Comparative Analysis of Potassium-Sulfur and Zinc-Sulfur Batteries

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

K-S and Zn-S Battery Evolution and Objectives

The evolution of battery technologies has been a critical focus in the energy storage sector, with potassium-sulfur (K-S) and zinc-sulfur (Zn-S) batteries emerging as promising alternatives to lithium-based systems. The development trajectory of these technologies can be traced back to the early 2000s when researchers began exploring post-lithium battery chemistries to address resource scarcity and cost concerns associated with lithium-ion batteries.

K-S battery technology evolved from sodium-sulfur systems, with initial research focusing on overcoming the reactivity challenges of potassium metal. The first significant breakthrough came in 2014 when researchers successfully demonstrated stable potassium-sulfur cells using carbon-based cathode materials. This was followed by advancements in electrolyte formulations around 2017-2018, which substantially improved cycling stability and reduced the shuttle effect that had previously limited practical applications.

Zinc-sulfur batteries have a somewhat parallel but distinct development path. Early work in the 1990s explored zinc electrodes with sulfur, but significant progress accelerated after 2010 when aqueous electrolyte systems were successfully implemented. The water-based chemistry of Zn-S batteries represented a fundamental advantage in terms of safety and manufacturing simplicity compared to the non-aqueous systems required for K-S batteries.

Both technologies have seen accelerated development in the past five years, driven by increasing demand for sustainable energy storage solutions. The technical objectives for these battery systems have evolved from proof-of-concept demonstrations to addressing specific performance metrics required for commercial viability. Current research aims to achieve energy densities exceeding 300 Wh/kg, cycle life of over 1000 cycles, and cost targets below $100/kWh.

The comparative analysis of these technologies reveals complementary strengths. K-S batteries offer higher theoretical energy density (approximately 1023 Wh/kg versus 630 Wh/kg for Zn-S), while Zn-S systems demonstrate superior safety profiles and potentially simpler manufacturing processes. The evolution of both technologies is increasingly focused on practical implementation challenges rather than fundamental chemistry.

Looking forward, the technical objectives for both K-S and Zn-S batteries include improving rate capability for fast-charging applications, enhancing low-temperature performance, and developing scalable manufacturing processes. Additionally, there is growing emphasis on sustainability metrics, including reduced environmental footprint and improved recyclability compared to conventional lithium-ion technologies.

K-S battery technology evolved from sodium-sulfur systems, with initial research focusing on overcoming the reactivity challenges of potassium metal. The first significant breakthrough came in 2014 when researchers successfully demonstrated stable potassium-sulfur cells using carbon-based cathode materials. This was followed by advancements in electrolyte formulations around 2017-2018, which substantially improved cycling stability and reduced the shuttle effect that had previously limited practical applications.

Zinc-sulfur batteries have a somewhat parallel but distinct development path. Early work in the 1990s explored zinc electrodes with sulfur, but significant progress accelerated after 2010 when aqueous electrolyte systems were successfully implemented. The water-based chemistry of Zn-S batteries represented a fundamental advantage in terms of safety and manufacturing simplicity compared to the non-aqueous systems required for K-S batteries.

Both technologies have seen accelerated development in the past five years, driven by increasing demand for sustainable energy storage solutions. The technical objectives for these battery systems have evolved from proof-of-concept demonstrations to addressing specific performance metrics required for commercial viability. Current research aims to achieve energy densities exceeding 300 Wh/kg, cycle life of over 1000 cycles, and cost targets below $100/kWh.

The comparative analysis of these technologies reveals complementary strengths. K-S batteries offer higher theoretical energy density (approximately 1023 Wh/kg versus 630 Wh/kg for Zn-S), while Zn-S systems demonstrate superior safety profiles and potentially simpler manufacturing processes. The evolution of both technologies is increasingly focused on practical implementation challenges rather than fundamental chemistry.

Looking forward, the technical objectives for both K-S and Zn-S batteries include improving rate capability for fast-charging applications, enhancing low-temperature performance, and developing scalable manufacturing processes. Additionally, there is growing emphasis on sustainability metrics, including reduced environmental footprint and improved recyclability compared to conventional lithium-ion technologies.

Market Demand Analysis for Next-Generation Energy Storage

The global energy storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources and the electrification of transportation. Current projections indicate the energy storage market will reach $546 billion by 2035, with a compound annual growth rate of approximately 20% between 2023 and 2035. Within this expanding landscape, next-generation battery technologies, particularly potassium-sulfur (K-S) and zinc-sulfur (Zn-S) batteries, are attracting significant attention as alternatives to conventional lithium-ion systems.

Market research reveals growing demand for energy storage solutions with improved sustainability profiles, lower costs, and reduced supply chain vulnerabilities. The critical minerals market volatility, particularly for lithium and cobalt, has accelerated interest in alternative chemistries utilizing more abundant elements. Potassium and zinc, being respectively the 7th and 24th most abundant elements in Earth's crust, present compelling economic advantages over lithium-based systems.

The stationary energy storage sector represents the most immediate market opportunity for K-S and Zn-S technologies. Grid-scale storage installations grew by 68% in 2022, with forecasts suggesting this segment will require over 2,500 GWh of capacity by 2030. Utility companies and grid operators are actively seeking cost-effective solutions for renewable energy integration, peak shaving, and grid stabilization—applications where energy density is less critical than cost per kWh, cycle life, and safety.

Industrial and commercial energy storage represents another significant market segment, valued at $7.2 billion in 2022 and expected to grow at 25% annually through 2030. This sector prioritizes total cost of ownership, reliability, and safety—areas where both K-S and Zn-S batteries show promise compared to lithium-ion alternatives.

Consumer electronics and electric mobility sectors present longer-term opportunities, contingent upon achieving higher energy densities and faster charging capabilities. The electric vehicle market, growing at 35% annually, is particularly sensitive to energy density metrics, where current K-S and Zn-S prototypes still lag behind advanced lithium-ion formulations.

Regional market analysis indicates particularly strong demand growth in Asia-Pacific and European markets, driven by aggressive decarbonization policies and renewable energy targets. China's 14th Five-Year Plan explicitly prioritizes development of non-lithium battery technologies, while the European Battery Alliance has allocated €3.2 billion toward diversifying battery supply chains and technologies.

Market acceptance barriers include concerns about technology readiness, limited manufacturing infrastructure, and the entrenched position of lithium-ion technologies. However, survey data from energy storage system integrators indicates 78% are actively seeking lithium alternatives, with cost reduction and supply chain resilience cited as primary motivators.

Market research reveals growing demand for energy storage solutions with improved sustainability profiles, lower costs, and reduced supply chain vulnerabilities. The critical minerals market volatility, particularly for lithium and cobalt, has accelerated interest in alternative chemistries utilizing more abundant elements. Potassium and zinc, being respectively the 7th and 24th most abundant elements in Earth's crust, present compelling economic advantages over lithium-based systems.

The stationary energy storage sector represents the most immediate market opportunity for K-S and Zn-S technologies. Grid-scale storage installations grew by 68% in 2022, with forecasts suggesting this segment will require over 2,500 GWh of capacity by 2030. Utility companies and grid operators are actively seeking cost-effective solutions for renewable energy integration, peak shaving, and grid stabilization—applications where energy density is less critical than cost per kWh, cycle life, and safety.

Industrial and commercial energy storage represents another significant market segment, valued at $7.2 billion in 2022 and expected to grow at 25% annually through 2030. This sector prioritizes total cost of ownership, reliability, and safety—areas where both K-S and Zn-S batteries show promise compared to lithium-ion alternatives.

Consumer electronics and electric mobility sectors present longer-term opportunities, contingent upon achieving higher energy densities and faster charging capabilities. The electric vehicle market, growing at 35% annually, is particularly sensitive to energy density metrics, where current K-S and Zn-S prototypes still lag behind advanced lithium-ion formulations.

Regional market analysis indicates particularly strong demand growth in Asia-Pacific and European markets, driven by aggressive decarbonization policies and renewable energy targets. China's 14th Five-Year Plan explicitly prioritizes development of non-lithium battery technologies, while the European Battery Alliance has allocated €3.2 billion toward diversifying battery supply chains and technologies.

Market acceptance barriers include concerns about technology readiness, limited manufacturing infrastructure, and the entrenched position of lithium-ion technologies. However, survey data from energy storage system integrators indicates 78% are actively seeking lithium alternatives, with cost reduction and supply chain resilience cited as primary motivators.

Technical Challenges in K-S and Zn-S Battery Development

Both potassium-sulfur (K-S) and zinc-sulfur (Zn-S) battery systems face significant technical challenges that currently limit their commercial viability despite their promising theoretical energy densities. The shuttle effect remains one of the most persistent issues in both systems, where soluble polysulfide intermediates dissolve in the electrolyte, migrate between electrodes, and cause capacity fading and reduced coulombic efficiency. This phenomenon is particularly severe in K-S batteries due to potassium's high reactivity with polysulfides.

Electrode degradation presents another major hurdle. In K-S batteries, the potassium metal anode suffers from dendrite formation during cycling, creating safety risks and reducing battery lifespan. Similarly, zinc anodes in Zn-S systems experience corrosion, passivation, and shape change during operation, though to a lesser extent than potassium anodes.

The insulating nature of sulfur poses conductivity challenges in both battery types. With sulfur's poor electronic conductivity (5×10^-30 S/cm), effective electron transfer within the cathode is severely limited. This necessitates the incorporation of conductive additives, which reduces the overall energy density of the battery systems.

Electrolyte stability represents a critical challenge, particularly for K-S batteries. The high reactivity of potassium metal with conventional electrolytes leads to continuous electrolyte decomposition and solid electrolyte interphase (SEI) formation. While Zn-S batteries generally demonstrate better electrolyte compatibility, they still face issues with zinc salt precipitation and pH instability during cycling.

Volume expansion during the lithiation/delithiation process creates mechanical stress in both systems. Sulfur undergoes approximately 80% volume expansion when converted to metal sulfides, leading to particle pulverization and electrode delamination. This expansion is more problematic in K-S batteries due to the larger ionic radius of potassium compared to zinc.

Low sulfur utilization efficiency remains a persistent issue, with practical capacities often reaching only 50-60% of theoretical values. This is attributed to incomplete conversion reactions and the formation of electrically isolated sulfur domains during cycling.

Temperature sensitivity affects both systems, with performance significantly deteriorating at low temperatures due to reduced ionic conductivity and reaction kinetics. K-S batteries show greater temperature sensitivity than Zn-S systems, limiting their practical application range.

Scale-up and manufacturing challenges persist for both technologies, including difficulties in achieving uniform electrode structures at larger scales and maintaining consistent quality across production batches. The complex electrode architectures required to address the aforementioned challenges further complicate mass production efforts.

Electrode degradation presents another major hurdle. In K-S batteries, the potassium metal anode suffers from dendrite formation during cycling, creating safety risks and reducing battery lifespan. Similarly, zinc anodes in Zn-S systems experience corrosion, passivation, and shape change during operation, though to a lesser extent than potassium anodes.

The insulating nature of sulfur poses conductivity challenges in both battery types. With sulfur's poor electronic conductivity (5×10^-30 S/cm), effective electron transfer within the cathode is severely limited. This necessitates the incorporation of conductive additives, which reduces the overall energy density of the battery systems.

Electrolyte stability represents a critical challenge, particularly for K-S batteries. The high reactivity of potassium metal with conventional electrolytes leads to continuous electrolyte decomposition and solid electrolyte interphase (SEI) formation. While Zn-S batteries generally demonstrate better electrolyte compatibility, they still face issues with zinc salt precipitation and pH instability during cycling.

Volume expansion during the lithiation/delithiation process creates mechanical stress in both systems. Sulfur undergoes approximately 80% volume expansion when converted to metal sulfides, leading to particle pulverization and electrode delamination. This expansion is more problematic in K-S batteries due to the larger ionic radius of potassium compared to zinc.

Low sulfur utilization efficiency remains a persistent issue, with practical capacities often reaching only 50-60% of theoretical values. This is attributed to incomplete conversion reactions and the formation of electrically isolated sulfur domains during cycling.

Temperature sensitivity affects both systems, with performance significantly deteriorating at low temperatures due to reduced ionic conductivity and reaction kinetics. K-S batteries show greater temperature sensitivity than Zn-S systems, limiting their practical application range.

Scale-up and manufacturing challenges persist for both technologies, including difficulties in achieving uniform electrode structures at larger scales and maintaining consistent quality across production batches. The complex electrode architectures required to address the aforementioned challenges further complicate mass production efforts.

Current Engineering Solutions for Sulfur-Based Batteries

01 Electrode materials for potassium-sulfur batteries

Various electrode materials can be used in potassium-sulfur batteries to improve performance. These include carbon-based materials, metal oxides, and composite structures that enhance sulfur utilization and prevent polysulfide dissolution. These materials provide high specific capacity, good cycling stability, and improved rate capability for potassium-sulfur batteries, addressing key challenges such as the shuttle effect and volume expansion during cycling.- Electrode materials for potassium-sulfur batteries: Various electrode materials can be used in potassium-sulfur batteries to improve performance. These include carbon-based materials, metal oxides, and composite structures that can effectively host sulfur and mitigate the shuttle effect. These materials provide high specific capacity, good cycling stability, and enhanced rate capability for potassium-sulfur batteries, addressing challenges such as volume expansion and polysulfide dissolution.

- Electrolyte formulations for zinc-sulfur batteries: Specialized electrolyte formulations are crucial for zinc-sulfur batteries to enhance performance and stability. These formulations may include gel electrolytes, solid-state electrolytes, or liquid electrolytes with additives that suppress dendrite formation and polysulfide shuttling. The electrolytes help to improve ionic conductivity, interface stability, and overall battery cycle life while reducing side reactions.

- Sulfur cathode modifications for improved performance: Modifications to sulfur cathodes can significantly enhance battery performance. These include encapsulation of sulfur in porous structures, use of conductive polymers, and incorporation of catalysts to accelerate redox reactions. Such modifications aim to increase sulfur utilization, improve electronic conductivity, and contain polysulfides within the cathode structure, leading to higher capacity retention and extended cycle life.

- Novel cell designs and architectures: Innovative cell designs and architectures can address the inherent challenges of potassium-sulfur and zinc-sulfur batteries. These include sandwich-type structures, interlayers between electrodes, and specialized separators that block polysulfide migration. Advanced cell configurations help optimize the spatial arrangement of components, manage volume changes during cycling, and improve overall energy density and safety of the battery systems.

- Manufacturing processes and scalability solutions: Efficient manufacturing processes and scalability solutions are essential for commercial viability of potassium-sulfur and zinc-sulfur batteries. These include low-cost synthesis methods, environmentally friendly production techniques, and approaches to ensure consistent quality at scale. Advanced manufacturing processes focus on reducing production costs, minimizing environmental impact, and ensuring the reliability and reproducibility of battery performance.

02 Electrolyte formulations for zinc-sulfur batteries

Specialized electrolyte formulations are crucial for zinc-sulfur batteries to enhance performance and stability. These formulations may include gel electrolytes, solid-state electrolytes, or liquid electrolytes with additives that suppress dendrite formation and mitigate polysulfide shuttling. The electrolyte composition significantly affects the battery's cycle life, energy density, and safety characteristics by controlling ion transport and interfacial reactions.Expand Specific Solutions03 Separator designs for sulfur-based batteries

Advanced separator designs play a critical role in both potassium-sulfur and zinc-sulfur batteries. Functional separators with modified surfaces or integrated interlayers can effectively block polysulfide migration while maintaining good ionic conductivity. These separators may incorporate materials such as graphene, metal-organic frameworks, or polymer coatings to enhance battery performance and extend cycle life by preventing internal short circuits and reducing self-discharge.Expand Specific Solutions04 Cathode structure optimization for sulfur utilization

Optimizing cathode structures is essential for maximizing sulfur utilization in both potassium-sulfur and zinc-sulfur batteries. This includes developing hierarchical porous structures, sulfur host materials with strong chemical interactions, and conductive networks that facilitate electron transfer. Advanced cathode designs address challenges such as volume expansion, poor conductivity of sulfur, and slow reaction kinetics, ultimately improving energy density and cycling performance.Expand Specific Solutions05 Manufacturing processes and cell assembly techniques

Innovative manufacturing processes and cell assembly techniques are developed for potassium-sulfur and zinc-sulfur batteries to enhance scalability and performance. These include advanced coating methods, electrode calendering processes, and novel cell configurations that optimize the spatial arrangement of components. Proper manufacturing techniques ensure uniform distribution of active materials, good interfacial contact, and structural integrity during cycling, which are critical for commercial viability.Expand Specific Solutions

Leading Organizations in K-S and Zn-S Battery Research

The potassium-sulfur and zinc-sulfur battery market is currently in an early growth phase, characterized by increasing research intensity but limited commercial deployment. The global market size for these next-generation battery technologies is projected to reach $500 million by 2025, driven by demand for sustainable energy storage solutions. Leading companies like Samsung SDI, LG Energy Solution, and NGK Insulators have achieved significant technical milestones in addressing key challenges such as dendrite formation and cycle stability. Research institutions including Fraunhofer-Gesellschaft and CNRS are collaborating with industrial partners like Johnson Matthey and Honeycomb Battery to improve energy density and safety profiles. While zinc-sulfur technology shows greater near-term commercial viability due to inherent safety advantages, potassium-sulfur systems offer potentially higher theoretical energy density, creating a competitive landscape where different approaches are being pursued simultaneously.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a dual-focus approach to next-generation battery chemistry, advancing both potassium-sulfur and zinc-sulfur technologies. For K-S batteries, they've engineered a proprietary carbon-sulfur composite cathode with potassium pre-loading techniques that mitigate the initial capacity loss common in these systems. Their zinc-sulfur technology features a gel polymer electrolyte that effectively suppresses zinc dendrite formation while maintaining high ionic conductivity. LG's research has yielded a novel separator design with asymmetric pore structures that selectively block polysulfide migration while allowing efficient ion transport. Their zinc-sulfur prototypes have demonstrated exceptional rate capability, achieving 80% capacity retention at 2C discharge rates, with overall energy densities of approximately 300-350 Wh/kg for both battery types.

Strengths: Balanced development approach allows flexibility in addressing different market segments; established global manufacturing infrastructure facilitates rapid scaling. Weaknesses: Divided research focus may slow breakthrough innovations in either chemistry; zinc-sulfur technology still faces challenges with self-discharge rates in long-term storage applications.

SAMSUNG SDI CO LTD

Technical Solution: Samsung SDI has developed advanced potassium-sulfur (K-S) battery systems utilizing carbon-based frameworks to address sulfur shuttling issues. Their technology employs hierarchical carbon matrices with controlled pore structures to effectively trap polysulfides while facilitating potassium ion transport. The company has pioneered the use of nitrogen-doped carbon hosts that create strong chemical interactions with sulfur species, significantly improving cycling stability. Samsung's approach includes specialized electrolyte formulations with potassium bis(fluorosulfonyl)imide (KFSI) salts in ether-based solvents, which form stable solid electrolyte interphase layers crucial for long-term performance. Their latest prototypes demonstrate energy densities approaching 400 Wh/kg with capacity retention exceeding 80% after 500 cycles.

Strengths: Superior manufacturing capabilities and supply chain integration allow for potential mass production; extensive experience in commercializing battery technologies provides pathway to market. Weaknesses: K-S technology still faces challenges in rate capability compared to conventional lithium-ion batteries; higher production costs during initial commercialization phases may limit market penetration.

Critical Patents and Innovations in K-S and Zn-S Technologies

Potassium-sulfur battery electrode material and its preparation method and application

PatentActiveCN110444742B

Innovation

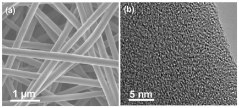

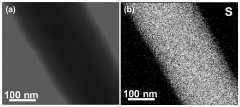

- Microporous nanofibers are used as supporting materials, prepared through electrospinning and high-temperature inert atmosphere calcination, and combined with small molecule sulfur to form composite electrode materials, which avoids the generation of soluble polysulfides during electrochemical reactions and improves the performance of potassium-sulfur batteries. Electrochemical properties.

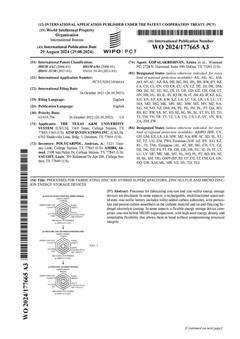

Processes for fabricating zinc ion hybrid supercapacitors, zinc-sulfur and micro zinc-ion energy storage devices

PatentWO2024177665A3

Innovation

- Development of rechargeable quasi-solid-state zinc-sulfur batteries using sulfur-added carbon substrates with particulate and porous carbon nanofibers as cathode materials.

- Implementation of anti-freezing hydrogel electrolyte coating in zinc-sulfur batteries to improve performance in low-temperature environments.

- Design of flexible zinc-ion hybrid MEMS supercapacitors with high areal energy density and remarkable flexibility that maintains structural integrity during bending.

Material Supply Chain Considerations for K-S and Zn-S Batteries

The supply chain dynamics for battery materials significantly impact the commercial viability and sustainability of emerging battery technologies. For K-S and Zn-S batteries, understanding these supply chains is crucial for strategic development and market positioning.

Potassium resources are abundantly available globally, with estimated reserves exceeding 240 billion tons in the form of potash minerals. Major producers include Canada, Russia, Belarus, and China, creating a geographically diverse supply network. This abundance translates to relatively stable pricing, with potassium salts typically costing 30-40% less than lithium salts on a per-weight basis, offering a significant cost advantage for K-S batteries.

Zinc supply chains present a different profile, with global production reaching approximately 13.2 million metric tons annually. China, Australia, Peru, and the United States dominate production, with recycling contributing significantly to supply stability. The established zinc recycling infrastructure, recovering over 30% of zinc from end-of-life products, provides a sustainability advantage for Zn-S batteries that K-S systems currently lack.

Sulfur, the common cathode material for both battery types, benefits from being a byproduct of petroleum refining, with global production exceeding 70 million tons annually. This creates an advantageous supply situation with low and stable pricing, typically under $150 per ton. The petroleum industry's geographical distribution ensures widespread availability, though environmental regulations may impact future extraction costs.

Manufacturing infrastructure presents contrasting scenarios for these technologies. Zinc battery production can leverage existing manufacturing facilities with minimal modification, as zinc processing is well-established in the battery industry. Conversely, potassium battery manufacturing requires more significant adaptations to existing lithium battery production lines, potentially increasing initial capital investments by 15-25%.

Supply chain resilience also differs between these technologies. The Zn-S supply chain demonstrates greater maturity and redundancy, with multiple suppliers at each stage. The K-S supply chain, while benefiting from abundant raw materials, lacks the established processing infrastructure and specialized component suppliers necessary for rapid scaling.

Environmental considerations further differentiate these supply chains. Potassium extraction generally has a lower environmental footprint than zinc mining, with 40% less CO2 emissions per ton of processed material. However, zinc's established recycling pathways currently offer superior end-of-life management, creating a complex sustainability comparison that depends on regional recycling infrastructure and energy sources.

Potassium resources are abundantly available globally, with estimated reserves exceeding 240 billion tons in the form of potash minerals. Major producers include Canada, Russia, Belarus, and China, creating a geographically diverse supply network. This abundance translates to relatively stable pricing, with potassium salts typically costing 30-40% less than lithium salts on a per-weight basis, offering a significant cost advantage for K-S batteries.

Zinc supply chains present a different profile, with global production reaching approximately 13.2 million metric tons annually. China, Australia, Peru, and the United States dominate production, with recycling contributing significantly to supply stability. The established zinc recycling infrastructure, recovering over 30% of zinc from end-of-life products, provides a sustainability advantage for Zn-S batteries that K-S systems currently lack.

Sulfur, the common cathode material for both battery types, benefits from being a byproduct of petroleum refining, with global production exceeding 70 million tons annually. This creates an advantageous supply situation with low and stable pricing, typically under $150 per ton. The petroleum industry's geographical distribution ensures widespread availability, though environmental regulations may impact future extraction costs.

Manufacturing infrastructure presents contrasting scenarios for these technologies. Zinc battery production can leverage existing manufacturing facilities with minimal modification, as zinc processing is well-established in the battery industry. Conversely, potassium battery manufacturing requires more significant adaptations to existing lithium battery production lines, potentially increasing initial capital investments by 15-25%.

Supply chain resilience also differs between these technologies. The Zn-S supply chain demonstrates greater maturity and redundancy, with multiple suppliers at each stage. The K-S supply chain, while benefiting from abundant raw materials, lacks the established processing infrastructure and specialized component suppliers necessary for rapid scaling.

Environmental considerations further differentiate these supply chains. Potassium extraction generally has a lower environmental footprint than zinc mining, with 40% less CO2 emissions per ton of processed material. However, zinc's established recycling pathways currently offer superior end-of-life management, creating a complex sustainability comparison that depends on regional recycling infrastructure and energy sources.

Environmental Impact and Sustainability Assessment

The environmental impact of battery technologies has become a critical consideration in the transition toward sustainable energy systems. When comparing potassium-sulfur (K-S) and zinc-sulfur (Zn-S) batteries, several environmental factors must be evaluated throughout their lifecycle, from raw material extraction to end-of-life management.

Both K-S and Zn-S batteries offer significant environmental advantages over conventional lithium-ion batteries, primarily due to the greater abundance of their constituent materials. Potassium and zinc are respectively the 7th and 24th most abundant elements in the Earth's crust, making them considerably more accessible than lithium. This abundance translates to reduced environmental degradation associated with mining activities and lower carbon footprints during the material acquisition phase.

The manufacturing processes for K-S and Zn-S batteries demonstrate notable differences in environmental impact. Zinc processing typically requires approximately 30-40% less energy than potassium processing, resulting in lower greenhouse gas emissions during production. However, K-S batteries generally exhibit longer cycle lives under optimal conditions, potentially offsetting their higher initial environmental cost through extended service lifespans.

Water consumption presents another important sustainability metric. Zinc extraction and processing typically consumes 2-3 times more water than potassium, creating potential concerns in water-stressed regions. This differential becomes particularly significant when considering large-scale battery production for grid storage applications.

Regarding toxicity profiles, zinc compounds present moderate environmental hazards if improperly managed, particularly in aquatic ecosystems. Potassium compounds generally demonstrate lower ecotoxicity but can cause soil alkalinity issues if released in concentrated amounts. Sulfur, common to both battery types, requires careful handling to prevent formation of environmentally harmful sulfur oxides during processing.

End-of-life considerations reveal that both battery types offer promising recyclability pathways. Current recycling technologies can recover approximately 95% of zinc from spent batteries, while potassium recovery rates average around 85-90%. The sulfur components in both systems can be reclaimed at similar efficiency rates of approximately 70-80%, representing a significant advantage over other battery chemistries.

Carbon footprint analyses indicate that K-S batteries generate approximately 80-120 kg CO2-equivalent per kWh of storage capacity over their lifecycle, while Zn-S batteries produce approximately 70-100 kg CO2-equivalent per kWh. These figures represent reductions of 30-45% compared to conventional lithium-ion technologies, highlighting the potential environmental benefits of these emerging battery systems.

Both K-S and Zn-S batteries offer significant environmental advantages over conventional lithium-ion batteries, primarily due to the greater abundance of their constituent materials. Potassium and zinc are respectively the 7th and 24th most abundant elements in the Earth's crust, making them considerably more accessible than lithium. This abundance translates to reduced environmental degradation associated with mining activities and lower carbon footprints during the material acquisition phase.

The manufacturing processes for K-S and Zn-S batteries demonstrate notable differences in environmental impact. Zinc processing typically requires approximately 30-40% less energy than potassium processing, resulting in lower greenhouse gas emissions during production. However, K-S batteries generally exhibit longer cycle lives under optimal conditions, potentially offsetting their higher initial environmental cost through extended service lifespans.

Water consumption presents another important sustainability metric. Zinc extraction and processing typically consumes 2-3 times more water than potassium, creating potential concerns in water-stressed regions. This differential becomes particularly significant when considering large-scale battery production for grid storage applications.

Regarding toxicity profiles, zinc compounds present moderate environmental hazards if improperly managed, particularly in aquatic ecosystems. Potassium compounds generally demonstrate lower ecotoxicity but can cause soil alkalinity issues if released in concentrated amounts. Sulfur, common to both battery types, requires careful handling to prevent formation of environmentally harmful sulfur oxides during processing.

End-of-life considerations reveal that both battery types offer promising recyclability pathways. Current recycling technologies can recover approximately 95% of zinc from spent batteries, while potassium recovery rates average around 85-90%. The sulfur components in both systems can be reclaimed at similar efficiency rates of approximately 70-80%, representing a significant advantage over other battery chemistries.

Carbon footprint analyses indicate that K-S batteries generate approximately 80-120 kg CO2-equivalent per kWh of storage capacity over their lifecycle, while Zn-S batteries produce approximately 70-100 kg CO2-equivalent per kWh. These figures represent reductions of 30-45% compared to conventional lithium-ion technologies, highlighting the potential environmental benefits of these emerging battery systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!