Risk dispersion type stock selection algorithm based on stock association network clustering

An associative network, decentralized technology, applied in computing, computer components, data processing applications, etc., can solve problems such as insufficient consideration of stock connection relationships, and achieve the effect of high return to risk ratio

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

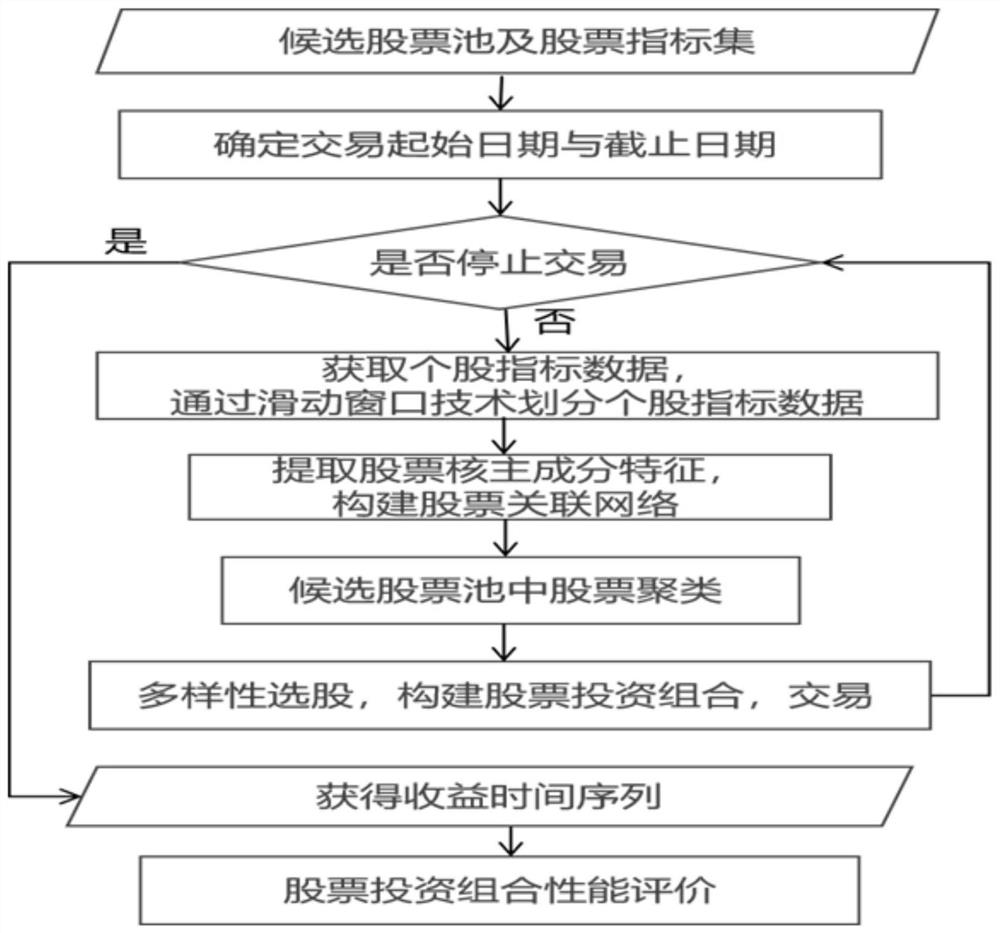

[0032] see figure 2 , the present embodiment provides a risk-dispersed stock selection algorithm based on stock association network clustering, including the following steps:

[0033] Step 1: Construct a stock association network based on the stock index core principal component features:

[0034] In this embodiment, considering both the technical trend and the fundamental situation of the stock, 21 commonly used stock trading indexes and fundamental indexes are selected as the stock index set, as shown in Table 1 and Table 2 below. Individual stocks are represented by weekly data from the Equity Indicators Aggregate indicator as described below.

[0035] Table 1: Introduction to Stock Trading Indicators

[0036]

[0037] Table 2 Introduction to Stock Fundamental Indicators

[0038]

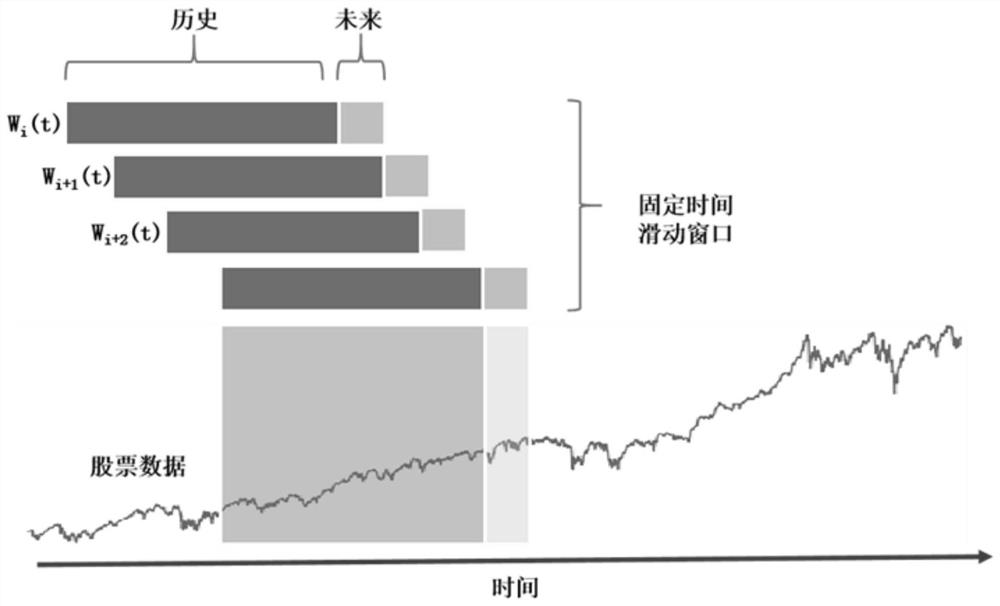

[0039] The candidate stock pool is denoted as {S 1 ,S 2 ,...,S i}, where S i Represents the i-th stock in the candidate stock pool, and the maximum value of i represents the number ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com