Deep-learning-oriented network personal credit fraud behavior detection method

A deep learning and detection method technology, applied in the field of computer science, can solve the problems of poor noise resistance and robustness, achieve strong noise resistance and robustness, and improve the effect of fraud detection

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0054] In order to better understand the above-mentioned technical solution, the above-mentioned technical solution will be described in detail below in conjunction with the accompanying drawings and specific implementation methods.

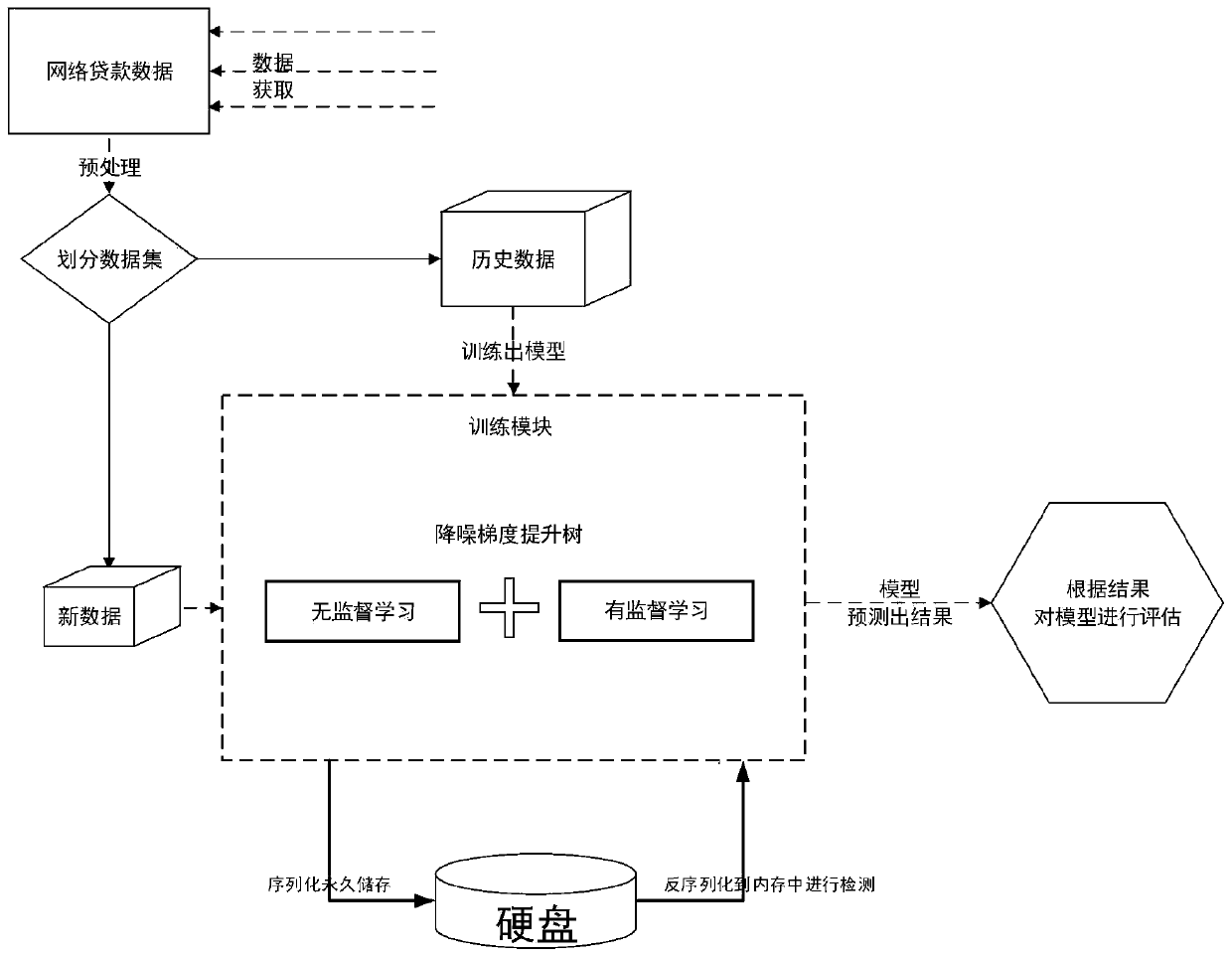

[0055] please see figure 1 A kind of deep learning-oriented network personal credit fraud detection method provided by the invention comprises the following steps:

[0056] Step 1. Obtain historical online personal credit information;

[0057] Step 2, select the first sub-parameter of the denoising gradient boosting tree;

[0058] Step 3, train the denoising gradient boosting tree, use the historical network personal credit information for unsupervised learning, and obtain the first data feature;

[0059] Step 4, use the first data feature to carry out supervised learning, and complete the training of the denoising gradient boosting tree model;

[0060] Step 5, storing the denoising gradient boosting tree model;

[0061] Step 6. Input new net...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com