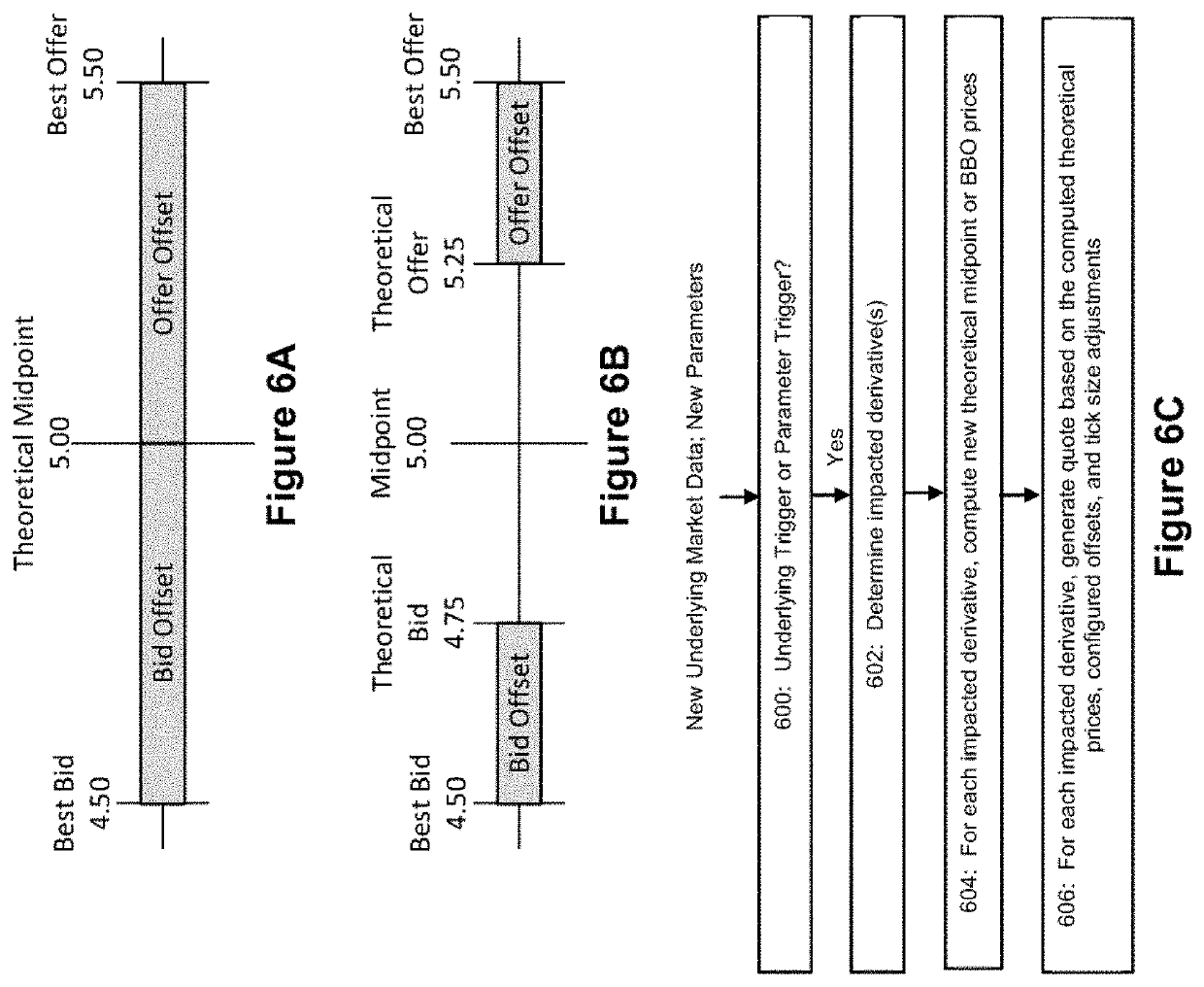

Competition among market makers for these opportunities to capture the spread generally drives offer and bid prices closer together, thus narrowing the spread and reducing the profit on each market making trade.

Firstly, the price of a derivative instrument generally depends on the price of its underlying instrument.

How to arrive at the fair value of an option contract is complex and computationally intensive.

While the Black-Scholes model is computationally far simpler than CRR, it makes simplistic assumptions, lacks support for American exercise, and therefore lacks of precision for many strategies in modern

electronic markets.

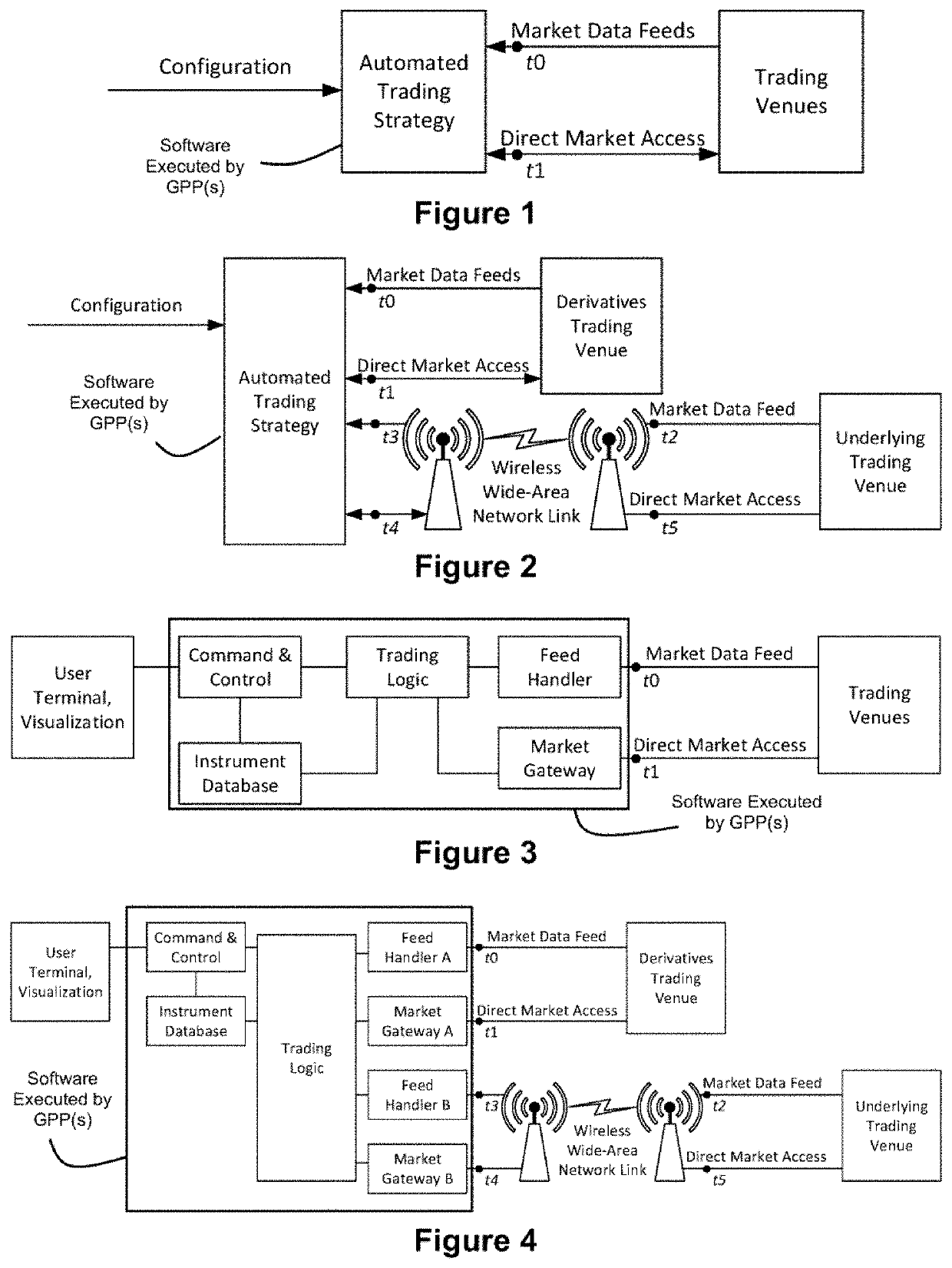

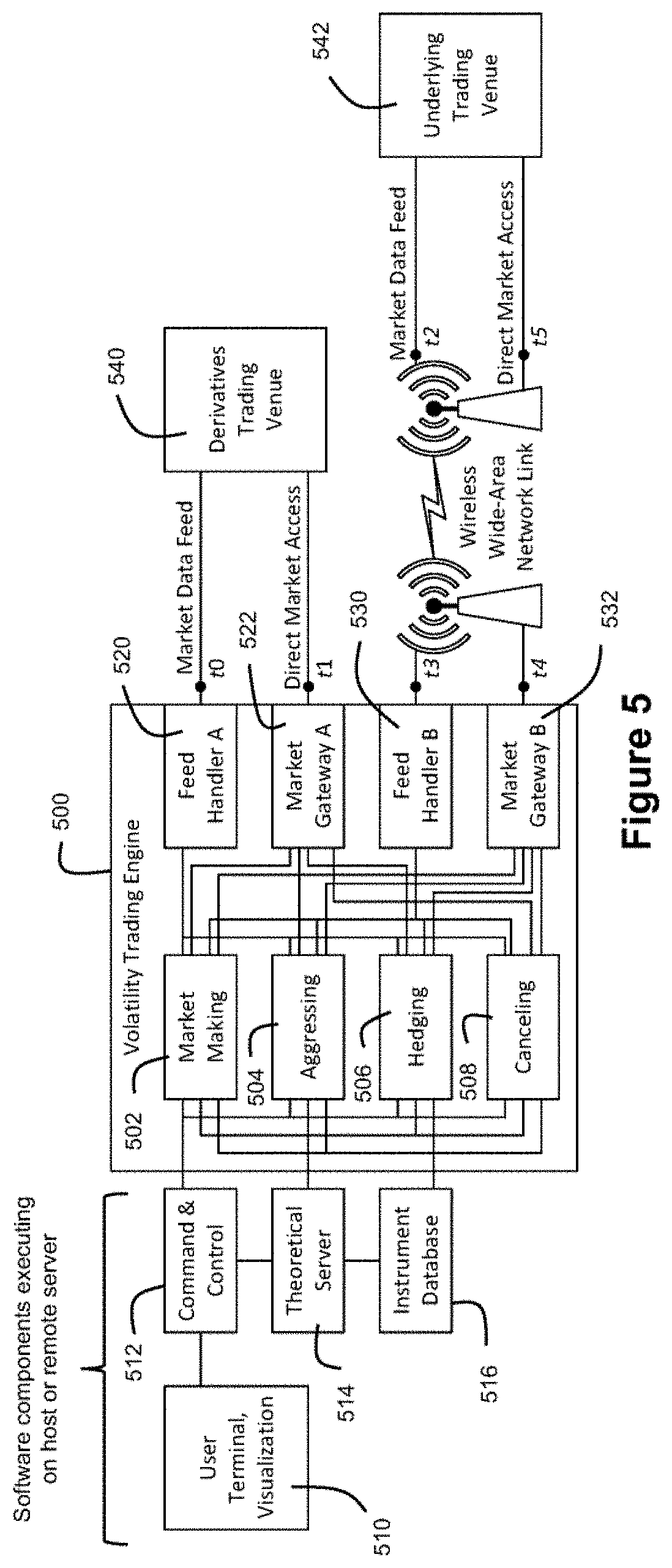

In addition to the complexity of computing fair values and the large number of financial instruments, automated trading in derivatives markets presents additional challenges when the underlying financial instruments are traded on a different market (e.g. stocks on the New York Stock Exchange) and in a different physical location than the derivative financial instruments (e.g. stock options on the Chicago Board Options Exchange).

Especially in the case of derivatives market making strategies, it may not be possible for an automated trading strategy to respond to a change in underlying prices by computing new fair prices and sending a message with new

mass quotes for thousands of derivative instruments before another

market participant is able to send a single message that successfully aggresses against one of those derivatives instruments.

For this reason, automated trading strategies frequently choose to cancel

mass quotes or orders when they determine that an undue risk of adverse trades exists.

There may be other conditions, such as a technical outage on the trading venue for underlying instruments, that cause the strategy to cancel all

mass quotes and orders for all contracts.

Volatility trading represents one of the most computationally intensive forms of automated trading due to large number of financial instruments, the need to perform fair value calculations for each derivative instrument in order to drive trading logic, and the complexity of each of those fair value calculations.

Furthermore, volatility trading strategies face more risk of adverse trades from aggressing orders of other market participants.

Accordingly, these conventional

software-based approaches to automated trading are not adequate for automated trading of derivatives because these conventional

software-based approaches are not sufficiently fast.

That is to say that these conventional

software-based approaches to automated trading suffer from a technical shortcoming in that they are not able to adequately take into consideration up-to-date pricing information for swiftly changing

market conditions in derivatives markets.

While the use of FPGA-based Feed Handlers constitutes a significant improvement over systems that implement the

full cycle in software, such alternate approaches still suffer from relatively high

tick to trade latencies due to the latency present in the software-based Trading Logic.

All of these steps undesirably result in reduced opportunities to trade and may eliminate incentives to trade in certain contracts or markets.

Furthermore, given the limitations imposed by trading venues on the number of messages per second that may be transmitted by a

market participant, conventional GPP-based trading strategies must do one of the following, all of which increase

tick-to-trade latencies and thus reduce trading opportunities and increase risk:(1) perform trade decision-making and message scheduling serially on a single GPP platform(2) perform trade decision-making in parallel on multiple GPP platforms and then

multiplex messages to the trading venues through another platform that performs scheduling and aggregate risk checks

The inventors believe that such levels of responsiveness for automated trading strategies are simply not something that conventional automated trading systems are technically capable of achieving.

As explained above, techniques such as Black-Scholes or CRR for computing the fair market price of an option can be unduly slow due to the large numbers of iterations that are needed by these techniques to arrive at theoretical fair market prices.

Accordingly, by the time these conventional techniques are able to arrive at a theoretical fair market price, it is almost certain that the pricing for the financial instrument underlying the derivative has changed, in which case the computed theoretical fair market price will be stale and may not accurately reflect

market conditions (and a trading strategy that relies on such theoretical fair market price computations will be carrying risks that arise from potential mispricing).

Login to View More

Login to View More  Login to View More

Login to View More