Electronic invoice system based on blockchain and realization method

A technology of electronic invoices and implementation methods, which is applied in the direction of payment system, invoicing/invoicing, payment system structure, etc. It can solve the problems of information islands, illegal use, electronic invoice data transmission and storage, etc. Isolated islands, avoiding single-point problems, and ensuring authenticity

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047] Preferred embodiments of the present invention will be described below in conjunction with the accompanying drawings. It should be understood that the embodiments described here are only used to illustrate and explain the present invention, and are not intended to limit the present invention.

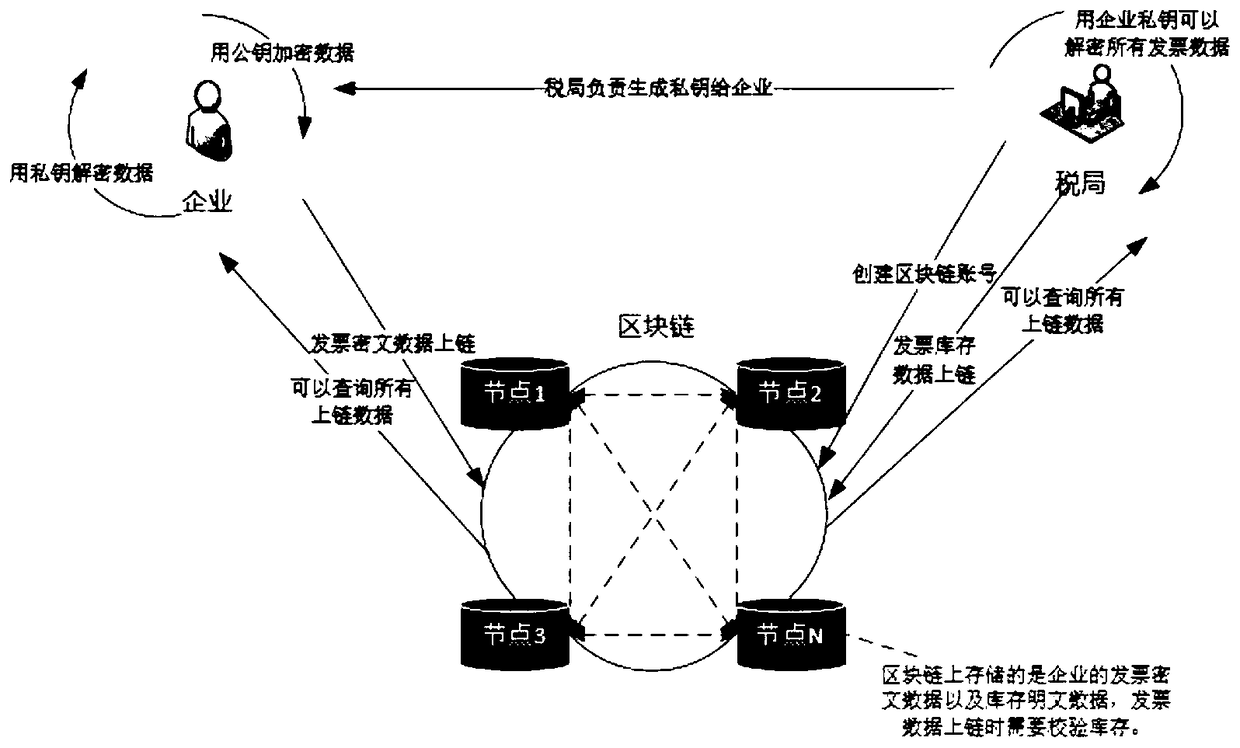

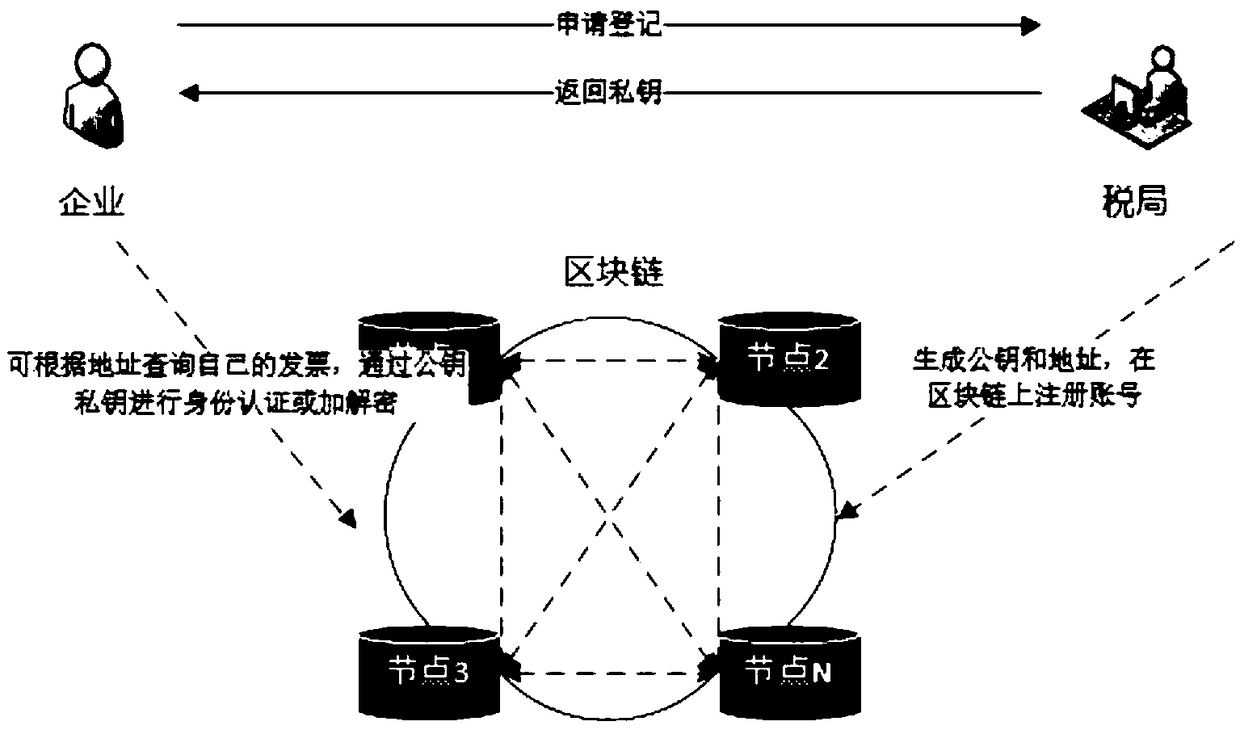

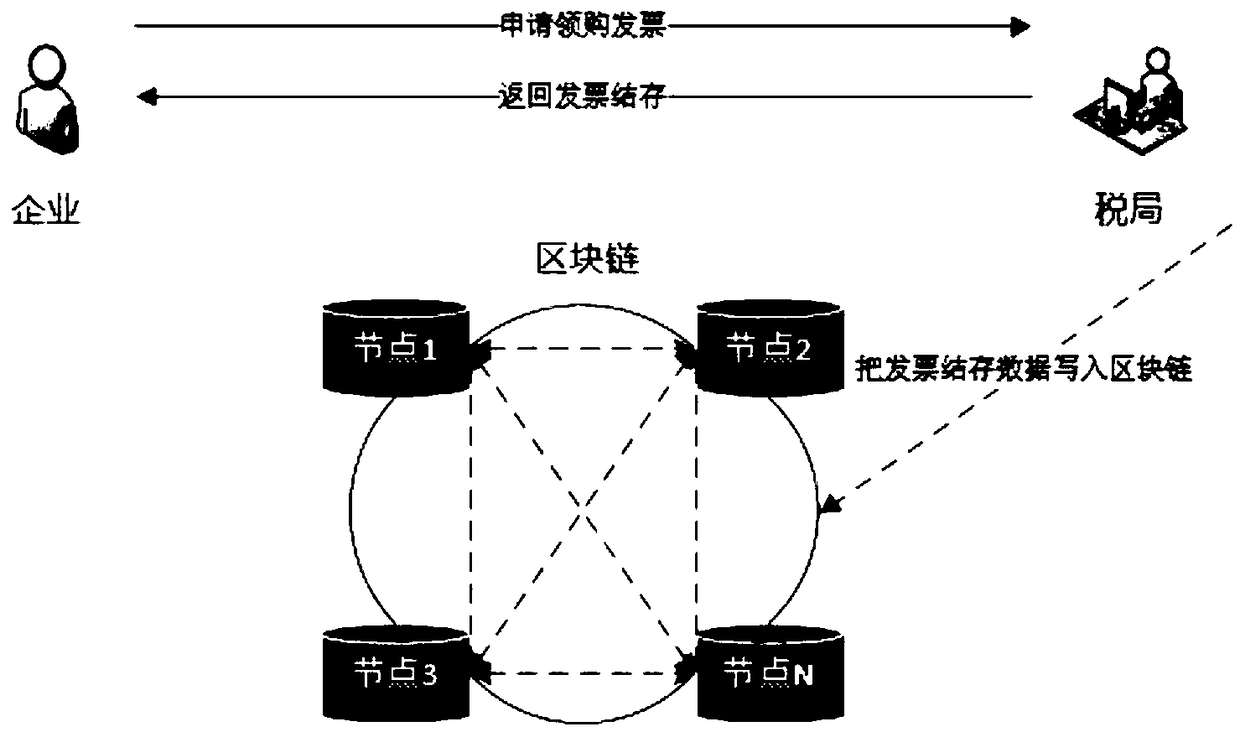

[0048] Such as figure 1 As shown, a blockchain-based electronic invoice system includes a taxpayer client, a tax bureau, a blockchain system, and a blockchain network; Block chain nodes, the block chain nodes are connected in a chain, and the block chain nodes exchange relevant information between the taxpayer client and the tax bureau end and each adjacent node in at least one target adjacent node Publish the data information to the blockchain network, the data information includes secret key information and address information;

[0049]The block chain network includes a taxpayer user node, a tax bureau node, a response node and an information identification node, and the taxpa...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com