System and method for enhanced fraud detection in automated electronic credit card processing

a fraud detection and automated technology, applied in the field of credit card verification processes, can solve the problems of only being able to perform authorization techniques, unauthorized users, credit cards inherently possessing a certain degree of fraud risk, etc., and achieve the effect of reducing the number of fraudulent electronic credit card transactions, enhancing fraud detection, and reducing the number of fraudulent transactions

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

The following description is provided to enable any person skilled in the art to make and use the invention and sets forth the best modes contemplated by the inventors of carrying out their invention. Various modifications, however, will remain readily apparent to those skilled in the art, since the general principles of the present invention have been defined herein specifically to provide enhanced fraud detection in automated electronic credit card processing.

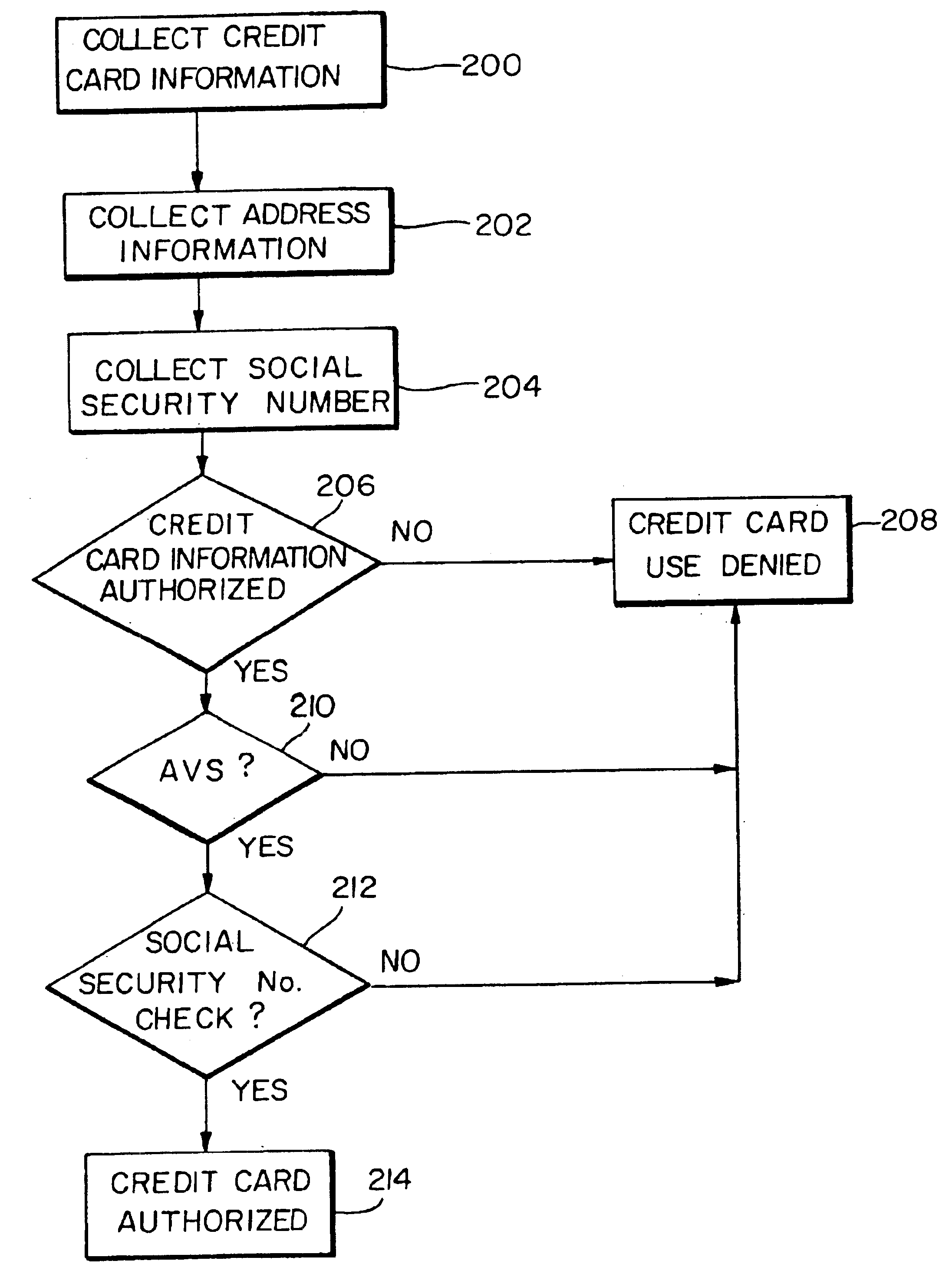

Referring now to FIG. 1, a schematic block diagram of the components of the electronic credit card processing system 10 of the present invention is illustrated. The system 10 includes a central station 12, a remote terminal 14, a cardholder information database 16 of an issuer of a credit card, and a social security number information database 18. Central station 12 includes a processing unit 20, memory 22, and input / output (I / O) interface 24. Processing unit 20 may include a central processing unit (CPU), microprocessor, or ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com