Mobile User Identify And Risk/Fraud Model Service

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0034]In accordance with various embodiments described herein, methods and systems are provided that may generate a transaction score and / or data to detect and prevent potential identity theft, transaction risk or fraud when using a payment system with, for example, a Near Field Communication (NFC), blue tooth or infrared enabled client device. Such transaction score or potential risk / fraud data may be generated in real time and may be based on user data that includes a user profile and transaction information that may pertain, for example, to financial transactions performed by a user in relation to various merchants, or other user to user, merchant to merchant, or merchant to user transactions. Such transactions may be facilitated by a payment service provider.

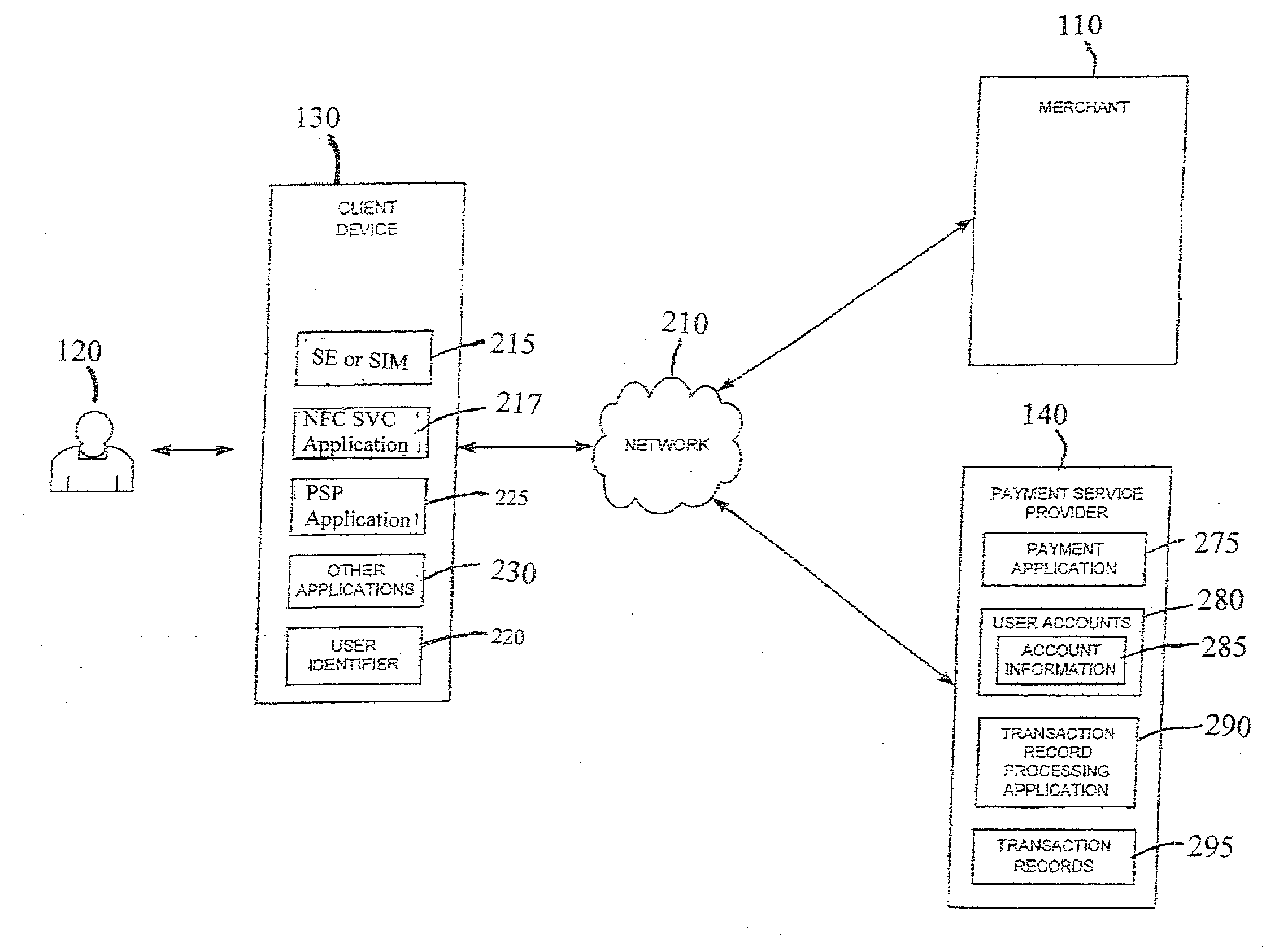

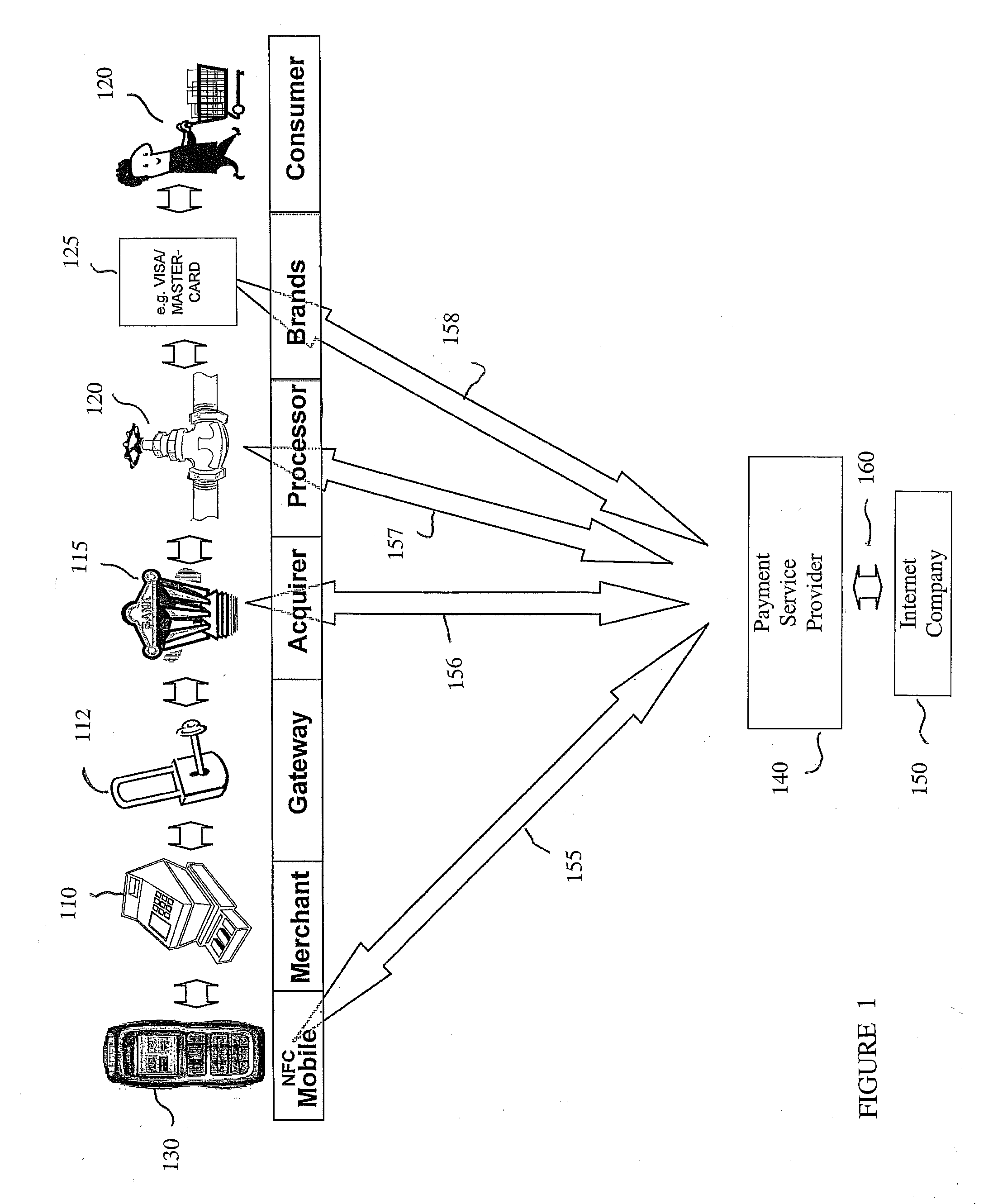

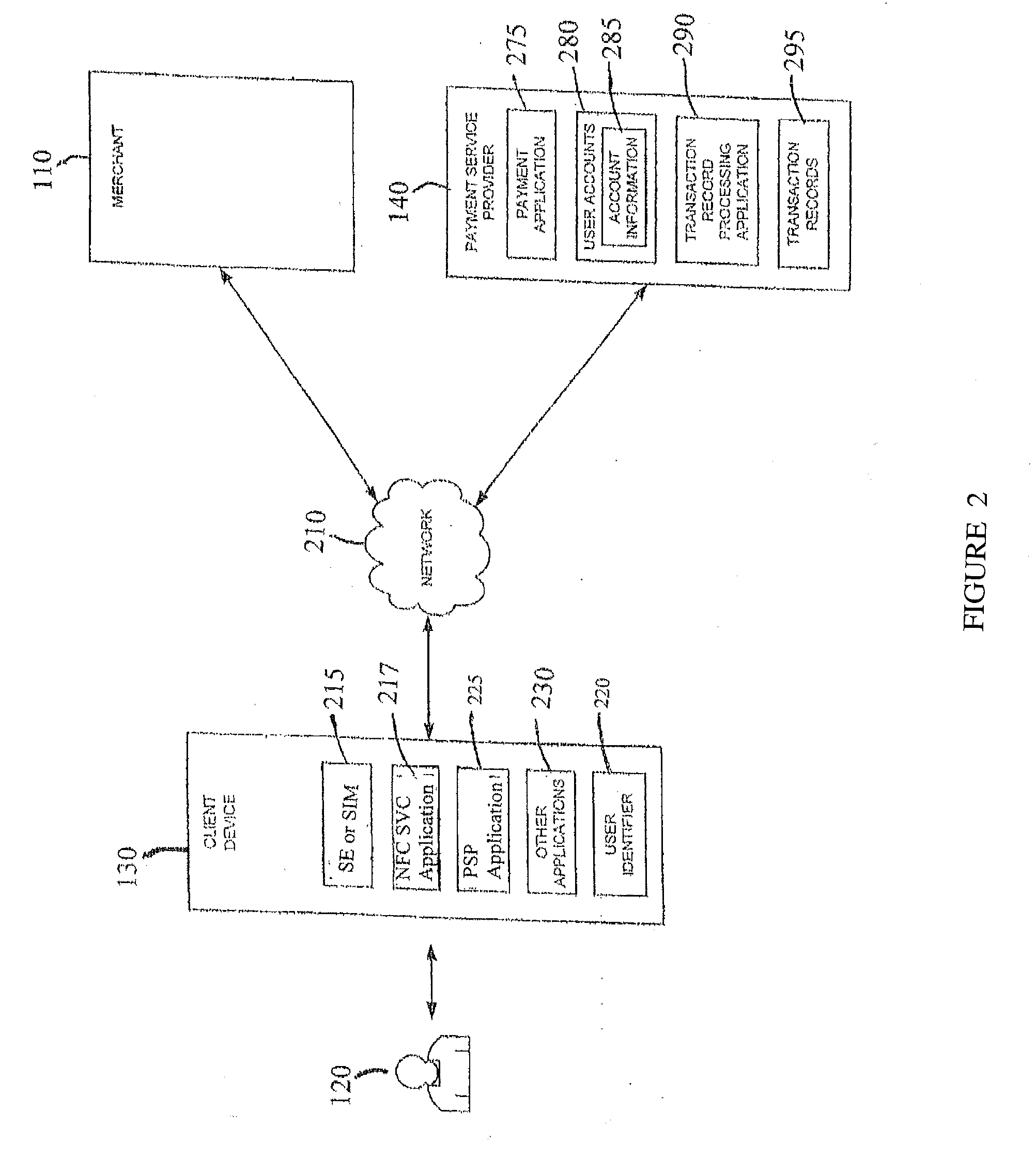

[0035]Referring now to the drawings wherein the showings are for purposes of illustrating embodiments of the present disclosure only, and not for purposes of limiting the same, FIG. 1 illustrates a payment system according t...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com