Transaction decision system based on risk control quantitative model

A quantitative model and decision-making system technology, applied in instruments, finance, data processing applications, etc., can solve problems such as blind trading, continuous losses, and cognitive biases

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

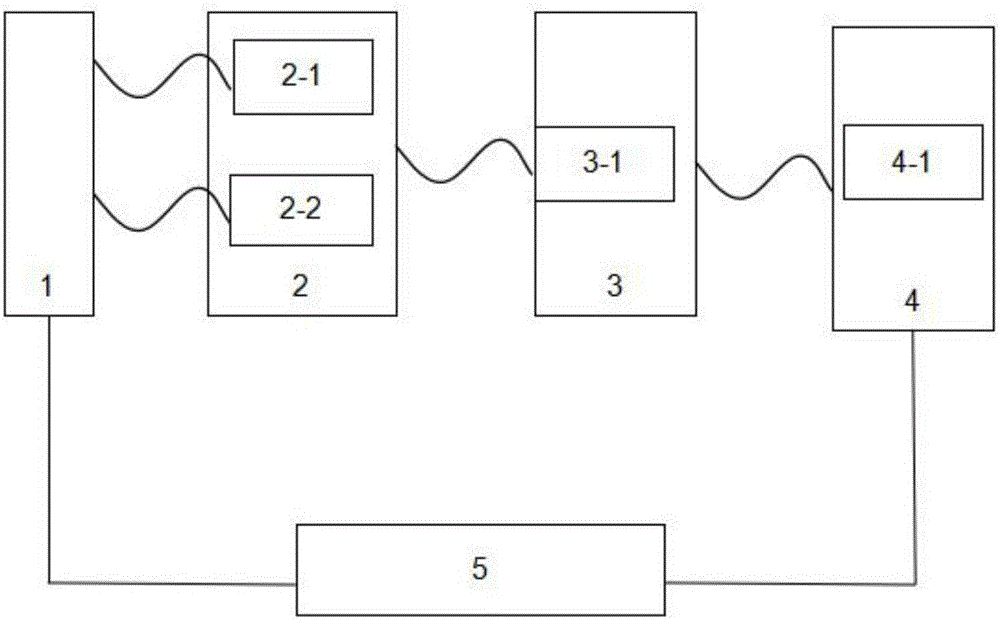

[0055] Such as figure 1 As shown, a trading decision-making system based on a quantitative risk control model, the trading decision-making system first selects stocks through a multi-factor quantitative timing model, and invests in the stocks selected by the system and the stocks selected by customers through the risk control model Real-time quantitative assessment of risk, through the client, give accurate buy, sell, stop profit, stop loss orders in real time, as well as real-time position risk status reminder information anytime, anywhere.

[0056] The transaction decision-making system includes an input module, a processing module, a transaction decision-making module and a client, and the client includes an instruction output module; one end of the processing module is connected to the input module, and the other end is connected to the transaction decision-making module. The module is connected with the instruction output module in the client;

[0057] The processing mod...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com