Tax estimation system model

An evaluation system and model technology, applied in the direction of instruments, data processing applications, calculations, etc., can solve the problems of collection and management technology content, low degree of information application, weak deterrence, taxpayers' weak awareness of paying taxes according to law, etc., to reduce entry The frequency of inspections, the effect of improving law enforcement capabilities and raising tax awareness

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

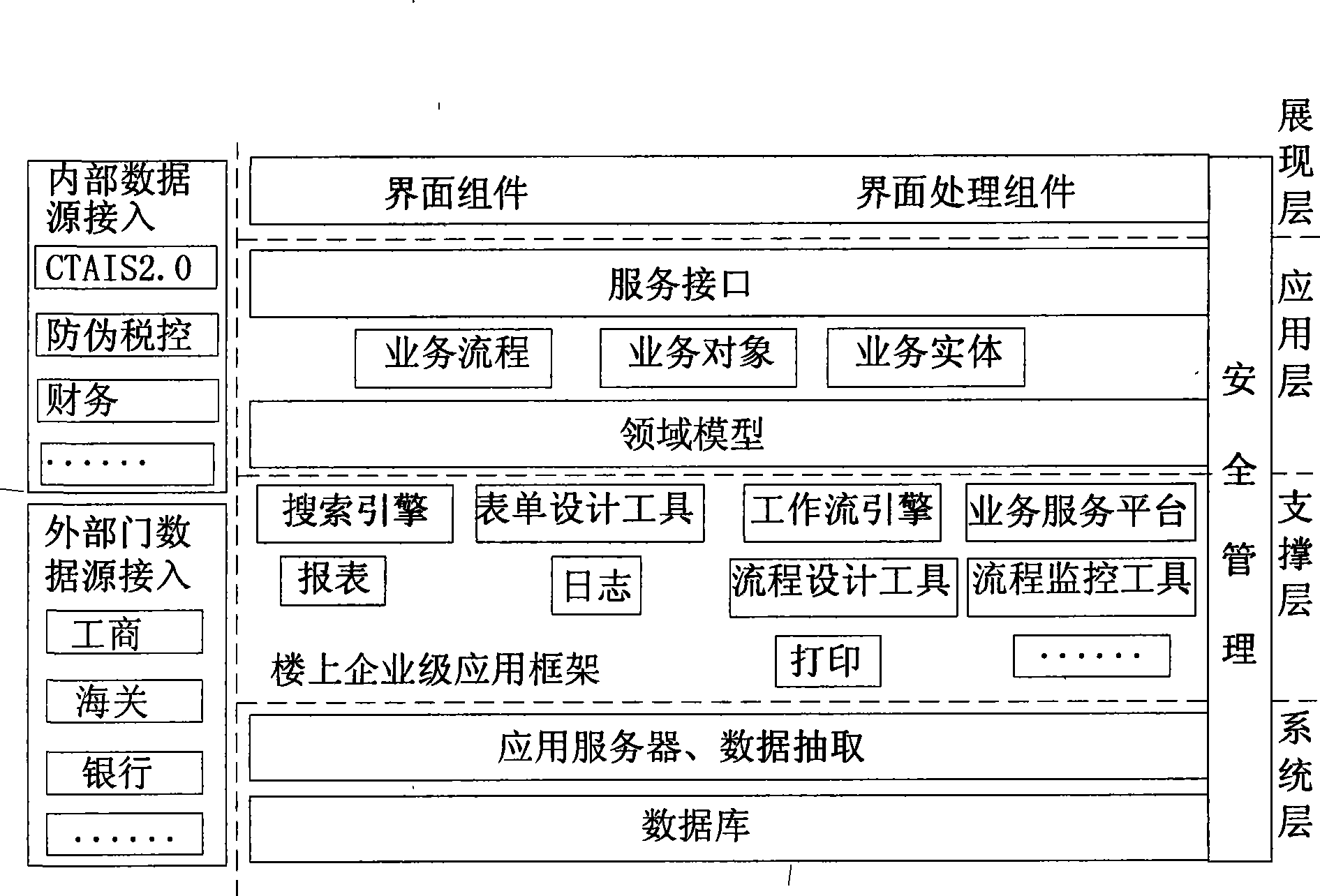

[0056] The entire system architecture is divided into system layer, support layer, application layer, and presentation layer, and security management runs through each layer. System data sources are divided into internal data sources and external departmental data sources, and exchange data with each data source through data interfaces. The various layers of the system architecture are described as follows:

[0057] System layer

[0058] The system layer, as the lowest level of application system operation support platform, is composed of hardware platforms such as network, server, working end, operating system, database, and application server to provide basic support for system applications.

[0059] Support layer

[0060] On the basis of the system layer, use Inspur LOUSHANG enterprise-level application platform to develop applications. The platform provides components such as workflow engine, data extraction tool, search engine, business service platform, and form design tool ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com