Tax service system based on cloud service

A technology of service system and cloud service, which is applied in the direction of transmission system, resource allocation, program control design, etc., can solve problems such as drive-influence conflicts, inconvenience for taxpayers, and inability to handle tax-related business normally, so as to reduce the pressure of taxation , Improving the efficiency of tax handling and optimizing the effect of the government's business environment

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0032] In order to make the purpose, technical solutions and advantages of the embodiments of the present invention clearer, the technical solutions in the embodiments of the present invention will be clearly and completely described below in conjunction with the drawings in the embodiments of the present invention. Obviously, the described embodiments It is a part of the embodiments of the present invention, but not all of them. Based on the embodiments of the present invention, all other embodiments obtained by those of ordinary skill in the art without creative work belong to the protection of the present invention. scope.

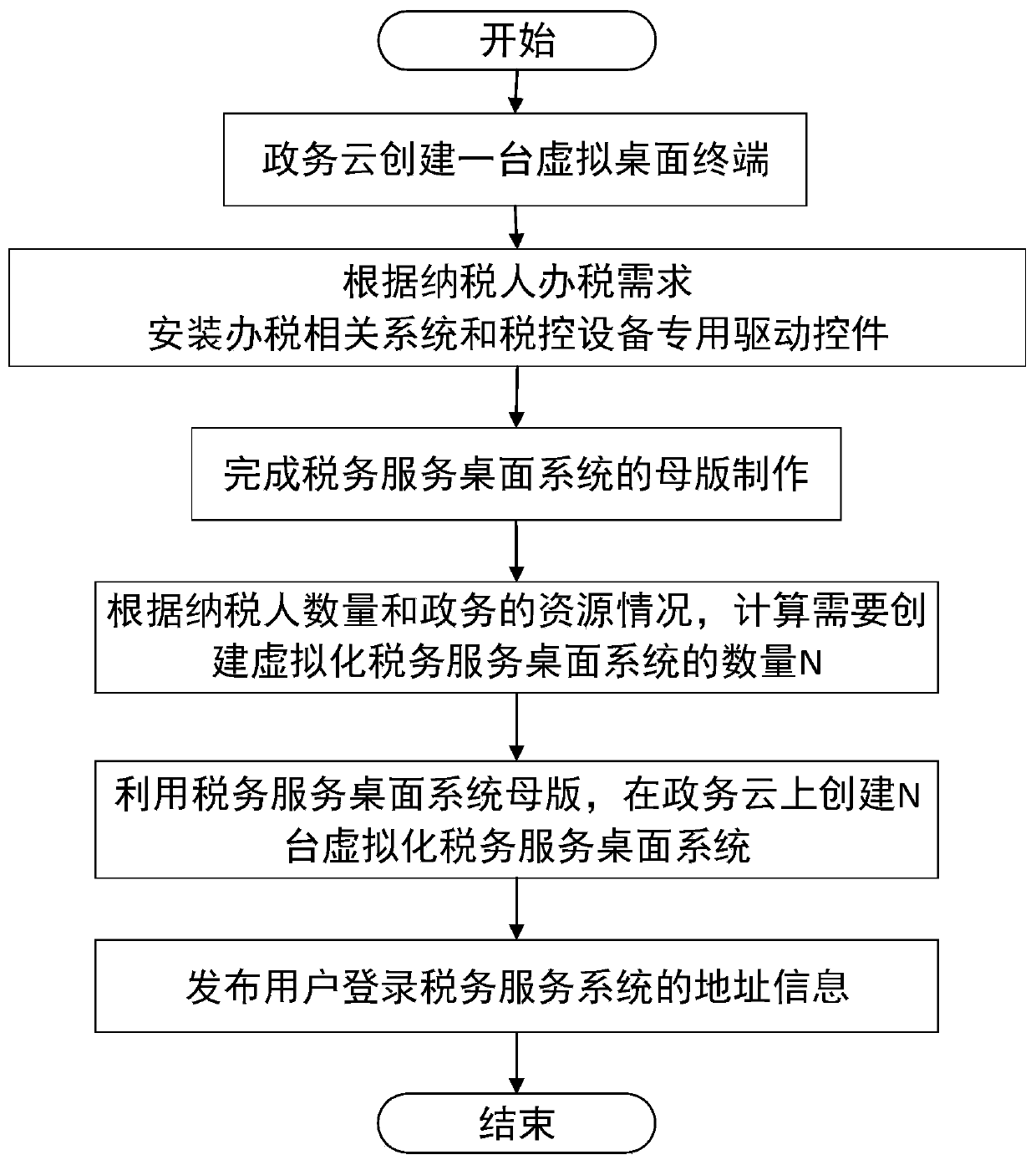

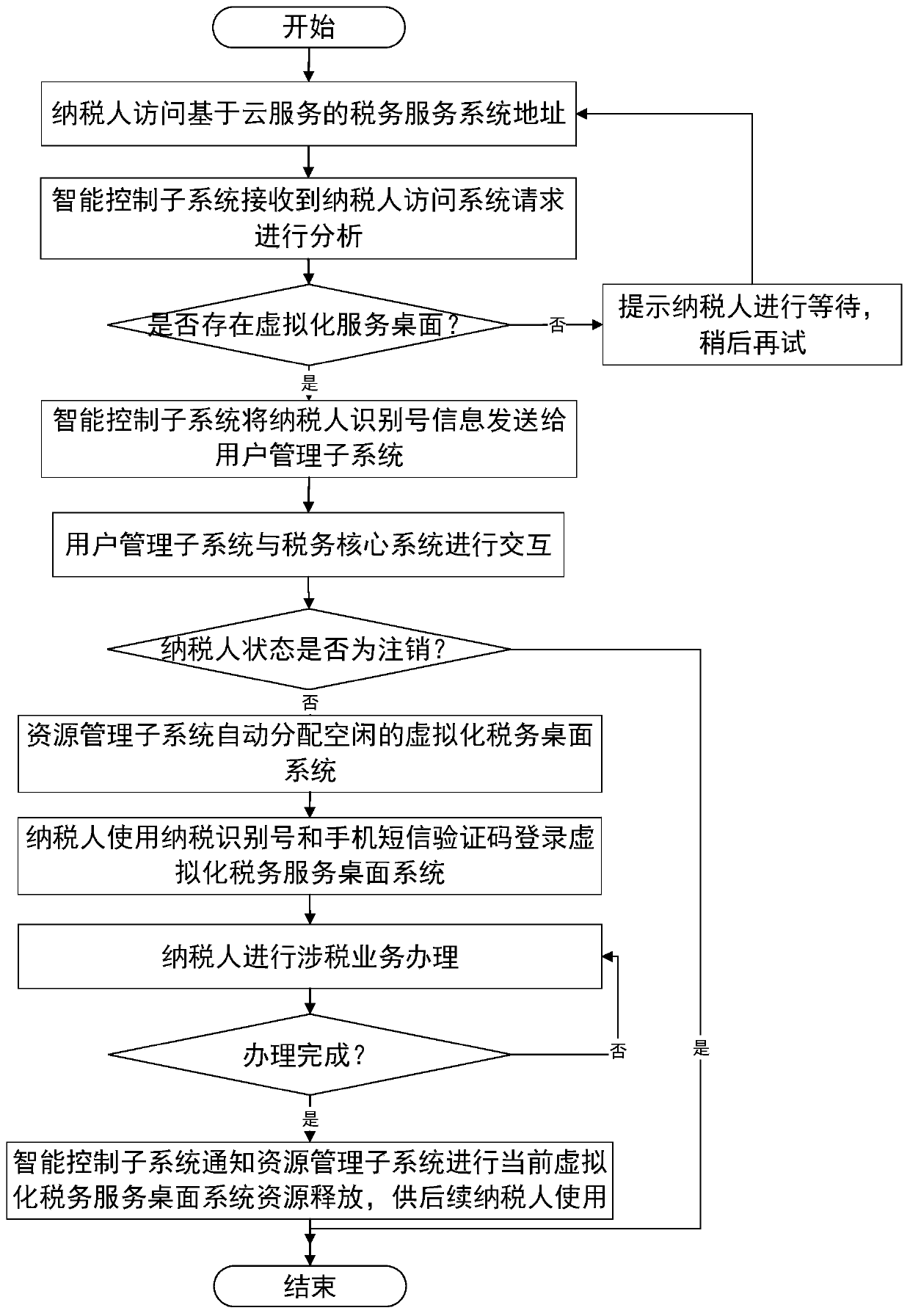

[0033] The present invention utilizes network communication technology, virtualization technology, intelligent monitoring, security encryption and other technologies, and relies on the basic resources of the government cloud to deploy an electronic tax bureau and a value-added tax invoice comprehensive service platform system to provide taxpayers with ma...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com