Stock rise and fall prediction technical method combining LSTM and attention mechanism

A forecasting technology and attention technology, applied in forecasting, neural learning methods, data processing applications, etc., can solve the problems of not considering the reliability of stock evaluation opinions, not capturing the time sensitivity of news information in a timely manner, and achieving intuitive and comprehensive information. , enhance interpretability, the effect of interpretability enhancement

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

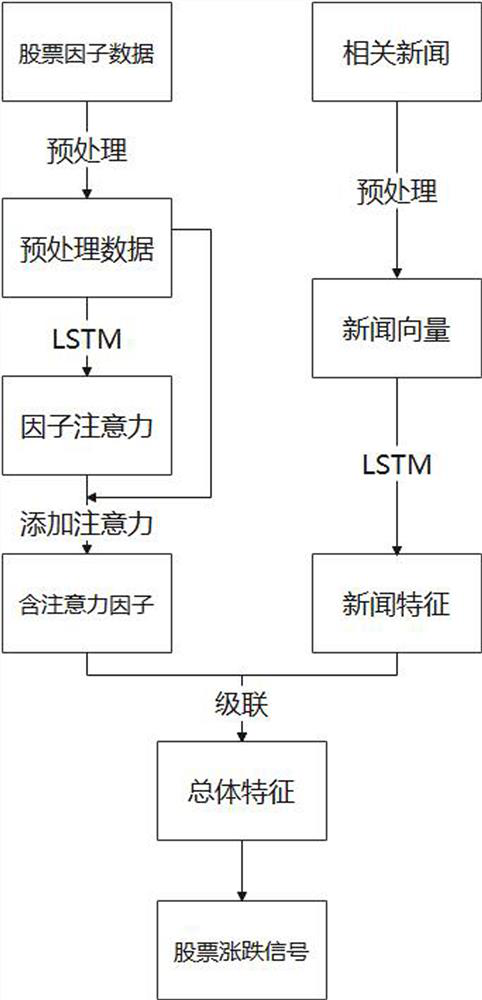

[0029] refer to figure 1 , a technical method for stock fluctuation prediction combining LSTM and attention mechanism, including the following steps:

[0030] Step 1: Make a stock dataset:

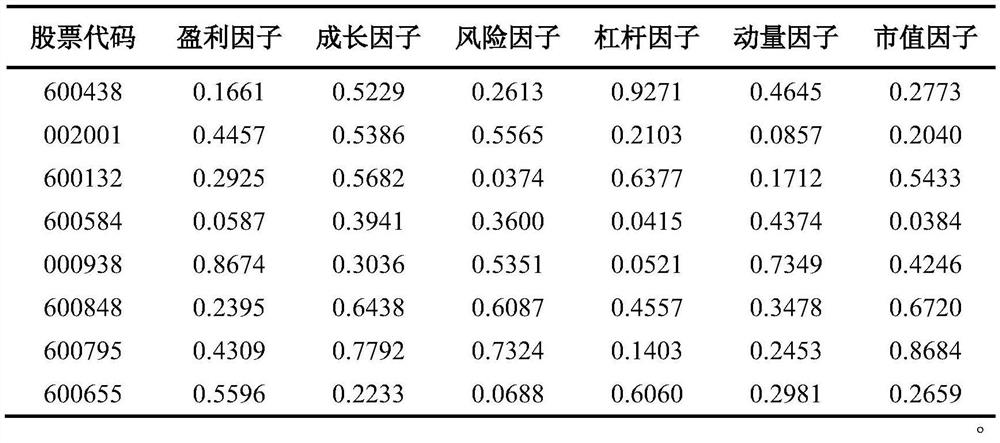

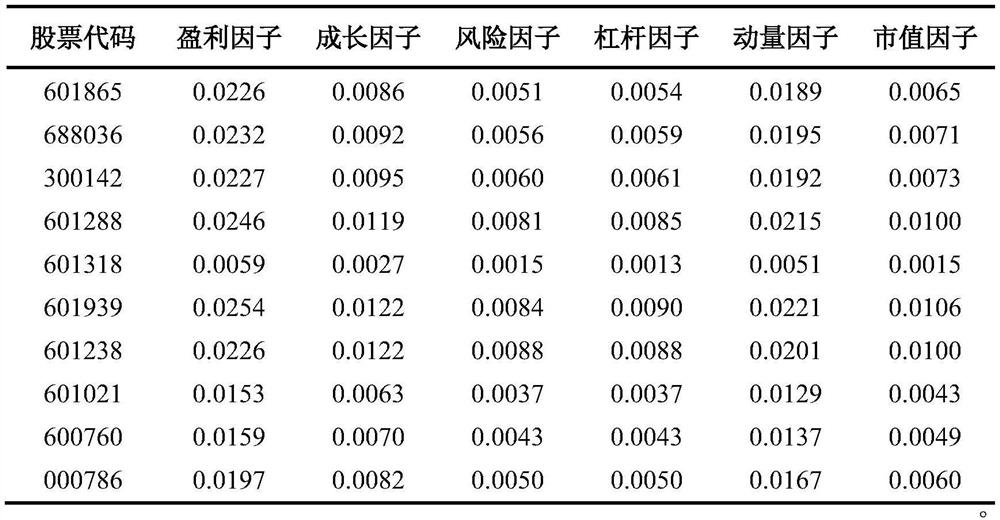

[0031] Step 11: Data collection: collect the raw data of stock factors, such as market capitalization factor, profit factor, growth factor, leverage factor, momentum factor, risk factor, style factor, industry factor, etc., and use the daily closing price of the stock as the stock price change to calculate Raw data, stock news information is used as the raw data of news features for the prediction of stock ups and downs;

[0032] Step 12: Make a stock factor data set: Divide the factor data according to a fixed duration, namely daily, weekly and monthly, and calculate the factor data values within the fixed time interval as the index value, denoted as X r , to judge the rise and fall of the stock price in a fixed time, that is, the ratio of the closing price difference between the initia...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com