AR auxiliary tax management method and system

A tax and electronic tax technology, applied in the field of tax informatization, can solve problems such as taxpayer dissatisfaction, taxpayer queuing, taxpayer satisfaction with tax hall services, etc., and achieves the effect of improving service efficiency and liberating energy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

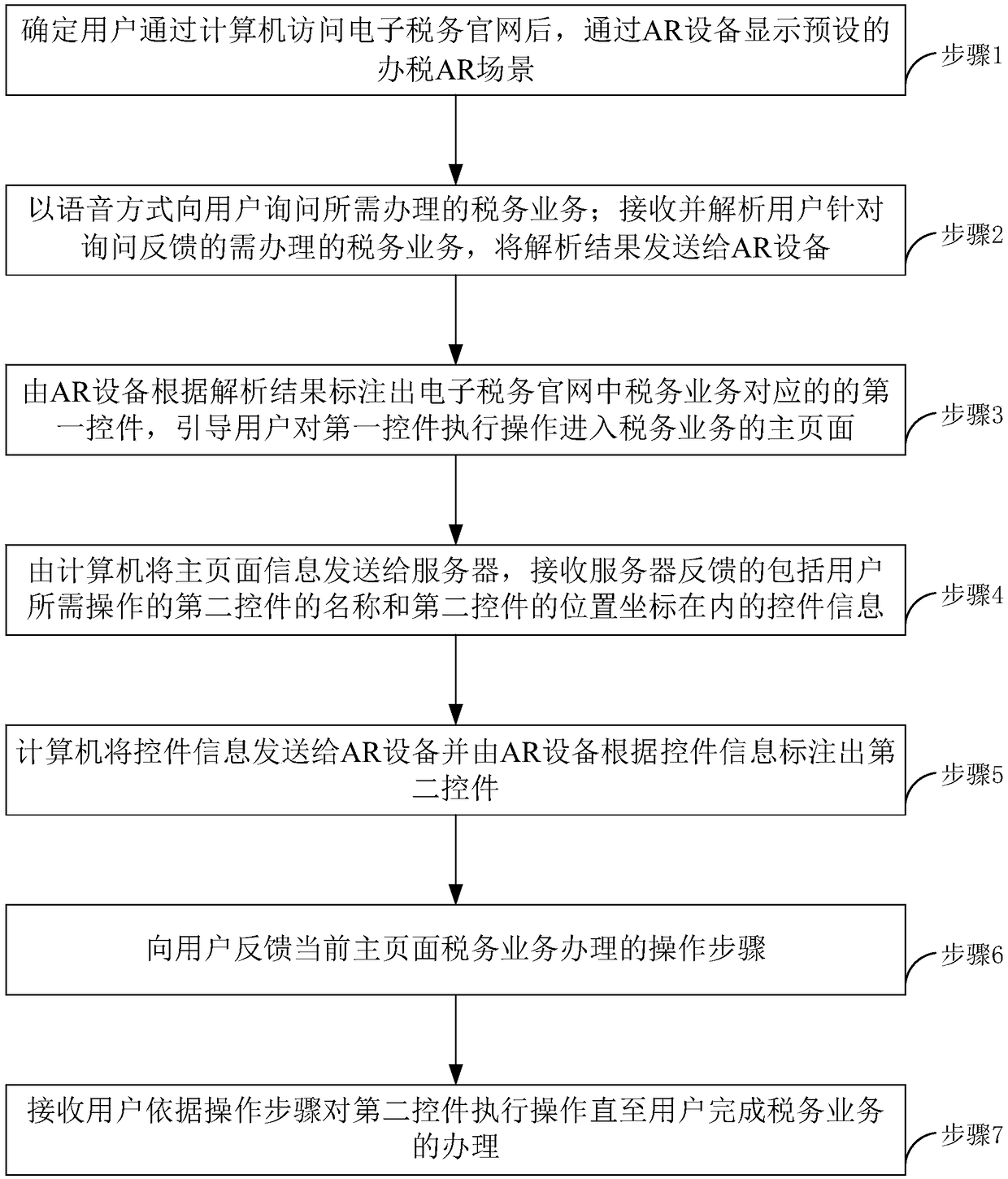

[0052] see figure 1 , the AR-assisted tax handling method in the embodiment of the present invention includes:

[0053] Step 1, after confirming that the user accesses the electronic tax official website through the computer, the AR device displays the preset tax-handling AR scene; wherein, the computer and the AR device are connected.

[0054] Step 2: Ask the user about the tax business that needs to be handled in the form of voice; receive and analyze the tax business that needs to be handled in response to the query feedback from the user, and send the analysis result to the AR device.

[0055]Step 3: According to the analysis result, the AR device marks the first control corresponding to the tax business in the electronic tax official website, and guides the user to perform operations on the first control to enter the main page of the tax business.

[0056] Step 4, the computer sends the main page information including the main page URL, the ID of the main page, the name ...

Embodiment 2

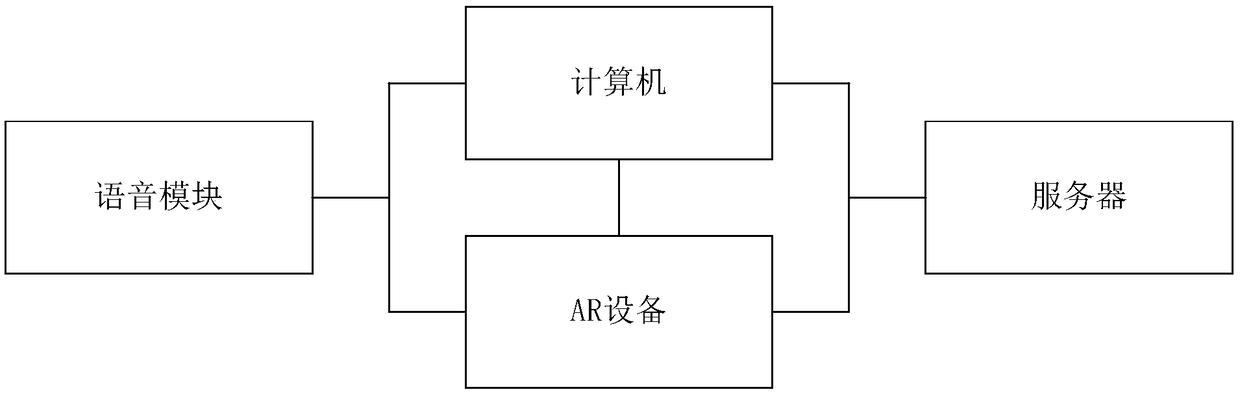

[0096] see image 3 , the AR assisted tax handling system in the embodiment of the present invention includes:

[0097] A computer is used for users to access the electronic tax official website to handle tax business.

[0098] AR equipment is used for AR display and human-computer interaction when users visit the e-tax official website to handle tax business.

[0099] The voice module is used for voice interaction when users visit the e-tax official website to handle tax business.

[0100] The server is used for network communication and data interaction with computers and AR devices.

[0101] The computer and the AR device are connected, and the server communicates with the computer and the AR device respectively.

[0102] After confirming that the user visits the electronic tax official website, the AR device displays the preset tax AR scene to the user; the voice module asks the user the tax business that needs to be handled in voice mode; receives and analyzes the tax ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com