Tax knowledge middle platform based on natural language understanding and construction method of platform

A technology of natural language understanding and construction method, which is applied in the tax knowledge middle-end and its construction field based on natural language understanding. Knowledge retrieval and search inefficiency and other problems, to achieve the effect of achieving high efficiency and accuracy, solving knowledge sorting problems, and ensuring timeliness

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

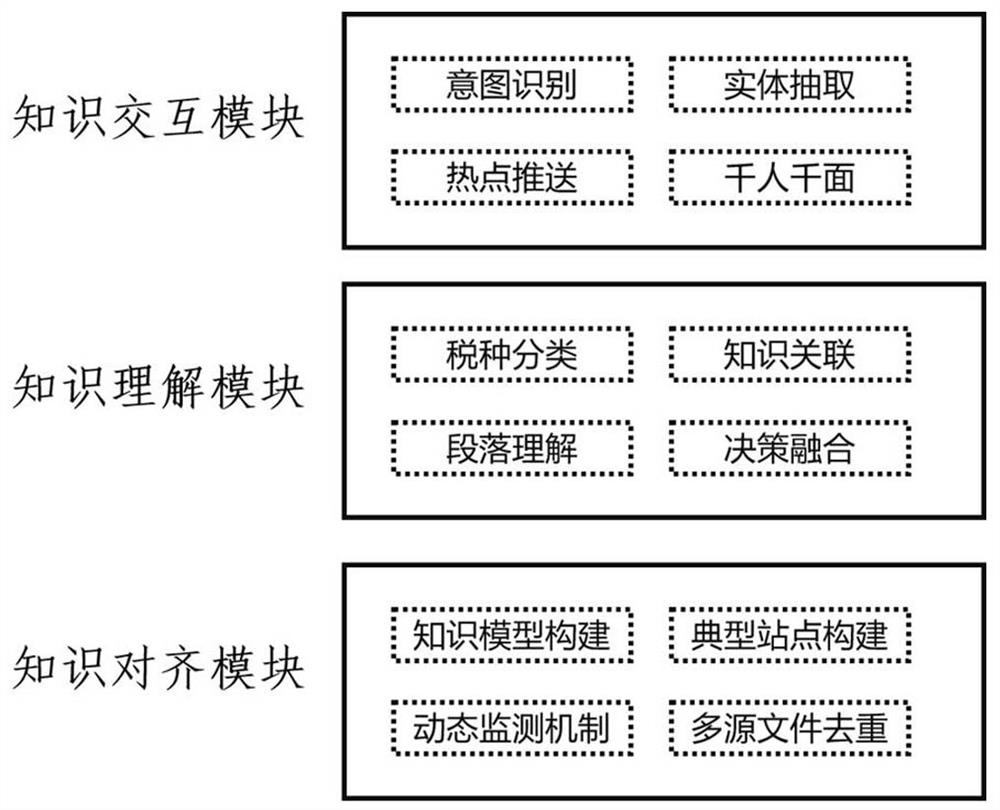

[0036] Considering the characteristics of many sources of tax policy knowledge, strong policy, strong professionalism, irregular update, and strong regional characteristics, this embodiment discloses a tax knowledge platform based on natural language understanding, which can be widely used at all levels Tax bureau, various enterprises and institutions and personal use. Such as figure 1 As shown, the knowledge center includes knowledge alignment module, knowledge understanding module and knowledge interaction module.

[0037] The knowledge alignment module is used to realize the collation and knowledge alignment of multi-source tax policy knowledge, and construct highly structured data; the collation refers to the localization of multi-source knowledge, and the alignment refers to the deduplication and prioritization of multi-source knowledge .

[0038] The knowledge understanding module uses multi-dimensional natural language understanding technology to realize the associati...

Embodiment 2

[0041] This embodiment discloses a method for constructing a tax knowledge center, including the following steps:

[0042] S01), build a knowledge alignment module, which is used to realize the collation and knowledge alignment of multi-source tax policy knowledge, and build highly structured data; here collation refers to the localization of multi-source knowledge, and alignment refers to multi-source Knowledge deduplication and prioritization.

[0043] The specific steps to construct the knowledge alignment module are as follows:

[0044] S11), build a local structured tax policy knowledge base model based on the structured database, and realize the structured arrangement of tax knowledge on this basis;

[0045] In this embodiment, the structured database is a relational database or a Mysql database.

[0046] S12), sort out typical tax policy knowledge sites, and build a typical site library;

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com