Method for agency invoicing of second-hand house transaction receipt through self-service tax terminal

A self-service tax terminal and second-hand house technology, which is applied in the field of value-added tax invoices for second-hand house transactions on behalf of the local tax and the national tax, can solve the problems of crowded tax service halls and high work pressure at the invoice window, and reduce waiting in line time, reduce work pressure, and ensure safety and accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

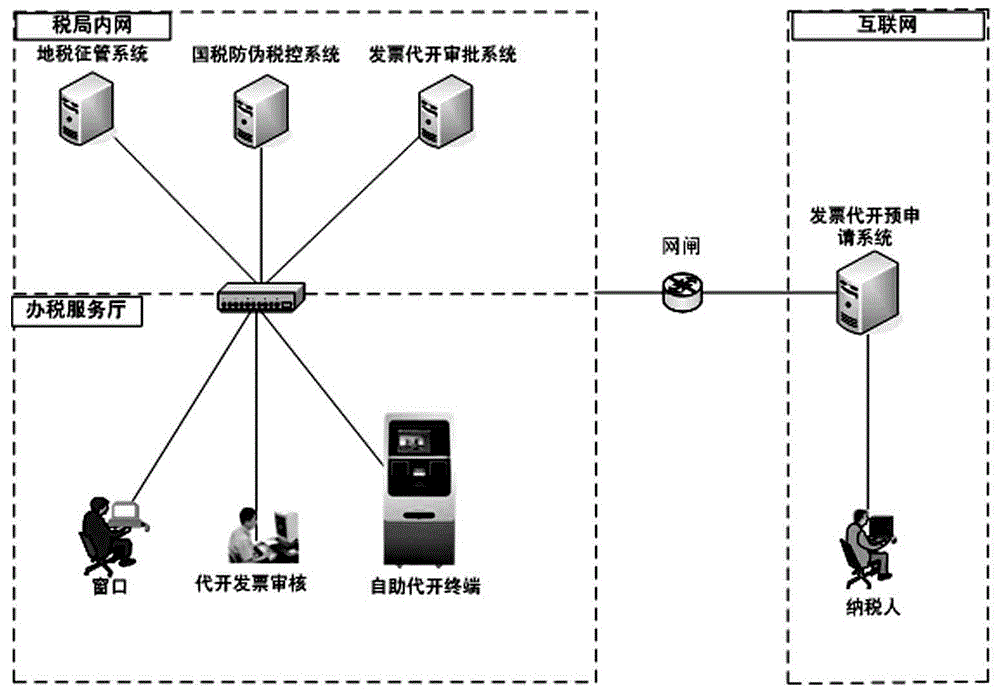

[0020] The method of issuing second-hand housing transaction invoices through the self-service tax terminal is through invoice information pre-examination, invoice information review, identity identification, invoice information confirmation, physical invoice identification, value-added tax declaration, tax payment, tax payment certificate printing, and invoice issuance The action, relying on the Internet + tax bureau private network model, is replaced by computer automation technology, and through automatic identification and information monitoring technology, the method of self-service invoicing for taxpayers has been realized.

[0021] The steps of the described method are as follows:

[0022] 1) Pre-examination of invoice information: the taxpayer fills in the application information for invoicing through the invoice pre-examination system. The information includes: the name, tax number, address, telephone number, bank information, etc. Specifications, unit price, quantity...

Embodiment 2

[0032] Adopting the method of business separation and integration of tax information on internal and external networks, the specific operation steps are as follows:

[0033] 1) Taxpayers who apply for agent issuance of invoices enter the application information of the secondary agent issuance of invoices through the extranet "Invoice Agent Issuance Pre-examination System" (web version or mobile version), and submit paper materials to be reviewed at the same time (such as: invoice receipt payment certificate, scanned copy of business license, etc.); the external network "invoice issuance pre-examination system" sends the agent invoice information and image data to the intranet "invoice issuance approval system";

[0034] 2) The tax officer obtains the pre-examination information submitted by the taxpayer and the electronic data information for verification. After the audit is passed, the taxpayer can go to the self-service tax terminal to issue an invoice;

[0035] 3) The taxpa...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com