Dynamic mortgage loan supervision method and system based on blockchain, equipment and storage medium

A blockchain, dynamic technology, applied in the field of blockchain to achieve the effect of realizing information, enhancing financial attributes, and reducing risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0077] The embodiments of the present invention will be described in detail below with reference to the accompanying drawings, but the present invention can be implemented in many different ways as defined and covered below.

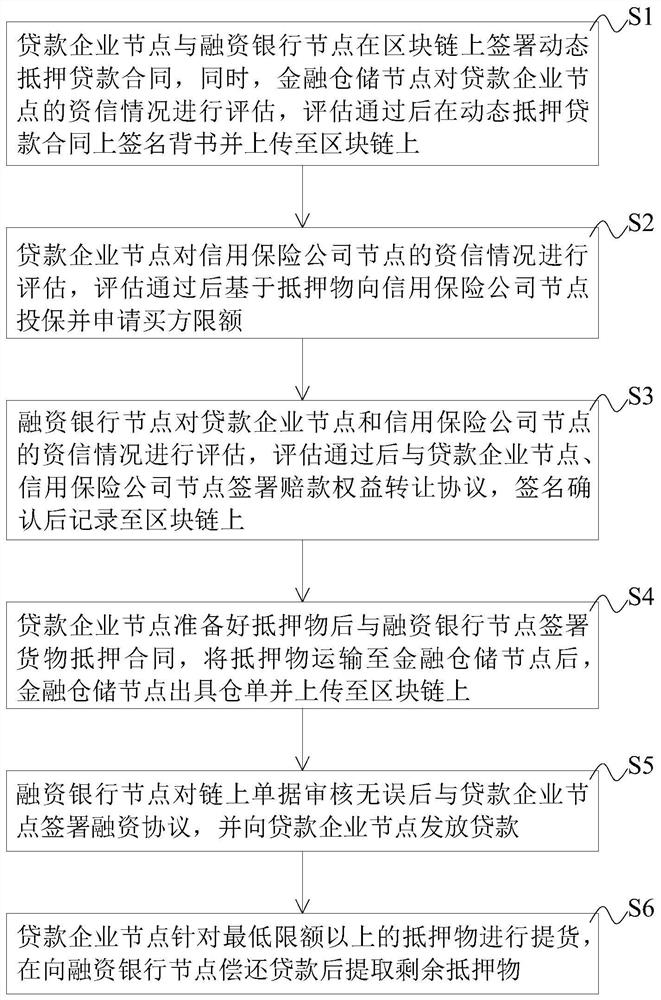

[0078] like figure 1 As shown, the preferred embodiment of the present invention provides a blockchain-based dynamic mortgage loan supervision method, including the following:

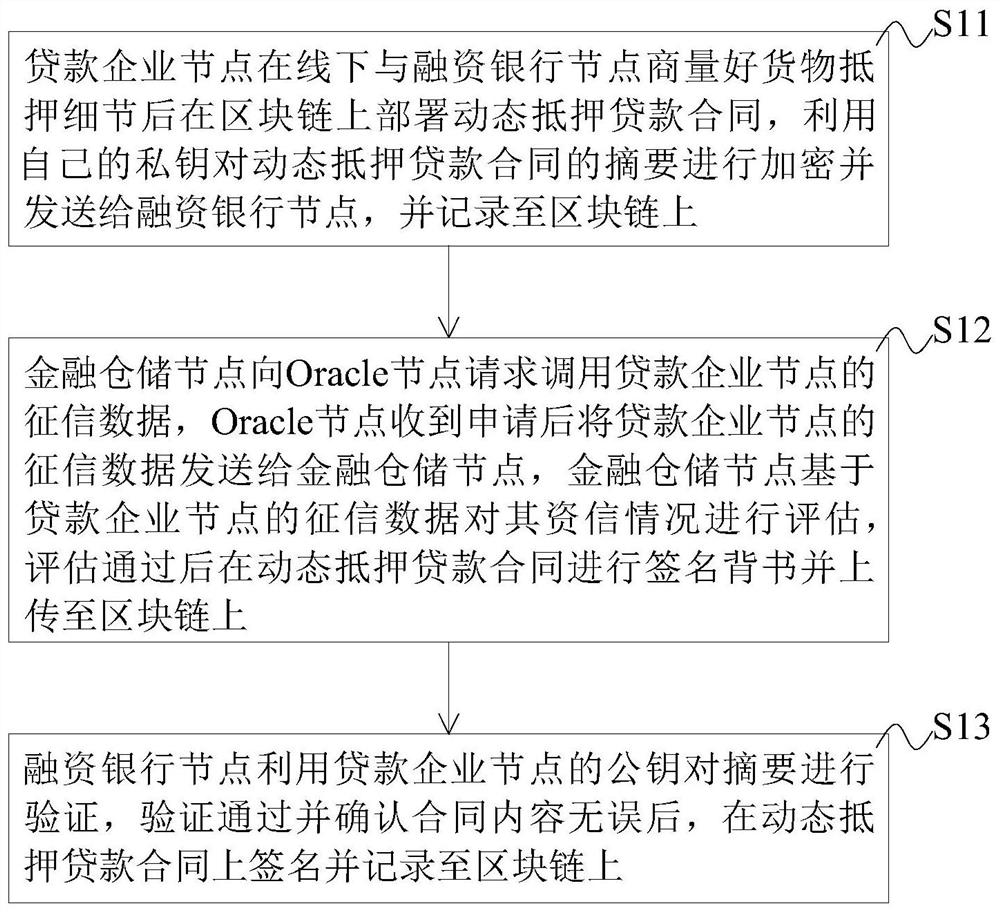

[0079] Step S1: The loan enterprise node and the financing bank node sign the dynamic mortgage loan contract on the blockchain. At the same time, the financial warehousing node evaluates the credit status of the loan enterprise node. After the evaluation is passed, the dynamic mortgage loan contract is signed and endorsed and uploaded to on the blockchain;

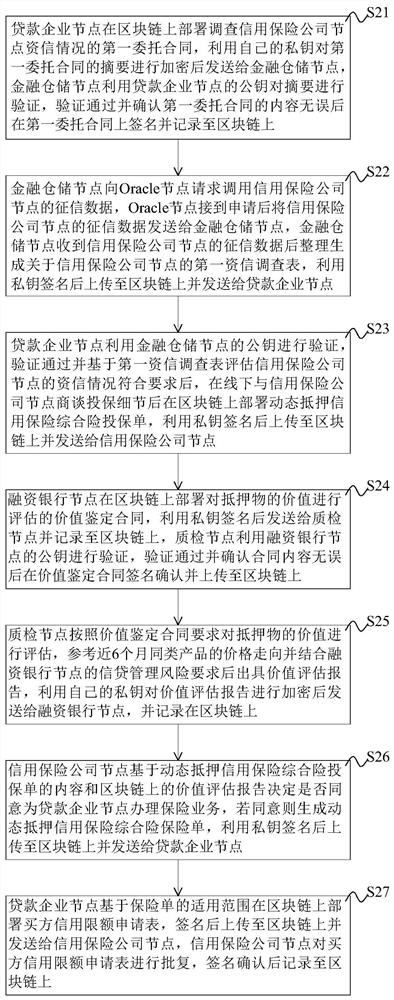

[0080] Step S2: The loan enterprise node evaluates the credit status of the credit insurance company node, and after the evaluation passes, insures the credit insurance company node based on the collateral and applies for th...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com