Mortgage financing method and system based on block chain technology

A blockchain and technology technology, applied in transmission systems, digital transmission systems, finance, etc., can solve the problems of increased platform compliance costs, increased trust and compliance costs, and high time costs, and achieve reduced technology and operation and maintenance costs , automatic execution is convenient and credible, and there is no intermediary cost effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0033] In order to enable those skilled in the art to better understand the technical solutions of the present invention, the present invention will be further described in detail below in conjunction with the accompanying drawings.

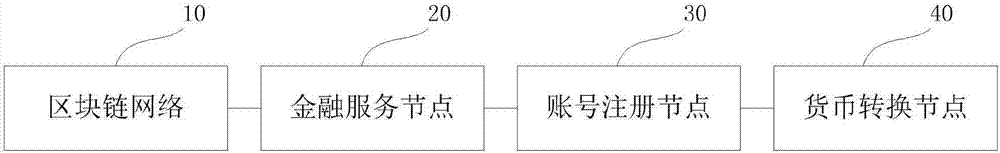

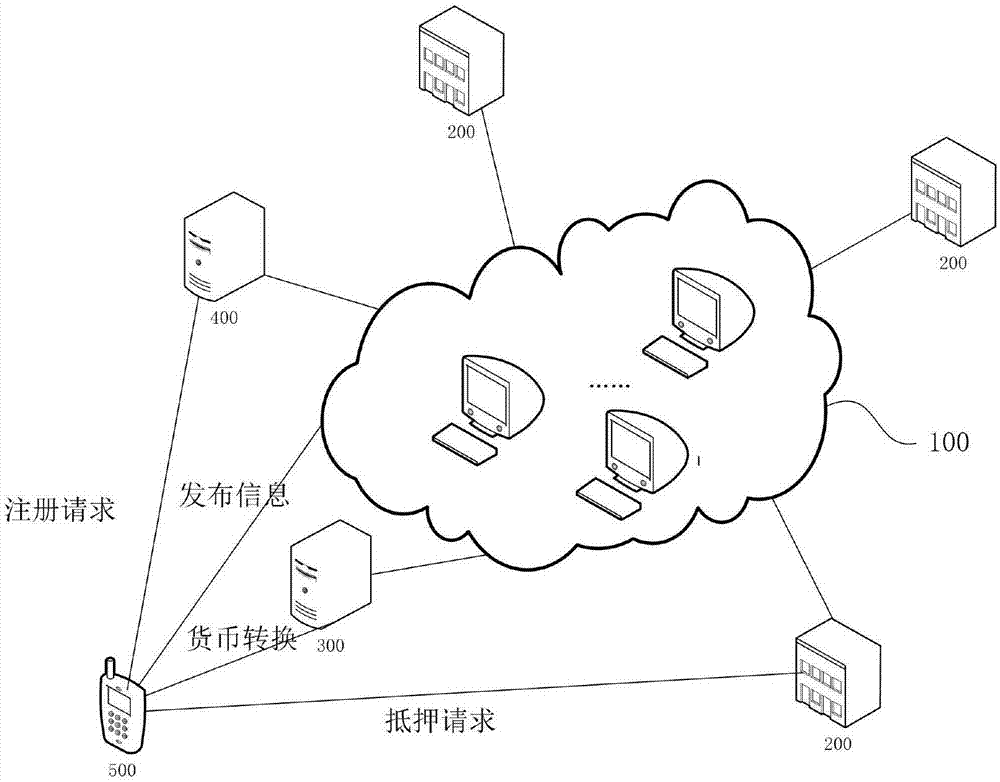

[0034] Such as Figure 1-2 As shown, the present invention provides a mortgage financing system based on blockchain technology, including a blockchain network 10, a financial service node 20, an account registration node 30, and a currency conversion gateway 40, wherein,

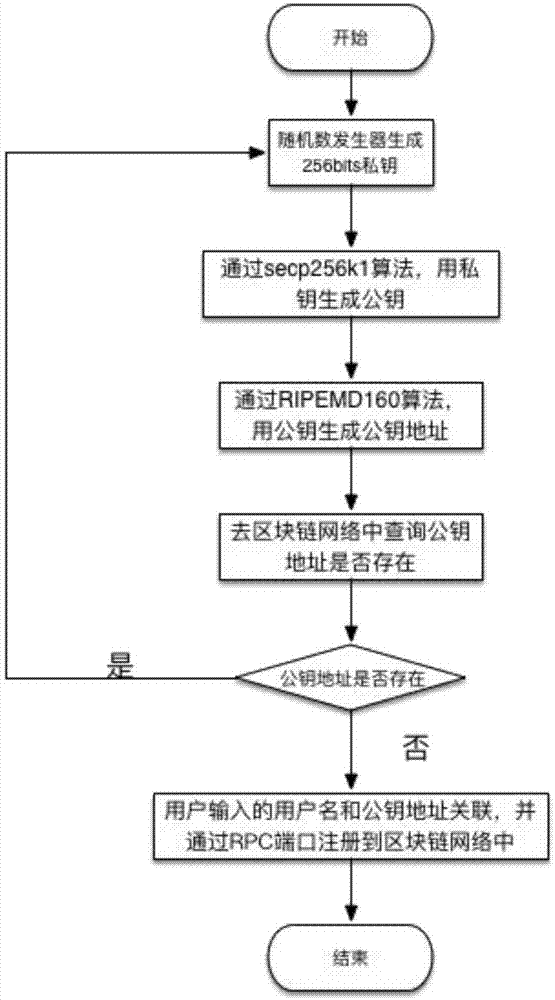

[0035] The account registration node 30 is used to receive the public key and registration information generated by the user client, obtain account information according to the registration information, and register the public key and account information to the blockchain network; the client of the present invention obtains the public-private key pair through registration, The client sends the public key and registration information to instruct the account registration node, an...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com