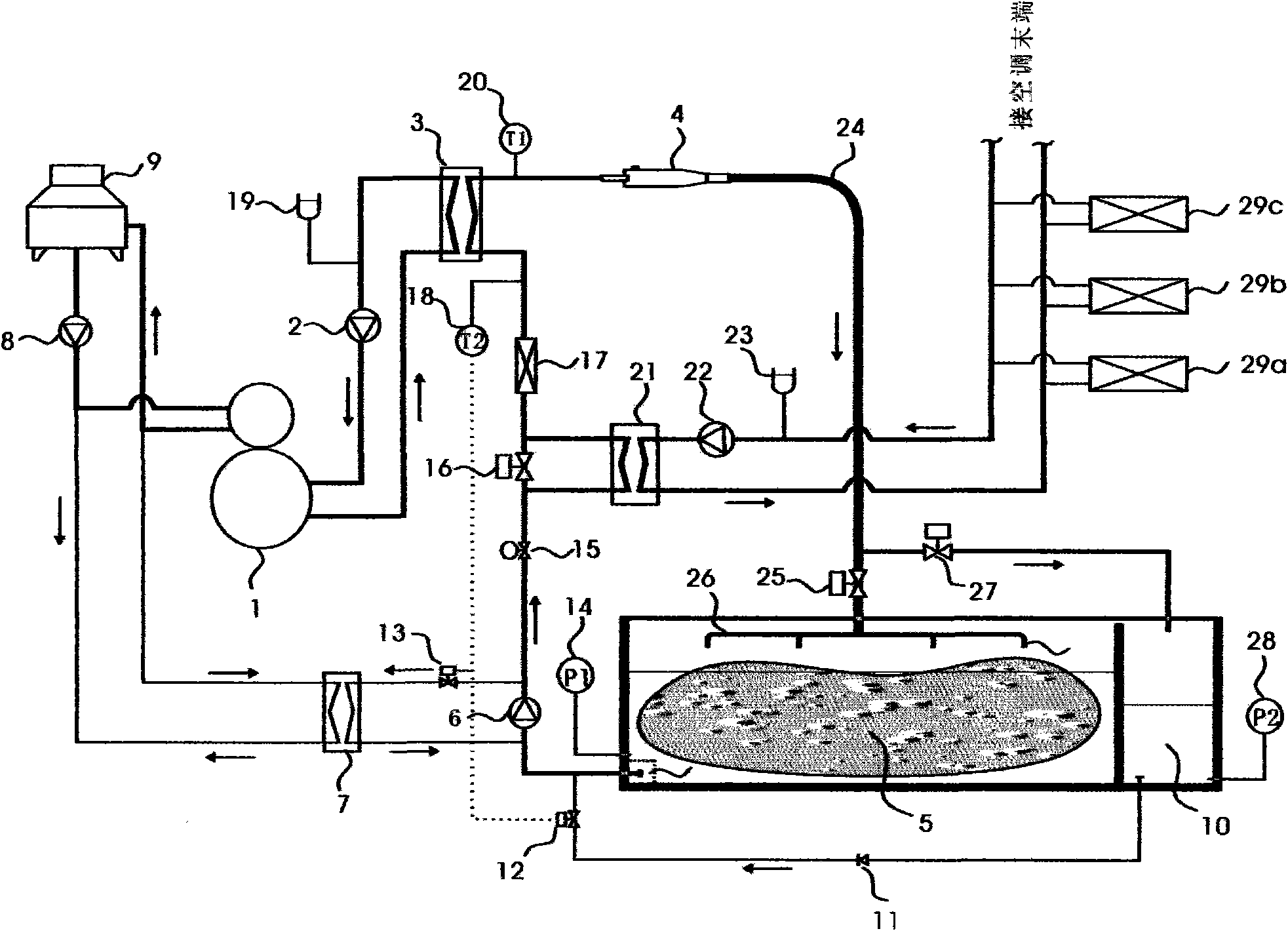

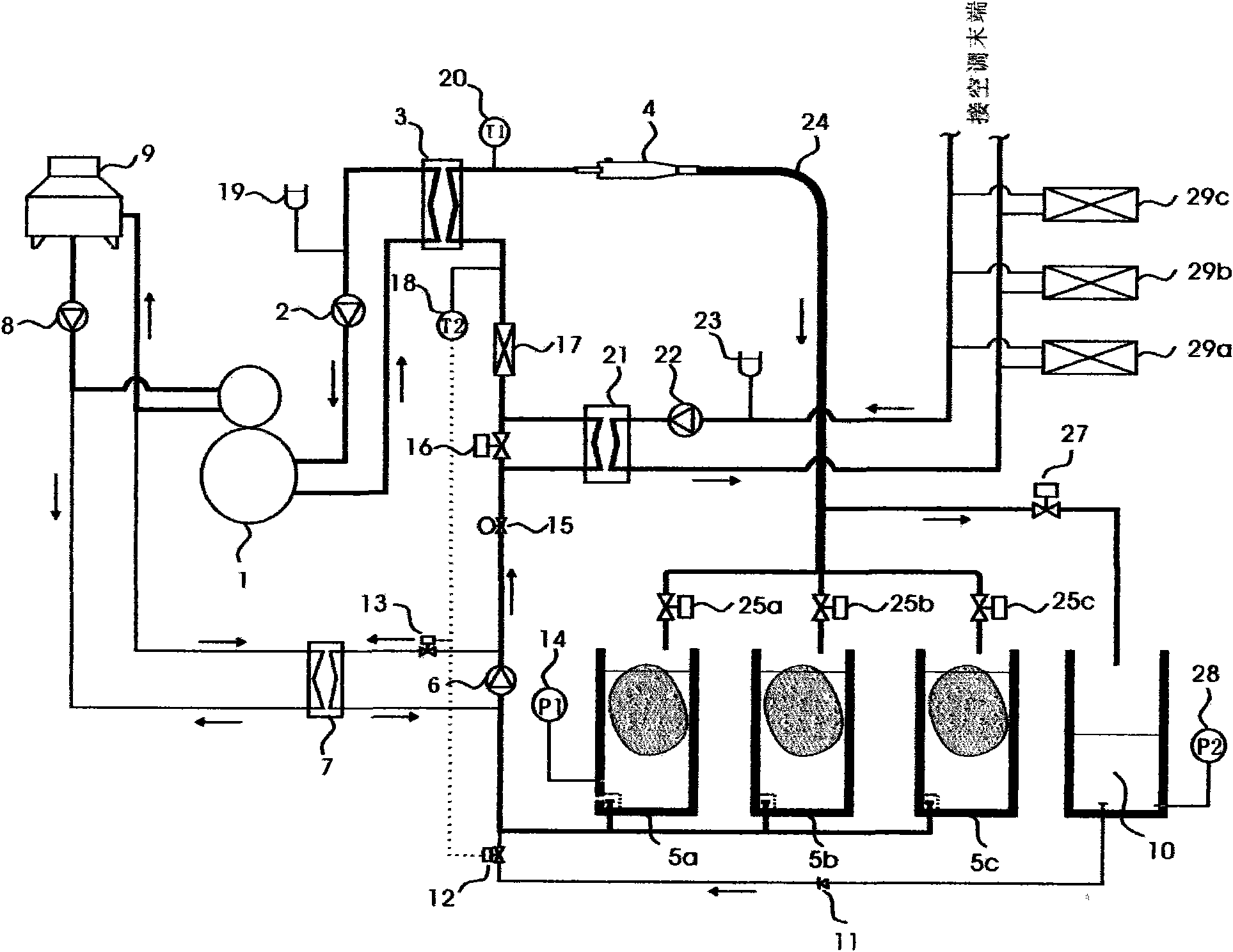

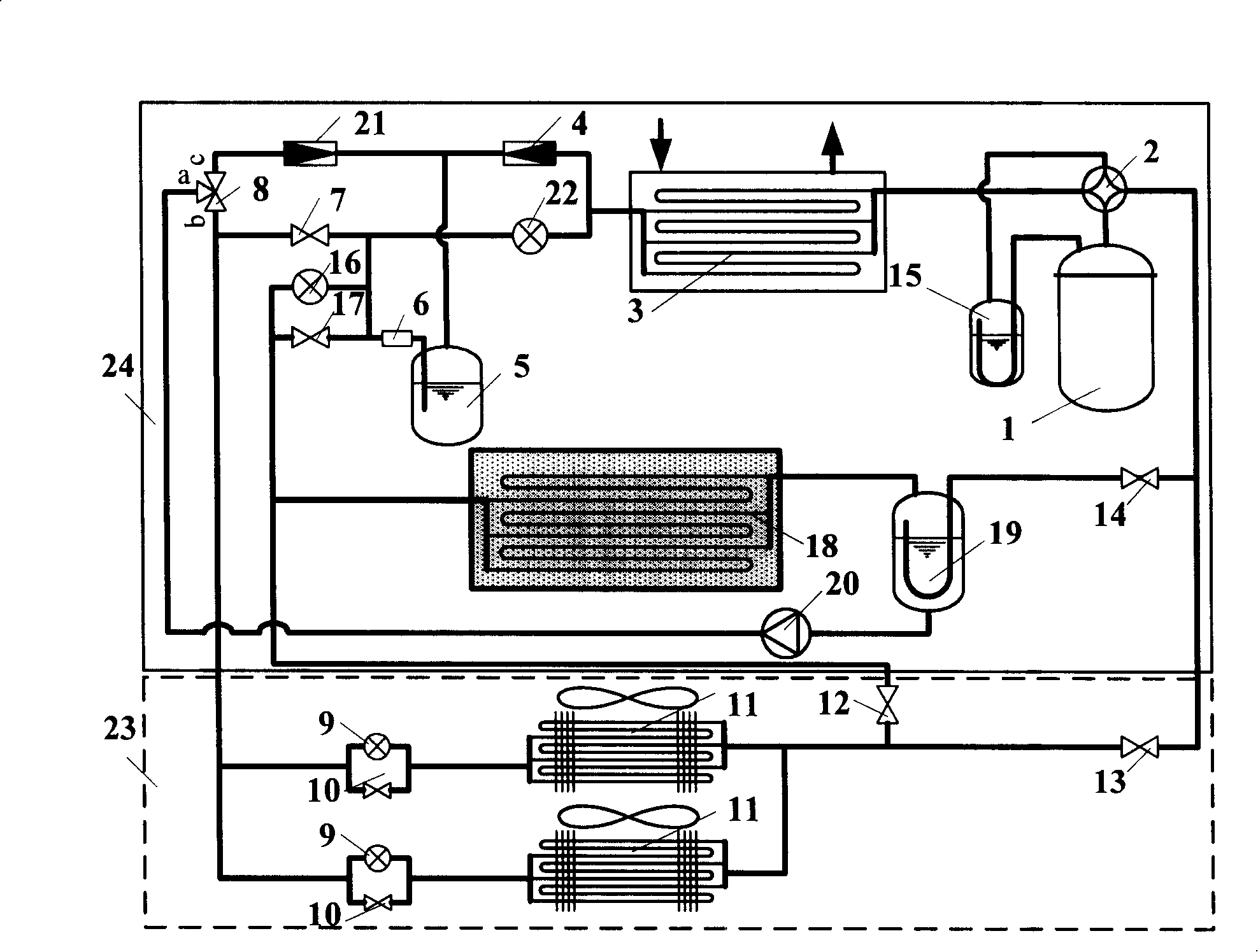

Central air-conditioning system of ice slurry cold storage

InactiveCN101629748ASimple structureIce storage tank requirements are lowLighting and heating apparatusAir conditioning systemsSlurryMotor power

The invention belongs to a central air-conditioning system, in particular to an energy-saving central air-conditioning system which uses ice slurry as an energy storage carrier for transferring the load of an electricity peak in the daytime to an electricity valley in the night. The central air-conditioning system mainly comprises a host refrigerating machine, a plate heat exchanger, an ice slurry generator, an ice storage tank, a water pump, a control system, and the like. The central air-conditioning system has the main functions of providing low-temperature water of about 1DEG C and low-temperature wind of about 15 DEG C, reducing the total installed capacity of the host refrigerating machine of a building, the diameter of a cold water pipe and the motor power of an end blower, balancing the power loads of the electricity peak and the electricity valley of a power system and reducing the operation cost of air conditioners, electrical capacity fees, initial cost, and the like by utilizing the power price difference between peak and valley power demand periods.

Owner:深圳力合节能技术有限公司 +2

System and method for risk management using average expiration times

A margin requirement is computed while trading. The margin requirement may be calculated while trading because the preferred system takes into account working orders to generate the margin requirement. The on the fly possibility allows the preferred system to provide pre-trade risk calculations, but can also be used to provide post-trade calculations. A generic spread number and the maximum number of outright positions are determined. Average expirations for the generic spread are computed. Using the spread positions, the average expirations and the maximum number of outright positions, a spread margin and an outright margin are calculated, which when summed provide a total margin requirement. Limits based in part on the total margin requirement may be imposed on one or more traders.

Owner:TRADING TECH INT INC

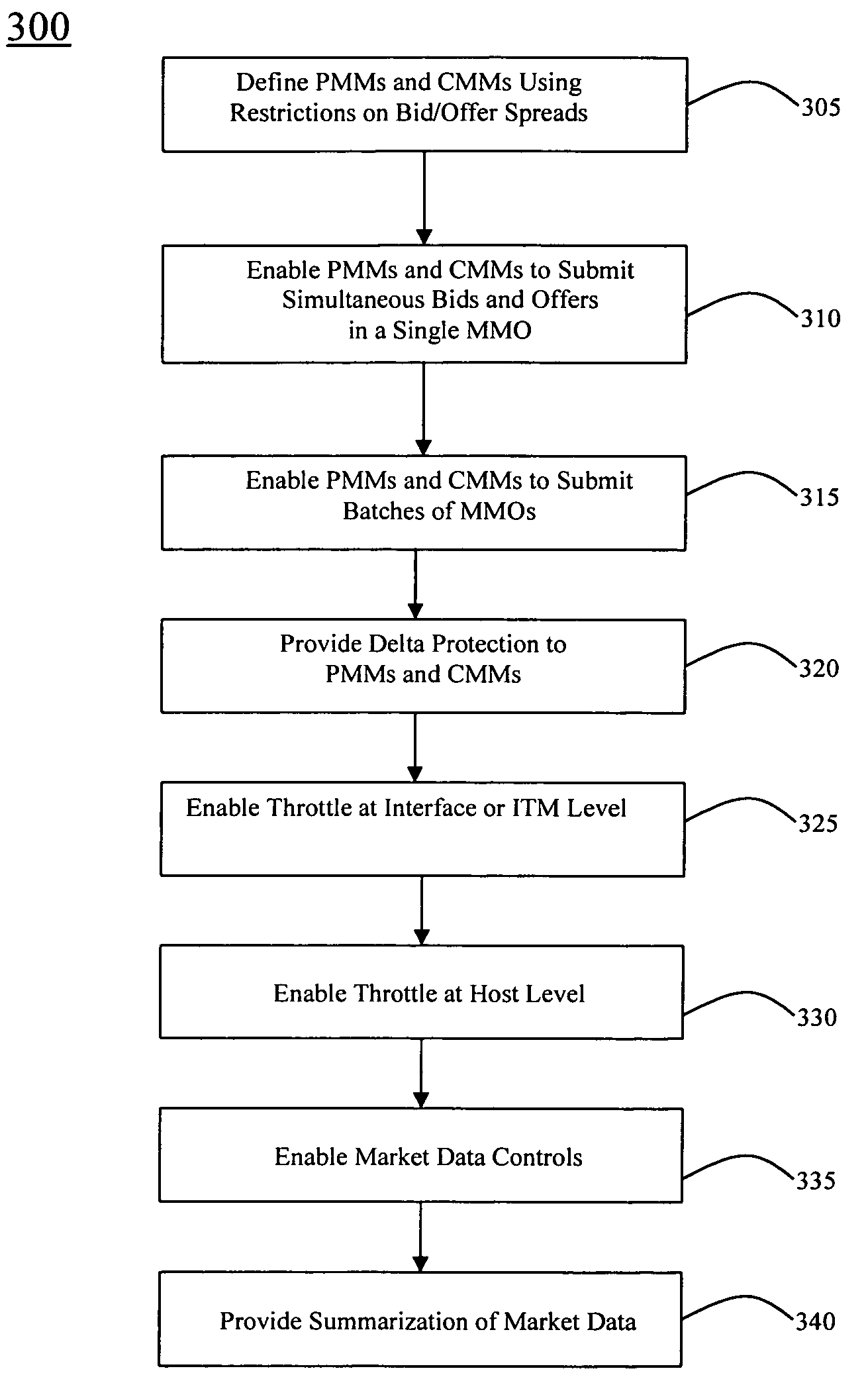

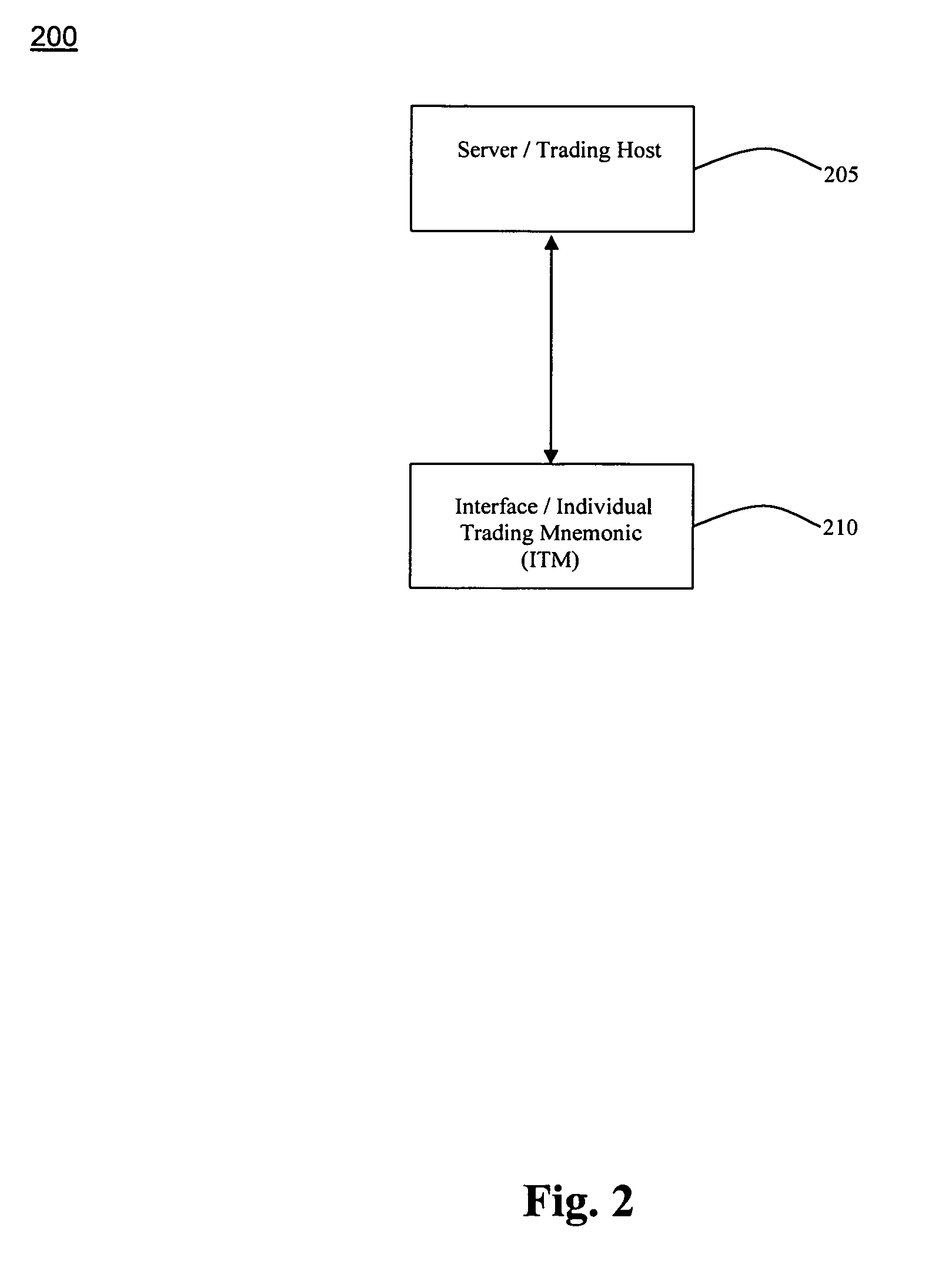

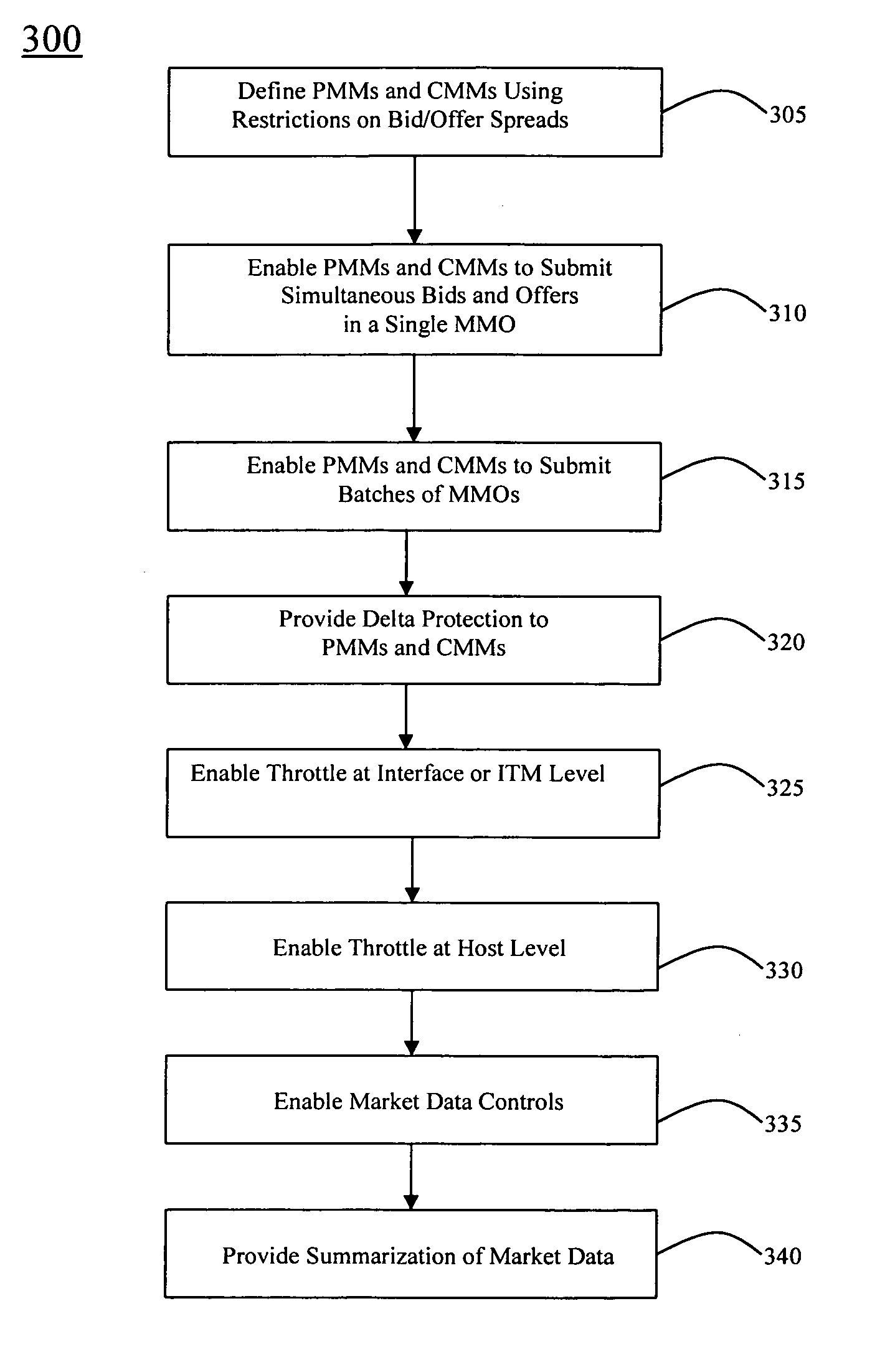

System and method for simultaneous trading of options

A method and system for facilitating trading of equity and index options is provided. The system incentivizes market makers to voluntarily agree to restrict the bid / offer spread on price quotes for options by enabling the market makers to submit batches of bids and offers simultaneously. The system also provides protection to the market makers by enabling withdrawal of certain bids and offers if a cumulative delta on traded options has been exceeded. The system also provides limits on the rates at which individual traders and the overall market submit bids and offers. The system provides summarization of market data to enable market makers to have relevant and timely data at all stages. In this manner, the system achieves increased liquidity of the equity and index options markets.

Owner:LIFFE ADMINISTRATION & MANAGEMENT

Electronic trading GUI

InactiveUS20100057602A1Quick and efficientFinanceInput/output processes for data processingGraphicsGraphical user interface

In accordance with the principles of the present invention, a graphical user interface for computer trading is provided. A display represents best bid and best ask prices for an execution venue, with one axis representing available prices, and another axis representing time. The display includes a sell area, a bid-ask spread, and a buy area. The boundary of the sell area and the bid-ask spread represents best ask price for the execution venue, and the boundary of the buy area and the bid-ask spread represents best bid price for the execution venue. First indicium on the display represents order executions and second indicium on the display represents orders. The position of the first indicium represents the time and price of the execution, the size represents the size or quantity of the execution, and the colour represents execution type and execution venue. The position of the second indicium represents the price of the order; the size represents the duration of the order, and the colour represents the order type and posted exchange venue. The second indicium can further comprise a transparency representing the size of the order.

Owner:ARMUTCU ERCAN S

System and method for simultaneous trading of options

A method and system for facilitating trading of equity and index options is provided. The system incentivizes market makers to voluntarily agree to restrict the bid / offer spread on price quotes for options by enabling the market makers to submit batches of bids and offers simultaneously. The system also provides protection to the market makers by enabling withdrawal of certain bids and offers if a cumulative delta on traded options has been exceeded. The system also provides limits on the rates at which individual traders and the overall market submit bids and offers. The system provides summarization of market data to enable market makers to have relevant and timely data at all stages. In this manner, the system achieves increased liquidity of the equity and index options markets.

Owner:LIFFE ADMINISTRATION & MANAGEMENT

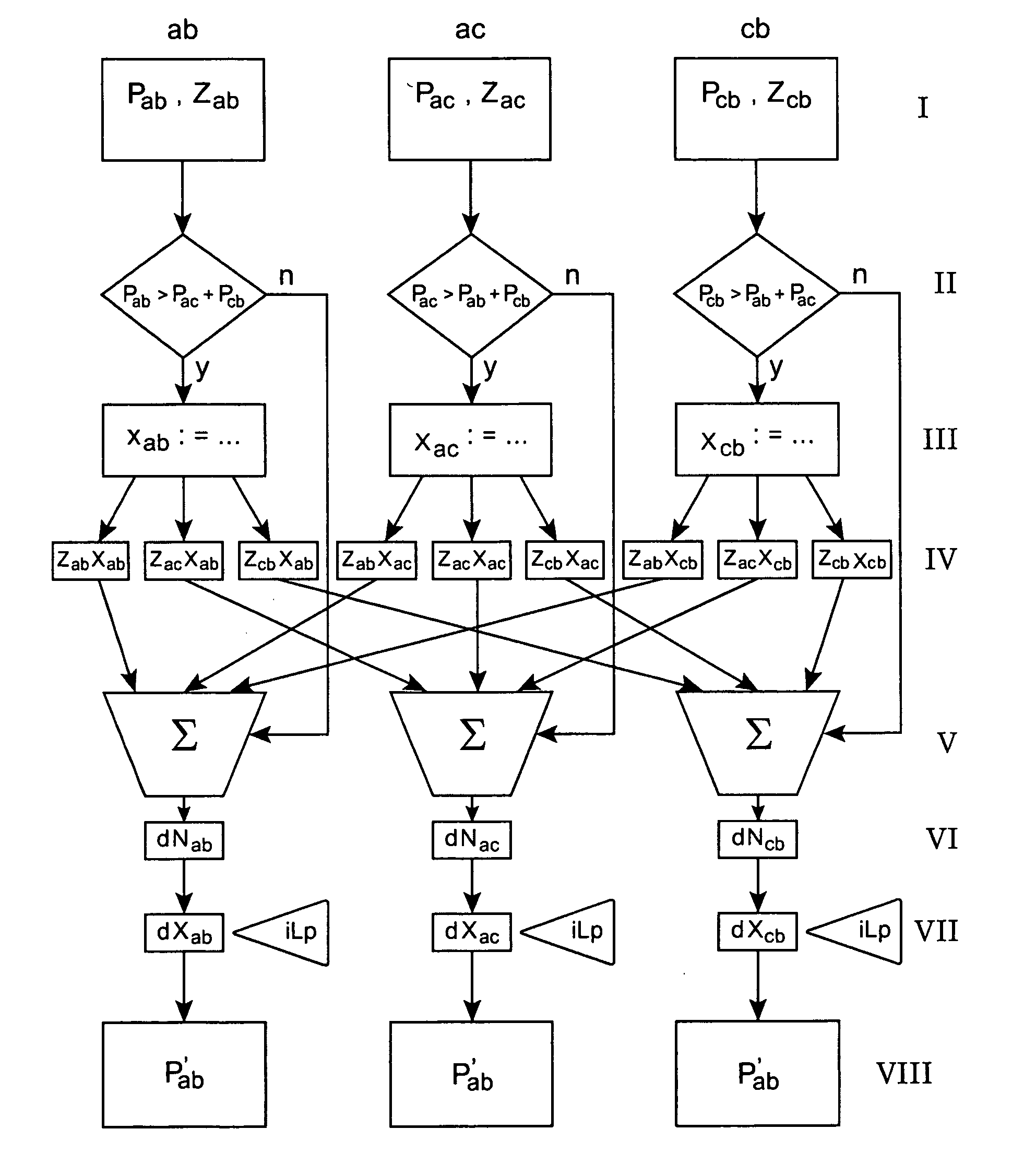

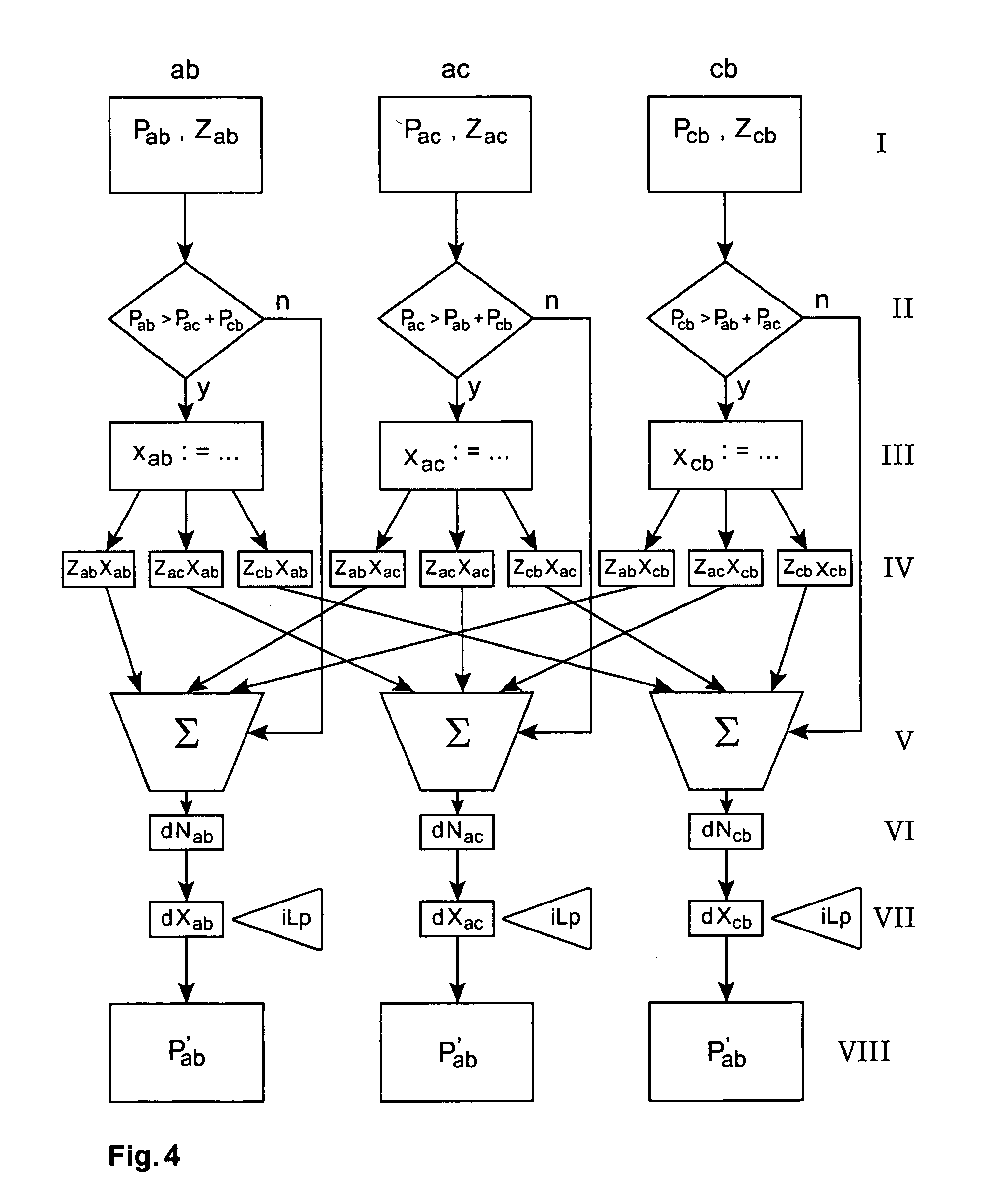

Method and device for calculating a price for using a specific link in a network

InactiveUS20050278262A1Accurate pictureComplete banking machinesMetering/charging/biilling arrangementsPrice differenceTotal price

The invention relates to a method for calculating in a network that comprises links, a price for using a specific link in the network. The method comprises the following steps: a) a comparison step for determining a price difference between the price for using the specific link and the price for using instead of the specific link an alternative path in the network, which does not comprise the specific link, b) a change-calculation step for determining a link-price change in the price for using the specific link, and a link-price change in the price for using the links in the alternative path, in response to the determined price difference, c) a combination step for combining for the specific link the determined link-price changes on the price for using the specific link from all links in the network, to determine a total price-change for the specific link, d) a merging step for merging the determined total price-change with a market-induced price change in the price for using the specific link, to calculate the price for using the specific link, wherein the market-induced price change is being driven by at least one random variable.

Owner:IBM CORP

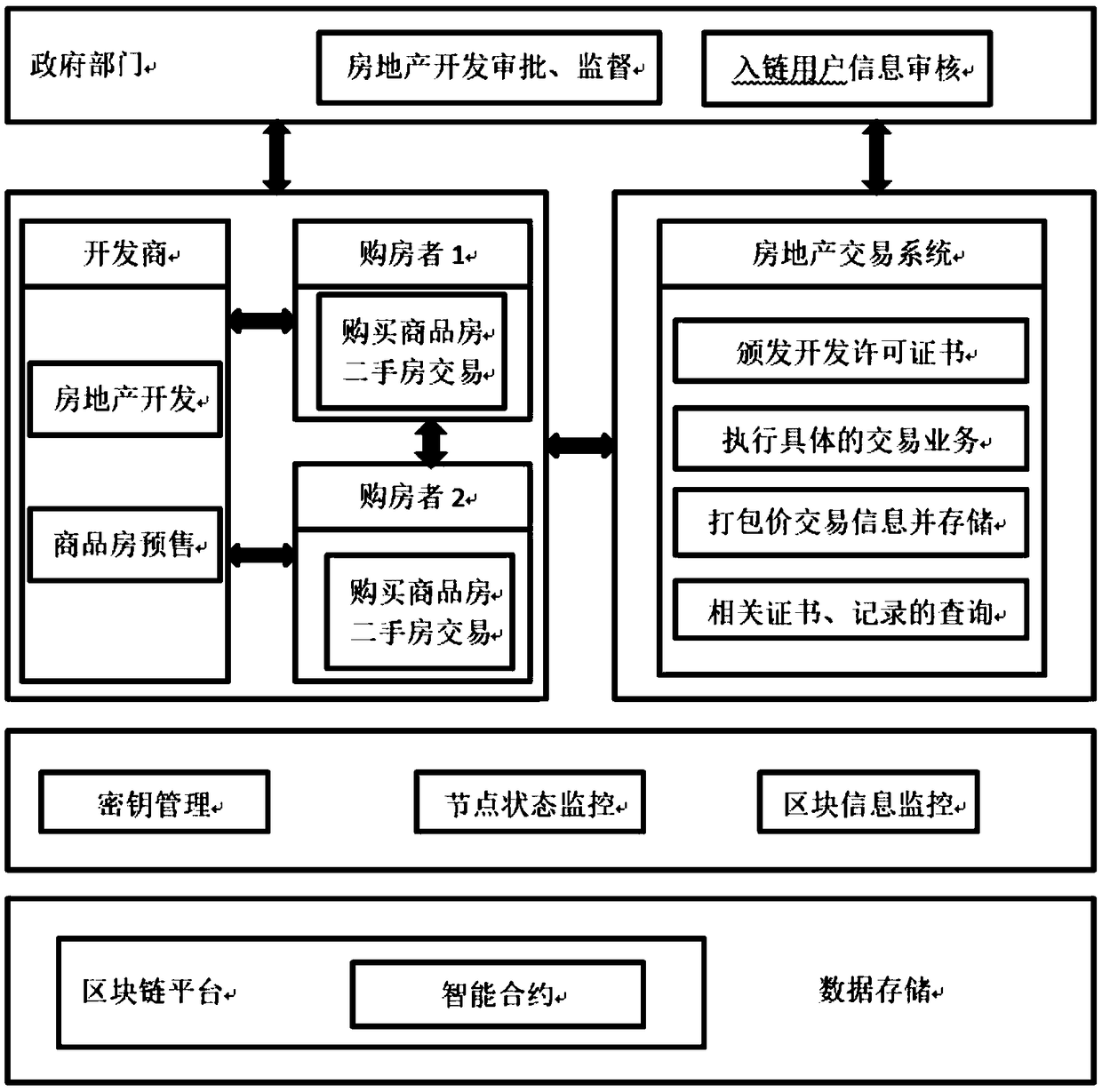

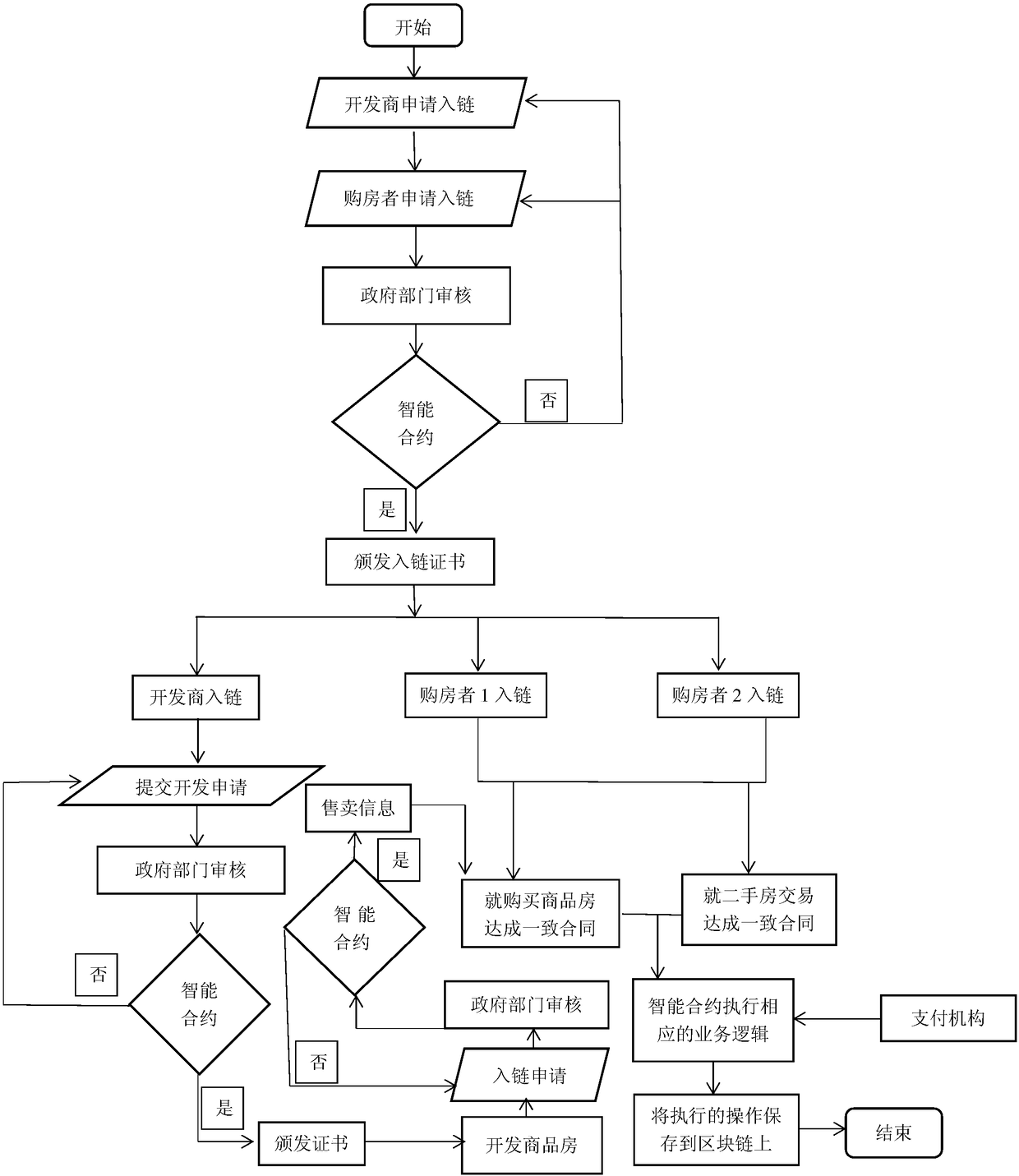

Real estate storage and transaction method based on a block chain

InactiveCN109493196AReduce riskTransaction is reliablePayment protocolsBuying/selling/leasing transactionsThird partyPrice difference

The invention discloses a real estate storage and transaction method based on a block chain. The system comprises the following function modules: an audit admission module, a real estate development module, a commercial house chain entering module, a commercial house pre-selling module, a second-hand room selling module and a data storage module, according to the invention, the problem of unsmoothinformation circulation among mechanisms is solved; house property development efficiency is low, certificates are counterfeited, the house property data traceability is poor; a series of problems ofprofit-in-the-middle quotient difference, real estate dispute and the like are solved; the invention discloses a real estate transaction method. Compared with the prior art, the transaction process is simplified, the participation of the third-party intermediary is needed in the traditional real estate transaction process, the real estate certificate storage and transaction method based on the block chain can realize the direct transaction of the seller and the buyer without the third-party intermediary, the transaction cost is reduced, the transaction efficiency is improved, and the high efficiency of real estate development, auditing and transaction is realized.

Owner:HANGZHOU QULIAN TECH CO LTD

System and method for risk management using average expiration times

A margin requirement is computed while trading. The margin requirement may be calculated while trading because the preferred system takes into account working orders to generate the margin requirement. The on the fly possibility allows the preferred system to provide pre-trade risk calculations, but can also be used to provide post-trade calculations. A generic spread number and the maximum number of outright positions are determined. Average expirations for the generic spread are computed. Using the spread positions, the average expirations and the maximum number of outright positions, a spread margin and an outright margin are calculated, which when summed provide a total margin requirement. Limits based in part on the total margin requirement may be imposed on one or more traders.

Owner:TRADING TECH INT INC

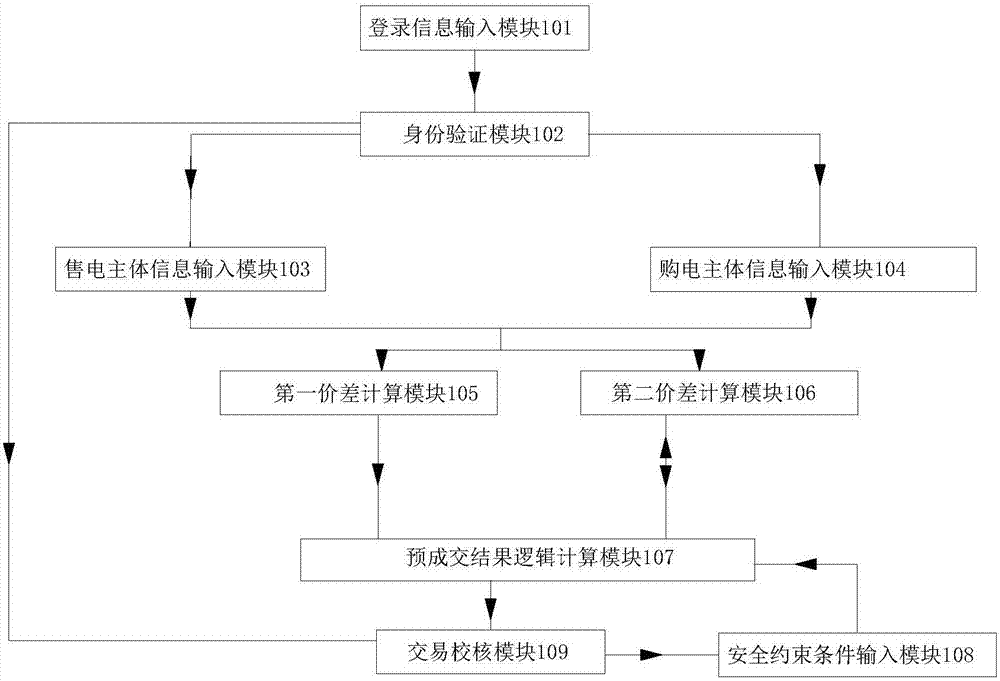

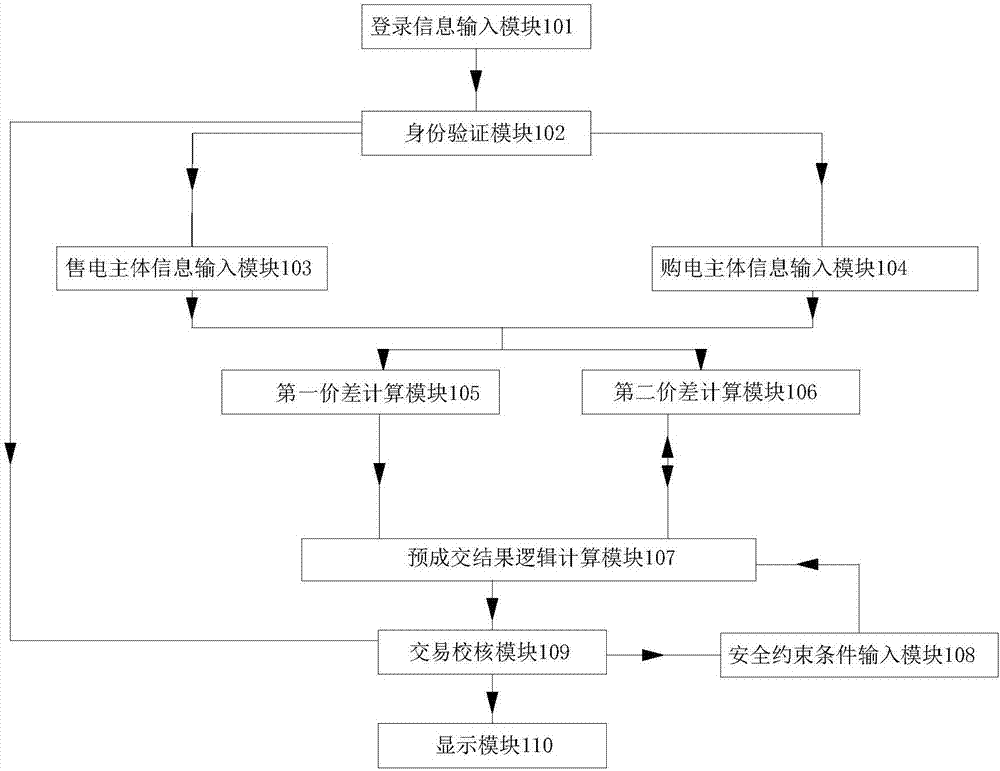

Concentrated price bidding and trading system and method for electric power market trading

ActiveCN107292710AImprove reusabilityImprove scalabilityBuying/selling/leasing transactionsMarketingElectricity marketElectric power system

The invention provides a concentrated price bidding and trading system and a method for electric power market trading, which belong to the electric power market trading system technology field. The method comprises the steps of user log-in, declared information input, price difference calculation, pre-traded result calculation and trade verification. The concentrated price bidding and trading system proposed by the invention is high in reuse and extendibility and can be used for electric power trading in terms of day, month and quarter. With the system of the invention, the seller and buyer can trade on the same platform and can effectively promote the fair, transparent, and regulated trading among all parties of the market. The market supply and demand balance can be maintained; and the electric power system can be run more stably and safely.

Owner:昆明电力交易中心有限责任公司

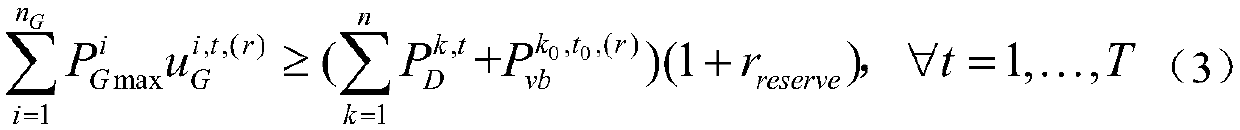

Method for calculating influences, on recent node price differences in electricity markets, of virtual bidding

ActiveCN108921595AQuick calculationImprove efficiencyMarket predictionsFinanceElectricity marketSimulation

The invention discloses a method for calculating influences, on recent node price differences in electricity markets, of virtual bidding, and belongs to the technical field of electricity market transaction. The method comprises the following steps of: firstly obtaining calculated grid system transaction basic data corresponding to a recent electricity market and constructing a recent electricitymarket electricity transaction uniform voidance model according to the basic data; establishing and solving a recent electricity market security constraint electronic dispatching model by utilizing asolution result of the model, so as to obtain a feasible bid quantity interval and a node price difference corresponding to a set virtual bid quantity; and carrying out repeated iteration to finally obtain a ladder-like curve of an influence, on the node price difference in the recent electricity market, of virtual bidding which takes the virtual bid quantity as an independent variable and takes the node price difference as a dependent variable. According to the method, the problem of how to correctly describing a nonlinear relationship between the virtual bid quantity and the node price difference in the recent electricity market is solved, a calculation tool can be provided for discriminating market member speculation spaces in advance, and the high efficiency and orderness of the electricity market are ensured.

Owner:TSINGHUA UNIV

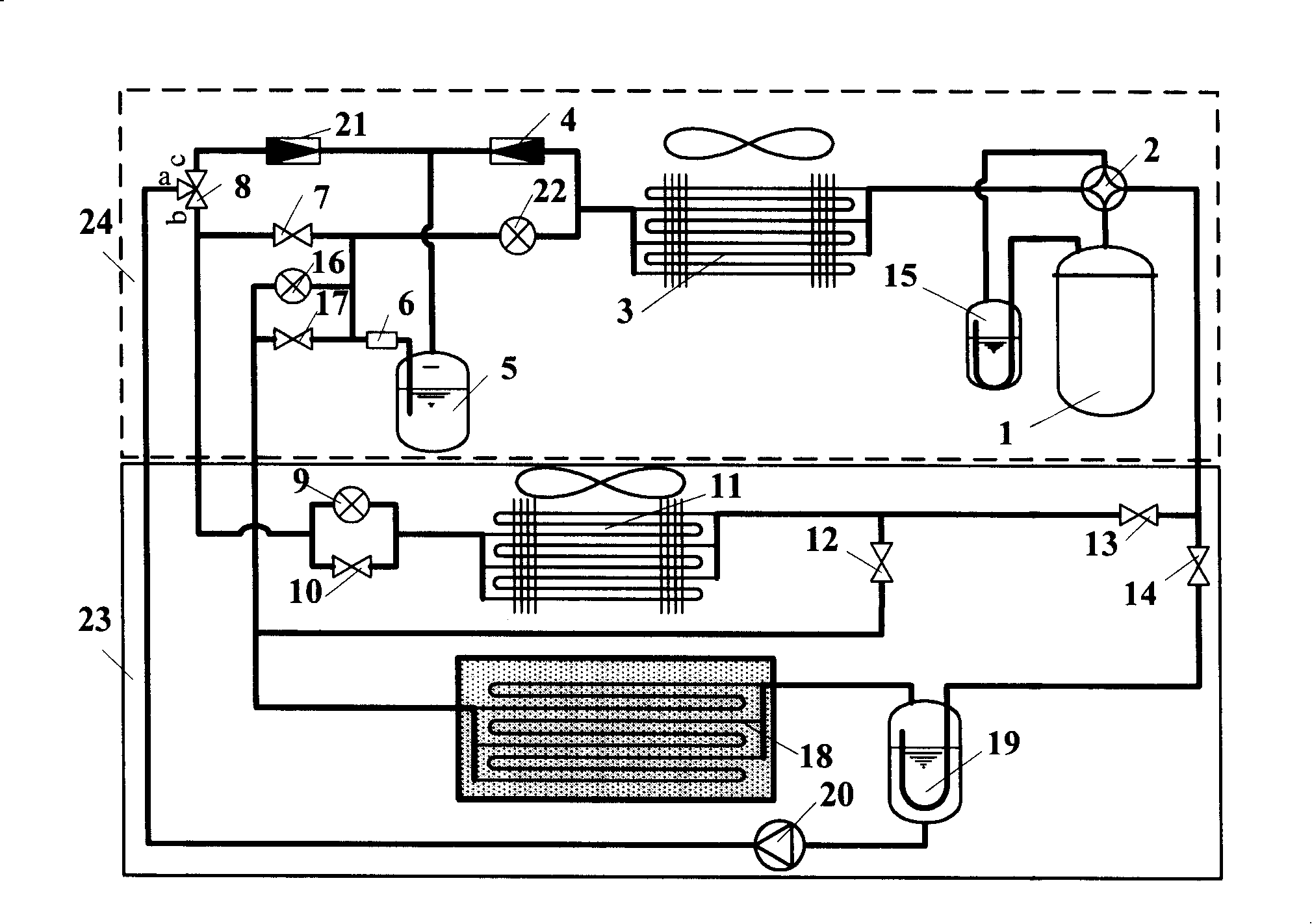

Refrigerant mechanical circulation type ice storage cold-hot pump air-conditioning unit

InactiveCN101201198AIncrease the effective cold storage capacityGuaranteed uptimeCompression machines with reversible cycleAir conditioning systemsIce storageEngineering

The invention discloses a refrigerant mechanical circulation ice-storage heat-pump air-conditioning unit which comprises an outdoor unit and an indoor unit. The invention belongs to the technical field of cold storage type heat pump air conditioning. A cold storage device is additionally provided with a working substance pump and a circulation reservoir. When in a cold relief operation, the working substance pump is utilized to raise the pressure on the liquid freezing medium after condensed and liquefied by an ice barrel and the liquid freezing medium after condensed and liquefied is transmitted into each indoor heat exchanger of the indoor unit through a freezing medium pipeline to supply cold to form freezing medium mechanical circulation old supply. After the ice barrel melts completely, the freezing medium is supercooled by the lower temperature water of the ice barrel so as to improve the unit performance. The invention effectively enlarges the transfer rate for peak electrical load of the air conditioner system, increasing the effective cold storage amount of the ice barrel, enlarging the function selection of the unit to lead the unit to be more flexible and improving the operation economy and reliability of the system. The invention is suitable for the application occasions for supplying cold and hot by taking a wind cooling( or air heating ) heat exchanger as a hanging or a packaged air conditioner unit of the heat exchanger of the indoor machine in the areas with a power peak-valley price difference.

Owner:NANJING UNIV OF SCI & TECH

Systems and methods for controlling traders from manipulating electronic trading markets

Systems and methods are provided to control gaming in electronic trading markets. These systems and methods alleviate the problem of a seller or buyer trying to act on a trader's original bid or offer only to trade at an unfavorable level after the trader changes the bid or offer. A pricing method suspends trading for a period of time if a price difference between two bids or offers by the same trader is too great. A timing method prevents a trader from canceling or replacing a bid or offer for a period of time. These methods provide a more fair and efficient way of executing electronic trades.

Owner:BGC PARTNERS LP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com