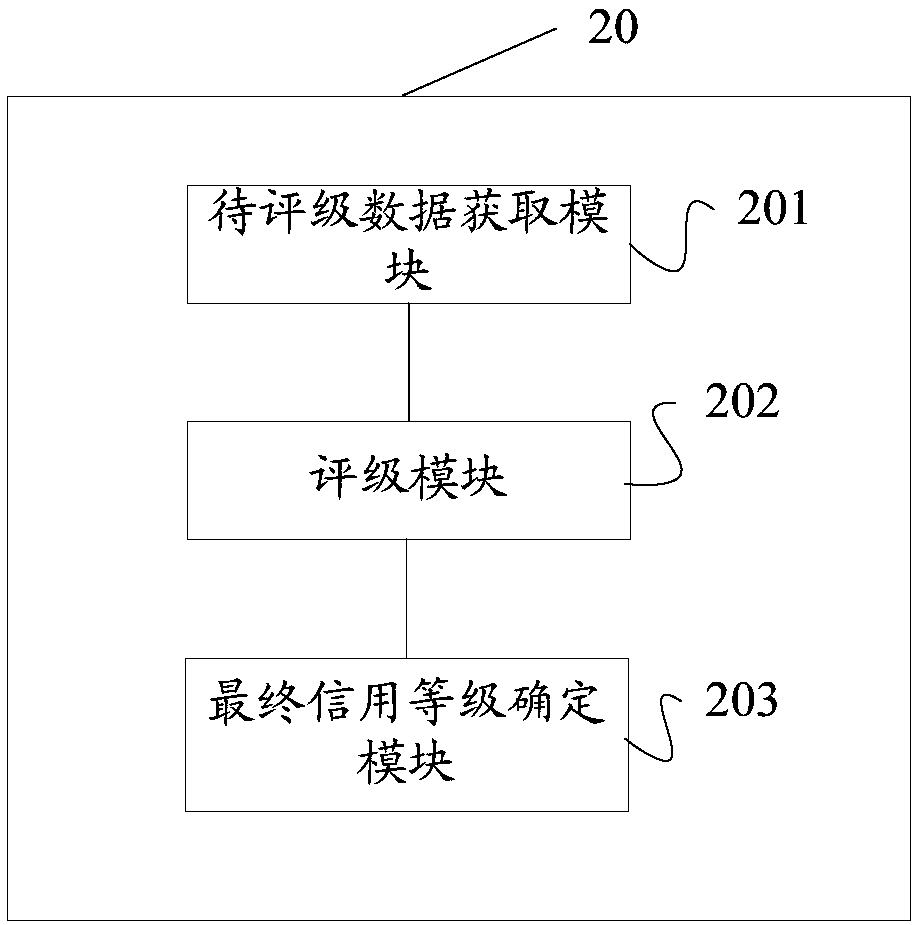

Credit rating method and device, computer readable storage medium and terminal

A computer and credit rating technology, applied in the field of data processing, can solve the problems of financial institutions such as losses, high communication costs, and reduced approval efficiency, and achieve the effects of reducing costs and bad debt rates, improving accuracy and efficiency, and high accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0026] As mentioned in the background technology, the rating model in the prior art has relatively high requirements for sample data when it is generated, for example, it must have credit data that is overdue for 60 or 90 days Data, such as more than 3000 data records. Therefore, it usually takes at least one year to retrain the rating model; even if there is new data to retrain after one year, it will take 2-3 months for specialized personnel, and the cost of online testing and communication during the period is also high. Very high, the development cycle of the rating model is long. In the case of rapid changes in customer groups, products, and policy environments, the update speed of the rating model cannot keep up, resulting in reduced approval efficiency and losses to financial institutions.

[0027] The technical solution of the present invention comprehensively considers the original grade and the new grade obtained by the original rating model and the new rating model...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com