Method and a device for invoicing

A technology for invoicing and invoicing, which is applied in invoicing/invoicing, etc., can solve the problems of waste of human resources, the ineffective connection between the issuing software and the entrusted collection system, etc., so as to reduce the cost of taxation, improve the efficiency of taxation, and reduce the pressure. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

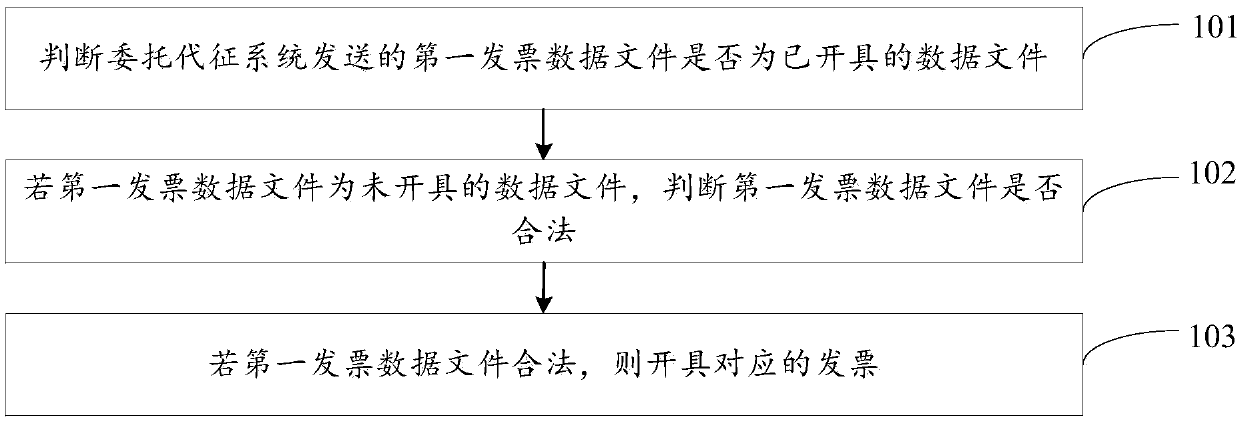

[0032] refer to figure 1 , shows a flow chart of the steps of issuing an invoice in Embodiment 1 of the present invention.

[0033] The method for issuing an invoice provided by the embodiment of the present invention includes the following steps:

[0034] Step 101: Determine whether the first invoice data file sent by the entrusting collection system is a data file that has already been issued.

[0035] Actual tax collection refers to a collection and management method in which tax authorities entrust units or individuals with certain conditions to collect taxes on behalf of them.

[0036] The tax control and collection system obtains the taxpayer's identity information or unit information and other tax information as the first invoice data file.

[0037]Import the first invoice data file in XML (Extensible Markup Language) format to issue invoices: click the "document" button on the invoice filling interface, open the DKDR folder under the installation directory of the age...

Embodiment 2

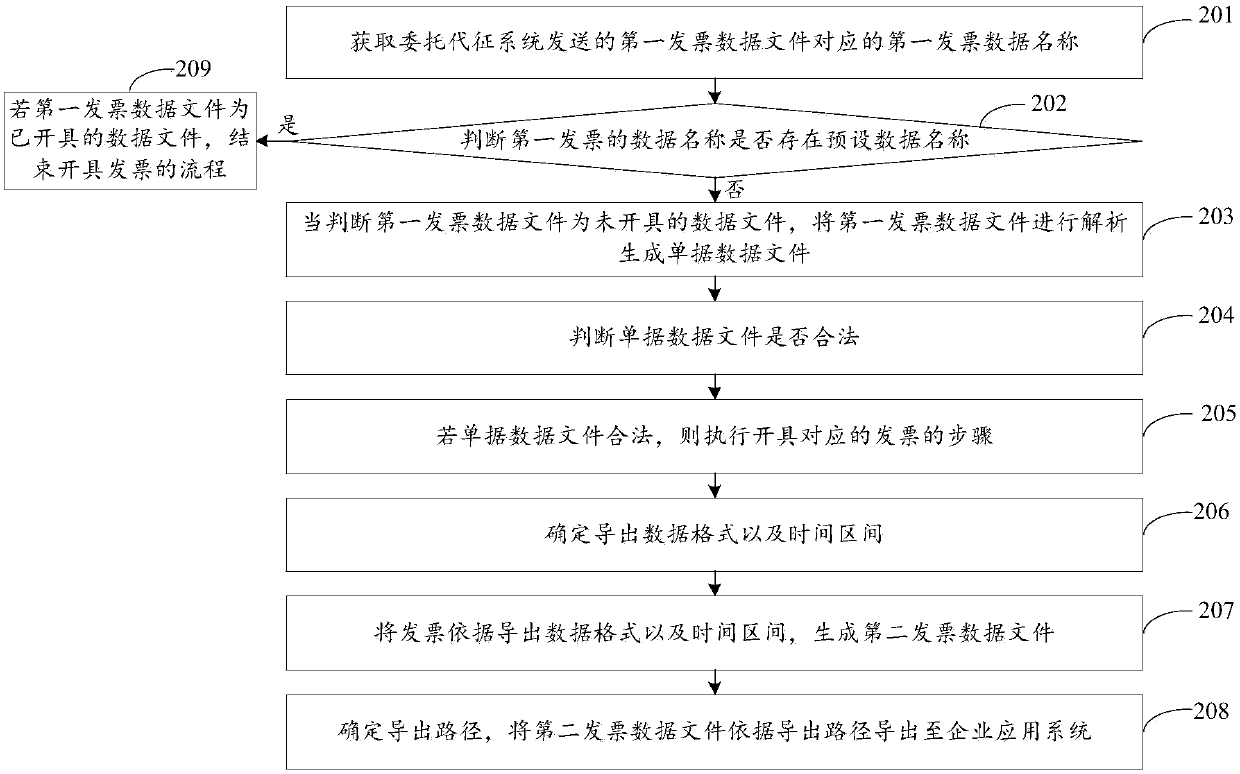

[0047] refer to figure 2 , shows a flow chart of steps for issuing an invoice in Embodiment 2 of the present invention.

[0048] The method for issuing an invoice provided by the embodiment of the present invention includes the following steps:

[0049] Step 201: Obtain the name of the first invoice data corresponding to the first invoice data file sent by the entrusting collection system.

[0050] Wherein, the format of the first invoice data file is XML format.

[0051] Actual tax collection refers to a collection and management method in which tax authorities entrust units or individuals with certain conditions to collect taxes on behalf of them.

[0052] The tax control and collection system obtains the taxpayer's identity information or unit information and other tax information as the first invoice data file.

[0053] Import the first invoice data file in XML (Extensible Markup Language) format to issue invoices: click the "document" button on the invoice filling int...

Embodiment 3

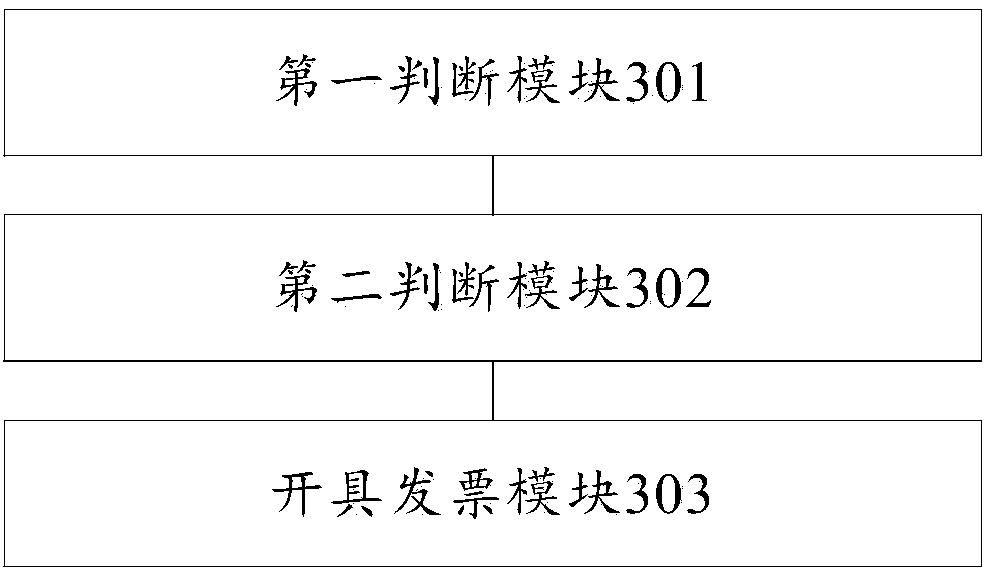

[0077] refer to image 3 , shows a structural block diagram of an invoice issuing device according to Embodiment 3 of the present invention.

[0078] The device for issuing invoices provided by the embodiment of the present invention includes: a first judging module 301, a second judging module 302, and an invoice issuing module 303; data file, and the judgment result is sent to the second judgment module 302; when the first judgment module 301 judges that the first invoice data file is an unissued data file, the judgment result is sent to the second judgment module 302, When the judgment result of the second judging module 302 is that the first invoice data file is legal, the judging result is sent to the invoice issuing module 303, and the invoice issuing module 303 issues a corresponding invoice.

[0079] It can be seen from the above technical solutions that the embodiment of the present invention judges whether the first invoice data file sent by the entrusted collection...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com