Insurance product data pushing method and system based on big data and computer equipment

A product data and big data technology, applied in the field of big data, can solve problems such as low prediction accuracy and inability to realize intelligent selection, and achieve the effect of improving accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

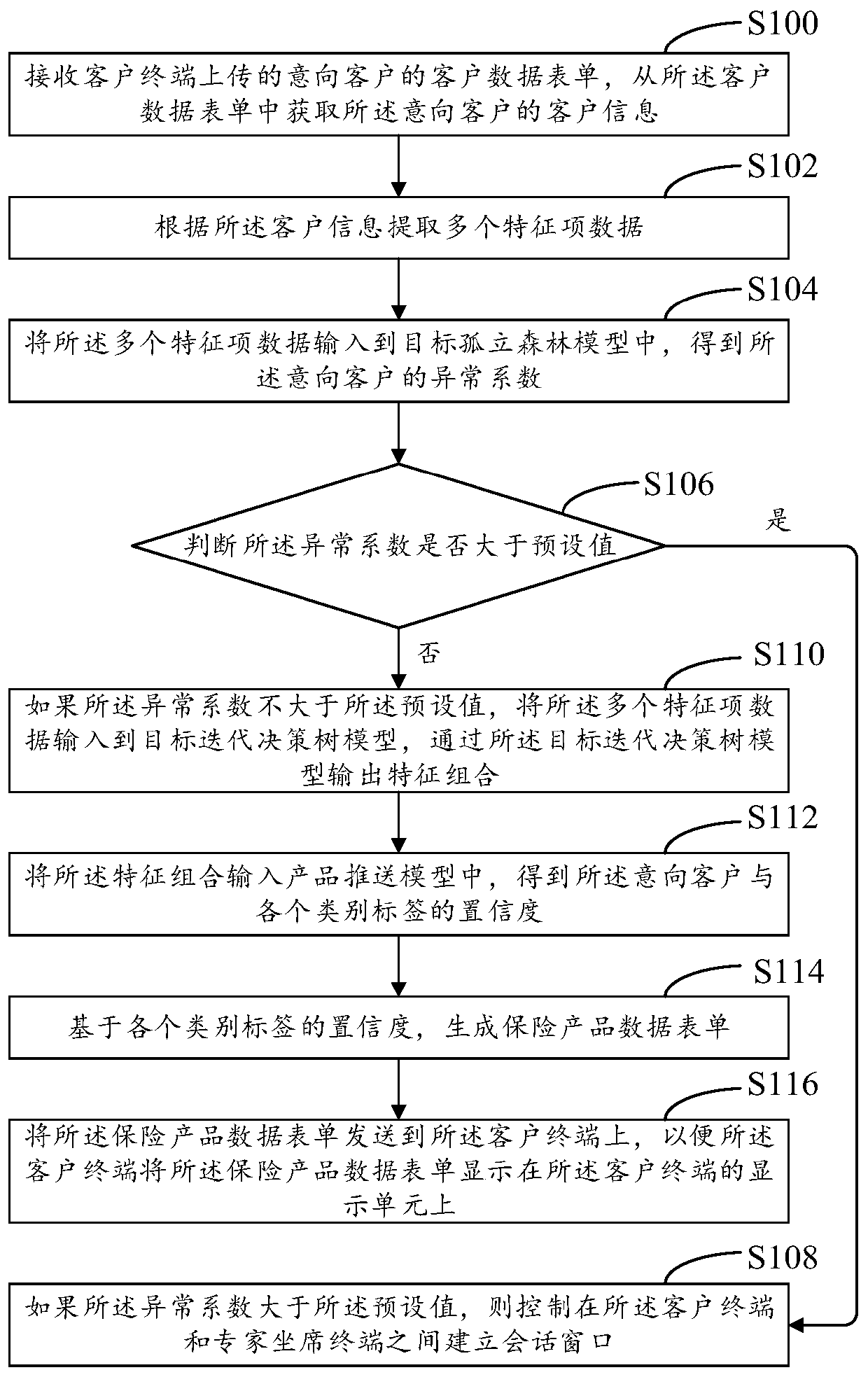

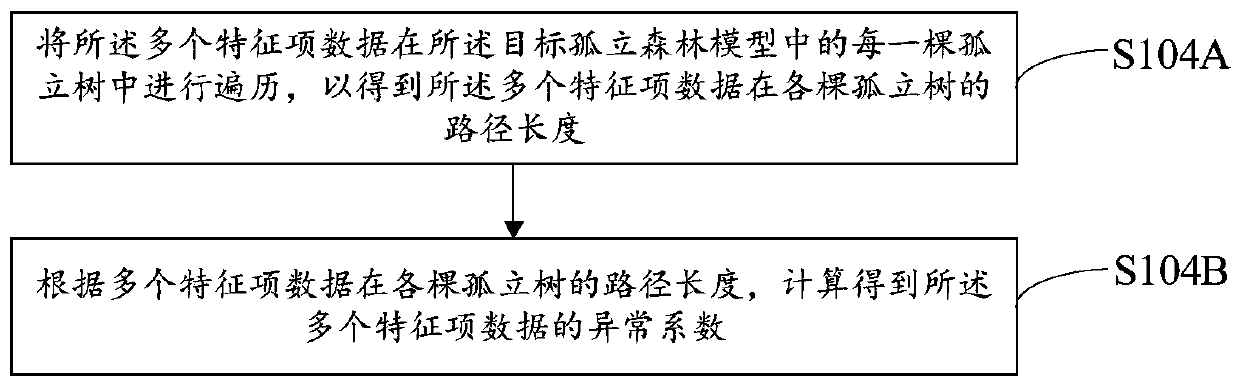

[0064] Refer to figure 1 , Shows a step flow chart of the method for pushing insurance product data based on big data in the first embodiment of the present invention. It can be understood that the flowchart in this method embodiment is not used to limit the order of execution of the steps. details as follows:

[0065] Step S100: Receive the customer data form of the intended customer uploaded by the client terminal, and obtain the customer information of the intended customer from the customer data form.

[0066] Exemplarily, the customer information includes, but is not limited to, occupation, age, gender, marital status, working years, education, annual income, property rating, car rating, etc.

[0067] Step S102: Extract multiple feature item data according to the customer information.

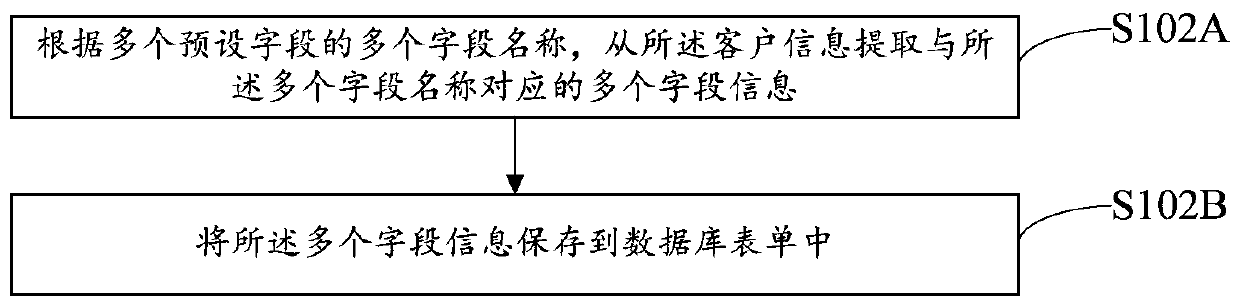

[0068] Exemplarily, the step S102 may further include:

[0069] Step S102A, extracting multiple field information corresponding to the multiple field names from the customer information according ...

Embodiment 2

[0113] Please keep reading Figure 5 , Shows a schematic diagram of the program modules of the second embodiment of the big data-based insurance product data push system 20 of the present invention. In this embodiment, the insurance product data push system 20 based on big data may include or be divided into one or more program modules, and the one or more program modules are stored in a storage medium and run by one or more processors. It is executed to complete the present invention and realize the above-mentioned method for pushing insurance product data based on big data. The program module referred to in the embodiment of the present invention refers to a series of computer program instruction segments that can complete specific functions, and is more suitable than the program itself to describe the execution process of the insurance product data push system 20 based on big data in the storage medium. The following description will specifically introduce the functions of e...

Embodiment 3

[0134] Refer to Image 6 , Is a schematic diagram of the hardware architecture of the computer device in the third embodiment of the present invention. In this embodiment, the computer device 2 is a device that can automatically perform numerical calculation and / or information processing according to pre-set or stored instructions. The computer device 2 may be a rack server, a blade server, a tower server, or a cabinet server (including an independent server, or a server cluster composed of multiple servers). As shown in the figure, the computer device 2 at least includes, but is not limited to, a memory 21, a processor 22, a network interface 23, and an insurance product data push system 20 that can communicate with each other through a system bus. among them:

[0135] In this embodiment, the memory 21 includes at least one type of computer-readable storage medium. The readable storage medium includes flash memory, hard disk, multimedia card, card-type memory (for example, SD ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com