Enterprise financial service risk prediction method and device

A risk prediction and enterprise technology, applied in the field of data processing, can solve problems such as large labor costs, difficulty in obtaining enterprise information, and inability to cover all enterprises in financial institutions, so as to improve accuracy and intelligence, solve insufficient training samples, The effect of reducing labor costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0078] In order to make the purpose, technical solutions and advantages of the embodiments of the present application clearer, the technical solutions in the embodiments of the present application will be clearly and completely described below in conjunction with the drawings in the embodiments of the present application. Obviously, the described embodiments It is a part of the embodiments of this application, not all of them. Based on the embodiments in this application, all other embodiments obtained by persons of ordinary skill in the art without creative efforts fall within the protection scope of this application.

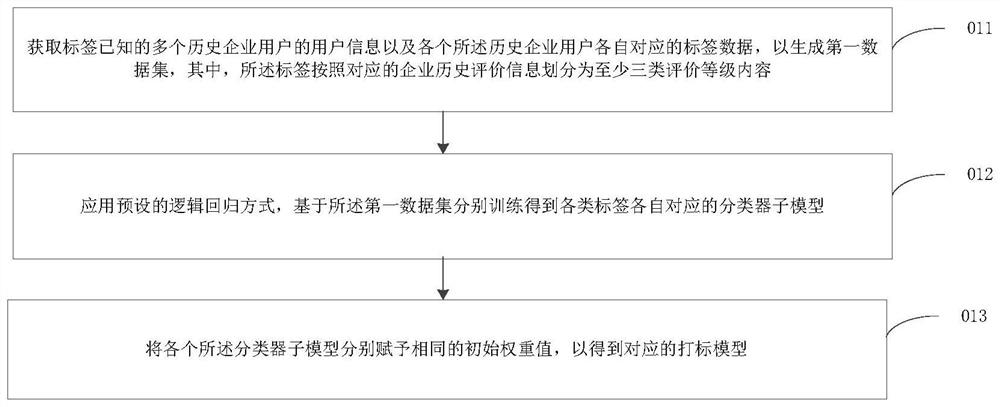

[0079] Considering that a successful model needs to rely on a large amount of data labeling training, and the bank's small and micro enterprise customers cannot cover all small enterprises, nor can they score all small enterprises through expert evaluation, this application provides a risk prediction for enterprise financial services The method, enterprise fin...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com