Blockchain-based tax method and architecture

A blockchain and taxation technology, applied in special data processing applications, instruments, electronic digital data processing, etc., can solve problems such as tax schemes that cannot meet taxation needs, and achieve the effect of promoting fairness and strengthening security

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0045] As mentioned above, the transaction process of the present invention is as follows, as figure 2 Shown:

[0046] If it is the first time user, it will first enter the member management module through the user identity initialization interface to register, and then enter the service layer through the identity authentication interface after successful registration; if it is an old user, it can directly enter the service layer through the identity authentication interface;

[0047] ① The merchant presents the QR code to the user to request payment.

[0048] ②The user scans the QR code to confirm the transaction.

[0049] ③ At this time, the transaction money does not enter the merchant's account, but enters the chain code service module. The merchant confirms the execution of taxes at the terminal, and the chain code service module pays taxes according to the tax rules, and deposits the tax bill into the block service module.

[0050] ④ The merchant executes payment coll...

Embodiment 2

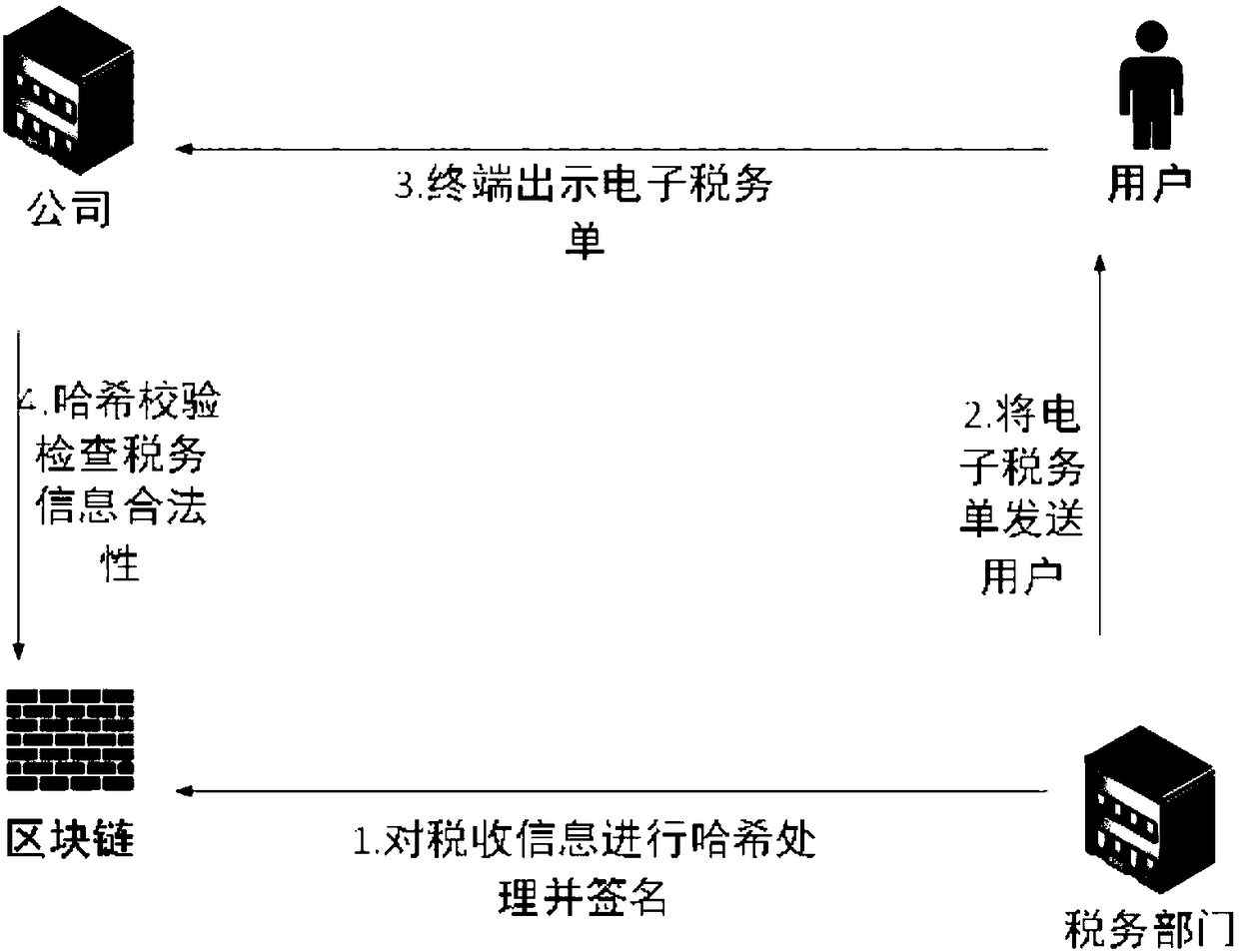

[0055] As mentioned above, the proof process of the present invention is as follows, as image 3 Shown:

[0056] ① After the tax department proves the electronic taxation process of a transaction through the supervision interface, the supervision module generates a tax bill for the transaction, and the block service module hashes the tax bill, and records the private key signature in the block service module.

[0057] ②The tax department encrypts the tax bill with the buyer's public key and sends it directly to the buyer.

[0058] ③ The buyer presents the tax bill to the company for reimbursement.

[0059] ④ The company finds the corresponding certification information of the block service module through the authentication record query interface, and compares the tax bill after verification with the seller's public key with the result of the hashed tax bill to complete the proof of reimbursement.

[0060] To sum up, the present invention realizes the automatic taxation funct...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com