System and method for quantitative analysis of foreign exchange investment risk through big data

A quantitative analysis and big data technology, applied in the field of big data applications, can solve the problem of inability to determine the best delivery time of foreign exchange transactions, and achieve the effect of reducing market risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

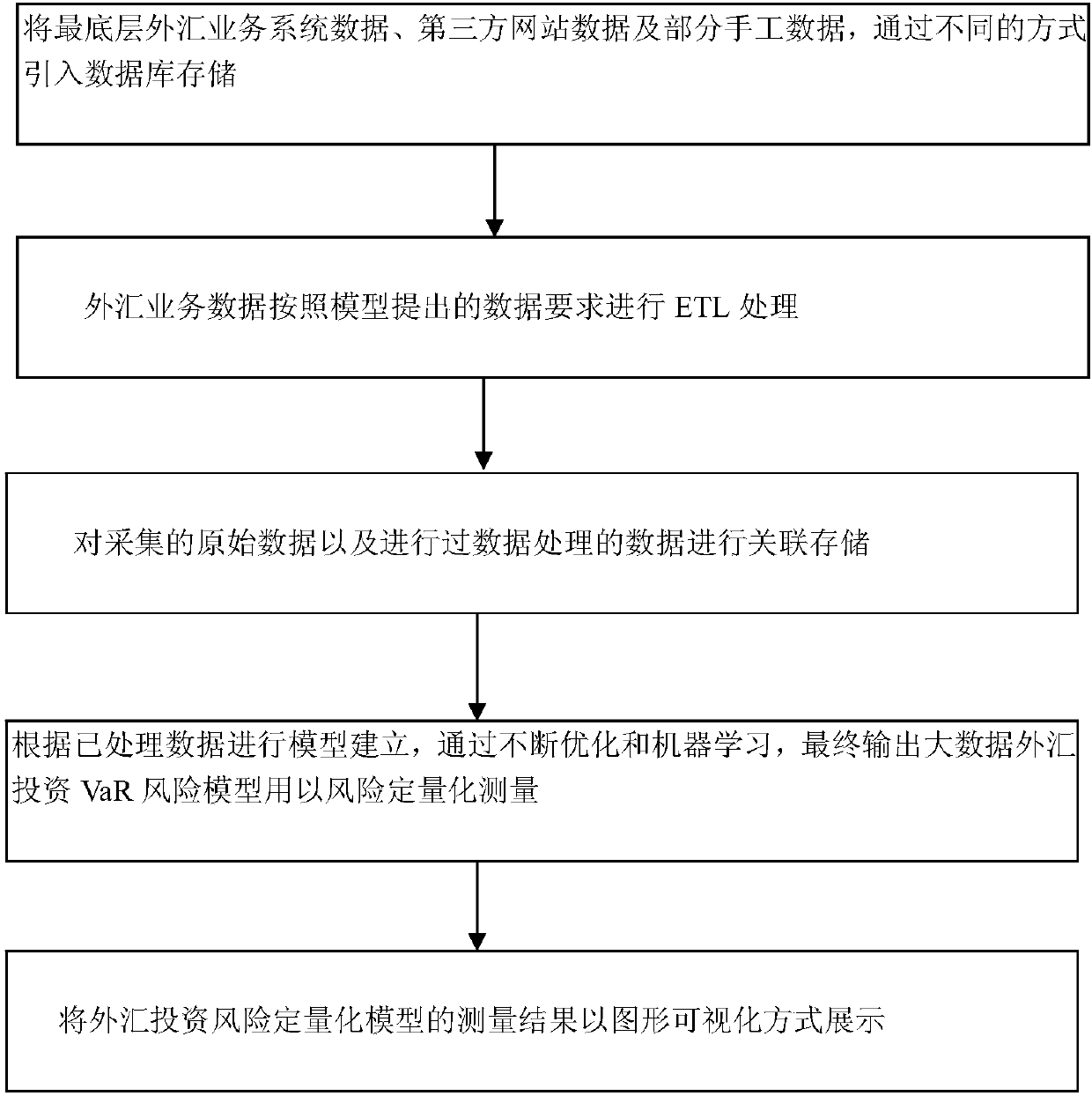

[0034] The present invention aims to propose a system and method for quantitatively analyzing foreign exchange investment risks using big data, so as to evaluate the risk maximum loss value of different foreign exchange at different delivery times under normal dynamic fluctuations in the market, for intuitive reference by enterprises.

[0035] In terms of specific implementation, the system in the present invention includes: a data acquisition module, a data storage module, a data processing module, a big data foreign exchange investment VaR risk model algorithm module, and a model result output display module;

[0036] The data collection module is to introduce the lowest-level foreign exchange business system data, third-party website data and some manual data into database storage in different ways;

[0037] The data storage module is for associatively storing the collected raw data and the processed data, and supports incremental storage;

[0038] The data processing modul...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com