Finance and tax knowledge metadata classification conversion and storage method

A metadata and knowledge technology, which is applied in the field of metadata classification, transformation and storage of financial and taxation knowledge, can solve problems such as invalidation, failure to realize automatic reference, etc., and achieve the effect of realizing intelligence

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

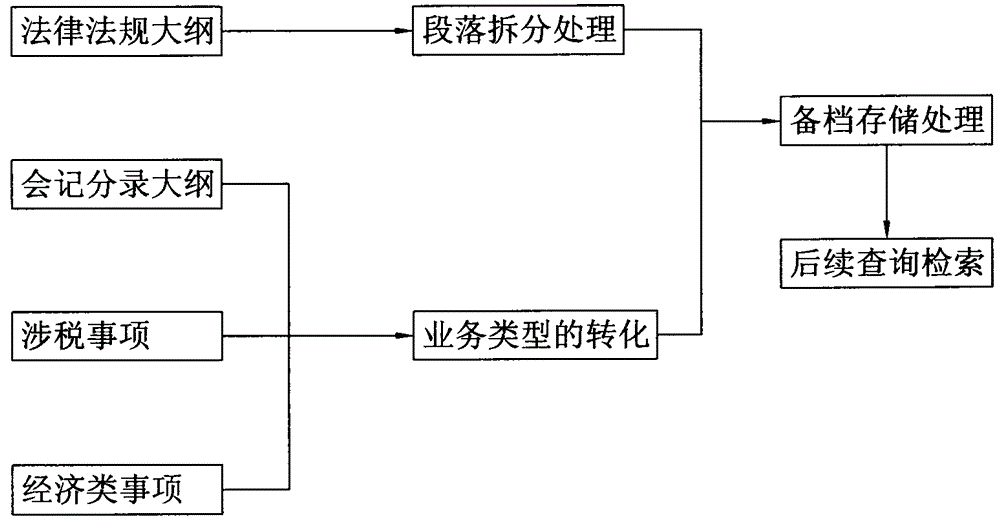

[0008] see figure 1 , this specific implementation mode adopts the following technical scheme: it divides the text information data of fiscal and taxation knowledge into four categories: the outline of laws and regulations, the outline of accounting entries, tax-related matters and economic matters, and then splits the outline of laws and regulations into paragraphs The simple way of processing is splitting, and the split data is archived and stored to facilitate subsequent query and retrieval; at the same time, the conversion of entry outline, tax-related matters and economic matters will be recorded according to business type The conversion of business types is more complicated: the conversion of financial accounting entry outline needs to fully collect applicable accounting subjects, and define conversion rules corresponding to relevant regulations; Conduct in-depth analysis to form a transformation template of "subject + behavior + rules", and make judgments and confirmati...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com