Transaction verification method, automatic transaction verification system and transaction verification unit (variants)

An automatic exchange and transaction technology, applied in the field of confirmation, can solve problems such as high knowledge requirements, high cost of receiving and payment transaction verification, and difficulty in multi-level transaction verification

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

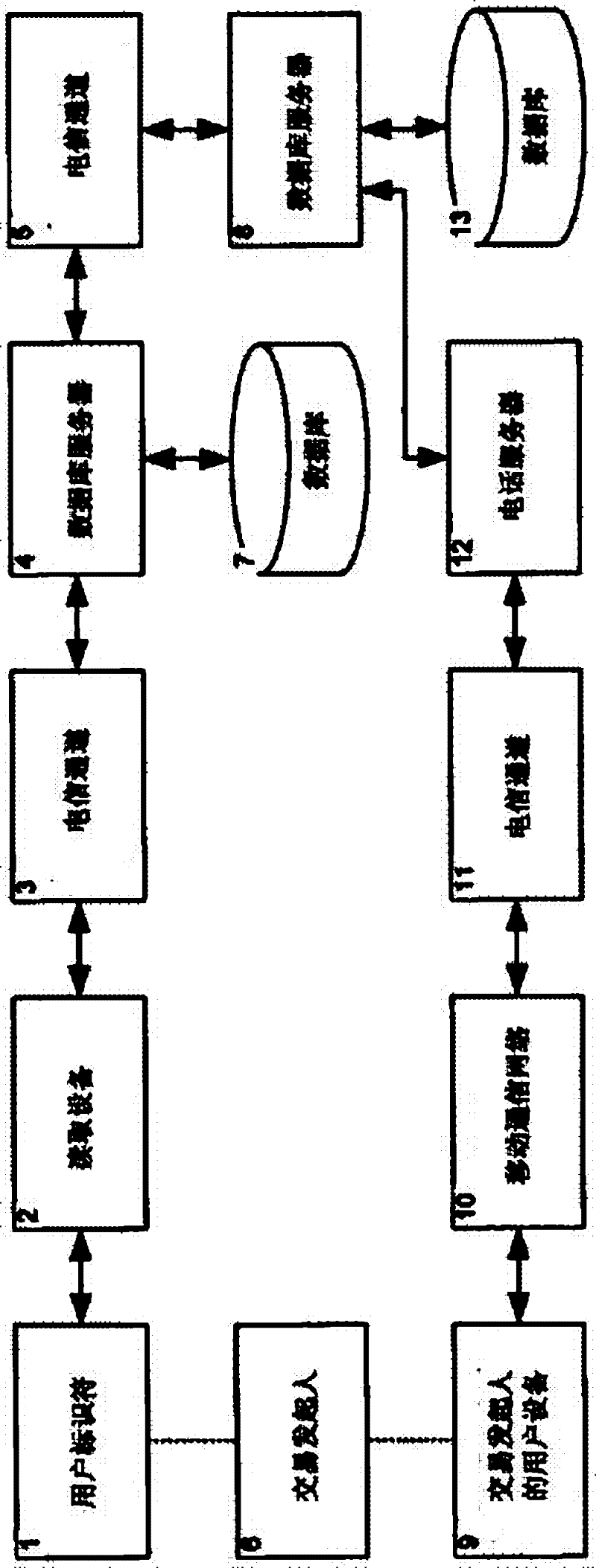

[0137] Embodiment 1 Transaction Verification System

[0138] like figure 1 As shown, the transaction verification system includes a reading device 2 and a transaction digital processing device 4 sequentially connected to the telecommunication channel 3, the transaction database 7 is connected to the digital processing device 4, and the database server 8 is connected to the digital processing device 4 through the telecommunication channel 5, The database 13 is connected to the database server 8 , the mobile communication network 10 is connected to the automatic switching telephone network 11 , and the user equipment (not shown) of the verifier is correspondingly connected to the telephone server 12 , which is connected to the database 8 . In order for the system to allow the transaction initiator 6 to use the identifier 1 already recorded on the medium, and the mobile phone 9 as the user equipment of the person authorized for the transaction.

[0139] In the current example, f...

Embodiment 2

[0168] Example 2 Operation of a transaction verification system for plastic card business in the banking sector.

[0169] Figure 9 What is shown is a schematic diagram of the verification service performed by the transaction verification system with the plastic card as the medium of the user identifier 1 .

[0170] For simplicity, it is assumed that the transaction originator and grantee are the same. The transaction initiator 6 inserts the bank plastic card (as the medium of the identifier 1 in the user) into the ATM (reading device 2) located in the commercial area, enters the password and instructs the ATM to withdraw cash from the transaction initiator's personal account. The ATM machine transmits the card data through the telecommunication channel 13 to the bank processing center (transaction digital processing device 4) located in the bank area. The processing center 4 uses the database 7 and the received identifier of the transaction initiator 1 to find out the ID2, ...

Embodiment 3

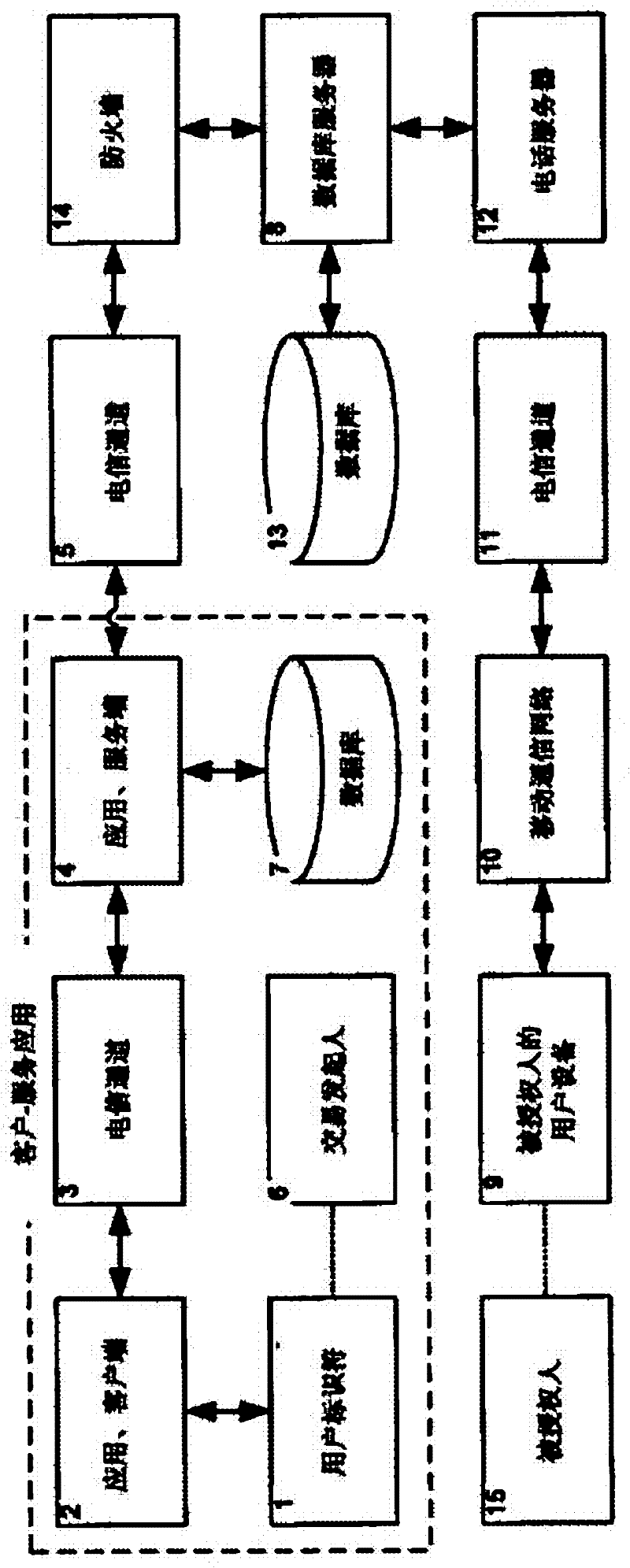

[0174] like figure 2 As shown, the authorization element of the present invention can be used with an authorization element already recorded on a credit or debit bank card when the transaction initiator withdraws cash from an ATM.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com