Credit score card model training method and taxpayer abnormal risk assessment method

A credit scoring and taxpayer technology, applied in data processing applications, digital data information retrieval, special data processing applications, etc., can solve problems such as monotonicity of binning results, achieve reasonable binning results, reduce tax losses, Avoid monotonic effects

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0042] This part describes in detail the specific implementation of the invention.

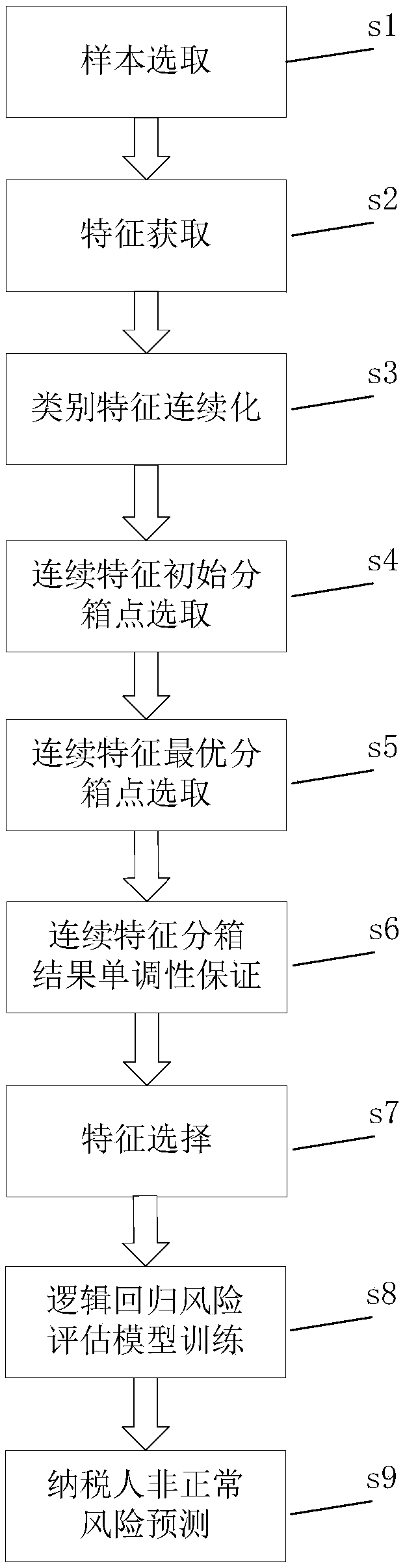

[0043] The optimal WOE binned credit scorecard model proposed by the present invention and the abnormal risk assessment method for taxpayers are mainly divided into figure 1 There are 9 steps in total from s1 to s9 shown.

[0044] The s1 step is sample selection, and the sample selection stage is mainly to determine the division of black and white samples and the time interval for sample selection. In the present invention, the main goal is to predict the risk of taxpayers becoming abnormal households, so taxpayers whose taxpayer status is abnormal are used as black samples, and taxpayers whose taxpayer status is normal are used as white samples. At the same time, according to the time when the taxpayer became an abnormal household, the historical period, observation period, and performance period are divided, and the samples of the historical period are used for model training, and the sampl...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com