Interactive Mortgage and Loan Information and Real-Time Trading System

a technology applied in the field of interactivity and mortgage and loan information and real-time trading, system, can solve the problems of limiting the flexibility of the parties to the transaction, no known system in the field of mortgage lending to provide relatively, and the cost of initiating loan transactions is relatively high. achieve the effect of maintaining consistency and integrity

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0014]In the following description, a preferred embodiment of the invention is described with regard to preferred process steps and data structures. Those skilled in the art would recognize after perusal of this application that embodiments of the invention can be implemented using general purpose switching processors or special purpose switching processors or other circuits adapted to particular process steps and data structures described herein, and that implementation of the process steps and data structures described herein would not require undue experimentation or further invention.

System Architecture

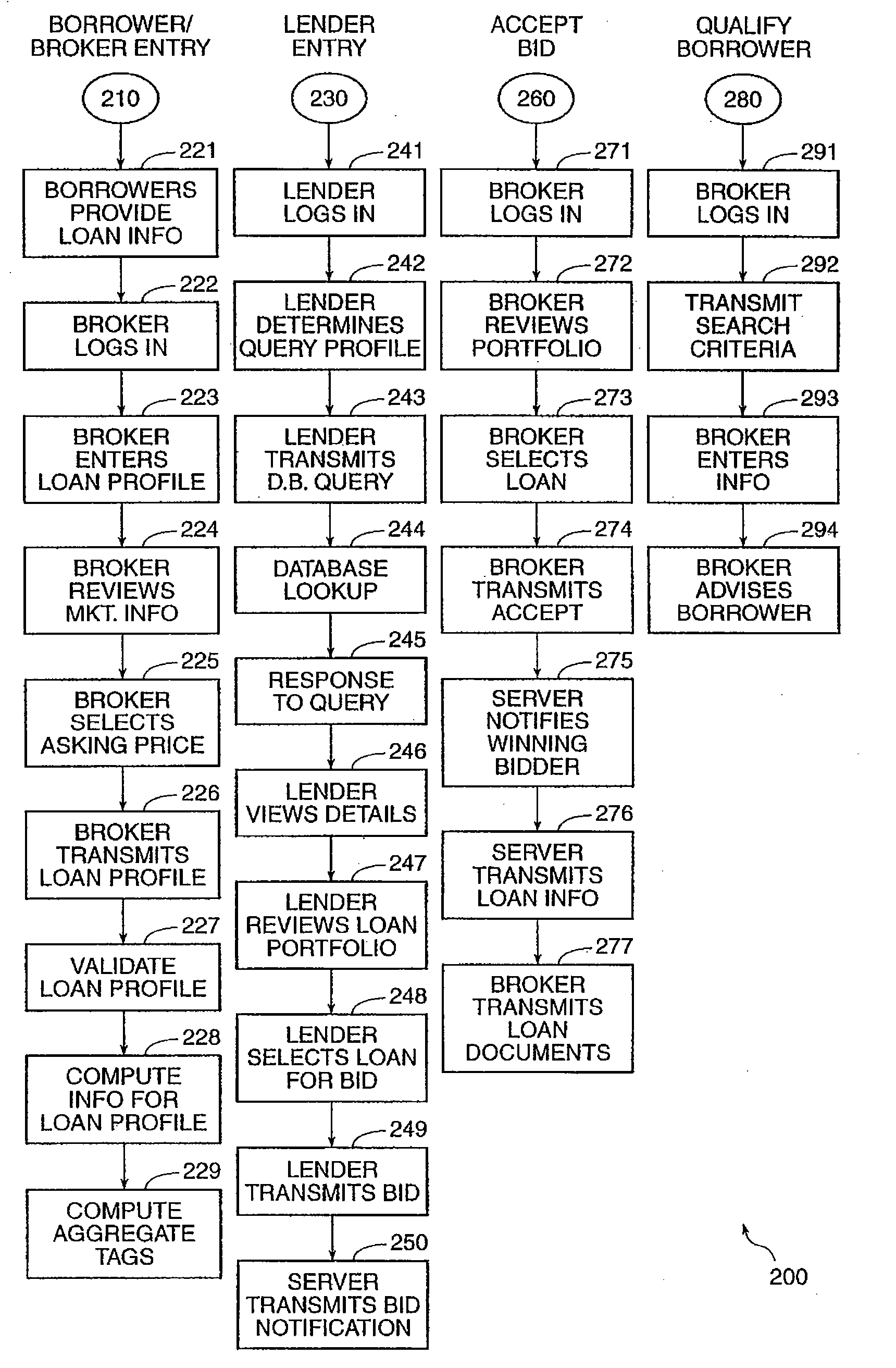

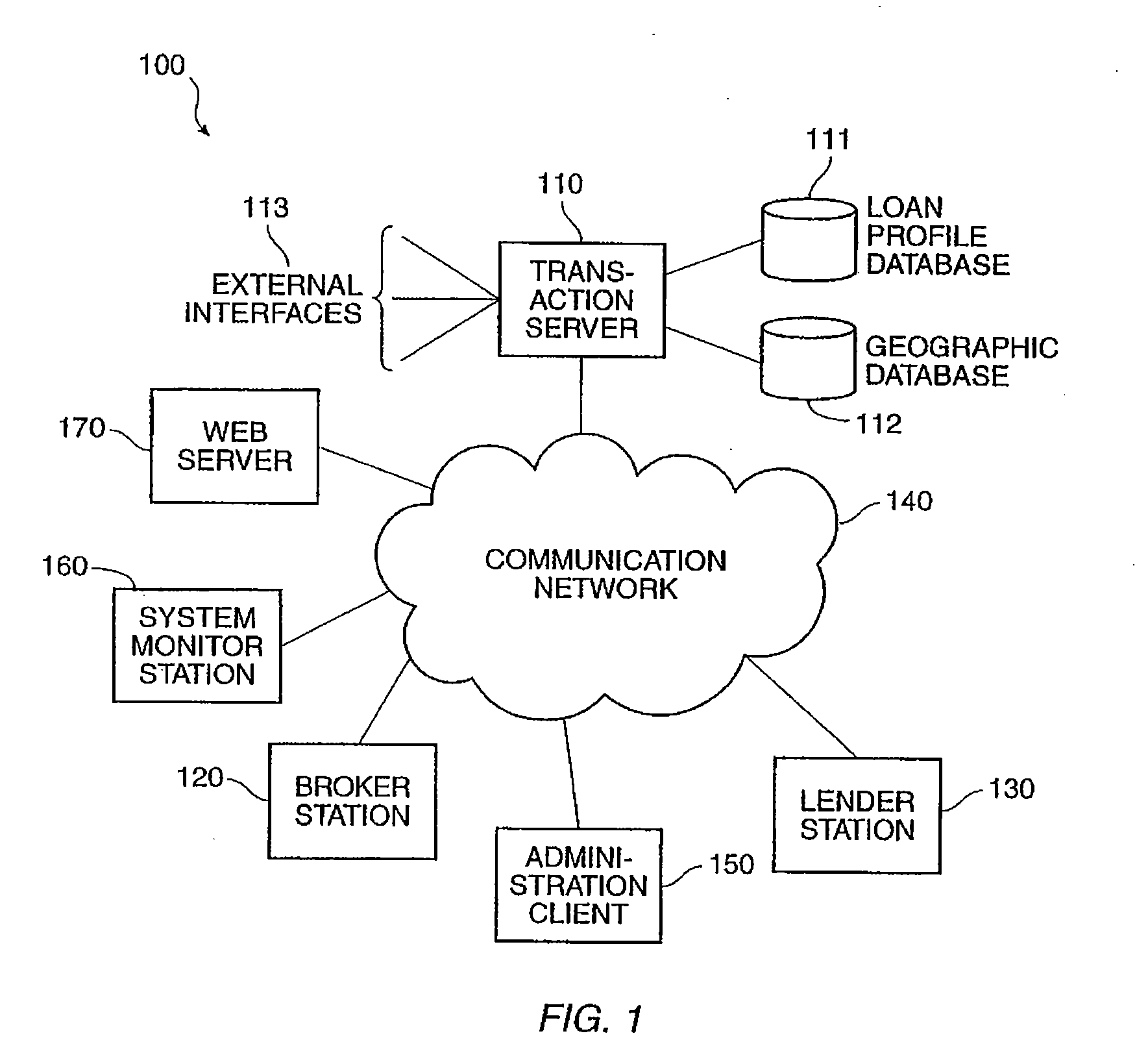

[0015]FIG. 1 shows a block diagram of an interactive mortgage and loan information and real-time trading system.

[0016]An interactive mortgage and loan information and trading system 100 includes a transaction server 110, a set of broker stations 120, a set of lender stations 130, an administration client 150, a set of system monitor stations 160, a web server 170, and a communicat...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com