Debit/credit method and debit/credit system

A loan and participant technology, applied in the field of lending methods and lending systems, can solve the problems of creditors unable to enjoy deposit interest income, difficult to protect creditor interests, and prolong repayment period, so as to reduce default risks, improve capital security, and maintain effect of interest

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

no. 1 example

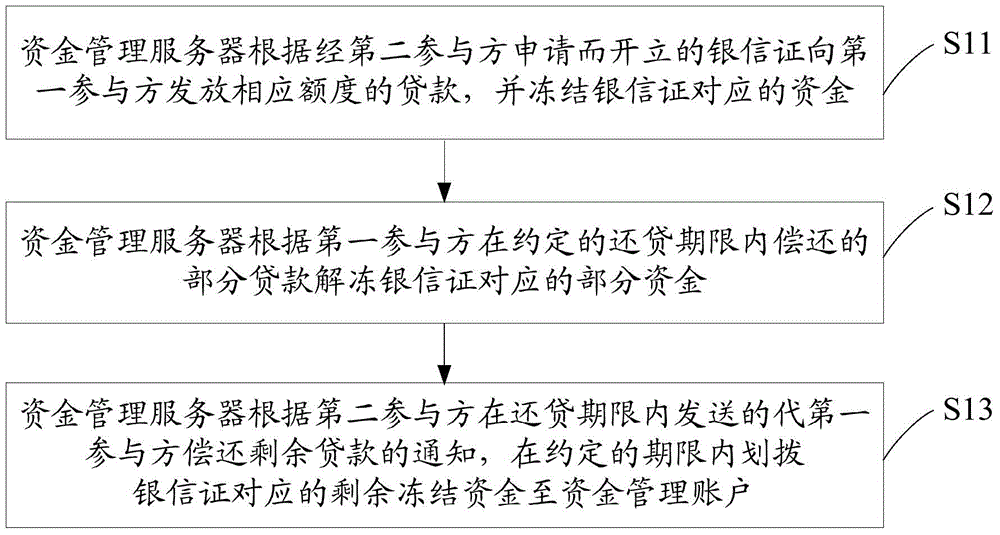

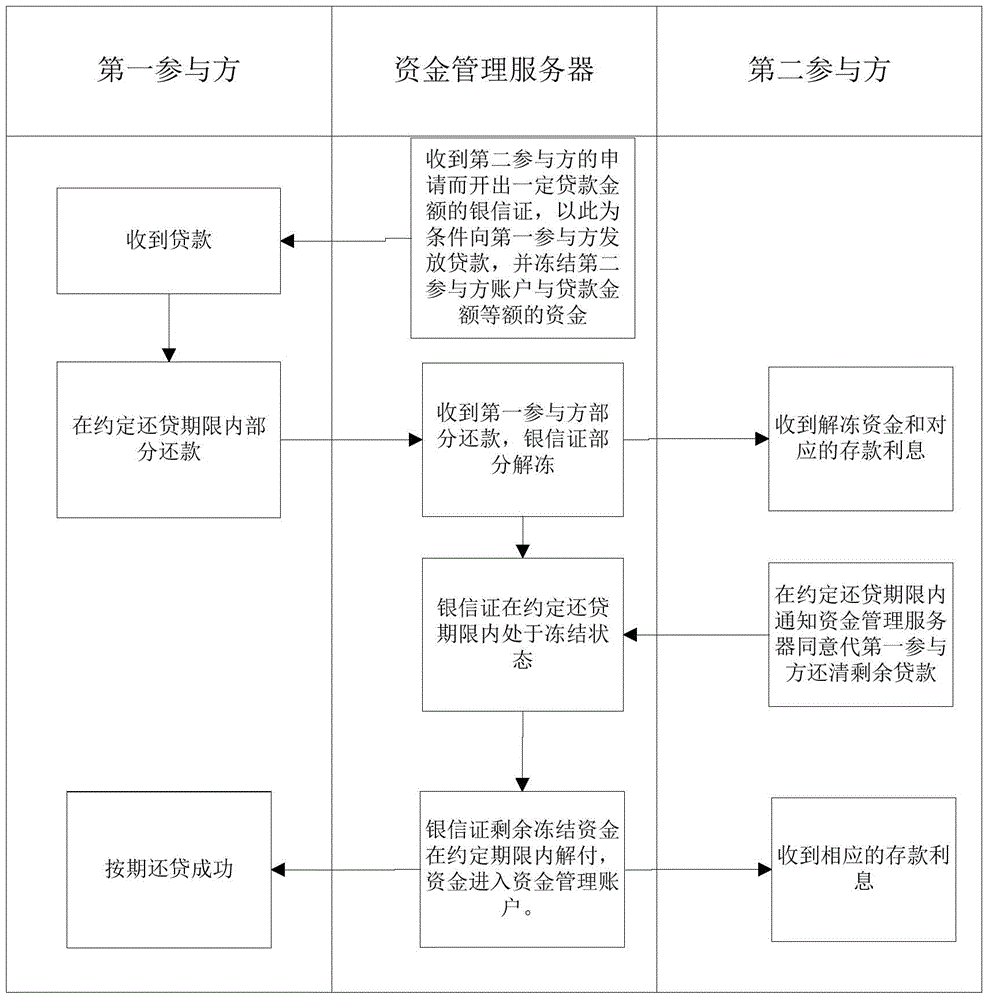

[0030] see figure 1 , figure 2 , the first embodiment of the loan method of the present invention is proposed, and the loan method includes the following steps:

[0031] S11. The fund management server grants a loan of a corresponding amount to the first participant according to the bank letter issued by the second participant, and freezes the funds corresponding to the bank letter.

[0032] Specifically, the second participant opens an account with the fund management institution and deposits deposits. The second participant, the first participant and the fund management institution agree on the loan amount, loan repayment period, and loan interest paid to the fund management institution. After receiving the loan information, the second participant applies to the fund management server based on the aforementioned loan information, and after the fund management server opens a bank letter, the fund management server freezes the deposit account of the second participant accord...

no. 2 example

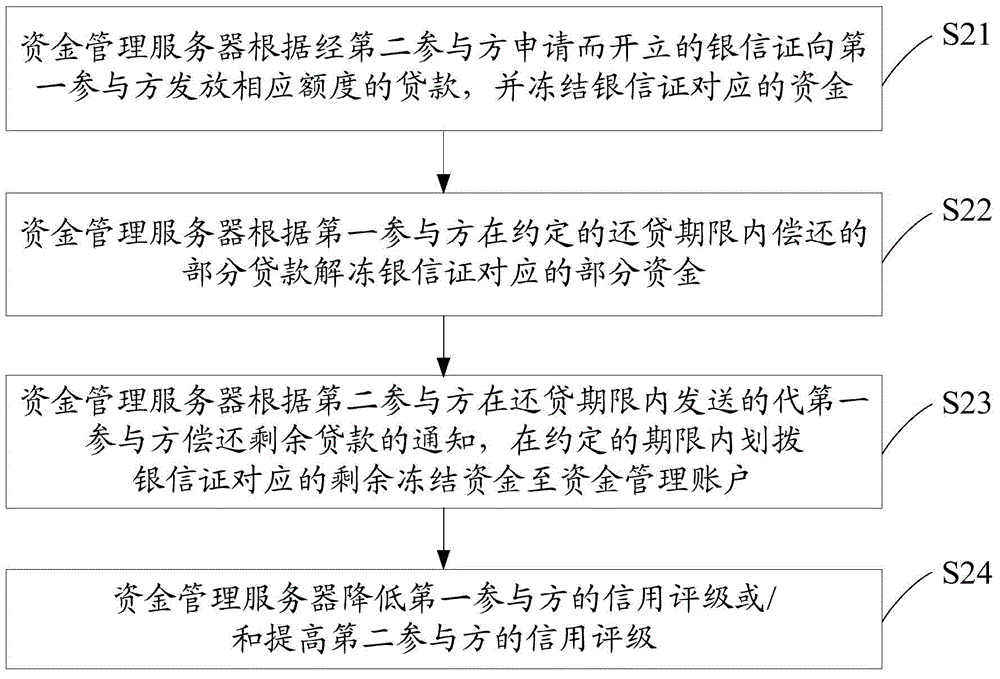

[0040] see image 3 , the second embodiment of the loan method of the present invention is proposed, and the loan method includes the following steps:

[0041] S21. The fund management server grants a loan of a corresponding amount to the first participant according to the bank letter issued by the second participant, and freezes the funds corresponding to the bank letter.

[0042] S22. The fund management server unfreezes part of the funds corresponding to the bank letter of credit according to the part of the loan repaid by the first participant within the agreed loan repayment period.

[0043] S23. The fund management server transfers the remaining frozen funds corresponding to the bank letter to the fund management account within the agreed time limit according to the notice sent by the second party to repay the remaining loan on behalf of the first party within the loan repayment period.

[0044] In this embodiment, steps S21-S23 are the same as steps S11-S13 in the firs...

no. 3 example

[0047] see Figure 4 , propose the third embodiment of the loan method of the present invention, the loan method includes the following steps:

[0048] S31. The fund management server grants a loan of a corresponding amount to the first participant according to the bank letter issued by the second participant, and freezes the funds corresponding to the bank letter.

[0049] S32. The fund management server unfreezes part of the funds corresponding to the bank letter of credit according to the part of the loan repaid by the first participant within the agreed loan repayment period, and distributes the loan interest between the second participant's account and the fund management account according to preset rules.

[0050] In this embodiment, the second participant and the fund management agency also agree on the distribution of loan interest, that is, in this embodiment, the second participant can not only obtain deposit interest, but also obtain part of loan interest. For exam...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com