Credit estimation method and system

A credit evaluation and credit degree technology, applied in data processing applications, commerce, instruments, etc., can solve the problem of low accuracy of credit evaluation values, and achieve the effects of reducing risks, improving accuracy, and improving reliability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0050] In order to make the above objects, features and advantages of the present invention more comprehensible, the present invention will be further described in detail below in conjunction with the accompanying drawings and specific embodiments.

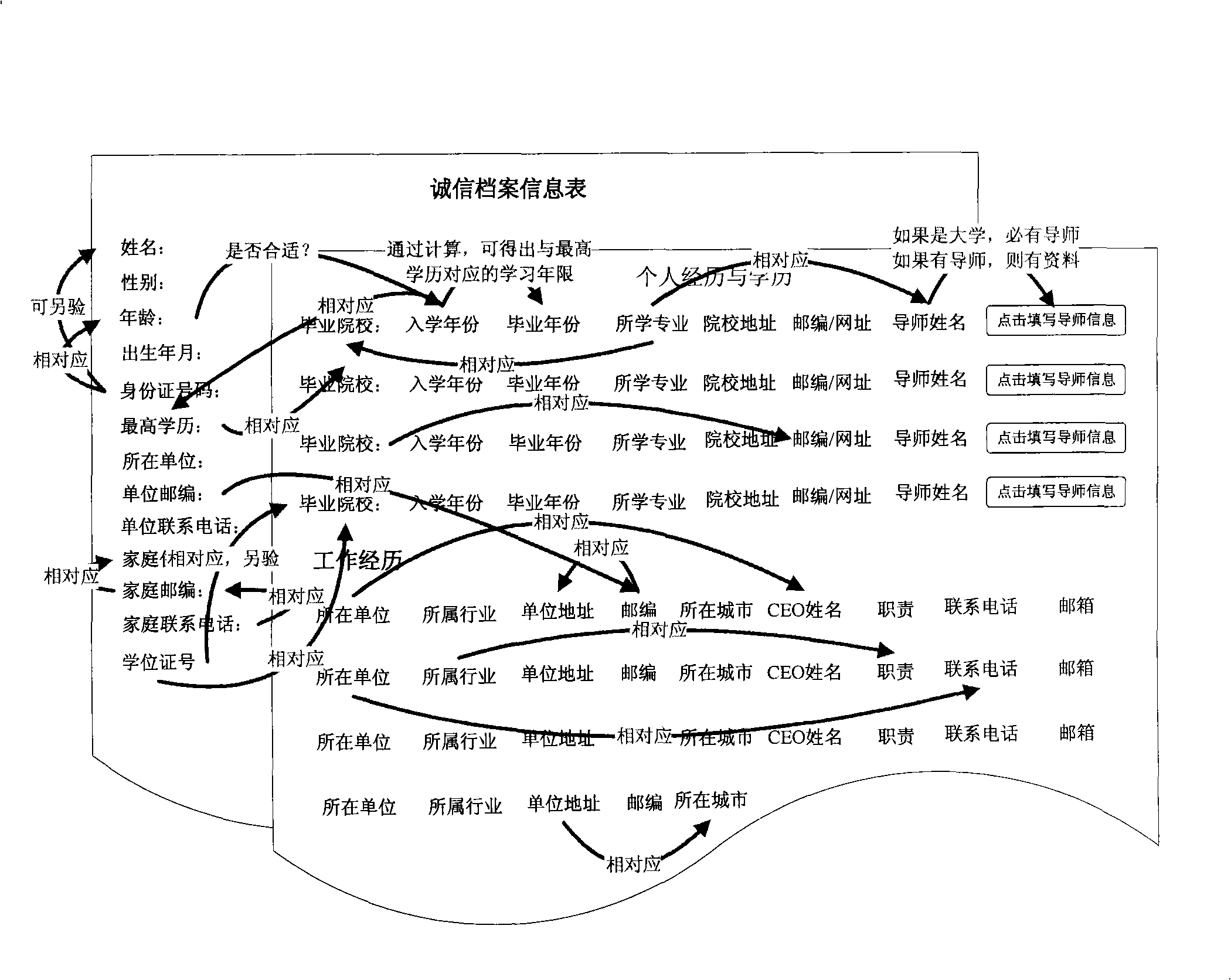

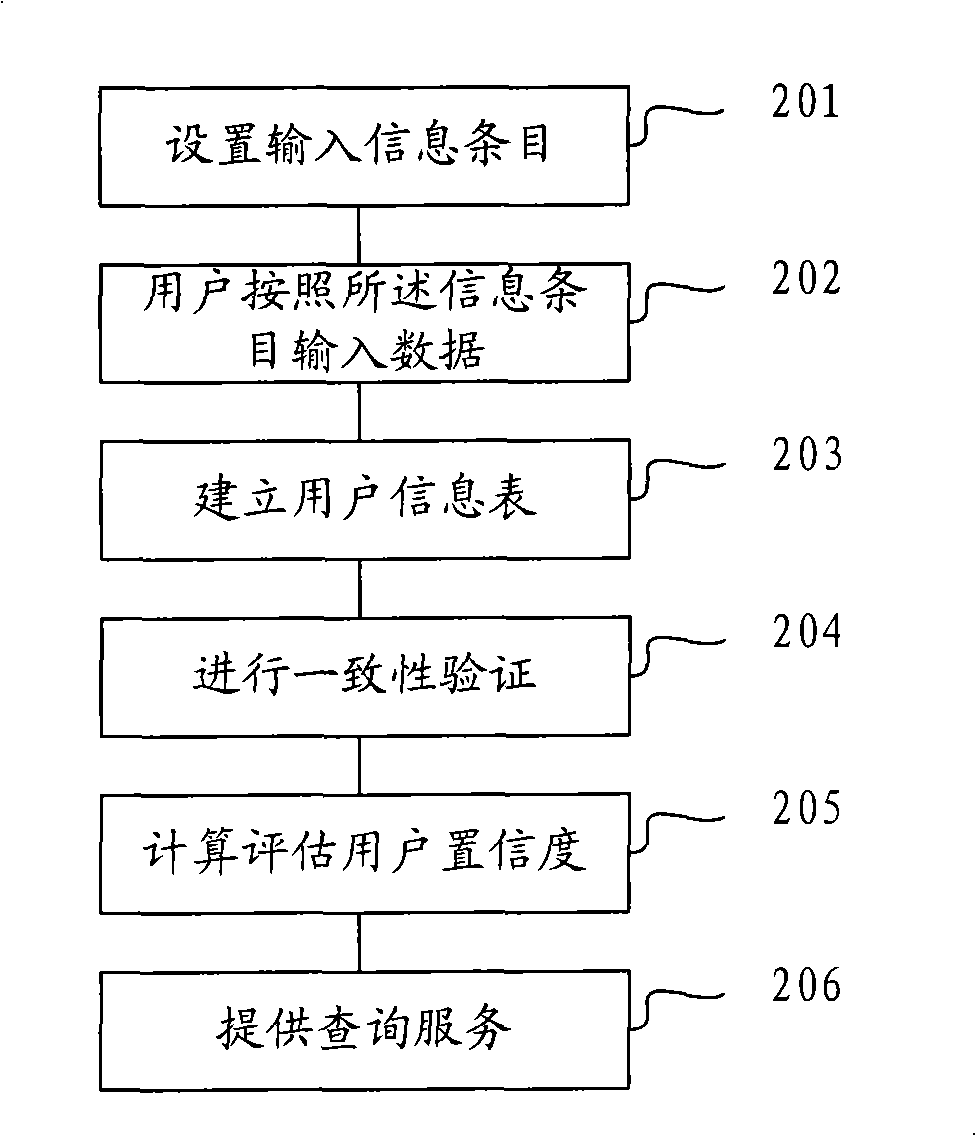

[0051] The embodiment of the present invention proposes an objective credit evaluation method, which finds out whether the information input by the user is credible by deeply digging the implicit consistency relationship between the user information items, thereby objectively judging the credit degree of the user. Moreover, for different application scenarios, different evaluation models are set to evaluate the user's credit. In different application fields, the information items that can reflect the user's credit are different. Therefore, when establishing different evaluation models, the information items that meet the specific scenarios are selected, and the data input by the user is further calculated and evaluated.

[0052] T...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com