Negotiable instrument with fraud protection

a technology of fraud protection and negotiable instruments, applied in the field of negotiable instruments with fraud protection, can solve the problems of inability to ask the check writer for information nor use it as a security measure, and the customer and merchant are victims of check fraud and identity theft, and achieve the effect of effective bar code location and maximize deterrent

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

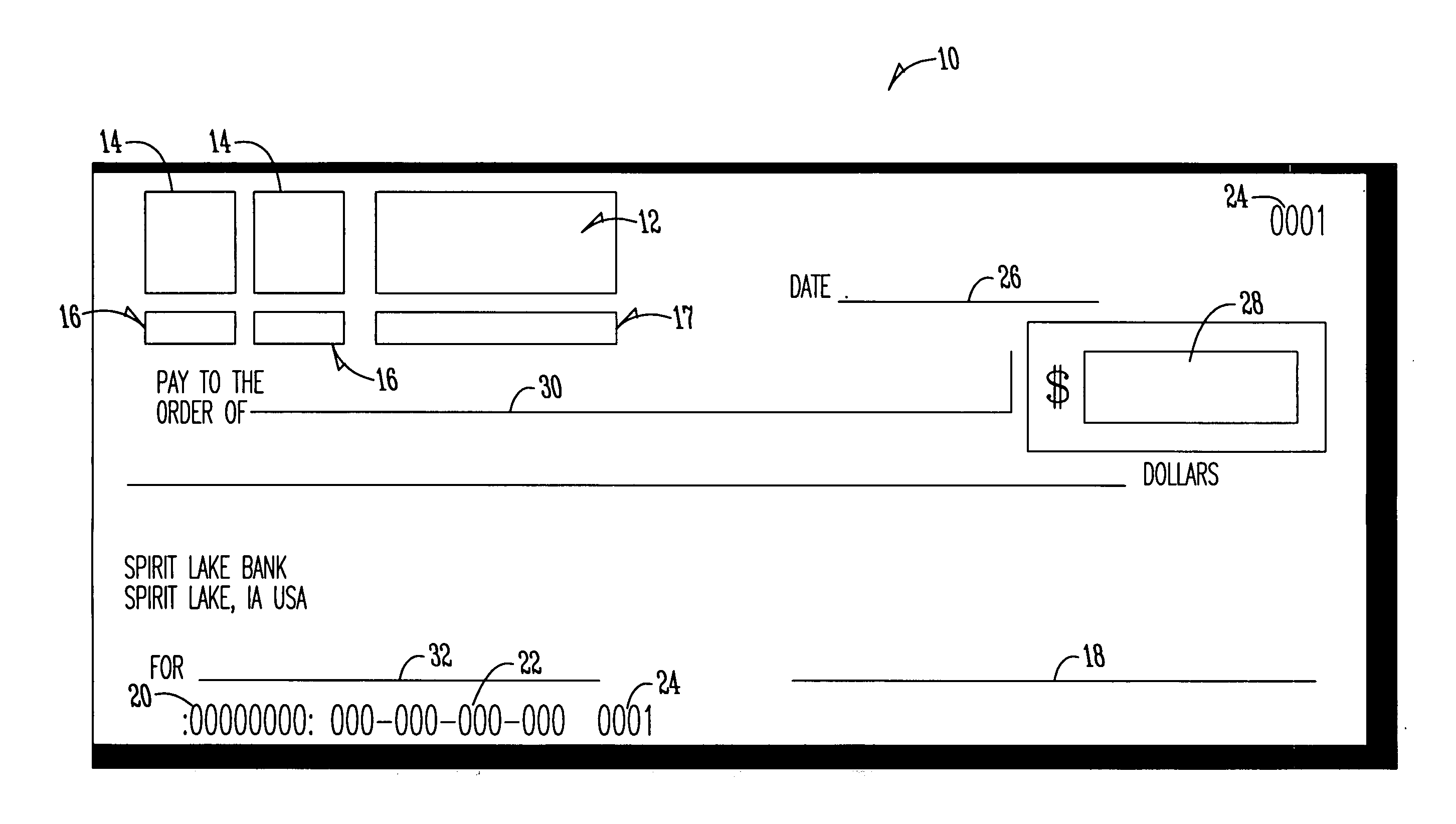

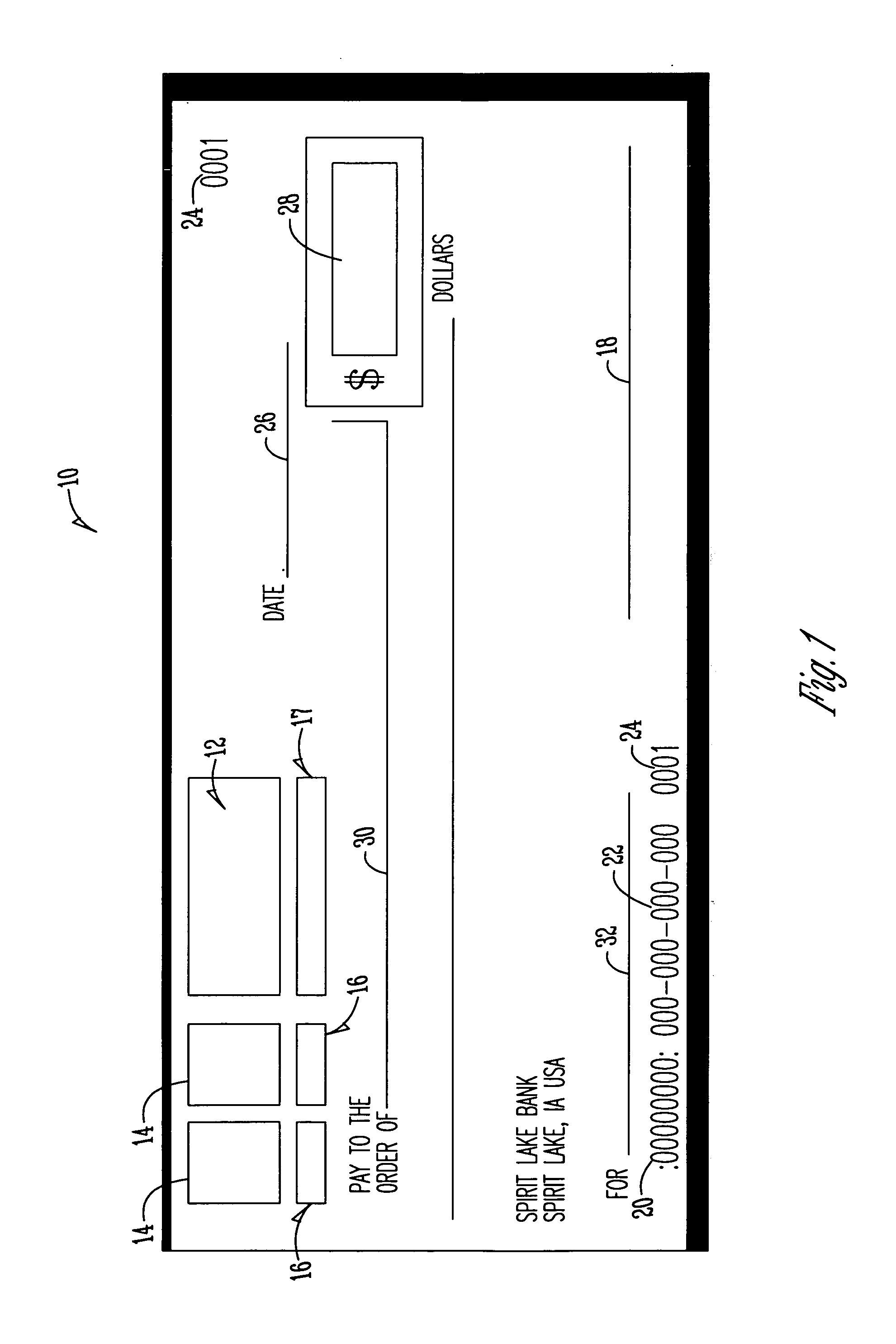

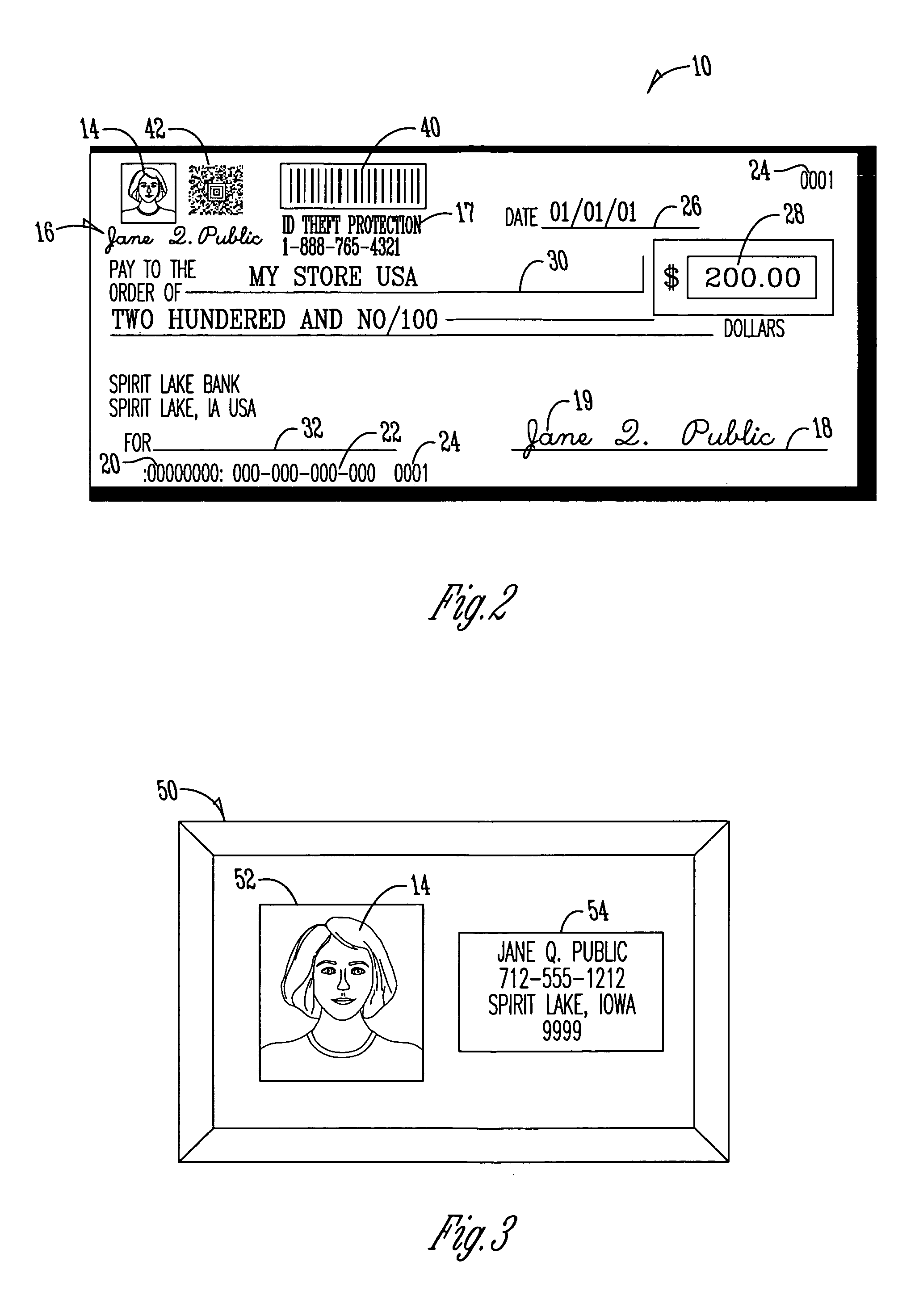

[0029] As seen in FIG. 1, a check with fraud and identity theft protection is generally referred to by numeral 10. Although the term check is used, it is to be understood that checks are part of a broader class called negotiable instruments. Other negotiable instruments may be used interchangeably with the present invention including money orders and traveler's checks.

[0030] The check 10 has a bar code region 12, as illustrated by FIG. 1. The bar code contains personal identification information including a valid check writer's home address and telephone number. Other personal information may be included in the bar code and include a pin number (secret number), social security number, telephone number, driver's license number, password, account number, bank routing number, check number and a digital signature and / or picture. In addition, a description of the account holder may be included in the bar code, displaying such personally identifying information as date of birth (DOB), ge...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com