System for maintaining an escrow account for reimbursing administrators of payments

a payment administrator and escrow account technology, applied in the field of managing claims payment transactions, can solve the problems of time-consuming and difficult process, and achieve the effect of reducing escrow accounts and efficient and accurate methods

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0021]The present invention overcomes many of the prior art problems associated with reconciling ledger accounts administrated by TPAs. The advantages, and other features of the system disclosed herein, will become more readily apparent to those having ordinary skill in the art from the following detailed description of certain preferred embodiments taken in conjunction with the drawings which set forth representative embodiments of the present invention.

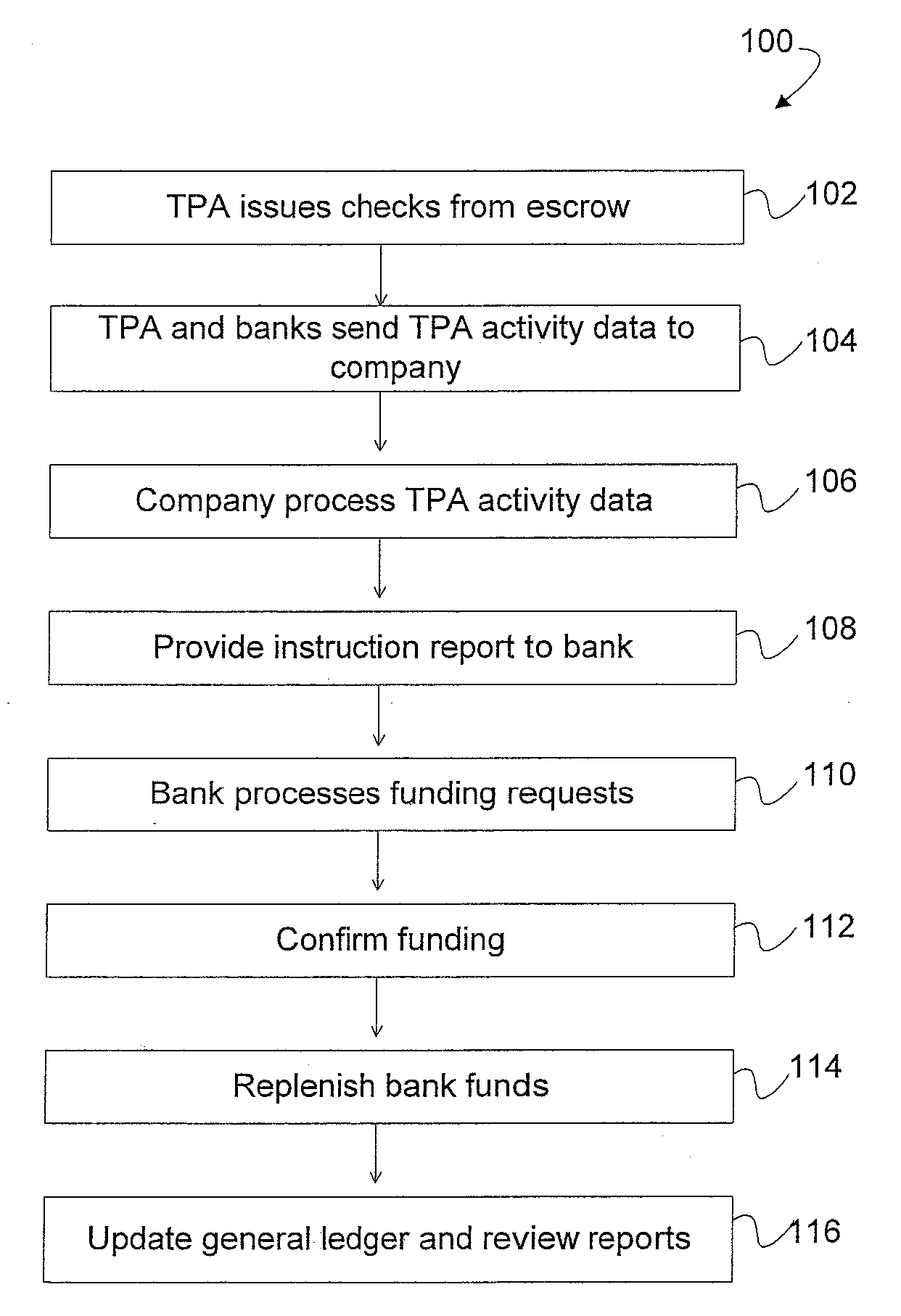

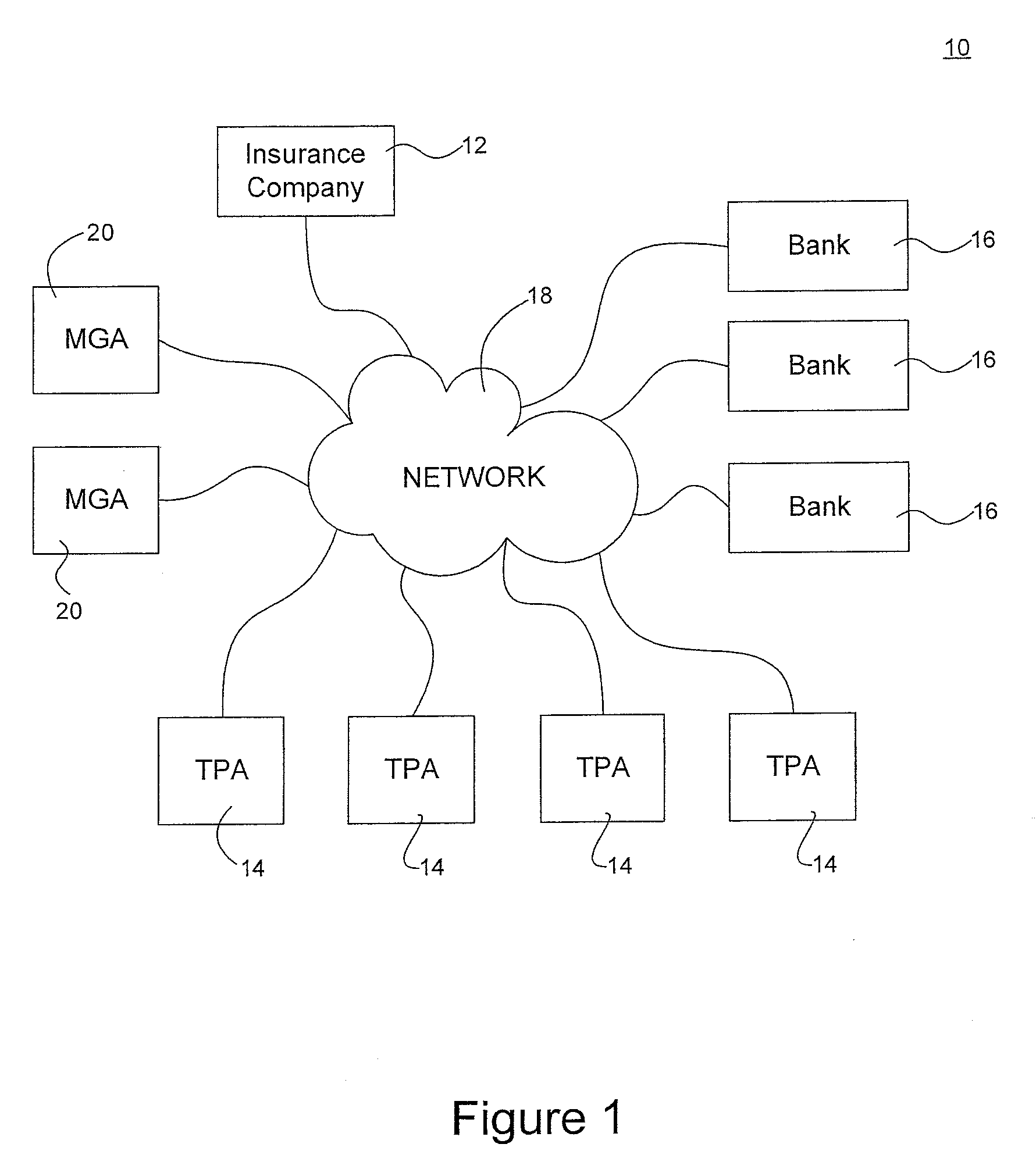

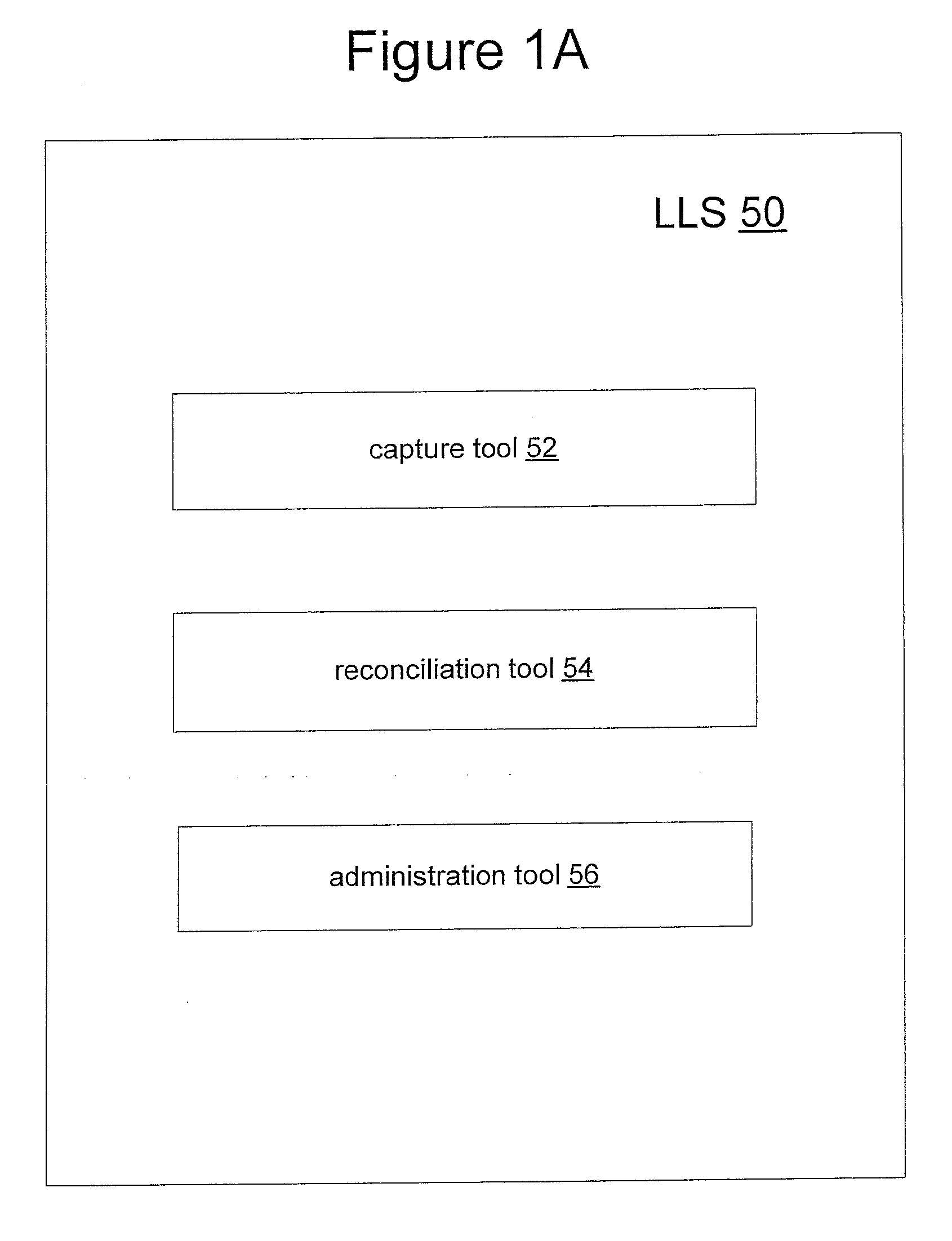

[0022]Referring now to FIG. 1, there is shown a block diagram of an environment 10 with a loss ledger system embodying and implementing the methodology of the present disclosure. The environment 10 interconnects a company 12 with a plurality of TPAs 14, banks 16, managing general agencies / brokers (individually, an “MGA” or collectively, “MGAs”) 20 and the like via a network 18. In one embodiment, the company 12 is an insurance company that uses TPAs to make payments to qualified subscribers. The company 12 and TPAs 14 work with MGAs...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com