Matching computer of a negotiated matching system

a matching computer and negotiated matching technology, applied in the field of matching computer of negotiated matching system, can solve the problems of not providing traders with the opportunity to filter out potential deals with other traders, known automated trading system cannot accommodate types of financial instruments that are traded using more subjective, less-quantifiable criteria, etc., and achieve the effect of simplifying the system

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

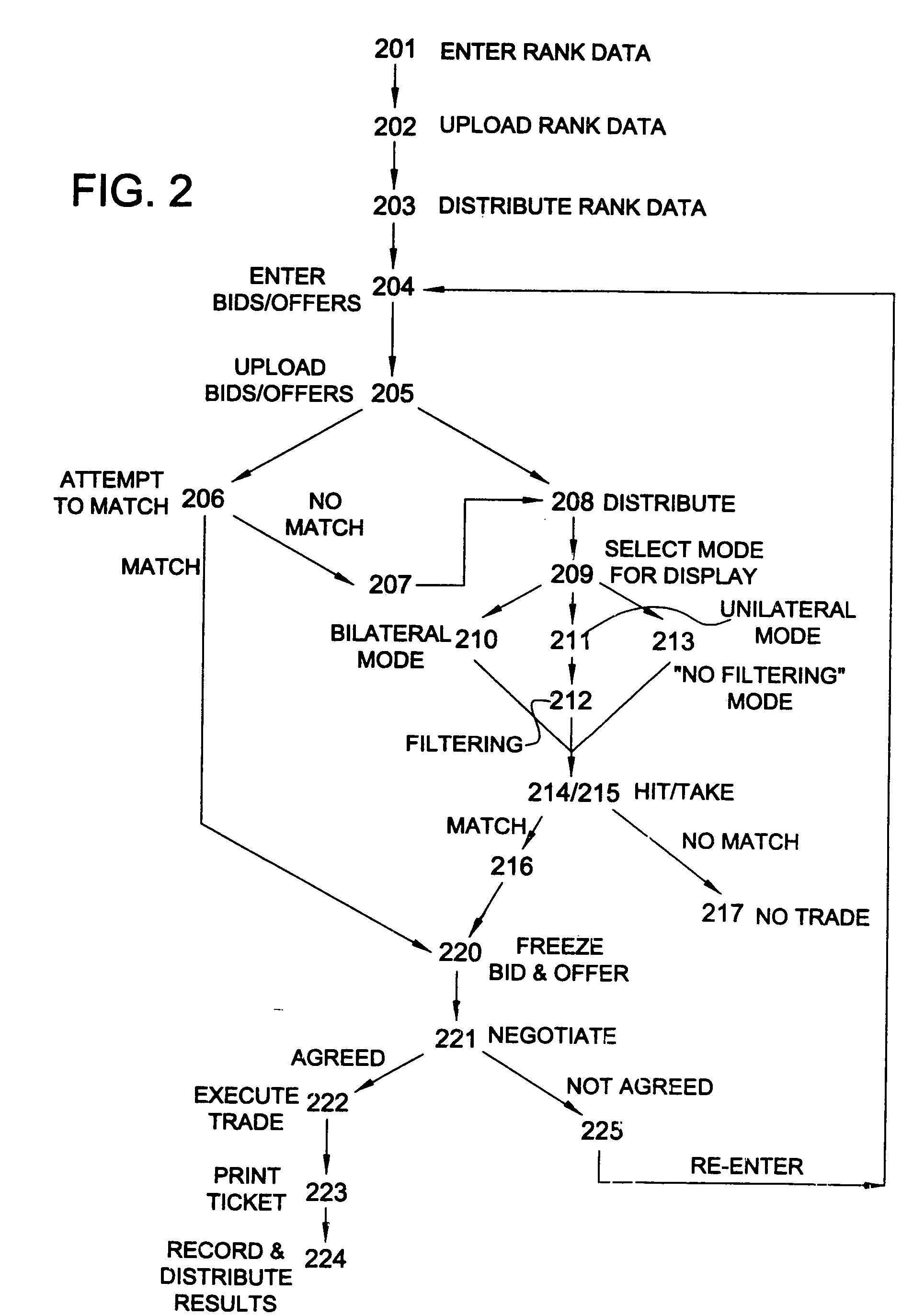

[0024] The negotiated matching system according to the present invention will now be described with reference to the accompanying drawings.

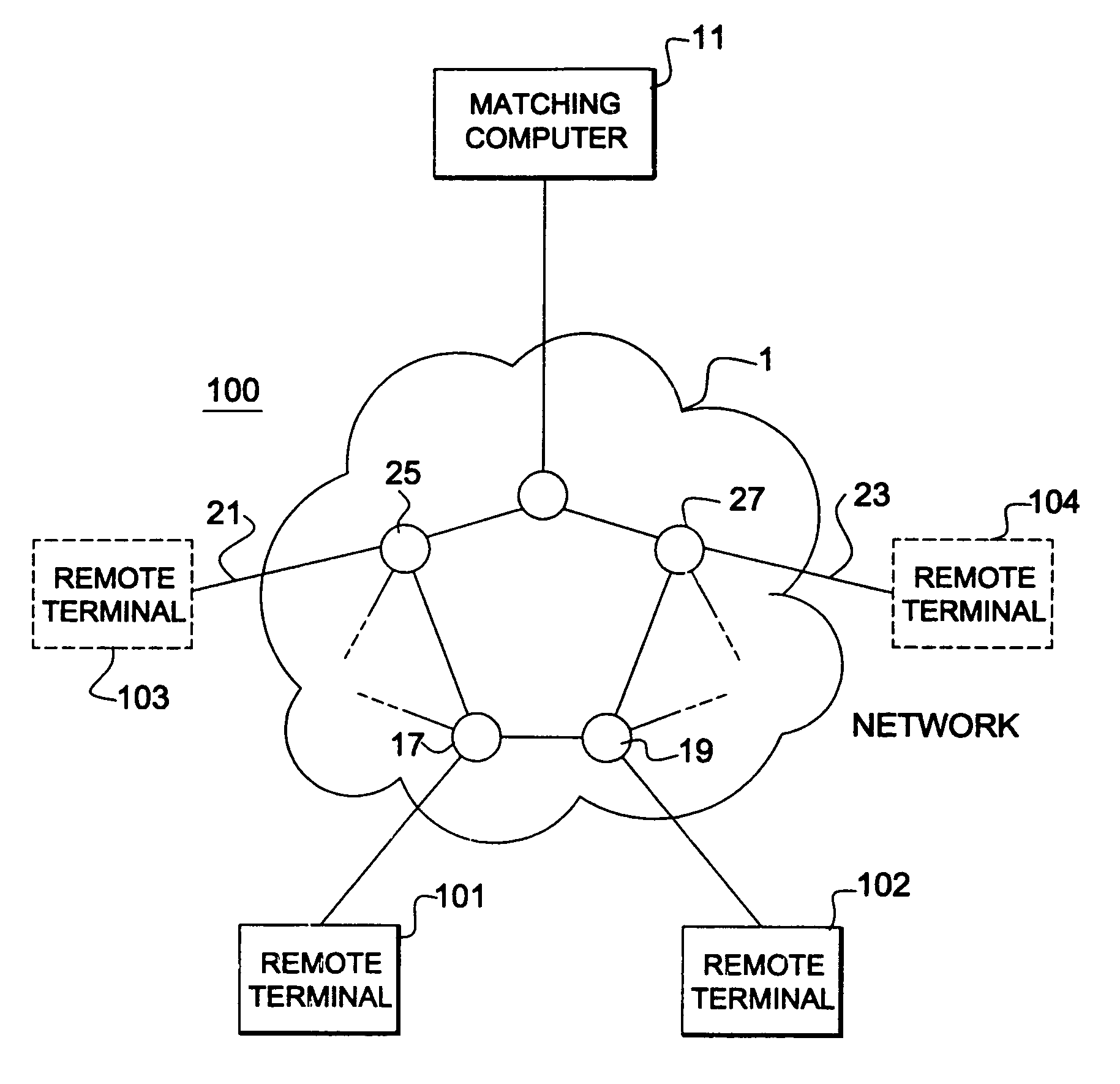

[0025] With reference to FIG. 1, one possible configuration of the negotiated matching system 100 according to the present invention includes a matching computer 11 and remote terminals 101 and 102. The system contemplates a plurality of remote terminals whereby a large number of users have simultaneous access to the negotiated matching system; however, for description purposes, two remote terminals 101 and 102 and optional remote terminals 103 and 104 are shown in FIG. 1.

[0026] The matching computer 11 is connected to the remote terminals 101 and 102 through a communication network 1. Nodes 17 and 19 may also be inserted into the communication network 1 between matching computer 11 and remote terminals 101 and 102. These nodes 17 and 19 may be intelligent nodes which, for example, perform filtering operations or passive nodes (repeater station...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com